Document

Exhibit 99.1

|

|

|

|

|

|

| FOR IMMEDIATE RELEASE |

February 23, 2023 |

Teleflex Reports Fourth Quarter and Full Year 2022 Financial Results

Wayne, PA -- Teleflex Incorporated (NYSE: TFX) (the “Company”) today announced financial results for the fourth quarter ended December 31, 2022.

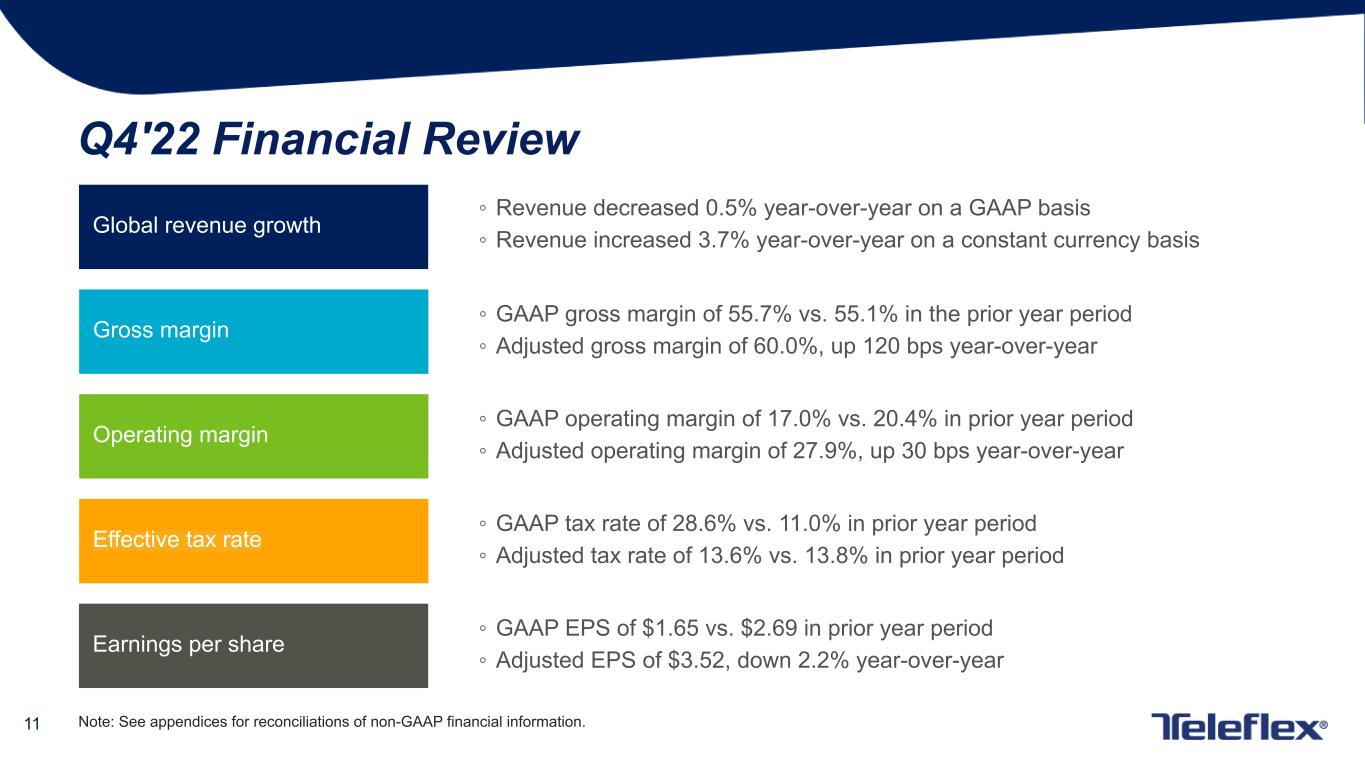

Fourth quarter financial summary

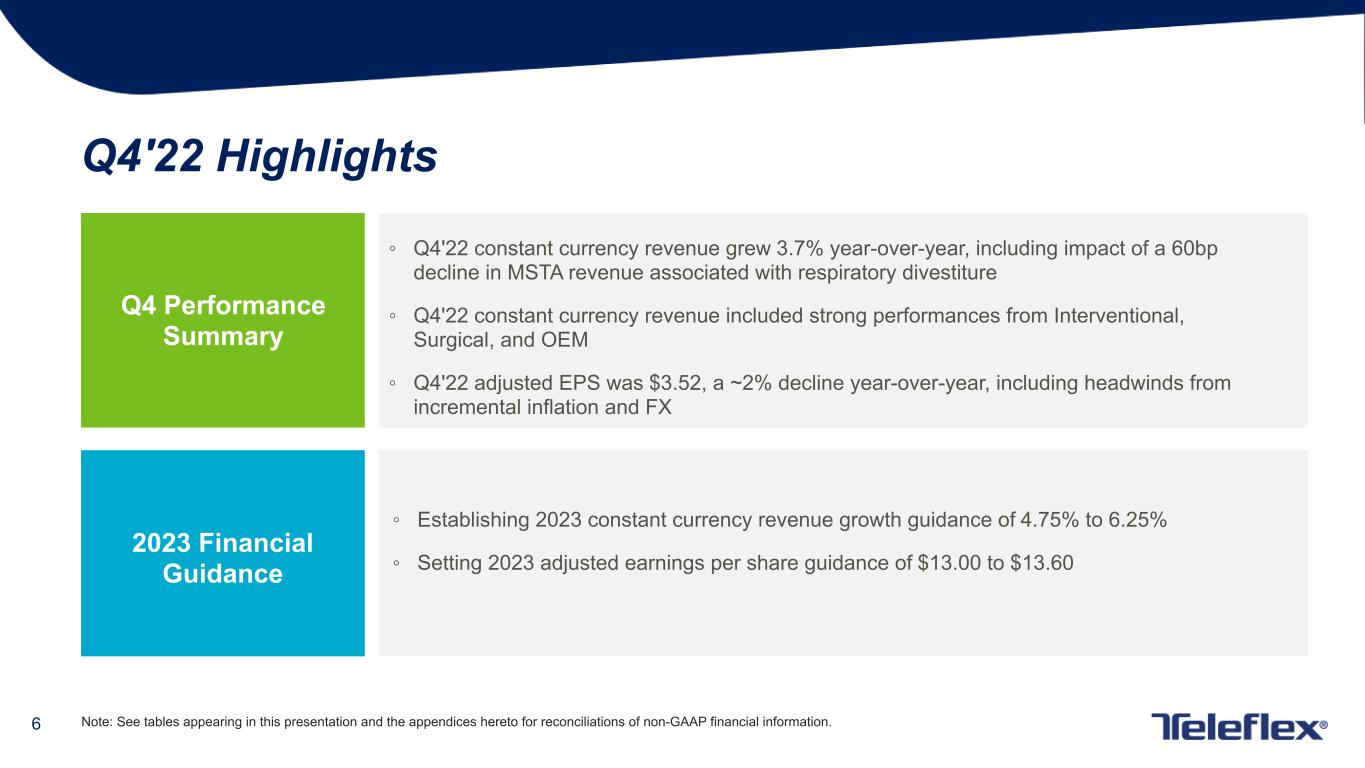

•Revenues of $758.0 million, down 0.5% compared to the prior year period, up 3.7% on a constant currency basis

•GAAP diluted EPS from continuing operations of $1.65, compared to $2.69 in the prior year period

•Adjusted diluted EPS from continuing operations of $3.52, compared to $3.60 in the prior year period

Full year 2022 financial summary

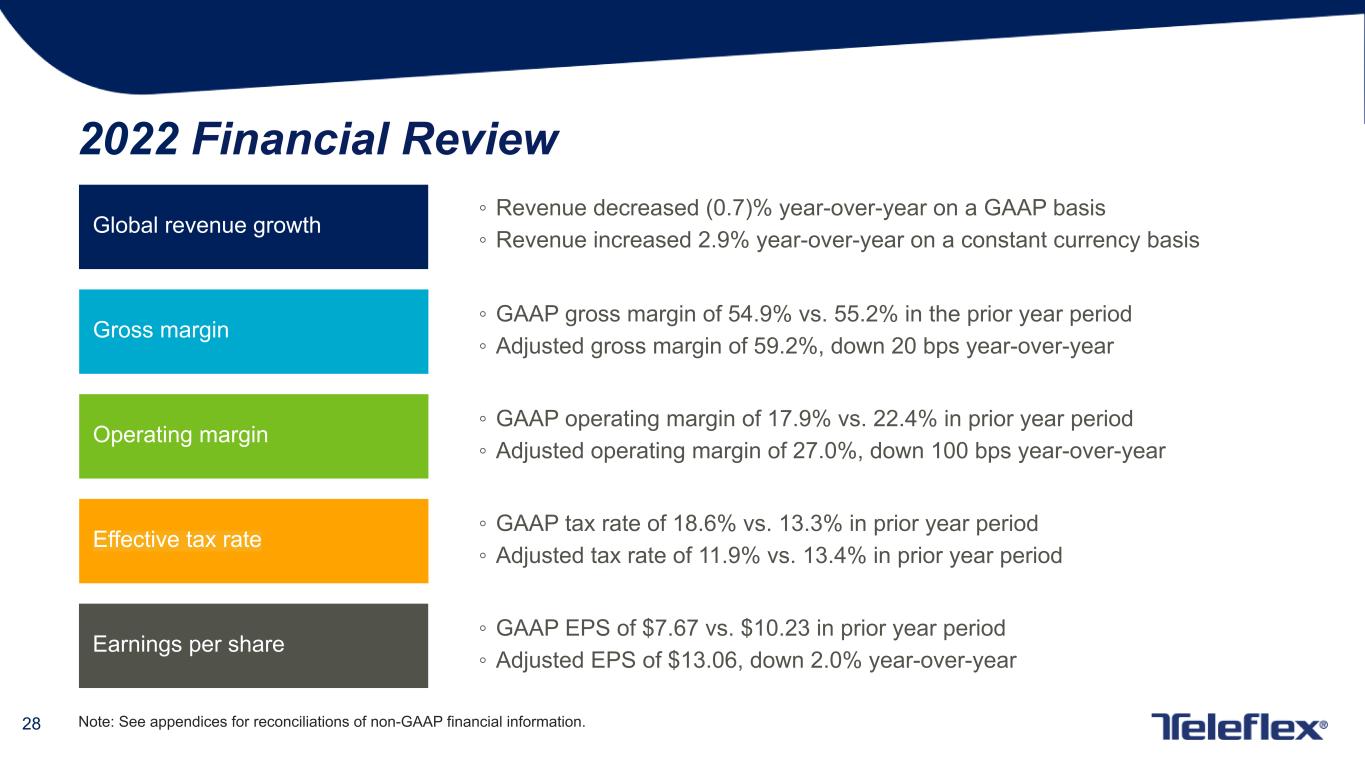

•Revenues of $2,791.0 million, down 0.7% year-over-year; up 2.9% on a constant currency basis

•GAAP diluted EPS from continuing operations of $7.67, compared to $10.23 in the prior year

