0000046250false2024FYiso4217:USDxbrli:sharesiso4217:USDxbrli:shareshwkn:Segmentutr:Ratexbrli:purehwkn:lease00000462502023-04-032024-03-3100000462502023-10-0100000462502024-05-1000000462502024-03-3100000462502023-04-0200000462502022-04-042023-04-0200000462502021-03-292022-04-030000046250us-gaap:AccumulatedOtherComprehensiveIncomeMember2023-04-032024-03-310000046250us-gaap:AccumulatedOtherComprehensiveIncomeMember2022-04-042023-04-020000046250us-gaap:AccumulatedOtherComprehensiveIncomeMember2021-03-292022-04-030000046250us-gaap:CommonStockMember2021-03-280000046250us-gaap:AdditionalPaidInCapitalMember2021-03-280000046250us-gaap:RetainedEarningsMember2021-03-280000046250us-gaap:AccumulatedOtherComprehensiveIncomeMember2021-03-2800000462502021-03-280000046250us-gaap:CommonStockMember2021-03-292022-04-030000046250us-gaap:AdditionalPaidInCapitalMember2021-03-292022-04-030000046250us-gaap:RetainedEarningsMember2021-03-292022-04-030000046250us-gaap:CommonStockMember2022-04-030000046250us-gaap:AdditionalPaidInCapitalMember2022-04-030000046250us-gaap:RetainedEarningsMember2022-04-030000046250us-gaap:AccumulatedOtherComprehensiveIncomeMember2022-04-0300000462502022-04-030000046250us-gaap:CommonStockMember2022-04-042023-04-020000046250us-gaap:AdditionalPaidInCapitalMember2022-04-042023-04-020000046250us-gaap:RetainedEarningsMember2022-04-042023-04-020000046250us-gaap:CommonStockMember2023-04-020000046250us-gaap:AdditionalPaidInCapitalMember2023-04-020000046250us-gaap:RetainedEarningsMember2023-04-020000046250us-gaap:AccumulatedOtherComprehensiveIncomeMember2023-04-020000046250us-gaap:CommonStockMember2023-04-032024-03-310000046250us-gaap:AdditionalPaidInCapitalMember2023-04-032024-03-310000046250us-gaap:RetainedEarningsMember2023-04-032024-03-310000046250us-gaap:CommonStockMember2024-03-310000046250us-gaap:AdditionalPaidInCapitalMember2024-03-310000046250us-gaap:RetainedEarningsMember2024-03-310000046250us-gaap:AccumulatedOtherComprehensiveIncomeMember2024-03-310000046250us-gaap:CustomerConcentrationRiskMemberus-gaap:AccountsReceivableMemberus-gaap:TradeAccountsReceivableMember2023-04-032024-03-310000046250us-gaap:BuildingAndBuildingImprovementsMembersrt:MinimumMember2024-03-310000046250srt:MaximumMemberus-gaap:BuildingAndBuildingImprovementsMember2024-03-310000046250us-gaap:MachineryAndEquipmentMembersrt:MinimumMember2024-03-310000046250srt:MaximumMemberus-gaap:MachineryAndEquipmentMember2024-03-310000046250srt:MinimumMemberus-gaap:OfficeEquipmentMember2024-03-310000046250us-gaap:TransportationEquipmentMembersrt:MinimumMember2024-03-310000046250srt:MaximumMemberus-gaap:TransportationEquipmentMember2024-03-310000046250srt:MaximumMemberus-gaap:OfficeEquipmentMember2024-03-310000046250srt:WeightedAverageMember2024-03-310000046250hwkn:IndustrialResearchCorporationMember2024-03-082024-03-080000046250us-gaap:CustomerListsMemberhwkn:IndustrialResearchCorporationMember2024-03-080000046250hwkn:TheMiamiProductsChemicalCompanyMember2023-10-312023-10-310000046250hwkn:TheMiamiProductsChemicalCompanyMemberus-gaap:CustomerListsMember2023-10-310000046250us-gaap:TradeNamesMemberhwkn:TheMiamiProductsChemicalCompanyMember2023-10-310000046250hwkn:WaterSolutionsUnlimitedInc.Member2023-10-272023-10-270000046250us-gaap:CustomerListsMemberhwkn:WaterSolutionsUnlimitedInc.Member2023-10-270000046250us-gaap:TradeNamesMemberhwkn:WaterSolutionsUnlimitedInc.Member2023-10-270000046250hwkn:WaterSolutionsUnlimitedInc.Memberus-gaap:NoncompeteAgreementsMember2023-10-270000046250hwkn:EcoTechEnterprisesInc.Member2023-07-142023-07-1400000462502023-03-302023-03-300000046250hwkn:IndustrialMemberhwkn:ManufacturedblendedorrepackagedproductsMember2023-04-032024-03-310000046250hwkn:ManufacturedblendedorrepackagedproductsMemberhwkn:WaterTreatmentMember2023-04-032024-03-310000046250hwkn:ManufacturedblendedorrepackagedproductsMemberhwkn:HealthandNutritionMember2023-04-032024-03-310000046250hwkn:ManufacturedblendedorrepackagedproductsMember2023-04-032024-03-310000046250hwkn:IndustrialMemberhwkn:DistributedSpecialtyProductsMember2023-04-032024-03-310000046250hwkn:WaterTreatmentMemberhwkn:DistributedSpecialtyProductsMember2023-04-032024-03-310000046250hwkn:DistributedSpecialtyProductsMemberhwkn:HealthandNutritionMember2023-04-032024-03-310000046250hwkn:DistributedSpecialtyProductsMember2023-04-032024-03-310000046250hwkn:IndustrialMemberhwkn:BulkMember2023-04-032024-03-310000046250hwkn:BulkMemberhwkn:WaterTreatmentMember2023-04-032024-03-310000046250hwkn:BulkMemberhwkn:HealthandNutritionMember2023-04-032024-03-310000046250hwkn:BulkMember2023-04-032024-03-310000046250hwkn:OtherMemberhwkn:IndustrialMember2023-04-032024-03-310000046250hwkn:OtherMemberhwkn:WaterTreatmentMember2023-04-032024-03-310000046250hwkn:OtherMemberhwkn:HealthandNutritionMember2023-04-032024-03-310000046250hwkn:OtherMember2023-04-032024-03-310000046250hwkn:IndustrialMember2023-04-032024-03-310000046250hwkn:WaterTreatmentMember2023-04-032024-03-310000046250hwkn:HealthandNutritionMember2023-04-032024-03-310000046250hwkn:IndustrialMemberhwkn:ManufacturedblendedorrepackagedproductsMember2022-04-042023-04-020000046250hwkn:ManufacturedblendedorrepackagedproductsMemberhwkn:WaterTreatmentMember2022-04-042023-04-020000046250hwkn:ManufacturedblendedorrepackagedproductsMemberhwkn:HealthandNutritionMember2022-04-042023-04-020000046250hwkn:ManufacturedblendedorrepackagedproductsMember2022-04-042023-04-020000046250hwkn:IndustrialMemberhwkn:DistributedSpecialtyProductsMember2022-04-042023-04-020000046250hwkn:WaterTreatmentMemberhwkn:DistributedSpecialtyProductsMember2022-04-042023-04-020000046250hwkn:DistributedSpecialtyProductsMemberhwkn:HealthandNutritionMember2022-04-042023-04-020000046250hwkn:DistributedSpecialtyProductsMember2022-04-042023-04-020000046250hwkn:IndustrialMemberhwkn:BulkMember2022-04-042023-04-020000046250hwkn:BulkMemberhwkn:WaterTreatmentMember2022-04-042023-04-020000046250hwkn:BulkMemberhwkn:HealthandNutritionMember2022-04-042023-04-020000046250hwkn:BulkMember2022-04-042023-04-020000046250hwkn:OtherMemberhwkn:IndustrialMember2022-04-042023-04-020000046250