| ☒ | ANNUAL REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934 | ||||

| ☐ | TRANSITION REPORT PURSUANT TO SECTION 13 or 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934 | ||||

| TN | 62-0803242 | ||||||||||

| (State or other jurisdiction incorporation of organization) |

(IRS Employer Identification No.) |

||||||||||

| 165 Madison Avenue | |||||||||||

| Memphis, | Tennessee | 38103 | |||||||||

| (Address of principal executive office) | (Zip Code) | ||||||||||

| Title of Each Class | Trading Symbol(s) | Name of Exchange on which Registered | ||||||

| $.625 Par Value Common Capital Stock | FHN | New York Stock Exchange LLC | ||||||

| Depositary Shares, each representing a 1/400th interest in a share of Non-Cumulative Perpetual Preferred Stock, Series B |

FHN PR B | New York Stock Exchange LLC | ||||||

| Depositary Shares, each representing a 1/400th interest in a share of Non-Cumulative Perpetual Preferred Stock, Series C |

FHN PR C | New York Stock Exchange LLC | ||||||

| Depositary Shares, each representing a 1/400th interest in a share of Non-Cumulative Perpetual Preferred Stock, Series D |

FHN PR D | New York Stock Exchange LLC | ||||||

| Depositary Shares, each representing a 1/4,000th interest in a share of Non-Cumulative Perpetual Preferred Stock, Series E |

FHN PR E | New York Stock Exchange LLC | ||||||

| Depositary Shares, each representing a 1/4,000th interest in a share of Non-Cumulative Perpetual Preferred Stock, Series F |

FHN PR F | New York Stock Exchange LLC | ||||||

| Large Accelerated Filer | ☒ | Accelerated filer | ☐ | Non-accelerated filer | ☐ | ||||||||||||||||||

| Smaller reporting company | ☐ | Emerging Growth Company | ☐ | ||||||||||||||||||||

| TABLE OF CONTENTS and GLOSSARY | ||

| Page | Page | |||||||||||||||||||

| Glossary | Item 8. | Financial Statements and Supplementary Data | ||||||||||||||||||

| Executive Summary of Principal Investment Risks | Item 9. | Changes in and Disagreements with | ||||||||||||||||||

| Forward-Looking Statements | Accountants on Accounting and Financial | |||||||||||||||||||

Part I |

Disclosure | |||||||||||||||||||

| Item 1. | Business | Item 9A. | Controls and Procedures | |||||||||||||||||

| Item 1A. | Risk Factors | Item 9B. | Other Information | |||||||||||||||||

| Item 1B. | Unresolved Staff Comments | Item 9C. | Disclosure Regarding Foreign Jurisdictions that | |||||||||||||||||

| Item 1C. | Cybersecurity | Prevent Inspections | ||||||||||||||||||

| Item 2. | Properties | Part III | ||||||||||||||||||

| Item 3. | Legal Proceedings | Item 10. | Directors, Executive Officers and Corporate | |||||||||||||||||

| Item 4. | Mine Safety Disclosures | Governance | ||||||||||||||||||

| Supplemental Part I Information | Item 11. | Executive Compensation | ||||||||||||||||||

| Part II | Item 12. | Security Ownership of Certain Beneficial | ||||||||||||||||||

| Item 5. | Market for the Registrant’s Common Equity, | Owners and Management and Related | ||||||||||||||||||

| Related Stockholder Matters, and Issuer | Stockholder Matters | |||||||||||||||||||

| Purchases of Equity Securities | Item 13. | Certain Relationships and Related Transactions, | ||||||||||||||||||

| Item 6. | [Reserved] | and Director Independence | ||||||||||||||||||

| Item 7. | Management’s Discussion and Analysis of | Item 14. | Principal Accountant Fees and Services | |||||||||||||||||

| Financial Condition and Results of | Part IV | |||||||||||||||||||

| Operations | Item 15. | Exhibits and Financial Statement Schedules | ||||||||||||||||||

