Ohio |

1-4982 | 34-0451060 | ||||||

|

(State or other jurisdiction of

Incorporation or Organization)

|

(Commission File Number) |

(I.R.S. Employer

Identification No.)

|

||||||

6035 Parkland Boulevard, Cleveland, Ohio |

44124-4141 | |||||||

(Address of Principal Executive Offices) |

(Zip Code) |

|||||||

| Title of Each Class | Trading Symbol | Name of Each Exchange on which Registered | ||||||||||||

| Common Shares, $.50 par value | PH | New York Stock Exchange | ||||||||||||

Emerging growth company ☐ | ||

| PARKER-HANNIFIN CORPORATION | |||||||||||

| By: /s/ Todd M. Leombruno | |||||||||||

| Todd M. Leombruno | |||||||||||

| Executive Vice President and Chief Financial Officer | |||||||||||

| Date: | May 2, 2024 | ||||||||||

| For Release: | Immediately | Exhibit 99.1 | ||||||

| Contact: | Media - | |||||||

| Aidan Gormley - Director, Global Communications and Branding | 216-896-3258 | |||||||

| aidan.gormley@parker.com | ||||||||

| Financial Analysts - | ||||||||

| Jeff Miller - Vice President, Investor Relations | 216-896-2708 | |||||||

| jeffrey.miller@parker.com | ||||||||

| Stock Symbol: | PH - NYSE | |||||||

| PARKER HANNIFIN CORPORATION - MARCH 31, 2024 | Exhibit 99.1 | |||||||||||||||||||||||||

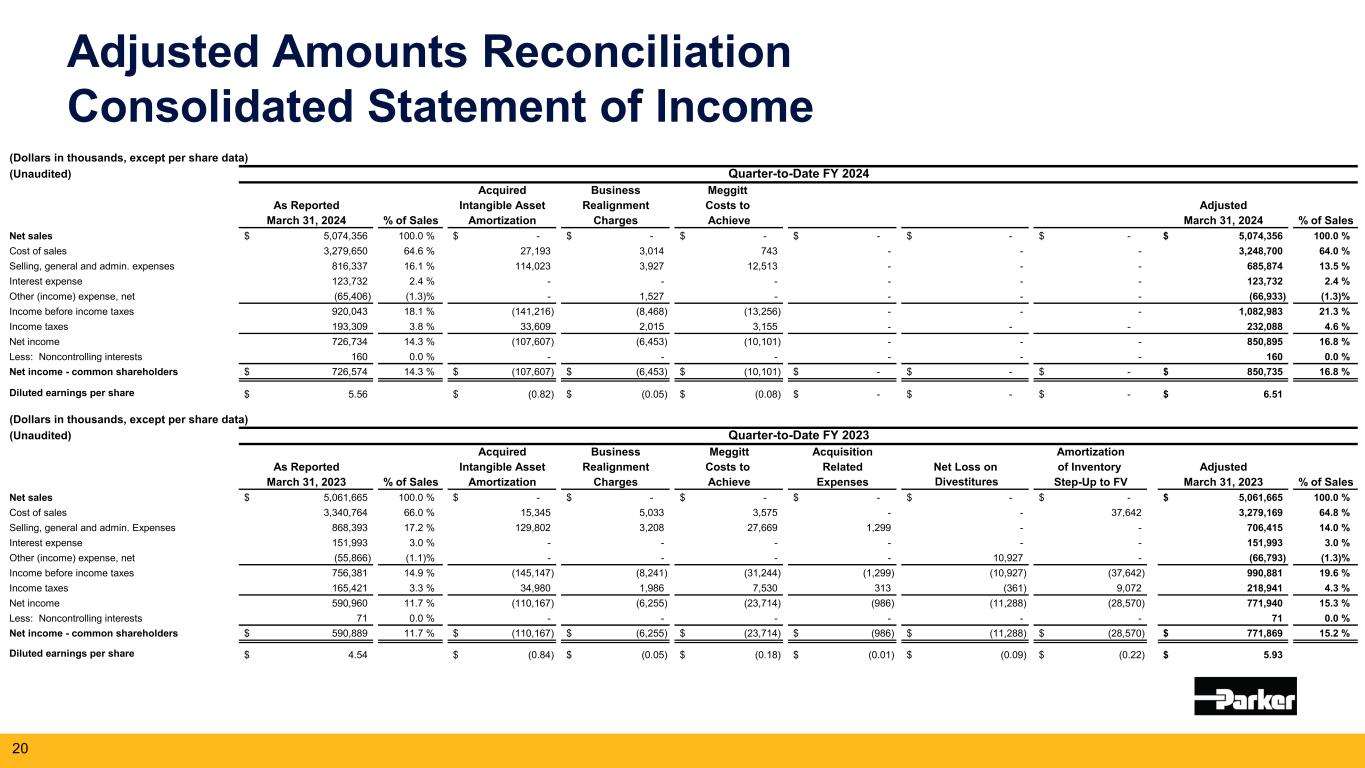

| CONSOLIDATED STATEMENT OF INCOME | ||||||||||||||||||||||||||

| (Unaudited) | Three Months Ended March 31, | Nine Months Ended March 31, | ||||||||||||||||||||||||

