TN |

001-15185 | 62-0803242 | |||||||||

(State or other jurisdiction of incorporation) |

(Commission File Number) | (I.R.S. Employer Identification No.) |

|||||||||

| 165 Madison Avenue | Memphis, | Tennessee | 38103 | ||||||||

(Address of Principal Executive Offices) |

(Zip Code) |

||||||||||

| Title of Each Class | Trading Symbol(s) | Name of Exchange on which Registered | ||||||

| $0.625 Par Value Common Capital Stock | FHN | New York Stock Exchange LLC | ||||||

| Depositary Shares, each representing a 1/400th interest in | FHN PR B | New York Stock Exchange LLC | ||||||

| a share of Non-Cumulative Perpetual Preferred Stock, Series B | ||||||||

| Depositary Shares, each representing a 1/400th interest in | FHN PR C | New York Stock Exchange LLC | ||||||

| a share of Non-Cumulative Perpetual Preferred Stock, Series C | ||||||||

| Depositary Shares, each representing a 1/4,000th interest in | FHN PR E | New York Stock Exchange LLC | ||||||

| a share of Non-Cumulative Perpetual Preferred Stock, Series E | ||||||||

| Depositary Shares, each representing a 1/4,000th interest in | FHN PR F | New York Stock Exchange LLC | ||||||

| a share of Non-Cumulative Perpetual Preferred Stock, Series F | ||||||||

| FIRST HORIZON CORPORATION | 2 |

FORM 8-K CURRENT REPORT 07/17/2024 | ||||||

| Exhibit # | Description | |||||||

| 99.1 | ||||||||

| 99.2 | ||||||||

| 104 | Cover Page Interactive Data File, formatted in Inline XBRL | |||||||

| FIRST HORIZON CORPORATION | 3 |

FORM 8-K CURRENT REPORT 07/17/2024 | ||||||

| FIRST HORIZON CORPORATION | |||||||||||||||||

| (Registrant) | |||||||||||||||||

| Date: | July 17, 2024 | By: | /s/ Hope Dmuchowski | ||||||||||||||

| Hope Dmuchowski | |||||||||||||||||

| Senior Executive Vice President—Chief Financial Officer | |||||||||||||||||

| (Duly Authorized Officer and Principal Financial Officer) | |||||||||||||||||

| FIRST HORIZON CORPORATION | 4 |

FORM 8-K CURRENT REPORT 07/17/2024 | ||||||

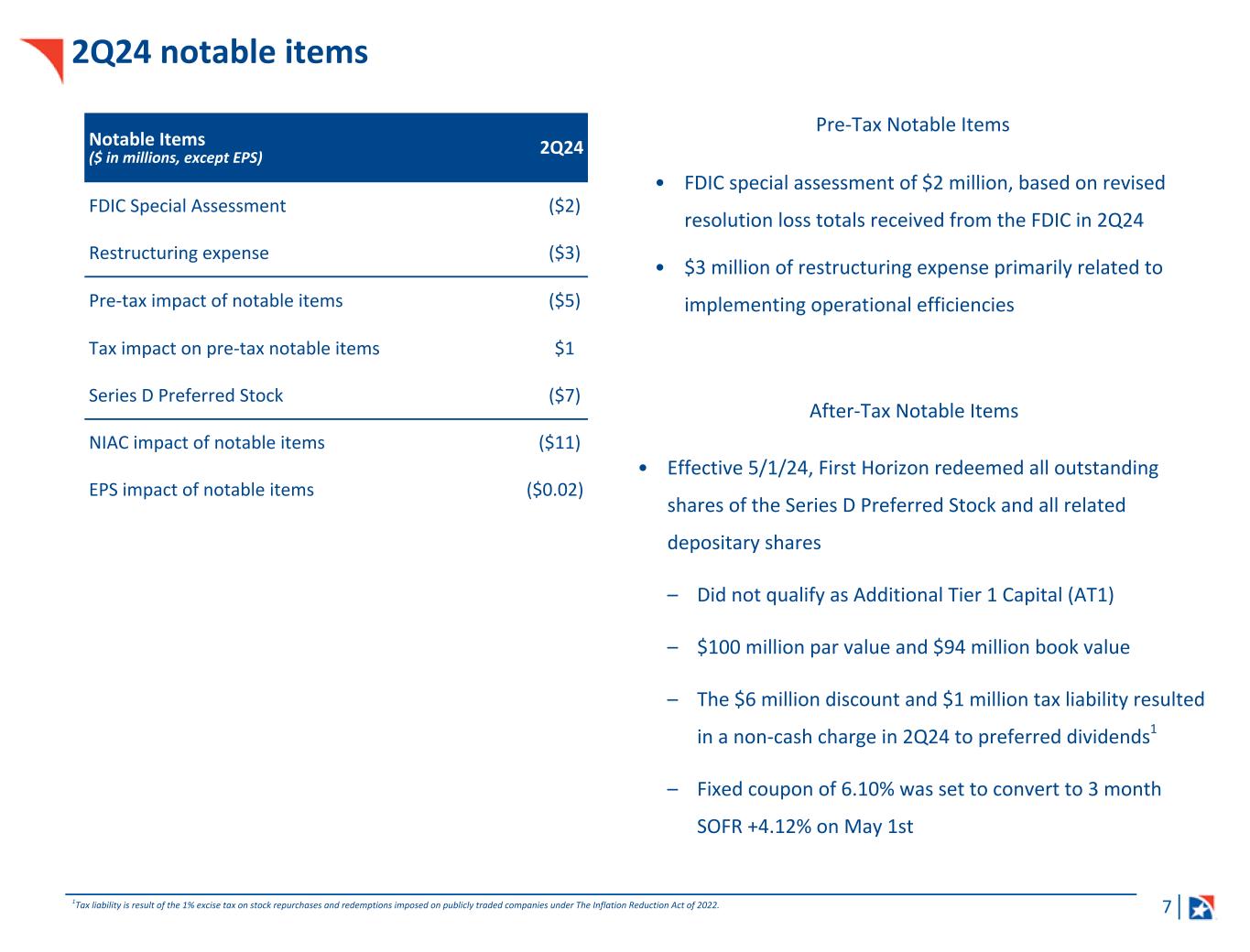

| Notable Items | ||||||||||||||||||||

| Quarterly, Unaudited ($ in millions, except per share data) | 2Q24 | 1Q24 | 2Q23 | |||||||||||||||||

| Summary of Notable Items: | ||||||||||||||||||||

| Gain on merger termination | $ | — | $ | — | $ | 225 | ||||||||||||||

| Net merger/acquisition/transaction-related items | — | — | (30) | |||||||||||||||||

| FDIC special assessment (other noninterest expense) | (2) | (10) | — | |||||||||||||||||

| Other notable expenses | (3) | (5) | (65) | |||||||||||||||||

| Total notable items (pre-tax) | $ | (5) | $ | (15) | $ | 130 | ||||||||||||||

| Total notable items (after-tax) | $ | (11) | $ | (12) | $ | 98 | ||||||||||||||

| Numbers may not foot due to rounding. | ||||||||||||||||||||

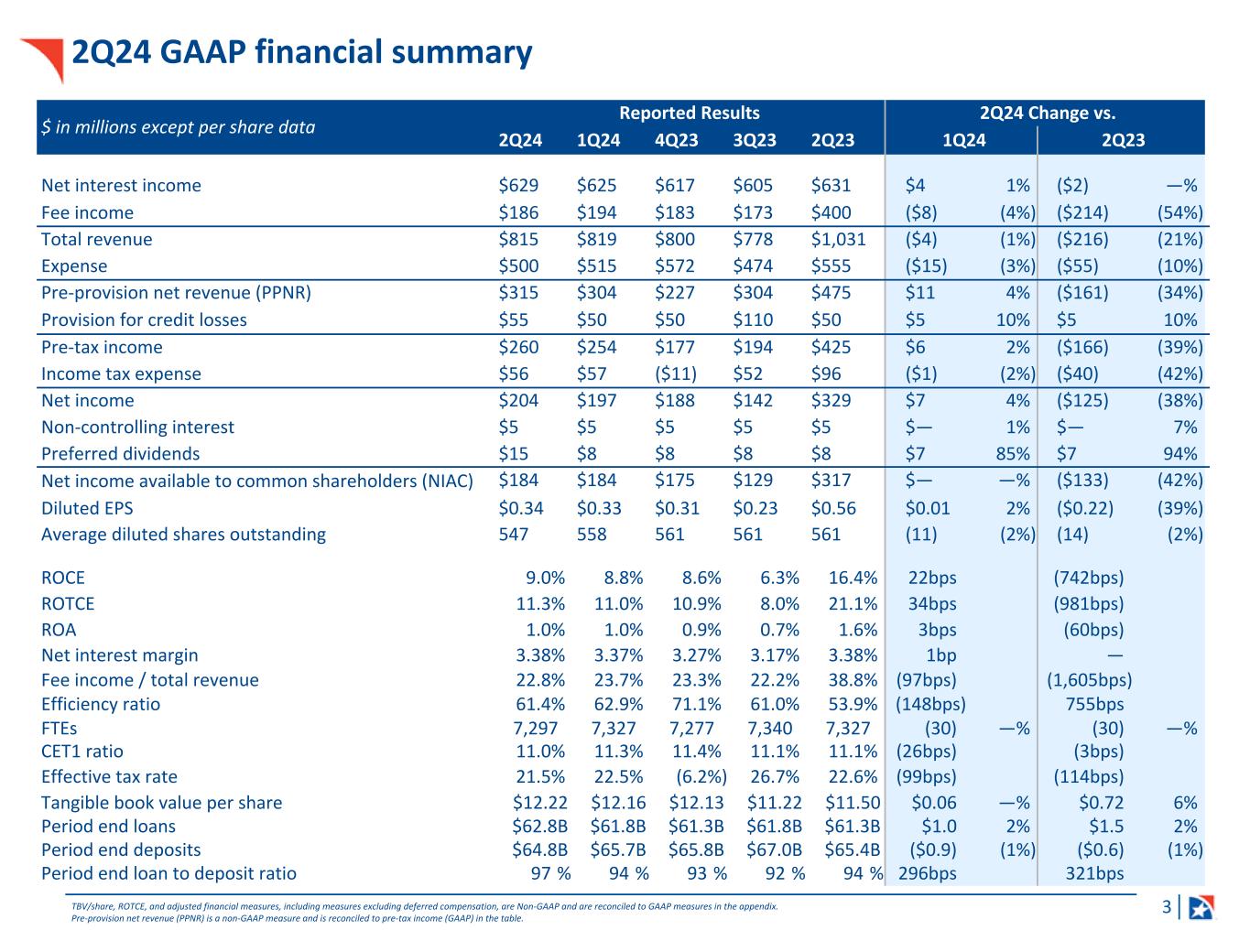

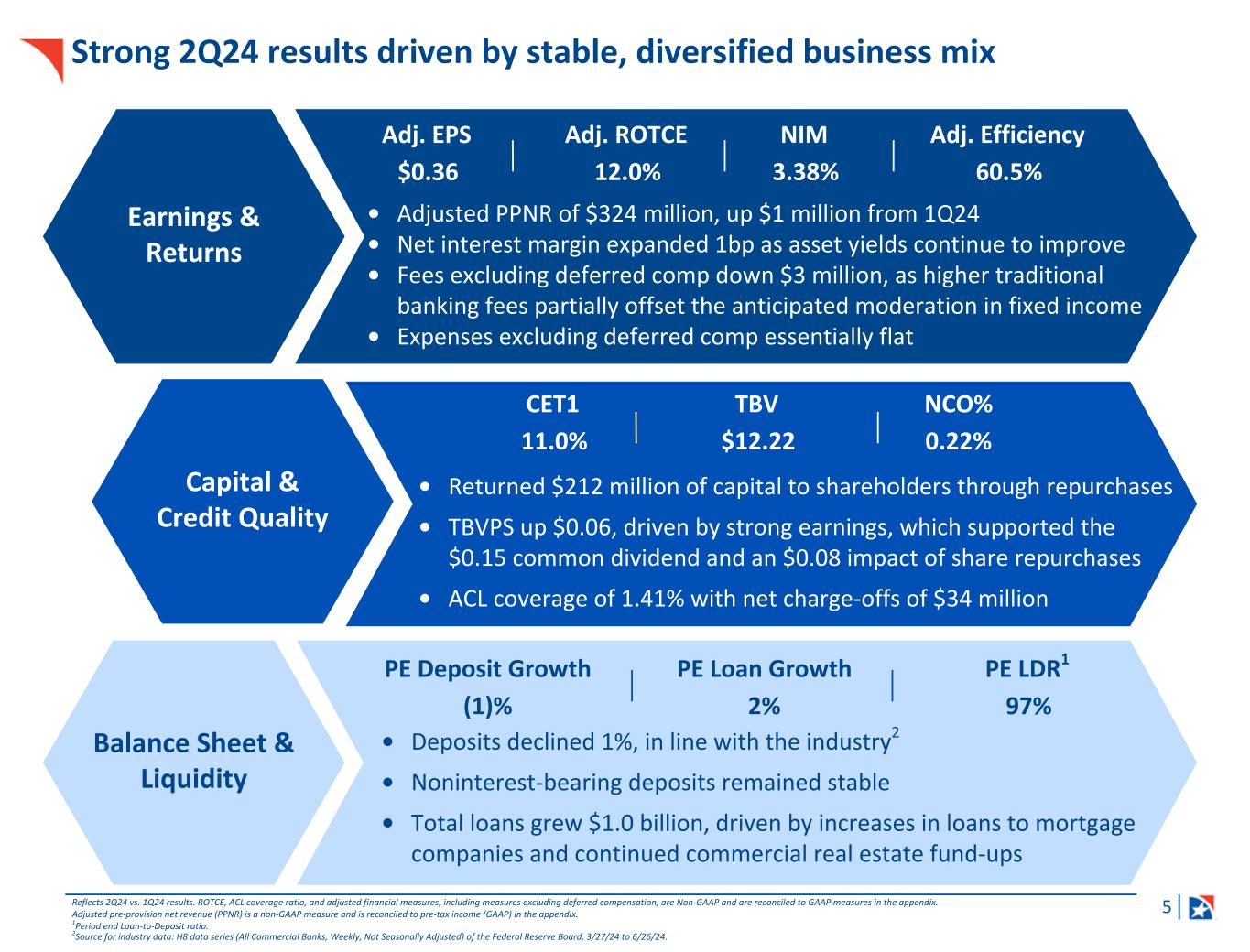

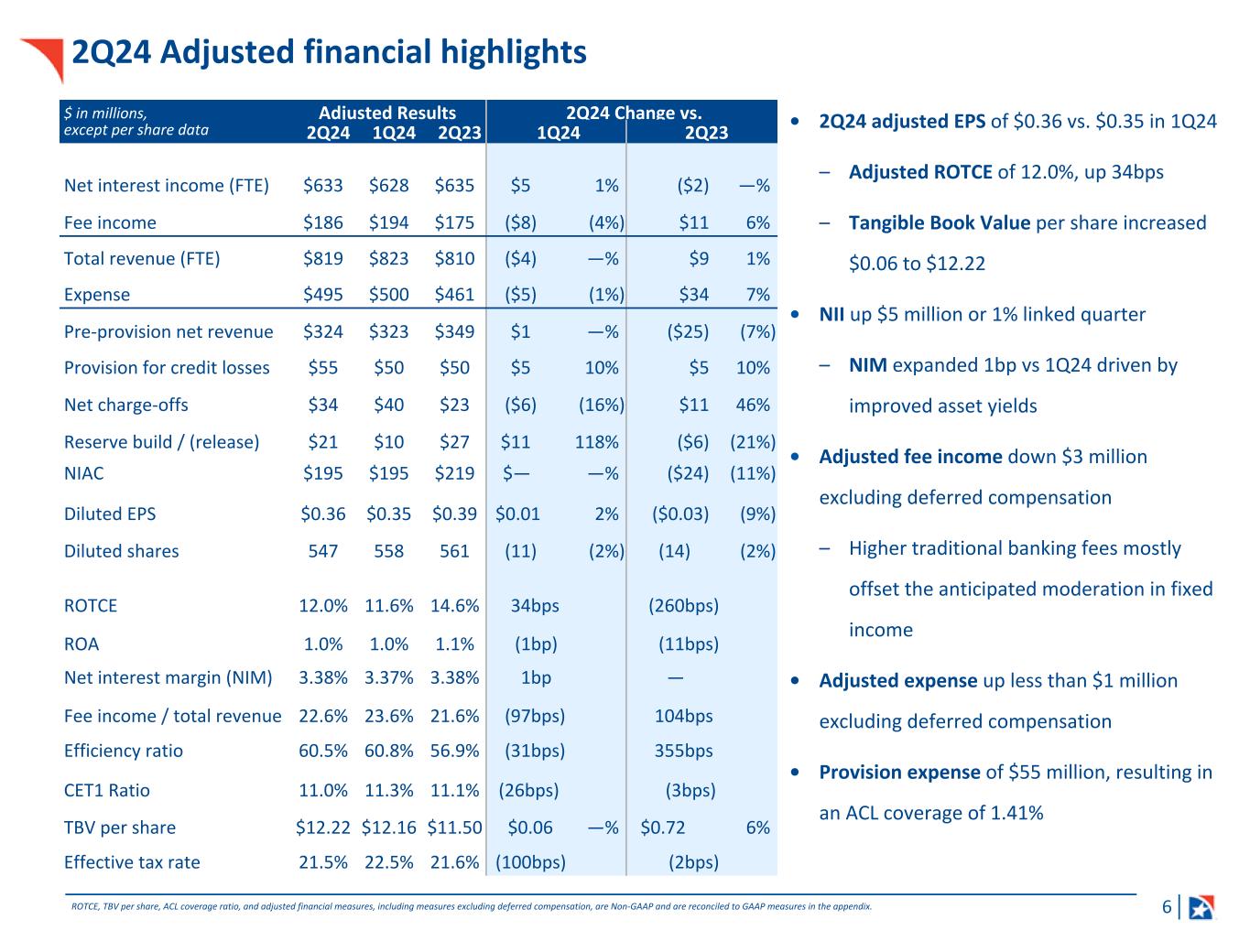

| SUMMARY RESULTS | ||||||||||||||||||||||||||||||||||||||||||||

| Quarterly, Unaudited | ||||||||||||||||||||||||||||||||||||||||||||

| 2Q24 Change vs. | ||||||||||||||||||||||||||||||||||||||||||||

| ($s in millions, except per share and balance sheet data) | 2Q24 | 1Q24 | 2Q23 | 1Q24 | 2Q23 | |||||||||||||||||||||||||||||||||||||||

| $/bp | % | $/bp | % | |||||||||||||||||||||||||||||||||||||||||

| Income Statement | ||||||||||||||||||||||||||||||||||||||||||||

Interest income - taxable equivalent1 |

$ | 1,097 | $ | 1,076 | $ | 1,019 | $ | 21 | 2 | % | $ | 78 | 8 | % | ||||||||||||||||||||||||||||||

Interest expense- taxable equivalent1 |

464 | 448 | 385 | 16 | 4 | 79 | 21 | |||||||||||||||||||||||||||||||||||||

| Net interest income- taxable equivalent | 633 | 628 | 635 | 5 | 1 | (2) | — | |||||||||||||||||||||||||||||||||||||

| Less: Taxable-equivalent adjustment | 4 | 4 | 4 | — | 10 | — | 6 | |||||||||||||||||||||||||||||||||||||

| Net interest income | 629 | 625 | 631 | 4 | 1 | (2) | — | |||||||||||||||||||||||||||||||||||||

| Noninterest income | 186 | 194 | 400 | (8) | (4) | (214) | (54) | |||||||||||||||||||||||||||||||||||||

| Total revenue | 815 | 819 | 1,031 | (4) | (1) | (216) | (21) | |||||||||||||||||||||||||||||||||||||

| Noninterest expense | 500 | 515 | 555 | (15) | (3) | (55) | (10) | |||||||||||||||||||||||||||||||||||||

Pre-provision net revenue3 |

315 | 304 | 475 | 11 | 4 | (161) | (34) | |||||||||||||||||||||||||||||||||||||

| Provision for credit losses | 55 | 50 | 50 | 5 | 10 | 5 | 10 | |||||||||||||||||||||||||||||||||||||

| Income before income taxes | 260 | 254 | 425 | 6 | 2 | (166) | (39) | |||||||||||||||||||||||||||||||||||||

| Provision for income taxes | 56 | 57 | 96 | (1) | (2) | (40) | (42) | |||||||||||||||||||||||||||||||||||||

| Net income | 204 | 197 | 329 | 7 | 4 | (125) | (38) | |||||||||||||||||||||||||||||||||||||

| Net income attributable to noncontrolling interest | 5 | 5 | 5 | — | 1 | — | 7 | |||||||||||||||||||||||||||||||||||||

| Net income attributable to controlling interest | 199 | 192 | 325 | 7 | 4 | (126) | (39) | |||||||||||||||||||||||||||||||||||||

| Preferred stock dividends | 15 | 8 | 8 | 7 | 85 | 7 | 94 | |||||||||||||||||||||||||||||||||||||

| Net income available to common shareholders | $ | 184 | $ | 184 | $ | 317 | $ | — | — | % | $ | (133) | (42) | % | ||||||||||||||||||||||||||||||

Adjusted net income4 |

$ | 208 | $ | 208 | $ | 231 | $ | — | — | % | $ | (23) | (10) | % | ||||||||||||||||||||||||||||||

Adjusted net income available to common shareholders4 |

$ | 195 | $ | 195 | $ | 219 | $ | — | — | % | $ | (24) | (11) | % | ||||||||||||||||||||||||||||||

| Common stock information | ||||||||||||||||||||||||||||||||||||||||||||

| EPS | $ | 0.34 | $ | 0.33 | $ | 0.56 | $ | 0.01 | 2 | % | $ | (0.22) | (39) | % | ||||||||||||||||||||||||||||||

Adjusted EPS4 |

$ | 0.36 | $ | 0.35 | $ | 0.39 | $ | 0.01 | 2 | % | $ | (0.03) | (9) | % | ||||||||||||||||||||||||||||||

Diluted shares8 |

547 | 558 | 561 | (11) | (2) | % | (14) | (2) | % | |||||||||||||||||||||||||||||||||||

| Key performance metrics | ||||||||||||||||||||||||||||||||||||||||||||

Net interest margin6 |

3.38 | % | 3.37 | % | 3.38 | % | 1 | bp | — | bp | ||||||||||||||||||||||||||||||||||

| Efficiency ratio | 61.44 | 62.92 | 53.89 | (148) | 755 | |||||||||||||||||||||||||||||||||||||||