| Item 7A. | Quantitative and Qualitative Disclosures | Item 16. | Form 10-K Summary | |||||||||||||||||

| about Market Risk | Signatures | |||||||||||||||||||

| ACL | Allowance for credit losses | ||||

| AFS | Available for sale | ||||

| AIR | Accrued interest receivable | ||||

| ALCO | Asset/Liability Committee | ||||

| ALLL | Allowance for loan and lease losses | ||||

| ALM | Asset/liability management | ||||

| AOCI | Accumulated other comprehensive income | ||||

| ASC | FASB Accounting Standards Codification | ||||

| Associate | Person employed by FHN | ||||

| ASU | Accounting Standards Update | ||||

| Bank | First Horizon Bank | ||||

| BOLI | Bank-owned life insurance | ||||

BTFP |

Bank Term Funding Program |

||||

| C&I | Commercial, financial, and industrial loan portfolio | ||||

| CAS | Credit Assurance Services | ||||

| CARES Act | Coronavirus Aid, Relief, and Economic Security Act | ||||

| CBF | Capital Bank Financial | ||||

| CCAR | Comprehensive Capital Analysis and Review | ||||

| CECL | Current expected credit loss | ||||

| CEO | Chief Executive Officer | ||||

| CFPB | Consumer Financial Protection Bureau | ||||

| CMO | Collateralized mortgage obligations | ||||

CODM |

Chief Operating Decision-Maker |

||||

|

1 |

2023 FORM 10-K ANNUAL REPORT | ||||||

| TABLE OF CONTENTS and GLOSSARY | ||

| Company | First Horizon Corporation | ||||

| Corporation | First Horizon Corporation | ||||

| CRA | Community Reinvestment Act | ||||

| CRE | Commercial Real Estate | ||||

| CRMC | Credit Risk Management Committee | ||||

| DTA | Deferred tax asset | ||||

| DTL | Deferred tax liability | ||||

EAD |

Exposure as default |

||||

| ECP | Equity Compensation Plan | ||||

| EPS | Earnings per share | ||||

Fannie Mae |

Federal National Mortgage Association | ||||

| FASB | Financial Accounting Standards Board | ||||

| FDIC | Federal Deposit Insurance Corporation | ||||

| Federal Reserve | Federal Reserve Board | ||||

| Fed | Federal Reserve Board | ||||

| FHA | Federal Housing Administration | ||||

| FHLB | Federal Home Loan Bank | ||||

| FHN | First Horizon Corporation | ||||

| FHNF | FHN Financial; FHN's fixed income division | ||||

| FICO | Fair Isaac Corporation | ||||

| First Horizon | First Horizon Corporation | ||||

| FRB | Federal Reserve Bank or the Federal Reserve Board | ||||

Freddie Mac |

Federal Home Loan Mortgage Corporation | ||||

| FTE | Fully taxable equivalent | ||||

| FTRESC | FT Real Estate Securities Company, Inc. | ||||

| GAAP | Generally accepted accounting principles (U.S.) |

||||

GHG |

Greenhouse Gas |

||||

GNMA |

Government National Mortgage Association or Ginnie Mae |

||||

| GSE | Government sponsored enterprises, in this filing references Fannie Mae and Freddie Mac | ||||

| HELOC | Home equity line of credit | ||||

| HFS | Held for sale | ||||

HR |

Human Resources |

||||

| HTM | Held to maturity | ||||

| IBKC | IBERIABANK Corporation | ||||

| IBKC merger | FHN's merger of equals with IBKC that closed July 2020 | ||||

| ISDA | International Swap and Derivatives Association | ||||

| IRS | Internal Revenue Service | ||||

| LGD | Loss given default | ||||

| LIBOR | London Inter-Bank Offered Rate | ||||

| LIHTC | Low Income Housing Tax Credit | ||||

| LLC | Limited Liability Company | ||||

| LMC | Loans to mortgage companies | ||||

| LOCOM | Lower of cost or market | ||||

| LRRD | Loan Rehab and Recovery Department | ||||

| LTV | Loan-to-value | ||||

| MBS | Mortgage-backed securities | ||||

| MD&A | Management’s Discussion and Analysis of Financial Condition and Results of Operations | ||||

