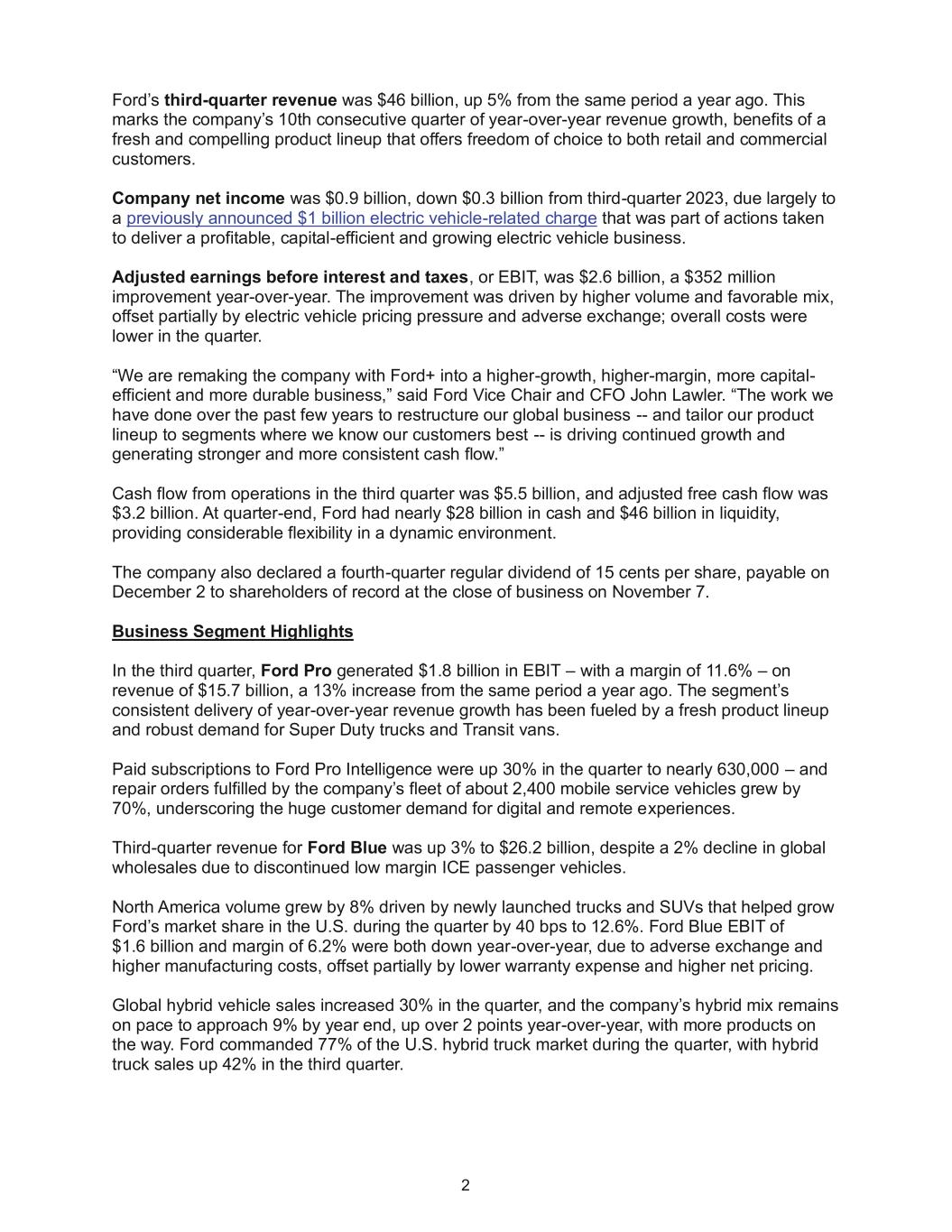

1 https://ford.to/facebook https://x.com/ford https://ford.to/linkedin Cost Improvement, Ford Pro Growth Fuel Solid Q3 Results; Ford+ Sets Up Long-term Value Creation • Ford reports third quarter revenue of $46 billion; net income of $0.9 billion, including a previously announced $1 billion electric vehicle-related charge; adjusted EBIT of $2.6 billion • Ford Pro revenue increases 13%; Ford Pro Intelligence paid software subscriptions up 30% to nearly 630,000 users • Company declares fourth-quarter regular dividend of 15 cents per share • Full-year 2024 adjusted EBIT now expected to be about $10 billion DEARBORN, Mich., Oct. 28, 2024 – Ford reported third-quarter 2024 results that indicate the long-term value creation made possible by a winning lineup of internal combustion, hybrid and electric vehicles for retail and commercial customers combined with an advantaged strategy and global footprint. “We are in a strong position with Ford+ as our industry undergoes a sweeping transformation,” said Ford President and CEO Jim Farley. “We have made strategic decisions and taken the tough actions to create advantages for Ford versus the competition in key areas like Ford Pro, international operations, software and next-generation electric vehicles. Importantly, over time, we have significant financial upside as we bend the curve on cost and quality, a key focus of our team.” Company Key Metrics Summary Third Quarter First Nine Months 2023 2024 H / (L) 2023 2024 H / (L) Wholesale Units (000) 1,086 1,095 9 3,261 3,282 21 GAAP Cash Flows from Op. Activities ($B) $ 4.6 $ 5.5 $ 0.9 $ 12.4 $ 12.4 $ (0.0) Revenue ($B) 43.8 46.2 2.4 130.2 136.8 6.6 Net Income / (Loss) ($B) 1.2 0.9 (0.3) 4.9 4.1 (0.8) Net Income / (Loss) Margin (%) 2.7 % 1.9 % (0.8) ppts 3.7 % 3.0 % (0.8) ppts EPS (Diluted) $ 0.30 $ 0.22 $ (0.08) $ 1.21 $ 1.01 $ (0.20) Non-GAAP Company Adj. Free Cash Flow ($B) $ 1.2 $ 3.2 $ 2.0 $ 4.8 $ 5.9 $ 1.1 Company Adj. EBIT ($B) 2.2 2.6 0.4 9.4 8.1 (1.3) Company Adj. EBIT Margin (%) 5.0 % 5.5 % 0.5 ppts 7.2 % 5.9 % (1.3) ppts Adjusted EPS (Diluted) $ 0.39 $ 0.49 $ 0.10 $ 1.73 $ 1.46 $ (0.27) Adjusted ROIC (Trailing Four Qtrs) 15.1 % 11.4 % (3.7) ppts

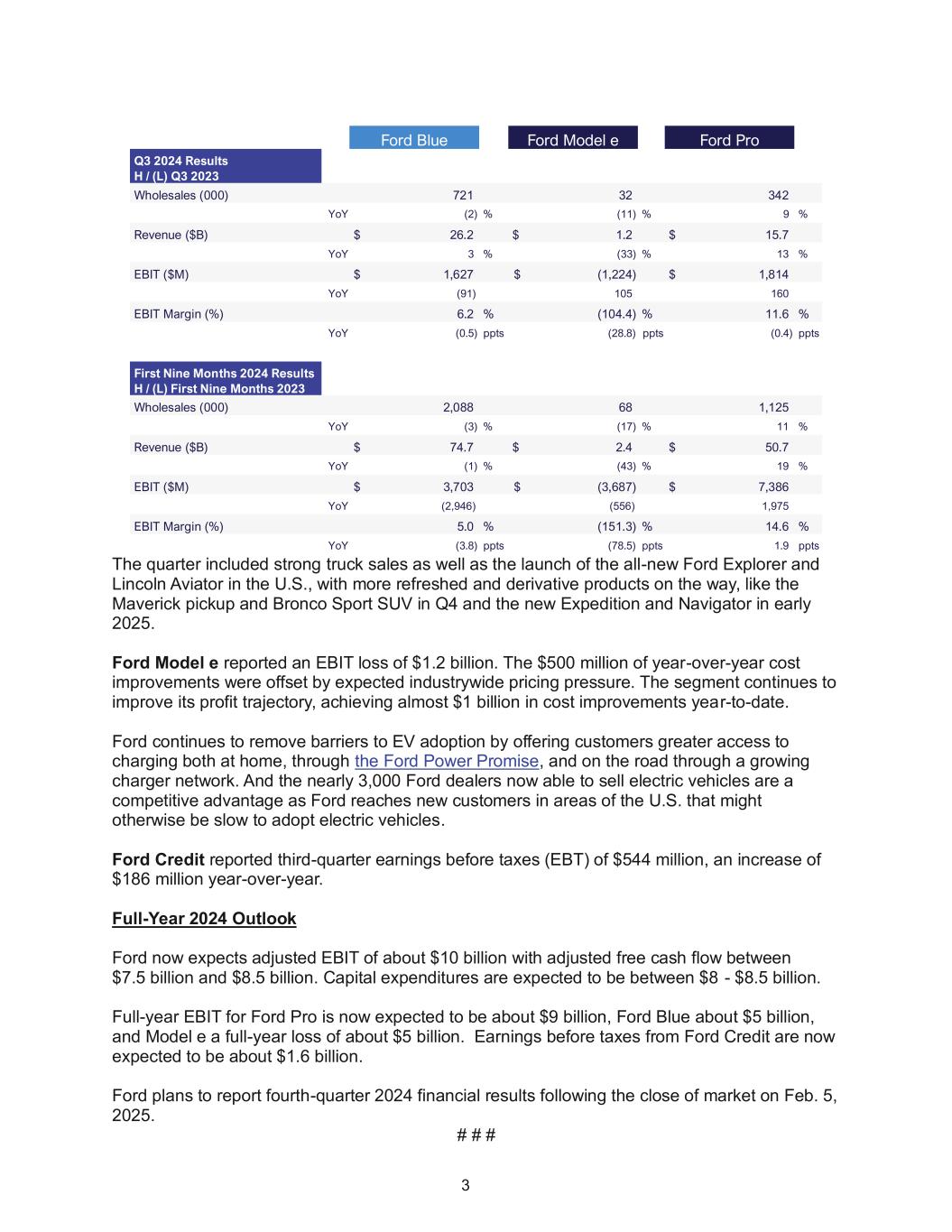

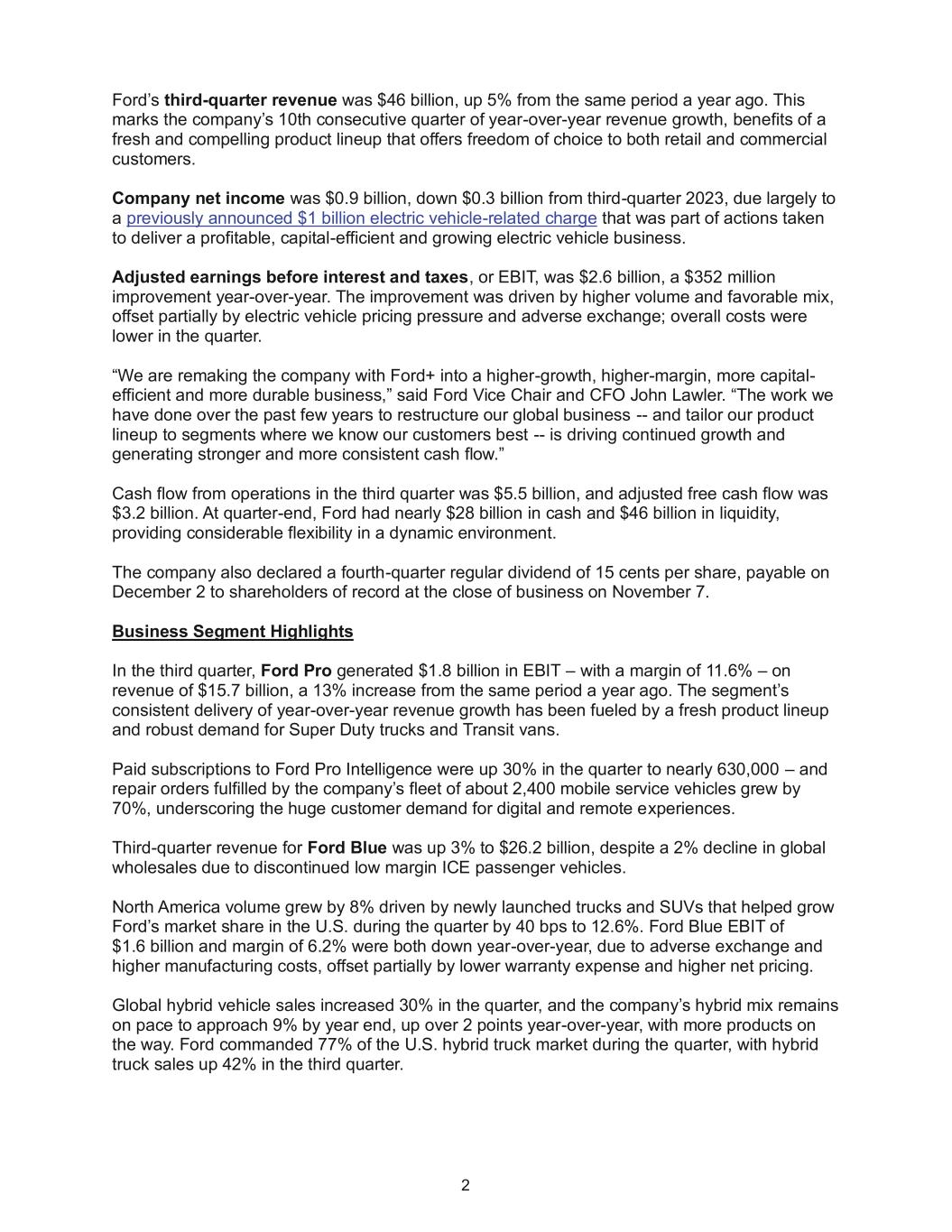

2 Ford’s third-quarter revenue was $46 billion, up 5% from the same period a year ago. This marks the company’s 10th consecutive quarter of year-over-year revenue growth, benefits of a fresh and compelling product lineup that offers freedom of choice to both retail and commercial customers. Company net income was $0.9 billion, down $0.3 billion from third-quarter 2023, due largely to a previously announced $1 billion electric vehicle-related charge that was part of actions taken to deliver a profitable, capital-efficient and growing electric vehicle business. Adjusted earnings before interest and taxes, or EBIT, was $2.6 billion, a $352 million improvement year-over-year. The improvement was driven by higher volume and favorable mix, offset partially by electric vehicle pricing pressure and adverse exchange; overall costs were lower in the quarter. “We are remaking the company with Ford+ into a higher-growth, higher-margin, more capital- efficient and more durable business,” said Ford Vice Chair and CFO John Lawler. “The work we have done over the past few years to restructure our global business -- and tailor our product lineup to segments where we know our customers best -- is driving continued growth and generating stronger and more consistent cash flow.” Cash flow from operations in the third quarter was $5.5 billion, and adjusted free cash flow was $3.2 billion. At quarter-end, Ford had nearly $28 billion in cash and $46 billion in liquidity, providing considerable flexibility in a dynamic environment. The company also declared a fourth-quarter regular dividend of 15 cents per share, payable on December 2 to shareholders of record at the close of business on November 7. Business Segment Highlights In the third quarter, Ford Pro generated $1.8 billion in EBIT – with a margin of 11.6% – on revenue of $15.7 billion, a 13% increase from the same period a year ago. The segment’s consistent delivery of year-over-year revenue growth has been fueled by a fresh product lineup and robust demand for Super Duty trucks and Transit vans. Paid subscriptions to Ford Pro Intelligence were up 30% in the quarter to nearly 630,000 – and repair orders fulfilled by the company’s fleet of about 2,400 mobile service vehicles grew by 70%, underscoring the huge customer demand for digital and remote experiences. Third-quarter revenue for Ford Blue was up 3% to $26.2 billion, despite a 2% decline in global wholesales due to discontinued low margin ICE passenger vehicles. North America volume grew by 8% driven by newly launched trucks and SUVs that helped grow Ford’s market share in the U.S. during the quarter by 40 bps to 12.6%. Ford Blue EBIT of $1.6 billion and margin of 6.2% were both down year-over-year, due to adverse exchange and higher manufacturing costs, offset partially by lower warranty expense and higher net pricing. Global hybrid vehicle sales increased 30% in the quarter, and the company’s hybrid mix remains on pace to approach 9% by year end, up over 2 points year-over-year, with more products on the way. Ford commanded 77% of the U.S. hybrid truck market during the quarter, with hybrid truck sales up 42% in the third quarter.

