Document

Owens & Minor Reports First Quarter 2023 Financial Results

Strength of Patient Direct Drove Gross Margin Expansion

Operating Model Realignment Program Remains on Track

Raised Midpoint of 2023 Guidance Based on Strong Patient Direct Performance and Profit Improvement Efforts

RICHMOND, VA – May 5, 2023 – Owens & Minor, Inc. (NYSE: OMI) today reported financial results for the first quarter ended March 31, 2023.

Key Highlights:

•Consolidated revenue of $2.5 billion in the first quarter

•Net loss per common share of $(0.32) and adjusted net income per common share of $0.05 in the first quarter

•$158 million of operating cash flow generated in the first quarter

•$117 million in debt pay down

•2023 outlook reflects strong financial performance in the Patient Direct segment, progress made in operational improvements, cost saving measures, and improved cash flow generation

“Our Patient Direct segment continues to outperform the market and once again was a significant driver of our year-over-year top-line growth and margin expansion during the quarter. As we outlined last quarter, we took the necessary steps to initiate the total company Operating Model Realignment Program and improve our overall cost structure. These initiatives are progressing well, and we are on pace to reach our adjusted operating income target of $30 million for the year. In our Products & Healthcare Services segment, we continued to experience pressure, including destocking during the quarter, however, we were pleased with our Medical Distribution division’s ability to navigate a challenging environment and produce solid results for the quarter,” said Edward A. Pesicka, President & Chief Executive Officer of Owens & Minor.

Pesicka concluded, “Our strong cash flow generation in the quarter enabled us to pay down $117 million in debt. In the quarter, we began to effectively reduce working capital and manage our costs, while investing for future growth. We will continue to take a disciplined approach to working capital management, cost management, and capital allocation. Overall, we are encouraged by our results to start the year and continue to expect our performance will be heavily weighted toward the second half of 2023.”

|

|

|

|

|

|

|

|

|

|

|

|

Financial Summary (1) |

|

|

|

($ in millions, except per share data) |

1Q23 |

|

1Q22 |

|

|

|

|

Revenue |

$2,523 |

|

$2,407 |

|

|

|

|

Operating income, GAAP |

$9.8 |

|

$61.1 |

Adj. Operating Income, Non-GAAP |

$47.7 |

|

$104.9 |

|

|

|

|

Net (loss) income, GAAP |

$(24.4) |

|

$39.3 |

Adj. Net Income, Non-GAAP |

$3.6 |

|

$72.8 |

|

|

|

|

Adj. EBITDA, Non-GAAP |

$108.7 |

|

$122.6 |

|

|

|

|

Net (loss) income per common share, GAAP |

$(0.32) |

|

$0.52 |

Adj. Net Income per share, Non-GAAP |

$0.05 |

|

$0.96 |

(1) Reconciliations of the differences between the non-GAAP financial measures presented in this release and their most directly comparable GAAP financial measures are included in the tables below.

Results and Business Highlights

•Financial Highlights

◦Q1 Consolidated revenue of $2.5 billion

◦Patient Direct revenue of $607 million, up 10.4% compared to the first quarter of 2022 on a pro forma basis

◦Products & Healthcare Services revenue of $1.9 billion was negatively impacted from the decline in personal protective equipment (PPE) sales volumes and prices which was partially offset by strong sales growth excluding PPE

◦Reduced total debt by $117 million in the first quarter and $260 million since funding the Apria acquisition

◦Generated $158 million of operating cash flow in the quarter, up 99% year-over-year and up 82% versus the fourth quarter of 2022

◦Adjusted EBITDA of $109 million, compared to $123 million in the year ago period

•Business Highlights

◦Published Operating Room Efficiency Research Report, examining the relationship between efficient ORs and clinical outcomes

◦Sponsored sterile processing certification scholarships through Healthcare Sterile Processing Association Foundation

