| 001-11507 | 13-5593032 | |||||||||||||

| (Commission File Number) | (IRS Employer Identification No.) | |||||||||||||

111 River Street, Hoboken New Jersey |

07030 |

|||||||||||||

| (Address of principal executive offices) | (Zip Code) | |||||||||||||

| Registrant’s telephone number, including area code: | (201) 748-6000 |

|||||||||||||

☐ |

Written communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425) | ||||

☐ |

Soliciting material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12) | ||||

☐ |

Pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b)) | ||||

☐ |

Pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4(c)) | ||||

| Title of each class | Trading Symbol(s) | Name of each exchange on which registered | ||||||||||||

| Class A Common Stock, par value $1.00 per share | WLY | New York Stock Exchange | ||||||||||||

| Class B Common Stock, par value $1.00 per share | WLYB | New York Stock Exchange | ||||||||||||

| JOHN WILEY & SONS, INC. | ||||||||||||||

| (Registrant) | ||||||||||||||

| By | /s/ Matthew S. Kissner | |||||||||||||

| Matthew S. Kissner | ||||||||||||||

| President and Chief Executive Officer | ||||||||||||||

| Dated: March 6, 2025 | ||||||||||||||

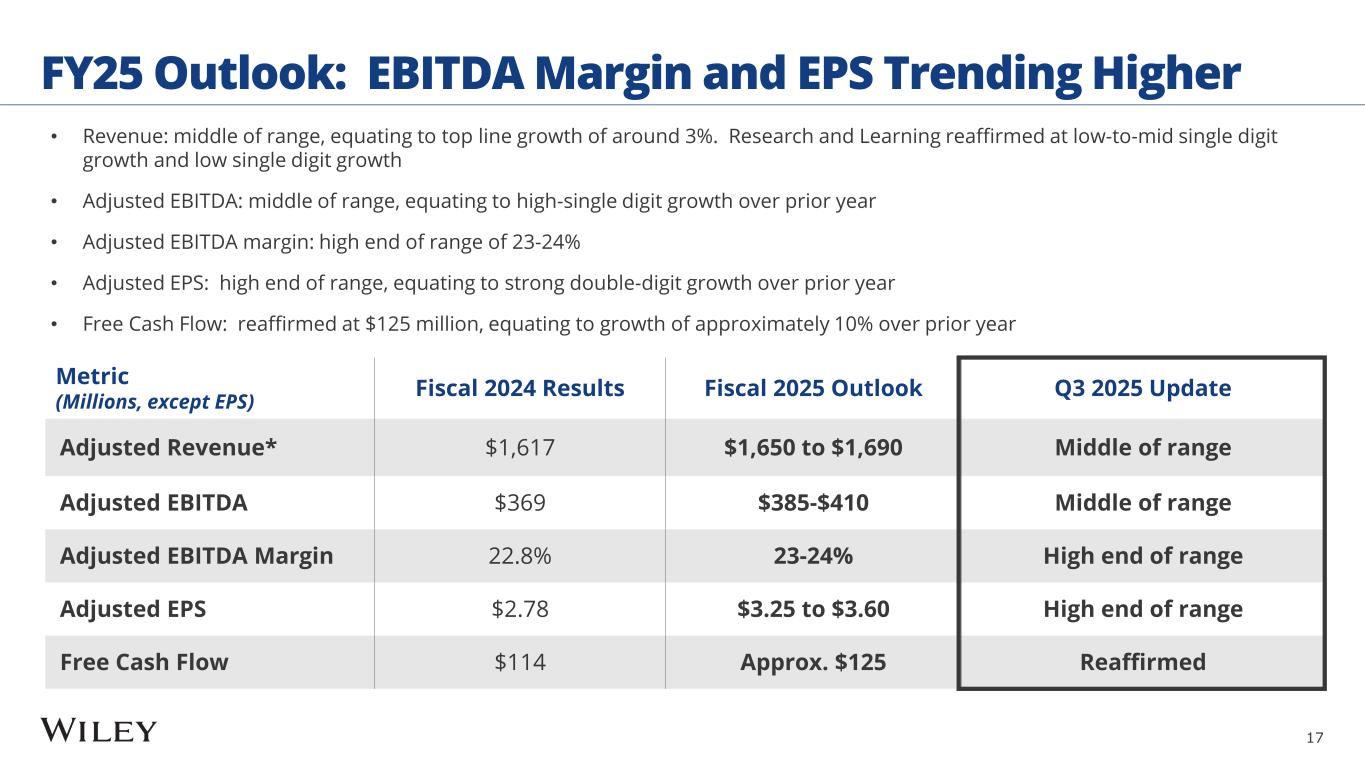

| Metric | Fiscal 2024 Results | Fiscal 2025 Outlook | Q3 2025 Update | ||||||||

| Adj. Revenue* | $1,617 | $1,650 to $1,690 | Middle of range | ||||||||

|

Adj. EBITDA*

Margin

|

$369

22.8%

|

$385 to $410

23-24%

|

Middle of range

High end of range

|

||||||||

| Adj. EPS* | $2.78 | $3.25 to $3.60 | High end of range | ||||||||

| Free Cash Flow | $114 | Approx. $125 | Reaffirmed | ||||||||

| Three Months Ended January 31, |

Nine Months Ended January 31, |

||||||||||||||||||||||

| 2025 | 2024 | 2025 | 2024 | ||||||||||||||||||||

| Revenue, net | $ | 404,626 | $ | 460,705 | $ | 1,235,030 | $ | 1,404,526 | |||||||||||||||

| Costs and expenses: | |||||||||||||||||||||||

| Cost of sales | 104,219 | 143,662 | 320,439 | 456,377 | |||||||||||||||||||

| Operating and administrative expenses | 229,960 | 253,375 | 717,670 | 761,458 | |||||||||||||||||||

Impairment of goodwill(3) |

— | 81,754 | — | 108,449 | |||||||||||||||||||

| Restructuring and related charges | 5,574 | 14,808 | 13,071 | 52,033 | |||||||||||||||||||

| Amortization of intangible assets | 13,042 | 13,517 | 38,913 | 42,730 | |||||||||||||||||||

| Total costs and expenses | 352,795 | 507,116 | 1,090,093 | 1,421,047 | |||||||||||||||||||

| Operating income (loss) | 51,831 | (46,411) | 144,937 | (16,521) | |||||||||||||||||||

| As a % of revenue | 12.8 | % | -10.1 | % | 11.7 | % | -1.2 | % | |||||||||||||||

| Interest expense | (14,027) | (13,321) | (41,277) | (37,592) | |||||||||||||||||||

| Net foreign exchange transaction (losses) gains | (4,222) | 488 | (7,316) | (3,489) | |||||||||||||||||||

Net loss on sale of businesses, assets, and impairment charges related to assets held-for-sale(3) |

(15,930) | (52,404) | (9,760) | (179,747) | |||||||||||||||||||

| Other income (expense), net | 1,021 | (648) | 4,029 | (3,700) | |||||||||||||||||||

| Income (loss) before taxes | 18,673 | (112,296) | 90,613 | (241,049) | |||||||||||||||||||

| Provision (benefit) for income taxes | 41,627 | 1,579 | 74,545 | (15,465) | |||||||||||||||||||

| Effective tax rate | 222.9 | % | -1.4 | % | 82.3 | % | 6.4 | % | |||||||||||||||

| Net (loss) income | $ | (22,954) | $ | (113,875) | $ | 16,068 | $ | (225,584) | |||||||||||||||

| As a % of revenue | -5.7 | % | -24.7 | % | 1.3 | % | -16.1 | % | |||||||||||||||

| (Loss) earnings per share | |||||||||||||||||||||||

| Basic | $ | (0.43) | $ | (2.08) | $ | 0.30 | $ | (4.10) | |||||||||||||||

Diluted(4) |

$ | (0.43) | $ | (2.08) | $ | 0.29 | $ | (4.10) | |||||||||||||||

| Weighted average number of common shares outstanding | |||||||||||||||||||||||

| Basic | 53,952 | 54,812 | 54,173 | 55,061 | |||||||||||||||||||

Diluted(4) |

53,952 | 54,812 | 54,815 | 55,061 | |||||||||||||||||||

Notes: | ||

| (1) The supplementary information included in this press release for the three and nine months ended January 31, 2025 is preliminary and subject to change prior to the filing of our upcoming Quarterly Report on Form 10-Q with the Securities and Exchange Commission. | ||

| (2) All amounts are approximate due to rounding. | ||

|

(3) Net loss on sale of businesses, assets, and impairment charges related to assets held-for-sale

For the three and nine months ended January 31, 2025 and 2024, we recorded net pretax loss on sale of businesses, assets, and impairment charges related to assets held-for-sale as follows:

| ||

| Three Months Ended January 31, |

Nine Months Ended January 31, |

||||||||||||||||||||||

| 2025 | 2024 | 2025 | 2024 | ||||||||||||||||||||

| Wiley Edge | $ | (15,566) | $ | (20,676) | $ | (14,778) | $ | (20,676) | |||||||||||||||

| University Services | (639) | (25,946) | 850 | (101,412) | |||||||||||||||||||

| CrossKnowledge | 275 | (5,782) | 4,197 | (56,159) | |||||||||||||||||||

| Tuition Manager | — | — | 120 | (1,500) | |||||||||||||||||||

| Sale of assets | — | — | (149) | — | |||||||||||||||||||

| Net loss on sale of businesses, assets, and impairment charges related to assets held-for-sale | $ | (15,930) | $ | (52,404) | $ | (9,760) | $ | (179,747) | |||||||||||||||

|

As previously announced in fiscal year 2024, we executed a plan to divest non-core businesses included in our Held for Sale or Sold segment, including University Services, Wiley Edge, and CrossKnowledge. These three businesses met the held-for-sale criteria starting in the first quarter of fiscal year 2024. We measured each disposal group at the lower of carrying value or fair value less costs to sell prior to its disposition.

