FORM |

8-K |

||||

| Delaware | 001-36609 | 36-2723087 | |||||||||||||||

| (State or other jurisdiction of incorporation) | (Commission File Number) | (IRS Employer Identification No.) | |||||||||||||||

| 50 South LaSalle Street | 60603 | ||||||||||||||||

| Chicago, | Illinois | (Zip Code) | |||||||||||||||

| (Address of principal executive offices) | |||||||||||||||||

| ☐ | Written communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425) | ||||

| ☐ | Soliciting material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12) | ||||

| ☐ | Pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b)) | ||||

| ☐ | Pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4(c)) | ||||

| Title of each class | Trading Symbol | Name of each exchange on which registered | ||||||

| Common Stock, $1.66 2/3 Par Value | NTRS | The NASDAQ Stock Market LLC | ||||||

| Depositary Shares, each representing 1/1,000th interest in a share of Series E Non-Cumulative Perpetual Preferred Stock |

NTRSO | The NASDAQ Stock Market LLC | ||||||

| Exhibit Number | Description | |||||||

| 104 | The cover page from this Current Report on Form 8-K, formatted in Inline XBRL. | |||||||

| NORTHERN TRUST CORPORATION | |||||||||||||||||

| (Registrant) | |||||||||||||||||

| Dated: | July 23, 2025 | By: | /s/ David W. Fox, Jr. | ||||||||||||||

| David W. Fox, Jr. | |||||||||||||||||

| Executive Vice President and Chief Financial Officer | |||||||||||||||||

| NEWS RELEASE |  |

|||||||

| www.northerntrust.com | ||||||||

| MICHAEL O’GRADY, CHAIRMAN AND CHIEF EXECUTIVE OFFICER: | ||

| “Northern Trust reported another quarter of strengthening results, featuring mid-single digit trust fee growth, record net interest income, and meaningful expansion in our pretax margin, all of which drove a 20% increase in our earnings per share, excluding notables in the prior period. The second quarter marks our fourth consecutive quarter of generating year-over-year improvement in our expense-to-trust fee ratio and delivering both positive trust fee operating leverage and overall operating leverage, all excluding notables. During this period, we have also returned over 100% of our earnings, including record share repurchases this quarter. Yesterday, our Board of Directors approved a $0.05 or 7% increase to our quarterly dividend. We enter the second half of the year with good momentum, squarely focused on delivering exceptional value to our clients, driving sustainable and profitable growth, and creating long-term value for our shareholders.” | ||

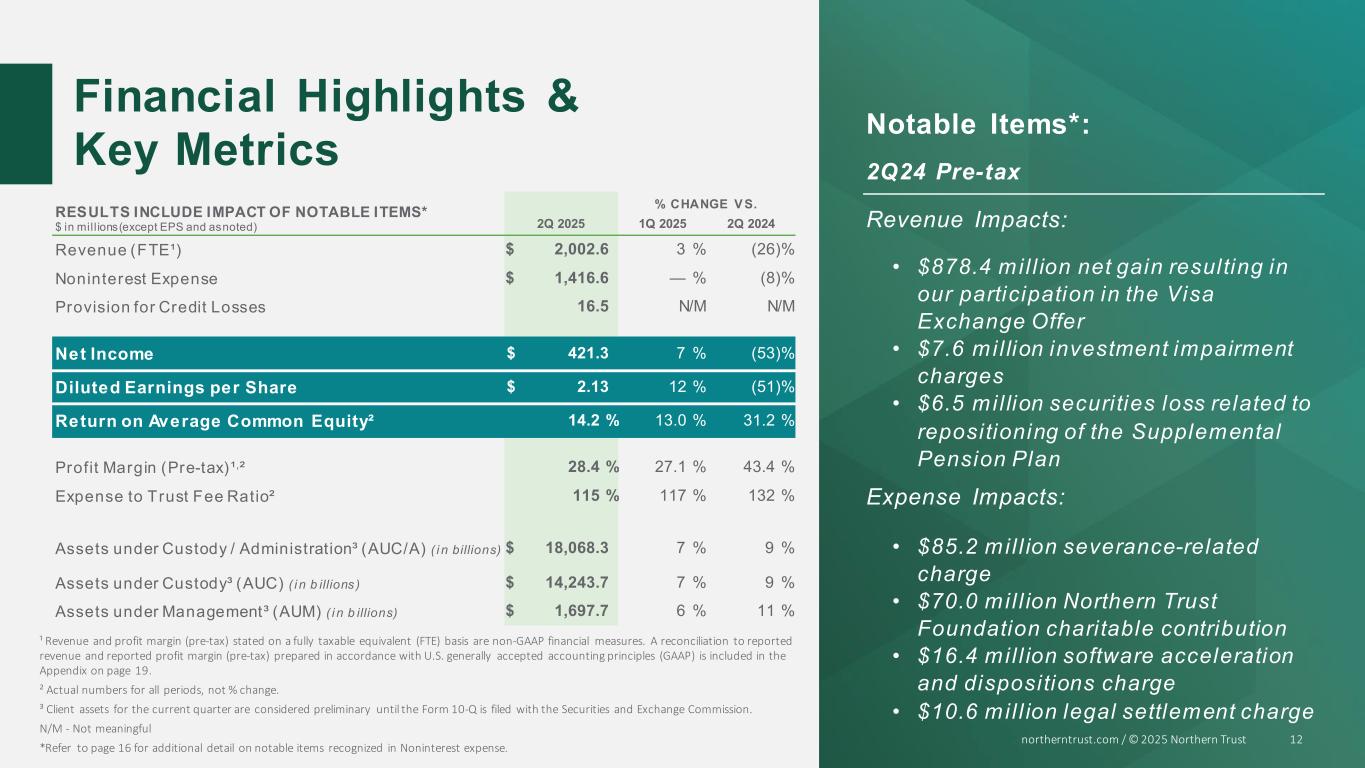

| FINANCIAL SUMMARY & KEY METRICS | ||||||||||||||||||||

% Change Q2 2025 vs. |

||||||||||||||||||||

| ($ In Millions except per share data) | Q2 2025 | Q1 2025 | Q2 2024 | Q1 2025 | Q2 2024 | |||||||||||||||

| Trust, Investment and Other Servicing Fees | $ | 1,231.1 | $ | 1,213.8 | $ | 1,166.1 | 1 | % | 6 | % | ||||||||||

Other Noninterest Income (1) |

156.3 | 158.1 | 1,026.5 | (1) | (85) | |||||||||||||||

| Net Interest Income (FTE*) | 615.2 | 573.7 | 529.8 | 7 | 16 | |||||||||||||||

| Total Revenue (FTE*) | $ | 2,002.6 | $ | 1,945.6 | $ | 2,722.4 | 3 | % | (26) | % | ||||||||||

Noninterest Expense (2) |

$ | 1,416.6 | $ | 1,417.6 | $ | 1,533.9 | — | % | (8) | % | ||||||||||

| Provision for Credit Losses | 16.5 | 1.0 | 8.0 | N/M | N/M | |||||||||||||||

| Provision for Income Taxes | 143.5 | 129.4 | 277.5 | 11 | (48) | |||||||||||||||

| FTE Adjustment* | 4.7 | 5.6 | 6.9 | (14) | (31) | |||||||||||||||

| Net Income | $ | 421.3 | $ | 392.0 | $ | 896.1 | 7 | % | (53) | % | ||||||||||

| Earnings Allocated to Common and Potential Common Shares | $ | 412.8 | $ | 372.2 | $ | 884.3 | 11 | % | (53) | % | ||||||||||

| Diluted Earnings per Common Share | $ | 2.13 | $ | 1.90 | $ | 4.34 | 12 | (51) | ||||||||||||

| Return on Average Common Equity | 14.2 | % | 13.0 | % | 31.2 | % | ||||||||||||||

| Average Assets | $ | 157,719.2 | $ | 150,262.1 | $ | 148,001.2 | 5 | % | 7 | % | ||||||||||

NORTHERN TRUST CORPORATION SECOND QUARTER 2025 RESULTS | ||

| CLIENT ASSETS | ||||||||||||||||||||

Assets under custody/administration (AUC/A) and assets under management are a driver of the Corporation’s trust, investment and other servicing fees, the largest component of noninterest income. | ||||||||||||||||||||

| As of | % Change June 30, 2025 vs. |

|||||||||||||||||||

| ($ In Billions) | June 30, 2025* | March 31, 2025 | June 30, 2024 | March 31, 2025 | June 30, 2024 | |||||||||||||||

| Assets Under Custody/Administration | ||||||||||||||||||||

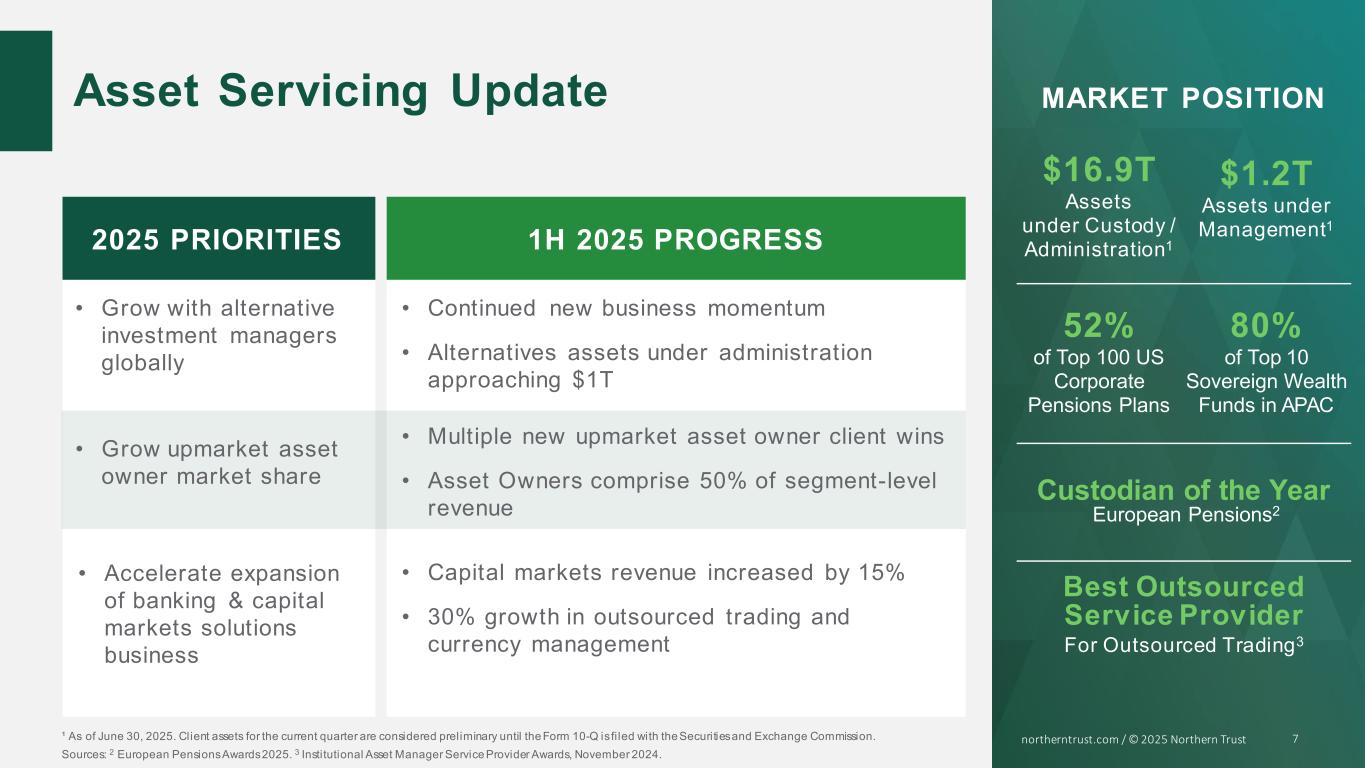

| Asset Servicing | $ | 16,864.9 | $ | 15,804.7 | $ | 15,470.8 | 7 | % | 9 | % | ||||||||||

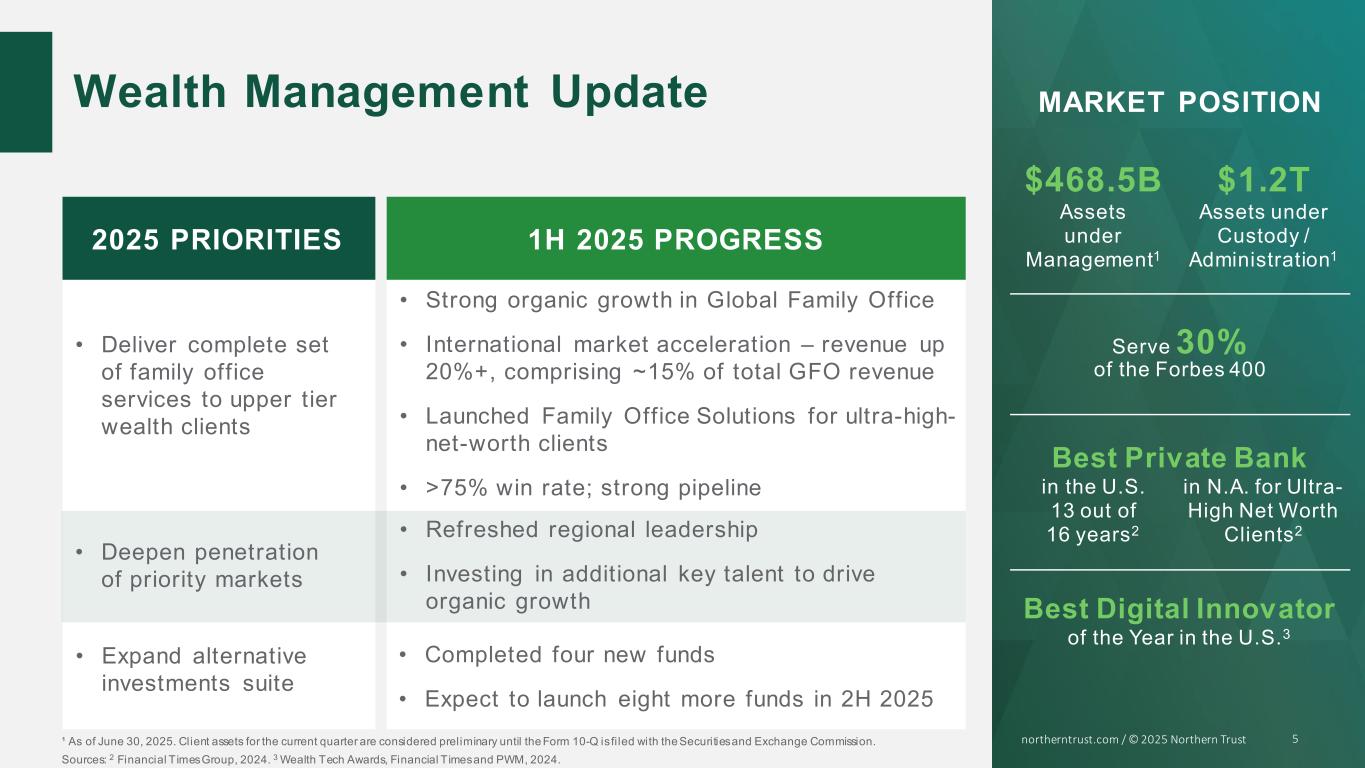

| Wealth Management | 1,203.4 | 1,119.3 | 1,096.6 | 8 | 10 | |||||||||||||||

| Total Assets Under Custody/Administration | $ | 18,068.3 | $ | 16,924.0 | $ | 16,567.4 | 7 | % | 9 | % | ||||||||||

