Chair’s letter and Notice of Meeting Annual General Meeting Hilton London Bankside 11.30am on 1 May 2024 Realising our full potential

This document is important and requires your immediate attention. If you are in any doubt as to any aspects of the proposals referred to in this document or as to the action you should take, you should seek your own advice from a stockbroker, solicitor, accountant or other professional adviser as soon as possible. If you have sold or otherwise transferred all of your shares, please pass this document to the purchaser or transferee, or to the person who arranged the sale or transfer so they can pass this document to the person who now holds the shares. Dear Shareholder, I write to provide you with notice of the Annual General Meeting (the ‘AGM’) of Unilever PLC (the ‘Company’) to be held at 11.30am BST on Wednesday 1 May 2024 at Hilton London Bankside, 2-8 Great Suffolk Street, London SE1 0UG. At the AGM, Hein Schumacher, the Chief Executive Officer, will update you on the progress of the business in 2023. Following this presentation, we will have a Q&A session before we conduct the formal business of the meeting. I was appointed by your Board as a Non-Executive Director with effect from 1 September 2023 and I was very pleased to take up this position. I was subsequently delighted to become the Chair of Unilever, in succession to Nils Andersen, on 1 December 2023. I will offer myself for election by shareholders at this AGM. Nils currently remains as a Non-Executive Director and will stand down at the conclusion of the AGM. It is an honour to have succeeded Nils as Chair of Unilever and I would like to give my thanks to Nils for his years of service, having chaired the company through a period of significant volatility and some of the most challenging operating conditions in decades. We announced the appointment of Fernando Fernandez as the Chief Financial Officer of Unilever in October 2023 and Fernando became an Executive Director and Chief Financial Officer on 1 January 2024. Fernando has an extensive track record in a variety of financial, marketing and general management roles in the Company. He will offer himself for election by shareholders at this AGM. We also announced on 31 January 2024 that Judith Hartmann, Strive Masiyiwa and Youngme Moon had decided not to stand for re-election at the AGM. Judith, who joined Unilever in April 2015 as a Non-Executive Director and will have completed 9 years in this role by the AGM, has served on the Nomination and Corporate Governance Committee, the Compensation Committee and the Audit Committee. Strive Masiyiwa and Youngme Moon both joined as Non-Executive Directors in April 2016. Strive has been the Chair of our Corporate Responsibility Committee since April 2017 and Youngme Moon was our Senior Independent Director from April 2018 to April 2021. I would like to thank Judith, Strive and Youngme for their time on the Board. Unilever PLC Registered in England and Wales No 41424. Registered office: Port Sunlight, Wirral, Merseyside CH62 4ZD, United Kingdom Unilever House, 100 Victoria Embankment, London EC4Y 0DY Telephone +44 (0)20 7438 2800 18 March 2024 Ian Meakins Chair

We also announced on 31 January 2024 that Judith McKenna would be appointed to the Board with effect from 1 March 2024. Judith has deep and extensive experience of the consumer goods and retail sectors having spent 27 years at Walmart in senior roles in the US and internationally and also as Chief Financial Officer of ASDA in the UK. We welcome Judith to the Board and Judith will offer herself for election by shareholders at the AGM. Other than with respect to Nils Andersen, Judith Hartmann, Strive Masiyiwa and Youngme Moon, all of the current Directors are offering themselves for election or re-election (as the case may be) at the AGM. We are asking you to approve a new Directors’ Remuneration Policy in accordance with our ongoing commitment to put this to shareholders for approval every three years. We have consulted with institutional shareholders on this over the last year and have taken into consideration these views in formulating the new policy. The new Directors’ Remuneration Policy supports our growth agenda and further details are set out in the explanatory notes to Resolution 3. In 2021 Unilever published its first Climate Transition Action Plan (CTAP). The CTAP sets out the actions we are taking to reduce greenhouse gas (GHG) emissions in our business and across our value chain aimed at our ambition to reach net zero by 2039. The CTAP received overwhelming support from our shareholders, reflected through an advisory vote at the Company’s 2021 Annual General Meeting. Shareholders now have the opportunity to voice their support for the 2024 update of the CTAP as reflected in Resolution 4 by way of an advisory vote. The updated CTAP responds to evolving stakeholder expectations by including new, near-term Scope 3 GHG reduction targets developed with reference to the Science Based Targets Initiative (SBTi) 1.5oC criteria and recommendations for near–term targets (see pages 7 and 8 for more details), more granularity about the actions we are going to take within our operations and our value chain, and details of how the plans are integrated into our business strategy. In the process of updating the CTAP, we consulted a variety of shareholders on the topic. We were pleased that the key elements of the plan – the new higher ambition new, near-term Scope 3 GHG reduction targets, the continued focus on absolute emission reductions rather than carbon offsetting, and the shift to focus on the specific Scope 3 emissions which we believe we can influence – were widely welcomed. Further details can be found in the explanatory notes to Resolution 4 and the Climate Transition Action Plan can be found on our website at www.unilever.com/agm. Amendments to the Articles of Association are proposed in order to provide a general update in accordance with company law and market practice. Full details of these are in the explanatory notes to Resolution 22 and the Appendix. Information on how to view the proposed new Articles of Association is set out in the explanatory notes to Resolution 22. The remaining resolutions cover ordinary course business for an AGM. Resolutions 1 and 2 and 5 to 13 cover consideration of the Annual Report and Accounts 2023, approval of the Directors’ Remuneration Report 2023 and the election and re-election of Directors. Resolutions 14 to 21 are similar to those which shareholders have passed in previous years, covering issues such as authorities for the allotment and repurchase of shares and the re-appointment of the auditor. Full explanations of all proposed resolutions are set out in the explanatory notes to the Resolutions. Your Board believes that all the resolutions set out in the Notice of Meeting are in the best interests of the Company and its shareholders. Accordingly, the Directors unanimously recommend that you vote in favour of the resolutions, as they intend to do themselves in respect of their own shares in the Company. Unilever understands that certain of our shareholders may be unable to attend the AGM in person. We will therefore be streaming a live webcast of the AGM (including the Q&A session) and details on how shareholders can access this webcast are provided on pages 13 and 14. Shareholders following the AGM remotely will be unable to submit questions during the meeting. Attending the live webcast of the AGM does not constitute attendance at the AGM. Shareholders are encouraged to submit questions for the Q&A session in advance by emailing shareholder. services@unilever.com before 1.00pm BST on Wednesday 17 April 2024 whether or not they intend to attend the AGM. After responding to these pre-submitted questions, shareholders who attend the AGM in person will be able to ask questions. Of course, you are also invited to write to me at any time should you wish. Alternatively, you may be able to find the answer to your question on our website at www.unilever.com. Any updates relating to the AGM will be included on Unilever’s website (www.unilever.com/agm). Unilever PLC Notice of Meeting Chair’s letter 2024 continued Unilever Chair’s Letter and Notice of Meeting 2024 3

Enclosed with this letter you will find the formal Notice of Meeting being convened, together with the Explanatory Notes to the business of the meeting. Our 2023 year-end documents are available on our website at www.unilever. com/ara. You can register your proxy vote either using our electronic voting facility via www.unilever.com/agm or by completing and returning the proxy form, in accordance with the instructions set out on the back of your proxy form. Institutional investors are able to cast their votes using CREST electronic proxy voting. Holders of shares in the Company held through Euroclear Nederland who wish to participate in the voting process can render their voting instructions electronically via www.abnamro.com/evoting. As usual at the AGM, all resolutions will be put to a poll. This will ensure an exact and definitive result. We encourage you to appoint the chair of the meeting as your proxy to ensure that your vote is counted if you are unable to attend and vote on the day of the AGM. The results of the AGM will be announced on the Unilever website www.unilever.com/agm as soon as possible after being released to the London Stock Exchange. All your votes are important to us and I would urge you to complete and return your votes by proxy in good time, and in any event no later than 11.30am BST on Monday 29 April 2024. Shareholders will have received the Unilever Annual Report and Accounts 2023, or will have been notified of its availability on our website at www.unilever.com/ara. The Company is encouraging all shareholders to receive shareholder communication and payments electronically as part of a commitment to reducing its environmental footprint. Please log onto www.investorcentre.co.uk for further information. I look forward to seeing as many of you as possible on 1 May 2024. Yours sincerely, Ian Meakins Chair Unilever PLC Notice of Meeting Chair’s letter 2024 continued Unilever Chair’s Letter and Notice of Meeting 20244

