| Delaware | 0-1088 | 38-1510762 | ||||||

| (State or other jurisdiction | (Commission | (IRS Employer | ||||||

| of incorporation) | File Number) | Identification No.) | ||||||

|

Title of each

class

|

Trading

Symbols

|

Name of each exchange

on which registered

|

||||||

| Class A Common | KELYA | NASDAQ Global Market | ||||||

| Class B Common | KELYB | NASDAQ Global Market | ||||||

| Exhibit No. | Description | ||||

| Press Release dated August 8, 2024. | |||||

| Presentation materials for August 8, 2024 conference call. | |||||

| 104 | Cover Page Interactive Data File (embedded within the Inline XBRL document) | ||||

| August 8, 2024 | ||||||||

|

/s/ Laura S. Lockhart

Laura S. Lockhart

Vice President, Corporate Controller and

Chief Accounting Officer

(Principal Accounting Officer)

|

||||||||

| Exhibit No. | Description | ||||

| 99.1 | Press Release dated August 8, 2024. | ||||

| 99.2 | Presentation materials for August 8, 2024 conference call. | ||||

| 104 | Cover Page Interactive Data File (embedded within the Inline XBRL document) | ||||

| ANALYST & MEDIA CONTACT: | |||||||||||

| Scott Thomas | |||||||||||

| (248) 251-7264 | |||||||||||

| scott.thomas@kellyservices.com | |||||||||||

| KELLY SERVICES, INC. AND SUBSIDIARIES | |||||||||||||||||||||||||||||||||||

| CONSOLIDATED STATEMENTS OF EARNINGS | |||||||||||||||||||||||||||||||||||

| FOR THE 13 WEEKS ENDED JUNE 30, 2024 AND JULY 2, 2023 | |||||||||||||||||||||||||||||||||||

| (UNAUDITED) | |||||||||||||||||||||||||||||||||||

| (In millions of dollars except per share data) | |||||||||||||||||||||||||||||||||||

| % | CC % | ||||||||||||||||||||||||||||||||||

| 2024 | 2023 | Change | Change | Change | |||||||||||||||||||||||||||||||

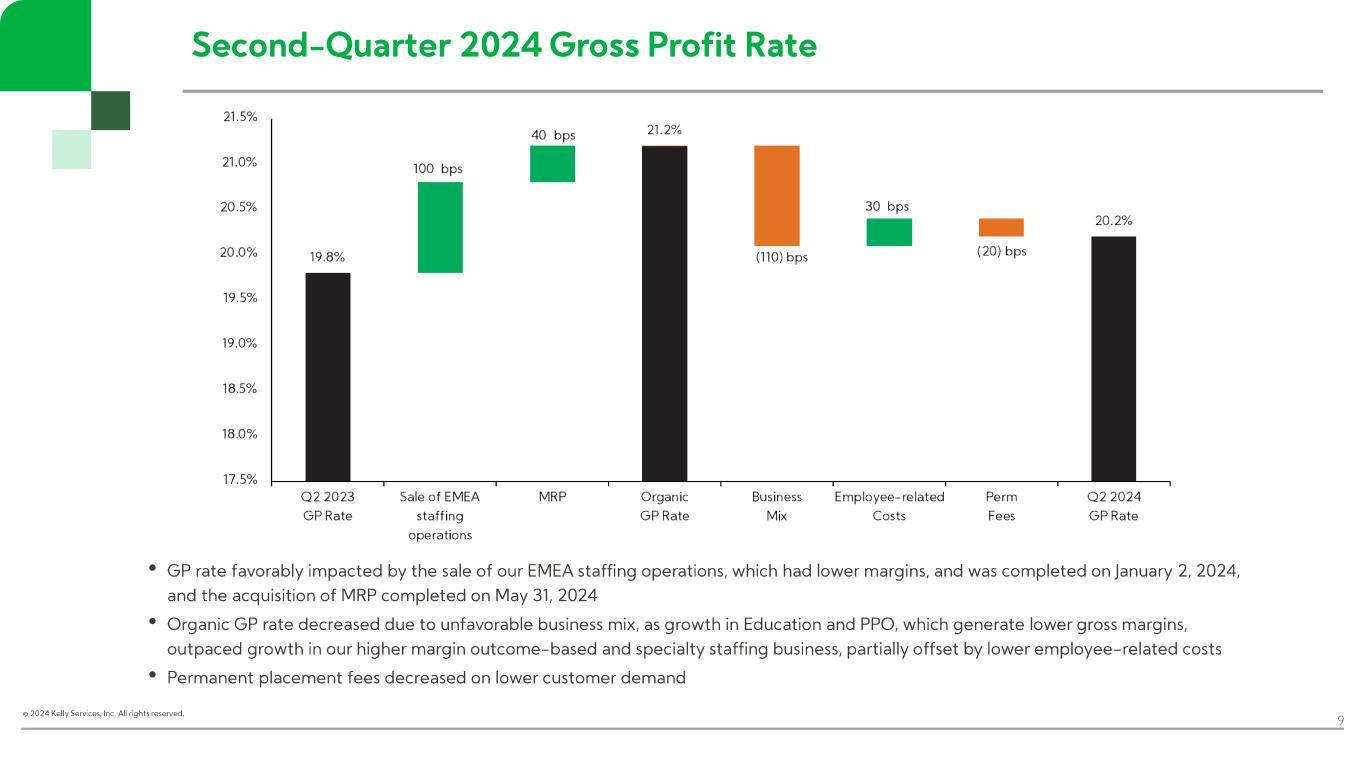

| Revenue from services | $ | 1,057.5 | $ | 1,217.2 | $ | (159.7) | (13.1) | % | (13.0) | % | |||||||||||||||||||||||||

| Cost of services | 843.8 | 976.6 | (132.8) | (13.6) | |||||||||||||||||||||||||||||||

| Gross profit | 213.7 | 240.6 | (26.9) | (11.2) | (11.1) | ||||||||||||||||||||||||||||||

