| Massachusetts | 001-07511 | 04-2456637 | ||||||||||||

| (State or other jurisdiction of incorporation) | (Commission File Number) | (IRS Employer Identification No.) | ||||||||||||

| One Congress Street | |||||||||||

| Boston | Massachusetts | 02114 | |||||||||

| (Address of principal executive offices, and Zip Code) | |||||||||||

Registrant’s telephone number, including area code: |

(617) |

786-3000 |

||||||

| Title of each class | Trading Symbol(s) | Name of each exchange on which registered | ||||||||||||

| Common stock, $1 par value per share | STT | New York Stock Exchange | ||||||||||||

| Depositary Shares, each representing a 1/4,000th ownership interest in a share of | STT.PRG | New York Stock Exchange | ||||||||||||

| Fixed-to-Floating Rate Non-Cumulative Perpetual Preferred Stock, Series G, without par value per share | ||||||||||||||

| Emerging growth company | ☐ | ||||

| Exhibit No. | Description | |||||||

| * | 104 | Cover Page Interactive Data File (formatted as Inline XBRL) | ||||||

| * | Submitted electronically herewith | |||||||

| STATE STREET CORPORATION | |||||||||||||||||

| By: | /s/ Elizabeth M. Schaefer | ||||||||||||||||

| Name: | Elizabeth M. Schaefer, | ||||||||||||||||

| Title: | Senior Vice President and Chief Accounting Officer | ||||||||||||||||

| Date: | July 15, 2025 | ||||||||||||||||

|

Exhibit 99.1 State Street Corporation One Congress Street Boston, MA 02114 NYSE: STT www.statestreet.com |

|||||||

STATE STREET REPORTS SECOND QUARTER 2025 EPS OF $2.17; $2.53 EXCLUDING NOTABLE ITEMS | ||

See note (a) below for a description of the presentation in this news release | ||

|

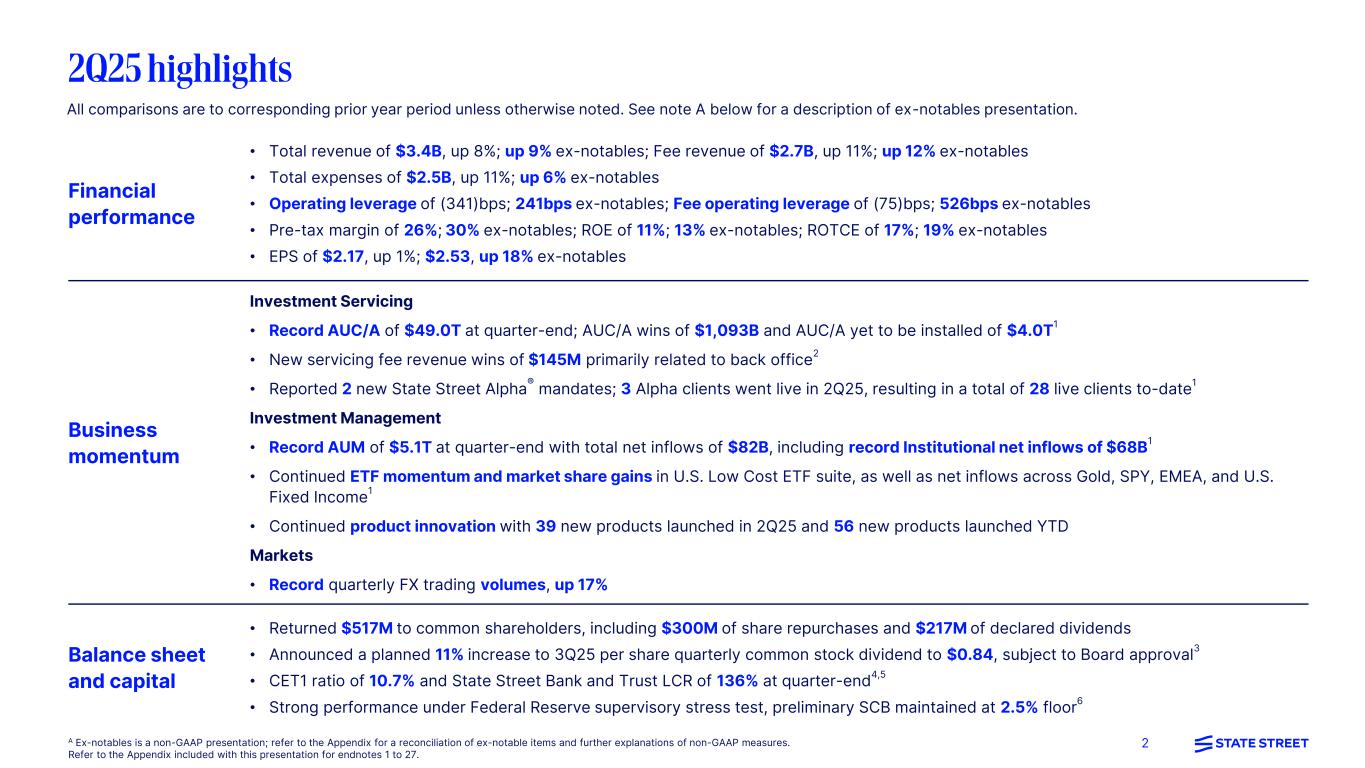

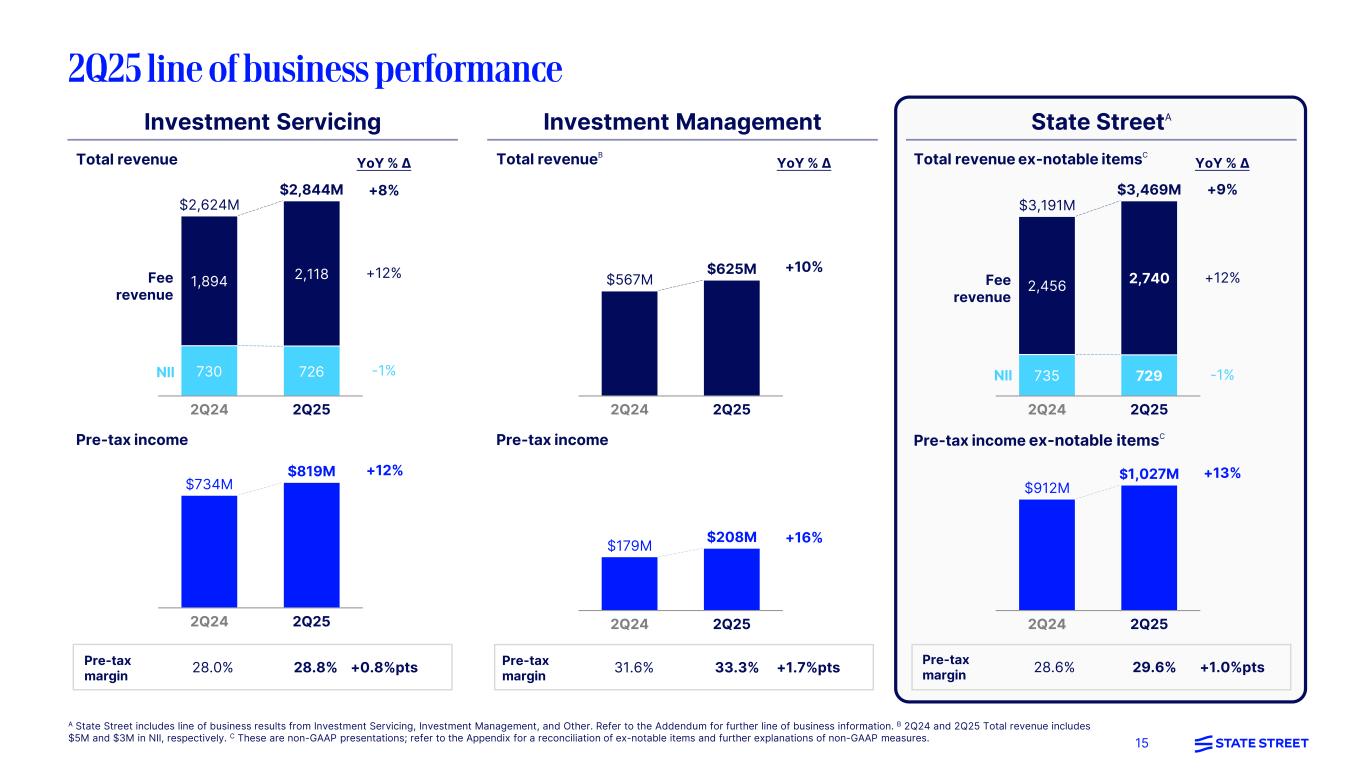

Ron O'Hanley, Chairman and Chief Executive Officer: "We delivered strong financial results and continued business momentum, all while supporting our clients and growing revenues amid heightened market uncertainty and volatility. During the second quarter, we achieved robust fee revenue growth across the franchise with total fee revenue up 11% year-over-year, and up 12%, excluding notable items, coupled with ongoing expense management."

O'Hanley added: "Disciplined execution of our strategy continues to drive positive results. In 2Q, we achieved a sixth straight quarter of positive year-over-year total operating leverage, excluding notable items, generated near-record sales in Investment Services, surpassed $5 trillion in AUM at State Street Investment Management and generated record FX trading client volumes. This momentum underscores the strong foundation we have built to support long-term growth. As we build on this progress, we remain focused on creating value for our shareholders while delivering operational excellence for our clients."

O'Hanley concluded: "The results of the Federal Reserve's stress test reaffirm our financial strength, and we were pleased to announce a planned 11% increase in our per share quarterly common stock dividend. As we look ahead, given the strength of our strategy and our focus on disciplined execution, we expect this momentum will continue, which positions us well to deliver improved results and drive long-term, sustainable growth for our shareholders."

| ||

| (Table presents summary results, dollars in millions, except per share amounts, or where otherwise noted) | 2Q25 | 1Q25 | 2Q24 | % QoQ | % YoY | |||||||||||||||||||||||||||

| Income statement: | ||||||||||||||||||||||||||||||||

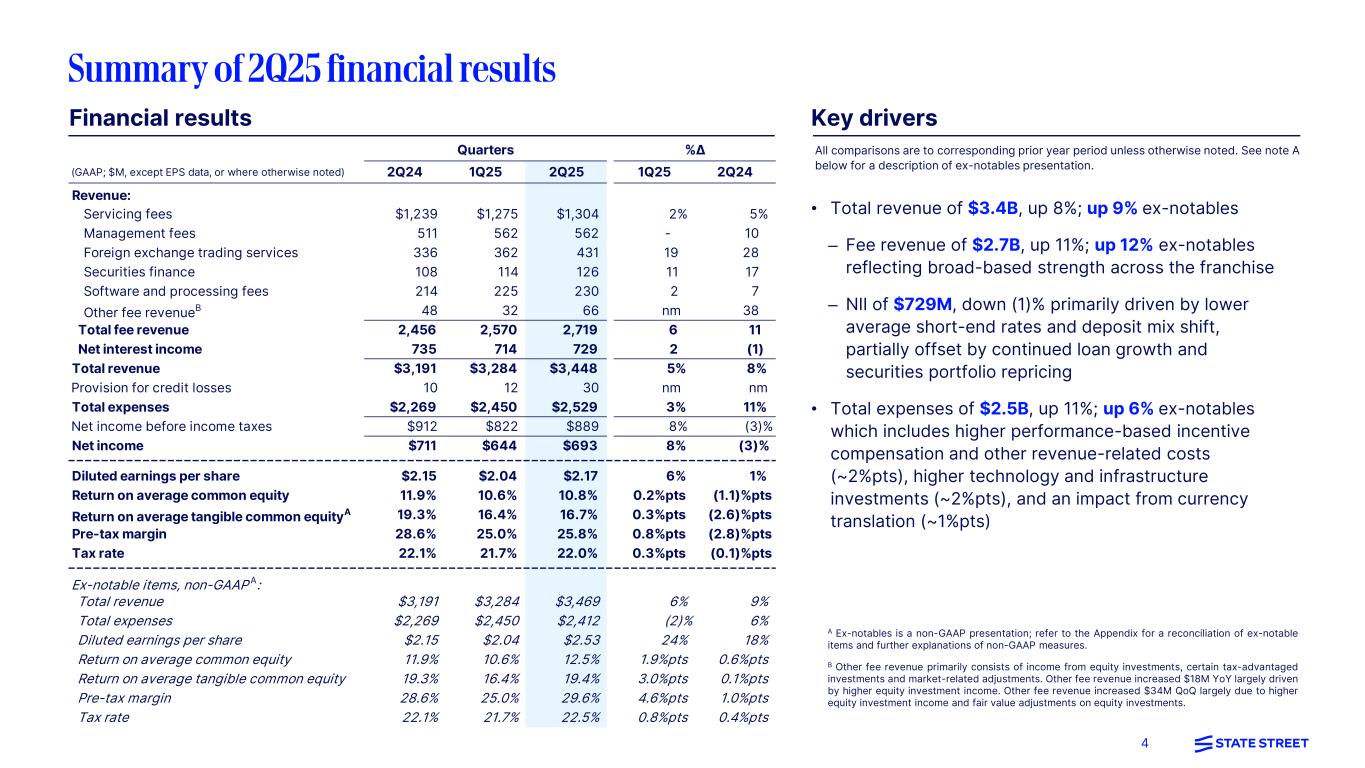

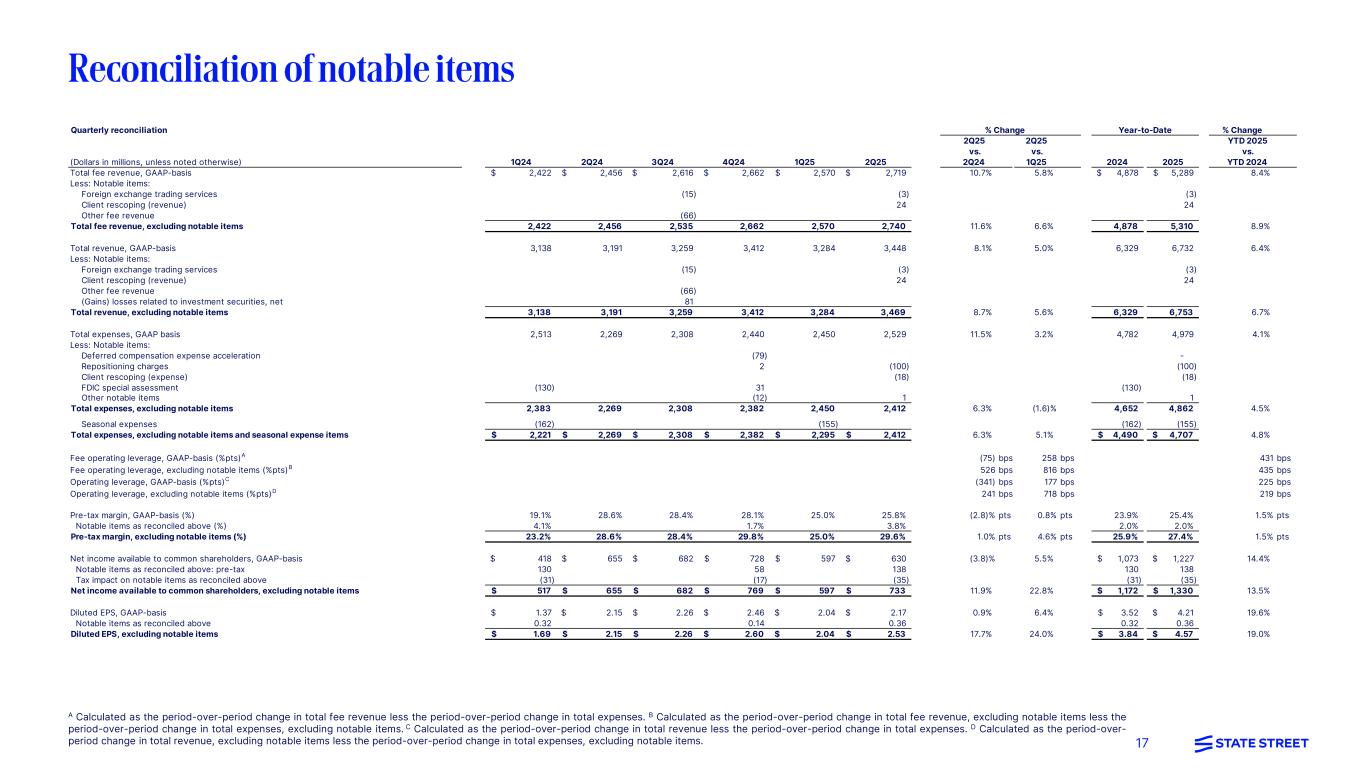

| Total fee revenue | $ | 2,719 | $ | 2,570 | $ | 2,456 | 6 | % | 11 | % | ||||||||||||||||||||||