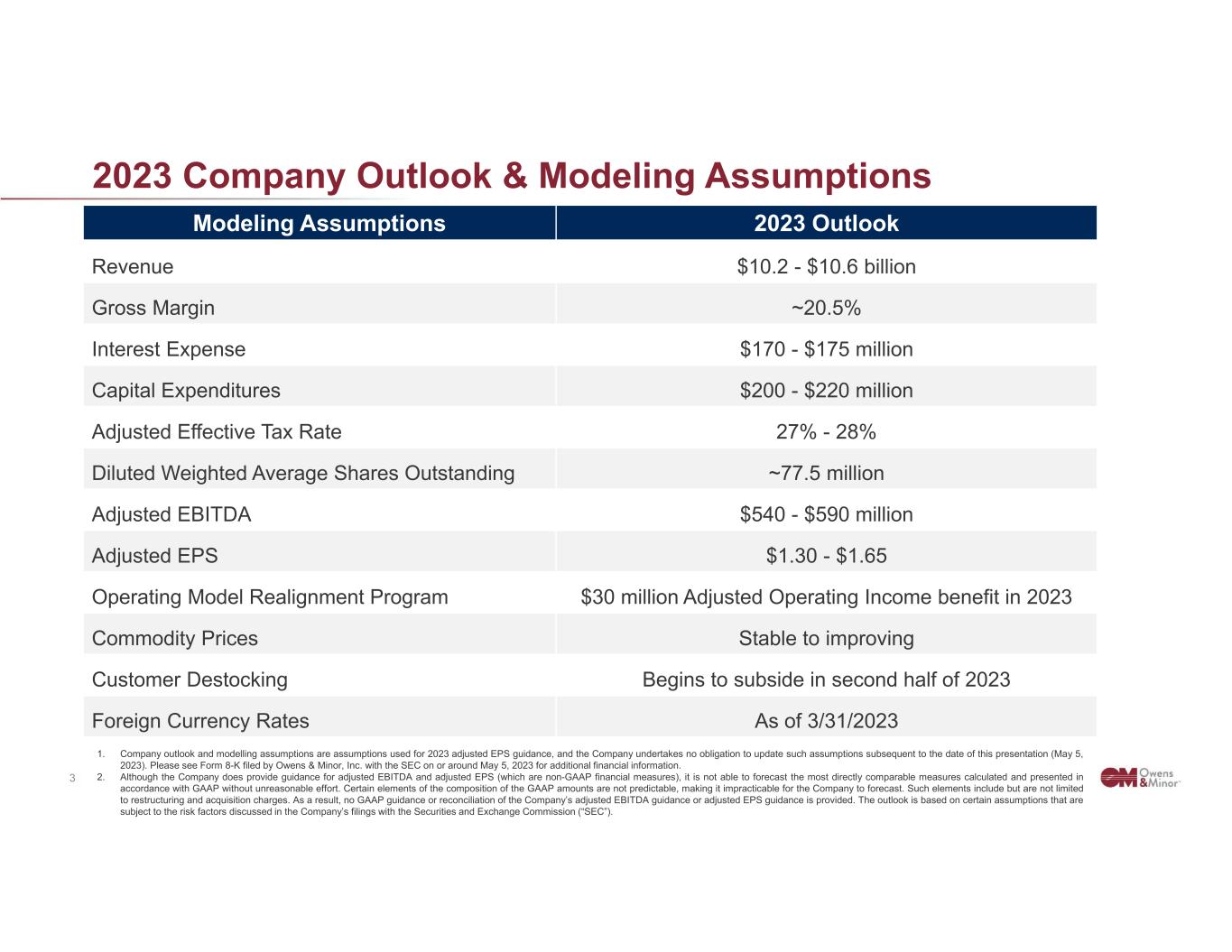

2023 Financial Outlook

The Company’s revised its outlook for 2023; summarized below:

•Revenue for 2023 to be in a range of $10.2 billion to $10.6 billion

•Adjusted EBITDA for 2023 to be in a range of $540 million to $590 million

•Adjusted EPS for 2023 to be in a range of $1.30 to $1.65

The Company’s outlook for 2023 contains assumptions, including current expectations regarding the impact of general economic conditions, including inflation, and the continuation of pressure on pricing and demand in our Products & Healthcare Services segment. Key assumptions supporting the Company’s 2023 financial guidance include:

•Adjusted operating income benefit of $30 million from the Operating Model Realignment Program

•Gross margin rate of ~20.5%

•Interest expense of $170 to $175 million

•Adjusted effective tax rate of 27% to 28%

•Diluted weighted average shares of ~77.5 million

•Capital expenditures of $200 to $220 million

•Stable to improving commodity prices

•FX rates as of 3/31/2023

Although the Company does provide guidance for adjusted EBITDA and adjusted EPS (which are non-GAAP financial measures), it is not able to forecast the most directly comparable measures calculated and presented in accordance with GAAP without unreasonable effort. Certain elements of the composition of the GAAP amounts are not predictable, making it impracticable for the Company to forecast. Such elements include but are not limited to restructuring and acquisition charges. As a result, no GAAP guidance or reconciliation of the Company’s adjusted EBITDA guidance or adjusted EPS guidance is provided. The outlook is based on certain assumptions that are subject to the risk factors discussed in the Company’s filings with the Securities and Exchange Commission (“SEC”).

