| Delaware | 001-02979 | No. | 41-0449260 | ||||||||||||||

| (State or Other Jurisdiction of Incorporation) |

(Commission File Number) |

(IRS Employer Identification No.) |

|||||||||||||||

Title of Each Class |

Trading Symbol |

Name of Each Exchange on Which Registered |

||||||

Common Stock, par value $1-2/3 |

WFC |

New York Stock

Exchange

(NYSE)

|

||||||

7.5% Non-Cumulative Perpetual Convertible Class A Preferred Stock, Series L |

WFC.PRL |

NYSE |

||||||

Depositary Shares, each representing a 1/1000th interest in a share of 6.625% Fixed-to-Floating Rate Non-Cumulative Perpetual Class A Preferred Stock, Series R |

WFC.PRR |

NYSE |

||||||

Depositary Shares, each representing a 1/1000th interest in a share of Non-Cumulative Perpetual Class A Preferred Stock, Series Y |

WFC.PRY |

NYSE |

||||||

Depositary Shares, each representing a 1/1000th interest in a share of Non-Cumulative Perpetual Class A Preferred Stock, Series Z |

WFC.PRZ |

NYSE |

||||||

Depositary Shares, each representing a 1/1000th interest in a share of Non-Cumulative Perpetual Class A Preferred Stock, Series AA |

WFC.PRA |

NYSE |

||||||

| Depositary Shares, each representing a 1/1000th interest in a share of Non-Cumulative Perpetual Class A Preferred Stock, Series CC | WFC.PRC |

NYSE |

||||||

| Depositary Shares, each representing a 1/1000th interest in a share of Non-Cumulative Perpetual Class A Preferred Stock, Series DD | WFC.PRD |

NYSE |

||||||

Guarantee of Medium-Term Notes, Series A, due October 30, 2028 of Wells Fargo Finance LLC |

WFC/28A |

NYSE |

||||||

| Exhibit No. | Description | Location | ||||||

| Filed herewith | ||||||||

| Filed herewith | ||||||||

|

Furnished herewith, except for

the “2024 net interest income

considerations” portion on

page 18, which portion is

deemed filed herewith

|

||||||||

| 104 | Cover Page Interactive Data File | Embedded within the Inline XBRL document |

||||||

| Dated: | January 12, 2024 | WELLS FARGO & COMPANY | |||||||||

| By: | /s/ MUNEERA S. CARR | ||||||||||

| Muneera S. Carr | |||||||||||

|

Executive Vice President,

Chief Accounting Officer and Controller

|

|||||||||||

|

News Release | January 12, 2024

Wells Fargo Reports Fourth Quarter 2023 Net Income of $3.4 billion, or $0.86 per Diluted Share

Full Year 2023 Net Income of $19.1 billion, or $4.83 per Diluted Share

|

||||

Company-wide Financial Summary |

||||||||||||||

| Quarter ended | ||||||||||||||

| Dec 31, 2023 |

Dec 31, 2022 |

|||||||||||||

|

Selected Income Statement Data

($ in millions except per share amounts)

|

||||||||||||||

| Total revenue | $ | 20,478 | 20,034 | |||||||||||

| Noninterest expense | 15,786 | 16,186 | ||||||||||||

| Provision for credit losses1 | 1,282 | 957 | ||||||||||||

| Net income | 3,446 | 3,155 | ||||||||||||

| Diluted earnings per common share | 0.86 | 0.75 | ||||||||||||

|

Selected Balance Sheet Data

($ in billions)

|

||||||||||||||

| Average loans | $ | 938.0 | 948.5 | |||||||||||

| Average deposits | 1,340.9 | 1,380.5 | ||||||||||||

CET12 |

11.4 | % | 10.6 | |||||||||||

| Performance Metrics | ||||||||||||||

| ROE3 | 7.6 | % | 7.1 | |||||||||||

ROTCE4 |

9.0 | 8.5 | ||||||||||||

Operating Segments and Other Highlights | |||||||||||||||||||||||

| Quarter ended | Dec 31, 2023 % Change from |

||||||||||||||||||||||

| ($ in billions) | Dec 31, 2023 |

Sep 30, 2023 |

Dec 31, 2022 |

||||||||||||||||||||

| Average loans | |||||||||||||||||||||||

| Consumer Banking and Lending | $ | 333.5 | (1) | % | (1) | ||||||||||||||||||

| Commercial Banking | 223.3 | — | 2 | ||||||||||||||||||||

| Corporate and Investment Banking | 290.1 | (1) | (3) | ||||||||||||||||||||

| Wealth and Investment Management | 82.2 | — | (3) | ||||||||||||||||||||

| Average deposits | |||||||||||||||||||||||

| Consumer Banking and Lending | 779.5 | (3) | (10) | ||||||||||||||||||||

| Commercial Banking | 163.3 | 2 | (7) | ||||||||||||||||||||

| Corporate and Investment Banking | 173.1 | 10 | 11 | ||||||||||||||||||||

| Wealth and Investment Management | 102.1 | (5) | (28) | ||||||||||||||||||||

Fourth quarter 2023 results included: | ||

|

Chief Executive Officer Charlie Scharf commented, “Although our improved 2023 results benefited from the strong economic environment and higher interest rates, our continued focus on efficiency and strong credit discipline were important contributors as well.”

“We continue to execute on our strategic priorities and while it is early and we have more to do, we are starting to see improved growth and increased market share in parts of the company which we believe will drive higher returns over time. For example, our new credit card products have driven an increase in consumer spend at a rate significantly better than the industry average. We have also been investing in the Corporate and Investment Bank where revenue grew 26% from a year ago and our investment banking and trading market shares increased. The positive results in both areas were accomplished while maintaining our existing risk appetite,” Scharf continued.

“Additionally, continued execution of our more focused home lending strategy should also produce higher returns and earnings over the next several years. And while our Consumer, Small and Business Banking, Commercial Banking, and Wealth and Investment Management businesses remain strong, opportunities to increase share are significant,” Scharf added.

“As we look forward, our business performance remains sensitive to interest rates and the health of the U.S. economy, but we are confident that the actions we are taking will drive stronger returns over the cycle. We are closely monitoring credit and while we see modest deterioration, it remains consistent with our expectations. Our capital position remains strong and returning excess capital to shareholders remains a priority,” Scharf continued.

“I want to thank everyone who works at Wells Fargo for their dedication, talent, and all they do to move our company forward.” Scharf concluded.

| ||

| Quarter ended | Dec 31, 2023 % Change from |

Year ended | ||||||||||||||||||||||||||||||||||||||||||

| Dec 31, 2023 |

Sep 30, 2023 |

Dec 31, 2022 |

Sep 30, 2023 |

Dec 31, 2022 |

Dec 31, 2023 |

Dec 31, 2022 |

||||||||||||||||||||||||||||||||||||||

| Earnings ($ in millions except per share amounts) | ||||||||||||||||||||||||||||||||||||||||||||

| Net interest income | $ | 12,771 | 13,105 | 13,433 | (3) | % | (5) | $ | 52,375 | 44,950 | ||||||||||||||||||||||||||||||||||

| Noninterest income | 7,707 | 7,752 | 6,601 | (1) | 17 | 30,222 | 29,418 | |||||||||||||||||||||||||||||||||||||

| Total revenue | 20,478 | 20,857 | 20,034 | (2) | 2 | 82,597 | 74,368 | |||||||||||||||||||||||||||||||||||||

| Net charge-offs | 1,258 | 864 | 560 | 46 | 125 | 3,450 | 1,609 | |||||||||||||||||||||||||||||||||||||

| Change in the allowance for credit losses | 24 | 333 | 397 | (93) | (94) | 1,949 | (75) | |||||||||||||||||||||||||||||||||||||

| Provision for credit losses (a) | 1,282 | 1,197 | 957 | 7 | 34 | 5,399 | 1,534 | |||||||||||||||||||||||||||||||||||||

| Noninterest expense | 15,786 | 13,113 | 16,186 | 20 | (2) | 55,562 | 57,205 | |||||||||||||||||||||||||||||||||||||

Income tax expense (benefit) |

(100) | 811 | (29) | NM | 245 | 2,607 | 2,251 | |||||||||||||||||||||||||||||||||||||

| Wells Fargo net income | $ | 3,446 | 5,767 | 3,155 | (40) | 9 | $ | 19,142 | 13,677 | |||||||||||||||||||||||||||||||||||

| Diluted earnings per common share | 0.86 | 1.48 | 0.75 | (42) | 15 | 4.83 | 3.27 | |||||||||||||||||||||||||||||||||||||

| Balance Sheet Data (average) ($ in billions) | ||||||||||||||||||||||||||||||||||||||||||||

| Loans | $ | 938.0 | 943.2 | 948.5 | (1) | (1) | $ | 943.9 | 929.8 | |||||||||||||||||||||||||||||||||||

| Deposits | 1,340.9 | 1,340.3 | 1,380.5 | — | (3) | 1,346.3 | 1,424.3 | |||||||||||||||||||||||||||||||||||||

| Assets | 1,907.5 | 1,891.9 | 1,875.2 | 1 | 2 | 1,885.5 | 1,894.3 | |||||||||||||||||||||||||||||||||||||

Financial Ratios |

||||||||||||||||||||||||||||||||||||||||||||

| Return on assets (ROA) | 0.72 | % | 1.21 | 0.67 | 1.02 | % | 0.72 | |||||||||||||||||||||||||||||||||||||

| Return on equity (ROE) | 7.6 | 13.3 | 7.1 | 11.0 | 7.8 | |||||||||||||||||||||||||||||||||||||||

Return on average tangible common equity (ROTCE) (b) |

9.0 | 15.9 | 8.5 | 13.1 | 9.3 | |||||||||||||||||||||||||||||||||||||||

| Efficiency ratio (c) | 77 | 63 | 81 | 67 | 77 | |||||||||||||||||||||||||||||||||||||||

| Net interest margin on a taxable-equivalent basis | 2.92 | 3.03 | 3.14 | 3.06 | 2.63 | |||||||||||||||||||||||||||||||||||||||

| Quarter ended | ||||||||||||||||||||

| ($ in billions) | Dec 31, 2023 |

Sep 30, 2023 |

Dec 31, 2022 |

|||||||||||||||||

| Capital: | ||||||||||||||||||||

| Total equity | $ | 187.4 | 182.4 | 182.2 | ||||||||||||||||

| Common stockholders’ equity | 166.4 | 161.4 | 161.0 | |||||||||||||||||

Tangible common equity (a) |

141.2 | 136.2 | 134.1 | |||||||||||||||||

Common Equity Tier 1 (CET1) ratio (b) |

11.4 | % | 11.0 | 10.6 | ||||||||||||||||

Total loss absorbing capacity (TLAC) ratio (c) |

25.0 | 24.0 | 23.3 | |||||||||||||||||

Supplementary Leverage Ratio (SLR) (d) |

7.1 | 6.9 | 6.9 | |||||||||||||||||

| Liquidity: | ||||||||||||||||||||

| Liquidity Coverage Ratio (LCR) (e) | 125 | % | 123 | 122 | ||||||||||||||||

| Quarter ended | ||||||||||||||||||||

| ($ in millions) | Dec 31, 2023 |

Sep 30, 2023 |

Dec 31, 2022 |

|||||||||||||||||

| Net loan charge-offs | $ | 1,252 | 850 | 560 | ||||||||||||||||

| Net loan charge-offs as a % of average total loans (annualized) | 0.53 | % | 0.36 | 0.23 | ||||||||||||||||

| Total nonaccrual loans | $ | 8,256 | 8,002 | 5,626 | ||||||||||||||||

| As a % of total loans | 0.88 | % | 0.85 | 0.59 | ||||||||||||||||

| Total nonperforming assets | $ | 8,443 | 8,179 | 5,763 | ||||||||||||||||

| As a % of total loans | 0.90 | % | 0.87 | 0.60 | ||||||||||||||||

| Allowance for credit losses for loans | $ | 15,088 | 15,064 | 13,609 | ||||||||||||||||

| As a % of total loans | 1.61 | % | 1.60 | 1.42 | ||||||||||||||||

| Quarter ended | Dec 31, 2023 % Change from |

||||||||||||||||||||||||||||||||||

| Dec 31, 2023 |

Sep 30, 2023 |

Dec 31, 2022 |

Sep 30, 2023 |

Dec 31, 2022 |

|||||||||||||||||||||||||||||||

| Earnings (in millions) | |||||||||||||||||||||||||||||||||||

Consumer, Small and Business Banking |

$ | 6,657 | 6,665 | 6,608 | — | % | 1 | ||||||||||||||||||||||||||||

| Consumer Lending: | |||||||||||||||||||||||||||||||||||

| Home Lending | 839 | 840 | 786 | — | 7 | ||||||||||||||||||||||||||||||

| Credit Card | 1,346 | 1,375 | 1,353 | (2) | (1) | ||||||||||||||||||||||||||||||