Notice is hereby given that the Annual General Meeting of Unilever PLC (the ‘Company’) will be held at Hilton London Bankside, 2-8 Great Suffolk Street, London SE1 0UG at 11.30am BST on Wednesday 1 May 2024 to transact the following business: To consider and, if thought fit, pass resolutions 1 to 17 (inclusive) as ordinary resolutions: 1. To receive and consider the Accounts and Balance Sheet for the year ended 31 December 2023, together with the Directors’ reports. 2. To consider and, if thought fit, approve the Directors’ Remuneration Report for the year ended 31 December 2023 which is set out on pages 116 to 153 of the Unilever Annual Report and Accounts 2023 (excluding the Directors’ Remuneration Policy which is set out on pages 119 to 127 of the Directors’ Remuneration Report). 3. To consider and, if thought fit, approve the Directors’ Remuneration Policy, the full text of which is included in the Directors’ Remuneration Report for the year ended 31 December 2023 and set out on pages 119 to 127 of the Unilever Annual Report and Accounts 2023. 4. To consider and, if thought fit, approve the Unilever Climate Transition Action Plan in the form produced to the meeting. 5. To elect Fernando Fernandez as a Director. 6. To re-elect Adrian Hennah as a Director. 7. To re-elect Andrea Jung as a Director. 8. To re-elect Susan Kilsby as a Director. 9. To re-elect Ruby Lu as a Director. 10. To elect Ian Meakins as a Director. 11. To elect Judith McKenna as a Director. 12. To re-elect Nelson Peltz as a Director. 13. To re-elect Hein Schumacher as a Director. 14. To reappoint KPMG LLP as Auditor of the Company to hold office until the conclusion of the next general meeting at which Accounts are laid before the members. 15. To authorise the Directors to fix the remuneration of the Auditor. 16. THAT in accordance with Section 366 of the Companies Act 2006, the Company and all companies that are its subsidiaries at any time during the period for which this resolution is effective be and are hereby authorised to: a make political donations (as such term is defined in Section 364 of the Companies Act 2006) to political parties to which Part 14 of the Companies Act 2006 applies and independent election candidates to whom Part 14 of the Companies Act 2006 applies, not exceeding £100,000 in aggregate in any financial year; b make political donations (as such term is defined in Section 364 of the Companies Act 2006) to political organisations to which Part 14 of the Companies Act 2006 applies other than to political parties (to which Part 14 of the Companies Act 2006 applies) not exceeding £100,000 in aggregate in any financial year; and c to incur political expenditure (as such term is defined in Section 365 of the Companies Act 2006) not exceeding £100,000 in aggregate in any financial year; in each case during the period beginning with the date of passing this resolution and ending at the earlier of the conclusion of next year’s Annual General Meeting or at close of business on 30 June 2025 provided that the aggregate expenditure under parts (a), (b) and (c) shall not exceed £100,000 in total. 17. THAT the Directors be and are hereby generally and unconditionally authorised pursuant to and in accordance with Section 551 of the Companies Act 2006 to exercise all the powers of the Company to allot shares in the Company and to grant rights to subscribe for or to convert any security into shares in the Company up to an aggregate nominal amount of £25,946,666, such authority to apply in substitution for all previous authorities pursuant to Section 551 of the Companies Act 2006 and to expire at the earlier of the conclusion of next year’s Annual General Meeting or at close of business on 30 June 2025, save that the Company may before such expiry make an offer or agreement which would or might require shares to be allotted or rights to subscribe for or convert securities into shares to be granted after such expiry and the Directors may allot shares or grant rights to subscribe for or convert securities into shares under any such offer or agreement as if the authority had not expired. To consider and, if thought fit, pass resolutions 18 to 22 (inclusive) as special resolutions: 18. THAT, subject to the passing of resolution 17 above, the Directors be authorised to allot equity securities (as defined in Section 560(1) of the Companies Act 2006) or to sell treasury shares wholly for cash pursuant to the authority given by resolution 17 above in each case: a in connection with a pre-emptive offer; and b otherwise than in connection with a pre-emptive offer, up to an aggregate nominal amount of £3,892,715; as if Section 561(1) of the Companies Act 2006 did not apply to any such allotment; provided that this authority shall expire at the earlier of the conclusion of next year’s Annual General Meeting or at close of business on 30 June 2025, save that the Company may, before such expiry, make offers and enter into agreements which would, or might, require equity securities to be allotted and treasury shares to be sold after such expiry and the Directors may allot equity securities and sell treasury shares in pursuance of any such offer or agreement as if the authority had not expired. For the purposes of this resolution: I. ‘pre-emptive offer’ means an offer of equity securities open for acceptance for a period fixed by the Directors to: i holders (other than the Company) on the register on a record date fixed by the Directors of ordinary shares in proportion to their respective holdings; and ii other persons so entitled by virtue of the rights attaching to any other equity securities held by them; but subject in both cases to such exclusions or other arrangements as the Directors may deem necessary or expedient in relation to treasury shares, fractional entitlements, record dates or legal, regulatory or practical problems in, or under the laws of, any territory; and Unilever PLC Notice of Meeting 2024 Unilever Chair’s Letter and Notice of Meeting 2024 5

II. the nominal amount of any securities shall be taken to be, in the case of rights to subscribe for or convert any securities into shares of the Company, the nominal amount of such shares which may be allotted pursuant to such rights. 19. THAT, subject to the passing of resolution 17 above and in addition to any authority granted under resolution 18 above, the Directors be authorised to allot equity securities (as defined in Section 560(1) of the Companies Act 2006) or sell treasury shares wholly for cash pursuant to the authority given by resolution 17 above as if Section 561(1) of the Companies Act 2006 did not apply to any such allotment or sale such authority to be: a limited to the allotment of equity securities or sale of treasury shares up to an aggregate nominal amount of £3,892,715; and b used only for the purposes of financing (or refinancing, if the authority is to be used within twelve months after the original transaction) a transaction which the Board of Directors of the Company determines to be an acquisition or other capital investment of a kind contemplated by the Statement of Principles on Disapplying Pre-Emption Rights most recently published by the Pre-Emption Group prior to the date of this Notice; provided that this authority shall expire at the earlier of the conclusion of next year’s Annual General Meeting or at close of business on 30 June 2025, save that the Company may, before such expiry, make offers and enter into agreements which would, or might, require equity securities to be allotted and treasury shares to be sold after the authority given by this resolution has expired and the Directors may allot equity securities and sell treasury shares under any such offer or agreement as if the authority had not expired. For the purposes of this resolution, the nominal amount of any securities shall be taken to be, in the case of rights to subscribe for or convert any securities into shares of the Company, the nominal amount of such shares which may be allotted pursuant to such rights. 20. THAT the Company be and is hereby generally and unconditionally authorised for the purpose of Section 701 of the Companies Act 2006 to make one or more market purchases (within the meaning of Section 693(4) of the Companies Act 2006) of ordinary shares of 31/9p each in the capital of the Company, subject to the following conditions: a the maximum number of shares which may be hereby purchased is 250,200,000 ordinary shares; b the minimum price, exclusive of expenses, which may be paid for each ordinary share is 31/9p; and c the maximum price, exclusive of expenses, which may be paid for each ordinary share is not more than the higher of: (i) 5% above the average market value of an ordinary share for the five business days immediately preceding the day on which that ordinary share is contracted to be purchased; and (ii) the higher of the price of the last independent trade and the highest current independent bid on the trading venue where the purchase is carried out. The authority conferred by this resolution shall expire at the earlier of the conclusion of next year’s Annual General Meeting or at close of business on 30 June 2025, save that the Company may before such expiry enter into any contract under which a purchase of ordinary shares may be completed or executed wholly or partly after such expiry and the Company may purchase ordinary shares in pursuance of such contract as if the authority conferred hereby had not expired. 21. THAT a general meeting other than an annual general meeting may be called on not less than 14 clear days’ notice. 22. THAT, with effect from the conclusion of this Annual General Meeting, the draft Articles of Association of the Company in the form produced to the meeting and signed by the Chair of the meeting for the purpose of identification be adopted as the articles of association of the Company in substitution for, and to the exclusion of, the Company’s existing articles of association. By order of the Board Maria Varsellona Chief Legal Officer and Group Secretary 18 March 2024 Unilever PLC Notice of Meeting 2024 continued Unilever Chair’s Letter and Notice of Meeting 20246

The explanatory notes that follow form part of the notice of this AGM and provide important information regarding the items of business to be considered at the AGM. Resolutions 1 to 17 (inclusive) are proposed as ordinary resolutions. This means that for each of these resolutions to be passed, more than half the votes cast must be in favour of the resolution. Resolutions 18 to 22 (inclusive) are proposed as special resolutions. This means that for each of these resolutions to be passed, at least three-quarters of the votes cast must be in favour of the resolution. Resolution 1 Report and Accounts for the year ended 31 December 2023 The Directors must lay the Company’s Accounts, the Directors’ Report, the Auditor’s Report and the Strategic Report before the shareholders at a general meeting. This is a legal requirement after the Directors have approved the Accounts, the Directors’ Report and the Strategic Report, and the Auditor has prepared its Report. Resolution 2 Directors’ Remuneration Report Resolution 2 is an advisory vote to approve the Directors’ Remuneration Report for the year ended 31 December 2023, which is set out on pages 116 to 153 of the Unilever Annual Report and Accounts 2023 (excluding the Directors’ Remuneration Policy which is set out on pages 119 to 127 of the Directors’ Remuneration Report). The Directors’ Remuneration Report has been prepared in accordance with the Large and Medium-sized Companies and Groups (Accounts and Reports) Regulations 2008 (as amended) and approved by the Directors. Shareholders must, under Section 439 of the Companies Act 2006, be given the opportunity to approve the Directors’ Remuneration Report. In accordance with these requirements, this is an advisory vote meaning that the Directors’ entitlements to remuneration are not conditional upon the resolution being passed. Resolution 3 Directors’ Remuneration Policy The full text of the Directors’ Remuneration Policy is set out on pages 119 to 127 of the Annual Report and Accounts 2023. The Directors’ Remuneration Policy was last put to shareholders at the AGM in April 2021 and was approved by 93.5% of investors. We have engaged with our largest shareholders in the last year to discuss the renewal of the Directors’ Remuneration Policy and the proposed Directors’ Remuneration Policy reflects the feedback that we have received. The Company believes that the current remuneration structure reflects the market norms for a European listed company and does not propose to make any changes to the overall structure or the incentive quantum. Accordingly the proposed structure of the new Directors’ Remuneration Policy follows the structure of the current Directors’ Remuneration Policy that was approved by shareholders in 2021 and no changes are proposed to this: – fixed pay comprising a consolidated base salary and contribution in lieu of pension; – benefits such as life insurance and medical insurance; – an annual bonus with 50% paid in cash and 50% deferred in to Unilever shares vesting after 3 years; and – a performance share plan which vests after three years subject to performance and followed by a two year holding period. The two key changes that are proposed to be made are: I. to amend the remuneration benchmarking peer group to focus on global consumer companies. Following feedback from investors we propose to focus our peer group solely on consumer companies and to extend the peer group from European only companies to European and US companies. This provides a better comparison with Unilever’s global profile. The new peer group is set out in full in the proposed Directors’ Remuneration Policy on www.unilever.com/agm; and II. to amend the performance measures and weightings used in the annual bonus and performance share plan for 2024 onwards. With respect to the annual bonus, Underlying Operating Profit, including the impact of restructuring, will replace Underlying Operating Margin as one of the measures as this provides a focus on absolute profitability. With respect to the performance share plan, Underlying Sales Growth will be included in place of % Business Winning and Relative Total Shareholder Return will be included in place of Cumulative Free Cashflow. Our consultation indicates that this aligns remuneration with the focus of investors. The complete set of measures and the weightings attached to them are set out in the new Directors’ Remuneration Policy. Following the AGM in 2023, where the advisory vote on the Directors’ Remuneration Report was not approved by a majority of shareholders, we consulted with shareholders on Directors’ remuneration and announced on 30 October 2023 that the fixed pay of the Chief Executive Officer would not be increased in 2024 or 2025. The commitment to this will remain in place under the proposed new Directors’ Remuneration Policy. We confirm in addition that the remuneration of our Chief Financial Officer already sits within the framework of the proposed Directors’ Remuneration Policy and is at the median level of the peer pay benchmarking group. The vote on Resolution 3 is binding in nature and, if approved, the revised Directors’ Remuneration Policy will take effect from the end of this AGM. Once the Directors’ Remuneration Policy has been approved, the Company may not make a remuneration payment or payment for loss of office to a director or former director of the Company unless that payment is consistent with the approved Directors’ Remuneration Policy, or has otherwise been approved by a shareholder resolution. Shareholders must, under Section 439A of the Companies Act 2006, be given the opportunity to approve the Directors’ Remuneration Policy at least every three years by way of a binding vote. Shareholder approval is for a period of up to three years and so a Directors’ Remuneration Policy will be put to shareholders for approval again no later than the Annual General Meeting of the Company in 2027. A copy of the Directors’ Remuneration Policy which was approved at the annual general meeting in 2021 is available on our website at www.unilever.com/ara. Resolution 4 Updated Climate Transition Action Plan (CTAP) In 2021, the Company published its first CTAP and Resolution 4 is an advisory vote to approve an updated CTAP. The updated CTAP sets out the actions we are taking to reduce greenhouse gas (GHG) emissions in our business and across our value chain aimed at our ambition to reach net zero emissions by 2039. Shareholders overwhelmingly supported Unilever’s climate strategy, reflected through an advisory vote on the CTAP at the 2021 Annual General Meeting. The plan included a commitment to report progress against the CTAP within our Annual Report and Accounts, and a commitment to return to shareholders in 2024 with an updated plan. While we have succeeded in reducing emissions in our operations by 74% in absolute terms (vs 2015) and reducing the emissions intensity of our products across our value chain by 21% (vs 2010), achieving significant absolute reductions in our Scope 3 emissions has proven more challenging. This has prompted us to look again at where and how we believe we Explanatory notes to the resolutions Unilever Chair’s Letter and Notice of Meeting 2024 7

