Document

SOUTHWEST AIRLINES REPORTS THIRD QUARTER 2024 RESULTS

DALLAS, TEXAS - October 24, 2024 - Southwest Airlines Co. (NYSE: LUV) (the "Company") today reported its third quarter 2024 financial results:

•Net income of $67 million, or $0.11 per diluted share

•Net income, excluding special items1, of $89 million, or $0.15 per diluted share

•Record third quarter operating revenues of $6.9 billion

•Liquidity2 of $10.4 billion, well in excess of debt outstanding of $8.0 billion

•Announced a $250 million accelerated share repurchase program under the Company's $2.5 billion share repurchase authorization

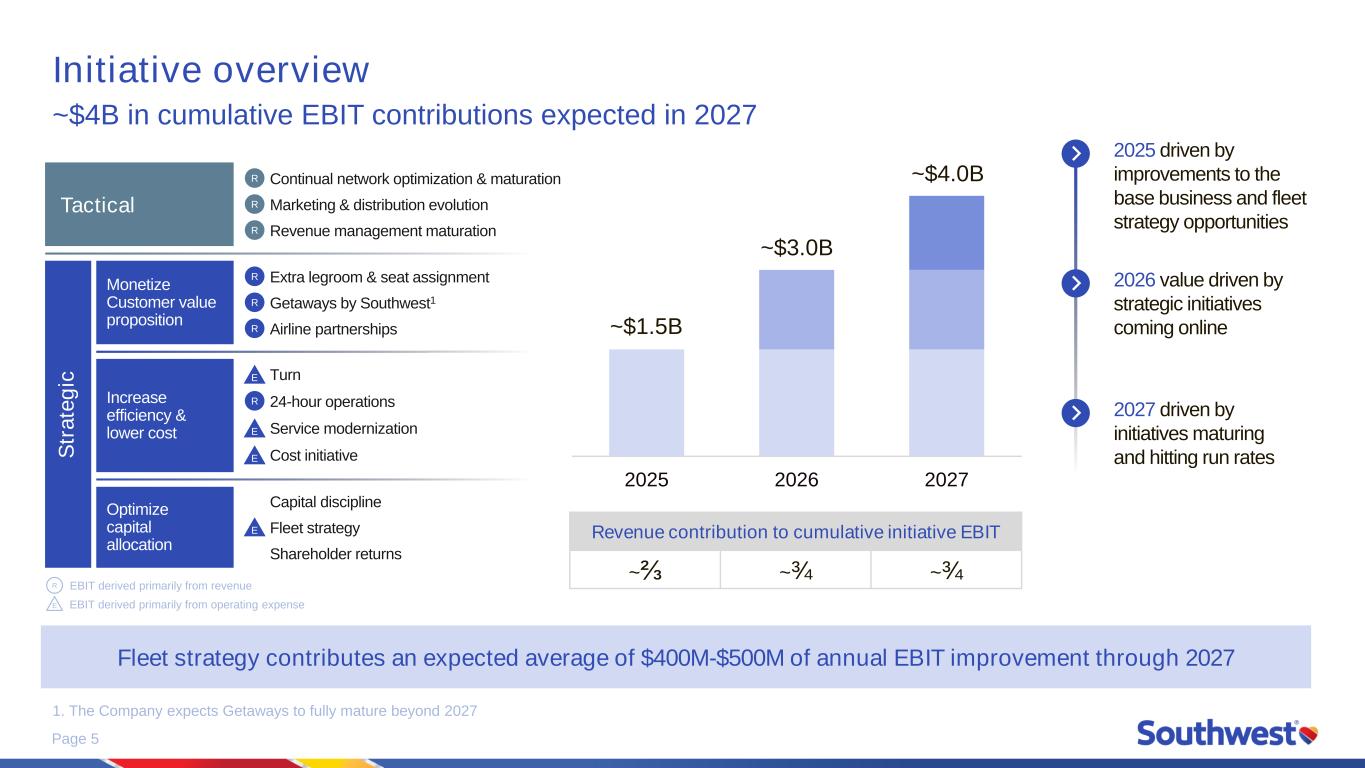

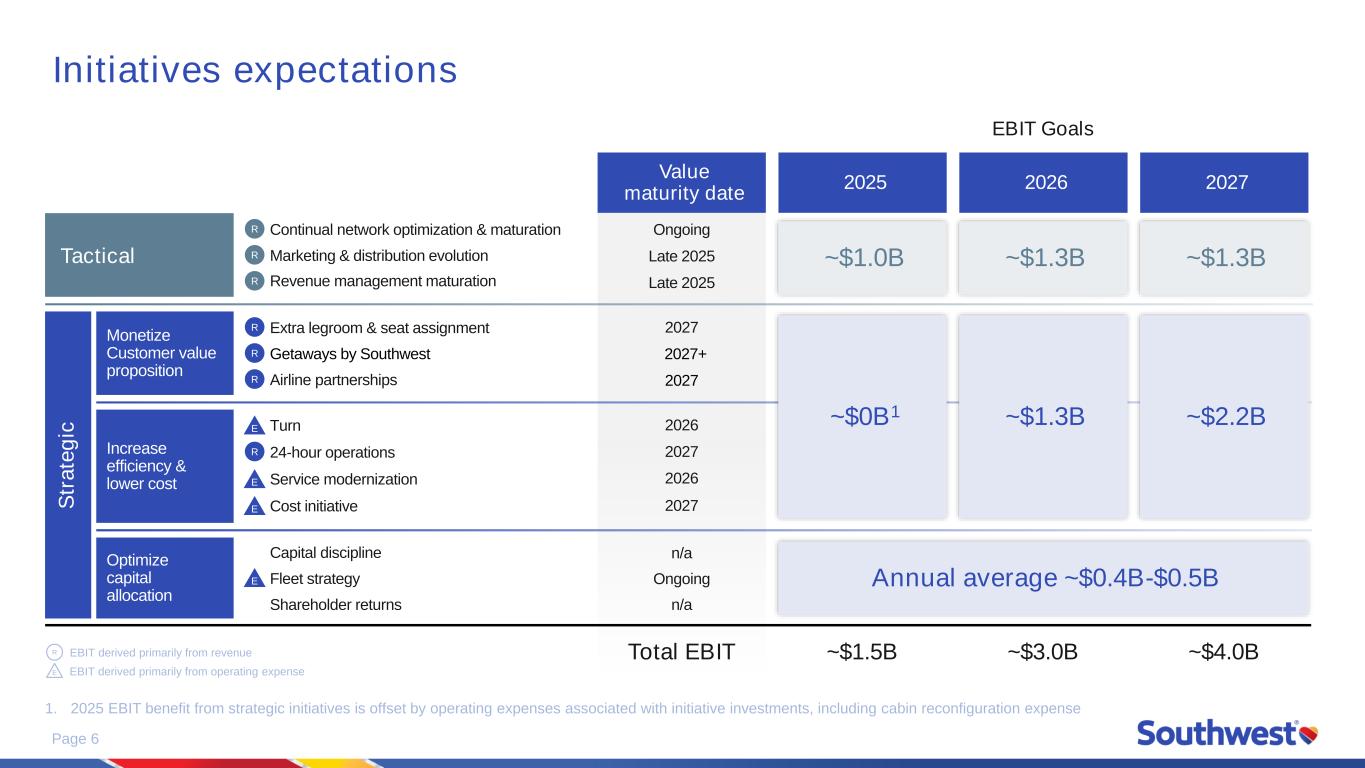

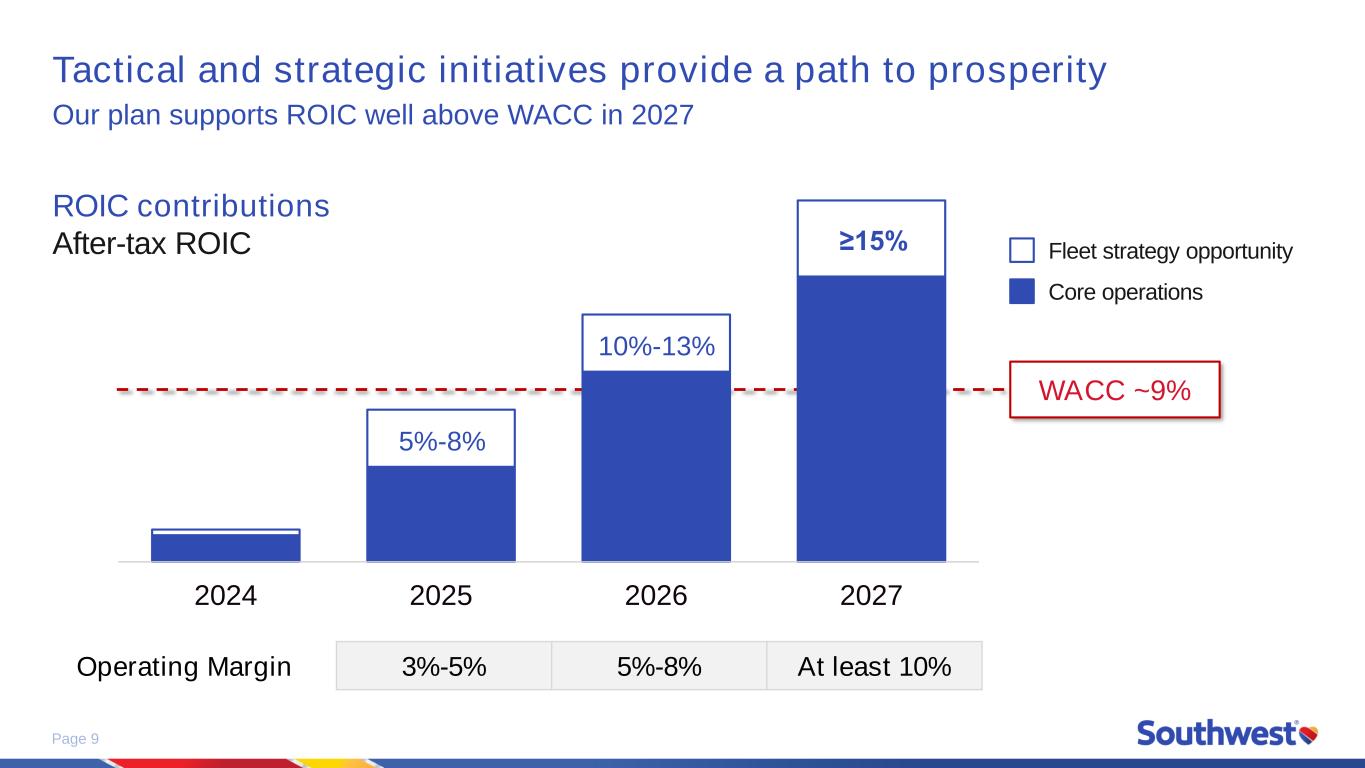

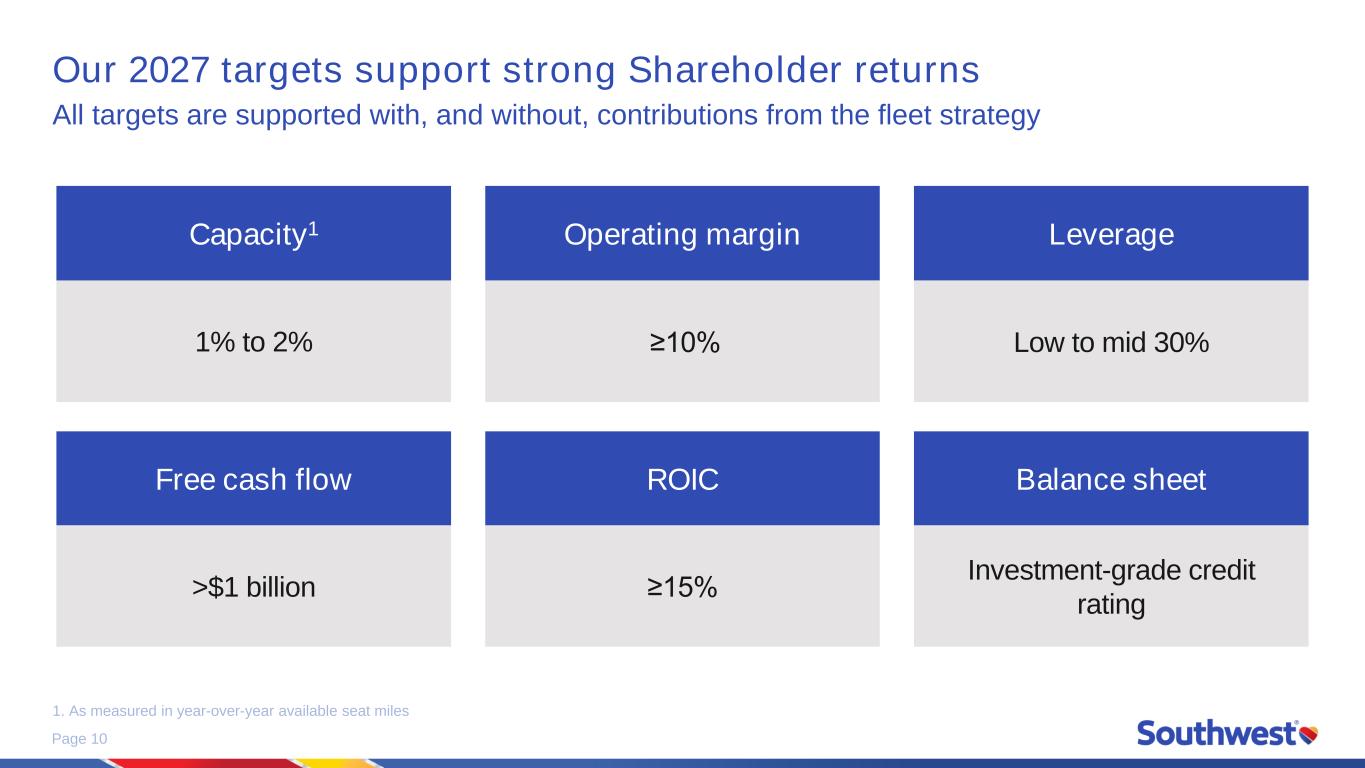

Bob Jordan, President, Chief Executive Officer, & Vice Chairman of the Board of Directors, stated, "It’s an exciting time for us as we execute on our ‘Southwest. Even Better.’ plan outlined last month at Investor Day. The transformational plan represents a culmination of the dedication and hard work of our Team. We are laser-focused on delivering the robust set of tactical and strategic initiatives included in our plan and returning to the strong financial performance we expect. We are fully committed to executing our plan and to reporting regularly on our progress. Our third quarter profit and strong operational results are reflective of the actions we are taking to deliver our plan and achieve our North Star goal of ROIC3 of at least 15 percent or greater, well above our cost of capital, in 2027. Based on our current progress, outlook, and confidence in our ability to execute our plan, we intend to repurchase an initial $250 million of Southwest common stock through an accelerated share repurchase program, which is under the $2.5 billion share repurchase authorization announced last month." The following table provides selected financial guidance for fourth quarter 2024:

Guidance and Outlook:

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

4Q 2024 Estimation |

|

|

| RASM (a), year-over-year |

|

|

Up 3.5% to 5.5% |

|

|

| ASMs (b), year-over-year |

|

|

Down ~4% |

|

|

Economic fuel costs per gallon1,4 |

|

|

$2.25 to $2.35 |

|

|

| Fuel hedging premium expense per gallon |

|

|

$0.07 |

|

|

| Fuel hedging cash settlement gains per gallon |

|

|

$0.01 |

|

|

| ASMs per gallon (fuel efficiency) |

|

|

81 to 82 |

|

|

CASM-X (c), year-over-year1,5 |

|

|

Up 11% to 13% |

|

|

| Scheduled debt repayments (millions) |

|

|

~$5 |

|

|

| Interest expense (millions) |

|

|

~$62 |

|

|

| Aircraft (d) |

|

|

796 |

|

|

(a) Operating revenue per available seat mile ("RASM" or "unit revenues").