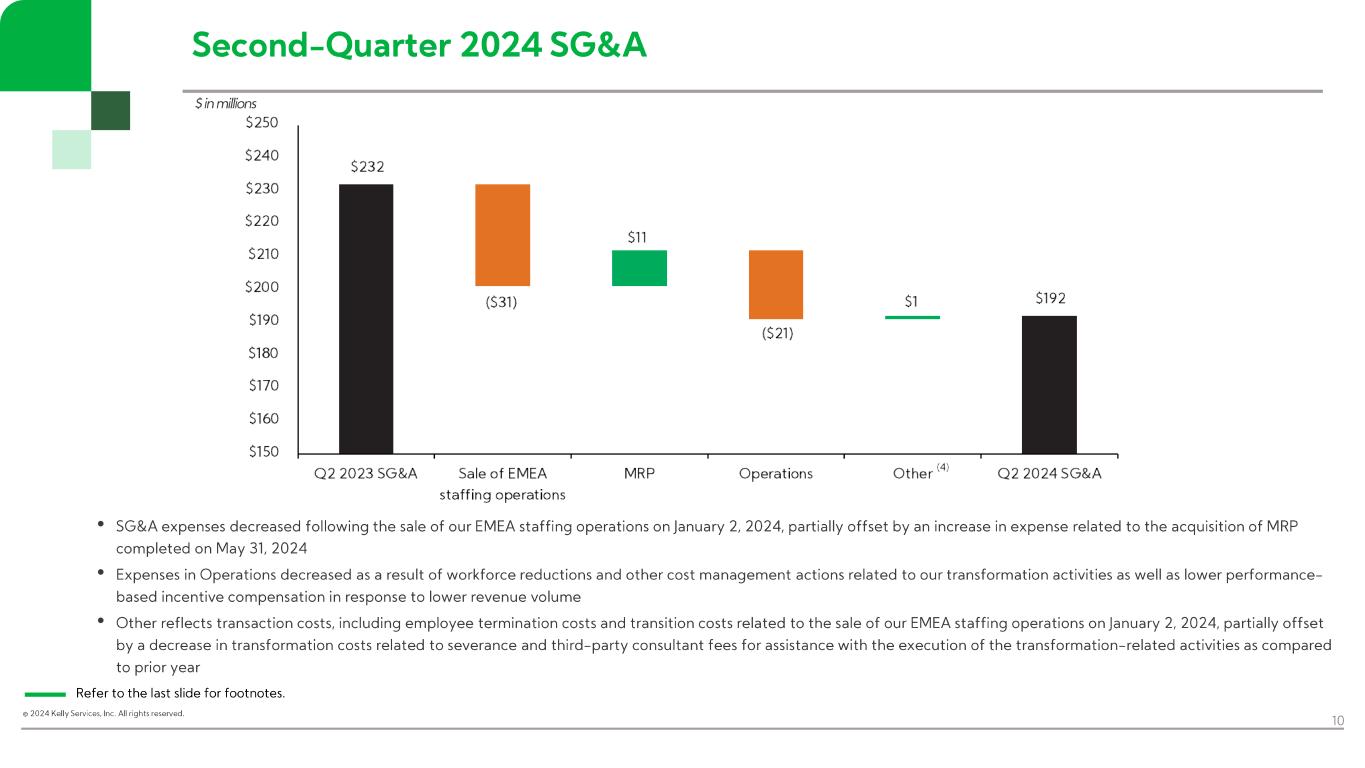

| Selling, general and administrative expenses | 191.5 | 232.0 | (40.5) | (17.4) | (17.4) | ||||||||||||||||||||||||||||||

| Asset impairment charge | 5.5 | 2.4 | 3.1 | 124.1 | |||||||||||||||||||||||||||||||

| Loss on sale of EMEA staffing operations | 10.0 | — | 10.0 | NM | |||||||||||||||||||||||||||||||

| Gain on sale of assets | (5.5) | — | (5.5) | NM | |||||||||||||||||||||||||||||||

| Earnings from operations | 12.2 | 6.2 | 6.0 | 95.9 | |||||||||||||||||||||||||||||||

| Other income (expense), net | (6.5) | (0.6) | (5.9) | NM | |||||||||||||||||||||||||||||||

| Earnings before taxes | 5.7 | 5.6 | 0.1 | 1.4 | |||||||||||||||||||||||||||||||

| Income tax expense (benefit) | 1.1 | (1.9) | 3.0 | 160.7 | |||||||||||||||||||||||||||||||

| Net earnings | $ | 4.6 | $ | 7.5 | $ | (2.9) | (38.2) | ||||||||||||||||||||||||||||

| Basic earnings per share | $ | 0.13 | $ | 0.20 | $ | (0.07) | (35.0) | ||||||||||||||||||||||||||||

| Diluted earnings per share | $ | 0.12 | $ | 0.20 | $ | (0.08) | (40.0) | ||||||||||||||||||||||||||||

| STATISTICS: | |||||||||||||||||||||||||||||||||||

| Permanent placement revenue (included in revenue from services) | $ | 10.7 | $ | 15.7 | $ | (5.0) | (32.0) | % | (32.0) | % | |||||||||||||||||||||||||

| Gross profit rate | 20.2 | % | 19.8 | % | 0.4 | pts. | |||||||||||||||||||||||||||||

| Adjusted EBITDA | $ | 40.5 | $ | 24.6 | $ | 15.9 | |||||||||||||||||||||||||||||

| Adjusted EBITDA margin | 3.8 | % | 2.0 | % | 1.8 | pts. | |||||||||||||||||||||||||||||

| Effective income tax rate | 19.4 | % | (32.4) | % | 51.8 | pts. | |||||||||||||||||||||||||||||

| Average number of shares outstanding (millions): | |||||||||||||||||||||||||||||||||||

| Basic | 35.5 | 36.0 | |||||||||||||||||||||||||||||||||

| Diluted | 35.9 | 36.4 | |||||||||||||||||||||||||||||||||

| KELLY SERVICES, INC. AND SUBSIDIARIES | |||||||||||||||||||||||||||||||||||

| CONSOLIDATED STATEMENTS OF EARNINGS | |||||||||||||||||||||||||||||||||||

| FOR THE 26 WEEKS ENDED JUNE 30, 2024 AND JULY 2, 2023 | |||||||||||||||||||||||||||||||||||

| (UNAUDITED) | |||||||||||||||||||||||||||||||||||

| (In millions of dollars except per share data) | |||||||||||||||||||||||||||||||||||

