1 STATE STREET CORPORATION AMENDED AND RESTATED 2017 STOCK INCENTIVE PLAN [____] Deferred Stock Award Agreement Subject to your acceptance of the terms set forth in this agreement and the addenda attached hereto (“Agreement”), State Street Corporation (“Company”) has awarded you, under the State Street Corporation Amended and Restated 2017 Stock Incentive Plan (“Plan”), and pursuant to this Agreement and the terms set forth herein, a contingent right to receive the number of shares of Common Stock (“Deferred Shares”) (“Award”) as set forth in the statement pertaining to this Award (“Statement”) on the website (“Website”) maintained by Fidelity Stock Plan Services LLC, an independent service provider based in the United States, or another party designated by the Company (“Equity Administrator”). Copies of the Plan, the Company’s Prospectus for the Plan and any employee tax information supplement to the Prospectus for your country of employment (“Tax Supplement”) are located on the Website for your reference. Your acceptance of this Award constitutes your acknowledgement that you have read and understood this Agreement, the Plan, the Prospectus for the Plan and the Tax Supplement. The provisions of the Plan are incorporated herein by reference, and all terms used herein shall have the meaning given to them in the Plan, except as otherwise expressly provided herein. In the event of any conflict between the provisions of this Agreement and the provisions of the Plan, the provisions of the Plan shall control. As used herein, “State Street” means the Company and each Subsidiary. “Subsidiary” means the Company’s subsidiaries and affiliates as determined by the Company in its sole discretion. “Employer” means the Subsidiary that employs you, or which last employed you, following the termination of your employment. The terms of your Award are as follows: 1. Grant of Deferred Shares. To be entitled to any payment under this Award, you must accept your Award and in so doing agree to comply with the terms and conditions of this Agreement and the applicable provisions of the addendum outlined in Appendix A (“Countries Addendum,” which is incorporated into, and forms a material and integral part of, this Agreement). You may consider this Agreement for up to thirty (30) days from the date it was first made available to you on the Website. Failure to accept this Award within thirty (30) days following the posting of this Agreement on the Website will result in forfeiture of this Award. Subject to the terms and conditions of this Agreement, Deferred Shares shall vest and be settled in the form of shares of Common Stock according to the vesting schedule set forth in your Statement. The term “vest” as used herein means the lapsing of certain (but not all) restrictions described herein and in the Plan with respect to one or more Deferred Shares as of each applicable vesting date. To vest in all or any portion of this Award as of any date, you must have been continuously employed with the Company or a Subsidiary from and after the date hereof and until (and including) the applicable vesting date, except as otherwise provided herein. By accepting this Award, you and the Company agree that any claim arising out of this Award or any Common Stock issued by the Company pursuant to this Award may only be brought in the federal or state courts of the Commonwealth of Massachusetts, regardless of where or whether you are employed by the Company or a Subsidiary. You consent to personal jurisdiction in such courts for any such claim, consent to service of process by any means allowed by such courts or Exhibit 10.1

2 applicable law, and waive any arguments that such courts are not an appropriate or convenient forum. This Award is subject to any forfeiture, compensation recovery or similar requirements set forth in this Agreement, as well as any other forfeiture, compensation recovery or similar requirements under applicable law and related implementing regulations and guidance, and to other forfeiture, compensation recovery or similar requirements under plans, policies and practices of the Company or its relevant Subsidiaries in effect from time to time, including those set forth in your offer letter, employment or service agreement and in the State Street Corporation Compensation Recovery Policy. Your rights to receive and retain any shares (and the value thereof) under this Award are conditioned on the full satisfaction of all conditions to delivery and the lapse of all forfeiture, compensation recovery, and similar requirements. In the event pursuant to this Agreement or pursuant to any applicable law or related implementing regulations or guidance, or pursuant to any Company or its relevant Subsidiaries plans, policies or practices, the Board or State Street is required or permitted to reduce, forfeit or cancel any amount remaining to be paid, or to recover any amount previously paid, with respect to this Award, or to otherwise impose or apply restrictions on this Award or shares of Common Stock subject hereto, it shall, in its sole discretion, be authorized to do so. By accepting this Award, you consent to making payment to your Employer in the event of a compensation recovery determination by the Board or State Street. 2. Payment of Common Stock. (a) The Company will issue and transfer to you, no later than thirty (30) days following the applicable vesting dates, the number of shares of Common Stock specified in the vesting schedule in your Statement. The Company’s obligation to issue and transfer Common Stock in the future pursuant to this Agreement is an unsecured and unfunded contractual obligation. (b) Notwithstanding the foregoing, the Company may, in its sole discretion, settle any vested Deferred Shares in the form of: (i) a cash payment to the extent settlement in shares of Common Stock (1) is prohibited under local law, rules or regulations, (2) would require you, the Company or your Employer to obtain the approval of any governmental and/or regulatory body in your country of residence (or country of employment, if different), or (3) is administratively burdensome; or (ii) shares of Common Stock, but require you to immediately sell such shares of Common Stock (in which case, you hereby expressly authorize the Company to issue sales instructions on your behalf). 3. Identified Staff Holding Requirement. Notwithstanding anything herein to the contrary, you agree and covenant that, as a condition to the receipt of this Award and the settlement of the Deferred Shares in the form of shares of Common Stock hereunder, in the event the Company or any Subsidiary notifies you at any time before or after this Award is made that you have been designated Identified Staff for purposes of the Capital Requirements Directive V, the Alternative Fund Managers Directive (“AIFMD”) or the Undertakings for Collective Investment in Transferrable Securities (“UCITS”) (or any implementing or successor rule, regulation or guidance, including the rules and regulations of the United Kingdom Financial Conduct Authority (“FCA”), Prudential Regulation Authority (“PRA”),

3 Central Bank of Ireland (“CBI”), German Federal Financial Supervisory Authority (“BaFin”) or any other applicable regulatory authority), you will not sell or otherwise transfer any shares of Common Stock issued and transferred to you pursuant to this Award until the date that is at least twelve (12) months for UK and State Street Bank International GmbH (“SSBI”) Identified Staff and at least six (6) months for AIFMD and UCITS Identified Staff (or such longer period as is stipulated by the FCA, the PRA, the CBI, BaFin or any other applicable regulatory authority) after the vesting date of Deferred Shares paid in connection with this Award, except that: (a) you shall be permitted to sell, upon such vesting date, a number of shares of Common Stock sufficient to pay applicable tax and social security withholding, if any, with respect to such vesting (or, alternatively, if the Company withholds such shares pursuant to Section 21 of this Agreement, the requirements in this Section 3 not to sell or otherwise transfer any shares shall only apply to the number of such shares delivered to you (i.e., after such withholding of shares)); (b) transfers by will or pursuant to the laws of descent or distribution are permitted; and (c) this holding requirement shall not apply to such portion of the Deferred Shares, if any, that were awarded with respect to a period of time, as determined by the Company in its discretion, during which you were not subject to such holding requirement. Any attempt by you (or in the case of your death, by your Designated Beneficiary) to assign or transfer shares of Common Stock subject to this Award, either voluntarily or involuntarily, contrary to the provisions hereof, shall be null and void and without effect. The Company may, in its sole discretion, impose restrictions on the assignment or transfer of shares of Common Stock consistent with the provisions hereof, including, without limitation, by or through the transfer agent for such shares or by means of legending Common Stock certificates or otherwise. This Section 3 applies in addition to, and not to the exclusion of, any other holding, forfeiture and/or clawback provisions contained in this Agreement. 4. General Circumstances of Forfeiture. (a) You will immediately forfeit any and all rights to receive shares of Common Stock under this Agreement not previously vested, issued and transferred to you in the event: (i) you cease to be employed by the Company and its Subsidiaries due to Circumstances of Forfeiture; (ii) the Company, in its sole discretion, determines that circumstances prior to the date on which you ceased to be employed by the Company and its Subsidiaries for any reason constituted grounds for an involuntary termination constituting Circumstances of Forfeiture; or (iii) you fail to comply with the terms of this Agreement or the terms of any other Restrictive Covenant you agree to or have agreed to with the Company or any Subsidiary or the terms of any agreement containing a condition precedent to your entry into or right to receive shares under this Agreement. (b) If your employment terminates by reason of [Retirement or ]Disability or any reason other than for Circumstances of Forfeiture, then unless accelerated as provided in Section 9, your

4 unvested right to receive shares of Common Stock hereunder shall continue to vest in accordance with the vesting schedule detailed in your Statement, subject to the terms and conditions of this Agreement. (c) For purposes hereof: (i) “Circumstances of Forfeiture” means the termination of your employment with the Company and its Subsidiaries either (A) voluntarily (other than [(x) by reason of Retirement or (y)] for Good Reason on or prior to the first anniversary of a Change in Control) or (B) involuntarily for reasons determined by the Company or the relevant Subsidiary in its sole discretion to constitute “gross misconduct” [(including while you are Retirement eligible)]. (ii) “Disability” means, in the Company’s sole discretion, that: (a) you are unable to engage in any substantial gainful activity by reason of any medically determinable physical or mental impairment that can be expected to result in your death or can be expected to last for a continuous period of not less than twelve (12) months; or (b) by reason of any medically determinable physical or mental impairment that can be expected to result in your death or can be expected to last for a continuous period of not less than twelve (12) months, you are receiving income replacement benefits for a period of not less than six (6) months under an accident and health plan covering employees of the Employer. (iii) “Restrictive Covenant” means any confidentiality, non-solicitation, non- competition, non-disparagement, post-employment cooperation or notice period provision that you agree to or had agreed to with the Company or any Subsidiary, including but not limited to the restrictions contained in this Award Agreement, any offer letter, employment or service agreement, including letters amending the employment or service agreement, promotion letters, deferred compensation award agreements of any type, or change in control employment agreements, or applicable restrictions required as a condition to entitlement to payment under any executive supplemental retirement plan. [ (iv) “Retirement” means your attainment of age fifty-five (55) and completion of five (5) years of continuous service with the Company and its Subsidiaries.] (d) The grant of this Award and the terms and conditions governing this Award are intended to comply with the age discrimination provisions of the European Union Equal Treatment Framework Directive, as implemented into local law, including for avoidance of doubt in the UK, the Equality Act of 2010 (the “Age Discrimination Legislation”). To the extent a court or tribunal of competent jurisdiction determines that any provision of this Award is invalid or unenforceable, in whole or in part, under the Age Discrimination Legislation, the Company, in its sole discretion, shall have the power and authority to revise or strike such provision to the minimum extent necessary to make it valid and enforceable to the full extent permitted under applicable local law. (e) This Section 4 applies in addition to, and not to the exclusion of, any other holding, forfeiture and/or clawback provisions contained in this Agreement. 5. Material Risk Taker Malus-Based Forfeiture. In the event you hold a title of Executive Vice President or higher during the calendar year in which this Award is made, or you hold the status of “material risk taker” at the time this Award is made or any time thereafter, you acknowledge and agree that this Award is subject to the provisions of this Section 5. In respect of any Award remaining to be issued and transferred to

5 you in Common Stock or otherwise paid may, in the sole discretion of the Board, be reduced, forfeited or cancelled, in the event that it is determined by the Board, in its sole discretion, that your actions, whether discovered during or after your employment with your Employer, exposed the Business to any inappropriate risk or risks (including where you failed to timely identify, analyze, assess or raise concerns about such risk or risks, including in a supervisory capacity, where it was reasonable to expect you to do so), and such exposure has resulted or could reasonably be expected to result in a material loss or losses that are or would be substantial in relation to the revenues, capital and overall risk tolerance of the Business. The “Business” shall mean State Street, or, to the extent you devote substantially all of your business time to a particular business unit (e.g., Institutional Services, Global Delivery, Global Markets or State Street Alpha) or business division (e.g., Global Clients Division, Charles River Development or Global Technology Services), then “Business” shall refer to such business unit or business division. This provision applies in addition to, and not to the exclusion of, any other holding, forfeiture and/or clawback provisions contained in this Agreement. For the avoidance of doubt, this Section 5 also applies to you if you hold the status of Singapore Senior Manager and/or Singapore Material Risk Personnel. 6. Identified Staff Malus-Based Forfeiture and Clawback. (a) In the event the Company or any Subsidiary notifies you at any time before or after this Award is made that you have been designated Identified Staff for purposes of a UK (either PRA or FCA, including those subject to the Investment Firms Prudential Regime), AIFMD or UCITS Remuneration Code, you acknowledge and agree that this Award is subject to the provisions of this Section 6 for a period of up to seven (7) years, as separately communicated to you, from the date this Award is granted. For those Identified Staff fulfilling a PRA Senior Management Function, the seven (7)-year period may be extended to ten (10) years in certain circumstances where: (i) the Company has commenced an investigation into facts or events which it considers could potentially lead to the application of a clawback under this Section 6 were it not for the expiration of the seven (7)-year period; or (ii) the Company has been notified by a regulatory authority that an investigation has commenced into facts or events which the Company considers could potentially lead to the application of clawback by the Company under this Section 6 were it not for the expiration of the seven (7)-year period. (b) If the Company determines that a UK, AIFMD or UCITS Forfeiture Event has occurred it may elect to reduce, forfeit or cancel all or part of any amount remaining to be issued and transferred to you in Common Stock or otherwise paid in respect of this Award (“UK Malus- Based Forfeiture” or “AIFMD or UCITS Malus-Based Forfeiture”). (c) If the Company determines that a UK, AIFMD or UCITS Clawback Event has occurred it may require the repayment by you (or otherwise seek to recover from you) of all or part of any compensation paid to you in respect of this Award. (d) The Company may produce guidelines from time to time in respect of its operation of the provisions of this Section 6. The Company intends to apply such guidelines in deciding whether and when to effect any reduction, cancellation, forfeiture or recovery of compensation but, in the event of any inconsistency between the provisions of this Section 6 and any such guidelines, this Section 6 shall prevail. Such guidelines do not form part of any employee’s

6 contract of employment, and the Company may amend such guidelines and their application at any time. (e) By accepting this Award on the Website, you expressly and explicitly: (i) consent to making the required payment to the Company (or to your Employer on behalf of the Company) upon a UK, AIFMD or UCITS Clawback Event; and (ii) authorize the Company to issue related instructions, on your behalf, to the Equity Administrator and any brokerage firm and/or third-party administrator engaged by the Company to hold your shares of Common Stock and other amounts acquired under the Plan and to re-convey, transfer or otherwise return such shares of Common Stock and/or other amounts to the Company. (f) For the purposes of this Section 6: (i) A “UK Forfeiture Event” or a “AIFMD/UCITS Forfeiture Event” means a determination by the Company, in its sole discretion, that (A) there is reasonable evidence of your misbehavior or material error; or (B) the Company, one of its Subsidiaries or a relevant business unit has suffered a material downturn in its financial performance; or (C) the Company, one of its Subsidiaries or a relevant business unit has suffered a material failure of risk management; and (ii) A “UK Clawback Event” or a “AIFMD/UCITS Forfeiture Event” means a determination by the Company, in its sole discretion, that either (A) there is reasonable evidence of your misbehavior or material error or (B) the Company, one of its Subsidiaries or a relevant business unit has suffered a material failure of risk management. (g) This Section 6 applies in addition to, and not to the exclusion of, any other holding, forfeiture and/or clawback provisions contained in this Agreement. 7. SSBI Affordability Limitations, and Malus-Based Forfeiture and Clawback. (a) Awards issued to SSBI staff may be impacted by the financial situation of the bank and/or regulatory group, as prescribed by regulatory requirements in its applicable version (e.g., the Remuneration Ordinance for Institutions and/or German Banking Act). Awards may also be limited to the extent ordered by the competent supervisory authority according to sec. 45 para. 2 sentence 1 no. 5a, 10, 11 German Banking Act. Further, entitlement to an Award may lapse if the competent supervisory authority issues a corresponding definitive order according to sec. 45 para. 7 German Banking Act. (b) In the event the Company or any Subsidiary notifies you at any time before or after this Award is made that you have been designated SSBI Identified Staff for purposes of the German Remuneration Ordinance, you acknowledge and agree that this Award is subject to forfeiture and clawback for a period from the date the Award is granted until two (2) years from the date that the final tranche of this Award vests. A clawback applies if you, as SSBI Identified Staff, (i) contributed significantly to, or was responsible for, conduct that resulted in significant losses or regulatory sanctions for SSBI, or

7 (ii) are responsible for a serious breach of relevant external or internal rules on good conduct (each of (i) and (ii) constituting an “SSBI Identified Staff Clawback Event”). (c) This Section 7 applies in addition to, and not to the exclusion of, any other holding, forfeiture and/or clawback provisions contained in this Agreement. 8. Executive Committee/Executive Vice President Forfeiture and Clawback. (a) If, at the time the Award is made, you are a member of the State Street Corporation Executive Committee or any successor committee or body (“Executive Committee” or “EC”) or hold the title Executive Vice President (“EVP”) or higher, any amount remaining to be paid in respect of this Award may, in the sole discretion of the Board, be reduced, forfeited or cancelled, in whole or in part, in the event that it is determined by the Board, in its sole discretion, that: (i) you engaged in fraud, gross negligence or any misconduct, including in a supervisory capacity, that was materially detrimental to the interests or business reputation of State Street or any of its businesses; or (ii) you engaged in conduct that constituted a violation of State Street policies and procedures or the State Street Standard of Conduct in a manner which either caused or could have caused reputational harm that is material to State Street or placed or could have placed State Street at material legal or financial risk; or (iii) as a result of a material financial restatement by State Street contained in a filing with the U.S. Securities and Exchange Commission (“SEC”), or miscalculation or inaccuracy in the determination of performance metrics, financial results or other criteria used in determining the amount of this Award, you would have received a smaller or no Award hereunder. (b) If, at the time the Award is made, you are a member of the Executive Committee or hold the title EVP or higher, this Award also is subject to compensation recovery as provided herein. Upon the occurrence of either an EC/EVP Clawback Event or an EC/EVP Clawback Breach, the Board may, in its sole discretion, determine to recover the EC/EVP Clawback Amount, in whole or in part. Following such a determination, you agree to immediately repay such compensation, in no event later than sixty (60) days following such determination, in the form of any shares of Common Stock delivered to you previously by the Company or cash (or a combination of such shares and cash). (c) For purposes of calculating the value of both the EC/EVP Clawback Amount determined by the Board to be recovered and the amount of such compensation repaid, shares of Common Stock will be valued in an amount equal to the market value of the Deferred Shares delivered to you under this Award by the Company as determined at the time of such delivery. (d) For purposes of this Section 8: (i) “EC/EVP Clawback Event” means a determination by the Board, in its sole discretion, within three (3) years (within one (1) year for an EVP) after the date of grant of this Award: (A) with respect to any event or series of related events, that you engaged in fraud or willful misconduct, including in a supervisory capacity, that resulted in financial or reputational harm that is material to State Street and

8 resulted in the termination of your employment by the Company and its Subsidiaries (or, following a cessation of your employment for any other reason, such circumstances constituting grounds for termination are determined applicable); or (B) a material financial restatement or miscalculation or inaccuracy in financial results, performance metrics, or other criteria used in determining this Award by State Street occurred. For the avoidance of doubt and as applicable, an EC/EVP Clawback Event includes any determination by the Board that is based on circumstances prior to the date on which you cease to be employed by the Company and its Subsidiaries for any reason, even if the determination by the Board occurs after such cessation of employment. (ii) “EC/EVP Clawback Breach” means a determination by the Board, in its sole discretion, that you failed to comply with the terms of any covenant not to compete entered into by you with the Company or any Subsidiary, whether in the Countries Addendum attached to this Award or in any other agreement. (iii) “EC/EVP Clawback Amount” means: (A) with respect to an EC/EVP Clawback Event described in Section 8(d)(i)(A), the value of the Deferred Shares (based upon the market value of the respective Deferred Shares at delivery) that were delivered to you under this Award by the Company during the period of three (3) years (one (1) year for an EVP) immediately prior to such EC/EVP Clawback Event; or (B) with respect to an EC/EVP Clawback Event described in Section 8(d)(i)(B), the value of the Deferred Shares (based upon the market value of the respective Deferred Shares at delivery) that were delivered to you under this Award by the Company (x) during the period of three (3) years (one (1) year for an EVP) immediately prior to an associated date designated by the Board and (y) that represents an amount that, in the sole discretion of the Board, exceeds the amount you would have been awarded under this Award had the financial statements or other applicable records of State Street been accurate; or (C) with respect to an EC/EVP Clawback Breach described in Section 8(d)(ii), the value of the Deferred Shares (based upon the market value of the respective Deferred Shares at delivery), that were delivered to you under this Award by the Company after the earlier to occur of the date your employment terminated or the date your failure to comply with the applicable covenant(s) not to compete commenced, as determined by the Board in its sole discretion; and (D) in each case, reduced, by taking into account any portion of this Award that was previously recovered by the Company under this Section 8 to avoid a greater than one hundred percent (100%) recovery. (e) In connection with any EC/EVP Clawback Event or EC/EVP Clawback Breach, to the extent not prohibited by applicable law and subject to Section 25 (if applicable), if you fail to comply with any requirement to repay compensation under Section 8(b), the Board may determine, in its sole discretion, in addition to any other remedies available to the Company, that

9 you will satisfy your repayment obligation through an offset to any future payments owed by the Company or any of its Subsidiaries to you. Further, you expressly and explicitly authorize the Company to issue instructions, on your behalf, to any brokerage firm or third-party administrator engaged by the Company to hold your shares of Common Stock acquired pursuant to awards granted under the Plan (or any other amounts acquired pursuant to the Plan) to re-convey, transfer or otherwise return such shares of Common Stock and/or other amounts to the Company. (f) This Section 8 applies in addition to, and not to the exclusion of, any other holding, forfeiture and/or clawback provisions contained in this Agreement. 9. Acceleration of Vesting upon Certain Events. Subject to applicable law and regulation (including the rules and regulations of any applicable regulatory authority): (a) Notwithstanding anything in this Agreement to the contrary, if you die or incur a Disability while employed by the Company or any of its Subsidiaries, or in the event that you die or incur a Disability after your employment has terminated for a reason permitting continued vesting pursuant to Section 4(b) above, any unvested Deferred Shares shall vest on the date of your death or Disability and the Company will issue and pay the value of such Deferred Shares under this Award in the form of a cash payment/issuance of shares of Common Stock within thirty (30) days of death (to your Designated Beneficiary) or Disability. In addition, Sections 5, 6, 7 and 8 of this Agreement shall cease to apply upon your death at any time provided, however, if a UK Clawback Event, SSBI Identified Staff Clawback Event, an EC/EVP Clawback Event, or an EC/EVP Clawback Breach has occurred pursuant to Section 6, 7 or 8, respectively, at or prior to your death, any amount that the Board has made a determination to recover under such Sections shall continue to be payable to the Company. (b) If your employment with the Company and its Subsidiaries is terminated by the Company or the applicable Subsidiary without Cause, [or] by you for Good Reason or [on account of your Retirement], in each case, on or prior to the first anniversary of a Change in Control (and provided that such Change in Control constitutes a “change in control event” as that term is defined under Section 409A of the U.S. Internal Revenue Code of 1986, as amended, (“Code”) and U.S. Treasury Regulation Section 1.409A-3(i)(5)) prior to the full settlement of your Award, the unvested portion of this Award shall vest on the date of such termination and the Company will promptly issue and pay to you within thirty (30) days of such termination any such shares of Common Stock under this Award. For purposes of this Section 9(b), termination of employment shall mean a “separation from service” as determined in accordance with U.S. Treasury Regulation Section 1.409A-1(h). 10. Confidentiality. (a) You acknowledge that, during the course of or as a result of your employment, you have access to Confidential Information which is not generally known or made available to the general public and that such Confidential Information is the property of the Company, its Subsidiaries or its or their licensors, suppliers or customers. You acknowledge that any unauthorized use or disclosure of Confidential Information may cause damage to the Company, its Subsidiaries or its or their licensors, suppliers or customers. Subject to Section 19 below, you agree specifically as follows, in each case whether during your employment or following the termination thereof:

10 (i) You will always preserve as confidential all Confidential Information, and will never use it for your own benefit or for the benefit of others; this includes, but is not limited to, that you will not use the knowledge of activities or positions in clients’ securities portfolio accounts or cash accounts for your own personal gain or for the gain of others. (ii) You will not disclose, divulge, or communicate Confidential Information to any unauthorized person, business or corporation during or after the termination of your employment with the Company and its Subsidiaries. You will use your best efforts and exercise due diligence to protect, to not disclose and to keep as confidential all Confidential Information. (iii) You will not transmit Confidential Information outside of State Street’s electronic systems except as required for the proper performance of your duties to State Street. (iv) You will not initiate or facilitate any unauthorized attempts to intercept data in transmission or attempt entry into data systems or files. You will not intentionally affect the integrity of any data or systems of the Company or any of its Subsidiaries through the introduction of unauthorized code or data, or through unauthorized deletion or addition. You will abide by all applicable policies concerning the protection of data at State Street. (v) Upon the earlier of request or termination of employment, you agree to return to the Company or the relevant Subsidiaries, or if so directed by the Company or the relevant Subsidiaries, destroy any and all copies of materials in your possession containing Confidential Information. (b) The terms of Section 10(a) of this Agreement do not apply to any information which is previously known to you without an obligation of confidence or without breach of this Agreement, is publicly disclosed (other than by a violation by you of the terms of this Agreement) either prior to or subsequent to your receipt of such information, or is rightfully received by you from a third party without obligation of confidence and other than in relation to your employment with the Company or any of its Subsidiaries. (c) As set forth in more detail in Section 19, State Street recognizes that certain disclosures of Confidential Information to appropriate government authorities or other designated persons are protected by “whistleblower” and other laws. Nothing in this Agreement is intended to or should be understood or construed to prohibit or otherwise discourage such disclosures. State Street will not tolerate any discipline or other retaliation against employees who properly make such legally-protected disclosures. See Section 19 for more information. (d) Nothing in this Agreement prevents you from (i) reporting in good faith an offense to a law enforcement agency; or (ii) cooperating in good faith with a criminal investigation or prosecution. (e) For purposes of this Agreement, “Confidential Information” includes but is not limited to all trade secrets, trade knowledge, systems, software, code, data documentation, files, formulas, processes, programs, training aids, printed materials, methods, books, records, client files, policies and procedures, client and prospect lists, employee data and other information (whether in written, oral, visual or electronic form and wherever located) relating to the operations of the Company or any of its Subsidiaries and to its or any of their customers, and any and all discoveries, inventions or improvements thereof made or conceived by you or others for the Company or any of its Subsidiaries whether or not patented or copyrighted, as well as cash and securities account transactions and position records of clients, regardless of whether such information is stamped “confidential.”

11 11. Assignment and Disclosure. (a) You acknowledge that, by reason of being employed by your Employer, to the extent permitted by law, all works, deliverables, products, methodologies and other work product conceived, created and/or reduced to practice by you, individually or jointly with others, during the period of your employment by your Employer and relating to the Company or any of its Subsidiaries or demonstrably anticipated business, products, activities, research or development of the Company or any of its Subsidiaries or resulting from any work performed by you for the Company or any of its Subsidiaries, including, without limitation, any track record with which you may be associated as an investment manager or fund manager (collectively, “Work Product”), that consists of copyrightable subject matter is "work made for hire" as defined in the Copyright Act of 1976 (17 U.S.C. § 101), and such copyrights are therefore owned, upon creation, exclusively by State Street. To the extent the foregoing does not apply and to the extent permitted by law, you hereby assign and agree to assign, for no additional consideration, all of your rights, title and interest in any Work Product and any intellectual property rights therein to State Street. You hereby waive in favor of State Street any and all artist’s or moral rights (including without limitation, all rights of integrity and attribution) you may have pursuant to any state, federal or foreign laws, rules or regulations in respect of any Work Product and all similar rights thereto. You will not pursue any ownership or other interest in such Work Product, including, without limitation, any intellectual property rights. (b) You will disclose promptly and in writing to the Company or your Employer all Work Product, whether or not patentable or copyrightable. You agree to reasonably cooperate with State Street: (i) to transfer to State Street the Work Product and any intellectual property rights therein; (ii) to obtain or perfect such right; (iii) to execute all papers, at State Street’s expense, that State Street shall deem necessary to apply for and obtain domestic and foreign patents, copyright and other registrations; and (iv) to protect and enforce State Street’s interest in them. (c) These obligations shall continue beyond the period of your employment with respect to inventions or creations conceived or made by you during the period of your employment. 12. Cooperation with State Street. You agree that, during your employment with the Company and its Subsidiaries and following its termination for any reason, you will reasonably cooperate with the Company or the relevant Subsidiary with respect to any matters arising during or related to your employment, including but not limited to reasonable cooperation in connection with any litigation, governmental investigation, or regulatory or other proceeding (even if such litigation, governmental investigation, or regulatory or other proceeding arises following the date of this Award or following the termination of your employment). The Company or any of its Subsidiaries shall reimburse you for any reasonable out-of-pocket and properly documented expenses you incur in connection with such cooperation. 13. Non-Disparagement.

12 Subject to Section 19, below, you agree that during your employment and following the termination thereof you shall not make any false, disparaging, or derogatory statements to any media outlet (including Internet-based chat rooms, message boards, any and all social media, and/or web pages), industry groups, financial institutions, or to any current, former or prospective employees, consultants, clients, or customers of the Company or its Subsidiaries regarding the Company, its Subsidiaries or any of their respective directors, officers, employees, agents, or representatives, or about the business affairs or financial condition of the Company or any of its Subsidiaries. However, nothing in this Agreement prevents you from discussing or disclosing information about unlawful acts in the workplace, such as harassment or discrimination or any other conduct that you have reason to believe is unlawful. 14. Enforcement. You acknowledge and agree that the promises contained in this Agreement are reasonable and necessary to the protection of the legitimate business interests of your Employer, the Company and its Subsidiaries, including without limitation its and their Confidential Information, trade secrets and goodwill, and are material and integral to the undertakings of the Company under this Award. You further agree that one or more of your Employer, the Company and its Subsidiaries will be irreparably harmed in the event you do not perform such promises in accordance with their specific terms or otherwise breach the promises made herein. Accordingly, your Employer, the Company and any of its Subsidiaries shall each be entitled to preliminary or permanent injunctive or other equitable relief or remedy without the need to post bond unless otherwise required by law, and to recover its or their reasonable attorney’s fees and costs incurred in securing such relief, in addition to, and not in lieu of, any other relief or remedy at law to which it or they may be entitled. You further agree that any periods of restriction contained in this Agreement shall be tolled, and shall not run, during any period in which you are in violation of the terms of this Agreement, so that your Employer, the Company and its Subsidiaries shall have the full protection of the periods agreed to herein. Should the Company determine that any portion of the Deferred Shares granted to you in connection with this Award are to be forfeited on account of your breach of the provisions of this Agreement, any unvested portion of your Award will cease to vest upon such determination. 15. No Waiver. No delay by your Employer, the Company or any of its Subsidiaries in exercising any right under this Agreement shall operate as a waiver of that right or of any other right. Any waiver or consent as to any of the provisions herein provided by your Employer, the Company or any of its Subsidiaries must be in writing, is effective only in that instance, and may not be construed as a broader waiver of rights or as a bar to enforcement of the provision(s) at issue on any other occasion. 16. Relationship to Other Agreements. This Agreement supplements and does not limit, amend or replace any other obligations you may have under applicable law or any other agreement or understanding you may have with your Employer, the Company or any of its Subsidiaries or pursuant to the applicable policies of any of them, whether such additional obligations have been agreed to in the past, or are agreed to in the future.

13 17. Interpretation of Business Protections. The agreements made by you in this Agreement with regard to non-solicitation, notice period upon resignation, non-competition and post-employment cooperation shall be construed and interpreted in any judicial or other adjudicatory proceeding to permit their enforcement to the maximum extent permitted by law, and each of the provisions to this Agreement is a separate, severable and independently enforceable provision that applies concurrently and without reference to the enforcement of any other provision and is not intended to limit the operation, interpretation or severability of any other provision. If any restriction set forth in this Agreement is found by any court of competent jurisdiction to be unenforceable because it extends for too long a period of time or over too great a range of activities or in too broad a geographic area, it shall be interpreted to extend only over the maximum period of time, range of activities or geographic area as to which it may be enforceable. 18. Assignment. Except as provided otherwise herein, this Agreement shall be binding upon and inure to the benefit of both parties and their respective successors and assigns, including any person or entity which acquires the Company or its assets or business; provided, however, that your obligations are personal and may not be assigned by you. 19. Certain Limitations. (a) Nothing in this Agreement prohibits you from reporting possible violations of law or regulation to any governmental, law enforcement, self-regulatory, or regulatory agency or authority or from making other disclosures that are protected under the whistleblower provisions of applicable law or regulation. Moreover, nothing in this Agreement requires you to notify the Company that you have made any such report or disclosure. However, in connection with any such activity, you acknowledge you must take reasonable precautions to ensure that any Confidential Information that is disclosed to such authority is not made generally available to the public, including by informing such authority of the confidentiality of the same. (b) You shall not be held criminally or civilly liable under any federal or state trade secret law if you disclose a Company trade secret: (i) in confidence to a federal, state, or local government official, either directly or indirectly, or to an attorney, solely for the purposes of reporting or investigating a suspected violation of law; or (ii) in a complaint or other document filed in a lawsuit or other proceeding, if such filing is made under seal. (c) You may have a legal obligation to avoid disclosure of materials subject to the bank examiner’s privilege, and/or privileges applicable to information covered by the Bank Secrecy Act (31 U.S.C. §§ 5311-5330) or similar legislation adopted in the jurisdiction in which you are employed, including information that would reveal the existence or contemplated filing of a suspicious activity report, or similar privileges applicable in any jurisdiction. The Company and its Subsidiaries do not waive any applicable privileges or the right to continue to protect its and their privileged attorney-client information, attorney work product, and other privileged information and you are not authorized to waive any privilege that belongs to the Company or any of its Subsidiaries.

14 20. Shareholder Rights. You are not entitled to any rights as a shareholder with respect to any shares of Common Stock subject to this Award until they are transferred to you. Without limiting the foregoing, prior to the issuance and transfer to you of shares of Common Stock pursuant to this Agreement, you will have no right to receive dividends or amounts in lieu of dividends with respect to the shares of Common Stock subject to this Award nor any right to vote the shares of Common Stock prior to any shares being transferred to you. 21. Withholding of Tax-Related Items. Regardless of any action your Employer takes with respect to any or all income tax (including U.S. federal, state and local taxes and/or non-U.S. taxes), social insurance, payroll tax, fringe benefits tax, or payment on account of other tax-related withholding (“Tax-Related Items”), you acknowledge and agree that the ultimate liability for all Tax-Related Items legally due from you is and remains your responsibility. Furthermore, neither the Company nor any Subsidiary (a) makes any representations or undertakings regarding the treatment of any Tax-Related Items in connection with any aspect of this Award, including the grant of this Award, the vesting of this Award and the issuance of shares of Common Stock in settlement of this Award, the subsequent sale of any shares of Common Stock acquired upon vesting, the cancellation, forfeiture or repayment of any shares of Common Stock (or cash in lieu thereof); or (b) commits to structure the terms of the grant, vesting, settlement, cancellation, forfeiture, repayment or any other aspect of this Award to reduce or eliminate your liability for Tax-Related Items. Prior to the delivery of shares of Common Stock upon the vesting of this Award, if any taxing jurisdiction requires withholding of Tax-Related Items in connection with the Award, the Company may withhold a sufficient number of whole shares of Common Stock that have an aggregate fair market value sufficient to pay the Tax-Related Items required to be withheld with respect to this Award. The cash equivalent of the shares of Common Stock withheld will be used to settle the obligation to withhold the Tax-Related Items (determined in the Company’s and/or Employer’s reasonable discretion). No fractional shares of Common Stock will be withheld or issued pursuant to the grant of the Deferred Shares and the issuance of Common Stock hereunder. Alternatively, the Company and/or your Employer may, in its discretion, withhold any amount necessary to pay the Tax-Related Items from your salary, wages or other amounts payable to you, with no withholding in shares of Common Stock. In the event the withholding requirements are not satisfied through the withholding of shares or through your salary, wages or other amounts payable to you, no shares of Common Stock will be issued upon vesting of this Award unless and until satisfactory arrangements (as determined by the Company or your Employer) have been made by you with respect to the payment of any Tax-Related Items which the Company or your Employer determines, in its sole discretion, must be withheld or collected with respect to such Award. Depending on the withholding method, the Company and/or your Employer may withhold for Tax- Related Items by considering any applicable statutory withholding amounts or other applicable withholding rates, including maximum applicable rates. If you are subject to taxation in more than one jurisdiction, you hereby expressly acknowledge that the Company, your Employer or another Subsidiary may be required to withhold and/or account for Tax-Related Items in more than one jurisdiction. By accepting this Award, you hereby expressly consent to the withholding of shares of Common Stock and/or cash as provided for hereunder. All other Tax-Related Items related to this Award

15 and any Common Stock delivered in payment thereof, including the extent to which the Company or your Employer does not so-withhold shares of Common Stock and/or cash, are your sole responsibility. 22. Changes in Capitalization or Corporate Structure. This Award is subject to adjustment pursuant to Section 10(a) of the Plan in the circumstances therein described. 23. Employee Rights. Nothing in this Award shall be construed to guarantee you any right of employment with the Company or any Subsidiary or to limit the discretion of any of them to terminate your employment at any time to the maximum extent permitted under local law. In consideration of the grant of the Award, you acknowledge and agree that you will have no entitlement to compensation or damages in consequence of the termination of your employment (for any reason whatsoever and whether or not in breach of contract or local labor laws), insofar as such entitlement arises or may arise from your ceasing to have rights under or to be entitled to the Award as a result of such termination, or from the loss or diminution in value of the Award. By accepting this Award, you shall be deemed irrevocably to have waived any such claim or entitlement against the Company and all Subsidiaries that may arise; if, notwithstanding the foregoing, any such claim is found by a court of competent jurisdiction to have arisen, then, by accepting this Agreement, you shall be deemed irrevocably to have waived your entitlement to pursue such claim. In the event your employment ends and you are subsequently rehired by the Company or any Subsidiary, no Award previously forfeited or recovered will be reinstated. 24. Non-Transferability, Etc. This Award shall not be transferable other than (1) by will or the laws of descent and distribution or (2) pursuant to the terms of a court-approved domestic relations order, official marital settlement agreement or other divorce or settlement instrument satisfactory to State Street, in its sole discretion. In the case of transfer pursuant to (2) above, this Award shall remain subject to all the terms and conditions contained in the Plan and this Agreement, including vesting, forfeiture and clawback terms and conditions. Any attempt by you (or in the case of your death, by your Designated Beneficiary) to assign or transfer this Award, either voluntarily or involuntarily, contrary to the provisions hereof, shall be null, void and without effect and shall render this Award itself null and void. 25. Compliance with Section 409A of the Code. (a) The provisions of this Award are intended to be exempt from, or compliant with, Section 409A of the Code, and shall be construed and interpreted consistently therewith. Notwithstanding the foregoing, neither the Company nor any Subsidiary shall have any liability to you or to any other person if this Award is not so exempt or compliant. (b) If and to the extent:

16 (i) any portion of any payment, compensation or other benefit provided to you pursuant to the Plan in connection with your employment termination constitutes “nonqualified deferred compensation” within the meaning of Section 409A of the Code; and (ii) you are a specified employee as defined in Section 409A(a)(2)(B)(i) of the Code, in each case as determined by the Company in accordance with its procedures, by which determinations you (through accepting this Award) agree that you are bound, such portion of the payment, compensation or other benefit shall not be paid before the day that is six (6) months plus one day after the date of “separation from service” (as determined under Section 409A of the Code) (the “New Payment Date”), except as Section 409A of the Code may then permit. The aggregate of any payments that otherwise would have been paid to you during the period between the date of separation from service and the New Payment Date shall be paid to you in a lump sum on such New Payment Date, and any remaining payments will be paid on their original deferral schedule. 26. Miscellaneous. (a) Awards Discretionary. By accepting this Award, you acknowledge and agree that the Plan is discretionary in nature and limited in duration, and may be amended, cancelled, forfeited, or terminated by the Company, in its sole discretion, at any time. The grant of this Award is a one-time benefit and does not create any contractual or other right to receive an award, compensation or benefits in lieu of an award in the future. Future awards, if any, will be at the sole discretion of the Company, including, but not limited to, the form and timing of an award, the number of shares of Common Stock subject to an award, and forfeiture, clawback and vesting provisions. (b) Company and Board Discretion. Sections 3, 4, 5, 6, 7 and 8 of this Agreement are intended to comply with and meet the requirements of applicable law and related implementing regulations regarding incentive compensation and will be interpreted and administered accordingly as well as in accordance with any implementing policies and practices of the Company or its relevant Subsidiaries in effect from time to time. In making determinations under such Sections, the Company, the relevant Subsidiary or the Board, as applicable, may take into account, in its sole discretion, all factors that it deems appropriate or relevant. Furthermore, the Company, the relevant Subsidiary or the Board may, as applicable, take any and all actions it deems necessary or appropriate in its sole discretion, as permitted by applicable law, to implement the intent of Sections 4, 5, 6, 7 and 8, including suspension of vesting and payment pending an investigation or the determination by the Company, the relevant Subsidiary or the Board as applicable. Each such Section is without prejudice to the provisions of the other Sections, and the Company, the relevant Subsidiary or the Board, as applicable, may elect or be required to apply any or all of the provisions of Sections 3, 4, 5, 6, 7 and 8 to this Award. Sections 3, 4, 5, 6, 7 and 8 of this Agreement shall cease to apply upon your death at any time provided, however, if a UK Clawback Event, SSBI Identified Staff Clawback Event, a EC/EVP Clawback Event or a EC/EVP Clawback Breach has occurred pursuant to Section 6, 7 or 8, respectively, at or prior to your death, any amount that the Board has made a determination to recover under such Section shall continue to be payable to the Company. (c) Voluntary Participation. Your participation in the Plan is voluntary. The value of this Award is an extraordinary item of compensation, is outside the scope of your employment contract, if any, and is not part of your normal or expected compensation for purposes of

17 calculating any severance, resignation, redundancy, end of service payments, bonuses, long- service awards, pension, or retirement benefits or similar payments. (d) Electronic Delivery. The Company or any of its Subsidiaries may, in its sole discretion, decide to deliver any documents related to this Award by electronic means. You hereby consent to receive such documents by electronic delivery and agree to participate in the Plan through an on-line or electronic system, including the Website, established and maintained by the Company, any of its Subsidiaries, the Equity Administrator or another party designated by the Company. (e) Electronic Acceptance. By accepting this Award electronically, (i) you acknowledge and agree that you are bound by the terms of this Agreement and the Plan and that you and this Award are subject to all of the rights, power and discretion of the Company, its Subsidiaries and the Board set forth in this Agreement and the Plan; (ii) this Award is deemed accepted by the Company and the Company shall be deemed to be bound by the terms of this Agreement; and (iii) you agree that this electronic acceptance by both you and the Company shall be deemed equivalent to the Award having been signed by both parties. (f) Language. By participating in the Plan, you acknowledge that you are sufficiently proficient in English or have consulted with an advisor who is sufficiently proficient in English so as to allow you to understand the terms and conditions of this Agreement. You acknowledge and agree that it is your express intent that this Agreement, the Plan and all other documents, notices and legal proceedings entered into, given or instituted pursuant to this Award, be drawn up in English. If you have received this Agreement, the Plan or any other documents related to this Award translated into a language other than English, and if the meaning of the translated version is different than the English version, the English version will prevail to the extent permitted under local law. France: Vous pouvez obtenir une copie du présent Contrat en français sur le site internet de Fidelity. Poland: Kopię tej Umowy w języku polskim może Pan/Pani otrzymać wchodząc na Stronę. (g) Additional Requirements. The Company reserves the right to impose other requirements on this Award, any shares of Common Stock acquired pursuant to this Award, and your participation in the Plan, to the extent the Company determines, in its sole discretion, that such other requirements are necessary or advisable in order to comply with local laws, rules and regulations, or to facilitate the operation and administration of this Award and the Plan. Such requirements may include (but are not limited to) requiring you to sign any agreements or undertakings that may be necessary to accomplish the foregoing. Further, issuance of Common Stock hereunder is subject to compliance by the Company and you with all legal requirements applicable thereto, including compliance with the requirements of 12 C.F.R. Part 359, and with all applicable regulations of any stock exchange on which the Common Stock may be listed at the time of issuance. (h) Public Offering. If you are a resident and/or employed outside the United States, the grant of this Award is not intended to be a public offering of securities in your country of residence (and country of employment, if different). The Company has not submitted any registration statement, prospectus or other filings with the local securities authorities (unless otherwise required under local law), and the grant of this Award is not subject to the supervision of the local securities authorities.

