00001071402025FYfalsehttp://wiley.com/20250430#RestructuringAndRelatedCreditsChargeshttp://wiley.com/20250430#RestructuringAndRelatedCreditsChargeshttp://fasb.org/us-gaap/2024#OtherNonoperatingIncomeExpense0.1iso4217:USDxbrli:sharesiso4217:USDxbrli:sharesjwa:segmentxbrli:purejwa:performanceObligationjwa:vote00001071402024-05-012025-04-300000107140jwa:ClassACommonStockParValue100PerShareMember2024-05-012025-04-300000107140jwa:ClassBCommonStockParValue100PerShareMember2024-05-012025-04-3000001071402024-10-310000107140jwa:ClassACommonStockParValue100PerShareMember2025-05-310000107140jwa:ClassBCommonStockParValue100PerShareMember2025-05-3100001071402025-04-3000001071402024-04-300000107140us-gaap:CommonClassAMember2024-04-300000107140us-gaap:CommonClassAMember2025-04-300000107140us-gaap:CommonClassBMember2025-04-300000107140us-gaap:CommonClassBMember2024-04-3000001071402023-05-012024-04-3000001071402022-05-012023-04-3000001071402023-04-3000001071402022-04-300000107140us-gaap:CommonStockMemberus-gaap:CommonClassAMember2022-04-300000107140us-gaap:CommonStockMemberus-gaap:CommonClassBMember2022-04-300000107140us-gaap:AdditionalPaidInCapitalMember2022-04-300000107140us-gaap:RetainedEarningsMember2022-04-300000107140us-gaap:AccumulatedOtherComprehensiveIncomeMember2022-04-300000107140us-gaap:TreasuryStockCommonMember2022-04-300000107140us-gaap:AdditionalPaidInCapitalMember2022-05-012023-04-300000107140us-gaap:RetainedEarningsMember2022-05-012023-04-300000107140us-gaap:TreasuryStockCommonMember2022-05-012023-04-300000107140us-gaap:CommonClassAMember2022-05-012023-04-300000107140us-gaap:RetainedEarningsMemberus-gaap:CommonClassAMember2022-05-012023-04-300000107140us-gaap:CommonClassBMember2022-05-012023-04-300000107140us-gaap:RetainedEarningsMemberus-gaap:CommonClassBMember2022-05-012023-04-300000107140us-gaap:CommonStockMemberus-gaap:CommonClassAMember2022-05-012023-04-300000107140us-gaap:CommonStockMemberus-gaap:CommonClassBMember2022-05-012023-04-300000107140us-gaap:AccumulatedOtherComprehensiveIncomeMember2022-05-012023-04-300000107140us-gaap:CommonStockMemberus-gaap:CommonClassAMember2023-04-300000107140us-gaap:CommonStockMemberus-gaap:CommonClassBMember2023-04-300000107140us-gaap:AdditionalPaidInCapitalMember2023-04-300000107140us-gaap:RetainedEarningsMember2023-04-300000107140us-gaap:AccumulatedOtherComprehensiveIncomeMember2023-04-300000107140us-gaap:TreasuryStockCommonMember2023-04-300000107140us-gaap:AdditionalPaidInCapitalMember2023-05-012024-04-300000107140us-gaap:RetainedEarningsMember2023-05-012024-04-300000107140us-gaap:TreasuryStockCommonMember2023-05-012024-04-300000107140us-gaap:CommonClassAMember2023-05-012024-04-300000107140us-gaap:RetainedEarningsMemberus-gaap:CommonClassAMember2023-05-012024-04-300000107140us-gaap:CommonClassBMember2023-05-012024-04-300000107140us-gaap:RetainedEarningsMemberus-gaap:CommonClassBMember2023-05-012024-04-300000107140us-gaap:CommonStockMemberus-gaap:CommonClassAMember2023-05-012024-04-300000107140us-gaap:CommonStockMemberus-gaap:CommonClassBMember2023-05-012024-04-300000107140us-gaap:AccumulatedOtherComprehensiveIncomeMember2023-05-012024-04-300000107140us-gaap:CommonStockMemberus-gaap:CommonClassAMember2024-04-300000107140us-gaap:CommonStockMemberus-gaap:CommonClassBMember2024-04-300000107140us-gaap:AdditionalPaidInCapitalMember2024-04-300000107140us-gaap:RetainedEarningsMember2024-04-300000107140us-gaap:AccumulatedOtherComprehensiveIncomeMember2024-04-300000107140us-gaap:TreasuryStockCommonMember2024-04-300000107140us-gaap:AdditionalPaidInCapitalMember2024-05-012025-04-300000107140us-gaap:RetainedEarningsMember2024-05-012025-04-300000107140us-gaap:TreasuryStockCommonMember2024-05-012025-04-300000107140us-gaap:CommonClassAMember2024-05-012025-04-300000107140us-gaap:RetainedEarningsMemberus-gaap:CommonClassAMember2024-05-012025-04-300000107140us-gaap:CommonClassBMember2024-05-012025-04-300000107140us-gaap:RetainedEarningsMemberus-gaap:CommonClassBMember2024-05-012025-04-300000107140us-gaap:CommonStockMemberus-gaap:CommonClassAMember2024-05-012025-04-300000107140us-gaap:CommonStockMemberus-gaap:CommonClassBMember2024-05-012025-04-300000107140us-gaap:AccumulatedOtherComprehensiveIncomeMember2024-05-012025-04-300000107140us-gaap:CommonStockMemberus-gaap:CommonClassAMember2025-04-300000107140us-gaap:CommonStockMemberus-gaap:CommonClassBMember2025-04-300000107140us-gaap:AdditionalPaidInCapitalMember2025-04-300000107140us-gaap:RetainedEarningsMember2025-04-300000107140us-gaap:AccumulatedOtherComprehensiveIncomeMember2025-04-300000107140us-gaap:TreasuryStockCommonMember2025-04-300000107140srt:MinimumMemberjwa:BookCompositionCostsMember2024-05-012025-04-300000107140srt:MaximumMemberjwa:BookCompositionCostsMember2024-05-012025-04-300000107140srt:WeightedAverageMemberjwa:OtherProductDevelopmentCostsMember2024-05-012025-04-300000107140us-gaap:CostOfSalesMember2024-05-012025-04-300000107140us-gaap:CostOfSalesMember2023-05-012024-04-300000107140us-gaap:CostOfSalesMember2022-05-012023-04-300000107140us-gaap:GeneralAndAdministrativeExpenseMember2024-05-012025-04-300000107140us-gaap:GeneralAndAdministrativeExpenseMember2023-05-012024-04-300000107140us-gaap:GeneralAndAdministrativeExpenseMember2022-05-012023-04-300000107140srt:MinimumMemberus-gaap:SoftwareAndSoftwareDevelopmentCostsMember2025-04-300000107140srt:MaximumMemberus-gaap:SoftwareAndSoftwareDevelopmentCostsMember2025-04-300000107140srt:MinimumMemberus-gaap:ComputerEquipmentMember2025-04-300000107140srt:MaximumMemberus-gaap:ComputerEquipmentMember2025-04-300000107140srt:MaximumMemberjwa:BuildingAndLeaseholdImprovementsMember2025-04-300000107140srt:MinimumMemberjwa:FurnitureFixturesAndWarehouseEquipmentMember2025-04-300000107140srt:MaximumMemberjwa:FurnitureFixturesAndWarehouseEquipmentMember2025-04-300000107140srt:MinimumMemberus-gaap:SoftwareDevelopmentMember2025-04-300000107140srt:MaximumMemberus-gaap:SoftwareDevelopmentMember2025-04-300000107140us-gaap:ArtisticRelatedIntangibleAssetsMembersrt:WeightedAverageMember2025-04-300000107140us-gaap:CustomerRelationshipsMembersrt:WeightedAverageMember2025-04-300000107140us-gaap:DevelopedTechnologyRightsMember2025-04-300000107140us-gaap:TrademarksAndTradeNamesMembersrt:WeightedAverageMember2025-04-300000107140us-gaap:NoncompeteAgreementsMembersrt:WeightedAverageMember2025-04-300000107140us-gaap:PerformanceSharesMember2024-05-012025-04-300000107140us-gaap:OperatingSegmentsMemberjwa:ResearchPublishingMemberjwa:ResearchSegmentMember2024-05-012025-04-300000107140us-gaap:OperatingSegmentsMemberjwa:ResearchPublishingMemberjwa:ResearchSegmentMember2023-05-012024-04-300000107140us-gaap:OperatingSegmentsMemberjwa:ResearchPublishingMemberjwa:ResearchSegmentMember2022-05-012023-04-300000107140us-gaap:OperatingSegmentsMemberjwa:ResearchSolutionsMemberjwa:ResearchSegmentMember2024-05-012025-04-300000107140us-gaap:OperatingSegmentsMemberjwa:ResearchSolutionsMemberjwa:ResearchSegmentMember2023-05-012024-04-300000107140us-gaap:OperatingSegmentsMemberjwa:ResearchSolutionsMemberjwa:ResearchSegmentMember2022-05-012023-04-300000107140us-gaap:OperatingSegmentsMemberjwa:ResearchSegmentMember2024-05-012025-04-300000107140us-gaap:OperatingSegmentsMemberjwa:ResearchSegmentMember2023-05-012024-04-300000107140us-gaap:OperatingSegmentsMemberjwa:ResearchSegmentMember2022-05-012023-04-300000107140us-gaap:OperatingSegmentsMemberjwa:AcademicMemberjwa:LearningSegmentMember2024-05-012025-04-300000107140us-gaap:OperatingSegmentsMemberjwa:AcademicMemberjwa:LearningSegmentMember2023-05-012024-04-300000107140us-gaap:OperatingSegmentsMemberjwa:AcademicMemberjwa:LearningSegmentMember2022-05-012023-04-300000107140us-gaap:OperatingSegmentsMemberjwa:ProfessionalMemberjwa:LearningSegmentMember2024-05-012025-04-300000107140us-gaap:OperatingSegmentsMemberjwa:ProfessionalMemberjwa:LearningSegmentMember2023-05-012024-04-300000107140us-gaap:OperatingSegmentsMemberjwa:ProfessionalMemberjwa:LearningSegmentMember2022-05-012023-04-300000107140us-gaap:OperatingSegmentsMemberjwa:LearningSegmentMember2024-05-012025-04-300000107140us-gaap:OperatingSegmentsMemberjwa:LearningSegmentMember2023-05-012024-04-300000107140us-gaap:OperatingSegmentsMemberjwa:LearningSegmentMember2022-05-012023-04-300000107140us-gaap:OperatingSegmentsMemberjwa:HeldForSaleOrSoldSegmentMember2024-05-012025-04-300000107140us-gaap:OperatingSegmentsMemberjwa:HeldForSaleOrSoldSegmentMember2023-05-012024-04-300000107140us-gaap:OperatingSegmentsMemberjwa:HeldForSaleOrSoldSegmentMember2022-05-012023-04-300000107140us-gaap:ProductConcentrationRiskMemberjwa:ResearchPublishingMemberus-gaap:RevenueFromContractWithCustomerMember2024-05-012025-04-300000107140jwa:ResearchPublishingMemberjwa:ResearchSegmentMemberjwa:JournalRevenueMember2024-05-012025-04-300000107140jwa:ResearchPublishingMemberjwa:LearningSegmentMemberjwa:JournalRevenueMember2024-05-012025-04-300000107140us-gaap:OperatingSegmentsMemberjwa:ResearchSolutionsProductsAndServicesMemberjwa:ResearchSegmentMember2024-05-012025-04-300000107140us-gaap:ProductConcentrationRiskMemberjwa:EducationPublishingMemberus-gaap:RevenueFromContractWithCustomerMember2024-05-012025-