| NAICS | North American Industry Classification System | ||||

| NII | Net interest income | ||||

| NM | Not meaningful | ||||

| NMTC | New Market Tax Credit | ||||

| NPA | Nonperforming asset | ||||

| Non-PCD | Non-Purchased Credit Deteriorated Financial Assets | ||||

| NPL | Nonperforming loan | ||||

| OREO | Other Real Estate Owned |

||||

| PCAOB | Public Company Accounting Oversight Board | ||||

| PCD | Purchased credit deteriorated financial assets |

||||

| PCI | Purchased credit impaired | ||||

| PD | Probability of default | ||||

| PM | Portfolio managers | ||||

| PPP | Paycheck Protection Program | ||||

| PSU | Performance Stock Unit | ||||

| RE | Real estate | ||||

| RM | Relationship managers | ||||

| ROA | Return on Assets | ||||

| ROU | Right of use | ||||

| RPL | Reasonably possible loss | ||||

| SBA | Small Business Administration | ||||

| SEC | Securities and Exchange Commission | ||||

| SOFR | Secure Overnight Funding Rate | ||||

| SVaR | Stressed Value-at-Risk | ||||

| TD | The Toronto-Dominion Bank | ||||

| TD Merger Agreement | Merger agreement between FHN, TD, and certain TD subsidiaries, signed in February 2022 and terminated in May 2023 |