| % | CC % | ||||||||||||||||||||||||||||||||||

| 2024 | 2023 | Change | Change | Change | |||||||||||||||||||||||||||||||

| Revenue from services | $ | 2,102.6 | $ | 2,485.5 | $ | (382.9) | (15.4) | % | (15.4) | % | |||||||||||||||||||||||||

| Cost of services | 1,683.2 | 1,990.8 | (307.6) | (15.4) | |||||||||||||||||||||||||||||||

| Gross profit | 419.4 | 494.7 | (75.3) | (15.2) | (15.2) | ||||||||||||||||||||||||||||||

| Selling, general and administrative expenses | 382.0 | 475.4 | (93.4) | (19.6) | (19.7) | ||||||||||||||||||||||||||||||

| Asset impairment charge | 5.5 | 2.4 | 3.1 | 124.1 | |||||||||||||||||||||||||||||||

| Gain on sale of EMEA staffing operations | (1.6) | — | (1.6) | NM | |||||||||||||||||||||||||||||||

| Gain on sale of assets | (5.5) | — | (5.5) | NM | |||||||||||||||||||||||||||||||

| Earnings from operations | 39.0 | 16.9 | 22.1 | 130.2 | |||||||||||||||||||||||||||||||

| Gain on forward contract | 1.2 | — | 1.2 | NM | |||||||||||||||||||||||||||||||

| Other income (expense), net | (4.7) | 1.4 | (6.1) | (439.8) | |||||||||||||||||||||||||||||||

| Earnings before taxes | 35.5 | 18.3 | 17.2 | 93.8 | |||||||||||||||||||||||||||||||

| Income tax expense (benefit) | 5.1 | (0.1) | 5.2 | NM | |||||||||||||||||||||||||||||||

| Net earnings | $ | 30.4 | $ | 18.4 | $ | 12.0 | 65.3 | ||||||||||||||||||||||||||||

| Basic earnings per share | $ | 0.84 | $ | 0.49 | $ | 0.35 | 71.4 | ||||||||||||||||||||||||||||

| Diluted earnings per share | $ | 0.83 | $ | 0.49 | $ | 0.34 | 69.4 | ||||||||||||||||||||||||||||

| STATISTICS: | |||||||||||||||||||||||||||||||||||

| Permanent placement revenue (included in revenue from services) | $ | 18.7 | $ | 33.2 | $ | (14.5) | (43.7) | % | (43.8) | % | |||||||||||||||||||||||||

| Gross profit rate | 19.9 | % | 19.9 | % | — | pts. | |||||||||||||||||||||||||||||

| Adjusted EBITDA | $ | 73.8 | $ | 51.4 | $ | 22.4 | |||||||||||||||||||||||||||||

| Adjusted EBITDA margin | 3.5 | % | 2.1 | % | 1.4 | pts. | |||||||||||||||||||||||||||||

| Effective income tax rate | 14.4 | % | (0.3) | % | 14.7 | pts. | |||||||||||||||||||||||||||||

| Average number of shares outstanding (millions): | |||||||||||||||||||||||||||||||||||

| Basic | 35.5 | 36.5 | |||||||||||||||||||||||||||||||||

| Diluted | 35.9 | 36.9 | |||||||||||||||||||||||||||||||||

| KELLY SERVICES, INC. AND SUBSIDIARIES | ||||||||||||||||||||||||||||||||

| SEGMENT INFORMATION | ||||||||||||||||||||||||||||||||

| (UNAUDITED) | ||||||||||||||||||||||||||||||||

| (In millions of dollars) | ||||||||||||||||||||||||||||||||

| We utilize business unit profit (loss) to evaluate the performance of our segments. Business unit profit (loss) and SG&A expenses as presented in the segment information table below do not include depreciation and amortization expenses. | ||||||||||||||||||||||||||||||||

| Second Quarter | ||||||||||||||||||||||||||||||||

| % | CC % | |||||||||||||||||||||||||||||||

| 2024 | 2023 | Change | Change | |||||||||||||||||||||||||||||

| Professional & Industrial | ||||||||||||||||||||||||||||||||

| Revenue from services | $ | 357.7 | $ | 390.8 | (8.5) | % | (8.4) | % | ||||||||||||||||||||||||

| Gross profit | 62.3 | 68.5 | (8.9) | (8.8) | ||||||||||||||||||||||||||||

| Total SG&A expenses | 55.4 | 65.0 | (14.8) | (14.7) | ||||||||||||||||||||||||||||

| Asset impairment charge | — | 0.3 | (100.0) | |||||||||||||||||||||||||||||

| Business unit profit (loss) | 6.9 | 3.2 | 124.5 | |||||||||||||||||||||||||||||

| Gross profit rate | 17.4 | % | 17.5 | % | (0.1) | pts. | ||||||||||||||||||||||||||

| Science, Engineering & Technology | ||||||||||||||||||||||||||||||||

| Revenue from services | $ | 332.2 | $ | 301.4 | 10.2 | % | 10.2 | % | ||||||||||||||||||||||||

| Gross profit | 77.3 | 68.1 | 13.5 | 13.5 | ||||||||||||||||||||||||||||

| Total SG&A expenses | 52.8 | 50.1 | 5.6 | 5.6 | ||||||||||||||||||||||||||||

| Asset impairment charge | — | 0.1 | (100.0) | |||||||||||||||||||||||||||||

| Business unit profit (loss) | 24.5 | 17.9 | 36.2 | |||||||||||||||||||||||||||||

| Gross profit rate | 23.3 | % | 22.6 | % | 0.7 | pts. | ||||||||||||||||||||||||||

| Education | ||||||||||||||||||||||||||||||||

| Revenue from services | $ | 251.1 | $ | 206.4 | 21.7 | % | 21.7 | % | ||||||||||||||||||||||||

| Gross profit | 36.9 | 32.5 | 13.4 | 13.4 | ||||||||||||||||||||||||||||

| Total SG&A expenses | 24.2 | 23.2 | 4.3 | 4.3 | ||||||||||||||||||||||||||||

| Business unit profit (loss) | 12.7 | 9.3 | 36.2 | |||||||||||||||||||||||||||||

| Gross profit rate | 14.7 | % | 15.8 | % | (1.1) | pts. | ||||||||||||||||||||||||||

