| Michigan | 0-7818 | 38-2032782 | ||||||

| (State or other jurisdiction of incorporation) | (Commission File Number) | (IRS Employer Identification No.) | ||||||

|

4200 East Beltline

Grand Rapids, Michigan

|

49525 | ||||

| (Address of principal executive office) | (Zip Code) | ||||

| o | Written communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425) | ||||

| o | Soliciting material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12) | ||||

| o | Pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b)) | ||||

| o | Pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4(c)) | ||||

| Title of each class | Trading symbol(s) | Name of each exchange on which registered | ||||||

| Common stock, no par value | IBCP | NASDAQ Global Select Market | ||||||

Press release dated April 25, 2024. |

|||||

Supplemental data to the Registrant’s press release dated April 25, 2024. |

|||||

| Earnings conference call presentation. | |||||

| INDEPENDENT BANK CORPORATION | ||||||||||||||

| (Registrant) | ||||||||||||||

| Date | 4/25/2024 | By | s/Gavin A. Mohr | |||||||||||

| Gavin A. Mohr, Principal Financial Officer | ||||||||||||||

| For Release: | Immediately | ||||

| Contact: |

William B. Kessel, President and CEO, 616.447.3933

Gavin A. Mohr, Chief Financial Officer, 616.447.3929

|

||||

| Three months ended | |||||||||||

| 3/31/2024 | 3/31/2023 | ||||||||||

| (In thousands) | |||||||||||

| Mortgage loan servicing, net: | |||||||||||

| Revenue, net | $ | 2,219 | $ | 2,222 | |||||||

| Fair value change due to price | 1,265 | (635) | |||||||||

| Fair value change due to pay-downs | (759) | (861) | |||||||||

| Total | $ | 2,725 | $ | 726 | |||||||

| 3/31/2024 | 12/31/2023 | 3/31/2023 | |||||||||||||||

| Loan Type | (Dollars in thousands) | ||||||||||||||||

| Commercial | $ | 25 | $ | 28 | $ | 36 | |||||||||||

| Mortgage | 4,620 | 6,425 | 5,536 | ||||||||||||||

| Installment | 710 | 970 | 644 | ||||||||||||||

| Sub total | 5,355 | 7,423 | 6,216 | ||||||||||||||

| Less - government guaranteed loans | 1,665 | 2,191 | 2,330 | ||||||||||||||

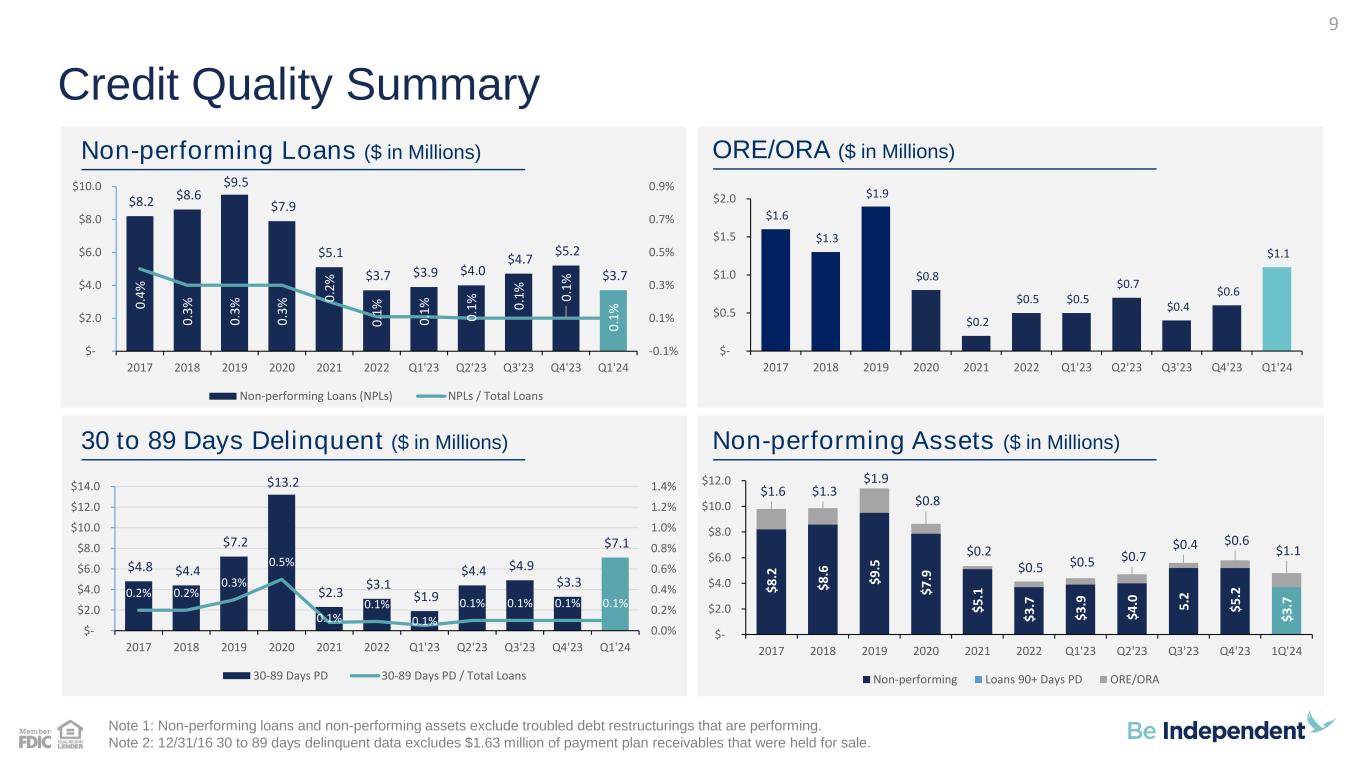

| Total non-performing loans | $ | 3,690 | $ | 5,232 | $ | 3,886 | |||||||||||

| Ratio of non-performing loans to total portfolio loans | 0.10 | % | 0.14 | % | 0.11 | % | |||||||||||

| Ratio of non-performing assets to total assets | 0.09 | % | 0.11 | % | 0.09 | % | |||||||||||

| Ratio of allowance for credit losses to total non-performing loans | 1526.10 | % | 1044.69 | % | 1300.82 | % | |||||||||||

| Regulatory Capital Ratios | 3/31/2024 | 12/31/2023 | Well Capitalized Minimum |

||||||||||||||

| Tier 1 capital to average total assets | 9.05 | % | 8.80 | % | 5.00 | % | |||||||||||

| Tier 1 common equity to risk-weighted assets | 11.37 | % | 11.21 | % | 6.50 | % | |||||||||||

| Tier 1 capital to risk-weighted assets | 11.37 | % | 11.21 | % | 8.00 | % | |||||||||||

| Total capital to risk-weighted assets | 12.62 | % | 12.46 | % | 10.00 | % | |||||||||||

| March 31, 2024 | December 31, 2023 | |||||||||||||

| (Unaudited) | ||||||||||||||

| (In thousands, except share amounts) |

||||||||||||||

| Assets | ||||||||||||||

| Cash and due from banks | $ | 41,646 | $ | 68,208 | ||||||||||

| Interest bearing deposits | 120,198 | 101,573 | ||||||||||||

| Cash and Cash Equivalents | 161,844 | 169,781 | ||||||||||||

| Securities available for sale | 613,620 | 679,350 | ||||||||||||

Securities held to maturity (fair value of $311,013 at March 31, 2024 and $318,606 at December 31, 2023) |