| (Dollars in thousands, except per share amounts) | 2024 | 2023 | 2024 | 2023 | ||||||||||||||||||||||

| Net sales | $ | 5,074,356 | $ | 5,061,665 | $ | 14,742,791 | $ | 13,969,251 | ||||||||||||||||||

| Cost of sales | 3,279,650 | 3,340,764 | 9,478,961 | 9,373,032 | ||||||||||||||||||||||

| Selling, general and administrative expenses | 816,337 | 868,393 | 2,496,830 | 2,519,163 | ||||||||||||||||||||||

| Interest expense | 123,732 | 151,993 | 387,229 | 416,718 | ||||||||||||||||||||||

| Other income, net | (65,406) | (55,866) | (228,872) | (116,131) | ||||||||||||||||||||||

| Income before income taxes | 920,043 | 756,381 | 2,608,643 | 1,776,469 | ||||||||||||||||||||||

| Income taxes | 193,309 | 165,421 | 548,780 | 402,011 | ||||||||||||||||||||||

| Net income | 726,734 | 590,960 | 2,059,863 | 1,374,458 | ||||||||||||||||||||||

| Less: Noncontrolling interests | 160 | 71 | 611 | 478 | ||||||||||||||||||||||

| Net income attributable to common shareholders | $ | 726,574 | $ | 590,889 | $ | 2,059,252 | $ | 1,373,980 | ||||||||||||||||||

| Earnings per share attributable to common shareholders: | ||||||||||||||||||||||||||

| Basic earnings per share | $ | 5.65 | $ | 4.61 | $ | 16.03 | $ | 10.71 | ||||||||||||||||||

| Diluted earnings per share | $ | 5.56 | $ | 4.54 | $ | 15.82 | $ | 10.58 | ||||||||||||||||||

| Average shares outstanding during period - Basic | 128,502,829 | 128,293,039 | 128,467,209 | 128,343,788 | ||||||||||||||||||||||

| Average shares outstanding during period - Diluted | 130,593,026 | 130,151,487 | 130,169,331 | 129,831,989 | ||||||||||||||||||||||

| CASH DIVIDENDS PER COMMON SHARE | ||||||||||||||||||||||||||

| (Unaudited) | Three Months Ended March 31, | Nine Months Ended March 31, | ||||||||||||||||||||||||

| (Amounts in dollars) | 2024 | 2023 | 2024 | 2023 | ||||||||||||||||||||||

| Cash dividends per common share | $ | 1.48 | $ | 1.33 | $ | 4.44 | $ | 3.99 | ||||||||||||||||||

| RECONCILIATION OF ORGANIC GROWTH | ||||||||||||||||||||||||||

| (Unaudited) | Three Months Ended March 31, | Nine Months Ended March 31, | ||||||||||||||||||||||||