Investor Conference Call for First Quarter 2023 Financial Results

Owens & Minor executives will host a conference call for investors and analysts at 8:30 a.m. ET on the same day. Participants may access the call via the toll-free dial-in number at 1-888-300-2035, or the toll dial-in number at 1-646-517-7437. The conference ID access code is 1058917.

All interested stakeholders are encouraged to access the simultaneous live webcast by visiting the investor relations page of the Owens & Minor website available at investors.owens-minor.com/events-presentations/. A replay of the webcast can be accessed following the presentation at the link provided above.

Safe Harbor

This release is intended to be disclosure through methods reasonably designed to provide broad, non-exclusionary distribution to the public in compliance with the SEC's Fair Disclosure Regulation. This release contains certain ''forward-looking'' statements made pursuant to the Safe Harbor provisions of the Private Securities Litigation Reform Act of 1995. These statements include, but are not limited to, the statements in this release regarding our future prospects and performance, including our expectations with respect to our 2023 financial performance, the integration of the Apria transaction, including related synergies and the expected performance of the Apria business, our Operating Model Realignment Program and other cost-saving initiatives, future indebtedness and growth, industry trends, as well as statements related to our expectations regarding the performance of its business, including the results of our Operating Model Realignment Program and our ability to address macro and market conditions. Forward-looking statements involve known and unknown risks and uncertainties that may cause our actual results in future periods to differ materially from those projected or contemplated in the forward-looking statements. Investors should refer to Owens & Minor’s Annual Report on Form 10-K for the year ended December 31, 2022, filed with the SEC including the sections captioned “Cautionary Note Regarding Forward-Looking Statements” and “Item 1A. Risk Factors,” and subsequent quarterly reports on Form 10-Q and current reports on Form 8-K filed with or furnished to the SEC, for a discussion of certain known risk factors that could cause the Company’s actual results to differ materially from its current estimates. These filings are available at www.owens-minor.com. Given these risks and uncertainties, Owens & Minor can give no assurance that any forward-looking statements will, in fact, transpire and, therefore, cautions investors not to place undue reliance on them. Owens & Minor specifically disclaims any obligation to update or revise any forward-looking statements, whether as a result of new information, future developments or otherwise.

About Owens & Minor

Owens & Minor, Inc. (NYSE: OMI) is a Fortune 500 global healthcare solutions company integrating product manufacturing and delivery, home health supply and perioperative services to support care through the hospital and into the home. Owens & Minor drives visibility, control and efficiency for patients, providers and healthcare professionals across the supply chain with proprietary technology and solutions, an extensive product portfolio, an Americas-based manufacturing footprint for personal protective equipment (PPE) and surgical products, as well as a robust portfolio of products and services for patients managing chronic and acute conditions in the home setting. Operating continuously since 1882 from its headquarters in Richmond, Va., Owens & Minor is a 140-year-old company powered by more than 20,000 global teammates. Learn more at https://www.owens-minor.com, follow @Owens_Minor on Twitter and connect on LinkedIn at www.linkedin.com/company/owens-&-minor.

CONTACT:

Investors

Alpha IR Group

Jackie Marcus or Alec Buchmelter

OMI@alpha-ir.com

Jonathan Leon

SVP Finance & Treasurer

Investor.Relations@owens-minor.com

Media

Stacy Law

media@owens-minor.com

SOURCE: Owens & Minor, Inc.

Owens & Minor, Inc.