349,957 | 353,988 | ||||||||||||

| Federal Home Loan Bank and Federal Reserve Bank stock, at cost | 16,821 | 16,821 | ||||||||||||

| Loans held for sale, carried at fair value | 8,935 | 12,063 | ||||||||||||

| Loans | ||||||||||||||

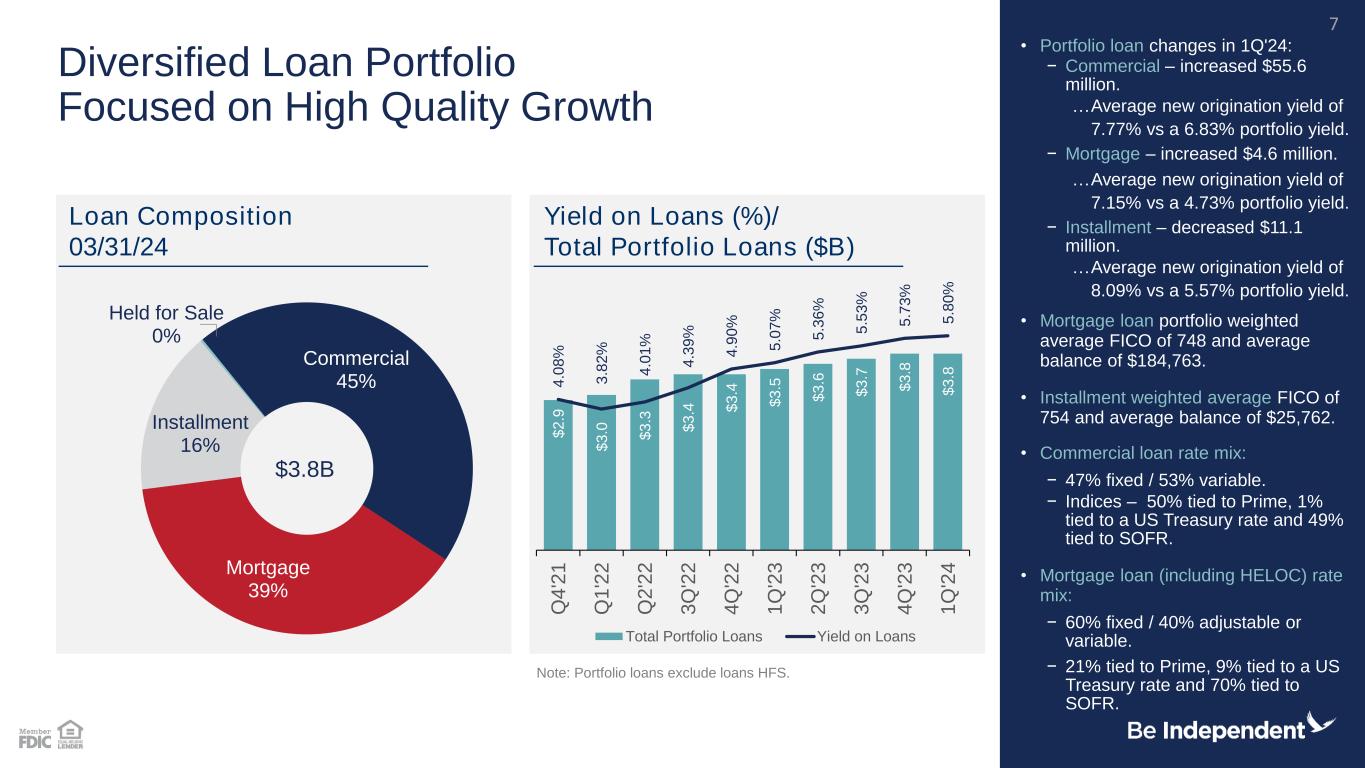

| Commercial | 1,735,284 | 1,679,731 | ||||||||||||

| Mortgage | 1,490,441 | 1,485,872 | ||||||||||||

| Installment | 614,240 | 625,298 | ||||||||||||

| Total Loans | 3,839,965 | 3,790,901 | ||||||||||||

| Allowance for credit losses | (56,313) | (54,658) | ||||||||||||

| Net Loans | 3,783,652 | 3,736,243 | ||||||||||||

| Other real estate and repossessed assets, net | 1,059 | 569 | ||||||||||||

| Property and equipment, net | 34,587 | 35,523 | ||||||||||||

| Bank-owned life insurance | 53,633 | 54,341 | ||||||||||||

| Capitalized mortgage loan servicing rights, carried at fair value | 43,577 | 42,243 | ||||||||||||