hwkn:OtherMemberhwkn:WaterTreatmentMember2022-04-042023-04-020000046250hwkn:OtherMemberhwkn:HealthandNutritionMember2022-04-042023-04-020000046250hwkn:OtherMember2022-04-042023-04-020000046250hwkn:IndustrialMember2022-04-042023-04-020000046250hwkn:WaterTreatmentMember2022-04-042023-04-020000046250hwkn:HealthandNutritionMember2022-04-042023-04-020000046250hwkn:IndustrialMemberhwkn:ManufacturedblendedorrepackagedproductsMember2021-03-292022-04-030000046250hwkn:ManufacturedblendedorrepackagedproductsMemberhwkn:WaterTreatmentMember2021-03-292022-04-030000046250hwkn:ManufacturedblendedorrepackagedproductsMemberhwkn:HealthandNutritionMember2021-03-292022-04-030000046250hwkn:ManufacturedblendedorrepackagedproductsMember2021-03-292022-04-030000046250hwkn:IndustrialMemberhwkn:DistributedSpecialtyProductsMember2021-03-292022-04-030000046250hwkn:WaterTreatmentMemberhwkn:DistributedSpecialtyProductsMember2021-03-292022-04-030000046250hwkn:DistributedSpecialtyProductsMemberhwkn:HealthandNutritionMember2021-03-292022-04-030000046250hwkn:DistributedSpecialtyProductsMember2021-03-292022-04-030000046250hwkn:IndustrialMemberhwkn:BulkMember2021-03-292022-04-030000046250hwkn:BulkMemberhwkn:WaterTreatmentMember2021-03-292022-04-030000046250hwkn:BulkMemberhwkn:HealthandNutritionMember2021-03-292022-04-030000046250hwkn:BulkMember2021-03-292022-04-030000046250hwkn:OtherMemberhwkn:IndustrialMember2021-03-292022-04-030000046250hwkn:OtherMemberhwkn:WaterTreatmentMember2021-03-292022-04-030000046250hwkn:OtherMemberhwkn:HealthandNutritionMember2021-03-292022-04-030000046250hwkn:OtherMember2021-03-292022-04-030000046250hwkn:IndustrialMember2021-03-292022-04-030000046250hwkn:WaterTreatmentMember2021-03-292022-04-030000046250hwkn:HealthandNutritionMember2021-03-292022-04-030000046250us-gaap:FairValueInputsLevel1Member2024-03-310000046250us-gaap:FairValueInputsLevel1Member2023-04-020000046250us-gaap:FairValueInputsLevel2Member2024-03-310000046250us-gaap:FairValueInputsLevel2Member2023-04-020000046250us-gaap:FairValueInputsLevel3Member2024-03-310000046250us-gaap:FairValueInputsLevel3Member2023-04-020000046250hwkn:IndustrialMember2023-04-020000046250hwkn:WaterTreatmentMember2023-04-020000046250hwkn:HealthandNutritionMember2023-04-020000046250hwkn:IndustrialMember2024-03-310000046250hwkn:WaterTreatmentMember2024-03-310000046250hwkn:HealthandNutritionMember2024-03-310000046250us-gaap:CustomerRelationshipsMember2024-03-310000046250us-gaap:TrademarksMember2024-03-310000046250us-gaap:OtherIntangibleAssetsMember2024-03-310000046250us-gaap:CustomerRelationshipsMember2023-04-020000046250us-gaap:TrademarksMember2023-04-020000046250us-gaap:OtherIntangibleAssetsMember2023-04-020000046250srt:MinimumMember2023-04-032024-03-310000046250srt:MaximumMember2023-04-032024-03-310000046250hwkn:PreviousCreditFacilityMember2024-03-310000046250srt:MaximumMember2024-03-310000046250srt:MinimumMember2024-03-310000046250us-gaap:RevolvingCreditFacilityMember2024-03-310000046250us-gaap:RevolvingCreditFacilityMember2023-04-020000046250us-gaap:PerformanceSharesMember2023-04-032024-03-310000046250us-gaap:PerformanceSharesMember2021-03-280000046250us-gaap:PerformanceSharesMember2021-03-292022-04-030000046250us-gaap:PerformanceSharesMember2022-04-030000046250us-gaap:PerformanceSharesMember2022-04-042023-04-020000046250us-gaap:PerformanceSharesMember2023-04-020000046250us-gaap:PerformanceSharesMember2024-03-310000046250srt:WeightedAverageMemberus-gaap:PerformanceSharesMember2023-04-032024-03-310000046250us-gaap:RestrictedStockMember2023-04-032024-03-310000046250us-gaap:RestrictedStockMember2021-03-280000046250us-gaap:RestrictedStockMember2021-03-292022-04-030000046250us-gaap:RestrictedStockMember2022-04-030000046250us-gaap:RestrictedStockMember2022-04-042023-04-020000046250us-gaap:RestrictedStockMember2023-04-020000046250us-gaap:RestrictedStockMember2024-03-310000046250srt:WeightedAverageMemberus-gaap:RestrictedStockMember2023-04-032024-03-310000046250us-gaap:DeferredProfitSharingMemberus-gaap:QualifiedPlanMembersrt:MinimumMember2023-04-032024-03-310000046250us-gaap:DeferredProfitSharingMemberus-gaap:QualifiedPlanMembersrt:MinimumMember2022-04-042023-04-020000046250srt:MaximumMemberus-gaap:DeferredProfitSharingMemberus-gaap:QualifiedPlanMember2023-04-032024-03-310000046250srt:MaximumMemberus-gaap:DeferredProfitSharingMemberus-gaap:QualifiedPlanMember2022-04-042023-04-020000046250hwkn:BargainingUnitEmployeePlansMemberus-gaap:DeferredProfitSharingMemberus-gaap:QualifiedPlanMembersrt:MinimumMember2023-04-032024-03-310000046250hwkn:BargainingUnitEmployeePlansMembersrt:MaximumMemberus-gaap:DeferredProfitSharingMemberus-gaap:QualifiedPlanMember2023-04-032024-03-310000046250hwkn:A401kplanMembersrt:MaximumMemberus-gaap:QualifiedPlanMember2023-04-032024-03-310000046250us-gaap:QualifiedPlanMembersrt:MinimumMemberus-gaap:EmployeeStockOwnershipPlanESOPPlanDomain2022-04-042023-04-020000046250us-gaap:QualifiedPlanMembersrt:MinimumMemberus-gaap:EmployeeStockOwnershipPlanESOPPlanDomain2023-04-032024-03-310000046250srt:MaximumMemberus-gaap:QualifiedPlanMemberus-gaap:EmployeeStockOwnershipPlanESOPPlanDomain2023-04-032024-03-310000046250srt:MaximumMemberus-gaap:QualifiedPlanMemberus-gaap:EmployeeStockOwnershipPlanESOPPlanDomain2022-04-042023-04-020000046250srt:MaximumMemberus-gaap:DeferredProfitSharingMemberus-gaap:NonqualifiedPlanMember2023-04-032024-03-310000046250srt:MaximumMemberus-gaap:DeferredProfitSharingMemberus-gaap:NonqualifiedPlanMember2022-04-042023-04-020000046250hwkn:BargainingUnitEmployeePlansMember2023-04-032024-03-310000046250hwkn:BargainingUnitEmployeePlansMember2022-04-042023-04-020000046250hwkn:BargainingUnitEmployeePlansMember2021-03-292022-04-030000046250hwkn:IdentifiableMember2024-03-310000046250hwkn:IdentifiableMember2023-04-020000046250hwkn:IndustrialMember2022-04-030000046250hwkn:WaterTreatmentMember2022-04-030000046250hwkn:HealthandNutritionMember2022-04-030000046250hwkn:IdentifiableMember2022-04-030000046250hwkn:UnallocatedMember2024-03-310000046250hwkn:UnallocatedMember2023-04-020000046250hwkn:UnallocatedMember2022-04-03