Adjusted efficiency ratio4 |

60.47 | 60.78 | 56.92 | (31) | 355 | |||||||||||||||||||||||||||||||||||||||

| Effective income tax rate | 21.49 | 22.48 | 22.63 | (99) | (114) | |||||||||||||||||||||||||||||||||||||||

| Return on average assets | 1.00 | 0.97 | 1.60 | 3 | (60) | |||||||||||||||||||||||||||||||||||||||

Adjusted return on average assets4 |

1.02 | 1.03 | 1.13 | (1) | (11) | |||||||||||||||||||||||||||||||||||||||

| Return on average common equity (“ROCE") | 9.0 | 8.8 | 16.4 | 22 | (742) | |||||||||||||||||||||||||||||||||||||||

Return on average tangible common equity (“ROTCE”)4 |

11.3 | 11.0 | 21.1 | 34 | (981) | |||||||||||||||||||||||||||||||||||||||

Adjusted ROTCE4 |

12.0 | 11.6 | 14.6 | 34 | (260) | |||||||||||||||||||||||||||||||||||||||

| Noninterest income as a % of total revenue | 22.75 | 23.72 | 38.80 | (97) | (1,605) | |||||||||||||||||||||||||||||||||||||||

Adjusted noninterest income as a % of total revenue4 |

22.64 | % | 23.61 | % | 21.60 | % | (97) | bp | 104 | bp | ||||||||||||||||||||||||||||||||||

| Balance Sheet (billions) | ||||||||||||||||||||||||||||||||||||||||||||

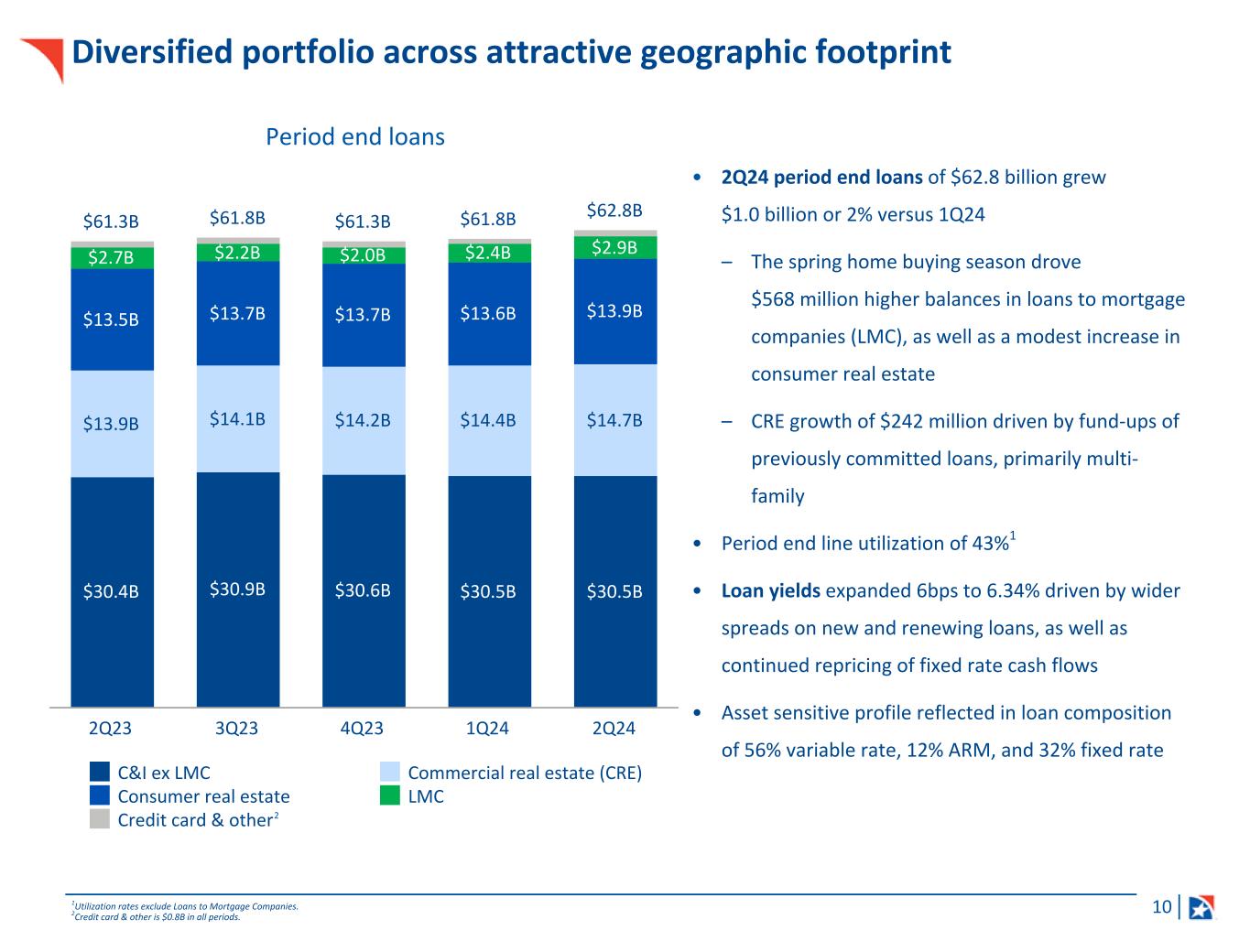

| Average loans | $ | 62.0 | $ | 61.2 | $ | 59.9 | $ | 0.9 | 1 | % | $ | 2.1 | 4 | % | ||||||||||||||||||||||||||||||

| Average deposits | 65.0 | 65.4 | 61.4 | (0.4) | (1) | 3.5 | 6 | |||||||||||||||||||||||||||||||||||||

| Average assets | 81.7 | 81.2 | 82.3 | 0.5 | 1 | (0.6) | (1) | |||||||||||||||||||||||||||||||||||||

| Average common equity | $ | 8.2 | $ | 8.4 | $ | 7.7 | $ | (0.2) | (2) | % | $ | 0.5 | 6 | % | ||||||||||||||||||||||||||||||

| Asset Quality Highlights | ||||||||||||||||||||||||||||||||||||||||||||

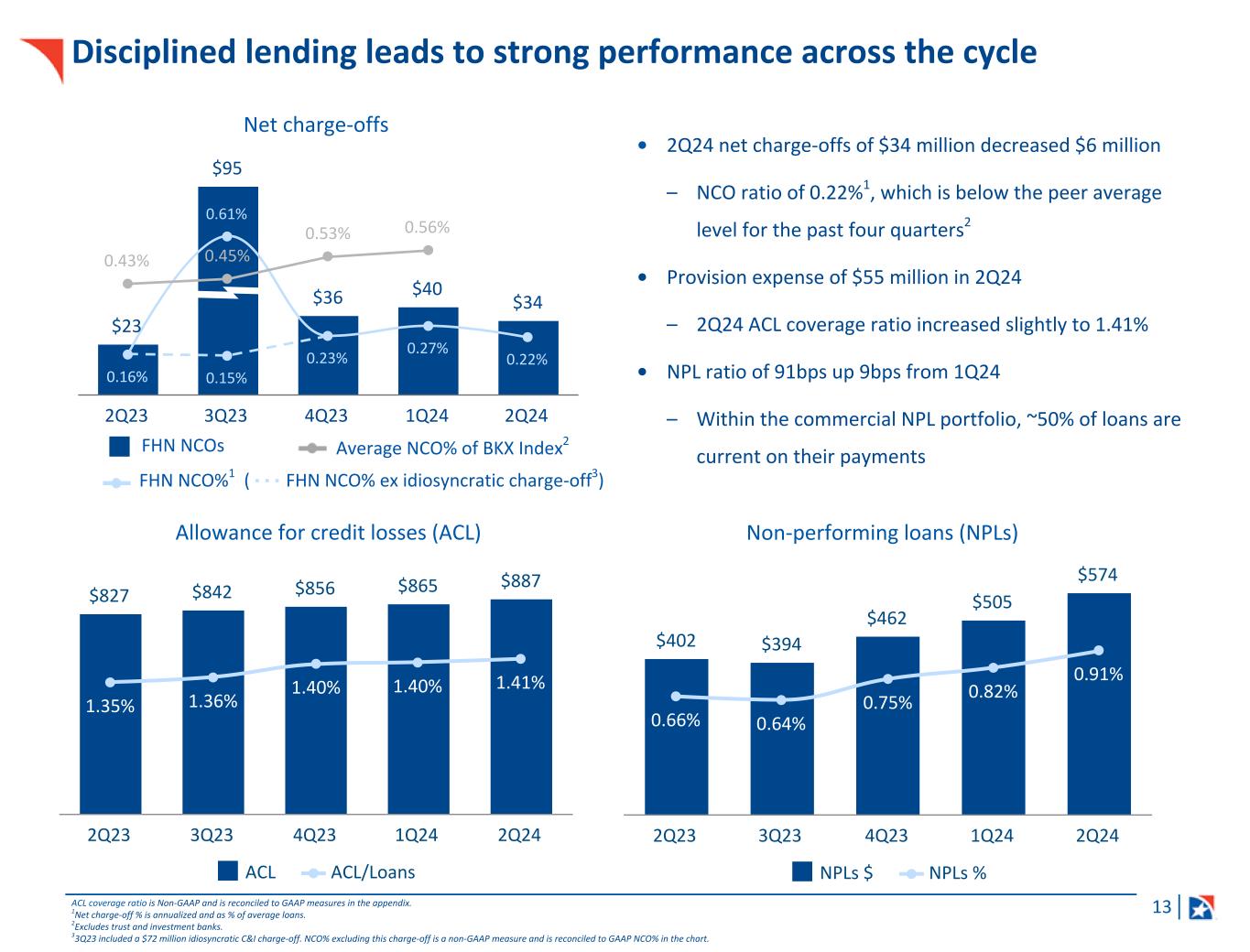

Allowance for credit losses to loans and leases4 |

1.41 | % | 1.40 | % | 1.35 | % | — | bp | 7 | bp | ||||||||||||||||||||||||||||||||||

| Nonperforming loan and leases ratio | 0.91 | % | 0.82 | % | 0.66 | % | 9 | bp | 25 | bp | ||||||||||||||||||||||||||||||||||

| Net charge-off ratio | 0.22 | % | 0.27 | % | 0.16 | % | (5) | bp | 6 | bp | ||||||||||||||||||||||||||||||||||

| Net Charge-offs | $ | 34 | $ | 40 | $ | 23 | $ | (6) | (16) | % | $ | 11 | 46 | % | ||||||||||||||||||||||||||||||

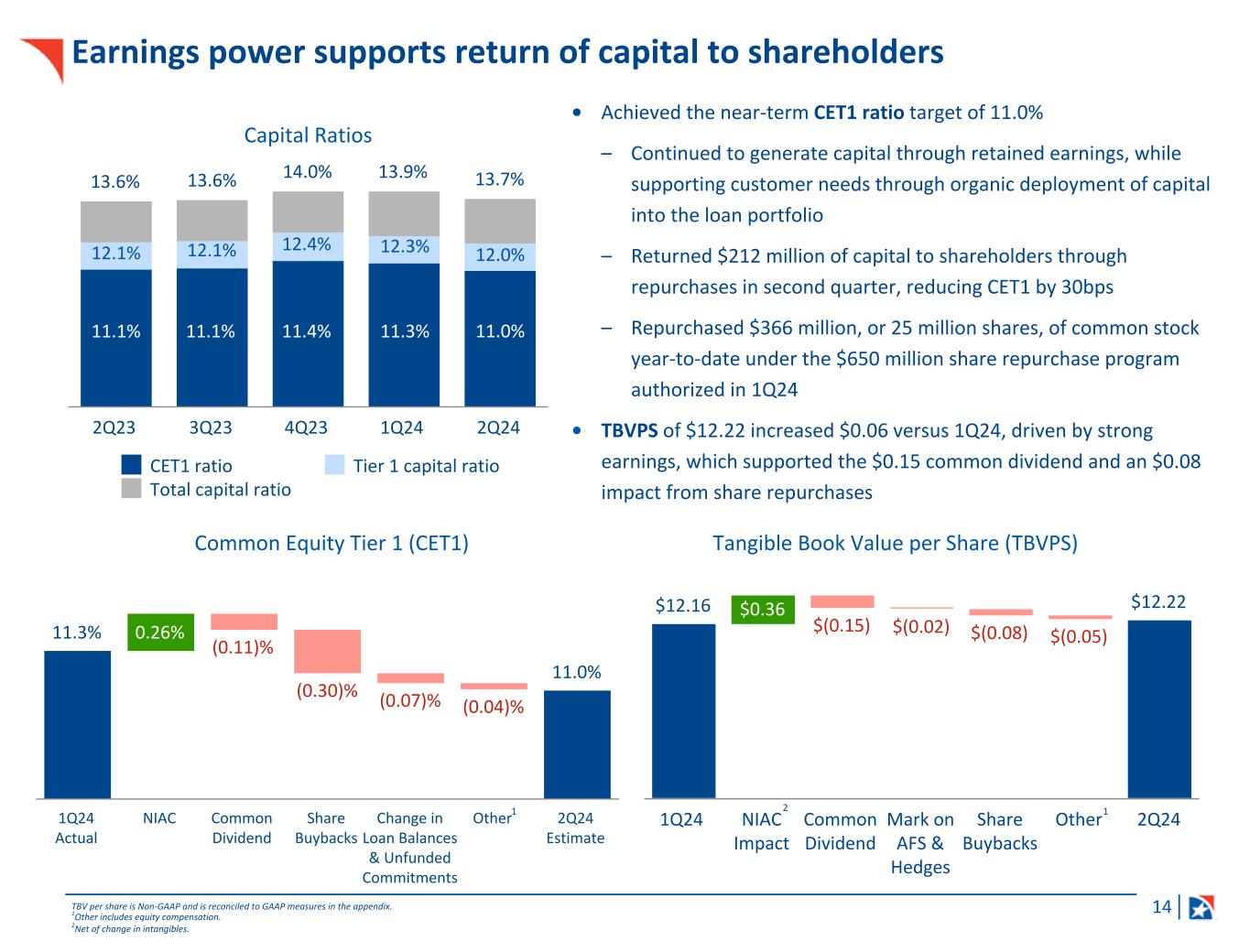

| Capital Ratio Highlights (current quarter is an estimate) | ||||||||||||||||||||||||||||||||||||||||||||

| Common Equity Tier 1 | 11.0 | % | 11.3 | % | 11.1 | % | (26) | bp | (3) | bp | ||||||||||||||||||||||||||||||||||

| Tier 1 | 12.0 | 12.3 | 12.1 | (27) | (4) | |||||||||||||||||||||||||||||||||||||||

| Total Capital | 13.7 | 13.9 | 13.6 | (26) | 9 | |||||||||||||||||||||||||||||||||||||||

| Tier 1 leverage | 10.6 | % | 10.8 | % | 10.5 | % | (21) | bp | 9 | bp | ||||||||||||||||||||||||||||||||||

| CONSOLIDATED INCOME STATEMENT | ||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| Quarterly, Unaudited | ||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| 2Q24 Change vs. | ||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| ($s in millions, except per share data) | 2Q24 | 1Q24 | 4Q23 | 3Q23 | 2Q23 | 1Q24 | 2Q23 | |||||||||||||||||||||||||||||||||||||||||||||||||

| $ | % | $ | % | |||||||||||||||||||||||||||||||||||||||||||||||||||||

Interest income - taxable equivalent1 |

$ | 1,097 | $ | 1,076 | $ | 1,090 | $ | 1,084 | $ | 1,019 | $ | 21 | 2 | % | $ | 78 | 8 | % | ||||||||||||||||||||||||||||||||||||||

Interest expense- taxable equivalent1 |

464 | 448 | 469 | 475 | 385 | 16 | 4 | 79 | 21 | |||||||||||||||||||||||||||||||||||||||||||||||

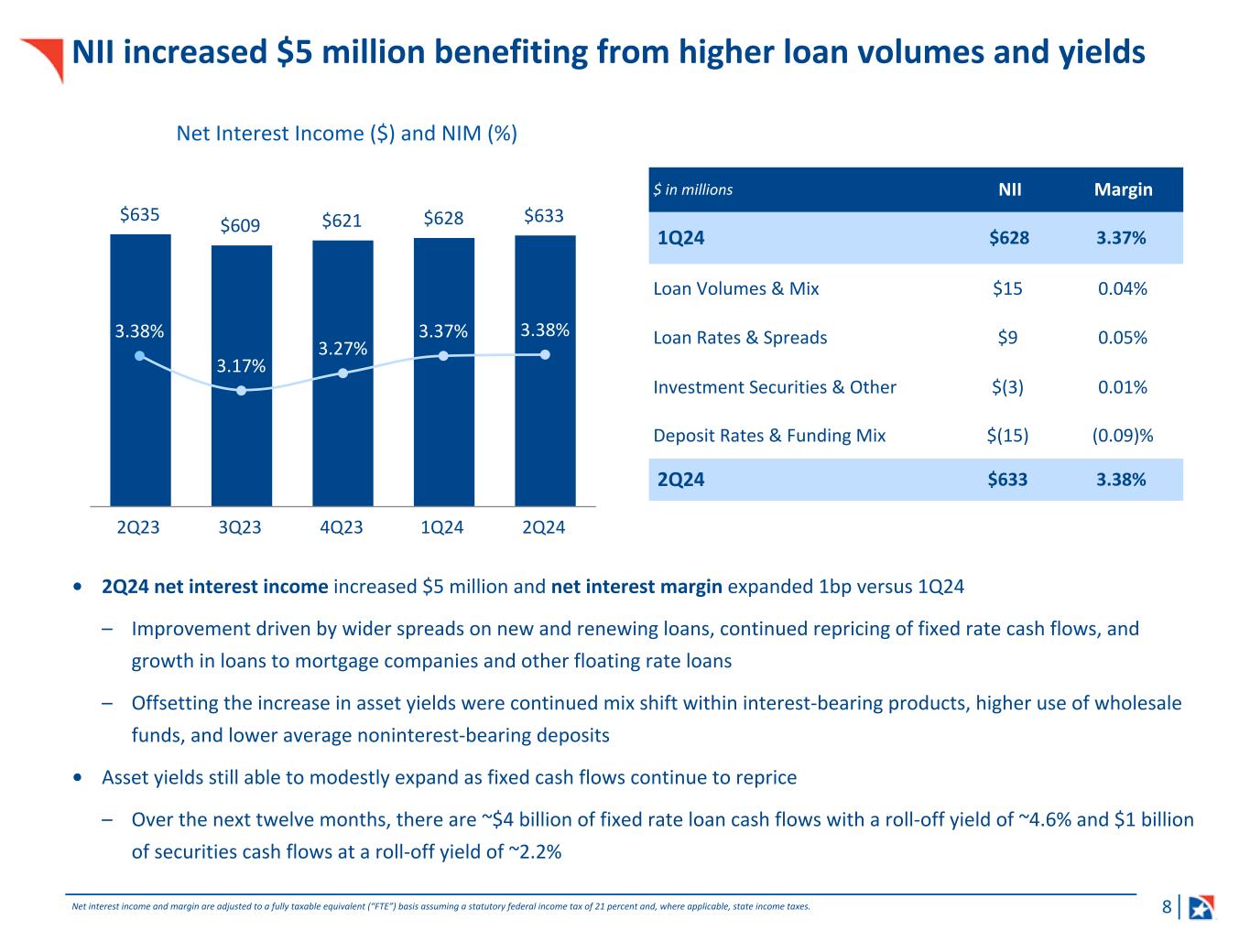

| Net interest income- taxable equivalent | 633 | 628 | 621 | 609 | 635 | 5 | 1 | (2) | — | |||||||||||||||||||||||||||||||||||||||||||||||

| Less: Taxable-equivalent adjustment | 4 | 4 | 4 | 4 | 4 | — | 10 | — | 6 | |||||||||||||||||||||||||||||||||||||||||||||||

| Net interest income | 629 | 625 | 617 | 605 | 631 | 4 | 1 | (2) | — | |||||||||||||||||||||||||||||||||||||||||||||||

| Noninterest income: | ||||||||||||||||||||||||||||||||||||||||||||||||||||||||

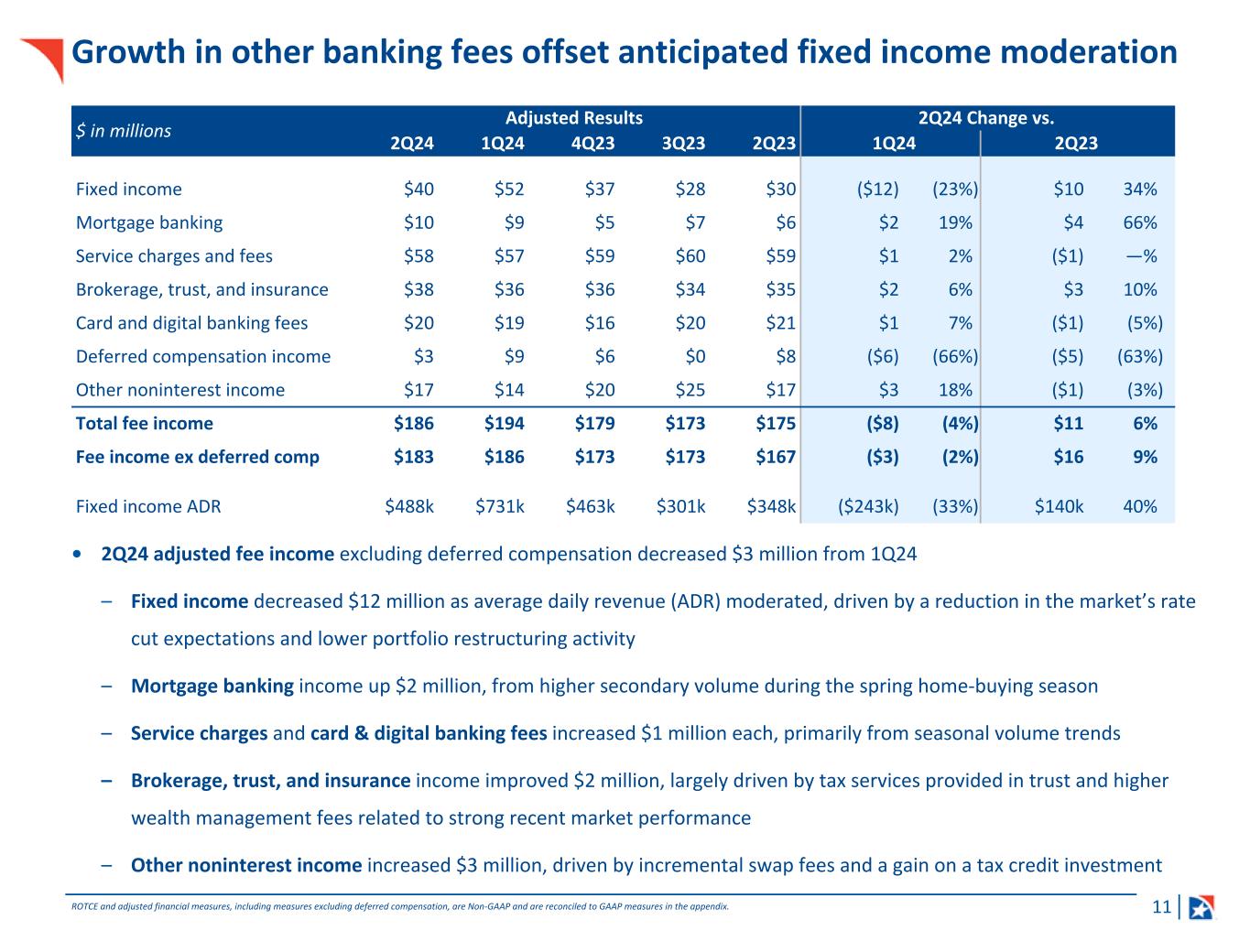

| Fixed income | 40 | 52 | 37 | 28 | 30 | (12) | (23) | 10 | 34 | |||||||||||||||||||||||||||||||||||||||||||||||

| Mortgage banking | 10 | 9 | 5 | 7 | 6 | 2 | 19 | 4 | 66 | |||||||||||||||||||||||||||||||||||||||||||||||

| Brokerage, trust, and insurance | 38 | 36 | 36 | 34 | 35 | 2 | 6 | 3 | 10 | |||||||||||||||||||||||||||||||||||||||||||||||

| Service charges and fees | 58 | 57 | 59 | 60 | 59 | 1 | 2 | (1) | — | |||||||||||||||||||||||||||||||||||||||||||||||

| Card and digital banking fees | 20 | 19 | 16 | 20 | 21 | 1 | 7 | (1) | (5) | |||||||||||||||||||||||||||||||||||||||||||||||

| Deferred compensation income | 3 | 9 | 6 | — | 8 | (6) | (66) | (5) | (63) | |||||||||||||||||||||||||||||||||||||||||||||||

| Gain on merger termination | — | — | — | — | 225 | — | NM | (225) | (100) | |||||||||||||||||||||||||||||||||||||||||||||||

| Other noninterest income | 17 | 14 | 23 | 25 | 17 | 3 | 18 | (1) | (3) | |||||||||||||||||||||||||||||||||||||||||||||||

| Total noninterest income | 186 | 194 | 183 | 173 | 400 | (8) | (4) | (214) | (54) | |||||||||||||||||||||||||||||||||||||||||||||||

| Total revenue | 815 | 819 | 800 | 778 | 1,031 | (4) | (1) | (216) | (21) | |||||||||||||||||||||||||||||||||||||||||||||||

| Noninterest expense: | ||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| Personnel expense: | ||||||||||||||||||||||||||||||||||||||||||||||||||||||||