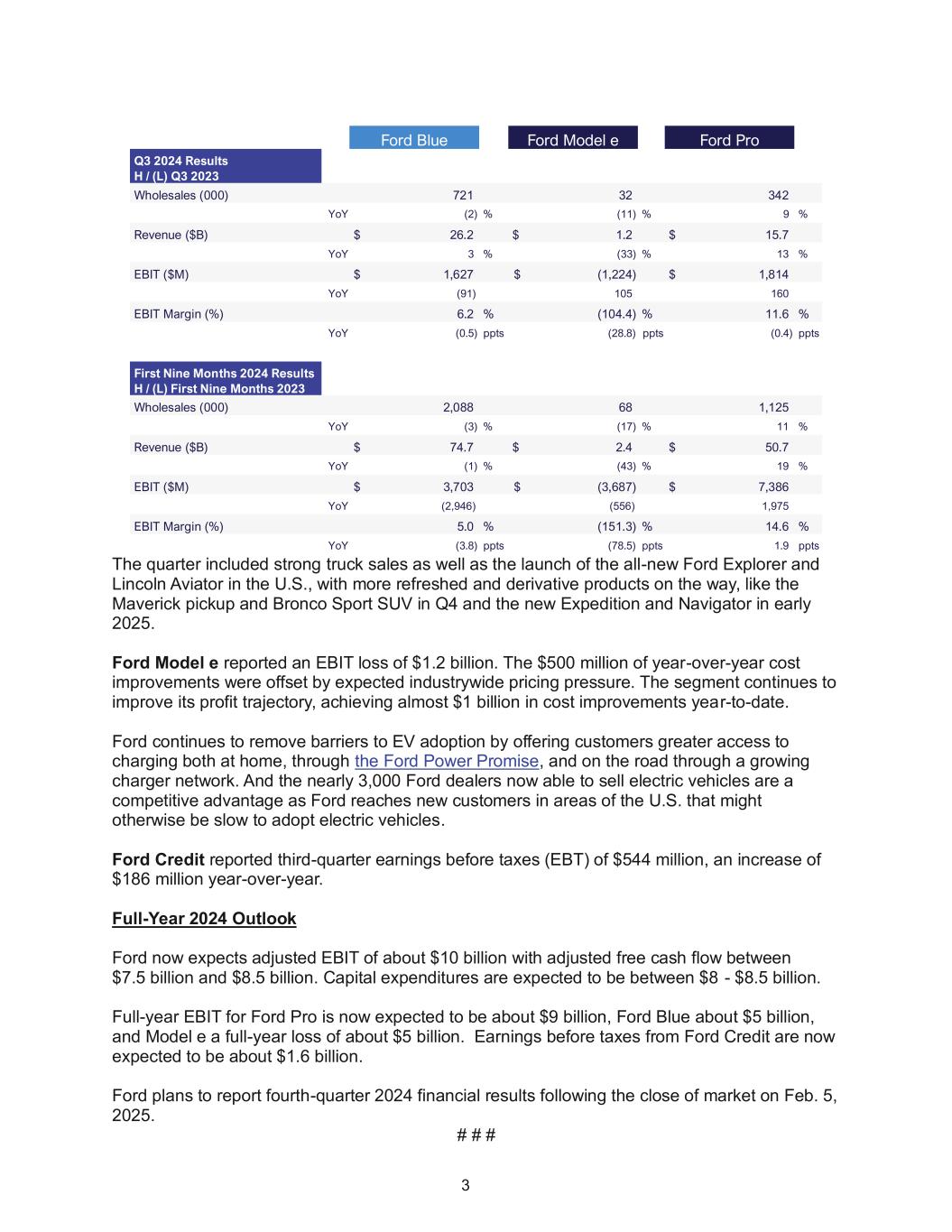

3 Ford Blue Ford Model e Ford Pro Q3 2024 Results H / (L) Q3 2023 Wholesales (000) 721 32 342 YoY (2) % (11) % 9 % Revenue ($B) $ 26.2 $ 1.2 $ 15.7 YoY 3 % (33) % 13 % EBIT ($M) $ 1,627 $ (1,224) $ 1,814 YoY (91) 105 160 EBIT Margin (%) 6.2 % (104.4) % 11.6 % YoY (0.5) ppts (28.8) ppts (0.4) ppts First Nine Months 2024 Results H / (L) First Nine Months 2023 Wholesales (000) 2,088 68 1,125 YoY (3) % (17) % 11 % Revenue ($B) $ 74.7 $ 2.4 $ 50.7 YoY (1) % (43) % 19 % EBIT ($M) $ 3,703 $ (3,687) $ 7,386 YoY (2,946) (556) 1,975 EBIT Margin (%) 5.0 % (151.3) % 14.6 % YoY (3.8) ppts (78.5) ppts 1.9 ppts The quarter included strong truck sales as well as the launch of the all-new Ford Explorer and Lincoln Aviator in the U.S., with more refreshed and derivative products on the way, like the Maverick pickup and Bronco Sport SUV in Q4 and the new Expedition and Navigator in early 2025. Ford Model e reported an EBIT loss of $1.2 billion. The $500 million of year-over-year cost improvements were offset by expected industrywide pricing pressure. The segment continues to improve its profit trajectory, achieving almost $1 billion in cost improvements year-to-date. Ford continues to remove barriers to EV adoption by offering customers greater access to charging both at home, through the Ford Power Promise, and on the road through a growing charger network. And the nearly 3,000 Ford dealers now able to sell electric vehicles are a competitive advantage as Ford reaches new customers in areas of the U.S. that might otherwise be slow to adopt electric vehicles. Ford Credit reported third-quarter earnings before taxes (EBT) of $544 million, an increase of $186 million year-over-year. Full-Year 2024 Outlook Ford now expects adjusted EBIT of about $10 billion with adjusted free cash flow between $7.5 billion and $8.5 billion. Capital expenditures are expected to be between $8 - $8.5 billion. Full-year EBIT for Ford Pro is now expected to be about $9 billion, Ford Blue about $5 billion, and Model e a full-year loss of about $5 billion. Earnings before taxes from Ford Credit are now expected to be about $1.6 billion. Ford plans to report fourth-quarter 2024 financial results following the close of market on Feb. 5, 2025. # # #

4 About Ford Motor Company Ford Motor Company (NYSE: F) is a global company based in Dearborn, Michigan, committed to helping build a better world, where every person is free to move and pursue their dreams. The company’s Ford+ plan for growth and value creation combines existing strengths, new capabilities and always-on relationships with customers to enrich experiences for customers and deepen their loyalty. Ford develops and delivers innovative, must-have Ford trucks, sport utility vehicles, commercial vans and cars and Lincoln luxury vehicles, along with connected services. The company does that through three customer- centered business segments: Ford Blue, engineering iconic gas-powered and hybrid vehicles; Ford Model e, inventing breakthrough electric vehicles along with embedded software that defines exceptional digital experiences for all customers; and Ford Pro, helping commercial customers transform and expand their businesses with vehicles and services tailored to their needs. Additionally, Ford provides financial services through Ford Motor Credit Company. Ford employs about 174,000 people worldwide. More information about the company and its products and services is available at corporate.ford.com. Contacts: Media Equity Investment Community Fixed Income Investment Community Shareholder Inquiries Ian Thibodeau Lynn Antipas Tyson Jessica Vila- Goulding 1.800.555.5259 or 1.313.268.6056 1.914.485.1150 1.313.248.3896 1.313.845.8540 ithibode@ford.com ltyson4@ford.com jvila5@ford.com stockinf@ford.com

5 Conference Call Details Ford Motor Company (NYSE: F) and Ford Motor Credit Company released their third-quarter 2024 financial results at 4:05 p.m. ET on Monday, October 28. Following the release, at 5:00 p.m. ET, Jim Farley, Ford president and chief executive officer; John Lawler, Ford vice chair and chief financial officer; and other members of the Ford senior leadership team will host a conference call to discuss the results in the context of the company’s ambitious Ford+ plan for growth and value creation. The presentation and supporting materials will be available at shareholder.ford.com. Representatives of the investment community will be able to ask questions on the call. Ford Third-Quarter Earnings Call: Monday, October 28, at 5:00 p.m. ET Listen Only Dial In: 1-805-309-0220 International Dial In Lines: Click here Conference ID: 9261965# Webcast: Click here Replay Available after 8:00 p.m. ET on Monday, October 28, and through Monday, November 4 Webcast: Click here The following applies to the information throughout this release: • See tables later in this release for the nature and amount of special items, and reconciliations of the non-GAAP financial measures designated as “adjusted” to the most comparable financial measures calculated in accordance with U.S. generally accepted accounting principles (“GAAP”). • Wholesale unit and production volumes include Ford and Lincoln brand vehicles produced and sold by Ford or our unconsolidated affiliates and Jiangling Motors Corporation (“JMC”) brand vehicles produced and sold in China by our unconsolidated affiliate. Revenue does not include vehicles produced and sold by our unconsolidated affiliates. Wholesales and revenue exclude transactions between the Ford Blue, Ford Model e and Ford Pro business segments. See materials supporting the October 28, 2024, conference call at shareholder.ford.com for further discussion of wholesale unit volumes. Cautionary Note on Forward-Looking Statements Statements included or incorporated by reference herein may constitute “forward-looking statements” within the meaning of the Private Securities Litigation Reform Act of 1995. Forward-looking statements are based on expectations, forecasts, and assumptions by our management and involve a number of risks, uncertainties, and other factors that could cause actual results to differ materially from those stated, including, without limitation: • Ford is highly dependent on its suppliers to deliver components in accordance with Ford’s production schedule and specifications, and a shortage of or inability to acquire key components or raw materials, such as lithium, cobalt, nickel, graphite, and manganese, can disrupt Ford’s production of vehicles; • To facilitate access to the raw materials and other components necessary for the production of electric vehicles, Ford has entered into and may, in the future, enter into multi-year commitments to raw material and other suppliers that subject Ford to risks associated with lower future demand for such items as well as costs that fluctuate and are difficult to accurately forecast; • Ford’s long-term competitiveness depends on the successful execution of Ford+;

6 • Ford’s vehicles could be affected by defects that result in recall campaigns, increased warranty costs, or delays in new model launches, and the time it takes to improve the quality of our vehicles and services could continue to have an adverse effect on our business; • Ford may not realize the anticipated benefits of existing or pending strategic alliances, joint ventures, acquisitions, divestitures, or business strategies; • Ford may not realize the anticipated benefits of restructuring actions and such actions may cause Ford to incur significant charges, disrupt our operations, or harm our reputation; • Operational information systems, security systems, vehicles, and services could be affected by cybersecurity incidents, ransomware attacks, and other disruptions and impact Ford and Ford Credit as well as their suppliers and dealers; • Ford’s production, as well as Ford’s suppliers’ production, and/or the ability to deliver products to consumers could be disrupted by labor issues, public health issues, natural or man-made disasters, adverse effects of climate change, financial distress, production difficulties, capacity limitations, or other factors; • Failure to develop and deploy secure digital services that appeal to customers could have a negative impact on Ford’s business; • Ford’s ability to maintain a competitive cost structure could be affected by labor or other constraints; • Ford’s ability to attract, develop, grow, and reward talent is critical to its success and competitiveness; • Ford’s new and existing products and digital, software, and physical services are subject to market acceptance and face significant competition from existing and new entrants in the automotive and digital and software services industries, and its reputation may be harmed if it is unable to achieve the initiatives it has announced; • Ford’s results are dependent on sales of larger, more profitable vehicles, particularly in the United States; • With a global footprint and supply chain, Ford’s results and operations could be adversely affected by economic or geopolitical developments, including protectionist trade policies such as tariffs, or other events; • Industry sales volume can be volatile and could decline if there is a financial crisis, recession, public health emergency, or significant geopolitical event; • Ford may face increased price competition or a reduction in demand for its products resulting from industry excess capacity, currency fluctuations, competitive actions, or other factors, particularly for electric vehicles; • Inflationary pressure and fluctuations in commodity and energy prices, foreign currency exchange rates, interest rates, and market value of Ford or Ford Credit’s investments, including marketable securities, can have a significant effect on results; • Ford and Ford Credit’s access to debt, securitization, or derivative markets around the world at competitive rates or in sufficient amounts could be affected by credit rating downgrades, market volatility, market disruption, regulatory requirements, or other factors; • The impact of government incentives on Ford’s business could be significant, and Ford’s receipt of government incentives could be subject to reduction, termination, or clawback; • Ford Credit could experience higher-than-expected credit losses, lower-than-anticipated residual values, or higher-than-expected return volumes for leased vehicles; • Economic and demographic experience for pension and OPEB plans (e.g., discount rates or investment returns) could be worse than Ford has assumed; • Pension and other postretirement liabilities could adversely affect Ford’s liquidity and financial condition; • Ford and Ford Credit could experience unusual or significant litigation, governmental investigations, or adverse publicity arising out of alleged defects in products, services, perceived environmental impacts, or otherwise;

7 • Ford may need to substantially modify its product plans and facilities to comply with safety, emissions, fuel economy, autonomous driving technology, environmental, and other regulations; • Ford and Ford Credit could be affected by the continued development of more stringent privacy, data use, data protection, and artificial intelligence laws and regulations as well as consumers’ heightened expectations to safeguard their personal information; and • Ford Credit could be subject to new or increased credit regulations, consumer protection regulations, or other regulations. We cannot be certain that any expectation, forecast, or assumption made in preparing forward-looking statements will prove accurate, or that any projection will be realized. It is to be expected that there may be differences between projected and actual results. Our forward-looking statements speak only as of the date of their initial issuance, and we do not undertake any obligation to update or revise publicly any forward-looking statement, whether as a result of new information, future events, or otherwise. For additional discussion, see “Item 1A. Risk Factors” in our Annual Report on Form 10-K for the year ended December 31, 2023, as updated by our subsequent Quarterly Reports on Form 10-Q and Current Reports on Form 8-K.

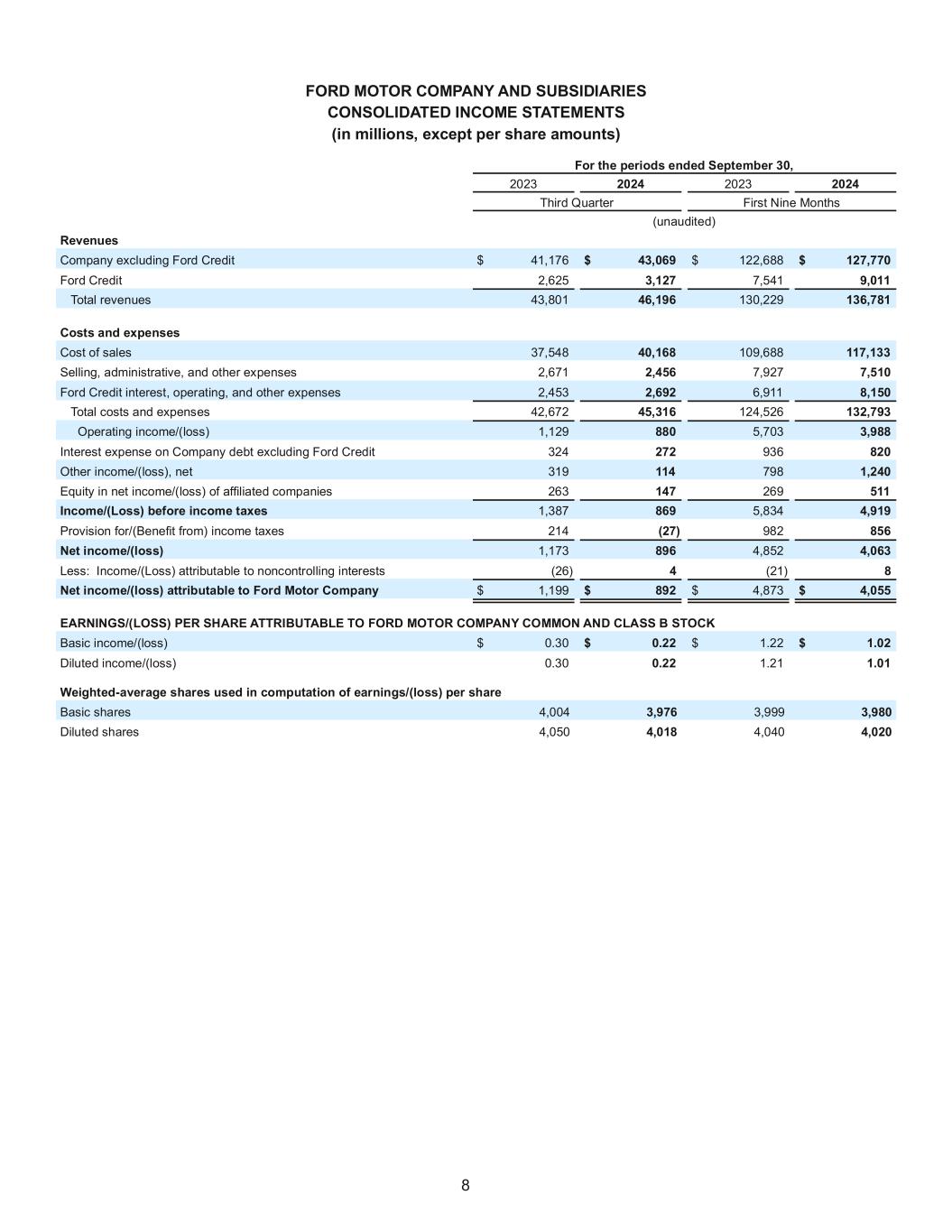

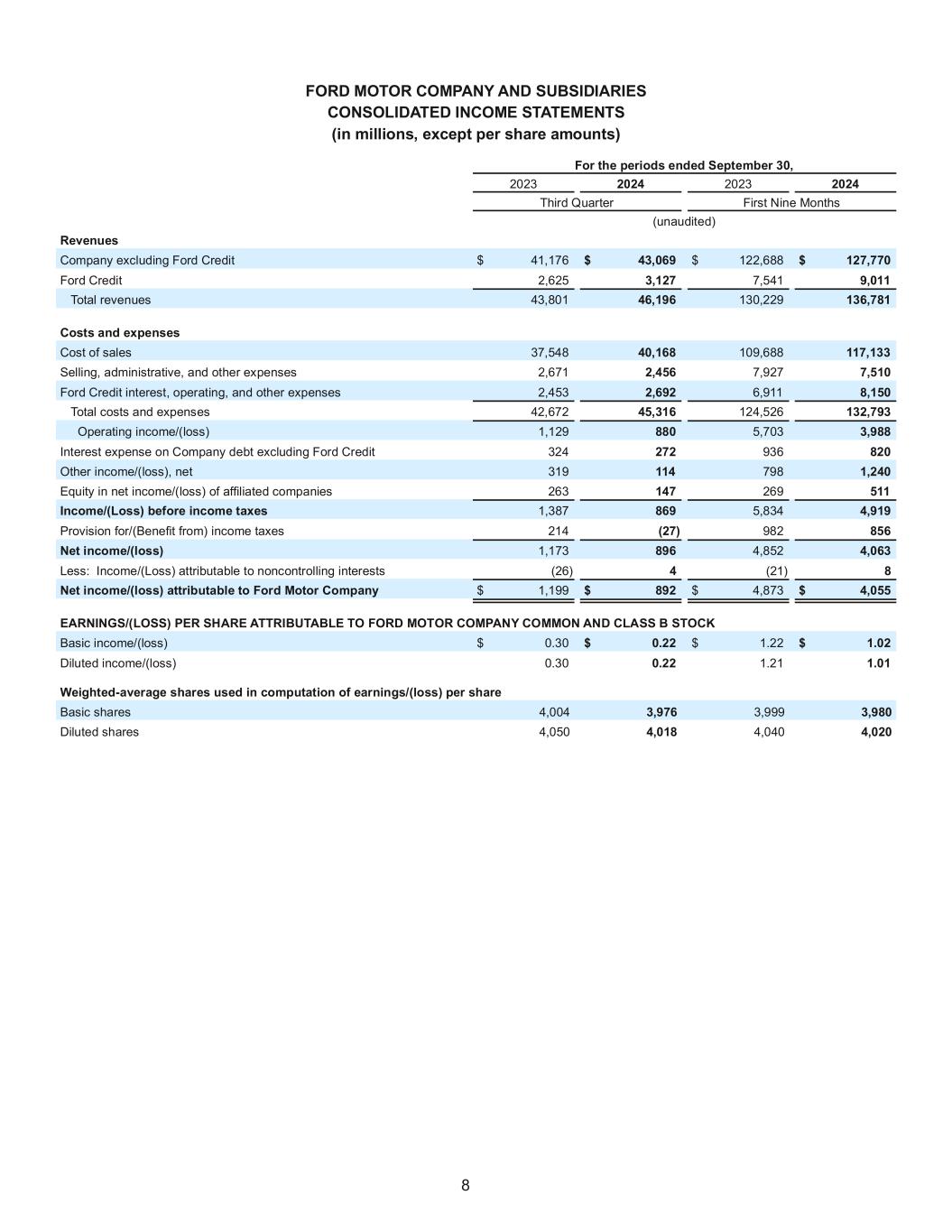

8 FORD MOTOR COMPANY AND SUBSIDIARIES CONSOLIDATED INCOME STATEMENTS (in millions, except per share amounts) For the periods ended September 30, 2023 2024 2023 2024 Third Quarter First Nine Months (unaudited) Revenues Company excluding Ford Credit $ 41,176 $ 43,069 $ 122,688 $ 127,770 Ford Credit 2,625 3,127 7,541 9,011 Total revenues 43,801 46,196 130,229 136,781 Costs and expenses Cost of sales 37,548 40,168 109,688 117,133 Selling, administrative, and other expenses 2,671 2,456 7,927 7,510 Ford Credit interest, operating, and other expenses 2,453 2,692 6,911 8,150 Total costs and expenses 42,672 45,316 124,526 132,793 Operating income/(loss) 1,129 880 5,703 3,988 Interest expense on Company debt excluding Ford Credit 324 272 936 820 Other income/(loss), net 319 114 798 1,240 Equity in net income/(loss) of affiliated companies 263 147 269 511 Income/(Loss) before income taxes 1,387 869 5,834 4,919 Provision for/(Benefit from) income taxes 214 (27) 982 856 Net income/(loss) 1,173 896 4,852 4,063 Less: Income/(Loss) attributable to noncontrolling interests (26) 4 (21) 8 Net income/(loss) attributable to Ford Motor Company $ 1,199 $ 892 $ 4,873 $ 4,055 EARNINGS/(LOSS) PER SHARE ATTRIBUTABLE TO FORD MOTOR COMPANY COMMON AND CLASS B STOCK Basic income/(loss) $ 0.30 $ 0.22 $ 1.22 $ 1.02 Diluted income/(loss) 0.30 0.22 1.21 1.01 Weighted-average shares used in computation of earnings/(loss) per share Basic shares 4,004 3,976 3,999 3,980 Diluted shares 4,050 4,018 4,040 4,020

