Document

|

|

|

|

|

|

P R E S S R E L E A S E |

|

|

Contact:

Investor Relations

804.289.9709

|

BRINK’S CORPORATE

The Brink’s Company

1801 Bayberry Court

Richmond, VA 23226-8100 USA

|

Brink's Announces Strong First-Quarter Results and Affirms Full Year Guidance

Record First Quarter Revenue Reflecting 4% Growth and 12% Organic Growth

GAAP net income up 229% to $49M and record adjusted EBITDA up 15% to $218M

GAAP EPS up 263% to $1.09 and non-GAAP EPS up 20% to $1.52

TTM GAAP Net Cash from Operations up 56% to $800M: non-GAAP Free Cash Flow up 61% to $363M

RICHMOND, Va., May 8, 2024 – The Brink’s Company (NYSE:BCO), a leading global provider of cash and valuables management, digital retail solutions (DRS), and ATM managed services (AMS), today announced first-quarter results.

Mark Eubanks, president and CEO, said: “In the first quarter we delivered robust organic revenue growth across all segments and customer offerings. Organic growth in AMS and DRS accelerated sequentially and was up 18% year-over-year as customer demand continues to build for our value-added solutions. First quarter adjusted EBITDA margins expanded 160 basis-points, representing the highest first quarter margins since we first reported the metric. This was enabled by improving AMS and DRS mix and productivity gains from the early developments of the Brink's Business System. Earnings per share growth of 20% was driven by strong margin expansion and a four percent reduction in outstanding share count year-over-year."

“I remain encouraged by the accelerating pace in our business transformation initiatives. With growing demand for our DRS and AMS offerings, and expanding profit margins, we are well positioned to deliver our 2024 commitments. With another strong quarter behind us, I am confident that continued execution of our strategy will create additional value for our shareholders for years to come.”

First-quarter results are summarized in the following table:

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| (In millions, except for per share amounts) |

First-Quarter 2024 (vs. 2023) |

|

GAAP |

|

Change |

|

Non-GAAP |

|

Change |

|

Constant Currency Change(b) |

| Revenue |

$ |

1,236 |

|

|

4% |

|

$ |

1,236 |

|

|

4% |

|

12% |

| Operating Profit |

$ |

121 |

|

|

52% |

|

$ |

145 |

|

|

14% |

|

37% |

| Operating Margin |

9.8 |

% |

|

310 bps |

|

11.7 |

% |

|

100 bps |

|

240 bps |

Net Income / Adjusted EBITDA(a) |

$ |

49 |

|

|

229% |

|

$ |

218 |

|

|

15% |

|

30% |

| EPS |

$ |

1.09 |

|

|

263% |

|

$ |

1.52 |

|

|

20% |

|

57% |

(a)The non-GAAP financial metric, adjusted EBITDA, is presented with its corresponding GAAP metric, net income attributable to Brink's.

(b)Constant currency represents 2024 Non-GAAP results at 2023 exchange rates.

2024 Guidance (Unaudited)

(In millions, except for percentages and per share amounts)

The 2024 Non-GAAP outlook amounts cannot be reconciled to GAAP without unreasonable effort, as we are unable to accurately forecast certain amounts that are necessary for reconciliation, including the impact of highly inflationary accounting on our Argentina operations in 2024 or other potential Non-GAAP adjusting items for which the timing and amounts are currently under review, such as future restructuring actions and the impact of possible future acquisitions. We are also unable to forecast changes in cash held for customer obligations or proceeds from the sale of property, equipment and investments in 2024. The 2024 Non-GAAP outlook reflects management's current assumptions regarding variables that are difficult to accurately forecast, including those discussed in the Risk Factors set forth in the Company's filings with the United States Securities and Exchange Commission. The 2024 outlook assumes the continuation of current economic trends and does not contemplate a significant economic downturn for the balance of the year.

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

2024 Non-GAAP Outlook |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Revenues |

$ |

5,075 - 5,225 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Adjusted EBITDA |

$ |

935 - 985 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Adjusted EBITDA margin |

|

18.4% - 18.9% |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Free cash flow before dividends |

$ |

415 - 465 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| EPS from continuing operations attributable to Brink's |

$ |

7.30 - 8.00 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Conference Call

Brink’s will host a conference call on May 8 at 8:30 a.m. ET to review first-quarter results. Interested parties can listen by calling 888-349-0094 (in the U.S.) or 412-902-0124 (international). Participants can preregister at https://dpregister.com/sreg/10188083/fc2d7fb8f2 to receive a direct dial-in number for the call. The call also will be accessible live via webcast on the Brink’s website (www.brinks.com). A replay of the call will be available through May 15, 2024 at 877-344-7529 (in the U.S.) or 412-317-0088 (international). The access code is 2724238. An archived version of the webcast will be available online in the Investor Relations section of http://investors.brinks.com.

The Brink’s Company and subsidiaries

(In millions, except for per share amounts) (Unaudited)

Condensed Consolidated Balance Sheets

|

|

|

|

|

|

|

|

|

|

|

|

|

December 31, 2023 |

|

March 31, 2024 |

| Assets |

|

|

|

| Current assets: |

|

|

|

| Cash and cash equivalents |

$ |

1,176.6 |

|

|

1,122.7 |

|

| Restricted cash |

507.0 |

|

|

557.9 |

|

| Accounts receivable, net |

779.0 |

|

|

857.0 |

|

| Prepaid expenses and other |

325.7 |

|

|

367.5 |

|

| Total current assets |

2,788.3 |

|

|

2,905.1 |

|

|

|

|

|

| Right-of-use assets, net |

337.7 |

|

|

334.5 |

|

| Property and equipment, net |

1,013.3 |

|

|

1,003.3 |

|

| Goodwill |

1,473.8 |

|

|

1,457.7 |

|

| Other intangibles, net |

488.3 |

|

|

469.4 |

|

| Deferred tax assets, net |

231.8 |

|

|

226.3 |

|

| Other |

268.6 |

|

|

283.0 |

|

|

|

|

|

| Total assets |

$ |

6,601.8 |

|

|

6,679.3 |

|

|

|

|

|

| Liabilities and Equity |

|

|

|

|

|

|

|

| Current liabilities: |

|

|

|

| Short-term borrowings |

151.7 |

|

|

155.0 |

|

| Current maturities of long-term debt |

117.1 |

|

|

125.6 |

|

| Accounts payable |

249.7 |

|

|

265.1 |

|

| Accrued liabilities |

1,126.9 |

|

|

1,105.2 |

|

| Restricted cash held for customers |

298.7 |

|

|

340.6 |

|

| Total current liabilities |

1,944.1 |

|

|

1,991.5 |

|

|

|

|

|

| Long-term debt |

3,262.5 |

|

|

3,309.3 |

|

| Accrued pension costs |

148.5 |

|

|

145.3 |

|

| Retirement benefits other than pensions |

159.6 |

|

|

155.8 |

|

| Lease liabilities |

265.8 |

|

|

262.8 |

|

| Deferred tax liabilities |

56.5 |

|

|

57.9 |

|

| Other |

244.6 |

|

|

236.8 |

|

| Total liabilities |

6,081.6 |

|

|

6,159.4 |

|

|

|

|

|

| Equity: |

|

|

|

| The Brink's Company ("Brink's") shareholders: |

|

|

|

Common stock, par value $1 per share: |

|

|

|

Shares authorized: 100.0 |

|

|

|

Shares issued and outstanding: 2024 - 44.6; 2023 - 44.5 |

44.5 |

|

|

44.6 |

|

| Capital in excess of par value |

675.9 |

|

|

666.8 |

|

| Retained earnings |

333.0 |

|

|

354.0 |

|

| Accumulated other comprehensive income (loss) |

(656.0) |

|

|

(669.0) |

|

| Brink's shareholders |

397.4 |

|

|

396.4 |

|

|

|

|

|

| Noncontrolling interests |

122.8 |

|

|

123.5 |

|

|

|

|

|

| Total equity |

520.2 |

|

|

519.9 |

|

|

|

|

|

| Total liabilities and equity |

$ |

6,601.8 |

|

|

6,679.3 |

|

The Brink’s Company and subsidiaries

(In millions) (Unaudited)