Assets Under Custody(1) |

||||||||||||||||||||

| Asset Servicing | $ | 13,056.5 | $ | 12,163.6 | $ | 11,955.5 | 7 | % | 9 | % | ||||||||||

| Wealth Management | 1,187.2 | 1,105.9 | 1,085.9 | 7 | 9 | |||||||||||||||

| Total Assets Under Custody | $ | 14,243.7 | $ | 13,269.5 | $ | 13,041.4 | 7 | % | 9 | % | ||||||||||

| Assets Under Management | ||||||||||||||||||||

| Asset Servicing | $ | 1,229.2 | $ | 1,160.9 | $ | 1,107.3 | 6 | % | 11 | % | ||||||||||

| Wealth Management | 468.5 | 446.9 | 419.4 | 5 | 12 | |||||||||||||||

| Total Assets Under Management | $ | 1,697.7 | $ | 1,607.8 | $ | 1,526.7 | 6 | % | 11 | % | ||||||||||

| TRUST, INVESTMENT AND OTHER SERVICING FEES | ||||||||||||||||||||

% Change Q2 2025 vs. |

||||||||||||||||||||

| ($ In Millions) | Q2 2025 | Q1 2025 | Q2 2024 | Q1 2025 | Q2 2024 | |||||||||||||||

| Asset Servicing | ||||||||||||||||||||

| Custody and Fund Administration | $ | 469.2 | $ | 453.3 | $ | 445.9 | 4 | % | 5 | % | ||||||||||

| Investment Management | 157.3 | 152.5 | 145.7 | 3 | 8 | |||||||||||||||

| Securities Lending | 20.2 | 17.9 | 16.5 | 13 | 22 | |||||||||||||||

| Other | 45.1 | 48.2 | 42.5 | (7) | 6 | |||||||||||||||

| Total Asset Servicing Trust, Investment and Other Servicing Fees | $ | 691.8 | $ | 671.9 | $ | 650.6 | 3 | % | 6 | % | ||||||||||

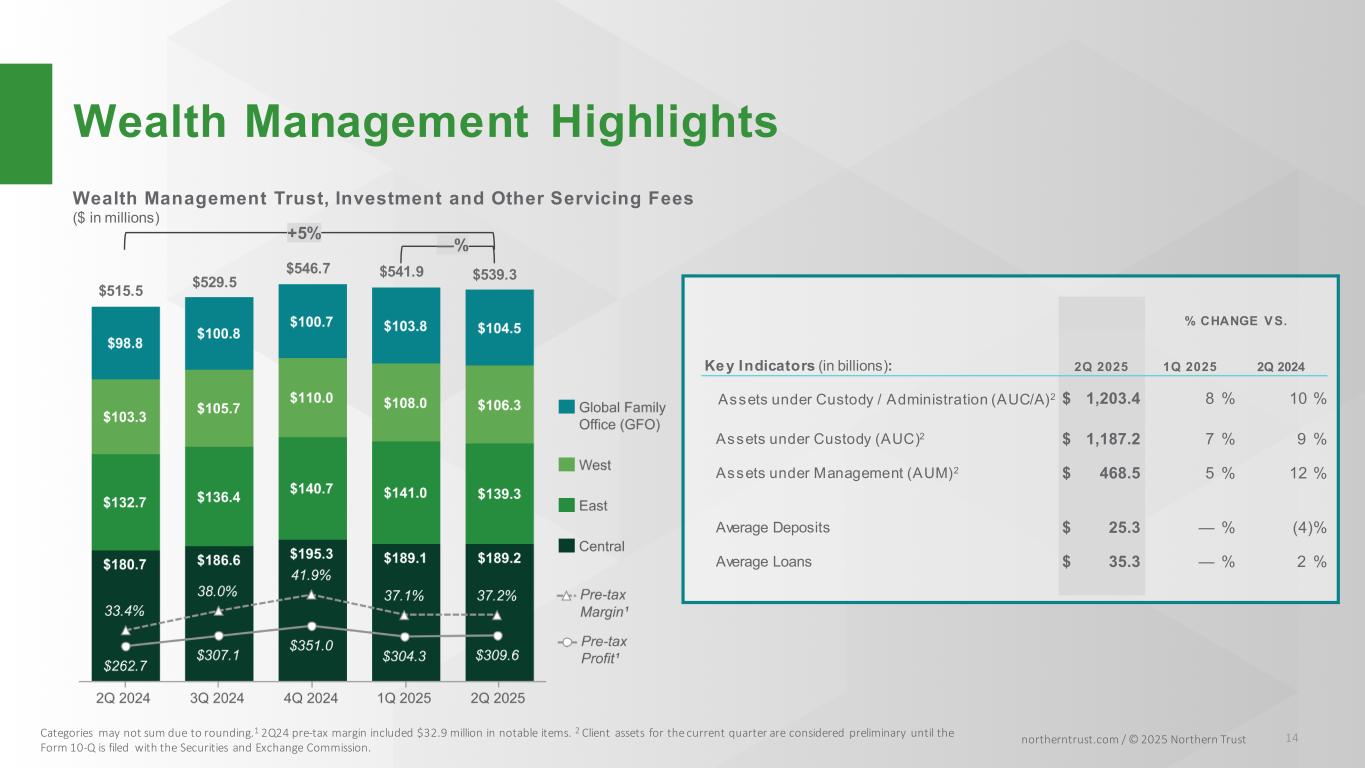

| Wealth Management | ||||||||||||||||||||

| Central | $ | 189.2 | $ | 189.1 | $ | 180.7 | — | % | 5 | % | ||||||||||

| East | 139.3 | 141.0 | 132.7 | (1) | 5 | |||||||||||||||

| West | 106.3 | 108.0 | 103.3 | (2) | 3 | |||||||||||||||

| Global Family Office (GFO) | 104.5 | 103.8 | 98.8 | 1 | 6 | |||||||||||||||

| Total Wealth Management Trust, Investment and Other Servicing Fees | $ | 539.3 | $ | 541.9 | $ | 515.5 | — | % | 5 | % | ||||||||||

| Total Consolidated Trust, Investment and Other Servicing Fees | $ | 1,231.1 | $ | 1,213.8 | $ | 1,166.1 | 1 | % | 6 | % | ||||||||||

NORTHERN TRUST CORPORATION SECOND QUARTER 2025 RESULTS | ||

| REPORTING SEGMENT RESULTS | ||||||||||||||||||||

% Change Q2 2025 vs. |

||||||||||||||||||||

| ($ In Millions) | Q2 2025 | Q1 2025 | Q2 2024 | Q1 2025 | Q2 2024 | |||||||||||||||

Income (Loss) before Income Taxes (FTE*)(1) |

||||||||||||||||||||

| Asset Servicing | $ | 271.1 | $ | 235.4 | $ | 135.6 | 15 | % | 100 | % | ||||||||||

| Wealth Management | 309.6 | 304.3 | 262.7 | 2 | 18 | |||||||||||||||

| Other | (11.2) | (12.7) | 782.2 | N/M | N/M | |||||||||||||||

| Total Income before Income Taxes (FTE*) | $ | 569.5 | $ | 527.0 | $ | 1,180.5 | 8 | % | (52) | % | ||||||||||

Profit Margin (pre-tax) (FTE*)(1) |

||||||||||||||||||||

| Asset Servicing | 23.2 | % | 20.9 | % | 12.9 | % | 2.3 | pts | 10.3 | pts | ||||||||||

| Wealth Management | 37.2 | 37.1 | 33.4 | 0.1 | 3.8 | |||||||||||||||

| Total Profit Margin (pre-tax) (FTE*) | 28.4 | 27.1 | 43.4 | 1.3 | (15.0) | |||||||||||||||

| Average Loans | ||||||||||||||||||||

| Asset Servicing | $ | 5,812.8 | $ | 5,749.3 | $ | 6,472.3 | 1 | % | (10) | % | ||||||||||

| Wealth Management | 35,345.2 | 35,327.2 | 34,562.3 | — | 2 | |||||||||||||||

| Total Average Loans | $ | 41,158.0 | $ | 41,076.5 | $ | 41,034.6 | — | % | — | % | ||||||||||

| Average Deposits | ||||||||||||||||||||

| Asset Servicing | $ | 95,506.7 | $ | 89,296.5 | $ | 86,223.0 | 7 | % | 11 | % | ||||||||||

| Wealth Management | 25,291.0 | 25,289.6 | 26,236.4 | — | (4) | |||||||||||||||

| Other | 1,580.1 | 1,333.0 | 882.2 | 19 | 79 | |||||||||||||||

| Total Average Deposits | $ | 122,377.8 | $ | 115,919.1 | $ | 113,341.6 | 6 | % | 8 | % | ||||||||||

| OTHER NONINTEREST INCOME | ||||||||||||||||||||

% Change Q2 2025 vs. |

||||||||||||||||||||

| ($ In Millions) | Q2 2025 | Q1 2025 | Q2 2024 | Q1 2025 | Q2 2024 | |||||||||||||||

| Other Noninterest Income | ||||||||||||||||||||

| Foreign Exchange Trading Income | $ | 50.6 | $ | 58.7 | $ | 58.4 | (14) | % | (13) | % | ||||||||||

| Treasury Management Fees | 9.7 | 9.6 | 9.0 | — | 7 | |||||||||||||||

| Security Commissions and Trading Income | 39.6 | 39.1 | 34.3 | 1 | 16 | |||||||||||||||

| Other Operating Income | 56.4 | 50.7 | 924.7 | 11 | (94) | |||||||||||||||

| Investment Security Gains (Losses), net | — | — | 0.1 | N/M | N/M | |||||||||||||||

| Total Other Noninterest Income | $ | 156.3 | $ | 158.1 | $ | 1,026.5 | (1) | % | (85) | % | ||||||||||

NORTHERN TRUST CORPORATION SECOND QUARTER 2025 RESULTS | ||

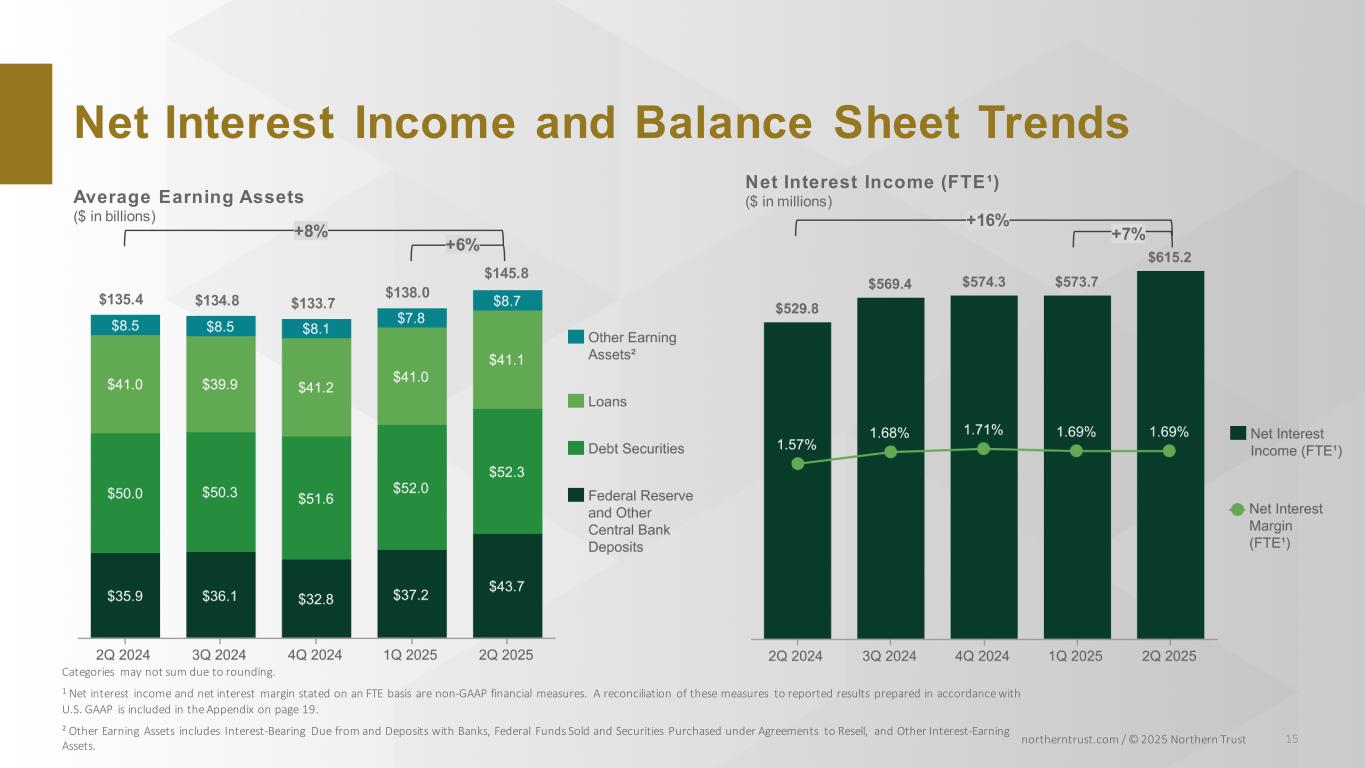

| NET INTEREST INCOME | ||||||||||||||||||||

% Change Q2 2025 vs. |

||||||||||||||||||||

| ($ In Millions) | Q2 2025 | Q1 2025 | Q2 2024 | Q1 2025 | Q2 2024 | |||||||||||||||