On January 1, 2024, we completed the sale of University Services. On May 31, 2024, we completed the sale of Wiley Edge, with the exception of its India operations which sold on August 31, 2024. On August 31, 2024, we completed the sale of CrossKnowledge. On May 31, 2023, we completed the sale of Tuition Manager.

In the three months ended January 31, 2025, we recognized a net loss of $15.6 million for Wiley Edge primarily due to subsequent changes in the fair value less costs to sell. We reduced the fair value of the contingent consideration in the form of an earnout from $15.0 million to zero as of January 31, 2025, as current market conditions have significantly lowered expected gross profit below the payment threshold required in the agreement.

In the second quarter of fiscal year 2025, we sold a facility which was reflected in Technology, property, and equipment, net in our Unaudited Condensed Consolidated Statements of Financial Position.

Impairment of goodwill

In fiscal year 2024, we reorganized our segments and recorded pretax noncash goodwill impairments of $108.4 million which included $81.7 million related to Wiley Edge, $11.4 million related to University Services, and $15.3 million related to CrossKnowledge.

| ||

| (4) In calculating diluted net loss per common share for the three months ended January 31, 2025 and the three and nine months ended January 31, 2024, our diluted weighted average number of common shares outstanding excludes the effect of unvested restricted stock units and other stock awards as the effect was antidilutive. This occurs when a US GAAP net loss is reported and the effect of using dilutive shares is antidilutive. | ||

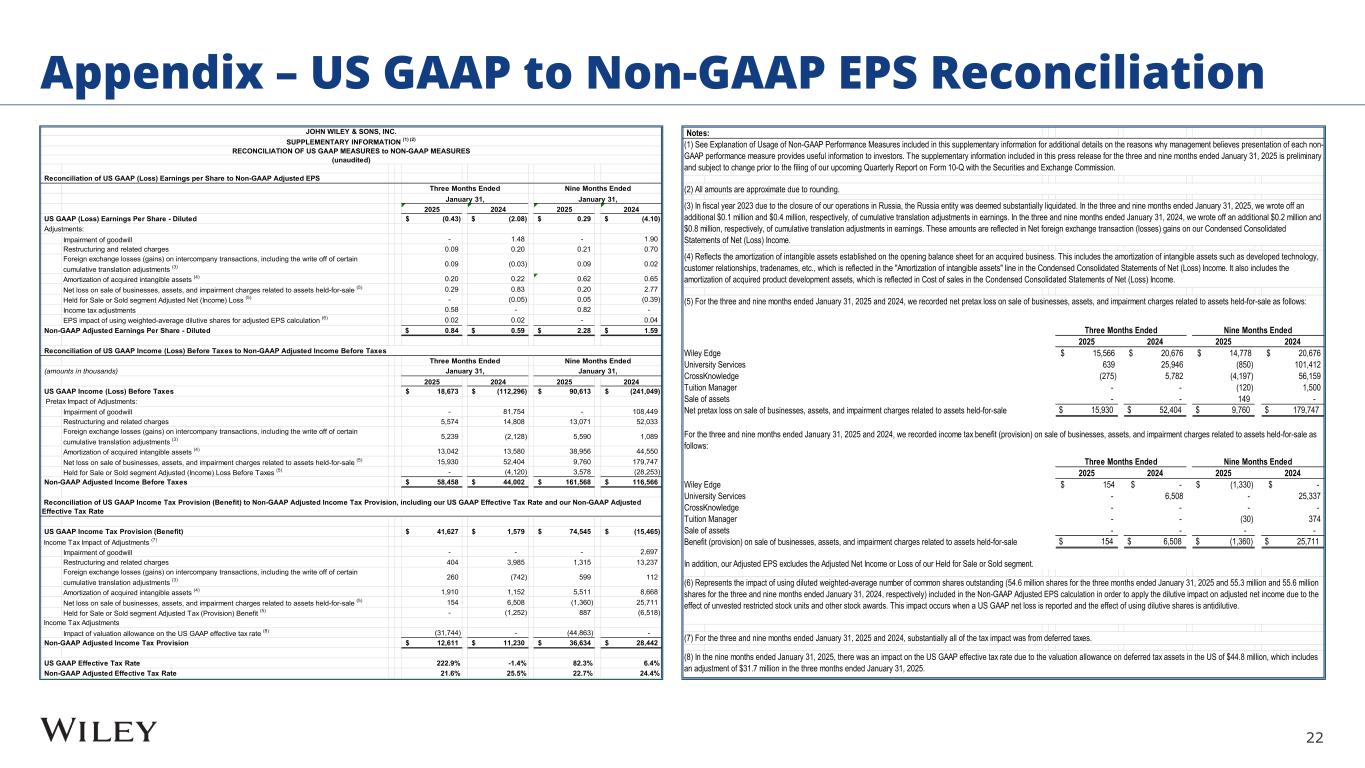

| Reconciliation of US GAAP (Loss) Earnings per Share to Non-GAAP Adjusted EPS | |||||||||||||||||||||||

| Three Months Ended January 31, |

Nine Months Ended January 31, |

||||||||||||||||||||||

| 2025 | 2024 | 2025 | 2024 | ||||||||||||||||||||

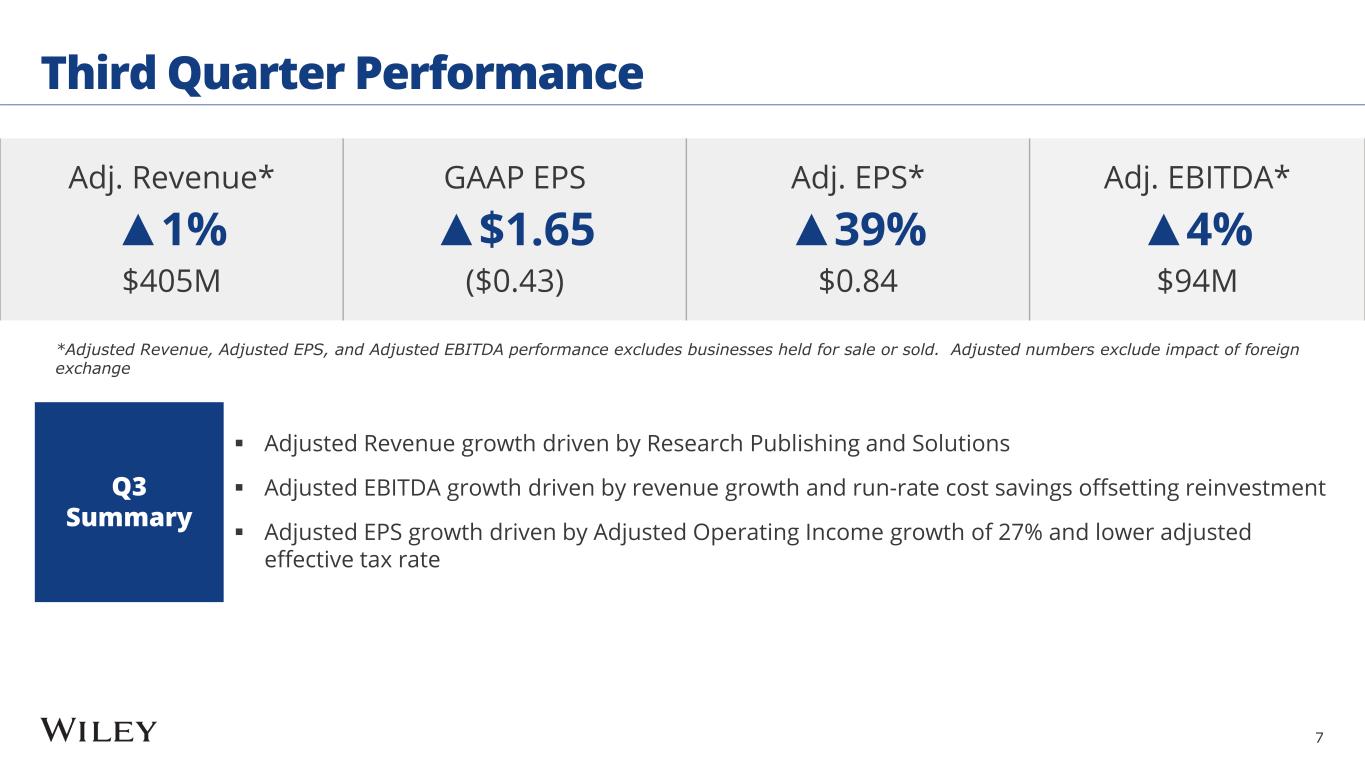

| US GAAP (Loss) Earnings Per Share - Diluted | $ | (0.43) | $ | (2.08) | $ | 0.29 | $ | (4.10) | |||||||||||||||

