| Delaware | 001-02979 | No. | 41-0449260 | ||||||||||||||

| (State or Other Jurisdiction of Incorporation) |

(Commission File Number) |

(IRS Employer Identification No.) |

|||||||||||||||

Title of Each Class |

Trading Symbol |

Name of Each Exchange on Which Registered |

||||||

Common Stock, par value $1-2/3 |

WFC |

New York Stock

Exchange

(NYSE)

|

||||||

7.5% Non-Cumulative Perpetual Convertible Class A Preferred Stock, Series L |

WFC.PRL |

NYSE |

||||||

Depositary Shares, each representing a 1/1000th interest in a share of Non-Cumulative Perpetual Class A Preferred Stock, Series Y |

WFC.PRY |

NYSE |

||||||

Depositary Shares, each representing a 1/1000th interest in a share of Non-Cumulative Perpetual Class A Preferred Stock, Series Z |

WFC.PRZ |

NYSE |

||||||

Depositary Shares, each representing a 1/1000th interest in a share of Non-Cumulative Perpetual Class A Preferred Stock, Series AA |

WFC.PRA |

NYSE |

||||||

| Depositary Shares, each representing a 1/1000th interest in a share of Non-Cumulative Perpetual Class A Preferred Stock, Series CC | WFC.PRC |

NYSE |

||||||

| Depositary Shares, each representing a 1/1000th interest in a share of Non-Cumulative Perpetual Class A Preferred Stock, Series DD | WFC.PRD |

NYSE |

||||||

Guarantee of Medium-Term Notes, Series A, due October 30, 2028 of Wells Fargo Finance LLC |

WFC/28A |

NYSE |

||||||

| Exhibit No. | Description | Location | ||||||

| Filed herewith | ||||||||

| Filed herewith | ||||||||

|

Furnished herewith, except for

the “2025 net interest income

expectation” portion on

page 18, which portion is

deemed filed herewith

|

||||||||

| 104 | Cover Page Interactive Data File | Embedded within the Inline XBRL document |

||||||

| Dated: | January 15, 2025 | WELLS FARGO & COMPANY | |||||||||

| By: | /s/ MUNEERA S. CARR | ||||||||||

| Muneera S. Carr | |||||||||||

|

Executive Vice President,

Chief Accounting Officer and Controller

|

|||||||||||

|

News Release | January 15, 2025

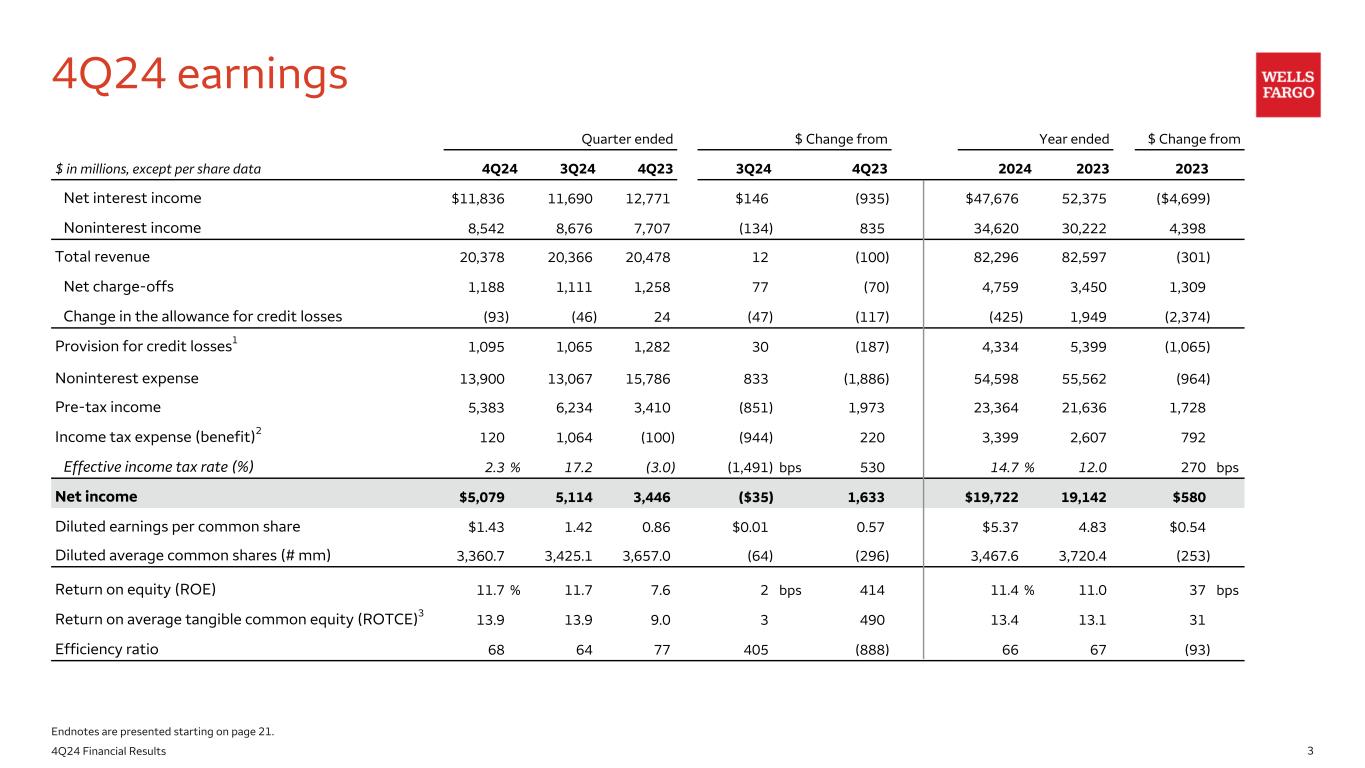

Wells Fargo Reports Fourth Quarter 2024 Net Income of $5.1 billion, or $1.43 per Diluted Share

Full Year 2024 Net Income of $19.7 billion, or $5.37 per Diluted Share

|

||||

Company-wide Financial Summary |

||||||||||||||

| Quarter ended | ||||||||||||||

| Dec 31, 2024 |

Dec 31, 2023 |

|||||||||||||

|

Selected Income Statement Data

($ in millions except per share amounts)

|

||||||||||||||

| Total revenue | $ | 20,378 | 20,478 | |||||||||||

| Noninterest expense | 13,900 | 15,786 | ||||||||||||

Provision for credit losses1 |

1,095 | 1,282 | ||||||||||||

| Net income | 5,079 | 3,446 | ||||||||||||

| Diluted earnings per common share | 1.43 | 0.86 | ||||||||||||

|

Selected Balance Sheet Data

($ in billions)

|

||||||||||||||

| Average loans | $ | 906.4 | 938.0 | |||||||||||

| Average deposits | 1,353.8 | 1,340.9 | ||||||||||||

CET12 |

11.1 | % | 11.4 | |||||||||||

| Performance Metrics | ||||||||||||||

ROE3 |

11.7 | % | 7.6 | |||||||||||

ROTCE4 |

13.9 | 9.0 | ||||||||||||

| Operating Segments and Other Highlights | |||||||||||||||||||||||

| Quarter ended | Dec 31, 2024 % Change from |

||||||||||||||||||||||

| ($ in billions) | Dec 31, 2024 |

Sep 30, 2024 |

Dec 31, 2023 |

||||||||||||||||||||

| Average loans | |||||||||||||||||||||||

| Consumer Banking and Lending | $ | 321.4 | (1) | % | (4) | ||||||||||||||||||

| Commercial Banking | 221.8 | — | (1) | ||||||||||||||||||||

| Corporate and Investment Banking | 274.0 | — | (6) | ||||||||||||||||||||

| Wealth and Investment Management | 83.6 | 1 | 2 | ||||||||||||||||||||

| Average deposits | |||||||||||||||||||||||

| Consumer Banking and Lending | 773.6 | — | (1) | ||||||||||||||||||||

| Commercial Banking | 184.3 | 6 | 13 | ||||||||||||||||||||

| Corporate and Investment Banking | 205.1 | 6 | 18 | ||||||||||||||||||||

| Wealth and Investment Management | 118.3 | 10 | 16 | ||||||||||||||||||||

Fourth quarter 2024 results included: | ||

|

Chief Executive Officer Charlie Scharf commented, “Let me start by acknowledging the unbelievable devastation from the Los Angeles wildfires. Our hearts go out to everyone who has been impacted including both our customers and employees, and we are committed to providing support to these communities.

Turning to Wells Fargo’s performance, our solid performance this quarter caps a year of significant progress for Wells Fargo. Our earnings profile continues to improve, we are seeing the benefit from investments we are making to increase our growth and improve how we serve our customers and communities, we maintained a strong balance sheet, we returned approximately $25 billion of capital to shareholders, and we made significant progress on our risk and control work.

Our diluted earnings per share increased 11% from a year ago and benefited from decisions we made to exit or scale back certain businesses, decrease our reliance on net interest income by growing fee-based revenues, increase investments in our core businesses, and consistently look to increase efficiencies across the company. Strong fee-based revenue growth, up 15% from a year ago, largely offset the expected decline in net interest income. Expenses declined from a year ago, and credit trends remained relatively stable. We maintained significant excess capital with an 11.1% CET1 ratio at year end while we repurchased approximately $20 billion of common stock during the year, up 64% from a year ago, and increased our common stock dividend per share by 15%. Average common shares outstanding decreased 21% since the fourth quarter of 2019.”

“I’m proud of the clear progress we’ve made on our risk and control agenda. The OCC terminated a consent order it issued in 2016 regarding sales practices, an important milestone for Wells Fargo. Our operational risk and compliance infrastructure is greatly changed from when I arrived and while we are not done, I’m confident that we will successfully complete the work required in our consent orders and embed an operational risk and compliance mindset into our culture,” Scharf added.

“I’m excited about the opportunities ahead as we’ve seen improved results and increased market share in many of the businesses that we believe will drive higher growth and returns over time. For example, our credit card business continues to generate strong growth while maintaining a strong credit profile. After several years of minimal growth, we grew net checking accounts more meaningfully in 2024. We also grew mobile active customers by 1.5 million in 2024. For our affluent clients, we are starting to see some early benefits from the enhancements we have been making to our Wells Fargo Premier offerings, including higher deposit and investment balances. Fees and market share from investment banking and trading activities have been growing and our revenues in both trading and investment banking grew by double-digits in 2024, reflecting the investments we have been making in talent and technology,” Scharf continued.

“I believe we are still in the early stages of seeing the benefits of the momentum we are building, and our financial performance should continue to benefit from the work we are doing to transform the company. I want to thank everyone who works at Wells Fargo for their hard work over the past year and for what they do every single day to support our customers, clients, and communities.” Scharf concluded.

| ||

Endnotes are presented on page 9. |

||||||||

| Quarter ended | Dec 31, 2024 % Change from |

Year ended | ||||||||||||||||||||||||||||||||||||||||||

| Dec 31, 2024 |

Sep 30, 2024 |

Dec 31, 2023 |

Sep 30, 2024 |

Dec 31, 2023 |

Dec 31, 2024 |

Dec 31, 2023 |

||||||||||||||||||||||||||||||||||||||

| Earnings ($ in millions except per share amounts) | ||||||||||||||||||||||||||||||||||||||||||||

| Net interest income | $ | 11,836 | 11,690 | 12,771 | 1 | % | (7) | $ | 47,676 | 52,375 | ||||||||||||||||||||||||||||||||||

| Noninterest income | 8,542 | 8,676 | 7,707 | (2) | 11 | 34,620 | 30,222 | |||||||||||||||||||||||||||||||||||||

| Total revenue | 20,378 | 20,366 | 20,478 | — | — | 82,296 | 82,597 | |||||||||||||||||||||||||||||||||||||

| Net charge-offs | 1,188 | 1,111 | 1,258 | 7 | (6) | 4,759 | 3,450 | |||||||||||||||||||||||||||||||||||||

| Change in the allowance for credit losses | (93) | (46) | 24 | NM | NM | (425) | 1,949 | |||||||||||||||||||||||||||||||||||||

