1 Investing in Efficiency, Sustainability and Growth Investor Update: March 2024

2 Cautionary Statement Regarding Forward-Looking Information Much of the information contained in this presentation is forward-looking information based upon management’s current expectations and projections that involve risks and uncertainties. Forward-looking information includes, among other things, information concerning earnings per share, rate case activity, earnings per share growth, cash flow, sources of revenue, dividend growth and dividend payout ratios, sales volumes, capital plans, credit ratings, credit metrics, debt-financings, construction costs, investment opportunities, corporate initiatives (including the ESG Progress Plan), rate base, and environmental matters (including emission reductions). Readers are cautioned not to place undue reliance on this forward-looking information. Forward-looking information is not a guarantee of future performance and actual results may differ materially from those set forth in the forward-looking information. Factors that could cause actual results to differ materially from those contemplated in any forward-looking statements include, but are not limited to: general economic conditions, including business and competitive conditions in the company’s service territories; timing, resolution and impact of rate cases and other regulatory decisions, including rider reconciliations; the company’s ability to continue to successfully integrate the operations of its subsidiaries; availability of the company’s generating facilities and/or distribution systems; unanticipated changes in fuel and purchased power costs; key personnel changes; unusual, varying or severe weather conditions; continued industry restructuring and consolidation; continued advances in, and adoption of, new technologies that produce power or reduce power consumption; energy and environmental conservation efforts; electrification initiatives, mandates and other efforts to reduce the use of natural gas; the company’s ability to successfully acquire and/or dispose of assets and projects and to execute on its capital plan; terrorist, physical or cyber-security threats or attacks and data security breaches; construction risks; labor disruptions; equity and bond market fluctuations; changes in the company’s and its subsidiaries’ ability to access the capital markets and shareholder approval of related proposals; changes in tax legislation or our ability to use certain tax benefits and carryforwards; federal, state, and local legislative and regulatory changes, including changes in rate-setting policies or procedures and environmental standards, the enforcement of these laws and regulations or permit conditions and changes in the interpretation of regulations by regulatory agencies; supply chain disruptions; inflation; political or geopolitical developments, including impacts on the global economy, supply chain and fuel prices, generally, from ongoing, escalating, or expanding regional conflicts; the impact from any health crises, including epidemics and pandemics; current and future litigation and regulatory investigations, proceedings or inquiries; changes in accounting standards; the financial performance of the American Transmission Company as well as projects in which the company’s energy infrastructure business invests; the ability of the company to obtain additional generating capacity at competitive prices; goodwill and its possible impairment; and other factors described under the heading “Factors Affecting Results, Liquidity and Capital Resources” in Management’s Discussion and Analysis of Financial Condition and Results of Operations and under the headings “Cautionary Statement Regarding Forward-Looking Information” and “Risk Factors” contained in WEC Energy Group’s Form 10-K for the year ended December 31, 2023, and in subsequent reports filed with the Securities and Exchange Commission. Except as may be required by law, WEC Energy Group expressly disclaims any obligation to publicly update or revise any forward-looking information.

3 The Premier Energy Company in America’s Heartland * As of February 29, 2024 $24.8 billion market cap* 4.7 million retail customers 60% ownership of American Transmission Company $43.9 billion of assets

4 A History of Quality Earnings Growth $0.00 $1.00 $2.00 $3.00 $4.00 $5.00 $6.00 '04 '05 '06 '07 '08 '09 '10 '11 '12 '13 '14 '15 '16 '17 '18 '19 '20 '21 '22 '23 '24 GAAP Adjusted** 2024 Guidance * Estimated based on 2024 guidance midpoint of $4.85 per share. ** See Appendix for reconciliation of adjusted amounts to GAAP amounts. $4.80-$4.90

5 EPS Guidance 2023 Exceeded* 2022 Exceeded 2021 Exceeded 2020 Exceeded 2019 Exceeded 2018 Exceeded 2017 Exceeded 2016 Exceeded 2015 Exceeded 2014 Exceeded 2013 Exceeded 2012 Exceeded 2011 Exceeded 2010 Exceeded 2009 Exceeded 2008 Exceeded 2007 Exceeded 2006 Exceeded 2005 Exceeded 2004 Exceeded The only utility to beat guidance every year for 20 years running. Consistent Performance Over Time * On an adjusted basis, excluding a noncash charge of 41 cents per share

6 In January, raised the dividend by 7.0% to a new annual rate of $3.34 per share* Marks the 21st consecutive year of rewarding shareholders with higher dividends Top decile dividend growth in industry** Added to S&P's High Yield Dividend Aristocrats Index Strong Dividend Growth Continues * Annualized based on the first quarter of 2024 dividend of 83.5 cents per share ** Reflects current and expected dividends declared in 2024

7 What’s New?

8 Affirmed 2024 earnings guidance of $4.80 to $4.90 per share* In light of one of the warmest winters in history, first-quarter earnings guidance lowered to a range of $1.89 to $1.91 per share Previous first-quarter earnings guidance was $1.96 to $2.00 per share First-quarter 2023 earnings were $1.61 per share Earnings Guidance Update *Assumes normal weather going forward

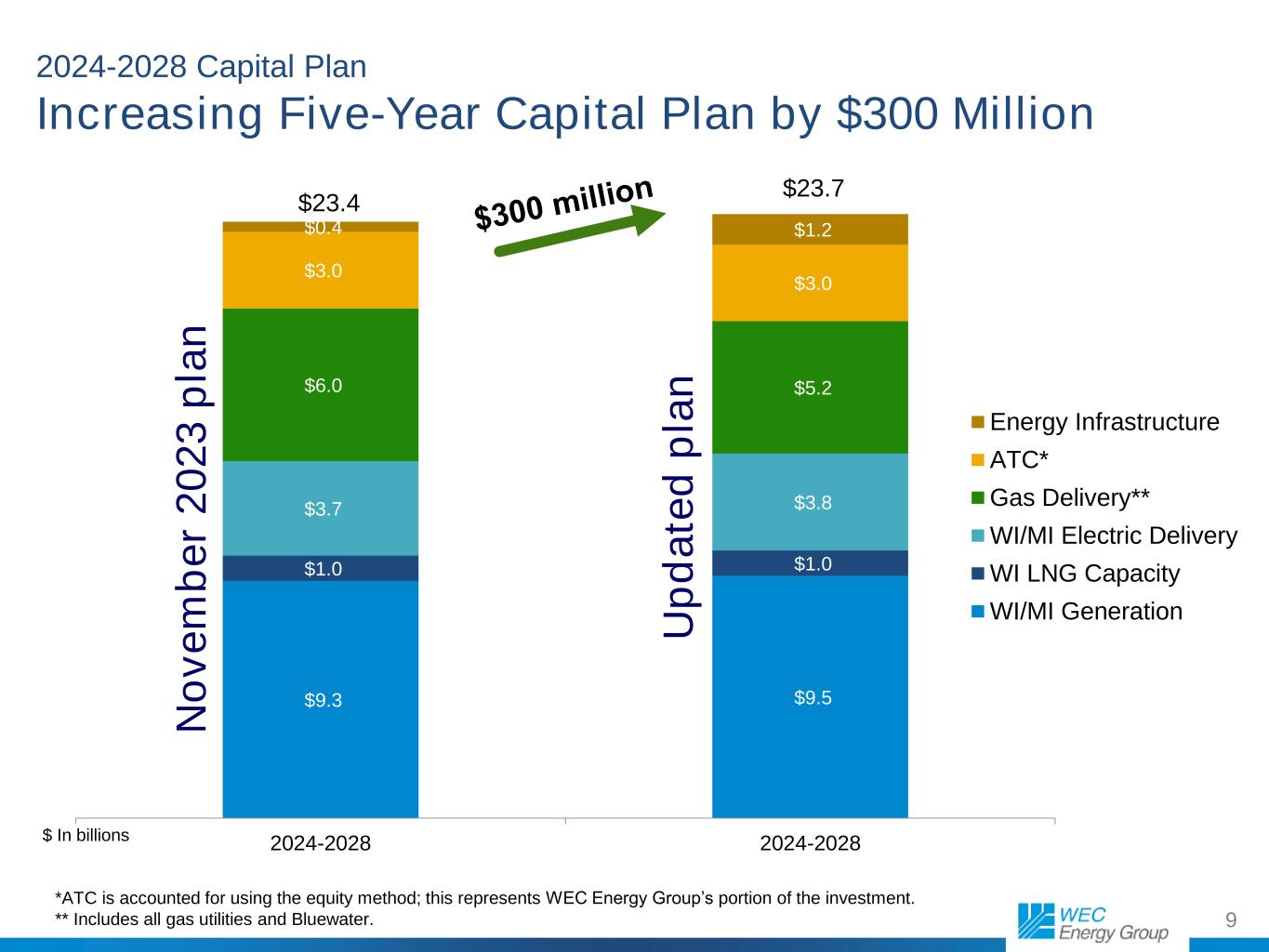

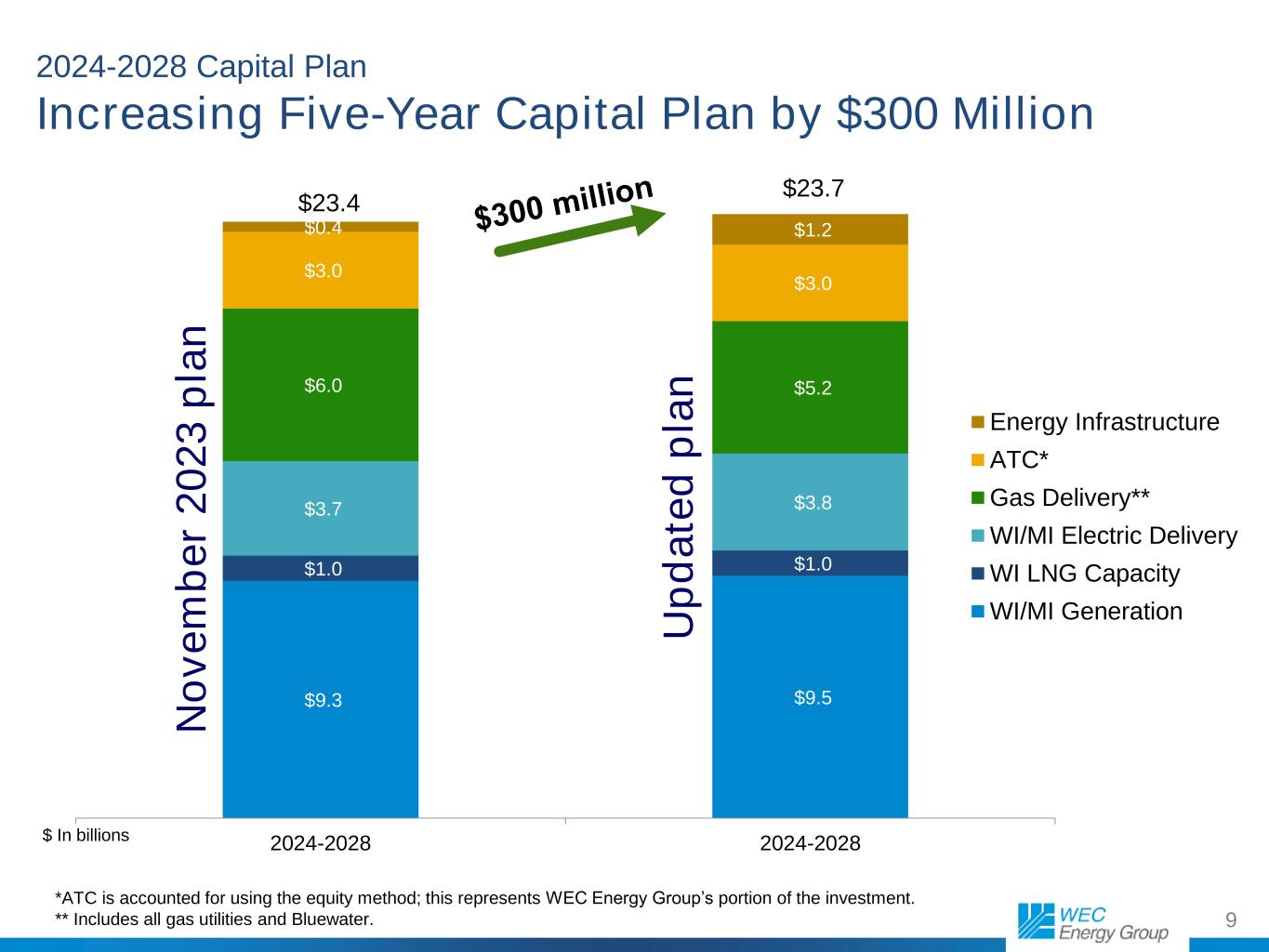

9 $9.3 $9.5 $1.0 $1.0 $3.7 $3.8 $6.0 $5.2 $3.0 $3.0 $0.4 $1.2 $23.4 $23.7 2024-2028 2024-2028 Energy Infrastructure ATC* Gas Delivery** WI/MI Electric Delivery WI LNG Capacity WI/MI Generation U p d a te d p la n N o v e m b e r 2 0 2 3 p la n $ In billions *ATC is accounted for using the equity method; this represents WEC Energy Group’s portion of the investment. ** Includes all gas utilities and Bluewater. 2024-2028 Capital Plan Increasing Five-Year Capital Plan by $300 Million

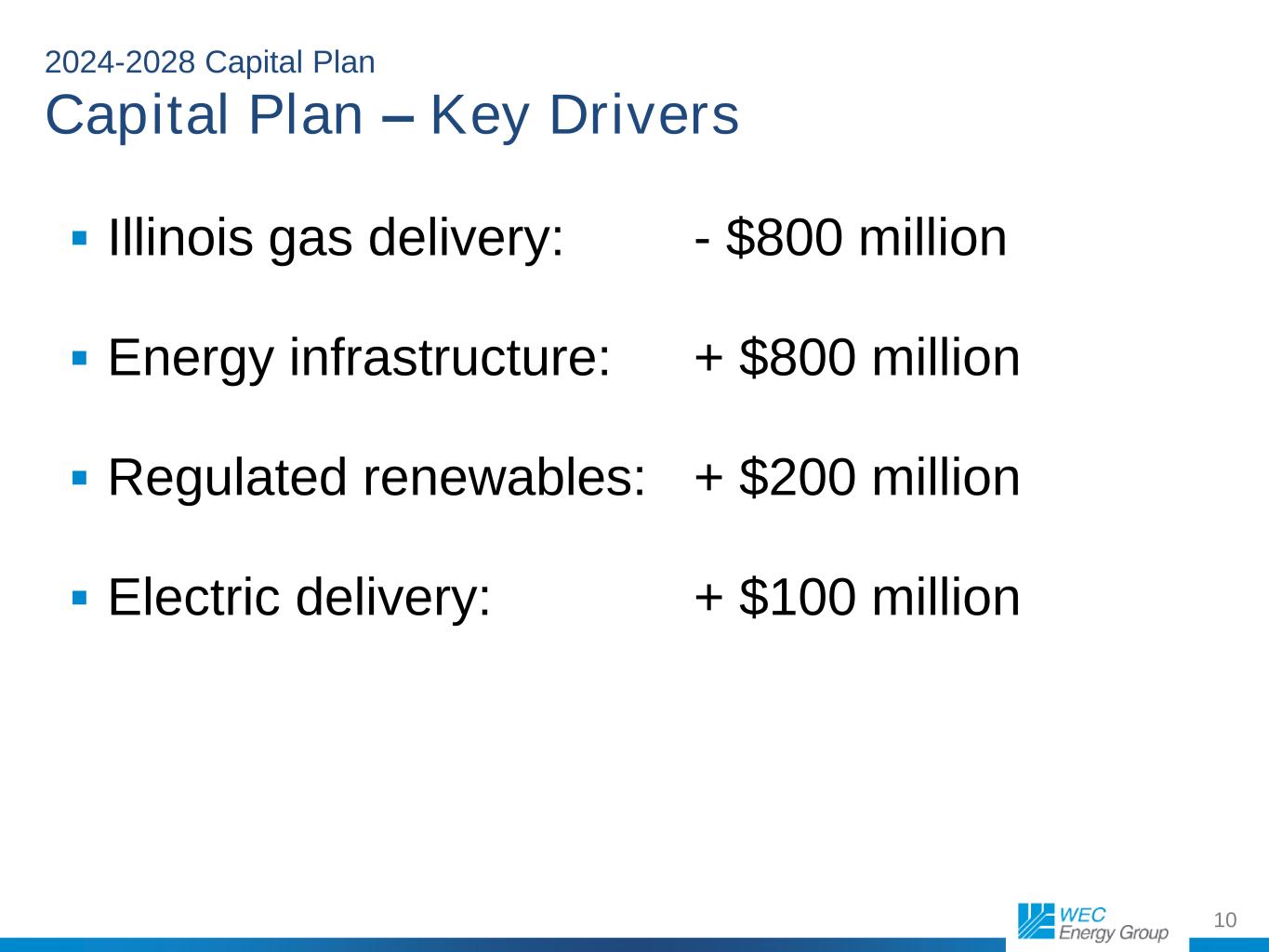

10 Capital Plan – Key Drivers Illinois gas delivery: - $800 million Energy infrastructure: + $800 million Regulated renewables: + $200 million Electric delivery: + $100 million 2024-2028 Capital Plan