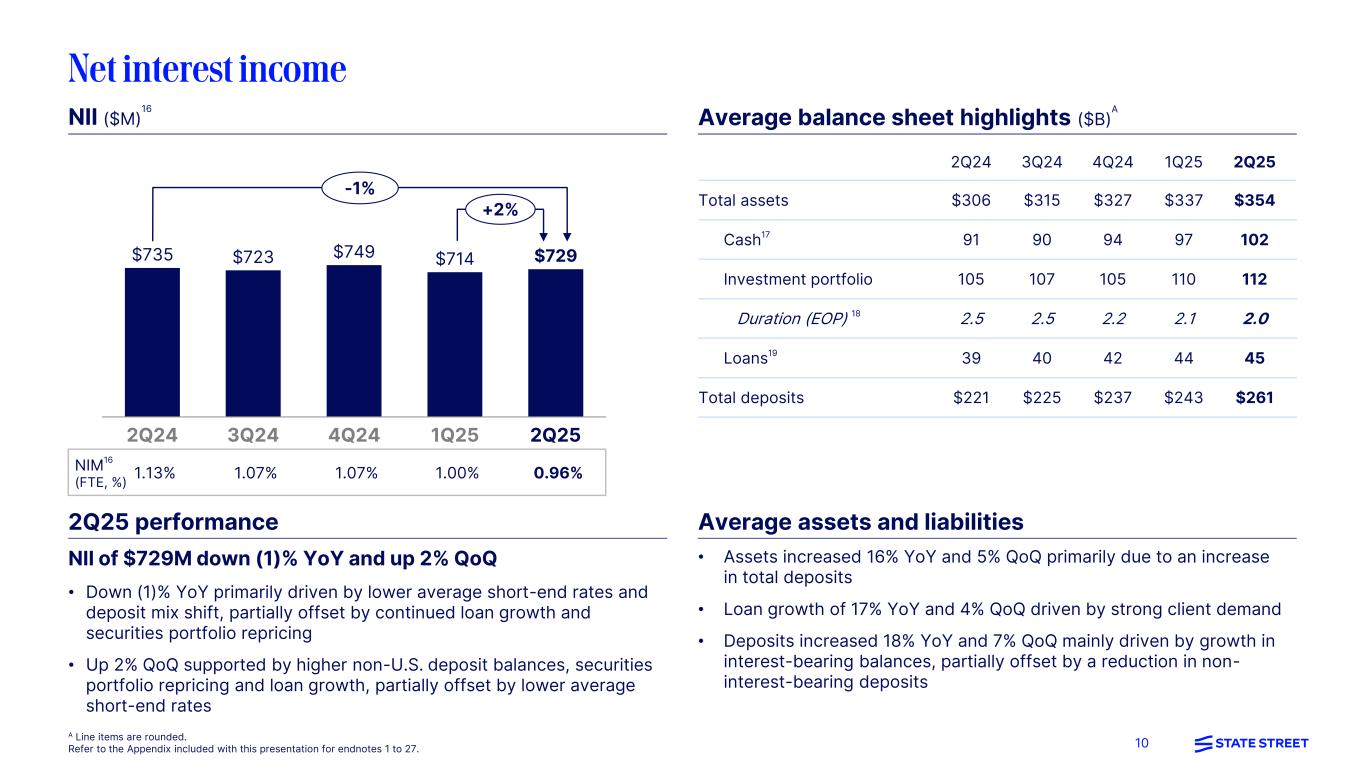

| Net interest income | 729 | 714 | 735 | 2 | (1) | |||||||||||||||||||||||||||

| Total revenue | 3,448 | 3,284 | 3,191 | 5 | 8 | |||||||||||||||||||||||||||

| Provision for credit losses | 30 | 12 | 10 | nm | nm | |||||||||||||||||||||||||||

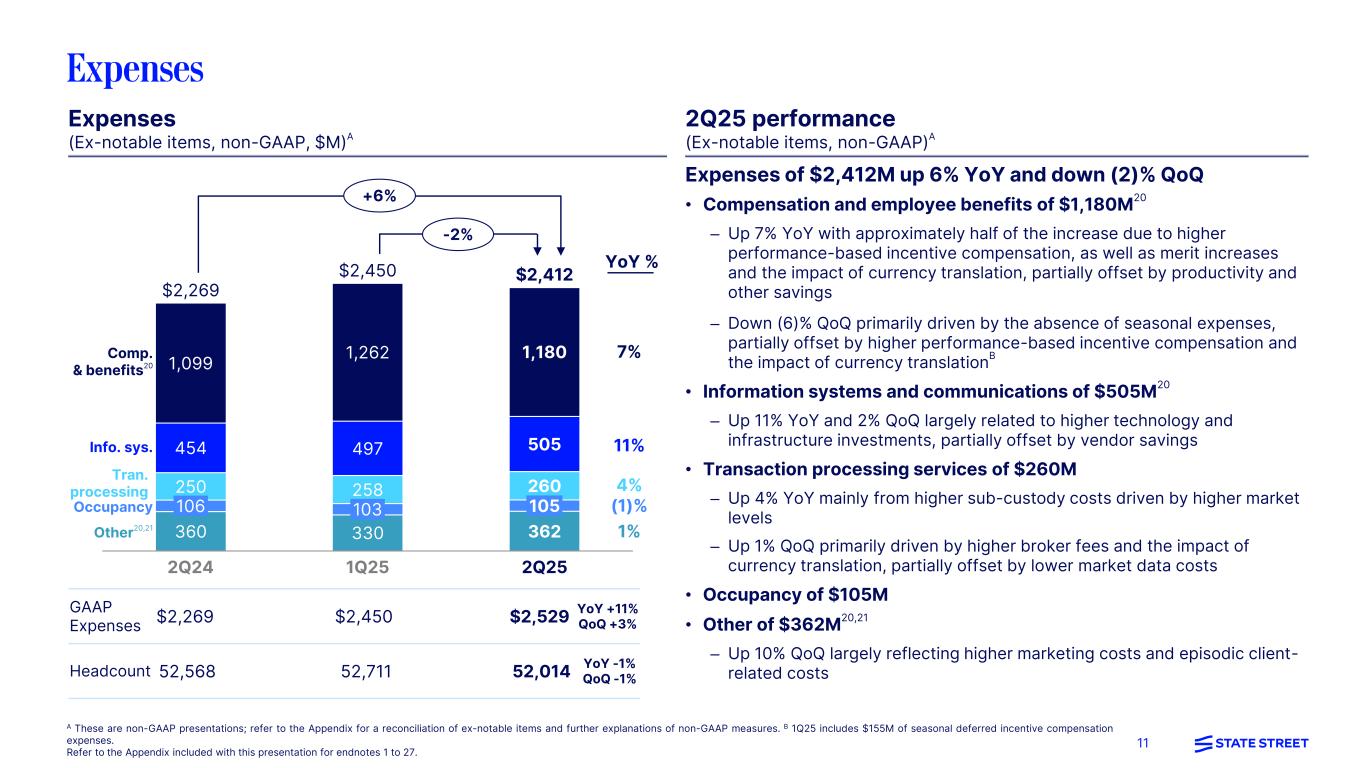

| Total expenses | 2,529 | 2,450 | 2,269 | 3 | 11 | |||||||||||||||||||||||||||

| Net income | 693 | 644 | 711 | 8 | (3) | |||||||||||||||||||||||||||

| Financial ratios and other metrics: | ||||||||||||||||||||||||||||||||

| Diluted earnings per share (EPS) | $ | 2.17 | $ | 2.04 | $ | 2.15 | 6 | % | 1 | % | ||||||||||||||||||||||

| Return on average common equity (ROE) | 10.8 | % | 10.6 | % | 11.9 | % | 0.2 | % | pts | (1.1) | % | pts | ||||||||||||||||||||

| Pre-tax margin | 25.8 | 25.0 | 28.6 | 0.8 | % | pts | (2.8) | % | pts | |||||||||||||||||||||||

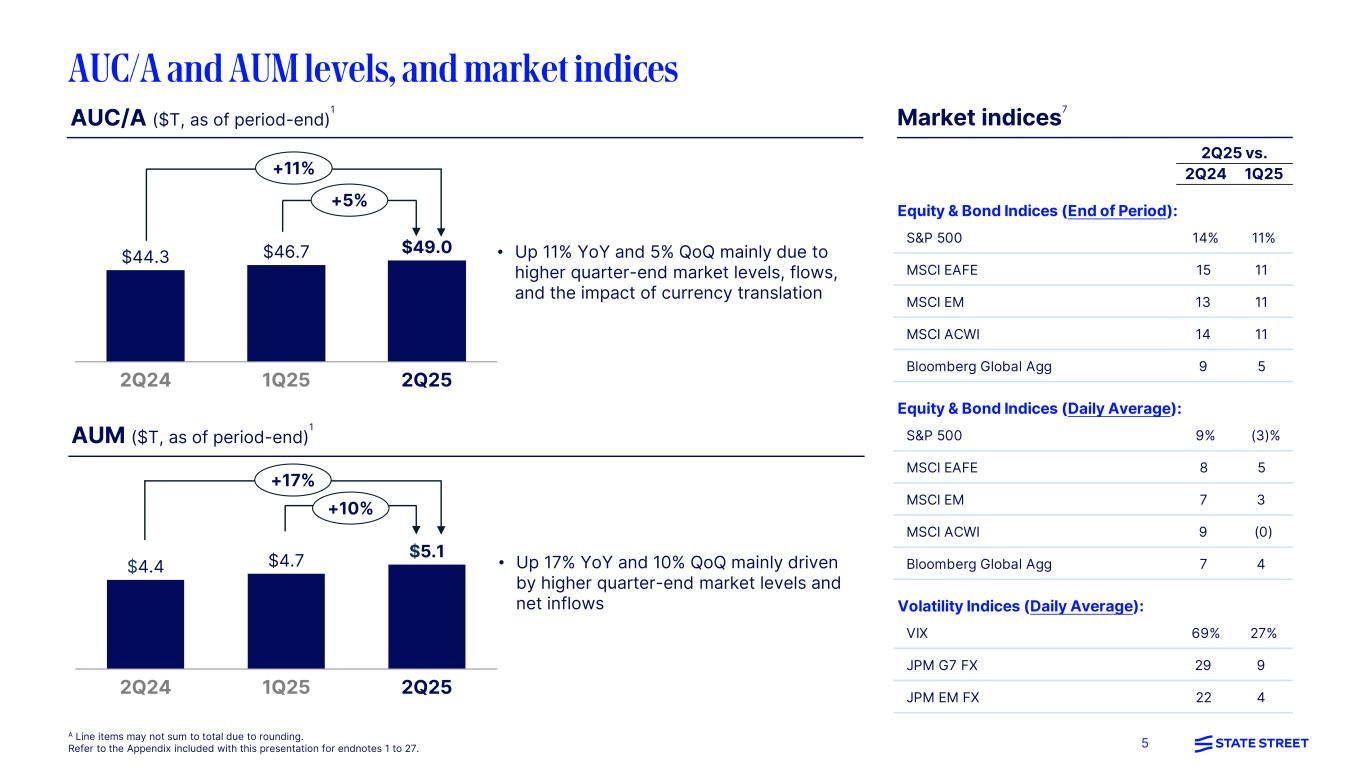

AUC/A ($ billions)(1) |

$ | 49,000 | $ | 46,733 | $ | 44,312 | 5 | % | 11 | % | ||||||||||||||||||||||

AUM ($ billions)(1) |

5,117 | 4,665 | 4,369 | 10 | 17 | |||||||||||||||||||||||||||

| (Dollars in millions, except EPS amounts) | 2Q25 | 1Q25 | 2Q24 | |||||||||||

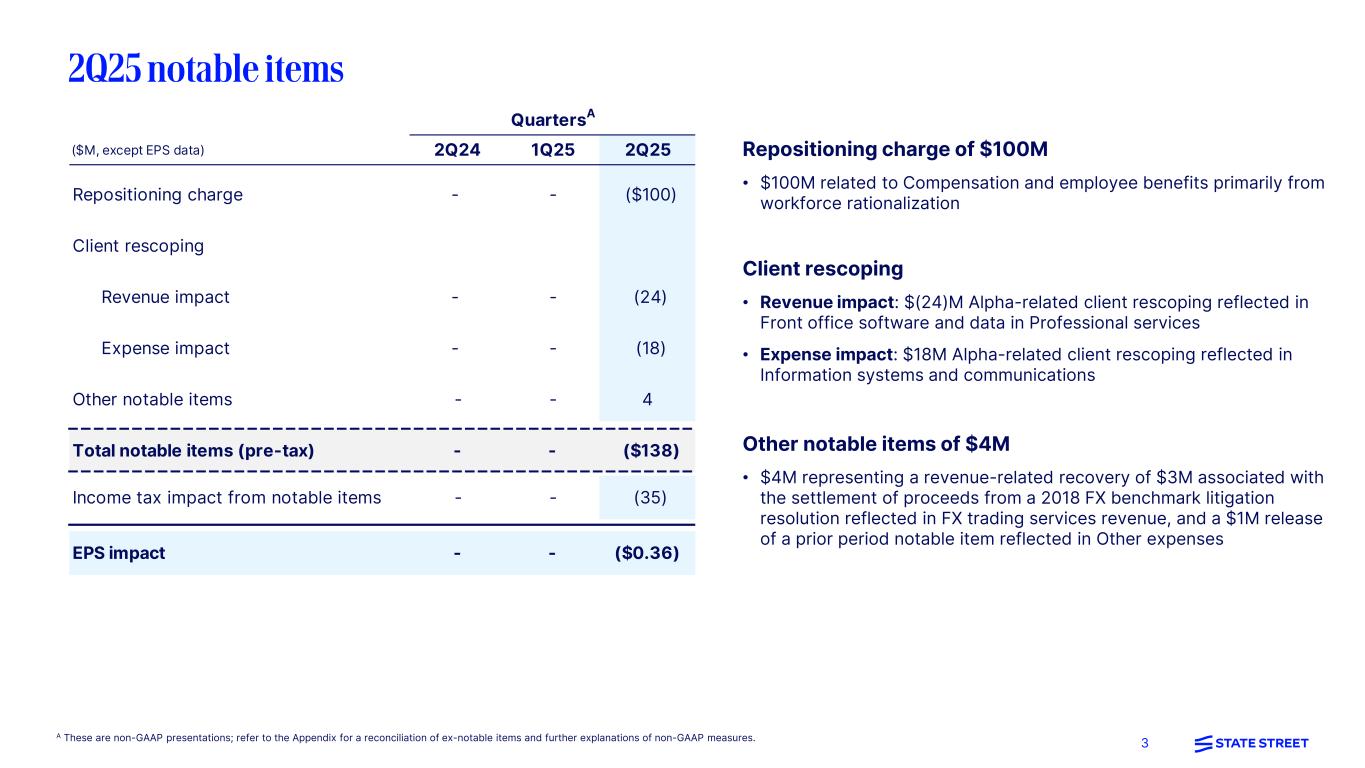

Repositioning charge |

$ | (100) | $ | — | $ | — | ||||||||

Client rescoping |

||||||||||||||

Revenue impact |

(24) | — | — | |||||||||||

Expense impact |

(18) | — | — | |||||||||||

Other notable items |

4 | — | — | |||||||||||

| Total notable items (pre-tax) | $ | (138) | $ | — | $ | — | ||||||||

| Income tax impact from notable items | (35) | — | — | |||||||||||

| EPS impact | $ | (0.36) | $ | — | $ | — | ||||||||

(Dollars in billions, except market indices and foreign exchange rates)(1) |

2Q25 | 1Q25 | 2Q24 | % QoQ | % YoY | ||||||||||||

Assets under Custody and/or Administration (AUC/A)(2)(3) |

$ | 49,000 | $ | 46,733 | $ | 44,312 | 5 | % | 11 | % | |||||||

Assets under Management (AUM)(3) |

5,117 | 4,665 | 4,369 | 10 | 17 | ||||||||||||

Market Indices:(4) |

|||||||||||||||||

| S&P 500 EOP | 6,205 | 5,612 | 5,460 | 11 | 14 | ||||||||||||

| S&P 500 Daily Average | 5,732 | 5,895 | 5,247 | (3) | 9 | ||||||||||||

| MSCI EAFE EOP | 2,655 | 2,401 | 2,315 | 11 | 15 | ||||||||||||

| MSCI EAFE Daily Average | 2,514 | 2,395 | 2,325 | 5 | 8 | ||||||||||||

| MSCI Emerging Markets EOP | 1,223 | 1,101 | 1,086 | 11 | 13 | ||||||||||||

| MSCI Emerging Markets Daily Average | 1,140 | 1,104 | 1,063 | 3 | 7 | ||||||||||||

| MSCI ACWI EOP | 918 | 827 | 802 | 11 | 14 | ||||||||||||

| MSCI ACWI Daily Average | 853 | 856 | 782 | — | 9 | ||||||||||||

| Bloomberg Global Aggregate Bond Index EOP | 497 | 476 | 456 | 5 | 9 | ||||||||||||

| Bloomberg Global Aggregate Bond Index Daily Average | 487 | 469 | 456 | 4 | 7 | ||||||||||||