Explanatory notes to the resolutions continued can seek absolute emissions reductions in our value chain, resulting in the updated CTAP which sets out new, near-term Scope 3 GHG reduction targets developed with reference to the Science Based Targets Initiative (SBTi) 1.5oC criteria and recommendations for near–term targets1 and time-bound emissions reduction plans that are integrated into our five Business Groups’ financial growth plans. These targets have been submitted to the SBTi for validation. The development of these plans has been informed by significant improvements in the measurement of our GHG emissions, allowing us to build more granular action plans. The updated CTAP therefore includes our existing near-term targets to reduce GHG emissions from our operations (Scope 1&2) by 2030 by 100% against a 2015 baseline (and by 70% by 2025 against a 2015 baseline), new near-term targets to reduce value chain (Scope 3) GHG emissions from energy and industrial sources by 42% by 2030 against a 2021 baseline, and value chain (Scope 3) GHG emissions from forest, land and agriculture by 30.3% by 2030 against a 2021 baseline. We will retire our current value chain emissions intensity targets once our new near-term Scope 3 GHG reduction targets have been validated by the SBTi. The new Scope 3 targets follow the scope of our Net Zero by 2039 ambition in excluding indirect consumer use emissions (e.g. emissions from the hot water in showers when consumers use our products) over which we have little direct influence. These new targets, and the CTAP, were designed to drive near-term delivery. Full details of these targets can be found in the CTAP. The CTAP sets out the priority action areas for delivering these targets. They cover key phases of the lifecycle of our products, including the raw materials we purchase, their production and distribution, packaging, direct emissions in the consumer-use phase, and finally, their end of life. Some action areas are relevant to all Business Groups (such as the Supplier Climate Programme, Packaging, and Logistics). Others are specific to one or more Business Groups (US and Canada Aerosol Propellants for Beauty & Wellbeing and Personal Care, Ice Cream Cabinets for Ice Cream). The action areas have been integrated into each of our Business Groups’ financial growth plans. These plans identify mitigating actions capable of delivering our near-term Scope 1&2 GHG reduction target and approximately two-thirds of our near-term Scope 3 GHG reduction targets, with one-third left to find in the coming years. The CTAP also provides information on how the plan will be governed, including information on progress reporting, and supporting policies to enable delivery. We have also recognised the need for more targeted external engagement to drive systemic change. Detailed advocacy priorities now target specific barriers to the delivery of our CTAP and provide increased clarity on where we must work with governments, regulators, or industry to shift the systems of which we are a part. The updated CTAP will drive progress towards our targets, but we know we have more to do. Our commitment to transparent and regular reporting, Board oversight, climate-linked executive remuneration, and a focus on emissions reductions rather than offsetting, should help us to progress at pace. In addition to the specific mitigating actions set out in the CTAP, we know we have more to do to reach our near-term Scope 3 GHG reduction targets. The Company recognises additional innovations will be needed if we are to meet both these near-term targets and deliver our Net Zero by 2039 ambition. We believe that by being open and transparent about our challenges and dependencies, both for the plan as a whole and for the specific action areas identified within the plan, we can help accelerate the changes needed to get our business and the world on track for net zero. In the process of updating the CTAP, we consulted a variety of shareholders on the topic. The feedback was overall positive towards Unilever’s approach. We were pleased that the key elements of the plan – the new higher ambition near-term Scope 3 GHG reduction targets, the continued focus on absolute emission reductions rather than carbon offsetting, and the shift to focus on the specific Scope 3 emissions which we believe we can influence – were widely welcomed. The Board and the Unilever Leadership Executive are responsible for setting Unilever’s climate strategy and implementing it. We engaged with certain shareholders as part of our updating process, seeking their feedback so that we could take it into account in making our decision as to how to update the plan. We are grateful to those shareholders who provided feedback on the plan and we view the advisory vote on the CTAP as an opportunity for all our shareholders to provide us with feedback on our updated plan, which we will take into account in making future decisions regarding further updates to our plan. We would like to make it clear that the advisory vote is non-binding and we are not asking shareholders to take responsibility for approving or objecting to the Company’s climate strategy. If a significant number of votes are cast against the resolution to approve the CTAP (more than 20%), we will engage with, and provide updates to, investors as prescribed under provision 4 of the UK Corporate Governance Code and, as mentioned above, we will take the voting outcome for this resolution into account when making future decisions regarding further updates to our plan. A copy of the updated Climate Transition Action Plan is available on the Unilever website at www.unilever.com/agm. 1 v5.1 (April 2023) Resolutions 5 to 13 Election and re-election of Executive and Non-Executive Directors All Executive Directors and Non-Executive Directors retire each year with such retirement to become effective at the conclusion of the Annual General Meeting of the Company. In deciding whether to nominate a Director, the Board takes into consideration the outcomes of the Chairman’s discussions with each Director on individual performance, the evaluation of the Board and its Committees and the continued good performance of individual Directors. Non-Executive Directors normally serve for a period of up to nine years. Ian Meakins, Fernando Fernandez and Judith McKenna have each been proposed for election as a Director. The evaluation of the Board conducted in respect of 2023 considered that all Directors being proposed for election or re-election were effective in their roles and were committed to making available the appropriate time for Board meetings and other duties. Each Director also continues to demonstrate his/her broad and relevant experience, commitment to his/ her role and international outlook. Further information about the evaluation can be found on page 96 of the Unilever Annual Report and Accounts 2023. An overview of the skills and experience of the Directors and the biographical details of each Director proposed for re-election and election can be found on pages 84 and 85 of the Unilever Annual Report and Accounts 2023. Therefore, the Board of Directors, following the recommendations made by the Nominating and Corporate Governance Committee, proposes to elect and re-elect the nominated Directors. Unilever Chair’s Letter and Notice of Meeting 20248

Explanatory notes to the resolutions continued Resolution 14 Reappointment of Auditor At each meeting at which Accounts are laid before the members, the Company is required to appoint an Auditor or Auditors to serve until the next such meeting. Resolution 15 This resolution gives authority to the Directors to determine the Auditor’s remuneration, which will be disclosed in the next set of Accounts of the Company. Resolution 16 Political donations and expenditure Part 14 of the Companies Act 2006 imposes restrictions on companies making political donations to: (a) political parties; (b) other political organisations; and (c) independent election candidates and on incurring political expenditure (in each case, as defined in the Companies Act 2006) without shareholders’ consent. It is the policy of the Company not to make such political donations or to incur political expenditure (within the ordinary meaning of those words) and the Directors have no intention of changing that policy. However, as the definitions used in the Companies Act 2006 are broad, it is possible that normal business activities, which might not be thought to be political donations or expenditure in the usual sense, could be caught. On that basis, the authority is being sought purely as a precaution. Resolution 17 Directors’ authorities to allot shares Renewal of this authority is sought at the Annual General Meeting each year. Section 551 of the Companies Act 2006 provides that the Directors may not issue new shares without shareholder approval. The purpose of this resolution, therefore, is to give the Directors the authority to issue new shares, limited to a maximum of £25,946,666 in new shares at their nominal value (representing 834,000,000 ordinary shares). At 1 March 2024, being the latest practicable date prior to publication of the Notice of Meeting, this represented approximately one- third of the Company’s issued ordinary share capital (excluding treasury shares and ordinary shares (including ordinary shares represented by Unilever PLC ADRs) held by or on behalf of companies in the Unilever Group). The authority sought under this resolution will expire at the earlier of the conclusion of next year’s Annual General Meeting or the close of business on 30 June 2025, being the last date by which the Company must hold an Annual General Meeting in 2025. The Directors have no present intention of exercising the authority sought under this resolution, save that the Company may issue new shares for the purposes of satisfying awards under employee share schemes. As at 1 March 2024, being the latest practicable date prior to publication of the Notice of Meeting, the Company held 16,181,572 ordinary shares in treasury (representing 0.64% of the ordinary issued share capital of the company (excluding treasury shares). As at 1 March 2024, 2,855,817 ordinary shares (including ordinary shares represented by Unilever PLC ADSs) were held by or on behalf of companies in the Unilever Group. The voting rights attaching to those ordinary shares are not exercisable. Therefore, as at 1 March 2024 and excluding those ordinary shares (including ordinary shares represented by Unilever PLC ADSs) held by or on behalf of companies in the Unilever Group, the total number of ordinary shares with exercisable voting rights is 2,502,459,949. Resolutions 18 and 19 Disapplication of pre-emption rights Under the Companies Act 2006, a company is generally not permitted to allot shares for cash without first offering those shares: (i) to holders of ordinary shares in proportion to their existing holdings; and (ii) in accordance with a detailed set of procedural requirements. These restrictions may be disapplied in whole or in part provided that shareholder approval is obtained by special resolution, as described below. In these explanatory notes to Resolutions 18 and 19, reference to an allotment of shares includes allotments of other types of equity securities as well as sales of treasury shares. Resolution 18: disapplication for pre-emptive offers and limited non pre-emptive offers Part (a) of Resolution 18 seeks shareholder authority for the Directors to allot shares for cash without regard to the procedural requirements noted above, provided that the shares are offered to holders of ordinary shares in proportion to their existing holdings. This authority will provide Directors with the flexibility, in connection with such an offer, to make such arrangements as they deem appropriate to deal with relevant legal, regulatory or practical issues, for example, in relation to fractional entitlements. Part (b) of Resolution 18 seeks shareholder authority for the Directors to allot a limited number of shares for cash, without first offering those shares to holders of ordinary shares in proportion to existing holdings. The aggregate nominal value of shares that may be allotted pursuant to part (b) is £3,892,715. This amount is equivalent to 5% of the total issued ordinary share capital of the Company (excluding treasury shares and ordinary shares (including ordinary shares represented by Unilever PLC ADSs) held by or on behalf of companies in the Unilever Group), as at 1 March 2024, being the latest practicable date prior to publication of the Notice of Meeting. As at 1 March 2024, being the latest practicable date prior to publication of the Notice of Meeting, the Company held 16,181,572 ordinary shares in treasury. As at 1 March 2024, 2,855,817 ordinary shares (including ordinary shares represented by Unilever PLC ADSs) were held by or on behalf of companies in the Unilever Group. The voting rights attaching to those ordinary shares are not exercisable. Therefore, as at 1 March 2024 and excluding those ordinary shares (including ordinary shares represented by Unilever PLC ADSs) held by or on behalf of companies in the Unilever Group, the total number of ordinary shares with exercisable voting rights is 2,502,459,949. Resolution 19: disapplication for limited non pre-emptive offers in connection with acquisitions and specified capital investments The purpose of Resolution 19 is to provide Directors with an additional authority to that sought under part (b) of Resolution 18, for use in the limited circumstances described below. Resolution 19 seeks shareholder authority for the Directors to allot an additional, limited number of shares for cash, without first offering those shares to holders of ordinary shares in proportion to existing holdings. However, any such allotment may only be made in connection with an acquisition or specified capital investment which is announced contemporaneously with the allotment, or which has taken place in the preceding twelve month period and is disclosed in the announcement of the allotment. Unilever Chair’s Letter and Notice of Meeting 2024 9