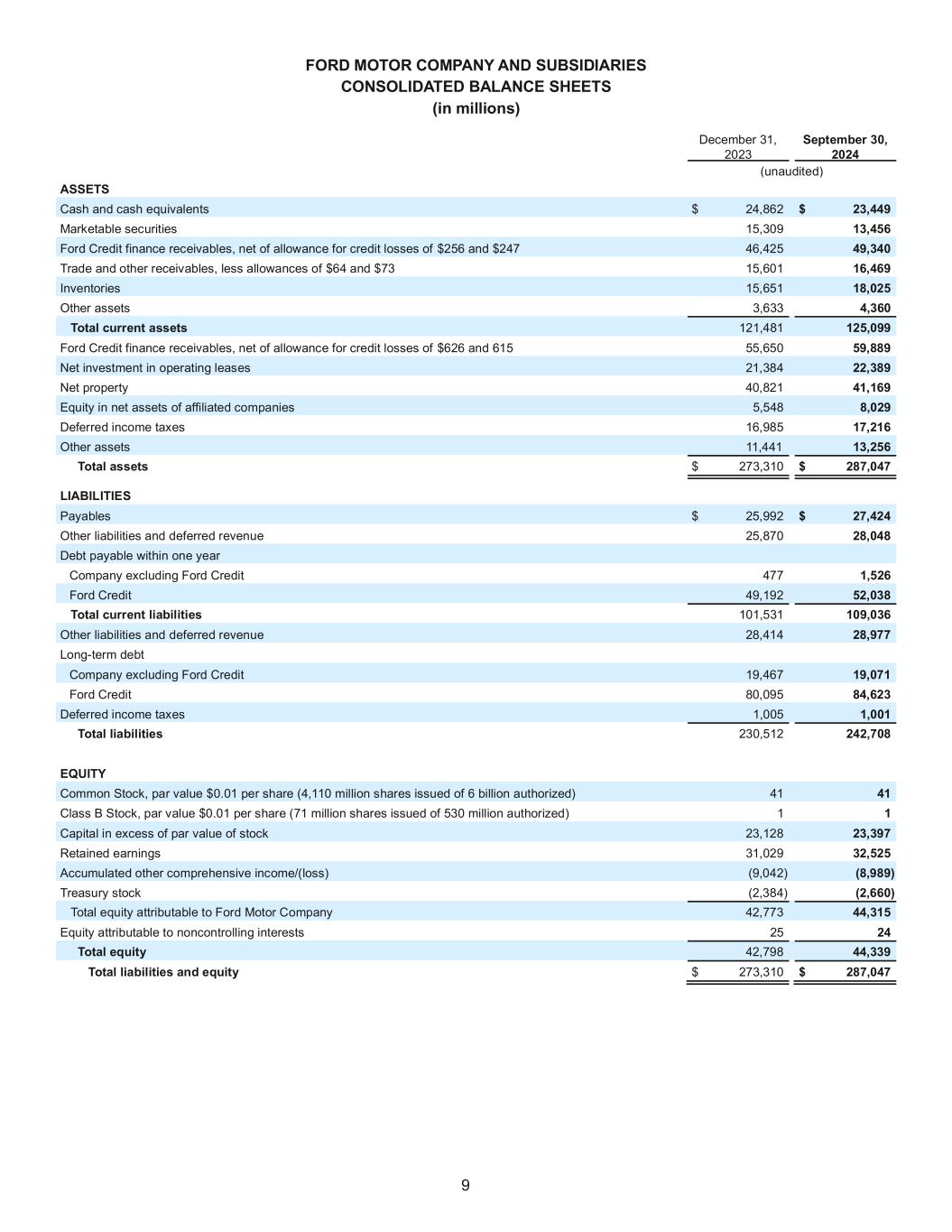

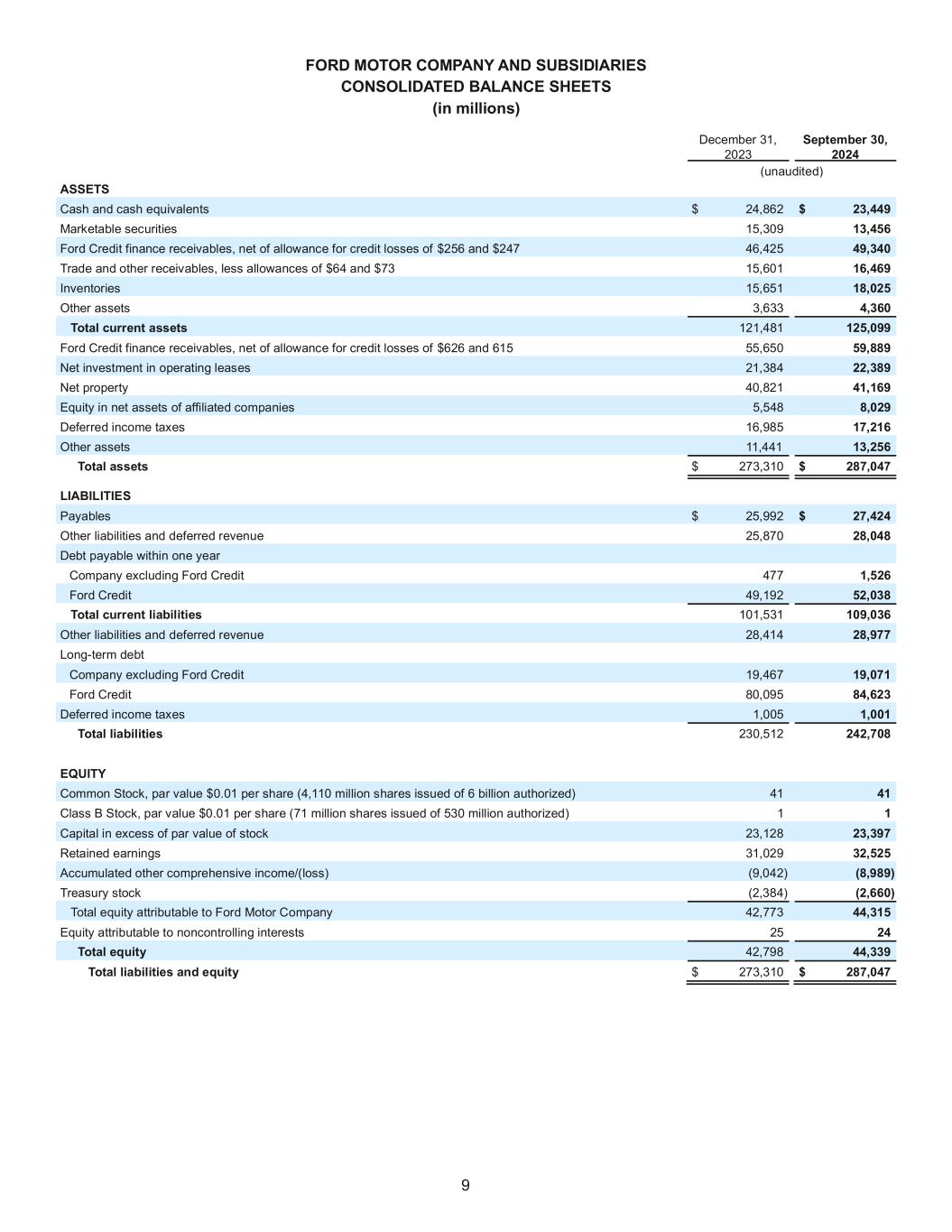

9 FORD MOTOR COMPANY AND SUBSIDIARIES CONSOLIDATED BALANCE SHEETS (in millions) December 31, 2023 September 30, 2024 (unaudited) ASSETS Cash and cash equivalents $ 24,862 $ 23,449 Marketable securities 15,309 13,456 Ford Credit finance receivables, net of allowance for credit losses of $256 and $247 46,425 49,340 Trade and other receivables, less allowances of $64 and $73 15,601 16,469 Inventories 15,651 18,025 Other assets 3,633 4,360 Total current assets 121,481 125,099 Ford Credit finance receivables, net of allowance for credit losses of $626 and 615 55,650 59,889 Net investment in operating leases 21,384 22,389 Net property 40,821 41,169 Equity in net assets of affiliated companies 5,548 8,029 Deferred income taxes 16,985 17,216 Other assets 11,441 13,256 Total assets $ 273,310 $ 287,047 LIABILITIES Payables $ 25,992 $ 27,424 Other liabilities and deferred revenue 25,870 28,048 Debt payable within one year Company excluding Ford Credit 477 1,526 Ford Credit 49,192 52,038 Total current liabilities 101,531 109,036 Other liabilities and deferred revenue 28,414 28,977 Long-term debt Company excluding Ford Credit 19,467 19,071 Ford Credit 80,095 84,623 Deferred income taxes 1,005 1,001 Total liabilities 230,512 242,708 EQUITY Common Stock, par value $0.01 per share (4,110 million shares issued of 6 billion authorized) 41 41 Class B Stock, par value $0.01 per share (71 million shares issued of 530 million authorized) 1 1 Capital in excess of par value of stock 23,128 23,397 Retained earnings 31,029 32,525 Accumulated other comprehensive income/(loss) (9,042) (8,989) Treasury stock (2,384) (2,660) Total equity attributable to Ford Motor Company 42,773 44,315 Equity attributable to noncontrolling interests 25 24 Total equity 42,798 44,339 Total liabilities and equity $ 273,310 $ 287,047

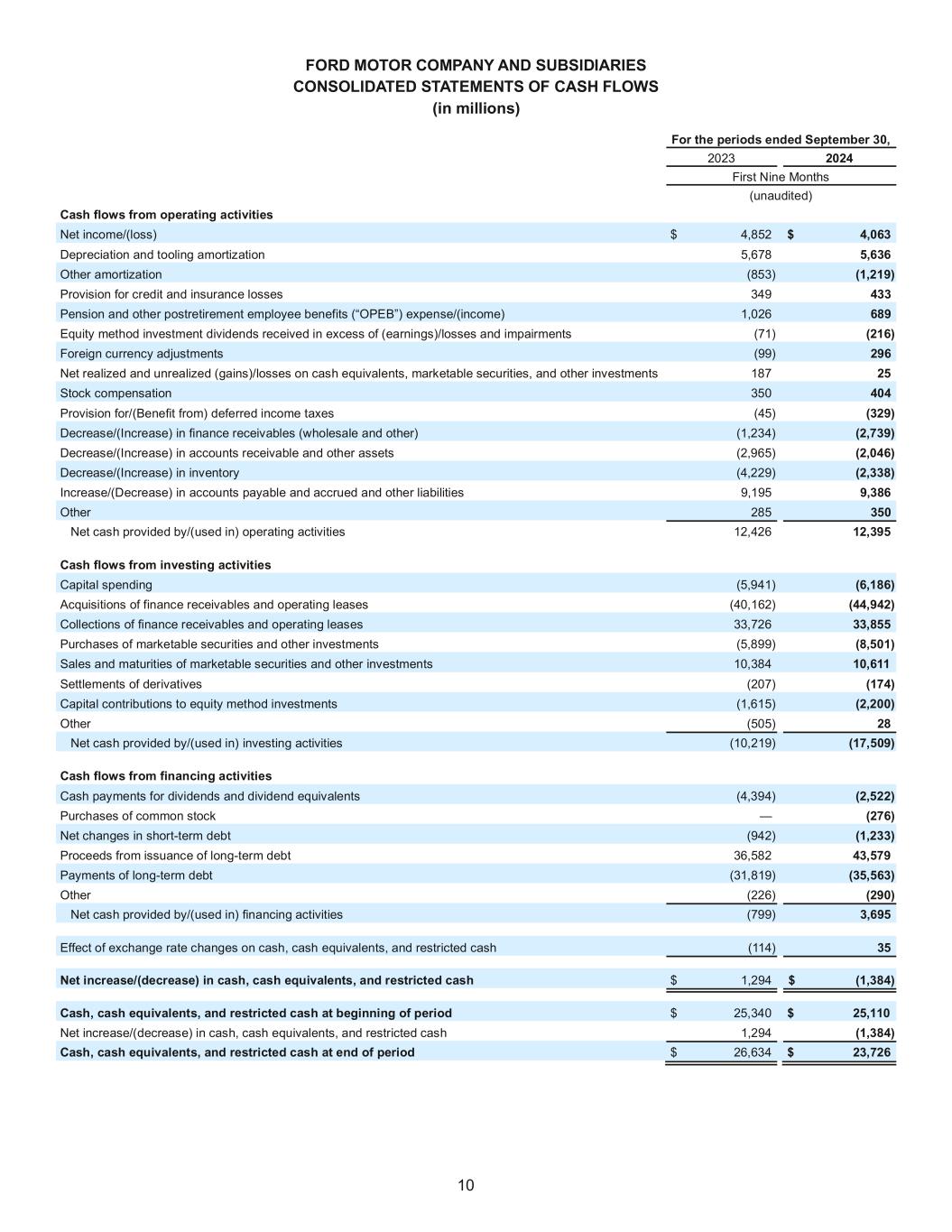

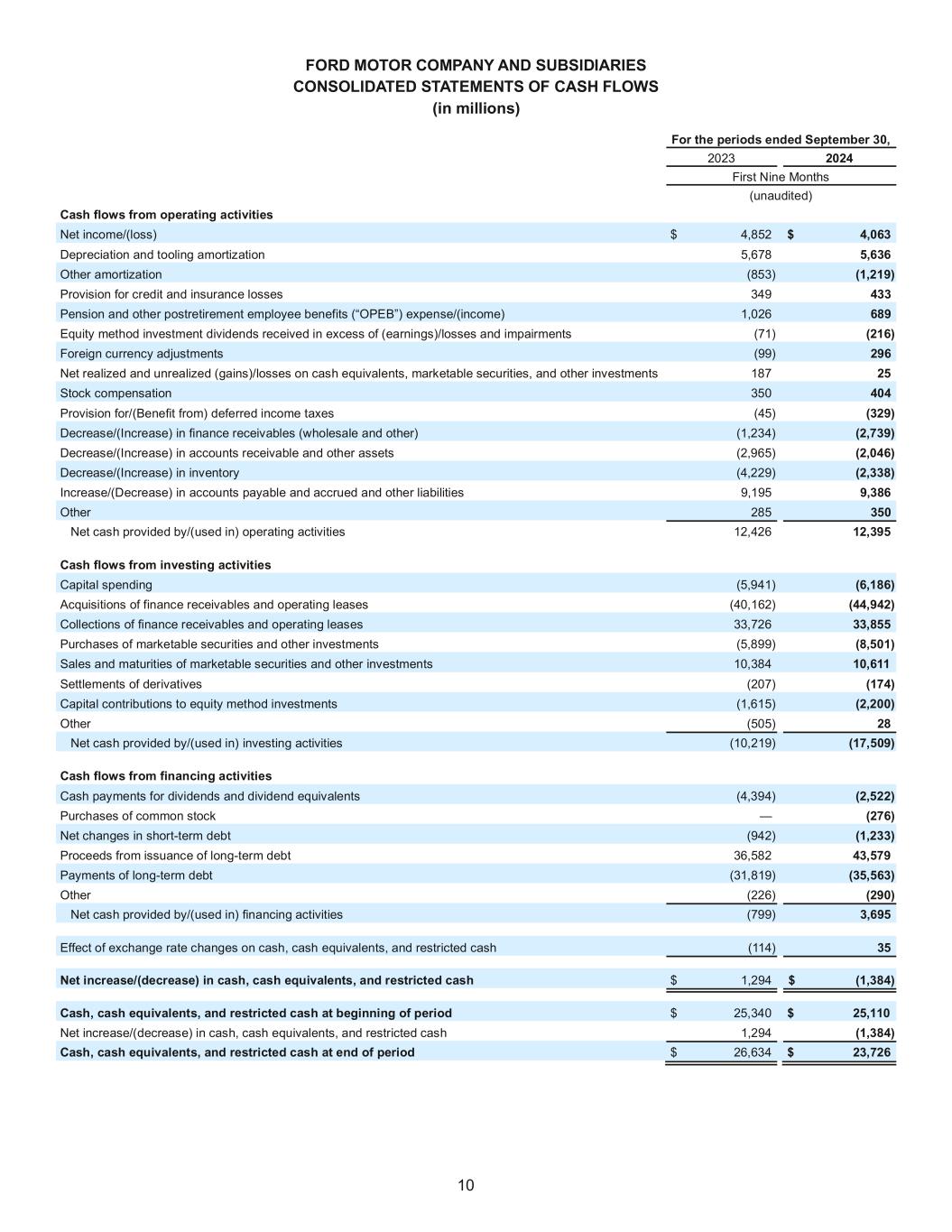

10 FORD MOTOR COMPANY AND SUBSIDIARIES CONSOLIDATED STATEMENTS OF CASH FLOWS (in millions) For the periods ended September 30, 2023 2024 First Nine Months (unaudited) Cash flows from operating activities Net income/(loss) $ 4,852 $ 4,063 Depreciation and tooling amortization 5,678 5,636 Other amortization (853) (1,219) Provision for credit and insurance losses 349 433 Pension and other postretirement employee benefits (“OPEB”) expense/(income) 1,026 689 Equity method investment dividends received in excess of (earnings)/losses and impairments (71) (216) Foreign currency adjustments (99) 296 Net realized and unrealized (gains)/losses on cash equivalents, marketable securities, and other investments 187 25 Stock compensation 350 404 Provision for/(Benefit from) deferred income taxes (45) (329) Decrease/(Increase) in finance receivables (wholesale and other) (1,234) (2,739) Decrease/(Increase) in accounts receivable and other assets (2,965) (2,046) Decrease/(Increase) in inventory (4,229) (2,338) Increase/(Decrease) in accounts payable and accrued and other liabilities 9,195 9,386 Other 285 350 Net cash provided by/(used in) operating activities 12,426 12,395 Cash flows from investing activities Capital spending (5,941) (6,186) Acquisitions of finance receivables and operating leases (40,162) (44,942) Collections of finance receivables and operating leases 33,726 33,855 Purchases of marketable securities and other investments (5,899) (8,501) Sales and maturities of marketable securities and other investments 10,384 10,611 Settlements of derivatives (207) (174) Capital contributions to equity method investments (1,615) (2,200) Other (505) 28 Net cash provided by/(used in) investing activities (10,219) (17,509) Cash flows from financing activities Cash payments for dividends and dividend equivalents (4,394) (2,522) Purchases of common stock — (276) Net changes in short-term debt (942) (1,233) Proceeds from issuance of long-term debt 36,582 43,579 Payments of long-term debt (31,819) (35,563) Other (226) (290) Net cash provided by/(used in) financing activities (799) 3,695 Effect of exchange rate changes on cash, cash equivalents, and restricted cash (114) 35 Net increase/(decrease) in cash, cash equivalents, and restricted cash $ 1,294 $ (1,384) Cash, cash equivalents, and restricted cash at beginning of period $ 25,340 $ 25,110 Net increase/(decrease) in cash, cash equivalents, and restricted cash 1,294 (1,384) Cash, cash equivalents, and restricted cash at end of period $ 26,634 $ 23,726