Provision for credit losses1 |

1,095 | 1,065 | 1,282 | 3 | (15) | 4,334 | 5,399 | |||||||||||||||||||||||||||||||||||||

| Noninterest expense | 13,900 | 13,067 | 15,786 | 6 | (12) | 54,598 | 55,562 | |||||||||||||||||||||||||||||||||||||

| Income tax expense (benefit) | 120 | 1,064 | (100) | (89) | NM | 3,399 | 2,607 | |||||||||||||||||||||||||||||||||||||

| Wells Fargo net income | $ | 5,079 | 5,114 | 3,446 | (1) | 47 | $ | 19,722 | 19,142 | |||||||||||||||||||||||||||||||||||

| Diluted earnings per common share | 1.43 | 1.42 | 0.86 | 1 | 66 | 5.37 | 4.83 | |||||||||||||||||||||||||||||||||||||

| Balance Sheet Data (average) ($ in billions) | ||||||||||||||||||||||||||||||||||||||||||||

| Loans | $ | 906.4 | 910.3 | 938.0 | — | (3) | $ | 915.4 | 943.9 | |||||||||||||||||||||||||||||||||||

| Deposits | 1,353.8 | 1,341.7 | 1,340.9 | 1 | 1 | 1,345.9 | 1,346.3 | |||||||||||||||||||||||||||||||||||||

| Assets | 1,918.5 | 1,916.6 | 1,907.5 | — | 1 | 1,916.7 | 1,885.5 | |||||||||||||||||||||||||||||||||||||

Financial Ratios |

||||||||||||||||||||||||||||||||||||||||||||

| Return on assets (ROA) | 1.05 | % | 1.06 | 0.72 | 1.03 | % | 1.02 | |||||||||||||||||||||||||||||||||||||

| Return on equity (ROE) | 11.7 | 11.7 | 7.6 | 11.4 | 11.0 | |||||||||||||||||||||||||||||||||||||||

Return on average tangible common equity (ROTCE)2 |

13.9 | 13.9 | 9.0 | 13.4 | 13.1 | |||||||||||||||||||||||||||||||||||||||

Efficiency ratio3 |

68 | 64 | 77 | 66 | 67 | |||||||||||||||||||||||||||||||||||||||

| Net interest margin on a taxable-equivalent basis | 2.70 | 2.67 | 2.92 | 2.73 | 3.06 | |||||||||||||||||||||||||||||||||||||||

Endnotes are presented on page 9. |

2 |

|||||||

| Quarter ended | ||||||||||||||||||||

| ($ in billions) | Dec 31, 2024 |

Sep 30, 2024 |

Dec 31, 2023 |

|||||||||||||||||

| Capital: | ||||||||||||||||||||

| Total equity | $ | 181.1 | 185.0 | 187.4 | ||||||||||||||||

| Common stockholders’ equity | 160.7 | 164.8 | 166.4 | |||||||||||||||||

Tangible common equity1 |

135.6 | 139.7 | 141.2 | |||||||||||||||||

Common Equity Tier 1 (CET1) ratio2 |

11.1 | % | 11.3 | 11.4 | ||||||||||||||||

Total loss absorbing capacity (TLAC) ratio3 |

24.8 | 25.3 | 25.0 | |||||||||||||||||

Supplementary Leverage Ratio (SLR)4 |

6.7 | 6.9 | 7.1 | |||||||||||||||||

| Liquidity: | ||||||||||||||||||||

Liquidity Coverage Ratio (LCR)5 |

125 | % | 127 | 125 | ||||||||||||||||

| Quarter ended | ||||||||||||||||||||

| ($ in millions) | Dec 31, 2024 |

Sep 30, 2024 |

Dec 31, 2023 |

|||||||||||||||||

| Net loan charge-offs | $ | 1,211 | 1,111 | 1,252 | ||||||||||||||||

| Net loan charge-offs as a % of average total loans (annualized) | 0.53 | % | 0.49 | 0.53 | ||||||||||||||||

| Total nonaccrual loans | $ | 7,730 | 8,172 | 8,256 | ||||||||||||||||

| As a % of total loans | 0.85 | % | 0.90 | 0.88 | ||||||||||||||||

| Total nonperforming assets | $ | 7,936 | 8,384 | 8,443 | ||||||||||||||||

| As a % of total loans | 0.87 | % | 0.92 | 0.90 | ||||||||||||||||

| Allowance for credit losses for loans | $ | 14,636 | 14,739 | 15,088 | ||||||||||||||||

| As a % of total loans | 1.60 | % | 1.62 | 1.61 | ||||||||||||||||

Endnotes are presented on page 9. |

3 |

|||||||

| Quarter ended | Dec 31, 2024 % Change from |

||||||||||||||||||||||||||||||||||

| Dec 31, 2024 |

Sep 30, 2024 |

Dec 31, 2023 |

Sep 30, 2024 |

Dec 31, 2023 |

|||||||||||||||||||||||||||||||

| Earnings (in millions) | |||||||||||||||||||||||||||||||||||

Consumer, Small and Business Banking |

$ | 6,067 | 6,222 | 6,554 | (2) | % | (7) | ||||||||||||||||||||||||||||

| Consumer Lending: | |||||||||||||||||||||||||||||||||||

| Home Lending | 854 | 842 | 839 | 1 | 2 | ||||||||||||||||||||||||||||||

Credit Card |

1,489 | 1,471 | 1,449 | 1 | 3 | ||||||||||||||||||||||||||||||

| Auto | 263 | 273 | 334 | (4) | (21) | ||||||||||||||||||||||||||||||

| Personal Lending | 307 | 316 | 343 | (3) | (10) | ||||||||||||||||||||||||||||||

| Total revenue | 8,980 | 9,124 | 9,519 | (2) | (6) | ||||||||||||||||||||||||||||||

| Provision for credit losses | 911 | 930 | 790 | (2) | 15 | ||||||||||||||||||||||||||||||

| Noninterest expense | 5,925 | 5,624 | 6,046 | 5 | (2) | ||||||||||||||||||||||||||||||

| Net income | $ | 1,602 | 1,924 | 2,011 | (17) | (20) | |||||||||||||||||||||||||||||

| Average balances (in billions) | |||||||||||||||||||||||||||||||||||

| Loans | $ | 321.4 | 323.6 | 333.5 | (1) | (4) | |||||||||||||||||||||||||||||

| Deposits | 773.6 | 773.6 | 779.5 | — | (1) | ||||||||||||||||||||||||||||||

| Quarter ended | Dec 31, 2024 % Change from |

||||||||||||||||||||||||||||||||||

| Dec 31, 2024 |

Sep 30, 2024 |

Dec 31, 2023 |

Sep 30, 2024 |

Dec 31, 2023 |

|||||||||||||||||||||||||||||||

| Earnings (in millions) | |||||||||||||||||||||||||||||||||||

Middle Market Banking |

$ | 2,144 | 2,187 | 2,196 | (2) | % | (2) | ||||||||||||||||||||||||||||

Asset-Based Lending and Leasing |

1,027 | 1,146 | 1,172 | (10) | (12) | ||||||||||||||||||||||||||||||

| Total revenue | 3,171 | 3,333 | 3,368 | (5) | (6) | ||||||||||||||||||||||||||||||

| Provision for credit losses | 33 | 85 | 40 | (61) | (18) | ||||||||||||||||||||||||||||||

| Noninterest expense | 1,525 | 1,480 | 1,630 | 3 | (6) | ||||||||||||||||||||||||||||||

| Net income | $ | 1,203 | 1,318 | 1,273 | (9) | (5) | |||||||||||||||||||||||||||||

| Average balances (in billions) | |||||||||||||||||||||||||||||||||||

| Loans | $ | 221.8 | 222.1 | 223.3 | — | (1) | |||||||||||||||||||||||||||||

| Deposits | 184.3 | 173.2 | 163.3 | 6 | 13 | ||||||||||||||||||||||||||||||

| Quarter ended | Dec 31, 2024 % Change from |

||||||||||||||||||||||||||||||||||

| Dec 31, 2024 |

Sep 30, 2024 |

Dec 31, 2023 |

Sep 30, 2024 |

Dec 31, 2023 |

|||||||||||||||||||||||||||||||

| Earnings (in millions) | |||||||||||||||||||||||||||||||||||

| Banking: | |||||||||||||||||||||||||||||||||||

| Lending | $ | 691 | 698 | 774 | (1) | % | (11) | ||||||||||||||||||||||||||||

| Treasury Management and Payments | 644 | 695 | 742 | (7) | (13) | ||||||||||||||||||||||||||||||

| Investment Banking | 491 | 419 | 383 | 17 | 28 | ||||||||||||||||||||||||||||||

| Total Banking | 1,826 | 1,812 | 1,899 | 1 | (4) | ||||||||||||||||||||||||||||||

| Commercial Real Estate | 1,274 | 1,364 | 1,291 | (7) | (1) | ||||||||||||||||||||||||||||||

| Markets: | |||||||||||||||||||||||||||||||||||

| Fixed Income, Currencies, and Commodities (FICC) | 1,179 | 1,327 | 1,122 | (11) | 5 | ||||||||||||||||||||||||||||||

| Equities | 385 | 396 | 457 | (3) | (16) | ||||||||||||||||||||||||||||||

| Credit Adjustment (CVA/DVA/FVA) and Other | (71) | 31 | (8) | NM | NM | ||||||||||||||||||||||||||||||

| Total Markets | 1,493 | 1,754 | 1,571 | (15) | (5) | ||||||||||||||||||||||||||||||

| Other | 20 | (19) | (26) | 205 | 177 | ||||||||||||||||||||||||||||||

| Total revenue | 4,613 | 4,911 | 4,735 | (6) | (3) | ||||||||||||||||||||||||||||||

| Provision for credit losses | 205 | 26 | 498 | 688 | (59) | ||||||||||||||||||||||||||||||

| Noninterest expense | 2,300 | 2,229 | 2,132 | 3 | 8 | ||||||||||||||||||||||||||||||

| Net income | $ | 1,580 | 1,992 | 1,582 | (21) | — | |||||||||||||||||||||||||||||

| Average balances (in billions) | |||||||||||||||||||||||||||||||||||

| Loans | $ | 274.0 | 275.2 | 290.1 | — | (6) | |||||||||||||||||||||||||||||

| Deposits | 205.1 | 194.3 | 173.1 | 6 | 18 | ||||||||||||||||||||||||||||||

| Quarter ended | Dec 31, 2024 % Change from |

|||||||||||||||||||||||||||||||

| Dec 31, 2024 |

Sep 30, 2024 |

Dec 31, 2023 |

Sep 30, 2024 |

Dec 31, 2023 |

||||||||||||||||||||||||||||

| Earnings (in millions) | ||||||||||||||||||||||||||||||||

| Net interest income | $ | 856 | 842 | 906 | 2 | % | (6) | |||||||||||||||||||||||||

| Noninterest income | 3,102 | 3,036 | 2,754 | 2 | 13 | |||||||||||||||||||||||||||

| Total revenue | 3,958 | 3,878 | 3,660 | 2 | 8 | |||||||||||||||||||||||||||

| Provision for credit losses | (27) | 16 | (19) | NM | (42) | |||||||||||||||||||||||||||

| Noninterest expense | 3,307 | 3,154 | 3,023 | 5 | 9 | |||||||||||||||||||||||||||

| Net income | $ | 508 | 529 | 491 | (4) | 3 | ||||||||||||||||||||||||||

Total client assets (in billions) |

2,293 | 2,294 | 2,084 | — | 10 | |||||||||||||||||||||||||||

| Average balances (in billions) | ||||||||||||||||||||||||||||||||

| Loans | $ | 83.6 | 82.8 | 82.2 | 1 | 2 | ||||||||||||||||||||||||||

| Deposits | 118.3 | 108.0 | 102.1 | 10 | 16 | |||||||||||||||||||||||||||

| Quarter ended | Dec 31, 2024 % Change from |

|||||||||||||||||||||||||||||||

| Dec 31, 2024 |

Sep 30, 2024 |

Dec 31, 2023 |

Sep 30, 2024 |

Dec 31, 2023 |

||||||||||||||||||||||||||||

| Earnings (in millions) | ||||||||||||||||||||||||||||||||

| Net interest income | $ | (264) | (415) | (544) | 36 | % | 51 | |||||||||||||||||||||||||

| Noninterest income | 368 | 78 | 284 | 372 | 30 | |||||||||||||||||||||||||||

| Total revenue | 104 | (337) | (260) | 131 | 140 | |||||||||||||||||||||||||||

| Provision for credit losses | (27) | 8 | (27) | NM | — | |||||||||||||||||||||||||||

| Noninterest expense | 843 | 580 | 2,955 | 45 | (71) | |||||||||||||||||||||||||||