18 (i) Limitation of Liability. No individual acting as a director, officer, employee or agent of the Company or any of its Subsidiaries will be liable to you or any other person for any action, including any Award forfeiture, Award recovery or other discretionary action taken pursuant to this Agreement or any related implementing policy or procedure of the Company. (j) Insider Trading. By participating in the Plan, you agree to comply with the Company’s policy on insider trading (to the extent that it is applicable to you). You further acknowledge that, depending on your country of residence (and country of employment, if different) or your broker’s country of residence or where the shares of Common Stock are listed, you may be subject to insider trading restrictions and/or market abuse laws which may affect your ability to accept, acquire, sell or otherwise dispose of the shares of Common Stock, rights to shares of Common Stock (e.g., this Award) or rights linked to the value of shares of Common Stock, during such times you are considered to have “inside information” regarding the Company (as defined by the laws or regulations in your country of residence (and country of employment, if different)). Local insider trading laws and regulations may prohibit the cancellation, forfeiture or amendment of orders you place before you possess inside information. Furthermore, you are prohibited from: (i) disclosing the inside information to any third party (other than on a “need to know” basis); and (ii) “tipping” third parties or causing them otherwise to buy or sell securities. You understand that third parties include fellow employees. Any restriction under these laws or regulations is separate from and in addition to any restrictions that may be imposed under any applicable Company insider trading policy. You hereby expressly acknowledge that it is your responsibility to be informed of and compliant with such regulations, and that you should consult with your personal advisor for additional information. (k) Exchange Rates. Neither the Company or any Subsidiary shall be liable for any foreign exchange rate fluctuation, where applicable, between your local currency and the United States dollar that may affect the value of an Award or of any amounts due to you pursuant to the settlement of this Award or the subsequent sale of any shares of Common Stock acquired under the Plan. (l) Applicable Law. This Agreement shall be subject to and governed by the laws of the Commonwealth of Massachusetts, United States of America without regard to that Commonwealth’s conflicts of law principles. (m) Integration. The Plan and the Agreement, including the Countries Addendum, constitute the complete understanding and agreement between the parties with respect to this Award, and supersedes and cancels any previous oral or written discussions, agreements or representations regarding this Award or the Common Stock; provided, however, that any condition precedent to your acceptance of this Award and receipt of the Common Stock that is contained in a signed written agreement between you, on the one hand, and the Company or any of its Subsidiaries, on the other, remains in full force and effect. 27. Application of Local Law and Countries Addendum. If your country of residence (or country of employment, if different) is not the United States, you agree:

19 (a) Notwithstanding Section 26(l), this Award shall be subject to all applicable laws, rules and regulations of your country of residence (and country of employment, if different) and any special terms and conditions for your country of residence (and country of employment, if different), including as set forth in the Countries Addendum, but limited to the extent required by local law. The Company reserves the right, in its sole discretion, to add to or amend the terms and conditions set out in the Countries Addendum as necessary or advisable in order to comply with applicable laws, rules and regulations or to facilitate the operation and administration of this Award and the Plan, including (but not limited to) circumstances where you transfer residence and/or employment to another country. (b) As a condition to this Award, you agree to repatriate all payments attributable to the Common Stock acquired under the Plan in accordance with local foreign exchange rules and regulations in your country of residence (and country of employment, if different). In addition, you also agree to take any and all actions, and consent to any and all actions taken by the Company and its Subsidiaries, as may be required to allow the Company and its Subsidiaries to comply with local laws, rules and regulations in your country of residence (and country of employment, if different). Finally, you agree to take any and all actions as may be required to comply with your personal legal, tax and other obligations under local laws, rules and regulations in your country of residence (and country of employment, if different). 28. Data Privacy. The Company is located at One Congress Street, Boston, Massachusetts, 02114, U.S.A. and grants Awards under the Plan to employees of the Company and its Subsidiaries in its sole discretion. You should carefully review the following information about the Company’s data privacy practices in relation to your Award. (a) Data Collection, Processing and Usage. Pursuant to applicable data protection laws, you are hereby notified that the Company and your Employer collect, process and use certain personal data about you for the legitimate interest of implementing, administering and managing the Plan and generally administering Awards; specifically, including your name, home address, email address and telephone number, date of birth, social security number, social insurance number or other identification number, salary, citizenship, job title, any shares of Common Stock or directorships held in the Company, and details of all Awards or any other incentive compensation awards granted, canceled, forfeited, exercised, vested, or outstanding in your favor, which the Company receives from you or your Employer. In granting Awards under the Plan, the Company will collect your personal data for purposes of allocating Awards and implementing, administering and managing the Plan. The Company’s collection, processing and use of your personal data is necessary for the performance of the Company’s contractual obligations under the Plan and pursuant to the Company’s legitimate interest of managing and generally administering employee incentive compensation awards. Your refusal to provide personal data would make it impossible for the Company to perform its contractual obligations and may affect your ability to participate in the Plan. As such, by participating in the Plan, you voluntarily acknowledge the collection, processing and use of your personal data as described herein. (b) Equity Administrator. The Company transfers your personal data to the Equity Administrator, which assists the Company with the implementation, administration and management of the Plan. In the future, the Company may select a different Equity Administrator and share your personal data with another company that serves in a similar manner. The Equity Administrator will open an account for you to track your Award and to ultimately receive and trade

20 shares of Common Stock acquired under the Plan. You will be asked to agree on separate terms and acknowledge data processing practices with the Equity Administrator, which is a condition to your ability to participate in the Plan. (c) Data Retention. The Company will use your personal data only as long as is necessary to implement, administer and manage your participation in the Plan or as required to comply with legal or regulatory obligations, including under tax and security laws. If the Company keeps your data longer, it would be to satisfy legal or regulatory obligations and the Company’s legal basis would be for compliance with relevant laws or regulations. For further information about the processing of your personal data, please see the Privacy Notice to Internal Users- Global, available at the Corporate Policy and Standard Center. STATE STREET CORPORATION By: /s/ Kathryn M. Horgan Kathryn M. Horgan Executive Vice President, Chief Human Resources and Citizenship Officer ****************************

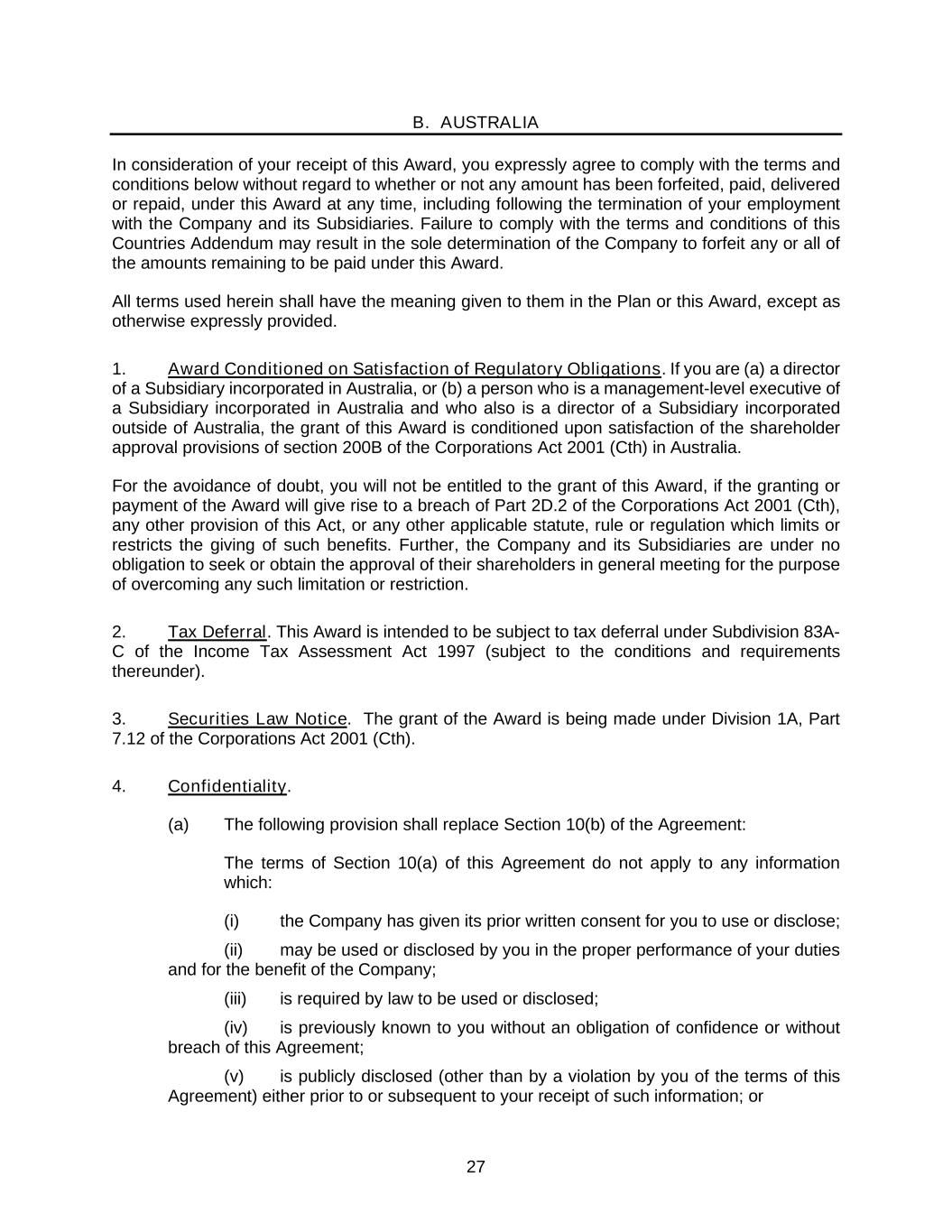

21 APPENDIX A COUNTRIES ADDENDUM TO [____] DEFERRED STOCK AWARD AGREEMENT STATE STREET CORPORATION AMENDED AND RESTATED 2017 STOCK INCENTIVE PLAN Capitalized terms used but not defined herein shall have the meanings consistent with the terms of the Agreement. This Countries Addendum includes additional terms and conditions that govern the Award granted to you under the Plan if you work and/or reside in any of the countries listed below, and is part of the Agreement. To the extent there are any inconsistencies between the Agreement and this Countries Addendum, the terms and conditions reflected in this Countries Addendum shall prevail. The information contained in this Countries Addendum is based on the securities, exchange control and other laws in effect in the respective countries as of [date]. If you are a citizen or resident of a country other than the one in which you are currently residing and/or working, transfer employment and/or residency to another country after the Award date, or are considered a resident of another country for local law purposes, the Company shall, in its discretion, determine to what extent the terms and conditions contained herein shall be applicable to you (or the Company may establish alternative terms and conditions as may be necessary or advisable to accommodate your transfer). A. United States B. Australia C. Belgium D. Brazil E. Canada F. Chile G. China H. Colombia I. France J. Germany K. Hong Kong L. India M. Ireland N. Italy O. Japan P. Luxembourg Q. Mexico R. Netherlands S. Oman T. Poland U. Portugal V. Saudi Arabia W. Singapore X. South Korea Y. Switzerland Z. Taiwan AA. United Arab Emirates BB. United Kingdom

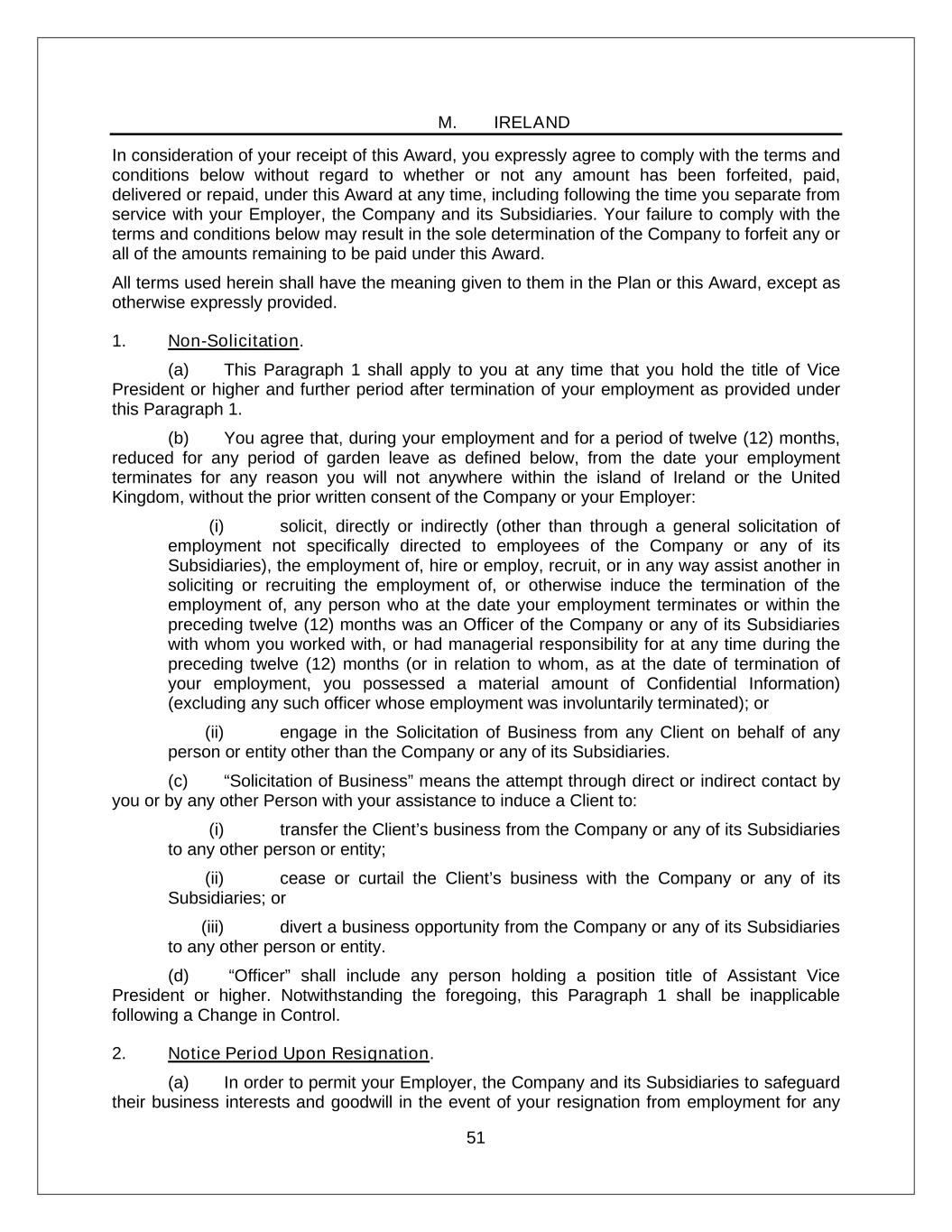

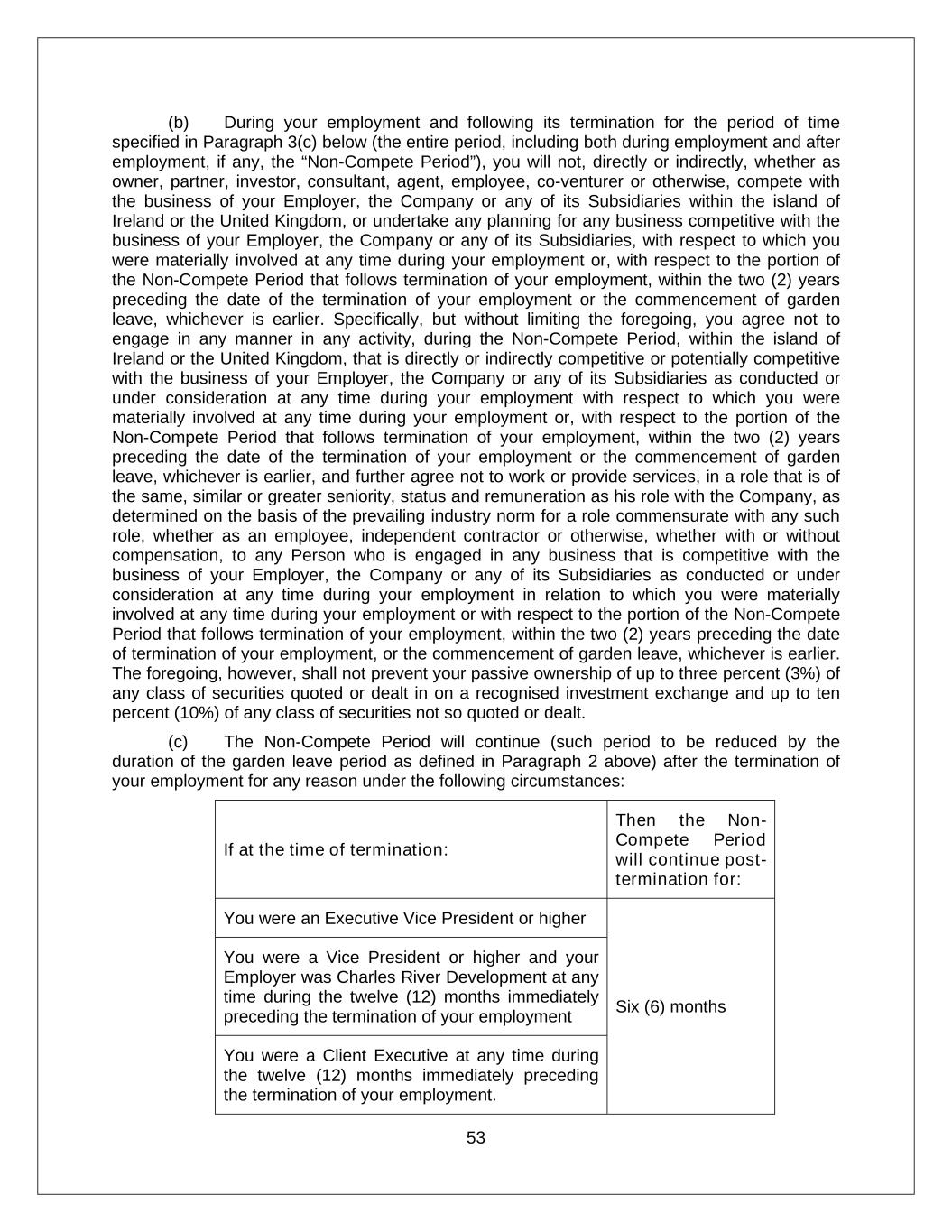

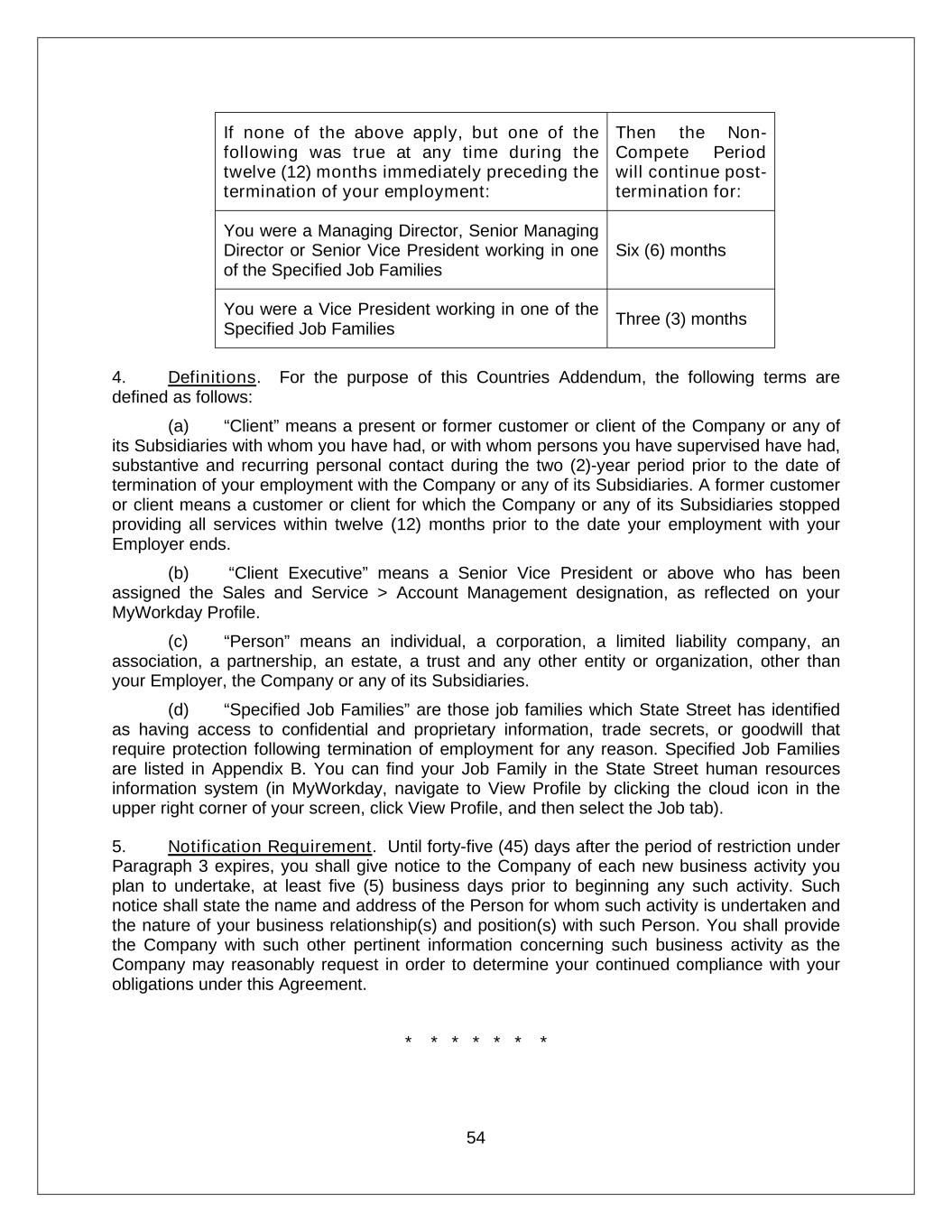

22 A. UNITED STATES In consideration of your receipt of this Award, you expressly agree to comply with the terms and conditions below without regard to whether or not any amount has been forfeited, paid, delivered or repaid, under this Award at any time, including following your separation from service with the Company and its Subsidiaries. Failure to comply with the terms and conditions of this Countries Addendum may result in the sole determination of the Company to forfeit any or all of the amounts remaining to be paid under this Award. In addition, your eligibility to participate in the Plan in the future, including any potential future grants of awards under the Plan (or any successor incentive plan of the Company), is subject to and conditioned on your compliance with the terms and conditions of this Countries Addendum. This Countries Addendum contains a covenant not to compete in Paragraph 3 which shall apply to you under the circumstances described in such Paragraph 3. You should review it carefully. You may consult with an attorney before accepting the Award. By accepting the Award, you acknowledge and agree that it is fair and adequate consideration for the covenant not to compete and other promises you make in this Countries Addendum and that the covenant not to compete and other promises are reasonable and necessary to protect the legitimate interests of the Company and its Subsidiaries. All terms used herein shall have the meaning given to them in the Plan or this Award, except as otherwise expressly provided. 1. Non-Solicitation. (a) This Paragraph 1 shall apply to you at any time that you hold the title of Vice President or higher. (b) You agree that, during your employment and for a period of eighteen (18) months from the date your employment terminates for any reason, you will not, without the prior written consent of the Company or your Employer: (i) solicit, directly or indirectly (other than through a general solicitation of employment not specifically directed to employees of the Company or any of its Subsidiaries), the employment of, hire or employ, recruit, or in any way assist another in soliciting or recruiting the employment of, or otherwise induce the termination of the employment of, any person who then or within the preceding twelve (12) months was an officer of the Company or any of its Subsidiaries (excluding any such officer whose employment was involuntarily terminated); or (ii) engage in the Solicitation of Business from any Client on behalf of any person or entity other than the Company or any of its Subsidiaries. (c) Paragraph 1(b)(i) above shall be deemed to exclude the words “hire or employ” if your work location is in California or New York, and shall be construed and administered accordingly. In addition, if you reside in or have a primary reporting location in California, then following the termination of your employment for any reason, Paragraph 1(b)(ii) shall apply only if you use a trade secret of State Street in any such solicitation.

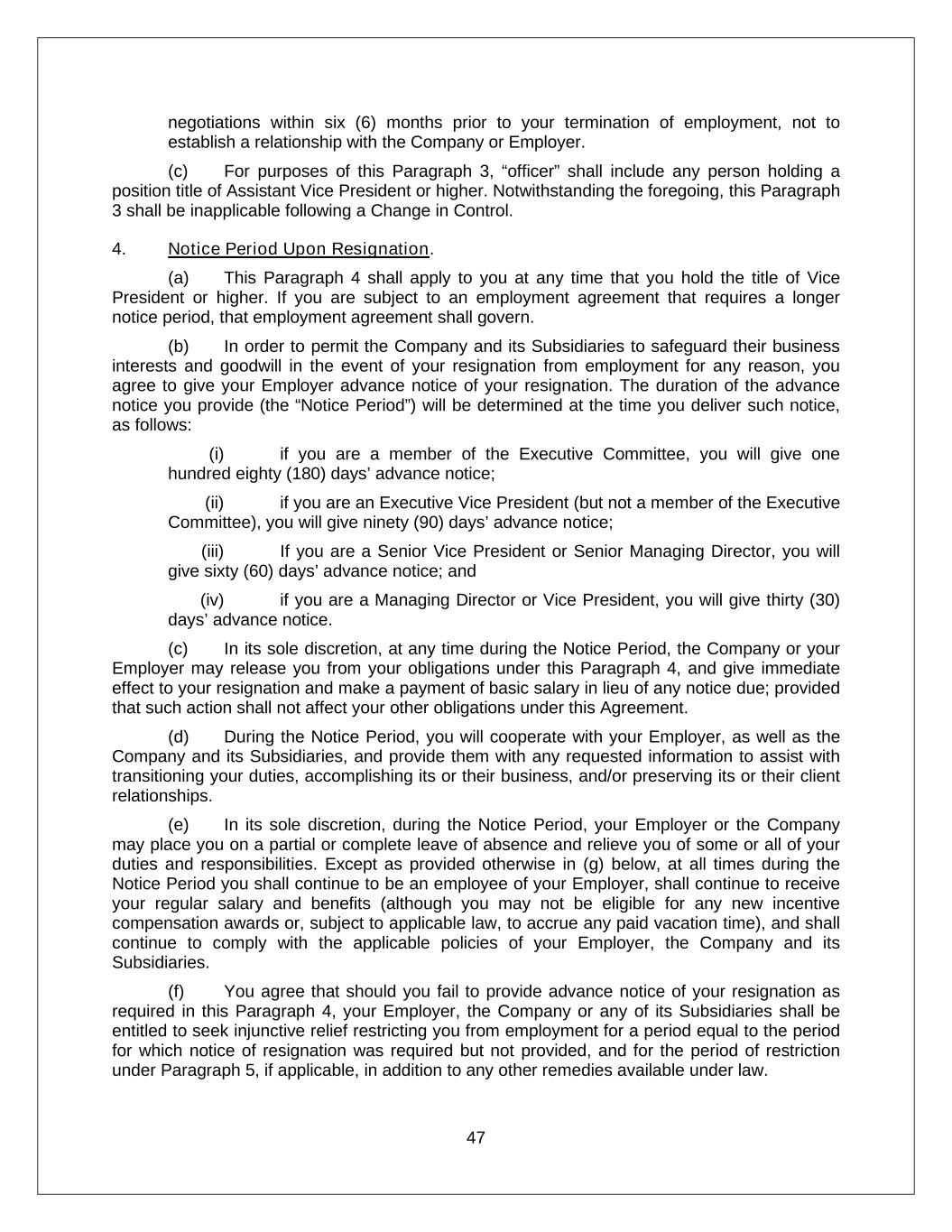

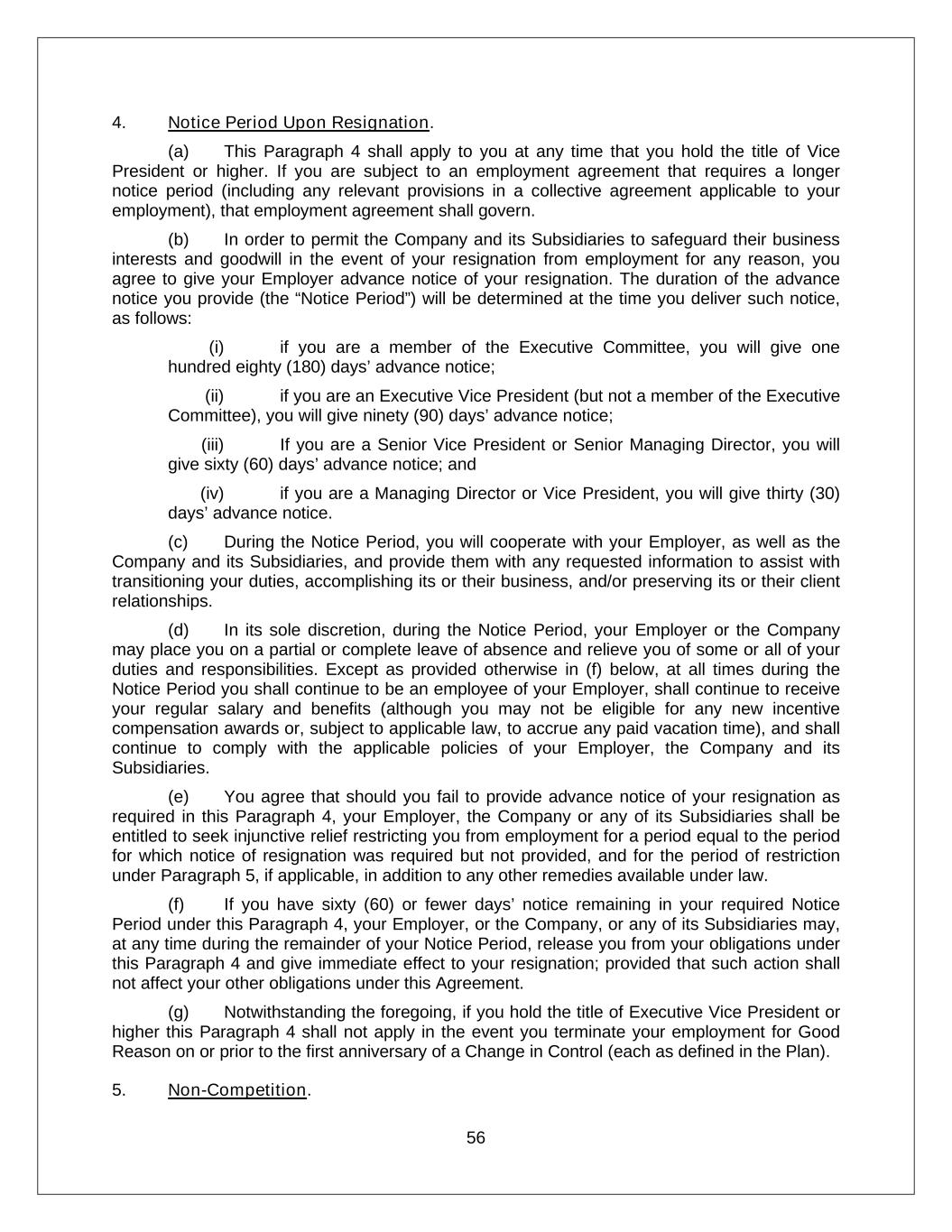

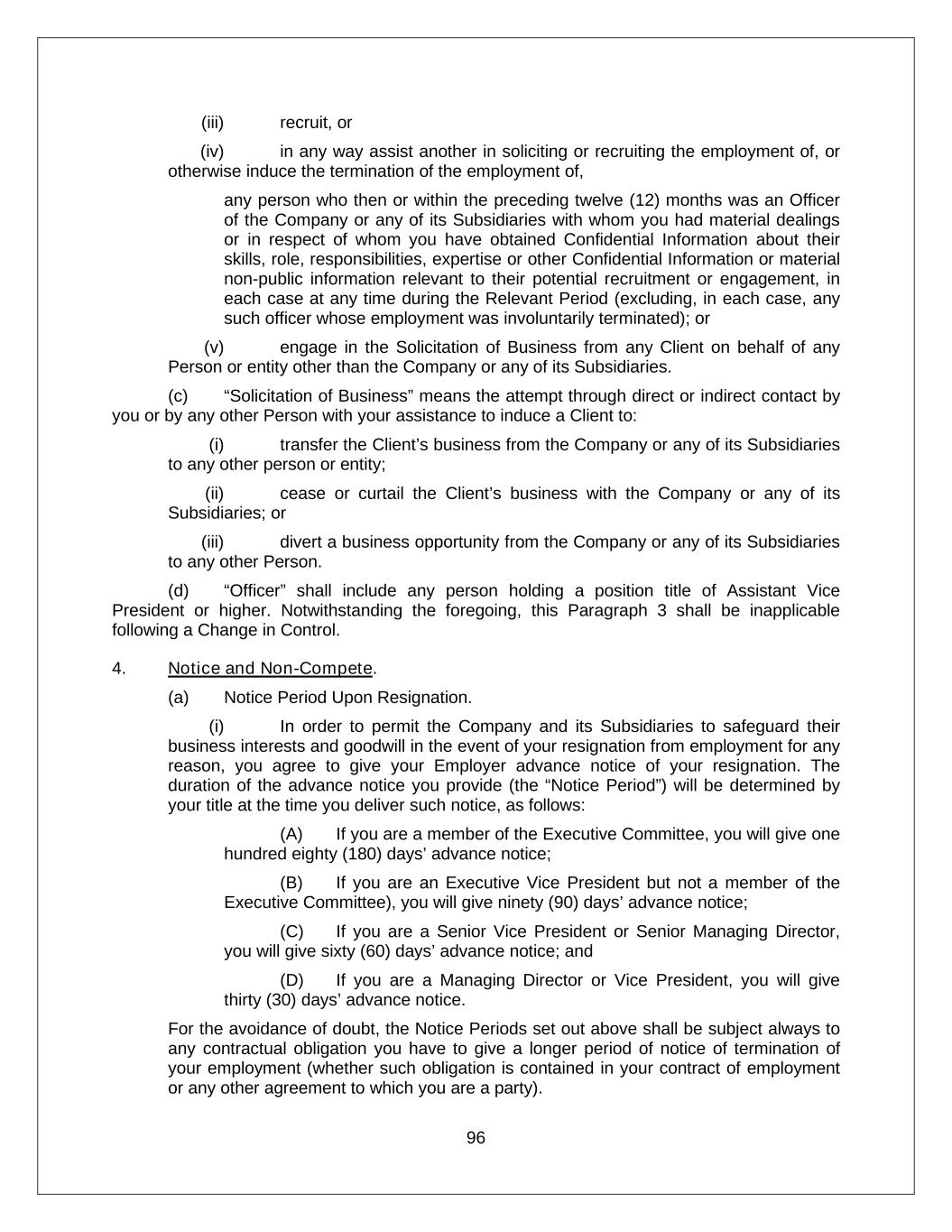

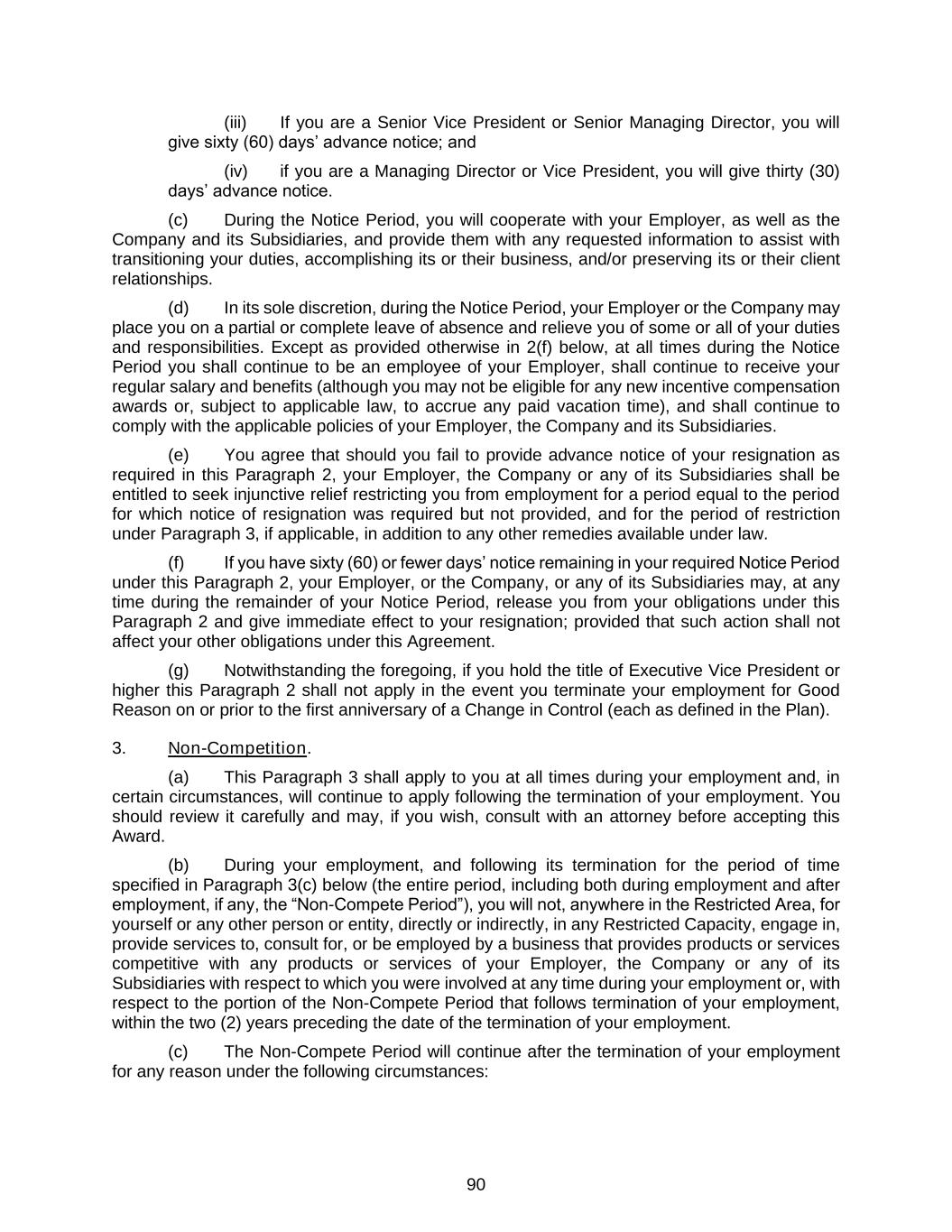

23 (d) For purposes of this Paragraph 1, “officer” shall include any person holding a position title of Assistant Vice President or higher. Notwithstanding the foregoing, this Paragraph 1 shall be inapplicable following a Change in Control. 2. Notice Period Upon Resignation. (a) This Paragraph 2 shall apply to you at any time that you hold the title of Vice President or higher. If you are subject to an employment agreement that requires a longer notice period, that employment agreement shall govern. (b) In order to permit the Company and its Subsidiaries to safeguard their business interests and goodwill in the event of your resignation from employment for any reason, you agree to give your Employer advance notice of your resignation. The duration of the advance notice you provide (the “Notice Period”) will be determined at the time you deliver such notice, as follows: (i) if you are a member of the Executive Committee, you will give one hundred eighty (180) days’ advance notice; (ii) if you are an Executive Vice President (but not a member of the Executive Committee), you will give ninety (90) days’ advance notice; (iii) If you are a Senior Vice President or Senior Managing Director, you will give sixty (60) days’ advance notice; and (iv) if you are a Managing Director or Vice President, you will give thirty (30) days’ advance notice. (c) During the Notice Period, you will cooperate with your Employer, as well as the Company and its Subsidiaries, and provide them with any requested information to assist with transitioning your duties, accomplishing its or their business, and/or preserving its or their client relationships. (d) In its sole discretion, during the Notice Period, your Employer or the Company may place you on a partial or complete leave of absence and relieve you of some or all of your duties and responsibilities. Except as provided otherwise in (f) below, at all times during the Notice Period you shall continue to be an employee of your Employer, shall continue to receive your regular salary and benefits (although you may not be eligible for any new incentive compensation awards or, subject to applicable law, to accrue any paid vacation time), and shall continue to comply with the applicable policies of your Employer, the Company and its Subsidiaries. (e) You agree that should you fail to provide advance notice of your resignation as required in this Paragraph 2, your Employer or the Company shall be entitled to seek injunctive relief restricting you from employment for a period equal to the period for which notice of resignation was required but not provided, and for the period of restriction under Paragraph 3, if applicable, in addition to any other remedies available under law. (f) If you have sixty (60) or fewer days’ notice remaining in your required Notice Period under this Paragraph 2, your Employer or the Company may, at any time during the remainder of your Notice Period, release you from your obligations under this Paragraph 2 and give immediate effect to your resignation; provided, that such action shall not affect your other obligations under this Agreement.