| Net Interest Income | ||||||||||||||||||||

| Interest Income (FTE*) | $ | 2,217.5 | $ | 2,146.5 | $ | 2,513.4 | 3 | % | (12) | % | ||||||||||

| Interest Expense | 1,602.3 | 1,572.8 | 1,983.6 | 2 | (19) | |||||||||||||||

| Net Interest Income (FTE*) | $ | 615.2 | $ | 573.7 | $ | 529.8 | 7 | % | 16 | % | ||||||||||

| Average Earning Assets | $ | 145,822.0 | $ | 138,007.9 | $ | 135,401.1 | 6 | % | 8 | % | ||||||||||

| Net Interest Margin (FTE*) | 1.69 | % | 1.69 | % | 1.57 | % | — | bps | 12 | bps | ||||||||||

| PROVISION FOR CREDIT LOSSES | ||||||||||||||||||||

| As of and for the three-months ended, | % Change June 30, 2025 vs. |

|||||||||||||||||||

| ($ In Millions) | June 30, 2025 | March 31, 2025 | June 30, 2024 | March 31, 2025 | June 30, 2024 | |||||||||||||||

| Allowance for Credit Losses | ||||||||||||||||||||

| Beginning Allowance for Credit Losses | $ | 207.3 | $ | 206.1 | $ | 201.5 | 1 | % | 3 | % | ||||||||||

| Provision for Credit Losses | 16.5 | 1.0 | 8.0 | N/M | N/M | |||||||||||||||

| Net Recoveries | 0.3 | 0.2 | 0.1 | N/M | N/M | |||||||||||||||

| Ending Allowance for Credit Losses | $ | 224.1 | $ | 207.3 | $ | 209.6 | 8 | % | 7 | % | ||||||||||

| Allowance assigned to: | ||||||||||||||||||||

| Loans | $ | 180.5 | $ | 167.1 | $ | 167.7 | 8 | % | 8 | % | ||||||||||

| Undrawn Loan Commitments and Standby Letters of Credit | 34.7 | 32.8 | 29.5 | 6 | 18 | |||||||||||||||

| Debt Securities and Other Financial Assets | 8.9 | 7.4 | 12.4 | 20 | (29) | |||||||||||||||

| Ending Allowance for Credit Losses | $ | 224.1 | $ | 207.3 | $ | 209.6 | 8 | % | 7 | % | ||||||||||

NORTHERN TRUST CORPORATION SECOND QUARTER 2025 RESULTS | ||

| NONINTEREST EXPENSE | ||||||||||||||||||||

% Change Q2 2025 vs. |

||||||||||||||||||||

| ($ In Millions) | Q2 2025 | Q1 2025 | Q2 2024 | Q1 2025 | Q2 2024 | |||||||||||||||

| Noninterest Expense | ||||||||||||||||||||

| Compensation | $ | 614.8 | $ | 644.4 | $ | 665.2 | (5) | % | (8) | % | ||||||||||

| Employee Benefits | 117.7 | 109.7 | 100.2 | 7 | 17 | |||||||||||||||

| Outside Services | 247.0 | 245.2 | 260.9 | 1 | (5) | |||||||||||||||

| Equipment and Software | 293.7 | 280.9 | 277.5 | 5 | 6 | |||||||||||||||

| Occupancy | 52.5 | 53.4 | 54.8 | (2) | (4) | |||||||||||||||

| Other Operating Expense | 90.9 | 84.0 | 175.3 | 8 | (48) | |||||||||||||||

| Total Noninterest Expense | $ | 1,416.6 | $ | 1,417.6 | $ | 1,533.9 | — | % | (8) | % | ||||||||||

| End of Period Full-Time Equivalent Employees | 23,400 | 23,400 | 23,000 | — | % | 2 | % | |||||||||||||

| PROVISION FOR INCOME TAXES | ||||||||||||||||||||

% Change Q2 2025 vs. |

||||||||||||||||||||

| ($ In Millions) | Q2 2025 | Q1 2025 | Q2 2024 | Q1 2025 | Q2 2024 | |||||||||||||||

| Net Income | ||||||||||||||||||||

| Income before Income Taxes | $ | 564.8 | $ | 521.4 | $ | 1,173.6 | 8% | (52)% | ||||||||||||

| Provision for Income Taxes | 143.5 | 129.4 | 277.5 | 11 | (48) | |||||||||||||||

| Net Income | $ | 421.3 | $ | 392.0 | $ | 896.1 | 7% | (53)% | ||||||||||||

| Effective Tax Rate | 25.4 | % | 24.8 | % | 23.6 | % | 60 | bps | 180 | bps | ||||||||||

| CAPITAL ACTIONS | ||

NORTHERN TRUST CORPORATION SECOND QUARTER 2025 RESULTS | ||

| REGULATORY CAPITAL | ||

| ($ In Millions) | Standardized Approach | Advanced Approach | ||||||||||||||||||||||||||||||

| Northern Trust Corporation | June 30, 2025* | March 31, 2025 | June 30, 2024 | June 30, 2025* | March 31, 2025 | June 30, 2024 | Well-Capitalized Ratios | Minimum Capital Ratios | ||||||||||||||||||||||||

| Regulatory Capital | ||||||||||||||||||||||||||||||||

| Common Equity Tier 1 Capital | $ | 11,108.2 | $ | 11,140.9 | $ | 10,931.6 | $ | 11,108.2 | $ | 11,140.9 | $ | 10,931.6 | ||||||||||||||||||||

| Tier 1 Capital | 11,938.5 | 11,973.0 | 11,768.9 | 11,938.5 | 11,973.0 | 11,768.9 | ||||||||||||||||||||||||||

| Total Capital | 13,508.9 | 13,527.3 | 13,473.1 | 13,285.6 | 13,320.1 | 13,264.2 | ||||||||||||||||||||||||||

| Assets | ||||||||||||||||||||||||||||||||

| Risk-Weighted Assets | $ | 91,385.4 | $ | 86,141.8 | $ | 86,750.6 | $ | 74,176.8 | $ | 72,722.8 | $ | 78,399.7 | ||||||||||||||||||||

| Average Adjusted Total Assets | 156,854.5 | 149,331.9 | 146,998.5 | 156,854.5 | 149,331.9 | 146,998.5 | ||||||||||||||||||||||||||

| Supplementary Leverage Exposure | N/A | N/A | N/A | 131,379.4 | 130,890.7 | 129,540.1 | ||||||||||||||||||||||||||

| Capital Ratios | ||||||||||||||||||||||||||||||||

| Common Equity Tier 1 Capital | 12.2 | % | 12.9 | % | 12.6 | % | 15.0 | % | 15.3 | % | 13.9 | % | N/A | 4.5 | % | |||||||||||||||||

| Tier 1 Capital | 13.1 | 13.9 | 13.6 | 16.1 | 16.5 | 15.0 | 6.0 | 6.0 | ||||||||||||||||||||||||

| Total Capital | 14.8 | 15.7 | 15.5 | 17.9 | 18.3 | 16.9 | 10.0 | 8.0 | ||||||||||||||||||||||||

| Tier 1 Leverage | 7.6 | 8.0 | 8.0 | 7.6 | 8.0 | 8.0 | N/A | 4.0 | ||||||||||||||||||||||||

| Supplementary Leverage | N/A | N/A | N/A | 9.1 | 9.1 | 9.1 | N/A | 3.0 | ||||||||||||||||||||||||

| ($ In Millions) | Standardized Approach | Advanced Approach | ||||||||||||||||||||||||||||||

|

The Northern Trust Company |

June 30, 2025* | March 31, 2025 | June 30, 2024 | June 30, 2025* | March 31, 2025 | June 30, 2024 | Well-Capitalized Ratios | Minimum Capital Ratios | ||||||||||||||||||||||||

| Regulatory Capital | ||||||||||||||||||||||||||||||||

| Common Equity Tier 1 Capital | $ | 10,278.6 | $ | 10,185.4 | $ | 11,097.6 | $ | 10,278.6 | $ | 10,185.4 | $ | 11,097.6 | ||||||||||||||||||||

| Tier 1 Capital | 10,278.6 | 10,185.4 | 11,097.6 | 10,278.6 | 10,185.4 | 11,097.6 | ||||||||||||||||||||||||||

| Total Capital | 11,501.8 | 11,392.7 | 12,508.5 | 11,278.6 | 11,185.4 | 12,299.6 | ||||||||||||||||||||||||||

| Assets | ||||||||||||||||||||||||||||||||

| Risk-Weighted Assets | $ | 90,205.6 | $ | 84,975.0 | $ | 85,757.1 | $ | 72,017.5 | $ | 70,567.2 | $ | 76,172.9 | ||||||||||||||||||||

| Average Adjusted Total Assets | 156,405.8 | 148,888.6 | 146,578.0 | 156,405.8 | 148,888.6 | 146,578.0 | ||||||||||||||||||||||||||

| Supplementary Leverage Exposure | N/A | N/A | N/A | 130,930.4 | 130,447.1 | 129,016.4 | ||||||||||||||||||||||||||

| Capital Ratios | ||||||||||||||||||||||||||||||||

| Common Equity Tier 1 Capital | 11.4 | % | 12.0 | % | 12.9 | % | 14.3 | % | 14.4 | % | 14.6 | % | 6.5 | % | 4.5 | % | ||||||||||||||||

| Tier 1 Capital | 11.4 | 12.0 | 12.9 | 14.3 | 14.4 | 14.6 | 8.0 | 6.0 | ||||||||||||||||||||||||

| Total Capital | 12.8 | 13.4 | 14.6 | 15.7 | 15.9 | 16.1 | 10.0 | 8.0 | ||||||||||||||||||||||||

| Tier 1 Leverage | 6.6 | 6.8 | 7.6 | 6.6 | 6.8 | 7.6 | 5.0 | 4.0 | ||||||||||||||||||||||||

| Supplementary Leverage | N/A | N/A | N/A | 7.9 | 7.8 | 8.6 | 3.0 | 3.0 | ||||||||||||||||||||||||

NORTHERN TRUST CORPORATION SECOND QUARTER 2025 RESULTS | ||

| RECONCILIATION TO FULLY TAXABLE EQUIVALENT | ||

| QUARTERS | ||||||||||||||||||||

| 2025 | 2024 | |||||||||||||||||||

| ($ in Millions) | SECOND | FIRST | FOURTH | THIRD | SECOND | |||||||||||||||

| Net Interest Income | ||||||||||||||||||||

| Interest Income - GAAP | $ | 2,212.8 | $ | 2,140.9 | $ | 2,280.0 | $ | 2,530.2 | $ | 2,506.5 | ||||||||||

| Add: FTE Adjustment | 4.7 | 5.6 | 10.5 | 7.1 | 6.9 | |||||||||||||||

| Interest Income (FTE) - Non-GAAP | $ | 2,217.5 | $ | 2,146.5 | $ | 2,290.5 | $ | 2,537.3 | $ | 2,513.4 | ||||||||||

| Net Interest Income - GAAP | $ | 610.5 | $ | 568.1 | $ | 563.8 | $ | 562.3 | $ | 522.9 | ||||||||||

| Add: FTE Adjustment | 4.7 | 5.6 | 10.5 | 7.1 | 6.9 | |||||||||||||||

| Net Interest Income (FTE) - Non-GAAP | $ | 615.2 | $ | 573.7 | $ | 574.3 | $ | 569.4 | $ | 529.8 | ||||||||||

Net Interest Margin - GAAP(1) |

1.68 | % | 1.67 | % | 1.68 | % | 1.66 | % | 1.55 | % | ||||||||||

Net Interest Margin (FTE) - Non-GAAP(1) |

1.69 | % | 1.69 | % | 1.71 | % | 1.68 | % | 1.57 | % | ||||||||||

| Total Revenue | ||||||||||||||||||||

| Total Revenue - GAAP | $ | 1,997.9 | $ | 1,940.0 | $ | 1,959.6 | $ | 1,968.5 | $ | 2,715.5 | ||||||||||

| Add: FTE Adjustment | 4.7 | 5.6 | 10.5 | 7.1 | 6.9 | |||||||||||||||

| Total Revenue (FTE) - Non-GAAP | $ | 2,002.6 | $ | 1,945.6 | $ | 1,970.1 | $ | 1,975.6 | $ | 2,722.4 | ||||||||||

| Income before Income Taxes | ||||||||||||||||||||

| Income before Income Taxes - GAAP | $ | 564.8 | $ | 521.4 | $ | 594.2 | $ | 601.1 | $ | 1,173.6 | ||||||||||

| Add: FTE Adjustment | $ | 4.7 | $ | 5.6 | $ | 10.5 | $ | 7.1 | $ | 6.9 | ||||||||||

| Income before Income Taxes (FTE) - Non-GAAP | $ | 569.5 | $ | 527.0 | $ | 604.7 | $ | 608.2 | $ | 1,180.5 | ||||||||||