Net income (loss) |

$ | 186 | (649) | (1,911) | 129 | 110 | ||||||||||||||||||||||||||

| ||

Page |

|||||

| Consolidated Results | |||||

| Average Balances and Interest Rates (Taxable-Equivalent Basis) | |||||

| Reportable Operating Segment Results | |||||

Combined Segment Results

|

|||||

| Consumer Banking and Lending | |||||

| Commercial Banking | |||||

| Corporate and Investment Banking | |||||

| Wealth and Investment Management | |||||

| Corporate | |||||

| Credit-Related Information | |||||

Consolidated Loans Outstanding – Period-End Balances, Average Balances, and Average Interest Rates |

|||||

| Net Loan Charge-offs | |||||

| Changes in Allowance for Credit Losses for Loans | |||||

| Allocation of the Allowance for Credit Losses for Loans | |||||

Nonperforming Assets (Nonaccrual Loans and Foreclosed Assets) |

|||||

| Commercial and Industrial Loans and Lease Financing by Industry | |||||

| Commercial Real Estate Loans by Property Type | |||||

| Trading Activities | |||||

Net Interest Income and Net Gains from Trading Activities |

|||||

| Equity | |||||

| Tangible Common Equity | |||||

| Risk-Based Capital Ratios Under Basel III | |||||

| Quarter ended | Dec 31, 2024 % Change from |

Year ended | |||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| (in millions, except ratios and per share amounts) | Dec 31, 2024 |

Sep 30, 2024 |

Jun 30, 2024 |

Mar 31, 2024 |

Dec 31, 2023 |

Sep 30, 2024 |

Dec 31, 2023 |

Dec 31, 2024 |

Dec 31, 2023 |

% Change |

|||||||||||||||||||||||||||||||||||||||||||||||||

| Selected Income Statement Data | |||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| Total revenue | $ | 20,378 | 20,366 | 20,689 | 20,863 | 20,478 | — | % | — | $ | 82,296 | 82,597 | — | % | |||||||||||||||||||||||||||||||||||||||||||||

| Noninterest expense | 13,900 | 13,067 | 13,293 | 14,338 | 15,786 | 6 | (12) | 54,598 | 55,562 | (2) | |||||||||||||||||||||||||||||||||||||||||||||||||

| Pre-tax pre-provision profit (PTPP) (1) | 6,478 | 7,299 | 7,396 | 6,525 | 4,692 | (11) | 38 | 27,698 | 27,035 | 2 | |||||||||||||||||||||||||||||||||||||||||||||||||

| Provision for credit losses (2) | 1,095 | 1,065 | 1,236 | 938 | 1,282 | 3 | (15) | 4,334 | 5,399 | (20) | |||||||||||||||||||||||||||||||||||||||||||||||||

| Wells Fargo net income | 5,079 | 5,114 | 4,910 | 4,619 | 3,446 | (1) | 47 | 19,722 | 19,142 | 3 | |||||||||||||||||||||||||||||||||||||||||||||||||

| Wells Fargo net income applicable to common stock | 4,801 | 4,852 | 4,640 | 4,313 | 3,160 | (1) | 52 | 18,606 | 17,982 | 3 | |||||||||||||||||||||||||||||||||||||||||||||||||

| Common Share Data | |||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| Diluted earnings per common share | 1.43 | 1.42 | 1.33 | 1.20 | 0.86 | 1 | 66 | 5.37 | 4.83 | 11 | |||||||||||||||||||||||||||||||||||||||||||||||||

Dividends declared per common share |

0.40 | 0.40 | 0.35 | 0.35 | 0.35 | — | 14 | 1.50 | 1.30 | 15 | |||||||||||||||||||||||||||||||||||||||||||||||||

| Common shares outstanding | 3,288.9 | 3,345.5 | 3,402.7 | 3,501.7 | 3,598.9 | (2) | (9) | ||||||||||||||||||||||||||||||||||||||||||||||||||||

| Average common shares outstanding | 3,312.8 | 3,384.8 | 3,448.3 | 3,560.1 | 3,620.9 | (2) | (9) | 3,426.1 | 3,688.3 | (7) | |||||||||||||||||||||||||||||||||||||||||||||||||

| Diluted average common shares outstanding | 3,360.7 | 3,425.1 | 3,486.2 | 3,600.1 | 3,657.0 | (2) | (8) | 3,467.6 | 3,720.4 | (7) | |||||||||||||||||||||||||||||||||||||||||||||||||

| Book value per common share (3) | $ | 48.85 | 49.26 | 47.01 | 46.40 | 46.25 | (1) | 6 | |||||||||||||||||||||||||||||||||||||||||||||||||||

Tangible book value per common share (3)(4) |

41.24 | 41.76 | 39.57 | 39.17 | 39.23 | (1) | 5 | ||||||||||||||||||||||||||||||||||||||||||||||||||||

| Selected Equity Data (period-end) | |||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| Total equity | 181,066 | 185,011 | 178,148 | 182,674 | 187,443 | (2) | (3) | ||||||||||||||||||||||||||||||||||||||||||||||||||||

| Common stockholders' equity | 160,656 | 164,801 | 159,963 | 162,481 | 166,444 | (3) | (3) | ||||||||||||||||||||||||||||||||||||||||||||||||||||

Tangible common equity (4) |

135,628 | 139,711 | 134,660 | 137,163 | 141,193 | (3) | (4) | ||||||||||||||||||||||||||||||||||||||||||||||||||||

| Performance Ratios | |||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| Return on average assets (ROA) (5) | 1.05 | % | 1.06 | 1.03 | 0.97 | 0.72 | 1.03 | % | 1.02 | ||||||||||||||||||||||||||||||||||||||||||||||||||

| Return on average equity (ROE) (6) | 11.7 | 11.7 | 11.5 | 10.5 | 7.6 | 11.4 | 11.0 | ||||||||||||||||||||||||||||||||||||||||||||||||||||

Return on average tangible common equity (ROTCE) (4) |

13.9 | 13.9 | 13.7 | 12.3 | 9.0 | 13.4 | 13.1 | ||||||||||||||||||||||||||||||||||||||||||||||||||||

Efficiency ratio (7) |

68 | 64 | 64 | 69 | 77 | 66 | 67 | ||||||||||||||||||||||||||||||||||||||||||||||||||||

| Net interest margin on a taxable-equivalent basis | 2.70 | 2.67 | 2.75 | 2.81 | 2.92 | 2.73 | 3.06 | ||||||||||||||||||||||||||||||||||||||||||||||||||||

| Average deposit cost | 1.73 | 1.91 | 1.84 | 1.74 | 1.58 | 1.80 | 1.23 | ||||||||||||||||||||||||||||||||||||||||||||||||||||

| Quarter ended | Dec 31, 2024 % Change from |

Year ended | |||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| ($ in millions, unless otherwise noted) | Dec 31, 2024 |

Sep 30, 2024 |

Jun 30, 2024 |

Mar 31, 2024 |

Dec 31, 2023 |

Sep 30, 2024 |

Dec 31, 2023 |

Dec 31, 2024 |

Dec 31, 2023 |

% Change |

|||||||||||||||||||||||||||||||||||||||||||||||||

Selected Balance Sheet Data (average) |

|||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| Loans | $ | 906,353 | 910,255 | 916,977 | 928,075 | 938,041 | — | % | (3) | $ | 915,376 | 943,916 | (3) | % | |||||||||||||||||||||||||||||||||||||||||||||

| Assets | 1,918,536 | 1,916,612 | 1,914,647 | 1,916,974 | 1,907,535 | — | 1 | 1,916,697 | 1,885,475 | 2 | |||||||||||||||||||||||||||||||||||||||||||||||||

| Deposits | 1,353,836 | 1,341,680 | 1,346,478 | 1,341,628 | 1,340,916 | 1 | 1 | 1,345,915 | 1,346,282 | — | |||||||||||||||||||||||||||||||||||||||||||||||||

| Selected Balance Sheet Data (period-end) | |||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| Debt securities | 519,131 | 529,832 | 520,254 | 506,280 | 490,458 | (2) | 6 | ||||||||||||||||||||||||||||||||||||||||||||||||||||

| Loans | 912,745 | 909,711 | 917,907 | 922,784 | 936,682 | — | (3) | ||||||||||||||||||||||||||||||||||||||||||||||||||||

| Allowance for credit losses for loans | 14,636 | 14,739 | 14,789 | 14,862 | 15,088 | (1) | (3) | ||||||||||||||||||||||||||||||||||||||||||||||||||||

| Equity securities | 60,644 | 59,771 | 60,763 | 59,556 | 57,336 | 1 | 6 | ||||||||||||||||||||||||||||||||||||||||||||||||||||

| Assets | 1,929,845 | 1,922,125 | 1,940,073 | 1,959,153 | 1,932,468 | — | — | ||||||||||||||||||||||||||||||||||||||||||||||||||||

| Deposits | 1,371,804 | 1,349,646 | 1,365,894 | 1,383,147 | 1,358,173 | 2 | 1 | ||||||||||||||||||||||||||||||||||||||||||||||||||||

| Headcount (#) (period-end) | 217,502 | 220,167 | 222,544 | 224,824 | 225,869 | (1) | (4) | ||||||||||||||||||||||||||||||||||||||||||||||||||||

Capital and other metrics (1) |

|||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| Risk-based capital ratios and components (2): | |||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

Standardized Approach: |

|||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| Common Equity Tier 1 (CET1) | 11.1 | % | 11.3 | 11.0 | 11.2 | 11.4 | |||||||||||||||||||||||||||||||||||||||||||||||||||||

| Tier 1 capital | 12.6 | 12.8 | 12.3 | 12.7 | 13.0 | ||||||||||||||||||||||||||||||||||||||||||||||||||||||

| Total capital | 15.2 | 15.5 | 15.0 | 15.4 | 15.7 | ||||||||||||||||||||||||||||||||||||||||||||||||||||||

| Risk-weighted assets (RWAs) (in billions) | $ | 1,215.8 | 1,219.9 | 1,219.5 | 1,221.6 | 1,231.7 | — | (1) | |||||||||||||||||||||||||||||||||||||||||||||||||||

Advanced Approach: |

|||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| Common Equity Tier 1 (CET1) | 12.4 | % | 12.7 | 12.3 | 12.4 | 12.6 | |||||||||||||||||||||||||||||||||||||||||||||||||||||

| Tier 1 capital | 14.1 | 14.4 | 13.8 | 14.1 | 14.3 | ||||||||||||||||||||||||||||||||||||||||||||||||||||||

| Total capital | 16.1 | 16.4 | 15.8 | 16.2 | 16.4 | ||||||||||||||||||||||||||||||||||||||||||||||||||||||

| Risk-weighted assets (RWAs) (in billions) | $ | 1,085.5 | 1,089.3 | 1,093.0 | 1,099.6 | 1,114.3 | — | (3) | |||||||||||||||||||||||||||||||||||||||||||||||||||

Tier 1 leverage ratio |

8.1 | % | 8.3 | 8.0 | 8.2 | 8.5 | |||||||||||||||||||||||||||||||||||||||||||||||||||||

Supplementary Leverage Ratio (SLR) |

6.7 | 6.9 | 6.7 | 6.9 | 7.1 | ||||||||||||||||||||||||||||||||||||||||||||||||||||||

Total Loss Absorbing Capacity (TLAC) Ratio (3) |

24.8 | 25.3 | 24.8 | 25.1 | 25.0 | ||||||||||||||||||||||||||||||||||||||||||||||||||||||

Liquidity Coverage Ratio (LCR) (4) |

125 | 127 | 124 | 126 | 125 | ||||||||||||||||||||||||||||||||||||||||||||||||||||||

| Quarter ended | Dec 31, 2024 % Change from |

Year ended | |||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| (in millions, except per share amounts) | Dec 31, 2024 |