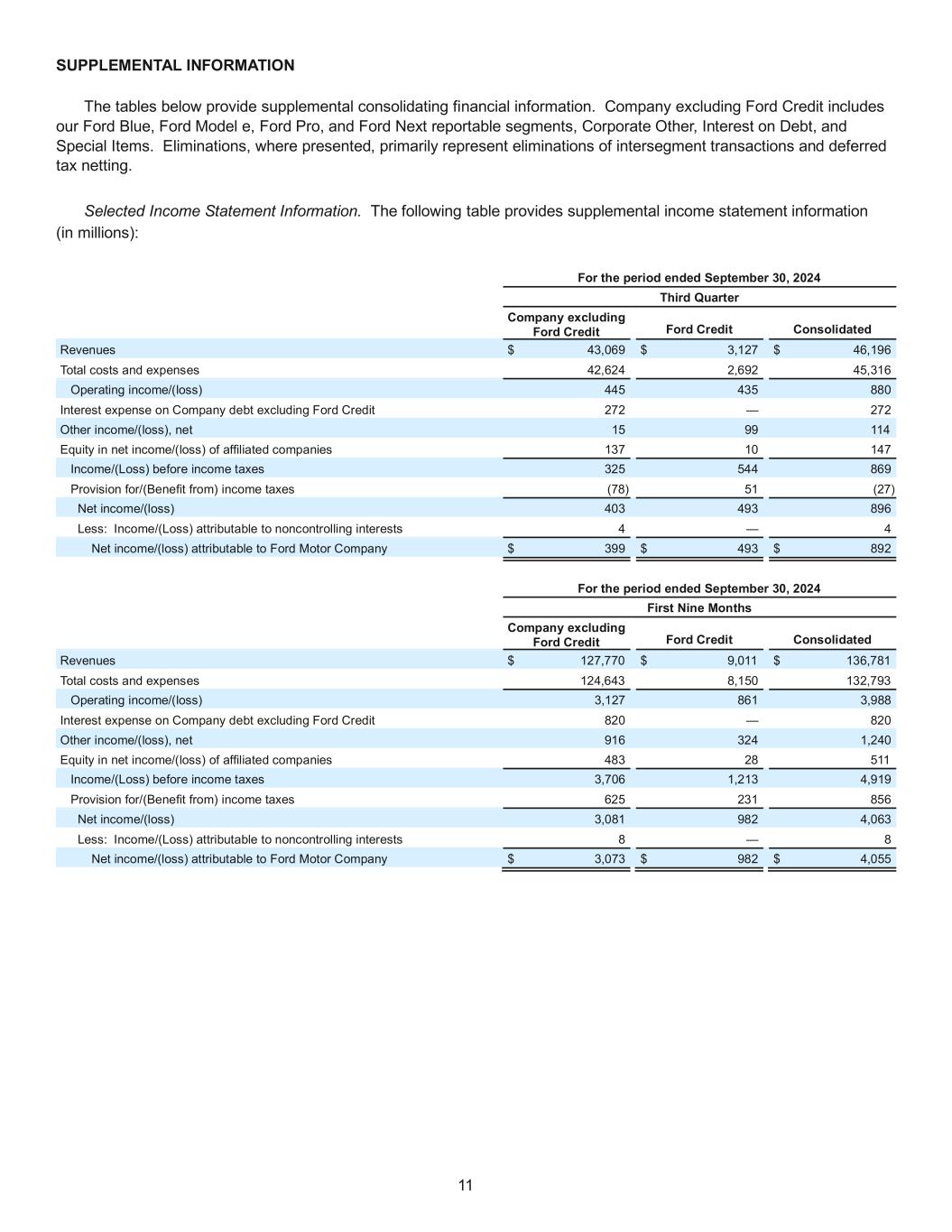

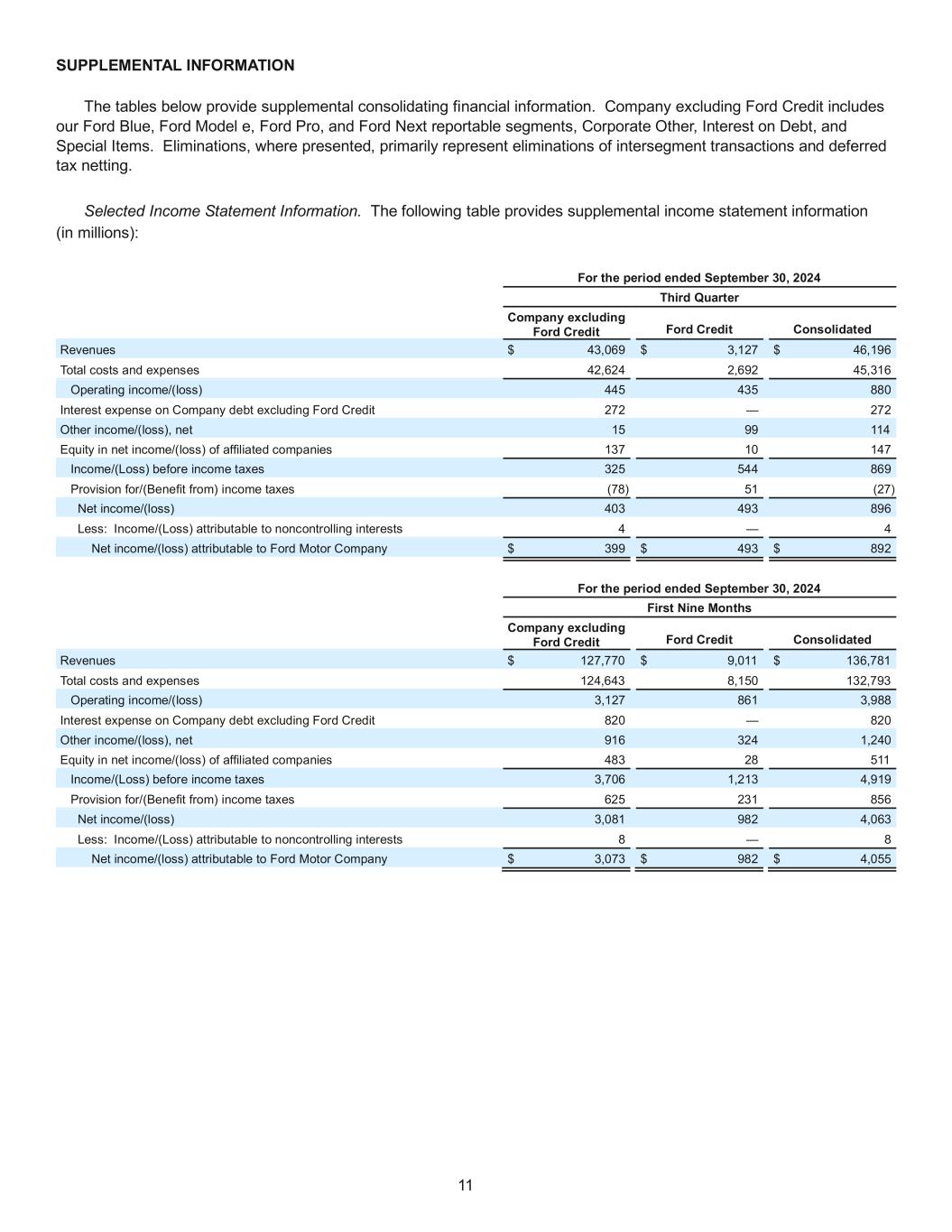

11 SUPPLEMENTAL INFORMATION The tables below provide supplemental consolidating financial information. Company excluding Ford Credit includes our Ford Blue, Ford Model e, Ford Pro, and Ford Next reportable segments, Corporate Other, Interest on Debt, and Special Items. Eliminations, where presented, primarily represent eliminations of intersegment transactions and deferred tax netting. Selected Income Statement Information. The following table provides supplemental income statement information (in millions): For the period ended September 30, 2024 Third Quarter Company excluding Ford Credit Ford Credit Consolidated Revenues $ 43,069 $ 3,127 $ 46,196 Total costs and expenses 42,624 2,692 45,316 Operating income/(loss) 445 435 880 Interest expense on Company debt excluding Ford Credit 272 — 272 Other income/(loss), net 15 99 114 Equity in net income/(loss) of affiliated companies 137 10 147 Income/(Loss) before income taxes 325 544 869 Provision for/(Benefit from) income taxes (78) 51 (27) Net income/(loss) 403 493 896 Less: Income/(Loss) attributable to noncontrolling interests 4 — 4 Net income/(loss) attributable to Ford Motor Company $ 399 $ 493 $ 892 For the period ended September 30, 2024 First Nine Months Company excluding Ford Credit Ford Credit Consolidated Revenues $ 127,770 $ 9,011 $ 136,781 Total costs and expenses 124,643 8,150 132,793 Operating income/(loss) 3,127 861 3,988 Interest expense on Company debt excluding Ford Credit 820 — 820 Other income/(loss), net 916 324 1,240 Equity in net income/(loss) of affiliated companies 483 28 511 Income/(Loss) before income taxes 3,706 1,213 4,919 Provision for/(Benefit from) income taxes 625 231 856 Net income/(loss) 3,081 982 4,063 Less: Income/(Loss) attributable to noncontrolling interests 8 — 8 Net income/(loss) attributable to Ford Motor Company $ 3,073 $ 982 $ 4,055

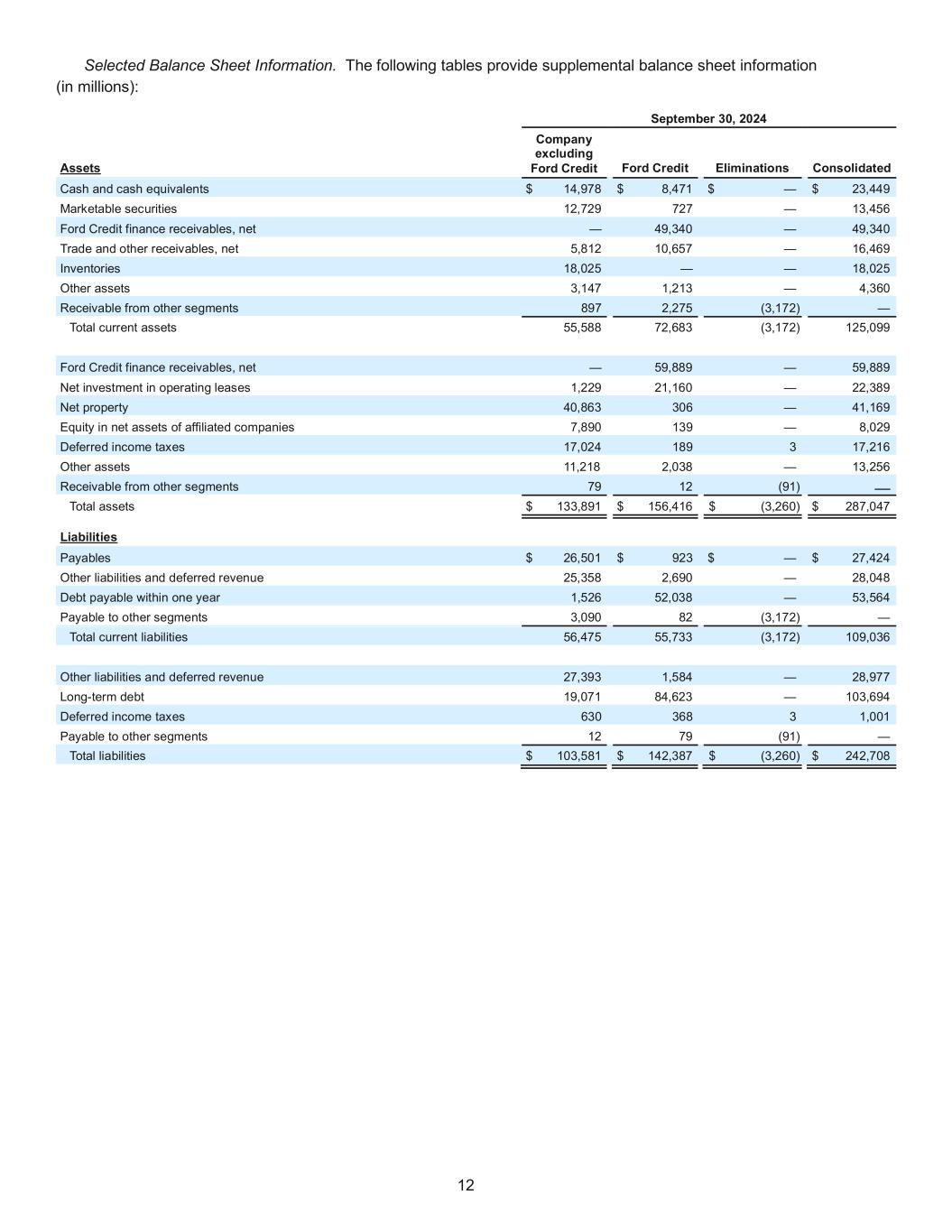

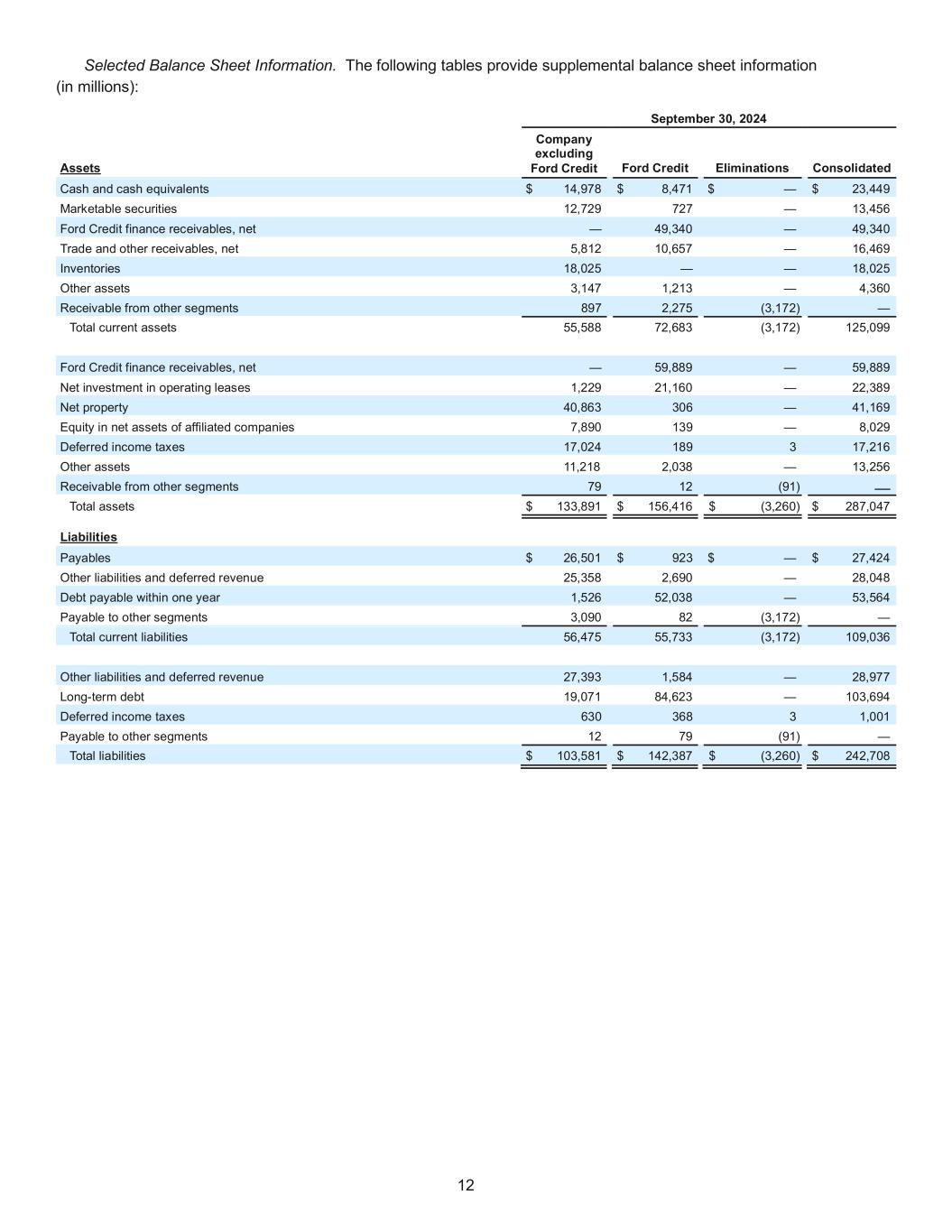

12 Selected Balance Sheet Information. The following tables provide supplemental balance sheet information (in millions): September 30, 2024 Assets Company excluding Ford Credit Ford Credit Eliminations Consolidated Cash and cash equivalents $ 14,978 $ 8,471 $ — $ 23,449 Marketable securities 12,729 727 — 13,456 Ford Credit finance receivables, net — 49,340 — 49,340 Trade and other receivables, net 5,812 10,657 — 16,469 Inventories 18,025 — — 18,025 Other assets 3,147 1,213 — 4,360 Receivable from other segments 897 2,275 (3,172) — Total current assets 55,588 72,683 (3,172) 125,099 Ford Credit finance receivables, net — 59,889 — 59,889 Net investment in operating leases 1,229 21,160 — 22,389 Net property 40,863 306 — 41,169 Equity in net assets of affiliated companies 7,890 139 — 8,029 Deferred income taxes 17,024 189 3 17,216 Other assets 11,218 2,038 — 13,256 Receivable from other segments 79 12 (91) — Total assets $ 133,891 $ 156,416 $ (3,260) $ 287,047 Liabilities Payables $ 26,501 $ 923 $ — $ 27,424 Other liabilities and deferred revenue 25,358 2,690 — 28,048 Debt payable within one year 1,526 52,038 — 53,564 Payable to other segments 3,090 82 (3,172) — Total current liabilities 56,475 55,733 (3,172) 109,036 Other liabilities and deferred revenue 27,393 1,584 — 28,977 Long-term debt 19,071 84,623 — 103,694 Deferred income taxes 630 368 3 1,001 Payable to other segments 12 79 (91) — Total liabilities $ 103,581 $ 142,387 $ (3,260) $ 242,708

