Annual Meeting of Shareholders April 30, 2024 Exhibit 99.1

Imperial | 2024 2 Cautionary statement Statements of future events or conditions in this report, including projections, goals, expectations, estimates, business plans and descriptions of strategic and emission reduction goals are forward-looking statements. Similarly, discussion of roadmaps or future plans related to carbon capture, transportation and storage, biofuel, hydrogen, and other future plans to reduce emissions and emission intensity of the company, its affiliates and third parties are dependent on future market factors, such as continued technological progress, policy support and timely rule-making and permitting, and represent forward-looking statements. Forward-looking statements can be identified by words such as believe, anticipate, propose, plan, goal, estimate, expect, strategy, outlook, future, continue, likely, may, should, will and similar references to future periods. Forward-looking statements in this report include, but are not limited to, references to Imperial’s company-wide net-zero goal by 2050 (Scope 1 and 2) and the company’s greenhouse gas emissions intensity goal for 2030 for its oil sands operations; the company's climate strategy, including the timing, development, and impact of specific technologies and R&D activities; progress and impact of the Pathways Alliance carbon capture and storage project; Kearl future unit cash cost targets and production outlook of 280kbd in 2024; the impact of converting Kearl haul trucks to autonomous operation, including in respect of productivity, workforce safety and operating costs; the impact and timing of the Cold Lake Grand Rapids Phase 1 and Leming projects, including expected production and reductions to greenhouse gas emissions intensity; the company’s Strathcona renewable diesel project, including timing, feedstock sources, expected production, and reduction to greenhouse gas emissions; outlooks for cash flows; the quality, life and rate of decline of the company’s assets; the company’s strategies and areas of focus, including maximizing value from existing assets, lowering unit costs, maintaining capital discipline, growing volumes and margins, developing a lower-carbon product offering, and progressing value-accretive growth opportunities; capital allocation priorities, returning surplus cash to shareholders, and shareholder returns including 2024 dividends and future potential dividend growth; and the company’s confidence in the future and ability to deliver shareholder value. Forward-looking statements are based on the company's current expectations, estimates, projections and assumptions at the time the statements are made. Actual future financial and operating results, including expectations and assumptions concerning future energy demand, supply and mix; production rates, growth and mix across various assets; production life, resource recoveries and reservoir performance; project plans, timing, costs, technical evaluations and capacities, and the company's ability to effectively execute on these plans and operate its assets, including the Cold Lake Grand Rapids Phase 1 project and the Strathcona renewable diesel project; the adoption and impact of new facilities and technologies on capital efficiency, production and reductions to greenhouse gas emissions intensity, including but not limited to technologies using solvents to replace energy intensive steam at Cold Lake, the EBRT project, boiler flue gas technology at Kearl, Strathcona renewable diesel, carbon capture and storage including in connection with hydrogen for the renewable diesel project, and any changes in the scope, terms, or costs of such projects; for renewable diesel, the availability and cost of locally-sourced and grown feedstock and the supply of renewable diesel to British Columbia in connection with its low-carbon fuel legislation; the amount and timing of emissions reductions, including the impact of lower carbon fuels; that any required support from policymakers and other stakeholders for various new technologies such as carbon capture and storage will be provided; receipt of regulatory approvals in a timely manner, especially with respect to large scale emissions reduction projects; applicable laws and government policies, including with respect to climate change, GHG emissions reductions and low carbon fuel legislation; refinery utilization; cash generation, financing sources and capital structure, such as dividends and shareholder returns, including the timing and amounts of share repurchases; commodity prices, foreign exchange rates and general market conditions; and capital and environmental expenditures, could differ materially depending on a number of factors. These factors include global, regional or local changes in supply and demand for oil, natural gas, petroleum and petrochemical products and resulting demand, price, differential and margin impacts, including foreign government action with respect to supply levels and prices, and the occurrence of wars; political or regulatory events, including changes in law or government policy; environmental risks inherent in oil and gas exploration and production activities; environmental regulation, including climate change and greenhouse gas regulation and changes to such regulation; failure, delay or uncertainty regarding supportive policy and market development for the adoption of emerging lower emission energy technologies and other technologies that support emissions reductions; the receipt, in a timely manner, of regulatory and third-party approvals, including for new technologies that will help the company meet its lower emissions goals; the results of research programs and new technologies, including with respect to greenhouse gas emissions, and the ability to bring new technologies to scale on a commercially competitive basis, and the competitiveness of alternative energy and other emission reduction technologies; unexpected technological developments; unanticipated technical or operational difficulties; availability and performance of third-party service providers; third-party opposition to company and service provider operations, projects and infrastructure; the impact of future consumer choices on roadmap trajectory and timing; availability and allocation of capital; operational hazards and risks; cybersecurity incidents; general economic conditions, including the occurrence and duration of economic recessions or downturns; and other factors discussed in Item 1A risk factors and Item 7 management's discussion and analysis of the company's most recent annual report on Form 10-K. Forward-looking statements are not guarantees of future performance and involve a number of risks and uncertainties, some that are similar to other oil and gas companies and some that are unique to Imperial. lmperial's actual results may differ materially from those expressed or implied by its forward-looking statements and readers are cautioned not to place undue reliance on them. Imperial undertakes no obligation to update any forward-looking statements contained herein, except as required by applicable law. Forward-looking and other statements regarding lmperial's environmental, social and other sustainability efforts and aspirations are not an indication that these statements are material to investors or require disclosure in the company's filings with securities regulators. In addition, historical, current and forward-looking environmental, social and sustainability-related statements may be based on standards for measuring progress that are still developing, internal controls and processes that continue to evolve, and assumptions that are subject to change in the future, including future rule-making. Individual projects or opportunities may advance based on a number of factors, including availability of supportive policy, technology for cost-effective abatement, company planning process, and alignment with our partners and other stakeholders.

