00000677162024FYfalse0.250.25http://fasb.org/us-gaap/2024#IncomeLossFromDiscontinuedOperationsNetOfTaxAttributableToReportingEntityhttp://fasb.org/us-gaap/2024#IncomeLossFromDiscontinuedOperationsNetOfTaxAttributableToReportingEntityhttp://fasb.org/us-gaap/2024#IncomeLossFromDiscontinuedOperationsNetOfTaxAttributableToReportingEntity0.250.25P12M12http://fasb.org/us-gaap/2024#OtherLiabilitiesCurrenthttp://fasb.org/us-gaap/2024#OtherLiabilitiesNoncurrentiso4217:USDxbrli:sharesiso4217:USDxbrli:sharesxbrli:pureutr:MW00000677162024-01-012024-12-3100000677162024-06-2800000677162025-02-1300000677162023-01-012023-12-3100000677162022-01-012022-12-3100000677162024-12-3100000677162023-12-310000067716us-gaap:CommonStockMember2021-12-310000067716us-gaap:AdditionalPaidInCapitalMember2021-12-310000067716us-gaap:RetainedEarningsMember2021-12-310000067716us-gaap:AccumulatedOtherComprehensiveIncomeMember2021-12-310000067716us-gaap:TreasuryStockCommonMember2021-12-3100000677162021-12-310000067716us-gaap:RetainedEarningsMember2022-01-012022-12-310000067716us-gaap:AccumulatedOtherComprehensiveIncomeMember2022-01-012022-12-310000067716us-gaap:AdditionalPaidInCapitalMember2022-01-012022-12-310000067716us-gaap:TreasuryStockCommonMember2022-01-012022-12-310000067716us-gaap:CommonStockMember2022-01-012022-12-310000067716us-gaap:CommonStockMember2022-12-310000067716us-gaap:AdditionalPaidInCapitalMember2022-12-310000067716us-gaap:RetainedEarningsMember2022-12-310000067716us-gaap:AccumulatedOtherComprehensiveIncomeMember2022-12-310000067716us-gaap:TreasuryStockCommonMember2022-12-3100000677162022-12-310000067716us-gaap:RetainedEarningsMember2023-01-012023-12-310000067716us-gaap:AccumulatedOtherComprehensiveIncomeMember2023-01-012023-12-310000067716us-gaap:AdditionalPaidInCapitalMember2023-01-012023-12-310000067716us-gaap:TreasuryStockCommonMember2023-01-012023-12-310000067716us-gaap:CommonStockMember2023-01-012023-12-310000067716us-gaap:CommonStockMember2023-12-310000067716us-gaap:AdditionalPaidInCapitalMember2023-12-310000067716us-gaap:RetainedEarningsMember2023-12-310000067716us-gaap:AccumulatedOtherComprehensiveIncomeMember2023-12-310000067716us-gaap:TreasuryStockCommonMember2023-12-310000067716us-gaap:RetainedEarningsMember2024-01-012024-12-310000067716us-gaap:AccumulatedOtherComprehensiveIncomeMember2024-01-012024-12-310000067716us-gaap:AdditionalPaidInCapitalMember2024-01-012024-12-310000067716us-gaap:CommonStockMember2024-01-012024-12-310000067716us-gaap:CommonStockMember2024-12-310000067716us-gaap:AdditionalPaidInCapitalMember2024-12-310000067716us-gaap:RetainedEarningsMember2024-12-310000067716us-gaap:AccumulatedOtherComprehensiveIncomeMember2024-12-310000067716us-gaap:TreasuryStockCommonMember2024-12-310000067716us-gaap:DiscontinuedOperationsDisposedOfByMeansOtherThanSaleSpinoffMembermdu:KnifeRiverCorporationMember2023-05-310000067716srt:RevisionOfPriorPeriodErrorCorrectionAdjustmentMember2023-01-012023-12-310000067716srt:RevisionOfPriorPeriodErrorCorrectionAdjustmentMember2022-01-012022-12-310000067716us-gaap:DiscontinuedOperationsDisposedOfByMeansOtherThanSaleSpinoffMembermdu:KnifeRiverCorporationMember2023-05-312023-05-310000067716us-gaap:DiscontinuedOperationsDisposedOfByMeansOtherThanSaleSpinoffMembermdu:EverusMember2024-10-312024-10-310000067716us-gaap:TradeAccountsReceivableMembermdu:ElectricMember2022-12-310000067716us-gaap:TradeAccountsReceivableMembermdu:NaturalGasDistributionMember2022-12-310000067716us-gaap:TradeAccountsReceivableMembermdu:PipelineandMidstreamMember2022-12-310000067716us-gaap:TradeAccountsReceivableMember2022-12-310000067716us-gaap:TradeAccountsReceivableMembermdu:ElectricMember2023-01-012023-12-310000067716us-gaap:TradeAccountsReceivableMembermdu:NaturalGasDistributionMember2023-01-012023-12-310000067716us-gaap:TradeAccountsReceivableMembermdu:PipelineandMidstreamMember2023-01-012023-12-310000067716us-gaap:TradeAccountsReceivableMember2023-01-012023-12-310000067716us-gaap:TradeAccountsReceivableMembermdu:ElectricMember2023-12-310000067716us-gaap:TradeAccountsReceivableMembermdu:NaturalGasDistributionMember2023-12-310000067716us-gaap:TradeAccountsReceivableMembermdu:PipelineandMidstreamMember2023-12-310000067716us-gaap:TradeAccountsReceivableMember2023-12-310000067716us-gaap:TradeAccountsReceivableMembermdu:ElectricMember2024-01-012024-12-310000067716us-gaap:TradeAccountsReceivableMembermdu:NaturalGasDistributionMember2024-01-012024-12-310000067716us-gaap:TradeAccountsReceivableMembermdu:PipelineandMidstreamMember2024-01-012024-12-310000067716us-gaap:TradeAccountsReceivableMember2024-01-012024-12-310000067716us-gaap:TradeAccountsReceivableMembermdu:ElectricMember2024-12-310000067716us-gaap:TradeAccountsReceivableMembermdu:NaturalGasDistributionMember2024-12-310000067716us-gaap:TradeAccountsReceivableMembermdu:PipelineandMidstreamMember2024-12-310000067716us-gaap:TradeAccountsReceivableMember2024-12-310000067716us-gaap:DiscontinuedOperationsDisposedOfByMeansOtherThanSaleSpinoffMembermdu:KnifeRiverCorporationMember2023-11-012023-11-300000067716mdu:KnifeRiverCorporationMemberus-gaap:SeniorNotesMember2023-04-250000067716mdu:KnifeRiverCorporationMemberus-gaap:RevolvingCreditFacilityMember2023-04-250000067716mdu:KnifeRiverCorporationMembermdu:TermLoanAgreementMember2023-04-250000067716mdu:KnifeRiverCorporationMember2023-04-252023-04-250000067716mdu:KnifeRiverCorporationMemberus-gaap:DiscontinuedOperationsDisposedOfByMeansOtherThanSaleSpinoffMembermdu:CashReceivedTSAMember2024-01-012024-12-310000067716mdu:KnifeRiverCorporationMemberus-gaap:DiscontinuedOperationsDisposedOfByMeansOtherThanSaleSpinoffMembermdu:CashReceivedTSAMember2023-01-012023-12-310000067716mdu:KnifeRiverCorporationMemberus-gaap:DiscontinuedOperationsDisposedOfByMeansOtherThanSaleSpinoffMembermdu:CashPaidTSAMember2024-01-012024-12-310000067716mdu:KnifeRiverCorporationMemberus-gaap:DiscontinuedOperationsDisposedOfByMeansOtherThanSaleSpinoffMembermdu:CashPaidTSAMember2023-01-012023-12-310000067716mdu:EverusMemberus-gaap:DiscontinuedOperationsDisposedOfByMeansOtherThanSaleSpinoffMembermdu:CashReceivedTSAMember2024-01-012024-12-310000067716mdu:EverusMemberus-gaap:DiscontinuedOperationsDisposedOfByMeansOtherThanSaleSpinoffMembermdu:CashPaidTSAMember2024-01-012024-12-310000067716us-gaap:DiscontinuedOperationsDisposedOfByMeansOtherThanSaleSpinoffMembermdu:EverusMember2024-01-012024-12-310000067716mdu:EverusMemberus-gaap:DiscontinuedOperationsDisposedOfByMeansOtherThanSaleSpinoffMembersrt:MaximumMember2024-01-012024-12-310000067716us-gaap:DiscontinuedOperationsDisposedOfByMeansOtherThanSaleSpinoffMembermdu:KnifeRiverCorporationMember2024-01-012024-12-310000067716us-gaap:DiscontinuedOperationsDisposedOfByMeansOtherThanSaleSpinoffMembermdu:KnifeRiverCorporationMember2023-01-012023-12-310000067716us-gaap:DiscontinuedOperationsDisposedOfByMeansOtherThanSaleSpinoffMembermdu:KnifeRiverCorporationMember2022-01-012022-12-310000067716us-gaap:DiscontinuedOperationsDisposedOfByMeansOtherThanSaleSpinoffMembermdu:EverusCorporationMember2023-12-310000067716mdu:ResidentialUtilitySalesMemberus-gaap:OperatingSegmentsMembermdu:ElectricMember2024-01-012024-12-310000067716mdu:ResidentialUtilitySalesMemberus-gaap:OperatingSegmentsMembermdu:NaturalGasDistributionMember2024-01-012024-12-310000067716mdu:ResidentialUtilitySalesMemberus-gaap:OperatingSegmentsMembermdu:PipelineandMidstreamMember2024-01-012024-12-310000067716mdu:ResidentialUtilitySalesMemberus-gaap:OperatingSegmentsMemberus-gaap:CorporateAndOtherMember2024-01-012024-12-310000067716mdu:ResidentialUtilitySalesMember2024-01-012024-12-310000067716mdu:CommercialUtilitySalesMemberus-gaap:OperatingSegmentsMembermdu:ElectricMember2024-01-012024-12-310000067716mdu:CommercialUtilitySalesMemberus-gaap:OperatingSegmentsMembermdu:NaturalGasDistributionMember2024-01-012024-12-310000067716mdu:CommercialUtilitySalesMemberus-gaap:OperatingSegmentsMembermdu:PipelineandMidstreamMember2024-01-012024-12-310000067716mdu:CommercialUtilitySalesMemberus-gaap:OperatingSegmentsMemberus-gaap:CorporateAndOtherMember2024-01-012024-12-310000067716mdu:CommercialUtilitySalesMember2024-01-012024-12-310000067716mdu:IndustrialUtilitySalesMemberus-gaap:OperatingSegmentsMembermdu:ElectricMember2024-01-012024-12-310000067716mdu:IndustrialUtilitySalesMemberus-gaap:OperatingSegmentsMembermdu:NaturalGasDistributionMember2024-01-012024-12-310000067716mdu:IndustrialUtilitySalesMemberus-gaap:OperatingSegmentsMembermdu:PipelineandMidstreamMember2024-01-012024-12-310000067716mdu:IndustrialUtilitySalesMemberus-gaap:OperatingSegmentsMemberus-gaap:CorporateAndOtherMember2024-01-012024-12-310000067716mdu:IndustrialUtilitySalesMember2024-01-012024-12-310000067716mdu:OtherUtilitySalesMemberus-gaap:OperatingSegmentsMembermdu:ElectricMember2024-01-012024-12-310000067716mdu:OtherUtilitySalesMemberus-gaap:OperatingSegmentsMembermdu:NaturalGasDistributionMember2024-01-012024-12-310000067716mdu:OtherUtilitySalesMemberus-gaap:OperatingSegmentsMembermdu:PipelineandMidstreamMember2024-01-012024-12-310000067716mdu:OtherUtilitySalesMemberus-gaap:OperatingSegmentsMemberus-gaap:CorporateAndOtherMember2024-01-012024-12-310000067716mdu:OtherUtilitySalesMember2024-01-012024-12-310000067716us-gaap:OperatingSegmentsMembermdu:NaturalGasTransportationMembermdu:ElectricMember2024-01-012024-12-310000067716us-gaap:OperatingSegmentsMembermdu:NaturalGasTransportationMembermdu:NaturalGasDistributionMember2024-01-012024-12-310000067716us-gaap:OperatingSegmentsMembermdu:NaturalGasTransportationMembermdu:PipelineandMidstreamMember2024-01-012024-12-310000067716us-gaap:OperatingSegmentsMembermdu:NaturalGasTransportationMemberus-gaap:CorporateAndOtherMember2024-01-012024-12-310000067716mdu:NaturalGasTransportationMember2024-01-012024-12-310000067716us-gaap:OperatingSegmentsMemberus-gaap:NaturalGasStorageMembermdu:ElectricMember2024-01-012024-12-310000067716us-gaap:OperatingSegmentsMemberus-gaap:NaturalGasStorageMembermdu:NaturalGasDistributionMember2024-01-012024-12-310000067716us-gaap:OperatingSegmentsMemberus-gaap:NaturalGasStorageMembermdu:PipelineandMidstreamMember2024-01-012024-12-310000067716us-gaap:OperatingSegmentsMemberus-gaap:NaturalGasStorageMemberus-gaap:CorporateAndOtherMember2024-01-012024-12-310000067716us-gaap:NaturalGasStorageMember2024-01-012024-12-310000067716us-gaap:OperatingSegmentsMembermdu:OtherRevenuesMembermdu:ElectricMember2024-01-012024-12-310000067716us-gaap:OperatingSegmentsMembermdu:OtherRevenuesMembermdu:NaturalGasDistributionMember2024-01-012024-12-310000067716us-gaap:OperatingSegmentsMembermdu:OtherRevenuesMembermdu:PipelineandMidstreamMember2024-01-012024-12-310000067716us-gaap:OperatingSegmentsMembermdu:OtherRevenuesMemberus-gaap:CorporateAndOtherMember2024-01-012024-12-310000067716mdu:OtherRevenuesMember2024-01-012