| Adjustments: | |||||||||||||||||||||||

| Impairment of goodwill | — | 1.48 | — | 1.90 | |||||||||||||||||||

| Restructuring and related charges | 0.09 | 0.20 | 0.21 | 0.70 | |||||||||||||||||||

Foreign exchange losses (gains) on intercompany transactions, including the write off of certain cumulative translation adjustments (3) |

0.09 | (0.03) | 0.09 | 0.02 | |||||||||||||||||||

Amortization of acquired intangible assets (4) |

0.20 | 0.22 | 0.62 | 0.65 | |||||||||||||||||||

Net loss on sale of businesses, assets, and impairment charges related to assets held-for-sale (5) |

0.29 | 0.83 | 0.20 | 2.77 | |||||||||||||||||||

Held for Sale or Sold segment Adjusted Net (Income) Loss (5) |

— | (0.05) | 0.05 | (0.39) | |||||||||||||||||||

| Income tax adjustments | 0.58 | — | 0.82 | — | |||||||||||||||||||

EPS impact of using weighted-average dilutive shares for adjusted EPS calculation (6) |

0.02 | 0.02 | — | 0.04 | |||||||||||||||||||

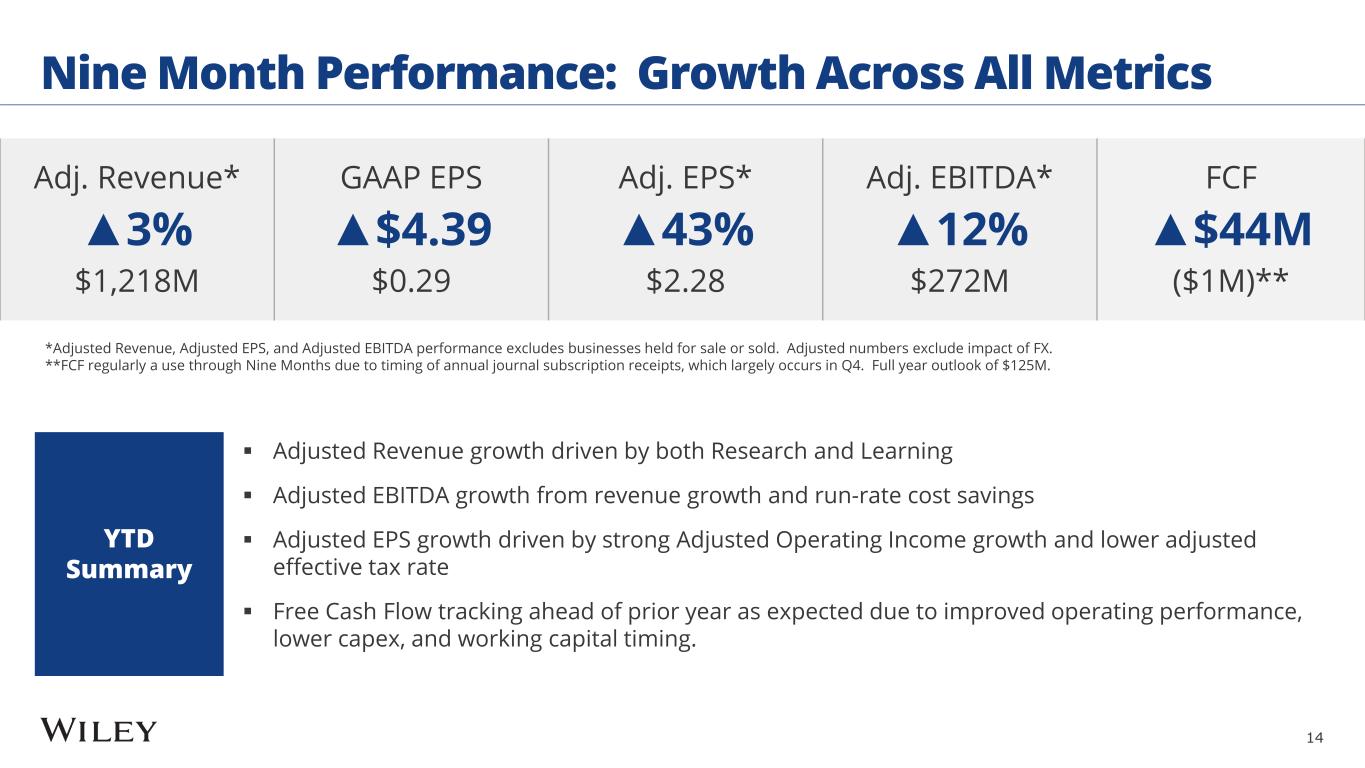

| Non-GAAP Adjusted Earnings Per Share - Diluted | $ | 0.84 | $ | 0.59 | $ | 2.28 | $ | 1.59 | |||||||||||||||

| Reconciliation of US GAAP Income (Loss) Before Taxes to Non-GAAP Adjusted Income Before Taxes | |||||||||||||||||||||||

(amounts in thousands) |

Three Months Ended January 31, |

Nine Months Ended January 31, |

|||||||||||||||||||||

| 2025 | 2024 | 2025 | 2024 | ||||||||||||||||||||

| US GAAP Income (Loss) Before Taxes | $ | 18,673 | $ | (112,296) | $ | 90,613 | $ | (241,049) | |||||||||||||||

| Pretax Impact of Adjustments: | |||||||||||||||||||||||

| Impairment of goodwill | — | 81,754 | — | 108,449 | |||||||||||||||||||

| Restructuring and related charges | 5,574 | 14,808 | 13,071 | 52,033 | |||||||||||||||||||

Foreign exchange losses (gains) on intercompany transactions, including the write off of certain cumulative translation adjustments (3) |

5,239 | (2,128) | 5,590 | 1,089 | |||||||||||||||||||

Amortization of acquired intangible assets (4) |

13,042 | 13,580 | 38,956 | 44,550 | |||||||||||||||||||

Net loss on sale of businesses, assets, and impairment charges related to assets held-for-sale (5) |

15,930 | 52,404 | 9,760 | 179,747 | |||||||||||||||||||

Held for Sale or Sold segment Adjusted (Income) Loss Before Taxes (5) |

— | (4,120) | 3,578 | (28,253) | |||||||||||||||||||

| Non-GAAP Adjusted Income Before Taxes | $ | 58,458 | $ | 44,002 | $ | 161,568 | $ | 116,566 | |||||||||||||||

| Reconciliation of US GAAP Income Tax Provision (Benefit) to Non-GAAP Adjusted Income Tax Provision, including our US GAAP Effective Tax Rate and our Non-GAAP Adjusted Effective Tax Rate | |||||||||||||||||||||||

| US GAAP Income Tax Provision (Benefit) | $ | 41,627 | $ | 1,579 | $ | 74,545 | $ | (15,465) | |||||||||||||||

Income Tax Impact of Adjustments (7) |

|||||||||||||||||||||||

| Impairment of goodwill | — | — | — | 2,697 | |||||||||||||||||||

| Restructuring and related charges | 404 | 3,985 | 1,315 | 13,237 | |||||||||||||||||||

Foreign exchange losses (gains) on intercompany transactions, including the write off of certain cumulative translation adjustments (3) |

260 | (742) | 599 | 112 | |||||||||||||||||||

Amortization of acquired intangible assets (4) |

1,910 | 1,152 | 5,511 | 8,668 | |||||||||||||||||||

Net loss on sale of businesses, assets, and impairment charges related to assets held-for-sale (5) |