||||

TD Transaction |

The acquisition of FHN by TD contemplated by the TD Merger Agreement |

||||

| TDR | Troubled Debt Restructuring | ||||

| TRUP | Trust preferred loan | ||||

| UPB | Unpaid principal balance | ||||

| USDA | United States Department of Agriculture | ||||

| VaR | Value-at-Risk | ||||

| VIE | Variable Interest Entities | ||||

| we/us/our | First Horizon Corporation | ||||

|

2 |

2023 FORM 10-K ANNUAL REPORT | ||||||

| EXECUTIVE SUMMARY OF PRINCIPAL INVESTMENT RISKS | ||||||||

|

3 |

2023 FORM 10-K ANNUAL REPORT | ||||||

| EXECUTIVE SUMMARY OF PRINCIPAL INVESTMENT RISKS | ||||||||

|

4 |

2023 FORM 10-K ANNUAL REPORT | ||||||

| FORWARD-LOOKING STATEMENTS | ||||||||

|

5 |

2023 FORM 10-K ANNUAL REPORT | ||||||

| ITEM 1. BUSINESS | ||||||||

| PART I | ||

| Businesses | Principal Brands | ||||

| Banking & financial services generally |

First Horizon &

First Horizon Bank

|

||||

| Fixed income / capital markets | FHN Financial |

||||

| Mortgage lending | First Horizon Bank |

||||

| Insurance brokerage & management services | First Horizon Advisors |

||||

| Wealth management & brokerage services | First Horizon Advisors |

||||

| State | # | State | # | |||||||||||

| Tennessee | 135 | Arkansas | 12 | |||||||||||

| North Carolina | 79 | South Carolina | 10 | |||||||||||

| Florida | 76 | Texas | 8 | |||||||||||

| Louisiana | 56 | Virginia | 8 | |||||||||||

| Alabama | 13 | Mississippi | 4 | |||||||||||

| Georgia | 13 | New York | 1 | |||||||||||

|

6 |

2023 FORM 10-K ANNUAL REPORT | ||||||

| ITEM 1. BUSINESS | ||||||||

| Commercial | $47 B |

76 | % | ||||||||

| Consumer | $14 B |

24 | % | ||||||||

| Total Loans | $61 B |

100 | % | ||||||||

| Commercial Portfolios | % of Type | % of Total | |||||||||

| C&I | 70 | % | 53 | % | |||||||

| CRE | 30 | 23 | |||||||||

| Consumer Portfolios | % of Type | % of Total | |||||||||

| Consumer real estate | 95 | % | 23 | % | |||||||

| Credit card/other | 5 | 1 | |||||||||

C&I ($33B) |

CRE ($14B) |

Cons. RE ($14B) |

|||||||||||||||||||||

| Tennessee | 21 | % | Florida | 27 | % | Florida | 29 | % | |||||||||||||||

| Florida | 13 | % | Texas | 13 | % | Tennessee | 22 | % | |||||||||||||||

| Texas | 11 | % | N. Carolina | 12 | % | Texas | 11 | % | |||||||||||||||

| N. Carolina | 7 | % | Georgia | 9 | % | Louisiana | 8 | % | |||||||||||||||

| Louisiana | 6 | % | Tennessee | 9 | % | N. Carolina | 7 | % | |||||||||||||||

| Georgia | 5 | % | Louisiana | 8 | % | New York | 5 | % | |||||||||||||||

| California | 5 | % | All other | 22 | % | Georgia | 5 | % | |||||||||||||||

| All other | 32 | % | All other | 13 | % | ||||||||||||||||||

| Finance and insurance | 12 | % | ||||||

| Real estate and rental and leasing (a) | 12 | |||||||

| Health care and social assistance | 8 | |||||||

| Accommodation and food service | 7 | |||||||

| Manufacturing | 7 | |||||||

| Wholesale trade | 7 | |||||||

| Loans to mortgage companies | 6 | |||||||

| Retail trade | 6 | |||||||

| Transportation and warehousing | 5 | |||||||

| Energy | 4 | |||||||

| Other C&I | 26 | |||||||

| Multi-family | 31 | % | ||||||

| Office | 20 | |||||||

| Retail | 16 | |||||||

| Industrial | 16 | |||||||

| Hospitality | 10 | |||||||

| Land/land development | 2 | |||||||

| Other CRE | 5 | |||||||

|

7 |

2023 FORM 10-K ANNUAL REPORT | ||||||

| ITEM 1. BUSINESS | ||||||||

| Client Types | % of Total | Acct Types | % of Total | FDIC Insured Status | % of Total | Source | % of Total | |||||||||||||||||||||||||

| Commercial | 55% | Savings | 38% | Estimated Insured | 59% | Tennessee | 38% |

|||||||||||||||||||||||||

| Consumer | 45% | Time deposits | 10% | Est. Uninsured - Total | 41% | Florida | 18% |

|||||||||||||||||||||||||

| Other interest | 26% | Est. Uninsured - Collateralized | 8% | Louisiana | 12% |

|||||||||||||||||||||||||||

| Noninterest | 26% | N. Carolina | 12% |

|||||||||||||||||||||||||||||

| All other | 20% | |||||||||||||||||||||||||||||||

| (Dollars in millions) | Regional | Specialty | |||||||||

2023 Average assets |

$ | 45,858 | $ | 20,161 | |||||||

2023 Net interest income |

$ | 2,354 | $ | 518 | |||||||

2023 Noninterest income |

$ | 433 | $ | 209 | |||||||

2023 Pre-tax income |

$ | 1,262 | $ | 313 | |||||||

|

8 |

2023 FORM 10-K ANNUAL REPORT | ||||||

| ITEM 1. BUSINESS | ||||||||

|

9 |

2023 FORM 10-K ANNUAL REPORT | ||||||

| ITEM 1. BUSINESS | ||||||||

| 2023 | 2022 | 2021 | 2020 | 2019 | |||||||||||||

| Net interest income | $ | 2,540 | $ | 2,392 | $ | 1,994 | $ | 1,662 | $ | 1,210 | |||||||

| Noninterest income | 927 | 815 | 1,076 | 1,492 | 654 | ||||||||||||

| Net income available to common shareholders | 865 | 868 | 962 | 822 | 435 | ||||||||||||

| Total loans and leases | 61,292 | 58,102 | 54,859 | 58,232 | 31,061 | ||||||||||||

| Provision (benefit) for credit losses | 260 | 95 | (310) | 503 | 45 | ||||||||||||

