Document

News Release

Patrick Industries, Inc. Reports Fourth Quarter and Full Year 2023 Financial Results and Declares Quarterly Cash Dividend

Fourth Quarter and Full Year 2023 Highlights (compared to Fourth Quarter 2022 unless otherwise noted)

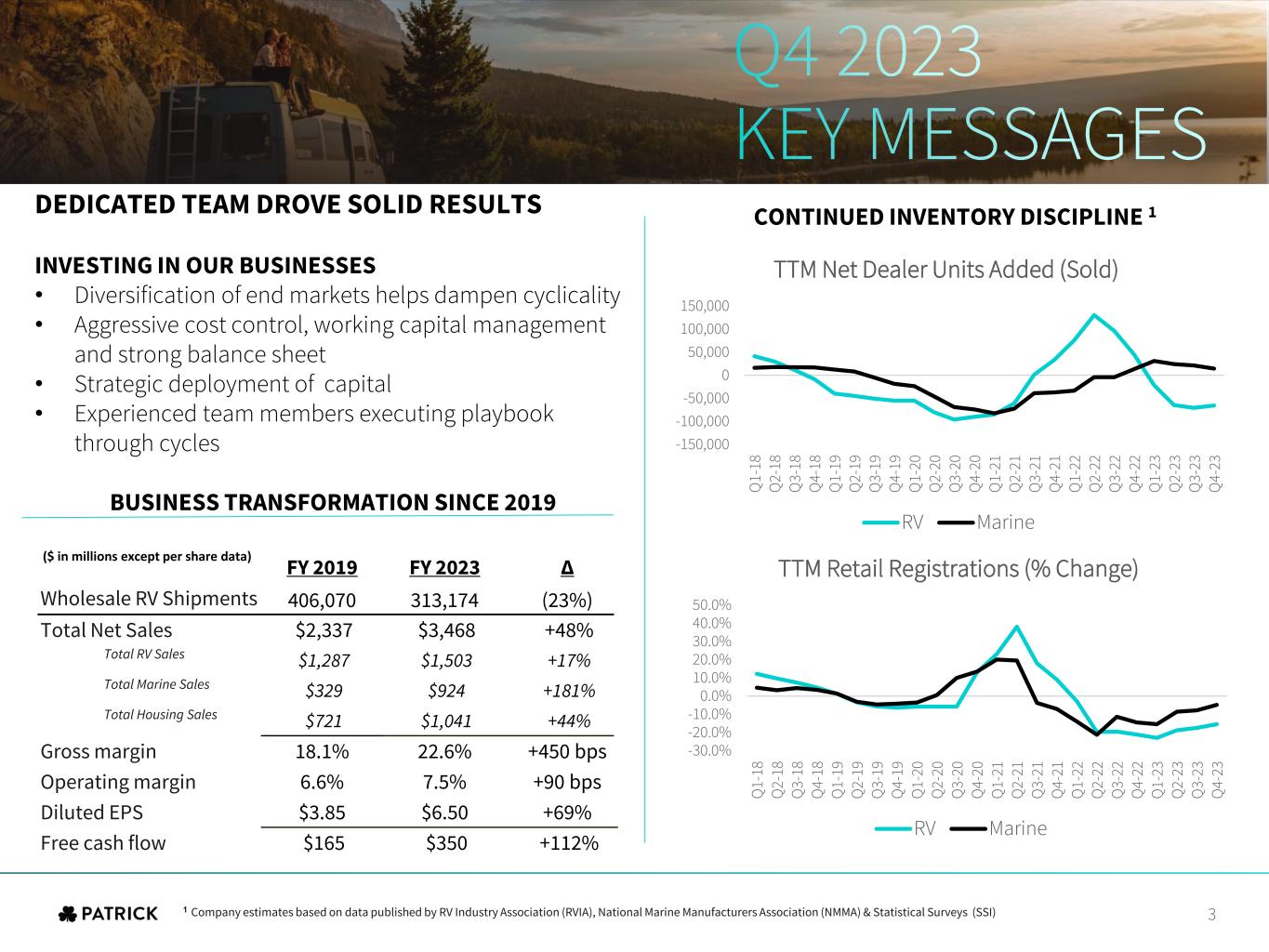