Consolidated Statements of Operations (unaudited)

(dollars in thousands, except per share data)

|

|

|

|

|

|

|

|

|

|

|

|

|

Three Months Ended

March 31, |

|

2023 |

|

2022 |

| Net revenue |

$ |

2,522,849 |

|

|

$ |

2,406,952 |

|

| Cost of goods sold |

2,025,542 |

|

|

2,033,504 |

|

| Gross margin |

497,307 |

|

|

373,448 |

|

| Distribution, selling and administrative expenses |

448,722 |

|

|

269,471 |

|

| Acquisition-related charges and intangible amortization |

22,188 |

|

|

42,135 |

|

| Exit and realignment charges |

15,674 |

|

|

1,682 |

|

| Other operating expense (income), net |

916 |

|

|

(899) |

|

| Operating income |

9,807 |

|

|

61,059 |

|

| Interest expense, net |

42,198 |

|

|

12,019 |

|

| Other expense, net |

1,387 |

|

|

783 |

|

| (Loss) income before income taxes |

(33,778) |

|

|

48,257 |

|

| Income tax (benefit) provision |

(9,360) |

|

|

8,978 |

|

| Net (loss) income |

$ |

(24,418) |

|

|

$ |

39,279 |

|

|

|

|

|

| Net (loss) income per common share: |

|

|

|

| Basic |

$ |

(0.32) |

|

|

$ |

0.53 |

|

| Diluted |

$ |

(0.32) |

|

|

$ |

0.52 |

|

Owens & Minor, Inc.

Condensed Consolidated Balance Sheets (unaudited)

(dollars in thousands)

|

|

|

|

|

|

|

|

|

|

|

|

|

March 31, |

|

December 31, |

|

2023 |

|

2022 |

| Assets |

|

|

|

| Current assets |

|

|

|

| Cash and cash equivalents |

$ |

66,840 |

|

|

$ |

69,467 |

|

| Accounts receivable, net of allowances of $9,549 and $9,063 |

757,802 |

|

|

763,497 |

|

| Merchandise inventories |

1,288,288 |

|

|

1,333,585 |

|

| Other current assets |

155,397 |

|

|

128,636 |

|

| Total current assets |

2,268,327 |

|

|

2,295,185 |

|

| Property and equipment, net of accumulated depreciation of $482,861 and $450,286 |

569,908 |

|

|

578,269 |

|

| Operating lease assets |

276,562 |

|

|

280,665 |

|

| Goodwill |

1,639,133 |

|

|

1,636,705 |

|

| Intangible assets, net |

424,530 |

|

|

445,042 |

|

| Other assets, net |

131,743 |

|

|

150,417 |

|

| Total assets |

$ |

5,310,203 |

|

|

$ |

5,386,283 |

|

| Liabilities and equity |

|

|

|

| Current liabilities |

|

|

|

| Accounts payable |

$ |

1,165,799 |

|

|

$ |

1,147,414 |

|

| Accrued payroll and related liabilities |

87,110 |

|

|

93,296 |

|

| Other current liabilities |

377,721 |

|

|

325,756 |

|

| Total current liabilities |

1,630,630 |

|

|

1,566,466 |

|

| Long-term debt, excluding current portion |

2,362,453 |

|

|

2,482,968 |

|

| Operating lease liabilities, excluding current portion |

208,276 |

|

|

215,469 |

|

| Deferred income taxes |

61,099 |

|

|

60,833 |

|

| Other liabilities |

123,345 |

|

|

114,943 |

|

| Total liabilities |

4,385,803 |

|

|

4,440,679 |

|

| Total equity |

924,400 |

|

|

945,604 |

|

| Total liabilities and equity |

$ |

5,310,203 |

|

|

$ |

5,386,283 |

|

Owens & Minor, Inc.

Consolidated Statements of Cash Flows (unaudited)

(dollars in thousands)

|

|

|

|

|

|

|

|

|

|

|

|

|

Three Months Ended March 31, |

|

2023 |

|

2022 |

| Operating activities: |

|

|

|

| Net (loss) income |

$ |

(24,418) |

|

|

$ |

39,279 |

|

| Adjustments to reconcile net (loss) income to cash provided by operating activities: |

