| Wisconsin | 1-7283 | 39-0875718 | ||||||

| (State or Other Jurisdiction of Incorporation) | (Commission File Number) | (IRS Employer Identification No.) | ||||||

| Title of each class | Trading symbol | Name of each exchange on which registered | ||||||

| Common Stock | RRX | New York Stock Exchange | ||||||

| Exhibit Number | Exhibit Description | |||||||

| 99.1 | ||||||||

| 99.2 | ||||||||

| 104.1 | Cover Page Interactive Data File (the Cover Page Interactive Data File is embedded within the Inline XBRL document). | |||||||

|

|

||||

| CONSOLIDATED STATEMENTS OF INCOME (LOSS) | ||||||||||||||||||||||||||

| Unaudited | ||||||||||||||||||||||||||

| (Dollars in Millions, Except per Share Data) | ||||||||||||||||||||||||||

| Three Months Ended | Year Ended | |||||||||||||||||||||||||

| Dec 31, 2023 |

Dec 31, 2022 |

Dec 31, 2023 |

Dec 31, 2022 |

|||||||||||||||||||||||

| Net Sales | $ | 1,608.2 | $ | 1,244.7 | $ | 6,250.7 | $ | 5,217.9 | ||||||||||||||||||

| Cost of Sales | 1,045.0 | 838.1 | 4,183.4 | 3,548.2 | ||||||||||||||||||||||

| Gross Profit | 563.2 | 406.6 | 2,067.3 | 1,669.7 | ||||||||||||||||||||||

| Operating Expenses | 409.5 | 254.0 | 1,537.4 | 978.4 | ||||||||||||||||||||||

| (Gain) Loss on Assets Held for Sale | (25.0) | — | 87.7 | — | ||||||||||||||||||||||

| Goodwill Impairment | — | — | 57.3 | — | ||||||||||||||||||||||

| Asset Impairments | 1.7 | 0.9 | 7.8 | 0.9 | ||||||||||||||||||||||

| Total Operating Expenses | 386.2 | 254.9 | 1,690.2 | 979.3 | ||||||||||||||||||||||

| Income from Operations | 177.0 | 151.7 | 377.1 | 690.4 | ||||||||||||||||||||||

| Interest Expense | 107.7 | 43.4 | 431.0 | 87.2 | ||||||||||||||||||||||

| Interest Income | (3.1) | (2.0) | (43.6) | (5.2) | ||||||||||||||||||||||

| Other Income, Net | (2.0) | (1.3) | (8.7) | (5.4) | ||||||||||||||||||||||

| Income (Loss) before Taxes | 74.4 | 111.6 | (1.6) | 613.8 | ||||||||||||||||||||||

| Provision for Income Taxes | 17.8 | 8.9 | 52.7 | 118.9 | ||||||||||||||||||||||

| Net Income (Loss) | 56.6 | 102.7 | (54.3) | 494.9 | ||||||||||||||||||||||

| Less: Net Income Attributable to Noncontrolling Interests | 0.7 | 1.2 | 3.1 | 6.0 | ||||||||||||||||||||||

| Net Income (Loss) Attributable to Regal Rexnord Corporation | $ | 55.9 | $ | 101.5 | $ | (57.4) | $ | 488.9 | ||||||||||||||||||

| Earnings (Loss) Per Share Attributable to Regal Rexnord Corporation: | ||||||||||||||||||||||||||

| Basic | $ | 0.84 | $ | 1.53 | $ | (0.87) | $ | 7.33 | ||||||||||||||||||

| Assuming Dilution | $ | 0.84 | $ | 1.53 | $ | (0.87) | $ | 7.29 | ||||||||||||||||||

| Cash Dividends Declared Per Share | $ | 0.35 | $ | 0.35 | $ | 1.40 | $ | 1.38 | ||||||||||||||||||

| Weighted Average Number of Shares Outstanding: | ||||||||||||||||||||||||||

| Basic | 66.3 | 66.2 | 66.3 | 66.7 | ||||||||||||||||||||||

| Assuming Dilution | 66.7 | 66.5 | 66.3 | 67.1 | ||||||||||||||||||||||

| CONSOLIDATED BALANCE SHEETS | ||||||||||||||

| Unaudited | ||||||||||||||

| (Dollars in Millions) | ||||||||||||||

| Dec 31, 2023 | Dec 31, 2022 | |||||||||||||

| ASSETS | ||||||||||||||

| Current Assets: | ||||||||||||||

| Cash and Cash Equivalents | $ | 574.0 | $ | 688.5 | ||||||||||

| Trade Receivables, Less Allowances of $30.3 Million in 2023 and $30.9 Million in 2022 | 921.6 | 797.4 | ||||||||||||

| Inventories | 1,274.2 | 1,336.9 | ||||||||||||

| Prepaid Expenses and Other Current Assets | 245.6 | 150.9 | ||||||||||||

| Deferred Financing Fees | — | 17.0 | ||||||||||||

| Assets Held for Sale | 368.6 | 9.8 | ||||||||||||

| Total Current Assets | 3,384.0 | 3,000.5 | ||||||||||||

| Net Property, Plant and Equipment | 1,041.2 | 807.0 | ||||||||||||

| Operating Lease Assets | 172.8 | 110.9 | ||||||||||||

| Goodwill | 6,553.1 | 4,018.8 | ||||||||||||

| Intangible Assets, Net of Amortization | 4,083.4 | 2,229.9 | ||||||||||||

| Deferred Income Tax Benefits | 33.8 | 43.9 | ||||||||||||

| Other Noncurrent Assets | 69.0 | 57.9 | ||||||||||||

| Noncurrent Assets Held for Sale | 94.1 | — | ||||||||||||

| Total Assets | $ | 15,431.4 | $ | 10,268.9 | ||||||||||

| LIABILITIES AND EQUITY | ||||||||||||||

| Current Liabilities: | ||||||||||||||

| Accounts Payable | $ | 549.4 | $ | 497.7 | ||||||||||

| Dividends Payable | 23.2 | 23.2 | ||||||||||||

| Accrued Compensation and Benefits | 198.7 | 141.1 | ||||||||||||

| Accrued Interest | 85.1 | 5.2 | ||||||||||||

| Other Accrued Expenses | 325.2 | 274.8 | ||||||||||||

| Current Operating Lease Liabilities | 37.2 | 26.4 | ||||||||||||

| Current Maturities of Long-Term Debt | 3.9 | 33.8 | ||||||||||||

| Liabilities Held for Sale | 103.7 | — | ||||||||||||

| Total Current Liabilities | 1,326.4 | 1,002.2 | ||||||||||||

| Long-Term Debt | 6,377.0 | 1,989.7 | ||||||||||||

| Deferred Income Taxes | 1,012.7 | 591.9 | ||||||||||||

| Pension and Other Post Retirement Benefits | 120.4 | 97.6 | ||||||||||||

| Noncurrent Operating Lease Liabilities | 132.2 | 88.1 | ||||||||||||

| Other Noncurrent Liabilities | 77.2 | 76.8 | ||||||||||||

| Noncurrent Liabilities Held for Sale | 20.4 | — | ||||||||||||

| Equity: | ||||||||||||||

| Regal Rexnord Corporation Shareholders' Equity: | ||||||||||||||

| Common Stock, $0.01 Par Value, 100.0 Million Shares Authorized, 66.3 Million and 66.2 Million Shares Issued and Outstanding at 2023 and 2022, Respectively | 0.7 | 0.7 | ||||||||||||

| Additional Paid-In Capital | 4,646.2 | 4,609.6 | ||||||||||||

| Retained Earnings | 1,979.8 | 2,130.0 | ||||||||||||

| Accumulated Other Comprehensive Loss | (282.4) | (352.1) | ||||||||||||

| Total Regal Rexnord Corporation Shareholders' Equity | 6,344.3 | 6,388.2 | ||||||||||||

| Noncontrolling Interests | 20.8 | 34.4 | ||||||||||||

| Total Equity | 6,365.1 | 6,422.6 | ||||||||||||

| Total Liabilities and Equity | $ | 15,431.4 | $ | 10,268.9 | ||||||||||

| CONSOLIDATED STATEMENTS OF CASH FLOW | ||||||||||||||||||||||||||

| Unaudited | ||||||||||||||||||||||||||

| (Dollars in Millions) | ||||||||||||||||||||||||||

| Three Months Ended | Year Ended | |||||||||||||||||||||||||

| Dec 31, 2023 | Dec 31, 2022 | Dec 31, 2023 | Dec 31, 2022 | |||||||||||||||||||||||

| CASH FLOWS FROM OPERATING ACTIVITIES: | ||||||||||||||||||||||||||

| Net Income (Loss) | $ | 56.6 | $ | 102.7 | $ | (54.3) | $ | 494.9 | ||||||||||||||||||

| Adjustments to Reconcile Net Income (Loss) to Net Cash Provided by Operating Activities (Net of Acquisitions and Divestitures): | ||||||||||||||||||||||||||

| Depreciation | 53.3 | 30.9 | 185.0 | 121.9 | ||||||||||||||||||||||

| Amortization | 85.1 | 46.1 | 307.8 | 185.5 | ||||||||||||||||||||||

| Goodwill Impairment | — | — | 57.3 | — | ||||||||||||||||||||||

| Asset Impairments | 1.7 | 0.9 | 7.8 | 0.9 | ||||||||||||||||||||||

| (Gain) Loss on Assets Held for Sale | (25.0) | — | 87.7 | — | ||||||||||||||||||||||

| Noncash Lease Expense | 11.3 | 7.6 | 42.9 | 31.9 | ||||||||||||||||||||||

| Share-Based Compensation Expense | 9.1 | 5.5 | 58.2 | 22.5 | ||||||||||||||||||||||

| Financing Fee Expense | 3.0 | 17.8 | 32.8 | 19.6 | ||||||||||||||||||||||

| Benefit from Deferred Income Taxes | (25.9) | (19.5) | (115.3) | (80.1) | ||||||||||||||||||||||

| Other Non-Cash Changes | 3.4 | 1.9 | 9.0 | 2.7 | ||||||||||||||||||||||

| Change in Operating Assets and Liabilities, Net of Acquisitions and Divestitures | ||||||||||||||||||||||||||

| Receivables | 22.5 | 38.1 | 51.7 | (38.1) | ||||||||||||||||||||||

| Inventories | 55.9 | 47.9 | 262.6 | (174.4) | ||||||||||||||||||||||

| Accounts Payable | (51.4) | (64.7) | (70.1) | (129.5) | ||||||||||||||||||||||

| Other Assets and Liabilities | 1.7 | (17.0) | (147.8) | (21.6) | ||||||||||||||||||||||

| Net Cash Provided by Operating Activities | 201.3 | 198.2 | 715.3 | 436.2 | ||||||||||||||||||||||

| CASH FLOWS FROM INVESTING ACTIVITIES: | ||||||||||||||||||||||||||

| Additions to Property, Plant and Equipment | (30.4) | (29.2) | (119.1) | (83.8) | ||||||||||||||||||||||

| Business Acquisitions, Net of Cash Acquired | — | — | (4,870.2) | (35.0) | ||||||||||||||||||||||

| Proceeds Received from Sales of Property, Plant and Equipment | — | — | 6.3 | 5.5 | ||||||||||||||||||||||

| Net Cash Used in Investing Activities | (30.4) | (29.2) | (4,983.0) | (113.3) | ||||||||||||||||||||||

| CASH FLOWS FROM FINANCING ACTIVITIES: | ||||||||||||||||||||||||||

| Borrowings Under Revolving Credit Facility | 492.8 | 322.4 | 2,294.1 | 2,119.6 | ||||||||||||||||||||||

| Repayments Under Revolving Credit Facility | (411.2) | (493.4) | (2,625.0) | (2,427.3) | ||||||||||||||||||||||

| Proceeds from Short-Term Borrowings | 23.3 | 4.2 | 58.0 | 10.2 | ||||||||||||||||||||||

| Repayments of Short-Term Borrowings | (23.0) | (1.1) | (61.2) | (9.1) | ||||||||||||||||||||||

| Proceeds from Long-Term Borrowings | — | — | 5,532.9 | 1,536.8 | ||||||||||||||||||||||

| Repayments of Long-Term Borrowings | (201.6) | (7.8) | (826.3) | (1,123.7) | ||||||||||||||||||||||

| Dividends Paid to Shareholders | (23.2) | (23.0) | (92.8) | (90.9) | ||||||||||||||||||||||

| Proceeds from the Exercise of Stock Options | 0.2 | 0.3 | 3.3 | 5.1 | ||||||||||||||||||||||

| Shares Surrendered for Taxes | (0.6) | (0.3) | (12.1) | (8.9) | ||||||||||||||||||||||

| Financing Fees Paid | — | (34.1) | (51.1) | (40.6) | ||||||||||||||||||||||

| Repurchase of Common Stock | — | — | — | (239.2) | ||||||||||||||||||||||

| Distributions to Noncontrolling Interests | (7.8) | — | (16.2) | (6.2) | ||||||||||||||||||||||

| Net Cash Provided by (Used in) Financing Activities | (151.1) | (232.8) | 4,203.6 | (274.2) | ||||||||||||||||||||||

| EFFECT OF EXCHANGE RATES ON CASH and CASH EQUIVALENTS | 16.7 | 28.7 | 10.9 | (33.0) | ||||||||||||||||||||||

| Net Increase (Decrease) in Cash and Cash Equivalents | 36.5 | (35.1) | (53.2) | 15.7 | ||||||||||||||||||||||

| Cash and Cash Equivalents at Beginning of Period | 598.8 | 723.6 | 688.5 | 672.8 | ||||||||||||||||||||||

| Cash and Cash Equivalents at End of Period | $ | 635.3 | $ | 688.5 | $ | 635.3 | $ | 688.5 | ||||||||||||||||||

| SEGMENT INFORMATION | ||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| Unaudited | ||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| (Dollars in Millions) | ||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| Three Months Ended | ||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| Industrial Powertrain Solutions | Power Efficiency Solutions | Automation & Motion Control | Industrial Systems | Total Regal Rexnord | ||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| Dec 31, 2023 |