Sep 30, 2024 |

Jun 30, 2024 |

Mar 31, 2024 |

Dec 31, 2023 |

Sep 30, 2024 |

Dec 31, 2023 |

Dec 31, 2024 |

Dec 31, 2023 |

% Change |

|||||||||||||||||||||||||||||||||||||||||||||||||

| Interest income | $ | 22,055 | 22,998 | 22,884 | 22,840 | 22,839 | (4) | % | (3) | $ | 90,777 | 85,118 | 7 | % | |||||||||||||||||||||||||||||||||||||||||||||

| Interest expense | 10,219 | 11,308 | 10,961 | 10,613 | 10,068 | (10) | 1 | 43,101 | 32,743 | 32 | |||||||||||||||||||||||||||||||||||||||||||||||||

| Net interest income | 11,836 | 11,690 | 11,923 | 12,227 | 12,771 | 1 | (7) | 47,676 | 52,375 | (9) | |||||||||||||||||||||||||||||||||||||||||||||||||

| Noninterest income | |||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| Deposit-related fees | 1,237 | 1,299 | 1,249 | 1,230 | 1,202 | (5) | 3 | 5,015 | 4,694 | 7 | |||||||||||||||||||||||||||||||||||||||||||||||||

| Lending-related fees | 388 | 376 | 369 | 367 | 366 | 3 | 6 | 1,500 | 1,446 | 4 | |||||||||||||||||||||||||||||||||||||||||||||||||

| Investment advisory and other asset-based fees | 2,566 | 2,463 | 2,415 | 2,331 | 2,169 | 4 | 18 | 9,775 | 8,670 | 13 | |||||||||||||||||||||||||||||||||||||||||||||||||

| Commissions and brokerage services fees | 635 | 646 | 614 | 626 | 619 | (2) | 3 | 2,521 | 2,375 | 6 | |||||||||||||||||||||||||||||||||||||||||||||||||

| Investment banking fees | 725 | 672 | 641 | 627 | 455 | 8 | 59 | 2,665 | 1,649 | 62 | |||||||||||||||||||||||||||||||||||||||||||||||||

| Card fees | 1,084 | 1,096 | 1,101 | 1,061 | 1,027 | (1) | 6 | 4,342 | 4,256 | 2 | |||||||||||||||||||||||||||||||||||||||||||||||||

| Mortgage banking | 294 | 280 | 243 | 230 | 202 | 5 | 46 | 1,047 | 829 | 26 | |||||||||||||||||||||||||||||||||||||||||||||||||

| Net gains from trading activities | 950 | 1,438 | 1,442 | 1,454 | 1,070 | (34) | (11) | 5,284 | 4,799 | 10 | |||||||||||||||||||||||||||||||||||||||||||||||||

| Net gains (losses) from debt securities | (448) | (447) | — | (25) | — | — | NM | (920) | 10 | NM | |||||||||||||||||||||||||||||||||||||||||||||||||

| Net gains (losses) from equity securities | 715 | 257 | 80 | 18 | 35 | 178 | NM | 1,070 | (441) | 343 | |||||||||||||||||||||||||||||||||||||||||||||||||

| Lease income | 241 | 277 | 292 | 421 | 292 | (13) | (17) | 1,231 | 1,237 | — | |||||||||||||||||||||||||||||||||||||||||||||||||

| Other | 155 | 319 | 320 | 296 | 270 | (51) | (43) | 1,090 | 698 | 56 | |||||||||||||||||||||||||||||||||||||||||||||||||

| Total noninterest income | 8,542 | 8,676 | 8,766 | 8,636 | 7,707 | (2) | 11 | 34,620 | 30,222 | 15 | |||||||||||||||||||||||||||||||||||||||||||||||||

| Total revenue | 20,378 | 20,366 | 20,689 | 20,863 | 20,478 | — | — | 82,296 | 82,597 | — | |||||||||||||||||||||||||||||||||||||||||||||||||

| Provision for credit losses (1) | 1,095 | 1,065 | 1,236 | 938 | 1,282 | 3 | (15) | 4,334 | 5,399 | (20) | |||||||||||||||||||||||||||||||||||||||||||||||||

| Noninterest expense | |||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| Personnel | 9,071 | 8,591 | 8,575 | 9,492 | 9,181 | 6 | (1) | 35,729 | 35,829 | — | |||||||||||||||||||||||||||||||||||||||||||||||||

| Technology, telecommunications and equipment | 1,282 | 1,142 | 1,106 | 1,053 | 1,076 | 12 | 19 | 4,583 | 3,920 | 17 | |||||||||||||||||||||||||||||||||||||||||||||||||

| Occupancy | 789 | 786 | 763 | 714 | 740 | — | 7 | 3,052 | 2,884 | 6 | |||||||||||||||||||||||||||||||||||||||||||||||||

| Operating losses | 338 | 293 | 493 | 633 | 355 | 15 | (5) | 1,757 | 1,183 | 49 | |||||||||||||||||||||||||||||||||||||||||||||||||

| Professional and outside services | 1,237 | 1,130 | 1,139 | 1,101 | 1,242 | 9 | — | 4,607 | 5,085 | (9) | |||||||||||||||||||||||||||||||||||||||||||||||||

| Leases (2) | 158 | 152 | 159 | 164 | 168 | 4 | (6) | 633 | 697 | (9) | |||||||||||||||||||||||||||||||||||||||||||||||||

| Advertising and promotion | 243 | 205 | 224 | 197 | 259 | 19 | (6) | 869 | 812 | 7 | |||||||||||||||||||||||||||||||||||||||||||||||||

| Other | 782 | 768 | 834 | 984 | 2,765 | 2 | (72) | 3,368 | 5,152 | (35) | |||||||||||||||||||||||||||||||||||||||||||||||||

| Total noninterest expense | 13,900 | 13,067 | 13,293 | 14,338 | 15,786 | 6 | (12) | 54,598 | 55,562 | (2) | |||||||||||||||||||||||||||||||||||||||||||||||||

Income before income tax expense (benefit) |

5,383 | 6,234 | 6,160 | 5,587 | 3,410 | (14) | 58 | 23,364 | 21,636 | 8 | |||||||||||||||||||||||||||||||||||||||||||||||||

| Income tax expense (benefit) | 120 | 1,064 | 1,251 | 964 | (100) | (89) | NM | 3,399 | 2,607 | 30 | |||||||||||||||||||||||||||||||||||||||||||||||||

| Net income before noncontrolling interests | 5,263 | 5,170 | 4,909 | 4,623 | 3,510 | 2 | 50 | 19,965 | 19,029 | 5 | |||||||||||||||||||||||||||||||||||||||||||||||||

Less: Net income (loss) from noncontrolling interests |

184 | 56 | (1) | 4 | 64 | 229 | 188 | 243 | (113) | 315 | |||||||||||||||||||||||||||||||||||||||||||||||||

| Wells Fargo net income | $ | 5,079 | 5,114 | 4,910 | 4,619 | 3,446 | (1) | % | 47 | $ | 19,722 | 19,142 | 3 | % | |||||||||||||||||||||||||||||||||||||||||||||

| Less: Preferred stock dividends and other | 278 | 262 | 270 | 306 | 286 | 6 | (3) | 1,116 | 1,160 | (4) | |||||||||||||||||||||||||||||||||||||||||||||||||

| Wells Fargo net income applicable to common stock | $ | 4,801 | 4,852 | 4,640 | 4,313 | 3,160 | (1) | % | 52 | $ | 18,606 | 17,982 | 3 | % | |||||||||||||||||||||||||||||||||||||||||||||

| Per share information | |||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| Earnings per common share | $ | 1.45 | 1.43 | 1.35 | 1.21 | 0.87 | 1 | % | 67 | $ | 5.43 | 4.88 | 11 | % | |||||||||||||||||||||||||||||||||||||||||||||

| Diluted earnings per common share | 1.43 | 1.42 | 1.33 | 1.20 | 0.86 | 1 | 66 | 5.37 | 4.83 | 11 | |||||||||||||||||||||||||||||||||||||||||||||||||

| Dec 31, 2024 % Change from |

|||||||||||||||||||||||||||||||||||||||||

| (in millions) | Dec 31, 2024 |

Sep 30, 2024 |

Jun 30, 2024 |

Mar 31, 2024 |

Dec 31, 2023 |

Sep 30, 2024 |

Dec 31, 2023 |

||||||||||||||||||||||||||||||||||

| Assets | |||||||||||||||||||||||||||||||||||||||||

| Cash and due from banks | $ | 37,080 | 33,530 | 32,701 | 30,180 | 33,026 | 11 | % | 12 | ||||||||||||||||||||||||||||||||

| Interest-earning deposits with banks | 166,281 | 152,016 | 199,322 | 239,467 | 204,193 | 9 | (19) | ||||||||||||||||||||||||||||||||||

| Federal funds sold and securities purchased under resale agreements | 105,330 | 105,390 | 82,259 | 68,751 | 80,456 | — | 31 | ||||||||||||||||||||||||||||||||||

| Debt securities: | |||||||||||||||||||||||||||||||||||||||||

| Trading, at fair value | 121,205 | 120,677 | 120,766 | 109,324 | 97,302 | — | 25 | ||||||||||||||||||||||||||||||||||

| Available-for-sale, at fair value | 162,978 | 166,004 | 148,752 | 138,245 | 130,448 | (2) | 25 | ||||||||||||||||||||||||||||||||||

| Held-to-maturity, at amortized cost | 234,948 | 243,151 | 250,736 | 258,711 | 262,708 | (3) | (11) | ||||||||||||||||||||||||||||||||||

| Loans held for sale | 6,260 | 7,275 | 7,312 | 5,473 | 4,936 | (14) | 27 | ||||||||||||||||||||||||||||||||||

| Loans | 912,745 | 909,711 | 917,907 | 922,784 | 936,682 | — | (3) | ||||||||||||||||||||||||||||||||||

| Allowance for loan losses | (14,183) | (14,330) | (14,360) | (14,421) | (14,606) | 1 | 3 | ||||||||||||||||||||||||||||||||||

| Net loans | 898,562 | 895,381 | 903,547 | 908,363 | 922,076 | — | (3) | ||||||||||||||||||||||||||||||||||

| Mortgage servicing rights | 7,779 | 7,493 | 8,027 | 8,248 | 8,508 | 4 | (9) | ||||||||||||||||||||||||||||||||||

| Premises and equipment, net | 10,297 | 9,955 | 9,648 | 9,426 | 9,266 | 3 | 11 | ||||||||||||||||||||||||||||||||||

| Goodwill | 25,167 | 25,173 | 25,172 | 25,173 | 25,175 | — | — | ||||||||||||||||||||||||||||||||||

| Derivative assets | 20,012 | 17,721 | 18,721 | 17,653 | 18,223 | 13 | 10 | ||||||||||||||||||||||||||||||||||

| Equity securities | 60,644 | 59,771 | 60,763 | 59,556 | 57,336 | 1 | 6 | ||||||||||||||||||||||||||||||||||

| Other assets | 73,302 | 78,588 | 72,347 | 80,583 | 78,815 | (7) | (7) | ||||||||||||||||||||||||||||||||||

| Total assets | $ | 1,929,845 | 1,922,125 | 1,940,073 | 1,959,153 | 1,932,468 | — | — | |||||||||||||||||||||||||||||||||

| Liabilities | |||||||||||||||||||||||||||||||||||||||||

| Noninterest-bearing deposits | $ | 383,616 | 370,005 | 348,525 | 356,162 | 360,279 | 4 | 6 | |||||||||||||||||||||||||||||||||

| Interest-bearing deposits | 988,188 | 979,641 | 1,017,369 | 1,026,985 | 997,894 | 1 | (1) | ||||||||||||||||||||||||||||||||||

| Total deposits | 1,371,804 | 1,349,646 | 1,365,894 | 1,383,147 | 1,358,173 | 2 | 1 | ||||||||||||||||||||||||||||||||||

| Short-term borrowings (1) | 108,806 | 111,894 | 118,834 | 109,014 | 89,559 | (3) | 21 | ||||||||||||||||||||||||||||||||||

| Derivative liabilities | 16,335 | 11,390 | 16,237 | 17,116 | 18,495 | 43 | (12) | ||||||||||||||||||||||||||||||||||

| Accrued expenses and other liabilities | 78,756 | 82,169 | 81,824 | 79,438 | 71,210 | (4) | 11 | ||||||||||||||||||||||||||||||||||

| Long-term debt (2) | 173,078 | 182,015 | 179,136 | 187,764 | 207,588 | (5) | (17) | ||||||||||||||||||||||||||||||||||

| Total liabilities | 1,748,779 | 1,737,114 | 1,761,925 | 1,776,479 | 1,745,025 | 1 | — | ||||||||||||||||||||||||||||||||||

| Equity | |||||||||||||||||||||||||||||||||||||||||

| Wells Fargo stockholders’ equity: | |||||||||||||||||||||||||||||||||||||||||

| Preferred stock | 18,608 | 18,608 | 16,608 | 18,608 | 19,448 | — | (4) | ||||||||||||||||||||||||||||||||||

Common stock – $1-2/3 par value, authorized 9,000,000,000 shares; issued 5,481,811,474 shares |