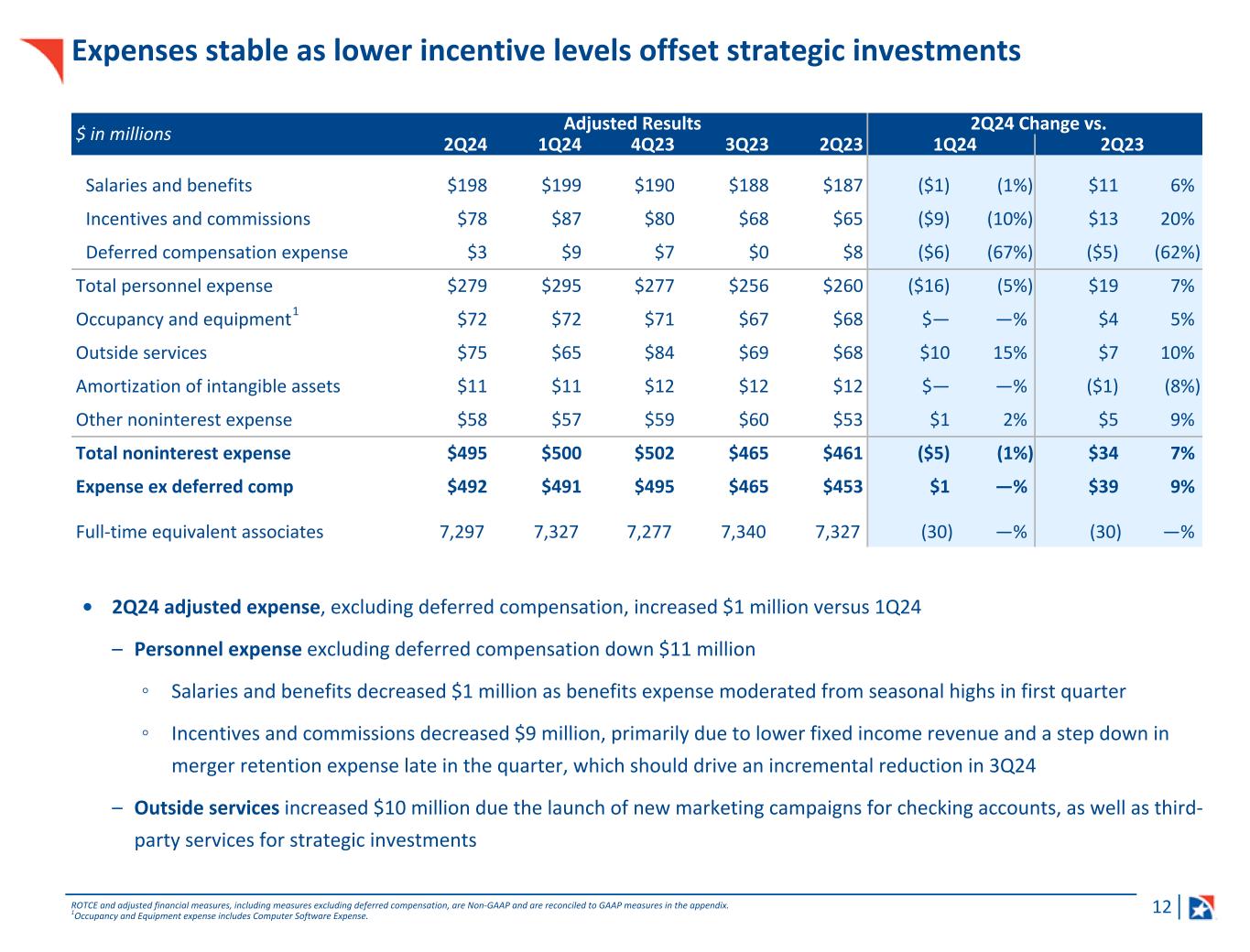

| Salaries and benefits | 198 | 200 | 190 | 188 | 191 | (2) | (1) | 7 | 4 | |||||||||||||||||||||||||||||||||||||||||||||||

| Incentives and commissions | 79 | 92 | 82 | 77 | 86 | (13) | (14) | (8) | (9) | |||||||||||||||||||||||||||||||||||||||||||||||

| Deferred compensation expense | 3 | 9 | 7 | — | 8 | (6) | (67) | (5) | (62) | |||||||||||||||||||||||||||||||||||||||||||||||

| Total personnel expense | 279 | 301 | 279 | 266 | 285 | (21) | (7) | (5) | (2) | |||||||||||||||||||||||||||||||||||||||||||||||

Occupancy and equipment2 |

72 | 72 | 71 | 67 | 68 | — | — | 4 | 5 | |||||||||||||||||||||||||||||||||||||||||||||||

| Outside services | 78 | 65 | 84 | 69 | 71 | 13 | 19 | 7 | 10 | |||||||||||||||||||||||||||||||||||||||||||||||

| Amortization of intangible assets | 11 | 11 | 12 | 12 | 12 | — | — | (1) | (8) | |||||||||||||||||||||||||||||||||||||||||||||||

| Other noninterest expense | 60 | 67 | 127 | 60 | 119 | (6) | (10) | (59) | (50) | |||||||||||||||||||||||||||||||||||||||||||||||

| Total noninterest expense | 500 | 515 | 572 | 474 | 555 | (15) | (3) | (55) | (10) | |||||||||||||||||||||||||||||||||||||||||||||||

Pre-provision net revenue3 |

315 | 304 | 227 | 304 | 475 | 11 | 4 | (161) | (34) | |||||||||||||||||||||||||||||||||||||||||||||||

| Provision for credit losses | 55 | 50 | 50 | 110 | 50 | 5 | 10 | 5 | 10 | |||||||||||||||||||||||||||||||||||||||||||||||

| Income before income taxes | 260 | 254 | 177 | 194 | 425 | 6 | 2 | (166) | (39) | |||||||||||||||||||||||||||||||||||||||||||||||

| Provision for income taxes | 56 | 57 | (11) | 52 | 96 | (1) | (2) | (40) | (42) | |||||||||||||||||||||||||||||||||||||||||||||||

| Net income | 204 | 197 | 188 | 142 | 329 | 7 | 4 | (125) | (38) | |||||||||||||||||||||||||||||||||||||||||||||||

| Net income attributable to noncontrolling interest | 5 | 5 | 5 | 5 | 5 | — | 1 | — | 7 | |||||||||||||||||||||||||||||||||||||||||||||||

| Net income attributable to controlling interest | 199 | 192 | 183 | 137 | 325 | 7 | 4 | (126) | (39) | |||||||||||||||||||||||||||||||||||||||||||||||

| Preferred stock dividends | 15 | 8 | 8 | 8 | 8 | 7 | 85 | 7 | 94 | |||||||||||||||||||||||||||||||||||||||||||||||

| Net income available to common shareholders | $ | 184 | $ | 184 | $ | 175 | $ | 129 | $ | 317 | $ | — | — | % | $ | (133) | (42) | % | ||||||||||||||||||||||||||||||||||||||

| Common Share Data | ||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| EPS | $ | 0.34 | $ | 0.33 | $ | 0.31 | $ | 0.23 | $ | 0.59 | $ | 0.01 | 2 | % | $ | (0.25) | (42) | % | ||||||||||||||||||||||||||||||||||||||

| Basic shares | 544 | 555 | 559 | 559 | 539 | (11) | (2) | 5 | 1 | |||||||||||||||||||||||||||||||||||||||||||||||

| Diluted EPS | $ | 0.34 | $ | 0.33 | $ | 0.31 | $ | 0.23 | $ | 0.56 | $ | 0.01 | 2 | $ | (0.22) | (39) | ||||||||||||||||||||||||||||||||||||||||

Diluted shares8 |

547 | 558 | 561 | 561 | 561 | (11) | (2) | % | (14) | (2) | % | |||||||||||||||||||||||||||||||||||||||||||||

| Effective tax rate | 21.5 | % | 22.5 | % | (6.2) | % | 26.7 | % | 22.6 | % | ||||||||||||||||||||||||||||||||||||||||||||||

ADJUSTED4 FINANCIAL DATA - SEE NOTABLE ITEMS ON PAGE 8 | ||

| Quarterly, Unaudited | ||

| 2Q24 Change vs. | ||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| ($s in millions, except per share data) | 2Q24 | 1Q24 | 4Q23 | 3Q23 | 2Q23 | 1Q24 | 2Q23 | |||||||||||||||||||||||||||||||||||||||||||||||||

| $ | % | $ | % | |||||||||||||||||||||||||||||||||||||||||||||||||||||

Net interest income (FTE)1 |

$ | 633 | $ | 628 | $ | 621 | $ | 609 | $ | 635 | $ | 5 | 1 | % | $ | (2) | — | % | ||||||||||||||||||||||||||||||||||||||

| Adjusted noninterest income: | ||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| Fixed income | 40 | 52 | 37 | 28 | 30 | (12) | (23) | 10 | 34 | |||||||||||||||||||||||||||||||||||||||||||||||

| Mortgage banking | 10 | 9 | 5 | 7 | 6 | 2 | 19 | 4 | 66 | |||||||||||||||||||||||||||||||||||||||||||||||

| Brokerage, trust, and insurance | 38 | 36 | 36 | 34 | 35 | 2 | 6 | 3 | 10 | |||||||||||||||||||||||||||||||||||||||||||||||

| Service charges and fees | 58 | 57 | 59 | 60 | 59 | 1 | 2 | (1) | — | |||||||||||||||||||||||||||||||||||||||||||||||

| Card and digital banking fees | 20 | 19 | 16 | 20 | 21 | 1 | 7 | (1) | (5) | |||||||||||||||||||||||||||||||||||||||||||||||

| Deferred compensation income | 3 | 9 | 6 | — | 8 | (6) | (66) | (5) | (63) | |||||||||||||||||||||||||||||||||||||||||||||||

| Gain on merger termination | — | — | — | — | — | — | NM | — | NM | |||||||||||||||||||||||||||||||||||||||||||||||

| Adjusted other noninterest income | 17 | 14 | 20 | 25 | 17 | 3 | 18 | (1) | (3) | |||||||||||||||||||||||||||||||||||||||||||||||

| Adjusted total noninterest income | $ | 186 | $ | 194 | $ | 179 | $ | 173 | $ | 175 | $ | (8) | (4) | % | $ | 11 | 6 | % | ||||||||||||||||||||||||||||||||||||||

Total revenue (FTE)1 |

$ | 819 | $ | 823 | $ | 800 | $ | 782 | $ | 810 | $ | (4) | — | % | $ | 9 | 1 | % | ||||||||||||||||||||||||||||||||||||||

| Adjusted noninterest expense: | ||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| Adjusted personnel expense: | ||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| Adjusted salaries and benefits | $ | 198 | $ | 199 | $ | 190 | $ | 188 | $ | 187 | $ | (1) | (1) | % | $ | 11 | 6 | % | ||||||||||||||||||||||||||||||||||||||

| Adjusted Incentives and commissions | 78 | 87 | 80 | 68 | 65 | (9) | (10) | 13 | 20 | |||||||||||||||||||||||||||||||||||||||||||||||

| Deferred compensation expense | 3 | 9 | 7 | — | 8 | (6) | (67) | (5) | (62) | |||||||||||||||||||||||||||||||||||||||||||||||

| Adjusted total personnel expense | 279 | 295 | 277 | 256 | 260 | (16) | (5) | 19 | 7 | |||||||||||||||||||||||||||||||||||||||||||||||

Adjusted occupancy and equipment2 |

72 | 72 | 71 | 67 | 68 | — | — | 4 | 5 | |||||||||||||||||||||||||||||||||||||||||||||||

| Outside services | 75 | 65 | 84 | 69 | 68 | 10 | 15 | 7 | 10 | |||||||||||||||||||||||||||||||||||||||||||||||

| Amortization of intangible assets | 11 | 11 | 12 | 12 | 12 | — | — | (1) | (8) | |||||||||||||||||||||||||||||||||||||||||||||||

| Adjusted other noninterest expense | 58 | 57 | 59 | 60 | 53 | 1 | 2 | 5 | 9 | |||||||||||||||||||||||||||||||||||||||||||||||

| Adjusted total noninterest expense | $ | 495 | $ | 500 | $ | 502 | $ | 465 | $ | 461 | $ | (5) | (1) | % | $ | 34 | 7 | % | ||||||||||||||||||||||||||||||||||||||

Adjusted pre-provision net revenue4 |

$ | 324 | $ | 323 | $ | 298 | $ | 318 | $ | 349 | $ | 1 | — | % | $ | (25) | (7) | % | ||||||||||||||||||||||||||||||||||||||

| Provision for credit losses | $ | 55 | $ | 50 | $ | 50 | $ | 110 | $ | 50 | $ | 5 | 10 | % | $ | 5 | 10 | % | ||||||||||||||||||||||||||||||||||||||

| Adjusted net income available to common shareholders | $ | 195 | $ | 195 | $ | 178 | $ | 150 | $ | 219 | $ | — | — | % | $ | (24) | (11) | % | ||||||||||||||||||||||||||||||||||||||

| Adjusted Common Share Data | ||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| Adjusted diluted EPS | $ | 0.36 | $ | 0.35 | $ | 0.32 | $ | 0.27 | $ | 0.39 | $ | 0.01 | 2 | % | $ | (0.03) | (9) | % | ||||||||||||||||||||||||||||||||||||||

Diluted shares8 |

547 | 558 | 561 | 561 | 561 | (11) | (2) | % | (14) | (2) | % | |||||||||||||||||||||||||||||||||||||||||||||

| Adjusted effective tax rate | 21.5 | % | 22.5 | % | 21.7 | % | 20.1 | % | 21.6 | % | ||||||||||||||||||||||||||||||||||||||||||||||

| Adjusted ROTCE | 12.0 | % | 11.6 | % | 11.1 | % | 9.2 | % | 14.6 | % | ||||||||||||||||||||||||||||||||||||||||||||||

| Adjusted efficiency ratio | 60.5 | % | 60.8 | % | 62.8 | % | 59.4 | % | 56.9 | % | ||||||||||||||||||||||||||||||||||||||||||||||

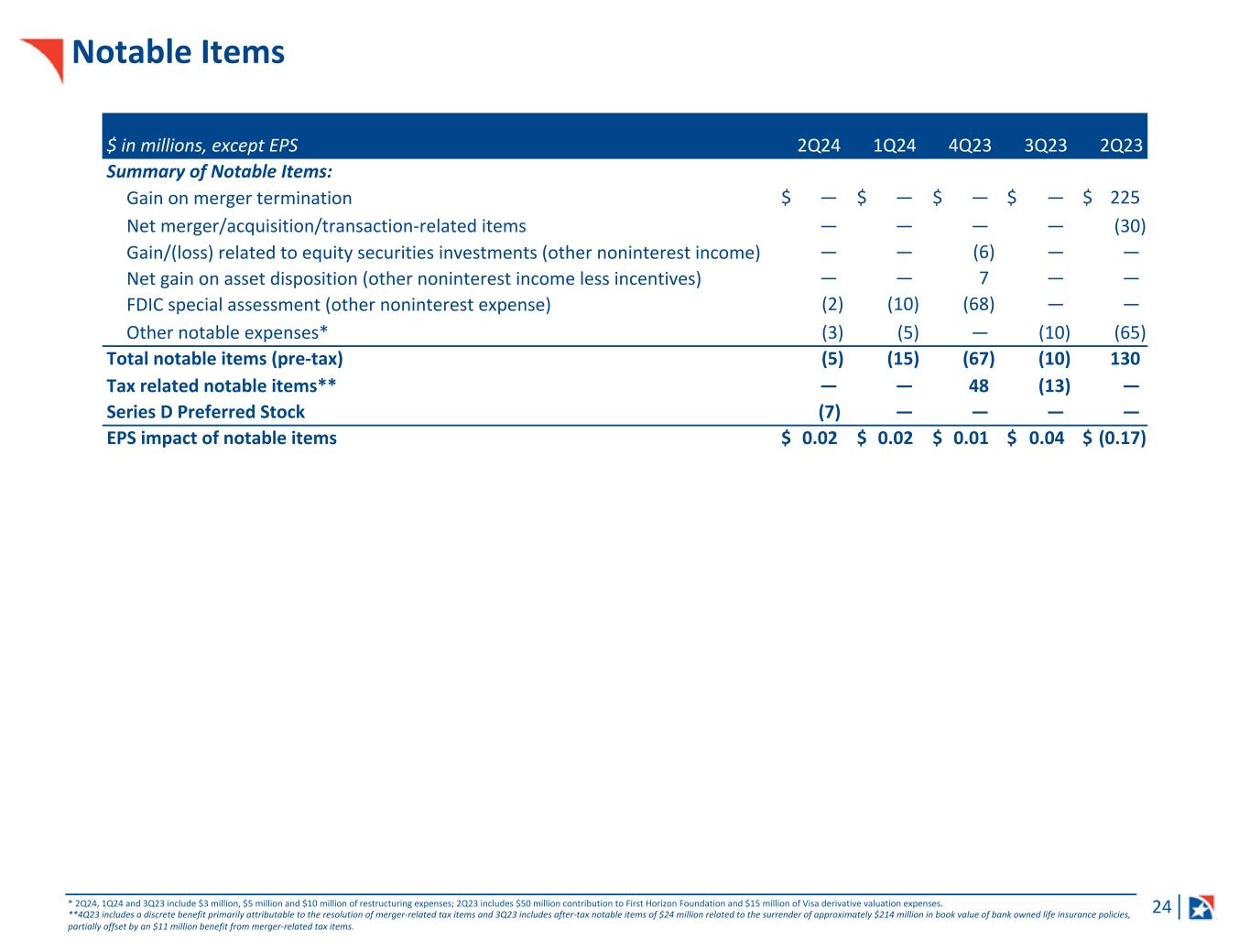

| NOTABLE ITEMS | ||

| Quarterly, Unaudited | ||

| (In millions) | 2Q24 | 1Q24 | 4Q23 | 3Q23 | 2Q23 | |||||||||||||||||||||||||||

| Summary of Notable Items: | ||||||||||||||||||||||||||||||||

| Gain on merger termination | $ | — | $ | — | $ | — | $ | — | $ | 225 | ||||||||||||||||||||||

| Net merger/acquisition/transaction-related items | — | — | — | — | (30) | |||||||||||||||||||||||||||

| Gain/(loss) related to equity securities investments (other noninterest income) | — | — | (6) | — | — | |||||||||||||||||||||||||||

| Net gain on asset disposition (other noninterest income less incentives) | — | — | 7 | — | — | |||||||||||||||||||||||||||

| FDIC special assessment (other noninterest expense) | (2) | (10) | (68) | — | — | |||||||||||||||||||||||||||

| Other notable expenses * | (3) | (5) | — | (10) | (65) | |||||||||||||||||||||||||||

| Total notable items (pre-tax) | $ | (5) | $ | (15) | $ | (67) | $ | (10) | $ | 130 | ||||||||||||||||||||||

| Tax-related notable items ** | $ | — | $ | — | $ | 48 | $ | (13) | $ | — | ||||||||||||||||||||||

| Preferred Stock Dividend *** | $ | (7) | $ | — | $ | — | $ | — | $ | — | ||||||||||||||||||||||

| IMPACT OF NOTABLE ITEMS: | ||

| Quarterly, Unaudited | ||

| (In millions) | 2Q24 | 1Q24 | 4Q23 | 3Q23 | 2Q23 | ||||||||||||||||||||||||

| Impacts of Notable Items: | |||||||||||||||||||||||||||||

| Noninterest income: | |||||||||||||||||||||||||||||

| Gain on merger termination | $ | — | $ | — | $ | — | $ | — | $ | (225) | |||||||||||||||||||

| Other noninterest income | — | — | (4) | — | — | ||||||||||||||||||||||||

| Total noninterest income | $ | — | $ | — | $ | (4) | $ | — | $ | (225) | |||||||||||||||||||

| Noninterest expense: | |||||||||||||||||||||||||||||

| Personnel expenses: | |||||||||||||||||||||||||||||

| Salaries and benefits | $ | — | $ | — | $ | — | $ | — | $ | (4) | |||||||||||||||||||

| Incentives and commissions | (1) | (5) | (2) | (9) | (21) | ||||||||||||||||||||||||

| Total personnel expenses | (1) | (5) | (2) | (10) | (25) | ||||||||||||||||||||||||

| Outside services | (3) | — | — | — | (4) | ||||||||||||||||||||||||

| Other noninterest expense | (2) | (10) | (68) | — | (66) | ||||||||||||||||||||||||

| Total noninterest expense | $ | (5) | $ | (15) | $ | (70) | $ | (10) | $ | (95) | |||||||||||||||||||

| Income before income taxes | $ | 5 | $ | 15 | $ | 67 | $ | 10 | $ | (130) | |||||||||||||||||||

| Provision for income taxes * | 1 | 3 | 64 | (11) | (33) | ||||||||||||||||||||||||

| Preferred stock dividends ** | (7) | — | — | — | — | ||||||||||||||||||||||||

| Net income/(loss) available to common shareholders | $ | 11 | $ | 12 | $ | 3 | $ | 20 | $ | (98) | |||||||||||||||||||

| EPS impact of notable items | $ | 0.02 | $ | 0.02 | $ | 0.01 | $ | 0.04 | $ | (0.17) | |||||||||||||||||||

| FINANCIAL RATIOS | ||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| Quarterly, Unaudited | ||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| 2Q24 Change vs. | ||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| 2Q24 | 1Q24 | 4Q23 | 3Q23 | 2Q23 | 1Q24 | 2Q23 | ||||||||||||||||||||||||||||||||||||||||||||||||||

| FINANCIAL RATIOS | $/bp | % | $/bp | % | ||||||||||||||||||||||||||||||||||||||||||||||||||||