Foreign Exchange Volatility Indices:(4) |

|||||||||||||||||

| CBOE Volatility Index (VIX) Daily Average | 23.6 | 18.5 | 14.0 | 27 | 69 | ||||||||||||

| JPM G7 Volatility Index Daily Average | 9.3 | 8.5 | 7.2 | 9 | 29 | ||||||||||||

| JPM Emerging Market Volatility Index Daily Average | 8.7 | 8.3 | 7.1 | 4 | 22 | ||||||||||||

Average Foreign Exchange Rates: |

|||||||||||||||||

| EUR vs. USD | 1.135 | 1.053 | 1.076 | 8 | 5 | ||||||||||||

| GBP vs. USD | 1.336 | 1.260 | 1.261 | 6 | 6 | ||||||||||||

| (Dollars in billions) | 2Q25 | 1Q25 | 4Q24 | 3Q24 | 2Q24 | ||||||||||||

North America - (U.S. Domiciled) Morningstar Direct Market Data:(1)(2) |

|||||||||||||||||

Long-term Funds |

$ | (180) | $ | (148) | $ | (129) | $ | (117) | $ | (111) | |||||||

| Money Market | (14) | 100 | 376 | 230 | 62 | ||||||||||||

| ETF | 247 | 291 | 427 | 288 | 206 | ||||||||||||

Total Flows(3) |

$ | 54 | $ | 243 | $ | 673 | $ | 401 | $ | 157 | |||||||

EMEA - Morningstar Direct Market Data:(1)(4) |

|||||||||||||||||

Long-term Funds |

$ | 70 | $ | 75 | $ | 108 | $ | 82 | $ | 52 | |||||||

| Money Market | 41 | 58 | 73 | 107 | 39 | ||||||||||||

| ETF | 72 | 92 | 85 | 66 | 57 | ||||||||||||

Total Flows(3) |

$ | 183 | $ | 224 | $ | 265 | $ | 255 | $ | 148 | |||||||

| (As of period end, dollars in billions) | 2Q25 | 1Q25 | 2Q24 | % QoQ | % YoY | ||||||||||||

Assets Under Custody and/or Administration(1) |

|||||||||||||||||

| By product classification: | |||||||||||||||||

| Collective funds, including ETFs | $ | 16,728 | $ | 15,430 | $ | 14,573 | 8 | % | 15 | % | |||||||

| Mutual funds | 12,641 | 12,143 | 11,645 | 4 | 9 | ||||||||||||

| Pension products | 9,679 | 9,377 | 8,916 | 3 | 9 | ||||||||||||

| Insurance and other products | 9,952 | 9,783 | 9,178 | 2 | 8 | ||||||||||||

| Total Assets Under Custody and/or Administration | $ | 49,000 | $ | 46,733 | $ | 44,312 | 5 | % | 11 | % | |||||||

| By asset class: | |||||||||||||||||

| Equities | $ | 29,311 | $ | 27,508 | $ | 26,291 | 7 | % | 11 | % | |||||||

| Fixed-income | 12,122 | 11,900 | 11,303 | 2 | 7 | ||||||||||||

Short-term and other investments(2) |

7,567 | 7,325 | 6,718 | 3 | 13 | ||||||||||||

| Total Assets Under Custody and/or Administration | $ | 49,000 | $ | 46,733 | $ | 44,312 | 5 | % | 11 | % | |||||||

| (Dollars in billions) | Equity | Fixed- Income | Cash | Multi-Asset Class Solutions | Alternative Investments(1) |

Total | ||||||||||||||

Beginning balance as of March 31, 2025 |

$ | 2,901 | $ | 633 | $ | 518 | $ | 390 | $ | 223 | $ | 4,665 | ||||||||

| Net asset flows: | ||||||||||||||||||||

Long-term institutional(2) |

6 | 48 | — | 25 | (11) | 68 | ||||||||||||||

| ETF | 8 | 3 | — | — | 4 | 15 | ||||||||||||||

Cash |

— | — | (1) | — | — | (1) | ||||||||||||||

| Total flows, net | $ | 14 | $ | 51 | $ | (1) | $ | 25 | $ | (7) | $ | 82 | ||||||||

| Market appreciation/(depreciation) | 273 | 7 | 6 | 27 | 5 | 318 | ||||||||||||||

| Foreign exchange impact | 30 | 9 | 2 | 7 | 4 | 52 | ||||||||||||||

| Total market and foreign exchange impact | $ | 303 | $ | 16 | $ | 8 | $ | 34 | $ | 9 | $ | 370 | ||||||||

Ending balance as of June 30, 2025 |

$ | 3,218 | $ | 700 | $ | 525 | $ | 449 | $ | 225 | $ | 5,117 | ||||||||

| (Dollars in billions) | 2Q25 | 1Q25 | 4Q24 | 3Q24(1) |

2Q24(1) |

||||||||||||

| Beginning balance | $ | 4,665 | $ | 4,715 | $ | 4,732 | $ | 4,369 | $ | 4,299 | |||||||

| Net asset flows: | |||||||||||||||||

Long-term institutional(2) |

68 | (15) | 26 | 9 | (8) | ||||||||||||

| ETF | 15 | 1 | 65 | 37 | 6 | ||||||||||||

Cash |

(1) | 1 | (27) | 54 | (4) | ||||||||||||

| Total flows, net | $ | 82 | $ | (13) | $ | 64 | $ | 100 | $ | (6) | |||||||

| Market appreciation/(depreciation) | 318 | (65) | 1 | 208 | 83 | ||||||||||||

| Foreign exchange impact | 52 | 28 | (82) | 55 | (7) | ||||||||||||

| Total market and foreign exchange impact | $ | 370 | $ | (37) | $ | (81) | $ | 263 | $ | 76 | |||||||

| Ending balance | $ | 5,117 | $ | 4,665 | $ | 4,715 | $ | 4,732 | $ | 4,369 | |||||||

| (Dollars in millions) | 2Q25 | 1Q25 | 2Q24 | % QoQ | % YoY | ||||||||||||

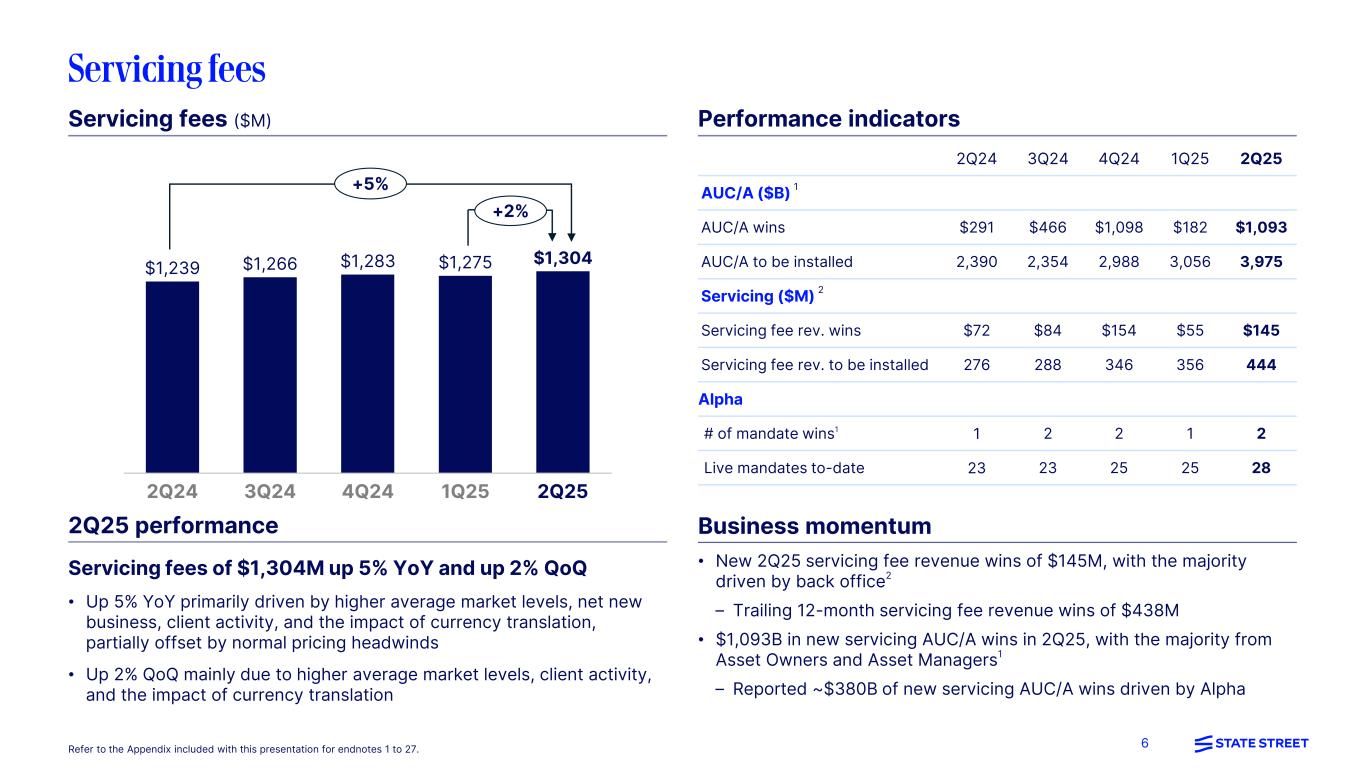

| Servicing fees | $ | 1,304 | $ | 1,275 | $ | 1,239 | 2.3 | % | 5.2 | % | |||||||

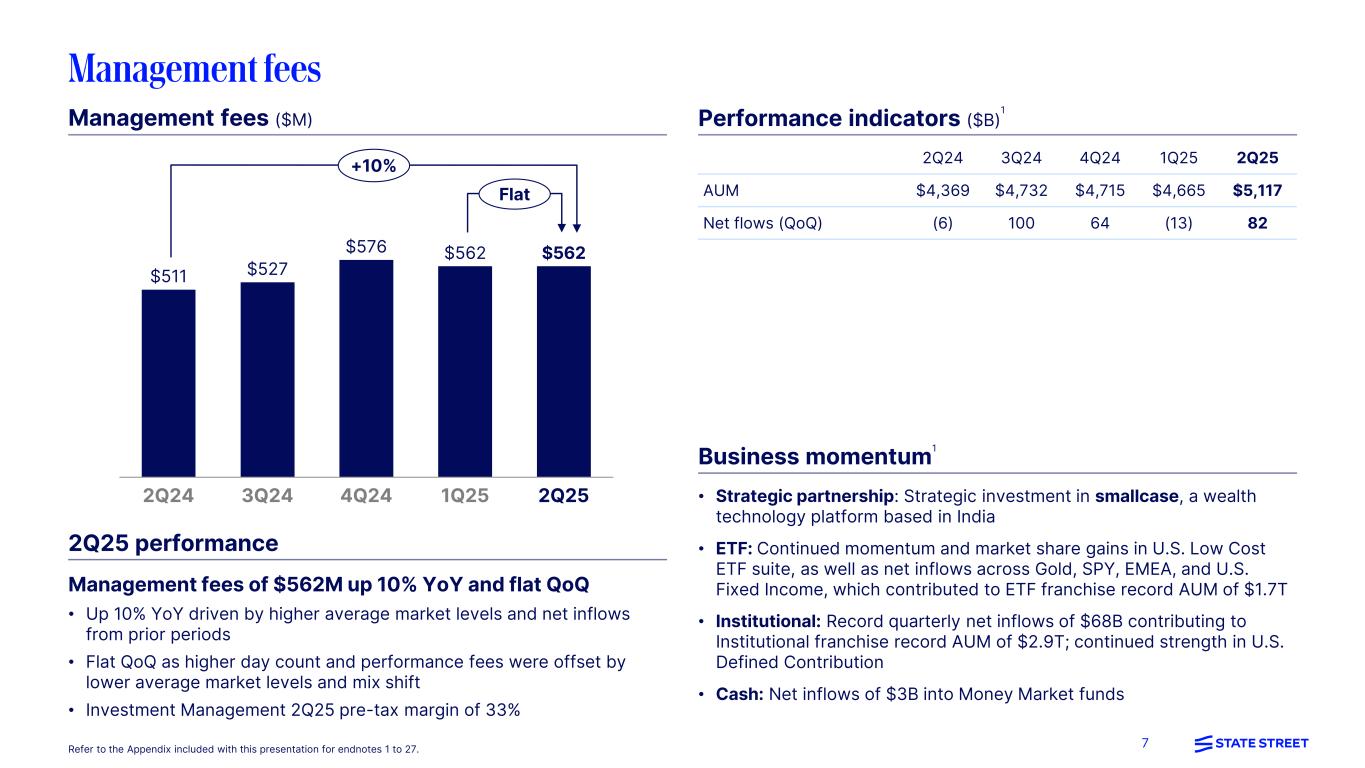

| Management fees | 562 | 562 | 511 | — | 10.0 | ||||||||||||

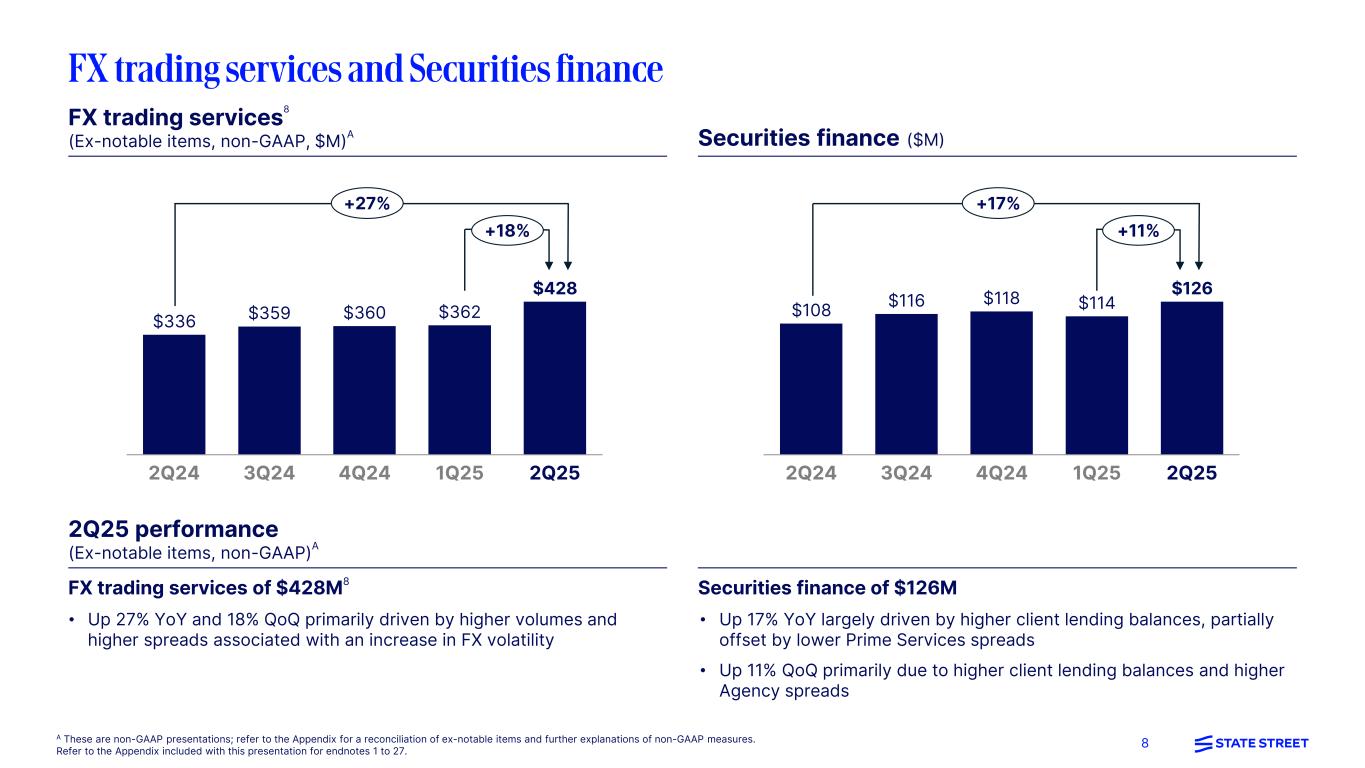

| Foreign exchange trading services | 431 | 362 | 336 | 19.1 | 28.3 | ||||||||||||