Profit Margin (pre-tax) - GAAP(2) |

28.3 | % | 26.9 | % | 30.3 | % | 30.5 | % | 43.2 | % | ||||||||||

Profit Margin (pre-tax) (FTE) - Non-GAAP(2) |

28.4 | % | 27.1 | % | 30.7 | % | 30.8 | % | 43.4 | % | ||||||||||

NORTHERN TRUST CORPORATION SECOND QUARTER 2025 RESULTS | ||

| FORWARD LOOKING STATEMENTS | ||

WEBCAST OF SECOND QUARTER EARNINGS CONFERENCE CALL | ||

| NORTHERN TRUST CORPORATION | ||

| (Supplemental Consolidated Financial Information) | ||

| STATEMENT OF INCOME DATA | % Change(1) |

|||||||||||||||||||

| ($ In Millions Except Per Share Data) | Q2 2025 vs. |

|||||||||||||||||||

| Q2 2025 | Q1 2025 | Q2 2024 | Q1 2025 | Q2 2024 | ||||||||||||||||

| Noninterest Income | ||||||||||||||||||||

| Trust, Investment and Other Servicing Fees | $ | 1,231.1 | $ | 1,213.8 | $ | 1,166.1 | 1 | % | 6 | % | ||||||||||

| Foreign Exchange Trading Income | 50.6 | 58.7 | 58.4 | (14) | (13) | |||||||||||||||

| Treasury Management Fees | 9.7 | 9.6 | 9.0 | — | 7 | |||||||||||||||

| Security Commissions and Trading Income | 39.6 | 39.1 | 34.3 | 1 | 16 | |||||||||||||||

| Other Operating Income | 56.4 | 50.7 | 924.7 | 11 | (94) | |||||||||||||||

| Investment Security Gains (Losses), net | — | — | 0.1 | N/M | N/M | |||||||||||||||

| Total Noninterest Income | 1,387.4 | 1,371.9 | 2,192.6 | 1 | (37) | |||||||||||||||

| Net Interest Income | ||||||||||||||||||||

| Interest Income | 2,212.8 | 2,140.9 | 2,506.5 | 3 | (12) | |||||||||||||||

| Interest Expense | 1,602.3 | 1,572.8 | 1,983.6 | 2 | (19) | |||||||||||||||

| Net Interest Income | 610.5 | 568.1 | 522.9 | 7 | 17 | |||||||||||||||

| Total Revenue | 1,997.9 | 1,940.0 | 2,715.5 | 3 | (26) | |||||||||||||||

| Provision for Credit Losses | 16.5 | 1.0 | 8.0 | N/M | N/M | |||||||||||||||

| Noninterest Expense | ||||||||||||||||||||

| Compensation | 614.8 | 644.4 | 665.2 | (5) | (8) | |||||||||||||||

| Employee Benefits | 117.7 | 109.7 | 100.2 | 7 | 17 | |||||||||||||||

| Outside Services | 247.0 | 245.2 | 260.9 | 1 | (5) | |||||||||||||||

| Equipment and Software | 293.7 | 280.9 | 277.5 | 5 | 6 | |||||||||||||||

| Occupancy | 52.5 | 53.4 | 54.8 | (2) | (4) | |||||||||||||||

| Other Operating Expense | 90.9 | 84.0 | 175.3 | 8 | (48) | |||||||||||||||

| Total Noninterest Expense | 1,416.6 | 1,417.6 | 1,533.9 | — | (8) | |||||||||||||||

| Income before Income Taxes | 564.8 | 521.4 | 1,173.6 | 8 | (52) | |||||||||||||||

| Provision for Income Taxes | 143.5 | 129.4 | 277.5 | 11 | (48) | |||||||||||||||

| NET INCOME | $ | 421.3 | $ | 392.0 | $ | 896.1 | 7 | % | (53) | % | ||||||||||

| Preferred Stock Dividends | 4.7 | 16.2 | 4.7 | (71) | — | |||||||||||||||

| NET INCOME APPLICABLE TO COMMON STOCK | $ | 416.6 | $ | 375.8 | $ | 891.4 | 11 | % | (53) | % | ||||||||||

| Earnings Allocated to Participating Securities | 3.8 | 3.6 | 7.1 | 7 | (46) | |||||||||||||||

| Earnings Allocated to Common and Potential Common Shares | $ | 412.8 | $ | 372.2 | $ | 884.3 | 11 | % | (53) | % | ||||||||||

| Per Common Share | ||||||||||||||||||||

| Net Income | ||||||||||||||||||||

| Basic | $ | 2.14 | $ | 1.91 | $ | 4.35 | 12 | % | (51) | % | ||||||||||

| Diluted | 2.13 | 1.90 | 4.34 | 12 | (51) | |||||||||||||||

| Average Common Equity | $ | 11,727.2 | $ | 11,719.1 | $ | 11,473.9 | — | % | 2 | % | ||||||||||

| Return on Average Common Equity | 14.2 | % | 13.0 | % | 31.2 | % | ||||||||||||||

| Cash Dividends Declared per Common Share | $ | 0.75 | $ | 0.75 | $ | 0.75 | — | % | — | % | ||||||||||

| Average Common Shares Outstanding (000s) | ||||||||||||||||||||

| Basic | 192,752 | 195,193 | 203,306 | (1) | % | (5) | % | |||||||||||||

| Diluted | 193,375 | 196,125 | 203,739 | (1) | (5) | |||||||||||||||

| Common Shares Outstanding (EOP) (000s) | 191,233 | 194,539 | 201,638 | (2) | (5) | |||||||||||||||

| NORTHERN TRUST CORPORATION | ||

| (Supplemental Consolidated Financial Information) | ||

| STATEMENT OF INCOME DATA | ||||||||||||||

| ($ In Millions Except Per Share Data) | SIX MONTHS | |||||||||||||

| 2025 | 2024 | % Change(1) |

||||||||||||

| Noninterest Income | ||||||||||||||

| Trust, Investment and Other Servicing Fees | $ | 2,444.9 | $ | 2,309.0 | 6 | % | ||||||||

| Foreign Exchange Trading Income | 109.3 | 115.4 | (5) | |||||||||||

| Treasury Management Fees | 19.3 | 18.3 | 5 | |||||||||||

| Security Commissions and Trading Income | 78.7 | 72.2 | 9 | |||||||||||

| Other Operating Income | 107.1 | 985.7 | (89) | |||||||||||

| Investment Security Gains (Losses), net | — | (189.3) | N/M | |||||||||||

| Total Noninterest Income | 2,759.3 | 3,311.3 | (17) | |||||||||||

| Net Interest Income | ||||||||||||||

| Interest Income | 4,353.7 | 4,952.1 | (12) | |||||||||||

| Interest Expense | 3,175.1 | 3,901.1 | (19) | |||||||||||

| Net Interest Income | 1,178.6 | 1,051.0 | 12 | |||||||||||

| Total Revenue | 3,937.9 | 4,362.3 | (10) | |||||||||||

| Provision for Credit Losses | 17.5 | (0.5) | N/M | |||||||||||

| Noninterest Expense | ||||||||||||||

| Compensation | 1,259.2 | 1,292.3 | (3) | |||||||||||

| Employee Benefits | 227.4 | 201.3 | 13 | |||||||||||

| Outside Services | 492.2 | 490.2 | — | |||||||||||

| Equipment and Software | 574.6 | 530.2 | 8 | |||||||||||

| Occupancy | 105.9 | 108.9 | (3) | |||||||||||

| Other Operating Expense | 174.9 | 275.7 | (37) | |||||||||||

| Total Noninterest Expense | 2,834.2 | 2,898.6 | (2) | |||||||||||

| Income before Income Taxes | 1,086.2 | 1,464.2 | (26) | |||||||||||

| Provision for Income Taxes | 272.9 | 353.4 | (23) | |||||||||||

| NET INCOME | $ | 813.3 | $ | 1,110.8 | (27) | % | ||||||||

Preferred Stock Dividends |

20.9 | 20.9 | — | |||||||||||

| NET INCOME APPLICABLE TO COMMON STOCK | $ | 792.4 | $ | 1,089.9 | (27) | % | ||||||||

| Earnings Allocated to Participating Securities | 7.4 | 9.5 | (22) | |||||||||||

| Earnings Allocated to Common and Potential Common Shares | $ | 785.0 | $ | 1,080.4 | (27) | % | ||||||||

| Per Common Share | ||||||||||||||

| Net Income | ||||||||||||||

| Basic | $ | 4.05 | $ | 5.30 | (24) | % | ||||||||

| Diluted | 4.03 | 5.28 | (24) | |||||||||||

| Average Common Equity | $ | 11,723.2 | $ | 11,186.4 | 5 | % | ||||||||

| Return on Average Common Equity | 13.6 | % | 19.6 | % | ||||||||||

| Cash Dividends Declared per Common Share | $ | 1.50 | $ | 1.50 | — | % | ||||||||

| Average Common Shares Outstanding (000s) | ||||||||||||||

| Basic | 193,966 | 203,968 | (5) | % | ||||||||||

| Diluted | 194,742 | 204,437 | (5) | |||||||||||

| Common Shares Outstanding (EOP) (000s) | 191,233 | 201,638 | (5) | |||||||||||

| NORTHERN TRUST CORPORATION | ||

| (Supplemental Consolidated Financial Information) | ||

| BALANCE SHEET | ||||||||||||||||||||

| ($ In Millions) | % Change(1) |

|||||||||||||||||||

June 30, 2025 vs. |

||||||||||||||||||||

| June 30, 2025 | March 31, 2025 | June 30, 2024 | March 31, 2025 | June 30, 2024 | ||||||||||||||||

| Assets | ||||||||||||||||||||

| Federal Reserve and Other Central Bank Deposits | $ | 52,265.5 | $ | 52,794.5 | $ | 43,206.1 | (1) | % | 21 | % | ||||||||||

Interest-Bearing Due from and Deposits with Banks(2) |

6,800.9 | 5,277.1 | 5,558.9 | 29 | 22 | |||||||||||||||

| Federal Funds Sold and Securities Purchased under Agreements to Resell | 921.9 | 124.4 | 859.6 | N/M | 7 | |||||||||||||||

| Debt Securities | ||||||||||||||||||||

| Available for Sale | 32,250.4 | 30,464.3 | 26,861.7 | 6 | 20 | |||||||||||||||

| Held to Maturity | 21,400.8 | 20,874.3 | 22,798.6 | 3 | (6) | |||||||||||||||

| Total Debt Securities | 53,651.2 | 51,338.6 | 49,660.3 | 5 | 8 | |||||||||||||||

| Loans | 43,323.4 | 40,833.3 | 42,135.2 | 6 | 3 | |||||||||||||||

Other Interest-Earning Assets(3) |

2,522.6 | 2,834.1 | 3,025.2 | (11) | (17) | |||||||||||||||

| Total Earning Assets | 159,485.5 | 153,202.0 | 144,445.3 | 4 | 10 | |||||||||||||||

| Allowance for Credit Losses | (188.5) | (174.5) | (179.5) | 8 | 5 | |||||||||||||||

Cash and Due from Banks and Other Central Bank Deposits(4) |

2,035.1 | 737.4 | 2,390.1 | 176 | (15) | |||||||||||||||

| Buildings and Equipment | 467.7 | 477.4 | 481.0 | (2) | (3) | |||||||||||||||

| Goodwill | 714.6 | 700.5 | 697.4 | 2 | 2 | |||||||||||||||

| Other Assets | 9,369.2 | 10,128.4 | 8,962.8 | (7) | 5 | |||||||||||||||

| Total Assets | $ | 171,883.6 | $ | 165,071.2 | $ | 156,797.1 | 4 | % | 10 | % | ||||||||||

| Liabilities and Stockholders’ Equity | ||||||||||||||||||||

| Interest-Bearing Deposits | ||||||||||||||||||||

| Savings, Money Market and Other | $ | 27,965.1 | $ | 28,489.1 | $ | 28,074.0 | (2) | % | — | % | ||||||||||

| Savings Certificates and Other Time | 6,742.5 | 6,680.2 | 6,378.4 | 1 | 6 | |||||||||||||||

| Non-U.S. Offices - Interest-Bearing | 77,206.9 | 73,951.0 | 67,612.3 | 4 | 14 | |||||||||||||||

| Total Interest-Bearing Deposits | 111,914.5 | 109,120.3 | 102,064.7 | 3 | 10 | |||||||||||||||

| Federal Funds Purchased | 2,388.5 | 2,377.6 | 2,406.4 | — | (1) | |||||||||||||||

| Securities Sold under Agreements to Repurchase | 841.4 | 335.7 | 629.2 | 151 | 34 | |||||||||||||||

Other Borrowings(5) |

6,532.9 | 6,534.5 | 6,823.7 | — | (4) | |||||||||||||||

| Senior Notes | 2,835.2 | 2,809.3 | 2,744.0 | 1 | 3 | |||||||||||||||

| Long-Term Debt | 4,089.8 | 4,085.6 | 4,073.0 | — | — | |||||||||||||||

| Total Interest-Bearing Liabilities | 128,602.3 | 125,263.0 | 118,741.0 | 3 | 8 | |||||||||||||||

| Demand and Other Noninterest-Bearing Deposits | 25,139.2 | 21,905.3 | 20,926.2 | 15 | 20 | |||||||||||||||

| Other Liabilities | 5,275.6 | 5,024.4 | 4,474.1 | 5 | 18 | |||||||||||||||

| Total Liabilities | 159,017.1 | 152,192.7 | 144,141.3 | 4 | 10 | |||||||||||||||

| Common Equity | ||||||||||||||||||||

| Common Equity, excluding Accumulated Other Comprehensive Income | 12,680.8 | 12,733.0 | 12,635.9 | — | — | |||||||||||||||

| Accumulated Other Comprehensive Income (Loss) | (699.2) | (739.4) | (865.0) | (5) | (19) | |||||||||||||||

| Total Common Equity | 11,981.6 | 11,993.6 | 11,770.9 | — | 2 | |||||||||||||||

| Preferred Equity | 884.9 | 884.9 | 884.9 | — | — | |||||||||||||||

| Total Equity | 12,866.5 | 12,878.5 | 12,655.8 | — | 2 | |||||||||||||||

| Total Liabilities and Stockholders’ Equity | $ | 171,883.6 | $ | 165,071.2 | $ | 156,797.1 | 4 | % | 10 | % | ||||||||||

| NORTHERN TRUST CORPORATION | ||

| (Supplemental Consolidated Financial Information) | ||

| AVERAGE BALANCE SHEET | ||||||||||||||||||||

| ($ In Millions) | % Change(1) |

|||||||||||||||||||

Q2 2025 vs. |

||||||||||||||||||||

| Q2 2025 | Q1 2025 | Q2 2024 | Q1 2025 | Q2 2024 | ||||||||||||||||

| Assets | ||||||||||||||||||||

| Federal Reserve and Other Central Bank Deposits | $ | 43,655.3 | $ | 37,161.0 | $ | 35,924.1 | 17 | % | 22 | % | ||||||||||

