FORM |

8-K |

||||

| Delaware | 001-36609 | 36-2723087 | |||||||||||||||

| (State or other jurisdiction of incorporation) | (Commission File Number) | (IRS Employer Identification No.) | |||||||||||||||

| 50 South LaSalle Street | 60603 | ||||||||||||||||

| Chicago, | Illinois | (Zip Code) | |||||||||||||||

| (Address of principal executive offices) | |||||||||||||||||

| ☐ | Written communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425) | ||||

| ☐ | Soliciting material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12) | ||||

| ☐ | Pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b)) | ||||

| ☐ | Pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4(c)) | ||||

| Title of each class | Trading Symbol | Name of each exchange on which registered | ||||||

| Common Stock, $1.66 2/3 Par Value | NTRS | The NASDAQ Stock Market LLC | ||||||

| Depositary Shares, each representing 1/1,000th interest in a share of Series E Non-Cumulative Perpetual Preferred Stock |

NTRSO | The NASDAQ Stock Market LLC | ||||||

| Exhibit Number | Description | |||||||

| 104 | The cover page from this Current Report on Form 8-K, formatted in Inline XBRL. | |||||||

| NORTHERN TRUST CORPORATION | |||||||||||||||||

| (Registrant) | |||||||||||||||||

| Dated: | July 20, 2022 | By: | /s/ Jason J. Tyler | ||||||||||||||

| Jason J. Tyler | |||||||||||||||||

| Executive Vice President and Chief Financial Officer | |||||||||||||||||

| NEWS RELEASE |  |

|||||||

| www.northerntrust.com | ||||||||

|

Total Revenue

$1.8 billion

|

Return on Average Common Equity 15.7% |

Common Equity Tier 1 Capital 10.5% |

||||||||||||||||||||||||

| MICHAEL O’GRADY, CHAIRMAN AND CHIEF EXECUTIVE OFFICER: | ||

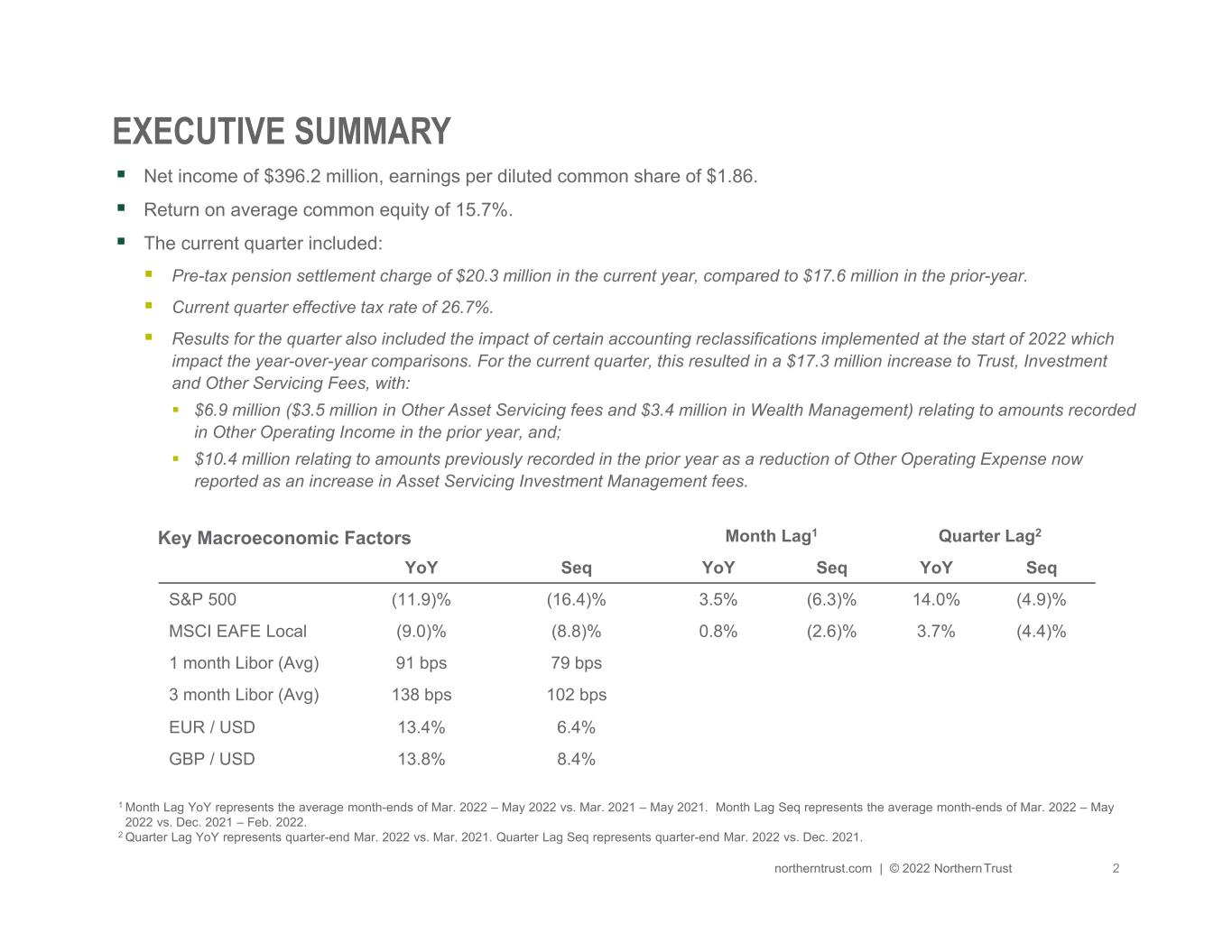

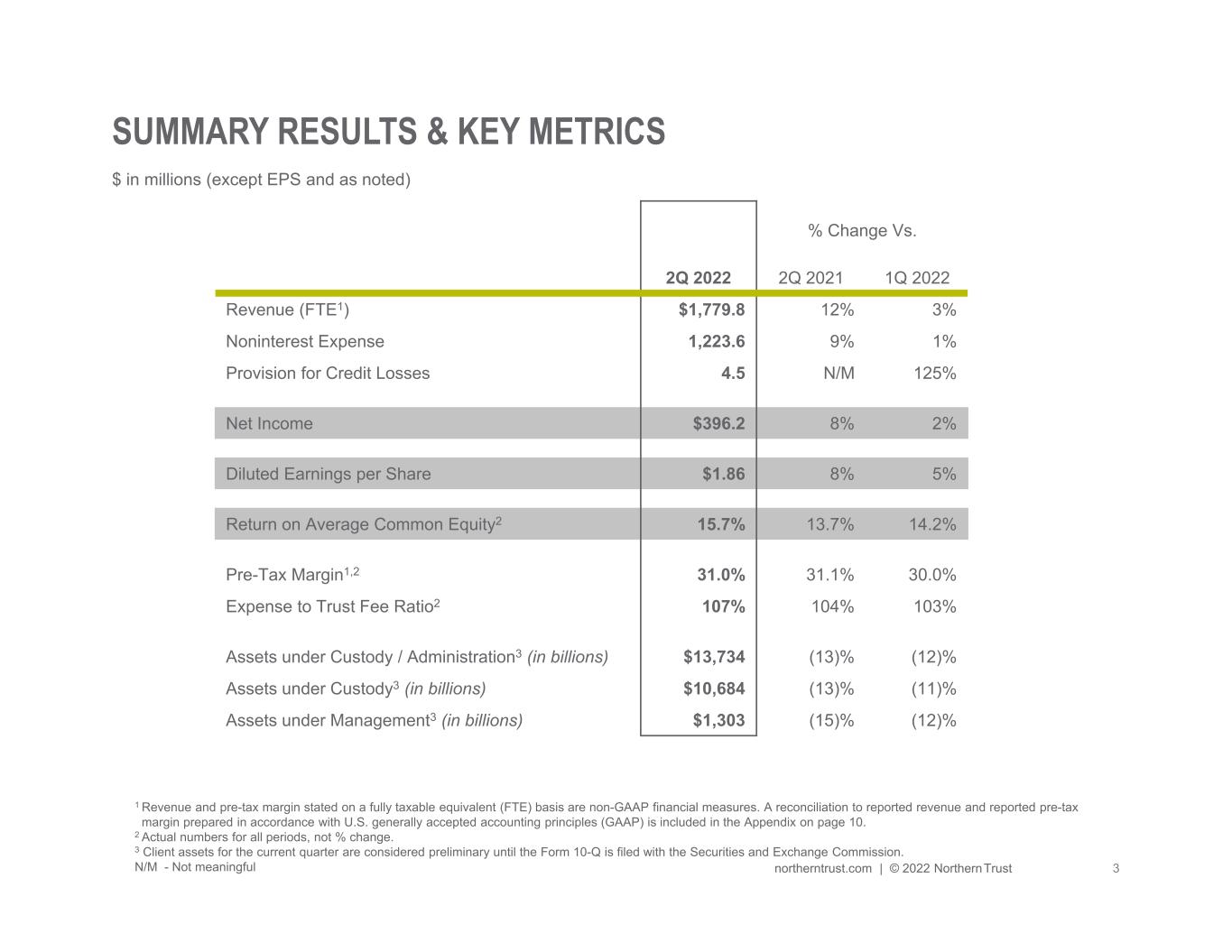

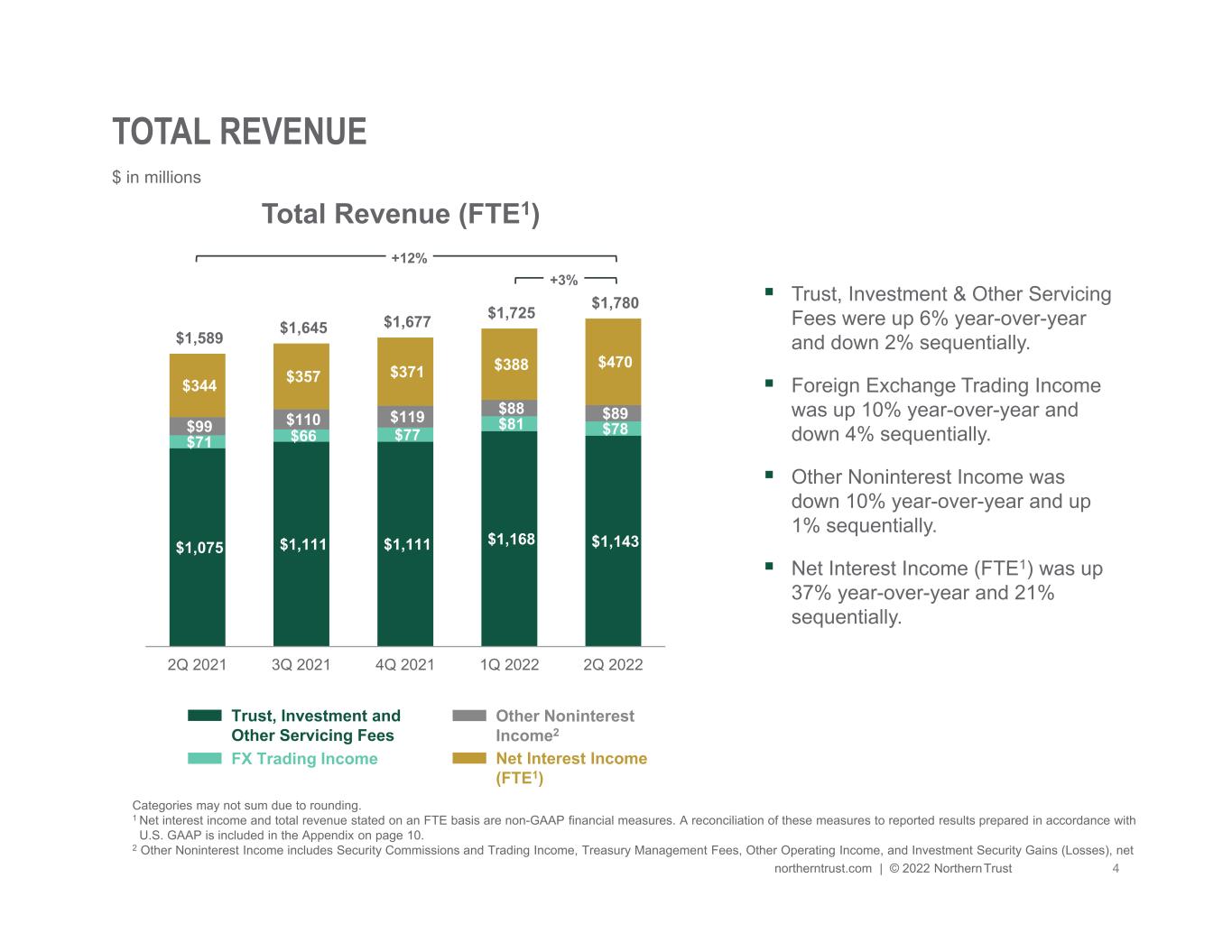

“Northern Trust delivered a solid second quarter financial performance, including revenue growth of 12%, earnings per share growth of 8%, both compared to the prior year, and return on average common equity of 15.7%. The elimination of fee waivers and our continued new business generation contributed to a 6% increase in trust, investment and other servicing fees, while rising interest rates drove a 37% increase in net interest income. Expenses grew 9%, reflecting growth and investment in our business, coupled with continued inflationary pressures. This combination resulted in three points of positive operating leverage compared to the prior year. As announced yesterday, our Board of Directors increased our dividend 7% to $0.75 per share for the third quarter, reflecting the strength of our balance sheet and capital position. As we look to the second half of the year, we remain focused on serving our clients, executing on our long-term growth priorities, and investing prudently for the future.” | ||

| FINANCIAL SUMMARY & KEY METRICS | ||||||||||||||||||||

% Change Q2 2022 vs. |

||||||||||||||||||||

| ($ In Millions except per share data) | Q2 2022 | Q1 2022 | Q2 2021 | Q1 2022 | Q2 2021 | |||||||||||||||

| Trust, Investment and Other Servicing Fees | $ | 1,143.4 | $ | 1,168.4 | $ | 1,075.4 | (2) | % | 6 | % | ||||||||||

| Other Noninterest Income | 166.6 | 169.3 | 169.3 | (2) | (2) | |||||||||||||||

| Net Interest Income (FTE*) | 469.8 | 387.7 | 343.9 | 21 | 37 | |||||||||||||||

| Total Revenue (FTE*) | $ | 1,779.8 | $ | 1,725.4 | $ | 1,588.6 | 3 | % | 12 | % | ||||||||||

| Noninterest Expense | $ | 1,223.6 | $ | 1,205.9 | $ | 1,120.8 | 1 | % | 9 | % | ||||||||||

| Provision for Credit Losses | 4.5 | 2.0 | (27.0) | 125 | N/M | |||||||||||||||

| Provision for Income Taxes | 144.4 | 121.5 | 118.4 | 19 | 22 | |||||||||||||||

| FTE Adjustment* | 11.1 | 6.7 | 8.3 | 68 | 35 | |||||||||||||||

| Net Income | $ | 396.2 | $ | 389.3 | $ | 368.1 | 2 | % | 8 | % | ||||||||||

| Earnings Allocated to Common and Potential Common Shares |

$ | 388.3 | $ | 370.0 | $ | 360.2 | 5 | % | 8 | % | ||||||||||

| Diluted Earnings per Common Share | $ | 1.86 | $ | 1.77 | $ | 1.72 | 5 | % | 8 | % | ||||||||||

| Return on Average Common Equity | 15.7 | % | 14.2 | % | 13.7 | % | ||||||||||||||

| Return on Average Assets | 1.03 | % | 0.97 | % | 0.96 | % | ||||||||||||||

| Average Assets | $ | 154,084.1 | $ | 162,143.0 | $ | 154,300.1 | (5) | % | — | % | ||||||||||