(b) Available seat miles ("ASMs" or "capacity"). The Company's flight schedule is published for sale through June 4, 2025. The Company expects first quarter 2025 capacity to decrease in the range of 1 percent to 3 percent, year-over-year.

(c) Operating expenses per available seat mile, excluding fuel and oil expense, special items, and profitsharing ("CASM-X").

(d) Aircraft on property, end of period. The Company continues to plan for approximately 20 Boeing 737-8 ("-8") aircraft deliveries and now expects 41 aircraft retirements in 2024, comprised of 37 Boeing 737-700s ("-700") and four Boeing 737-800s ("-800"). The delivery schedule for the Boeing 737-7 ("-7") is dependent on the Federal Aviation Administration ("FAA") issuing required certifications and approvals to The Boeing Company ("Boeing") and the Company. The FAA will ultimately determine the timing of the -7 certification and entry into service, and Boeing may continue to experience manufacturing challenges, so the Company offers no assurances that current estimations and timelines will be met.

Revenue Results and Outlook:

•Third quarter 2024 operating revenues were a third quarter record of $6.9 billion, a 5.3 percent increase, year-over-year

•Third quarter 2024 passenger revenues were a third quarter record of $6.3 billion, a 5.7 percent increase, year-over-year

•Third quarter 2024 RASM increased 2.8 percent, year-over-year—within the Company's previous guidance range

The Company's record third quarter performance for both operating and passenger revenues was driven primarily by yield improvements from capacity moderation across the industry and progress in managing tactical initiatives to drive results. The Company's third quarter 2024 RASM increased 2.8 percent, year-over-year, a solid sequential improvement, and at the better end of its recently improved guidance range of 2 percent to 3 percent, year-over-year.

The Company expects fourth quarter 2024 unit revenues to increase in the range of 3.5 percent to 5.5 percent on a year-over-year basis with capacity down approximately 4 percent, also on a year-over-year basis. This guidance range contemplates a headwind of just under one-half point from Hurricane Milton and the resulting Customer cancellations. Thus far in the quarter, travel demand remains healthy and bookings-to-date for the holiday season are strong, demonstrating the continued resilience of the leisure travel market. The guidance range represents another sequential year-over-year unit revenue improvement driven by the Company's focus on tactical actions including network optimization and capacity moderation, marketing and distribution evolution, and continued efforts to advance revenue management techniques.