9,136 | 9,136 | 9,136 | 9,136 | 9,136 | — | — | ||||||||||||||||||||||||||||||||||

| Additional paid-in capital | 60,817 | 60,623 | 60,373 | 60,131 | 60,555 | — | — | ||||||||||||||||||||||||||||||||||

| Retained earnings | 214,198 | 210,749 | 207,281 | 203,870 | 201,136 | 2 | 6 | ||||||||||||||||||||||||||||||||||

| Accumulated other comprehensive loss | (12,176) | (8,372) | (12,721) | (12,546) | (11,580) | (45) | (5) | ||||||||||||||||||||||||||||||||||

| Treasury stock (3) | (111,463) | (107,479) | (104,247) | (98,256) | (92,960) | (4) | (20) | ||||||||||||||||||||||||||||||||||

| Total Wells Fargo stockholders’ equity | 179,120 | 183,265 | 176,430 | 180,943 | 185,735 | (2) | (4) | ||||||||||||||||||||||||||||||||||

| Noncontrolling interests | 1,946 | 1,746 | 1,718 | 1,731 | 1,708 | 11 | 14 | ||||||||||||||||||||||||||||||||||

| Total equity | 181,066 | 185,011 | 178,148 | 182,674 | 187,443 | (2) | (3) | ||||||||||||||||||||||||||||||||||

| Total liabilities and equity | $ | 1,929,845 | 1,922,125 | 1,940,073 | 1,959,153 | 1,932,468 | — | — | |||||||||||||||||||||||||||||||||

| Quarter ended | Dec 31, 2024 % Change from |

Year ended | % Change |

||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| ($ in millions) | Dec 31, 2024 | Sep 30, 2024 | Jun 30, 2024 | Mar 31, 2024 | Dec 31, 2023 | Sep 30, 2024 | Dec 31, 2023 | Dec 31, 2024 | Dec 31, 2023 | ||||||||||||||||||||||||||||||||||||||||||||||||||

| Average Balances | |||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| Assets | |||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| Interest-earning deposits with banks | $ | 171,100 | 182,219 | 196,436 | 207,568 | 193,647 | (6) | % | (12) | $ | 189,261 | 149,401 | 27 | % | |||||||||||||||||||||||||||||||||||||||||||||

| Federal funds sold and securities purchased under resale agreements | 93,294 | 81,549 | 71,769 | 69,719 | 72,626 | 14 | 28 | 79,128 | 69,878 | 13 | |||||||||||||||||||||||||||||||||||||||||||||||||

| Trading debt securities | 127,639 | 125,083 | 120,590 | 112,170 | 109,340 | 2 | 17 | 121,398 | 104,588 | 16 | |||||||||||||||||||||||||||||||||||||||||||||||||

| Available-for-sale debt securities | 168,511 | 160,729 | 150,024 | 139,986 | 136,389 | 5 | 24 | 154,866 | 142,743 | 8 | |||||||||||||||||||||||||||||||||||||||||||||||||

| Held-to-maturity debt securities | 242,961 | 250,010 | 258,631 | 264,755 | 268,905 | (3) | (10) | 254,048 | 275,441 | (8) | |||||||||||||||||||||||||||||||||||||||||||||||||

| Loans held for sale | 7,210 | 7,032 | 7,091 | 5,835 | 4,990 | 3 | 44 | 6,794 | 5,762 | 18 | |||||||||||||||||||||||||||||||||||||||||||||||||

| Loans | 906,353 | 910,255 | 916,977 | 928,075 | 938,041 | — | (3) | 915,376 | 943,916 | (3) | |||||||||||||||||||||||||||||||||||||||||||||||||

| Equity securities | 29,211 | 27,480 | 26,332 | 21,350 | 22,198 | 6 | 32 | 26,105 | 25,920 | 1 | |||||||||||||||||||||||||||||||||||||||||||||||||

| Other interest-earning assets | 10,079 | 9,711 | 8,128 | 8,940 | 8,861 | 4 | 14 | 9,219 | 9,638 | (4) | |||||||||||||||||||||||||||||||||||||||||||||||||

| Total interest-earning assets | 1,756,358 | 1,754,068 | 1,755,978 | 1,758,398 | 1,754,997 | — | — | 1,756,195 | 1,727,287 | 2 | |||||||||||||||||||||||||||||||||||||||||||||||||

Total noninterest-earning assets |

162,178 | 162,544 | 158,669 | 158,576 | 152,538 | — | 6 | 160,502 | 158,188 | 1 | |||||||||||||||||||||||||||||||||||||||||||||||||

| Total assets | $ | 1,918,536 | 1,916,612 | 1,914,647 | 1,916,974 | 1,907,535 | — | 1 | $ | 1,916,697 | 1,885,475 | 2 | |||||||||||||||||||||||||||||||||||||||||||||||

| Liabilities | |||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| Interest-bearing deposits | $ | 984,438 | 986,206 | 1,006,806 | 996,874 | 974,890 | — | 1 | $ | 993,536 | 946,545 | 5 | |||||||||||||||||||||||||||||||||||||||||||||||

| Short-term borrowings | 109,178 | 109,902 | 106,685 | 94,988 | 92,032 | (1) | 19 | 105,212 | 81,033 | 30 | |||||||||||||||||||||||||||||||||||||||||||||||||

| Long-term debt | 175,414 | 183,586 | 182,201 | 197,116 | 196,213 | (4) | (11) | 184,551 | 180,464 | 2 | |||||||||||||||||||||||||||||||||||||||||||||||||

| Other interest-bearing liabilities | 36,245 | 34,735 | 34,613 | 32,821 | 31,342 | 4 | 16 | 34,608 | 32,950 | 5 | |||||||||||||||||||||||||||||||||||||||||||||||||

| Total interest-bearing liabilities | 1,305,275 | 1,314,429 | 1,330,305 | 1,321,799 | 1,294,477 | (1) | 1 | 1,317,907 | 1,240,992 | 6 | |||||||||||||||||||||||||||||||||||||||||||||||||

Noninterest-bearing deposits |

369,398 | 355,474 | 339,672 | 344,754 | 366,026 | 4 | 1 | 352,379 | 399,737 | (12) | |||||||||||||||||||||||||||||||||||||||||||||||||

| Other noninterest-bearing liabilities | 60,930 | 62,341 | 63,118 | 63,752 | 61,179 | (2) | — | 62,532 | 59,886 | 4 | |||||||||||||||||||||||||||||||||||||||||||||||||

| Total liabilities | 1,735,603 | 1,732,244 | 1,733,095 | 1,730,305 | 1,721,682 | — | 1 | 1,732,818 | 1,700,615 | 2 | |||||||||||||||||||||||||||||||||||||||||||||||||

| Total equity | 182,933 | 184,368 | 181,552 | 186,669 | 185,853 | (1) | (2) | 183,879 | 184,860 | (1) | |||||||||||||||||||||||||||||||||||||||||||||||||

| Total liabilities and equity | $ | 1,918,536 | 1,916,612 | 1,914,647 | 1,916,974 | 1,907,535 | — | 1 | $ | 1,916,697 | 1,885,475 | 2 | |||||||||||||||||||||||||||||||||||||||||||||||

| Average Interest Rates | |||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| Interest-earning assets | |||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| Interest-earning deposits with banks | 4.36 | % | 4.95 | 5.05 | 4.99 | 4.98 | 4.85 | % | 4.67 | ||||||||||||||||||||||||||||||||||||||||||||||||||

| Federal funds sold and securities purchased under resale agreements | 4.66 | 5.24 | 5.27 | 5.28 | 5.30 | 5.08 | 4.83 | ||||||||||||||||||||||||||||||||||||||||||||||||||||

| Trading debt securities | 4.16 | 4.25 | 4.14 | 4.08 | 3.82 | 4.16 | 3.64 | ||||||||||||||||||||||||||||||||||||||||||||||||||||

| Available-for-sale debt securities | 4.45 | 4.33 | 4.21 | 3.99 | 3.87 | 4.26 | 3.76 | ||||||||||||||||||||||||||||||||||||||||||||||||||||

| Held-to-maturity debt securities | 2.51 | 2.57 | 2.64 | 2.70 | 2.69 | 2.61 | 2.63 | ||||||||||||||||||||||||||||||||||||||||||||||||||||

| Loans held for sale | 6.38 | 7.33 | 7.53 | 7.82 | 6.75 | 7.23 | 6.29 | ||||||||||||||||||||||||||||||||||||||||||||||||||||

| Loans | 6.16 | 6.41 | 6.40 | 6.38 | 6.35 | 6.34 | 6.07 | ||||||||||||||||||||||||||||||||||||||||||||||||||||

| Equity securities | 2.40 | 2.26 | 2.99 | 2.82 | 2.99 | 2.60 | 2.63 | ||||||||||||||||||||||||||||||||||||||||||||||||||||

| Other interest-earning assets | 4.73 | 5.12 | 5.42 | 5.14 | 4.99 | 5.08 | 4.80 | ||||||||||||||||||||||||||||||||||||||||||||||||||||

| Total interest-earning assets | 5.02 | 5.24 | 5.25 | 5.24 | 5.20 | 5.19 | 4.95 | ||||||||||||||||||||||||||||||||||||||||||||||||||||

| Interest-bearing liabilities | |||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| Interest-bearing deposits | 2.37 | 2.60 | 2.46 | 2.34 | 2.17 | 2.44 | 1.74 | ||||||||||||||||||||||||||||||||||||||||||||||||||||

| Short-term borrowings | 4.67 | 5.20 | 5.19 | 5.16 | 5.10 | 5.05 | 4.75 | ||||||||||||||||||||||||||||||||||||||||||||||||||||

| Long-term debt | 6.35 | 6.89 | 6.95 | 6.80 | 6.78 | 6.75 | 6.41 | ||||||||||||||||||||||||||||||||||||||||||||||||||||

| Other interest-bearing liabilities | 3.01 | 3.05 | 3.13 | 2.88 | 2.87 | 3.02 | 2.49 | ||||||||||||||||||||||||||||||||||||||||||||||||||||

| Total interest-bearing liabilities | 3.12 | 3.43 | 3.31 | 3.22 | 3.09 | 3.27 | 2.64 | ||||||||||||||||||||||||||||||||||||||||||||||||||||

Interest rate spread on a taxable-equivalent basis (2) |

1.90 | 1.81 | 1.94 | 2.02 | 2.11 | 1.92 | 2.31 | ||||||||||||||||||||||||||||||||||||||||||||||||||||

Net interest margin on a taxable-equivalent basis (2) |

2.70 | 2.67 | 2.75 | 2.81 | 2.92 | 2.73 | 3.06 | ||||||||||||||||||||||||||||||||||||||||||||||||||||

| Quarter ended December 31, 2024 | |||||||||||||||||||||||||||||||||||||||||

| (in millions) | Consumer Banking and Lending | Commercial Banking | Corporate and Investment Banking | Wealth and Investment Management | Corporate (2) | Reconciling Items (3) | Consolidated Company |

||||||||||||||||||||||||||||||||||

| Net interest income | $ | 7,020 | 2,248 | 2,054 | 856 | (264) | (78) | 11,836 | |||||||||||||||||||||||||||||||||

| Noninterest income | 1,960 | 923 | 2,559 | 3,102 | 368 | (370) | 8,542 | ||||||||||||||||||||||||||||||||||

| Total revenue | 8,980 | 3,171 | 4,613 | 3,958 | 104 | (448) | 20,378 | ||||||||||||||||||||||||||||||||||

| Provision for credit losses | 911 | 33 | 205 | (27) | (27) | — | 1,095 | ||||||||||||||||||||||||||||||||||

| Noninterest expense | 5,925 | 1,525 | 2,300 | 3,307 | 843 | — | 13,900 | ||||||||||||||||||||||||||||||||||

| Income (loss) before income tax expense (benefit) | 2,144 | 1,613 | 2,108 | 678 | (712) | (448) | 5,383 | ||||||||||||||||||||||||||||||||||

| Income tax expense (benefit) | 542 | 408 | 528 | 170 | (1,080) | (448) | 120 | ||||||||||||||||||||||||||||||||||

| Net income before noncontrolling interests | 1,602 | 1,205 | 1,580 | 508 | 368 | — | 5,263 | ||||||||||||||||||||||||||||||||||