024-12-310000067716us-gaap:IntersegmentEliminationMembermdu:ElectricMember2024-01-012024-12-310000067716us-gaap:IntersegmentEliminationMembermdu:NaturalGasDistributionMember2024-01-012024-12-310000067716us-gaap:IntersegmentEliminationMembermdu:PipelineandMidstreamMember2024-01-012024-12-310000067716us-gaap:IntersegmentEliminationMemberus-gaap:CorporateAndOtherMember2024-01-012024-12-310000067716us-gaap:IntersegmentEliminationMember2024-01-012024-12-310000067716us-gaap:OperatingSegmentsMembermdu:ElectricMember2024-01-012024-12-310000067716us-gaap:OperatingSegmentsMembermdu:NaturalGasDistributionMember2024-01-012024-12-310000067716us-gaap:OperatingSegmentsMembermdu:PipelineandMidstreamMember2024-01-012024-12-310000067716us-gaap:OperatingSegmentsMemberus-gaap:CorporateAndOtherMember2024-01-012024-12-310000067716mdu:ResidentialUtilitySalesMemberus-gaap:OperatingSegmentsMembermdu:ElectricMember2023-01-012023-12-310000067716mdu:ResidentialUtilitySalesMemberus-gaap:OperatingSegmentsMembermdu:NaturalGasDistributionMember2023-01-012023-12-310000067716mdu:ResidentialUtilitySalesMemberus-gaap:OperatingSegmentsMembermdu:PipelineandMidstreamMember2023-01-012023-12-310000067716mdu:ResidentialUtilitySalesMemberus-gaap:OperatingSegmentsMemberus-gaap:CorporateAndOtherMember2023-01-012023-12-310000067716mdu:ResidentialUtilitySalesMember2023-01-012023-12-310000067716mdu:CommercialUtilitySalesMemberus-gaap:OperatingSegmentsMembermdu:ElectricMember2023-01-012023-12-310000067716mdu:CommercialUtilitySalesMemberus-gaap:OperatingSegmentsMembermdu:NaturalGasDistributionMember2023-01-012023-12-310000067716mdu:CommercialUtilitySalesMemberus-gaap:OperatingSegmentsMembermdu:PipelineandMidstreamMember2023-01-012023-12-310000067716mdu:CommercialUtilitySalesMemberus-gaap:OperatingSegmentsMemberus-gaap:CorporateAndOtherMember2023-01-012023-12-310000067716mdu:CommercialUtilitySalesMember2023-01-012023-12-310000067716mdu:IndustrialUtilitySalesMemberus-gaap:OperatingSegmentsMembermdu:ElectricMember2023-01-012023-12-310000067716mdu:IndustrialUtilitySalesMemberus-gaap:OperatingSegmentsMembermdu:NaturalGasDistributionMember2023-01-012023-12-310000067716mdu:IndustrialUtilitySalesMemberus-gaap:OperatingSegmentsMembermdu:PipelineandMidstreamMember2023-01-012023-12-310000067716mdu:IndustrialUtilitySalesMemberus-gaap:OperatingSegmentsMemberus-gaap:CorporateAndOtherMember2023-01-012023-12-310000067716mdu:IndustrialUtilitySalesMember2023-01-012023-12-310000067716mdu:OtherUtilitySalesMemberus-gaap:OperatingSegmentsMembermdu:ElectricMember2023-01-012023-12-310000067716mdu:OtherUtilitySalesMemberus-gaap:OperatingSegmentsMembermdu:NaturalGasDistributionMember2023-01-012023-12-310000067716mdu:OtherUtilitySalesMemberus-gaap:OperatingSegmentsMembermdu:PipelineandMidstreamMember2023-01-012023-12-310000067716mdu:OtherUtilitySalesMemberus-gaap:OperatingSegmentsMemberus-gaap:CorporateAndOtherMember2023-01-012023-12-310000067716mdu:OtherUtilitySalesMember2023-01-012023-12-310000067716us-gaap:OperatingSegmentsMembermdu:NaturalGasTransportationMembermdu:ElectricMember2023-01-012023-12-310000067716us-gaap:OperatingSegmentsMembermdu:NaturalGasTransportationMembermdu:NaturalGasDistributionMember2023-01-012023-12-310000067716us-gaap:OperatingSegmentsMembermdu:NaturalGasTransportationMembermdu:PipelineandMidstreamMember2023-01-012023-12-310000067716us-gaap:OperatingSegmentsMembermdu:NaturalGasTransportationMemberus-gaap:CorporateAndOtherMember2023-01-012023-12-310000067716mdu:NaturalGasTransportationMember2023-01-012023-12-310000067716us-gaap:OperatingSegmentsMemberus-gaap:NaturalGasStorageMembermdu:ElectricMember2023-01-012023-12-310000067716us-gaap:OperatingSegmentsMemberus-gaap:NaturalGasStorageMembermdu:NaturalGasDistributionMember2023-01-012023-12-310000067716us-gaap:OperatingSegmentsMemberus-gaap:NaturalGasStorageMembermdu:PipelineandMidstreamMember2023-01-012023-12-310000067716us-gaap:OperatingSegmentsMemberus-gaap:NaturalGasStorageMemberus-gaap:CorporateAndOtherMember2023-01-012023-12-310000067716us-gaap:NaturalGasStorageMember2023-01-012023-12-310000067716us-gaap:OperatingSegmentsMembermdu:OtherRevenuesMembermdu:ElectricMember2023-01-012023-12-310000067716us-gaap:OperatingSegmentsMembermdu:OtherRevenuesMembermdu:NaturalGasDistributionMember2023-01-012023-12-310000067716us-gaap:OperatingSegmentsMembermdu:OtherRevenuesMembermdu:PipelineandMidstreamMember2023-01-012023-12-310000067716us-gaap:OperatingSegmentsMembermdu:OtherRevenuesMemberus-gaap:CorporateAndOtherMember2023-01-012023-12-310000067716mdu:OtherRevenuesMember2023-01-012023-12-310000067716us-gaap:IntersegmentEliminationMembermdu:ElectricMember2023-01-012023-12-310000067716us-gaap:IntersegmentEliminationMembermdu:NaturalGasDistributionMember2023-01-012023-12-310000067716us-gaap:IntersegmentEliminationMembermdu:PipelineandMidstreamMember2023-01-012023-12-310000067716us-gaap:IntersegmentEliminationMemberus-gaap:CorporateAndOtherMember2023-01-012023-12-310000067716us-gaap:IntersegmentEliminationMember2023-01-012023-12-310000067716us-gaap:OperatingSegmentsMembermdu:ElectricMember2023-01-012023-12-310000067716us-gaap:OperatingSegmentsMembermdu:NaturalGasDistributionMember2023-01-012023-12-310000067716us-gaap:OperatingSegmentsMembermdu:PipelineandMidstreamMember2023-01-012023-12-310000067716us-gaap:OperatingSegmentsMemberus-gaap:CorporateAndOtherMember2023-01-012023-12-310000067716mdu:ResidentialUtilitySalesMemberus-gaap:OperatingSegmentsMembermdu:ElectricMember2022-01-012022-12-310000067716mdu:ResidentialUtilitySalesMemberus-gaap:OperatingSegmentsMembermdu:NaturalGasDistributionMember2022-01-012022-12-310000067716mdu:ResidentialUtilitySalesMemberus-gaap:OperatingSegmentsMembermdu:PipelineandMidstreamMember2022-01-012022-12-310000067716mdu:ResidentialUtilitySalesMemberus-gaap:OperatingSegmentsMemberus-gaap:CorporateAndOtherMember2022-01-012022-12-310000067716mdu:ResidentialUtilitySalesMember2022-01-012022-12-310000067716mdu:CommercialUtilitySalesMemberus-gaap:OperatingSegmentsMembermdu:ElectricMember2022-01-012022-12-310000067716mdu:CommercialUtilitySalesMemberus-gaap:OperatingSegmentsMembermdu:NaturalGasDistributionMember2022-01-012022-12-310000067716mdu:CommercialUtilitySalesMemberus-gaap:OperatingSegmentsMembermdu:PipelineandMidstreamMember2022-01-012022-12-310000067716mdu:CommercialUtilitySalesMemberus-gaap:OperatingSegmentsMemberus-gaap:CorporateAndOtherMember2022-01-012022-12-310000067716mdu:CommercialUtilitySalesMember2022-01-012022-12-310000067716mdu:IndustrialUtilitySalesMemberus-gaap:OperatingSegmentsMembermdu:ElectricMember2022-01-012022-12-310000067716mdu:IndustrialUtilitySalesMemberus-gaap:OperatingSegmentsMembermdu:NaturalGasDistributionMember2022-01-012022-12-310000067716mdu:IndustrialUtilitySalesMemberus-gaap:OperatingSegmentsMembermdu:PipelineandMidstreamMember2022-01-012022-12-310000067716mdu:IndustrialUtilitySalesMemberus-gaap:OperatingSegmentsMemberus-gaap:CorporateAndOtherMember2022-01-012022-12-310000067716mdu:IndustrialUtilitySalesMember2022-01-012022-12-310000067716mdu:OtherUtilitySalesMemberus-gaap:OperatingSegmentsMembermdu:ElectricMember2022-01-012022-12-310000067716mdu:OtherUtilitySalesMemberus-gaap:OperatingSegmentsMembermdu:NaturalGasDistributionMember2022-01-012022-12-310000067716mdu:OtherUtilitySalesMemberus-gaap:OperatingSegmentsMembermdu:PipelineandMidstreamMember2022-01-012022-12-310000067716mdu:OtherUtilitySalesMemberus-gaap:OperatingSegmentsMemberus-gaap:CorporateAndOtherMember2022-01-012022-12-310000067716mdu:OtherUtilitySalesMember2022-01-012022-12-310000067716us-gaap:OperatingSegmentsMembermdu:NaturalGasTransportationMembermdu:ElectricMember2022-01-012022-12-310000067716us-gaap:OperatingSegmentsMembermdu:NaturalGasTransportationMembermdu:NaturalGasDistributionMember2022-01-012022-12-310000067716us-gaap:OperatingSegmentsMembermdu:NaturalGasTransportationMembermdu:PipelineandMidstreamMember2022-01-012022-12-310000067716us-gaap:OperatingSegmentsMembermdu:NaturalGasTransportationMemberus-gaap:CorporateAndOtherMember2022-01-012022-12-310000067716mdu:NaturalGasTransportationMember2022-01-012022-12-310000067716us-gaap:OperatingSegmentsMemberus-gaap:NaturalGasStorageMembermdu:ElectricMember2022-01-012022-12-310000067716us-gaap:OperatingSegmentsMemberus-gaap:NaturalGasStorageMembermdu:NaturalGasDistributionMember2022-01-012022-12-310000067716us-gaap:OperatingSegmentsMemberus-gaap:NaturalGasStorageMembermdu:PipelineandMidstreamMember2022-01-012022-12-310000067716us-gaap:OperatingSegmentsMemberus-gaap:NaturalGasStorageMemberus-gaap:CorporateAndOtherMember2022-01-012022-12-310000067716us-gaap:NaturalGasStorageMember2022-01-012022-12-310000067716us-gaap:OperatingSegmentsMembermdu:OtherRevenuesMembermdu:ElectricMember2022-01-012022-12-310000067716us-gaap:OperatingSegmentsMembermdu:OtherRevenuesMembermdu:NaturalGasDistributionMember2022-01-012022-12-310000067716us-gaap:OperatingSegmentsMembermdu:OtherRevenuesMembermdu:PipelineandMidstreamMember2022-01-012022-12-310000067716us-gaap:OperatingSegmentsMembermdu:OtherRevenuesMemberus-gaap:CorporateAndOtherMember2022-01-012022-12-310000067716mdu:OtherRevenuesMember2022-01-012022-12-310000067716us-gaap:IntersegmentEliminationMembermdu:ElectricMember2022-01-012022-12-310000067716us-gaap:IntersegmentEliminationMembermdu:NaturalGasDistributionMember2022-01-012022-12-310000067716us-gaap:IntersegmentEliminationMembermdu:PipelineandMidstreamMember2022-01-012022-12-310000067716us-gaap:IntersegmentEliminationMemberus-gaap:CorporateAndOtherMember2022-01-012022-12-310000067716us-gaap:IntersegmentEliminationMember2022-01-012022-12-310000067716us-gaap:OperatingSegmentsMembermdu:ElectricMember2022-01-012022-12-310000067716us-gaap:OperatingSegmentsMembermdu:NaturalGasDistributionMember2022-01-012022-12-310000067716us-gaap:OperatingSegmentsMembermdu:PipelineandMidstreamMember2022-01-012022-12-310000067716us-gaap:OperatingSegmentsMemberus-gaap:CorporateAndOtherMember2022-01-012022-12-310000067716mdu:FirmTransportationContractMember2024-01-012024-12-310000067716mdu:FirmStorageContractMember2024-01-012024-12-3100000677162025-01-012024-12-3100000677162026-01-012024-12-3100000677162027-01-012024-12-310000067716us-gaap:ElectricGenerationEquipmentMembermdu:ElectricMember2024-12-310000067716us-gaap:ElectricGenerationEquipmentMembermdu:ElectricMember2023-12-310000067716us-gaap:ElectricDistributionMembermdu:ElectricMember2024-12-310000067716us-gaap:ElectricDistributionMembermdu:ElectricMember2023-12-310000067716us-gaap:ElectricTransmissionMembermdu:ElectricMember2024-12-310000067716us-gaap:ElectricTransmissionMembermdu:ElectricMember2023-12-310000067716us-gaap:ConstructionInProgressMembermdu:ElectricMember2024-12-310000067716us-gaap:ConstructionInProgressMembermdu:ElectricMember2023-12-310000067716us-gaap:OtherCapitalizedPropertyPlantAndEquipmentMembermdu:ElectricMember2024-12-310000067716us-gaap:OtherCapitalizedPropertyPlantAndEquipmentMembermdu:ElectricMember2023-12-310000067716us-gaap:GasDistributionMembermdu:NaturalGasDistributionMember2024-12-310000067716us-gaap:GasDistributionMembermdu:NaturalGasDistributionMember2023-12-310000067716us-gaap:GasTransmissionMembermdu:NaturalGasDistributionMember2024-12-310000067716us-gaap:GasTransmissionMembermdu:NaturalGasDistributionMember2023-12-310000067716us-gaap:NaturalGasStorageMembermdu:NaturalGasDistributionMember2024-12-310000067716us-gaap:NaturalGasStorageMembermdu:NaturalGasDistributionMember2023-12-310000067716mdu:GeneralMembermdu:NaturalGasDistributionMember2024-12-310000067716mdu:GeneralMembermdu:NaturalGasDistributionMember2023-12-310000067716us-gaap:ConstructionInProgressMembermdu:NaturalGasDistributionMember2024-12-310000067716us-gaap:ConstructionInProgressMembermdu:NaturalGasDistributionMember2023-12-310000067716us-gaap:OtherCapitalizedPropertyPlantAndEquipmentMembermdu:NaturalGasDistributionMember2024-12-310000067716us-gaap:OtherCapitalizedPropertyPlantAndEquipmentMembermdu:NaturalGasDistributionMember2023-12-310000067716us-gaap:GasTransmissionMembermdu:PipelineandMidstreamMember2024-12-310000067716us-gaap:GasTransmissionMembermdu:PipelineandMidstreamMember2023-12-310000067716us-gaap:NaturalGasStorageMembermdu:PipelineandMidstreamMember2024-12-310000067716us-gaap:NaturalGasStorageMembermdu:PipelineandMidstreamMember2023-12-310000067716us-gaap:ConstructionInProgressMembermdu:PipelineandMidstreamMember2024-12-310000067716us-gaap:ConstructionInProgressMembermdu:PipelineandMidstreamMember2023-12-310000067716us-gaap:OtherCapitalizedPropertyPlantAndEquipmentMembermdu:PipelineandMidstreamMember2024-12-310000067716us-gaap:OtherCapitalizedPropertyPlantAndEquipmentMembermdu:PipelineandMidstreamMember2023-12-310000067716us-gaap:LandMemberus-gaap:CorporateAndOtherMember2024-12-310000067716us-gaap:LandMemberus-gaap:CorporateAndOtherMember2023-12-310000067716us-gaap:AssetRecoverableGasCostsMembersrt:MinimumMember2024-12-310000067716us-gaap:AssetRecoverableGasCostsMember2024-12-310000067716us-gaap:AssetRecoverableGasCostsMember2023-12-310000067716mdu:EnvironmentalComplianceProgramsMembersrt:MinimumMember2024-12-310000067716mdu:EnvironmentalComplianceProgramsMember2024-12-310000067716mdu:EnvironmentalComplianceProgramsMember2023-12-310000067716us-gaap:RenewableEnergyProgramMember2024-12-310000067716us-gaap:RenewableEnergyProgramMember2023-12-310000067716mdu:ElectricFuelAndPurchasedPowerDeferralMembersrt:MinimumMember2024-12-310000067716mdu:ElectricFuelAndPurchasedPowerDeferralMember2024-12-310000067716mdu:ElectricFuelAndPurchasedPowerDeferralMember2023-12-310000067716mdu:DecouplingMember2024-12-310000067716mdu:DecouplingMember2023-12-310000067716us-gaap:RegulatoryClauseRevenuesUnderRecoveredMembersrt:MinimumMember2024-12-310000067716us-gaap:RegulatoryClauseRevenuesUnderRecoveredMember2024-12-310000067716us-gaap:RegulatoryClauseRevenuesUnderRecoveredMember2023-12-310000067716us-gaap:OtherRegulatoryAssetsLiabilitiesMembersrt:MinimumMember2024-12-310000067716us-gaap:OtherRegulatoryAssetsLiabilitiesMember2024-12-310000067716us-gaap:OtherRegulatoryAssetsLiabilitiesMember2023-12-310000067716us-gaap:PensionAndOtherPostretirementPlansCostsMember2024-12-310000067716us-gaap:PensionAndOtherPostretirementPlansCostsMember2023-12-310000067716us-gaap:RegulatoryClauseRevenuesUnderRecoveredMembersrt:MaximumMember2024-12-310000067716us-gaap:AssetRetirementObligationCostsMember2024-12-310000067716us-gaap:AssetRetirementObligationCostsMember2023-12-310000067716us-gaap:EnvironmentalRestorationCostsMember2024-12-310000067716us-gaap:EnvironmentalRestorationCostsMember2023-12-310000067716us-gaap:DeferredIncomeTaxChargesMember2024-12-310000067716us-gaap:DeferredIncomeTaxChargesMember2023-12-310000067716mdu:ElectricFuelAndPurchasedPowerDeferralMembersrt:MaximumMember2024-12-310000067716mdu:Covid19DeferredCostsMember2024-12-310000067716mdu:Covid19DeferredCostsMember2023-12-310000067716us-gaap:LossOnReacquiredDebtMember2024-12-310000067716us-gaap:LossOnReacquiredDebtMember2023-12-310000067716us-gaap:AssetRecoverableGasCostsMembersrt:MaximumMember2024-12-310000067716mdu:EnvironmentalComplianceProgramsMember2024-12-310000067716mdu:EnvironmentalComplianceProgramsMember2023-12-310000067716mdu:LiabilitiesRefundableGasCostsMember2024-12-310000067716mdu:LiabilitiesRefundableGasCostsMember2023-12-310000067716mdu:MarginSharingMember2024-12-310000067716mdu:MarginSharingMember2023-12-310000067716mdu:ProvisionForRateRefundMember2024-12-310000067716mdu:ProvisionForRateRefundMember2023-12-310000067716us-gaap:DeferredIncomeTaxChargesMember2024-12-310000067716us-gaap:DeferredIncomeTaxChargesMember2023-12-310000067716us-gaap:RenewableEnergyProgramMember2024-12-310000067716us-gaap:RenewableEnergyProgramMember2023-12-310000067716mdu:RegulatoryClauseRevenuesOverRecoveredMembersrt:MaximumMember2024-12-310000067716mdu:RegulatoryClauseRevenuesOverRecoveredMember2024-12-310000067716mdu:RegulatoryClauseRevenuesOverRecoveredMember2023-12-310000067716us-gaap:OtherRegulatoryAssetsLiabilitiesMembersrt:MaximumMember2024-12-310000067716us-gaap:OtherRegulatoryAssetsLiabilitiesMember2024-12-310000067716us-gaap:OtherRegulatoryAssetsLiabilitiesMember2023-12-310000067716us-gaap:RemovalCostsMember2024-12-310000067716us-gaap:RemovalCostsMember2023-12-310000067716mdu:AccumulatedDefferedITCMember2024-12-310000067716mdu:AccumulatedDefferedITCMember2023-12-310000067716us-gaap:PensionAndOtherPostretirementPlansCostsMember2024-12-310000067716us-gaap:PensionAndOtherPostretirementPlansCostsMember2023-12-310000067716mdu:NaturalGasDistributionMember2024-12-310000067716mdu:NaturalGasDistributionMember2023-12-3100000677162024-01-012024-03-3100000677162023-10-012023-12-310000067716us-gaap:MortgageBackedSecuritiesMember2024-12-310000067716us-gaap:USTreasurySecuritiesMember2024-12-310000067716us-gaap:MortgageBackedSecuritiesMember2023-12-310000067716us-gaap:USTreasurySecuritiesMember2023-12-310000067716us-gaap:FairValueInputsLevel1Memberus-gaap:FairValueMeasurementsRecurringMemberus-gaap:MoneyMarketFundsMember2024-12-310000067716us-gaap:FairValueInputsLevel2Memberus-gaap:FairValueMeasurementsRecurringMemberus-gaap:MoneyMarketFundsMember2024-12-310000067716us-gaap:FairValueInputsLevel3Memberus-gaap:FairValueMeasurementsRecurringMemberus-gaap:MoneyMarketFundsMember2024-12-310000067716us-gaap:FairValueMeasurementsRecurringMemberus-gaap:MoneyMarketFundsMember2024-12-310000067716us-gaap:FairValueInputsLevel1Memberus-gaap:FairValueMeasurementsRecurringMemberus-gaap:CashSurrenderValueMember2024-12-310000067716us-gaap:FairValueInputsLevel2Memberus-gaap:FairValueMeasurementsRecurringMemberus-gaap:CashSurrenderValueMember2024-12-310000067716us-gaap:FairValueInputsLevel3Memberus-gaap:FairValueMeasurementsRecurringMemberus-gaap:CashSurrenderValueMember2024-12-310000067716us-gaap:FairValueMeasurementsRecurringMemberus-gaap:CashSurrenderValueMember2024-12-310000067716us-gaap:FairValueInputsLevel1Memberus-gaap:FairValueMeasurementsRecurringMemberus-gaap:MortgageBackedSecuritiesMember2024-12-310000067716us-gaap:FairValueInputsLevel2Memberus-gaap:FairValueMeasurementsRecurringMemberus-gaap:MortgageBackedSecuritiesMember2024-12-310000067716us-gaap:FairValueInputsLevel3Memberus-gaap:FairValueMeasurementsRecurringMemberus-gaap:MortgageBackedSecuritiesMember2024-12-310000067716us-gaap:FairValueMeasurementsRecurringMemberus-gaap:MortgageBackedSecuritiesMember2024-12-310000067716us-gaap:FairValueInputsLevel1Memberus-gaap:FairValueMeasurementsRecurringMemberus-gaap:USTreasurySecuritiesMember2024-12-310000067716us-gaap:FairValueInputsLevel2Memberus-gaap:FairValueMeasurementsRecurringMemberus-gaap:USTreasurySecuritiesMember2024-12-310000067716us-gaap:FairValueInputsLevel3Memberus-gaap:FairValueMeasurementsRecurringMemberus-gaap:USTreasurySecuritiesMember2024-12-310000067716us-gaap:FairValueMeasurementsRecurringMemberus-gaap:USTreasurySecuritiesMember2024-12-310000067716us-gaap:FairValueInputsLevel1Memberus-gaap:FairValueMeasurementsRecurringMember2024-12-310000067716us-gaap:FairValueInputsLevel2Memberus-gaap:FairValueMeasurementsRecurringMember2024-12-310000067716us-gaap:FairValueInputsLevel3Memberus-gaap:FairValueMeasurementsRecurringMember2024-12-310000067716us-gaap:FairValueMeasurementsRecurringMember2024-12-310000067716us-gaap:FairValueInputsLevel1Memberus-gaap:FairValueMeasurementsRecurringMemberus-gaap:MoneyMarketFundsMember2023-12-310000067716us-gaap:FairValueInputsLevel2Memberus-gaap:FairValueMeasurementsRecurringMemberus-gaap:MoneyMarketFundsMember2023-12-310000067716us-gaap:FairValueInputsLevel3Memberus-gaap:FairValueMeasurementsRecurringMemberus-gaap:MoneyMarketFundsMember2023-12-310000067716us-gaap:FairValueMeasurementsRecurringMemberus-gaap:MoneyMarketFundsMember2023-12-310000067716us-gaap:FairValueInputsLevel1Memberus-gaap:FairValueMeasurementsRecurringMemberus-gaap:CashSurrenderValueMember2023-12-310000067716us-gaap:FairValueInputsLevel2Memberus-gaap:FairValueMeasurementsRecurringMemberus-gaap:CashSurrenderValueMember2023-12-310000067716us-gaap:FairValueInputsLevel3Memberus-gaap:FairValueMeasurementsRecurringMemberus-gaap:CashSurrenderValueMember2023-12-310000067716us-gaap:FairValueMeasurementsRecurringMemberus-gaap:CashSurrenderValueMember2023-12-310000067716us-gaap:FairValueInputsLevel1Memberus-gaap:FairValueMeasurementsRecurringMemberus-gaap:MortgageBackedSecuritiesMember2023-12-310000067716us-gaap:FairValueInputsLevel2Memberus-gaap:FairValueMeasurementsRecurringMemberus-gaap:MortgageBackedSecuritiesMember2023-12-310000067716us-gaap:FairValueInputsLevel3Memberus-gaap:FairValueMeasurementsRecurringMemberus-gaap:MortgageBackedSecuritiesMember2023-12-310000067716us-gaap:FairValueMeasurementsRecurringMemberus-gaap:MortgageBackedSecuritiesMember2023-12-310000067716us-gaap:FairValueInputsLevel1Memberus-gaap:FairValueMeasurementsRecurringMemberus-gaap:USTreasurySecuritiesMember2023-12-310000067716us-gaap:FairValueInputsLevel2Memberus-gaap:FairValueMeasurementsRecurringMemberus-gaap:USTreasurySecuritiesMember2023-12-310000067716us-gaap:FairValueInputsLevel3Memberus-gaap:FairValueMeasurementsRecurringMemberus-gaap:USTreasurySecuritiesMember2023-12-310000067716us-gaap:FairValueMeasurementsRecurringMemberus-gaap:USTreasurySecuritiesMember2023-12-310000067716us-gaap:FairValueInputsLevel1Memberus-gaap:FairValueMeasurementsRecurringMember2023-12-310000067716us-gaap:FairValueInputsLevel2Memberus-gaap:FairValueMeasurementsRecurringMember2023-12-310000067716us-gaap:FairValueInputsLevel3Memberus-gaap:FairValueMeasurementsRecurringMember2023-12-310000067716us-gaap:FairValueMeasurementsRecurringMember2023-12-310000067716us-gaap:CarryingReportedAmountFairValueDisclosureMember2024-12-310000067716us-gaap:CarryingReportedAmountFairValueDisclosureMember2023-12-310000067716us-gaap:EstimateOfFairValueFairValueDisclosureMember2024-12-310000067716us-gaap:EstimateOfFairValueFairValueDisclosureMember2023-12-310000067716mdu:CreditAgreementExpiringOctober2028Membermdu:MontanaDakotaUtilitiesCo.Memberus-gaap:RevolvingCreditFacilityMember2024-12-310000067716mdu:CreditAgreementExpiringOctober2028Membermdu:MontanaDakotaUtilitiesCo.Memberus-gaap:RevolvingCreditFacilityMember2023-12-310000067716mdu:CreditAgreementExpiringJune2029Membermdu:CascadeNaturalGasCorporationMemberus-gaap:RevolvingCreditFacilityMember2024-12-310000067716mdu:CreditAgreementExpiringJune2029Membermdu:CascadeNaturalGasCorporationMemberus-gaap:RevolvingCreditFacilityMember2023-12-310000067716mdu:CreditAgreementExpiringJune2029Membermdu:IntermountainGasCompanyMemberus-gaap:RevolvingCreditFacilityMember2024-12-310000067716mdu:CreditAgreementExpiringJune2029Membermdu:IntermountainGasCompanyMemberus-gaap:RevolvingCreditFacilityMember2023-12-310000067716mdu:CreditAgreementExpiringMay2028Membermdu:MDUResourcesGroupInc.Memberus-gaap:RevolvingCreditFacilityMember2024-12-310000067716mdu:CreditAgreementExpiringMay2028Membermdu:MDUResourcesGroupInc.Memberus-gaap:RevolvingCreditFacilityMember2023-12-310000067716mdu:CascadeNaturalGasMembermdu:TermLoanAgreementMember2023-01-200000067716mdu:CascadeNaturalGasMembermdu:TermLoanAgreementMember2023-12-052023-12-050000067716mdu:CascadeNaturalGasMembermdu:TermLoanAgreementMember2024-01-192024-01-190000067716mdu:IntermountainGasCompanyMembermdu:TermLoanAgreementMember2023-01-200000067716mdu:IntermountainGasCompanyMembermdu:TermLoanAgreementMember2023-03-012023-03-310000067716mdu:IntermountainGasCompanyMembermdu:TermLoanAgreementMember2023-04-012023-04-300000067716mdu:IntermountainGasCompanyMembermdu:TermLoanAgreementMember2023-05-012023-05-310000067716mdu:IntermountainGasCompanyMembermdu:TermLoanAgreementMember2024-01-192024-01-190000067716mdu:MDUResourcesGroupInc.Memberus-gaap:RevolvingCreditFacilityMember2023-05-310000067716mdu:MDUResourcesGroupInc.Memberus-gaap:RevolvingCreditFacilityMember2023-12-310000067716us-gaap:SeniorNotesMember2024-12-310000067716us-gaap:SeniorNotesMember2023-12-310000067716us-gaap:LineOfCreditMember2024-12-310000067716us-gaap:LineOfCreditMember2023-12-310000067716us-gaap:CommercialPaperMember2024-12-310000067716us-gaap:CommercialPaperMember2023-12-310000067716us-gaap:LoansPayableMember2024-12-310000067716us-gaap:LoansPayableMember2023-12-310000067716us-gaap:MediumTermNotesMember2024-12-310000067716us-gaap:MediumTermNotesMember2023-12-310000067716us-gaap:NotesPayableToBanksMember2024-12-310000067716us-gaap:NotesPayableToBanksMember2023-12-310000067716mdu:MontanaDakotaUtilitiesCo.Memberus-gaap:RevolvingCreditFacilityMember2023-10-180000067716mdu:MontanaDakotaUtilitiesCo.Memberus-gaap:RevolvingCreditFacilityMember2024-12-310000067716mdu:MontanaDakotaUtilitiesCo.Memberus-gaap:SeniorNotesMember2024-07-110000067716mdu:MontanaDakotaUtilitiesCo.Member2024-12-310000067716mdu:CascadeNaturalGasMembermdu:RevolvingCreditAgreementMember2024-06-190000067716mdu:CascadeNaturalGasMembermdu:RevolvingCreditAgreementMember2024-06-200000067716mdu:CascadeNaturalGasMemberus-gaap:RevolvingCreditFacilityMember2024-12-310000067716mdu:CascadeNaturalGasMemberus-gaap:SeniorNotesMember2024-12-310000067716mdu:IntermountainGasCompanyMembermdu:RevolvingCreditAgreementMember2024-06-190000067716mdu:IntermountainGasCompanyMembermdu:RevolvingCreditAgreementMember2024-06-200000067716mdu:IntermountainGasCompanyMemberus-gaap:RevolvingCreditFacilityMember2024-12-310000067716mdu:IntermountainGasCompanyMemberus-gaap:SeniorNotesMember2024-12-310000067716mdu:MDUResourcesGroupInc.Memberus-gaap:RevolvingCreditFacilityMember2023-05-310000067716mdu:MDUResourcesGroupInc.Memberus-gaap:RevolvingCreditFacilityMember2024-12-310000067716mdu:MDUResourcesGroupInc.Membermdu:TermLoanAgreementMember2023-05-310000067716mdu:MDUResourcesGroupInc.Membermdu:TermLoanAgreementMember2023-11-152023-11-150000067716mdu:MDUResourcesGroupInc.Membermdu:TermLoanAgreementMember2024-11-012024-11-010000067716mdu:MDUResourcesGroupInc.Memberus-gaap:SeniorNotesMember2024-12-310000067716mdu:WBIEnergyTransmissionMembermdu:UncommittedNotePurchaseAndPrivateShelfAgreementMember2024-12-310000067716mdu:WBIEnergyTransmissionMembermdu:TermLoanAgreementMember2024-04-010000067716us-gaap:AssetRetirementObligationCostsMember2024-01-012024-12-310000067716us-gaap:AssetRetirementObligationCostsMember2023-01-012023-12-310000067716us-gaap:CommonStockMember2024-01-012024-12-310000067716us-gaap:CommonStockMember2023-01-012023-12-310000067716us-gaap:CommonStockMember2022-01-012022-12-310000067716mdu:KPlanMember2024-12-310000067716us-gaap:PreferredStockMember2024-12-310000067716us-gaap:PreferredStockMember2023-12-310000067716us-gaap:RestrictedStockUnitsRSUMember2024-01-012024-12-310000067716us-gaap:StockCompensationPlanMember2024-01-012024-12-310000067716us-gaap:StockCompensationPlanMember2023-01-012023-12-310000067716us-gaap:StockCompensationPlanMember2022-01-012022-12-310000067716us-gaap:RestrictedStockUnitsRSUMembermdu:GrantDateFebruary2023July2023Member2024-12-310000067716us-gaap:RestrictedStockUnitsRSUMembermdu:GrantDateFebruary2024June2024Member2024-12-310000067716us-gaap:RestrictedStockUnitsRSUMember2023-12-310000067716us-gaap:RestrictedStockUnitsRSUMember2024-01-012024-10-300000067716us-gaap:RestrictedStockUnitsRSUMember2024-10-310000067716us-gaap:RestrictedStockUnitsRSUMember2024-11-012024-12-310000067716us-gaap:RestrictedStockUnitsRSUMember2024-12-310000067716us-gaap:PerformanceSharesMember2023-01-012023-12-310000067716mdu:MarketConditionMemberus-gaap:PerformanceSharesMembersrt:MinimumMember2024-01-012024-12-310000067716mdu:MarketConditionMemberus-gaap:PerformanceSharesMembersrt:MaximumMember2024-01-012024-12-310000067716us-gaap:PerformanceSharesMembermdu:MarketConditionMember2024-01-012024-12-310000067716us-gaap:PerformanceSharesMembermdu:MarketConditionMember2022-01-012022-12-310000067716mdu:PerformanceConditionMemberus-gaap:PerformanceSharesMembersrt:MinimumMember2024-01-012024-12-310000067716mdu:PerformanceConditionMemberus-gaap:PerformanceSharesMembersrt:MaximumMember2024-01-012024-12-310000067716us-gaap:PerformanceSharesMembermdu:PerformanceConditionMember2022-01-012022-12-310000067716us-gaap:PerformanceSharesMember2022-01-012022-12-310000067716us-gaap:AccumulatedGainLossNetCashFlowHedgeParentMember2022-12-310000067716us-gaap:AccumulatedDefinedBenefitPlansAdjustmentMember2022-12-310000067716us-gaap:AccumulatedNetUnrealizedInvestmentGainLossMember2022-12-310000067716us-gaap:AccumulatedGainLossNetCashFlowHedgeParentMember2023-01-012023-12-310000067716us-gaap:AccumulatedDefinedBenefitPlansAdjustmentMember2023-01-012023-12-310000067716us-gaap:AccumulatedNetUnrealizedInvestmentGainLossMember2023-01-012023-12-310000067716mdu:KnifeRiverCorporationMemberus-gaap:DiscontinuedOperationsDisposedOfByMeansOtherThanSaleSpinoffMemberus-gaap:AccumulatedGainLossNetCashFlowHedgeParentMember2023-01-012023-12-310000067716mdu:KnifeRiverCorporationMemberus-gaap:DiscontinuedOperationsDisposedOfByMeansOtherThanSaleSpinoffMemberus-gaap:AccumulatedDefinedBenefitPlansAdjustmentMember2023-01-012023-12-310000067716mdu:KnifeRiverCorporationMemberus-gaap:DiscontinuedOperationsDisposedOfByMeansOtherThanSaleSpinoffMemberus-gaap:AccumulatedNetUnrealizedInvestmentGainLossMember2023-01-012023-12-310000067716us-gaap:AccumulatedGainLossNetCashFlowHedgeParentMember2023-12-310000067716us-gaap:AccumulatedDefinedBenefitPlansAdjustmentMember2023-12-310000067716us-gaap:AccumulatedNetUnrealizedInvestmentGainLossMember2023-12-310000067716us-gaap:AccumulatedGainLossNetCashFlowHedgeParentMember2024-01-012024-12-310000067716us-gaap:AccumulatedDefinedBenefitPlansAdjustmentMember2024-01-012024-12-310000067716us-gaap:AccumulatedNetUnrealizedInvestmentGainLossMember2024-01-012024-12-310000067716us-gaap:AccumulatedGainLossNetCashFlowHedgeParentMember2024-12-310000067716us-gaap:AccumulatedDefinedBenefitPlansAdjustmentMember2024-12-310000067716us-gaap:AccumulatedNetUnrealizedInvestmentGainLossMember2024-12-310000067716us-gaap:InterestRateContractMemberus-gaap:AccumulatedGainLossNetCashFlowHedgeParentMemberus-gaap:ReclassificationOutOfAccumulatedOtherComprehensiveIncomeMember2024-01-012024-12-310000067716us-gaap:InterestRateContractMemberus-gaap:AccumulatedGainLossNetCashFlowHedgeParentMemberus-gaap:ReclassificationOutOfAccumulatedOtherComprehensiveIncomeMember2023-01-012023-12-310000067716us-gaap:AccumulatedDefinedBenefitPlansAdjustmentMemberus-gaap:ReclassificationOutOfAccumulatedOtherComprehensiveIncomeMember2024-01-012024-12-310000067716us-gaap:AccumulatedDefinedBenefitPlansAdjustmentMemberus-gaap:ReclassificationOutOfAccumulatedOtherComprehensiveIncomeMember2023-01-012023-12-310000067716us-gaap:AccumulatedNetUnrealizedInvestmentGainLossMemberus-gaap:ReclassificationOutOfAccumulatedOtherComprehensiveIncomeMember2024-01-012024-12-310000067716us-gaap:AccumulatedNetUnrealizedInvestmentGainLossMemberus-gaap:ReclassificationOutOfAccumulatedOtherComprehensiveIncomeMember2023-01-012023-12-310000067716us-gaap:ReclassificationOutOfAccumulatedOtherComprehensiveIncomeMember2024-01-012024-12-310000067716us-gaap:ReclassificationOutOfAccumulatedOtherComprehensiveIncomeMember2023-01-012023-12-310000067716us-gaap:StateAndLocalJurisdictionMember2023-12-310000067716us-gaap:StateAndLocalJurisdictionMember2024-12-310000067716mdu:ContinuingAndDiscontinuedOperationsMember2024-01-012024-12-310000067716mdu:ContinuingAndDiscontinuedOperationsMember2023-01-012023-12-310000067716mdu:ContinuingAndDiscontinuedOperationsMember2022-01-012022-12-310000067716us-gaap:OperatingSegmentsMembermdu:ElectricMember2024-12-310000067716us-gaap:OperatingSegmentsMembermdu:NaturalGasDistributionMember2024-12-310000067716us-gaap:OperatingSegmentsMembermdu:PipelineandMidstreamMember2024-12-310000067716us-gaap:OperatingSegmentsMemberus-gaap:CorporateAndOtherMember2024-12-310000067716us-gaap:OperatingSegmentsMembermdu:ElectricMember2023-12-310000067716us-gaap:OperatingSegmentsMembermdu:NaturalGasDistributionMember2023-12-310000067716us-gaap:OperatingSegmentsMembermdu:PipelineandMidstreamMember2023-12-310000067716us-gaap:OperatingSegmentsMemberus-gaap:CorporateAndOtherMember2023-12-310000067716us-gaap:OperatingSegmentsMembermdu:ElectricMember2022-12-310000067716us-gaap:OperatingSegmentsMembermdu:NaturalGasDistributionMember2022-12-310000067716us-gaap:OperatingSegmentsMembermdu:PipelineandMidstreamMember2022-12-310000067716us-gaap:OperatingSegmentsMemberus-gaap:CorporateAndOtherMember2022-12-310000067716us-gaap:OperatingSegmentsMember2024-01-012024-12-310000067716us-gaap:OperatingSegmentsMember2023-01-012