04-300000107140jwa:EducationPublishingMembersrt:MinimumMemberjwa:ResearchSegmentMemberjwa:AtyponPlatformsAndServicesMember2024-05-012025-04-300000107140jwa:EducationPublishingMembersrt:MaximumMemberjwa:ResearchSegmentMemberjwa:AtyponPlatformsAndServicesMember2024-05-012025-04-300000107140us-gaap:OperatingSegmentsMemberjwa:AcademicProductsMemberjwa:LearningSegmentMember2024-05-012025-04-300000107140us-gaap:ProductConcentrationRiskMemberjwa:AcademicProductsMemberus-gaap:RevenueFromContractWithCustomerMember2024-05-012025-04-300000107140us-gaap:ProductConcentrationRiskMemberjwa:DigitalCoursewareMemberus-gaap:RevenueFromContractWithCustomerMember2024-05-012025-04-300000107140us-gaap:OperatingSegmentsMemberjwa:ProfessionalProductsMemberjwa:LearningSegmentMember2024-05-012025-04-300000107140us-gaap:ProductConcentrationRiskMemberjwa:ProfessionalProductsMemberus-gaap:RevenueFromContractWithCustomerMember2024-05-012025-04-300000107140us-gaap:ProductConcentrationRiskMemberjwa:ProfessionalProductsMixMemberus-gaap:RevenueFromContractWithCustomerMember2024-05-012025-04-300000107140us-gaap:DisposalGroupHeldForSaleOrDisposedOfBySaleNotDiscontinuedOperationsMember2024-05-012025-04-3000001071402025-05-012025-04-3000001071402026-05-012025-04-300000107140jwa:CrossKnowledgeMember2024-05-012025-04-300000107140jwa:CrossKnowledgeMember2023-05-012024-04-300000107140jwa:CrossKnowledgeMember2022-05-012023-04-300000107140jwa:WileyEdgeMember2024-05-012025-04-300000107140jwa:WileyEdgeMember2023-05-012024-04-300000107140jwa:WileyEdgeMember2022-05-012023-04-300000107140jwa:UniversityServicesMember2024-05-012025-04-300000107140jwa:UniversityServicesMember2023-05-012024-04-300000107140jwa:UniversityServicesMember2022-05-012023-04-300000107140jwa:TuitionManagerMember2024-05-012025-04-300000107140jwa:TuitionManagerMember2023-05-012024-04-300000107140jwa:TuitionManagerMember2022-05-012023-04-300000107140jwa:TestPrepAndAdvancementCoursesMember2024-05-012025-04-300000107140jwa:TestPrepAndAdvancementCoursesMember2023-05-012024-04-300000107140jwa:TestPrepAndAdvancementCoursesMember2022-05-012023-04-300000107140jwa:SaleOfAssetsMember2024-05-012025-04-300000107140jwa:SaleOfAssetsMember2023-05-012024-04-300000107140jwa:SaleOfAssetsMember2022-05-012023-04-300000107140us-gaap:DisposalGroupDisposedOfBySaleNotDiscontinuedOperationsMemberjwa:CrossKnowledgeMember2025-04-300000107140us-gaap:DisposalGroupDisposedOfBySaleNotDiscontinuedOperationsMemberjwa:CrossKnowledgeMember2024-05-012025-04-300000107140us-gaap:DisposalGroupHeldforsaleNotDiscontinuedOperationsMemberjwa:CrossKnowledgeMember2024-05-012025-04-300000107140us-gaap:DisposalGroupHeldforsaleNotDiscontinuedOperationsMemberjwa:CrossKnowledgeMember2023-05-012024-04-300000107140us-gaap:DisposalGroupDisposedOfBySaleNotDiscontinuedOperationsMemberjwa:WileyEdgeMember2025-04-300000107140us-gaap:DisposalGroupDisposedOfBySaleNotDiscontinuedOperationsMemberjwa:WileyEdgeMember2025-04-302025-04-300000107140jwa:WileyEdgeMemberjwa:EarnoutMemberus-gaap:DisposalGroupDisposedOfBySaleNotDiscontinuedOperationsMember2025-04-300000107140jwa:WileyEdgeMemberjwa:InspiritSellerNoteMemberus-gaap:DisposalGroupDisposedOfBySaleNotDiscontinuedOperationsMember2024-05-310000107140jwa:WileyEdgeMemberjwa:InspiritSellerNoteMemberus-gaap:DisposalGroupDisposedOfBySaleNotDiscontinuedOperationsMember2024-05-312024-05-310000107140jwa:WileyEdgeMemberjwa:EarnoutMemberus-gaap:DisposalGroupDisposedOfBySaleNotDiscontinuedOperationsMember2024-05-310000107140us-gaap:DisposalGroupDisposedOfBySaleNotDiscontinuedOperationsMemberjwa:WileyEdgeMember2025-01-310000107140us-gaap:DisposalGroupDisposedOfBySaleNotDiscontinuedOperationsMemberjwa:WileyEdgeMember2024-05-012025-04-300000107140us-gaap:DisposalGroupHeldforsaleNotDiscontinuedOperationsMemberjwa:WileyEdgeMember2023-05-012024-04-300000107140us-gaap:DisposalGroupDisposedOfBySaleNotDiscontinuedOperationsMemberjwa:UniversityServicesMember2023-05-012024-04-300000107140jwa:UniversityServicesMemberjwa:TVGInvestmentMemberus-gaap:DisposalGroupDisposedOfBySaleNotDiscontinuedOperationsMember2024-01-010000107140jwa:UniversityServicesMemberjwa:EarnoutMemberus-gaap:DisposalGroupDisposedOfBySaleNotDiscontinuedOperationsMember2025-04-300000107140jwa:UniversityServicesMemberus-gaap:PrepaidExpensesAndOtherCurrentAssetsMemberus-gaap:DisposalGroupDisposedOfBySaleNotDiscontinuedOperationsMember2025-04-300000107140jwa:UniversityServicesMemberus-gaap:DisposalGroupDisposedOfBySaleNotDiscontinuedOperationsMemberus-gaap:SubsequentEventMember2025-06-050000107140us-gaap:DisposalGroupDisposedOfBySaleNotDiscontinuedOperationsMemberjwa:UniversityServicesMember2024-05-012025-04-300000107140us-gaap:DisposalGroupDisposedOfBySaleNotDiscontinuedOperationsMemberjwa:TuitionManagerMember2023-05-312023-05-310000107140us-gaap:DisposalGroupDisposedOfBySaleNotDiscontinuedOperationsMemberjwa:TuitionManagerMember2023-05-012024-04-300000107140us-gaap:DisposalGroupDisposedOfBySaleNotDiscontinuedOperationsMemberjwa:TuitionManagerMember2024-05-012025-04-300000107140us-gaap:DisposalGroupDisposedOfBySaleNotDiscontinuedOperationsMemberjwa:WileysEffectiveLearningAndAdvancementCoursesBusinessMember2023-02-282023-04-300000107140us-gaap:DisposalGroupDisposedOfBySaleNotDiscontinuedOperationsMemberjwa:WileysEffectiveLearningAndAdvancementCoursesBusinessMember2023-02-282023-03-310000107140us-gaap:DisposalGroupDisposedOfBySaleNotDiscontinuedOperationsMemberjwa:WileysEffectiveLearningAndAdvancementCoursesBusinessMember2023-04-012023-04-300000107140us-gaap:DisposalGroupHeldforsaleNotDiscontinuedOperationsMemberjwa:CrossKnowledgeMember2024-04-300000107140us-gaap:DisposalGroupHeldforsaleNotDiscontinuedOperationsMemberjwa:WileyEdgeMember2024-04-300000107140us-gaap:DisposalGroupHeldforsaleNotDiscontinuedOperationsMember2024-04-300000107140jwa:SaleOfAssetsMember2024-08-012024-10-310000107140us-gaap:AccumulatedTranslationAdjustmentMember2022-04-300000107140us-gaap:AccumulatedDefinedBenefitPlansAdjustmentNetUnamortizedGainLossMember2022-04-300000107140us-gaap:AccumulatedGainLossNetCashFlowHedgeParentMember2022-04-300000107140us-gaap:AccumulatedTranslationAdjustmentMember2022-05-012023-04-300000107140us-gaap:AccumulatedDefinedBenefitPlansAdjustmentNetUnamortizedGainLossMember2022-05-012023-04-300000107140us-gaap:AccumulatedGainLossNetCashFlowHedgeParentMember2022-05-012023-04-300000107140us-gaap:AccumulatedTranslationAdjustmentMember2023-04-300000107140us-gaap:AccumulatedDefinedBenefitPlansAdjustmentNetUnamortizedGainLossMember2023-04-300000107140us-gaap:AccumulatedGainLossNetCashFlowHedgeParentMember2023-04-300000107140us-gaap:AccumulatedTranslationAdjustmentMember2023-05-012024-04-300000107140us-gaap:AccumulatedDefinedBenefitPlansAdjustmentNetUnamortizedGainLossMember2023-05-012024-04-300000107140us-gaap:AccumulatedGainLossNetCashFlowHedgeParentMember2023-05-012024-04-300000107140us-gaap:AccumulatedTranslationAdjustmentMember2024-04-300000107140us-gaap:AccumulatedDefinedBenefitPlansAdjustmentNetUnamortizedGainLossMember2024-04-300000107140us-gaap:AccumulatedGainLossNetCashFlowHedgeParentMember2024-04-300000107140us-gaap:AccumulatedTranslationAdjustmentMember2024-05-012025-04-300000107140us-gaap:AccumulatedDefinedBenefitPlansAdjustmentNetUnamortizedGainLossMember2024-05-012025-04-300000107140us-gaap:AccumulatedGainLossNetCashFlowHedgeParentMember2024-05-012025-04-300000107140us-gaap:AccumulatedTranslationAdjustmentMember2025-04-300000107140us-gaap:AccumulatedDefinedBenefitPlansAdjustmentNetUnamortizedGainLossMember2025-04-300000107140us-gaap:AccumulatedGainLossNetCashFlowHedgeParentMember2025-04-300000107140jwa:WileyEdgeAndCrossKnowledgeMember2024-05-012025-04-300000107140us-gaap:ReclassificationOutOfAccumulatedOtherComprehensiveIncomeMember2024-05-012025-04-300000107140us-gaap:ReclassificationOutOfAccumulatedOtherComprehensiveIncomeMember2023-05-012024-04-300000107140us-gaap:ReclassificationOutOfAccumulatedOtherComprehensiveIncomeMember2022-05-012023-04-300000107140jwa:GlobalRestructuringProgramMember2024-05-012025-04-300000107140jwa:GlobalRestructuringProgramMemberus-gaap:OperatingSegmentsMemberjwa:ResearchSegmentMember2024-05-012025-04-300000107140jwa:GlobalRestructuringProgramMemberus-gaap:OperatingSegmentsMemberjwa:ResearchSegmentMember2023-05-012024-04-300000107140jwa:GlobalRestructuringProgramMemberus-gaap:OperatingSegmentsMemberjwa:ResearchSegmentMember2022-05-012023-04-300000107140jwa:GlobalRestructuringProgramMemberus-gaap:OperatingSegmentsMemberjwa:ResearchSegmentMember2025-04-300000107140jwa:GlobalRestructuringProgramMemberus-gaap:OperatingSegmentsMemberjwa:LearningSegmentMember2024-05-012025-04-300000107140jwa:GlobalRestructuringProgramMemberus-gaap:OperatingSegmentsMemberjwa:LearningSegmentMember2023-05-012024-04-300000107140jwa:GlobalRestructuringProgramMemberus-gaap:OperatingSegmentsMemberjwa:LearningSegmentMember2022-05-012023-04-300000107140jwa:GlobalRestructuringProgramMemberus-gaap:OperatingSegmentsMemberjwa:LearningSegmentMember2025-04-300000107140jwa:GlobalRestructuringProgramMemberus-gaap:OperatingSegmentsMemberjwa:HeldForSaleOrSoldSegmentMember2024-05-012025-04-300000107140jwa:GlobalRestructuringProgramMemberus-gaap:OperatingSegmentsMemberjwa:HeldForSaleOrSoldSegmentMember2023-05-012024-04-300000107140jwa:GlobalRestructuringProgramMemberus-gaap:OperatingSegmentsMemberjwa:HeldForSaleOrSoldSegmentMember2022-05-012023-04-300000107140jwa:GlobalRestructuringProgramMemberus-gaap:OperatingSegmentsMemberjwa:HeldForSaleOrSoldSegmentMember2025-04-300000107140us-gaap:CorporateNonSegmentMemberjwa:GlobalRestructuringProgramMember2024-05-012025-04-300000107140us-gaap:CorporateNonSegmentMemberjwa:GlobalRestructuringProgramMember2023-05-012024-04-300000107140us-gaap:CorporateNonSegmentMemberjwa:GlobalRestructuringProgramMember2022-05-012023-04-300000107140us-gaap:CorporateNonSegmentMemberjwa:GlobalRestructuringProgramMember2025-04-300000107140jwa:GlobalRestructuringProgramMember2023-05-012024-04-300000107140jwa:GlobalRestructuringProgramMember2022-05-012023-04-300000107140jwa:GlobalRestructuringProgramMember2025-04-300000107140us-gaap:EmployeeSeveranceMemberjwa:GlobalRestructuringProgramMember2024-05-012025-04-300000107140us-gaap:EmployeeSeveranceMemberjwa:GlobalRestructuringProgramMember2023-05-012024-04-300000107140us-gaap:EmployeeSeveranceMemberjwa:GlobalRestructuringProgramMember2022-05-012023-04-300000107140us-gaap:EmployeeSeveranceMemberjwa:GlobalRestructuringProgramMember2025-04-300000107140jwa:ImpairmentOfOperatingLeaseRightOfUseAssetsAndPropertyAndEquipmentMemberjwa:GlobalRestructuringProgramMember2024-05-012025-04-300000107140jwa:ImpairmentOfOperatingLeaseRightOfUseAssetsAndPropertyAndEquipmentMemberjwa:GlobalRestructuringProgramMember2023-05-012024-04-300000107140jwa:ImpairmentOfOperatingLeaseRightOfUseAssetsAndPropertyAndEquipmentMemberjwa:GlobalRestructuringProgramMember2022-05-012023-04-300000107140jwa:ImpairmentOfOperatingLeaseRightOfUseAssetsAndPropertyAndEquipmentMemberjwa:GlobalRestructuringProgramMember2025-04-300000107140jwa:AccelerationOfExpenseRelatedToOperatingLeaseRightOfUseAssetsAndPropertyAndEquipmentMemberjwa:GlobalRestructuringProgramMember2024-05-012025-04-300000107140jwa:AccelerationOfExpenseRelatedToOperatingLeaseRightOfUseAssetsAndPropertyAndEquipmentMemberjwa:GlobalRestructuringProgramMember2023-05-012024-04-300000107140jwa:AccelerationOfExpenseRelatedToOperatingLeaseRightOfUseAssetsAndPropertyAndEquipmentMemberjwa:GlobalRestructuringProgramMember2022-05-012023-04-300000107140jwa:AccelerationOfExpenseRelatedToOperatingLeaseRightOfUseAssetsAndPropertyAndEquipmentMemberjwa:GlobalRestructuringProgramMember2025-04-300000107140us-gaap:FacilityClosingMemberjwa:GlobalRestructuringProgramMember2024-05-012025-04-300000107140us-gaap:FacilityClosingMemberjwa:GlobalRestructuringProgramMember2023-05-012024-04-300000107140us-gaap:FacilityClosingMemberjwa:GlobalRestructuringProgramMember2022-05-012023-04-300000107140us-gaap:FacilityClosingMemberjwa:GlobalRestructuringProgramMember2025-04-300000107140jwa:ConsultingCostsMemberjwa:GlobalRestructuringProgramMember2024-05-012025-04-300000107140jwa:ConsultingCostsMemberjwa:GlobalRestructuringProgramMember2023-05-012024-04-300000107140jwa:ConsultingCostsMemberjwa:GlobalRestructuringProgramMember2022-05-012023-04-300000107140jwa:ConsultingCostsMemberjwa:GlobalRestructuringProgramMember2025-04-300000107140us-gaap:OtherRestructuringMemberjwa:GlobalRestructuringProgramMember2024-05-012025-04-300000107140us-gaap:OtherRestructuringMemberjwa:GlobalRestructuringProgramMember2023-05-012024-04-300000107140us-gaap:OtherRestructuringMemberjwa:GlobalRestructuringProgramMember2022-05-012023-04-300000107140us-gaap:OtherRestructuringMemberjwa:GlobalRestructuringProgramMember2025-04-300000107140jwa:GlobalRestructuringProgramMember2024-04-300000107140jwa:GlobalRestructuringProgramMember2023-04-300000107140us-gaap:EmployeeSeveranceMemberjwa:GlobalRestructuringProgramMember2024-04-300000107140jwa:ConsultingCostsMemberjwa:GlobalRestructuringProgramMember2024-04-300000107140us-gaap:OtherRestructuringMemberjwa:GlobalRestructuringProgramMember2024-04-300000107140jwa:BusinessOptimizationProgramMember2024-05-012025-04-300000107140jwa:BusinessOptimizationProgramMember2023-05-012024-04-300000107140jwa:BusinessOptimizationProgramMember2022-05-012023-04-300000107140jwa:BookCompositionCostsMember2025-04-300000107140jwa:BookCompositionCostsMember2024-04-300000107140jwa:SoftwareCostsMember2025-04-300000107140jwa:SoftwareCostsMember2024-04-300000107140jwa:ContentDevelopmentCostsMember2025-04-300000107140jwa:ContentDevelopmentCostsMember2024-04-300000107140us-gaap:SoftwareDevelopmentMember2025-04-300000107140us-gaap:SoftwareDevelopmentMember2024-04-300000107140us-gaap:ComputerEquipmentMember2025-04-300000107140us-gaap:ComputerEquipmentMember2024-04-300000107140jwa:BuildingAndLeaseholdImprovementsMember2025-04-300000107140jwa:BuildingAndLeaseholdImprovementsMember2024-04-300000107140jwa:FurnitureFixturesAndWarehouseEquipmentMember2025-04-300000107140jwa:FurnitureFixturesAndWarehouseEquipmentMember2024-04-300000107140us-gaap:LandAndLandImprovementsMember2025-04-300000107140us-gaap:LandAndLandImprovementsMember2024-04-300000107140jwa:RestructuringAndRelatedChargesMember2024-05-012025-04-300000107140us-gaap:SellingGeneralAndAdministrativeExpensesMember2023-05-012024-04-300000107140jwa:RestructuringAndRelatedChargesMember2023-05-012024-04-300000107140jwa:ResearchSegmentMember2023-04-300000107140jwa:LearningSegmentMember2023-04-300000107140us-gaap:ReportableSegmentAggregationBeforeOtherOperatingSegmentMember2023-04-300000107140jwa:HeldForSaleOrSoldSegmentMember2023-04-300000107140jwa:ResearchSegmentMember2023-05-012024-04-300000107140jwa:LearningSegmentMember2023-05-012024-04-300000107140us-gaap:ReportableSegmentAggregationBeforeOtherOperatingSegmentMember2023-05-012024-04-300000107140jwa:HeldForSaleOrSoldSegmentMember2023-05-012024-04-300000107140jwa:ResearchSegmentMember2024-04-300000107140jwa:LearningSegmentMember2024-04-300000107140us-gaap:ReportableSegmentAggregationBeforeOtherOperatingSegmentMember2024-04-300000107140jwa:HeldForSaleOrSoldSegmentMember2024-04-300000107140jwa:ResearchSegmentMember2024-05-012025-04-300000107140jwa:LearningSegmentMember2024-05-012025-04-300000107140us-gaap:ReportableSegmentAggregationBeforeOtherOperatingSegmentMember2024-05-012025-04-300000107140jwa:HeldForSaleOrSoldSegmentMember2024-05-012025-04-300000107140jwa:ResearchSegmentMember2025-04-300000107140jwa:LearningSegmentMember2025-04-300000107140us-gaap:ReportableSegmentAggregationBeforeOtherOperatingSegmentMember2025-04-300000107140jwa:HeldForSaleOrSoldSegmentMember2025-04-300000107140jwa:UniversityServicesMember2024-05-012025-04-300000107140jwa:UniversityServicesMember2025-04-300000107140jwa:CrossKnowledgeMember2024-05-012025-04-300000107140jwa:CrossKnowledgeMember2025-04-300000107140us-gaap:DisposalGroupHeldforsaleNotDiscontinuedOperationsMemberjwa:WileyEdgeMember2024-05-012025-04-300000107140us-gaap:DisposalGroupHeldforsaleNotDiscontinuedOperationsMemberjwa:WileyEdgeMember2025-04-300000107140jwa:EducationServicesMember2024-05-012025-04-300000107140jwa:UniversityServicesMember2024-05-012025-04-300000107140us-gaap:ArtisticRelatedIntangibleAssetsMember2025-04-300000107140us-gaap:ArtisticRelatedIntangibleAssetsMember2024-04-300000107140us-gaap:CustomerRelationshipsMember2025-04-300000107140us-gaap:CustomerRelationshipsMember2024-04-300000107140us-gaap:DevelopedTechnologyRightsMember2024-04-300000107140us-gaap:TrademarksAndTradeNamesMember2025-04-300000107140us-gaap:TrademarksAndTradeNamesMember2024-04-300000107140us-gaap:NoncompeteAgreementsMember2025-04-300000107140us-gaap:NoncompeteAgreementsMember2024-04-300000107140us-gaap:TrademarksAndTradeNamesMember2025-04-300000107140us-gaap:TrademarksAndTradeNamesMember2024-04-300000107140us-gaap:ArtisticRelatedIntangibleAssetsMember2025-04-300000107140us-gaap:ArtisticRelatedIntangibleAssetsMember2024-04-300000107140us-gaap:OtherNoncurrentAssetsMember2025-04-300000107140us-gaap:OtherNoncurrentAssetsMember2024-04-300000107140us-gaap:OtherNoncurrentLiabilitiesMember2025-04-300000107140us-gaap:OtherNoncurrentLiabilitiesMember2024-04-300000107140jwa:CapitalizedSoftwareMember2024-04-300000107140us-gaap:StateAndLocalJurisdictionMember2025-04-300000107140us-gaap:StateAndLocalJurisdictionMember2024-05-012025-04-300000107140us-gaap:ForeignCountryMember2025-04-300000107140us-gaap:DomesticCountryMember2025-04-300000107140us-gaap:DomesticCountryMember2024-05-012025-04-300000107140srt:MinimumMemberus-gaap:StateAndLocalJurisdictionMember2024-05-012025-04-300000107140jwa:AmendedAndRestatedRevolvingCreditAgreementMemberjwa:TermLoanAFacilityMember2025-04-300000107140jwa:AmendedAndRestatedRevolvingCreditAgreementMemberjwa:TermLoanAFacilityMember2024-04-300000107140jwa:AmendedAndRestatedRevolvingCreditAgreementMemberus-gaap:RevolvingCreditFacilityMember2025-04-300000107140jwa:AmendedAndRestatedRevolvingCreditAgreementMemberus-gaap:RevolvingCreditFacilityMember2024-04-300000107140jwa:AmendedAndRestatedRevolvingCreditAgreementMemberus-gaap:RevolvingCreditFacilityMember2022-11-302022-11-300000107140jwa:AmendedAndRestatedRevolvingCreditAgreementMemberus-gaap:RevolvingCreditFacilityMember2022-11-300000107140jwa:AmendedAndRestatedRevolvingCreditAgreementMemberjwa:TermLoanAFacilityMember2022-11-302022-11-300000107140jwa:AmendedAndRestatedRevolvingCreditAgreementMemberjwa:TermLoanAFacilityMember2022-11-300000107140jwa:AmendedAndRestatedRevolvingCreditAgreementMemberjwa:RevolvingCreditFacilityThroughMay2024Member2022-11-300000107140jwa:SyndicateBankGroupMemberjwa:AmendedAndRestatedRevolvingCreditAgreementMemberus-gaap:RevolvingCreditFacilityMemberjwa:SOFRSONIAAndEURIBORBasedRatesMembersrt:MinimumMember2022-11-302022-11-300000107140jwa:SyndicateBankGroupMemberjwa:AmendedAndRestatedRevolvingCreditAgreementMemberus-gaap:RevolvingCreditFacilityMemberjwa:SOFRSONIAAndEURIBORBasedRatesMembersrt:MaximumMember2022-11-302022-11-300000107140jwa:SyndicateBankGroupMemberjwa:AmendedAndRestatedRevolvingCreditAgreementMemberus-gaap:RevolvingCreditFacilityMemberus-gaap:BaseRateMembersrt:MinimumMember2022-11-302022-11-300000107140jwa:SyndicateBankGroupMemberjwa:AmendedAndRestatedRevolvingCreditAgreementMemberus-gaap:RevolvingCreditFacilityMemberus-gaap:BaseRateMember2022-11-302022-11-300000107140jwa:AmendedAndRestatedRevolvingCreditAgreementMemberus-gaap:RevolvingCreditFacilityMemberus-gaap:SecuredOvernightFinancingRateSofrMembersrt:MinimumMember2022-11-302022-11-300000107140jwa:AmendedAndRestatedRevolvingCreditAgreementMemberus-gaap:RevolvingCreditFacilityMemberus-gaap:SecuredOvernightFinancingRateSofrMembersrt:MaximumMember2022-11-302022-11-300000107140jwa:SyndicateBankGroupMemberjwa:AmendedAndRestatedRevolvingCreditAgreementMemberus-gaap:RevolvingCreditFacilityMemberus-gaap:FederalFundsEffectiveSwapRateMembersrt:MaximumMember2022-11-302022-11-300000107140jwa:SyndicateBankGroupMemberjwa:AmendedAndRestatedRevolvingCreditAgreementMemberus-gaap:RevolvingCreditFacilityMemberjwa:DailySecuredOvernightFinancingRateSOFRMember2022-11-302022-11-300000107140jwa:SyndicateBankGroupMemberjwa:AmendedAndRestatedRevolvingCreditAgreementMemberus-gaap:RevolvingCreditFacilityMembersrt:MinimumMember2022-11-302022-11-300000107140jwa:SyndicateBankGroupMemberjwa:AmendedAndRestatedRevolvingCreditAgreementMemberus-gaap:RevolvingCreditFacilityMembersrt:MaximumMember2022-11-302022-11-300000107140jwa:SyndicateBankGroupMemberjwa:AmendedAndRestatedRevolvingCreditAgreementMemberus-gaap:RevolvingCreditFacilityMember2022-11-300000107140jwa:AmendedAndRestatedRevolvingCreditAgreementMemberus-gaap:RevolvingCreditFacilityMember2022-11-012023-01-310000107140jwa:AmendedAndRestatedRevolvingCreditAgreementMemberjwa:RevolvingCreditFacilityThroughNovember2027Member2024-05-012025-04-300000107140jwa:AmendedAndRestatedRevolvingCreditAgreementMemberjwa:RevolvingCreditFacilityThroughMay2024Member2024-05-012025-04-300000107140jwa:AmendedAndRestatedRevolvingCreditAgreementMember2024-05-012025-04-300000107140jwa:AmendedAndRestatedRevolvingCreditAgreementMember2023-05-012024-04-300000107140jwa:AmendedAndRestatedRevolvingCreditAgreementMember2022-05-012023-04-300000107140jwa:OtherCreditFacilitiesMemberus-gaap:LineOfCreditMember2025-04-300000107140jwa:OtherCreditFacilitiesMemberus-gaap:LineOfCreditMember2024-04-300000107140us-gaap:LineOfCreditMember2025-04-300000107140us-gaap:LineOfCreditMember2024-05-012025-04-300000107140us-gaap:LineOfCreditMember2023-05-012024-04-300000107140us-gaap:LineOfCreditMember2024-04-300000107140us-gaap:InterestRateSwapMember2024-04-300000107140us-gaap:InterestRateSwapMember2025-04-300000107140us-gaap:InterestRateSwapMember2024-05-012025-04-300000107140us-gaap:InterestRateSwapMember2023-05-012024-04-300000107140us-gaap:InterestRateSwapMember2022-05-012023-04-300000107140us-gaap:InterestExpenseMemberus-gaap:InterestRateSwapMember2024-05-012025-04-300000107140us-gaap:InterestExpenseMemberus-gaap:InterestRateSwapMember2023-05-012024-04-300000107140us-gaap:InterestExpenseMemberus-gaap:InterestRateSwapMember2022-05-012023-04-300000107140srt:MinimumMember2024-05-012025-04-300000107140srt:MaximumMember2024-05-012025-04-300000107140us-gaap:SupplementalEmployeeRetirementPlanDefinedBenefitMember2024-05-012025-04-300000107140country:US2024-05-012025-04-300000107140jwa:CanadaUKMember2024-05-012025-04-300000107140country:US2023-05-012024-04-300000107140jwa:CanadaUKMember2023-05-012024-04-300000107140country:US2022-05-012023-04-300000107140jwa:CanadaUKMember2022-05-012023-04-300000107140jwa:RetirementIndemnityPlanMember2022-05-012023-04-300000107140jwa:RussiaPensionPlanMembercountry:RUsrt:MaximumMember2022-05-012023-04-300000107140country:US2024-04-300000107140jwa:CanadaUKMember2024-04-300000107140country:US2023-04-300000107140jwa:CanadaUKMember2023-04-300000107140country:US2025-04-300000107140jwa:CanadaUKMember2025-04-300000107140us-gaap:DefinedBenefitPlanEquitySecuritiesMember2025-04-300000107140jwa:FixedIncomeSecuritiesAndCashMember2025-04-300000107140us-gaap:FairValueInputsLevel1Membercountry:USjwa:DefinedBenefitPlanEquitySecuritiesNonUSLimitedPartnershipMember2025-04-300000107140us-gaap:FairValueInputsLevel2Membercountry:USjwa:DefinedBenefitPlanEquitySecuritiesNonUSLimitedPartnershipMember2025-04-300000107140us-gaap:FairValueMeasuredAtNetAssetValuePerShareMembercountry:USjwa:DefinedBenefitPlanEquitySecuritiesNonUSLimitedPartnershipMember2025-04-300000107140country:USjwa:DefinedBenefitPlanEquitySecuritiesNonUSLimitedPartnershipMember2025-04-300000107140us-gaap:FairValueInputsLevel1Membercountry:USjwa:DefinedBenefitPlanEquitySecuritiesNonUSLimitedPartnershipMember2024-04-300000107140us-gaap:FairValueInputsLevel2Membercountry:USjwa:DefinedBenefitPlanEquitySecuritiesNonUSLimitedPartnershipMember2024-04-300000107140us-gaap:FairValueMeasuredAtNetAssetValuePerShareMembercountry:USjwa:DefinedBenefitPlanEquitySecuritiesNonUSLimitedPartnershipMember2024-04-300000107140country:USjwa:DefinedBenefitPlanEquitySecuritiesNonUSLimitedPartnershipMember2024-04-300000107140us-gaap:FairValueMeasuredAtNetAssetValuePerShareMembercountry:USus-gaap:FixedIncomeFundsMember2025-04-300000107140country:USus-gaap:FixedIncomeFundsMember2025-04-300000107140us-gaap:FairValueMeasuredAtNetAssetValuePerShareMembercountry:USus-gaap:FixedIncomeFundsMember2024-04-300000107140country:USus-gaap:FixedIncomeFundsMember2024-04-300000107140us-gaap:FairValueInputsLevel1Membercountry:US2025-04-300000107140us-gaap:FairValueInputsLevel2Membercountry:US2025-04-300000107140us-gaap:FairValueMeasuredAtNetAssetValuePerShareMembercountry:US2025-04-300000107140us-gaap:FairValueInputsLevel1Membercountry:US2024-04-300000107140us-gaap:FairValueInputsLevel2Membercountry:US2024-04-300000107140us-gaap:FairValueMeasuredAtNetAssetValuePerShareMembercountry:US2024-04-300000107140us-gaap:FairValueInputsLevel1Memberjwa:CanadaUKMemberus-gaap:DefinedBenefitPlanEquitySecuritiesUsMember2025-04-300000107140us-gaap:FairValueInputsLevel2Memberjwa:CanadaUKMemberus-gaap:DefinedBenefitPlanEquitySecuritiesUsMember2025-04-300000107140jwa:CanadaUKMemberus-gaap:DefinedBenefitPlanEquitySecuritiesUsMember2025-04-300000107140us-gaap:FairValueInputsLevel1Memberjwa:CanadaUKMemberus-gaap:DefinedBenefitPlanEquitySecuritiesUsMember2024-04-300000107140us-gaap:FairValueInputsLevel2Memberjwa:CanadaUKMemberus-gaap:DefinedBenefitPlanEquitySecuritiesUsMember2024-04-300000107140jwa:CanadaUKMemberus-gaap:DefinedBenefitPlanEquitySecuritiesUsMember2024-04-300000107140us-gaap:FairValueInputsLevel1Memberjwa:CanadaUKMemberus-gaap:DefinedBenefitPlanEquitySecuritiesNonUsMember2025-04-300000107140us-gaap:FairValueInputsLevel2Memberjwa:CanadaUKMemberus-gaap:DefinedBenefitPlanEquitySecuritiesNonUsMember2025-04-300000107140jwa:CanadaUKMemberus-gaap:DefinedBenefitPlanEquitySecuritiesNonUsMember2025-04-300000107140us-gaap:FairValueInputsLevel1Memberjwa:CanadaUKMemberus-gaap:DefinedBenefitPlanEquitySecuritiesNonUsMember2024-04-300000107140us-gaap:FairValueInputsLevel2Memberjwa:CanadaUKMemberus-gaap:DefinedBenefitPlanEquitySecuritiesNonUsMember2024-04-300000107140jwa:CanadaUKMemberus-gaap:DefinedBenefitPlanEquitySecuritiesNonUsMember2024-04-300000107140us-gaap:FairValueInputsLevel1Memberjwa:CanadaUKMemberjwa:BalancedManagedFundsMember2025-04-300000107140us-gaap:FairValueInputsLevel2Memberjwa:CanadaUKMemberjwa:BalancedManagedFundsMember2025-04-300000107140jwa:CanadaUKMemberjwa:BalancedManagedFundsMember2025-04-300000107140us-gaap:FairValueInputsLevel1Memberjwa:CanadaUKMemberjwa:BalancedManagedFundsMember2024-04-300000107140us-gaap:FairValueInputsLevel2Memberjwa:CanadaUKMemberjwa:BalancedManagedFundsMember2024-04-300000107140jwa:CanadaUKMemberjwa:BalancedManagedFundsMember2024-04-300000107140us-gaap:FairValueInputsLevel1Memberjwa:CanadaUKMemberus-gaap:FixedIncomeFundsMember2025-04-300000107140us-gaap:FairValueInputsLevel2Memberjwa:CanadaUKMemberus-gaap:FixedIncomeFundsMember2025-04-300000107140jwa:CanadaUKMemberus-gaap:FixedIncomeFundsMember2025-04-300000107140us-gaap:FairValueInputsLevel1Memberjwa:CanadaUKMemberus-gaap:FixedIncomeFundsMember2024-04-300000107140us-gaap:FairValueInputsLevel2Memberjwa:CanadaUKMemberus-gaap:FixedIncomeFundsMember2024-04-300000107140jwa:CanadaUKMemberus-gaap:FixedIncomeFundsMember2024-04-300000107140us-gaap:FairValueInputsLevel1Memberjwa:CanadaUKMemberus-gaap:DefinedBenefitPlanRealEstateMember2025-