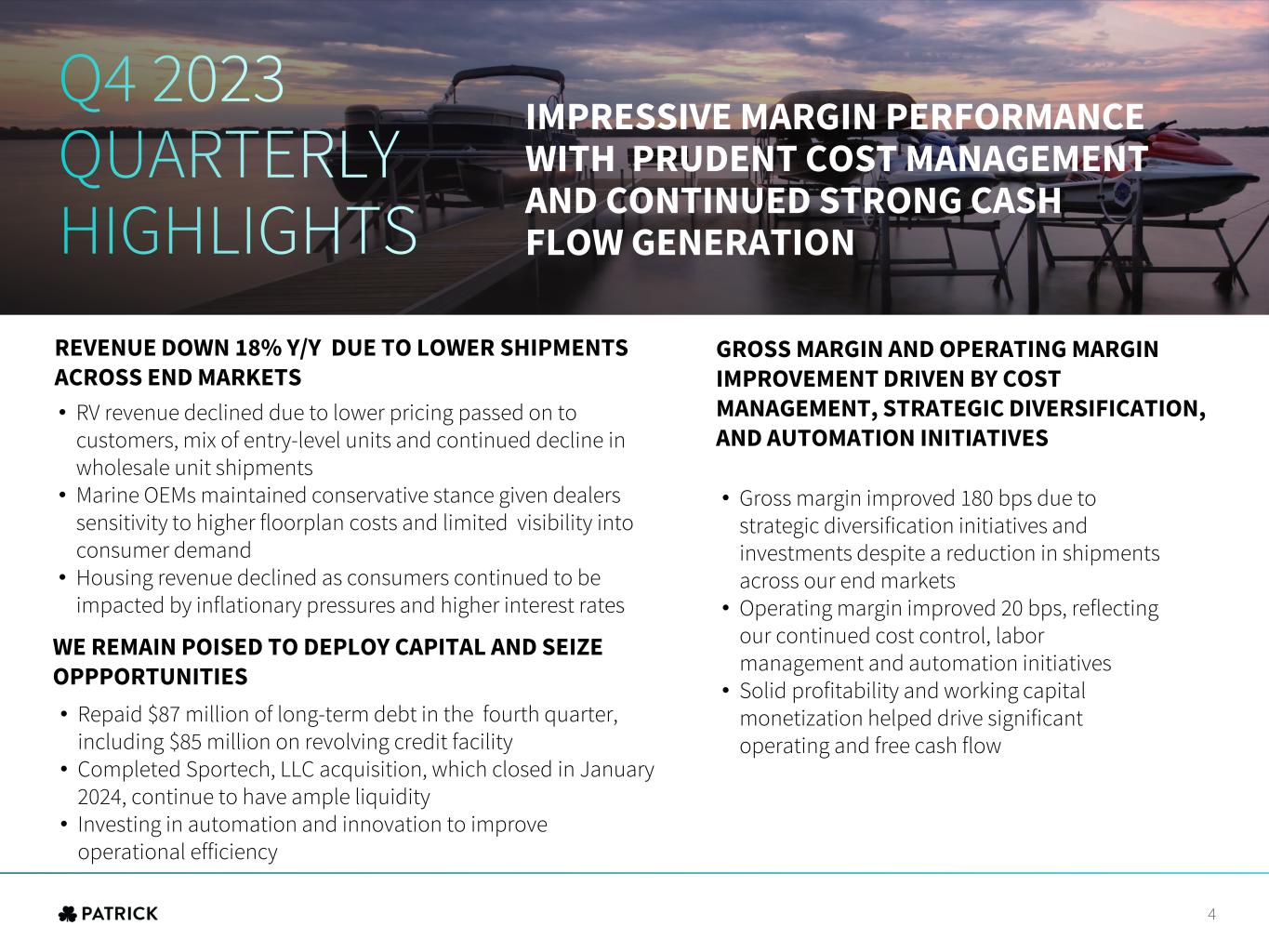

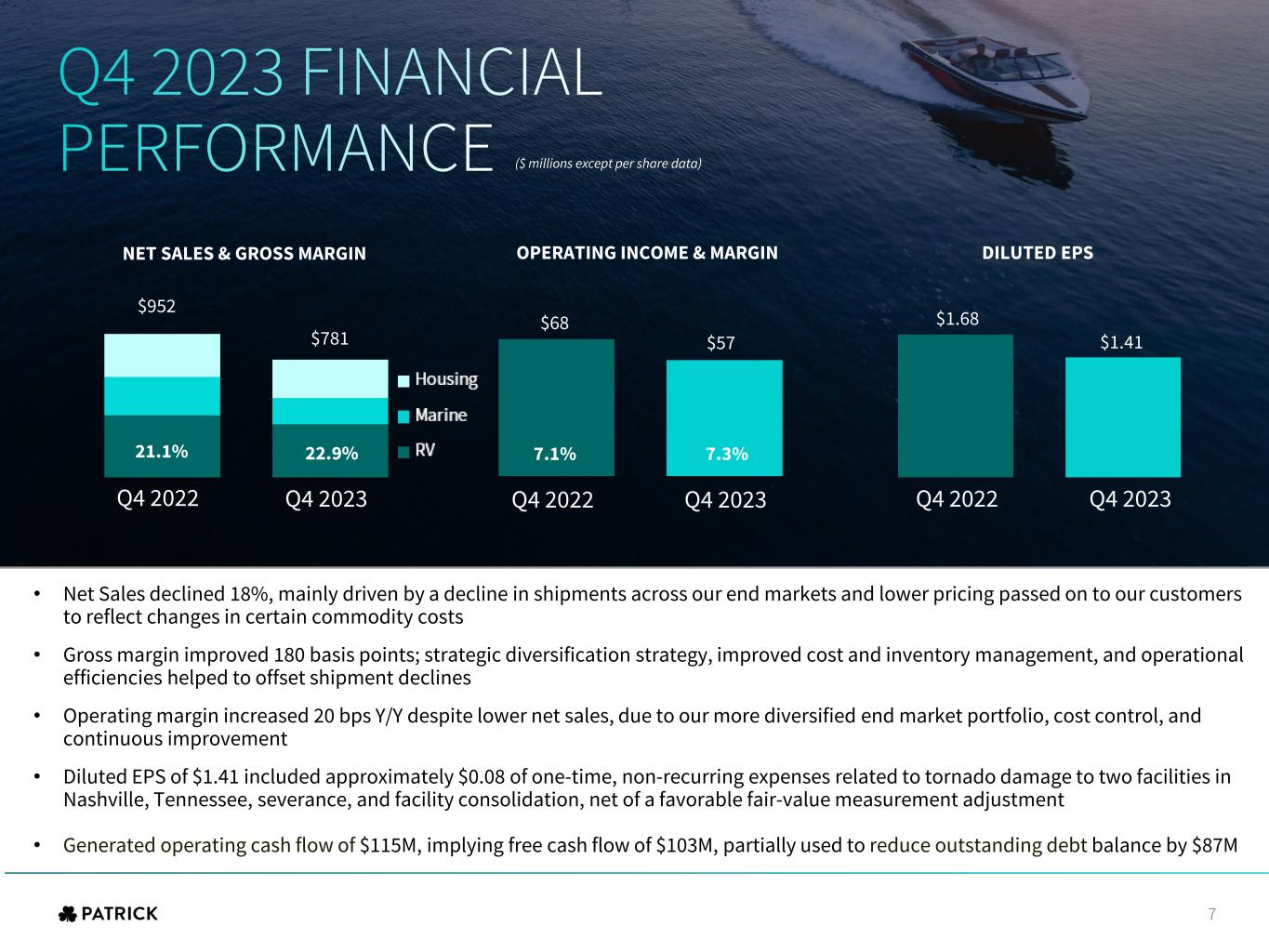

•Fourth quarter net sales of $781 million decreased 18% as a result of lower OEM wholesale unit shipments in our end markets and lower pricing passed on to our customers to reflect changes in certain commodity costs.