| Other intangibles | 1,875 | 2,004 | ||||||||||||

| Goodwill | 28,300 | 28,300 | ||||||||||||

| Accrued income and other assets | 133,395 | 132,500 | ||||||||||||

| Total Assets | $ | 5,231,255 | $ | 5,263,726 | ||||||||||

| Liabilities and Shareholders' Equity | ||||||||||||||

| Deposits | ||||||||||||||

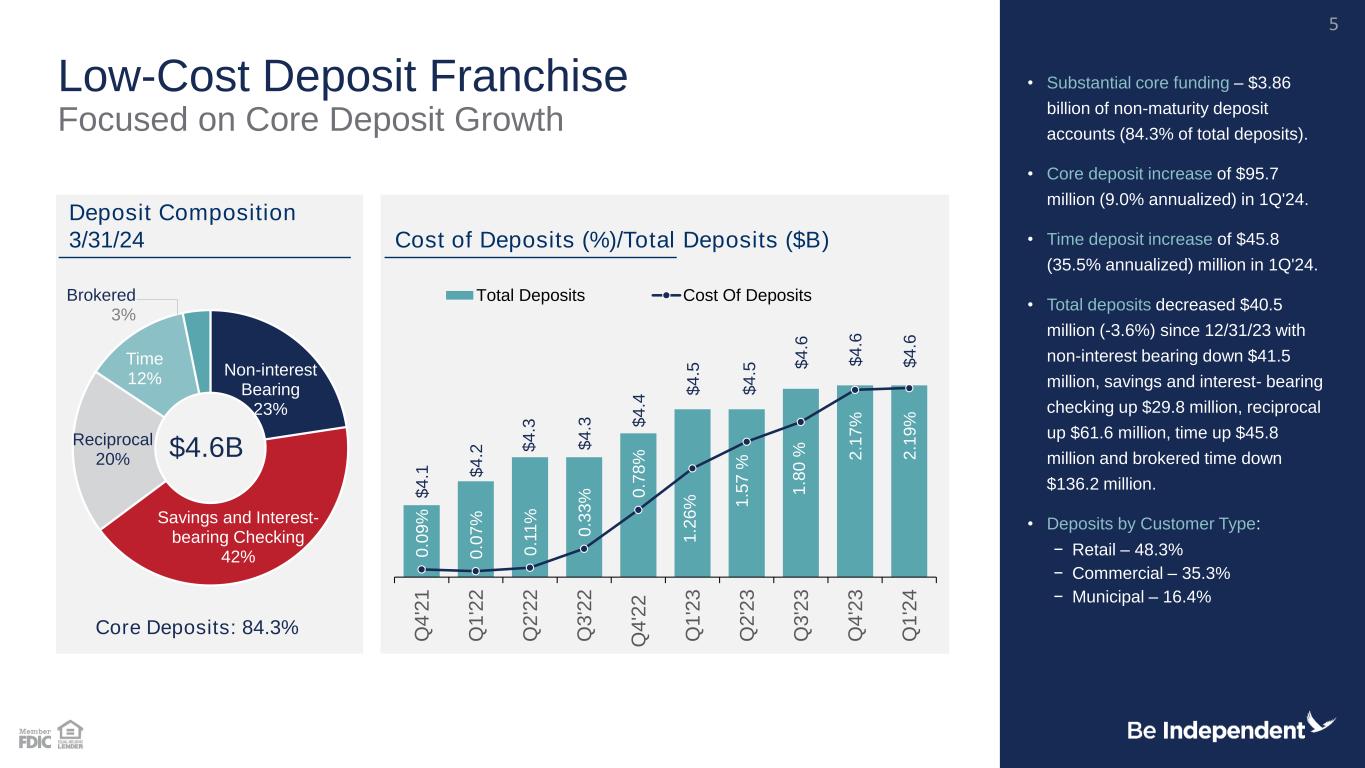

| Non-interest bearing | $ | 1,034,605 | $ | 1,076,093 | ||||||||||

| Savings and interest-bearing checking | 1,935,451 | 1,905,701 | ||||||||||||

| Reciprocal | 893,643 | 832,020 | ||||||||||||

| Time | 570,130 | 524,325 | ||||||||||||

| Brokered time | 148,585 | 284,740 | ||||||||||||

| Total Deposits | 4,582,414 | 4,622,879 | ||||||||||||

| Other borrowings | 49,977 | 50,026 | ||||||||||||

| Subordinated debt | 39,529 | 39,510 | ||||||||||||

| Subordinated debentures | 39,745 | 39,728 | ||||||||||||

| Accrued expenses and other liabilities | 104,020 | 107,134 | ||||||||||||

| Total Liabilities | 4,815,685 | 4,859,277 | ||||||||||||

| Shareholders’ Equity | ||||||||||||||

Preferred stock, no par value, 200,000 shares authorized; none issued or outstanding |

— | — | ||||||||||||

Common stock, no par value, 500,000,000 shares authorized; issued and outstanding: 20,903,677 shares at March 31, 2024 and 20,835,633 shares at December 31, 2023 |

317,099 | 317,483 | ||||||||||||

| Retained earnings | 170,100 | 159,108 | ||||||||||||

| Accumulated other comprehensive loss | (71,629) | (72,142) | ||||||||||||

| Total Shareholders’ Equity | 415,570 | 404,449 | ||||||||||||

| Total Liabilities and Shareholders’ Equity | $ | 5,231,255 | $ | 5,263,726 | ||||||||||

| Three Months Ended | ||||||||||||||||||||

| March 31, 2024 |

December 31, 2023 | March 31, 2023 |

||||||||||||||||||

| (Unaudited) | ||||||||||||||||||||

| Interest Income | (In thousands, except per share amounts) | |||||||||||||||||||

| Interest and fees on loans | $ | 55,043 | $ | 54,333 | $ | 44,294 | ||||||||||||||

| Interest on securities | ||||||||||||||||||||

| Taxable | 5,251 | 5,646 | 5,884 | |||||||||||||||||

| Tax-exempt | 3,391 | 3,434 | 3,083 | |||||||||||||||||

| Other investments | 1,441 | 1,948 | 675 | |||||||||||||||||

| Total Interest Income | 65,126 | 65,361 | 53,936 | |||||||||||||||||

| Interest Expense | ||||||||||||||||||||

| Deposits | 22,810 | 23,111 | 13,760 | |||||||||||||||||

| Other borrowings and subordinated debt and debentures | 2,119 | 2,139 | 1,735 | |||||||||||||||||

| Total Interest Expense | 24,929 | 25,250 | 15,495 | |||||||||||||||||

| Net Interest Income | 40,197 | 40,111 | 38,441 | |||||||||||||||||

| Provision for credit losses | 744 | (617) | 2,160 | |||||||||||||||||

| Net Interest Income After Provision for Credit Losses | 39,453 | 40,728 | 36,281 | |||||||||||||||||

| Non-interest Income | ||||||||||||||||||||

| Interchange income | 3,151 | 3,336 | 3,205 | |||||||||||||||||

| Service charges on deposit accounts | 2,872 | 3,061 | 2,857 | |||||||||||||||||

| Net gains (losses) on assets | ||||||||||||||||||||

| Mortgage loans | 1,364 | 1,961 | 1,256 | |||||||||||||||||

| Securities available for sale | (269) | — | (222) | |||||||||||||||||

| Mortgage loan servicing, net | 2,725 | (2,442) | 726 | |||||||||||||||||

| Other | 2,718 | 3,181 | 2,729 | |||||||||||||||||

| Total Non-interest Income | 12,561 | 9,097 | 10,551 | |||||||||||||||||

| Non-interest Expense | ||||||||||||||||||||

| Compensation and employee benefits | 20,770 | 19,049 | 19,339 | |||||||||||||||||

| Data processing | 3,255 | 2,909 | 2,991 | |||||||||||||||||

| Occupancy, net | 2,074 | 1,933 | 2,159 | |||||||||||||||||

| Interchange expense | 1,097 | 1,110 | 1,049 | |||||||||||||||||

| Furniture, fixtures and equipment | 954 | 974 | 926 | |||||||||||||||||

| FDIC deposit insurance | 782 | 796 | 783 | |||||||||||||||||

| Communications | 615 | 535 | 668 | |||||||||||||||||

| Loan and collection | 512 | 456 | 578 | |||||||||||||||||

| Advertising | 491 | 879 | 495 | |||||||||||||||||

| Legal and professional | 486 | 585 | 607 | |||||||||||||||||

| Costs (recoveries) related to unfunded lending commitments | (652) | 348 | (475) | |||||||||||||||||