| Auto | 334 | 360 | 413 | (7) | (19) | ||||||||||||||||||||||||||||||

| Personal Lending | 343 | 341 | 303 | 1 | 13 | ||||||||||||||||||||||||||||||

| Total revenue | 9,519 | 9,581 | 9,463 | (1) | 1 | ||||||||||||||||||||||||||||||

| Provision for credit losses | 790 | 768 | 936 | 3 | (16) | ||||||||||||||||||||||||||||||

| Noninterest expense | 6,046 | 5,913 | 7,088 | 2 | (15) | ||||||||||||||||||||||||||||||

| Net income | $ | 2,011 | 2,173 | 1,077 | (7) | 87 | |||||||||||||||||||||||||||||

| Average balances (in billions) | |||||||||||||||||||||||||||||||||||

| Loans | $ | 333.5 | 335.5 | 338.0 | (1) | (1) | |||||||||||||||||||||||||||||

| Deposits | 779.5 | 801.1 | 864.6 | (3) | (10) | ||||||||||||||||||||||||||||||

| Quarter ended | Dec 31, 2023 % Change from |

||||||||||||||||||||||||||||||||||

| Dec 31, 2023 |

Sep 30, 2023 |

Dec 31, 2022 |

Sep 30, 2023 |

Dec 31, 2022 |

|||||||||||||||||||||||||||||||

| Earnings (in millions) | |||||||||||||||||||||||||||||||||||

| Middle Market Banking | $ | 2,196 | 2,212 | 2,076 | (1) | % | 6 | ||||||||||||||||||||||||||||

| Asset-Based Lending and Leasing | 1,172 | 1,193 | 1,073 | (2) | 9 | ||||||||||||||||||||||||||||||

| Total revenue | 3,368 | 3,405 | 3,149 | (1) | 7 | ||||||||||||||||||||||||||||||

| Provision for credit losses | 40 | 52 | (43) | (23) | 193 | ||||||||||||||||||||||||||||||

| Noninterest expense | 1,630 | 1,543 | 1,523 | 6 | 7 | ||||||||||||||||||||||||||||||

| Net income | $ | 1,273 | 1,354 | 1,238 | (6) | 3 | |||||||||||||||||||||||||||||

| Average balances (in billions) | |||||||||||||||||||||||||||||||||||

| Loans | $ | 223.3 | 224.4 | 218.4 | — | 2 | |||||||||||||||||||||||||||||

| Deposits | 163.3 | 160.6 | 175.4 | 2 | (7) | ||||||||||||||||||||||||||||||

| Quarter ended | Dec 31, 2023 % Change from |

||||||||||||||||||||||||||||||||||

| Dec 31, 2023 |

Sep 30, 2023 |

Dec 31, 2022 |

Sep 30, 2023 |

Dec 31, 2022 |

|||||||||||||||||||||||||||||||

| Earnings (in millions) | |||||||||||||||||||||||||||||||||||

| Banking: | |||||||||||||||||||||||||||||||||||

| Lending | $ | 774 | 721 | 593 | 7 | % | 31 | ||||||||||||||||||||||||||||

| Treasury Management and Payments | 742 | 747 | 738 | (1) | 1 | ||||||||||||||||||||||||||||||

| Investment Banking | 383 | 430 | 317 | (11) | 21 | ||||||||||||||||||||||||||||||

| Total Banking | 1,899 | 1,898 | 1,648 | — | 15 | ||||||||||||||||||||||||||||||

| Commercial Real Estate | 1,291 | 1,376 | 1,267 | (6) | 2 | ||||||||||||||||||||||||||||||

| Markets: | |||||||||||||||||||||||||||||||||||

| Fixed Income, Currencies, and Commodities (FICC) | 1,122 | 1,148 | 935 | (2) | 20 | ||||||||||||||||||||||||||||||

| Equities | 457 | 518 | 279 | (12) | 64 | ||||||||||||||||||||||||||||||

| Credit Adjustment (CVA/DVA) and Other | (8) | (12) | (35) | 33 | 77 | ||||||||||||||||||||||||||||||

| Total Markets | 1,571 | 1,654 | 1,179 | (5) | 33 | ||||||||||||||||||||||||||||||

| Other | (26) | (5) | 45 | NM | NM | ||||||||||||||||||||||||||||||

| Total revenue | 4,735 | 4,923 | 4,139 | (4) | 14 | ||||||||||||||||||||||||||||||

| Provision for credit losses | 498 | 324 | 41 | 54 | NM | ||||||||||||||||||||||||||||||

| Noninterest expense | 2,132 | 2,182 | 1,837 | (2) | 16 | ||||||||||||||||||||||||||||||

| Net income | $ | 1,582 | 1,816 | 1,692 | (13) | (7) | |||||||||||||||||||||||||||||

| Average balances (in billions) | |||||||||||||||||||||||||||||||||||

| Loans | $ | 290.1 | 291.7 | 298.3 | (1) | (3) | |||||||||||||||||||||||||||||

| Deposits | 173.1 | 157.2 | 156.2 | 10 | 11 | ||||||||||||||||||||||||||||||

| Quarter ended | Dec 31, 2023 % Change from |

|||||||||||||||||||||||||||||||

| Dec 31, 2023 |

Sep 30, 2023 |

Dec 31, 2022 |

Sep 30, 2023 |

Dec 31, 2022 |

||||||||||||||||||||||||||||

| Earnings (in millions) | ||||||||||||||||||||||||||||||||

| Net interest income | $ | 906 | 1,007 | 1,124 | (10) | % | (19) | |||||||||||||||||||||||||

| Noninterest income | 2,754 | 2,695 | 2,571 | 2 | 7 | |||||||||||||||||||||||||||

| Total revenue | 3,660 | 3,702 | 3,695 | (1) | (1) | |||||||||||||||||||||||||||

| Provision for credit losses | (19) | (10) | 11 | (90) | NM | |||||||||||||||||||||||||||

| Noninterest expense | 3,023 | 3,006 | 2,731 | 1 | 11 | |||||||||||||||||||||||||||

| Net income | $ | 491 | 529 | 715 | (7) | (31) | ||||||||||||||||||||||||||

| Total client assets (in billions) | 2,084 | 1,948 | 1,861 | 7 | 12 | |||||||||||||||||||||||||||

| Average balances (in billions) | ||||||||||||||||||||||||||||||||

| Loans | $ | 82.2 | 82.2 | 84.8 | — | (3) | ||||||||||||||||||||||||||

| Deposits | 102.1 | 107.5 | 142.2 | (5) | (28) | |||||||||||||||||||||||||||

| Quarter ended | Dec 31, 2023 % Change from |

|||||||||||||||||||||||||||||||

| Dec 31, 2023 |

Sep 30, 2023 |

Dec 31, 2022 |

Sep 30, 2023 |

Dec 31, 2022 |

||||||||||||||||||||||||||||

| Earnings (in millions) | ||||||||||||||||||||||||||||||||

| Net interest income | $ | (544) | (269) | 78 | NM | NM | ||||||||||||||||||||||||||

| Noninterest income | 284 | 21 | 7 | NM | NM | |||||||||||||||||||||||||||

| Total revenue | (260) | (248) | 85 | (5) | % | NM | ||||||||||||||||||||||||||

| Provision for credit losses | (27) | 63 | 12 | NM | NM | |||||||||||||||||||||||||||

| Noninterest expense | 2,955 | 469 | 3,007 | 530 | (2) | |||||||||||||||||||||||||||

Net loss |

$ | (1,911) | (105) | (1,567) | NM | (22) | ||||||||||||||||||||||||||

| ||

| Pages | |||||

| Consolidated Results | |||||

| Average Balances and Interest Rates (Taxable-Equivalent Basis) | |||||

| Reportable Operating Segment Results | |||||

Combined Segment Results

|

|||||

| Consumer Banking and Lending | |||||

| Commercial Banking | |||||

| Corporate and Investment Banking | |||||

| Wealth and Investment Management | |||||

| Corporate | |||||

| Credit-Related Information | |||||

Consolidated Loans Outstanding – Period-End Balances, Average Balances, and Average Interest Rates |

|||||

| Net Loan Charge-offs | |||||

| Changes in Allowance for Credit Losses for Loans | |||||

| Allocation of the Allowance for Credit Losses for Loans | |||||

Nonperforming Assets (Nonaccrual Loans and Foreclosed Assets) |

|||||

| Commercial and Industrial Loans and Lease Financing by Industry | |||||

| Commercial Real Estate Loans by Property Type | |||||

| Equity | |||||

| Tangible Common Equity | |||||

| Risk-Based Capital Ratios Under Basel III – Standardized Approach | |||||

| Risk-Based Capital Ratios Under Basel III – Advanced Approach | |||||

| Quarter ended | Dec 31, 2023 % Change from |

Year ended | |||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| (in millions, except ratios and per share amounts) | Dec 31, 2023 |

Sep 30, 2023 |

Jun 30, 2023 |

Mar 31, 2023 |

Dec 31, 2022 |

Sep 30, 2023 |

Dec 31, 2022 |

Dec 31, 2023 |

Dec 31, 2022 |

% Change |

|||||||||||||||||||||||||||||||||||||||||||||||||

| Selected Income Statement Data | |||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| Total revenue | $ | 20,478 | 20,857 | 20,533 | 20,729 | 20,034 | (2) | % | 2 | $ | 82,597 | 74,368 | 11 | % | |||||||||||||||||||||||||||||||||||||||||||||

| Noninterest expense | 15,786 | 13,113 | 12,987 | 13,676 | 16,186 | 20 | (2) | 55,562 | 57,205 | (3) | |||||||||||||||||||||||||||||||||||||||||||||||||

| Pre-tax pre-provision profit (PTPP) (1) | 4,692 | 7,744 | 7,546 | 7,053 | 3,848 | (39) | 22 | 27,035 | 17,163 | 58 | |||||||||||||||||||||||||||||||||||||||||||||||||

| Provision for credit losses (2) | 1,282 | 1,197 | 1,713 | 1,207 | 957 | 7 | 34 | 5,399 | 1,534 | 252 | |||||||||||||||||||||||||||||||||||||||||||||||||

| Wells Fargo net income | 3,446 | 5,767 | 4,938 | 4,991 | 3,155 | (40) | 9 | 19,142 | 13,677 | 40 | |||||||||||||||||||||||||||||||||||||||||||||||||

| Wells Fargo net income applicable to common stock | 3,160 | 5,450 | 4,659 | 4,713 | 2,877 | (42) | 10 | 17,982 | 12,562 | 43 | |||||||||||||||||||||||||||||||||||||||||||||||||

| Common Share Data | |||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| Diluted earnings per common share | 0.86 | 1.48 | 1.25 | 1.23 | 0.75 | (42) | 15 | 4.83 | 3.27 | 48 | |||||||||||||||||||||||||||||||||||||||||||||||||

| Dividends declared per common share | 0.35 | 0.35 | 0.30 | 0.30 | 0.30 | — | 17 | 1.30 | 1.10 | 18 | |||||||||||||||||||||||||||||||||||||||||||||||||

| Common shares outstanding | 3,598.9 | 3,637.9 | 3,667.7 | 3,763.2 | 3,833.8 | (1) | (6) | ||||||||||||||||||||||||||||||||||||||||||||||||||||

| Average common shares outstanding | 3,620.9 | 3,648.8 | 3,699.9 | 3,785.6 | 3,799.9 | (1) | (5) | 3,688.3 | 3,805.2 | (3) | |||||||||||||||||||||||||||||||||||||||||||||||||

| Diluted average common shares outstanding | 3,657.0 | 3,680.6 | 3,724.9 | 3,818.7 | 3,832.7 | (1) | (5) | 3,720.4 | 3,837.0 | (3) | |||||||||||||||||||||||||||||||||||||||||||||||||

| Book value per common share (3) | $ | 46.25 | 44.37 | 43.87 | 43.02 | 41.98 | 4 | 10 | |||||||||||||||||||||||||||||||||||||||||||||||||||