|

|

|

| Depreciation and amortization |

70,926 |

|

|

24,125 |

|

| Share-based compensation expense |

6,463 |

|

|

5,403 |

|

| (Benefit) provision for losses on accounts receivable |

(521) |

|

|

5,628 |

|

| Loss on extinguishment of debt |

564 |

|

|

— |

|

| Deferred income tax benefit |

(591) |

|

|

(69) |

|

| Changes in operating lease right-of-use assets and lease liabilities |

(225) |

|

|

(462) |

|

| Gain on sale and dispositions of property and equipment |

(8,269) |

|

|

— |

|

| Changes in operating assets and liabilities, net of acquisitions: |

|

|

|

| Accounts receivable |

5,240 |

|

|

(12,919) |

|

| Merchandise inventories |

45,832 |

|

|

58,098 |

|

| Accounts payable |

23,082 |

|

|

(6,967) |

|

| Net change in other assets and liabilities |

36,483 |

|

|

(33,165) |

|

| Other, net |

3,832 |

|

|

748 |

|

| Cash provided by operating activities |

158,398 |

|

|

79,699 |

|

| Investing activities: |

|

|

|

| Acquisition, net of cash acquired |

— |

|

|

(1,576,278) |

|

| Additions to property and equipment |

(46,150) |

|

|

(9,609) |

|

| Additions to computer software |

(5,340) |

|

|

(1,352) |

|

| Proceeds from sale of property and equipment |

17,306 |

|

|

3 |

|

| Cash used for investing activities |

(34,184) |

|

|

(1,587,236) |

|

| Financing activities: |

|

|

|

| Borrowings under amended Receivables Financing Agreement |

232,100 |

|

|

— |

|

| Repayments under amended Receivables Financing Agreement |

(328,100) |

|

|

— |

|

| Repayments of debt |

(26,500) |

|

|

— |

|

| Proceeds from issuance of debt |

— |

|

|

1,691,000 |

|

| Borrowings under revolving credit facility, net and Receivable Financing Agreement |

— |

|

|

41,700 |

|

| Financing costs paid |

— |

|

|

(33,744) |

|

| Other, net |

(4,989) |

|

|

(34,762) |

|

| Cash (used for) provided by financing activities |

(127,489) |

|

|

1,664,194 |

|

| Effect of exchange rate changes on cash, cash equivalents and restricted cash |

284 |

|

|

(669) |

|

| Net (decrease) increase in cash, cash equivalents and restricted cash |

(2,991) |

|

|

155,988 |

|

| Cash, cash equivalents and restricted cash at beginning of period |

86,185 |

|

|

72,035 |

|

Cash, cash equivalents and restricted cash at end of period(1) |

$ |

83,194 |

|

|

$ |

228,023 |

|

| Supplemental disclosure of cash flow information: |

|

|

|

| Income taxes paid, net of refunds |

$ |

2,405 |

|

|

$ |

4,478 |

|

| Interest paid |

$ |

32,536 |

|

|

$ |

12,626 |

|

| Noncash investing activity: |

|

|

|

| Unpaid purchases of property and equipment and software at end of period |

$ |

64,658 |

|

|

$ |

— |

|

(1) Restricted cash as of March 31, 2023 and December 31, 2022 represents $16.4 million and $16.7 million, primarily held in an escrow account as required by the Centers for Medicare & Medicaid Services (CMS) in conjunction with the Bundled Payments for Care Improvement (BPCI) initiatives related to wind-down costs of Fusion5.

Owens & Minor, Inc.

Summary Segment Information (unaudited)

(dollars in thousands)

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Three Months Ended March 31, |