Less: Net income from noncontrolling interests |

— | 2 | — | — | 182 | — | 184 | ||||||||||||||||||||||||||||||||||

| Net income | $ | 1,602 | 1,203 | 1,580 | 508 | 186 | — | 5,079 | |||||||||||||||||||||||||||||||||

| Quarter ended September 30, 2024 | |||||||||||||||||||||||||||||||||||||||||

| Net interest income | $ | 7,149 | 2,289 | 1,909 | 842 | (415) | (84) | 11,690 | |||||||||||||||||||||||||||||||||

| Noninterest income | 1,975 | 1,044 | 3,002 | 3,036 | 78 | (459) | 8,676 | ||||||||||||||||||||||||||||||||||

| Total revenue | 9,124 | 3,333 | 4,911 | 3,878 | (337) | (543) | 20,366 | ||||||||||||||||||||||||||||||||||

| Provision for credit losses | 930 | 85 | 26 | 16 | 8 | — | 1,065 | ||||||||||||||||||||||||||||||||||

| Noninterest expense | 5,624 | 1,480 | 2,229 | 3,154 | 580 | — | 13,067 | ||||||||||||||||||||||||||||||||||

| Income (loss) before income tax expense (benefit) | 2,570 | 1,768 | 2,656 | 708 | (925) | (543) | 6,234 | ||||||||||||||||||||||||||||||||||

| Income tax expense (benefit) | 646 | 448 | 664 | 179 | (330) | (543) | 1,064 | ||||||||||||||||||||||||||||||||||

Net income (loss) before noncontrolling interests |

1,924 | 1,320 | 1,992 | 529 | (595) | — | 5,170 | ||||||||||||||||||||||||||||||||||

| Less: Net income from noncontrolling interests | — | 2 | — | — | 54 | — | 56 | ||||||||||||||||||||||||||||||||||

Net income (loss) |

$ | 1,924 | 1,318 | 1,992 | 529 | (649) | — | 5,114 | |||||||||||||||||||||||||||||||||

| Quarter ended December 31, 2023 | |||||||||||||||||||||||||||||||||||||||||

| Net interest income | $ | 7,629 | 2,525 | 2,359 | 906 | (544) | (104) | 12,771 | |||||||||||||||||||||||||||||||||

| Noninterest income | 1,890 | 843 | 2,376 | 2,754 | 284 | (440) | 7,707 | ||||||||||||||||||||||||||||||||||

| Total revenue | 9,519 | 3,368 | 4,735 | 3,660 | (260) | (544) | 20,478 | ||||||||||||||||||||||||||||||||||

| Provision for credit losses | 790 | 40 | 498 | (19) | (27) | — | 1,282 | ||||||||||||||||||||||||||||||||||

| Noninterest expense | 6,046 | 1,630 | 2,132 | 3,023 | 2,955 | — | 15,786 | ||||||||||||||||||||||||||||||||||

| Income (loss) before income tax expense (benefit) | 2,683 | 1,698 | 2,105 | 656 | (3,188) | (544) | 3,410 | ||||||||||||||||||||||||||||||||||

| Income tax expense (benefit) | 672 | 423 | 523 | 165 | (1,339) | (544) | (100) | ||||||||||||||||||||||||||||||||||

| Net income (loss) before noncontrolling interests | 2,011 | 1,275 | 1,582 | 491 | (1,849) | — | 3,510 | ||||||||||||||||||||||||||||||||||

| Less: Net income from noncontrolling interests | — | 2 | — | — | 62 | — | 64 | ||||||||||||||||||||||||||||||||||

| Net income (loss) | $ | 2,011 | 1,273 | 1,582 | 491 | (1,911) | — | 3,446 | |||||||||||||||||||||||||||||||||

| Year ended December 31, 2024 | |||||||||||||||||||||||||||||||||||||||||

| (in millions) | Consumer Banking and Lending | Commercial Banking | Corporate and Investment Banking | Wealth and Investment Management | Corporate (2) | Reconciling Items (3) | Consolidated Company |

||||||||||||||||||||||||||||||||||

| Net interest income | $ | 28,303 | 9,096 | 7,935 | 3,473 | (791) | (340) | 47,676 | |||||||||||||||||||||||||||||||||

| Noninterest income | 7,898 | 3,682 | 11,409 | 11,963 | 1,129 | (1,461) | 34,620 | ||||||||||||||||||||||||||||||||||

| Total revenue | 36,201 | 12,778 | 19,344 | 15,436 | 338 | (1,801) | 82,296 | ||||||||||||||||||||||||||||||||||

| Provision for credit losses | 3,561 | 290 | 521 | (22) | (16) | — | 4,334 | ||||||||||||||||||||||||||||||||||

| Noninterest expense | 23,274 | 6,190 | 9,029 | 12,884 | 3,221 | — | 54,598 | ||||||||||||||||||||||||||||||||||

Income (loss) before income tax expense (benefit) |

9,366 | 6,298 | 9,794 | 2,574 | (2,867) | (1,801) | 23,364 | ||||||||||||||||||||||||||||||||||

| Income tax expense (benefit) | 2,357 | 1,599 | 2,456 | 672 | (1,884) | (1,801) | 3,399 | ||||||||||||||||||||||||||||||||||

| Net income (loss) before noncontrolling interests | 7,009 | 4,699 | 7,338 | 1,902 | (983) | — | 19,965 | ||||||||||||||||||||||||||||||||||

Less: Net income from noncontrolling interests |

— | 10 | — | — | 233 | — | 243 | ||||||||||||||||||||||||||||||||||

| Net income (loss) | $ | 7,009 | 4,689 | 7,338 | 1,902 | (1,216) | — | 19,722 | |||||||||||||||||||||||||||||||||

| Year ended December 31, 2023 | |||||||||||||||||||||||||||||||||||||||||

| Net interest income | $ | 30,185 | 10,034 | 9,498 | 3,966 | (888) | (420) | 52,375 | |||||||||||||||||||||||||||||||||

| Noninterest income | 7,734 | 3,415 | 9,693 | 10,725 | 431 | (1,776) | 30,222 | ||||||||||||||||||||||||||||||||||

| Total revenue | 37,919 | 13,449 | 19,191 | 14,691 | (457) | (2,196) | 82,597 | ||||||||||||||||||||||||||||||||||

| Provision for credit losses | 3,299 | 75 | 2,007 | 6 | 12 | — | 5,399 | ||||||||||||||||||||||||||||||||||

| Noninterest expense | 24,024 | 6,555 | 8,618 | 12,064 | 4,301 | — | 55,562 | ||||||||||||||||||||||||||||||||||

Income (loss) before income tax expense (benefit) |

10,596 | 6,819 | 8,566 | 2,621 | (4,770) | (2,196) | 21,636 | ||||||||||||||||||||||||||||||||||

| Income tax expense (benefit) | 2,657 | 1,704 | 2,140 | 657 | (2,355) | (2,196) | 2,607 | ||||||||||||||||||||||||||||||||||

| Net income (loss) before noncontrolling interests | 7,939 | 5,115 | 6,426 | 1,964 | (2,415) | — | 19,029 | ||||||||||||||||||||||||||||||||||

| Less: Net income (loss) from noncontrolling interests | — | 11 | — | — | (124) | — | (113) | ||||||||||||||||||||||||||||||||||

| Net income (loss) | $ | 7,939 | 5,104 | 6,426 | 1,964 | (2,291) | — | 19,142 | |||||||||||||||||||||||||||||||||

| Quarter ended | Dec 31, 2024 % Change from |

Year ended | |||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| ($ in millions) | Dec 31, 2024 |

Sep 30, 2024 |

Jun 30, 2024 |

Mar 31, 2024 |

Dec 31, 2023 |

Sep 30, 2024 |

Dec 31, 2023 |

Dec 31, 2024 |

Dec 31, 2023 |

% Change |

|||||||||||||||||||||||||||||||||||||||||||||||||

| Income Statement | |||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| Net interest income | $ | 7,020 | 7,149 | 7,024 | 7,110 | 7,629 | (2) | % | (8) | $ | 28,303 | 30,185 | (6) | % | |||||||||||||||||||||||||||||||||||||||||||||

| Noninterest income: | |||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| Deposit-related fees | 657 | 710 | 690 | 677 | 694 | (7) | (5) | 2,734 | 2,702 | 1 | |||||||||||||||||||||||||||||||||||||||||||||||||

| Card fees | 1,019 | 1,031 | 1,036 | 990 | 960 | (1) | 6 | 4,076 | 3,967 | 3 | |||||||||||||||||||||||||||||||||||||||||||||||||

| Mortgage banking | 185 | 137 | 135 | 193 | 115 | 35 | 61 | 650 | 512 | 27 | |||||||||||||||||||||||||||||||||||||||||||||||||

| Other | 99 | 97 | 121 | 121 | 121 | 2 | (18) | 438 | 553 | (21) | |||||||||||||||||||||||||||||||||||||||||||||||||

| Total noninterest income | 1,960 | 1,975 | 1,982 | 1,981 | 1,890 | (1) | 4 | 7,898 | 7,734 | 2 | |||||||||||||||||||||||||||||||||||||||||||||||||

| Total revenue | 8,980 | 9,124 | 9,006 | 9,091 | 9,519 | (2) | (6) | 36,201 | 37,919 | (5) | |||||||||||||||||||||||||||||||||||||||||||||||||

| Net charge-offs | 887 | 871 | 907 | 881 | 852 | 2 | 4 | 3,546 | 2,784 | 27 | |||||||||||||||||||||||||||||||||||||||||||||||||

| Change in the allowance for credit losses | 24 | 59 | 25 | (93) | (62) | (59) | 139 | 15 | 515 | (97) | |||||||||||||||||||||||||||||||||||||||||||||||||

| Provision for credit losses | 911 | 930 | 932 | 788 | 790 | (2) | 15 | 3,561 | 3,299 | 8 | |||||||||||||||||||||||||||||||||||||||||||||||||

| Noninterest expense | 5,925 | 5,624 | 5,701 | 6,024 | 6,046 | 5 | (2) | 23,274 | 24,024 | (3) | |||||||||||||||||||||||||||||||||||||||||||||||||

| Income before income tax expense | 2,144 | 2,570 | 2,373 | 2,279 | 2,683 | (17) | (20) | 9,366 | 10,596 | (12) | |||||||||||||||||||||||||||||||||||||||||||||||||

| Income tax expense | 542 | 646 | 596 | 573 | 672 | (16) | (19) | 2,357 | 2,657 | (11) | |||||||||||||||||||||||||||||||||||||||||||||||||

| Net income | $ | 1,602 | 1,924 | 1,777 | 1,706 | 2,011 | (17) | (20) | $ | 7,009 | 7,939 | (12) | |||||||||||||||||||||||||||||||||||||||||||||||

| Revenue by Line of Business | |||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| Consumer, Small and Business Banking | $ | 6,067 | 6,222 | 6,129 | 6,092 | 6,554 | (2) | (7) | $ | 24,510 | 25,922 | (5) | |||||||||||||||||||||||||||||||||||||||||||||||

| Consumer Lending: | |||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| Home Lending | 854 | 842 | 823 | 864 | 839 | 1 | 2 | 3,383 | 3,389 | — | |||||||||||||||||||||||||||||||||||||||||||||||||

| Credit Card | 1,489 | 1,471 | 1,452 | 1,496 | 1,449 | 1 | 3 | 5,908 | 5,809 | 2 | |||||||||||||||||||||||||||||||||||||||||||||||||

| Auto | 263 | 273 | 282 | 300 | 334 | (4) | (21) | 1,118 | 1,464 | (24) | |||||||||||||||||||||||||||||||||||||||||||||||||

| Personal Lending | 307 | 316 | 320 | 339 | 343 | (3) | (10) | 1,282 | 1,335 | (4) | |||||||||||||||||||||||||||||||||||||||||||||||||

| Total revenue | $ | 8,980 | 9,124 | 9,006 | 9,091 | 9,519 | (2) | (6) | $ | 36,201 | 37,919 | (5) | |||||||||||||||||||||||||||||||||||||||||||||||

| Selected Balance Sheet Data (average) | |||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| Loans by Line of Business: | |||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| Consumer, Small and Business Banking | $ | 6,105 | 6,230 | 6,370 | 6,465 | 6,494 | (2) | (6) | $ | 6,292 | 6,740 | (7) | |||||||||||||||||||||||||||||||||||||||||||||||

| Consumer Lending: | |||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| Home Lending | 207,780 | 209,825 | 211,994 | 214,335 | 216,733 | (1) | (4) | 210,972 | 219,601 | (4) | |||||||||||||||||||||||||||||||||||||||||||||||||