Dec 31, 2022 |

Dec 31, 2023 |

Dec 31, 2022 |

Dec 31, 2023 |

Dec 31, 2022 |

Dec 31, 2023 |

Dec 31, 2022 |

Dec 31, 2023 |

Dec 31, 2022 |

|||||||||||||||||||||||||||||||||||||||||||||||||||||

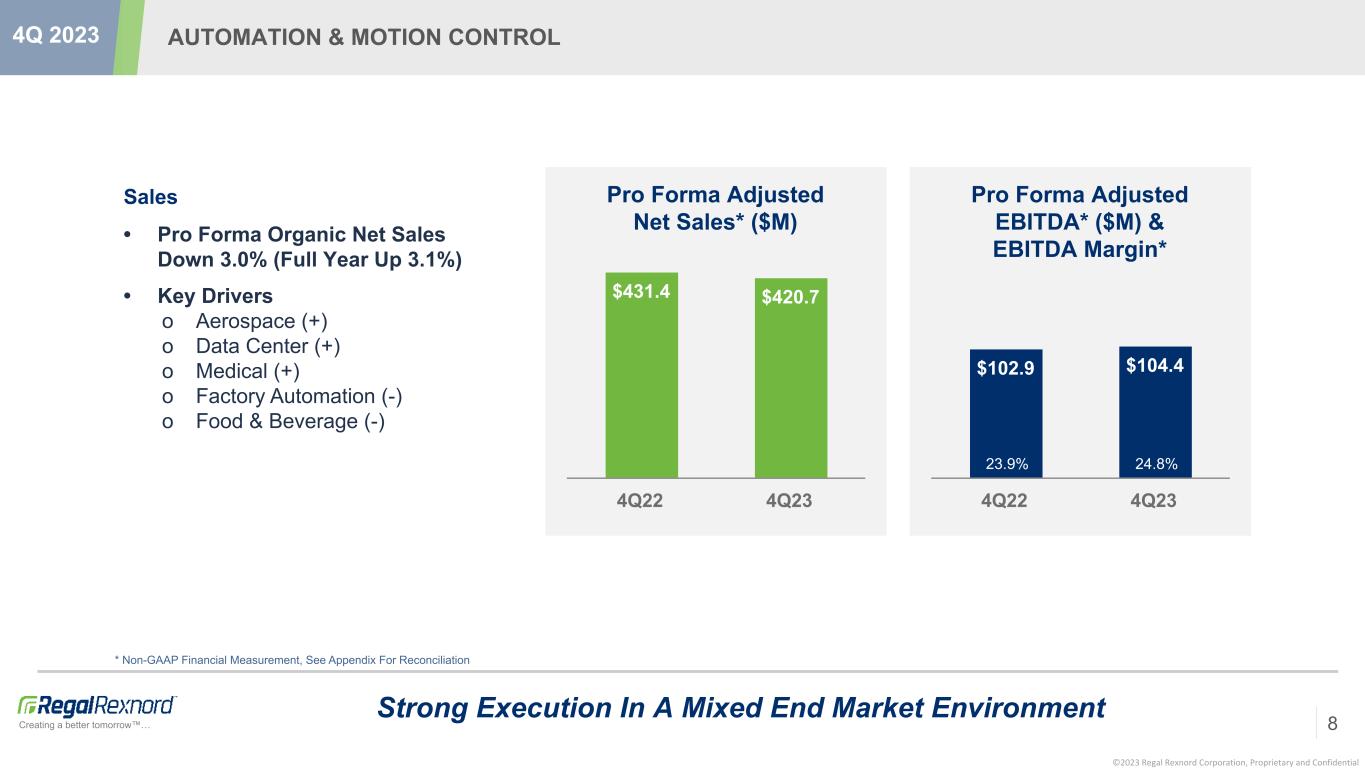

| Net Sales | $ | 649.7 | $ | 412.3 | $ | 418.0 | $ | 495.5 | $ | 420.7 | $ | 201.3 | $ | 119.8 | $ | 135.6 | $ | 1,608.2 | $ | 1,244.7 | ||||||||||||||||||||||||||||||||||||||||||

| Adjusted Net Sales | $ | 649.7 | $ | 412.3 | $ | 418.0 | $ | 495.5 | $ | 420.7 | $ | 201.3 | $ | 119.8 | $ | 135.6 | $ | 1,608.2 | $ | 1,244.7 | ||||||||||||||||||||||||||||||||||||||||||

| GAAP Operating Margin |

7.1 | % | 13.4 | % | 11.3 | % | 13.2 | % | 12.5 | % | 12.1 | % | 25.9 | % | 4.8 | % | 11.0 | % | 12.2 | % | ||||||||||||||||||||||||||||||||||||||||||

| Adjusted Operating Margin | 12.2 | % | 17.8 | % | 14.9 | % | 15.2 | % | 13.7 | % | 15.0 | % | 8.3 | % | 8.0 | % | 13.0 | % | 15.2 | % | ||||||||||||||||||||||||||||||||||||||||||

| Adjusted EBITDA Margin % |

24.0 | % | 28.3 | % | 18.1 | % | 18.0 | % | 24.8 | % | 26.2 | % | 9.1 | % | 10.8 | % | 21.5 | % | 22.0 | % | ||||||||||||||||||||||||||||||||||||||||||

| Components of Net Sales: |

||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| Organic Sales Growth | (1.1) | % | 16.0 | % | (16.0) | % | (2.7) | % | (0.1) | % | (1.3) | % | (12.0) | % | 7.6 | % | (8.1) | % | 4.2 | % | ||||||||||||||||||||||||||||||||||||||||||

| Acquisitions | 57.9 | % | — | % | — | % | — | % | 108.0 | % | 8.0 | % | — | % | — | % | 36.7 | % | 1.3 | % | ||||||||||||||||||||||||||||||||||||||||||

| Foreign Currency Impact |

0.8 | % | (2.6) | % | 0.4 | % | (2.5) | % | 1.1 | % | (5.1) | % | 0.3 | % | (4.9) | % | 0.6 | % | (3.1) | % | ||||||||||||||||||||||||||||||||||||||||||

| SEGMENT INFORMATION | ||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| Unaudited | ||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| (Dollars in Millions) | ||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| Year Ended | ||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| Industrial Powertrain Solutions | Power Efficiency Solutions | Automation & Motion Control | Industrial Systems | Total Regal Rexnord | ||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| Dec 31, 2023 |

Dec 31, 2022 |

Dec 31, 2023 |

Dec 31, 2022 |

Dec 31, 2023 |

Dec 31, 2022 |

Dec 31, 2023 |

Dec 31, 2022 |

Dec 31, 2023 |

Dec 31, 2022 |

|||||||||||||||||||||||||||||||||||||||||||||||||||||

| Net Sales | $ | 2,403.5 | $ | 1,666.3 | $ | 1,808.9 | $ | 2,227.2 | $ | 1,516.8 | $ | 772.3 | $ | 521.5 | $ | 552.1 | $ | 6,250.7 | $ | 5,217.9 | ||||||||||||||||||||||||||||||||||||||||||

| Adjusted Net Sales | $ | 2,403.5 | $ | 1,666.3 | $ | 1,808.9 | $ | 2,227.2 | $ | 1,516.8 | $ | 772.3 | $ | 521.5 | $ | 552.1 | $ | 6,250.7 | $ | 5,217.9 | ||||||||||||||||||||||||||||||||||||||||||

| GAAP Operating Margin |

6.3 | % | 14.5 | % | 12.0 | % | 14.7 | % | 9.2 | % | 10.1 | % | (25.1) | % | 7.8 | % | 6.0 | % | 13.2 | % | ||||||||||||||||||||||||||||||||||||||||||

| Adjusted Operating Margin | 12.0 | % | 16.8 | % | 14.3 | % | 15.5 | % | 12.8 | % | 13.0 | % | 5.0 | % | 9.1 | % | 12.3 | % | 14.9 | % | ||||||||||||||||||||||||||||||||||||||||||

| Adjusted EBITDA Margin % |

24.2 | % | 27.6 | % | 17.5 | % | 18.1 | % | 24.5 | % | 23.8 | % | 7.5 | % | 11.8 | % | 20.9 | % | 21.3 | % | ||||||||||||||||||||||||||||||||||||||||||

| Components of Net Sales: |

||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| Organic Sales Growth | (1.9) | % | 9.1 | % | (18.4) | % | 9.8 | % | 5.9 | % | 4.7 | % | (4.3) | % | 10.7 | % | (8.0) | % | 9.3 | % | ||||||||||||||||||||||||||||||||||||||||||

| Acquisitions | 46.1 | % | 84.1 | % | — | % | — | % | 90.8 | % | 112.3 | % | — | % | — | % | 28.2 | % | 29.9 | % | ||||||||||||||||||||||||||||||||||||||||||

| Foreign Currency Impact |

— | % | (2.1) | % | (0.4) | % | (1.8) | % | (0.3) | % | (3.5) | % | (1.2) | % | (3.3) | % | (0.3) | % | (2.2) | % | ||||||||||||||||||||||||||||||||||||||||||

| ADJUSTED DILUTED EARNINGS PER SHARE | ||||||||||||||||||||||||||

| Unaudited | Three Months Ended | Year Ended | ||||||||||||||||||||||||

| Dec 31, 2023 |

Dec 31, 2022 |

Dec 31, 2023 |

Dec 31, 2022 |

|||||||||||||||||||||||

| GAAP Earnings (Loss) Per Share | $ | 0.84 | $ | 1.53 | $ | (0.87) | $ | 7.29 | ||||||||||||||||||

| Intangible Amortization | 0.96 | 0.52 | 3.49 | 2.09 | ||||||||||||||||||||||

Restructuring and Related Costs (a) |

0.50 | 0.21 | 0.96 | 0.65 | ||||||||||||||||||||||

Share-Based Compensation Expense (b) |

0.08 | 0.06 | 0.72 | 0.28 | ||||||||||||||||||||||

| Inventory and Operating Lease Asset Step Up | 0.01 | — | 0.62 | 0.06 | ||||||||||||||||||||||

| Impairments and Exit Related Costs | 0.04 | 0.01 | 0.11 | 0.01 | ||||||||||||||||||||||

(Gain) Loss on Assets Held for Sale and Gain on Sale of Assets (c) |

(0.38) | — | 1.31 | (0.04) | ||||||||||||||||||||||

| Goodwill Impairment | — | — | 0.86 | — | ||||||||||||||||||||||

Transaction and Integration Related Costs (d) |

0.05 | 0.39 | 1.65 | 0.47 | ||||||||||||||||||||||

| Discrete Tax Items | 0.18 | (0.08) | 0.30 | (0.06) | ||||||||||||||||||||||

| Adjusted Diluted Earnings Per Share | $ | 2.28 | $ | 2.64 | $ | 9.15 | $ | 10.75 | ||||||||||||||||||

| (a) | Relates to costs associated with actions taken for employee reductions, facility consolidations and site closures, product line exits and other asset charges. Includes $11.8 Million of accelerated depreciation for the three months ended December 2023 and $19.3 Million for the year ended December 2023. | ||||

| (b) | Includes the impact related to the accelerated vesting of awards for certain former Altra employees in the first quarter 2023. | ||||

| (c) | For the three months and year ended December 31, 2023, primarily reflects the gain and loss on assets held for sale of $25.0 million and $87.7 million, respectively, related to the pending sale of the industrial motors and generators businesses. | ||||

| (d) | For 2023, primarily relates to (1) legal, professional service, severance, certain other employee compensation and financing costs and incremental net interest expense on new debt associated with the Altra Transaction and integration and (2) legal, professional service, and rebranding costs associated with the pending sale of the industrial motors and generators businesses. For 2022, primarily relates to legal and professional service costs associated with the merger with the Rexnord PMC business and acquisition of the Arrowhead business. | ||||