Condensed Consolidated Statements of Cash Flows

|

|

|

|

|

|

|

|

|

|

|

|

|

Three Months Ended March 31, |

|

2023 |

|

2024 |

| Cash flows from operating activities: |

|

|

|

| Net income |

$ |

18.3 |

|

|

52.2 |

|

| Adjustments to reconcile net income to net cash provided by operating activities: |

|

|

|

| (Income) loss from discontinued operations, net of tax |

(0.7) |

|

|

— |

|

| Depreciation and amortization |

67.6 |

|

|

72.4 |

|

| Share-based compensation expense |

10.9 |

|

|

9.3 |

|

| Deferred income taxes |

(0.2) |

|

|

2.5 |

|

| (Gain) loss on marketable securities and sale of property and equipment |

0.1 |

|

|

(2.2) |

|

| Loss on business dispositions |

2.0 |

|

|

— |

|

| Impairment losses |

3.7 |

|

|

0.5 |

|

| Retirement benefit funding (more) less than expense: |

|

|

|

| Pension |

(2.3) |

|

|

(2.4) |

|

| Other than pension |

(5.6) |

|

|

(3.7) |

|

| Remeasurement losses due to Argentina currency devaluations |

9.8 |

|

|

— |

|

| Other operating |

9.0 |

|

|

11.7 |

|

| Changes in operating assets and liabilities, net of effects of acquisitions: |

|

|

|

| (Increase) decrease in accounts receivable and income taxes receivable |

(4.6) |

|

|

(73.6) |

|

| Increase (decrease) in accounts payable, income taxes payable and accrued liabilities |

(81.1) |

|

|

(44.1) |

|

| Increase (decrease) in restricted cash held for customers |

(43.7) |

|

|

57.3 |

|

| Increase (decrease) in customer obligations |

(9.6) |

|

|

24.0 |

|

| Increase (decrease) in prepaid and other current assets |

(21.8) |

|

|

(27.2) |

|

| Other |

3.1 |

|

|

(12.8) |

|

| Net cash (used in) provided by operating activities |

(45.1) |

|

|

63.9 |

|

|

|

|

|

| Cash flows from investing activities: |

|

|

|

| Capital expenditures |

(45.2) |

|

|

(52.2) |

|

| Acquisitions, net of cash acquired |

— |

|

|

0.7 |

|

| Dispositions, net of cash disposed |

1.1 |

|

|

— |

|

| Marketable securities: |

|

|

|

| Purchases |

(3.2) |

|

|

(0.3) |

|

| Sales |

0.3 |

|

|

0.8 |

|

| Cash proceeds from sale of property, equipment and investments |

0.3 |

|

|

3.5 |

|

|

|

|

|

| Net change in loans held for investment |

(10.5) |

|

|

1.8 |

|

| Other |

(0.4) |

|

|

(0.1) |

|

|

|

|

|

| Net cash used in investing activities |

(57.6) |

|

|

(45.8) |

|

|

|

|

|

| Cash flows from financing activities: |

|

|

|

| Borrowings (repayments) of debt: |

|

|

|

| Short-term borrowings |

44.7 |

|

|

5.0 |

|

| Long-term revolving credit facilities: |

|

|

|

| Borrowings |

1,961.1 |

|

|

2,536.9 |

|

| Repayments |

(2,044.1) |

|

|

(2,470.8) |

|

| Other long-term debt: |

|

|

|

| Borrowings |

0.3 |

|

|

4.3 |

|

| Repayments |

(22.8) |

|

|

(26.9) |

|

| Acquisition of noncontrolling interest |

— |

|

|

(0.2) |

|

| Cash paid for acquisition related settlements and obligations |

(5.1) |

|

|

— |

|

|

|

|

|

| Repurchase shares of Brink's common stock |

(16.0) |

|

|

(23.0) |

|

| Dividends to: |

|

|

|

| Shareholders of Brink’s |

(9.3) |

|

|

(9.8) |

|

| Noncontrolling interests in subsidiaries |

(0.4) |

|

|

— |

|

| Tax withholdings associated with share-based compensation |

(6.6) |

|

|

(16.8) |

|

| Other |

1.1 |

|

|

— |

|

| Net cash used in financing activities |

(97.1) |

|

|

(1.3) |

|

|

|

|

|

| Effect of exchange rate changes on cash |

7.7 |

|

|

(19.8) |

|

| Cash, cash equivalents and restricted cash: |

|

|

|

| Decrease |

(192.1) |

|

|

(3.0) |

|

| Balance at beginning of period |

1,410.5 |

|

|

1,683.6 |

|

| Balance at end of period |

$ |

1,218.4 |

|

|

1,680.6 |

|

|

|

|

|

|

|

|

|

|

|

|

|

| Supplemental Cash Flow Information |

Three Months Ended March 31, |

|

2023 |

|

2024 |

| Cash paid for income taxes, net |

$ |

(23.3) |

|

|

(28.2) |

|

The Brink’s Company and subsidiaries

(In millions, except for per share amounts) (Unaudited)