Imperial | 2024 3 Meeting Proceedings Brad Corson Chairman, president and chief executive officer Ian Laing Vice-president, general counsel and corporate secretary

Imperial | 2024 4 Election of directors Neil Hansen David Cornhill Bradley Corson Sharon Driscoll John Floren Gary Goldberg Miranda Hubbs

Imperial | 2024 5 Appointment of the auditor PricewaterhouseCoopers LLP

Imperial | 2024 6 Shareholder proposal

Imperial | 2024 7 Chairman’s remarks Brad Corson Chairman, president and chief executive officer

Imperial | 2024 8 Consistently delivering results Sustained strong operational performance Underpins robust 2023 financial results Priority on safety, environmental performance, reliable operations Remaining focused on: Maximizing value from existing assets Lowering unit cash costs Maintaining capital discipline Progressing value-accretive growth opportunities Getting the most out of our assets 2023 results Earnings $4.9B Upstream production (OEBD) 413K Refinery capacity utilization 94%

Imperial | 2024 9 Strong shareholder returns in 2023 Effectively returning cash to shareholders 29th consecutive year of growth Dividend nearly tripled since 1Q21 8% shares repurchased Reduced shares outstanding by 27% since start of 2021 18% Total shareholder return $1.1B Dividends $3.8B Share buybacks 10 20 30 40 50 60 70 80 90 100 110 $/share 2021 2022 2023 2024

