United States of America |

001-12307 |

87-0189025 |

|||||||||

(State or other jurisdiction of incorporation or organization) |

(Commission File Number) |

(IRS Employer Identification No.) |

|||||||||

One South Main, |

Salt Lake City, |

Utah |

84133-1109 |

||||||||

(Address of Principal Executive Offices) |

(Zip Code) |

||||||||||

| Former name or former address, if changed since last report | ||

| Title of Each Class | Trading Symbols | Name of Each Exchange on Which Registered | ||||||

| Common Stock, par value $0.001 | ZION | The NASDAQ Stock Market, LLC | ||||||

| Depositary Shares each representing a 1/40th ownership interest in a share of: | ||||||||

| Series A Floating-Rate Non-Cumulative Perpetual Preferred Stock | ZIONP | The NASDAQ Stock Market, LLC | ||||||

| Exhibit Number | Description | ||||

Press Release dated January 21, 2025 (furnished herewith). |

|||||

Earnings Release Presentation dated January 21, 2025 (furnished herewith). |

|||||

| 101 | Cover Page Interactive Data File - the cover page XBRL tags are embedded within the Inline XBRL document. | ||||

| 104 | The cover page from this Current Report on form 8-K, formatted as Inline XBRL. | ||||

| ZIONS BANCORPORATION, NATIONAL ASSOCIATION | ||||||||

| By: | /s/ R. Ryan Richards | |||||||

| Name: R. Ryan Richards | ||||||||

Title: Executive Vice President and Chief Financial Officer |

||||||||

Date: January 21, 2025 |

||||||||

| Zions Bancorporation, N.A. One South Main Salt Lake City, UT 84133 January 21, 2025 |

|

||||

| www.zionsbancorporation.com | |||||

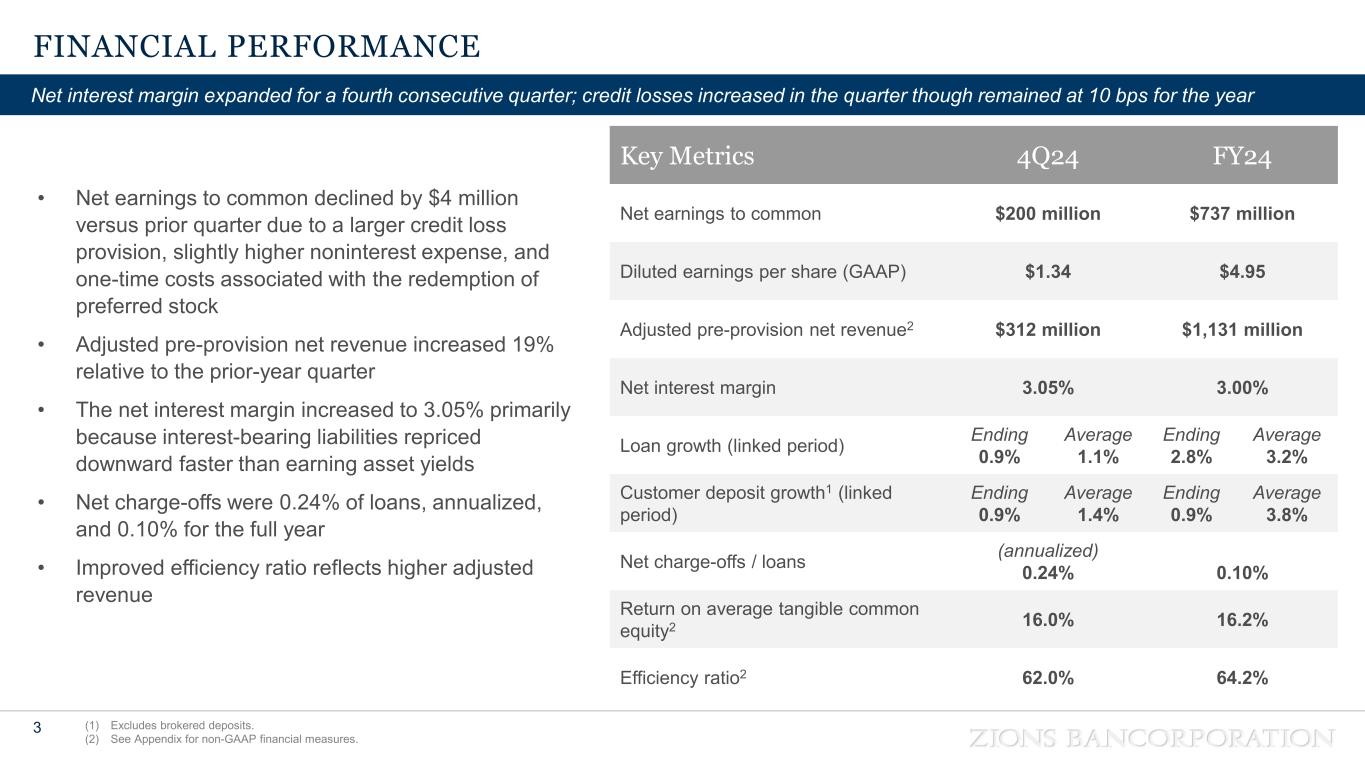

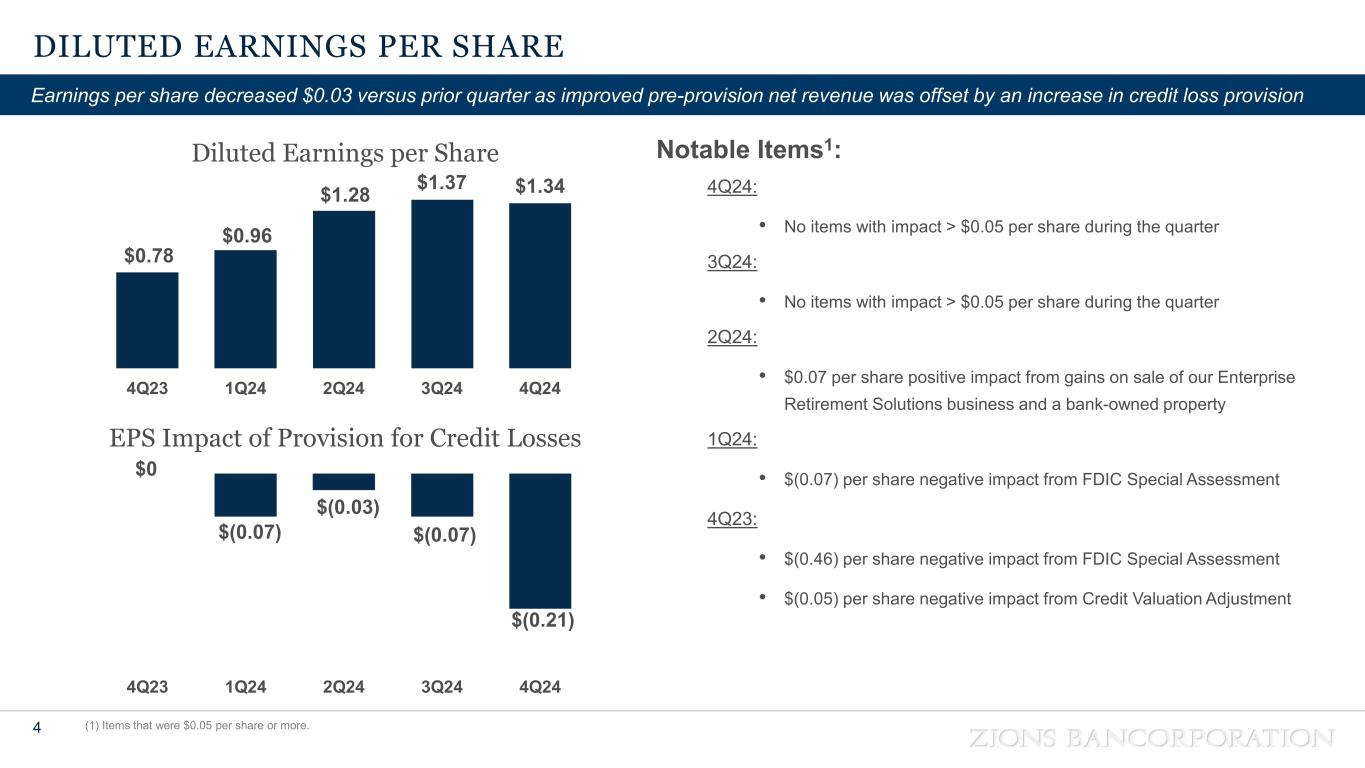

| Zions Bancorporation, N.A. reports: 4Q24 Net Earnings of $200 million, diluted EPS of $1.34 | ||

| compared with 4Q23 Net Earnings of $116 million, diluted EPS of $0.78, and 3Q24 Net Earnings of $204 million, diluted EPS of $1.37 | ||

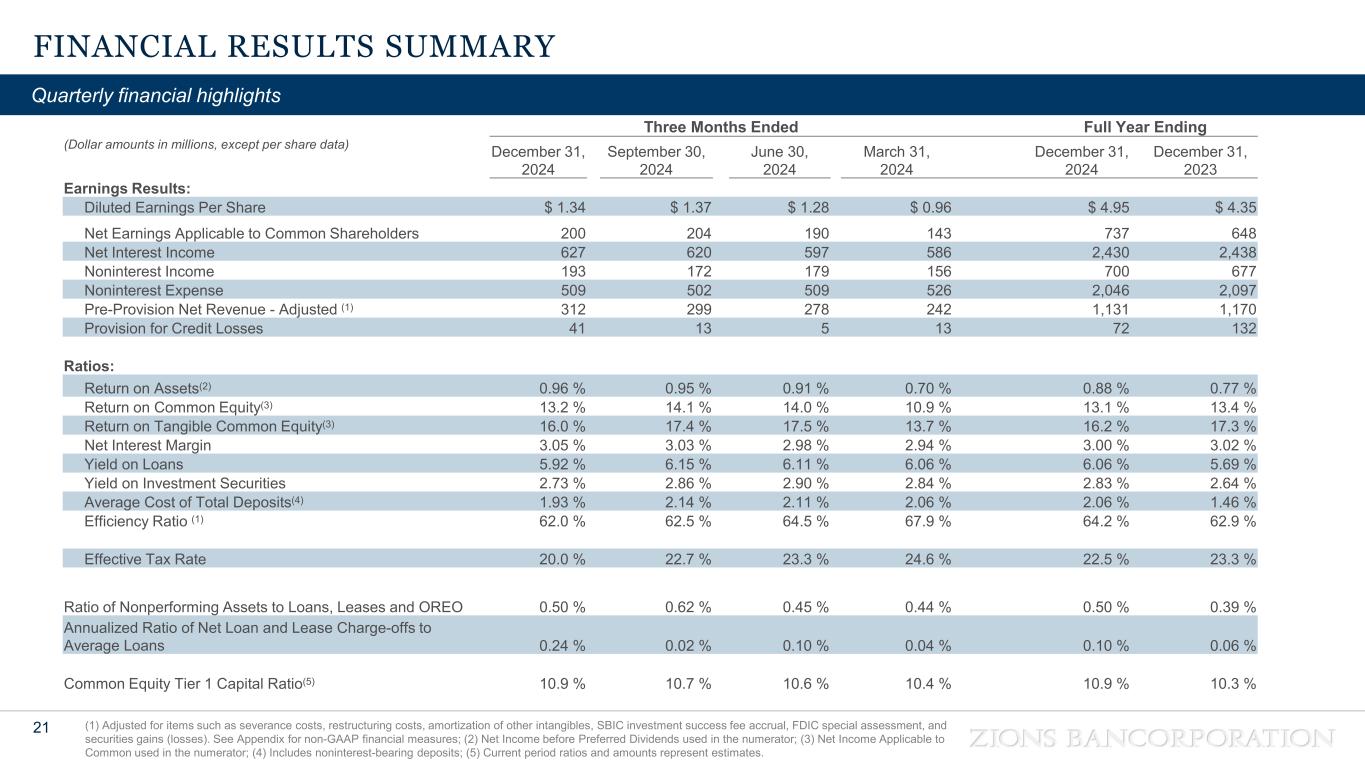

| $1.34 | $200 million | 3.05% | 10.9% | |||||||||||||||||

Net earnings per diluted common share |

Net earnings | Net interest margin (“NIM”) | Estimated Common Equity Tier 1 ratio |

|||||||||||||||||

| FOURTH QUARTER HIGHLIGHTS¹ | ||||||||

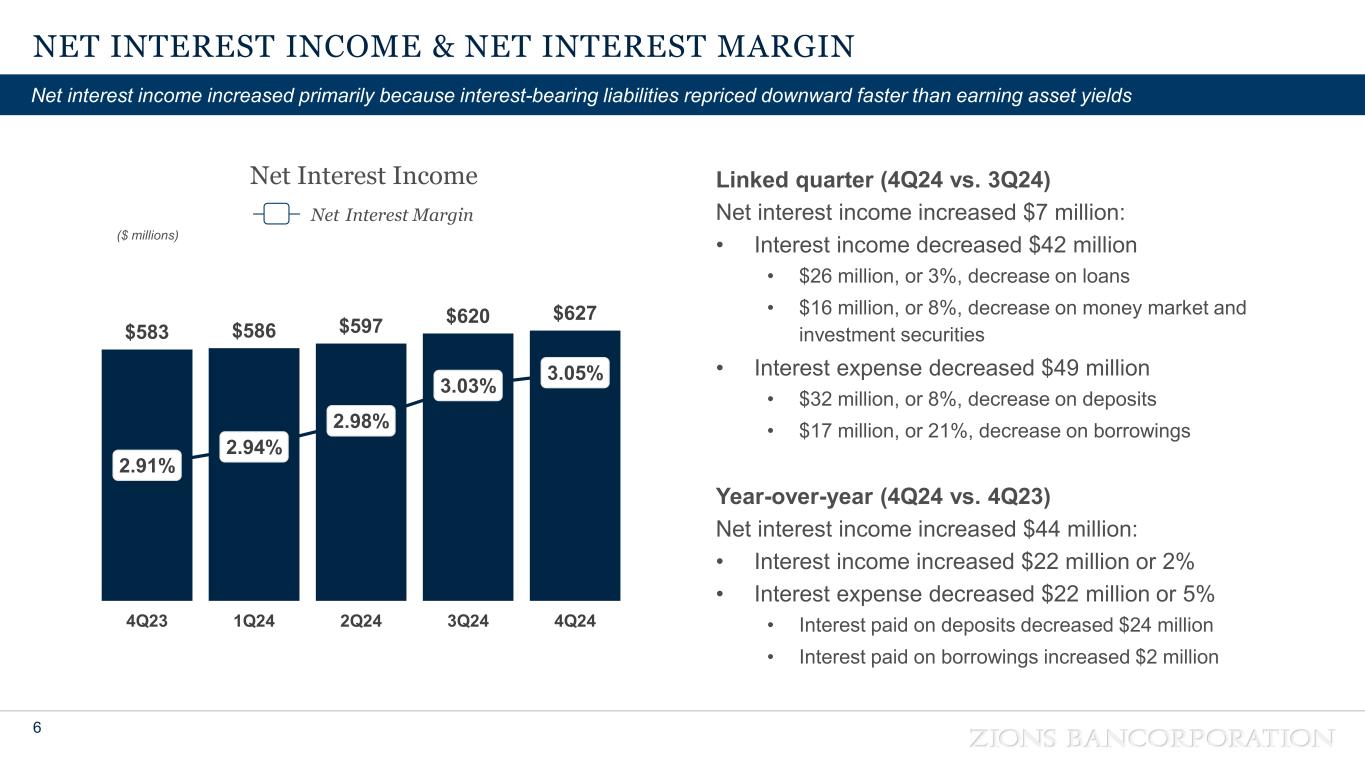

| Net Interest Income and NIM | • |

Net interest income was $627 million, up 8% | ||||||

• |

NIM was 3.05%, compared with 2.91% | |||||||

| Operating Performance | • |

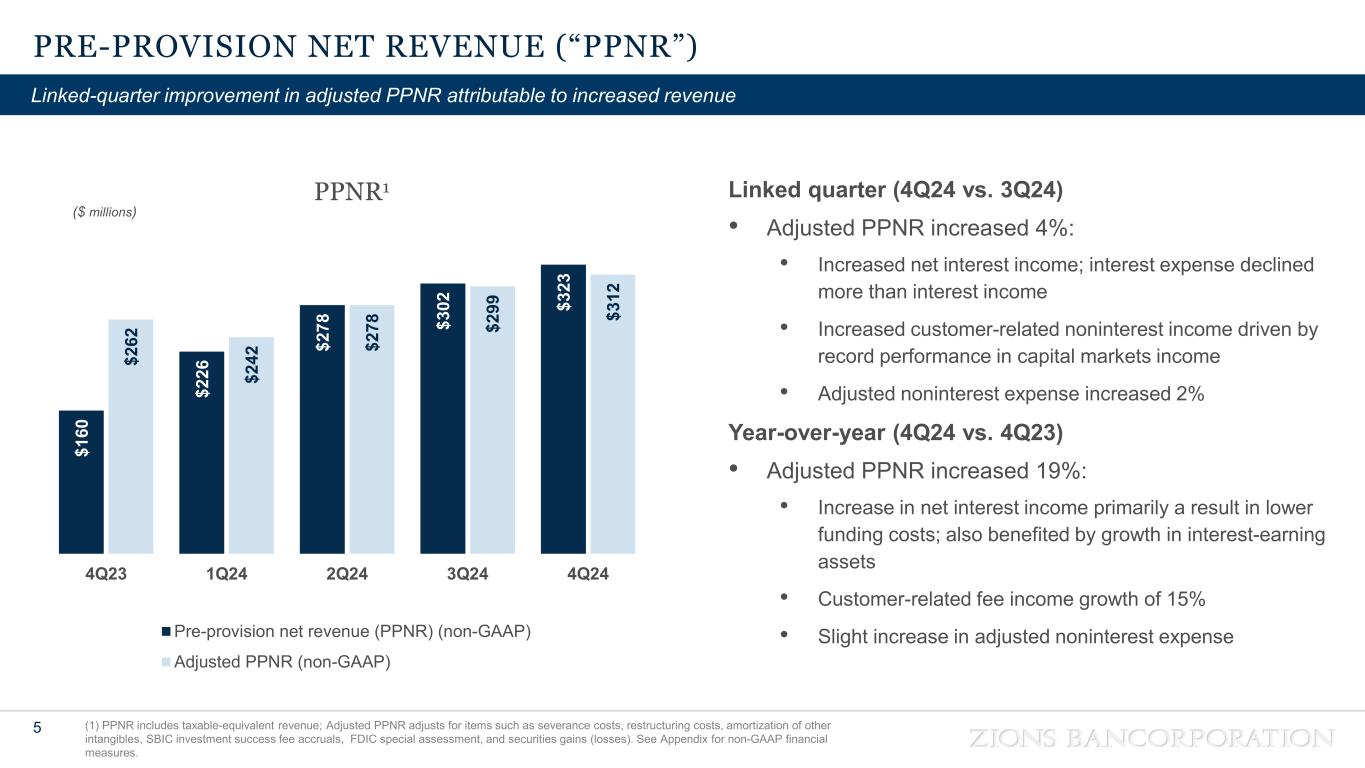

Pre-provision net revenue² ("PPNR") was $323 million, up 102%; adjusted PPNR² was $312 million, up 19% | ||||||

