DE |

001-06991 | 71-0415188 |

||||||

(State or other jurisdiction of incorporation or organization) |

(Commission File Number) |

(I.R.S. Employer Identification No.) |

||||||

| Title of each class | Trading Symbol(s) | Name of each exchange on which registered | ||||||||||||

| Common Stock, par value $0.10 per share | WMT | NYSE | ||||||||||||

| 2.550% Notes Due 2026 | WMT26 | NYSE | ||||||||||||

| The following documents are furnished as exhibits to this Current Report on Form 8-K: | |||||

| 99.1 | |||||

| 99.2 | |||||

| Exhibit 104 | Cover Page Interactive Data File (formatted as Inline XBRL). | ||||

| WALMART INC. | |||||

| By: | /s/ John David Rainey | ||||

| Name: | John David Rainey | ||||

| Title: | Executive Vice President and Chief Financial Officer |

||||

|

|||||||||||||||||||||||

| Walmart Reports Second Quarter Results |

|||||||||||||||||||||||

|

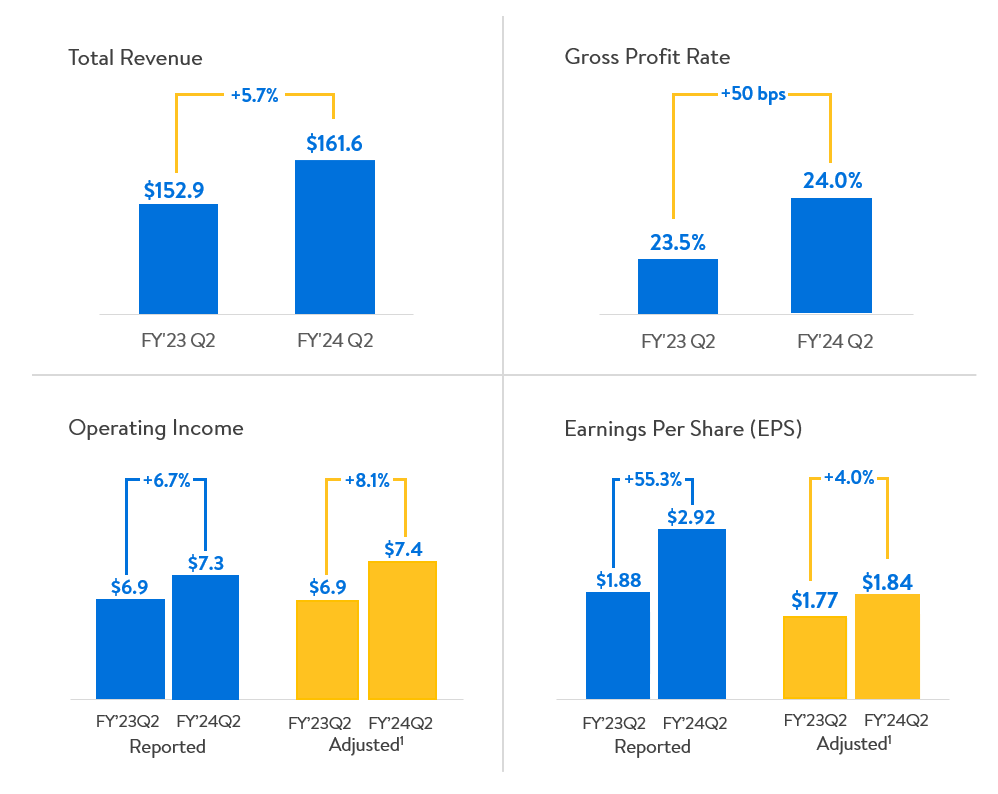

•Strong revenue growth of 5.7%; operating income growing faster at 6.7%

•eCommerce up 24% globally

•GAAP EPS of $2.92; Adjusted EPS of $1.841

•Guides Q3 and raises FY24 outlook

|

|||||||||||||||||||||||

“ |

We had another strong quarter. Around the world, our customers and members are prioritizing value and convenience. They’re shopping with us across channels — in stores, Sam’s Clubs, and they’re driving eCommerce, which was up 24% globally. Food is a strength, but we’re also encouraged by our results in general merchandise versus our expectations when we started the quarter. Our associates helped deliver increases in transaction counts and units sold, and profit is growing faster than sales. We’re in good shape with inventory, and we like our position for the back half of the year.”

Doug McMillon

President and CEO, Walmart

|

||||||||||||||||||||||

BENTONVILLE, Ark., Aug 17, 2023 – Walmart Inc. (NYSE: WMT) announces second quarter results, including strong revenue and operating income growth of 5.7% and 6.7%, respectively. The Company sees strength in its omnichannel model across segments with strong comp sales globally, including 6.4%3 for Walmart U.S. The Company raises guidance for FY24 to reflect Q2 upside, confidence in continued business momentum and ongoing customer response to its value proposition. |

|||||||||||||||||||||||

Second Quarter Highlights |

|||||||||||||||||||||||

|

•Consolidated revenue of $161.6 billion, up 5.7%, or 5.4% in constant currency (“cc”)1

•Consolidated gross margin rate up 50bps on lapping elevated markdowns and supply chain costs, partially offset by ongoing mix pressure in grocery and health & wellness

•Consolidated operating expenses as a percentage of net sales grew 33bps

•Consolidated operating income up $0.5 billion, or 6.7%, adjusted operating income up 8.1%1