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

|

|

|

|

|

|

|

|

|

|

|

|

|

Form 10-K |

| ☑ |

ANNUAL REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE |

|

SECURITIES EXCHANGE ACT OF 1934 |

|

For the Fiscal Year Ended |

March 31, 2024 |

| ☐ |

TRANSITION REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE |

|

SECURITIES EXCHANGE ACT OF 1934 |

|

Commission File No. 0-7647 |

HAWKINS, INC.

(Exact Name of Registrant as Specified in its Charter)

|

|

|

|

|

|

|

|

|

| Minnesota |

|

41-0771293 |

| (State of Incorporation) |

|

(I.R.S. Employer Identification No.) |

2381 Rosegate, Roseville, Minnesota |

|

55113 |

| (Address of Principal Executive Offices) |

|

(Zip Code) |

(612) 331-6910

(Registrant’s Telephone Number, Including Area Code)

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Securities registered pursuant to Section 12(b) of the Act: |

| Title of each class |

Trading Symbol: |

Name of exchange on which registered: |

| Common Shares, par value $.01 per share |

HWKN |

Nasdaq Stock Market LLC |

| Securities registered pursuant to Section 12(g) of the Act: None |

Indicate by check mark if the registrant is a well-known seasoned issuer, as defined in Rule 405 of the Securities Act. Yes ☑ No ☐

Indicate by check mark if the registrant is not required to file reports pursuant to Section 13 or Section 15(d) of the Act. Yes ☐ No ☑

Indicate by check mark whether the Registrant (1) has filed all reports required to be filed by Section 13 or 15(d) of the Securities Exchange Act of 1934 during the preceding twelve months (or for such shorter period that the Registrant was required to file such reports) and (2) has been subject to such filing requirements for the past 90 days. Yes ☑ No ☐

Indicate by check mark whether the registrant has submitted electronically every Interactive Data File required to be submitted pursuant to Rule 405 of Regulation S-T during the preceding 12 months (or for such shorter period that the Registrant was required to submit such files). Yes ☑ No ☐

Indicate by check mark whether the registrant is a large accelerated filer, an accelerated filer, a non-accelerated filer, a smaller reporting company, or an emerging growth company. See the definitions of “large accelerated filer,” “accelerated filer,” “smaller reporting company,” and “emerging growth company” in Rule 12b-2 of the Exchange Act.

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Large accelerated filer |

☑ |

|

|

|

|

|

|

|

Accelerated filer |

☐ |

| Non-accelerated filer |

☐ |

|

|

|

|

|

|

|

Smaller reporting company |

☐ |

|

|

|

|

|

|

|

|

|

Emerging growth company |

☐ |

If an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act. ☐

Indicate by check mark whether the registrant has filed a report on and attestation to its management’s assessment of the effectiveness of its internal control over financial reporting under Section 404(b) of the Sarbanes-Oxley Act (15 U.S.C. 7262(b)) by the registered public accounting firm that prepared or issued its audit report. ☑

Indicate by check mark whether the registrant is a shell company (as defined in Rule 12b-2 of the Exchange Act). Yes ☐ No ☑

If securities are registered pursuant to Section 12(b) of the Act, indicate by check mark whether the financial statements of the registrant included in the filing reflect the correction of an error to previously issued financial statements. ☐

Indicate by check mark whether any of those error corrections are restatements that required a recovery analysis of incentive-based compensation received by any of the registrant’s executive officers during the relevant recovery period pursuant to §240.10D-1(b). ☐

The aggregate market value of voting stock held by non-affiliates of the Registrant on October 1, 2023 (the last business day of the Registrant’s most recently completed second fiscal quarter) was approximately $1,187.5 million based upon the closing sale price for the Registrant’s common shares on that date as reported by The Nasdaq Stock Market LLC, excluding all shares held by officers and directors of the Registrant and by the Trustees of the Registrant’s Employee Stock Ownership Plan and Trust.

As of May 10, 2024, the Registrant had 20,912,338 shares of common shares outstanding.

DOCUMENTS INCORPORATED BY REFERENCE

Portions of our definitive Proxy Statement for the annual meeting of shareholders to be held July 31, 2024, are incorporated by reference in Part III of this Annual Report on Form 10-K The information presented in this Annual Report on Form 10-K contains forward-looking statements within the meaning of Section 21E of the Securities Exchange Act of 1934, as amended (the “Exchange Act”).

FORWARD-LOOKING STATEMENTS

These forward-looking statements have been made pursuant to the provisions of the Private Securities Litigation Reform Act of 1995. These statements are not historical facts, but rather are based on our current expectations, estimates and projections, and our beliefs and assumptions. Words such as “anticipate,” “expect,” “intend,” “plan,” “believe,” “seek,” “estimate,” “will” and similar expressions may identify forward-looking statements. These statements are not guarantees of future performance and are subject to certain risks, uncertainties and other factors, some of which are beyond our control and are difficult to predict. These factors could cause actual results to differ materially from those expressed or forecasted in the forward-looking statements. These risks and uncertainties are described in the risk factors and elsewhere in this Annual Report on Form 10-K. We caution you not to place undue reliance on these forward-looking statements, which reflect our management’s view only as of the date of this Annual Report on Form 10-K. We are not obligated to update these statements or publicly release the result of any revisions to them to reflect events or circumstances after the date of this Annual Report on Form 10-K or to reflect the occurrence of unanticipated events.

As used in this Annual Report on Form 10-K, except where otherwise stated or indicated by the context, “Hawkins,” “we,” “us,” “the Company,” “our,” or “the Registrant” means Hawkins, Inc. References to "fiscal 2025" means our fiscal year ending March 30, 2025, “fiscal 2024” means our fiscal year ended March 31, 2024, “fiscal 2023” means our fiscal year ended April 2, 2023, and “fiscal 2022” means our fiscal year ended April 3, 2022.

Hawkins, Inc.

Annual Report on Form 10-K

For the Fiscal Year Ended March 31, 2024

|

|

|

|

|

|

|

|

|

|

|

|

| |

|

Page |

| PART I |

| ITEM 1. |

|

|

| ITEM 1A. |

|

|

| ITEM 1B. |

|

|

| ITEM 1C. |

|

|

| ITEM 2. |

|

|

| ITEM 3. |

|

|

| ITEM 4. |

|

|

| PART II |

| ITEM 5. |

|

|

| ITEM 6. |

|

|

| ITEM 7. |

|

|

| ITEM 7A. |

|

|

| ITEM 8. |

|

|

| ITEM 9. |

|

|

| ITEM 9A. |

|

|

| ITEM 9B. |

|

|

| ITEM 9C. |

|

|

| PART III |

| ITEM 10. |

|

|

| ITEM 11. |

|

|

| ITEM 12. |

|

|

| ITEM 13. |

|

|

| ITEM 14. |

|

|

| PART IV |

| ITEM 15. |

|

|

| ITEM 16. |

|

|

PART I

ITEM 1. BUSINESS

We are a leading specialty chemical and ingredients company that formulates, distributes, blends and manufactures products for our Industrial, Water Treatment and Health and Nutrition customers. We believe that we create value for our customers through superb service and support, quality products, personalized applications and trustworthy, creative employees.

We conduct our business in three segments: Industrial, Water Treatment, and Health and Nutrition.

Industrial Segment. Our Industrial Group specializes in providing industrial chemicals, products and services to industries such as agriculture, chemical processing, electronics, energy, food, pharmaceutical and plating. This group’s principal products are acids, alkalis and food-grade and pharmaceutical salts and ingredients.

The Industrial Group:

•Manufactures sodium hypochlorite (bleach), certain food-grade and pharmaceutical products, including liquid phosphates, lactates and other blended products, and agricultural products;

•Receives, stores and distributes various chemicals in bulk quantities, including liquid caustic soda, sulfuric acid, hydrochloric acid, urea, phosphoric acid, aqua ammonia and potassium hydroxide;

•Repackages water treatment chemicals for our Water Treatment Group and bulk industrial chemicals to sell in smaller quantities to our customers; and

•Performs custom blending of chemicals according to customer formulas and specifications.

The group’s sales are concentrated primarily in the central United States, while the group sells food and pharmaceutical products, as well as some agricultural products, nationally. The Industrial Group relies on a specially trained sales staff that works directly with customers on their specific needs. The group conducts its business primarily through manufacturing locations and terminal operations. Agricultural sales within this group tend to be seasonal, with higher sales during the typical planting season of March through June given the regions of the country we serve.

Water Treatment Segment. Our Water Treatment Group specializes in providing chemicals, products, equipment, services and solutions for potable water, municipal and industrial wastewater, industrial process water, non-residential swimming pool water and agricultural water. This group has the resources and flexibility to treat systems ranging in size from a single small well to a multi-million-gallon-per-day facility.

The group utilizes delivery routes operated by our employees who typically serve as route driver, salesperson and trained technician to deliver our products and diagnose our customers’ water treatment needs. We believe that the high level of service provided by these individuals allows us to serve as the trusted water treatment expert for many of the municipalities and other customers that we serve. We also believe that there are significant synergies between our Water Treatment and Industrial Groups that allow us to obtain a competitive cost position on many of the chemicals sold by the Water Treatment Group due to the volumes of these chemicals purchased by our Industrial Group. In addition, our Industrial and Water Treatment groups share certain resources, which leverage fixed costs across both groups.

The Water Treatment group operates out of 47 warehouses supplying products and services to customers in 46 states. We expect to continue to invest in existing and new branches to expand the group’s geographic coverage. Our Water Treatment Group has historically experienced higher sales during April to September, primarily due to a seasonal increase in chemicals used by municipal water treatment facilities.