| 2024 | 2023 | 2024 | 2023 | |||||||||||||||||||||||

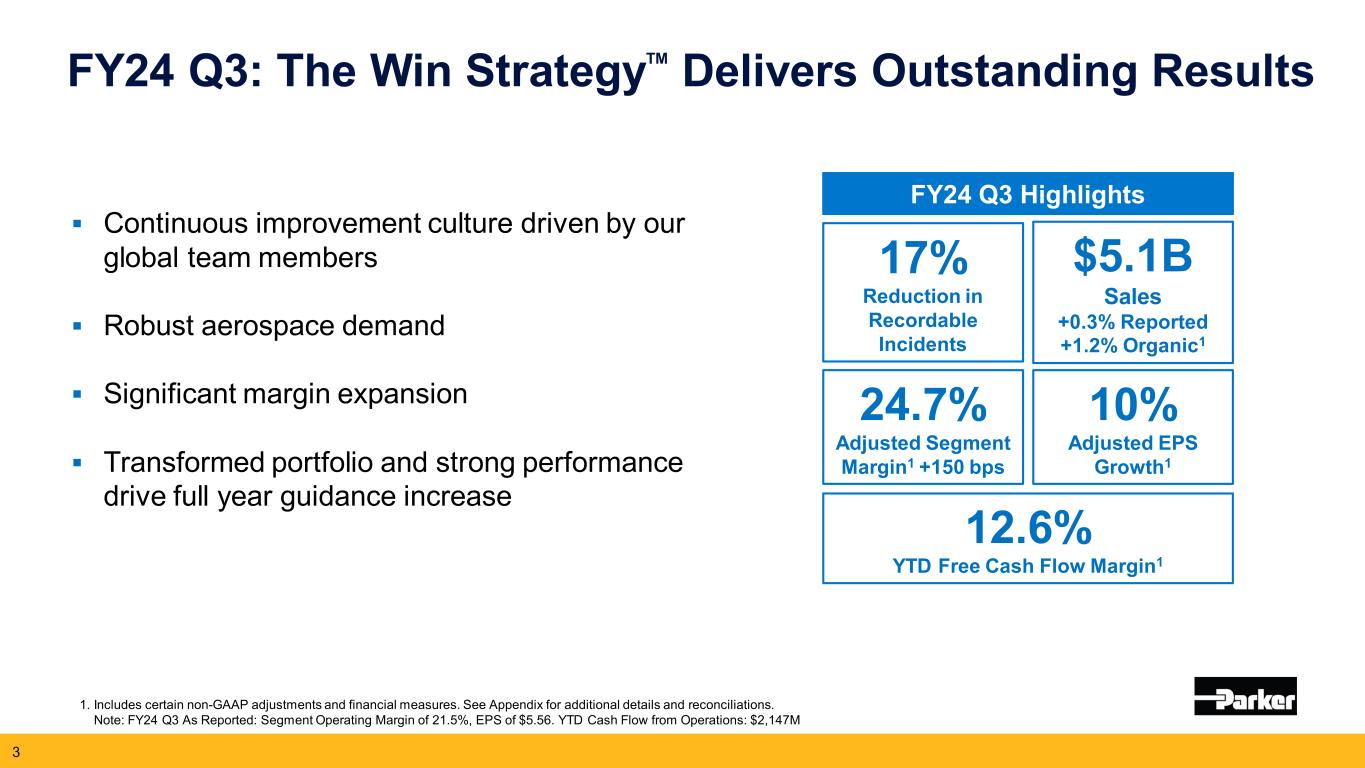

| Sales growth - as reported | 0.3 | % | 23.9 | % | 5.5 | % | 19.7 | % | ||||||||||||||||||

| Adjustments: | ||||||||||||||||||||||||||

| Acquisitions | — | % | 15.3 | % | 3.6 | % | 12.0 | % | ||||||||||||||||||

| Divestitures | (0.3) | % | (0.5) | % | (0.4) | % | (0.4) | % | ||||||||||||||||||

| Currency | (0.6) | % | (2.4) | % | 0.2 | % | (3.9) | % | ||||||||||||||||||

| Organic sales growth | 1.2 | % | 11.5 | % | 2.1 | % | 12.0 | % | ||||||||||||||||||

| PARKER HANNIFIN CORPORATION - MARCH 31, 2024 | Exhibit 99.1 | |||||||||||||||||||||||||

| RECONCILIATION OF NET INCOME ATTRIBUTABLE TO COMMON SHAREHOLDERS TO ADJUSTED NET INCOME ATTRIBUTABLE TO COMMON SHAREHOLDERS | ||||||||||||||||||||||||||

| (Unaudited) | Three Months Ended March 31, | Nine Months Ended March 31, | ||||||||||||||||||||||||

| (Dollars in thousands) | 2024 | 2023 | 2024 | 2023 | ||||||||||||||||||||||

| Net income attributable to common shareholders | $ | 726,574 | $ | 590,889 | $ | 2,059,252 | $ | 1,373,980 | ||||||||||||||||||

| Adjustments: | ||||||||||||||||||||||||||

| Acquired intangible asset amortization expense | 141,216 | 145,147 | 438,763 | 374,417 | ||||||||||||||||||||||

| Business realignment charges | 8,468 | 8,241 | 35,914 | 17,480 | ||||||||||||||||||||||

| Integration costs to achieve | 13,256 | 31,244 | 29,676 | 76,653 | ||||||||||||||||||||||

| Acquisition-related expenses | — | 1,299 | — | 163,540 | ||||||||||||||||||||||

| Loss on deal-contingent forward contracts | — | — | — | 389,992 | ||||||||||||||||||||||

| Net loss (gain) on divestitures | — | 10,927 | (25,651) | (362,003) | ||||||||||||||||||||||

| Amortization of inventory step-up to fair value | — | 37,642 | — | 167,973 | ||||||||||||||||||||||

Tax effect of adjustments1 |

(38,779) | (53,520) | (108,403) | (195,766) | ||||||||||||||||||||||

| Adjusted net income attributable to common shareholders | $ | 850,735 | $ | 771,869 | $ | 2,429,551 | $ | 2,006,266 | ||||||||||||||||||

| RECONCILIATION OF EARNINGS PER DILUTED SHARE TO ADJUSTED EARNINGS PER DILUTED SHARE | ||||||||||||||||||||||||||

| (Unaudited) | Three Months Ended March 31, | Nine Months Ended March 31, | ||||||||||||||||||||||||

| (Amounts in dollars) | 2024 | 2023 | 2024 | 2023 | ||||||||||||||||||||||

| Earnings per diluted share | $ | 5.56 | $ | 4.54 | $ | 15.82 | $ | 10.58 | ||||||||||||||||||

| Adjustments: | ||||||||||||||||||||||||||

| Acquired intangible asset amortization expense | 1.08 | 1.12 | 3.36 | 2.88 | ||||||||||||||||||||||

| Business realignment charges | 0.06 | 0.06 | 0.27 | 0.13 | ||||||||||||||||||||||

| Integration costs to achieve | 0.10 | 0.24 | 0.23 | 0.59 | ||||||||||||||||||||||

| Acquisition-related expenses | — | 0.01 | — | 1.27 | ||||||||||||||||||||||

| Loss on deal-contingent forward contracts | — | — | — | 3.00 | ||||||||||||||||||||||

| Net loss (gain) on divestitures | — | 0.09 | (0.20) | (2.78) | ||||||||||||||||||||||

| Amortization of inventory step-up to fair value | — | 0.29 | — | 1.29 | ||||||||||||||||||||||