Net interest margin6 |

3.38 | % | 3.37 | % | 3.27 | % | 3.17 | % | 3.38 | % | 1 | bp | — | bp | ||||||||||||||||||||||||||||||||||||||||||

| Return on average assets | 1.00 | % | 0.97 | % | 0.91 | % | 0.68 | % | 1.60 | % | 3 | (60) | ||||||||||||||||||||||||||||||||||||||||||||

Adjusted return on average assets4 |

1.02 | % | 1.03 | % | 0.92 | % | 0.78 | % | 1.13 | % | (1) | (11) | ||||||||||||||||||||||||||||||||||||||||||||

| Return on average common equity (“ROCE”) | 8.98 | % | 8.76 | % | 8.60 | % | 6.28 | % | 16.40 | % | 22 | (742) | ||||||||||||||||||||||||||||||||||||||||||||

Return on average tangible common equity (“ROTCE”)4 |

11.29 | % | 10.95 | % | 10.89 | % | 7.95 | % | 21.10 | % | 34 | (981) | ||||||||||||||||||||||||||||||||||||||||||||

Adjusted ROTCE4 |

11.99 | % | 11.65 | % | 11.05 | % | 9.21 | % | 14.59 | % | 34 | (260) | ||||||||||||||||||||||||||||||||||||||||||||

| Noninterest income as a % of total revenue | 22.75 | % | 23.72 | % | 23.33 | % | 22.23 | % | 38.80 | % | (97) | (1,605) | ||||||||||||||||||||||||||||||||||||||||||||

Adjusted noninterest income as a % of total revenue4 |

22.64 | % | 23.61 | % | 22.32 | % | 22.11 | % | 21.60 | % | (97) | 104 | ||||||||||||||||||||||||||||||||||||||||||||

| Efficiency ratio | 61.44 | % | 62.92 | % | 71.14 | % | 60.96 | % | 53.89 | % | (148) | 755 | ||||||||||||||||||||||||||||||||||||||||||||

Adjusted efficiency ratio4 |

60.47 | % | 60.78 | % | 62.84 | % | 59.43 | % | 56.92 | % | (31) | 355 | ||||||||||||||||||||||||||||||||||||||||||||

Allowance for credit losses to loans and leases4 |

1.41 | % | 1.40 | % | 1.40 | % | 1.36 | % | 1.35 | % | 1 | 6 | ||||||||||||||||||||||||||||||||||||||||||||

| CAPITAL DATA | ||||||||||||||||||||||||||||||||||||||||||||||||||||||||

CET1 capital ratio* |

11.0 | % | 11.3 | % | 11.4 | % | 11.1 | % | 11.1 | % | (26) | bp | (3) | bp | ||||||||||||||||||||||||||||||||||||||||||

| Tier 1 capital ratio* | 12.0 | % | 12.3 | % | 12.4 | % | 12.1 | % | 12.1 | % | (27) | bp | (4) | bp | ||||||||||||||||||||||||||||||||||||||||||

| Total capital ratio* | 13.7 | % | 13.9 | % | 14.0 | % | 13.6 | % | 13.6 | % | (26) | bp | 9 | bp | ||||||||||||||||||||||||||||||||||||||||||

| Tier 1 leverage ratio* | 10.6 | % | 10.8 | % | 10.7 | % | 10.5 | % | 10.5 | % | (21) | bp | 9 | bp | ||||||||||||||||||||||||||||||||||||||||||

| Risk-weighted assets (“RWA”) (billions)* | $ | 71.9 | $ | 71.1 | $ | 71.1 | $ | 71.9 | $ | 71.5 | $ | 0.8 | 1 | % | $ | 0.4 | 1 | % | ||||||||||||||||||||||||||||||||||||||

| Total equity to total assets | 10.89 | % | 11.21 | % | 11.38 | % | 10.65 | % | 10.53 | % | (32) | bp | 36 | bp | ||||||||||||||||||||||||||||||||||||||||||

Tangible common equity/tangible assets (“TCE/TA”)4 |

8.14 | % | 8.33 | % | 8.48 | % | 7.76 | % | 7.71 | % | (19) | bp | 44 | bp | ||||||||||||||||||||||||||||||||||||||||||

Period-end shares outstanding (millions)8 |

537 | 549 | 559 | 559 | 559 | (12) | (2) | % | (22) | (4) | % | |||||||||||||||||||||||||||||||||||||||||||||

| Cash dividends declared per common share | $ | 0.15 | $ | 0.15 | $ | 0.15 | $ | 0.15 | $ | 0.15 | $ | — | — | % | $ | — | — | % | ||||||||||||||||||||||||||||||||||||||

| Book value per common share | $ | 15.34 | $ | 15.23 | $ | 15.17 | $ | 14.28 | $ | 14.58 | $ | 0.11 | 1 | % | $ | 0.76 | 5 | % | ||||||||||||||||||||||||||||||||||||||

Tangible book value per common share4 |

$ | 12.22 | $ | 12.16 | $ | 12.13 | $ | 11.22 | $ | 11.50 | $ | 0.06 | — | % | $ | 0.72 | 6 | % | ||||||||||||||||||||||||||||||||||||||

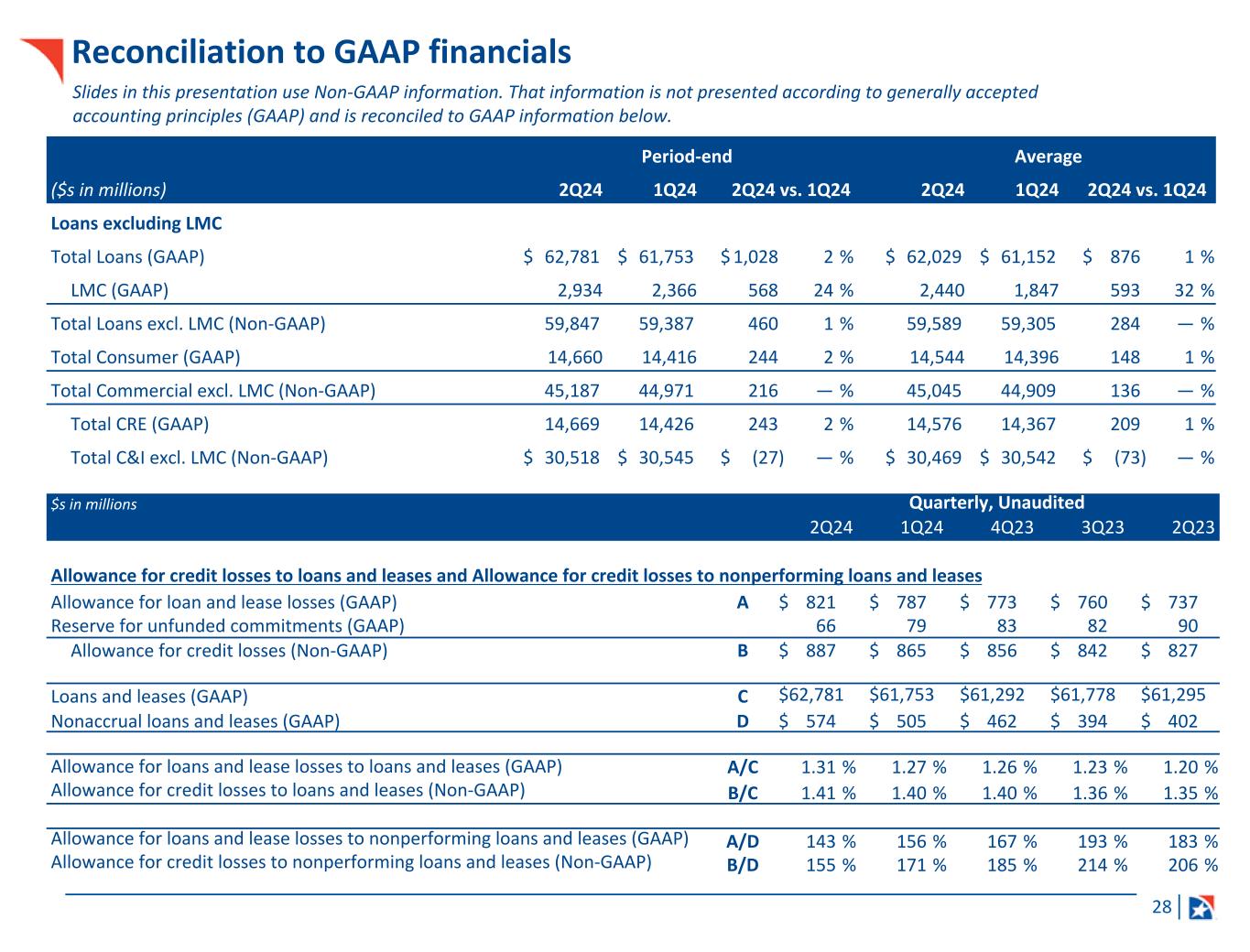

| SELECTED BALANCE SHEET DATA | ||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| Loans-to-deposit ratio (period-end balances) | 96.89 | % | 93.93 | % | 93.18 | % | 92.18 | % | 93.68 | % | 296 | bp | 321 | bp | ||||||||||||||||||||||||||||||||||||||||||

| Loans-to-deposit ratio (average balances) | 95.49 | % | 93.54 | % | 91.53 | % | 92.35 | % | 97.52 | % | 195 | bp | (203) | bp | ||||||||||||||||||||||||||||||||||||||||||

| Full-time equivalent associates | 7,297 | 7,327 | 7,277 | 7,340 | 7,327 | (30) | — | % | (30) | — | % | |||||||||||||||||||||||||||||||||||||||||||||

| 2Q24 Change vs. | ||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| (In millions) | 2Q24 | 1Q24 | 4Q23 | 3Q23 | 2Q23 | 1Q24 | 2Q23 | |||||||||||||||||||||||||||||||||||||||||||||||||

| Assets: | $ | % | $ | % | ||||||||||||||||||||||||||||||||||||||||||||||||||||

| Loans and leases: | ||||||||||||||||||||||||||||||||||||||||||||||||||||||||

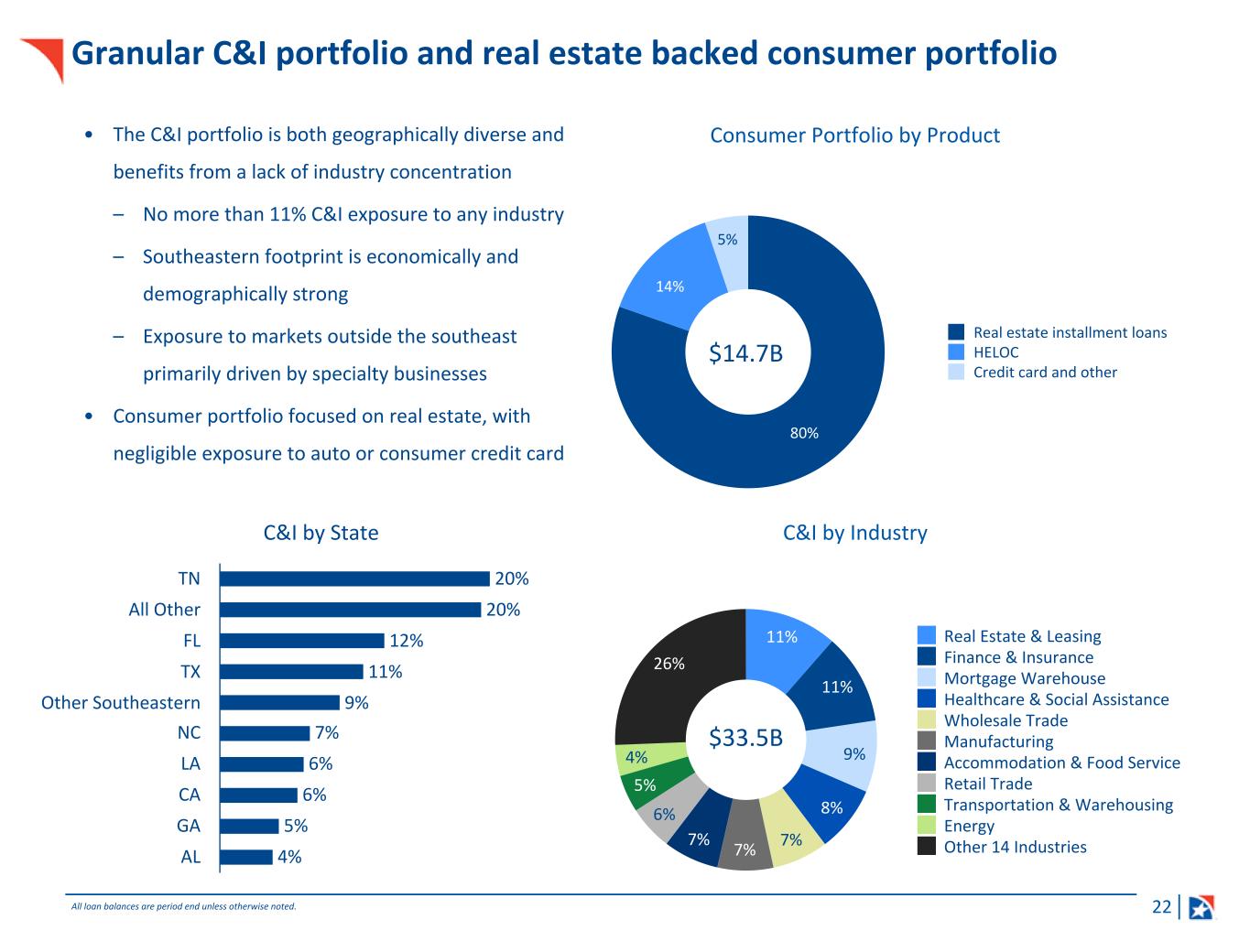

| Commercial, financial, and industrial (C&I) | $ | 33,452 | $ | 32,911 | $ | 32,632 | $ | 33,163 | $ | 33,116 | $ | 542 | 2 | % | $ | 337 | 1 | % | ||||||||||||||||||||||||||||||||||||||

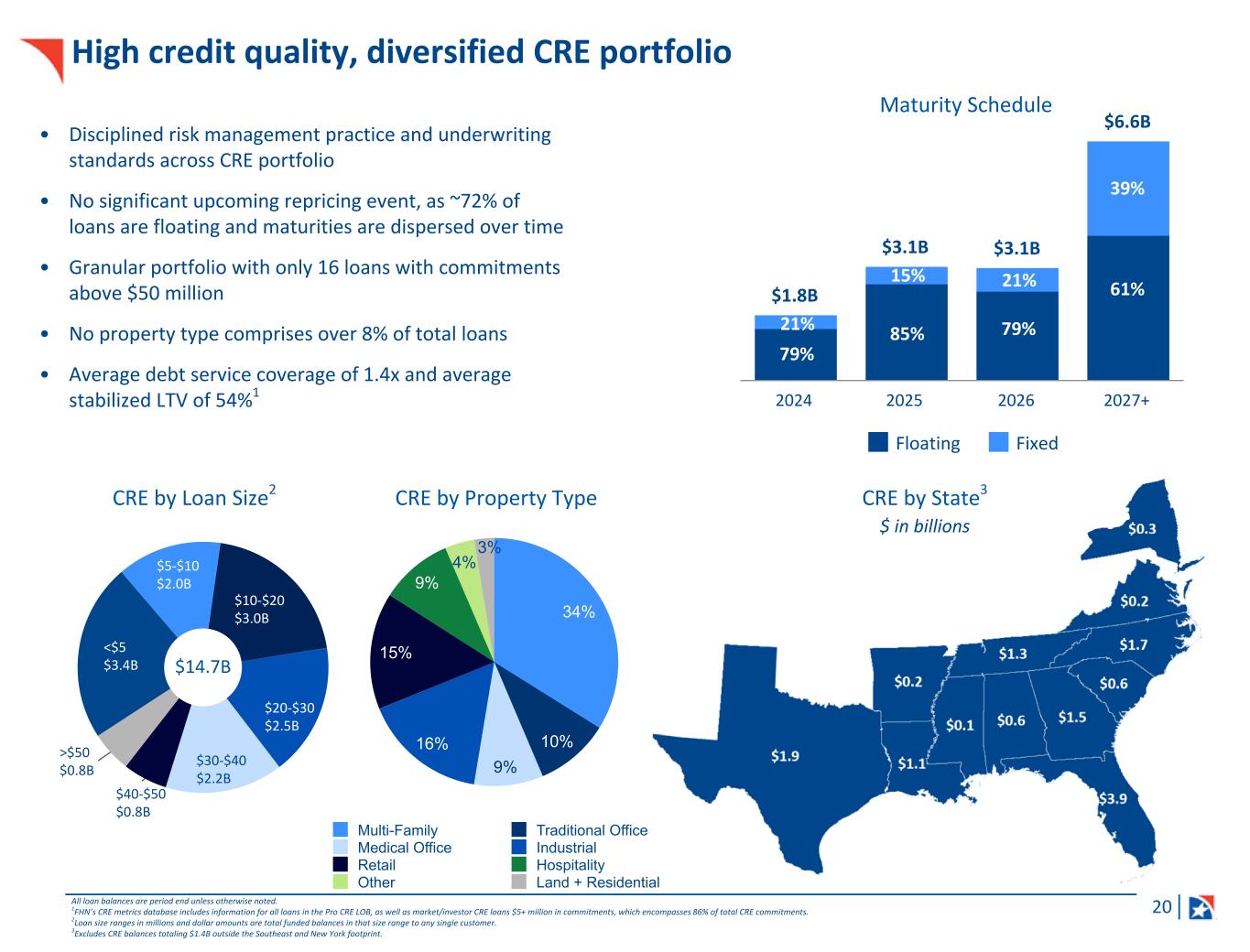

| Commercial real estate | 14,669 | 14,426 | 14,216 | 14,121 | 13,891 | 242 | 2 | 778 | 6 | |||||||||||||||||||||||||||||||||||||||||||||||

| Total Commercial | 48,121 | 47,337 | 46,849 | 47,283 | 47,006 | 784 | 2 | 1,115 | 2 | |||||||||||||||||||||||||||||||||||||||||||||||

| Consumer real estate | 13,909 | 13,645 | 13,650 | 13,685 | 13,475 | 264 | 2 | 434 | 3 | |||||||||||||||||||||||||||||||||||||||||||||||

Credit card and other5 |

751 | 771 | 793 | 809 | 813 | (20) | (3) | (63) | (8) | |||||||||||||||||||||||||||||||||||||||||||||||

| Total Consumer | 14,660 | 14,416 | 14,443 | 14,494 | 14,289 | 244 | 2 | 371 | 3 | |||||||||||||||||||||||||||||||||||||||||||||||

| Loans and leases, net of unearned income | 62,781 | 61,753 | 61,292 | 61,778 | 61,295 | 1,028 | 2 | 1,486 | 2 | |||||||||||||||||||||||||||||||||||||||||||||||

| Loans held for sale | 471 | 395 | 502 | 613 | 789 | 76 | 19 | (319) | (40) | |||||||||||||||||||||||||||||||||||||||||||||||