Tangible book value per common share (3)(4) |

39.23 | 37.43 | 36.53 | 35.87 | 34.98 | 5 | 12 | ||||||||||||||||||||||||||||||||||||||||||||||||||||

| Selected Equity Data (period-end) | |||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| Total equity | 187,443 | 182,373 | 181,952 | 183,220 | 182,213 | 3 | 3 | ||||||||||||||||||||||||||||||||||||||||||||||||||||

| Common stockholders' equity | 166,444 | 161,424 | 160,916 | 161,893 | 160,952 | 3 | 3 | ||||||||||||||||||||||||||||||||||||||||||||||||||||

Tangible common equity (4) |

141,193 | 136,153 | 133,990 | 134,992 | 134,090 | 4 | 5 | ||||||||||||||||||||||||||||||||||||||||||||||||||||

Performance Ratios |

|||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| Return on average assets (ROA) (5) | 0.72 | % | 1.21 | 1.05 | 1.09 | 0.67 | 1.02 | % | 0.72 | ||||||||||||||||||||||||||||||||||||||||||||||||||

| Return on average equity (ROE) (6) | 7.6 | 13.3 | 11.4 | 11.7 | 7.1 | 11.0 | 7.8 | ||||||||||||||||||||||||||||||||||||||||||||||||||||

Return on average tangible common equity (ROTCE) (4) |

9.0 | 15.9 | 13.7 | 14.0 | 8.5 | 13.1 | 9.3 | ||||||||||||||||||||||||||||||||||||||||||||||||||||

Efficiency ratio (7) |

77 | 63 | 63 | 66 | 81 | 67 | 77 | ||||||||||||||||||||||||||||||||||||||||||||||||||||

| Net interest margin on a taxable-equivalent basis | 2.92 | 3.03 | 3.09 | 3.20 | 3.14 | 3.06 | 2.63 | ||||||||||||||||||||||||||||||||||||||||||||||||||||

| Average deposit cost | 1.58 | 1.36 | 1.13 | 0.83 | 0.46 | 1.23 | 0.16 | ||||||||||||||||||||||||||||||||||||||||||||||||||||

| Quarter ended | Dec 31, 2023 % Change from |

Year ended | |||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| ($ in millions, unless otherwise noted) | Dec 31, 2023 |

Sep 30, 2023 |

Jun 30, 2023 |

Mar 31, 2023 |

Dec 31, 2022 |

Sep 30, 2023 |

Dec 31, 2022 |

Dec 31, 2023 |

Dec 31, 2022 |

% Change |

|||||||||||||||||||||||||||||||||||||||||||||||||

Selected Balance Sheet Data (average) |

|||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| Loans | $ | 938,041 | 943,193 | 945,906 | 948,651 | 948,517 | (1) | % | (1) | $ | 943,916 | 929,820 | 2 | % | |||||||||||||||||||||||||||||||||||||||||||||

| Assets | 1,907,535 | 1,891,883 | 1,878,253 | 1,863,676 | 1,875,191 | 1 | 2 | 1,885,475 | 1,894,303 | — | |||||||||||||||||||||||||||||||||||||||||||||||||

| Deposits | 1,340,916 | 1,340,307 | 1,347,449 | 1,356,694 | 1,380,459 | — | (3) | 1,346,282 | 1,424,269 | (5) | |||||||||||||||||||||||||||||||||||||||||||||||||

| Selected Balance Sheet Data (period-end) | |||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| Debt securities | 490,458 | 490,726 | 503,468 | 511,597 | 496,808 | — | (1) | ||||||||||||||||||||||||||||||||||||||||||||||||||||

| Loans | 936,682 | 942,424 | 947,960 | 947,991 | 955,871 | (1) | (2) | ||||||||||||||||||||||||||||||||||||||||||||||||||||

| Allowance for credit losses for loans | 15,088 | 15,064 | 14,786 | 13,705 | 13,609 | — | 11 | ||||||||||||||||||||||||||||||||||||||||||||||||||||

| Equity securities | 57,336 | 56,026 | 67,471 | 60,610 | 64,414 | 2 | (11) | ||||||||||||||||||||||||||||||||||||||||||||||||||||

| Assets | 1,932,468 | 1,909,261 | 1,876,320 | 1,886,400 | 1,881,020 | 1 | 3 | ||||||||||||||||||||||||||||||||||||||||||||||||||||

| Deposits | 1,358,173 | 1,354,010 | 1,344,584 | 1,362,629 | 1,383,985 | — | (2) | ||||||||||||||||||||||||||||||||||||||||||||||||||||

| Headcount (#) (period-end) | 225,869 | 227,363 | 233,834 | 235,591 | 238,698 | (1) | (5) | ||||||||||||||||||||||||||||||||||||||||||||||||||||

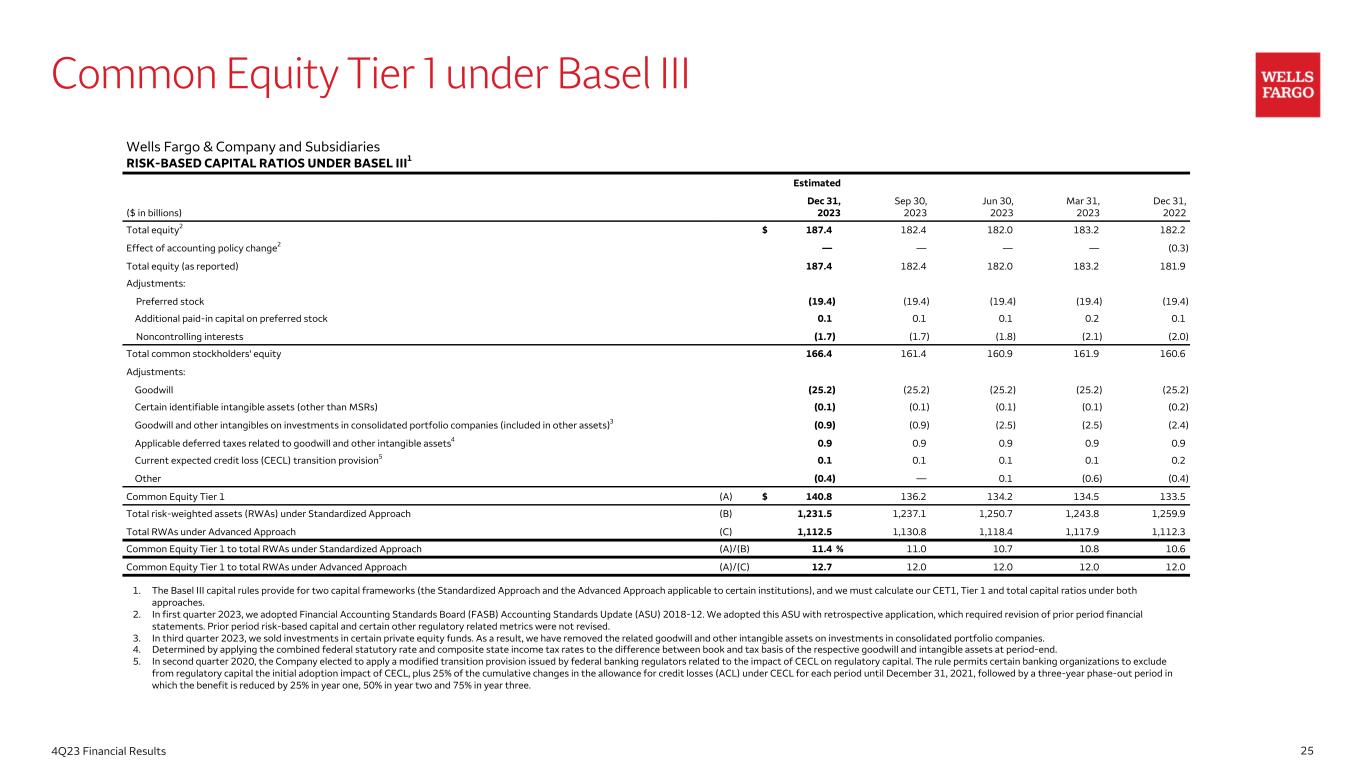

Capital and other metrics (1) |

|||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| Risk-based capital ratios and components (2): | |||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| Standardized Approach: | |||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| Common Equity Tier 1 (CET1) | 11.4 | % | 11.0 | 10.7 | 10.8 | 10.6 | |||||||||||||||||||||||||||||||||||||||||||||||||||||

| Tier 1 capital | 13.0 | 12.6 | 12.2 | 12.3 | 12.1 | ||||||||||||||||||||||||||||||||||||||||||||||||||||||

| Total capital | 15.7 | 15.3 | 15.0 | 15.1 | 14.8 | ||||||||||||||||||||||||||||||||||||||||||||||||||||||

| Risk-weighted assets (RWAs) (in billions) | $ | 1,231.5 | 1,237.1 | 1,250.7 | 1,243.8 | 1,259.9 | — | (2) | |||||||||||||||||||||||||||||||||||||||||||||||||||

| Advanced Approach: | |||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| Common Equity Tier 1 (CET1) | 12.7 | % | 12.0 | 12.0 | 12.0 | 12.0 | |||||||||||||||||||||||||||||||||||||||||||||||||||||

| Tier 1 capital | 14.4 | 13.7 | 13.7 | 13.7 | 13.7 | ||||||||||||||||||||||||||||||||||||||||||||||||||||||

| Total capital | 16.4 | 15.8 | 15.8 | 15.9 | 15.9 | ||||||||||||||||||||||||||||||||||||||||||||||||||||||

| Risk-weighted assets (RWAs) (in billions) | $ | 1,112.5 | 1,130.8 | 1,118.4 | 1,117.9 | 1,112.3 | (2) | — | |||||||||||||||||||||||||||||||||||||||||||||||||||

| Tier 1 leverage ratio | 8.5 | % | 8.3 | 8.3 | 8.4 | 8.3 | |||||||||||||||||||||||||||||||||||||||||||||||||||||

| Supplementary Leverage Ratio (SLR) | 7.1 | 6.9 | 6.9 | 7.0 | 6.9 | ||||||||||||||||||||||||||||||||||||||||||||||||||||||

Total Loss Absorbing Capacity (TLAC) Ratio (3) |

25.0 | 24.0 | 23.1 | 23.3 | 23.3 | ||||||||||||||||||||||||||||||||||||||||||||||||||||||

Liquidity Coverage Ratio (LCR) (4) |

125 | 123 | 123 | 122 | 122 | ||||||||||||||||||||||||||||||||||||||||||||||||||||||

| Quarter ended | Dec 31, 2023 % Change from |

Year ended | |||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| (in millions, except per share amounts) | Dec 31, 2023 |

Sep 30, 2023 |

Jun 30, 2023 |

Mar 31, 2023 |

Dec 31, 2022 |

Sep 30, 2023 |

Dec 31, 2022 |

Dec 31, 2023 |

Dec 31, 2022 |

% Change |

|||||||||||||||||||||||||||||||||||||||||||||||||

| Interest income | $ | 22,839 | 22,093 | 20,830 | 19,356 | 17,793 | 3 | % | 28 | $ | 85,118 | 54,024 | 58 | % | |||||||||||||||||||||||||||||||||||||||||||||

| Interest expense | 10,068 | 8,988 | 7,667 | 6,020 | 4,360 | 12 | 131 | 32,743 | 9,074 | 261 | |||||||||||||||||||||||||||||||||||||||||||||||||

| Net interest income | 12,771 | 13,105 | 13,163 | 13,336 | 13,433 | (3) | (5) | 52,375 | 44,950 | 17 | |||||||||||||||||||||||||||||||||||||||||||||||||

| Noninterest income | |||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| Deposit-related fees | 1,202 | 1,179 | 1,165 | 1,148 | 1,178 | 2 | 2 | 4,694 | 5,316 | (12) | |||||||||||||||||||||||||||||||||||||||||||||||||

| Lending-related fees | 366 | 372 | 352 | 356 | 344 | (2) | 6 | 1,446 | 1,397 | 4 | |||||||||||||||||||||||||||||||||||||||||||||||||

| Investment advisory and other asset-based fees | 2,169 | 2,224 | 2,163 | 2,114 | 2,049 | (2) | 6 | 8,670 | 9,004 | (4) | |||||||||||||||||||||||||||||||||||||||||||||||||

| Commissions and brokerage services fees | 619 | 567 | 570 | 619 | 601 | 9 | 3 | 2,375 | 2,242 | 6 | |||||||||||||||||||||||||||||||||||||||||||||||||

| Investment banking fees | 455 | 492 | 376 | 326 | 331 | (8) | 37 | 1,649 | 1,439 | 15 | |||||||||||||||||||||||||||||||||||||||||||||||||

| Card fees | 1,027 | 1,098 | 1,098 | 1,033 | 1,095 | (6) | (6) | 4,256 | 4,355 | (2) | |||||||||||||||||||||||||||||||||||||||||||||||||

| Mortgage banking | 202 | 193 | 202 | 232 | 79 | 5 | 156 | 829 | 1,383 | (40) | |||||||||||||||||||||||||||||||||||||||||||||||||

| Net gains from trading activities | 1,070 | 1,265 | 1,122 | 1,342 | 552 | (15) | 94 | 4,799 | 2,116 | 127 | |||||||||||||||||||||||||||||||||||||||||||||||||

| Net gains from debt securities | — | 6 | 4 | — | — | (100) | NM | 10 | 151 | (93) | |||||||||||||||||||||||||||||||||||||||||||||||||