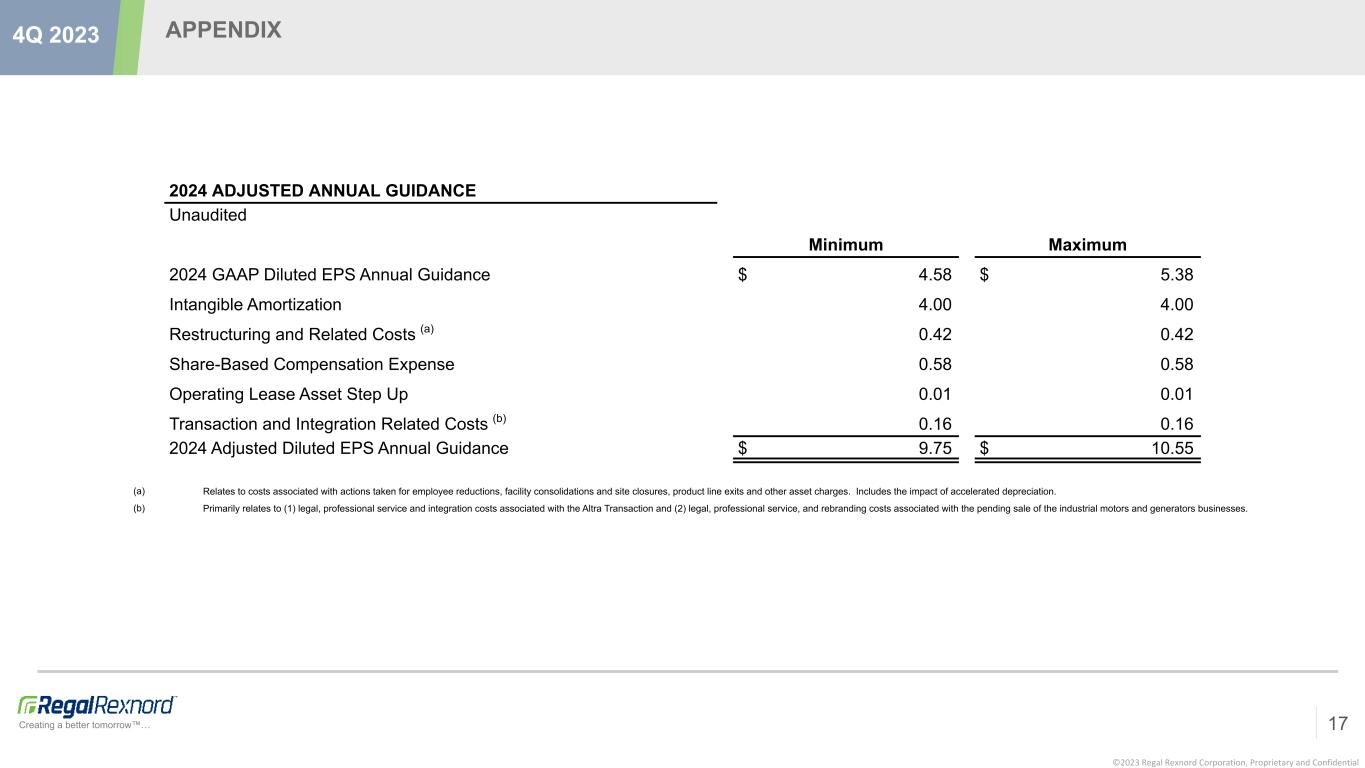

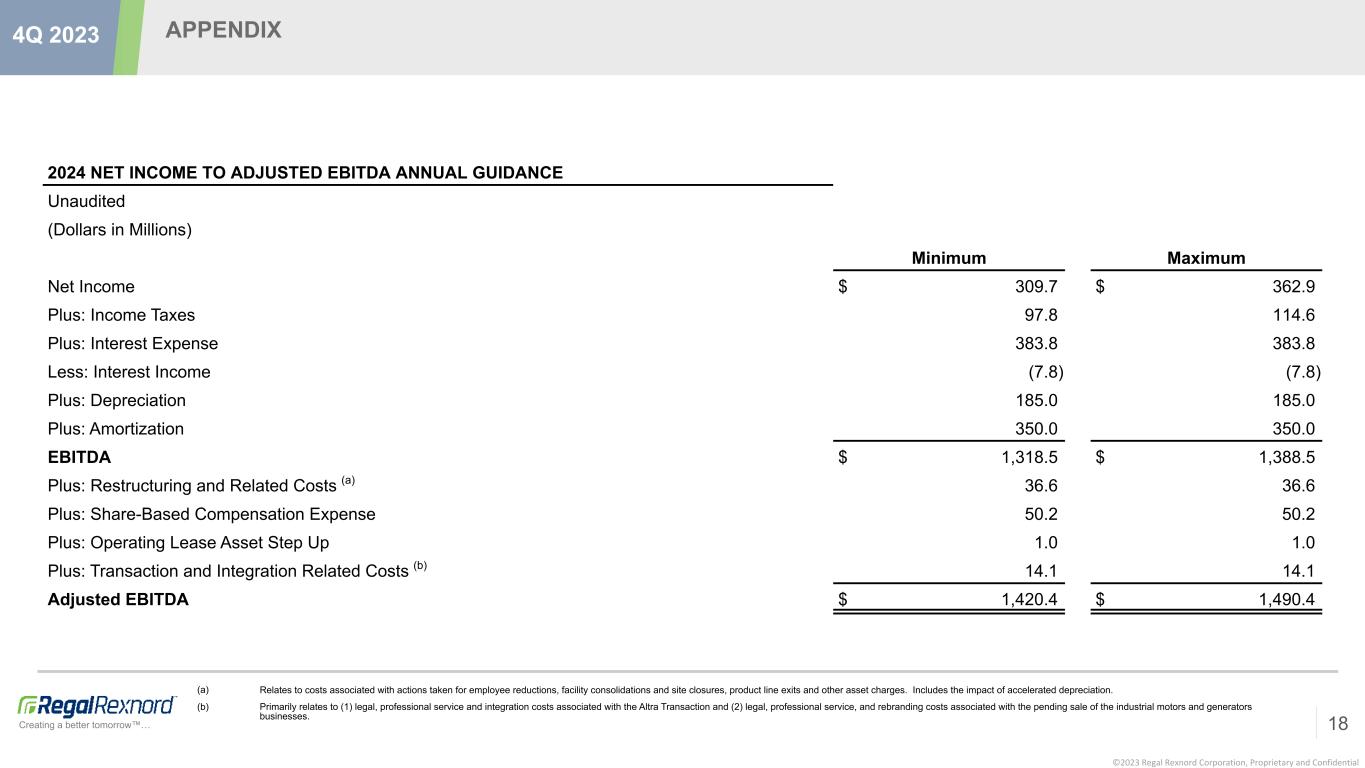

| 2024 ADJUSTED ANNUAL GUIDANCE | ||||||||||||||

| Unaudited | ||||||||||||||

| Minimum | Maximum | |||||||||||||

| 2024 GAAP Diluted EPS Annual Guidance | $ | 4.58 | $ | 5.38 | ||||||||||

| Intangible Amortization | 4.00 | 4.00 | ||||||||||||

Restructuring and Related Costs (a) |

0.42 | 0.42 | ||||||||||||

| Share-Based Compensation Expense | 0.58 | 0.58 | ||||||||||||

| Operating Lease Asset Step Up | 0.01 | 0.01 | ||||||||||||

Transaction and Integration Related Costs (b) |

0.16 | 0.16 | ||||||||||||

| 2024 Adjusted Diluted EPS Annual Guidance | $ | 9.75 | $ | 10.55 | ||||||||||

| (a) | Relates to costs associated with actions taken for employee reductions, facility consolidations and site closures, product line exits and other asset charges. Includes the impact of accelerated depreciation. | ||||

| (b) | Primarily relates to (1) legal, professional service and integration costs associated with the Altra Transaction and (2) legal, professional service, and rebranding costs associated with the pending sale of the industrial motors and generators businesses. | ||||

| ADJUSTED EBITDA | Three Months Ended | |||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| Unaudited | Industrial Powertrain Solutions | Power Efficiency Solutions | Automation & Motion Control | Industrial Systems | Total Regal Rexnord | |||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| (Dollars in Millions) | Dec 31, 2023 | Dec 31, 2022 | Dec 31, 2023 | Dec 31, 2022 | Dec 31, 2023 | Dec 31, 2022 | Dec 31, 2023 | Dec 31, 2022 | Dec 31, 2023 | Dec 31, 2022 | ||||||||||||||||||||||||||||||||||||||||||||||||||||

| GAAP Income from Operations | $ | 46.3 | $ | 55.2 | $ | 47.2 | $ | 65.6 | $ | 52.5 | $ | 24.4 | $ | 31.0 | $ | 6.5 | $ | 177.0 | $ | 151.7 | ||||||||||||||||||||||||||||||||||||||||||

Restructuring and Related Costs (a) |

24.6 | 8.0 | 14.4 | 9.5 | 3.9 | 1.4 | 1.5 | 1.1 | 44.4 | 20.0 | ||||||||||||||||||||||||||||||||||||||||||||||||||||

| Inventory and Operating Lease Asset Step Up | 1.8 | — | — | — | (0.2) | — | — | — | 1.6 | — | ||||||||||||||||||||||||||||||||||||||||||||||||||||

| Impairments and Exit Related Costs | 2.7 | 0.9 | — | — | 0.8 | — | — | — | 3.5 | 0.9 | ||||||||||||||||||||||||||||||||||||||||||||||||||||

(Gain) Loss on Assets Held for Sale (b) |

— | — | — | — | — | — | (25.0) | — | (25.0) | — | ||||||||||||||||||||||||||||||||||||||||||||||||||||

Transaction and Integration Related Costs (c) |

3.6 | 9.4 | 0.5 | — | 0.8 | 4.3 | 2.4 | 3.3 | 7.3 | 17.0 | ||||||||||||||||||||||||||||||||||||||||||||||||||||

| Adjusted Income from Operations* | $ | 79.0 | $ | 73.5 | $ | 62.1 | $ | 75.1 | $ | 57.8 | $ | 30.1 | $ | 9.9 | $ | 10.9 | $ | 208.8 | $ | 189.6 | ||||||||||||||||||||||||||||||||||||||||||

| Amortization | $ | 49.4 | $ | 28.7 | $ | 2.0 | $ | 2.0 | $ | 33.4 | $ | 15.2 | $ | 0.3 | $ | 0.2 | $ | 85.1 | $ | 46.1 | ||||||||||||||||||||||||||||||||||||||||||

| Depreciation | 22.1 | 12.0 | 8.0 | 9.4 | 11.4 | 6.4 | — | 3.1 | 41.5 | 30.9 | ||||||||||||||||||||||||||||||||||||||||||||||||||||

| Share-Based Compensation Expense | 4.4 | 2.1 | 2.8 | 2.1 | 1.3 | 0.9 | 0.6 | 0.4 | 9.1 | 5.5 | ||||||||||||||||||||||||||||||||||||||||||||||||||||

| Other Income, Net | 0.8 | 0.4 | 0.6 | 0.6 | 0.5 | 0.2 | 0.1 | 0.1 | 2.0 | 1.3 | ||||||||||||||||||||||||||||||||||||||||||||||||||||

| Adjusted EBITDA | $ | 155.7 | $ | 116.7 | $ | 75.5 | $ | 89.2 | $ | 104.4 | $ | 52.8 | $ | 10.9 | $ | 14.7 | $ | 346.5 | $ | 273.4 | ||||||||||||||||||||||||||||||||||||||||||

| GAAP Operating Margin % | 7.1% | 13.4% | 11.3% | 13.2% | 12.5% | 12.1% | 25.9% | 4.8% | 11.0% | 12.2% | ||||||||||||||||||||||||||||||||||||||||||||||||||||

| Adjusted Operating Margin % | 12.2% | 17.8% | 14.9% | 15.2% | 13.7% | 15.0% | 8.3% | 8.0% | 13.0% | 15.2% | ||||||||||||||||||||||||||||||||||||||||||||||||||||

| Adjusted EBITDA Margin % | 24.0% | 28.3% | 18.1% | 18.0% | 24.8% | 26.2% | 9.1% | 10.8% | 21.5% | 22.0% | ||||||||||||||||||||||||||||||||||||||||||||||||||||

| (a) | Relates to costs associated with actions taken for employee reductions, facility consolidations and site closures, product line exits and other asset charges. Includes $11.8 Million of accelerated depreciation in 2023. | ||||

| (b) | Reflects the gain on assets held for sale of $25.0 million related to the pending sale of the industrial motors and generators businesses. | ||||

| (c) | Primarily relates to (1) legal, professional service, and certain other employee compensation costs associated with the Altra Transaction and integration and (2) legal, professional service, and rebranding costs associated with the pending sale of the industrial motors and generators businesses. | ||||

