000006270912/312024Q1FALSE00000627092024-01-012024-03-310000062709exch:XNYS2024-01-012024-03-310000062709exch:XCHI2024-01-012024-03-3100000627092024-04-15xbrli:sharesiso4217:USD00000627092023-01-012023-03-31iso4217:USDxbrli:shares00000627092024-03-3100000627092023-03-3100000627092023-12-3100000627092022-12-310000062709us-gaap:CommonStockMember2023-12-310000062709us-gaap:CommonStockMember2022-12-310000062709us-gaap:AdditionalPaidInCapitalMember2023-12-310000062709us-gaap:AdditionalPaidInCapitalMember2022-12-310000062709us-gaap:AdditionalPaidInCapitalMember2024-01-012024-03-310000062709us-gaap:AdditionalPaidInCapitalMember2023-01-012023-03-310000062709us-gaap:AdditionalPaidInCapitalMember2024-03-310000062709us-gaap:AdditionalPaidInCapitalMember2023-03-310000062709us-gaap:RetainedEarningsMember2023-12-310000062709us-gaap:RetainedEarningsMember2022-12-310000062709us-gaap:RetainedEarningsMember2024-01-012024-03-310000062709us-gaap:RetainedEarningsMember2023-01-012023-03-310000062709us-gaap:RetainedEarningsMember2024-03-310000062709us-gaap:RetainedEarningsMember2023-03-310000062709us-gaap:AccumulatedOtherComprehensiveIncomeMember2023-12-310000062709us-gaap:AccumulatedOtherComprehensiveIncomeMember2022-12-310000062709us-gaap:AccumulatedOtherComprehensiveIncomeMember2024-01-012024-03-310000062709us-gaap:AccumulatedOtherComprehensiveIncomeMember2023-01-012023-03-310000062709us-gaap:AccumulatedOtherComprehensiveIncomeMember2024-03-310000062709us-gaap:AccumulatedOtherComprehensiveIncomeMember2023-03-310000062709us-gaap:TreasuryStockCommonMember2023-12-310000062709us-gaap:TreasuryStockCommonMember2022-12-310000062709us-gaap:TreasuryStockCommonMember2024-01-012024-03-310000062709us-gaap:TreasuryStockCommonMember2023-01-012023-03-310000062709us-gaap:TreasuryStockCommonMember2024-03-310000062709us-gaap:TreasuryStockCommonMember2023-03-310000062709us-gaap:NoncontrollingInterestMember2023-12-310000062709us-gaap:NoncontrollingInterestMember2022-12-310000062709us-gaap:NoncontrollingInterestMember2024-01-012024-03-310000062709us-gaap:NoncontrollingInterestMember2023-01-012023-03-310000062709us-gaap:NoncontrollingInterestMember2024-03-310000062709us-gaap:NoncontrollingInterestMember2023-03-31mmc:segmentxbrli:pure0000062709us-gaap:OperatingSegmentsMembermmc:RiskandInsuranceServicesSegmentMemberus-gaap:EMEAMember2024-01-012024-03-310000062709us-gaap:OperatingSegmentsMembermmc:RiskandInsuranceServicesSegmentMemberus-gaap:EMEAMember2023-01-012023-03-310000062709us-gaap:OperatingSegmentsMembermmc:RiskandInsuranceServicesSegmentMembersrt:AsiaPacificMember2024-01-012024-03-310000062709us-gaap:OperatingSegmentsMembermmc:RiskandInsuranceServicesSegmentMembersrt:AsiaPacificMember2023-01-012023-03-310000062709us-gaap:OperatingSegmentsMembersrt:LatinAmericaMembermmc:RiskandInsuranceServicesSegmentMember2024-01-012024-03-310000062709us-gaap:OperatingSegmentsMembersrt:LatinAmericaMembermmc:RiskandInsuranceServicesSegmentMember2023-01-012023-03-310000062709us-gaap:OperatingSegmentsMembermmc:InternationalMembermmc:RiskandInsuranceServicesSegmentMember2024-01-012024-03-310000062709us-gaap:OperatingSegmentsMembermmc:InternationalMembermmc:RiskandInsuranceServicesSegmentMember2023-01-012023-03-310000062709us-gaap:OperatingSegmentsMembermmc:RiskandInsuranceServicesSegmentMembermmc:UnitedStatesandCanadaMember2024-01-012024-03-310000062709us-gaap:OperatingSegmentsMembermmc:RiskandInsuranceServicesSegmentMembermmc:UnitedStatesandCanadaMember2023-01-012023-03-310000062709us-gaap:OperatingSegmentsMembermmc:RiskandInsuranceServicesSegmentMembermmc:MarshMember2024-01-012024-03-310000062709us-gaap:OperatingSegmentsMembermmc:RiskandInsuranceServicesSegmentMembermmc:MarshMember2023-01-012023-03-310000062709us-gaap:OperatingSegmentsMembermmc:GuyCarpenterMembermmc:RiskandInsuranceServicesSegmentMember2024-01-012024-03-310000062709us-gaap:OperatingSegmentsMembermmc:GuyCarpenterMembermmc:RiskandInsuranceServicesSegmentMember2023-01-012023-03-310000062709us-gaap:OperatingSegmentsMembermmc:RiskandInsuranceServicesSegmentMembermmc:MarshGuyCarpenterMember2024-01-012024-03-310000062709us-gaap:OperatingSegmentsMembermmc:RiskandInsuranceServicesSegmentMembermmc:MarshGuyCarpenterMember2023-01-012023-03-310000062709us-gaap:OperatingSegmentsMembermmc:RiskandInsuranceServicesSegmentMember2024-01-012024-03-310000062709us-gaap:OperatingSegmentsMembermmc:RiskandInsuranceServicesSegmentMember2023-01-012023-03-310000062709us-gaap:OperatingSegmentsMembermmc:ConsultingSegmentMembermmc:MercerConsultingGroupMembermmc:WealthMember2024-01-012024-03-310000062709us-gaap:OperatingSegmentsMembermmc:ConsultingSegmentMembermmc:MercerConsultingGroupMembermmc:WealthMember2023-01-012023-03-310000062709us-gaap:OperatingSegmentsMembermmc:ConsultingSegmentMembermmc:MercerConsultingGroupMembermmc:HealthMember2024-01-012024-03-310000062709us-gaap:OperatingSegmentsMembermmc:ConsultingSegmentMembermmc:MercerConsultingGroupMembermmc:HealthMember2023-01-012023-03-310000062709us-gaap:OperatingSegmentsMembermmc:ConsultingSegmentMembermmc:MercerConsultingGroupMembermmc:CareerMember2024-01-012024-03-310000062709us-gaap:OperatingSegmentsMembermmc:ConsultingSegmentMembermmc:MercerConsultingGroupMembermmc:CareerMember2023-01-012023-03-310000062709us-gaap:OperatingSegmentsMembermmc:ConsultingSegmentMembermmc:MercerConsultingGroupMember2024-01-012024-03-310000062709us-gaap:OperatingSegmentsMembermmc:ConsultingSegmentMembermmc:MercerConsultingGroupMember2023-01-012023-03-310000062709us-gaap:OperatingSegmentsMembermmc:ConsultingSegmentMembermmc:OliverWymanGroupConsultingGroupMember2024-01-012024-03-310000062709us-gaap:OperatingSegmentsMembermmc:ConsultingSegmentMembermmc:OliverWymanGroupConsultingGroupMember2023-01-012023-03-310000062709us-gaap:OperatingSegmentsMembermmc:ConsultingSegmentMember2024-01-012024-03-310000062709us-gaap:OperatingSegmentsMembermmc:ConsultingSegmentMember2023-01-012023-03-310000062709us-gaap:AccumulatedDefinedBenefitPlansAdjustmentMember2023-12-310000062709us-gaap:AccumulatedTranslationAdjustmentMember2023-12-310000062709us-gaap:AccumulatedDefinedBenefitPlansAdjustmentMember2024-01-012024-03-310000062709us-gaap:AccumulatedTranslationAdjustmentMember2024-01-012024-03-310000062709us-gaap:AccumulatedDefinedBenefitPlansAdjustmentMember2024-03-310000062709us-gaap:AccumulatedTranslationAdjustmentMember2024-03-310000062709us-gaap:AccumulatedDefinedBenefitPlansAdjustmentMember2022-12-310000062709us-gaap:AccumulatedTranslationAdjustmentMember2022-12-310000062709us-gaap:AccumulatedDefinedBenefitPlansAdjustmentMember2023-01-012023-03-310000062709us-gaap:AccumulatedTranslationAdjustmentMember2023-01-012023-03-310000062709us-gaap:AccumulatedDefinedBenefitPlansAdjustmentMember2023-03-310000062709us-gaap:AccumulatedTranslationAdjustmentMember2023-03-310000062709us-gaap:AccumulatedDefinedBenefitPlansAdjustmentNetUnamortizedGainLossMember2024-01-012024-03-310000062709us-gaap:AccumulatedDefinedBenefitPlansAdjustmentNetUnamortizedGainLossMember2023-01-012023-03-310000062709mmc:AccumulatedDefinedBenefitPlansAdjustmentForeignCurrencyTranslationAdjustmentsAttributableToParentMember2024-01-012024-03-310000062709mmc:AccumulatedDefinedBenefitPlansAdjustmentForeignCurrencyTranslationAdjustmentsAttributableToParentMember2023-01-012023-03-310000062709mmc:RiskandInsuranceServicesSegmentMember2024-01-012024-03-31mmc:acquisition0000062709mmc:ConsultingSegmentMember2024-01-012024-03-310000062709srt:MinimumMember2024-01-012024-03-310000062709srt:MaximumMember2024-01-012024-03-310000062709mmc:PriorFiscalPeriodsAcquisitionsMember2024-01-012024-03-310000062709mmc:CurrentFiscalPeriodAcquisitionsMember2024-01-012024-03-310000062709mmc:CurrentFiscalPeriodAcquisitionsMember2024-03-310000062709us-gaap:CustomerRelationshipsMember2024-01-012024-03-310000062709us-gaap:CustomerRelationshipsMember2024-03-310000062709us-gaap:OtherIntangibleAssetsMember2024-01-012024-03-310000062709us-gaap:OtherIntangibleAssetsMember2024-03-310000062709mmc:WestpacTransactionMember2024-01-012024-03-310000062709mmc:WestpacTransactionMember2023-01-012023-03-310000062709us-gaap:DiscontinuedOperationsDisposedOfBySaleMembermmc:USHealthAndBenefitsAndUKPensionAdministrationBusinessesMember2024-01-012024-01-010000062709mmc:RiskandInsuranceServicesSegmentMember2023-01-012023-12-310000062709mmc:ConsultingSegmentMember2023-01-012023-12-310000062709srt:MinimumMember2023-01-012023-03-310000062709srt:MaximumMember2023-01-012023-03-310000062709mmc:PriorFiscalPeriodsAcquisitionsMember2023-01-012023-03-310000062709mmc:SmallIndividualFinancialAdvisoryBusinessMemberus-gaap:OperatingSegmentsMember2023-01-012023-03-3100000627092023-04-012023-06-300000062709mmc:RiskandInsuranceServicesSegmentMember2024-03-310000062709mmc:ConsultingSegmentMember2024-03-310000062709us-gaap:CustomerRelationshipsMember2023-12-310000062709us-gaap:OtherIntangibleAssetsMember2023-12-310000062709us-gaap:OtherAssetsMemberus-gaap:FairValueInputsLevel1Memberus-gaap:FairValueMeasurementsRecurringMember2024-03-310000062709us-gaap:OtherAssetsMemberus-gaap:FairValueInputsLevel1Memberus-gaap:FairValueMeasurementsRecurringMember2023-12-310000062709us-gaap:OtherAssetsMemberus-gaap:FairValueInputsLevel2Memberus-gaap:FairValueMeasurementsRecurringMember2024-03-310000062709us-gaap:OtherAssetsMemberus-gaap:FairValueInputsLevel2Memberus-gaap:FairValueMeasurementsRecurringMember2023-12-310000062709us-gaap:OtherAssetsMemberus-gaap:FairValueInputsLevel3Memberus-gaap:FairValueMeasurementsRecurringMember2024-03-310000062709us-gaap:OtherAssetsMemberus-gaap:FairValueInputsLevel3Memberus-gaap:FairValueMeasurementsRecurringMember2023-12-310000062709us-gaap:OtherAssetsMemberus-gaap:FairValueMeasurementsRecurringMember2024-03-310000062709us-gaap:OtherAssetsMemberus-gaap:FairValueMeasurementsRecurringMember2023-12-310000062709us-gaap:CashAndCashEquivalentsMemberus-gaap:FairValueInputsLevel1Memberus-gaap:FairValueMeasurementsRecurringMember2024-03-310000062709us-gaap:CashAndCashEquivalentsMemberus-gaap:FairValueInputsLevel1Memberus-gaap:FairValueMeasurementsRecurringMember2023-12-310000062709us-gaap:CashAndCashEquivalentsMemberus-gaap:FairValueInputsLevel2Memberus-gaap:FairValueMeasurementsRecurringMember2024-03-310000062709us-gaap:CashAndCashEquivalentsMemberus-gaap:FairValueInputsLevel2Memberus-gaap:FairValueMeasurementsRecurringMember2023-12-310000062709us-gaap:CashAndCashEquivalentsMemberus-gaap:FairValueInputsLevel3Memberus-gaap:FairValueMeasurementsRecurringMember2024-03-310000062709us-gaap:CashAndCashEquivalentsMemberus-gaap:FairValueInputsLevel3Memberus-gaap:FairValueMeasurementsRecurringMember2023-12-310000062709us-gaap:CashAndCashEquivalentsMemberus-gaap:FairValueMeasurementsRecurringMember2024-03-310000062709us-gaap:CashAndCashEquivalentsMemberus-gaap:FairValueMeasurementsRecurringMember2023-12-310000062709us-gaap:FairValueInputsLevel1Membermmc:OtherReceivablesMemberus-gaap:FairValueMeasurementsRecurringMember2024-03-310000062709us-gaap:FairValueInputsLevel1Membermmc:OtherReceivablesMemberus-gaap:FairValueMeasurementsRecurringMember2023-12-310000062709us-gaap:FairValueInputsLevel2Membermmc:OtherReceivablesMemberus-gaap:FairValueMeasurementsRecurringMember2024-03-310000062709us-gaap:FairValueInputsLevel2Membermmc:OtherReceivablesMemberus-gaap:FairValueMeasurementsRecurringMember2023-12-310000062709us-gaap:FairValueInputsLevel3Membermmc:OtherReceivablesMemberus-gaap:FairValueMeasurementsRecurringMember2024-03-310000062709us-gaap:FairValueInputsLevel3Membermmc:OtherReceivablesMemberus-gaap:FairValueMeasurementsRecurringMember2023-12-310000062709mmc:OtherReceivablesMemberus-gaap:FairValueMeasurementsRecurringMember2024-03-310000062709mmc:OtherReceivablesMemberus-gaap:FairValueMeasurementsRecurringMember2023-12-310000062709us-gaap:FairValueInputsLevel1Memberus-gaap:FairValueMeasurementsRecurringMember2024-03-310000062709us-gaap:FairValueInputsLevel1Memberus-gaap:FairValueMeasurementsRecurringMember2023-12-310000062709us-gaap:FairValueInputsLevel2Memberus-gaap:FairValueMeasurementsRecurringMember2024-03-310000062709us-gaap:FairValueInputsLevel2Memberus-gaap:FairValueMeasurementsRecurringMember2023-12-310000062709us-gaap:FairValueInputsLevel3Memberus-gaap:FairValueMeasurementsRecurringMember2024-03-310000062709us-gaap:FairValueInputsLevel3Memberus-gaap:FairValueMeasurementsRecurringMember2023-12-310000062709us-gaap:FairValueMeasurementsRecurringMember2024-03-310000062709us-gaap:FairValueMeasurementsRecurringMember2023-12-310000062709us-gaap:FairValueInputsLevel1Memberus-gaap:FairValueMeasurementsRecurringMemberus-gaap:MoneyMarketFundsMember2024-03-310000062709us-gaap:FairValueInputsLevel1Memberus-gaap:FairValueMeasurementsRecurringMemberus-gaap:MoneyMarketFundsMember2023-12-310000062709us-gaap:FairValueInputsLevel2Memberus-gaap:FairValueMeasurementsRecurringMemberus-gaap:MoneyMarketFundsMember2024-03-310000062709us-gaap:FairValueInputsLevel2Memberus-gaap:FairValueMeasurementsRecurringMemberus-gaap:MoneyMarketFundsMember2023-12-310000062709us-gaap:FairValueInputsLevel3Memberus-gaap:FairValueMeasurementsRecurringMemberus-gaap:MoneyMarketFundsMember2024-03-310000062709us-gaap:FairValueInputsLevel3Memberus-gaap:FairValueMeasurementsRecurringMemberus-gaap:MoneyMarketFundsMember2023-12-310000062709us-gaap:FairValueMeasurementsRecurringMemberus-gaap:MoneyMarketFundsMember2024-03-310000062709us-gaap:FairValueMeasurementsRecurringMemberus-gaap:MoneyMarketFundsMember2023-12-310000062709us-gaap:FairValueInputsLevel1Memberus-gaap:FairValueMeasurementsRecurringMembermmc:AccountsPayableandAccruedLiabilitiesandOtherLiabilitiesMember2024-03-310000062709us-gaap:FairValueInputsLevel1Memberus-gaap:FairValueMeasurementsRecurringMembermmc:AccountsPayableandAccruedLiabilitiesandOtherLiabilitiesMember2023-12-310000062709us-gaap:FairValueInputsLevel2Memberus-gaap:FairValueMeasurementsRecurringMembermmc:AccountsPayableandAccruedLiabilitiesandOtherLiabilitiesMember2024-03-310000062709us-gaap:FairValueInputsLevel2Memberus-gaap:FairValueMeasurementsRecurringMembermmc:AccountsPayableandAccruedLiabilitiesandOtherLiabilitiesMember2023-12-310000062709us-gaap:FairValueInputsLevel3Memberus-gaap:FairValueMeasurementsRecurringMembermmc:AccountsPayableandAccruedLiabilitiesandOtherLiabilitiesMember2024-03-310000062709us-gaap:FairValueInputsLevel3Memberus-gaap:FairValueMeasurementsRecurringMembermmc:AccountsPayableandAccruedLiabilitiesandOtherLiabilitiesMember2023-12-310000062709us-gaap:FairValueMeasurementsRecurringMembermmc:AccountsPayableandAccruedLiabilitiesandOtherLiabilitiesMember2024-03-310000062709us-gaap:FairValueMeasurementsRecurringMembermmc:AccountsPayableandAccruedLiabilitiesandOtherLiabilitiesMember2023-12-310000062709mmc:ContingentConsiderationMember2023-12-310000062709mmc:ContingentConsiderationMember2022-12-310000062709mmc:ContingentConsiderationMember2024-01-012024-03-310000062709mmc:ContingentConsiderationMember2023-01-012023-03-310000062709mmc:ContingentConsiderationMember2024-03-310000062709mmc:ContingentConsiderationMember2023-03-310000062709mmc:PrivateInsuranceandConsultingMember2024-03-310000062709mmc:PrivateInsuranceandConsultingMember2023-12-310000062709us-gaap:PrivateEquityFundsMember2024-03-310000062709us-gaap:PrivateEquityFundsMember2023-12-310000062709us-gaap:PrivateEquityFundsMember2024-01-012024-03-310000062709us-gaap:PrivateEquityFundsMember2023-01-012023-03-310000062709us-gaap:EquitySecuritiesMember2024-03-310000062709us-gaap:EquitySecuritiesMember2023-12-310000062709us-gaap:NetInvestmentHedgingMember2024-03-31iso4217:EUR0000062709srt:MinimumMember2024-03-310000062709srt:MaximumMember2024-03-310000062709us-gaap:PensionPlansDefinedBenefitMember2024-01-012024-03-310000062709us-gaap:PensionPlansDefinedBenefitMember2023-01-012023-03-310000062709us-gaap:PensionPlansDefinedBenefitMemberus-gaap:ForeignPlanMember2024-01-012024-03-310000062709us-gaap:PensionPlansDefinedBenefitMemberus-gaap:ForeignPlanMember2023-01-012023-03-310000062709us-gaap:PensionPlansDefinedBenefitMembercountry:US2023-01-012023-03-310000062709us-gaap:PensionPlansDefinedBenefitMembercountry:US2024-01-012024-03-310000062709us-gaap:EquityFundsMembercountry:US2024-03-310000062709us-gaap:FixedIncomeFundsMembercountry:US2024-03-310000062709us-gaap:EquityFundsMembercountry:GB2024-03-310000062709us-gaap:FixedIncomeFundsMembercountry:GB2024-03-310000062709country:GBus-gaap:GeographicConcentrationRiskMembermmc:UnitedKingdomPensionandPostretirementBenefitPlanDefinedBenefitMember2023-12-312023-12-310000062709us-gaap:PensionPlansDefinedBenefitMember2024-03-310000062709country:US2024-01-012024-03-310000062709country:US2023-01-012023-03-310000062709country:GB2024-01-012024-03-310000062709country:GB2023-01-012023-03-310000062709mmc:A350SeniorDebtObligationsDue2024Member2024-03-310000062709mmc:A350SeniorDebtObligationsDue2024Member2023-12-310000062709mmc:A3.875SeniorDebtObligationsDue2024Member2024-03-310000062709mmc:A3.875SeniorDebtObligationsDue2024Member2023-12-310000062709mmc:A3.50SeniorDebtObligationsDue2025Member2024-03-310000062709mmc:A3.50SeniorDebtObligationsDue2025Member2023-12-310000062709mmc:A1.349SeniorDebtObligationsDue2026Member2024-03-310000062709mmc:A1.349SeniorDebtObligationsDue2026Member2023