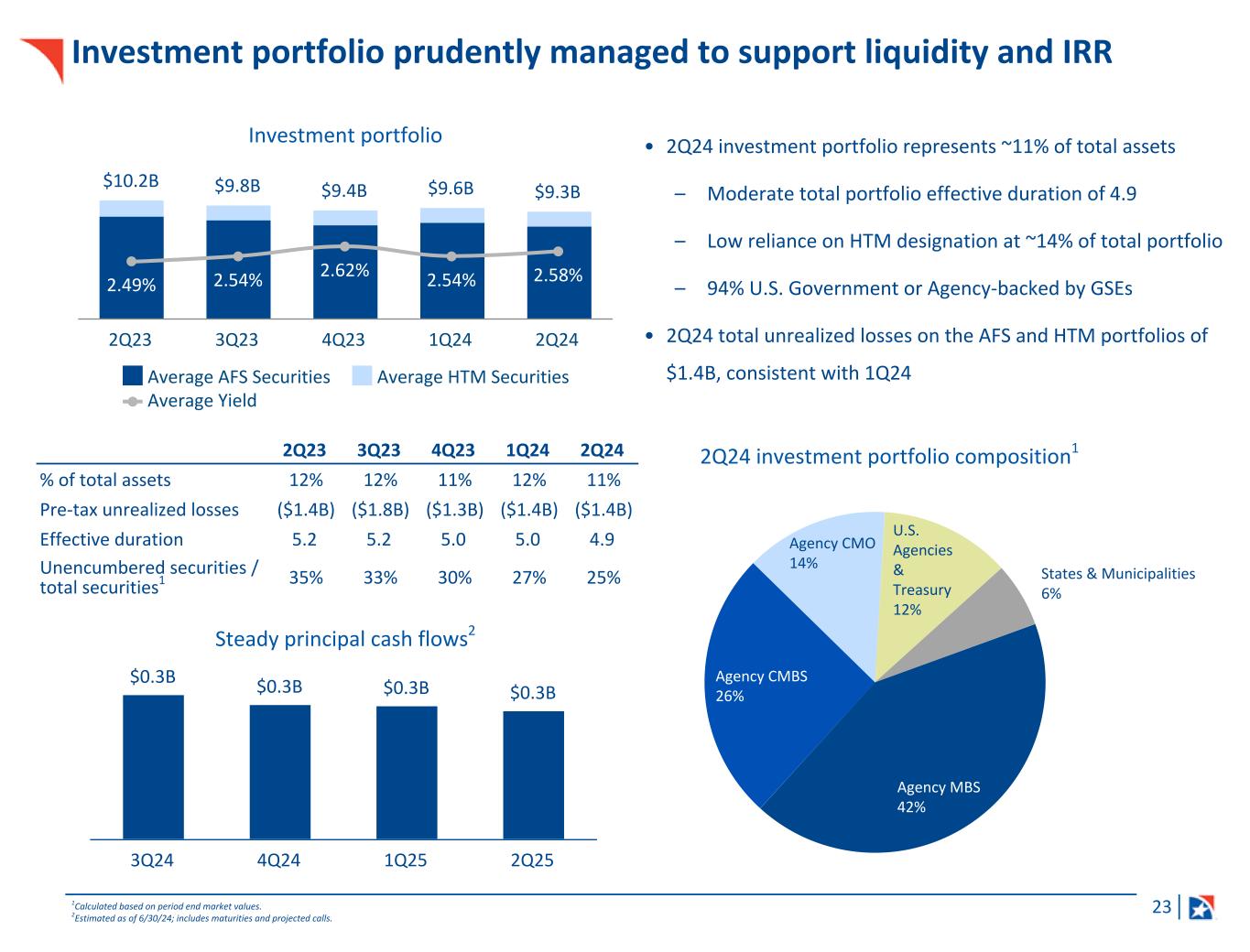

| Investment securities | 9,221 | 9,460 | 9,714 | 9,435 | 9,949 | (238) | (3) | (728) | (7) | |||||||||||||||||||||||||||||||||||||||||||||||

| Trading securities | 1,249 | 1,161 | 1,412 | 1,231 | 1,059 | 88 | 8 | 191 | 18 | |||||||||||||||||||||||||||||||||||||||||||||||

| Interest-bearing deposits with banks | 1,452 | 1,885 | 1,328 | 1,917 | 4,523 | (432) | (23) | (3,071) | (68) | |||||||||||||||||||||||||||||||||||||||||||||||

| Federal funds sold and securities purchased under agreements to resell | 487 | 817 | 719 | 416 | 282 | (330) | (40) | 205 | 73 | |||||||||||||||||||||||||||||||||||||||||||||||

| Total interest earning assets | 75,662 | 75,470 | 74,967 | 75,389 | 77,898 | 191 | — | (2,236) | (3) | |||||||||||||||||||||||||||||||||||||||||||||||

| Cash and due from banks | 969 | 749 | 1,012 | 1,022 | 1,137 | 219 | 29 | (168) | (15) | |||||||||||||||||||||||||||||||||||||||||||||||

| Goodwill and other intangible assets, net | 1,674 | 1,685 | 1,696 | 1,709 | 1,720 | (11) | (1) | (46) | (3) | |||||||||||||||||||||||||||||||||||||||||||||||

| Premises and equipment, net | 584 | 586 | 590 | 590 | 595 | (3) | — | (11) | (2) | |||||||||||||||||||||||||||||||||||||||||||||||

| Allowance for loan and lease losses | (821) | (787) | (773) | (760) | (737) | (34) | (4) | (84) | (11) | |||||||||||||||||||||||||||||||||||||||||||||||

| Other assets | 4,162 | 4,094 | 4,169 | 4,584 | 4,458 | 68 | 2 | (296) | (7) | |||||||||||||||||||||||||||||||||||||||||||||||

| Total assets | $ | 82,230 | $ | 81,799 | $ | 81,661 | $ | 82,533 | $ | 85,071 | $ | 431 | 1 | % | $ | (2,841) | (3) | % | ||||||||||||||||||||||||||||||||||||||

| Liabilities and Shareholders' Equity: | ||||||||||||||||||||||||||||||||||||||||||||||||||||||||

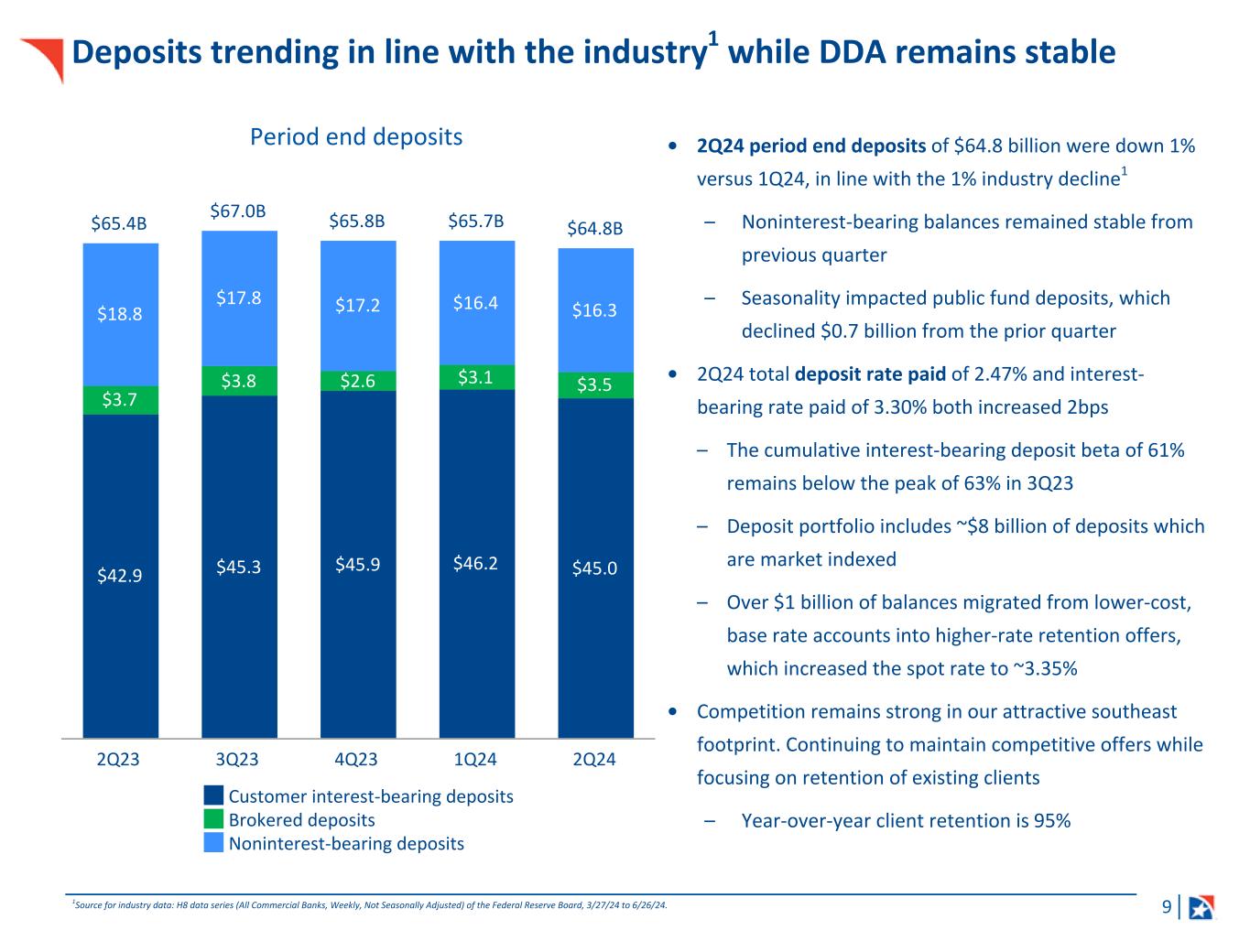

| Deposits: | ||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| Savings | $ | 25,437 | $ | 25,847 | $ | 25,082 | $ | 25,590 | $ | 23,733 | $ | (410) | (2) | % | $ | 1,704 | 7 | % | ||||||||||||||||||||||||||||||||||||||

| Time deposits | 7,163 | 6,297 | 6,804 | 7,783 | 8,279 | 866 | 14 | (1,116) | (13) | |||||||||||||||||||||||||||||||||||||||||||||||

| Other interest-bearing deposits | 15,845 | 17,186 | 16,689 | 15,817 | 14,620 | (1,341) | (8) | 1,226 | 8 | |||||||||||||||||||||||||||||||||||||||||||||||

| Total interest-bearing deposits | 48,446 | 49,331 | 48,576 | 49,190 | 46,632 | (885) | (2) | 1,814 | 4 | |||||||||||||||||||||||||||||||||||||||||||||||

| Trading liabilities | 423 | 467 | 509 | 366 | 174 | (44) | (9) | 248 | NM | |||||||||||||||||||||||||||||||||||||||||||||||

| Federal funds purchased and securities sold under agreements to repurchase | 2,572 | 2,137 | 2,223 | 2,015 | 2,169 | 435 | 20 | 403 | 19 | |||||||||||||||||||||||||||||||||||||||||||||||

| Short-term borrowings | 1,943 | 566 | 326 | 492 | 4,777 | 1,377 | NM | (2,834) | (59) | |||||||||||||||||||||||||||||||||||||||||||||||

| Term borrowings | 1,175 | 1,165 | 1,150 | 1,157 | 1,156 | 10 | 1 | 19 | 2 | |||||||||||||||||||||||||||||||||||||||||||||||

| Total interest-bearing liabilities | 54,559 | 53,665 | 52,783 | 53,220 | 54,908 | 893 | 2 | (350) | (1) | |||||||||||||||||||||||||||||||||||||||||||||||

| Noninterest-bearing deposits | 16,348 | 16,410 | 17,204 | 17,825 | 18,801 | (62) | — | (2,453) | (13) | |||||||||||||||||||||||||||||||||||||||||||||||

| Other liabilities | 2,368 | 2,550 | 2,383 | 2,694 | 2,403 | (182) | (7) | (34) | (1) | |||||||||||||||||||||||||||||||||||||||||||||||

| Total liabilities | 73,275 | 72,626 | 72,370 | 73,740 | 76,112 | 649 | 1 | (2,837) | (4) | |||||||||||||||||||||||||||||||||||||||||||||||

| Shareholders' Equity: | ||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| Preferred stock | 426 | 520 | 520 | 520 | 520 | (94) | (18) | (94) | (18) | |||||||||||||||||||||||||||||||||||||||||||||||

| Common stock | 336 | 343 | 349 | 349 | 349 | (7) | (2) | (14) | (4) | |||||||||||||||||||||||||||||||||||||||||||||||

| Capital surplus | 5,007 | 5,214 | 5,351 | 5,337 | 5,324 | (207) | (4) | (317) | (6) | |||||||||||||||||||||||||||||||||||||||||||||||

| Retained earnings | 4,172 | 4,072 | 3,964 | 3,874 | 3,830 | 101 | 2 | 342 | 9 | |||||||||||||||||||||||||||||||||||||||||||||||

| Accumulated other comprehensive loss, net | (1,281) | (1,271) | (1,188) | (1,582) | (1,359) | (10) | (1) | 78 | 6 | |||||||||||||||||||||||||||||||||||||||||||||||

| Combined shareholders' equity | 8,660 | 8,878 | 8,996 | 8,498 | 8,664 | (218) | (2) | (4) | — | |||||||||||||||||||||||||||||||||||||||||||||||

| Noncontrolling interest | 295 | 295 | 295 | 295 | 295 | — | — | — | — | |||||||||||||||||||||||||||||||||||||||||||||||

| Total shareholders' equity | 8,955 | 9,173 | 9,291 | 8,794 | 8,960 | (218) | (2) | (4) | — | |||||||||||||||||||||||||||||||||||||||||||||||

| Total liabilities and shareholders' equity | $ | 82,230 | $ | 81,799 | $ | 81,661 | $ | 82,533 | $ | 85,071 | $ | 431 | 1 | % | $ | (2,841) | (3) | % | ||||||||||||||||||||||||||||||||||||||

| Memo: | ||||||||||||||||||||||||||||||||||||||||||||||||||||||||

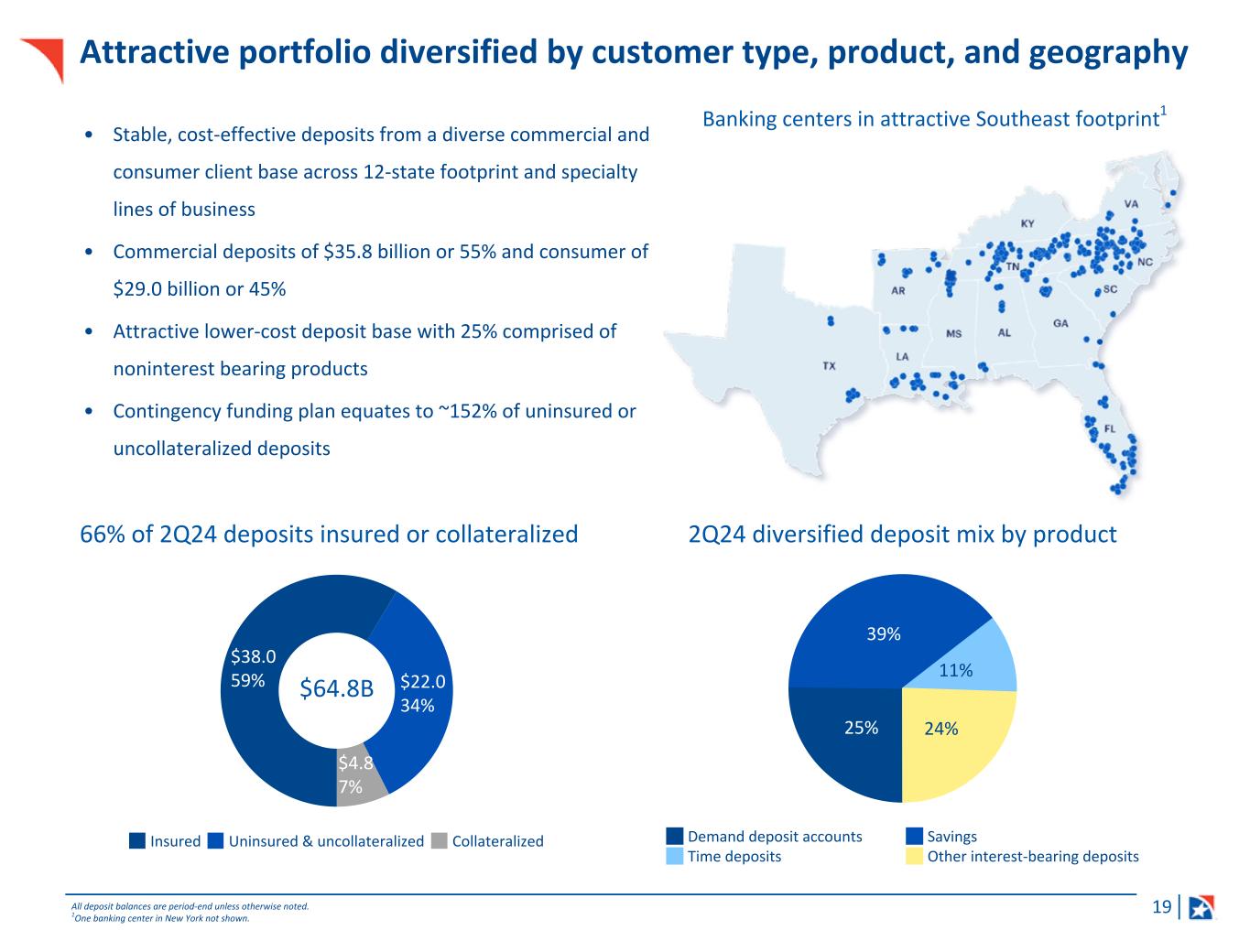

| Total deposits | $ | 64,794 | $ | 65,741 | $ | 65,780 | $ | 67,015 | $ | 65,433 | $ | (947) | (1) | % | $ | (639) | (1) | % | ||||||||||||||||||||||||||||||||||||||

| Loans to mortgage companies | $ | 2,934 | $ | 2,366 | $ | 2,024 | $ | 2,237 | $ | 2,691 | $ | 568 | 24 | % | $ | 243 | 9 | % | ||||||||||||||||||||||||||||||||||||||

| Unfunded Loan Commitments: | ||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| Commercial | $ | 18,781 | $ | 19,996 | $ | 21,328 | $ | 22,063 | $ | 22,134 | $ | (1,215) | (6) | % | $ | (3,353) | (15) | % | ||||||||||||||||||||||||||||||||||||||

| Consumer | $ | 4,334 | $ | 4,383 | $ | 4,401 | $ | 4,432 | $ | 4,400 | $ | (49) | (1) | % | $ | (66) | (2) | % | ||||||||||||||||||||||||||||||||||||||

| 2Q24 Change vs. | ||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| (In millions) | 2Q24 | 1Q24 | 4Q23 | 3Q23 | 2Q23 | 1Q24 | 2Q23 | |||||||||||||||||||||||||||||||||||||||||||||||||

| Assets: | $ | % | $ | % | ||||||||||||||||||||||||||||||||||||||||||||||||||||

| Loans and leases: | ||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| Commercial, financial, and industrial (C&I) | $ | 32,909 | $ | 32,389 | $ | 32,520 | $ | 33,042 | $ | 32,423 | $ | 519 | 2 | % | $ | 485 | 1 | % | ||||||||||||||||||||||||||||||||||||||

| Commercial real estate | 14,576 | 14,367 | 14,210 | 13,999 | 13,628 | 209 | 1 | 949 | 7 | |||||||||||||||||||||||||||||||||||||||||||||||

| Total Commercial | 47,485 | 46,756 | 46,730 | 47,041 | 46,051 | 728 | 2 | 1,434 | 3 | |||||||||||||||||||||||||||||||||||||||||||||||

| Consumer real estate | 13,783 | 13,615 | 13,664 | 13,575 | 13,058 | 168 | 1 | 725 | 6 | |||||||||||||||||||||||||||||||||||||||||||||||

Credit card and other5 |

761 | 781 | 802 | 816 | 815 | (20) | (3) | (54) | (7) | |||||||||||||||||||||||||||||||||||||||||||||||

| Total Consumer | 14,544 | 14,396 | 14,466 | 14,391 | 13,873 | 148 | 1 | 671 | 5 | |||||||||||||||||||||||||||||||||||||||||||||||

| Loans and leases, net of unearned income | 62,029 | 61,152 | 61,197 | 61,432 | 59,924 | 876 | 1 | 2,105 | 4 | |||||||||||||||||||||||||||||||||||||||||||||||

| Loans held-for-sale | 462 | 454 | 547 | 782 | 731 | 8 | 2 | (269) | (37) | |||||||||||||||||||||||||||||||||||||||||||||||

| Investment securities | 9,261 | 9,590 | 9,394 | 9,811 | 10,192 | (329) | (3) | (931) | (9) | |||||||||||||||||||||||||||||||||||||||||||||||

| Trading securities | 1,367 | 1,245 | 1,225 | 1,099 | 1,110 | 122 | 10 | 257 | 23 | |||||||||||||||||||||||||||||||||||||||||||||||

| Interest-bearing deposits with banks | 1,449 | 1,793 | 2,556 | 2,867 | 3,110 | (344) | (19) | (1,661) | (53) | |||||||||||||||||||||||||||||||||||||||||||||||

| Federal funds sold and securities purchased under agreements to resell | 676 | 544 | 529 | 315 | 279 | 132 | 24 | 397 | 142 | |||||||||||||||||||||||||||||||||||||||||||||||

| Total interest earning assets | 75,243 | 74,778 | 75,448 | 76,306 | 75,346 | 465 | 1 | (103) | — | |||||||||||||||||||||||||||||||||||||||||||||||

| Cash and due from banks | 904 | 948 | 994 | 997 | 1,024 | (45) | (5) | (121) | (12) | |||||||||||||||||||||||||||||||||||||||||||||||

| Goodwill and other intangibles assets, net | 1,680 | 1,691 | 1,702 | 1,714 | 1,726 | (11) | (1) | (47) | (3) | |||||||||||||||||||||||||||||||||||||||||||||||

| Premises and equipment, net | 585 | 587 | 589 | 592 | 598 | (2) | — | (13) | (2) | |||||||||||||||||||||||||||||||||||||||||||||||

| Allowances for loan and lease losses | (810) | (789) | (772) | (766) | (728) | (22) | (3) | (82) | (11) | |||||||||||||||||||||||||||||||||||||||||||||||

| Other assets | 4,120 | 4,028 | 4,352 | 4,377 | 4,338 | 92 | 2 | (218) | (5) | |||||||||||||||||||||||||||||||||||||||||||||||

| Total assets | $ | 81,721 | $ | 81,243 | $ | 82,313 | $ | 83,220 | $ | 82,304 | $ | 477 | 1 | % | $ | (583) | (1) | % | ||||||||||||||||||||||||||||||||||||||

| Liabilities and shareholders' equity: | ||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| Deposits: | ||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| Savings | $ | 25,462 | $ | 25,390 | $ | 25,799 | $ | 24,963 | $ | 21,542 | $ | 72 | — | % | $ | 3,920 | 18 | % | ||||||||||||||||||||||||||||||||||||||

| Time deposits | 6,683 | 6,628 | 7,372 | 8,087 | 5,520 | 55 | 1 | 1,163 | 21 | |||||||||||||||||||||||||||||||||||||||||||||||

| Other interest-bearing deposits | 16,484 | 16,735 | 16,344 | 15,329 | 14,719 | (251) | (2) | 1,765 | 12 | |||||||||||||||||||||||||||||||||||||||||||||||

| Total interest-bearing deposits | 48,629 | 48,753 | 49,515 | 48,379 | 41,781 | (124) | — | 6,847 | 16 | |||||||||||||||||||||||||||||||||||||||||||||||

| Trading liabilities | 605 | 462 | 386 | 276 | 216 | 144 | 31 | 389 | NM | |||||||||||||||||||||||||||||||||||||||||||||||

| Federal funds purchased and securities sold under agreements to repurchase | 2,208 | 2,014 | 1,982 | 1,970 | 1,634 | 195 | 10 | % | 574 | 35 | % | |||||||||||||||||||||||||||||||||||||||||||||

| Short-term borrowings | 1,267 | 537 | 437 | 1,790 | 6,365 | 730 | 136 | (5,098) | (80) | |||||||||||||||||||||||||||||||||||||||||||||||

| Term borrowings | 1,170 | 1,156 | 1,156 | 1,161 | 1,428 | 14 | 1 | (258) | (18) | |||||||||||||||||||||||||||||||||||||||||||||||