|

2023 |

|

2022 |

|

|

|

% of |

|

|

|

% of |

|

|

|

consolidated |

|

|

|

consolidated |

|

Amount |

|

net revenue |

|

Amount |

|

net revenue |

| Net revenue: |

|

|

|

|

|

|

|

| Products & Healthcare Services |

$ |

1,915,489 |

|

|

75.93 |

% |

|

$ |

2,134,041 |

|

|

88.66 |

% |

| Patient Direct |

607,360 |

|

|

24.07 |

% |

|

272,911 |

|

|

11.34 |

% |

| Consolidated net revenue |

$ |

2,522,849 |

|

|

100.00 |

% |

|

$ |

2,406,952 |

|

|

100.00 |

% |

|

|

|

|

|

|

|

|

|

|

|

% of segment |

|

|

|

% of segment |

| Operating income: |

|

|

net revenue |

|

|

|

net revenue |

| Products & Healthcare Services |

$ |

1,820 |

|

|

0.10 |

% |

|

$ |

89,083 |

|

|

4.17 |

% |

| Patient Direct |

45,849 |

|

|

7.55 |

% |

|

15,793 |

|

|

5.79 |

% |

| Acquisition-related charges and intangible amortization |

(22,188) |

|

|

|

|

(42,135) |

|

|

|

| Exit and realignment charges |

(15,674) |

|

|

|

|

(1,682) |

|

|

|

| Consolidated operating income |

$ |

9,807 |

|

|

0.39 |

% |

|

$ |

61,059 |

|

|

2.54 |

% |

|

|

|

|

|

|

|

|

| Depreciation and amortization: |

|

|

|

|

|

|

|

| Products & Healthcare Services |

$ |

18,566 |

|

|

|

|

$ |

18,994 |

|

|

|

| Patient Direct |

52,360 |

|

|

|

|

5,131 |

|

|

|

| Consolidated depreciation and amortization |

$ |

70,926 |

|

|

|

|

$ |

24,125 |

|

|

|

|

|

|

|

|

|

|

|

| Capital expenditures: |

|

|

|

|

|

|

|

| Products & Healthcare Services |

$ |

6,332 |

|

|

|

|

$ |

10,643 |

|

|

|

| Patient Direct |

45,158 |

|

|

|

|

318 |

|

|

|

| Consolidated capital expenditures |

$ |

51,490 |

|

|

|

|

$ |

10,961 |

|

|

|

Owens & Minor, Inc.

Net (Loss) Income Per Common Share (unaudited)

(dollars in thousands, except per share data)

|

|

|

|

|

|

|

|

|

|

|

|

|

Three Months Ended

March 31, |

|

2023 |

|

2022 |

| Net (loss) income |

$ |

(24,418) |

|

|

$ |

39,279 |

|

|

|

|

|

| Weighted average shares outstanding - basic |

75,177 |

|

73,643 |

| Dilutive shares |

— |

|

|

2,376 |

|

| Weighted average shares outstanding - diluted |

75,177 |

|

|

76,019 |

|

|

|

|

|

| Net (loss) income per common share: |

|

|

|

| Basic |

$ |

(0.32) |

|

|

$ |

0.53 |

|

| Diluted |

$ |

(0.32) |

|

|

$ |

0.52 |

|

Share-based awards for the three months ended March 31, 2023 of approximately 1.7 million shares were excluded from the calculation of net loss per diluted common share as the effect would be anti-dilutive.

Owens & Minor, Inc.

GAAP/Non-GAAP Reconciliations (unaudited)

(dollars in thousands, except per share data)

The following table provides a reconciliation of reported operating income, net (loss) income and net (loss) income per share to non-GAAP measures used by management.

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Three Months Ended

March 31, |

|

|

2023 |

|

2022 |

| Operating income, as reported (GAAP) |

|

$ |

9,807 |

|

$ |

61,059 |

Acquisition-related charges and intangible amortization (1) |

|

22,188 |

|

|

42,135 |

Exit and realignment charges (2) |

|

15,674 |

|

|

1,682 |

| Operating income, adjusted (non-GAAP) (Adjusted Operating Income) |

|

$ |

47,669 |

|

$ |

104,876 |

| Operating income as a percent of net revenue (GAAP) |

|

0.39% |

|

2.54% |

| Adjusted operating income as a percent of net revenue (non-GAAP) |

|

1.89% |

|

4.36% |

|

|

|

|

|

| Net (loss) income, as reported (GAAP) |

|

$ |

(24,418) |

|

$ |

39,279 |

| Pre-tax adjustments: |

|

|

|

|

Acquisition-related charges and intangible amortization (1) |

|

22,188 |

|

42,135 |

Exit and realignment charges (2) |

|

15,674 |

|

1,682 |

Other (3) |

|

1,129 |

|

525 |

Income tax benefit on pre-tax adjustments (4) |

|

(10,977) |

|

(10,869) |

| Net income, adjusted (non-GAAP) (Adjusted Net Income) |

|

$ |

3,596 |

|

$ |

72,752 |

|

|

|

|

|

Net (loss) income percommon share, as reported (GAAP) |

|

$ |

(0.32) |

|

|

$ |

0.52 |

| After-tax adjustments: |

|

|

|

|

Acquisition-related charges and intangible amortization (1) |

|

0.21 |

|

0.41 |

Exit and realignment charges (2) |

|

0.15 |

|

0.02 |

Other (3) |

|

0.01 |

|

0.01 |

| Net income per common share, adjusted (non-GAAP) (Adjusted EPS) |

|

$ |

0.05 |

|

$ |

0.96 |

Owens & Minor, Inc.