| Securities finance | 126 | 114 | 108 | 10.5 | 16.7 | ||||||||||||

| Front office software and data | 169 | 158 | 152 | 7.0 | 11.2 | ||||||||||||

| Lending related and other fees | 61 | 67 | 62 | (9.0) | (1.6) | ||||||||||||

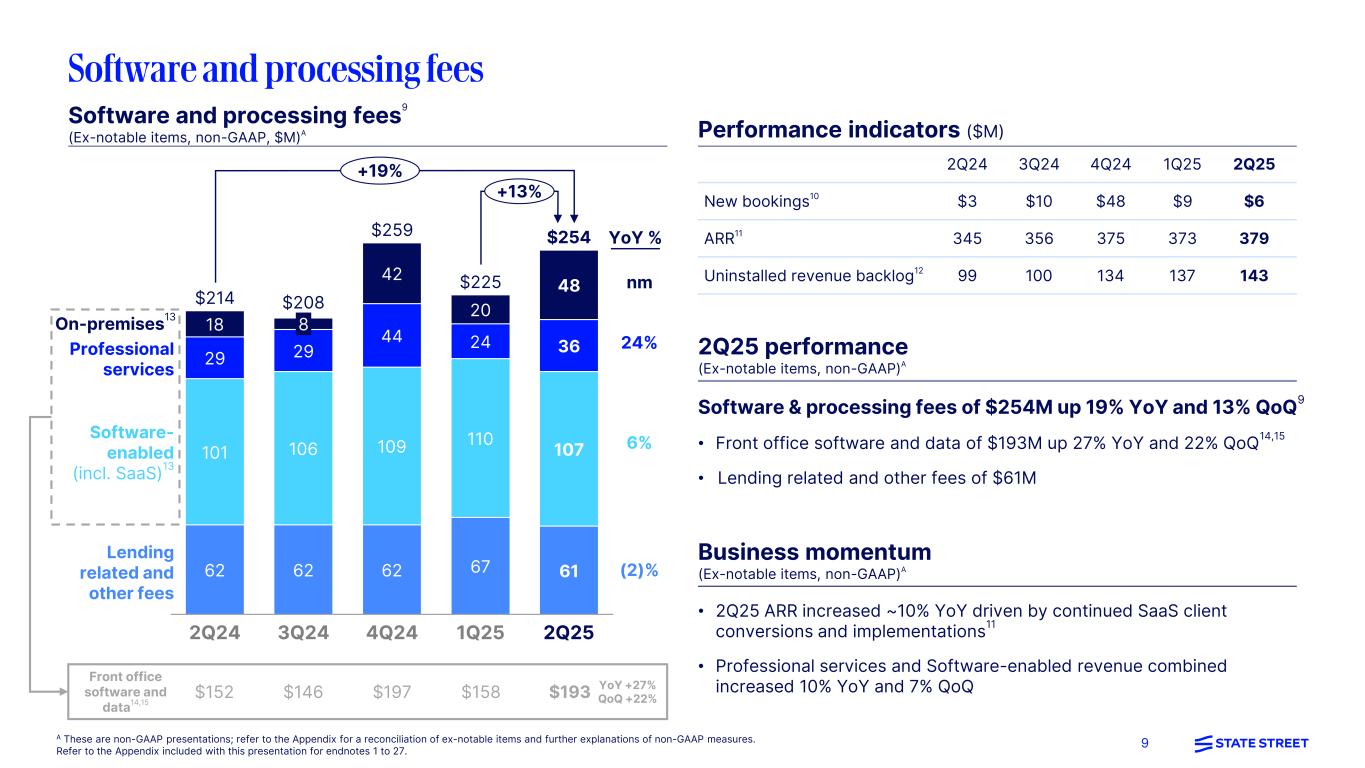

| Software and processing fees | 230 | 225 | 214 | 2.2 | 7.5 | ||||||||||||

| Other fee revenue | 66 | 32 | 48 | nm | 37.5 | ||||||||||||

| Total fee revenue | $ | 2,719 | $ | 2,570 | $ | 2,456 | 5.8 | % | 10.7 | % | |||||||

| Net interest income | 729 | 714 | 735 | 2.1 | % | (0.8) | % | ||||||||||

| Total Revenue | $ | 3,448 | $ | 3,284 | $ | 3,191 | 5.0 | % | 8.1 | % | |||||||

Total revenue, excluding notable items(1) |

$ | 3,469 | $ | 3,284 | $ | 3,191 | 5.6 | % | 8.7 | % | |||||||

Net interest margin (FTE)(2) |

0.96 | % | 1.00 | % | 1.13 | % | (0.04) | % | (0.17) | % | |||||||

| (Dollars in millions) | 2Q25 | 1Q25 | 2Q24 | % QoQ | % YoY | ||||||||||||||||||

| Allowance for credit losses: | |||||||||||||||||||||||

| Beginning balance | $ | 186 | $ | 183 | $ | 146 | 1.6 | % | 27.4 | % | |||||||||||||

| Provision for credit losses | 30 | 12 | 10 | nm | nm | ||||||||||||||||||

| Charge-offs | (24) | (9) | (11) | nm | nm | ||||||||||||||||||

| Ending Balance | $ | 192 | $ | 186 | $ | 145 | 3.2 | % | 32.4 | % | |||||||||||||

| (Dollars in millions) | 2Q25 | 1Q25 | 2Q24 | % QoQ | % YoY | ||||||||||||||||||

| Compensation and employee benefits | $ | 1,280 | $ | 1,262 | $ | 1,099 | 1.4 | % | 16.5 | % | |||||||||||||

| Information systems and communications | 523 | 497 | 454 | 5.2 | 15.2 | ||||||||||||||||||

| Transaction processing services | 260 | 258 | 250 | 0.8 | 4.0 | ||||||||||||||||||

| Occupancy | 105 | 103 | 106 | 1.9 | (0.9) | ||||||||||||||||||

| Amortization of other intangible assets | 56 | 54 | 60 | 3.7 | (6.7) | ||||||||||||||||||

| Other | 305 | 276 | 300 | 10.5 | 1.7 | ||||||||||||||||||

| Total Expenses | $ | 2,529 | $ | 2,450 | $ | 2,269 | 3.2 | % | 11.5 | % | |||||||||||||

Total expenses, excluding notable items(1) |

$ | 2,412 | $ | 2,450 | $ | 2,269 | (1.6) | % | 6.3 | % | |||||||||||||

| Effective tax rate | 22.0 | % | 21.7 | % | 22.1 | % | 0.3 | % | pts | (0.1) | % | pts | |||||||||||

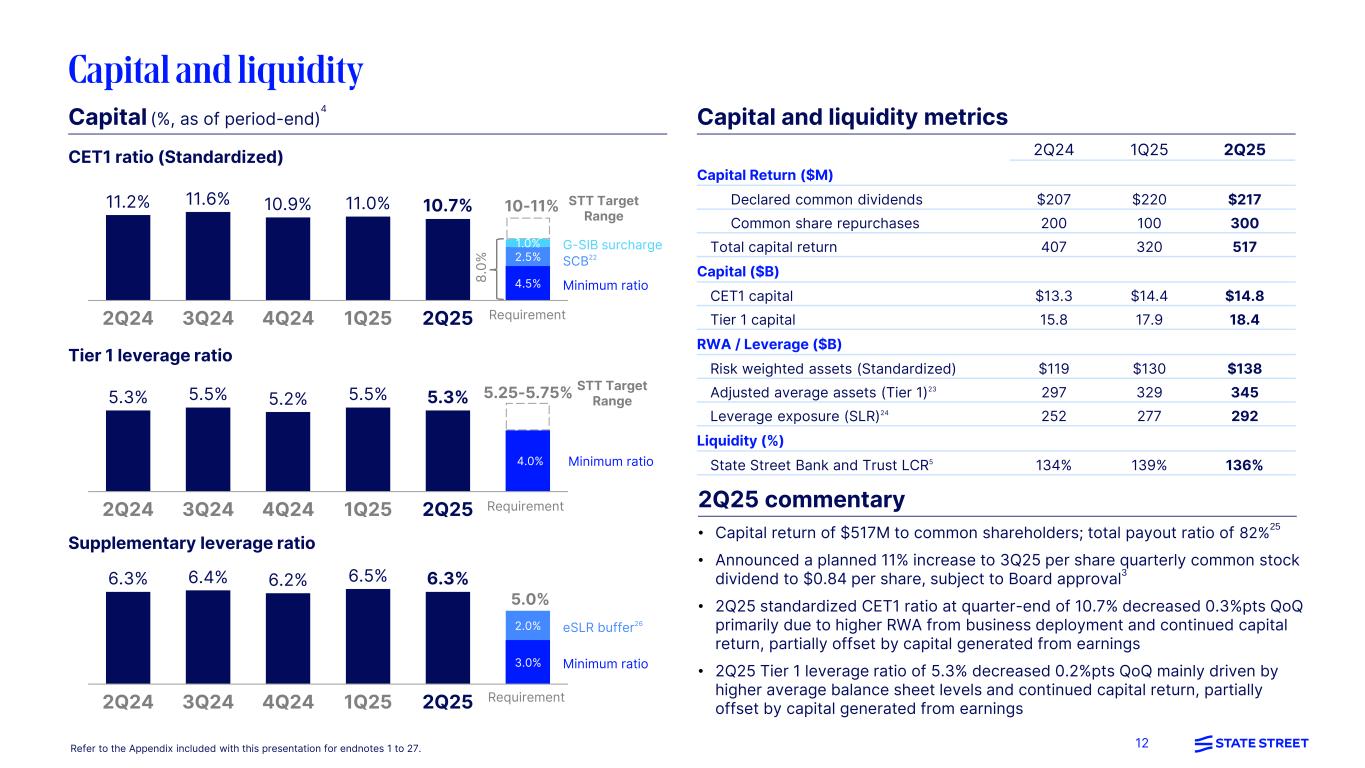

| (As of period end) | 2Q25 | 1Q25 | 2Q24 | ||||||||||||||

| Basel III Standardized Approach: | |||||||||||||||||

| Common equity tier 1 ratio (CET1) | 10.7 | % | 11.0 | % | 11.2 | % | |||||||||||

| Tier 1 capital ratio | 13.3 | 13.8 | 13.3 | ||||||||||||||

| Total capital ratio | 14.8 | 15.3 | 15.0 | ||||||||||||||

| Basel III Advanced Approaches: | |||||||||||||||||

| Common equity tier 1 ratio (CET1) | 12.5 | 12.6 | 12.0 | ||||||||||||||

| Tier 1 capital ratio | 15.5 | 15.7 | 14.2 | ||||||||||||||

| Total capital ratio | 17.0 | 17.3 | 15.9 | ||||||||||||||

| Tier 1 leverage ratio | 5.3 | 5.5 | 5.3 | ||||||||||||||

| Supplementary leverage ratio | 6.3 | 6.5 | 6.3 | ||||||||||||||

Liquidity coverage ratio (LCR) (1) |

107 | % | 106 | % | 106 | % | |||||||||||

LCR - State Street Bank and Trust (1) |

136 | % | 139 | % | 134 | % | |||||||||||

| STATE STREET CORPORATION | |||||

| EARNINGS RELEASE ADDENDUM | |||||

| June 30, 2025 | |||||

| Table of Contents | |||||

| GAAP-Basis Financial Information: | |||||

| 4-Year Summary of Results | |||||

| Consolidated Results of Operations | |||||

| Consolidated Statement of Condition | |||||

| Average Statement of Condition - Rates Earned and Paid - Fully Taxable-Equivalent Basis | |||||

| Average Statement of Condition - Rates Earned and Paid - Fully Taxable-Equivalent Basis - Year-to-Date | |||||

| Selected Average Balances by Currency - Rates Earned and Paid | |||||

| Investment Portfolio Holdings by Asset Class | |||||

| Allowance for Credit Losses |

11 |

||||

| Assets Under Custody and/or Administration |

12 |

||||

| Assets Under Management |

13 |

||||

| Line of Business Information |

14 |

||||

| Capital: | |||||

| Regulatory Capital |

15 |

||||

| Reconciliations of Tangible Book Value per Share and Return on Tangible Common Equity |

16 |

||||

| Non-GAAP Financial Information: | |||||

| Reconciliations of Non-GAAP Financial Information |

17 |

||||

| Reconciliation of Pre-tax Margin Excluding Notable Items | |||||

| Reconciliations of Constant Currency FX Impacts |

22 |

||||

| This financial information should be read in conjunction with State Street's news release dated July 15, 2025. | |||||

| STATE STREET CORPORATION | ||||||||||||||||||||||||||

| EARNINGS RELEASE ADDENDUM | ||||||||||||||||||||||||||

| 4-YEAR SUMMARY OF RESULTS | ||||||||||||||||||||||||||

| (Dollars in millions, except per share amounts, or where otherwise noted) | 2021 | 2022 | 2023 | 2024 | ||||||||||||||||||||||

| Year ended December 31: | ||||||||||||||||||||||||||

| Total fee revenue | $ | 10,012 | $ | 9,606 | $ | 9,480 | $ | 10,156 | ||||||||||||||||||

| Net interest income | 1,905 | 2,544 | 2,759 | 2,923 | ||||||||||||||||||||||

| Other income | 110 | (2) | (294) | (79) | ||||||||||||||||||||||

| Total revenue | 12,027 | 12,148 | 11,945 | 13,000 | ||||||||||||||||||||||

| Provision for credit losses | (33) | 20 | 46 | 75 | ||||||||||||||||||||||

| Total expenses | 8,889 | 8,801 | 9,583 | 9,530 | ||||||||||||||||||||||

| Income before income tax expense | 3,171 | 3,327 | 2,316 | 3,395 | ||||||||||||||||||||||

| Income tax expense | 478 | 553 | 372 | 708 | ||||||||||||||||||||||

| Net income | 2,693 | 2,774 | 1,944 | 2,687 | ||||||||||||||||||||||

| Net income available to common shareholders | $ | 2,572 | $ | 2,660 | $ | 1,821 | $ | 2,483 | ||||||||||||||||||

| Per common share: | ||||||||||||||||||||||||||

| Diluted earnings per common share | $ | 7.19 | $ | 7.19 | $ | 5.58 | $ | 8.21 | ||||||||||||||||||

| Average diluted common shares outstanding (in thousands) | 357,962 | 370,109 | 326,568 | 302,226 | ||||||||||||||||||||||

| Cash dividends declared per common share | $ | 2.18 | $ | 2.40 | $ | 2.64 | $ | 2.90 | ||||||||||||||||||

| Closing price per share of common stock (at year end) | 93.00 | 77.57 | 77.46 | 98.15 | ||||||||||||||||||||||

| Average balance sheet: | ||||||||||||||||||||||||||

| Investment securities | $ | 111,730 | $ | 111,929 | $ | 105,765 | $ | 104,784 | ||||||||||||||||||

| Total assets | 299,743 | 286,430 | 274,696 | 311,723 | ||||||||||||||||||||||

| Total deposits | 235,404 | 222,874 | 205,111 | 225,611 | ||||||||||||||||||||||

| Ratios and other metrics: | ||||||||||||||||||||||||||

| Return on average common equity | 10.7 | % | 11.1 | % | 8.2 | % | 11.1 | % | ||||||||||||||||||