| Credit Card | 50,243 | 49,141 | 47,463 | 46,412 | 45,842 | 2 | 10 | 48,322 | 42,894 | 13 | |||||||||||||||||||||||||||||||||||||||||||||||||

| Auto | 43,005 | 43,949 | 45,650 | 47,621 | 49,078 | (2) | (12) | 45,048 | 51,689 | (13) | |||||||||||||||||||||||||||||||||||||||||||||||||

| Personal Lending | 14,291 | 14,470 | 14,462 | 14,896 | 15,386 | (1) | (7) | 14,529 | 14,996 | (3) | |||||||||||||||||||||||||||||||||||||||||||||||||

| Total loans | $ | 321,424 | 323,615 | 325,939 | 329,729 | 333,533 | (1) | (4) | $ | 325,163 | 335,920 | (3) | |||||||||||||||||||||||||||||||||||||||||||||||

| Total deposits | 773,631 | 773,554 | 778,228 | 773,248 | 779,490 | — | (1) | 774,660 | 811,091 | (4) | |||||||||||||||||||||||||||||||||||||||||||||||||

| Allocated capital | 45,500 | 45,500 | 45,500 | 45,500 | 44,000 | — | 3 | 45,500 | 44,000 | 3 | |||||||||||||||||||||||||||||||||||||||||||||||||

| Selected Balance Sheet Data (period-end) | |||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| Loans by Line of Business: | |||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| Consumer, Small and Business Banking | $ | 6,256 | 6,372 | 6,513 | 6,584 | 6,735 | (2) | (7) | |||||||||||||||||||||||||||||||||||||||||||||||||||

| Consumer Lending: | |||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| Home Lending | 207,022 | 209,083 | 211,172 | 213,289 | 215,823 | (1) | (4) | ||||||||||||||||||||||||||||||||||||||||||||||||||||

| Credit Card | 50,992 | 49,521 | 48,400 | 46,867 | 46,735 | 3 | 9 | ||||||||||||||||||||||||||||||||||||||||||||||||||||

| Auto | 42,914 | 43,356 | 44,780 | 46,692 | 48,283 | (1) | (11) | ||||||||||||||||||||||||||||||||||||||||||||||||||||

| Personal Lending | 14,246 | 14,413 | 14,495 | 14,575 | 15,291 | (1) | (7) | ||||||||||||||||||||||||||||||||||||||||||||||||||||

| Total loans | $ | 321,430 | 322,745 | 325,360 | 328,007 | 332,867 | — | (3) | |||||||||||||||||||||||||||||||||||||||||||||||||||

| Total deposits | 783,490 | 775,745 | 781,817 | 794,160 | 782,309 | 1 | — | ||||||||||||||||||||||||||||||||||||||||||||||||||||

| Quarter ended | Dec 31, 2024 % Change from |

Year ended | |||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| ($ in millions, unless otherwise noted) | Dec 31, 2024 |

Sep 30, 2024 |

Jun 30, 2024 |

Mar 31, 2024 |

Dec 31, 2023 |

Sep 30, 2024 |

Dec 31, 2023 |

Dec 31, 2024 |

Dec 31, 2023 |

% Change |

|||||||||||||||||||||||||||||||||||||||||||||||||

| Selected Metrics | |||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| Consumer Banking and Lending: | |||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

Return on allocated capital (1) |

13.4 | % | 16.3 | 15.1 | 14.5 | 17.6 | 14.8 | % | 17.5 | ||||||||||||||||||||||||||||||||||||||||||||||||||

| Efficiency ratio (2) | 66 | 62 | 63 | 66 | 64 | 64 | 63 | ||||||||||||||||||||||||||||||||||||||||||||||||||||

Retail bank branches (#, period-end) |

4,177 | 4,196 | 4,227 | 4,247 | 4,311 | — | % | (3) | |||||||||||||||||||||||||||||||||||||||||||||||||||

Digital active customers (# in millions, period-end) (3) |

36.0 | 35.8 | 35.6 | 35.5 | 34.8 | 1 | 3 | ||||||||||||||||||||||||||||||||||||||||||||||||||||

Mobile active customers (# in millions, period-end) (3) |

31.4 | 31.2 | 30.8 | 30.5 | 29.9 | 1 | 5 | ||||||||||||||||||||||||||||||||||||||||||||||||||||

Consumer, Small and Business Banking: |

|||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| Deposit spread (4) | 2.5 | % | 2.5 | 2.5 | 2.5 | 2.7 | 2.5 | % | 2.6 | ||||||||||||||||||||||||||||||||||||||||||||||||||

Debit card purchase volume ($ in billions) (5) |

$ | 131.0 | 126.8 | 128.2 | 121.5 | 126.1 | 3 | 4 | $ | 507.5 | 492.8 | 3 | % | ||||||||||||||||||||||||||||||||||||||||||||||

Debit card purchase transactions (# in millions) (5) |

2,622 | 2,585 | 2,581 | 2,442 | 2,546 | 1 | 3 | 10,230 | 10,000 | 2 | |||||||||||||||||||||||||||||||||||||||||||||||||

| Home Lending: | |||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| Mortgage banking: | |||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| Net servicing income | $ | 128 | 114 | 89 | 91 | 113 | 12 | 13 | $ | 422 | 300 | 41 | |||||||||||||||||||||||||||||||||||||||||||||||

Net gains on mortgage loan originations/sales |

57 | 23 | 46 | 102 | 2 | 148 | NM | 228 | 212 | 8 | |||||||||||||||||||||||||||||||||||||||||||||||||

| Total mortgage banking | $ | 185 | 137 | 135 | 193 | 115 | 35 | 61 | $ | 650 | 512 | 27 | |||||||||||||||||||||||||||||||||||||||||||||||

Retail originations ($ in billions) |

$ | 5.9 | 5.5 | 5.3 | 3.5 | 4.5 | 7 | 31 | $ | 20.2 | 24.2 | (17) | |||||||||||||||||||||||||||||||||||||||||||||||

| % of originations held for sale (HFS) | 40.3 | % | 41.0 | 38.6 | 43.5 | 45.4 | 40.6 | % | 44.6 | ||||||||||||||||||||||||||||||||||||||||||||||||||

| Third party mortgage loans serviced ($ in billions, period-end) (6) | $ | 486.9 | 499.1 | 512.8 | 527.5 | 559.7 | (2) | (13) | |||||||||||||||||||||||||||||||||||||||||||||||||||

| Mortgage servicing rights (MSR) carrying value (period-end) | 6,844 | 6,544 | 7,061 | 7,249 | 7,468 | 5 | (8) | ||||||||||||||||||||||||||||||||||||||||||||||||||||

| Ratio of MSR carrying value (period-end) to third party mortgage loans serviced (period-end) (6) | 1.41 | % | 1.31 | 1.38 | 1.37 | 1.33 | |||||||||||||||||||||||||||||||||||||||||||||||||||||

| Home lending loans 30+ days delinquency rate (period-end) (7)(8)(9) | 0.29 | 0.30 | 0.33 | 0.30 | 0.32 | ||||||||||||||||||||||||||||||||||||||||||||||||||||||

| Credit Card: | |||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| Point of sale (POS) volume ($ in billions) | $ | 45.1 | 43.4 | 42.9 | 39.1 | 41.2 | 4 | 9 | $ | 170.5 | 153.1 | 11 | |||||||||||||||||||||||||||||||||||||||||||||||

| New accounts (# in thousands) | 486 | 615 | 677 | 651 | 655 | (21) | (26) | 2,429 | 2,566 | (5) | |||||||||||||||||||||||||||||||||||||||||||||||||

| Credit card loans 30+ days delinquency rate (period-end) (8)(9) | 2.91 | % | 2.87 | 2.71 | 2.92 | 2.80 | |||||||||||||||||||||||||||||||||||||||||||||||||||||

| Credit card loans 90+ days delinquency rate (period-end) (8)(9) | 1.51 | 1.43 | 1.40 | 1.55 | 1.41 | ||||||||||||||||||||||||||||||||||||||||||||||||||||||

| Auto: | |||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| Auto originations ($ in billions) | $ | 5.0 | 4.1 | 3.7 | 4.1 | 3.3 | 22 | 52 | $ | 16.9 | 17.2 | (2) | |||||||||||||||||||||||||||||||||||||||||||||||

| Auto loans 30+ days delinquency rate (period-end) (8)(9) | 2.31 | % | 2.28 | 2.31 | 2.36 | 2.80 | |||||||||||||||||||||||||||||||||||||||||||||||||||||

| Personal Lending: | |||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| New volume ($ in billions) | $ | 2.5 | 2.7 | 2.7 | 2.2 | 2.6 | (7) | (4) | $ | 10.1 | 11.9 | (15) | |||||||||||||||||||||||||||||||||||||||||||||||

| Quarter ended | Dec 31, 2024 % Change from |

Year ended | |||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| ($ in millions) | Dec 31, 2024 |

Sep 30, 2024 |

Jun 30, 2024 |

Mar 31, 2024 |

Dec 31, 2023 |

Sep 30, 2024 |

Dec 31, 2023 |

Dec 31, 2024 |

Dec 31, 2023 |

% Change |

|||||||||||||||||||||||||||||||||||||||||||||||||

| Income Statement | |||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| Net interest income | $ | 2,248 | 2,289 | 2,281 | 2,278 | 2,525 | (2) | % | (11) | $ | 9,096 | 10,034 | (9) | % | |||||||||||||||||||||||||||||||||||||||||||||

| Noninterest income: | |||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| Deposit-related fees | 303 | 303 | 290 | 284 | 257 | — | 18 | 1,180 | 998 | 18 | |||||||||||||||||||||||||||||||||||||||||||||||||

| Lending-related fees | 140 | 138 | 139 | 138 | 138 | 1 | 1 | 555 | 531 | 5 | |||||||||||||||||||||||||||||||||||||||||||||||||

| Lease income | 124 | 126 | 133 | 149 | 155 | (2) | (20) | 532 | 644 | (17) | |||||||||||||||||||||||||||||||||||||||||||||||||

| Other | 356 | 477 | 279 | 303 | 293 | (25) | 22 | 1,415 | 1,242 | 14 | |||||||||||||||||||||||||||||||||||||||||||||||||

| Total noninterest income | 923 | 1,044 | 841 | 874 | 843 | (12) | 9 | 3,682 | 3,415 | 8 | |||||||||||||||||||||||||||||||||||||||||||||||||

| Total revenue | 3,171 | 3,333 | 3,122 | 3,152 | 3,368 | (5) | (6) | 12,778 | 13,449 | (5) | |||||||||||||||||||||||||||||||||||||||||||||||||

| Net charge-offs | 111 | 50 | 97 | 75 | 35 | 122 | 217 | 333 | 96 | 247 | |||||||||||||||||||||||||||||||||||||||||||||||||

| Change in the allowance for credit losses | (78) | 35 | (68) | 68 | 5 | NM | NM | (43) | (21) | NM | |||||||||||||||||||||||||||||||||||||||||||||||||

| Provision for credit losses | 33 | 85 | 29 | 143 | 40 | (61) | (18) | 290 | 75 | 287 | |||||||||||||||||||||||||||||||||||||||||||||||||

| Noninterest expense | 1,525 | 1,480 | 1,506 | 1,679 | 1,630 | 3 | (6) | 6,190 | 6,555 | (6) | |||||||||||||||||||||||||||||||||||||||||||||||||

| Income before income tax expense | 1,613 | 1,768 | 1,587 | 1,330 | 1,698 | (9) | (5) | 6,298 | 6,819 | (8) | |||||||||||||||||||||||||||||||||||||||||||||||||

| Income tax expense | 408 | 448 | 402 | 341 | 423 | (9) | (4) | 1,599 | 1,704 | (6) | |||||||||||||||||||||||||||||||||||||||||||||||||

| Less: Net income from noncontrolling interests | 2 | 2 | 3 | 3 | 2 | — | — | 10 | 11 | (9) | |||||||||||||||||||||||||||||||||||||||||||||||||

| Net income | $ | 1,203 | 1,318 | 1,182 | 986 | 1,273 | (9) | (5) | $ | 4,689 | 5,104 | (8) | |||||||||||||||||||||||||||||||||||||||||||||||

| Revenue by Line of Business | |||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| Middle Market Banking | $ | 2,144 | 2,187 | 2,153 | 2,078 | 2,196 | (2) | (2) | $ | 8,562 | 8,762 | (2) | |||||||||||||||||||||||||||||||||||||||||||||||

| Asset-Based Lending and Leasing | 1,027 | 1,146 | 969 | 1,074 | 1,172 | (10) | (12) | 4,216 | 4,687 | (10) | |||||||||||||||||||||||||||||||||||||||||||||||||

| Total revenue | $ | 3,171 | 3,333 | 3,122 | 3,152 | 3,368 | (5) | (6) | $ | 12,778 | 13,449 | (5) | |||||||||||||||||||||||||||||||||||||||||||||||

| Revenue by Product | |||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| Lending and leasing | $ | 1,291 | 1,293 | 1,308 | 1,309 | 1,337 | — | (3) | $ | 5,201 | 5,314 | (2) | |||||||||||||||||||||||||||||||||||||||||||||||

| Treasury management and payments | 1,423 | 1,434 | 1,412 | 1,421 | 1,527 | (1) | (7) | 5,690 | 6,214 | (8) | |||||||||||||||||||||||||||||||||||||||||||||||||

| Other | 457 | 606 | 402 | 422 | 504 | (25) | (9) | 1,887 | 1,921 | (2) | |||||||||||||||||||||||||||||||||||||||||||||||||

| Total revenue | $ | 3,171 | 3,333 | 3,122 | 3,152 | 3,368 | (5) | (6) | $ | 12,778 | 13,449 | (5) | |||||||||||||||||||||||||||||||||||||||||||||||

| Selected Metrics | |||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| Return on allocated capital | 17.4 | % | 19.2 | 17.3 | 14.3 | 19.0 | 17.1 | % | 19.1 | ||||||||||||||||||||||||||||||||||||||||||||||||||

| Efficiency ratio | 48 | 44 | 48 | 53 | 48 | 48 | 49 | ||||||||||||||||||||||||||||||||||||||||||||||||||||

| Quarter ended | Dec 31, 2024 % Change from |

Year ended | |||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| ($ in millions) | Dec 31, 2024 |