GAAP/Non-GAAP Reconciliations (unaudited), continued

(dollars in thousands)

The following tables provide reconciliations of net (loss) income and total debt to non-GAAP measures used by management.

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Three Months Ended

March 31, |

|

|

2023 |

|

2022 |

| Net (loss) income, as reported (GAAP) |

|

$ |

(24,418) |

|

|

$ |

39,279 |

|

| Income tax (benefit) provision |

|

(9,360) |

|

|

8,978 |

|

| Interest expense, net |

|

42,198 |

|

|

12,019 |

|

Acquisition-related charges and intangible amortization (1) |

|

22,188 |

|

|

42,135 |

|

Exit and realignment charges (2) |

|

15,674 |

|

|

1,682 |

|

Other depreciation and amortization (5) |

|

49,991 |

|

|

13,856 |

|

Stock compensation (6) |

|

6,350 |

|

|

4,596 |

|

LIFO charges and (credits) (7) |

|

4,940 |

|

|

(509) |

|

Other (3) |

|

1,129 |

|

|

525 |

|

| Adjusted EBITDA (non-GAAP) |

|

$ |

108,692 |

|

|

$ |

122,561 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

March 31, |

|

|

2023 |

| Total debt, as reported (GAAP) |

|

$ |

2,383,515 |

|

| Cash and cash equivalents |

|

66,840 |

|

| Net debt (non-GAAP) |

|

$ |

2,316,675 |

|

|

|

|

|

|

|

Owens & Minor, Inc.

GAAP/Non-GAAP Reconciliations (unaudited), continued

The following items have been excluded in our non-GAAP financial measures:

(1) Acquisition-related charges and intangible amortization includes acquisition-related charges primarily related to the Apria acquisition and amortization of intangible assets established during acquisition method of accounting for business combinations. These amounts are highly dependent on the size and frequency of acquisitions and are being excluded to allow for a more consistent comparison with forecasted, current and historical results.

(2) During the three months ended March 31, 2023 exit and realignment charges consisted of severance, professional, and other fees primarily associated with our Operating Model Realignment Program. During the three months ended March 31, 2022 exit and realignment charges consisted of severance and other charges associated with the reorganization of our segments and an increase in reserves associated with certain retained assets of Fusion5.

(3) For the three months ended March 31, 2023 other includes loss on extinguishment of debt for the write-off of deferred financing costs of $0.6 million associated with early principal payments. Additionally, for the three months ended March 31, 2023 and 2022 other includes interest costs and net actuarial losses related to our frozen noncontributory, unfunded retirement plan for certain retirees in the U.S. of $0.5 million for the periods ended March 31, 2023 and 2022.

(4) These charges have been tax effected by determining the income tax rate depending on the amount of charges incurred in different tax jurisdictions and the deductibility of those charges for income tax purposes.

(5) Other depreciation and amortization relates to property and equipment and capitalized computer software.

(6) Stock compensation includes share-based compensation expense related to our share-based compensation plans, excluding such amounts captured within exit and realignment charges or acquisition-related charges.

(7) LIFO charges and (credits) includes non-cash adjustments to merchandise inventories valued at the lower of cost or market, with the approximate cost determined by the last-in, first-out (LIFO) method for distribution inventories in the United States (U.S.) within our Products & Healthcare Services segment.

Use of Non-GAAP Measures

This earnings release contains financial measures that are not calculated in accordance with U.S. generally accepted accounting principles ("GAAP"). In general, the measures exclude items and charges that (i) management does not believe reflect Owens & Minor, Inc.'s (the "Company") core business and relate more to strategic, multi-year corporate activities; or (ii) relate to activities or actions that may have occurred over multiple or in prior periods without predictable trends. Management uses these non-GAAP financial measures internally to evaluate the Company's performance, evaluate the balance sheet, engage in financial and operational planning and determine incentive compensation.

Management provides these non-GAAP financial measures to investors as supplemental metrics to assist readers in assessing the effects of items and events on its financial and operating results and in comparing the Company's performance to that of its competitors. However, the non-GAAP financial measures used by the Company may be calculated differently from, and therefore may not be comparable to, similarly titled measures used by other companies.

The non-GAAP financial measures disclosed by the Company should not be considered substitutes for, or superior to, financial measures calculated in accordance with GAAP, and the financial results calculated in accordance with GAAP and reconciliations to those financial statements set forth above should be carefully evaluated.