NORTHERN TRUST CORPORATION SECOND QUARTER 2022 RESULTS | ||

| ACCOUNTING RECLASSIFICATION | ||||||||||||||||||||

Beginning in the first quarter of 2022, Trust, Investment and Other Servicing fees were impacted by the change in classification of certain fees that were previously recorded in Other Operating Income or as a reduction of Other Operating Expense but resulted in no impact to net income. The accounting reclassification increased Trust, Investment and Other Servicing fees in the current-year quarter by $17.3 million, with a $6.9 million decrease in Other Operating Income and a $10.4 million increase in Other Operating Expense. The classification changes are deemed to be a better representation of the underlying nature of the business as they are directly tied to client asset levels and the related services are more akin to our core service offerings. Prior-year amounts have not been reclassified. | ||||||||||||||||||||

| CLIENT ASSETS | ||||||||||||||||||||

Assets under custody/administration (AUC/A) and assets under management are a driver of the Corporation’s trust, investment and other servicing fees, the largest component of noninterest income. | ||||||||||||||||||||

| As of | % Change June 30, 2022 vs. |

|||||||||||||||||||

| ($ In Billions) | June 30, 2022* | March 31, 2022 | June 30, 2021 | March 31, 2022 | June 30, 2021 | |||||||||||||||

| Assets Under Custody/Administration | ||||||||||||||||||||

| Asset Servicing | $ | 12,812.2 | $ | 14,513.0 | $ | 14,754.1 | (12) | % | (13) | % | ||||||||||

| Wealth Management | 921.5 | 1,031.1 | 973.0 | (11) | (5) | |||||||||||||||

| Total Assets Under Custody/Administration | $ | 13,733.7 | $ | 15,544.1 | $ | 15,727.1 | (12) | % | (13) | % | ||||||||||

Assets Under Custody(1) |

||||||||||||||||||||

| Asset Servicing | $ | 9,771.2 | $ | 10,987.5 | $ | 11,260.8 | (11) | % | (13) | % | ||||||||||

| Wealth Management | 913.0 | 1,022.9 | 967.8 | (11) | (6) | |||||||||||||||

| Total Assets Under Custody | $ | 10,684.2 | $ | 12,010.4 | $ | 12,228.6 | (11) | % | (13) | % | ||||||||||

| Assets Under Management | ||||||||||||||||||||

| Asset Servicing | $ | 950.0 | $ | 1,091.6 | $ | 1,168.3 | (13) | % | (19) | % | ||||||||||

| Wealth Management | 352.8 | 396.2 | 371.1 | (11) | (5) | |||||||||||||||

| Total Assets Under Management | $ | 1,302.8 | $ | 1,487.8 | $ | 1,539.4 | (12) | % | (15) | % | ||||||||||

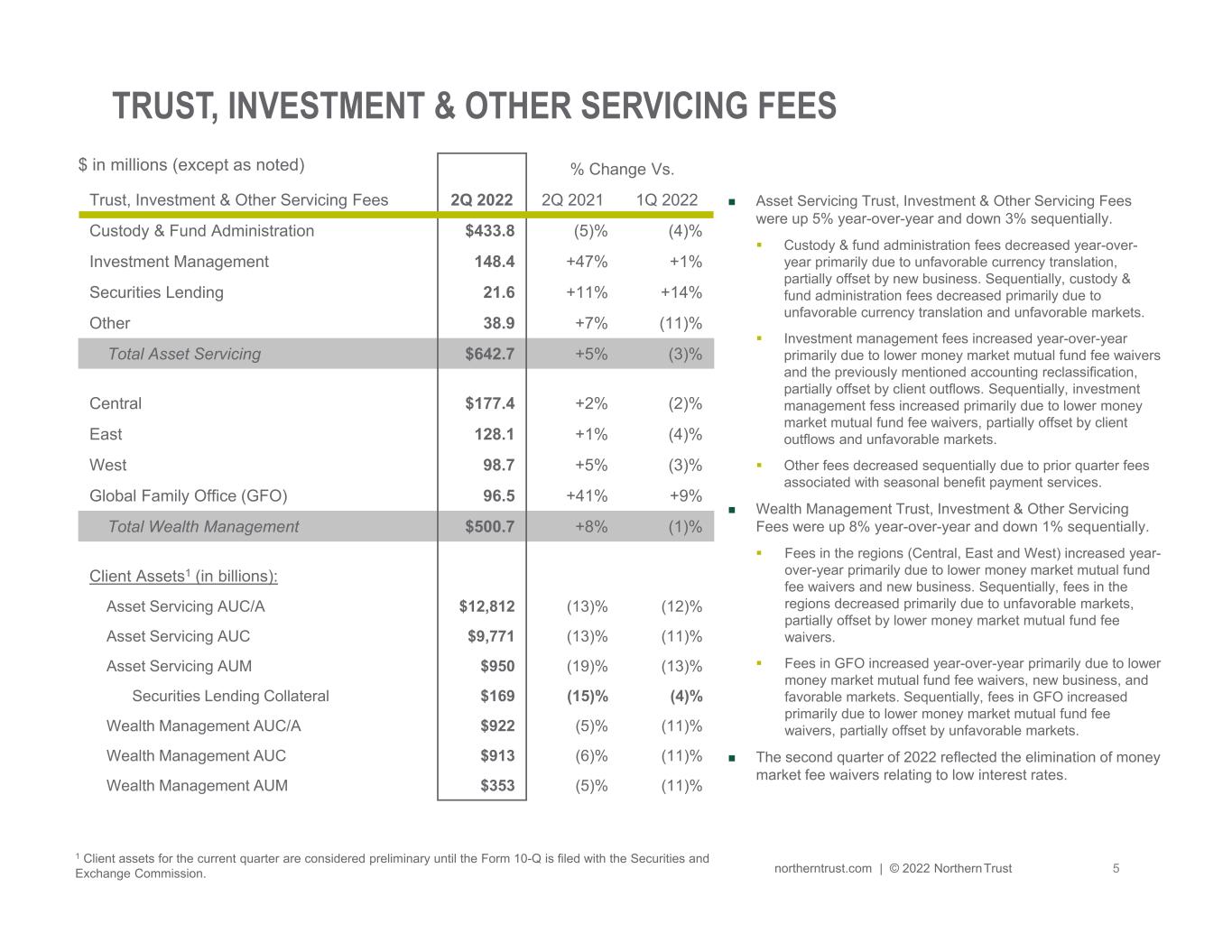

| TRUST, INVESTMENT AND OTHER SERVICING FEES | ||||||||||||||||||||

% Change Q2 2022 vs. |

||||||||||||||||||||

| ($ In Millions) | Q2 2022 | Q1 2022 | Q2 2021 | Q1 2022 | Q2 2021 | |||||||||||||||

| Asset Servicing Trust, Investment and Other Servicing Fees | ||||||||||||||||||||

| Custody and Fund Administration | $ | 433.8 | $ | 452.7 | $ | 454.9 | (4) | % | (5) | % | ||||||||||

| Investment Management | 148.4 | 146.9 | 100.7 | 1 | 47 | |||||||||||||||

| Securities Lending | 21.6 | 18.8 | 19.5 | 14 | 11 | |||||||||||||||

| Other | 38.9 | 44.0 | 36.4 | (11) | 7 | |||||||||||||||

| Total Asset Servicing | $ | 642.7 | $ | 662.4 | $ | 611.5 | (3) | % | 5 | % | ||||||||||

| Wealth Management Trust, Investment and Other Servicing Fees | ||||||||||||||||||||

| Central | $ | 177.4 | $ | 181.7 | $ | 174.3 | (2) | % | 2 | % | ||||||||||

| East | 128.1 | 134.0 | 127.2 | (4) | 1 | |||||||||||||||

| West | 98.7 | 101.4 | 93.8 | (3) | 5 | |||||||||||||||

| Global Family Office (GFO) | 96.5 | 88.9 | 68.6 | 9 | 41 | |||||||||||||||

| Total Wealth Management | $ | 500.7 | $ | 506.0 | $ | 463.9 | (1) | % | 8 | % | ||||||||||

| Total Consolidated Trust, Investment and Other Servicing Fees | $ | 1,143.4 | $ | 1,168.4 | $ | 1,075.4 | (2) | % | 6 | % | ||||||||||

NORTHERN TRUST CORPORATION SECOND QUARTER 2022 RESULTS | ||

| OTHER NONINTEREST INCOME | ||||||||||||||||||||

% Change Q2 2022 vs. |

||||||||||||||||||||

| ($ In Millions) | Q2 2022 | Q1 2022 | Q2 2021 | Q1 2022 | Q2 2021 | |||||||||||||||

| Other Noninterest Income | ||||||||||||||||||||

| Foreign Exchange Trading Income | $ | 77.6 | $ | 80.9 | $ | 70.6 | (4) | % | 10 | % | ||||||||||

| Treasury Management Fees | 10.6 | 11.1 | 11.3 | (5) | (6) | |||||||||||||||

| Security Commissions and Trading Income | 32.8 | 36.2 | 33.0 | (9) | (1) | |||||||||||||||

| Other Operating Income | 45.6 | 41.1 | 54.4 | 11 | (16) | |||||||||||||||

| Investment Security Gains (Losses), net | — | — | — | N/M | N/M | |||||||||||||||

| Total Other Noninterest Income | $ | 166.6 | $ | 169.3 | $ | 169.3 | (2) | % | (2) | % | ||||||||||

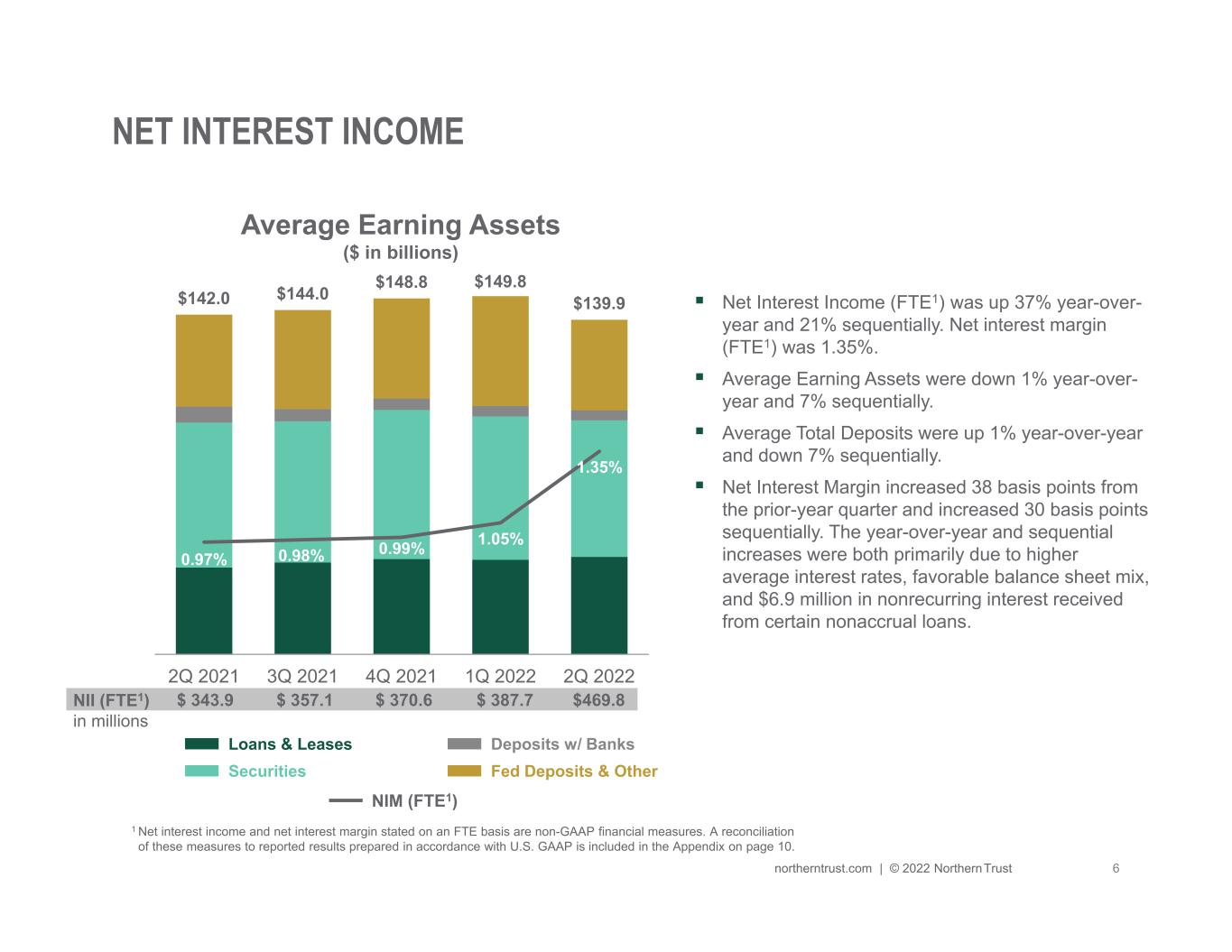

| NET INTEREST INCOME | ||||||||||||||||||||

% Change Q2 2022 vs. |

||||||||||||||||||||

| ($ In Millions) | Q2 2022 | Q1 2022 | Q2 2021 | Q1 2022 | Q2 2021 | |||||||||||||||

| Net Interest Income | ||||||||||||||||||||

| Interest Income (FTE*) | $ | 535.9 | $ | 390.2 | $ | 351.4 | 37 % | 52 % | ||||||||||||

| Interest Expense | 66.1 | 2.5 | 7.5 | N/M | N/M | |||||||||||||||

| Net Interest Income (FTE*) | $ | 469.8 | $ | 387.7 | $ | 343.9 | 21 % | 37 % | ||||||||||||

| Average Earning Assets | $ | 139,902 | $ | 149,768 | $ | 142,024 | (7)% | (1)% | ||||||||||||

| Net Interest Margin (FTE*) | 1.35 | % | 1.05 | % | 0.97 | % | 30 | bps | 38 | bps | ||||||||||