Net gains (losses) from equity securities |

35 | (25) | (94) | (357) | (733) | 240 | 105 | (441) | (806) | 45 | |||||||||||||||||||||||||||||||||||||||||||||||||

| Lease income | 292 | 291 | 307 | 347 | 287 | — | 2 | 1,237 | 1,269 | (3) | |||||||||||||||||||||||||||||||||||||||||||||||||

| Other | 270 | 90 | 105 | 233 | 818 | 200 | (67) | 698 | 1,552 | (55) | |||||||||||||||||||||||||||||||||||||||||||||||||

| Total noninterest income | 7,707 | 7,752 | 7,370 | 7,393 | 6,601 | (1) | 17 | 30,222 | 29,418 | 3 | |||||||||||||||||||||||||||||||||||||||||||||||||

| Total revenue | 20,478 | 20,857 | 20,533 | 20,729 | 20,034 | (2) | 2 | 82,597 | 74,368 | 11 | |||||||||||||||||||||||||||||||||||||||||||||||||

| Provision for credit losses (1) | 1,282 | 1,197 | 1,713 | 1,207 | 957 | 7 | 34 | 5,399 | 1,534 | 252 | |||||||||||||||||||||||||||||||||||||||||||||||||

| Noninterest expense | |||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| Personnel | 9,181 | 8,627 | 8,606 | 9,415 | 8,415 | 6 | 9 | 35,829 | 34,340 | 4 | |||||||||||||||||||||||||||||||||||||||||||||||||

| Technology, telecommunications and equipment | 1,076 | 975 | 947 | 922 | 902 | 10 | 19 | 3,920 | 3,375 | 16 | |||||||||||||||||||||||||||||||||||||||||||||||||

| Occupancy | 740 | 724 | 707 | 713 | 722 | 2 | 2 | 2,884 | 2,881 | — | |||||||||||||||||||||||||||||||||||||||||||||||||

| Operating losses | 355 | 329 | 232 | 267 | 3,517 | 8 | (90) | 1,183 | 6,984 | (83) | |||||||||||||||||||||||||||||||||||||||||||||||||

| Professional and outside services | 1,242 | 1,310 | 1,304 | 1,229 | 1,357 | (5) | (8) | 5,085 | 5,188 | (2) | |||||||||||||||||||||||||||||||||||||||||||||||||

| Leases (2) | 168 | 172 | 180 | 177 | 191 | (2) | (12) | 697 | 750 | (7) | |||||||||||||||||||||||||||||||||||||||||||||||||

| Advertising and promotion | 259 | 215 | 184 | 154 | 178 | 20 | 46 | 812 | 505 | 61 | |||||||||||||||||||||||||||||||||||||||||||||||||

| Other | 2,765 | 761 | 827 | 799 | 904 | 263 | 206 | 5,152 | 3,182 | 62 | |||||||||||||||||||||||||||||||||||||||||||||||||

| Total noninterest expense | 15,786 | 13,113 | 12,987 | 13,676 | 16,186 | 20 | (2) | 55,562 | 57,205 | (3) | |||||||||||||||||||||||||||||||||||||||||||||||||

| Income before income tax expense (benefit) | 3,410 | 6,547 | 5,833 | 5,846 | 2,891 | (48) | 18 | 21,636 | 15,629 | 38 | |||||||||||||||||||||||||||||||||||||||||||||||||

| Income tax expense (benefit) | (100) | 811 | 930 | 966 | (29) | NM | 245 | 2,607 | 2,251 | 16 | |||||||||||||||||||||||||||||||||||||||||||||||||

| Net income before noncontrolling interests | 3,510 | 5,736 | 4,903 | 4,880 | 2,920 | (39) | 20 | 19,029 | 13,378 | 42 | |||||||||||||||||||||||||||||||||||||||||||||||||

Less: Net income (loss) from noncontrolling interests |

64 | (31) | (35) | (111) | (235) | 306 | 127 | (113) | (299) | 62 | |||||||||||||||||||||||||||||||||||||||||||||||||

| Wells Fargo net income | $ | 3,446 | 5,767 | 4,938 | 4,991 | 3,155 | (40) | % | 9 | $ | 19,142 | 13,677 | 40 | % | |||||||||||||||||||||||||||||||||||||||||||||

| Less: Preferred stock dividends and other | 286 | 317 | 279 | 278 | 278 | (10) | 3 | 1,160 | 1,115 | 4 | |||||||||||||||||||||||||||||||||||||||||||||||||

| Wells Fargo net income applicable to common stock | $ | 3,160 | 5,450 | 4,659 | 4,713 | 2,877 | (42) | % | 10 | $ | 17,982 | 12,562 | 43 | % | |||||||||||||||||||||||||||||||||||||||||||||

| Per share information | |||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| Earnings per common share | $ | 0.87 | 1.49 | 1.26 | 1.24 | 0.76 | (42) | % | 14 | $ | 4.88 | 3.30 | 48 | % | |||||||||||||||||||||||||||||||||||||||||||||

| Diluted earnings per common share | 0.86 | 1.48 | 1.25 | 1.23 | 0.75 | (42) | 15 | 4.83 | 3.27 | 48 | |||||||||||||||||||||||||||||||||||||||||||||||||

| Dec 31, 2023 % Change from |

|||||||||||||||||||||||||||||||||||||||||

| (in millions) | Dec 31, 2023 |

Sep 30, 2023 |

Jun 30, 2023 |

Mar 31, 2023 |

Dec 31, 2022 |

Sep 30, 2023 |

Dec 31, 2022 |

||||||||||||||||||||||||||||||||||

| Assets | |||||||||||||||||||||||||||||||||||||||||

| Cash and due from banks | $ | 33,026 | 30,815 | 31,915 | 31,958 | 34,596 | 7 | % | (5) | ||||||||||||||||||||||||||||||||

| Interest-earning deposits with banks | 204,193 | 187,081 | 123,418 | 130,478 | 124,561 | 9 | 64 | ||||||||||||||||||||||||||||||||||

| Federal funds sold and securities purchased under resale agreements | 80,456 | 70,431 | 66,500 | 67,288 | 68,036 | 14 | 18 | ||||||||||||||||||||||||||||||||||

| Debt securities: | |||||||||||||||||||||||||||||||||||||||||

| Trading, at fair value | 97,302 | 97,075 | 96,857 | 90,052 | 86,155 | — | 13 | ||||||||||||||||||||||||||||||||||

| Available-for-sale, at fair value | 130,448 | 126,437 | 134,251 | 144,398 | 113,594 | 3 | 15 | ||||||||||||||||||||||||||||||||||

| Held-to-maturity, at amortized cost | 262,708 | 267,214 | 272,360 | 277,147 | 297,059 | (2) | (12) | ||||||||||||||||||||||||||||||||||

| Loans held for sale | 4,936 | 4,308 | 6,029 | 6,199 | 7,104 | 15 | (31) | ||||||||||||||||||||||||||||||||||

| Loans | 936,682 | 942,424 | 947,960 | 947,991 | 955,871 | (1) | (2) | ||||||||||||||||||||||||||||||||||

| Allowance for loan losses | (14,606) | (14,554) | (14,258) | (13,120) | (12,985) | — | (12) | ||||||||||||||||||||||||||||||||||

| Net loans | 922,076 | 927,870 | 933,702 | 934,871 | 942,886 | (1) | (2) | ||||||||||||||||||||||||||||||||||

| Mortgage servicing rights | 8,508 | 9,526 | 9,345 | 9,950 | 10,480 | (11) | (19) | ||||||||||||||||||||||||||||||||||

| Premises and equipment, net | 9,266 | 8,559 | 8,392 | 8,416 | 8,350 | 8 | 11 | ||||||||||||||||||||||||||||||||||

| Goodwill | 25,175 | 25,174 | 25,175 | 25,173 | 25,173 | — | — | ||||||||||||||||||||||||||||||||||

| Derivative assets | 18,223 | 21,096 | 17,990 | 17,117 | 22,774 | (14) | (20) | ||||||||||||||||||||||||||||||||||

| Equity securities | 57,336 | 56,026 | 67,471 | 60,610 | 64,414 | 2 | (11) | ||||||||||||||||||||||||||||||||||

| Other assets | 78,815 | 77,649 | 82,915 | 82,743 | 75,838 | 2 | 4 | ||||||||||||||||||||||||||||||||||

| Total assets | $ | 1,932,468 | 1,909,261 | 1,876,320 | 1,886,400 | 1,881,020 | 1 | 3 | |||||||||||||||||||||||||||||||||

| Liabilities | |||||||||||||||||||||||||||||||||||||||||

| Noninterest-bearing deposits | $ | 360,279 | 384,330 | 402,322 | 434,912 | 458,010 | (6) | (21) | |||||||||||||||||||||||||||||||||

| Interest-bearing deposits | 997,894 | 969,680 | 942,262 | 927,717 | 925,975 | 3 | 8 | ||||||||||||||||||||||||||||||||||

| Total deposits | 1,358,173 | 1,354,010 | 1,344,584 | 1,362,629 | 1,383,985 | — | (2) | ||||||||||||||||||||||||||||||||||

| Short-term borrowings (1) | 89,559 | 93,330 | 84,255 | 81,007 | 51,145 | (4) | 75 | ||||||||||||||||||||||||||||||||||

| Derivative liabilities | 18,495 | 23,463 | 21,431 | 16,897 | 20,067 | (21) | (8) | ||||||||||||||||||||||||||||||||||

| Accrued expenses and other liabilities | 71,210 | 66,050 | 73,466 | 69,181 | 68,740 | 8 | 4 | ||||||||||||||||||||||||||||||||||

| Long-term debt (2) | 207,588 | 190,035 | 170,632 | 173,466 | 174,870 | 9 | 19 | ||||||||||||||||||||||||||||||||||

| Total liabilities | 1,745,025 | 1,726,888 | 1,694,368 | 1,703,180 | 1,698,807 | 1 | 3 | ||||||||||||||||||||||||||||||||||

| Equity | |||||||||||||||||||||||||||||||||||||||||

| Wells Fargo stockholders’ equity: | |||||||||||||||||||||||||||||||||||||||||

| Preferred stock | 19,448 | 19,448 | 19,448 | 19,448 | 19,448 | — | — | ||||||||||||||||||||||||||||||||||

Common stock – $1-2/3 par value, authorized 9,000,000,000 shares; issued 5,481,811,474 shares |