Fuel Costs and Outlook:

•Third quarter 2024 economic fuel costs were $2.55 per gallon1—within the Company's previous guidance range—and included $0.07 per gallon in premium expense and $0.02 per gallon in favorable cash settlements from fuel derivative contracts

•Third quarter 2024 fuel efficiency improved 1.5 percent, year-over-year, primarily due to more -8 aircraft, the Company's most fuel-efficient aircraft, as a percentage of its fleet

•As of October 16, 2024, the fair market value of the Company's fuel derivative contracts settling in fourth quarter 2024 through the end of 2027 was an asset of $144 million

The Company's multi-year fuel hedging program continues to provide protection against spikes in energy prices. The Company's current fuel derivative contracts contain a combination of instruments based on West Texas Intermediate and Brent crude oil, and refined products, such as heating oil. The economic fuel price per gallon sensitivities4 provided in the table below assume the relationship between Brent crude oil and refined products based on market prices as of October 16, 2024.

|

|

|

|

|

|

|

|

|

|

Estimated economic fuel price per gallon,

including taxes and fuel hedging premiums |

Average Brent Crude Oil

price per barrel |

4Q 2024 |

2024 |

|

|

|

| $60 |

$1.85 - $1.95 |

$2.50 - $2.60 |

| $70 |

$2.05 - $2.15 |

$2.55 - $2.65 |

| Current Market (a) |

$2.25 - $2.35 |

$2.60 - $2.70 |

| $90 |

$2.70 - $2.80 |

$2.70 - $2.80 |

| $100 |

$2.90 - $3.00 |

$2.75 - $2.85 |

| $110 |

$3.10 - $3.20 |

$2.80 - $2.90 |

|

|

|

Fair market value of

fuel derivative contracts settling in period |

$8 million |

$57 million |

| Estimated premium costs |

$39 million |

$158 million |

(a) Brent crude oil average market prices as of October 16, 2024, were $74 and $80 per barrel for fourth quarter and full year 2024, respectively.

In addition, the Company is providing its maximum percentage of estimated fuel consumption6 covered by fuel derivative contracts in the following table:

|

|

|

|

|

|

|

|

|

| Period |

Maximum fuel hedged percentage (a) |

| 2024 |

58% |

| 2025 |

47% |

| 2026 |

43% |

| 2027 |

Less than 10% |

(a) Based on the Company's current available seat mile plans. The Company is currently 59 percent hedged in fourth quarter 2024.

Non-Fuel Costs and Outlook

•Third quarter 2024 operating expenses increased 6.6 percent, year-over-year, to $6.8 billion

•Third quarter 2024 operating expenses, excluding fuel and oil expense, special items, and profitsharing1, increased 14.3 percent, year-over-year

•Third quarter 2024 CASM-X increased 11.6 percent, year-over-year—within the Company's previous guidance range

The Company's third quarter CASM-X increase came in at the better end of its previous expected range. The Company continues to take urgent steps to control costs, including offering voluntary time off programs and controlling hiring to address overstaffing. The Company also continues to expect savings from its cost plan announced last month to ramp up over the next three years to reach over $500 million in run rate cost savings in 2027.

The Company anticipates fourth quarter 2024 CASM-X to increase in the range of 11 percent to 13 percent, year-over-year, as cost pressures continue, particularly from new labor contracts. Fourth quarter CASM-X is further pressured by a 4 percent reduction in year-over-year capacity, as well as just over one-half point of unit cost headwind from flight cancellations associated with Hurricane Milton.

The Company continues to estimate its full year 2024 effective tax rate to be approximately 24 percent.

Capacity, Fleet, and Capital Spending:

•Third quarter 2024 capacity increased 2.4 percent, year-over-year—in line with the Company's previous guidance

•The Company received nine -8 aircraft and retired 15 aircraft (14 -700 aircraft and one -800 aircraft) in third quarter 2024, ending the quarter with 811 aircraft

•Third quarter 2024 capital expenditures were $517 million, driven primarily by aircraft-related capital spending, as well as technology, facilities, and operational investments

Given the Company's ongoing discussions with Boeing and expected aircraft delivery delays, the Company continues to plan for approximately 20 -8 aircraft deliveries in 2024, which differs from its contractual order book displayed in the table below. The Company has also chosen to retire six additional aircraft in 2024, bringing total aircraft retirements for the year to approximately 41 (37 -700s and four -800s), resulting in a fleet of roughly 796 aircraft at year-end 2024.

The Company's flight schedule is published for sale through June 4, 2025. The Company estimates fourth quarter 2024 capacity to decrease approximately 4 percent and first quarter 2025 capacity to decrease in the range of 1 percent to 3 percent, both year-over-year. The Company continues to expect annual capacity growth in 2025, 2026, and 2027 to be in the 1 percent to 2 percent range, on a year-over-year basis, funded through tactical initiatives of improving aircraft turn time and launching redeye flights.

The Company now estimates its 2024 capital spending to be roughly $2.1 billion, which includes approximately $825 million in aircraft capital spending, assuming approximately 20 -8 aircraft deliveries in 2024. The reduction from prior guidance of approximately $2.5 billion is primarily due to changes in expectations of future aircraft delivery timing as Boeing delivery delays persist into 2025. The Company and Boeing continue to have ongoing discussions regarding the financial impacts to the Company as a result of aircraft delivery delays.

Since the previous financial results released on July 25, 2024, the Company exercised nine -7 options for delivery in 2025, one -7 option for delivery in 2026, and converted nine 2025 -7 firm orders into 2025 -8 firm orders. The following tables provide further information regarding the Company's contractual order book and compare its contractual order book as of October 24, 2024, with its previous order book as of July 25, 2024. The contractual order book as of October 24, 2024 does not include the impact of delivery delays and is subject to change based on ongoing discussions with Boeing and subject to their production capability.

Current 737 Contractual Order Book as of October 24, 2024:

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

The Boeing Company |

|

|

|

|

|

|

|

|

|

-7 Firm Orders |

|

-8 Firm Orders |

|

-7 or -8 Options |

|

|

|

Total |

|

|

| 2024 |

|

|

27 |

|

|

58 |

|

|

— |

|

|

|

|

85 |

|

(c) |

|

| 2025 |

|

|

40 |

|

|

30 |

|

|

3 |

|

|

|

|

73 |

|

|

|

| 2026 |

|

|

60 |

|

|

— |

|

|

26 |

|

|

|

|

86 |

|

|

|

| 2027 |

|

|

19 |

|

|

46 |

|

|

25 |

|

|

|

|

90 |

|

|

|

| 2028 |

|

|

15 |

|

|

50 |

|

|

25 |

|

|

|

|

90 |

|

|

|

| 2029 |

|

|

38 |

|

|

34 |

|

|

18 |

|

|

|

|

90 |

|

|

|

| 2030 |

|

|

45 |

|

|

— |

|

|

45 |

|

|

|

|

90 |

|

|

|

| 2031 |

|

|

45 |

|

|

— |

|

|

45 |

|

|

|

|

90 |

|

|

|

|

|

|

289 |

|

(a) |

218 |

|

(b) |

187 |

|

|

|

|

694 |

|

|

|

(a) The delivery timing for the -7 is dependent on the FAA issuing required certifications and approvals to Boeing and the Company. The FAA will ultimately determine the timing of the -7 certification and entry into service, and the Company therefore offers no assurances that current estimations and timelines are correct.

(b) The Company has flexibility to designate firm orders or options as -7s or -8s, upon written advance notification as stated in the contract.

(c) Includes 19 -8 deliveries received year-to-date through September 30, 2024. Given the Company's continued discussions with Boeing and expected aircraft delivery delays, the Company continues to plan for approximately 20 -8 aircraft deliveries in 2024.

Previous 737 Order Book as of July 25, 2024 (a):

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

The Boeing Company |

|

|

|

|

|

|

|

|

|

-7 Firm Orders |

|

-8 Firm Orders |

|

-7 or -8 Options |

|

|

|

Total |

|

|

| 2024 |

|

|

27 |

|

|

58 |

|

|

— |

|

|

|

|

85 |

|

|

|

| 2025 |

|

|

40 |

|

|

21 |

|

|

12 |

|

|

|

|

73 |

|

|

|

| 2026 |

|

|

59 |

|

|

— |

|

|

27 |

|

|

|

|

86 |

|

|

|

| 2027 |

|

|

19 |

|

|

46 |

|

|

25 |

|

|

|

|

90 |

|

|

|

| 2028 |

|

|

15 |

|

|

50 |

|

|

25 |

|

|

|

|

90 |

|

|

|

| 2029 |

|

|

38 |

|

|

34 |

|

|

18 |

|

|

|

|

90 |

|

|

|

| 2030 |

|

|

45 |

|

|

— |

|

|

45 |

|

|

|

|

90 |

|

|

|

| 2031 |

|

|

45 |

|

|

— |

|

|

45 |

|

|

|

|

90 |

|

|

|

|

|

|

288 |

|

|

209 |

|

|

197 |

|

|

|

|

694 |

|

|

|

(a) The 'Previous 737 Order Book' is for reference and comparative purposes only. It should not be relied upon. See 'Current 737 Contractual Order Book' for the Company's current aircraft order book.