First-Quarter 2024 vs. 2023

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

GAAP |

|

|

Organic |

|

Acquisitions / |

|

|

|

|

|

% Change |

|

|

1Q'23 |

|

Change |

|

Dispositions(a) |

|

Currency(b) |

|

1Q'24 |

|

Total |

|

Organic |

|

| Revenues: |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

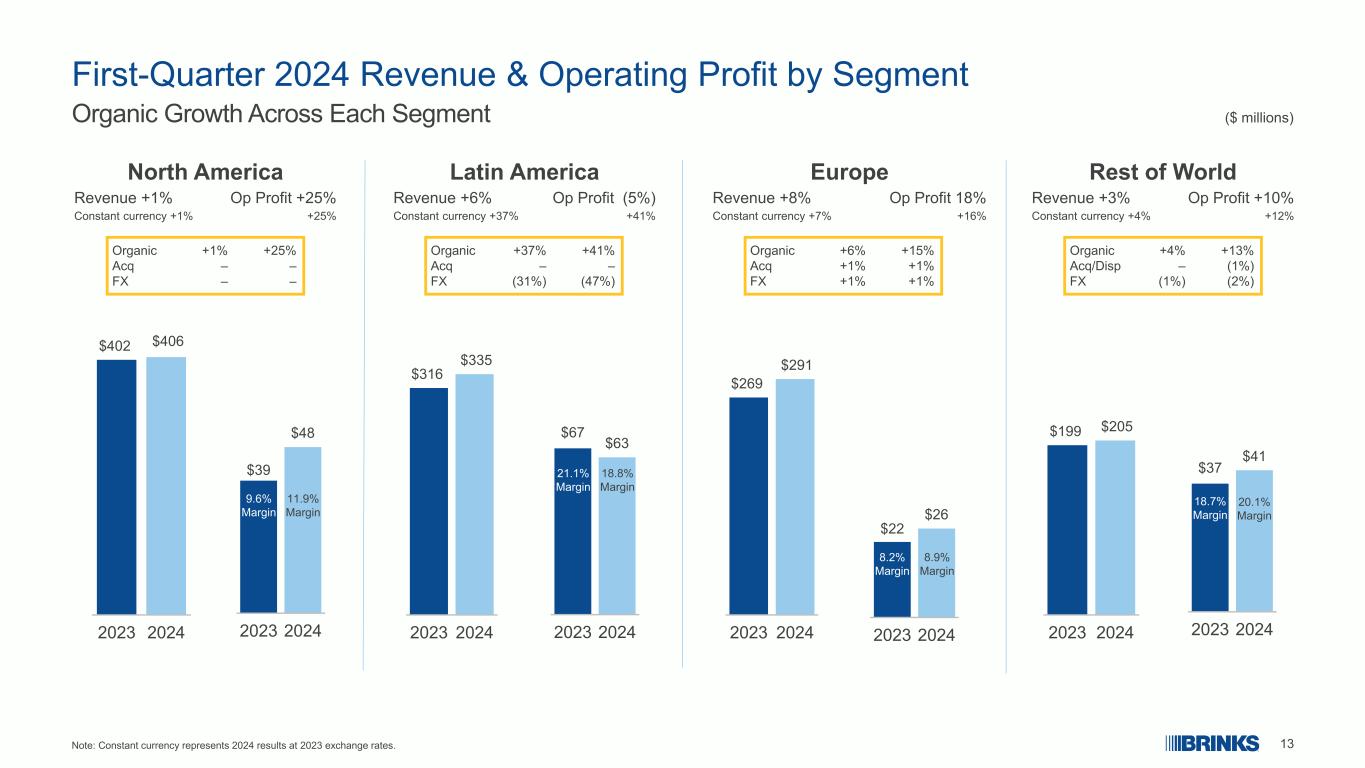

| North America |

$ |

402 |

|

|

4 |

|

|

— |

|

|

— |

|

|

406 |

|

|

1 |

|

|

1 |

|

|

| Latin America |

316 |

|

|

117 |

|

|

— |

|

|

(98) |

|

|

335 |

|

|

6 |

|

|

37 |

|

|

| Europe |

269 |

|

|

17 |

|

|

2 |

|

|

4 |

|

|

291 |

|

|

8 |

|

|

6 |

|

|

| Rest of World |

199 |

|

|

8 |

|

|

— |

|

|

(3) |

|

|

205 |

|

|

3 |

|

|

4 |

|

|

Segment revenues(c) |

$ |

1,185 |

|

|

146 |

|

|

2 |

|

|

(97) |

|

|

1,236 |

|

|

4 |

|

|

12 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Revenues - GAAP |

$ |

1,185 |

|

|

146 |

|

|

2 |

|

|

(97) |

|

|

1,236 |

|

|

4 |

|

|

12 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Operating profit: |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| North America |

$ |

39 |

|

|

10 |

|

|

— |

|

|

— |

|

|

48 |

|

|

25 |

|

|

25 |

|

|

| Latin America |

67 |

|

|

28 |

|

|

— |

|

|

(31) |

|

|

63 |

|

|

(5) |

|

|

41 |

|

|

| Europe |

22 |

|

|

3 |

|

|

— |

|

|

— |

|

|

26 |

|

|

18 |

|

|

15 |

|

|

| Rest of World |

37 |

|

|

5 |

|

|

— |

|

|

(1) |

|

|

41 |

|

|

10 |

|

|

13 |

|

|

| Segment operating profit |

165 |

|

|

45 |

|

|

— |

|

|

(31) |

|

|

178 |

|

|

8 |

|

|

28 |

|

|

Corporate(d) |

(37) |

|

|

2 |

|

|

— |

|

|

1 |

|

|

(33) |

|

|

(10) |

|

|

(6) |

|

|

| Operating profit - non-GAAP |

$ |

127 |

|

|

48 |

|

|

— |

|

|

(30) |

|

|

145 |

|

|

14 |

|

|

38 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Other items not allocated to segments(e) |

(48) |

|

|

5 |

|

|

8 |

|

|

10 |

|

|

(24) |

|

|

(49) |

|

|

(11) |

|

|

| Operating profit - GAAP |

$ |

80 |

|

|

53 |

|

|

8 |

|

|

(20) |

|

|

121 |

|

|

52 |

|

|

67 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| GAAP interest expense |

(47) |

|

|

|

|

|

|

|

|

(56) |

|

|

20 |

|

|

|

|

| GAAP interest and other income (expense) |

5 |

|

|

|

|

|

|

|

|

13 |

|

|

fav |

|

|

|

| GAAP provision (benefit) for income taxes |

20 |

|

|

|

|

|

|

|

|

26 |

|

|

29 |

|

|

|

|

| GAAP noncontrolling interests |

3 |

|

|

|

|

|

|

|

|

3 |

|

|

(12) |

|

|

|

|

GAAP income from continuing operations(f) |

14 |

|

|

|

|

|

|

|

|

49 |

|

|

fav |

|

|

|

GAAP EPS(f) |

$ |

0.30 |

|

|

|

|

|

|

|

|

1.09 |

|

|

fav |

|

|

|

| GAAP weighted-average diluted shares |

47.4 |

|

|

|

|

|

|

|

|

45.3 |

|

|

(4) |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Non-GAAP(g) |

|

|

Organic |

|

Acquisitions / |

|

|

|

|

|

% Change |

|

|

1Q'23 |

|

Change |

|

Dispositions(a) |

|

Currency(b) |

|

1Q'24 |

|

Total |

|

Organic |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Segment revenues - GAAP/non-GAAP |

$ |

1,185 |

|

|

146 |

|

|

2 |

|

|

(97) |

|

|

1,236 |

|

|

4 |

|

|

12 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Non-GAAP operating profit |

127 |

|

|

48 |

|

|

— |

|

|

(30) |

|

|

145 |

|

|

14 |

|

|

38 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Non-GAAP interest expense |

(46) |

|

|

|

|

|

|

|

|

(56) |

|

|

20 |

|

|

|

|

| Non-GAAP interest and other income (expense) |

3 |

|

|

|

|

|

|

|

|

12 |

|

|

fav |

|

|

|

| Non-GAAP provision for income taxes |

21 |

|

|

|

|

|

|

|

|

29 |

|

|

39 |

|

|

|

|

| Non-GAAP noncontrolling interests |

3 |

|

|

|

|

|

|

|

|

3 |

|

|

(13) |

|

|

|

|

Non-GAAP income from continuing operations(f) |

60 |

|

|

|

|

|

|

|

|

69 |

|

|

14 |

|

|

|

|

Non-GAAP EPS(f) |

$ |

1.27 |

|

|

|

|

|

|

|

|

1.52 |

|

|

20 |

|

|

|

|

| Non-GAAP weighted-average diluted shares |

47.4 |

|

|

|

|

|

|

|

|

45.3 |

|

|

(4) |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Amounts may not add due to rounding.

(a)Non-GAAP amounts include the impact of prior year comparable period results for acquired and disposed businesses. GAAP results also include the impact of acquisition-related intangible amortization, restructuring and other charges, and disposition related gains/losses.

(b)The amounts in the “Currency” column consist of the effects of Argentina devaluations under highly inflationary accounting and the sum of monthly currency changes. Monthly currency changes represent the accumulation throughout the year of the impact on current period results from changes in foreign currency rates from the prior year period.

(c)Segment revenues equal our total reported non-GAAP revenues.

(d)Corporate expenses are not allocated to segment results. Corporate expenses include salaries and other costs to manage the global business and to perform activities required of public companies.

(e)See pages

7-

9 for more information.

(f)Attributable to Brink's.

(g)Non-GAAP results are reconciled to applicable GAAP results on pages

10-

13.

About The Brink’s Company

The Brink’s Company (NYSE:BCO) is a leading global provider of cash and valuables management, digital retail solutions, and ATM managed services. Our customers include financial institutions, retailers, government agencies, mints, jewelers and other commercial operations. Our network of operations in 52 countries serves customers in more than 100 countries. For more information, please visit our website at www.brinks.com or call 804-289-9709.

Forward-Looking Statements

This release contains forward-looking information. Words such as "anticipate," "assume," "estimate," "expect," “target” "project," "predict," "intend," "plan," "believe," "potential," "may," "should" and similar expressions may identify forward-looking information. Forward-looking information in these materials includes, but is not limited to: 2024 outlook, including revenue, adjusted EBITDA, adjusted EBITDA margin, earnings per share, and free cash flow before dividends (and drivers thereof), the impact of the global restructuring plan, expected impact from deployment of technology-enabled solutions, including digital retail solutions and ATM managed services, and strategic priorities and initiatives, including the Brink's Business System.