Health and Nutrition Segment. Our Health and Nutrition Group specializes in providing ingredient distribution, processing and formulation solutions to manufacturers of nutraceutical, functional food and beverage, personal care, dietary supplement and other nutritional food, health and wellness products. This group offers a diverse product portfolio including minerals, vitamins and amino acids, excipients, joint products, botanicals and herbs, sweeteners and enzymes.

The Health and Nutrition Group relies on a specially trained sales staff that works directly with customers on their specific needs. The group’s extensive product portfolio combined with value-added services, including product formulation, sourcing and distribution, and processing and blending, positions this group as a one-stop ingredient solutions provider to its customers. The group also follows rigorous quality control and compliance processes to provide reliable, high-quality products to its customers. The group operates out of facilities in California and New York and its products are sold nationally and, in certain cases, internationally.

Raw Materials. We have numerous suppliers, including many of the major chemical producers in the United States. We source our health and nutrition ingredients from a wide array of domestic and international vendors. We typically have distributorship agreements or supply contracts with our suppliers that are periodically renewed. We believe that most of the products we purchase can be obtained from alternative sources should existing relationships be terminated. We are dependent upon the availability of our raw materials. While we believe that we have adequate sources of supply for our raw material and product requirements, we cannot be sure that supplies will be consistently available in the future. In the event that certain raw materials become generally unavailable, suppliers may extend lead times or limit or cut off the supply of materials to us. As a result, we may not be able to supply or manufacture products for our customers.

Intellectual Property. Our intellectual property portfolio is of economic importance to our business. When appropriate, we have pursued, and we will continue to pursue, patents covering our products. We have also obtained certain trademarks for our products to distinguish them from our competitors’ products. We regard many of the formulas, information and processes that we generate and use in the conduct of our business as proprietary and protectable under applicable copyright, patent, trademark, trade secret and unfair competition laws.

Customer Concentration. In fiscal 2024, none of our customers accounted for 10% or more of our total sales.

Competition. We operate in a competitive industry and compete with many producers, distributors and sales agents offering products equivalent to substantially all of the products we offer. Many of our competitors are larger than we are and may have greater financial resources, although no one competitor is dominant in all of the markets we serve. We compete by offering quality products with outstanding customer service at competitive prices coupled with value-added services or product formulation where needed. Because of our long-standing relationships with many of our suppliers, we are often able to leverage those relationships to obtain products when supplies are limited or to obtain competitive pricing.

Working Capital. Due to the nature of our operations, which includes purchases of large quantities of bulk chemicals, the timing of purchases can result in significant changes in working capital and the resulting operating cash flow. Historically, our cash requirements for working capital increase during the period from March through November as caustic soda inventory levels increase with most of our barges received during this period.

Regulatory Matters. We are subject to numerous federal, state and local environmental, health and safety laws and regulations in the jurisdictions in which we operate, including laws and regulations relating to the management, storage, transportation and disposal of chemicals and wastes; product regulation; air, water and soil contamination; and the investigation and cleanup of any spills or releases that may result from our management, handling, storage, sale, or transportation of chemicals and other products. In addition, societal concerns regarding the safety of chemicals in commerce and their potential impact on the environment have resulted in a growing trend towards increasing levels of product safety and environmental protection regulations. These concerns have led to, and could continue to result in, more stringent regulatory intervention by governmental authorities.

In addition, we operate a fleet of more than 350 commercial vehicles, primarily in our Water Treatment Group, which are highly regulated, including by the U.S. Department of Transportation (“DOT”). The DOT governs transportation matters including authorization to engage in motor carrier service, including the necessary permits to conduct our businesses, equipment operation, and safety.

The manufacture, packaging, labeling, advertising, promotion, distribution and sale of our agricultural, food, pharmaceutical, pesticide and health and nutrition products are subject to regulation by numerous national and local governmental agencies in the United States and other countries. The primary regulatory bodies in the United States are the Food and Drug Administration (the “FDA”), the Environmental Protection Agency, the United States Department of Agriculture and the Federal Trade Commission, and we are also subject to similar regulators in other countries. In particular, the FDA’s current good manufacturing practices (“GMPs”) describe policies and procedures designed to ensure that nutraceuticals, pharmaceuticals and dietary supplements are produced in a quality manner, do not contain contaminants or impurities, and are accurately labeled and cover the manufacturing, packaging, labeling and storing of products, with requirements for quality control, design and construction of manufacturing plants, testing of ingredients and final products, record keeping, and complaints processes.

Further information related to government regulation applicable to our business is included in this Annual Report on Form 10-K, in Part I, Item 1A - Risk Factors.

Human Capital. Our team is a key to our success and we are committed to creating a workplace that attracts top talent, develops leaders and drives performance on behalf of our customers and shareholders.

We strive to recruit the best people for the job regardless of race, color, nationality, gender, age, disability, sexual orientation or any other status protected by law. It is our policy to comply fully with all applicable laws relating to discrimination in the workplace and are committed to advancing an inclusive, collaborative and respectful culture.

The health and safety of our employees is our highest priority. We work to ensure our employees have a thorough understanding of health and safety precautions that need to be taken in all business functions. Specific safety initiatives include accident prevention work, improving process controls, safety training, safety committees, safety audits, incident investigation and improvement measures.

We strive to provide employees with competitive wages commensurate with their skill levels, experience, knowledge and the regional market. Full-time employees are eligible for health, dental and vision insurance, paid and unpaid leaves, 401(K) plan, retirement plans, life and disability/accident coverage and our employee assistance program.

As of March 31, 2024, we had 934 employees across the United States, of which 928 were full-time employees. Approximately 41% of our employees were female or racially and ethnically diverse, and approximately 10% were covered by a collective bargaining agreement. Of the eight members of our Board of Directors, two are female, six are male, one is Asian American and seven are white.

Available Information. Our Internet address is www.hawkinsinc.com. We have made available, free of charge, our Annual Reports on Form 10-K, Quarterly Reports on Form 10-Q, Current Reports on Form 8-K, and, if applicable, amendments to those reports, as soon as reasonably practicable after we electronically file these materials with, or furnish them to, the Securities and Exchange Commission ("SEC"). Reports of beneficial ownership filed by our directors and executive officers pursuant to Section 16(a) of the Exchange Act are also available on our website. We are not including the information contained on our website as part of, or incorporating it by reference into, this Annual Report on Form 10-K. The SEC also maintains an internet site that contains reports, proxy and information statements, and other information regarding our company at http://www.sec.gov.

ITEM 1A. RISK FACTORS

You should carefully consider the following material factors regarding risks relating to an investment in our securities and when reading the information, including the financial information, contained in this Annual Report on Form 10-K. Shareholders are cautioned that these and other factors may affect future performance and cause actual results to differ materially from those that may be anticipated.

COMPETITIVE AND REPUTATIONAL RISKS

We operate in a highly competitive environment and face significant competition and price pressure.

We operate in a highly competitive industry and compete with producers, manufacturers, distributors and sales agents offering products equivalent to substantially all of the products we offer. Competition is based on several key criteria, including product price, product performance, product quality, product availability and security of supply, breadth of product offerings, geographic reach, responsiveness of product development in cooperation with customers, technical expertise and customer service. Many of our competitors are larger than we are and may have greater financial resources, more product offerings and a broader geographic reach. As a result, these competitors may be able to offer a broader array of products to a larger geographic area and may be better able than us to withstand changes in conditions within our industry, changes in the prices and availability of raw materials and changes in general economic conditions as well as be able to introduce innovative products that reduce demand for or the profit from our products. Additionally, competitors’ pricing decisions could compel us to decrease our prices, which could adversely affect our margins and profitability. Our ability to maintain or increase our profitability would be dependent upon our ability to offset competitive decreases in the prices and margins of our products by improving production efficiency, investing in infrastructure to reduce freight costs, identifying and selling higher margin products, providing higher levels of technical expertise and customer service, and improving existing products through innovation and research and development. If we are unable to maintain our profitability or competitive position, we could lose market share to our competitors and experience reduced profitability.

Our businesses expose us to potential product liability claims and recalls, which could adversely affect our financial condition and performance.