NORTHERN TRUST CORPORATION SECOND QUARTER 2022 RESULTS | ||

| PROVISION FOR CREDIT LOSSES | ||||||||||||||||||||

| As of and for the three-months ended, | % Change June 30, 2022 vs. |

|||||||||||||||||||

| ($ In Millions) | June 30, 2022 | March 31, 2022 | June 30, 2021 | March 31, 2022 | June 30, 2021 | |||||||||||||||

| Allowance for Credit Losses | ||||||||||||||||||||

| Beginning Allowance for Credit Losses | $ | 189.9 | $ | 184.7 | $ | 230.8 | 3 | % | (18) | % | ||||||||||

| Provision for Credit Losses | 4.5 | 2.0 | (27.0) | 125 | N/M | |||||||||||||||

| Net Recoveries (Charge-Offs) | 5.5 | 3.2 | 3.2 | N/M | N/M | |||||||||||||||

| Ending Allowance for Credit Losses | $ | 199.9 | $ | 189.9 | $ | 207.0 | 5 | % | (3) | % | ||||||||||

| Allowance assigned to: | ||||||||||||||||||||

| Loans and Leases | $ | 138.2 | $ | 136.3 | $ | 148.8 | 1 | % | (7) | % | ||||||||||

| Undrawn Loan Commitments and Standby Letters of Credit |

43.5 | 37.5 | 46.5 | 16 | (6) | |||||||||||||||

| Debt Securities and Other Financial Assets | 18.2 | 16.1 | 11.7 | 13 | 56 | |||||||||||||||

| Ending Allowance for Credit Losses | $ | 199.9 | $ | 189.9 | $ | 207.0 | 5 | % | (3) | % | ||||||||||

NORTHERN TRUST CORPORATION SECOND QUARTER 2022 RESULTS | ||

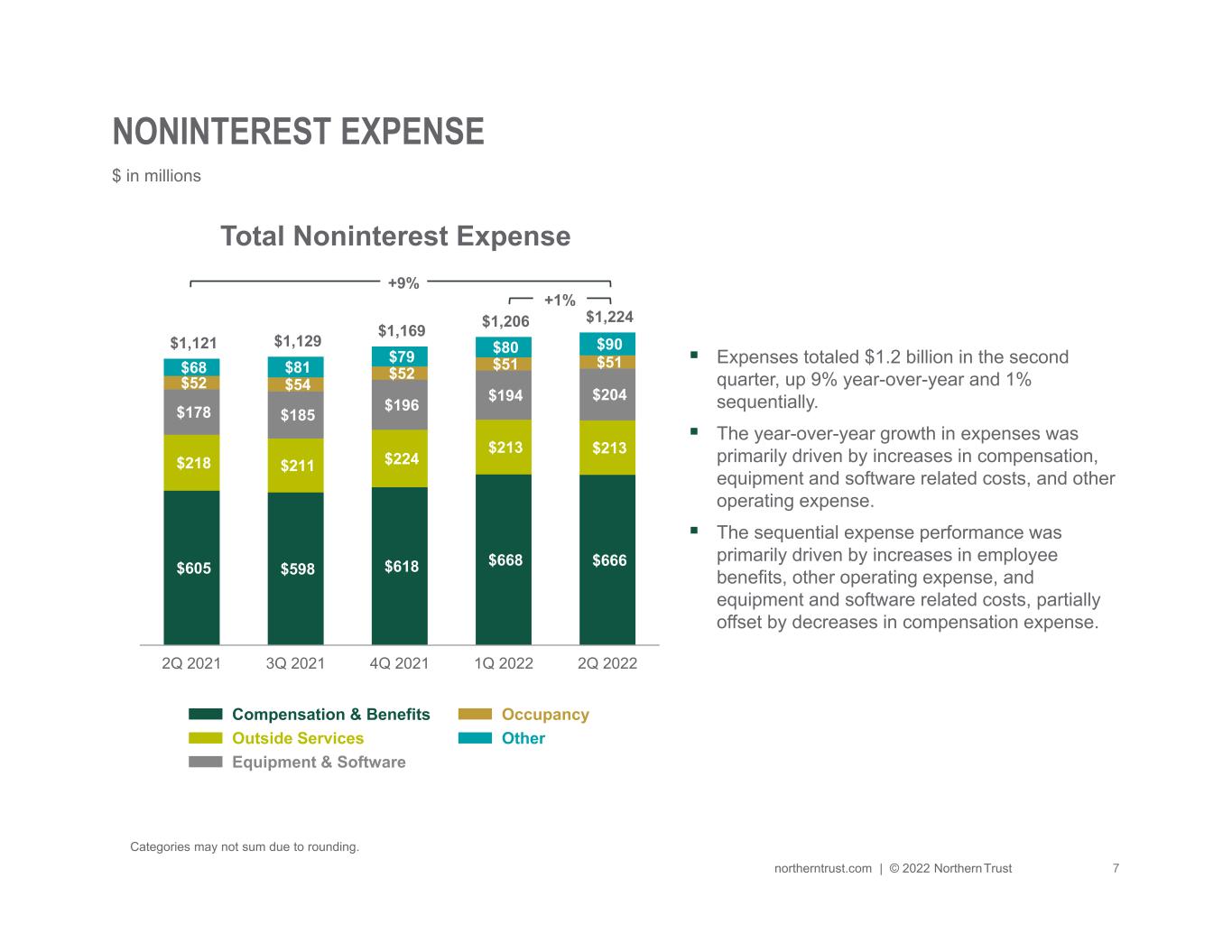

| NONINTEREST EXPENSE | ||||||||||||||||||||

% Change Q2 2022 vs. |

||||||||||||||||||||

| ($ In Millions) | Q2 2022 | Q1 2022 | Q2 2021 | Q1 2022 | Q2 2021 | |||||||||||||||

| Noninterest Expense | ||||||||||||||||||||

| Compensation | $ | 546.5 | $ | 563.9 | $ | 486.3 | (3) | % | 12 | % | ||||||||||

| Employee Benefits | 119.6 | 104.3 | 118.4 | 15 | 1 | |||||||||||||||

| Outside Services | 213.1 | 213.4 | 218.1 | — | (2) | |||||||||||||||

| Equipment and Software | 203.5 | 193.5 | 178.3 | 5 | 14 | |||||||||||||||

| Occupancy | 51.0 | 51.1 | 52.2 | — | (2) | |||||||||||||||

| Other Operating Expense | 89.9 | 79.7 | 67.5 | 13 | 33 | |||||||||||||||

| Total Noninterest Expense | $ | 1,223.6 | $ | 1,205.9 | $ | 1,120.8 | 1 | % | 9 | % | ||||||||||

| End of Period Full-Time Equivalent Staff | 22,500 | 21,700 | 20,600 | 4 | % | 9 | % | |||||||||||||

| PROVISION FOR INCOME TAX | ||||||||||||||||||||

% Change Q2 2022 vs. |

||||||||||||||||||||

| ($ In Millions) | Q2 2022 | Q1 2022 | Q2 2021 | Q1 2022 | Q2 2021 | |||||||||||||||

| Net Income | ||||||||||||||||||||

| Income before Income Taxes | $ | 540.6 | $ | 510.8 | $ | 486.5 | 6 | % | 11 | % | ||||||||||

| Provision for Income Taxes | 144.4 | 121.5 | 118.4 | 19 | 22 | |||||||||||||||

| Net Income | $ | 396.2 | $ | 389.3 | $ | 368.1 | 2 | % | 8 | % | ||||||||||

| Effective Tax Rate | 26.7 | % | 23.8 | % | 24.3 | % | 291 | bps | 236 | bps | ||||||||||

NORTHERN TRUST CORPORATION SECOND QUARTER 2022 RESULTS | ||

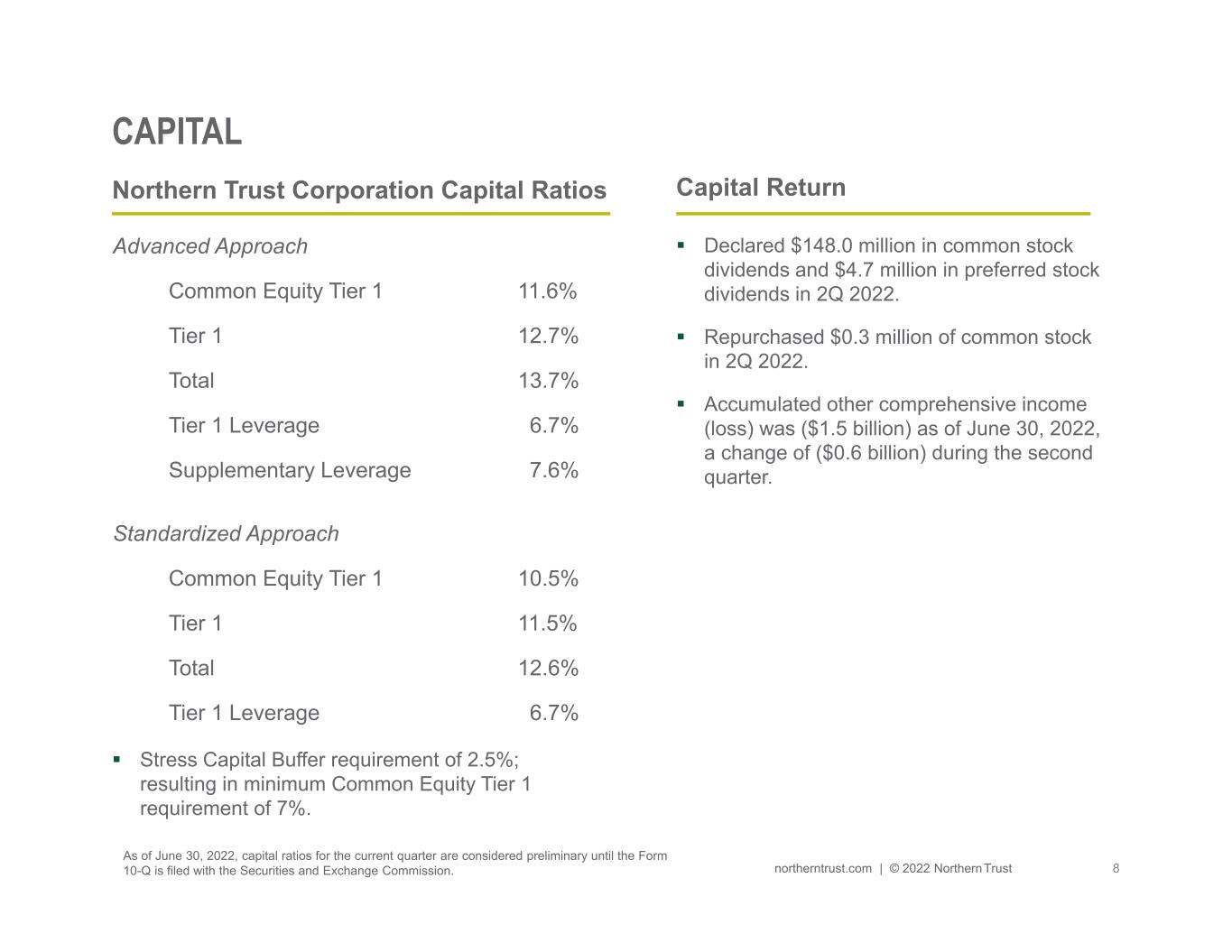

| CAPITAL ACTIONS | ||

| CAPITAL RATIOS | ||

| June 30, 2022* | March 31, 2022 | June 30, 2021 | |||||||||||||||||||||||||||

| Capital Ratios - Northern Trust Corporation |

Standardized Approach | Advanced Approach | Standardized Approach | Advanced Approach | Standardized Approach | Advanced Approach | Well-Capitalized Ratios | Minimum Capital Ratios | |||||||||||||||||||||

| Common Equity Tier 1 Capital | 10.5 | % | 11.6 | % | 11.4 | % | 12.1 | % | 12.0 | % | 13.1 | % | N/A | 4.5 | % | ||||||||||||||

| Tier 1 Capital | 11.5 | 12.7 | 12.4 | 13.2 | 13.1 | 14.2 | 6.0 | 6.0 | |||||||||||||||||||||

| Total Capital | 12.6 | 13.7 | 13.6 | 14.2 | 14.5 | 15.5 | 10.0 | 8.0 | |||||||||||||||||||||

| Tier 1 Leverage | 6.7 | 6.7 | 6.5 | 6.5 | 7.1 | 7.1 | N/A | 4.0 | |||||||||||||||||||||

| Supplementary Leverage | N/A | 7.6 | N/A | 7.9 | N/A | 8.2 | N/A | 3.0 | |||||||||||||||||||||

| June 30, 2022* | March 31, 2022 | June 30, 2021 | |||||||||||||||||||||||||||

| Capital Ratios - The Northern Trust Company |

Standardized Approach | Advanced Approach | Standardized Approach | Advanced Approach | Standardized Approach | Advanced Approach | Well-Capitalized Ratios | Minimum Capital Ratios | |||||||||||||||||||||

| Common Equity Tier 1 Capital | 11.0 | % | 12.3 | % | 11.7 | % | 12.6 | % | 12.3 | % | 13.6 | % | 6.5 | % | 4.5 | % | |||||||||||||

| Tier 1 Capital | 11.0 | 12.3 | 11.7 | 12.6 | 12.3 | 13.6 | 8.0 | 6.0 | |||||||||||||||||||||

| Total Capital | 11.9 | 13.1 | 12.6 | 13.4 | 13.6 | 14.7 | 10.0 | 8.0 | |||||||||||||||||||||

| Tier 1 Leverage | 6.3 | 6.3 | 6.1 | 6.1 | 6.7 | 6.7 | 5.0 | 4.0 | |||||||||||||||||||||

| Supplementary Leverage | N/A | 7.2 | N/A | 7.4 | N/A | 7.7 | 3.0 | 3.0 | |||||||||||||||||||||