• |

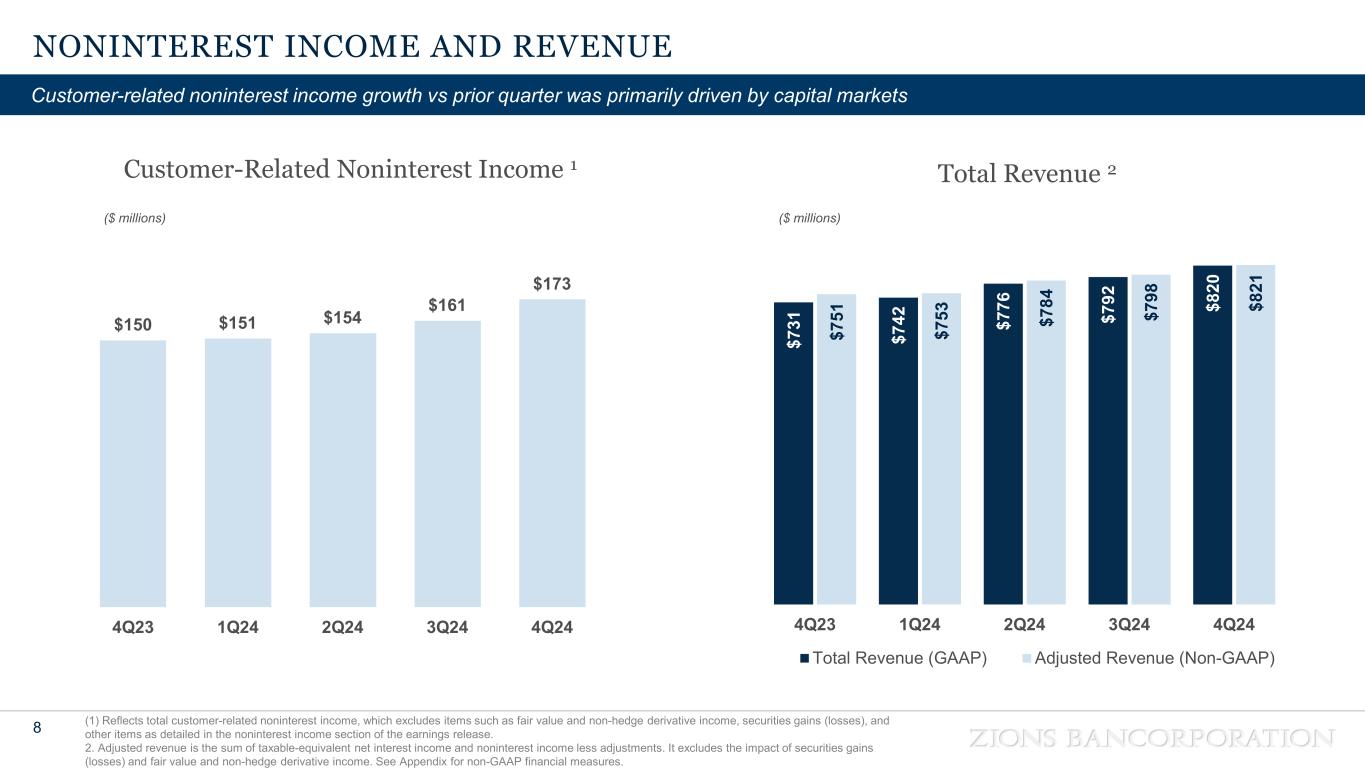

Customer-related noninterest income was $173 million, up 15% | |||||||

• |

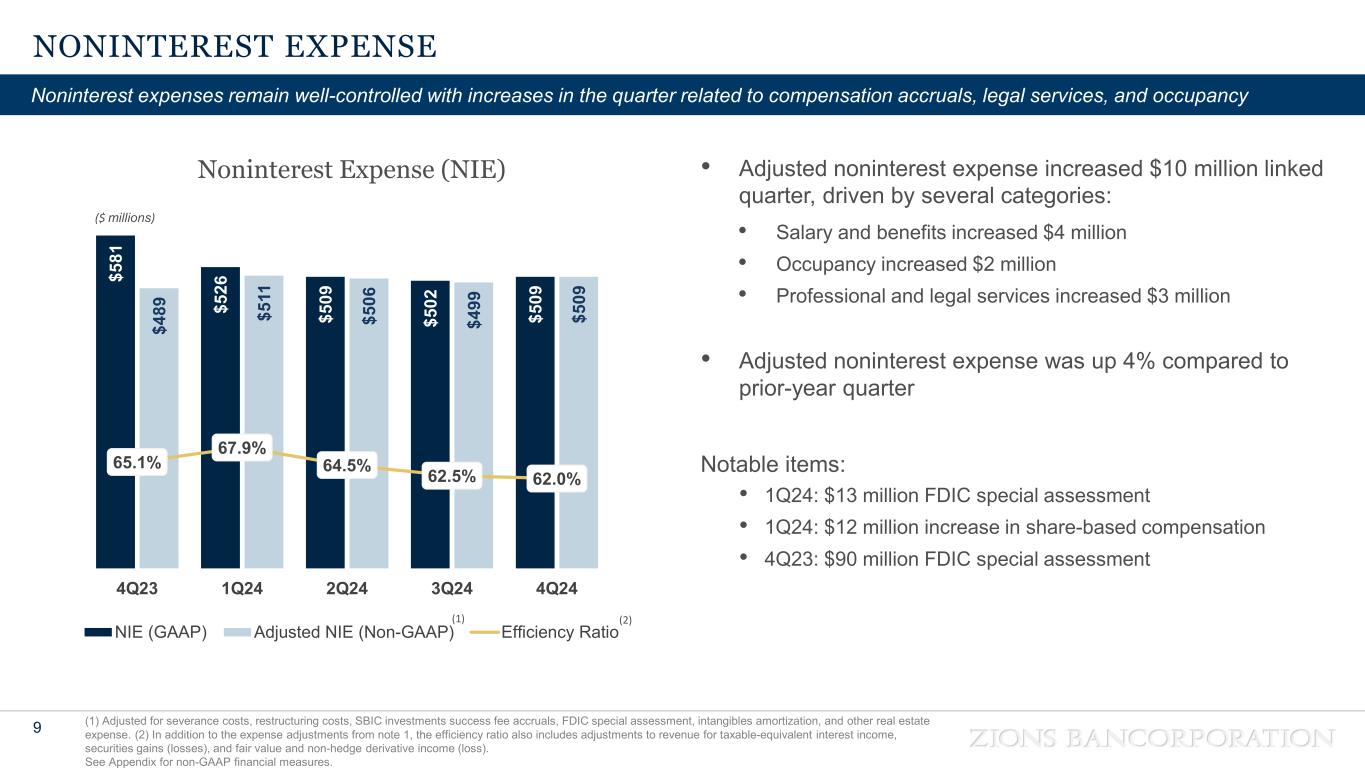

Noninterest expense was $509 million, down 12%; adjusted noninterest expense² was $509 million, up 4% | |||||||

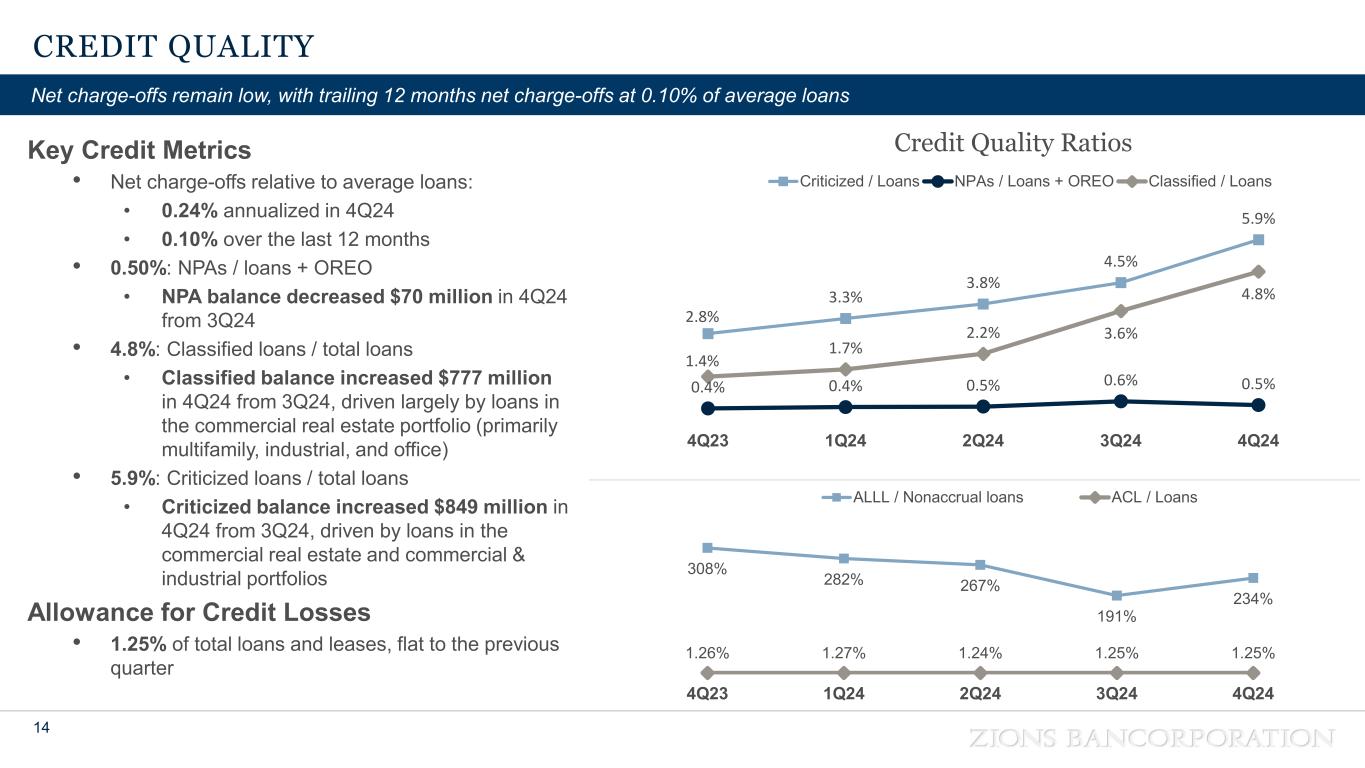

| Loans and Credit Quality | • |

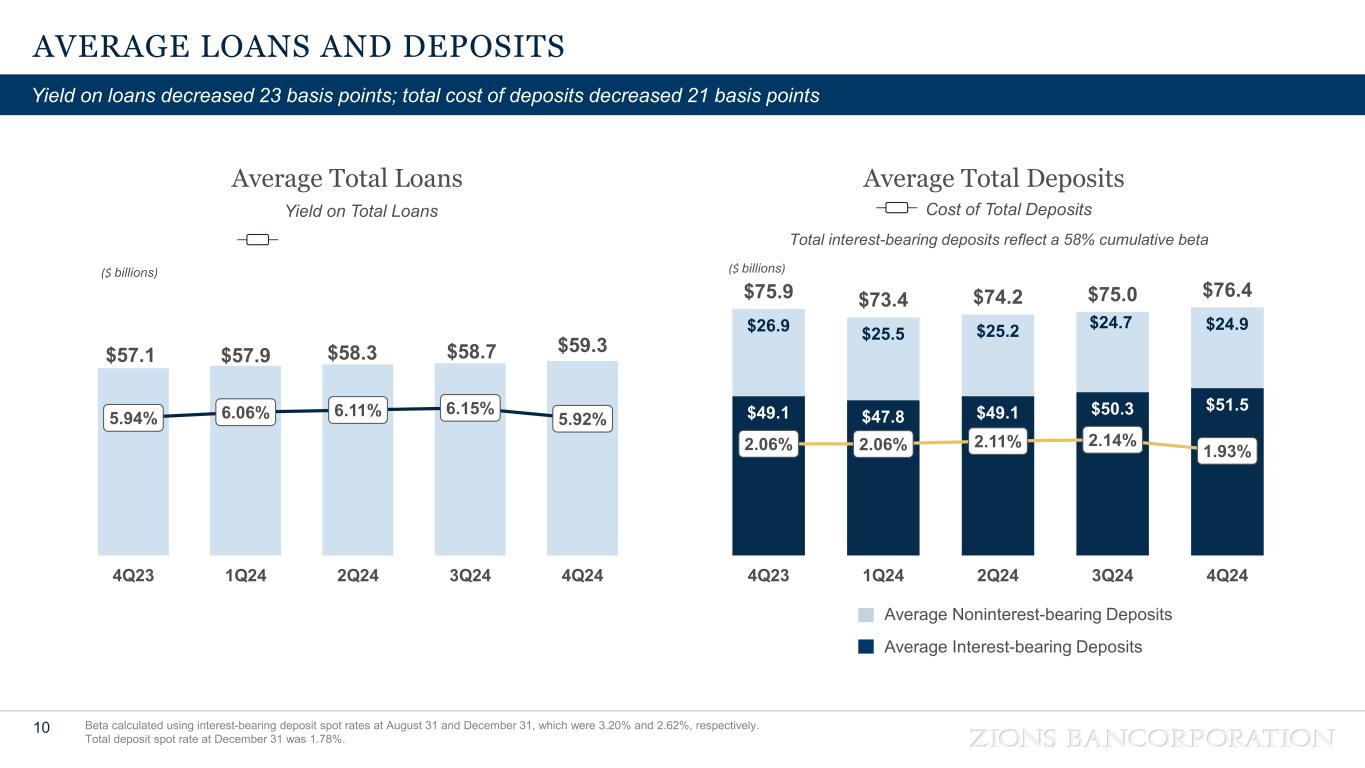

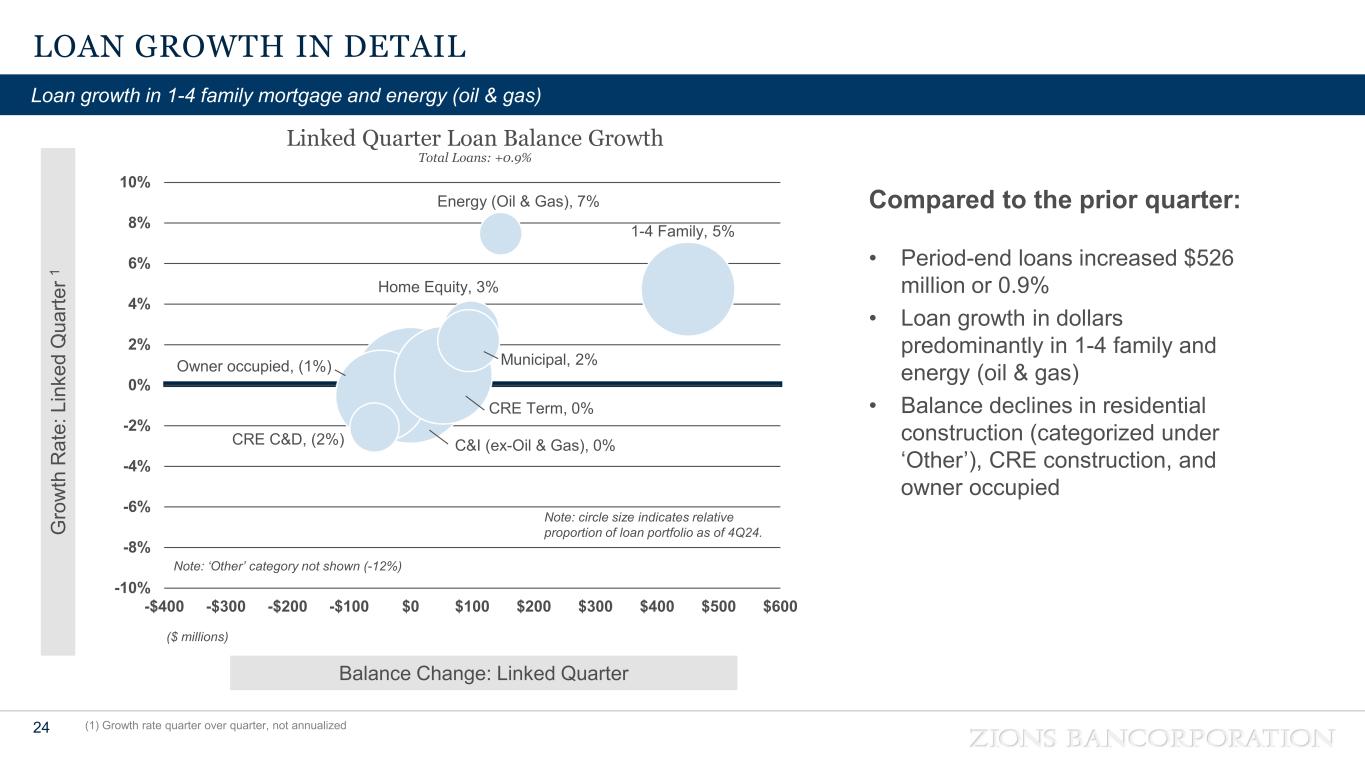

Loans and leases were $59.4 billion, up 3% | ||||||

• |

The provision for credit losses was $41 million, compared with less than $1 million | |||||||

• |

The annualized ratio of net loan and lease charge-offs to average loans and leases was 0.24%, compared with 0.06% | |||||||