The repackaging, blending, mixing and distribution of products by us, including chemical products and products used in food or food ingredients or with medical, pharmaceutical or dietary supplement applications, involve an inherent risk of exposure to product liability claims, product recalls, product seizures and related adverse publicity, including, without limitation, claims for exposure to our products, spills or release of our products, personal injuries, food-related claims and property damage or environmental claims. A product liability claim, judgment or recall against our customers could also result in substantial and unexpected expenditures for us, affect consumer confidence in our products and divert management’s attention from other responsibilities. Although we maintain product liability insurance, there can be no assurance that the type or level of coverage is adequate or that we will be able to continue to maintain our existing insurance or obtain comparable insurance at a reasonable cost, if at all. A product recall or a partially or completely uninsured judgment against us could have a material adverse effect on our business, financial condition and results of operations.

Changes in our customers’ needs or failure of our products to meet customers’ requirements could adversely affect our sales and profitability.

Our products are used for a broad range of applications by our customers. Changes in our customers’ product needs or processes, or reductions in demand for their end products, may enable or require our customers to reduce or eliminate consumption of the products that we provide. Customers may also find alternative materials or processes that no longer require our products. Consequently, it is important that we develop new products to replace the sales of products that mature and decline in use.

Our products provide important performance attributes to our customers’ products. If our products fail to meet the customers’ requirements or comply with applicable laws or regulations, perform in a manner inconsistent with the customers’ expectations or have a shorter useful life than required, a customer could seek replacement of the product or damages for costs incurred as a result of the product failure. A successful claim or series of claims against us could have a material adverse effect on our financial condition and results of operations and could result in a loss of one or more customers. Reductions in demand for our products could adversely affect our sales and financial results and result in facility closures.

Adverse publicity or negative public perception regarding particular ingredients or products or the dietary supplement industry in general could adversely affect the financial performance of those portions of our business.

Purchasing decisions made by consumers of products that contain our ingredients may be affected by adverse publicity or negative public perception regarding particular ingredients or products or the dietary supplement industry in general. This negative public perception may include publicity regarding the risks, efficacy, legality or quality of particular ingredients or products in general or of other companies or our products or ingredients specifically. Negative public perception may also arise from regulatory investigations, regardless of whether those investigations involve us. We are highly dependent upon consumers’ perception of the safety and quality of products that contain our ingredients as well as similar products distributed by other companies. Thus, the mere publication of reports asserting that such products may be harmful could have a material adverse effect on us, regardless of whether these reports are scientifically supported. Publicity related to dietary supplements or food ingredients may also result in increased regulatory scrutiny of our industry. Adverse publicity may have a material adverse effect on our business, financial condition, results of operations and cash flows.

Failure to adequately protect critical data and technology systems could materially affect our operations.

Information technology system failures, network disruptions and breaches of data security due to internal or external factors including phishing or cyber-attacks could disrupt our operations by causing delays or cancellation of customer orders, impede the manufacture or shipment of products or cause standard business processes to become ineffective, resulting in the unintentional disclosure of information or damage to our reputation. While we have taken steps to address these concerns by implementing network security and internal control measures, including employee training, comprehensive monitoring of our networks and systems, maintenance of backup and protective systems and disaster recovery and incident response plans, our employees, systems, networks, products, facilities and services remain vulnerable to phishing attacks and cyber-assault, and, as such, there can be no assurance that a system failure, network disruption or data security breach will not have a material adverse effect on our business, financial condition, operating results or cash flows.

RISKS RELATED TO OUR INDUSTRY

Fluctuations in the prices and availability of our raw materials, which may be cyclical in nature, could have a material adverse effect on our operations and the margins we receive on sales of our products.

We experience regular and recurring fluctuations in the pricing of our raw materials. Those fluctuations can be significant and occur rapidly. The cyclicality of commodity markets, such as the market for caustic soda, primarily results from changes in the balance between supply and demand and the level of general economic activity. We cannot predict whether the markets for our raw materials will favorably impact or negatively impact the margins we can realize.

The prices we pay for our principal chemical raw materials generally lag the market prices of the underlying raw material. The cost of inventory we have on hand, particularly inventories of our bulk commodity chemicals where we have significant volumes stored at our facilities, generally will lag the current market pricing of such inventory. The pricing within our supply contracts generally adjusts quarterly or monthly. While we attempt to maintain competitive pricing and stable margin dollars, the potential variance in our cost of inventory from the current market pricing can cause significant volatility in our margins realized. We do not engage in futures or other derivatives contracts to hedge against fluctuations in future prices. We may enter into sales contracts where the selling prices for our products are fixed for a period of time, exposing us to volatility in raw materials prices that we acquire on a spot market or short-term contractual basis. We attempt to pass commodity pricing changes to our customers, but we may be unable to or be delayed in doing so. Our inability to pass through price increases or any limitation or delay in our passing through price increases could adversely affect our profit margins.

We are also dependent upon the availability of our raw materials. In the event that raw materials are in short supply or unavailable, raw material suppliers may extend lead times or limit or cut off supplies. As a result, we may not be able to supply or manufacture products for some or all of our customers. Constraints on the supply or delivery of critical raw materials could disrupt our operations and adversely affect the performance of our businesses.

Demand for our products is affected by general economic conditions and by the cyclical nature of many of the industries we serve, which could cause significant fluctuations in our sales volumes and results.

Demand for our products is affected by general economic conditions. A decline in general economic or business conditions in the industries served by our customers could have a material adverse effect on our businesses. Although we sell to areas traditionally considered non-cyclical, such as water treatment, food products and health and nutritional ingredients, many of our customers are in businesses that are cyclical in nature, such as the industrial manufacturing and energy industries which include the ethanol and agriculture industries. Downturns in these industries could adversely affect our sales and our financial results by affecting demand for and pricing of our products.

Our business is subject to hazards common to chemical businesses, any of which could interrupt our production and adversely affect our results of operations.

Our business is subject to hazards common to chemical manufacturing, blending, storage, handling and transportation, including explosions, fires, severe weather, natural disasters, mechanical failure, unscheduled downtime, transportation interruptions, traffic accidents involving our delivery vehicles, derailments, chemical spills, discharges or releases of toxic or hazardous substances or gases and other risks. These hazards could cause personal injury and loss of life, severe damage to or destruction of property and equipment, and environmental contamination. In addition, the occurrence of material operating problems or the absence of personnel due to pandemics or other disasters at any of our facilities due to any of these hazards may make it impossible for us to make sales to our customers and may result in a negative public or political reaction. Many of our facilities are near significant residential populations which increases the risk of negative public or political reaction should an environmental issue occur and could lead to adverse zoning or other regulatory actions that could limit our ability to operate our business in those locations. Accordingly, these hazards and their consequences could have a material adverse effect on our operations as a whole, including our results of operations and cash flows, both during and after the period of operational difficulties.

Environmental problems at any of our facilities could result in significant unexpected costs.

We are subject to federal, state and local environmental regulations regarding the ownership of real property and the operations conducted on real property. Under various federal, state and local laws, ordinances and regulations, we may own or operate real property or may have arranged for the disposal or treatment of hazardous or toxic substances at a property and, therefore, may become liable for the costs of removal or remediation of certain hazardous substances released on or in our property or disposed of by us, as well as certain other potential costs which could relate to hazardous or toxic substances (including governmental fines and injuries to persons and property). Such liability may be imposed whether or not we knew of, or were responsible for, the presence of these hazardous or toxic substances. Further, future changes in environmental laws or regulations may require additional investment in capital equipment or the implementation of additional compliance programs in the future. The cost of investigation, remediation or removal of such substances may be substantial.

In the conduct of our operations, we have handled and do handle materials that are considered hazardous, toxic or volatile under federal, state and local laws. The potential for the accidental release of such products cannot be completely eliminated. In addition, we operate or own facilities located on or near real property that was formerly owned and operated by others. These properties may have been used in ways that involved hazardous materials. Contaminates may migrate from, within or through any such property, which may give rise to claims against us. Third parties who are responsible for contamination may not have funds, or may not make funds available when needed, to pay remediation costs imposed upon us jointly with them under environmental laws and regulations.

Our Water Treatment Group and our agricultural product sales within our Industrial Group are subject to seasonality and weather conditions, which could adversely affect our results of operations.

Our Water Treatment Group has historically experienced higher sales during April to September, primarily due to a seasonal increase in chemicals used by municipal water treatment facilities. Our agricultural product sales within our Industrial Group are also seasonal, primarily corresponding with the planting season. Demand in both of these areas is also affected by weather conditions, as either higher or lower than normal precipitation or temperatures may affect water usage and the timing and the amount of consumption of our products. We cannot assure you that seasonality or fluctuating weather conditions will not have a material adverse effect on our results of operations.