•Fourth quarter and full year 2023 diluted earnings per share (EPS) was $1.41 and $6.50, respectively. Fourth quarter and full year 2023 EPS included approximately $0.08 and $0.21, respectively, of one-time, non-recurring expenses related to tornado damage, severance, and facility consolidations, net of a favorable fair-value measurement adjustment.

•Operating margin for the fourth quarter improved 20 basis points to 7.3%, reflecting the continued benefits of our diversification strategy, successful labor management and cost control, and continuous improvement and automation initiatives.

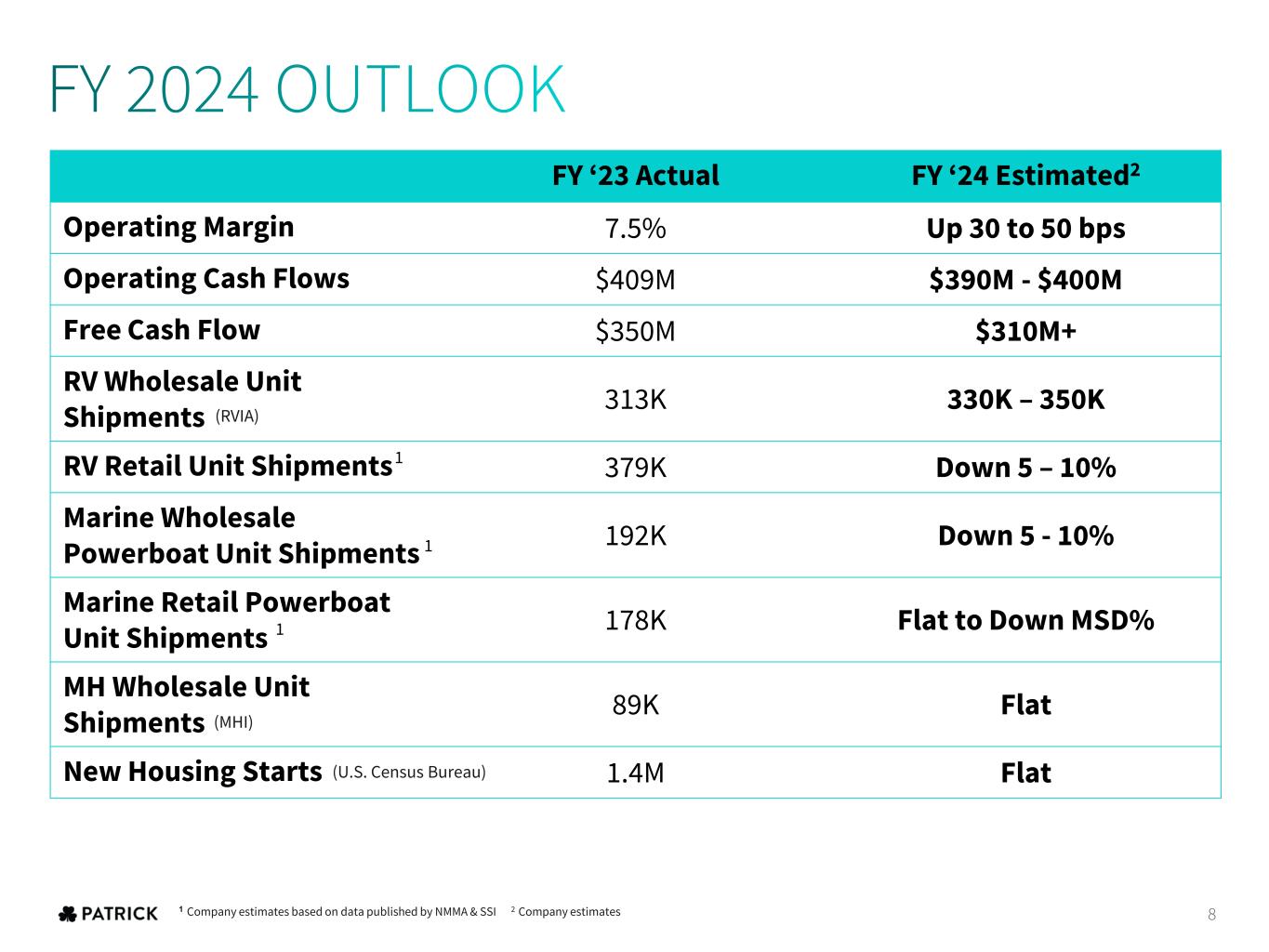

•Achieved full year 2023 operating margin of 7.5%.