Return on average tangible common equity(1) |

17.2 | 17.4 | 13.3 | 17.9 | ||||||||||||||||||||||

| Pre-tax margin | 26.4 | 27.4 | 19.4 | 26.1 | ||||||||||||||||||||||

Pre-tax margin, excluding notable items(2) |

27.6 | 28.4 | 26.4 | 27.6 | ||||||||||||||||||||||

| Net interest margin, fully taxable-equivalent basis | 0.74 | 1.03 | 1.20 | 1.10 | ||||||||||||||||||||||

Common equity tier 1 ratio(3)(4) |

14.3 | 13.6 | 11.6 | 10.9 | ||||||||||||||||||||||

Tier 1 capital ratio(3)(4) |

16.1 | 15.4 | 13.4 | 13.2 | ||||||||||||||||||||||

Total capital ratio(3)(4) |

17.5 | 16.8 | 15.2 | 14.8 | ||||||||||||||||||||||

Tier 1 leverage ratio(3) |

6.1 | 6.0 | 5.5 | 5.2 | ||||||||||||||||||||||

Supplementary leverage ratio(3) |

7.4 | 7.0 | 6.2 | 6.2 | ||||||||||||||||||||||

| Assets under custody and/or administration (in trillions) | $ | 43.68 | $ | 36.74 | $ | 41.81 | $ | 46.56 | ||||||||||||||||||

| Assets under management (in trillions) | 4.14 | 3.48 | 4.13 | 4.72 | ||||||||||||||||||||||

(1) Return on average tangible common equity is calculated by dividing the net income available to common shareholders (GAAP-basis) for the relevant period by average tangible common equity (non-GAAP). Refer to the Reconciliations of Tangible Book Value per Common Share and Return on Tangible Common Equity page for details. | ||||||||||||||||||||||||||

(2) Notable items include acquisition and restructuring costs, repositioning charges and legal and other notable items. Refer to Reconciliations of pre-tax margin excluding notable items for details. | ||||||||||||||||||||||||||

(3) The capital ratios presented are calculated in conformity with the applicable regulatory guidance in effect as of each period end. | ||||||||||||||||||||||||||

(4) The reportable ratios represent the lower of each of the risk-based capital ratios under both the Standardized Approach and the Advanced Approaches. | ||||||||||||||||||||||||||

| STATE STREET CORPORATION | ||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| EARNINGS RELEASE ADDENDUM | ||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| CONSOLIDATED RESULTS OF OPERATIONS | ||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| Quarters | % Change | Year-to-Date | % Change | |||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| (Dollars in millions, except per share amounts, or where otherwise noted) | 1Q24 | 2Q24 | 3Q24 | 4Q24 | 1Q25 | 2Q25 | 2Q25 vs. 2Q24 |

2Q25 vs. 1Q25 |

2024 | 2025 | YTD2025 vs. YTD2024 |

|||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| Fee revenue: | ||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| Servicing fees | $ | 1,228 | $ | 1,239 | $ | 1,266 | $ | 1,283 | $ | 1,275 | $ | 1,304 | 5.2 | % | 2.3 | % | $ | 2,467 | $ | 2,579 | 4.5 | % | ||||||||||||||||||||||||||||||||||||||||||||||||||||

| Management fees | 510 | 511 | 527 | 576 | 562 | 562 | 10.0 | — | 1,021 | 1,124 | 10.1 | |||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| Foreign exchange trading services | 331 | 336 | 374 | 360 | 362 | 431 | 28.3 | 19.1 | 667 | 793 | 18.9 | |||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| Securities finance | 96 | 108 | 116 | 118 | 114 | 126 | 16.7 | 10.5 | 204 | 240 | 17.6 | |||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| Front office software and data | 144 | 152 | 146 | 197 | 158 | 169 | 11.2 | 7.0 | 296 | 327 | 10.5 | |||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| Lending related and other fees | 63 | 62 | 62 | 62 | 67 | 61 | (1.6) | (9.0) | 125 | 128 | 2.4 | |||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| Software and processing fees | 207 | 214 | 208 | 259 | 225 | 230 | 7.5 | 2.2 | 421 | 455 | 8.1 | |||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| Other fee revenue | 50 | 48 | 125 | 66 | 32 | 66 | 37.5 | nm | 98 | 98 | — | |||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| Total fee revenue | 2,422 | 2,456 | 2,616 | 2,662 | 2,570 | 2,719 | 10.7 | 5.8 | 4,878 | 5,289 | 8.4 | |||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| Net interest income: | ||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| Interest income | 2,889 | 2,998 | 3,081 | 3,009 | 2,922 | 3,055 | 1.9 | 4.6 | 5,887 | 5,977 | 1.5 | |||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| Interest expense | 2,173 | 2,263 | 2,358 | 2,260 | 2,208 | 2,326 | 2.8 | 5.3 | 4,436 | 4,534 | 2.2 | |||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| Net interest income | 716 | 735 | 723 | 749 | 714 | 729 | (0.8) | 2.1 | 1,451 | 1,443 | (0.6) | |||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| Other income: | ||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| Gains (losses) related to investment securities, net | — | — | (80) | 1 | — | — | — | — | — | — | — | |||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| Total other income | — | — | (80) | 1 | — | — | — | — | — | — | — | |||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| Total revenue | 3,138 | 3,191 | 3,259 | 3,412 | 3,284 | 3,448 | 8.1 | 5.0 | 6,329 | 6,732 | 6.4 | |||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| Provision for credit losses | 27 | 10 | 26 | 12 | 12 | 30 | nm | nm | 37 | 42 | 13.5 | |||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| Expenses: | ||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| Compensation and employee benefits | 1,252 | 1,099 | 1,134 | 1,212 | 1,262 | 1,280 | 16.5 | 1.4 | 2,351 | 2,542 | 8.1 | |||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| Information systems and communications | 432 | 454 | 463 | 480 | 497 | 523 | 15.2 | 5.2 | 886 | 1,020 | 15.1 | |||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| Transaction processing services | 248 | 250 | 255 | 245 | 258 | 260 | 4.0 | 0.8 | 498 | 518 | 4.0 | |||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| Occupancy | 103 | 106 | 105 | 123 | 103 | 105 | (0.9) | 1.9 | 209 | 208 | (0.5) | |||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| Amortization of other intangible assets | 60 | 60 | 56 | 54 | 54 | 56 | (6.7) | 3.7 | 120 | 110 | (8.3) | |||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| Other | 418 | 300 | 295 | 326 | 276 | 305 | 1.7 | 10.5 | 718 | 581 | (19.1) | |||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| Total expenses | 2,513 | 2,269 | 2,308 | 2,440 | 2,450 | 2,529 | 11.5 | 3.2 | 4,782 | 4,979 | 4.1 | |||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| Income before income tax expense | 598 | 912 | 925 | 960 | 822 | 889 | (2.5) | 8.2 | 1,510 | 1,711 | 13.3 | |||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| Income tax expense | 135 | 201 | 195 | 177 | 178 | 196 | (2.5) | 10.1 | 336 | 374 | 11.3 | |||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| Net income | $ | 463 | $ | 711 | $ | 730 | $ | 783 | $ | 644 | $ | 693 | (2.5) | 7.6 | $ | 1,174 | $ | 1,337 | 13.9 | |||||||||||||||||||||||||||||||||||||||||||||||||||||||

| STATE STREET CORPORATION | |||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| EARNINGS RELEASE ADDENDUM | |||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| CONSOLIDATED RESULTS OF OPERATIONS (Continued) | |||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| Quarters | % Change | Year-to-Date | % Change | ||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| (Dollars in millions, except per share amounts, or where otherwise noted) | 1Q24 | 2Q24 | 3Q24 | 4Q24 | 1Q25 | 2Q25 | 2Q25 vs. 2Q24 |

2Q25 vs. 1Q25 |

2024 | 2025 | YTD2025 vs. YTD2024 |

||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| Adjustments to net income: | |||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| Dividends on preferred stock | $ | (45) | $ | (55) | $ | (48) | $ | (54) | $ | (46) | $ | (63) | (14.5) | % | (37.0) | % | $ | (100) | $ | (109) | (9.0) | % | |||||||||||||||||||||||||||||||||||||||||||||||||||||||

| Earnings allocated to participating securities | — | (1) | — | (1) | (1) | — | nm | nm | (1) | (1) | — | ||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| Net income available to common shareholders | $ | 418 | $ | 655 | $ | 682 | $ | 728 | $ | 597 | $ | 630 | (3.8) | 5.5 | $ | 1,073 | $ | 1,227 | 14.4 | ||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| Per common share: | |||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| Basic earnings | $ | 1.38 | $ | 2.18 | $ | 2.29 | 2.50 | $ | 2.07 | $ | 2.20 | 0.9 | 6.3 | $ | 3.56 | $ | 4.27 | 19.9 | |||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| Diluted earnings | 1.37 | 2.15 | 2.26 | 2.46 | 2.04 | 2.17 | 0.9 | 6.4 | 3.52 | 4.21 | 19.6 | ||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| Average common shares outstanding (in thousands): | |||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| Basic | 301,991 | 300,564 | 297,365 | 291,686 | 288,562 | 286,281 | (4.8) | (0.8) | 301,278 | 287,415 | (4.6) | ||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| Diluted | 305,943 | 304,765 | 301,847 | 296,420 | 292,716 | 290,490 | (4.7) | (0.8) | 305,354 | 291,596 | (4.5) | ||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| Cash dividends declared per common share | $ | 0.69 | $ | 0.69 | $ | 0.76 | $ | 0.76 | $ | 0.76 | $ | 0.76 | 10.1 | — | $ | 1.38 | $ | 1.52 | 10.1 | ||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| Closing price per share of common stock (as of quarter end) | 77.32 | 74.00 | 88.47 | 98.15 | 89.53 | 106.34 | 43.7 | 18.8 | 74.00 | 106.34 | 43.7 | ||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| Book value per common share | $ | 72.85 | $ | 74.50 | $ | 78.22 | $ | 77.95 | $ | 80.13 | $ | 83.16 | 11.6 | 3.8 | $ | 74.50 | $ | 83.16 | 11.6 | ||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

Tangible book value per common share(1) |

45.06 | 46.10 | 49.22 | 49.14 | 51.23 | 53.56 | 16.2 | 4.5 | 46.10 | 53.56 | 16.2 | ||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| Balance sheet averages: | |||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| Investment securities | $ | 101,318 | $ | 105,098 | $ | 107,364 | $ | 105,322 | $ | 110,070 | $ | 112,083 | 6.6 | 1.8 | $ | 103,208 | $ | 111,082 | 7.6 | ||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| Total assets | 298,570 | 306,298 | 314,640 | 327,181 | 337,291 | 353,779 | 15.5 | 4.9 | 302,434 | 345,580 | 14.3 | ||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| Total deposits | 218,892 | 220,881 | 225,482 | 237,066 | 243,036 | 260,745 | 18.0 | 7.3 | 219,886 | 251,938 | 14.6 | ||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| Ratios and other metrics: | |||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| Effective tax rate | 22.5 | % | 22.1 | % | 21.1 | % | 18.4 | % | 21.7 | % | 22.0 | % | (0.1) | % | pts | 0.3 | % | pts | 22.3 | % | 21.9 | % | (0.4) | % | pts | ||||||||||||||||||||||||||||||||||||||||||||||||||||

| Return on average common equity | 7.7 | 11.9 | 12.0 | 12.7 | 10.6 | 10.8 | (1.1) | 0.2 | 9.8 | 10.7 | 0.9 | ||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

Return on average tangible common equity(2) |

12.4 | 19.3 | 19.3 | 20.3 | 16.4 | 16.7 | (2.6) | 0.3 | 15.9 | 16.6 | 0.7 | ||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| Pre-tax margin | 19.1 | 28.6 | 28.4 | 28.1 | 25.0 | 25.8 | (2.8) | 0.8 | 23.9 | 25.4 | 1.5 | ||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

Pre-tax margin, excluding notable items(3) |

23.2 | 28.6 | 28.4 | 29.8 | 25.0 | 29.6 | 1.0 | 4.6 | 25.9 | 27.4 | 1.5 | ||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| Net interest margin, fully taxable-equivalent basis | 1.13 | 1.13 | 1.07 | 1.07 | 1.00 | 0.96 | (0.2) | — | 1.13 | 0.98 | (0.2) | ||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

Common equity tier 1 ratio(4)(5) |

11.1 | 11.2 | 11.6 | 10.9 | 11.0 | 10.7 | (0.5) | (0.3) | 11.2 | 10.7 | (0.5) | ||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

Tier 1 capital ratio(4)(5) |

13.2 | 13.3 | 13.9 | 13.2 | 13.8 | 13.3 | — | (0.5) | 13.3 | 13.3 | — | ||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

Total capital ratio(4)(5) |

14.9 | 15.0 | 15.6 | 14.8 | 15.3 | 14.8 | (0.2) | (0.5) | 15.0 | 14.8 | (0.2) | ||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

Tier 1 leverage ratio(4) |

5.4 | 5.3 | 5.5 | 5.2 | 5.5 | 5.3 | — | (0.2) | 5.3 | 5.3 | — | ||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

Supplementary leverage ratio(4) |

6.5 | 6.3 | 6.4 | 6.2 | 6.5 | 6.3 | — | (0.2) | 6.3 | 6.3 | — | ||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| Assets under custody and/or administration (in billions) | $ | 43,912 | $ | 44,312 | $ | 46,759 | $ | 46,557 | $ | 46,733 | $ | 49,000 | 10.6 | % | 4.9 | % | $ | 44,312 | $ | 49,000 | 10.6 | % | |||||||||||||||||||||||||||||||||||||||||||||||||||||||

| Assets under management (in billions) | 4,299 | 4,369 | 4,732 | 4,715 | 4,665 | 5,117 | 17.1 | 9.7 | 4,369 | 5,117 | 17.1 | ||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

Average securities on loan(6) |

301,247 | 334,675 | 349,113 | 354,372 | 358,869 | 386,730 | 15.6 | 7.8 | 317,961 | 372,877 | 17.3 | ||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