•Adjusted diluted EPS from continuing operations of $13.06, compared to $13.33 in the prior year

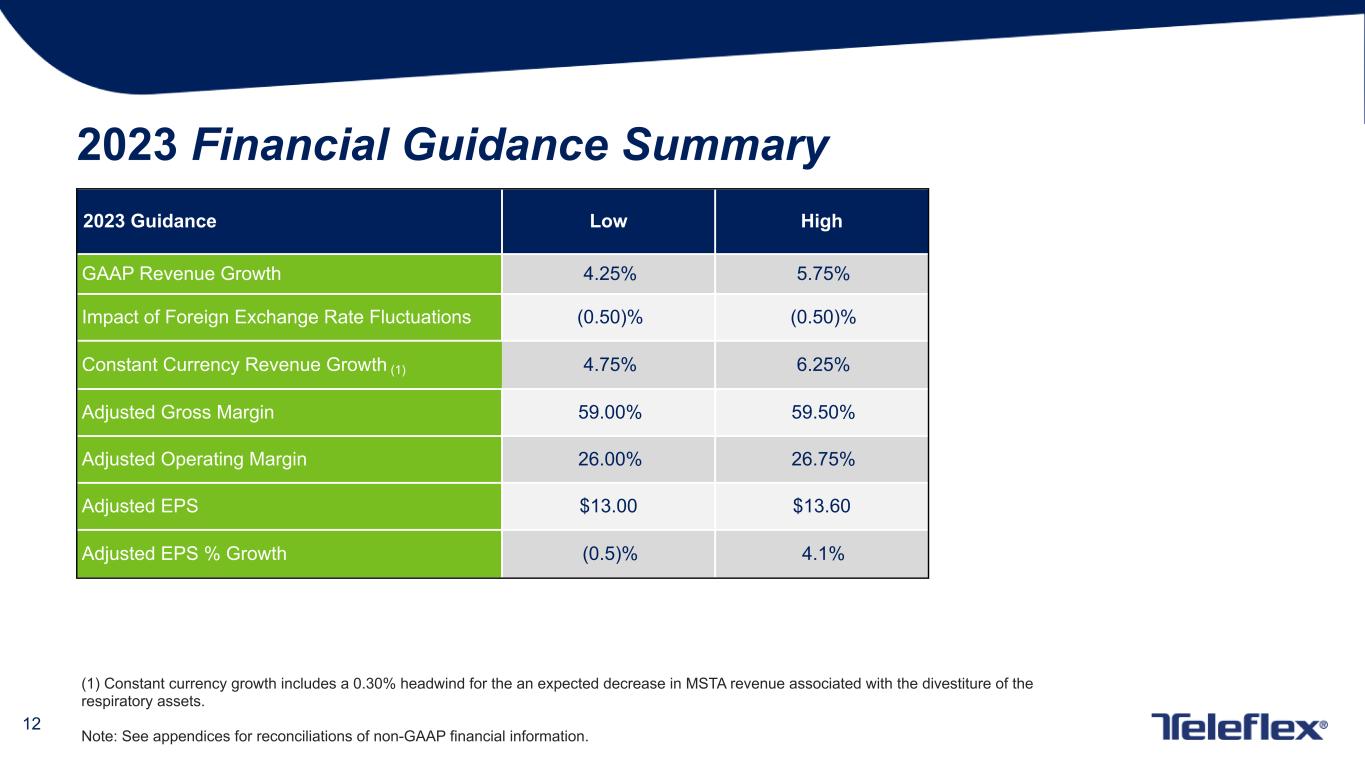

2023 guidance summary

•GAAP revenue growth guidance of 4.25% to 5.75%

•Constant currency revenue growth guidance of 4.75% to 6.25%

•GAAP EPS from continuing operations guidance of $8.26 to $8.86

•Adjusted diluted EPS from continuing operations guidance of $13.00 to $13.60

"Our business showed continued resilience in the fourth quarter with a sequential improvement in constant currency revenue growth and margin expansion" said Liam Kelly, Teleflex's Chairman, President and Chief Executive Officer. "In the quarter, we maintained healthy margins, and advanced our capital allocation strategy with the completion of the acquisition of Standard Bariatrics. As we look into 2023, we remain committed to our corporate strategy for durable growth." The following table provides information regarding net revenues in each of the Company's reportable operating segments for the three and twelve months ended December 31, 2022 and December 31, 2021 on both a GAAP and constant currency basis.