Interest-Bearing Due from and Deposits with Banks(2) |

5,321.5 | 4,877.6 | 4,999.7 | 9 | 6 | |||||||||||||||

| Federal Funds Sold and Securities Purchased under Agreements to Resell | 713.2 | 394.5 | 732.2 | 81 | (3) | |||||||||||||||

| Debt Securities | ||||||||||||||||||||

| Available for Sale | 31,415.0 | 30,168.3 | 26,591.4 | 4 | 18 | |||||||||||||||

| Held to Maturity | 20,895.9 | 21,821.9 | 23,373.8 | (4) | (11) | |||||||||||||||

| Total Debt Securities | 52,310.9 | 51,990.2 | 49,965.2 | 1 | 5 | |||||||||||||||

| Loans | 41,158.0 | 41,076.5 | 41,034.6 | — | — | |||||||||||||||

Other Interest-Earning Assets(3) |

2,663.1 | 2,508.1 | 2,745.3 | 6 | (3) | |||||||||||||||

| Total Earning Assets | 145,822.0 | 138,007.9 | 135,401.1 | 6 | 8 | |||||||||||||||

| Allowance for Credit Losses | (174.9) | (175.6) | (175.8) | — | (1) | |||||||||||||||

Cash and Due from Banks and Other Central Bank Deposits(4) |

1,069.8 | 1,041.2 | 1,802.0 | 3 | (41) | |||||||||||||||

| Buildings and Equipment | 479.3 | 484.8 | 485.8 | (1) | (1) | |||||||||||||||

| Goodwill | 709.1 | 696.4 | 697.1 | 2 | 2 | |||||||||||||||

| Other Assets | 9,813.9 | 10,207.4 | 9,791.0 | (4) | — | |||||||||||||||

| Total Assets | $ | 157,719.2 | $ | 150,262.1 | $ | 148,001.2 | 5 | % | 7 | % | ||||||||||

| Liabilities and Stockholders’ Equity | ||||||||||||||||||||

| Interest-Bearing Deposits | ||||||||||||||||||||

| Savings, Money Market and Other | $ | 28,797.4 | $ | 27,720.5 | $ | 27,554.9 | 4 | % | 5 | % | ||||||||||

| Savings Certificates and Other Time | 6,652.0 | 6,874.0 | 6,027.4 | (3) | 10 | |||||||||||||||

| Non-U.S. Offices - Interest-Bearing | 70,158.0 | 64,454.3 | 63,216.3 | 9 | 11 | |||||||||||||||

| Total Interest-Bearing Deposits | 105,607.4 | 99,048.8 | 96,798.6 | 7 | 9 | |||||||||||||||

| Federal Funds Purchased | 2,469.0 | 2,393.6 | 3,010.7 | 3 | (18) | |||||||||||||||

| Securities Sold under Agreements to Repurchase | 584.6 | 442.4 | 574.6 | 32 | 2 | |||||||||||||||

Other Borrowings(5) |

7,008.2 | 7,024.4 | 7,053.5 | — | (1) | |||||||||||||||

| Senior Notes | 2,818.2 | 2,781.6 | 2,728.7 | 1 | 3 | |||||||||||||||

| Long-Term Debt | 4,087.8 | 4,083.5 | 4,071.1 | — | — | |||||||||||||||

| Total Interest-Bearing Liabilities | 122,575.2 | 115,774.3 | 114,237.2 | 6 | 7 | |||||||||||||||

| Demand and Other Noninterest-Bearing Deposits | 16,770.4 | 16,870.3 | 16,543.0 | (1) | 1 | |||||||||||||||

| Other Liabilities | 5,761.5 | 5,013.5 | 4,862.2 | 15 | 18 | |||||||||||||||

| Total Liabilities | 145,107.1 | 137,658.1 | 135,642.4 | 5 | 7 | |||||||||||||||

| Common Equity | ||||||||||||||||||||

| Common Equity, excluding Accumulated Other Comprehensive Income | 12,500.4 | 12,527.2 | 12,375.7 | — | 1 | |||||||||||||||

| Accumulated Other Comprehensive Income (Loss) | (773.2) | (808.1) | (901.8) | (4) | (14) | |||||||||||||||

| Total Common Equity | 11,727.2 | 11,719.1 | 11,473.9 | — | 2 | |||||||||||||||

| Preferred Equity | 884.9 | 884.9 | 884.9 | — | — | |||||||||||||||

| Total Equity | 12,612.1 | 12,604.0 | 12,358.8 | — | 2 | |||||||||||||||

| Total Liabilities and Stockholders’ Equity | $ | 157,719.2 | $ | 150,262.1 | $ | 148,001.2 | 5 | % | 7 | % | ||||||||||

| NORTHERN TRUST CORPORATION | ||

| (Supplemental Consolidated Financial Information) | ||

| QUARTERLY TREND DATA | QUARTERS | |||||||||||||||||||

| ($ In Millions Except Per Share Data) | 2025 | 2024 | ||||||||||||||||||

| SECOND | FIRST | FOURTH | THIRD | SECOND | ||||||||||||||||

| Net Income Summary | ||||||||||||||||||||

| Trust, Investment and Other Servicing Fees | $ | 1,231.1 | $ | 1,213.8 | $ | 1,222.2 | $ | 1,196.6 | $ | 1,166.1 | ||||||||||

| Other Noninterest Income | 156.3 | 158.1 | 173.6 | 209.6 | 1,026.5 | |||||||||||||||

| Net Interest Income | 610.5 | 568.1 | 563.8 | 562.3 | 522.9 | |||||||||||||||

| Total Revenue | 1,997.9 | 1,940.0 | 1,959.6 | 1,968.5 | 2,715.5 | |||||||||||||||

| Provision for Credit Losses | 16.5 | 1.0 | (10.5) | 8.0 | 8.0 | |||||||||||||||

| Noninterest Expense | 1,416.6 | 1,417.6 | 1,375.9 | 1,359.4 | 1,533.9 | |||||||||||||||

| Income before Income Taxes | 564.8 | 521.4 | 594.2 | 601.1 | 1,173.6 | |||||||||||||||

| Provision for Income Taxes | 143.5 | 129.4 | 138.8 | 136.2 | 277.5 | |||||||||||||||

| Net Income | $ | 421.3 | $ | 392.0 | $ | 455.4 | $ | 464.9 | $ | 896.1 | ||||||||||

| Per Common Share | ||||||||||||||||||||

| Net Income - Basic | $ | 2.14 | $ | 1.91 | $ | 2.27 | $ | 2.23 | $ | 4.35 | ||||||||||

| - Diluted | 2.13 | 1.90 | 2.26 | 2.22 | 4.34 | |||||||||||||||

| Cash Dividends Declared per Common Share | 0.75 | 0.75 | 0.75 | 0.75 | 0.75 | |||||||||||||||

| Book Value (EOP) | 62.65 | 61.65 | 60.74 | 59.85 | 58.38 | |||||||||||||||

| Market Value (EOP) | 126.79 | 98.65 | 102.50 | 90.03 | 83.98 | |||||||||||||||

| Financial Ratios | ||||||||||||||||||||

| Return on Average Common Equity | 14.2 | % | 13.0 | % | 15.3 | % | 15.4 | % | 31.2 | % | ||||||||||

| Net Interest Margin (GAAP) | 1.68 | 1.67 | 1.68 | 1.66 | 1.55 | |||||||||||||||

| Net Interest Margin (FTE*) | 1.69 | 1.69 | 1.71 | 1.68 | 1.57 | |||||||||||||||

| Assets Under Custody / Administration ($ in Billions) - End Of Period | ||||||||||||||||||||

| Asset Servicing | $ | 16,864.9 | $ | 15,804.7 | $ | 15,640.1 | $ | 16,278.0 | $ | 15,470.8 | ||||||||||

| Wealth Management | 1,203.4 | 1,119.3 | 1,147.9 | 1,145.0 | 1,096.6 | |||||||||||||||

| Total Assets Under Custody / Administration | $ | 18,068.3 | $ | 16,924.0 | $ | 16,788.0 | $ | 17,423.0 | $ | 16,567.4 | ||||||||||

| Assets Under Custody ($ In Billions) - End Of Period | ||||||||||||||||||||

| Asset Servicing | $ | 13,056.5 | $ | 12,163.6 | $ | 12,214.0 | $ | 12,662.1 | $ | 11,955.5 | ||||||||||

| Wealth Management | 1,187.2 | 1,105.9 | 1,135.2 | 1,132.7 | 1,085.9 | |||||||||||||||

| Total Assets Under Custody | $ | 14,243.7 | $ | 13,269.5 | $ | 13,349.2 | $ | 13,794.8 | $ | 13,041.4 | ||||||||||

| Assets Under Management ($ In Billions) - End Of Period | ||||||||||||||||||||

| Asset Servicing | $ | 1,229.2 | $ | 1,160.9 | $ | 1,159.7 | $ | 1,177.9 | $ | 1,107.3 | ||||||||||

| Wealth Management | 468.5 | 446.9 | 450.7 | 443.9 | 419.4 | |||||||||||||||

| Total Assets Under Management | $ | 1,697.7 | $ | 1,607.8 | $ | 1,610.4 | $ | 1,621.8 | $ | 1,526.7 | ||||||||||

| Asset Quality ($ In Millions) - End Of Period | ||||||||||||||||||||

Nonaccrual Loans/Assets(1) |

$ | 92.8 | $ | 73.1 | $ | 56.0 | $ | 39.3 | $ | 38.5 | ||||||||||

Nonaccrual Assets / Loans(1) |

0.21 | % | 0.18 | % | 0.13 | % | 0.09 | % | 0.09 | % | ||||||||||

| Gross Charge-offs | $ | (0.1) | $ | (0.3) | $ | (4.1) | $ | — | $ | (0.3) | ||||||||||

| Gross Recoveries | 0.4 | 0.5 | 0.7 | 2.4 | 0.4 | |||||||||||||||

| Net Recoveries (Charge-offs) | $ | 0.3 | $ | 0.2 | $ | (3.4) | $ | 2.4 | $ | 0.1 | ||||||||||

| Annualized Net Recoveries (Charge-offs) to Avg Loans | — | % | — | % | (0.03) | % | 0.02 | % | — | % | ||||||||||

| Allowance for Credit Losses Assigned to: | ||||||||||||||||||||

| Loans | $ | 180.5 | $ | 167.1 | $ | 168.0 | $ | 184.8 | $ | 167.7 | ||||||||||

| Undrawn Loan Commitments and Standby Letters of Credit | 34.7 | 32.8 | 30.4 | 26.5 | 29.5 | |||||||||||||||

| Debt Securities and Other Financial Assets | 8.9 | 7.4 | 7.7 | 8.7 | 12.4 | |||||||||||||||

| Loans Allowance / Nonaccrual Loans | 1.9 | x | 2.3 | x | 3.0 | x | 4.7 | x | 4.4 | x | ||||||||||

| Jennifer Childe | ||

| Senior Vice President, Director of Investor Relations | ||

| (312) 444-3290 or jennifer.childe@ntrs.com | ||

| Trace Stegeman | ||

| Senior Financial Analyst, Investor Relations | ||

| (312) 630-1428 or trace.stegeman@ntrs.com | ||

| TABLE OF CONTENTS | |||||||||||

| 1 | 7 | ||||||||||

| Financial Summary | Balance Sheet Mix Trends | ||||||||||

| 2 | 8 | ||||||||||

| Income Statement | Interest Rate Trends | ||||||||||

| 3 | 9 | ||||||||||

| Net Income Trends | Asset Quality | ||||||||||

| 4 | 10 | ||||||||||

| Reporting Segment Results | Trust Assets | ||||||||||

| 5 | 11 | ||||||||||

| Balance Sheet (EOP) | Reconciliation to FTE | ||||||||||

| 6 | 12 | ||||||||||

| Balance Sheet Trends | Reconciliation to FTE (Ratios) | ||||||||||

| Northern Trust Corporation | ||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| FINANCIAL SUMMARY | ||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| ($ in Millions except per share information) | ||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| 2024 | 2025 | |||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| 2020 | 2021 | 2022 | 2023 | 2024 | 1st Qtr | 2nd Qtr | 3rd Qtr | 4th Qtr | 1st Qtr | 2nd Qtr | 3rd Qtr | 4th Qtr | ||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| Profitability: | ||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| $ | 1,209.3 | $ | 1,545.3 | $ | 1,336.0 | $ | 1,107.3 | $ | 2,031.1 | Net Income | $ | 214.7 | $ | 896.1 | $ | 464.9 | $ | 455.4 | $ | 392.0 | $ | 421.3 | ||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| Earnings Allocated to Common and Potential | ||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| 1,141.0 | 1,490.6 | 1,282.4 | 1,053.9 | 1,972.4 | Common Shares | 196.1 | 884.3 | 445.0 | 447.0 | 372.2 | 412.8 | |||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| $ | 5.48 | $ | 7.16 | $ | 6.16 | $ | 5.09 | $ | 9.80 | Basic Earnings Per Share | $ | 0.96 | $ | 4.35 | $ | 2.23 | $ | 2.27 | $ | 1.91 | $ | 2.14 | ||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| 5.46 | 7.14 | 6.14 | 5.08 | 9.77 | Diluted Earnings Per Share | 0.96 | 4.34 | 2.22 | 2.26 | 1.90 | 2.13 | |||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| (18 | %) | 31 | % | (14 | %) | (17 | %) | 92 | % | Diluted EPS Growth over Previous Year | (37 | %) | 179 | % | 49 | % | N/M | 99 | % | (51 | %) | |||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| 11.2 | % | 13.9 | % | 12.7 | % | 10.0 | % | 17.4 | % | Return on Average Common Equity | 7.3 | % | 31.2 | % | 15.4 | % | 15.3 | % | 13.0 | % | 14.2 | % | ||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| 27.1 | % | 31.5 | % | 26.6 | % | 22.3 | % | 32.3 | % | Profit Margin (pre-tax) (FTE)(1) |