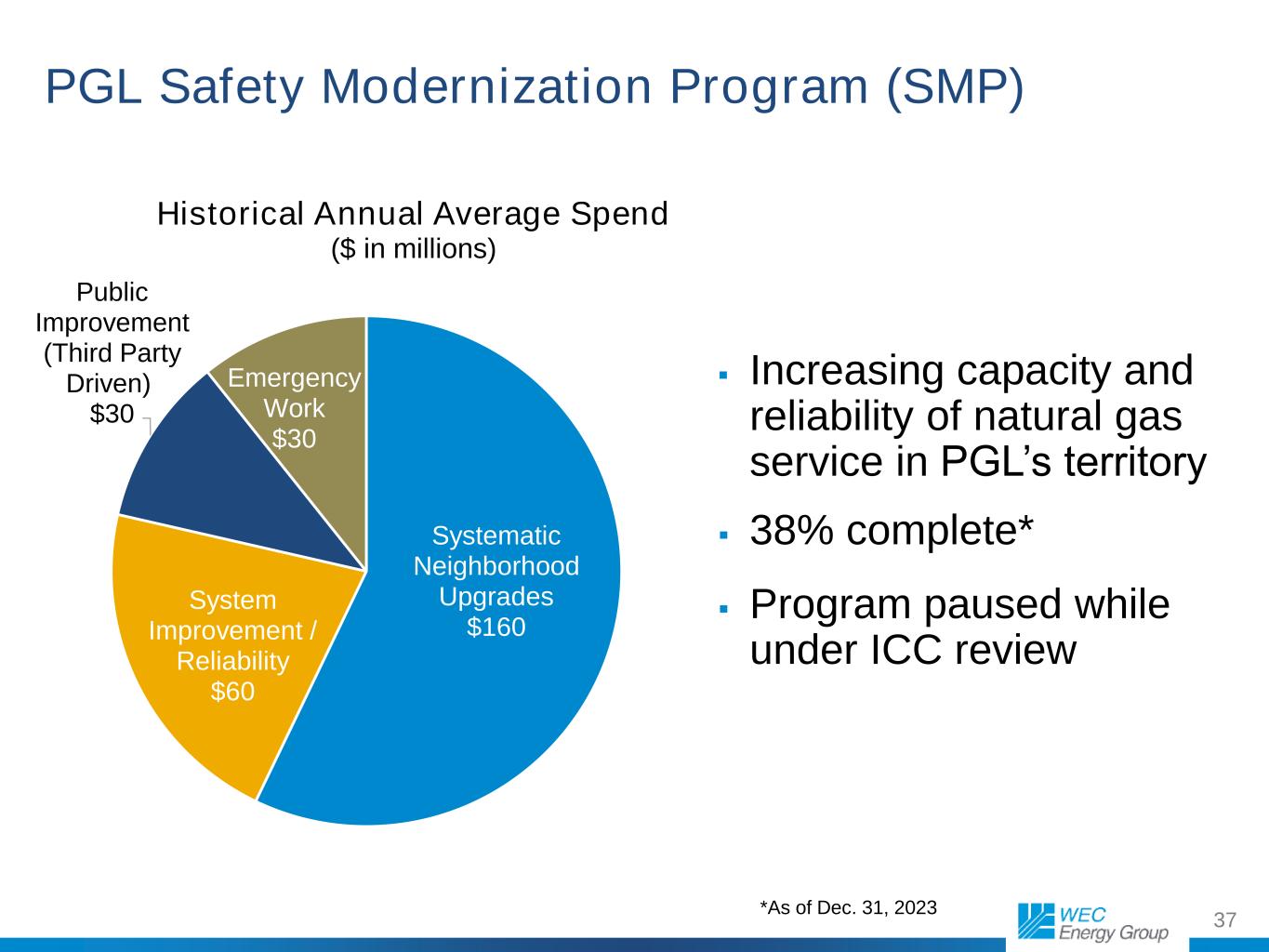

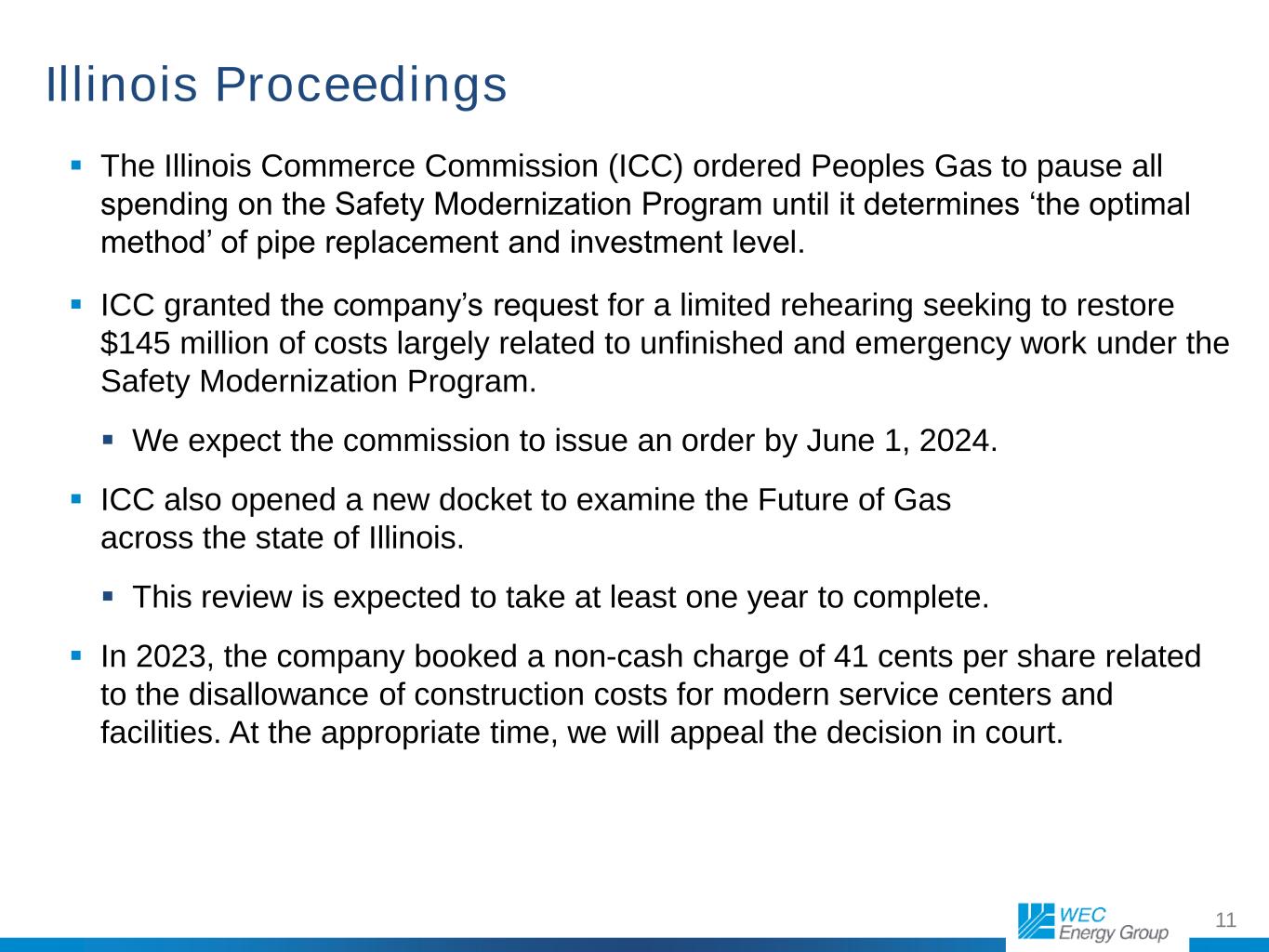

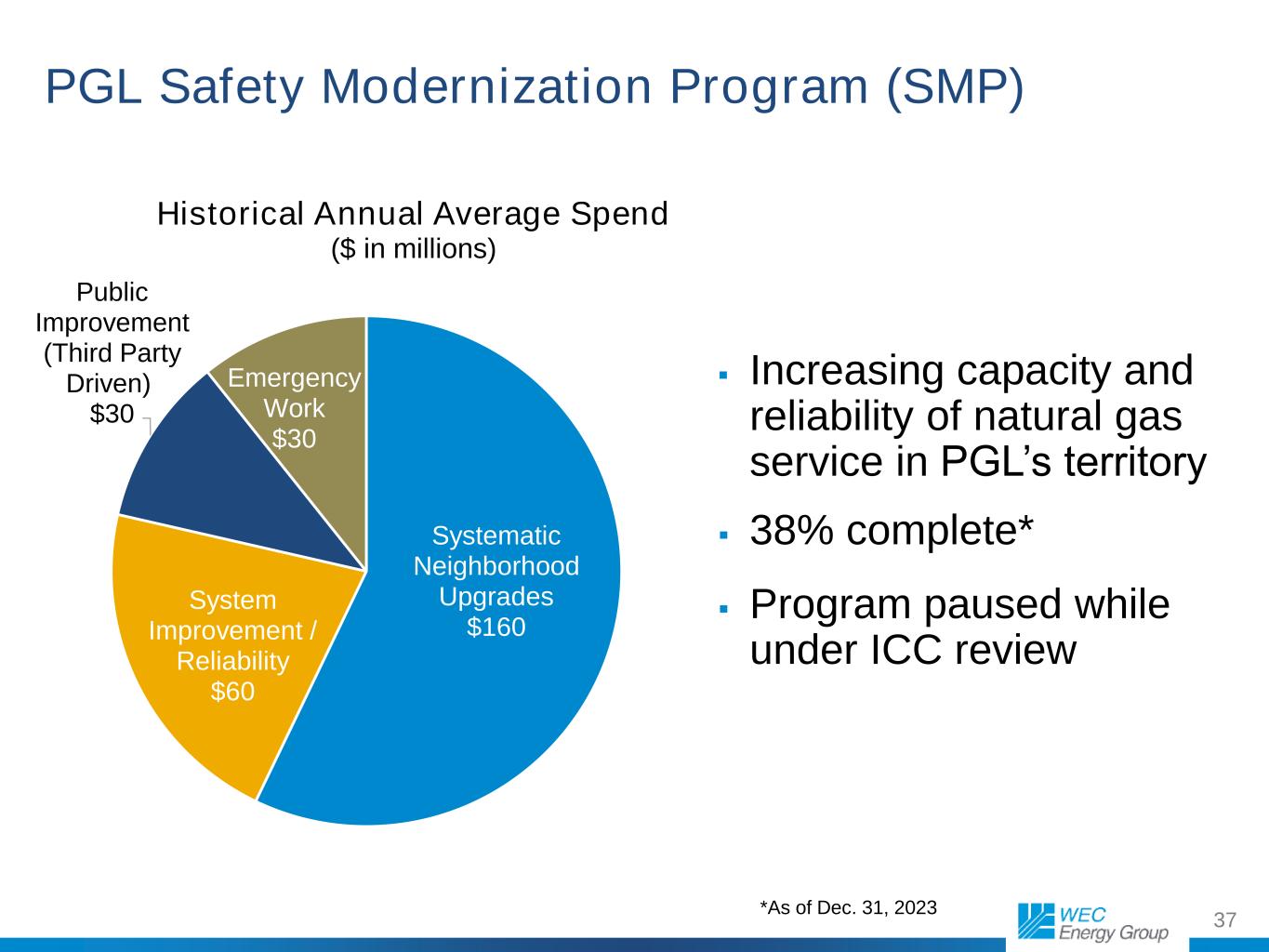

11 The Illinois Commerce Commission (ICC) ordered Peoples Gas to pause all spending on the Safety Modernization Program until it determines ‘the optimal method’ of pipe replacement and investment level. ICC granted the company’s request for a limited rehearing seeking to restore $145 million of costs largely related to unfinished and emergency work under the Safety Modernization Program. We expect the commission to issue an order by June 1, 2024. ICC also opened a new docket to examine the Future of Gas across the state of Illinois. This review is expected to take at least one year to complete. In 2023, the company booked a non-cash charge of 41 cents per share related to the disallowance of construction costs for modern service centers and facilities. At the appropriate time, we will appeal the decision in court. Illinois Proceedings

12 $29.4 billion $43.4 billion 2023A 2028E* Robust Growth in Asset Base *Estimated year-end average asset base. Expect compound annual EPS growth of 6.5% to 7.0% 8.1% Growth

13 Business Portfolio Growing in Electric Transmission and Generation 2028E*2023A Electric generation and distribution 48% Natural gas distribution 35% WECI 7% Electric transmission** 10% ** ATC is accounted for using the equity method; this represents WEC Energy Group’s portion of the asset base. Electric generation and distribution 52% Natural gas distribution 30% WECI 6% Electric transmission** 12% * Based on estimated year-end average asset base.

14 We now plan to eliminate coal as an energy source three years earlier - by end of 2032. Retirements planned: Oak Creek Units 5-6: 528 MW (May 2024) Oak Creek Units 7-8: 611 MW (late in 2025) Columbia Units 1-2: 300 MW (by June 1, 2026) Weston Unit 3: 328 MW (end of 2031) Enhancing fuel flexibility (gas blending) at Oak Creek Power the Future units and Weston Unit 4. By end of 2030, we expect to use coal only as a backup fuel. Exiting Coal

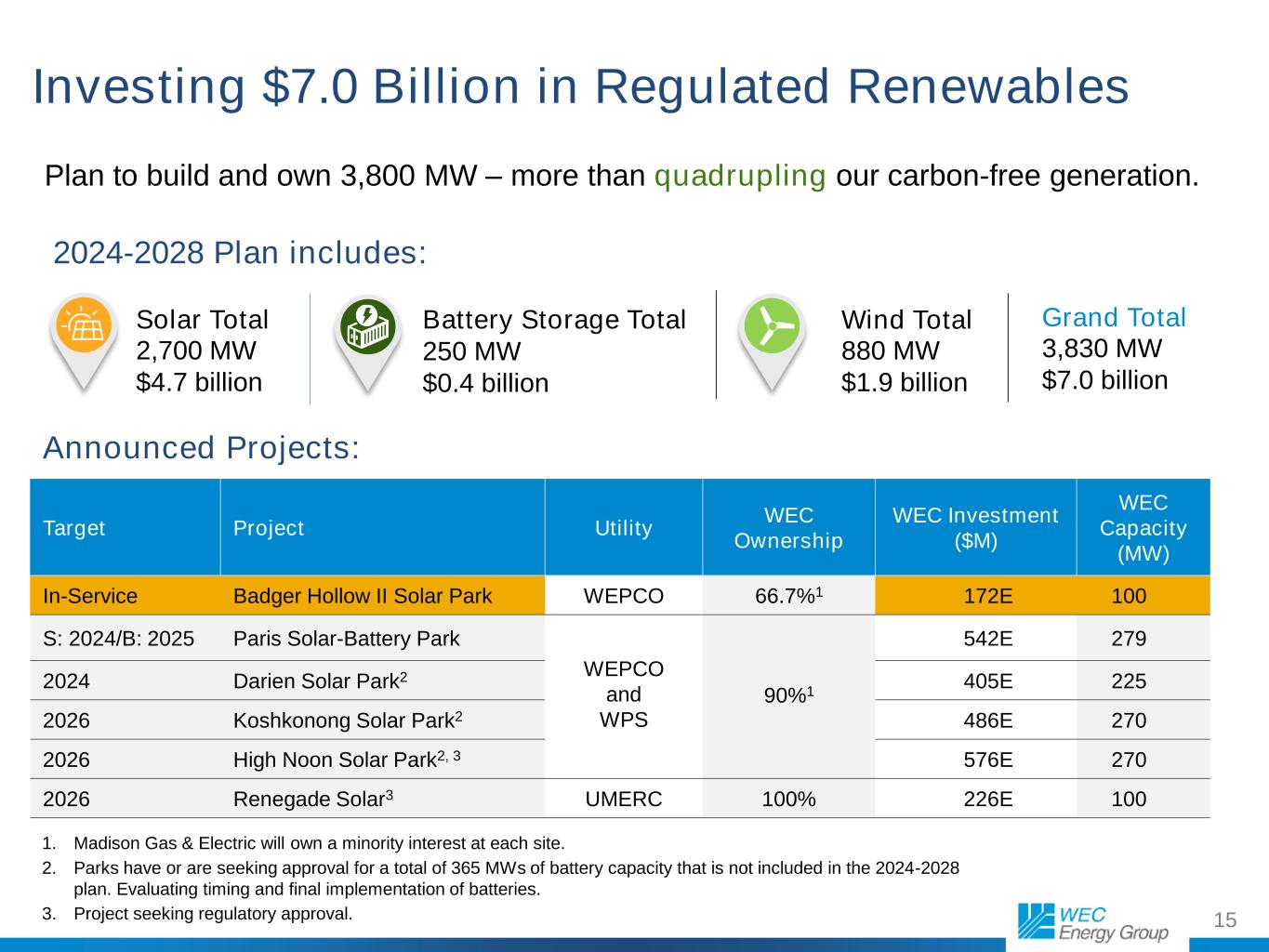

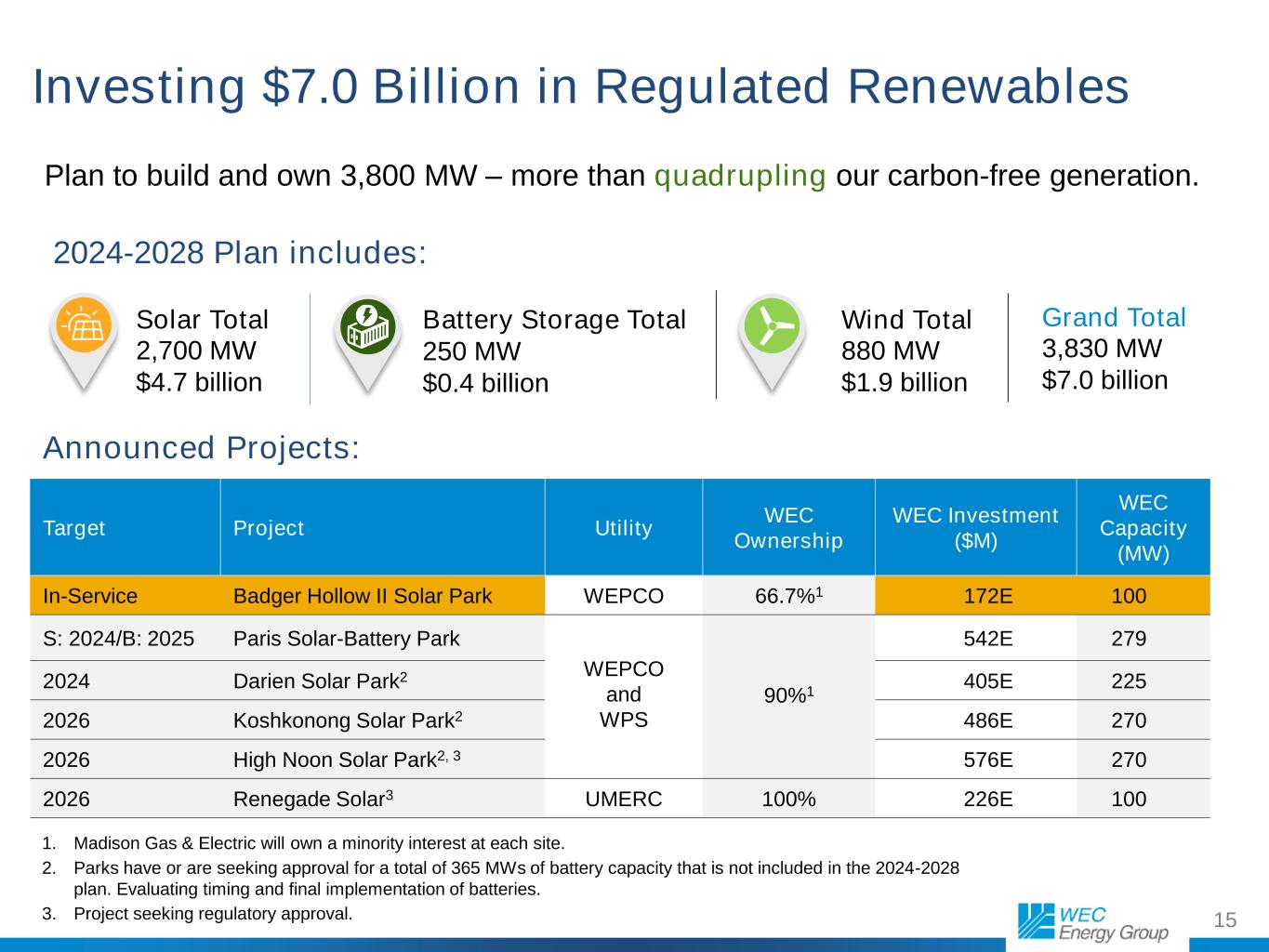

15 Target Project Utility WEC Ownership WEC Investment ($M) WEC Capacity (MW) In-Service Badger Hollow II Solar Park WEPCO 66.7%1 172E 100 S: 2024/B: 2025 Paris Solar-Battery Park WEPCO and WPS 90%1 542E 279 2024 Darien Solar Park2 405E 225 2026 Koshkonong Solar Park2 486E 270 2026 High Noon Solar Park2, 3 576E 270 2026 Renegade Solar3 UMERC 100% 226E 100 1. Madison Gas & Electric will own a minority interest at each site. 2. Parks have or are seeking approval for a total of 365 MWs of battery capacity that is not included in the 2024-2028 plan. Evaluating timing and final implementation of batteries. 3. Project seeking regulatory approval. Solar Total 2,700 MW $4.7 billion Battery Storage Total 250 MW $0.4 billion Wind Total 880 MW $1.9 billion Grand Total 3,830 MW $7.0 billion 2024-2028 Plan includes: Plan to build and own 3,800 MW – more than quadrupling our carbon-free generation. Announced Projects: Investing $7.0 Billion in Regulated Renewables

16 Modern, efficient natural gas generation will serve as a critical resource in our energy transformation. Modernizing Our Gas-Fueled Generation Fleet West Riverside Energy Center Combined-Cycle Additional 100 MW option Expected investment: $100 million Received approval from the Wisconsin Commission on February 22, 2024 Target: Q2 2024 Oak Creek Combustion Turbines 1,125 MW planned Expected investment: $1.2 billion Paris RICE generation 132 MW planned Expected investment: $211 million 2024-2028 Capital Plan Weston RICE

17 Investing in Reliability for Our Natural Gas Network New proposed LNG storage facilities are needed to ensure gas supply for winter reliability. Expected investment: $860 million 4 Bcf planned Bluff Creek and Ixonia LNG facilities completed Investment: ~$410 million 2 Bcf In-service dates: Bluff Creek LNG Facility: November 30, 2023 Ixonia LNG Facility: February 23, 2024 LNG provides a solution to meet peak customer demand for heating and ensures gas supply for power generation.