023-12-310000067716us-gaap:OperatingSegmentsMember2022-01-012022-12-310000067716us-gaap:CorporateNonSegmentMember2024-01-012024-12-310000067716us-gaap:CorporateNonSegmentMember2023-01-012023-12-310000067716us-gaap:CorporateNonSegmentMember2022-01-012022-12-310000067716us-gaap:OperatingSegmentsMember2024-12-310000067716us-gaap:OperatingSegmentsMember2023-12-310000067716us-gaap:OperatingSegmentsMember2022-12-310000067716us-gaap:CorporateNonSegmentMember2024-12-310000067716us-gaap:CorporateNonSegmentMember2023-12-310000067716us-gaap:CorporateNonSegmentMember2022-12-310000067716us-gaap:IntersegmentEliminationMember2024-12-310000067716us-gaap:IntersegmentEliminationMember2023-12-310000067716us-gaap:IntersegmentEliminationMember2022-12-310000067716us-gaap:PensionPlansDefinedBenefitMember2023-12-310000067716us-gaap:PensionPlansDefinedBenefitMember2022-12-310000067716us-gaap:OtherPostretirementBenefitPlansDefinedBenefitMember2023-12-310000067716us-gaap:OtherPostretirementBenefitPlansDefinedBenefitMember2022-12-310000067716us-gaap:PensionPlansDefinedBenefitMember2024-01-012024-12-310000067716us-gaap:PensionPlansDefinedBenefitMember2023-01-012023-12-310000067716us-gaap:OtherPostretirementBenefitPlansDefinedBenefitMember2024-01-012024-12-310000067716us-gaap:OtherPostretirementBenefitPlansDefinedBenefitMember2023-01-012023-12-310000067716us-gaap:PensionPlansDefinedBenefitMember2024-12-310000067716us-gaap:OtherPostretirementBenefitPlansDefinedBenefitMember2024-12-310000067716us-gaap:PensionPlansDefinedBenefitMember2022-01-012022-12-310000067716us-gaap:OtherPostretirementBenefitPlansDefinedBenefitMember2022-01-012022-12-310000067716us-gaap:PensionPlansDefinedBenefitMembersrt:MinimumMemberus-gaap:EquitySecuritiesMember2024-12-310000067716us-gaap:PensionPlansDefinedBenefitMembersrt:MaximumMemberus-gaap:EquitySecuritiesMember2024-12-310000067716us-gaap:PensionPlansDefinedBenefitMembersrt:MinimumMemberus-gaap:FixedIncomeSecuritiesMember2024-12-310000067716us-gaap:PensionPlansDefinedBenefitMembersrt:MaximumMemberus-gaap:FixedIncomeSecuritiesMember2024-12-310000067716us-gaap:OtherPostretirementBenefitPlansDefinedBenefitMembersrt:MinimumMemberus-gaap:EquitySecuritiesMember2024-12-310000067716us-gaap:OtherPostretirementBenefitPlansDefinedBenefitMembersrt:MaximumMemberus-gaap:EquitySecuritiesMember2024-12-310000067716us-gaap:OtherPostretirementBenefitPlansDefinedBenefitMembersrt:MinimumMemberus-gaap:FixedIncomeSecuritiesMember2024-12-310000067716us-gaap:OtherPostretirementBenefitPlansDefinedBenefitMembersrt:MaximumMemberus-gaap:FixedIncomeSecuritiesMember2024-12-310000067716us-gaap:OtherPostretirementBenefitPlansDefinedBenefitMembermdu:Pre65Member2024-12-310000067716us-gaap:OtherPostretirementBenefitPlansDefinedBenefitMembermdu:Post65Member2024-12-310000067716us-gaap:OtherPostretirementBenefitPlansDefinedBenefitMembermdu:Pre65Member2023-12-310000067716us-gaap:OtherPostretirementBenefitPlansDefinedBenefitMembermdu:Post65Member2023-12-310000067716us-gaap:FairValueInputsLevel1Memberus-gaap:PensionPlansDefinedBenefitMemberus-gaap:DefinedBenefitPlanCashAndCashEquivalentsMember2024-12-310000067716us-gaap:FairValueInputsLevel2Memberus-gaap:PensionPlansDefinedBenefitMemberus-gaap:DefinedBenefitPlanCashAndCashEquivalentsMember2024-12-310000067716us-gaap:FairValueInputsLevel3Memberus-gaap:PensionPlansDefinedBenefitMemberus-gaap:DefinedBenefitPlanCashAndCashEquivalentsMember2024-12-310000067716us-gaap:FairValueInputsLevel12And3Memberus-gaap:PensionPlansDefinedBenefitMemberus-gaap:DefinedBenefitPlanCashAndCashEquivalentsMember2024-12-310000067716us-gaap:FairValueInputsLevel1Memberus-gaap:PensionPlansDefinedBenefitMemberus-gaap:DefinedBenefitPlanEquitySecuritiesUsMember2024-12-310000067716us-gaap:FairValueInputsLevel2Memberus-gaap:PensionPlansDefinedBenefitMemberus-gaap:DefinedBenefitPlanEquitySecuritiesUsMember2024-12-310000067716us-gaap:FairValueInputsLevel3Memberus-gaap:PensionPlansDefinedBenefitMemberus-gaap:DefinedBenefitPlanEquitySecuritiesUsMember2024-12-310000067716us-gaap:FairValueInputsLevel12And3Memberus-gaap:PensionPlansDefinedBenefitMemberus-gaap:DefinedBenefitPlanEquitySecuritiesUsMember2024-12-310000067716us-gaap:FairValueInputsLevel1Memberus-gaap:PensionPlansDefinedBenefitMembermdu:CollectiveAndMutualFundsMember2024-12-310000067716us-gaap:FairValueInputsLevel2Memberus-gaap:PensionPlansDefinedBenefitMembermdu:CollectiveAndMutualFundsMember2024-12-310000067716us-gaap:FairValueInputsLevel3Memberus-gaap:PensionPlansDefinedBenefitMembermdu:CollectiveAndMutualFundsMember2024-12-310000067716us-gaap:FairValueInputsLevel12And3Memberus-gaap:PensionPlansDefinedBenefitMembermdu:CollectiveAndMutualFundsMember2024-12-310000067716us-gaap:FairValueInputsLevel1Memberus-gaap:PensionPlansDefinedBenefitMemberus-gaap:USTreasurySecuritiesMember2024-12-310000067716us-gaap:FairValueInputsLevel2Memberus-gaap:PensionPlansDefinedBenefitMemberus-gaap:USTreasurySecuritiesMember2024-12-310000067716us-gaap:FairValueInputsLevel3Memberus-gaap:PensionPlansDefinedBenefitMemberus-gaap:USTreasurySecuritiesMember2024-12-310000067716us-gaap:FairValueInputsLevel12And3Memberus-gaap:PensionPlansDefinedBenefitMemberus-gaap:USTreasurySecuritiesMember2024-12-310000067716us-gaap:FairValueMeasuredAtNetAssetValuePerShareMemberus-gaap:PensionPlansDefinedBenefitMember2024-12-310000067716us-gaap:FairValueInputsLevel1Memberus-gaap:PensionPlansDefinedBenefitMember2024-12-310000067716us-gaap:FairValueInputsLevel2Memberus-gaap:PensionPlansDefinedBenefitMember2024-12-310000067716us-gaap:FairValueInputsLevel3Memberus-gaap:PensionPlansDefinedBenefitMember2024-12-310000067716us-gaap:PensionPlansDefinedBenefitMemberus-gaap:CorporateDebtSecuritiesMember2024-12-310000067716us-gaap:PensionPlansDefinedBenefitMemberus-gaap:USTreasurySecuritiesMember2024-12-310000067716us-gaap:PensionPlansDefinedBenefitMemberus-gaap:OtherInvestmentsMember2024-12-310000067716us-gaap:PensionPlansDefinedBenefitMemberus-gaap:DefinedBenefitPlanEquitySecuritiesNonUsMember2024-12-310000067716us-gaap:PensionPlansDefinedBenefitMemberus-gaap:DefinedBenefitPlanEquitySecuritiesUsLargeCapMember2024-12-310000067716us-gaap:PensionPlansDefinedBenefitMemberus-gaap:DefinedBenefitPlanCashAndCashEquivalentsMember2024-12-310000067716us-gaap:FairValueInputsLevel1Memberus-gaap:PensionPlansDefinedBenefitMemberus-gaap:DefinedBenefitPlanCashAndCashEquivalentsMember2023-12-310000067716us-gaap:FairValueInputsLevel2Memberus-gaap:PensionPlansDefinedBenefitMemberus-gaap:DefinedBenefitPlanCashAndCashEquivalentsMember2023-12-310000067716us-gaap:FairValueInputsLevel3Memberus-gaap:PensionPlansDefinedBenefitMemberus-gaap:DefinedBenefitPlanCashAndCashEquivalentsMember2023-12-310000067716us-gaap:FairValueInputsLevel12And3Memberus-gaap:PensionPlansDefinedBenefitMemberus-gaap:DefinedBenefitPlanCashAndCashEquivalentsMember2023-12-310000067716us-gaap:FairValueInputsLevel1Memberus-gaap:PensionPlansDefinedBenefitMemberus-gaap:DefinedBenefitPlanEquitySecuritiesUsMember2023-12-310000067716us-gaap:FairValueInputsLevel2Memberus-gaap:PensionPlansDefinedBenefitMemberus-gaap:DefinedBenefitPlanEquitySecuritiesUsMember2023-12-310000067716us-gaap:FairValueInputsLevel3Memberus-gaap:PensionPlansDefinedBenefitMemberus-gaap:DefinedBenefitPlanEquitySecuritiesUsMember2023-12-310000067716us-gaap:FairValueInputsLevel12And3Memberus-gaap:PensionPlansDefinedBenefitMemberus-gaap:DefinedBenefitPlanEquitySecuritiesUsMember2023-12-310000067716us-gaap:FairValueInputsLevel1Memberus-gaap:PensionPlansDefinedBenefitMembermdu:CollectiveAndMutualFundsMember2023-12-310000067716us-gaap:FairValueInputsLevel2Memberus-gaap:PensionPlansDefinedBenefitMembermdu:CollectiveAndMutualFundsMember2023-12-310000067716us-gaap:FairValueInputsLevel3Memberus-gaap:PensionPlansDefinedBenefitMembermdu:CollectiveAndMutualFundsMember2023-12-310000067716us-gaap:FairValueInputsLevel12And3Memberus-gaap:PensionPlansDefinedBenefitMembermdu:CollectiveAndMutualFundsMember2023-12-310000067716us-gaap:FairValueInputsLevel1Memberus-gaap:PensionPlansDefinedBenefitMemberus-gaap:USTreasurySecuritiesMember2023-12-310000067716us-gaap:FairValueInputsLevel2Memberus-gaap:PensionPlansDefinedBenefitMemberus-gaap:USTreasurySecuritiesMember2023-12-310000067716us-gaap:FairValueInputsLevel3Memberus-gaap:PensionPlansDefinedBenefitMemberus-gaap:USTreasurySecuritiesMember2023-12-310000067716us-gaap:FairValueInputsLevel12And3Memberus-gaap:PensionPlansDefinedBenefitMemberus-gaap:USTreasurySecuritiesMember2023-12-310000067716us-gaap:FairValueMeasuredAtNetAssetValuePerShareMemberus-gaap:PensionPlansDefinedBenefitMember2023-12-310000067716us-gaap:FairValueInputsLevel1Memberus-gaap:PensionPlansDefinedBenefitMember2023-12-310000067716us-gaap:FairValueInputsLevel2Memberus-gaap:PensionPlansDefinedBenefitMember2023-12-310000067716us-gaap:FairValueInputsLevel3Memberus-gaap:PensionPlansDefinedBenefitMember2023-12-310000067716us-gaap:PensionPlansDefinedBenefitMemberus-gaap:CorporateDebtSecuritiesMember2023-12-310000067716us-gaap:PensionPlansDefinedBenefitMemberus-gaap:DefinedBenefitPlanEquitySecuritiesNonUsMember2023-12-310000067716us-gaap:PensionPlansDefinedBenefitMemberus-gaap:DefinedBenefitPlanEquitySecuritiesUsLargeCapMember2023-12-310000067716us-gaap:PensionPlansDefinedBenefitMemberus-gaap:DefinedBenefitPlanCashAndCashEquivalentsMember2023-12-310000067716us-gaap:PensionPlansDefinedBenefitMemberus-gaap:USTreasurySecuritiesMember2023-12-310000067716us-gaap:PensionPlansDefinedBenefitMemberus-gaap:OtherInvestmentsMember2023-12-310000067716us-gaap:FairValueInputsLevel1Memberus-gaap:OtherPostretirementBenefitPlansDefinedBenefitMemberus-gaap:DefinedBenefitPlanCashAndCashEquivalentsMember2024-12-310000067716us-gaap:FairValueInputsLevel2Memberus-gaap:OtherPostretirementBenefitPlansDefinedBenefitMemberus-gaap:DefinedBenefitPlanCashAndCashEquivalentsMember2024-12-310000067716us-gaap:FairValueInputsLevel3Memberus-gaap:OtherPostretirementBenefitPlansDefinedBenefitMemberus-gaap:DefinedBenefitPlanCashAndCashEquivalentsMember2024-12-310000067716us-gaap:FairValueInputsLevel12And3Memberus-gaap:OtherPostretirementBenefitPlansDefinedBenefitMemberus-gaap:DefinedBenefitPlanCashAndCashEquivalentsMember2024-12-310000067716us-gaap:FairValueInputsLevel1Memberus-gaap:OtherPostretirementBenefitPlansDefinedBenefitMemberus-gaap:DefinedBenefitPlanEquitySecuritiesUsMember2024-12-310000067716us-gaap:FairValueInputsLevel2Memberus-gaap:OtherPostretirementBenefitPlansDefinedBenefitMemberus-gaap:DefinedBenefitPlanEquitySecuritiesUsMember2024-12-310000067716us-gaap:FairValueInputsLevel3Memberus-gaap:OtherPostretirementBenefitPlansDefinedBenefitMemberus-gaap:DefinedBenefitPlanEquitySecuritiesUsMember2024-12-310000067716us-gaap:FairValueInputsLevel12And3Memberus-gaap:OtherPostretirementBenefitPlansDefinedBenefitMemberus-gaap:DefinedBenefitPlanEquitySecuritiesUsMember2024-12-310000067716us-gaap:FairValueInputsLevel1Memberus-gaap:OtherPostretirementBenefitPlansDefinedBenefitMembermdu:InsuranceInvestmentContractMember2024-12-310000067716us-gaap:FairValueInputsLevel2Memberus-gaap:OtherPostretirementBenefitPlansDefinedBenefitMembermdu:InsuranceInvestmentContractMember2024-12-310000067716us-gaap:FairValueInputsLevel3Memberus-gaap:OtherPostretirementBenefitPlansDefinedBenefitMembermdu:InsuranceInvestmentContractMember2024-12-310000067716us-gaap:FairValueInputsLevel12And3Memberus-gaap:OtherPostretirementBenefitPlansDefinedBenefitMembermdu:InsuranceInvestmentContractMember2024-12-310000067716us-gaap:FairValueInputsLevel1Memberus-gaap:OtherPostretirementBenefitPlansDefinedBenefitMember2024-12-310000067716us-gaap:FairValueInputsLevel2Memberus-gaap:OtherPostretirementBenefitPlansDefinedBenefitMember2024-12-310000067716us-gaap:FairValueInputsLevel3Memberus-gaap:OtherPostretirementBenefitPlansDefinedBenefitMember2024-12-310000067716us-gaap:OtherPostretirementBenefitPlansDefinedBenefitMemberus-gaap:CorporateDebtSecuritiesMember2024-12-310000067716us-gaap:OtherPostretirementBenefitPlansDefinedBenefitMemberus-gaap:USTreasurySecuritiesMember2024-12-310000067716us-gaap:OtherPostretirementBenefitPlansDefinedBenefitMemberus-gaap:DefinedBenefitPlanEquitySecuritiesUsLargeCapMember2024-12-310000067716us-gaap:OtherPostretirementBenefitPlansDefinedBenefitMemberus-gaap:DefinedBenefitPlanEquitySecuritiesUsSmallCapMember2024-12-310000067716us-gaap:OtherPostretirementBenefitPlansDefinedBenefitMemberus-gaap:OtherInvestmentsMember2024-12-310000067716us-gaap:FairValueInputsLevel1Memberus-gaap:OtherPostretirementBenefitPlansDefinedBenefitMemberus-gaap:DefinedBenefitPlanCashAndCashEquivalentsMember2023-12-310000067716us-gaap:FairValueInputsLevel2Memberus-gaap:OtherPostretirementBenefitPlansDefinedBenefitMemberus-gaap:DefinedBenefitPlanCashAndCashEquivalentsMember2023-12-310000067716us-gaap:FairValueInputsLevel3Memberus-gaap:OtherPostretirementBenefitPlansDefinedBenefitMemberus-gaap:DefinedBenefitPlanCashAndCashEquivalentsMember2023-12-310000067716us-gaap:FairValueInputsLevel12And3Memberus-gaap:OtherPostretirementBenefitPlansDefinedBenefitMemberus-gaap:DefinedBenefitPlanCashAndCashEquivalentsMember2023-12-310000067716us-gaap:FairValueInputsLevel1Memberus-gaap:OtherPostretirementBenefitPlansDefinedBenefitMemberus-gaap:DefinedBenefitPlanEquitySecuritiesUsMember2023-12-310000067716us-gaap:FairValueInputsLevel2Memberus-gaap:OtherPostretirementBenefitPlansDefinedBenefitMemberus-gaap:DefinedBenefitPlanEquitySecuritiesUsMember2023-12-310000067716us-gaap:FairValueInputsLevel3Memberus-gaap:OtherPostretirementBenefitPlansDefinedBenefitMemberus-gaap:DefinedBenefitPlanEquitySecuritiesUsMember2023-12-310000067716us-gaap:FairValueInputsLevel12And3Memberus-gaap:OtherPostretirementBenefitPlansDefinedBenefitMemberus-gaap:DefinedBenefitPlanEquitySecuritiesUsMember2023-12-310000067716us-gaap:FairValueInputsLevel1Memberus-gaap:OtherPostretirementBenefitPlansDefinedBenefitMembermdu:InsuranceInvestmentContractMember2023-12-310000067716us-gaap:FairValueInputsLevel2Memberus-gaap:OtherPostretirementBenefitPlansDefinedBenefitMembermdu:InsuranceInvestmentContractMember2023-12-310000067716us-gaap:FairValueInputsLevel3Memberus-gaap:OtherPostretirementBenefitPlansDefinedBenefitMembermdu:InsuranceInvestmentContractMember2023-12-310000067716us-gaap:FairValueInputsLevel12And3Memberus-gaap:OtherPostretirementBenefitPlansDefinedBenefitMembermdu:InsuranceInvestmentContractMember2023-12-310000067716us-gaap:FairValueInputsLevel1Memberus-gaap:OtherPostretirementBenefitPlansDefinedBenefitMember2023-12-310000067716us-gaap:FairValueInputsLevel2Memberus-gaap:OtherPostretirementBenefitPlansDefinedBenefitMember2023-12-310000067716us-gaap:FairValueInputsLevel3Memberus-gaap:OtherPostretirementBenefitPlansDefinedBenefitMember2023-12-310000067716us-gaap:OtherPostretirementBenefitPlansDefinedBenefitMemberus-gaap:CorporateDebtSecuritiesMember2023-12-310000067716us-gaap:OtherPostretirementBenefitPlansDefinedBenefitMemberus-gaap:DefinedBenefitPlanEquitySecuritiesUsLargeCapMember2023-12-310000067716us-gaap:OtherPostretirementBenefitPlansDefinedBenefitMemberus-gaap:USTreasurySecuritiesMember2023-12-310000067716us-gaap:OtherPostretirementBenefitPlansDefinedBenefitMemberus-gaap:DefinedBenefitPlanEquitySecuritiesUsSmallCapMember2023-12-310000067716us-gaap:OtherPostretirementBenefitPlansDefinedBenefitMemberus-gaap:OtherInvestmentsMember2023-12-310000067716us-gaap:SupplementalEmployeeRetirementPlanDefinedBenefitMember2024-12-310000067716us-gaap:SupplementalEmployeeRetirementPlanDefinedBenefitMember2023-12-310000067716us-gaap:SupplementalEmployeeRetirementPlanDefinedBenefitMember2024-01-012024-12-310000067716us-gaap:SupplementalEmployeeRetirementPlanDefinedBenefitMember2023-01-012023-12-310000067716us-gaap:SupplementalEmployeeRetirementPlanDefinedBenefitMember2022-01-012022-12-310000067716us-gaap:SupplementalEmployeeRetirementPlanDefinedBenefitMemberus-gaap:EquitySecuritiesMember2024-12-310000067716us-gaap:SupplementalEmployeeRetirementPlanDefinedBenefitMemberus-gaap:EquitySecuritiesMember2023-12-310000067716us-gaap:SupplementalEmployeeRetirementPlanDefinedBenefitMembermdu:LifeInsuranceCarriedOnPlanParticipantsMember2024-12-310000067716us-gaap:SupplementalEmployeeRetirementPlanDefinedBenefitMembermdu:LifeInsuranceCarriedOnPlanParticipantsMember2023-12-310000067716us-gaap:SupplementalEmployeeRetirementPlanDefinedBenefitMemberus-gaap:OtherInvestmentsMember2024-12-310000067716us-gaap:SupplementalEmployeeRetirementPlanDefinedBenefitMemberus-gaap:OtherInvestmentsMember2023-12-310000067716mdu:DefinedContributionPlanMember2024-01-012024-12-310000067716mdu:DefinedContributionPlanMember2023-01-012023-12-310000067716mdu:DefinedContributionPlanMember2022-01-012022-12-310000067716srt:MaximumMember2024-01-012024-12-310000067716srt:MinimumMember2024-01-012024-12-310000067716mdu:IdahoPlumbersandPipefittersPensionPlanMemberus-gaap:PensionPlansDefinedBenefitMember2024-01-012024-12-310000067716mdu:IdahoPlumbersandPipefittersPensionPlanMemberus-gaap:PensionPlansDefinedBenefitMember2023-01-012023-12-310000067716mdu:IdahoPlumbersandPipefittersPensionPlanMemberus-gaap:PensionPlansDefinedBenefitMember2022-01-012022-12-310000067716us-gaap:JointlyOwnedElectricityGenerationPlantMembermdu:BigStoneStationMember2024-12-310000067716us-gaap:JointlyOwnedElectricityGenerationPlantMembermdu:BigStoneStationMember2023-12-310000067716us-gaap:JointlyOwnedElectricityTransmissionAndDistributionSystemMembermdu:BSSEMember2024-12-310000067716us-gaap:JointlyOwnedElectricityTransmissionAndDistributionSystemMembermdu:BSSEMember2023-12-310000067716us-gaap:JointlyOwnedElectricityGenerationPlantMembermdu:CoyoteStationMember2024-12-310000067716us-gaap:JointlyOwnedElectricityGenerationPlantMembermdu:CoyoteStationMember2023-12-310000067716us-gaap:JointlyOwnedElectricityTransmissionAndDistributionSystemMembermdu:JETxMember2024-12-310000067716us-gaap:JointlyOwnedElectricityTransmissionAndDistributionSystemMembermdu:JETxMember2023-12-310000067716us-gaap:JointlyOwnedElectricityGenerationPlantMembermdu:WygenIiiMember2024-12-310000067716us-gaap:JointlyOwnedElectricityGenerationPlantMembermdu:WygenIiiMember2023-12-310000067716mdu:MontanaDakotaUtilitiesCo.Membermdu:MTPSCMembermdu:NaturalGasDistributionMember2024-07-152024-07-150000067716mdu:MontanaDakotaUtilitiesCo.Membermdu:MTPSCMembermdu:NaturalGasDistributionMember2024-10-152024-10-150000067716mdu:MontanaDakotaUtilitiesCo.Membermdu:MTPSCMembermdu:NaturalGasDistributionMemberus-gaap:SubsequentEventMember2025-01-142025-01-140000067716mdu:MontanaDakotaUtilitiesCo.Membermdu:NDPSCMembermdu:NaturalGasDistributionMember2023-11-012023-11-010000067716mdu:MontanaDakotaUtilitiesCo.Membermdu:NDPSCMembermdu:NaturalGasDistributionMember2023-12-132023-12-130000067716mdu:MontanaDakotaUtilitiesCo.Membermdu:NDPSCMember2024-09-160000067716mdu:MontanaDakotaUtilitiesCo.Membermdu:NDPSCMembermdu:ElectricMember2024-11-012024-11-010000067716mdu:PendingRateCaseMultiYearYearOneMembermdu:CascadeNaturalGasMembermdu:WUTCMembermdu:NaturalGasDistributionMember2024-03-292024-03-290000067716mdu:PendingRateCaseMultiYearYearTwoMembermdu:CascadeNaturalGasMembermdu:WUTCMembermdu:NaturalGasDistributionMember2024-03-292024-03-290000067716mdu:PendingRateCaseMultiYearYearOneMembermdu:CascadeNaturalGasMembermdu:WUTCMembermdu:NaturalGasDistributionMember2024-12-112024-12-110000067716mdu:PendingRateCaseMultiYearYearTwoMembermdu:CascadeNaturalGasMembermdu:WUTCMembermdu:NaturalGasDistributionMember2024-12-112024-12-110000067716mdu:PendingRateCaseMembermdu:MontanaDakotaUtilitiesCo.Membermdu:WYPSCMembermdu:NaturalGasDistributionMember2024-10-312024-10-310000067716mdu:MontanaDakotaUtilitiesCo.Membermdu:FERCMembermdu:TransmissionFormulaMember2024-08-292024-08-290000067716mdu:MissoulaMTmanufacturedgasplantsiteMember2024-01-012024-12-310000067716mdu:MissoulaMTmanufacturedgasplantsiteMember2024-12-310000067716mdu:BremertonWAManufacturedGasPlantSiteMember2024-01-012024-12-310000067716mdu:BremertonWAManufacturedGasPlantSiteMembersrt:MinimumMember2024-01-012024-12-310000067716mdu:BremertonWAManufacturedGasPlantSiteMembersrt:MaximumMember2024-01-012024-12-310000067716mdu:BremertonWAManufacturedGasPlantSiteMember2024-12-310000067716mdu:BellinghamWAManufacturedGasPlantSiteMembersrt:MinimumMember2024-01-012024-12-310000067716mdu:BellinghamWAManufacturedGasPlantSiteMembersrt:MaximumMember2024-01-012024-12-310000067716mdu:BellinghamWAManufacturedGasPlantSiteMember2024-01-012024-12-310000067716us-gaap:InventoriesMember2024-12-310000067716us-gaap:LineOfCreditMember2024-12-310000067716us-gaap:MachineryAndEquipmentMember2024-12-310000067716us-gaap:BuildingMember2024-12-310000067716mdu:FuelContractMember2024-12-310000067716us-gaap:JointlyOwnedElectricityGenerationPlantMembermdu:BadgerWindLLCMemberus-gaap:SubsequentEventMember2025-02-130000067716us-gaap:JointlyOwnedElectricityGenerationPlantMembermdu:BadgerWindLLCMemberus-gaap:SubsequentEventMember2025-02-132025-02-1300000677162024-10-012024-12-310000067716srt:ParentCompanyMember2024-01-012024-12-310000067716srt:ParentCompanyMember2023-01-012023-12-310000067716srt:ParentCompanyMember2022-01-012022-12-310000067716srt:ParentCompanyMember2024-12-310000067716srt:ParentCompanyMember2023-12-310000067716srt:SubsidiariesMembersrt:ParentCompanyMember2024-12-310000067716srt:SubsidiariesMembersrt:ParentCompanyMember2023-12-310000067716srt:SubsidiariesMembersrt:ParentCompanyMember2024-01-012024-12-310000067716srt:SubsidiariesMembersrt:ParentCompanyMember2023-01-012023-12-310000067716srt:SubsidiariesMembersrt:ParentCompanyMember2022-01-012022-12-310000067716srt:ParentCompanyMember2022-12-310000067716srt:ParentCompanyMember2021-12-31