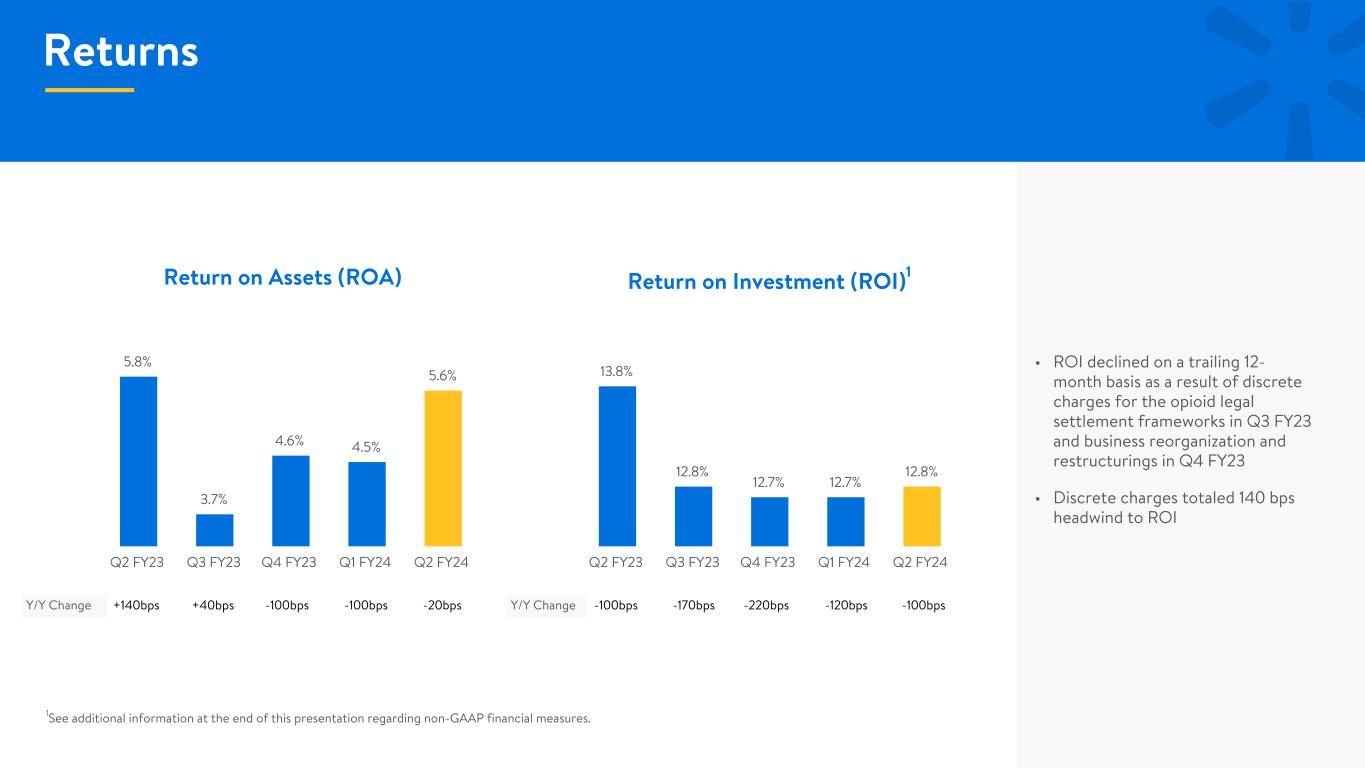

•ROA at 5.6%; ROI at 12.8%1, negatively affected by 140bps of discrete charges in Q3 & Q4 FY23

•Global advertising business2 grew approximately 35%

•Walmart U.S. comp sales up 6.4%3; eCommerce up 24%, led by pickup & delivery

•Celebrating the 65th anniversary of Bodega Aurrera stores in Mexico

|

|||||||||||||||||||||||

|

|||||||||||||||||||||||

|

1 See additional information at the end of the release regarding non-GAAP financial measures.

2 Our global advertising business is recorded in either net sales or as a reduction to cost of sales, depending on the nature of the advertising arrangement.

3 Comp sales for the 13-week period ended July 28th, 2023 compared to the 13-week period ended July 29th, 2022, and excludes fuel. See Supplemental Financial Information for additional information.

“cc” - constant currency

|

|||||||||||||||||||||||

|

||||||||||||||

Balance Sheet and Liquidity | ||||||||||||||

•Cash and cash equivalents of $13.9 billion | ||||||||||||||

•Total debt of $50.4 billion2 | ||||||||||||||

•Operating cash flow of $18.2 billion, an increase of $9.0 billion | ||||||||||||||

•Free cash flow of $9.0 billion1, an increase of $7.2 billion | ||||||||||||||

•Repurchased 8.0 million shares3 YTD, or $1.2 billion | ||||||||||||||

|

1 See additional information at the end of this release regarding non-GAAP financial measures.

2 Debt includes short-term borrowings, long-term debt due within one year, finance lease obligations due within one year, long-term debt and long-term finance lease obligations.

3 $18.2 billion remaining of $20 billion authorization approved in November 2022.

| ||||||||||||||

|

Business Highlights

and Strategic Initiatives

Dollars in billions, except as noted. Dollar and percentage changes may not recalculate due to rounding.