Forward-looking information in this document is subject to known and unknown risks, uncertainties and contingencies, which are difficult to predict or quantify, and which could cause actual results, performance or achievements to differ materially from those that are anticipated. These risks, uncertainties and contingencies, many of which are beyond our control, include, but are not limited to: our ability to improve profitability and execute further cost and operational improvement and efficiencies in our core businesses; our ability to improve service levels and quality in our core businesses; market volatility and commodity price fluctuations; general economic issues, including supply chain disruptions, fuel price increases, changes in interest rates, and interest rate increases; seasonality, pricing and other competitive industry factors; investment in information technology (“IT”) and its impact on revenue and profit growth; our ability to maintain an effective IT infrastructure and safeguard confidential information, including from a cybersecurity incident; our ability to effectively develop and implement solutions for our customers; risks associated with operating in foreign countries, including changing political, labor and economic conditions (including political conflict or unrest), regulatory issues (including the imposition of international sanctions, including by the U.S. government), military conflicts (including but not limited to the conflict in Israel and surrounding areas, as well as the possible expansion of such conflicts and potential geopolitical consequences), currency restrictions and devaluations, restrictions on and cost of repatriating earnings and capital, impact on the Company’s financial results as a result of jurisdictions determined to be highly inflationary, and restrictive government actions, including nationalization; labor issues, including labor shortages negotiations with organized labor and work stoppages; pandemics , acts of terrorism, strikes or other extraordinary events that negatively affect global or regional cash commerce; the strength of the U.S. dollar relative to foreign currencies and foreign currency exchange rates; our ability to identify, evaluate and complete acquisitions and other strategic transactions and to successfully integrate acquired companies; costs related to dispositions and product or market exits; our ability to obtain appropriate insurance coverage, positions taken by insurers relative to claims and the financial condition of insurers; safety and security performance and loss experience; employee and environmental liabilities in connection with former coal operations, including black lung claims; the impact of the American Rescue Plan Act and Patient Protection and Affordable Care Act on legacy liabilities and ongoing operations; funding requirements, accounting treatment, and investment performance of our pension plans, the VEBA and other employee benefits; changes to estimated liabilities and assets in actuarial assumptions; the nature of hedging relationships and counterparty risk; access to the capital and credit markets; our ability to realize deferred tax assets; the outcome of pending and future claims, litigation, and administrative proceedings; public perception of our business, reputation and brand; changes in estimates and assumptions underlying critical accounting policies; the promulgation and adoption of new accounting standards, new government regulations and interpretation of existing standards and regulations.

This list of risks, uncertainties and contingencies is not intended to be exhaustive. Additional factors that could cause our results to differ materially from those described in the forward-looking statements can be found under "Risk Factors" in Item 1A of our Annual Report on Form 10-K for the period ended December 31, 2023, and in related disclosures in our other public filings with the Securities and Exchange Commission. The forward-looking information included in this document is representative only as of the date of this document and The Brink's Company undertakes no obligation to update any information contained in this document.

The Brink’s Company and subsidiaries

Segment Results: 2023 and 2024 (Unaudited)

(In millions, except for percentages)

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Revenues |

|

2023 |

|

|

2024 |

|

1Q |

|

2Q |

|

3Q |

|

4Q |

|

Full Year |

|

|

1Q |

|

|

|

|

|

|

|

|

| Revenues: |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| North America |

$ |

401.9 |

|

|

397.4 |

|

|

398.1 |

|

|

403.7 |

|

|

1,601.1 |

|

|

|

$ |

405.5 |

|

|

|

|

|

|

|

|

|

| Latin America |

315.5 |

|

|

333.9 |

|

|

339.6 |

|

|

343.3 |

|

|

1,332.3 |

|

|

|

334.7 |

|

|

|

|

|

|

|

|

|

| Europe |

268.7 |

|

|

285.9 |

|

|

287.8 |

|

|

294.4 |

|

|

1,136.8 |

|

|

|

291.4 |

|

|

|

|

|

|

|

|

|

| Rest of World |

199.3 |

|

|

199.0 |

|

|

201.9 |

|

|

204.2 |

|

|

804.4 |

|

|

|

204.5 |

|

|

|

|

|

|

|

|

|

| Segment revenues - GAAP and Non-GAAP |

$ |

1,185.4 |

|

|

1,216.2 |

|

|

1,227.4 |

|

|

1,245.6 |

|

|

4,874.6 |

|

|

|

$ |

1,236.1 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Operating Profit |

|

2023 |

|

|

2024 |

|

1Q |

|

2Q |

|

3Q |

|

4Q |

|

Full Year |

|

|

1Q |

|

|

|

|

|

|

|

|

| Operating profit: |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| North America |

$ |

38.6 |

|

|

37.5 |

|

|

47.5 |

|

|

61.6 |

|

|

185.2 |

|

|

|

$ |

48.4 |

|

|

|

|

|

|

|

|

|

| Latin America |

66.6 |

|

|

65.9 |

|

|

68.1 |

|

|

79.7 |

|

|

280.3 |

|

|

|

63.0 |

|

|

|

|

|

|

|

|

|

| Europe |

22.0 |

|

|

29.3 |

|

|

35.8 |

|

|

37.9 |

|

|

125.0 |

|

|

|

25.9 |

|

|

|

|

|

|

|

|

|

| Rest of World |

37.3 |

|

|

41.3 |

|

|

42.6 |

|

|

42.9 |

|

|

164.1 |

|

|

|

41.1 |

|

|

|

|

|

|

|

|

|

| Corporate |

(37.1) |

|

|

(42.2) |

|

|

(27.7) |

|

|

(32.6) |

|

|

(139.6) |

|

|

|

(33.4) |

|

|

|

|

|

|

|

|

|

| Non-GAAP |

127.4 |

|

|

131.8 |

|

|

166.3 |

|

|

189.5 |

|

|

615.0 |

|

|

|

145.0 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Other items not allocated to segments(a) |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Reorganization and Restructuring |

(14.2) |

|

|

— |

|

|

(0.4) |

|

|

(3.0) |

|

|

(17.6) |

|

|

|

(1.4) |

|

|

|

|

|

|

|

|

|

| Acquisitions and dispositions |

(22.0) |

|

|

(15.0) |

|

|

(19.4) |

|

|

(14.2) |

|

|

(70.6) |

|

|

|

(15.9) |

|

|

|

|

|

|

|

|

|

| Argentina highly inflationary impact |

(11.2) |

|

|

(11.0) |

|

|

(8.1) |

|

|

(56.5) |

|

|

(86.8) |

|

|

|

(1.6) |

|

|

|

|

|

|

|

|

|

| Transformation initiatives |

— |

|

|

— |

|

|

— |

|

|

(5.5) |

|

|

(5.5) |

|

|

|

(4.8) |

|

|

|

|

|

|

|

|

|

| Non-routine auto loss matter |

— |

|

|

— |

|

|

— |

|

|

(8.0) |

|

|

(8.0) |

|

|

|

— |

|

|

|

|

|

|

|

|

|

| Chile antitrust matter |

(0.2) |

|

|

(0.2) |

|

|

— |

|

|

(0.1) |

|

|

(0.5) |

|

|

|

(0.4) |

|

|

|

|

|

|

|

|

|

| Reporting compliance |

— |

|

|

— |

|

|

(0.7) |

|

|

(0.1) |

|

|

(0.8) |

|

|

|

— |

|

|

|

|

|

|

|

|

|

| GAAP |

$ |

79.8 |

|

|

105.6 |

|

|

137.7 |

|

|

102.1 |

|

|

425.2 |

|

|

|

$ |

120.9 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Operating Margin Percentage |

|

2023 |

|

|

2024 |

|

1Q |

|

2Q |

|

3Q |

|

4Q |

|

Full Year |

|

|

1Q |

|

|

|

|

|

|

|

|

| Operating margin percentage: |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| North America |

9.6 |

|

|

9.4 |

|

|

11.9 |

|

|

15.3 |

|

|

11.6 |

|

|

|

11.9 |

|

|

|

|

|

|

|

|

|

| Latin America |

21.1 |

|

|

19.7 |

|

|

20.1 |

|

|

23.2 |

|

|

21.0 |

|

|

|

18.8 |

|

|

|

|

|

|

|

|

|

| Europe |

8.2 |

|

|

10.2 |

|

|

12.4 |

|

|

12.9 |

|

|

11.0 |

|

|

|

8.9 |

|

|

|

|

|

|

|

|

|

| Rest of World |

18.7 |

|

|

20.8 |

|

|

21.1 |

|

|

21.0 |

|

|

20.4 |

|

|

|

20.1 |

|

|

|

|

|

|

|

|

|

| Non-GAAP |

10.7 |

|

|

10.8 |

|

|

13.5 |

|

|

15.2 |

|

|

12.6 |

|

|

|

11.7 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Other items not allocated to segments(a) |

(4.0) |

|

|

(2.1) |

|

|

(2.3) |

|

|

(7.0) |

|

|

(3.9) |

|

|

|

(1.9) |

|

|

|

|

|

|

|

|

|

| GAAP |

6.7 |

|

|

8.7 |

|

|

11.2 |

|

|

8.2 |

|

|

8.7 |

|

|

|

9.8 |

|

|

|

|

|

|

|

|

|

(a)See explanation of items on page

8-

9.