-12-310000062709mmc:A3.75SeniorDebtObligationsDue2026Member2024-03-310000062709mmc:A3.75SeniorDebtObligationsDue2026Member2023-12-310000062709mmc:A4375SeniorDebtObligationsDue2029Member2024-03-310000062709mmc:A4375SeniorDebtObligationsDue2029Member2023-12-310000062709mmc:A1.979SeniorDebtObligationsDue2030Member2024-03-310000062709mmc:A1.979SeniorDebtObligationsDue2030Member2023-12-310000062709mmc:A225SeniorDebtObligationsDue2030Member2024-03-310000062709mmc:A225SeniorDebtObligationsDue2030Member2023-12-310000062709mmc:A2375SeniorDebtObligationsDue2031Member2024-03-310000062709mmc:A2375SeniorDebtObligationsDue2031Member2023-12-310000062709mmc:A5750SeniorDebtObligationsDue2032Member2024-03-310000062709mmc:A5750SeniorDebtObligationsDue2032Member2023-12-310000062709mmc:A5875SeniorDebtObligationsDue2033Member2024-03-310000062709mmc:A5875SeniorDebtObligationsDue2033Member2023-12-310000062709mmc:A5400SeniorDebtObligationsDue2033Member2024-03-310000062709mmc:A5400SeniorDebtObligationsDue2033Member2023-12-310000062709mmc:A5.150SeniorDebtObligationsDue2034Member2024-03-310000062709mmc:A5.150SeniorDebtObligationsDue2034Member2023-12-310000062709mmc:A4.75SeniorDebtObligationsDue2039Member2024-03-310000062709mmc:A4.75SeniorDebtObligationsDue2039Member2023-12-310000062709mmc:A435SeniorDebtObligationDue2047Member2024-03-310000062709mmc:A435SeniorDebtObligationDue2047Member2023-12-310000062709mmc:A420SeniorDebtObligationsDue2048Member2024-03-310000062709mmc:A420SeniorDebtObligationsDue2048Member2023-12-310000062709mmc:A4.90SeniorDebtObligationsDue2049Member2024-03-310000062709mmc:A4.90SeniorDebtObligationsDue2049Member2023-12-310000062709mmc:A290SeniorDebtObligationsDue2051Member2024-03-310000062709mmc:A290SeniorDebtObligationsDue2051Member2023-12-310000062709mmc:A625SeniorDebtObligationsDue2052Member2024-03-310000062709mmc:A625SeniorDebtObligationsDue2052Member2023-12-310000062709mmc:A5450SeniorDebtObligationsDue2053Member2024-03-310000062709mmc:A5450SeniorDebtObligationsDue2053Member2023-12-310000062709mmc:A5.700SeniorDebtObligationsDue2052Member2024-03-310000062709mmc:A5.700SeniorDebtObligationsDue2052Member2023-12-310000062709mmc:A5.450SeniorDebtObligationsDue2054Member2024-03-310000062709mmc:A5.450SeniorDebtObligationsDue2054Member2023-12-310000062709mmc:MortgageDue2035Member2024-03-310000062709mmc:MortgageDue2035Member2023-12-310000062709mmc:OtherDebtInstrumentsMember2024-03-310000062709mmc:OtherDebtInstrumentsMember2023-12-310000062709us-gaap:CommercialPaperMember2023-11-300000062709us-gaap:CommercialPaperMember2023-10-310000062709us-gaap:CommercialPaperMember2022-09-300000062709us-gaap:CommercialPaperMember2024-03-310000062709us-gaap:RevolvingCreditFacilityMember2023-10-012023-10-310000062709us-gaap:RevolvingCreditFacilityMember2023-10-310000062709mmc:NewFacilityMemberus-gaap:RevolvingCreditFacilityMember2023-09-300000062709mmc:NewFacilityMemberus-gaap:RevolvingCreditFacilityMember2024-03-310000062709mmc:NewFacilityMemberus-gaap:RevolvingCreditFacilityMember2023-12-310000062709mmc:UncommittedCreditFacilityMemberus-gaap:RevolvingCreditFacilityMember2023-10-012023-10-310000062709mmc:UncommittedCreditFacilityMemberus-gaap:RevolvingCreditFacilityMember2023-03-310000062709mmc:OtherDebtFacilitiesMember2024-03-310000062709mmc:OtherDebtFacilitiesMember2023-12-310000062709mmc:A3.875SeniorDebtObligationsOctober2024Memberus-gaap:SeniorNotesMember2024-01-012024-03-310000062709mmc:A3.875SeniorDebtObligationsOctober2024Member2024-03-310000062709mmc:A5.150SeniorDebtObligationsDue2034Memberus-gaap:SeniorNotesMember2024-02-290000062709mmc:A5.150SeniorDebtObligationsDue2034Member2024-02-290000062709mmc:A5.450SeniorDebtObligationsDue2054Memberus-gaap:SeniorNotesMember2024-02-290000062709mmc:A5.450SeniorDebtObligationsDue2054Member2024-02-290000062709mmc:A405SeniorDebtObligationsOctober2023Memberus-gaap:SeniorNotesMember2023-10-012023-10-310000062709mmc:A405SeniorDebtObligationsOctober2023Member2023-10-310000062709us-gaap:SeniorNotesMembermmc:A5400SeniorDebtObligationsDue2033Member2023-09-300000062709mmc:A5400SeniorDebtObligationsDue2033Member2023-09-300000062709us-gaap:SeniorNotesMembermmc:A5700SeniorDebtObligationsDue2053Member2023-09-300000062709mmc:A5700SeniorDebtObligationsDue2053Member2023-09-300000062709us-gaap:SeniorNotesMembermmc:A5450SeniorDebtObligationsDue2053Member2023-03-310000062709mmc:A5450SeniorDebtObligationsDue2053Member2023-03-310000062709us-gaap:CarryingReportedAmountFairValueDisclosureMember2024-03-310000062709us-gaap:EstimateOfFairValueFairValueDisclosureMember2024-03-310000062709us-gaap:CarryingReportedAmountFairValueDisclosureMember2023-12-310000062709us-gaap:EstimateOfFairValueFairValueDisclosureMember2023-12-310000062709mmc:SeveranceAndLeaseExitChargesMember2024-01-012024-03-310000062709mmc:RiskandInsuranceServicesSegmentMember2023-01-012023-03-310000062709mmc:ConsultingSegmentMember2023-01-012023-03-310000062709us-gaap:CorporateNonSegmentMember2024-01-012024-03-310000062709us-gaap:CorporateNonSegmentMember2023-01-012023-03-310000062709mmc:JardineLloydThompsonGroupplcMemberus-gaap:EmployeeSeveranceMember2022-12-310000062709mmc:JardineLloydThompsonGroupplcMembermmc:RealEstateRelatedCostsMember2022-12-310000062709mmc:JardineLloydThompsonGroupplcMembermmc:InformationTechnologyMember2022-12-310000062709mmc:LegalConsultingandOtherOutsideServicesMembermmc:JardineLloydThompsonGroupplcMember2022-12-310000062709mmc:JardineLloydThompsonGroupplcMember2022-12-310000062709mmc:JardineLloydThompsonGroupplcMemberus-gaap:EmployeeSeveranceMember2023-01-012023-12-310000062709mmc:JardineLloydThompsonGroupplcMembermmc:RealEstateRelatedCostsMember2023-01-012023-12-310000062709mmc:JardineLloydThompsonGroupplcMembermmc:InformationTechnologyMember2023-01-012023-12-310000062709mmc:LegalConsultingandOtherOutsideServicesMembermmc:JardineLloydThompsonGroupplcMember2023-01-012023-12-310000062709mmc:JardineLloydThompsonGroupplcMember2023-01-012023-12-310000062709mmc:JardineLloydThompsonGroupplcMemberus-gaap:EmployeeSeveranceMember2023-12-310000062709mmc:JardineLloydThompsonGroupplcMembermmc:RealEstateRelatedCostsMember2023-12-310000062709mmc:JardineLloydThompsonGroupplcMembermmc:InformationTechnologyMember2023-12-310000062709mmc:LegalConsultingandOtherOutsideServicesMembermmc:JardineLloydThompsonGroupplcMember2023-12-310000062709mmc:JardineLloydThompsonGroupplcMember2023-12-310000062709mmc:JardineLloydThompsonGroupplcMemberus-gaap:EmployeeSeveranceMember2024-01-012024-03-310000062709mmc:JardineLloydThompsonGroupplcMembermmc:RealEstateRelatedCostsMember2024-01-012024-03-310000062709mmc:JardineLloydThompsonGroupplcMembermmc:InformationTechnologyMember2024-01-012024-03-310000062709mmc:LegalConsultingandOtherOutsideServicesMembermmc:JardineLloydThompsonGroupplcMember2024-01-012024-03-310000062709mmc:JardineLloydThompsonGroupplcMember2024-01-012024-03-310000062709mmc:JardineLloydThompsonGroupplcMemberus-gaap:EmployeeSeveranceMember2024-03-310000062709mmc:JardineLloydThompsonGroupplcMembermmc:RealEstateRelatedCostsMember2024-03-310000062709mmc:JardineLloydThompsonGroupplcMembermmc:InformationTechnologyMember2024-03-310000062709mmc:LegalConsultingandOtherOutsideServicesMembermmc:JardineLloydThompsonGroupplcMember2024-03-310000062709mmc:JardineLloydThompsonGroupplcMember2024-03-310000062709us-gaap:CommonStockMember2024-01-012024-03-310000062709us-gaap:CommonStockMember2024-03-3100000627092024-03-012024-03-3100000627092024-02-012024-02-290000062709us-gaap:OperatingSegmentsMember2024-01-012024-03-310000062709mmc:CorporateAndEliminationsMember2024-01-012024-03-310000062709us-gaap:OperatingSegmentsMember2023-01-012023-03-310000062709mmc:CorporateAndEliminationsMember2023-01-012023-03-310000062709us-gaap:IntersegmentEliminationMembermmc:ConsultingSegmentMember2024-01-012024-03-310000062709us-gaap:IntersegmentEliminationMembermmc:ConsultingSegmentMember2023-01-012023-03-310000062709us-gaap:OperatingSegmentsMemberus-gaap:DiscontinuedOperationsDisposedOfBySaleMembermmc:SmallIndividualFinancialAdvisoryBusinessMember2024-01-012024-03-310000062709mmc:MarshInsuranceGroupMemberus-gaap:OperatingSegmentsMembermmc:RiskandInsuranceServicesSegmentMember2024-01-012024-03-310000062709mmc:MarshInsuranceGroupMemberus-gaap:OperatingSegmentsMembermmc:RiskandInsuranceServicesSegmentMember2023-01-012023-03-310000062709us-gaap:OperatingSegmentsMembermmc:RiskandInsuranceServicesSegmentMembermmc:GuyCarpenterReinsuranceGroupMember2024-01-012024-03-310000062709us-gaap:OperatingSegmentsMembermmc:RiskandInsuranceServicesSegmentMembermmc:GuyCarpenterReinsuranceGroupMember2023-01-012023-03-31