NET REVENUE BY SEGMENT

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Three Months Ended |

|

% Increase / (Decrease) |

|

December 31, 2022 |

|

December 31, 2021 |

|

Reported Revenue Growth |

|

Currency Impact |

|

Constant Currency Revenue Growth |

| Americas |

$458.0 |

|

$451.7 |

|

1.4% |

|

(0.3)% |

|

1.7% |

| EMEA |

147.8 |

|

164.5 |

|

(10.2)% |

|

(11.6)% |

|

1.4% |

| Asia |

78.5 |

|

78.5 |

|

—% |

|

(13.3)% |

|

13.3% |

| OEM |

73.7 |

|

67.2 |

|

9.7% |

|

(2.3)% |

|

12.0% |

| Consolidated |

$758.0 |

|

$761.9 |

|

(0.5)% |

|

(4.2)% |

|

3.7% |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Year Ended |

|

% Increase / (Decrease) |

|

December 31, 2022 |

|

December 31, 2021 |

|

Reported Revenue Growth |

|

Currency Impact |

|

Constant Currency Revenue Growth |

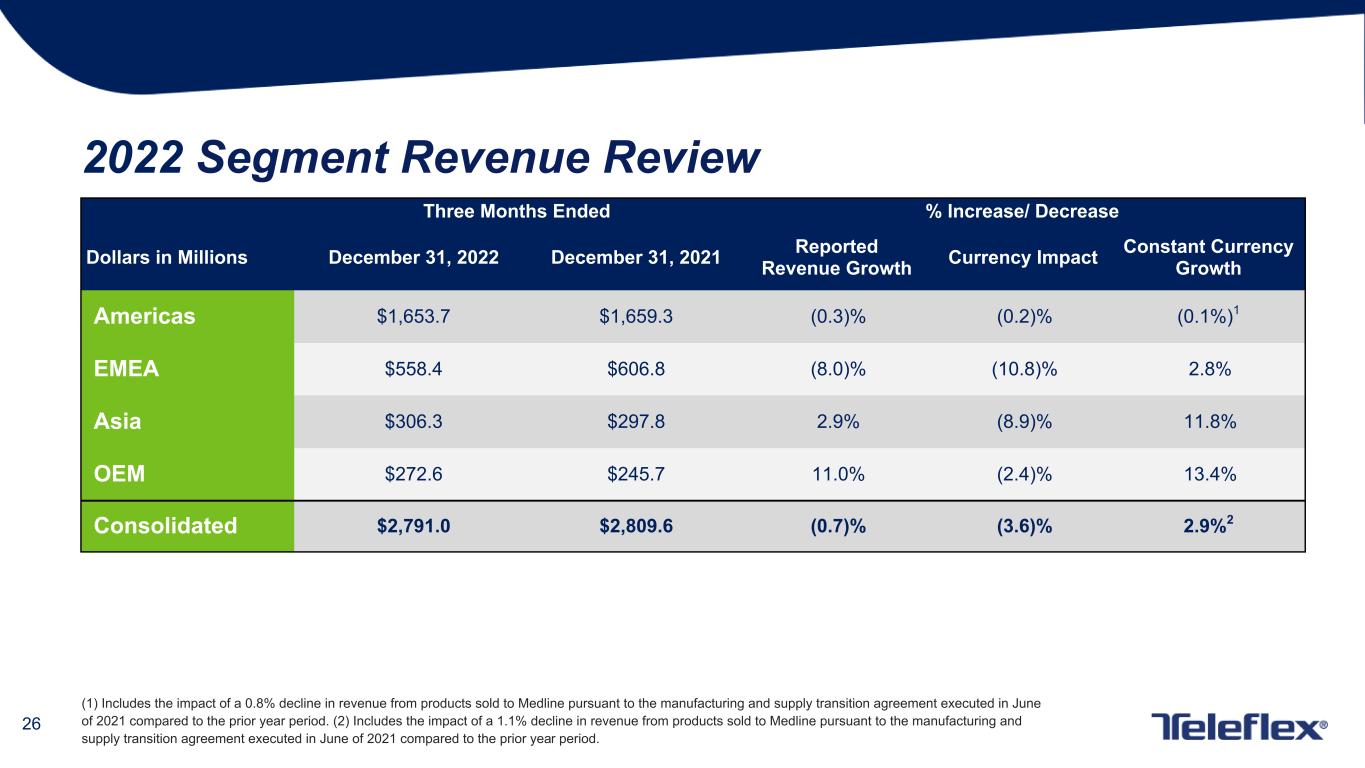

| Americas |

$1,653.7 |

|

$1,659.3 |

|

(0.3)% |

|

(0.2)% |

|

(0.1)% |

| EMEA |

558.4 |

|

606.8 |

|

(8.0)% |

|

(10.8)% |

|

2.8% |

| Asia |

306.3 |

|

297.8 |

|

2.9% |

|

(8.9)% |

|

11.8% |

| OEM |

272.6 |

|

245.7 |

|

11.0% |

|

(2.4)% |

|

13.4% |

| Consolidated |

$2,791.0 |

|

$2,809.6 |

|

(0.7)% |

|

(3.6)% |

|

2.9% |

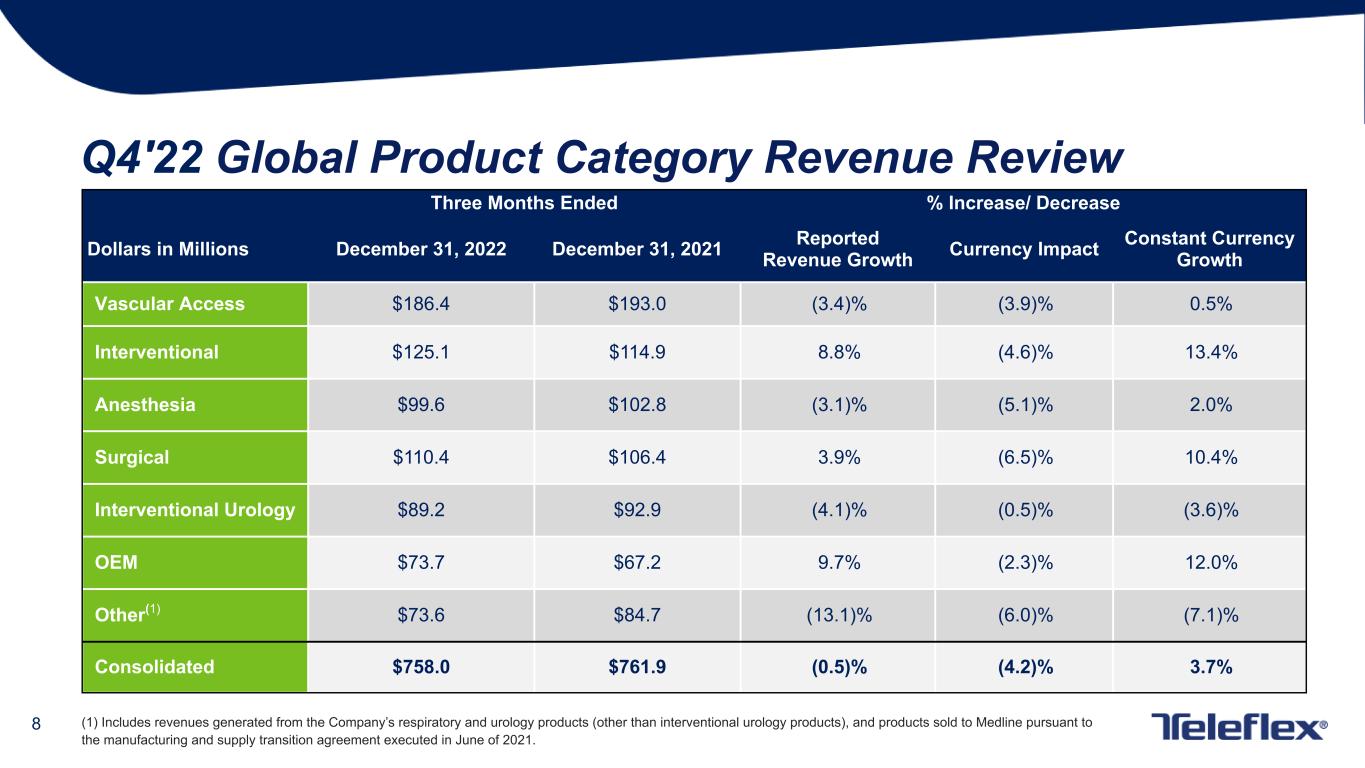

NET REVENUE BY GLOBAL PRODUCT CATEGORY

The following table provides information regarding net revenues in each of the Company's global product categories for the three and twelve months ended December 31, 2022 and December 31, 2021 on both a GAAP and constant currency basis.

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Three Months Ended |

|

% Increase / (Decrease) |

|

December 31, 2022 |

|

December 31, 2021 |

|

Reported Revenue Growth |

|

Currency Impact |

|

Constant Currency Revenue Growth |

| Vascular Access |

$186.4 |

|

$193.0 |

|

(3.4)% |

|

(3.9)% |

|

0.5% |

| Interventional |

125.1 |

|

114.9 |

|

8.8% |

|

(4.6)% |

|

13.4% |

| Anesthesia |

99.6 |

|

102.8 |

|

(3.1)% |

|

(5.1)% |

|

2.0% |

| Surgical |

110.4 |

|

106.4 |

|

3.9% |

|

(6.5)% |

|

10.4% |

| Interventional Urology |

89.2 |

|

92.9 |

|

(4.1)% |

|

(0.5)% |

|

(3.6)% |

| OEM |

73.7 |

|

67.2 |

|

9.7% |

|

(2.3)% |

|

12.0% |

| Other |

73.6 |

|

84.7 |

|

(13.1)% |

|

(6.0)% |

|

(7.1)% |

| Consolidated |

$758.0 |

|

$761.9 |

|

(0.5)% |

|

(4.2)% |

|

3.7% |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Year Ended |

|

% Increase / (Decrease) |

|

December 31, 2022 |

|

December 31, 2021 |

|

Reported Revenue Growth |

|

Currency Impact |

|

Constant Currency Revenue Growth |

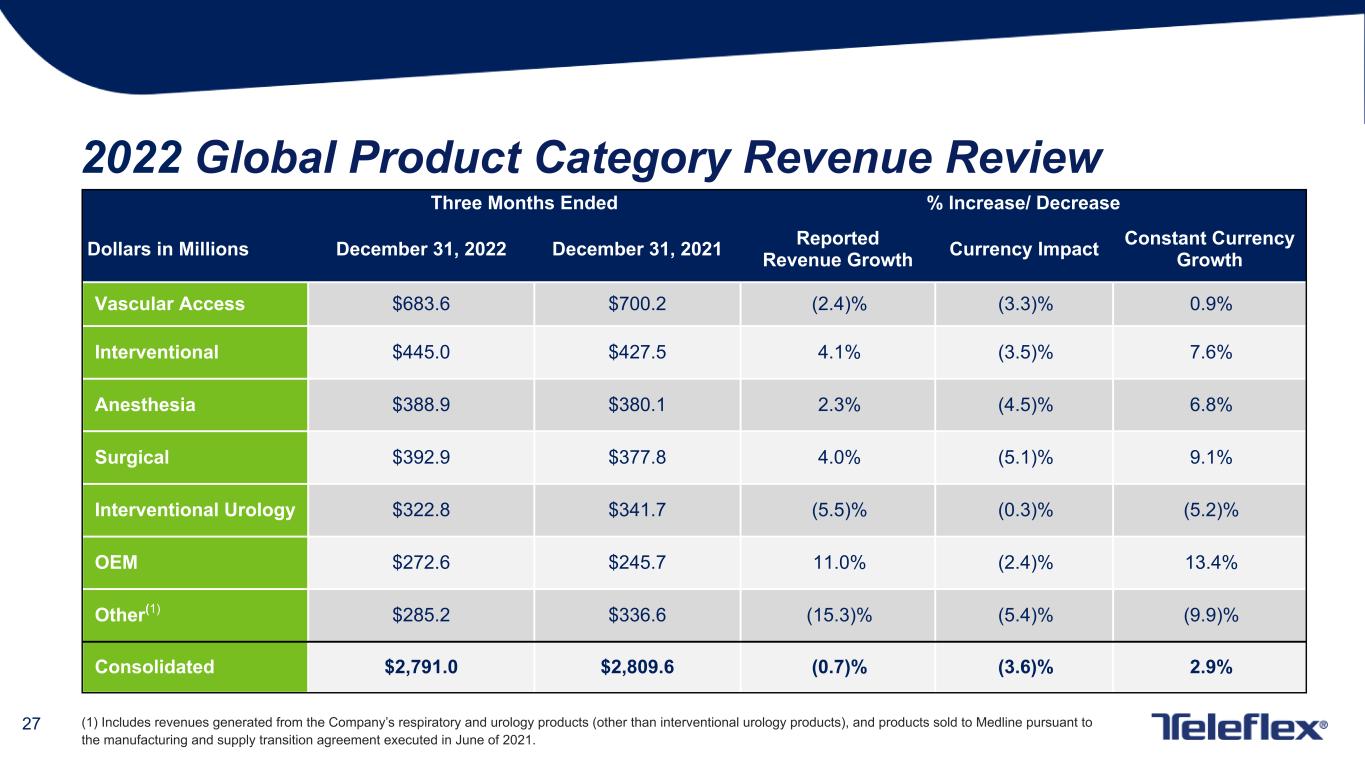

| Vascular Access |

$683.6 |

|

$700.2 |

|

(2.4)% |

|

(3.3)% |

|

0.9% |

| Interventional |

445.0 |

|

427.5 |

|

4.1% |

|

(3.5)% |

|

7.6% |

| Anesthesia |

388.9 |

|

380.1 |

|

2.3% |

|

(4.5)% |

|

6.8% |

| Surgical |

392.9 |

|

377.8 |

|

4.0% |

|

(5.1)% |

|

9.1% |

| Interventional Urology |

322.8 |

|

341.7 |

|

(5.5)% |

|

(0.3)% |

|

(5.2)% |

| OEM |

272.6 |

|

245.7 |

|

11.0% |

|

(2.4)% |

|

13.4% |

| Other |

285.2 |

|

336.6 |

|

(15.3)% |

|

(5.4)% |

|

(9.9)% |

| Consolidated |

$2,791.0 |

|

$2,809.6 |

|

(0.7)% |

|

(3.6)% |

|

2.9% |

OTHER FINANCIAL HIGHLIGHTS

•Depreciation expense, amortization of intangible assets and deferred financing charges for the twelve months ended December 31, 2022 totaled $234.6 million compared to $241.9 million for the prior year period.

•Cash and cash equivalents at December 31, 2022 were $292.0 million compared to $445.1 million at December 31, 2021.

•Net accounts receivable at December 31, 2022 were 408.8 million compared to $383.6 million at December 31, 2021.

•Inventories at December 31, 2022 were $578.5 million compared to $477.6 million at December 31, 2021.

2023 OUTLOOK

On a GAAP basis, full year 2023 revenue growth outlook is expected to be 4.25% to 5.75%, reflecting our estimate of an approximately 0.50% negative impact of foreign exchange rate fluctuations. On a constant currency basis, the Company expects full year 2023 revenue growth of 4.75% to 6.25% year-over-year.

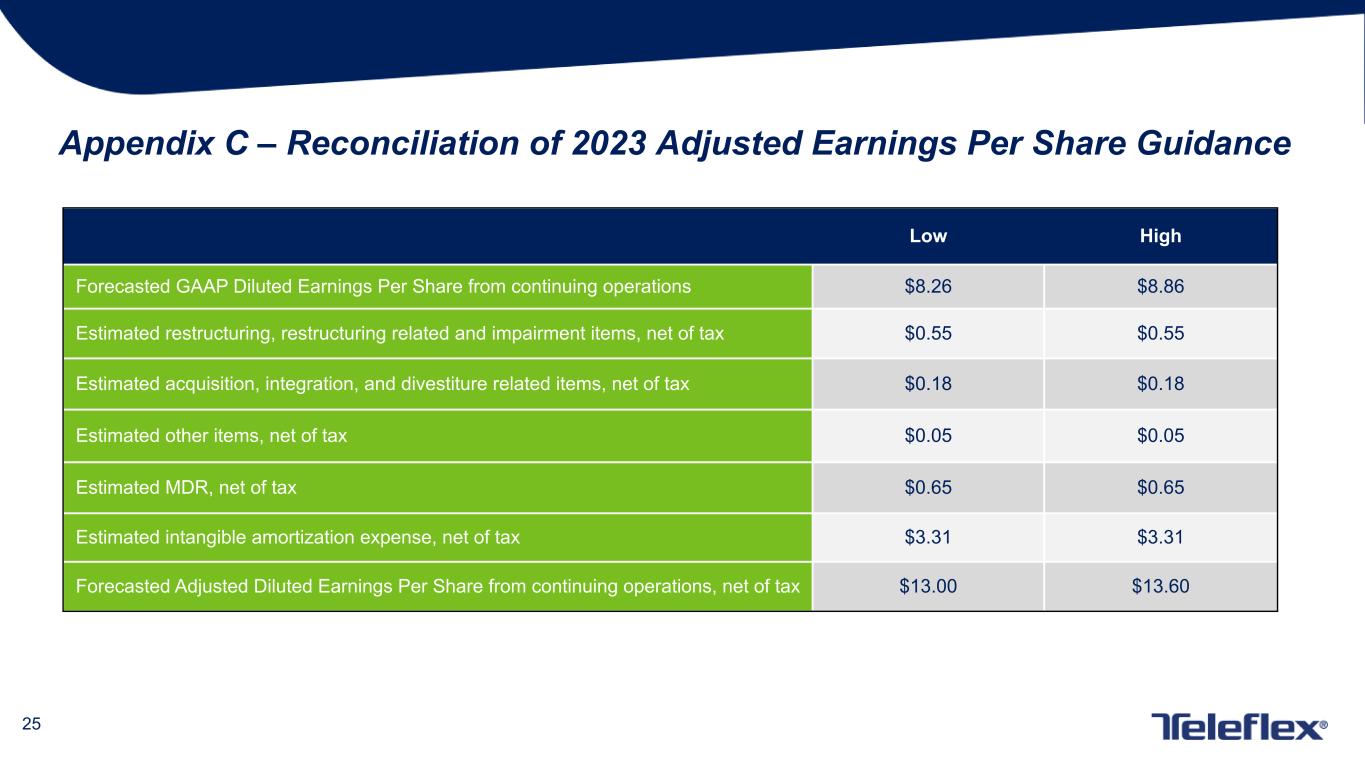

The Company expects full year 2023 GAAP diluted earnings per share from continuing operations of $8.26 to $8.86. The Company expects 2023 adjusted diluted earnings per share from continuing operations of $13.00 to $13.60, representing growth of (0.5)% to 4.1% year-over-year.