18 $636 $867 $1,148 $1,187 $1,152 $382 $520 $689 $712 $691 2024 2025 2026 2027 2028 ATC WEC portion 60% Includes $330 million for MISO Tranche 1 (in 2022 dollars) MISO Tranche 2 planning underway WEC portion of ATC investment expected from 2024-2028: $3.0 billion Future Transmission Investment Projected Capital Expenditures (millions)

19 Projected Cash Flows and Financing Plan ($ in billions) Cash from Operations $16.5 - $17.5 Incremental Debt $7.15 - $8.15 Dividends $6.0 - $6.2 Capital Plan* $20.7 Cash Uses Cash Sources Common Equity $1.95 - $2.35 * Excludes ATC’s capital. ATC is accounted for using the equity method. 2024 - 2028

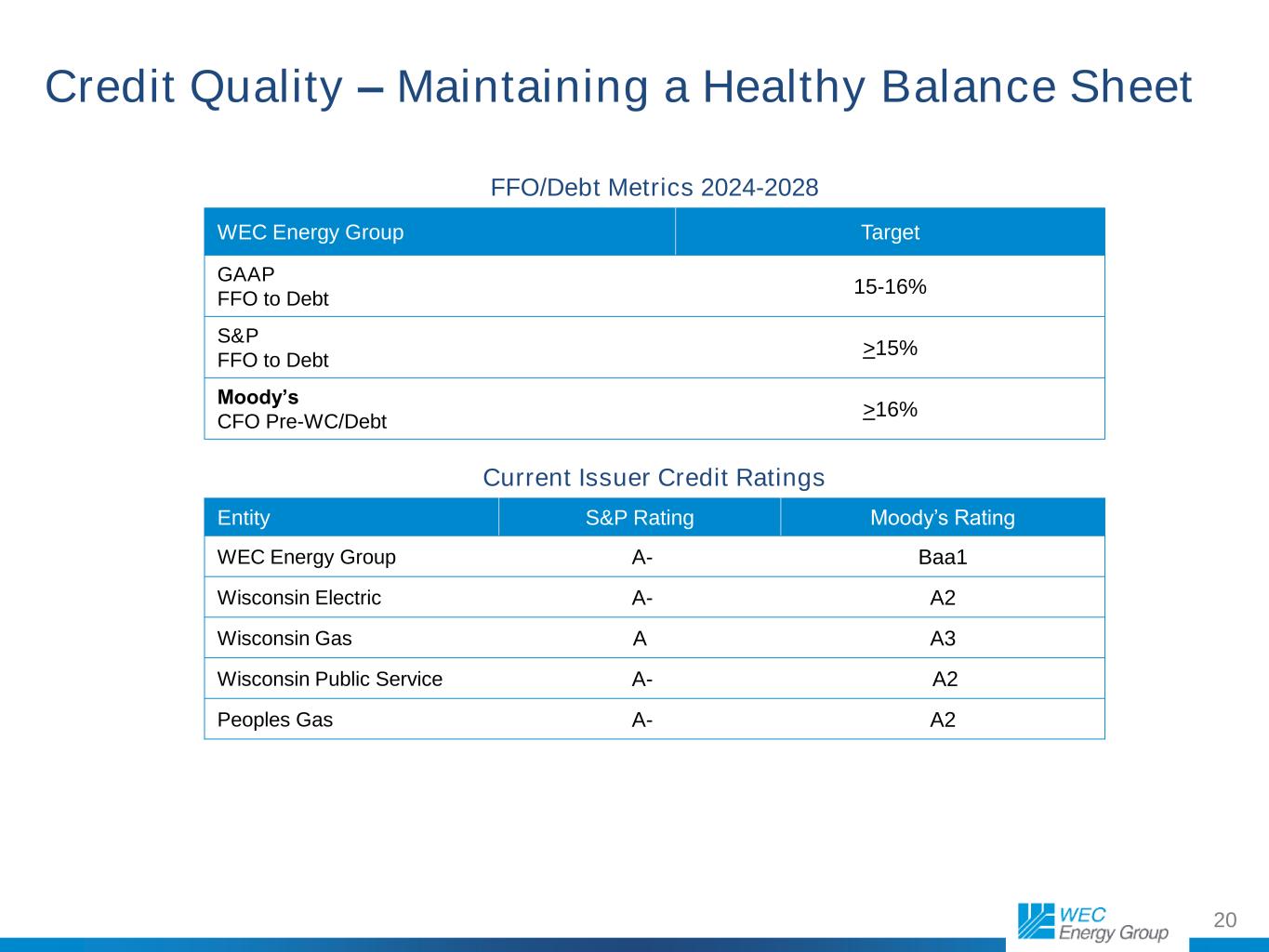

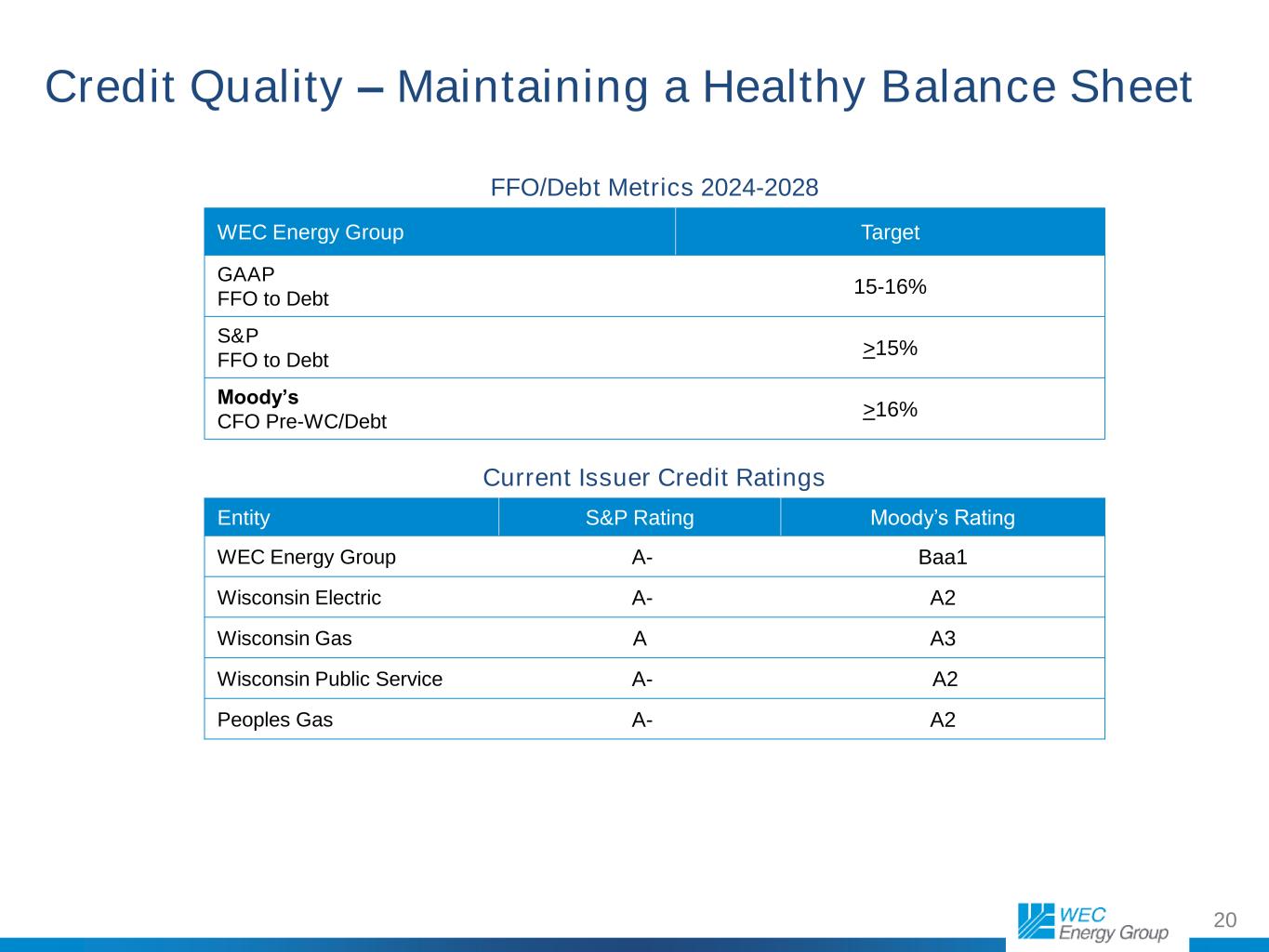

20 Credit Quality – Maintaining a Healthy Balance Sheet Current Issuer Credit Ratings Entity S&P Rating Moody’s Rating WEC Energy Group A- Baa1 Wisconsin Electric A- A2 Wisconsin Gas A A3 Wisconsin Public Service A- A2 Peoples Gas A- A2 FFO/Debt Metrics 2024-2028 WEC Energy Group Target GAAP FFO to Debt 15-16% S&P FFO to Debt >15% Moody’s CFO Pre-WC/Debt >16%

21 *Includes projection of potential carbon offsets by 2050. Carbon Reduction Goals – Electric Generation We have established aggressive carbon reduction goals for our electric generating fleet, aligned with or surpassing global emissions pathways aimed at limiting warming to 1.5°C. Reduction goals: 60% below 2005 levels by end of 2025 80% below 2005 levels by end of 2030 Net carbon neutral by 2050 -100 -80 -60 -40 -20 0 2005 2023 2025 2030 2050 Achieved and anticipated CO2 reductions (net mass)* -54%

22 1. Represents a decrease in the rate of methane emissions across our system from a 2011 baseline. 2. This goal applies to emissions from WEC Energy Group natural gas distribution companies calculated in accordance with EPA’s 40 Code of Federal Regulations Part 98, Subpart W reporting rule. 3. Mandatory Greenhouse Gas Reporting Program, 40 CFR Part 98 Subpart W-Petroleum and Natural Gas Systems reporting information for goal estimation is preliminary and subject to change after regulatory reporting. -100% -80% -60% -40% -20% 0% 2011 2023E 2030 Achieved1 and anticipated methane emission reduction from natural gas distribution. Aligns with effort to limit warming to 1.5°C. -23%3 Goal: Net zero by end of 20302 Use of renewable natural gas (RNG) is expected to contribute significantly to our goal. Methane Reduction

23 Leading a pilot project to test a new form of long-duration energy storage. Partnering with EPRI and CMBlu Energy This system uses a proprietary technology that incorporates environmentally friendly materials - ‘a green battery.’ The project will test battery system performance, including the ability to store and discharge energy for up to twice as long as the typical lithium-ion batteries in use today. Results will be shared across the industry Organic Flow Battery Storage New Clean Energy Pilot Project

24 Regional Economy

25 Powering Industry Leaders in Our Region

26 Longer-Term Sales Forecast Wisconsin Segment Year-Over-Year 2026-2028 Electric 4.5%-5.0% Gas 0.7%-1.0% Sales Growth Forecast (weather-normalized)

27 Industry leading earnings quality. Top decile dividend growth. Capital plan drives premium long-term EPS growth of 6.5% to 7.0%. 95%+ of capital allocated to regulated businesses. Aggressive environmental goals in place. By end of 2030, we expect to use coal only as a backup fuel. Exit from coal planned by end of 2032. Poised to deliver among the best risk-adjusted returns in the industry. Key Takeaways for WEC Energy Group

Appendix

29 Electric Distribution Electric Transmission 60% ownership Electric Generation Energy Infrastructure Natural Gas Distribution

30 Extension of production tax credits (PTC) and investment tax credits (ITC). PTC option for solar projects. ITC for stand-alone electric storage projects. Tax credit “transferability” to provide additional options for monetization. Credit positive. At WEC, no material impact expected from alternative minimum tax. Inflation Reduction Act Customer Benefit and Investment Opportunity

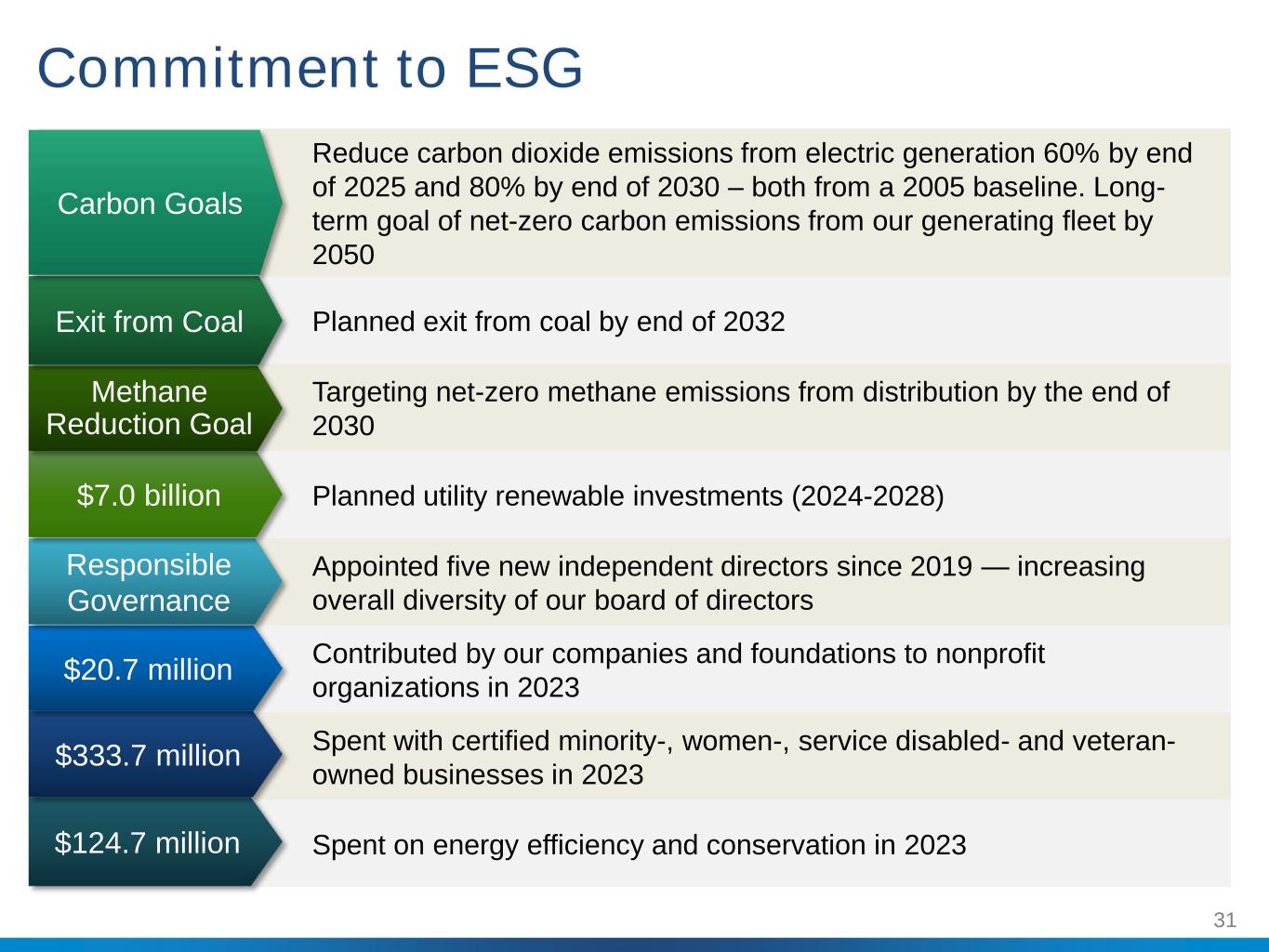

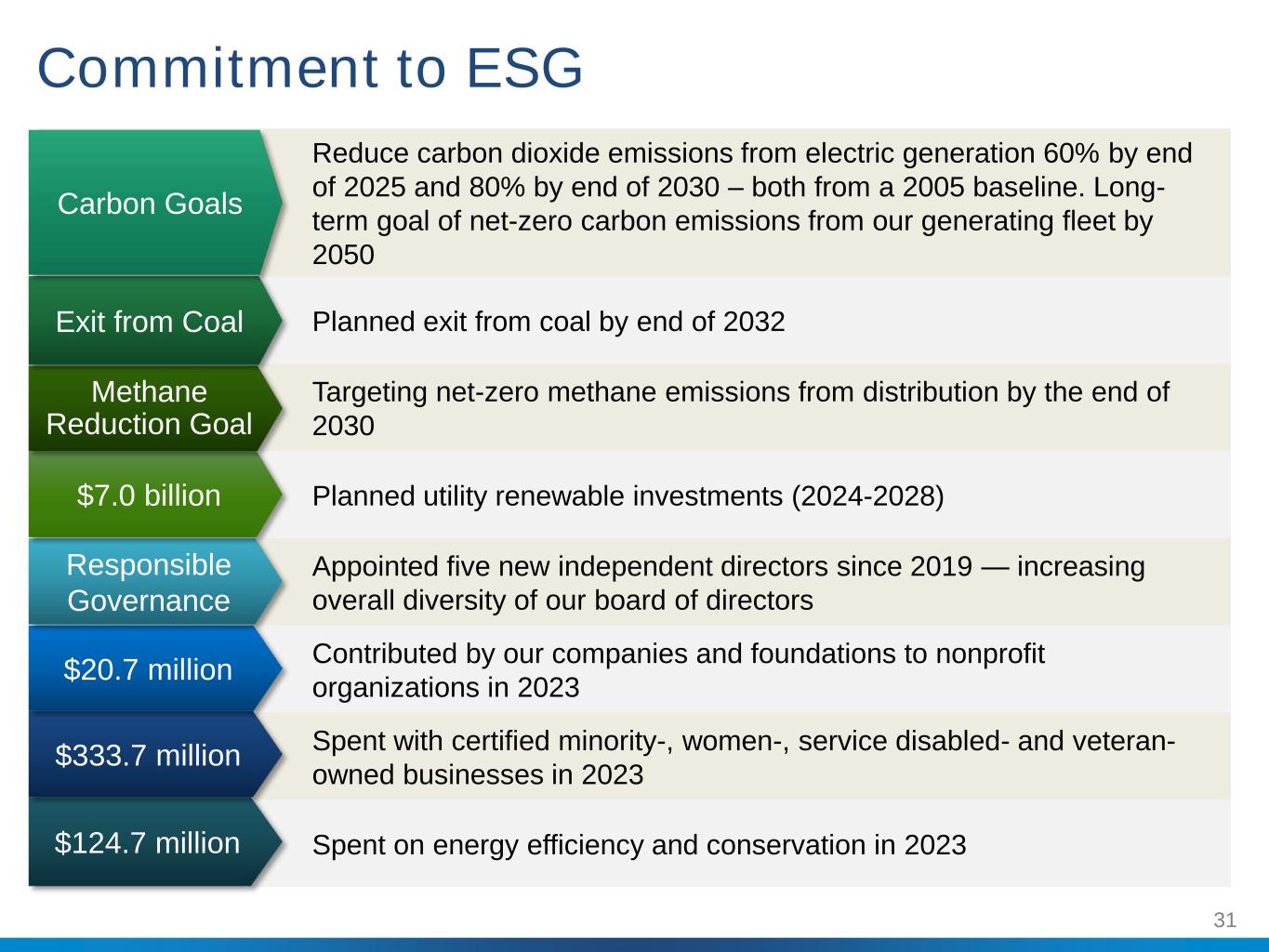

31 Reduce carbon dioxide emissions from electric generation 60% by end of 2025 and 80% by end of 2030 – both from a 2005 baseline. Long- term goal of net-zero carbon emissions from our generating fleet by 2050 Planned exit from coal by end of 2032 Targeting net-zero methane emissions from distribution by the end of 2030 Planned utility renewable investments (2024-2028) ) Appointed five new independent directors since 2019 — increasing overall diversity of our board of directors Contributed by our companies and foundations to nonprofit organizations in 2023 Spent with certified minority-, women-, service disabled- and veteran- owned businesses in 2023 Spent on energy efficiency and conservation in 2023 Commitment to ESG $124.7 million $333.7 million $20.7 million Responsible Governance $7.0 billion Methane Reduction Goal Exit from Coal Carbon Goals