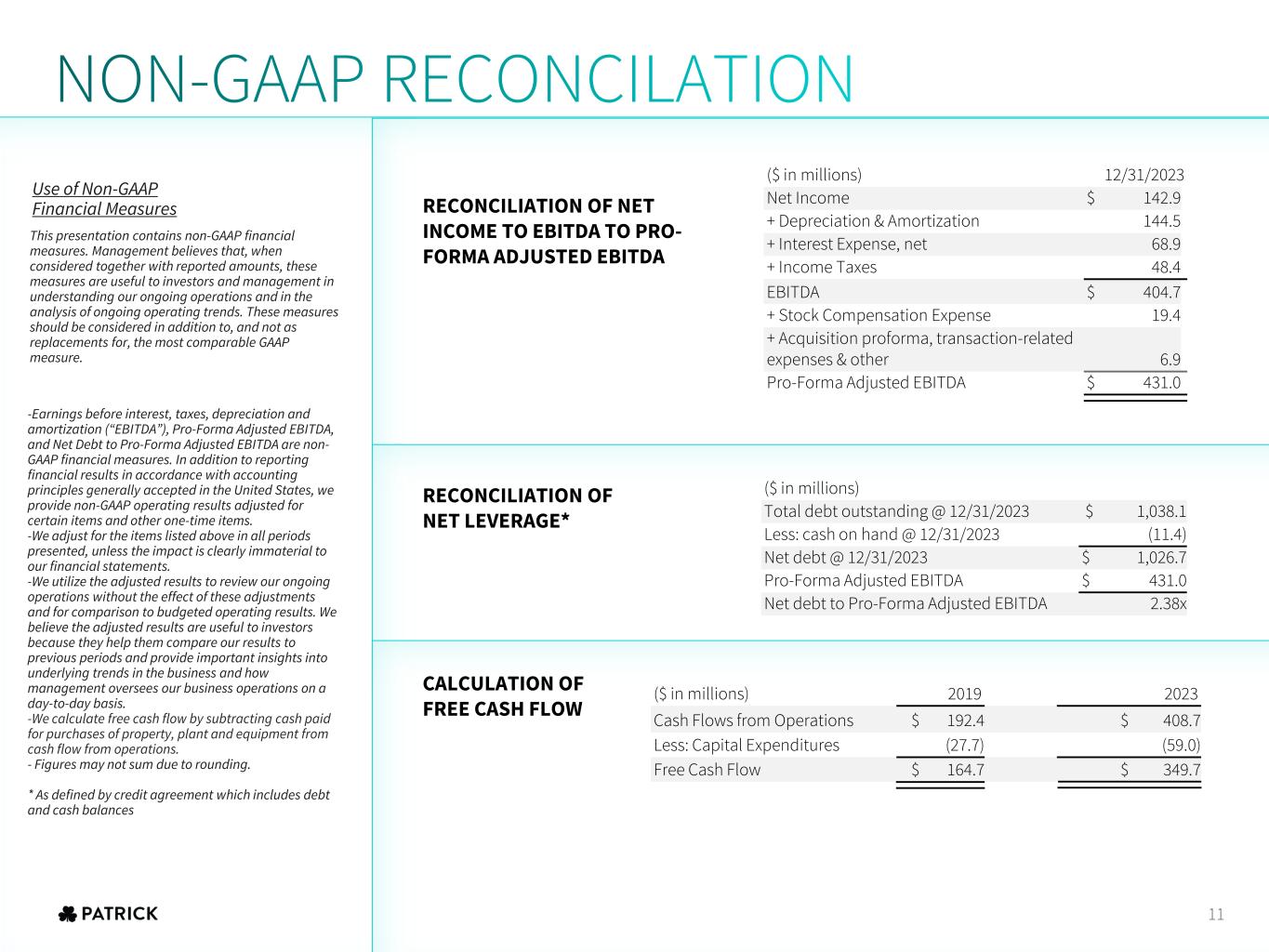

•Fourth quarter adjusted EBITDA of $100 million decreased 8%, while fourth quarter adjusted EBITDA margin increased 140 basis points to 12.8%; full year 2023 adjusted EBITDA of $425 million decreased 34%, while full year 2023 adjusted EBITDA margin decreased 100 basis points to 12.2%.

•Inventory reduction of $158 million from year-end 2022.

•Cash provided by operations for full year 2023 was $409 million versus $412 million for 2022; free cash flow for 2023 was $350 million, an increase of 5% compared to $332 million for 2022.