Forecasted 2023 Constant Currency Revenue Growth Reconciliation

|

|

|

|

|

|

|

|

|

|

|

|

|

Low |

|

High |

Forecasted 2023 GAAP revenue growth |

4.25% |

|

5.75% |

| Estimated impact of foreign currency exchange rate fluctuations |

(0.50)% |

|

(0.50)% |

Forecasted 2023 constant currency revenue growth |

4.75% |

|

6.25% |

Forecasted 2023 Adjusted Diluted Earnings Per Share From Continuing Operations Reconciliation

|

|

|

|

|

|

|

|

|

|

|

|

|

Low |

|

High |

| Forecasted GAAP diluted earnings per share from continuing operations |

$8.26 |

|

$8.86 |

| Restructuring, restructuring related and impairment items, net of tax |

$0.55 |

|

$0.55 |

| Acquisition, integration and divestiture related items, net of tax |

$0.18 |

|

$0.18 |

| Other items, net of tax |

$0.05 |

|

$0.05 |

| MDR |

$0.65 |

|

$0.65 |

| Intangible amortization expense, net of tax |

$3.31 |

|

$3.31 |

| Forecasted adjusted diluted earnings per share from continuing operations |

$13.00 |

|

$13.60 |

CONFERENCE CALL WEBCAST AND ADDITIONAL INFORMATION

A webcast of Teleflex's fourth quarter 2022 investor conference call can be accessed live from a link on the Company's website at teleflex.com. The call will begin at 8:00 am ET on February 23, 2023.

An audio replay of the investor call will be available beginning at 11:00 am ET on February 23, 2023, either on the Teleflex website or by telephone. The call can be accessed by dialing 1 866 813 9403 (U.S.) or +44 204 525 0658 (all other locations). The confirmation code is 903856.

ADDITIONAL NOTES

References in this release to the impact of foreign currency exchange rate fluctuations on adjusted diluted earnings per share include both the impact of translating foreign currencies into U.S. dollars and the impact of foreign currency exchange rate fluctuations on foreign currency denominated transactions.

In the discussion of segment results, "new products" refers to products for which we initiated commercial sales within the past 36 months and "existing products" refers to products we have sold commercially for more than 36 months.

Certain financial information is presented on a rounded basis, which may cause minor differences. Segment results and commentary exclude the impact of discontinued operations.

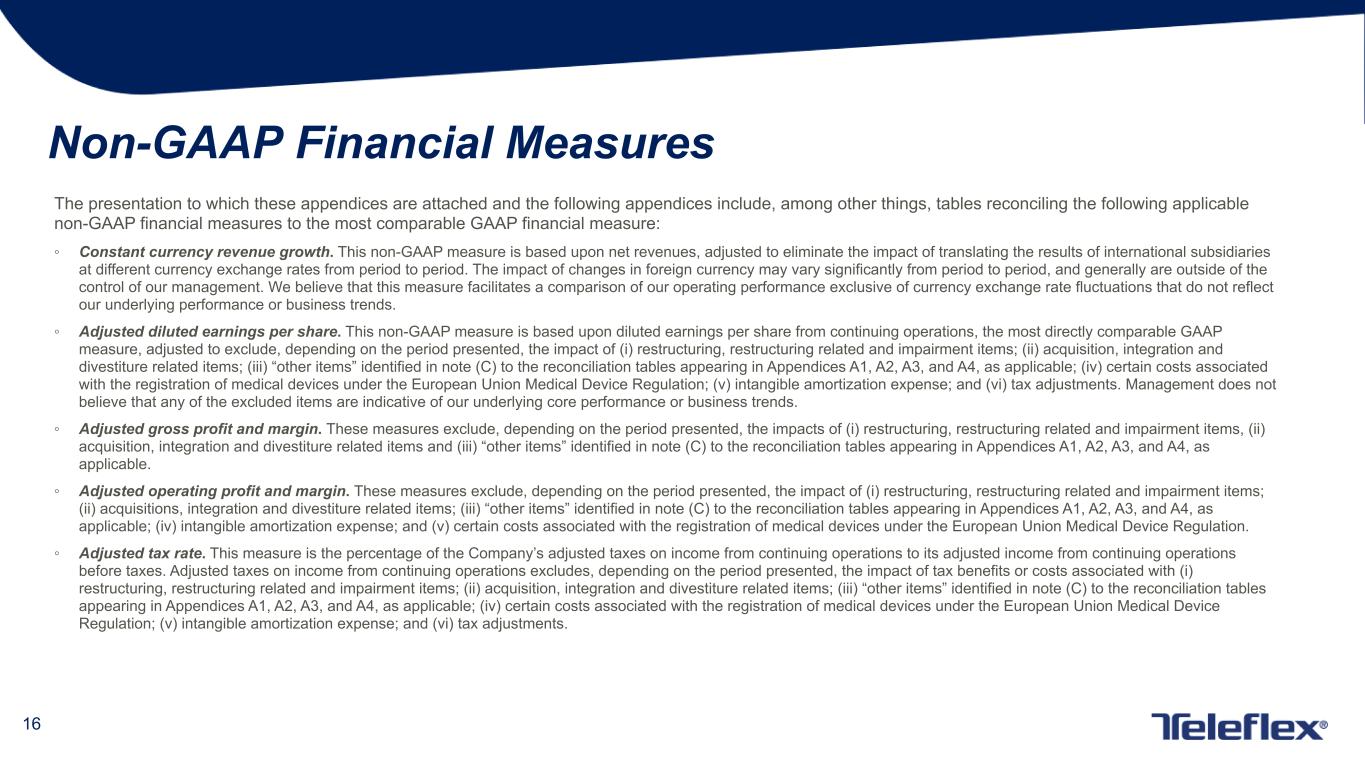

NOTES ON NON-GAAP FINANCIAL MEASURES

We report our financial results in accordance with accounting principles generally accepted in the United States, commonly referred to as “GAAP.” In this press release, we provide supplemental information, consisting of the following non-GAAP financial measures: constant currency revenue growth and adjusted diluted earnings per share. These non-GAAP measures are described in more detail below. Management uses these financial measures to assess Teleflex’s financial performance, make operating decisions, allocate financial resources, provide guidance on possible future results, and assist in its evaluation of period-to-period and peer comparisons. The non-GAAP measures may be useful to investors because they provide insight into management’s assessment of our business, and provide supplemental information pertinent to a comparison of period-to-period results of our ongoing operations. The non-GAAP financial measures are presented in addition to results presented in accordance with GAAP and should not be relied upon as a substitute for GAAP financial measures. Moreover, our non-GAAP financial measures may not be comparable to similarly titled measures used by other companies.

Tables reconciling changes in historical constant currency net revenues to historical GAAP net revenues are set forth above under “Net Revenue by Segment" and "Net Revenue by Global Product Category". Tables reconciling historical adjusted diluted earnings per share from continuing operations to historical GAAP diluted earnings per share from continuing operations are set forth below.

Constant currency revenue growth: This non-GAAP measure is based upon net revenues, adjusted to eliminate the impact of translating the results of international subsidiaries at different currency exchange rates from period to period. The impact of changes in foreign currency may vary significantly from period to period, and such changes generally are outside of the control of our management. We believe that this measure facilitates a comparison of our operating performance exclusive of currency exchange rate fluctuations that do not reflect our underlying performance or business trends.

Adjusted diluted earnings per share: This non-GAAP measure is based upon diluted earnings per share from continuing operations, the most directly comparable GAAP measure, adjusted to exclude, depending on the period presented, the items described below. Management does not believe that any of the excluded items are indicative of our underlying core performance or business trends.