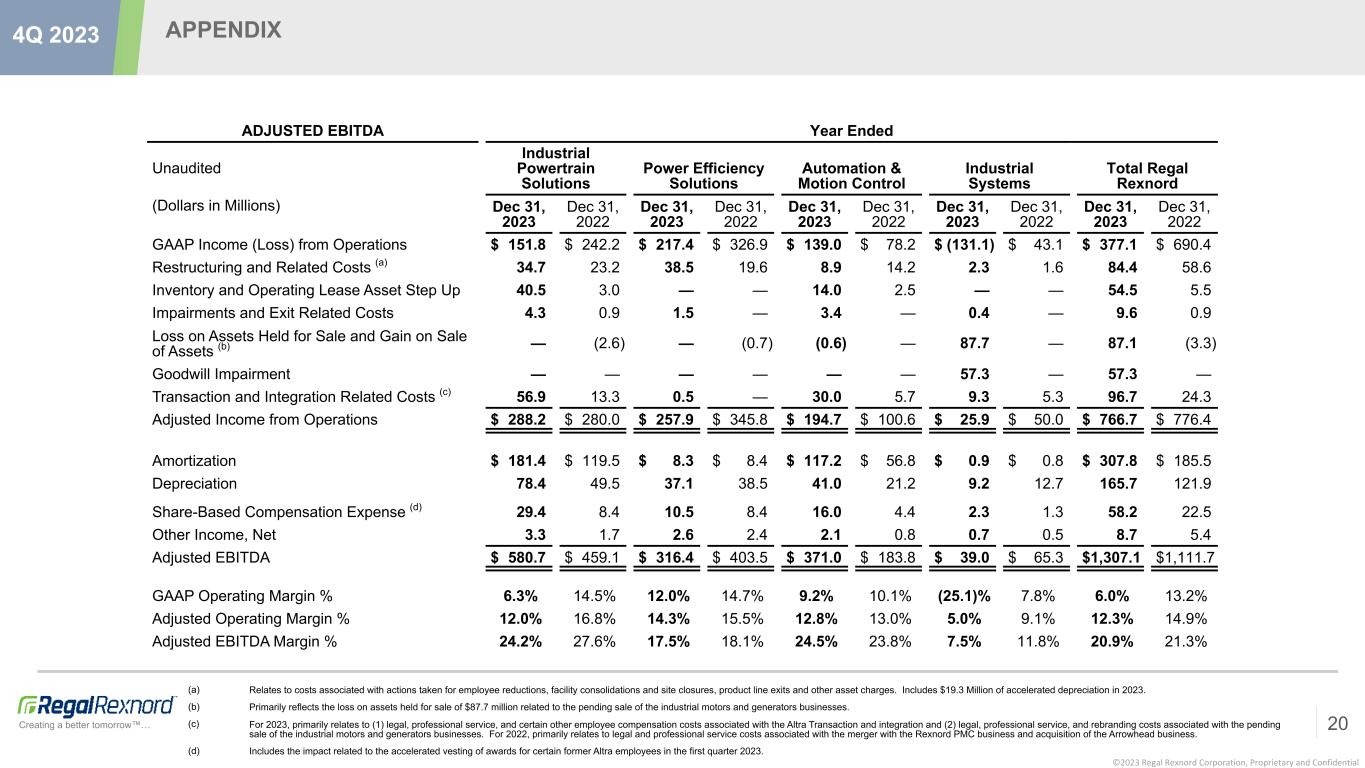

| ADJUSTED EBITDA | Year Ended | |||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| Unaudited | Industrial Powertrain Solutions | Power Efficiency Solutions | Automation & Motion Control | Industrial Systems | Total Regal Rexnord | |||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| (Dollars in Millions) | Dec 31, 2023 | Dec 31, 2022 | Dec 31, 2023 | Dec 31, 2022 | Dec 31, 2023 | Dec 31, 2022 | Dec 31, 2023 | Dec 31, 2022 | Dec 31, 2023 | Dec 31, 2022 | ||||||||||||||||||||||||||||||||||||||||||||||||||||

| GAAP Income (Loss) from Operations | $ | 151.8 | $ | 242.2 | $ | 217.4 | $ | 326.9 | $ | 139.0 | $ | 78.2 | $ | (131.1) | $ | 43.1 | $ | 377.1 | $ | 690.4 | ||||||||||||||||||||||||||||||||||||||||||

Restructuring and Related Costs (a) |

34.7 | 23.2 | 38.5 | 19.6 | 8.9 | 14.2 | 2.3 | 1.6 | 84.4 | 58.6 | ||||||||||||||||||||||||||||||||||||||||||||||||||||

| Inventory and Operating Lease Asset Step Up | 40.5 | 3.0 | — | — | 14.0 | 2.5 | — | — | 54.5 | 5.5 | ||||||||||||||||||||||||||||||||||||||||||||||||||||

| Impairments and Exit Related Costs | 4.3 | 0.9 | 1.5 | — | 3.4 | — | 0.4 | — | 9.6 | 0.9 | ||||||||||||||||||||||||||||||||||||||||||||||||||||

Loss on Assets Held for Sale and Gain on Sale of Assets (b) |

— | (2.6) | — | (0.7) | (0.6) | — | 87.7 | — | 87.1 | (3.3) | ||||||||||||||||||||||||||||||||||||||||||||||||||||

| Goodwill Impairment | — | — | — | — | — | — | 57.3 | — | 57.3 | — | ||||||||||||||||||||||||||||||||||||||||||||||||||||

Transaction and Integration Related Costs (c) |

56.9 | 13.3 | 0.5 | — | 30.0 | 5.7 | 9.3 | 5.3 | 96.7 | 24.3 | ||||||||||||||||||||||||||||||||||||||||||||||||||||

| Adjusted Income from Operations | $ | 288.2 | $ | 280.0 | $ | 257.9 | $ | 345.8 | $ | 194.7 | $ | 100.6 | $ | 25.9 | $ | 50.0 | $ | 766.7 | $ | 776.4 | ||||||||||||||||||||||||||||||||||||||||||

| Amortization | $ | 181.4 | $ | 119.5 | $ | 8.3 | $ | 8.4 | $ | 117.2 | $ | 56.8 | $ | 0.9 | $ | 0.8 | $ | 307.8 | $ | 185.5 | ||||||||||||||||||||||||||||||||||||||||||

| Depreciation | 78.4 | 49.5 | 37.1 | 38.5 | 41.0 | 21.2 | 9.2 | 12.7 | 165.7 | 121.9 | ||||||||||||||||||||||||||||||||||||||||||||||||||||

Share-Based Compensation Expense (d) |

29.4 | 8.4 | 10.5 | 8.4 | 16.0 | 4.4 | 2.3 | 1.3 | 58.2 | 22.5 | ||||||||||||||||||||||||||||||||||||||||||||||||||||

| Other Income, Net | 3.3 | 1.7 | 2.6 | 2.4 | 2.1 | 0.8 | 0.7 | 0.5 | 8.7 | 5.4 | ||||||||||||||||||||||||||||||||||||||||||||||||||||

| Adjusted EBITDA | $ | 580.7 | $ | 459.1 | $ | 316.4 | $ | 403.5 | $ | 371.0 | $ | 183.8 | $ | 39.0 | $ | 65.3 | $ | 1,307.1 | $ | 1,111.7 | ||||||||||||||||||||||||||||||||||||||||||

| GAAP Operating Margin % | 6.3% | 14.5% | 12.0% | 14.7% | 9.2% | 10.1% | (25.1)% | 7.8% | 6.0% | 13.2% | ||||||||||||||||||||||||||||||||||||||||||||||||||||

| Adjusted Operating Margin % | 12.0% | 16.8% | 14.3% | 15.5% | 12.8% | 13.0% | 5.0% | 9.1% | 12.3% | 14.9% | ||||||||||||||||||||||||||||||||||||||||||||||||||||

| Adjusted EBITDA Margin % | 24.2% | 27.6% | 17.5% | 18.1% | 24.5% | 23.8% | 7.5% | 11.8% | 20.9% | 21.3% | ||||||||||||||||||||||||||||||||||||||||||||||||||||

| (a) | Relates to costs associated with actions taken for employee reductions, facility consolidations and site closures, product line exits and other asset charges. Includes $19.3 Million of accelerated depreciation in 2023. | ||||

| (b) | Primarily reflects the loss on assets held for sale of $87.7 million related to the pending sale of the industrial motors and generators businesses. | ||||

| (c) | For 2023, primarily relates to (1) legal, professional service, and certain other employee compensation costs associated with the Altra Transaction and integration and (2) legal, professional service, and rebranding costs associated with the pending sale of the industrial motors and generators businesses. For 2022, primarily relates to legal and professional service costs associated with the merger with the Rexnord PMC business and acquisition of the Arrowhead business. | ||||

| (d) | Includes the impact related to the accelerated vesting of awards for certain former Altra employees in the first quarter 2023. | ||||

| NET INCOME TO ADJUSTED EBITDA | ||||||||||||||||||||||||||

| Unaudited | ||||||||||||||||||||||||||

| (Dollars in Millions) | ||||||||||||||||||||||||||

| Three Months Ended | Year Ended | |||||||||||||||||||||||||

| Dec 31, 2023 |

Dec 31, 2022 |

Dec 31, 2023 |

Dec 31, 2022 |

|||||||||||||||||||||||

| Net Income (Loss) | $ | 56.6 | $ | 102.7 | $ | (54.3) | $ | 494.9 | ||||||||||||||||||

| Plus: Income Taxes | 17.8 | 8.9 | 52.7 | 118.9 | ||||||||||||||||||||||

| Plus: Interest Expense | 107.7 | 43.4 | 431.0 | 87.2 | ||||||||||||||||||||||

| Less: Interest Income | (3.1) | (2.0) | (43.6) | (5.2) | ||||||||||||||||||||||

| Plus: Depreciation | 41.5 | 30.9 | 165.7 | 121.9 | ||||||||||||||||||||||

| Plus: Amortization | 85.1 | 46.1 | 307.8 | 185.5 | ||||||||||||||||||||||

| EBITDA | 305.6 | 230.0 | 859.3 | 1,003.2 | ||||||||||||||||||||||

Plus: Restructuring and Related Costs (a) |

44.4 | 20.0 | 84.4 | 58.6 | ||||||||||||||||||||||

Plus: Share-Based Compensation Expense (b) |

9.1 | 5.5 | 58.2 | 22.5 | ||||||||||||||||||||||

| Plus: Inventory and Operating Lease Asset Step Up | 1.6 | — | 54.5 | 5.5 | ||||||||||||||||||||||

| Plus: Impairments and Exit Related Costs | 3.5 | 0.9 | 9.6 | 0.9 | ||||||||||||||||||||||

Plus: (Gain) Loss on Assets Held for Sale and Gain on Sale of Assets (c) |

(25.0) | — | 87.1 | (3.3) | ||||||||||||||||||||||

| Plus: Goodwill Impairment | — | — | 57.3 | — | ||||||||||||||||||||||

Plus: Transaction and Integration Related Costs (d) |

7.3 | 17.0 | 96.7 | 24.3 | ||||||||||||||||||||||

| Adjusted EBITDA | $ | 346.5 | $ | 273.4 | $ | 1,307.1 | $ | 1,111.7 | ||||||||||||||||||

| (a) | Relates to costs associated with actions taken for employee reductions, facility consolidations and site closures, product line exits and other asset charges. Includes $11.8 Million of accelerated depreciation for the three months ended December 2023 and $19.3 Million for the year ended December 2023. | ||||

| (b) | Includes the impact related to the accelerated vesting of awards for certain former Altra employees in the first quarter 2023. | ||||

| (c) | For the three months and year ended December 31, 2023, primarily reflects the gain and loss on assets held for sale of $25.0 million and $87.7 million, respectively, related to the pending sale of the industrial motors and generators businesses. | ||||

| (d) | For 2023, primarily relates to (1) legal, professional service, and certain other employee compensation costs associated with the Altra Transaction and integration and (2) legal, professional service, and rebranding costs associated with the pending sale of the industrial motors and generators businesses. For 2022, primarily relates to legal and professional service costs associated with the merger with the Rexnord PMC business and acquisition of the Arrowhead business. | ||||