OPERATIONAL RISKS

Disruptions within our supply chain have negatively impacted, and could continue to negatively impact, our production, financial condition and results of operations.

We have been, and could continue to be, adversely affected by disruptions within our supply chain and transportation network. The raw materials we need are transported by truck, rail, barge or ship by third-party providers. The costs of transporting our products or necessary raw materials could be negatively affected by factors outside of our control, including rail service interruptions or rate increases, extreme weather events, tariffs, rising fuel costs and capacity constraints. In recent years, unprecedented congestion in ocean shipping adversely impacted the reliability of our imported raw materials, and transport driver shortages caused extended lead times for domestic shipments. In addition, rail shipments can be unreliable, with significant delays in service and increased costs. The impacts of high-profile derailments could further degrade service levels and cause railroads to increase costs. Significant delays or increased costs relating to transportation could materially affect our financial condition and results of operations.

Similar supply chain issues have impacted and could continue to impact both our suppliers and our customers. The supply of our necessary raw materials could be interrupted due to shortages of raw materials, effects of economic, political or financial market conditions on a supplier's operations, labor disputes or weather conditions affecting products or shipments, transportation disruptions, natural disasters, outbreaks of disease, information system disruptions or other reasons beyond our control. Similar disruptions at our customers could reduce demand for our products, reducing our sales and profitability. Product shortages or delays in deliveries, along with other factors such as price inflation and higher transportation costs, have also resulted in price increases from our suppliers. We may be unable to pass these price increases on to our customers, which could erode our profit margins. These supply chain constraints, increased product costs and inflationary pressures could continue or escalate in the future, which would have an adverse impact on our business and results of operations.

We are highly dependent upon transportation infrastructure to ship and receive our products and delays in these shipments could adversely affect our results of operations.

Although we maintain a number of owned trucks and trailers, we rely heavily upon transportation provided by third parties (including common carriers, barge companies, rail companies and trans-ocean cargo companies) to deliver products to us and to our customers. Our access to third-party transportation is not guaranteed, and we may be unable to transport our products in a timely manner, or at all, in certain circumstances, or at economically attractive rates. Disruptions in transportation are common, are often out of our control, and can happen suddenly and without warning. Rail limitations, such as limitations in rail capacity, availability of railcars, workforce shortages, threats of strikes, derailments, embargoes and adverse weather conditions have disrupted or delayed rail shipments in the past and could do so in the future. Barge shipments are delayed or impossible under certain circumstances, including during times of high or low water levels, when waterways are frozen and when locks and dams are inoperable. The availability and reliability of truck transportation has been negatively impacted by a number of factors, including limited availability of qualified drivers and equipment, limitations on drivers’ hours of service and failures of critical infrastructure, such as bridges. The volumes handled by, and operating challenges at, ocean ports have at times been volatile and can delay the receipt of goods, or cause the cost of shipping goods to be more expensive. Our failure to ship or receive products in a timely and efficient manner could have a material adverse effect on our financial condition and results of operations.

If we are unable to retain key personnel or attract new skilled personnel, it could have an adverse impact on our businesses.

Because of the specialized and technical nature of our businesses, our future performance is dependent on the continued service of, and on our ability to attract and retain, qualified management, scientific, technical and support personnel. The unanticipated departure of key members of our management team could have an adverse impact on our business.

We may not be able to successfully consummate future acquisitions or dispositions or integrate acquisitions into our business, which could result in unanticipated expenses and losses.

As part of our business growth strategy, we have acquired businesses and may pursue acquisitions in the future. Our ability to pursue this strategy will be limited by our ability to identify appropriate acquisition candidates and our financial resources, including available cash and borrowing capacity. In addition, we may seek to divest of businesses that are underperforming or not core to our future business. The expense incurred in consummating transactions, the time it takes to integrate an acquisition or our failure to integrate businesses successfully could result in unanticipated expenses and losses. Furthermore, we may not be able to realize the anticipated benefits from acquisitions.

The process of integrating acquired operations into our existing operations may result in unforeseen operating difficulties and may require significant financial resources that would otherwise be available for the ongoing development or expansion of existing operations. The risks associated with the integration of acquisitions include potential disruption of our ongoing businesses and distraction of management, unforeseen claims, liabilities, adjustments, charges and write-offs, difficulty in conforming the acquired business’ standards, processes, procedures and controls with our operations, and challenges arising from the increased scope, geographic diversity and complexity of the expanded operations.

Our businesses are subject to risks stemming from natural disasters or other extraordinary events outside of our control, which could interrupt our production and adversely affect our results of operations.

Natural disasters have the potential of interrupting our operations and damaging our properties, which could adversely affect our businesses. Flooding of the Mississippi River has temporarily shifted the Company’s terminal operations out of its buildings four times since the spring of 2010, including most recently the spring of 2019. We can give no assurance that flooding or other natural disasters will not recur or that there will not be material damage or interruption to our operations in the future from such disasters.

Chemical-related assets may be at greater risk of future terrorist attacks than other possible targets in the United States. Federal law imposes site security requirements, specifically on chemical facilities, which have increased our overhead expenses. Federal regulations have also been adopted to increase the security of the transportation of hazardous chemicals in the United States. We ship and receive materials that are classified as hazardous and we believe we have met these requirements, but additional federal and local regulations that limit the distribution of hazardous materials are being considered. Bans on movement of hazardous materials through certain cities or via certain modes of transportation could adversely affect the efficiency of our logistical operations. Broader restrictions on hazardous material movements could lead to additional investment and could change where and what products we provide.

The occurrence of extraordinary events, including future terrorist attacks, wars, global health developments and pandemics, or escalation of hostilities, cannot be predicted, but their occurrence can be expected to negatively affect the economy in general, and specifically the markets for our products. The resulting damage from a direct attack on our assets, or assets used by us, could include loss of life and property damage. In addition, available insurance coverage may not be sufficient to cover all of the damage incurred or, if available, may be prohibitively expensive.

We may not be able to renew our leases of land where four of our operations facilities reside.

We lease the land where our three main terminals are located and where another significant manufacturing plant is located. These leases, including all renewal periods, have expiration dates from 2024 to 2044. The failure to secure extended lease terms on any one of these facilities may have a material adverse impact on our business, as they are where a portion of our chemicals are manufactured and where the majority of our bulk chemicals are stored. While we can make no assurances, based on historical experience and anticipated future needs, we intend to extend these leases and believe that we will be able to renew our leases as the renewal periods expire. If we are unable to renew three of our leases (two relate to terminals and one to manufacturing) any property remaining on the land becomes the property of the lessor, and the lessor has the option to either maintain the property or remove the property at our expense. The fourth lease provides that we turn any property remaining on the land over to the lessor for them to maintain or remove at their expense. The cost to relocate our operations could have a material adverse effect on our results of operations and financial condition.

LEGAL AND REGULATORY RISKS

Environmental, health and safety, transportation and storage laws and regulations cause us to incur substantial costs and may subject us to future liabilities and risks.

We are subject to numerous federal, state and local environmental, health, safety and land use laws and regulations in the jurisdictions in which we operate, including the management, storage, transportation and disposal of chemicals and wastes; product regulation; air water and soil contamination; land use, fire code and zoning; and the investigation and cleanup of any spills or releases that may result from our management, handling, storage, sale, or transportation of chemicals and other products. The nature of our business exposes us to risks of liability under these laws and regulations. Ongoing compliance with such laws and regulations is an important consideration for us and we invest substantial capital and incur significant operating costs in our compliance efforts. In addition, societal concerns regarding the safety of chemicals in commerce and their potential impact on the environment have resulted in a growing trend towards increasing levels of product safety and environmental protection regulations and restrictions on the locations and operations of chemical facilities. These concerns have led to, and could continue to result in, more stringent regulatory intervention by governmental authorities. In addition, these concerns could influence public perceptions, impact the commercial viability of the products we sell and increase the costs to comply with increasingly complex regulations, which could have a negative impact on our business, financial condition and results of operations.

In addition, we operate a fleet of more than 350 commercial vehicles, primarily in our Water Treatment Group, which are highly regulated, including by the DOT. The DOT governs transportation matters including authorization to engage in motor carrier service, including the necessary permits to conduct our businesses, equipment operation, and safety. We are audited periodically by the DOT to ensure that we are in compliance with various safety, hours-of-service, and other rules and regulations. If we were found to be out of compliance, the DOT could severely restrict or otherwise impact our operations, which could have a material adverse effect on our operations as a whole, including our results of operations and cash flows.