(1) Tangible book value per common share is calculated by dividing the period end tangible common equity (non-GAAP) by the total common shares outstanding at period end. Refer to the Reconciliations of Tangible Book Value per Common Share and Return on Tangible Common Equity page for details. |

|||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

(2) Return on average tangible common equity is calculated by dividing annualized net income available to common shareholders (GAAP-basis) for the relevant period by average tangible common equity (non-GAAP). Beginning in the third quarter of 2024, quarterly annualized net income available to common shareholders is utilized in the quarterly return on average tangible common equity calculation as compared to year-to-date annualized net income available to common shareholders utilized in prior quarters. Prior quarterly periods have been revised to conform to the current presentation. Refer to the Reconciliations of Tangible Book Value per Common Share and Return on Tangible Common Equity page for details. |

|||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

(3) Notable items include acquisition and restructuring costs, repositioning charges and legal and other notable items. Refer to Reconciliations of non-GAAP Financial Information pages for details. |

|||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

(4) The capital ratios presented are calculated in conformity with the applicable regulatory guidance in effect as of each period end. Capital ratios as of June 30, 2025 are estimates. |

|||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

(5) The reportable ratios represent the lower of each of the risk-based capital ratios under both the Standardized Approach and the Advanced Approaches. Refer to Regulatory Capital for details on Standardized and Advanced Approaches ratios. |

|||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

(6) End-of-period securities on loan were $339,940 million, $339,111 million, $378,713 million and $327,389 million at March 31, 2024, June 30, 2024, September 30, 2024 and December 31, 2024, respectively, and $376,269 million and $387,070 million at March 31, 2025 and June 30, 2025, respectively. |

|||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

nm Denotes not meaningful |

|||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| STATE STREET CORPORATION | |||||||||||||||||||||||||||||||||||||||||||||||||||||

| EARNINGS RELEASE ADDENDUM | |||||||||||||||||||||||||||||||||||||||||||||||||||||

| CONSOLIDATED STATEMENT OF CONDITION | |||||||||||||||||||||||||||||||||||||||||||||||||||||

| As of | % Change | ||||||||||||||||||||||||||||||||||||||||||||||||||||

| (Dollars in millions, except per share amounts) | March 31, 2024 | June 30, 2024 | September 30, 2024 | December 31, 2024 | March 31, 2025 | June 30, 2025 | 2Q25 vs. 2Q24 |

2Q25 vs. 1Q25 |

|||||||||||||||||||||||||||||||||||||||||||||

| Assets: | |||||||||||||||||||||||||||||||||||||||||||||||||||||

| Cash and due from banks | $ | 3,413 | $ | 2,898 | $ | 4,067 | $ | 3,145 | $ | 4,658 | $ | 4,020 | 38.7 | % | (13.7) | % | |||||||||||||||||||||||||||||||||||||

| Interest-bearing deposits with banks, net | 125,486 | 99,876 | 105,121 | 112,957 | 119,464 | 118,835 | 19.0 | (0.5) | |||||||||||||||||||||||||||||||||||||||||||||

| Securities purchased under resale agreements | 7,489 | 6,340 | 8,334 | 6,679 | 7,971 | 8,275 | 30.5 | 3.8 | |||||||||||||||||||||||||||||||||||||||||||||

| Trading account assets | 760 | 780 | 802 | 768 | 743 | 791 | 1.4 | 6.5 | |||||||||||||||||||||||||||||||||||||||||||||

| Investment securities: | |||||||||||||||||||||||||||||||||||||||||||||||||||||

| Investment securities available-for-sale, net | 48,640 | 56,755 | 56,853 | 58,895 | 67,444 | 70,603 | 24.4 | 4.7 | |||||||||||||||||||||||||||||||||||||||||||||

Investment securities held-to-maturity, net(1) |

52,914 | 51,051 | 49,477 | 47,727 | 45,505 | 43,286 | (15.2) | (4.9) | |||||||||||||||||||||||||||||||||||||||||||||

| Total investment securities | 101,554 | 107,806 | 106,330 | 106,622 | 112,949 | 113,889 | 5.6 | 0.8 | |||||||||||||||||||||||||||||||||||||||||||||

| Loans | 38,635 | 39,376 | 41,961 | 43,200 | 44,685 | 47,279 | 20.1 | 5.8 | |||||||||||||||||||||||||||||||||||||||||||||

Allowance for credit losses on loans(2) |

135 | 136 | 162 | 174 | 176 | 179 | 31.6 | 1.7 | |||||||||||||||||||||||||||||||||||||||||||||

| Loans, net | 38,500 | 39,240 | 41,799 | 43,026 | 44,509 | 47,100 | 20.0 | 5.8 | |||||||||||||||||||||||||||||||||||||||||||||

Premises and equipment, net(3) |

2,479 | 2,539 | 2,621 | 2,715 | 2,784 | 2,942 | 15.9 | 5.7 | |||||||||||||||||||||||||||||||||||||||||||||

| Accrued interest and fees receivable | 4,014 | 4,066 | 4,160 | 4,034 | 4,280 | 4,589 | 12.9 | 7.2 | |||||||||||||||||||||||||||||||||||||||||||||

| Goodwill | 7,582 | 7,751 | 7,833 | 7,691 | 7,763 | 7,918 | 2.2 | 2.0 | |||||||||||||||||||||||||||||||||||||||||||||

| Other intangible assets | 1,258 | 1,209 | 1,166 | 1,089 | 1,046 | 1,014 | (16.1) | (3.1) | |||||||||||||||||||||||||||||||||||||||||||||

| Other assets | 45,468 | 53,098 | 56,248 | 64,514 | 66,526 | 67,344 | 26.8 | 1.2 | |||||||||||||||||||||||||||||||||||||||||||||

| Total assets | $ | 338,003 | $ | 325,603 | $ | 338,481 | $ | 353,240 | $ | 372,693 | $ | 376,717 | 15.7 | 1.1 | |||||||||||||||||||||||||||||||||||||||

| Liabilities: | |||||||||||||||||||||||||||||||||||||||||||||||||||||

| Deposits: | |||||||||||||||||||||||||||||||||||||||||||||||||||||

| Non-interest-bearing | $ | 37,367 | $ | 34,519 | $ | 31,448 | $ | 33,180 | $ | 32,265 | $ | 34,569 | 0.1 | 7.1 | |||||||||||||||||||||||||||||||||||||||

| Interest-bearing - U.S. | 148,485 | 140,983 | 145,527 | 166,483 | 168,362 | 169,444 | 20.2 | 0.6 | |||||||||||||||||||||||||||||||||||||||||||||

| Interest-bearing - Non-U.S. | 66,032 | 63,658 | 70,454 | 62,257 | 71,429 | 79,011 | 24.1 | 10.6 | |||||||||||||||||||||||||||||||||||||||||||||

Total deposits(4) |

251,884 | 239,160 | 247,429 | 261,920 | 272,056 | 283,024 | 18.3 | 4.0 | |||||||||||||||||||||||||||||||||||||||||||||

| Securities sold under repurchase agreements | 3,576 | 2,716 | 2,119 | 3,681 | 3,524 | 2,377 | (12.5) | (32.5) | |||||||||||||||||||||||||||||||||||||||||||||

| Other short-term borrowings | 11,541 | 13,571 | 10,018 | 9,840 | 11,849 | 9,844 | (27.5) | (16.9) | |||||||||||||||||||||||||||||||||||||||||||||

| Accrued expenses and other liabilities | 26,823 | 25,657 | 32,185 | 29,201 | 33,726 | 28,254 | 10.1 | (16.2) | |||||||||||||||||||||||||||||||||||||||||||||

| Long-term debt | 19,746 | 19,737 | 20,902 | 23,272 | 24,846 | 25,911 | 31.3 | 4.3 | |||||||||||||||||||||||||||||||||||||||||||||

| Total liabilities | 313,570 | 300,841 | 312,653 | 327,914 | 346,001 | 349,410 | 16.1 | 1.0 | |||||||||||||||||||||||||||||||||||||||||||||

| Shareholders' equity: | |||||||||||||||||||||||||||||||||||||||||||||||||||||

| Preferred stock, no par, 3,500,000 shares authorized: | |||||||||||||||||||||||||||||||||||||||||||||||||||||

| Series G, 5,000 shares issued and outstanding | 493 | 493 | 493 | 493 | 493 | 493 | — | — | |||||||||||||||||||||||||||||||||||||||||||||

| Series H, 5,000 shares issued and outstanding | 494 | 494 | — | — | — | — | nm | — | |||||||||||||||||||||||||||||||||||||||||||||

| Series I, 15,000 shares issued and outstanding | 1,481 | 1,481 | 1,481 | 1,481 | 1,481 | 1,481 | — | — | |||||||||||||||||||||||||||||||||||||||||||||

| Series J, 8,500 shares issued and outstanding | — | — | 842 | 842 | 842 | 842 | nm | — | |||||||||||||||||||||||||||||||||||||||||||||

| Series K, 7,500 shares issued and outstanding | — | — | — | — | 743 | 743 | nm | nm | |||||||||||||||||||||||||||||||||||||||||||||

Common stock, $1 par, 750,000,000 shares authorized(5)(6) |

504 | 504 | 504 | 504 | 504 | 504 | — | — | |||||||||||||||||||||||||||||||||||||||||||||

| Surplus | 10,724 | 10,721 | 10,723 | 10,722 | 10,693 | 10,698 | (0.2) | — | |||||||||||||||||||||||||||||||||||||||||||||

| Retained earnings | 28,166 | 28,615 | 29,073 | 29,582 | 29,959 | 30,373 | 6.1 | 1.4 | |||||||||||||||||||||||||||||||||||||||||||||

| Accumulated other comprehensive income (loss) | (2,369) | (2,314) | (1,625) | (2,100) | (1,792) | (1,321) | 42.9 | 26.3 | |||||||||||||||||||||||||||||||||||||||||||||

Treasury stock, at cost(7) |

(15,060) | (15,232) | (15,663) | (16,198) | (16,231) | (16,506) | (8.4) | (1.7) | |||||||||||||||||||||||||||||||||||||||||||||

| Total shareholders' equity | 24,433 | 24,762 | 25,828 | 25,326 | 26,692 | 27,307 | 10.3 | 2.3 | |||||||||||||||||||||||||||||||||||||||||||||

| Total liabilities and equity | $ | 338,003 | $ | 325,603 | $ | 338,481 | $ | 353,240 | $ | 372,693 | $ | 376,717 | 15.7 | 1.1 | |||||||||||||||||||||||||||||||||||||||

(1) Fair value of investment securities held-to-maturity |

$ | 46,823 | $ | 44,916 | $ | 44,925 | $ | 41,906 | $ | 40,424 | $ | 38,485 | |||||||||||||||||||||||||||||||||||||||||

(2) Total allowance for credit losses including off-balance sheet commitments |

146 | 145 | 171 | 183 | 186 | 192 | |||||||||||||||||||||||||||||||||||||||||||||||

(3) Accumulated depreciation for premises and equipment |

6,193 | 6,318 | 6,400 | 6,461 | 6,635 | 6,824 | |||||||||||||||||||||||||||||||||||||||||||||||

(4) Average total deposits |

218,892 | 220,881 | 225,482 | 237,066 | 243,036 | 260,745 | |||||||||||||||||||||||||||||||||||||||||||||||

(5) Common stock shares issued |

503,879,642 | 503,879,642 | 503,879,642 | 503,879,642 | 503,879,642 | 503,879,642 | |||||||||||||||||||||||||||||||||||||||||||||||

(6) Total common shares outstanding |

301,504,470 | 299,231,005 | 294,191,001 | 288,766,452 | 288,676,229 | 285,561,974 | |||||||||||||||||||||||||||||||||||||||||||||||

(7) Treasury stock shares |

202,375,172 | 204,648,637 | 209,688,641 | 215,113,190 | 215,203,413 | 218,317,668 | |||||||||||||||||||||||||||||||||||||||||||||||

nm Denotes not meaningful |

|||||||||||||||||||||||||||||||||||||||||||||||||||||

| STATE STREET CORPORATION | |||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| EARNINGS RELEASE ADDENDUM | |||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

AVERAGE STATEMENT OF CONDITION - RATES EARNED AND PAID - FULLY TAXABLE-EQUIVALENT BASIS(1) |

|||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| The following table presents average rates earned and paid, on a fully taxable-equivalent basis, on consolidated average interest-earning assets and average interest-bearing liabilities for the quarters indicated. Tax-equivalent adjustments were calculated using a federal income tax rate of 21%, adjusted for applicable state income taxes, net of related federal benefit. | |||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| Quarters | % Change | ||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| 1Q24 | 2Q24 | 3Q24 | 4Q24 | 1Q25 | 2Q25 | 2Q25 vs. 2Q24 |

2Q25 vs. 1Q25 |

||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| (Dollars in millions; fully-taxable equivalent basis) | Average balance | Average rates | Average balance | Average rates | Average balance | Average rates | Average balance | Average rates | Average balance | Average rates | Average balance | Average rates | Average balance | Average balance | |||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| Assets: | |||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| Interest-bearing deposits with banks, net | $ | 90,230 | 4.45 | % | $ | 87,894 | 4.25 | % | $ | 86,884 | 4.02 | % | $ | 90,018 | 3.67 | % | $ | 92,780 | 3.36 | % | $ | 98,321 | 3.23 | % | 11.9 | % | 6.0 | % | |||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

Securities purchased under resale agreements(2) |

6,118 | 10.97 | 6,558 | 10.17 | 6,991 | 10.44 | 7,480 | 9.04 | 7,716 | 8.66 | 9,169 | 7.83 | 39.8 | 18.8 | |||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| Trading account assets | 767 | — | 779 | — | 788 | — | 795 | — | 756 | 0.15 | 791 | 0.06 | 1.5 | 4.6 | |||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| Investment securities: | |||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| Investment securities available-for-sale, net | 46,497 | 4.93 | 53,204 | 5.06 | 57,302 | 5.13 | 57,205 | 4.90 | 63,428 | 4.57 | 67,718 | 4.45 | 27.3 | 6.8 | |||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| Investment securities held-to-maturity, net | 54,821 | 2.14 | 51,894 | 2.14 | 50,062 | 2.12 | 48,117 | 2.11 | 46,642 | 2.07 | 44,365 | 2.11 | (14.5) | (4.9) | |||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

Total investment securities |

101,318 | 3.42 | 105,098 | 3.62 | 107,364 | 3.73 | 105,322 | 3.63 | 110,070 | 3.51 | 112,083 | 3.52 | 6.6 | 1.8 | |||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

Loans(3) |

37,747 | 5.82 | 38,703 | 5.85 | 39,782 | 5.79 | 42,377 | 5.48 | 43,730 | 5.17 | 45,277 | 5.08 | 17.0 | 3.5 | |||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| Other interest-earning assets | 18,153 | 6.92 | 22,708 | 6.92 | 27,697 | 6.35 | 32,534 | 5.76 | 34,464 | 5.49 | 39,007 | 5.38 | 71.8 | 13.2 | |||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| Total interest-earning assets | 254,333 | 4.57 | 261,740 | 4.61 | 269,506 | 4.55 | 278,526 | 4.30 | 289,516 | 4.09 | 304,648 | 4.02 | 16.4 | 5.2 | |||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| Cash and due from banks | 4,608 | 2,861 | 3,417 | 3,811 | 4,516 | 4,058 | 41.8 | (10.1) | |||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| Other non-interest-earning assets | 39,629 | 41,697 | 41,717 | 44,844 | 43,259 | 45,073 | 8.1 | 4.2 | |||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| Total assets | $ | 298,570 | $ | 306,298 | $ | 314,640 | $ | 327,181 | $ | 337,291 | $ | 353,779 | 15.5 | 4.9 | |||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| Liabilities: | |||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| Interest-bearing deposits: | |||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| U.S. | $ | 129,846 | 4.22 | % | $ | 132,162 | 4.15 | % | $ | 135,440 | 4.16 | % | $ | 146,040 | 3.79 | % | $ | 154,462 | 3.54 | % | $ | 159,770 | 3.50 | % | 20.9 | % | 3.4 | % | |||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| Non-U.S. | 62,087 | 1.80 | 63,767 | 1.72 | 65,824 | 1.70 | 64,871 | 1.62 | 63,677 | 1.38 | 76,807 | 1.55 | 20.4 | 20.6 | |||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