|

|

||||||||||||||||

| Walmart U.S. | FY’24Q2 | FY’23Q2 | Change | |||||||||||

| Net Sales | $110.9 | $105.1 | $5.7 | 5.4% | ||||||||||

Comp Sales (ex. fuel)2 |

6.4% | 6.5% | NP | NP | ||||||||||

| Transactions | 2.9% | 1.0% | NP | NP | ||||||||||

| Average Ticket | 3.4% | 5.5% | NP | NP | ||||||||||

| eCommerce contribution to comp | ~230 bps | ~100 bps | NP | NP | ||||||||||

| Operating Income | $6.1 | $5.7 | $0.4 | 7.6% | ||||||||||

| Walmart International | FY’24Q2 | FY’23Q2 | Change | |||||||||||

| Net sales | $27.6 | $24.4 | $3.2 | 13.3% | ||||||||||

Net sales cc1 |

$27.0 | $24.4 | $2.7 | 11.0% | ||||||||||

| Operating income | $1.2 | $1.0 | $0.1 | 14.1% | ||||||||||

Operating income cc1 |

$1.1 | $1.0 | $— | 2.2% | ||||||||||

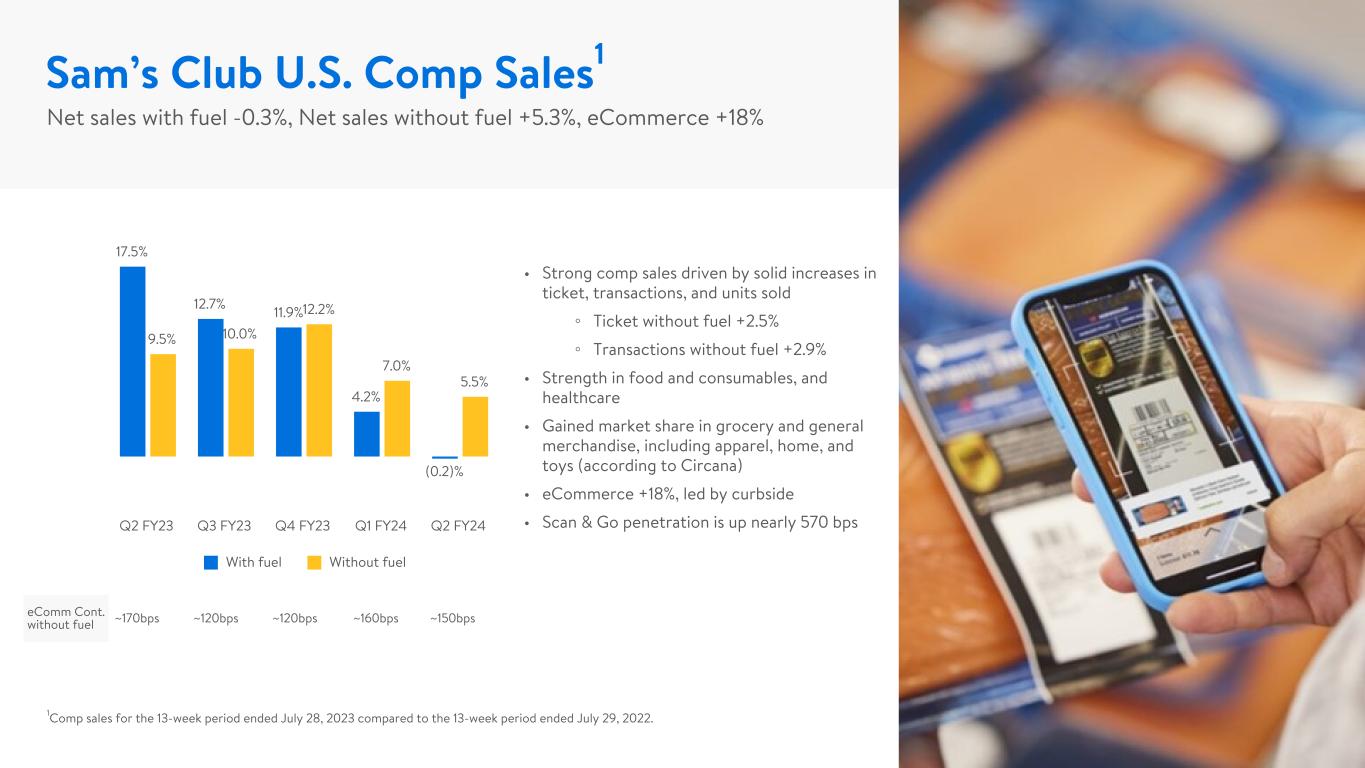

| Sam’s Club U.S. | FY’24Q2 | FY’23Q2 | Change | |||||||||||

| Net Sales | $21.8 | $21.9 | -$0.1 | -0.3% | ||||||||||

| Net Sales (ex. fuel) | $18.9 | $18.0 | $0.9 | 5.3% | ||||||||||

Comp Sales (ex. fuel)1 |

5.5% | 9.5% | NP | NP | ||||||||||

| Transactions | 2.9% | 9.8% | NP | NP | ||||||||||

| Average Ticket | 2.5% | -0.2% | NP | NP | ||||||||||

| eCommerce contribution to comp | ~150 bps | ~170 bps | NP | NP | ||||||||||

| Operating Income | $0.5 | $0.4 | $0.1 | 22.0% | ||||||||||

|

|

|

||||||||||||||||||

|

||||||||||||||||||||

| Guidance |  |

||||||||||||||||

The following guidance reflects the Company’s expectations for the third quarter and fiscal year 2024 and is provided on a non-GAAP basis as the Company cannot predict certain elements that are included in reported GAAP results, such as the changes in fair value of the Company’s equity and other investments. Growth rates reflect an adjusted basis for prior year results. Additionally, the Company’s guidance assumes a generally stable consumer and continued pressure from its mix of products and formats globally. The Company’s fiscal year guidance is based on the following previously disclosed FY23 figures: Net sales: $605.9 billion, adjusted operating income1: $24.6 billion, and adjusted EPS1: $6.29. |

|||||||||||

| Third Quarter | |||||||||||

| Metric | Q3 | ||||||||||

| Consolidated net sales (cc) | Increase approximately 3.0% | ||||||||||

Consolidated operating income (cc) |

Increase approximately 1.0% | ||||||||||

| Adjusted EPS | $1.45 to $1.50 | ||||||||||

Fiscal Year 20242 |

|||||||||||

| Metric | FY 2024 | ||||||||||

| Consolidated net sales (cc) | Increase approximately 4.0% to 4.5% | ||||||||||

| Consolidated operating income (cc) | Increase approximately 7.0%-7.5%, including an expected 30bps tailwind from LIFO | ||||||||||

| Interest, net | Increase approximately $500M v. LY | ||||||||||

| Effective tax rate | Unchanged at 26.5% | ||||||||||

| Non-controlling interest | Approximately $0.26 headwind to EPS | ||||||||||

| Adjusted EPS | $6.36 to $6.46, including an expected $0.05 impact from LIFO | ||||||||||

| Capital expenditures | Flat to up slightly v. LY, unchanged from prior guidance | ||||||||||

|

1 For relevant reconciliations, see Q4 FY23 earnings release furnished on Form 8-K on February 21, 2023.

2 Our expectations are for Walmart U.S. and International to grow slightly faster than our prior view and for Sam’s Club growth to be consistent with our February guidance.

|

|||||||||||

| ||

|

About Walmart

Walmart Inc. (NYSE: WMT) is a people-led, tech-powered omnichannel retailer helping people save money and live better - anytime and anywhere - in stores, online, and through their mobile devices. Each week, approximately 240 million customers and members visit more than 10,500 stores and numerous eCommerce websites in 19 countries. With fiscal year 2023 revenue of $611 billion, Walmart employs approximately 2.1 million associates worldwide. Walmart continues to be a leader in sustainability, corporate philanthropy, and employment opportunity. Additional information about Walmart can be found by visiting corporate.walmart.com, on Facebook at facebook.com/walmart, on X (formerly known as Twitter) at twitter.com/walmart, and on LinkedIn at linkedin.com/company/walmart.