| Net Charge-offs | 170 | 59 | 2 | 120 | 27 | ||||||||||||

| Net interest margin | 3.42 | % | 3.10 | % | 2.48 | % | 2.86 | % | 3.28 | % | |||||||

| Total assets | 81,661 | 78,953 | 89,092 | 84,209 | 43,311 | ||||||||||||

| Total deposits | 65,780 | 63,489 | 74,895 | 69,982 | 32,430 | ||||||||||||

| Total term borrowings | 1,150 | 1,597 | 1,590 | 1,670 | 791 | ||||||||||||

| Total liabilities | 72,370 | 70,406 | 80,598 | 75,902 | 38,235 | ||||||||||||

| Preferred stock | 520 | 1,014 | 520 | 470 | 96 | ||||||||||||

| Total shareholders’ equity (financial statement) | 9,291 | 8,547 | 8,494 | 8,307 | 5,076 | ||||||||||||

| Common Equity Tier 1 Capital (regulatory) | 8,104 | 7,032 | 6,367 | 6,110 | 3,409 | ||||||||||||

|

10 |

2023 FORM 10-K ANNUAL REPORT | ||||||

| ITEM 1. BUSINESS | ||||||||

|

11 |

2023 FORM 10-K ANNUAL REPORT | ||||||

| ITEM 1. BUSINESS | ||||||||

|

12 |

2023 FORM 10-K ANNUAL REPORT | ||||||

| ITEM 1. BUSINESS | ||||||||

|

13 |

2023 FORM 10-K ANNUAL REPORT | ||||||

| ITEM 1. BUSINESS | ||||||||

|

14 |

2023 FORM 10-K ANNUAL REPORT | ||||||

| ITEM 1. BUSINESS | ||||||||

|

15 |

2023 FORM 10-K ANNUAL REPORT | ||||||

| ITEM 1. BUSINESS | ||||||||

|

16 |

2023 FORM 10-K ANNUAL REPORT | ||||||

| ITEM 1. BUSINESS | ||||||||

| Federal Reserve Policy Phase | |||||||||||

| Tightening | Neutral | Easing | |||||||||

| Fixed Income Performance Tends to be |

Weaker | Average | Stronger | ||||||||

|

17 |

2023 FORM 10-K ANNUAL REPORT | ||||||

| ITEM 1. BUSINESS | ||||||||

| Driver | If Driver Is: | FI Revenues Tend to Be: | ||||||

| Interest rates | Rising/up | Lower | ||||||

| Falling/down | Higher | |||||||

| Market volatility |

Extreme

(low or high)

|

Lower | ||||||

| Moderate | Higher | |||||||

| Yield curve | Flat or Inverted | Lower | ||||||

| Steep | Higher | |||||||

| Credit spreads | Tighter | Lower | ||||||

| Wider | Higher | |||||||

| Depository Liquidity | Lower | Lower | ||||||

| Greater | Higher | |||||||

| Economy outlook | Positive | Lower | ||||||

| Negative | Higher | |||||||

|

18 |

2023 FORM 10-K ANNUAL REPORT | ||||||

| ITEM 1. BUSINESS | ||||||||

|

19 |

2023 FORM 10-K ANNUAL REPORT | ||||||

| ITEM 1. BUSINESS | ||||||||

|

20 |

2023 FORM 10-K ANNUAL REPORT | ||||||

| ITEM 1. BUSINESS | ||||||||

|

21 |

2023 FORM 10-K ANNUAL REPORT | ||||||

| ITEM 1. BUSINESS | ||||||||

|

22 |

2023 FORM 10-K ANNUAL REPORT | ||||||

| ITEM 1. BUSINESS | ||||||||

| Well capitalized |

•Common Equity Tier 1 Capital ratio of at least 6.5%

•Tier 1 Capital ratio of at least 8%

•Total Capital ratio of at least 10%

•Leverage ratio of at least 5%

•Not subject to a directive, order, or written agreement to meet and maintain specific capital levels