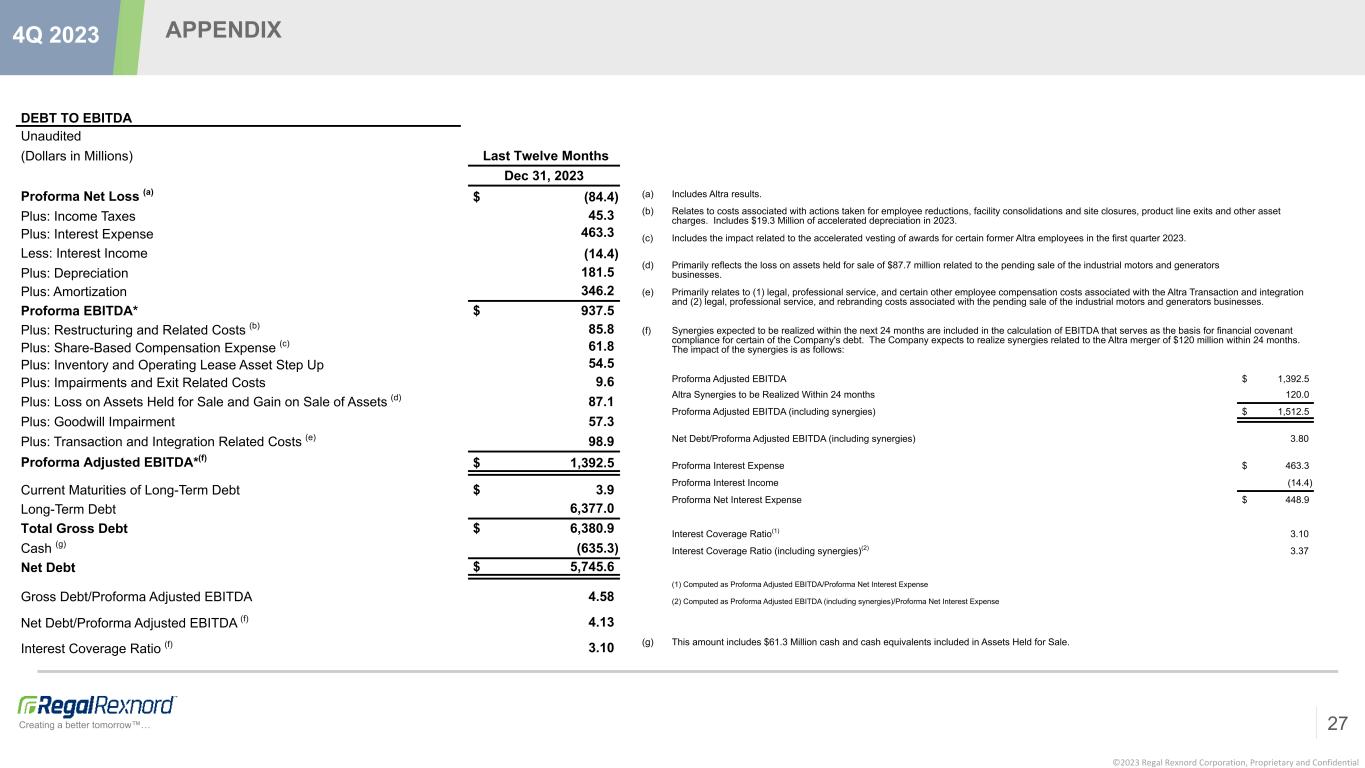

| DEBT TO EBITDA | ||||||||||||||

| Unaudited | ||||||||||||||

| (Dollars in Millions) | Last Twelve Months | |||||||||||||

| Dec 31, 2023 | ||||||||||||||

Proforma Net Loss (a) |

$ | (84.4) | ||||||||||||

| Plus: Income Taxes | 45.3 | |||||||||||||

| Plus: Interest Expense | 463.3 | |||||||||||||

| Less: Interest Income | (14.4) | |||||||||||||

| Plus: Depreciation | 181.5 | |||||||||||||

| Plus: Amortization | 346.2 | |||||||||||||

| Proforma EBITDA* | $ | 937.5 | ||||||||||||

Plus: Restructuring and Related Costs (b) |

85.8 | |||||||||||||

Plus: Share-Based Compensation Expense (c) |

61.8 | |||||||||||||

| Plus: Inventory and Operating Lease Asset Step Up | 54.5 | |||||||||||||

| Plus: Impairments and Exit Related Costs | 9.6 | |||||||||||||

Plus: Loss on Assets Held for Sale and Gain on Sale of Assets (d) |

87.1 | |||||||||||||

| Plus: Goodwill Impairment | 57.3 | |||||||||||||

Plus: Transaction and Integration Related Costs (e) |

98.9 | |||||||||||||

Proforma Adjusted EBITDA*(f) |

$ | 1,392.5 | ||||||||||||

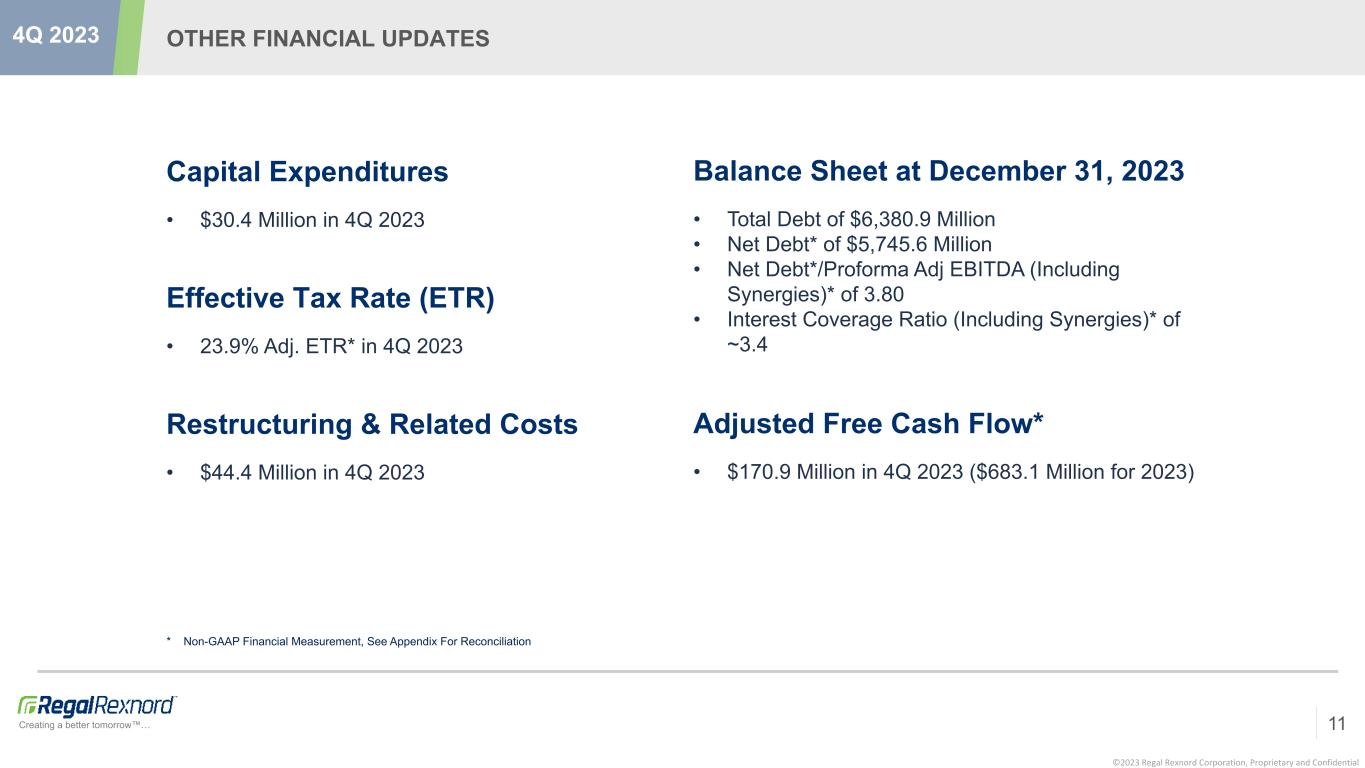

| Current Maturities of Long-Term Debt | $ | 3.9 | ||||||||||||

| Long-Term Debt | 6,377.0 | |||||||||||||

| Total Gross Debt | $ | 6,380.9 | ||||||||||||

Cash (g) |

(635.3) | |||||||||||||

| Net Debt | $ | 5,745.6 | ||||||||||||

| Gross Debt/Proforma Adjusted EBITDA | 4.58 | |||||||||||||

Net Debt/Proforma Adjusted EBITDA (f) |

4.13 | |||||||||||||

Interest Coverage Ratio (f) |

3.10 | |||||||||||||

| (a) | Includes Altra results. | |||||||

| (b) | Relates to costs associated with actions taken for employee reductions, facility consolidations and site closures, product line exits and other asset charges. Includes $19.3 Million of accelerated depreciation in 2023. | |||||||

| (c) | Includes the impact related to the accelerated vesting of awards for certain former Altra employees in the first quarter 2023. | |||||||

| (d) | Primarily reflects the loss on assets held for sale of $87.7 million related to the pending sale of the industrial motors and generators businesses. | |||||||

| (e) | Primarily relates to (1) legal, professional service, and certain other employee compensation costs associated with the Altra Transaction and integration and (2) legal, professional service, and rebranding costs associated with the pending sale of the industrial motors and generators businesses. | |||||||

| (f) | Synergies expected to be realized within the next 24 months are included in the calculation of EBITDA that serves as the basis for financial covenant compliance for certain of the Company's debt. The Company expects to realize synergies related to the Altra merger of $120 million within 24 months. The impact of the synergies is as follows: | |||||||

| Proforma Adjusted EBITDA | $ | 1,392.5 | ||||||

| Altra Synergies to be Realized Within 24 months | 120.0 | |||||||

| Proforma Adjusted EBITDA (including synergies) | $ | 1,512.5 | ||||||

| Net Debt/Proforma Adjusted EBITDA (including synergies) | 3.80 | |||||||

| Proforma Interest Expense | $ | 463.3 | ||||||

| Proforma Interest Income | (14.4) | |||||||

| Proforma Net Interest Expense | $ | 448.9 | ||||||

Interest Coverage Ratio(1) |

3.10 | |||||||

Interest Coverage Ratio (including synergies)(2) |

3.37 | |||||||

| (1) Computed as Proforma Adjusted EBITDA/Proforma Net Interest Expense | ||||||||

| (2) Computed as Proforma Adjusted EBITDA (including synergies)/Proforma Net Interest Expense | ||||||||

| (g) | This amount includes $61.3 Million cash and cash equivalents included in Assets Held for Sale. | |||||||

| PROFORMA NET LOSS | |||||||||||||||||

| Unaudited | |||||||||||||||||

| (Dollars in Millions) | |||||||||||||||||

| The following proforma net loss has been prepared in accordance with Article 11 of Regulation S-X in order to give effect to the Altra Transaction and related debt financing as if they had occurred on January 2, 2022, the first day of Regal Rexnord’s fiscal year 2022. | |||||||||||||||||

| Regal Rexnord Year Ended December 31, 2023 | Altra January 1, 2023 to March 27, 2023 | Transaction Accounting Adjustments - Altra Transaction (Note 1) | Transaction Accounting Adjustments - Debt Financing (Note 2) | Proforma Combined | |||||||||||||

| Net (Loss) Income | (54.3) | 31.4 | (13.4) | (48.1) | (84.4) | ||||||||||||

| Note 1 - Proforma Transaction Accounting Adjustments - Altra Transaction | |||||||||||||||||

Property, Plant and Equipment Depreciation Step Up(1) |

$ | (5.3) | |||||||||||||||

Incremental Charge in Amortization of Intangible Assets(2) |

(20.1) | ||||||||||||||||

Removal of Historical Altra Interest Expense(3) |

12.0 | ||||||||||||||||

| (13.4) | |||||||||||||||||

| (1) Adjustment for incremental depreciation expense relating to the estimated preliminary step-up in fair value of Property, Plant and Equipment | |||||||||||||||||

| (2) Adjustment for incremental amortization expense relating to the estimated preliminary fair value of intangible assets recognized in the Altra Transaction | |||||||||||||||||

| (3) Adjustment to remove interest expense related to the Altra debt that was settled in connection with the Altra Transaction | |||||||||||||||||

| Note 2 - Proforma Transaction Accounting Adjustments - Debt Financing | |||||||||||||||||

New Interest Expense on Debt Financing(4) |

(25.1) | ||||||||||||||||

Removal of Interest Income(5) |

(23.0) | ||||||||||||||||

| (48.1) | |||||||||||||||||

| (4) Adjustment to recognize interest expense on the new debt related to the Altra Transaction | |||||||||||||||||

| (5) Adjustment to remove interest income associated with income earned on the investment of the proceeds of the debt financing prior to the close of the Altra Transaction during the three months ended March 31, 2023 | |||||||||||||||||

| ADJUSTED FREE CASH FLOW | ||||||||||||||||||||||||||

| Unaudited | ||||||||||||||||||||||||||

| (Dollars in Millions) | Three Months Ended | Year Ended | ||||||||||||||||||||||||

| Dec 31, 2023 |

Dec 31, 2022 |

Dec 31, 2023 |

Dec 31, 2022 |

|||||||||||||||||||||||

| Net Cash Provided by Operating Activities | $ | 201.3 | $ | 198.2 | $ | 715.3 | $ | 436.2 | ||||||||||||||||||