| Outsourcing & Consulting | ||||||||||||||||||||||||||||||||

| Revenue from services | $ | 117.0 | $ | 113.7 | 2.9 | % | 3.2 | % | ||||||||||||||||||||||||

| Gross profit | 37.2 | 41.3 | (10.2) | (9.8) | ||||||||||||||||||||||||||||

| Total SG&A expenses | 34.2 | 39.1 | (12.3) | (12.2) | ||||||||||||||||||||||||||||

| Asset impairment charge | — | 2.0 | (100.0) | |||||||||||||||||||||||||||||

| Business unit profit (loss) | 3.0 | 0.2 | NM | |||||||||||||||||||||||||||||

| Gross profit rate | 31.8 | % | 36.4 | % | (4.6) | pts. | ||||||||||||||||||||||||||

| International | ||||||||||||||||||||||||||||||||

| Revenue from services | $ | — | $ | 205.9 | (100.0) | % | (100.0) | % | ||||||||||||||||||||||||

| Gross profit | — | 30.2 | (100.0) | (100.0) | ||||||||||||||||||||||||||||

| Total SG&A expenses | — | 30.2 | (100.0) | (100.0) | ||||||||||||||||||||||||||||

| Business unit profit (loss) | — | — | (100.0) | |||||||||||||||||||||||||||||

| Gross profit rate | — | % | 14.7 | % | (14.7) | pts. | ||||||||||||||||||||||||||

| KELLY SERVICES, INC. AND SUBSIDIARIES | ||||||||||||||||||||||||||||||||

| RESULTS OF OPERATIONS BY SEGMENT | ||||||||||||||||||||||||||||||||

| (UNAUDITED) | ||||||||||||||||||||||||||||||||

| (In millions of dollars) | ||||||||||||||||||||||||||||||||

| We utilize business unit profit (loss) to evaluate the performance of our segments. Business unit profit (loss) and SG&A expenses as presented in the segment information table below do not include depreciation and amortization expenses. | ||||||||||||||||||||||||||||||||

| June Year to Date | ||||||||||||||||||||||||||||||||

| % | CC % | |||||||||||||||||||||||||||||||

| 2024 | 2023 | Change | Change | |||||||||||||||||||||||||||||

| Professional & Industrial | ||||||||||||||||||||||||||||||||

| Revenue from services | $ | 716.1 | $ | 793.4 | (9.8) | % | (9.9) | % | ||||||||||||||||||||||||

| Gross profit | 126.2 | 140.7 | (10.3) | (10.5) | ||||||||||||||||||||||||||||

| SG&A expenses excluding restructuring charges | 113.0 | 135.1 | (16.3) | (16.4) | ||||||||||||||||||||||||||||

| Restructuring charges | 0.4 | 3.3 | (89.3) | (89.3) | ||||||||||||||||||||||||||||

| Total SG&A expenses | 113.4 | 138.4 | (18.0) | (18.2) | ||||||||||||||||||||||||||||

| Asset impairment charge | — | 0.3 | (100.0) | |||||||||||||||||||||||||||||

| Business unit profit (loss) | 12.8 | 2.0 | NM | |||||||||||||||||||||||||||||

| Business unit profit (loss) excluding restructuring charges | 13.2 | 5.3 | 147.0 | |||||||||||||||||||||||||||||

| Gross profit rate | 17.6 | % | 17.7 | % | (0.1) | pts. | ||||||||||||||||||||||||||

| Science, Engineering & Technology | ||||||||||||||||||||||||||||||||

| Revenue from services | $ | 621.5 | $ | 607.8 | 2.2 | % | 2.3 | % | ||||||||||||||||||||||||

| Gross profit | 141.7 | 139.4 | 1.7 | 1.7 | ||||||||||||||||||||||||||||

| Total SG&A expenses | 99.0 | 102.9 | (3.7) | (3.7) | ||||||||||||||||||||||||||||

| Asset impairment charge | — | 0.1 | (100.0) | |||||||||||||||||||||||||||||

| Business unit profit (loss) | 42.7 | 36.4 | 17.2 | |||||||||||||||||||||||||||||

| Gross profit rate | 22.8 | % | 22.9 | % | (0.1) | pts. | ||||||||||||||||||||||||||

| Education | ||||||||||||||||||||||||||||||||

| Revenue from services | $ | 541.0 | $ | 455.8 | 18.7 | % | 18.7 | % | ||||||||||||||||||||||||

| Gross profit | 79.0 | 71.8 | 10.0 | 10.0 | ||||||||||||||||||||||||||||

| Total SG&A expenses | 48.2 | 47.1 | 2.3 | 2.3 | ||||||||||||||||||||||||||||

| Business unit profit (loss) | 30.8 | 24.7 | 24.7 | |||||||||||||||||||||||||||||

| Gross profit rate | 14.6 | % | 15.8 | % | (1.2) | pts. | ||||||||||||||||||||||||||

| Outsourcing & Consulting | ||||||||||||||||||||||||||||||||

| Revenue from services | $ | 225.0 | $ | 228.3 | (1.4) | % | (1.1) | % | ||||||||||||||||||||||||

| Gross profit | 72.5 | 82.9 | (12.6) | (12.4) | ||||||||||||||||||||||||||||

| Total SG&A expenses | 71.3 | 80.8 | (11.7) | (11.7) | ||||||||||||||||||||||||||||

| Asset impairment charge | — | 2.0 | (100.0) | |||||||||||||||||||||||||||||

| Business unit profit (loss) | 1.2 | 0.1 | NM | |||||||||||||||||||||||||||||

| Gross profit rate | 32.2 | % | 36.3 | % | (4.1) | pts. | ||||||||||||||||||||||||||

| International | ||||||||||||||||||||||||||||||||

| Revenue from services | $ | — | $ | 401.7 | (100.0) | % | (100.0) | % | ||||||||||||||||||||||||

| Gross profit | — | 59.9 | (100.0) | (100.0) | ||||||||||||||||||||||||||||

| Total SG&A expenses | — | 60.6 | (100.0) | (100.0) | ||||||||||||||||||||||||||||

| Business unit profit (loss) | — | (0.7) | (100.0) | |||||||||||||||||||||||||||||

| Gross profit rate | — | % | 14.9 | % | (14.9) | pts. | ||||||||||||||||||||||||||