Investor Relations contact: Steph Wissink – ir@walmart.com

Media Relations contact: Randy Hargrove – (800) 331-0085

| ||

| Forward-Looking Statements |  |

||||||||||||||||

|

This release and related management commentary contains statements or may include or may incorporate by reference Walmart management’s guidance regarding adjusted earnings per share, consolidated net sales, consolidated operating income and consolidated adjusted operating income, consolidated operating expense, net interest expenses, non-controlling interest, capital expenditures, share repurchases, Walmart’s effective tax rate for the fiscal year ending January 31, 2024, and comparable sales, among other items. Walmart believes such statements may be deemed to be "forward-looking statements" within the meaning of Section 21E of the Securities Exchange Act of 1934, as amended (the "Act") and are intended to enjoy the protection of the safe harbor for forward-looking statements provided by the Act as well as protections afforded by other federal securities laws. Assumptions on which such forward-looking statements are based are also forward-looking statements. Such forward-looking statements are not statements of historical facts, but instead express our estimates or expectations for our consolidated, or one of our segment's or business’, economic performance or results of operations for future periods or as of future dates or events or developments that may occur in the future or discuss our plans, objectives or goals. Our actual results may differ materially from those expressed in or implied by any of these forward-looking statements as a result of changes in circumstances, assumptions not being realized or other risks, uncertainties and factors including: capital markets and business conditions; trends and events around the world and in the markets in which we operate; currency exchange rate fluctuations, changes in market interest rates and market levels of wages; changes in the size of various markets, including eCommerce markets; unemployment levels; inflation or deflation, generally and in particular product categories; consumer confidence, disposable income, credit availability, spending levels, shopping patterns, debt levels and demand for certain merchandise; the effectiveness of the implementation and operation of our strategies, plans, programs and initiatives; unexpected changes in our objectives and plans; the impact of acquisitions, investments, divestitures, and other strategic decisions; our ability to successfully integrate acquired businesses; changes in the trading prices or fair value of certain equity investments we hold; initiatives of competitors, competitors' entry into and expansion in our markets, and competitive pressures; customer traffic and average transactions in our stores and clubs and on our eCommerce websites; the mix of merchandise we sell, the cost of goods we sell and the shrinkage we experience; our gross profit margins; the financial performance of Walmart and each of its segments, including the amounts of our cash flow during various periods; the amount of our net sales and operating expenses denominated in the U.S. dollar and various foreign currencies; commodity prices and the price of gasoline and diesel fuel; challenges with our supply chain, including disruptions and issues relating to inventory management; disruptions in seasonal buying patterns; the availability of goods from suppliers and the cost of goods acquired from suppliers; our ability to respond to changing trends in consumer shopping habits; consumer acceptance of and response to our stores, clubs, eCommerce platforms, programs, merchandise offerings and delivery methods; cyber security events affecting us and related costs and impact to the business; developments in, outcomes of, and costs incurred in legal or regulatory proceedings to which we are a party or are subject, and the liabilities, obligations and expenses, if any, that we may incur in connection therewith; casualty and accident related costs and insurance costs; the turnover in our workforce and labor costs, including healthcare and other benefit costs; our effective tax rate and the factors affecting our effective tax rate, including assessments of certain tax contingencies, valuation allowances, changes in law, administrative audit outcomes, impact of discrete items and the mix of earnings between the U.S. and Walmart's international operations; changes in existing tax, labor and other laws and regulations and changes in tax rates including the enactment of laws and the adoption and interpretation of administrative rules and regulations; the imposition of new taxes on imports, new tariffs and changes in existing tariff rates; the imposition of new trade restrictions and changes in existing trade restrictions; adoption or creation of new, and modification of existing, governmental policies, programs, initiatives and actions in the markets in which Walmart operates and elsewhere and actions with respect to such policies, programs and initiatives; changes in accounting estimates or judgments; the level of public assistance payments; natural disasters, changes in climate, geopolitical events, global health epidemics or pandemics (such as the COVID-19 pandemic) and catastrophic events; and changes in generally accepted accounting principles in the United States.

Our most recent annual report on Form 10-K and subsequent quarterly report on Form 10-Q filed with the SEC discuss other risks and factors that could cause actual results to differ materially from those expressed or implied by any forward-looking statement in the release and related management commentary. We urge you to consider all of the risks, uncertainties and factors identified above or discussed in such reports carefully in evaluating the forward-looking statements in this release. Walmart cannot assure you that the results reflected in or implied by any forward-looking statement will be realized or, even if substantially realized, that those results will have the forecasted or expected consequences and effects for or on our operations or financial performance. The forward-looking statements made today are as of the date of this release. Walmart undertakes no obligation to update these forward-looking statements to reflect subsequent events or circumstances.

|

|||||||||||||||||

|

Walmart Inc.

Condensed Consolidated Statements of Income

(Unaudited)

|

|

||||||||||||||||

| Three Months Ended | Six Months Ended | |||||||||||||||||||||||||||||||||||||

| July 31, | July 31, | |||||||||||||||||||||||||||||||||||||

| (Amounts in millions, except per share data) | 2023 | 2022 | Percent Change | 2023 | 2022 | Percent Change | ||||||||||||||||||||||||||||||||

| Revenues: | ||||||||||||||||||||||||||||||||||||||

| Net sales | $ | 160,280 | $ | 151,381 | 5.9 | % | $ | 311,284 | $ | 291,669 | 6.7 | % | ||||||||||||||||||||||||||

| Membership and other income | 1,352 | 1,478 | (8.5) | % | 2,649 | 2,759 | (4.0) | % | ||||||||||||||||||||||||||||||

| Total revenues | 161,632 | 152,859 | 5.7 | % | 313,933 | 294,428 | 6.6 | % | ||||||||||||||||||||||||||||||

| Costs and expenses: | ||||||||||||||||||||||||||||||||||||||

| Cost of sales | 121,850 | 115,838 | 5.2 | % | 237,134 | 222,685 | 6.5 | % | ||||||||||||||||||||||||||||||

| Operating, selling, general and administrative expenses | 32,466 | 30,167 | 7.6 | % | 63,243 | 59,571 | 6.2 | % | ||||||||||||||||||||||||||||||

| Operating income | 7,316 | 6,854 | 6.7 | % | 13,556 | 12,172 | 11.4 | % | ||||||||||||||||||||||||||||||