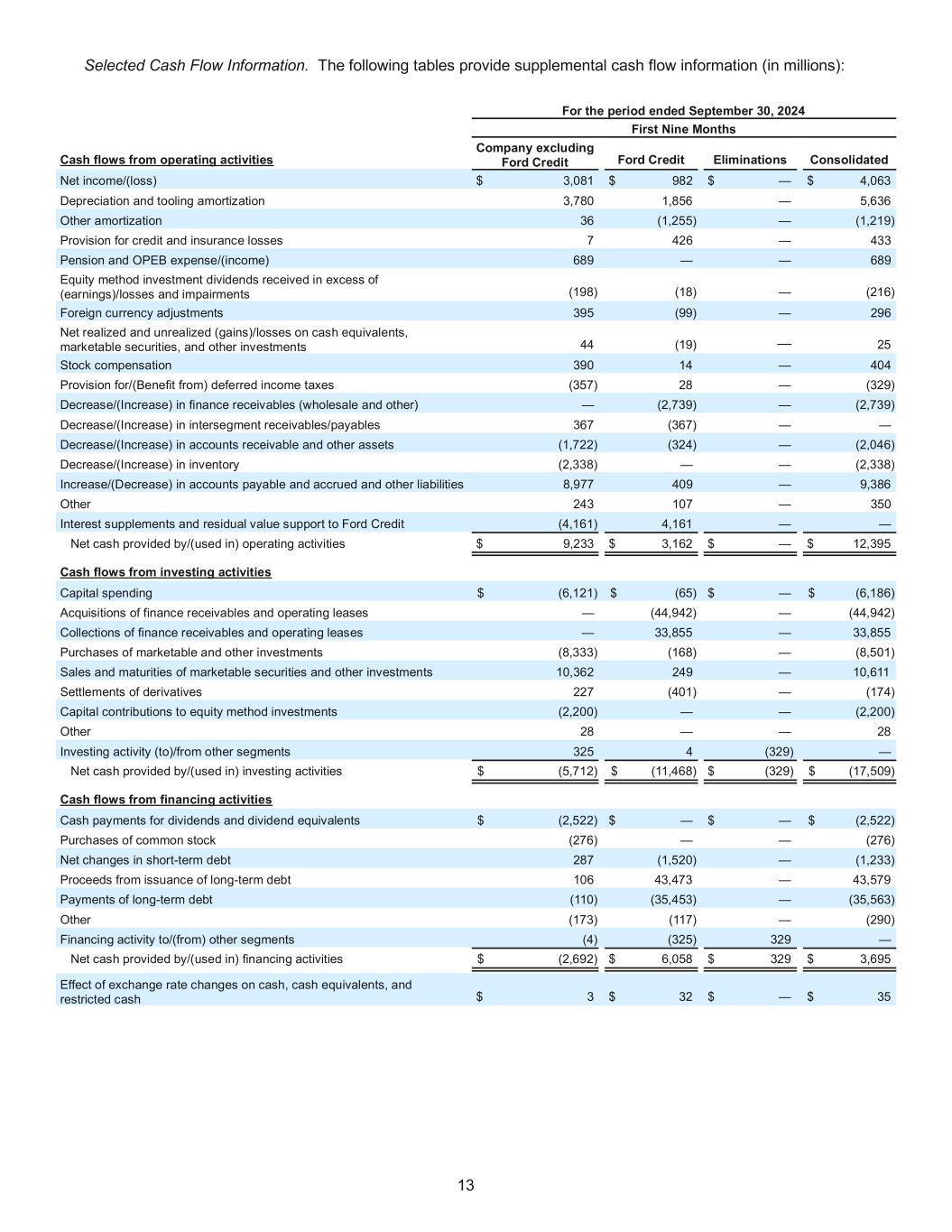

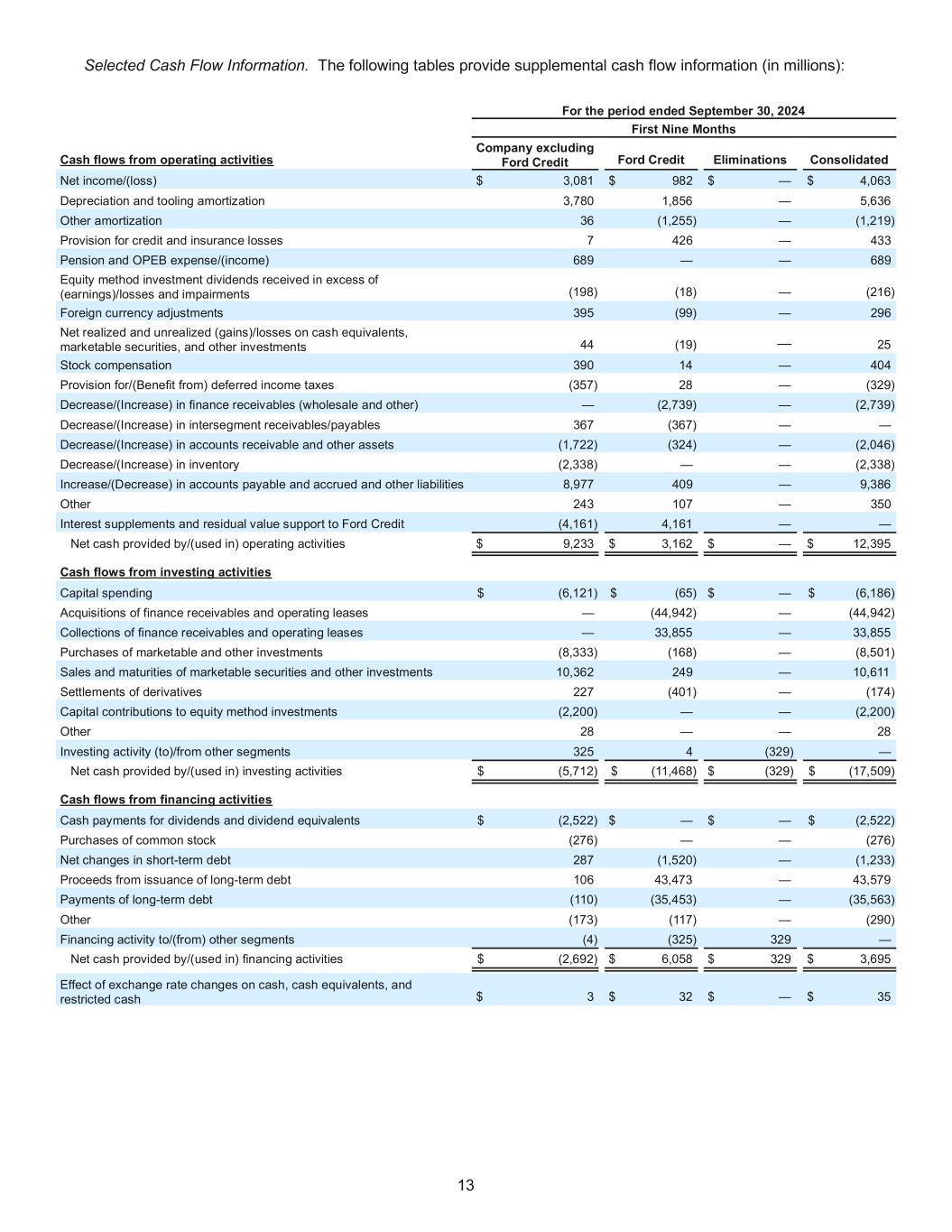

13 Selected Cash Flow Information. The following tables provide supplemental cash flow information (in millions): For the period ended September 30, 2024 First Nine Months Cash flows from operating activities Company excluding Ford Credit Ford Credit Eliminations Consolidated Net income/(loss) $ 3,081 $ 982 $ — $ 4,063 Depreciation and tooling amortization 3,780 1,856 — 5,636 Other amortization 36 (1,255) — (1,219) Provision for credit and insurance losses 7 426 — 433 Pension and OPEB expense/(income) 689 — — 689 Equity method investment dividends received in excess of (earnings)/losses and impairments (198) (18) — (216) Foreign currency adjustments 395 (99) — 296 Net realized and unrealized (gains)/losses on cash equivalents, marketable securities, and other investments 44 (19) — 25 Stock compensation 390 14 — 404 Provision for/(Benefit from) deferred income taxes (357) 28 — (329) Decrease/(Increase) in finance receivables (wholesale and other) — (2,739) — (2,739) Decrease/(Increase) in intersegment receivables/payables 367 (367) — — Decrease/(Increase) in accounts receivable and other assets (1,722) (324) — (2,046) Decrease/(Increase) in inventory (2,338) — — (2,338) Increase/(Decrease) in accounts payable and accrued and other liabilities 8,977 409 — 9,386 Other 243 107 — 350 Interest supplements and residual value support to Ford Credit (4,161) 4,161 — — Net cash provided by/(used in) operating activities $ 9,233 $ 3,162 $ — $ 12,395 Cash flows from investing activities Capital spending $ (6,121) $ (65) $ — $ (6,186) Acquisitions of finance receivables and operating leases — (44,942) — (44,942) Collections of finance receivables and operating leases — 33,855 — 33,855 Purchases of marketable and other investments (8,333) (168) — (8,501) Sales and maturities of marketable securities and other investments 10,362 249 — 10,611 Settlements of derivatives 227 (401) — (174) Capital contributions to equity method investments (2,200) — — (2,200) Other 28 — — 28 Investing activity (to)/from other segments 325 4 (329) — Net cash provided by/(used in) investing activities $ (5,712) $ (11,468) $ (329) $ (17,509) Cash flows from financing activities Cash payments for dividends and dividend equivalents $ (2,522) $ — $ — $ (2,522) Purchases of common stock (276) — — (276) Net changes in short-term debt 287 (1,520) — (1,233) Proceeds from issuance of long-term debt 106 43,473 — 43,579 Payments of long-term debt (110) (35,453) — (35,563) Other (173) (117) — (290) Financing activity to/(from) other segments (4) (325) 329 — Net cash provided by/(used in) financing activities $ (2,692) $ 6,058 $ 329 $ 3,695 Effect of exchange rate changes on cash, cash equivalents, and restricted cash $ 3 $ 32 $ — $ 35

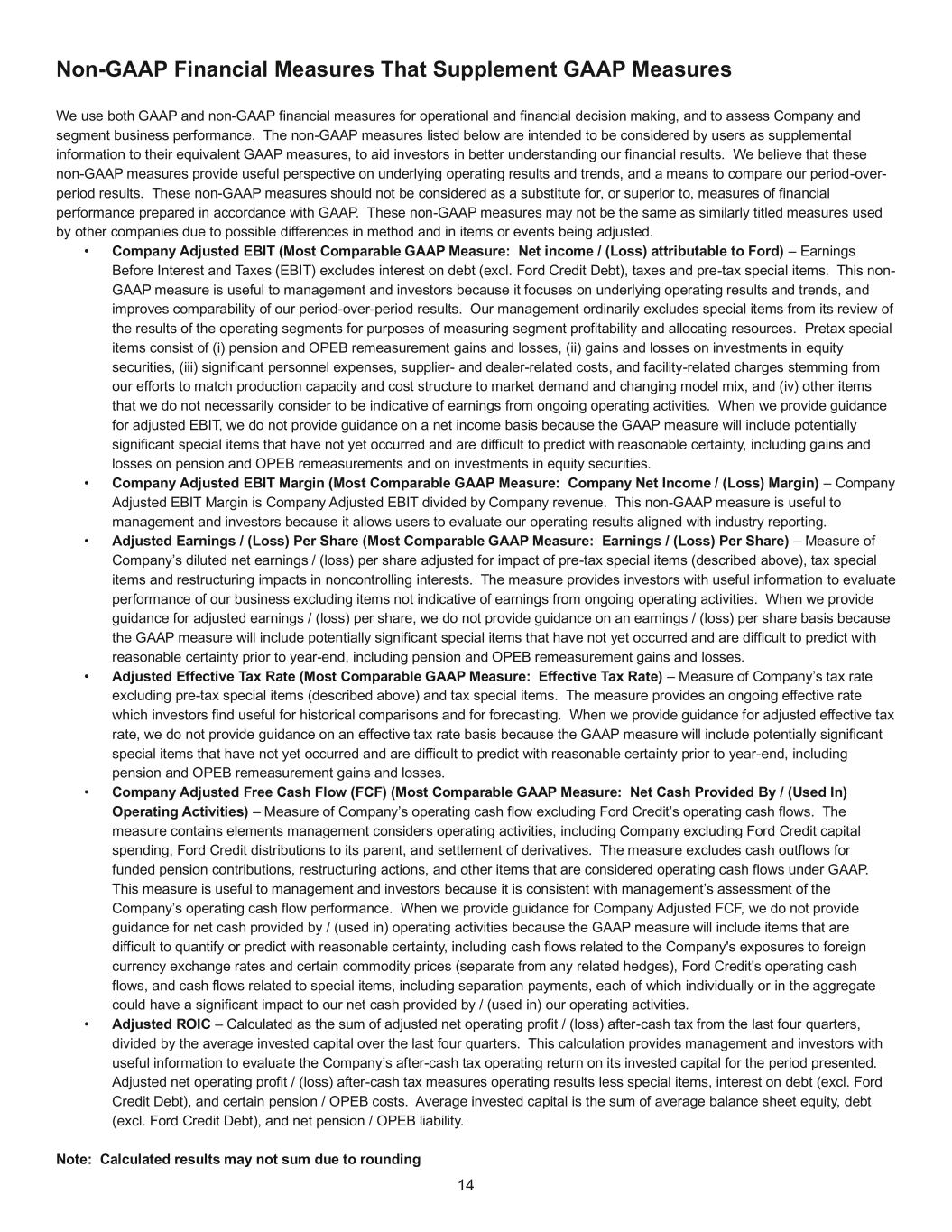

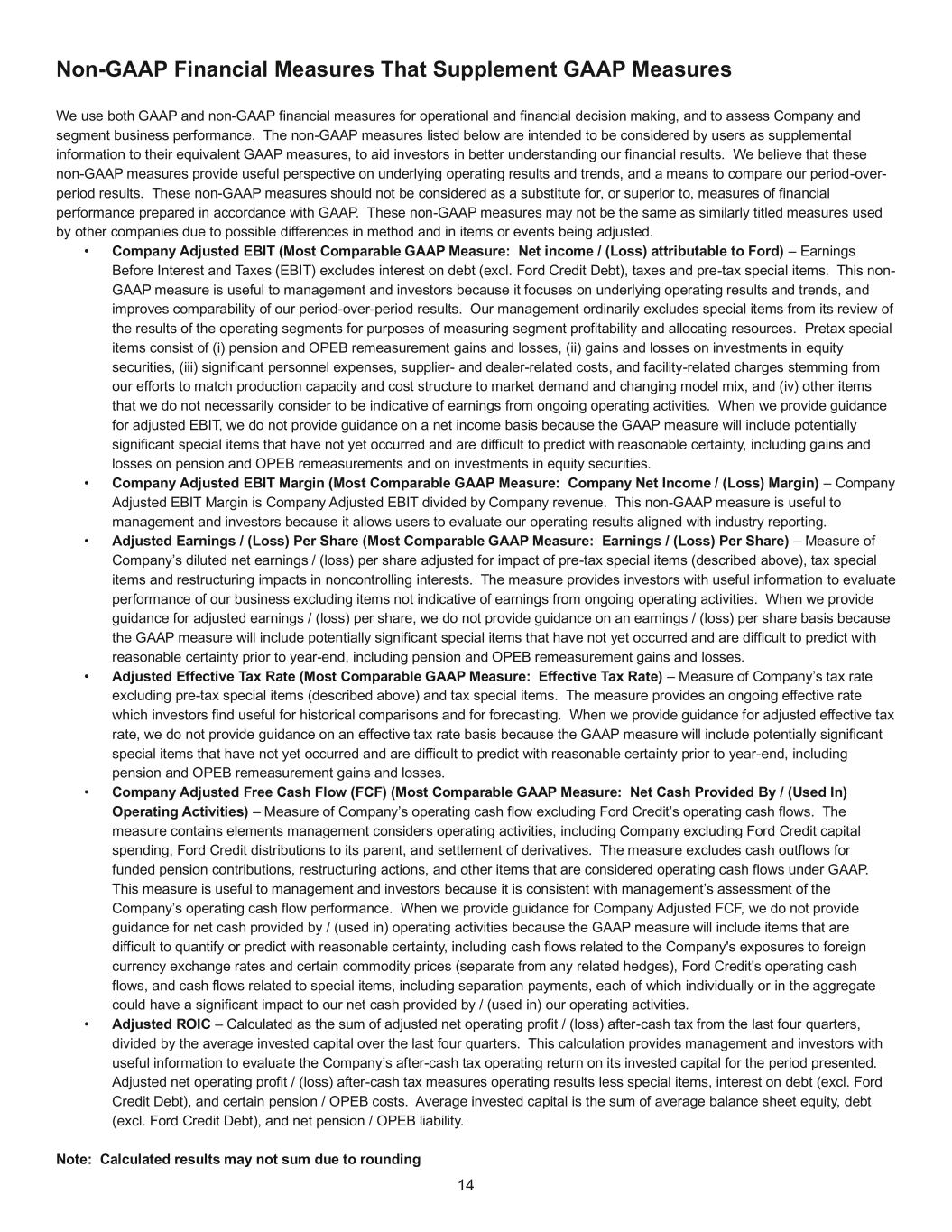

14 Non-GAAP Financial Measures That Supplement GAAP Measures We use both GAAP and non-GAAP financial measures for operational and financial decision making, and to assess Company and segment business performance. The non-GAAP measures listed below are intended to be considered by users as supplemental information to their equivalent GAAP measures, to aid investors in better understanding our financial results. We believe that these non-GAAP measures provide useful perspective on underlying operating results and trends, and a means to compare our period-over- period results. These non-GAAP measures should not be considered as a substitute for, or superior to, measures of financial performance prepared in accordance with GAAP. These non-GAAP measures may not be the same as similarly titled measures used by other companies due to possible differences in method and in items or events being adjusted. • Company Adjusted EBIT (Most Comparable GAAP Measure: Net income / (Loss) attributable to Ford) – Earnings Before Interest and Taxes (EBIT) excludes interest on debt (excl. Ford Credit Debt), taxes and pre-tax special items. This non- GAAP measure is useful to management and investors because it focuses on underlying operating results and trends, and improves comparability of our period-over-period results. Our management ordinarily excludes special items from its review of the results of the operating segments for purposes of measuring segment profitability and allocating resources. Pretax special items consist of (i) pension and OPEB remeasurement gains and losses, (ii) gains and losses on investments in equity securities, (iii) significant personnel expenses, supplier- and dealer-related costs, and facility-related charges stemming from our efforts to match production capacity and cost structure to market demand and changing model mix, and (iv) other items that we do not necessarily consider to be indicative of earnings from ongoing operating activities. When we provide guidance for adjusted EBIT, we do not provide guidance on a net income basis because the GAAP measure will include potentially significant special items that have not yet occurred and are difficult to predict with reasonable certainty, including gains and losses on pension and OPEB remeasurements and on investments in equity securities. • Company Adjusted EBIT Margin (Most Comparable GAAP Measure: Company Net Income / (Loss) Margin) – Company Adjusted EBIT Margin is Company Adjusted EBIT divided by Company revenue. This non-GAAP measure is useful to management and investors because it allows users to evaluate our operating results aligned with industry reporting. • Adjusted Earnings / (Loss) Per Share (Most Comparable GAAP Measure: Earnings / (Loss) Per Share) – Measure of Company’s diluted net earnings / (loss) per share adjusted for impact of pre-tax special items (described above), tax special items and restructuring impacts in noncontrolling interests. The measure provides investors with useful information to evaluate performance of our business excluding items not indicative of earnings from ongoing operating activities. When we provide guidance for adjusted earnings / (loss) per share, we do not provide guidance on an earnings / (loss) per share basis because the GAAP measure will include potentially significant special items that have not yet occurred and are difficult to predict with reasonable certainty prior to year-end, including pension and OPEB remeasurement gains and losses. • Adjusted Effective Tax Rate (Most Comparable GAAP Measure: Effective Tax Rate) – Measure of Company’s tax rate excluding pre-tax special items (described above) and tax special items. The measure provides an ongoing effective rate which investors find useful for historical comparisons and for forecasting. When we provide guidance for adjusted effective tax rate, we do not provide guidance on an effective tax rate basis because the GAAP measure will include potentially significant special items that have not yet occurred and are difficult to predict with reasonable certainty prior to year-end, including pension and OPEB remeasurement gains and losses. • Company Adjusted Free Cash Flow (FCF) (Most Comparable GAAP Measure: Net Cash Provided By / (Used In) Operating Activities) – Measure of Company’s operating cash flow excluding Ford Credit’s operating cash flows. The measure contains elements management considers operating activities, including Company excluding Ford Credit capital spending, Ford Credit distributions to its parent, and settlement of derivatives. The measure excludes cash outflows for funded pension contributions, restructuring actions, and other items that are considered operating cash flows under GAAP. This measure is useful to management and investors because it is consistent with management’s assessment of the Company’s operating cash flow performance. When we provide guidance for Company Adjusted FCF, we do not provide guidance for net cash provided by / (used in) operating activities because the GAAP measure will include items that are difficult to quantify or predict with reasonable certainty, including cash flows related to the Company's exposures to foreign currency exchange rates and certain commodity prices (separate from any related hedges), Ford Credit's operating cash flows, and cash flows related to special items, including separation payments, each of which individually or in the aggregate could have a significant impact to our net cash provided by / (used in) our operating activities. • Adjusted ROIC – Calculated as the sum of adjusted net operating profit / (loss) after-cash tax from the last four quarters, divided by the average invested capital over the last four quarters. This calculation provides management and investors with useful information to evaluate the Company’s after-cash tax operating return on its invested capital for the period presented. Adjusted net operating profit / (loss) after-cash tax measures operating results less special items, interest on debt (excl. Ford Credit Debt), and certain pension / OPEB costs. Average invested capital is the sum of average balance sheet equity, debt (excl. Ford Credit Debt), and net pension / OPEB liability. Note: Calculated results may not sum due to rounding