Liquidity and Capital Deployment:

•The Company ended third quarter 2024 with $9.4 billion in cash and cash equivalents and short-term investments, and a fully available revolving credit line of $1.0 billion

•The Company continues to have a large base of unencumbered assets with a net book value of approximately $17.1 billion, including $14.2 billion in aircraft value and $2.9 billion in non-aircraft assets such as spare engines, ground equipment, and real estate

•The Company had a net cash position7 of $1.4 billion, and adjusted debt to invested capital ("leverage")8 of 46 percent as of September 30, 2024

•The Company has returned $431 million to its Shareholders through the payment of dividends year-to-date as of September 30, 2024

•Under the $2.5 billion share repurchase program authorized by the Company's Board of Directors in September 2024, the Company intends to launch an initial $250 million accelerated share repurchase program soon ("fourth quarter 2024 ASR program"). Subsequent to the launch of the fourth quarter 2024 ASR program, the Company will have $2.25 billion remaining under the recently authorized $2.5 billion share repurchase program

•The Company paid $11 million during third quarter 2024 to retire debt and finance lease obligations, including $5 million in principal related to lease return and lease buyout transactions and $6 million in scheduled lease payments

Awards and Recognitions:

•Ranked on The Wall Street Journal’s Best Managed Companies list

•The Southwest Rapid Rewards® Premier and Priority Credit Cards, issued by Chase, were named the top two Co-Branded Airline Credit Cards for Customer Satisfaction in the J.D. Power 2024 U.S. Credit Card Satisfaction Study9

•Named a Best Place to Work for Disability Inclusion after achieving a top score on Disability:IN's 2024 Disability Equality Index

•The Southwest Airlines Repurpose with Purpose program won the Changemakers Award in the People & Community Category at the 2024 Skift IDEA Awards

•Recognized by the Denver Business Journal as a 2024 Partner in Philanthropy recipient

•Achieved Qurator certification, the official mark of excellence for Hawai‘i-based and operating businesses, from the Hawai‘i Tourism Authority (HTA)

Environmental, Social, and Governance ("ESG"):

•SAFFiRE Renewables, a part of the Southwest Airlines Renewable Ventures investment portfolio, broke ground on its pilot plant at Conestoga Energy’s Arkalon Energy facility in Liberal, Kansas. This marks a significant step in SAFFiRE’s journey to transform corn stover into an abundant low carbon feedstock for sustainable aviation fuel

•Signed a memorandum of understanding with Archer Aviation to develop operational plans for electric air taxi networks utilizing Archer's eVTOL aircraft at California airports where Southwest operates

•Celebrated Disability Pride Month throughout July 2024, recognizing people with disabilities and their contributions to society

•Announced a partnership with the National Park Foundation, the official charitable partner of the National Park Service dedicated to protecting and enhancing America's national parks for present and future generations

•Celebrated the contributions and influence of Hispanic Americans throughout Hispanic Heritage Month

•Visit southwest.com/citizenship for details about the Company's ongoing ESG efforts

Supplemental Financial Information:

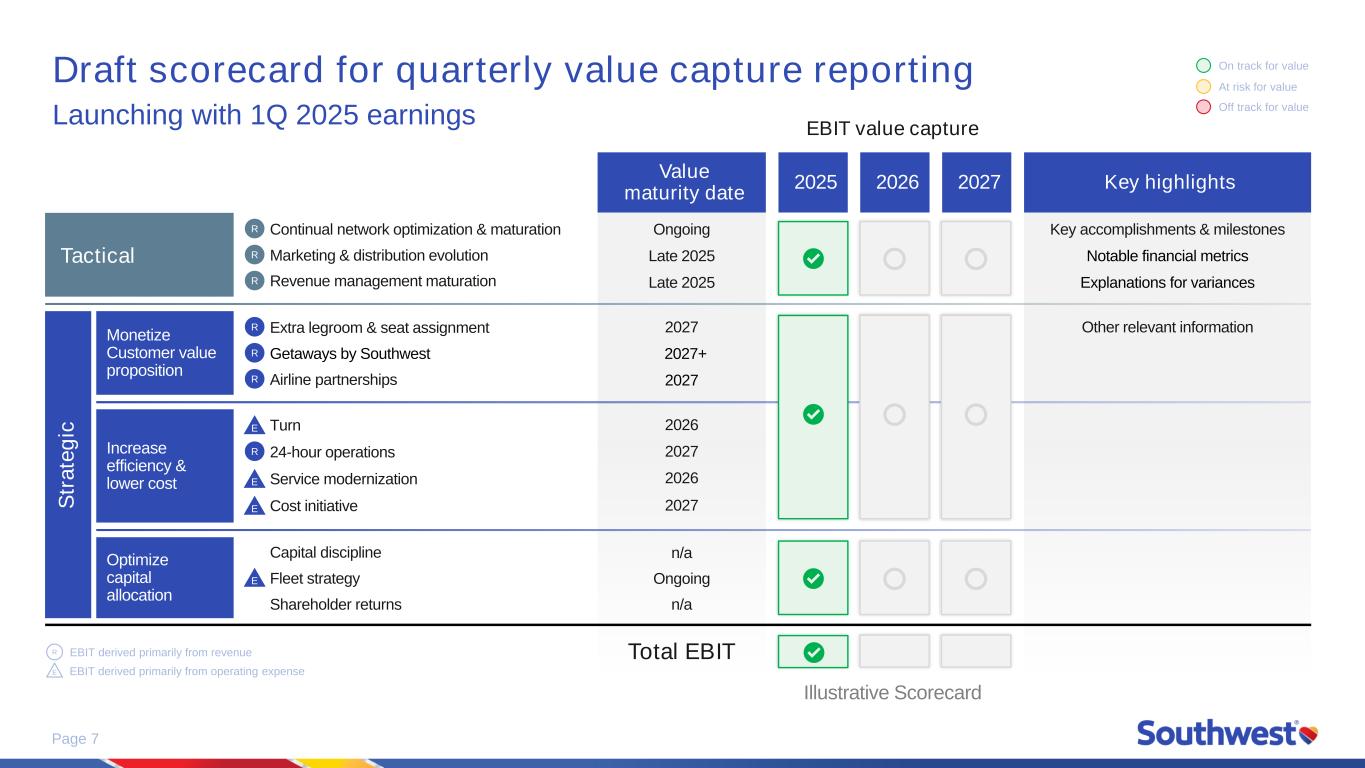

The Company will provide additional details on progress against initiative development and expected financial results, including a scorecard. This will be available on the Investor Relations website at

https://www.southwestairlinesinvestorrelations.com.

Conference Call:

The Company will discuss its third quarter 2024 results on a conference call at 12:30 p.m. Eastern Time today. To listen to a live broadcast of the conference call, please go to

https://www.southwestairlinesinvestorrelations.com.

Footnotes

1See Note Regarding Use of Non-GAAP Financial Measures for additional information on special items. In addition, information regarding special items and economic results is included in the accompanying table Reconciliation of Reported Amounts to Non-GAAP Measures (also referred to as "excluding special items").

2Includes $9.4 billion in cash and cash equivalents and short-term investments, and a fully available revolving credit line of $1.0 billion.

3Return on invested capital ("ROIC"). See Note Regarding Use of Non-GAAP Financial Measures for additional information on ROIC. In addition, information regarding ROIC and economic results is included in the accompanying table Non-GAAP Return on Invested Capital (ROIC).

4Based on the Company's existing fuel derivative contracts and market prices as of October 16, 2024, fourth quarter and full year 2024 economic fuel costs per gallon are estimated to be in the range of $2.25 to $2.35 and $2.60 to $2.70, respectively. Economic fuel cost projections do not reflect the potential impact of special items because the Company cannot reliably predict or estimate the hedge accounting impact associated with the volatility of the energy markets, or the impact to its financial statements in future periods. Accordingly, the Company believes a reconciliation of non-GAAP financial measures to the equivalent GAAP financial measures for projected results is not meaningful or available without unreasonable effort. See Note Regarding Use of Non-GAAP Financial Measures.

5Projections do not reflect the potential impact of fuel and oil expense, special items, and profitsharing because the Company cannot reliably predict or estimate those items or expenses or their impact to its financial statements in future periods, especially considering the significant volatility of the fuel and oil expense line item. Accordingly, the Company believes a reconciliation of non-GAAP financial measures to the equivalent GAAP financial measures for these projected results is not meaningful or available without unreasonable effort.

6The Company's maximum fuel hedged percentage is calculated using the maximum number of gallons that are covered by derivative contracts divided by the Company's estimate of total fuel gallons to be consumed for each respective period. The Company's maximum number of gallons that are covered by derivative contracts may be at different strike prices and at strike prices materially higher than the current market prices. The volume of gallons covered by derivative contracts that are ultimately exercised in any given period may vary significantly from the volumes used to calculate the Company's maximum fuel hedged percentages, as market prices and the Company's fuel consumption fluctuate.

7Net cash position is calculated as the sum of cash and cash equivalents and short-term investments, less the sum of short-term and long-term debt.

8See Note Regarding Use of Non-GAAP Financial Measures for an explanation of the Company's leverage calculation.

9Southwest Rapid Rewards Premier Card, issued by J.P. Morgan Chase Bank, N.A., received the highest score in the Airline Co-Brand Credit Cards segment of the J.D. Power 2024 U.S. Credit Card Satisfaction Study. This study profiles the experiences of customers from the largest credit card issuers. Visit jdpower.com/awards for more details.

Cautionary Statement Regarding Forward-Looking Statements

This news release contains forward-looking statements within the meaning of Section 27A of the Securities Act of 1933, as amended, and Section 21E of the Securities Exchange Act of 1934, as amended.