32 Electricity Supply by Fuel Type (megawatt-hours delivered to regulated utility customers) 73% 32% 7% 37% 43% 17% 22% 21% 3% 9% 34% 2005 2023 2030E 2032 2050 Coal Natural Gas Nuclear Renewables Exiting Coal <2% Net carbon neutral goal Planned exit from coal

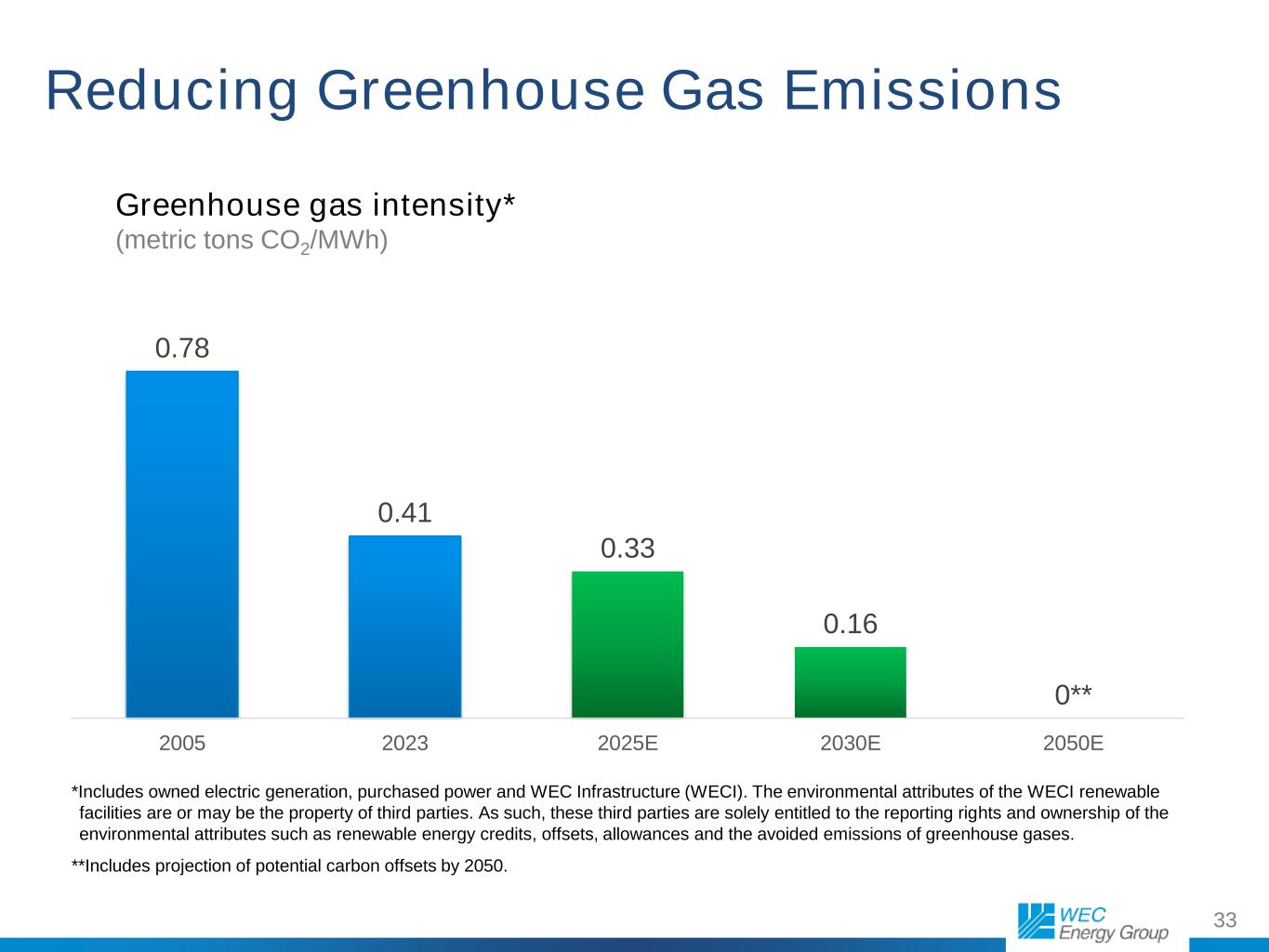

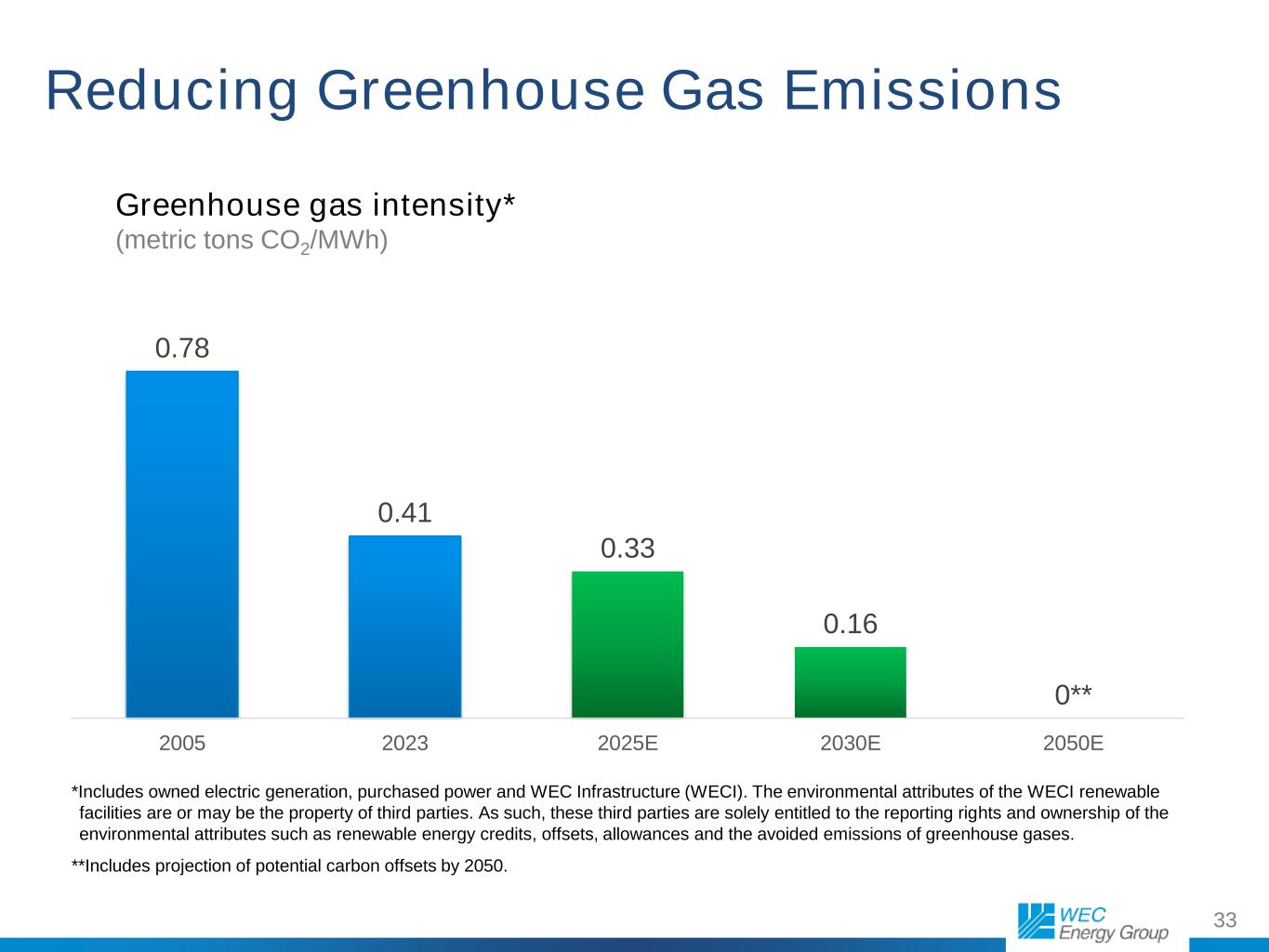

33 Reducing Greenhouse Gas Emissions 0.78 0.41 0.33 0.16 0** 2005 2023 2025E 2030E 2050E Greenhouse gas intensity* (metric tons CO2/MWh) *Includes owned electric generation, purchased power and WEC Infrastructure (WECI). The environmental attributes of the WECI renewable facilities are or may be the property of third parties. As such, these third parties are solely entitled to the reporting rights and ownership of the environmental attributes such as renewable energy credits, offsets, allowances and the avoided emissions of greenhouse gases. **Includes projection of potential carbon offsets by 2050.

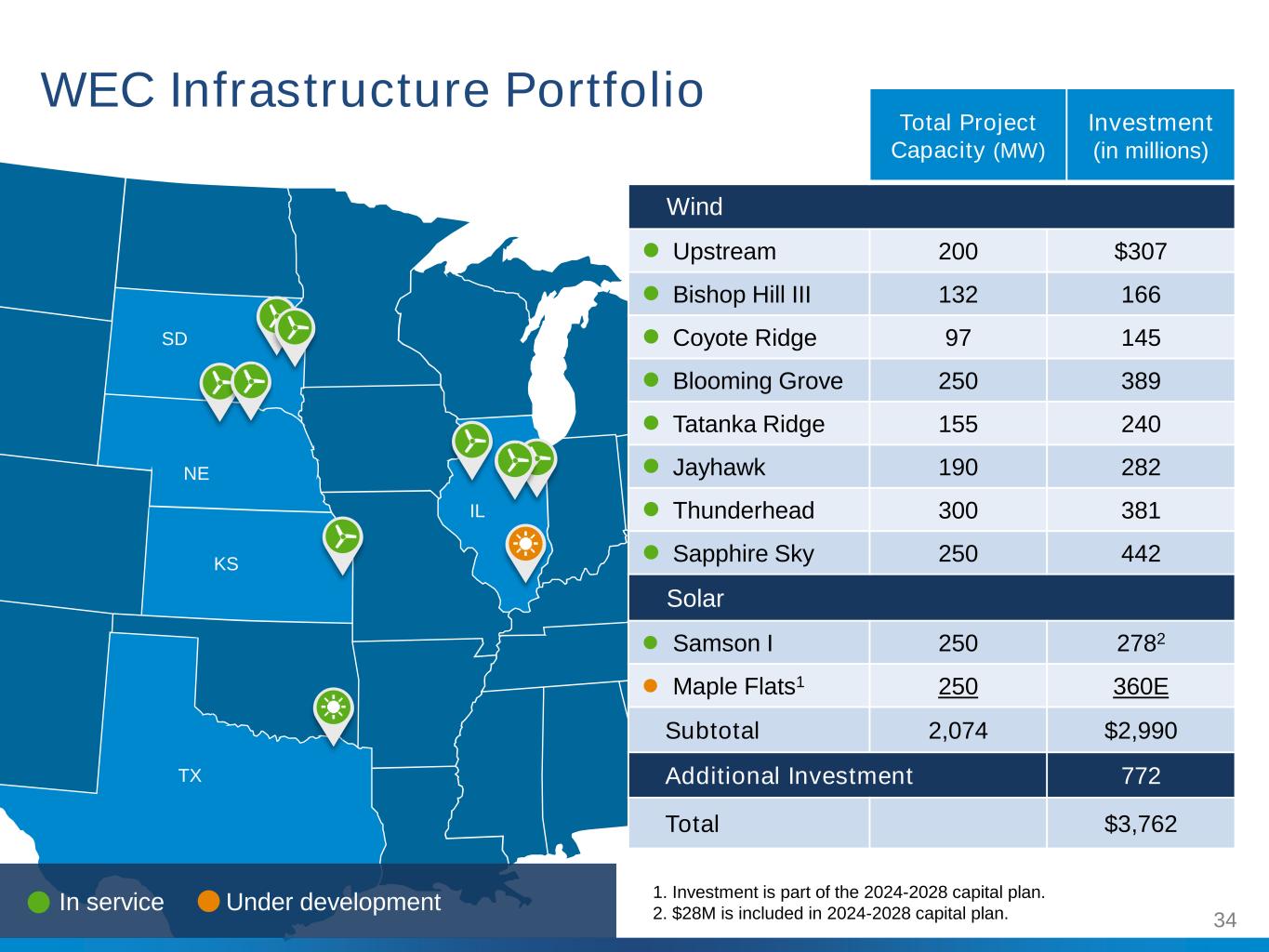

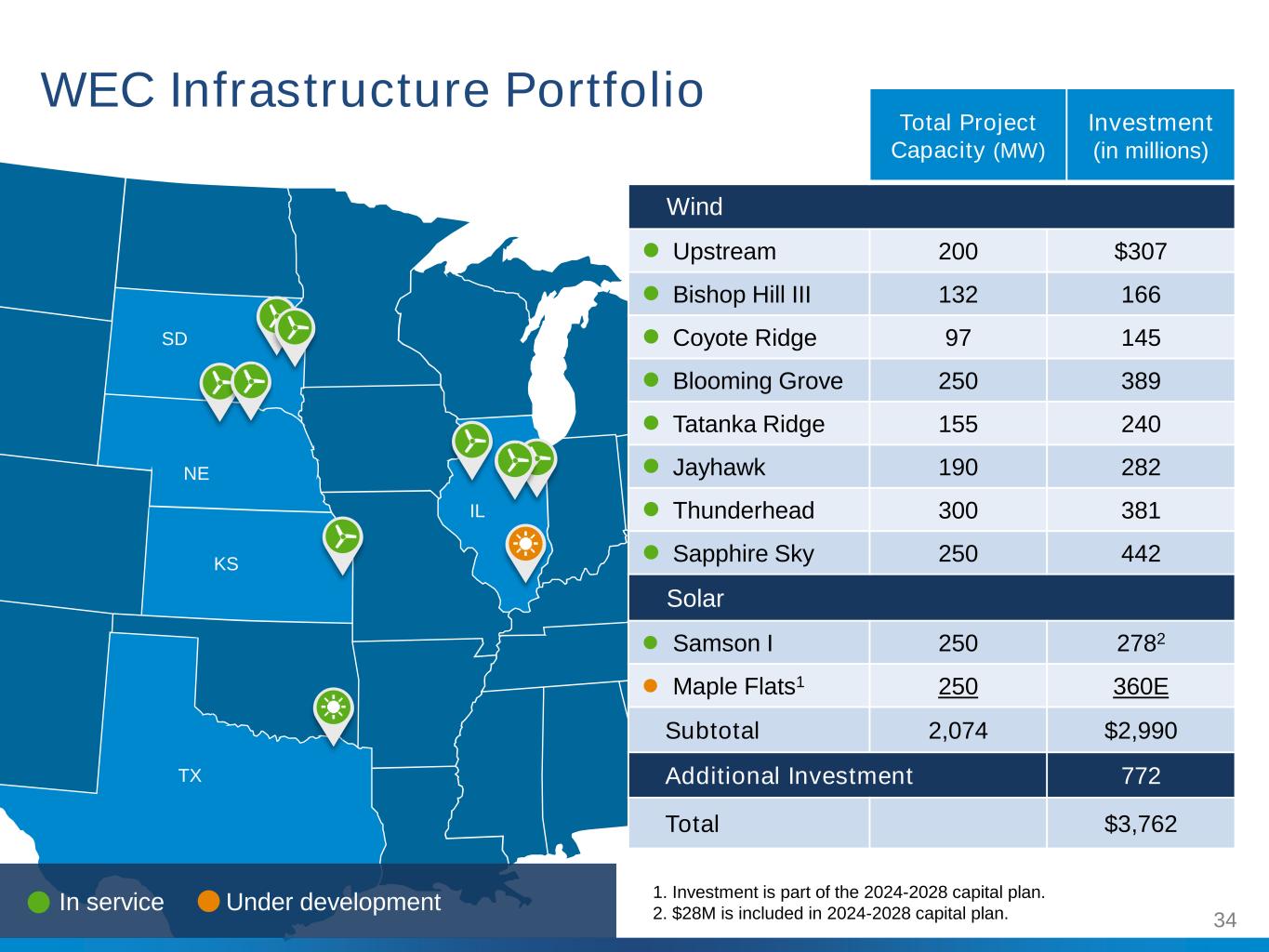

34 SD IL NE In service Under development Total Project Capacity (MW) Investment (in millions) Wind ● Upstream 200 $307 ● Bishop Hill III 132 166 ● Coyote Ridge 97 145 ● Blooming Grove 250 389 ● Tatanka Ridge 155 240 ● Jayhawk 190 282 ● Thunderhead 300 381 ● Sapphire Sky 250 442 Solar ● Samson I 250 2782 ● Maple Flats1 250 360E Subtotal 2,074 $2,990 Additional Investment 772 Total $3,762 1. Investment is part of the 2024-2028 capital plan. 2. $28M is included in 2024-2028 capital plan. KS TX WEC Infrastructure Portfolio

35 Project Developer Investment Offtake Agreement WEC Commercial Operations Total Project Capacity Bishop Hill III Wind Energy Center Invenergy $166M for 90% ownership WPPI Energy 22 years 8/31/18 132 MW Upstream Wind Energy Center Invenergy $307M for 90% ownership Affiliate of Allianz 10 years 1/10/19 200 MW Coyote Ridge Wind Farm Avangrid Renewables $145M for 80% ownership and 99% of tax benefits Google Energy LLC 12 years 12/20/19 97 MW Blooming Grove Wind Farm Invenergy $389M for 90% ownership Verizon and Saint-Gobain North America 12 years 12/8/20 250 MW Tatanka Ridge Wind Farm Avangrid Renewables $240M for 85% ownership and 99% of tax benefits Google Energy – 12 years Dairyland Power – 10 years 1/5/21 155 MW Jayhawk Wind Farm Apex Clean Energy $282M for 90% ownership and 99% of tax benefits Meta Platforms Inc. 10 years 12/15/21 190 MW Thunderhead Wind Energy Center Invenergy $381M for 90% ownership Verizon, GM, Ultium Cells LLC, and a Fortune 100 Company 12 years 11/16/22 300 MW Sapphire Sky Wind Energy Center Invenergy $442M for 90% ownership Microsoft Corp – 12 years 2/7/23 250 MW Samson I Solar Energy Center Invenergy $250M for 80% ownership, $28M for 10% AT&T Corp – 15 years 80% on 2/24/23,10% on 1/1/24 250 MW Maple Flats Solar Energy Center Invenergy $360M expected for 80% ownership Fortune 100 Company Projected: Q4 2024 250 MW Infrastructure Investment Summary