9,136 | 9,136 | 9,136 | 9,136 | 9,136 | — | — | ||||||||||||||||||||||||||||||||||

| Additional paid-in capital | 60,555 | 60,365 | 60,173 | 59,946 | 60,319 | — | — | ||||||||||||||||||||||||||||||||||

| Retained earnings | 201,136 | 199,287 | 195,164 | 191,688 | 187,968 | 1 | 7 | ||||||||||||||||||||||||||||||||||

| Accumulated other comprehensive income (loss) | (11,580) | (15,877) | (13,441) | (12,572) | (13,362) | 27 | 13 | ||||||||||||||||||||||||||||||||||

| Treasury stock (3) | (92,960) | (91,215) | (89,860) | (86,049) | (82,853) | (2) | (12) | ||||||||||||||||||||||||||||||||||

| Unearned ESOP shares | — | (429) | (429) | (429) | (429) | 100 | 100 | ||||||||||||||||||||||||||||||||||

| Total Wells Fargo stockholders’ equity | 185,735 | 180,715 | 180,191 | 181,168 | 180,227 | 3 | 3 | ||||||||||||||||||||||||||||||||||

| Noncontrolling interests | 1,708 | 1,658 | 1,761 | 2,052 | 1,986 | 3 | (14) | ||||||||||||||||||||||||||||||||||

| Total equity | 187,443 | 182,373 | 181,952 | 183,220 | 182,213 | 3 | 3 | ||||||||||||||||||||||||||||||||||

| Total liabilities and equity | $ | 1,932,468 | 1,909,261 | 1,876,320 | 1,886,400 | 1,881,020 | 1 | 3 | |||||||||||||||||||||||||||||||||

| Quarter ended | Dec 31, 2023 % Change from |

Year ended | % Change |

||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| ($ in millions) | Dec 31, 2023 | Sep 30, 2023 | Jun 30, 2023 | Mar 31, 2023 | Dec 31, 2022 | Sep 30, 2023 | Dec 31, 2022 | Dec 31, 2023 | Dec 31, 2022 | ||||||||||||||||||||||||||||||||||||||||||||||||||

| Average Balances | |||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| Assets | |||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| Interest-earning deposits with banks | $ | 193,647 | 158,893 | 129,236 | 114,858 | 127,854 | 22 | % | 51 | $ | 149,401 | 145,802 | 2 | % | |||||||||||||||||||||||||||||||||||||||||||||

| Federal funds sold and securities purchased under resale agreements | 72,626 | 68,715 | 69,505 | 68,633 | 65,860 | 6 | 10 | 69,878 | 62,137 | 12 | |||||||||||||||||||||||||||||||||||||||||||||||||

| Trading debt securities | 109,340 | 109,802 | 102,605 | 96,405 | 94,465 | — | 16 | 104,588 | 91,515 | 14 | |||||||||||||||||||||||||||||||||||||||||||||||||

| Available-for-sale debt securities | 136,389 | 139,511 | 149,320 | 145,894 | 122,271 | (2) | 12 | 142,743 | 141,404 | 1 | |||||||||||||||||||||||||||||||||||||||||||||||||

| Held-to-maturity debt securities | 268,905 | 273,948 | 279,093 | 279,955 | 303,391 | (2) | (11) | 275,441 | 296,540 | (7) | |||||||||||||||||||||||||||||||||||||||||||||||||

| Loans held for sale | 4,990 | 5,437 | 6,031 | 6,611 | 9,932 | (8) | (50) | 5,762 | 13,900 | (59) | |||||||||||||||||||||||||||||||||||||||||||||||||

| Loans | 938,041 | 943,193 | 945,906 | 948,651 | 948,517 | (1) | (1) | 943,916 | 929,820 | 2 | |||||||||||||||||||||||||||||||||||||||||||||||||

| Equity securities | 22,198 | 25,019 | 27,891 | 28,651 | 28,587 | (11) | (22) | 25,920 | 30,575 | (15) | |||||||||||||||||||||||||||||||||||||||||||||||||

| Other | 8,861 | 8,565 | 10,118 | 11,043 | 11,932 | 3 | (26) | 9,638 | 13,275 | (27) | |||||||||||||||||||||||||||||||||||||||||||||||||

| Total interest-earning assets | 1,754,997 | 1,733,083 | 1,719,705 | 1,700,701 | 1,712,809 | 1 | 2 | 1,727,287 | 1,724,968 | — | |||||||||||||||||||||||||||||||||||||||||||||||||

| Total noninterest-earning assets | 152,538 | 158,800 | 158,548 | 162,975 | 162,382 | (4) | (6) | 158,188 | 169,335 | (7) | |||||||||||||||||||||||||||||||||||||||||||||||||

| Total assets | $ | 1,907,535 | 1,891,883 | 1,878,253 | 1,863,676 | 1,875,191 | 1 | 2 | $ | 1,885,475 | 1,894,303 | — | |||||||||||||||||||||||||||||||||||||||||||||||

| Liabilities | |||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| Interest-bearing deposits | $ | 974,890 | 953,500 | 936,886 | 920,226 | 902,564 | 2 | 8 | $ | 946,545 | 918,499 | 3 | |||||||||||||||||||||||||||||||||||||||||||||||

| Short-term borrowings | 92,032 | 90,078 | 83,059 | 58,496 | 51,246 | 2 | 80 | 81,033 | 39,810 | 104 | |||||||||||||||||||||||||||||||||||||||||||||||||

| Long-term debt | 196,213 | 181,955 | 170,843 | 172,567 | 166,796 | 8 | 18 | 180,464 | 157,742 | 14 | |||||||||||||||||||||||||||||||||||||||||||||||||

| Other liabilities | 31,342 | 32,564 | 34,496 | 33,427 | 33,559 | (4) | (7) | 32,950 | 34,126 | (3) | |||||||||||||||||||||||||||||||||||||||||||||||||

| Total interest-bearing liabilities | 1,294,477 | 1,258,097 | 1,225,284 | 1,184,716 | 1,154,165 | 3 | 12 | 1,240,992 | 1,150,177 | 8 | |||||||||||||||||||||||||||||||||||||||||||||||||

| Noninterest-bearing demand deposits | 366,026 | 386,807 | 410,563 | 436,468 | 477,895 | (5) | (23) | 399,737 | 505,770 | (21) | |||||||||||||||||||||||||||||||||||||||||||||||||

| Other noninterest-bearing liabilities | 61,179 | 62,151 | 57,963 | 58,195 | 60,510 | (2) | 1 | 59,886 | 55,189 | 9 | |||||||||||||||||||||||||||||||||||||||||||||||||

| Total liabilities | 1,721,682 | 1,707,055 | 1,693,810 | 1,679,379 | 1,692,570 | 1 | 2 | 1,700,615 | 1,711,136 | (1) | |||||||||||||||||||||||||||||||||||||||||||||||||

| Total equity | 185,853 | 184,828 | 184,443 | 184,297 | 182,621 | 1 | 2 | 184,860 | 183,167 | 1 | |||||||||||||||||||||||||||||||||||||||||||||||||

| Total liabilities and equity | $ | 1,907,535 | 1,891,883 | 1,878,253 | 1,863,676 | 1,875,191 | 1 | 2 | $ | 1,885,475 | 1,894,303 | — | |||||||||||||||||||||||||||||||||||||||||||||||

| Average Interest Rates | |||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| Interest-earning assets | |||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| Interest-earning deposits with banks | 4.98 | % | 4.81 | 4.50 | 4.12 | 3.50 | 4.67 | % | 1.54 | ||||||||||||||||||||||||||||||||||||||||||||||||||

| Federal funds sold and securities purchased under resale agreements | 5.30 | 5.13 | 4.73 | 4.12 | 3.29 | 4.83 | 1.38 | ||||||||||||||||||||||||||||||||||||||||||||||||||||

| Trading debt securities | 3.82 | 3.86 | 3.50 | 3.33 | 3.17 | 3.64 | 2.72 | ||||||||||||||||||||||||||||||||||||||||||||||||||||

| Available-for-sale debt securities | 3.87 | 3.92 | 3.72 | 3.54 | 3.10 | 3.76 | 2.24 | ||||||||||||||||||||||||||||||||||||||||||||||||||||

| Held-to-maturity debt securities | 2.69 | 2.65 | 2.62 | 2.55 | 2.45 | 2.63 | 2.19 | ||||||||||||||||||||||||||||||||||||||||||||||||||||

| Loans held for sale | 6.75 | 6.40 | 6.22 | 5.90 | 5.11 | 6.29 | 3.69 | ||||||||||||||||||||||||||||||||||||||||||||||||||||

| Loans | 6.35 | 6.23 | 5.99 | 5.69 | 5.13 | 6.07 | 4.06 | ||||||||||||||||||||||||||||||||||||||||||||||||||||

| Equity securities | 2.99 | 2.42 | 2.79 | 2.39 | 2.63 | 2.63 | 2.31 | ||||||||||||||||||||||||||||||||||||||||||||||||||||

| Other | 4.99 | 4.93 | 4.76 | 4.60 | 3.57 | 4.80 | 1.54 | ||||||||||||||||||||||||||||||||||||||||||||||||||||

| Total interest-earning assets | 5.20 | 5.09 | 4.88 | 4.62 | 4.16 | 4.95 | 3.16 | ||||||||||||||||||||||||||||||||||||||||||||||||||||

| Interest-bearing liabilities | |||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| Interest-bearing deposits | 2.17 | 1.92 | 1.63 | 1.22 | 0.70 | 1.74 | 0.26 | ||||||||||||||||||||||||||||||||||||||||||||||||||||

| Short-term borrowings | 5.10 | 4.99 | 4.64 | 3.95 | 3.15 | 4.75 | 1.46 | ||||||||||||||||||||||||||||||||||||||||||||||||||||

| Long-term debt | 6.78 | 6.67 | 6.31 | 5.83 | 5.22 | 6.41 | 3.49 | ||||||||||||||||||||||||||||||||||||||||||||||||||||

| Other liabilities | 2.87 | 2.54 | 2.41 | 2.16 | 2.09 | 2.49 | 1.87 | ||||||||||||||||||||||||||||||||||||||||||||||||||||

| Total interest-bearing liabilities | 3.09 | 2.84 | 2.51 | 2.05 | 1.50 | 2.64 | 0.79 | ||||||||||||||||||||||||||||||||||||||||||||||||||||

| Interest rate spread on a taxable-equivalent basis (2) | 2.11 | 2.25 | 2.37 | 2.57 | 2.66 | 2.31 | 2.37 | ||||||||||||||||||||||||||||||||||||||||||||||||||||

| Net interest margin on a taxable-equivalent basis (2) | 2.92 | 3.03 | 3.09 | 3.20 | 3.14 | 3.06 | 2.63 | ||||||||||||||||||||||||||||||||||||||||||||||||||||

| Quarter ended December 31, 2023 | |||||||||||||||||||||||||||||||||||||||||

| (in millions) | Consumer Banking and Lending | Commercial Banking | Corporate and Investment Banking | Wealth and Investment Management | Corporate (2) | Reconciling Items (3) | Consolidated Company |

||||||||||||||||||||||||||||||||||

| Net interest income | $ | 7,629 | 2,525 | 2,359 | 906 | (544) | (104) | 12,771 | |||||||||||||||||||||||||||||||||

| Noninterest income | 1,890 | 843 | 2,376 | 2,754 | 284 | (440) | 7,707 | ||||||||||||||||||||||||||||||||||

| Total revenue | 9,519 | 3,368 | 4,735 | 3,660 | (260) | (544) | 20,478 | ||||||||||||||||||||||||||||||||||

| Provision for credit losses | 790 | 40 | 498 | (19) | (27) | — | 1,282 | ||||||||||||||||||||||||||||||||||

| Noninterest expense | 6,046 | 1,630 | 2,132 | 3,023 | 2,955 | — | 15,786 | ||||||||||||||||||||||||||||||||||

| Income (loss) before income tax expense (benefit) | 2,683 | 1,698 | 2,105 | 656 | (3,188) | (544) | 3,410 | ||||||||||||||||||||||||||||||||||

| Income tax expense (benefit) | 672 | 423 | 523 | 165 | (1,339) | (544) | (100) | ||||||||||||||||||||||||||||||||||

Net income (loss) before noncontrolling interests |

2,011 | 1,275 | 1,582 | 491 | (1,849) | — | 3,510 | ||||||||||||||||||||||||||||||||||

Less: Net income from noncontrolling interests |

— | 2 | — | — | 62 | — | 64 | ||||||||||||||||||||||||||||||||||

Net income (loss) |

$ | 2,011 | 1,273 | 1,582 | 491 | (1,911) | — | 3,446 | |||||||||||||||||||||||||||||||||

| Quarter ended September 30, 2023 | |||||||||||||||||||||||||||||||||||||||||

| Net interest income | $ | 7,633 | 2,519 | 2,319 | 1,007 | (269) | (104) | 13,105 | |||||||||||||||||||||||||||||||||

| Noninterest income | 1,948 | 886 | 2,604 | 2,695 | 21 | (402) | 7,752 | ||||||||||||||||||||||||||||||||||

| Total revenue | 9,581 | 3,405 | 4,923 | 3,702 | (248) | (506) | 20,857 | ||||||||||||||||||||||||||||||||||

| Provision for credit losses | 768 | 52 | 324 | (10) | 63 | — | 1,197 | ||||||||||||||||||||||||||||||||||

| Noninterest expense | 5,913 | 1,543 | 2,182 | 3,006 | 469 | — | 13,113 | ||||||||||||||||||||||||||||||||||

| Income (loss) before income tax expense (benefit) | 2,900 | 1,810 | 2,417 | 706 | (780) | (506) | 6,547 | ||||||||||||||||||||||||||||||||||

| Income tax expense (benefit) | 727 | 453 | 601 | 177 | (641) | (506) | 811 | ||||||||||||||||||||||||||||||||||

Net income (loss) before noncontrolling interests |

2,173 | 1,357 | 1,816 | 529 | (139) | — | 5,736 | ||||||||||||||||||||||||||||||||||

| Less: Net income (loss) from noncontrolling interests | — | 3 | — | — | (34) | — | (31) | ||||||||||||||||||||||||||||||||||