| Other | 1,809 | 2,304 | 1,837 | |||||||||||||||||

| Total Non-interest Expense | 32,193 | 31,878 | 30,957 | |||||||||||||||||

| Income Before Income Tax | 19,821 | 17,947 | 15,875 | |||||||||||||||||

| Income tax expense | 3,830 | 4,204 | 2,884 | |||||||||||||||||

| Net Income | $ | 15,991 | $ | 13,743 | $ | 12,991 | ||||||||||||||

| Net Income Per Common Share | ||||||||||||||||||||

| Basic | $ | 0.77 | $ | 0.66 | $ | 0.62 | ||||||||||||||

| Diluted | $ | 0.76 | $ | 0.65 | $ | 0.61 | ||||||||||||||

| March 31, 2024 |

December 31, 2023 |

September 30, 2023 |

June 30, 2023 |

March 31, 2023 |

|||||||||||||||||||||||||

| (unaudited) | |||||||||||||||||||||||||||||

| (Dollars in thousands except per share data) | |||||||||||||||||||||||||||||

| Three Months Ended | |||||||||||||||||||||||||||||

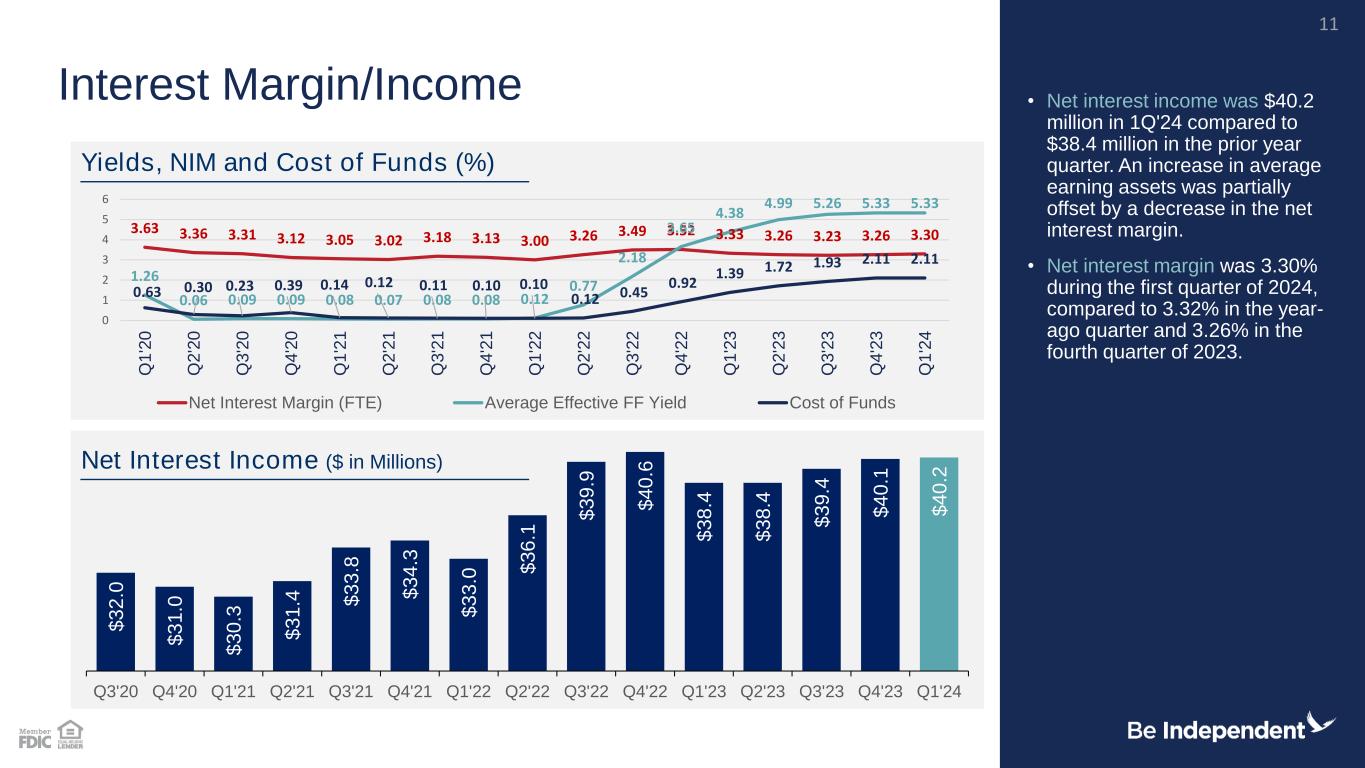

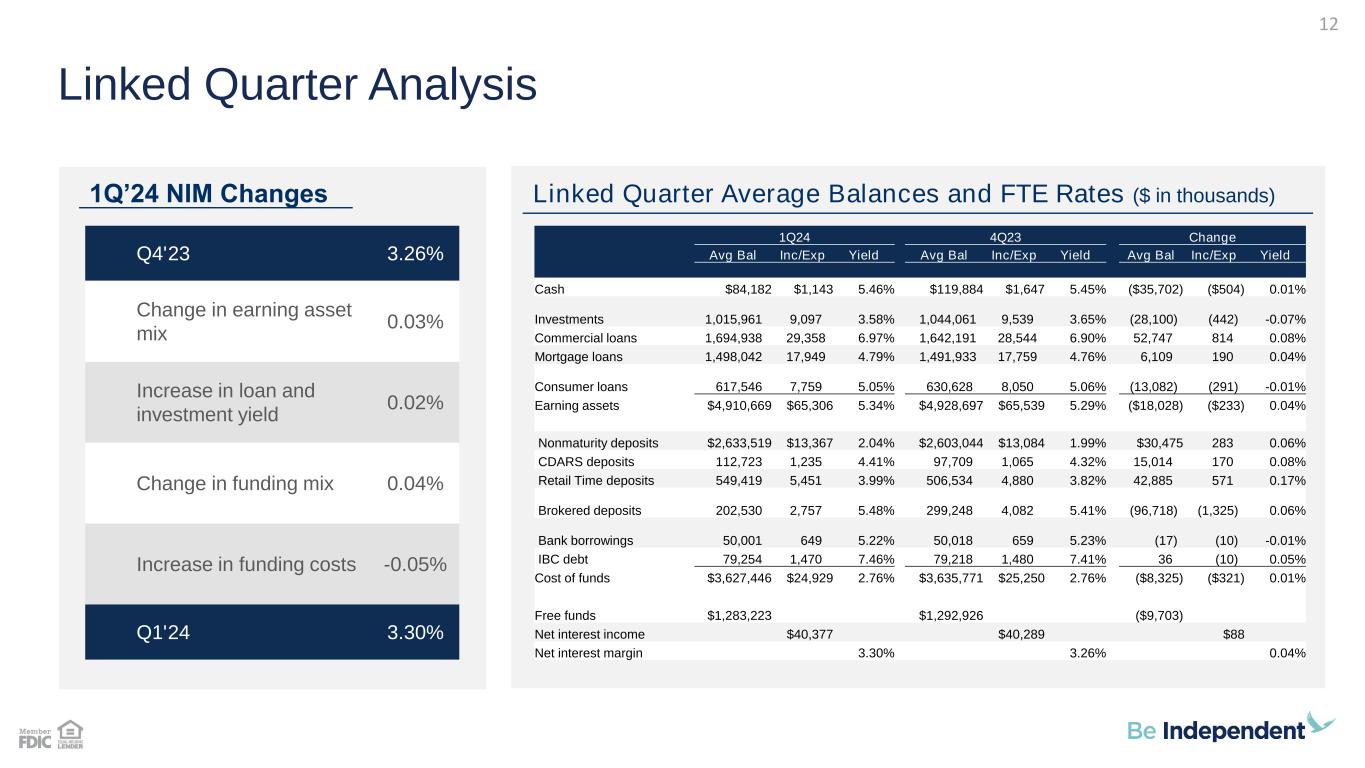

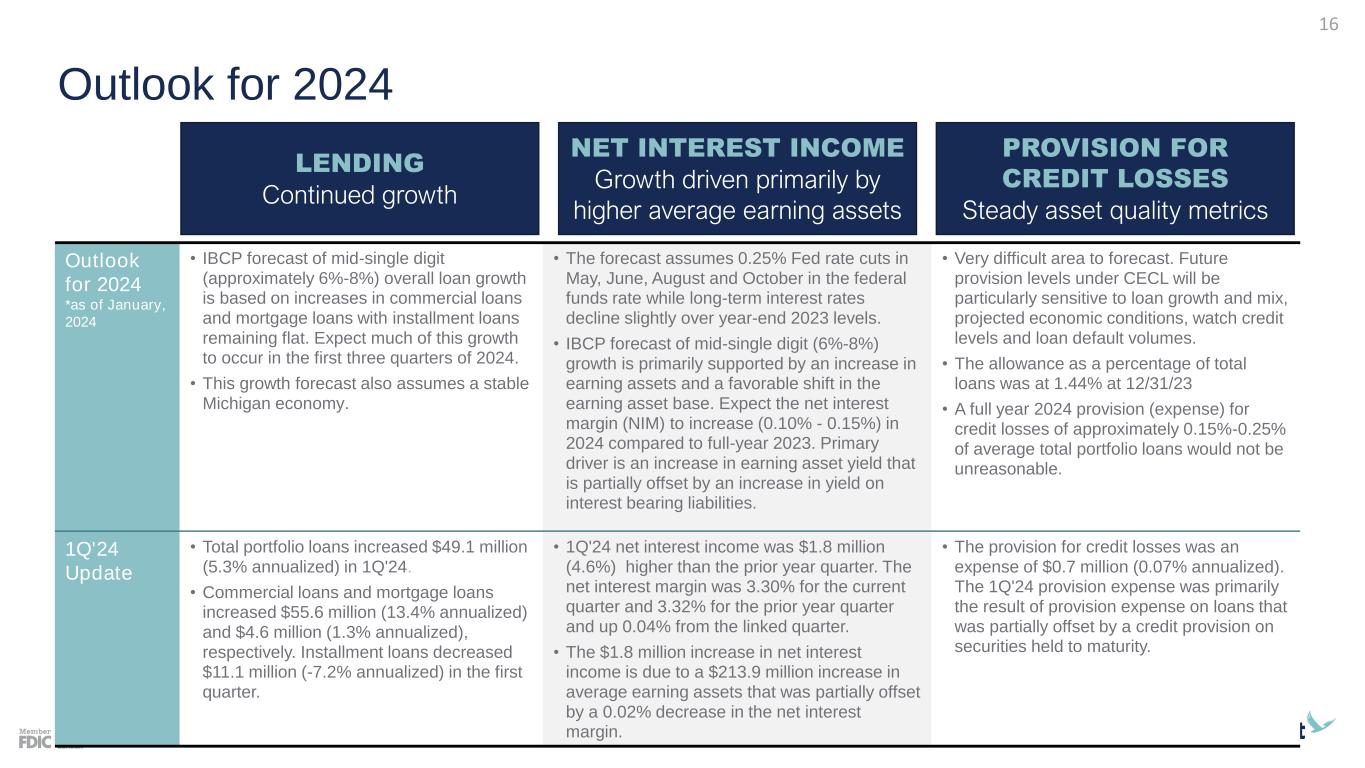

| Net interest income | $ | 40,197 | $ | 40,111 | $ | 39,427 | $ | 38,350 | $ | 38,441 | |||||||||||||||||||

| Provision for credit losses | 744 | (617) | 1,350 | 3,317 | 2,160 | ||||||||||||||||||||||||

| Non-interest income | 12,561 | 9,097 | 15,611 | 15,417 | 10,551 | ||||||||||||||||||||||||

| Non-interest expense | 32,193 | 31,878 | 32,036 | 32,248 | 30,957 | ||||||||||||||||||||||||

| Income before income tax | 19,821 | 17,947 | 21,652 | 18,202 | 15,875 | ||||||||||||||||||||||||

| Income tax expense | 3,830 | 4,204 | 4,109 | 3,412 | 2,884 | ||||||||||||||||||||||||

| Net income | $ | 15,991 | $ | 13,743 | $ | 17,543 | $ | 14,790 | $ | 12,991 | |||||||||||||||||||

| Basic earnings per share | $ | 0.77 | $ | 0.66 | $ | 0.84 | $ | 0.70 | $ | 0.62 | |||||||||||||||||||

| Diluted earnings per share | 0.76 | 0.65 | 0.83 | 0.70 | 0.61 | ||||||||||||||||||||||||

| Cash dividend per share | 0.24 | 0.23 | 0.23 | 0.23 | 0.23 | ||||||||||||||||||||||||

| Average shares outstanding | 20,877,067 | 20,840,680 | 20,922,431 | 21,040,349 | 21,103,831 | ||||||||||||||||||||||||