• |

Nonperforming assets3 were $298 million, or 0.50% of loans and leases and other real estate owned, compared with $228 million, or 0.39% |

|||||||

• |

Classified loans were $2.9 billion, or 4.8% of loans and leases, compared with $825 million, or 1.4% | |||||||

| Deposits and Borrowed Funds | • |

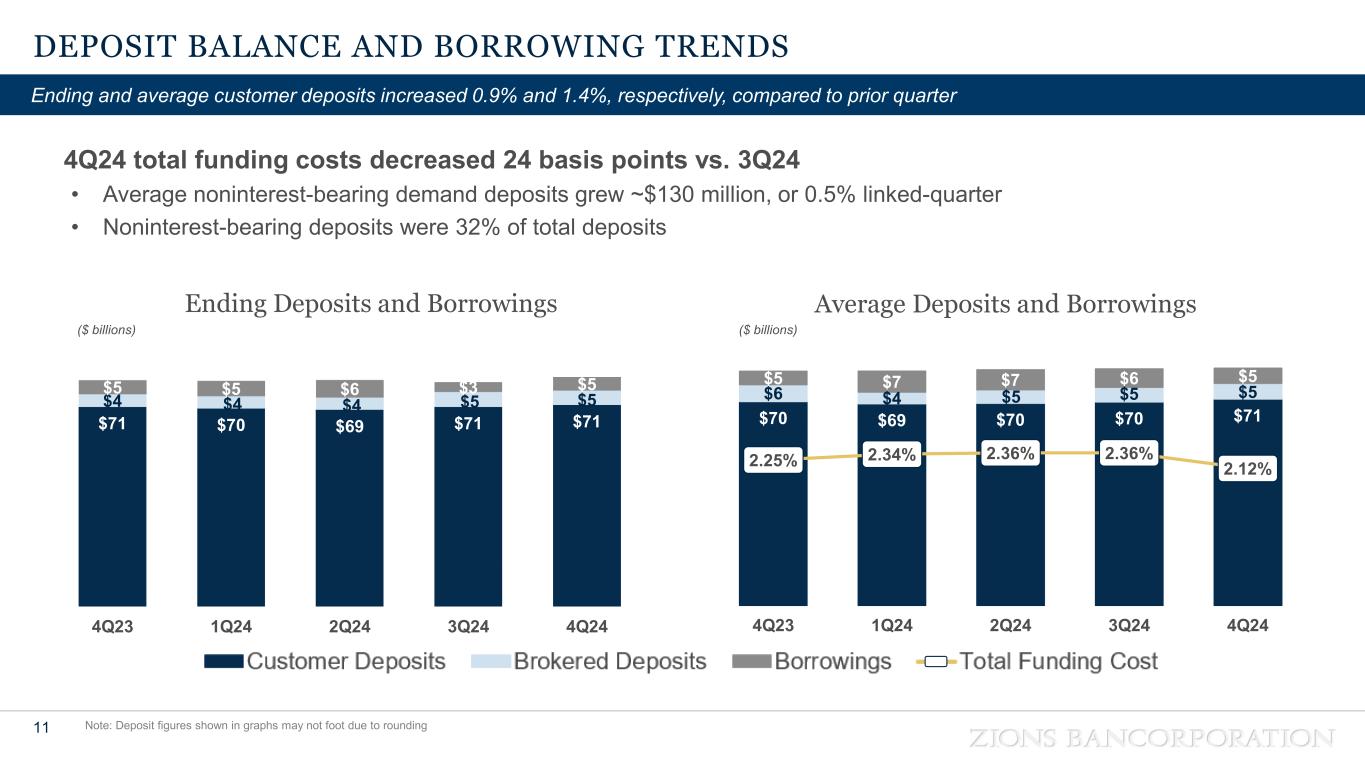

Total deposits were $76.2 billion, up 2%; customer deposits (excluding brokered deposits) were $71.2 billion, up 1% | ||||||

• |

Short-term borrowings, consisting primarily of secured borrowings, were $3.8 billion, down 12% | |||||||

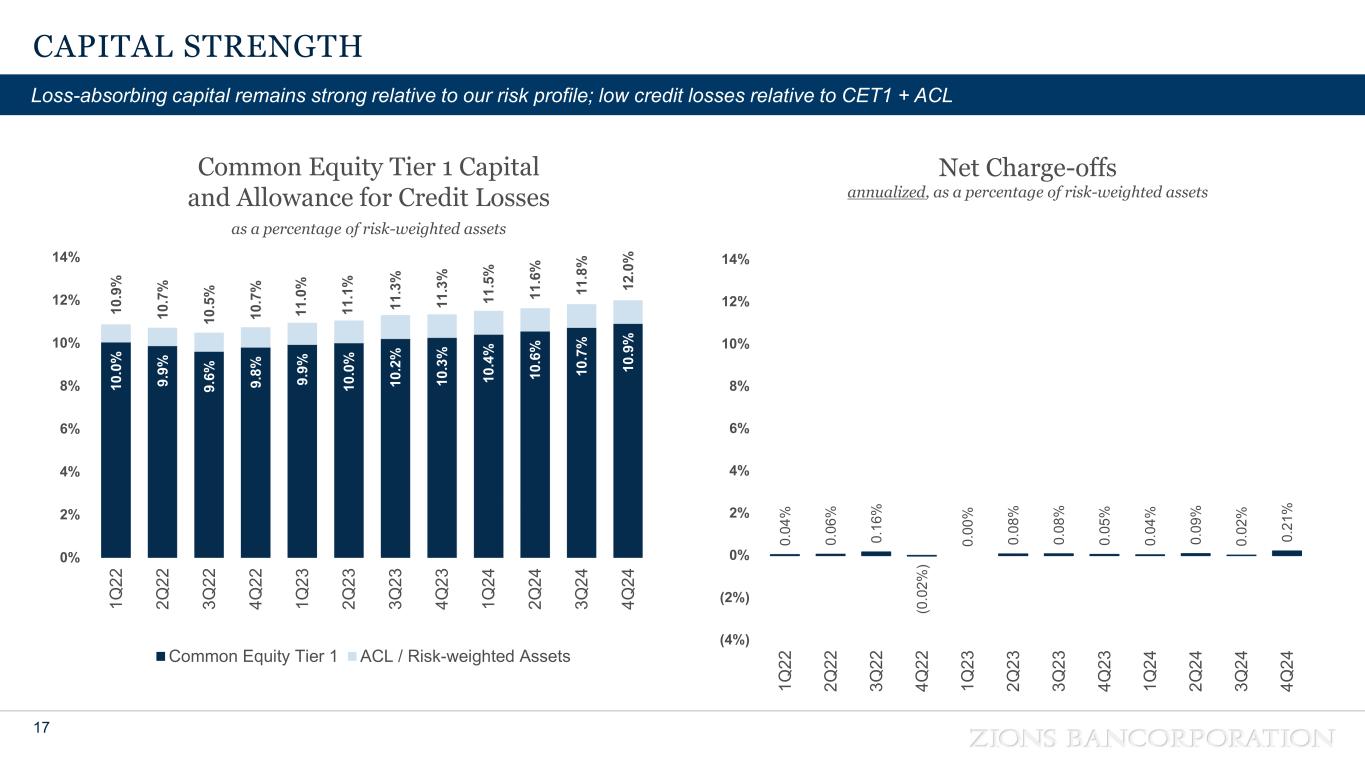

| Capital | • |

The estimated CET1 capital ratio was 10.9%, compared with 10.3% | ||||||

| Notable Items | • |

Redemption of our Series G, I, and J preferred stock of $374 million | ||||||

| CEO COMMENTARY | ||

|

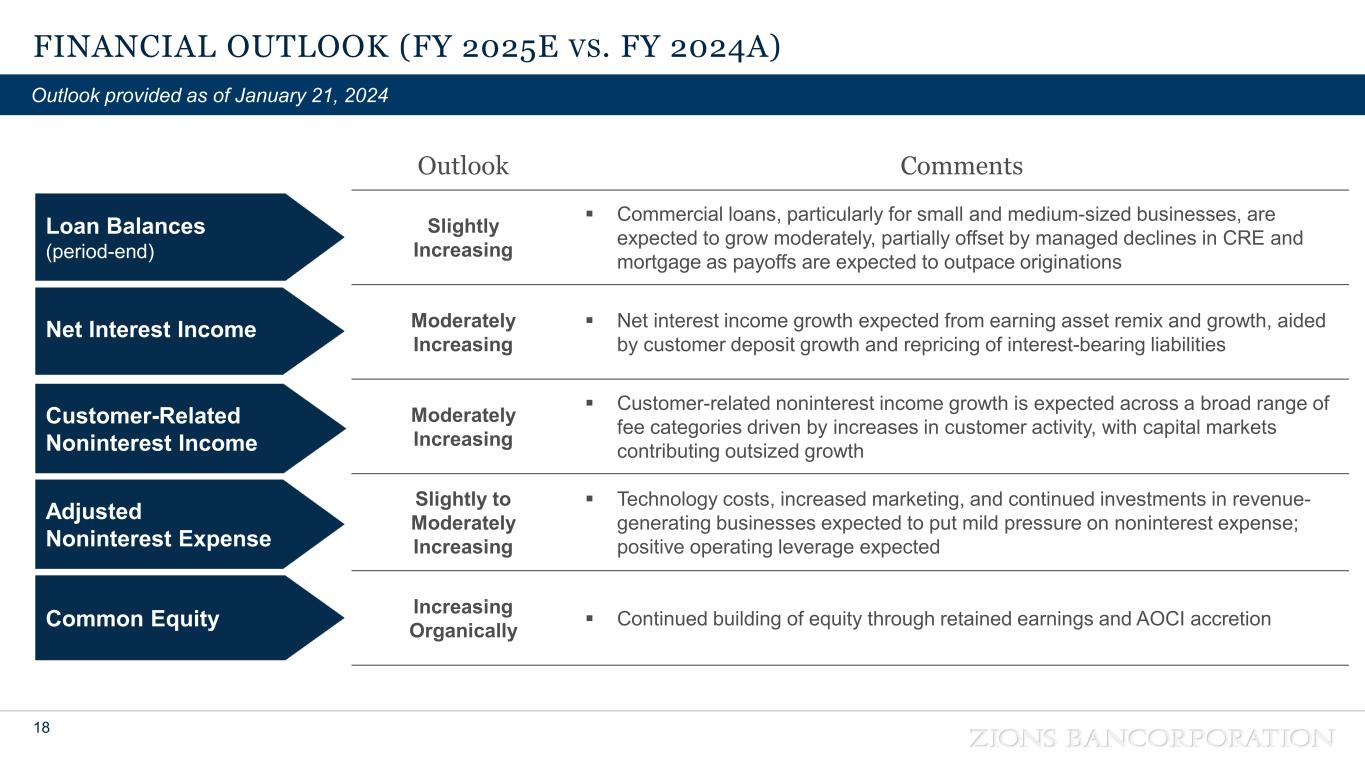

Harris H. Simmons, Chairman and CEO of Zions Bancorporation, commented, “We’re pleased with the continued improvement in the financial performance demonstrated by our fourth quarter results. Adjusted taxable-equivalent revenue increased 9% relative to year-ago levels, while adjusted noninterest expense increased 4%, resulting in a 19% increase in adjusted pre-provision net revenue.”

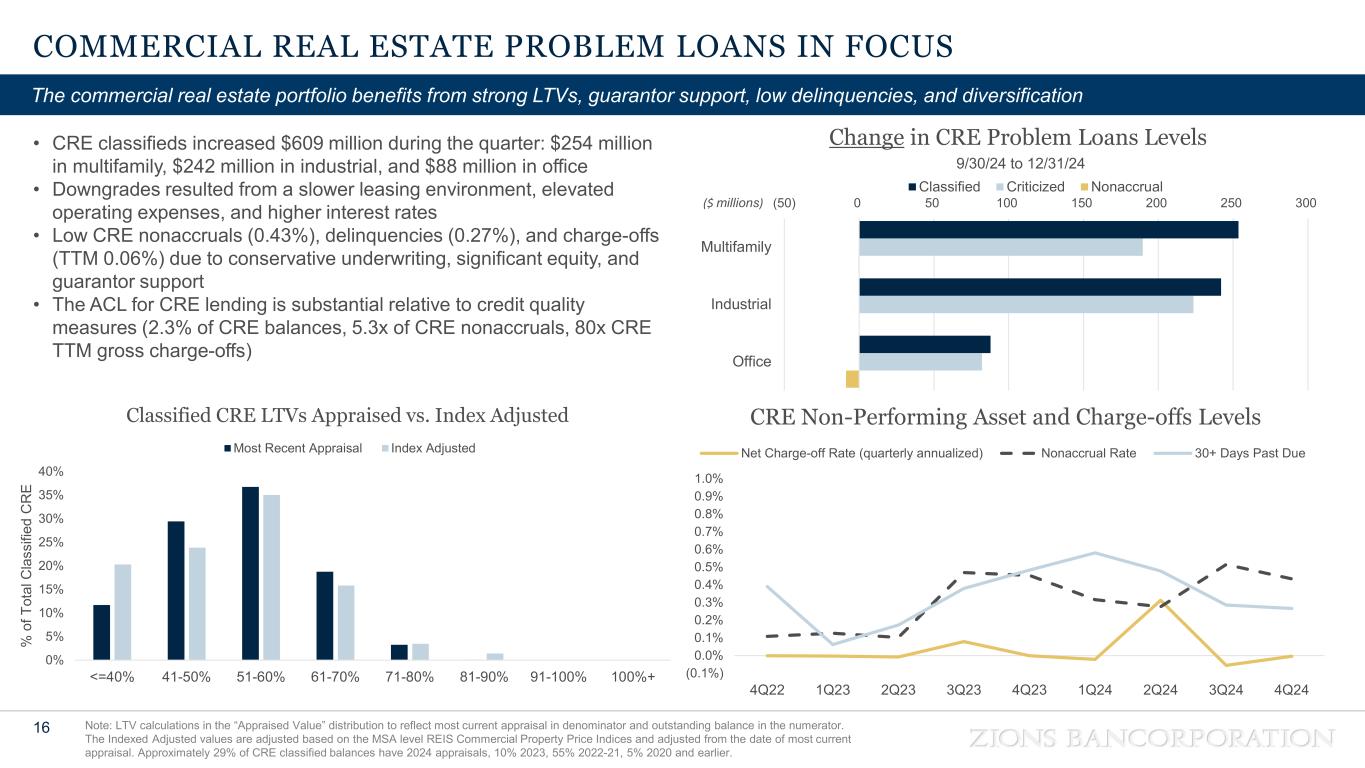

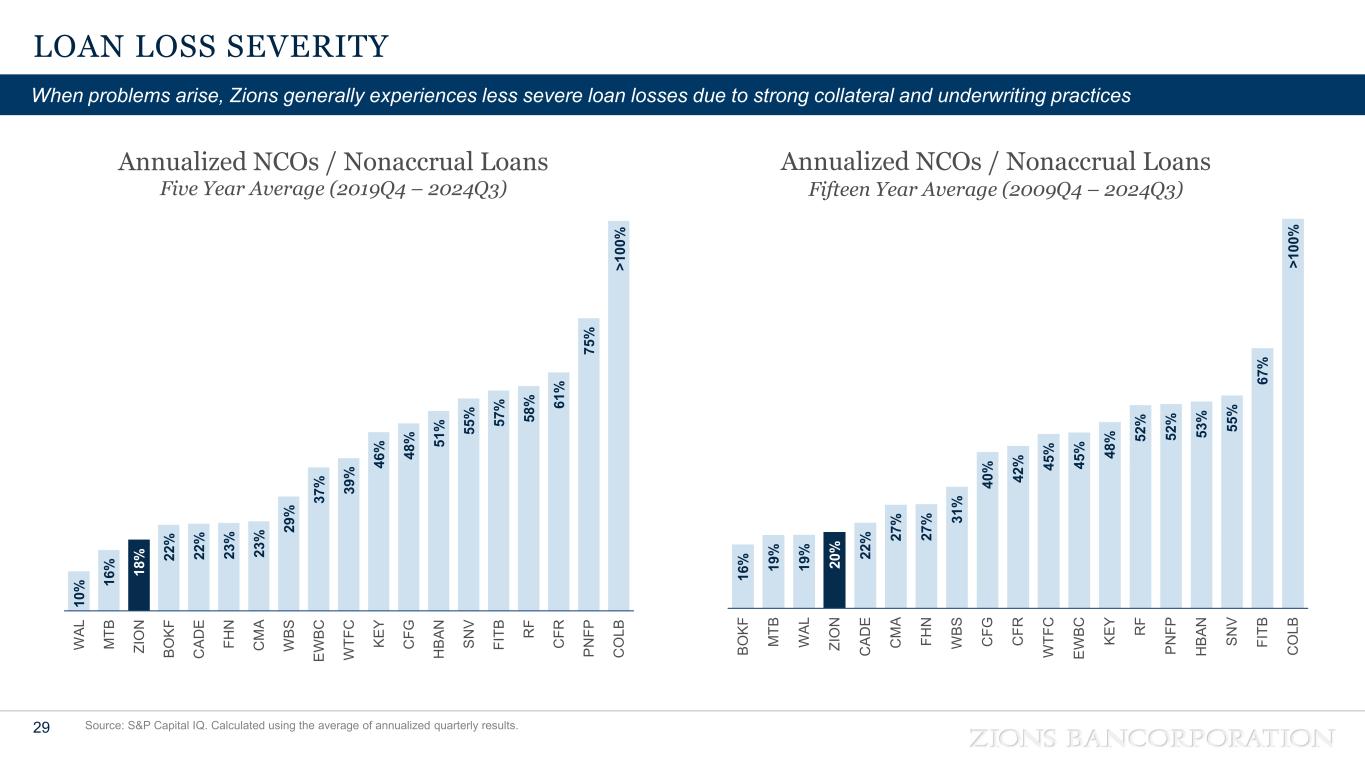

Mr. Simmons continued, “Net loan losses were higher in the quarter, at an annualized rate of 0.24%, with two-thirds of the net loss amount attributable to a single commercial & industrial credit. At the same time, nonperforming loans decreased 18% relative to the third quarter, to 0.50% of total loans. While classified loans have continued to increase, primarily in the commercial real estate portfolio, strong collateral and guarantor support mitigate the risk of significant defaults and losses in this portfolio.”