Sep 30, 2024 |

Jun 30, 2024 |

Mar 31, 2024 |

Dec 31, 2023 |

Sep 30, 2024 |

Dec 31, 2023 |

Dec 31, 2024 |

Dec 31, 2023 |

% Change |

|||||||||||||||||||||||||||||||||||||||||||||||||

| Selected Balance Sheet Data (average) | |||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| Loans: | |||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| Commercial and industrial | $ | 162,060 | 161,967 | 164,027 | 163,273 | 162,877 | — | % | (1) | $ | 162,827 | 164,062 | (1) | % | |||||||||||||||||||||||||||||||||||||||||||||

| Commercial real estate | 44,555 | 44,756 | 44,990 | 45,296 | 45,393 | — | (2) | 44,898 | 45,705 | (2) | |||||||||||||||||||||||||||||||||||||||||||||||||

| Lease financing and other | 15,180 | 15,393 | 15,406 | 15,352 | 15,062 | (1) | 1 | 15,332 | 14,335 | 7 | |||||||||||||||||||||||||||||||||||||||||||||||||

| Total loans | $ | 221,795 | 222,116 | 224,423 | 223,921 | 223,332 | — | (1) | $ | 223,057 | 224,102 | — | |||||||||||||||||||||||||||||||||||||||||||||||

| Loans by Line of Business: | |||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| Middle Market Banking | $ | 126,767 | 127,321 | 128,259 | 119,273 | 118,971 | — | 7 | $ | 125,414 | 120,819 | 4 | |||||||||||||||||||||||||||||||||||||||||||||||

| Asset-Based Lending and Leasing | 95,028 | 94,795 | 96,164 | 104,648 | 104,361 | — | (9) | 97,643 | 103,283 | (5) | |||||||||||||||||||||||||||||||||||||||||||||||||

| Total loans | $ | 221,795 | 222,116 | 224,423 | 223,921 | 223,332 | — | (1) | $ | 223,057 | 224,102 | — | |||||||||||||||||||||||||||||||||||||||||||||||

| Total deposits | 184,293 | 173,158 | 166,892 | 164,027 | 163,299 | 6 | 13 | 172,129 | 165,235 | 4 | |||||||||||||||||||||||||||||||||||||||||||||||||

| Allocated capital | 26,000 | 26,000 | 26,000 | 26,000 | 25,500 | — | 2 | 26,000 | 25,500 | 2 | |||||||||||||||||||||||||||||||||||||||||||||||||

| Selected Balance Sheet Data (period-end) | |||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| Loans: | |||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| Commercial and industrial | $ | 163,464 | 163,878 | 165,878 | 166,842 | 163,797 | — | — | |||||||||||||||||||||||||||||||||||||||||||||||||||

| Commercial real estate | 44,506 | 44,715 | 44,978 | 45,292 | 45,534 | — | (2) | ||||||||||||||||||||||||||||||||||||||||||||||||||||

| Lease financing and other | 15,348 | 15,406 | 15,617 | 15,526 | 15,443 | — | (1) | ||||||||||||||||||||||||||||||||||||||||||||||||||||

| Total loans | $ | 223,318 | 223,999 | 226,473 | 227,660 | 224,774 | — | (1) | |||||||||||||||||||||||||||||||||||||||||||||||||||

| Loans by Line of Business: | |||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

Middle Market Banking |

$ | 126,877 | 127,048 | 129,023 | 120,401 | 118,482 | — | 7 | |||||||||||||||||||||||||||||||||||||||||||||||||||

Asset-Based Lending and Leasing |

96,441 | 96,951 | 97,450 | 107,259 | 106,292 | (1) | (9) | ||||||||||||||||||||||||||||||||||||||||||||||||||||

| Total loans | $ | 223,318 | 223,999 | 226,473 | 227,660 | 224,774 | — | (1) | |||||||||||||||||||||||||||||||||||||||||||||||||||

| Total deposits | 188,650 | 178,406 | 168,979 | 168,547 | 162,526 | 6 | 16 | ||||||||||||||||||||||||||||||||||||||||||||||||||||

| Quarter ended | Dec 31, 2024 % Change from |

Year ended | |||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| ($ in millions) | Dec 31, 2024 |

Sep 30, 2024 |

Jun 30, 2024 |

Mar 31, 2024 |

Dec 31, 2023 |

Sep 30, 2024 |

Dec 31, 2023 |

Dec 31, 2024 |

Dec 31, 2023 |

% Change |

|||||||||||||||||||||||||||||||||||||||||||||||||

| Income Statement | |||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| Net interest income | $ | 2,054 | 1,909 | 1,945 | 2,027 | 2,359 | 8 | % | (13) | $ | 7,935 | 9,498 | (16) | % | |||||||||||||||||||||||||||||||||||||||||||||

| Noninterest income: | |||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| Deposit-related fees | 269 | 279 | 263 | 262 | 246 | (4) | 9 | 1,073 | 976 | 10 | |||||||||||||||||||||||||||||||||||||||||||||||||

| Lending-related fees | 221 | 213 | 205 | 203 | 199 | 4 | 11 | 842 | 790 | 7 | |||||||||||||||||||||||||||||||||||||||||||||||||

| Investment banking fees | 726 | 668 | 634 | 647 | 489 | 9 | 48 | 2,675 | 1,738 | 54 | |||||||||||||||||||||||||||||||||||||||||||||||||

| Net gains from trading activities | 933 | 1,366 | 1,387 | 1,405 | 1,022 | (32) | (9) | 5,091 | 4,553 | 12 | |||||||||||||||||||||||||||||||||||||||||||||||||

| Other | 410 | 476 | 404 | 438 | 420 | (14) | (2) | 1,728 | 1,636 | 6 | |||||||||||||||||||||||||||||||||||||||||||||||||

| Total noninterest income | 2,559 | 3,002 | 2,893 | 2,955 | 2,376 | (15) | 8 | 11,409 | 9,693 | 18 | |||||||||||||||||||||||||||||||||||||||||||||||||

| Total revenue | 4,613 | 4,911 | 4,838 | 4,982 | 4,735 | (6) | (3) | 19,344 | 19,191 | 1 | |||||||||||||||||||||||||||||||||||||||||||||||||

| Net charge-offs | 214 | 196 | 303 | 196 | 376 | 9 | (43) | 909 | 581 | 56 | |||||||||||||||||||||||||||||||||||||||||||||||||

| Change in the allowance for credit losses | (9) | (170) | (18) | (191) | 122 | 95 | NM | (388) | 1,426 | NM | |||||||||||||||||||||||||||||||||||||||||||||||||

| Provision for credit losses | 205 | 26 | 285 | 5 | 498 | 688 | (59) | 521 | 2,007 | (74) | |||||||||||||||||||||||||||||||||||||||||||||||||

| Noninterest expense | 2,300 | 2,229 | 2,170 | 2,330 | 2,132 | 3 | 8 | 9,029 | 8,618 | 5 | |||||||||||||||||||||||||||||||||||||||||||||||||

| Income before income tax expense | 2,108 | 2,656 | 2,383 | 2,647 | 2,105 | (21) | — | 9,794 | 8,566 | 14 | |||||||||||||||||||||||||||||||||||||||||||||||||

| Income tax expense | 528 | 664 | 598 | 666 | 523 | (20) | 1 | 2,456 | 2,140 | 15 | |||||||||||||||||||||||||||||||||||||||||||||||||

| Net income | $ | 1,580 | 1,992 | 1,785 | 1,981 | 1,582 | (21) | — | $ | 7,338 | 6,426 | 14 | |||||||||||||||||||||||||||||||||||||||||||||||

| Revenue by Line of Business | |||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| Banking: | |||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| Lending | $ | 691 | 698 | 688 | 681 | 774 | (1) | (11) | $ | 2,758 | 2,872 | (4) | |||||||||||||||||||||||||||||||||||||||||||||||

| Treasury Management and Payments | 644 | 695 | 687 | 686 | 742 | (7) | (13) | 2,712 | 3,036 | (11) | |||||||||||||||||||||||||||||||||||||||||||||||||

| Investment Banking | 491 | 419 | 430 | 474 | 383 | 17 | 28 | 1,814 | 1,404 | 29 | |||||||||||||||||||||||||||||||||||||||||||||||||

| Total Banking | 1,826 | 1,812 | 1,805 | 1,841 | 1,899 | 1 | (4) | 7,284 | 7,312 | — | |||||||||||||||||||||||||||||||||||||||||||||||||

| Commercial Real Estate | 1,274 | 1,364 | 1,283 | 1,223 | 1,291 | (7) | (1) | 5,144 | 5,311 | (3) | |||||||||||||||||||||||||||||||||||||||||||||||||

| Markets: | |||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| Fixed Income, Currencies, and Commodities (FICC) | 1,179 | 1,327 | 1,228 | 1,359 | 1,122 | (11) | 5 | 5,093 | 4,688 | 9 | |||||||||||||||||||||||||||||||||||||||||||||||||

| Equities | 385 | 396 | 558 | 450 | 457 | (3) | (16) | 1,789 | 1,809 | (1) | |||||||||||||||||||||||||||||||||||||||||||||||||

Credit Adjustment (CVA/DVA/FVA) and Other (1) |

(71) | 31 | 7 | 19 | (8) | NM | NM | (14) | 65 | NM | |||||||||||||||||||||||||||||||||||||||||||||||||

| Total Markets | 1,493 | 1,754 | 1,793 | 1,828 | 1,571 | (15) | (5) | 6,868 | 6,562 | 5 | |||||||||||||||||||||||||||||||||||||||||||||||||

| Other | 20 | (19) | (43) | 90 | (26) | 205 | 177 | 48 | 6 | 700 | |||||||||||||||||||||||||||||||||||||||||||||||||

| Total revenue | $ | 4,613 | 4,911 | 4,838 | 4,982 | 4,735 | (6) | (3) | $ | 19,344 | 19,191 | 1 | |||||||||||||||||||||||||||||||||||||||||||||||

| Selected Metrics | |||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| Return on allocated capital | 13.4 | % | 17.1 | 15.4 | 17.2 | 13.4 | 15.7 | % | 13.8 | ||||||||||||||||||||||||||||||||||||||||||||||||||

| Efficiency ratio | 50 | 45 | 45 | 47 | 45 | 47 | 45 | ||||||||||||||||||||||||||||||||||||||||||||||||||||

| Quarter ended | Dec 31, 2024 % Change from |

Year ended | |||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| ($ in millions) | Dec 31, 2024 |

Sep 30, 2024 |

Jun 30, 2024 |

Mar 31, 2024 |

Dec 31, 2023 |

Sep 30, 2024 |

Dec 31, 2023 |

Dec 31, 2024 |

Dec 31, 2023 |

% Change |