The Brink’s Company and subsidiaries

Other Items Not Allocated To Segments (Unaudited)

(In millions)

Brink’s measures its segment results before income and expenses for corporate activities and for certain other items. See below for a summary of the other items not allocated to segments.

Reorganization and Restructuring

2022 Global Restructuring Plan

In the first quarter of 2023, management completed the review and approval of the previously announced restructuring plan across our global business operations. The actions were taken to enable growth, reduce costs and related infrastructure, and to mitigate the potential impact of external economic conditions. In total, we have recognized $34.2 million in charges under this program, including $1.0 million in the first three months of 2024. We expect total expenses from this program to be between $36 million and $38 million. When completed, the current restructuring actions are expected to reduce our workforce by 3,200 to 3,400 positions and result in annualized cost savings of approximately $60 million.

Other Restructurings

Management periodically implements restructuring actions in targeted sections of our business. As a result of these actions, we recognized $6.6 million in net costs in 2023. We recognized $0.4 million in net costs in the first three months of 2024. The majority of the costs in both the 2024 and 2023 periods result from the exit of a line of business in a specific geography with most of the remaining costs due to management initiatives to address the COVID-19 pandemic.

Due to the unique circumstances around these charges, these management-directed items have not been allocated to segment results and are excluded from non-GAAP results.

Acquisitions and dispositions Certain acquisition and disposition items that are not considered part of the ongoing activities of the

business and are special in nature are consistently excluded from non-GAAP results. These items are described below:

2024 Acquisitions and Dispositions

•Amortization expense for acquisition-related intangible assets was $14.5 million in the first three months of 2024.

•We recognized $0.7 million in charges in Argentina in the first three months of 2024 for an inflation-adjusted labor increase to expected payments to union workers of the Maco Transportadora and Maco Litoral businesses (together "Maco"). Although the Maco operations were acquired in 2017, formal antitrust approval was obtained in 2021, which triggered negotiation and approval of the expected payments in 2022.

•We incurred $0.3 million in integration costs in the first three months of 2024.

•Transaction costs related to business acquisitions were $0.3 million in the first three months of 2024.

•Compensation expense related to the retention of key PAI employees was $0.1 million in the first three months of 2024.

2023 Acquisitions and Dispositions

•Amortization expense for acquisition-related intangible assets was $57.8 million in 2023.

•We derecognized a contingent consideration liability related to the NoteMachine business acquisition and recognized a gain of $4.8 million. We also derecognized a contingent consideration liability related to the Touchpoint 21 acquisition and recognized a gain of $1.4 million.

•We recognized $4.9 million in charges in Argentina in 2023 for expected payments to union workers of the Maco businesses.

•Net charges of $3.4 million were incurred for post-acquisition adjustments to indemnification assets related to previous business acquisitions.

•We incurred $2.2 million in integration costs, primarily related to PAI, in 2023.

•Transaction costs related to business acquisitions were $4.2 million in 2023.

•We recognized a $2.0 million loss on the disposition of Russia-based operations in 2023.

•Compensation expense related to the retention of key PAI employees was $1.6 million in 2023.

Argentina highly inflationary impact Beginning in the third quarter of 2018, we designated Argentina's economy as highly inflationary for accounting purposes. As a result, Argentine peso-denominated monetary assets and liabilities are now remeasured at each balance sheet date to the currency exchange rate then in effect, with currency remeasurement gains and losses recognized in earnings. In addition, nonmonetary assets retain a higher historical basis when the currency is devalued. The higher historical basis results in incremental expense being recognized when the nonmonetary assets are consumed. In December 2023, the administration of the newly inaugurated President of Argentina allowed the peso to devalue by more than 50%. In total, in 2023, the Argentine peso declined approximately 79%. In the first three months of 2024, we recognized $1.6 million in pretax charges related to highly inflationary accounting. In 2023, we recognized $86.8 million in pretax charges related to highly inflationary accounting, including currency remeasurement losses of $79.1 million. These amounts are excluded from non-GAAP results.

Transformation initiatives During 2023, we initiated a multi-year program intended to accelerate growth and drive margin expansion through transformation of our business model in the U.S., with expectations to then leverage the transformation changes and learnings globally. The program is designed to help us standardize our commercial and operational systems and processes, drive continuous improvement and achieve operational excellence. Accordingly, we incurred $4.8 million in the first three months of 2024 and $5.5 million of expense in 2023. The transformation costs primarily include third party professional services and project management charges and are excluded from segment and non-GAAP results.

Non-routine auto loss matter In 2023, a Brink’s employee was involved in a motor vehicle accident with unique circumstances that resulted in the death of a third party and, in connection with ensuing litigation, Brink’s recognized an $8.0 million charge. Due to the unusual nature of the contingency, we have excluded this charge from segment and non-GAAP results.