Mr. Simmons concluded, “We’re optimistic that the coming year will produce sustained growth, continued improvement in our net interest margin, and increased profitability.”

| ||

OPERATING PERFORMANCE2 | ||

| (In millions) | Three Months Ended December 31, |

Twelve Months Ended December 31, |

|||||||||||||||||||||

| 2024 | 2023 | 2024 | 2023 | ||||||||||||||||||||

| Adjusted PPNR | $ | 312 | $ | 262 | $ | 1,131 | $ | 1,170 | |||||||||||||||

| Net charge-offs (recoveries) | $ | 36 | $ | 9 | $ | 60 | $ | 36 | |||||||||||||||

| Efficiency ratio | 62.0 | % | 65.1 | % | 64.2 | % | 62.9 | % | |||||||||||||||

| Weighted average diluted shares | 147.3 | 147.6 | 147.2 | 147.8 | |||||||||||||||||||

Net Interest Income and Margin | |||||||||||||||||||||||||||||||||||||||||

| 4Q24 - 3Q24 | 4Q24 - 4Q23 | ||||||||||||||||||||||||||||||||||||||||

| (In millions) | 4Q24 | 3Q24 | 4Q23 | $ | % | $ | % | ||||||||||||||||||||||||||||||||||

| Interest and fees on loans | $ | 873 | $ | 899 | $ | 848 | $ | (26) | (3) | % | $ | 25 | 3 | % | |||||||||||||||||||||||||||

| Interest on money market investments | 60 | 67 | 48 | (7) | (10) | 12 | 25 | ||||||||||||||||||||||||||||||||||

| Interest on securities | 129 | 138 | 144 | (9) | (7) | (15) | (10) | ||||||||||||||||||||||||||||||||||

Total interest income |

1,062 | 1,104 | 1,040 | (42) | (4) | 22 | 2 | ||||||||||||||||||||||||||||||||||

| Interest on deposits | 371 | 403 | 395 | (32) | (8) | (24) | (6) | ||||||||||||||||||||||||||||||||||

| Interest on short- and long-term borrowings | 64 | 81 | 62 | (17) | (21) | 2 | 3 | ||||||||||||||||||||||||||||||||||

Total interest expense |

435 | 484 | 457 | (49) | (10) | (22) | (5) | ||||||||||||||||||||||||||||||||||

Net interest income |

$ | 627 | $ | 620 | $ | 583 | $ | 7 | 1 | $ | 44 | 8 | |||||||||||||||||||||||||||||

| bps | bps | ||||||||||||||||||||||||||||||||||||||||

Yield on interest-earning assets1 |

5.13 | % | 5.35 | % | 5.15 | % | (22) | (2) | |||||||||||||||||||||||||||||||||

Rate paid on total deposits and interest-bearing liabilities1 |

2.12 | % | 2.36 | % | 2.25 | % | (24) | (13) | |||||||||||||||||||||||||||||||||

Cost of total deposits1 |

1.93 | % | 2.14 | % | 2.06 | % | (21) | (13) | |||||||||||||||||||||||||||||||||

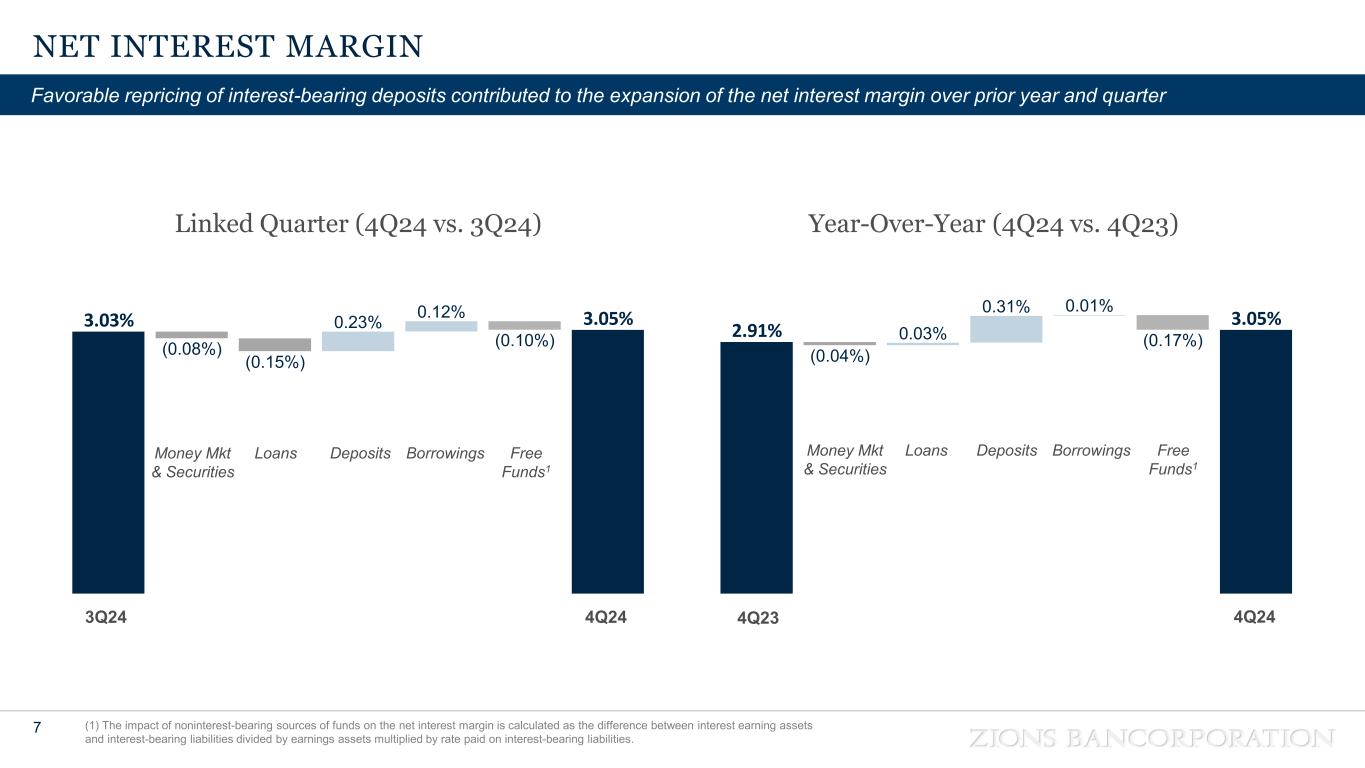

Net interest margin1 |

3.05 | % | 3.03 | % | 2.91 | % | 2 | 14 | |||||||||||||||||||||||||||||||||

Noninterest Income | |||||||||||||||||||||||||||||||||||||||||

| 4Q24 - 3Q24 | 4Q24 - 4Q23 | ||||||||||||||||||||||||||||||||||||||||

| (In millions) | 4Q24 | 3Q24 | 4Q23 | $ | % | $ | % | ||||||||||||||||||||||||||||||||||

| Commercial account fees | $ | 47 | $ | 46 | $ | 43 | $ | 1 | 2 | % | $ | 4 | 9 | % | |||||||||||||||||||||||||||

| Card fees | 24 | 24 | 26 | — | — | (2) | (8) | ||||||||||||||||||||||||||||||||||

| Retail and business banking fees | 17 | 18 | 17 | (1) | (6) | — | — | ||||||||||||||||||||||||||||||||||

| Loan-related fees and income | 20 | 17 | 16 | 3 | 18 | 4 | 25 | ||||||||||||||||||||||||||||||||||

| Capital markets fees | 37 | 28 | 19 | 9 | 32 | 18 | 95 | ||||||||||||||||||||||||||||||||||

| Wealth management fees | 14 | 14 | 14 | — | — | — | — | ||||||||||||||||||||||||||||||||||

| Other customer-related fees | 14 | 14 | 15 | — | — | (1) | (7) | ||||||||||||||||||||||||||||||||||

| Customer-related noninterest income | 173 | 161 | 150 | 12 | 7 | 23 | 15 | ||||||||||||||||||||||||||||||||||

| Fair value and nonhedge derivative income (loss) | 3 | (3) | (9) | 6 | NM | 12 | NM | ||||||||||||||||||||||||||||||||||

| Dividends and other income | 9 | 5 | 8 | 4 | 80 | 1 | 13 | ||||||||||||||||||||||||||||||||||

| Securities gains (losses), net | 8 | 9 | (1) | (1) | (11) | 9 | NM | ||||||||||||||||||||||||||||||||||

| Noncustomer-related noninterest income | 20 | 11 | (2) | 9 | 82 | 22 | NM | ||||||||||||||||||||||||||||||||||

Total noninterest income |

$ | 193 | $ | 172 | $ | 148 | $ | 21 | 12 | $ | 45 | 30 | |||||||||||||||||||||||||||||

Noninterest Expense | |||||||||||||||||||||||||||||||||||||||||

| 4Q24 - 3Q24 | 4Q24 - 4Q23 | ||||||||||||||||||||||||||||||||||||||||

| (In millions) | 4Q24 | 3Q24 | 4Q23 | $ | % | $ | % | ||||||||||||||||||||||||||||||||||

| Salaries and employee benefits | $ | 321 | $ | 317 | $ | 301 | $ | 4 | 1 | % | $ | 20 | 7 | % | |||||||||||||||||||||||||||

| Technology, telecom, and information processing | 66 | 66 | 65 | — | — | 1 | 2 | ||||||||||||||||||||||||||||||||||

| Occupancy and equipment, net | 42 | 40 | 38 | 2 | 5 | 4 | 11 | ||||||||||||||||||||||||||||||||||

| Professional and legal services | 17 | 14 | 17 | 3 | 21 | — | — | ||||||||||||||||||||||||||||||||||

| Marketing and business development | 10 | 12 | 11 | (2) | (17) | (1) | (9) | ||||||||||||||||||||||||||||||||||

| Deposit insurance and regulatory expense | 17 | 19 | 109 | (2) | (11) | (92) | (84) | ||||||||||||||||||||||||||||||||||

| Credit-related expense | 6 | 6 | 7 | — | — | (1) | (14) | ||||||||||||||||||||||||||||||||||

| Other | 30 | 28 | 33 | 2 | 7 | (3) | (9) | ||||||||||||||||||||||||||||||||||

Total noninterest expense |

$ | 509 | $ | 502 | $ | 581 | $ | 7 | 1 | $ | (72) | (12) | |||||||||||||||||||||||||||||

Adjusted noninterest expense 1 |

$ | 509 | $ | 499 | $ | 489 | $ | 10 | 2 | $ | 20 | 4 | |||||||||||||||||||||||||||||

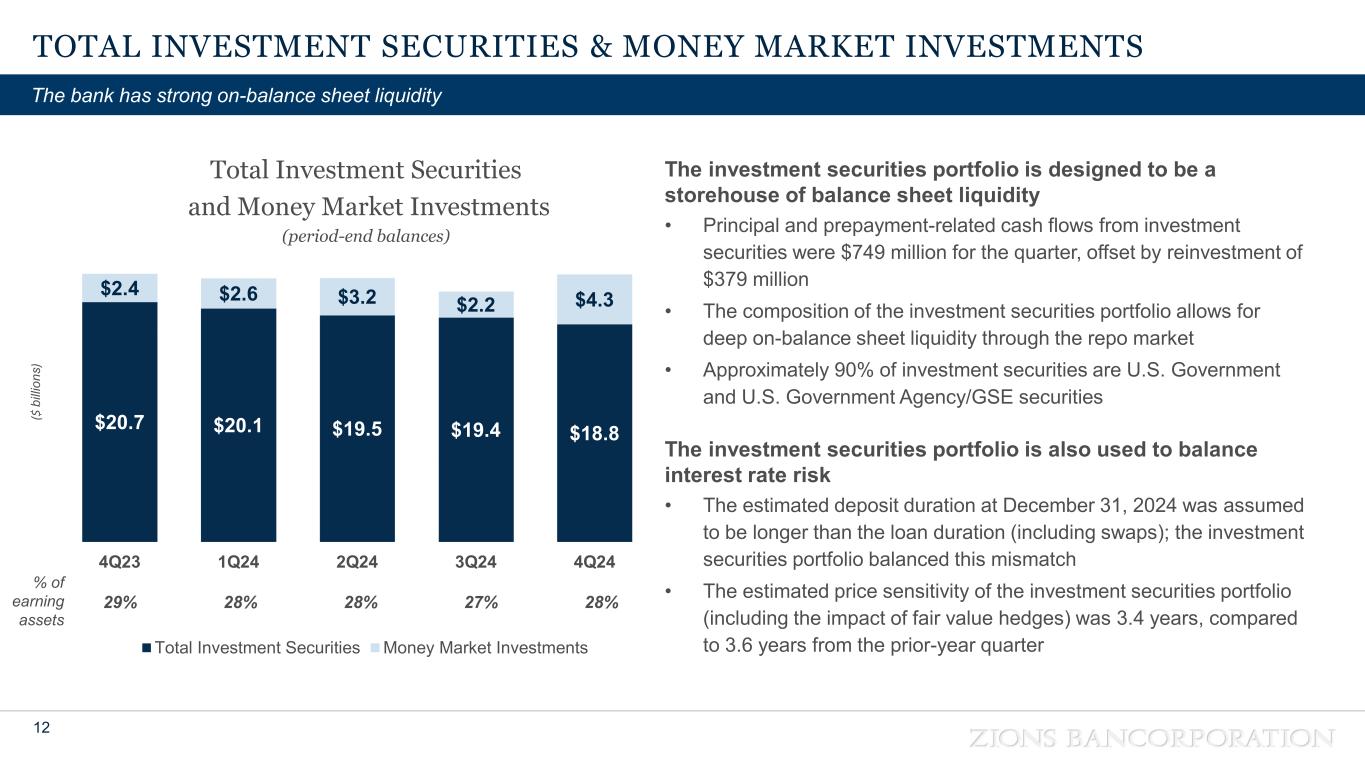

| Investment Securities | |||||||||||||||||||||||||||||||||||||||||

| 4Q24 - 3Q24 | 4Q24 - 4Q23 | ||||||||||||||||||||||||||||||||||||||||

| (In millions) | 4Q24 | 3Q24 | 4Q23 | $ | % | $ | % | ||||||||||||||||||||||||||||||||||

| Investment securities: | |||||||||||||||||||||||||||||||||||||||||

| Available-for-sale, at fair value | $ | 9,095 | $ | 9,495 | $ | 10,300 | $ | (400) | (4) | % | $ | (1,205) | (12) | % | |||||||||||||||||||||||||||

| Held-to-maturity, at amortized cost | 9,669 | 9,857 | 10,382 | (188) | (2) | (713) | (7) | ||||||||||||||||||||||||||||||||||

| Total investment securities, net of allowance | $ | 18,764 | $ | 19,352 | $ | 20,682 | $ | (588) | (3) | $ | (1,918) | (9) | |||||||||||||||||||||||||||||

| Loans and Leases | |||||||||||||||||||||||||||||||||||||||||

| 4Q24 - 3Q24 | 4Q24 - 4Q23 | ||||||||||||||||||||||||||||||||||||||||

| (In millions) | 4Q24 | 3Q24 | 4Q23 | $ | % | $ | % | ||||||||||||||||||||||||||||||||||

| Loans held for sale | $ | 74 | $ | 97 | $ | 53 | $ | (23) | (24) | % | $ | 21 | 40 | % | |||||||||||||||||||||||||||

| Loans and leases: | |||||||||||||||||||||||||||||||||||||||||

Commercial |

$ | 30,965 | $ | 30,785 | $ | 30,588 | $ | 180 | 1 | $ | 377 | 1 | |||||||||||||||||||||||||||||

Commercial real estate |

13,477 | 13,483 | 13,371 | (6) | — | 106 | 1 | ||||||||||||||||||||||||||||||||||

Consumer |

14,968 | 14,616 | 13,820 | 352 | 2 | 1,148 | 8 | ||||||||||||||||||||||||||||||||||

| Loans and leases, net of unearned income and fees | 59,410 | 58,884 | 57,779 | 526 | 1 | 1,631 | 3 | ||||||||||||||||||||||||||||||||||

Less allowance for loan losses |

696 | 694 | 684 | 2 | — | 12 | 2 | ||||||||||||||||||||||||||||||||||

Loans and leases held for investment, net of allowance |

$ | 58,714 | $ | 58,190 | $ | 57,095 | $ | 524 | 1 | $ | 1,619 | 3 | |||||||||||||||||||||||||||||

| Unfunded lending commitments | $ | 29,618 | $ | 29,121 | $ | 29,716 | $ | 497 | 2 | $ | (98) | — | |||||||||||||||||||||||||||||

| Credit Quality | |||||||||||||||||||||||||||||||||||||||||

| 4Q24 - 3Q24 | 4Q24 - 4Q23 | ||||||||||||||||||||||||||||||||||||||||

| (In millions) | 4Q24 | 3Q24 | 4Q23 | $ | % | $ | % | ||||||||||||||||||||||||||||||||||

| Provision for credit losses | $ | 41 | $ | 13 | $ | — | $ | 28 | NM | $ | 41 | NM | |||||||||||||||||||||||||||||

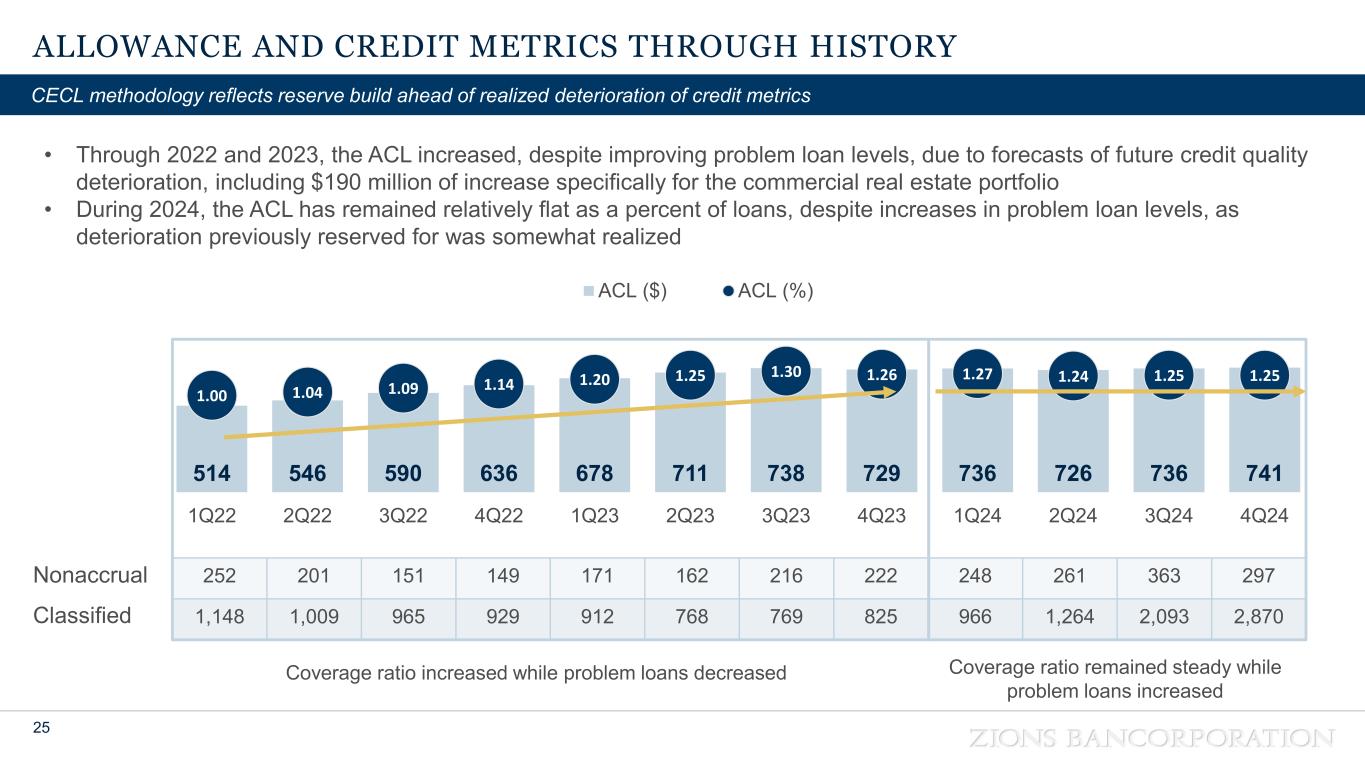

| Allowance for credit losses | 741 | 736 | 729 | 5 | 1 | % | 12 | 2 | % | ||||||||||||||||||||||||||||||||

| Net loan and lease charge-offs (recoveries) | 36 | 3 | 9 | 33 | NM | 27 | NM | ||||||||||||||||||||||||||||||||||

| Nonperforming assets | 298 | 368 | 228 | (70) | (19) | 70 | 31 | ||||||||||||||||||||||||||||||||||

| Classified loans | 2,870 | 2,093 | 825 | 777 | 37 | 2,045 | NM | ||||||||||||||||||||||||||||||||||

| 4Q24 | 3Q24 | 4Q23 | bps | bps | |||||||||||||||||||||||||||||||||||||

| Ratio of ACL to loans and leases outstanding, at period end | 1.25 | % | 1.25 | % | 1.26 | % | — | (1) | |||||||||||||||||||||||||||||||||

| Annualized ratio of net loan and lease charge-offs (recoveries) to average loans | 0.24 | % | 0.02 | % | 0.06 | % | 22 | 18 | |||||||||||||||||||||||||||||||||

| Ratio of nonperforming assets to loans and leases and other real estate owned | 0.50 | % | 0.62 | % | 0.39 | % | (12) | 11 | |||||||||||||||||||||||||||||||||

| Ratio of classified loans to total loans and leases | 4.83 | % | 3.55 | % | 1.43 | % | 128 | 340 | |||||||||||||||||||||||||||||||||

