United States of America |

001-12307 |

87-0189025 |

|||||||||

(State or other jurisdiction of incorporation or organization) |

(Commission File Number) |

(IRS Employer Identification No.) |

|||||||||

One South Main, |

Salt Lake City, |

Utah |

84133-1109 |

||||||||

(Address of Principal Executive Offices) |

(Zip Code) |

||||||||||

| Former name or former address, if changed since last report | ||

| Title of Each Class | Trading Symbols | Name of Each Exchange on Which Registered | ||||||

| Common Stock, par value $0.001 | ZION | The NASDAQ Stock Market, LLC | ||||||

| Depositary Shares each representing a 1/40th ownership interest in a share of: | ||||||||

| Series A Floating-Rate Non-Cumulative Perpetual Preferred Stock | ZIONP | The NASDAQ Stock Market, LLC | ||||||

| Series G Fixed/Floating-Rate Non-Cumulative Perpetual Preferred Stock | ZIONO | The NASDAQ Stock Market, LLC | ||||||

| 6.95% Fixed-to-Floating Rate Subordinated Notes due September 15, 2028 | ZIONL | The NASDAQ Stock Market, LLC | ||||||

| Exhibit Number | Description | ||||

Press Release dated October 21, 2024 (furnished herewith). |

|||||

Earnings Release Presentation dated October 21, 2024 (furnished herewith). |

|||||

| 101 | Cover Page Interactive Data File - the cover page XBRL tags are embedded within the Inline XBRL document. | ||||

| 104 | The cover page from this Current Report on form 8-K, formatted as Inline XBRL. | ||||

| ZIONS BANCORPORATION, NATIONAL ASSOCIATION | ||||||||

| By: | /s/ R. Ryan Richards | |||||||

| Name: R. Ryan Richards | ||||||||

Title: Executive Vice President and Chief Financial Officer |

||||||||

Date: October 21, 2024 |

||||||||

| Zions Bancorporation, N.A. One South Main Salt Lake City, UT 84133 October 21, 2024 |

|

||||

| www.zionsbancorporation.com | |||||

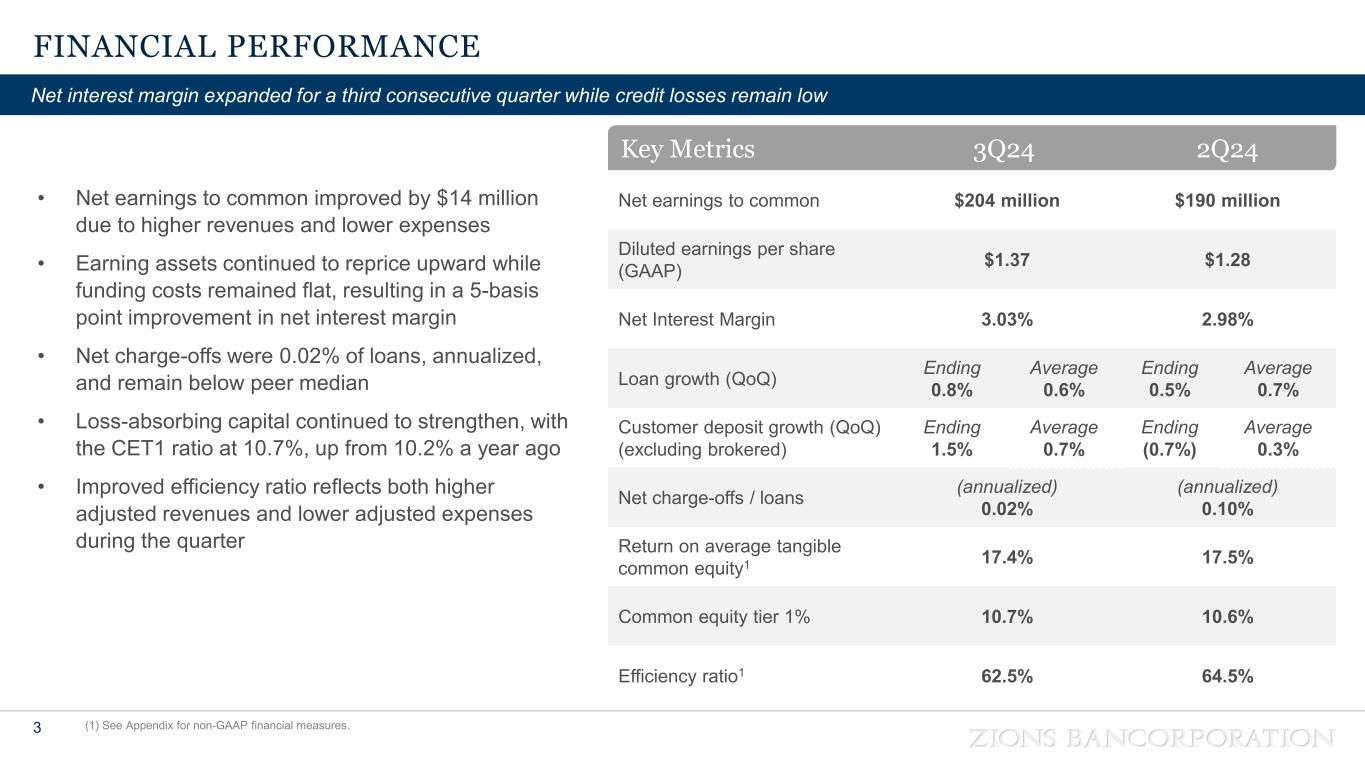

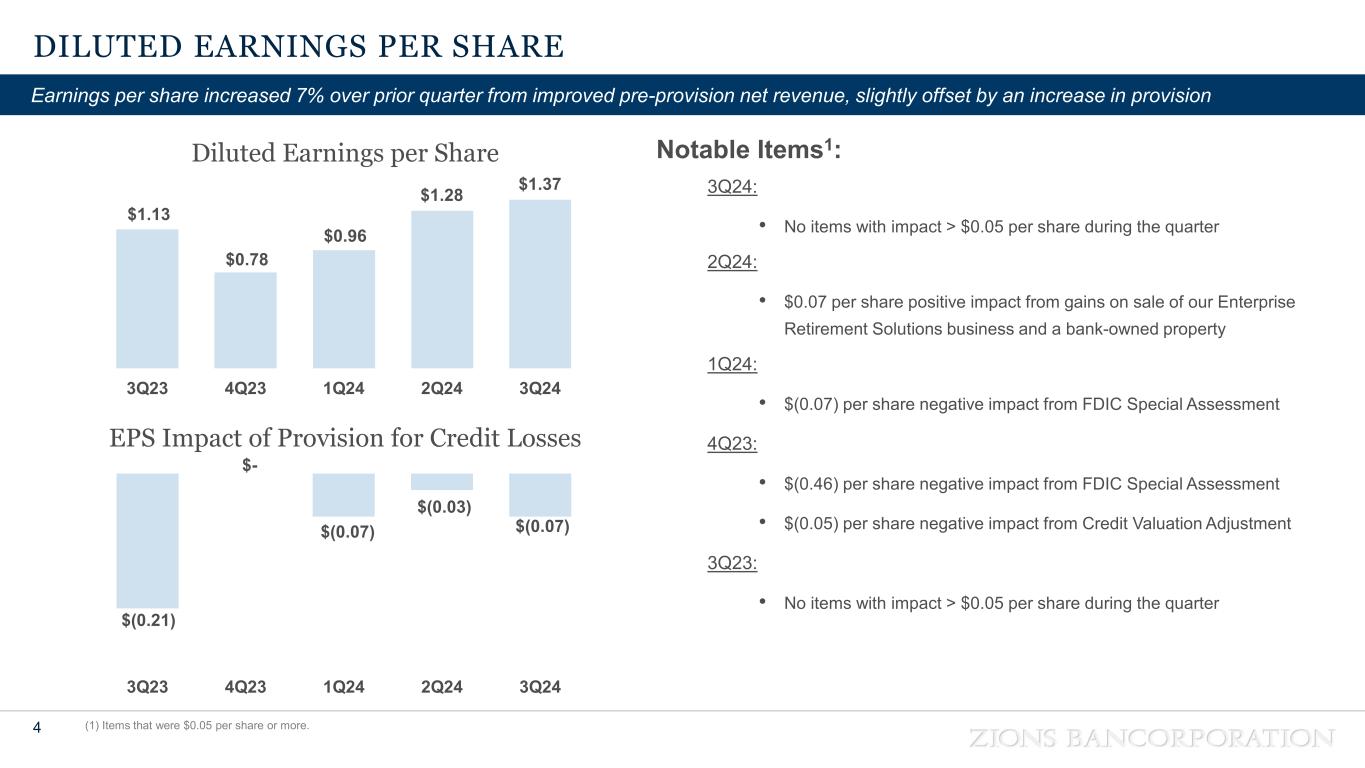

| Zions Bancorporation, N.A. reports: 3Q24 Net Earnings of $204 million, diluted EPS of $1.37 | ||

| compared with 3Q23 Net Earnings of $168 million, diluted EPS of $1.13, and 2Q24 Net Earnings of $190 million, diluted EPS of $1.28 | ||

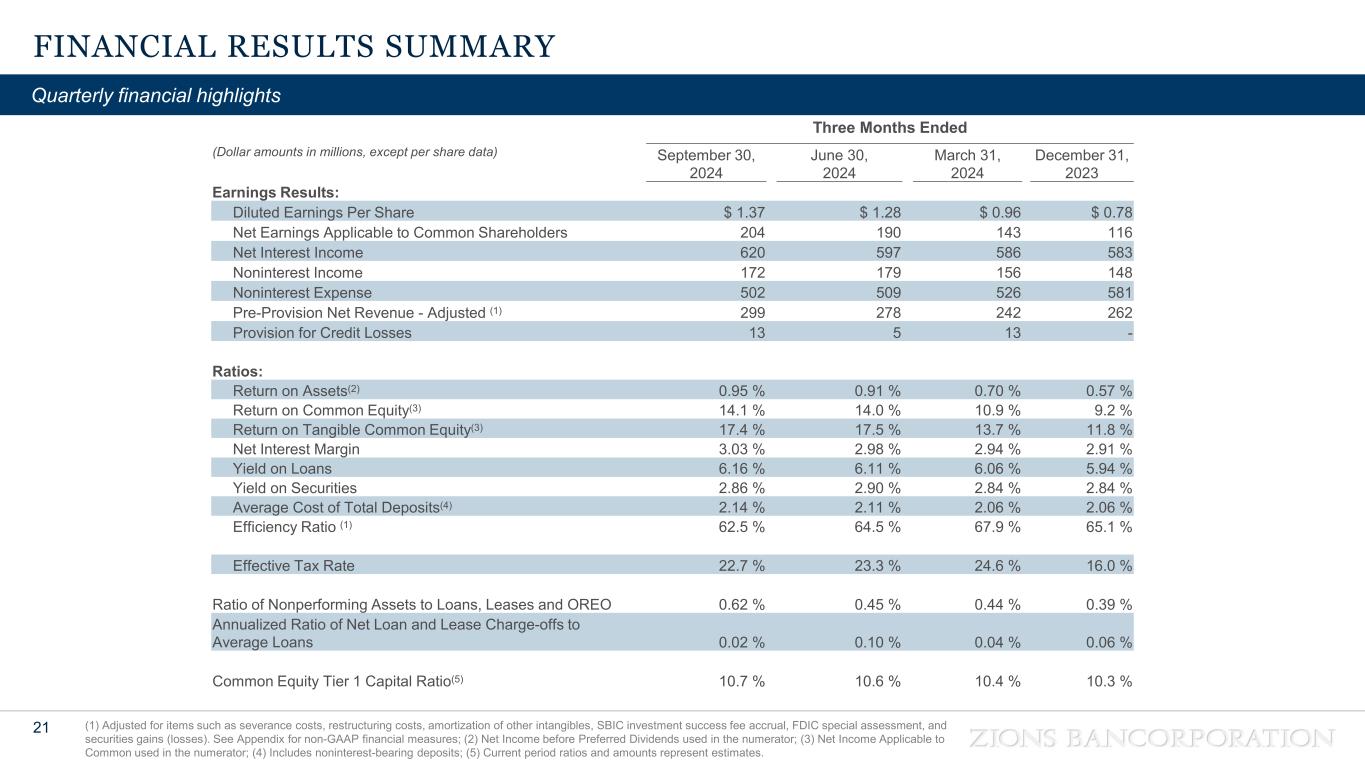

| $1.37 | $204 million | 3.03% | 10.7% | |||||||||||||||||

Net earnings per diluted common share |

Net earnings | Net interest margin (“NIM”) | Estimated Common Equity Tier 1 ratio |

|||||||||||||||||

| THIRD QUARTER HIGHLIGHTS¹ | ||||||||

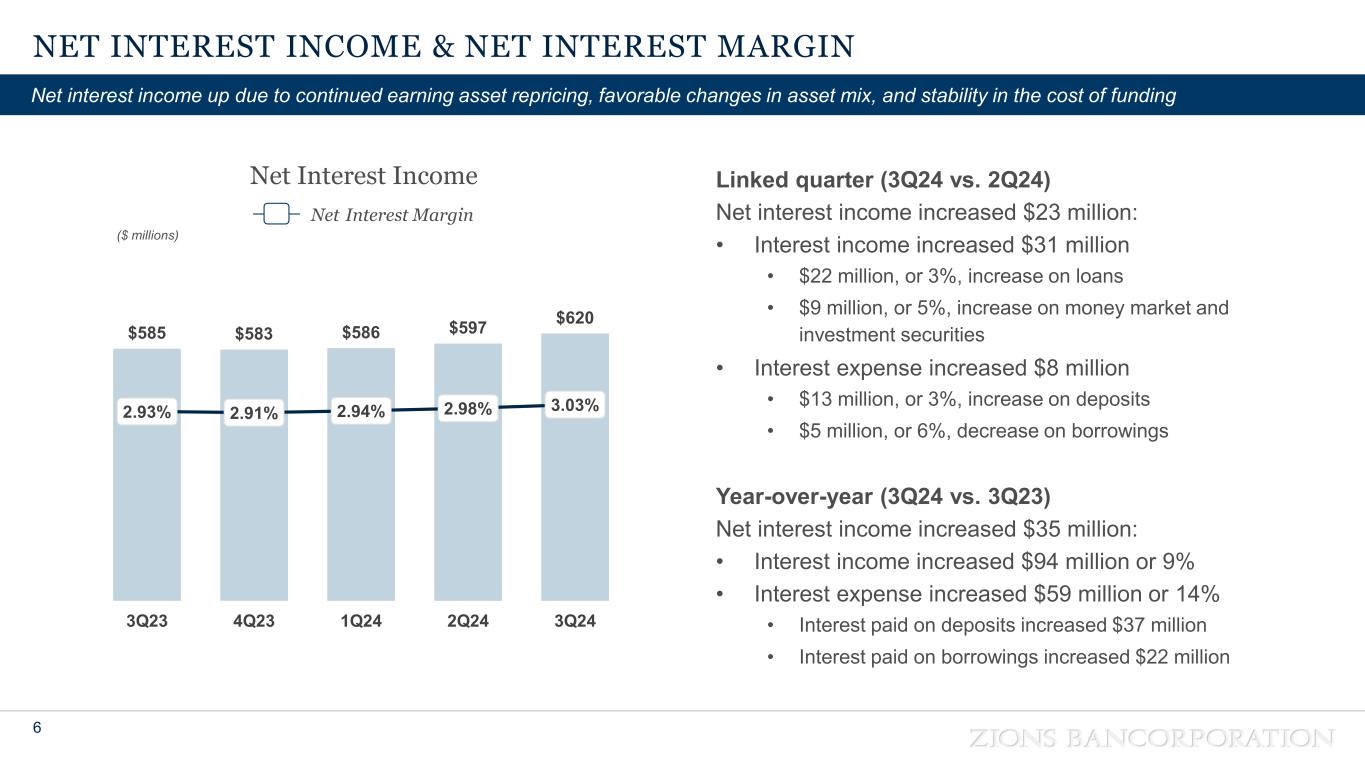

| Net Interest Income and NIM | • |

Net interest income was $620 million, up 6% | ||||||

• |

NIM was 3.03%, compared with 2.93% | |||||||

| Operating Performance | • |

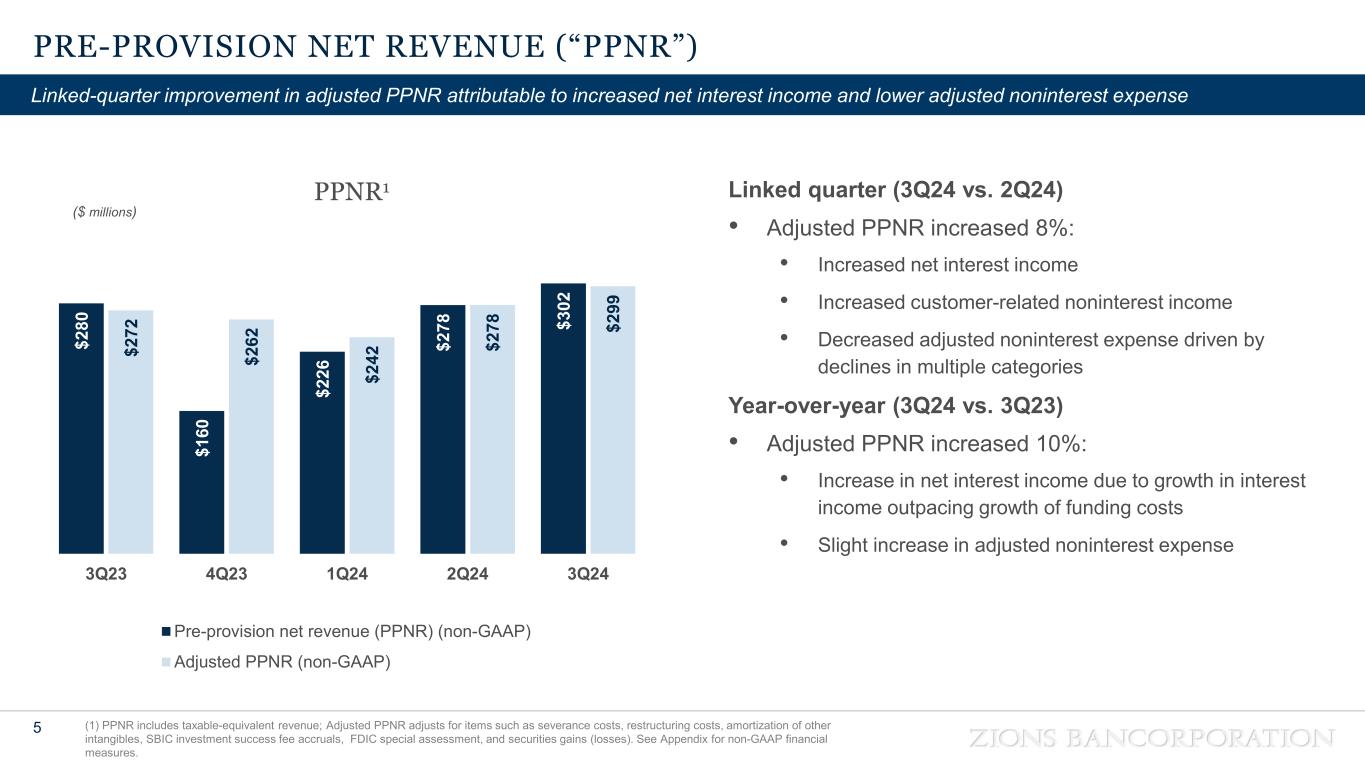

Pre-provision net revenue² ("PPNR") was $302 million, up 8%; adjusted PPNR² was $299 million, up 10% | ||||||