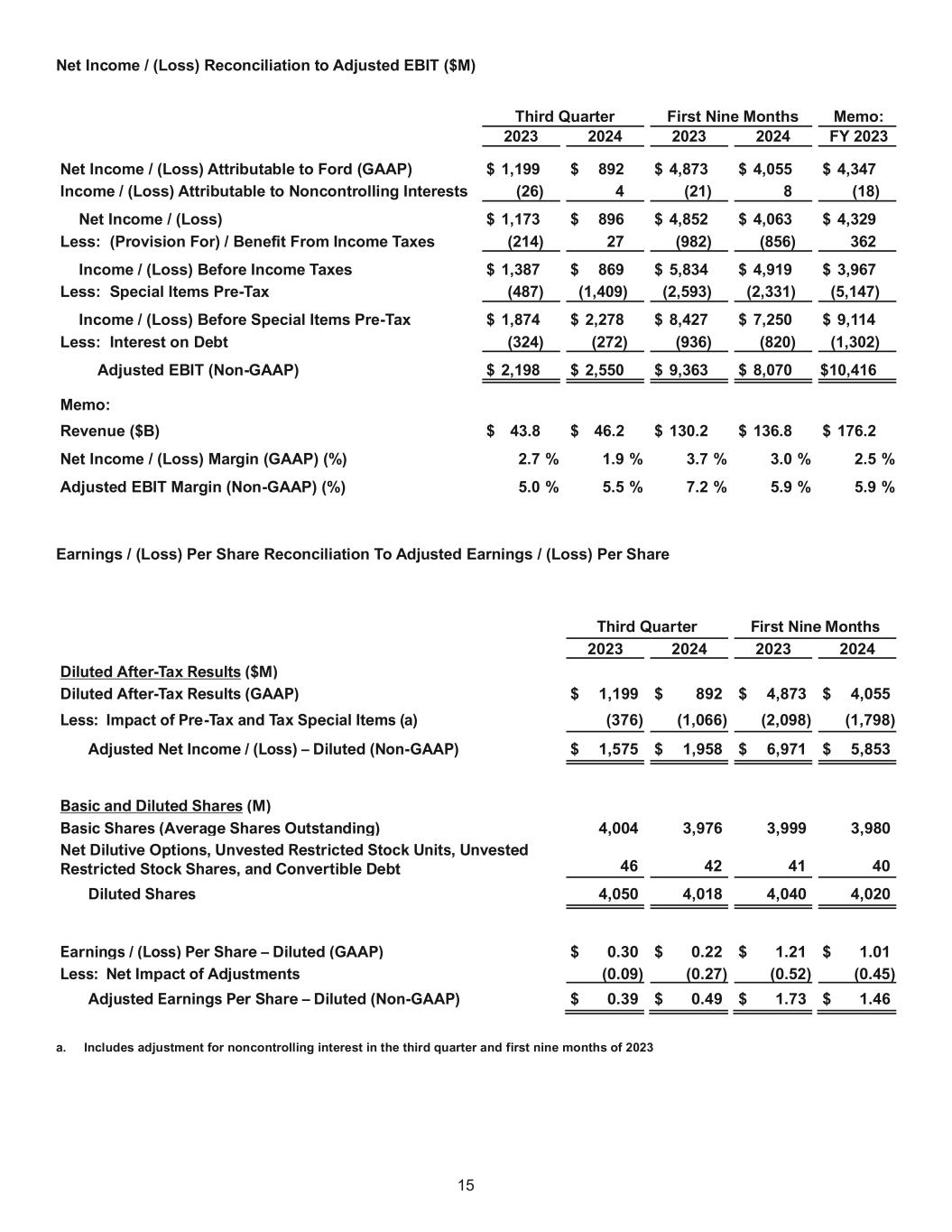

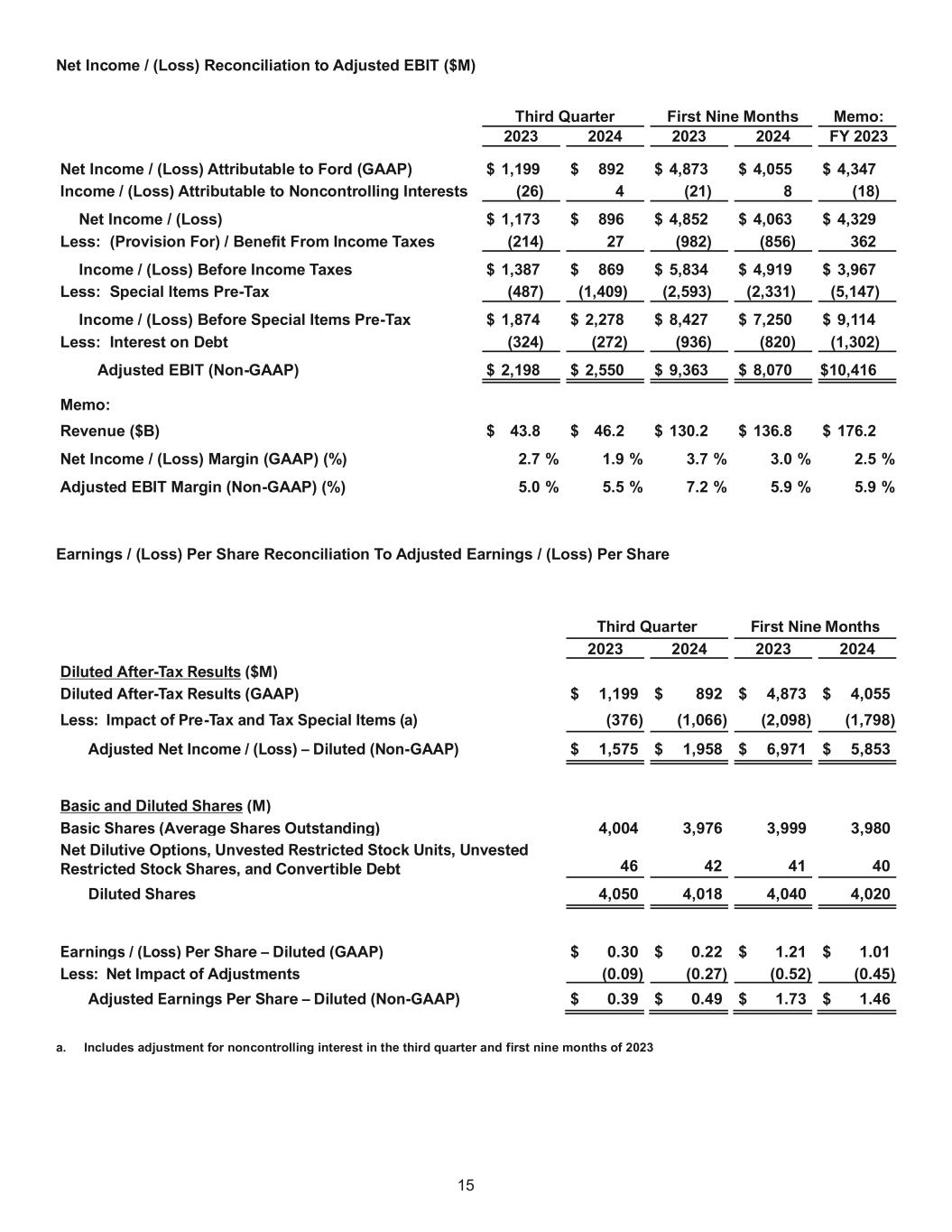

15 Net Income / (Loss) Reconciliation to Adjusted EBIT ($M) Third Quarter First Nine Months Memo: 2023 2024 2023 2024 FY 2023 Net Income / (Loss) Attributable to Ford (GAAP) $ 1,199 $ 892 $ 4,873 $ 4,055 $ 4,347 Income / (Loss) Attributable to Noncontrolling Interests (26) 4 (21) 8 (18) Net Income / (Loss) $ 1,173 $ 896 $ 4,852 $ 4,063 $ 4,329 Less: (Provision For) / Benefit From Income Taxes (214) 27 (982) (856) 362 Income / (Loss) Before Income Taxes $ 1,387 $ 869 $ 5,834 $ 4,919 $ 3,967 Less: Special Items Pre-Tax (487) (1,409) (2,593) (2,331) (5,147) Income / (Loss) Before Special Items Pre-Tax $ 1,874 $ 2,278 $ 8,427 $ 7,250 $ 9,114 Less: Interest on Debt (324) (272) (936) (820) (1,302) Adjusted EBIT (Non-GAAP) $ 2,198 $ 2,550 $ 9,363 $ 8,070 $ 10,416 Memo: Revenue ($B) $ 43.8 $ 46.2 $ 130.2 $ 136.8 $ 176.2 Net Income / (Loss) Margin (GAAP) (%) 2.7 % 1.9 % 3.7 % 3.0 % 2.5 % Adjusted EBIT Margin (Non-GAAP) (%) 5.0 % 5.5 % 7.2 % 5.9 % 5.9 % Earnings / (Loss) Per Share Reconciliation To Adjusted Earnings / (Loss) Per Share Third Quarter First Nine Months 2023 2024 2023 2024 Diluted After-Tax Results ($M) Diluted After-Tax Results (GAAP) $ 1,199 $ 892 $ 4,873 $ 4,055 Less: Impact of Pre-Tax and Tax Special Items (a) (376) (1,066) (2,098) (1,798) Adjusted Net Income / (Loss) – Diluted (Non-GAAP) $ 1,575 $ 1,958 $ 6,971 $ 5,853 Basic and Diluted Shares (M) Basic Shares (Average Shares Outstanding) 4,004 3,976 3,999 3,980 Net Dilutive Options, Unvested Restricted Stock Units, Unvested Restricted Stock Shares, and Convertible Debt 46 42 41 40 Diluted Shares 4,050 4,018 4,040 4,020 Earnings / (Loss) Per Share – Diluted (GAAP) $ 0.30 $ 0.22 $ 1.21 $ 1.01 Less: Net Impact of Adjustments (0.09) (0.27) (0.52) (0.45) Adjusted Earnings Per Share – Diluted (Non-GAAP) $ 0.39 $ 0.49 $ 1.73 $ 1.46 a. Includes adjustment for noncontrolling interest in the third quarter and first nine months of 2023

16 Effective Tax Rate Reconciliation To Adjusted Effective Tax Rate 2024 Memo: Q3 First Nine Months Full Year 2023 Pre-Tax Results ($M) Income / (Loss) Before Income Taxes (GAAP) $ 869 $ 4,919 $ 3,967 Less: Impact of Special Items (1,409) (2,331) (5,147) Adjusted Earnings Before Taxes (Non-GAAP) $ 2,278 $ 7,250 $ 9,114 Taxes ($M) (Provision For) / Benefit From Income Taxes (GAAP) (a) $ 27 $ (856) $ 362 Less: Impact of Special Items (b) 343 533 1,273 Adjusted (Provision For) / Benefit From Income Taxes (Non-GAAP) $ (316) $ (1,389) $ (911) Tax Rate (%) Effective Tax Rate (GAAP) (3.1)% 17.4 % (9.1)% Adjusted Effective Tax Rate (Non-GAAP) 13.9 % 19.2 % 10.0 % a. Full Year 2023 reflects benefits from U.S. research tax credits and legal entity restructuring within our leasing operations and China b. Full Year 2023 reflects benefits from China legal entity restructuring Net Cash Provided By / (Used In) Operating Activities Reconciliation To Company Adjusted Free Cash Flow ($M) 2023 2024 First Nine Months Q1 Q2 Q3 Q4 Q1 Q2 Q3 2023 2024 Net Cash Provided By / (Used In) Operating Activities (GAAP) $ 2,800 $ 5,035 $ 4,591 $ 2,492 $ 1,385 $ 5,508 $ 5,502 $12,426 $12,395 Less: Items Not Included in Company Adjusted Free Cash Flows Ford Credit Operating Cash Flows 626 581 1,800 (1,827) 1,181 685 1,296 3,007 3,162 Funded Pension Contributions (125) (109) (190) (168) (550) (83) (334) (424) (967) Restructuring (Including Separations) (a) (81) (118) (297) (529) (176) (289) (226) (496) (691) Ford Credit Tax Payments / (Refunds) Under Tax Sharing Agreement (5) — — 174 (33) — — (5) (33) Other, Net (140) (73) (151) 604 (b) (608) (c) 4 14 (364) (590) Add: Items Included in Company Adjusted Free Cash Flows Company Excluding Ford Credit Capital Spending (1,760) (1,927) (2,191) (2,274) (2,073) (2,078) (1,970) (5,878) (6,121) Ford Credit Distributions — — — — — 150 175 — 325 Settlement of Derivatives (72) 92 (13) — 23 (26) 230 7 227 Company Adjusted Free Cash Flow (Non-GAAP) $ 693 $ 2,919 $ 1,225 $ 1,964 $ (479) $ 3,237 $ 3,187 $ 4,837 $ 5,945 a. Restructuring excludes cash flows reported in investing activities b. Includes timing differences with a joint venture and currency impacts c. Includes $(365)M settlement of Transit Connect customs matter