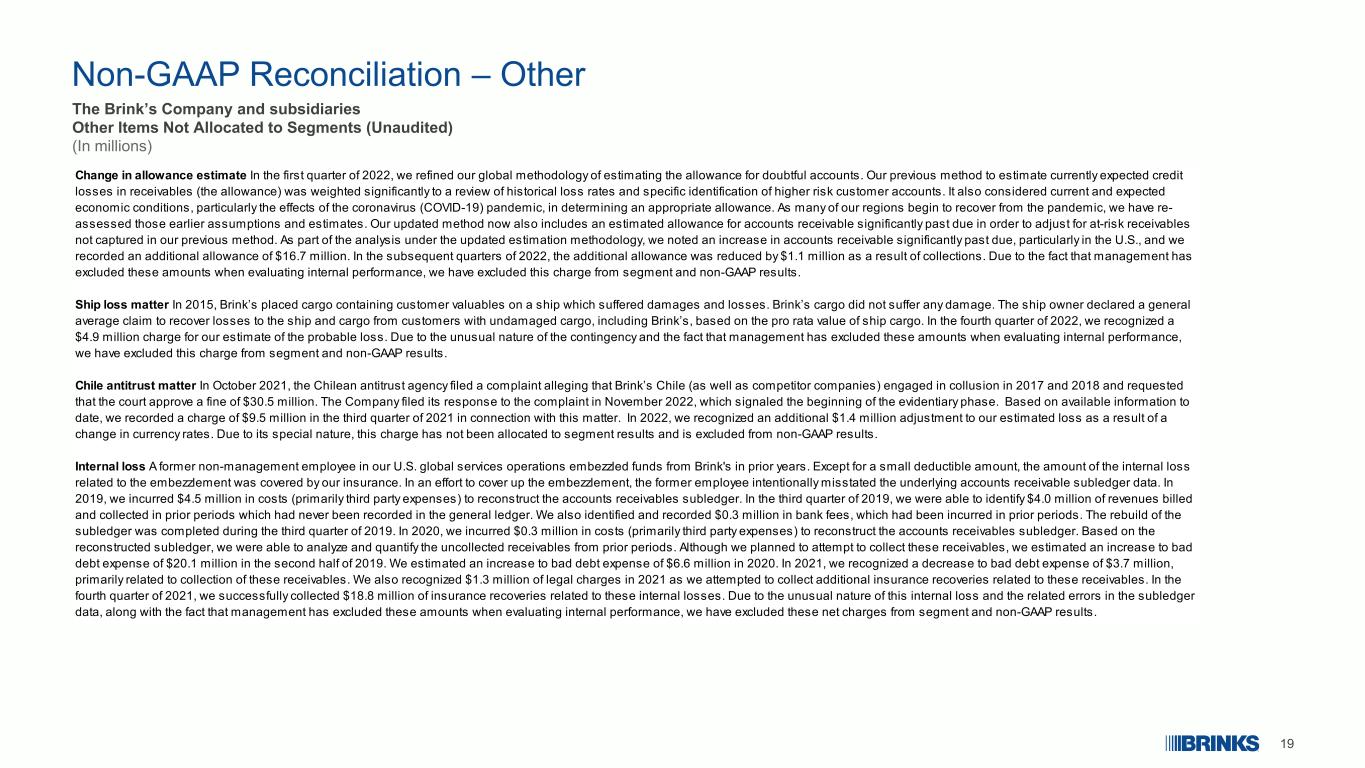

Chile antitrust matter In October 2021, the Chilean antitrust agency filed a complaint alleging that Brink’s Chile (as well as competitor companies) engaged in collusion in 2017 and 2018 and requested that the court approve a fine of $30.5 million. The Company filed its response to the complaint in

November 2022, which signaled the beginning of the evidentiary phase. Based on available information to date, we recorded a charge of $9.5 million in the third quarter of 2021 in connection with this matter. In 2023, we recognized an additional $0.5 million adjustment to our estimated loss as a result of a change in currency rates.

In the first three months of 2024, we recognized an additional $0.4 million adjustment to our estimated loss as a result of a change in currency rates. Due to its special nature, this charge has not been allocated to segment results and is excluded from non-GAAP results.

Reporting compliance Certain compliance costs (primarily third party expenses) are excluded from segment and non-GAAP results. In 2023, we incurred $0.8 million in costs related to mitigation of the material weakness. We did not incur any such costs in the first three months of 2024.

The Brink’s Company and subsidiaries

Non-GAAP Results Reconciled to GAAP (Unaudited)

(In millions, except for percentages and per share amounts)

Non-GAAP results described in this press release are financial measures that are not required by or presented in accordance with U.S. generally accepted accounting principles (“GAAP”). The purpose of the Non-GAAP results is to report financial information from the primary operations of our business by excluding the effects of certain income and expenses that do not reflect the ordinary earnings of our operations. The specific items excluded have not been allocated to segments, are described on pages

8 and

9 and in more detail in our Form 10-Q, and are reconciled to comparable GAAP measures below. In addition, we refer to non-GAAP constant currency amounts, which represent current period results and forecasts at prior period exchange rates.

Non-GAAP results adjust the quarterly Non-GAAP tax rates so that the Non-GAAP tax rate in each of the quarters is equal to the full-year estimated Non-GAAP tax rate. The full-year Non-GAAP tax rate in both years excludes certain pretax and income tax amounts. Amounts reported for prior periods have been updated in this report to present information consistently for all periods presented.

The 2024 Non-GAAP outlook amounts for EPS from continuing operations, free cash flow before dividends and Adjusted EBITDA cannot be reconciled to GAAP without unreasonable effort. We cannot reconcile these amounts to GAAP because we are unable to accurately forecast the impact of highly inflationary accounting on our Argentina operations or other potential Non-GAAP adjusting items for which the timing and amounts are currently under review, such as future restructuring actions and the impact of possible future acquisitions. We are also unable to forecast changes in cash held for customer obligations or proceeds from the sale of property, equipment and investments in 2024. The impact of highly inflationary accounting and other potential Non-GAAP adjusting items could be significant to our GAAP results.

The Non-GAAP financial measures are intended to provide investors with a supplemental comparison of our operating results and trends for the periods presented. Our management believes these measures are also useful to investors as such measures allow investors to evaluate our performance using the same metrics that our management uses to evaluate past performance and prospects for future performance. We do not consider these items to be reflective of our operating performance as they result from events and circumstances that are not a part of our core business. Additionally, non-GAAP results are utilized as performance measures in certain management incentive compensation plans. Non-GAAP results should not be considered as an alternative to revenue, net income, earnings per share or cash flows from operating activities amounts determined in accordance with GAAP and should be read in conjunction with their GAAP counterparts. Non-GAAP financial measures may not be comparable to Non-GAAP financial measures presented by other companies.

Non-GAAP Results Reconciled to GAAP

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

YTD '23 |

|

YTD '24 |

|

Pre-tax income |

|

Income taxes |

|

Effective tax rate |

|

Pre-tax income |

|

Income taxes |

|

Effective tax rate |

| Effective Income Tax Rate |

|

|

|

|

|

|

|

|

|

|

|

| GAAP |

$ |

37.9 |

|

|

20.3 |

|

|

53.6 |

% |

|

$ |

78.4 |

|

|

26.2 |

|

|

33.4 |

% |

Retirement plans(c) |

(2.2) |

|

|

(0.6) |

|

|

|

|

(1.5) |

|

|

(0.3) |

|

|

|

Reorganization and Restructuring(a) |

14.2 |

|

|

2.7 |

|

|

|

|

1.4 |

|

|

0.4 |

|

|

|

Acquisitions and dispositions(a) |

22.7 |

|

|

2.4 |

|

|

|

|

15.7 |

|

|

1.3 |

|

|

|

Argentina highly inflationary impact(a) |

11.5 |

|

|

(0.5) |

|

|

|

|

1.6 |

|

|

(0.1) |

|

|

|

Transformation initiatives(a) |

— |

|

|

— |

|

|

|

|

4.8 |

|

|

0.1 |

|

|

|

Valuation allowance on tax credits(f) |

— |

|

|

(2.6) |

|

|

|

|

— |

|

|

— |

|

|

|

Chile antitrust matter(a) |

0.2 |

|

|

— |

|

|

|

|

0.4 |

|

|

— |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Income tax rate adjustment(b) |

— |

|

|

(0.8) |

|

|

|

|

— |

|

|

1.5 |

|

|

|

| Non-GAAP |

$ |

84.3 |

|

|

20.9 |

|

|

24.8 |

% |

|

$ |

100.8 |

|

|

29.1 |

|

|

28.9 |

% |

Amounts may not add due to rounding.

(a)See “Other Items Not Allocated To Segments” on pages

7-

9 for details. We do not consider these items to be reflective of our operating performance as they result from events and circumstances that are not a part of our core business.

(b)Non-GAAP income from continuing operations and non-GAAP EPS have been adjusted to reflect an effective income tax rate in each interim period equal to the full-year non-GAAP effective income tax rate. The full-year non-GAAP effective tax rate is estimated at 28.9% for 2024 and was 24.8% for 2023.

(c)Our U.S. retirement plans are frozen and costs related to these plans are excluded from non-GAAP results. Certain non-U.S. operations also have retirement plans. Settlement charges and curtailment gains related to these non-U.S. plans and costs related to our frozen non-U.S. retirement plans are also excluded from non-GAAP results.

(d)Due to reorganization and restructuring activities, there was a $0.9 million non-GAAP adjustment to share-based compensation in the first quarter of 2023. There is no difference between GAAP and non-GAAP share-based compensation amounts for the periods presented.

(e)Due to the impact of Argentina highly inflationary accounting, there was a $0.3 million non-GAAP adjustment for a loss in the first quarter of 2023, a $0.3 million non-GAAP adjustment for a loss in the second quarter of 2023, a $22.7 million non-GAAP adjustment for a loss in the third quarter of 2023, and a $31.9 million non-GAAP adjustment for a loss in the fourth quarter of 2023. There is no difference between GAAP and non-GAAP share-based compensation amounts for the other period presented.

(f)In 2023, we recorded a portion of our valuation allowance on certain U.S. deferred tax assets primarily related to foreign tax credit carryforward attributes. The valuation allowance increase was due to new foreign tax credit Notices published by the U.S. Internal Revenue Service in 2023, which provided taxpayers relief from the 2022 foreign tax credit regulations until additional guidance is issued and effective date of such guidance is provided.