NORTHERN TRUST CORPORATION SECOND QUARTER 2022 RESULTS | ||

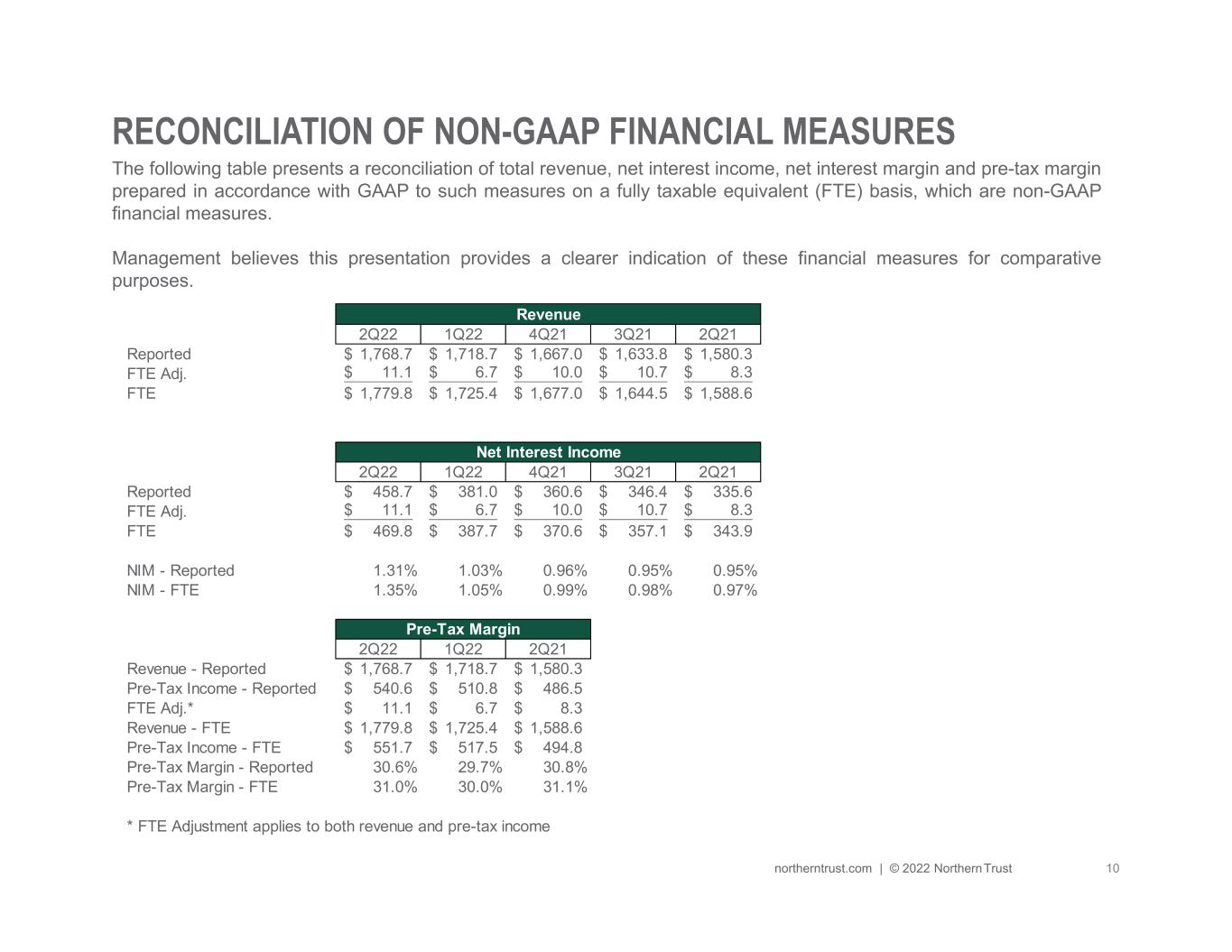

| RECONCILIATION TO FULLY TAXABLE EQUIVALENT | ||

| QUARTERS | ||||||||||||||||||||

| 2022 | 2021 | |||||||||||||||||||

| ($ in Millions) | SECOND | FIRST | FOURTH | THIRD | SECOND | |||||||||||||||

| Net Interest Income | ||||||||||||||||||||

| Interest Income - GAAP | $ | 524.8 | $ | 383.5 | $ | 362.2 | $ | 351.3 | $ | 343.1 | ||||||||||

| Add: FTE Adjustment | 11.1 | 6.7 | 10.0 | 10.7 | 8.3 | |||||||||||||||

| Interest Income (FTE) - Non-GAAP | $ | 535.9 | $ | 390.2 | $ | 372.2 | $ | 362.0 | $ | 351.4 | ||||||||||

| Net Interest Income - GAAP | $ | 458.7 | $ | 381.0 | $ | 360.6 | $ | 346.4 | $ | 335.6 | ||||||||||

| Add: FTE Adjustment | 11.1 | 6.7 | 10.0 | 10.7 | 8.3 | |||||||||||||||

| Net Interest Income (FTE) - Non-GAAP | $ | 469.8 | $ | 387.7 | $ | 370.6 | $ | 357.1 | $ | 343.9 | ||||||||||

| Net Interest Margin - GAAP | 1.31 | % | 1.03 | % | 0.96 | % | 0.95 | % | 0.95 | % | ||||||||||

| Net Interest Margin (FTE) - Non-GAAP | 1.35 | % | 1.05 | % | 0.99 | % | 0.98 | % | 0.97 | % | ||||||||||

| Total Revenue | ||||||||||||||||||||

| Total Revenue - GAAP | $ | 1,768.7 | $ | 1,718.7 | $ | 1,667.0 | $ | 1,633.8 | $ | 1,580.3 | ||||||||||

| Add: FTE Adjustment | 11.1 | 6.7 | 10.0 | 10.7 | 8.3 | |||||||||||||||

| Total Revenue (FTE) - Non-GAAP | $ | 1,779.8 | $ | 1,725.4 | $ | 1,677.0 | $ | 1,644.5 | $ | 1,588.6 | ||||||||||

NORTHERN TRUST CORPORATION SECOND QUARTER 2022 RESULTS | ||

| FORWARD LOOKING STATEMENTS | ||

WEBCAST OF SECOND QUARTER EARNINGS CONFERENCE CALL | ||

| NORTHERN TRUST CORPORATION | ||

| (Supplemental Consolidated Financial Information) | ||

| STATEMENT OF INCOME DATA | % Change(1) |

|||||||||||||||||||

| ($ In Millions Except Per Share Data) | Q2 2022 vs. |

|||||||||||||||||||

| Q2 2022 | Q1 2022 | Q2 2021 | Q1 2022 | Q2 2021 | ||||||||||||||||

| Noninterest Income | ||||||||||||||||||||

| Trust, Investment and Other Servicing Fees | $ | 1,143.4 | $ | 1,168.4 | $ | 1,075.4 | (2) | % | 6 | % | ||||||||||

| Foreign Exchange Trading Income | 77.6 | 80.9 | 70.6 | (4) | 10 | |||||||||||||||

| Treasury Management Fees | 10.6 | 11.1 | 11.3 | (5) | (6) | |||||||||||||||

| Security Commissions and Trading Income | 32.8 | 36.2 | 33.0 | (9) | (1) | |||||||||||||||

| Other Operating Income | 45.6 | 41.1 | 54.4 | 11 | (16) | |||||||||||||||

| Investment Security Gains (Losses), net | — | — | — | N/M | N/M | |||||||||||||||

| Total Noninterest Income | 1,310.0 | 1,337.7 | 1,244.7 | (2) | 5 | |||||||||||||||

| Net Interest Income | ||||||||||||||||||||

| Interest Income | 524.8 | 383.5 | 343.1 | 37 | 53 | |||||||||||||||

| Interest Expense | 66.1 | 2.5 | 7.5 | N/M | N/M | |||||||||||||||

| Net Interest Income | 458.7 | 381.0 | 335.6 | 20 | 37 | |||||||||||||||

| Total Revenue | 1,768.7 | 1,718.7 | 1,580.3 | 3 | 12 | |||||||||||||||

| Provision for Credit Losses | 4.5 | 2.0 | (27.0) | 125 | N/M | |||||||||||||||

| Noninterest Expense | ||||||||||||||||||||

| Compensation | 546.5 | 563.9 | 486.3 | (3) | 12 | |||||||||||||||

| Employee Benefits | 119.6 | 104.3 | 118.4 | 15 | 1 | |||||||||||||||

| Outside Services | 213.1 | 213.4 | 218.1 | — | (2) | |||||||||||||||

| Equipment and Software | 203.5 | 193.5 | 178.3 | 5 | 14 | |||||||||||||||

| Occupancy | 51.0 | 51.1 | 52.2 | — | (2) | |||||||||||||||

| Other Operating Expense | 89.9 | 79.7 | 67.5 | 13 | 33 | |||||||||||||||

| Total Noninterest Expense | 1,223.6 | 1,205.9 | 1,120.8 | 1 | 9 | |||||||||||||||

| Income before Income Taxes | 540.6 | 510.8 | 486.5 | 6 | 11 | |||||||||||||||

| Provision for Income Taxes | 144.4 | 121.5 | 118.4 | 19 | 22 | |||||||||||||||

| NET INCOME | $ | 396.2 | $ | 389.3 | $ | 368.1 | 2 | % | 8 | % | ||||||||||

| Preferred Stock Dividends | 4.7 | 16.2 | 4.7 | (71) | — | |||||||||||||||

| NET INCOME APPLICABLE TO COMMON STOCK | $ | 391.5 | $ | 373.1 | $ | 363.4 | 5 | % | 8 | % | ||||||||||

| Earnings Allocated to Participating Securities | 3.2 | 3.1 | 3.2 | 4 | — | |||||||||||||||

| Earnings Allocated to Common and Potential Common Shares | $ | 388.3 | $ | 370.0 | $ | 360.2 | 5 | % | 8 | % | ||||||||||

| Per Common Share | ||||||||||||||||||||

| Net Income | ||||||||||||||||||||

| Basic | $ | 1.86 | $ | 1.78 | $ | 1.73 | 5 | % | 8 | % | ||||||||||

| Diluted | 1.86 | 1.77 | 1.72 | 5 | 8 | |||||||||||||||

| Average Common Equity | $ | 10,022.1 | $ | 10,626.3 | $ | 10,666.1 | (6) | % | (6) | % | ||||||||||

| Return on Average Common Equity | 15.7 | % | 14.2 | % | 13.7 | % | ||||||||||||||

| Return on Average Assets | 1.03 | % | 0.97 | % | 0.96 | % | ||||||||||||||

| Cash Dividends Declared per Common Share | $ | 0.70 | $ | 0.70 | $ | 0.70 | — | % | — | % | ||||||||||

| Average Common Shares Outstanding (000s) | ||||||||||||||||||||

| Basic | 208,384 | 208,025 | 208,369 | |||||||||||||||||

| Diluted | 208,878 | 208,809 | 209,138 | |||||||||||||||||

| Common Shares Outstanding (EOP) (000s) | 208,387 | 208,380 | 208,395 | |||||||||||||||||

| NORTHERN TRUST CORPORATION | ||

| (Supplemental Consolidated Financial Information) | ||

| STATEMENT OF INCOME DATA | ||||||||||||||

| ($ In Millions Except Per Share Data) | SIX MONTHS | |||||||||||||

| 2022 | 2021 | % Change(1) |

||||||||||||

| Noninterest Income | ||||||||||||||

| Trust, Investment and Other Servicing Fees | $ | 2,311.8 | $ | 2,139.1 | 8 | % | ||||||||

| Foreign Exchange Trading Income | 158.5 | 149.3 | 6 | |||||||||||

| Treasury Management Fees | 21.7 | 22.5 | (3) | |||||||||||

| Security Commissions and Trading Income | 69.0 | 67.8 | 2 | |||||||||||

| Other Operating Income | 86.7 | 109.3 | (21) | |||||||||||

| Investment Security Gains (Losses), net | — | — | N/M | |||||||||||

| Total Noninterest Income | 2,647.7 | 2,488.0 | 6 | |||||||||||

| Net Interest Income | ||||||||||||||

| Interest Income | 908.3 | 693.0 | 31 | |||||||||||

| Interest Expense | 68.6 | 17.3 | N/M | |||||||||||

| Net Interest Income | 839.7 | 675.7 | 24 | |||||||||||

| Total Revenue | 3,487.4 | 3,163.7 | 10 | |||||||||||

| Provision for Credit Losses | 6.5 | (57.0) | N/M | |||||||||||

| Noninterest Expense | ||||||||||||||

| Compensation | 1,110.4 | 1,004.8 | 11 | |||||||||||

| Employee Benefits | 223.9 | 221.8 | 1 | |||||||||||

| Outside Services | 426.5 | 414.5 | 3 | |||||||||||

| Equipment and Software | 397.0 | 355.0 | 12 | |||||||||||

| Occupancy | 102.1 | 103.0 | (1) | |||||||||||

| Other Operating Expense | 169.6 | 139.2 | 22 | |||||||||||

| Total Noninterest Expense | 2,429.5 | 2,238.3 | 9 | |||||||||||

| Income before Income Taxes | 1,051.4 | 982.4 | 7 | |||||||||||

| Provision for Income Taxes | 265.9 | 239.2 | 11 | |||||||||||

| NET INCOME | $ | 785.5 | $ | 743.2 | 6 | % | ||||||||

Preferred Stock Dividends |

20.9 | 20.9 | — | |||||||||||

| NET INCOME APPLICABLE TO COMMON STOCK | $ | 764.6 | $ | 722.3 | 6 | % | ||||||||

| Earnings Allocated to Participating Securities | 6.3 | 6.9 | (8) | |||||||||||

| Earnings Allocated to Common and Potential Common Shares | $ | 758.3 | $ | 715.4 | 6 | % | ||||||||

| Per Common Share | ||||||||||||||

| Net Income | ||||||||||||||

| Basic | $ | 3.64 | $ | 3.44 | 6 | % | ||||||||

| Diluted | 3.63 | 3.42 | 6 | |||||||||||

| Average Common Equity | $ | 10,322.6 | $ | 10,659.3 | (3) | % | ||||||||

| Return on Average Common Equity | 14.9 | % | 13.7 | % | ||||||||||

| Return on Average Assets | 1.00 | % | 0.97 | % | ||||||||||

| Cash Dividends Declared per Common Share | $ | 1.40 | $ | 1.40 | — | % | ||||||||

| Average Common Shares Outstanding (000s) | ||||||||||||||

| Basic | 208,205 | 208,242 | ||||||||||||

| Diluted | 208,844 | 209,043 | ||||||||||||

| Common Shares Outstanding (EOP) (000s) | 208,387 | 208,395 | ||||||||||||

| NORTHERN TRUST CORPORATION | ||

| (Supplemental Consolidated Financial Information) | ||

| BALANCE SHEET | ||||||||||||||||||||

| ($ In Millions) | % Change(1) |

|||||||||||||||||||

June 30, 2022 vs. |

||||||||||||||||||||

| June 30, 2022 | March 31, 2022 | June 30, 2021 | March 31, 2022 | June 30, 2021 | ||||||||||||||||

| Assets | ||||||||||||||||||||

Federal Reserve and Other Central Bank Deposits and Other(2) |

$ | 37,948.3 | $ | 55,626.1 | $ | 54,159.5 | (32) | % | (30) | % | ||||||||||

Interest-Bearing Due from and Deposits with Banks(3) |

5,354.6 | 5,177.8 | 7,047.8 | 3 | (24) | |||||||||||||||

| Federal Funds Sold | 10.0 | — | 0.1 | N/M | N/M | |||||||||||||||

| Securities Purchased under Agreements to Resell | 1,171.8 | 1,031.4 | 947.8 | 14 | 24 | |||||||||||||||

| Securities | ||||||||||||||||||||

| U.S. Government | 2,645.3 | 2,596.0 | 2,657.9 | 2 | — | |||||||||||||||

| Obligations of States and Political Subdivisions | 3,453.3 | 3,647.8 | 3,489.9 | (5) | (1) | |||||||||||||||

| Government Sponsored Agency | 22,219.8 | 23,007.1 | 24,144.9 | (3) | (8) | |||||||||||||||