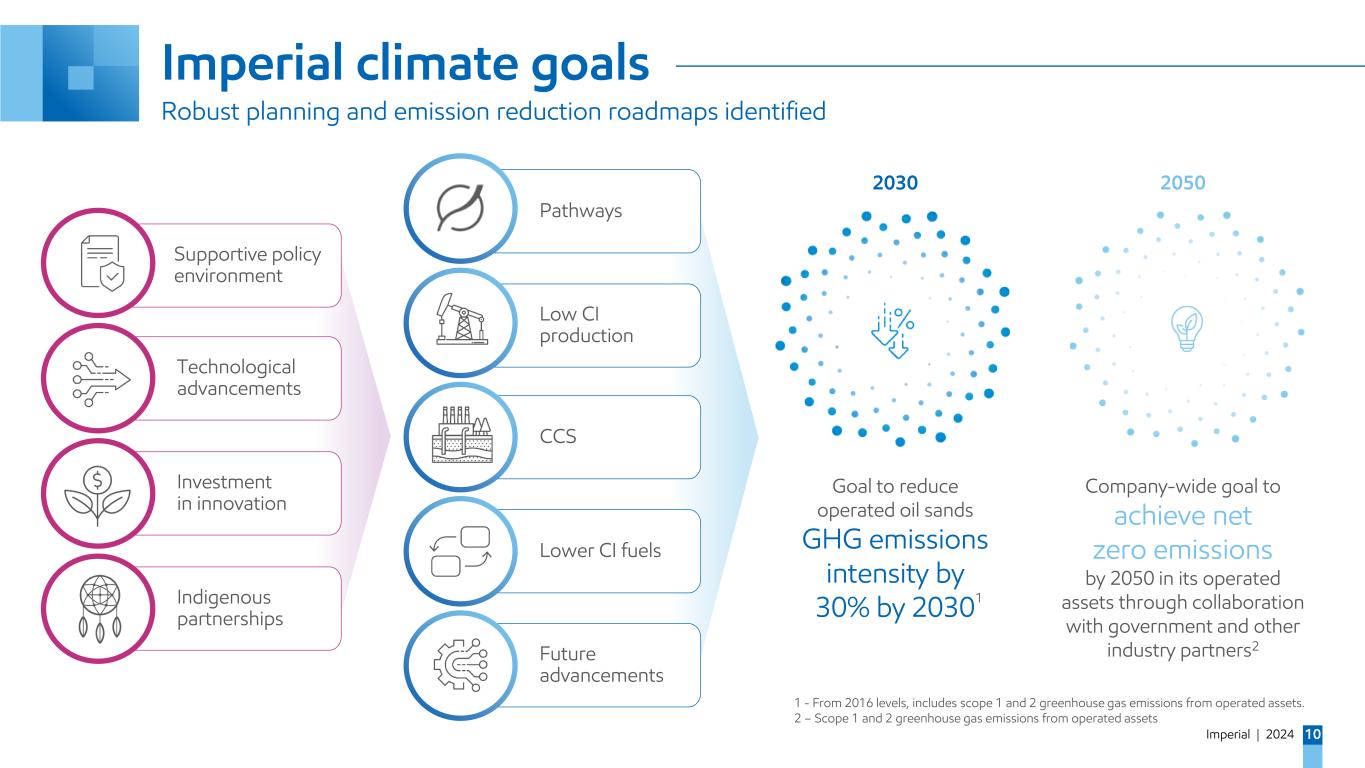

Imperial | 2024 10 Imperial climate goals Robust planning and emission reduction roadmaps identified Supportive policy environment Technological advancements Investment in innovation Indigenous partnerships Low CI production CCS Lower CI fuels Future advancements Pathways Company-wide goal to achieve net zero emissions by 2050 in its operated assets through collaboration with government and other industry partners2 Goal to reduce operated oil sands GHG emissions intensity by 30% by 2030 2030 2050 1 - From 2016 levels, includes scope 1 and 2 greenhouse gas emissions from operated assets. 2 – Scope 1 and 2 greenhouse gas emissions from operated assets 1

Imperial | 2024 11 Upstream performance 2023 net income $2.5B 2023 gross production of 413 koebd Highest-ever annual production at Kearl of 270 kbd Progressed pipeline of highly accretive investments Continued focus on industry leading unit cash cost and volume growth Outlook for robust cash flows across a range of price cases High quality, long life, low decline assets Delivering value and strengthening cash flow from operating activities Upstream production is Imperial share before royalties, except Kearl which is 100% interest. Kearl is jointly owned by Imperial (70.96%) and ExxonMobil Canada (29.04%)

Imperial | 2024 12 Setting records at Kearl Highest-ever annual production of 270 kbd1 in 2023 Highest-ever first-quarter production of 277 kbd1 during 1Q 2024 Growing production to 280 kbd1 in 2024 Significant progress achieved in reducing unit cash operating costs2 2023 unit cash operating cost2 reduced by $6.60 US/barrel compared to 2022 Continue to target <$20 US/barrel unit cash operating cost2 Completed autonomous haul truck fleet conversion Significantly expanded water seepage interception system Continuing focus on increased community engagement and information sharing Capital efficient production growth, unit cost reductions 1 Production 100% interest, before royalties. Kearl is jointly owned by Imperial (70.96%) and ExxonMobil Canada (29.04%) 2 Non-GAAP financial measure – see Supplemental Information for definition and reconciliation