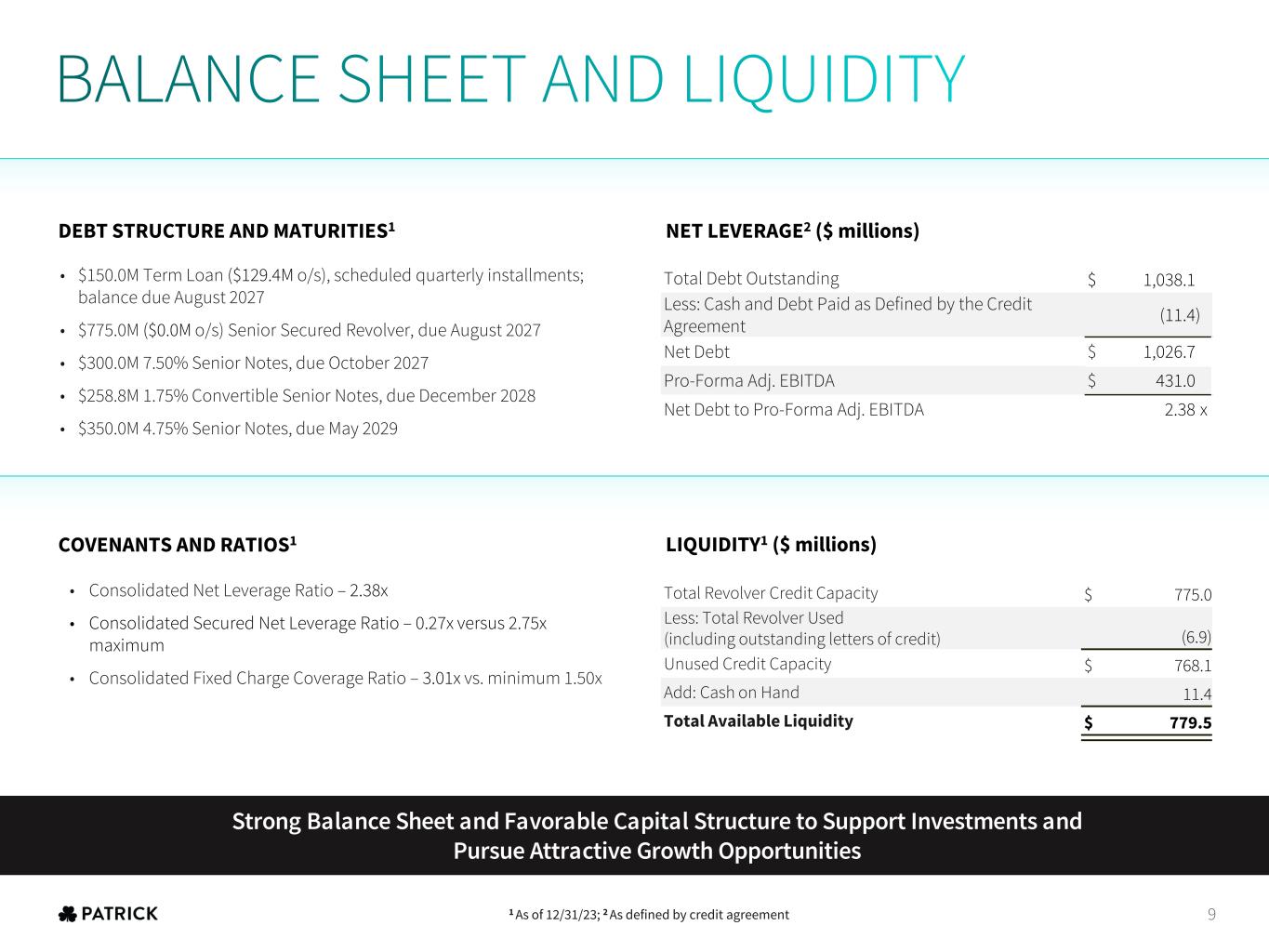

•Repaid $260 million of debt during the year, resulting in total net leverage of 2.4x and total available liquidity of $780 million at year-end 2023. Returned $61 million to shareholders in 2023 in the form of stock repurchases and dividends.

•Completed the acquisition of Sportech, LLC in January 2024, representing our largest acquisition to date.

ELKHART, IN, February 8, 2024 – Patrick Industries, Inc. (NASDAQ: PATK) ("Patrick" or the "Company"), a leading component solutions provider for the Outdoor Enthusiast and Housing markets, today reported financial results for the fourth quarter and year ended December 31, 2023.

Fourth quarter net sales decreased 18%, to $781 million from $952 million in the fourth quarter of 2022. The decline in revenue was primarily due to the impact on our business from lower OEM wholesale unit shipments across our end markets during the period and lower pricing passed on to our customers to reflect changes in certain commodity costs.

Operating income of $57 million decreased $11 million, or 15%, from $68 million in the fourth quarter of 2022. The decline was the result of lower sales, partially offset by cost reduction efforts. Operating margin of 7.3% increased 20 basis points compared to 7.1% in the same period a year ago due to our team's execution of cost savings initiatives, successful labor management, automation, continuous improvement and investments to strategically diversify our business through margin accretive acquisitions. These were partially offset by the higher fixed cost profile of our marine businesses.

Net income was $31 million, a decrease of 23%, compared to $40 million in the same period of 2022. Diluted earnings per share was $1.41, a decrease of 16% compared to $1.68. Fourth quarter 2023 diluted earnings per share included approximately $0.08 of one-time, non-recurring expenses related to tornado damage to two of our facilities in Nashville, Tennessee in December, severance, and facility consolidations, net of a favorable fair-value measurement adjustment. Adjusted EBITDA was $100 million in the quarter, a decline of 8%, while adjusted EBITDA margin increased 140 basis points to 12.8% versus the prior year period.

"I am extremely proud of our team's achievements throughout 2023 as they relentlessly focused on driving and delivering strong results in the face of challenging market conditions, with an unwavering commitment to our goal to be the supplier of choice to OEMs in the Outdoor Enthusiast and Housing markets," said Andy Nemeth, Chief Executive Officer. "Our team performed impressively, despite RV wholesale unit shipments hitting 10-year lows in 2023 and emerging marine headwinds that resulted in an almost 30% decline in marine wholesale shipment run rates in the second half of 2023 compared with the first half of the year. We executed on delivering strong free cash flows through disciplined cost control and prudent working capital management, while continuing to strengthen our financial foundation by repaying $260 million of debt in 2023, and reducing our inventory by $158 million. Our strong liquidity has enabled us to remain nimble and act decisively to take advantage of strategic opportunities, including investments like our recent acquisition of Sportech in January 2024. Our strategic diversification initiatives have enhanced our profitability despite cyclical pressures and we expect to see improved performance when demand recovers."

Jeff Rodino, President – RV, said, "We have continued to invest in our platform to ensure we remain focused on our goal of delivering the highest quality and service while actively listening to the voice of the customer. The recent creation of our Advanced Products Evolution Group, our continued investments in automation, AI, robotic learning, IT, and software solutions, represent our commitment to continuously improve our customer focused model, as well as our financial and structural processes, further enabling us to drive long-term benefits that support future growth."

Fourth Quarter 2023 Revenue by Market Sector (compared to Fourth Quarter 2022 unless otherwise noted)

RV (45% of Revenue)

•Revenue of $353 million decreased 14% while wholesale RV industry unit shipments decreased 3%

•Full year content per wholesale RV unit decreased 9% to $4,800

Marine (22% of Revenue)

•Revenue of $174 million decreased 32% while estimated wholesale powerboat industry unit shipments decreased 24%

•Full year estimated content per wholesale powerboat unit decreased 5% to $4,803

Housing (33% of Revenue, comprised of Manufactured Housing ("MH") and Industrial)

•Revenue of $254 million decreased 11%; wholesale MH industry unit shipments decreased 2%; total housing starts increased 2%, with single-family housing starts increasing 22% and multifamily housing starts decreasing 27%

•Full year MH content per wholesale MH unit increased 2% to $6,372

Full Year 2023 Results

Net sales of $3.5 billion decreased 29% from a record $4.9 billion in 2022, reflecting the impact of a 37% decline in RV wholesale unit shipments during the year, a 7% decline in estimated marine wholesale unit shipments, a 21% decline in MH wholesale unit shipments, and a 9% decline in new housing starts as inflation and interest rates weighed on demand.

Operating income of $260 million decreased 48%, compared to $496 million in 2022. Operating margin of 7.5% declined 270 basis points from 10.2% in the prior year. Net income of $143 million decreased 56% compared to $328 million in 2022. Diluted earnings per share of $6.50 decreased 52% compared to $13.49 in the prior year. Diluted earnings per share in 2023 included approximately $0.21 of one-time, non-recurring expenses related to tornado damage to our facilities in Nashville, Tennessee in December, severance, and facility consolidations, net of a favorable fair-value measurement adjustment. Adjusted EBITDA for full year 2023 was $425 million, decreasing 34% from 2022.