18.0 | % | 43.4 | % | 30.8 | % | 30.7 | % | 27.1 | % | 28.4 | % | ||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| 19.7 | % | 23.8 | % | 19.6 | % | 16.2 | % | 24.4 | % | Profit Margin (after-tax) (FTE)(1) |

13.0 | % | 32.9 | % | 23.5 | % | 23.1 | % | 20.1 | % | 21.0 | % | ||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| 75.9 | % | 78.2 | % | 71.6 | % | 70.1 | % | 73.5 | % | Noninterest Income to Total Revenue (FTE)(1) |

67.6 | % | 80.5 | % | 71.2 | % | 70.8 | % | 70.5 | % | 69.3 | % | ||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| 65.1 | % | 67.1 | % | 65.1 | % | 63.9 | % | 56.8 | % | Trust Fees to Total Revenue (FTE)(1) |

69.1 | % | 42.8 | % | 60.6 | % | 62.0 | % | 62.4 | % | 61.5 | % | ||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| 25.7 | % | 23.1 | % | 24.4 | % | 24.4 | % | 23.6 | % | Effective Tax Rate (US GAAP) | 26.1 | % | 23.6 | % | 22.7 | % | 23.4 | % | 24.8 | % | 25.4 | % | ||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| 27.2 | % | 24.5 | % | 26.3 | % | 27.3 | % | 24.5 | % | Effective Tax Rate (FTE)(1) |

27.9 | % | 24.1 | % | 23.5 | % | 24.7 | % | 25.6 | % | 26.0 | % | ||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

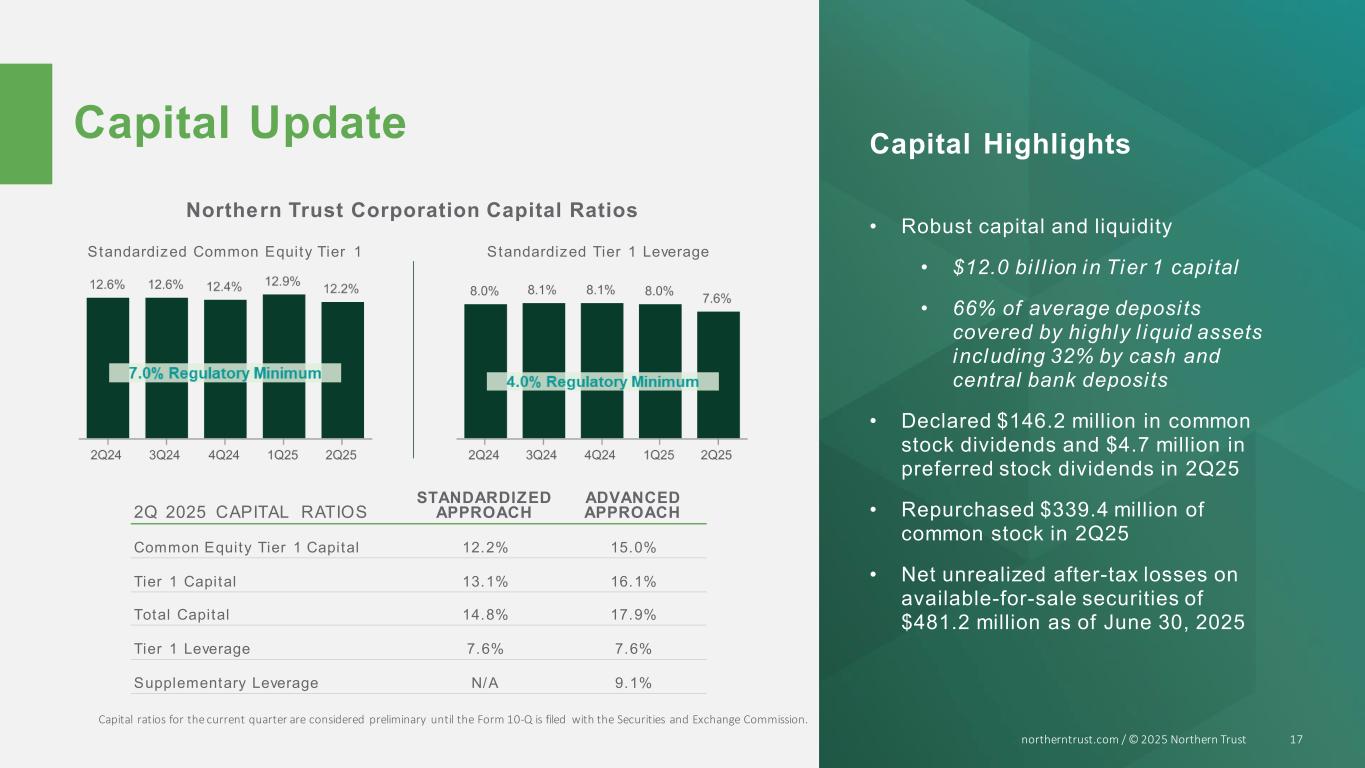

Capital Ratios:(2) |

||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| Standardized Approach | ||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| 12.8 | % | 11.9 | % | 10.8 | % | 11.4 | % | 12.4 | % | Common Equity Tier 1 Capital | 11.4 | % | 12.6 | % | 12.6 | % | 12.4 | % | 12.9 | % | 12.2 | % | ||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| 13.9 | % | 12.9 | % | 11.8 | % | 12.3 | % | 13.3 | % | Tier 1 Capital | 12.4 | % | 13.6 | % | 13.6 | % | 13.3 | % | 13.9 | % | 13.1 | % | ||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| 15.6 | % | 14.1 | % | 13.9 | % | 14.2 | % | 15.1 | % | Total Capital | 14.2 | % | 15.5 | % | 15.6 | % | 15.1 | % | 15.7 | % | 14.8 | % | ||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| 7.6 | % | 6.9 | % | 7.1 | % | 8.1 | % | 8.1 | % | Tier 1 Leverage | 7.8 | % | 8.0 | % | 8.1 | % | 8.1 | % | 8.0 | % | 7.6 | % | ||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| Advanced Approach | ||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| 13.4 | % | 13.2 | % | 11.5 | % | 13.4 | % | 14.5 | % | Common Equity Tier 1 Capital | 13.5 | % | 13.9 | % | 14.0 | % | 14.5 | % | 15.3 | % | 15.0 | % | ||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| 14.5 | % | 14.3 | % | 12.5 | % | 14.5 | % | 15.6 | % | Tier 1 Capital | 14.6 | % | 15.0 | % | 15.1 | % | 15.6 | % | 16.5 | % | 16.1 | % | ||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| 15.9 | % | 15.3 | % | 14.5 | % | 16.5 | % | 17.4 | % | Total Capital | 16.5 | % | 16.9 | % | 17.0 | % | 17.4 | % | 18.3 | % | 17.9 | % | ||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| 7.6 | % | 6.9 | % | 7.1 | % | 8.1 | % | 8.1 | % | Tier 1 Leverage | 7.8 | % | 8.0 | % | 8.1 | % | 8.1 | % | 8.0 | % | 7.6 | % | ||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| 8.6 | % | 8.2 | % | 7.9 | % | 8.6 | % | 8.9 | % | Supplementary Leverage (3) |

8.8 | % | 9.1 | % | 9.2 | % | 8.9 | % | 9.1 | % | 9.1 | % | ||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| Per Share Information / Ratios: | ||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| $ | 2.80 | $ | 2.80 | $ | 2.90 | $ | 3.00 | $ | 3.00 | Cash Dividends Declared Per Common Share | $ | 0.75 | $ | 0.75 | $ | 0.75 | $ | 0.75 | $ | 0.75 | $ | 0.75 | ||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| 51 | % | 39 | % | 47 | % | 59 | % | 31 | % | Dividend Payout Ratio | 78 | % | 17 | % | 34 | % | 33 | % | 39 | % | 35 | % | ||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| $ | 93.14 | $ | 119.61 | $ | 88.49 | $ | 84.38 | $ | 102.50 | Market Value Per Share (End of Period) | $ | 88.92 | $ | 83.98 | $ | 90.03 | $ | 102.50 | $ | 98.65 | $ | 126.79 | ||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| 17.1 | 16.8 | 14.4 | 16.6 | 10.5 | Stock Price Multiple of Earnings | 19.6 | 11.5 | 11.2 | 10.5 | 9.2 | 14.9 | |||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| (based on trailing 4 quarters of diluted EPS) | ||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| $ | 51.87 | $ | 53.58 | $ | 49.78 | $ | 53.69 | $ | 60.74 | Book Value Per Common Share (End of Period) | $ | 54.83 | $ | 58.38 | $ | 59.85 | $ | 60.74 | $ | 61.65 | $ | 62.65 | ||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

(1) |

Fully taxable equivalent (FTE). Presentation on an FTE basis is a non-generally accepted accounting principle financial measure. Please refer to the Reconciliation to Fully Taxable Equivalent - Ratios on page 12 for further detail. | |||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

(2) |

Regulatory Capital and resulting ratios for the current quarter are considered preliminary until the Form 10-Q is filed with the Securities and Exchange Commission. |

|||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

(3) |

From April 1, 2020, through April 1, 2021, the Federal Reserve issued temporary Supplementary Leverage Ratio (SLR) relief that required Northern Trust to exclude U.S. Treasury balances from the SLR. Please see the Northern Trust Corporation Pillar 3 disclosures for further SLR discussion. | |||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| Northern Trust Corporation | ||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| INCOME STATEMENT | ||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| ($ in Millions except per share information) | ||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| SIX MONTHS | CHANGE (2) |

SECOND QUARTER | CHANGE (2) |

|||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| 2025 | 2024 | $ | % | 2025 | 2024 | $ | % | |||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| $ | 1,363.7 | $ | 1,290.2 | $ | 73.5 | 6 | % | Asset Servicing Trust, Investment and Other Servicing Fees | $ | 691.8 | $ | 650.6 | $ | 41.2 | 6 | % | ||||||||||||||||||||||||||||||||||||||||||||||||||||

| 1,081.2 | 1,018.8 | 62.4 | 6 | % | WM Trust, Investment and Other Servicing Fees | 539.3 | 515.5 | 23.8 | 5 | % | ||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| 2,444.9 | 2,309.0 | 135.9 | 6 | % | Total Fees | 1,231.1 | 1,166.1 | 65.0 | 6 | % | ||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| 109.3 | 115.4 | (6.1) | (5) | % | Foreign Exchange Trading Income | 50.6 | 58.4 | (7.8) | (13) | % | ||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| 19.3 | 18.3 | 1.0 | 5 | % | Treasury Management Fees | 9.7 | 9.0 | 0.7 | 7 | % | ||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| 78.7 | 72.2 | 6.5 | 9 | % | Security Commissions and Trading Income | 39.6 | 34.3 | 5.3 | 16 | % | ||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| 107.1 | 985.7 | (878.6) | (89) | % | Other Operating Income | 56.4 | 924.7 | (868.3) | (94) | % | ||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| — | (189.3) | 189.3 | N/M | Investment Security Gains (Losses), net | — | 0.1 | (0.1) | N/M | ||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| 2,759.3 | 3,311.3 | (552.0) | (17) | % | Total Noninterest Income | 1,387.4 | 2,192.6 | (805.2) | (37) | % | ||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| 4,364.0 | 4,966.3 | (602.3) | (12) | % | Interest Income (FTE)(1) |

2,217.5 | 2,513.4 | (295.9) | (12) | % | ||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| 3,175.1 | 3,901.1 | (726.0) | (19) | % | Interest Expense | 1,602.3 | 1,983.6 | (381.3) | (19) | % | ||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| 1,188.9 | 1,065.2 | 123.7 | 12 | % | Net Interest Income (FTE)(1) |

615.2 | 529.8 | 85.4 | 16 | % | ||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| 3,948.2 | 4,376.5 | (428.3) | (10) | % | Total Revenue (FTE)(1) |

2,002.6 | 2,722.4 | (719.8) | (26) | % | ||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| 17.5 | (0.5) | 18.0 | N/M | Provision for Credit Losses | 16.5 | 8.0 | 8.5 | N/M | ||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| 1,259.2 | 1,292.3 | (33.1) | (3) | % | Compensation | 614.8 | 665.2 | (50.4) | (8) | % | ||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| 227.4 | 201.3 | 26.1 | 13 | % | Employee Benefits | 117.7 | 100.2 | 17.5 | 17 | % | ||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| 492.2 | 490.2 | 2.0 | — | % | Outside Services | 247.0 | 260.9 | (13.9) | (5) | % | ||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| 574.6 | 530.2 | 44.4 | 8 | % | Equipment and Software | 293.7 | 277.5 | 16.2 | 6 | % | ||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| 105.9 | 108.9 | (3.0) | (3) | % | Occupancy | 52.5 | 54.8 | (2.3) | (4) | % | ||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| 174.9 | 275.7 | (100.8) | (37) | % | Other Operating Expense | 90.9 | 175.3 | (84.4) | (48) | % | ||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| 2,834.2 | 2,898.6 | (64.4) | (2) | % | Total Noninterest Expense | 1,416.6 | 1,533.9 | (117.3) | (8) | % | ||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| 1,096.5 | 1,478.4 | (381.9) | (26) | % | Income before Income Taxes (FTE)(1) |