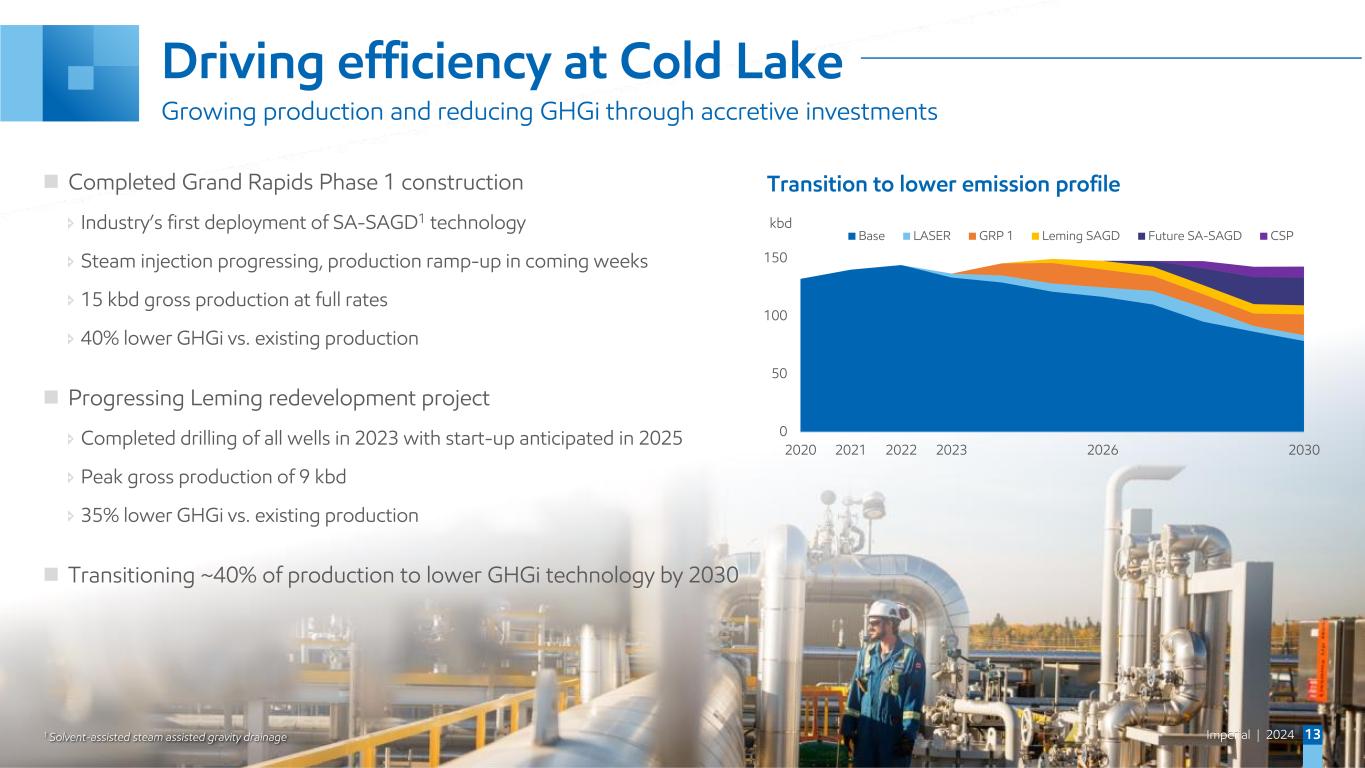

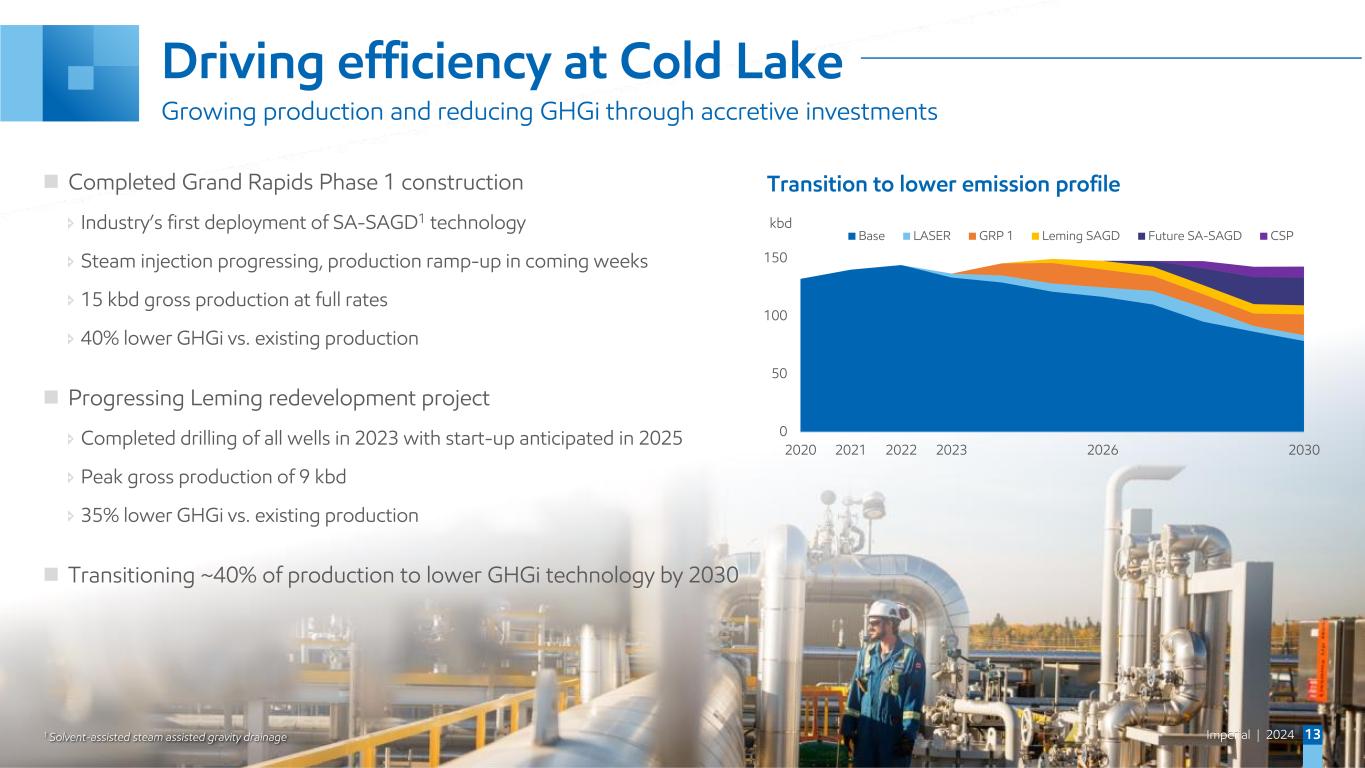

Imperial | 2024 13 Driving efficiency at Cold Lake Completed Grand Rapids Phase 1 construction Industry’s first deployment of SA-SAGD1 technology Steam injection progressing, production ramp-up in coming weeks 15 kbd gross production at full rates 40% lower GHGi vs. existing production Progressing Leming redevelopment project Completed drilling of all wells in 2023 with start-up anticipated in 2025 Peak gross production of 9 kbd 35% lower GHGi vs. existing production Transitioning ~40% of production to lower GHGi technology by 2030 Growing production and reducing GHGi through accretive investments Transition to lower emission profile 0 50 100 150 2020 2021 2022 2023 2026 2030 Base LASER GRP 1 Leming SAGD Future SA-SAGD CSP kbd 1 Solvent-assisted steam assisted gravity drainage

Imperial | 2024 14 Product Solutions performance Resilient business model, focused on increasing profitability 2023 net income $2.5B1 2023 refining throughput 407 kbd, utilization 94% Maintained high refinery utilization and profitability in heavy turnaround year Petroleum product sales 471 kbd, Petrochemical sales 820 kT Esso brand achieved #1 retail market share position in Canada in 20232 Builds on previous #1 market share position for Esso and Mobil brands combined Focusing on profitable volume and margin growth to capture upside Developing a compelling lower-carbon product offering Strathcona renewable diesel Refinery co-processing Chemicals advanced recycling 1 Combined downstream & chemical 2 Based on Kalibrate survey data for year-ended 2023