| Average diluted shares outstanding | 21,079,607 | 21,049,030 | 21,114,445 | 21,222,535 | 21,296,980 | ||||||||||||||||||||||||

| Performance Ratios | |||||||||||||||||||||||||||||

| Return on average assets | 1.24 | % | 1.04 | % | 1.34 | % | 1.18 | % | 1.06 | % | |||||||||||||||||||

| Return on average equity | 15.95 | 14.36 | 18.68 | 16.29 | 14.77 | ||||||||||||||||||||||||

| Efficiency ratio (1) | 60.26 | 64.27 | 57.52 | 59.26 | 62.07 | ||||||||||||||||||||||||

| As a Percent of Average Interest-Earning Assets (1) | |||||||||||||||||||||||||||||

| Interest income | 5.34 | % | 5.29 | % | 5.10 | % | 4.89 | % | 4.66 | % | |||||||||||||||||||

| Interest expense | 2.04 | 2.03 | 1.87 | 1.65 | 1.34 | ||||||||||||||||||||||||

| Net interest income | 3.30 | 3.26 | 3.23 | 3.24 | 3.32 | ||||||||||||||||||||||||

| Average Balances | |||||||||||||||||||||||||||||

| Loans | $ | 3,810,526 | $ | 3,764,752 | $ | 3,694,534 | $ | 3,567,920 | $ | 3,494,169 | |||||||||||||||||||

| Securities | 999,140 | 1,027,240 | 1,071,211 | 1,111,670 | 1,146,075 | ||||||||||||||||||||||||

| Total earning assets | 4,910,669 | 4,928,697 | 4,892,208 | 4,763,295 | 4,696,786 | ||||||||||||||||||||||||

| Total assets | 5,201,452 | 5,233,666 | 5,192,114 | 5,044,746 | 4,988,440 | ||||||||||||||||||||||||

| Deposits | 4,561,645 | 4,612,797 | 4,577,796 | 4,447,843 | 4,417,106 | ||||||||||||||||||||||||

| Interest bearing liabilities | 3,627,446 | 3,635,771 | 3,554,179 | 3,415,621 | 3,304,868 | ||||||||||||||||||||||||

| Shareholders' equity | 403,225 | 379,614 | 372,667 | 364,143 | 356,720 | ||||||||||||||||||||||||

| March 31, 2024 |

December 31, 2023 |

September 30, 2023 |

June 30, 2023 |

March 31, 2023 |

|||||||||||||||||||||||||

| (unaudited) | |||||||||||||||||||||||||||||

| (Dollars in thousands except per share data) | |||||||||||||||||||||||||||||

| End of Period | |||||||||||||||||||||||||||||

| Capital | |||||||||||||||||||||||||||||

| Tangible common equity ratio | 7.41 | % | 7.15 | % | 6.67 | % | 6.75 | % | 6.60 | % | |||||||||||||||||||