Tax effect of adjustments1 |

(0.29) | (0.42) | (0.82) | (1.51) | ||||||||||||||||||||||

| Adjusted earnings per diluted share | $ | 6.51 | $ | 5.93 | $ | 18.66 | $ | 15.45 | ||||||||||||||||||

1This line item reflects the aggregate tax effect of all non-tax adjustments reflected in the preceding line items of the table. We estimate the tax effect of each adjustment item by applying our overall effective tax rate for continuing operations to the pre-tax amount, unless the nature of the item and/or the tax jurisdiction in which the item has been recorded requires application of a specific tax rate or tax treatment, in which case the tax effect of such item is estimated by applying such specific tax rate or tax treatment. | ||||||||||||||||||||||||||

| PARKER HANNIFIN CORPORATION - MARCH 31, 2024 | Exhibit 99.1 | |||||||||||||||||||||||||

| BUSINESS SEGMENT INFORMATION | ||||||||||||||||||||||||||

| (Unaudited) | Three Months Ended March 31, | Nine Months Ended March 31, | ||||||||||||||||||||||||

| (Dollars in thousands) | 2024 | 2023 | 2024 | 2023 | ||||||||||||||||||||||

| Net sales | ||||||||||||||||||||||||||

| Diversified Industrial: | ||||||||||||||||||||||||||

| North America | $ | 2,231,478 | $ | 2,342,590 | $ | 6,571,587 | $ | 6,615,035 | ||||||||||||||||||

| International | 1,434,165 | 1,524,515 | 4,227,057 | 4,277,227 | ||||||||||||||||||||||

| Aerospace Systems | 1,408,713 | 1,194,560 | 3,944,147 | 3,076,989 | ||||||||||||||||||||||

| Total net sales | $ | 5,074,356 | $ | 5,061,665 | $ | 14,742,791 | $ | 13,969,251 | ||||||||||||||||||

| Segment operating income | ||||||||||||||||||||||||||

| Diversified Industrial: | ||||||||||||||||||||||||||

| North America | $ | 490,452 | $ | 489,349 | $ | 1,458,355 | $ | 1,362,256 | ||||||||||||||||||

| International | 309,759 | 329,498 | 900,944 | 908,958 | ||||||||||||||||||||||

| Aerospace Systems | 289,339 | 133,905 | 778,711 | 234,849 | ||||||||||||||||||||||

| Total segment operating income | 1,089,550 | 952,752 | 3,138,010 | 2,506,063 | ||||||||||||||||||||||

| Corporate general and administrative expenses | 56,782 | 45,780 | 162,340 | 146,341 | ||||||||||||||||||||||

| Income before interest expense and other (income) expense, net | 1,032,768 | 906,972 | 2,975,670 | 2,359,722 | ||||||||||||||||||||||

| Interest expense | 123,732 | 151,993 | 387,229 | 416,718 | ||||||||||||||||||||||

| Other (income) expense, net | (11,007) | (1,402) | (20,202) | 166,535 | ||||||||||||||||||||||

| Income before income taxes | $ | 920,043 | $ | 756,381 | $ | 2,608,643 | $ | 1,776,469 | ||||||||||||||||||

| RECONCILIATION OF SEGMENT OPERATING MARGINS TO ADJUSTED SEGMENT OPERATING MARGINS | ||||||||||||||||||||||||||

| (Unaudited) | Three Months Ended March 31, | Nine Months Ended March 31, | ||||||||||||||||||||||||

| (Dollars in thousands) | 2024 | 2023 | 2024 | 2023 | ||||||||||||||||||||||

| Diversified Industrial North America sales | $ | 2,231,478 | $ | 2,342,590 | $ | 6,571,587 | $ | 6,615,035 | ||||||||||||||||||

| Diversified Industrial North America operating income | $ | 490,452 | $ | 489,349 | $ | 1,458,355 | $ | 1,362,256 | ||||||||||||||||||

| Adjustments: | ||||||||||||||||||||||||||

| Acquired intangible asset amortization | 43,945 | 44,184 | 133,327 | 134,816 | ||||||||||||||||||||||

| Business realignment charges | 3,058 | 761 | 8,892 | 2,232 | ||||||||||||||||||||||

| Integration costs to achieve | 841 | 2,442 | 2,348 | 3,759 | ||||||||||||||||||||||

| Adjusted Diversified Industrial North America operating income | $ | 538,296 | $ | 536,736 | $ | 1,602,922 | $ | 1,503,063 | ||||||||||||||||||

| Diversified Industrial North America operating margin | 22.0 | % | 20.9 | % | 22.2 | % | 20.6 | % | ||||||||||||||||||

| Adjusted Diversified Industrial North America operating margin | 24.1 | % | 22.9 | % | 24.4 | % | 22.7 | % | ||||||||||||||||||