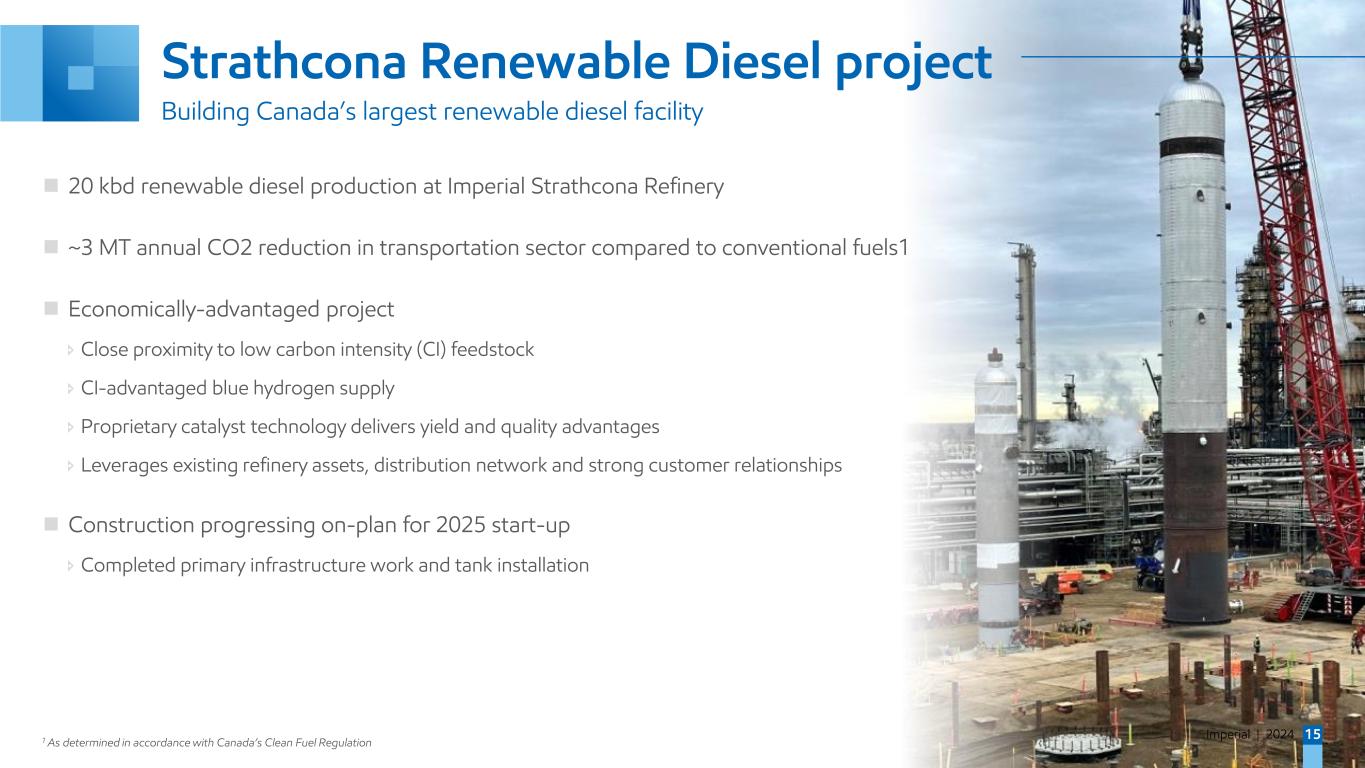

Imperial | 2024 15 Strathcona Renewable Diesel project 20 kbd renewable diesel production at Imperial Strathcona Refinery ~3 MT annual CO2 reduction in transportation sector compared to conventional fuels1 Economically-advantaged project Close proximity to low carbon intensity (CI) feedstock CI-advantaged blue hydrogen supply Proprietary catalyst technology delivers yield and quality advantages Leverages existing refinery assets, distribution network and strong customer relationships Construction progressing on-plan for 2025 start-up Completed primary infrastructure work and tank installation Building Canada’s largest renewable diesel facility 1 As determined in accordance with Canada’s Clean Fuel Regulation

Imperial | 2024 16 Capital allocation priorities Proven track record of returning surplus cash to shareholders 500 750 1,000 0.00 1.50 3.00 2018 2019 2020 2021 2022 2023 2024 Dividend paid Shares outstanding Dividend per share (paid basis) and shares outstanding $ Millions of shares Reliable and growing dividend 29 years of consecutive increases Nearly tripled dividend since 1Q21 Low sustaining capital requirements High-return capital-efficient investments in core assets Return surplus cash to shareholders Distributed $4.9B in dividends and buybacks in 2023 Optionality to invest in highly attractive opportunities over time 0 4 8 2016-20 Avg 2021 2022 2023 Dividend Buyback Annual cash distributions $B 1 1 Full-year 2024 dividend paid assumes quarterly dividends of 60 cents per share

Imperial | 2024 17 Why Imperial Confidence in the future High quality, long life, low decline upstream assets Continued growth through focus on optimization, debottlenecking Advantaged downstream assets Integrated across value chain, robust across business cycle Low cost, high return growth Progressing value accretive projects, maintaining optionality Driving shareholder value Financial discipline supports robust cash flow through the cycle, directed to shareholder returns Value driven focus on sustainability Corporate-wide net-zero ambition underpinned by technology, collaboration with governments and industry

Imperial | 2024 18 Q&A

Imperial | 2024 19 Scrutineers’ report Ian Laing Vice-president, general counsel and corporate secretary

Thank you for attending Imperial’s annual meeting of shareholders April 30, 2024

Imperial | 2024 21 Supplemental information – non-GAAP measures Non-GAAP measures Listed below are definitions of several of Imperial’s key business and financial performance measures. The definitions are provided to facilitate understanding of the terms and how they are calculated. These measures are not prescribed by U.S. Generally Accepted Accounting Principles (GAAP). These measures constitute “non-GAAP financial measures” under Securities and Exchange Commission Regulation G and Item 10(e) of Regulation S-K, and “specified financial measures” under National Instrument 52-112 Non-GAAP and Other Financial Measures Disclosure of the Canadian Securities Administrators. Reconciliation of these non-GAAP financial measures to the most comparable GAAP measure, and other information required by these regulations have been provided. Non-GAAP financial measures and specified financial measures are not standardized financial measures under GAAP and do not have a standardized definition. As such, these measures may not be directly comparable to measures presented by other companies, and should not be considered a substitute for GAAP financial measures. Cash flows from (used in) operating activities excluding working capital Cash flows from (used in) operating activities excluding working capital is a non-GAAP financial measure that is the total cash flows from operating activities less the changes in operating assets and liabilities in the period. The most directly comparable financial measure that is disclosed in the financial statements is "Cash flows from (used in) operating activities" within the company’s Consolidated statement of cash flows. Management believes it is useful for investors to consider these numbers in comparing the underlying performance of the company’s business across periods when there are significant period-to-period differences in the amount of changes in working capital. Changes in working capital is equal to “Changes in operating assets and liabilities” as disclosed in the company’s Consolidated statement of cash flows. This measure assesses the cash flows at an operating level, and as such, does not include proceeds from asset sales as defined in Cash flows from operating activities and asset sales in the Frequently Used Terms section of the company’s annual Form 10-K. millions of Canadian dollars 2023 2022 From Imperial's Consolidated statement of cash flows Cash flows from (used in) operating activities 3,734 10,482 Less changes in working capital Changes in operating assets and liabilities (2,701) 1,485 Cash flows from (used in) operating activities excl. working capital 6,435 8,997 Reconciliation of cash flows from (used in) operating activities excluding working capital