SECURITIES AND EXCHANGE COMMISSION

WASHINGTON, D.C. 20549

_____________________________________________

FORM 10-Q

_____________________________________________

(Mark One)

|

|

|

|

|

|

| ☒ |

Quarterly Report Pursuant to Section 13 or 15(d) of the Securities Exchange Act of 1934 |

For the quarterly period ended March 31, 2024

OR

|

|

|

|

|

|

| ☐ |

Transition Report Pursuant to Section 13 or 15(d) of the Securities Exchange Act of 1934 |

For the transition period from________ to________.

____________________________________________

Marsh & McLennan Companies, Inc.

1166 Avenue of the Americas

New York, New York 10036

(212) 345-5000

_____________________________________________

Commission file number 1-5998

State of Incorporation: Delaware

I.R.S. Employer Identification No. 36-2668272

_____________________________________________

Securities registered pursuant to Section 12(b) of the Act:

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Title of each class |

|

Trading symbol(s) |

|

Name of exchange on which registered |

| Common Stock, par value $1.00 per share |

|

MMC |

|

New York Stock Exchange |

|

|

|

|

Chicago Stock Exchange |

|

|

|

|

|

Indicate by check mark whether the registrant (1) has filed all reports required to be filed by Section 13 or 15(d) of the Securities Exchange Act of 1934 during the preceding 12 months (or for such shorter period that the registrant was required to file such reports), and (2) has been subject to such filing requirements for the past 90 days. Yes ý No ¨

Indicate by check mark whether the registrant has submitted electronically every Interactive Data File required to be submitted and posted pursuant to Rule 405 of Regulation S-T during the preceding 12 months (or for such shorter period that the registrant was required to submit and post such files). Yes ý No ¨

Indicate by check mark whether the registrant is a large accelerated filer, an accelerated filer, a non-accelerated filer, smaller reporting company, or an emerging growth company. See the definitions of "large accelerated filer," "accelerated filer," "smaller reporting company," and "emerging growth company" in Rule 12b-2 of the Exchange Act.

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Large Accelerated Filer |

☒ |

|

Accelerated Filer |

☐ |

|

|

|

|

| Non-Accelerated Filer |

☐ (Do not check if a smaller reporting company) |

|

Smaller Reporting Company |

☐ |

|

|

|

|

|

|

|

|

Emerging Growth Company |

☐ |

If an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act. ¨

Indicate by check mark whether the registrant is a shell company (as defined in Rule 12b-2 of the Exchange Act). Yes ☐ No ý

As of April 15, 2024, there were outstanding 492,724,025 shares of common stock, par value $1.00 per share, of the registrant.