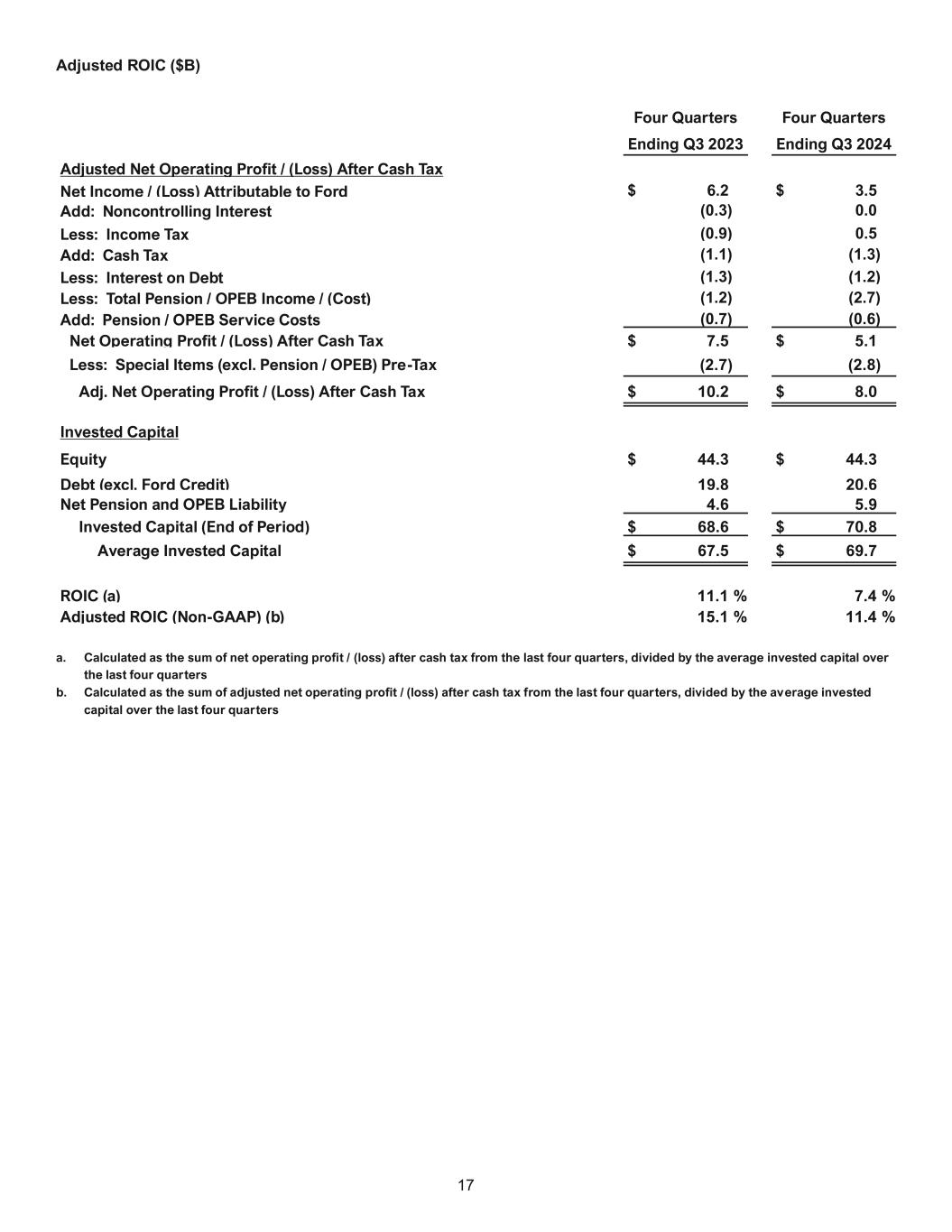

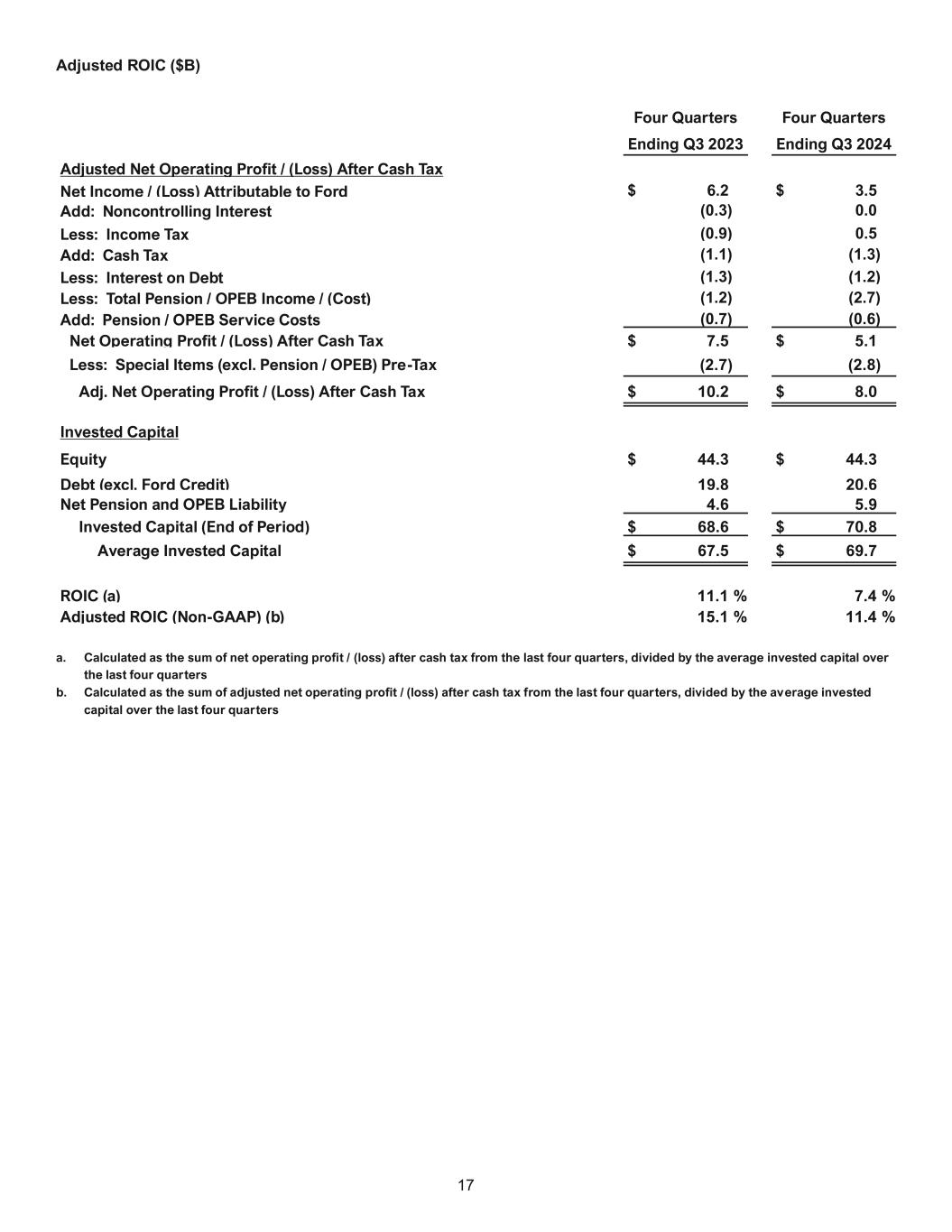

17 Adjusted ROIC ($B) Four Quarters Ending Q3 2023 Four Quarters Ending Q3 2024 Adjusted Net Operating Profit / (Loss) After Cash Tax Net Income / (Loss) Attributable to Ford $ 6.2 $ 3.5 Add: Noncontrolling Interest (0.3) 0.0 Less: Income Tax (0.9) 0.5 Add: Cash Tax (1.1) (1.3) Less: Interest on Debt (1.3) (1.2) Less: Total Pension / OPEB Income / (Cost) (1.2) (2.7) Add: Pension / OPEB Service Costs (0.7) (0.6) Net Operating Profit / (Loss) After Cash Tax $ 7.5 $ 5.1 Less: Special Items (excl. Pension / OPEB) Pre-Tax (2.7) (2.8) Adj. Net Operating Profit / (Loss) After Cash Tax $ 10.2 $ 8.0 Invested Capital Equity $ 44.3 $ 44.3 Debt (excl. Ford Credit) 19.8 20.6 Net Pension and OPEB Liability 4.6 5.9 Invested Capital (End of Period) $ 68.6 $ 70.8 Average Invested Capital $ 67.5 $ 69.7 ROIC (a) 11.1 % 7.4 % Adjusted ROIC (Non-GAAP) (b) 15.1 % 11.4 % a. Calculated as the sum of net operating profit / (loss) after cash tax from the last four quarters, divided by the average invested capital over the last four quarters b. Calculated as the sum of adjusted net operating profit / (loss) after cash tax from the last four quarters, divided by the average invested capital over the last four quarters

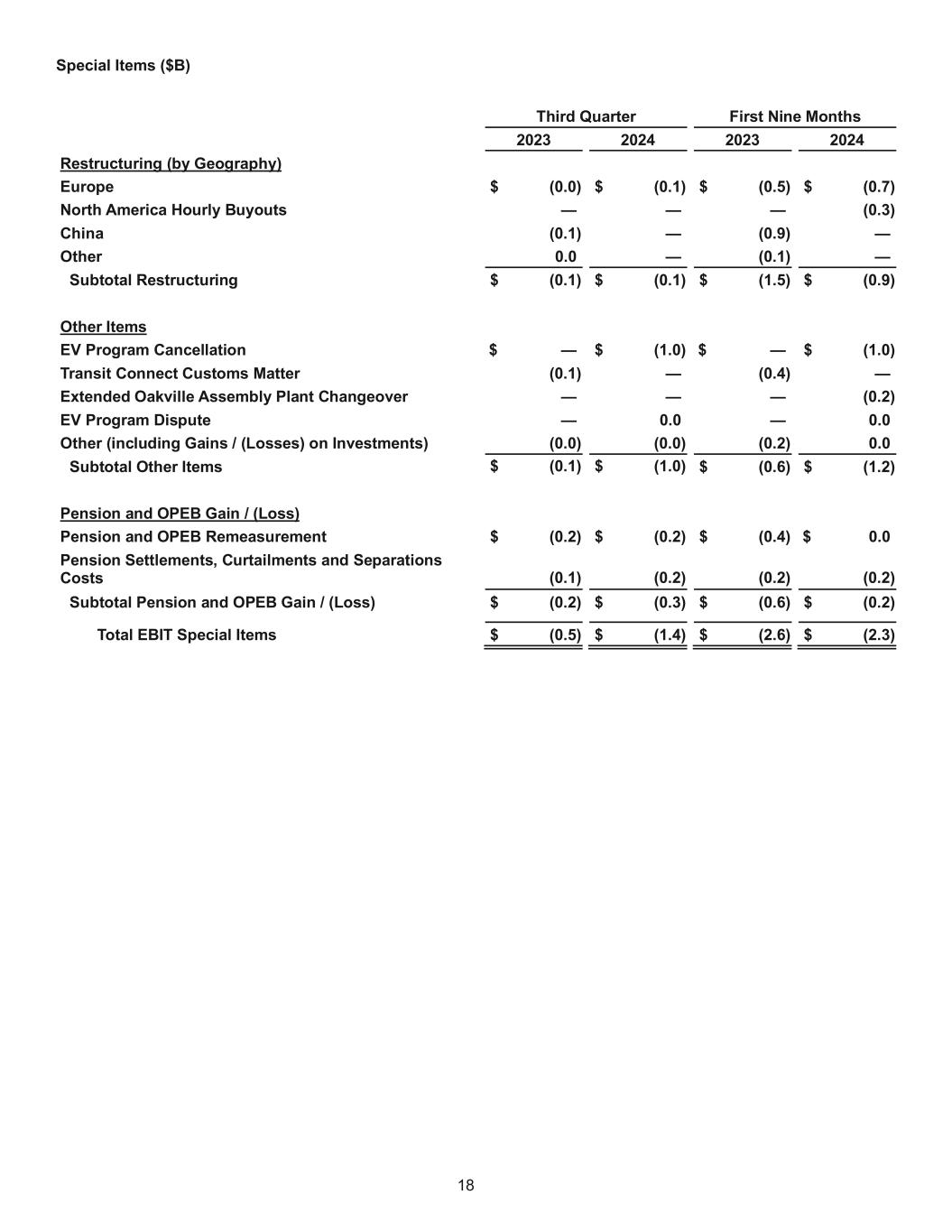

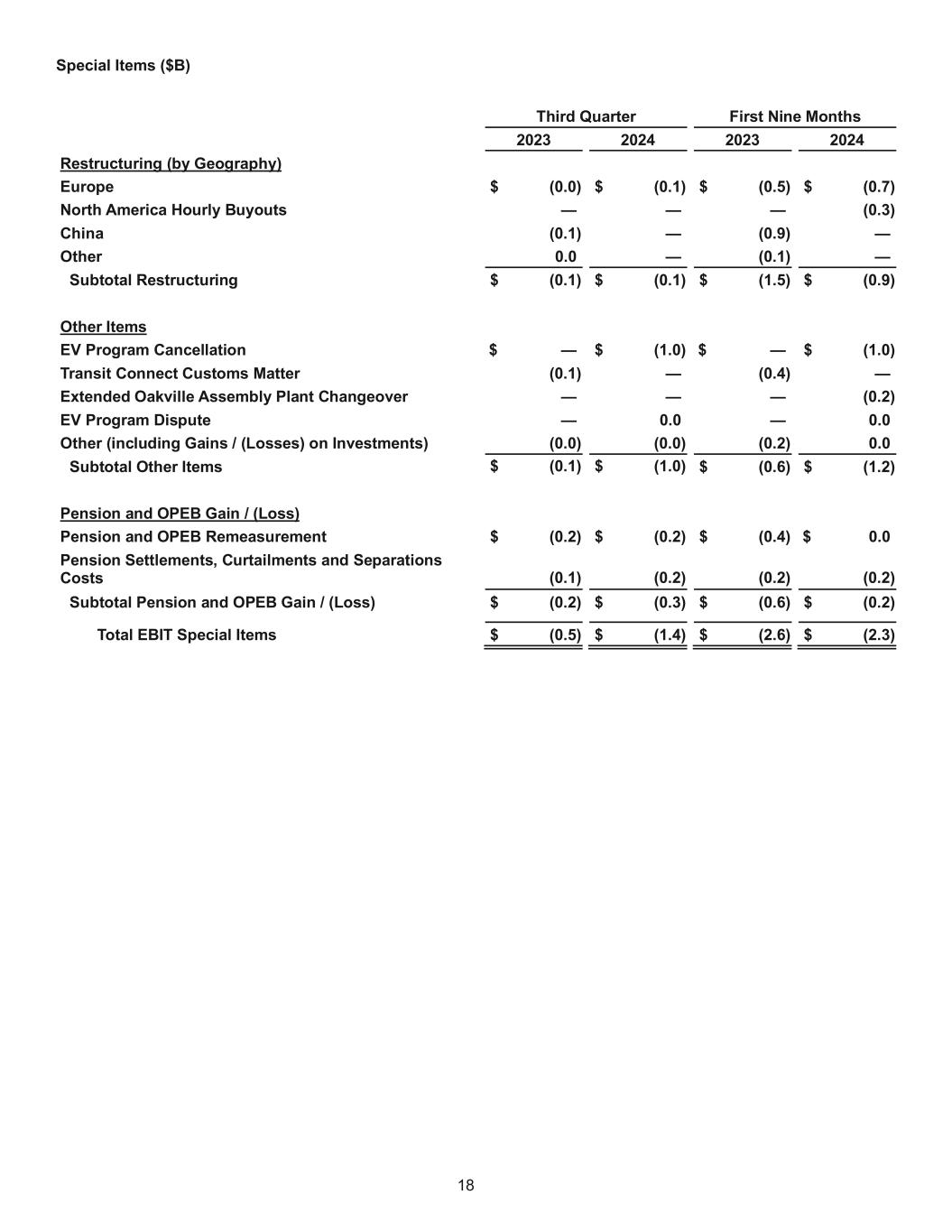

18 Special Items ($B) Third Quarter First Nine Months 2023 2024 2023 2024 Restructuring (by Geography) Europe $ (0.0) $ (0.1) $ (0.5) $ (0.7) North America Hourly Buyouts — — — (0.3) China (0.1) — (0.9) — Other 0.0 — (0.1) — Subtotal Restructuring $ (0.1) $ (0.1) $ (1.5) $ (0.9) Other Items EV Program Cancellation $ — $ (1.0) $ — $ (1.0) Transit Connect Customs Matter (0.1) — (0.4) — Extended Oakville Assembly Plant Changeover — — — (0.2) EV Program Dispute — 0.0 — 0.0 Other (including Gains / (Losses) on Investments) (0.0) (0.0) (0.2) 0.0 Subtotal Other Items $ (0.1) $ (1.0) $ (0.6) $ (1.2) Pension and OPEB Gain / (Loss) Pension and OPEB Remeasurement $ (0.2) $ (0.2) $ (0.4) $ 0.0 Pension Settlements, Curtailments and Separations Costs (0.1) (0.2) (0.2) (0.2) Subtotal Pension and OPEB Gain / (Loss) $ (0.2) $ (0.3) $ (0.6) $ (0.2) Total EBIT Special Items $ (0.5) $ (1.4) $ (2.6) $ (2.3)

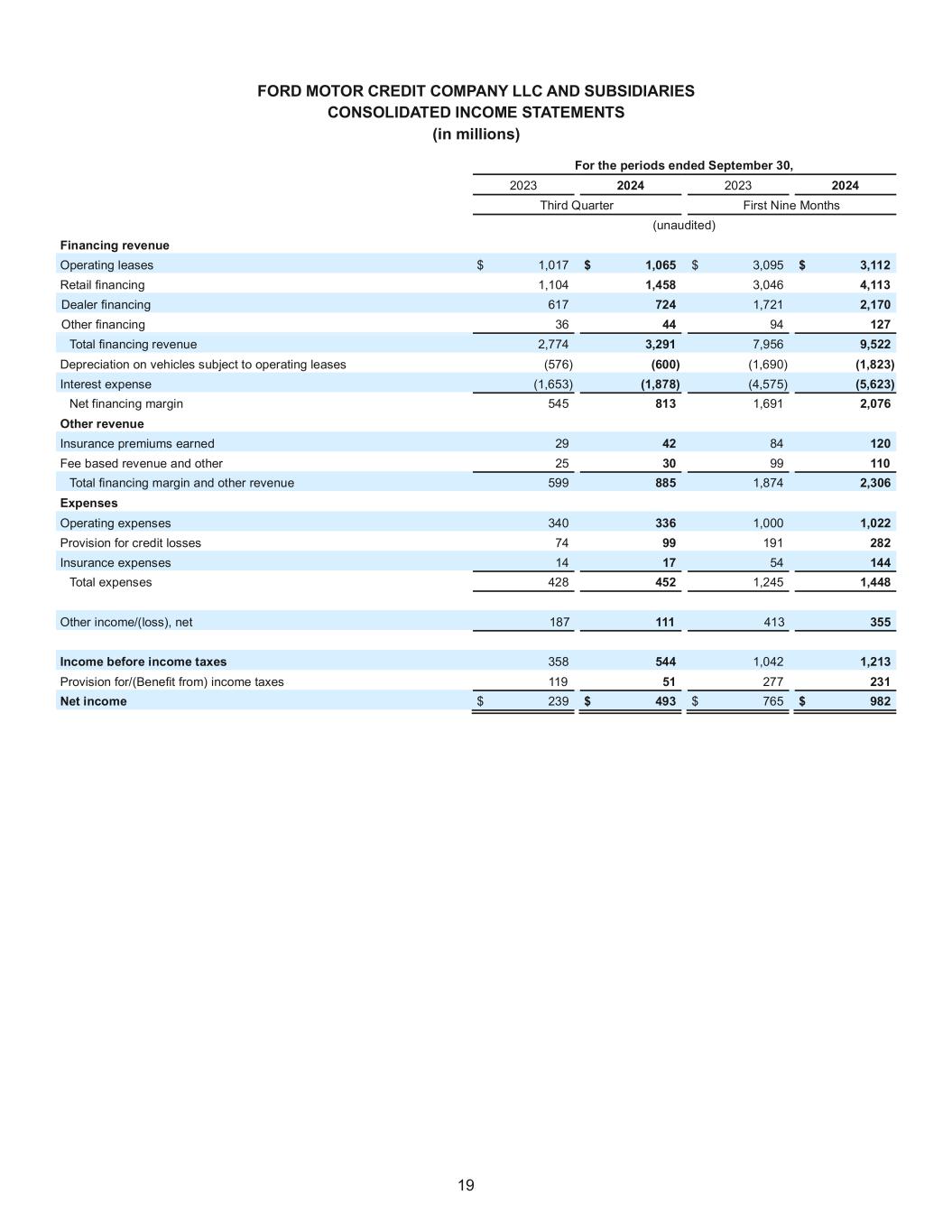

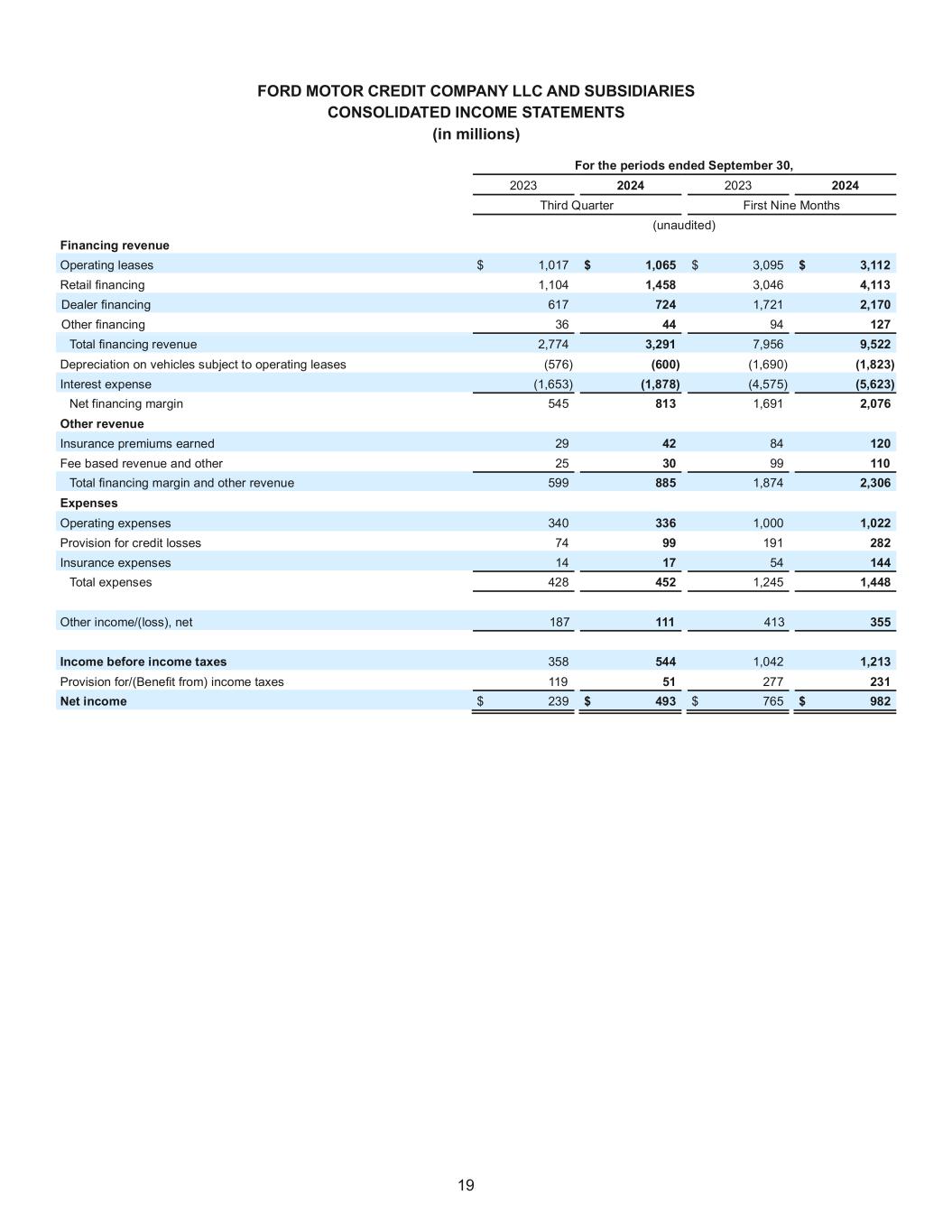

19 FORD MOTOR CREDIT COMPANY LLC AND SUBSIDIARIES CONSOLIDATED INCOME STATEMENTS (in millions) For the periods ended September 30, 2023 2024 2023 2024 Third Quarter First Nine Months (unaudited) Financing revenue Operating leases $ 1,017 $ 1,065 $ 3,095 $ 3,112 Retail financing 1,104 1,458 3,046 4,113 Dealer financing 617 724 1,721 2,170 Other financing 36 44 94 127 Total financing revenue 2,774 3,291 7,956 9,522 Depreciation on vehicles subject to operating leases (576) (600) (1,690) (1,823) Interest expense (1,653) (1,878) (4,575) (5,623) Net financing margin 545 813 1,691 2,076 Other revenue Insurance premiums earned 29 42 84 120 Fee based revenue and other 25 30 99 110 Total financing margin and other revenue 599 885 1,874 2,306 Expenses Operating expenses 340 336 1,000 1,022 Provision for credit losses 74 99 191 282 Insurance expenses 14 17 54 144 Total expenses 428 452 1,245 1,448 Other income/(loss), net 187 111 413 355 Income before income taxes 358 544 1,042 1,213 Provision for/(Benefit from) income taxes 119 51 277 231 Net income $ 239 $ 493 $ 765 $ 982

