0000073124false00000731242024-04-162024-04-160000073124us-gaap:CommonStockMember2024-04-162024-04-160000073124ntrs:DepositarySharesMember2024-04-162024-04-16

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

CURRENT REPORT

Pursuant to Section 13 or 15(d) of the

Securities Exchange Act of 1934

Date of Report (Date of earliest event reported) April 16, 2024

NORTHERN TRUST CORPORATION

(Exact name of registrant as specified in its charter)

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Delaware |

|

001-36609 |

|

36-2723087 |

| (State or other jurisdiction of incorporation) |

|

(Commission File Number) |

|

(IRS Employer Identification No.) |

|

|

|

|

|

| 50 South LaSalle Street |

|

|

|

60603 |

| Chicago, |

Illinois |

|

|

|

(Zip Code) |

| (Address of principal executive offices) |

|

|

|

|

Registrant’s telephone number, including area code (312) 630-6000

Check the appropriate box below if the Form 8-K filing is intended to simultaneously satisfy the filing obligation of the registrant under any of the following provisions:

|

|

|

|

|

|

| ☐ |

Written communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425) |

| ☐ |

Soliciting material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12) |

| ☐ |

Pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b)) |

| ☐ |

Pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4(c)) |

Securities registered pursuant to Section 12(b) of the Act:

|

|

|

|

|

|

|

|

|

| Title of each class |

Trading Symbol |

Name of each exchange on which registered |

| Common Stock, $1.66 2/3 Par Value |

NTRS |

The NASDAQ Stock Market LLC |

Depositary Shares, each representing 1/1,000th interest in a share of Series E Non-Cumulative Perpetual Preferred Stock

|

NTRSO |

The NASDAQ Stock Market LLC |

Indicate by check mark whether the registrant is an emerging growth company as defined in Rule 405 of the Securities Act of 1933 (§230.405 of this chapter) or Rule 12b-2 of the Securities Exchange Act of 1934 (§240.12b-2 of this chapter).

Emerging growth company ☐

If an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act. ☐

Item 7.01. Regulation FD Disclosure

On April 16, 2024, at approximately 10:30 a.m. (CT), Michael G. O’Grady, Chairman and Chief Executive Officer of the Corporation (the “Corporation”), spoke at the Corporation’s Annual Meeting of Stockholders (the “Annual Meeting”). A webcast of the presentation will be available for replay for 30 days from the presentation date and can be accessed from the “Investor Relations” section of the Corporation’s website at www.northerntrust.com/about-us/investor-relations. Attached as Exhibit 99.1 are the slides that Mr. O’Grady presented at the Annual Meeting.

The information in this Form 8-K, including Exhibit 99.1, is being furnished and shall not be deemed “filed” for purposes of Section 18 of the Securities Exchange Act of 1934, as amended (the “Exchange Act”), or otherwise subject to the liabilities of that section, nor shall it be deemed to be incorporated by reference in any registration statement or other document filed under the Securities Act of 1933, as amended, or the Exchange Act, except as otherwise stated in such filing.

Item 9.01. Financial Statements and Exhibits

(d) Exhibits:

|

|

|

|

|

|

|

|

|

|

Exhibit Number |

Description |

|

|

|

|

104 |

The cover page from this Current Report on Form 8-K, formatted in Inline XBRL. |

SIGNATURE

Pursuant to the requirements of the Securities Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf by the undersigned hereunto duly authorized.

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

NORTHERN TRUST CORPORATION |

|

|

|

(Registrant) |

|

|

|

|

|

|

| Dated: |

April 16, 2024 |

|

By: |

|

/s/ Jennifer L. Childe |

|

|

|

|

|

Jennifer L. Childe |

|

|

|

|

|

Senior Vice President and

Director of Investor Relations |

EX-99.1

2

annualmeetingslides.htm

EX-99.1

annualmeetingslides

NORTHERN TRUST CORPORATION northerntrust.com / © 2024 Northern Trust 2024 Annual Meeting Of Stockholders