04-300000107140us-gaap:FairValueInputsLevel2Memberjwa:CanadaUKMemberus-gaap:DefinedBenefitPlanRealEstateMember2025-04-300000107140jwa:CanadaUKMemberus-gaap:DefinedBenefitPlanRealEstateMember2025-04-300000107140us-gaap:FairValueInputsLevel1Memberjwa:CanadaUKMemberus-gaap:DefinedBenefitPlanRealEstateMember2024-04-300000107140us-gaap:FairValueInputsLevel2Memberjwa:CanadaUKMemberus-gaap:DefinedBenefitPlanRealEstateMember2024-04-300000107140jwa:CanadaUKMemberus-gaap:DefinedBenefitPlanRealEstateMember2024-04-300000107140us-gaap:FairValueInputsLevel1Memberjwa:CanadaUKMemberus-gaap:DefinedBenefitPlanCashAndCashEquivalentsMember2025-04-300000107140us-gaap:FairValueInputsLevel2Memberjwa:CanadaUKMemberus-gaap:DefinedBenefitPlanCashAndCashEquivalentsMember2025-04-300000107140jwa:CanadaUKMemberus-gaap:DefinedBenefitPlanCashAndCashEquivalentsMember2025-04-300000107140us-gaap:FairValueInputsLevel1Memberjwa:CanadaUKMemberus-gaap:DefinedBenefitPlanCashAndCashEquivalentsMember2024-04-300000107140us-gaap:FairValueInputsLevel2Memberjwa:CanadaUKMemberus-gaap:DefinedBenefitPlanCashAndCashEquivalentsMember2024-04-300000107140jwa:CanadaUKMemberus-gaap:DefinedBenefitPlanCashAndCashEquivalentsMember2024-04-300000107140us-gaap:FairValueInputsLevel1Memberjwa:CanadaUKMember2025-04-300000107140us-gaap:FairValueInputsLevel2Memberjwa:CanadaUKMember2025-04-300000107140us-gaap:FairValueMeasuredAtNetAssetValuePerShareMemberjwa:CanadaUKMember2025-04-300000107140us-gaap:FairValueInputsLevel1Memberjwa:CanadaUKMember2024-04-300000107140us-gaap:FairValueInputsLevel2Memberjwa:CanadaUKMember2024-04-300000107140us-gaap:FairValueMeasuredAtNetAssetValuePerShareMemberjwa:CanadaUKMember2024-04-300000107140us-gaap:FairValueInputsLevel1Member2025-04-300000107140us-gaap:FairValueInputsLevel2Member2025-04-300000107140us-gaap:FairValueMeasuredAtNetAssetValuePerShareMember2025-04-300000107140us-gaap:FairValueInputsLevel1Member2024-04-300000107140us-gaap:FairValueInputsLevel2Member2024-04-300000107140us-gaap:FairValueMeasuredAtNetAssetValuePerShareMember2024-04-300000107140us-gaap:ForeignPlanMembersrt:MinimumMember2025-04-300000107140us-gaap:OtherPostretirementBenefitPlansDefinedBenefitMember2024-04-300000107140us-gaap:OtherPostretirementBenefitPlansDefinedBenefitMember2025-04-300000107140us-gaap:OtherPostretirementBenefitPlansDefinedBenefitMember2023-05-012024-04-300000107140us-gaap:OtherPostretirementBenefitPlansDefinedBenefitMember2022-05-012023-04-300000107140us-gaap:OtherPostretirementBenefitPlansDefinedBenefitMember2024-05-012025-04-300000107140jwa:KeyEmployeeStockPlan2014Memberus-gaap:CommonClassAMember2025-04-300000107140us-gaap:EmployeeStockOptionMembersrt:MinimumMember2025-04-300000107140us-gaap:EmployeeStockOptionMembersrt:MaximumMember2024-05-012025-04-300000107140us-gaap:EmployeeStockOptionMemberus-gaap:ShareBasedCompensationAwardTrancheOneMember2024-05-012025-04-300000107140us-gaap:EmployeeStockOptionMemberus-gaap:ShareBasedCompensationAwardTrancheTwoMember2024-05-012025-04-300000107140us-gaap:EmployeeStockOptionMemberus-gaap:ShareBasedCompensationAwardTrancheThreeMember2024-05-012025-04-300000107140us-gaap:EmployeeStockOptionMemberjwa:ShareBasedCompensationAwardTrancheFourMember2024-05-012025-04-300000107140us-gaap:EmployeeStockOptionMember2023-05-012024-04-300000107140us-gaap:EmployeeStockOptionMember2022-05-012023-04-300000107140us-gaap:EmployeeStockOptionMember2024-04-300000107140us-gaap:EmployeeStockOptionMember2023-04-300000107140us-gaap:EmployeeStockOptionMember2025-04-300000107140us-gaap:EmployeeStockOptionMember2024-05-012025-04-300000107140jwa:ExercisePriceRange2Member2024-05-012025-04-300000107140jwa:ExercisePriceRange2Member2025-04-300000107140jwa:ExercisePriceRange3Member2024-05-012025-04-300000107140jwa:ExercisePriceRange3Member2025-04-300000107140us-gaap:PerformanceSharesMemberjwa:ShareBasedCompensationAwardTrancheThirteenMemberjwa:KeyEmployeesMember2024-05-012025-04-300000107140us-gaap:RestrictedStockMemberjwa:ShareBasedCompensationAwardTrancheEightMemberjwa:KeyEmployeesMember2024-05-012025-04-300000107140us-gaap:RestrictedStockMember2024-04-300000107140us-gaap:RestrictedStockMember2023-04-300000107140us-gaap:RestrictedStockMember2022-04-300000107140us-gaap:RestrictedStockMember2024-05-012025-04-300000107140us-gaap:RestrictedStockMember2023-05-012024-04-300000107140us-gaap:RestrictedStockMember2022-05-012023-04-300000107140us-gaap:RestrictedStockMember2025-04-3000001071402024-07-080000107140us-gaap:PerformanceSharesMember2024-07-080000107140us-gaap:RestrictedStockUnitsRSUMember2024-07-080000107140us-gaap:RestrictedStockUnitsRSUMember2024-07-082024-07-080000107140us-gaap:RestrictedStockUnitsRSUMemberus-gaap:ShareBasedCompensationAwardTrancheOneMember2024-07-082024-07-080000107140us-gaap:RestrictedStockUnitsRSUMemberus-gaap:ShareBasedCompensationAwardTrancheThreeMember2024-07-082024-07-080000107140us-gaap:RestrictedStockUnitsRSUMemberjwa:ShareBasedCompensationAwardTrancheFourMember2024-07-082024-07-080000107140us-gaap:RestrictedStockUnitsRSUMemberus-gaap:ShareBasedCompensationAwardTrancheTwoMember2024-07-082024-07-080000107140us-gaap:PerformanceSharesMember2024-07-082024-07-080000107140jwa:DirectorStockPlanMembersrt:DirectorMemberus-gaap:CommonClassAMember2024-05-012025-04-300000107140jwa:DirectorStockPlanMembersrt:DirectorMemberus-gaap:CommonClassAMember2023-05-012024-04-300000107140jwa:DirectorStockPlanMembersrt:DirectorMemberus-gaap:CommonClassAMember2022-05-012023-04-300000107140jwa:ShareRepurchaseProgramIn2020Member2020-04-300000107140jwa:ShareRepurchaseProgramIn2020Member2025-04-300000107140us-gaap:CommonClassAMember2023-04-300000107140us-gaap:CommonClassAMember2022-04-300000107140us-gaap:CommonClassBMember2023-04-300000107140us-gaap:CommonClassBMember2022-04-300000107140us-gaap:OperatingSegmentsMember2024-05-012025-04-300000107140us-gaap:OperatingSegmentsMember2023-05-012024-04-300000107140us-gaap:OperatingSegmentsMember2022-05-012023-04-3000001071402022-11-012023-01-3100001071402022-05-012022-07-310000107140us-gaap:CorporateNonSegmentMember2024-05-012025-04-300000107140us-gaap:CorporateNonSegmentMember2023-05-012024-04-300000107140us-gaap:CorporateNonSegmentMember2022-05-012023-04-300000107140country:US2024-05-012025-04-300000107140country:US2023-05-012024-04-300000107140country:US2022-05-012023-04-300000107140country:CN2024-05-012025-04-300000107140country:CN2023-05-012024-04-300000107140country:CN2022-05-012023-04-300000107140country:GB2024-05-012025-04-300000107140country:GB2023-05-012024-04-300000107140country:GB2022-05-012023-04-300000107140country:JP2024-05-012025-04-300000107140country:JP2023-05-012024-04-300000107140country:JP2022-05-012023-04-300000107140country:AU2024-05-012025-04-300000107140country:AU2023-05-012024-04-300000107140country:AU2022-05-012023-04-300000107140jwa:OtherCountriesMember2024-05-012025-04-300000107140jwa:OtherCountriesMember2023-05-012024-04-300000107140jwa:OtherCountriesMember2022-05-012023-04-300000107140country:US2025-04-300000107140country:US2024-04-300000107140country:US2023-04-300000107140country:GB2025-04-300000107140country:GB2024-04-300000107140country:GB2023-04-300000107140jwa:OtherCountriesMember2025-04-300000107140jwa:OtherCountriesMember2024-04-300000107140jwa:OtherCountriesMember2023-04-3000001071402025-02-012025-04-300000107140us-gaap:SalesReturnsAndAllowancesMember2024-04-300000107140us-gaap:SalesReturnsAndAllowancesMember2024-05-012025-04-300000107140us-gaap:SalesReturnsAndAllowancesMember2025-04-300000107140us-gaap:AllowanceForCreditLossMember2024-04-300000107140us-gaap:AllowanceForCreditLossMember2024-05-012025-04-300000107140us-gaap:AllowanceForCreditLossMember2025-04-300000107140us-gaap:InventoryValuationReserveMember2024-04-300000107140us-gaap:InventoryValuationReserveMember2024-05-012025-04-300000107140us-gaap:InventoryValuationReserveMember2025-04-300000107140us-gaap:ValuationAllowanceOfDeferredTaxAssetsMember2024-04-300000107140us-gaap:ValuationAllowanceOfDeferredTaxAssetsMember2024-05-012025-04-300000107140us-gaap:ValuationAllowanceOfDeferredTaxAssetsMember2025-04-300000107140us-gaap:SalesReturnsAndAllowancesMember2023-04-300000107140us-gaap:SalesReturnsAndAllowancesMember2023-05-012024-04-300000107140us-gaap:AllowanceForCreditLossMember2023-04-300000107140us-gaap:AllowanceForCreditLossMember2023-05-012024-04-300000107140us-gaap:InventoryValuationReserveMember2023-04-300000107140us-gaap:InventoryValuationReserveMember2023-05-012024-04-300000107140us-gaap:ValuationAllowanceOfDeferredTaxAssetsMember2023-04-300000107140us-gaap:ValuationAllowanceOfDeferredTaxAssetsMember2023-05-012024-04-300000107140us-gaap:SalesReturnsAndAllowancesMember2022-04-300000107140us-gaap:SalesReturnsAndAllowancesMember2022-05-012023-04-300000107140us-gaap:AllowanceForCreditLossMember2022-04-300000107140us-gaap:AllowanceForCreditLossMember2022-05-012023-04-300000107140us-gaap:InventoryValuationReserveMember2022-04-300000107140us-gaap:InventoryValuationReserveMember2022-05-012023-04-300000107140us-gaap:ValuationAllowanceOfDeferredTaxAssetsMember2022-04-300000107140us-gaap:ValuationAllowanceOfDeferredTaxAssetsMember2022-05-012023-04-30