INFORMATION CONCERNING FORWARD-LOOKING STATEMENTS

This Quarterly Report on Form 10-Q contains "forward-looking statements," as defined in the Private Securities Litigation Reform Act of 1995. These statements, which express management's current views concerning future events or results, use words like "anticipate," "assume," "believe," "continue," "estimate," "expect," "intend," "plan," "project" and similar terms, and future or conditional tense verbs like "could," "may," "might," "should," "will" and "would".

Forward-looking statements are subject to inherent risks and uncertainties that could cause actual results to differ materially from those expressed or implied in our forward-looking statements. Factors that could materially affect our future results include, among other things:

•the impact of geopolitical or macroeconomic conditions on us, our clients and the countries and industries in which we operate, including from multiple major wars, escalating conflict throughout the Middle East and rising tension in the South China Sea, slower GDP growth or recession, lower interest rates, capital markets volatility and inflation;

•the increasing prevalence of ransomware, supply chain and other forms of cyber attacks, and their potential to disrupt our operations, or the operations of our third party vendors, and result in the disclosure of confidential client or company information;

•the impact from lawsuits or investigations arising from errors and omissions, breaches of fiduciary duty or other claims against us in our capacity as a broker or investment advisor, including claims related to our investment business’ ability to execute timely trades;

•the financial and operational impact of complying with laws and regulations, including domestic and international sanctions regimes, anti-corruption laws such as the U.S. Foreign Corrupt Practices Act, U.K. Anti Bribery Act and cybersecurity, data privacy and artificial intelligence regulations;

•our ability to attract, retain and develop industry leading talent;

•our ability to compete effectively and adapt to competitive pressures in each of our businesses, including from disintermediation as well as technological change, digital disruption and other types of innovation such as artificial intelligence;

•our ability to manage potential conflicts of interest, including where our services to a client conflict, or are perceived to conflict, with the interests of another client or our own interests;

•the impact of changes in tax laws, guidance and interpretations, such as the implementation of the Organization for Economic Cooperation and Development international tax framework, or the increasing number of disagreements with and challenges by tax authorities in the current global tax environment; and

•the regulatory, contractual and reputational risks that arise based on insurance placement activities and insurer revenue streams.

The factors identified above are not exhaustive. Marsh & McLennan Companies, Inc., and its consolidated subsidiaries (the "Company") operate in a dynamic business environment in which new risks emerge frequently. Accordingly, we caution readers not to place undue reliance on any forward-looking statements, which are based only on information currently available to us and speak only as of the dates on which they are made. The Company undertakes no obligation to update or revise any forward-looking statement to reflect events or circumstances arising after the date on which it is made.

Further information concerning the Company, including information about factors that could materially affect our results of operations and financial condition, is contained in the Company's filings with the Securities and Exchange Commission, including the "Risk Factors" section and the "Management’s Discussion and Analysis of Financial Condition and Results of Operations" section of this Quarterly Report on Form 10-Q and our most recently filed Annual Report on Form 10-K.

TABLE OF CONTENTS

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| ITEM 1. |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| ITEM 2. |

|

|

|

OF OPERATIONS |

|

| ITEM 3. |

|

|

|

|

|

| ITEM 4. |

|

|

|

|

|

|

|

|

|

| ITEM 1. |

|

|

|

|

|

| ITEM 1A. |

|

|

|

|

|

| ITEM 2. |

|

|

|

|

|

| ITEM 3. |

|

|

|

|

|

| ITEM 4. |

|

|

|

|

|

| ITEM 5. |

|

|

|

|

|

| ITEM 6. |

|

|

PART I. FINANCIAL INFORMATION

Item 1.Financial Statements.

MARSH & McLENNAN COMPANIES, INC. AND SUBSIDIARIES

CONSOLIDATED STATEMENTS OF INCOME

(Unaudited)

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Three Months Ended

March 31, |

|

|

| (In millions, except per share data) |

2024 |

|

2023 |

|

|

|

|

| Revenue |

$ |

6,473 |

|

|

$ |

5,924 |

|

|

|

|

|

| Expense: |

|

|

|

|

|

|

|

| Compensation and benefits |

3,470 |

|

|

3,207 |

|

|

|

|

|

| Other operating expenses |

1,078 |

|

|

991 |

|

|

|

|

|

| Operating expenses |

4,548 |

|

|

4,198 |

|

|

|

|

|

| Operating income |

1,925 |

|

|

1,726 |

|

|

|

|

|

| Other net benefit credits |

67 |

|

|

58 |

|

|

|

|

|

| Interest income |

37 |

|

|

14 |

|

|

|

|

|

| Interest expense |

(159) |

|

|

(136) |

|

|

|

|

|

|

|

|

|

|

|

|

|

| Investment income |

1 |

|

|

2 |

|

|

|

|

|

|

|

|

|

|

|

|

|

| Income before income taxes |

1,871 |

|

|

1,664 |

|

|

|

|

|

| Income tax expense |

447 |

|

|

412 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Net income before non-controlling interests |

1,424 |

|

|

1,252 |

|

|

|

|

|

| Less: Net income attributable to non-controlling interests |

24 |

|

|

17 |

|

|

|

|

|

| Net income attributable to the Company |

$ |

1,400 |

|

|

$ |

1,235 |

|

|

|

|

|

| Net income per share attributable to the Company: |

|

|

|

|

|

|

|

| – Basic |

$ |

2.84 |

|

|

$ |

2.50 |

|

|

|

|

|

|

|

|

|

|

|

|

|

| – Diluted |

$ |

2.82 |

|

|

$ |

2.47 |

|

|

|

|

|

|

|

|

|

|

|

|

|

| Average number of shares outstanding: |

|

|

|

|

|

|

|

| – Basic |

492 |

|

|

495 |

|

|

|

|

|

| – Diluted |

497 |

|

|

500 |

|

|

|

|

|

| Shares outstanding at March 31, |

493 |

|

|

495 |

|

|

|

|

|

The accompanying notes are an integral part of these unaudited consolidated statements.

MARSH & McLENNAN COMPANIES, INC. AND SUBSIDIARIES

CONSOLIDATED STATEMENTS OF COMPREHENSIVE INCOME

(Unaudited)

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Three Months Ended

March 31, |

(In millions) |

|

|

|

|

2024 |

|

2023 |

| Net income before non-controlling interests |

|

|

|

|

$ |

1,424 |

|

|

$ |

1,252 |

|

| Other comprehensive (loss) income, before tax: |

|

|

|

|

|

|

|

| Foreign currency translation adjustments |

|

|

|

|

(244) |

|

|

119 |

|

|

|

|

|

|

|

|

|

| Gain (loss) related to pension/post-retirement plans |

|

|

|

|

50 |

|

|

(58) |

|

| Other comprehensive (loss) income before tax |

|

|

|

|

(194) |

|

|

61 |

|

| Income tax expense (benefit) on other comprehensive loss |

|

|

|

|

20 |

|

|

(19) |

|

| Other comprehensive (loss) income, net of tax |

|

|

|

|

(214) |

|

|

80 |

|

| Comprehensive income |

|

|

|

|

1,210 |

|

|

1,332 |

|

| Less: comprehensive income attributable to non-controlling interest |

|

|

|

|

24 |

|

|

17 |

|

| Comprehensive income attributable to the Company |

|

|

|

|

$ |

1,186 |

|

|

$ |

1,315 |

|

The accompanying notes are an integral part of these unaudited consolidated statements.

MARSH & McLENNAN COMPANIES, INC. AND SUBSIDIARIES

CONSOLIDATED BALANCE SHEETS

|

|

|

|

|

|

|

|

|

|

|

|

| (In millions, except share data) |

(Unaudited)

March 31, 2024

|

|

December 31, 2023 |

| ASSETS |

|

|

|

| Current assets: |

|

|

|

| Cash and cash equivalents |

$ |

1,452 |

|

|

$ |

3,358 |

|

| Cash and cash equivalents held in a fiduciary capacity |

11,458 |

|

|

10,794 |

|

| Receivables |

|

|

|

| Commissions and fees |

6,509 |

|

|

5,806 |

|

| Advanced premiums and claims |

107 |

|

|

103 |

|

|

|

|

|

| Other |

757 |

|

|

660 |

|

|

7,373 |

|

|

6,569 |

|

| Less-allowance for credit losses |

(157) |

|

|

(151) |

|

| Net receivables |

7,216 |

|

|

6,418 |

|

|

|

|

|

|

|

|

|

| Other current assets |

1,173 |

|

|

1,178 |

|

| Total current assets |

21,299 |

|

|

21,748 |

|

|

|

|

|

| Goodwill |

17,314 |

|

|

17,231 |

|

| Other intangible assets |

2,631 |

|

|

2,630 |

|

Fixed assets (net of accumulated depreciation and amortization of $1,585 at March 31, 2024 and $1,562 at December 31, 2023) |

877 |

|

|

882 |

|

| Pension related assets |

2,114 |

|

|

2,051 |

|

| Right of use assets |

1,494 |

|

|

1,541 |

|

| Deferred tax assets |

276 |

|

|

357 |

|

| Other assets |

1,567 |

|

|

1,590 |

|

| |

$ |

47,572 |

|

|

$ |

48,030 |

|

The accompanying notes are an integral part of these unaudited consolidated statements.