• |

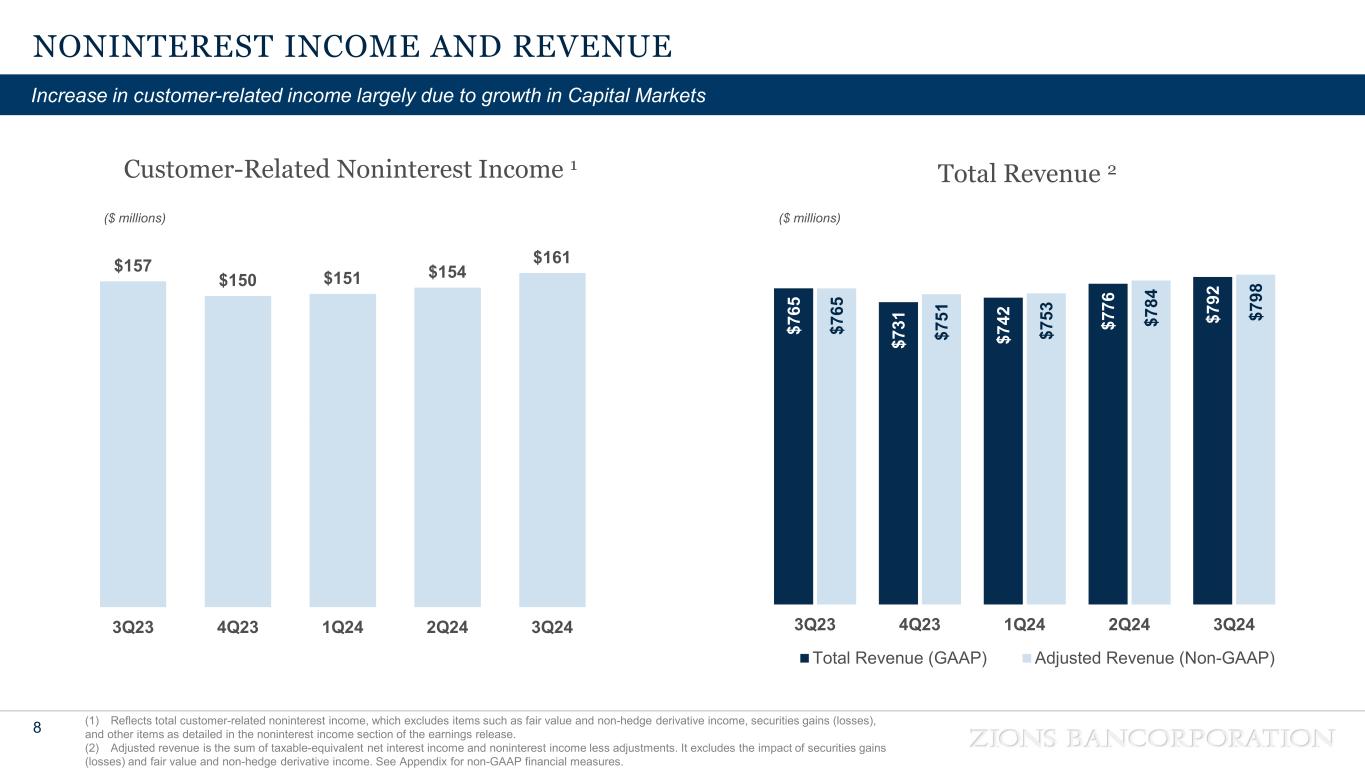

Customer-related noninterest income was $161 million, up 3% | |||||||

• |

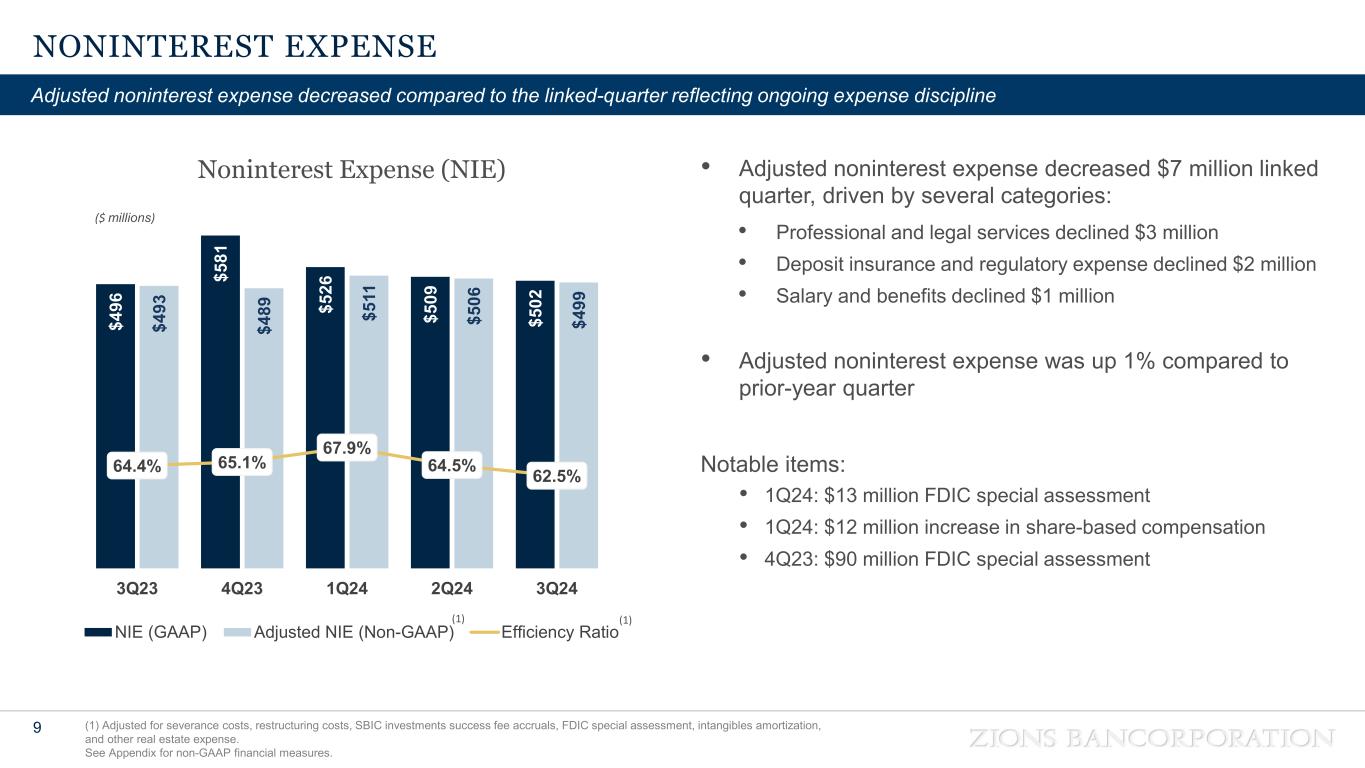

Noninterest expense was $502 million, up 1%; adjusted noninterest expense² was $499 million, up 1% | |||||||

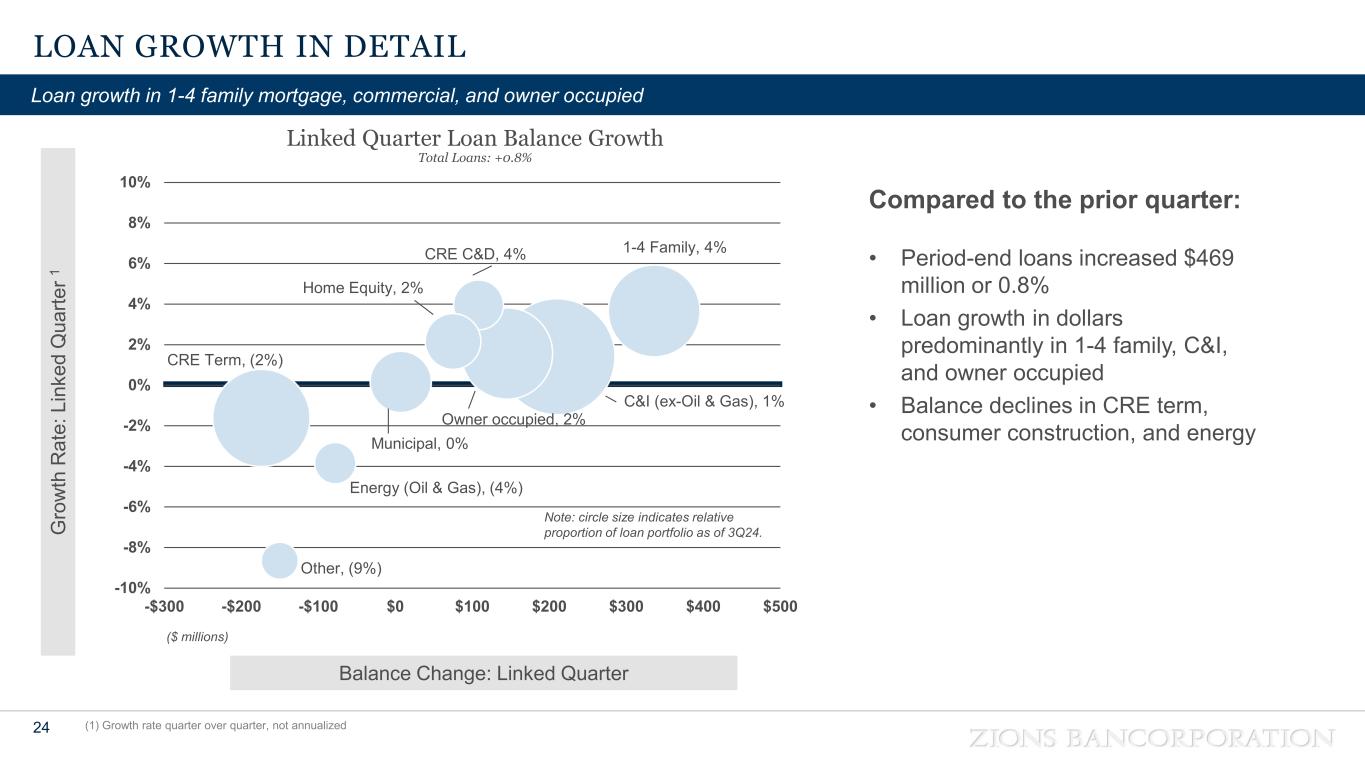

| Loans and Credit Quality | • |

Loans and leases were $58.9 billion, up 3% | ||||||

• |

The provision for credit losses was $13 million, compared with $41 million | |||||||

• |

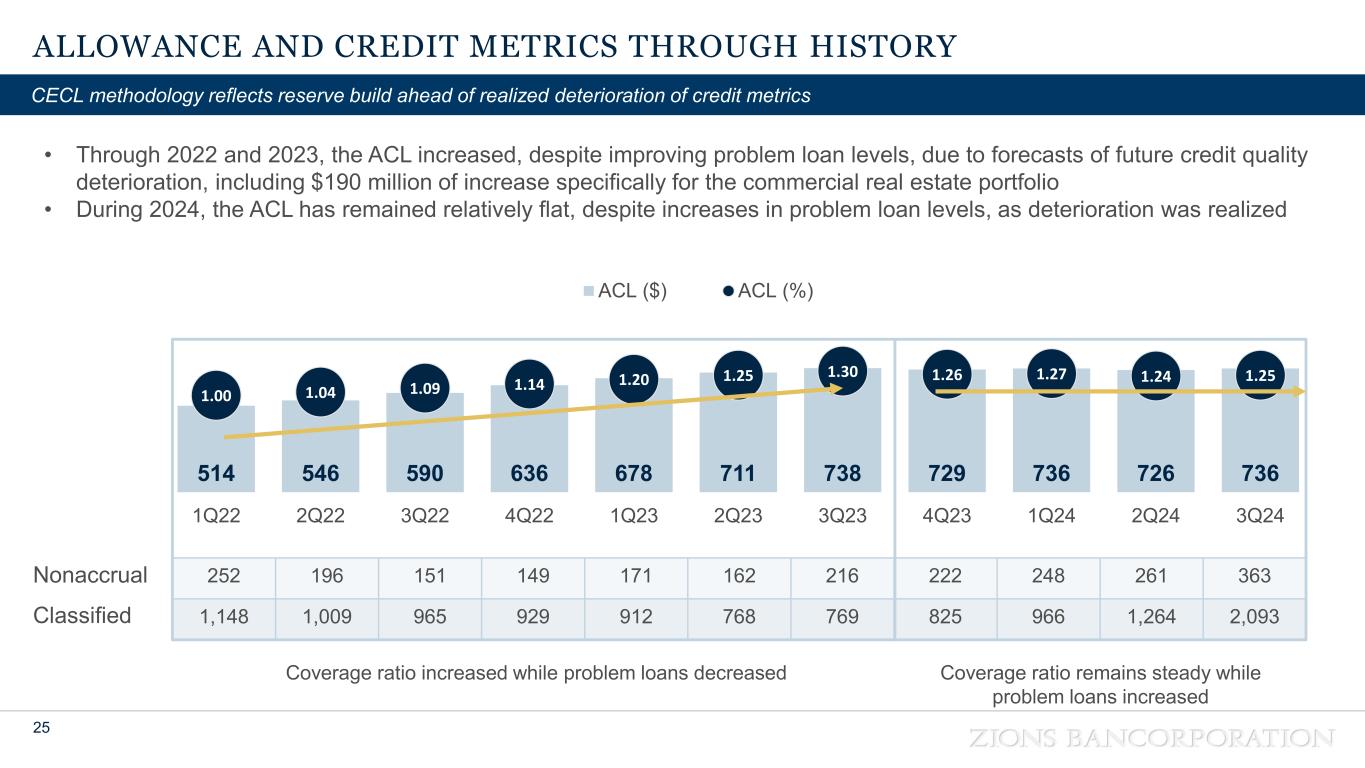

The allowance for credit losses was 1.25%, compared with 1.30%, of loans and leases | |||||||

• |

The annualized ratio of net loan and lease charge-offs to average loans and leases was 0.02%, compared with 0.10% | |||||||