| Interest: | ||||||||||||||||||||||||||||||||||||||

| Debt | 543 | 395 | 37.5 | % | 1,111 | 767 | 44.9 | % | ||||||||||||||||||||||||||||||

| Finance lease obligations | 99 | 84 | 17.9 | % | 195 | 167 | 16.8 | % | ||||||||||||||||||||||||||||||

| Interest income | (148) | (31) | 377.4 | % | (255) | (67) | 280.6 | % | ||||||||||||||||||||||||||||||

| Interest, net | 494 | 448 | 10.3 | % | 1,051 | 867 | 21.2 | % | ||||||||||||||||||||||||||||||

| Other (gains) and losses | (3,905) | (238) | 1,540.8 | % | (910) | 1,760 | NM | |||||||||||||||||||||||||||||||

| Income before income taxes | 10,727 | 6,644 | 61.5 | % | 13,415 | 9,545 | 40.5 | % | ||||||||||||||||||||||||||||||

| Provision for income taxes | 2,674 | 1,497 | 78.6 | % | 3,466 | 2,295 | 51.0 | % | ||||||||||||||||||||||||||||||

| Consolidated net income | 8,053 | 5,147 | 56.5 | % | 9,949 | 7,250 | 37.2 | % | ||||||||||||||||||||||||||||||

| Consolidated net (income) loss attributable to noncontrolling interest | (162) | 2 | NM | (385) | (47) | 719.1 | % | |||||||||||||||||||||||||||||||

| Consolidated net income attributable to Walmart | $ | 7,891 | $ | 5,149 | 53.3 | % | $ | 9,564 | $ | 7,203 | 32.8 | % | ||||||||||||||||||||||||||

| Net income per common share: | ||||||||||||||||||||||||||||||||||||||

| Basic net income per common share attributable to Walmart | $ | 2.93 | $ | 1.88 | 55.9 | % | $ | 3.55 | $ | 2.62 | 35.5 | % | ||||||||||||||||||||||||||

| Diluted net income per common share attributable to Walmart | $ | 2.92 | $ | 1.88 | 55.3 | % | $ | 3.54 | $ | 2.61 | 35.6 | % | ||||||||||||||||||||||||||

| Weighted-average common shares outstanding: | ||||||||||||||||||||||||||||||||||||||

| Basic | 2,693 | 2,736 | 2,694 | 2,745 | ||||||||||||||||||||||||||||||||||

| Diluted | 2,703 | 2,745 | 2,703 | 2,755 | ||||||||||||||||||||||||||||||||||

| Dividends declared per common share | $ | — | $ | — | $ | 2.28 | $ | 2.24 | ||||||||||||||||||||||||||||||

|

Walmart Inc.

Condensed Consolidated Balance Sheets

(Unaudited)

|

|

||||||||||||||||

| July 31, | January 31, | July 31, | ||||||||||||||||||

| (Amounts in millions) | 2023 | 2023 | 2022 | |||||||||||||||||

| ASSETS | ||||||||||||||||||||

| Current assets: | ||||||||||||||||||||

| Cash and cash equivalents | $ | 13,888 | $ | 8,625 | $ | 13,923 | ||||||||||||||

| Receivables, net | 7,891 | 7,933 | 7,522 | |||||||||||||||||

| Inventories | 56,722 | 56,576 | 59,921 | |||||||||||||||||

| Prepaid expenses and other | 3,531 | 2,521 | 2,798 | |||||||||||||||||

| Total current assets | 82,032 | 75,655 | 84,164 | |||||||||||||||||

| Property and equipment, net | 104,733 | 100,760 | 96,006 | |||||||||||||||||

| Operating lease right-of-use assets | 13,710 | 13,555 | 13,872 | |||||||||||||||||

| Finance lease right-of-use assets, net | 5,552 | 4,919 | 4,514 | |||||||||||||||||

| Goodwill | 28,268 | 28,174 | 28,664 | |||||||||||||||||

| Other long-term assets | 20,826 | 20,134 | 19,979 | |||||||||||||||||

| Total assets | $ | 255,121 | $ | 243,197 | $ | 247,199 | ||||||||||||||

| LIABILITIES, REDEEMABLE NONCONTROLLING INTEREST, AND EQUITY | ||||||||||||||||||||

| Current liabilities: | ||||||||||||||||||||

| Short-term borrowings | $ | 4,546 | $ | 372 | $ | 10,634 | ||||||||||||||

| Accounts payable | 56,576 | 53,742 | 54,191 | |||||||||||||||||

| Dividends payable | 3,067 | — | 3,049 | |||||||||||||||||

| Accrued liabilities | 29,239 | 31,126 | 23,843 | |||||||||||||||||

| Accrued income taxes | 770 | 727 | 868 | |||||||||||||||||

| Long-term debt due within one year | 2,897 | 4,191 | 5,316 | |||||||||||||||||

| Operating lease obligations due within one year | 1,472 | 1,473 | 1,464 | |||||||||||||||||

| Finance lease obligations due within one year | 653 | 567 | 534 | |||||||||||||||||

| Total current liabilities | 99,220 | 92,198 | 99,899 | |||||||||||||||||

| Long-term debt | 36,806 | 34,649 | 29,801 | |||||||||||||||||

| Long-term operating lease obligations | 12,978 | 12,828 | 13,140 | |||||||||||||||||

| Long-term finance lease obligations | 5,449 | 4,843 | 4,420 | |||||||||||||||||

| Deferred income taxes and other | 15,109 | 14,688 | 14,092 | |||||||||||||||||

| Commitments and contingencies | ||||||||||||||||||||

| Redeemable noncontrolling interest | 232 | 237 | 260 | |||||||||||||||||

| Equity: | ||||||||||||||||||||

| Common stock | 269 | 269 | 272 | |||||||||||||||||

| Capital in excess of par value | 4,635 | 4,969 | 4,672 | |||||||||||||||||

| Retained earnings | 85,470 | 83,135 | 82,519 | |||||||||||||||||

| Accumulated other comprehensive loss | (10,818) | (11,680) | (9,894) | |||||||||||||||||

| Total Walmart shareholders’ equity | 79,556 | 76,693 | 77,569 | |||||||||||||||||

| Nonredeemable noncontrolling interest | 5,771 | 7,061 | 8,018 | |||||||||||||||||

| Total equity | 85,327 | 83,754 | 85,587 | |||||||||||||||||

| Total liabilities, redeemable noncontrolling interest, and equity | $ | 255,121 | $ | 243,197 | $ | 247,199 | ||||||||||||||

|

Walmart Inc.