|

||||

| Adequately capitalized |

•Common Equity Tier 1 Capital ratio of at least 4.5%

•Tier 1 Capital ratio of at least 6%

•Total Capital ratio of at least 8%

•Leverage ratio of at least 4%

•Not subject to a directive, order, or written agreement to meet and maintain specific capital levels

|

||||

| Undercapitalized | Failure to maintain any requirement to be adequately capitalized | ||||

| Significantly Undercapitalized | Failure to maintain Common Equity Tier 1 Capital ratio of at least 3%, Tier 1 Capital ratio of at least 4%, Total Capital ratio of at least 6%, or a Leverage ratio of at least 3% | ||||

| Critically Undercapitalized | Failure to maintain a level of tangible equity equal to at least 2% of total assets | ||||

|

23 |

2023 FORM 10-K ANNUAL REPORT | ||||||

| ITEM 1. BUSINESS | ||||||||

|

24 |

2023 FORM 10-K ANNUAL REPORT | ||||||

| ITEM 1. BUSINESS | ||||||||

|

25 |

2023 FORM 10-K ANNUAL REPORT | ||||||

| ITEM 1. BUSINESS | ||||||||

|

26 |

2023 FORM 10-K ANNUAL REPORT | ||||||

| ITEM 1. BUSINESS | ||||||||

|

27 |

2023 FORM 10-K ANNUAL REPORT | ||||||

| ITEM 1. BUSINESS | ||||||||

|

28 |

2023 FORM 10-K ANNUAL REPORT | ||||||

| ITEM 1A. RISK FACTORS | ||||||||

| Topic | Page | Topic | Page | |||||||||||||||||

| Traditional Competition Risks | Risks of Expense Control | |||||||||||||||||||

| Traditional Strategic Risks | Geographic Risks | |||||||||||||||||||

| Industry Disruption | Insurance | |||||||||||||||||||

| Operational Risks | Liquidity & Funding Risks | |||||||||||||||||||

| Cybersecurity Risks | Credit Ratings | |||||||||||||||||||

| Risks from Economic Downturns & Changes | Interest Rate & Yield Curve Risks | |||||||||||||||||||

| Risks Associated with Monetary Events | Asset Inventories & Market Risks | |||||||||||||||||||

| Risks Related to Businesses We May Exit | Mortgage Business Risks | |||||||||||||||||||