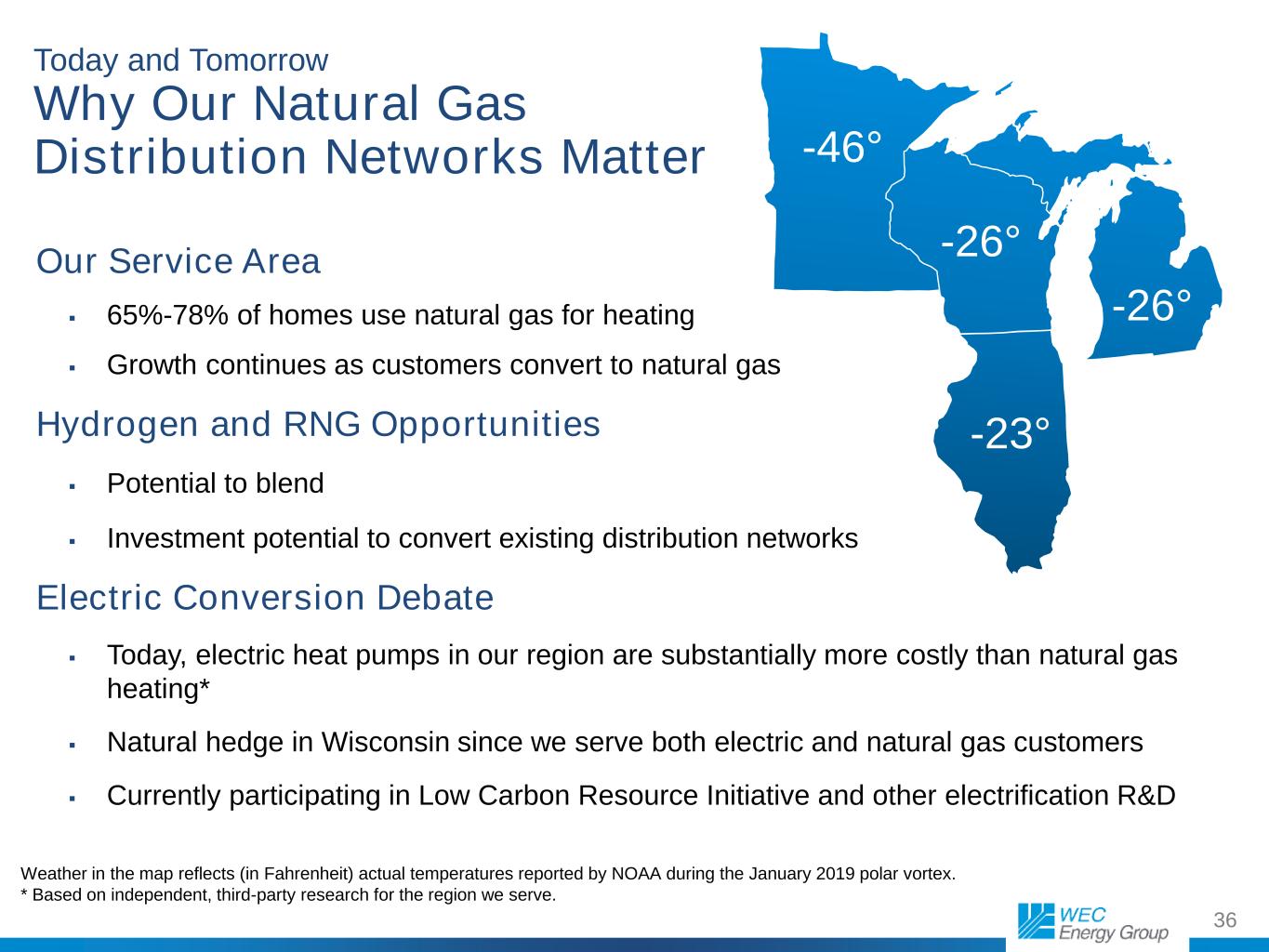

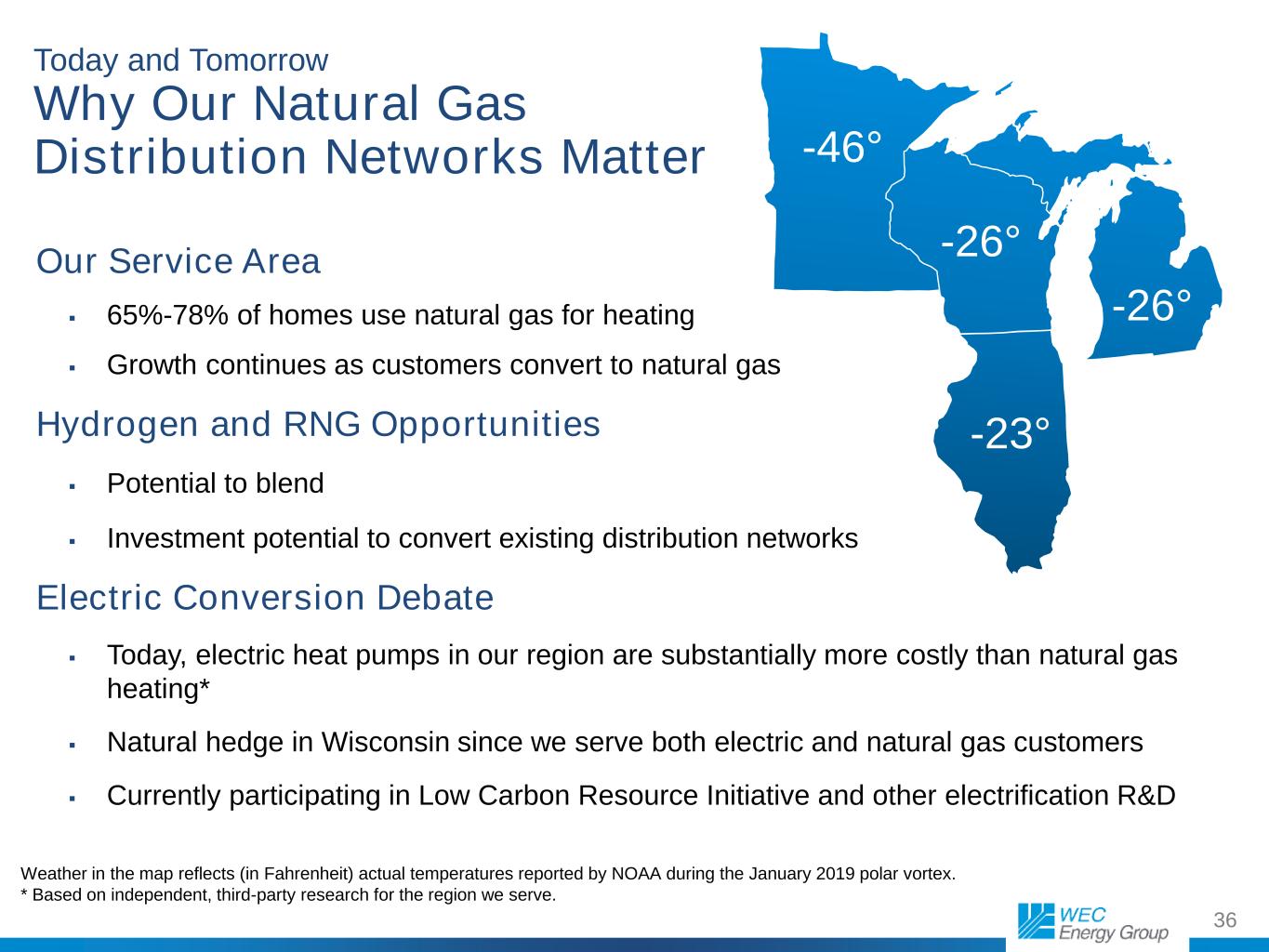

36 Today and Tomorrow Why Our Natural Gas Distribution Networks Matter Our Service Area 65%-78% of homes use natural gas for heating Growth continues as customers convert to natural gas Hydrogen and RNG Opportunities Potential to blend Investment potential to convert existing distribution networks Electric Conversion Debate Today, electric heat pumps in our region are substantially more costly than natural gas heating* Natural hedge in Wisconsin since we serve both electric and natural gas customers Currently participating in Low Carbon Resource Initiative and other electrification R&D -46° -26° -26° -23° Weather in the map reflects (in Fahrenheit) actual temperatures reported by NOAA during the January 2019 polar vortex. * Based on independent, third-party research for the region we serve.

37 PGL Safety Modernization Program (SMP) Increasing capacity and reliability of natural gas service in PGL’s territory 38% complete* Program paused while under ICC review Systematic Neighborhood Upgrades $160 System Improvement / Reliability $60 Public Improvement (Third Party Driven), $30 Emergency Work $30 Historical Annual Average Spend ($ in millions) *As of Dec. 31, 2023

38 Progress on Efficiency, Sustainability and Growth Electric delivery redesign/resilience Addressing aging infrastructure and system hardening Enhancing efficiencies and reducing operating costs Expect to spend $3.8 billion (2024-2028) with continued investment over next decade Taking Steps to Maintain Reliable and Affordable Service for Our Customers

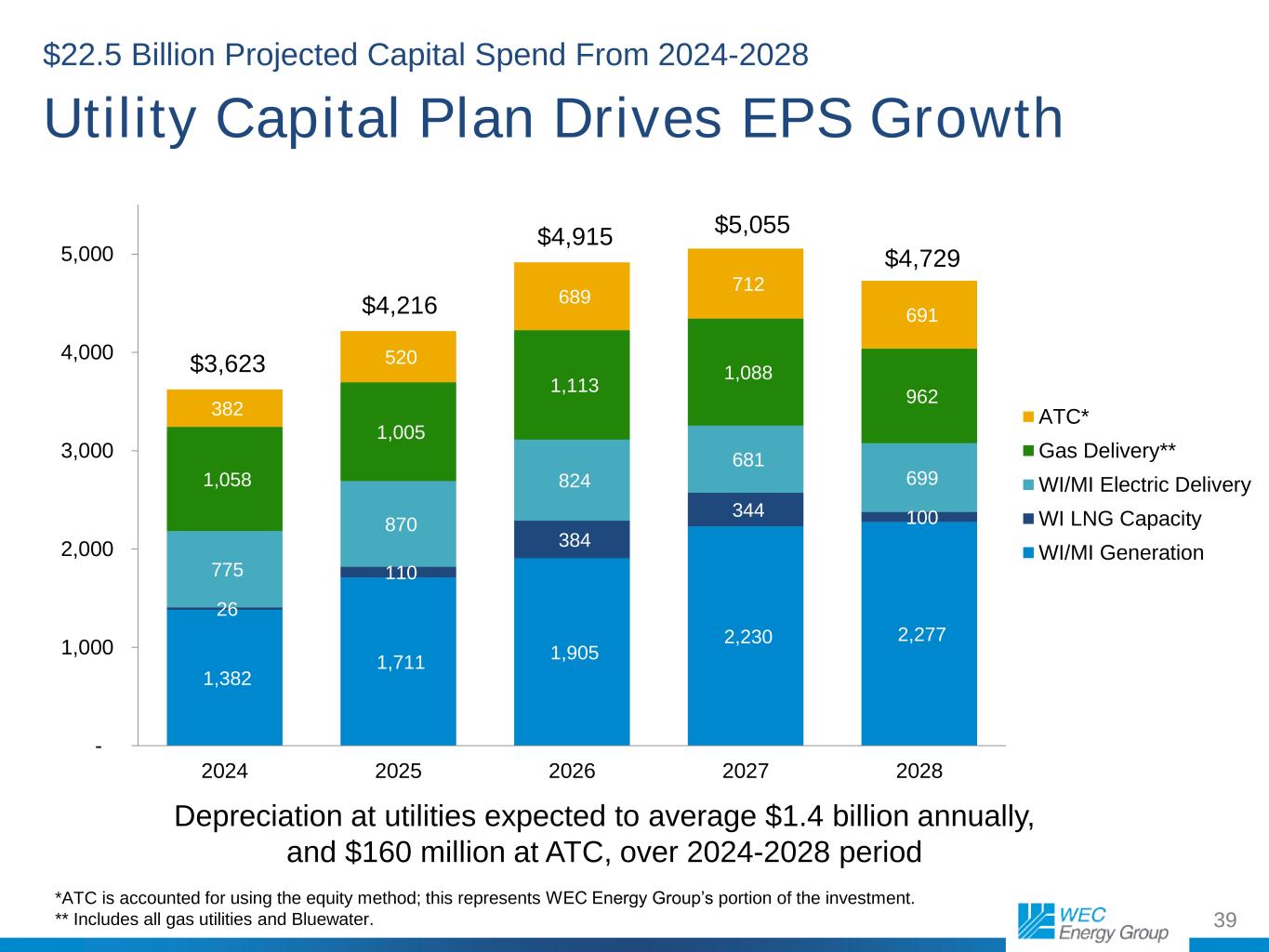

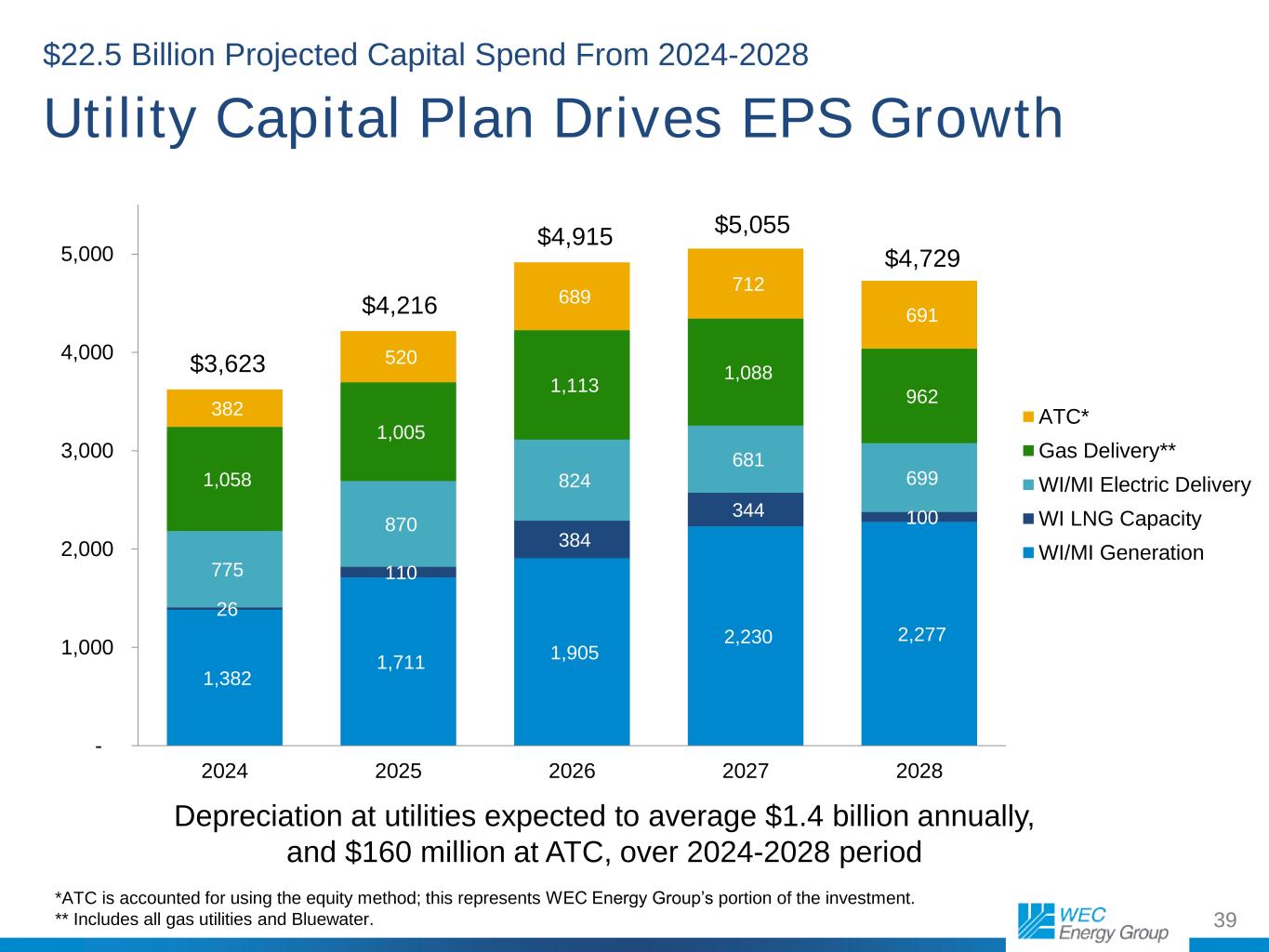

39 Utility Capital Plan Drives EPS Growth $22.5 Billion Projected Capital Spend From 2024-2028 1,382 1,711 1,905 2,230 2,277 26 110 384 344 100 775 870 824 681 699 1,058 1,005 1,113 1,088 962 382 520 689 712 691 $3,623 $4,216 $4,915 $5,055 $4,729 - 1,000 2,000 3,000 4,000 5,000 2024 2025 2026 2027 2028 ATC* Gas Delivery** WI/MI Electric Delivery WI LNG Capacity WI/MI Generation Depreciation at utilities expected to average $1.4 billion annually, and $160 million at ATC, over 2024-2028 period *ATC is accounted for using the equity method; this represents WEC Energy Group’s portion of the investment. ** Includes all gas utilities and Bluewater.