| PARKER HANNIFIN CORPORATION - MARCH 31, 2024 | Exhibit 99.1 | |||||||||||||||||||||||||

| RECONCILIATION OF SEGMENT OPERATING MARGINS TO ADJUSTED SEGMENT OPERATING MARGINS | ||||||||||||||||||||||||||

| (Unaudited) | Three Months Ended March 31, | Nine Months Ended March 31, | ||||||||||||||||||||||||

| (Dollars in thousands) | 2024 | 2023 | 2024 | 2023 | ||||||||||||||||||||||

| Diversified Industrial International sales | $ | 1,434,165 | $ | 1,524,515 | $ | 4,227,057 | $ | 4,277,227 | ||||||||||||||||||

| Diversified Industrial International operating income | $ | 309,759 | $ | 329,498 | $ | 900,944 | $ | 908,958 | ||||||||||||||||||

| Adjustments: | ||||||||||||||||||||||||||

| Acquired intangible asset amortization | 22,464 | 17,266 | 68,342 | 50,890 | ||||||||||||||||||||||

| Business realignment charges | 3,895 | 7,314 | 23,985 | 12,232 | ||||||||||||||||||||||

| Integration costs to achieve | 451 | 2,953 | 954 | 3,517 | ||||||||||||||||||||||

| Adjusted Diversified Industrial International operating income | $ | 336,569 | $ | 357,031 | $ | 994,225 | $ | 975,597 | ||||||||||||||||||

| Diversified Industrial International operating margin | 21.6 | % | 21.6 | % | 21.3 | % | 21.3 | % | ||||||||||||||||||

| Adjusted Diversified Industrial International operating margin | 23.5 | % | 23.4 | % | 23.5 | % | 22.8 | % | ||||||||||||||||||

| (Unaudited) | Three Months Ended March 31, | Nine Months Ended March 31, | ||||||||||||||||||||||||

| (Dollars in thousands) | 2024 | 2023 | 2024 | 2023 | ||||||||||||||||||||||

| Aerospace Systems sales | $ | 1,408,713 | $ | 1,194,560 | $ | 3,944,147 | $ | 3,076,989 | ||||||||||||||||||

| Aerospace Systems operating income | $ | 289,339 | $ | 133,905 | $ | 778,711 | $ | 234,849 | ||||||||||||||||||

| Adjustments: | ||||||||||||||||||||||||||

| Acquired intangible asset amortization | 74,807 | 83,697 | 237,094 | 188,711 | ||||||||||||||||||||||

| Business realignment charges | (12) | 166 | 318 | 3,016 | ||||||||||||||||||||||

| Integration costs to achieve | 11,964 | 25,849 | 26,374 | 69,377 | ||||||||||||||||||||||

| Amortization of inventory step-up to fair value | — | 37,642 | — | 167,973 | ||||||||||||||||||||||

| Adjusted Aerospace Systems operating income | $ | 376,098 | $ | 281,259 | $ | 1,042,497 | $ | 663,926 | ||||||||||||||||||

| Aerospace Systems operating margin | 20.5 | % | 11.2 | % | 19.7 | % | 7.6 | % | ||||||||||||||||||

| Adjusted Aerospace Systems operating margin | 26.7 | % | 23.5 | % | 26.4 | % | 21.6 | % | ||||||||||||||||||

| (Unaudited) | Three Months Ended March 31, | Nine Months Ended March 31, | ||||||||||||||||||||||||

| (Dollars in thousands) | 2024 | 2023 | 2024 | 2023 | ||||||||||||||||||||||

| Total net sales | $ | 5,074,356 | $ | 5,061,665 | $ | 14,742,791 | $ | 13,969,251 | ||||||||||||||||||

| Total segment operating income | $ | 1,089,550 | $ | 952,752 | $ | 3,138,010 | $ | 2,506,063 | ||||||||||||||||||

| Adjustments: | ||||||||||||||||||||||||||

| Acquired intangible asset amortization | 141,216 | 145,147 | 438,763 | 374,417 | ||||||||||||||||||||||

| Business realignment charges | 6,941 | 8,241 | 33,195 | 17,480 | ||||||||||||||||||||||

| Integration costs to achieve | 13,256 | 31,244 | 29,676 | 76,653 | ||||||||||||||||||||||

| Amortization of inventory step-up to fair value | — | 37,642 | — | 167,973 | ||||||||||||||||||||||

| Adjusted total segment operating income | $ | 1,250,963 | $ | 1,175,026 | $ | 3,639,644 | $ | 3,142,586 | ||||||||||||||||||

| Total segment operating margin | 21.5 | % | 18.8 | % | 21.3 | % | 17.9 | % | ||||||||||||||||||

| Adjusted total segment operating margin | 24.7 | % | 23.2 | % | 24.7 | % | 22.5 | % | ||||||||||||||||||