Balance Sheet, Cash Flow and Capital Allocation

Cash provided by operations for the full year 2023 was $409 million versus $412 million in 2022, as our monetization of working capital largely offset the year-over-year decrease in net income. Purchases of property, plant and equipment for full year 2023 totaled $59 million, reflecting continued investments in automation and technology initiatives in support of scalable growth. For the full year 2023, business acquisitions totaled $26 million, primarily related to the acquisition of Patrick Marine Transport in the second quarter. Free cash flow in 2023 was $350 million, an increase of 5% compared to $332 million in 2022.

In alignment with our capital allocation strategy, we returned $19 million to shareholders in the fourth quarter of 2023, consisting of $7 million in opportunistic repurchases of approximately 90,800 shares and $12 million in dividends. For the full year, we repurchased approximately 276,800 shares for a total of $19 million and returned $42 million in dividends to our shareholders.

We repaid long-term debt of approximately $260 million in 2023. Our total debt at the end of the quarter was approximately $1.0 billion, resulting in a total net leverage ratio of 2.4x (as calculated in accordance with our credit agreement). Available liquidity, comprised of borrowing availability under our credit facility and cash on hand, was approximately $780 million. In January 2024, we completed the $315 million acquisition of Sportech, primarily funded by borrowings under our credit facility.

Business Outlook and Summary

"In the face of a challenging environment, our team members demonstrated our BETTER Together values, prioritizing improving our customer service, meeting our customers' needs and managing in alignment with their dynamic production schedules while also focusing on our financial strength through initiatives including debt reduction, prudent working capital and cost management, and realized operational efficiencies," continued Mr. Nemeth. "We are confident in the long-term growth potential of our business and remain optimistic that we will begin to see improvement in our end markets this year, starting with the RV market. Our recent acquisition of Sportech, with a focus on the attractive utility and premium off-road vehicle segment of the Powersports market, provides us with another solid platform for future organic and strategic growth. Sportech enables us to further accelerate our momentum within the attractive Outdoor Enthusiast space, and we continue to see the potential to expand our total addressable market, furthering our strategic diversification. Looking ahead to 2024 with our strong capital structure and liquidity position, nimble business model, and focus on delivering the highest level of customer service, we remain ready to flex our business both for challenges and opportunities and drive profitable long-term growth."

Quarterly Cash Dividend

On February 5, 2024, the Company's Board of Directors declared a quarterly cash dividend of $0.55 per share of common stock. The dividend is payable on March 4, 2024, to shareholders of record at the close of business on February 20, 2024.

Conference Call Webcast

As previously announced, Patrick Industries will host an online webcast of its fourth quarter 2023 earnings conference call that can be accessed on the Company’s website, www.patrickind.com, under “For Investors,” on Thursday, February 8, 2024 at 10:00 a.m. Eastern time. In addition, a supplemental earnings presentation can be accessed on the Company’s website, www.patrickind.com under “For Investors.”

About Patrick Industries, Inc.

Patrick Industries (NASDAQ: PATK) is a leading component solutions provider for the RV, Marine, Powersports and Housing markets. Founded in 1959, Patrick is based in Elkhart, Indiana, employing approximately 10,000 team members throughout the United States.

Cautionary Statement Regarding Forward-Looking Statements

This press release contains certain statements related to future results, our intentions, beliefs and expectations or predictions for the future, which are forward-looking statements as that term is defined in the Private Securities Litigation Reform Act of 1995. These forward-looking statements involve a number of risks and uncertainties that could cause actual results to differ materially from either historical or anticipated results depending on a variety of factors. Potential factors that could impact results include: the effects of external macroeconomic factors, including adverse developments in world financial markets, disruptions related to tariffs and other trade issues, and global supply chain interruptions; adverse economic and business conditions, including inflationary pressures, cyclicality and seasonality in the industries we sell our products; the effects of interest rate changes and other monetary and market fluctuations; the deterioration of the financial condition of our customers or suppliers; the ability to adjust our production schedules up or down quickly in response to rapid changes in demand; the loss of a significant customer; changes in consumer preferences; pricing pressures due to competition; conditions in the credit market limiting the ability of consumers and wholesale customers to obtain retail and wholesale financing for RVs, manufactured homes, and marine products; public health emergencies or pandemics, such as the COVID-19 pandemic; the imposition of, or changes in, restrictions and taxes on imports of raw materials and components used in our products; information technology performance and security, including our ability to deter cyberattacks or other information security incidents; any increased cost or limited availability of certain raw materials; the impact of governmental and environmental regulations, and our inability to comply with them; our level of indebtedness; the ability to remain in compliance with our credit agreement covenants; the availability and costs of labor and production facilities and the impact of labor shortages; inventory levels of retailers and manufacturers; the ability to manage working capital, including inventory and inventory obsolescence; the ability to generate cash flow or obtain financing to fund growth; future growth rates in the Company's core businesses; realization and impact of efficiency improvements and cost reductions; the successful integration of acquisitions and other growth initiatives; increases in interest rates and oil and gasoline prices; the ability to retain key executive and management personnel; the impact on our business resulting from wars and military conflicts such as war in Ukraine and evolving conflict in Israel, Gaza and Syria, and throughout the Middle East; natural disasters or other unforeseen events, and adverse weather conditions.

There can be no assurance that any forward-looking statement will be realized or that actual results will not be significantly different from that set forth in such forward-looking statement. Information about certain risks that could affect our business and cause actual results to differ from those expressed or implied in the forward-looking statements are contained in the section entitled “Risk Factors” in the Company’s Annual Report on Form 10-K for the year ended December 31, 2022, and in the Company's Forms 10-Q for subsequent quarterly periods, which are filed with the Securities and Exchange Commission (“SEC”) and are available on the SEC’s website at www.sec.gov. In addition, future dividends are subject to Board approval. Each forward-looking statement speaks only as of the date of this press release, and we undertake no obligation to update any forward-looking statement to reflect events or circumstances occurring after the date on which it is made.