| KELLY SERVICES, INC. AND SUBSIDIARIES | |||||||||||||||||||||||

| CONSOLIDATED BALANCE SHEETS | |||||||||||||||||||||||

| (UNAUDITED) | |||||||||||||||||||||||

| (In millions of dollars) | |||||||||||||||||||||||

| June 30, 2024 | December 31, 2023 | July 2, 2023 | |||||||||||||||||||||

| Current Assets | |||||||||||||||||||||||

| Cash and equivalents | $ | 38.2 | $ | 125.8 | $ | 124.8 | |||||||||||||||||

| Trade accounts receivable, less allowances of | |||||||||||||||||||||||

| $7.9, $10.9, and $10.7, respectively | 1,193.9 | 1,160.6 | 1,423.6 | ||||||||||||||||||||

| Prepaid expenses and other current assets | 78.7 | 48.9 | 79.8 | ||||||||||||||||||||

| Assets held for sale | — | 291.3 | — | ||||||||||||||||||||

| Total current assets | 1,310.8 | 1,626.6 | 1,628.2 | ||||||||||||||||||||

| Noncurrent Assets | |||||||||||||||||||||||

| Property and equipment, net | 26.8 | 24.6 | 28.8 | ||||||||||||||||||||

| Operating lease right-of-use assets | 53.1 | 47.1 | 61.6 | ||||||||||||||||||||

| Deferred taxes | 302.3 | 321.1 | 308.4 | ||||||||||||||||||||

| Retirement plan assets | 245.9 | 230.3 | 217.8 | ||||||||||||||||||||

| Goodwill, net | 372.6 | 151.1 | 151.1 | ||||||||||||||||||||

| Intangibles, net | 272.3 | 137.7 | 148.2 | ||||||||||||||||||||

| Other assets | 44.4 | 43.1 | 50.9 | ||||||||||||||||||||

| Total noncurrent assets | 1,317.4 | 955.0 | 966.8 | ||||||||||||||||||||

| Total Assets | $ | 2,628.2 | $ | 2,581.6 | $ | 2,595.0 | |||||||||||||||||

| Current Liabilities | |||||||||||||||||||||||

| Accounts payable and accrued liabilities | $ | 594.8 | $ | 646.1 | $ | 692.7 | |||||||||||||||||

| Operating lease liabilities | 12.4 | 8.4 | 13.9 | ||||||||||||||||||||

| Accrued payroll and related taxes | 168.3 | 156.2 | 270.6 | ||||||||||||||||||||

| Accrued workers' compensation and other claims | 18.7 | 22.1 | 23.3 | ||||||||||||||||||||

| Income and other taxes | 18.1 | 17.2 | 54.4 | ||||||||||||||||||||

| Liabilities held for sale | — | 169.9 | — | ||||||||||||||||||||

| Total current liabilities | 812.3 | 1,019.9 | 1,054.9 | ||||||||||||||||||||

| Noncurrent Liabilities | |||||||||||||||||||||||

| Long-term debt | 210.4 | — | — | ||||||||||||||||||||

| Operating lease liabilities | 49.6 | 42.9 | 52.6 | ||||||||||||||||||||

| Accrued workers' compensation and other claims | 34.7 | 40.9 | 41.4 | ||||||||||||||||||||

| Accrued retirement benefits | 232.6 | 217.4 | 193.0 | ||||||||||||||||||||

| Other long-term liabilities | 8.7 | 6.8 | 11.2 | ||||||||||||||||||||

| Total noncurrent liabilities | 536.0 | 308.0 | 298.2 | ||||||||||||||||||||

| Stockholders' Equity | |||||||||||||||||||||||

| Common stock | 38.5 | 38.5 | 38.5 | ||||||||||||||||||||

| Treasury stock | (52.3) | (57.3) | (51.3) | ||||||||||||||||||||

| Paid-in capital | 29.5 | 30.6 | 29.0 | ||||||||||||||||||||

| Earnings invested in the business | 1,266.7 | 1,241.7 | 1,229.1 | ||||||||||||||||||||

| Accumulated other comprehensive income (loss) | (2.5) | 0.2 | (3.4) | ||||||||||||||||||||

| Total stockholders' equity | 1,279.9 | 1,253.7 | 1,241.9 | ||||||||||||||||||||

| Total Liabilities and Stockholders' Equity | $ | 2,628.2 | $ | 2,581.6 | $ | 2,595.0 | |||||||||||||||||

| STATISTICS: | |||||||||||||||||||||||

| Working Capital | $ | 498.5 | $ | 606.7 | $ | 573.3 | |||||||||||||||||

| Current Ratio | 1.6 | 1.6 | 1.5 | ||||||||||||||||||||

| Debt-to-capital % | 14.1 | % | 0.0 | % | 0.0 | % | |||||||||||||||||

| Global Days Sales Outstanding | 57 | 59 | 61 | ||||||||||||||||||||

| Year-to-Date Free Cash Flow | $ | 25.5 | $ | 61.4 | $ | 14.1 | |||||||||||||||||

| KELLY SERVICES, INC. AND SUBSIDIARIES | ||||||||||||||

| CONSOLIDATED STATEMENTS OF CASH FLOWS | ||||||||||||||

| FOR THE 26 WEEKS ENDED JUNE 30, 2024 AND JULY 2, 2023 | ||||||||||||||

| (UNAUDITED) | ||||||||||||||

| (In millions of dollars) | ||||||||||||||

| 2024 | 2023 | |||||||||||||

| Cash flows from operating activities: | ||||||||||||||

| Net earnings | $ | 30.4 | $ | 18.4 | ||||||||||

| Adjustments to reconcile net earnings to net cash from operating activities: | ||||||||||||||

| Asset impairment charge | 5.5 | 2.4 | ||||||||||||

| Gain on sale of EMEA staffing operations | (1.6) | — | ||||||||||||

| Gain on sale of assets | (5.5) | — | ||||||||||||

| Depreciation and amortization | 17.6 | 17.2 | ||||||||||||

| Operating lease asset amortization | 4.6 | 8.4 | ||||||||||||

| Provision for credit losses and sales allowances | (0.2) | 0.4 | ||||||||||||

| Stock-based compensation | 5.2 | 5.6 | ||||||||||||

| Gain on sale of equity securities | — | (2.0) | ||||||||||||

| Gain on forward contract | (1.2) | — | ||||||||||||

| Other, net | (1.1) | 0.5 | ||||||||||||

| Changes in operating assets and liabilities, net of acquisition | (21.5) | (27.5) | ||||||||||||