Other(4) |

28,173.8 | 30,110.2 | 29,551.3 | (6) | (5) | |||||||||||||||

| Total Securities | 56,492.2 | 59,361.1 | 59,844.0 | (5) | (6) | |||||||||||||||

| Loans and Leases | 41,207.8 | 39,239.1 | 37,406.6 | 5 | 10 | |||||||||||||||

| Total Earning Assets | 142,184.7 | 160,435.5 | 159,405.8 | (11) | (11) | |||||||||||||||

| Allowance for Credit Losses | (154.7) | (152.0) | (160.5) | 2 | (4) | |||||||||||||||

Cash and Due from Banks and Other Central Bank Deposits(5) |

2,357.6 | 1,502.0 | 1,683.3 | 57 | 40 | |||||||||||||||

| Buildings and Equipment | 476.6 | 486.0 | 496.5 | (2) | (4) | |||||||||||||||

| Client Security Settlement Receivables | 2,284.7 | 2,183.9 | 2,011.6 | 5 | 14 | |||||||||||||||

| Goodwill | 690.0 | 702.0 | 709.4 | (2) | (3) | |||||||||||||||

| Other Assets | 9,947.4 | 7,407.6 | 8,145.0 | 34 | 22 | |||||||||||||||

| Total Assets | $ | 157,786.3 | $ | 172,565.0 | $ | 172,291.1 | (9) | % | (8) | % | ||||||||||

| Liabilities and Stockholders’ Equity | ||||||||||||||||||||

| Interest-Bearing Deposits | ||||||||||||||||||||

| Savings, Money Market and Other | $ | 30,857.0 | $ | 31,703.7 | $ | 31,604.7 | (3) | % | (2) | % | ||||||||||

| Savings Certificates and Other Time | 785.0 | 846.0 | 877.7 | (7) | (11) | |||||||||||||||

| Non-U.S. Offices - Interest-Bearing | 69,951.1 | 69,541.5 | 71,705.4 | 1 | (2) | |||||||||||||||

| Total Interest-Bearing Deposits | 101,593.1 | 102,091.2 | 104,187.8 | — | (2) | |||||||||||||||

| Federal Funds Purchased | 389.2 | 0.2 | 0.2 | N/M | N/M | |||||||||||||||

| Securities Sold under Agreements to Repurchase | 799.4 | 329.7 | 529.1 | 142 | 51 | |||||||||||||||

| Other Borrowings | 3,514.9 | 3,521.1 | 5,140.6 | — | (32) | |||||||||||||||

| Senior Notes | 3,305.8 | 2,377.5 | 3,036.0 | 39 | 9 | |||||||||||||||

| Long-Term Debt | 1,094.1 | 1,106.9 | 1,165.3 | (1) | (6) | |||||||||||||||

| Floating Rate Capital Debt | — | — | 277.8 | N/M | (100) | |||||||||||||||

| Total Interest-Related Funds | 110,696.5 | 109,426.6 | 114,336.8 | 1 | (3) | |||||||||||||||

| Demand and Other Noninterest-Bearing Deposits | 32,081.5 | 47,538.4 | 42,022.4 | (33) | (24) | |||||||||||||||

| Other Liabilities | 3,938.6 | 4,190.2 | 4,108.9 | (6) | (4) | |||||||||||||||

| Total Liabilities | 146,716.6 | 161,155.2 | 160,468.1 | (9) | (9) | |||||||||||||||

| Common Equity | 10,184.8 | 10,524.9 | 10,938.1 | (3) | (7) | |||||||||||||||

| Preferred Equity | 884.9 | 884.9 | 884.9 | — | — | |||||||||||||||

| Total Equity | 11,069.7 | 11,409.8 | 11,823.0 | (3) | (6) | |||||||||||||||

| Total Liabilities and Stockholders’ Equity | $ | 157,786.3 | $ | 172,565.0 | $ | 172,291.1 | (9) | % | (8) | % | ||||||||||

| NORTHERN TRUST CORPORATION | ||

| (Supplemental Consolidated Financial Information) | ||

| AVERAGE BALANCE SHEET | ||||||||||||||||||||

| ($ In Millions) | % Change(1) |

|||||||||||||||||||

Q2 2022 vs. |

||||||||||||||||||||

| Q2 2022 | Q1 2022 | Q2 2021 | Q1 2022 | Q2 2021 | ||||||||||||||||

| Assets | ||||||||||||||||||||

Federal Reserve and Other Central Bank Deposits and Other(2) |

$ | 36,708.4 | $ | 45,220.6 | $ | 37,424.5 | (19) | % | (2) | % | ||||||||||

Interest-Bearing Due from and Deposits with Banks(3) |

4,227.6 | 4,384.0 | 6,736.7 | (4) | (37) | |||||||||||||||

| Federal Funds Sold | 2.2 | 0.7 | 0.1 | 199 | N/M | |||||||||||||||

| Securities Purchased under Agreements to Resell | 1,149.3 | 691.6 | 1,011.5 | 66 | 14 | |||||||||||||||

| Securities | ||||||||||||||||||||

| U.S. Government | 2,648.1 | 2,500.7 | 2,676.0 | 6 | (1) | |||||||||||||||

| Obligations of States and Political Subdivisions | 3,486.6 | 3,793.4 | 3,373.0 | (8) | 3 | |||||||||||||||

| Government Sponsored Agency | 22,468.3 | 23,511.4 | 24,520.5 | (4) | (8) | |||||||||||||||

Other(4) |

28,464.0 | 30,121.7 | 30,000.0 | (6) | (5) | |||||||||||||||

| Total Securities | 57,067.0 | 59,927.2 | 60,569.5 | (5) | (6) | |||||||||||||||

| Loans and Leases | 40,747.0 | 39,544.3 | 36,282.1 | 3 | 12 | |||||||||||||||

| Total Earning Assets | 139,901.5 | 149,768.4 | 142,024.4 | (7) | (1) | |||||||||||||||

| Allowance for Credit Losses | (155.8) | (152.0) | (177.0) | 2 | (12) | |||||||||||||||

Cash and Due from Banks and Other Central Bank Deposits(5) |

2,559.1 | 2,047.0 | 2,402.5 | 25 | 7 | |||||||||||||||

| Buildings and Equipment | 487.7 | 495.1 | 504.8 | (1) | (3) | |||||||||||||||

| Client Security Settlement Receivables | 1,587.8 | 1,825.5 | 1,532.6 | (13) | 4 | |||||||||||||||

| Goodwill | 693.8 | 704.2 | 707.8 | (1) | (2) | |||||||||||||||

| Other Assets | 9,010.0 | 7,454.8 | 7,305.0 | 21 | 23 | |||||||||||||||

| Total Assets | $ | 154,084.1 | $ | 162,143.0 | $ | 154,300.1 | (5) | % | — | % | ||||||||||

| Liabilities and Stockholders’ Equity | ||||||||||||||||||||

| Interest-Bearing Deposits | ||||||||||||||||||||

| Savings, Money Market and Other | $ | 30,967.5 | $ | 32,329.2 | $ | 27,427.0 | (4) | % | 13 | % | ||||||||||

| Savings Certificates and Other Time | 792.3 | 842.3 | 898.9 | (6) | (12) | |||||||||||||||

| Non-U.S. Offices - Interest-Bearing | 63,900.7 | 68,199.6 | 69,202.4 | (6) | (8) | |||||||||||||||

| Total Interest-Bearing Deposits | 95,660.5 | 101,371.1 | 97,528.3 | (6) | (2) | |||||||||||||||

| Federal Funds Purchased | 922.8 | 0.2 | 195.3 | N/M | N/M | |||||||||||||||

| Securities Sold under Agreements to Repurchase | 596.7 | 253.7 | 228.5 | 135 | 161 | |||||||||||||||

| Other Borrowings | 4,186.7 | 3,690.7 | 5,195.7 | 13 | (19) | |||||||||||||||

| Senior Notes | 2,885.1 | 2,442.4 | 3,022.9 | 18 | (5) | |||||||||||||||

| Long-Term Debt | 1,096.4 | 1,128.3 | 1,168.8 | (3) | (6) | |||||||||||||||

| Floating Rate Capital Debt | — | — | 277.8 | N/M | (100) | |||||||||||||||

| Total Interest-Related Funds | 105,348.2 | 108,886.4 | 107,617.3 | (3) | (2) | |||||||||||||||

| Demand and Other Noninterest-Bearing Deposits | 33,733.3 | 37,129.1 | 30,469.2 | (9) | 11 | |||||||||||||||

| Other Liabilities | 4,095.6 | 4,616.3 | 4,662.6 | (11) | (12) | |||||||||||||||

| Total Liabilities | 143,177.1 | 150,631.8 | 142,749.1 | (5) | — | |||||||||||||||

| Common Equity | 10,022.1 | 10,626.3 | 10,666.1 | (6) | (6) | |||||||||||||||

| Preferred Equity | 884.9 | 884.9 | 884.9 | — | — | |||||||||||||||

| Total Equity | 10,907.0 | 11,511.2 | 11,551.0 | (5) | (6) | |||||||||||||||

| Total Liabilities and Stockholders’ Equity | $ | 154,084.1 | $ | 162,143.0 | $ | 154,300.1 | (5) | % | — | % | ||||||||||

| NORTHERN TRUST CORPORATION | ||

| (Supplemental Consolidated Financial Information) | ||

| QUARTERLY TREND DATA | QUARTERS | ||||||||||||||||||||||||||||

| ($ In Millions Except Per Share Data) | 2022 | 2021 | |||||||||||||||||||||||||||

| SECOND | FIRST | FOURTH | THIRD | SECOND | |||||||||||||||||||||||||

| Net Income Summary | |||||||||||||||||||||||||||||

| Trust, Investment and Other Servicing Fees | $ | 1,143.4 | $ | 1,168.4 | $ | 1,111.0 | $ | 1,111.0 | $ | 1,075.4 | |||||||||||||||||||

| Other Noninterest Income | 166.6 | 169.3 | 195.4 | 176.4 | 169.3 | ||||||||||||||||||||||||

| Net Interest Income | 458.7 | 381.0 | 360.6 | 346.4 | 335.6 | ||||||||||||||||||||||||

| Total Revenue | 1,768.7 | 1,718.7 | 1,667.0 | 1,633.8 | 1,580.3 | ||||||||||||||||||||||||

| Provision for Credit Losses | 4.5 | 2.0 | (11.5) | (13.0) | (27.0) | ||||||||||||||||||||||||

| Noninterest Expense | 1,223.6 | 1,205.9 | 1,168.9 | 1,128.7 | 1,120.8 | ||||||||||||||||||||||||

| Income before Income Taxes | 540.6 | 510.8 | 509.6 | 518.1 | 486.5 | ||||||||||||||||||||||||

| Provision for Income Taxes | 144.4 | 121.5 | 103.2 | 122.4 | 118.4 | ||||||||||||||||||||||||

| Net Income | $ | 396.2 | $ | 389.3 | $ | 406.4 | $ | 395.7 | $ | 368.1 | |||||||||||||||||||

| Per Common Share | |||||||||||||||||||||||||||||

| Net Income - Basic | $ | 1.86 | $ | 1.78 | $ | 1.92 | $ | 1.81 | $ | 1.73 | |||||||||||||||||||

| - Diluted | 1.86 | 1.77 | 1.91 | 1.80 | 1.72 | ||||||||||||||||||||||||

| Cash Dividends Declared per Common Share | 0.70 | 0.70 | 0.70 | 0.70 | 0.70 | ||||||||||||||||||||||||

| Book Value (EOP) | 48.87 | 50.51 | 53.58 | 53.04 | 52.49 | ||||||||||||||||||||||||

| Market Value (EOP) | 96.48 | 116.45 | 119.61 | 107.81 | 115.62 | ||||||||||||||||||||||||

| Financial Ratios | |||||||||||||||||||||||||||||

| Return on Average Common Equity | 15.7 | % | 14.2 | % | 14.5 | % | 13.7 | % | 13.7 | % | |||||||||||||||||||

| Return on Average Assets | 1.03 | 0.97 | 1.00 | 1.00 | 0.96 | ||||||||||||||||||||||||

| Net Interest Margin (GAAP) | 1.31 | 1.03 | 0.96 | 0.95 | 0.95 | ||||||||||||||||||||||||

| Net Interest Margin (FTE*) | 1.35 | 1.05 | 0.99 | 0.98 | 0.97 | ||||||||||||||||||||||||

| Assets Under Custody / Administration ($ in Billions) - End Of Period | |||||||||||||||||||||||||||||

| Asset Servicing | $ | 12,812.2 | $ | 14,513.0 | $ | 15,183.2 | $ | 14,800.2 | $ | 14,754.1 | |||||||||||||||||||

| Wealth Management | 921.5 | 1,031.1 | 1,065.6 | 976.0 | 973.0 | ||||||||||||||||||||||||

| Total Assets Under Custody / Administration | $ | 13,733.7 | $ | 15,544.1 | $ | 16,248.8 | $ | 15,776.2 | $ | 15,727.1 | |||||||||||||||||||