• |

Nonperforming assets3 were $368 million, or 0.62%, compared with $219 million, or 0.38%, of loans and leases and other real estate owned |

|||||||

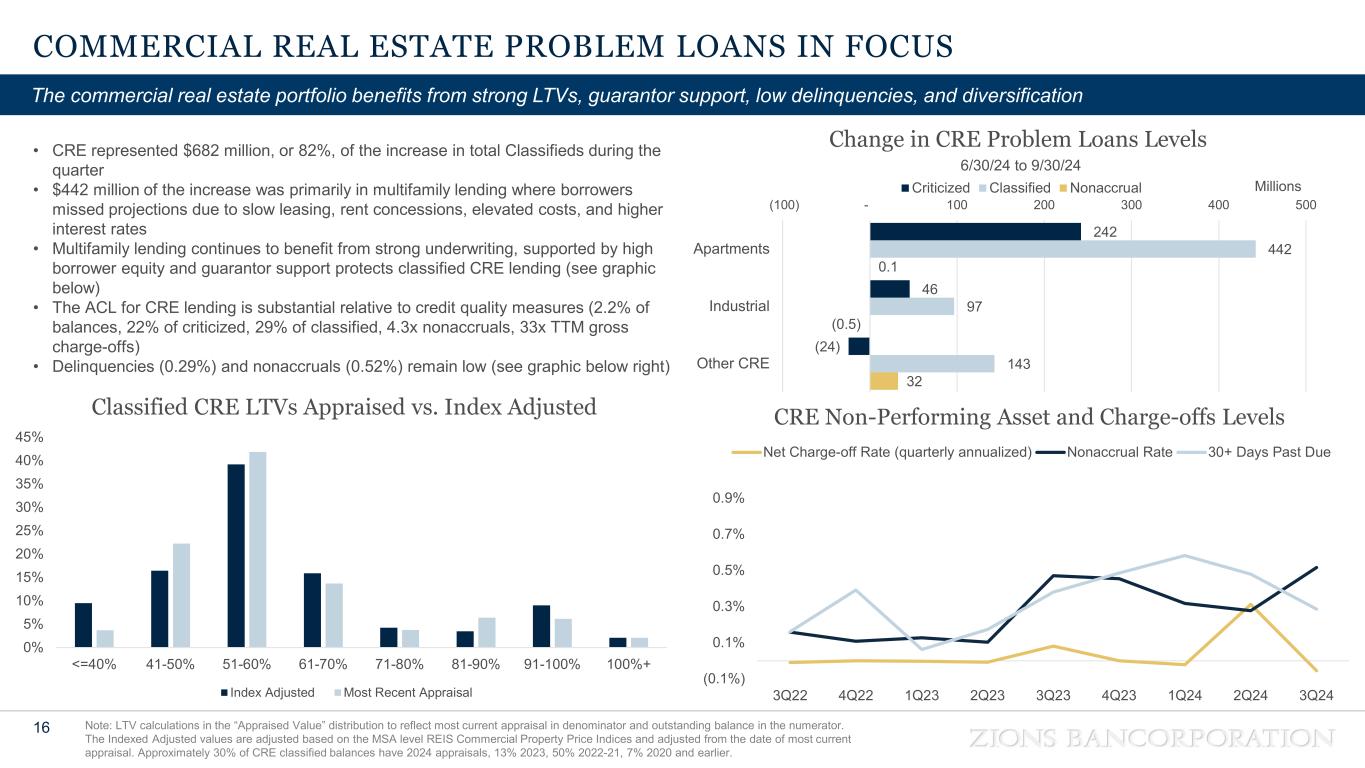

• |

Classified loans were $2.1 billion, or 3.55%, compared with $769 million, or 1.35%, of loans and leases | |||||||

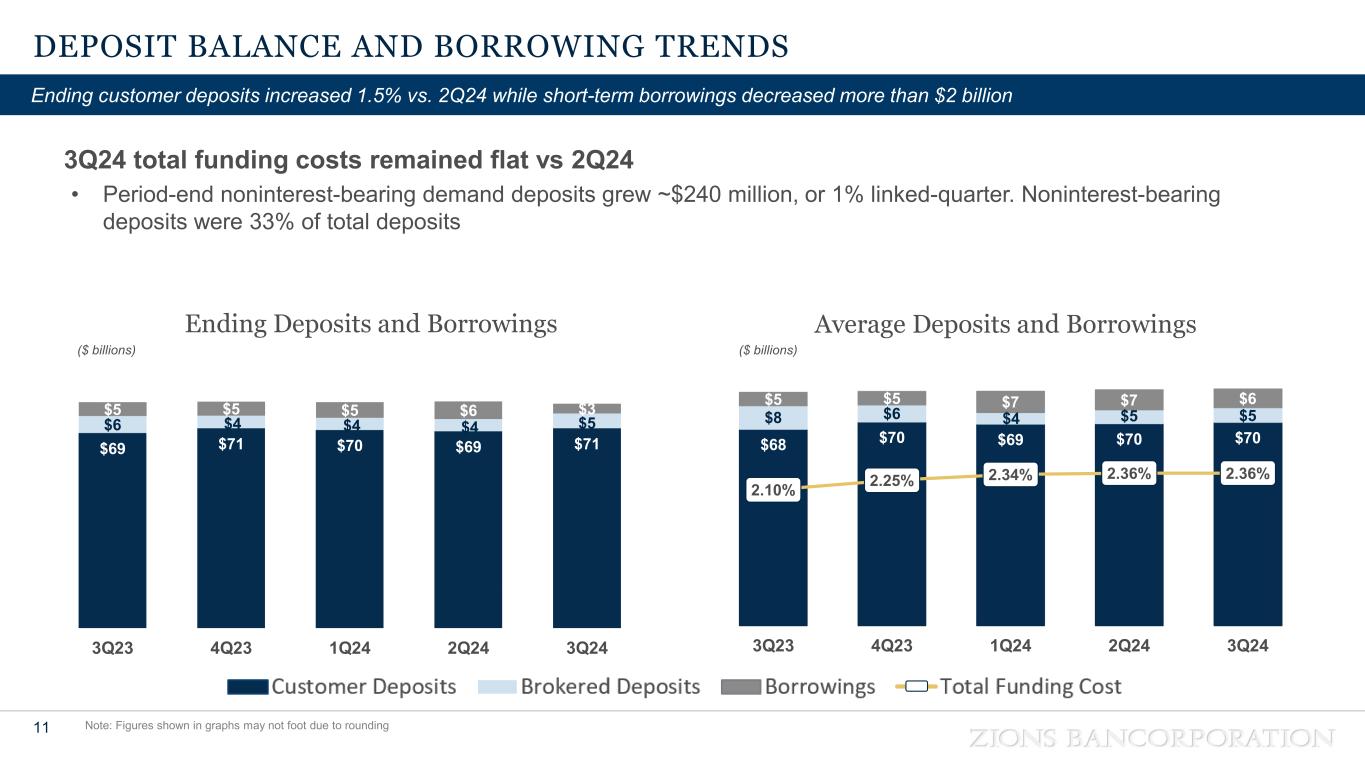

| Deposits and Borrowed Funds | • |

Total deposits were $75.7 billion, up 0.4%; customer deposits (excluding brokered deposits) were $70.5 billion, up 2% | ||||||

• |

Short-term borrowings, consisting primarily of secured borrowings, were $2.9 billion, down 33% | |||||||

| Capital | • |

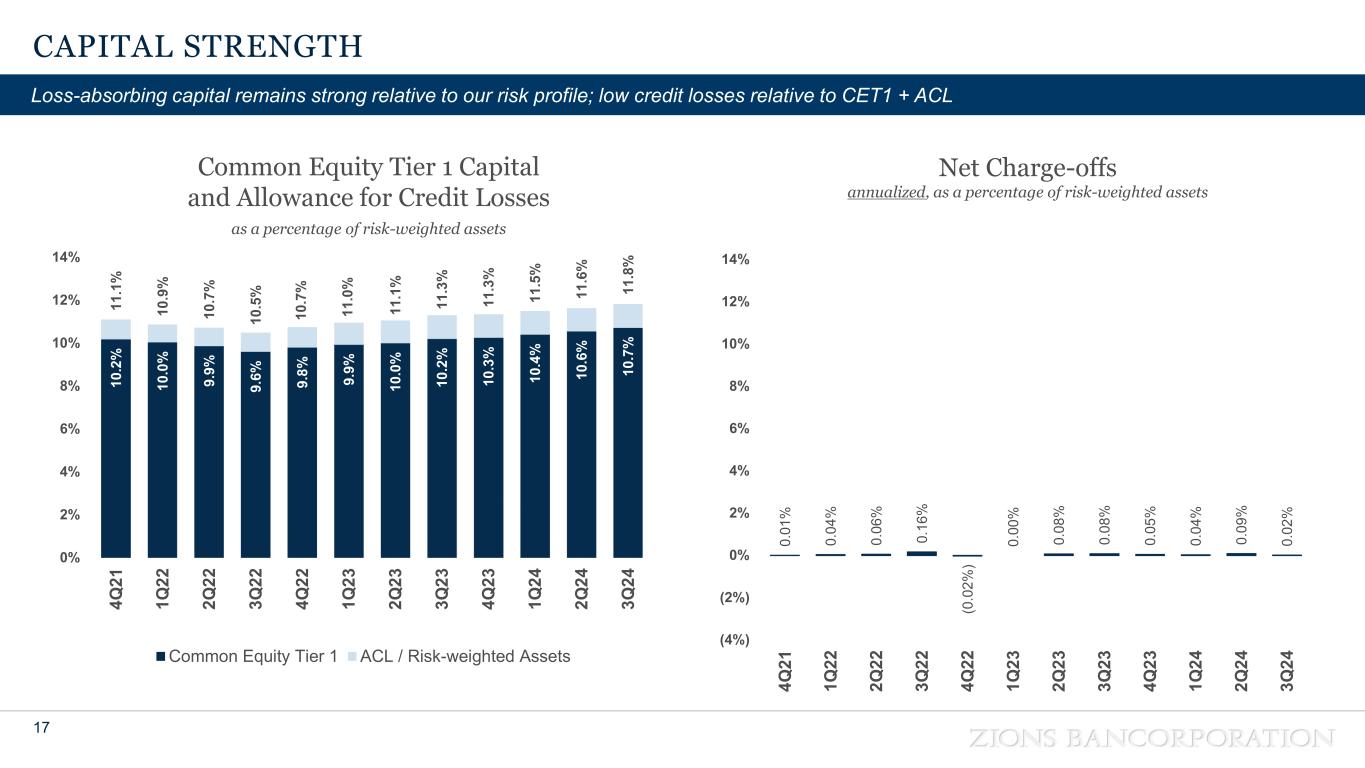

The estimated CET1 capital ratio was 10.7%, compared with 10.2% | ||||||

| CEO COMMENTARY | ||

|

Harris H. Simmons, Chairman and CEO of Zions Bancorporation, commented, “We’re pleased with the continued improvement in our financial performance, reflected in the 21% increase in earnings per share over the same period last year. The net interest margin strengthened to 3.03% from 2.93% a year ago, and operating costs increased a modest 1%. Average noninterest-bearing demand deposits decreased 1.7% relative to the prior quarter of this year, but were flat to last quarter’s ending balance, suggesting continued stabilization of this important source of low-cost funding. Tangible common equity has grown 28% over the past year, and 8% over the past quarter.”

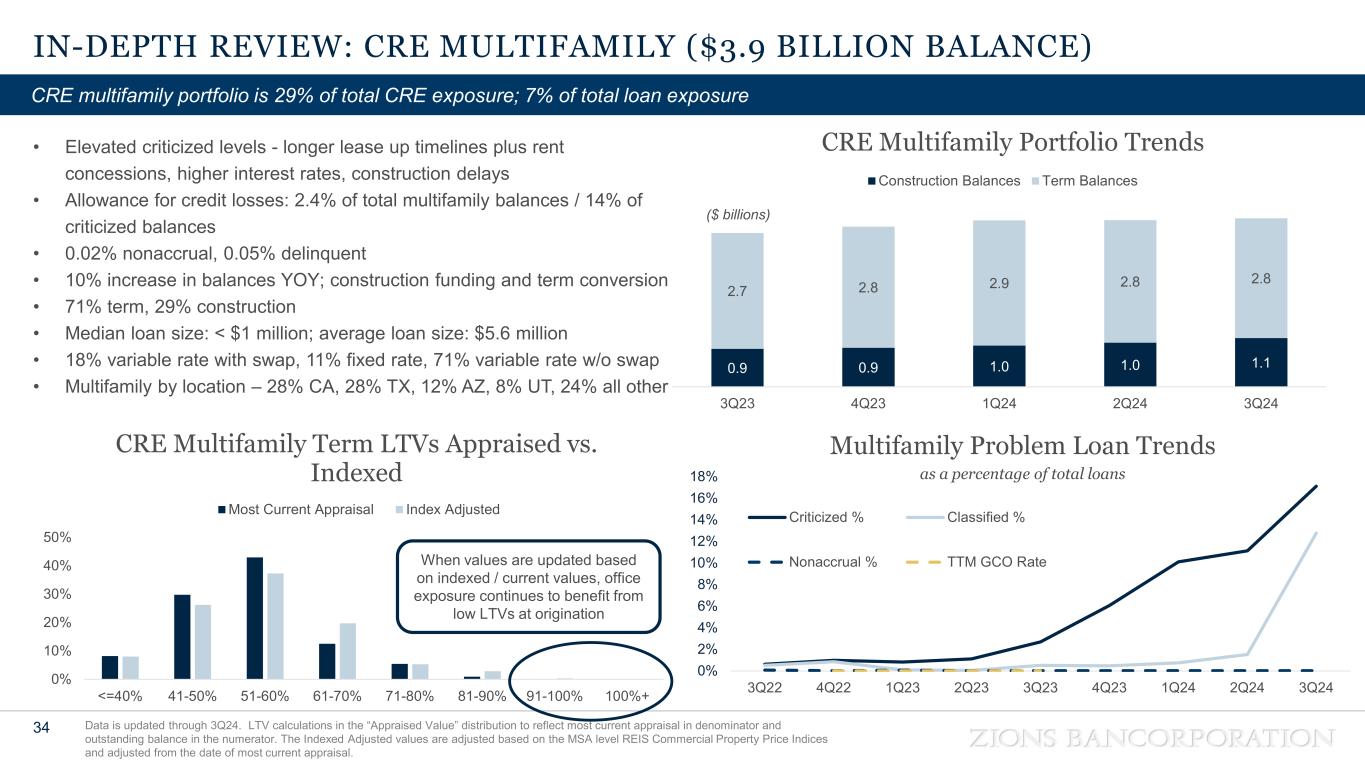

Mr. Simmons continued, “While classified loans increased 66% quarter over quarter, reflecting somewhat weaker fundamental performance in multi-family residential loans, we expect credit losses to remain well controlled as a result of strong equity and sponsorship in these deals. Realized total credit losses remained very low during the quarter at an annualized rate of 0.02% of loans.”

Mr. Simmons concluded, “Finally, we were pleased to announce during the quarter an agreement with FirstBank, headquartered in Lakewood, Colorado, to purchase four of their branches in California’s Coachella Valley with approximately $730 million in deposits and $420 million in loans. Upon receiving regulatory approval, these offices will become part of California Bank & Trust, and will strengthen our competitive position in that market.”

| ||

OPERATING PERFORMANCE2 | ||

| (In millions) | Three Months Ended September 30, |

Nine Months Ended September 30, |

|||||||||||||||||||||

| 2024 | 2023 | 2024 | 2023 | ||||||||||||||||||||

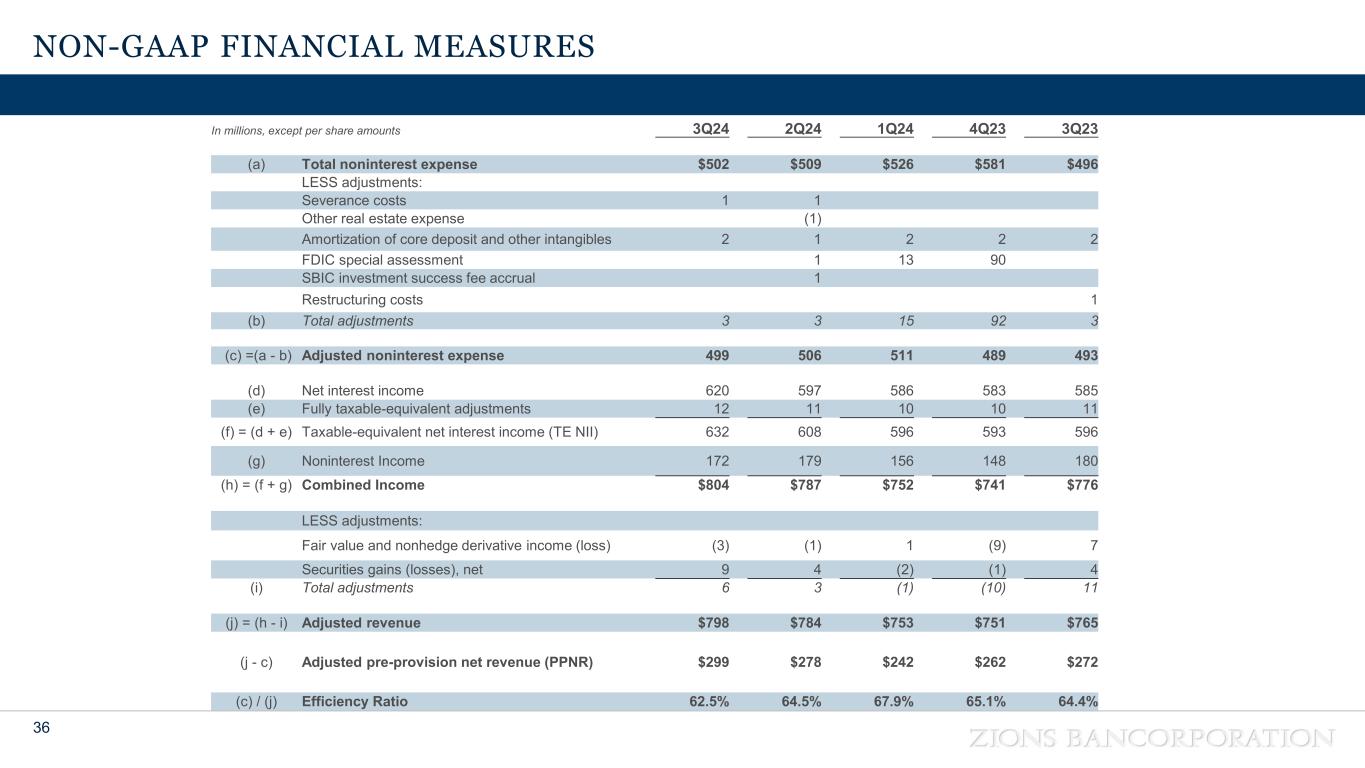

| Adjusted PPNR | $ | 299 | $ | 272 | $ | 819 | $ | 909 | |||||||||||||||

| Net charge-offs (recoveries) | $ | 3 | $ | 14 | $ | 24 | $ | 27 | |||||||||||||||

| Efficiency ratio | 62.5 | % | 64.4 | % | 64.9 | % | 62.2 | % | |||||||||||||||

| Weighted average diluted shares | 147.2 | 147.7 | 147.2 | 147.8 | |||||||||||||||||||