Specific forward-looking statements include, without limitation, statements related to (i) the Company’s planned shareholder returns; (ii) the Company’s initiatives, strategic priorities and focus areas, goals, and opportunities, including with respect to returning to strong financial performance, creating shareholder value, restoring margins, shareholder returns, improved operational efficiency, capital allocation, Customer Experience enhancements, and improved return on invested capital; (iii) the Company's financial and operational outlook, expectations, goals, plans, and projected results of operations, including with respect to its initiatives, and including factors and assumptions underlying the Company's expectations and projections; (iv) the Company’s plans and expectations with respect to its network, its capacity, its network optimization efforts, its network plan, and capacity and network adjustments, and including factors and assumptions underlying the Company's expectations and projections; (v) the Company's expectations with respect to fuel costs, hedging gains, and fuel efficiency, and the Company's related management of risks associated with changing jet fuel prices, including factors underlying the Company's expectations; (vi) the Company's plans, estimates, and assumptions related to repayment of debt obligations, interest expense, effective tax rate, and capital spending, including factors and assumptions underlying the Company's expectations and projections; (vii) the Company’s fleet plans and expectations, including with respect to fleet utilization, fleet modernization, flexibility, and expected fleet deliveries and retirements, and including factors and assumptions underlying the Company's plans and expectations; (viii) the Company’s plans and expectations with respect to marketing and distribution evolution and its continued efforts to advance revenue management techniques; (ix)

the Company’s labor plans and expectations, including the Company’s hiring and headcount plans and expectations; and (x) the Company’s plans and expectations with respect to redeye flying and reducing turn times. These forward-looking statements are based on the Company's current estimates, intentions, beliefs, expectations, goals, strategies, and projections for the future and are not guarantees of future performance. Forward-looking statements involve risks, uncertainties, assumptions, and other factors that are difficult to predict and that could cause actual results to vary materially from those expressed in or indicated by them. Factors include, among others, the impact of fears or actual outbreaks of diseases, extreme or severe weather and natural disasters, actions of competitors (including, without limitation, pricing, scheduling, capacity, and network decisions, and consolidation and alliance activities), consumer perception, economic conditions, banking conditions, fears or actual acts of terrorism or war, sociodemographic trends, and other factors beyond the Company's control, on consumer behavior and the Company's results of operations and business decisions, plans, strategies, and results; (ii) the Company's ability to timely and effectively implement, transition, operate, and maintain the necessary information technology systems and infrastructure to support its operations and initiatives, including with respect to revenue management and assigned and premium seating; (iii) the cost and effects of the actions of activist shareholders; (iv) the Company’s ability to obtain and maintain adequate infrastructure and equipment to support its operations and initiatives; (v) the impact of fuel price changes, fuel price volatility, volatility of commodities used by the Company for hedging jet fuel, and any changes to the Company's fuel hedging strategies and positions, on the Company's business plans and results of operations; (vi) the Company's dependence on The Boeing Company (“Boeing”) and Boeing suppliers with respect to the Company's aircraft deliveries, Boeing MAX 7 aircraft certifications, fleet and capacity plans, operations, maintenance, strategies, and goals; (vii) the Company's dependence on the Federal Aviation Administration with respect to safety approvals for the new cabin layout and the certification of the Boeing MAX 7 aircraft; (viii) the Company's dependence on other third parties, in particular with respect to its technology plans, its plans and expectations related to revenue management, operational reliability, fuel supply, maintenance, Global Distribution Systems, environmental sustainability, and the impact on the Company's operations and results of operations of any third party delays or nonperformance; (ix) the Company’s ability to timely and effectively prioritize its initiatives and focus areas and related expenditures; (x) the impact of labor matters on the Company's business decisions, plans, strategies, and results; (xi) the impact of governmental regulations and other governmental actions on the Company's business plans, results, and operations; (xii) the Company's dependence on its workforce, including its ability to employ and retain sufficient numbers of qualified Employees with appropriate skills and expertise to effectively and efficiently maintain its operations and execute the Company’s plans, strategies, and initiatives; (xiii) the emergence of additional costs or effects associated with the cancelled flights in December 2022, including litigation, government investigation and actions, and internal actions; and (xiv) other factors, as described in the Company's filings with the Securities and Exchange Commission, including the detailed factors discussed under the heading "Risk Factors" in the Company's Annual Report on Form 10-K for the fiscal year ended December 31, 2023, and in the Company’s Quarterly Report on Form 10-Q for the fiscal quarter ended June 30, 2024.

Investor Contact:

Southwest Airlines Investor Relations

214-792-4415

Media Contact:

Southwest Airlines Media Relations

214-792-4847

swamedia@wnco.com

SW-QFS

Southwest Airlines Co.

Condensed Consolidated Statement of Income

(in millions, except per share amounts)

(unaudited)

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Three months ended |

|

|

|

Nine months ended |

|

|

|

September 30, |

|

|

|

September 30, |

|

|

|

2024 |

|

2023 |

|

Percent Change |

|

2024 |

|

2023 |

|

Percent Change |

| OPERATING REVENUES: |

|

|

|

|

|

|

|

|

|

|

|

| Passenger |

$ |

6,250 |

|

|

$ |

5,912 |

|

|

5.7 |

|

$ |

18,673 |

|

|

$ |

17,426 |

|

|

7.2 |

| Freight |

43 |

|

|

44 |

|

|

(2.3) |

|

131 |

|

|

131 |

|

|

— |

| Other |

577 |

|

|

569 |

|

|

1.4 |

|

1,749 |

|

|

1,711 |

|

|

2.2 |

| Total operating revenues |

6,870 |

|

|

6,525 |

|

|

5.3 |

|

20,553 |

|

|

19,268 |

|

|

6.7 |

|

|

|

|

|

|

|

|

|

|

|

|

| OPERATING EXPENSES: |

|

|

|

|

|

|

|

|

|

|

|

| Salaries, wages, and benefits |

3,070 |

|

|

2,728 |

|

|

12.5 |

|

9,010 |

|

|

7,991 |

|

|

12.8 |

|

|

|

|

|

|

|

|

|

|

|

|

| Fuel and oil |

1,417 |

|

|

1,564 |

|

|

(9.4) |

|

4,548 |

|

|

4,514 |

|

|

0.8 |

| Maintenance materials and repairs |

335 |

|

|

326 |

|

|

2.8 |

|

1,046 |

|

|

836 |

|

|

25.1 |

| Landing fees and airport rentals |

493 |

|

|

457 |

|

|

7.9 |

|

1,468 |

|

|

1,324 |

|

|

10.9 |

| Depreciation and amortization |

438 |

|

|

375 |

|

|

16.8 |

|

1,250 |

|

|

1,107 |

|

|

12.9 |

| Other operating expenses |

1,079 |

|

|

958 |

|

|

12.6 |

|

3,188 |

|

|

2,868 |

|

|

11.2 |

| Total operating expenses |

6,832 |

|

|

6,408 |

|

|

6.6 |

|

20,510 |

|

|

18,640 |

|

|

10.0 |

|

|

|

|

|

|

|

|

|

|

|

|

| OPERATING INCOME |

38 |

|

|

117 |

|

|

(67.5) |

|

43 |

|

|

628 |

|

|

(93.2) |

|

|

|

|

|

|

|

|

|

|

|

|

| OTHER EXPENSES (INCOME): |

|

|

|

|

|

|

|

|

|

|

|

| Interest expense |

63 |

|

|

63 |

|

|

— |

|

191 |

|

|

193 |

|

|

(1.0) |

| Capitalized interest |

(9) |

|

|

(4) |

|

|

125.0 |

|

(24) |

|

|

(15) |

|

|

60.0 |

| Interest income |

(121) |

|

|

(156) |

|

|

(22.4) |

|

(392) |

|

|

(425) |

|

|

(7.8) |

|

|

|

|

|

|

|

|

|

|

|

|

| Other (gains) losses, net |

16 |

|

|

(23) |

|

|

n.m. |

|

(1) |

|

|

(44) |

|

|

(97.7) |

| Total other income |

(51) |

|

|

(120) |

|

|

(57.5) |

|

(226) |

|

|

(291) |

|

|

(22.3) |

|

|

|

|

|

|

|

|

|

|

|

|

| INCOME BEFORE INCOME TAXES |

89 |

|

|

237 |

|

|

(62.4) |

|

269 |

|

|

919 |

|

|

(70.7) |

| PROVISION FOR INCOME TAXES |

22 |

|

|

44 |

|

|

(50.0) |

|

65 |

|

|

202 |

|

|

(67.8) |

| NET INCOME |

$ |

67 |

|

|

$ |

193 |

|

|

(65.3) |

|

$ |

204 |

|

|

$ |

717 |

|

|

(71.5) |

|

|

|

|

|

|

|

|

|

|

|

|

| NET INCOME PER SHARE: |

|

|

|

|

|

|

|

|

|

|

|

| Basic |

$ |

0.11 |

|

|

$ |

0.32 |

|

|

(65.6) |

|

$ |

0.34 |

|

|

$ |

1.20 |

|

|

(71.7) |

| Diluted |

$ |

0.11 |

|

|

$ |

0.31 |

|

|

(64.5) |

|

$ |

0.34 |

|

|

$ |

1.15 |

|

|

(70.4) |

|

|

|

|

|

|

|

|

|

|

|

|

| WEIGHTED AVERAGE SHARES OUTSTANDING: |

|

|

|

|

|

|

|

|

|

|

|

| Basic |

599 |

|

|

596 |

|

|

0.5 |

|

598 |

|

|

595 |

|

|

0.5 |

| Diluted |

601 |

|

|

640 |

|

|

(6.1) |

|

643 |

|

|

639 |

|

|

0.6 |

|

|

|

|

|

|

|

|

|

|

|

|

Southwest Airlines Co.