Payments for Certain Acquisition Costs (Net of Tax of $11.4 Million) (a) |

— | — | 86.9 | — | ||||||||||||||||||||||

| Adjusted Cash Flows from Operations* | 201.3 | 198.2 | 802.2 | 436.2 | ||||||||||||||||||||||

| Additions to Property Plant and Equipment | (30.4) | (29.2) | (119.1) | (83.8) | ||||||||||||||||||||||

| Adjusted Free Cash Flow* | $ | 170.9 | $ | 169.0 | $ | 683.1 | $ | 352.4 | ||||||||||||||||||

| GAAP Net Income (Loss) Attributable to Regal Rexnord Corporation | $ | 55.9 | $ | 101.5 | $ | (57.4) | $ | 488.9 | ||||||||||||||||||

Certain Acquisition Costs (Net of Tax of $5.9 Million) (b) |

— | — | 32.3 | — | ||||||||||||||||||||||

| Write-Off of Bridge Facility Costs (Net of Tax of $4.1 Million) | — | — | 13.0 | — | ||||||||||||||||||||||

| (Gain) Loss on Assets Held for Sale (Zero Tax Impact) | (25.0) | — | 87.7 | — | ||||||||||||||||||||||

| Impairments (Net of Tax of $0.4 Million and $1.9 Million in 2023, respectively, and $0.2 Million in 2022) | 1.3 | 0.7 | 63.2 | 0.7 | ||||||||||||||||||||||

| Adjusted Net Income Attributable to Regal Rexnord Corporation* | $ | 32.2 | $ | 102.2 | $ | 138.8 | $ | 489.6 | ||||||||||||||||||

| Adjusted Free Cash Flow as a Percentage of Adjusted Net Income Attributable to Regal Rexnord Corporation* | 530.7 | % | 165.4 | % | 492.1 | % | 72.0 | % | ||||||||||||||||||

| (a) | Reflects the payment of Regal Rexnord's and Altra's advisor success fees. | ||||

| (b) | Reflects the charge related to Regal Rexnord's advisor success fees. | ||||

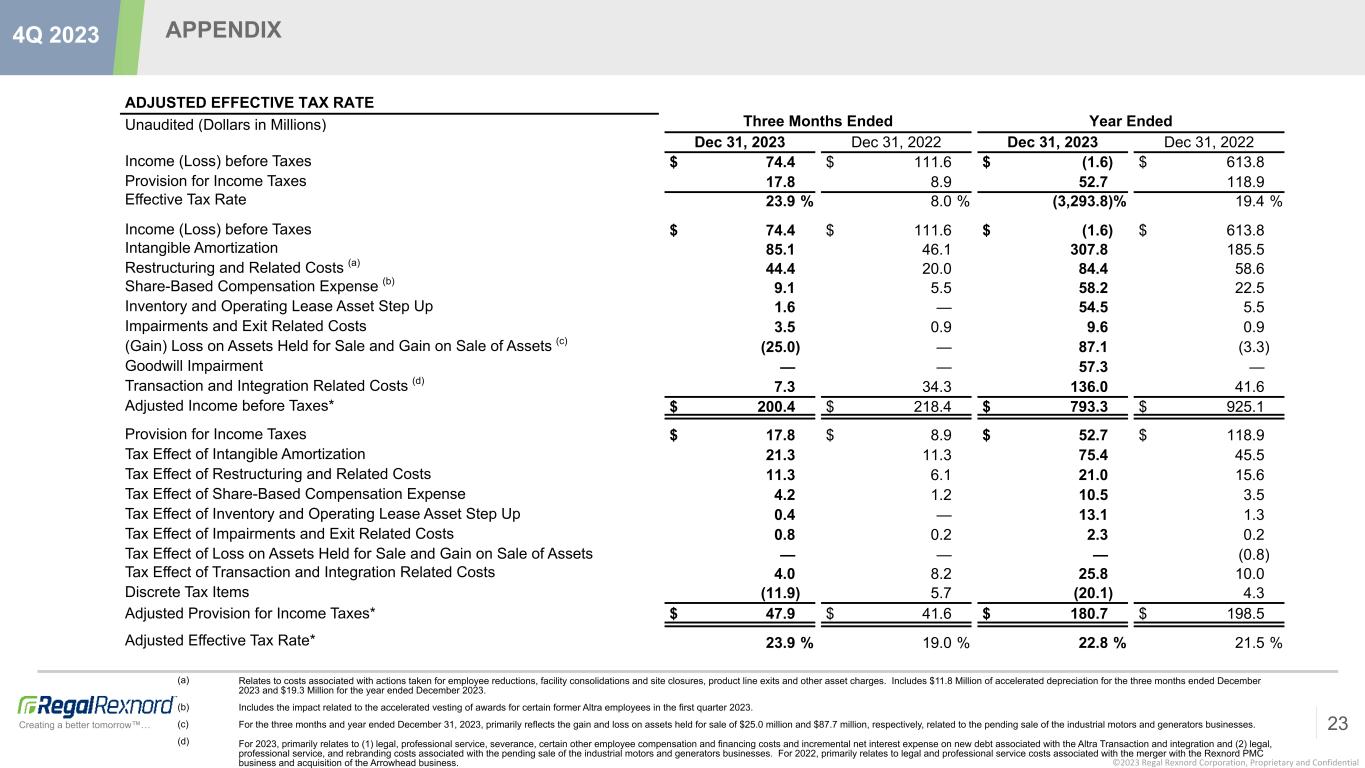

| ADJUSTED EFFECTIVE TAX RATE | |||||||||||||||||||||||

| Unaudited | |||||||||||||||||||||||

| (Dollars in Millions) | Three Months Ended | Year Ended | |||||||||||||||||||||

| Dec 31, 2023 |

Dec 31, 2022 |

Dec 31, 2023 |

Dec 31, 2022 |

||||||||||||||||||||

| Income (Loss) before Taxes | $ | 74.4 | $ | 111.6 | $ | (1.6) | $ | 613.8 | |||||||||||||||

| Provision for Income Taxes | 17.8 | 8.9 | 52.7 | 118.9 | |||||||||||||||||||

| Effective Tax Rate | 23.9 | % | 8.0 | % | (3,293.8) | % | 19.4 | % | |||||||||||||||

| Income (Loss) before Taxes | $ | 74.4 | $ | 111.6 | $ | (1.6) | $ | 613.8 | |||||||||||||||

| Intangible Amortization | 85.1 | 46.1 | 307.8 | 185.5 | |||||||||||||||||||

Restructuring and Related Costs (a) |

44.4 | 20.0 | 84.4 | 58.6 | |||||||||||||||||||

Share-Based Compensation Expense (b) |

9.1 | 5.5 | 58.2 | 22.5 | |||||||||||||||||||

| Inventory and Operating Lease Asset Step Up | 1.6 | — | 54.5 | 5.5 | |||||||||||||||||||

| Impairments and Exit Related Costs | 3.5 | 0.9 | 9.6 | 0.9 | |||||||||||||||||||

(Gain) Loss on Assets Held for Sale and Gain on Sale of Assets (c) |

(25.0) | — | 87.1 | (3.3) | |||||||||||||||||||

| Goodwill Impairment | — | — | 57.3 | — | |||||||||||||||||||

Transaction and Integration Related Costs (d) |

7.3 | 34.3 | 136.0 | 41.6 | |||||||||||||||||||

| Adjusted Income before Taxes* | $ | 200.4 | $ | 218.4 | $ | 793.3 | $ | 925.1 | |||||||||||||||

| Provision for Income Taxes | $ | 17.8 | $ | 8.9 | $ | 52.7 | $ | 118.9 | |||||||||||||||

| Tax Effect of Intangible Amortization | 21.3 | 11.3 | 75.4 | 45.5 | |||||||||||||||||||

| Tax Effect of Restructuring and Related Costs | 11.3 | 6.1 | 21.0 | 15.6 | |||||||||||||||||||

| Tax Effect of Share-Based Compensation Expense | 4.2 | 1.2 | 10.5 | 3.5 | |||||||||||||||||||

| Tax Effect of Inventory and Operating Lease Asset Step Up | 0.4 | — | 13.1 | 1.3 | |||||||||||||||||||

| Tax Effect of Impairments and Exit Related Costs | 0.8 | 0.2 | 2.3 | 0.2 | |||||||||||||||||||

| Tax Effect of Loss on Assets Held for Sale and Gain on Sale of Assets | — | — | — | (0.8) | |||||||||||||||||||

| Tax Effect of Transaction and Integration Related Costs | 4.0 | 8.2 | 25.8 | 10.0 | |||||||||||||||||||

| Discrete Tax Items | (11.9) | 5.7 | (20.1) | 4.3 | |||||||||||||||||||

| Adjusted Provision for Income Taxes* | $ | 47.9 | $ | 41.6 | $ | 180.7 | $ | 198.5 | |||||||||||||||

| Adjusted Effective Tax Rate* | 23.9 | % | 19.0 | % | 22.8 | % | 21.5 | % | |||||||||||||||

| (a) | Relates to costs associated with actions taken for employee reductions, facility consolidations and site closures, product line exits and other asset charges. Includes $11.8 Million of accelerated depreciation for the three months ended December 2023 and $19.3 Million for the year ended December 2023. | ||||

| (b) | Includes the impact related to the accelerated vesting of awards for certain former Altra employees in the first quarter 2023. | ||||

| (c) | For the three months and year ended December 31, 2023, primarily reflects the gain and loss on assets held for sale of $25.0 million and $87.7 million, respectively, related to the pending sale of the industrial motors and generators businesses. | ||||

| (d) | For 2023, primarily relates to (1) legal, professional service, severance, certain other employee compensation and financing costs and incremental net interest expense on new debt associated with the Altra Transaction and integration and (2) legal, professional service, and rebranding costs associated with the pending sale of the industrial motors and generators businesses. For 2022, primarily relates to legal and professional service costs associated with the merger with the Rexnord PMC business and acquisition of the Arrowhead business. | ||||

| ORGANIC SALES GROWTH | ||||||||||||||||||||||||||||||||

| Unaudited | ||||||||||||||||||||||||||||||||

| (Dollars in Millions) | Three Months Ended | |||||||||||||||||||||||||||||||

| Industrial Powertrain Solutions | Power Efficiency Solutions | Automation & Motion Control | Industrial Systems | Total Regal Rexnord | ||||||||||||||||||||||||||||

| Net Sales Three Months Ended Dec 31, 2023 | $ | 649.7 | $ | 418.0 | $ | 420.7 | $ | 119.8 | $ | 1,608.2 | ||||||||||||||||||||||

| Net Sales from Businesses Acquired | (238.7) | — | (217.5) | — | (456.2) | |||||||||||||||||||||||||||

| Impact from Foreign Currency Exchange Rates | (3.3) | (1.8) | (2.1) | (0.5) | (7.7) | |||||||||||||||||||||||||||

| Organic Sales Three Months Ended Dec 31, 2023 | $ | 407.7 | $ | 416.2 | $ | 201.1 | $ | 119.3 | $ | 1,144.3 | ||||||||||||||||||||||

| Net Sales Three Months Ended Dec 31, 2022 | $ | 412.3 | $ | 495.5 | $ | 201.3 | $ | 135.6 | $ | 1,244.7 | ||||||||||||||||||||||

| Adjusted Net Sales Three Months Ended Dec 31, 2022 | $ | 412.3 | $ | 495.5 | $ | 201.3 | $ | 135.6 | $ | 1,244.7 | ||||||||||||||||||||||

| Three Months Ended Dec 31, 2023 Organic Sales Growth % | (1.1) | % | (16.0) | % | (0.1) | % | (12.0) | % | (8.1) | % | ||||||||||||||||||||||

| Three Months Ended Dec 31, 2023 Net Sales Growth % | 57.6 | % | (15.6) | % | 109.0 | % | (11.7) | % | 29.2 | % | ||||||||||||||||||||||

| ORGANIC SALES GROWTH | ||||||||||||||||||||||||||||||||

| Unaudited | ||||||||||||||||||||||||||||||||

| (Dollars in Millions) | Year Ended | |||||||||||||||||||||||||||||||

| Industrial Powertrain Solutions | Power Efficiency Solutions | Automation & Motion Control | Industrial Systems | Total Regal Rexnord | ||||||||||||||||||||||||||||

| Net Sales Year Ended Dec 31, 2023 | $ | 2,403.5 | $ | 1,808.9 | $ | 1,516.8 | $ | 521.5 | $ | 6,250.7 | ||||||||||||||||||||||

| Net Sales from Businesses Acquired | (768.3) | — | (701.4) | — | (1,469.7) | |||||||||||||||||||||||||||

| Impact from Foreign Currency Exchange Rates | 0.1 | 8.4 | 2.1 | 6.9 | 17.5 | |||||||||||||||||||||||||||

| Organic Sales Year Ended Dec 31, 2023 | $ | 1,635.3 | $ | 1,817.3 | $ | 817.5 | $ | 528.4 | $ | 4,798.5 | ||||||||||||||||||||||

| Net Sales Year Ended Dec 31, 2022 | $ | 1,666.3 | $ | 2,227.2 | $ | 772.3 | $ | 552.1 | $ | 5,217.9 | ||||||||||||||||||||||

| Adjusted Net Sales Year Ended Dec 31, 2022 | $ | 1,666.3 | $ | 2,227.2 | $ | 772.3 | $ | 552.1 | $ | 5,217.9 | ||||||||||||||||||||||

| Year Ended Dec 31, 2023 Organic Sales Growth % | (1.9) | % | (18.4) | % | 5.9 | % | (4.3) | % | (8.0) | % | ||||||||||||||||||||||

| Year Ended Dec 31, 2023 Net sales Growth % | 44.2 | % | (18.8) | % | 96.4 | % | (5.5) | % | 19.8 | % | ||||||||||||||||||||||