For these purposes, a ‘specified capital investment’ means one or more specific capital investment related uses for the proceeds of an allotment of shares, in respect of which sufficient information regarding the effect of the transaction on the Company, the assets the subject of the transaction and (where appropriate) the profits attributable to them is made available to shareholders to enable them to reach an assessment of the potential return. The aggregate nominal value of shares that may be allotted pursuant to Resolution 19 is £3,892,715. This amount is equivalent to 5% of the total issued ordinary share capital of the Company (excluding treasury shares and ordinary shares (including ordinary shares represented by Unilever PLC ADSs) held by or on behalf of companies in the Unilever Group), as at 1 March 2024 (being the latest practicable date prior to publication of the Notice of Meeting) and is in addition to an equivalent number of shares which may be allotted pursuant to part (b) of Resolution 18. If the authority sought in Resolution 19 is used, the Company will publish details of such use in its next annual report. As at 1 March 2024, the Company held 16,181,572 ordinary shares in treasury. The Directors have no current intention of exercising the authorities sought in Resolutions 18 and 19 but consider that they are appropriate in order to allow the Company the flexibility to finance business opportunities without the need to comply with the strict requirements of the Companies Act 2006. The Directors will only exercise such authorities where they consider that doing so is in the best interests of the Company. The authorities sought under Resolutions 18 and 19 are in line with institutional shareholder guidance, and in particular, with the Pre-Emption Group Principles and the Investment Association’s share capital management guidelines. In respect of Resolutions 18 and 19, the Directors confirm their intention to follow the shareholder protections in Part 2B of the Pre-Emption Group Principles and, if relevant, the expected features of a follow-on offer as set out in paragraph 3 of the Pre-Emption Group Principles. The authorities sought under Resolutions 18 and 19 will expire at the earlier of the conclusion of next year’s Annual General Meeting or the close of business on 30 June 2025, being the last date by which the Company must hold an Annual General Meeting in 2025. Resolution 20 Company’s authority to purchase its own shares Renewal of this authority is also sought at the Annual General Meeting each year. The Directors believe that it is advantageous for the Company to have the flexibility to purchase its own shares, and this resolution provides the authority from shareholders to do so. The resolution specifies the maximum number of shares which may be acquired which at 1 March 2024 (being the latest practicable date prior to the publication of this Notice of Meeting) represented just under 10% of the Company’s issued ordinary share capital (excluding treasury shares and ordinary shares (including ordinary shares represented by Unilever PLC ADSs) held by or on behalf of companies in the Unilever Group, as detailed below) and the maximum and minimum prices at which they may be bought. As at 1 March 2024, the Company held 16,181,572 ordinary shares in treasury. As at 1 March 2024, 2,855,817 ordinary shares (including ordinary shares represented by Unilever PLC ADSs) were held by or on behalf of companies in the Unilever Group. The voting rights attaching to those ordinary shares are not exercisable. Therefore, as at 1 March 2024 and excluding those ordinary shares (including ordinary shares represented by Unilever PLC ADSs) held by or on behalf of companies in the Unilever Group, the total number of ordinary shares with exercisable voting rights in the Company is 2,502,459,949. The purchase of shares by the Company under this authority would be carried out by a purchase in the market and should not be confused with any share dealing facilities which may be offered to shareholders by the Company from time to time. The Company would consider holding any of its own shares that it purchases pursuant to the authority conferred by this resolution as treasury shares. This would give the Company the ability to sell or transfer treasury shares quickly and cost- effectively, including for the purposes of meeting obligations under employees’ share schemes, and would provide the Company with additional flexibility in the management of its capital base. The authority sought under this resolution will expire at the earlier of the conclusion of next year’s Annual General Meeting or the close of business on 30 June 2025, being the last date by which the Company must hold an Annual General Meeting in 2025. Any shares purchased would be held as ‘treasury shares’, in which case they could be held in the name of the Company or another Unilever Group company pending their use to meet obligations under an employee share scheme or resale. Shares purchased and not otherwise so used may also be cancelled at the discretion of the Company. Resolution 21 Notice period for General Meetings This resolution seeks the approval of shareholders (as required by the Companies (Shareholders’ Rights) Regulations 2009 (the ‘Shareholders’ Rights Regulations’)) to replace a similar authority granted to the Directors at the 2023 Annual General Meeting to allow the Company to call general meetings (other than annual general meetings) on 14 clear days’ notice. The Company does not intend to use this authority routinely. The Company envisions that this authority would be used only in limited circumstances for time-sensitive matters where a shorter notice period would be to the advantage of shareholders as a whole. The Company would also need to meet the requirements for electronic voting in the Shareholders’ Rights Regulations before it could then call a general meeting on 14 clear days’ notice. The authority sought under this resolution will expire at the earlier of the conclusion of next year’s Annual General Meeting or the close of business on 30 June 2025, being the last date by which the Company must hold an Annual General Meeting in 2025. Resolution 22 Adoption of new Articles of Association This resolution seeks approval of the adoption of the new Articles of Association of the Company (the “New Articles of Association”), to reflect changes to company law and market practice. The changes introduced in the New Articles of Association are summarised in the Appendix to this Notice. A copy of the New Articles of Association, and a version of the New Articles of Association showing the changes made, are available for inspection on the Unilever website at www. unilever.com.agm. Explanatory notes to the resolutions continued Unilever Chair’s Letter and Notice of Meeting 202410