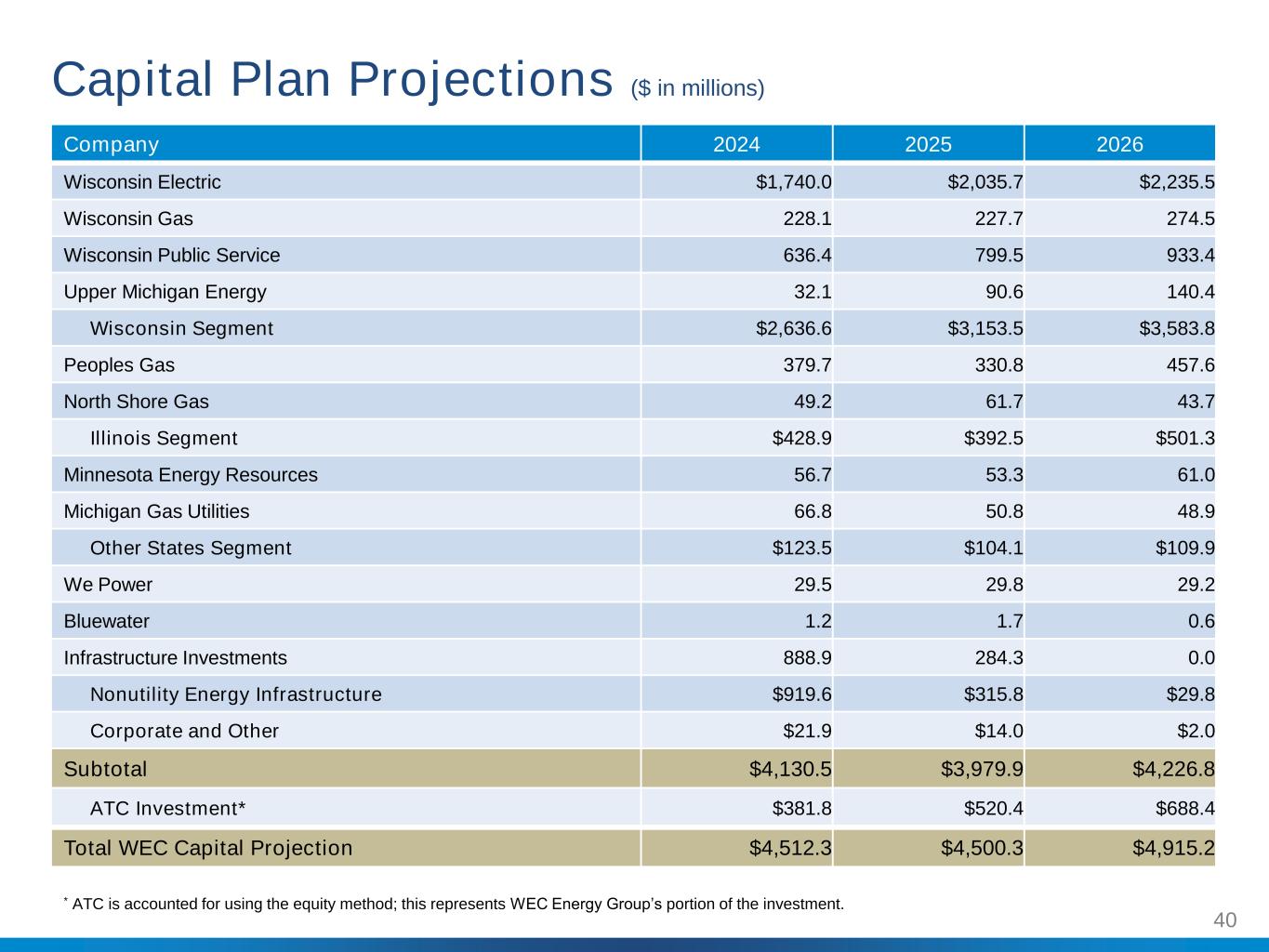

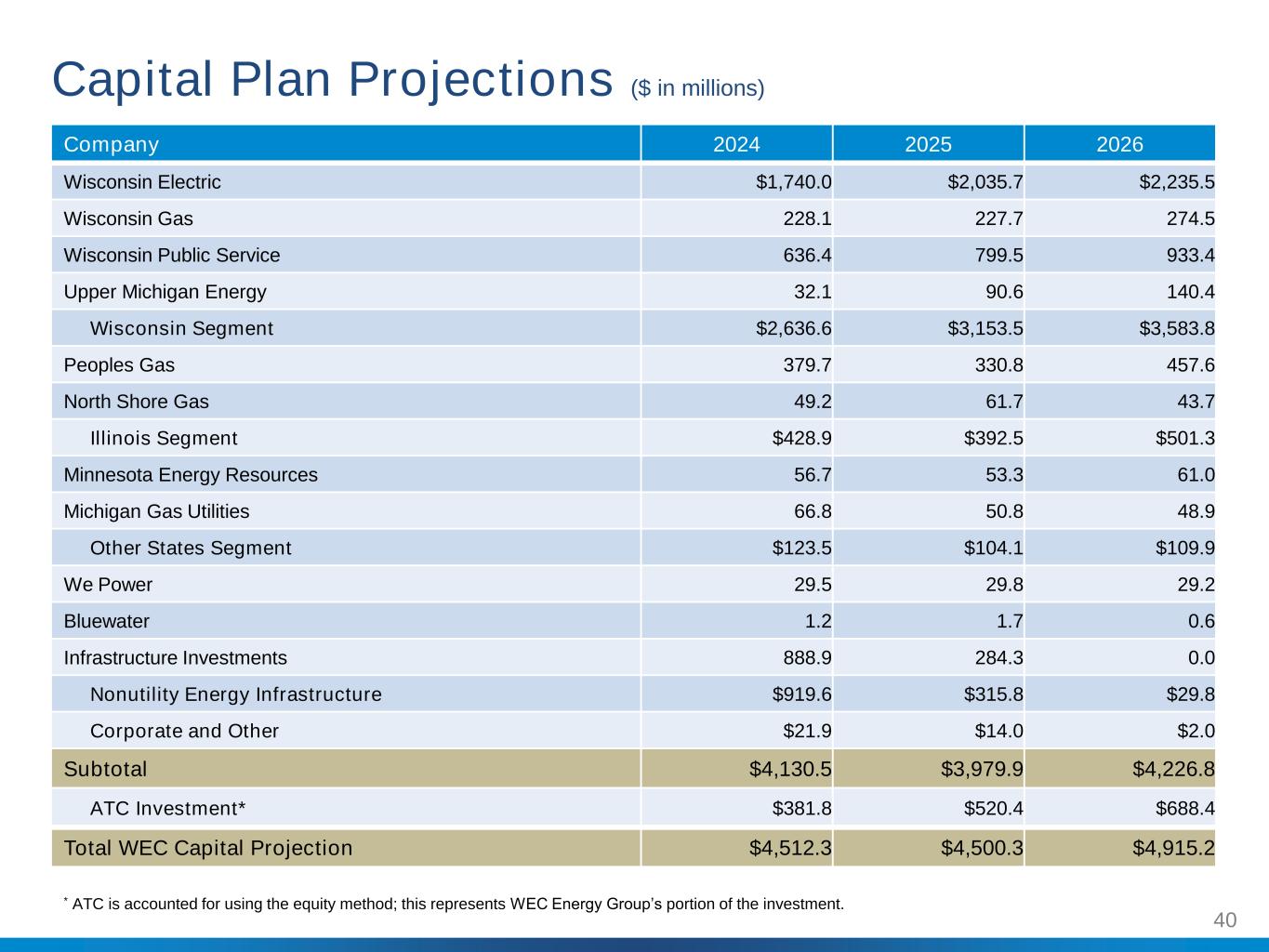

40 Company 2024 2025 2026 Wisconsin Electric $1,740.0 $2,035.7 $2,235.5 Wisconsin Gas 228.1 227.7 274.5 Wisconsin Public Service 636.4 799.5 933.4 Upper Michigan Energy 32.1 90.6 140.4 Wisconsin Segment $2,636.6 $3,153.5 $3,583.8 Peoples Gas 379.7 330.8 457.6 North Shore Gas 49.2 61.7 43.7 Illinois Segment $428.9 $392.5 $501.3 Minnesota Energy Resources 56.7 53.3 61.0 Michigan Gas Utilities 66.8 50.8 48.9 Other States Segment $123.5 $104.1 $109.9 We Power 29.5 29.8 29.2 Bluewater 1.2 1.7 0.6 Infrastructure Investments 888.9 284.3 0.0 Nonutility Energy Infrastructure $919.6 $315.8 $29.8 Corporate and Other $21.9 $14.0 $2.0 Subtotal $4,130.5 $3,979.9 $4,226.8 ATC Investment* $381.8 $520.4 $688.4 Total WEC Capital Projection $4,512.3 $4,500.3 $4,915.2 Capital Plan Projections ($ in millions) * ATC is accounted for using the equity method; this represents WEC Energy Group’s portion of the investment.

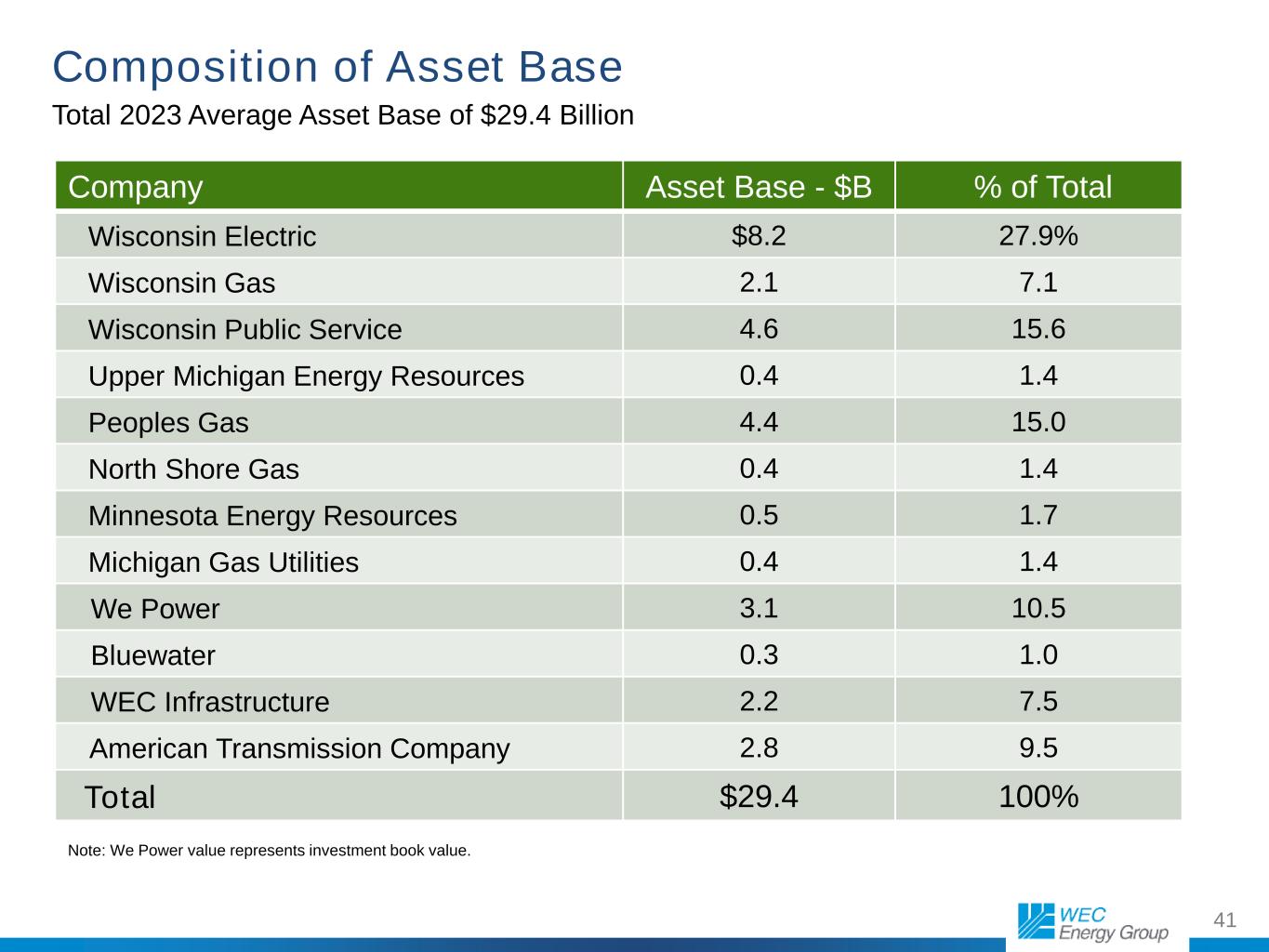

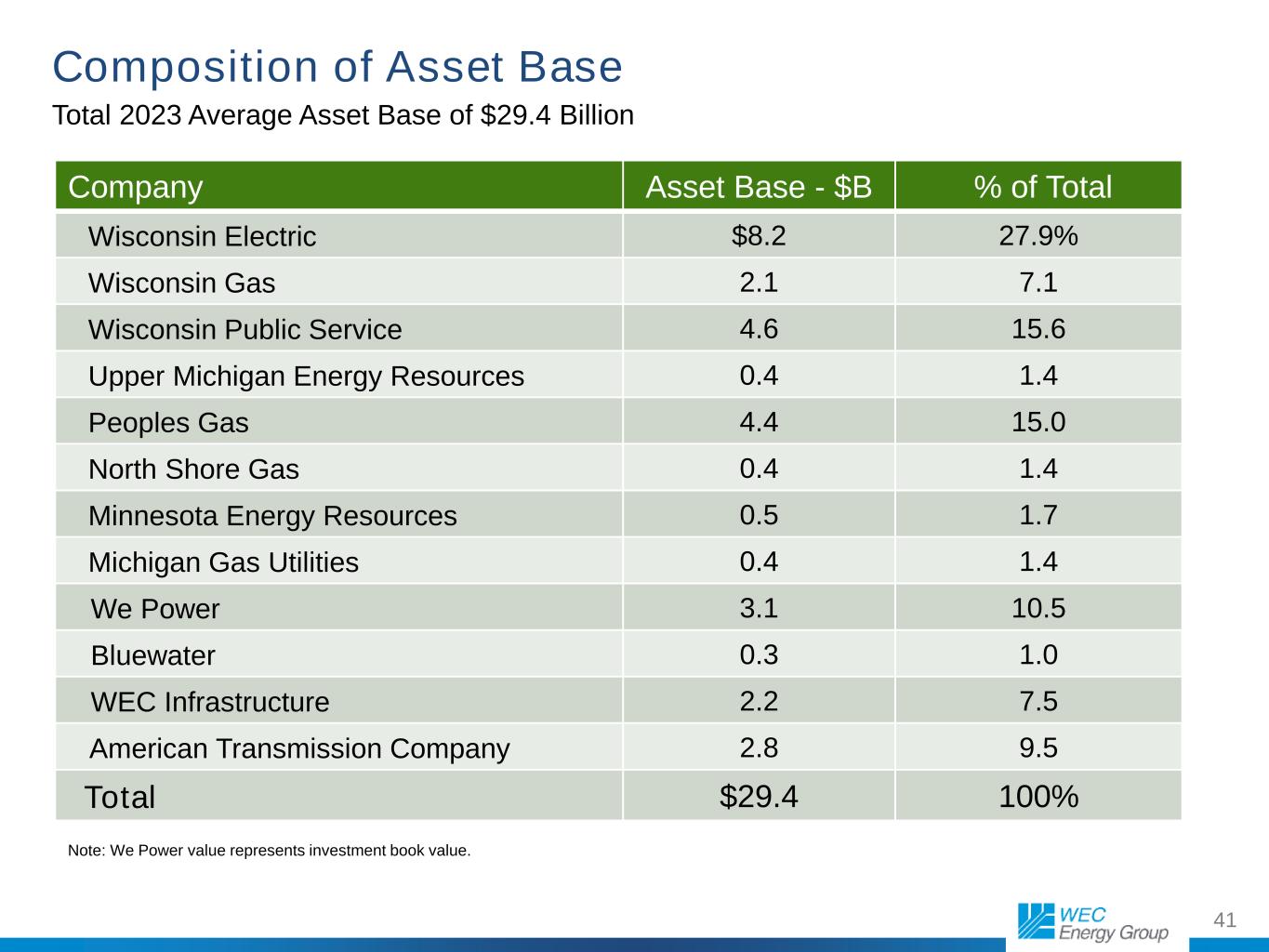

41 Composition of Asset Base Total 2023 Average Asset Base of $29.4 Billion Note: We Power value represents investment book value. Company Asset Base - $B % of Total Wisconsin Electric $8.2 27.9% Wisconsin Gas 2.1 7.1 Wisconsin Public Service 4.6 15.6 Upper Michigan Energy Resources 0.4 1.4 Peoples Gas 4.4 15.0 North Shore Gas 0.4 1.4 Minnesota Energy Resources 0.5 1.7 Michigan Gas Utilities 0.4 1.4 We Power 3.1 10.5 Bluewater 0.3 1.0 WEC Infrastructure 2.2 7.5 American Transmission Company 2.8 9.5 Total $29.4 100%

42 Diverse Portfolio of Businesses Based on 2023 average asset base. WI 62% IL 16% MI/MN 5% WECI 7% ATC* 10% By Jurisdiction By Business Electric generation and distribution 48% Natural gas distribution 35% WECI 7% Electric transmission* 10% *ATC is accounted for using the equity method; this represents WEC Energy Group’s portion of the asset base.

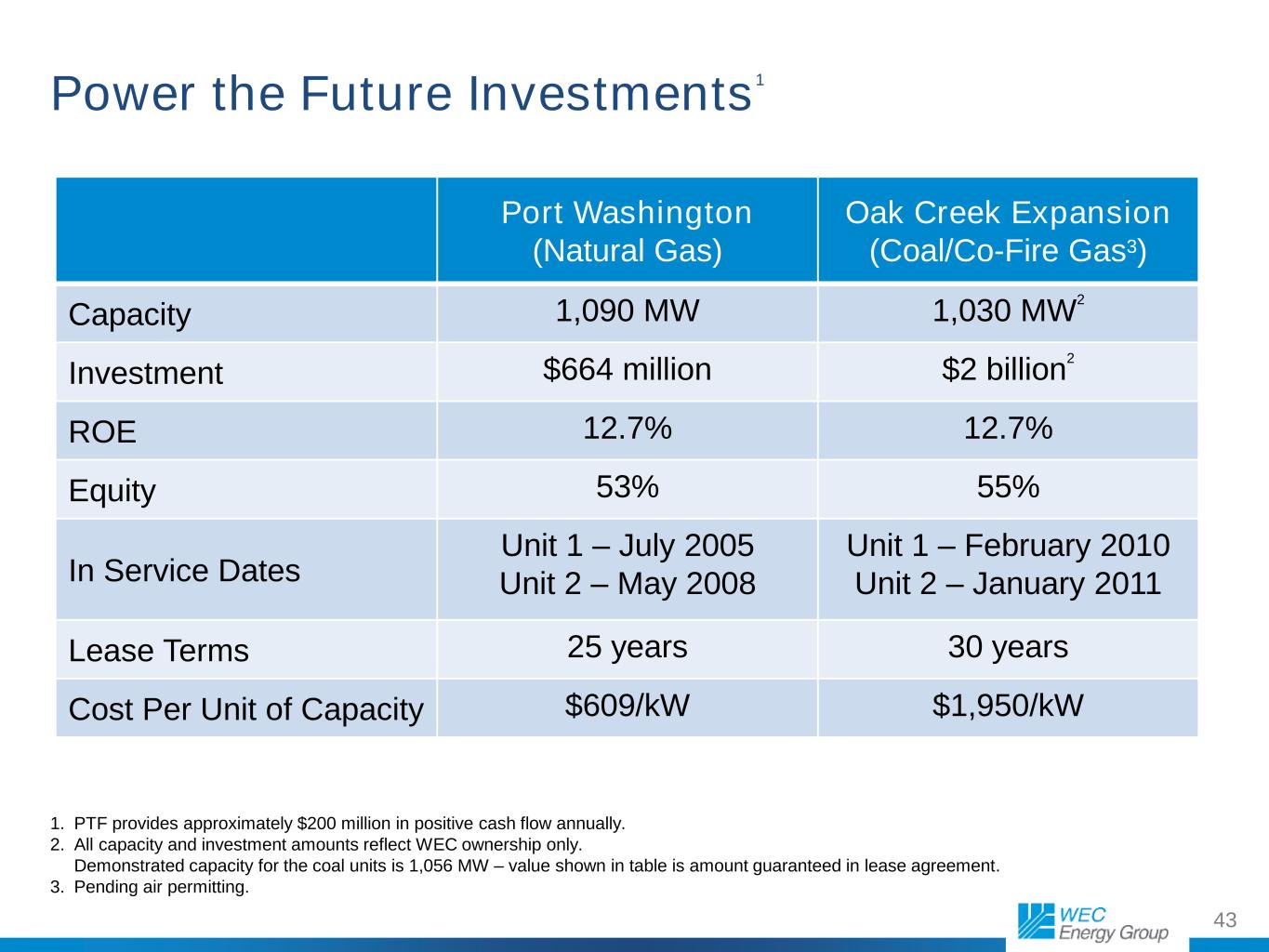

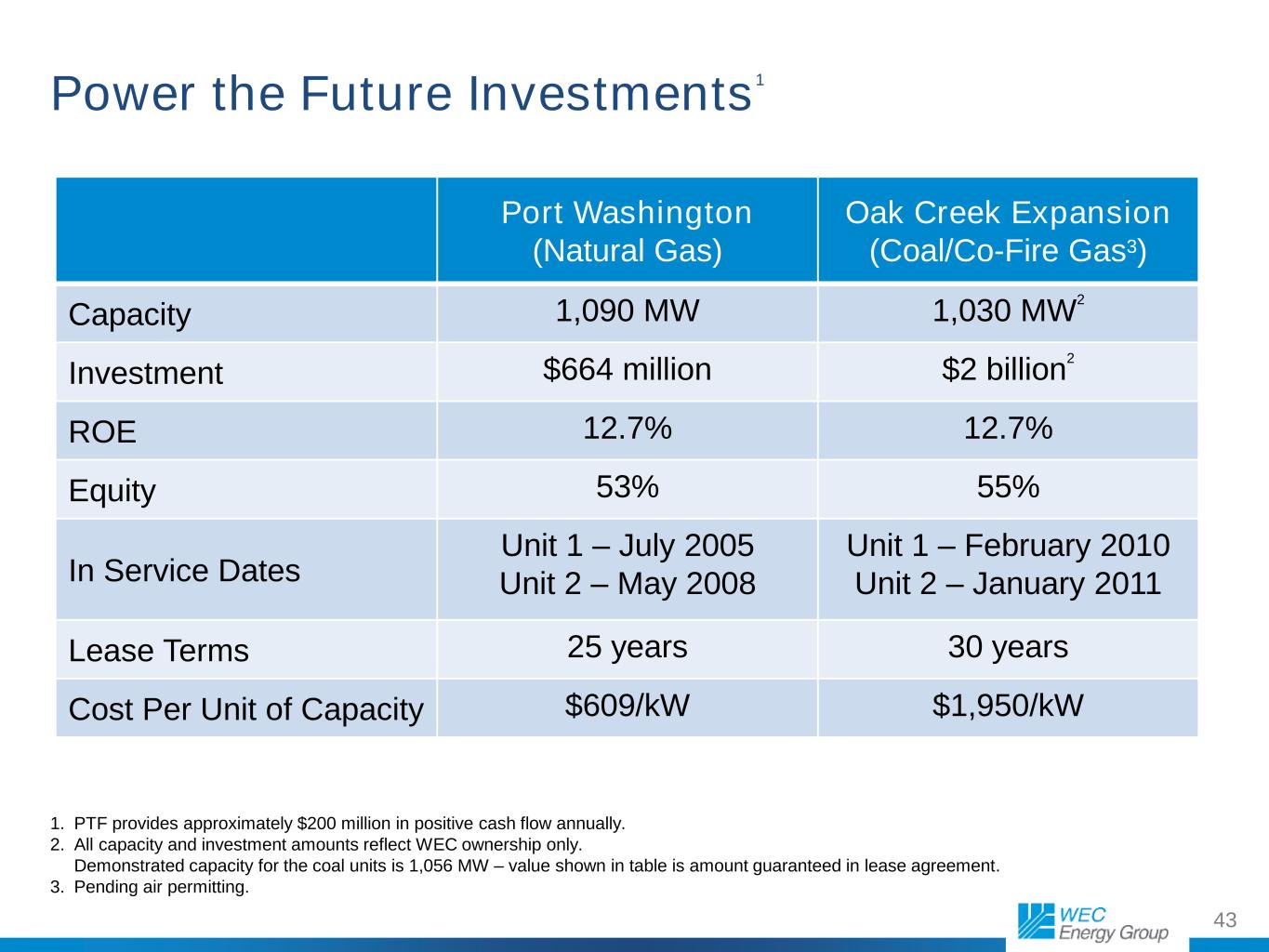

43 Power the Future Investments 1 Port Washington (Natural Gas) Oak Creek Expansion (Coal/Co-Fire Gas3) Capacity 1,090 MW 1,030 MW 2 Investment $664 million $2 billion 2 ROE 12.7% 12.7% Equity 53% 55% In Service Dates Unit 1 – July 2005 Unit 2 – May 2008 Unit 1 – February 2010 Unit 2 – January 2011 Lease Terms 25 years 30 years Cost Per Unit of Capacity $609/kW $1,950/kW 1. PTF provides approximately $200 million in positive cash flow annually. 2. All capacity and investment amounts reflect WEC ownership only. Demonstrated capacity for the coal units is 1,056 MW – value shown in table is amount guaranteed in lease agreement. 3. Pending air permitting.