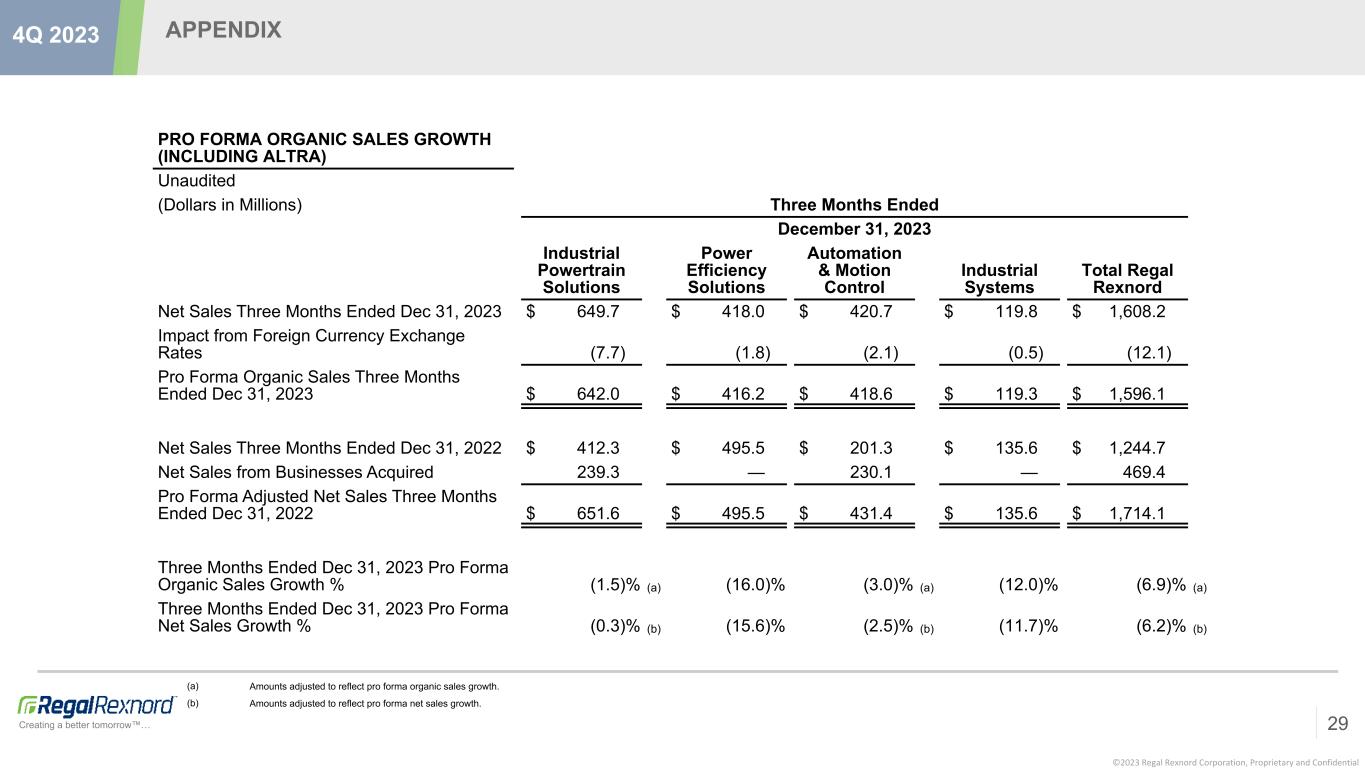

| PRO FORMA ORGANIC SALES GROWTH (INCLUDING ALTRA) | ||||||||||||||||||||||||||||||||||||||

| Unaudited | ||||||||||||||||||||||||||||||||||||||

| (Dollars in Millions) | Three Months Ended | |||||||||||||||||||||||||||||||||||||

| December 31, 2023 | ||||||||||||||||||||||||||||||||||||||

| Industrial Powertrain Solutions | Power Efficiency Solutions | Automation & Motion Control | Industrial Systems | Total Regal Rexnord | ||||||||||||||||||||||||||||||||||

| Net Sales Three Months Ended Dec 31, 2023 | $ | 649.7 | $ | 418.0 | $ | 420.7 | $ | 119.8 | $ | 1,608.2 | ||||||||||||||||||||||||||||

| Impact from Foreign Currency Exchange Rates | (7.7) | (1.8) | (2.1) | (0.5) | (12.1) | |||||||||||||||||||||||||||||||||

| Pro Forma Organic Sales Three Months Ended Dec 31, 2023 | $ | 642.0 | $ | 416.2 | $ | 418.6 | $ | 119.3 | $ | 1,596.1 | ||||||||||||||||||||||||||||

| Net Sales Three Months Ended Dec 31, 2022 | $ | 412.3 | $ | 495.5 | $ | 201.3 | $ | 135.6 | $ | 1,244.7 | ||||||||||||||||||||||||||||

| Net Sales from Businesses Acquired | 239.3 | — | 230.1 | — | 469.4 | |||||||||||||||||||||||||||||||||

| Pro Forma Adjusted Net Sales Three Months Ended Dec 31, 2022 | $ | 651.6 | $ | 495.5 | $ | 431.4 | $ | 135.6 | $ | 1,714.1 | ||||||||||||||||||||||||||||

| Three Months Ended Dec 31, 2023 Pro Forma Organic Sales Growth % | (1.5) | % | (a) | (16.0) | % | (3.0) | % | (a) | (12.0) | % | (6.9) | % | (a) | |||||||||||||||||||||||||

| Three Months Ended Dec 31, 2023 Pro Forma Net Sales Growth % | (0.3) | % | (b) | (15.6) | % | (2.5) | % | (b) | (11.7) | % | (6.2) | % | (b) | |||||||||||||||||||||||||

| (a) | Amounts adjusted to reflect pro forma organic sales growth. | |||||||||||||||||||||||||||||||||||||

| (b) | Amounts adjusted to reflect pro forma net sales growth. | |||||||||||||||||||||||||||||||||||||

| PRO FORMA ORGANIC SALES GROWTH (INCLUDING ALTRA) | ||||||||||||||||||||||||||||||||||||||

| Unaudited | ||||||||||||||||||||||||||||||||||||||

| (Dollars in Millions) | Year Ended | |||||||||||||||||||||||||||||||||||||

| December 31, 2023 | ||||||||||||||||||||||||||||||||||||||

| Industrial Powertrain Solutions | Power Efficiency Solutions | Automation & Motion Control | Industrial Systems | Total Regal Rexnord | ||||||||||||||||||||||||||||||||||

| Net Sales Year Ended Dec 31, 2023 | $ | 2,403.5 | $ | 1,808.9 | $ | 1,516.8 | $ | 521.5 | $ | 6,250.7 | (d) | |||||||||||||||||||||||||||

| Net Sales from Businesses Acquired | 234.4 | — | 216.7 | — | 451.1 | (d) | ||||||||||||||||||||||||||||||||

| Impact from Foreign Currency Exchange Rates | (3.7) | 8.4 | 12.8 | 6.9 | 24.4 | |||||||||||||||||||||||||||||||||

| Pro Forma Organic Sales Year Ended Dec 31, 2023 | $ | 2,634.2 | $ | 1,817.3 | $ | 1,746.3 | $ | 528.4 | $ | 6,726.2 | ||||||||||||||||||||||||||||

| Net Sales Year Ended Dec 31, 2022 | $ | 1,666.3 | $ | 2,227.2 | $ | 772.3 | $ | 552.1 | $ | 5,217.9 | ||||||||||||||||||||||||||||

Net Sales from Businesses Acquired (a) |

982.2 | — | 921.9 | — | 1,904.1 | |||||||||||||||||||||||||||||||||

| Pro Forma Adjusted Net Sales Year Ended Dec 31, 2022 | $ | 2,648.5 | $ | 2,227.2 | $ | 1,694.2 | $ | 552.1 | $ | 7,122.0 | ||||||||||||||||||||||||||||

| Year Ended Dec 31, 2023 Pro Forma Organic Sales Growth % | (0.5) | % | (b) | (18.4) | % | 3.1 | % | (b) | (4.3) | % | (5.6) | % | (b) | |||||||||||||||||||||||||

| Year Ended Dec 31, 2023 Pro Forma Net Sales Growth % | (9.3) | % | (c) | (18.8) | % | (10.5) | % | (c) | (5.5) | % | (12.2) | % | (c) | |||||||||||||||||||||||||

| (a) | Excludes the revenues from Altra's Jacobs Vehicle Systems business, which was sold in April 2022. | |||||||||||||||||||||||||||||||||||||

| (b) | Amounts adjusted to reflect pro forma organic sales growth. | |||||||||||||||||||||||||||||||||||||

| (c) | Amounts adjusted to reflect pro forma net sales growth. | |||||||||||||||||||||||||||||||||||||

| (d) | Total represents Pro Forma Net Sales for the year ended December 2023 of $6,701.8 Million. | |||||||||||||||||||||||||||||||||||||

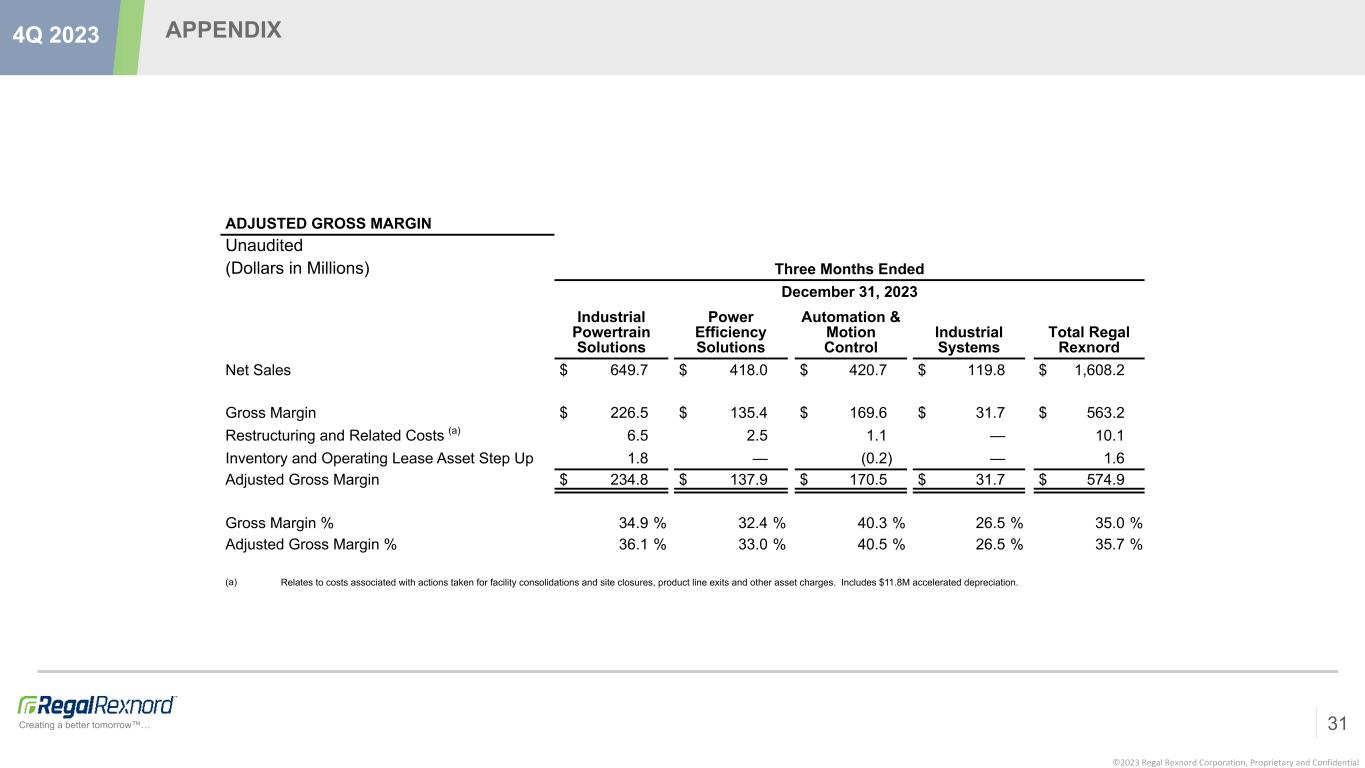

| ADJUSTED GROSS MARGIN | ||||||||||||||||||||||||||||||||

| Unaudited | ||||||||||||||||||||||||||||||||

| (Dollars in Millions) | Three Months Ended | |||||||||||||||||||||||||||||||

| December 31, 2023 | ||||||||||||||||||||||||||||||||

| Industrial Powertrain Solutions | Power Efficiency Solutions | Automation & Motion Control | Industrial Systems | Total Regal Rexnord | ||||||||||||||||||||||||||||

| Net Sales | $ | 649.7 | $ | 418.0 | $ | 420.7 | $ | 119.8 | $ | 1,608.2 | ||||||||||||||||||||||

| Gross Margin | $ | 226.5 | $ | 135.4 | $ | 169.6 | $ | 31.7 | $ | 563.2 | ||||||||||||||||||||||