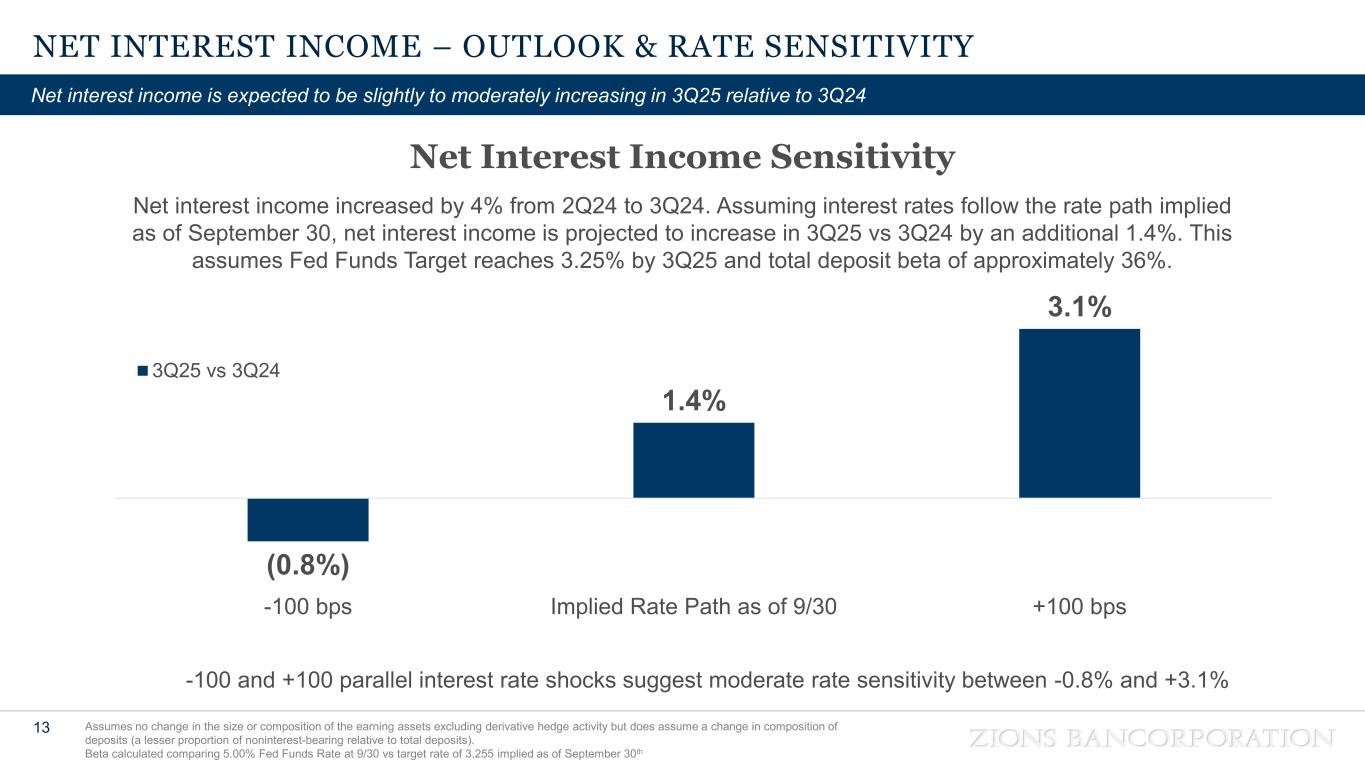

Net Interest Income and Margin | |||||||||||||||||||||||||||||||||||||||||

| 3Q24 - 2Q24 | 3Q24 - 3Q23 | ||||||||||||||||||||||||||||||||||||||||

| (In millions) | 3Q24 | 2Q24 | 3Q23 | $ | % | $ | % | ||||||||||||||||||||||||||||||||||

| Interest and fees on loans | $ | 899 | $ | 877 | $ | 831 | $ | 22 | 3 | % | $ | 68 | 8 | % | |||||||||||||||||||||||||||

| Interest on money market investments | 67 | 56 | 35 | 11 | 20 | 32 | 91 | ||||||||||||||||||||||||||||||||||

| Interest on securities | 138 | 140 | 144 | (2) | (1) | (6) | (4) | ||||||||||||||||||||||||||||||||||

Total interest income |

1,104 | 1,073 | 1,010 | 31 | 3 | 94 | 9 | ||||||||||||||||||||||||||||||||||

| Interest on deposits | 403 | 390 | 366 | 13 | 3 | 37 | 10 | ||||||||||||||||||||||||||||||||||

| Interest on short- and long-term borrowings | 81 | 86 | 59 | (5) | (6) | 22 | 37 | ||||||||||||||||||||||||||||||||||

Total interest expense |

484 | 476 | 425 | 8 | 2 | 59 | 14 | ||||||||||||||||||||||||||||||||||

Net interest income |

$ | 620 | $ | 597 | $ | 585 | $ | 23 | 4 | $ | 35 | 6 | |||||||||||||||||||||||||||||

| bps | bps | ||||||||||||||||||||||||||||||||||||||||

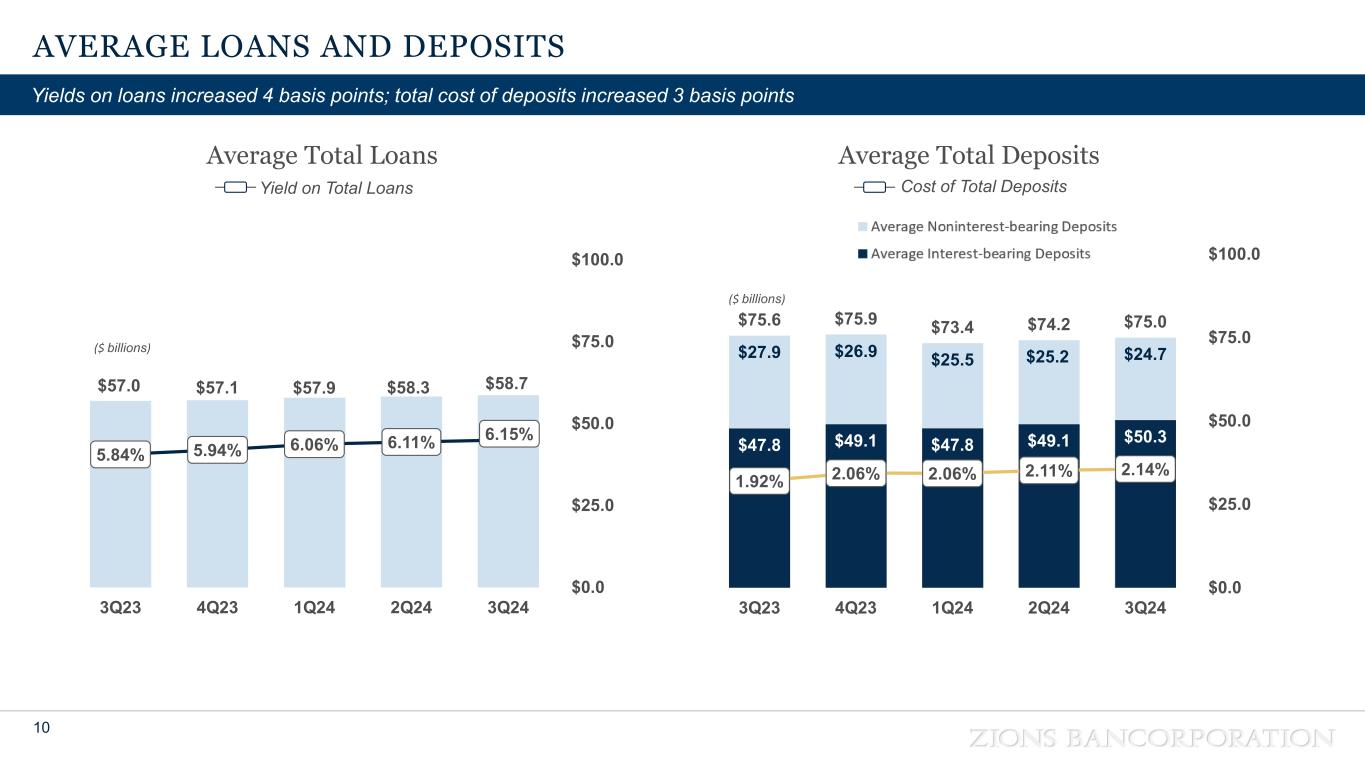

Yield on interest-earning assets1 |

5.35 | % | 5.31 | % | 5.02 | % | 4 | 33 | |||||||||||||||||||||||||||||||||

Rate paid on total deposits and interest-bearing liabilities1 |

2.36 | % | 2.36 | % | 2.10 | % | — | 26 | |||||||||||||||||||||||||||||||||

Cost of total deposits1 |

2.14 | % | 2.11 | % | 1.92 | % | 3 | 22 | |||||||||||||||||||||||||||||||||

Net interest margin1 |

3.03 | % | 2.98 | % | 2.93 | % | 5 | 10 | |||||||||||||||||||||||||||||||||

Noninterest Income | |||||||||||||||||||||||||||||||||||||||||

| 3Q24 - 2Q24 | 3Q24 - 3Q23 | ||||||||||||||||||||||||||||||||||||||||

| (In millions) | 3Q24 | 2Q24 | 3Q23 | $ | % | $ | % | ||||||||||||||||||||||||||||||||||

| Commercial account fees | $ | 46 | $ | 45 | $ | 43 | $ | 1 | 2 | % | $ | 3 | 7 | % | |||||||||||||||||||||||||||

| Card fees | 24 | 25 | 26 | (1) | (4) | (2) | (8) | ||||||||||||||||||||||||||||||||||

| Retail and business banking fees | 18 | 16 | 17 | 2 | 13 | 1 | 6 | ||||||||||||||||||||||||||||||||||

| Loan-related fees and income | 17 | 18 | 23 | (1) | (6) | (6) | (26) | ||||||||||||||||||||||||||||||||||

| Capital markets fees | 28 | 21 | 18 | 7 | 33 | 10 | 56 | ||||||||||||||||||||||||||||||||||

| Wealth management fees | 14 | 15 | 15 | (1) | (7) | (1) | (7) | ||||||||||||||||||||||||||||||||||

| Other customer-related fees | 14 | 14 | 15 | — | — | (1) | (7) | ||||||||||||||||||||||||||||||||||

| Customer-related noninterest income | 161 | 154 | 157 | 7 | 5 | 4 | 3 | ||||||||||||||||||||||||||||||||||

| Fair value and nonhedge derivative income (loss) | (3) | (1) | 7 | (2) | NM | (10) | NM | ||||||||||||||||||||||||||||||||||

| Dividends and other income | 5 | 22 | 12 | (17) | (77) | (7) | (58) | ||||||||||||||||||||||||||||||||||

| Securities gains (losses), net | 9 | 4 | 4 | 5 | NM | 5 | NM | ||||||||||||||||||||||||||||||||||

Total noninterest income |

$ | 172 | $ | 179 | $ | 180 | $ | (7) | (4) | $ | (8) | (4) | |||||||||||||||||||||||||||||

Noninterest Expense | |||||||||||||||||||||||||||||||||||||||||

| 3Q24 - 2Q24 | 3Q24 - 3Q23 | ||||||||||||||||||||||||||||||||||||||||

| (In millions) | 3Q24 | 2Q24 | 3Q23 | $ | % | $ | % | ||||||||||||||||||||||||||||||||||

| Salaries and employee benefits | $ | 317 | $ | 318 | $ | 311 | $ | (1) | — | % | $ | 6 | 2 | % | |||||||||||||||||||||||||||

| Technology, telecom, and information processing | 66 | 66 | 62 | — | — | 4 | 6 | ||||||||||||||||||||||||||||||||||

| Occupancy and equipment, net | 40 | 40 | 42 | — | — | (2) | (5) | ||||||||||||||||||||||||||||||||||

| Professional and legal services | 14 | 17 | 16 | (3) | (18) | (2) | (13) | ||||||||||||||||||||||||||||||||||

| Marketing and business development | 12 | 13 | 10 | (1) | (8) | 2 | 20 | ||||||||||||||||||||||||||||||||||

| Deposit insurance and regulatory expense | 19 | 21 | 20 | (2) | (10) | (1) | (5) | ||||||||||||||||||||||||||||||||||

| Credit-related expense | 6 | 6 | 6 | — | — | — | — | ||||||||||||||||||||||||||||||||||

| Other real estate expense, net | — | (1) | — | 1 | NM | — | NM | ||||||||||||||||||||||||||||||||||

| Other | 28 | 29 | 29 | (1) | (3) | (1) | (3) | ||||||||||||||||||||||||||||||||||

Total noninterest expense |

$ | 502 | $ | 509 | $ | 496 | $ | (7) | (1) | $ | 6 | 1 | |||||||||||||||||||||||||||||

Adjusted noninterest expense 1 |

$ | 499 | $ | 506 | $ | 493 | $ | (7) | (1) | $ | 6 | 1 | |||||||||||||||||||||||||||||

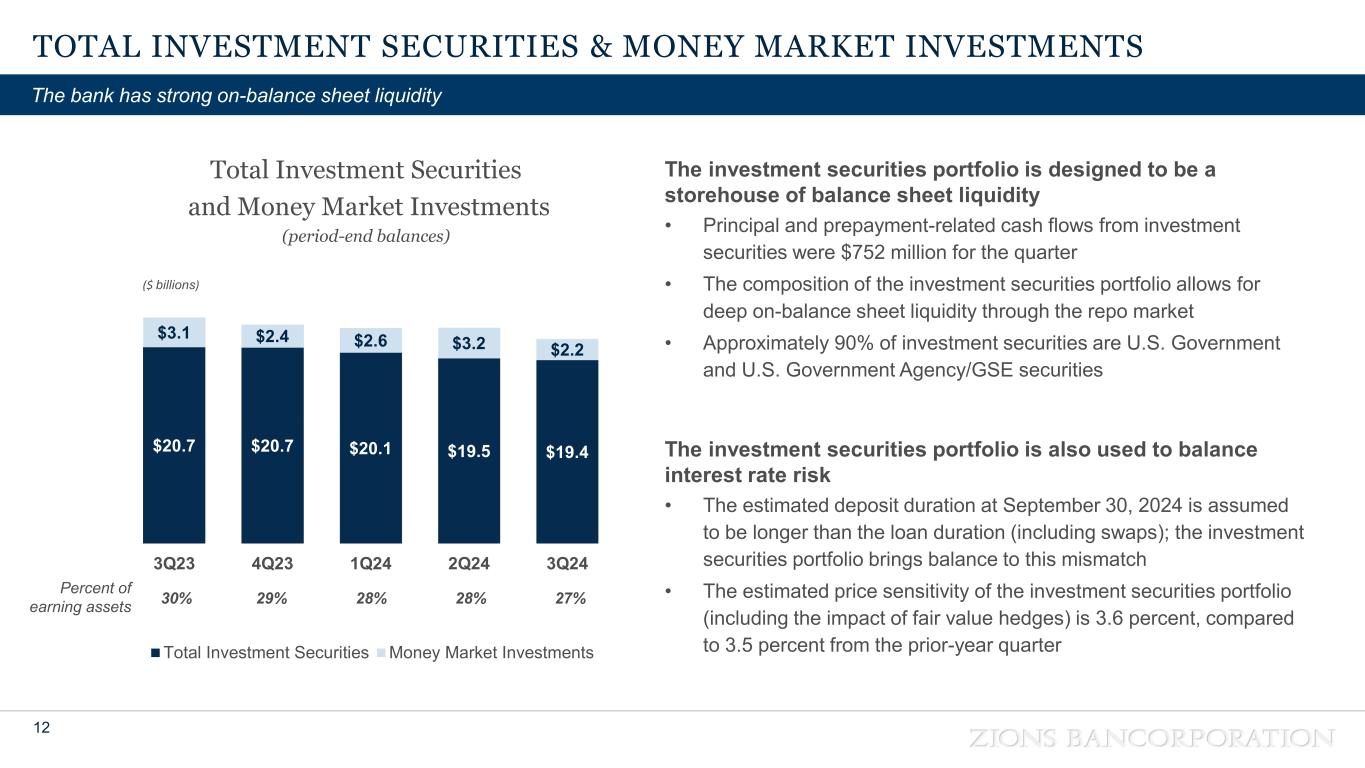

| Investment Securities | |||||||||||||||||||||||||||||||||||||||||

| 3Q24 - 2Q24 | 3Q24 - 3Q23 | ||||||||||||||||||||||||||||||||||||||||

| (In millions) | 3Q24 | 2Q24 | 3Q23 | $ | % | $ | % | ||||||||||||||||||||||||||||||||||

| Investment securities: | |||||||||||||||||||||||||||||||||||||||||

| Available-for-sale, at fair value | $ | 9,495 | $ | 9,483 | $ | 10,148 | $ | 12 | — | % | $ | (653) | (6) | % | |||||||||||||||||||||||||||

| Held-to-maturity, at amortized cost | 9,857 | 10,065 | 10,559 | (208) | (2) | (702) | (7) | ||||||||||||||||||||||||||||||||||

| Total investment securities, net of allowance | $ | 19,352 | $ | 19,548 | $ | 20,707 | $ | (196) | (1) | $ | (1,355) | (7) | |||||||||||||||||||||||||||||

| Loans and Leases | |||||||||||||||||||||||||||||||||||||||||

| 3Q24 - 2Q24 | 3Q24 - 3Q23 | ||||||||||||||||||||||||||||||||||||||||

| (In millions) | 3Q24 | 2Q24 | 3Q23 | $ | % | $ | % | ||||||||||||||||||||||||||||||||||

| Loans held for sale | $ | 97 | $ | 112 | $ | 41 | $ | (15) | (13) | % | $ | 56 | NM | ||||||||||||||||||||||||||||

| Loans and leases: | |||||||||||||||||||||||||||||||||||||||||

Commercial |

$ | 30,785 | $ | 30,511 | $ | 30,208 | $ | 274 | 1 | $ | 577 | 2 | % | ||||||||||||||||||||||||||||