569.5 | 1,180.5 | (611.0) | (52) | % | ||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| 272.9 | 353.4 | (80.5) | (23) | % | Provision for Income Taxes | 143.5 | 277.5 | (134.0) | (48) | % | ||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| 10.3 | 14.2 | (3.9) | (27) | % | Taxable Equivalent Adjustment | 4.7 | 6.9 | (2.2) | (31) | % | ||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| 283.2 | 367.6 | (84.4) | (23) | % | Total Taxes (FTE)(1) |

148.2 | 284.4 | (136.2) | (48) | % | ||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| $ | 813.3 | $ | 1,110.8 | $ | (297.5) | (27) | % | Net Income | $ | 421.3 | $ | 896.1 | $ | (474.8) | (53) | % | ||||||||||||||||||||||||||||||||||||||||||||||||||||

| $ | 20.9 | $ | 20.9 | $ | — | — | % | Dividends on Preferred Stock | $ | 4.7 | $ | 4.7 | $ | — | — | % | ||||||||||||||||||||||||||||||||||||||||||||||||||||

| 7.4 | 9.5 | (2.1) | (22) | % | Earnings Allocated to Participating Securities | 3.8 | 7.1 | (3.3) | (46) | % | ||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| 785.0 | 1,080.4 | (295.4) | (27) | % | Earnings Allocated to Common and Potential Common Shares | 412.8 | 884.3 | (471.5) | (53) | % | ||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| $ | 4.05 | $ | 5.30 | $ | (1.25) | (24) | % | Earnings Per Share - Basic | $ | 2.14 | $ | 4.35 | $ | (2.21) | (51) | % | ||||||||||||||||||||||||||||||||||||||||||||||||||||

| $ | 4.03 | $ | 5.28 | $ | (1.25) | (24) | % | Earnings Per Share - Diluted | $ | 2.13 | $ | 4.34 | $ | (2.21) | (51) | % | ||||||||||||||||||||||||||||||||||||||||||||||||||||

| 193,966 | 203,968 | (10,002) | (5) | % | Average Basic Shares (000s) | 192,752 | 203,306 | (10,554) | (5) | % | ||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| 194,742 | 204,437 | (9,695) | (5) | % | Average Diluted Shares (000s) | 193,375 | 203,739 | (10,364) | (5) | % | ||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| 191,233 | 201,638 | (10,405) | (5) | % | End of Period Shares Outstanding (000s) | 191,233 | 201,638 | (10,405) | (5) | % | ||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| N/M - Not meaningful | ||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

(1) Fully taxable equivalent (FTE). Presentation on an FTE basis is a non-generally accepted accounting principle financial measure. Please refer to the Reconciliation to Fully Taxable Equivalent on page 11 for further detail. |

||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

(2) Percentage calculations are based on actual balances rather than the rounded amounts presented in the table above. |

||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| Northern Trust Corporation | |||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| NET INCOME TRENDS | |||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| ($ in Millions except per share information) | |||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| 2024 | 2025 | ||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| 2020 | 2021 | 2022 | 2023 | 2024 | 1st Qtr | 2nd Qtr | 3rd Qtr | 4th Qtr | 1st Qtr | 2nd Qtr | 3rd Qtr | 4th Qtr | |||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| $ | 2,321.6 | $ | 2,487.3 | $ | 2,496.3 | $ | 2,461.9 | $ | 2,632.8 | Asset Servicing Trust, Investment and Other Servicing Fees | $ | 639.6 | $ | 650.6 | $ | 667.1 | $ | 675.5 | $ | 671.9 | $ | 691.8 | |||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| 1,673.4 | 1,873.8 | 1,936.3 | 1,899.9 | 2,095.0 | WM Trust, Investment and Other Servicing Fees | 503.3 | 515.5 | 529.5 | 546.7 | 541.9 | 539.3 | ||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| 3,995.0 | 4,361.1 | 4,432.6 | 4,361.8 | 4,727.8 | Total Fees | 1,142.9 | 1,166.1 | 1,196.6 | 1,222.2 | 1,213.8 | 1,231.1 | ||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| 290.4 | 292.6 | 288.6 | 203.9 | 231.2 | Foreign Exchange Trading Income | 57.0 | 58.4 | 54.1 | 61.7 | 58.7 | 50.6 | ||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| 45.4 | 44.3 | 39.3 | 31.6 | 35.7 | Treasury Management Fees | 9.3 | 9.0 | 8.2 | 9.2 | 9.6 | 9.7 | ||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| 133.2 | 140.2 | 136.2 | 135.0 | 150.5 | Security Commissions and Trading Income | 37.9 | 34.3 | 35.5 | 42.8 | 39.1 | 39.6 | ||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| 194.0 | 243.9 | 191.3 | 228.7 | 1,157.4 | Other Operating Income | 61.0 | 924.7 | 111.8 | 59.9 | 50.7 | 56.4 | ||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| (0.4) | (0.3) | (214.0) | (169.5) | (189.3) | Investment Security Gains (Losses), net | (189.4) | 0.1 | — | — | — | — | ||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| 4,657.6 | 5,081.8 | 4,874.0 | 4,791.5 | 6,113.3 | Total Noninterest Income | 1,118.7 | 2,192.6 | 1,406.2 | 1,395.8 | 1,371.9 | 1,387.4 | ||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| 1,477.6 | 1,418.3 | 1,932.8 | 2,039.5 | 2,208.9 | Net Interest Income (FTE)(1) |

535.4 | 529.8 | 569.4 | 574.3 | 573.7 | 615.2 | ||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| 6,135.2 | 6,500.1 | 6,806.8 | 6,831.0 | 8,322.2 | Total Revenue (FTE)(1) |

1,654.1 | 2,722.4 | 1,975.6 | 1,970.1 | 1,945.6 | 2,002.6 | ||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| 125.0 | (81.5) | 12.0 | 24.5 | (3.0) | Provision for (Release of) Credit Losses | (8.5) | 8.0 | 8.0 | (10.5) | 1.0 | 16.5 | ||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| 1,947.1 | 2,011.0 | 2,248.0 | 2,321.8 | 2,471.1 | Compensation | 627.1 | 665.2 | 583.6 | 595.2 | 644.4 | 614.8 | ||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| 387.7 | 431.4 | 437.4 | 405.2 | 417.8 | Employee Benefits | 101.1 | 100.2 | 109.2 | 107.3 | 109.7 | 117.7 | ||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| 763.1 | 849.4 | 880.3 | 906.5 | 998.0 | Outside Services | 229.3 | 260.9 | 256.3 | 251.5 | 245.2 | 247.0 | ||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| 673.5 | 736.3 | 838.8 | 945.5 | 1,075.0 | Equipment and Software | 252.7 | 277.5 | 270.4 | 274.4 | 280.9 | 293.7 | ||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| 230.1 | 208.7 | 219.1 | 232.3 | 216.8 | Occupancy | 54.1 | 54.8 | 53.8 | 54.1 | 53.4 | 52.5 | ||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| 346.7 | 299.1 | 359.3 | 472.9 | 455.2 | Other Operating Expense | 100.4 | 175.3 | 86.1 | 93.4 | 84.0 | 90.9 | ||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| 4,348.2 | 4,535.9 | 4,982.9 | 5,284.2 | 5,633.9 | Total Noninterest Expense | 1,364.7 | 1,533.9 | 1,359.4 | 1,375.9 | 1,417.6 | 1,416.6 | ||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| 1,662.0 | 2,045.7 | 1,811.9 | 1,522.3 | 2,691.3 | Income before Income Taxes (FTE)(1) |

297.9 | 1,180.5 | 608.2 | 604.7 | 527.0 | 569.5 | ||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| 418.3 | 464.8 | 430.3 | 357.5 | 628.4 | Provision for Income Taxes | 75.9 | 277.5 | 136.2 | 138.8 | 129.4 | 143.5 | ||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| 34.4 | 35.6 | 45.6 | 57.5 | 31.8 | Taxable Equivalent Adjustment | 7.3 | 6.9 | 7.1 | 10.5 | 5.6 | 4.7 | ||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| 452.7 | 500.4 | 475.9 | 415.0 | 660.2 | Total Taxes (FTE)(1) |

83.2 | 284.4 | 143.3 | 149.3 | 135.0 | 148.2 | ||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| $ | 1,209.3 | $ | 1,545.3 | $ | 1,336.0 | $ | 1,107.3 | $ | 2,031.1 | Net Income | $ | 214.7 | $ | 896.1 | $ | 464.9 | $ | 455.4 | $ | 392.0 | $ | 421.3 | |||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| $ | 5.48 | $ | 7.16 | $ | 6.16 | $ | 5.09 | $ | 9.80 | Earnings Per Share - Basic | $ | 0.96 | $ | 4.35 | $ | 2.23 | $ | 2.27 | $ | 1.91 | $ | 2.14 | |||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| 5.46 | 7.14 | 6.14 | 5.08 | 9.77 | Earnings Per Share - Diluted | 0.96 | 4.34 | 2.22 | 2.26 | 1.90 | 2.13 | ||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| 209,008 | 208,899 | 208,867 | 207,564 | 201,870 | Average Diluted Shares (000s) | 205,135 | 203,739 | 200,549 | 198,114 | 196,125 | 193,375 | ||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| $ | 56.2 | $ | 41.8 | $ | 41.8 | $ | 41.8 | $ | 41.8 | Preferred Dividends(2) |

$ | 16.2 | $ | 4.7 | $ | 16.2 | $ | 4.7 | $ | 16.2 | $ | 4.7 | |||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

(1) Fully taxable equivalent (FTE). Presentation on an FTE basis is a non-generally accepted accounting principle financial measure. Please refer to the Reconciliation to Fully Taxable Equivalent on page 11 for further detail. |

|||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

(2) Dividends on Preferred Stock in 2020 includes $11.5 million related to the difference between the redemption amount of the Corporation's Series C Non-Cumulative Perpetual Preferred Stock, which was redeemed in the first quarter of 2020, and its carrying value. |

|||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| Northern Trust Corporation | |||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

Reporting Segment Results(1) |

|||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| ($ in Millions) | |||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| 2024 | 2025 | ||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| 2020 | 2021 | 2022 | 2023 | 2024 | Asset Servicing | 1st Qtr | 2nd Qtr | 3rd Qtr | 4th Qtr | 1st Qtr | 2nd Qtr | 3rd Qtr | 4th Qtr | ||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| $ | 1,586.1 | $ | 1,818.8 | $ | 1,700.1 | $ | 1,689.5 | $ | 1,792.6 | Custody & Fund Administration | $ | 436.7 | $ | 445.9 | $ | 453.1 | $ | 456.9 | $ | 453.3 | $ | 469.2 | |||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| 511.1 | 443.5 | 555.1 | 528.1 | 595.2 | Investment Management | 140.0 | 145.7 | 152.6 | 156.9 | 152.5 | 157.3 | ||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| 88.0 | 76.7 | 81.4 | 83.0 | 72.3 | Securities Lending | 17.9 | 16.5 | 17.5 | 20.4 | 17.9 | 20.2 | ||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| 136.4 | 148.3 | 159.7 | 161.3 | 172.7 | Other | 45.0 | 42.5 | 43.9 | 41.3 | 48.2 | 45.1 | ||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| $ | 2,321.6 | $ | 2,487.3 | $ | 2,496.3 | $ | 2,461.9 | $ | 2,632.8 | Total Asset Servicing Trust, Investment and Other Servicing Fees | $ | 639.6 | $ | 650.6 | $ | 667.1 | $ | 675.5 | $ | 671.9 | $ | 691.8 | |||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| $ | 740.2 | $ | 905.1 | $ | 1,083.2 | $ | 871.0 | $ | 877.4 | Income before Income Taxes (FTE)(2) |

$ | 219.3 | $ | 135.6 | $ | 258.4 | $ | 264.1 | $ | 235.4 | $ | 271.1 | |||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| 21.5 | % | 25.0 | % | 26.7 | % | 21.1 | % | 20.1 | % | Profit Margin (pre-tax) (FTE)(2) |

20.6 | % | 12.9 | % | 23.2 | % | 23.4 | % | 20.9 | % | 23.2 | % | |||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| $ | 6,018.2 | $ | 5,663.4 | $ | 7,208.0 | $ | 7,372.6 | $ | 6,315.5 | Average Loans | $ | 6,909.5 | $ | 6,472.3 | $ | 5,615.8 | $ | 6,272.6 | $ | 5,749.3 | $ | 5,812.8 | |||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| 84,691.0 | 101,588.5 | 96,085.5 | 81,742.1 | 86,691.3 | Average Deposits | 86,688.6 | 86,223.0 | 86,635.7 | 87,212.9 | 89,296.5 | 95,506.7 | ||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| Wealth Management | |||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| $ | 607.3 | $ | 698.7 | $ | 692.6 | $ | 673.8 | $ | 740.9 | Central | $ | 178.3 | $ | 180.7 | $ | 186.6 | $ | 195.3 | $ | 189.1 | $ | 189.2 | |||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| 442.1 | 509.3 | 504.0 | 491.5 | 539.7 | East | 129.9 | 132.7 | 136.4 | 140.7 | 141.0 | 139.3 | ||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| 337.7 | 380.2 | 382.1 | 378.0 | 418.9 | West | 99.9 | 103.3 | 105.7 | 110.0 | 108.0 | 106.3 | ||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| 286.3 | 285.6 | 357.6 | 356.6 | 395.5 | Global Family Office | 95.2 | 98.8 | 100.8 | 100.7 | 103.8 | 104.5 | ||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| $ | 1,673.4 | $ | 1,873.8 | $ | 1,936.3 | $ | 1,899.9 | $ | 2,095.0 | Total Wealth Management Trust, Investment and Other Servicing Fees | $ | 503.3 | $ | 515.5 | $ | 529.5 | $ | 546.7 | $ | 541.9 | $ | 539.3 | |||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| $ | 1,022.9 | $ | 1,271.3 | $ | 1,153.8 | $ | 983.5 | $ | 1,213.1 | Income before Income Taxes (FTE)(2) |