Deposits and Borrowed Funds | |||||||||||||||||||||||||||||||||||||||||

| 4Q24 - 3Q24 | 4Q24 - 4Q23 | ||||||||||||||||||||||||||||||||||||||||

| (In millions) | 4Q24 | 3Q24 | 4Q23 | $ | % | $ | % | ||||||||||||||||||||||||||||||||||

| Deposits: | |||||||||||||||||||||||||||||||||||||||||

| Noninterest-bearing demand | $ | 24,704 | $ | 24,973 | $ | 26,244 | $ | (269) | (1) | % | $ | (1,540) | (6) | % | |||||||||||||||||||||||||||

| Interest-bearing: | |||||||||||||||||||||||||||||||||||||||||

| Savings and money market | 40,037 | 39,215 | 38,663 | 822 | 2 | 1,374 | 4 | ||||||||||||||||||||||||||||||||||

| Time | 6,448 | 6,333 | 5,619 | 115 | 2 | 829 | 15 | ||||||||||||||||||||||||||||||||||

| Brokered | 5,034 | 5,197 | 4,435 | (163) | (3) | 599 | 14 | ||||||||||||||||||||||||||||||||||

| Total interest-bearing | 51,519 | 50,745 | 48,717 | 774 | 2 | 2,802 | 6 | ||||||||||||||||||||||||||||||||||

| Total deposits | $ | 76,223 | $ | 75,718 | $ | 74,961 | $ | 505 | 1 | $ | 1,262 | 2 | |||||||||||||||||||||||||||||

| Borrowed funds: | |||||||||||||||||||||||||||||||||||||||||

| Federal funds purchased and other short-term borrowings | $ | 3,832 | $ | 2,919 | $ | 4,379 | $ | 913 | 31 | $ | (547) | (12) | |||||||||||||||||||||||||||||

| Long-term debt | 950 | 548 | 542 | 402 | 73 | 408 | 75 | ||||||||||||||||||||||||||||||||||

| Total borrowed funds | $ | 4,782 | $ | 3,467 | $ | 4,921 | $ | 1,315 | 38 | $ | (139) | (3) | |||||||||||||||||||||||||||||

| Shareholders’ Equity | |||||||||||||||||||||||||||||||||||||||||

| 4Q24 - 3Q24 | 4Q24 - 4Q23 | ||||||||||||||||||||||||||||||||||||||||

| (In millions, except share data) | 4Q24 | 3Q24 | 4Q23 | $ | % | $ | % | ||||||||||||||||||||||||||||||||||

| Shareholders’ equity: | |||||||||||||||||||||||||||||||||||||||||

Preferred stock |

$ | 66 | $ | 440 | $ | 440 | $ | (374) | (85) | % | $ | (374) | (85) | % | |||||||||||||||||||||||||||

Common stock and additional paid-in capital |

1,737 | 1,717 | 1,731 | 20 | 1 | 6 | — | ||||||||||||||||||||||||||||||||||

Retained earnings |

6,701 | 6,564 | 6,212 | 137 | 2 | 489 | 8 | ||||||||||||||||||||||||||||||||||

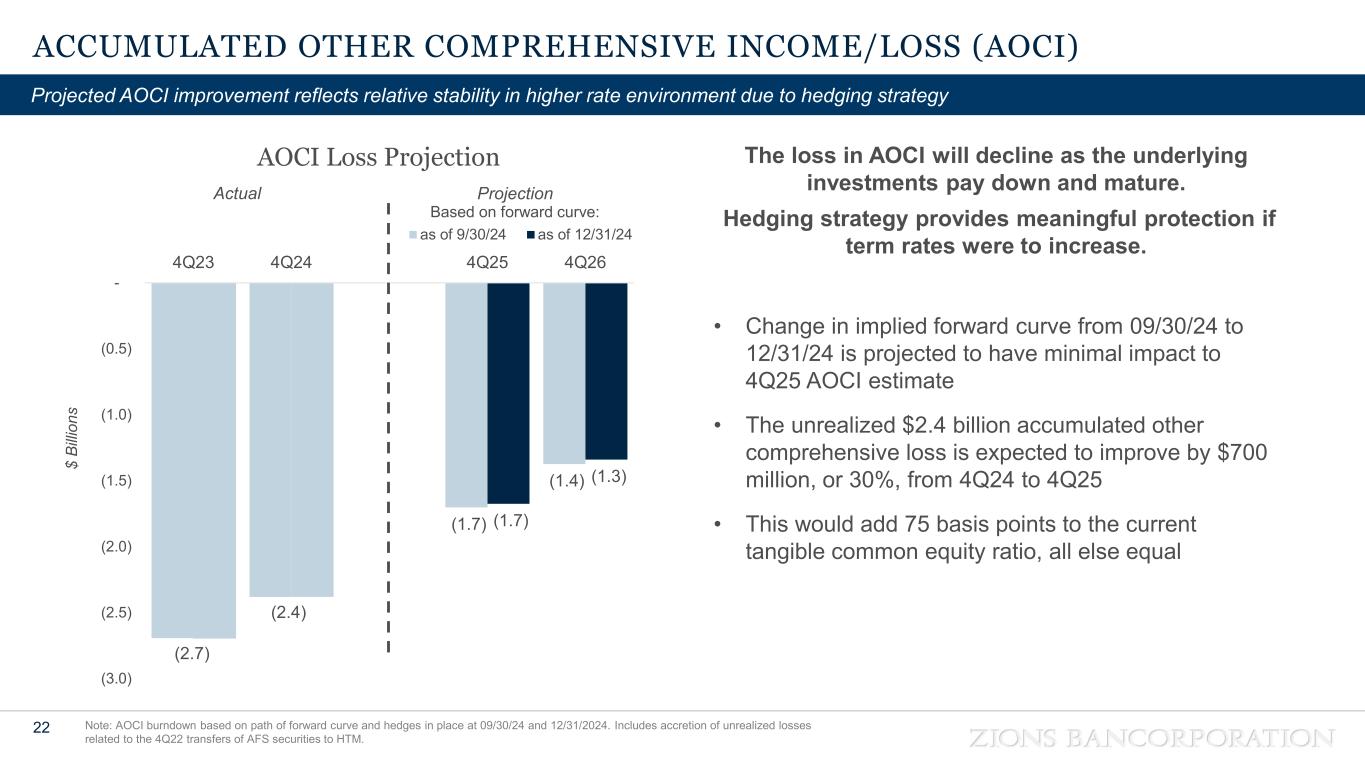

| Accumulated other comprehensive income (loss) | (2,380) | (2,336) | (2,692) | (44) | (2) | 312 | 12 | ||||||||||||||||||||||||||||||||||

| Total shareholders’ equity | $ | 6,124 | $ | 6,385 | $ | 5,691 | $ | (261) | (4) | $ | 433 | 8 | |||||||||||||||||||||||||||||

| Capital distributions: | |||||||||||||||||||||||||||||||||||||||||

| Common dividends paid | $ | 64 | $ | 61 | $ | 61 | $ | 3 | 5 | $ | 3 | 5 | |||||||||||||||||||||||||||||

| Bank common stock repurchased | — | — | — | — | — | — | — | ||||||||||||||||||||||||||||||||||

| Total capital distributed to common shareholders | $ | 64 | $ | 61 | $ | 61 | $ | 3 | 5 | $ | 3 | 5 | |||||||||||||||||||||||||||||

| shares | % | shares | % | ||||||||||||||||||||||||||||||||||||||

Weighted average diluted common shares outstanding (in thousands) |

147,329 | 147,150 | 147,645 | 179 | — | % | (316) | — | % | ||||||||||||||||||||||||||||||||

| Common shares outstanding, at period end (in thousands) | 147,871 | 147,699 | 148,153 | 172 | — | (282) | — | ||||||||||||||||||||||||||||||||||

| Three Months Ended | |||||||||||||||||||||||||||||

| (In millions, except share, per share, and ratio data) | December 31, 2024 |

September 30, 2024 |

June 30, 2024 |

March 31, 2024 |

December 31, 2023 |

||||||||||||||||||||||||

BALANCE SHEET 1 |

|||||||||||||||||||||||||||||

| Loans held for investment, net of allowance | $ | 58,714 | $ | 58,190 | $ | 57,719 | $ | 57,410 | $ | 57,095 | |||||||||||||||||||

| Total assets | 88,775 | 87,032 | 87,606 | 87,060 | 87,203 | ||||||||||||||||||||||||

| Deposits | 76,223 | 75,718 | 73,770 | 74,237 | 74,961 | ||||||||||||||||||||||||

| Total shareholders’ equity | 6,124 | 6,385 | 6,025 | 5,829 | 5,691 | ||||||||||||||||||||||||

| STATEMENT OF INCOME | |||||||||||||||||||||||||||||

Net earnings applicable to common shareholders |

$ | 200 | $ | 204 | $ | 190 | $ | 143 | $ | 116 | |||||||||||||||||||

| Net interest income | 627 | 620 | 597 | 586 | 583 | ||||||||||||||||||||||||

Taxable-equivalent net interest income 2 |

639 | 632 | 608 | 596 | 593 | ||||||||||||||||||||||||

| Total noninterest income | 193 | 172 | 179 | 156 | 148 | ||||||||||||||||||||||||

| Total noninterest expense | 509 | 502 | 509 | 526 | 581 | ||||||||||||||||||||||||

Pre-provision net revenue 2 |

323 | 302 | 278 | 226 | 160 | ||||||||||||||||||||||||

Adjusted pre-provision net revenue 2 |

312 | 299 | 278 | 242 | 262 | ||||||||||||||||||||||||

| Provision for credit losses | 41 | 13 | 5 | 13 | — | ||||||||||||||||||||||||

| SHARE AND PER COMMON SHARE AMOUNTS | |||||||||||||||||||||||||||||

| Net earnings per diluted common share | $ | 1.34 | $ | 1.37 | $ | 1.28 | $ | 0.96 | $ | 0.78 | |||||||||||||||||||

| Dividends | 0.43 | 0.41 | 0.41 | 0.41 | 0.41 | ||||||||||||||||||||||||

Book value per common share 1 |

40.97 | 40.25 | 37.82 | 36.50 | 35.44 | ||||||||||||||||||||||||

Tangible book value per common share 1, 2 |

33.85 | 33.12 | 30.67 | 29.34 | 28.30 | ||||||||||||||||||||||||

| Weighted average share price | 54.60 | 47.13 | 42.01 | 41.03 | 35.95 | ||||||||||||||||||||||||

Weighted average diluted common shares outstanding (in thousands) |

147,329 | 147,150 | 147,120 | 147,343 | 147,645 | ||||||||||||||||||||||||

Common shares outstanding (in thousands) 1 |

147,871 | 147,699 | 147,684 | 147,653 | 148,153 | ||||||||||||||||||||||||

| SELECTED RATIOS AND OTHER DATA | |||||||||||||||||||||||||||||

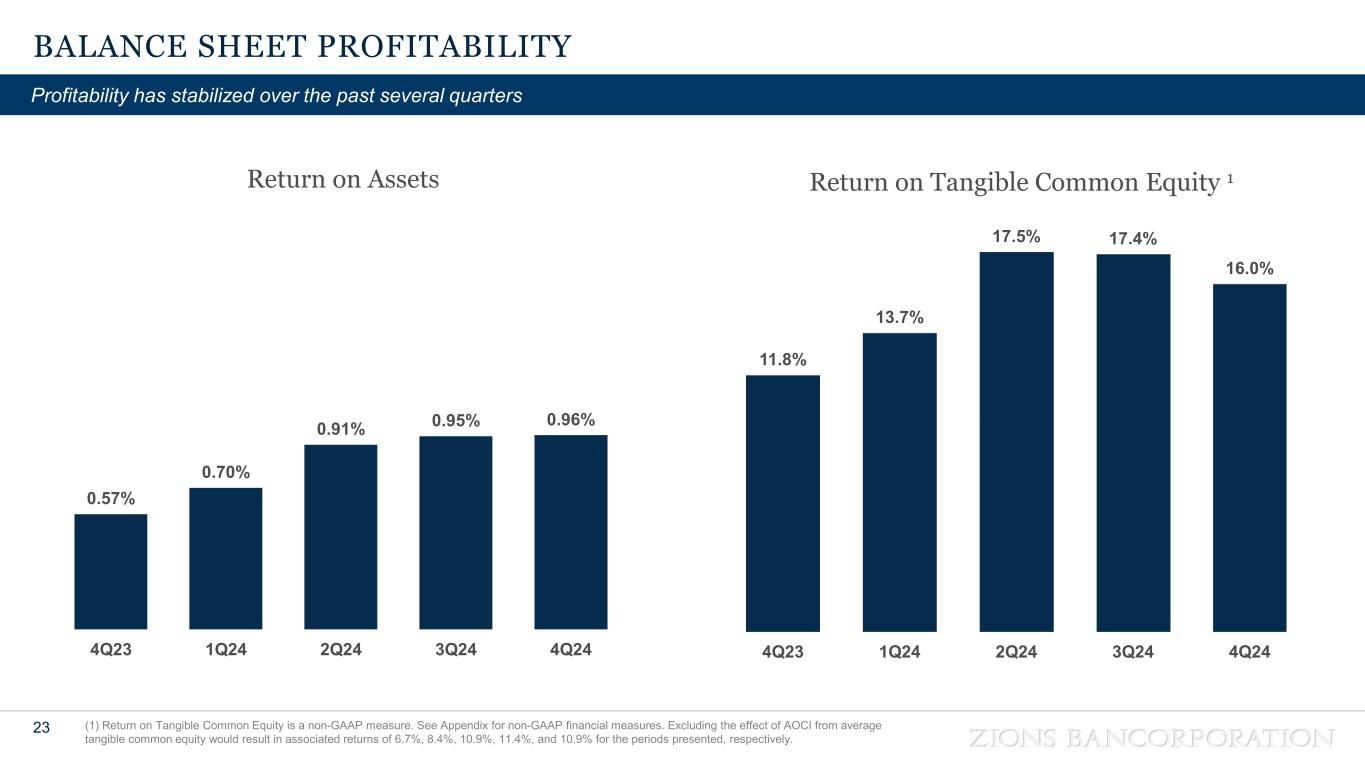

| Return on average assets | 0.96 | % | 0.95 | % | 0.91 | % | 0.70 | % | 0.57 | % | |||||||||||||||||||

| Return on average common equity | 13.2 | % | 14.1 | % | 14.0 | % | 10.9 | % | 9.2 | % | |||||||||||||||||||

Return on average tangible common equity 2 |

16.0 | % | 17.4 | % | 17.5 | % | 13.7 | % | 11.8 | % | |||||||||||||||||||

| Net interest margin | 3.05 | % | 3.03 | % | 2.98 | % | 2.94 | % | 2.91 | % | |||||||||||||||||||

| Cost of total deposits | 1.93 | % | 2.14 | % | 2.11 | % | 2.06 | % | 2.06 | % | |||||||||||||||||||

Efficiency ratio 2 |

62.0 | % | 62.5 | % | 64.5 | % | 67.9 | % | 65.1 | % | |||||||||||||||||||

Effective tax rate 3 |

20.0 | % | 22.7 | % | 23.3 | % | 24.6 | % | 16.0 | % | |||||||||||||||||||

Ratio of nonperforming assets to loans and leases and other real estate owned |

0.50 | % | 0.62 | % | 0.45 | % | 0.44 | % | 0.39 | % | |||||||||||||||||||

| Annualized ratio of net loan and lease charge-offs to average loans | 0.24 | % | 0.02 | % | 0.10 | % | 0.04 | % | 0.06 | % | |||||||||||||||||||

Ratio of total allowance for credit losses to loans and leases outstanding 1 |

1.25 | % | 1.25 | % | 1.24 | % | 1.27 | % | 1.26 | % | |||||||||||||||||||

Full-time equivalent employees |

9,406 | 9,503 | 9,696 | 9,708 | 9,679 | ||||||||||||||||||||||||

CAPITAL RATIOS AND DATA 1 |

|||||||||||||||||||||||||||||

Tangible common equity ratio 2 |

5.7 | % | 5.7 | % | 5.2 | % | 5.0 | % | 4.9 | % | |||||||||||||||||||

Common equity tier 1 capital 4 |

$ | 7,363 | $ | 7,206 | $ | 7,057 | $ | 6,920 | $ | 6,863 | |||||||||||||||||||

Risk-weighted assets 4 |

$ | 67,660 | $ | 67,305 | $ | 66,885 | $ | 66,824 | $ | 66,934 | |||||||||||||||||||