| Net cash from operating activities | 32.2 | 23.4 | ||||||||||||

| Cash flows from investing activities: | ||||||||||||||

| Capital expenditures | (6.7) | (9.3) | ||||||||||||

| Proceeds from sale of EMEA staffing operations, net of cash disposed | 77.1 | — | ||||||||||||

| Proceeds from sale of assets | 4.4 | — | ||||||||||||

| Acquisition of company, net of cash received | (427.4) | — | ||||||||||||

| Payment for settlement of forward contract | (2.4) | — | ||||||||||||

| Proceeds from equity securities | — | 2.0 | ||||||||||||

| Other investing activities | 1.9 | (0.4) | ||||||||||||

| Net cash used in investing activities | (353.1) | (7.7) | ||||||||||||

| Cash flows from financing activities: | ||||||||||||||

| Net change in short-term borrowings | — | (0.7) | ||||||||||||

| Proceeds from long-term debt | 378.6 | — | ||||||||||||

| Payments on long-term debt | (168.2) | — | ||||||||||||

| Financing lease payments | — | (0.5) | ||||||||||||

| Dividend payments | (5.4) | (5.6) | ||||||||||||

| Payments of tax withholding for stock awards | (2.1) | (1.3) | ||||||||||||

| Buyback of common shares | — | (34.8) | ||||||||||||

| Contingent consideration payments | — | (2.5) | ||||||||||||

| Other financing activities | (1.3) | — | ||||||||||||

| Net cash from (used in) financing activities | 201.6 | (45.4) | ||||||||||||

| Effect of exchange rates on cash, cash equivalents and restricted cash | (2.7) | 1.8 | ||||||||||||

| Net change in cash, cash equivalents and restricted cash | (122.0) | (27.9) | ||||||||||||

| Cash, cash equivalents and restricted cash at beginning of period | 167.6 | 162.4 | ||||||||||||

| Cash, cash equivalents and restricted cash at end of period | $ | 45.6 | $ | 134.5 | ||||||||||

| KELLY SERVICES, INC. AND SUBSIDIARIES | |||||||||||||||||||||||||||||

| REVENUE FROM SERVICES BY GEOGRAPHY | |||||||||||||||||||||||||||||

| (UNAUDITED) | |||||||||||||||||||||||||||||

| (In millions of dollars) | |||||||||||||||||||||||||||||

| Second Quarter | |||||||||||||||||||||||||||||

| % | CC % | ||||||||||||||||||||||||||||

| 2024 | 2023 | Change | Change | ||||||||||||||||||||||||||

| Americas | |||||||||||||||||||||||||||||

| United States | $ | 944.2 | $ | 892.4 | 5.8 | % | 5.8 | % | |||||||||||||||||||||

| Canada | 46.4 | 46.4 | (0.1) | 1.8 | |||||||||||||||||||||||||

| Puerto Rico | 28.2 | 27.7 | 1.6 | 1.6 | |||||||||||||||||||||||||

| Mexico | 15.4 | 20.0 | (22.9) | (24.8) | |||||||||||||||||||||||||

| Total Americas Region | 1,034.2 | 986.5 | 4.8 | 4.9 | |||||||||||||||||||||||||

| Europe | |||||||||||||||||||||||||||||

| Switzerland | 1.0 | 56.0 | (98.2) | (98.2) | |||||||||||||||||||||||||

| France | — | 50.2 | (100.0) | (100.0) | |||||||||||||||||||||||||

| Portugal | — | 49.3 | (100.0) | (100.0) | |||||||||||||||||||||||||

| Italy | — | 16.5 | (100.0) | (100.0) | |||||||||||||||||||||||||

| Other | 9.8 | 47.6 | (79.3) | (79.2) | |||||||||||||||||||||||||

| Total Europe Region | 10.8 | 219.6 | (95.1) | (95.0) | |||||||||||||||||||||||||

| Total Asia-Pacific Region | 12.5 | 11.1 | 12.3 | 14.9 | |||||||||||||||||||||||||

| Total Kelly Services, Inc. | $ | 1,057.5 | $ | 1,217.2 | (13.1) | % | (13.0) | % | |||||||||||||||||||||

| KELLY SERVICES, INC. AND SUBSIDIARIES | |||||||||||||||||||||||||||||

| REVENUE FROM SERVICES BY GEOGRAPHY | |||||||||||||||||||||||||||||

| (UNAUDITED) | |||||||||||||||||||||||||||||

| (In millions of dollars) | |||||||||||||||||||||||||||||

| June Year to Date | |||||||||||||||||||||||||||||

| % | CC % | ||||||||||||||||||||||||||||

| 2024 | 2023 | Change | Change | ||||||||||||||||||||||||||

| Americas | |||||||||||||||||||||||||||||

| United States | $ | 1,877.8 | $ | 1,851.6 | 1.4 | % | 1.4 | % | |||||||||||||||||||||

| Canada | 91.8 | 91.3 | 0.6 | 1.4 | |||||||||||||||||||||||||

| Puerto Rico | 53.1 | 54.6 | (2.8) | (2.8) | |||||||||||||||||||||||||

| Mexico | 34.3 | 36.7 | (6.5) | (12.2) | |||||||||||||||||||||||||

| Total Americas Region | 2,057.0 | 2,034.2 | 1.1 | 1.1 | |||||||||||||||||||||||||

| Europe | |||||||||||||||||||||||||||||

| Switzerland | 2.1 | 108.9 | (98.1) | (98.1) | |||||||||||||||||||||||||

| France | — | 98.0 | (100.0) | (100.0) | |||||||||||||||||||||||||

| Portugal | — | 93.7 | (100.0) | (100.0) | |||||||||||||||||||||||||

| Italy | — | 33.4 | (100.0) | (100.0) | |||||||||||||||||||||||||

| Other | 19.5 | 95.3 | (79.5) | (79.7) | |||||||||||||||||||||||||

| Total Europe Region | 21.6 | 429.3 | (95.0) | (95.0) | |||||||||||||||||||||||||