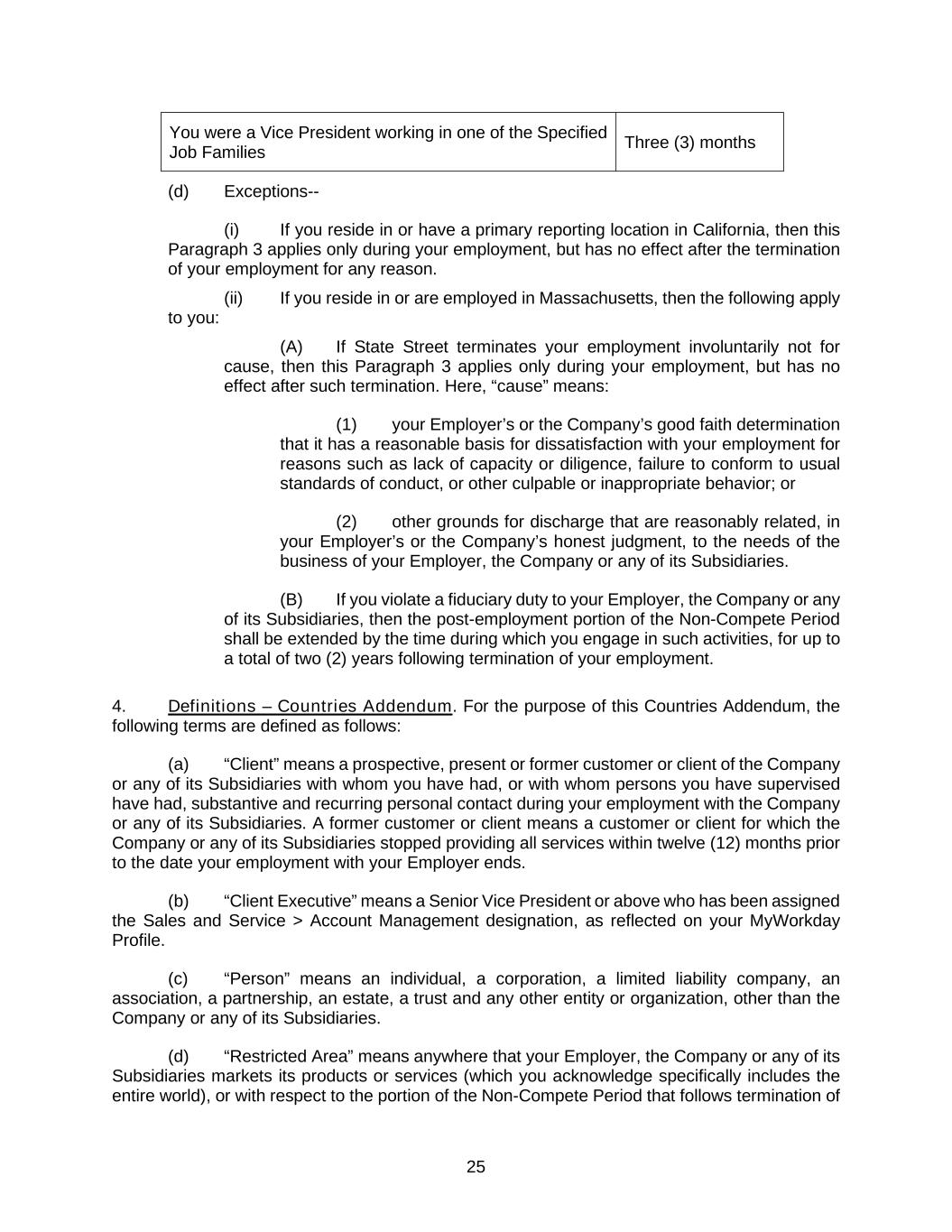

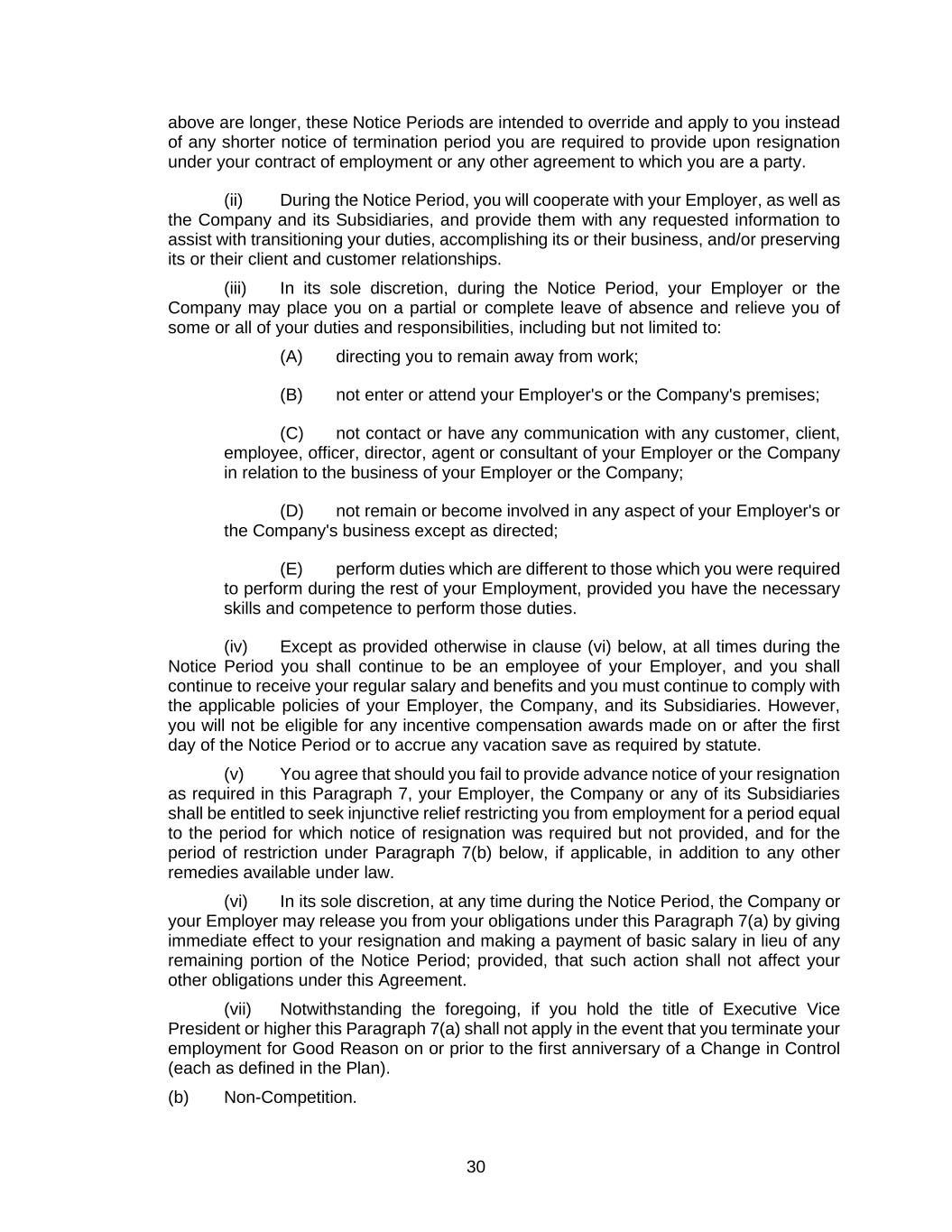

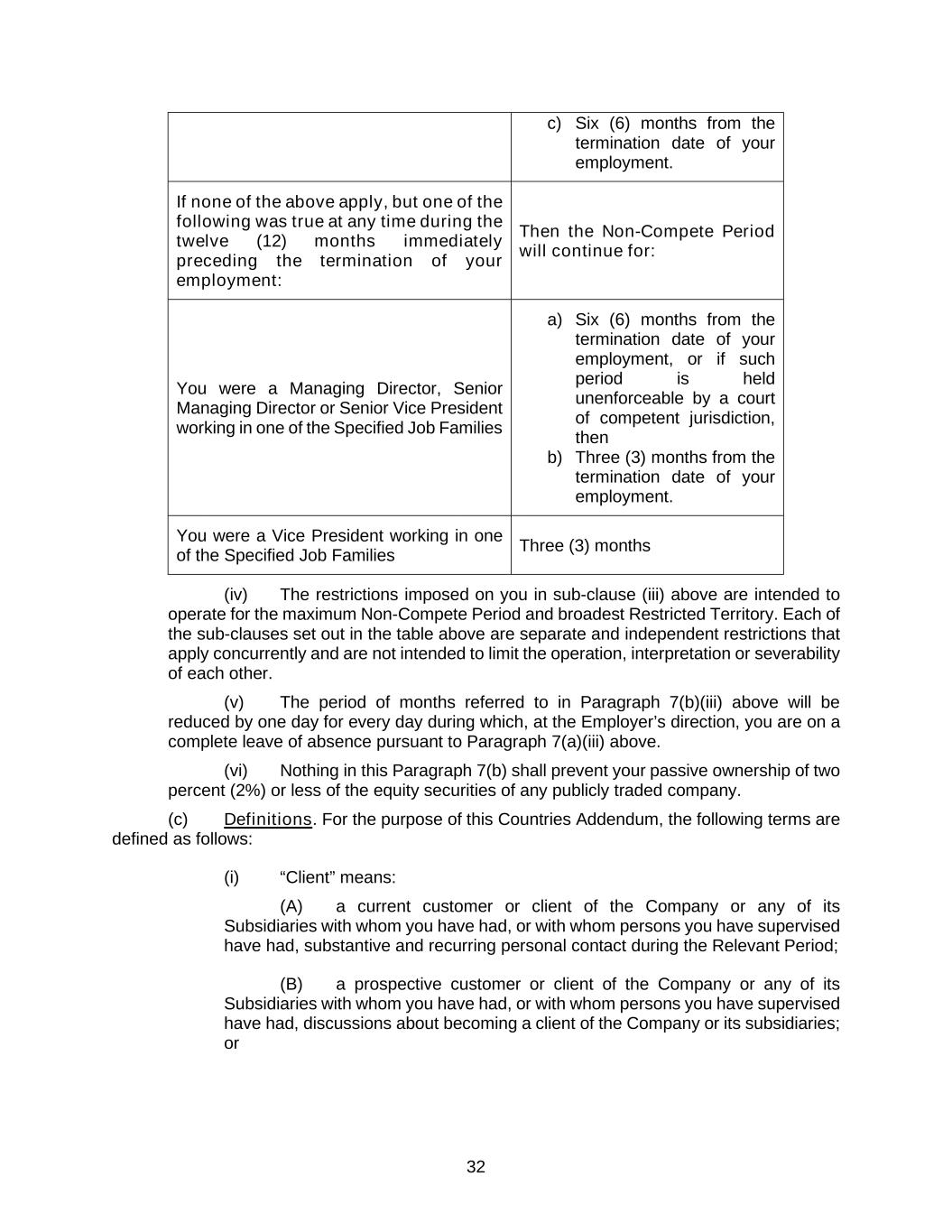

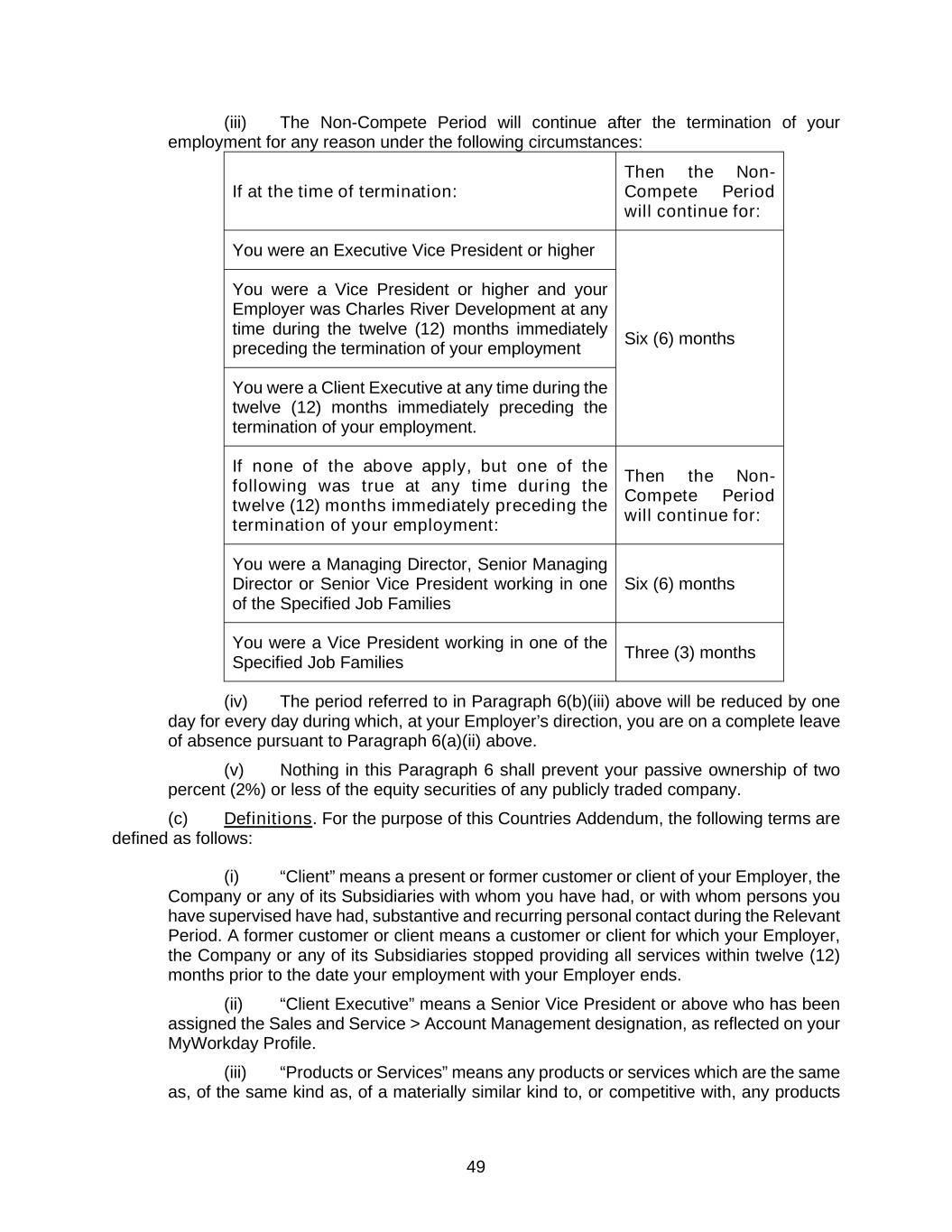

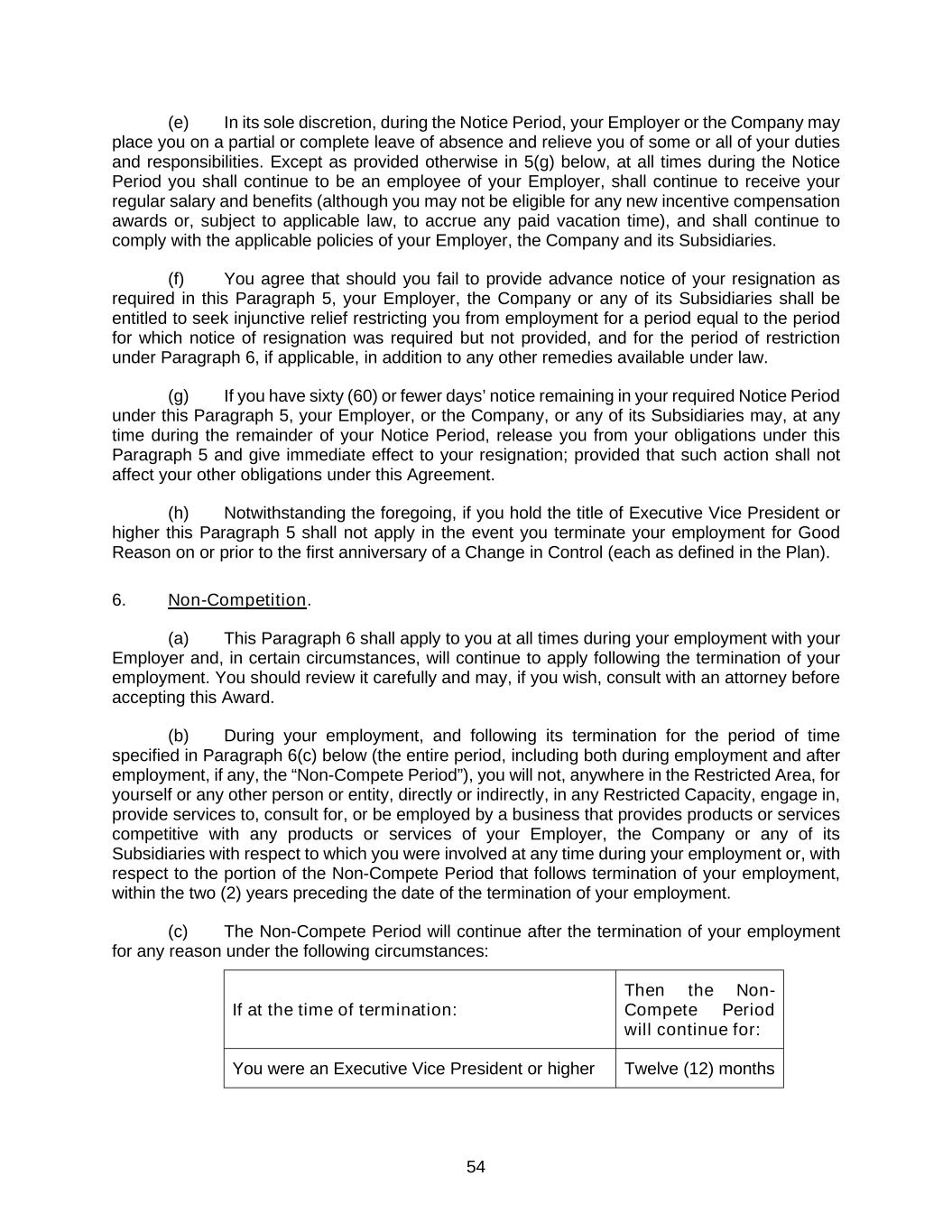

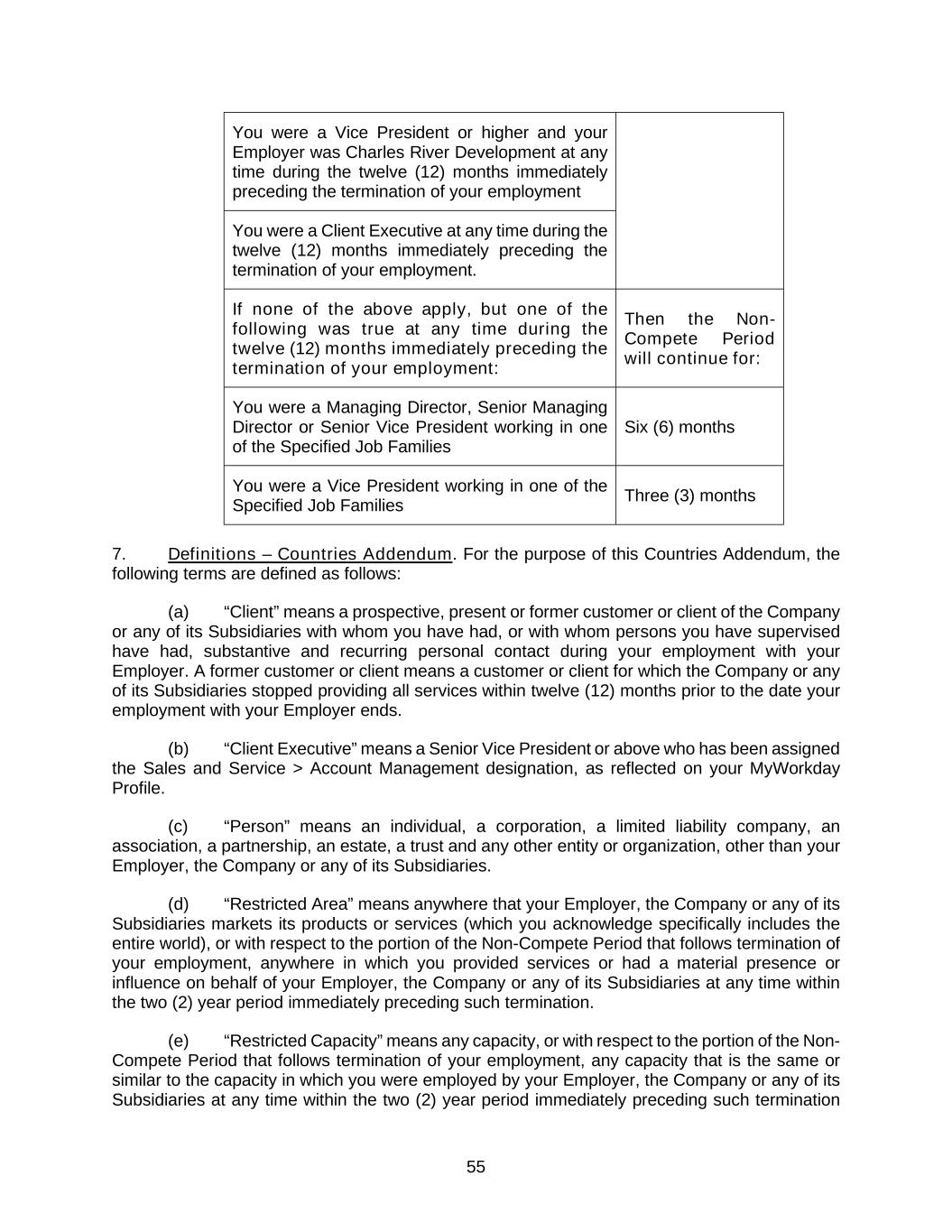

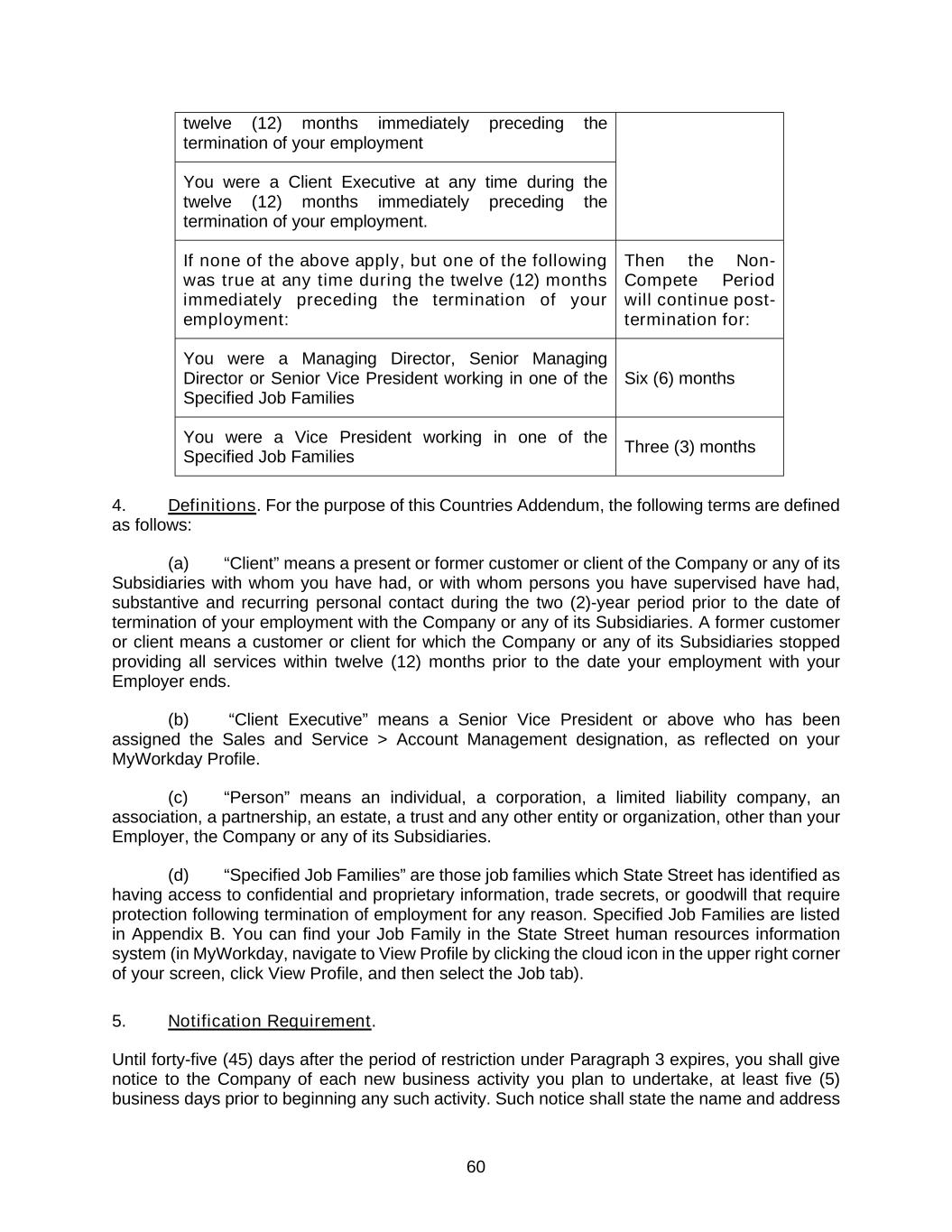

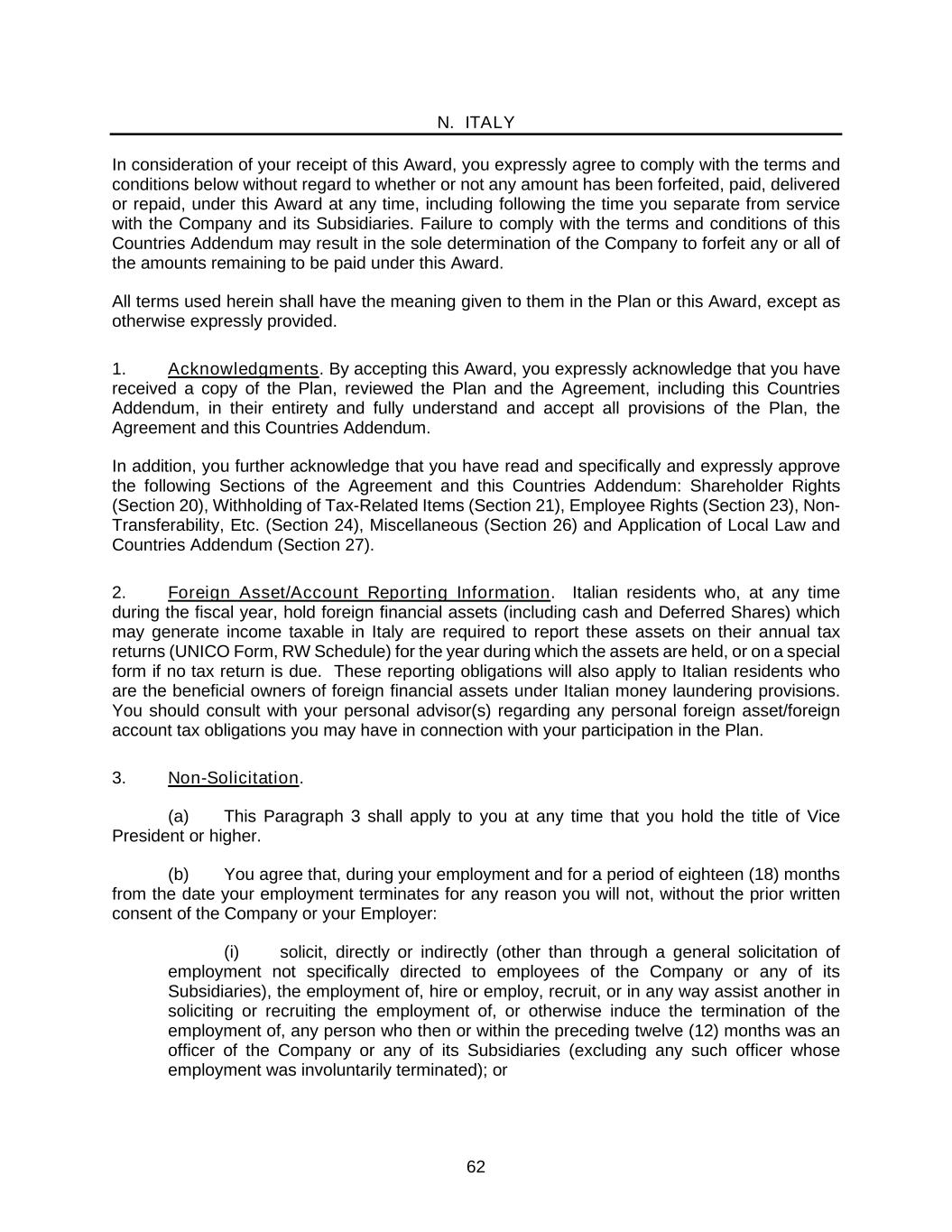

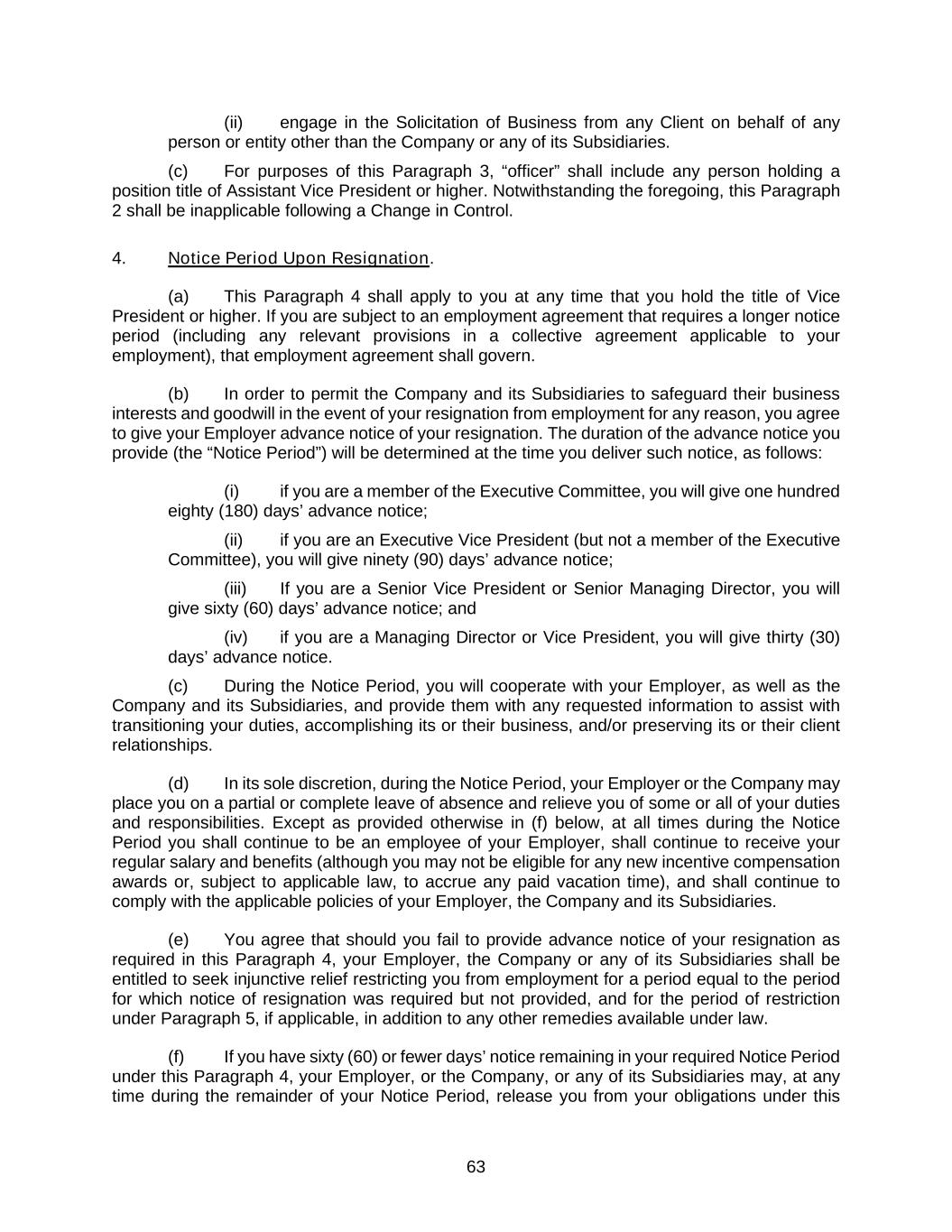

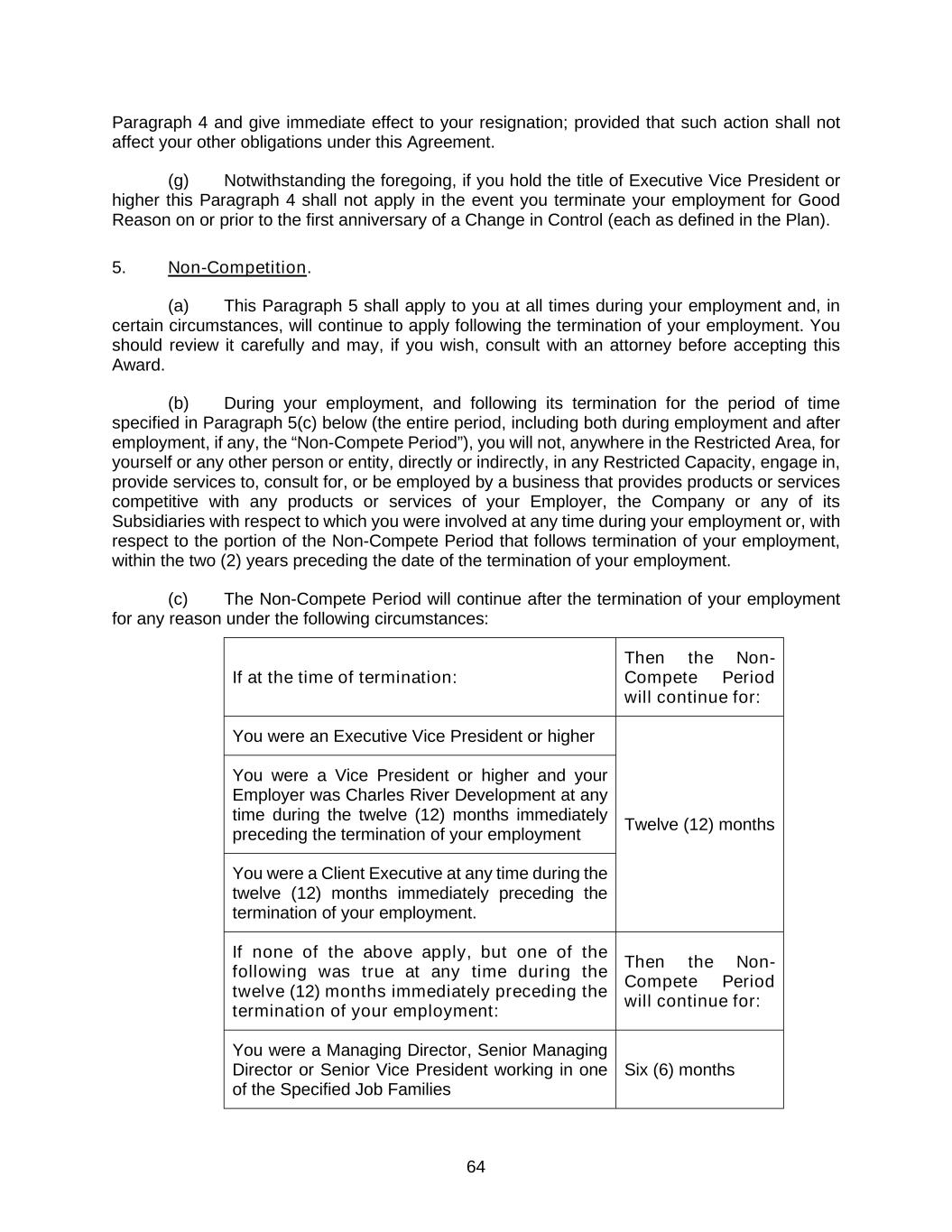

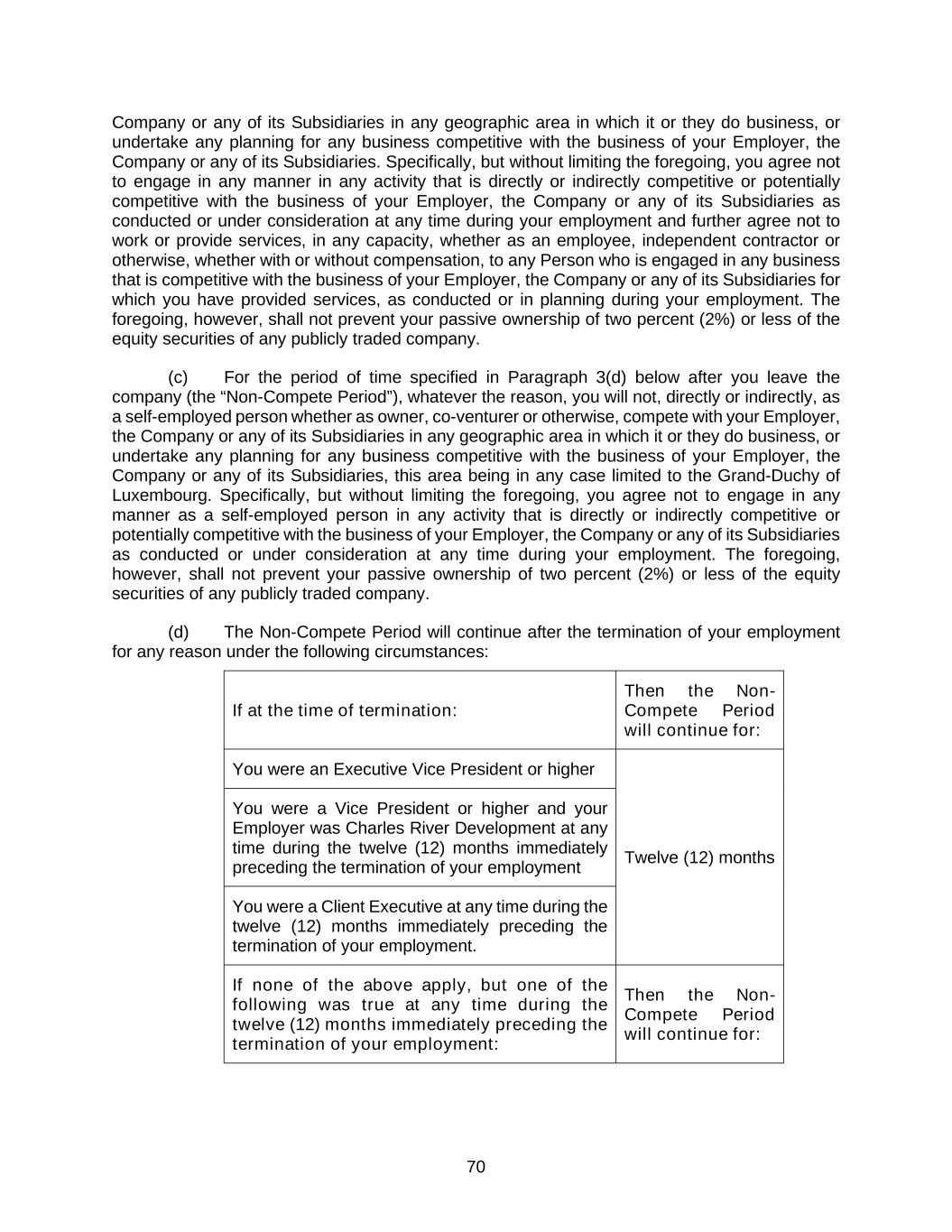

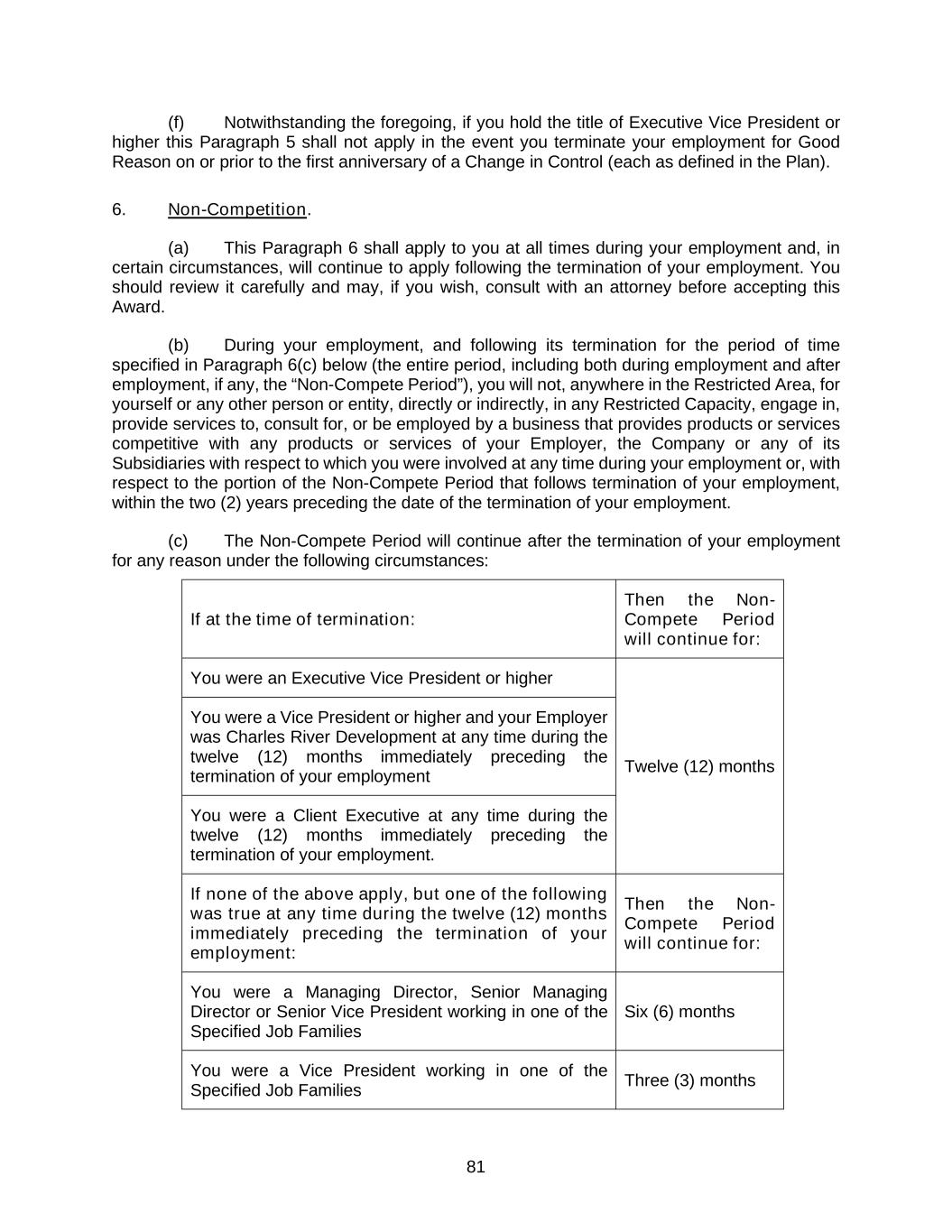

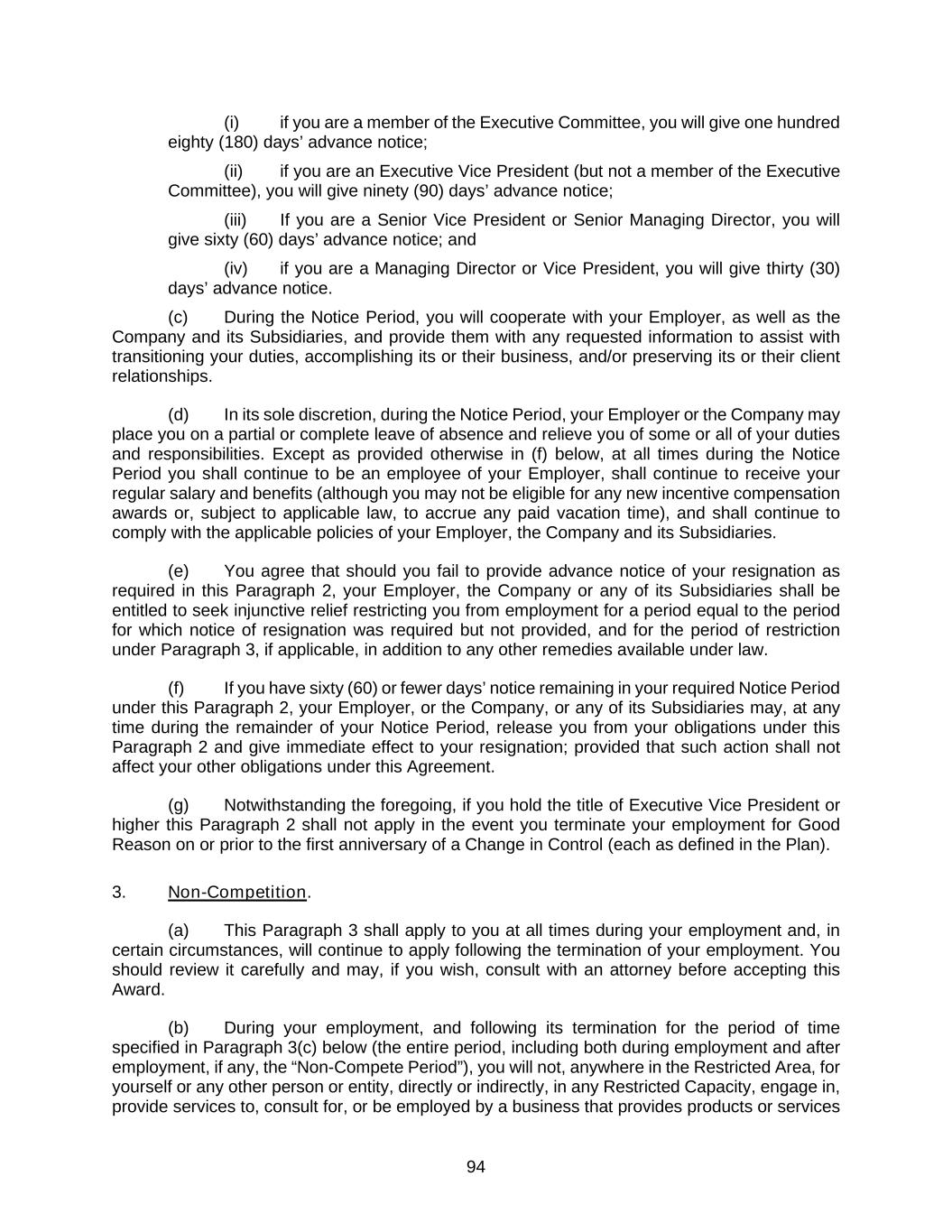

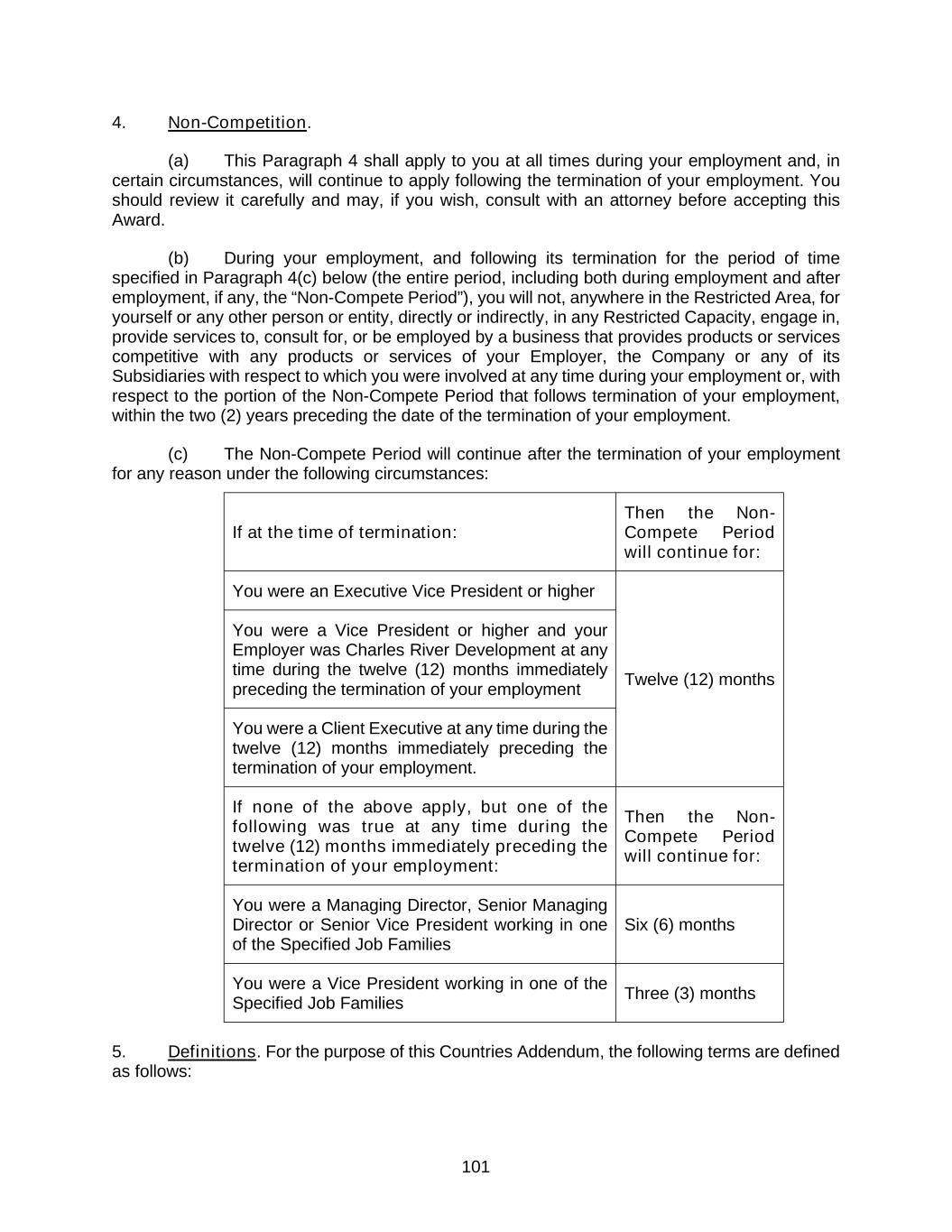

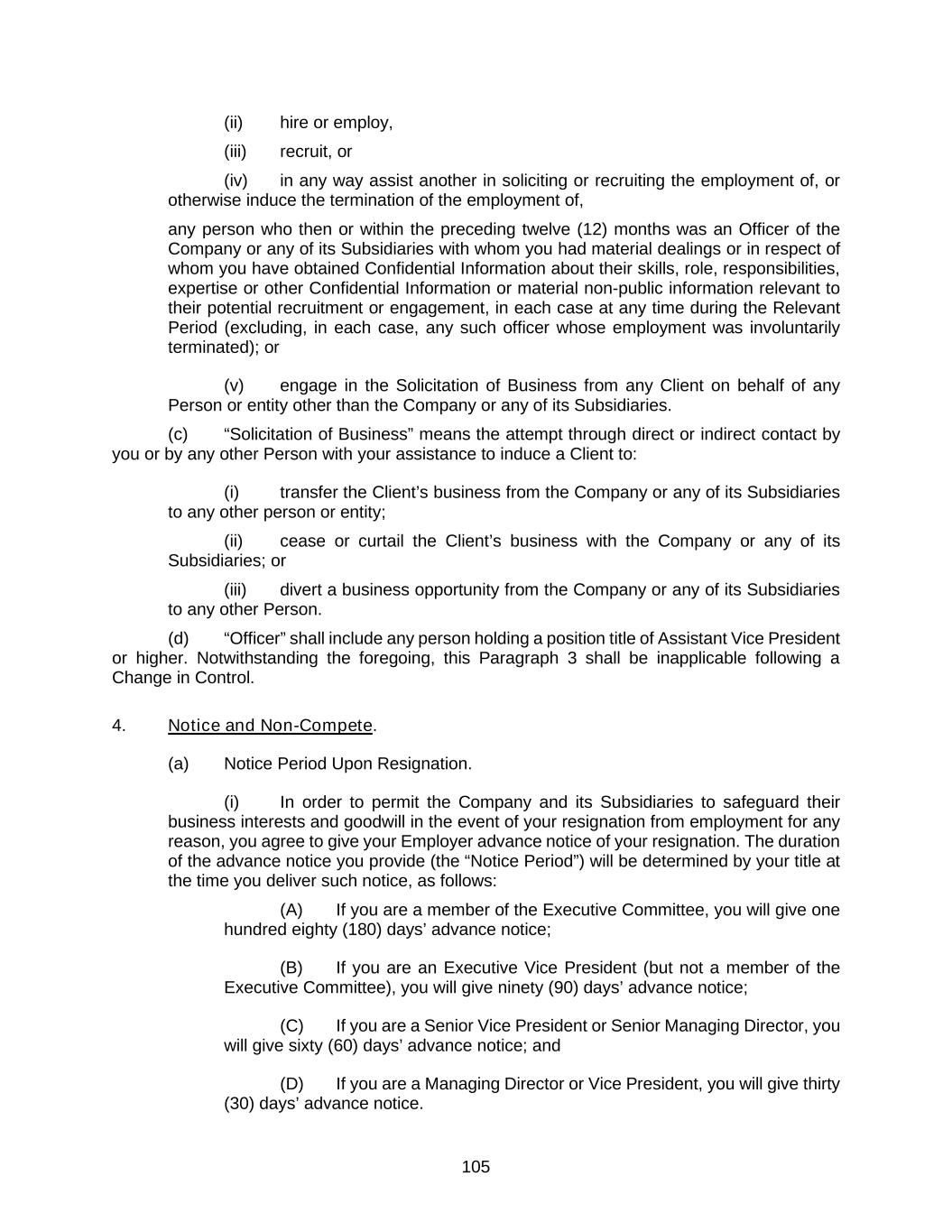

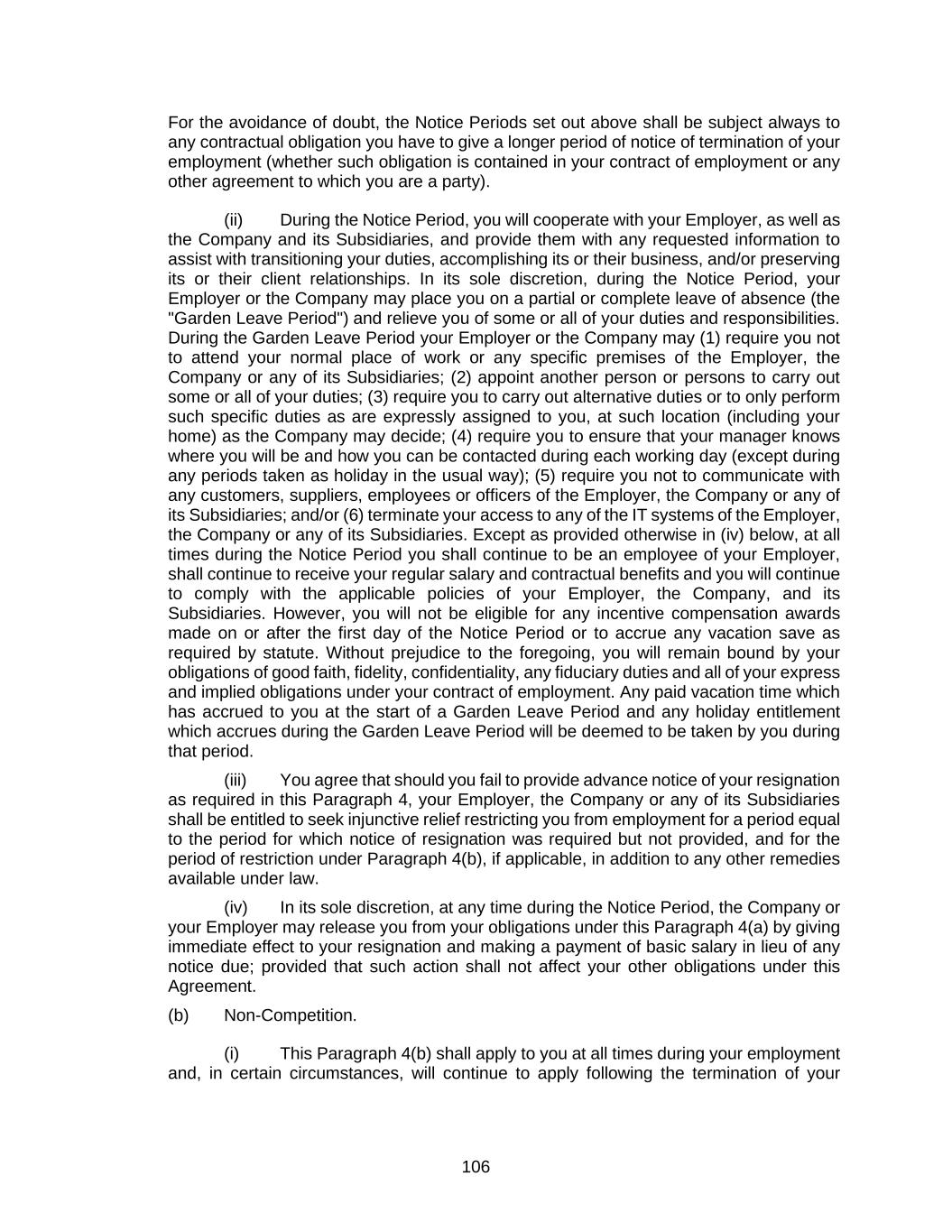

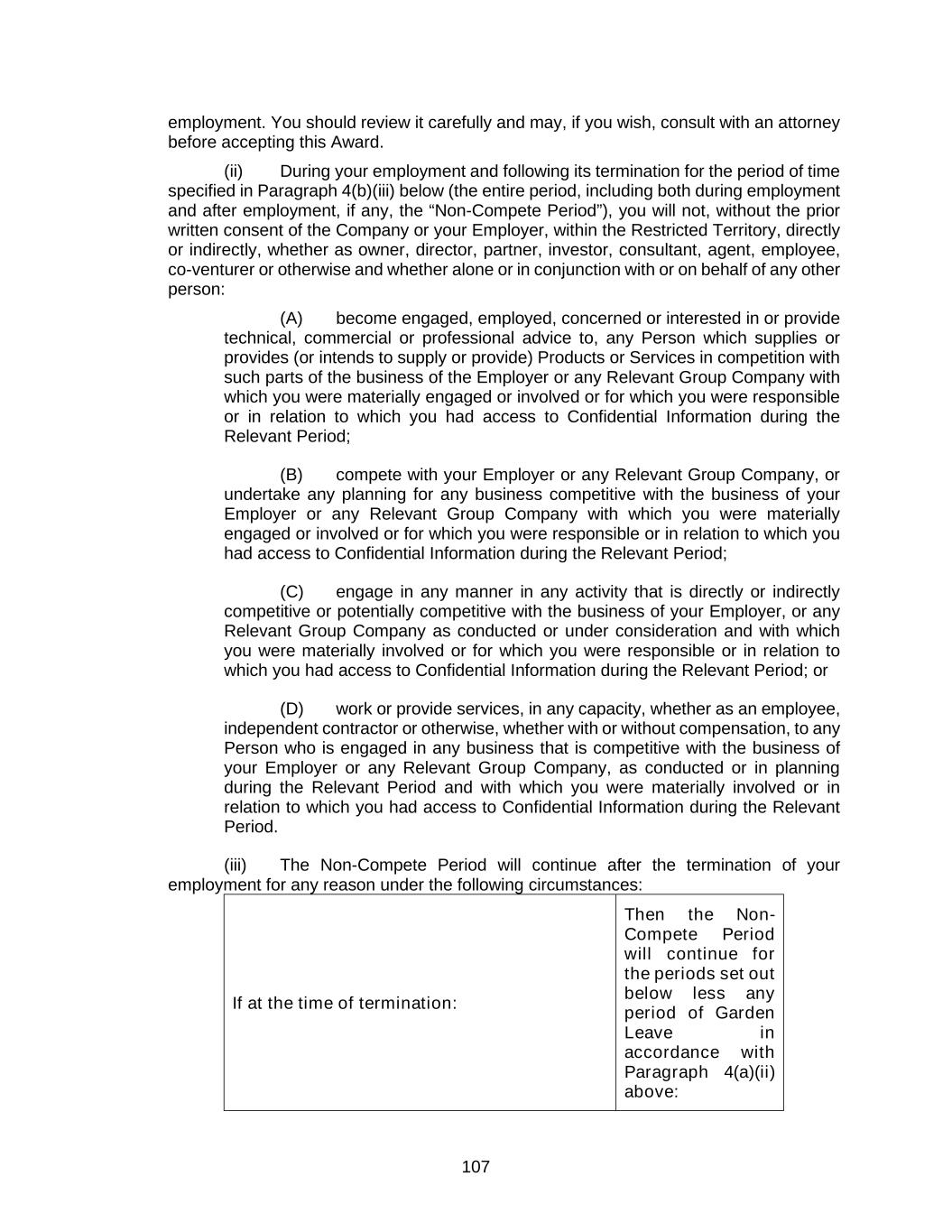

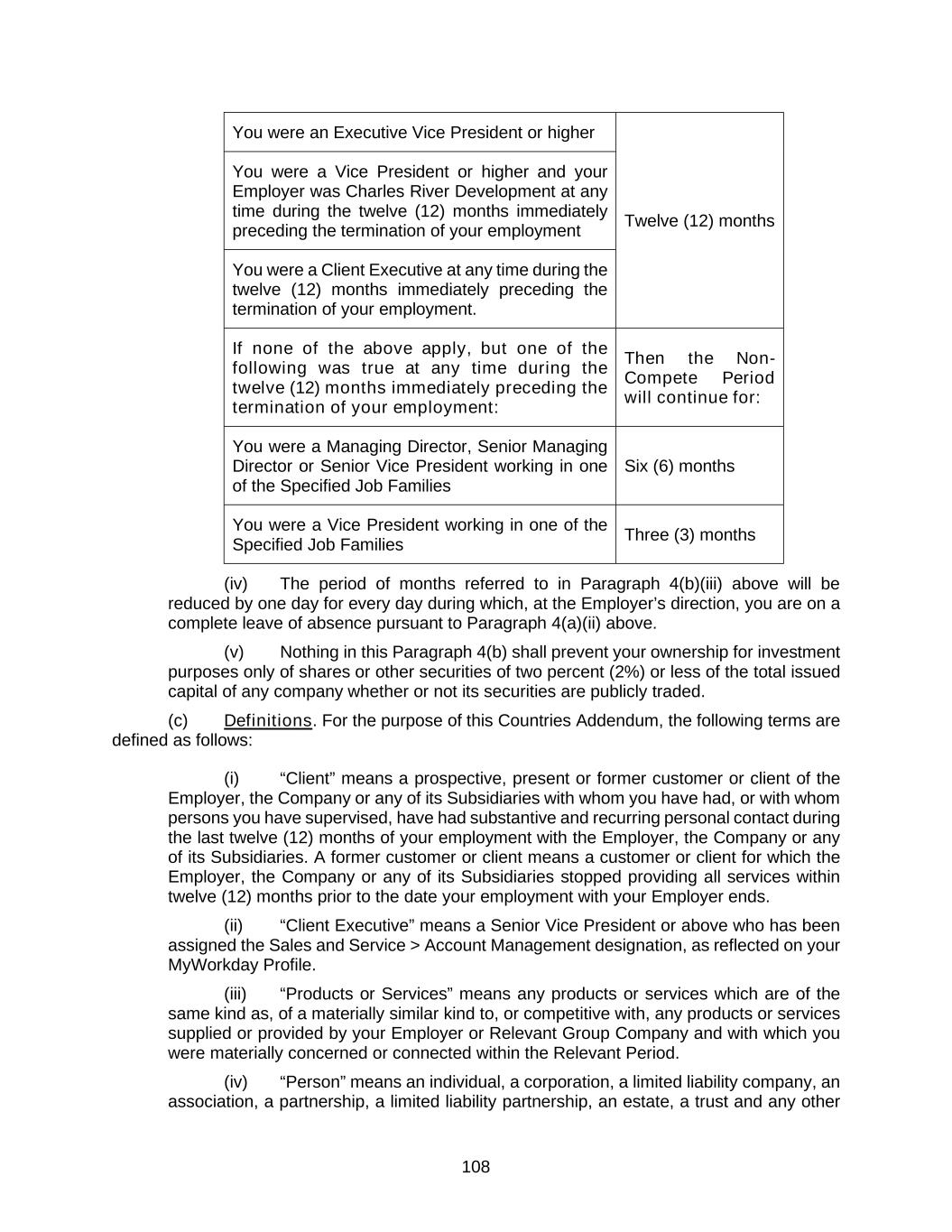

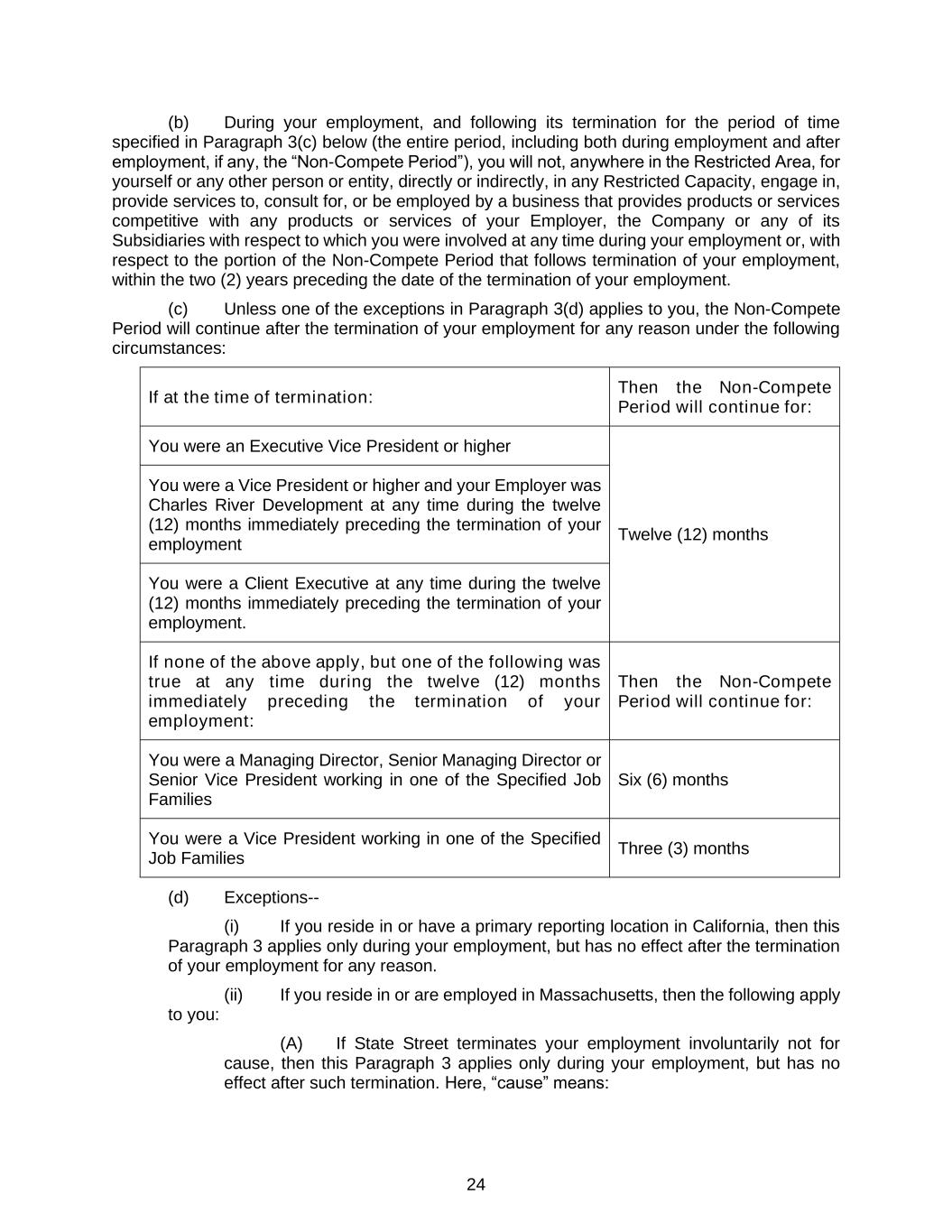

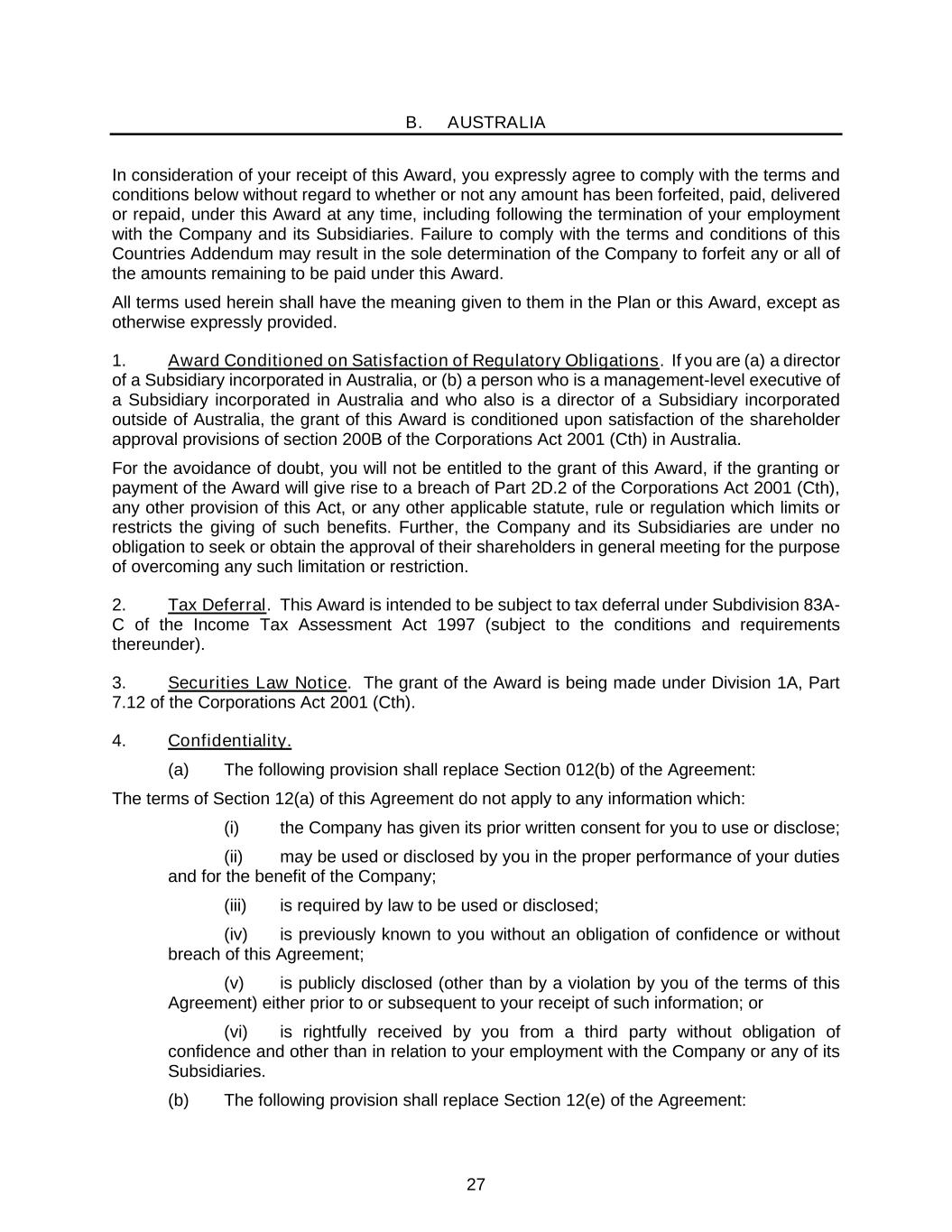

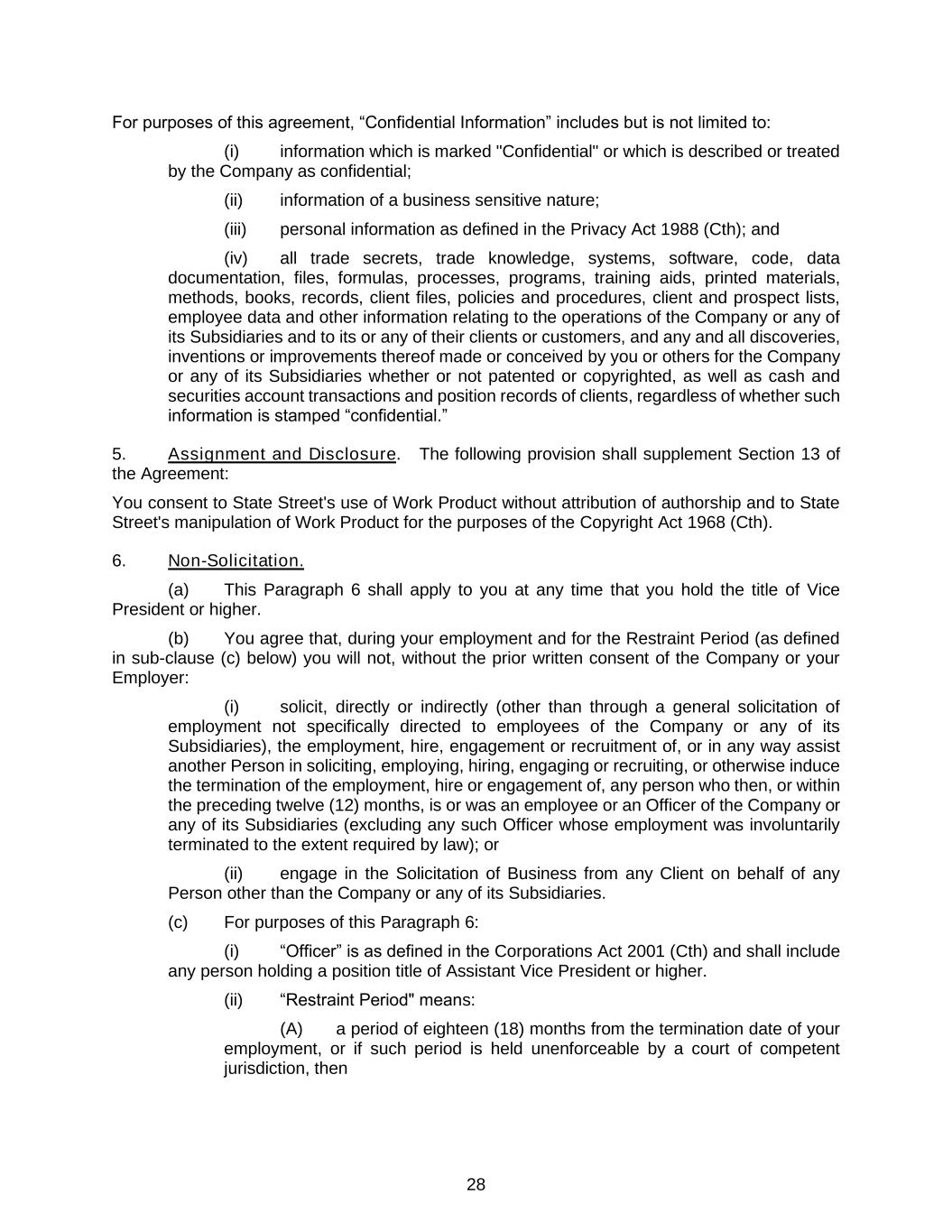

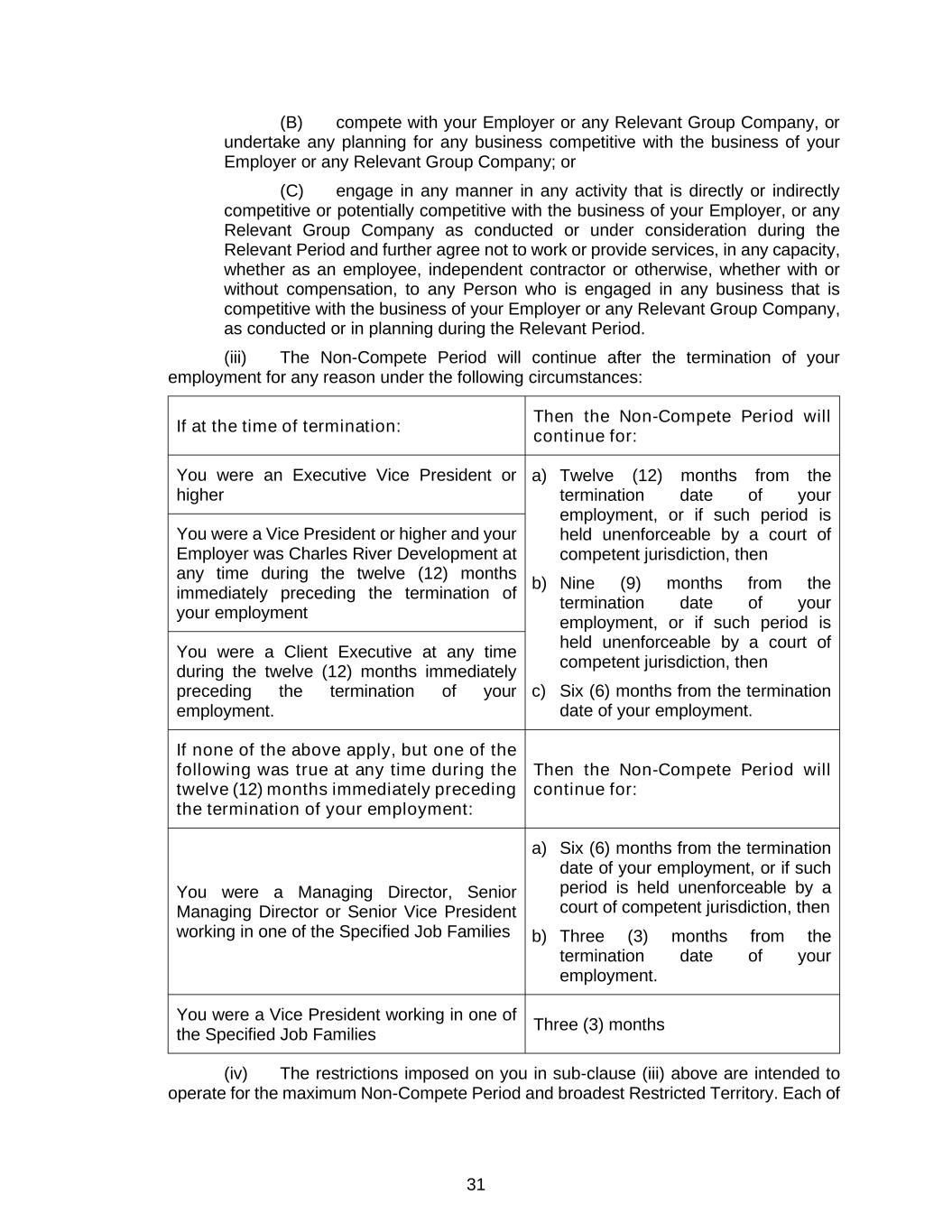

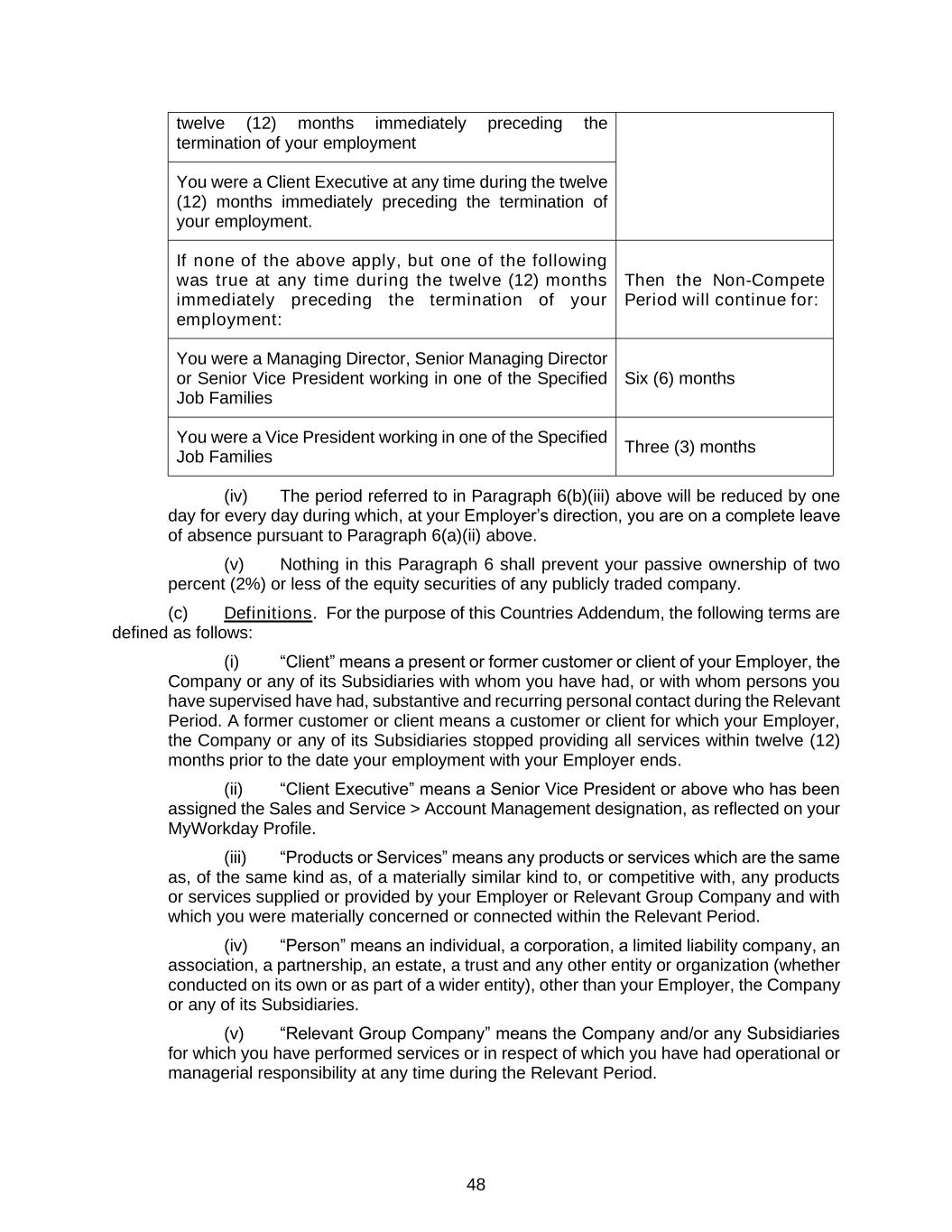

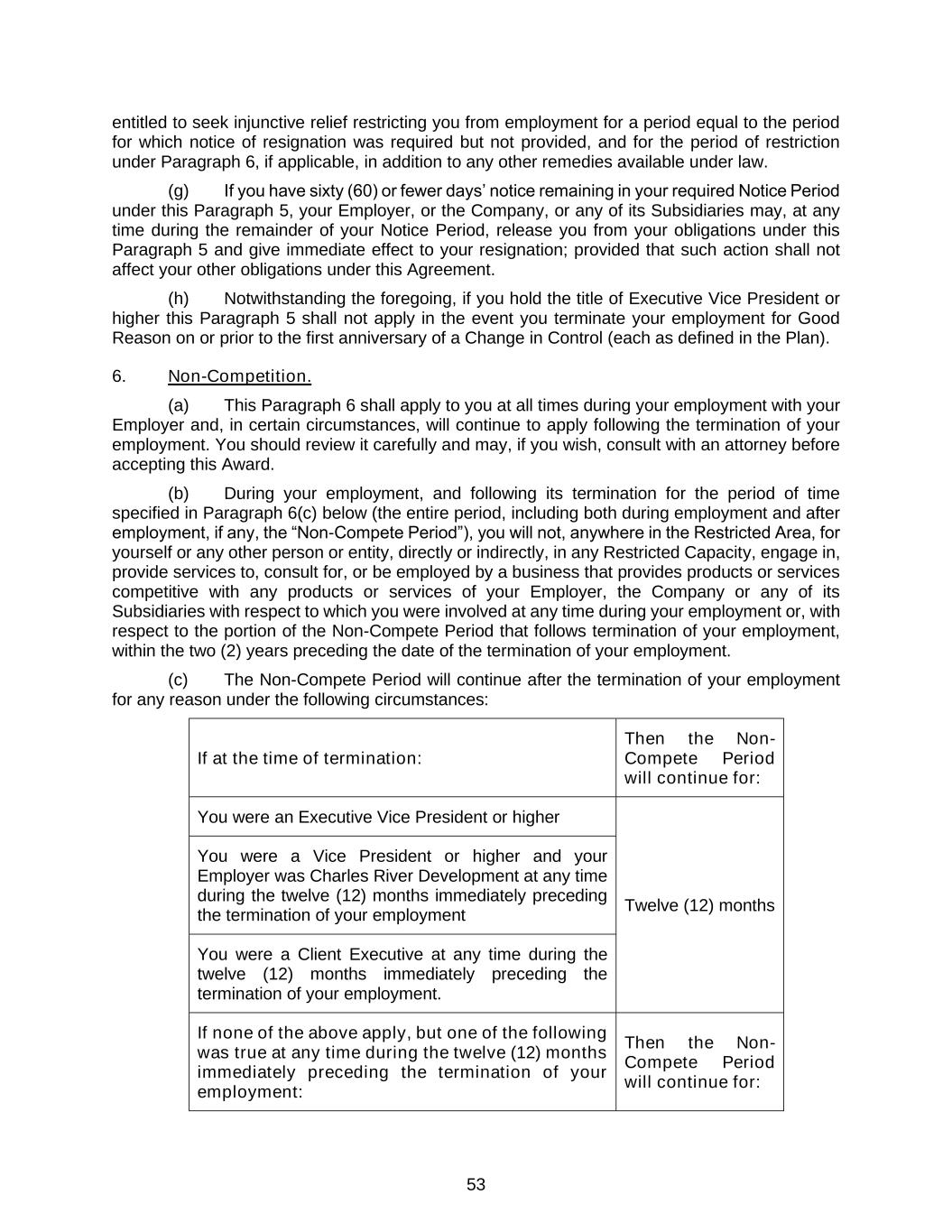