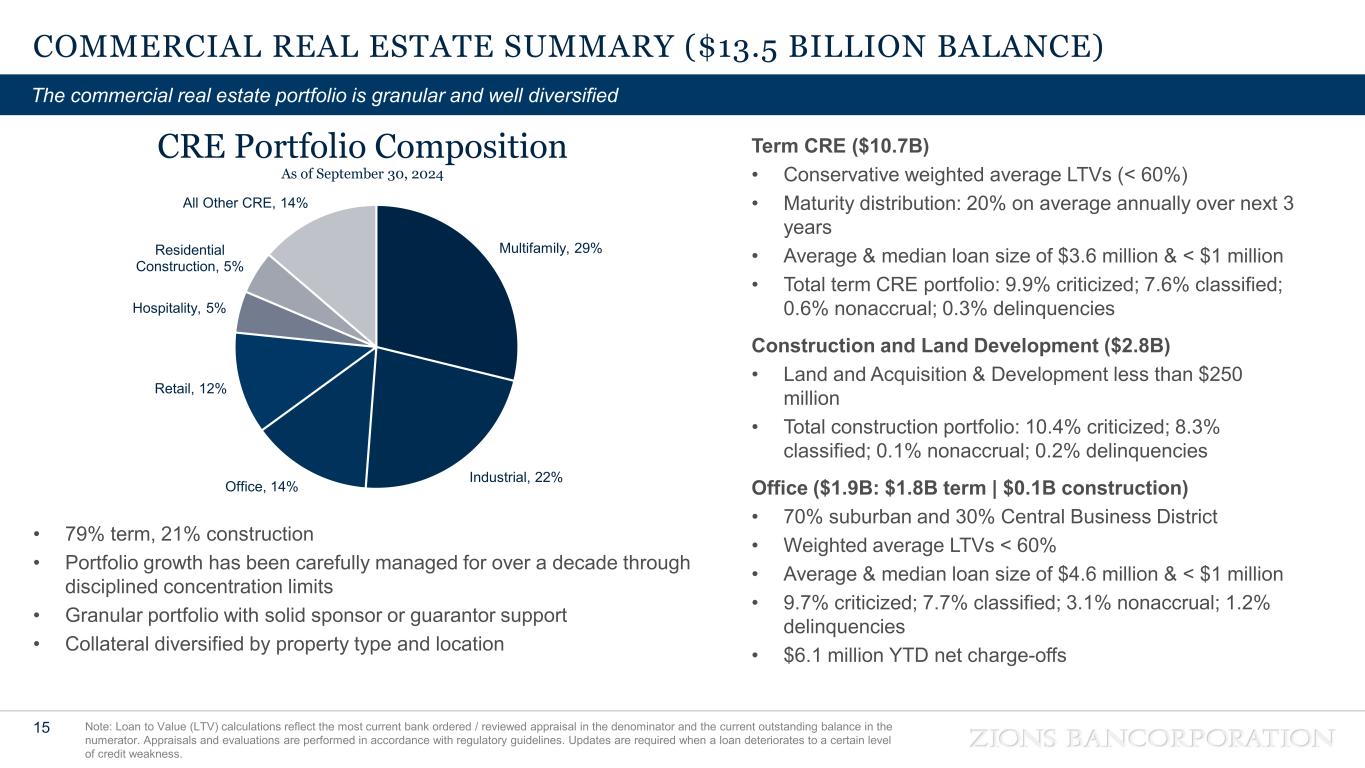

Commercial real estate |

13,483 | 13,549 | 13,140 | (66) | — | 343 | 3 | ||||||||||||||||||||||||||||||||||

Consumer |

14,616 | 14,355 | 13,545 | 261 | 2 | 1,071 | 8 | ||||||||||||||||||||||||||||||||||

| Loans and leases, net of unearned income and fees | 58,884 | 58,415 | 56,893 | 469 | 1 | 1,991 | 3 | ||||||||||||||||||||||||||||||||||

Less allowance for loan losses |

694 | 696 | 681 | (2) | — | 13 | 2 | ||||||||||||||||||||||||||||||||||

Loans and leases held for investment, net of allowance |

$ | 58,190 | $ | 57,719 | $ | 56,212 | $ | 471 | 1 | $ | 1,978 | 4 | |||||||||||||||||||||||||||||

| Unfunded lending commitments | $ | 29,121 | $ | 29,122 | $ | 30,442 | $ | (1) | — | $ | (1,321) | (4) | |||||||||||||||||||||||||||||

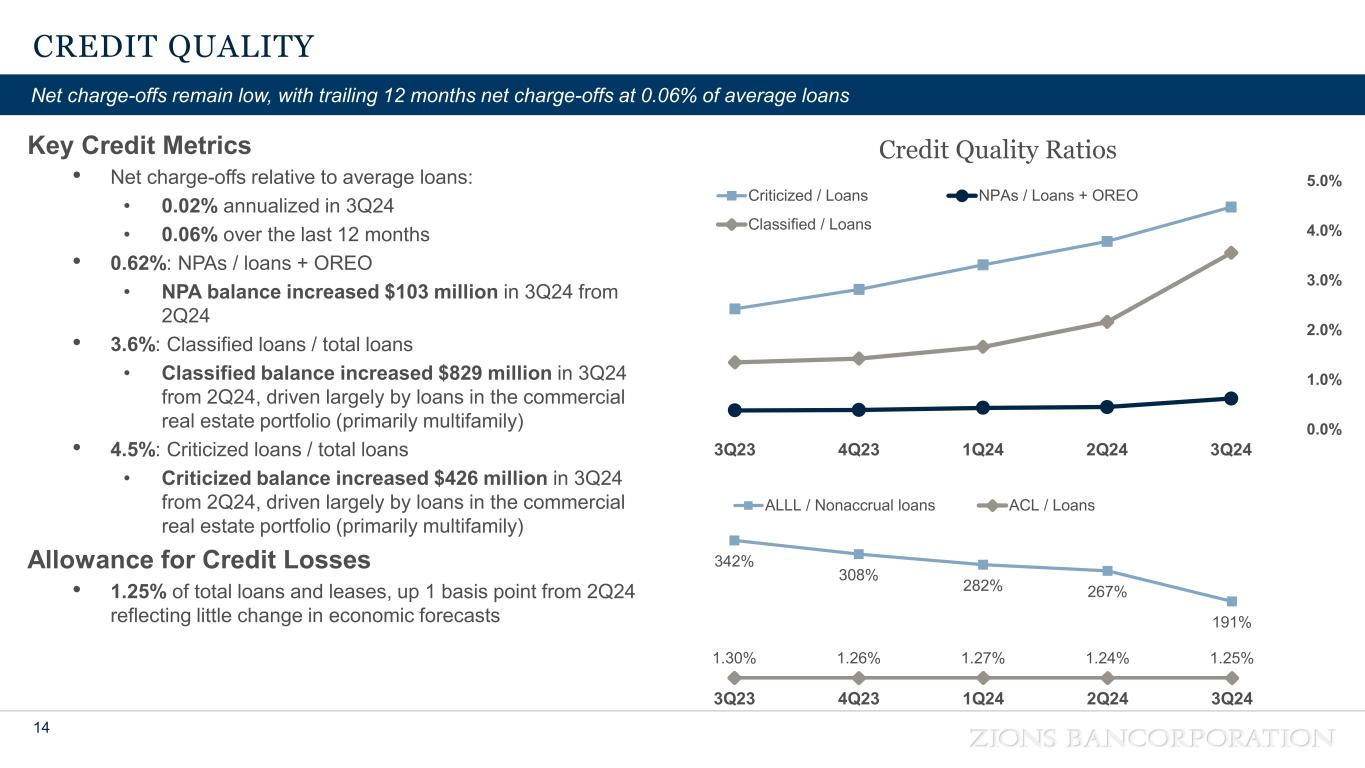

| Credit Quality | |||||||||||||||||||||||||||||||||||||||||

| 3Q24 - 2Q24 | 3Q24 - 3Q23 | ||||||||||||||||||||||||||||||||||||||||

| (In millions) | 3Q24 | 2Q24 | 3Q23 | $ | % | $ | % | ||||||||||||||||||||||||||||||||||

| Provision for credit losses | $ | 13 | $ | 5 | $ | 41 | $ | 8 | NM | $ | (28) | (68) | % | ||||||||||||||||||||||||||||

| Allowance for credit losses | 736 | 726 | 738 | 10 | 1 | % | (2) | — | |||||||||||||||||||||||||||||||||

| Net loan and lease charge-offs (recoveries) | 3 | 15 | 14 | (12) | (80) | (11) | (79) | ||||||||||||||||||||||||||||||||||

| Nonperforming assets | 368 | 265 | 219 | 103 | 39 | 149 | 68 | ||||||||||||||||||||||||||||||||||

| Classified loans | 2,093 | 1,264 | 769 | 829 | 66 | 1,324 | NM | ||||||||||||||||||||||||||||||||||

| 3Q24 | 2Q24 | 3Q23 | bps | bps | |||||||||||||||||||||||||||||||||||||

| Ratio of ACL to loans and leases outstanding, at period end | 1.25 | % | 1.24 | % | 1.30 | % | 1 | (5) | |||||||||||||||||||||||||||||||||

| Annualized ratio of net loan and lease charge-offs (recoveries) to average loans | 0.02 | % | 0.10 | % | 0.10 | % | (8) | (8) | |||||||||||||||||||||||||||||||||

| Ratio of nonperforming assets to loans and leases and other real estate owned | 0.62 | % | 0.45 | % | 0.38 | % | 17 | 24 | |||||||||||||||||||||||||||||||||

| Ratio of classified loans to total loans and leases | 3.55 | % | 2.16 | % | 1.35 | % | 139 | 220 | |||||||||||||||||||||||||||||||||

Deposits and Borrowed Funds | |||||||||||||||||||||||||||||||||||||||||

| 3Q24 - 2Q24 | 3Q24 - 3Q23 | ||||||||||||||||||||||||||||||||||||||||

| (In millions) | 3Q24 | 2Q24 | 3Q23 | $ | % | $ | % | ||||||||||||||||||||||||||||||||||

| Deposits: | |||||||||||||||||||||||||||||||||||||||||

| Noninterest-bearing demand | $ | 24,973 | $ | 24,731 | $ | 26,733 | $ | 242 | 1 | % | $ | (1,760) | (7) | % | |||||||||||||||||||||||||||

| Interest-bearing: | |||||||||||||||||||||||||||||||||||||||||

| Savings and money market | 39,215 | 38,560 | 37,026 | 655 | 2 | 2,189 | 6 | ||||||||||||||||||||||||||||||||||

| Time | 6,333 | 6,189 | 5,089 | 144 | 2 | 1,244 | 24 | ||||||||||||||||||||||||||||||||||

| Brokered | 5,197 | 4,290 | 6,551 | 907 | 21 | (1,354) | (21) | ||||||||||||||||||||||||||||||||||

| Total interest-bearing | 50,745 | 49,039 | 48,666 | 1,706 | 3 | 2,079 | 4 | ||||||||||||||||||||||||||||||||||

| Total deposits | $ | 75,718 | $ | 73,770 | $ | 75,399 | $ | 1,948 | 3 | $ | 319 | — | |||||||||||||||||||||||||||||

| Borrowed funds: | |||||||||||||||||||||||||||||||||||||||||

| Federal funds purchased and other short-term borrowings | $ | 2,919 | $ | 5,651 | $ | 4,346 | $ | (2,732) | (48) | $ | (1,427) | (33) | |||||||||||||||||||||||||||||

| Long-term debt | 548 | 546 | 540 | 2 | — | 8 | 1 | ||||||||||||||||||||||||||||||||||

| Total borrowed funds | $ | 3,467 | $ | 6,197 | $ | 4,886 | $ | (2,730) | (44) | $ | (1,419) | (29) | |||||||||||||||||||||||||||||

| Shareholders’ Equity | |||||||||||||||||||||||||||||||||||||||||

| 3Q24 - 2Q24 | 3Q24 - 3Q23 | ||||||||||||||||||||||||||||||||||||||||

| (In millions, except share data) | 3Q24 | 2Q24 | 3Q23 | $ | % | $ | % | ||||||||||||||||||||||||||||||||||

| Shareholders’ equity: | |||||||||||||||||||||||||||||||||||||||||

Preferred stock |

$ | 440 | $ | 440 | $ | 440 | $ | — | — | % | $ | — | — | % | |||||||||||||||||||||||||||

Common stock and additional paid-in capital |

1,717 | 1,713 | 1,726 | 4 | — | (9) | (1) | ||||||||||||||||||||||||||||||||||

Retained earnings |

6,564 | 6,421 | 6,157 | 143 | 2 | 407 | 7 | ||||||||||||||||||||||||||||||||||

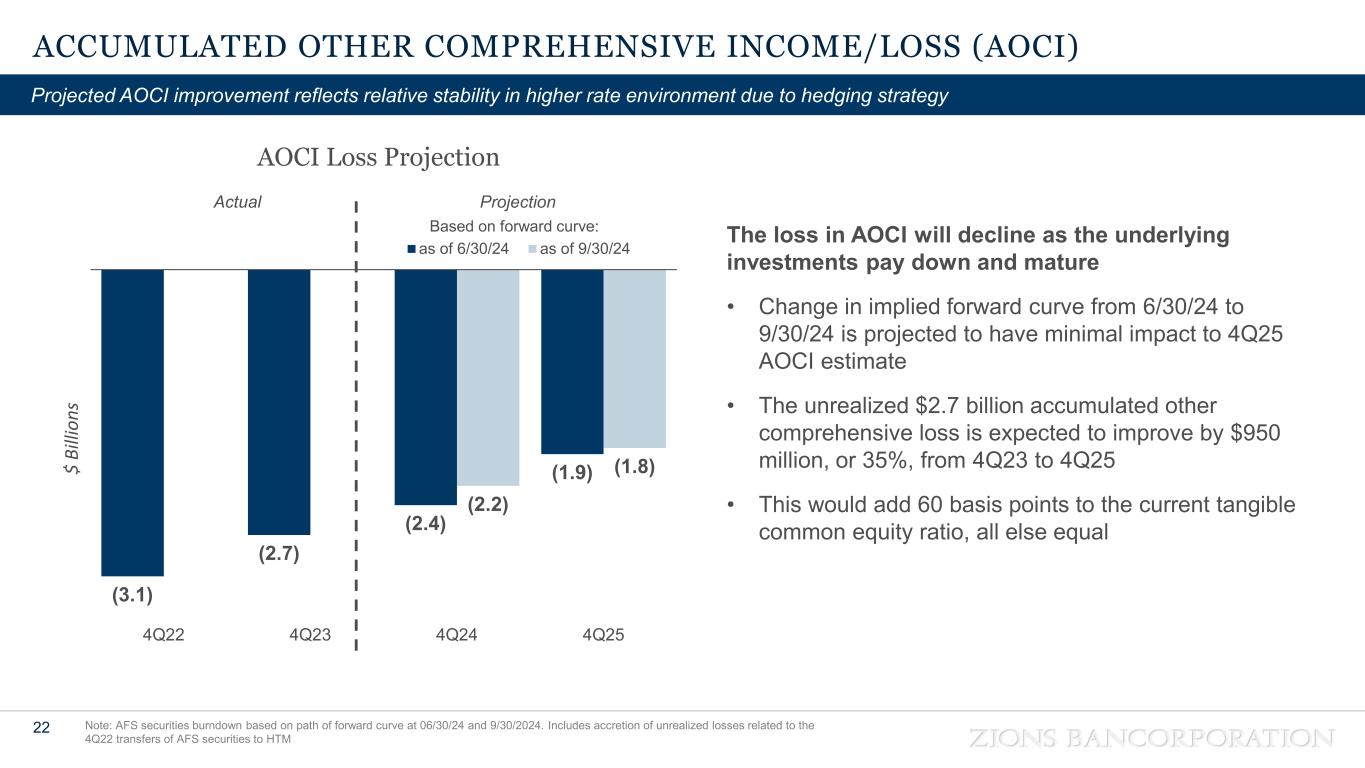

| Accumulated other comprehensive income (loss) | (2,336) | (2,549) | (3,008) | 213 | 8 | 672 | 22 | ||||||||||||||||||||||||||||||||||

| Total shareholders’ equity | $ | 6,385 | $ | 6,025 | $ | 5,315 | $ | 360 | 6 | $ | 1,070 | 20 | |||||||||||||||||||||||||||||

| Capital distributions: | |||||||||||||||||||||||||||||||||||||||||

| Common dividends paid | $ | 61 | $ | 61 | $ | 61 | $ | — | — | $ | — | — | |||||||||||||||||||||||||||||

| Bank common stock repurchased | — | — | — | — | — | — | — | ||||||||||||||||||||||||||||||||||

| Total capital distributed to common shareholders | $ | 61 | $ | 61 | $ | 61 | $ | — | — | $ | — | — | |||||||||||||||||||||||||||||

| shares | % | shares | % | ||||||||||||||||||||||||||||||||||||||

Weighted average diluted common shares outstanding (in thousands) |

147,150 | 147,120 | 147,653 | 30 | — | % | (503) | — | % | ||||||||||||||||||||||||||||||||

| Common shares outstanding, at period end (in thousands) | 147,699 | 147,684 | 148,146 | 15 | — | (447) | — | ||||||||||||||||||||||||||||||||||

| Three Months Ended | |||||||||||||||||||||||||||||

| (In millions, except share, per share, and ratio data) | September 30, 2024 |

June 30, 2024 |

March 31, 2024 |

December 31, 2023 |

September 30, 2023 |

||||||||||||||||||||||||

BALANCE SHEET 1 |

|||||||||||||||||||||||||||||

| Loans held for investment, net of allowance | $ | 58,190 | $ | 57,719 | $ | 57,410 | $ | 57,095 | $ | 56,212 | |||||||||||||||||||

| Total assets | 87,032 | 87,606 | 87,060 | 87,203 | 87,269 | ||||||||||||||||||||||||

| Deposits | 75,718 | 73,770 | 74,237 | 74,961 | 75,399 | ||||||||||||||||||||||||

| Total shareholders’ equity | 6,385 | 6,025 | 5,829 | 5,691 | 5,315 | ||||||||||||||||||||||||

| STATEMENT OF INCOME | |||||||||||||||||||||||||||||

Net earnings applicable to common shareholders |

$ | 204 | $ | 190 | $ | 143 | $ | 116 | $ | 168 | |||||||||||||||||||

| Net interest income | 620 | 597 | 586 | 583 | 585 | ||||||||||||||||||||||||

Taxable-equivalent net interest income 2 |

632 | 608 | 596 | 593 | 596 | ||||||||||||||||||||||||

| Total noninterest income | 172 | 179 | 156 | 148 | 180 | ||||||||||||||||||||||||

| Total noninterest expense | 502 | 509 | 526 | 581 | 496 | ||||||||||||||||||||||||