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, DC 20549

FORM 10-K

(Mark One)

|

|

|

|

|

|

| x |

ANNUAL REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934 |

For the fiscal year ended: April 30, 2025

OR

|

|

|

|

|

|

| o |

TRANSITION REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934 |

For the transition period from _________ to _________

Commission file number 001-11507

JOHN WILEY & SONS, INC.

(Exact name of Registrant as specified in its charter)

|

|

|

|

|

|

|

|

|

| New York |

|

13-5593032 |

| State or other jurisdiction of incorporation or organization |

|

I.R.S. Employer Identification No. |

|

|

|

111 River Street, Hoboken, NJ |

|

07030 |

| Address of principal executive offices |

|

Zip Code |

|

|

|

(201) 748-6000 |

| Registrant’s telephone number including area code |

|

|

|

|

|

|

|

|

|

Securities registered pursuant to Section 12(b) of the Act:

Title of each class |

Trading Symbol |

Name of each exchange on which registered |

| Class A Common Stock, par value $1.00 per share |

WLY |

New York Stock Exchange |

| Class B Common Stock, par value $1.00 per share |

WLYB |

New York Stock Exchange |

|

|

|

|

|

|

|

|

|

|

Securities registered pursuant to Section 12(g) of the Act: |

|

|

None |

|

Indicate by check mark if the registrant is a well-known seasoned issuer, as defined in Rule 405 of the Securities Act. Yes x No o

Indicate by check mark if the registrant is not required to file reports pursuant to Section 13 or Section 15(d) of the Act.

Yes o No x

Indicate by check mark whether the registrant (1) has filed all reports required to be filed by Section 13 or 15(d) of the Securities Exchange Act of 1934 during the preceding 12 months (or for such shorter period that the registrant was required to file such reports), and (2) has been subject to such filing requirements for the past 90 days. Yes x No o

Indicate by check mark whether the registrant has submitted electronically every Interactive Data File required to be submitted pursuant to Rule 405 of Regulation S-T (§232.405 of this chapter) during the preceding 12 months (or for such shorter period that the registrant was required to submit such files). Yes x No o

Indicate by check mark whether the registrant is a large accelerated filer, an accelerated filer, a non-accelerated filer, a smaller reporting company, or an emerging growth company. See the definitions of “large accelerated filer,” “accelerated filer,” “smaller reporting company,” and “emerging growth company” in Rule 12b-2 of the Exchange Act.

|

|

|

|

|

|

Large accelerated filer x |

Accelerated filer o |

Non-accelerated filer o |

Smaller reporting company o |

|

Emerging growth company o |

If an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act. o

Indicate by check mark whether the registrant has filed a report on and attestation to its management’s assessment of the effectiveness of its internal control over financial reporting under Section 404(b) of the Sarbanes-Oxley Act (15 U.S.C. 7262(b)) by the registered public accounting firm that prepared or issued its audit report. x

If securities are registered pursuant to Section 12(b) of the Act, indicate by check mark whether the financial statements of the registrant included in the filing reflect the correction of an error to previously issued financial statements. o

Indicate by check mark whether any of those error corrections are restatements that required a recovery analysis of incentive-based compensation received by any of the registrant’s executive officers during the relevant recovery period pursuant to §240.10D-1(b). o

Indicate by check mark whether the registrant is a shell company (as defined in Rule 12b-2 of the Act). Yes o No x

The aggregate market value of the voting stock held by non-affiliates of the registrant, computed by reference to the closing price as of the last business day of the registrant’s most recently completed second fiscal quarter, October 31, 2024, was approximately $2,055 million. The registrant has no non-voting common stock.

The number of shares outstanding of the registrant’s Class A and Class B Common Stock as of May 31, 2025 was 44,624,949 and 8,768,531 respectively.

DOCUMENTS INCORPORATED BY REFERENCE

Portions of the registrant’s definitive proxy statement for use in connection with its annual meeting of stockholders scheduled to be held on September 25, 2025, are incorporated by reference into Part III of this Annual Report on Form 10-K.