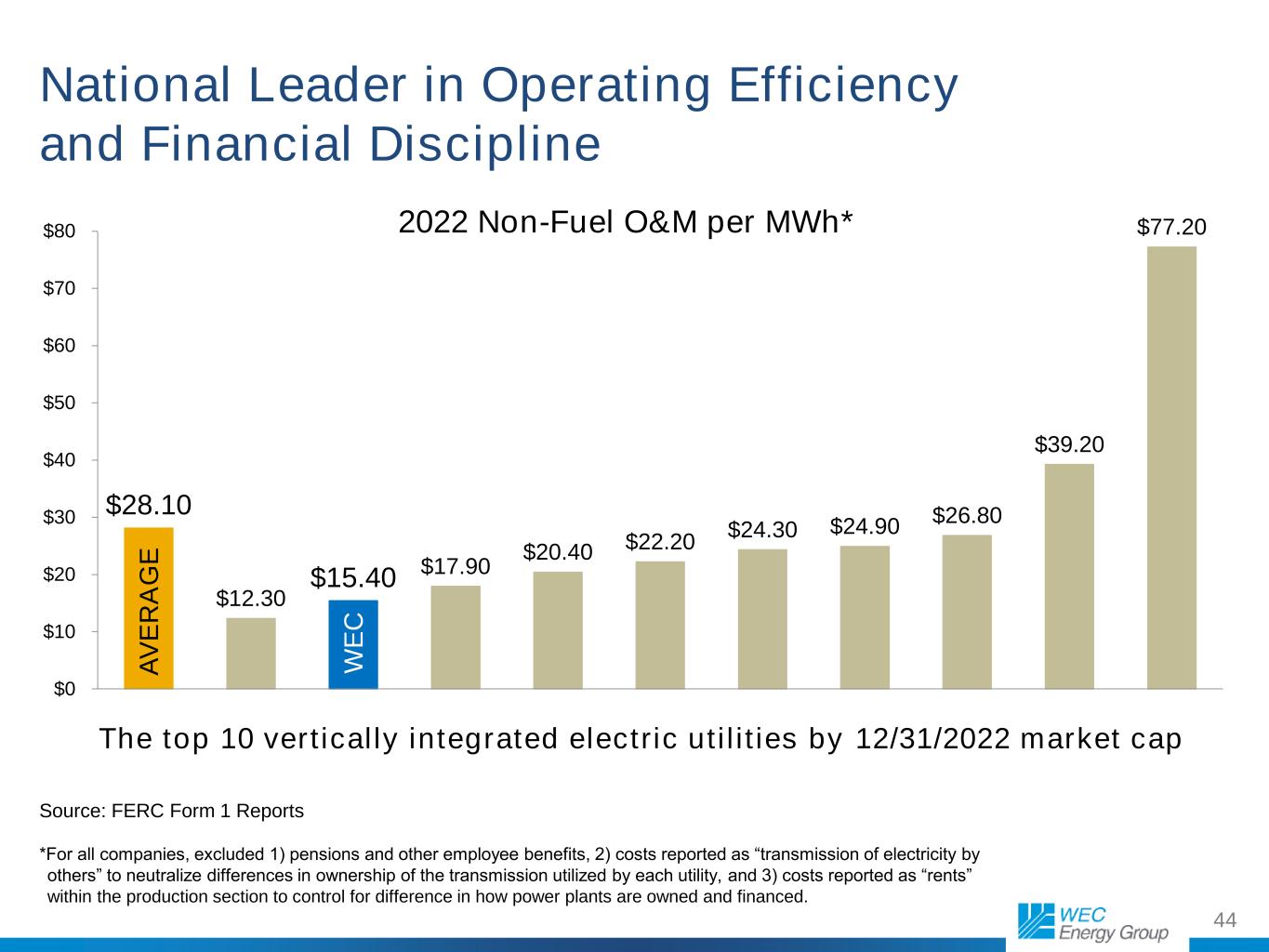

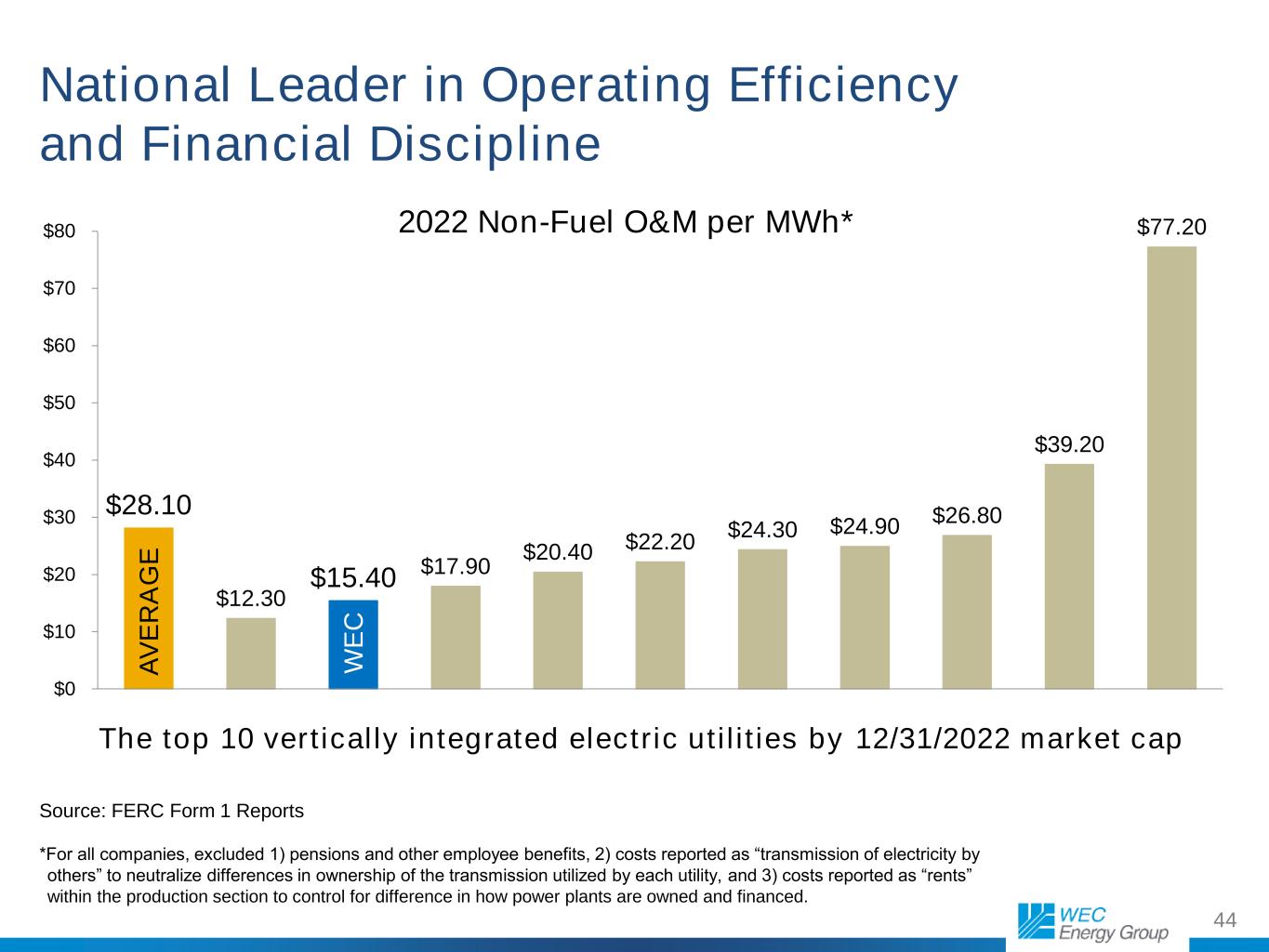

44 National Leader in Operating Efficiency and Financial Discipline $28.10 $12.30 $15.40 $17.90 $20.40 $22.20 $24.30 $24.90 $26.80 $39.20 $77.20 $0 $10 $20 $30 $40 $50 $60 $70 $80 2022 Non-Fuel O&M per MWh* Source: FERC Form 1 Reports *For all companies, excluded 1) pensions and other employee benefits, 2) costs reported as “transmission of electricity by others” to neutralize differences in ownership of the transmission utilized by each utility, and 3) costs reported as “rents” within the production section to control for difference in how power plants are owned and financed. The top 10 vertically integrated electric utilities by 12/31/2022 market cap W E C A V E R A G E

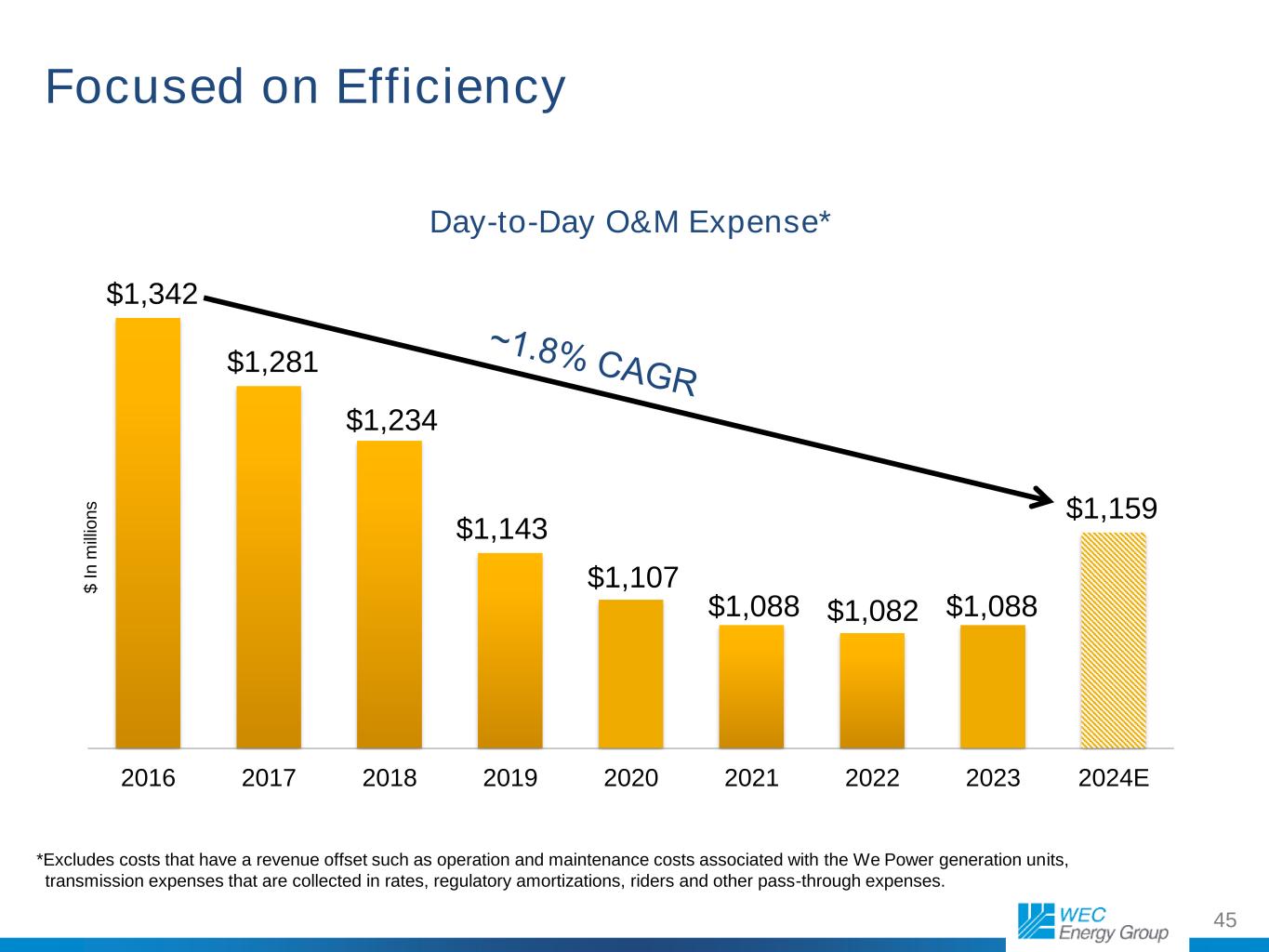

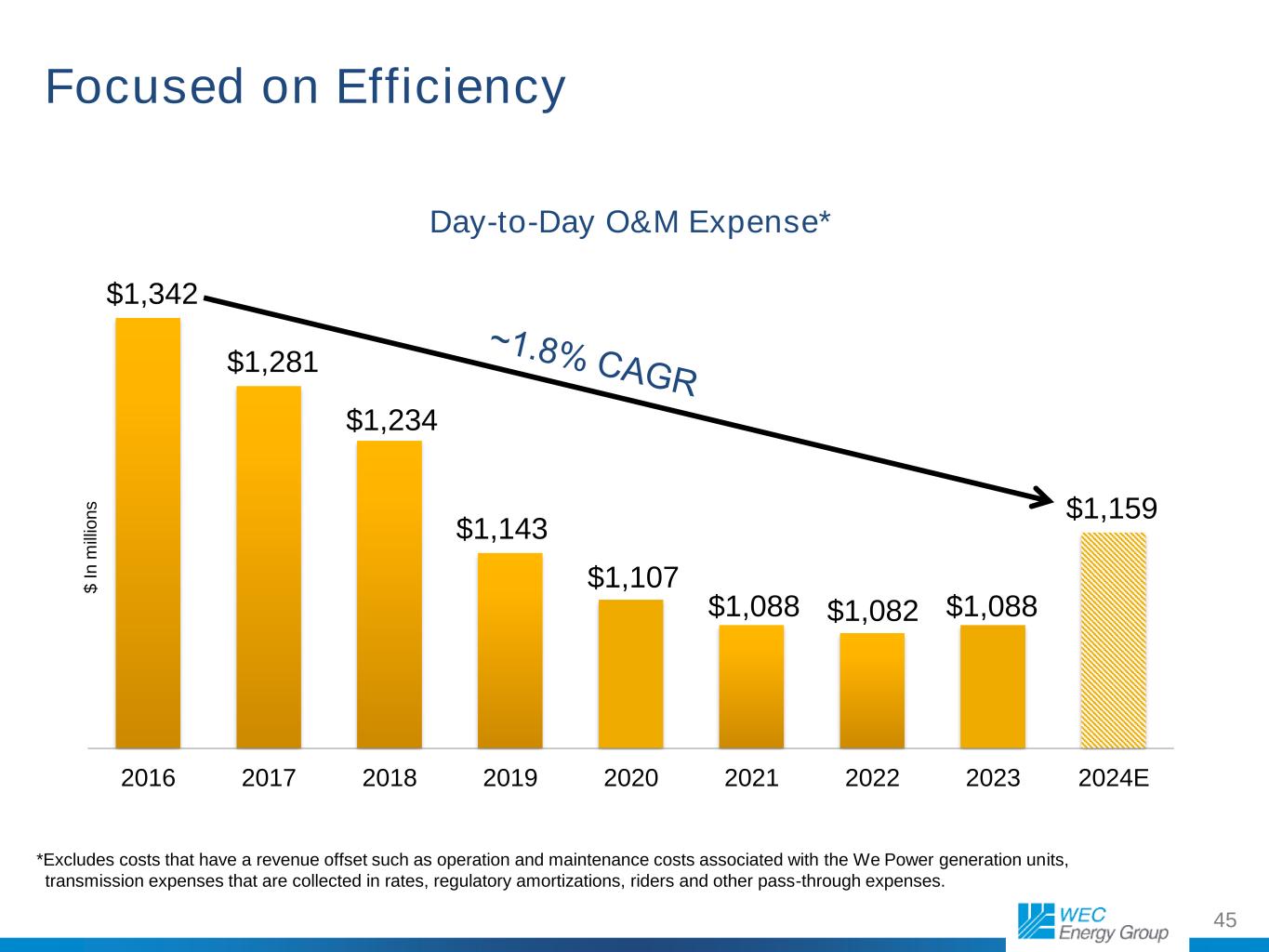

45 Focused on Efficiency $1,342 $1,281 $1,234 $1,143 $1,107 $1,088 $1,082 $1,088 $1,159 2016 2017 2018 2019 2020 2021 2022 2023 2024E $ I n m ill io n s *Excludes costs that have a revenue offset such as operation and maintenance costs associated with the We Power generation units, transmission expenses that are collected in rates, regulatory amortizations, riders and other pass-through expenses. Day-to-Day O&M Expense*