Reconciliation of Reported Amounts to Non-GAAP Financial Measures (excluding special items)

(See Note Regarding Use of Non-GAAP Financial Measures)

(in millions, except per share and per ASM amounts)(unaudited)

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| |

Three months ended |

|

|

|

Nine months ended |

|

|

|

September 30, |

|

Percent |

|

September 30, |

|

Percent |

|

2024 |

|

2023 |

|

Change |

|

2024 |

|

2023 |

|

Change |

| Fuel and oil expense, unhedged |

$ |

1,409 |

|

|

$ |

1,616 |

|

|

|

|

$ |

4,500 |

|

|

$ |

4,608 |

|

|

|

| Add: Premium cost of fuel contracts designated as hedges |

34 |

|

|

30 |

|

|

|

|

114 |

|

|

91 |

|

|

|

| Deduct: Fuel hedge gains included in Fuel and oil expense, net |

(26) |

|

|

(82) |

|

|

|

|

(66) |

|

|

(185) |

|

|

|

| Fuel and oil expense, as reported |

$ |

1,417 |

|

|

$ |

1,564 |

|

|

(9.4) |

|

$ |

4,548 |

|

|

$ |

4,514 |

|

|

0.8 |

| Add (Deduct): Fuel hedge contracts settling in the current period, but for which (gains) losses were reclassified from AOCI |

14 |

|

|

(11) |

|

|

|

|

14 |

|

|

(12) |

|

|

|

| Add: Premium cost of fuel contracts not designated as hedges |

5 |

|

|

— |

|

|

|

|

5 |

|

|

— |

|

|

|

| Fuel and oil expense, excluding special items (economic) |

$ |

1,436 |

|

|

$ |

1,553 |

|

|

(7.5) |

|

$ |

4,567 |

|

|

$ |

4,502 |

|

|

1.4 |

|

|

|

|

|

|

|

|

|

|

|

|

| Total operating expenses, net, as reported |

$ |

6,832 |

|

|

$ |

6,408 |

|

|

|

|

$ |

20,510 |

|

|

$ |

18,640 |

|

|

|

| Deduct: Labor contract adjustment (a) |

— |

|

|

(96) |

|

|

|

|

(9) |

|

|

(180) |

|

|

|

| Add (Deduct): Fuel hedge contracts settling in the current period, but for which (gains) losses were reclassified from AOCI |

14 |

|

|

(11) |

|

|

|

|

14 |

|

|

(12) |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Add: Premium cost of fuel contracts not designated as hedges |

5 |

|

|

— |

|

|

|

|

5 |

|

|

— |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Deduct: Litigation settlements |

— |

|

|

— |

|

|

|

|

(7) |

|

|

(12) |

|

|

|

| Deduct: Professional advisory fees |

(13) |

|

|

— |

|

|

|

|

(20) |

|

|

— |

|

|

|

| Total operating expenses, excluding special items |

$ |

6,838 |

|

|

$ |

6,301 |

|

|

8.5 |

|

$ |

20,493 |

|

|

$ |

18,436 |

|

|

11.2 |

| Deduct: Fuel and oil expense, excluding special items (economic) |

(1,436) |

|

|

(1,553) |

|

|

|

|

(4,567) |

|

|

(4,502) |

|

|

|

| Operating expenses, excluding Fuel and oil expense and special items |

$ |

5,402 |

|

|

$ |

4,748 |

|

|

13.8 |

|

$ |

15,926 |

|

|

$ |

13,934 |

|

|

14.3 |

| Deduct: Profitsharing expense |

(18) |

|

|

(38) |

|

|

|

|

(49) |

|

|

(158) |

|

|

|

| Operating expenses, excluding Fuel and oil expense, special items, and profitsharing |

$ |

5,384 |

|

|

$ |

4,710 |

|

|

14.3 |

|

$ |

15,877 |

|

|

$ |

13,776 |

|

|

15.3 |

|

|

|

|

|

|

|

|

|

|

|

|

| Operating income, as reported |

$ |

38 |

|

|

$ |

117 |

|

|

|

|

$ |

43 |

|

|

$ |

628 |

|

|

|

| Add: Labor contract adjustment (a) |

— |

|

|

96 |

|

|

|

|

9 |

|

|

180 |

|

|

|

| Add (Deduct): Fuel hedge contracts settling in the current period, but for which (gains) losses were reclassified from AOCI |

(14) |

|

|

11 |

|

|

|

|

(14) |

|

|

12 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Deduct: Premium cost of fuel contracts not designated as hedges |

(5) |

|

|

— |

|

|

|

|

(5) |

|

|

— |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Add: Litigation settlements |

— |

|

|

— |

|

|

|

|

7 |

|

|

12 |

|

|

|

| Add: Professional advisory fees |

13 |

|

|

— |

|

|

|

|

20 |

|

|

— |

|

|

|

| Operating income, excluding special items |

$ |

32 |

|

|

$ |

224 |

|

|

(85.7) |

|

$ |

60 |

|

|

$ |

832 |

|

|

(92.8) |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| |

Three months ended |

|

|

|

Nine months ended |

|

|

|

September 30, |

|

Percent |

|

September 30, |

|

Percent |

|

2024 |

|

2023 |

|

Change |

|

2024 |

|

2023 |

|

Change |

| Other (gains) losses, net, as reported |

$ |

16 |

|

|

$ |

(23) |

|

|

|

|

$ |

(1) |

|

|

$ |

(44) |

|

|

|

| Add (Deduct): Mark-to-market impact from fuel contracts settling in future periods |

(29) |

|

|

33 |

|

|

|

|

(31) |

|

|

26 |

|

|

|

| Deduct: Premium cost of fuel contracts not designated as hedges |

(5) |

|

|

— |

|

|

|

|

(5) |

|

|

— |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Add: Unrealized mark-to-market adjustment on available for sale securities |

— |

|

|

— |

|

|

|

|

— |

|

|

4 |

|

|

|

| Other (gains) losses, net, excluding special items |

$ |

(18) |

|

|

$ |

10 |

|

|

n.m. |

|

$ |

(37) |

|

|

$ |

(14) |

|

|

164.3 |

|

|

|

|

|

|

|

|

|

|

|

|

| Income before income taxes, as reported |

$ |

89 |

|

|

$ |

237 |

|

|

|

|

$ |

269 |

|

|

$ |

919 |

|

|

|

| Add: Labor contract adjustment (a) |

— |

|

|

96 |

|

|

|

|

9 |

|

|

180 |

|

|

|

| Add (Deduct): Fuel hedge contracts settling in the current period, but for which (gains) losses were reclassified from AOCI |

(14) |

|

|

11 |

|

|

|

|

(14) |

|

|

12 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Add (Deduct): Mark-to-market impact from fuel contracts settling in future periods |

29 |

|

|

(33) |

|

|

|

|

31 |

|

|

(26) |

|

|

|

| Add: Litigation settlements |

— |

|

|

— |

|

|

|

|

7 |

|

|

12 |

|

|

|

| Add: Professional advisory fees |

13 |

|

|

— |

|

|

|

|

20 |

|

|

— |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Deduct: Unrealized mark-to-market adjustment on available for sale securities |

— |

|

|

— |

|

|

|

|

— |

|

|

(4) |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Income before income taxes, excluding special items |

$ |

117 |

|

|

$ |

311 |

|

|

(62.4) |

|

$ |

322 |

|

|

$ |

1,093 |

|

|

(70.5) |

|

|

|

|

|

|

|

|

|

|

|

|

| Provision for income taxes, as reported |

$ |

22 |

|

|

$ |

44 |

|

|

|

|

$ |

65 |

|

|

$ |

202 |

|

|

|

| Add: Net income tax impact of fuel and special items (b) |

6 |

|

|

27 |

|

|

|

|

16 |

|

|

55 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Provision for income taxes, net, excluding special items |

$ |

28 |

|

|

$ |

71 |

|

|

(60.6) |

|

$ |

81 |

|

|

$ |

257 |

|

|

(68.5) |

|

|

|

|

|

|

|

|

|

|

|

|

| Net income, as reported |

$ |

67 |

|

|

$ |

193 |

|

|

|

|

$ |

204 |

|

|

$ |

717 |

|

|

|

| Add: Labor contract adjustment (a) |

— |

|

|

96 |

|

|

|

|

9 |

|

|

180 |

|

|

|

| Add (Deduct): Fuel hedge contracts settling in the current period, but for which (gains) losses were reclassified from AOCI |

(14) |

|

|

11 |

|

|

|

|

(14) |

|

|

12 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Add (Deduct): Mark-to-market impact from fuel contracts settling in future periods |

29 |

|

|

(33) |

|

|

|

|

31 |

|

|

(26) |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Add: Litigation settlements |

— |

|

|

— |

|

|

|

|

7 |

|

|

12 |

|

|

|

| Add: Professional advisory fees |

13 |

|

|

— |

|

|

|

|

20 |

|

|

— |

|

|

|

| Deduct: Unrealized mark-to-market adjustment on available for sale securities |