(g)Adjusted EBITDA is defined as non-GAAP income from continuing operations excluding the impact of non-GAAP interest expense, non-GAAP income tax provision, non-GAAP depreciation and amortization, non-GAAP share-based compensation and non-GAAP marketable securities (gain) loss.

The Brink’s Company and subsidiaries

Non-GAAP Results Reconciled to GAAP (Unaudited) - continued

(In millions, except for percentages and per share amounts)

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

2023 |

|

2024 |

|

1Q |

|

2Q |

|

3Q |

|

4Q |

|

Full Year |

|

1Q |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Revenues: |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| GAAP |

$ |

1,185.4 |

|

|

1,216.2 |

|

|

1,227.4 |

|

|

1,245.6 |

|

|

4,874.6 |

|

|

$ |

1,236.1 |

|

|

|

|

|

|

|

| Non-GAAP |

$ |

1,185.4 |

|

|

1,216.2 |

|

|

1,227.4 |

|

|

1,245.6 |

|

|

4,874.6 |

|

|

$ |

1,236.1 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Operating profit (loss): |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| GAAP |

$ |

79.8 |

|

|

105.6 |

|

|

137.7 |

|

|

102.1 |

|

|

425.2 |

|

|

$ |

120.9 |

|

|

|

|

|

|

|

Reorganization and Restructuring(a) |

14.2 |

|

|

— |

|

|

0.4 |

|

|

3.0 |

|

|

17.6 |

|

|

1.4 |

|

|

|

|

|

|

|

Acquisitions and dispositions(a) |

22.0 |

|

|

15.0 |

|

|

19.4 |

|

|

14.2 |

|

|

70.6 |

|

|

15.9 |

|

|

|

|

|

|

|

Argentina highly inflationary impact(a) |

11.2 |

|

|

11.0 |

|

|

8.1 |

|

|

56.5 |

|

|

86.8 |

|

|

1.6 |

|

|

|

|

|

|

|

Transformation initiatives(a) |

— |

|

|

— |

|

|

— |

|

|

5.5 |

|

|

5.5 |

|

|

4.8 |

|

|

|

|

|

|

|

Non-routine auto loss matter(a) |

— |

|

|

— |

|

|

— |

|

|

8.0 |

|

|

8.0 |

|

|

— |

|

|

|

|

|

|

|

Chile antitrust matter(a) |

0.2 |

|

|

0.2 |

|

|

— |

|

|

0.1 |

|

|

0.5 |

|

|

0.4 |

|

|

|

|

|

|

|

Reporting compliance(a) |

— |

|

|

— |

|

|

0.7 |

|

|

0.1 |

|

|

0.8 |

|

|

— |

|

|

|

|

|

|

|

| Non-GAAP |

$ |

127.4 |

|

|

131.8 |

|

|

166.3 |

|

|

189.5 |

|

|

615.0 |

|

|

$ |

145.0 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Operating margin: |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| GAAP margin |

6.7 |

% |

|

8.7 |

% |

|

11.2 |

% |

|

8.2 |

% |

|

8.7 |

% |

|

9.8 |

% |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Non-GAAP margin |

10.7 |

% |

|

10.8 |

% |

|

13.5 |

% |

|

15.2 |

% |

|

12.6 |

% |

|

11.7 |

% |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Interest expense: |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| GAAP |

$ |

(46.6) |

|

|

(51.1) |

|

|

(53.8) |

|

|

(52.3) |

|

|

(203.8) |

|

|

$ |

(55.8) |

|

|

|

|

|

|

|

Acquisitions and dispositions(a) |

0.2 |

|

|

0.3 |

|

|

0.2 |

|

|

0.1 |

|

|

0.8 |

|

|

— |

|

|

|

|

|

|

|

| Non-GAAP |

$ |

(46.4) |

|

|

(50.8) |

|

|

(53.6) |

|

|

(52.2) |

|

|

(203.0) |

|

|

$ |

(55.8) |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Interest and other income (expense): |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| GAAP |

$ |

4.7 |

|

|

4.1 |

|

|

2.9 |

|

|

2.7 |

|

|

14.4 |

|

|

$ |

13.3 |

|

|

|

|

|

|

|

Retirement plans(c) |

(2.2) |

|

|

(1.9) |

|

|

(2.1) |

|

|

(2.8) |

|

|

(9.0) |

|

|

(1.5) |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Acquisitions and dispositions(a) |

0.5 |

|

|

0.6 |

|

|

(0.9) |

|

|

1.0 |

|

|

1.2 |

|

|

(0.2) |

|

|

|

|

|

|

|

Argentina highly inflationary impact(a) |

0.3 |

|

|

0.3 |

|

|

22.7 |

|

|

31.9 |

|

|

55.2 |

|

|

— |

|

|

|

|

|

|

|

| Non-GAAP |

$ |

3.3 |

|

|

3.1 |

|

|

22.6 |

|

|

32.8 |

|

|

61.8 |

|

|

$ |

11.6 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Taxes: |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| GAAP |

$ |

20.3 |

|

|

23.4 |

|

|

37.3 |

|

|

58.2 |

|

|

139.2 |

|

|

$ |

26.2 |

|

|

|

|

|

|

|

Retirement plans(c) |

(0.6) |

|

|

(0.1) |

|

|

(0.6) |

|

|

(0.7) |

|

|

(2.0) |

|

|

(0.3) |

|

|

|

|

|

|

|

Reorganization and Restructuring(a) |

2.7 |

|

|

(0.1) |

|

|

0.1 |

|

|

0.7 |

|

|

3.4 |

|

|

0.4 |

|

|

|

|

|

|

|

Acquisitions and dispositions(a) |

2.4 |

|

|

2.0 |

|

|

3.3 |

|

|

1.2 |

|

|

8.9 |

|

|

1.3 |

|

|

|

|

|

|

|

Argentina highly inflationary impact(a) |

(0.5) |

|

|

(0.2) |

|

|

(0.9) |

|

|

(2.9) |

|

|

(4.5) |

|

|

(0.1) |

|

|

|

|

|

|

|

Transformation initiatives(a) |

— |

|

|

— |

|

|

— |

|

|

0.1 |

|

|

0.1 |

|

|

0.1 |

|

|

|

|

|

|

|

Non-routine auto loss matter(a) |

— |

|

|

— |

|

|

— |

|

|

0.2 |

|

|

0.2 |

|

|

— |

|

|

|

|

|

|

|

Valuation allowance on tax credits(f) |

(2.6) |

|

|

(4.1) |

|

|

— |

|

|

(21.1) |

|

|

(27.8) |

|

|

— |

|

|

|

|

|

|

|

Chile antitrust matter(a) |

— |

|

|

0.1 |

|

|

— |

|

|

— |

|

|

0.1 |

|

|

— |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Income tax rate adjustment(b) |

(0.8) |

|

|

(0.1) |

|

|

(5.6) |

|

|

6.5 |

|

|

— |

|

|

1.5 |

|

|

|

|

|

|

|

| Non-GAAP |

$ |

20.9 |

|

|

20.9 |

|

|

33.6 |

|

|

42.2 |

|

|

117.6 |

|

|

$ |

29.1 |

|

|

|

|

|

|

|

Amounts may not add due to rounding.

See page

10 for footnote explanations.