| Tangible common equity ratio excluding accumulated other comprehensive loss | 8.57 | 8.31 | 8.20 | 8.09 | 7.95 | ||||||||||||||||||||||||

| Average equity to average assets | 7.75 | 7.25 | 7.18 | 7.22 | 7.15 | ||||||||||||||||||||||||

| Total capital to risk-weighted assets (2) | 13.85 | 13.71 | 13.58 | 13.66 | 13.80 | ||||||||||||||||||||||||

| Tier 1 capital to risk-weighted assets (2) | 11.65 | 11.50 | 11.37 | 11.42 | 11.53 | ||||||||||||||||||||||||

| Common equity tier 1 capital to risk-weighted assets (2) | 10.73 | 10.58 | 10.44 | 10.46 | 10.55 | ||||||||||||||||||||||||

| Tier 1 capital to average assets (2) | 9.29 | 9.03 | 8.94 | 8.97 | 8.92 | ||||||||||||||||||||||||

| Common shareholders' equity per share of common stock | $ | 19.88 | $ | 19.41 | $ | 17.99 | $ | 17.91 | $ | 17.40 | |||||||||||||||||||

| Tangible common equity per share of common stock | 18.44 | 17.96 | 16.53 | 16.45 | 15.94 | ||||||||||||||||||||||||

| Total shares outstanding | 20,903,677 | 20,835,633 | 20,850,455 | 20,943,694 | 21,138,303 | ||||||||||||||||||||||||

| Selected Balances | |||||||||||||||||||||||||||||

| Loans | $ | 3,839,965 | $ | 3,790,901 | $ | 3,741,486 | $ | 3,631,114 | $ | 3,509,809 | |||||||||||||||||||

| Securities | 963,577 | 1,033,338 | 1,043,540 | 1,092,703 | 1,137,103 | ||||||||||||||||||||||||

| Total earning assets | 4,949,496 | 4,954,696 | 4,884,720 | 4,830,185 | 4,860,696 | ||||||||||||||||||||||||

| Total assets | 5,231,255 | 5,263,726 | 5,200,018 | 5,135,564 | 5,138,934 | ||||||||||||||||||||||||

| Deposits | 4,582,414 | 4,622,879 | 4,585,612 | 4,487,636 | 4,544,749 | ||||||||||||||||||||||||

| Interest bearing liabilities | 3,677,060 | 3,676,050 | 3,573,187 | 3,501,280 | 3,481,511 | ||||||||||||||||||||||||

| Shareholders' equity | 415,570 | 404,449 | 374,998 | 375,162 | 367,714 | ||||||||||||||||||||||||

| Three Months Ended March 31, | ||||||||||||||

| 2024 | 2023 | |||||||||||||

| (Dollars in thousands) | ||||||||||||||

| Net Interest Margin, Fully Taxable Equivalent ("FTE") | ||||||||||||||

| Net interest income | $ | 40,197 | $ | 38,441 | ||||||||||

| Add: taxable equivalent adjustment | 180 | 288 | ||||||||||||

| Net interest income - taxable equivalent | $ | 40,377 | $ | 38,729 | ||||||||||

| Net interest margin (GAAP) (1) | 3.28 | % | 3.29 | % | ||||||||||

| Net interest margin (FTE) (1) | 3.30 | % | 3.32 | % | ||||||||||

| March 31, 2024 |

December 31, 2023 | September 30, 2023 | June 30, 2023 | March 31, 2023 | |||||||||||||||||||||||||

| (Dollars in thousands) | |||||||||||||||||||||||||||||

| Common shareholders' equity | $ | 415,570 | $ | 404,449 | $ | 374,998 | $ | 375,162 | $ | 367,714 | |||||||||||||||||||

| Less: | |||||||||||||||||||||||||||||

| Goodwill | 28,300 | 28,300 | 28,300 | 28,300 | 28,300 | ||||||||||||||||||||||||

| Other intangibles | 1,875 | 2,004 | 2,141 | 2,278 | 2,415 | ||||||||||||||||||||||||

| Tangible common equity | 385,395 | 374,145 | 344,557 | 344,584 | 336,999 | ||||||||||||||||||||||||

| Addition: | |||||||||||||||||||||||||||||

| Accumulated other comprehensive loss for regulatory purposes | 65,831 | 66,344 | 86,507 | 74,712 | 75,013 | ||||||||||||||||||||||||

| Tangible common equity excluding other comprehensive loss adjustments | $ | 451,226 | $ | 440,489 | $ | 431,064 | $ | 419,296 | $ | 412,012 | |||||||||||||||||||

| Total assets | $ | 5,231,255 | $ | 5,263,726 | $ | 5,200,018 | $ | 5,135,564 | $ | 5,138,934 | |||||||||||||||||||

| Less: | |||||||||||||||||||||||||||||

| Goodwill | 28,300 | 28,300 | 28,300 | 28,300 | 28,300 | ||||||||||||||||||||||||

| Other intangibles | 1,875 | 2,004 | 2,141 | 2,278 | 2,415 | ||||||||||||||||||||||||

| Tangible assets | 5,201,080 | 5,233,422 | 5,169,577 | 5,104,986 | 5,108,219 | ||||||||||||||||||||||||

| Addition: | |||||||||||||||||||||||||||||

| Net unrealized losses on available for sale securities and derivatives, net of tax | 65,831 | 66,344 | 86,507 | 74,712 | 75,013 | ||||||||||||||||||||||||

| Tangible assets excluding other comprehensive loss adjustments | $ | 5,266,911 | $ | 5,299,766 | $ | 5,256,084 | $ | 5,179,698 | $ | 5,183,232 | |||||||||||||||||||

| Common equity ratio | 7.94 | % | 7.68 | % | 7.21 | % | 7.31 | % | 7.16 | % | |||||||||||||||||||

| Tangible common equity ratio | 7.41 | % | 7.15 | % | 6.67 | % | 6.75 | % | 6.60 | % | |||||||||||||||||||

| Tangible common equity ratio excluding other comprehensive loss | 8.57 | % | 8.31 | % | 8.20 | % | 8.09 | % | 7.95 | % | |||||||||||||||||||

| Tangible Common Equity per Share of Common Stock: | |||||||||||||||||||||||||||||

| Common shareholders' equity | $ | 415,570 | $ | 404,449 | $ | 374,998 | $ | 375,162 | $ | 367,714 | |||||||||||||||||||

| Tangible common equity | $ | 385,395 | $ | 374,145 | $ | 344,557 | $ | 344,584 | $ | 336,999 | |||||||||||||||||||

| Shares of common stock outstanding (in thousands) | 20,904 | 20,836 | 20,850 | 20,944 | 21,138 | ||||||||||||||||||||||||

| Common shareholders' equity per share of common stock | $ | 19.88 | $ | 19.41 | $ | 17.99 | $ | 17.91 | $ | 17.40 | |||||||||||||||||||

| Tangible common equity per share of common stock | $ | 18.44 | $ | 17.96 | $ | 16.53 | $ | 16.45 | $ | 15.94 | |||||||||||||||||||