Total interest-bearing deposits(4) |

191,933 | 3.44 | 195,929 | 3.36 | 201,264 | 3.35 | 210,911 | 3.12 | 218,139 | 2.91 | 236,577 | 2.87 | 20.7 | 8.5 | |||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| Securities sold under repurchase agreements | 3,122 | 5.06 | 3,404 | 5.07 | 2,193 | 4.98 | 3,937 | 4.67 | 4,530 | 4.54 | 3,160 | 4.42 | (7.2) | (30.2) | |||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| Other short-term borrowings | 8,314 | 4.85 | 13,073 | 5.15 | 13,639 | 5.16 | 10,656 | 4.96 | 11,848 | 4.64 | 10,179 | 4.51 | (22.1) | (14.1) | |||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| Long-term debt | 18,944 | 5.44 | 19,694 | 5.44 | 20,258 | 5.27 | 22,658 | 5.18 | 23,742 | 5.00 | 25,864 | 4.98 | 31.3 | 8.9 | |||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| Other interest-bearing liabilities | 4,430 | 12.29 | 4,753 | 12.57 | 5,238 | 14.41 | 4,873 | 10.93 | 5,471 | 11.76 | 3,543 | 18.35 | (25.5) | (35.2) | |||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| Total interest-bearing liabilities | 226,743 | 3.85 | 236,853 | 3.84 | 242,592 | 3.87 | 253,035 | 3.55 | 263,730 | 3.40 | 279,323 | 3.34 | 17.9 | 5.9 | |||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

Non-interest-bearing deposits(5) |

26,959 | 24,952 | 24,218 | 26,155 | 24,897 | 24,168 | (3.1) | (2.9) | |||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| Other non-interest-bearing liabilities | 20,233 | 19,964 | 22,119 | 22,431 | 22,554 | 23,232 | 16.4 | 3.0 | |||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| Preferred shareholders' equity | 2,785 | 2,468 | 3,020 | 2,816 | 3,263 | 3,560 | 44.2 | 9.1 | |||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| Common shareholders' equity | 21,850 | 22,061 | 22,691 | 22,744 | 22,847 | 23,496 | 6.5 | 2.8 | |||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| Total liabilities and shareholders' equity | $ | 298,570 | $ | 306,298 | $ | 314,640 | $ | 327,181 | $ | 337,291 | $ | 353,779 | 15.5 | 4.9 | |||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| Total deposits | $ | 218,892 | $ | 220,881 | $ | 225,482 | $ | 237,066 | $ | 243,036 | $ | 260,745 | 18.0 | 7.3 | |||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| Excess of rate earned over rate paid | 0.72 | % | 0.77 | % | 0.68 | % | 0.74 | % | 0.70 | % | 0.68 | % | |||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| Net interest margin | 1.13 | % | 1.13 | % | 1.07 | % | 1.07 | % | 1.00 | % | 0.96 | % | |||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| Net interest income, fully taxable-equivalent basis | $ | 717 | $ | 736 | $ | 724 | $ | 749 | $ | 714 | $ | 729 | |||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| Tax-equivalent adjustment | (1) | (1) | (1) | — | — | — | |||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

Net interest income, GAAP-basis(4) |

$ | 716 | $ | 735 | $ | 723 | $ | 749 | $ | 714 | $ | 729 | |||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

(1) Average rates earned and paid on interest-earning assets and interest-bearing liabilities include the impact of hedge activities associated with our asset and liability management activities where applicable. |

|||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

(2) Reflects the impact of balance sheet netting under enforceable netting agreements of approximately $172 billion, $180 billion, $201 billion and $212 billion in the first, second, third and fourth quarters of 2024, respectively, and approximately $232 billion and $253 billion in the first and second quarters of 2025, respectively. Excluding the impact of netting, the average interest rates would be approximately 0.38%, 0.36%, 0.35% and 0.31% in the first, second, third and fourth quarters of 2024, respectively, and approximately 0.28% and 0.27% in the first and second quarters of 2025, respectively. |

|||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

(3) Average loans are presented on a gross basis. Average loans net of expected credit losses were approximately $37,626 million, $38,573 million, $39,645 million and $42,214 million in the first, second, third and fourth quarters of 2024 , respectively and approximately $43,562 million and $45,113 million in the first and second quarters of 2025, respectively. |

|||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

(4) Average rates includes the impact of FX swap expense of approximately ($49) million, ($64) million, ($82) million and ($80) million in the first, second, third and fourth quarters of 2024, respectively, and approximately ($83) million and ($42) million in the first and second quarters of 2025, respectively. Average rates for total interest-bearing deposits excluding the impact of FX swap expense were approximately 3.54%, 3.49%, 3.52% and 3.27% in the first, second, third and fourth quarters of 2024, respectively, and approximately 3.07% and 2.94% in the first and second quarters of 2025, respectively. |

|||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

(5) Average non-interest-bearing deposits are primarily composed of deposit balances denominated in U.S. dollars. |

|||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| STATE STREET CORPORATION | ||||||||||||||||||||||||||||||||

| EARNINGS RELEASE ADDENDUM | ||||||||||||||||||||||||||||||||

AVERAGE STATEMENT OF CONDITION - RATES EARNED AND PAID - FULLY TAXABLE-EQUIVALENT BASIS - YEAR TO DATE(1) |

||||||||||||||||||||||||||||||||

| The following table presents consolidated average interest-earning assets, average interest-bearing liabilities and related average rates earned and paid, respectively, for the years indicated, on a fully taxable-equivalent basis, which is a non-GAAP measure. Tax-equivalent adjustments were calculated using a federal income tax rate of 21% for periods ending in 2024 and 2025, adjusted for applicable state income taxes, net of related federal benefit. | ||||||||||||||||||||||||||||||||

| Year-to-Date | % Change | |||||||||||||||||||||||||||||||

| 2024 | 2025 | YTD2025 vs YTD2024 | ||||||||||||||||||||||||||||||

| (Dollars in millions; fully-taxable equivalent basis) | Average balance | Average rates | Average balance | Average rates | Average balance | |||||||||||||||||||||||||||

| Assets: | ||||||||||||||||||||||||||||||||

| Interest-bearing deposits with banks, net | $ | 89,062 | 4.36 | % | $ | 95,565 | 3.29 | % | 7.3 | % | ||||||||||||||||||||||

Securities purchased under resale agreements(2) |

6,338 | 10.58 | 8,447 | 8.21 | 33.3 | |||||||||||||||||||||||||||

| Trading account assets | 773 | — | 773 | 0.11 | — | |||||||||||||||||||||||||||

| Investment securities: | ||||||||||||||||||||||||||||||||

| Investment securities available-for-sale, net | 49,850 | 5.00 | 65,585 | 4.50 | 31.6 | |||||||||||||||||||||||||||

| Investment securities held-to-maturity, net | 53,358 | 2.14 | 45,497 | 2.09 | (14.7) | |||||||||||||||||||||||||||

Total investment securities |

103,208 | 3.52 | 111,082 | 3.52 | 7.6 | |||||||||||||||||||||||||||

Loans(3) |

38,225 | 5.84 | 44,508 | 5.12 | 16.4 | |||||||||||||||||||||||||||

| Other interest-earning assets | 20,430 | 6.92 | 36,748 | 5.43 | 79.9 | |||||||||||||||||||||||||||

| Total interest-earning assets | 258,036 | 4.59 | 297,123 | 4.06 | 15.1 | |||||||||||||||||||||||||||

| Cash and due from banks | 3,734 | 4,286 | 14.8 | |||||||||||||||||||||||||||||

| Other non-interest-earning assets | 40,664 | 44,171 | 8.6 | |||||||||||||||||||||||||||||

| Total assets | $ | 302,434 | $ | 345,580 | 14.3 | |||||||||||||||||||||||||||

| Liabilities: | ||||||||||||||||||||||||||||||||

| Interest-bearing deposits: | ||||||||||||||||||||||||||||||||

| U.S. | $ | 131,004 | 4.19 | $ | 157,130 | 3.52 | 19.9 | |||||||||||||||||||||||||

| Non-U.S. | 62,927 | 1.76 | 70,278 | 1.48 | 11.7 | |||||||||||||||||||||||||||

Total interest-bearing deposits(4) |

193,931 | 3.41 | 227,408 | 2.89 | 17.3 | |||||||||||||||||||||||||||

| Securities sold under repurchase agreements | 3,263 | 5.07 | 3,841 | 4.49 | 17.7 | |||||||||||||||||||||||||||

| Other short-term borrowings | 10,694 | 5.05 | 11,009 | 4.58 | 2.9 | |||||||||||||||||||||||||||

| Long-term debt | 19,319 | 5.44 | 24,809 | 4.99 | 28.4 | |||||||||||||||||||||||||||

| Other interest-bearing liabilities | 4,591 | 12.43 | 4,503 | 14.37 | (1.9) | |||||||||||||||||||||||||||

| Total interest-bearing liabilities | 231,798 | 3.85 | 271,570 | 3.37 | 17.2 | |||||||||||||||||||||||||||

Non-interest-bearing deposits(5) |

25,955 | 24,530 | (5.5) | |||||||||||||||||||||||||||||

| Other non-interest-bearing liabilities | 20,098 | 22,894 | 13.9 | |||||||||||||||||||||||||||||

| Preferred shareholders' equity | 2,626 | 3,411 | 29.9 | |||||||||||||||||||||||||||||

| Common shareholders' equity | 21,957 | 23,175 | 5.5 | |||||||||||||||||||||||||||||

| Total liabilities and shareholders' equity | $ | 302,434 | $ | 345,580 | 14.3 | |||||||||||||||||||||||||||

| Total deposits | $ | 219,886 | $ | 251,938 | 14.6 | |||||||||||||||||||||||||||

| Excess of rate earned over rate paid | 0.74 | % | 0.69 | % | ||||||||||||||||||||||||||||

| Net interest margin | 1.13 | % | 0.98 | % | ||||||||||||||||||||||||||||

| Net interest income, fully taxable-equivalent basis | $ | 1,453 | $ | 1,443 | ||||||||||||||||||||||||||||

| Tax-equivalent adjustment | (2) | — | ||||||||||||||||||||||||||||||

Net interest income, GAAP-basis(4) |

$ | 1,451 | $ | 1,443 | ||||||||||||||||||||||||||||

(1) Average rates earned and paid on interest-earning assets and interest-bearing liabilities include the impact of hedge activities associated with our asset and liability management activities where applicable. |

||||||||||||||||||||||||||||||||

(2) Reflects the impact of balance sheet netting under enforceable netting agreements of approximately $176 billion and $243 billion as of June 30, 2024 and 2025, respectively. Excluding the impact of netting, the average interest rates would be approximately 0.37% and 0.28% for the six months ended June 30, 2024 and 2025, respectively. |

||||||||||||||||||||||||||||||||

(3) Average loans are presented on a gross basis. Average loans net of expected credit losses as of June 30, 2024 and 2025 was approximately $38,100 million and $44,342 million, respectively. |

||||||||||||||||||||||||||||||||

(4) Average rates include the impact of FX swap cost of approximately ($112) million and ($125) million for the six months ended June 30, 2024 and 2025, respectively. Average rates for total interest-bearing deposits excluding the impact of FX swap cost were 3.51% and 3.00% for the six months ended June 30, 2024 and 2025, respectively. |

||||||||||||||||||||||||||||||||

(5) Average non-interest-bearing deposits are primarily composed of deposit balances denominated in U.S. dollars. |

||||||||||||||||||||||||||||||||

| STATE STREET CORPORATION | ||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| EARNINGS RELEASE ADDENDUM | ||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

SELECTED AVERAGE BALANCES BY CURRENCY - RATES EARNED AND PAID(1) | ||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| 2Q25 | ||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| USD | EUR | GBP | Other | Total | ||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| (Dollars in millions, except where otherwise noted) | Average Balance | Average Rates | Average Balance | Average Rates | Average Balance | Average Rates | Average Balance | Average Rates | Average Balance | Average Rates | ||||||||||||||||||||||||||||||||||||||||||||||||||||

| Interest-bearing deposits with banks | $ | 43,978 | 4.53 | % | $ | 30,178 | 2.19 | % | $ | 6,417 | 4.32 | % | $ | 17,748 | 1.39 | % | $ | 98,321 | 3.23 | % | ||||||||||||||||||||||||||||||||||||||||||

| Total investment securities | 91,562 | 3.50 | 8,427 | 2.54 | 6,289 | 4.50 | 5,805 | 4.24 | 112,083 | 3.52 | ||||||||||||||||||||||||||||||||||||||||||||||||||||

| Loans | 36,459 | 5.19 | 6,873 | 4.31 | 1,309 | 6.22 | 636 | 5.02 | 45,277 | 5.08 | ||||||||||||||||||||||||||||||||||||||||||||||||||||

Total other interest-earning assets(2) |

44,091 | 5.99 | 999 | 1.55 | 329 | 3.42 | 3,548 | 4.21 | 48,967 | 5.76 | ||||||||||||||||||||||||||||||||||||||||||||||||||||

Total interest-earning assets |

$ | 216,090 | 4.51 | $ | 46,477 | 2.55 | $ | 14,344 | 4.56 | $ | 27,737 | 2.43 | $ | 304,648 | 4.02 | |||||||||||||||||||||||||||||||||||||||||||||||

Total interest-bearing deposits(3)(4) |

$ | 157,056 | 3.75 | $ | 41,656 | 1.32 | $ | 12,465 | 1.95 | $ | 25,400 | 0.43 | $ | 236,577 | 2.87 | |||||||||||||||||||||||||||||||||||||||||||||||

Central Bank Rate(5) |

4.50 | 2.22 | 4.35 | |||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| 1Q25 | ||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| USD | EUR | GBP | Other | Total | ||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| (Dollars in millions, except where otherwise noted) | Average Balance | Average Rates | Average Balance | Average Rates | Average Balance | Average Rates | Average Balance | Average Rates | Average Balance | Average Rates | ||||||||||||||||||||||||||||||||||||||||||||||||||||

| Interest-bearing deposits with banks | $ | 42,137 | 4.52 | % | $ | 25,385 | 2.71 | % | $ | 5,709 | 4.68 | % | $ | 19,549 | 1.30 | % | $ | 92,780 | 3.36 | % | ||||||||||||||||||||||||||||||||||||||||||

| Total investment securities | 91,215 | 3.47 | 7,339 | 2.51 | 5,487 | 4.52 | 6,029 | 4.42 | 110,070 | 3.51 | ||||||||||||||||||||||||||||||||||||||||||||||||||||

| Loans | 35,740 | 5.27 | 6,085 | 4.54 | 1,349 | 6.00 | 556 | 3.70 | 43,730 | 5.17 | ||||||||||||||||||||||||||||||||||||||||||||||||||||

Total other interest-earning assets(2) |

40,091 | 6.10 | 203 | 2.28 | 138 | 3.47 | 2,504 | 4.35 | 42,936 | 5.97 | ||||||||||||||||||||||||||||||||||||||||||||||||||||

Total interest-earning assets |

$ | 209,183 | 4.51 | $ | 39,012 | 2.96 | $ | 12,683 | 4.76 | $ | 28,638 | 2.28 | $ | 289,516 | 4.09 | |||||||||||||||||||||||||||||||||||||||||||||||

Total interest-bearing deposits(3)(4) |

$ | 153,068 | 3.74 | $ | 33,657 | 1.63 | $ | 10,772 | 1.94 | $ | 20,642 | (0.65) | $ | 218,139 | 2.91 | |||||||||||||||||||||||||||||||||||||||||||||||