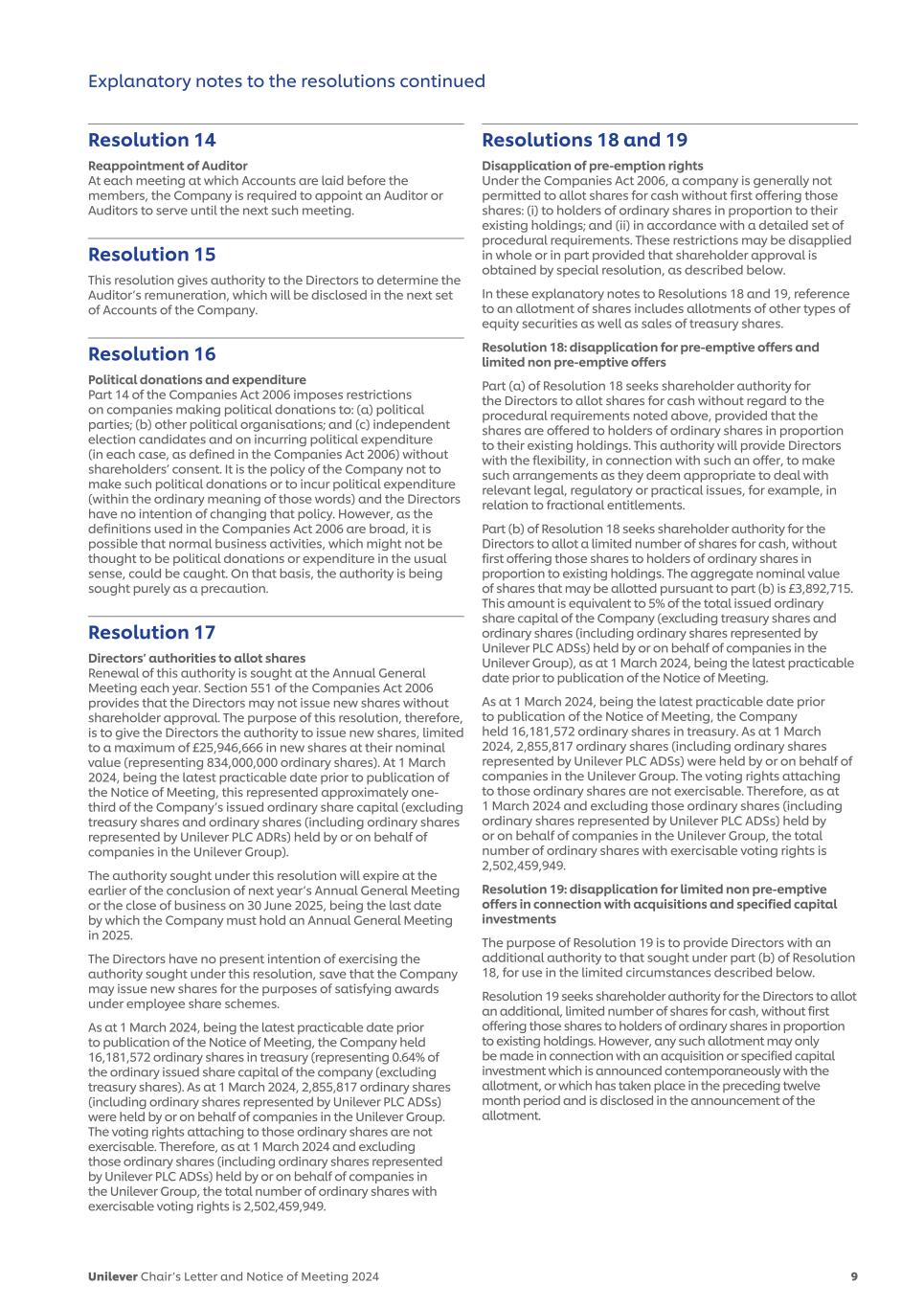

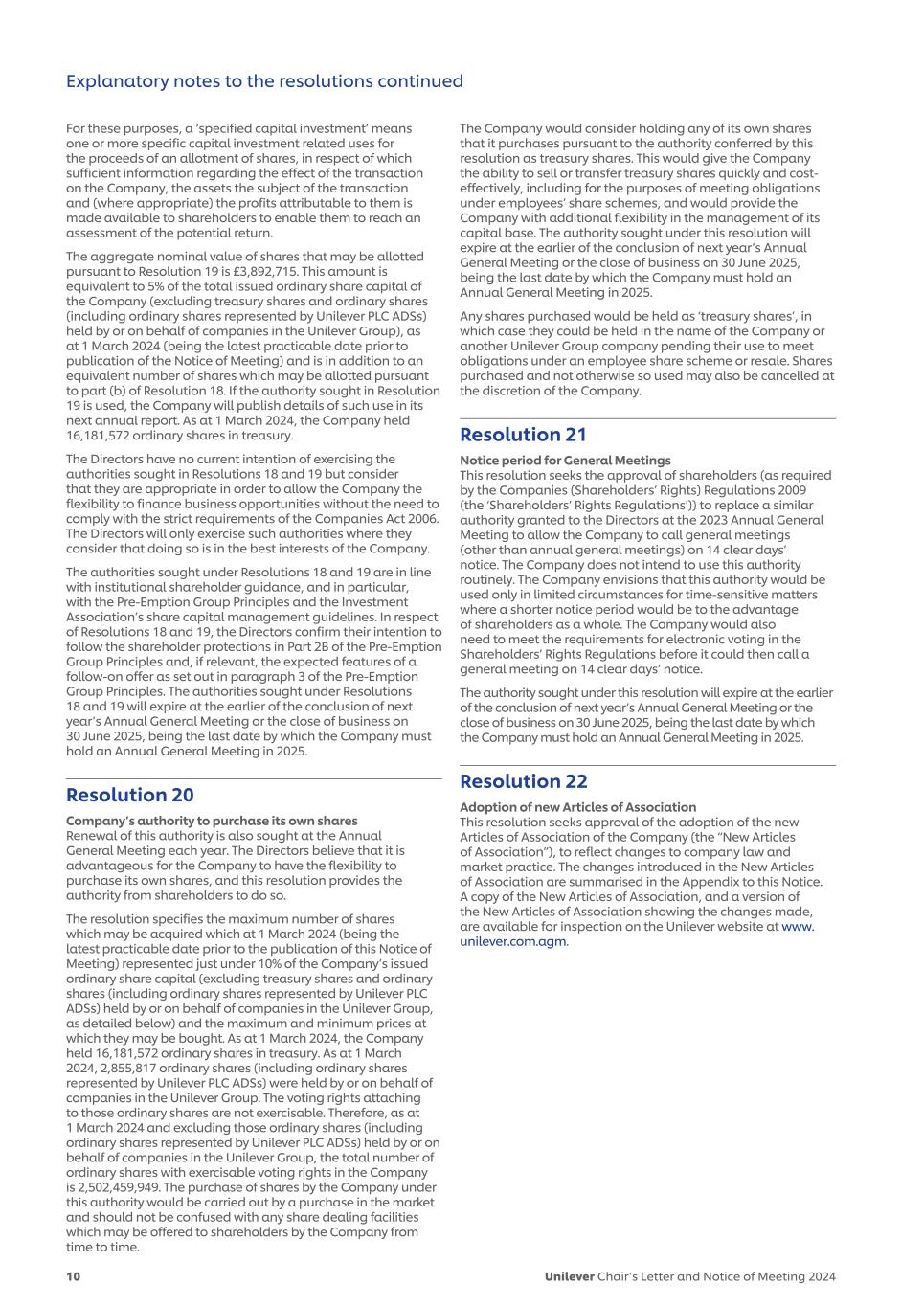

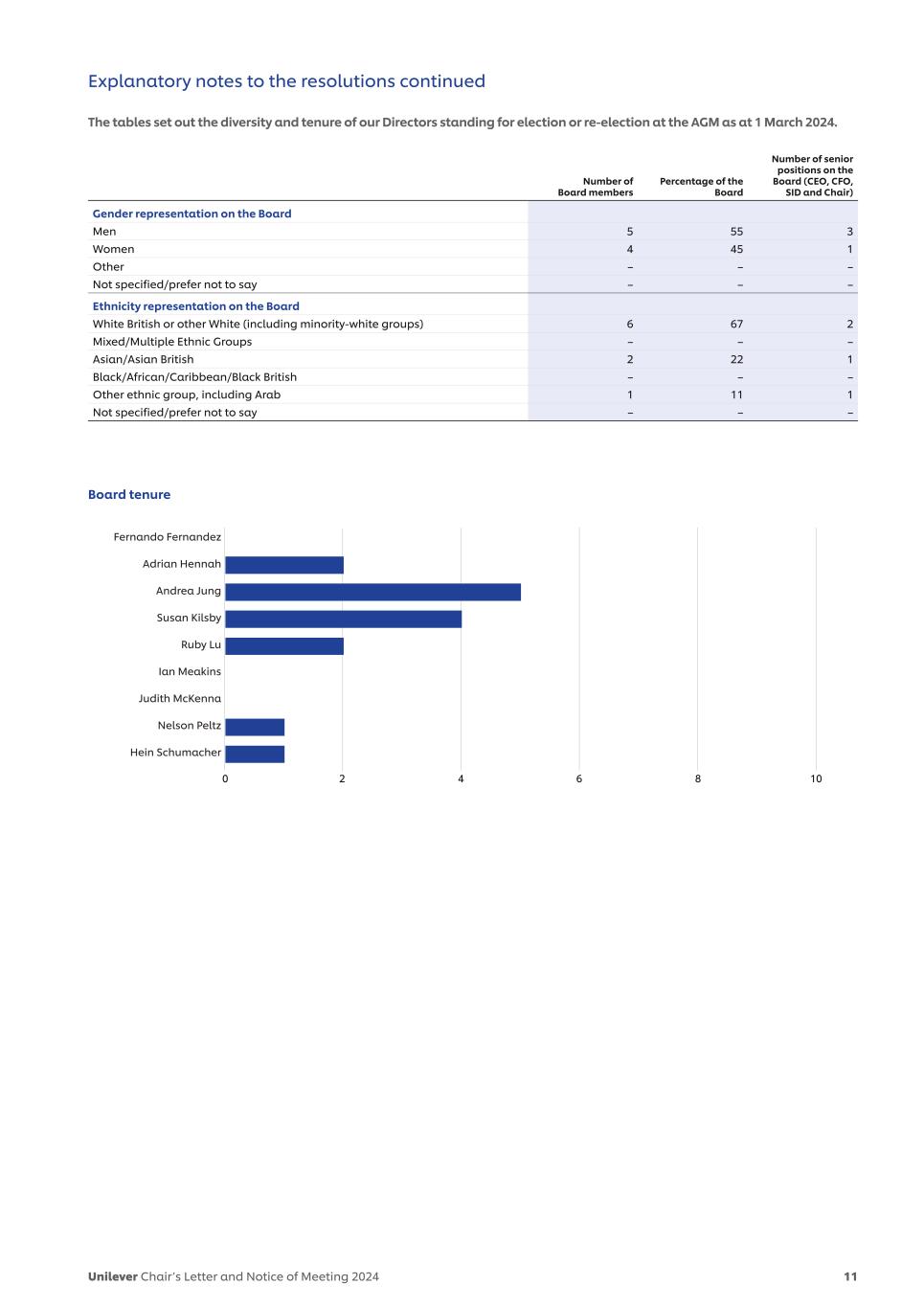

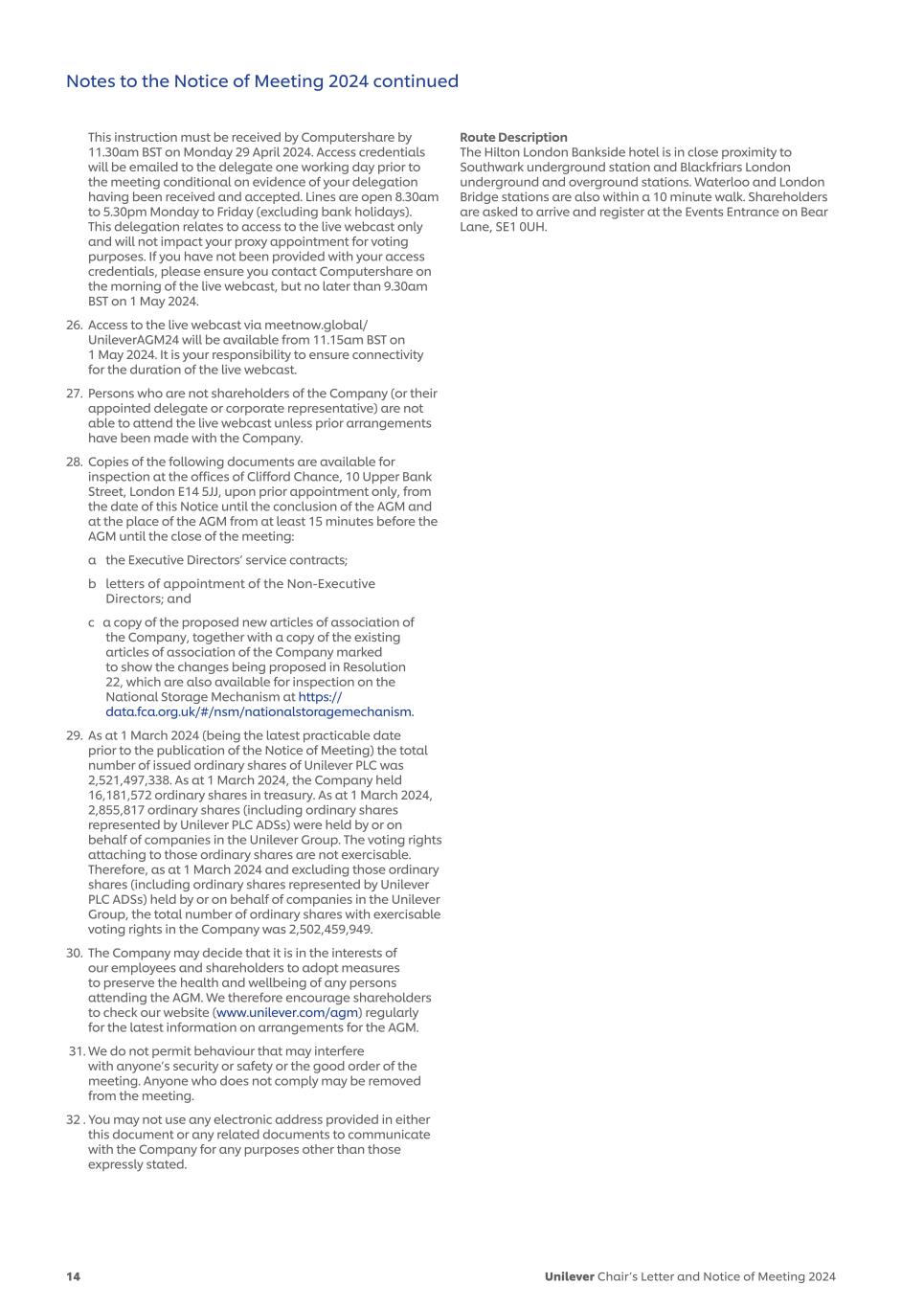

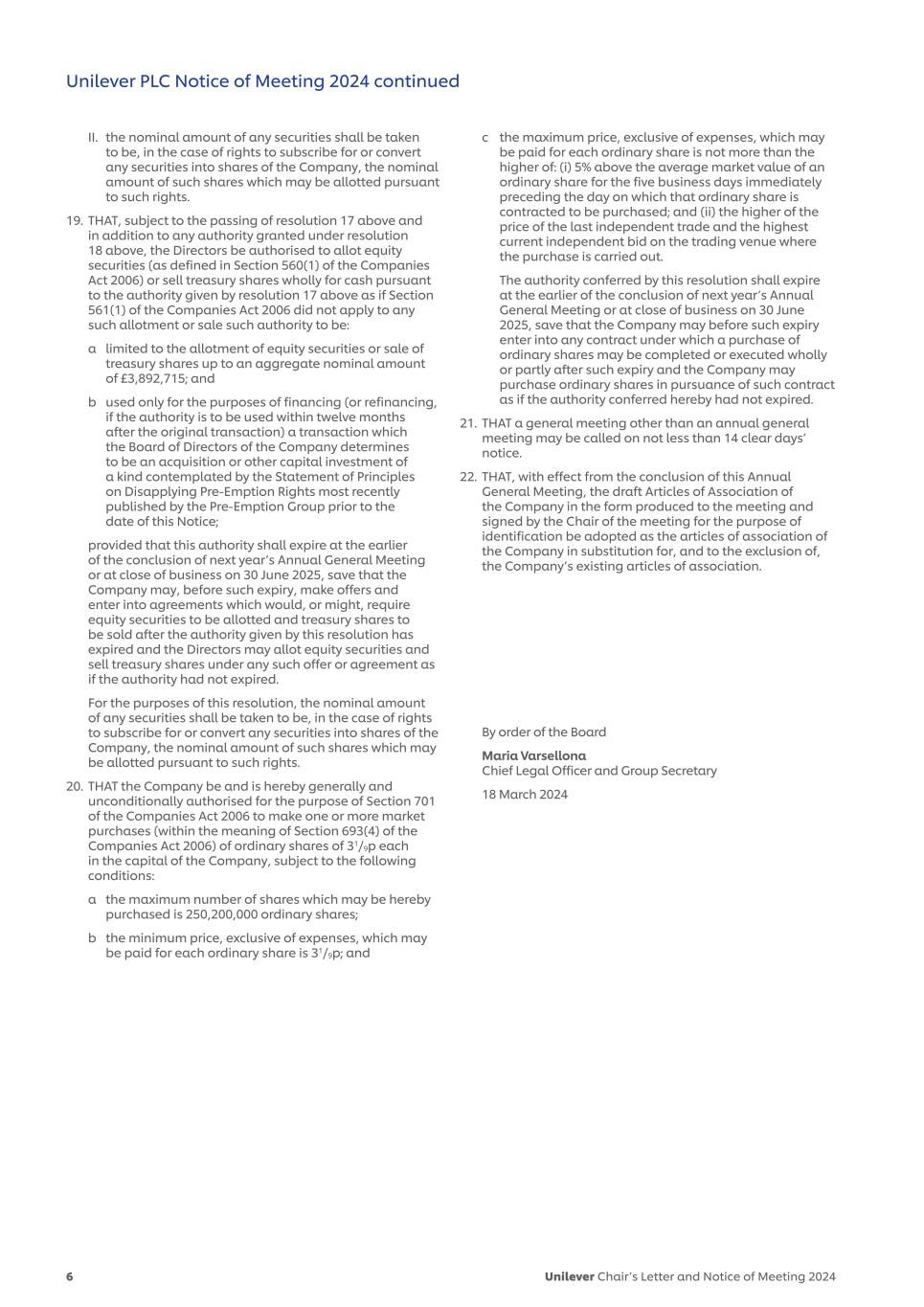

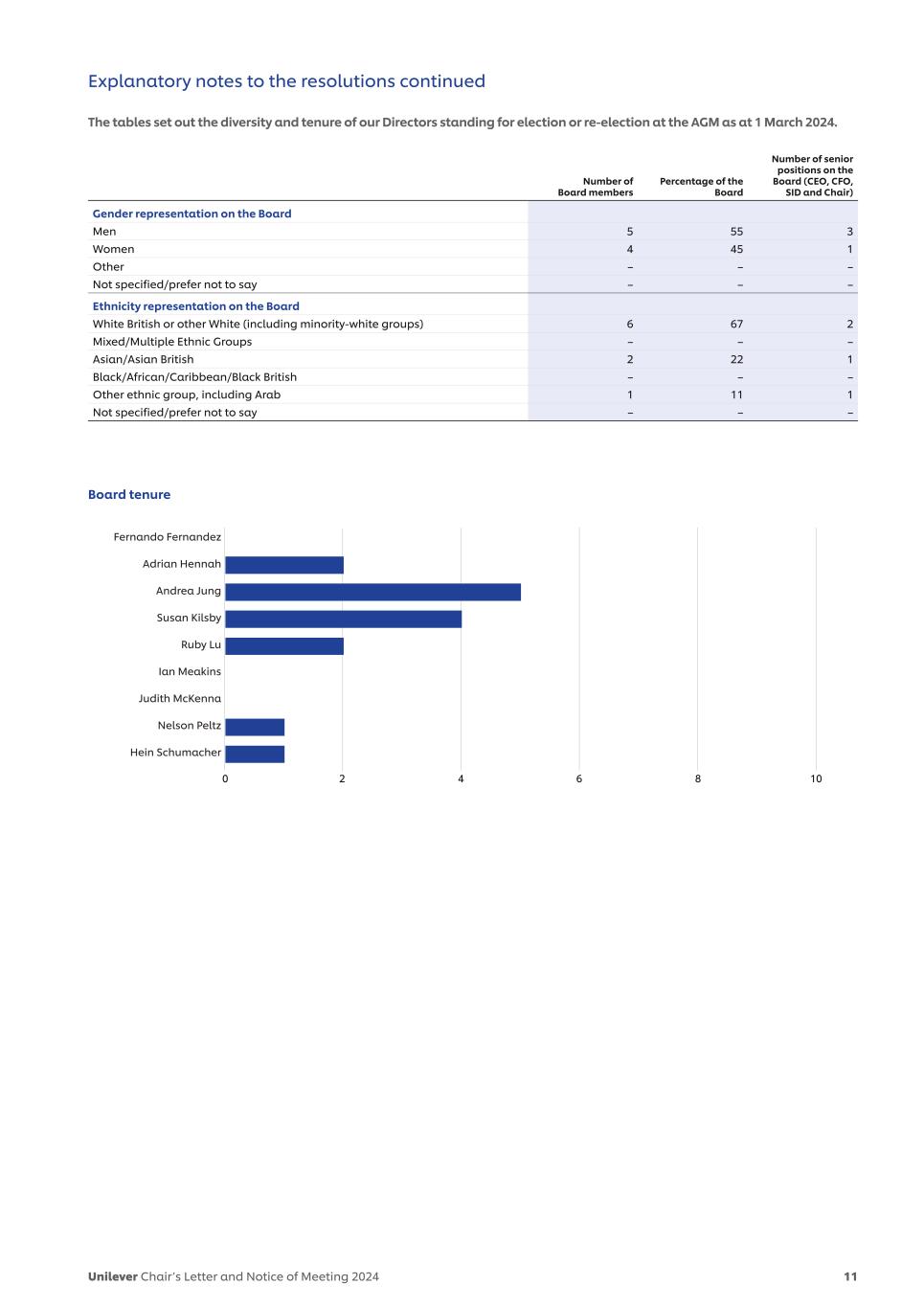

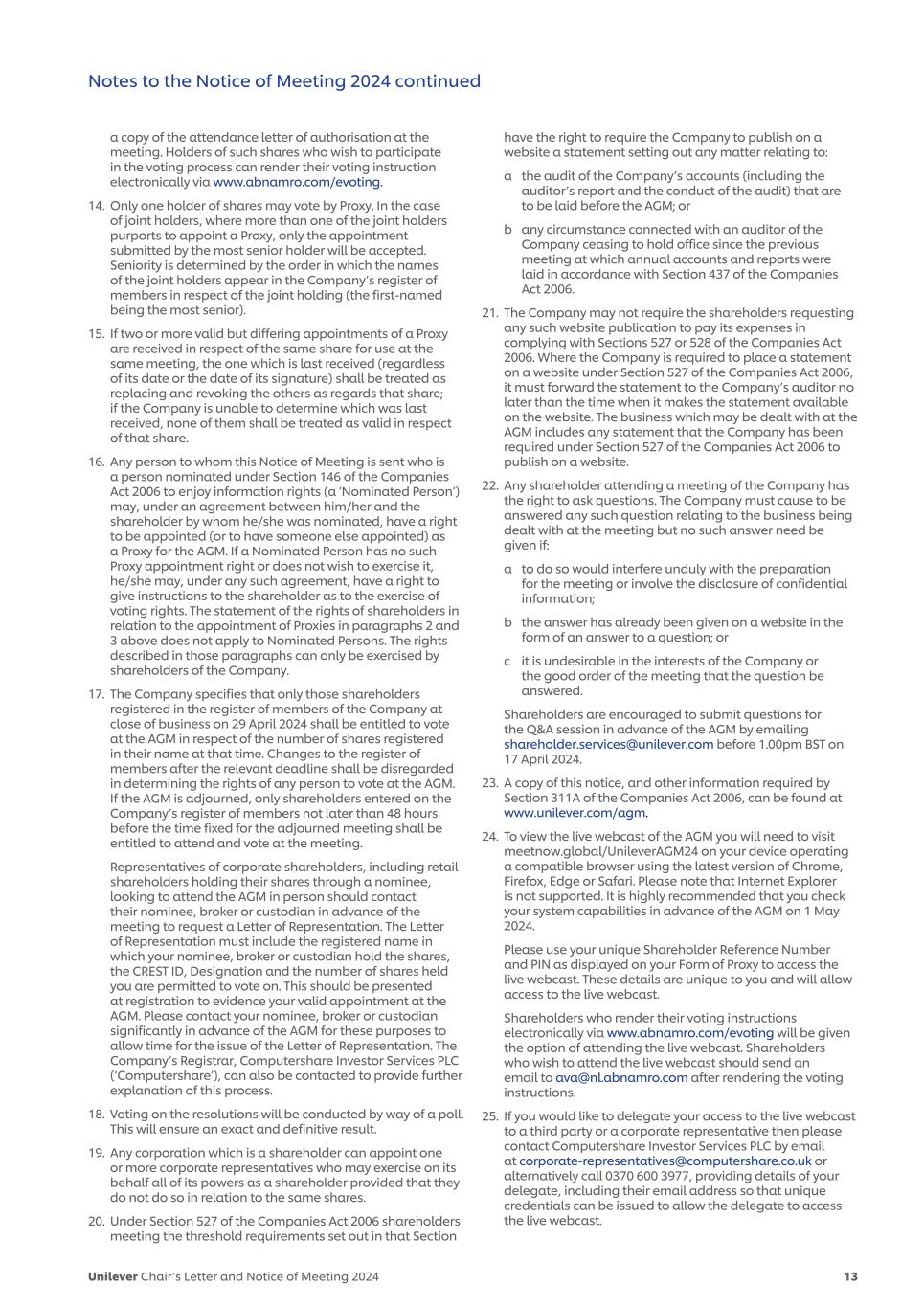

The tables set out the diversity and tenure of our Directors standing for election or re-election at the AGM as at 1 March 2024. Explanatory notes to the resolutions continued Unilever Chair’s Letter and Notice of Meeting 2024 11 Number of Board members Percentage of the Board Number of senior positions on the Board (CEO, CFO, SID and Chair) Gender representation on the Board Men 5 55 3 Women 4 45 1 Other – – – Not specified/prefer not to say – – – Ethnicity representation on the Board White British or other White (including minority-white groups) 6 67 2 Mixed/Multiple Ethnic Groups – – – Asian/Asian British 2 22 1 Black/African/Caribbean/Black British – – – Other ethnic group, including Arab 1 11 1 Not specified/prefer not to say – – – Board tenure Fernando Fernandez Adrian Hennah Andrea Jung Susan Kilsby Ruby Lu Ian Meakins Judith McKenna Nelson Peltz Hein Schumacher 0 2 4 6 8 10

1. Shareholders will have the right to attend and vote at the Annual General Meeting (AGM). Registration will start at 10.45am BST. If you are attending the AGM in person please bring the Attendance Card included within your Proxy Form or, if you opt to receive your communications electronically, a copy of your shareholder email and hand it in on arrival. It is necessary for your admission to the meeting. If you do not bring this form or email with you, then proof of identification will be required for you to gain admittance to the AGM. 2. A shareholder who is unable or does not wish to attend the AGM is entitled to appoint one or more Proxies to exercise all or any of his/her rights to attend and to speak and vote on his/her behalf at the meeting. A Proxy need not be a shareholder. A Proxy Form which may be used to make such appointment and give Proxy instructions accompanies this Notice of Meeting. If you do not have a Proxy Form and believe that you should have one, or if you require additional forms, please contact Computershare Investor Services PLC on 0370 600 3977. You can only appoint a Proxy using the procedures set out in these notes and the notes to the Proxy Form. The return of a completed Proxy Form, or the registration of appointment of a Proxy or any CREST Proxy Instruction (as described in paragraph 11 below), will not prevent a shareholder from attending the meeting and voting in person if they wish to do so. Shareholders are encouraged to appoint the Chair of the AGM as their proxy, even if they intend to attend the AGM in person. This is to ensure that your vote is counted if you are unable to attend in person on the day of the AGM. 3. A shareholder may appoint more than one Proxy in relation to the AGM, provided that each Proxy is appointed to exercise the rights