JOHN WILEY & SONS, INC. AND SUBSIDIARIES

FORM 10-K

FOR THE FISCAL YEAR ENDED APRIL 30, 2025

INDEX

Cautionary Notice Regarding Forward-Looking Statements “Safe Harbor” Statement under the Private Securities Litigation Reform Act of 1995:

This report contains “forward-looking statements” within the meaning of the safe harbor provisions of the Private Securities Litigation Reform Act of 1995 concerning our business, consolidated financial condition, and results of operations. The Securities and Exchange Commission (SEC) encourages companies to disclose forward-looking information so that investors can better understand a company’s prospects and make informed investment decisions. Forward-looking statements are subject to risks and uncertainties, many of which are outside our control, which could cause actual results to differ materially from these statements. Therefore, you should not rely on any of these forward-looking statements. Forward-looking statements can be identified by such words as “anticipates,” “believes,” “plan,” “assumes,” “could,” “should,” “estimates,” “expects,” “intends,” “potential,” “seek,” “predict,” “may,” “will,” and similar references to future periods. All statements other than statements of historical facts included in this report regarding our strategies, prospects, financial condition, operations, costs, plans, and objectives are forward-looking statements. Examples of forward-looking statements include, among others, anticipated restructuring charges and savings, operations, performance, and financial condition. Reliance should not be placed on forward-looking statements, as actual results may differ materially from those described in any forward-looking statements. Any such forward-looking statements are based upon many assumptions and estimates that are inherently subject to uncertainties and contingencies, many of which are beyond our control, and are subject to change based on many important factors. Such factors include, but are not limited to (i) the level of investment by Wiley in new technologies and products; (ii) subscriber renewal rates for our journals; (iii) the financial stability and liquidity of journal subscription agents; (iv) the consolidation of book wholesalers and retail accounts; (v) the market position and financial stability of key retailers; (vi) the seasonal nature of our educational business and the impact of the used book market; (vii) worldwide economic and political conditions; (viii) our ability to protect our copyrights and other intellectual property worldwide; (ix) our ability to successfully integrate acquired operations and realize expected opportunities; (x) the ability to realize operating savings over time and in fiscal year 2026 in connection with our multiyear Global Restructuring Program and completed dispositions; (xi) cyber risk and the failure to maintain the integrity of our operational or security systems or infrastructure, or those of third parties with which we do business; (xii) as a result of acquisitions, we have and may record a significant amount of goodwill and other identifiable intangible assets and we may never realize the full carrying value of these assets; (xiii) our ability to leverage artificial intelligence technologies in our products and services, including generative artificial intelligence, large language models, machine learning, and other artificial intelligence tools; and (xiv) other factors detailed from time to time in our filings with the SEC. We undertake no obligation to update or revise any such forward-looking statements to reflect subsequent events or circumstances.

Please refer to Part I, Item 1A, “Risk Factors,” of our Annual Report on Form 10-K for important factors that we believe could cause actual results to differ materially from those in our forward-looking statements. Any forward-looking statement made by us in this report is based only on information currently available to us and speaks only as of the date on which it is made. We undertake no obligation to publicly update any forward-looking statement, whether written or oral, that may be made from time to time, whether as a result of new information, future developments or otherwise.

Non-GAAP Financial Measures:

We present financial information that conforms to Generally Accepted Accounting Principles in the United States of America (US GAAP). We also present financial information that does not conform to US GAAP, which we refer to as non-GAAP.

In this report, we may present the following non-GAAP performance measures:

•Adjusted Earnings Per Share (Adjusted EPS);

•Free Cash Flow less Product Development Spending;

•Adjusted Revenue;

•Adjusted Operating Income and margin;

•Adjusted Income Before Taxes;

•Adjusted Income Tax Provision;

•Adjusted Effective Tax Rate;

•EBITDA (earnings before interest, taxes, depreciation and amortization), Adjusted EBITDA and margin;

•Organic revenue; and

•Results on a constant currency basis.

Management uses these non-GAAP performance measures as supplemental indicators of our operating performance and financial position as well as for internal reporting and forecasting purposes, when publicly providing our outlook, to evaluate our performance and calculate incentive compensation. We present these non-GAAP performance measures in addition to US GAAP financial results because we believe that these non-GAAP performance measures provide useful information to certain investors and financial analysts for operational trends and comparisons over time. The use of these non-GAAP performance measures may also provide a consistent basis to evaluate operating profitability and performance trends by excluding items that we do not consider to be controllable activities for this purpose.

The performance metric used by our chief operating decision maker to evaluate performance of our reportable segments is Adjusted Operating Income. We present both Adjusted Operating Income and Adjusted EBITDA for each of our reportable segments as we believe Adjusted EBITDA provides additional useful information to certain investors and financial analysts for operational trends and comparisons over time. It removes the impact of depreciation and amortization expense, as well as presents a consistent basis to evaluate operating profitability and compare our financial performance to that of our peer companies and competitors.

For example:

•Adjusted EPS, Adjusted Revenue, Adjusted Operating Income, Adjusted Income Before Taxes, Adjusted Income Tax Provision, Adjusted Effective Tax Rate, Adjusted EBITDA, and organic revenue (excluding acquisitions) provide a more comparable basis to analyze operating results and earnings and are measures commonly used by shareholders to measure our performance.

•Free Cash Flow less Product Development Spending helps assess our ability, over the long term, to create value for our shareholders as it represents cash available to repay debt, pay common stock dividends, and fund share repurchases and acquisitions.

•Results on a constant currency basis remove distortion from the effects of foreign currency movements to provide better comparability of our business trends from period to period. We measure our performance excluding the impact of foreign currency (or at constant currency), which means that we apply the same foreign currency exchange rates for the current and equivalent prior period.

In addition, we have historically provided these or similar non-GAAP performance measures and understand that some investors and financial analysts find this information helpful in analyzing our operating margins and net income, and in comparing our financial performance to that of our peer companies and competitors. Based on interactions with investors, we also believe that our non-GAAP performance measures are regarded as useful to our investors as supplemental to our US GAAP financial results, and that there is no confusion regarding the adjustments or our operating performance to our investors due to the comprehensive nature of our disclosures.

Non-GAAP performance measures do not have standardized meanings prescribed by US GAAP and therefore may not be comparable to the calculation of similar measures used by other companies and should not be viewed as alternatives to measures of financial results under US GAAP. The adjusted metrics have limitations as analytical tools, and should not be considered in isolation from, or as a substitute for, US GAAP information. It does not purport to represent any similarly titled US GAAP information and is not an indicator of our performance under US GAAP. Non-GAAP financial metrics that we present may not be comparable with similarly titled measures used by others. Investors are cautioned against placing undue reliance on these non-GAAP measures.

PART I

Item 1. Business

The Company, founded in 1807, was incorporated in the state of New York on January 15, 1904. Throughout this report, when we refer to “Wiley,” the “Company,” “we,” “our,” or “us,” we are referring to John Wiley & Sons, Inc. and all of our subsidiaries, except where the context indicates otherwise.

Please refer to Part II, Item 8, “Financial Statements and Supplementary Data,” for financial information about the Company and its subsidiaries, which is incorporated herein by reference. Also, when we cross reference to a “Note,” we are referring to our “Notes to Consolidated Financial Statements,” in Part II, Item 8, “Financial Statements and Supplementary Data” unless the context indicates otherwise.

Wiley is one of the world’s largest publishers and a global leader in research and learning. The Company's content, services, platforms, and knowledge networks are tailored to meet the evolving needs of its customers and partners, including researchers, students, instructors, professionals, institutions, and corporations. Wiley is a predominantly digital company with 83% of its Adjusted Revenue for fiscal year 2025 generated by digital products and services. For fiscal year 2025, 48% of Adjusted Revenue is recurring which includes revenue that is contractually obligated or set to recur with a high degree of certainty. See Part II, Item 7, “Management’s Discussion and Analysis of Financial Condition and Results of Operations” in the section “Consolidated Results of Operations” of this Annual Report on Form 10-K for the reconciliation of consolidated Revenue to Adjusted Revenue.

We report financial information for the following reportable segments, as well as a Corporate category, which includes certain costs that are not allocated to the reportable segments:

•Research includes the reporting lines of Research Publishing and Research Solutions;

•Learning includes the Academic and Professional reporting lines and consists of publishing, courseware, and assessments.

Wiley also reports a Held for Sale or Sold segment, which primarily includes non-core businesses which were classified as held-for-sale until the date of sale, as well other businesses which were sold as described further below.

Our operations are primarily located in the United States (US) and the United Kingdom (UK), with smaller offices in Sri Lanka, Germany, and India. In the year ended April 30, 2025, approximately 49% of our consolidated revenue was from outside the US.

Wiley’s business strategies are tightly aligned with consistent long-term growth trends, including ever-increasing global research and development (R&D) investment, leading to growth in scientific research output and the number of institutions and researchers worldwide. These strategies include expanding our publishing program and journal portfolio to meet the global demand for peer-reviewed research, driving additional value in our subscription-based models for universities and corporations, volume-based models for open access, content licensing opportunities for applications in science and innovation, and content platform and service offerings for corporations and societies. Learning strategies include selectively scaling high-value digital content, courseware, and assessments to meet targeted opportunities in education and professional development.

Business Segments

Research:

Research’s mission is to support researchers, professionals, and learners in the discovery and use of research knowledge to help them achieve their goals. Research provides over 1,800 scientific, technical, medical, and scholarly journals, as well as related content and services in areas of physical sciences and engineering, health sciences, social sciences and humanities, and life sciences. Research customers include academic, corporate, government, and public libraries, funders of research, researchers, scientists, clinicians, engineers and technologists, scholarly and professional societies, and students and professors. Research products are sold and distributed globally through multiple channels, including direct to research libraries and library consortia via multi-year agreements, through independent subscription agents, and direct to researchers and professional society members, and other customers. For fiscal year 2025, approximately 96% of Research revenue is generated by digital and online products, and services. Publishing centers include Australia, China, Germany, India, the UK, and the US. Research revenue accounted for approximately 64% of our consolidated revenue in the year ended April 30, 2025, with a 32.1% Adjusted EBITDA margin. See Part II, Item 7, “Management’s Discussion and Analysis of Financial Condition and Results of Operations” in the section “Segment Operating Results” of this Annual Report on Form 10-K for further details and for the reconciliation of Adjusted Operating Income to Adjusted EBITDA.

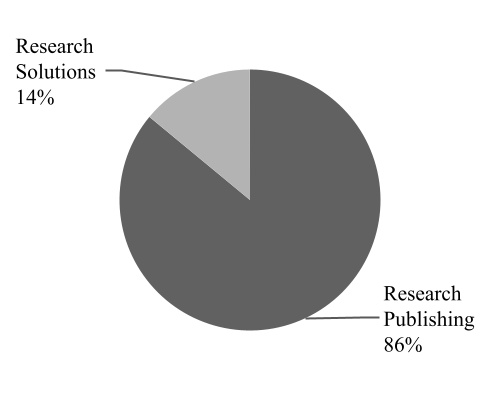

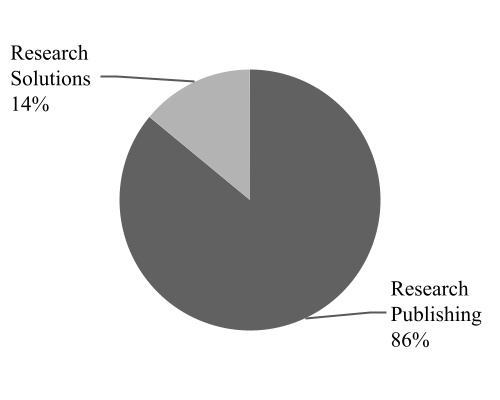

Research revenue by product type includes Research Publishing and Research Solutions. The graphs below present revenue by product type for the years ended April 30, 2025 and 2024:

Key growth strategies for the Research segment include publishing more peer-reviewed research and expanding our journal portfolio, thereby increasing the value of our Journal Subscriptions (pay to read) and Transformational Agreements (pay to read and publish), developing new open access journals and volume-based revenue streams (pay to publish), focusing on high-growth and emerging research markets, licensing our content for innovation in the corporate R&D value chain, and developing new digital products and information services to meet the needs of researchers, authors, societies, and corporate customers.