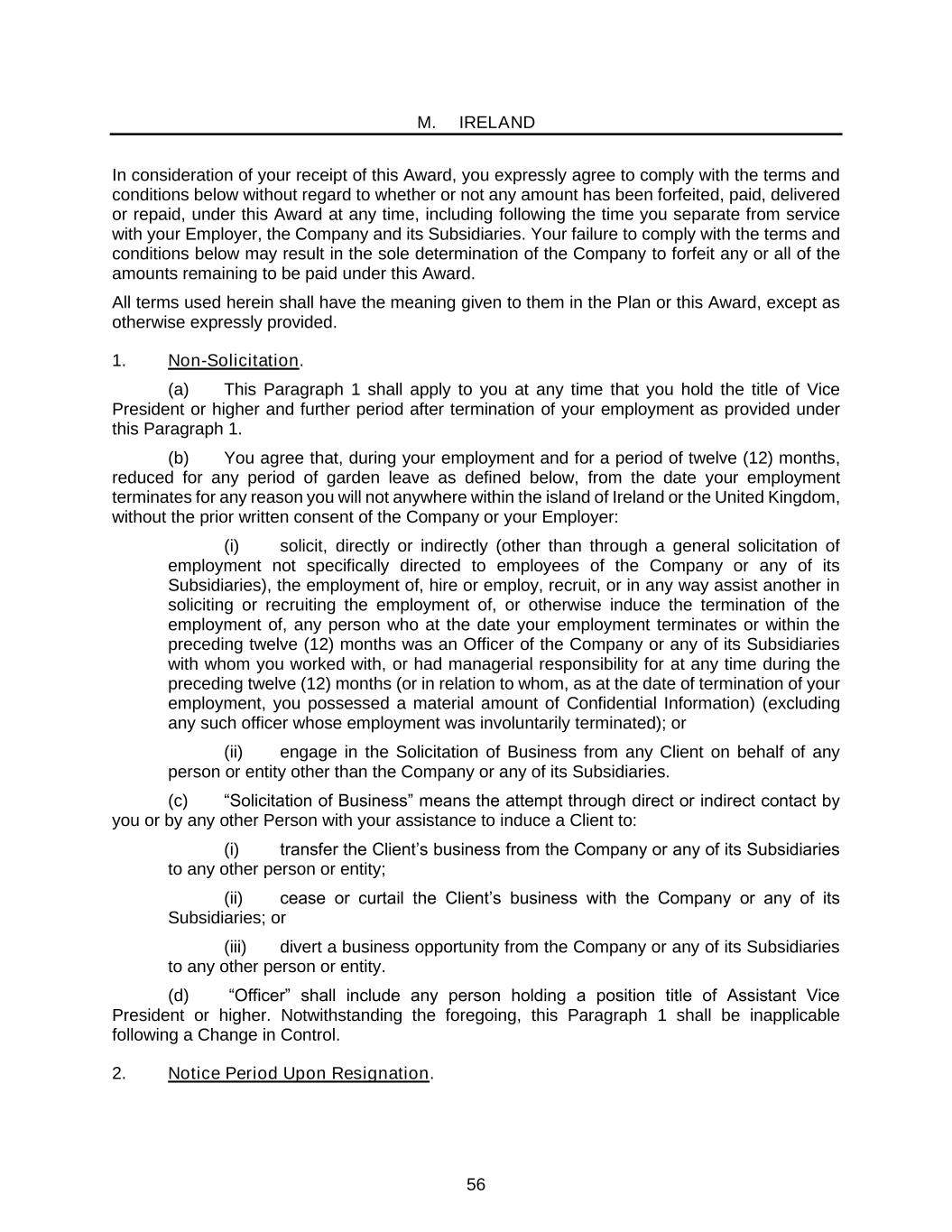

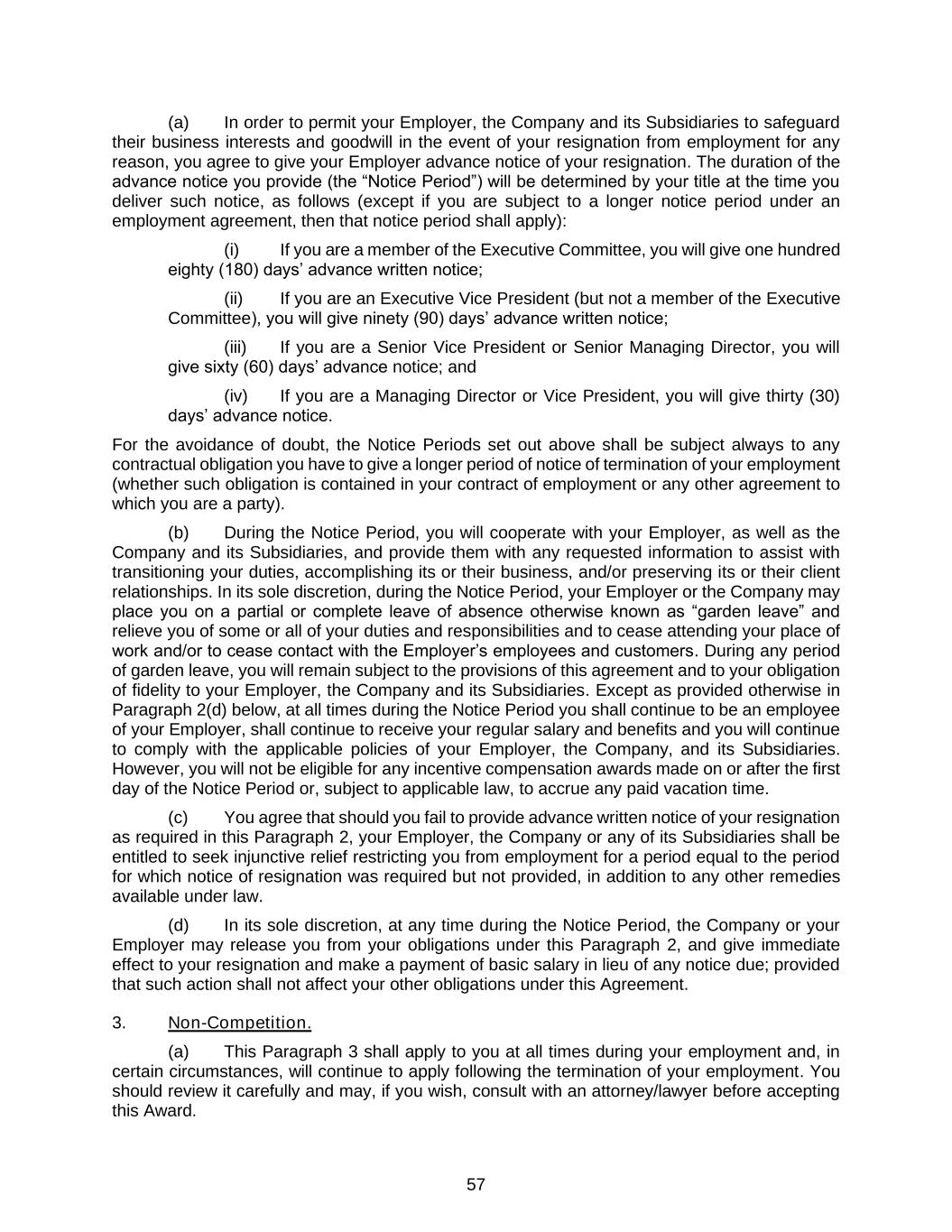

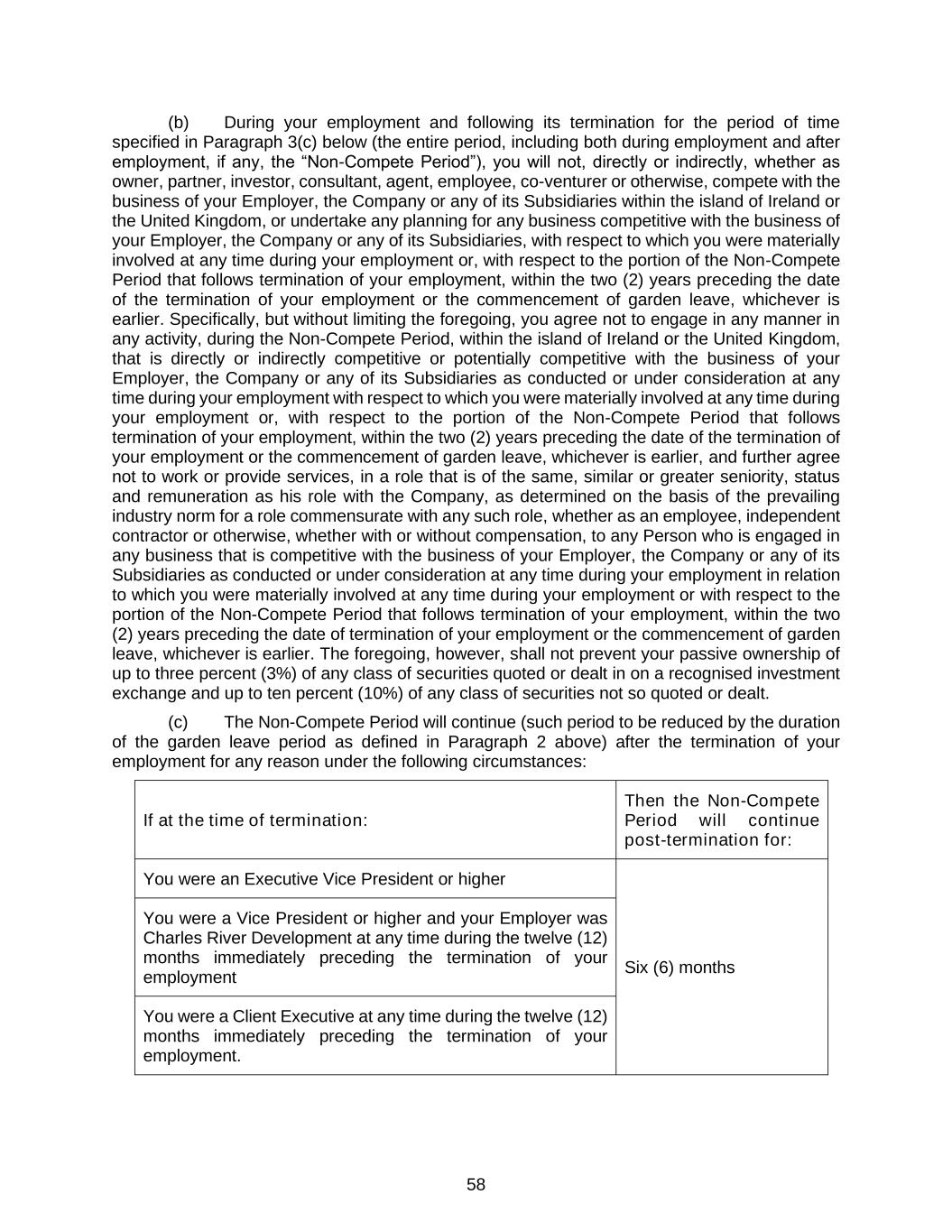

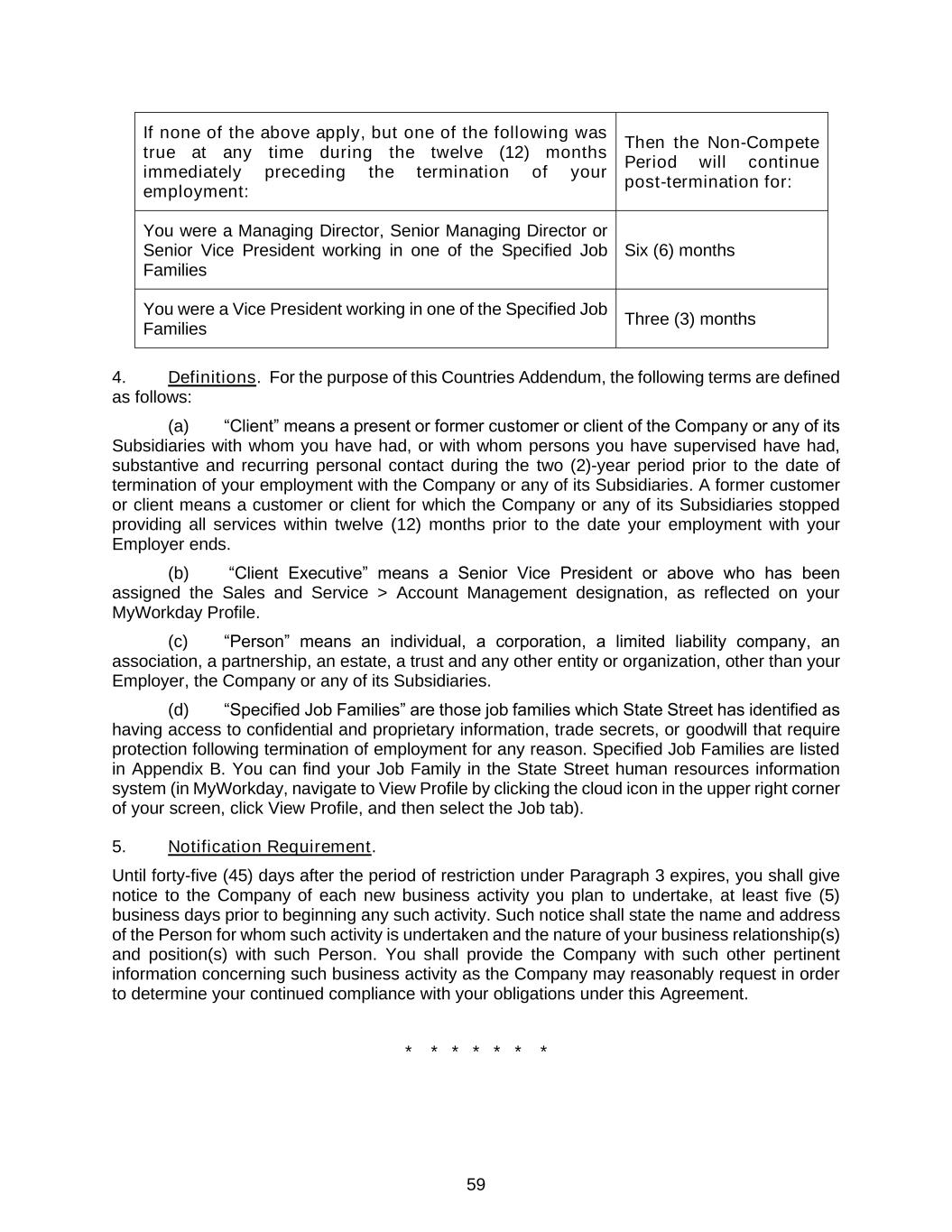

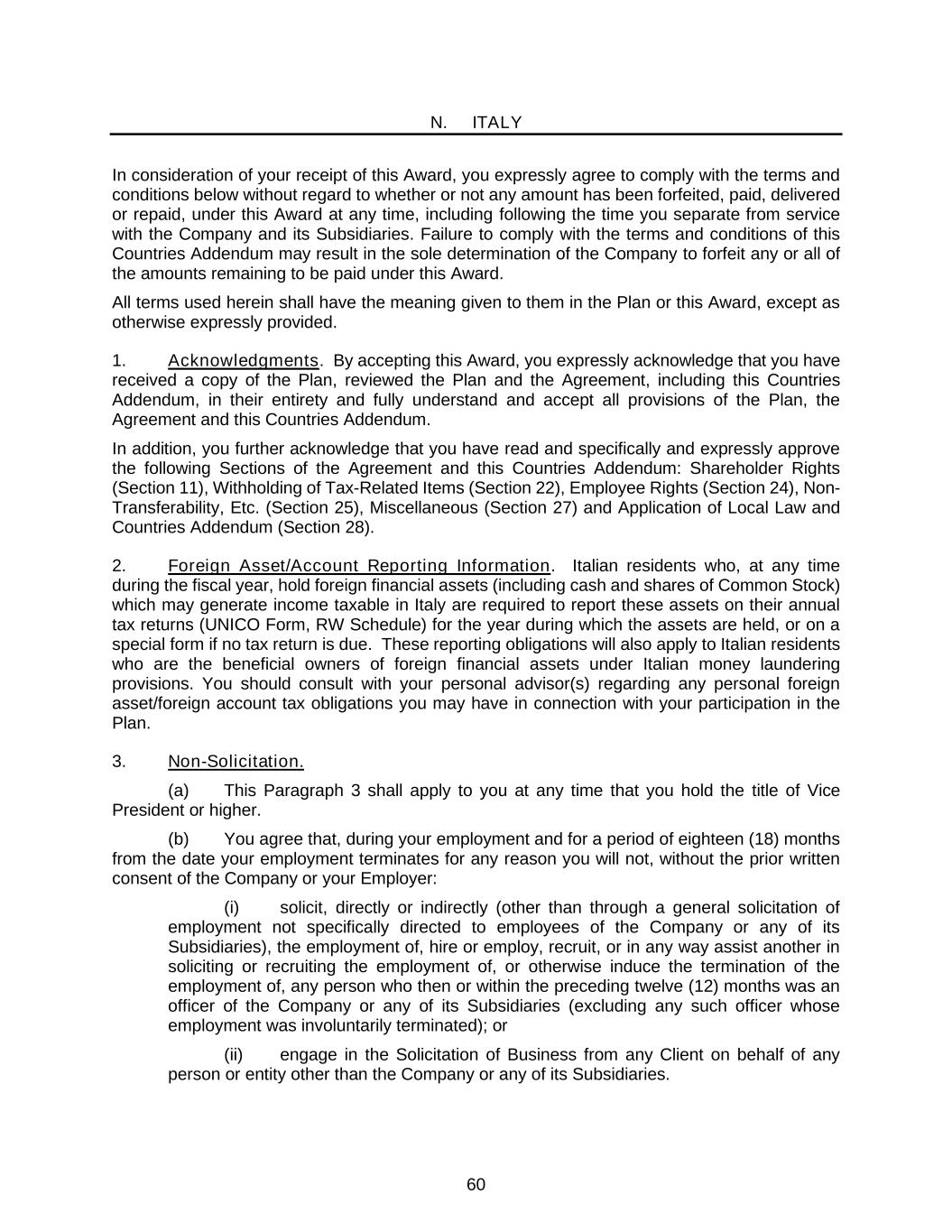

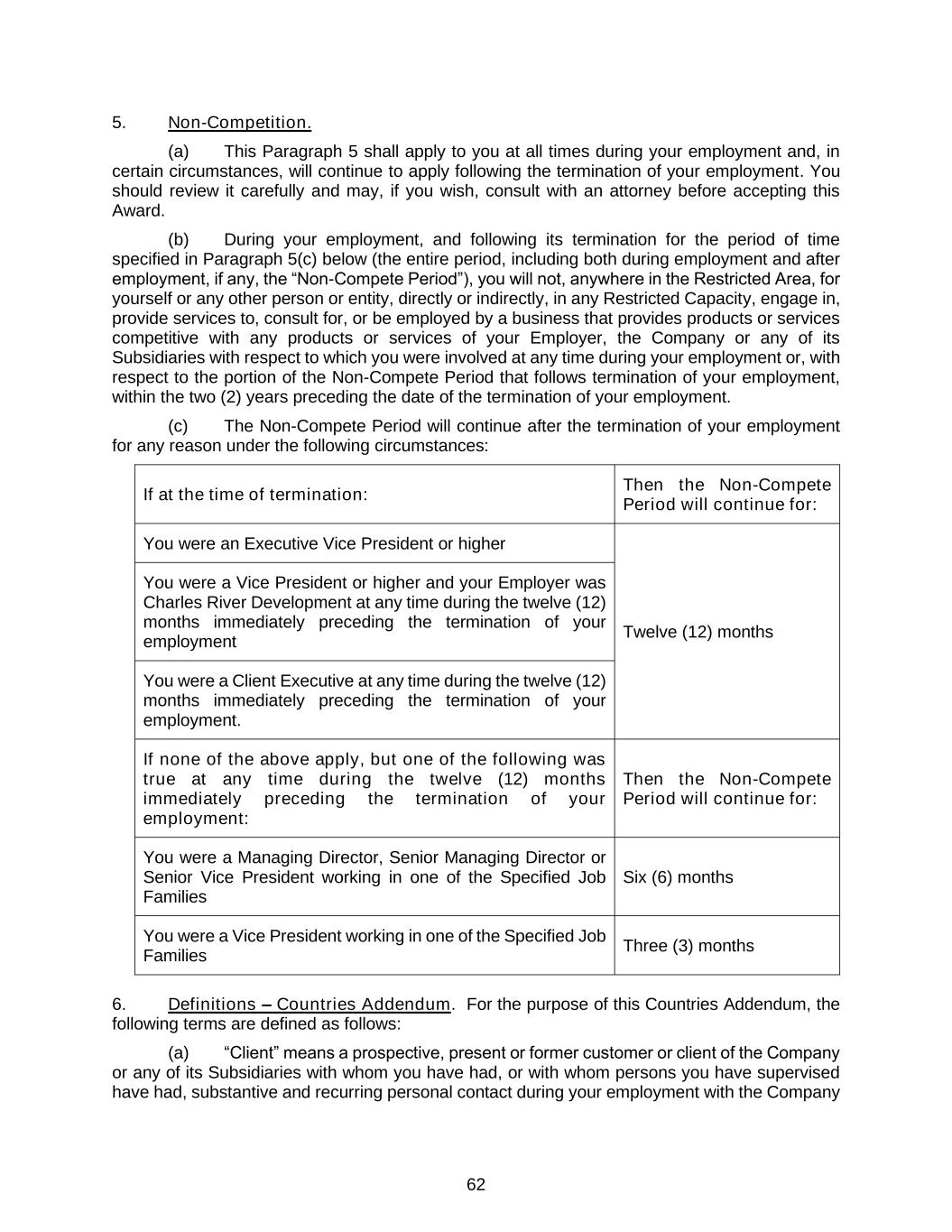

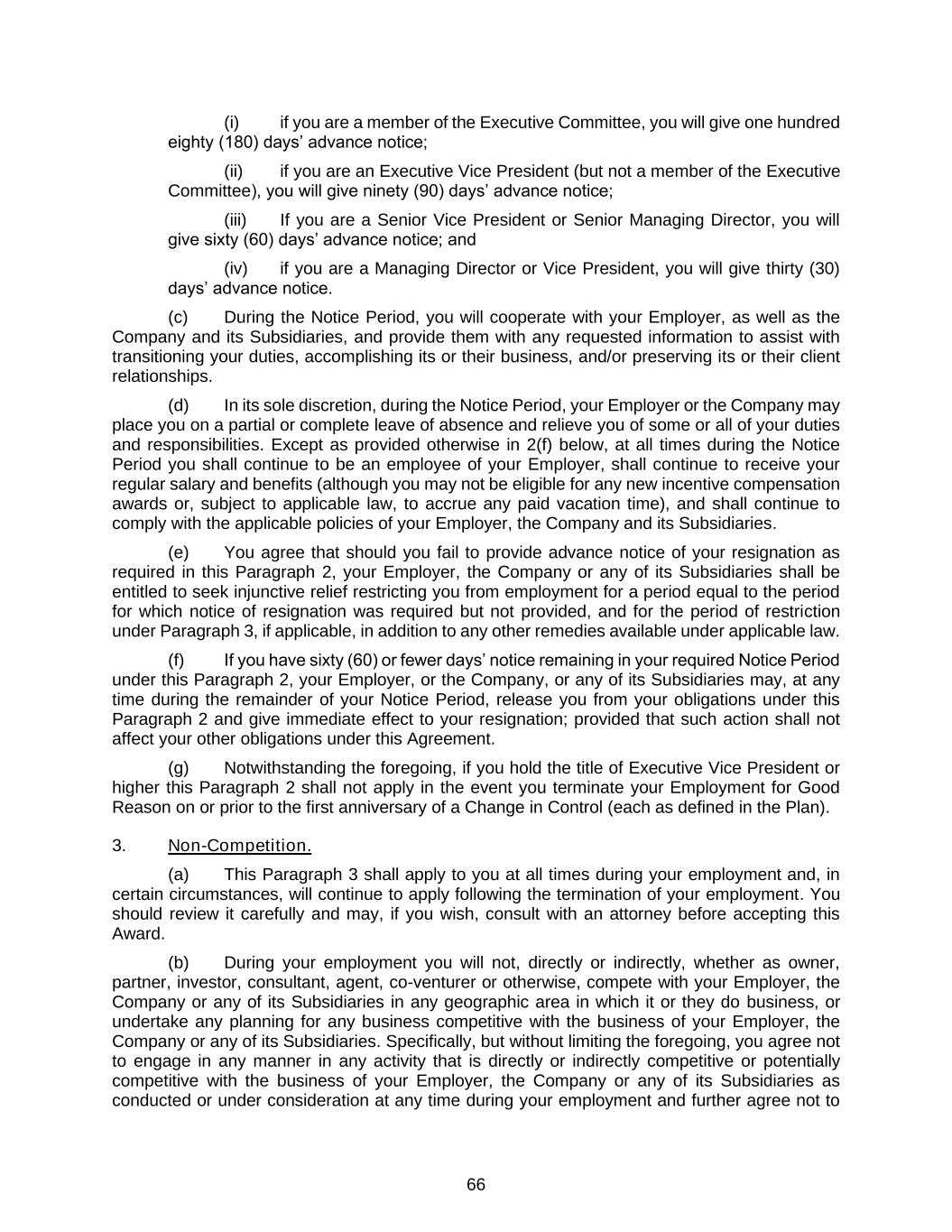

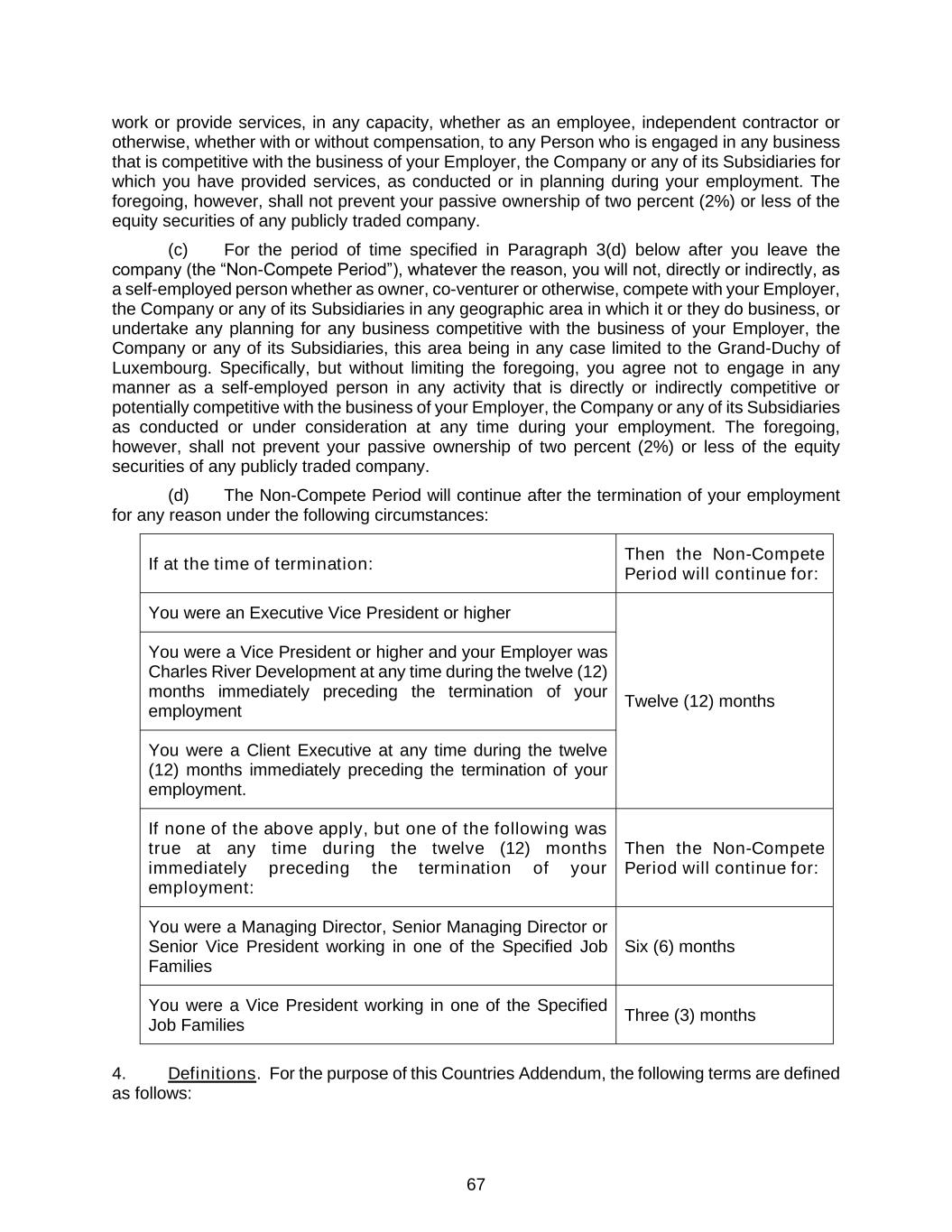

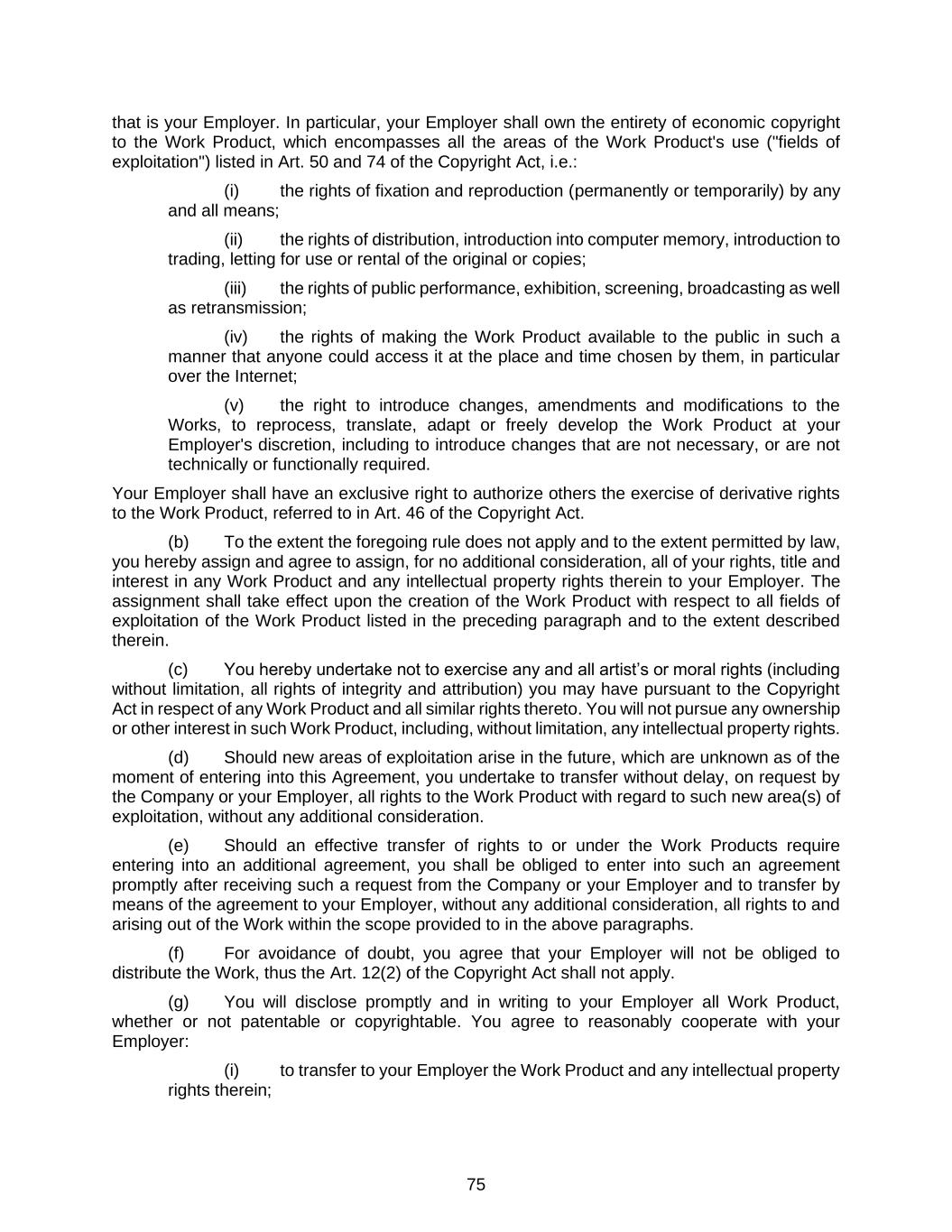

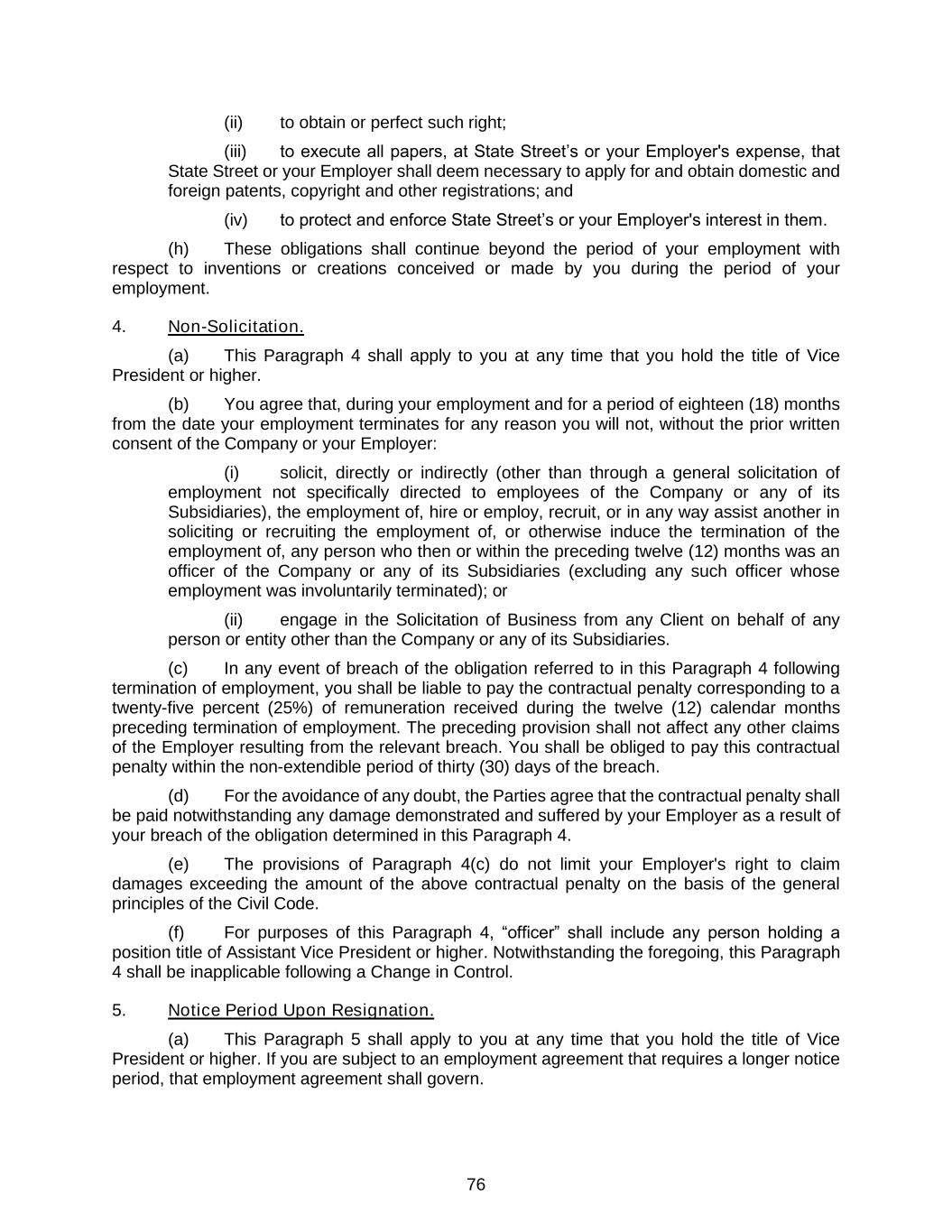

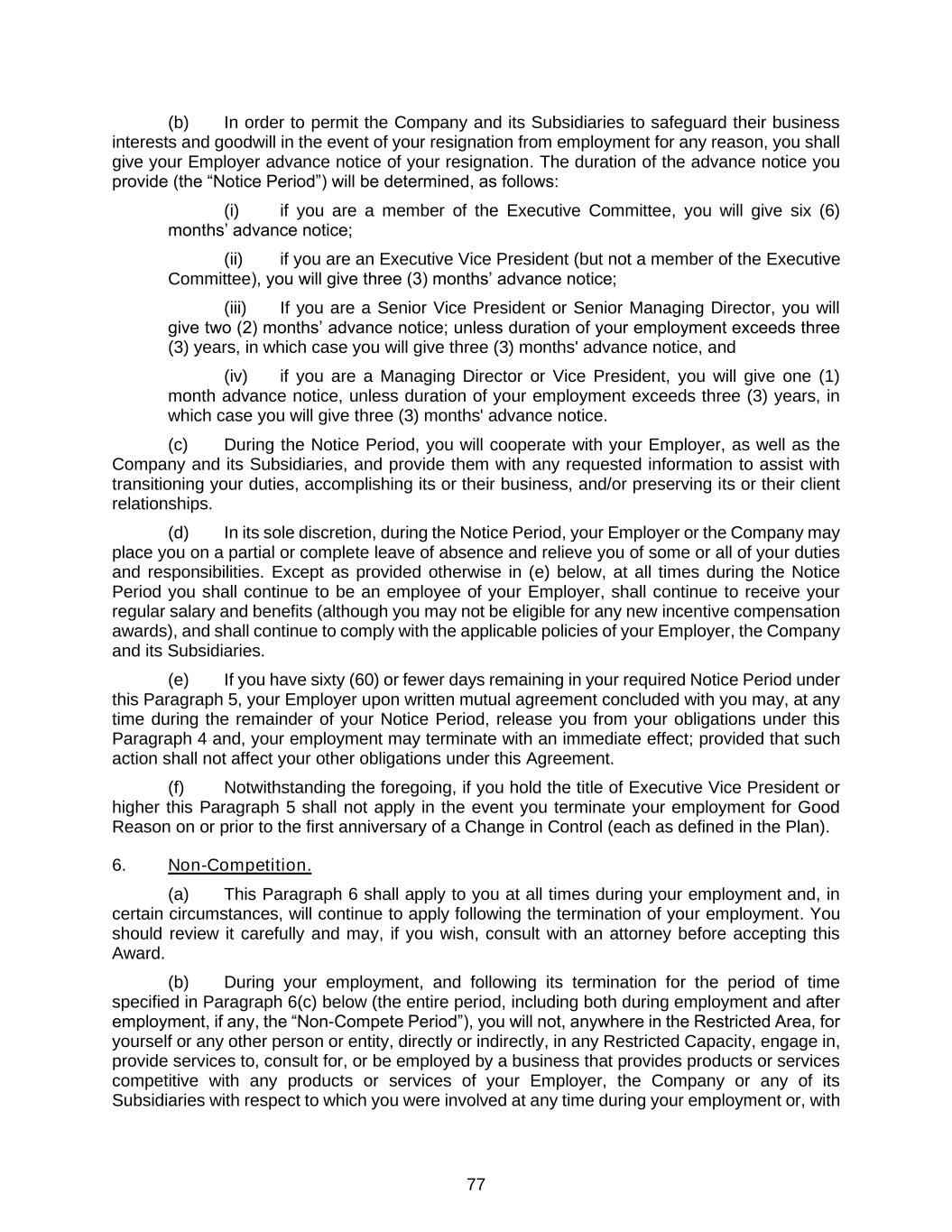

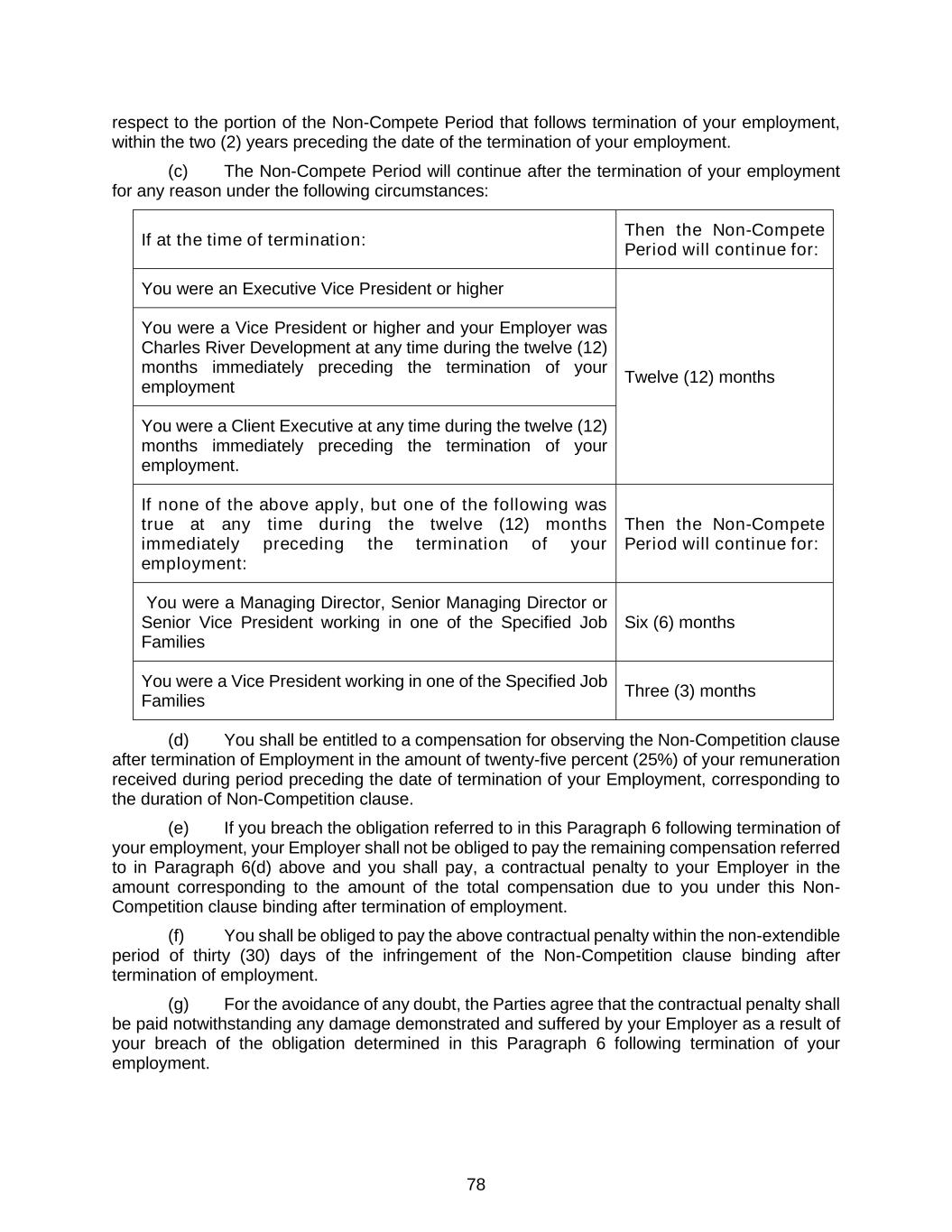

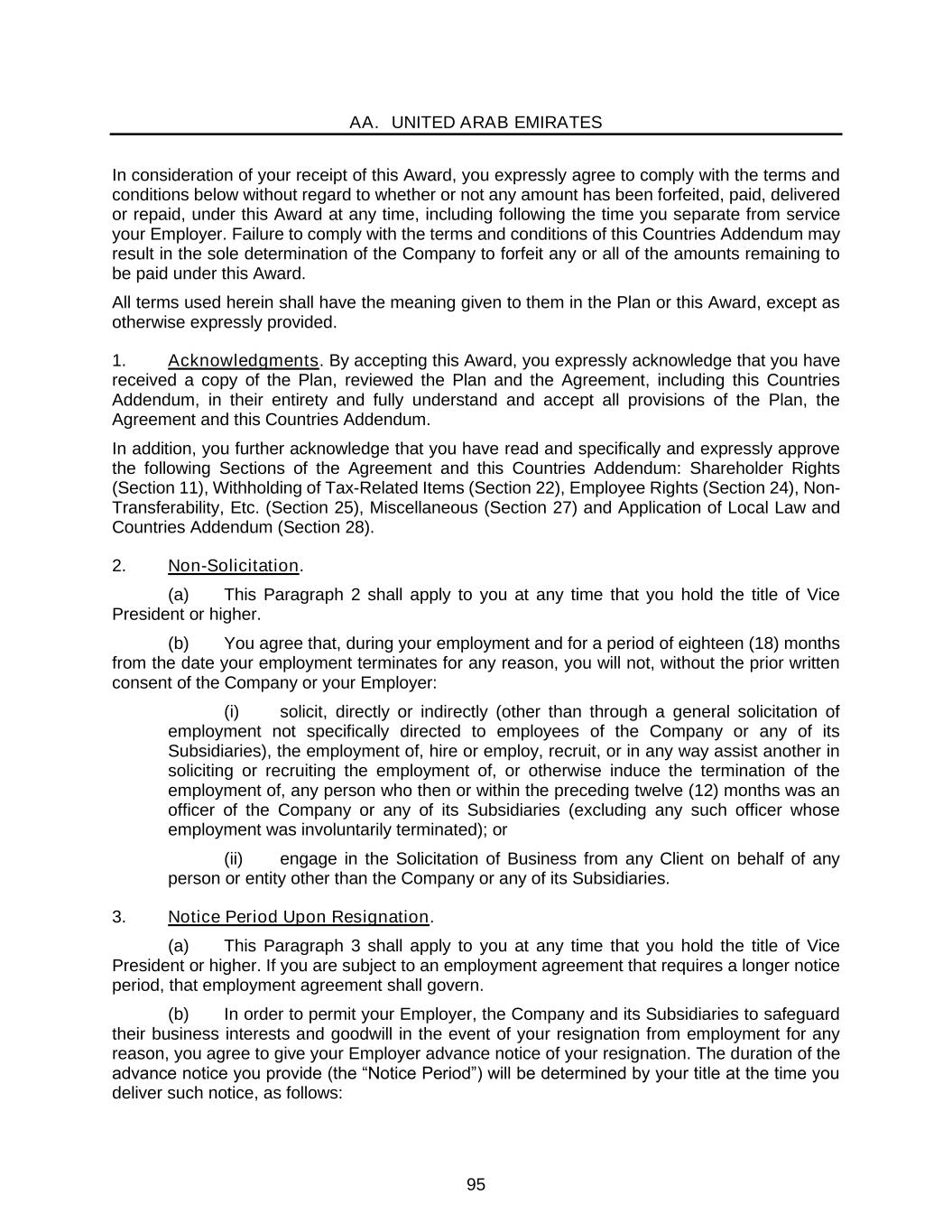

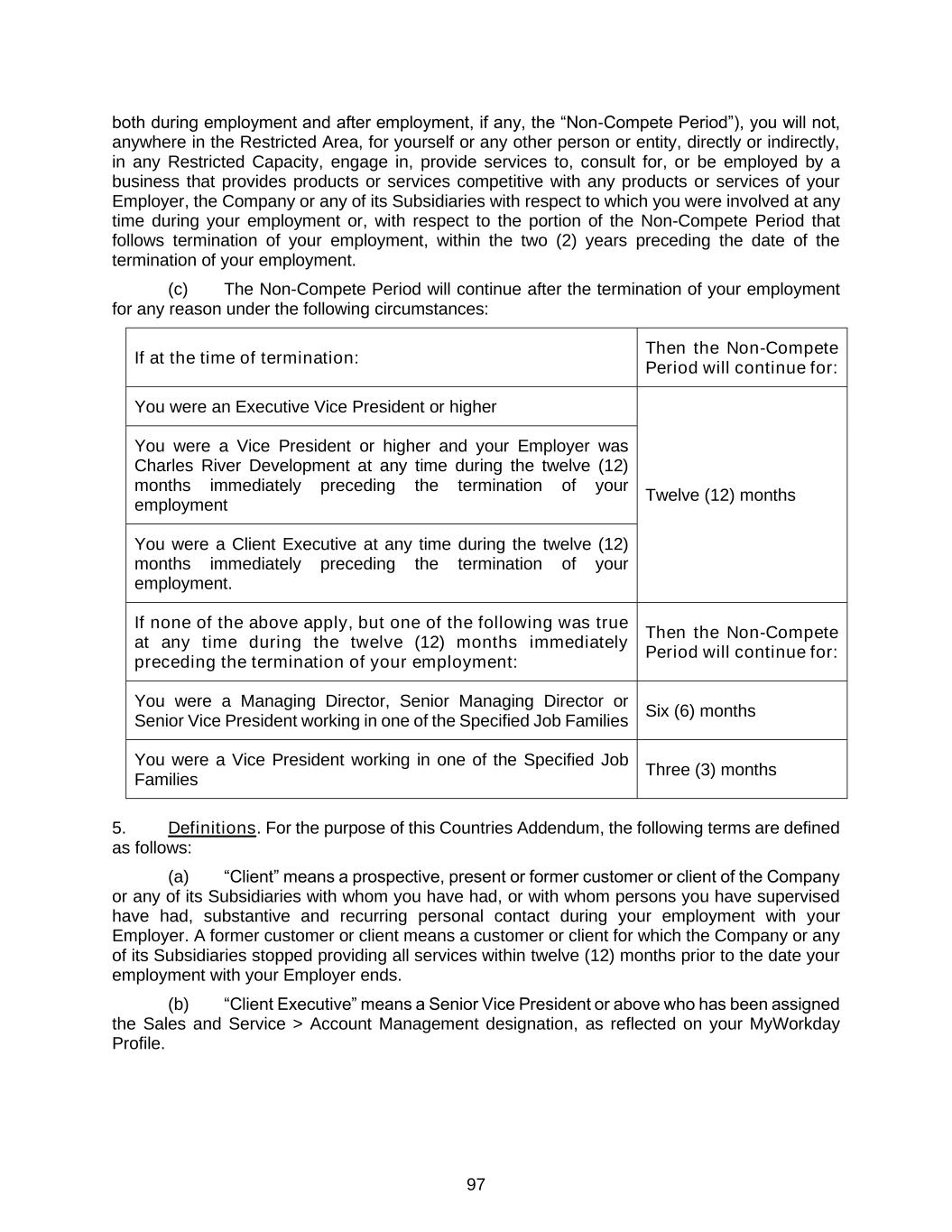

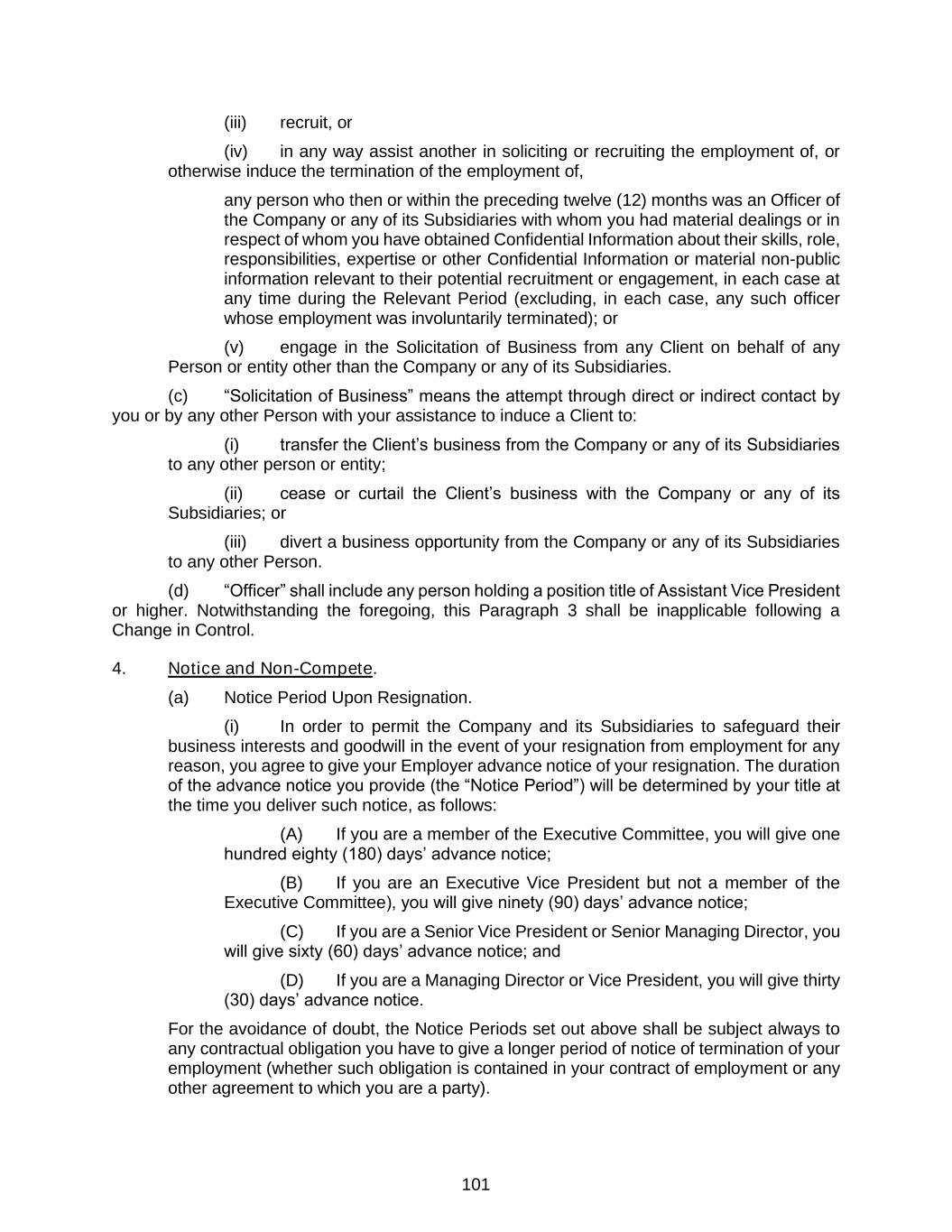

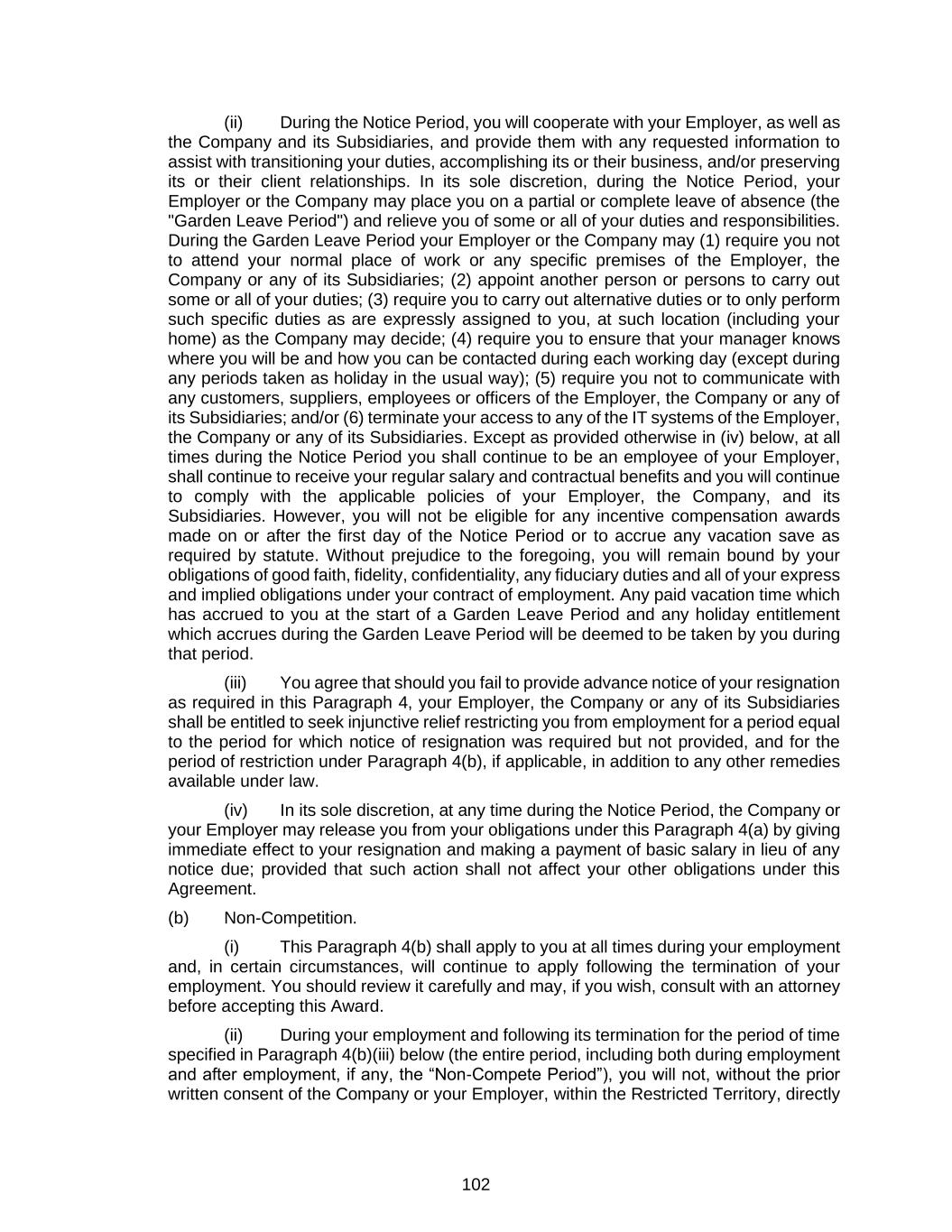

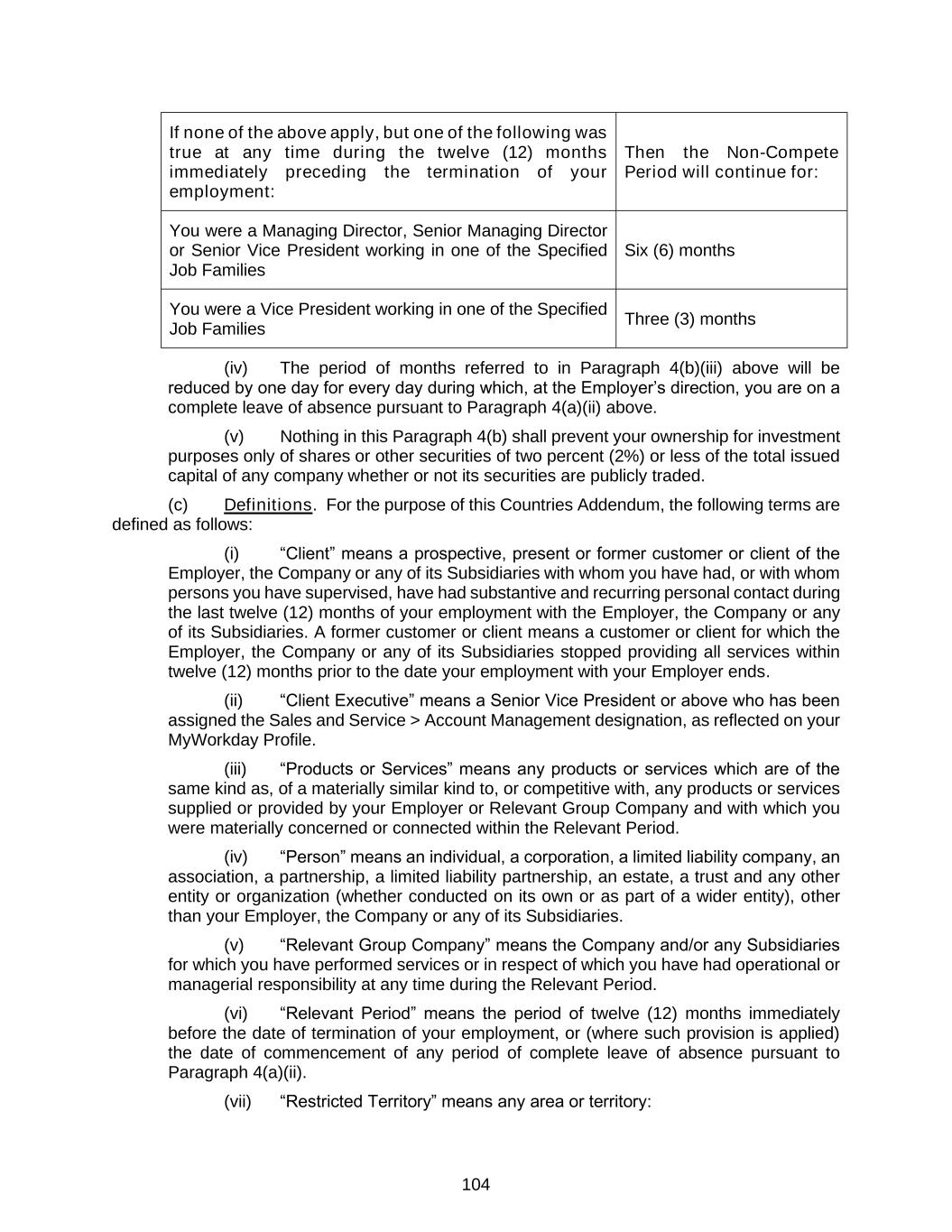

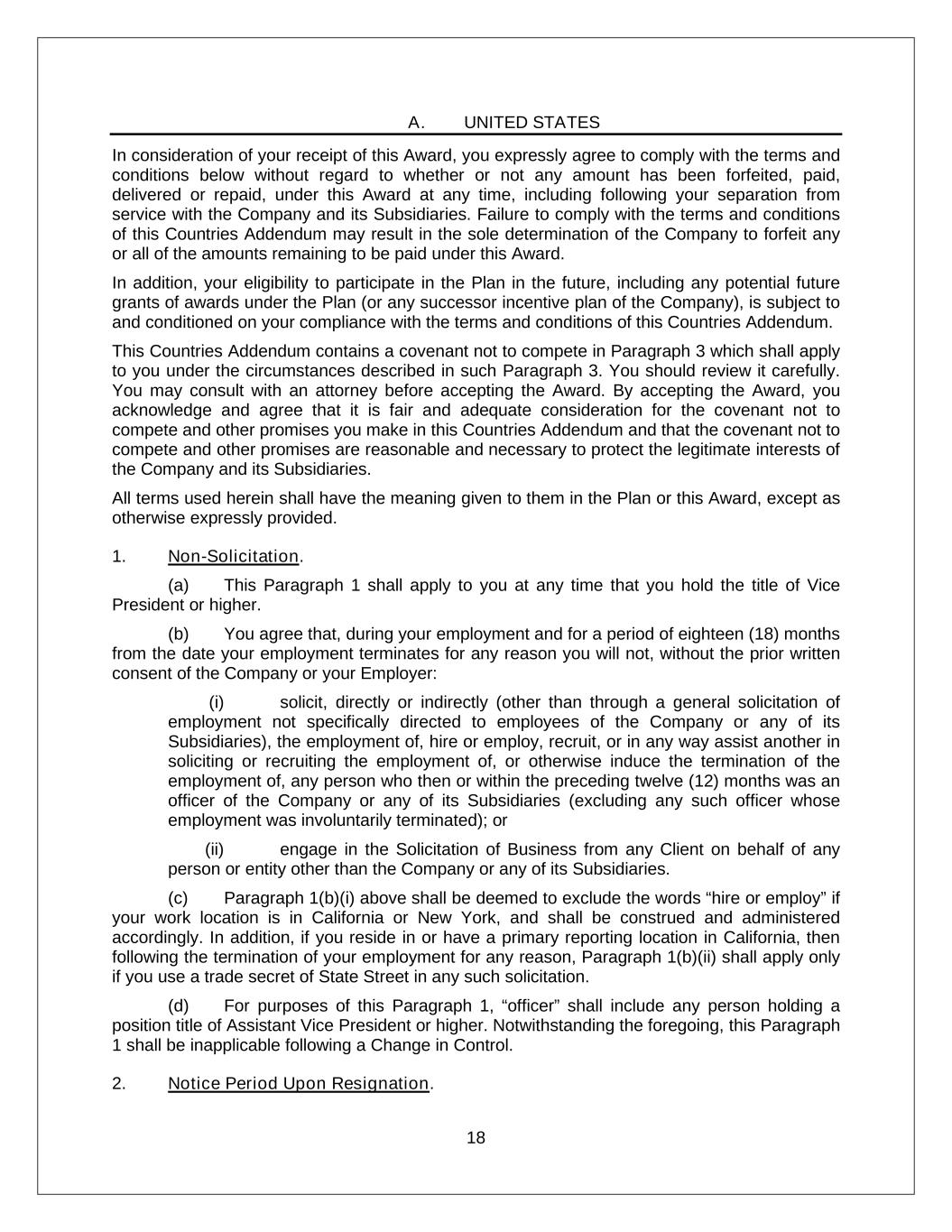

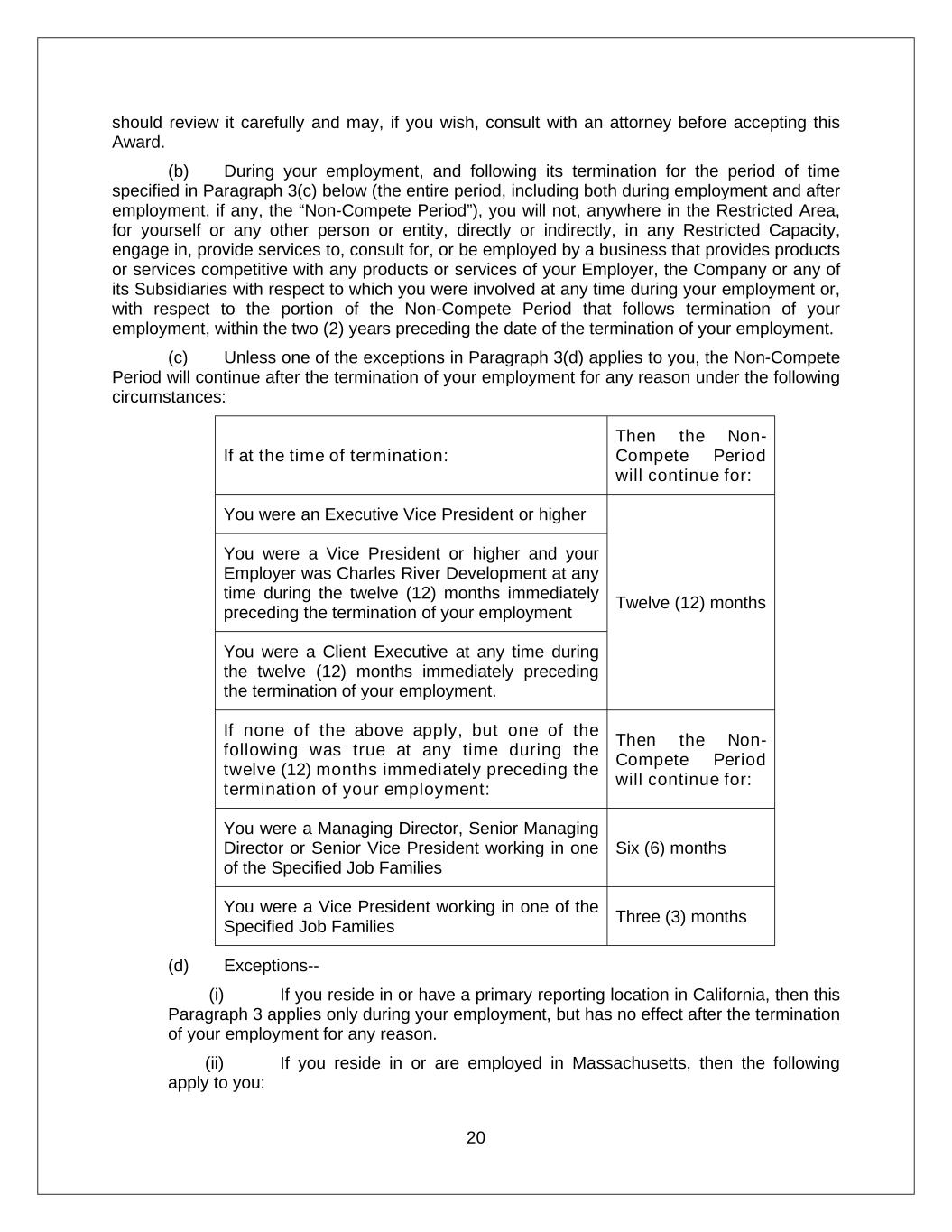

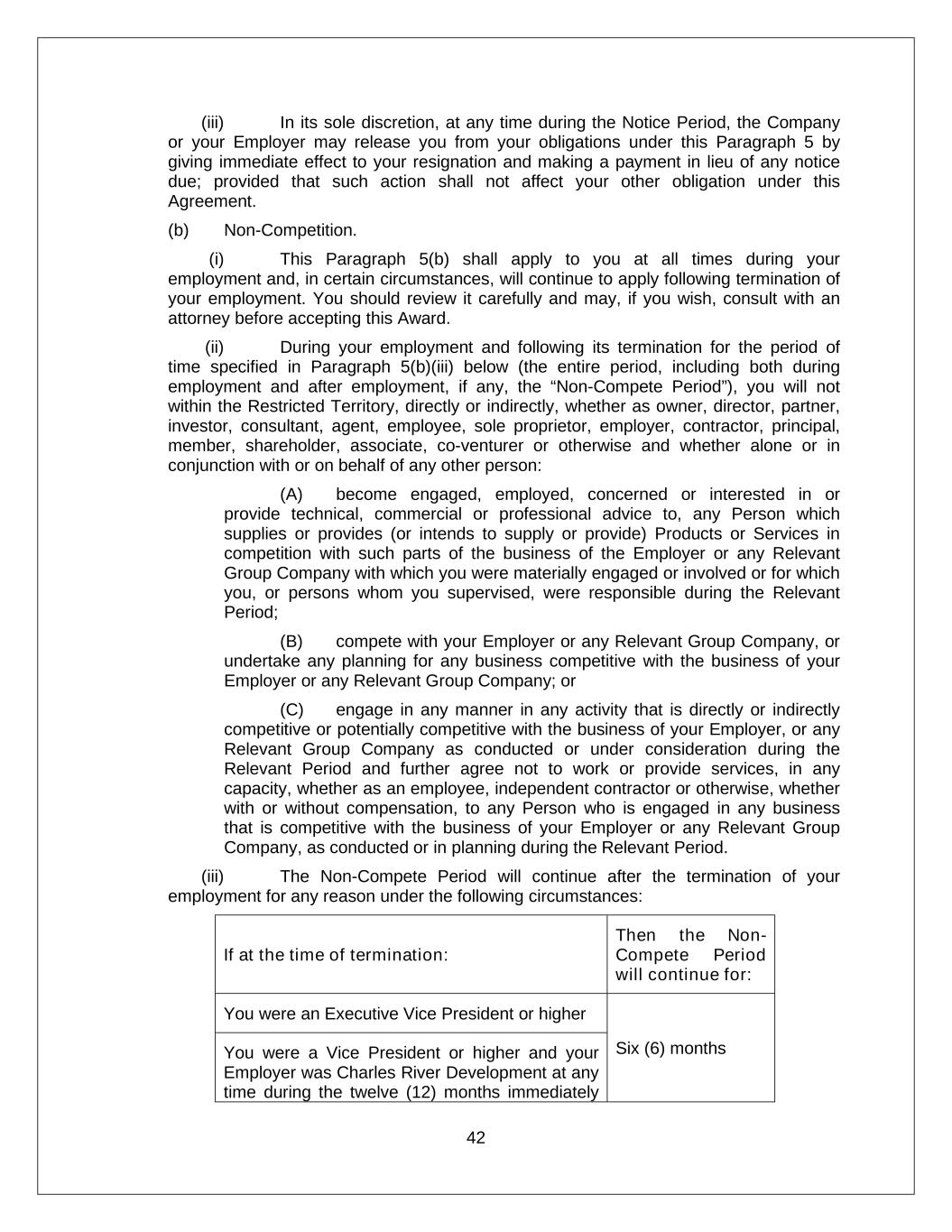

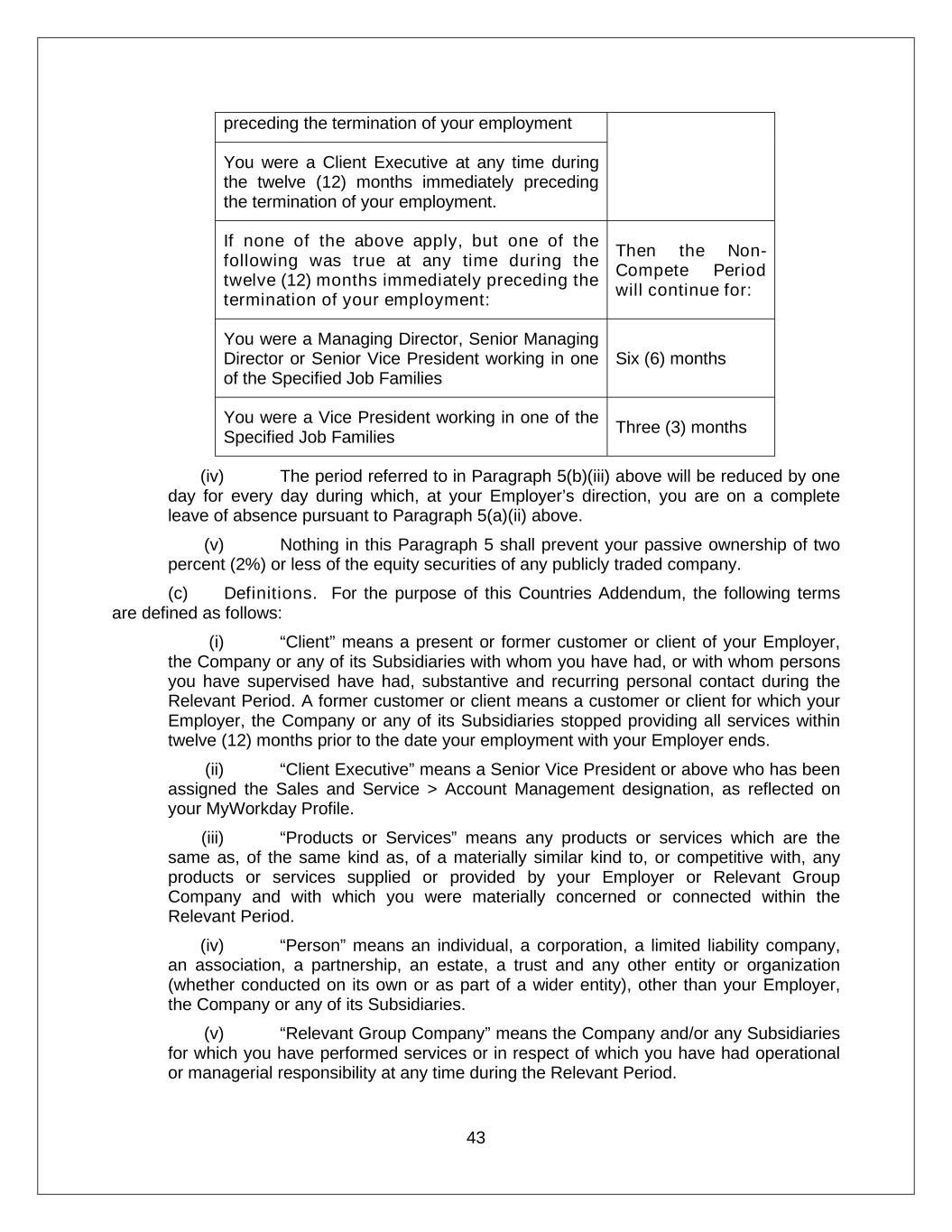

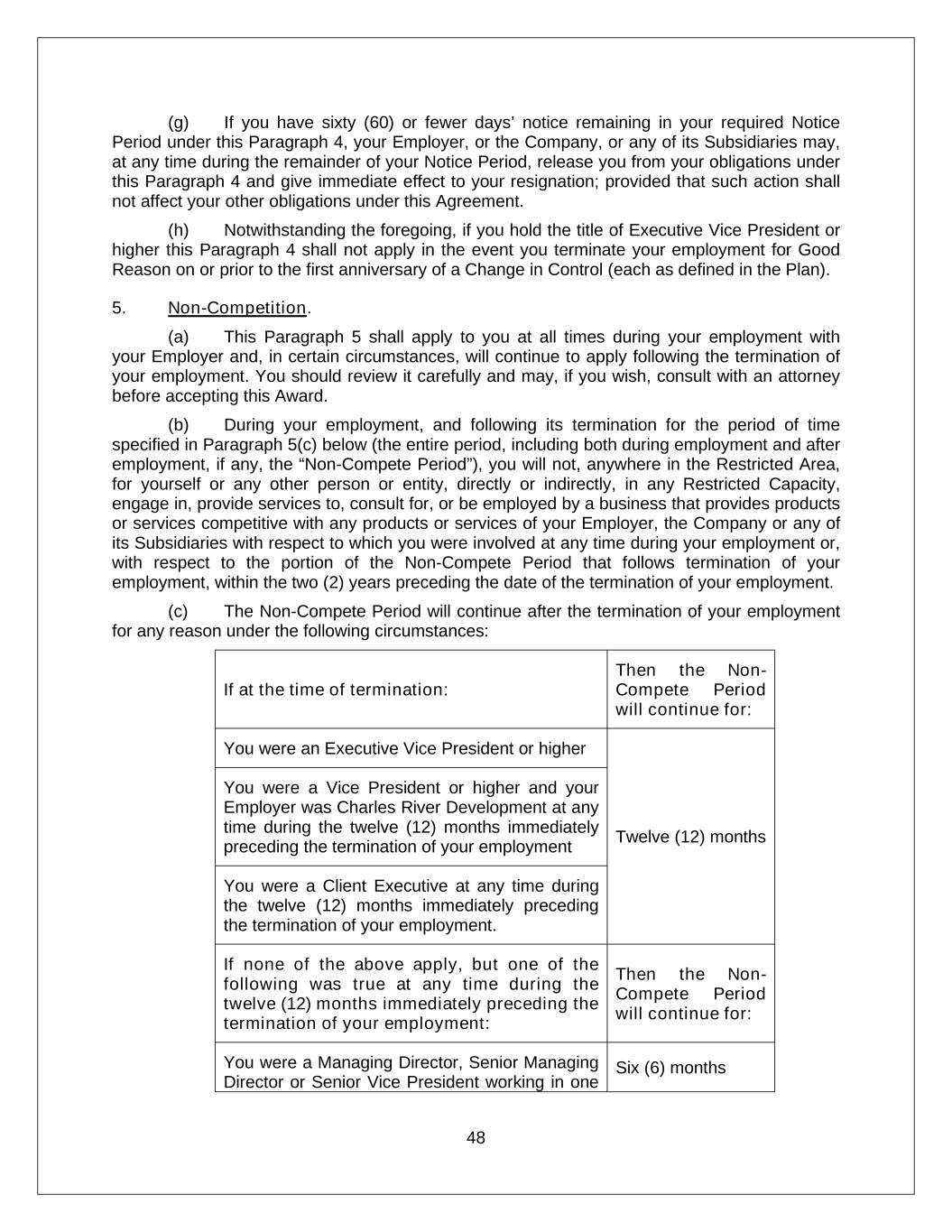

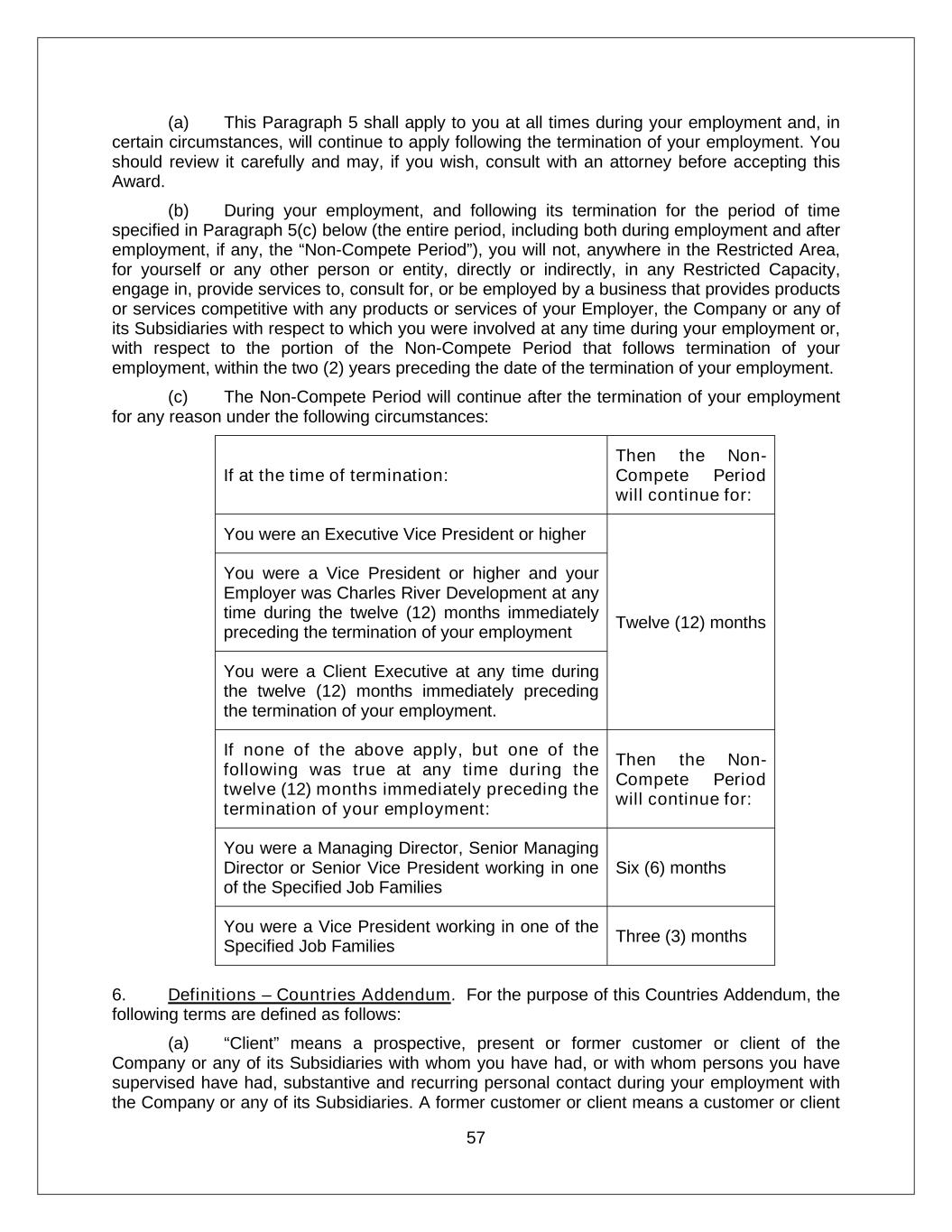

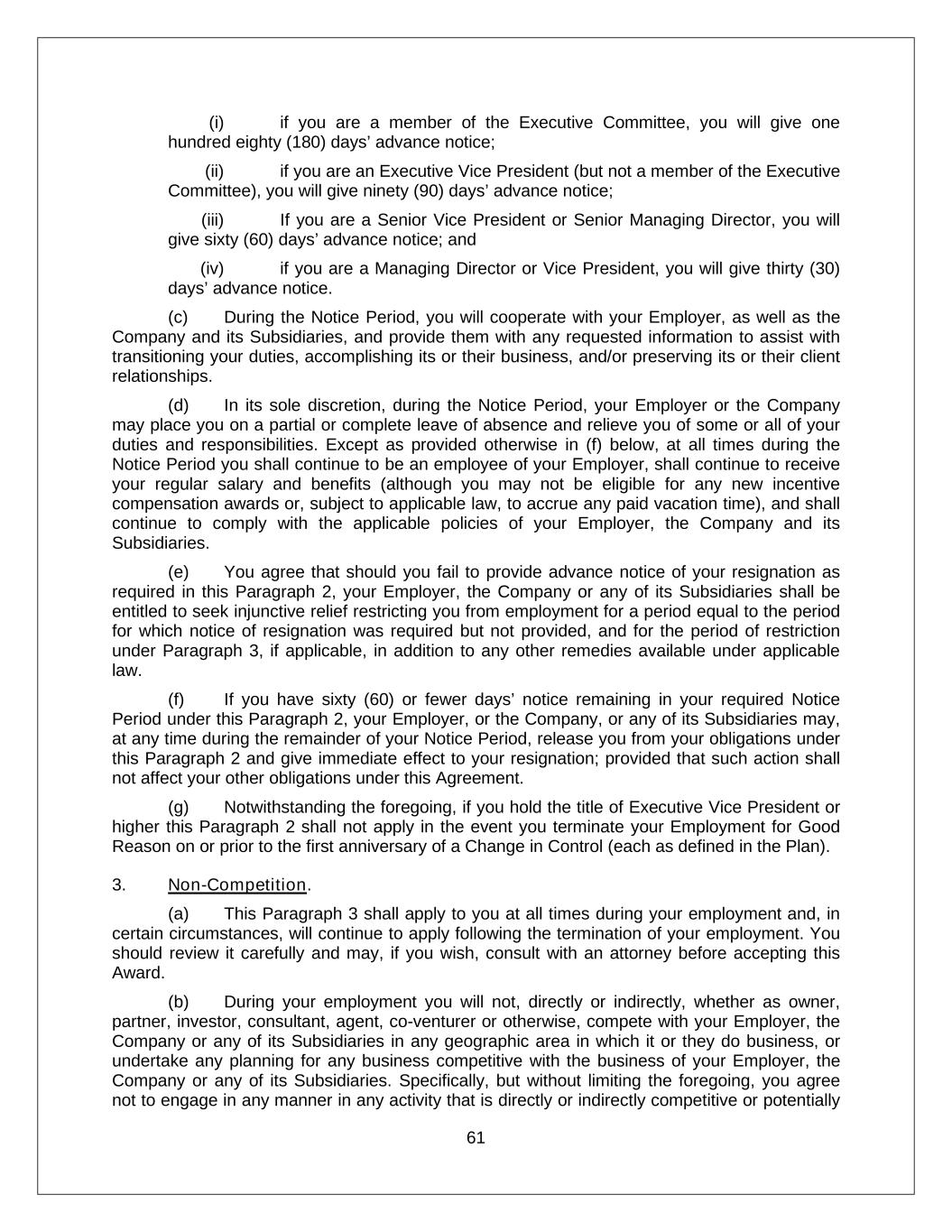

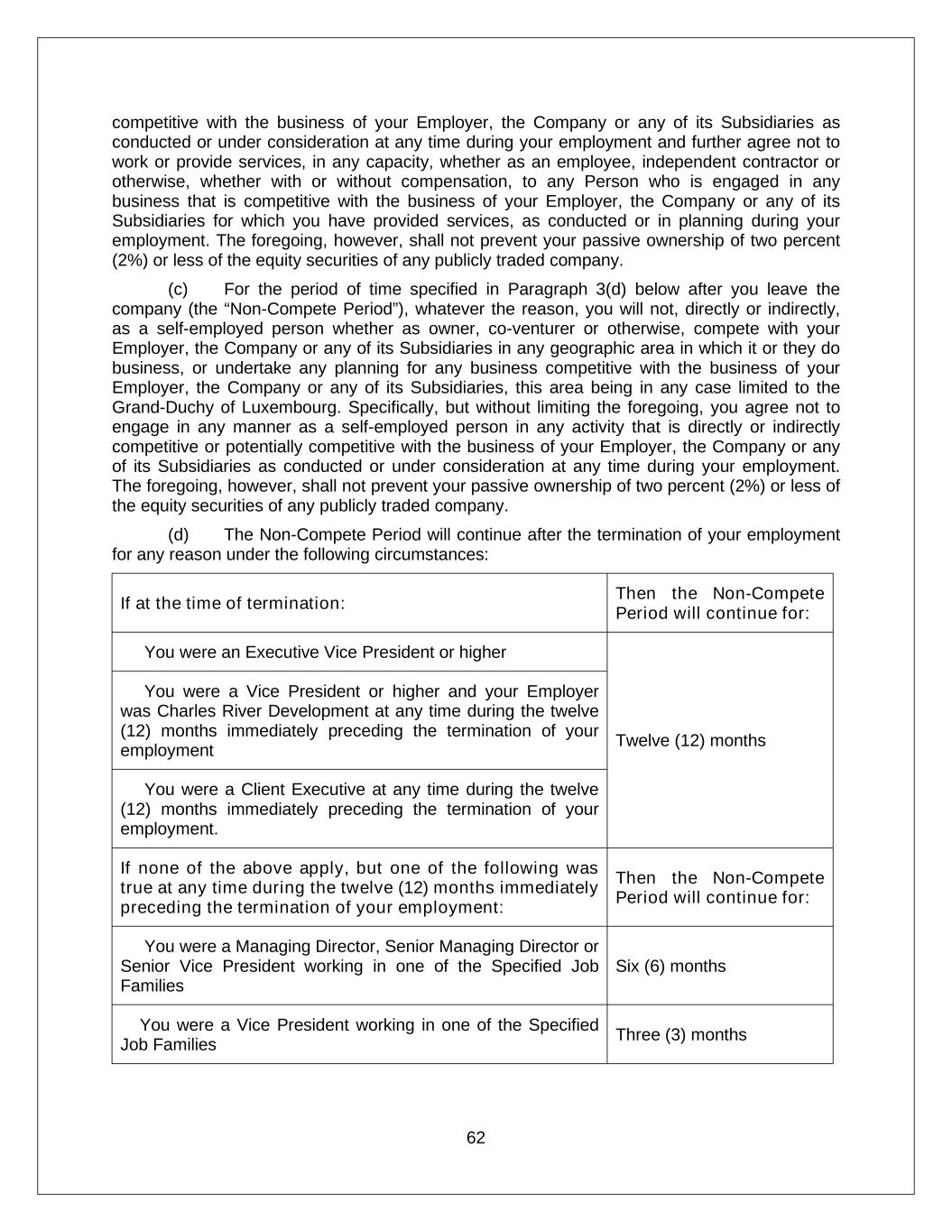