Pre-provision net revenue 2 |

302 | 278 | 226 | 160 | 280 | ||||||||||||||||||||||||

Adjusted pre-provision net revenue 2 |

299 | 278 | 242 | 262 | 272 | ||||||||||||||||||||||||

| Provision for credit losses | 13 | 5 | 13 | — | 41 | ||||||||||||||||||||||||

| SHARE AND PER COMMON SHARE AMOUNTS | |||||||||||||||||||||||||||||

| Net earnings per diluted common share | $ | 1.37 | $ | 1.28 | $ | 0.96 | $ | 0.78 | $ | 1.13 | |||||||||||||||||||

| Dividends | 0.41 | 0.41 | 0.41 | 0.41 | 0.41 | ||||||||||||||||||||||||

Book value per common share 1 |

40.25 | 37.82 | 36.50 | 35.44 | 32.91 | ||||||||||||||||||||||||

Tangible book value per common share 1, 2 |

33.12 | 30.67 | 29.34 | 28.30 | 25.75 | ||||||||||||||||||||||||

| Weighted average share price | 47.13 | 42.01 | 41.03 | 35.95 | 34.67 | ||||||||||||||||||||||||

Weighted average diluted common shares outstanding (in thousands) |

147,150 | 147,120 | 147,343 | 147,645 | 147,653 | ||||||||||||||||||||||||

Common shares outstanding (in thousands) 1 |

147,699 | 147,684 | 147,653 | 148,153 | 148,146 | ||||||||||||||||||||||||

| SELECTED RATIOS AND OTHER DATA | |||||||||||||||||||||||||||||

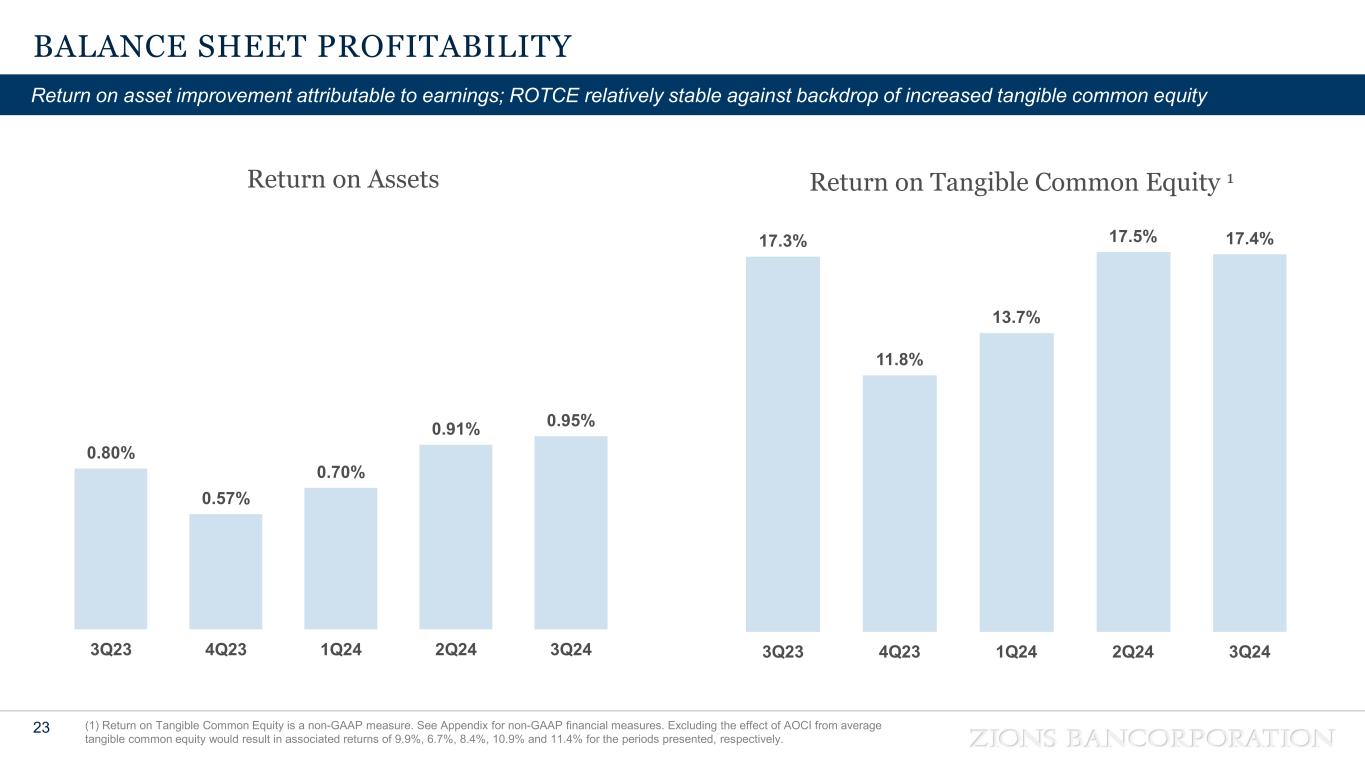

| Return on average assets | 0.95 | % | 0.91 | % | 0.70 | % | 0.57 | % | 0.80 | % | |||||||||||||||||||

| Return on average common equity | 14.1 | % | 14.0 | % | 10.9 | % | 9.2 | % | 13.5 | % | |||||||||||||||||||

Return on average tangible common equity 2 |

17.4 | % | 17.5 | % | 13.7 | % | 11.8 | % | 17.3 | % | |||||||||||||||||||

| Net interest margin | 3.03 | % | 2.98 | % | 2.94 | % | 2.91 | % | 2.93 | % | |||||||||||||||||||

| Cost of total deposits | 2.14 | % | 2.11 | % | 2.06 | % | 2.06 | % | 1.92 | % | |||||||||||||||||||

Efficiency ratio 2 |

62.5 | % | 64.5 | % | 67.9 | % | 65.1 | % | 64.4 | % | |||||||||||||||||||

Effective tax rate 3 |

22.7 | % | 23.3 | % | 24.6 | % | 16.0 | % | 23.2 | % | |||||||||||||||||||

Ratio of nonperforming assets to loans and leases and other real estate owned |

0.62 | % | 0.45 | % | 0.44 | % | 0.39 | % | 0.38 | % | |||||||||||||||||||

| Annualized ratio of net loan and lease charge-offs to average loans | 0.02 | % | 0.10 | % | 0.04 | % | 0.06 | % | 0.10 | % | |||||||||||||||||||

Ratio of total allowance for credit losses to loans and leases outstanding 1 |

1.25 | % | 1.24 | % | 1.27 | % | 1.26 | % | 1.30 | % | |||||||||||||||||||

Full-time equivalent employees |

9,503 | 9,696 | 9,708 | 9,679 | 9,984 | ||||||||||||||||||||||||

CAPITAL RATIOS AND DATA 1 |

|||||||||||||||||||||||||||||

Tangible common equity ratio 2 |

5.7 | % | 5.2 | % | 5.0 | % | 4.9 | % | 4.4 | % | |||||||||||||||||||

Common equity tier 1 capital 4 |

$ | 7,206 | $ | 7,057 | $ | 6,920 | $ | 6,863 | $ | 6,803 | |||||||||||||||||||

Risk-weighted assets 4 |

$ | 67,199 | $ | 66,885 | $ | 66,824 | $ | 66,934 | $ | 66,615 | |||||||||||||||||||

Common equity tier 1 capital ratio 4 |

10.7 | % | 10.6 | % | 10.4 | % | 10.3 | % | 10.2 | % | |||||||||||||||||||

Tier 1 risk-based capital ratio 4 |

11.4 | % | 11.2 | % | 11.0 | % | 10.9 | % | 10.9 | % | |||||||||||||||||||

Total risk-based capital ratio 4 |

13.2 | % | 13.1 | % | 12.9 | % | 12.8 | % | 12.8 | % | |||||||||||||||||||

Tier 1 leverage ratio 4 |

8.6 | % | 8.5 | % | 8.4 | % | 8.3 | % | 8.3 | % | |||||||||||||||||||

| (In millions, shares in thousands) | September 30, 2024 |

June 30, 2024 |

March 31, 2024 |

December 31, 2023 |

September 30, 2023 |

||||||||||||||||||||||||

| (Unaudited) | (Unaudited) | (Unaudited) | (Unaudited) | ||||||||||||||||||||||||||

| ASSETS | |||||||||||||||||||||||||||||

| Cash and due from banks | $ | 1,114 | $ | 717 | $ | 709 | $ | 716 | $ | 700 | |||||||||||||||||||

| Money market investments: | |||||||||||||||||||||||||||||

| Interest-bearing deposits | 1,253 | 2,276 | 1,688 | 1,488 | 1,704 | ||||||||||||||||||||||||

| Federal funds sold and securities purchased under agreements to resell | 986 | 936 | 894 | 937 | 1,427 | ||||||||||||||||||||||||

| Trading securities, at fair value | 68 | 24 | 59 | 48 | 31 | ||||||||||||||||||||||||

| Investment securities: | |||||||||||||||||||||||||||||

| Available-for-sale, at fair value | 9,495 | 9,483 | 9,931 | 10,300 | 10,148 | ||||||||||||||||||||||||

Held-to-maturity1, at amortized cost |

9,857 | 10,065 | 10,209 | 10,382 | 10,559 | ||||||||||||||||||||||||

| Total investment securities, net of allowance | 19,352 | 19,548 | 20,140 | 20,682 | 20,707 | ||||||||||||||||||||||||

Loans held for sale2 |

97 | 112 | 12 | 53 | 41 | ||||||||||||||||||||||||

| Loans and leases, net of unearned income and fees | 58,884 | 58,415 | 58,109 | 57,779 | 56,893 | ||||||||||||||||||||||||

| Less allowance for loan losses | 694 | 696 | 699 | 684 | 681 | ||||||||||||||||||||||||

| Loans held for investment, net of allowance | 58,190 | 57,719 | 57,410 | 57,095 | 56,212 | ||||||||||||||||||||||||

| Other noninterest-bearing investments | 946 | 987 | 922 | 950 | 929 | ||||||||||||||||||||||||

| Premises, equipment, and software, net | 1,372 | 1,383 | 1,396 | 1,400 | 1,410 | ||||||||||||||||||||||||

| Goodwill and intangibles | 1,053 | 1,055 | 1,057 | 1,059 | 1,060 | ||||||||||||||||||||||||

| Other real estate owned | 5 | 4 | 6 | 6 | 7 | ||||||||||||||||||||||||

| Other assets | 2,596 | 2,845 | 2,767 | 2,769 | 3,041 | ||||||||||||||||||||||||

| Total assets | $ | 87,032 | $ | 87,606 | $ | 87,060 | $ | 87,203 | $ | 87,269 | |||||||||||||||||||

| LIABILITIES AND SHAREHOLDERS’ EQUITY | |||||||||||||||||||||||||||||

| Deposits: | |||||||||||||||||||||||||||||

| Noninterest-bearing demand | $ | 24,973 | $ | 24,731 | $ | 25,137 | $ | 26,244 | $ | 26,733 | |||||||||||||||||||

| Interest-bearing: | |||||||||||||||||||||||||||||

| Savings and money market | 39,242 | 38,596 | 38,879 | 38,721 | 37,090 | ||||||||||||||||||||||||

| Time | 11,503 | 10,443 | 10,221 | 9,996 | 11,576 | ||||||||||||||||||||||||

| Total deposits | 75,718 | 73,770 | 74,237 | 74,961 | 75,399 | ||||||||||||||||||||||||

| Federal funds and other short-term borrowings | 2,919 | 5,651 | 4,895 | 4,379 | 4,346 | ||||||||||||||||||||||||

| Long-term debt | 548 | 546 | 544 | 542 | 540 | ||||||||||||||||||||||||

| Reserve for unfunded lending commitments | 42 | 30 | 37 | 45 | 57 | ||||||||||||||||||||||||

| Other liabilities | 1,420 | 1,584 | 1,518 | 1,585 | 1,612 | ||||||||||||||||||||||||

| Total liabilities | 80,647 | 81,581 | 81,231 | 81,512 | 81,954 | ||||||||||||||||||||||||

| Shareholders’ equity: | |||||||||||||||||||||||||||||

| Preferred stock, without par value; authorized 4,400 shares | 440 | 440 | 440 | 440 | 440 | ||||||||||||||||||||||||

Common stock3 ($0.001 par value; authorized 350,000 shares) and additional paid-in capital |

1,717 | 1,713 | 1,705 | 1,731 | 1,726 | ||||||||||||||||||||||||

| Retained earnings | 6,564 | 6,421 | 6,293 | 6,212 | 6,157 | ||||||||||||||||||||||||

| Accumulated other comprehensive income (loss) | (2,336) | (2,549) | (2,609) | (2,692) | (3,008) | ||||||||||||||||||||||||

| Total shareholders’ equity | 6,385 | 6,025 | 5,829 | 5,691 | 5,315 | ||||||||||||||||||||||||

| Total liabilities and shareholders’ equity | $ | 87,032 | $ | 87,606 | $ | 87,060 | $ | 87,203 | $ | 87,269 | |||||||||||||||||||

1 Held-to-maturity (fair value) |

$ | 10,024 | $ | 9,891 | $ | 10,105 | $ | 10,466 | $ | 10,049 | |||||||||||||||||||