Net income (loss) |

$ | 2,173 | 1,354 | 1,816 | 529 | (105) | — | 5,767 | |||||||||||||||||||||||||||||||||

| Quarter ended December 31, 2022 | |||||||||||||||||||||||||||||||||||||||||

| Net interest income | $ | 7,574 | 2,357 | 2,416 | 1,124 | 78 | (116) | 13,433 | |||||||||||||||||||||||||||||||||

| Noninterest income | 1,889 | 792 | 1,723 | 2,571 | 7 | (381) | 6,601 | ||||||||||||||||||||||||||||||||||

| Total revenue | 9,463 | 3,149 | 4,139 | 3,695 | 85 | (497) | 20,034 | ||||||||||||||||||||||||||||||||||

| Provision for credit losses | 936 | (43) | 41 | 11 | 12 | — | 957 | ||||||||||||||||||||||||||||||||||

| Noninterest expense | 7,088 | 1,523 | 1,837 | 2,731 | 3,007 | — | 16,186 | ||||||||||||||||||||||||||||||||||

| Income (loss) before income tax expense (benefit) | 1,439 | 1,669 | 2,261 | 953 | (2,934) | (497) | 2,891 | ||||||||||||||||||||||||||||||||||

| Income tax expense (benefit) | 362 | 428 | 569 | 238 | (1,129) | (497) | (29) | ||||||||||||||||||||||||||||||||||

| Net income (loss) before noncontrolling interests | 1,077 | 1,241 | 1,692 | 715 | (1,805) | — | 2,920 | ||||||||||||||||||||||||||||||||||

| Less: Net income (loss) from noncontrolling interests | — | 3 | — | — | (238) | — | (235) | ||||||||||||||||||||||||||||||||||

| Net income (loss) | $ | 1,077 | 1,238 | 1,692 | 715 | (1,567) | — | 3,155 | |||||||||||||||||||||||||||||||||

| Year ended December 31, 2023 | |||||||||||||||||||||||||||||||||||||||||

| (in millions) | Consumer Banking and Lending | Commercial Banking | Corporate and Investment Banking | Wealth and Investment Management | Corporate (2) | Reconciling Items (3) | Consolidated Company |

||||||||||||||||||||||||||||||||||

| Net interest income | $ | 30,185 | 10,034 | 9,498 | 3,966 | (888) | (420) | 52,375 | |||||||||||||||||||||||||||||||||

| Noninterest income | 7,734 | 3,415 | 9,693 | 10,725 | 431 | (1,776) | 30,222 | ||||||||||||||||||||||||||||||||||

| Total revenue | 37,919 | 13,449 | 19,191 | 14,691 | (457) | (2,196) | 82,597 | ||||||||||||||||||||||||||||||||||

| Provision for credit losses | 3,299 | 75 | 2,007 | 6 | 12 | — | 5,399 | ||||||||||||||||||||||||||||||||||

| Noninterest expense | 24,024 | 6,555 | 8,618 | 12,064 | 4,301 | — | 55,562 | ||||||||||||||||||||||||||||||||||

Income (loss) before income tax expense (benefit) |

10,596 | 6,819 | 8,566 | 2,621 | (4,770) | (2,196) | 21,636 | ||||||||||||||||||||||||||||||||||

| Income tax expense (benefit) | 2,657 | 1,704 | 2,140 | 657 | (2,355) | (2,196) | 2,607 | ||||||||||||||||||||||||||||||||||

| Net income (loss) before noncontrolling interests | 7,939 | 5,115 | 6,426 | 1,964 | (2,415) | — | 19,029 | ||||||||||||||||||||||||||||||||||

Less: Net income (loss) from noncontrolling interests |

— | 11 | — | — | (124) | — | (113) | ||||||||||||||||||||||||||||||||||

| Net income (loss) | $ | 7,939 | 5,104 | 6,426 | 1,964 | (2,291) | — | 19,142 | |||||||||||||||||||||||||||||||||

| Year ended December 31, 2022 | |||||||||||||||||||||||||||||||||||||||||

| Net interest income | $ | 27,044 | 7,289 | 8,733 | 3,927 | (1,607) | (436) | 44,950 | |||||||||||||||||||||||||||||||||

| Noninterest income | 8,766 | 3,631 | 6,509 | 10,895 | 1,192 | (1,575) | 29,418 | ||||||||||||||||||||||||||||||||||

| Total revenue | 35,810 | 10,920 | 15,242 | 14,822 | (415) | (2,011) | 74,368 | ||||||||||||||||||||||||||||||||||

| Provision for credit losses | 2,276 | (534) | (185) | (25) | 2 | — | 1,534 | ||||||||||||||||||||||||||||||||||

| Noninterest expense | 26,277 | 6,058 | 7,560 | 11,613 | 5,697 | — | 57,205 | ||||||||||||||||||||||||||||||||||

Income (loss) before income tax expense (benefit) |

7,257 | 5,396 | 7,867 | 3,234 | (6,114) | (2,011) | 15,629 | ||||||||||||||||||||||||||||||||||

| Income tax expense (benefit) | 1,816 | 1,366 | 1,989 | 812 | (1,721) | (2,011) | 2,251 | ||||||||||||||||||||||||||||||||||

| Net income (loss) before noncontrolling interests | 5,441 | 4,030 | 5,878 | 2,422 | (4,393) | — | 13,378 | ||||||||||||||||||||||||||||||||||

| Less: Net income (loss) from noncontrolling interests | — | 12 | — | — | (311) | — | (299) | ||||||||||||||||||||||||||||||||||

| Net income (loss) | $ | 5,441 | 4,018 | 5,878 | 2,422 | (4,082) | — | 13,677 | |||||||||||||||||||||||||||||||||

| Quarter ended | Dec 31, 2023 % Change from |

Year ended | |||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| ($ in millions) | Dec 31, 2023 |

Sep 30, 2023 |

Jun 30, 2023 |

Mar 31, 2023 |

Dec 31, 2022 |

Sep 30, 2023 |

Dec 31, 2022 |

Dec 31, 2023 |

Dec 31, 2022 |

% Change |

|||||||||||||||||||||||||||||||||||||||||||||||||

| Income Statement | |||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| Net interest income | $ | 7,629 | 7,633 | 7,490 | 7,433 | 7,574 | — | % | 1 | $ | 30,185 | 27,044 | 12 | % | |||||||||||||||||||||||||||||||||||||||||||||

| Noninterest income: | |||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| Deposit-related fees | 694 | 670 | 666 | 672 | 696 | 4 | — | 2,702 | 3,093 | (13) | |||||||||||||||||||||||||||||||||||||||||||||||||

| Card fees | 960 | 1,027 | 1,022 | 958 | 1,025 | (7) | (6) | 3,967 | 4,067 | (2) | |||||||||||||||||||||||||||||||||||||||||||||||||

| Mortgage banking | 115 | 105 | 132 | 160 | 23 | 10 | 400 | 512 | 1,100 | (53) | |||||||||||||||||||||||||||||||||||||||||||||||||

| Other | 121 | 146 | 145 | 141 | 145 | (17) | (17) | 553 | 506 | 9 | |||||||||||||||||||||||||||||||||||||||||||||||||

| Total noninterest income | 1,890 | 1,948 | 1,965 | 1,931 | 1,889 | (3) | — | 7,734 | 8,766 | (12) | |||||||||||||||||||||||||||||||||||||||||||||||||

| Total revenue | 9,519 | 9,581 | 9,455 | 9,364 | 9,463 | (1) | 1 | 37,919 | 35,810 | 6 | |||||||||||||||||||||||||||||||||||||||||||||||||

| Net charge-offs | 852 | 722 | 621 | 589 | 525 | 18 | 62 | 2,784 | 1,693 | 64 | |||||||||||||||||||||||||||||||||||||||||||||||||

| Change in the allowance for credit losses | (62) | 46 | 253 | 278 | 411 | NM | NM | 515 | 583 | (12) | |||||||||||||||||||||||||||||||||||||||||||||||||

| Provision for credit losses | 790 | 768 | 874 | 867 | 936 | 3 | (16) | 3,299 | 2,276 | 45 | |||||||||||||||||||||||||||||||||||||||||||||||||

| Noninterest expense | 6,046 | 5,913 | 6,027 | 6,038 | 7,088 | 2 | (15) | 24,024 | 26,277 | (9) | |||||||||||||||||||||||||||||||||||||||||||||||||

| Income before income tax expense | 2,683 | 2,900 | 2,554 | 2,459 | 1,439 | (7) | 86 | 10,596 | 7,257 | 46 | |||||||||||||||||||||||||||||||||||||||||||||||||

| Income tax expense | 672 | 727 | 640 | 618 | 362 | (8) | 86 | 2,657 | 1,816 | 46 | |||||||||||||||||||||||||||||||||||||||||||||||||

| Net income | $ | 2,011 | 2,173 | 1,914 | 1,841 | 1,077 | (7) | 87 | $ | 7,939 | 5,441 | 46 | |||||||||||||||||||||||||||||||||||||||||||||||

| Revenue by Line of Business | |||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

Consumer, Small and Business Banking |

$ | 6,657 | 6,665 | 6,576 | 6,486 | 6,608 | — | 1 | $ | 26,384 | 23,421 | 13 | |||||||||||||||||||||||||||||||||||||||||||||||

| Consumer Lending: | |||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| Home Lending | 839 | 840 | 847 | 863 | 786 | — | 7 | 3,389 | 4,221 | (20) | |||||||||||||||||||||||||||||||||||||||||||||||||

| Credit Card | 1,346 | 1,375 | 1,321 | 1,305 | 1,353 | (2) | (1) | 5,347 | 5,271 | 1 | |||||||||||||||||||||||||||||||||||||||||||||||||

| Auto | 334 | 360 | 378 | 392 | 413 | (7) | (19) | 1,464 | 1,716 | (15) | |||||||||||||||||||||||||||||||||||||||||||||||||

| Personal Lending | 343 | 341 | 333 | 318 | 303 | 1 | 13 | 1,335 | 1,181 | 13 | |||||||||||||||||||||||||||||||||||||||||||||||||

| Total revenue | $ | 9,519 | 9,581 | 9,455 | 9,364 | 9,463 | (1) | 1 | $ | 37,919 | 35,810 | 6 | |||||||||||||||||||||||||||||||||||||||||||||||

| Selected Balance Sheet Data (average) | |||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| Loans by Line of Business: | |||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

Consumer, Small and Business Banking |

$ | 8,863 | 8,983 | 9,215 | 9,363 | 9,590 | (1) | (8) | $ | 9,104 | 10,132 | (10) | |||||||||||||||||||||||||||||||||||||||||||||||

| Consumer Lending: | |||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| Home Lending | 216,733 | 218,546 | 220,641 | 222,561 | 222,546 | (1) | (3) | 219,601 | 219,157 | — | |||||||||||||||||||||||||||||||||||||||||||||||||

| Credit Card | 43,473 | 41,168 | 39,225 | 38,190 | 37,152 | 6 | 17 | 40,530 | 34,151 | 19 | |||||||||||||||||||||||||||||||||||||||||||||||||

| Auto | 49,078 | 51,578 | 52,476 | 53,676 | 54,490 | (5) | (10) | 51,689 | 55,994 | (8) | |||||||||||||||||||||||||||||||||||||||||||||||||

| Personal Lending | 15,386 | 15,270 | 14,794 | 14,518 | 14,219 | 1 | 8 | 14,996 | 12,999 | 15 | |||||||||||||||||||||||||||||||||||||||||||||||||

| Total loans | $ | 333,533 | 335,545 | 336,351 | 338,308 | 337,997 | (1) | (1) | $ | 335,920 | 332,433 | 1 | |||||||||||||||||||||||||||||||||||||||||||||||

| Total deposits | 779,490 | 801,061 | 823,339 | 841,265 | 864,623 | (3) | (10) | 811,091 | 883,130 | (8) | |||||||||||||||||||||||||||||||||||||||||||||||||

| Allocated capital | 44,000 | 44,000 | 44,000 | 44,000 | 48,000 | — | (8) | 44,000 | 48,000 | (8) | |||||||||||||||||||||||||||||||||||||||||||||||||

| Selected Balance Sheet Data (period-end) | |||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| Loans by Line of Business: | |||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