— |

|

|

— |

|

|

|

|

— |

|

|

(4) |

|

|

|

| Deduct: Net income tax impact of special items (b) |

(6) |

|

|

(27) |

|

|

|

|

(16) |

|

|

(55) |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Net income, excluding special items |

$ |

89 |

|

|

$ |

240 |

|

|

(62.9) |

|

$ |

241 |

|

|

$ |

836 |

|

|

(71.2) |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| |

Three months ended |

|

|

|

Nine months ended |

|

|

|

September 30, |

|

Percent |

|

September 30, |

|

Percent |

|

2024 |

|

2023 |

|

Change |

|

2024 |

|

2023 |

|

Change |

| Net income per share, diluted, as reported |

$ |

0.11 |

|

|

$ |

0.31 |

|

|

|

|

$ |

0.34 |

|

|

$ |

1.15 |

|

|

|

| Add: Impact of special items |

0.01 |

|

|

0.14 |

|

|

|

|

0.06 |

|

|

0.29 |

|

|

|

| Add (Deduct): Net impact of net income above from fuel contracts divided by dilutive shares |

0.02 |

|

|

(0.03) |

|

|

|

|

0.03 |

|

|

(0.02) |

|

|

|

| Deduct: Net income tax impact of special items (b) |

— |

|

|

(0.04) |

|

|

|

|

(0.03) |

|

|

(0.09) |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Add: GAAP to Non-GAAP diluted weighted average shares difference (c) |

$ |

0.01 |

|

|

$ |

— |

|

|

|

|

$ |

— |

|

|

$ |

— |

|

|

|

| Net income per share, diluted, excluding special items |

$ |

0.15 |

|

|

$ |

0.38 |

|

|

(60.5) |

|

$ |

0.40 |

|

|

$ |

1.33 |

|

|

(69.9) |

|

|

|

|

|

|

|

|

|

|

|

|

| Operating expenses per ASM (cents) |

¢ |

15.11 |

|

|

¢ |

14.51 |

|

|

|

|

¢ |

15.34 |

|

|

¢ |

14.93 |

|

|

|

| Deduct: Impact of special items |

(0.03) |

|

|

(0.24) |

|

|

|

|

(0.03) |

|

|

(0.16) |

|

|

|

| Deduct: Fuel and oil expense divided by ASMs |

(3.14) |

|

|

(3.52) |

|

|

|

|

(3.40) |

|

|

(3.61) |

|

|

|

| Deduct: Profitsharing expense divided by ASMs |

(0.03) |

|

|

(0.08) |

|

|

|

|

(0.04) |

|

|

(0.12) |

|

|

|

| Operating expenses per ASM, excluding Fuel and oil expense, special items, and profitsharing (cents) |

¢ |

11.91 |

|

|

¢ |

10.67 |

|

|

11.6 |

|

¢ |

11.87 |

|

|

¢ |

11.04 |

|

|

7.5 |

(a) Represents incremental expense associated with contract ratification bonuses for various workgroups related to additional compensation for services performed by Employees outside of the applicable fiscal period. See the Note Regarding Use of Non-GAAP Financial Measures for further information.

(b) Tax amounts for each individual special item are calculated at the Company's effective rate for the applicable period and totaled in this line item.

(c) Adjustment related to GAAP and Non-GAAP diluted weighted average shares difference due to the Convertible Notes being anti-dilutive for GAAP but dilutive for Non-GAAP for the three months ended September 30, 2024.

Southwest Airlines Co.

Comparative Consolidated Operating Statistics

(unaudited)

Relevant comparative operating statistics for the three and nine months ended September 30, 2024 and 2023 are included below. The Company provides these operating statistics because they are commonly used in the airline industry and, as such, allow readers to compare the Company’s performance against its results for the prior year period, as well as against the performance of the Company’s peers.

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Three months ended |

|

|

|

Nine months ended |

|

|

|

September 30, |

|

Percent |

|

September 30, |

|

Percent |

| |

2024 |

|

2023 |

|

Change |

|

2024 |

|

2023 |

|

Change |

| Revenue passengers carried (000s) |

35,516 |

|

|

35,349 |

|

|

0.5 |

|

105,897 |

|

|

101,296 |

|

|

4.5 |

| Enplaned passengers (000s) |

44,711 |

|

|

44,598 |

|

|

0.3 |

|

132,875 |

|

|

127,050 |

|

|

4.6 |

| Revenue passenger miles (RPMs) (in millions) (a) |

36,735 |

|

|

35,624 |

|

|

3.1 |

|

108,044 |

|

|

100,676 |

|

|

7.3 |

| Available seat miles (ASMs) (in millions) (b) |

45,219 |

|

|

44,169 |

|

|

2.4 |

|

133,717 |

|

|

124,810 |

|

|

7.1 |

| Load factor (c) |

81.2 |

% |

|

80.7 |

% |

|

0.5 pts. |

|

80.8 |

% |

|

80.7 |

% |

|

0.1 pts. |

| Average length of passenger haul (miles) |

1,034 |

|

|

1,008 |

|

|

2.6 |

|

1,020 |

|

|

994 |

|

|

2.6 |

| Average aircraft stage length (miles) |

770 |

|

|

735 |

|

|

4.8 |

|

763 |

|

|

726 |

|

|

5.1 |

| Trips flown |

364,609 |

|

|

374,926 |

|

|

(2.8) |

|

1,090,337 |

|

|

1,074,136 |

|

|

1.5 |

| Seats flown (000s) (d) |

58,119 |

|

|

59,494 |

|

|

(2.3) |

|

173,588 |

|

|

170,116 |

|

|

2.0 |

| Seats per trip (e) |

159.4 |

|

|

158.7 |

|

|

0.4 |

|

159.2 |

|

|

158.4 |

|

|

0.5 |

| Average passenger fare |

$ |

175.97 |

|

|

$ |

167.24 |

|

|

5.2 |

|

$ |

176.34 |

|

|

$ |

172.03 |

|

|

2.5 |

| Passenger revenue yield per RPM (cents) (f) |

17.01 |

|

|

16.60 |

|

|

2.5 |

|

17.28 |

|

|

17.31 |

|

|

(0.2) |

| RASM (cents) (g) |

15.19 |

|

|

14.77 |

|

|

2.8 |

|

15.37 |

|

|

15.44 |

|

|

(0.5) |

| PRASM (cents) (h) |

13.82 |

|

|

13.38 |

|

|

3.3 |

|

13.96 |

|

|

13.96 |

|

|

— |

| CASM (cents) (i) |

15.11 |

|

|

14.51 |

|

|

4.1 |

|

15.34 |

|

|

14.93 |

|

|

2.7 |

| CASM, excluding Fuel and oil expense (cents) |

11.97 |

|

|

10.97 |

|

|

9.1 |

|

11.94 |

|

|

11.32 |

|

|

5.5 |

| CASM, excluding special items (cents) |

15.12 |

|

|

14.27 |

|

|

6.0 |

|

15.33 |

|

|

14.77 |

|

|

3.8 |

| CASM, excluding Fuel and oil expense and special items (cents) |

11.95 |

|

|

10.75 |

|

|

11.2 |

|

11.91 |

|

|

11.16 |

|

|

6.7 |

| CASM, excluding Fuel and oil expense, special items, and profitsharing expense (cents) |

11.91 |

|

|

10.67 |

|

|

11.6 |

|

11.87 |

|

|

11.04 |

|

|

7.5 |

| Fuel costs per gallon, including fuel tax (unhedged) |

$ |

2.50 |

|

|

$ |

2.89 |

|

|

(13.5) |

|

$ |

2.70 |

|

|

$ |

2.91 |

|

|

(7.2) |

| Fuel costs per gallon, including fuel tax |

$ |

2.52 |

|

|

$ |

2.80 |

|

|

(10.0) |

|

$ |

2.73 |

|

|

$ |

2.85 |

|

|

(4.2) |

| Fuel costs per gallon, including fuel tax (economic) |

$ |

2.55 |

|

|

$ |

2.78 |

|

|

(8.3) |

|

$ |

2.74 |

|

|

$ |

2.85 |

|

|

(3.9) |

| Fuel consumed, in gallons (millions) |

562 |

|

|

557 |

|

|

0.9 |

|

1,663 |

|

|

1,578 |

|

|

5.4 |

| Active fulltime equivalent Employees |

73,463 |

|

|

74,181 |

|

|

(1.0) |

|

73,463 |

|

|

74,181 |

|

|

(1.0) |

| Aircraft at end of period (j) |

811 |

|

|

817 |

|

|

(0.7) |

|

811 |

|

|

817 |

|

|

(0.7) |

(a) A revenue passenger mile is one paying passenger flown one mile. Also referred to as "traffic," which is a measure of demand for a given period.

(b) An available seat mile is one seat (empty or full) flown one mile. Also referred to as "capacity," which is a measure of the space available to carry passengers in a given period.

(c) Revenue passenger miles divided by available seat miles.

(d) Seats flown is calculated using total number of seats available by aircraft type multiplied by the total trips flown by the same aircraft type during a particular period.

(e) Seats per trip is calculated by dividing seats flown by trips flown.

(f) Calculated as passenger revenue divided by revenue passenger miles. Also referred to as "yield," this is the average cost paid by a paying passenger to fly one mile, which is a measure of revenue production and fares.

(g) RASM (unit revenue) - Operating revenue yield per ASM, calculated as operating revenue divided by available seat miles. Also referred to as "operating unit revenues," this is a measure of operating revenue production based on the total available seat miles flown during a particular period.