2 Loans held for sale (carried at fair value) |

58 | 58 | — | 43 | — | ||||||||||||||||||||||||

3 Common shares (issued and outstanding) |

147,699 | 147,684 | 147,653 | 148,153 | 148,146 | ||||||||||||||||||||||||

| (Unaudited) | Three Months Ended | ||||||||||||||||||||||||||||

| (In millions, except share and per share amounts) | September 30, 2024 |

June 30, 2024 |

March 31, 2024 |

December 31, 2023 |

September 30, 2023 |

||||||||||||||||||||||||

| Interest income: | |||||||||||||||||||||||||||||

| Interest and fees on loans | $ | 899 | $ | 877 | $ | 865 | $ | 848 | $ | 831 | |||||||||||||||||||

| Interest on money market investments | 67 | 56 | 47 | 48 | 35 | ||||||||||||||||||||||||

| Interest on securities | 138 | 140 | 142 | 144 | 144 | ||||||||||||||||||||||||

| Total interest income | 1,104 | 1,073 | 1,054 | 1,040 | 1,010 | ||||||||||||||||||||||||

| Interest expense: | |||||||||||||||||||||||||||||

| Interest on deposits | 403 | 390 | 376 | 395 | 366 | ||||||||||||||||||||||||

| Interest on short- and long-term borrowings | 81 | 86 | 92 | 62 | 59 | ||||||||||||||||||||||||

| Total interest expense | 484 | 476 | 468 | 457 | 425 | ||||||||||||||||||||||||

| Net interest income | 620 | 597 | 586 | 583 | 585 | ||||||||||||||||||||||||

| Provision for credit losses: | |||||||||||||||||||||||||||||

| Provision for loan losses | 1 | 12 | 21 | 12 | 44 | ||||||||||||||||||||||||

| Provision for unfunded lending commitments | 12 | (7) | (8) | (12) | (3) | ||||||||||||||||||||||||

| Total provision for credit losses | 13 | 5 | 13 | — | 41 | ||||||||||||||||||||||||

| Net interest income after provision for credit losses | 607 | 592 | 573 | 583 | 544 | ||||||||||||||||||||||||

| Noninterest income: | |||||||||||||||||||||||||||||

| Commercial account fees | 46 | 45 | 44 | 43 | 43 | ||||||||||||||||||||||||

| Card fees | 24 | 25 | 23 | 26 | 26 | ||||||||||||||||||||||||

| Retail and business banking fees | 18 | 16 | 16 | 17 | 17 | ||||||||||||||||||||||||

| Loan-related fees and income | 17 | 18 | 15 | 16 | 23 | ||||||||||||||||||||||||

| Capital markets fees | 28 | 21 | 24 | 19 | 18 | ||||||||||||||||||||||||

| Wealth management fees | 14 | 15 | 15 | 14 | 15 | ||||||||||||||||||||||||

| Other customer-related fees | 14 | 14 | 14 | 15 | 15 | ||||||||||||||||||||||||

| Customer-related noninterest income | 161 | 154 | 151 | 150 | 157 | ||||||||||||||||||||||||

| Fair value and nonhedge derivative income (loss) | (3) | (1) | 1 | (9) | 7 | ||||||||||||||||||||||||

| Dividends and other income | 5 | 22 | 6 | 8 | 12 | ||||||||||||||||||||||||

| Securities gains (losses), net | 9 | 4 | (2) | (1) | 4 | ||||||||||||||||||||||||

| Total noninterest income | 172 | 179 | 156 | 148 | 180 | ||||||||||||||||||||||||

| Noninterest expense: | |||||||||||||||||||||||||||||

| Salaries and employee benefits | 317 | 318 | 331 | 301 | 311 | ||||||||||||||||||||||||

| Technology, telecom, and information processing | 66 | 66 | 62 | 65 | 62 | ||||||||||||||||||||||||

| Occupancy and equipment, net | 40 | 40 | 39 | 38 | 42 | ||||||||||||||||||||||||

| Professional and legal services | 14 | 17 | 16 | 17 | 16 | ||||||||||||||||||||||||

| Marketing and business development | 12 | 13 | 10 | 11 | 10 | ||||||||||||||||||||||||

| Deposit insurance and regulatory expense | 19 | 21 | 34 | 109 | 20 | ||||||||||||||||||||||||

| Credit-related expense | 6 | 6 | 7 | 7 | 6 | ||||||||||||||||||||||||

| Other real estate expense, net | — | (1) | — | — | — | ||||||||||||||||||||||||

| Other | 28 | 29 | 27 | 33 | 29 | ||||||||||||||||||||||||

| Total noninterest expense | 502 | 509 | 526 | 581 | 496 | ||||||||||||||||||||||||

| Income before income taxes | 277 | 262 | 203 | 150 | 228 | ||||||||||||||||||||||||

| Income taxes | 63 | 61 | 50 | 24 | 53 | ||||||||||||||||||||||||

| Net income | 214 | 201 | 153 | 126 | 175 | ||||||||||||||||||||||||

| Preferred stock dividends | (10) | (11) | (10) | (10) | (7) | ||||||||||||||||||||||||

| Net earnings applicable to common shareholders | $ | 204 | $ | 190 | $ | 143 | $ | 116 | $ | 168 | |||||||||||||||||||

| Weighted average common shares outstanding during the period: | |||||||||||||||||||||||||||||

| Basic shares (in thousands) | 147,138 | 147,115 | 147,338 | 147,640 | 147,648 | ||||||||||||||||||||||||

| Diluted shares (in thousands) | 147,150 | 147,120 | 147,343 | 147,645 | 147,653 | ||||||||||||||||||||||||

| Net earnings per common share: | |||||||||||||||||||||||||||||

| Basic | $ | 1.37 | $ | 1.28 | $ | 0.96 | $ | 0.78 | $ | 1.13 | |||||||||||||||||||

| Diluted | 1.37 | 1.28 | 0.96 | 0.78 | 1.13 | ||||||||||||||||||||||||

| (In millions) | September 30, 2024 |

June 30, 2024 |

March 31, 2024 |

December 31, 2023 |

September 30, 2023 |

||||||||||||||||||||||||

| Commercial: | |||||||||||||||||||||||||||||

| Commercial and industrial | $ | 16,757 | $ | 16,622 | $ | 16,519 | $ | 16,684 | $ | 16,341 | |||||||||||||||||||

| Leasing | 377 | 390 | 388 | 383 | 373 | ||||||||||||||||||||||||

| Owner occupied | 9,381 | 9,236 | 9,295 | 9,219 | 9,273 | ||||||||||||||||||||||||

| Municipal | 4,270 | 4,263 | 4,277 | 4,302 | 4,221 | ||||||||||||||||||||||||

| Total commercial | 30,785 | 30,511 | 30,479 | 30,588 | 30,208 | ||||||||||||||||||||||||

| Commercial real estate: | |||||||||||||||||||||||||||||

| Construction and land development | 2,833 | 2,725 | 2,686 | 2,669 | 2,575 | ||||||||||||||||||||||||

| Term | 10,650 | 10,824 | 10,892 | 10,702 | 10,565 | ||||||||||||||||||||||||

| Total commercial real estate | 13,483 | 13,549 | 13,578 | 13,371 | 13,140 | ||||||||||||||||||||||||

| Consumer: | |||||||||||||||||||||||||||||

| Home equity credit line | 3,543 | 3,468 | 3,382 | 3,356 | 3,313 | ||||||||||||||||||||||||

| 1-4 family residential | 9,489 | 9,153 | 8,778 | 8,415 | 8,116 | ||||||||||||||||||||||||

| Construction and other consumer real estate | 997 | 1,139 | 1,321 | 1,442 | 1,510 | ||||||||||||||||||||||||

| Bankcard and other revolving plans | 461 | 466 | 439 | 474 | 475 | ||||||||||||||||||||||||

| Other | 126 | 129 | 132 | 133 | 131 | ||||||||||||||||||||||||

| Total consumer | 14,616 | 14,355 | 14,052 | 13,820 | 13,545 | ||||||||||||||||||||||||

| Total loans and leases | $ | 58,884 | $ | 58,415 | $ | 58,109 | $ | 57,779 | $ | 56,893 | |||||||||||||||||||

| (In millions) | September 30, 2024 |

June 30, 2024 |

March 31, 2024 |

December 31, 2023 |

September 30, 2023 |

||||||||||||||||||||||||

Nonaccrual loans 1 |

$ | 363 | $ | 261 | $ | 248 | $ | 222 | $ | 216 | |||||||||||||||||||

Other real estate owned 2 |

5 | 4 | 6 | 6 | 3 | ||||||||||||||||||||||||

| Total nonperforming assets | $ | 368 | $ | 265 | $ | 254 | $ | 228 | $ | 219 | |||||||||||||||||||

Ratio of nonperforming assets to loans1 and leases and other real estate owned 2 |

0.62 | % | 0.45 | % | 0.44 | % | 0.39 | % | 0.38 | % | |||||||||||||||||||

| Accruing loans past due 90 days or more | $ | 7 | $ | 6 | $ | 3 | $ | 3 | $ | 16 | |||||||||||||||||||

Ratio of accruing loans past due 90 days or more to loans1 and leases |

0.01 | % | 0.01 | % | 0.01 | % | 0.01 | % | 0.03 | % | |||||||||||||||||||

Nonaccrual loans and accruing loans past due 90 days or more |

$ | 370 | $ | 267 | $ | 251 | $ | 225 | $ | 232 | |||||||||||||||||||

Ratio of nonperforming assets1 and accruing loans 90 days or more past due to loans and leases and other real estate owned |

0.64 | % | 0.46 | % | 0.44 | % | 0.40 | % | 0.41 | % | |||||||||||||||||||

| Accruing loans past due 30-89 days | $ | 89 | $ | 114 | $ | 77 | $ | 86 | $ | 86 | |||||||||||||||||||

| Classified loans | 2,093 | 1,264 | 966 | 825 | 769 | ||||||||||||||||||||||||

| Ratio of classified loans to total loans and leases | 3.55 | % | 2.16 | % | 1.66 | % | 1.43 | % | 1.35 | % | |||||||||||||||||||

| Three Months Ended | |||||||||||||||||||||||||||||

| (In millions) | September 30, 2024 |

June 30, 2024 |

March 31, 2024 |

December 31, 2023 |

September 30, 2023 |

||||||||||||||||||||||||

| Allowance for Loan and Lease Losses | |||||||||||||||||||||||||||||

| Balance at beginning of period | $ | 696 | $ | 699 | $ | 684 | $ | 681 | $ | 651 | |||||||||||||||||||

| Provision for loan losses | 1 | 12 | 21 | 12 | 44 | ||||||||||||||||||||||||

| Loan and lease charge-offs | 15 | 21 | 14 | 13 | 20 | ||||||||||||||||||||||||

| Less: Recoveries | 12 | 6 | 8 | 4 | 6 | ||||||||||||||||||||||||

| Net loan and lease charge-offs (recoveries) | 3 | 15 | 6 | 9 | 14 | ||||||||||||||||||||||||

| Balance at end of period | $ | 694 | $ | 696 | $ | 699 | $ | 684 | $ | 681 | |||||||||||||||||||

Ratio of allowance for loan losses to loans1 and leases, at period end |

1.18 | % | 1.19 | % | 1.20 | % | 1.18 | % | 1.20 | % | |||||||||||||||||||

Ratio of allowance for loan losses to nonaccrual loans1 at period end |

191 | % | 267 | % | 282 | % | 308 | % | 342 | % | |||||||||||||||||||

| Annualized ratio of net loan and lease charge-offs (recoveries) to average loans | 0.02 | % | 0.10 | % | 0.04 | % | 0.06 | % | 0.10 | % | |||||||||||||||||||

| Reserve for Unfunded Lending Commitments | |||||||||||||||||||||||||||||

| Balance at beginning of period | $ | 30 | $ | 37 | $ | 45 | $ | 57 | $ | 60 | |||||||||||||||||||

| Provision for unfunded lending commitments | 12 | (7) | (8) | (12) | (3) | ||||||||||||||||||||||||

| Balance at end of period | $ | 42 | $ | 30 | $ | 37 | $ | 45 | $ | 57 | |||||||||||||||||||

| Allowance for Credit Losses | |||||||||||||||||||||||||||||

| Allowance for loan losses | $ | 694 | $ | 696 | $ | 699 | $ | 684 | $ | 681 | |||||||||||||||||||

| Reserve for unfunded lending commitments | 42 | 30 | 37 | 45 | 57 | ||||||||||||||||||||||||

| Total allowance for credit losses | $ | 736 | $ | 726 | $ | 736 | $ | 729 | $ | 738 | |||||||||||||||||||

Ratio of ACL to loans1 and leases outstanding, at period end |

1.25 | % | 1.24 | % | 1.27 | % | 1.26 | % | 1.30 | % | |||||||||||||||||||

| (In millions) | September 30, 2024 |

June 30, 2024 |

March 31, 2024 |

December 31, 2023 |

September 30, 2023 |

||||||||||||||||||||||||

| Loans held for sale | $ | — | $ | — | $ | — | $ | — | $ | 17 | |||||||||||||||||||

| Commercial: | |||||||||||||||||||||||||||||

| Commercial and industrial | $ | 173 | $ | 111 | $ | 110 | $ | 82 | $ | 59 | |||||||||||||||||||

| Leasing | 2 | 2 | 2 | 2 | — | ||||||||||||||||||||||||

| Owner occupied | 29 | 28 | 20 | 20 | 27 | ||||||||||||||||||||||||

| Municipal | 11 | 6 | — | — | — | ||||||||||||||||||||||||

| Total commercial | 215 | 147 | 132 | 104 | 86 | ||||||||||||||||||||||||

| Commercial real estate: | |||||||||||||||||||||||||||||

| Construction and land development | 2 | 2 | 1 | 22 | 22 | ||||||||||||||||||||||||

| Term | 67 | 35 | 42 | 39 | 40 | ||||||||||||||||||||||||

| Total commercial real estate | 69 | 37 | 43 | 61 | 62 | ||||||||||||||||||||||||

| Consumer: | |||||||||||||||||||||||||||||

| Home equity credit line | 30 | 29 | 27 | 17 | 16 | ||||||||||||||||||||||||

| 1-4 family residential | 47 | 46 | 44 | 40 | 35 | ||||||||||||||||||||||||

| Bankcard and other revolving plans | 1 | 1 | 1 | — | — | ||||||||||||||||||||||||

| Other | 1 | 1 | 1 | — | — | ||||||||||||||||||||||||

| Total consumer | 79 | 77 | 73 | 57 | 51 | ||||||||||||||||||||||||

| Total nonaccrual loans | $ | 363 | $ | 261 | $ | 248 | $ | 222 | $ | 216 | |||||||||||||||||||

| (In millions) | September 30, 2024 |

June 30, 2024 |

March 31, 2024 |

December 31, 2023 |

September 30, 2023 |

||||||||||||||||||||||||

| Commercial: | |||||||||||||||||||||||||||||

| Commercial and industrial | $ | 3 | $ | 4 | $ | 4 | $ | 7 | $ | 8 | |||||||||||||||||||

| Owner occupied | — | — | — | — | (1) | ||||||||||||||||||||||||

| Total commercial | 3 | 4 | 4 | 7 | 7 | ||||||||||||||||||||||||

| Commercial real estate: | |||||||||||||||||||||||||||||

| Construction and land development | — | — | (1) | — | 1 | ||||||||||||||||||||||||

| Term | (2) | 11 | — | — | 2 | ||||||||||||||||||||||||

| Total commercial real estate | (2) | 11 | (1) | — | 3 | ||||||||||||||||||||||||

| Consumer: | |||||||||||||||||||||||||||||

| Home equity credit line | — | — | — | — | 2 | ||||||||||||||||||||||||

| 1-4 family residential | — | (1) | 1 | — | — | ||||||||||||||||||||||||

| Bankcard and other revolving plans | 2 | 1 | 1 | 2 | 2 | ||||||||||||||||||||||||

| Other | — | — | 1 | — | — | ||||||||||||||||||||||||

| Total consumer loans | 2 | — | 3 | 2 | 4 | ||||||||||||||||||||||||

| Total net charge-offs (recoveries) | $ | 3 | $ | 15 | $ | 6 | $ | 9 | $ | 14 | |||||||||||||||||||

| (Unaudited) | Three Months Ended | ||||||||||||||||||||||||||||||||||

| September 30, 2024 | June 30, 2024 | September 30, 2023 | |||||||||||||||||||||||||||||||||

| (In millions) | Average balance | Average yield/rate 1 |

Average balance | Average yield/rate 1 |

Average balance | Average yield/rate 1 |

|||||||||||||||||||||||||||||

| ASSETS | |||||||||||||||||||||||||||||||||||

| Money market investments: | |||||||||||||||||||||||||||||||||||

| Interest-bearing deposits | $ | 2,457 | 5.53 | % | $ | 1,909 | 5.57 | % | $ | 1,539 | 5.52 | % | |||||||||||||||||||||||

| Federal funds sold and securities purchased under agreements to resell | 2,258 | 5.82 | % | 2,026 | 5.87 | % | 874 | 6.13 | % | ||||||||||||||||||||||||||

| Total money market investments | 4,715 | 5.67 | % | 3,935 | 5.72 | % | 2,413 | 5.74 | % | ||||||||||||||||||||||||||

| Trading securities | 32 | 4.18 | % | 39 | 4.74 | % | 20 | 4.65 | % | ||||||||||||||||||||||||||

| Investment securities: | |||||||||||||||||||||||||||||||||||

| Available-for-sale | 9,442 | 3.53 | % | 9,670 | 3.57 | % | 10,606 | 3.24 | % | ||||||||||||||||||||||||||

| Held-to-maturity | 9,936 | 2.22 | % | 10,120 | 2.25 | % | 10,625 | 2.21 | % | ||||||||||||||||||||||||||

| Total investment securities | 19,378 | 2.86 | % | 19,790 | 2.90 | % | 21,231 | 2.73 | % | ||||||||||||||||||||||||||

| Loans held for sale | 104 | NM | 43 | NM | 46 | NM | |||||||||||||||||||||||||||||