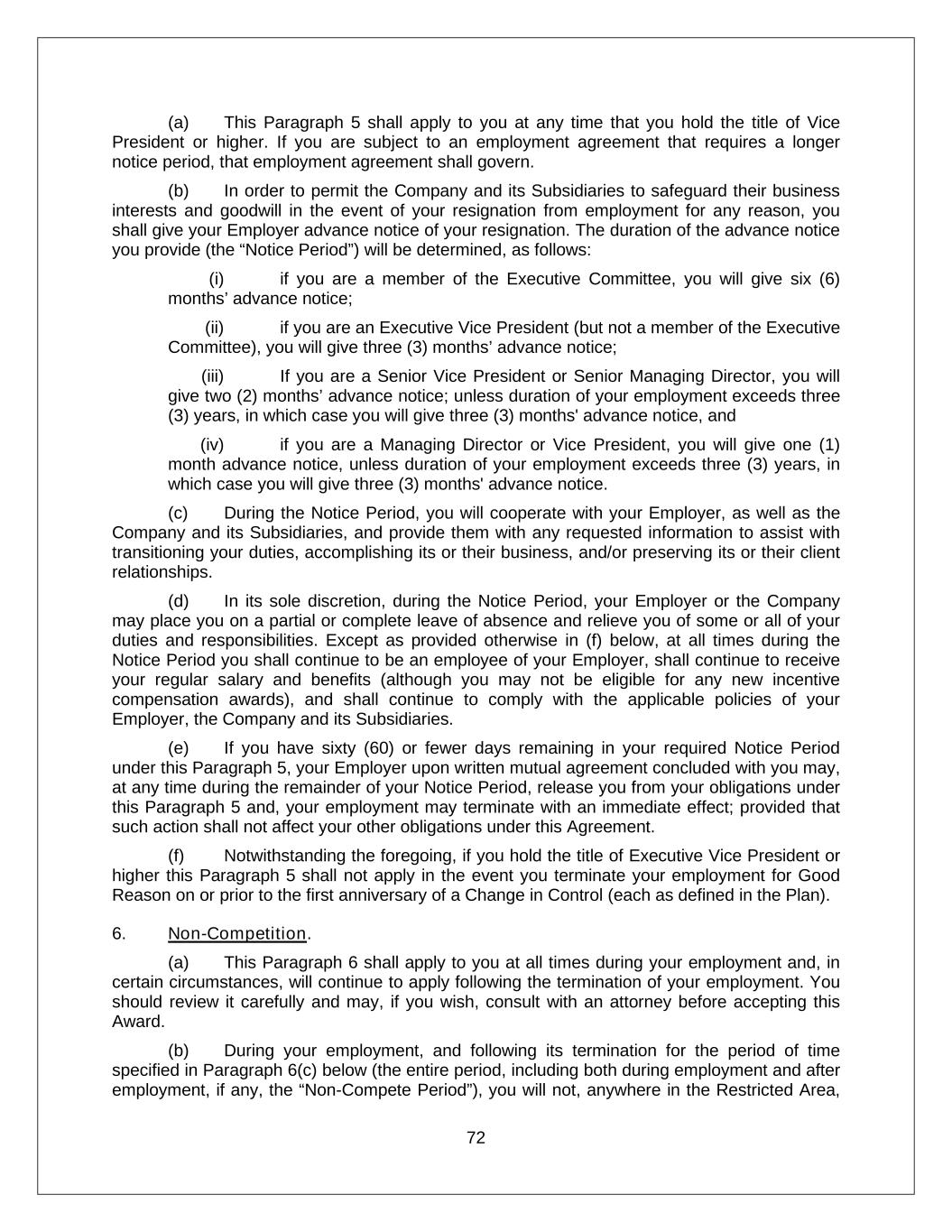

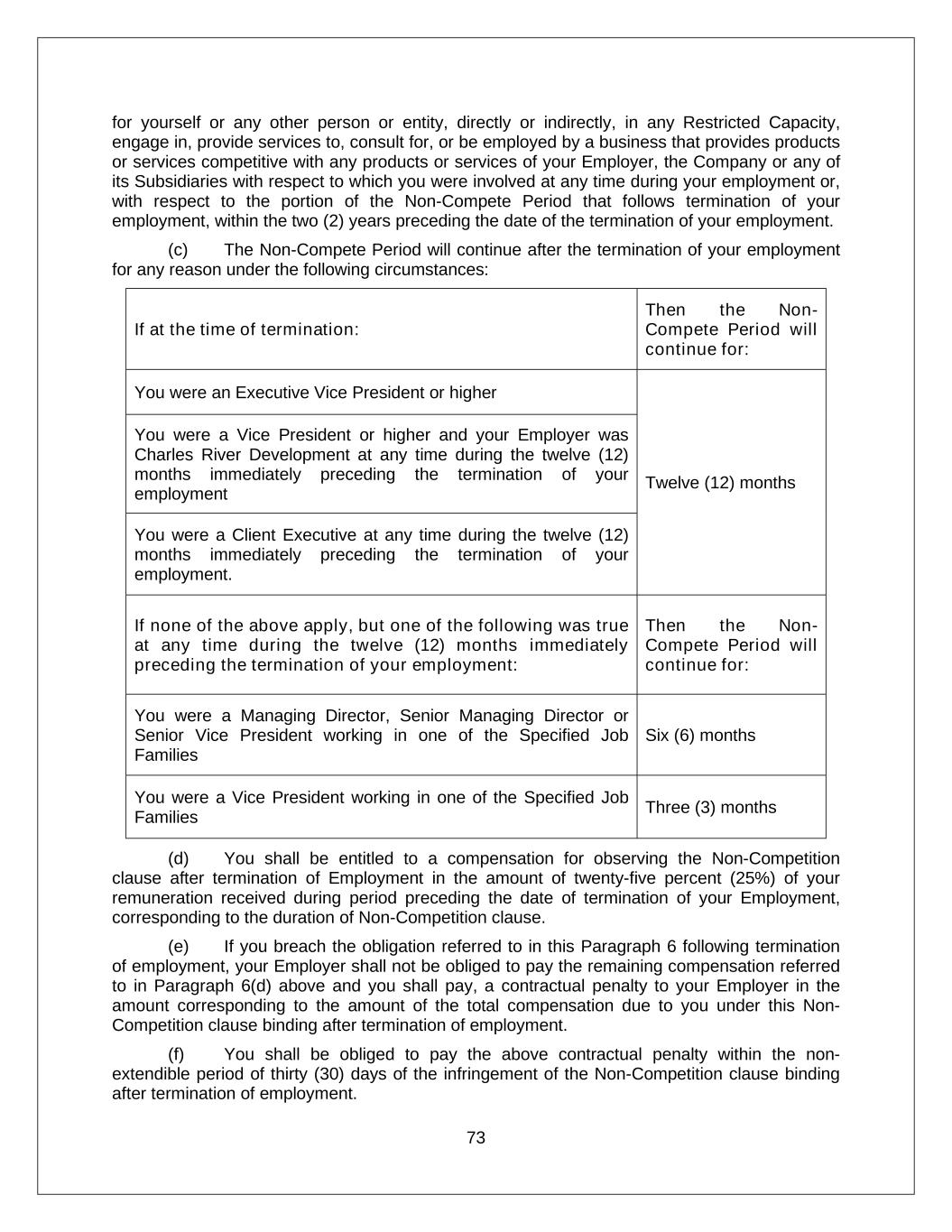

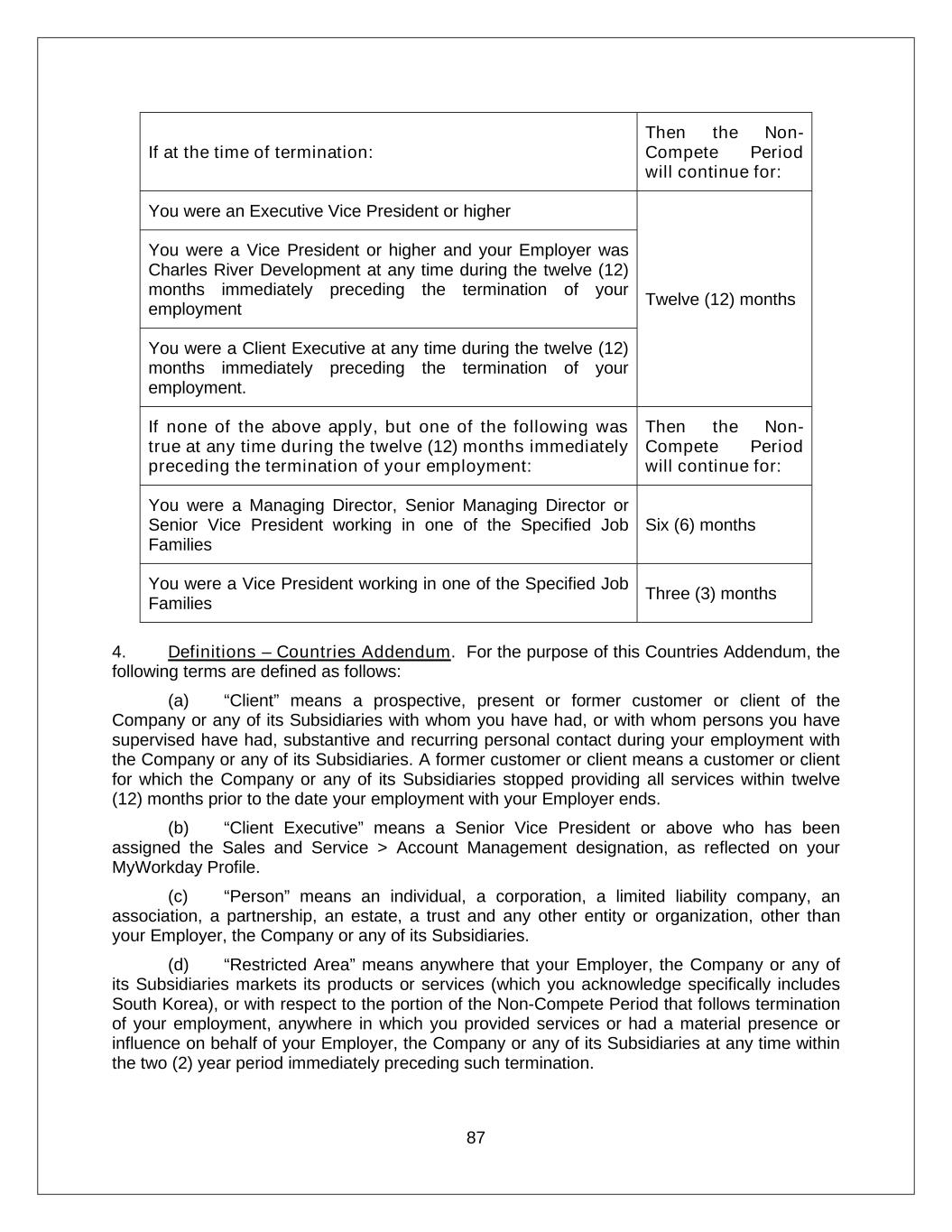

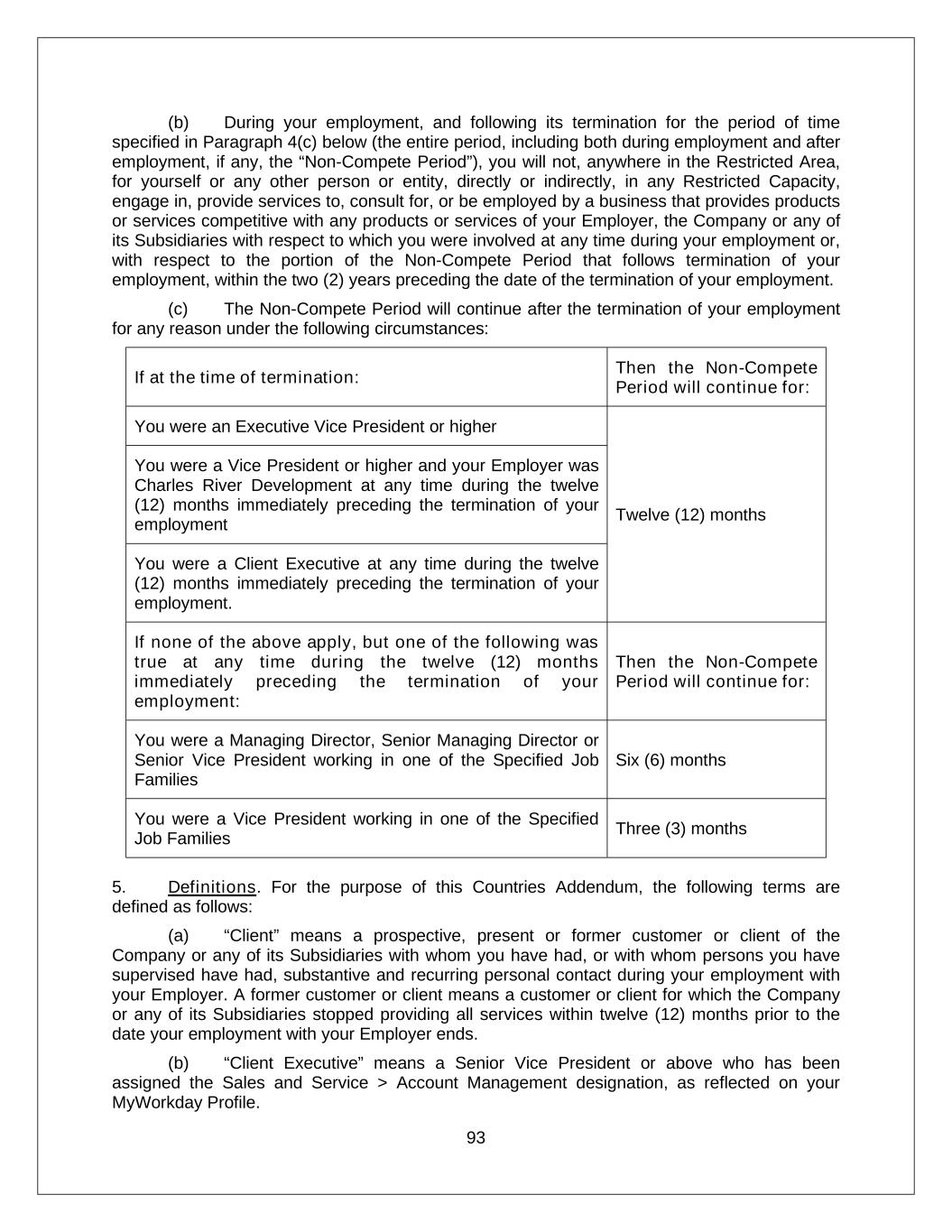

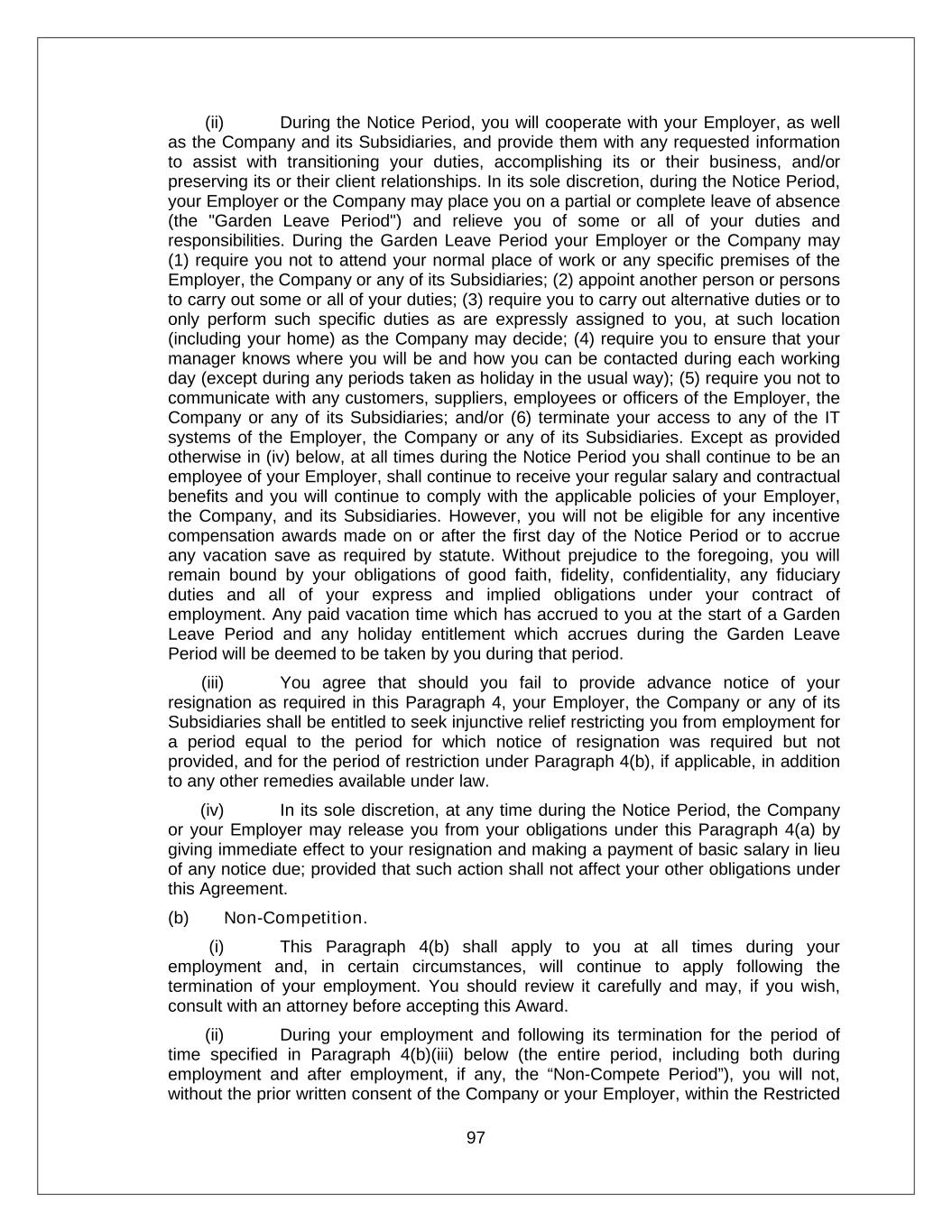

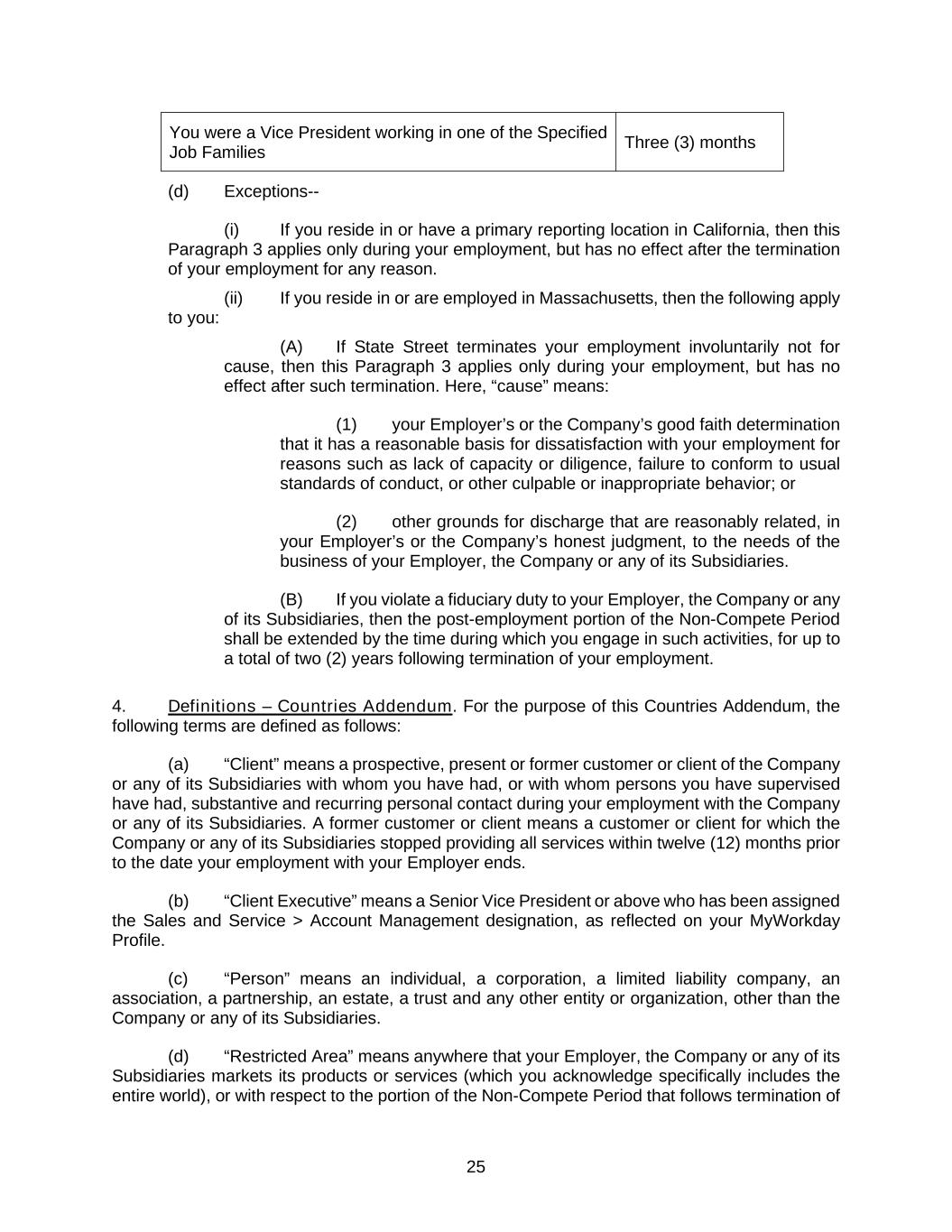

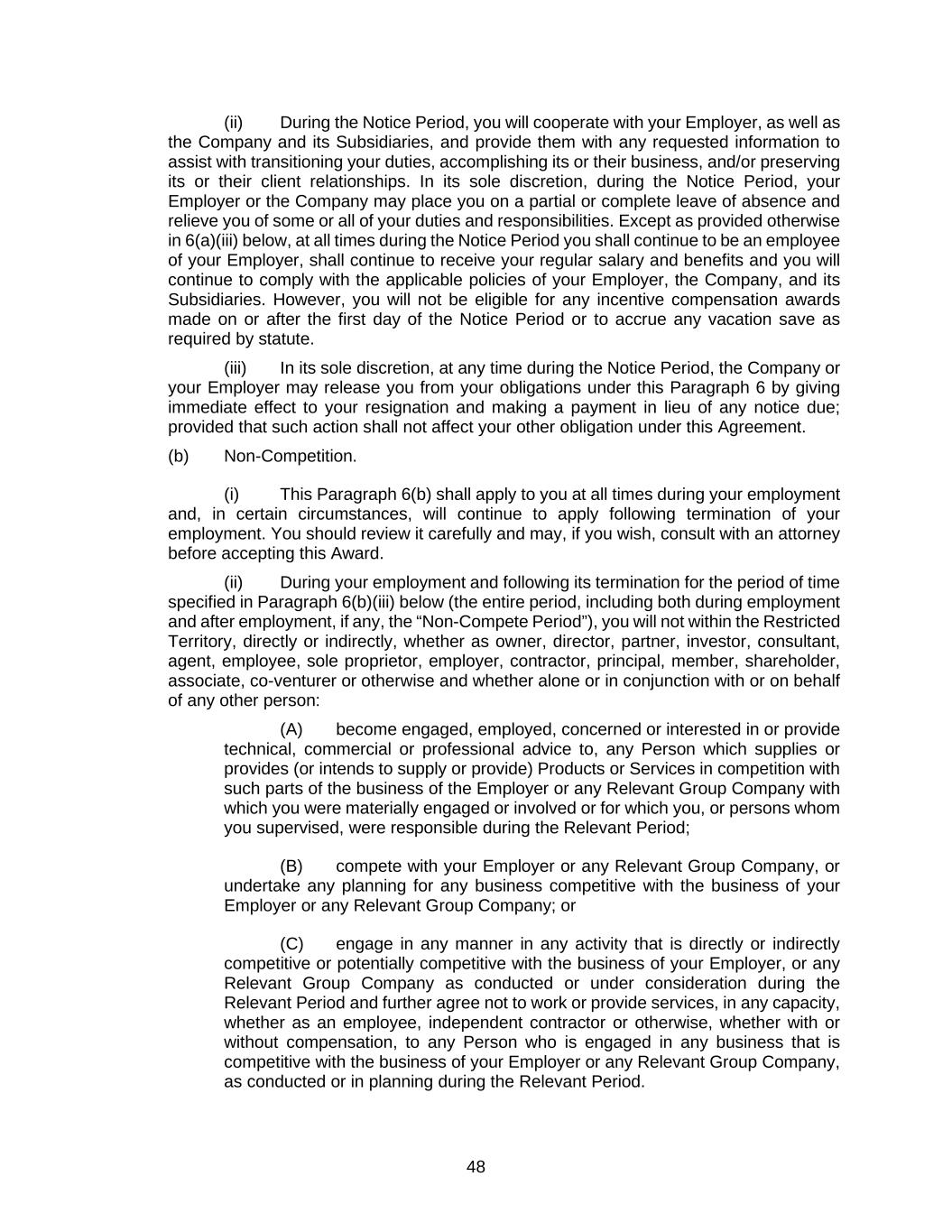

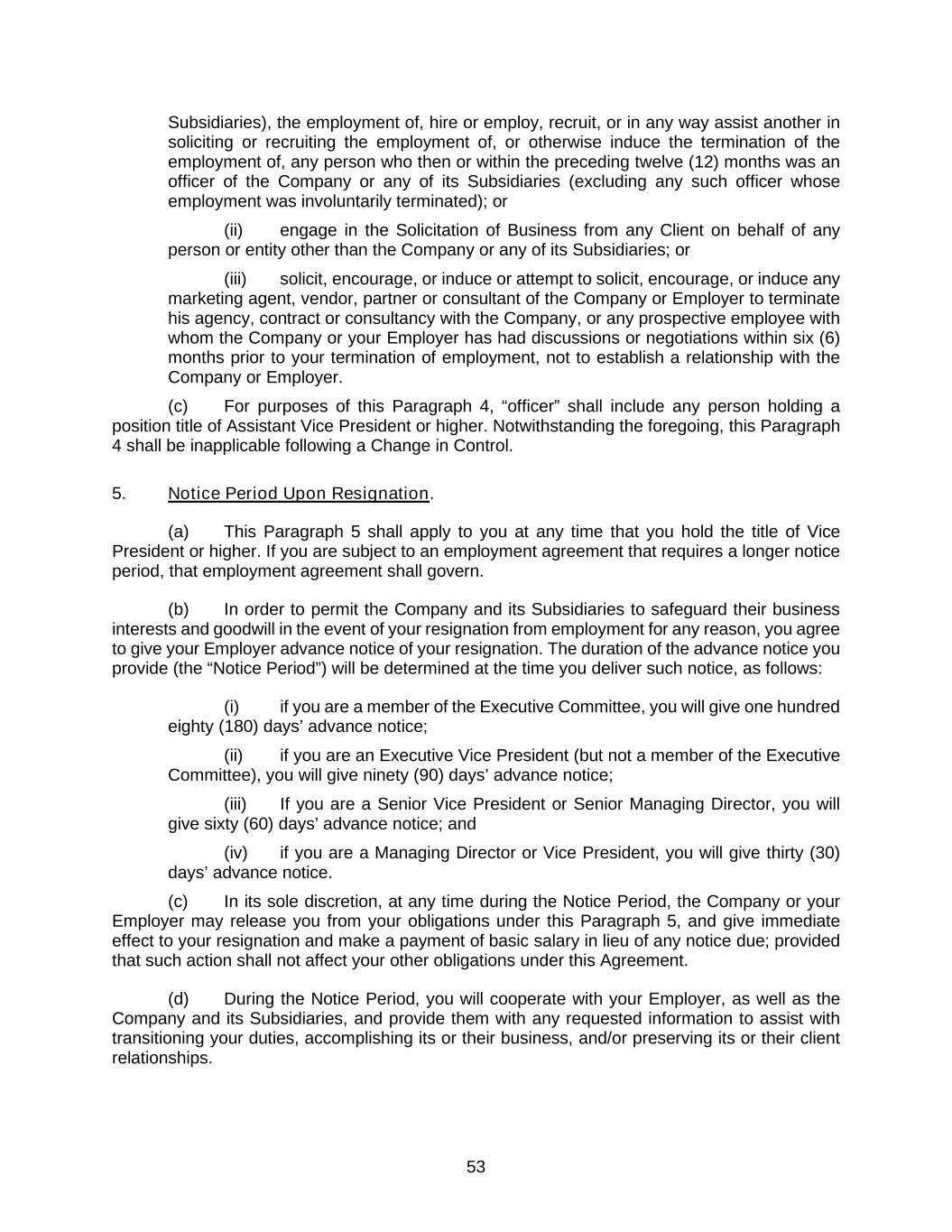

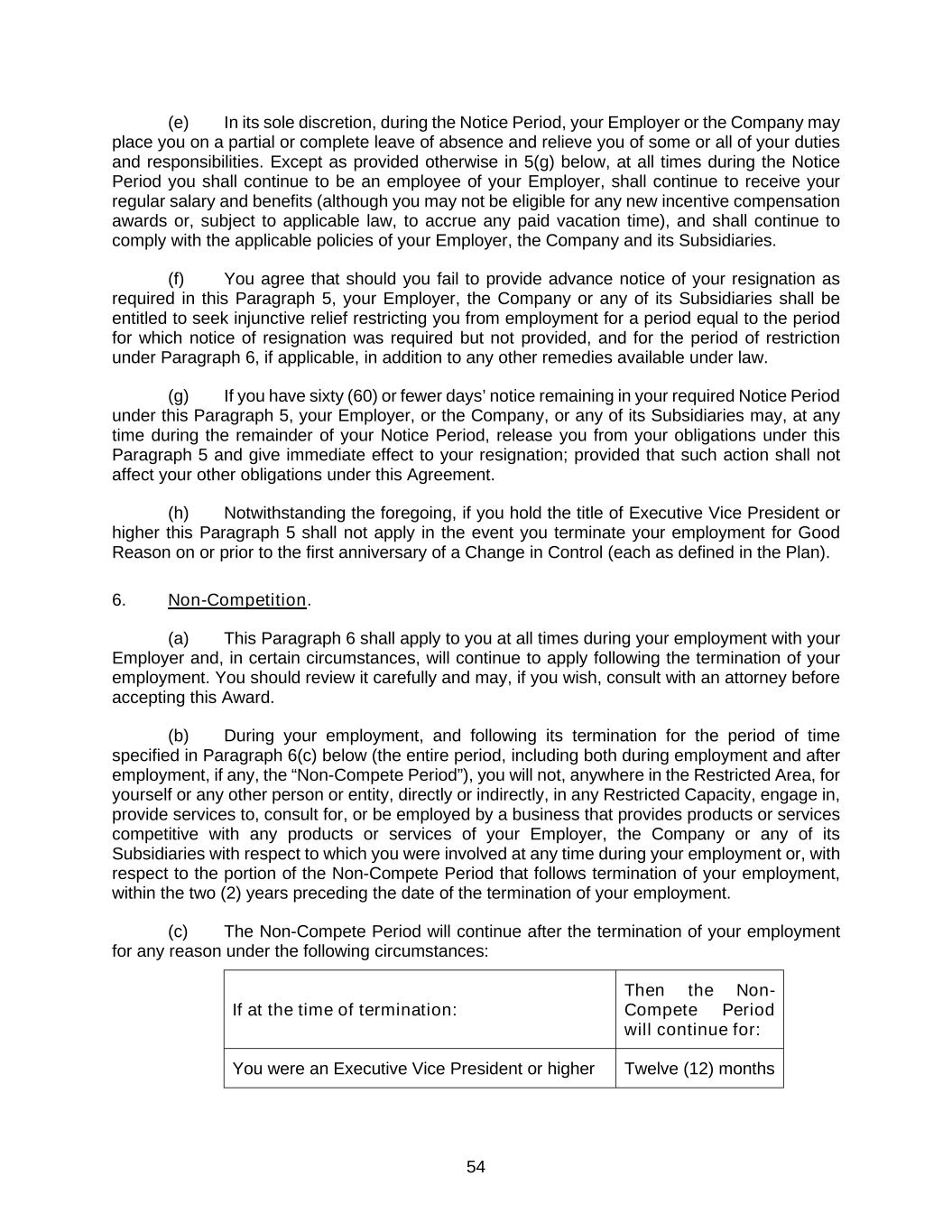

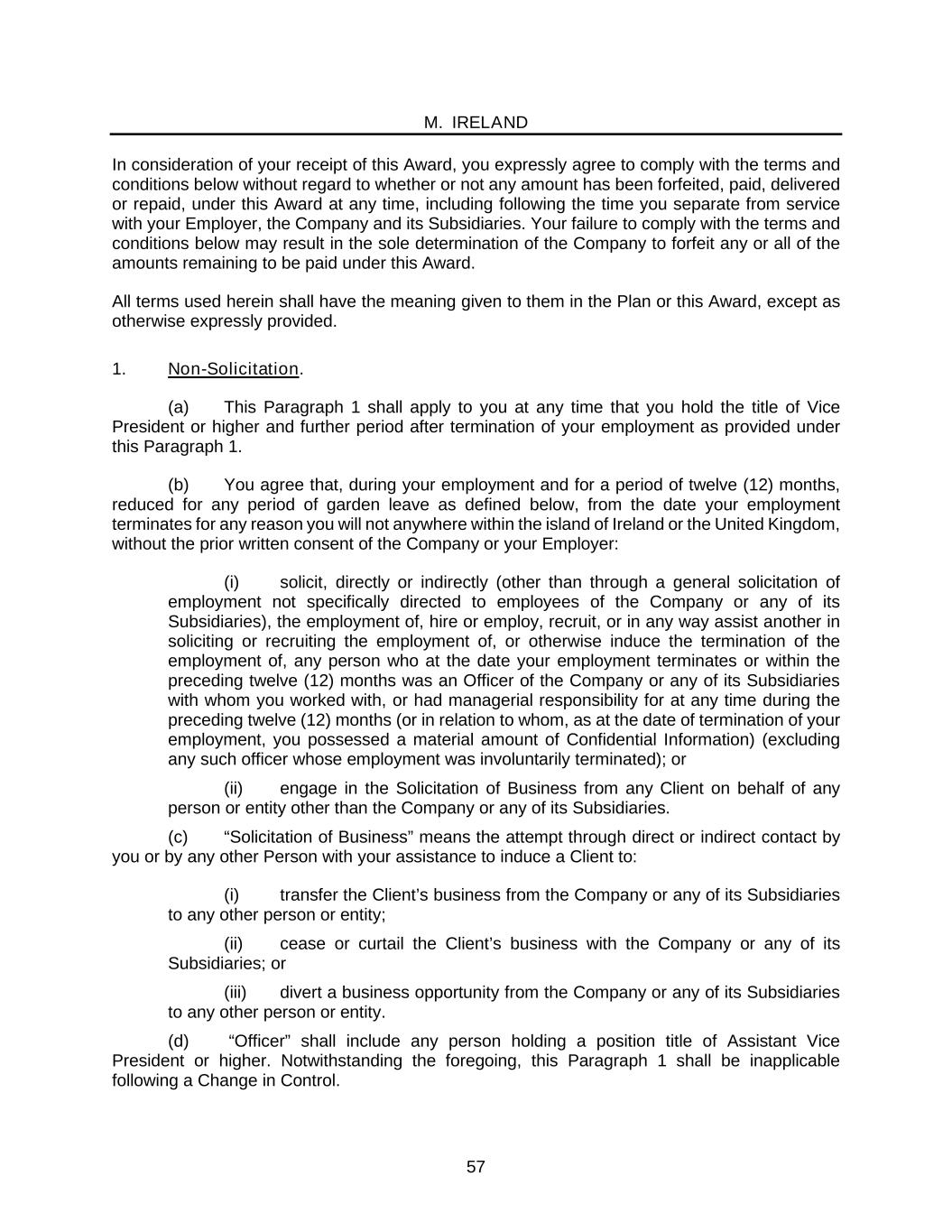

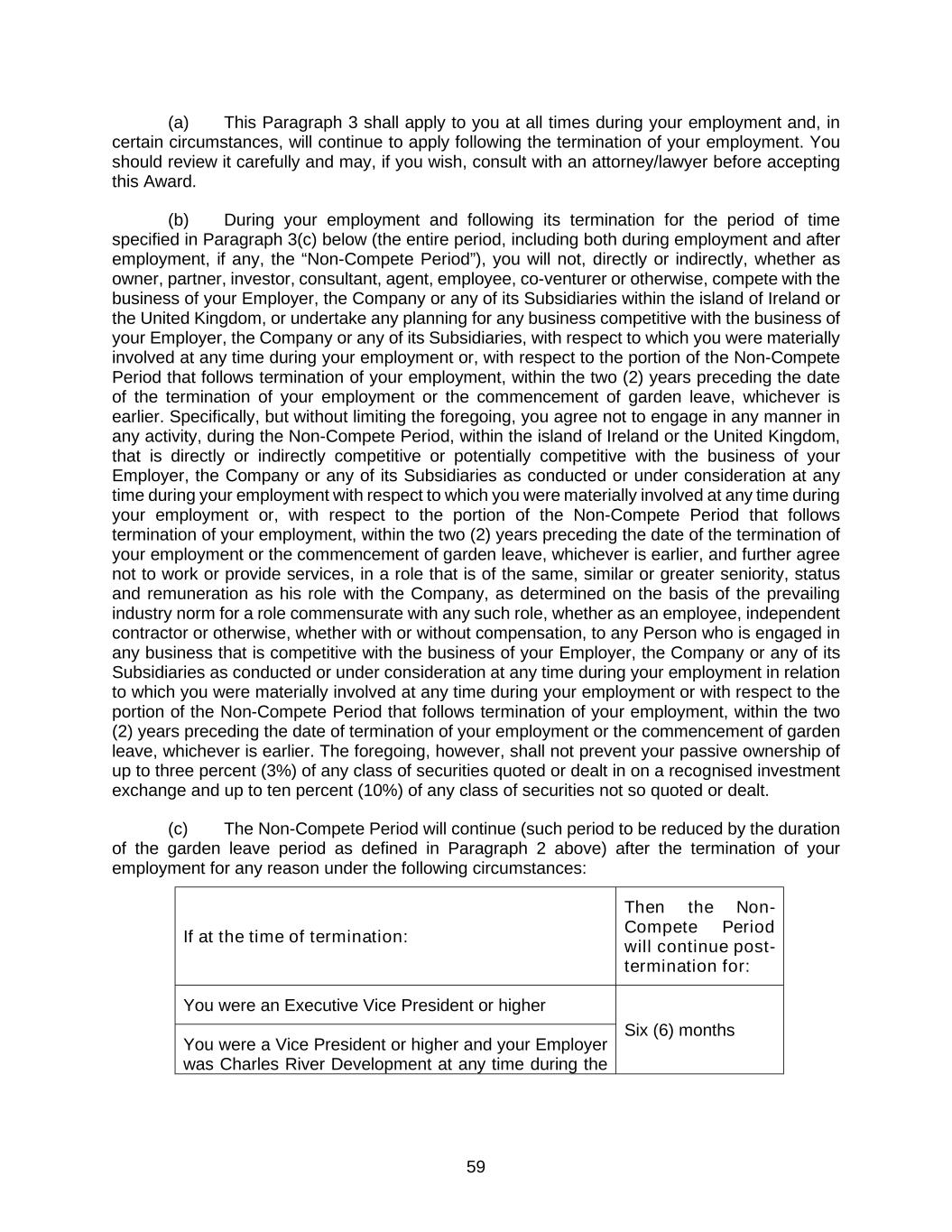

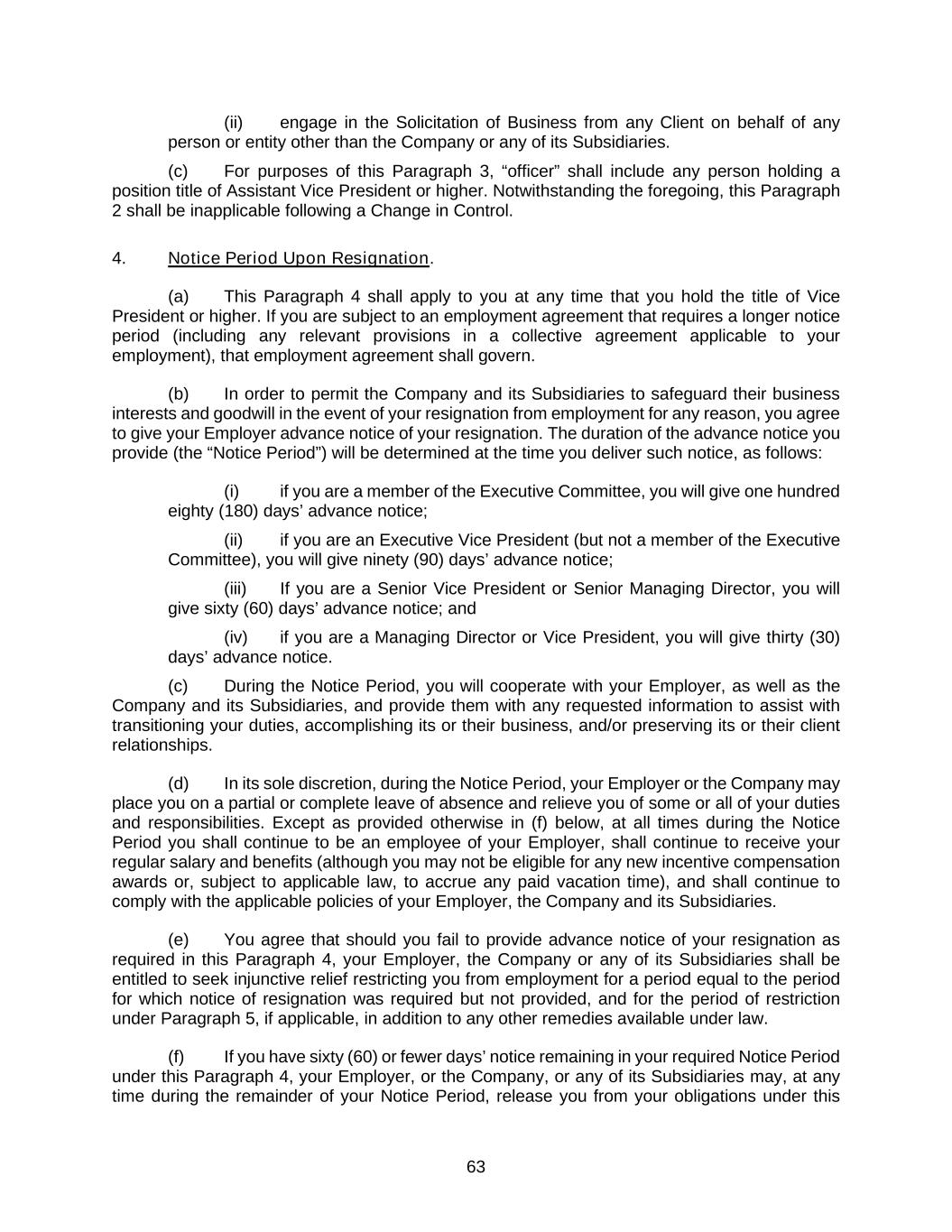

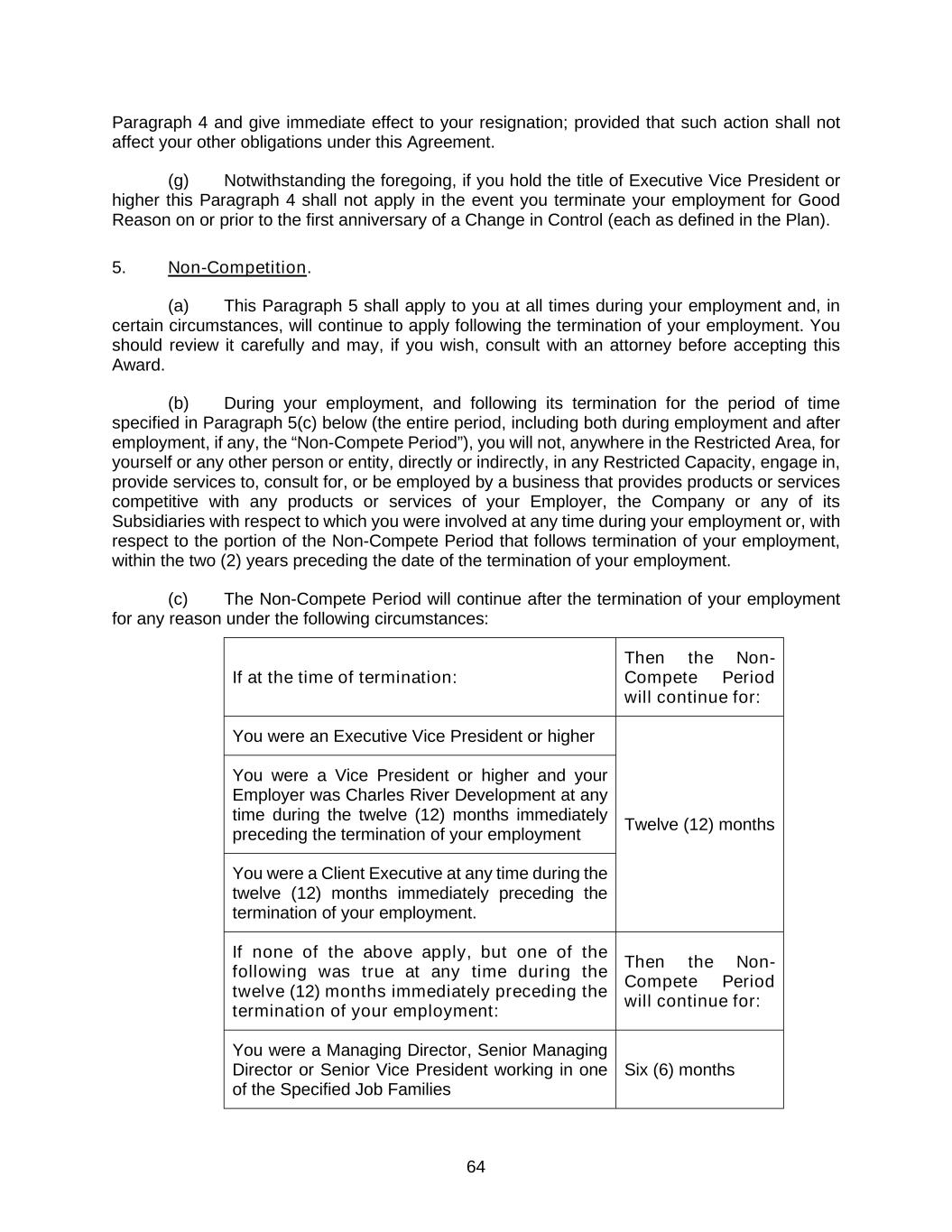

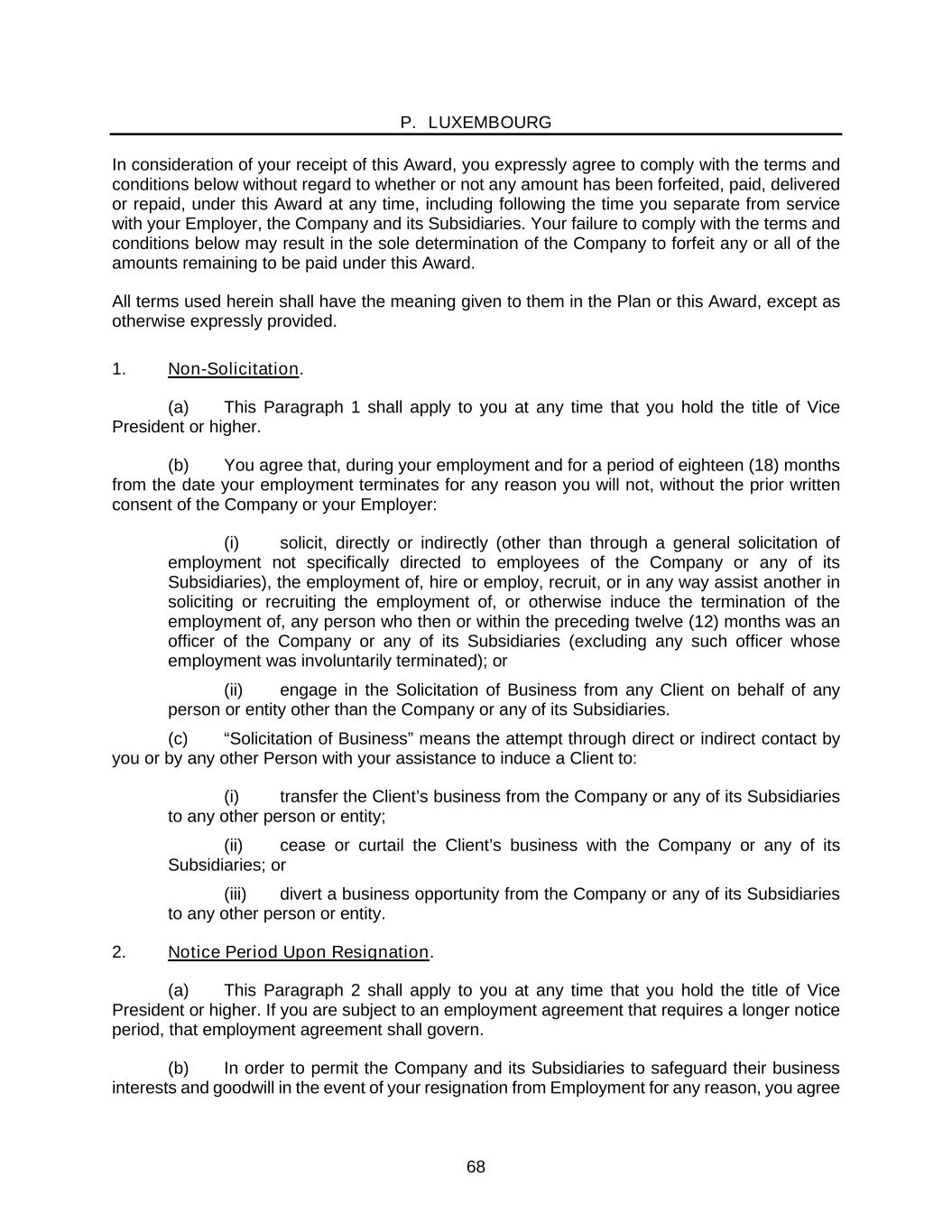

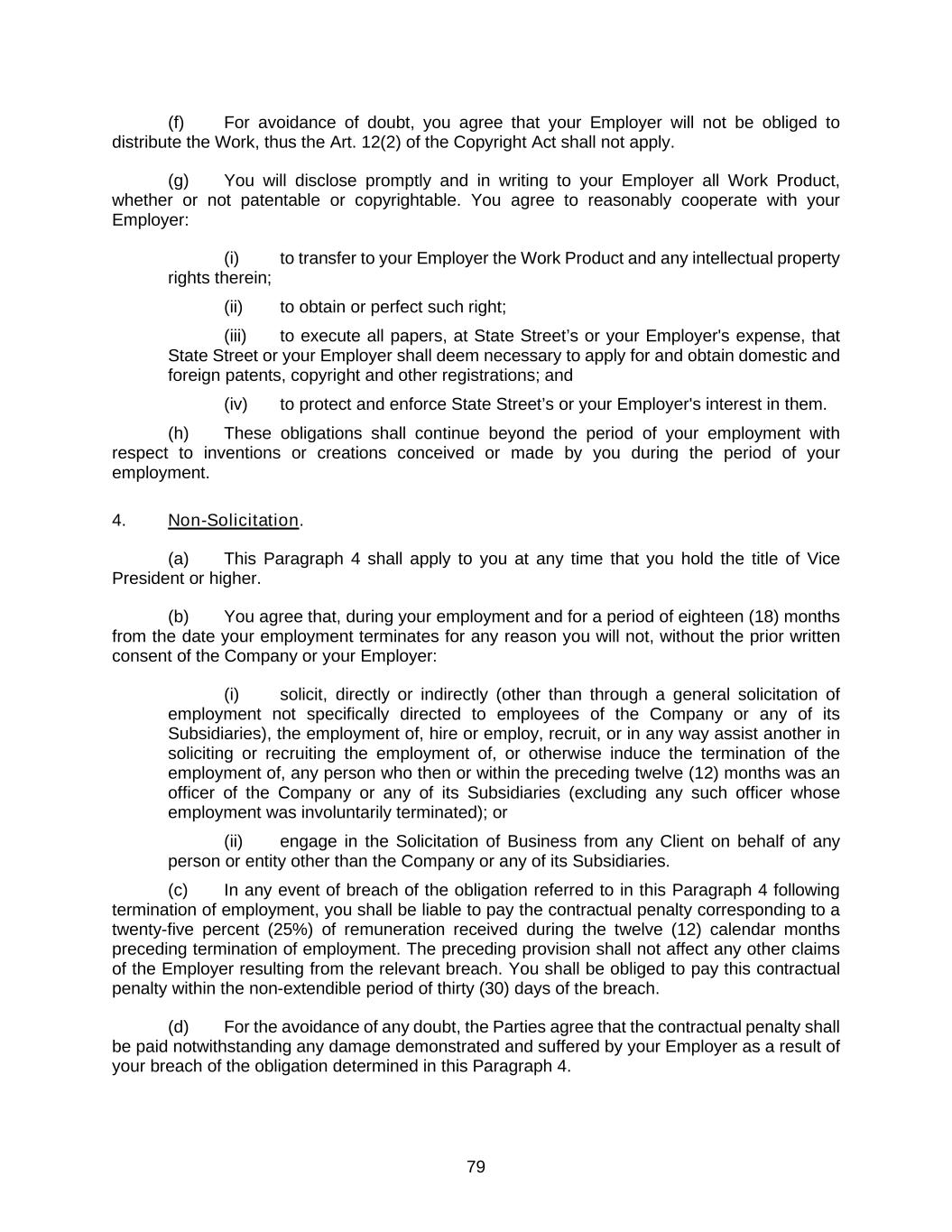

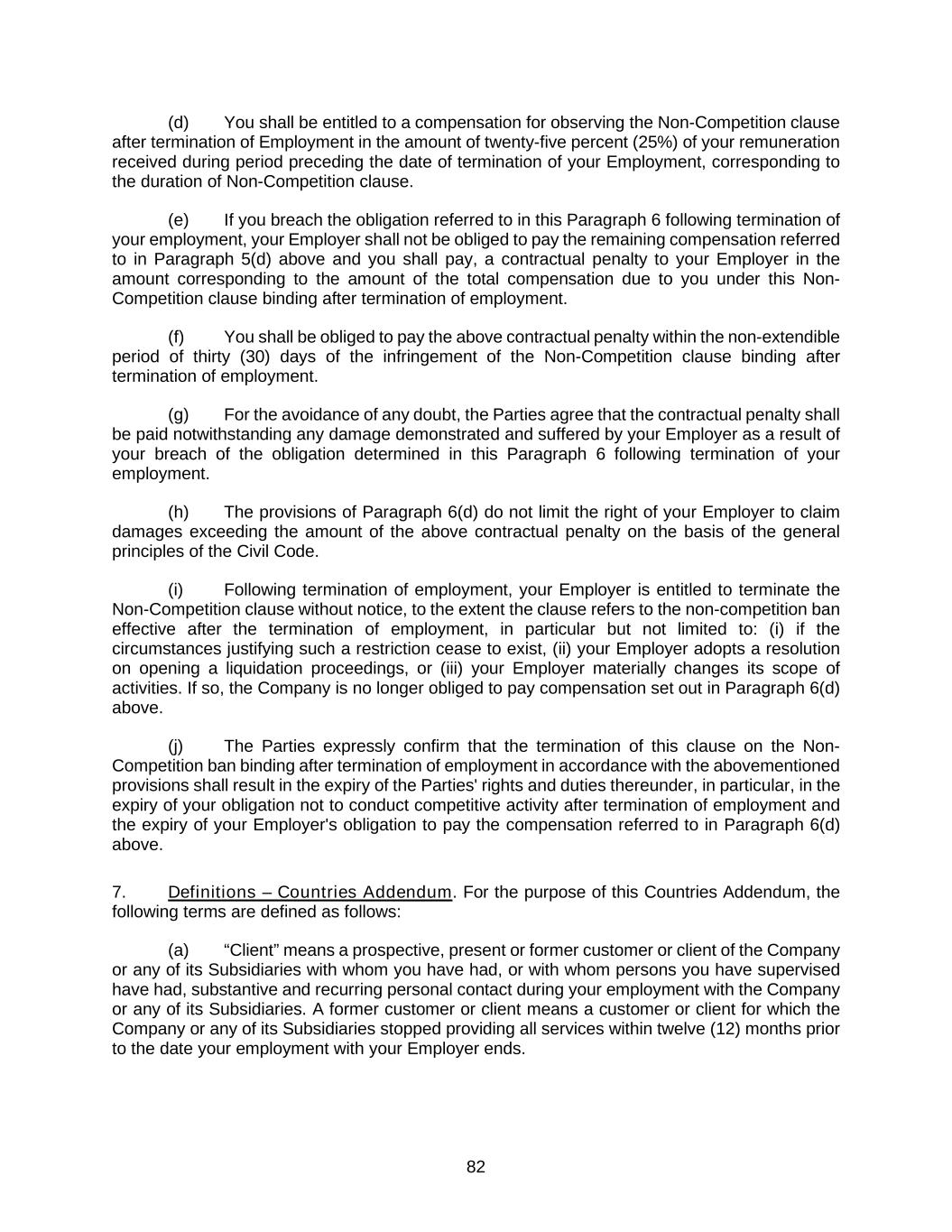

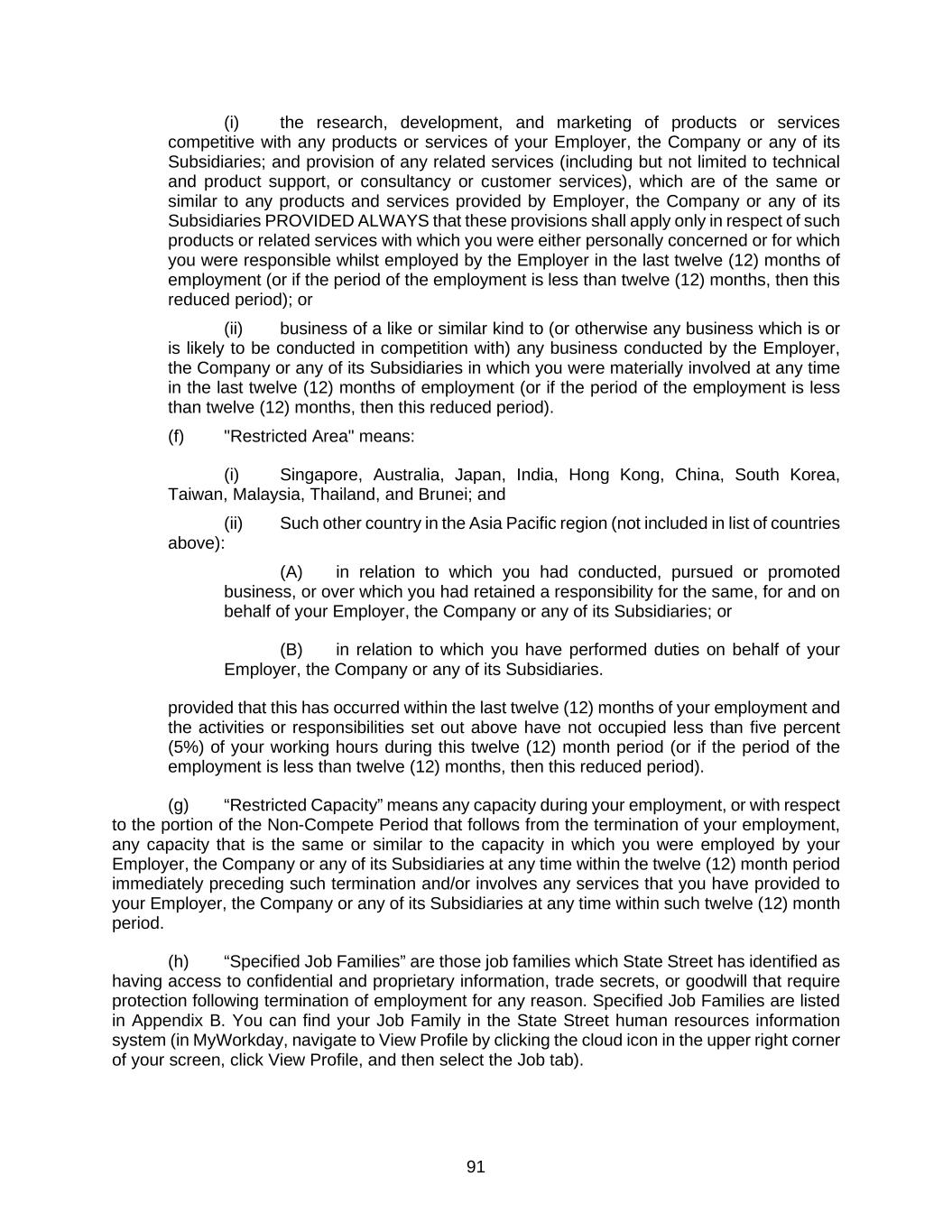

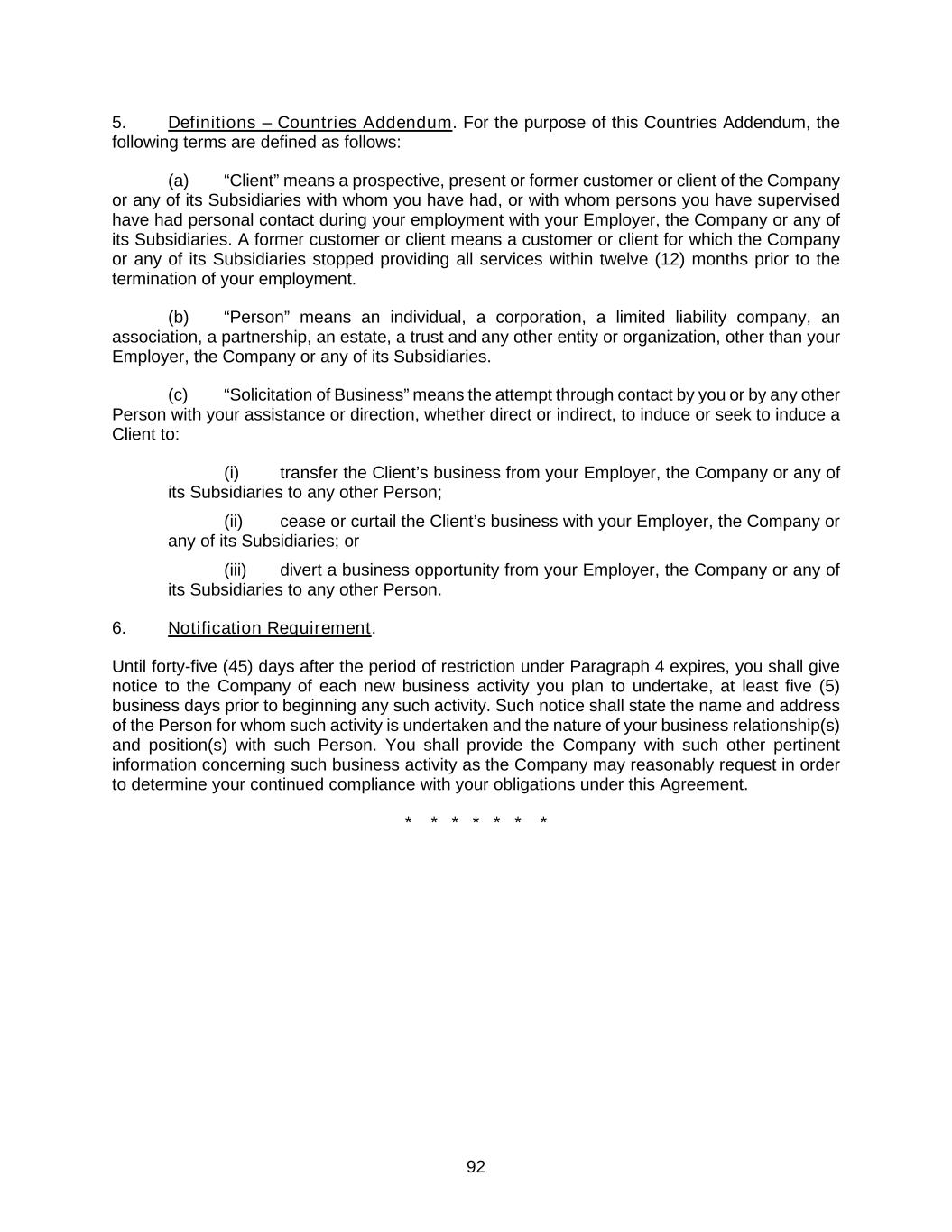

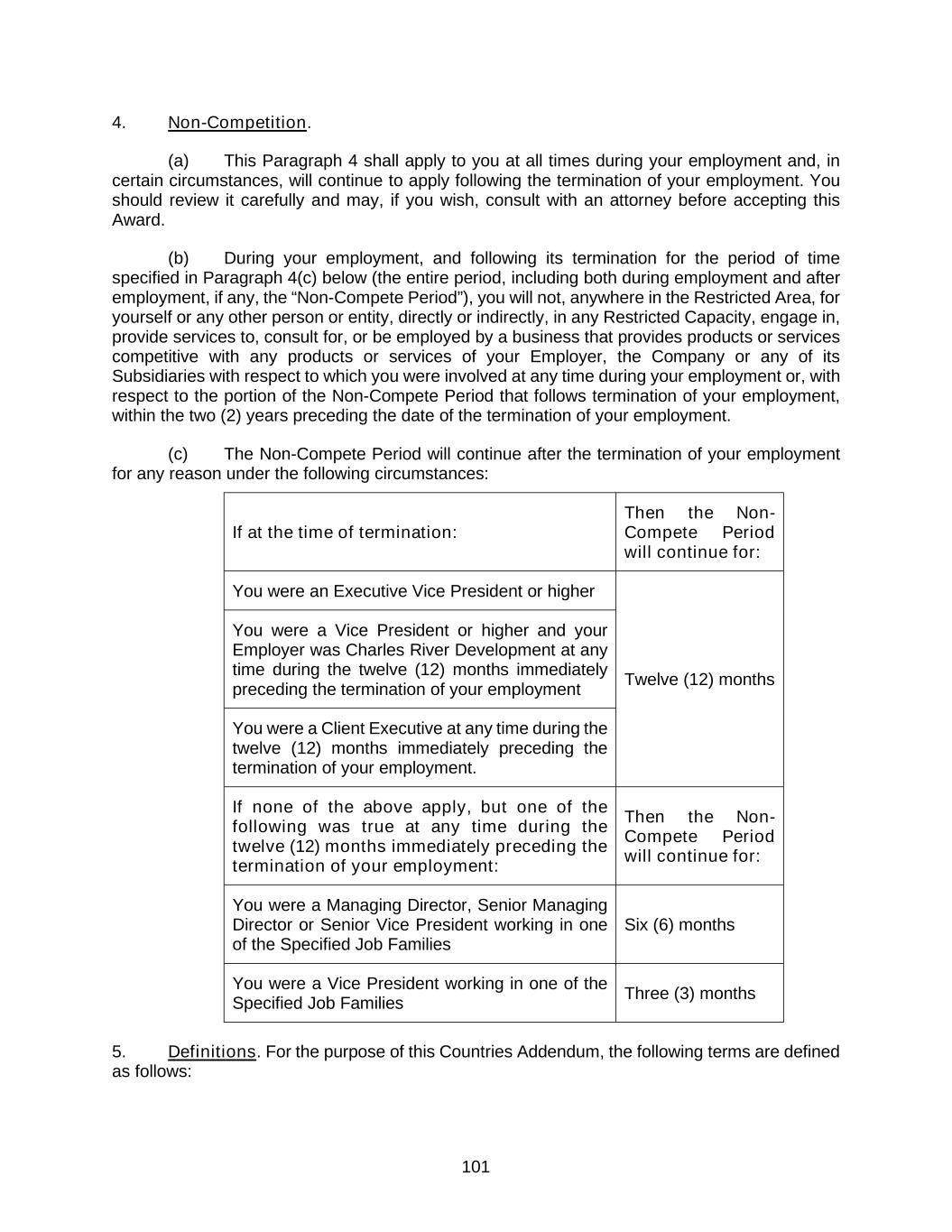

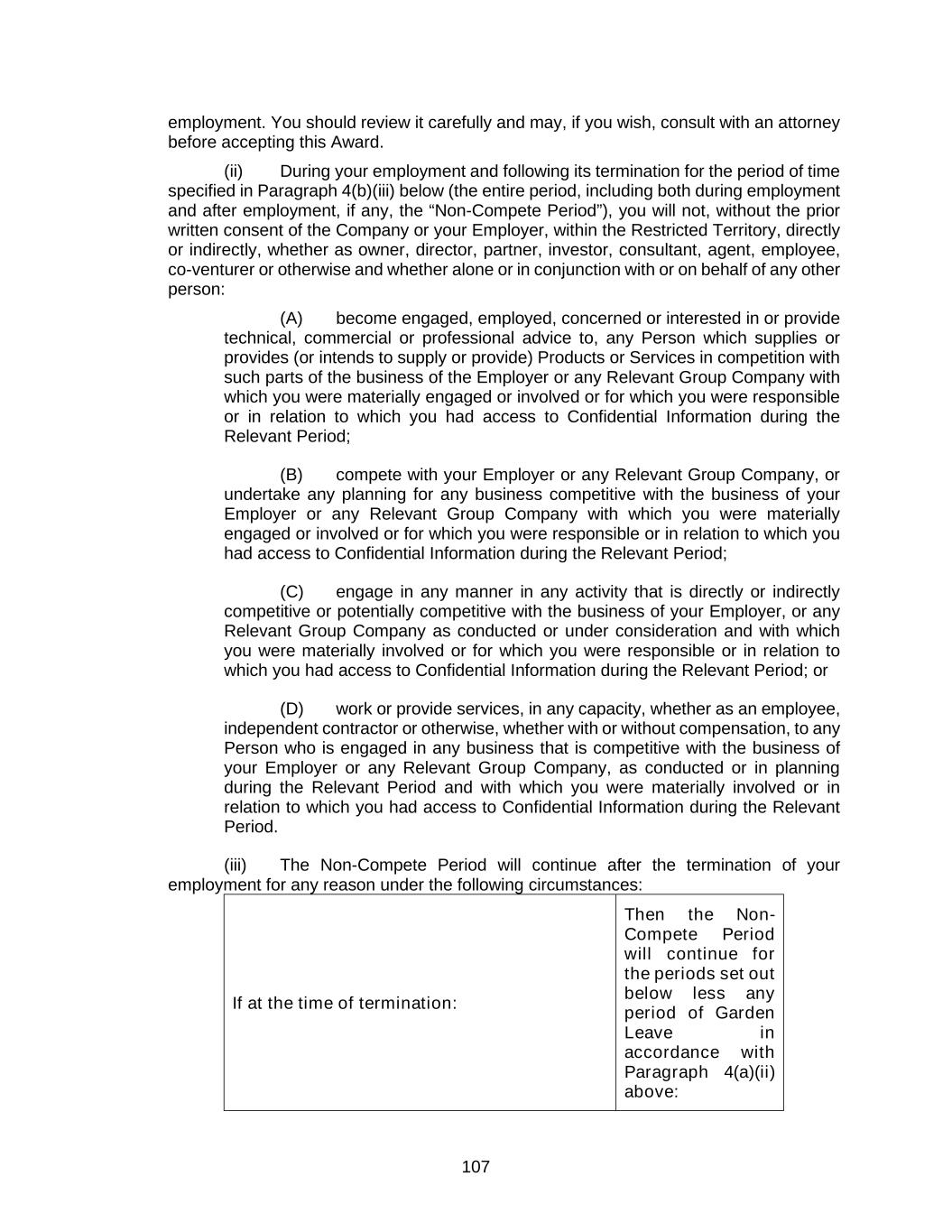

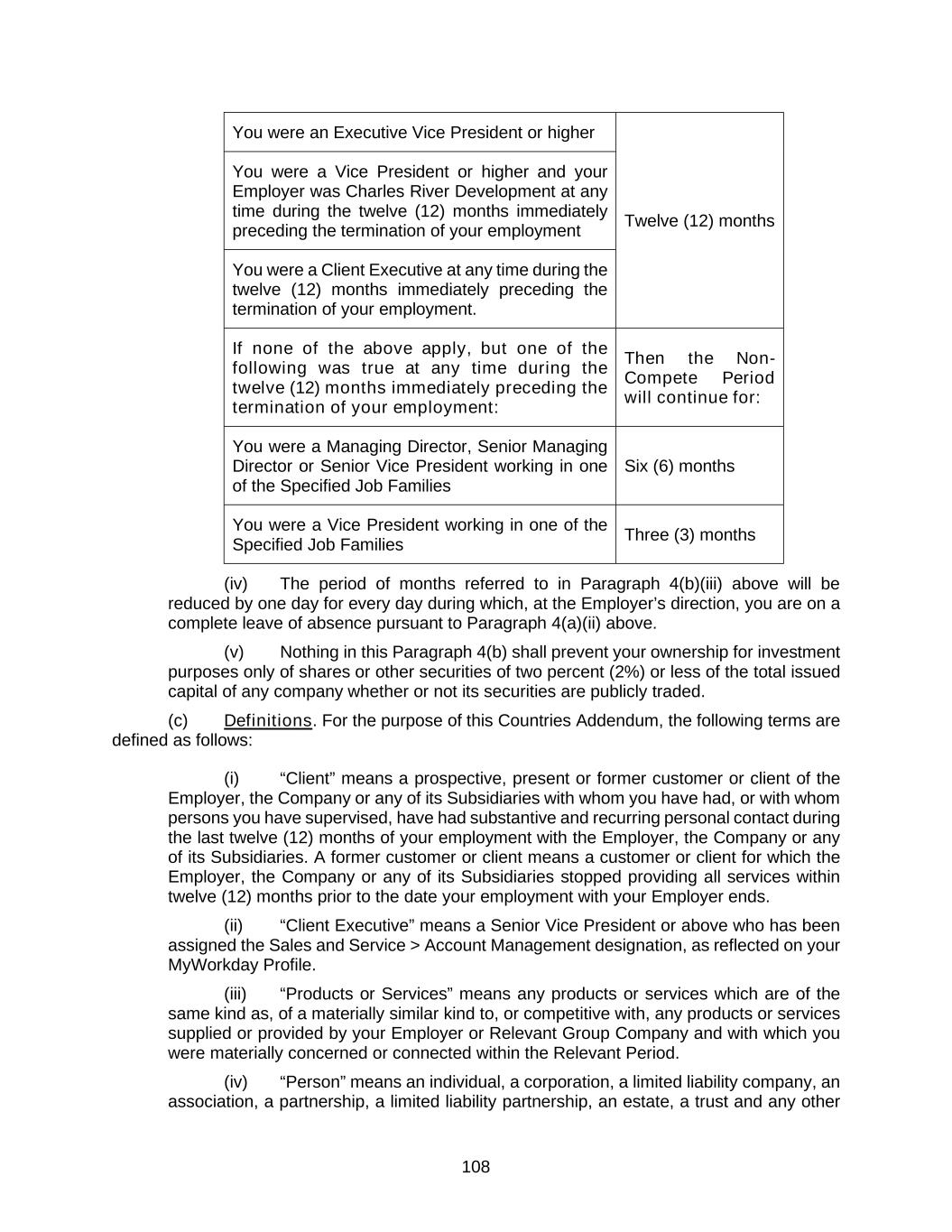

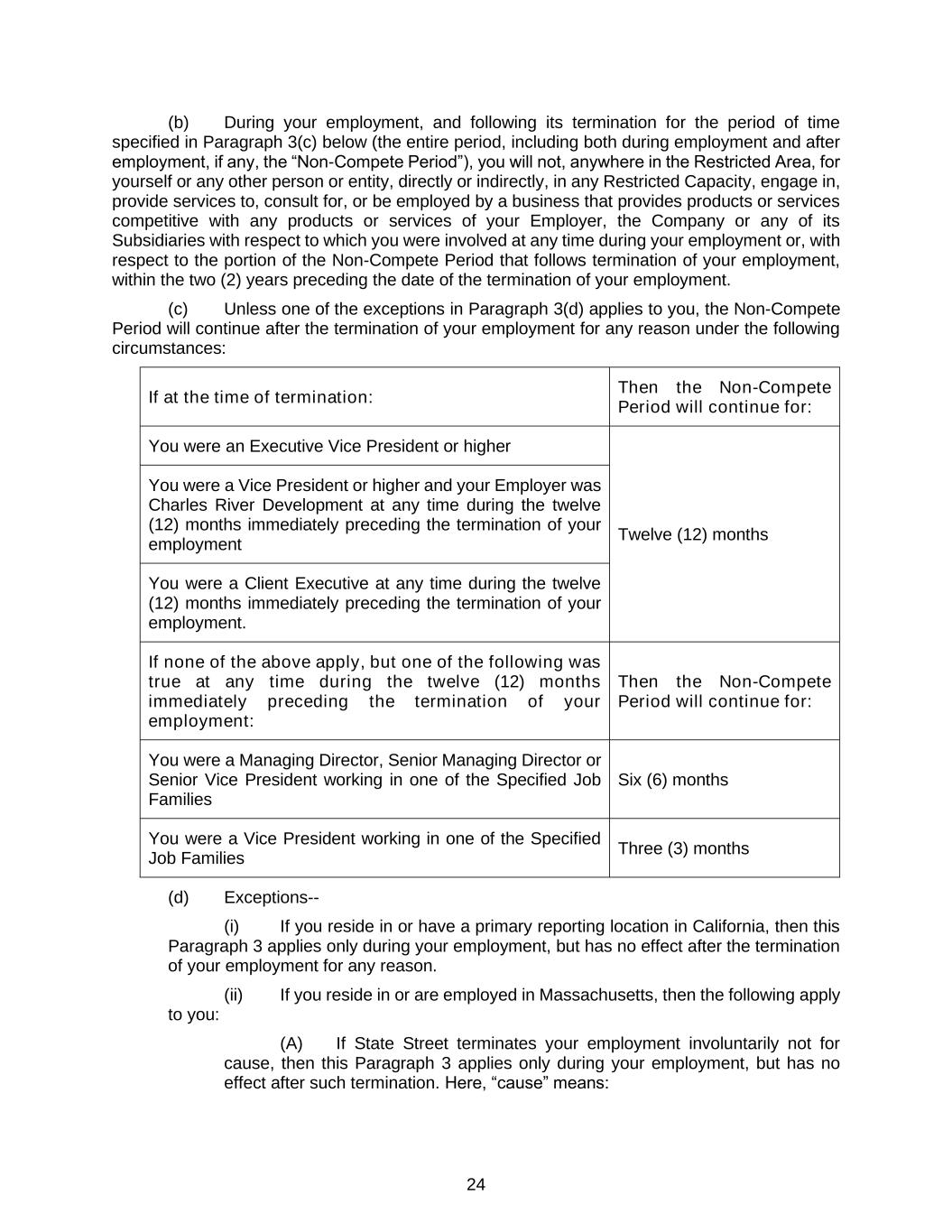

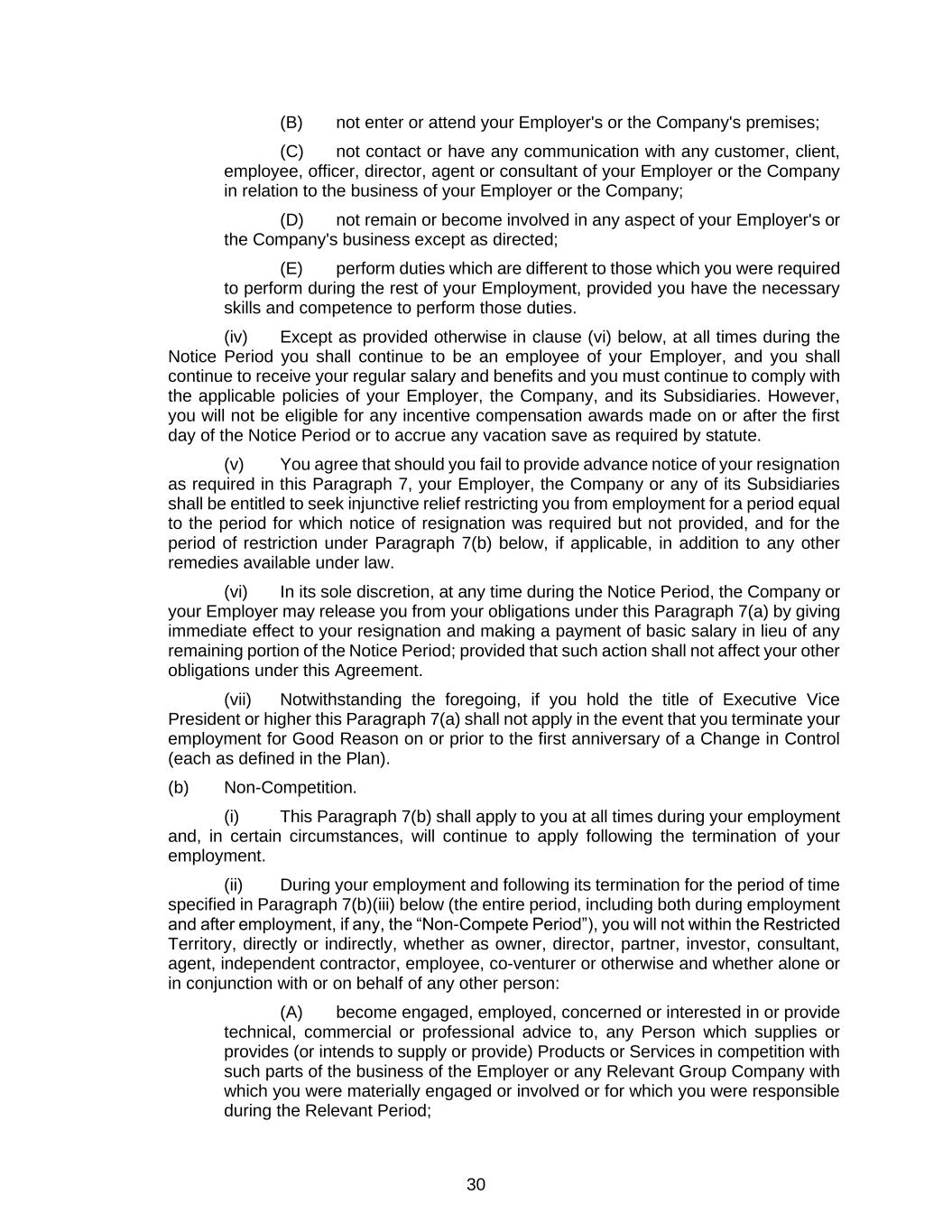

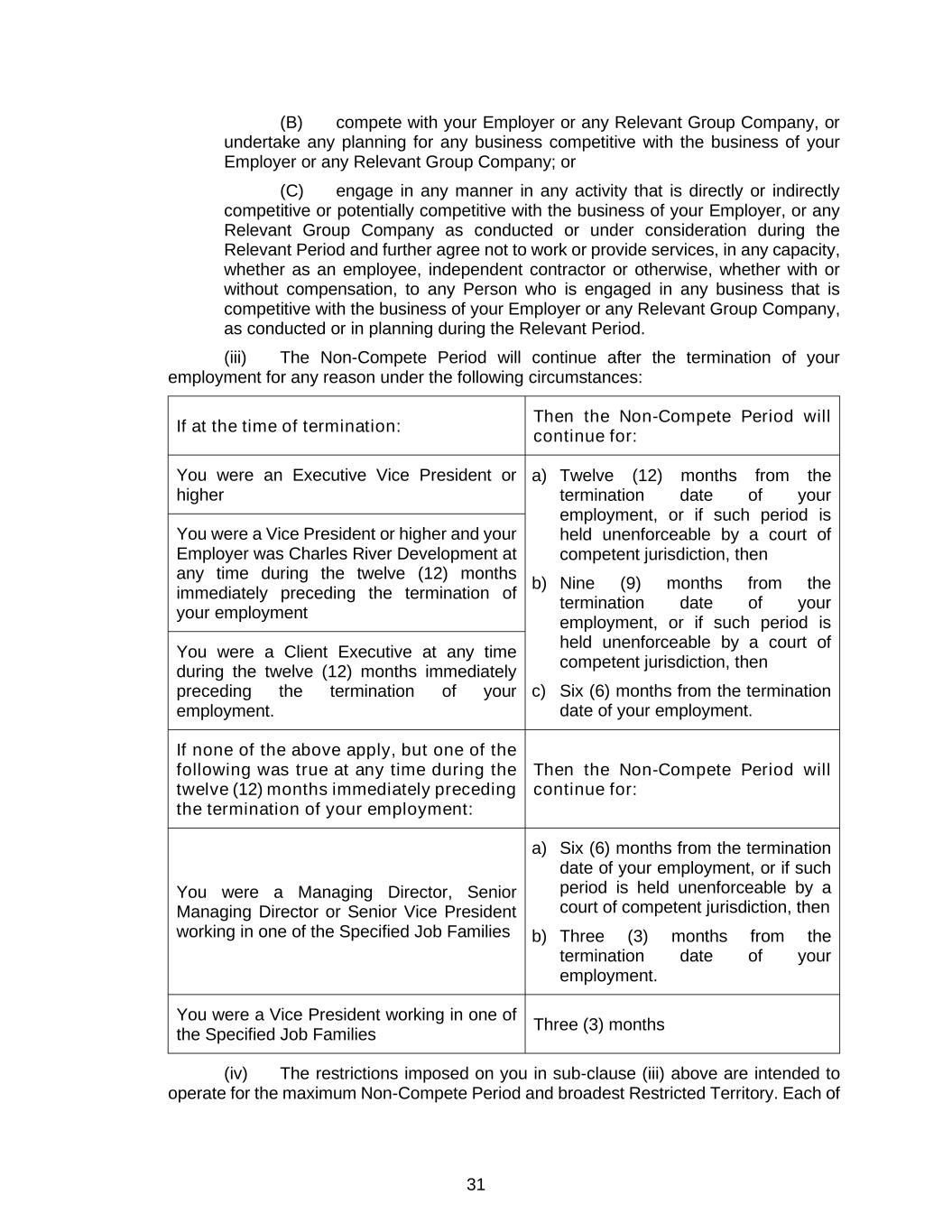