attached to a different share or shares held by that shareholder. To do this, that shareholder must compete a separate Proxy Form for each Proxy. Shareholders can copy their original Proxy Form for this purpose. A proxy form is included with this Notice of Meeting and additional Proxy Forms can also be obtained from Computershare Investor Services PLC on 0370 600 3977. A shareholder appointing more than one Proxy should indicate the number of shares for which each Proxy is authorised to act on his or her behalf and place an ‘X’ in the box provided on the Proxy Form to confirm the instruction is one of a multiple. 4. To be valid any Proxy Form must be received by hand or by post at Computershare Investor Services PLC, The Pavilions, Bridgwater Road, Bristol BS99 6ZY, no later than 11.30am BST on 29 April 2024. 5. A shareholder can also submit his or her vote or, in accordance with Section 333A of the Companies Act 2006, appoint a Proxy electronically, by logging on to www.unilever. com/agm, clicking on ‘AGM and Voting’ and selecting the electronic voting option. To do this, a shareholder will need the Shareholder Reference Number (SRN), Control Number and five-digit PIN shown on the front of the Proxy Form or via e-mail if you subscribe to electronic communications. Electronic Proxy appointments must be received, in accordance with the instructions on the website, by no later than 11.30am BST on 29 April 2024. Please note that an electronic communication in respect of the appointment of a Proxy which contains a computer virus may not be accepted. The Company will try to inform the shareholder in question of a rejected communication and will try to ensure that its outgoing electronic communications are, as far as reasonably practicable, virus free. 6. In the case of a shareholder which is a company, the Proxy Form must be executed under its common seal or be signed on its behalf by an attorney or officer duly authorised. All signatories must state their capacity (e.g. director, secretary). 7. Any power of attorney or any other authority under which the Proxy Form is signed (or a copy of such authority certified by a notary) must be included with the Proxy Form. 8. A ‘Vote withheld’ is not a vote in law, which means that the vote will not be counted in the proportion of votes ‘For’ and ‘Against’ the resolutions. A shareholder who does not give any voting instructions in relation to the resolutions should note that his/her Proxy will have authority to vote or to withhold a vote on the resolution as he/she thinks fit. A Proxy will also have authority to vote or to withhold a vote on any other business (including amendments to the resolutions) which properly comes before the AGM as he/ she thinks fit. 9. CREST members who wish to appoint a Proxy or Proxies through the CREST electronic proxy appointment service may do so for the AGM and any adjournment(s) thereof by using the procedures described in the CREST Manual. CREST personal members or other CREST sponsored members, and those CREST members who have appointed a service provider(s), should refer to their CREST sponsor or voting service provider(s), who will be able to take the appropriate action on their behalf. 