Imperial | 2024 22 Supplemental information – non-GAAP measures Cash operating costs (cash costs) Cash operating costs is a non-GAAP financial measure that consists of total expenses, less purchases of crude oil and products, federal excise taxes and fuel charge, financing, and costs that are non-cash in nature, including depreciation and depletion, and non-service pension and postretirement benefit. The components of cash operating costs include "Production and manufacturing", "Selling and general" and "Exploration" from the company’s Consolidated statement of income. The sum of these income statement lines serves as an indication of cash operating costs and does not reflect the total cash expenditures of the company. The most directly comparable financial measure that is disclosed in the financial statements is "Total expenses" within the company’s Consolidated statement of income. This measure is useful for investors to understand the company’s efforts to optimize cash through disciplined expense management. millions of Canadian dollars 2023 2022 From Imperial's Consolidated statement of income Total expenses 44,600 50,186 Less: Purchases of crude oil and products 32,399 37,742 Federal excise taxes and fuel charge 2,402 2,179 Depreciation and depletion 1,907 1,897 Non-service pension and postretirement benefit 82 17 Financing 69 60 Cash operating costs 7,741 8,291 Reconciliation of cash operating costs

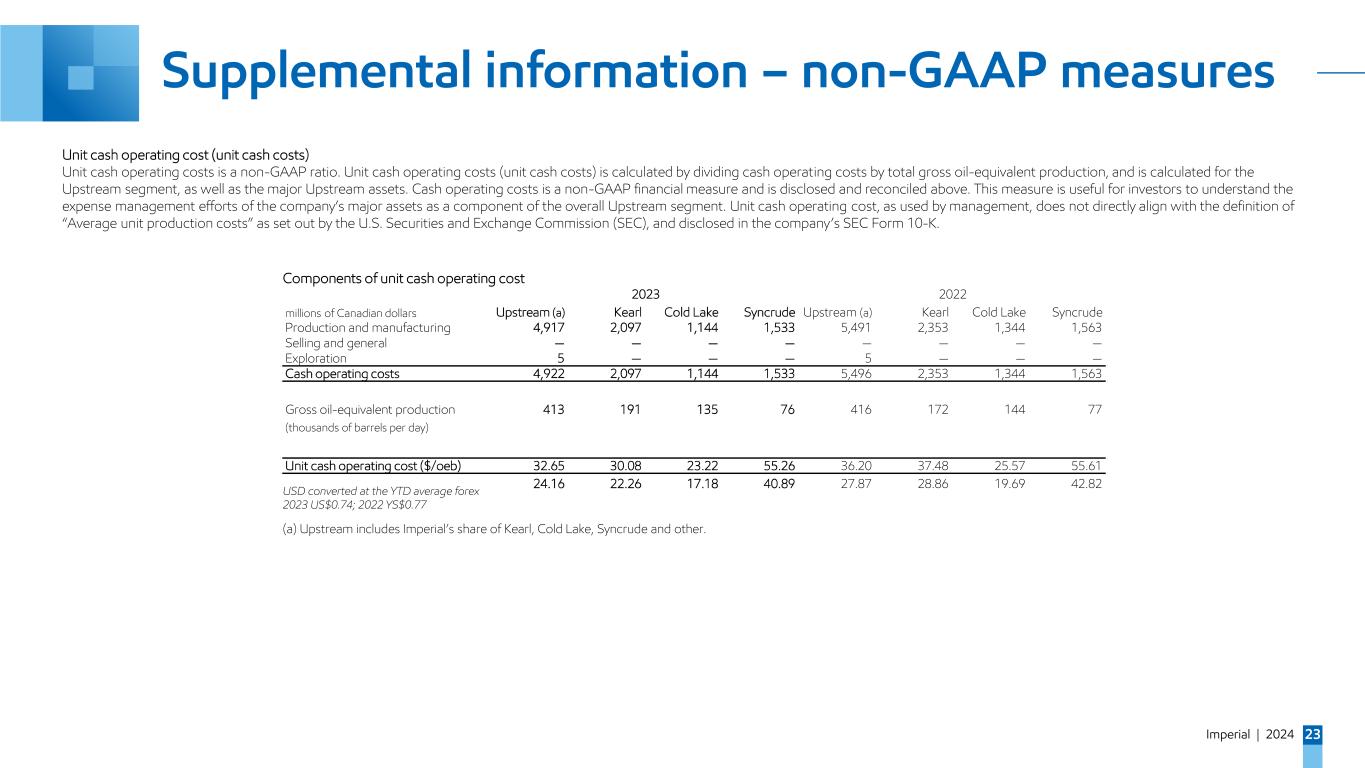

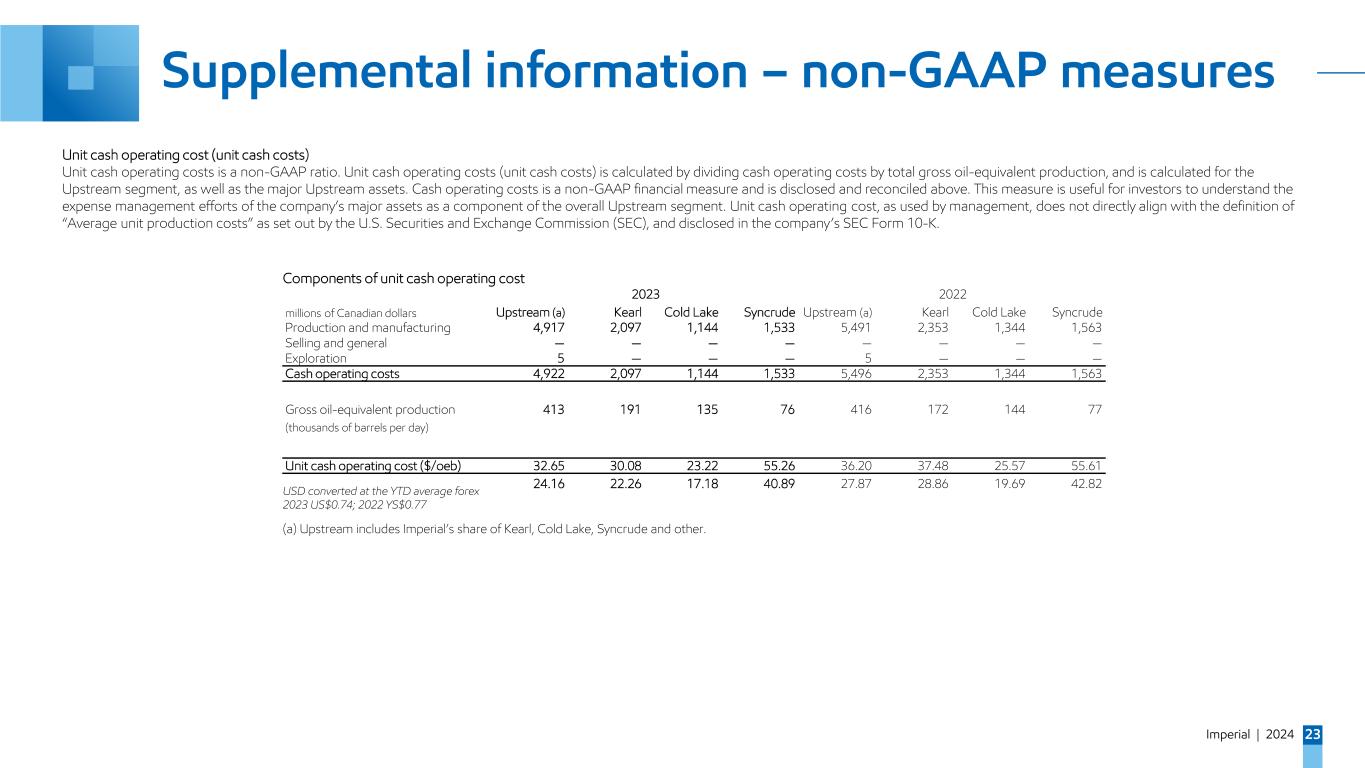