MARSH & McLENNAN COMPANIES, INC. AND SUBSIDIARIES

CONSOLIDATED BALANCE SHEETS (Continued)

|

|

|

|

|

|

|

|

|

|

|

|

| (In millions, except share data) |

(Unaudited)

March 31, 2024

|

|

December 31, 2023 |

| LIABILITIES AND EQUITY |

|

|

|

| Current liabilities: |

|

|

|

| Short-term debt |

$ |

1,169 |

|

|

$ |

1,619 |

|

| Accounts payable and accrued liabilities |

3,379 |

|

|

3,403 |

|

| Accrued compensation and employee benefits |

1,539 |

|

|

3,346 |

|

|

|

|

|

| Current lease liabilities |

310 |

|

|

312 |

|

| Accrued income taxes |

456 |

|

|

321 |

|

| Dividends payable |

349 |

|

|

— |

|

| Fiduciary liabilities |

11,458 |

|

|

10,794 |

|

| Total current liabilities |

18,660 |

|

|

19,795 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Long-term debt |

12,300 |

|

|

11,844 |

|

| Pension, post-retirement and post-employment benefits |

747 |

|

|

779 |

|

| Long-term lease liabilities |

1,600 |

|

|

1,661 |

|

| Liabilities for errors and omissions |

324 |

|

|

314 |

|

| Other liabilities |

1,319 |

|

|

1,267 |

|

| Commitments and contingencies |

— |

|

|

— |

|

|

|

|

|

| Equity: |

|

|

|

Preferred stock, $1 par value, authorized 6,000,000 shares, none issued |

— |

|

|

— |

|

Common stock, $1 par value, authorized 1,600,000,000 shares, issued 560,641,640 shares at March 31, 2024 and December 31, 2023 |

561 |

|

|

561 |

|

| Additional paid-in capital |

1,112 |

|

|

1,242 |

|

| Retained earnings |

23,456 |

|

|

22,759 |

|

| Accumulated other comprehensive loss |

(5,509) |

|

|

(5,295) |

|

| Non-controlling interests |

200 |

|

|

179 |

|

|

19,820 |

|

|

19,446 |

|

|

Less – treasury shares, at cost, 67,816,273 shares at March 31, 2024

and 68,635,498 shares at December 31, 2023

|

(7,198) |

|

|

(7,076) |

|

| Total equity |

12,622 |

|

|

12,370 |

|

| |

$ |

47,572 |

|

|

$ |

48,030 |

|

The accompanying notes are an integral part of these unaudited consolidated statements.

MARSH & McLENNAN COMPANIES, INC. AND SUBSIDIARIES

CONSOLIDATED STATEMENTS OF CASH FLOWS

(Unaudited)

|

|

|

|

|

|

|

|

|

|

|

|

For the Three Months Ended March 31, |

|

|

|

(In millions) |

2024 |

|

2023 |

| Operating cash flows: |

|

|

|

| Net income before non-controlling interests |

$ |

1,424 |

|

|

$ |

1,252 |

|

| Adjustments to reconcile net income provided by operations: |

|

|

|

| Depreciation and amortization of fixed assets and capitalized software |

99 |

|

|

84 |

|

| Amortization of intangible assets |

90 |

|

|

85 |

|

|

|

|

|

| Non-cash lease expense |

67 |

|

|

73 |

|

| Adjustments and payments related to contingent consideration assets and liabilities |

(8) |

|

|

8 |

|

|

|

|

|

|

|

|

|

|

|

|

|

| Net gain on investments |

(1) |

|

|

(2) |

|

| Net (gain) loss on disposition of assets |

(19) |

|

|

21 |

|

| Share-based compensation expense |

103 |

|

|

99 |

|

|

|

|

|

| Changes in assets and liabilities: |

|

|

|

| Net receivables |

(742) |

|

|

(775) |

|

|

|

|

|

| Other assets |

(70) |

|

|

(163) |

|

|

|

|

|

| Accrued compensation and employee benefits |

(1,779) |

|

|

(1,670) |

|

| Provision for taxes, net of payments and refunds |

209 |

|

|

189 |

|

| Contributions to pension and other benefit plans in excess of current year credit |

(88) |

|

|

(75) |

|

| Other liabilities |

11 |

|

|

134 |

|

| Operating lease liabilities |

(77) |

|

|

(79) |

|

|

|

|

|

| Net cash used by operations |

(781) |

|

|

(819) |

|

| Financing cash flows: |

|

|

|

| Purchase of treasury shares |

(300) |

|

|

(300) |

|

| Net proceeds from issuance of commercial paper |

50 |

|

|

594 |

|

|

|

|

|

|

|

|

|

| Borrowings from term-loan and credit facilities |

— |

|

|

250 |

|

| Proceeds from issuance of debt |

989 |

|

|

589 |

|

| Repayments of debt |

(1,004) |

|

|

(4) |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Shares withheld for taxes on vested units – treasury shares |

(169) |

|

|

(136) |

|

| Issuance of common stock from treasury shares |

113 |

|

|

42 |

|

| Payments of deferred and contingent consideration for acquisitions |

(15) |

|

|

(13) |

|

| Receipts of contingent consideration for dispositions |

— |

|

|

2 |

|

| Distributions of non-controlling interests |

(4) |

|

|

(3) |

|

| Dividends paid |

(354) |

|

|

(296) |

|

| Change in fiduciary liabilities |

829 |

|

|

48 |

|

| Net cash provided by financing activities |

135 |

|

|

773 |

|

| Investing cash flows: |

|

|

|

| Capital expenditures |

(87) |

|

|

(84) |

|

| Purchases of long term investments |

(10) |

|

|

(4) |

|

| Sales of long term investments |

4 |

|

|

— |

|

|

|

|

|

|

|

|

|

| Dispositions |

26 |

|

|

(20) |

|

| Acquisitions, net of cash and cash held in a fiduciary capacity acquired |

(301) |

|

|

(263) |

|

|

|

|

|

| Other, net |

— |

|

|

3 |

|

| Net cash used for investing activities |

(368) |

|

|

(368) |

|

| Effect of exchange rate changes on cash, cash equivalents, and cash and cash equivalents held in a fiduciary capacity |

(228) |

|

|

152 |

|

| Decrease in cash, cash equivalents, and cash and cash equivalents held in a fiduciary capacity |

(1,242) |

|

|

(262) |

|

| Cash, cash equivalents, and cash and cash equivalents held in a fiduciary capacity at beginning of period |

14,152 |

|

|

12,102 |

|

| Cash, cash equivalents, and cash and cash equivalents held in a fiduciary capacity at end of period |

$ |

12,910 |

|

|

$ |

11,840 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Reconciliation of cash, cash equivalents, and cash and cash equivalents held in a fiduciary capacity to the Consolidated Balance Sheets |

Balance at March 31, |

2024 |

|

2023 |

| (In millions) |

|

|

|

| Cash and cash equivalents |

$ |

1,452 |

|

|

$ |

1,006 |

|

| Cash and cash equivalents held in a fiduciary capacity |

11,458 |

|

|

10,834 |

|

| Total cash, cash equivalents, and cash and cash equivalents held in a fiduciary capacity |

$ |

12,910 |

|

|

$ |

11,840 |

|

The accompanying notes are an integral part of these unaudited consolidated statements.

MARSH & McLENNAN COMPANIES, INC. AND SUBSIDIARIES

CONSOLIDATED STATEMENTS OF EQUITY

(Unaudited)

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Three Months Ended

March 31, |

|

|

(In millions, except per share data) |

2024 |

|

2023 |

|

|

|

|

| COMMON STOCK |

|

|

|

|

|

|

|

| Balance, beginning and end of period |

$ |

561 |

|

|

$ |

561 |

|

|

|

|

|

| ADDITIONAL PAID-IN CAPITAL |

|

|

|

|

|

|

|

| Balance, beginning of period |

$ |

1,242 |

|

|

$ |

1,179 |

|

|

|

|

|

| Change in accrued stock compensation costs |

(205) |

|

|

(190) |

|

|

|

|

|

| Issuance of shares under stock compensation plans and employee stock purchase plans |

75 |

|

|

75 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Balance, end of period |

$ |

1,112 |

|

|

$ |

1,064 |

|

|

|

|

|

| RETAINED EARNINGS |

|

|

|

|

|

|

|

| Balance, beginning of period |

$ |

22,759 |

|

|

$ |

20,301 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Net income attributable to the Company |