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

WASHINGTON, D.C. 20549

FORM 10-K

|

|

|

|

|

|

| ☒ |

ANNUAL REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934 |

For the fiscal year ended December 31, 2024

OR

|

|

|

|

|

|

| ☐ |

TRANSITION REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934 |

For the transition period from _____________ to ______________

Commission file number 1-03480

MDU RESOURCES GROUP, INC.

(Exact name of registrant as specified in its charter)

|

|

|

|

|

|

|

|

|

| Delaware |

|

30-1133956 |

(State or other jurisdiction of

incorporation or organization) |

|

(I.R.S. Employer Identification No.) |

1200 West Century Avenue

P.O. Box 5650

Bismarck, North Dakota 58506-5650

(Address of principal executive offices)

(Zip Code)

(701) 530-1000

(Registrant's telephone number, including area code)

Securities registered pursuant to Section 12(b) of the Act:

|

|

|

|

|

|

|

|

|

| Title of each class |

Trading symbol(s) |

Name of each exchange on which registered |

| Common Stock, par value $1.00 per share |

MDU |

New York Stock Exchange |

Securities registered pursuant to Section 12(g) of the Act: None

Indicate by check mark if the registrant is a well-known seasoned issuer, as defined in Rule 405 of the Securities Act. Yes ☒ No ☐.

Indicate by check mark if the registrant is not required to file reports pursuant to Section 13 or Section 15(d) of the Act. Yes ☐ No ☒.

Indicate by check mark whether the registrant (1) has filed all reports required to be filed by Section 13 or 15(d) of the Securities Exchange Act of 1934 during the preceding 12 months (or for such shorter period that the registrant was required to file such reports), and (2) has been subject to such filing requirements for the past 90 days. Yes ☒ No ☐.

Indicate by check mark whether the registrant has submitted electronically every Interactive Data File required to be submitted pursuant to Rule 405 of Regulation S-T (§ 232.405 of this chapter) during the preceding 12 months (or for such shorter period that the registrant was required to submit such files). Yes ☒ No ☐.

Indicate by check mark whether the registrant is a large accelerated filer, an accelerated filer, a non-accelerated filer, a smaller reporting company, or an emerging growth company. See the definitions of "large accelerated filer," "accelerated filer," "smaller reporting company," and "emerging growth company" in Rule 12b-2 of the Exchange Act.

|

|

|

|

|

|

|

|

|

|

|

|

| Large accelerated filer |

☒ |

Accelerated filer |

☐ |

| Non-accelerated filer |

☐ |

Smaller reporting company |

☐ |

|

|

Emerging growth company |

☐ |

If an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act. ☐

Indicate by check mark whether the registrant has filed a report on and attestation to its management's assessment of the effectiveness of its internal control over financial reporting under Section 404(b) of the Sarbanes-Oxley Act (15 U.S.C. 7262(b)) by the registered public accounting firm that prepared or issued its audit report. ☒

If securities are registered pursuant to Section 12(b) of the Act, indicate by check mark whether the financial statements of the registrant included in the filing reflect the correction of an error to previously issued financial statements. ☐

Indicate by check mark whether any of those error corrections are restatements that required a recovery analysis of incentive-based compensation received by any of the registrant's executive officers during the relevant recovery period pursuant to §240.10D-1(b). ☐

Indicate by check mark whether the registrant is a shell company (as defined in Rule 12b-2 of the Act). Yes ☐ No ☒.

State the aggregate market value of the voting common stock held by non-affiliates of the registrant as of June 28, 2024: $5,095,923,531, which does not reflect MDU Resources Group, Inc.'s market value after the separation and distribution of Everus Construction Group, Inc. on October 31, 2024.

Indicate the number of shares outstanding of the registrant's common stock, as of February 13, 2025: 204,331,170 shares.

DOCUMENTS INCORPORATED BY REFERENCE

Relevant portions of the registrant's 2025 Proxy Statement, to be filed no later than 120 days from December 31, 2024, are incorporated by reference in Part III, Items 10, 11, 12, 13 and 14 of this Report.

|

|

|

|

|

|

|

|

|

| Part I |

Page |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Item 1A |

|

|

|

|

|

Item 1B |

|

|

|

|

|

Item 1C |

|

|

|

|

|

Item 3 |

|

|

|

|

|

|

|

|

| Part II |

|

|

|

|

Item 5 |

|

|

|

|

|

Item 6 |

|

|

|

|

|

Item 7 |

|

|

|

|

|

Item 7A |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

2 MDU Resources Group, Inc. Form 10-K

|

|

|

|

|

|

|

|

|

| Part II (continued) |

Page |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Item 9 |

|

|

|

|

|

Item 9A |

|

|

|

|

|

Item 9B |

|

|

|

|

|

Item 9C |

|

|

|

|

|

| Part III |

|

|

|

|

Item 10 |

|

|

|

|

|

Item 11 |

|

|

|

|

|

Item 12 |

|

|

|

|

|

Item 13 |

|

|

|

|

|

Item 14 |

|

|

|

|

|

| Part IV |

|

|

|

|

| Item 15 |

|

|

|

|

|

|

|

|

|

|

Item 16 |

|

|

|

|

|

|

|

|

|

|

|

|

|

MDU Resources Group, Inc. Form 10-K 3

|

|

|

|

|

|

| The following abbreviations and acronyms used in this Form 10-K are defined below: |

Abbreviation or Acronym |

|

| AFUDC |

Allowance for funds used during construction |

Applied Digital |

Applied Digital Corporation |

| Army Corps |

U.S. Army Corps of Engineers |

| ASC |

FASB Accounting Standards Codification |

| ASU |

FASB Accounting Standards Update |

| Bcf |

Billion cubic feet |

| Big Stone Station |

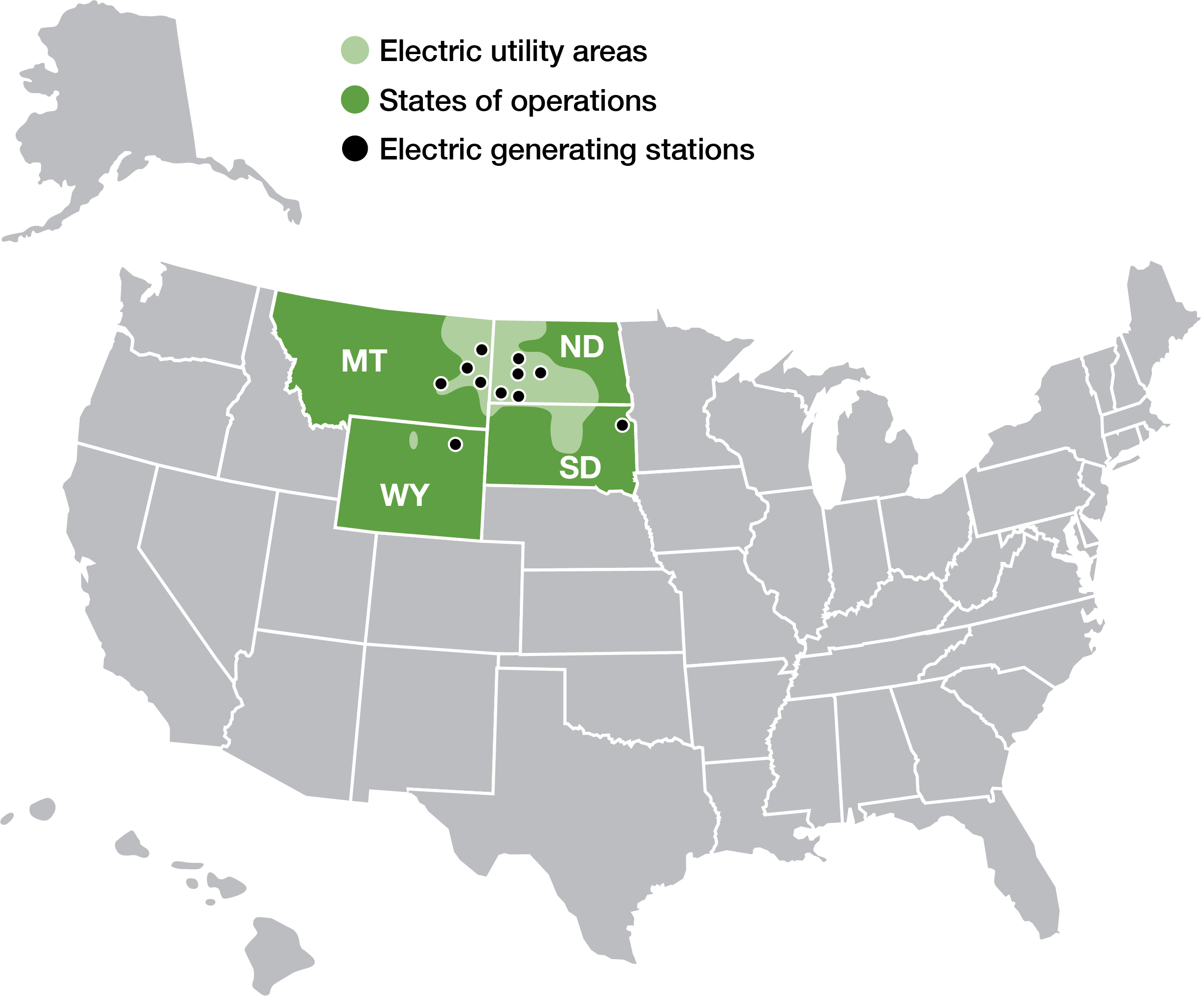

475-MW coal-fired electric generating facility near Big Stone City, South Dakota (22.7 percent ownership) |

| BSSE |

345-kV transmission line from Ellendale, North Dakota, to Big Stone City, South Dakota (50 percent ownership) |