10. In order for a Proxy appointment or instruction made using the CREST service to be valid, the appropriate CREST message (a ‘CREST Proxy Instruction’) must be properly authenticated in accordance with the specifications of Euroclear UK and Ireland Limited (Euroclear), and must contain the information required for such instruction, as described in the CREST Manual (available via www. euroclear.com). The message, regardless of whether it constitutes the appointment of a Proxy or is an amendment to the instruction given to a previously appointed Proxy, must, in order to be valid, be transmitted so as to be received by the Company’s agent (ID number 3RA50) by the latest time for receipt of Proxy appointments specified in this Notice of Meeting. For this purpose, the time of receipt will be taken to be the time (as determined by the timestamp applied to the message by the CREST Application Host) from which the Company’s agent is able to retrieve the message by enquiry to CREST in the manner prescribed by CREST. After this time any change of instructions to Proxies appointed through CREST should be communicated to the appointee through other means. 11. CREST members and, where applicable, their CREST sponsors or voting service providers, should note that Euroclear does not make available special procedures in CREST for any particular message. Normal system timings and limitations will therefore apply in relation to the input of CREST Proxy Instructions. It is the responsibility of the CREST member concerned to take (or, if the CREST member is a CREST personal member, or sponsored member or has appointed a voting service provider, to procure that his CREST sponsor or voting service provider(s) take(s)) such action as shall be necessary to ensure that a message is transmitted by means of the CREST system by any particular time. In connection with this, CREST members and, where applicable, their CREST sponsors or voting system providers are referred, in particular, to those sections of the CREST Manual concerning practical limitations of the CREST system and timing. 12. The Company may treat as invalid a CREST Proxy Instruction in the circumstances set out in Regulation 35(5)(a) of the Uncertificated Securities Regulations 2001. 13. Holders of shares in the Company held through Euroclear Nederland who wish to attend the meeting in person can register themselves via www.abnamro.com/evoting. Holders of such shares who wish to attend the meeting in person must further request an attendance letter of authorisation for the annual general meeting of the Company via AVA@nl.abnamro.com. To be admitted to the meeting, holders of such shares will be asked to provide Notes to the Notice of Meeting 2024 Unilever Chair’s Letter and Notice of Meeting 202412