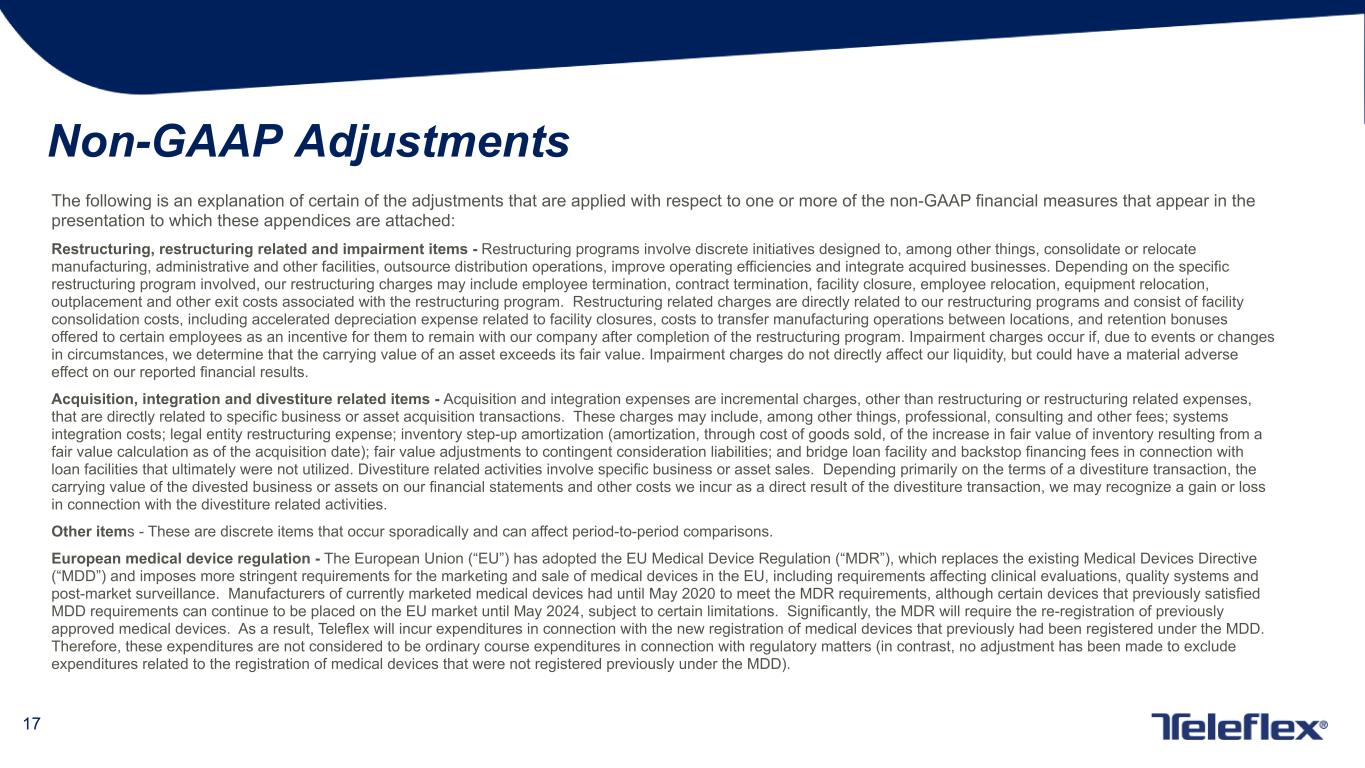

Restructuring, restructuring related and impairment items - Restructuring programs involve discrete initiatives designed to, among other things, consolidate or relocate manufacturing, administrative and other facilities, outsource distribution operations, improve operating efficiencies and integrate acquired businesses. Depending on the specific restructuring program involved, our restructuring charges may include employee termination, contract termination, facility closure, employee relocation, equipment relocation, outplacement and other exit costs associated with the restructuring program. Restructuring related charges are directly related to our restructuring programs and consist of facility consolidation costs, including accelerated depreciation expense related to facility closures, costs to transfer manufacturing operations between locations, and retention bonuses offered to certain employees as an incentive for them to remain with our company after completion of the restructuring program. Impairment charges occur if, due to events or changes in circumstances, we determine that the carrying value of an asset exceeds its fair value. Impairment charges do not directly affect our liquidity, but could have a material adverse effect on our reported financial results.

Acquisition, integration and divestiture related items - Acquisition and integration expenses are incremental charges, other than restructuring or restructuring related expenses, that are directly related to specific business or asset acquisition transactions. These charges may include, among other things, professional, consulting and other fees; systems integration costs; legal entity restructuring expense; inventory step-up amortization (amortization, through cost of goods sold, of the increase in fair value of inventory resulting from a fair value calculation as of the acquisition date); fair value adjustments to contingent consideration liabilities; and bridge loan facility and backstop financing fees in connection with loan facilities that ultimately were not utilized. Divestiture related activities involve specific business or asset sales. Depending primarily on the terms of a divestiture transaction, the carrying value of the divested business or assets on our financial statements and other costs we incur as a direct result of the divestiture transaction, we may recognize a gain or loss in connection with the divestiture related activities.

Other - These are discrete items that occur sporadically and can affect period-to-period comparisons. See footnote C to the reconciliation tables set forth below for additional details.

European medical device regulation - The European Union (“EU”) has adopted the EU Medical Device Regulation (“MDR”), which replaces the existing Medical Devices Directive (“MDD”) and imposes more stringent requirements for the marketing and sale of medical devices in the EU, including requirements affecting clinical evaluations, quality systems and post-market surveillance. The MDR requirements became effective in May 2021, although certain devices that previously satisfied MDD requirements can continue to be marketed in the EU until May 2024, subject to certain limitations. Significantly, the MDR will require the re-registration of previously approved medical devices. As a result, Teleflex will incur expenditures in connection with the new registration of medical devices that previously had been registered under the MDD. Therefore, these expenditures are not considered to be ordinary course expenditures in connection with regulatory matters (in contrast, no adjustment has been made to exclude expenditures related to the registration of medical devices that were not registered previously under the MDD).

Intangible amortization expense - Certain intangible assets, including customer relationships, intellectual property, distribution rights, trade names and non-competition agreements, initially are recorded at historical cost and then amortized over their respective estimated useful lives. The amount of such amortization can vary from period to period as a result of, among other things, business or asset acquisitions or dispositions.

Tax adjustments - These adjustments represent the impact of the expiration of applicable statutes of limitations for prior year returns, the resolution of audits, the filing of amended returns with respect to prior tax years and/or tax law or certain other discrete changes affecting our deferred tax liability.