| Total interest-bearing liabilities | 53,879 | 52,921 | 53,475 | 53,575 | 51,424 | 957 | 2 | 2,455 | 5 | |||||||||||||||||||||||||||||||||||||||||||||||

| Noninterest-bearing deposits | 16,332 | 16,626 | 17,347 | 18,145 | 19,664 | (294) | (2) | (3,332) | (17) | |||||||||||||||||||||||||||||||||||||||||||||||

| Other liabilities | 2,561 | 2,445 | 2,585 | 2,522 | 2,187 | 116 | 5 | 374 | 17 | |||||||||||||||||||||||||||||||||||||||||||||||

| Total liabilities | 72,772 | 71,992 | 73,407 | 74,242 | 73,275 | 779 | 1 | (503) | (1) | |||||||||||||||||||||||||||||||||||||||||||||||

| Shareholders' Equity: | ||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| Preferred stock | 426 | 520 | 520 | 520 | 986 | (94) | (18) | (560) | (57) | |||||||||||||||||||||||||||||||||||||||||||||||

| Common stock | 340 | 347 | 349 | 349 | 337 | (7) | (2) | 3 | 1 | |||||||||||||||||||||||||||||||||||||||||||||||

| Capital surplus | 5,127 | 5,301 | 5,343 | 5,330 | 4,891 | (174) | (3) | 236 | 5 | |||||||||||||||||||||||||||||||||||||||||||||||

| Retained earnings | 4,122 | 4,028 | 3,935 | 3,861 | 3,759 | 93 | 2 | 362 | 10 | |||||||||||||||||||||||||||||||||||||||||||||||

| Accumulated other comprehensive loss, net | (1,361) | (1,240) | (1,538) | (1,378) | (1,241) | (121) | (10) | (121) | (10) | |||||||||||||||||||||||||||||||||||||||||||||||

| Combined shareholders' equity | 8,654 | 8,956 | 8,610 | 8,683 | 8,734 | (302) | (3) | (80) | (1) | |||||||||||||||||||||||||||||||||||||||||||||||

| Noncontrolling interest | 295 | 295 | 295 | 295 | 295 | — | — | — | — | |||||||||||||||||||||||||||||||||||||||||||||||

| Total shareholders' equity | 8,949 | 9,251 | 8,905 | 8,978 | 9,029 | (302) | (3) | (80) | (1) | |||||||||||||||||||||||||||||||||||||||||||||||

| Total liabilities and shareholders' equity | $ | 81,721 | $ | 81,243 | $ | 82,313 | $ | 83,220 | $ | 82,304 | $ | 477 | 1 | % | $ | (583) | (1) | % | ||||||||||||||||||||||||||||||||||||||

| Memo: | ||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| Total deposits | $ | 64,960 | $ | 65,379 | $ | 66,862 | $ | 66,523 | $ | 61,445 | $ | (418) | (1) | % | $ | 3,515 | 6 | % | ||||||||||||||||||||||||||||||||||||||

| Loans to mortgage companies | $ | 2,440 | $ | 1,847 | $ | 1,948 | $ | 2,353 | $ | 2,262 | $ | 593 | 32 | % | $ | 177 | 8 | % | ||||||||||||||||||||||||||||||||||||||

| CONSOLIDATED NET INTEREST INCOME AND AVERAGE BALANCE SHEET: YIELDS AND RATES | |||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| Quarterly, Unaudited | |||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| 2Q24 Change vs. | |||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| 2Q24 | 1Q24 | 4Q23 | 3Q23 | 2Q23 | 1Q24 | 2Q23 | |||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| (In millions, except rates) | Income/Expense | Rate | Income/Expense | Rate | Income/Expense | Rate | Income/Expense | Rate | Income/Expense | Rate | Income/Expense | Income/Expense | |||||||||||||||||||||||||||||||||||||||||||||||||||||

| $/bp | % | $/bp | % | ||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| Interest earning assets/Interest income: | |||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| Loans and leases, net of unearned income: | |||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| Commercial | $ | 800 | 6.78 | % | $ | 782 | 6.73 | % | $ | 783 | 6.65 | % | $ | 779 | 6.58 | % | $ | 727 | 6.34 | % | $ | 18 | 2 | % | $ | 73 | 10 | % | |||||||||||||||||||||||||||||||||||||

| Consumer | 179 | 4.91 | 173 | 4.80 | 171 | 4.71 | 165 | 4.55 | 153 | 4.39 | 6 | 3 | 26 | 17 | |||||||||||||||||||||||||||||||||||||||||||||||||||

| Loans and leases, net of unearned income | 978 | 6.34 | 955 | 6.28 | 954 | 6.19 | 944 | 6.10 | 880 | 5.89 | 23 | 2 | 98 | 11 | |||||||||||||||||||||||||||||||||||||||||||||||||||

| Loans held-for-sale | 9 | 7.50 | 9 | 7.80 | 11 | 8.34 | 15 | 7.88 | 14 | 7.58 | — | (1) | (5) | (37) | |||||||||||||||||||||||||||||||||||||||||||||||||||

| Investment securities | 60 | 2.58 | 61 | 2.54 | 61 | 2.62 | 62 | 2.54 | 63 | 2.49 | (1) | (2) | (4) | (6) | |||||||||||||||||||||||||||||||||||||||||||||||||||

| Trading securities | 22 | 6.30 | 20 | 6.48 | 20 | 6.63 | 19 | 7.03 | 19 | 6.69 | 1 | 7 | 3 | 16 | |||||||||||||||||||||||||||||||||||||||||||||||||||

| Interest-bearing deposits with banks | 20 | 5.46 | 24 | 5.46 | 35 | 5.46 | 39 | 5.34 | 40 | 5.13 | (5) | (19) | (20) | (51) | |||||||||||||||||||||||||||||||||||||||||||||||||||

| Federal funds sold and securities purchased under agreements | 9 | 5.31 | 7 | 5.16 | 7 | 5.32 | 4 | 5.06 | 3 | 4.85 | 2 | 28 | 6 | NM | |||||||||||||||||||||||||||||||||||||||||||||||||||

| Interest income | $ | 1,097 | 5.86 | % | $ | 1,076 | 5.78 | % | $ | 1,089 | 5.74 | % | $ | 1,084 | 5.64 | % | $ | 1,019 | 5.42 | % | $ | 21 | 2 | % | $ | 78 | 8 | % | |||||||||||||||||||||||||||||||||||||

| Interest bearing liabilities/Interest expense: | |||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| Interest-bearing deposits: | |||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| Savings | $ | 208 | 3.29 | % | $ | 206 | 3.27 | % | $ | 222 | 3.42 | % | $ | 219 | 3.48 | % | $ | 141 | 2.63 | % | $ | 2 | 1 | % | $ | 67 | 48 | % | |||||||||||||||||||||||||||||||||||||

| Time deposits | 74 | 4.45 | 73 | 4.42 | 82 | 4.42 | 89 | 4.35 | 49 | 3.56 | 1 | 1 | 25 | 51 | |||||||||||||||||||||||||||||||||||||||||||||||||||

| Other interest-bearing deposits | 117 | 2.86 | 119 | 2.86 | 116 | 2.81 | 102 | 2.64 | 75 | 2.06 | (2) | (1) | 42 | 56 | |||||||||||||||||||||||||||||||||||||||||||||||||||

| Total interest-bearing deposits | 399 | 3.30 | 398 | 3.28 | 420 | 3.37 | 409 | 3.36 | 265 | 2.55 | 1 | — | 134 | 50 | |||||||||||||||||||||||||||||||||||||||||||||||||||

| Trading liabilities | 7 | 4.46 | 5 | 4.31 | 4 | 4.59 | 3 | 4.20 | 2 | 3.82 | 2 | 35 | 5 | NM | |||||||||||||||||||||||||||||||||||||||||||||||||||

| Federal funds purchased and securities sold under agreements to repurchase | 24 | 4.36 | 21 | 4.24 | 22 | 4.35 | 21 | 4.24 | 15 | 3.74 | 3 | 13 | 9 | 57 | |||||||||||||||||||||||||||||||||||||||||||||||||||

| Short-term borrowings | 17 | 5.48 | 7 | 5.43 | 6 | 5.41 | 24 | 5.42 | 83 | 5.25 | 10 | 138 | (66) | (79) | |||||||||||||||||||||||||||||||||||||||||||||||||||

| Term borrowings | 17 | 5.64 | 17 | 5.71 | 17 | 5.75 | 17 | 5.82 | 19 | 5.21 | — | — | (2) | (11) | |||||||||||||||||||||||||||||||||||||||||||||||||||

| Interest expense | 464 | 3.46 | 448 | 3.40 | 469 | 3.48 | 475 | 3.52 | 385 | 3.00 | 16 | 4 | 79 | 21 | |||||||||||||||||||||||||||||||||||||||||||||||||||

| Net interest income - tax equivalent basis | 633 | 2.40 | 628 | 2.38 | 621 | 2.26 | 609 | 2.12 | 635 | 2.42 | 5 | 1 | (2) | — | |||||||||||||||||||||||||||||||||||||||||||||||||||

| Fully taxable equivalent adjustment | (4) | 0.98 | (4) | 0.99 | (4) | 1.01 | (4) | 1.05 | (4) | 0.96 | — | (10) | — | (6) | |||||||||||||||||||||||||||||||||||||||||||||||||||

| Net interest income | $ | 629 | 3.38 | % | $ | 625 | 3.37 | % | $ | 617 | 3.27 | % | $ | 605 | 3.17 | % | $ | 631 | 3.38 | % | $ | 4 | 1 | % | $ | (2) | — | % | |||||||||||||||||||||||||||||||||||||

| Memo: | |||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| Total loan yield | 6.34 | % | 6.28 | % | 6.19 | % | 6.10 | % | 5.89 | % | 6 | bp | 45 | bp | |||||||||||||||||||||||||||||||||||||||||||||||||||

| Total deposit cost | 2.47 | % | 2.45 | % | 2.49 | % | 2.44 | % | 1.73 | % | 2 | bp | 74 | bp | |||||||||||||||||||||||||||||||||||||||||||||||||||

| Total funding cost | 2.66 | % | 2.59 | % | 2.63 | % | 2.63 | % | 2.17 | % | 7 | bp | 49 | bp | |||||||||||||||||||||||||||||||||||||||||||||||||||

| Average loans and leases, net of unearned income | $ | 62,029 | $ | 61,152 | $ | 61,197 | $ | 61,432 | $ | 59,924 | $ | 876 | 1 | % | $ | 2,105 | 4 | % | |||||||||||||||||||||||||||||||||||||||||||||||

| Average deposits | 64,960 | 65,379 | 66,862 | 66,523 | 61,445 | (418) | (1) | % | 3,515 | 6 | % | ||||||||||||||||||||||||||||||||||||||||||||||||||||||

| Average funded liabilities | 70,210 | 69,547 | 70,822 | 71,720 | 71,088 | $ | 663 | 1 | % | $ | (877) | (1) | % | ||||||||||||||||||||||||||||||||||||||||||||||||||||

CONSOLIDATED NONPERFORMING LOANS AND LEASES ("NPL") |

|||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| Quarterly, Unaudited | |||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| As of | 2Q24 change vs. | ||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| (In millions, except ratio data) | 2Q24 | 1Q24 | 4Q23 | 3Q23 | 2Q23 | 1Q24 | 2Q23 | ||||||||||||||||||||||||||||||||||||||||||||||||||||

| $ | % | $ | % | ||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| Nonperforming loans and leases | |||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| Commercial, financial, and industrial (C&I) | $ | 167 | $ | 206 | $ | 184 | $ | 123 | $ | 184 | $ | (39) | (19) | % | $ | (16) | (9) | % | |||||||||||||||||||||||||||||||||||||||||

| Commercial real estate | 261 | 157 | 136 | 125 | 73 | 104 | 66 | 188 | NM | ||||||||||||||||||||||||||||||||||||||||||||||||||

| Consumer real estate | 143 | 140 | 139 | 145 | 144 | 4 | 3 | (1) | — | ||||||||||||||||||||||||||||||||||||||||||||||||||

Credit card and other5 |

2 | 2 | 2 | 2 | 2 | — | 21 | — | (15) | ||||||||||||||||||||||||||||||||||||||||||||||||||

| Total nonperforming loans and leases | $ | 574 | $ | 505 | $ | 462 | $ | 394 | $ | 402 | $ | 69 | 14 | % | $ | 171 | 43 | % | |||||||||||||||||||||||||||||||||||||||||

| Asset Quality Ratio | |||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| Nonperforming loans and leases to loans and leases | |||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| Commercial, financial, and industrial (C&I) | 0.50 | % | 0.63 | % | 0.57 | % | 0.37 | % | 0.55 | % | |||||||||||||||||||||||||||||||||||||||||||||||||

| Commercial real estate | 1.78 | 1.09 | 0.96 | 0.88 | 0.52 | ||||||||||||||||||||||||||||||||||||||||||||||||||||||

| Consumer real estate | 1.03 | 1.02 | 1.02 | 1.06 | 1.07 | ||||||||||||||||||||||||||||||||||||||||||||||||||||||

Credit card and other5 |

0.25 | 0.20 | 0.30 | 0.26 | 0.27 | ||||||||||||||||||||||||||||||||||||||||||||||||||||||

| Total nonperforming loans and leases to loans and leases | 0.91 | % | 0.82 | % | 0.75 | % | 0.64 | % | 0.66 | % | |||||||||||||||||||||||||||||||||||||||||||||||||

CONSOLIDATED LOANS AND LEASES 90 DAYS OR MORE PAST DUE AND ACCRUING |

|||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| Quarterly, Unaudited | |||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| As of | 2Q24 change vs. | ||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| (In millions) | 2Q24 | 1Q24 | 4Q23 | 3Q23 | 2Q23 | 1Q24 | 2Q23 | ||||||||||||||||||||||||||||||||||||||||||||||||||||

| $ | % | $ | % | ||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| Loans and leases 90 days or more past due and accruing | |||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| Commercial, financial, and industrial (C&I) | $ | — | $ | — | $ | 1 | $ | 3 | $ | 1 | $ | — | NM | $ | (1) | NM | |||||||||||||||||||||||||||||||||||||||||||

| Commercial real estate | — | — | — | — | — | — | NM | — | NM | ||||||||||||||||||||||||||||||||||||||||||||||||||

| Consumer real estate | 3 | 6 | 17 | 12 | 8 | (3) | (47) | (5) | (58) | ||||||||||||||||||||||||||||||||||||||||||||||||||

Credit card and other5 |

2 | 3 | 3 | 3 | 5 | (1) | (25) | (2) | (52) | ||||||||||||||||||||||||||||||||||||||||||||||||||

| Total loans and leases 90 days or more past due and accruing | $ | 6 | $ | 10 | $ | 21 | $ | 17 | $ | 14 | $ | (4) | (38) | % | $ | (8) | (56) | % | |||||||||||||||||||||||||||||||||||||||||

CONSOLIDATED NET CHARGE-OFFS (RECOVERIES) | |||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| Quarterly, Unaudited | |||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| As of | 2Q24 change vs. | ||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| (In millions, except ratio data) | 2Q24 | 1Q24 | 4Q23 | 3Q23 | 2Q23 | 1Q24 | 2Q23 | ||||||||||||||||||||||||||||||||||||||||||||||||||||

| Charge-off, Recoveries and Related Ratios | $ | % | $ | % | |||||||||||||||||||||||||||||||||||||||||||||||||||||||

| Gross Charge-offs | |||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| Commercial, financial, and industrial (C&I) * | $ | 24 | $ | 28 | $ | 31 | $ | 92 | $ | 19 | $ | (4) | (13) | % | $ | 5 | 28 | % | |||||||||||||||||||||||||||||||||||||||||

| Commercial real estate | 19 | 12 | 2 | 5 | 8 | 7 | 54 | 11 | NM | ||||||||||||||||||||||||||||||||||||||||||||||||||

| Consumer real estate | 1 | — | 1 | 1 | 1 | 1 | NM | — | 46 | ||||||||||||||||||||||||||||||||||||||||||||||||||

Credit card and other5 |

5 | 6 | 6 | 7 | 5 | (1) | (16) | — | 1 | ||||||||||||||||||||||||||||||||||||||||||||||||||

| Total gross charge-offs | $ | 49 | $ | 46 | $ | 41 | $ | 104 | $ | 33 | $ | 3 | 6 | % | $ | 16 | 50 | % | |||||||||||||||||||||||||||||||||||||||||

| Gross Recoveries | |||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| Commercial, financial, and industrial (C&I) | $ | (11) | $ | (3) | $ | (2) | $ | (5) | $ | (5) | $ | (9) | NM | $ | (7) | NM | |||||||||||||||||||||||||||||||||||||||||||

| Commercial real estate | — | — | — | — | (1) | — | 91 | 1 | 99 | ||||||||||||||||||||||||||||||||||||||||||||||||||

| Consumer real estate | (2) | (1) | (2) | (2) | (3) | (1) | (74) | — | 9 | ||||||||||||||||||||||||||||||||||||||||||||||||||

Credit card and other5 |

(1) | (2) | (1) | (1) | (1) | — | 27 | — | (2) | ||||||||||||||||||||||||||||||||||||||||||||||||||

| Total gross recoveries | $ | (15) | $ | (6) | $ | (5) | $ | (9) | $ | (9) | $ | (9) | NM | $ | (6) | (62) | % | ||||||||||||||||||||||||||||||||||||||||||

| Net Charge-offs (Recoveries) | |||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| Commercial, financial, and industrial (C&I) * | $ | 13 | $ | 25 | $ | 29 | $ | 86 | $ | 14 | $ | (12) | (49) | % | $ | (1) | (10) | % | |||||||||||||||||||||||||||||||||||||||||

| Commercial real estate | 19 | 12 | 2 | 4 | 8 | 7 | 55 | 11 | NM | ||||||||||||||||||||||||||||||||||||||||||||||||||

| Consumer real estate | (1) | (1) | — | (2) | (2) | — | (53) | 1 | 29 | ||||||||||||||||||||||||||||||||||||||||||||||||||

Credit card and other5 |

3 | 4 | 5 | 6 | 3 | — | (12) | — | 1 | ||||||||||||||||||||||||||||||||||||||||||||||||||

| Total net charge-offs | $ | 34 | $ | 40 | $ | 36 | $ | 95 | $ | 23 | $ | (6) | (16) | % | $ | 11 | 46 | % | |||||||||||||||||||||||||||||||||||||||||

| Annualized Net Charge-off (Recovery) Rates | |||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| Commercial, financial, and industrial (C&I) * | 0.16 | % | 0.31 | % | 0.36 | % | 1.04 | % | 0.18 | % | |||||||||||||||||||||||||||||||||||||||||||||||||

| Commercial real estate | 0.53 | 0.35 | 0.06 | 0.12 | 0.23 | ||||||||||||||||||||||||||||||||||||||||||||||||||||||

| Consumer real estate | (0.04) | (0.03) | — | (0.05) | (0.06) | ||||||||||||||||||||||||||||||||||||||||||||||||||||||

Credit card and other5 |

1.79 | 1.98 | 2.36 | 2.77 | 1.65 | ||||||||||||||||||||||||||||||||||||||||||||||||||||||

| Total loans and leases | 0.22 | % | 0.27 | % | 0.23 | % | 0.61 | % | 0.16 | % | |||||||||||||||||||||||||||||||||||||||||||||||||

| CONSOLIDATED ALLOWANCE FOR LOAN AND LEASE LOSSES AND RESERVE FOR UNFUNDED COMMITMENTS | |||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| Quarterly, Unaudited | |||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| As of | 2Q24 Change vs. | ||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| (In millions) | 2Q24 | 1Q24 | 4Q23 | 3Q23 | 2Q23 | 1Q24 | 2Q23 | ||||||||||||||||||||||||||||||||||||||||||||||||||||

| Summary of Changes in the Components of the Allowance For Credit Losses | $ | % | $ | % | |||||||||||||||||||||||||||||||||||||||||||||||||||||||

| Allowance for loan and lease losses - beginning | $ | 787 | $ | 773 | $ | 760 | $ | 737 | $ | 715 | $ | 14 | 2 | % | $ | 72 | 10 | % | |||||||||||||||||||||||||||||||||||||||||

| Charge-offs: | |||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| Commercial, financial, and industrial (C&I) * | (24) | (28) | (31) | (92) | (19) | 4 | 13 | (5) | (28) | ||||||||||||||||||||||||||||||||||||||||||||||||||

| Commercial real estate | (19) | (12) | (2) | (5) | (8) | (7) | (54) | (11) | NM | ||||||||||||||||||||||||||||||||||||||||||||||||||

| Consumer real estate | (1) | — | (1) | (1) | (1) | (1) | NM | — | (46) | ||||||||||||||||||||||||||||||||||||||||||||||||||

Credit card and other5 |

(5) | (6) | (6) | (7) | (5) | 1 | 16 | — | (1) | ||||||||||||||||||||||||||||||||||||||||||||||||||

| Total charge-offs | (49) | (46) | (41) | (104) | (33) | (3) | (6) | (16) | (50) | ||||||||||||||||||||||||||||||||||||||||||||||||||

| Recoveries: | |||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| Commercial, financial, and industrial (C&I) | 11 | 3 | 2 | 5 | 5 | 9 | NM | 7 | NM | ||||||||||||||||||||||||||||||||||||||||||||||||||

| Commercial real estate | — | — | — | — | 1 | — | (91) | (1) | (99) | ||||||||||||||||||||||||||||||||||||||||||||||||||

| Consumer real estate | 2 | 1 | 2 | 2 | 3 | 1 | 74 | — | (9) | ||||||||||||||||||||||||||||||||||||||||||||||||||

Credit card and other5 |

1 | 2 | 1 | 1 | 1 | — | (27) | — | 2 | ||||||||||||||||||||||||||||||||||||||||||||||||||

| Total Recoveries | 15 | 6 | 5 | 9 | 9 | 9 | NM | 6 | 62 | ||||||||||||||||||||||||||||||||||||||||||||||||||

| Provision for loan and lease losses: | |||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| Commercial, financial, and industrial (C&I) * | 9 | 34 | 33 | 96 | 15 | (24) | (72) | (6) | (39) | ||||||||||||||||||||||||||||||||||||||||||||||||||

| Commercial real estate | 59 | 21 | 6 | 14 | 16 | 38 | NM | 43 | NM | ||||||||||||||||||||||||||||||||||||||||||||||||||

| Consumer real estate | (1) | (3) | 5 | 5 | 10 | 2 | 73 | (11) | NM | ||||||||||||||||||||||||||||||||||||||||||||||||||

Credit card and other5 |

— | 3 | 5 | 3 | 3 | (2) | (88) | (3) | (89) | ||||||||||||||||||||||||||||||||||||||||||||||||||