1,400 |

|

|

1,235 |

|

|

|

|

|

| Dividend equivalents declared |

(5) |

|

|

(4) |

|

|

|

|

|

| Dividends declared |

(698) |

|

|

(583) |

|

|

|

|

|

| Balance, end of period |

$ |

23,456 |

|

|

$ |

20,949 |

|

|

|

|

|

| ACCUMULATED OTHER COMPREHENSIVE LOSS |

|

|

|

|

|

|

|

| Balance, beginning of period |

$ |

(5,295) |

|

|

$ |

(5,314) |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Other comprehensive loss (income), net of tax |

(214) |

|

|

80 |

|

|

|

|

|

| Balance, end of period |

$ |

(5,509) |

|

|

$ |

(5,234) |

|

|

|

|

|

| TREASURY SHARES |

|

|

|

|

|

|

|

| Balance, beginning of period |

$ |

(7,076) |

|

|

$ |

(6,207) |

|

|

|

|

|

| Issuance of shares under stock compensation plans and employee stock purchase plans |

178 |

|

|

120 |

|

|

|

|

|

|

|

|

|

|

|

|

|

| Purchase of treasury shares |

(300) |

|

|

(300) |

|

|

|

|

|

| Balance, end of period |

$ |

(7,198) |

|

|

$ |

(6,387) |

|

|

|

|

|

| NON-CONTROLLING INTERESTS |

|

|

|

|

|

|

|

| Balance, beginning of period |

$ |

179 |

|

|

$ |

229 |

|

|

|

|

|

| Net income attributable to non-controlling interests |

24 |

|

|

17 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Distributions and other changes |

(3) |

|

|

(3) |

|

|

|

|

|

|

|

|

|

|

|

|

|

| Balance, end of period |

$ |

200 |

|

|

$ |

243 |

|

|

|

|

|

| TOTAL EQUITY |

$ |

12,622 |

|

|

$ |

11,196 |

|

|

|

|

|

| Dividends declared per share |

$ |

1.42 |

|

|

$ |

1.18 |

|

|

|

|

|

|

|

|

|

|

|

|

|

The accompanying notes are an integral part of these unaudited consolidated statements.

MARSH & McLENNAN COMPANIES, INC. AND SUBSIDIARIES

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS

(Unaudited)

1. Nature of Operations

Marsh & McLennan Companies, Inc., and its consolidated subsidiaries (the "Company"), a global professional services firm, is organized based on the different services that it offers. Under this structure, the Company’s two business segments are Risk and Insurance Services and Consulting.

The Risk and Insurance Services segment ("RIS") includes risk management activities (risk advice, risk transfer, and risk control and mitigation solutions) as well as insurance and reinsurance broking and services for businesses, public entities, insurance companies, associations, professional services organizations, and private clients. The Company conducts business in this segment through Marsh and Guy Carpenter. Marsh provides data-driven risk advisory services and insurance solutions to commercial and consumer clients. Guy Carpenter develops advanced risk, reinsurance and capital strategies that help clients grow profitably and pursue emerging opportunities.

The Consulting segment includes health, wealth and career advice, solutions and products, and specialized management, strategic, economic and brand consulting services. The Company conducts business in this segment through Mercer and Oliver Wyman Group. Mercer delivers advice and technology-driven solutions that help organizations redefine the future of work, reshape retirement and investment outcomes, and unlock health and well-being for a changing workforce. Oliver Wyman Group serves as a critical strategic, economic and brand advisor to private sector and governmental clients.

2. Principles of Consolidation and Other Matters

The Company prepared the consolidated financial statements included herein pursuant to the rules and regulations of the Securities and Exchange Commission. For interim filings, certain information and disclosures normally included in financial statements prepared in accordance with accounting principles generally accepted in the United States of America (U.S.) have been omitted pursuant to such rules and regulations. The Company believes that the information and disclosures presented are adequate to make such information and disclosures not misleading. These consolidated financial statements should be read in conjunction with the consolidated financial statements and the notes thereto included in the Company’s Annual Report on Form 10-K for the year ended December 31, 2023 (the "2023 Form 10-K").

The accompanied consolidated financial statements include all wholly-owned and majority owned subsidiaries. All significant inter-company transactions and balances have been eliminated.

The financial information contained herein reflects all normal recurring adjustments which are, in the opinion of management, necessary for a fair presentation of the Company’s consolidated financial statements as of and for the three months ended March 31, 2024 and 2023.

The preparation of the consolidated financial statements requires management to make estimates and assumptions that affect the reported amounts of assets and liabilities and disclosures of assets and liabilities at the date of the financial statements, and the reported amounts of revenue and expense during the reporting period.

On an ongoing basis, the Company evaluates its estimates, judgments and methodologies. The estimates are based on historical experience and on various other assumptions that the Company believes are reasonable.

Such matters include:

•estimates of revenue;

•impairment assessments and charges;

•recoverability of long-lived assets;

•liabilities for errors and omissions;

•deferred tax assets, uncertain tax positions and income tax expense;

•share-based and incentive compensation expense;

•the allowance for current expected credit losses on receivables;

•useful lives assigned to long-lived assets, and depreciation and amortization; and

•fair value estimates of contingent consideration receivable or payable related to acquisitions or dispositions.

The Company believes these estimates are reasonable based on information currently available at the time they are made. The Company also considered the potential impact of macroeconomic factors including from the multiple major wars, escalating conflict throughout the Middle East and rising tension in the South China Sea, slower GDP growth or recession, lower interest rates, capital markets volatility and inflation to its customer base in various industries and geographies. Insurance exposures subject to variable factors are subject to mid-term and end-of-term adjustments, as well as policy audits, which may reduce premiums and corresponding commissions. Estimates were updated based on internal and industry specific economic data. Actual results may differ from these estimates.

Cash and Cash Equivalents

Cash and cash equivalents primarily consist of certificates of deposit and time deposits, with original maturities of three months or less, and money market funds. The estimated fair value of the Company's cash and cash equivalents approximates their carrying value. The Company is required to maintain operating funds primarily related to regulatory requirements outside of the U.S. or as collateral under captive insurance arrangements. At March 31, 2024, the Company maintained $480 million compared to $486 million at December 31, 2023 related to these regulatory requirements.

Allowance for Credit Losses on Accounts Receivable

The Company’s policy for providing an allowance for credit losses on its accounts receivable is based on a combination of factors, including historical write-offs, aging of balances, and other qualitative and quantitative analyses. The charge related to expected credit losses was not material to the consolidated statements of income for the three months ended March 31, 2024 and 2023, respectively.

Investments

The caption "Investment income" in the consolidated statements of income comprises realized and unrealized gains and losses from investments recognized in earnings. It includes, when applicable, other than temporary declines in the value of securities, mark-to-market increases or decreases in equity investments with readily determinable fair values and equity method gains or losses on the Company's investments in private equity funds.

The Company holds investments in certain private equity funds. Investments in private equity funds are accounted for in accordance with the equity method of accounting using a consistently applied three-month lag period adjusted for any known significant changes from the lag period to the reporting date of the Company. The underlying private equity funds follow investment company accounting, where investments within the fund are carried at fair value. Investment gains or losses for its proportionate share of the change in fair value of the funds are recorded in earnings. Investments accounted for in accordance with the equity method of accounting are included in other assets in the consolidated balance sheets.

The Company recorded net investment income of $1 million and $2 million for the three months ended March 31, 2024 and 2023, respectively.

Income Taxes

The Company's effective tax rate for the three months ended March 31, 2024 was 23.9%, compared with 24.7% for the corresponding quarter of 2023.

The tax rate in each period reflects the impact of discrete tax items such as excess tax benefits related to share-based compensation, enacted tax legislation, changes in uncertain tax positions, deferred tax adjustments, non-taxable adjustments related to contingent consideration for acquisitions, and valuation allowances for certain tax credits and attributes. The rate for the three months ended March 31, 2024 reflects the previously enacted change in the United Kingdom (U.K.) corporate income tax rate from 19% to 25%, which was effective April 1, 2023. The blended U.K. statutory tax rate for 2023 was 23.5%.

The excess tax benefit related to share-based payments is the most significant discrete item in both periods, reducing the effective tax rate by 2.3% and 1.3% for the three months ended March 31, 2024 and 2023, respectively.

The Company's tax rate reflects its income, statutory tax rates, and tax planning in the various jurisdictions in which it operates. Significant judgment is required in determining the annual effective tax rate and in evaluating uncertain tax positions.

Losses in one jurisdiction, generally, cannot offset earnings in another, and within certain jurisdictions profits and losses may not offset between entities. Consequently, losses in certain jurisdictions may require valuation allowances affecting the effective tax rate, depending on estimates of the realizability of associated deferred tax assets. The tax rate is also sensitive to changes in unrecognized tax benefits, including the impact of settled tax audits and expired statutes of limitations.

The Company reports a liability for unrecognized tax benefits resulting from uncertain tax positions taken or expected to be taken in tax returns. The Company's gross unrecognized tax benefits were $127 million at March 31, 2024, and $124 million at December 31, 2023. It is reasonably possible that the total amount of unrecognized tax benefits could decrease up to approximately $66 million within the next twelve months due to settlement of audits and expirations of statutes of limitations.