Contact:

Steve O'Hara

Vice President of Investor Relations

oharas@patrickind.com

574.294.7511

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| PATRICK INDUSTRIES, INC. |

| CONDENSED CONSOLIDATED STATEMENTS OF INCOME (Unaudited) |

|

|

|

|

|

|

|

|

|

Fourth Quarter Ended December 31 |

|

Year Ended December 31 |

| ($ in thousands, except per share data) |

2023 |

|

2022 |

|

2023 |

|

2022 |

|

|

|

|

|

|

|

|

| NET SALES |

$ |

781,187 |

|

|

$ |

951,915 |

|

|

$ |

3,468,045 |

|

|

$ |

4,881,872 |

|

| Cost of goods sold |

602,285 |

|

|

750,877 |

|

|

2,685,812 |

|

|

3,821,934 |

|

| GROSS PROFIT |

178,902 |

|

|

201,038 |

|

|

782,233 |

|

|

1,059,938 |

|

|

|

|

|

|

|

|

|

| Operating Expenses: |

|

|

|

|

|

|

|

| Warehouse and delivery |

34,381 |

|

|

37,813 |

|

|

143,921 |

|

|

163,026 |

|

| Selling, general and administrative |

67,604 |

|

|

76,544 |

|

|

299,418 |

|

|

327,513 |

|

| Amortization of intangible assets |

19,601 |

|

|

19,054 |

|

|

78,694 |

|

|

73,229 |

|

| Total operating expenses |

121,586 |

|

|

133,411 |

|

|

522,033 |

|

|

563,768 |

|

|

|

|

|

|

|

|

|

| OPERATING INCOME |

57,316 |

|

|

67,627 |

|

|

260,200 |

|

|

496,170 |

|

| Interest expense, net |

15,319 |

|

|

15,770 |

|

|

68,942 |

|

|

60,760 |

|

| Income before income taxes |

41,997 |

|

|

51,857 |

|

|

191,258 |

|

|

435,410 |

|

| Income taxes |

11,180 |

|

|

11,677 |

|

|

48,361 |

|

|

107,214 |

|

| NET INCOME |

$ |

30,817 |

|

|

$ |

40,180 |

|

|

$ |

142,897 |

|

|

$ |

328,196 |

|

|

|

|

|

|

|

|

|

| BASIC EARNINGS PER COMMON SHARE |

$ |

1.44 |

|

|

$ |

1.85 |

|

|

$ |

6.64 |

|

|

$ |

14.82 |

|

| DILUTED EARNINGS PER COMMON SHARE |

$ |

1.41 |

|

|

$ |

1.68 |

|

|

$ |

6.50 |

|

|

$ |

13.49 |

|

|

|

|

|

|

|

|

|

| Weighted average shares outstanding - Basic |

21,451 |

|

|

21,771 |

|

|

21,519 |

|

|

22,140 |

|

| Weighted average shares outstanding - Diluted |

21,914 |

|

|

24,191 |

|

|

22,025 |

|

|

24,471 |

|

|

|

|

|

|

|

|

|

|

|

|

|

| PATRICK INDUSTRIES, INC. |

| CONDENSED CONSOLIDATED BALANCE SHEETS (Unaudited) |

|

|

|

|

|

As of December 31 |

| ($ in thousands) |

2023 |

|

2022 |

| ASSETS |

|

|

|

| Current Assets |

|

|

|

| Cash and cash equivalents |

$ |

11,409 |

|

|

$ |

22,847 |

|

| Trade receivables, net |

163,838 |

|

|

172,890 |

|

| Inventories |

510,133 |

|

|

667,841 |

|

| Prepaid expenses and other |

49,251 |

|

|

46,326 |

|

| Total current assets |

734,631 |

|

|

909,904 |

|

| Property, plant and equipment, net |

353,625 |

|

|

350,572 |

|

| Operating lease right-of-use assets |

177,717 |

|

|

163,674 |

|

| Goodwill and intangible assets, net |

1,288,546 |

|

|

1,349,493 |

|

| Other non-current assets |

7,929 |

|

|

8,828 |

|

| TOTAL ASSETS |

$ |

2,562,448 |

|

|

$ |

2,782,471 |

|

|

|

|

|

| LIABILITIES AND SHAREHOLDERS’ EQUITY |

|

|

|

| Current Liabilities |

|

|

|

| Current maturities of long-term debt |

$ |

7,500 |

|

|

$ |

7,500 |

|

| Current operating lease liabilities |

48,761 |

|

|

44,235 |

|

| Accounts payable |

140,524 |

|

|

142,910 |

|

| Accrued liabilities |

111,711 |

|

|

172,595 |

|

| Total current liabilities |

308,496 |

|

|

367,240 |

|

| Long-term debt, less current maturities, net |

1,018,356 |

|

|

1,276,149 |

|

| Long-term operating lease liabilities |

132,444 |

|

|

122,471 |

|

| Deferred tax liabilities, net |

46,724 |

|

|

48,392 |

|

| Other long-term liabilities |

11,091 |

|

|

13,050 |

|

| TOTAL LIABILITIES |

1,517,111 |

|

|

1,827,302 |

|

|

|

|

|

| TOTAL SHAREHOLDERS’ EQUITY |

$ |

1,045,337 |

|

|

$ |

955,169 |

|

|

|

|

|

| TOTAL LIABILITIES AND SHAREHOLDERS’ EQUITY |

$ |

2,562,448 |

|

|

$ |

2,782,471 |

|

PATRICK INDUSTRIES, INC.

CONDENSED CONSOLIDATED STATEMENTS OF CASH FLOWS (Unaudited)

|

|

|

|

|

|

|

|

|

|

|

|

|

Year Ended December 31 |

| ($ in thousands) |

2023 |

|

2022 |

| CASH FLOWS FROM OPERATING ACTIVITIES |

|

|

|

| Net income |

$ |

142,897 |

|

|

$ |

328,196 |

|

| Depreciation and amortization |

144,543 |

|

|

130,757 |

|

| Amortization of convertible notes debt discount |

1,072 |

|

|

1,851 |

|

| Stock-based compensation expense |

19,429 |

|

|

21,751 |

|

| Other adjustments to reconcile net income to net cash provided by operating activities |

1,836 |

|

|

(10,124) |

|

| Change in operating assets and liabilities, net of acquisitions of businesses |

98,895 |

|

|

(60,693) |

|

| Net cash provided by operating activities |

408,672 |

|

|

411,738 |

|

| CASH FLOWS FROM INVESTING ACTIVITIES |

|

|

|

| Capital expenditures |

(58,987) |

|

|

(79,883) |

|

| Business acquisitions and other investing activities |

(27,558) |

|

|

(241,584) |

|

| Net cash used in investing activities |

(86,545) |

|

|

(321,467) |

|

| NET CASH FLOWS USED IN FINANCING ACTIVITIES |

(333,565) |

|

|

(190,273) |

|

| Decrease in cash and cash equivalents |

(11,438) |

|

|

(100,002) |

|

| Cash and cash equivalents at beginning of year |

22,847 |

|

|

122,849 |

|

| Cash and cash equivalents at end of year |

$ |

11,409 |

|

|

$ |

22,847 |

|

PATRICK INDUSTRIES, INC.