(h) PRASM (Passenger unit revenue) - Passenger revenue yield per ASM, calculated as passenger revenue divided by available seat miles. Also referred to as “passenger unit revenues,” this is a measure of passenger revenue production based on the total available seat miles flown during a particular period.

(i) CASM (unit costs) - Operating expenses per ASM, calculated as operating expenses divided by available seat miles. Also referred to as "unit costs" or "cost per available seat mile," this is the average cost to fly an aircraft seat (empty or full) one mile, which is a measure of cost efficiencies.

(j) Included three Boeing 737 Next Generation aircraft in storage as of September 30, 2023.

Southwest Airlines Co.

Non-GAAP Return on Invested Capital (ROIC)

(See Note Regarding Use of Non-GAAP Financial Measures)

(in millions)

(unaudited)

|

|

|

|

|

|

|

|

|

|

|

|

Twelve months ended |

|

|

|

|

September 30, 2024 |

|

|

|

| Operating loss, as reported |

$ |

(361) |

|

|

|

|

| TWU 555 contract adjustment |

9 |

|

|

|

|

| SWAPA contract adjustment |

354 |

|

|

|

|

| Net impact from fuel contracts |

(14) |

|

|

|

|

| Professional advisory fees |

20 |

|

|

|

|

| DOT settlement |

107 |

|

|

|

|

| Litigation settlements |

7 |

|

|

|

|

|

|

|

|

|

| Operating income, non-GAAP |

$ |

122 |

|

|

|

|

| Net adjustment for aircraft leases (a) |

128 |

|

|

|

|

| Adjusted operating income, non-GAAP (A) |

$ |

250 |

|

|

|

|

|

|

|

|

|

| Non-GAAP tax rate (B) |

24.3 |

% |

(d) |

|

|

|

|

|

|

|

| Net operating profit after-tax, NOPAT (A* (1-B) = C) |

$ |

189 |

|

|

|

|

|

|

|

|

|

| Debt, including finance leases (b) |

$ |

8,005 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Equity (b) |

10,528 |

|

|

|

|

| Net present value of aircraft operating leases (b) |

910 |

|

|

|

|

| Average invested capital |

$ |

19,443 |

|

|

|

|

| Equity adjustment for hedge accounting (c) |

(39) |

|

|

|

|

| Adjusted average invested capital (D) |

$ |

19,404 |

|

|

|

|

|

|

|

|

|

| Non-GAAP ROIC, pre-tax (A/D) |

1.3 |

% |

|

|

|

|

|

|

|

|

| Non-GAAP ROIC, after-tax (C/D) |

1.0 |

% |

|

|

|

(a) Net adjustment related to presumption that all aircraft in fleet are owned (i.e., the impact of eliminating aircraft rent expense and replacing with estimated depreciation expense for those same aircraft). The Company makes this adjustment to enhance comparability to other entities that have different capital structures by utilizing alternative financing decisions.

(b) Calculated as an average of the five most recent quarter end balances or remaining obligations. The Net present value of aircraft operating leases represents the assumption that all aircraft in the Company’s fleet are owned, as it reflects the remaining contractual commitments discounted at the Company's estimated incremental borrowing rate as of the time each individual lease was signed.

(c) The Equity adjustment in the denominator adjusts for the cumulative impacts, in Accumulated other comprehensive income and Retained earnings, of gains and/or losses that will settle in future periods, including those associated with the Company's fuel hedges. The current period impact of these gains and/or losses is reflected in the Net impact from fuel contracts in the numerator.

(d) The GAAP twelve month rolling tax rate as of September 30, 2024, was (186.0) percent, and the Non-GAAP twelve month rolling tax rate was 24.3 percent. The GAAP twelve month rolling tax rate as of September 30, 2024 is negative primarily due to the Company's pre-tax book loss for the twelve months ended September 30, 2024. See Note Regarding Use of Non-GAAP Financial Measures for additional information.

Southwest Airlines Co.

Condensed Consolidated Balance Sheet

(in millions)

(unaudited)

|

|

|

|

|

|

|

|

|

|

|

|

|

September 30, 2024 |

|

December 31, 2023 |

| ASSETS |

|

|

|

| Current assets: |

|

|

|

| Cash and cash equivalents |

$ |

8,503 |

|

|

$ |

9,288 |

|

| Short-term investments |

879 |

|

|

2,186 |

|

| Accounts and other receivables |

1,177 |

|

|

1,154 |

|

| Inventories of parts and supplies, at cost |

770 |

|

|

807 |

|

| Prepaid expenses and other current assets |

601 |

|

|

520 |

|

| Total current assets |

11,930 |

|

|

13,955 |

|

| Property and equipment, at cost: |

|

|

|

| Flight equipment |

26,394 |

|

|

26,060 |

|

| Ground property and equipment |

7,955 |

|

|

7,460 |

|

| Deposits on flight equipment purchase contracts |

428 |

|

|

236 |

|

| Assets constructed for others |

87 |

|

|

62 |

|

| |

34,864 |

|

|

33,818 |

|

| Less allowance for depreciation and amortization |

15,091 |

|

|

14,443 |

|

| |

19,773 |

|

|

19,375 |

|

| Goodwill |

970 |

|

|

970 |

|

| Operating lease right-of-use assets |

1,101 |

|

|

1,223 |

|

| Other assets |

1,073 |

|

|

964 |

|

| |

$ |

34,847 |

|

|

$ |

36,487 |

|

| LIABILITIES AND STOCKHOLDERS' EQUITY |

|

|

|

| Current liabilities: |

|

|

|

| Accounts payable |

$ |

1,518 |

|

|

$ |

1,862 |

|

| Accrued liabilities |

2,096 |

|

|

3,606 |

|

| Current operating lease liabilities |

202 |

|

|

208 |

|

| Air traffic liability |

6,743 |

|

|

6,551 |

|

| Current maturities of long-term debt |

2,930 |

|

|

29 |

|

| Total current liabilities |

13,489 |

|

|

12,256 |

|

|

|

|

|

| Long-term debt less current maturities |

5,075 |

|

|

7,978 |

|

| Air traffic liability - noncurrent |

1,957 |

|

|

1,728 |

|

| Deferred income taxes |

2,094 |

|

|

2,044 |

|

|

|

|

|

| Noncurrent operating lease liabilities |

888 |

|

|

985 |

|

| Other noncurrent liabilities |

933 |

|

|

981 |

|

| Stockholders' equity: |

|

|

|

| Common stock |

888 |

|

|

888 |

|

| Capital in excess of par value |

4,180 |

|

|

4,153 |

|

| Retained earnings |

16,178 |

|

|

16,297 |

|

| Accumulated other comprehensive income |

(37) |

|

|

— |

|

| Treasury stock, at cost |

(10,798) |

|

|

(10,823) |

|

| Total stockholders' equity |

10,411 |

|

|

10,515 |

|

|

$ |

34,847 |

|

|

$ |

36,487 |

|

Southwest Airlines Co.

Condensed Consolidated Statement of Cash Flows

(in millions) (unaudited)

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Three months ended September 30, |

|

Nine months ended September 30, |

|

|

2024 |

|

2023 |

|

2024 |

|

2023 |

|

| CASH FLOWS FROM OPERATING ACTIVITIES: |

|

|

|

|

|

|

|

|

| Net income |

$ |

67 |

|

|

$ |

193 |

|

|

$ |

204 |

|

|

$ |

717 |

|

|

| Adjustments to reconcile net income to net cash provided by (used in) operating activities: |

|

|

|

|

|

|

|

|

| Depreciation and amortization |

438 |

|

|

375 |

|

|

1,250 |

|

|

1,107 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Unrealized mark-to-market adjustment on available for sale securities |

— |

|

|

— |

|

|

— |

|

|

(4) |

|

|

| Unrealized/realized gain (loss) on fuel derivative instruments |

15 |

|

|

(21) |

|

|

17 |

|

|

(14) |

|

|

| Deferred income taxes |

19 |

|

|

57 |

|

|

62 |

|

|

214 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Changes in certain assets and liabilities: |

|

|

|

|

|

|

|

|

| Accounts and other receivables |

193 |

|

|

(216) |

|

|

(80) |

|

|

(405) |

|

|

| Other assets |

(13) |

|

|

(35) |

|

|

4 |

|

|

74 |

|

|

| Accounts payable and accrued liabilities |

(196) |

|

|

352 |

|

|

(1,668) |

|

|

645 |

|

|

| Air traffic liability |

(377) |

|

|

(59) |

|

|

421 |

|

|

750 |

|

|

| Other liabilities |

(18) |

|

|

(89) |

|

|

(136) |

|

|

(180) |

|

|

| Cash collateral received from (provided to) derivative counterparties |

(8) |

|

|

40 |

|

|

(28) |

|

|

(6) |

|

|

| Other, net |

(7) |

|

|

19 |

|

|

(60) |

|

|

(159) |

|

|

| Net cash provided by (used in) operating activities |

113 |

|

|

616 |

|

|

(14) |

|

|

2,739 |

|

|

|

|

|

|

|

|

|

|

|

| CASH FLOWS FROM INVESTING ACTIVITIES: |

|

|

|

|

|

|

|

|

| Capital expenditures |

(517) |

|

|

(842) |

|

|

(1,594) |

|

|

(2,812) |

|

|

|

|

|

|

|

|

|

|