Changes in tax laws, rulings, policies, or related legal and regulatory interpretations occur frequently and may have significant favorable or adverse impacts on our effective tax rate. In 2021, the Organization for Economic Cooperation and Development ("OECD") released model rules for a 15% global minimum tax, known as Pillar Two. Pillar Two has now been enacted by approximately 30 countries, including the U.K. and Ireland. This minimum tax is treated as a period cost beginning in 2024 and does not have a material impact on the Company's financial results of operations for the current period. The Company is monitoring legislative developments, as well as additional guidance from countries that have enacted legislation. We anticipate further legislative activity and administrative guidance in 2024.

Restructuring Costs

Charges associated with restructuring activities are recognized in accordance with applicable accounting guidance which includes accounting for disposal or exit activities, guidance related to impairment of right-of-use ("ROU") assets related to real estate leases, as well as other costs resulting from accelerated depreciation or amortization of leasehold improvements and other property and equipment.

Severance and related costs are recognized based on amounts due under established severance plans or estimates of one-time benefits that will be provided. Typically, severance benefits are recognized when the impacted colleagues are notified of their expected termination and such termination is expected to occur within the legally required notification period. These costs are included in compensation and benefits in the consolidated statements of income.

Costs for real estate consolidation are recognized based on the type of cost, and the expected future use of the facility. For locations where the Company does not expect to sub-lease the property, the amortization of any ROU asset is accelerated from the decision date to the cease use date. For locations where the Company expects to sub-lease the properties subsequent to its vacating the property, the ROU asset is reviewed for potential impairment at the earlier of the cease use date or the date a sub-lease is signed. To determine the amount of impairment, the fair value of the ROU asset is determined based on the present value of the estimated net cash flows related to the property. Contractual costs outside of the ROU asset are recognized based on the net present value of expected future cash outflows for which the Company will not receive any benefit. Such amounts are reliant on estimates of future sub-lease income to be received and future contractual costs to be incurred. These costs are included in other operating expenses in the consolidated statements of income. Other costs related to restructuring, such as moving, legal or consulting costs are recognized as incurred. These costs are included in other operating expenses in the consolidated statements of income.

Foreign Currency

The financial statements of our international subsidiaries are translated from functional currency to U.S. dollars using month-end exchange rates for assets and liabilities, and average monthly exchange rates during the period for revenues and expenses. Translation adjustments are recorded in accumulated other comprehensive income (loss) ("AOCI") within the consolidated statements of equity. Foreign exchange transaction gains and losses resulting from the conversion of the transaction currency to functional currency are included in operating income in the consolidated statements of income.

3. Revenue

The core principle of the revenue recognition guidance is that an entity should recognize revenue to depict the transfer of promised goods or services to customers in an amount that reflects the consideration to which the entity expects to be entitled in exchange for those goods or services.

To achieve this principle, the entity applies the following steps: identify the contract(s) with the customer, identify the performance obligations in the contract(s), determine the transaction price, allocate the transaction price to the performance obligations in the contract, and recognize revenue when (or as) the entity satisfies a performance obligation. In accordance with the accounting guidance, a performance obligation is satisfied either at a "point in time" or "over time", depending on the nature of the product or service provided, and the specific terms of the contract with customers.

Other revenue included in the consolidated statements of income that is not from contracts with customers is less than 1% of total revenue and is not presented as a separate line item.

The Company's revenue policies are provided in more detail in Note 2, Revenue, in the 2023 Form 10-K.

The following table disaggregates various components of the Company's revenue:

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Three Months Ended

March 31, |

| (In millions) |

|

|

|

2024 |

|

2023 |

| Marsh: |

|

|

|

|

|

|

| EMEA |

|

|

|

$ |

1,025 |

|

|

$ |

932 |

|

| Asia Pacific |

|

|

|

336 |

|

|

312 |

|

| Latin America |

|

|

|

125 |

|

|

115 |

|

| Total International |

|

|

|

1,486 |

|

|

1,359 |

|

| U.S./Canada |

|

|

|

1,517 |

|

|

1,385 |

|

| Total Marsh |

|

|

|

3,003 |

|

|

2,744 |

|

| Guy Carpenter |

|

|

|

1,148 |

|

|

1,071 |

|

| Subtotal |

|

|

|

4,151 |

|

|

3,815 |

|

| Fiduciary interest income |

|

|

|

122 |

|

|

91 |

|

| Total Risk and Insurance Services |

|

|

|

$ |

4,273 |

|

|

$ |

3,906 |

|

|

|

|

|

|

|

|

| Mercer: |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Wealth |

|

|

|

$ |

672 |

|

|

$ |

581 |

|

| Health |

|

|

|

538 |

|

|

545 |

|

| Career |

|

|

|

215 |

|

|

218 |

|

| Total Mercer |

|

|

|

1,425 |

|

|

1,344 |

|

| Oliver Wyman Group |

|

|

|

789 |

|

|

687 |

|

| Total Consulting |

|

|

|

$ |

2,214 |

|

|

$ |

2,031 |

|

The following table provides contract assets and contract liabilities information from contracts with customers:

|

|

|

|

|

|

|

|

|

|

|

|

| (In millions) |

March 31, 2024 |

|

December 31, 2023 |

| Contract assets |

$ |

389 |

|

|

$ |

357 |

|

| Contract liabilities |

$ |

902 |

|

|

$ |

869 |

|

The Company records accounts receivable when the right to consideration is unconditional, subject only to the passage of time. Contract assets primarily relate to quota share reinsurance brokerage and contingent insurer revenue. The Company does not have the right to bill and collect revenue for quota share brokerage until the underlying policies written by the ceding insurer attach to the treaty. Estimated revenue related to the achievement of volume or loss ratio metrics cannot be billed or collected until all related policy placements are completed and the contingency is resolved.

Contract assets are included in other current assets in the Company's consolidated balance sheets. Contract liabilities primarily relate to the advance consideration received from customers. Contract liabilities are included in current liabilities in the Company's consolidated balance sheets. Revenue recognized for the three months ended March 31, 2024 and 2023 that was included in the contract liability balance at the beginning of each of those periods was $315 million and $293 million, respectively.

The amount of revenue recognized for the three months ended March 31, 2024 and 2023 from performance obligations satisfied in previous periods, mainly due to variable consideration from contracts with insurers, quota share business and consulting contracts previously considered constrained was $14 million and $17 million, respectively.

The Company applies the practical expedient and does not disclose the value of unsatisfied performance obligations for (1) contracts with original contract terms of one year or less and (2) contracts where the Company has the right to invoice for services performed.

4. Fiduciary Assets and Liabilities

The Company, in its capacity as an insurance broker or agent, generally collects premiums from insureds and after deducting its commissions, remits the premiums to the respective insurance underwriters. The Company also collects claims or refunds from underwriters on behalf of insureds. Unremitted insurance premiums and claims proceeds are held by the Company in a fiduciary capacity. The Company's fiduciary assets primarily include bank or short-term time deposits and liquid money market funds, classified as cash and cash equivalents. Since cash and cash equivalents held in a fiduciary capacity are not available for corporate use, they are shown separately in the consolidated balance sheets as cash and cash equivalents held in a fiduciary capacity, with a corresponding amount in current liabilities.

Risk and Insurance Services revenue includes interest on fiduciary assets of $122 million and $91 million for the three months ended March 31, 2024 and 2023, respectively.

Net uncollected premiums and claims and the related payables were $15.2 billion at March 31, 2024, and $13.8 billion at December 31, 2023. The Company is not a principal to the contracts under which the right to receive premiums or the right to receive reimbursement of insured losses arises. Accordingly, net uncollected premiums and claims and the related payables are not assets and liabilities of the Company and are not included in the accompanying consolidated balance sheets.

In certain instances, the Company advances premiums, refunds or claims to insurance underwriters or insureds prior to collection. These advances are made from corporate funds and are reflected in the accompanying consolidated balance sheets as receivables.

5. Per Share Data

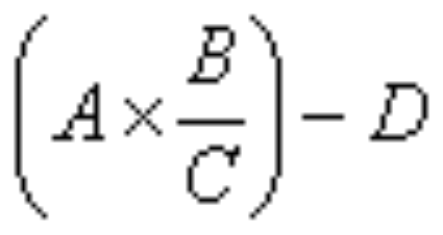

Basic net income per share attributable to the Company is calculated by dividing the after-tax income attributable to the Company by the weighted average number of outstanding shares of the Company’s common stock.

Diluted net income per share attributable to the Company is calculated by dividing the after-tax income attributable to the Company by the weighted average number of outstanding shares of the Company’s common stock, which have been adjusted for the dilutive effect of potentially issuable common shares.

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Basic and Diluted EPS Calculation |

Three Months Ended

March 31, |

|

|

| (In millions, except per share data) |

2024 |

|

2023 |

|

|

|

| Net income before non-controlling interests |

$ |

1,424 |

|

|

$ |

1,252 |

|

|

|

|