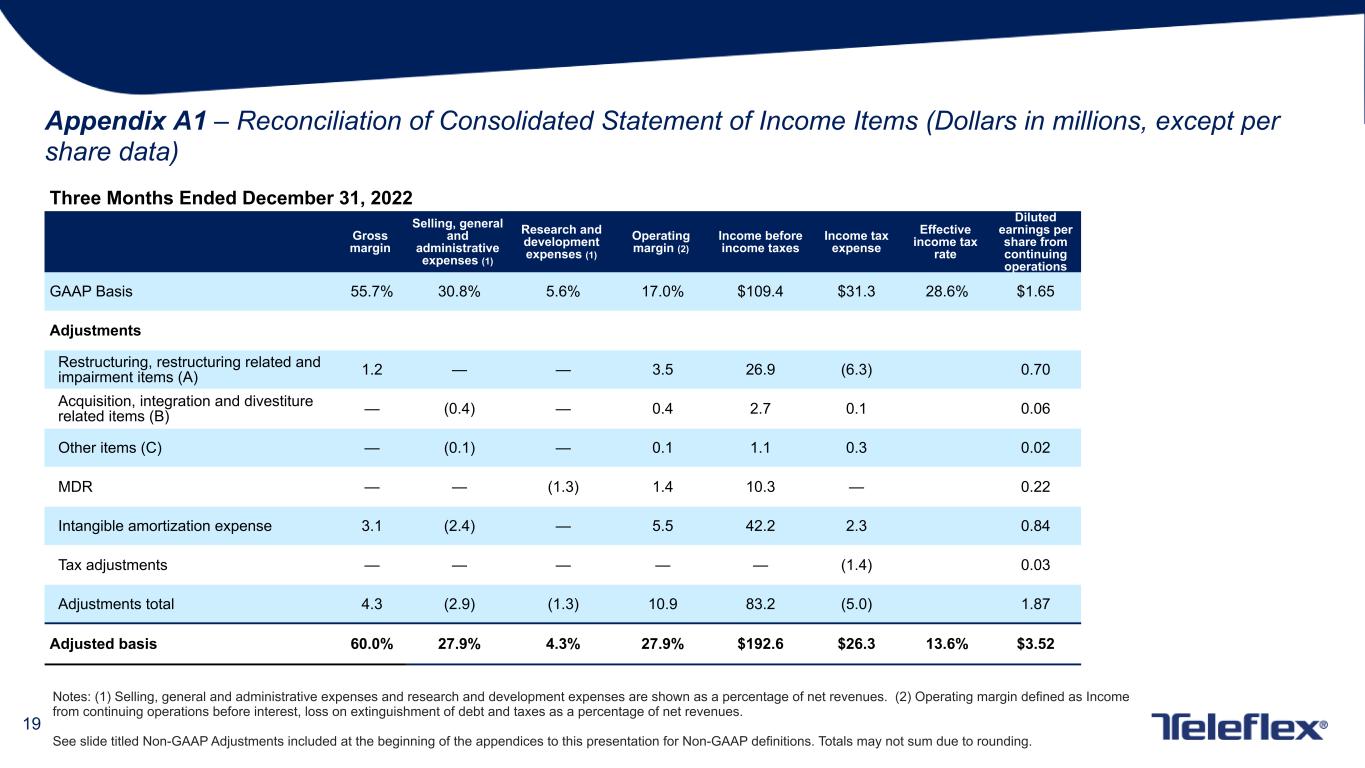

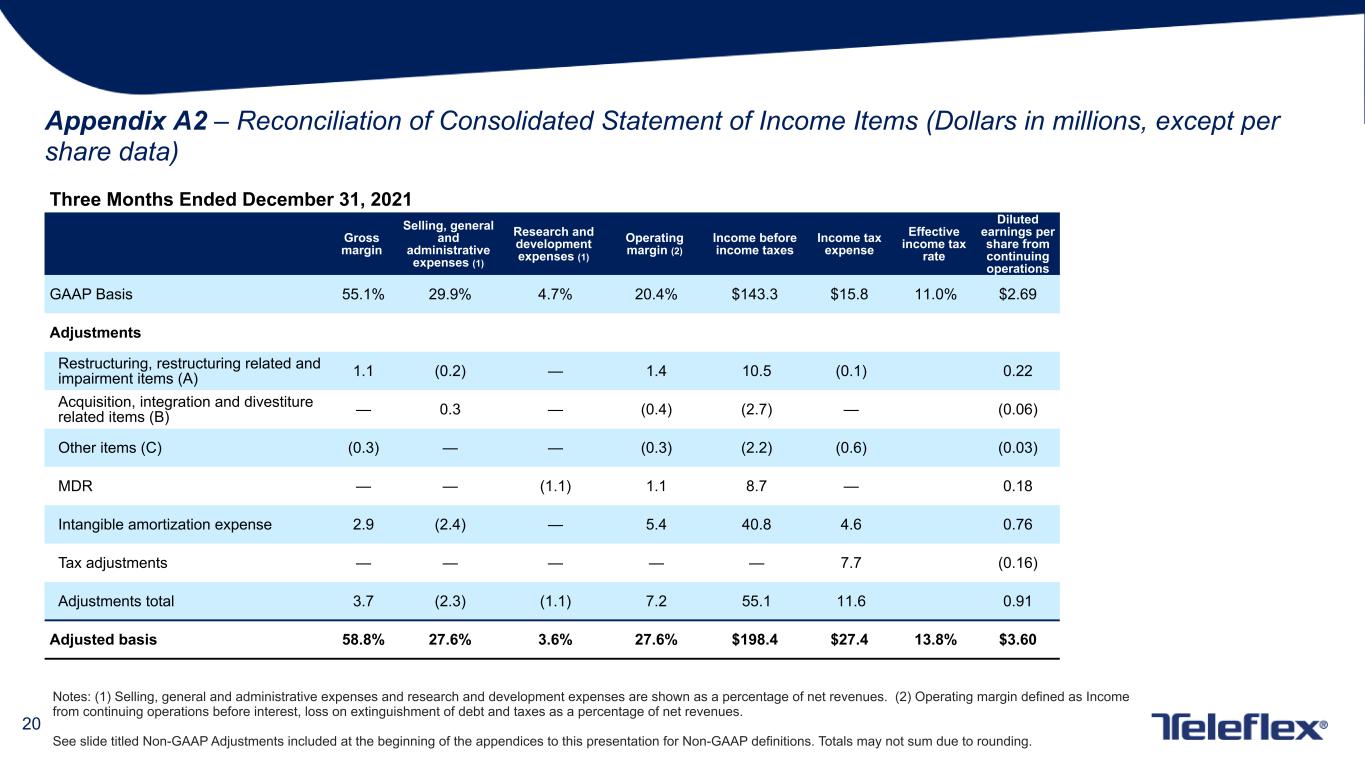

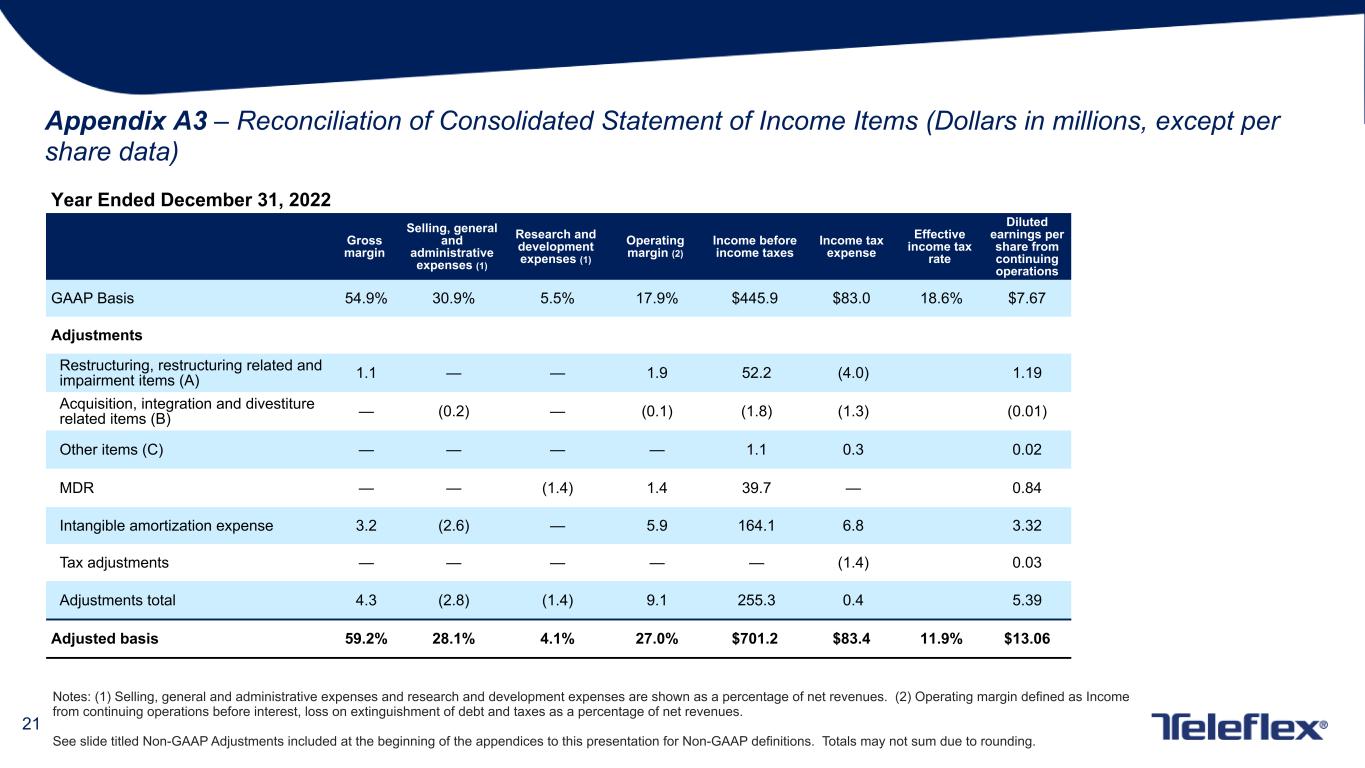

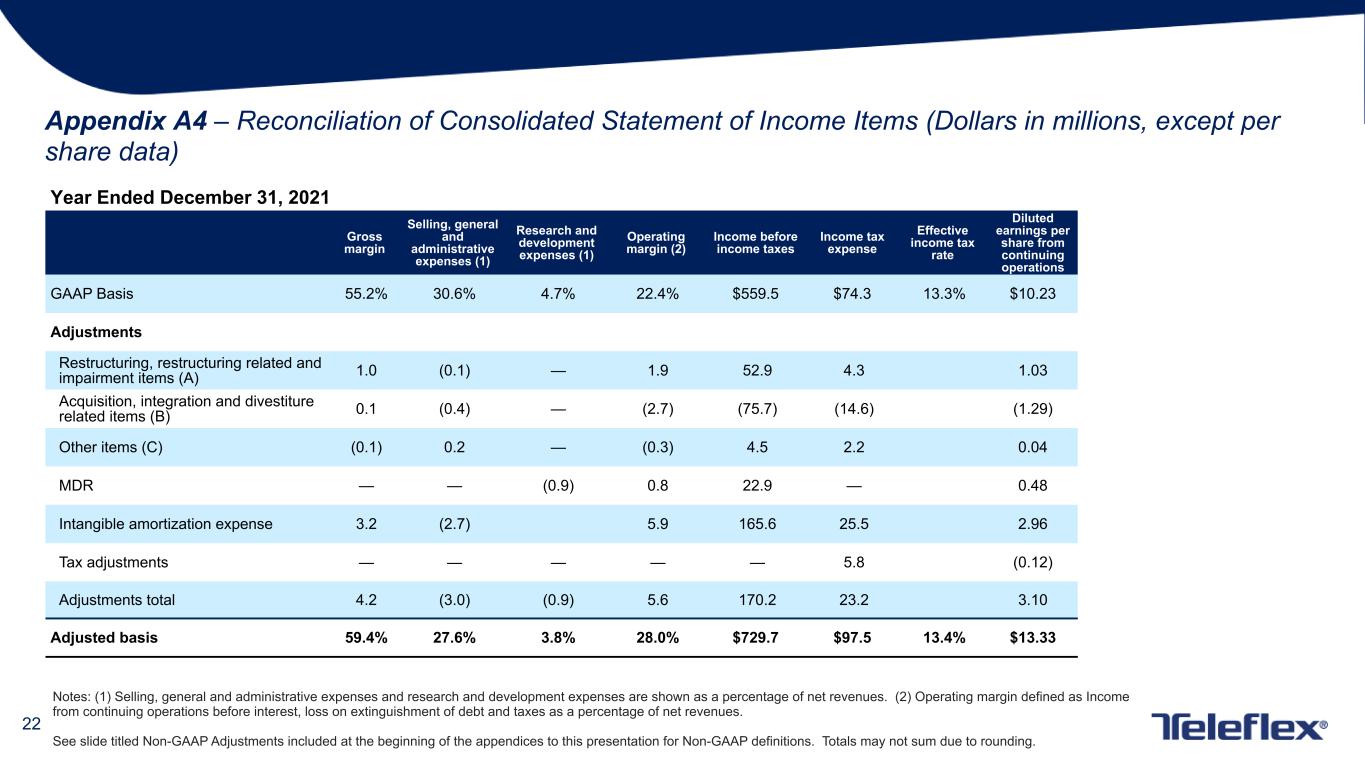

Reconciliation of Consolidated Statement of Income Items (Dollars in millions, except per share data)

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Three Months Ended December 31, 2022 |

|

Gross margin |

Selling, general and administrative expenses (1) |

Research and development expenses (1) |

Operating margin (2) |

Income before income taxes |

Income tax expense |

Effective income tax rate |

Diluted earnings per share from continuing operations |

| GAAP Basis |

55.7% |

30.8% |

5.6% |

17.0% |

$109.4 |

$31.3 |

28.6% |

$1.65 |

| Adjustments |

|

|

|

|

|

|

|

|

| Restructuring, restructuring related and impairment items (A) |

1.2 |

— |

— |

3.5 |

26.9 |

(6.3) |

|

0.70 |

| Acquisition, integration and divestiture related items (B) |

— |

(0.4) |

— |

0.4 |

2.7 |

0.1 |

|

0.06 |

| Other items (C) |

— |

(0.1) |

— |

0.1 |

1.1 |

0.3 |

|

0.02 |

| MDR |

— |

— |

(1.3) |

1.4 |

10.3 |

— |

|

0.22 |

| Intangible amortization expense |

3.1 |

(2.4) |

— |

5.5 |

42.2 |

2.3 |

|

0.84 |

| Tax adjustments |

— |

— |

— |

— |

— |

(1.4) |

|

0.03 |

| Adjustments total |

4.3 |

(2.9) |

(1.3) |

10.9 |

83.2 |

(5.0) |

|

1.87 |

| Adjusted basis |

60.0% |

27.9% |

4.3% |

27.9% |

$192.6 |

$26.3 |

13.6% |

$3.52 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Three Months Ended December 31, 2021 |

|

Gross margin |

Selling, general and administrative expenses (1) |

Research and development expenses (1) |

Operating margin (2) |

Income before income taxes |

Income tax expense |

Effective income tax rate |

Diluted earnings per share from continuing operations |

| GAAP Basis |

55.1% |

29.9% |

4.7% |

20.4% |

$143.3 |

$15.8 |

11.0% |

$2.69 |

| Adjustments |

|

|

|

|

|

|

|

|

| Restructuring, restructuring related and impairment items (A) |

1.1 |

(0.2) |

— |

1.4 |

10.5 |

(0.1) |

|

0.22 |

| Acquisition, integration and divestiture related items (B) |

— |

0.3 |

— |

(0.4) |

(2.7) |

— |

|

(0.06) |

| Other items (C) |

(0.3) |

— |

— |

(0.3) |

(2.2) |

(0.6) |

|

(0.03) |

| MDR |

— |

— |

(1.1) |

1.1 |

8.7 |

— |

|

0.18 |

| Intangible amortization expense |

2.9 |

(2.4) |

— |

5.4 |

40.8 |

4.6 |

|

0.76 |

| Tax adjustments |

— |

— |

— |

— |

— |

7.7 |

|

(0.16) |

| Adjustments total |

3.7 |

(2.3) |

(1.1) |

7.2 |

55.1 |

11.6 |

|

0.91 |

| Adjusted basis |

58.8% |

27.6% |

3.6% |

27.6% |

$198.4 |

$27.4 |

13.8% |

$3.60 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Year Ended December 31, 2022 |

|

Gross margin |

Selling, general and administrative expenses (1) |

Research and development expenses (1) |

Operating margin (2) |

Income before income taxes |

Income tax expense |

Effective income tax rate |

Diluted earnings per share from continuing operations |

| GAAP Basis |

54.9% |

30.9% |

5.5% |

17.9% |

$445.9 |

$83.0 |

18.6% |

$7.67 |

| Adjustments |

|

|

|

|

|

|

|

|

| Restructuring, restructuring related and impairment items (A) |

1.1 |

— |

— |

1.9 |

52.2 |

(4.0) |

|

1.19 |

| Acquisition, integration and divestiture related items (B) |

— |

(0.2) |

— |

(0.1) |

(1.8) |

(1.3) |

|

(0.01) |

| Other items (C) |

— |

— |

— |

— |

1.1 |

0.3 |

|

0.02 |

| MDR |

— |

— |

(1.4) |

1.4 |

39.7 |

— |

|

0.84 |

| Intangible amortization expense |

3.2 |

(2.6) |

— |

5.9 |

164.1 |

6.8 |

|

3.32 |

| Tax adjustments |

— |

— |

— |

— |

— |

(1.4) |

|

0.03 |

| Adjustments total |

4.3 |

(2.8) |

(1.4) |

9.1 |

255.3 |

0.4 |

|

5.39 |

| Adjusted basis |

59.2% |

28.1% |

4.1% |

27.0% |

$701.2 |

$83.4 |

11.9% |

$13.06 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Year Ended December 31, 2021 |