Common equity tier 1 capital ratio 4 |

10.9 | % | 10.7 | % | 10.6 | % | 10.4 | % | 10.3 | % | |||||||||||||||||||

Tier 1 risk-based capital ratio 4 |

11.0 | % | 11.4 | % | 11.2 | % | 11.0 | % | 10.9 | % | |||||||||||||||||||

Total risk-based capital ratio 4 |

13.3 | % | 13.2 | % | 13.1 | % | 12.9 | % | 12.8 | % | |||||||||||||||||||

Tier 1 leverage ratio 4 |

8.3 | % | 8.6 | % | 8.5 | % | 8.4 | % | 8.3 | % | |||||||||||||||||||

| (In millions, shares in thousands) | December 31, 2024 |

September 30, 2024 |

June 30, 2024 |

March 31, 2024 |

December 31, 2023 |

||||||||||||||||||||||||

| (Unaudited) | (Unaudited) | (Unaudited) | (Unaudited) | ||||||||||||||||||||||||||

| ASSETS | |||||||||||||||||||||||||||||

| Cash and due from banks | $ | 651 | $ | 1,114 | $ | 717 | $ | 709 | $ | 716 | |||||||||||||||||||

| Money market investments: | |||||||||||||||||||||||||||||

| Interest-bearing deposits | 2,850 | 1,253 | 2,276 | 1,688 | 1,488 | ||||||||||||||||||||||||

| Federal funds sold and securities purchased under agreements to resell | 1,453 | 986 | 936 | 894 | 937 | ||||||||||||||||||||||||

| Trading securities, at fair value | 35 | 68 | 24 | 59 | 48 | ||||||||||||||||||||||||

| Investment securities: | |||||||||||||||||||||||||||||

| Available-for-sale, at fair value | 9,095 | 9,495 | 9,483 | 9,931 | 10,300 | ||||||||||||||||||||||||

Held-to-maturity1, at amortized cost |

9,669 | 9,857 | 10,065 | 10,209 | 10,382 | ||||||||||||||||||||||||

| Total investment securities, net of allowance | 18,764 | 19,352 | 19,548 | 20,140 | 20,682 | ||||||||||||||||||||||||

Loans held for sale2 |

74 | 97 | 112 | 12 | 53 | ||||||||||||||||||||||||

| Loans and leases, net of unearned income and fees | 59,410 | 58,884 | 58,415 | 58,109 | 57,779 | ||||||||||||||||||||||||

| Less allowance for loan losses | 696 | 694 | 696 | 699 | 684 | ||||||||||||||||||||||||

| Loans held for investment, net of allowance | 58,714 | 58,190 | 57,719 | 57,410 | 57,095 | ||||||||||||||||||||||||

| Other noninterest-bearing investments | 1,020 | 946 | 987 | 922 | 950 | ||||||||||||||||||||||||

| Premises, equipment, and software, net | 1,366 | 1,372 | 1,383 | 1,396 | 1,400 | ||||||||||||||||||||||||

| Goodwill and intangibles | 1,052 | 1,053 | 1,055 | 1,057 | 1,059 | ||||||||||||||||||||||||

| Other real estate owned | 1 | 5 | 4 | 6 | 6 | ||||||||||||||||||||||||

| Other assets | 2,795 | 2,596 | 2,845 | 2,767 | 2,769 | ||||||||||||||||||||||||

| Total assets | $ | 88,775 | $ | 87,032 | $ | 87,606 | $ | 87,060 | $ | 87,203 | |||||||||||||||||||

| LIABILITIES AND SHAREHOLDERS’ EQUITY | |||||||||||||||||||||||||||||

| Deposits: | |||||||||||||||||||||||||||||

| Noninterest-bearing demand | $ | 24,704 | $ | 24,973 | $ | 24,731 | $ | 25,137 | $ | 26,244 | |||||||||||||||||||

| Interest-bearing: | |||||||||||||||||||||||||||||

| Savings and money market | 40,037 | 39,242 | 38,596 | 38,879 | 38,721 | ||||||||||||||||||||||||

| Time | 11,482 | 11,503 | 10,443 | 10,221 | 9,996 | ||||||||||||||||||||||||

| Total deposits | 76,223 | 75,718 | 73,770 | 74,237 | 74,961 | ||||||||||||||||||||||||

| Federal funds and other short-term borrowings | 3,832 | 2,919 | 5,651 | 4,895 | 4,379 | ||||||||||||||||||||||||

| Long-term debt | 950 | 548 | 546 | 544 | 542 | ||||||||||||||||||||||||

| Reserve for unfunded lending commitments | 45 | 42 | 30 | 37 | 45 | ||||||||||||||||||||||||

| Other liabilities | 1,601 | 1,420 | 1,584 | 1,518 | 1,585 | ||||||||||||||||||||||||

| Total liabilities | 82,651 | 80,647 | 81,581 | 81,231 | 81,512 | ||||||||||||||||||||||||

| Shareholders’ equity: | |||||||||||||||||||||||||||||

| Preferred stock, without par value; authorized 4,400 shares | 66 | 440 | 440 | 440 | 440 | ||||||||||||||||||||||||

Common stock3 ($0.001 par value; authorized 350,000 shares) and additional paid-in capital |

1,737 | 1,717 | 1,713 | 1,705 | 1,731 | ||||||||||||||||||||||||

| Retained earnings | 6,701 | 6,564 | 6,421 | 6,293 | 6,212 | ||||||||||||||||||||||||

| Accumulated other comprehensive income (loss) | (2,380) | (2,336) | (2,549) | (2,609) | (2,692) | ||||||||||||||||||||||||

| Total shareholders’ equity | 6,124 | 6,385 | 6,025 | 5,829 | 5,691 | ||||||||||||||||||||||||

| Total liabilities and shareholders’ equity | $ | 88,775 | $ | 87,032 | $ | 87,606 | $ | 87,060 | $ | 87,203 | |||||||||||||||||||

1 Held-to-maturity (fair value) |

$ | 9,382 | $ | 10,024 | $ | 9,891 | $ | 10,105 | $ | 10,466 | |||||||||||||||||||

2 Loans held for sale (carried at fair value) |

25 | 58 | 58 | — | 43 | ||||||||||||||||||||||||

3 Common shares (issued and outstanding) |

147,871 | 147,699 | 147,684 | 147,653 | 148,153 | ||||||||||||||||||||||||

| (Unaudited) | Three Months Ended | ||||||||||||||||||||||||||||

| (In millions, except share and per share amounts) | December 31, 2024 |

September 30, 2024 |

June 30, 2024 |

March 31, 2024 |

December 31, 2023 |

||||||||||||||||||||||||

| Interest income: | |||||||||||||||||||||||||||||

| Interest and fees on loans | $ | 873 | $ | 899 | $ | 877 | $ | 865 | $ | 848 | |||||||||||||||||||

| Interest on money market investments | 60 | 67 | 56 | 47 | 48 | ||||||||||||||||||||||||

| Interest on securities | 129 | 138 | 140 | 142 | 144 | ||||||||||||||||||||||||

| Total interest income | 1,062 | 1,104 | 1,073 | 1,054 | 1,040 | ||||||||||||||||||||||||

| Interest expense: | |||||||||||||||||||||||||||||

| Interest on deposits | 371 | 403 | 390 | 376 | 395 | ||||||||||||||||||||||||

| Interest on short- and long-term borrowings | 64 | 81 | 86 | 92 | 62 | ||||||||||||||||||||||||

| Total interest expense | 435 | 484 | 476 | 468 | 457 | ||||||||||||||||||||||||

| Net interest income | 627 | 620 | 597 | 586 | 583 | ||||||||||||||||||||||||

| Provision for credit losses: | |||||||||||||||||||||||||||||

| Provision for loan losses | 38 | 1 | 12 | 21 | 12 | ||||||||||||||||||||||||

| Provision for unfunded lending commitments | 3 | 12 | (7) | (8) | (12) | ||||||||||||||||||||||||

| Total provision for credit losses | 41 | 13 | 5 | 13 | — | ||||||||||||||||||||||||

| Net interest income after provision for credit losses | 586 | 607 | 592 | 573 | 583 | ||||||||||||||||||||||||

| Noninterest income: | |||||||||||||||||||||||||||||

| Commercial account fees | 47 | 46 | 45 | 44 | 43 | ||||||||||||||||||||||||

| Card fees | 24 | 24 | 25 | 23 | 26 | ||||||||||||||||||||||||

| Retail and business banking fees | 17 | 18 | 16 | 16 | 17 | ||||||||||||||||||||||||

| Loan-related fees and income | 20 | 17 | 18 | 15 | 16 | ||||||||||||||||||||||||

| Capital markets fees | 37 | 28 | 21 | 24 | 19 | ||||||||||||||||||||||||

| Wealth management fees | 14 | 14 | 15 | 15 | 14 | ||||||||||||||||||||||||

| Other customer-related fees | 14 | 14 | 14 | 14 | 15 | ||||||||||||||||||||||||

| Customer-related noninterest income | 173 | 161 | 154 | 151 | 150 | ||||||||||||||||||||||||

| Fair value and nonhedge derivative income (loss) | 3 | (3) | (1) | 1 | (9) | ||||||||||||||||||||||||

| Dividends and other income | 9 | 5 | 22 | 6 | 8 | ||||||||||||||||||||||||

| Securities gains (losses), net | 8 | 9 | 4 | (2) | (1) | ||||||||||||||||||||||||

| Total noninterest income | 193 | 172 | 179 | 156 | 148 | ||||||||||||||||||||||||

| Noninterest expense: | |||||||||||||||||||||||||||||

| Salaries and employee benefits | 321 | 317 | 318 | 331 | 301 | ||||||||||||||||||||||||

| Technology, telecom, and information processing | 66 | 66 | 66 | 62 | 65 | ||||||||||||||||||||||||

| Occupancy and equipment, net | 42 | 40 | 40 | 39 | 38 | ||||||||||||||||||||||||

| Professional and legal services | 17 | 14 | 17 | 16 | 17 | ||||||||||||||||||||||||

| Marketing and business development | 10 | 12 | 13 | 10 | 11 | ||||||||||||||||||||||||

| Deposit insurance and regulatory expense | 17 | 19 | 21 | 34 | 109 | ||||||||||||||||||||||||

| Credit-related expense | 6 | 6 | 6 | 7 | 7 | ||||||||||||||||||||||||

| Other real estate expense, net | — | — | (1) | — | — | ||||||||||||||||||||||||

| Other | 30 | 28 | 29 | 27 | 33 | ||||||||||||||||||||||||

| Total noninterest expense | 509 | 502 | 509 | 526 | 581 | ||||||||||||||||||||||||

| Income before income taxes | 270 | 277 | 262 | 203 | 150 | ||||||||||||||||||||||||

| Income taxes | 54 | 63 | 61 | 50 | 24 | ||||||||||||||||||||||||

| Net income | 216 | 214 | 201 | 153 | 126 | ||||||||||||||||||||||||

| Preferred stock dividends | (10) | (10) | (11) | (10) | (10) | ||||||||||||||||||||||||

| Preferred stock redemption | (6) | — | — | — | — | ||||||||||||||||||||||||

| Net earnings applicable to common shareholders | $ | 200 | $ | 204 | $ | 190 | $ | 143 | $ | 116 | |||||||||||||||||||

| Weighted average common shares outstanding during the period: | |||||||||||||||||||||||||||||

| Basic shares (in thousands) | 147,247 | 147,138 | 147,115 | 147,338 | 147,640 | ||||||||||||||||||||||||

| Diluted shares (in thousands) | 147,329 | 147,150 | 147,120 | 147,343 | 147,645 | ||||||||||||||||||||||||

| Net earnings per common share: | |||||||||||||||||||||||||||||

| Basic | $ | 1.34 | $ | 1.37 | $ | 1.28 | $ | 0.96 | $ | 0.78 | |||||||||||||||||||

| Diluted | 1.34 | 1.37 | 1.28 | 0.96 | 0.78 | ||||||||||||||||||||||||

| Year Ended December 31, | |||||||||||

| (In millions, except share and per share amounts) | 2024 | 2023 | |||||||||

| (Unaudited) | |||||||||||

| Interest income: | |||||||||||

| Interest and fees on loans | $ | 3,514 | $ | 3,196 | |||||||

| Interest on money market investments | 230 | 188 | |||||||||

| Interest on securities | 549 | 563 | |||||||||

| Total interest income | 4,293 | 3,947 | |||||||||

| Interest expense: | |||||||||||

| Interest on deposits | 1,540 | 1,063 | |||||||||

| Interest on short- and long-term borrowings | 323 | 446 | |||||||||

| Total interest expense | 1,863 | 1,509 | |||||||||

| Net interest income | 2,430 | 2,438 | |||||||||

| Provision for credit losses: | |||||||||||

| Provision for loan losses | 72 | 148 | |||||||||

| Provision for unfunded lending commitments | — | (16) | |||||||||

| Total provision for credit losses | 72 | 132 | |||||||||

| Net interest income after provision for loan losses | 2,358 | 2,306 | |||||||||

| Noninterest income: | |||||||||||

| Commercial account fees | 182 | 174 | |||||||||

| Card fees | 96 | 101 | |||||||||

| Retail and business banking fees | 67 | 66 | |||||||||

| Loan-related fees and income | 70 | 79 | |||||||||

| Capital markets fees | 110 | 81 | |||||||||

| Wealth management fees | 58 | 58 | |||||||||

| Other customer-related fees | 56 | 61 | |||||||||

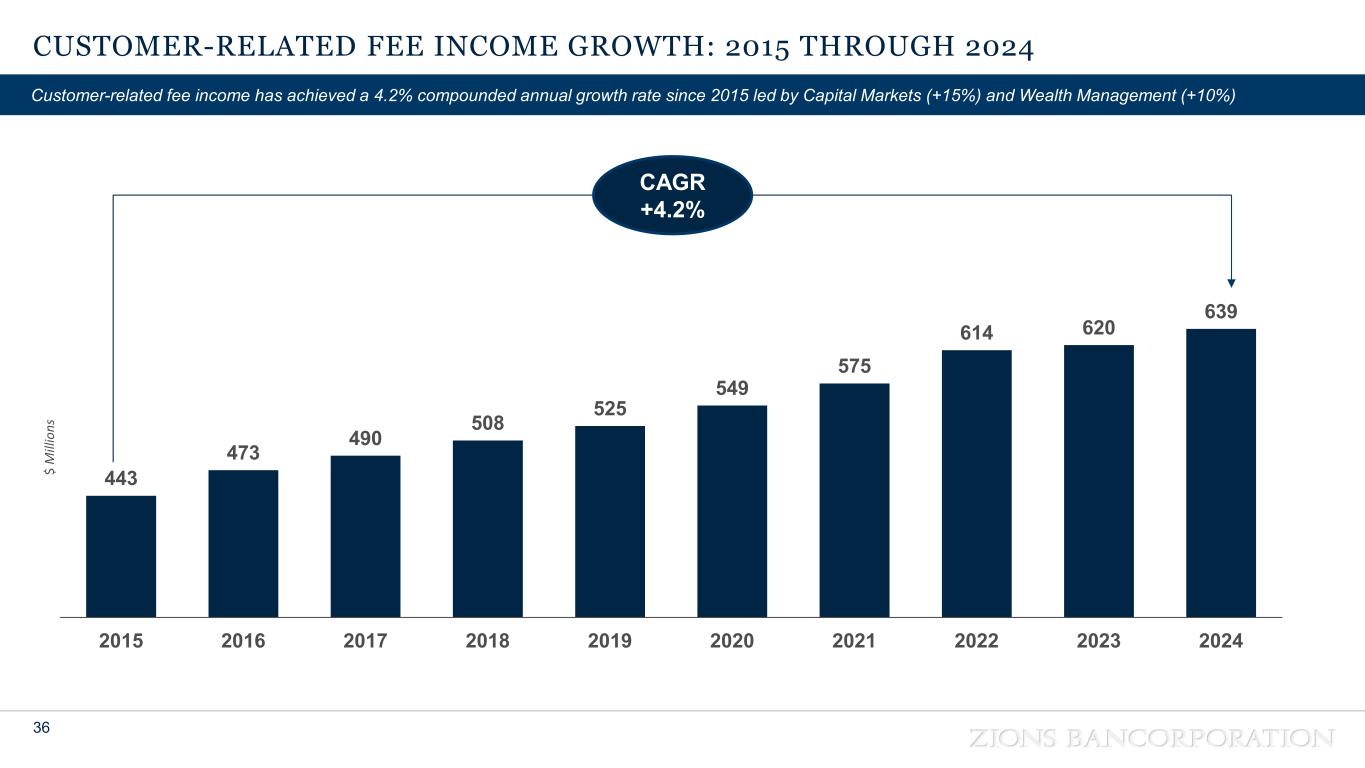

| Customer-related noninterest income | 639 | 620 | |||||||||

| Fair value and nonhedge derivative income (loss) | — | (4) | |||||||||

| Dividends and other income | 42 | 57 | |||||||||

| Securities gains (losses), net | 19 | 4 | |||||||||

| Total noninterest income | 700 | 677 | |||||||||

| Noninterest expense: | |||||||||||

| Salaries and employee benefits | 1,287 | 1,275 | |||||||||

| Technology, telecom, and information processing | 260 | 240 | |||||||||

| Occupancy and equipment, net | 161 | 160 | |||||||||

| Professional and legal services | 64 | 62 | |||||||||

| Marketing and business development | 45 | 46 | |||||||||

| Deposit insurance and regulatory expense | 91 | 169 | |||||||||

| Credit-related expense | 25 | 26 | |||||||||

| Other real estate expense, net | (1) | — | |||||||||

| Other | 114 | 119 | |||||||||

| Total noninterest expense | 2,046 | 2,097 | |||||||||

| Income before income taxes | 1,012 | 886 | |||||||||

| Income taxes | 228 | 206 | |||||||||

| Net income | 784 | 680 | |||||||||

| Preferred stock dividends | (41) | (32) | |||||||||

| Preferred stock redemption | (6) | — | |||||||||

| Net earnings applicable to common shareholders | $ | 737 | $ | 648 | |||||||

| Weighted average common shares outstanding during the year: | |||||||||||

| Basic shares (in thousands) | 147,210 | 147,748 | |||||||||

| Diluted shares (in thousands) | 147,215 | 147,756 | |||||||||

| Net earnings per common share: | |||||||||||

| Basic | $ | 4.95 | $ | 4.35 | |||||||

| Diluted | 4.95 | 4.35 | |||||||||

| (In millions) | December 31, 2024 |

September 30, 2024 |

June 30, 2024 |

March 31, 2024 |

December 31, 2023 |

||||||||||||||||||||||||

| Commercial: | |||||||||||||||||||||||||||||

| Commercial and industrial | $ | 16,891 | $ | 16,757 | $ | 16,622 | $ | 16,519 | $ | 16,684 | |||||||||||||||||||

| Leasing | 377 | 377 | 390 | 388 | 383 | ||||||||||||||||||||||||

| Owner occupied | 9,333 | 9,381 | 9,236 | 9,295 | 9,219 | ||||||||||||||||||||||||

| Municipal | 4,364 | 4,270 | 4,263 | 4,277 | 4,302 | ||||||||||||||||||||||||

| Total commercial | 30,965 | 30,785 | 30,511 | 30,479 | 30,588 | ||||||||||||||||||||||||

| Commercial real estate: | |||||||||||||||||||||||||||||

| Construction and land development | 2,774 | 2,833 | 2,725 | 2,686 | 2,669 | ||||||||||||||||||||||||

| Term | 10,703 | 10,650 | 10,824 | 10,892 | 10,702 | ||||||||||||||||||||||||

| Total commercial real estate | 13,477 | 13,483 | 13,549 | 13,578 | 13,371 | ||||||||||||||||||||||||

| Consumer: | |||||||||||||||||||||||||||||

| Home equity credit line | 3,641 | 3,543 | 3,468 | 3,382 | 3,356 | ||||||||||||||||||||||||

| 1-4 family residential | 9,939 | 9,489 | 9,153 | 8,778 | 8,415 | ||||||||||||||||||||||||

| Construction and other consumer real estate | 810 | 997 | 1,139 | 1,321 | 1,442 | ||||||||||||||||||||||||

| Bankcard and other revolving plans | 457 | 461 | 466 | 439 | 474 | ||||||||||||||||||||||||

| Other | 121 | 126 | 129 | 132 | 133 | ||||||||||||||||||||||||

| Total consumer | 14,968 | 14,616 | 14,355 | 14,052 | 13,820 | ||||||||||||||||||||||||

| Total loans and leases | $ | 59,410 | $ | 58,884 | $ | 58,415 | $ | 58,109 | $ | 57,779 | |||||||||||||||||||

| (In millions) | December 31, 2024 |

September 30, 2024 |

June 30, 2024 |

March 31, 2024 |

December 31, 2023 |

||||||||||||||||||||||||

Nonaccrual loans 1 |

$ | 297 | $ | 363 | $ | 261 | $ | 248 | $ | 222 | |||||||||||||||||||

Other real estate owned 2 |

1 | 5 | 4 | 6 | 6 | ||||||||||||||||||||||||

| Total nonperforming assets | $ | 298 | $ | 368 | $ | 265 | $ | 254 | $ | 228 | |||||||||||||||||||