154 | 6,508 | (1,360) | 25,711 | |||||||||||||||||||

Held for Sale or Sold segment Adjusted Tax (Provision) Benefit (5) |

— | (1,252) | 887 | (6,518) | |||||||||||||||||||

| Income Tax Adjustments | |||||||||||||||||||||||

Impact of valuation allowance on the US GAAP effective tax rate (8) |

(31,744) | — | (44,863) | — | |||||||||||||||||||

| Non-GAAP Adjusted Income Tax Provision | $ | 12,611 | $ | 11,230 | $ | 36,634 | $ | 28,442 | |||||||||||||||

| US GAAP Effective Tax Rate | 222.9 | % | -1.4 | % | 82.3 | % | 6.4 | % | |||||||||||||||

| Non-GAAP Adjusted Effective Tax Rate | 21.6 | % | 25.5 | % | 22.7 | % | 24.4 | % | |||||||||||||||

Notes: | ||

| (1) See Explanation of Usage of Non-GAAP Performance Measures included in this supplementary information for additional details on the reasons why management believes presentation of each non-GAAP performance measure provides useful information to investors. The supplementary information included in this press release for the three and nine months ended January 31, 2025 is preliminary and subject to change prior to the filing of our upcoming Quarterly Report on Form 10-Q with the Securities and Exchange Commission. | ||

| (2) All amounts are approximate due to rounding. | ||

| (3) In fiscal year 2023 due to the closure of our operations in Russia, the Russia entity was deemed substantially liquidated. In the three and nine months ended January 31, 2025, we wrote off an additional $0.1 million and $0.4 million, respectively, of cumulative translation adjustments in earnings. In the three and nine months ended January 31, 2024, we wrote off an additional $0.2 million and $0.8 million, respectively, of cumulative translation adjustments in earnings. These amounts are reflected in Net foreign exchange transaction (losses) gains on our Condensed Consolidated Statements of Net (Loss) Income. | ||

| (4) Reflects the amortization of intangible assets established on the opening balance sheet for an acquired business. This includes the amortization of intangible assets such as developed technology, customer relationships, tradenames, etc., which is reflected in the "Amortization of intangible assets" line in the Condensed Consolidated Statements of Net (Loss) Income. It also includes the amortization of acquired product development assets, which is reflected in Cost of sales in the Condensed Consolidated Statements of Net (Loss) Income. | ||

| (5) For the three and nine months ended January 31, 2025 and 2024, we recorded net pretax loss on sale of businesses, assets, and impairment charges related to assets held-for-sale as follows: | |||||||||||||||||||||||

| Three Months Ended January 31, |

Nine Months Ended January 31, |

||||||||||||||||||||||

| 2025 | 2024 | 2025 | 2024 | ||||||||||||||||||||

| Wiley Edge | $ | 15,566 | $ | 20,676 | $ | 14,778 | $ | 20,676 | |||||||||||||||

| University Services | 639 | 25,946 | (850) | 101,412 | |||||||||||||||||||

| CrossKnowledge | (275) | 5,782 | (4,197) | 56,159 | |||||||||||||||||||

| Tuition Manager | — | — | (120) | 1,500 | |||||||||||||||||||

| Sale of assets | — | — | 149 | — | |||||||||||||||||||

| Net pretax loss on sale of businesses, assets, and impairment charges related to assets held-for-sale | $ | 15,930 | $ | 52,404 | $ | 9,760 | $ | 179,747 | |||||||||||||||

| For the three and nine months ended January 31, 2025 and 2024, we recorded income tax benefit (provision) on sale of businesses, assets, and impairment charges related to assets held-for-sale as follows: | |||||||||||||||||||||||

| Three Months Ended January 31, |

Nine Months Ended January 31, |

||||||||||||||||||||||

| 2025 | 2024 | 2025 | 2024 | ||||||||||||||||||||

| Wiley Edge | $ | 154 | $ | — | $ | (1,330) | $ | — | |||||||||||||||

| University Services | — | 6,508 | — | 25,337 | |||||||||||||||||||

| CrossKnowledge | — | — | — | — | |||||||||||||||||||

| Tuition Manager | — | — | (30) | 374 | |||||||||||||||||||

| Sale of assets | — | — | — | — | |||||||||||||||||||

| Benefit (provision) on sale of businesses, assets, and impairment charges related to assets held-for-sale | $ | 154 | $ | 6,508 | $ | (1,360) | $ | 25,711 | |||||||||||||||

| In addition, our Adjusted EPS excludes the Adjusted Net Income or Loss of our Held for Sale or Sold segment. | |||||||||||||||||||||||

| (6) Represents the impact of using diluted weighted-average number of common shares outstanding (54.6 million shares for the three months ended January 31, 2025 and 55.3 million and 55.6 million shares for the three and nine months ended January 31, 2024, respectively) included in the Non-GAAP Adjusted EPS calculation in order to apply the dilutive impact on adjusted net income due to the effect of unvested restricted stock units and other stock awards. This impact occurs when a US GAAP net loss is reported and the effect of using dilutive shares is antidilutive. | ||

| (7) For the three and nine months ended January 31, 2025 and 2024, substantially all of the tax impact was from deferred taxes. | ||

| (8) In the nine months ended January 31, 2025, there was an impact on the US GAAP effective tax rate due to the valuation allowance on deferred tax assets in the US of $44.9 million, which includes an adjustment of $31.7 million in the three months ended January 31, 2025. | ||

| Three Months Ended January 31, |

Nine Months Ended January 31, |

||||||||||||||||||||||

| 2025 | 2024 | 2025 | 2024 | ||||||||||||||||||||

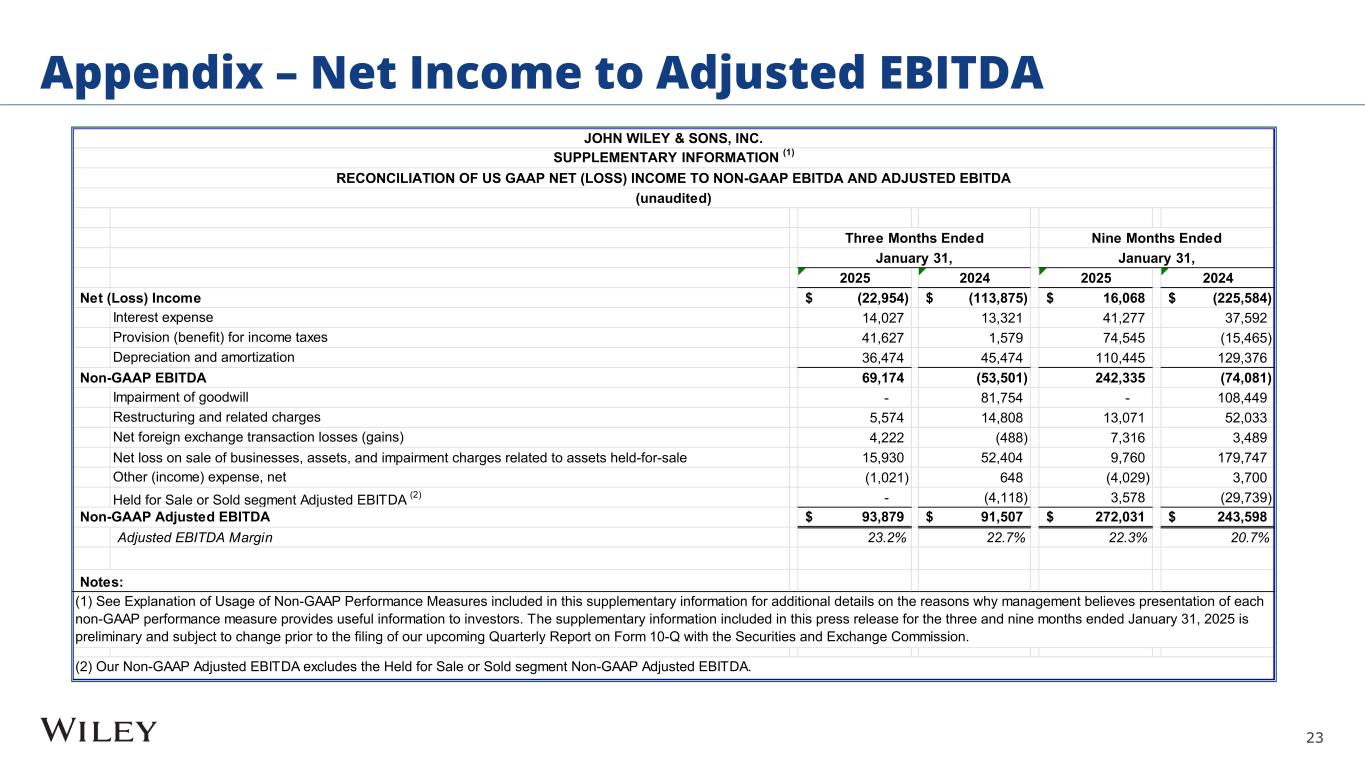

| Net (Loss) Income | $ | (22,954) | $ | (113,875) | $ | 16,068 | $ | (225,584) | |||||||||||||||

| Interest expense | 14,027 | 13,321 | 41,277 | 37,592 | |||||||||||||||||||

| Provision (benefit) for income taxes | 41,627 | 1,579 | 74,545 | (15,465) | |||||||||||||||||||

| Depreciation and amortization | 36,474 | 45,474 | 110,445 | 129,376 | |||||||||||||||||||

| Non-GAAP EBITDA | 69,174 | (53,501) | 242,335 | (74,081) | |||||||||||||||||||

| Impairment of goodwill | — | 81,754 | — | 108,449 | |||||||||||||||||||

| Restructuring and related charges | 5,574 | 14,808 | 13,071 | 52,033 | |||||||||||||||||||

| Net foreign exchange transaction losses (gains) | 4,222 | (488) | 7,316 | 3,489 | |||||||||||||||||||

| Net loss on sale of businesses, assets, and impairment charges related to assets held-for-sale | 15,930 | 52,404 | 9,760 | 179,747 | |||||||||||||||||||

| Other (income) expense, net | (1,021) | 648 | (4,029) | 3,700 | |||||||||||||||||||