|

Gross margin |

Selling, general and administrative expenses (1) |

Research and development expenses (1) |

Operating margin (2) |

Income before income taxes |

Income tax expense |

Effective income tax rate |

Diluted earnings per share from continuing operations |

| GAAP Basis |

55.2% |

30.6% |

4.7% |

22.4% |

$559.5 |

$74.3 |

13.3% |

$10.23 |

| Adjustments |

|

|

|

|

|

|

|

|

| Restructuring, restructuring related and impairment items (A) |

1.0 |

(0.1) |

— |

1.9 |

52.9 |

4.3 |

|

1.03 |

| Acquisition, integration and divestiture related items (B) |

0.1 |

(0.4) |

— |

(2.7) |

(75.7) |

(14.6) |

|

(1.29) |

| Other items (C) |

(0.1) |

0.2 |

— |

(0.3) |

4.5 |

2.2 |

|

0.04 |

| MDR |

— |

— |

(0.9) |

0.8 |

22.9 |

— |

|

0.48 |

| Intangible amortization expense |

3.2 |

(2.7) |

— |

5.9 |

165.6 |

25.5 |

|

2.96 |

| Tax adjustments |

— |

— |

— |

— |

— |

5.8 |

|

(0.12) |

| Adjustments total |

4.2 |

(3.0) |

(0.9) |

5.6 |

170.2 |

23.2 |

|

3.10 |

| Adjusted basis |

59.4% |

27.6% |

3.8% |

28.0% |

$729.7 |

$97.5 |

13.4% |

$13.33 |

Notes: (1) Selling, general and administrative expenses and research and development expenses are shown as a percentage of net revenues.

(2) Operating margin defined as Income from continuing operations before interest, loss on extinguishment of debt and taxes as a percentage of net revenues.

Totals may not sum due to rounding.

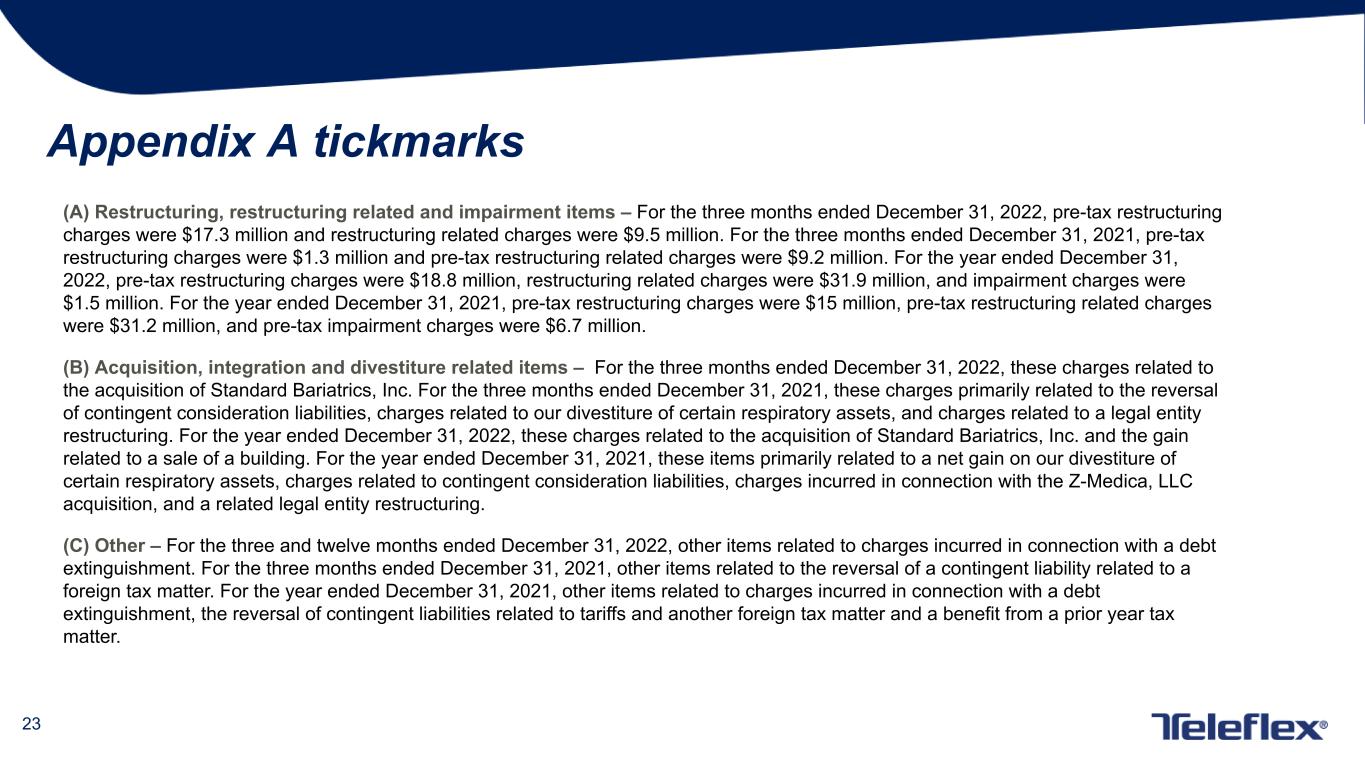

Tickmarks to Reconciliation Tables

(A)Restructuring, restructuring related and impairment items – For the three months ended December 31, 2022, pre-tax restructuring charges were $17.3 million and restructuring related charges were $9.5 million. For the three months ended December 31, 2021, pre-tax restructuring charges were $1.3 million; and pre-tax restructuring related charges were $9.2 million. For the year ended December 31, 2022, pre-tax restructuring charges were $18.8 million, restructuring related charges were $31.9 million, and impairment charges were $1.5 million. For the year ended December 31, 2021, pre-tax restructuring charges were $15 million; pre-tax restructuring related charges were $31.2 million; and pre-tax impairment charges were $6.7 million.

(B)Acquisition, integration and divestiture related items – For the three months ended December 31, 2022, these charges related to the acquisition of Standard Bariatrics, Inc. For the three months ended December 31, 2021, these charges primarily related to the reversal of contingent consideration liabilities, charges related to our divestiture of certain respiratory assets, and charges related to a legal entity restructuring. For the year ended December 31, 2022, these charges related to the acquisition of Standard Bariatrics, Inc. and the gain related to a sale of a building. For the year ended December 31, 2021, these items primarily related to a net gain on our divestiture of certain respiratory assets, charges related to contingent consideration liabilities, charges incurred in connection with the Z-Medica, LLC acquisition, and a related legal entity restructuring.

(C)Other – For the three and twelve months ended December 31, 2022, other items related to charges incurred in connection with a debt extinguishment. For the three months ended December 31, 2021, other items related to the reversal of a contingent liability related to a foreign tax matter. For the year ended December 31, 2021, other items were related to charges incurred in connection with a debt extinguishment; the reversal of contingent liabilities related to tariffs and another foreign tax matter; and a benefit from a prior year tax matter.

ABOUT TELEFLEX INCORPORATED

Teleflex is a global provider of medical technologies designed to improve the health and quality of people’s lives. We apply purpose driven innovation - a relentless pursuit of identifying unmet clinical needs - to benefit patients and healthcare providers. Our portfolio is diverse, with solutions in the fields of vascular access, interventional cardiology and radiology, anesthesia, emergency medicine, surgical, urology and respiratory care. Teleflex employees worldwide are united in the understanding that what we do every day makes a difference. For more information, please visit teleflex.com.

Teleflex is the home of Arrow®, Deknatel®, LMA®, Pilling®, QuikClot®, Rusch®, UroLift®, and Weck® - trusted brands united

by a common sense of purpose.

CAUTION CONCERNING FORWARD-LOOKING INFORMATION

This press release contains forward-looking statements, including, but not limited to, statements regarding our expectation that our acquisition of Standard Bariatrics will be accretive to our revenues and margins over time; forecasted 2022 GAAP and constant currency revenue growth and GAAP and adjusted diluted earnings per share; our estimates regarding the projected impact of foreign currency exchange rate fluctuations on our 2022 financial results; and our estimates with regard to the projected impacts of the divestiture of a significant portion of our respiratory business on our financial results. Actual results could differ materially from those in the forward-looking statements due to, among other things, delays or cancellations in shipments; demand for and market acceptance of new and existing products; our inability to provide products to our customers, which may be due to, among other things, events that impact key distributors, suppliers and third-party vendors that sterilize our products; our inability to integrate acquired businesses into our operations, realize planned synergies and operate such businesses profitably in accordance with our expectations; the inability of acquired businesses to generate revenues in accordance with our expectations; our inability to effectively execute our restructuring plans and programs; our inability to realize anticipated savings from restructuring plans and programs; the impact of healthcare reform legislation and proposals to amend, replace or repeal the legislation; changes in Medicare, Medicaid and third party coverage and reimbursements; the impact of enacted tax legislation and related regulations; competitive market conditions and resulting effects on revenues and pricing; increases in raw material costs that cannot be recovered in product pricing; global economic factors, including currency exchange rates, interest rates, trade disputes, sovereign debt issues and international conflicts and hostilities, such as the ongoing geopolitical conflict between Russia and Ukraine; public health epidemics, including the novel coronavirus (referred to as COVID-19); difficulties in entering new markets; general economic conditions; and other factors described or incorporated in our filings with the Securities and Exchange Commission, including our most recently filed Annual Report on Form 10-K. We expressly disclaim any obligation to update forward-looking statements, except as otherwise specifically stated by us or as required by law or regulation.