northerntrust.com / © 2024 Northern Trust 2 Forward-looking Statements This presentation may include statements which constitute “forward-looking statements” within the meaning of the safe harbor provisions of the Private Securities Litigation Reform Act of 1995. Forward-looking statements are identified typically by words or phrases such as “believe,” “expect,” “anticipate,” “intend,” “estimate,” “project,” “l ikely,” “plan,” “goal,” “target,” “strategy,” and similar expressions or future or conditional verbs such as “may,” “will,” “should,” “would,” and “could.” Forward-looking statements include statements, other than those related to historical facts, that relate to Northern Trust’s financial results and outlook, capital adequacy, dividend policy and share repurchase program, accounting estimates and assumptions, credit quality including allowance levels, future pension plan contributions, effective tax rate, anticipated expense levels, contingent l iabil it ies, acquisitions, strategies, market and industry trends, and expectations regarding the impact of accounting pronouncements and legislation. These statements are based on Northern Trust’s current beliefs and expectations of future events or future results and involve risks and uncertainties that are difficult to predict and subject to change. These statements are also based on assumptions about many important factors, including the factors discussed in Northern Trust’s most recent annual report on Form 10-K and other fi l ings with the U.S. Securities and Exchange Commission, all of which are available on Northern Trust’s website. We caution you not to place undue reliance on any forward-looking statement as actual results may differ materially from those expressed or implied by forward-looking statements. Northern Trust assumes no obligation to update its forward-looking statements.

northerntrust.com / © 2024 Northern Trust Our mission is to be our clients’ most trusted financial partner 3 Service Relentless drive to anticipate and exceed client expectations Expertise Resolving complex challenges with world class capabilities Integrity Consistently acting with the highest ethics, utmost honesty and unfailing reliability