Ratio of nonperforming assets to loans1 and leases and other real estate owned 2 |

0.50 | % | 0.62 | % | 0.45 | % | 0.44 | % | 0.39 | % | |||||||||||||||||||

| Accruing loans past due 90 days or more | $ | 18 | $ | 7 | $ | 6 | $ | 3 | $ | 3 | |||||||||||||||||||

Ratio of accruing loans past due 90 days or more to loans1 and leases |

0.03 | % | 0.01 | % | 0.01 | % | 0.01 | % | 0.01 | % | |||||||||||||||||||

Nonaccrual loans and accruing loans past due 90 days or more |

$ | 315 | $ | 370 | $ | 267 | $ | 251 | $ | 225 | |||||||||||||||||||

Ratio of nonperforming assets1 and accruing loans 90 days or more past due to loans and leases and other real estate owned |

0.53 | % | 0.64 | % | 0.46 | % | 0.44 | % | 0.40 | % | |||||||||||||||||||

| Accruing loans past due 30-89 days | $ | 57 | $ | 89 | $ | 114 | $ | 77 | $ | 86 | |||||||||||||||||||

| Classified loans | 2,870 | 2,093 | 1,264 | 966 | 825 | ||||||||||||||||||||||||

| Ratio of classified loans to total loans and leases | 4.83 | % | 3.55 | % | 2.16 | % | 1.66 | % | 1.43 | % | |||||||||||||||||||

| Three Months Ended | |||||||||||||||||||||||||||||

| (In millions) | December 31, 2024 |

September 30, 2024 |

June 30, 2024 |

March 31, 2024 |

December 31, 2023 |

||||||||||||||||||||||||

| Allowance for Loan and Lease Losses | |||||||||||||||||||||||||||||

| Balance at beginning of period | $ | 694 | $ | 696 | $ | 699 | $ | 684 | $ | 681 | |||||||||||||||||||

| Provision for loan losses | 38 | 1 | 12 | 21 | 12 | ||||||||||||||||||||||||

| Loan and lease charge-offs | 41 | 15 | 21 | 14 | 13 | ||||||||||||||||||||||||

| Less: Recoveries | 5 | 12 | 6 | 8 | 4 | ||||||||||||||||||||||||

| Net loan and lease charge-offs (recoveries) | 36 | 3 | 15 | 6 | 9 | ||||||||||||||||||||||||

| Balance at end of period | $ | 696 | $ | 694 | $ | 696 | $ | 699 | $ | 684 | |||||||||||||||||||

Ratio of allowance for loan losses to loans1 and leases, at period end |

1.17 | % | 1.18 | % | 1.19 | % | 1.20 | % | 1.18 | % | |||||||||||||||||||

Ratio of allowance for loan losses to nonaccrual loans1 at period end |

234 | % | 191 | % | 267 | % | 282 | % | 308 | % | |||||||||||||||||||

| Annualized ratio of net loan and lease charge-offs (recoveries) to average loans | 0.24 | % | 0.02 | % | 0.10 | % | 0.04 | % | 0.06 | % | |||||||||||||||||||

| Reserve for Unfunded Lending Commitments | |||||||||||||||||||||||||||||

| Balance at beginning of period | $ | 42 | $ | 30 | $ | 37 | $ | 45 | $ | 57 | |||||||||||||||||||

| Provision for unfunded lending commitments | 3 | 12 | (7) | (8) | (12) | ||||||||||||||||||||||||

| Balance at end of period | $ | 45 | $ | 42 | $ | 30 | $ | 37 | $ | 45 | |||||||||||||||||||

| Allowance for Credit Losses | |||||||||||||||||||||||||||||

| Allowance for loan losses | $ | 696 | $ | 694 | $ | 696 | $ | 699 | $ | 684 | |||||||||||||||||||

| Reserve for unfunded lending commitments | 45 | 42 | 30 | 37 | 45 | ||||||||||||||||||||||||

| Total allowance for credit losses | $ | 741 | $ | 736 | $ | 726 | $ | 736 | $ | 729 | |||||||||||||||||||

Ratio of ACL to loans1 and leases outstanding, at period end |

1.25 | % | 1.25 | % | 1.24 | % | 1.27 | % | 1.26 | % | |||||||||||||||||||

| (In millions) | December 31, 2024 |

September 30, 2024 |

June 30, 2024 |

March 31, 2024 |

December 31, 2023 |

||||||||||||||||||||||||

| Commercial: | |||||||||||||||||||||||||||||

| Commercial and industrial | $ | 114 | $ | 173 | $ | 111 | $ | 110 | $ | 82 | |||||||||||||||||||

| Leasing | 2 | 2 | 2 | 2 | 2 | ||||||||||||||||||||||||

| Owner occupied | 31 | 29 | 28 | 20 | 20 | ||||||||||||||||||||||||

| Municipal | 11 | 11 | 6 | — | — | ||||||||||||||||||||||||

| Total commercial | 158 | 215 | 147 | 132 | 104 | ||||||||||||||||||||||||

| Commercial real estate: | |||||||||||||||||||||||||||||

| Construction and land development | — | 2 | 2 | 1 | 22 | ||||||||||||||||||||||||

| Term | 59 | 67 | 35 | 42 | 39 | ||||||||||||||||||||||||

| Total commercial real estate | 59 | 69 | 37 | 43 | 61 | ||||||||||||||||||||||||

| Consumer: | |||||||||||||||||||||||||||||

| Home equity credit line | 30 | 30 | 29 | 27 | 17 | ||||||||||||||||||||||||

| 1-4 family residential | 49 | 47 | 46 | 44 | 40 | ||||||||||||||||||||||||

| Bankcard and other revolving plans | 1 | 1 | 1 | 1 | — | ||||||||||||||||||||||||

| Other | — | 1 | 1 | 1 | — | ||||||||||||||||||||||||

| Total consumer | 80 | 79 | 77 | 73 | 57 | ||||||||||||||||||||||||

| Total nonaccrual loans | $ | 297 | $ | 363 | $ | 261 | $ | 248 | $ | 222 | |||||||||||||||||||

| (In millions) | December 31, 2024 |

September 30, 2024 |

June 30, 2024 |

March 31, 2024 |

December 31, 2023 |

||||||||||||||||||||||||

| Commercial: | |||||||||||||||||||||||||||||

| Commercial and industrial | $ | 35 | $ | 3 | $ | 4 | $ | 4 | $ | 7 | |||||||||||||||||||

| Owner occupied | (1) | — | — | — | — | ||||||||||||||||||||||||

| Total commercial | 34 | 3 | 4 | 4 | 7 | ||||||||||||||||||||||||

| Commercial real estate: | |||||||||||||||||||||||||||||

| Construction and land development | — | — | — | (1) | — | ||||||||||||||||||||||||

| Term | — | (2) | 11 | — | — | ||||||||||||||||||||||||

| Total commercial real estate | — | (2) | 11 | (1) | — | ||||||||||||||||||||||||

| Consumer: | |||||||||||||||||||||||||||||

| Home equity credit line | — | — | — | — | — | ||||||||||||||||||||||||

| 1-4 family residential | — | — | (1) | 1 | — | ||||||||||||||||||||||||

| Bankcard and other revolving plans | 2 | 2 | 1 | 1 | 2 | ||||||||||||||||||||||||

| Other | — | — | — | 1 | — | ||||||||||||||||||||||||

| Total consumer loans | 2 | 2 | — | 3 | 2 | ||||||||||||||||||||||||

| Total net charge-offs (recoveries) | $ | 36 | $ | 3 | $ | 15 | $ | 6 | $ | 9 | |||||||||||||||||||

| (Unaudited) | Three Months Ended | ||||||||||||||||||||||||||||||||||

| December 31, 2024 | September 30, 2024 | December 31, 2023 | |||||||||||||||||||||||||||||||||

| (In millions) | Average balance |

Yield/

Rate 1

|

Average balance |

Yield/

Rate 1

|

Average balance |

Yield/

Rate 1

|

|||||||||||||||||||||||||||||

| ASSETS | |||||||||||||||||||||||||||||||||||

| Money market investments: | |||||||||||||||||||||||||||||||||||

| Interest-bearing deposits | $ | 2,059 | 4.87 | % | $ | 2,457 | 5.53 | % | $ | 1,590 | 5.52 | % | |||||||||||||||||||||||

| Federal funds sold and securities purchased under agreements to resell | 2,698 | 5.10 | % | 2,258 | 5.82 | % | 1,704 | 5.91 | % | ||||||||||||||||||||||||||

| Total money market investments | 4,757 | 5.00 | % | 4,715 | 5.67 | % | 3,294 | 5.72 | % | ||||||||||||||||||||||||||

| Trading securities | 40 | 4.37 | % | 32 | 4.18 | % | 39 | 4.80 | % | ||||||||||||||||||||||||||

| Investment securities: | |||||||||||||||||||||||||||||||||||

| Available-for-sale | 9,310 | 3.26 | % | 9,442 | 3.53 | % | 10,013 | 3.48 | % | ||||||||||||||||||||||||||

| Held-to-maturity | 9,739 | 2.22 | % | 9,936 | 2.22 | % | 10,448 | 2.22 | % | ||||||||||||||||||||||||||

| Total investment securities | 19,049 | 2.73 | % | 19,378 | 2.86 | % | 20,461 | 2.84 | % | ||||||||||||||||||||||||||

| Loans held for sale | 76 | NM | 104 | NM | 32 | NM | |||||||||||||||||||||||||||||

Loans and leases:2 |

|||||||||||||||||||||||||||||||||||

| Commercial | 31,020 | 5.89 | % | 30,671 | 6.14 | % | 30,219 | 5.81 | % | ||||||||||||||||||||||||||

| Commercial real estate | 13,514 | 6.86 | % | 13,523 | 7.23 | % | 13,264 | 7.19 | % | ||||||||||||||||||||||||||

| Consumer | 14,781 | 5.10 | % | 14,471 | 5.18 | % | 13,662 | 5.02 | % | ||||||||||||||||||||||||||

| Total loans and leases | 59,315 | 5.92 | % | 58,665 | 6.15 | % | 57,145 | 5.94 | % | ||||||||||||||||||||||||||

| Total interest-earning assets | 83,237 | 5.13 | % | 82,894 | 5.35 | % | 80,971 | 5.15 | % | ||||||||||||||||||||||||||

| Cash and due from banks | 751 | 703 | 739 | ||||||||||||||||||||||||||||||||

| Allowance for credit losses on loans and debt securities | (674) | (699) | (681) | ||||||||||||||||||||||||||||||||

| Goodwill and intangibles | 1,053 | 1,054 | 1,060 | ||||||||||||||||||||||||||||||||

| Other assets | 5,202 | 5,218 | 5,644 | ||||||||||||||||||||||||||||||||

| Total assets | $ | 89,569 | $ | 89,170 | $ | 87,733 | |||||||||||||||||||||||||||||

| LIABILITIES AND SHAREHOLDERS’ EQUITY | |||||||||||||||||||||||||||||||||||

| Interest-bearing deposits: | |||||||||||||||||||||||||||||||||||

| Savings and money market | $ | 39,765 | 2.37 | % | $ | 39,031 | 2.72 | % | $ | 37,941 | 2.71 | % | |||||||||||||||||||||||

| Time | 11,780 | 4.54 | % | 11,275 | 4.81 | % | 11,132 | 4.84 | % | ||||||||||||||||||||||||||

| Total interest-bearing deposits | 51,545 | 2.87 | % | 50,306 | 3.19 | % | 49,073 | 3.19 | % | ||||||||||||||||||||||||||

| Borrowed funds: | |||||||||||||||||||||||||||||||||||

Federal funds purchased and security repurchase agreements |

1,251 | 4.64 | % | 1,072 | 5.33 | % | 1,774 | 5.38 | % | ||||||||||||||||||||||||||

| Other short-term borrowings | 3,114 | 4.72 | % | 4,704 | 4.89 | % | 2,282 | 5.16 | % | ||||||||||||||||||||||||||

| Long-term debt | 767 | 6.32 | % | 546 | 5.91 | % | 541 | 6.06 | % | ||||||||||||||||||||||||||

| Total borrowed funds | 5,132 | 4.94 | % | 6,322 | 5.06 | % | 4,597 | 5.35 | % | ||||||||||||||||||||||||||

| Total interest-bearing liabilities | 56,677 | 3.05 | % | 56,628 | 3.40 | % | 53,670 | 3.38 | % | ||||||||||||||||||||||||||

| Noninterest-bearing demand deposits | 24,858 | 24,723 | 26,851 | ||||||||||||||||||||||||||||||||

| Other liabilities | 1,623 | 1,641 | 1,792 | ||||||||||||||||||||||||||||||||

| Total liabilities | 83,158 | 82,992 | 82,313 | ||||||||||||||||||||||||||||||||

| Shareholders’ equity: | |||||||||||||||||||||||||||||||||||

| Preferred equity | 375 | 440 | 440 | ||||||||||||||||||||||||||||||||

| Common equity | 6,036 | 5,738 | 4,980 | ||||||||||||||||||||||||||||||||

| Total shareholders’ equity | 6,411 | 6,178 | 5,420 | ||||||||||||||||||||||||||||||||

| Total liabilities and shareholders’ equity | $ | 89,569 | $ | 89,170 | $ | 87,733 | |||||||||||||||||||||||||||||

| Spread on average interest-bearing funds | 2.08 | % | 1.95 | % | 1.77 | % | |||||||||||||||||||||||||||||

| Impact of net noninterest-bearing sources of funds | 0.97 | % | 1.08 | % | 1.14 | % | |||||||||||||||||||||||||||||

| Net interest margin | 3.05 | % | 3.03 | % | 2.91 | % | |||||||||||||||||||||||||||||

| Memo: total cost of deposits | 1.93 | % | 2.14 | % | 2.06 | % | |||||||||||||||||||||||||||||

| Memo: total deposits and interest-bearing liabilities | $ | 81,535 | 2.12 | % | $ | 81,351 | 2.36 | % | $ | 80,521 | 2.25 | % | |||||||||||||||||||||||

| (Unaudited) | Twelve Months Ended | ||||||||||||||||||||||

| December 31, 2024 | December 31, 2023 | ||||||||||||||||||||||

| (In millions) | Average balance |

Yield/

Rate 1

|

Average balance |

Yield/

Rate 1

|

|||||||||||||||||||

| ASSETS | |||||||||||||||||||||||

| Money market investments: | |||||||||||||||||||||||

| Interest-bearing deposits | $ | 1,970 | 5.40 | % | $ | 2,163 | 5.18 | % | |||||||||||||||

| Federal funds sold and securities purchased under agreements to resell | 2,203 | 5.62 | % | 1,358 | 5.57 | % | |||||||||||||||||

| Total money market investments | 4,173 | 5.52 | % | 3,521 | 5.33 | % | |||||||||||||||||

| Trading securities | 36 | 4.41 | % | 53 | 2.86 | % | |||||||||||||||||

| Investment securities: | |||||||||||||||||||||||

| Available-for-sale | 9,621 | 3.46 | % | 10,900 | 3.03 | % | |||||||||||||||||

| Held-to-maturity | 10,017 | 2.23 | % | 10,731 | 2.24 | % | |||||||||||||||||

| Total investment securities | 19,638 | 2.83 | % | 21,631 | 2.64 | % | |||||||||||||||||

| Loans held for sale | 70 | NM | 39 | NM | |||||||||||||||||||

Loans and leases:2 |

|||||||||||||||||||||||

| Commercial | 30,671 | 6.01 | % | 30,519 | 5.50 | % | |||||||||||||||||

| Commercial real estate | 13,532 | 7.14 | % | 13,023 | 6.98 | % | |||||||||||||||||

| Consumer | 14,344 | 5.14 | % | 13,198 | 4.84 | % | |||||||||||||||||

| Total loans and leases | 58,547 | 6.06 | % | 56,740 | 5.69 | % | |||||||||||||||||

| Total interest-earning assets | 82,464 | 5.26 | % | 81,984 | 4.86 | % | |||||||||||||||||

| Cash and due from banks | 714 | 662 | |||||||||||||||||||||

| Allowance for credit losses on loans and debt securities | (689) | (632) | |||||||||||||||||||||