Earnings Per Common Share (Unaudited)

The table below illustrates the calculation for diluted share count which shows the dilutive impact of the adoption of ASU 2020-06 on our 1.00% convertible notes due 2023 as mentioned above:

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| |

|

Fourth Quarter Ended December 31 |

|

Year Ended December 31 |

| ($ in thousands, except per share data) |

|

2023 |

|

2022 |

|

2023 |

|

2022 |

| Numerator: |

|

|

|

|

|

|

|

|

| Earnings for basic per share calculation |

|

$ |

30,817 |

|

|

$ |

40,180 |

|

|

$ |

142,897 |

|

|

$ |

328,196 |

|

| Effect of interest on potentially dilutive convertible notes, net of tax |

|

— |

|

|

510 |

|

|

162 |

|

|

1,927 |

|

| Earnings for dilutive per share calculation |

|

$ |

30,817 |

|

|

$ |

40,690 |

|

|

$ |

143,059 |

|

|

$ |

330,123 |

|

| Denominator: |

|

|

|

|

|

|

|

|

| Weighted average common shares outstanding - basic |

|

21,451 |

|

21,771 |

|

21,519 |

|

22,140 |

| Weighted average impact of potentially dilutive convertible notes |

|

— |

|

|

2,078 |

|

166 |

|

2,059 |

| Weighted average impact of potentially dilutive securities |

|

463 |

|

342 |

|

340 |

|

272 |

| Weighted average common shares outstanding - diluted |

|

21,914 |

|

24,191 |

|

22,025 |

|

24,471 |

| Earnings per common share: |

|

|

|

|

|

|

|

|

| Basic earnings per common share |

|

$ |

1.44 |

|

|

$ |

1.85 |

|

|

$ |

6.64 |

|

|

$ |

14.82 |

|

| Diluted earnings per common share |

|

$ |

1.41 |

|

|

$ |

1.68 |

|

|

$ |

6.50 |

|

|

$ |

13.49 |

|

PATRICK INDUSTRIES, INC.

Non-GAAP Reconciliation (Unaudited)

Use of Non-GAAP Financial Metrics

In addition to reporting financial results in accordance with U.S. GAAP, the Company also provides financial metrics, such as net leverage ratio, content per unit, net debt, free cash flow, earnings before interest, taxes, depreciation and amortization (“EBITDA”), adjusted EBITDA, and available liquidity, which we believe are important measures of the Company's business performance. These metrics should not be considered alternatives to U.S. GAAP. Our computations of net leverage ratio, content per unit, net debt, free cash flow, EBITDA, adjusted EBITDA, and available liquidity may differ from similarly titled measures used by others. We calculate net debt by subtracting cash and cash equivalents from the gross value of debt outstanding. We calculate EBITDA by adding back depreciation and amortization, net interest expense, and income tax expense to net income. We calculate adjusted EBITDA by taking EBITDA and adding back stock-based compensation and loss on sale of property, plant and equipment and subtracting out gain on sale of property, plant and equipment. We calculate free cash flow by subtracting cash paid for purchases of property, plant and equipment from cash flow from operations. RV wholesale unit shipments are provided by the RV Industry Association. Marine wholesale unit shipments are Company estimates based on data provided by the National Marine Manufacturers Association. MH wholesale unit shipments are provided by the Manufactured Housing Institute. Housing starts are provided by the U.S. Census Bureau. You should not consider these metrics in isolation or as substitutes for an analysis of our results as reported under U.S. GAAP.

The following table reconciles net income to EBITDA and Adjusted EBITDA:

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| |

|

Fourth Quarter Ended December 31 |

|

Year Ended December 31 |

| ($ in thousands) |

|

2023 |

|

2022 |

|

2023 |

|

2022 |

| Net income |

|

$ |

30,817 |

|

|

$ |

40,180 |

|

|

$ |

142,897 |

|

|

$ |

328,196 |

|

| + Depreciation & amortization |

|

36,567 |

|

|

34,501 |

|

|

144,543 |

|

|

130,757 |

|

| + Interest expense, net |

|

15,319 |

|

|

15,770 |

|

|

68,942 |

|

|

60,760 |

|

| + Income taxes |

|

11,180 |

|

|

11,677 |

|

|

48,361 |

|

|

107,214 |

|

| EBITDA |

|

93,883 |

|

|

102,128 |

|

|

404,743 |

|

|

626,927 |

|

| + Stock based compensation |

|

5,754 |

|

|

6,155 |

|

|

19,429 |

|

|

21,751 |

|

| + (Gain) loss on sale of property, plant and equipment |

|

343 |

|

|

153 |

|

|

585 |

|

|

(5,560) |

|

| Adjusted EBITDA |

|

$ |

99,980 |

|

|

$ |

108,436 |

|

|

$ |

424,757 |

|

|

$ |

643,118 |

|

The following table reconciles full year cash flow from operations to free cash flow:

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| |

|

Year Ended December 31 |

| ($ in thousands) |

|

2023 |

|

2022 |

| Cash flow from operations |

|

$ |

408,672 |

|

|

$ |

411,738 |

|

| Less: purchases of property, plant and equipment |

|

(58,987) |

|

|

(79,883) |

|

| Free cash flow |

|

$ |

349,685 |

|

|

$ |

331,855 |

|

News Release

News Release