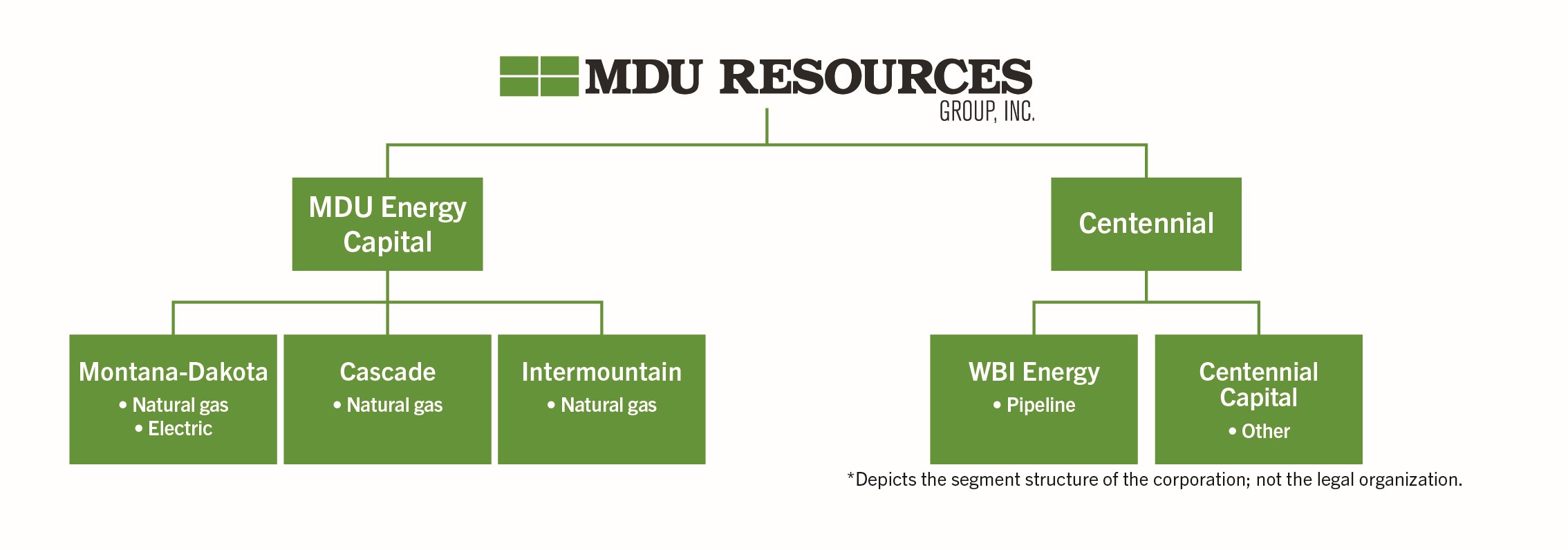

| Cascade |

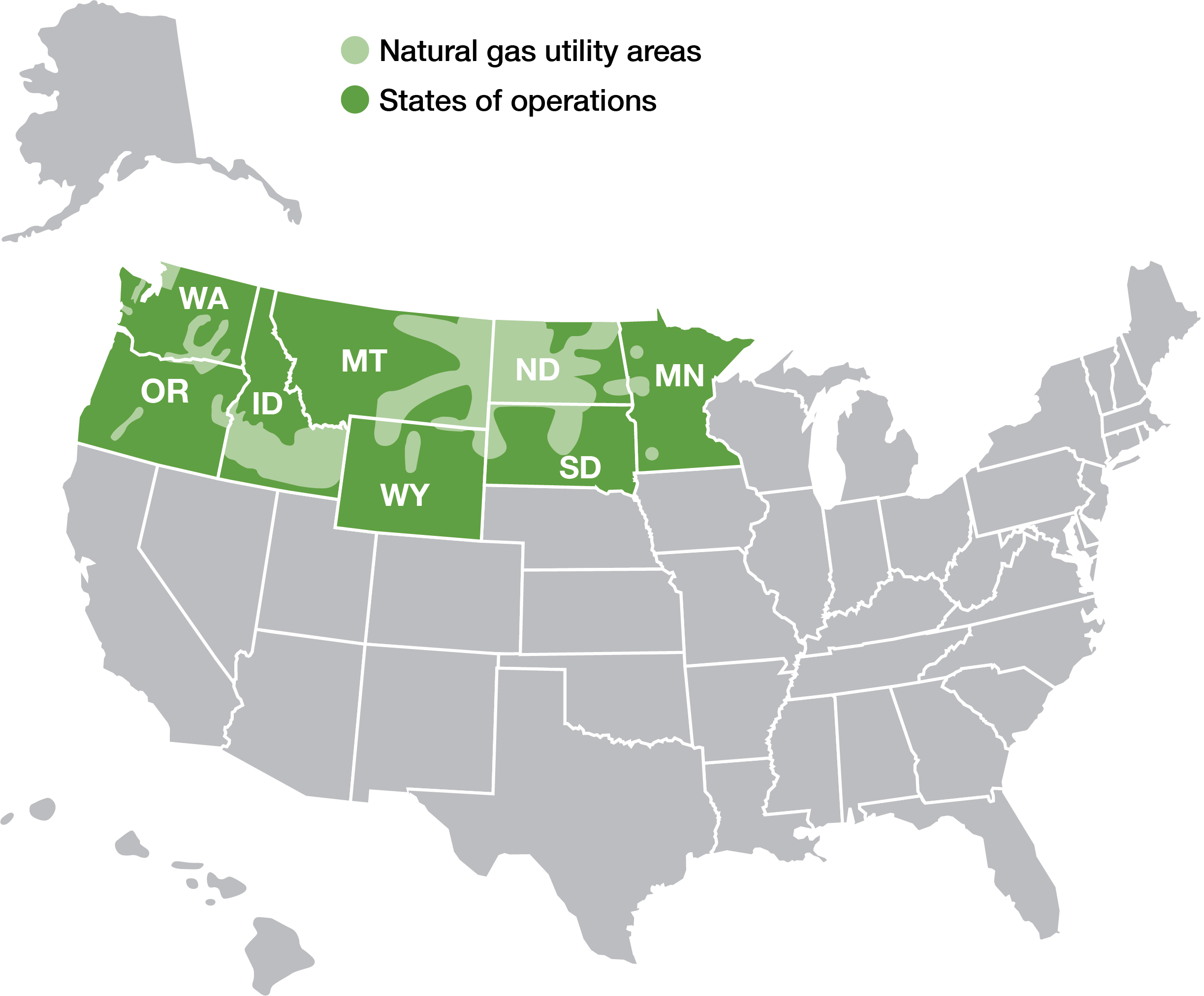

Cascade Natural Gas Corporation, an indirect wholly-owned subsidiary of MDU Energy Capital |

| Centennial |

CEHI, LLC, a direct wholly-owned subsidiary of the Company, formerly known as Centennial Energy Holdings, Inc. prior to the separation of Knife River from the Company. References to Centennial's historical business and operations refer to the business and operations of Centennial Energy Holdings, Inc. |

| Centennial Capital |

Centennial Holdings Capital LLC, a direct wholly-owned subsidiary of Centennial |

| CERCLA |

Comprehensive Environmental Response, Compensation and Liability Act |

CIO |

Chief Information Officer |

| Code |

U.S. Internal Revenue Code |

CODM |

Chief Operating Decision Maker |

| Company |

MDU Resources Group, Inc. |

| COVID-19 |

Coronavirus disease 2019 |

| Coyote Creek |

Coyote Creek Mining Company, LLC, a subsidiary of The North American Coal Corporation |

| Coyote Station |

427-MW coal-fired electric generating facility near Beulah, North Dakota (25 percent ownership) |

CWIP |

Construction work in progress, costs associated with the construction of new utility facilities recorded on the balance sheet until these facilities are placed in service. |

| CyROC |

Cyber Risk Oversight Committee |

DC Circuit Court |

U.S Court of Appeals for the D.C. Circuit |

| dk |

Decatherm |

| EBITDA |

Earnings before interest, taxes, depreciation and amortization |

| EIN |

Employer Identification Number |

| EPA |

U.S. Environmental Protection Agency |

| ERISA |

Employee Retirement Income Security Act of 1974, as amended |

ERM |

Enterprise risk management |

ESG |

Environmental, social and governance |

Everus |

Everus Construction Group, Inc., a wholly-owned subsidiary of the Company prior to the separation from the Company, that was established in conjunction with the separation of Everus Construction |

Everus Construction |

Everus Construction, Inc., a direct wholly-owned subsidiary of Centennial prior to the separation from the Company, formerly known as MDU Construction Services Group, Inc. prior to March 12, 2024 |

| Exchange Act |

Securities Exchange Act of 1934, as amended |

| FASB |

Financial Accounting Standards Board |

| FERC |

Federal Energy Regulatory Commission |

| Fidelity |

Fidelity Exploration & Production Company, an indirect wholly-owned subsidiary of Centennial (previously referred to as the Company's exploration and production segment) |

| FIP |

Funding improvement plan |

| GAAP |

Accounting principles generally accepted in the United States of America |

| GHG |

Greenhouse gas |

| Great Plains |

Great Plains Natural Gas Co., a public utility division of Montana-Dakota |

| GVTC |

Generation Verification Test Capacity |

4 MDU Resources Group, Inc. Form 10-K

|

|

|

|

|

|

| Holding Company Reorganization |

The internal holding company reorganization completed on January 1, 2019, pursuant to the agreement and plan of merger, dated as of December 31, 2018, by and among Montana-Dakota, the Company and MDUR Newco Sub, which resulted in the Company becoming a holding company and owning all of the outstanding capital stock of Montana-Dakota. |

| IBEW |

International Brotherhood of Electrical Workers |

| ICWU |

International Chemical Workers Union |

| Intermountain |

Intermountain Gas Company, an indirect wholly-owned subsidiary of MDU Energy Capital |

| IPUC |

Idaho Public Utilities Commission |

| IRA |

Inflation Reduction Act |

IRP |

Integrated Resource Plan |

| IRS |

Internal Revenue Service |

| Item 8 |

Financial Statements and Supplementary Data |

JETx |

345-kV transmission line from Jamestown, North Dakota to Ellendale, North Dakota (50 percent ownership) |

| Knife River |

Established as Knife River Corporation prior to the separation from the Company, a direct wholly-owned subsidiary of Centennial. Knife River refers to Knife River Corporation, during the period prior to separation, now known as "KRC Materials, Inc." Following the separation Knife River refers to Knife River Holding Company, now known as Knife River Corporation. |

| K-Plan |

Company's 401(k) Retirement Plan |

| kW |

Kilowatts |

| kWh |

Kilowatt-hour |

| kV |

Kilovolts |

Leading with Integrity Guide |

Company's code of business conduct |

| LIBOR |

London Inter-bank Offered Rate |

| MD&A |

Management's Discussion and Analysis of Financial Condition and Results of Operations |

| MDU Energy Capital |

MDU Energy Capital, LLC, a direct wholly-owned subsidiary of the Company |

| MDUR Newco |

MDUR Newco, Inc., a public holding company created by implementing the Holding Company Reorganization, now known as the Company |

| MDUR Newco Sub |

MDUR Newco Sub, Inc., a direct, wholly-owned subsidiary of MDUR Newco, which was merged with and into Montana-Dakota in the Holding Company Reorganization |

| MEPP |

Multiemployer pension plan |

| MISO |

Midcontinent Independent System Operator, Inc., the organization that provides open-access transmission services and monitors the high-voltage transmission system in the Midwest United States and Manitoba, Canada and a southern United States region which includes much of Arkansas, Mississippi and Louisiana |

| MMcf |

Million cubic feet |

| MMdk |

Million dk |

| MNPUC |

Minnesota Public Utilities Commission |

| Montana-Dakota |

Montana-Dakota Utilities Co. a direct wholly-owned subsidiary of MDU Energy Capital |

| MPPAA |

Multiemployer Pension Plan Amendments Act of 1980 |

| MTPSC |

Montana Public Service Commission |

| MW |

Megawatt |

| NDDEQ |

North Dakota Department of Environmental Quality |

| NDPSC |

North Dakota Public Service Commission |

| NERC |

North American Electric Reliability Corporation |

NYSE |

New York Stock Exchange |

ODEQ |

Oregon Department of Environmental Quality |

| OPUC |

Oregon Public Utility Commission |

| PCAOB |

Public Company Accounting Oversight Board |

| PCBs |

Polychlorinated biphenyls |

| PHMSA |

Pipeline and Hazardous Material Safety Administration |

| Proxy Statement |

Company's 2025 Proxy Statement |

| PRP |