Research Publishing

Research Publishing generates the majority of its revenue from contracts with its customers in the following revenue streams:

•Journal Subscriptions (pay to read) and Transformational Agreements (pay to read and publish) under multi-year arrangements

•Open Access (pay to publish)

•Licensing and ancillary products

Journal Subscriptions and Transformational Agreements

As of April 30, 2025, we publish over 1,800 academic research journals. We sell Journal Subscriptions directly to thousands of research institutions worldwide through our sales representatives, indirectly through independent subscription agents, through marketing campaigns, and through memberships in professional societies for those journals that are sponsored by societies. Journal Subscriptions are primarily licensed through contracts for digital content available online through our Wiley Online Library platform. Contracts are negotiated by us directly with customers or their subscription agents. Subscription periods typically cover calendar years. Payment for subscription revenue is generally collected in advance.

Transformational Agreements (read and publish) are a subscription-based model that blends Journal Subscriptions and Open Access offerings. For a single fee, a national or regional consortium of libraries pays for in advance and receives full read access to our journal portfolio and the ability to publish under an open access arrangement (articles made freely available and authors maintain copyright). Like Journal Subscriptions, Transformational Agreements involve recurring revenue under multi-year arrangements.

Long-term publishing alliances play a major role in Research Publishing’s success. Approximately 46% of Journal Subscriptions revenue is derived from publication rights that are owned by professional societies and other publishing partners such as research institutions or foundations, and are published by us pursuant to long-term contracts or owned jointly with such entities. These alliances, with many of them being decades-long in duration, bring mutual benefit: The partners gain Wiley’s publishing, marketing, sales, and distribution expertise, while Wiley benefits from being affiliated with prestigious organizations and their members. Societies that sponsor or own such journals generally receive a royalty and/or other financial consideration. We may procure editorial services from such societies on a prenegotiated fee basis. We also enter into agreements with outside independent editors of journals that define their editorial duties and the fees and expenses for their services. Contributors of articles to our journal portfolio transfer publication rights to us or a professional society, as applicable. We publish the journals of many prestigious societies, including the American Cancer Society, the American Heart Association, the American Anthropological Association, the American Geophysical Union, and the German Chemical Society.

Wiley Online Library, our digital content platform for researchers, provides the user with intuitive navigation, enhanced discoverability, expanded functionality, and a range of personalization options. Access to abstracts is free and full content is accessible through licensing agreements or as individual article purchases. Our online publishing platforms provide revenue growth opportunities through new applications and business models, online advertising, deeper market penetration, and individual sales and pay-per-view options. Also note that portions of our content are provided free or at nominal cost to developing nations through partnerships with certain nonprofit organizations.

The annual Clarivate Analytics’ Journal Citation Reports (JCR) are one of the most widely used sources of citation metrics used to analyze the performance of peer-reviewed journals. The most prominent of these metrics, the Impact Factor, is based on the frequency with which an average article is cited in the JCR report year. Alongside other metrics, this makes it an important tool for evaluating a journal’s impact on ongoing research.

Wiley’s performance in the 2024 release of the JCR remains strong, maintaining its top 3 position in terms of citations received. Wiley has 8% of titles, 8% of articles, and 10% of citations.

A total of 1,728 Wiley journals were included in the reports. Wiley journals ranked #1 in 17 categories across 17 of its titles and achieved 265 top-10 category rankings.

Open Access

Under the Open Access business model, accepted research articles are published subject to upfront payment of article publication charges (APCs) and then all open articles are immediately free to access online. Contributors of open access articles retain many rights and typically license their work under terms that permit reuse.

Open Access offers authors choices in how to share and disseminate their work, and it serves the needs of researchers who may be required by their research funder to make articles freely accessible without embargo. APCs are typically paid by the individual author or by the author’s funder, and payments are often mediated by the author’s institution. We provide specific workflows and infrastructure to authors, funders, and institutions to support the requirements of Open Access.

We offer two Open Access publishing models. The first of these is Hybrid Open Access where authors can publish in the majority of our paid subscription journals. The second offering is Gold Open Access, where authors can publish in open access-only journals. All Open Access articles are subject to the same rigorous peer-review process applied to our subscription-based journals. As with our subscription portfolio, a number of the Gold Open Access Journals are published under contract for, or in partnership with, prestigious societies, including the American Geophysical Union, the American Heart Association, and the British Ecological Society. The Open Access portfolio spans life, physical, medical, and social sciences and includes a choice of high impact journals and broad-scope titles that offer a responsive, author-centered service.

Licensing and ancillary products

Licensing and ancillary products includes the licensing of publishing rights, the licensing of content for artificial intelligence (AI) models, individual article sales, and backfile sales. Wiley engages with international publishers and receives licensing revenue from reproductions, translations, and other digital uses of our content. The licensing of content for AI models helps developers improve the accuracy and impact of their models. By accessing Wiley's rich content, developers can train their AI models to better understand and generate human-like text, improving overall performance and accuracy. Through the Article Select and PayPerView programs, we provide fee-based access to non-subscribed journal articles, content, book chapters, and major reference work articles. The Research Publishing business is also a provider of content and services in evidence-based medicine (EBM). Through our alliance with The Cochrane Collaboration, we publish The Cochrane Library, a premier source of high-quality independent evidence to inform healthcare decision-making. Backfile licenses provide access to a historical collection of Wiley journals, generally for a one-time fee.

Research Solutions

Research Solutions generates revenue through content platforms and services that enable corporations and societies to attract and retain customers.

Research Solutions includes advertising (journals and newsletters), sales, and marketing services (knowledge hubs for pharmaceutical companies). Our recruitment platform offers full-service career site management for pharmaceutical companies and other R&D centric corporations. Spectral database licenses grant access to scientific research-based data on microscopy, spectroscopy, bioanalysis, and separation science. Our projects business offers services related to content creation and distribution, an educational platform for health professionals, and digital events and webinars for corporations in health and physical sciences.

We also provide platform and workflow solutions for societies and publishers, including production and content hosting, submissions and peer review support, and editorial and copy editing services. The Atypon® publishing platform for societies and publishers delivers integrated access to more than 11 million articles from over two thousand publishers and societies, as well as around 29,000 online books and hundreds of multivolume reference works, laboratory protocols, and databases.

Learning:

Our Learning segment includes Academic and Professional, whose products and services include scientific, professional, and education print and digital books, digital courseware to support students and instructors, and assessment services for businesses and professionals. Primary categories served include business and leadership, technology, behavioral health, engineering/architecture, science, and professional education. Products are sold to and through brick-and-mortar and online retailers, wholesalers who supply such bookstores, college bookstores, individual practitioners, corporations, distributor networks, and government agencies.

Publishing centers include Australia, Germany, India, the UK, and the US. Learning accounted for approximately 35% of our consolidated revenue in the year ended April 30, 2025, with a 37.4% Adjusted EBITDA margin. See Part II, Item 7, “Management’s Discussion and Analysis of Financial Condition and Results of Operations” in the section “Segment Operating Results” of this Annual Report on Form 10-K for further details and for the reconciliation of Adjusted Operating Income to Adjusted EBITDA. For fiscal year 2025, approximately 60% of Learning revenue is from digital and online products and services.

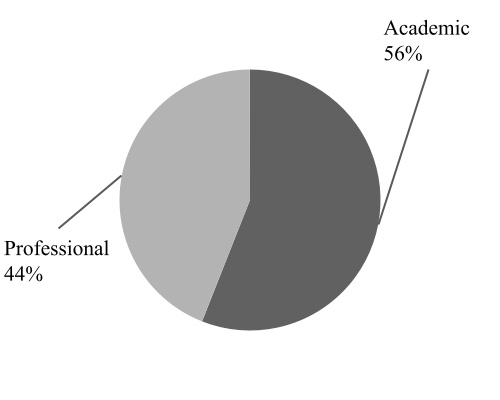

Learning revenue by product type includes Academic and Professional. The graphs below present revenue by product type for the years ended April 30, 2025 and 2024:

Key strategies for the Learning business include selectively scaling high-value digital content, courseware, and assessments where the Company is seeking content libraries for new licensing opportunities.

Book manuscripts and materials are sourced from authors around the world, utilizing the efforts of an internal editorial staff, external editorial support, and advisory boards. Most materials originate by the authors themselves or as the result of suggestions or solicitations by editors. We enter into agreements that state the terms and conditions under which the materials will be published, the author name in which the copyright will be registered, the basis for any royalties, and other matters. Author compensation models include royalties, which vary depending on the nature of the product and work-for-hire. We may make advance royalty payments against future royalties to authors of certain publications. Royalty advances are reviewed for recoverability and a reserve for loss is maintained, if appropriate.

We continue to add new titles, revise existing titles, and discontinue the sale of others in the normal course of our business. We also create adaptations of original content for specific markets based on customer demand. Our general practice is to revise our textbooks every 3 to 5 years, as warranted, and to revise other titles as appropriate. Subscription-based products are updated on a more frequent basis.

Wiley does not own any printing facilities. We generally contract independent printers and binderies globally for their services, using a variety of suppliers and materials to support our range of needs. As of April 30, 2025, we had one global warehousing and distribution facility remaining, which is in the UK. We have an agreement to outsource our US-based book distribution operations to Cengage Learning, with the continued aim of improving efficiency in our distribution activities and moving to a more variable cost model.

Book sales for Learning are generally made on a returnable basis with certain restrictions. We provide for estimated future returns on sales made during the year based on historical return experience and current market trends.

Academic

Academic generates the majority of its revenue from contracts with its customers in the following revenue streams:

•Print and Digital Publishing

•Digital Courseware

•Licensing and ancillary products

Print and Digital Publishing

Education textbooks, related supplementary material, and digital products are sold primarily to bookstores and online retailers serving educational institutions (primarily colleges and universities) and direct-to-students. We employ sales representatives who call on faculty responsible for adopting books to be used in courses, and on the bookstores that serve such institutions and their students. The textbook business is seasonal, with the majority of textbook sales occurring during the July-through-October and December-through-February periods. There are various channels to drive accessibility for print and digital materials within the higher education market, including used, rental, and inclusive access whereby the cost of digital course content is added to a student's tuition and fees. Technical and Medical (STM) reference books are sold and distributed globally in digital and print formats through multiple channels, including research libraries and library consortia, independent subscription agents, direct sales to professional society members, bookstores, online booksellers, and other customers.