Central Bank Rate(5) |

4.50 | 2.76 | 4.60 | |||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| 2Q24 | ||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| USD | EUR | GBP | Other | Total | ||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| (Dollars in millions, except where otherwise noted) | Average Balance | Average Rates | Average Balance | Average Rates | Average Balance | Average Rates | Average Balance | Average Rates | Average Balance | Average Rates | ||||||||||||||||||||||||||||||||||||||||||||||||||||

| Interest-bearing deposits with banks | $ | 38,412 | 5.56 | % | $ | 26,820 | 3.85 | % | $ | 6,609 | 5.15 | % | $ | 16,053 | 1.41 | % | $ | 87,894 | 4.25 | % | ||||||||||||||||||||||||||||||||||||||||||

| Total investment securities | 85,209 | 3.63 | 8,891 | 2.68 | 4,701 | 4.35 | 6,297 | 4.25 | 105,098 | 3.62 | ||||||||||||||||||||||||||||||||||||||||||||||||||||

| Loans | 31,156 | 5.82 | 5,614 | 5.88 | 1,239 | 6.85 | 694 | 5.34 | 38,703 | 5.85 | ||||||||||||||||||||||||||||||||||||||||||||||||||||

Total other interest-earning assets(2) |

27,570 | 7.77 | 135 | 3.25 | 51 | 6.59 | 2,289 | 3.87 | 30,045 | 7.45 | ||||||||||||||||||||||||||||||||||||||||||||||||||||

| Total interest-earning assets | $ | 182,347 | 5.05 | $ | 41,460 | 3.87 | $ | 12,600 | 5.04 | $ | 25,333 | 2.45 | $ | 261,740 | 4.61 | |||||||||||||||||||||||||||||||||||||||||||||||

Total interest-bearing deposits(3)(4) |

$ | 128,122 | 4.45 | $ | 35,166 | 2.16 | $ | 11,313 | 1.70 | $ | 21,328 | (0.32) | $ | 195,929 | 3.36 | |||||||||||||||||||||||||||||||||||||||||||||||

Central Bank Rate(5) |

5.50 | 3.93 | 5.25 | |||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

(1) Average rates earned and paid on interest-earning assets and interest-bearing liabilities include the impact of hedge activities associated with our asset and liability management activities where applicable. | ||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

(2) Average total other interest-earning assets include securities purchased under resale agreements, trading account assets and other interest-earning assets. Refer to average statement of condition - rates earned and paid - full taxable-equivalent basis for details. | ||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

(3) Average rates for interest-bearing deposit balances denominated in U.S. dollars include both client and wholesale deposits. | ||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

(4) FX swap costs for interest-bearing deposits are included in other currencies. | ||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

(5) Central Bank Rate represents the quarterly average Federal Funds Target Rate for USD, European Central Bank Deposit Facility Rate for EUR, and the Bank of England's Bank Rate for GBP. | ||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| STATE STREET CORPORATION | |||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| EARNINGS RELEASE ADDENDUM | |||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| INVESTMENT PORTFOLIO HOLDINGS BY ASSET CLASS | |||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| Quarters | |||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| 1Q24 | 2Q24 | 3Q24 | 4Q24 | 1Q25 | 2Q25 | ||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| (Dollars in billions, except where otherwise noted) | Average Balance | Average Rate | Average Balance | Average Rate | Average Balance | Average Rate | Average Balance | Average Rate | Average Balance | Average Rate | Average Balance | Average Rate | |||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| Available-for-sale investment securities: | |||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| Government & agency securities | $ | 25.1 | 4.44 | % | $ | 31.4 | 4.73 | % | $ | 35.0 | 4.89 | % | $ | 35.3 | 4.59 | % | $ | 41.3 | 4.29 | % | $ | 42.6 | 4.15 | % | |||||||||||||||||||||||||||||||||||||||||||||||||||||

| U.S. Treasury direct obligations | 9.6 | 5.11 | 15.6 | 5.27 | 18.7 | 5.12 | 20.4 | 4.95 | 26.5 | 4.48 | 26.4 | 4.43 | |||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| Non-U.S. sovereign, supranational and non-U.S. agency | 15.5 | 4.03 | 15.8 | 4.20 | 16.3 | 4.63 | 14.9 | 4.11 | 14.8 | 3.96 | 16.2 | 3.70 | |||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| Asset-backed securities | 6.9 | 5.61 | 7.2 | 5.68 | 7.6 | 5.53 | 8.1 | 5.41 | 7.8 | 5.09 | 8.5 | 4.75 | |||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| Mortgage-backed securities | 5.6 | 5.44 | 5.9 | 5.48 | 6.2 | 5.36 | 6.3 | 5.36 | 7.0 | 5.06 | 9.2 | 5.09 | |||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| CMBS | 5.6 | 5.81 | 5.4 | 5.75 | 5.1 | 5.81 | 4.5 | 5.55 | 4.3 | 4.86 | 4.2 | 4.74 | |||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| Other | 3.3 | 4.63 | 3.3 | 4.85 | 3.4 | 5.12 | 3.0 | 5.20 | 3.0 | 5.16 | 3.2 | 5.14 | |||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| Total available-for-sale portfolio | $ | 46.5 | 4.93 | $ | 53.2 | 5.06 | $ | 57.3 | 5.13 | $ | 57.2 | 4.90 | $ | 63.4 | 4.57 | $ | 67.7 | 4.45 | |||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| Quarters | |||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| 1Q24 | 2Q24 | 3Q24 | 4Q24 | 1Q25 | 2Q25 | ||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| (Dollars in billions, except where otherwise noted) | Average Balance | Average Rate | Average Balance | Average Rate | Average Balance | Average Rate | Average Balance | Average Rate | Average Balance | Average Rate | Average Balance | Average Rate | |||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| Held-to-maturity investment securities: | |||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| Government & agency securities | $ | 12.7 | 0.96 | % | $ | 10.8 | 0.88 | % | $ | 10.1 | 0.82 | % | $ | 9.3 | 0.76 | % | $ | 8.6 | 0.75 | % | $ | 7.2 | 0.78 | % | |||||||||||||||||||||||||||||||||||||||||||||||||||||

| U.S. Treasury direct obligations | 7.4 | 1.07 | 6.1 | 0.90 | 5.7 | 0.76 | 5.4 | 0.68 | 5.0 | 0.66 | 3.9 | 0.67 | |||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| Non-U.S. sovereign, supranational and non-U.S. agency | 5.3 | 0.80 | 4.7 | 0.84 | 4.4 | 0.90 | 3.9 | 0.88 | 3.6 | 0.89 | 3.3 | 0.92 | |||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| Asset-backed securities | 3.1 | 6.15 | 3.0 | 6.15 | 2.7 | 6.21 | 2.5 | 5.92 | 2.4 | 5.32 | 2.4 | 5.17 | |||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| Mortgage-backed securities | 33.8 | 2.25 | 32.9 | 2.23 | 32.1 | 2.22 | 31.1 | 2.24 | 30.5 | 2.22 | 29.7 | 2.21 | |||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| CMBS | 5.2 | 1.93 | 5.2 | 1.91 | 5.2 | 1.91 | 5.2 | 1.90 | 5.2 | 1.88 | 5.1 | 1.89 | |||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| Total held-for-maturity portfolio | $ | 54.8 | 2.14 | $ | 51.9 | 2.14 | $ | 50.1 | 2.12 | $ | 48.1 | 2.11 | $ | 46.7 | 2.07 | $ | 44.4 | 2.11 | |||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| Total investment securities | $ | 101.3 | 3.42 | $ | 105.1 | 3.62 | $ | 107.4 | 3.73 | $ | 105.3 | 3.63 | $ | 110.1 | 3.51 | $ | 112.1 | 3.52 | |||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| STATE STREET CORPORATION | |||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| EARNINGS RELEASE ADDENDUM | |||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| INVESTMENT PORTFOLIO HOLDINGS BY ASSET CLASS (continued) | |||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| Ratings | |||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| (Dollars in billions, or where otherwise noted) | UST/AGY | AAA | AA | A | BBB | <BBB | Fair Value | % Total |

Net Unrealized Pre-tax MTM Gain/(Loss)

(In millions)(1)

|

Fixed Rate/

Floating Rate(2)

|

|||||||||||||||||||||||||||||||||||||||||||||||||||||||

| Available-for-sale investment securities: | |||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| Government & agency securities | 62 | % | 21 | % | 14 | % | — | % | 2 | % | 1 | % | $ | 43.3 | 61.3 | % | $ | 78 | 94% / 6% | ||||||||||||||||||||||||||||||||||||||||||||||

| U.S. Treasury direct obligations | 100 | — | — | — | — | — | 26.8 | 61.9 | (17) | 100% / 0% | |||||||||||||||||||||||||||||||||||||||||||||||||||||||

| Non-U.S. sovereign, supranational and non-U.S. agency | — | 56 | 38 | — | 5 | 1 | 16.5 | 38.1 | 95 | 85% / 15% | |||||||||||||||||||||||||||||||||||||||||||||||||||||||

| Asset-backed securities | — | 94 | 6 | — | — | — | 9.1 | 12.9 | 15 | 0% / 100% | |||||||||||||||||||||||||||||||||||||||||||||||||||||||

| Mortgage-backed securities | 56 | — | 44 | — | — | — | 10.7 | 15.2 | (69) | 56% / 44% | |||||||||||||||||||||||||||||||||||||||||||||||||||||||

| CMBS | 100 | — | — | — | — | — | 4.1 | 5.8 | (24) | 5% / 95% | |||||||||||||||||||||||||||||||||||||||||||||||||||||||

| Other | — | 20 | 20 | 52 | 8 | — | 3.4 | 4.8 | 50 | 60% / 40% | |||||||||||||||||||||||||||||||||||||||||||||||||||||||

| Total available-for-sale portfolio | 53 | % | 26 | % | 17 | % | 2 | % | 2 | % | — | % | $ | 70.6 | 100.0 | % | $ | 50 | 70% / 30% | ||||||||||||||||||||||||||||||||||||||||||||||

| Fair Value | $ | 37.0 | $ | 18.5 | $ | 12.1 | $ | 1.7 | $ | 1.1 | $ | 0.2 | |||||||||||||||||||||||||||||||||||||||||||||||||||||

| Ratings | |||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| UST/AGY | AAA | AA | A | BBB | <BBB | Amortized Cost | % Total |

Net Unrealized Pre-tax MTM Gain/(Loss)

(In millions)(1)

|

Fixed Rate/

Floating Rate(2)

|

||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| Held-to-maturity investment securities: | |||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| Government & agency securities | 48 | % | 33 | % | 17 | % | 2 | % | — | % | — | % | $ | 6.4 | 14.8 | % | $ | (55) | 100% / 0% | ||||||||||||||||||||||||||||||||||||||||||||||

| U.S. Treasury direct obligations | 100 | — | — | — | — | — | 3.1 | 48.4 | (19) | 100% / 0% | |||||||||||||||||||||||||||||||||||||||||||||||||||||||

| Non-U.S. sovereign, supranational and non-U.S. agency | — | 64 | 33 | 3 | — | — | 3.3 | 51.6 | (36) | 100% / 0% | |||||||||||||||||||||||||||||||||||||||||||||||||||||||

| Asset-backed securities | — | 25 | 70 | 3 | — | 2 | 2.4 | 5.5 | (31) | 5% / 95% | |||||||||||||||||||||||||||||||||||||||||||||||||||||||

| Mortgage-backed securities | 100 | — | — | — | — | — | 29.4 | 67.9 | (4,206) | 100% / 0% | |||||||||||||||||||||||||||||||||||||||||||||||||||||||

| CMBS | 100 | — | — | — | — | — | 5.1 | 11.8 | (510) | 97% / 3% | |||||||||||||||||||||||||||||||||||||||||||||||||||||||

| Total held-for-maturity portfolio | 87 | % | 6 | % | 6 | % | 1 | % | — | % | — | % | $ | 43.3 | 100.0 | % | $ | (4,802) | 94% / 6% | ||||||||||||||||||||||||||||||||||||||||||||||

| Amortized Cost | $ | 37.6 | $ | 2.7 | $ | 2.8 | $ | 0.2 | $ | — | $ | — | |||||||||||||||||||||||||||||||||||||||||||||||||||||

Total Investment Securities(3) |

$ | 113.9 | 79% / 21% | ||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

(1) At June 30, 2025, the after-tax unrealized MTM gain/(loss) includes after-tax unrealized loss on securities available-for-sale of $36 million, after-tax unrealized loss on securities held-to-maturity of $3,462 million and after-tax unrealized loss primarily related to securities previously transferred from available-for-sale to held-to-maturity of $305 million. |

|||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

(2) At June 30, 2025, fixed-to-floating rate securities, which excludes the impact of hedges, had a book value of approximately $20 million or 0.02% of the total portfolio. |

|||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

(3) State Street has a highly liquid balance sheet, with more than half of total assets deemed HQLA. Based upon fair value as of June 30, 2025, approximately 84% of our investment portfolio was held in HQLA. |

|||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| STATE STREET CORPORATION | ||||||||||||||||||||||||||||||||||||||||||||||||||

| EARNINGS RELEASE ADDENDUM | ||||||||||||||||||||||||||||||||||||||||||||||||||

| ALLOWANCE FOR CREDIT LOSSES | ||||||||||||||||||||||||||||||||||||||||||||||||||

| Quarters | % Change | |||||||||||||||||||||||||||||||||||||||||||||||||

| (Dollars in millions) | 1Q24 | 2Q24 | 3Q24 | 4Q24 | 1Q25 | 2Q25 | 2Q25 vs. 2Q24 |

2Q25 vs. 1Q25 |

||||||||||||||||||||||||||||||||||||||||||

| Allowance for credit losses: | ||||||||||||||||||||||||||||||||||||||||||||||||||

| Beginning balance | $ | 150 | $ | 146 | $ | 145 | $ | 171 | $ | 183 | $ | 186 | 27.4 | % | 1.6 | % | ||||||||||||||||||||||||||||||||||

Provision for credit losses (funded commitments) |

31 | 12 | 26 | 12 | 11 | 27 | nm | nm | ||||||||||||||||||||||||||||||||||||||||||

Provision for credit losses (unfunded commitments) |

(4) | (2) | — | — | 1 | 2 | nm | nm | ||||||||||||||||||||||||||||||||||||||||||

| Provision for credit losses (all other) | — | — | — | — | — | 1 | nm | nm | ||||||||||||||||||||||||||||||||||||||||||

| Total provision | 27 | 10 | 26 | 12 | 12 | 30 | nm | nm | ||||||||||||||||||||||||||||||||||||||||||

| Charge-offs | (31) | (11) | — | — | (9) | (24) | nm | nm | ||||||||||||||||||||||||||||||||||||||||||

Ending balance(1) |

$ | 146 | $ | 145 | $ | 171 | $ | 183 | $ | 186 | $ | 192 | 32.4 | 3.2 | ||||||||||||||||||||||||||||||||||||

| Allowance for credit losses: | ||||||||||||||||||||||||||||||||||||||||||||||||||

| Loans | $ | 135 | $ | 136 | $ | 162 | $ | 174 | $ | 176 | $ | 179 | 31.6 | 1.7 | ||||||||||||||||||||||||||||||||||||

| Investment securities | 1 | 1 | 1 | — | — | — | nm | — | ||||||||||||||||||||||||||||||||||||||||||

| Unfunded (off-balance sheet) commitments | 10 | 8 | 8 | 9 | 9 | 11 | 37.5 | 22.2 | ||||||||||||||||||||||||||||||||||||||||||

| All other | — | — | — | — | 1 | 2 | — | nm | ||||||||||||||||||||||||||||||||||||||||||

Ending balance(1) |

$ | 146 | $ | 145 | $ | 171 | $ | 183 | $ | 186 | $ | 192 | 32.4 | 3.2 | ||||||||||||||||||||||||||||||||||||

(1) The allowance for credit losses on unfunded commitments is included within Other liabilities in the Consolidated Statement of Condition. |

||||||||||||||||||||||||||||||||||||||||||||||||||

nm Denotes not meaningful |

||||||||||||||||||||||||||||||||||||||||||||||||||

| STATE STREET CORPORATION | |||||||||||||||||||||||||||||||||||||||||||||||||||||

| EARNINGS RELEASE ADDENDUM | |||||||||||||||||||||||||||||||||||||||||||||||||||||

| ASSETS UNDER CUSTODY AND/OR ADMINISTRATION | |||||||||||||||||||||||||||||||||||||||||||||||||||||

| Quarters | % Change | ||||||||||||||||||||||||||||||||||||||||||||||||||||