| Total Asia-Pacific Region | 24.0 | 22.0 | 9.1 | 13.0 | |||||||||||||||||||||||||

| Total Kelly Services, Inc. | $ | 2,102.6 | $ | 2,485.5 | (15.4) | % | (15.4) | % | |||||||||||||||||||||

| KELLY SERVICES, INC. AND SUBSIDIARIES | |||||||||||||||||||||||

| RECONCILIATION OF NON-GAAP MEASURES | |||||||||||||||||||||||

| (UNAUDITED) | |||||||||||||||||||||||

| (In millions of dollars) | |||||||||||||||||||||||

| Second Quarter | June Year to Date | ||||||||||||||||||||||

| SG&A Expenses: | 2024 | 2023 | 2024 | 2023 | |||||||||||||||||||

| As reported | $ | 191.5 | $ | 232.0 | $ | 382.0 | $ | 475.4 | |||||||||||||||

Transaction costs(4) |

(1.6) | — | (7.2) | — | |||||||||||||||||||

Restructuring(6) |

(4.3) | (5.6) | (6.6) | (12.2) | |||||||||||||||||||

| Adjusted SG&A expenses | $ | 185.6 | $ | 226.4 | $ | 368.2 | $ | 463.2 | |||||||||||||||

| Second Quarter | June Year to Date | ||||||||||||||||||||||

| Earnings from Operations: | 2024 | 2023 | 2024 | 2023 | |||||||||||||||||||

| As reported | $ | 12.2 | $ | 6.2 | $ | 39.0 | $ | 16.9 | |||||||||||||||

(Gain) loss on sale of EMEA staffing operations(1) |

10.0 | — | (1.6) | — | |||||||||||||||||||

Gain on sale of assets(3) |

(5.5) | — | (5.5) | — | |||||||||||||||||||

Transaction costs(4) |

1.6 | — | 7.2 | — | |||||||||||||||||||

Asset impairment charge(5) |

5.5 | 2.4 | 5.5 | 2.4 | |||||||||||||||||||

Restructuring(6) |

4.3 | 5.6 | 6.6 | 12.2 | |||||||||||||||||||

| Adjusted earnings from operations | $ | 28.1 | $ | 14.2 | $ | 51.2 | $ | 31.5 | |||||||||||||||

| KELLY SERVICES, INC. AND SUBSIDIARIES | ||||||||||||||||||||||||||

| RECONCILIATION OF NON-GAAP MEASURES | ||||||||||||||||||||||||||

| (UNAUDITED) | ||||||||||||||||||||||||||

| (In millions of dollars except per share data) | ||||||||||||||||||||||||||

| Second Quarter | June Year to Date | |||||||||||||||||||||||||

| 2024 | 2023 | 2024 | 2023 | |||||||||||||||||||||||

| Income tax expense | $ | 1.1 | $ | (1.9) | $ | 5.1 | $ | (0.1) | ||||||||||||||||||

Taxes on gain on sale of EMEA staffing operations(1) |

— | — | (1.2) | — | ||||||||||||||||||||||

Taxes on gain on forward contract(2) |

— | — | — | — | ||||||||||||||||||||||

Taxes on gain on sale of assets(3) |

(1.4) | — | (1.4) | — | ||||||||||||||||||||||

Taxes on transaction costs(4) |

1.1 | — | 2.3 | — | ||||||||||||||||||||||

Taxes on asset impairment charge(5) |

1.4 | 0.6 | 1.4 | 0.6 | ||||||||||||||||||||||

Taxes on restructuring charges(6) |

1.1 | 1.4 | 1.7 | 3.0 | ||||||||||||||||||||||

| Adjusted income tax expense | $ | 3.3 | $ | 0.1 | $ | 7.9 | $ | 3.5 | ||||||||||||||||||

| Second Quarter | June Year to Date | |||||||||||||||||||||||||

| 2024 | 2023 | 2024 | 2023 | |||||||||||||||||||||||

| Net earnings | $ | 4.6 | $ | 7.5 | $ | 30.4 | $ | 18.4 | ||||||||||||||||||

(Gain) loss on sale of EMEA staffing operations, net of taxes(1) |

10.0 | — | (0.4) | — | ||||||||||||||||||||||

Gain on forward contract, net of taxes(2) |

— | — | (1.2) | — | ||||||||||||||||||||||

Gain on sale of assets, net of taxes(3) |

(4.1) | — | (4.1) | — | ||||||||||||||||||||||

Transaction costs, net of taxes(4) |

8.3 | — | 12.7 | — | ||||||||||||||||||||||

Asset impairment charge, net of taxes(5) |

4.1 | 1.8 | 4.1 | 1.8 | ||||||||||||||||||||||

Restructuring charges, net of taxes(6) |

3.2 | 4.2 | 4.9 | 9.2 | ||||||||||||||||||||||

| Adjusted net earnings | $ | 26.1 | $ | 13.5 | $ | 46.4 | $ | 29.4 | ||||||||||||||||||

| Second Quarter | June Year to Date | |||||||||||||||||||||||||

| 2024 | 2023 | 2024 | 2023 | |||||||||||||||||||||||

| Per Share | Per Share | |||||||||||||||||||||||||

| Net earnings | $ | 0.12 | $ | 0.20 | $ | 0.83 | $ | 0.49 | ||||||||||||||||||

(Gain) loss on sale of EMEA staffing operations, net of taxes(1) |

0.27 | — | (0.01) | — | ||||||||||||||||||||||

Gain on forward contract, net of taxes(2) |

— | — | (0.03) | — | ||||||||||||||||||||||

Gain on sale of assets, net of taxes(3) |

(0.11) | — | (0.11) | — | ||||||||||||||||||||||

Transaction costs, net of taxes(4) |

0.23 | — | 0.35 | — | ||||||||||||||||||||||

Asset impairment charge, net of taxes(5) |

0.11 | 0.05 | 0.11 | 0.05 | ||||||||||||||||||||||

Restructuring charges, net of taxes(6) |

0.09 | 0.11 | 0.13 | 0.24 | ||||||||||||||||||||||

| Adjusted net earnings | $ | 0.71 | $ | 0.36 | $ | 1.26 | $ | 0.78 | ||||||||||||||||||