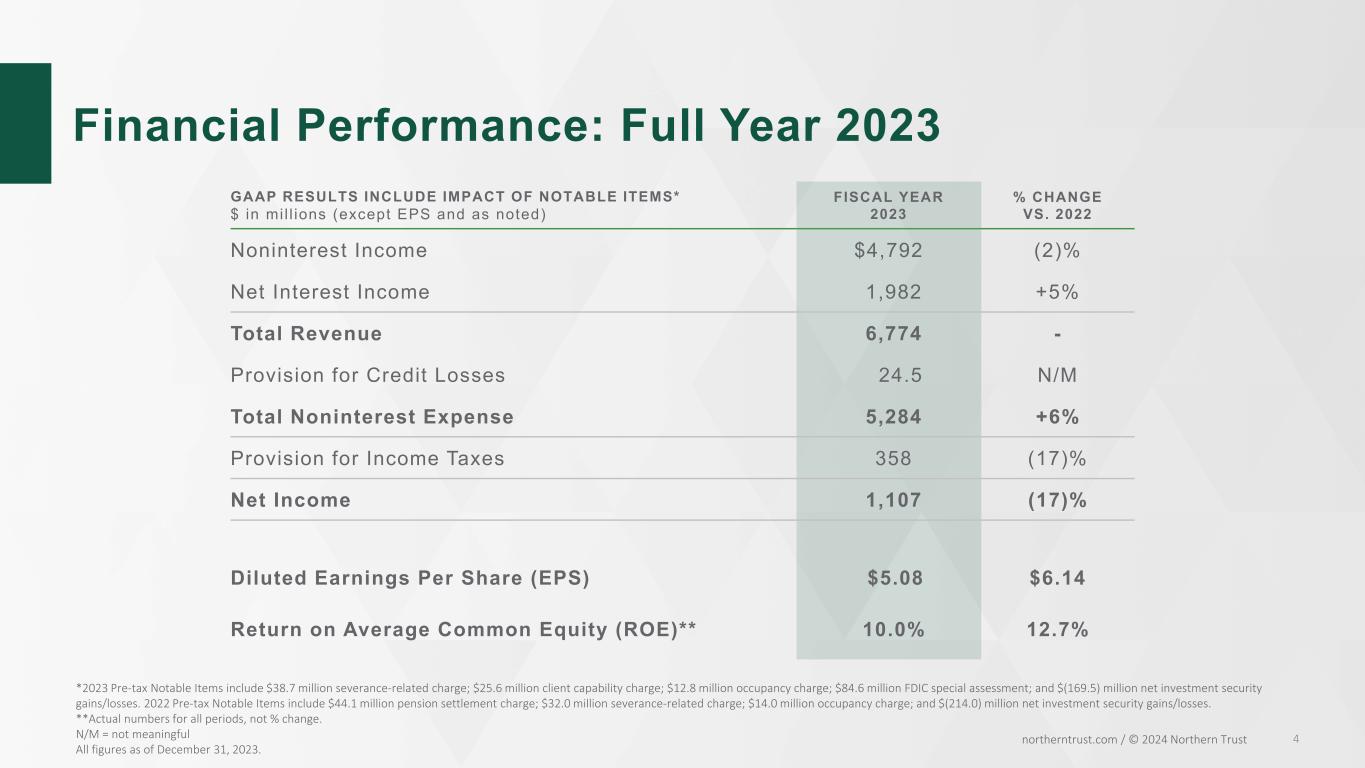

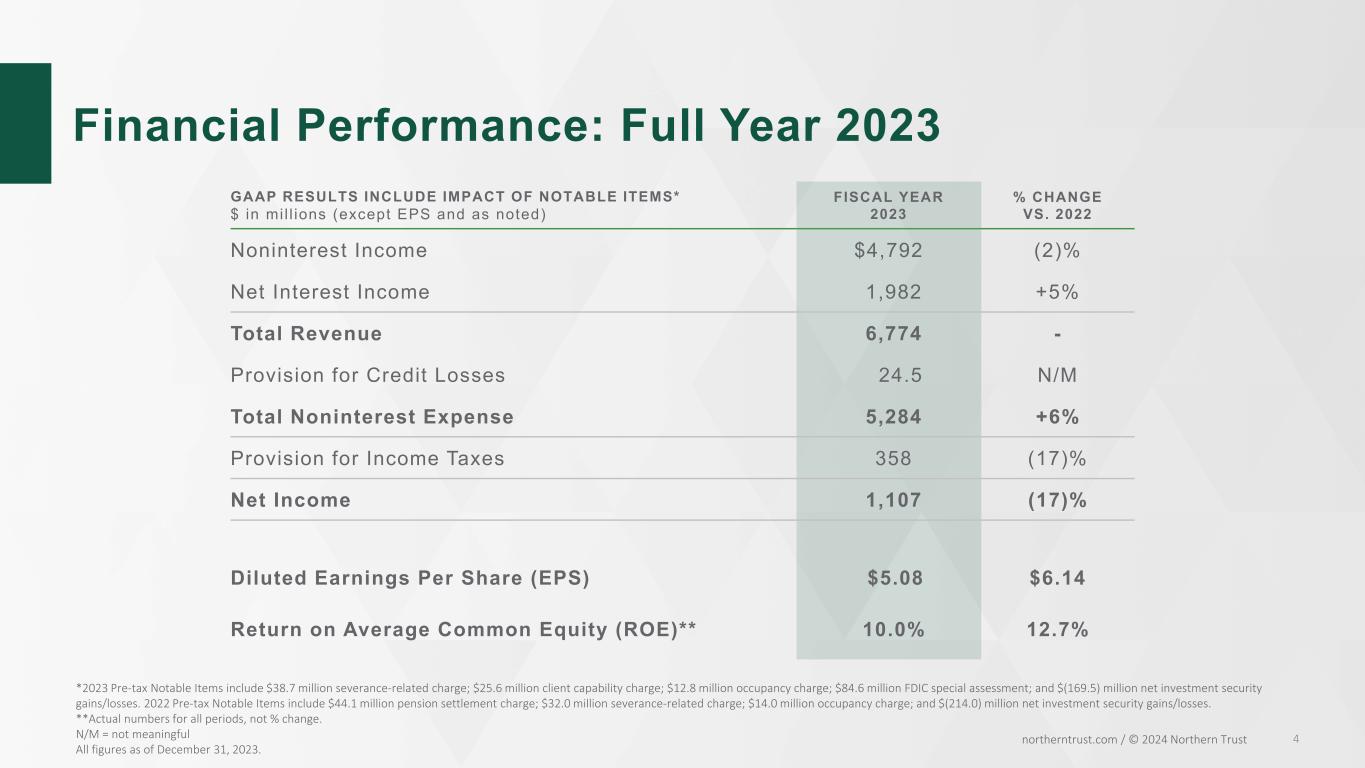

4 Financial Performance: Full Year 2023 northerntrust.com / © 2024 Northern Trust *2023 Pre-tax Notable Items include $38.7 million severance-related charge; $25.6 million client capability charge; $12.8 million occupancy charge; $84.6 million FDIC special assessment; and $(169.5) million net investment security gains/losses. 2022 Pre-tax Notable Items include $44.1 million pension settlement charge; $32.0 million severance-related charge; $14.0 million occupancy charge; and $(214.0) million net investment security gains/losses. **Actual numbers for all periods, not % change. N/M = not meaningful All figures as of December 31, 2023. GAAP RESULTS INCLUDE IMPACT OF NOTABLE ITEMS* $ in mi l l ions (except EPS and as noted) FISCAL YEAR 2023 % CHANGE VS. 2022 Noninterest Income $4,792 (2)% Net Interest Income 1,982 +5% Total Revenue 6,774 - Provision for Credit Losses 24.5 N/M Total Noninterest Expense 5,284 +6% Provision for Income Taxes 358 (17)% Net Income 1,107 (17)% Diluted Earnings Per Share (EPS) $5.08 $6.14 Return on Average Common Equity (ROE)** 10.0% 12.7%