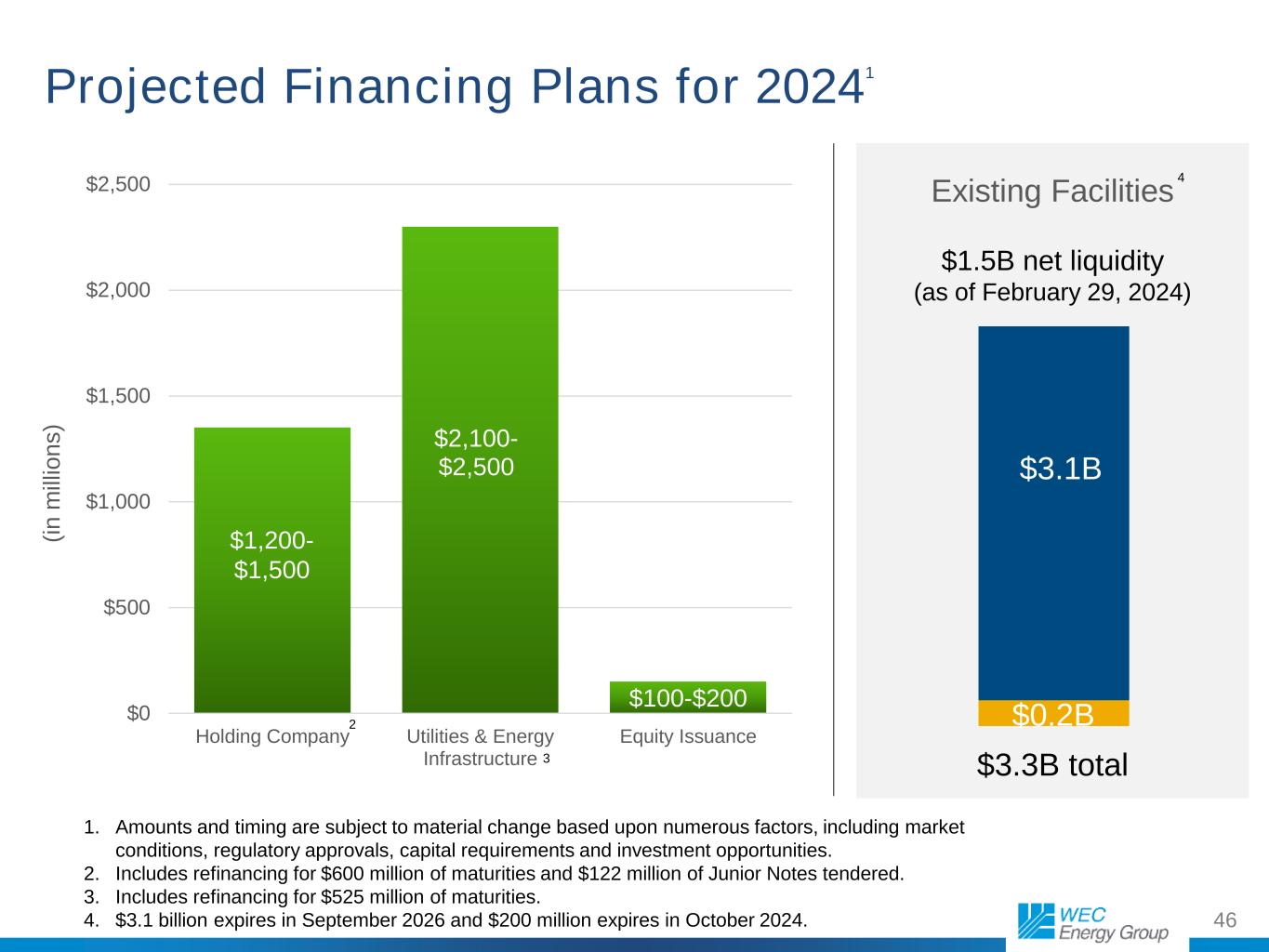

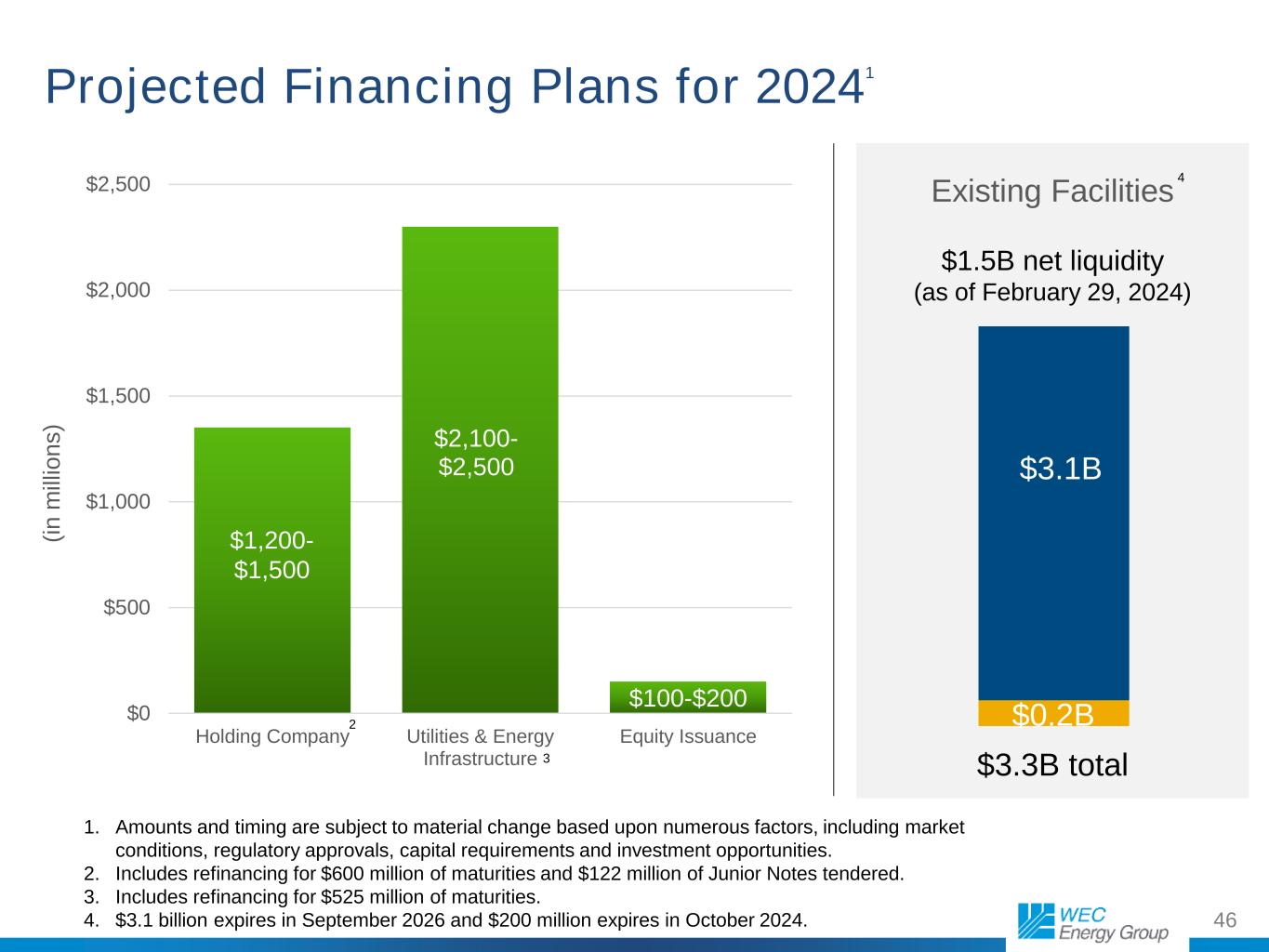

46 Projected Financing Plans for 2024 1 $2,100- $2,500 $100-$200 $0 $500 $1,000 $1,500 $2,000 $2,500 Holding Company Utilities & Energy Infrastructure Equity Issuance (i n m ill io n s ) $1,200- $1,500 2 1. Amounts and timing are subject to material change based upon numerous factors, including market conditions, regulatory approvals, capital requirements and investment opportunities. 2. Includes refinancing for $600 million of maturities and $122 million of Junior Notes tendered. 3. Includes refinancing for $525 million of maturities. 4. $3.1 billion expires in September 2026 and $200 million expires in October 2024. 3 Existing Facilities $1.5B net liquidity (as of February 29, 2024) $3.1B $0.2B $3.3B total 4

47 33% Large C&I by Segment Paper/Packaging 24% Mining/Minerals 11% Foundry (SIC 33) 10% Other Manufacturing 8% Metal (SIC 34,35,37) 7% Food/Agriculture 6% Medical 6% Education 4% Printing 2% Chemical 2% Office 2% Other 17% Balanced and Diverse Sales Mix Large C&I 33% Residential and Farm 31% Small C&I 36% 2023 Retail MWh Deliveries Mix* *Wisconsin segment includes Michigan electric and retail choice customers in the Upper Peninsula.

48 Estimated Decision Date Wisconsin (apps.psc.wi.gov) Decision on High Noon Solar and Battery Storage (Docket: 5-BS-276 filed 2/1/24) 2024 Illinois (icc.illinois.gov) Decision on limited rate review rehearing (Docket: PGL: 23-0069 granted 1/4/24) 6/2024 Decision on 2016 Rider QIP Reconciliation (Docket: 17-0137 filed 3/20/17) 2024 Decision on SMP Investigation (Docket: 24-0081 opened 1/31/24) Q1 2025 Michigan (michigan.gov/mpsc) Decision on Renegade Solar (UMERC Case: U-21081 filed 12/1/2023) 2024 Decision on proposed base rate increase of $17.6 million or 9.74% (MGU Case: U-21540 filed 3/1/2024) Q4 2024 Minnesota (mn.gov/puc) Regulatory Matters

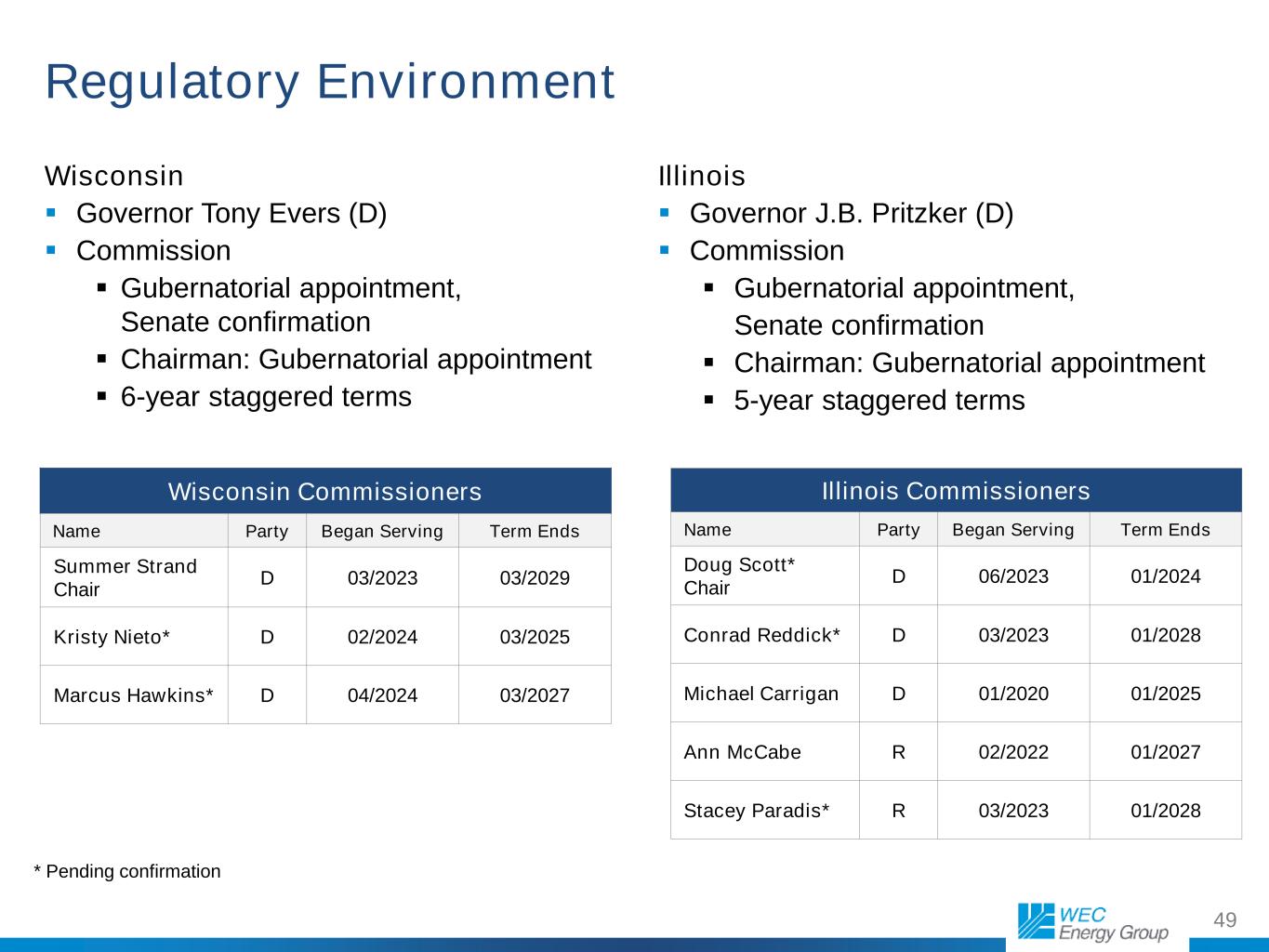

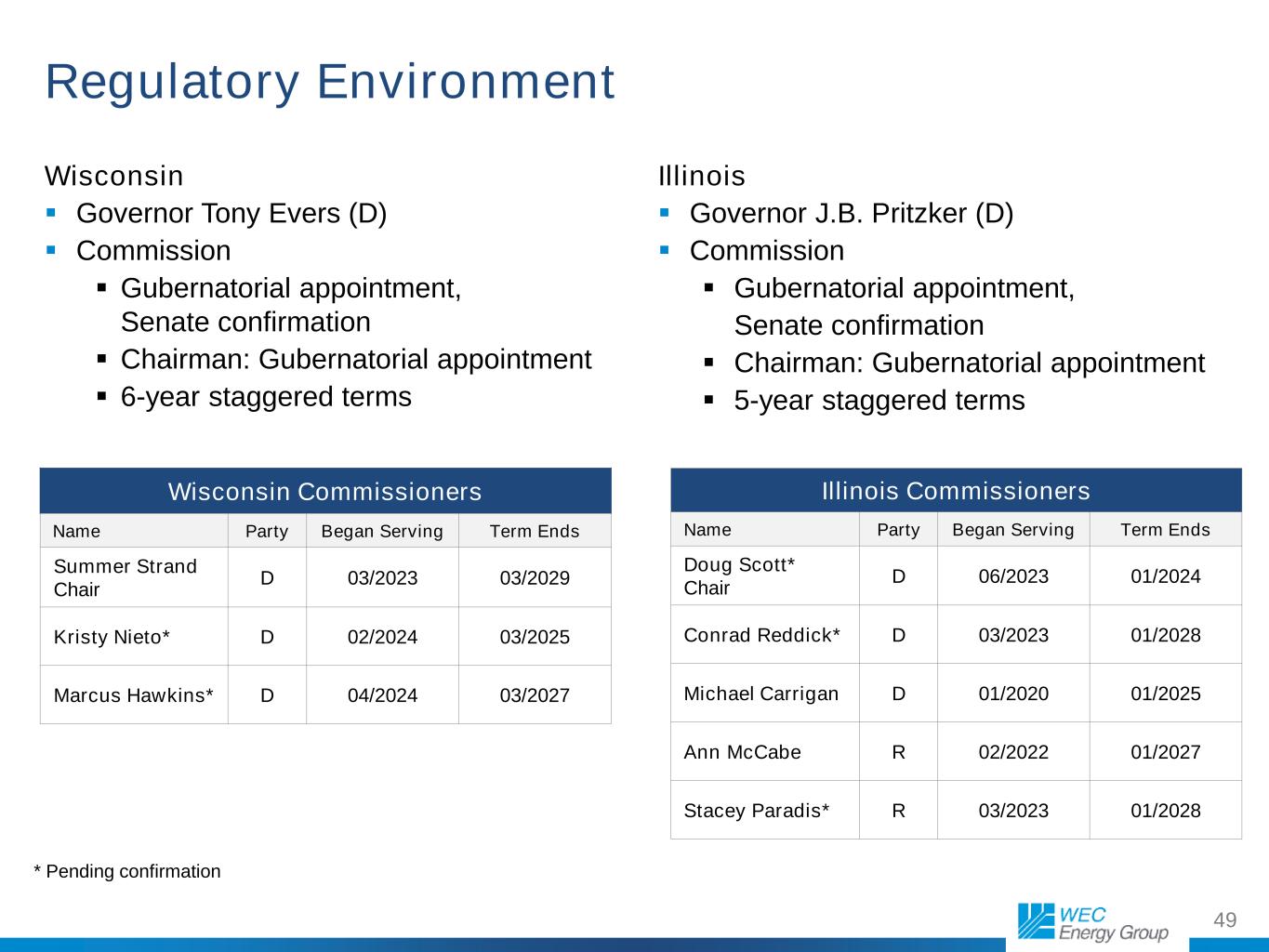

49 Regulatory Environment Wisconsin Governor Tony Evers (D) Commission Gubernatorial appointment, Senate confirmation Chairman: Gubernatorial appointment 6-year staggered terms Illinois Governor J.B. Pritzker (D) Commission Gubernatorial appointment, Senate confirmation Chairman: Gubernatorial appointment 5-year staggered terms Wisconsin Commissioners Name Party Began Serving Term Ends Summer Strand Chair D 03/2023 03/2029 Kristy Nieto* D 02/2024 03/2025 Marcus Hawkins* D 04/2024 03/2027 Illinois Commissioners Name Party Began Serving Term Ends Doug Scott* Chair D 06/2023 01/2024 Conrad Reddick* D 03/2023 01/2028 Michael Carrigan D 01/2020 01/2025 Ann McCabe R 02/2022 01/2027 Stacey Paradis* R 03/2023 01/2028 * Pending confirmation

50 Rate-Making Parameters by Company Utility Equity Layer1 Authorized ROE Wisconsin Electric 50.50%-55.50% 9.80% Wisconsin Public Service 50.50%-55.50% 9.80% Wisconsin Gas 50.50%-55.50% 9.80% Peoples Gas 50.79% 9.38% North Shore Gas 52.58% 9.38% Minnesota Energy Resources 53.00% 9.65% Michigan Gas Utilities 51.00% 9.80% We Power 53.00%-55.00% 12.70% American Transmission Company 50.00% 10.52% 1. Represents the equity component of capital; rates are set at the midpoint of any range. Constructive regulatory environments Earnings sharing mechanism at all Wisconsin utilities

51 Key Rate-Making Components Area Illinois– Gas Minnesota– Gas Michigan– Electric and Gas Wisconsin– Gas Wisconsin– Electric Gas Pipeline Replacement Rider MGU Bad Debt Rider ✓ Bad Debt Escrow Accounting Residential Residential Decoupling ✓ ✓ Fuel Cost Recovery 1 for 1 recovery of prudent fuel costs +/- 2% band MGP Site Clean Up Recovery ✓ ✓ ✓ ✓ N/A Invested Capital Tax Rider ✓ Forward-Looking Test Years ✓ ✓ ✓ 2 years 2 years Gas Utility Infrastructure Cost Rider Surcharge ✓ Earnings Sharing No sharing on first 15 bp above allowed ROE, 50/50 on next 60bp, 100% to customers beyond 75 bp

52 Reconciliation of EPS (GAAP) to Adjusted EPS (Non-GAAP) 2014 2015 2016 2017 2023 EPS – GAAP basis $2.59 $2.34 $ 2.96 $ 3.79 $4.22 Acquisition Costs 0.06 0.39 0.01 – Integrys Earnings (0.47) Impact of Additional Shares 0.47 Tax Benefit Related to Tax Cuts and Jobs Act of 2017 (0.65) Illinois Disallowance 0.41 Adjusted EPS – Non-GAAP Basis* $2.65 $2.73 $ 2.97 $ 3.14 $4.63 * WEC Energy Group has provided adjusted earnings per share (non-GAAP earnings per share) as a complement to, and not as an alternative to, earnings per share presented in accordance with GAAP. Adjusted earnings per share exclude, as applicable, (1) a one- time reduction in income tax expense related to a revaluation of our deferred taxes as a result of the Tax Cuts and Jobs Act of 2017; (2) costs related to the acquisition of Integrys Energy Group; (3) the results of operations of Integrys and its subsidiaries; (4) the additional shares of WEC Energy Group common stock that were issued as part of the acquisition; and (5) a non-cash charge related to the ICC’s disallowance of certain capital costs. None of these items are indicative of WEC Energy Group’s operating performance. Therefore, WEC Energy Group believes that the presentation of adjusted earnings per share is relevant and useful to investors to understand the company’s operating performance. Management uses such measures internally to evaluate the company’s performance and manage its operations.

53 Contact Information M. Beth Straka Senior Vice President – Investor Relations and Corporate Communications Beth.Straka@wecenergygroup.com 414-221-4639