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

2023 |

|

2024 |

|

1Q |

|

2Q |

|

3Q |

|

4Q |

|

Full Year |

|

1Q |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Noncontrolling interests: |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| GAAP |

$ |

3.3 |

|

|

3.0 |

|

|

3.8 |

|

|

0.5 |

|

|

10.6 |

|

|

$ |

2.9 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Acquisitions and dispositions(a) |

0.2 |

|

|

0.3 |

|

|

0.3 |

|

|

0.2 |

|

|

1.0 |

|

|

0.2 |

|

|

|

|

|

|

|

Income tax rate adjustment(b) |

(0.3) |

|

|

(0.3) |

|

|

0.1 |

|

|

0.5 |

|

|

— |

|

|

(0.3) |

|

|

|

|

|

|

|

| Non-GAAP |

$ |

3.2 |

|

|

3.0 |

|

|

4.2 |

|

|

1.2 |

|

|

11.6 |

|

|

$ |

2.8 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Income (loss) from continuing operations attributable to Brink's: |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| GAAP |

$ |

14.3 |

|

|

32.2 |

|

|

45.7 |

|

|

(6.2) |

|

|

86.0 |

|

|

$ |

49.3 |

|

|

|

|

|

|

|

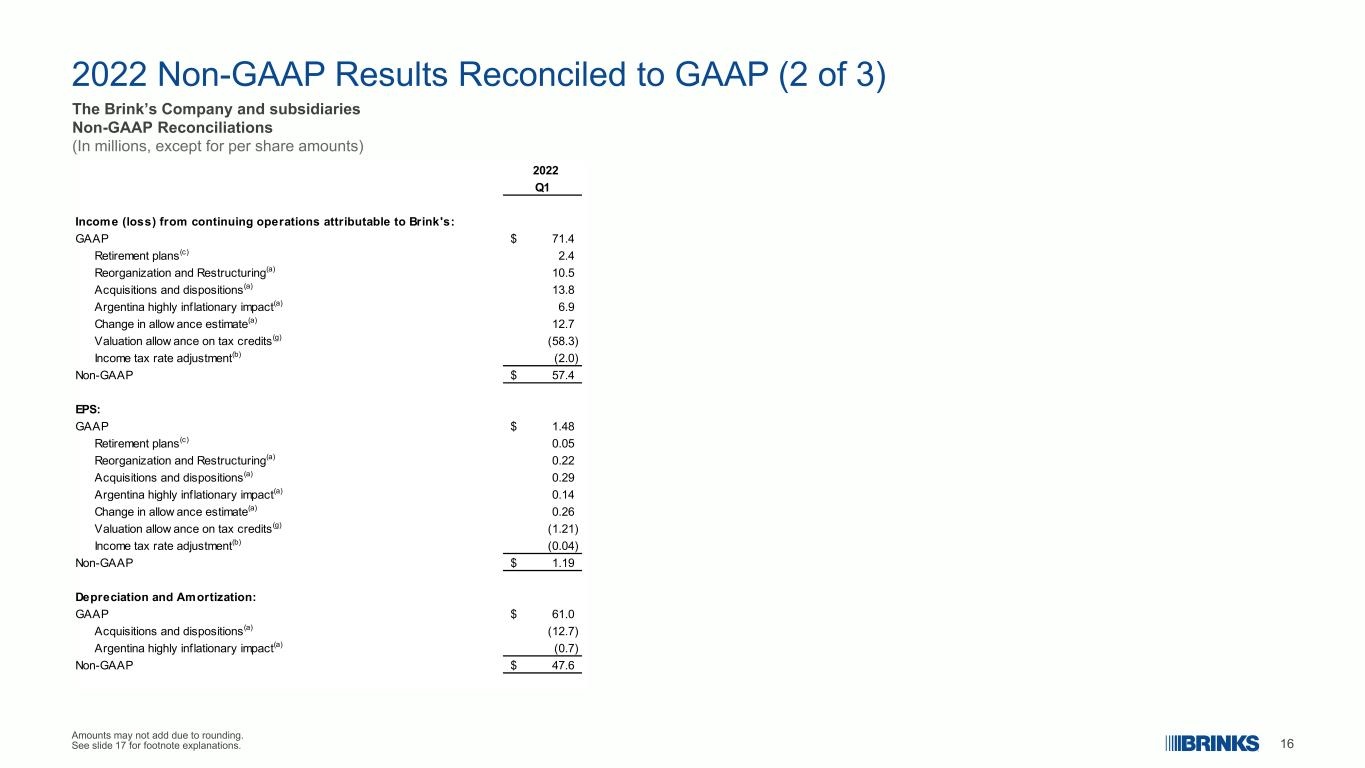

Retirement plans(c) |

(1.6) |

|

|

(1.8) |

|

|

(1.5) |

|

|

(2.1) |

|

|

(7.0) |

|

|

(1.2) |

|

|

|

|

|

|

|

Reorganization and Restructuring(a) |

11.5 |

|

|

0.1 |

|

|

0.3 |

|

|

2.3 |

|

|

14.2 |

|

|

1.0 |

|

|

|

|

|

|

|

Acquisitions and dispositions(a) |

20.1 |

|

|

13.6 |

|

|

15.1 |

|

|

13.9 |

|

|

62.7 |

|

|

14.2 |

|

|

|

|

|

|

|

Argentina highly inflationary impact(a) |

12.0 |

|

|

11.5 |

|

|

31.7 |

|

|

91.3 |

|

|

146.5 |

|

|

1.7 |

|

|

|

|

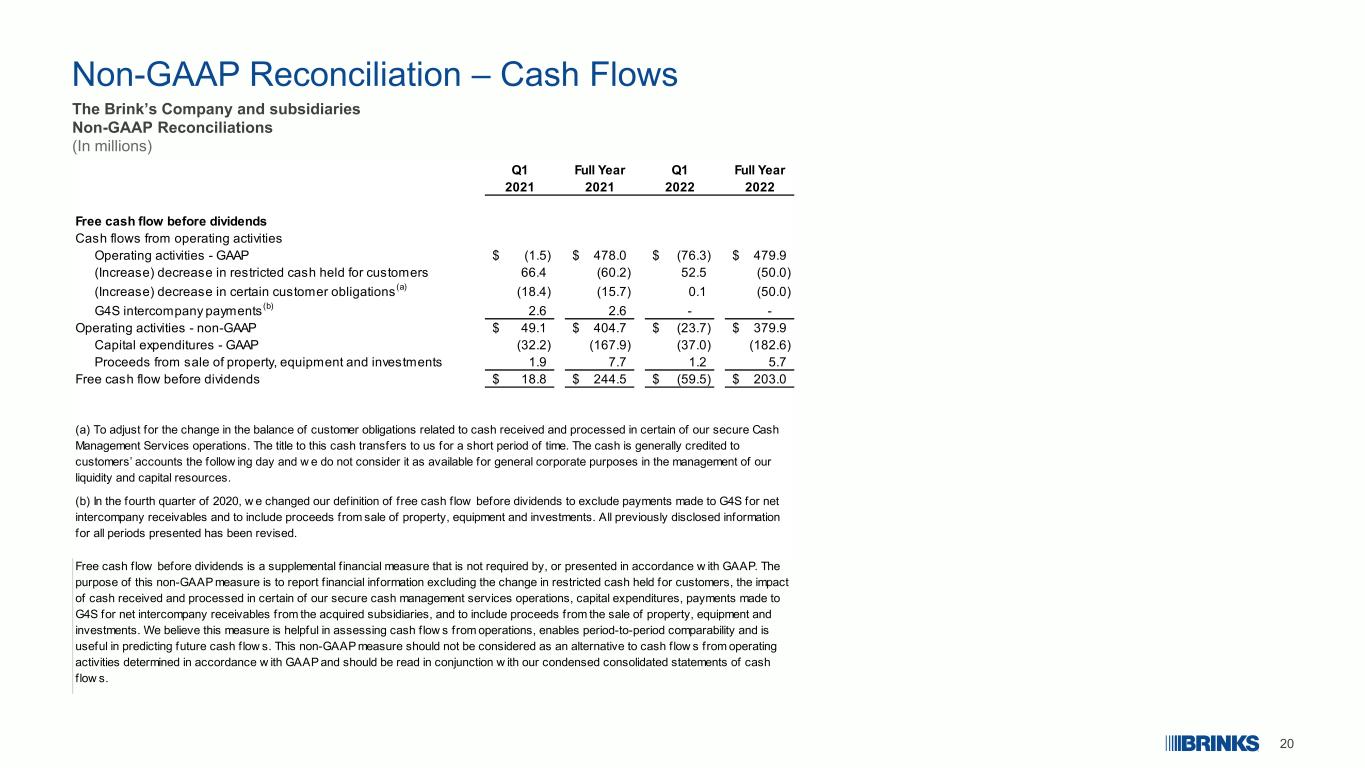

|