TELEFLEX INCORPORATED

CONSOLIDATED STATEMENTS OF INCOME

(Unaudited)

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Three Months Ended |

|

Twelve Months Ended |

| |

December 31, 2022 |

|

December 31, 2021 |

|

December 31, 2022 |

|

December 31, 2021 |

|

(Dollars and shares in thousands, except per share) |

| Net revenues |

$ |

757,996 |

|

|

$ |

761,914 |

|

|

$ |

2,791,041 |

|

|

$ |

2,809,563 |

|

| Cost of goods sold |

335,930 |

|

|

342,182 |

|

|

1,259,954 |

|

|

1,259,961 |

|

| Gross profit |

422,066 |

|

|

419,732 |

|

|

1,531,087 |

|

|

1,549,602 |

|

| Selling, general and administrative expenses |

233,375 |

|

|

227,584 |

|

|

863,748 |

|

|

860,085 |

|

| Research and development expenses |

42,755 |

|

|

35,795 |

|

|

153,819 |

|

|

130,841 |

|

| Restructuring and impairment charges |

17,349 |

|

|

1,287 |

|

|

20,299 |

|

|

21,738 |

|

| Gain on sale of assets and business |

— |

|

|

|

|

(6,504) |

|

|

(91,157) |

|

| Income from continuing operations before interest, loss on extinguishment of debt and taxes |

128,587 |

|

|

155,066 |

|

|

499,725 |

|

|

628,095 |

|

| Interest expense |

19,052 |

|

|

12,011 |

|

|

54,264 |

|

|

56,969 |

|

| Interest income |

(335) |

|

|

(222) |

|

|

(912) |

|

|

(1,328) |

|

| Loss on extinguishment of debt |

454 |

|

|

— |

|

|

454 |

|

|

12,986 |

|

| Income from continuing operations before taxes |

109,416 |

|

|

143,277 |

|

|

445,919 |

|

|

559,468 |

|

| Taxes on income from continuing operations |

31,303 |

|

|

15,814 |

|

|

83,003 |

|

|

74,349 |

|

| Income from continuing operations |

78,113 |

|

|

127,463 |

|

|

362,916 |

|

|

485,119 |

|

| Operating income (loss) from discontinued operations |

589 |

|

|

801 |

|

|

260 |

|

|

331 |

|

| Taxes (benefit) on operating loss from discontinued operations |

113 |

|

|

185 |

|

|

37 |

|

|

76 |

|

| Income (loss) from discontinued operations |

476 |

|

|

616 |

|

|

223 |

|

|

255 |

|

| Net income |

$ |

78,589 |

|

|

$ |

128,079 |

|

|

$ |

363,139 |

|

|

$ |

485,374 |

|

| Earnings per share: |

|

|

|

|

|

|

|

| Basic: |

|

|

|

|

|

|

|

| Income from continuing operations |

$ |

1.67 |

|

|

$ |

2.72 |

|

|

$ |

7.74 |

|

|

$ |

10.37 |

|

| Income (loss) from discontinued operations |

0.01 |

|

|

0.01 |

|

|

— |

|

|

0.01 |

|

| Net income |

$ |

1.68 |

|

|

$ |

2.73 |

|

|

$ |

7.74 |

|

|

$ |

10.38 |

|

| Diluted: |

|

|

|

|

|

|

|

| Income from continuing operations |

$ |

1.65 |

|

|

$ |

2.69 |

|

|

$ |

7.67 |

|

|

$ |

10.23 |

|

| Income (loss) from discontinued operations |

0.01 |

|

|

0.01 |

|

|

0.01 |

|

|

— |

|

| Net income |

$ |

1.66 |

|

|

$ |

2.70 |

|

|

$ |

7.68 |

|

|

$ |

10.23 |

|

|

|

|

|

|

|

|

|

| Weighted average shares outstanding: |

|

|

|

|

|

|

|

| Basic |

46,908 |

|

|

46,849 |

|

|

46,898 |

|

|

46,774 |

|

| Diluted |

47,226 |

|

|

47,417 |

|

|

47,309 |

|

|

47,427 |

|

TELEFLEX INCORPORATED

CONSOLIDATED BALANCE SHEETS

(Unaudited)

|

|

|

|

|

|

|

|

|

|

|

|

|

December 31, 2022 |

|

December 31, 2021 |

|

(Dollars in thousands) |

| ASSETS |

|

|

|

| Current assets |

|

|

|

| Cash and cash equivalents |

$ |

292,034 |

|

|

$ |

445,084 |

|

| Accounts receivable, net |

408,834 |

|

|

383,569 |

|

| Inventories |

578,507 |

|

|

477,643 |

|

| Prepaid expenses and other current assets |

125,084 |

|

|

117,277 |

|

| Prepaid taxes |

6,524 |

|

|

5,545 |

|

|

|

|

|

| Total current assets |

1,410,983 |

|

|

1,429,118 |

|

| Property, plant and equipment, net |

447,205 |

|

|

443,758 |

|

| Operating lease assets |

131,211 |

|

|

129,653 |

|

| Goodwill |

2,536,730 |

|

|

2,504,202 |

|

| Intangibles assets, net |

2,306,165 |

|

|

2,289,067 |

|

|

|

|

|

| Deferred tax assets |

6,402 |

|

|

6,820 |

|

| Other assets |

89,367 |

|

|

69,104 |

|

| Total assets |

$ |

6,928,063 |

|

|

$ |

6,871,722 |

|

| LIABILITIES AND EQUITY |

|

|

|

| Current liabilities |

|

|

|

| Current borrowings |

$ |

87,500 |

|

|

$ |

110,000 |

|

| Accounts payable |

126,807 |

|

|

118,236 |

|

| Accrued expenses |

140,644 |

|

|

163,441 |

|

|

|

|

|

| Payroll and benefit-related liabilities |

133,092 |

|

|

143,657 |

|

| Accrued interest |

5,332 |

|

|

5,209 |

|

| Income taxes payable |

24,736 |

|

|

83,943 |

|

| Other current liabilities |

63,381 |

|

|

55,633 |

|

| Total current liabilities |

581,492 |

|

|

680,119 |

|

| Long-term borrowings |

1,624,023 |

|

|

1,740,102 |

|

| Deferred tax liabilities |

388,886 |

|

|

370,124 |

|

| Pension and postretirement benefit liabilities |

31,394 |

|

|

45,185 |

|

| Noncurrent liability for uncertain tax positions |

5,805 |

|

|

8,646 |

|

|

|

|

|

| Noncurrent operating lease liabilities |

120,437 |

|

|

116,033 |

|

| Other liabilities |

154,058 |

|

|

156,765 |

|

| Total liabilities |

2,906,095 |

|

|

3,116,974 |

|

| Commitments and contingencies |

|

|

|

|

|

|

|

|

|

|

|

| Shareholders’ equity |

|

|

|

| Common shares, $1 par value Issued: 2022 — 47,957 shares; 2021 — 47,929 shares |

47,957 |

|

|

47,929 |

|

| Additional paid-in capital |

715,118 |

|

|

693,090 |

|

| Retained earnings |

3,817,304 |

|

|

3,517,954 |

|

| Accumulated other comprehensive loss |

(403,522) |

|

|

(346,959) |

|

|

4,176,857 |

|

|

3,912,014 |

|

| Less: Treasury stock, at cost |

154,889 |

|

|

157,266 |

|

| Total shareholders' equity |

4,021,968 |

|

|

3,754,748 |

|

|

|

|

|

|

|

|

|

| Total liabilities and shareholders' equity |

$ |

6,928,063 |

|

|

$ |

6,871,722 |

|

TELEFLEX INCORPORATED

CONSOLIDATED STATEMENTS OF CASH FLOWS

(Unaudited)

|

|

|

|

|

|

|

|

|

|

|

|

|

Year Ended |

|

December 31, 2022 |

|

December 31, 2021 |

|

(Dollars in thousands) |

| Cash flows from operating activities of continuing operations: |

|

|

|

| Net income |

$ |

363,139 |

|

|

$ |

485,374 |

|

| Adjustments to reconcile net income to net cash provided by operating activities: |

|

|

|

| (Income) loss from discontinued operations |

(223) |

|

|

(255) |

|

| Depreciation expense |

66,502 |

|

|

71,758 |

|

| Intangible asset amortization expense |

164,088 |

|

|

165,604 |

|

| Deferred financing costs and debt discount amortization expense |

4,053 |

|

|

4,493 |

|

|

|

|

|

| Loss on extinguishment of debt |

454 |

|

|

12,986 |

|

| Fair value step up of acquired inventory sold |

— |

|

|

3,993 |

|

| Changes in contingent consideration |

2,350 |

|

|

8,475 |

|

| Assets impairment charges |

1,497 |

|

|

6,739 |

|

|

|

|

|

| Stock-based compensation |

27,224 |

|

|

22,937 |

|

| Gain on sale of assets and business |

(6,504) |

|

|

(91,157) |

|

|

|

|

|

| Deferred income taxes, net |

(13,008) |

|

|

(110,239) |

|

| Payments for contingent consideration |

(3,016) |

|

|

(230) |

|

| Interest benefit on swaps designated as net investment hedges |

(20,880) |

|

|

(19,296) |

|

| Other |

(2,906) |

|

|

(36,388) |

|

| Changes in operating assets and liabilities, net of effects of acquisitions and disposals: |

|

|

|

| Accounts receivable |

(38,459) |

|

|

(600) |

|

| Inventories |

(110,686) |

|

|

(11,138) |

|

| Prepaid expenses and other current assets |

13,420 |

|

|

(28,410) |

|

| Accounts payable, accrued expenses and other liabilities |

(24,786) |

|

|

94,020 |

|

| Income taxes |

(79,453) |

|

|

73,473 |

|

| Net cash provided by operating activities from continuing operations |

342,806 |

|

|

652,139 |

|

| Cash flows from investing activities of continuing operations: |

|

|

|

| Expenditures for property, plant and equipment |

(79,190) |

|

|

(71,618) |

|

| Payments for businesses and intangibles acquired, net of cash acquired |

(198,429) |

|

|

(4,590) |

|

| Proceeds from sales of business and assets |

12,434 |

|

|

224,909 |

|

|

|

|

|

| Net interest proceeds on swaps designated as net investment hedges |

20,775 |

|

|

19,154 |

|

| Proceeds from sales of investments |

7,300 |

|

|

7,300 |

|

| Purchase of investments |

(22,300) |

|

|

(18,418) |

|

| Net cash (used in) provided by investing activities from continuing operations |

(259,410) |

|

|

156,737 |

|

| Cash flows from financing activities of continuing operations: |

|

|

|

| Proceeds from new borrowings |

744,250 |

|

|

400,000 |

|

| Reduction in borrowings |

(884,500) |

|

|

(1,034,500) |

|

| Debt extinguishment, issuance and amendment fees |

(5,200) |

|

|

(9,774) |

|

|

|

|

|

| Net proceeds from share based compensation plans and the related tax impacts |

(4,308) |

|

|

12,451 |

|

| Payments for contingent consideration |

(3,959) |

|

|

(31,448) |

|

| Dividends paid |

(63,789) |

|

|

(63,648) |

|

| Proceeds from sale of treasury stock |

— |

|

|

11,097 |

|

| Net cash (used in) provided by financing activities from continuing operations |

(217,506) |

|

|

(715,822) |

|

| Cash flows from discontinued operations: |

|

|

|

| Net cash used in operating activities |

(665) |

|

|

(720) |

|

| Net cash provided by investing activities |

1,469 |

|

|

— |

|

| Net cash provided by (used in) discontinued operations |

804 |

|

|

(720) |

|

| Effect of exchange rate changes on cash and cash equivalents |

(19,744) |

|

|

(23,130) |

|

| Net (decrease) increase in cash and cash equivalents |

(153,050) |

|

|

69,204 |

|

| Cash and cash equivalents at the beginning of the year |

445,084 |

|

|

375,880 |

|

| Cash and cash equivalents at the end of the year |

$ |

292,034 |

|

|

$ |

445,084 |

|

Contacts:

Teleflex Incorporated:

Lawrence Keusch

Vice President, Investor Relations and Strategy Development

John Hsu, CFA

Vice President, Investor Relations

investors.teleflex.com

610-948-2836