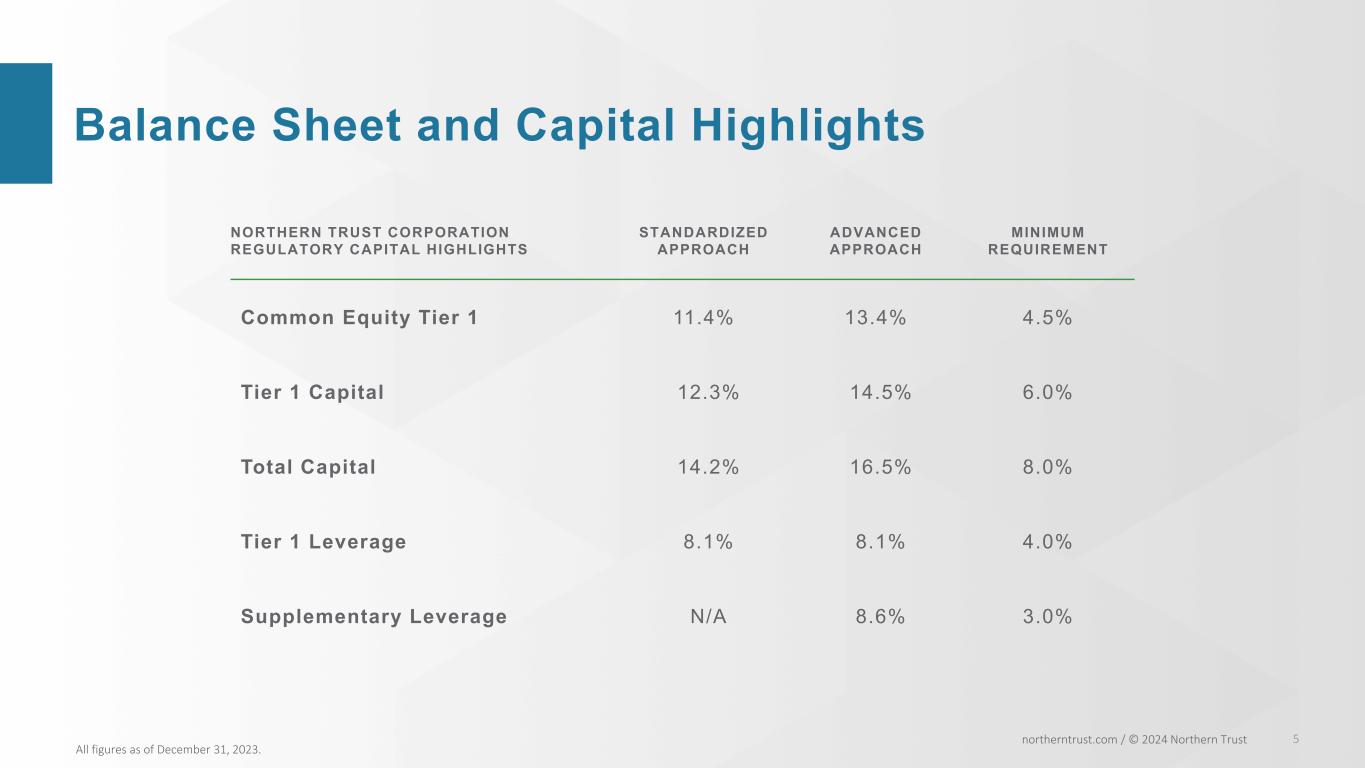

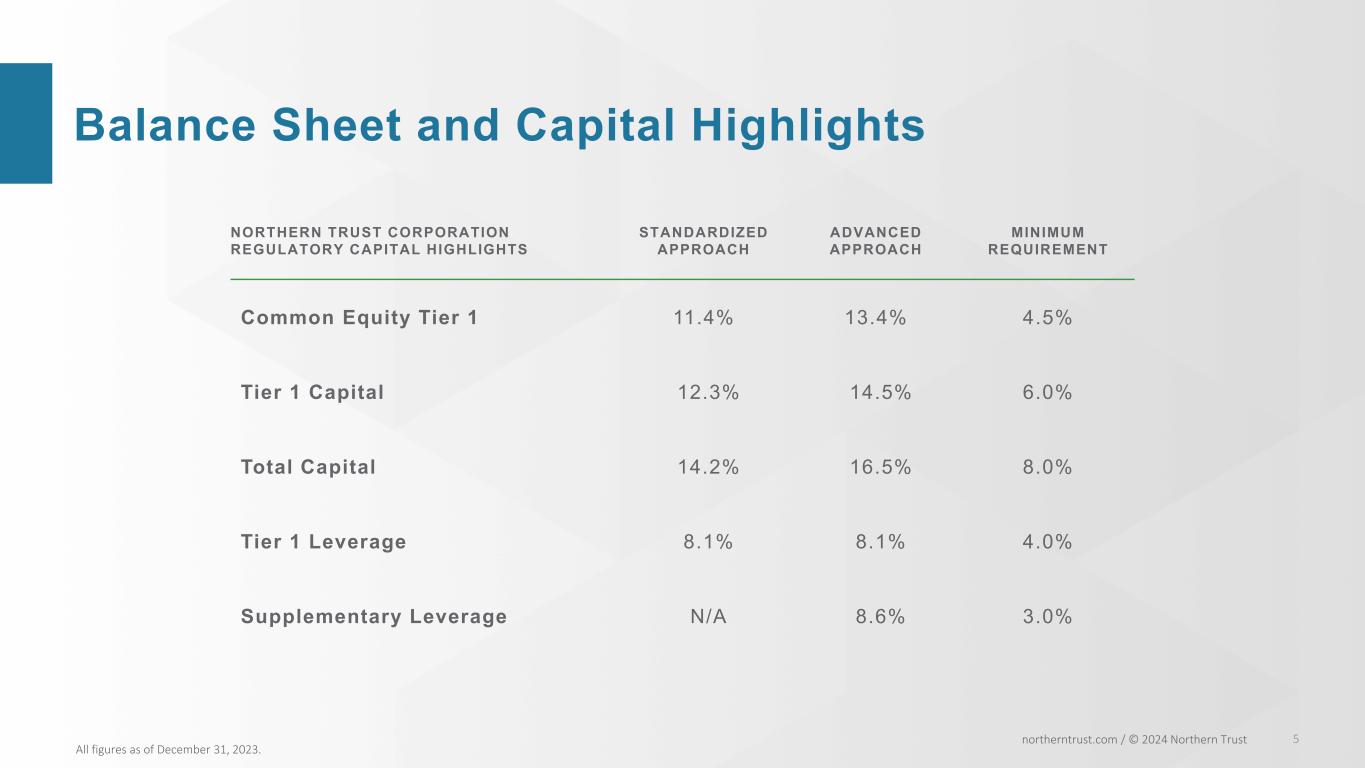

northerntrust.com / © 2024 Northern Trust 5 Balance Sheet and Capital Highlights NORTHERN TRUST CORPORATION REGULATORY CAPITAL HIGHLIGHTS STANDARDIZED APPROACH ADVANCED APPROACH MINIMUM REQUIREMENT Common Equity Tier 1 11.4% 13.4% 4.5% Tier 1 Capital 12.3% 14.5% 6.0% Total Capital 14.2% 16.5% 8.0% Tier 1 Leverage 8.1% 8.1% 4.0% Supplementary Leverage N/A 8.6% 3.0% All figures as of December 31, 2023.