Condensed Consolidated Statements of Cash Flows

(Unaudited)

|

|

||||||||||||||||

| Six Months Ended | ||||||||||||||

| July 31, | ||||||||||||||

| (Amounts in millions) | 2023 | 2022 | ||||||||||||

| Cash flows from operating activities: | ||||||||||||||

| Consolidated net income | $ | 9,949 | $ | 7,250 | ||||||||||

| Adjustments to reconcile consolidated net income to net cash provided by operating activities: | ||||||||||||||

| Depreciation and amortization | 5,750 | 5,379 | ||||||||||||

| Investment (gains) and losses, net | (773) | 1,988 | ||||||||||||

| Deferred income taxes | 436 | 111 | ||||||||||||

| Other operating activities | 849 | 244 | ||||||||||||

| Changes in certain assets and liabilities, net of effects of acquisitions and dispositions: | ||||||||||||||

| Receivables, net | 115 | 874 | ||||||||||||

| Inventories | 222 | (3,730) | ||||||||||||

| Accounts payable | 2,999 | (453) | ||||||||||||

| Accrued liabilities | (1,368) | (2,439) | ||||||||||||

| Accrued income taxes | 22 | 16 | ||||||||||||

| Net cash provided by operating activities | 18,201 | 9,240 | ||||||||||||

| Cash flows from investing activities: | ||||||||||||||

| Payments for property and equipment | (9,216) | (7,492) | ||||||||||||

| Proceeds from the disposal of property and equipment | 133 | 72 | ||||||||||||

| Proceeds from disposal of certain operations | 135 | — | ||||||||||||

| Payments for business acquisitions, net of cash acquired | (9) | (616) | ||||||||||||

| Other investing activities | (952) | (548) | ||||||||||||

| Net cash used in investing activities | (9,909) | (8,584) | ||||||||||||

| Cash flows from financing activities: | ||||||||||||||

| Net change in short-term borrowings | 4,181 | 10,230 | ||||||||||||

| Proceeds from issuance of long-term debt | 4,967 | — | ||||||||||||

| Repayments of long-term debt | (4,063) | (1,439) | ||||||||||||

| Dividends paid | (3,072) | (3,081) | ||||||||||||

| Purchase of Company stock | (1,171) | (5,747) | ||||||||||||

| Dividends paid to noncontrolling interest | (214) | — | ||||||||||||

| Sale of subsidiary stock | 697 | 45 | ||||||||||||

| Purchase of noncontrolling interest | (3,462) | — | ||||||||||||

| Other financing activities | (1,172) | (1,408) | ||||||||||||

| Net cash used in financing activities | (3,309) | (1,400) | ||||||||||||

| Effect of exchange rates on cash, cash equivalents and restricted cash | 147 | (100) | ||||||||||||

| Net increase (decrease) in cash, cash equivalents and restricted cash | 5,130 | (844) | ||||||||||||

| Cash, cash equivalents and restricted cash at beginning of year | 8,841 | 14,834 | ||||||||||||

| Cash, cash equivalents and restricted cash at end of period | $ | 13,971 | $ | 13,990 | ||||||||||

|

Walmart Inc.

Supplemental Financial Information

(Unaudited)

|

|

||||||||||||||||

| Net Sales | Operating Income | ||||||||||||||||||||||

| Three Months Ended | Three Months Ended | ||||||||||||||||||||||

| July 31, | July 31, | ||||||||||||||||||||||

| (dollars in millions) | 2023 | 2022 | Percent Change | 2023 | 2022 | Percent Change | |||||||||||||||||

| Walmart U.S. | $ | 110,854 | $ | 105,130 | 5.4 | % | $ | 6,114 | $ | 5,683 | 7.6 | % | |||||||||||

| Walmart International | 27,596 | 24,350 | 13.3 | % | 1,190 | 1,043 | 14.1 | % | |||||||||||||||

| Sam’s Club | 21,830 | 21,901 | -0.3 | % | 521 | 427 | 22.0 | % | |||||||||||||||

| Corporate and support | — | — | — | (509) | (299) | 70.2 | % | ||||||||||||||||

| Consolidated | $ | 160,280 | $ | 151,381 | 5.9 | % | $ | 7,316 | $ | 6,854 | 6.7 | % | |||||||||||

| With Fuel | Without Fuel | Fuel Impact | ||||||||||||||||||||||||||||||||||||

| 13 Weeks Ended | 13 Weeks Ended | 13 Weeks Ended | ||||||||||||||||||||||||||||||||||||

| 7/28/2023 | 7/29/2022 | 7/28/2023 | 7/29/2022 | 7/28/2023 | 7/29/2022 | |||||||||||||||||||||||||||||||||

| Walmart U.S. | 6.1 | % | 7.2 | % | 6.4 | % | 6.5 | % | -0.3 | % | 0.7 | % | ||||||||||||||||||||||||||

| Sam’s Club | -0.2 | % | 17.5 | % | 5.5 | % | 9.5 | % | -5.7 | % | 8.0 | % | ||||||||||||||||||||||||||

| Total U.S. | 5.0 | % | 8.8 | % | 6.3 | % | 7.0 | % | -1.3 | % | 1.8 | % | ||||||||||||||||||||||||||

|

Walmart Inc.