| Reputation Risks | Pre-2009 Mortgage Business Risks | |||||||||||||||||||

| Credit Risks | Accounting Risks | |||||||||||||||||||

| Service Risks | Share Owning & Governance Risks | |||||||||||||||||||

| Regulatory, Legislative, and Legal Risks | ||||||||||||||||||||

|

29 |

2023 FORM 10-K ANNUAL REPORT | ||||||

| ITEM 1A. RISK FACTORS | ||||||||

|

30 |

2023 FORM 10-K ANNUAL REPORT | ||||||

| ITEM 1A. RISK FACTORS | ||||||||

|

31 |

2023 FORM 10-K ANNUAL REPORT | ||||||

| ITEM 1A. RISK FACTORS | ||||||||

|

32 |

2023 FORM 10-K ANNUAL REPORT | ||||||

| ITEM 1A. RISK FACTORS | ||||||||

|

33 |

2023 FORM 10-K ANNUAL REPORT | ||||||

| ITEM 1A. RISK FACTORS | ||||||||

|

34 |

2023 FORM 10-K ANNUAL REPORT | ||||||

| ITEM 1A. RISK FACTORS | ||||||||

|

35 |

2023 FORM 10-K ANNUAL REPORT | ||||||

| ITEM 1A. RISK FACTORS | ||||||||

|

36 |

2023 FORM 10-K ANNUAL REPORT | ||||||

| ITEM 1A. RISK FACTORS | ||||||||

|

37 |

2023 FORM 10-K ANNUAL REPORT | ||||||

| ITEM 1A. RISK FACTORS | ||||||||

|

38 |

2023 FORM 10-K ANNUAL REPORT | ||||||

| ITEM 1A. RISK FACTORS | ||||||||

|

39 |

2023 FORM 10-K ANNUAL REPORT | ||||||

| ITEM 1A. RISK FACTORS | ||||||||

|

40 |

2023 FORM 10-K ANNUAL REPORT | ||||||

| ITEM 1A. RISK FACTORS | ||||||||

|

41 |

2023 FORM 10-K ANNUAL REPORT | ||||||

| ITEM 1A. RISK FACTORS | ||||||||

|

42 |

2023 FORM 10-K ANNUAL REPORT | ||||||

| ITEM 1A. RISK FACTORS | ||||||||

|

43 |

2023 FORM 10-K ANNUAL REPORT | ||||||

| ITEM 1A. RISK FACTORS | ||||||||

|

44 |

2023 FORM 10-K ANNUAL REPORT | ||||||

| ITEM 1A. RISK FACTORS | ||||||||

|

45 |

2023 FORM 10-K ANNUAL REPORT | ||||||

| ITEM 1A. RISK FACTORS | ||||||||

|

46 |

2023 FORM 10-K ANNUAL REPORT | ||||||

| ITEM 1A. RISK FACTORS | ||||||||

|

47 |

2023 FORM 10-K ANNUAL REPORT | ||||||

| ITEM 1A. RISK FACTORS | ||||||||

|

48 |

2023 FORM 10-K ANNUAL REPORT | ||||||

ITEM 1B. UNRESOLVED STAFF COMMENTS THRU ITEM 4. MINE SAFETY DISCLOSURES | ||||||||

|

49 |

2023 FORM 10-K ANNUAL REPORT | ||||||

| SUPPLEMENTAL PART I INFORMATION | ||||||||

| Name & Age | Current (Year First Elected to Office) and Recent Offices & Positions | ||||

|

Terry L. Akins

Age: 60

|

Senior Executive Vice President—Chief Risk Officer of First Horizon & the Bank (2020)

Following the closing of the merger of equals between First Horizon and IBKC, Ms. Akins assumed the role of Senior Executive Vice President—Chief Risk Officer of First Horizon and the Bank. Prior to the merger, she had several roles with IBERIABANK Corporation and IBERIABANK starting in 2002, the most recent of which was Senior Executive Vice President and Chief Risk Officer (2017-2020).

|

||||

|

Elizabeth A. Ardoin

Age: 54

|

Senior Executive Vice President—Chief Communications Officer of First Horizon & the Bank (2020)

Following the closing of the merger of equals between First Horizon and IBKC, Ms. Ardoin assumed the role of Senior Executive Vice President—Chief Communications Officer of First Horizon and the Bank. Prior to the merger, she had several roles with IBERIABANK Corporation and IBERIABANK starting in 2002, the most recent of which was Senior Executive Vice President and Director of Communications (2002-2020), which included marketing, public relations, human resources, and corporate real estate, and she served as chief of staff to the CEO.

|

||||

|

Hope Dmuchowski

Age: 45

Principal Financial Officer

|

Senior Executive Vice President—Chief Financial Officer of First Horizon & the Bank (2021)

Ms. Dmuchowski was elected to her current position in November 2021. Previously, she was Executive Vice President, Head of Financial Planning and Analysis and Management Reporting for Truist Financial Corp. (Sept.-Nov. 2021); Executive Vice President, Chief Financial Officer Corporate Banking, Commercial Banking and Corporate Groups for Truist (2019-2021); Executive Vice President, Chief Financial Officer Group Director for BB&T Corp. (2017-2019); and Sr. Vice President, Chief Financial and Operations Officer—Enterprise Operations Services for BB&T (2013-2017). Her career with BB&T, a predecessor of Truist, started in 2007.

|

||||

|

Jeff L. Fleming

Age: 62

Principal Accounting Officer

|

Executive Vice President—Chief Accounting Officer and Corporate Controller of First Horizon & the Bank (2012)