Imperial | 2024 23 Supplemental information – non-GAAP measures Unit cash operating cost (unit cash costs) Unit cash operating costs is a non-GAAP ratio. Unit cash operating costs (unit cash costs) is calculated by dividing cash operating costs by total gross oil-equivalent production, and is calculated for the Upstream segment, as well as the major Upstream assets. Cash operating costs is a non-GAAP financial measure and is disclosed and reconciled above. This measure is useful for investors to understand the expense management efforts of the company’s major assets as a component of the overall Upstream segment. Unit cash operating cost, as used by management, does not directly align with the definition of “Average unit production costs” as set out by the U.S. Securities and Exchange Commission (SEC), and disclosed in the company’s SEC Form 10-K. 2023 2022 millions of Canadian dollars Upstream (a) Kearl Cold Lake Syncrude Upstream (a) Kearl Cold Lake Syncrude Production and manufacturing 4,917 2,097 1,144 1,533 5,491 2,353 1,344 1,563 Selling and general — — — — — — — — Exploration 5 — — — 5 — — — Cash operating costs 4,922 2,097 1,144 1,533 5,496 2,353 1,344 1,563 Gross oil-equivalent production 413 191 135 76 416 172 144 77 (thousands of barrels per day) Unit cash operating cost ($/oeb) 32.65 30.08 23.22 55.26 36.20 37.48 25.57 55.61 24.16 22.26 17.18 40.89 27.87 28.86 19.69 42.82 Components of unit cash operating cost USD converted at the YTD average forex 2023 US$0.74; 2022 YS$0.77 (a) Upstream includes Imperial’s share of Kearl, Cold Lake, Syncrude and other.