| March 31, 2024 | December 31, 2023 | September 30, 2023 | June 30, 2023 | March 31, 2023 | |||||||||||||||||||||||||

| (Dollars in thousands) | |||||||||||||||||||||||||||||

| Non-accrual loans | $ | 5,355 | $ | 6,991 | $ | 6,969 | $ | 6,876 | $ | 6,216 | |||||||||||||||||||

| Loans 90 days or more past due and still accruing interest | — | 432 | — | — | — | ||||||||||||||||||||||||

| Subtotal | 5,355 | 7,423 | 6,969 | 6,876 | 6,216 | ||||||||||||||||||||||||

| Less: Government guaranteed loans | 1,665 | 2,191 | 2,254 | 2,882 | 2,330 | ||||||||||||||||||||||||

| Total non-performing loans | 3,690 | 5,232 | 4,715 | 3,994 | 3,886 | ||||||||||||||||||||||||

| Other real estate and repossessed assets | 1,060 | 569 | 443 | 658 | 499 | ||||||||||||||||||||||||

| Total non-performing assets | $ | 4,750 | $ | 5,801 | $ | 5,158 | $ | 4,652 | $ | 4,385 | |||||||||||||||||||

| As a percent of Portfolio Loans | |||||||||||||||||||||||||||||

| Non-performing loans | 0.10 | % | 0.14 | % | 0.13 | % | 0.11 | % | 0.11 | % | |||||||||||||||||||

| Allowance for credit losses | 1.47 | 1.44 | 1.48 | 1.49 | 1.44 | ||||||||||||||||||||||||

| Non-performing assets to total assets | 0.09 | 0.11 | 0.10 | 0.09 | 0.09 | ||||||||||||||||||||||||

| Allowance for credit losses as a percent of non-performing loans | 1,526.10 | 1,044.69 | 1,176.99 | 1,351.13 | 1,300.82 | ||||||||||||||||||||||||

| Three months ended March 31, | |||||||||||||||||||||||||||||||||||

| 2024 | 2023 | ||||||||||||||||||||||||||||||||||

| Loans | Securities | Unfunded Commitments |

Loans | Securities | Unfunded Commitments |

||||||||||||||||||||||||||||||

| (Dollars in thousands) | |||||||||||||||||||||||||||||||||||

| Balance at beginning of period | $ | 54,658 | $ | 157 | $ | 5,504 | $ | 52,435 | $ | 168 | $ | 5,080 | |||||||||||||||||||||||

| Additions (deductions) | |||||||||||||||||||||||||||||||||||

| Provision for credit losses | 1,871 | (1,127) | — | (832) | 2,992 | — | |||||||||||||||||||||||||||||

| Recoveries credited to allowance | 596 | 1,125 | — | 578 | — | — | |||||||||||||||||||||||||||||

| Assets charged against the allowance | (812) | — | — | (1,631) | (3,000) | — | |||||||||||||||||||||||||||||

| Additions included in non-interest expense | — | — | (652) | — | — | (475) | |||||||||||||||||||||||||||||

| Balance at end of period | $ | 56,313 | $ | 155 | $ | 4,852 | $ | 50,550 | $ | 160 | $ | 4,605 | |||||||||||||||||||||||

| Net loans charged (recovered) against the allowance to average Portfolio Loans | 0.02 | % | 0.12 | % | |||||||||||||||||||||||||||||||

1 | ||

| March 31, 2024 | December 31, 2023 | ||||||||||

| (In thousands) | |||||||||||

| Subordinated debt | $ | 39,529 | $ | 39,510 | |||||||

| Subordinated debentures | 39,745 | 39,728 | |||||||||

| Amount not qualifying as regulatory capital | (753) | (734) | |||||||||

| Amount qualifying as regulatory capital | 78,521 | 78,504 | |||||||||

| Shareholders’ equity | |||||||||||

| Common stock | 317,099 | 317,483 | |||||||||

| Retained earnings | 170,100 | 159,108 | |||||||||

| Accumulated other comprehensive income (loss) | (71,629) | (72,142) | |||||||||

| Total shareholders’ equity | 415,570 | 404,449 | |||||||||

| Total capitalization | $ | 494,091 | $ | 482,953 | |||||||

| Three months ended | |||||||||||||||||

| March 31, 2024 | December 31, 2023 | March 31, 2023 | |||||||||||||||

| (In thousands) | |||||||||||||||||

| Interchange income | $ | 3,151 | $ | 3,336 | $ | 3,205 | |||||||||||

| Service charges on deposit accounts | 2,872 | 3,061 | 2,857 | ||||||||||||||

| Net gains (losses) on assets | |||||||||||||||||

| Mortgage loans | 1,364 | 1,961 | 1,256 | ||||||||||||||

| Securities | (269) | — | (222) | ||||||||||||||

| Mortgage loan servicing, net | 2,725 | (2,442) | 726 | ||||||||||||||

| Investment and insurance commissions | 804 | 1,010 | 827 | ||||||||||||||

| Bank owned life insurance | 181 | 141 | 111 | ||||||||||||||

| Other | 1,733 | 2,030 | 1,791 | ||||||||||||||

| Total non-interest income | $ | 12,561 | $ | 9,097 | $ | 10,551 | |||||||||||

| Three months ended March 31, | |||||||||||

| 2024 | 2023 | ||||||||||

| (In thousands) | |||||||||||

| Balance at beginning of period | $ | 42,243 | $ | 42,489 | |||||||

| Originated servicing rights capitalized | 828 | 930 | |||||||||

| Change in fair value | 506 | (1,496) | |||||||||

| Balance at end of period | $ | 43,577 | $ | 41,923 | |||||||

2 | ||

| Three months ended | |||||||||||||||||

| March 31, 2024 | December 31, 2023 | March 31, 2023 | |||||||||||||||

| (Dollars in thousands) | |||||||||||||||||

| Mortgage loans originated | $ | 93,994 | $ | 108,011 | $ | 113,021 | |||||||||||

| Mortgage loans sold | 80,818 | 86,473 | 106,846 | ||||||||||||||

| Net gains on mortgage loans | 1,364 | 1,961 | 1,256 | ||||||||||||||

| Net gains as a percent of mortgage loans sold ("Loan Sales Margin") | 1.69 | % | 2.27 | % | 1.18 | % | |||||||||||

| Fair value adjustments included in the Loan Sales Margin | 0.44 | % | 0.69 | % | 1.20 | % | |||||||||||