$ | 292.3 | $ | 262.7 | $ | 307.1 | $ | 351.0 | $ | 304.3 | $ | 309.6 | |||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| 39.2 | % | 45.5 | % | 39.7 | % | 34.1 | % | 37.8 | % | Profit Margin (pre-tax) (FTE)(2) |

37.5 | % | 33.4 | % | 38.0 | % | 41.9 | % | 37.1 | % | 37.2 | % | |||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| $ | 27,480.6 | $ | 31,544.1 | $ | 33,822.6 | $ | 34,804.4 | $ | 34,601.2 | Average Loans | $ | 34,677.4 | $ | 34,562.3 | $ | 34,268.2 | $ | 34,897.3 | $ | 35,327.2 | $ | 35,345.2 | |||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| 23,410.3 | 28,387.9 | 29,426.3 | 23,432.9 | 25,558.2 | Average Deposits | 25,568.0 | 26,236.4 | 25,179.3 | 25,256.6 | 25,289.6 | 25,291.0 | ||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| Other | |||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| $ | (101.1) | $ | (130.7) | $ | (425.1) | $ | (332.2) | $ | 600.8 | Income before Income Taxes (FTE)(2) |

$ | (213.7) | $ | 782.2 | $ | 42.7 | $ | (10.4) | $ | (12.7) | $ | (11.2) | |||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| 409.8 | 106.7 | 80.6 | 70.5 | 450.8 | Average Deposits | 106.0 | 882.2 | 745.7 | 70.3 | 1,333.0 | 1,580.1 | ||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

(1) |

Reporting segment results are subject to reclassification when organizational changes are made. The results are also subject to refinements in revenue and expense allocation methodologies, which are typically reflected on a retrospective basis unless it is impractical to do so. | ||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

(2) |

Fully taxable equivalent (FTE). Presentation on an FTE basis is a non-generally accepted accounting principle financial measure. Please refer to the Reconciliation to Fully Taxable Equivalent section on pages 11 and 12 for further detail. | ||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| Northern Trust Corporation | |||||||||||||||||||||||||||||||||||||||||||||||||||||

| BALANCE SHEET | |||||||||||||||||||||||||||||||||||||||||||||||||||||

| END OF PERIOD | |||||||||||||||||||||||||||||||||||||||||||||||||||||

| ($ in Millions) | |||||||||||||||||||||||||||||||||||||||||||||||||||||

CHANGE (5) |

|||||||||||||||||||||||||||||||||||||||||||||||||||||

| Assets | 6/30/2025 | 6/30/2024 | $ | % | |||||||||||||||||||||||||||||||||||||||||||||||||

| Federal Reserve and Other Central Bank Deposits | $ | 52,265.5 | $ | 43,206.1 | $ | 9,059.4 | 21 | % | |||||||||||||||||||||||||||||||||||||||||||||

Interest-Bearing Due from and Deposits with Banks(1) |

6,800.9 | 5,558.9 | 1,242.0 | 22 | % | ||||||||||||||||||||||||||||||||||||||||||||||||

| Federal Funds Sold and Securities Purchased under Agreements to Resell | 921.9 | 859.6 | 62.3 | 7 | % | ||||||||||||||||||||||||||||||||||||||||||||||||

| Debt Securities: | |||||||||||||||||||||||||||||||||||||||||||||||||||||

| Available For Sale | 32,250.4 | 26,861.7 | 5,388.7 | 20 | % | ||||||||||||||||||||||||||||||||||||||||||||||||

| Held To Maturity | 21,400.8 | 22,798.6 | (1,397.8) | (6) | % | ||||||||||||||||||||||||||||||||||||||||||||||||

| Total Debt Securities | 53,651.2 | 49,660.3 | 3,990.9 | 8 | % | ||||||||||||||||||||||||||||||||||||||||||||||||

| Loans | 43,323.4 | 42,135.2 | 1,188.2 | 3 | % | ||||||||||||||||||||||||||||||||||||||||||||||||

Other Interest-Earning Assets(2) |

2,522.6 | 3,025.2 | (502.6) | (17) | % | ||||||||||||||||||||||||||||||||||||||||||||||||

| Total Earning Assets | 159,485.5 | 144,445.3 | 15,040.2 | 10 | % | ||||||||||||||||||||||||||||||||||||||||||||||||

| Allowance for Credit Losses | (188.5) | (179.5) | (9.0) | 5 | % | ||||||||||||||||||||||||||||||||||||||||||||||||

Cash and Due From Banks and Other Central Bank Deposits(3) |

2,035.1 | 2,390.1 | (355.0) | (15) | % | ||||||||||||||||||||||||||||||||||||||||||||||||

| Buildings and Equipment | 467.7 | 481.0 | (13.3) | (3) | % | ||||||||||||||||||||||||||||||||||||||||||||||||

| Goodwill | 714.6 | 697.4 | 17.2 | 2 | % | ||||||||||||||||||||||||||||||||||||||||||||||||

| Other Assets | 9,369.2 | 8,962.8 | 406.4 | 5 | % | ||||||||||||||||||||||||||||||||||||||||||||||||

| Total Assets | $ | 171,883.6 | $ | 156,797.1 | $ | 15,086.5 | 10 | % | |||||||||||||||||||||||||||||||||||||||||||||

| Liabilities and Stockholders' Equity | |||||||||||||||||||||||||||||||||||||||||||||||||||||

| Savings, Money Market and Other | $ | 27,965.1 | $ | 28,074.0 | $ | (108.9) | — | % | |||||||||||||||||||||||||||||||||||||||||||||

| Savings Certificates and Other Time | 6,742.5 | 6,378.4 | 364.1 | 6 | % | ||||||||||||||||||||||||||||||||||||||||||||||||

| Non-U.S. Offices - Interest-Bearing | 77,206.9 | 67,612.3 | 9,594.6 | 14 | % | ||||||||||||||||||||||||||||||||||||||||||||||||

| Total Interest-Bearing Deposits | 111,914.5 | 102,064.7 | 9,849.8 | 10 | % | ||||||||||||||||||||||||||||||||||||||||||||||||

| Federal Funds Purchased | 2,388.5 | 2,406.4 | (17.9) | (1) | % | ||||||||||||||||||||||||||||||||||||||||||||||||

| Securities Sold under Agreements to Repurchase | 841.4 | 629.2 | 212.2 | 34 | % | ||||||||||||||||||||||||||||||||||||||||||||||||

Other Borrowings(4) |

6,532.9 | 6,823.7 | (290.8) | (4) | % | ||||||||||||||||||||||||||||||||||||||||||||||||

| Senior Notes | 2,835.2 | 2,744.0 | 91.2 | 3 | % | ||||||||||||||||||||||||||||||||||||||||||||||||

| Long-Term Debt | 4,089.8 | 4,073.0 | 16.8 | — | % | ||||||||||||||||||||||||||||||||||||||||||||||||

| Total Interest-Bearing Liabilities | 128,602.3 | 118,741.0 | 9,861.3 | 8 | % | ||||||||||||||||||||||||||||||||||||||||||||||||

| Demand and Other Noninterest-Bearing Deposits | 25,139.2 | 20,926.2 | 4,213.0 | 20 | % | ||||||||||||||||||||||||||||||||||||||||||||||||

| Other Liabilities | 5,275.6 | 4,474.1 | 801.5 | 18 | % | ||||||||||||||||||||||||||||||||||||||||||||||||

| Total Liabilities | 159,017.1 | 144,141.3 | 14,875.8 | 10 | % | ||||||||||||||||||||||||||||||||||||||||||||||||

| Common Equity, excluding Accumulated Other Comprehensive Income | 12,680.8 | 12,635.9 | 44.9 | — | % | ||||||||||||||||||||||||||||||||||||||||||||||||

| Accumulated Other Comprehensive Income (Loss) | (699.2) | (865.0) | 165.8 | (19) | % | ||||||||||||||||||||||||||||||||||||||||||||||||

| Preferred Equity | 884.9 | 884.9 | — | — | % | ||||||||||||||||||||||||||||||||||||||||||||||||

| Total Stockholders' Equity | 12,866.5 | 12,655.8 | 210.7 | 2 | % | ||||||||||||||||||||||||||||||||||||||||||||||||

| Total Liabilities and Stockholders' Equity | $ | 171,883.6 | $ | 156,797.1 | $ | 15,086.5 | 10 | % | |||||||||||||||||||||||||||||||||||||||||||||

(1) |

Interest-Bearing Due from and Deposits with Banks includes the interest-bearing component of Cash and Due from Banks and Interest-Bearing Deposits with Banks as presented on the consolidated balance sheets in our periodic filings with the SEC. |

||||||||||||||||||||||||||||||||||||||||||||||||||||

(2) |

Other Interest-Earning Assets include certain community development investments, collateral deposits with certain securities depositories and clearing houses, Federal Home Loan Bank and Federal Reserve stock, and money market investments which are classified in Other Assets on the consolidated balance sheets in our periodic filings with the SEC. |

||||||||||||||||||||||||||||||||||||||||||||||||||||

(3) |

Cash and Due from Banks and Other Central Bank Deposits includes the noninterest-bearing component of Federal Reserve and Other Central Bank Deposits as presented on the consolidated balance sheets in our periodic filings with the SEC. |

||||||||||||||||||||||||||||||||||||||||||||||||||||

(4) |

Other Borrowings primarily includes advances from the Federal Home Loan Bank of Chicago. |

||||||||||||||||||||||||||||||||||||||||||||||||||||

| (5) | Percentage calculations are based on actual balances rather than the rounded amounts presented in the table above. | ||||||||||||||||||||||||||||||||||||||||||||||||||||

| Northern Trust Corporation | |||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| BALANCE SHEET TRENDS | |||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

PERIOD AVERAGES(1) | |||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| ($ in Millions) | |||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| 2024 | 2025 | ||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| 2020 | 2021 | 2022 | 2023 | 2024 | Assets | 1st Qtr | 2nd Qtr | 3rd Qtr | 4th Qtr | 1st Qtr | 2nd Qtr | 3rd Qtr | 4th Qtr | ||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| $ | 27,904.2 | $ | 39,028.2 | $ | 36,248.8 | $ | 31,205.4 | $ | 35,179.9 | Federal Reserve and Other Central Bank Deposits | $ | 35,897.3 | $ | 35,924.1 | $ | 36,067.3 | $ | 32,847.0 | $ | 37,161.0 | $ | 43,655.3 | |||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| 5,400.8 | 5,779.7 | 4,192.5 | 4,333.9 | 4,800.8 | Interest-Bearing Due from and Deposits with Banks(2) |

4,418.0 | 4,999.7 | 4,828.1 | 4,955.3 | 4,877.6 | 5,321.5 | ||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| 1,255.4 | 1,067.5 | 1,076.7 | 957.0 | 727.9 | Federal Funds Sold and Securities Purchased under Agreements to Resell | 518.4 | 732.2 | 977.4 | 681.3 | 394.5 | 713.2 | ||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| Debt Securities: | |||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| 40,642.7 | 38,986.9 | 32,060.2 | 24,356.6 | 26,871.9 | Available For Sale | 24,049.6 | 26,591.4 | 27,462.6 | 29,350.4 | 30,168.3 | 31,415.0 | ||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| 14,353.3 | 20,617.0 | 22,970.0 | 25,511.9 | 23,230.7 | Held To Maturity | 24,498.9 | 23,373.8 | 22,834.0 | 22,231.6 | 21,821.9 | 20,895.9 | ||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| 1.1 | 0.6 | 12.1 | 0.5 | — | Trading Account | — | — | — | — | — | — | ||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| 54,997.1 | 59,604.5 | 55,042.3 | 49,869.0 | 50,102.6 | Total Debt Securities | 48,548.5 | 49,965.2 | 50,296.6 | 51,582.0 | 51,990.2 | 52,310.9 | ||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| 33,498.8 | 37,207.5 | 41,030.6 | 42,177.0 | 40,916.7 | Loans and Leases | 41,586.9 | 41,034.6 | 39,884.0 | 41,169.9 | 41,076.5 | 41,158.0 | ||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| 1,076.6 | 1,185.6 | 1,248.1 | 2,259.0 | 2,688.4 | Other Interest-Earning Assets(3) |

2,847.7 | 2,745.3 | 2,714.4 | 2,448.5 | 2,508.1 | 2,663.1 | ||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| 124,132.9 | 143,873.0 | 138,839.0 | 130,801.3 | 134,416.3 | Total Earning Assets | 133,816.8 | 135,401.1 | 134,767.8 | 133,684.0 | 138,007.9 | 145,822.0 | ||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| (178.0) | (173.0) | (154.1) | (172.8) | (185.2) | Allowance for Credit Losses | (191.8) | (175.8) | (180.5) | (192.9) | (175.6) | (174.9) | ||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| 2,603.0 | 2,285.9 | 2,069.5 | 1,771.6 | 1,698.8 | Cash and Due From Banks and Other Central Bank Deposits(4) |

1,799.5 | 1,802.0 | 1,742.3 | 1,453.4 | 1,041.2 | 1,069.8 | ||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| 509.3 | 502.7 | 488.7 | 484.8 | 488.0 | Buildings and Equipment | 498.2 | 485.8 | 482.2 | 485.8 | 484.8 | 479.3 | ||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| 695.4 | 707.3 | 692.2 | 696.2 | 699.8 | Goodwill | 699.4 | 697.1 | 702.9 | 699.7 | 696.4 | 709.1 | ||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||