Total provision for loan and lease losses: |

68 | 54 | 49 | 118 | 45 | 14 | 26 | 23 | 51 | ||||||||||||||||||||||||||||||||||||||||||||||||||

| Allowance for loan and lease losses - ending | $ | 821 | $ | 787 | $ | 773 | $ | 760 | $ | 737 | $ | 34 | 4 | % | $ | 84 | 11 | % | |||||||||||||||||||||||||||||||||||||||||

| Reserve for unfunded commitments - beginning | $ | 79 | $ | 83 | $ | 82 | $ | 90 | $ | 85 | $ | (4) | (5) | % | $ | (6) | (7) | % | |||||||||||||||||||||||||||||||||||||||||

| Cumulative effect of change in accounting principle | — | — | — | — | — | — | NM | — | NM | ||||||||||||||||||||||||||||||||||||||||||||||||||

| Acquired reserve for unfunded commitments | — | — | — | — | — | — | NM | — | NM | ||||||||||||||||||||||||||||||||||||||||||||||||||

| Provision for unfunded commitments | (13) | (4) | 1 | (8) | 5 | (9) | NM | (18) | NM | ||||||||||||||||||||||||||||||||||||||||||||||||||

| Reserve for unfunded commitments - ending | $ | 66 | $ | 79 | $ | 83 | $ | 82 | $ | 90 | $ | (13) | (17) | % | $ | (24) | (27) | % | |||||||||||||||||||||||||||||||||||||||||

| Total allowance for credit losses- ending | $ | 887 | $ | 865 | $ | 856 | $ | 842 | $ | 827 | $ | 22 | 2 | % | $ | 60 | 7 | % | |||||||||||||||||||||||||||||||||||||||||

| CONSOLIDATED ASSET QUALITY RATIOS - ALLOWANCE FOR LOAN AND LEASE LOSSES | |||||||||||||||||||||||||||||||||||

| Quarterly, Unaudited | |||||||||||||||||||||||||||||||||||

| As of | |||||||||||||||||||||||||||||||||||

| 2Q24 | 1Q24 | 4Q23 | 3Q23 | 2Q23 | |||||||||||||||||||||||||||||||

| Allowance for loans and lease losses to loans and leases | |||||||||||||||||||||||||||||||||||

| Commercial, financial, and industrial (C&I) | 1.03 | % | 1.06 | % | 1.04 | % | 1.01 | % | 0.98 | % | |||||||||||||||||||||||||

| Commercial real estate | 1.51 | % | 1.26 | % | 1.21 | % | 1.19 | % | 1.14 | % | |||||||||||||||||||||||||

| Consumer real estate | 1.66 | % | 1.69 | % | 1.71 | % | 1.67 | % | 1.64 | % | |||||||||||||||||||||||||

Credit card and other5 |

3.26 | % | 3.57 | % | 3.63 | % | 3.48 | % | 3.79 | % | |||||||||||||||||||||||||

| Total allowance for loans and lease losses to loans and leases | 1.31 | % | 1.27 | % | 1.26 | % | 1.23 | % | 1.20 | % | |||||||||||||||||||||||||

| Allowance for loans and lease losses to nonperforming loans and leases | |||||||||||||||||||||||||||||||||||

| Commercial, financial, and industrial (C&I) | 205 | % | 168 | % | 184 | % | 273 | % | 177 | % | |||||||||||||||||||||||||

| Commercial real estate | 85 | % | 115 | % | 126 | % | 135 | % | 219 | % | |||||||||||||||||||||||||

| Consumer real estate | 161 | % | 165 | % | 168 | % | 158 | % | 154 | % | |||||||||||||||||||||||||

Credit card and other5 |

1,295 | % | 1,766 | % | 1,202 | % | 1,364 | % | 1,384 | % | |||||||||||||||||||||||||

| Total allowance for loans and lease losses to nonperforming loans and leases | 143 | % | 156 | % | 167 | % | 193 | % | 183 | % | |||||||||||||||||||||||||

| Allowance for credit losses ratios | |||||||||||||||||||||||||||||||||||

Total allowance for credit losses to loans and leases4 |

1.41 | % | 1.40 | % | 1.40 | % | 1.36 | % | 1.35 | % | |||||||||||||||||||||||||

Total allowance for credit losses to nonperforming loans and leases4 |

155 | % | 171 | % | 185 | % | 214 | % | 206 | % | |||||||||||||||||||||||||

| 2Q24 Change vs. | ||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| 2Q24 | 1Q24 | 4Q23 | 3Q23 | 2Q23 | 1Q24 | 2Q23 | ||||||||||||||||||||||||||||||||||||||||||||||||||

| $/bp | % | $/bp | % | |||||||||||||||||||||||||||||||||||||||||||||||||||||

| Income Statement (millions) | ||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| Net interest income | $ | 522 | $ | 532 | $ | 548 | $ | 558 | $ | 586 | $ | (10) | (2) | % | $ | (64) | (11) | % | ||||||||||||||||||||||||||||||||||||||

| Noninterest income | 109 | 105 | 106 | 106 | 106 | 4 | 4 | 3 | 3 | |||||||||||||||||||||||||||||||||||||||||||||||

| Total revenue | 632 | 637 | 655 | 664 | 691 | (5) | (1) | (59) | (9) | |||||||||||||||||||||||||||||||||||||||||||||||

| Noninterest expense | 334 | 324 | 334 | 311 | 314 | 10 | 3 | 20 | 6 | |||||||||||||||||||||||||||||||||||||||||||||||

Pre-provision net revenue3 |

298 | 313 | 321 | 353 | 377 | (15) | (5) | (79) | (21) | |||||||||||||||||||||||||||||||||||||||||||||||

| Provision for credit losses | 57 | 28 | 28 | 112 | 35 | 29 | 104 | 22 | 63 | |||||||||||||||||||||||||||||||||||||||||||||||

| Income before income tax expense | 241 | 285 | 293 | 241 | 342 | (44) | (15) | (101) | (30) | |||||||||||||||||||||||||||||||||||||||||||||||

| Income tax expense | 55 | 67 | 69 | 56 | 80 | (12) | (18) | (25) | (31) | |||||||||||||||||||||||||||||||||||||||||||||||

| Net income | $ | 185 | $ | 219 | $ | 224 | $ | 185 | $ | 262 | $ | (34) | (16) | % | $ | (77) | (29) | % | ||||||||||||||||||||||||||||||||||||||

| Average Balances (billions) | ||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| Total loans and leases | $ | 41.0 | $ | 40.6 | $ | 40.6 | $ | 40.6 | $ | 39.7 | $ | 0.4 | 1 | % | $ | 1.3 | 3 | % | ||||||||||||||||||||||||||||||||||||||

| Interest-earning assets | 41.0 | 40.6 | 40.6 | 40.6 | 39.7 | 0.4 | 1 | 1.3 | 3 | |||||||||||||||||||||||||||||||||||||||||||||||

| Total assets | 43.5 | 43.1 | 43.2 | 43.3 | 42.3 | 0.4 | 1 | 1.2 | 3 | |||||||||||||||||||||||||||||||||||||||||||||||

| Total deposits | 57.5 | 57.8 | 58.6 | 58.0 | 55.2 | (0.3) | (1) | 2.3 | 4 | |||||||||||||||||||||||||||||||||||||||||||||||

| Key Metrics | ||||||||||||||||||||||||||||||||||||||||||||||||||||||||

Net interest margin6 |

5.16 | % | 5.30 | % | 5.39 | % | 5.48 | % | 5.95 | % | (14) | bp | (79) | bp | ||||||||||||||||||||||||||||||||||||||||||

| Efficiency ratio | 52.80 | % | 50.83 | % | 51.04 | % | 46.82 | % | 45.41 | % | 197 | bp | 739 | bp | ||||||||||||||||||||||||||||||||||||||||||

| Loans-to-deposits ratio (period-end balances) | 72.05 | % | 69.82 | % | 68.76 | % | 69.68 | % | 70.22 | % | 223 | bp | 183 | bp | ||||||||||||||||||||||||||||||||||||||||||

| Loans-to-deposits ratio (average-end balances) | 71.32 | % | 70.18 | % | 69.34 | % | 70.03 | % | 71.83 | % | 114 | bp | (51) | bp | ||||||||||||||||||||||||||||||||||||||||||

| Return on average assets (annualized) | 1.71 | % | 2.04 | % | 2.06 | % | 1.70 | % | 2.48 | % | (33) | bp | (77) | bp | ||||||||||||||||||||||||||||||||||||||||||

Return on allocated equity7 |

21.47 | % | 25.37 | % | 25.84 | % | 21.30 | % | 30.36 | % | (390) | bp | (889) | bp | ||||||||||||||||||||||||||||||||||||||||||

| Financial center locations | 418 | 418 | 418 | 418 | 417 | — | 1 | |||||||||||||||||||||||||||||||||||||||||||||||||

| 2Q24 Change vs. | ||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| 2Q24 | 1Q24 | 4Q23 | 3Q23 | 2Q23 | 1Q24 | 2Q23 | ||||||||||||||||||||||||||||||||||||||||||||||||||

| $/bp | % | $/bp | % | |||||||||||||||||||||||||||||||||||||||||||||||||||||

| Income Statement (millions) | ||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| Net interest income | $ | 158 | $ | 153 | $ | 153 | $ | 161 | $ | 156 | $ | 5 | 3 | % | $ | 2 | 1 | % | ||||||||||||||||||||||||||||||||||||||

| Noninterest income | 64 | 72 | 64 | 49 | 50 | (7) | (10) | 14 | 27 | |||||||||||||||||||||||||||||||||||||||||||||||

| Total revenue | 222 | 224 | 217 | 209 | 206 | (3) | (1) | 15 | 7 | |||||||||||||||||||||||||||||||||||||||||||||||

| Noninterest expense | 103 | 104 | 101 | 96 | 95 | (1) | (1) | 8 | 8 | |||||||||||||||||||||||||||||||||||||||||||||||

Pre-provision net revenue3 |

119 | 120 | 116 | 114 | 112 | (1) | (1) | 8 | 7 | |||||||||||||||||||||||||||||||||||||||||||||||

| Provision for credit losses | 1 | 23 | 31 | 2 | 18 | (22) | (98) | (18) | (97) | |||||||||||||||||||||||||||||||||||||||||||||||

| Income before income tax expense | 119 | 97 | 85 | 111 | 93 | 21 | 22 | 25 | 27 | |||||||||||||||||||||||||||||||||||||||||||||||

| Income tax expense | 29 | 24 | 21 | 27 | 23 | 5 | 22 | 6 | 28 | |||||||||||||||||||||||||||||||||||||||||||||||

| Net income | $ | 90 | $ | 74 | $ | 64 | $ | 84 | $ | 71 | $ | 16 | 22 | % | $ | 19 | 27 | % | ||||||||||||||||||||||||||||||||||||||

| Average Balances (billions) | ||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| Total loans and leases | $ | 20.7 | $ | 20.2 | $ | 20.1 | $ | 20.4 | $ | 19.8 | $ | 0.5 | 3 | % | $ | 0.9 | 5 | % | ||||||||||||||||||||||||||||||||||||||

| Interest-earning assets | 23.3 | 22.4 | 22.4 | 22.7 | 22.0 | 0.8 | 4 | 1.3 | 6 | |||||||||||||||||||||||||||||||||||||||||||||||

| Total assets | 24.6 | 23.8 | 23.9 | 24.1 | 23.3 | 0.8 | 3 | 1.3 | 5 | |||||||||||||||||||||||||||||||||||||||||||||||

| Total deposits | 3.9 | 4.0 | 4.2 | 4.1 | 3.8 | (0.1) | (3) | 0.1 | 2 | |||||||||||||||||||||||||||||||||||||||||||||||

| Key Metrics | ||||||||||||||||||||||||||||||||||||||||||||||||||||||||

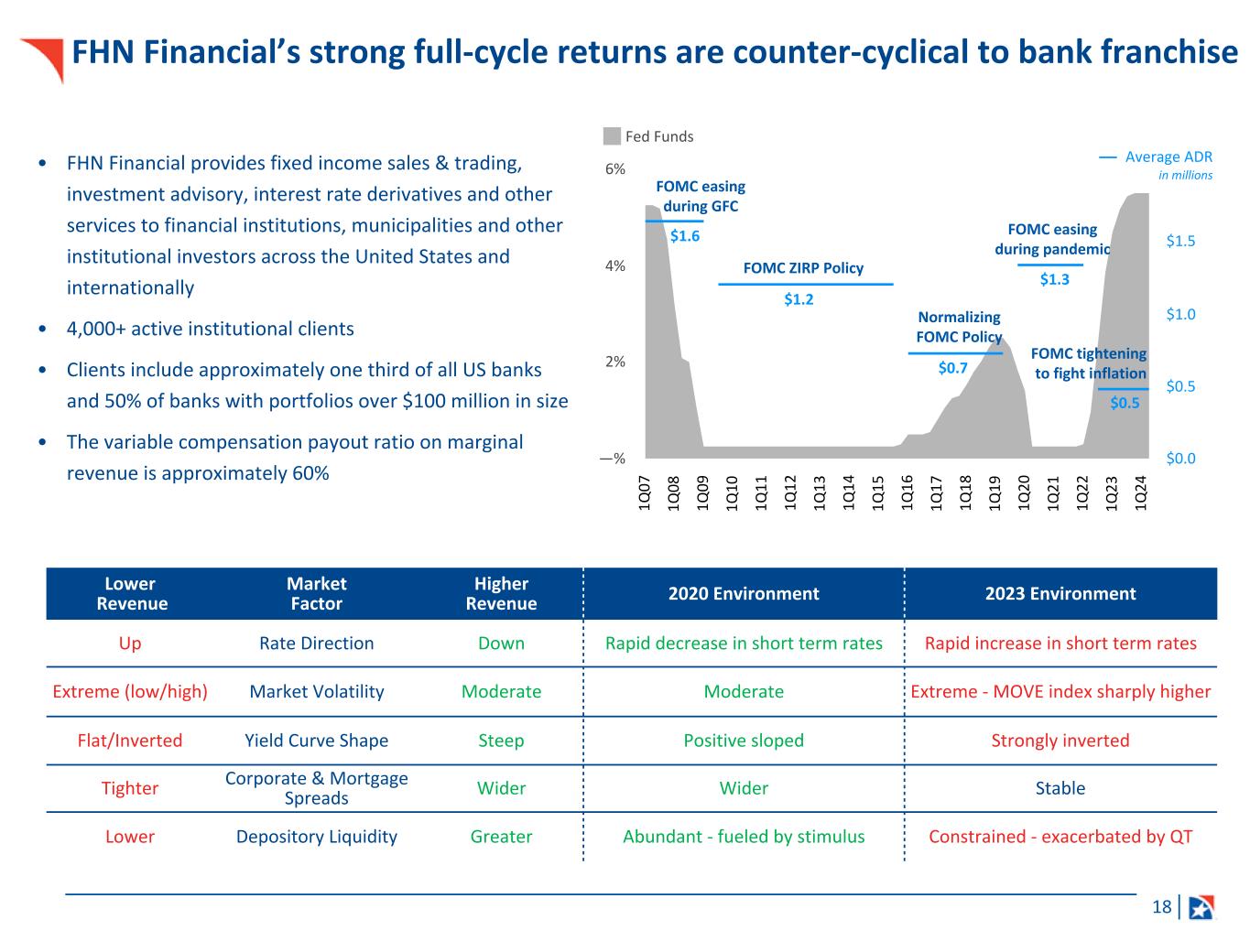

| Fixed income product average daily revenue (thousands) | $ | 488 | $ | 731 | $ | 463 | $ | 301 | $ | 348 | $ | (243) | (33) | % | $ | 140 | 40 | % | ||||||||||||||||||||||||||||||||||||||

Net interest margin6 |

2.72 | % | 2.73 | % | 2.71 | % | 2.81 | % | 2.85 | % | (1) | bp | (13) | bp | ||||||||||||||||||||||||||||||||||||||||||

| Efficiency ratio | 46.28 | % | 46.40 | % | 46.60 | % | 45.80 | % | 45.92 | % | (12) | bp | 36 | bp | ||||||||||||||||||||||||||||||||||||||||||

| Loans-to-deposits ratio (period-end balances) | 551 | % | 539 | % | 524 | % | 493 | % | 534 | % | 1,224 | bp | 1,684 | bp | ||||||||||||||||||||||||||||||||||||||||||

| Loans-to-deposits ratio (average-end balances) | 535 | % | 506 | % | 482 | % | 501 | % | 521 | % | 2,881 | bp | 1,330 | bp | ||||||||||||||||||||||||||||||||||||||||||

| Return on average assets (annualized) | 1.47 | % | 1.25 | % | 1.06 | % | 1.39 | % | 1.21 | % | 22 | bp | 26 | bp | ||||||||||||||||||||||||||||||||||||||||||

Return on allocated equity7 |

16.86 | % | 14.13 | % | 12.41 | % | 17.21 | % | 15.37 | % | 273 | bp | 149 | bp | ||||||||||||||||||||||||||||||||||||||||||

| 2Q24 Change vs. | ||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| 2Q24 | 1Q24 | 4Q23 | 3Q23 | 2Q23 | 1Q24 | 2Q23 | ||||||||||||||||||||||||||||||||||||||||||||||||||

| $ | % | $ | % | |||||||||||||||||||||||||||||||||||||||||||||||||||||

| Income Statement (millions) | ||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| Net interest income/(expense) | $ | (51) | $ | (60) | $ | (85) | $ | (113) | $ | (111) | $ | 9 | 15 | % | $ | 60 | 54 | % | ||||||||||||||||||||||||||||||||||||||

| Noninterest income | 13 | 18 | 13 | 18 | 244 | (5) | (28) | (231) | (95) | |||||||||||||||||||||||||||||||||||||||||||||||

| Total revenues | (39) | (43) | (72) | (95) | 133 | 4 | 9 | (172) | (129) | |||||||||||||||||||||||||||||||||||||||||||||||

| Noninterest expense | 64 | 87 | 137 | 67 | 147 | (23) | (27) | (83) | (56) | |||||||||||||||||||||||||||||||||||||||||||||||

Pre-provision net revenue3 |

(103) | (130) | (209) | (162) | (14) | 27 | 21 | (89) | NM | |||||||||||||||||||||||||||||||||||||||||||||||

| Provision for credit losses | (3) | (1) | (9) | (5) | (4) | (2) | NM | 1 | 17 | |||||||||||||||||||||||||||||||||||||||||||||||

| Income before income tax expense | (100) | (129) | (200) | (158) | (10) | 29 | 23 | (90) | NM | |||||||||||||||||||||||||||||||||||||||||||||||

| Income tax expense (benefit) | (29) | (33) | (100) | (31) | (7) | 5 | 15 | (22) | NM | |||||||||||||||||||||||||||||||||||||||||||||||

| Net income/(loss) | $ | (71) | $ | (95) | $ | (100) | $ | (127) | $ | (3) | $ | 24 | 26 | % | $ | (68) | NM | |||||||||||||||||||||||||||||||||||||||

| Average Balance Sheet (billions) | ||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| Interest bearing assets | $ | 11.0 | $ | 11.8 | $ | 12.4 | $ | 13.0 | $ | 13.7 | $ | (0.8) | (7) | % | $ | (2.7) | (20) | % | ||||||||||||||||||||||||||||||||||||||

| Total assets | 13.6 | 14.4 | 15.2 | 15.9 | 16.7 | (0.8) | (5) | (3.1) | (18) | |||||||||||||||||||||||||||||||||||||||||||||||