| Assets Under Custody ($ In Billions) - End Of Period | |||||||||||||||||||||||||||||

| Asset Servicing | $ | 9,771.2 | $ | 10,987.5 | $ | 11,554.8 | $ | 11,283.6 | $ | 11,260.8 | |||||||||||||||||||

| Wealth Management | 913.0 | 1,022.9 | 1,057.5 | 962.9 | 967.8 | ||||||||||||||||||||||||

| Total Assets Under Custody | $ | 10,684.2 | $ | 12,010.4 | $ | 12,612.3 | $ | 12,246.5 | $ | 12,228.6 | |||||||||||||||||||

| Assets Under Management ($ In Billions) - End Of Period | |||||||||||||||||||||||||||||

| Asset Servicing | $ | 950.0 | $ | 1,091.6 | $ | 1,191.0 | $ | 1,159.5 | $ | 1,168.3 | |||||||||||||||||||

| Wealth Management | 352.8 | 396.2 | 416.1 | 372.9 | 371.1 | ||||||||||||||||||||||||

| Total Assets Under Management | $ | 1,302.8 | $ | 1,487.8 | $ | 1,607.1 | $ | 1,532.4 | $ | 1,539.4 | |||||||||||||||||||

| Asset Quality ($ In Millions) - End Of Period | |||||||||||||||||||||||||||||

| Nonaccrual Loans and Leases | $ | 89.7 | $ | 100.8 | $ | 122.3 | $ | 141.0 | $ | 106.5 | |||||||||||||||||||

| Other Real Estate Owned (OREO) | 0.1 | 0.2 | 3.0 | 0.2 | 0.2 | ||||||||||||||||||||||||

| Total Nonaccrual Assets | $ | 89.8 | $ | 101.0 | $ | 125.3 | $ | 141.2 | $ | 106.7 | |||||||||||||||||||

| Nonaccrual Assets / Loans and Leases and OREO | 0.22 | % | 0.26 | % | 0.31 | % | 0.36 | % | 0.29 | % | |||||||||||||||||||

| Gross Charge-offs | $ | — | $ | (0.1) | $ | (0.3) | $ | — | $ | — | |||||||||||||||||||

| Gross Recoveries | 5.5 | 3.3 | 1.4 | 1.1 | 3.2 | ||||||||||||||||||||||||

| Net Recoveries (Charge-offs) | $ | 5.5 | $ | 3.2 | $ | 1.1 | $ | 1.1 | $ | 3.2 | |||||||||||||||||||

| Annualized Net Recoveries (Charge-offs) to Avg Loans and Leases | 0.05 | % | 0.03 | % | 0.01 | % | 0.01 | % | 0.04 | % | |||||||||||||||||||

| Allowance for Credit Losses Assigned to: | |||||||||||||||||||||||||||||

| Loans and Leases | $ | 138.2 | $ | 136.3 | $ | 138.4 | $ | 143.9 | $ | 148.8 | |||||||||||||||||||

| Undrawn Loan Commitments and Standby Letters of Credit | 43.5 | 37.5 | 34.1 | 39.8 | 46.5 | ||||||||||||||||||||||||

| Debt Securities and Other Financial Assets | 18.2 | 16.1 | 12.2 | 11.4 | 11.7 | ||||||||||||||||||||||||

| Loans and Leases Allowance / Nonaccrual Loans and Leases | 1.5 | x | 1.4 | x | 1.1 | x | 1.0 | x | 1.4 | x | |||||||||||||||||||

| Jennifer Childe | ||

| Senior Vice President, Director of Investor Relations | ||

| (312) 444-3290 or jennifer.childe@ntrs.com | ||

| Briar Rose | ||

| Vice President, Investor Relations | ||

(312) 557-5297 or briar.rose@ntrs.com | ||

| TABLE OF CONTENTS | |||||||||||

| 1 | 7 | ||||||||||

| Financial Summary | Balance Sheet Mix Trends | ||||||||||

| 2 | 8 | ||||||||||

| Income Statement | Interest Rate Trends | ||||||||||

| 3 | 9 | ||||||||||

| Net Income Trends | Asset Quality | ||||||||||

| 4 | 10 | ||||||||||

| Fee Detail | Trust Assets | ||||||||||

| 5 | 11 | ||||||||||

| Balance Sheet (EOP) | Reconciliation to FTE | ||||||||||

| 6 | 12 | ||||||||||

| Balance Sheet Trends | Reconciliation to FTE (Ratios) | ||||||||||

| Northern Trust Corporation | ||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| FINANCIAL SUMMARY | ||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| ($ in Millions except per share information) | ||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| 2021 | 2022 | |||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| 2017 | 2018 | 2019 | 2020 | 2021 | 1st Qtr | 2nd Qtr | 3rd Qtr | 4th Qtr | 1st Qtr | 2nd Qtr* | 3rd Qtr | 4th Qtr | ||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| Profitability: | ||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| $ | 1,199.0 | $ | 1,556.4 | $ | 1,492.2 | $ | 1,209.3 | $ | 1,545.3 | Net Income | $ | 375.1 | $ | 368.1 | $ | 395.7 | $ | 406.4 | $ | 389.3 | $ | 396.2 | ||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| 1,130.4 | 1,489.9 | 1,428.9 | 1,141.0 | 1,490.6 | Earnings Allocated to Common and Potential | 355.2 | 360.2 | 376.5 | 398.7 | 370.0 | 388.3 | |||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| Common Shares | ||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| $ | 4.95 | $ | 6.68 | $ | 6.66 | $ | 5.48 | $ | 7.16 | Basic Earnings Per Share | $ | 1.71 | $ | 1.73 | $ | 1.81 | $ | 1.92 | $ | 1.78 | $ | 1.86 | ||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| 4.92 | 6.64 | 6.63 | 5.46 | 7.14 | Diluted Earnings Per Share | 1.70 | 1.72 | 1.80 | 1.91 | 1.77 | 1.86 | |||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| 14 | % | 35 | % | — | % | (18 | %) | 31 | % | Diluted EPS Growth over Previous Year | 10 | % | 18 | % | 36 | % | 70 | % | 4 | % | 8 | % | ||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| 12.6 | % | 16.2 | % | 14.9 | % | 11.2 | % | 13.9 | % | Return on Average Common Equity | 13.7 | % | 13.7 | % | 13.7 | % | 14.5 | % | 14.2 | % | 15.7 | % | ||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| 1.00 | % | 1.27 | % | 1.27 | % | 0.88 | % | 0.99 | % | Return on Average Assets | 0.99 | % | 0.96 | % | 1.00 | % | 1.00 | % | 0.97 | % | 1.03 | % | ||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| 31.0 | % | 33.3 | % | 32.4 | % | 27.1 | % | 31.5 | % | Profit Margin (pre-tax) (FTE**) | 31.6 | % | 31.1 | % | 32.2 | % | 31.0 | % | 30.0 | % | 31.0 | % | ||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| 22.1 | % | 25.9 | % | 24.4 | % | 19.7 | % | 23.8 | % | Profit Margin (after-tax) (FTE**) | 23.6 | % | 23.2 | % | 24.1 | % | 24.2 | % | 22.6 | % | 22.3 | % | ||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| 72.8 | % | 72.3 | % | 72.0 | % | 75.9 | % | 78.2 | % | Noninterest Income to Total Revenue (FTE**) | 78.2 | % | 78.4 | % | 78.3 | % | 77.9 | % | 77.5 | % | 73.6 | % | ||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| 63.4 | % | 62.5 | % | 63.1 | % | 65.1 | % | 67.1 | % | Trust Fees to Total Revenue (FTE**) | 66.9 | % | 67.7 | % | 67.6 | % | 66.2 | % | 67.7 | % | 64.2 | % | ||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| 26.6 | % | 20.5 | % | 23.2 | % | 25.7 | % | 23.1 | % | Effective Tax Rate (US GAAP) | 24.4 | % | 24.3 | % | 23.6 | % | 20.2 | % | 23.8 | % | 26.7 | % | ||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| 28.6 | % | 22.1 | % | 24.5 | % | 27.2 | % | 24.5 | % | Effective Tax Rate (FTE**) | 25.4 | % | 25.6 | % | 25.2 | % | 21.8 | % | 24.8 | % | 28.2 | % | ||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| Capital Ratios: | ||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| Standardized Approach | ||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| 12.6 | % | 12.9 | % | 12.7 | % | 12.8 | % | 11.9 | % | Common Equity Tier 1 Capital | 12.0 | % | 12.0 | % | 11.9 | % | 11.9 | % | 11.4 | % | 10.5 | % | ||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| 13.8 | % | 14.1 | % | 14.5 | % | 13.9 | % | 12.9 | % | Tier 1 Capital | 13.0 | % | 13.1 | % | 12.9 | % | 12.9 | % | 12.4 | % | 11.5 | % | ||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| 15.8 | % | 16.1 | % | 16.3 | % | 15.6 | % | 14.1 | % | Total Capital | 14.5 | % | 14.5 | % | 14.3 | % | 14.1 | % | 13.6 | % | 12.6 | % | ||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| 7.8 | % | 8.0 | % | 8.7 | % | 7.6 | % | 6.9 | % | Tier 1 Leverage | 6.9 | % | 7.1 | % | 7.1 | % | 6.9 | % | 6.5 | % | 6.7 | % | ||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| Advanced Approach | ||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| 13.5 | % | 13.7 | % | 13.2 | % | 13.4 | % | 13.2 | % | Common Equity Tier 1 Capital | 12.8 | % | 13.1 | % | 13.0 | % | 13.2 | % | 12.1 | % | 11.6 | % | ||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| 14.8 | % | 15.0 | % | 15.0 | % | 14.5 | % | 14.3 | % | Tier 1 Capital | 14.0 | % | 14.2 | % | 14.1 | % | 14.3 | % | 13.2 | % | 12.7 | % | ||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| 16.7 | % | 16.9 | % | 16.8 | % | 15.9 | % | 15.3 | % | Total Capital | 15.2 | % | 15.5 | % | 15.4 | % | 15.3 | % | 14.2 | % | 13.7 | % | ||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| 7.8 | % | 8.0 | % | 8.7 | % | 7.6 | % | 6.9 | % | Tier 1 Leverage | 6.9 | % | 7.1 | % | 7.1 | % | 6.9 | % | 6.5 | % | 6.7 | % | ||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| 6.8 | % | 7.0 | % | 7.6 | % | 8.6 | % | 8.2 | % | Supplementary Leverage (a) (b) | 8.1 | % | 8.2 | % | 8.4 | % | 8.2 | % | 7.9 | % | 7.6 | % | ||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| Per Share Information / Ratios: | ||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| $ | 1.60 | $ | 1.94 | $ | 2.60 | $ | 2.80 | $ | 2.80 | Cash Dividends Declared Per Common Share | $ | 0.70 | $ | 0.70 | $ | 0.70 | $ | 0.70 | $ | 0.70 | $ | 0.70 | ||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| 33 | % | 29 | % | 39 | % | 51 | % | 39 | % | Dividend Payout Ratio | 41 | % | 41 | % | 39 | % | 37 | % | 40 | % | 38 | % | ||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| $ | 99.89 | $ | 83.59 | $ | 106.24 | $ | 93.14 | $ | 119.61 | Market Value Per Share (End of Period) | $ | 105.11 | $ | 115.62 | $ | 107.81 | $ | 119.61 | $ | 116.45 | $ | 96.48 | ||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| 20.3 | 12.6 | 16.0 | 17.1 | 16.8 | Stock Price Multiple of Earnings | 18.8 | 19.7 | 17.0 | 16.8 | 16.2 | 13.1 | |||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| (based on trailing 4 quarters of diluted EPS) | ||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| $ | 41.28 | $ | 43.95 | $ | 46.82 | $ | 51.87 | $ | 53.58 | Book Value Per Common Share (End of Period) | $ | 50.80 | $ | 52.49 | $ | 53.04 | $ | 53.58 | $ | 50.51 | $ | 48.87 | ||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| * | Capital ratios for the current quarter are considered preliminary until the Form 10-Q is filed with the Securities and Exchange Commission. |

|||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| ** | Fully taxable equivalent (FTE). Presentation on an FTE basis is a non-generally accepted accounting principle financial measure. Please refer to the Reconciliation to Fully Taxable Equivalent - Ratios on page 12 for further detail. | |||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| (a) | Effective January 1, 2018, the Corporation and Bank are subject to a minimum supplementary leverage ratio of 3 percent. | |||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| (b) | From April 1, 2020, through April 1, 2021, the Federal Reserve issued temporary Supplementary Leverage Ratio (SLR) relief that required Northern Trust to exclude U.S. Treasury balances from the SLR. Please see the Northern Trust Corporation Pillar 3 disclosures for further SLR discussion. |

|||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| Northern Trust Corporation | ||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| INCOME STATEMENT | ||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| ($ in Millions except per share information) | ||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| SIX MONTHS | CHANGE | SECOND QUARTER | CHANGE | |||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| 2022 | 2021 | $ | % | 2022 | 2021 | $ | % | |||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| $ | 1,305.1 | $ | 1,232.0 | $ | 73.1 | 6 | % | Asset Servicing Trust, Investment and Other Servicing Fees | $ | 642.7 | $ | 611.5 | $ | 31.2 | 5 | % | ||||||||||||||||||||||||||||||||||||||||||||||||||||