Loans and leases:2 |

|||||||||||||||||||||||||||||||||||

| Commercial | 30,671 | 6.14 | % | 30,505 | 6.05 | % | 30,535 | 5.69 | % | ||||||||||||||||||||||||||

| Commercial real estate | 13,523 | 7.23 | % | 13,587 | 7.22 | % | 13,016 | 7.14 | % | ||||||||||||||||||||||||||

| Consumer | 14,471 | 5.18 | % | 14,199 | 5.17 | % | 13,417 | 4.92 | % | ||||||||||||||||||||||||||

| Total loans and leases | 58,665 | 6.15 | % | 58,291 | 6.11 | % | 56,968 | 5.84 | % | ||||||||||||||||||||||||||

| Total interest-earning assets | 82,894 | 5.35 | % | 82,098 | 5.31 | % | 80,678 | 5.02 | % | ||||||||||||||||||||||||||

| Cash and due from banks | 703 | 691 | 712 | ||||||||||||||||||||||||||||||||

| Allowance for credit losses on loans and debt securities | (699) | (697) | (651) | ||||||||||||||||||||||||||||||||

| Goodwill and intangibles | 1,054 | 1,056 | 1,061 | ||||||||||||||||||||||||||||||||

| Other assets | 5,218 | 5,424 | 5,523 | ||||||||||||||||||||||||||||||||

| Total assets | $ | 89,170 | $ | 88,572 | $ | 87,323 | |||||||||||||||||||||||||||||

| LIABILITIES AND SHAREHOLDERS’ EQUITY | |||||||||||||||||||||||||||||||||||

| Interest-bearing deposits: | |||||||||||||||||||||||||||||||||||

| Savings and money market | $ | 39,031 | 2.72 | % | $ | 38,331 | 2.73 | % | $ | 35,346 | 2.42 | % | |||||||||||||||||||||||

| Time | 11,275 | 4.81 | % | 10,744 | 4.87 | % | 12,424 | 4.81 | % | ||||||||||||||||||||||||||

| Total interest-bearing deposits | 50,306 | 3.19 | % | 49,075 | 3.20 | % | 47,770 | 3.04 | % | ||||||||||||||||||||||||||

| Borrowed funds: | |||||||||||||||||||||||||||||||||||

Federal funds purchased and security repurchase agreements |

1,072 | 5.33 | % | 1,166 | 5.38 | % | 1,770 | 5.31 | % | ||||||||||||||||||||||||||

| Other short-term borrowings | 4,704 | 4.89 | % | 5,097 | 4.95 | % | 2,233 | 4.95 | % | ||||||||||||||||||||||||||

| Long-term debt | 546 | 5.91 | % | 544 | 5.98 | % | 539 | 5.37 | % | ||||||||||||||||||||||||||

| Total borrowed funds | 6,322 | 5.06 | % | 6,807 | 5.10 | % | 4,542 | 5.14 | % | ||||||||||||||||||||||||||

| Total interest-bearing liabilities | 56,628 | 3.40 | % | 55,882 | 3.43 | % | 52,312 | 3.22 | % | ||||||||||||||||||||||||||

| Noninterest-bearing demand deposits | 24,723 | 25,153 | 27,873 | ||||||||||||||||||||||||||||||||

| Other liabilities | 1,641 | 1,647 | 1,760 | ||||||||||||||||||||||||||||||||

| Total liabilities | 82,992 | 82,682 | 81,945 | ||||||||||||||||||||||||||||||||

| Shareholders’ equity: | |||||||||||||||||||||||||||||||||||

| Preferred equity | 440 | 440 | 440 | ||||||||||||||||||||||||||||||||

| Common equity | 5,738 | 5,450 | 4,938 | ||||||||||||||||||||||||||||||||

| Total shareholders’ equity | 6,178 | 5,890 | 5,378 | ||||||||||||||||||||||||||||||||

| Total liabilities and shareholders’ equity | $ | 89,170 | $ | 88,572 | $ | 87,323 | |||||||||||||||||||||||||||||

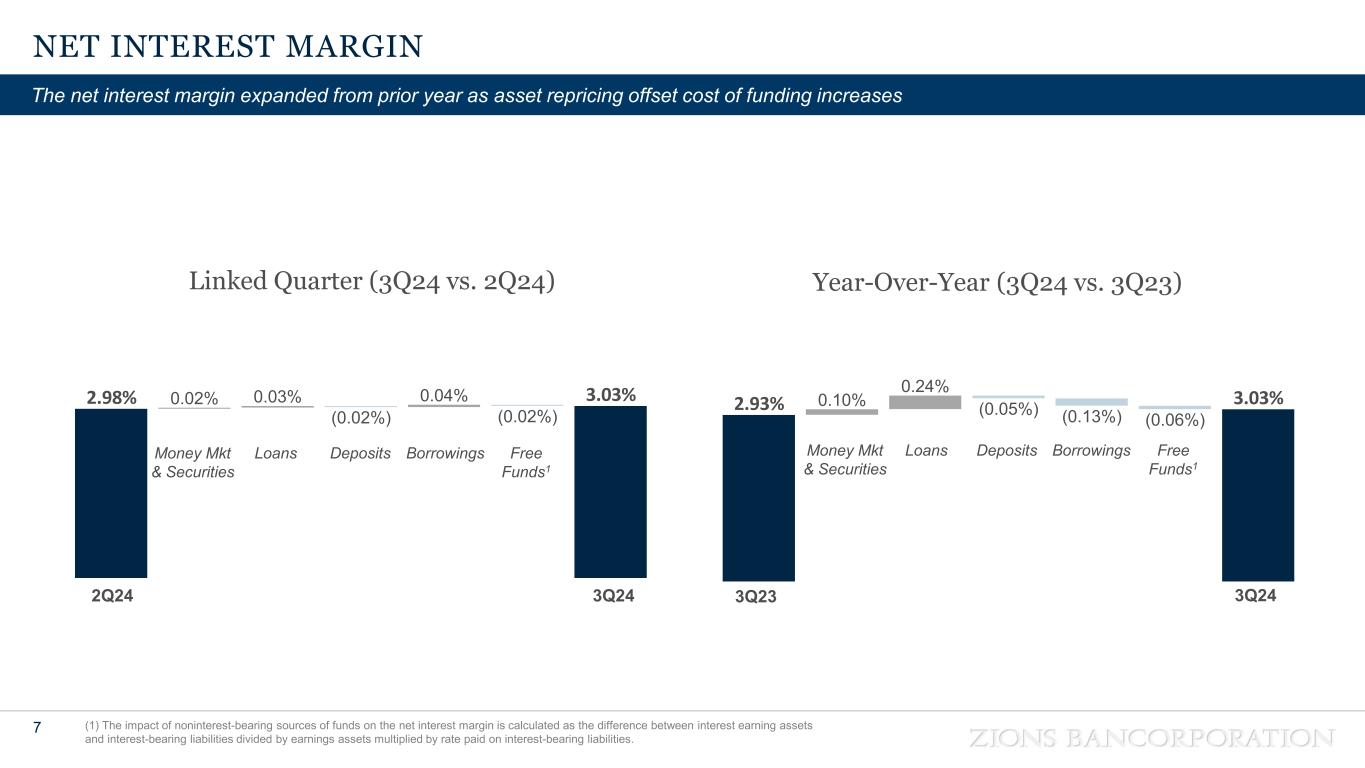

| Spread on average interest-bearing funds | 1.95 | % | 1.88 | % | 1.80 | % | |||||||||||||||||||||||||||||

| Impact of net noninterest-bearing sources of funds | 1.08 | % | 1.10 | % | 1.13 | % | |||||||||||||||||||||||||||||

| Net interest margin | 3.03 | % | 2.98 | % | 2.93 | % | |||||||||||||||||||||||||||||

| Memo: total cost of deposits | 2.14 | % | 2.11 | % | 1.92 | % | |||||||||||||||||||||||||||||

| Memo: total deposits and interest-bearing liabilities | $ | 81,351 | 2.36 | % | $ | 81,035 | 2.36 | % | $ | 80,185 | 2.10 | % | |||||||||||||||||||||||

| Three Months Ended | ||||||||||||||||||||||||||||||||

| (Dollar amounts in millions) | September 30, 2024 |

June 30, 2024 |

March 31, 2024 |

December 31, 2023 |

September 30, 2023 |

|||||||||||||||||||||||||||

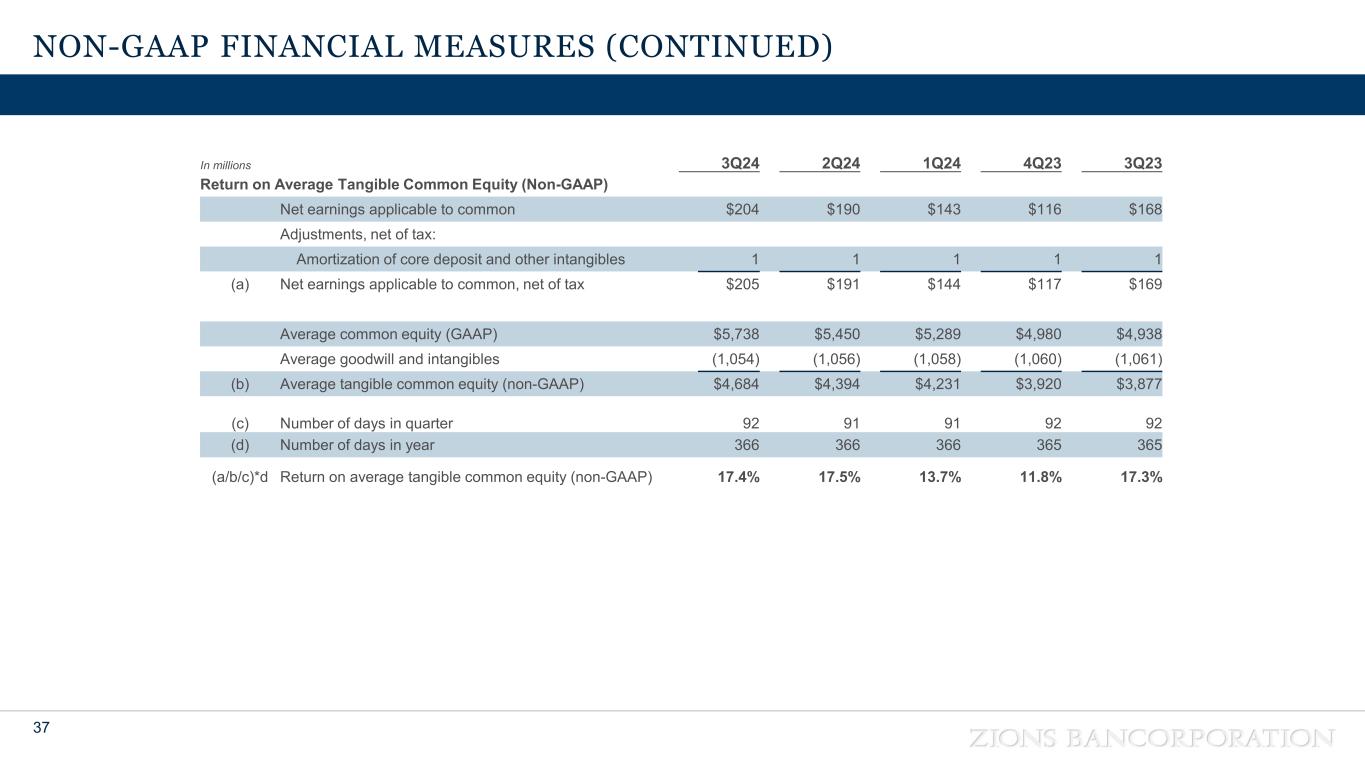

| Net earnings applicable to common shareholders (GAAP) | $ | 204 | $ | 190 | $ | 143 | $ | 116 | $ | 168 | ||||||||||||||||||||||

| Adjustments, net of tax: | ||||||||||||||||||||||||||||||||

| Amortization of core deposit and other intangibles | 1 | 1 | 1 | 1 | 1 | |||||||||||||||||||||||||||

| Adjusted net earnings applicable to common shareholders, net of tax | (a) | $ | 205 | $ | 191 | $ | 144 | $ | 117 | $ | 169 | |||||||||||||||||||||

| Average common equity (GAAP) | $ | 5,738 | $ | 5,450 | $ | 5,289 | $ | 4,980 | $ | 4,938 | ||||||||||||||||||||||

| Average goodwill and intangibles | (1,054) | (1,056) | (1,058) | (1,060) | (1,061) | |||||||||||||||||||||||||||

| Average tangible common equity (non-GAAP) | (b) | $ | 4,684 | $ | 4,394 | $ | 4,231 | $ | 3,920 | $ | 3,877 | |||||||||||||||||||||

| Number of days in quarter | (c) | 92 | 91 | 91 | 92 | 92 | ||||||||||||||||||||||||||

| Number of days in year | (d) | 366 | 366 | 366 | 365 | 365 | ||||||||||||||||||||||||||

Return on average tangible common equity (non-GAAP) 1 |

(a/b/c)*d | 17.4 | % | 17.5 | % | 13.7 | % | 11.8 | % | 17.3 | % | |||||||||||||||||||||

| (Dollar amounts in millions, except per share amounts) | September 30, 2024 |

June 30, 2024 |

March 31, 2024 |

December 31, 2023 |

September 30, 2023 |

|||||||||||||||||||||||||||

| Total shareholders’ equity (GAAP) | $ | 6,385 | $ | 6,025 | $ | 5,829 | $ | 5,691 | $ | 5,315 | ||||||||||||||||||||||

| Goodwill and intangibles | (1,053) | (1,055) | (1,057) | (1,059) | (1,060) | |||||||||||||||||||||||||||

| Tangible equity (non-GAAP) | (a) | 5,332 | 4,970 | 4,772 | 4,632 | 4,255 | ||||||||||||||||||||||||||

| Preferred stock | (440) | (440) | (440) | (440) | (440) | |||||||||||||||||||||||||||

| Tangible common equity (non-GAAP) | (b) | $ | 4,892 | $ | 4,530 | $ | 4,332 | $ | 4,192 | $ | 3,815 | |||||||||||||||||||||

| Total assets (GAAP) | $ | 87,032 | $ | 87,606 | $ | 87,060 | $ | 87,203 | $ | 87,269 | ||||||||||||||||||||||

| Goodwill and intangibles | (1,053) | (1,055) | (1,057) | (1,059) | (1,060) | |||||||||||||||||||||||||||

| Tangible assets (non-GAAP) | (c) | $ | 85,979 | $ | 86,551 | $ | 86,003 | $ | 86,144 | $ | 86,209 | |||||||||||||||||||||

| Common shares outstanding (in thousands) | (d) | 147,699 | 147,684 | 147,653 | 148,153 | 148,146 | ||||||||||||||||||||||||||

Tangible equity ratio (non-GAAP) 1 |

(a/c) | 6.2 | % | 5.7 | % | 5.5 | % | 5.4 | % | 4.9 | % | |||||||||||||||||||||

| Tangible common equity ratio (non-GAAP) | (b/c) | 5.7 | % | 5.2 | % | 5.0 | % | 4.9 | % | 4.4 | % | |||||||||||||||||||||

| Tangible book value per common share (non-GAAP) | (b/d) | $ | 33.12 | $ | 30.67 | $ | 29.34 | $ | 28.30 | $ | 25.75 | |||||||||||||||||||||

| Three Months Ended | ||||||||||||||||||||||||||||||||

| (Dollar amounts in millions) | September 30, 2024 |

June 30, 2024 |

March 31, 2024 |

December 31, 2023 |

September 30, 2023 |

|||||||||||||||||||||||||||

| Noninterest expense (GAAP) | (a) | $ | 502 | $ | 509 | $ | 526 | $ | 581 | $ | 496 | |||||||||||||||||||||

| Adjustments: | ||||||||||||||||||||||||||||||||

| Severance costs | 1 | 1 | — | — | — | |||||||||||||||||||||||||||

| Other real estate expense, net | — | (1) | — | — | — | |||||||||||||||||||||||||||

| Amortization of core deposit and other intangibles | 2 | 1 | 2 | 2 | 2 | |||||||||||||||||||||||||||

| Restructuring costs | — | — | — | — | 1 | |||||||||||||||||||||||||||

| SBIC investment success fee accrual | — | 1 | — | — | — | |||||||||||||||||||||||||||

| FDIC special assessment | — | 1 | 13 | 90 | — | |||||||||||||||||||||||||||

| Total adjustments | (b) | 3 | 3 | 15 | 92 | 3 | ||||||||||||||||||||||||||

| Adjusted noninterest expense (non-GAAP) | (c)=(a-b) | $ | 499 | $ | 506 | $ | 511 | $ | 489 | $ | 493 | |||||||||||||||||||||

| Net interest income (GAAP) | (d) | $ | 620 | $ | 597 | $ | 586 | $ | 583 | $ | 585 | |||||||||||||||||||||

| Fully taxable-equivalent adjustments | (e) | 12 | 11 | 10 | 10 | 11 | ||||||||||||||||||||||||||

| Taxable-equivalent net interest income (non-GAAP) | (f)=(d+e) | 632 | 608 | 596 | 593 | 596 | ||||||||||||||||||||||||||

| Noninterest income (GAAP) | (g) | 172 | 179 | 156 | 148 | 180 | ||||||||||||||||||||||||||

| Combined income (non-GAAP) | (h)=(f+g) | 804 | 787 | 752 | 741 | 776 | ||||||||||||||||||||||||||

| Adjustments: | ||||||||||||||||||||||||||||||||

| Fair value and nonhedge derivative income (loss) | (3) | (1) | 1 | (9) | 7 | |||||||||||||||||||||||||||

| Securities gains (losses), net | 9 | 4 | (2) | (1) | 4 | |||||||||||||||||||||||||||

| Total adjustments | (i) | 6 | 3 | (1) | (10) | 11 | ||||||||||||||||||||||||||

| Adjusted taxable-equivalent revenue (non-GAAP) | (j)=(h-i) | $ | 798 | $ | 784 | $ | 753 | $ | 751 | $ | 765 | |||||||||||||||||||||

| Pre-provision net revenue (PPNR) (non-GAAP) | (h)-(a) | $ | 302 | $ | 278 | $ | 226 | $ | 160 | $ | 280 | |||||||||||||||||||||

| Adjusted PPNR (non-GAAP) | (j)-(c) | 299 | 278 | 242 | 262 | 272 | ||||||||||||||||||||||||||

Efficiency ratio (non-GAAP) 1 |

(c/j) | 62.5 | % | 64.5 | % | 67.9 | % | 65.1 | % | 64.4 | % | |||||||||||||||||||||