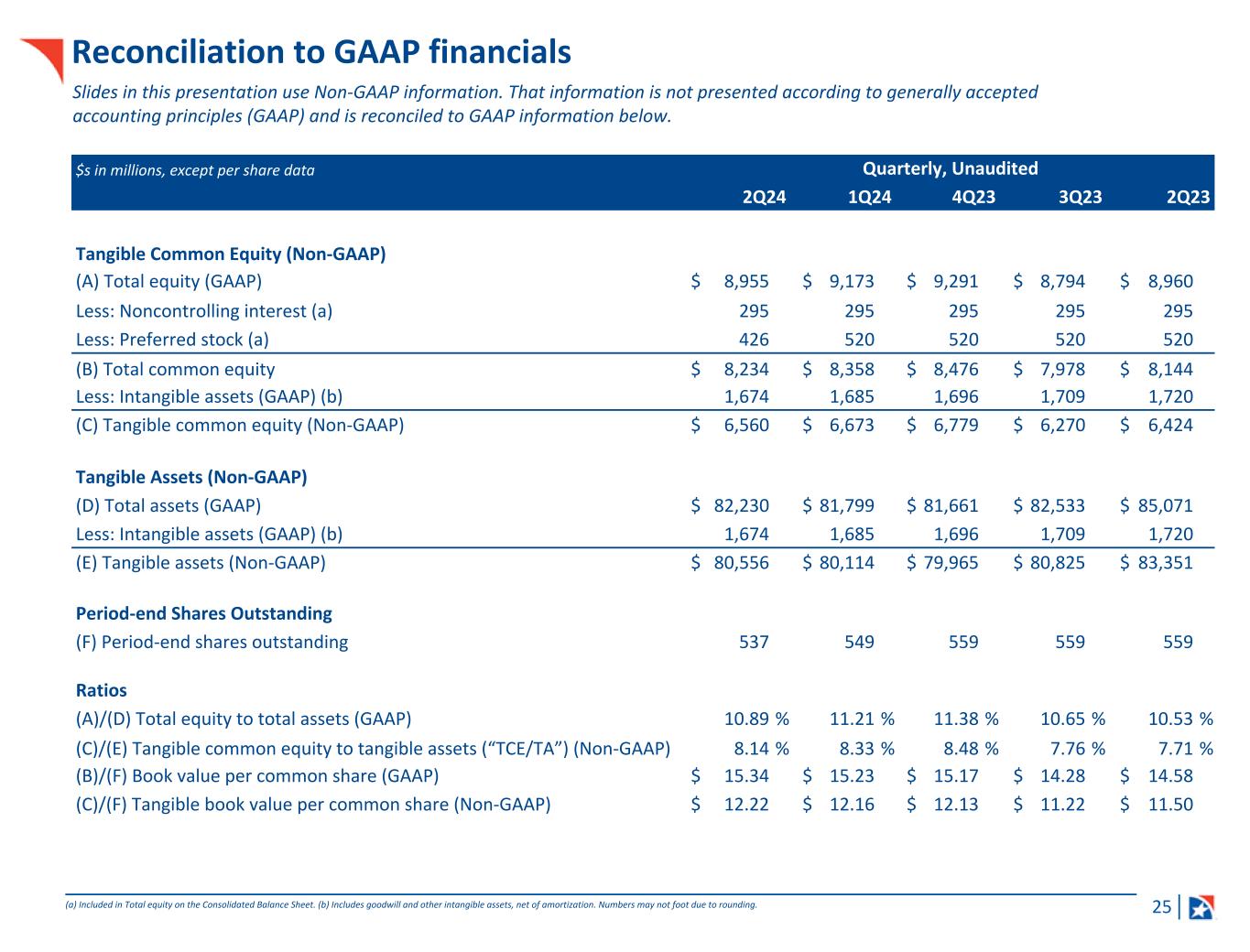

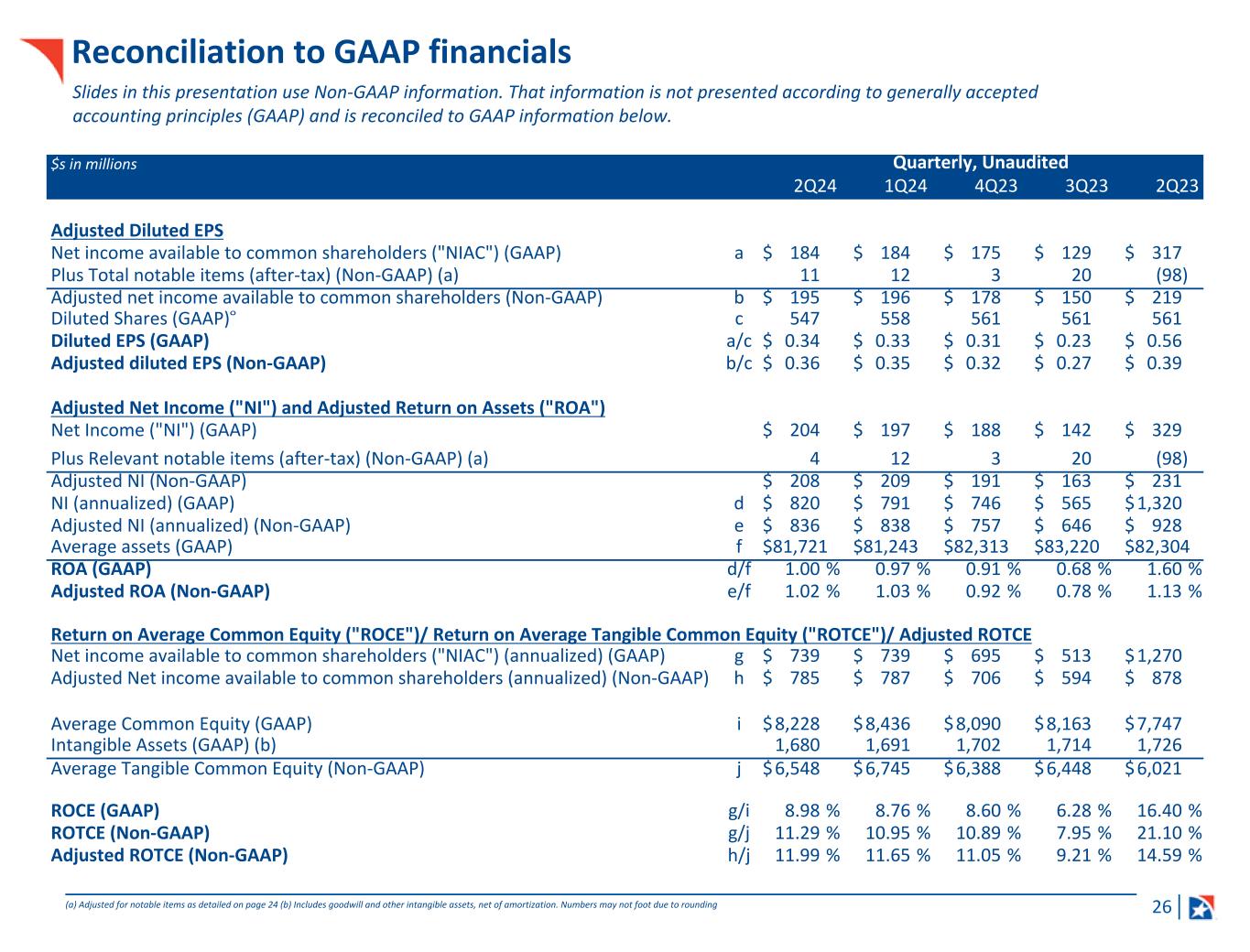

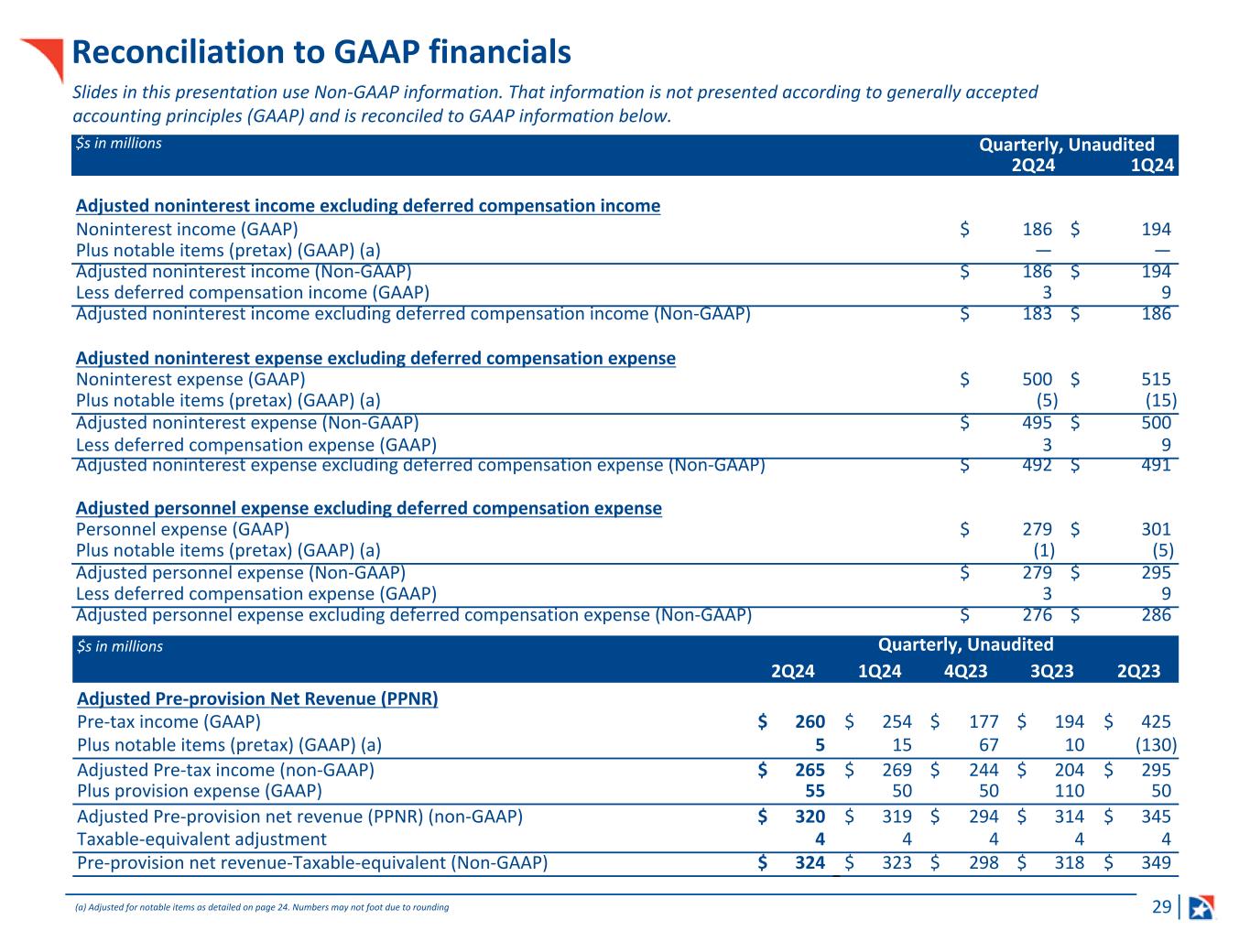

CONSOLIDATED NON-GAAP TO GAAP RECONCILIATION |

||||||||||||||||||||||||||||||||

| Quarterly, Unaudited | ||||||||||||||||||||||||||||||||

| ($s in millions, except per share data) | 2Q24 | 1Q24 | 4Q23 | 3Q23 | 2Q23 | |||||||||||||||||||||||||||

| Tangible Common Equity (Non-GAAP) | ||||||||||||||||||||||||||||||||

| (A) Total equity (GAAP) | $ | 8,955 | $ | 9,173 | $ | 9,291 | $ | 8,794 | $ | 8,960 | ||||||||||||||||||||||

| Less: Noncontrolling interest (a) | 295 | 295 | 295 | 295 | 295 | |||||||||||||||||||||||||||

| Less: Preferred stock (a) | 426 | 520 | 520 | 520 | 520 | |||||||||||||||||||||||||||

| (B) Total common equity | $ | 8,234 | $ | 8,358 | $ | 8,476 | $ | 7,978 | $ | 8,144 | ||||||||||||||||||||||

| Less: Intangible assets (GAAP) (b) | 1,674 | 1,685 | 1,696 | 1,709 | 1,720 | |||||||||||||||||||||||||||

| (C) Tangible common equity (Non-GAAP) | $ | 6,560 | $ | 6,673 | $ | 6,779 | $ | 6,270 | $ | 6,424 | ||||||||||||||||||||||

| Tangible Assets (Non-GAAP) | ||||||||||||||||||||||||||||||||

| (D) Total assets (GAAP) | $ | 82,230 | $ | 81,799 | $ | 81,661 | $ | 82,533 | $ | 85,071 | ||||||||||||||||||||||

| Less: Intangible assets (GAAP) (b) | 1,674 | 1,685 | 1,696 | 1,709 | 1,720 | |||||||||||||||||||||||||||

| (E) Tangible assets (Non-GAAP) | $ | 80,556 | $ | 80,114 | $ | 79,965 | $ | 80,825 | $ | 83,351 | ||||||||||||||||||||||

| Period-end Shares Outstanding | ||||||||||||||||||||||||||||||||

| (F) Period-end shares outstanding | 537 | 549 | 559 | 559 | 559 | |||||||||||||||||||||||||||

| Ratios | ||||||||||||||||||||||||||||||||

| (A)/(D) Total equity to total assets (GAAP) | 10.89 | % | 11.21 | % | 11.38 | % | 10.65 | % | 10.53 | % | ||||||||||||||||||||||

| (C)/(E) Tangible common equity to tangible assets (“TCE/TA”) (Non-GAAP) | 8.14 | % | 8.33 | % | 8.48 | % | 7.76 | % | 7.71 | % | ||||||||||||||||||||||

| (B)/(F) Book value per common share (GAAP) | $ | 15.34 | $ | 15.23 | $ | 15.17 | $ | 14.28 | $ | 14.58 | ||||||||||||||||||||||

| (C)/(F) Tangible book value per common share (Non-GAAP) | $ | 12.22 | $ | 12.16 | $ | 12.13 | $ | 11.22 | $ | 11.50 | ||||||||||||||||||||||

CONSOLIDATED NON-GAAP TO GAAP RECONCILIATION |

||||||||||||||||||||||||||||||||||||||

| Quarterly, Unaudited | ||||||||||||||||||||||||||||||||||||||

| ($s in millions, except per share data) | 2Q24 | 1Q24 | 4Q23 | 3Q23 | 2Q23 | |||||||||||||||||||||||||||||||||

| Adjusted Diluted EPS | ||||||||||||||||||||||||||||||||||||||

| Net income available to common shareholders ("NIAC") (GAAP) | a | $ | 184 | $ | 184 | $ | 175 | $ | 129 | $ | 317 | |||||||||||||||||||||||||||

| Plus Total notable items (after-tax) (Non-GAAP) (a) | $ | 11 | $ | 12 | $ | 3 | $ | 20 | $ | (98) | ||||||||||||||||||||||||||||

| Adjusted net income available to common shareholders (Non-GAAP) | b | $ | 195 | $ | 196 | $ | 178 | $ | 150 | $ | 219 | |||||||||||||||||||||||||||

Diluted Shares (GAAP)8 |

c | 547 | 558 | 561 | 561 | 561 | ||||||||||||||||||||||||||||||||

| Diluted EPS (GAAP) | a/c | $ | 0.34 | $ | 0.33 | $ | 0.31 | $ | 0.23 | $ | 0.56 | |||||||||||||||||||||||||||

| Adjusted diluted EPS (Non-GAAP) | b/c | $ | 0.36 | $ | 0.35 | $ | 0.32 | $ | 0.27 | $ | 0.39 | |||||||||||||||||||||||||||

| Adjusted Net Income ("NI") and Adjusted Return on Assets ("ROA") | ||||||||||||||||||||||||||||||||||||||

| Net Income ("NI") (GAAP) | $ | 204 | $ | 197 | $ | 188 | $ | 142 | $ | 329 | ||||||||||||||||||||||||||||

| Plus Relevant notable items (after-tax) (Non-GAAP) (a) | $ | 4 | $ | 12 | $ | 3 | $ | 20 | $ | (98) | ||||||||||||||||||||||||||||

| Adjusted NI (Non-GAAP) | $ | 208 | $ | 209 | $ | 191 | $ | 163 | $ | 231 | ||||||||||||||||||||||||||||

| NI (annualized) (GAAP) | d | $ | 820 | $ | 791 | $ | 746 | $ | 565 | $ | 1,320 | |||||||||||||||||||||||||||

| Adjusted NI (annualized) (Non-GAAP) | e | $ | 836 | $ | 838 | $ | 757 | $ | 646 | $ | 928 | |||||||||||||||||||||||||||

| Average assets (GAAP) | f | $ | 81,721 | $ | 81,243 | $ | 82,313 | $ | 83,220 | $ | 82,304 | |||||||||||||||||||||||||||

| ROA (GAAP) | d/f | 1.00 | % | 0.97 | % | 0.91 | % | 0.68 | % | 1.60 | % | |||||||||||||||||||||||||||

| Adjusted ROA (Non-GAAP) | e/f | 1.02 | % | 1.03 | % | 0.92 | % | 0.78 | % | 1.13 | % | |||||||||||||||||||||||||||

| Return on Average Common Equity ("ROCE")/ Return on Average Tangible Common Equity ("ROTCE")/ Adjusted ROTCE | ||||||||||||||||||||||||||||||||||||||

| Net income available to common shareholders ("NIAC") (annualized) (GAAP) | g | $ | 739 | $ | 739 | $ | 695 | $ | 513 | $ | 1,270 | |||||||||||||||||||||||||||

| Adjusted Net income available to common shareholders (annualized) (Non-GAAP) | h | $ | 785 | $ | 787 | $ | 706 | $ | 594 | $ | 878 | |||||||||||||||||||||||||||

| Average Common Equity (GAAP) | i | $ | 8,228 | $ | 8,436 | $ | 8,090 | $ | 8,163 | $ | 7,747 | |||||||||||||||||||||||||||

| Intangible Assets (GAAP) (b) | 1,680 | 1,691 | 1,702 | 1,714 | 1,726 | |||||||||||||||||||||||||||||||||

| Average Tangible Common Equity (Non-GAAP) | j | $ | 6,548 | $ | 6,745 | $ | 6,388 | $ | 6,448 | $ | 6,021 | |||||||||||||||||||||||||||

| ROCE (GAAP) | g/i | 8.98 | % | 8.76 | % | 8.60 | % | 6.28 | % | 16.40 | % | |||||||||||||||||||||||||||

| ROTCE (Non-GAAP) | g/j | 11.29 | % | 10.95 | % | 10.89 | % | 7.95 | % | 21.10 | % | |||||||||||||||||||||||||||

| Adjusted ROTCE (Non-GAAP) | h/j | 11.99 | % | 11.65 | % | 11.05 | % | 9.21 | % | 14.59 | % | |||||||||||||||||||||||||||

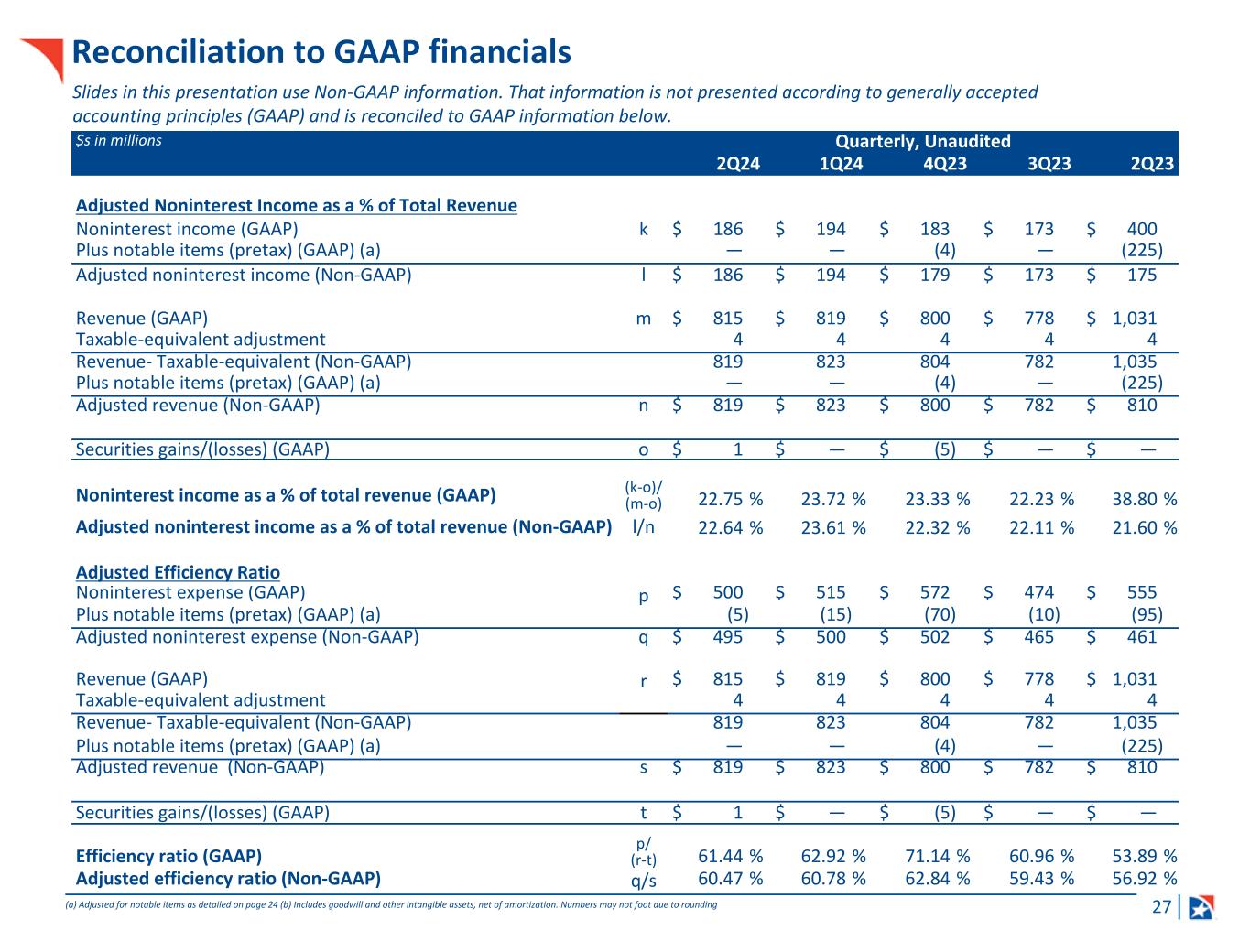

CONSOLIDATED NON-GAAP TO GAAP RECONCILIATION |

||||||||||||||||||||||||||||||||||||||

| Quarterly, Unaudited | ||||||||||||||||||||||||||||||||||||||

| (In millions) | 2Q24 | 1Q24 | 4Q23 | 3Q23 | 2Q23 | |||||||||||||||||||||||||||||||||

| Adjusted Noninterest Income as a % of Total Revenue | ||||||||||||||||||||||||||||||||||||||

| Noninterest income (GAAP) | k | $ | 186 | $ | 194 | $ | 183 | $ | 173 | $ | 400 | |||||||||||||||||||||||||||

| Plus notable items (pretax) (GAAP) (a) | — | — | (4) | — | (225) | |||||||||||||||||||||||||||||||||

| Adjusted noninterest income (Non-GAAP) | l | $ | 186 | $ | 194 | $ | 179 | $ | 173 | $ | 175 | |||||||||||||||||||||||||||

| Revenue (GAAP) | m | $ | 815 | $ | 819 | $ | 800 | $ | 778 | $ | 1,031 | |||||||||||||||||||||||||||

| Taxable-equivalent adjustment | 4 | 4 | 4 | 4 | 4 | |||||||||||||||||||||||||||||||||

| Revenue- Taxable-equivalent (Non-GAAP) | 819 | 823 | 804 | 782 | 1,035 | |||||||||||||||||||||||||||||||||

| Plus notable items (pretax) (GAAP) (a) | — | — | (4) | — | (225) | |||||||||||||||||||||||||||||||||

| Adjusted revenue (Non-GAAP) | n | $ | 819 | $ | 823 | $ | 800 | $ | 782 | $ | 810 | |||||||||||||||||||||||||||

| Securities gains/(losses) (GAAP) | o | $ | 1 | $ | — | $ | (5) | $ | — | $ | — | |||||||||||||||||||||||||||

| Noninterest income as a % of total revenue (GAAP) | (k-o)/ (m-o) | 22.75 | % | 23.72 | % | 23.33 | % | 22.23 | % | 38.80 | % | |||||||||||||||||||||||||||

| Adjusted noninterest income as a % of total revenue (Non-GAAP) | l/n | 22.64 | % | 23.61 | % | 22.32 | % | 22.11 | % | 21.60 | % | |||||||||||||||||||||||||||

| Adjusted Efficiency Ratio | ||||||||||||||||||||||||||||||||||||||

| Noninterest expense (GAAP) | p | $ | 500 | $ | 515 | $ | 572 | $ | 474 | $ | 555 | |||||||||||||||||||||||||||

| Plus notable items (pretax) (GAAP) (a) | (5) | (15) | (70) | (10) | (95) | |||||||||||||||||||||||||||||||||

| Adjusted noninterest expense (Non-GAAP) | q | $ | 495 | $ | 500 | $ | 502 | $ | 465 | $ | 461 | |||||||||||||||||||||||||||

| Revenue (GAAP) | r | $ | 815 | $ | 819 | $ | 800 | $ | 778 | $ | 1,031 | |||||||||||||||||||||||||||

| Taxable-equivalent adjustment | 4 | 4 | 4 | 4 | 4 | |||||||||||||||||||||||||||||||||