a copy of the attendance letter of authorisation at the meeting. Holders of such shares who wish to participate in the voting process can render their voting instruction electronically via www.abnamro.com/evoting. 14. Only one holder of shares may vote by Proxy. In the case of joint holders, where more than one of the joint holders purports to appoint a Proxy, only the appointment submitted by the most senior holder will be accepted. Seniority is determined by the order in which the names of the joint holders appear in the Company’s register of members in respect of the joint holding (the first-named being the most senior). 15. If two or more valid but differing appointments of a Proxy are received in respect of the same share for use at the same meeting, the one which is last received (regardless of its date or the date of its signature) shall be treated as replacing and revoking the others as regards that share; if the Company is unable to determine which was last received, none of them shall be treated as valid in respect of that share. 16. Any person to whom this Notice of Meeting is sent who is a person nominated under Section 146 of the Companies Act 2006 to enjoy information rights (a ‘Nominated Person’) may, under an agreement between him/her and the shareholder by whom he/she was nominated, have a right to be appointed (or to have someone else appointed) as a Proxy for the AGM. If a Nominated Person has no such Proxy appointment right or does not wish to exercise it, he/she may, under any such agreement, have a right to give instructions to the shareholder as to the exercise of voting rights. The statement of the rights of shareholders in relation to the appointment of Proxies in paragraphs 2 and 3 above does not apply to Nominated Persons. The rights described in those paragraphs can only be exercised by shareholders of the Company. 17. The Company specifies that only those shareholders registered in the register of members of the Company at close of business on 29 April 2024 shall be entitled to vote at the AGM in respect of the number of shares registered in their name at that time. Changes to the register of members after the relevant deadline shall be disregarded in determining the rights of any person to vote at the AGM. If the AGM is adjourned, only shareholders entered on the Company’s register of members not later than 48 hours before the time fixed for the adjourned meeting shall be entitled to attend and vote at the meeting. Representatives of corporate shareholders, including retail shareholders holding their shares through a nominee, looking to attend the AGM in person should contact their nominee, broker or custodian in advance of the meeting to request a Letter of Representation. The Letter of Representation must include the registered name in which your nominee, broker or custodian hold the shares, the CREST ID, Designation and the number of shares held you are permitted to vote on. This should be presented at registration to evidence your valid appointment at the AGM. Please contact your nominee, broker or custodian significantly in advance of the AGM for these purposes to allow time for the issue of the Letter of Representation. The Company’s Registrar, Computershare Investor Services PLC (‘Computershare’), can also be contacted to provide further explanation of this process. 18. Voting on the resolutions will be conducted by way of a poll. This will ensure an exact and definitive result. 19. Any corporation which is a shareholder can appoint one or more corporate representatives who may exercise on its behalf all of its powers as a shareholder provided that they do not do so in relation to the same shares. 20. Under Section 527 of the Companies Act 2006 shareholders meeting the threshold requirements set out in that Section have the right to require the Company to publish on a website a statement setting out any matter relating to: a the audit of the Company’s accounts (including the auditor’s report and the conduct of the audit) that are to be laid before the AGM; or b any circumstance connected with an auditor of the Company ceasing to hold office since the previous meeting at which annual accounts and reports were laid in accordance with Section 437 of the Companies Act 2006. 21. The Company may not require the shareholders requesting any such website publication to pay its expenses in complying with Sections 527 or 528 of the Companies Act 2006. Where the Company is required to place a statement on a website under Section 527 of the Companies Act 2006, it must forward the statement to the Company’s auditor no later than the time when it makes the statement available on the website. The business which may be dealt with at the AGM includes any statement that the Company has been required under Section 527 of the Companies Act 2006 to publish on a website. 22. Any shareholder attending a meeting of the Company has the right to ask questions. The Company must cause to be answered any such question relating to the business being dealt with at the meeting but no such answer need be given if: a to do so would interfere unduly with the preparation for the meeting or involve the disclosure of confidential information; b the answer has already been given on a website in the form of an answer to a question; or c it is undesirable in the interests of the Company or the good order of the meeting that the question be answered. Shareholders are encouraged to submit questions for the Q&A session in advance of the AGM by emailing shareholder.services@unilever.com before 1.00pm BST on 17 April 2024. 23. A copy of this notice, and other information required by Section 311A of the Companies Act 2006, can be found at www.unilever.com/agm. 24. To view the live webcast of the AGM you will need to visit meetnow.global/UnileverAGM24 on your device operating a compatible browser using the latest version of Chrome, Firefox, Edge or Safari. Please note that Internet Explorer is not supported. It is highly recommended that you check your system capabilities in advance of the AGM on 1 May 2024. Please use your unique Shareholder Reference Number and PIN as displayed on your Form of Proxy to access the live webcast. These details are unique to you and will allow access to the live webcast. Shareholders who render their voting instructions electronically via www.abnamro.com/evoting will be given the option of attending the live webcast. Shareholders who wish to attend the live webcast should send an email to ava@nl.abnamro.com after rendering the voting instructions. 25. If you would like to delegate your access to the live webcast to a third party or a corporate representative then please contact Computershare Investor Services PLC by email at corporate-representatives@computershare.co.uk or alternatively call 0370 600 3977, providing details of your delegate, including their email address so that unique credentials can be issued to allow the delegate to access the live webcast. Notes to the Notice of Meeting 2024 continued Unilever Chair’s Letter and Notice of Meeting 2024 13

This instruction must be received by Computershare by 11.30am BST on Monday 29 April 2024. Access credentials will be emailed to the delegate one working day prior to the meeting conditional on evidence of your delegation having been received and accepted. Lines are open 8.30am to 5.30pm Monday to Friday (excluding bank holidays). This delegation relates to access to the live webcast only and will not impact your proxy appointment for voting purposes. If you have not been provided with your access credentials, please ensure you contact Computershare on the morning of the live webcast, but no later than 9.30am BST on 1 May 2024. 26. Access to the live webcast via meetnow.global/ UnileverAGM24 will be available from 11.15am BST on 1 May 2024. It is your responsibility to ensure connectivity for the duration of the live webcast. 27. Persons who are not shareholders of the Company (or their appointed delegate or corporate representative) are not able to attend the live webcast unless prior arrangements have been made with the Company. 28. Copies of the following documents are available for inspection at the offices of Clifford Chance, 10 Upper Bank Street, London E14 5JJ, upon prior appointment only, from the date of this Notice until the conclusion of the AGM and at the place of the AGM from at least 15 minutes before the AGM until the close of the meeting: a the Executive Directors’ service contracts; b letters of appointment of the Non-Executive Directors; and c a copy of the proposed new articles of association of the Company, together with a copy of the existing articles of association of the Company marked to show the changes being proposed in Resolution 22, which are also available for inspection on the National Storage Mechanism at https:// data.fca.org.uk/#/nsm/nationalstoragemechanism. 29. As at 1 March 2024 (being the latest practicable date prior to the publication of the Notice of Meeting) the total number of issued ordinary shares of Unilever PLC was 2,521,497,338. As at 1 March 2024, the Company held 16,181,572 ordinary shares in treasury. As at 1 March 2024, 2,855,817 ordinary shares (including ordinary shares represented by Unilever PLC ADSs) were held by or on behalf of companies in the Unilever Group. The voting rights attaching to those ordinary shares are not exercisable. Therefore, as at 1 March 2024 and excluding those ordinary shares (including ordinary shares represented by Unilever PLC ADSs) held by or on behalf of companies in the Unilever Group, the total number of ordinary shares with exercisable voting rights in the Company was 2,502,459,949. 30. The Company may decide that it is in the interests of our employees and shareholders to adopt measures to preserve the health and wellbeing of any persons attending the AGM. We therefore encourage shareholders to check our website (www.unilever.com/agm) regularly for the latest information on arrangements for the AGM. 31. We do not permit behaviour that may interfere with anyone’s security or safety or the good order of the meeting. Anyone who does not comply may be removed from the meeting. 32 . You may not use any electronic address provided in either this document or any related documents to communicate with the Company for any purposes other than those expressly stated. Route Description The Hilton London Bankside hotel is in close proximity to Southwark underground station and Blackfriars London underground and overground stations. Waterloo and London Bridge stations are also within a 10 minute walk. Shareholders are asked to arrive and register at the Events Entrance on Bear Lane, SE1 0UH. Notes to the Notice of Meeting 2024 continued Unilever Chair’s Letter and Notice of Meeting 202414

Appendix The New Articles of Association of the Company The New Articles of Association of the Company contain the following changes: 1. Method of sending notices, documents and information The New Articles of Association clarify the definition of “address” to include, in relation to an uncertificated proxy instruction, the identification number of a participant in the relevant system (e.g. CREST) and also to include a website as a method for sending information to members. They also include a new definition of “post” which now includes “post, courier or an equivalent service”. The effect of this is to permit notices and documents to be sent by the Company using a service that is equivalent to post. By inclusion of this new definition, the provisions of the Articles of Association which deem such notices and documents to be delivered the day after they are put in the post are also extended to services that are equivalent to post. These changes provide greater flexibility to permit the Company to send notices, documents and information to members by means other than post, for instance by courier or other similar service and in addition by posting notices, documents and information to a website. 2. Conversion of Shares into Stock and Share Warrants The New Articles of Association no longer include articles relating to conversion of shares into stock and share warrants (also called share warrants to bearer). This is in line with changes to legislation which abolished the conversion of shares into stock and the use of share warrants. The conversion of shares into stock and the issue of new share warrants by companies has now been prohibited so these articles (previously Articles 43 – 54) are redundant. The Company is now removing these articles to streamline the New Articles of Association and reflect existing law. 3. Powers of delegation The New Articles of Association clarify that committees of the Board may sub-delegate their powers (new Article 108) and that the Board may delegate its powers to any executive officer of the Company, including both the Chief Executive Officer and the Chief Financial Officer (new Article 109 and definitions section). These changes are proposed to allow the Board greater operational flexibility. 4. Notice of General Meetings The New Articles of Association have additional provisions relating to the Company’s procedures for establishing the deadlines by which members are entitled to: (i) receive notices of general meetings; and (ii) attend or vote at general meetings. These additional provisions reflect the current practice of the Company and they have been added to the New Articles of Association so that members have further clarity and additional information in relation to such procedures. 5. Voting at meetings of Directors The New Articles of Association provide that, in the case of an equality of votes on a matter before a meeting of the Directors, the chair of the meeting shall have a second, casting vote (new Article 107). The existing Articles of Association provide that there shall be no casting vote in such an instance. This provision is commonly seen in the articles of association of UK public limited companies and promotes efficiency of board decision-making by providing a method for resolving deadlock. 6. Application of profits The New Articles of Association amend the provisions (new Article 115) relating to application of profits towards the payment of dividends by deleting a reference to profits being used first to pay a dividend at such rate as may be payable under the provisions of a Trust Deed dated 1st May 1909 and Deeds supplemental thereto. The dividend that was paid under this provision is paid in preference to dividends paid on the Ordinary Shares. The relevant trust has now terminated and therefore this provision has been deleted. 7. Interim Dividends The New Articles of Association include changes to the provisions that clarify the scope of the directors’ authority to pay or make interim dividends or distributions to PLC shareholders (new Article 117). These changes are consistent with English company law. 8. Payment Procedures The Articles of Association currently provide that a dividend or any other moneys payable on or in respect of shares in the Company may be paid by cheque, warrant or similar financial instrument, or by other means (new Article 121). The New Articles of Association clarify that it is the Directors who shall be responsible for determining the “other means” of payment. In particular, this change makes clear that the Directors may determine that payments to shareholders shall be made via electronic transfer. This change is consistent with English company law and the updated provisions in the New Articles of Association are consistent with those commonly seen in the Articles of Association of UK public limited companies. 9. Dividends in specie The New Articles of Association clarify the process for the distribution of non-cash assets to PLC shareholders (new Article 123). There is no change to the board and shareholder approvals required for dividends and distributions. 10. Other clarificatory changes Other clarificatory changes have been made to the New Articles of Association, which are: (i) the addition of the Uncertificated Securities Regulations 2001 to the definition of “the uncertificated securities rules”; and (ii) the appointment of proxies by members (new Article 67).

Unilever PLC Head Office 100 Victoria Embankment London EC4Y 0DY United Kingdom T +44 (0)20 7438 2800 (switchboard) AGM related queries T +44 (0)20 7822 9300 shareholder.services@unilever.com Registered Office Unilever PLC Port Sunlight Wirral Merseyside CH62 4ZD United Kingdom Registered in England and Wales Company Number: 41424 For further information about Unilever please visit our website: www.unilever.com