| PARKER HANNIFIN CORPORATION - MARCH 31, 2024 | Exhibit 99.1 | |||||||||||||||||||

| CONSOLIDATED BALANCE SHEET | ||||||||||||||||||||

| (Unaudited) | March 31, | June 30, | March 31, | |||||||||||||||||

| (Dollars in thousands) | 2024 | 2023 | 2023 | |||||||||||||||||

| Assets | ||||||||||||||||||||

| Current assets: | ||||||||||||||||||||

| Cash and cash equivalents | $ | 405,484 | $ | 475,182 | $ | 534,831 | ||||||||||||||

| Marketable securities and other investments | 9,968 | 8,390 | 23,466 | |||||||||||||||||

| Trade accounts receivable, net | 2,913,357 | 2,827,297 | 2,881,534 | |||||||||||||||||

| Non-trade and notes receivable | 310,355 | 309,167 | 349,903 | |||||||||||||||||

| Inventories | 2,966,336 | 2,907,879 | 3,067,614 | |||||||||||||||||

| Prepaid expenses and other | 337,055 | 306,314 | 376,066 | |||||||||||||||||

| Total current assets | 6,942,555 | 6,834,229 | 7,233,414 | |||||||||||||||||

| Property, plant and equipment, net | 2,870,919 | 2,865,030 | 2,843,795 | |||||||||||||||||

| Deferred income taxes | 72,808 | 81,429 | 131,782 | |||||||||||||||||

| Investments and other assets | 1,150,784 | 1,104,576 | 1,188,671 | |||||||||||||||||

| Intangible assets, net | 7,961,957 | 8,450,614 | 8,287,517 | |||||||||||||||||

| Goodwill | 10,579,307 | 10,628,594 | 10,830,548 | |||||||||||||||||

| Total assets | $ | 29,578,330 | $ | 29,964,472 | $ | 30,515,727 | ||||||||||||||

| Liabilities and equity | ||||||||||||||||||||

| Current liabilities: | ||||||||||||||||||||

| Notes payable and long-term debt payable within one year | $ | 4,080,759 | $ | 3,763,175 | $ | 1,992,919 | ||||||||||||||

| Accounts payable, trade | 1,964,211 | 2,050,934 | 2,080,147 | |||||||||||||||||

| Accrued payrolls and other compensation | 514,021 | 651,319 | 543,527 | |||||||||||||||||

| Accrued domestic and foreign taxes | 358,061 | 374,571 | 270,807 | |||||||||||||||||

| Other accrued liabilities | 1,077,318 | 895,371 | 900,769 | |||||||||||||||||

| Total current liabilities | 7,994,370 | 7,735,370 | 5,788,169 | |||||||||||||||||

| Long-term debt | 7,290,208 | 8,796,284 | 11,412,304 | |||||||||||||||||

| Pensions and other postretirement benefits | 455,254 | 551,510 | 781,139 | |||||||||||||||||

| Deferred income taxes | 1,528,529 | 1,649,674 | 1,780,533 | |||||||||||||||||

| Other liabilities | 709,548 | 893,355 | 960,417 | |||||||||||||||||

| Shareholders' equity | 11,590,852 | 10,326,888 | 9,781,297 | |||||||||||||||||

| Noncontrolling interests | 9,569 | 11,391 | 11,868 | |||||||||||||||||

| Total liabilities and equity | $ | 29,578,330 | $ | 29,964,472 | $ | 30,515,727 | ||||||||||||||

| PARKER HANNIFIN CORPORATION - MARCH 31, 2024 | Exhibit 99.1 | |||||||||||||

| CONSOLIDATED STATEMENT OF CASH FLOWS | ||||||||||||||

| (Unaudited) | Nine Months Ended March 31, | |||||||||||||

| (Dollars in thousands) | 2024 | 2023 | ||||||||||||

| Cash flows from operating activities: | ||||||||||||||

| Net income | $ | 2,059,863 | $ | 1,374,458 | ||||||||||

| Depreciation and amortization | 696,463 | 609,066 | ||||||||||||

| Stock incentive plan compensation | 128,682 | 117,536 | ||||||||||||

| Gain on sale of businesses | (23,667) | (366,345) | ||||||||||||

| Loss (gain) on property, plant and equipment and intangible assets | 5,847 | (1,270) | ||||||||||||

| Gain on marketable securities | (55) | (1,391) | ||||||||||||

| Gain on investments | (2,555) | (4,341) | ||||||||||||

| Net change in receivables, inventories and trade payables | (244,268) | (19,052) | ||||||||||||

| Net change in other assets and liabilities | (427,509) | (77,389) | ||||||||||||