Consumer, Small and Business Banking |

$ | 9,042 | 9,115 | 9,299 | 9,457 | 9,704 | (1) | (7) | |||||||||||||||||||||||||||||||||||||||||||||||||||

| Consumer Lending: | |||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| Home Lending | 215,823 | 217,955 | 219,595 | 222,012 | 223,525 | (1) | (3) | ||||||||||||||||||||||||||||||||||||||||||||||||||||

| Credit Card | 44,428 | 42,040 | 40,053 | 38,201 | 38,475 | 6 | 15 | ||||||||||||||||||||||||||||||||||||||||||||||||||||

| Auto | 48,283 | 50,407 | 52,175 | 53,244 | 54,281 | (4) | (11) | ||||||||||||||||||||||||||||||||||||||||||||||||||||

| Personal Lending | 15,291 | 15,439 | 15,095 | 14,597 | 14,544 | (1) | 5 | ||||||||||||||||||||||||||||||||||||||||||||||||||||

| Total loans | $ | 332,867 | 334,956 | 336,217 | 337,511 | 340,529 | (1) | (2) | |||||||||||||||||||||||||||||||||||||||||||||||||||

| Total deposits | 782,309 | 798,897 | 820,495 | 851,304 | 859,695 | (2) | (9) | ||||||||||||||||||||||||||||||||||||||||||||||||||||

| Quarter ended | Dec 31, 2023 % Change from |

Year ended | |||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| ($ in millions, unless otherwise noted) | Dec 31, 2023 |

Sep 30, 2023 |

Jun 30, 2023 |

Mar 31, 2023 |

Dec 31, 2022 |

Sep 30, 2023 |

Dec 31, 2022 |

Dec 31, 2023 |

Dec 31, 2022 |

% Change |

|||||||||||||||||||||||||||||||||||||||||||||||||

| Selected Metrics | |||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| Consumer Banking and Lending: | |||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| Return on allocated capital (1) | 17.6 | % | 19.1 | 16.9 | 16.5 | 8.3 | 17.5 | % | 10.8 | ||||||||||||||||||||||||||||||||||||||||||||||||||

| Efficiency ratio (2) | 64 | 62 | 64 | 64 | 75 | 63 | 73 | ||||||||||||||||||||||||||||||||||||||||||||||||||||

Retail bank branches (#, period-end) |

4,311 | 4,355 | 4,455 | 4,525 | 4,598 | (1) | % | (6) | |||||||||||||||||||||||||||||||||||||||||||||||||||

Digital active customers (# in millions, period-end) (3) |

34.8 | 34.6 | 34.2 | 34.3 | 33.5 | 1 | 4 | ||||||||||||||||||||||||||||||||||||||||||||||||||||

Mobile active customers (# in millions, period-end) (3) |

29.9 | 29.6 | 29.1 | 28.8 | 28.3 | 1 | 6 | ||||||||||||||||||||||||||||||||||||||||||||||||||||

Consumer, Small and Business Banking: |

|||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| Deposit spread (4) | 2.7 | % | 2.7 | 2.6 | 2.5 | 2.4 | 2.6 | % | 2.0 | ||||||||||||||||||||||||||||||||||||||||||||||||||

Debit card purchase volume ($ in billions) (5) |

$ | 126.1 | 124.5 | 124.9 | 117.3 | 124.0 | 1 | 2 | $ | 492.8 | 486.6 | 1 | |||||||||||||||||||||||||||||||||||||||||||||||

Debit card purchase transactions (# in millions) (5) |

2,546 | 2,550 | 2,535 | 2,369 | 2,496 | — | 2 | 10,000 | 9,852 | 2 | |||||||||||||||||||||||||||||||||||||||||||||||||

| Home Lending: | |||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| Mortgage banking: | |||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| Net servicing income | $ | 113 | 41 | 62 | 84 | 94 | 176 | 20 | $ | 300 | 368 | (18) | |||||||||||||||||||||||||||||||||||||||||||||||

| Net gains (losses) on mortgage loan originations/sales | 2 | 64 | 70 | 76 | (71) | (97) | 103 | 212 | 732 | (71) | |||||||||||||||||||||||||||||||||||||||||||||||||

| Total mortgage banking | $ | 115 | 105 | 132 | 160 | 23 | 10 | 400 | $ | 512 | 1,100 | (53) | |||||||||||||||||||||||||||||||||||||||||||||||

| Originations ($ in billions): | |||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| Retail | $ | 4.5 | 6.4 | 7.7 | 5.6 | 8.2 | (30) | (45) | $ | 24.2 | 64.3 | (62) | |||||||||||||||||||||||||||||||||||||||||||||||

| Correspondent | — | — | 0.1 | 1.0 | 6.4 | — | (100) | 1.1 | 43.8 | (97) | |||||||||||||||||||||||||||||||||||||||||||||||||

| Total originations | $ | 4.5 | 6.4 | 7.8 | 6.6 | 14.6 | (30) | (69) | $ | 25.3 | 108.1 | (77) | |||||||||||||||||||||||||||||||||||||||||||||||

| % of originations held for sale (HFS) | 45.4 | % | 40.7 | 45.3 | 46.8 | 60.7 | 44.6 | % | 52.5 | ||||||||||||||||||||||||||||||||||||||||||||||||||

Third party mortgage loans serviced ($ in billions, period-end) (6) |

$ | 559.7 | 591.8 | 609.1 | 666.8 | 679.2 | (5) | (18) | |||||||||||||||||||||||||||||||||||||||||||||||||||

| Mortgage servicing rights (MSR) carrying value (period-end) | 7,468 | 8,457 | 8,251 | 8,819 | 9,310 | (12) | (20) | ||||||||||||||||||||||||||||||||||||||||||||||||||||

|

Ratio of MSR carrying value (period-end) to third party mortgage loans serviced

(period-end) (6)

|

1.33 | % | 1.43 | 1.35 | 1.32 | 1.37 | |||||||||||||||||||||||||||||||||||||||||||||||||||||

Home lending loans 30+ days delinquency rate (period-end) (7)(8)(9) |

0.32 | 0.29 | 0.25 | 0.26 | 0.31 | ||||||||||||||||||||||||||||||||||||||||||||||||||||||

| Credit Card: | |||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| Point of sale (POS) volume ($ in billions) | $ | 37.1 | 35.2 | 34.0 | 30.1 | 32.3 | 5 | 15 | $ | 136.4 | 119.1 | 15 | |||||||||||||||||||||||||||||||||||||||||||||||

| New accounts (# in thousands) | 655 | 714 | 611 | 567 | 561 | (8) | 17 | 2,547 | 2,153 | 18 | |||||||||||||||||||||||||||||||||||||||||||||||||

Credit card loans 30+ days delinquency rate (period-end) (8) |

2.89 | % | 2.70 | 2.39 | 2.26 | 2.08 | |||||||||||||||||||||||||||||||||||||||||||||||||||||

Credit card loans 90+ days delinquency rate (period-end) (8) |

1.48 | 1.37 | 1.17 | 1.16 | 1.01 | ||||||||||||||||||||||||||||||||||||||||||||||||||||||

| Auto: | |||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| Auto originations ($ in billions) | $ | 3.3 | 4.1 | 4.8 | 5.0 | 5.0 | (20) | (34) | $ | 17.2 | 23.1 | (26) | |||||||||||||||||||||||||||||||||||||||||||||||

Auto loans 30+ days delinquency rate (period-end) (8)(9) |

2.80 | % | 2.60 | 2.55 | 2.25 | 2.64 | |||||||||||||||||||||||||||||||||||||||||||||||||||||

| Personal Lending: | |||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| New volume ($ in billions) | $ | 2.6 | 3.1 | 3.3 | 2.9 | 3.2 | (16) | (19) | $ | 11.9 | 12.6 | (6) | |||||||||||||||||||||||||||||||||||||||||||||||

| Quarter ended | Dec 31, 2023 % Change from |

Year ended | |||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| ($ in millions) | Dec 31, 2023 |

Sep 30, 2023 |

Jun 30, 2023 |

Mar 31, 2023 |

Dec 31, 2022 |

Sep 30, 2023 |

Dec 31, 2022 |

Dec 31, 2023 |

Dec 31, 2022 |

% Change |

|||||||||||||||||||||||||||||||||||||||||||||||||

| Income Statement | |||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| Net interest income | $ | 2,525 | 2,519 | 2,501 | 2,489 | 2,357 | — | % | 7 | $ | 10,034 | 7,289 | 38 | % | |||||||||||||||||||||||||||||||||||||||||||||

| Noninterest income: | |||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| Deposit-related fees | 257 | 257 | 248 | 236 | 237 | — | 8 | 998 | 1,131 | (12) | |||||||||||||||||||||||||||||||||||||||||||||||||

| Lending-related fees | 138 | 133 | 131 | 129 | 122 | 4 | 13 | 531 | 491 | 8 | |||||||||||||||||||||||||||||||||||||||||||||||||

| Lease income | 155 | 153 | 167 | 169 | 176 | 1 | (12) | 644 | 710 | (9) | |||||||||||||||||||||||||||||||||||||||||||||||||

| Other | 293 | 343 | 322 | 284 | 257 | (15) | 14 | 1,242 | 1,299 | (4) | |||||||||||||||||||||||||||||||||||||||||||||||||

| Total noninterest income | 843 | 886 | 868 | 818 | 792 | (5) | 6 | 3,415 | 3,631 | (6) | |||||||||||||||||||||||||||||||||||||||||||||||||

| Total revenue | 3,368 | 3,405 | 3,369 | 3,307 | 3,149 | (1) | 7 | 13,449 | 10,920 | 23 | |||||||||||||||||||||||||||||||||||||||||||||||||

| Net charge-offs | 35 | 37 | 63 | (39) | 32 | (5) | 9 | 96 | 4 | NM | |||||||||||||||||||||||||||||||||||||||||||||||||

| Change in the allowance for credit losses | 5 | 15 | (37) | (4) | (75) | (67) | 107 | (21) | (538) | 96 | |||||||||||||||||||||||||||||||||||||||||||||||||

| Provision for credit losses | 40 | 52 | 26 | (43) | (43) | (23) | 193 | 75 | (534) | 114 | |||||||||||||||||||||||||||||||||||||||||||||||||

| Noninterest expense | 1,630 | 1,543 | 1,630 | 1,752 | 1,523 | 6 | 7 | 6,555 | 6,058 | 8 | |||||||||||||||||||||||||||||||||||||||||||||||||

| Income before income tax expense | 1,698 | 1,810 | 1,713 | 1,598 | 1,669 | (6) | 2 | 6,819 | 5,396 | 26 | |||||||||||||||||||||||||||||||||||||||||||||||||

| Income tax expense | 423 | 453 | 429 | 399 | 428 | (7) | (1) | 1,704 | 1,366 | 25 | |||||||||||||||||||||||||||||||||||||||||||||||||

| Less: Net income from noncontrolling interests | 2 | 3 | 3 | 3 | 3 | (33) | (33) | 11 | 12 | (8) | |||||||||||||||||||||||||||||||||||||||||||||||||

| Net income | $ | 1,273 | 1,354 | 1,281 | 1,196 | 1,238 | (6) | 3 | $ | 5,104 | 4,018 | 27 | |||||||||||||||||||||||||||||||||||||||||||||||

| Revenue by Line of Business | |||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| Middle Market Banking | $ | 2,196 | 2,212 | 2,199 | 2,155 | 2,076 | (1) | 6 | $ | 8,762 | 6,574 | 33 | |||||||||||||||||||||||||||||||||||||||||||||||

| Asset-Based Lending and Leasing | 1,172 | 1,193 | 1,170 | 1,152 | 1,073 | (2) | 9 | 4,687 | 4,346 | 8 | |||||||||||||||||||||||||||||||||||||||||||||||||

| Total revenue | $ | 3,368 | 3,405 | 3,369 | 3,307 | 3,149 | (1) | 7 | $ | 13,449 | 10,920 | 23 | |||||||||||||||||||||||||||||||||||||||||||||||

| Revenue by Product | |||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| Lending and leasing | $ | 1,337 | 1,321 | 1,332 | 1,324 | 1,357 | 1 | (1) | $ | 5,314 | 5,253 | 1 | |||||||||||||||||||||||||||||||||||||||||||||||

| Treasury management and payments | 1,527 | 1,541 | 1,584 | 1,562 | 1,519 | (1) | 1 | 6,214 | 4,483 | 39 | |||||||||||||||||||||||||||||||||||||||||||||||||

| Other | 504 | 543 | 453 | 421 | 273 | (7) | 85 | 1,921 | 1,184 | 62 | |||||||||||||||||||||||||||||||||||||||||||||||||

| Total revenue | $ | 3,368 | 3,405 | 3,369 | 3,307 | 3,149 | (1) | 7 | $ | 13,449 | 10,920 | 23 | |||||||||||||||||||||||||||||||||||||||||||||||

| Selected Metrics | |||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| Return on allocated capital | 19.0 | % | 20.2 | 19.3 | 18.1 | 24.2 | 19.1 | % | 19.7 | ||||||||||||||||||||||||||||||||||||||||||||||||||

| Efficiency ratio | 48 | 45 | 48 | 53 | 48 | 49 | 55 | ||||||||||||||||||||||||||||||||||||||||||||||||||||

| Quarter ended | Dec 31, 2023 % Change from |

Year ended | |||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| ($ in millions) | Dec 31, 2023 |