If we violate applicable laws or regulations, in addition to being required to correct such violations, we could be held liable in administrative, civil or criminal proceedings for substantial fines and other sanctions that could disrupt, limit or halt our operations, which could have a material adverse effect on our operations as a whole, including our results of operations and cash flows. Liabilities associated with the investigation and cleanup of releases of hazardous substances, as well as personal injury, property damages or natural resource damages arising out of such releases of hazardous substances, may be imposed in many situations without regard to violations of laws or regulations or other fault, and may also be imposed jointly and severally (so that a responsible party may be held liable for more than its share of the losses involved, or even the entire loss). Such liabilities can be difficult to identify and the extent of any such liabilities can be difficult to predict. We use, and in the past have used, hazardous substances at many of our facilities, and have generated, and continue to generate, hazardous wastes at a number of our facilities. We have in the past been, and may in the future be, subject to claims relating to exposure to hazardous materials and the associated liabilities may be material.

Many of our products, particularly our food, pharmaceutical and health and nutrition products are subject to government regulation, both in the United States and abroad, which could increase our costs significantly and limit or prevent the sale of such products.

The manufacture, packaging, labeling, advertising, promotion, distribution and sale of many of our products, but our food, pharmaceutical, pesticide and health and nutrition products in particular, are subject to regulation by numerous national and local governmental agencies in the United States and other countries. The primary regulatory bodies in the United States are the Food and Drug Administration (the “FDA”), the Environmental Protection Agency, the United States Department of Agriculture and the Federal Trade Commission, and we are also subject to similar regulators in other countries. Failure to comply with these regulatory requirements may result in various types of penalties or fines. These include injunctions, product withdrawals, recalls, product seizures, fines and criminal prosecutions. Individual states also regulate our products. A state may interpret claims or products presumptively valid under federal law as illegal under that state’s regulations. Approvals or licensing may be conditioned on reformulation of products or may be unavailable with respect to certain products or product ingredients. Any of these government agencies, as well as legislative bodies, can change existing regulations, or impose new ones, or could take aggressive measures, causing or contributing to a variety of negative consequences, which may include one or more of the following:

• stopping the sale of products,

• requirements for the reformulation of certain or all products to meet new standards,

• the recall or discontinuance of certain or all products,

• additional record-keeping requirements,

• expanded documentation of the properties of certain or all products,

• expanded or different labeling,

• adverse event tracking and reporting, and

• additional scientific substantiation.

In particular, the FDA’s current GMPs describe policies and procedures designed to ensure that nutraceuticals, pharmaceuticals and dietary supplements are produced in a quality manner, do not contain contaminants or impurities, and are accurately labeled and cover the manufacturing, packaging, labeling and storing of products, with requirements for quality control, design and construction of manufacturing plants, testing of ingredients and final products, record keeping, and complaints processes. Those who manufacture, package or store dietary supplements must comply with current GMPs. If we or our suppliers fail to comply with current GMPs, the FDA may take enforcement action against us or our suppliers.

Any or all of the potential negative consequences described above could have a material adverse effect on us or substantially increase the cost of doing business in these areas. There can be no assurance that the regulatory environment in which we operate will not change or that such regulatory environment, or any specific action taken against us, will not result in a material adverse effect on us.

FINANCIAL RISKS

The insurance that we maintain may not fully cover all potential exposures.

We maintain lines of commercial insurance, such as property, general liability and casualty insurance, but such insurance may not cover all risks associated with the hazards of our businesses and is subject to limitations, including deductibles and limits on the liabilities covered. We may incur losses beyond the limits or outside the coverage of our insurance policies, including liabilities for environmental remediation and product liability. In addition, from time to time, various types of insurance for companies in the chemical, food or health and nutrition products industries have not been available on commercially acceptable terms or, in some cases, have not been available at all. In the future, we may not be able to obtain coverage at current levels, and our premiums may increase significantly on coverage that we maintain.

Failure to comply with the covenants under our credit facility may have a material adverse effect.

We are party to a credit agreement (the “Credit Agreement”) with U.S. Bank National Association ("U.S. Bank") and other lenders (collectively, the “Lenders”), which includes secured revolving credit facilities (the “Revolving Loan Facility”) totaling $250.0 million. The Revolving Loan Facility includes a $10.0 million letter of credit subfacility and $25.0 million swingline subfacility. At March 31, 2024, we had $99.0 million outstanding under the Revolving Loan Facility.

We may make payments on the Revolving Loan Facility from time to time. If we are unable to generate sufficient cash flow or otherwise obtain funds necessary to make payments on our credit facilities, we could be in default when the facilities become due in 2027. We are also required to comply with several financial covenants under the Credit Agreement. Our ability to comply with these financial covenants may be affected by events beyond our control, which could result in a default under the Credit Agreement; such default may have a material adverse effect on our business, financial condition, operating results or cash flows.

The Credit Agreement also contains other customary affirmative and negative covenants, including covenants that restrict our ability to incur additional indebtedness, dispose of significant assets, make certain investments, including any acquisitions other than permitted acquisitions, make certain payments, enter into sale and leaseback transactions, grant liens on its assets or rate management transactions, subject to certain limitations. These restrictions may adversely affect our business.

Impairment to the carrying value of our goodwill or other intangible assets could adversely affect our financial condition and consolidated results of operations.

Goodwill represents the excess of the cost of acquired businesses over the fair value of identifiable tangible net assets and identifiable intangible assets purchased. Goodwill is tested at least annually for impairment and is tested for impairment more frequently if events or changes in circumstances indicate that the asset might be impaired. A significant amount of judgment is involved in determining if an indication of impairment exists. Factors may include, among others: a significant decline in our expected future cash flows; a sustained, significant decline in our stock price and market capitalization; a significant adverse change in the business climate; unanticipated competition; and slower growth rates. An adverse change in these factors may have a significant impact on the recoverability of the net assets recorded, and any resulting impairment charge in the future could have a material adverse effect on our financial condition and consolidated results of operations.

We evaluate the useful lives of our intangible assets to determine if they are definite- or indefinite-lived. Reaching a determination on useful life requires significant judgments and assumptions regarding the future effects of obsolescence, demand, competition, other economic factors (such as the stability of the industry, legislative action that results in an uncertain or changing regulatory environment, and expected changes in distribution channels), and the expected lives of other related groups of assets.

We cannot accurately predict the amount and timing of any impairment of goodwill and other intangible assets. Should the value of these assets become impaired, there could be a material adverse effect on our financial condition and consolidated results of operations.

ITEM 1B. UNRESOLVED STAFF COMMENTS Hawkins is committed to maintaining robust cybersecurity practices to safeguard our operations, data, and stakeholders' interests.

None.

ITEM 1C. CYBERSECURITY

We monitor our cybersecurity landscape and adapt our strategies and governance practices to mitigate risks in this rapidly evolving area.

The Company acknowledges that cybersecurity threats present a risk of material adverse impacts on our operations, reputation, and financial condition. Cybersecurity threats are continuously evolving, becoming more sophisticated, and increasing in frequency. For Hawkins, these threats can potentially lead to data breaches, theft of intellectual property, operational disruptions, damage to persons and property, and financial losses. We have a comprehensive cybersecurity risk management strategy designed to promptly identify, assess, and mitigate the risk of occurrence and impact from cybersecurity threats. Despite our efforts, it is not possible to completely identify, prevent or mitigate the impacts of cybersecurity threats.

Cybersecurity Governance

Our Board of Directors is primarily responsible for oversight of risks from cybersecurity threats. Our audit committee is specifically responsible for oversight of cybersecurity risks within the Board of Directors. The audit committee is informed of our cybersecurity risk management practices at regularly scheduled meetings, including:

•Our cybersecurity policies and strategies.

•Incident response and recovery plans.

•Employee training and awareness programs.

•Cybersecurity audits and engagement with external cybersecurity experts and advisors on an as-needed basis.

Our Chief Information Officer ("CIO") is responsible for implementing our cybersecurity strategy, developing policies and procedures, and ensuring that appropriate resources are allocated to cybersecurity initiatives. The CIO and senior network and security resources at Hawkins have decades of experience in cybersecurity practices and compliance. The CIO is continually informed about the latest threats and developments in cybersecurity, including potential threats and innovative risk management techniques. This ongoing knowledge acquisition is important for the effective prevention, detection, mitigation, and remediation of cybersecurity incidents. The CIO implements and oversees processes based on the National Institute of Standards and Technology ("NIST") cybersecurity framework and is responsible for the regular monitoring of our information systems. This includes the deployment of advanced security measures and regular system audits to identify potential vulnerabilities. Management reports at least twice yearly to the audit committee on the status of our cybersecurity efforts, including assessments of significant risks identified and actions designed to mitigate such risks.