| Three months ended | |||||||||||||||||

| March 31, 2024 | December 31, 2023 | March 31, 2023 | |||||||||||||||

| (In thousands) | |||||||||||||||||

| Compensation | $ | 13,277 | $ | 12,656 | $ | 13,269 | |||||||||||

| Performance-based compensation | 3,476 | 2,644 | 2,245 | ||||||||||||||

| Payroll taxes and employee benefits | 4,017 | 3,749 | 3,825 | ||||||||||||||

| Compensation and employee benefits | 20,770 | 19,049 | 19,339 | ||||||||||||||

| Data processing | 3,255 | 2,909 | 2,991 | ||||||||||||||

| Occupancy, net | 2,074 | 1,933 | 2,159 | ||||||||||||||

| Interchange expense | 1,097 | 1,110 | 1,049 | ||||||||||||||

| Furniture, fixtures and equipment | 954 | 974 | 926 | ||||||||||||||

| FDIC deposit insurance | 782 | 796 | 783 | ||||||||||||||

| Communications | 615 | 535 | 668 | ||||||||||||||

| Loan and collection | 512 | 456 | 578 | ||||||||||||||

| Advertising | 491 | 879 | 495 | ||||||||||||||

| Legal and professional | 486 | 585 | 607 | ||||||||||||||

| Amortization of intangible assets | 129 | 137 | 137 | ||||||||||||||

| Supplies | 118 | 138 | 106 | ||||||||||||||

| Correspondent bank service fees | 46 | 55 | 63 | ||||||||||||||

| Provision for loss reimbursement on sold loans | 3 | (1) | 10 | ||||||||||||||

| Net (gains) losses on other real estate and repossessed assets | (76) | 1 | (46) | ||||||||||||||

| Costs (recoveries) related to unfunded lending commitments | (652) | 348 | (475) | ||||||||||||||

| Other | 1,589 | 1,974 | 1,567 | ||||||||||||||

| Total non-interest expense | $ | 32,193 | $ | 31,878 | $ | 30,957 | |||||||||||

3 | ||

| Three Months Ended March 31, | |||||||||||||||||||||||||||||||||||

| 2024 | 2023 | ||||||||||||||||||||||||||||||||||

| Average Balance |

Interest | Rate (2) | Average Balance |

Interest | Rate (2) | ||||||||||||||||||||||||||||||

| (Dollars in thousands) | |||||||||||||||||||||||||||||||||||

| Assets | |||||||||||||||||||||||||||||||||||

| Taxable loans | $ | 3,801,985 | $ | 54,955 | 5.80 | % | $ | 3,487,539 | $ | 44,234 | 5.12 | % | |||||||||||||||||||||||

| Tax-exempt loans (1) | 8,541 | 111 | 5.23 | 6,630 | 76 | 4.65 | |||||||||||||||||||||||||||||

| Taxable securities | 680,133 | 5,251 | 3.09 | 822,572 | 5,884 | 2.86 | |||||||||||||||||||||||||||||

| Tax-exempt securities (1) | 319,007 | 3,548 | 4.45 | 323,503 | 3,355 | 4.15 | |||||||||||||||||||||||||||||

| Interest bearing cash | 84,182 | 1,143 | 5.46 | 38,889 | 464 | 4.84 | |||||||||||||||||||||||||||||

| Other investments | 16,821 | 298 | 7.13 | 17,653 | 211 | 4.85 | |||||||||||||||||||||||||||||

| Interest Earning Assets | 4,910,669 | 65,306 | 5.34 | 4,696,786 | 54,224 | 4.67 | |||||||||||||||||||||||||||||

| Cash and due from banks | 55,550 | 60,442 | |||||||||||||||||||||||||||||||||

| Other assets, net | 235,233 | 231,212 | |||||||||||||||||||||||||||||||||

| Total Assets | $ | 5,201,452 | $ | 4,988,440 | |||||||||||||||||||||||||||||||

| Liabilities | |||||||||||||||||||||||||||||||||||

| Savings and interest-bearing checking | 2,633,519 | 13,367 | 2.04 | 2,535,045 | 8,857 | 1.42 | |||||||||||||||||||||||||||||

| Time deposits | 864,672 | 9,443 | 4.39 | 657,686 | 4,903 | 3.02 | |||||||||||||||||||||||||||||

| Other borrowings | 129,255 | 2,119 | 6.59 | 112,137 | 1,735 | 6.27 | |||||||||||||||||||||||||||||

| Interest Bearing Liabilities | 3,627,446 | 24,929 | 2.76 | % | 3,304,868 | 15,495 | 1.90 | ||||||||||||||||||||||||||||

| Non-interest bearing deposits | 1,063,454 | 1,224,375 | |||||||||||||||||||||||||||||||||

| Other liabilities | 107,327 | 102,477 | |||||||||||||||||||||||||||||||||

| Shareholders’ equity | 403,225 | 356,720 | |||||||||||||||||||||||||||||||||

| Total liabilities and shareholders’ equity | $ | 5,201,452 | $ | 4,988,440 | |||||||||||||||||||||||||||||||

| Net Interest Income | $ | 40,377 | $ | 38,729 | |||||||||||||||||||||||||||||||

| Net Interest Income as a Percent of Average Interest Earning Assets | 3.30 | % | 3.32 | % | |||||||||||||||||||||||||||||||

| (1) | Interest on tax-exempt loans and securities is presented on a fully tax equivalent basis assuming a marginal tax rate of 21%. | ||||

| (2) | Annualized | ||||

4 | ||

| Total Commercial Loans | |||||||||||||||||||||||||||||

| Watch Credits | Percent of Loan Category in Watch Credit | ||||||||||||||||||||||||||||

| Loan Category | All Loans | Performing | Non-accrual | Total | |||||||||||||||||||||||||

| (Dollars in thousands) | |||||||||||||||||||||||||||||

| Land | $ | 10,356 | $ | — | $ | — | $ | — | — | % | |||||||||||||||||||

| Land Development | 16,784 | — | — | — | — | ||||||||||||||||||||||||

| Construction | 135,236 | — | — | — | — | ||||||||||||||||||||||||

| Income Producing | 593,286 | 4,285 | — | 4,285 | 0.7 | ||||||||||||||||||||||||

| Owner Occupied | 490,023 | 14,418 | — | 14,418 | 2.9 | ||||||||||||||||||||||||

| Total Commercial Real Estate Loans | $ | 1,245,685 | $ | 18,703 | $ | — | $ | 18,703 | 1.5 | ||||||||||||||||||||

| Other Commercial Loans | $ | 489,599 | $ | 20,652 | 25 | $ | 20,677 | 4.2 | |||||||||||||||||||||

| Total non-performing commercial loans | $ | 25 | |||||||||||||||||||||||||||

| Total Commercial Loans | |||||||||||||||||||||||||||||

| Watch Credits | Percent of Loan Category in Watch Credit | ||||||||||||||||||||||||||||

| Loan Category | All Loans | Performing | Non-accrual | Total | |||||||||||||||||||||||||

| (Dollars in thousands) | |||||||||||||||||||||||||||||

| Land | $ | 10,620 | $ | 1 | $ | — | $ | 1 | 0.0 | % | |||||||||||||||||||

| Land Development | 17,966 | — | — | — | — | ||||||||||||||||||||||||

| Construction | 101,178 | — | — | — | — | ||||||||||||||||||||||||

| Income Producing | 625,927 | 4,177 | — | 4,177 | 0.7 | ||||||||||||||||||||||||

| Owner Occupied | 449,287 | 15,165 | — | 15,165 | 3.4 | ||||||||||||||||||||||||

| Total Commercial Real Estate Loans | $ | 1,204,978 | $ | 19,343 | $ | — | $ | 19,343 | 1.6 | ||||||||||||||||||||

| Other Commercial Loans | $ | 474,753 | $ | 16,537 | 28 | $ | 16,565 | 3.5 | |||||||||||||||||||||

| Total non-performing commercial loans | $ | 28 | |||||||||||||||||||||||||||

5 | ||