| Other, net | (45,724) | 163,622 | ||||||||||||

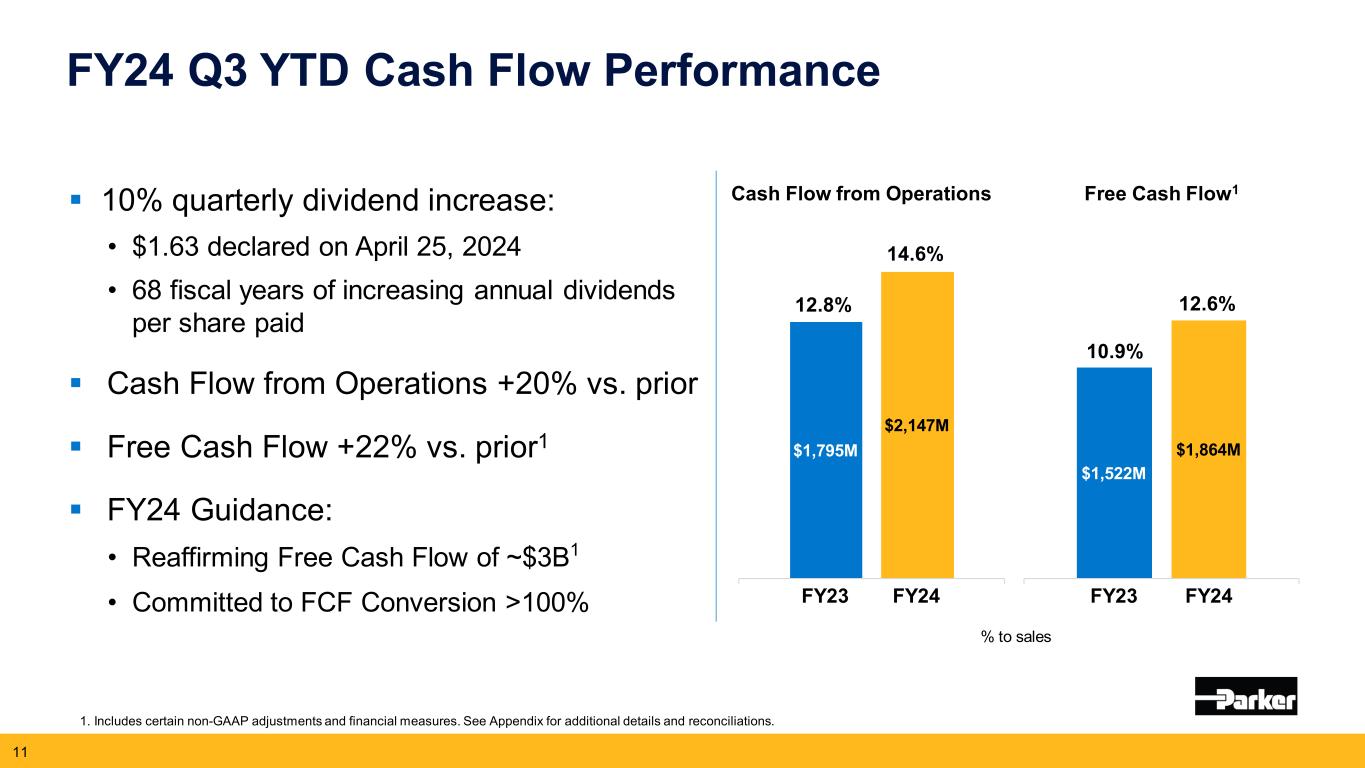

| Net cash provided by operating activities | 2,147,077 | 1,794,894 | ||||||||||||

| Cash flows from investing activities: | ||||||||||||||

| Acquisitions (net of cash of $89,704 in 2023) | — | (7,146,110) | ||||||||||||

| Capital expenditures | (283,328) | (272,603) | ||||||||||||

| Proceeds from sale of property, plant and equipment | 8,905 | 11,821 | ||||||||||||

| Proceeds from sale of businesses | 75,561 | 471,720 | ||||||||||||

| Purchases of marketable securities and other investments | (10,091) | (31,275) | ||||||||||||

| Maturities and sales of marketable securities and other investments | 8,664 | 35,075 | ||||||||||||

| Payments of deal-contingent forward contracts | — | (1,405,418) | ||||||||||||

| Other | 5,988 | 251,875 | ||||||||||||

| Net cash used in investing activities | (194,301) | (8,084,915) | ||||||||||||

| Cash flows from financing activities: | ||||||||||||||

| Net payments for common stock activity | (237,689) | (199,911) | ||||||||||||

| Acquisition of noncontrolling interests | (2,883) | — | ||||||||||||

| Net (payments for) proceeds from debt | (1,193,373) | 906,811 | ||||||||||||

| Financing fees paid | — | (8,911) | ||||||||||||

| Dividends paid | (571,583) | (513,232) | ||||||||||||

| Net cash (used in) provided by financing activities | (2,005,528) | 184,757 | ||||||||||||

| Effect of exchange rate changes on cash | (16,946) | (7,781) | ||||||||||||

| Net decrease in cash, cash equivalents and restricted cash | (69,698) | (6,113,045) | ||||||||||||

| Cash, cash equivalents and restricted cash at beginning of year | 475,182 | 6,647,876 | ||||||||||||

| Cash and cash equivalents at end of period | $ | 405,484 | $ | 534,831 | ||||||||||