| 1,006.7 | 907.1 | 99.6 | 11 | % | WM Trust, Investment and Other Servicing Fees | 500.7 | 463.9 | 36.8 | 8 | % | ||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| 2,311.8 | 2,139.1 | 172.7 | 8 | % | Total Fees | 1,143.4 | 1,075.4 | 68.0 | 6 | % | ||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| 158.5 | 149.3 | 9.2 | 6 | % | Foreign Exchange Trading Income | 77.6 | 70.6 | 7.0 | 10 | % | ||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| 21.7 | 22.5 | (0.8) | (3) | % | Treasury Management Fees | 10.6 | 11.3 | (0.7) | (6) | % | ||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| 69.0 | 67.8 | 1.2 | 2 | % | Security Commissions and Trading Income | 32.8 | 33.0 | (0.2) | (1) | % | ||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| 86.7 | 109.3 | (22.6) | (21) | % | Other Operating Income | 45.6 | 54.4 | (8.8) | (16) | % | ||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| — | — | — | N/M | Investment Security Gains (Losses), net | — | — | — | N/M | ||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| 2,647.7 | 2,488.0 | 159.7 | 6 | % | Total Noninterest Income | 1,310.0 | 1,244.7 | 65.3 | 5 | % | ||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| 926.1 | 707.9 | 218.2 | 31 | % | Interest Income (FTE*) | 535.9 | 351.4 | 184.5 | 52 | % | ||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| 68.6 | 17.3 | 51.3 | N/M | Interest Expense | 66.1 | 7.5 | 58.6 | N/M | ||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| 857.5 | 690.6 | 166.9 | 24 | % | Net Interest Income (FTE*) | 469.8 | 343.9 | 125.9 | 37 | % | ||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| 3,505.2 | 3,178.6 | 326.6 | 10 | % | Total Revenue (FTE*) | 1,779.8 | 1,588.6 | 191.2 | 12 | % | ||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| 6.5 | (57.0) | 63.5 | N/M | Provision for Credit Losses | 4.5 | (27.0) | 31.5 | N/M | ||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| 1,110.4 | 1,004.8 | 105.6 | 11 | % | Compensation | 546.5 | 486.3 | 60.2 | 12 | % | ||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| 223.9 | 221.8 | 2.1 | 1 | % | Employee Benefits | 119.6 | 118.4 | 1.2 | 1 | % | ||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| 426.5 | 414.5 | 12.0 | 3 | % | Outside Services | 213.1 | 218.1 | (5.0) | (2) | % | ||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| 397.0 | 355.0 | 42.0 | 12 | % | Equipment and Software | 203.5 | 178.3 | 25.2 | 14 | % | ||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| 102.1 | 103.0 | (0.9) | (1) | % | Occupancy | 51.0 | 52.2 | (1.2) | (2) | % | ||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| 169.6 | 139.2 | 30.4 | 22 | % | Other Operating Expense | 89.9 | 67.5 | 22.4 | 33 | % | ||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| 2,429.5 | 2,238.3 | 191.2 | 9 | % | Total Noninterest Expense | 1,223.6 | 1,120.8 | 102.8 | 9 | % | ||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| 1,069.2 | 997.3 | 71.9 | 7 | % | Income before Income Taxes (FTE*) | 551.7 | 494.8 | 56.9 | 12 | % | ||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| 265.9 | 239.2 | 26.7 | 11 | % | Provision for Income Taxes | 144.4 | 118.4 | 26.0 | 22 | % | ||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| 17.8 | 14.9 | 2.9 | 19 | % | Taxable Equivalent Adjustment | 11.1 | 8.3 | 2.8 | 35 | % | ||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| 283.7 | 254.1 | 29.6 | 12 | % | Total Taxes (FTE*) | 155.5 | 126.7 | 28.8 | 23 | % | ||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| $ | 785.5 | $ | 743.2 | $ | 42.3 | 6 | % | Net Income | $ | 396.2 | $ | 368.1 | $ | 28.1 | 8 | % | ||||||||||||||||||||||||||||||||||||||||||||||||||||

| $ | 20.9 | $ | 20.9 | $ | — | — | % | Dividends on Preferred Stock | $ | 4.7 | $ | 4.7 | $ | — | — | % | ||||||||||||||||||||||||||||||||||||||||||||||||||||

| 6.3 | 6.9 | (0.6) | (8) | % | Earnings Allocated to Participating Securities | 3.2 | 3.2 | — | — | % | ||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| 758.3 | 715.4 | 42.9 | 6 | % | Earnings Allocated to Common and Potential Common Shares | 388.3 | 360.2 | 28.1 | 8 | % | ||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| $ | 3.64 | $ | 3.44 | $ | 0.20 | 6 | % | Earnings Per Share - Basic | $ | 1.86 | $ | 1.73 | $ | 0.13 | 8 | % | ||||||||||||||||||||||||||||||||||||||||||||||||||||

| $ | 3.63 | $ | 3.42 | $ | 0.21 | 6 | % | Earnings Per Share - Diluted | $ | 1.86 | $ | 1.72 | $ | 0.14 | 8 | % | ||||||||||||||||||||||||||||||||||||||||||||||||||||

| 208,205 | 208,242 | Average Basic Shares (000s) | 208,384 | 208,369 | ||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| 208,844 | 209,043 | Average Diluted Shares (000s) | 208,878 | 209,138 | ||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| 208,387 | 208,395 | End of Period Shares Outstanding (000s) | 208,387 | 208,395 | ||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| N/M - Not meaningful | ||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| * Fully taxable equivalent (FTE). Presentation on an FTE basis is a non-generally accepted accounting principle financial measure. Please refer to the Reconciliation to Fully Taxable Equivalent on page 11 for further detail. | ||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| Northern Trust Corporation | |||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| NET INCOME TRENDS | |||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| ($ in Millions except per share information) | |||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| 2021 | 2022 | ||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| 2017 | 2018 | 2019 | 2020 | 2021 | 1st Qtr | 2nd Qtr | 3rd Qtr | 4th Qtr | 1st Qtr | 2nd Qtr | 3rd Qtr | 4th Qtr | |||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| $ | 1,984.5 | $ | 2,173.1 | $ | 2,211.5 | $ | 2,321.6 | $ | 2,487.3 | Asset Servicing Trust, Investment and Other Servicing Fees | $ | 620.5 | $ | 611.5 | $ | 630.2 | $ | 625.1 | $ | 662.4 | $ | 642.7 | |||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| 1,449.8 | 1,580.6 | 1,640.6 | 1,673.4 | 1,873.8 | WM Trust, Investment and Other Servicing Fees | 443.2 | 463.9 | 480.8 | 485.9 | 506.0 | 500.7 | ||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| 3,434.3 | 3,753.7 | 3,852.1 | 3,995.0 | 4,361.1 | Total Fees | 1,063.7 | 1,075.4 | 1,111.0 | 1,111.0 | 1,168.4 | 1,143.4 | ||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| 209.9 | 307.2 | 250.9 | 290.4 | 292.6 | Foreign Exchange Trading Income | 78.7 | 70.6 | 66.4 | 76.9 | 80.9 | 77.6 | ||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| 56.4 | 51.8 | 44.5 | 45.4 | 44.3 | Treasury Management Fees | 11.2 | 11.3 | 11.2 | 10.6 | 11.1 | 10.6 | ||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| 89.6 | 98.3 | 103.6 | 133.2 | 140.2 | Security Commissions and Trading Income | 34.8 | 33.0 | 36.5 | 35.9 | 36.2 | 32.8 | ||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| 157.5 | 127.5 | 145.5 | 194.0 | 243.9 | Other Operating Income | 54.9 | 54.4 | 62.3 | 72.3 | 41.1 | 45.6 | ||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| (1.6) | (1.0) | (1.4) | (0.4) | (0.3) | Investment Security Gains (Losses), net | — | — | — | (0.3) | — | — | ||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| 3,946.1 | 4,337.5 | 4,395.2 | 4,657.6 | 5,081.8 | Total Noninterest Income | 1,243.3 | 1,244.7 | 1,287.4 | 1,306.4 | 1,337.7 | 1,310.0 | ||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| 1,475.0 | 1,663.9 | 1,710.7 | 1,477.6 | 1,418.3 | Net Interest Income (FTE*) | 346.7 | 343.9 | 357.1 | 370.6 | 387.7 | 469.8 | ||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| 5,421.1 | 6,001.4 | 6,105.9 | 6,135.2 | 6,500.1 | Total Revenue (FTE*) | 1,590.0 | 1,588.6 | 1,644.5 | 1,677.0 | 1,725.4 | 1,779.8 | ||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| (28.0) | (14.5) | (14.5) | 125.0 | (81.5) | Provision for Credit Losses | (30.0) | (27.0) | (13.0) | (11.5) | 2.0 | 4.5 | ||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| 1,733.7 | 1,806.9 | 1,859.0 | 1,947.1 | 2,011.0 | Compensation | 518.5 | 486.3 | 496.0 | 510.2 | 563.9 | 546.5 | ||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| 319.9 | 356.7 | 355.2 | 387.7 | 431.4 | Employee Benefits | 103.4 | 118.4 | 101.7 | 107.9 | 104.3 | 119.6 | ||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| 668.4 | 739.4 | 774.5 | 763.1 | 849.4 | Outside Services | 196.4 | 218.1 | 210.7 | 224.2 | 213.4 | 213.1 | ||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| 524.0 | 582.2 | 612.1 | 673.5 | 736.3 | Equipment and Software | 176.7 | 178.3 | 185.2 | 196.1 | 193.5 | 203.5 | ||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| 191.8 | 201.1 | 212.9 | 230.1 | 208.7 | Occupancy | 50.8 | 52.2 | 53.9 | 51.8 | 51.1 | 51.0 | ||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| 331.6 | 330.6 | 329.8 | 346.7 | 299.1 | Other Operating Expense | 71.7 | 67.5 | 81.2 | 78.7 | 79.7 | 89.9 | ||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| 3,769.4 | 4,016.9 | 4,143.5 | 4,348.2 | 4,535.9 | Total Noninterest Expense | 1,117.5 | 1,120.8 | 1,128.7 | 1,168.9 | 1,205.9 | 1,223.6 | ||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| 1,679.7 | 1,999.0 | 1,976.9 | 1,662.0 | 2,045.7 | Income before Income Taxes (FTE*) | 502.5 | 494.8 | 528.8 | 519.6 | 517.5 | 551.7 | ||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| 434.9 | 401.4 | 451.9 | 418.3 | 464.8 | Provision for Income Taxes | 120.8 | 118.4 | 122.4 | 103.2 | 121.5 | 144.4 | ||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| 45.8 | 41.2 | 32.8 | 34.4 | 35.6 | Taxable Equivalent Adjustment | 6.6 | 8.3 | 10.7 | 10.0 | 6.7 | 11.1 | ||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| 480.7 | 442.6 | 484.7 | 452.7 | 500.4 | Total Taxes (FTE*) | 127.4 | 126.7 | 133.1 | 113.2 | 128.2 | 155.5 | ||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| $ | 1,199.0 | $ | 1,556.4 | $ | 1,492.2 | $ | 1,209.3 | $ | 1,545.3 | Net Income | $ | 375.1 | $ | 368.1 | $ | 395.7 | $ | 406.4 | $ | 389.3 | $ | 396.2 | |||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| $ | 4.95 | $ | 6.68 | $ | 6.66 | $ | 5.48 | $ | 7.16 | Earnings Per Share - Basic | $ | 1.71 | $ | 1.73 | $ | 1.81 | $ | 1.92 | $ | 1.78 | $ | 1.86 | |||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| 4.92 | 6.64 | 6.63 | 5.46 | 7.14 | Earnings Per Share - Diluted | 1.70 | 1.72 | 1.80 | 1.91 | 1.77 | 1.86 | ||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| 229,654 | 224,488 | 215,601 | 209,008 | 208,899 | Average Diluted Shares (000s) | 208,946 | 209,138 | 208,923 | 208,593 | 208,809 | 208,878 | ||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| $ | 49.8 | $ | 46.4 | $ | 46.4 | $ | 56.2 | $ | 41.8 | Preferred Dividends** | $ | 16.2 | $ | 4.7 | $ | 16.2 | $ | 4.7 | $ | 16.2 | $ | 4.7 | |||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| * Fully taxable equivalent (FTE). Presentation on an FTE basis is a non-generally accepted accounting principle financial measure. Please refer to the Reconciliation to Fully Taxable Equivalent on page 11 for further detail. | |||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| ** Dividends on Preferred Stock in 2020 includes $11.5 million related to the difference between the redemption amount of the Corporation's Series C Non-Cumulative Perpetual Preferred Stock, which was redeemed in the first quarter of 2020, and its carrying value. | |||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| Northern Trust Corporation | |||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| TRUST, INVESTMENT AND OTHER SERVICING FEES DETAIL | |||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| ($ in Millions) | |||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| 2021 | 2022 | ||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| 2017 | 2018 | 2019 | 2020 | 2021 | 1st Qtr | 2nd Qtr | 3rd Qtr | 4th Qtr | 1st Qtr | 2nd Qtr | 3rd Qtr | 4th Qtr | |||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| Asset Servicing | |||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| $ | 1,342.1 | $ | 1,501.1 | $ | 1,549.3 | $ | 1,586.1 | $ | 1,818.8 | Custody & Fund Administration | $ | 446.0 | $ | 454.9 | $ | 460.2 | $ | 457.7 | $ | 452.7 | $ | 433.8 | |||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| 403.5 | 436.8 | 445.7 | 511.1 | 443.5 | Investment Management | 115.9 | 100.7 | 113.6 | 113.3 | 146.9 | 148.4 | ||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| 96.4 | 102.0 | 87.2 | 88.0 | 76.7 | Securities Lending | 18.2 | 19.5 | 20.2 | 18.8 | 18.8 | 21.6 | ||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| 142.6 | 133.2 | 129.3 | 136.4 | 148.3 | Other | 40.4 | 36.4 | 36.2 | 35.3 | 44.0 | 38.9 | ||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| $ | 1,984.6 | $ | 2,173.1 | $ | 2,211.5 | $ | 2,321.6 | $ | 2,487.3 | Total Asset Servicing Trust, Investment and Other Servicing Fees | $ | 620.5 | $ | 611.5 | $ | 630.2 | $ | 625.1 | $ | 662.4 | $ | 642.7 | |||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| Wealth Management | |||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| $ | 575.5 | $ | 607.8 | $ | 619.3 | $ | 607.3 | $ | 698.7 | Central | $ | 164.2 | $ | 174.3 | $ | 178.8 | $ | 181.4 | $ | 181.7 | $ | 177.4 | |||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| 356.2 | 401.7 | 422.2 | 442.1 | 509.3 | East | 119.0 | 127.2 | 130.2 | 132.9 | 134.0 | 128.1 | ||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| 291.7 | 320.0 | 330.9 | 337.7 | 380.2 | West | 90.8 | 93.8 | 97.0 | 98.6 | 101.4 | 98.7 | ||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| 226.3 | 251.1 | 268.2 | 286.3 | 285.6 | Global Family Office | 69.2 | 68.6 | 74.8 | 73.0 | 88.9 | 96.5 | ||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| $ | 1,449.7 | $ | 1,580.6 | $ | 1,640.6 | $ | 1,673.4 | $ | 1,873.8 | Total WM Trust, Investment and Other Servicing Fees | $ | 443.2 | $ | 463.9 | $ | 480.8 | $ | 485.9 | $ | 506.0 | $ | 500.7 | |||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| Northern Trust Corporation | ||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| BALANCE SHEET | ||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| END OF PERIOD | ||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| ($ in Millions) | ||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| CHANGE | ||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| Assets | 6/30/2022 | 6/30/2021 | $ | % | ||||||||||||||||||||||||||||||||||||||||||||||||||||