Cybersecurity Risk Management and Strategy

Our cybersecurity risk management strategy is a separate component of our overall risk management process and is designed to protect our assets, including information technology systems, data, and operations, from cybersecurity threats. This involves:

•Continuous monitoring and assessment of our cybersecurity posture.

•Implementation of security measures such as firewalls, intrusion detection systems, and encryption.

•Ongoing cybersecurity training and testing of our employees.

•Regular cybersecurity assessments and penetration testing.

•Vendor risk management to ensure third-party compliance with our cybersecurity standards.

We also maintain an incident response plan ("IRP") that outlines procedures for responding to cybersecurity incidents, minimizing their impact, and communicating with relevant stakeholders, including regulators, customers, and employees. During a cyber incident, our CIO and network security team assess the severity of the incident and notify key management and (if deemed necessary) our audit committee as promptly as practicable. Our incident plan is reviewed annually and updated as appropriate to address evolving threats and our business conditions.

In the normal course of business, we experience cybersecurity threats and attempted breaches of our systems and network. We classify and track these events based on significance and implement remediation actions that we consider appropriate to address the risks relating to such incidents. We have not experienced any cybersecurity incident and the risks presented by cybersecurity threats have not materially impacted our business strategy, results of operations or financial condition. However, even well-designed and implemented cybersecurity programs cannot completely eliminate cybersecurity threats, and we cannot guarantee that such events or material impacts will not occur in the future.

ITEM 2. PROPERTIES

Our facilities material to our operations consist of our locations described below. In addition to the facilities listed below, our Water Treatment group operates out of several additional warehouse locations, the majority of which are owned by us. We believe that our facilities are adequate and suitable for the purposes they serve. Unless noted, each facility listed below is owned by us and is primarily used as office and warehouse space. We believe that we carry customary levels of insurance covering the replacement of damaged property.

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Group |

Location |

|

Rail/Barge Access |

|

Approx.

Square Feet |

|

Corporate headquarters |

Roseville, MN |

|

|

|

50,000 |

|

Health and Nutrition |

Fullerton, CA (1) |

|

|

|

56,000 |

|

|

Florida, NY (2) |

|

|

|

107,000 |

|

Industrial |

Minneapolis, MN (3) |

|

Rail |

|

177,000 |

|

|

Centralia, IL (3) |

|

Rail |

|

121,000 |

|

|

Dupo, IL (3) (4) |

|

Rail |

|

64,000 |

|

|

St. Paul, MN (3) (5) |

|

Rail/Barge |

|

32,000 |

|

|

Rosemount, MN (3) |

|

Rail |

|

153,000 |

|

Industrial and Water Treatment |

St. Paul, MN (3) (5) |

|

Rail/Barge |

|

59,000 |

|

|

Camanche, IA (3) |

|

Rail/Barge |

|

95,000 |

|

|

Memphis, TN (3) |

|

Rail/Barge |

|

41,000 |

|

Water Treatment |

Apopka, FL (3) |

|

Rail |

|

32,000 |

|

|

Camby, IN (3) |

|

|

|

41,000 |

|

|

Fairborn, OH (6) |

|

Rail |

|

7,000 |

|

|

Fayetteville, TN (3) |

|

|

|

54,000 |

|

|

Sulphur, LA (3) |

|

|

|

30,000 |

(1)This is a leased facility comprising administrative offices and a distribution facility. The lease runs through January 2026.

(2)This is comprised of (i) a 79,000 square foot manufacturing plant which sits on approximately 16 acres and (ii) a leased 28,000 square foot warehouse located in close proximity that is leased until December 2025.

(3)This is a manufacturing and/or distribution facility owned by the Company. This facility includes outside storage tanks for the storage of liquid bulk chemicals, as well as smaller tanks for storing and mixing chemicals.

(4)The land for this facility is leased from a third party. The lease expires in May 2024, with automatic one-year renewal periods.

(5)The land for these facilities is leased from the Port Authority of the City of St. Paul, Minnesota. One of the applicable leases runs through July 2024 with a letter of intent in place to extend the term, one runs through 2028, and one runs through 2044 including all available lease extensions.

(6)This is a bleach manufacturing facility owned by the Company.

ITEM 3. LEGAL PROCEEDINGS

There are no material pending legal proceedings, other than ordinary routine litigation incidental to the business, to which we or any of our subsidiaries are a party or of which any of our property is the subject.

ITEM 4. MINE SAFETY DISCLOSURES ITEM 5.

Not applicable.

PART II

MARKET FOR THE COMPANY’S COMMON EQUITY, RELATED SHAREHOLDER MATTERS AND ISSUER PURCHASES OF EQUITY SECURITIES

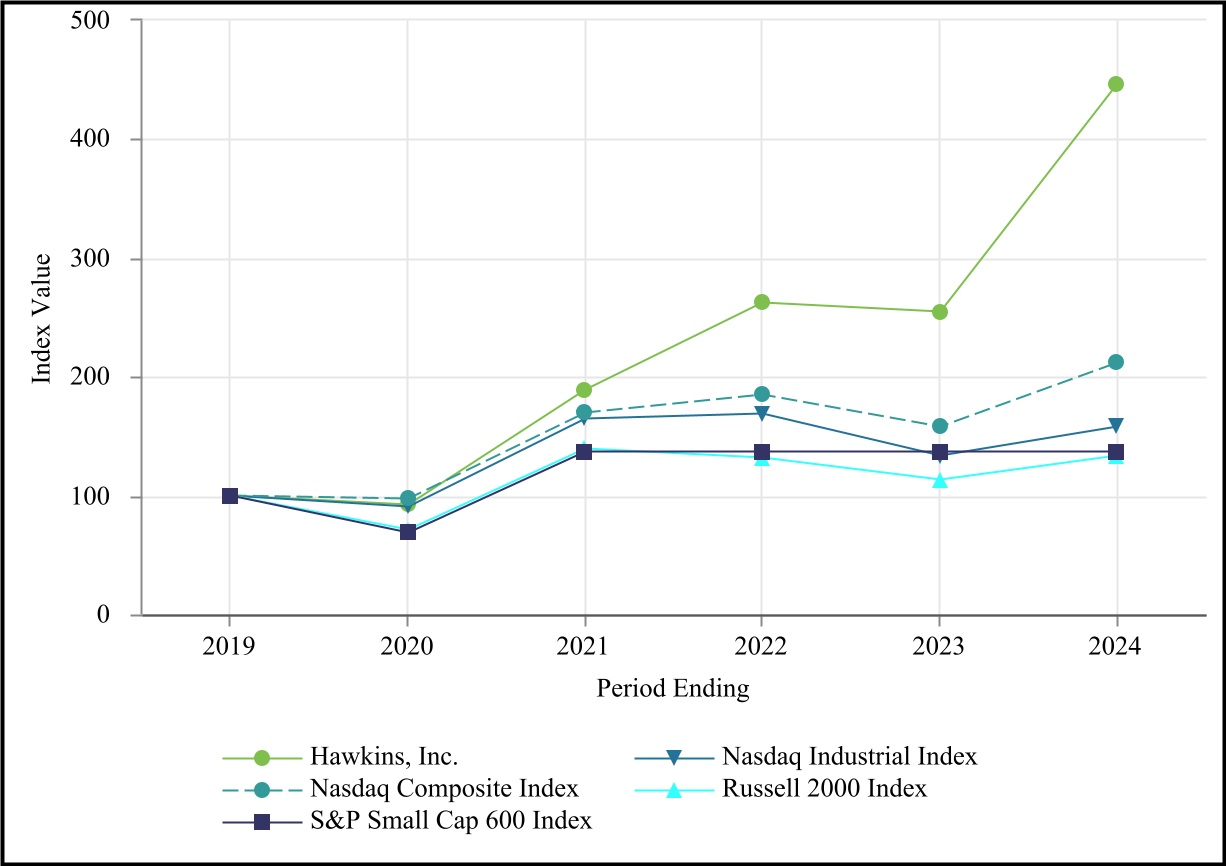

Our common shares are listed on the Nasdaq Global Select Market under the symbol “HWKN.” As of May 10, 2024, shares of our common shares were held by approximately 353 shareholders of record.