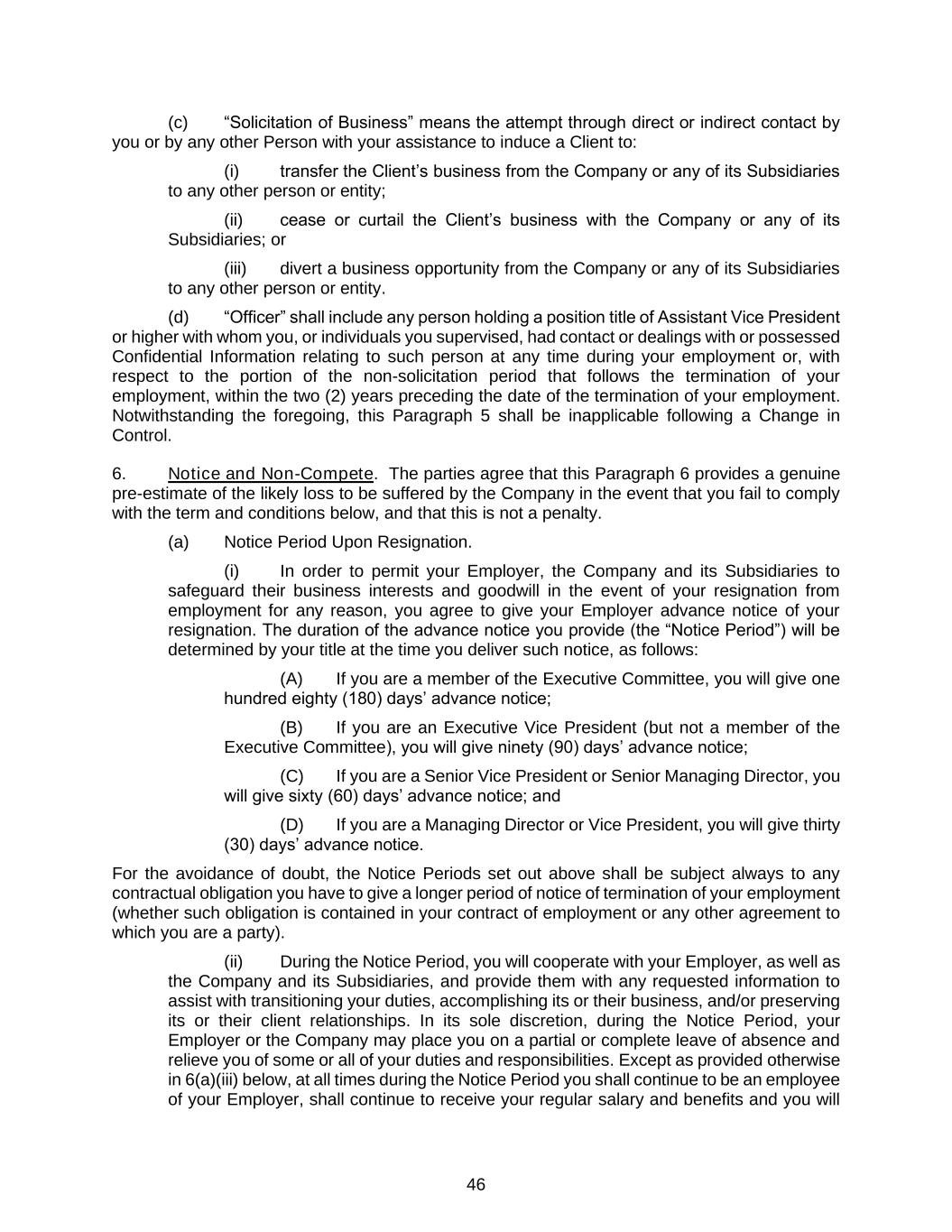

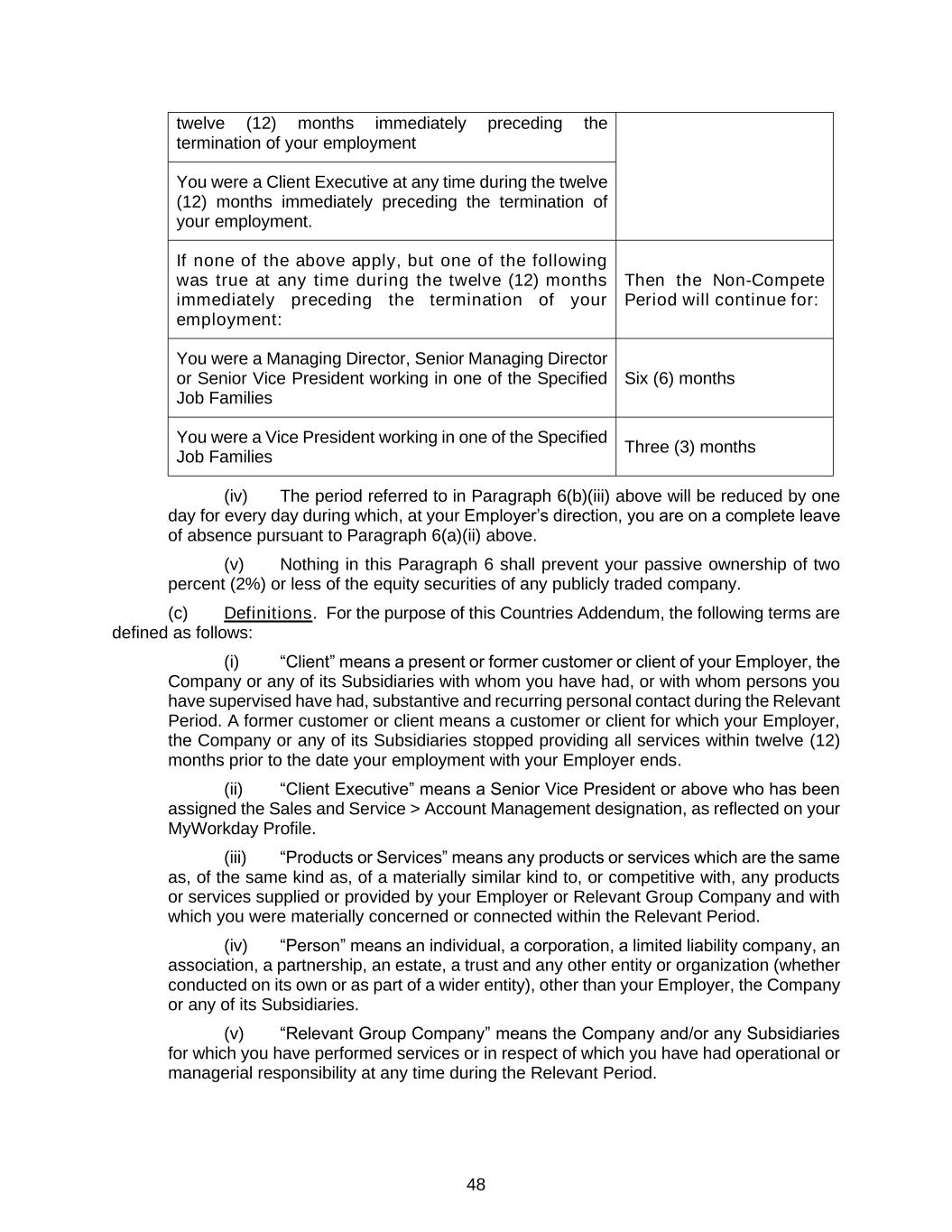

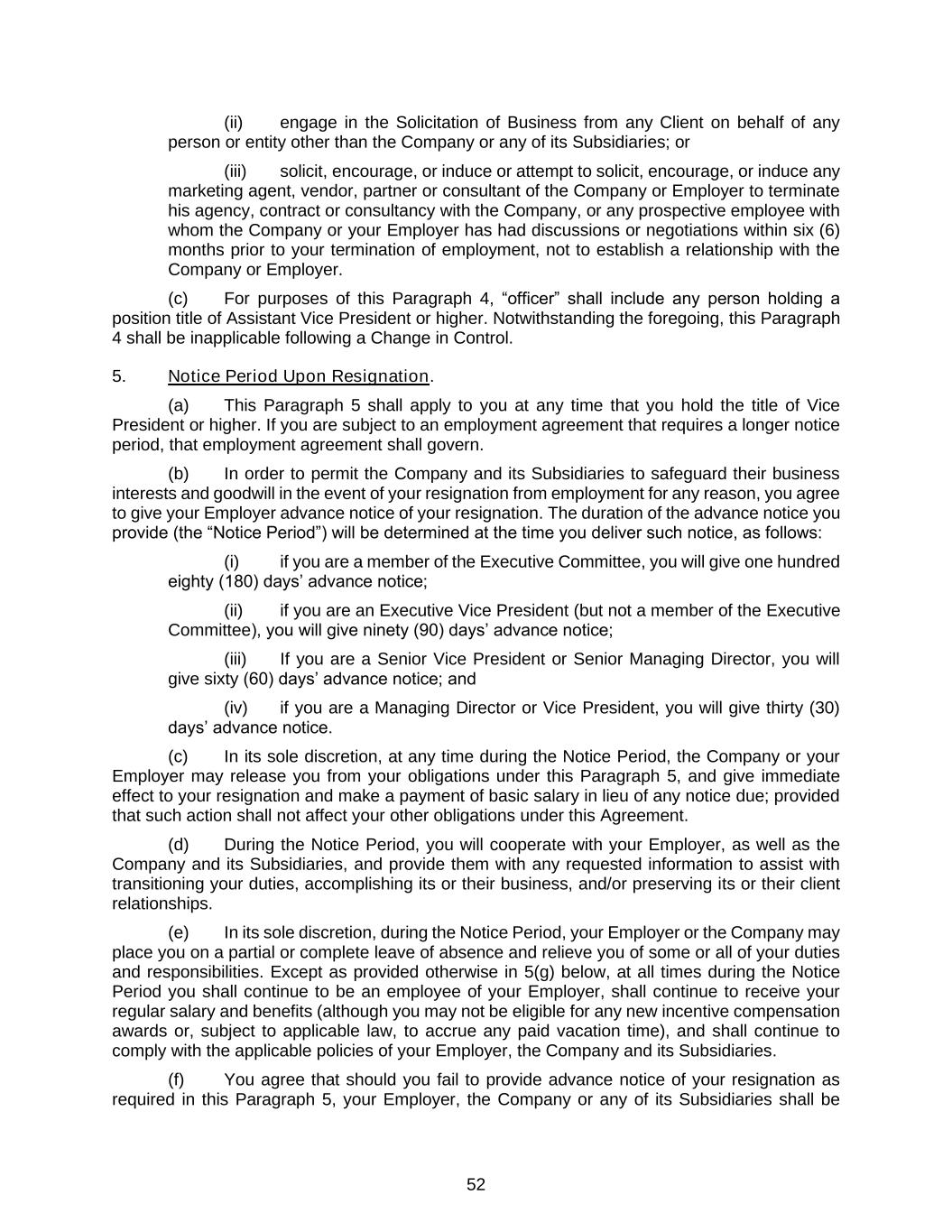

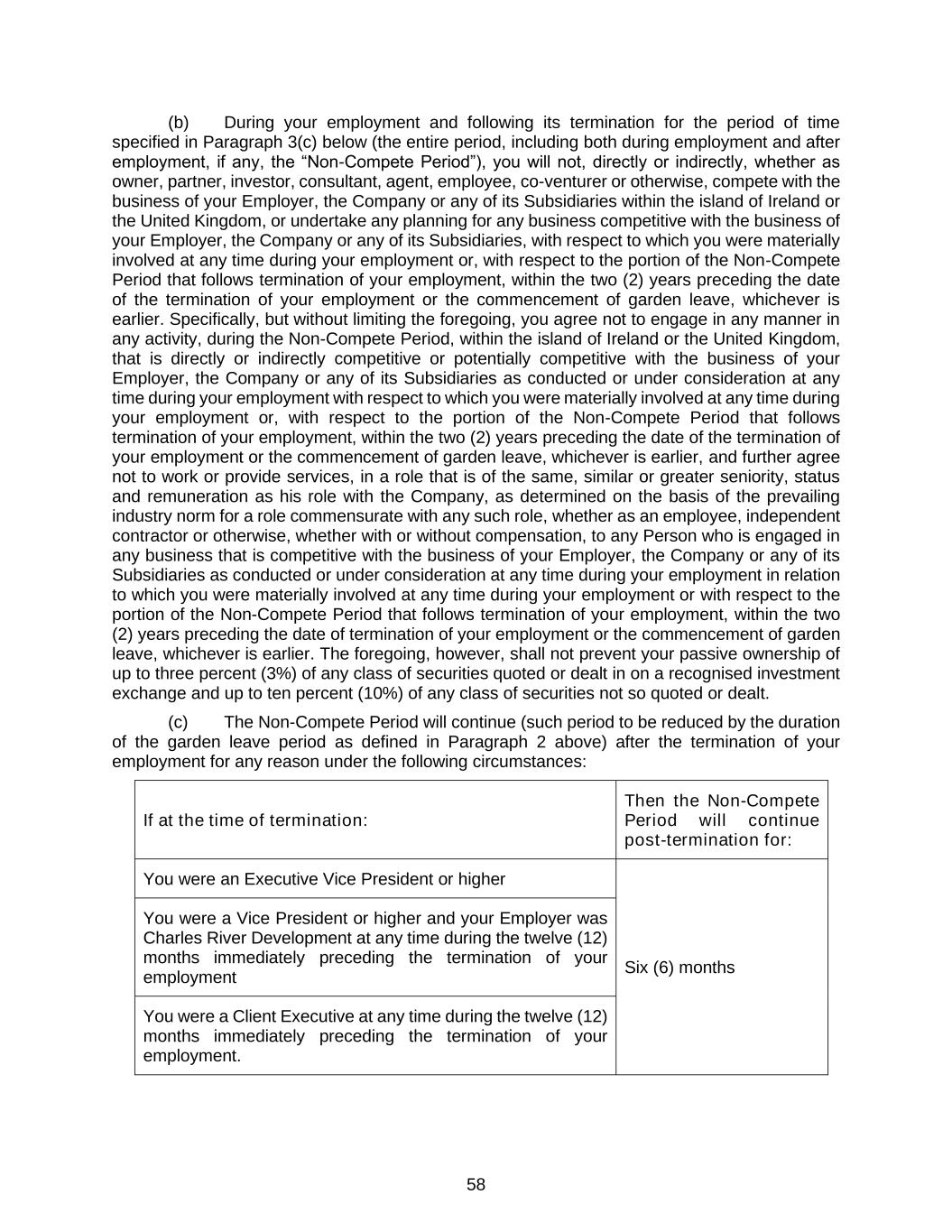

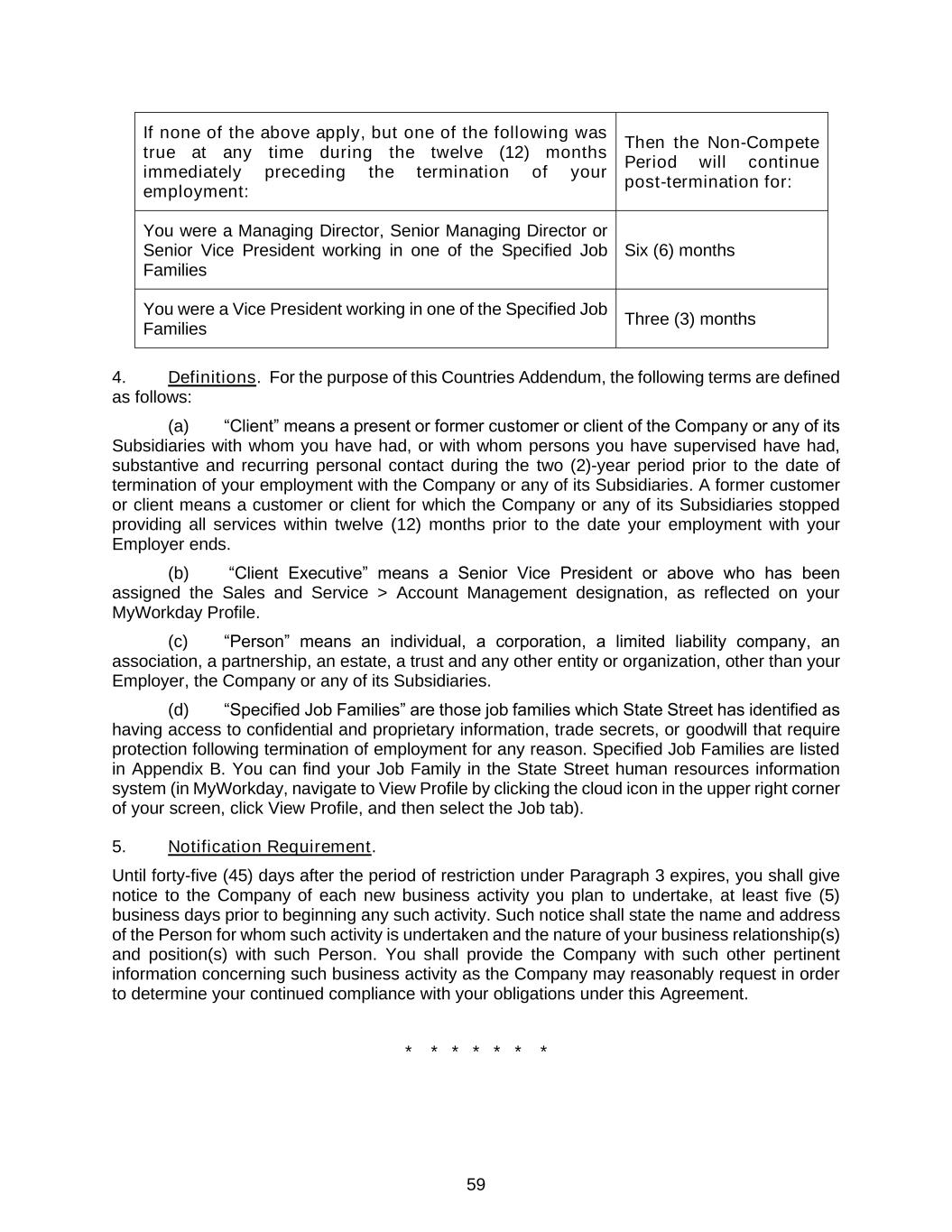

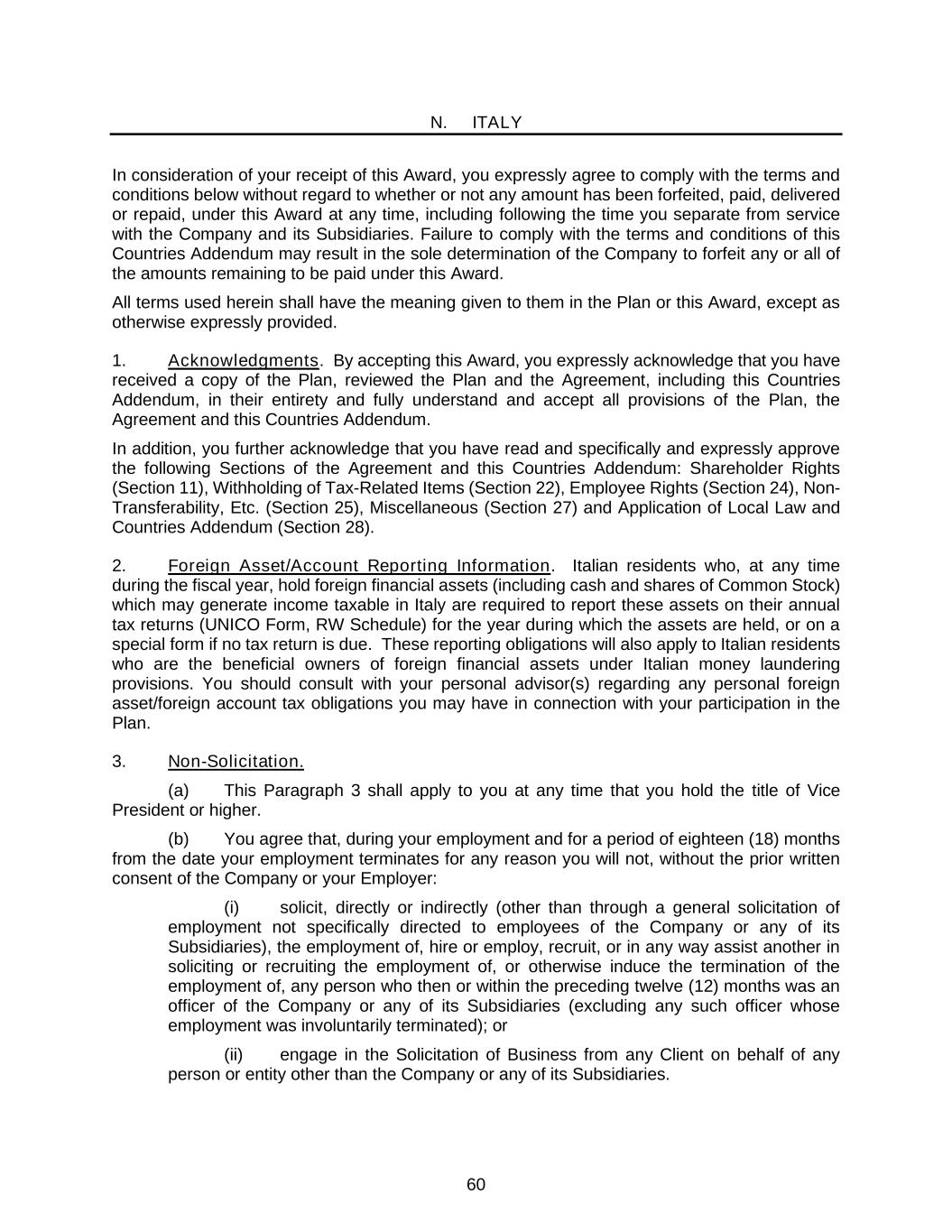

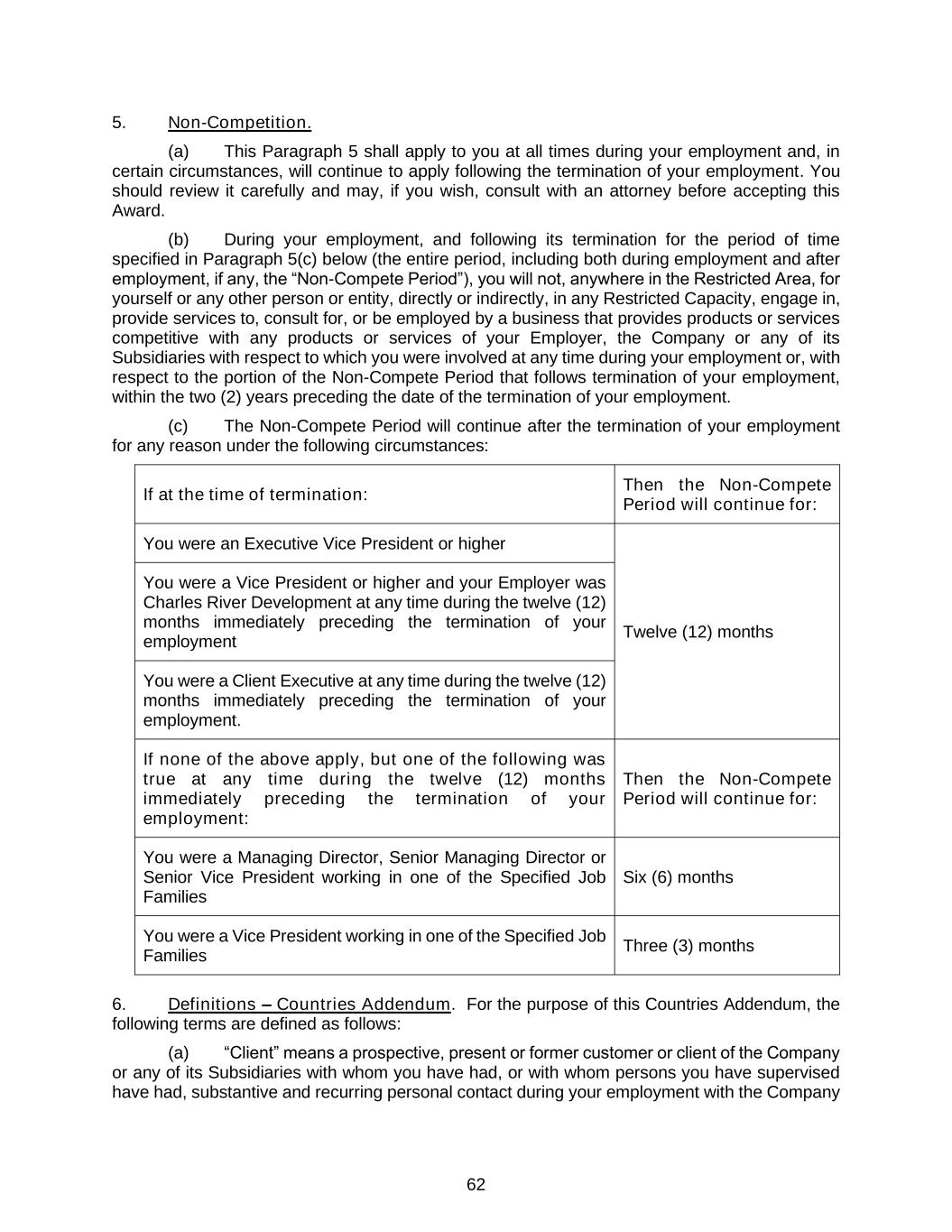

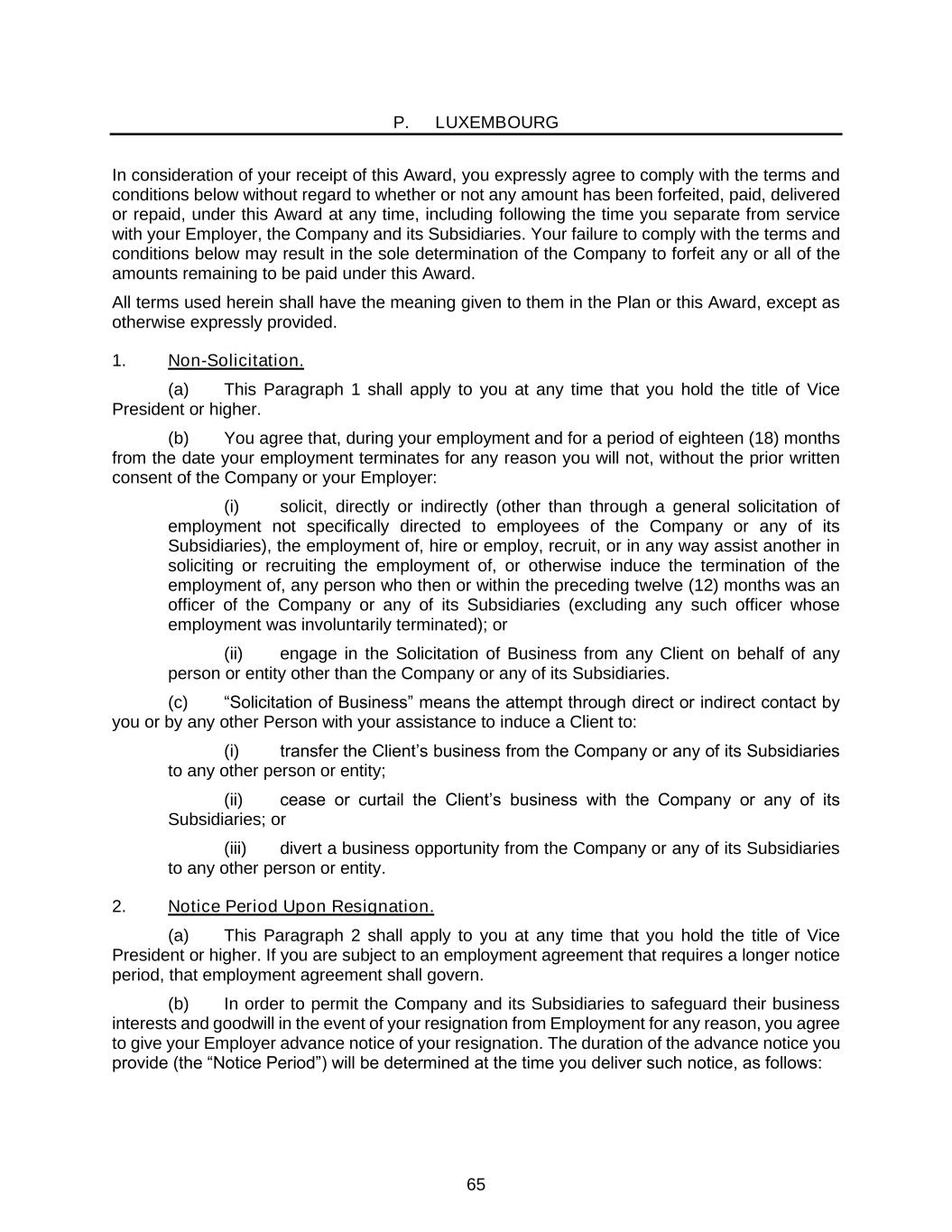

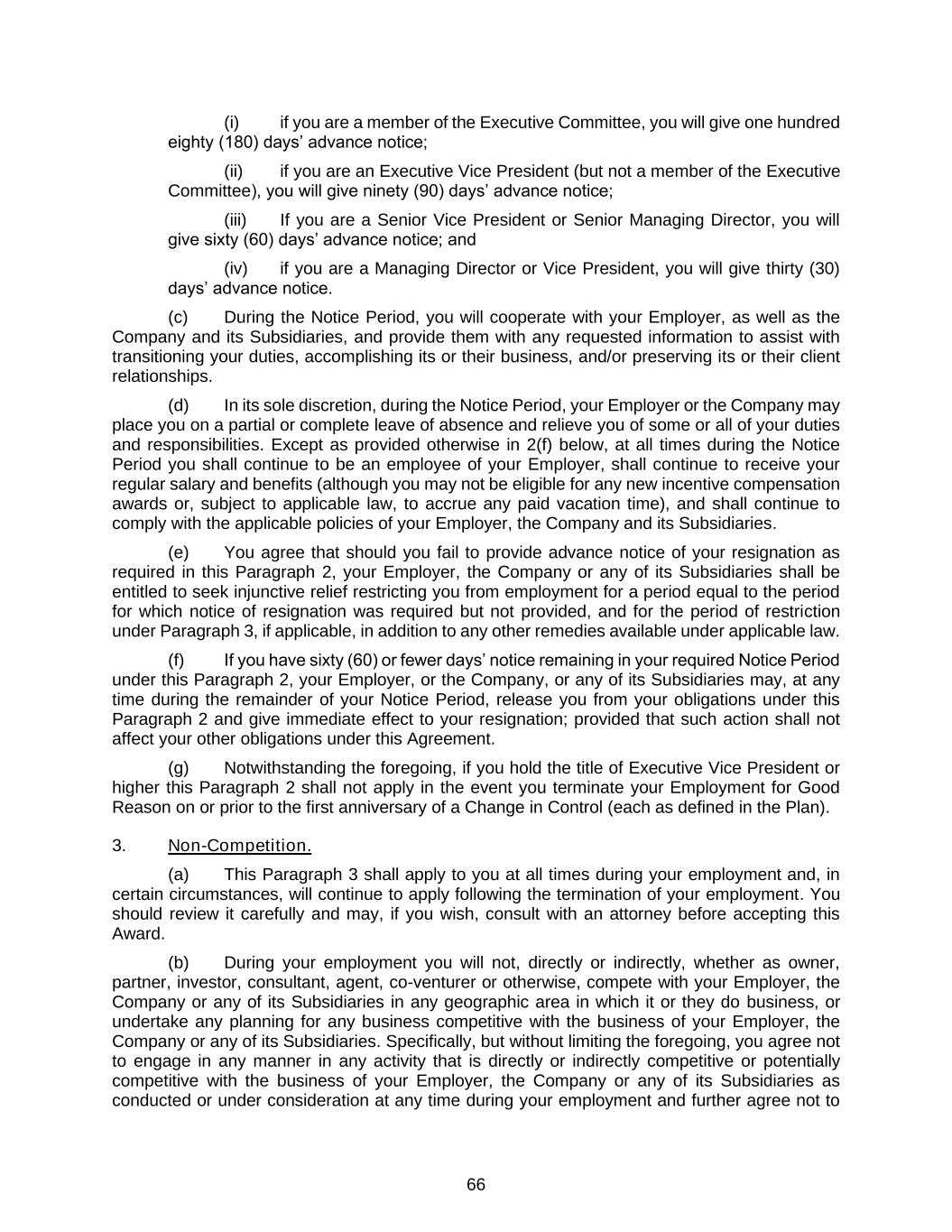

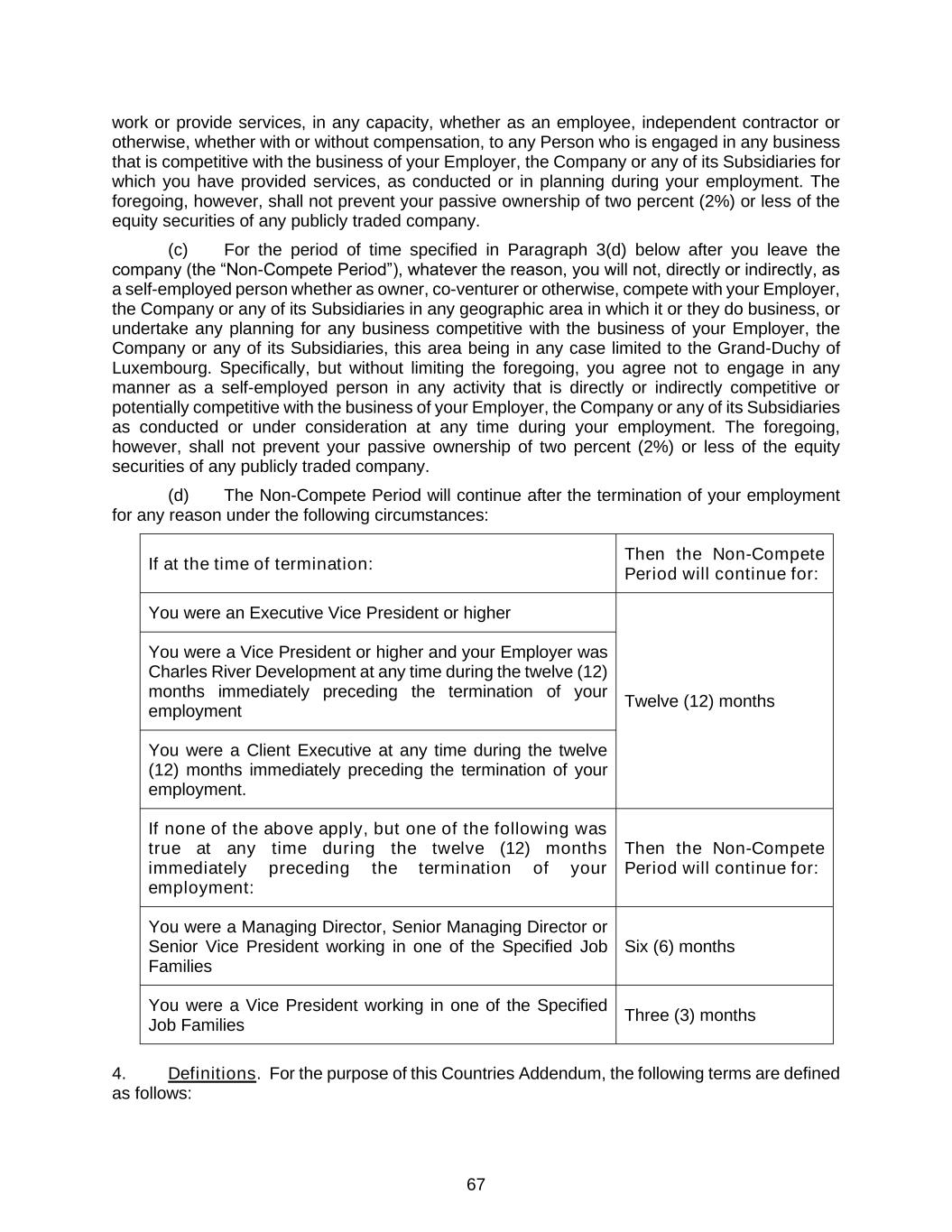

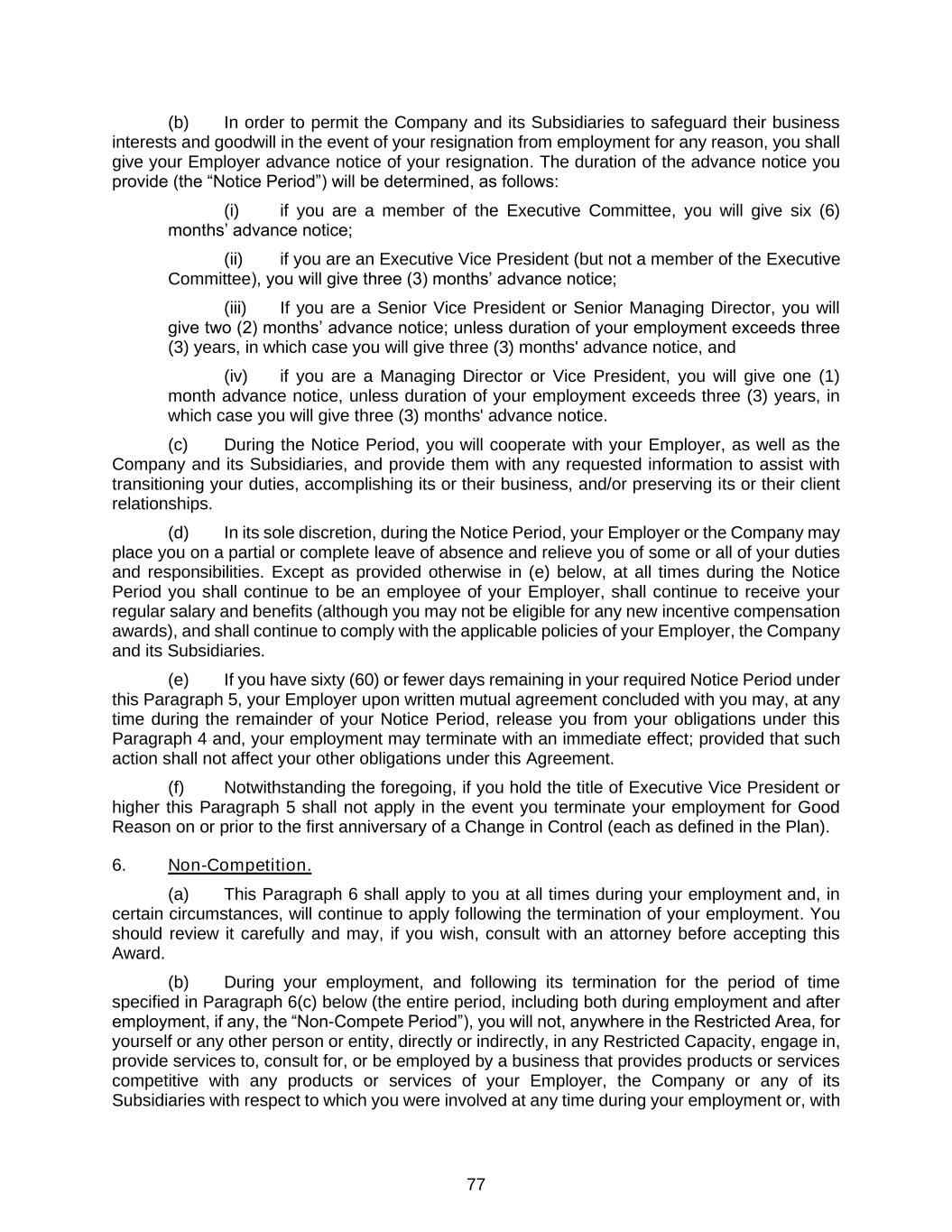

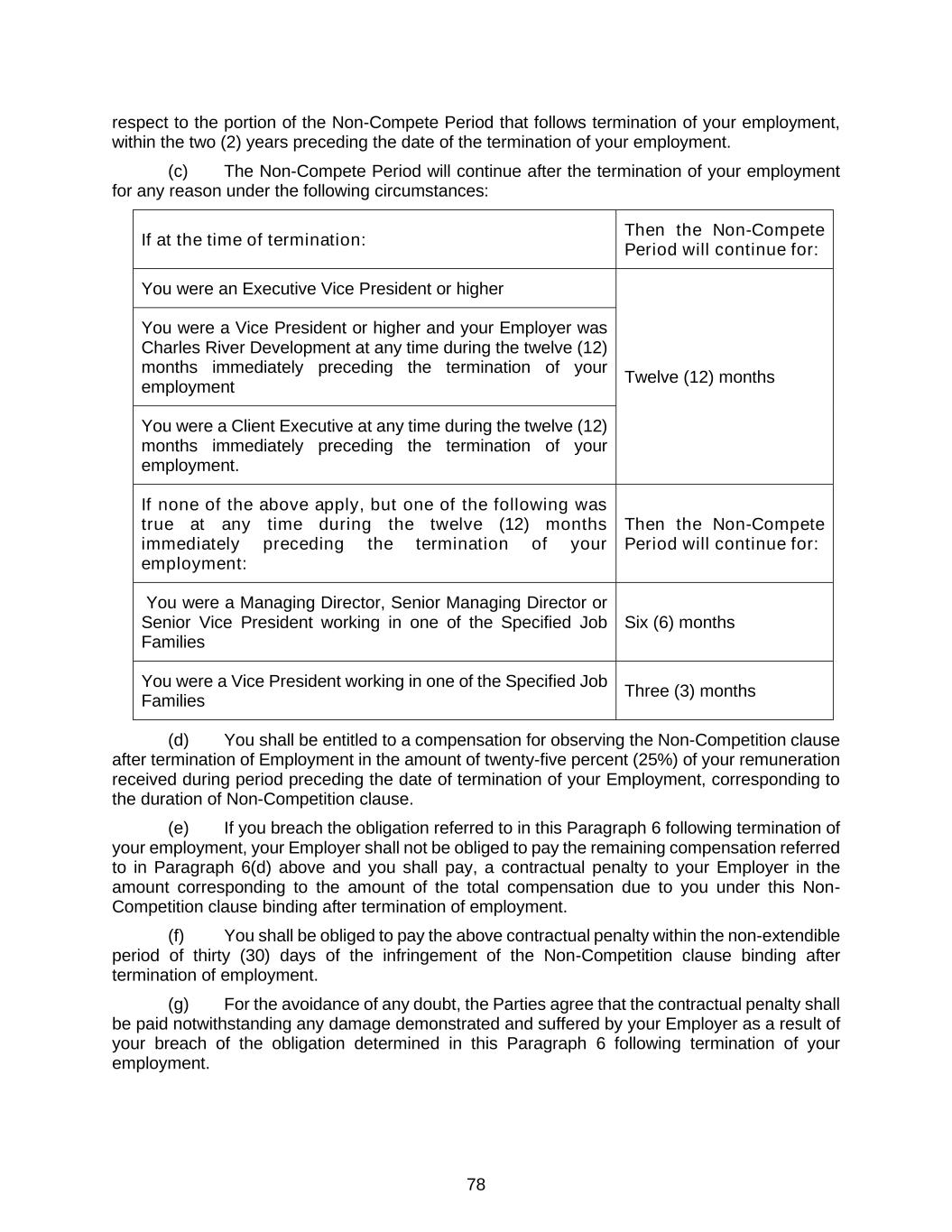

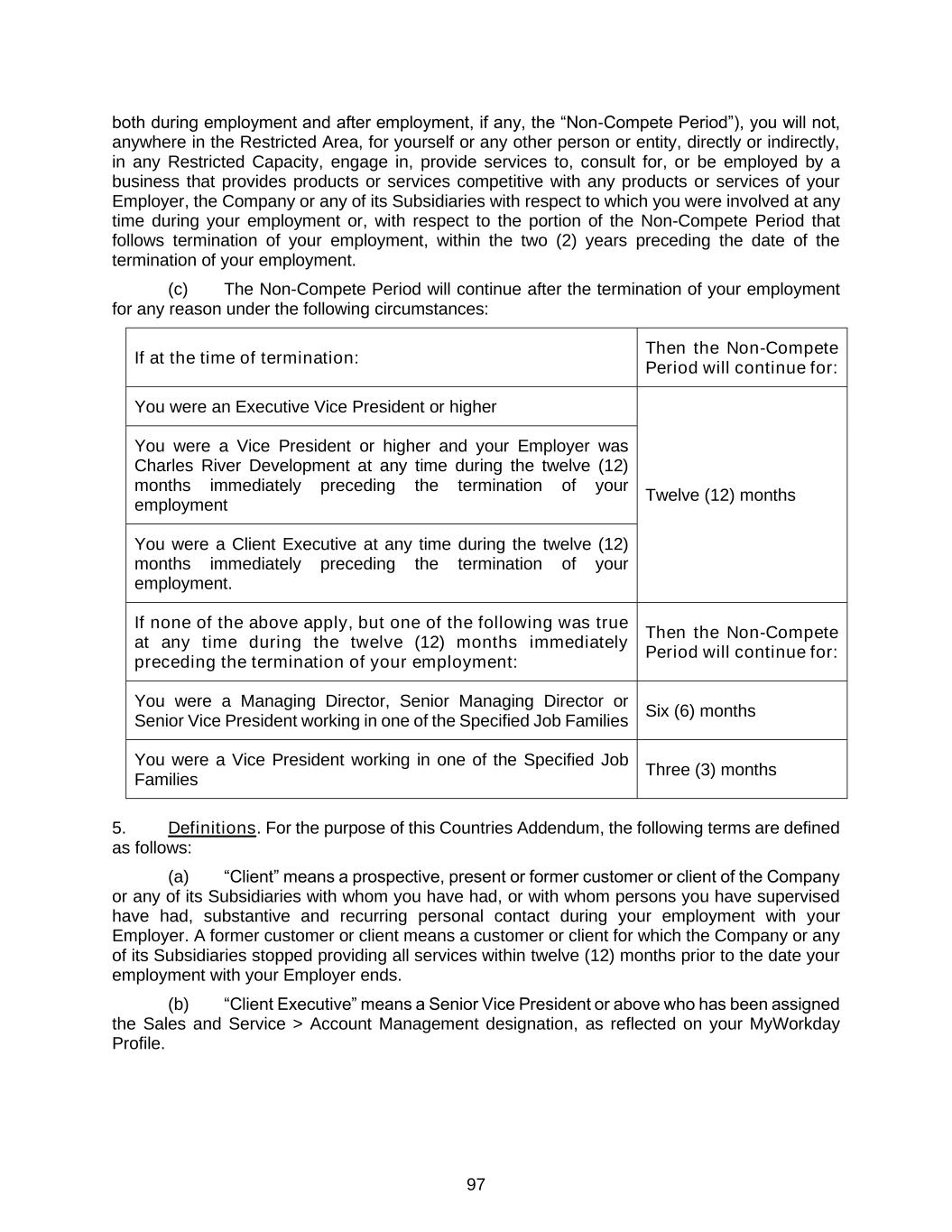

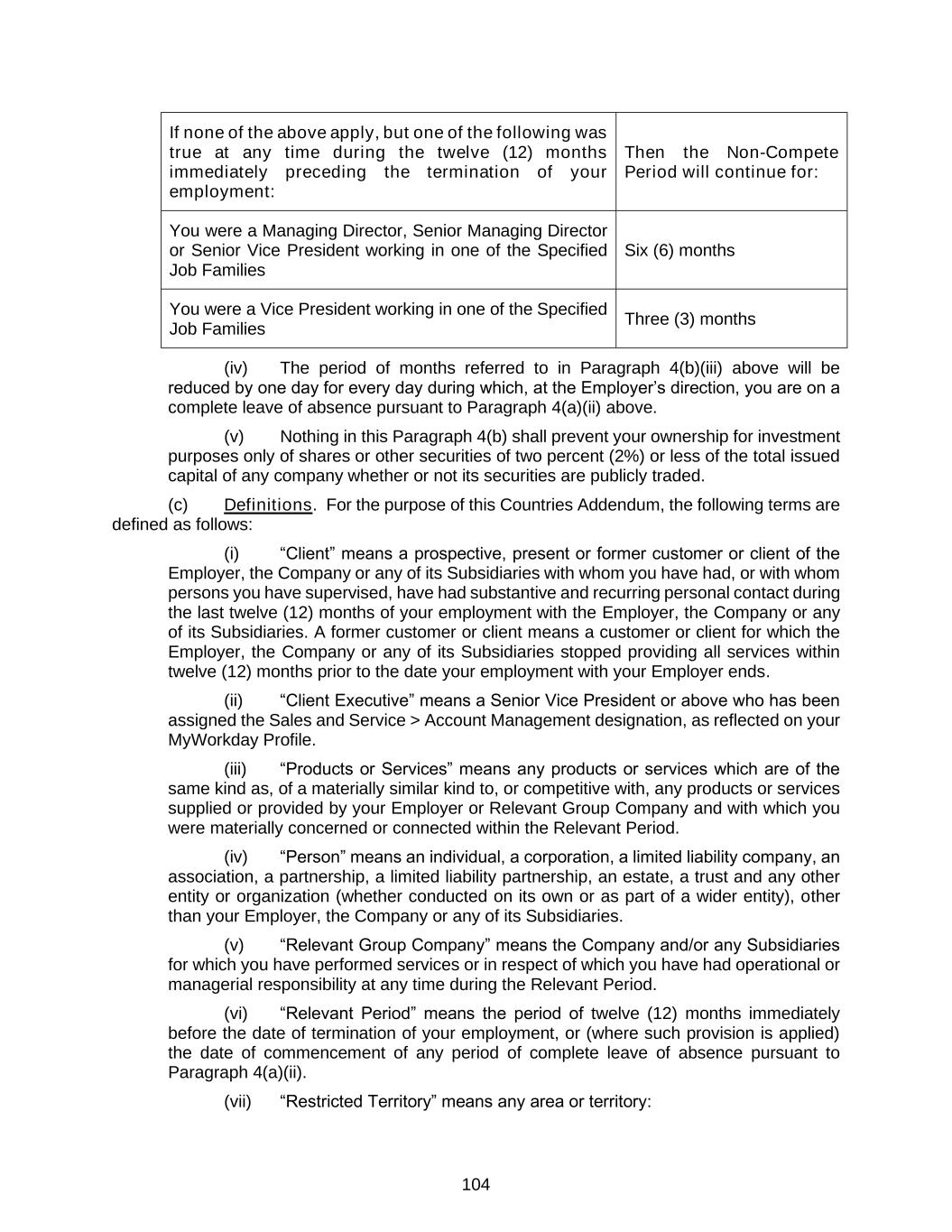

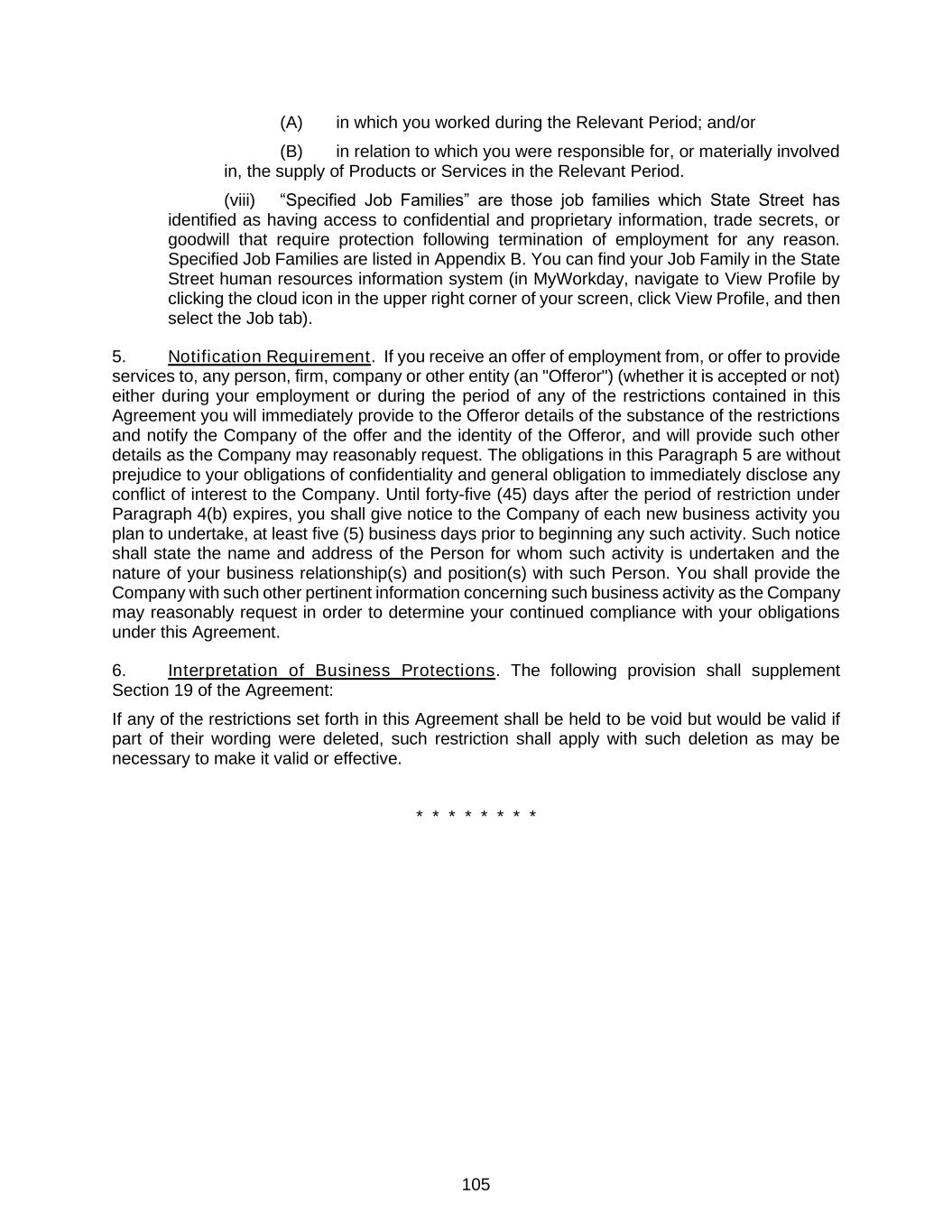

24 (g) Notwithstanding the foregoing, if you hold the title of Executive Vice President or higher, this Paragraph 2 shall not apply in the event you terminate your employment for Good Reason on or prior to the first anniversary of a Change in Control (each as defined in the Plan). 