| PARKER HANNIFIN CORPORATION - MARCH 31, 2024 | Exhibit 99.1 | |||||||

| RECONCILIATION OF FORECASTED SEGMENT OPERATING MARGIN TO ADJUSTED FORECASTED SEGMENT OPERATING MARGIN | ||||||||

| (Unaudited) | ||||||||

| (Amounts in percentages) | Fiscal Year 2024 | |||||||

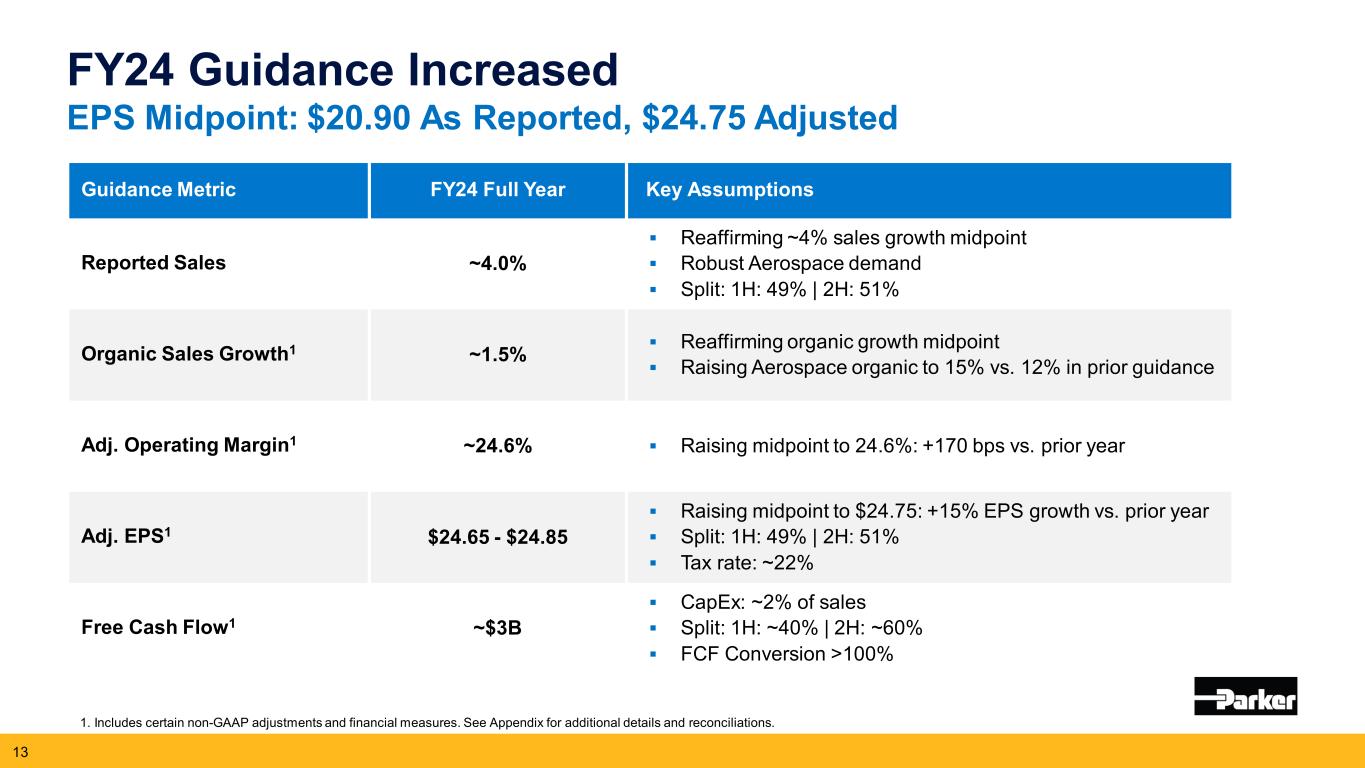

| Forecasted segment operating margin | ~21.2% | |||||||

| Adjustments: | ||||||||

| Business realignment charges | 0.3% | |||||||

| Costs to achieve | 0.2% | |||||||

| Acquisition-related intangible asset amortization expense | 2.9% | |||||||

| Adjusted forecasted segment operating margin | ~24.6% | |||||||

| RECONCILIATION OF FORECASTED EARNINGS PER DILUTED SHARE TO ADJUSTED FORECASTED EARNINGS PER DILUTED SHARE | ||||||||

| (Unaudited) | ||||||||

| (Amounts in dollars) | Fiscal Year 2024 | |||||||

| Forecasted earnings per diluted share | $20.80 to $21.00 | |||||||

| Adjustments: | ||||||||

| Business realignment charges | 0.46 | |||||||

| Costs to achieve | 0.27 | |||||||

| Acquisition-related intangible asset amortization expense | 4.44 | |||||||

| Net gain on divestitures | (0.20) | |||||||

Tax effect of adjustments1 |

(1.12) | |||||||

| Adjusted forecasted earnings per diluted share | $24.65 to $24.85 | |||||||

1This line item reflects the aggregate tax effect of all non-tax adjustments reflected in the preceding line items of the table. We estimate the tax effect of each adjustment item by applying our overall effective tax rate for continuing operations to the pre-tax amount, unless the nature of the item and/or the tax jurisdiction in which the item has been recorded requires application of a specific tax rate or tax treatment, in which case the tax effect of such item is estimated by applying such specific tax rate or tax treatment. | ||||||||