Restructuring and Related Costs (a) |

6.5 | 2.5 | 1.1 | — | 10.1 | |||||||||||||||||||||||||||

| Inventory and Operating Lease Asset Step Up | 1.8 | — | (0.2) | — | 1.6 | |||||||||||||||||||||||||||

| Adjusted Gross Margin | $ | 234.8 | $ | 137.9 | $ | 170.5 | $ | 31.7 | $ | 574.9 | ||||||||||||||||||||||

| Gross Margin % | 34.9 | % | 32.4 | % | 40.3 | % | 26.5 | % | 35.0 | % | ||||||||||||||||||||||

| Adjusted Gross Margin % | 36.1 | % | 33.0 | % | 40.5 | % | 26.5 | % | 35.7 | % | ||||||||||||||||||||||

| (a) | Relates to costs associated with actions taken for facility consolidations and site closures, product line exits and other asset charges. Includes $11.8M accelerated depreciation. | ||||

| ADJUSTED GROSS MARGIN | ||||||||||||||||||||||||||||||||

| Unaudited | ||||||||||||||||||||||||||||||||

| (Dollars in Millions) | Year Ended | |||||||||||||||||||||||||||||||

| December 31, 2023 | ||||||||||||||||||||||||||||||||

| Industrial Powertrain Solutions | Power Efficiency Solutions | Automation & Motion Control | Industrial Systems | Total Regal Rexnord | ||||||||||||||||||||||||||||

| Net Sales | $ | 2,403.5 | $ | 1,808.9 | $ | 1,516.8 | $ | 521.5 | $ | 6,250.7 | ||||||||||||||||||||||

| Gross Margin | $ | 844.1 | $ | 524.9 | $ | 582.4 | $ | 115.9 | $ | 2,067.3 | ||||||||||||||||||||||

Restructuring and Related Costs (a) |

11.2 | 21.8 | 3.7 | — | 36.7 | |||||||||||||||||||||||||||

| Inventory and Operating Lease Asset Step Up | 40.5 | — | 14.0 | — | 54.5 | |||||||||||||||||||||||||||

| Adjusted Gross Margin | $ | 895.8 | $ | 546.7 | $ | 600.1 | $ | 115.9 | $ | 2,158.5 | ||||||||||||||||||||||

| Gross Margin % | 35.1 | % | 29.0 | % | 38.4 | % | 22.2 | % | 33.1 | % | ||||||||||||||||||||||

| Adjusted Gross Margin % | 37.3 | % | 30.2 | % | 39.6 | % | 22.2 | % | 34.5 | % | ||||||||||||||||||||||

| ADJUSTED GROSS MARGIN | ||||||||||||||||||||||||||||||||

| Unaudited | ||||||||||||||||||||||||||||||||

| (Dollars in Millions) | Year Ended | |||||||||||||||||||||||||||||||

| December 31, 2022 | ||||||||||||||||||||||||||||||||

| Industrial Powertrain Solutions | Power Efficiency Solutions | Automation & Motion Control | Industrial Systems | Total Regal Rexnord | ||||||||||||||||||||||||||||

| Net Sales | $ | 1,666.3 | $ | 2,227.2 | $ | 772.3 | $ | 552.1 | $ | 5,217.9 | ||||||||||||||||||||||

| Gross Margin | $ | 653.8 | $ | 611.1 | $ | 274.8 | $ | 130.0 | $ | 1,669.7 | ||||||||||||||||||||||

Restructuring and Related Costs (a) |

19.1 | 14.5 | 12.1 | 1.3 | 47.0 | |||||||||||||||||||||||||||

| Inventory Step Up | 3.0 | — | 2.5 | — | 5.5 | |||||||||||||||||||||||||||

| Adjusted Gross Margin | $ | 675.9 | $ | 625.6 | $ | 289.4 | $ | 131.3 | $ | 1,722.2 | ||||||||||||||||||||||

| Gross Margin % | 39.2 | % | 27.4 | % | 35.6 | % | 23.5 | % | 32.0 | % | ||||||||||||||||||||||

| Adjusted Gross Margin % | 40.6 | % | 28.1 | % | 37.5 | % | 23.8 | % | 33.0 | % | ||||||||||||||||||||||

| (a) | Relates to costs associated with actions taken for facility consolidations and site closures, product line exits and other asset charges. 2023 includes $19.3M accelerated depreciation. | ||||

| PRO FORMA NET INCOME TO ADJUSTED EBITDA | |||||||||||||||||

| Unaudited | |||||||||||||||||

| (Dollars in Millions) | |||||||||||||||||

| Three Months Ended | Year Ended | ||||||||||||||||

| Dec 31, 2022 | Dec 31, 2023 | Dec 31, 2022 | |||||||||||||||

| Pro Forma Net Sales | $ | 1,714.1 | $ | 6,701.8 | $ | 7,162.1 | |||||||||||

Nets Sales from Businesses Divested/to be Exited (a) |

— | — | (40.1) | ||||||||||||||

| Pro Forma Adjusted Net Sales | $ | 1,714.1 | $ | 6,701.8 | $ | 7,122.0 | |||||||||||

| Pro Forma Net Income (Loss) | $ | 42.3 | $ | (84.4) | $ | 277.3 | |||||||||||

| Plus: Income Taxes | (2.1) | 45.3 | 88.0 | ||||||||||||||

| Plus: Interest Expense | 128.6 | 463.3 | 428.0 | ||||||||||||||

| Less: Interest Income | (2.0) | (14.4) | (5.2) | ||||||||||||||

| Plus: Depreciation | 47.6 | 181.5 | 189.8 | ||||||||||||||

| Plus: Amortization | 86.9 | 346.2 | 348.7 | ||||||||||||||

| Pro Forma EBITDA | 301.3 | 937.5 | 1,326.6 | ||||||||||||||

| Plus: Restructuring and Related Costs | 19.1 | 85.8 | 65.5 | ||||||||||||||

| Plus: Share-Based Compensation Expense | 8.7 | 61.8 | 37.8 | ||||||||||||||

| Plus: Inventory and Operating Lease Asset Step Up | — | 54.5 | 15.3 | ||||||||||||||

| Plus: Impairments and Exit Related Costs | 2.8 | 9.6 | 14.1 | ||||||||||||||

| Plus: Loss on Assets Held for Sale and Gain on Sale of Assets | — | 87.1 | (3.3) | ||||||||||||||

| Plus: Goodwill Impairment | — | 57.3 | — | ||||||||||||||

| Plus: Transaction and Integration Related Costs | 30.1 | 98.9 | 39.1 | ||||||||||||||

| Less: Jacobs Vehicle Systems Adjusted EBITDA | — | — | (9.3) | ||||||||||||||

| Pro Forma Adjusted EBITDA | $ | 362.0 | $ | 1,392.5 | $ | 1,485.8 | |||||||||||

| Pro Forma Adjusted EBITDA Margin % | 21.1 | % | 20.8 | % | 20.9 | % | |||||||||||

| (a) This represents Altra's Jacobs Vehicle Systems net sales, which was sold in April 2022. | |||||||||||||||||

| PROFORMA NET INCOME | |||||||||||||||||

| Unaudited | |||||||||||||||||

| (Dollars in Millions) | |||||||||||||||||

| The following proforma net income has been prepared in accordance with Article 11 of Regulation S-X in order to give effect to the Altra Transaction and related debt financing as if they had occurred on January 2, 2022, the first day of Regal Rexnord’s fiscal year 2022. | |||||||||||||||||

| Regal Rexnord Three Months Ended December 31, 2022 | Altra Three Months Ended December 31, 2022 | Transaction Accounting Adjustments - Altra Transaction (Note 1) | Transaction Accounting Adjustments - Debt Financing (Note 2) | Proforma Combined | |||||||||||||

| Net Income | 102.7 | 22.3 | (15.9) | (66.8) | 42.3 | ||||||||||||

| Note 1 - Proforma Transaction Accounting Adjustments - Altra Transaction | |||||||||||||||||

Property, Plant and Equipment Depreciation Step Up(1) |

$ | (5.7) | |||||||||||||||

Incremental Charge in Amortization of Intangible Assets(2) |

(21.5) | ||||||||||||||||

Removal of Historical Altra Interest Expense(3) |

11.3 | ||||||||||||||||

| (15.9) | |||||||||||||||||

| (1) Adjustment for incremental depreciation expense relating to the estimated preliminary step-up in fair value of Property, Plant and Equipment | |||||||||||||||||

| (2) Adjustment for incremental amortization expense relating to the estimated preliminary fair value of intangible assets recognized in the Altra Transaction | |||||||||||||||||

| (3) Adjustment to remove interest expense related to the Altra debt that was settled in connection with the Altra Transaction | |||||||||||||||||

| Note 2 - Proforma Transaction Accounting Adjustments - Debt Financing | |||||||||||||||||

New Interest Expense on Debt Financing(4) |

(66.8) | ||||||||||||||||

| (4) Adjustment to recognize interest expense on the new debt related to the Altra Transaction | |||||||||||||||||

| PROFORMA NET INCOME | |||||||||||||||||

| Unaudited | |||||||||||||||||

| (Dollars in Millions) | |||||||||||||||||

| The following proforma net income has been prepared in accordance with Article 11 of Regulation S-X in order to give effect to the Altra Transaction and related debt financing as if they had occurred on January 2, 2022, the first day of Regal Rexnord’s fiscal year 2022. | |||||||||||||||||

| Regal Rexnord Year Ended December 31, 2022 | Altra Year Ended December 31, 2022 | Transaction Accounting Adjustments - Altra Transaction (Note 1) | Transaction Accounting Adjustments - Debt Financing (Note 2) | Proforma Combined | |||||||||||||

| Net Income | 494.9 | 127.0 | (77.4) | (267.2) | 277.3 | ||||||||||||

| Note 1 - Proforma Transaction Accounting Adjustments - Altra Transaction | |||||||||||||||||

Inventory Step-up(1) |

$ | (5.8) | |||||||||||||||

Property, Plant and Equipment Depreciation Step-up(2) |

(22.8) | ||||||||||||||||

Incremental Charge in Amortization of Intangible Assets(3) |

(85.1) | ||||||||||||||||

Transaction Costs(4) |

(3.3) | ||||||||||||||||

Removal of Historical Altra Interest Expense(5) |

39.6 | ||||||||||||||||

| (77.4) | |||||||||||||||||

| (1) Adjustment for the runoff of inventory relating to the estimated preliminary step-up in fair value of Inventories | |||||||||||||||||

| (2) Adjustment for incremental depreciation expense relating to the estimated preliminary step-up in fair value of Property, Plant and Equipment | |||||||||||||||||

| (3) Adjustment for incremental amortization expense relating to the estimated preliminary fair value of intangible assets recognized in the Altra Transaction | |||||||||||||||||

| (4) Adjustment for additional transaction costs to be incurred by Regal Rexnord, consisting primarily of estimated expense for employee retention bonuses | |||||||||||||||||

| (5) Adjustment to remove interest expense related to the Altra debt that was settled in connection with the Altra Transaction | |||||||||||||||||

| Note 2 - Proforma Transaction Accounting Adjustments - Debt Financing | |||||||||||||||||

New Interest Expense on Debt Financing(6) |

(267.2) | ||||||||||||||||

| (6) Adjustment to recognize interest expense on the new debt related to the Altra Transaction | |||||||||||||||||