Held for Sale or Sold segment Adjusted EBITDA (2) |

— | (4,118) | 3,578 | (29,739) | |||||||||||||||||||

| Non-GAAP Adjusted EBITDA | $ | 93,879 | $ | 91,507 | $ | 272,031 | $ | 243,598 | |||||||||||||||

| Adjusted EBITDA Margin | 23.2 | % | 22.7 | % | 22.3 | % | 20.7 | % | |||||||||||||||

Notes: | ||

| (1) See Explanation of Usage of Non-GAAP Performance Measures included in this supplementary information for additional details on the reasons why management believes presentation of each non-GAAP performance measure provides useful information to investors. The supplementary information included in this press release for the three and nine months ended January 31, 2025 is preliminary and subject to change prior to the filing of our upcoming Quarterly Report on Form 10-Q with the Securities and Exchange Commission. | ||

| (2) Our Non-GAAP Adjusted EBITDA excludes the Held for Sale or Sold segment Non-GAAP Adjusted EBITDA. | ||

| % Change | |||||||||||||||||||||||

| Three Months Ended January 31, |

Favorable (Unfavorable) | ||||||||||||||||||||||

| 2025 | 2024 | Reported | Constant Currency |

||||||||||||||||||||

| Research: | |||||||||||||||||||||||

| Revenue, net | |||||||||||||||||||||||

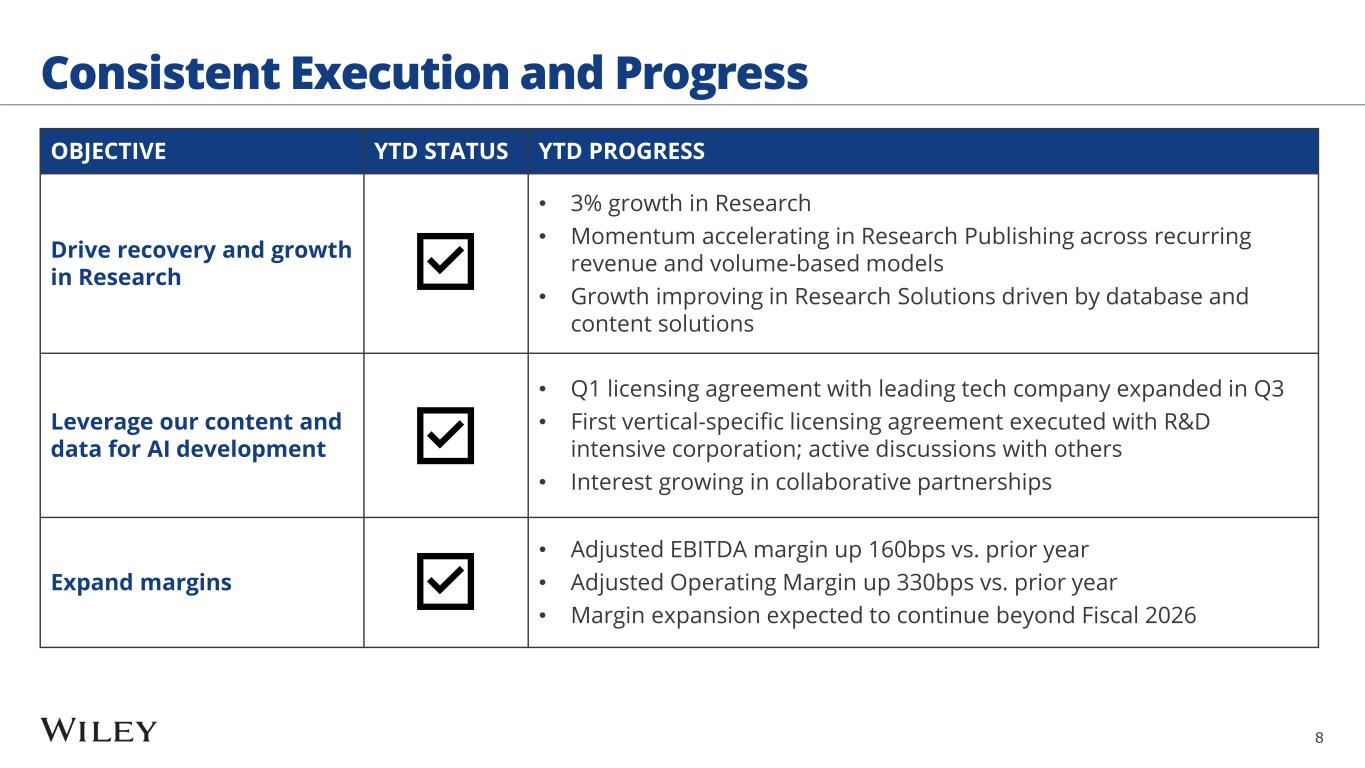

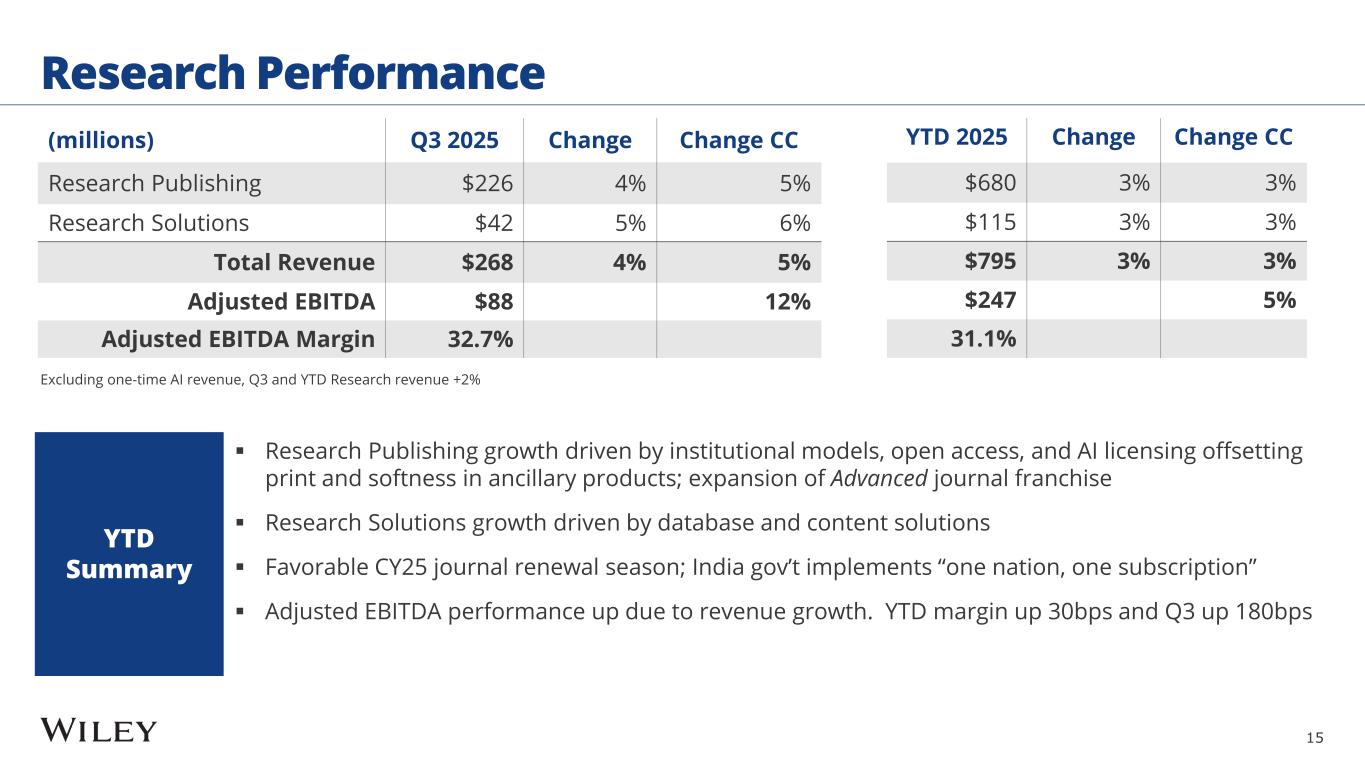

| Research Publishing | $ | 225,874 | $ | 216,586 | 4 | % | 5 | % | |||||||||||||||