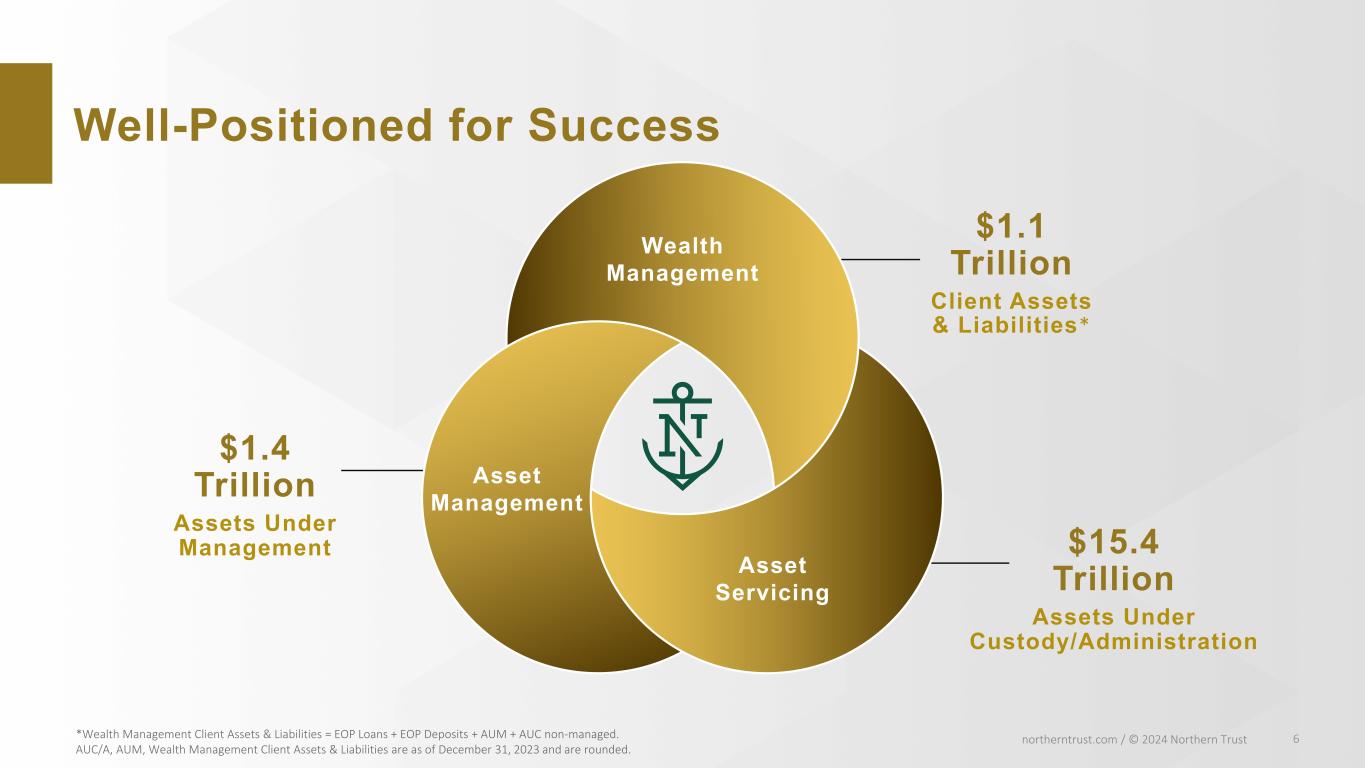

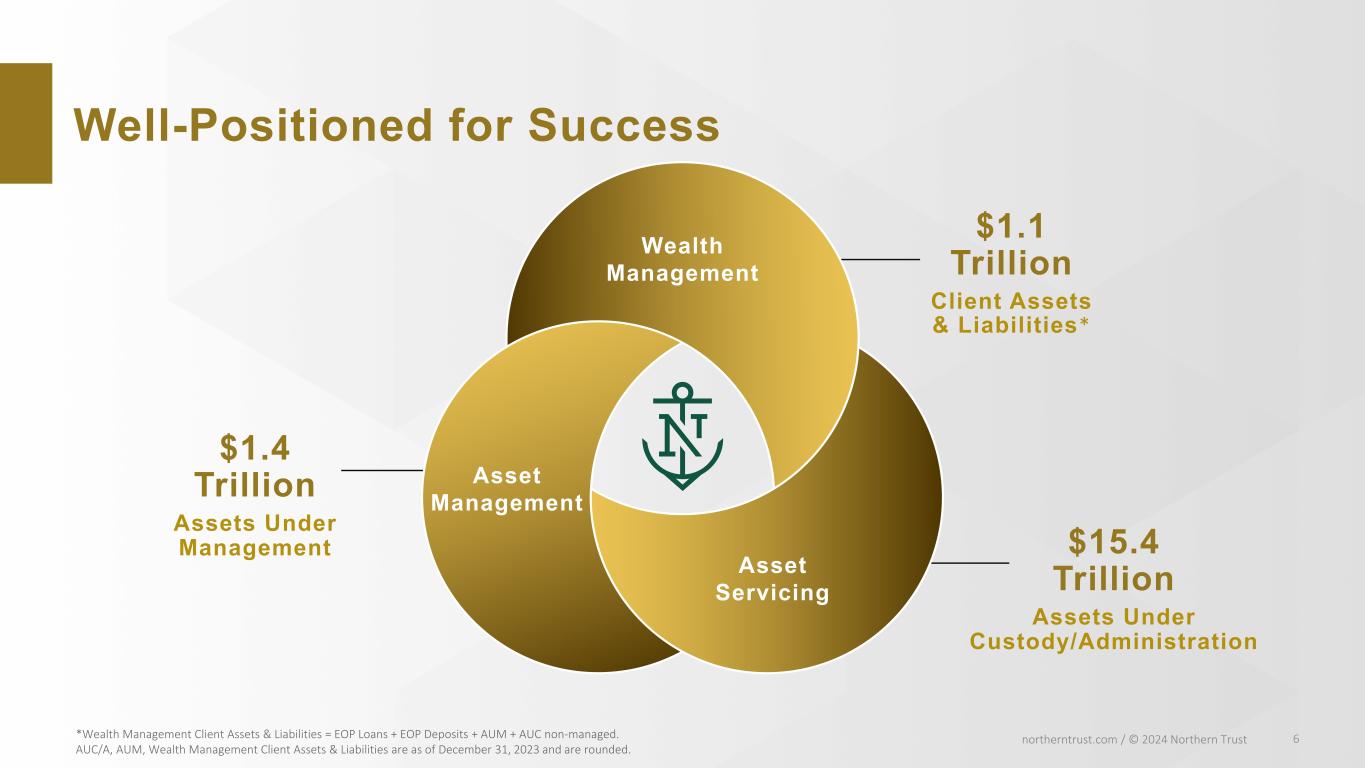

northerntrust.com / © 2024 Northern Trust 6 Well-Positioned for Success Wealth Management Asset Servicing Asset Management $1.4 Trillion Assets Under Management $1.1 Trillion Client Assets & Liabilities* $15.4 Trillion Assets Under Custody/Administration *Wealth Management Client Assets & Liabilities = EOP Loans + EOP Deposits + AUM + AUC non-managed. AUC/A, AUM, Wealth Management Client Assets & Liabilities are as of December 31, 2023 and are rounded.