Reconciliations of and Other Information Regarding Non-GAAP Financial Measures

(Unaudited)

|

|

||||||||||||||||

| Three Months Ended July 31, 2023 | Six Months Ended July 31, 2023 | ||||||||||||||||||||||||||||||||||

| Walmart International | Consolidated | Walmart International | Consolidated | ||||||||||||||||||||||||||||||||

| (Dollars in millions) | 2023 | Percent Change1 |

2023 | Percent Change1 |

2023 | Percent Change1 |

2023 | Percent Change1 |

|||||||||||||||||||||||||||

| Total revenues: | |||||||||||||||||||||||||||||||||||

| As reported | $ | 27,954 | 12.3 | % | $ | 161,632 | 5.7 | % | $ | 54,909 | 12.1 | % | $ | 313,933 | 6.6 | % | |||||||||||||||||||

| Currency exchange rate fluctuations | (576) | N/A | (576) | N/A | (347) | N/A | (347) | N/A | |||||||||||||||||||||||||||

| Total revenues (cc) | $ | 27,378 | 10.0 | % | $ | 161,056 | 5.4 | % | $ | 54,562 | 11.4 | % | $ | 313,586 | 6.5 | % | |||||||||||||||||||

| Net sales: | |||||||||||||||||||||||||||||||||||

| As reported | $ | 27,596 | 13.3 | % | $ | 160,280 | 5.9 | % | $ | 54,200 | 12.7 | % | $ | 311,284 | 6.7 | % | |||||||||||||||||||

| Currency exchange rate fluctuations | (574) | N/A | (574) | N/A | (349) | N/A | (349) | N/A | |||||||||||||||||||||||||||

| Net sales (cc) | $ | 27,022 | 11.0 | % | $ | 159,706 | 5.5 | % | $ | 53,851 | 11.9 | % | $ | 310,935 | 6.6 | % | |||||||||||||||||||

| Operating income: | |||||||||||||||||||||||||||||||||||

| As reported | $ | 1,190 | 14.1 | % | $ | 7,316 | 6.7 | % | $ | 2,354 | 29.7 | % | $ | 13,556 | 11.4 | % | |||||||||||||||||||

| Currency exchange rate fluctuations | (124) | N/A | (124) | N/A | (196) | N/A | (196) | N/A | |||||||||||||||||||||||||||

| Operating income (cc) | $ | 1,066 | 2.2 | % | $ | 7,192 | 4.9 | % | $ | 2,158 | 18.9 | % | $ | 13,360 | 9.8 | % | |||||||||||||||||||

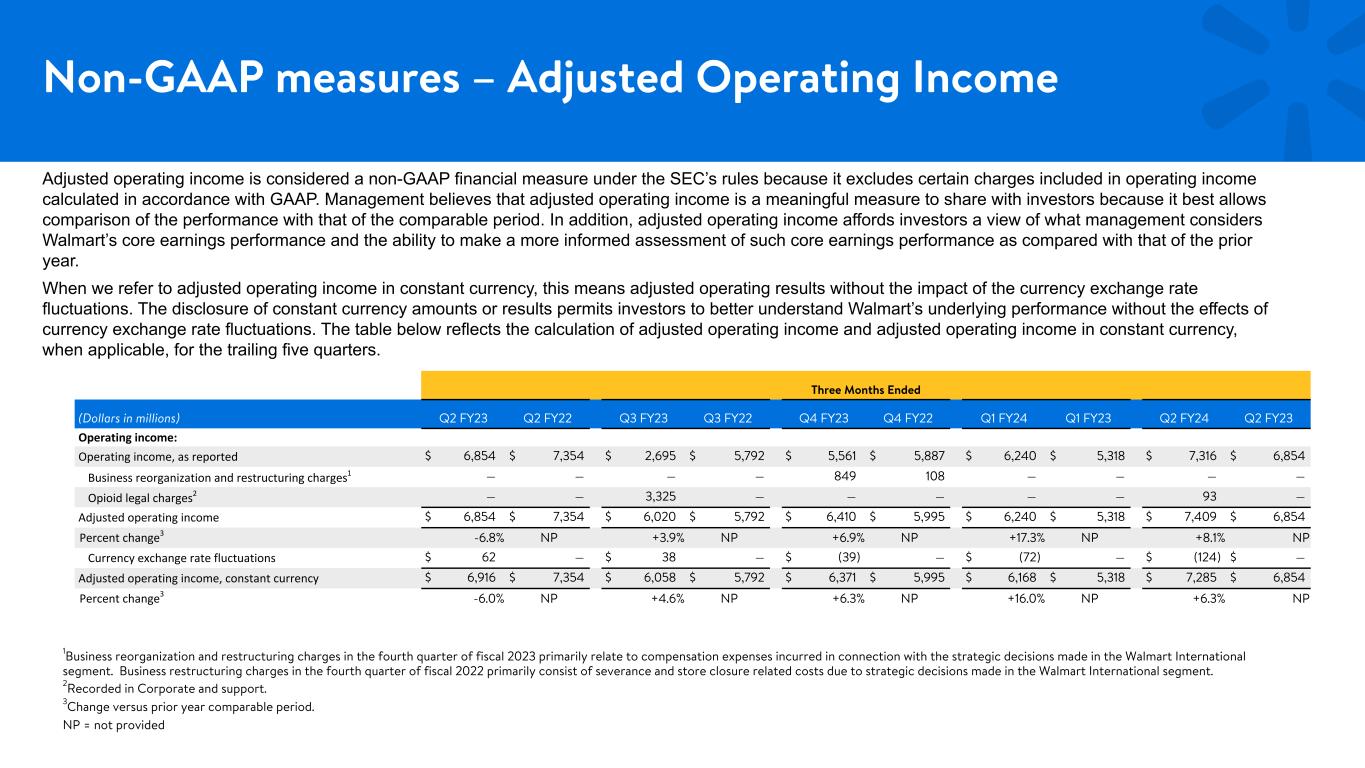

| Three Months Ended July 31, | ||||||||

| Consolidated | ||||||||

| (Dollars in millions) | 2023 | 2022 | ||||||

| Operating income: | ||||||||

| Operating income, as reported | $7,316 | $6,854 | ||||||

Incremental opioid settlement expense1 |

93 | — | ||||||

| Adjusted operating income | 7,409 | 6,854 | ||||||

Percent change2 |

8.1% | NP | ||||||

| Currency exchange rate fluctuations | (124) | — | ||||||

| Adjusted operating income, constant currency | $7,285 | 6,854 | ||||||

Percent change2 |

6.3% | NP | ||||||

| Six Months Ended July 31, | ||||||||

| Consolidated | ||||||||

| (Dollars in millions) | 2023 | 2022 | ||||||

| Operating income: | ||||||||

| Operating income, as reported | $13,556 | $12,172 | ||||||

Incremental opioid settlement expense1 |

93 | — | ||||||

| Adjusted operating income | 13,649 | 12,172 | ||||||

Percent change2 |

12.1% | NP | ||||||

| Currency exchange rate fluctuations | (196) | — | ||||||

| Adjusted operating income, constant currency | $13,453 | $12,172 | ||||||

Percent change2 |

10.5% | NP | ||||||

| Six Months Ended | ||||||||||||||

| July 31, | ||||||||||||||

| (Dollars in millions) | 2023 | 2022 | ||||||||||||

| Net cash provided by operating activities | $ | 18,201 | $ | 9,240 | ||||||||||