| Research Solutions | 41,670 | 39,613 | 5 | % | 6 | % | |||||||||||||||||

| Total Revenue, net | $ | 267,544 | $ | 256,199 | 4 | % | 5 | % | |||||||||||||||

| Non-GAAP Adjusted Operating Income | $ | 65,669 | $ | 57,098 | 15 | % | 17 | % | |||||||||||||||

| Depreciation and amortization | 21,918 | 22,029 | 1 | % | 0 | % | |||||||||||||||||

| Non-GAAP Adjusted EBITDA | $ | 87,587 | $ | 79,127 | 11 | % | 12 | % | |||||||||||||||

| Adjusted EBITDA margin | 32.7 | % | 30.9 | % | |||||||||||||||||||

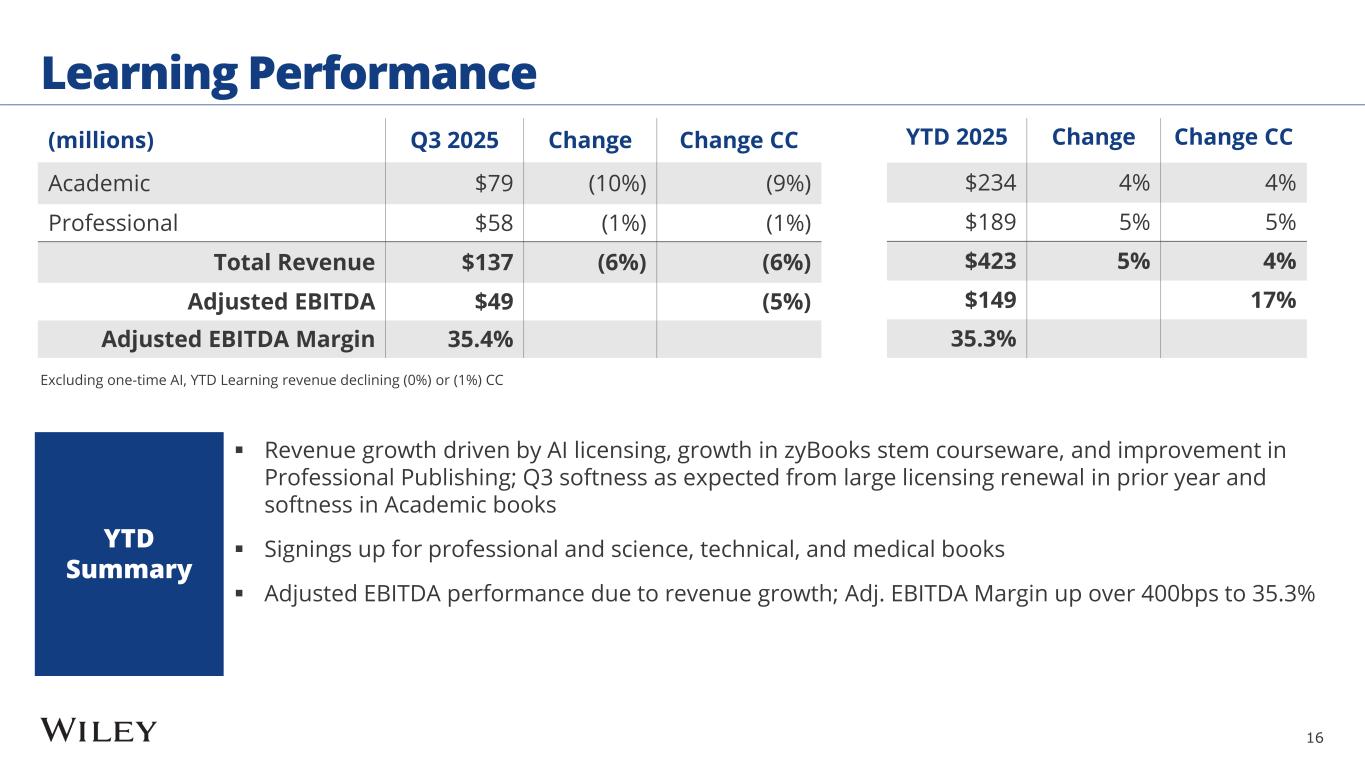

| Learning: | |||||||||||||||||||||||

| Revenue, net | |||||||||||||||||||||||

| Academic | $ | 78,795 | $ | 87,216 | -10 | % | -9 | % | |||||||||||||||

| Professional | 58,287 | 59,118 | -1 | % | -1 | % | |||||||||||||||||

| Total Revenue, net | $ | 137,082 | $ | 146,334 | -6 | % | -6 | % | |||||||||||||||

| Non-GAAP Adjusted Operating Income | $ | 37,764 | $ | 37,513 | 1 | % | 1 | % | |||||||||||||||

| Depreciation and amortization | 10,761 | 13,812 | 22 | % | 22 | % | |||||||||||||||||

| Non-GAAP Adjusted EBITDA | $ | 48,525 | $ | 51,325 | -5 | % | -5 | % | |||||||||||||||

| Adjusted EBITDA margin | 35.4 | % | 35.1 | % | |||||||||||||||||||

| Held for Sale or Sold: | |||||||||||||||||||||||

| Revenue, net | $ | — | $ | 58,172 | # | # | |||||||||||||||||

| Non-GAAP Adjusted Operating Income | $ | — | $ | 4,118 | # | # | |||||||||||||||||

| Depreciation and amortization | — | — | # | # | |||||||||||||||||||

| Non-GAAP Adjusted EBITDA | $ | — | $ | 4,118 | # | # | |||||||||||||||||

| Adjusted EBITDA margin | 0.0 | % | 7.1 | % | |||||||||||||||||||

| Corporate Expenses: | |||||||||||||||||||||||

| Non-GAAP Adjusted Corporate Expenses | $ | (46,028) | $ | (48,578) | 5 | % | 5 | % | |||||||||||||||

| Depreciation and amortization | 3,795 | 9,633 | 61 | % | 61 | % | |||||||||||||||||

| Non-GAAP Adjusted EBITDA | $ | (42,233) | $ | (38,945) | -8 | % | -9 | % | |||||||||||||||

| Consolidated Results: | |||||||||||||||||||||||

| Revenue, net | $ | 404,626 | $ | 460,705 | -12 | % | -12 | % | |||||||||||||||

Less: Held for Sale or Sold Segment (3) |

— | (58,172) | # | # | |||||||||||||||||||

| Adjusted Revenue, net | $ | 404,626 | $ | 402,533 | 1 | % | 1 | % | |||||||||||||||

| Operating Income (Loss) | $ | 51,831 | $ | (46,411) | # | # | |||||||||||||||||

| Adjustments: | |||||||||||||||||||||||

| Restructuring charges | 5,574 | 14,808 | 62 | % | 62 | % | |||||||||||||||||

| Impairment of goodwill | — | 81,754 | # | # | |||||||||||||||||||

Held for Sale or Sold Segment Adjusted Operating Income (3) |

— | (4,118) | # | # | |||||||||||||||||||

| Non-GAAP Adjusted Operating Income | $ | 57,405 | $ | 46,033 | 25 | % | 27 | % | |||||||||||||||

| Adjusted Operating Income margin | 14.2 | % | 11.4 | % | |||||||||||||||||||

| Depreciation and amortization | 36,474 | 45,474 | 20 | % | 19 | % | |||||||||||||||||