| Goodwill and intangibles | 1,055 | 1,062 | |||||||||||||||||||||

| Other assets | 5,279 | 5,579 | |||||||||||||||||||||

| Total assets | $ | 88,823 | $ | 88,655 | |||||||||||||||||||

| LIABILITIES AND SHAREHOLDERS’ EQUITY | |||||||||||||||||||||||

| Interest-bearing deposits: | |||||||||||||||||||||||

| Savings and money market | $ | 38,796 | 2.63 | % | $ | 34,135 | 1.90 | % | |||||||||||||||

| Time | 10,898 | 4.75 | % | 9,028 | 4.58 | % | |||||||||||||||||

| Total interest-bearing deposits | 49,694 | 3.10 | % | 43,163 | 2.46 | % | |||||||||||||||||

| Borrowed funds: | |||||||||||||||||||||||

Federal funds purchased and security repurchase agreements |

1,309 | 5.19 | % | 3,380 | 4.98 | % | |||||||||||||||||

| Other short-term borrowings | 4,458 | 4.90 | % | 4,741 | 5.08 | % | |||||||||||||||||

| Long-term debt | 600 | 6.07 | % | 592 | 6.09 | % | |||||||||||||||||

| Total borrowed funds | 6,367 | 5.07 | % | 8,713 | 5.11 | % | |||||||||||||||||

| Total interest-bearing funds | 56,061 | 3.32 | % | 51,876 | 2.91 | % | |||||||||||||||||

| Noninterest-bearing demand deposits | 25,066 | 29,703 | |||||||||||||||||||||

| Other liabilities | 1,643 | 1,797 | |||||||||||||||||||||

| Total liabilities | 82,770 | 83,376 | |||||||||||||||||||||

| Shareholders’ equity: | |||||||||||||||||||||||

| Preferred equity | 423 | 440 | |||||||||||||||||||||

| Common equity | 5,630 | 4,839 | |||||||||||||||||||||

| Total shareholders’ equity | 6,053 | 5,279 | |||||||||||||||||||||

| Total liabilities and shareholders’ equity | $ | 88,823 | $ | 88,655 | |||||||||||||||||||

| Spread on average interest-bearing funds | 1.94 | % | 1.95 | % | |||||||||||||||||||

| Impact of net noninterest-bearing sources of funds | 1.06 | % | 1.07 | % | |||||||||||||||||||

| Net interest margin | 3.00 | % | 3.02 | % | |||||||||||||||||||

| Memo: total cost of deposits | 2.06 | % | 1.46 | % | |||||||||||||||||||

| Memo: total deposits and interest-bearing liabilities | $ | 81,127 | 2.28 | % | $ | 81,579 | 1.87 | % | |||||||||||||||

| Three Months Ended | ||||||||||||||||||||||||||||||||

| (Dollar amounts in millions) | December 31, 2024 |

September 30, 2024 |

June 30, 2024 |

March 31, 2024 |

December 31, 2023 |

|||||||||||||||||||||||||||

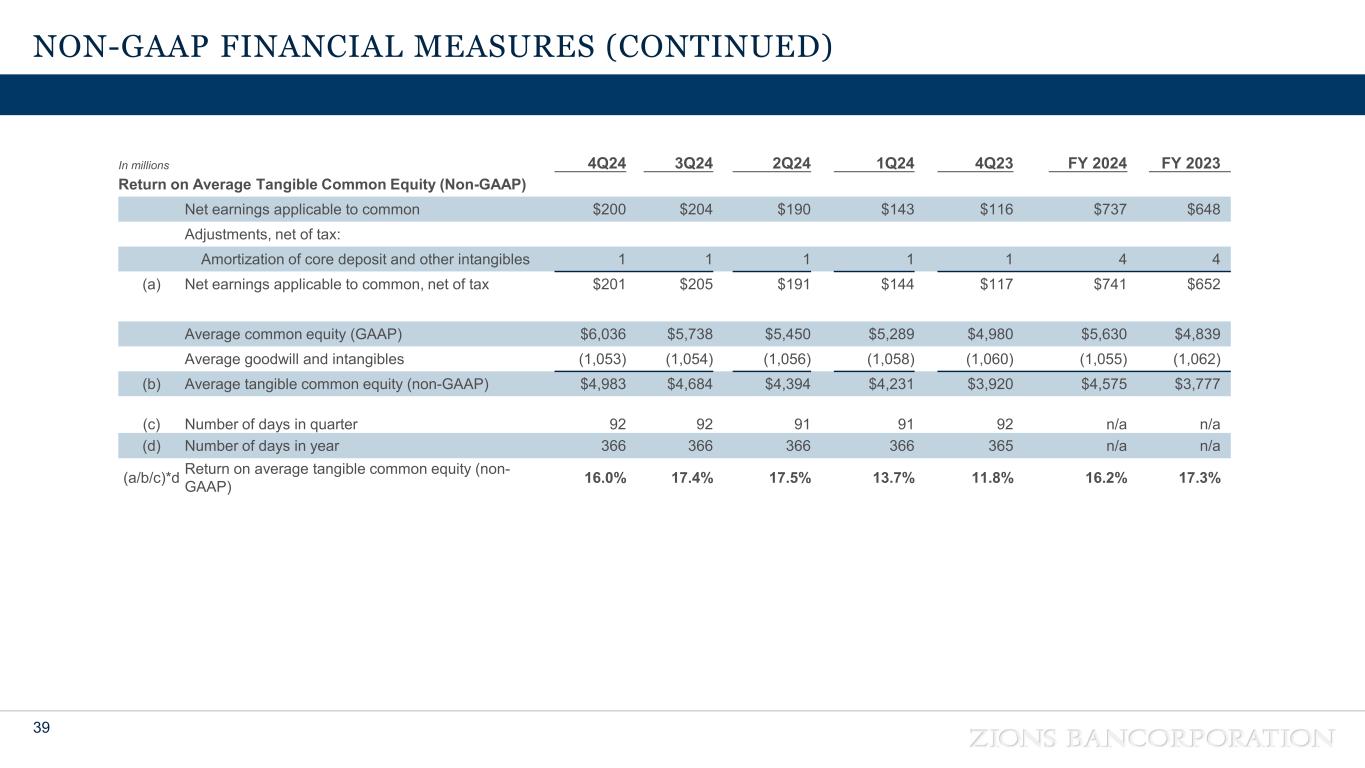

| Net earnings applicable to common shareholders (GAAP) | $ | 200 | $ | 204 | $ | 190 | $ | 143 | $ | 116 | ||||||||||||||||||||||

| Adjustments, net of tax: | ||||||||||||||||||||||||||||||||

| Amortization of core deposit and other intangibles | 1 | 1 | 1 | 1 | 1 | |||||||||||||||||||||||||||

| Adjusted net earnings applicable to common shareholders, net of tax | (a) | $ | 201 | $ | 205 | $ | 191 | $ | 144 | $ | 117 | |||||||||||||||||||||

| Average common equity (GAAP) | $ | 6,036 | $ | 5,738 | $ | 5,450 | $ | 5,289 | $ | 4,980 | ||||||||||||||||||||||

| Average goodwill and intangibles | (1,053) | (1,054) | (1,056) | (1,058) | (1,060) | |||||||||||||||||||||||||||

| Average tangible common equity (non-GAAP) | (b) | $ | 4,983 | $ | 4,684 | $ | 4,394 | $ | 4,231 | $ | 3,920 | |||||||||||||||||||||

| Number of days in quarter | (c) | 92 | 92 | 91 | 91 | 92 | ||||||||||||||||||||||||||

| Number of days in year | (d) | 366 | 366 | 366 | 366 | 365 | ||||||||||||||||||||||||||

Return on average tangible common equity (non-GAAP) 1 |

(a/b/c)*d | 16.0 | % | 17.4 | % | 17.5 | % | 13.7 | % | 11.8 | % | |||||||||||||||||||||

| (Dollar amounts in millions, except per share amounts) | December 31, 2024 |

September 30, 2024 |

June 30, 2024 |

March 31, 2024 |

December 31, 2023 |

|||||||||||||||||||||||||||

| Total shareholders’ equity (GAAP) | $ | 6,124 | $ | 6,385 | $ | 6,025 | $ | 5,829 | $ | 5,691 | ||||||||||||||||||||||

| Goodwill and intangibles | (1,052) | (1,053) | (1,055) | (1,057) | (1,059) | |||||||||||||||||||||||||||

| Tangible equity (non-GAAP) | (a) | 5,072 | 5,332 | 4,970 | 4,772 | 4,632 | ||||||||||||||||||||||||||

| Preferred stock | (66) | (440) | (440) | (440) | (440) | |||||||||||||||||||||||||||

| Tangible common equity (non-GAAP) | (b) | $ | 5,006 | $ | 4,892 | $ | 4,530 | $ | 4,332 | $ | 4,192 | |||||||||||||||||||||

| Total assets (GAAP) | $ | 88,775 | $ | 87,032 | $ | 87,606 | $ | 87,060 | $ | 87,203 | ||||||||||||||||||||||

| Goodwill and intangibles | (1,052) | (1,053) | (1,055) | (1,057) | (1,059) | |||||||||||||||||||||||||||

| Tangible assets (non-GAAP) | (c) | $ | 87,723 | $ | 85,979 | $ | 86,551 | $ | 86,003 | $ | 86,144 | |||||||||||||||||||||

| Common shares outstanding (in thousands) | (d) | 147,871 | 147,699 | 147,684 | 147,653 | 148,153 | ||||||||||||||||||||||||||

Tangible equity ratio (non-GAAP) 1 |

(a/c) | 5.8 | % | 6.2 | % | 5.7 | % | 5.5 | % | 5.4 | % | |||||||||||||||||||||

| Tangible common equity ratio (non-GAAP) | (b/c) | 5.7 | % | 5.7 | % | 5.2 | % | 5.0 | % | 4.9 | % | |||||||||||||||||||||

| Tangible book value per common share (non-GAAP) | (b/d) | $ | 33.85 | $ | 33.12 | $ | 30.67 | $ | 29.34 | $ | 28.30 | |||||||||||||||||||||

| Three Months Ended | ||||||||||||||||||||||||||||||||

| (Dollar amounts in millions) | December 31, 2024 |

September 30, 2024 |

June 30, 2024 |

March 31, 2024 |

December 31, 2023 |

|||||||||||||||||||||||||||

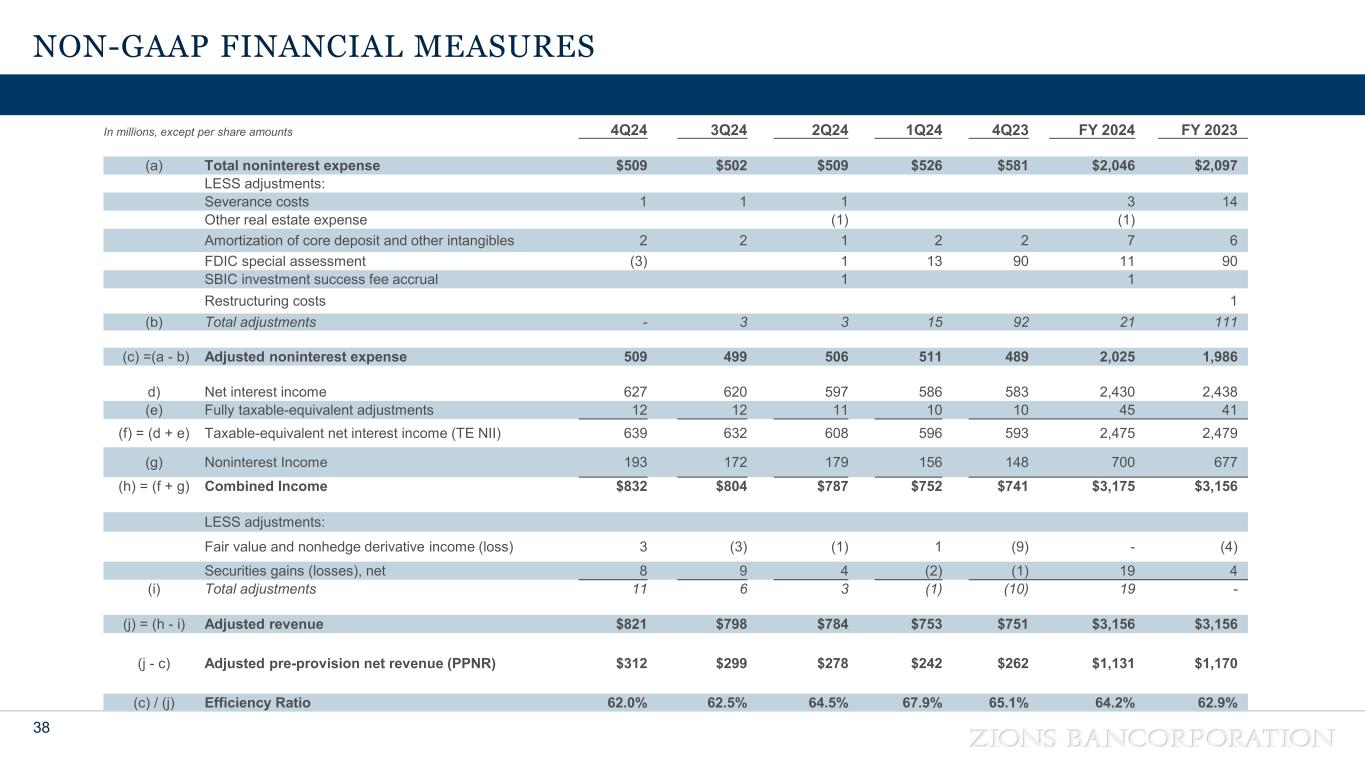

| Noninterest expense (GAAP) | (a) | $ | 509 | $ | 502 | $ | 509 | $ | 526 | $ | 581 | |||||||||||||||||||||

| Adjustments: | ||||||||||||||||||||||||||||||||

| Severance costs | 1 | 1 | 1 | — | — | |||||||||||||||||||||||||||

| Other real estate expense, net | — | — | (1) | — | — | |||||||||||||||||||||||||||

| Amortization of core deposit and other intangibles | 2 | 2 | 1 | 2 | 2 | |||||||||||||||||||||||||||

| SBIC investment success fee accrual | — | — | 1 | — | — | |||||||||||||||||||||||||||

| FDIC special assessment | (3) | — | 1 | 13 | 90 | |||||||||||||||||||||||||||

| Total adjustments | (b) | — | 3 | 3 | 15 | 92 | ||||||||||||||||||||||||||

| Adjusted noninterest expense (non-GAAP) | (c)=(a-b) | $ | 509 | $ | 499 | $ | 506 | $ | 511 | $ | 489 | |||||||||||||||||||||

| Net interest income (GAAP) | (d) | $ | 627 | $ | 620 | $ | 597 | $ | 586 | $ | 583 | |||||||||||||||||||||

| Fully taxable-equivalent adjustments | (e) | 12 | 12 | 11 | 10 | 10 | ||||||||||||||||||||||||||

| Taxable-equivalent net interest income (non-GAAP) | (f)=(d+e) | 639 | 632 | 608 | 596 | 593 | ||||||||||||||||||||||||||

| Noninterest income (GAAP) | (g) | 193 | 172 | 179 | 156 | 148 | ||||||||||||||||||||||||||

| Combined income (non-GAAP) | (h)=(f+g) | 832 | 804 | 787 | 752 | 741 | ||||||||||||||||||||||||||

| Adjustments: | ||||||||||||||||||||||||||||||||

| Fair value and nonhedge derivative income (loss) | 3 | (3) | (1) | 1 | (9) | |||||||||||||||||||||||||||

| Securities gains (losses), net | 8 | 9 | 4 | (2) | (1) | |||||||||||||||||||||||||||

| Total adjustments | (i) | 11 | 6 | 3 | (1) | (10) | ||||||||||||||||||||||||||

| Adjusted taxable-equivalent revenue (non-GAAP) | (j)=(h-i) | $ | 821 | $ | 798 | $ | 784 | $ | 753 | $ | 751 | |||||||||||||||||||||

| Pre-provision net revenue (PPNR) (non-GAAP) | (h)-(a) | $ | 323 | $ | 302 | $ | 278 | $ | 226 | $ | 160 | |||||||||||||||||||||

| Adjusted PPNR (non-GAAP) | (j)-(c) | 312 | 299 | 278 | 242 | 262 | ||||||||||||||||||||||||||

Efficiency ratio (non-GAAP) 1 |

(c/j) | 62.0 | % | 62.5 | % | 64.5 | % | 67.9 | % | 65.1 | % | |||||||||||||||||||||

| Twelve Months Ended | ||||||||||||||

| (Dollar amounts in millions) | December 31, 2024 |

December 31, 2023 |

||||||||||||

| Noninterest expense (GAAP) | (a) | $ | 2,046 | $ | 2,097 | |||||||||

| Adjustments: | ||||||||||||||

| Severance costs | 3 | 14 | ||||||||||||

| Other real estate expense | (1) | — | ||||||||||||

| Amortization of core deposit and other intangibles | 7 | 6 | ||||||||||||

| Restructuring costs | — | 1 | ||||||||||||

| SBIC investment success fee accrual | 1 | — | ||||||||||||

| FDIC special assessment | 11 | 90 | ||||||||||||

| Total adjustments | (b) | 21 | 111 | |||||||||||

| Adjusted noninterest expense (non-GAAP) | (a-b)=(c) | $ | 2,025 | $ | 1,986 | |||||||||

| Net interest income (GAAP) | (d) | $ | 2,430 | $ | 2,438 | |||||||||

| Fully taxable-equivalent adjustments | (e) | 45 | 41 | |||||||||||

| Taxable-equivalent net interest income (non-GAAP) | (d+e)=(f) | 2,475 | 2,479 | |||||||||||

| Noninterest income (GAAP) | (g) | 700 | 677 | |||||||||||

| Combined income (non-GAAP) | (f+g)=(h) | 3,175 | 3,156 | |||||||||||

| Adjustments: | ||||||||||||||

| Fair value and nonhedge derivative income (loss) | — | (4) | ||||||||||||

| Securities gains (losses), net | 19 | 4 | ||||||||||||

| Total adjustments | (i) | 19 | — | |||||||||||

| Adjusted taxable-equivalent revenue (non-GAAP) | (h-i)=(j) | $ | 3,156 | $ | 3,156 | |||||||||

| Pre-provision net revenue (PPNR) | (h)-(a) | $ | 1,129 | $ | 1,059 | |||||||||

| Adjusted PPNR (non-GAAP) | (j)-(c) | 1,131 | 1,170 | |||||||||||

| Efficiency ratio (non-GAAP) | (c/j) | 64.2 | % | 62.9 | % | |||||||||