northerntrust.com / © 2024 Northern Trust 7 Strategic Objectives Strengthen Resiliency Drive Productivity Optimize Growth

northerntrust.com / © 2024 Northern Trust Optimize Growth 8 Optimize Growth

northerntrust.com / © 2024 Northern Trust Strengthen Resiliency 9 Strengthen Resiliency

northerntrust.com / © 2024 Northern Trust Drive Productivity 10 Drive Productivity

northerntrust.com / © 2024 Northern Trust 11 Investing in Capabilities Talent Technology Data

northerntrust.com / © 2024 Northern Trust 12 Committed to Long-term Sustainability ENVIRONMENTAL SOCIAL GOVERNANCE

northerntrust.com / © 2024 Northern Trust Enduring Principles 13 Service Relentless drive to anticipate and exceed client expectations Expertise Resolving complex challenges with world class capabilities Integrity Consistently acting with the highest ethics, utmost honesty and unfailing reliability

Appendix northerntrust.com / © 2024 Northern Trust

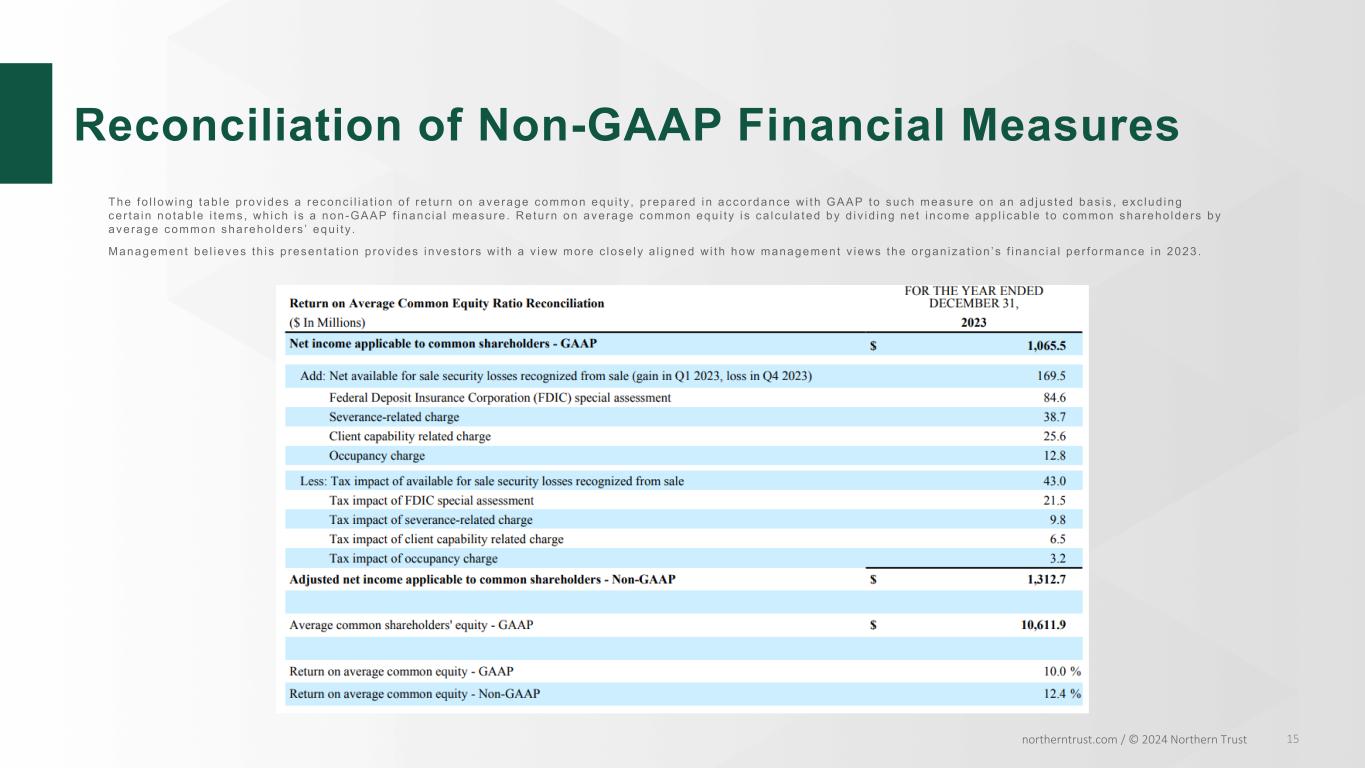

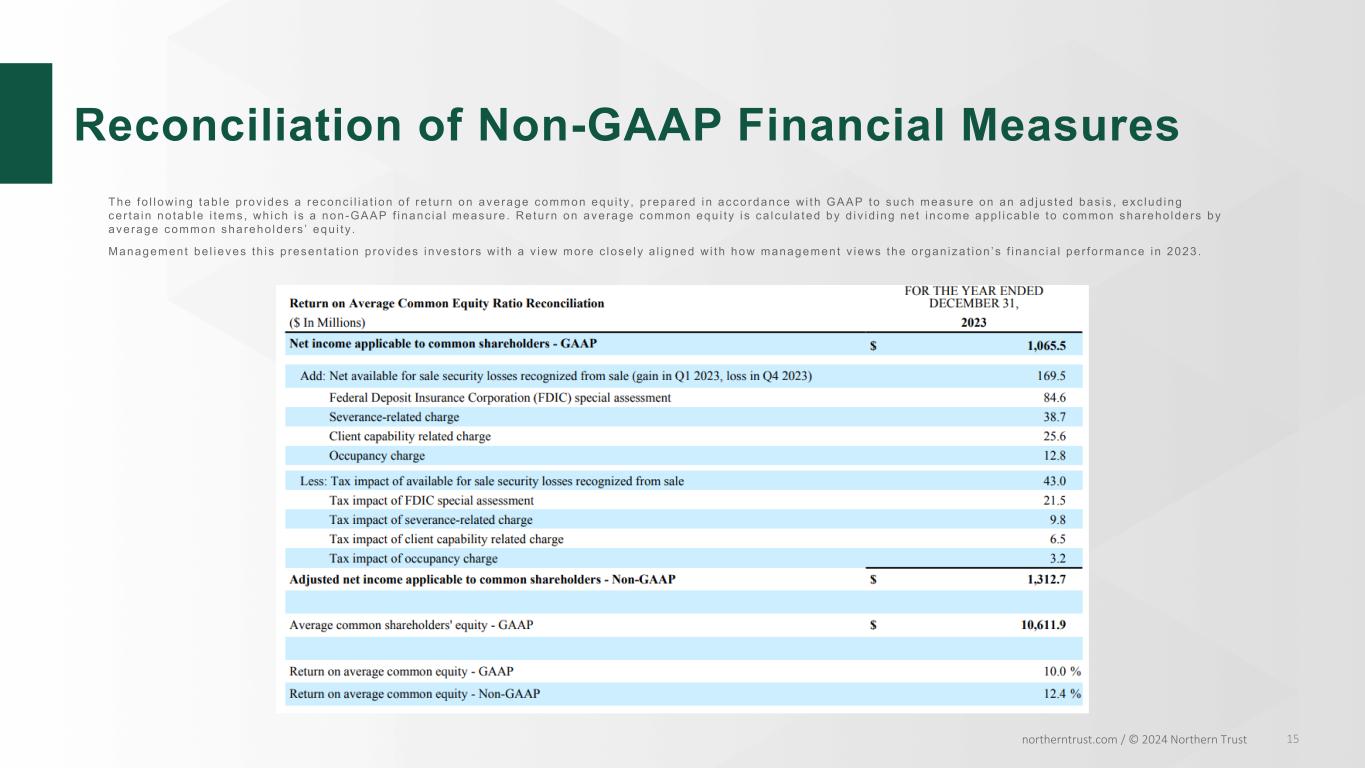

northerntrust.com / © 2024 Northern Trust 15 Reconciliation of Non-GAAP Financial Measures The fo l l ow ing tab le p rov ides a reconc i l i a t ion o f re tu rn on average common equ i t y , p repared i n accordance w i th GAAP to such measure on an ad jus ted bas i s , exc lud ing ce r ta in no tab le i t ems , wh ich i s a non-GAAP f i nanc ia l measure . Re tu rn on average common equ i t y i s ca l cu la ted by d i v id ing ne t i ncome app l i cab le to common shareho lde rs by ave rage common shareho lde rs ’ equ i t y . Management be l i eves th i s p resen ta t i on p rov ides i nves to rs w i th a v iew more c lose l y a l i gned w i th how management v iews the o rgan iza t i on ’ s f i nanc ia l pe r fo rmance i n 2023 .