Less: Held for Sale or Sold Segment depreciation and amortization (3) |

— | — | # | # | |||||||||||||||||||

| Non-GAAP Adjusted EBITDA | $ | 93,879 | $ | 91,507 | 3 | % | 4 | % | |||||||||||||||

| Adjusted EBITDA margin | 23.2 | % | 22.7 | % | |||||||||||||||||||

Notes: | ||

| (1) The supplementary information included in this press release for the three and nine months ended January 31, 2025 is preliminary and subject to change prior to the filing of our upcoming Quarterly Report on Form 10-Q with the Securities and Exchange Commission. | ||

| (2) All amounts are approximate due to rounding. | ||

| (3) Our Adjusted Revenue, Adjusted Operating Income and Adjusted EBITDA excludes the impact of our Held for Sale or Sold segment Revenue, Adjusted Operating Income or Loss and Adjusted EBITDA results. | ||

| # Variance greater than 100% | ||

| % Change | |||||||||||||||||||||||

| Nine Months Ended January 31, |

Favorable (Unfavorable) | ||||||||||||||||||||||

| 2025 | 2024 | Reported | Constant Currency |

||||||||||||||||||||

| Research: | |||||||||||||||||||||||

| Revenue, net | |||||||||||||||||||||||

| Research Publishing | $ | 679,492 | $ | 659,329 | 3 | % | 3 | % | |||||||||||||||

| Research Solutions | 115,246 | 112,344 | 3 | % | 3 | % | |||||||||||||||||

| Total Revenue, net | $ | 794,738 | $ | 771,673 | 3 | % | 3 | % | |||||||||||||||

| Non-GAAP Adjusted Operating Income | $ | 180,412 | $ | 169,481 | 6 | % | 7 | % | |||||||||||||||

| Depreciation and amortization | 66,999 | 67,909 | 1 | % | 2 | % | |||||||||||||||||

| Non-GAAP Adjusted EBITDA | $ | 247,411 | $ | 237,390 | 4 | % | 5 | % | |||||||||||||||

| Adjusted EBITDA margin | 31.1 | % | 30.8 | % | |||||||||||||||||||

| Learning: | |||||||||||||||||||||||

| Revenue, net | |||||||||||||||||||||||

| Academic | $ | 233,547 | $ | 224,633 | 4 | % | 4 | % | |||||||||||||||

| Professional | 189,363 | 179,961 | 5 | % | 5 | % | |||||||||||||||||

| Total Revenue, net | $ | 422,910 | $ | 404,594 | 5 | % | 4 | % | |||||||||||||||

| Non-GAAP Adjusted Operating Income | $ | 116,135 | $ | 85,051 | 37 | % | 36 | % | |||||||||||||||

| Depreciation and amortization | 32,952 | 41,338 | 20 | % | 20 | % | |||||||||||||||||

| Non-GAAP Adjusted EBITDA | $ | 149,087 | $ | 126,389 | 18 | % | 17 | % | |||||||||||||||

| Adjusted EBITDA margin | 35.3 | % | 31.2 | % | |||||||||||||||||||

| Held for Sale or Sold: | |||||||||||||||||||||||

| Revenue, net | $ | 17,382 | $ | 228,259 | -92 | % | -92 | % | |||||||||||||||

| Non-GAAP Adjusted Operating (Loss) Income | $ | (3,578) | $ | 26,302 | # | # | |||||||||||||||||

| Depreciation and amortization | — | 3,437 | # | # | |||||||||||||||||||

| Non-GAAP Adjusted EBITDA | $ | (3,578) | $ | 29,739 | # | # | |||||||||||||||||

| Adjusted EBITDA margin | -20.6 | % | 13.0 | % | |||||||||||||||||||

| Corporate Expenses: | |||||||||||||||||||||||

| Non-GAAP Adjusted Corporate Expenses | $ | (134,961) | $ | (136,873) | 1 | % | 2 | % | |||||||||||||||

| Depreciation and amortization | 10,494 | 16,692 | 37 | % | 37 | % | |||||||||||||||||

| Non-GAAP Adjusted EBITDA | $ | (124,467) | $ | (120,181) | -4 | % | -3 | % | |||||||||||||||

| Consolidated Results: | |||||||||||||||||||||||

| Revenue, net | $ | 1,235,030 | $ | 1,404,526 | -12 | % | -12 | % | |||||||||||||||

Less: Held for Sale or Sold Segment (3) |

(17,382) | (228,259) | -92 | % | -92 | % | |||||||||||||||||

| Adjusted Revenue, net | $ | 1,217,648 | $ | 1,176,267 | 4 | % | 3 | % | |||||||||||||||

| Operating Income (Loss) | $ | 144,937 | $ | (16,521) | # | # | |||||||||||||||||

| Adjustments: | |||||||||||||||||||||||

| Restructuring charges | 13,071 | 52,033 | 75 | % | 75 | % | |||||||||||||||||

| Impairment of goodwill | — | 108,449 | # | # | |||||||||||||||||||

Held for Sale or Sold Segment Adjusted Operating Loss (Income) (3) |

3,578 | (26,302) | # | # | |||||||||||||||||||

| Non-GAAP Adjusted Operating Income | $ | 161,586 | $ | 117,659 | 37 | % | 38 | % | |||||||||||||||

| Adjusted Operating Income margin | 13.3 | % | 10.0 | % | |||||||||||||||||||

| Depreciation and amortization | 110,445 | 129,376 | 15 | % | 15 | % | |||||||||||||||||

Less: Held for Sale or Sold depreciation and amortization (3) |

— | (3,437) | # | # | |||||||||||||||||||

| Non-GAAP Adjusted EBITDA | $ | 272,031 | $ | 243,598 | 12 | % | 12 | % | |||||||||||||||

| Adjusted EBITDA margin | 22.3 | % | 20.7 | % | |||||||||||||||||||

| January 31, 2025 |

April 30, 2024 |

||||||||||

| Assets: | |||||||||||

| Current assets | |||||||||||

| Cash and cash equivalents | $ | 104,510 | $ | 83,249 | |||||||

| Accounts receivable, net | 184,672 | 224,198 | |||||||||

| Inventories, net | 25,305 | 26,219 | |||||||||

| Prepaid expenses and other current assets | 80,277 | 85,954 | |||||||||

| Current assets held-for-sale | — | 34,422 | |||||||||

| Total current assets | 394,764 | 454,042 | |||||||||

| Technology, property and equipment, net | 164,502 | 192,438 | |||||||||

| Intangible assets, net | 572,123 | 615,694 | |||||||||

| Goodwill | 1,079,175 | 1,091,368 | |||||||||

| Operating lease right-of-use assets | 66,947 | 69,074 | |||||||||

| Other non-current assets | 322,341 | 283,719 | |||||||||

| Non-current assets held-for-sale | — | 19,160 | |||||||||

| Total assets | $ | 2,599,852 | $ | 2,725,495 | |||||||

| Liabilities and shareholders' equity: | |||||||||||

| Current liabilities | |||||||||||

| Accounts payable | $ | 53,220 | $ | 55,659 | |||||||

| Accrued royalties | 156,271 | 97,173 | |||||||||

| Short-term portion of long-term debt | 10,000 | 7,500 | |||||||||

| Contract liabilities | 313,278 | 483,778 | |||||||||

| Accrued employment costs | 74,307 | 96,980 | |||||||||

| Short-term portion of operating lease liabilities | 17,969 | 18,294 | |||||||||

| Other accrued liabilities | 92,213 | 76,266 | |||||||||

| Current liabilities held-for-sale | — | 37,632 | |||||||||

| Total current liabilities | 717,258 | 873,282 | |||||||||

| Long-term debt | 877,205 | 767,096 | |||||||||

| Accrued pension liability | 69,647 | 70,832 | |||||||||

| Deferred income tax liabilities | 94,567 | 97,186 | |||||||||

| Operating lease liabilities | 83,602 | 94,386 | |||||||||

| Other long-term liabilities | 72,329 | 71,760 | |||||||||

| Long-term liabilities held-for-sale | — | 11,237 | |||||||||

| Total liabilities | 1,914,608 | 1,985,779 | |||||||||

| Shareholders' equity | 685,244 | 739,716 | |||||||||

| Total liabilities and shareholders' equity | $ | 2,599,852 | $ | 2,725,495 | |||||||

Notes: | ||

| (1) The supplementary information included in this press release for January 31, 2025 is preliminary and subject to change prior to the filing of our upcoming Quarterly Report on Form 10-Q with the Securities and Exchange Commission. | ||

| Nine Months Ended January 31, |

|||||||||||

| 2025 | 2024 | ||||||||||

| Operating activities: | |||||||||||

| Net income (loss) | $ | 16,068 | $ | (225,584) | |||||||

| Impairment of goodwill | — | 108,449 | |||||||||

| Net loss on sale of businesses, assets, and impairment charges related to assets held-for-sale | 9,760 | 179,747 | |||||||||

| Amortization of intangible assets | 38,913 | 42,730 | |||||||||

| Amortization of product development assets | 12,669 | 17,894 | |||||||||

| Depreciation and amortization of technology, property, and equipment | 58,863 | 68,752 | |||||||||

| Other noncash charges | 67,268 | 50,146 | |||||||||

| Net change in operating assets and liabilities | (151,291) | (217,782) | |||||||||