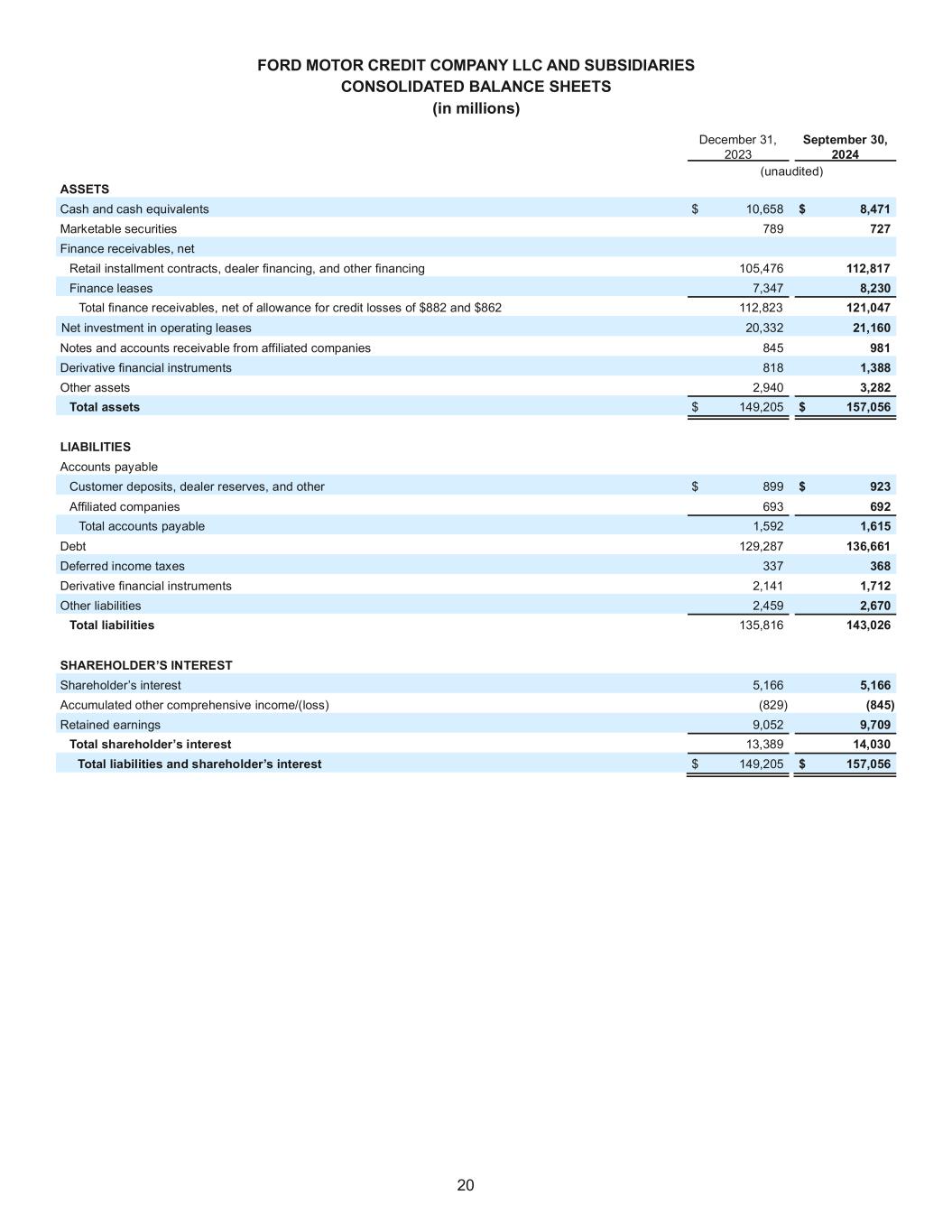

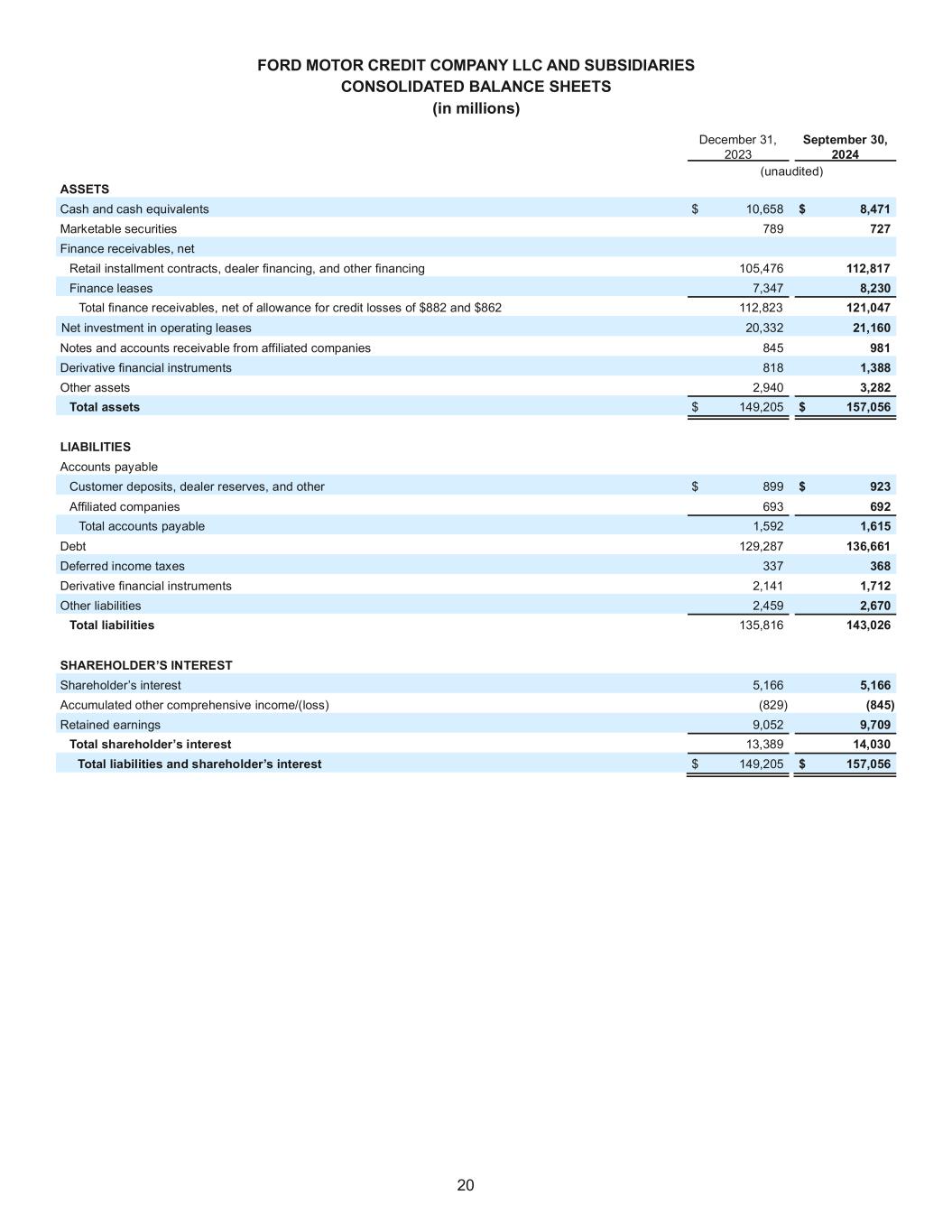

20 FORD MOTOR CREDIT COMPANY LLC AND SUBSIDIARIES CONSOLIDATED BALANCE SHEETS (in millions) December 31, 2023 September 30, 2024 (unaudited) ASSETS Cash and cash equivalents $ 10,658 $ 8,471 Marketable securities 789 727 Finance receivables, net Retail installment contracts, dealer financing, and other financing 105,476 112,817 Finance leases 7,347 8,230 Total finance receivables, net of allowance for credit losses of $882 and $862 112,823 121,047 Net investment in operating leases 20,332 21,160 Notes and accounts receivable from affiliated companies 845 981 Derivative financial instruments 818 1,388 Other assets 2,940 3,282 Total assets $ 149,205 $ 157,056 LIABILITIES Accounts payable Customer deposits, dealer reserves, and other $ 899 $ 923 Affiliated companies 693 692 Total accounts payable 1,592 1,615 Debt 129,287 136,661 Deferred income taxes 337 368 Derivative financial instruments 2,141 1,712 Other liabilities 2,459 2,670 Total liabilities 135,816 143,026 SHAREHOLDER’S INTEREST Shareholder’s interest 5,166 5,166 Accumulated other comprehensive income/(loss) (829) (845) Retained earnings 9,052 9,709 Total shareholder’s interest 13,389 14,030 Total liabilities and shareholder’s interest $ 149,205 $ 157,056

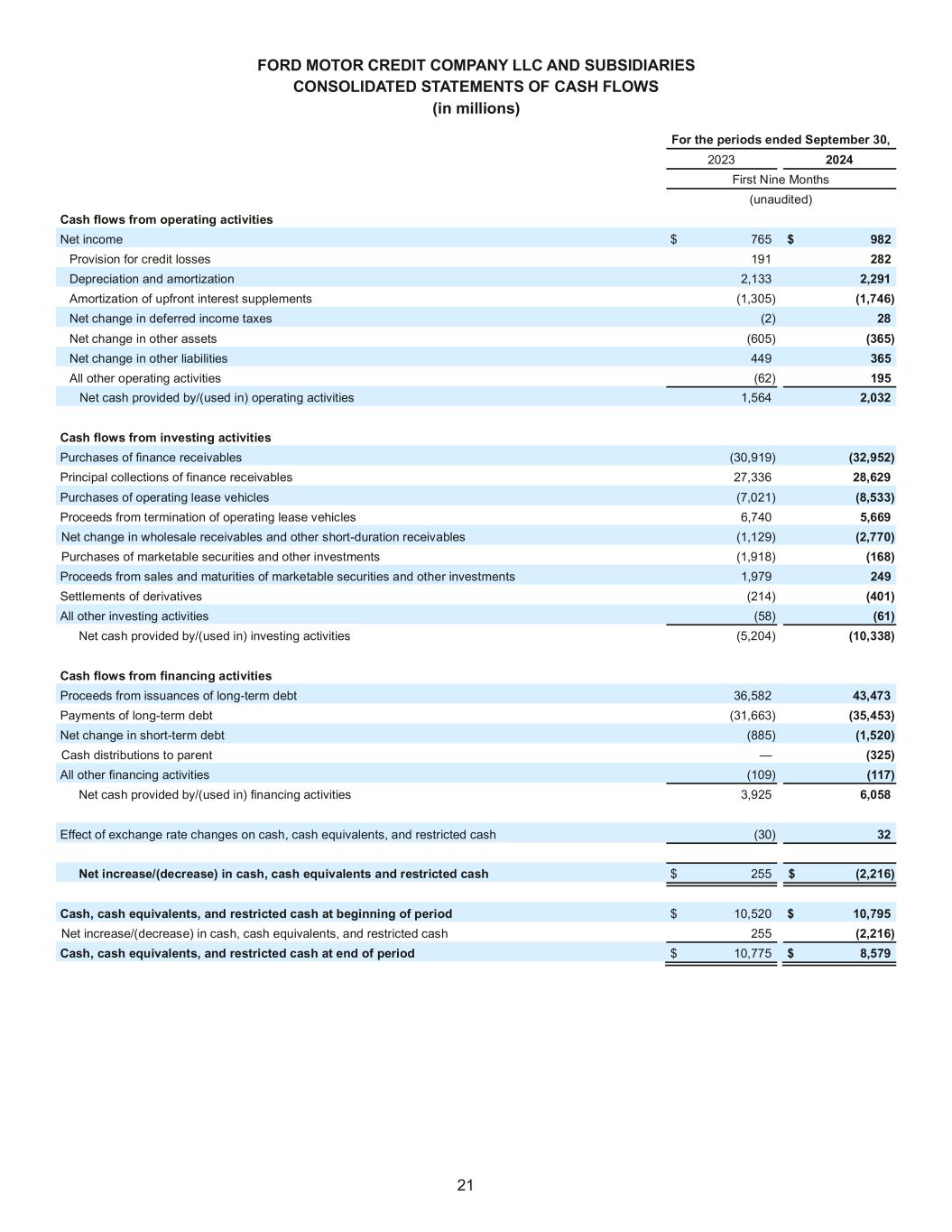

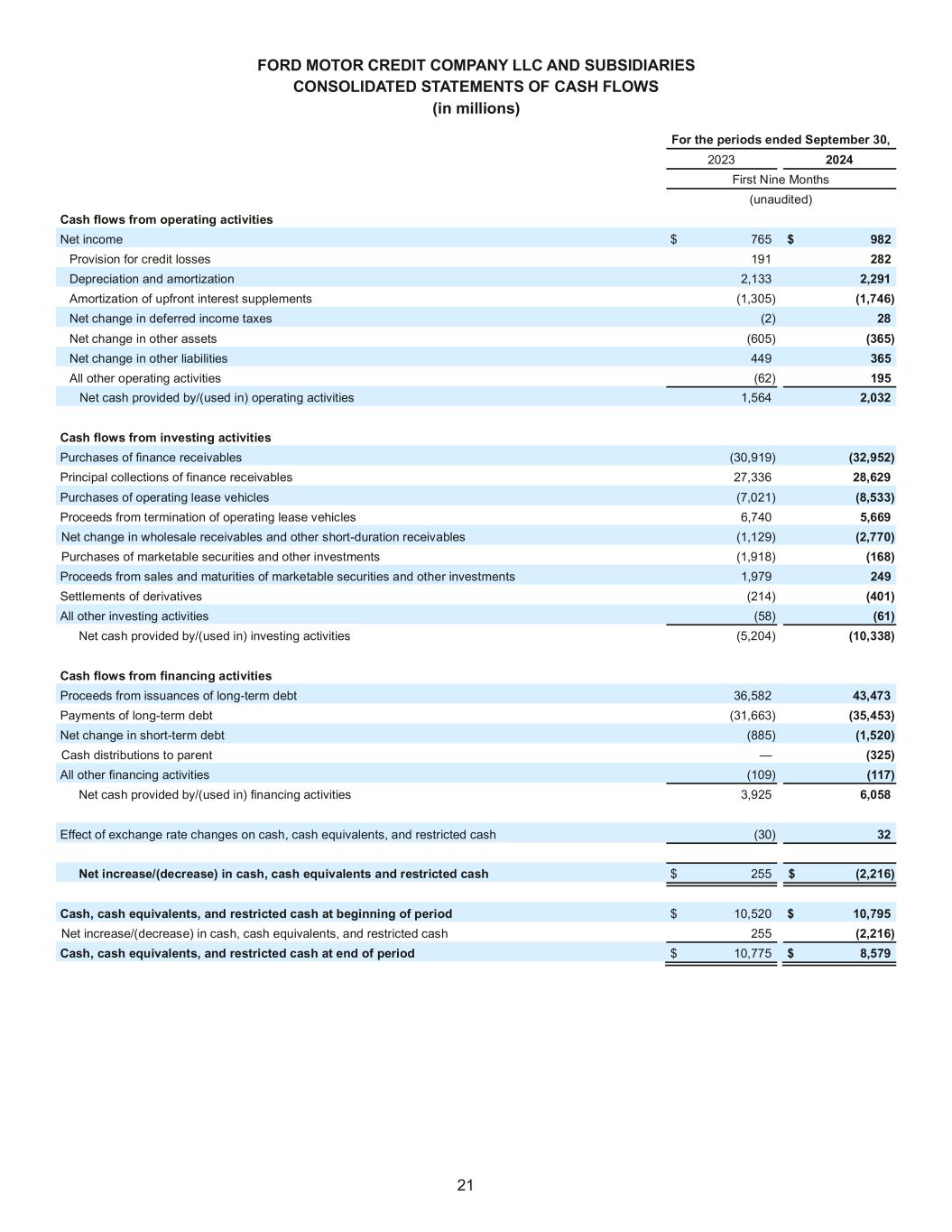

21 FORD MOTOR CREDIT COMPANY LLC AND SUBSIDIARIES CONSOLIDATED STATEMENTS OF CASH FLOWS (in millions) For the periods ended September 30, 2023 2024 First Nine Months (unaudited) Cash flows from operating activities Net income $ 765 $ 982 Provision for credit losses 191 282 Depreciation and amortization 2,133 2,291 Amortization of upfront interest supplements (1,305) (1,746) Net change in deferred income taxes (2) 28 Net change in other assets (605) (365) Net change in other liabilities 449 365 All other operating activities (62) 195 Net cash provided by/(used in) operating activities 1,564 2,032 Cash flows from investing activities Purchases of finance receivables (30,919) (32,952) Principal collections of finance receivables 27,336 28,629 Purchases of operating lease vehicles (7,021) (8,533) Proceeds from termination of operating lease vehicles 6,740 5,669 Net change in wholesale receivables and other short-duration receivables (1,129) (2,770) Purchases of marketable securities and other investments (1,918) (168) Proceeds from sales and maturities of marketable securities and other investments 1,979 249 Settlements of derivatives (214) (401) All other investing activities (58) (61) Net cash provided by/(used in) investing activities (5,204) (10,338) Cash flows from financing activities Proceeds from issuances of long-term debt 36,582 43,473 Payments of long-term debt (31,663) (35,453) Net change in short-term debt (885) (1,520) Cash distributions to parent — (325) All other financing activities (109) (117) Net cash provided by/(used in) financing activities 3,925 6,058 Effect of exchange rate changes on cash, cash equivalents, and restricted cash (30) 32 Net increase/(decrease) in cash, cash equivalents and restricted cash $ 255 $ (2,216) Cash, cash equivalents, and restricted cash at beginning of period $ 10,520 $ 10,795 Net increase/(decrease) in cash, cash equivalents, and restricted cash 255 (2,216) Cash, cash equivalents, and restricted cash at end of period $ 10,775 $ 8,579