| KELLY SERVICES, INC. AND SUBSIDIARIES | |||||||||||||||||||||||

| RECONCILIATION OF NON-GAAP MEASURES | |||||||||||||||||||||||

| (UNAUDITED) | |||||||||||||||||||||||

| (In millions of dollars) | |||||||||||||||||||||||

| Total Adjusted EBITDA: | |||||||||||||||||||||||

| Second Quarter | June Year to Date | ||||||||||||||||||||||

| 2024 | 2023 | 2024 | 2023 | ||||||||||||||||||||

| Net earnings | $ | 4.6 | $ | 7.5 | $ | 30.4 | $ | 18.4 | |||||||||||||||

| Other (income) expense, net | (1.4) | 0.6 | (3.2) | (1.4) | |||||||||||||||||||

| Income tax expense (benefit) | 1.1 | (1.9) | 5.1 | (0.1) | |||||||||||||||||||

| Depreciation and amortization | 12.5 | 10.2 | 22.7 | 19.7 | |||||||||||||||||||

(Gain) loss on sale of EMEA staffing operations(1) |

10.0 | — | (1.6) | — | |||||||||||||||||||

Gain on forward contract(2) |

— | — | (1.2) | — | |||||||||||||||||||

Gain on sale of assets(3) |

(5.5) | — | (5.5) | — | |||||||||||||||||||

Transaction costs(4) |

9.4 | — | 15.0 | — | |||||||||||||||||||

Asset impairment charge(5) |

5.5 | 2.4 | 5.5 | 2.4 | |||||||||||||||||||

Restructuring(6) |

4.3 | 5.6 | 6.6 | 12.2 | |||||||||||||||||||

| Other, net | — | 0.2 | — | 0.2 | |||||||||||||||||||

| Adjusted EBITDA | $ | 40.5 | $ | 24.6 | $ | 73.8 | $ | 51.4 | |||||||||||||||

| Adjusted EBITDA margin | 3.8 | % | 2.0 | % | 3.5 | % | 2.1 | % | |||||||||||||||

| Second Quarter 2024 | |||||||||||||||||||||||||||||

| Professional & Industrial | Science, Engineering & Technology | Education | Outsourcing & Consulting | International | |||||||||||||||||||||||||

| Business unit profit (loss) | $ | 6.9 | $ | 24.5 | $ | 12.7 | $ | 3.0 | $ | — | |||||||||||||||||||

Restructuring(6) |

0.3 | 0.3 | — | — | — | ||||||||||||||||||||||||

| Adjusted EBITDA | $ | 7.2 | $ | 24.8 | $ | 12.7 | $ | 3.0 | $ | — | |||||||||||||||||||

| Adjusted EBITDA margin | 2.0 | % | 7.5 | % | 5.1 | % | 2.5 | % | — | % | |||||||||||||||||||

| Second Quarter 2023 | |||||||||||||||||||||||||||||

| Professional & Industrial | Science, Engineering & Technology | Education | Outsourcing & Consulting | International | |||||||||||||||||||||||||

| Business unit profit (loss) | $ | 3.2 | $ | 17.9 | $ | 9.3 | $ | 0.2 | $ | — | |||||||||||||||||||

Asset impairment charge(5) |

0.3 | 0.1 | — | 2.0 | — | ||||||||||||||||||||||||

Restructuring(6) |

0.3 | — | 0.3 | (0.1) | — | ||||||||||||||||||||||||

| Adjusted EBITDA | $ | 3.8 | $ | 18.0 | $ | 9.6 | $ | 2.1 | $ | — | |||||||||||||||||||

| Adjusted EBITDA margin | 1.0 | % | 6.0 | % | 4.7 | % | 2.0 | % | — | % | |||||||||||||||||||

| KELLY SERVICES, INC. AND SUBSIDIARIES | |||||||||||||||||||||||||||||

| RECONCILIATION OF NON-GAAP MEASURES | |||||||||||||||||||||||||||||

| (UNAUDITED) | |||||||||||||||||||||||||||||

| (In millions of dollars) | |||||||||||||||||||||||||||||

| Business Unit Adjusted EBITDA (continued): | |||||||||||||||||||||||||||||

| June Year to Date 2024 | |||||||||||||||||||||||||||||

| Professional & Industrial | Science, Engineering & Technology | Education | Outsourcing & Consulting | International | |||||||||||||||||||||||||

| Business unit profit (loss) | $ | 12.8 | $ | 42.7 | $ | 30.8 | $ | 1.2 | $ | — | |||||||||||||||||||

Restructuring(6) |

0.4 | 0.3 | — | 0.6 | — | ||||||||||||||||||||||||

| Adjusted EBITDA | $ | 13.2 | $ | 43.0 | $ | 30.8 | $ | 1.8 | $ | — | |||||||||||||||||||

| Adjusted EBITDA margin | 1.8 | % | 6.9 | % | 5.7 | % | 0.8 | % | — | % | |||||||||||||||||||

| June Year to Date 2023 | |||||||||||||||||||||||||||||

| Professional & Industrial | Science, Engineering & Technology | Education | Outsourcing & Consulting | International | |||||||||||||||||||||||||

| Business unit profit (loss) | $ | 2.0 | $ | 36.4 | $ | 24.7 | $ | 0.1 | $ | (0.7) | |||||||||||||||||||

Asset impairment charge(5) |

0.3 | 0.1 | — | 2.0 | — | ||||||||||||||||||||||||

Restructuring(6) |

3.3 | 0.5 | 0.4 | 0.5 | 0.6 | ||||||||||||||||||||||||

| Adjusted EBITDA | $ | 5.6 | $ | 37.0 | $ | 25.1 | $ | 2.6 | $ | (0.1) | |||||||||||||||||||

| Adjusted EBITDA margin | 0.7 | % | 6.1 | % | 5.5 | % | 1.2 | % | — | % | |||||||||||||||||||

| June Year to Date | |||||||||||

| 2024 | 2023 | ||||||||||

| Net cash from operating activities | $ | 32.2 | $ | 23.4 | |||||||

| Capital expenditures | (6.7) | (9.3) | |||||||||

| Free Cash Flow | $ | 25.5 | $ | 14.1 | |||||||