Sep 30, 2023 |

Jun 30, 2023 |

Mar 31, 2023 |

Dec 31, 2022 |

Sep 30, 2023 |

Dec 31, 2022 |

Dec 31, 2023 |

Dec 31, 2022 |

% Change |

|||||||||||||||||||||||||||||||||||||||||||||||||

| Selected Balance Sheet Data (average) | |||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| Loans: | |||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| Commercial and industrial | $ | 162,877 | 164,182 | 165,980 | 163,210 | 159,236 | (1) | % | 2 | $ | 164,062 | 147,379 | 11 | % | |||||||||||||||||||||||||||||||||||||||||||||

| Commercial real estate | 45,393 | 45,716 | 45,855 | 45,862 | 45,551 | (1) | — | 45,705 | 45,130 | 1 | |||||||||||||||||||||||||||||||||||||||||||||||||

| Lease financing and other | 15,062 | 14,518 | 13,989 | 13,754 | 13,635 | 4 | 10 | 14,335 | 13,523 | 6 | |||||||||||||||||||||||||||||||||||||||||||||||||

| Total loans | $ | 223,332 | 224,416 | 225,824 | 222,826 | 218,422 | — | 2 | $ | 224,102 | 206,032 | 9 | |||||||||||||||||||||||||||||||||||||||||||||||

| Loans by Line of Business: | |||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| Middle Market Banking | $ | 118,971 | 120,509 | 122,204 | 121,625 | 119,740 | (1) | (1) | $ | 120,819 | 114,634 | 5 | |||||||||||||||||||||||||||||||||||||||||||||||

| Asset-Based Lending and Leasing | 104,361 | 103,907 | 103,620 | 101,201 | 98,682 | — | 6 | 103,283 | 91,398 | 13 | |||||||||||||||||||||||||||||||||||||||||||||||||

| Total loans | $ | 223,332 | 224,416 | 225,824 | 222,826 | 218,422 | — | 2 | $ | 224,102 | 206,032 | 9 | |||||||||||||||||||||||||||||||||||||||||||||||

| Total deposits | 163,299 | 160,556 | 166,747 | 170,467 | 175,442 | 2 | (7) | 165,235 | 186,079 | (11) | |||||||||||||||||||||||||||||||||||||||||||||||||

| Allocated capital | 25,500 | 25,500 | 25,500 | 25,500 | 19,500 | — | 31 | 25,500 | 19,500 | 31 | |||||||||||||||||||||||||||||||||||||||||||||||||

| Selected Balance Sheet Data (period-end) | |||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| Loans: | |||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| Commercial and industrial | $ | 163,797 | 165,094 | 168,492 | 166,853 | 163,797 | (1) | — | |||||||||||||||||||||||||||||||||||||||||||||||||||

| Commercial real estate | 45,534 | 45,663 | 45,784 | 45,895 | 45,816 | — | (1) | ||||||||||||||||||||||||||||||||||||||||||||||||||||

| Lease financing and other | 15,443 | 15,014 | 14,435 | 13,851 | 13,916 | 3 | 11 | ||||||||||||||||||||||||||||||||||||||||||||||||||||

| Total loans | $ | 224,774 | 225,771 | 228,711 | 226,599 | 223,529 | — | 1 | |||||||||||||||||||||||||||||||||||||||||||||||||||

| Loans by Line of Business: | |||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| Middle Market Banking | $ | 118,482 | 119,354 | 122,104 | 121,626 | 121,192 | (1) | (2) | |||||||||||||||||||||||||||||||||||||||||||||||||||

| Asset-Based Lending and Leasing | 106,292 | 106,417 | 106,607 | 104,973 | 102,337 | — | 4 | ||||||||||||||||||||||||||||||||||||||||||||||||||||

| Total loans | $ | 224,774 | 225,771 | 228,711 | 226,599 | 223,529 | — | 1 | |||||||||||||||||||||||||||||||||||||||||||||||||||

| Total deposits | 162,526 | 160,368 | 164,764 | 169,827 | 173,942 | 1 | (7) | ||||||||||||||||||||||||||||||||||||||||||||||||||||

| Quarter ended | Dec 31, 2023 % Change from |

Year ended | |||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| ($ in millions) | Dec 31, 2023 |

Sep 30, 2023 |

Jun 30, 2023 |

Mar 31, 2023 |

Dec 31, 2022 |

Sep 30, 2023 |

Dec 31, 2022 |

Dec 31, 2023 |

Dec 31, 2022 |

% Change |

|||||||||||||||||||||||||||||||||||||||||||||||||

| Income Statement | |||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| Net interest income | $ | 2,359 | 2,319 | 2,359 | 2,461 | 2,416 | 2 | % | (2) | $ | 9,498 | 8,733 | 9 | % | |||||||||||||||||||||||||||||||||||||||||||||

| Noninterest income: | |||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| Deposit-related fees | 246 | 247 | 247 | 236 | 240 | — | 3 | 976 | 1,068 | (9) | |||||||||||||||||||||||||||||||||||||||||||||||||

| Lending-related fees | 199 | 206 | 191 | 194 | 191 | (3) | 4 | 790 | 769 | 3 | |||||||||||||||||||||||||||||||||||||||||||||||||

| Investment banking fees | 489 | 545 | 390 | 314 | 331 | (10) | 48 | 1,738 | 1,492 | 16 | |||||||||||||||||||||||||||||||||||||||||||||||||

| Net gains from trading activities | 1,022 | 1,193 | 1,081 | 1,257 | 606 | (14) | 69 | 4,553 | 1,886 | 141 | |||||||||||||||||||||||||||||||||||||||||||||||||

| Other | 420 | 413 | 363 | 440 | 355 | 2 | 18 | 1,636 | 1,294 | 26 | |||||||||||||||||||||||||||||||||||||||||||||||||

| Total noninterest income | 2,376 | 2,604 | 2,272 | 2,441 | 1,723 | (9) | 38 | 9,693 | 6,509 | 49 | |||||||||||||||||||||||||||||||||||||||||||||||||

| Total revenue | 4,735 | 4,923 | 4,631 | 4,902 | 4,139 | (4) | 14 | 19,191 | 15,242 | 26 | |||||||||||||||||||||||||||||||||||||||||||||||||

| Net charge-offs | 376 | 105 | 83 | 17 | 10 | 258 | NM | 581 | (48) | NM | |||||||||||||||||||||||||||||||||||||||||||||||||

| Change in the allowance for credit losses | 122 | 219 | 850 | 235 | 31 | (44) | 294 | 1,426 | (137) | NM | |||||||||||||||||||||||||||||||||||||||||||||||||

| Provision for credit losses | 498 | 324 | 933 | 252 | 41 | 54 | NM | 2,007 | (185) | NM | |||||||||||||||||||||||||||||||||||||||||||||||||

| Noninterest expense | 2,132 | 2,182 | 2,087 | 2,217 | 1,837 | (2) | 16 | 8,618 | 7,560 | 14 | |||||||||||||||||||||||||||||||||||||||||||||||||

| Income before income tax expense | 2,105 | 2,417 | 1,611 | 2,433 | 2,261 | (13) | (7) | 8,566 | 7,867 | 9 | |||||||||||||||||||||||||||||||||||||||||||||||||

| Income tax expense | 523 | 601 | 401 | 615 | 569 | (13) | (8) | 2,140 | 1,989 | 8 | |||||||||||||||||||||||||||||||||||||||||||||||||

| Net income | $ | 1,582 | 1,816 | 1,210 | 1,818 | 1,692 | (13) | (7) | $ | 6,426 | 5,878 | 9 | |||||||||||||||||||||||||||||||||||||||||||||||

| Revenue by Line of Business | |||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| Banking: | |||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| Lending | $ | 774 | 721 | 685 | 692 | 593 | 7 | 31 | $ | 2,872 | 2,222 | 29 | |||||||||||||||||||||||||||||||||||||||||||||||

| Treasury Management and Payments | 742 | 747 | 762 | 785 | 738 | (1) | 1 | 3,036 | 2,369 | 28 | |||||||||||||||||||||||||||||||||||||||||||||||||

| Investment Banking | 383 | 430 | 311 | 280 | 317 | (11) | 21 | 1,404 | 1,206 | 16 | |||||||||||||||||||||||||||||||||||||||||||||||||

| Total Banking | 1,899 | 1,898 | 1,758 | 1,757 | 1,648 | — | 15 | 7,312 | 5,797 | 26 | |||||||||||||||||||||||||||||||||||||||||||||||||

| Commercial Real Estate | 1,291 | 1,376 | 1,333 | 1,311 | 1,267 | (6) | 2 | 5,311 | 4,534 | 17 | |||||||||||||||||||||||||||||||||||||||||||||||||

| Markets: | |||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| Fixed Income, Currencies, and Commodities (FICC) | 1,122 | 1,148 | 1,133 | 1,285 | 935 | (2) | 20 | 4,688 | 3,660 | 28 | |||||||||||||||||||||||||||||||||||||||||||||||||

| Equities | 457 | 518 | 397 | 437 | 279 | (12) | 64 | 1,809 | 1,115 | 62 | |||||||||||||||||||||||||||||||||||||||||||||||||

| Credit Adjustment (CVA/DVA) and Other | (8) | (12) | 14 | 71 | (35) | 33 | 77 | 65 | 20 | 225 | |||||||||||||||||||||||||||||||||||||||||||||||||

| Total Markets | 1,571 | 1,654 | 1,544 | 1,793 | 1,179 | (5) | 33 | 6,562 | 4,795 | 37 | |||||||||||||||||||||||||||||||||||||||||||||||||

| Other | (26) | (5) | (4) | 41 | 45 | NM | NM | 6 | 116 | (95) | |||||||||||||||||||||||||||||||||||||||||||||||||

| Total revenue | $ | 4,735 | 4,923 | 4,631 | 4,902 | 4,139 | (4) | 14 | $ | 19,191 | 15,242 | 26 | |||||||||||||||||||||||||||||||||||||||||||||||

| Selected Metrics | |||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| Return on allocated capital | 13.4 | % | 15.5 | 10.2 | 15.9 | 17.7 | 13.8 | % | 15.3 | ||||||||||||||||||||||||||||||||||||||||||||||||||

| Efficiency ratio | 45 | 44 | 45 | 45 | 44 | 45 | 50 | ||||||||||||||||||||||||||||||||||||||||||||||||||||

| Quarter ended | Dec 31, 2023 % Change from |

Year ended | |||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| ($ in millions) | Dec 31, 2023 |

Sep 30, 2023 |

Jun 30, 2023 |

Mar 31, 2023 |

Dec 31, 2022 |

Sep 30, 2023 |

Dec 31, 2022 |

Dec 31, 2023 |

Dec 31, 2022 |

% Change |

|||||||||||||||||||||||||||||||||||||||||||||||||

| Selected Balance Sheet Data (average) | |||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| Loans: | |||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| Commercial and industrial | $ | 191,014 | 191,128 | 190,529 | 193,770 | 196,697 | — | % | (3) | $ | 191,602 | 198,424 | (3) | % | |||||||||||||||||||||||||||||||||||||||||||||

| Commercial real estate | 99,077 | 100,523 | 100,941 | 100,972 | 101,553 | (1) | (2) | 100,373 | 98,560 | 2 | |||||||||||||||||||||||||||||||||||||||||||||||||

| Total loans | $ | 290,091 | 291,651 | 291,470 | 294,742 | 298,250 | (1) | (3) | $ | 291,975 | 296,984 | (2) | |||||||||||||||||||||||||||||||||||||||||||||||

| Loans by Line of Business: | |||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| Banking | $ | 94,699 | 94,010 | 95,413 | 99,078 | 104,187 | 1 | (9) | $ | 95,783 | 106,440 | (10) | |||||||||||||||||||||||||||||||||||||||||||||||

| Commercial Real Estate | 133,921 | 135,639 | 136,473 | 136,806 | 137,680 | (1) | (3) | 135,702 | 133,719 | 1 | |||||||||||||||||||||||||||||||||||||||||||||||||