Federal Reserve and Other Central Banks Deposits and Other(2) |

$ | 37,948.3 | $ | 54,159.5 | $ | (16,211.2) | (30) | % | ||||||||||||||||||||||||||||||||||||||||||||||||

Interest-Bearing Due from and Deposits with Banks(3) |

5,354.6 | 7,047.8 | (1,693.2) | (24) | % | |||||||||||||||||||||||||||||||||||||||||||||||||||

| Federal Funds Sold | 10.0 | 0.1 | 9.9 | N/M | ||||||||||||||||||||||||||||||||||||||||||||||||||||

| Securities Purchased under Agreements to Resell | 1,171.8 | 947.8 | 224.0 | 24 | % | |||||||||||||||||||||||||||||||||||||||||||||||||||

Securities:(1) |

||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| U.S. Government | 2,645.3 | 2,657.9 | (12.6) | — | % | |||||||||||||||||||||||||||||||||||||||||||||||||||

| Obligations of States and Political Subdivisions | 3,453.3 | 3,489.9 | (36.6) | (1) | % | |||||||||||||||||||||||||||||||||||||||||||||||||||

| Government Sponsored Agency | 22,219.8 | 24,144.9 | (1,925.1) | (8) | % | |||||||||||||||||||||||||||||||||||||||||||||||||||

Other(4) |

28,173.8 | 29,551.3 | (1,377.5) | (5) | % | |||||||||||||||||||||||||||||||||||||||||||||||||||

| Total Securities | 56,492.2 | 59,844.0 | (3,351.8) | (6) | % | |||||||||||||||||||||||||||||||||||||||||||||||||||

| Loans and Leases | 41,207.8 | 37,406.6 | 3,801.2 | 10 | % | |||||||||||||||||||||||||||||||||||||||||||||||||||

| Total Earning Assets | 142,184.7 | 159,405.8 | (17,221.1) | (11) | % | |||||||||||||||||||||||||||||||||||||||||||||||||||

| Allowance for Credit Losses | (154.7) | (160.5) | 5.8 | (4) | % | |||||||||||||||||||||||||||||||||||||||||||||||||||

Cash and Due From Banks and Other Central Bank Deposits(5) |

2,357.6 | 1,683.3 | 674.3 | 40 | % | |||||||||||||||||||||||||||||||||||||||||||||||||||

| Buildings and Equipment | 476.6 | 496.5 | (19.9) | (4) | % | |||||||||||||||||||||||||||||||||||||||||||||||||||

| Client Security Settlement Receivables | 2,284.7 | 2,011.6 | 273.1 | 14 | % | |||||||||||||||||||||||||||||||||||||||||||||||||||

| Goodwill | 690.0 | 709.4 | (19.4) | (3) | % | |||||||||||||||||||||||||||||||||||||||||||||||||||

| Other Assets | 9,947.4 | 8,145.0 | 1,802.4 | 22 | % | |||||||||||||||||||||||||||||||||||||||||||||||||||

| Total Assets | $ | 157,786.3 | $ | 172,291.1 | $ | (14,504.8) | (8) | % | ||||||||||||||||||||||||||||||||||||||||||||||||

| Liabilities and Stockholders' Equity | ||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| Savings, Money Market and Other | $ | 30,857.0 | $ | 31,604.7 | $ | (747.7) | (2) | % | ||||||||||||||||||||||||||||||||||||||||||||||||

| Savings Certificates and Other Time | 785.0 | 877.7 | (92.7) | (11) | % | |||||||||||||||||||||||||||||||||||||||||||||||||||

| Non- U.S. Offices - Interest-Bearing | 69,951.1 | 71,705.4 | (1,754.3) | (2) | % | |||||||||||||||||||||||||||||||||||||||||||||||||||

| Total Interest-Bearing Deposits | 101,593.1 | 104,187.8 | (2,594.7) | (2) | % | |||||||||||||||||||||||||||||||||||||||||||||||||||

| Federal Funds Purchased | 389.2 | 0.2 | 389.0 | N/M | ||||||||||||||||||||||||||||||||||||||||||||||||||||

| Securities Sold under Agreements to Repurchase | 799.4 | 529.1 | 270.3 | 51 | % | |||||||||||||||||||||||||||||||||||||||||||||||||||

| Other Borrowings | 3,514.9 | 5,140.6 | (1,625.7) | (32) | % | |||||||||||||||||||||||||||||||||||||||||||||||||||

| Senior Notes | 3,305.8 | 3,036.0 | 269.8 | 9 | % | |||||||||||||||||||||||||||||||||||||||||||||||||||

| Long-Term Debt | 1,094.1 | 1,165.3 | (71.2) | (6) | % | |||||||||||||||||||||||||||||||||||||||||||||||||||

| Floating Rate Capital Debt | — | 277.8 | (277.8) | (100) | % | |||||||||||||||||||||||||||||||||||||||||||||||||||

| Total Interest-Related Funds | 110,696.5 | 114,336.8 | (3,640.3) | (3) | % | |||||||||||||||||||||||||||||||||||||||||||||||||||

| Demand and Other Noninterest-Bearing Deposits | 32,081.5 | 42,022.4 | (9,940.9) | (24) | % | |||||||||||||||||||||||||||||||||||||||||||||||||||

| Other Liabilities | 3,938.6 | 4,108.9 | (170.3) | (4) | % | |||||||||||||||||||||||||||||||||||||||||||||||||||

| Total Liabilities | 146,716.6 | 160,468.1 | (13,751.5) | (9) | % | |||||||||||||||||||||||||||||||||||||||||||||||||||

| Common Equity | 10,184.8 | 10,938.1 | (753.3) | (7) | % | |||||||||||||||||||||||||||||||||||||||||||||||||||

| Preferred Equity | 884.9 | 884.9 | — | — | % | |||||||||||||||||||||||||||||||||||||||||||||||||||

| Total Stockholders' Equity | 11,069.7 | 11,823.0 | (753.3) | (6) | % | |||||||||||||||||||||||||||||||||||||||||||||||||||

| Total Liabilities and Stockholders' Equity | $ | 157,786.3 | $ | 172,291.1 | $ | (14,504.8) | (8) | % | ||||||||||||||||||||||||||||||||||||||||||||||||

(1) |

Memo - at 6/30/2022: | |||||||||||||||||||||||||||||||||||||||||||||||||||||||

| Held to Maturity Debt Securities | $ | 20,112.6 | ||||||||||||||||||||||||||||||||||||||||||||||||||||||

| Available for Sale Debt Securities | 35,017.9 | |||||||||||||||||||||||||||||||||||||||||||||||||||||||

| Trading Securities | 0.4 | |||||||||||||||||||||||||||||||||||||||||||||||||||||||

| Other Earning Assets | 1,361.3 | |||||||||||||||||||||||||||||||||||||||||||||||||||||||

| $ | 56,492.2 | |||||||||||||||||||||||||||||||||||||||||||||||||||||||

(2) |

Federal Reserve and Other Central Bank Deposits and Other includes collateral deposits with certain securities depositories and clearing houses for the purpose of presenting earning assets; such deposits are presented in Other Assets on the consolidated balance sheets in our periodic filings with the SEC. |

|||||||||||||||||||||||||||||||||||||||||||||||||||||||

(3) |

Interest-Bearing Due from and Deposits with Banks includes the interest-bearing component of Cash and Due from Banks and Interest-Bearing Deposits with Banks as presented on the consolidated balance sheets in our periodic filings with the SEC. |

|||||||||||||||||||||||||||||||||||||||||||||||||||||||

(4) |

Other securities include certain community development investments and Federal Home Loan Bank and Federal Reserve stock, which are classified in Other Assets on the consolidated balance sheets in our periodic filings with the SEC. |

|||||||||||||||||||||||||||||||||||||||||||||||||||||||

(5) |

Cash and Due from Banks and Other Central Bank Deposits includes the noninterest-bearing component of Federal Reserve and Other Central Bank Deposits as presented on the consolidated balance sheets in our periodic filings with the SEC. |

|||||||||||||||||||||||||||||||||||||||||||||||||||||||

| Northern Trust Corporation | |||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| BALANCE SHEET TRENDS | |||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

PERIOD AVERAGES(1) |

|||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| ($ in Millions) | |||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| 2021 | 2022 | ||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| 2017 | 2018 | 2019 | 2020 | 2021 | Assets | 1st Qtr | 2nd Qtr | 3rd Qtr | 4th Qtr | 1st Qtr | 2nd Qtr | 3rd Qtr | 4th Qtr | ||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| $ | 23,904 | $ | 23,899 | $ | 18,528 | $ | 27,921 | $ | 39,041 | Federal Reserve and Other Central Banks Deposits and Other(2) |

$ | 37,140 | $ | 37,425 | $ | 40,541 | $ | 40,999 | $ | 45,221 | $ | 36,708 | |||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| 7,143 | 6,023 | 5,997 | 5,401 | 5,780 | Interest-Bearing Due from and Deposits with Banks(3) |

6,464 | 6,737 | 5,165 | 4,778 | 4,384 | 4,228 | ||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| 18 | 21 | 13 | 2 | — | Federal Funds Sold | — | — | — | — | 1 | 2 | ||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| 1,832 | 1,478 | 835 | 1,253 | 1,067 | Securities Purchased under Agreements to Resell | 1,551 | 1,012 | 841 | 876 | 692 | 1,149 | ||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| Securities: | |||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| 6,342 | 5,737 | 5,297 | 4,257 | 2,685 | U.S. Government | 2,877 | 2,676 | 2,669 | 2,524 | 2,501 | 2,648 | ||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| 887 | 725 | 981 | 2,194 | 3,532 | Obligations of States and Political Subdivisions | 3,199 | 3,373 | 3,691 | 3,856 | 3,793 | 3,487 | ||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| 17,987 | 20,683 | 22,634 | 23,970 | 24,546 | Government Sponsored Agency | 24,846 | 24,521 | 24,414 | 24,408 | 23,511 | 22,468 | ||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| 19,499 | 23,136 | 21,773 | 25,635 | 30,014 | Other(4) |

30,310 | 30,000 | 28,221 | 31,534 | 30,122 | 28,464 | ||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| 44,716 | 50,281 | 50,684 | 56,057 | 60,778 | Total Securities | 61,231 | 60,570 | 58,996 | 62,321 | 59,927 | 57,067 | ||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| 33,565 | 32,029 | 31,053 | 33,499 | 37,208 | Loans and Leases | 34,201 | 36,282 | 38,411 | 39,860 | 39,544 | 40,747 | ||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| 111,178 | 113,731 | 107,109 | 124,133 | 143,873 | Total Earning Assets | 140,589 | 142,024 | 143,953 | 148,834 | 149,768 | 139,902 | ||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| (157) | (126) | (111) | (178) | (173) | Allowance for Credit Losses | (199) | (177) | (161) | (156) | (152) | (156) | ||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| 2,583 | 2,534 | 2,394 | 2,603 | 2,286 | Cash and Due From Banks and Other Central Bank Deposits(5) |

2,615 | 2,403 | 2,012 | 2,124 | 2,047 | 2,559 | ||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| 466 | 439 | 426 | 509 | 503 | Buildings and Equipment | 509 | 505 | 500 | 497 | 495 | 488 | ||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| 892 | 1,002 | 1,070 | 1,358 | 1,530 | Client Security Settlement Receivables | 1,669 | 1,533 | 1,284 | 1,639 | 1,826 | 1,588 | ||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| 544 | 643 | 683 | 695 | 707 | Goodwill | 707 | 708 | 709 | 705 | 704 | 694 | ||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| 4,101 | 4,725 | 5,981 | 7,691 | 7,637 | Other Assets | 7,367 | 7,305 | 8,156 | 7,711 | 7,455 | 9,010 | ||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| $ | 119,607 | $ | 122,947 | $ | 117,551 | $ | 136,811 | $ | 156,363 | Total Assets | $ | 153,256 | $ | 154,300 | $ | 156,453 | $ | 161,354 | $ | 162,143 | $ | 154,084 | |||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| Liabilities and Equity | |||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| $ | 15,576 | $ | 15,149 | $ | 16,578 | $ | 23,396 | $ | 28,339 | Savings, Money Market and Other | $ | 26,736 | $ | 27,427 | $ | 28,472 | $ | 30,676 | $ | 32,329 | $ | 30,968 | |||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| 1,273 | 871 | 868 | 1,266 | 887 | Savings Certificates and Other Time | 924 | 899 | 871 | 857 | 842 | 792 | ||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| 56,583 | 58,557 | 54,885 | 60,486 | 69,713 | Non- U.S. Offices - Interest-Bearing | 68,306 | 69,202 | 70,211 | 71,099 | 68,200 | 63,901 | ||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| 73,432 | 74,577 | 72,331 | 85,149 | 98,940 | Total Interest-Bearing Deposits | 95,965 | 97,528 | 99,554 | 102,631 | 101,371 | 95,661 | ||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| 1,103 | 2,763 | 1,267 | 981 | 191 | Federal Funds Purchased | 406 | 195 | 166 | — | — | 923 | ||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| 739 | 525 | 339 | 218 | 232 | Securities Sold under Agreements to Repurchase | 90 | 229 | 293 | 314 | 254 | 597 | ||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| 4,854 | 7,496 | 7,753 | 6,401 | 5,050 | Other Borrowings | 4,681 | 5,196 | 5,527 | 4,789 | 3,691 | 4,187 | ||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| 1,497 | 1,704 | 2,389 | 3,234 | 2,856 | Senior Notes | 3,058 | 3,023 | 2,841 | 2,510 | 2,442 | 2,885 | ||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| 1,519 | 1,297 | 1,139 | 1,189 | 1,166 | Long-Term Debt | 1,179 | 1,169 | 1,166 | 1,151 | 1,128 | 1,096 | ||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| 277 | 278 | 278 | 278 | 218 | Floating Rate Capital Debt | 278 | 278 | 278 | 42 | — | — | ||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| 83,422 | 88,638 | 85,495 | 97,450 | 108,653 | Total Interest-Related Funds | 105,656 | 107,617 | 109,824 | 111,437 | 108,886 | 105,348 | ||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| 23,073 | 20,527 | 17,456 | 23,362 | 31,144 | Demand and Other Noninterest-Bearing Deposits | 30,451 | 30,469 | 30,241 | 33,390 | 37,129 | 33,733 | ||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| 3,132 | 3,553 | 3,952 | 4,806 | 4,870 | Other Liabilities | 5,611 | 4,663 | 4,534 | 4,685 | 4,616 | 4,096 | ||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| 109,627 | 112,718 | 106,903 | 125,618 | 144,666 | Total Liabilities | 141,718 | 142,749 | 144,600 | 149,512 | 150,632 | 143,177 | ||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||