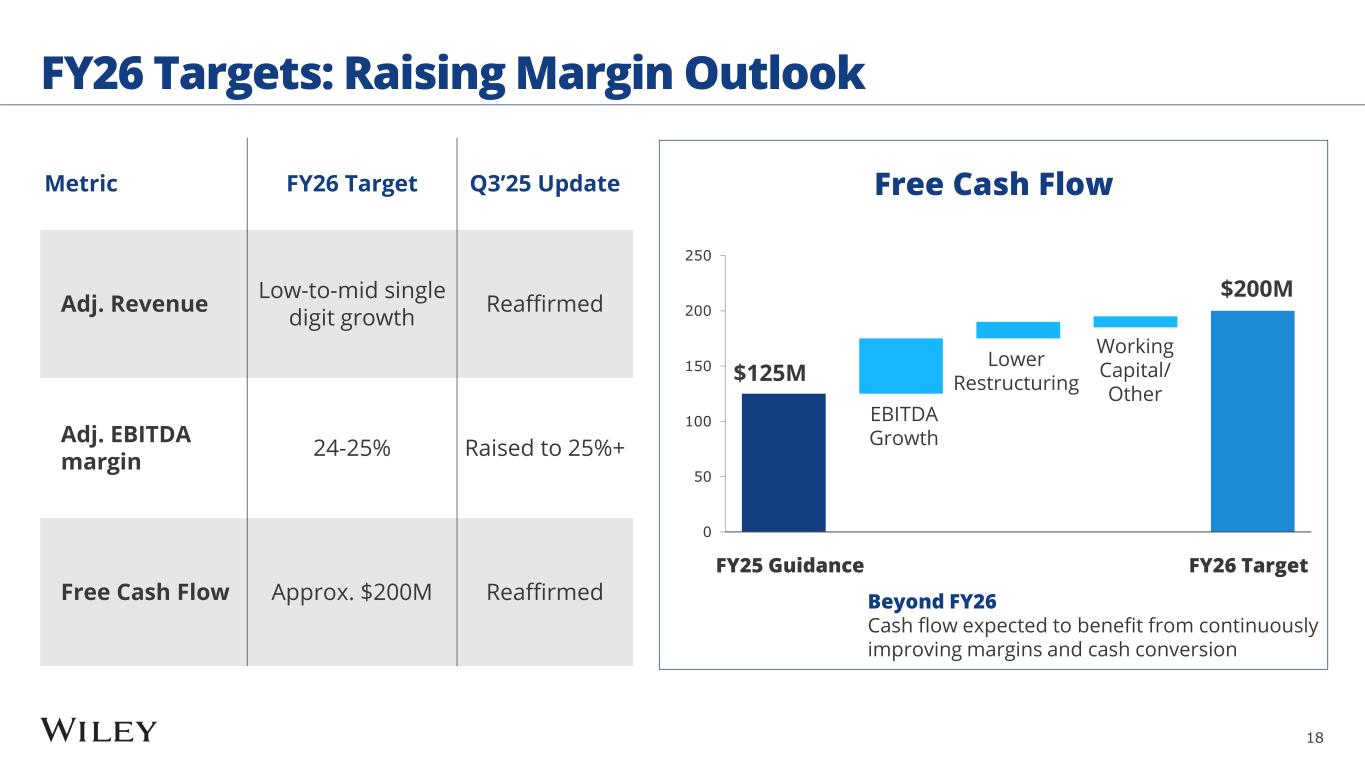

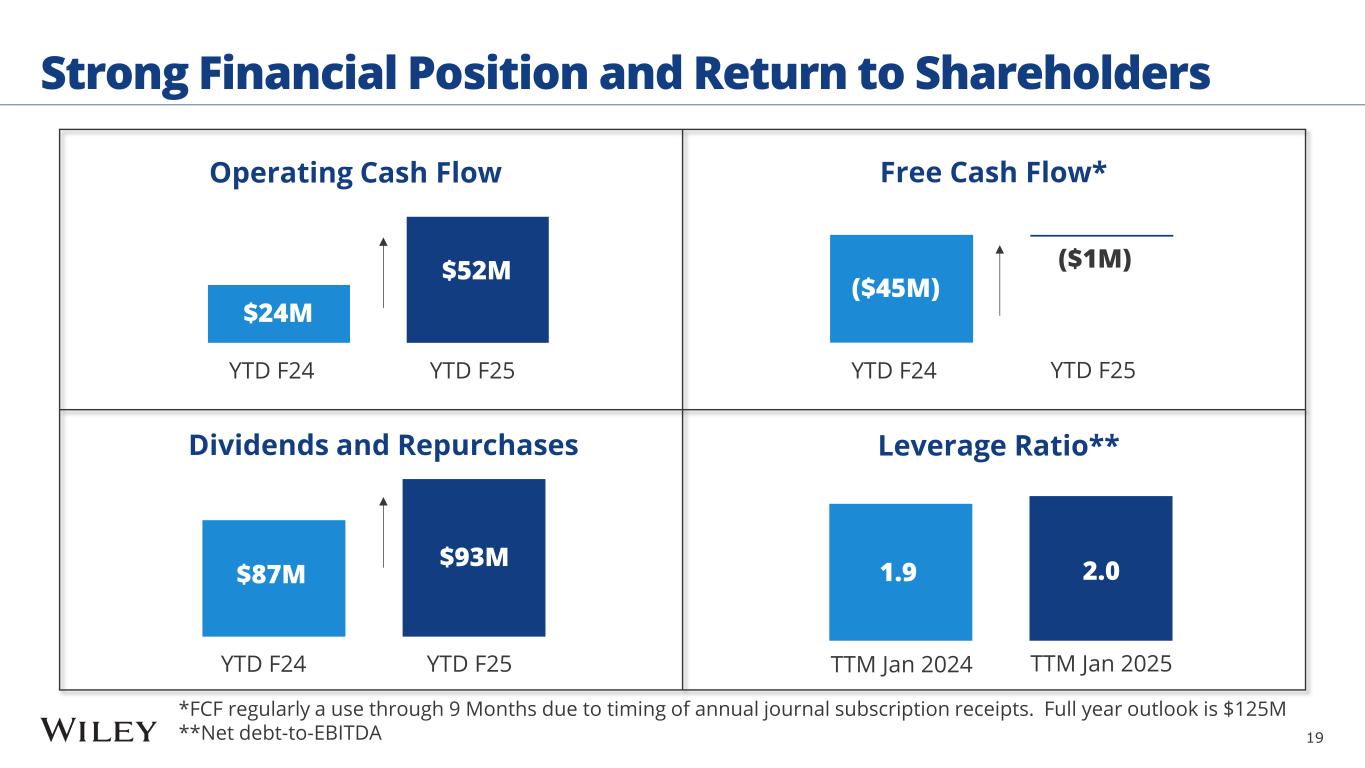

| Net cash provided by operating activities | 52,250 | 24,352 | |||||||||

| Investing activities: | |||||||||||

| Additions to technology, property, and equipment | (42,347) | (57,275) | |||||||||

| Product development spending | (11,054) | (12,324) | |||||||||

| Businesses acquired in purchase transactions, net of cash acquired | (915) | (3,116) | |||||||||

| Net cash transferred related to the sale of businesses and assets | (11,239) | (1,237) | |||||||||

| Acquisitions of publication rights and other | (4,139) | (4,541) | |||||||||

| Net cash used in investing activities | (69,694) | (78,493) | |||||||||

| Financing activities: | |||||||||||

| Net debt borrowings | 114,319 | 158,681 | |||||||||

| Cash dividends | (57,243) | (57,869) | |||||||||

| Purchases of treasury shares | (35,421) | (29,000) | |||||||||

| Other | 2,421 | (16,458) | |||||||||

| Net cash provided by financing activities | 24,076 | 55,354 | |||||||||

| Effects of exchange rate changes on cash, cash equivalents and restricted cash | (1,615) | 432 | |||||||||

| Change in cash, cash equivalents and restricted cash for period | 5,017 | 1,645 | |||||||||

| Cash, cash equivalents and restricted cash - beginning | 99,543 | 107,262 | |||||||||

| Cash, cash equivalents and restricted cash - ending | $ | 104,560 | $ | 108,907 | |||||||

CALCULATION OF NON-GAAP FREE CASH FLOW LESS PRODUCT DEVELOPMENT SPENDING (2) | |||||||||||

| Nine Months Ended January 31, |

|||||||||||

| 2025 | 2024 | ||||||||||

| Net cash provided by operating activities | $ | 52,250 | $ | 24,352 | |||||||

| Less: Additions to technology, property, and equipment | (42,347) | (57,275) | |||||||||

| Less: Product development spending | (11,054) | (12,324) | |||||||||

| Free cash flow less product development spending | $ | (1,151) | $ | (45,247) | |||||||

Notes: | ||

| (1) The supplementary information included in this press release for the nine months ended January 31, 2025 is preliminary and subject to change prior to the filing of our upcoming Quarterly Report on Form 10-Q with the Securities and Exchange Commission. | ||

| (2) See Explanation of Usage of Non-GAAP Performance Measures included in this supplemental information. | ||