| Payments for property and equipment (capital expenditures) | (9,216) | (7,492) | ||||||||||||

| Free cash flow | $ | 8,985 | $ | 1,748 | ||||||||||

Net cash used in investing activities1 |

$ | (9,909) | $ | (8,584) | ||||||||||

| Net cash used in financing activities | (3,309) | (1,400) | ||||||||||||

Three Months Ended July 31, 20234 |

||||||||||||||||||||||||||

| Diluted earnings per share: | ||||||||||||||||||||||||||

| Reported EPS | $2.92 | |||||||||||||||||||||||||

| Adjustments: | Pre-Tax Impact | Tax Impact1,2 |

NCI Impact3 |

Net Impact | ||||||||||||||||||||||

Unrealized and realized (gains) and losses on equity and other investments5 |

$(1.44) | $0.33 | $— | $(1.11) | ||||||||||||||||||||||

| Incremental opioid settlement expense | 0.04 | (0.01) | — | 0.03 | ||||||||||||||||||||||

| Net adjustments | $(1.08) | |||||||||||||||||||||||||

| Adjusted EPS | $1.84 | |||||||||||||||||||||||||

Six Months Ended July 31, 20234 |

||||||||||||||||||||||||||

| Diluted earnings per share: | ||||||||||||||||||||||||||

| Reported EPS | $3.54 | |||||||||||||||||||||||||

| Adjustments: | Pre-Tax Impact | Tax Impact1,2 |

NCI Impact3 |

Net Impact | ||||||||||||||||||||||

| Unrealized and realized (gains) and losses on equity and other investments | $(0.31) | $0.06 | $(0.01) | $(0.26) | ||||||||||||||||||||||

| Incremental opioid settlement expense | 0.04 | (0.01) | — | 0.03 | ||||||||||||||||||||||

| Net adjustments | $(0.23) | |||||||||||||||||||||||||

| Adjusted EPS | $3.31 | |||||||||||||||||||||||||

| Three Months Ended July 31, 2022 | ||||||||||||||||||||||||||

| Diluted earnings per share: | ||||||||||||||||||||||||||

| Reported EPS | $1.88 | |||||||||||||||||||||||||

| Adjustments: | Pre-Tax Impact | Tax Impact1, 2 |

NCI Impact3 |

Net Impact | ||||||||||||||||||||||

| Unrealized and realized (gains) and losses on equity and other investments | $0.14 | $(0.02) | $(0.01) | $0.11 | ||||||||||||||||||||||

| Gain on sale of equity method investment in Brazil | (0.16) | — | — | (0.16) | ||||||||||||||||||||||

| Discrete tax item | — | (0.06) | — | (0.06) | ||||||||||||||||||||||

| Net adjustments | $(0.11) | |||||||||||||||||||||||||

| Adjusted EPS | $1.77 | |||||||||||||||||||||||||

Six Months Ended July 31, 20224 |

||||||||||||||||||||||||||

| Diluted earnings per share: | ||||||||||||||||||||||||||

| Reported EPS | $2.61 | |||||||||||||||||||||||||

| Adjustments: | Pre-Tax Impact | Tax Impact1, 2 |

NCI Impact3 |

Net Impact | ||||||||||||||||||||||

| Unrealized and realized (gains) and losses on equity and other investments | $0.85 | $(0.16) | $(0.01) | $0.68 | ||||||||||||||||||||||

| Gain on sale of equity method investment in Brazil | (0.16) | — | — | (0.16) | ||||||||||||||||||||||

| Discrete tax item | — | (0.06) | — | (0.06) | ||||||||||||||||||||||

| Net adjustments | $0.46 | |||||||||||||||||||||||||

| Adjusted EPS | $3.07 | |||||||||||||||||||||||||

| CALCULATION OF RETURN ON ASSETS | ||||||||||||||||||||

| Trailing Twelve Months | ||||||||||||||||||||

| Ended | July 31, | |||||||||||||||||||

| (Dollars in millions) | 2023 | 2022 | ||||||||||||||||||

| Numerator | ||||||||||||||||||||

| Consolidated net income | $ | 13,991 | $ | 14,015 | ||||||||||||||||

| Denominator | ||||||||||||||||||||

Average total assets1 |

251,160 | 242,876 | ||||||||||||||||||

| Return on assets (ROA) | 5.6 | % | 5.8 | % | ||||||||||||||||

| CALCULATION OF RETURN ON INVESTMENT | ||||||||||||||||||||

| Numerator | ||||||||||||||||||||

| Operating income | $ | 21,812 | $ | 23,851 | ||||||||||||||||

| + Interest income | 442 | 155 | ||||||||||||||||||

| + Depreciation and amortization | 11,318 | 10,733 | ||||||||||||||||||

| + Rent | 2,284 | 2,302 | ||||||||||||||||||

| ROI operating income | $ | 35,856 | $ | 37,041 | ||||||||||||||||

| Denominator | ||||||||||||||||||||

Average total assets1 |

$ | 251,160 | $ | 242,876 | ||||||||||||||||

'+ Average accumulated depreciation and amortization1 |

110,921 | 102,155 | ||||||||||||||||||

'- Average accounts payable1 |

55,384 | 51,896 | ||||||||||||||||||

'- Average accrued liabilities1 |

26,541 | 23,878 | ||||||||||||||||||

| Average invested capital | $ | 280,156 | $ | 269,257 | ||||||||||||||||

| Return on investment (ROI) | 12.8 | % | 13.8 | % | ||||||||||||||||

| July 31, | ||||||||||||||||||||

| Certain Balance Sheet Data | 2023 | 2022 | 2021 | |||||||||||||||||

| Total assets | $ | 255,121 | $ | 247,199 | $ | 238,552 | ||||||||||||||

| Accumulated depreciation and amortization | 115,878 | 105,963 | 98,346 | |||||||||||||||||

| Accounts payable | 56,576 | 54,191 | 49,601 | |||||||||||||||||

| Accrued liabilities | 29,239 | 23,843 | 23,915 | |||||||||||||||||