3. Non-Competition. (a) This Paragraph 3 shall apply to you at all times during your employment and, in certain circumstances, will continue to apply following the termination of your employment. You should review it carefully and may, if you wish, consult with an attorney before accepting this Award. (b) During your employment, and following its termination for the period of time specified in Paragraph 3(c) below (the entire period, including both during employment and after employment, if any, the “Non-Compete Period”), you will not, anywhere in the Restricted Area, for yourself or any other person or entity, directly or indirectly, in any Restricted Capacity, engage in, provide services to, consult for, or be employed by a business that provides products or services competitive with any products or services of your Employer, the Company or any of its Subsidiaries with respect to which you were involved at any time during your employment or, with respect to the portion of the Non-Compete Period that follows termination of your employment, within the two (2) years preceding the date of the termination of your employment. (c) Unless one of the exceptions in Paragraph 3(d) applies to you, the Non-Compete Period will continue after the termination of your employment for any reason under the following circumstances: If at the time of termination: Then the Non- Compete Period will continue for: You were an Executive Vice President or higher Twelve (12) months You were a Vice President or higher and your Employer was Charles River Development at any time during the twelve (12) months immediately preceding the termination of your employment You were a Client Executive at any time during the twelve (12) months immediately preceding the termination of your employment. If none of the above apply, but one of the following was true at any time during the twelve (12) months immediately preceding the termination of your employment: Then the Non- Compete Period will continue for: You were a Managing Director, Senior Managing Director or Senior Vice President working in one of the Specified Job Families Six (6) months