Mr. Fleming assumed the role of Executive Vice President—Chief Accounting Officer and Corporate Controller in 2012. Previously, starting in 1984, he held several positions with us, most recently (before his current role) Executive Vice President—Corporate Controller (2010-2011).

|

||||

|

D. Bryan Jordan

Age: 62

Principal Executive Officer

|

President and Chief Executive Officer (2008) and Chairman of the Board (2012-2020 and since 2022) of First Horizon & the Bank

Mr. Jordan became President and Chief Executive Officer in 2008. He was Chairman of the Board from 2012 until we closed the merger of equals between First Horizon and IBKC in 2020. He resumed being Chairman in 2022 on the second anniversary of the IBKC merger. From 2007 until 2008 Mr. Jordan was Executive Vice President and Chief Financial Officer of First Horizon and the Bank. From 2000 until 2002 Mr. Jordan was Comptroller, and from 2002 until 2007 Mr. Jordan was Chief Financial Officer, of Regions Financial Corp. During that time he was also an Executive Vice President and a Senior Executive Vice President of Regions.

|

||||

|

50 |

2023 FORM 10-K ANNUAL REPORT | ||||||

| SUPPLEMENTAL PART I INFORMATION | ||||||||

| Name & Age | Current (Year First Elected to Office) and Recent Offices & Positions | ||||

|

Tammy S. LoCascio

Age: 55

|

Senior Executive Vice President—Chief Operating Officer of First Horizon & the Bank (2021)

Following the closing of the merger of equals between First Horizon and IBKC in 2020, Ms. LoCascio assumed the role of Senior Executive Vice President—Chief Human Resources Officer of First Horizon and the Bank. Prior to the merger, starting in 2011, she served in several roles with the Bank, most recently Executive Vice President—Consumer Banking (2017-2020). In that role she led the retail, private client/wealth management, mortgage, and small business units.

|

||||

|

David T. Popwell

Age: 64

|

President—Specialty Banking of First Horizon & the Bank (2020)

Following the closing of the merger of equals between First Horizon and IBKC, Mr. Popwell assumed the role of President—Specialty Banking of First Horizon and the Bank. Prior to the merger, starting in 2007, he served in several roles, the most recent of which (before his current role) was President—Regional Banking (2013-2020). From 2004 to 2007 Mr. Popwell was President of SunTrust Bank—Memphis, and prior to that was an Executive Vice President of National Commerce Financial Corp.

|

||||

|

Anthony J. Restel

Age: 54

|

President—Regional Banking of First Horizon & the Bank (2021)

Following the closing of the merger of equals between First Horizon and IBKC in 2020, Mr. Restel assumed the role of Senior Executive Vice President—Chief Operating Officer of First Horizon and the Bank. From July to November 2021, Mr. Restel also acted as interim Chief Financial Officer. Prior to the merger, he had several roles with IBERIABANK Corporation and IBERIABANK starting in 2001, the most recent of which was Vice Chairman and Chief Financial Officer (2005-2020). During his tenure as Chief Financial Officer, Mr. Restel also served as Chief Credit Officer of IBERIABANK (2007-2009).

|

||||

|

Susan L. Springfield

Age: 59

|

Senior Executive Vice President—Chief Credit Officer of First Horizon & the Bank (2013)

Ms. Springfield assumed the role of Executive Vice President—Chief Credit Officer of First Horizon & the Bank in 2013, with “Senior” added to her title in 2020. Previously, starting in 1998, she served the Bank in several roles, the most recent of which (before her current role) was Executive Vice President—Commercial Banking (2011-2013).

|

||||

|

51 |

2023 FORM 10-K ANNUAL REPORT | ||||||

ITEM 5. MARKET FOR COMMON EQUITY, STOCKHOLDER MATTERS, & EQUITY PURCHASES AND ITEM 6. | ||||||||

| PART II | ||

|

52 |

2023 FORM 10-K ANNUAL REPORT | ||||||

ITEM 5. MARKET FOR COMMON EQUITY, STOCKHOLDER MATTERS, & EQUITY PURCHASES AND ITEM 6. | ||||||||

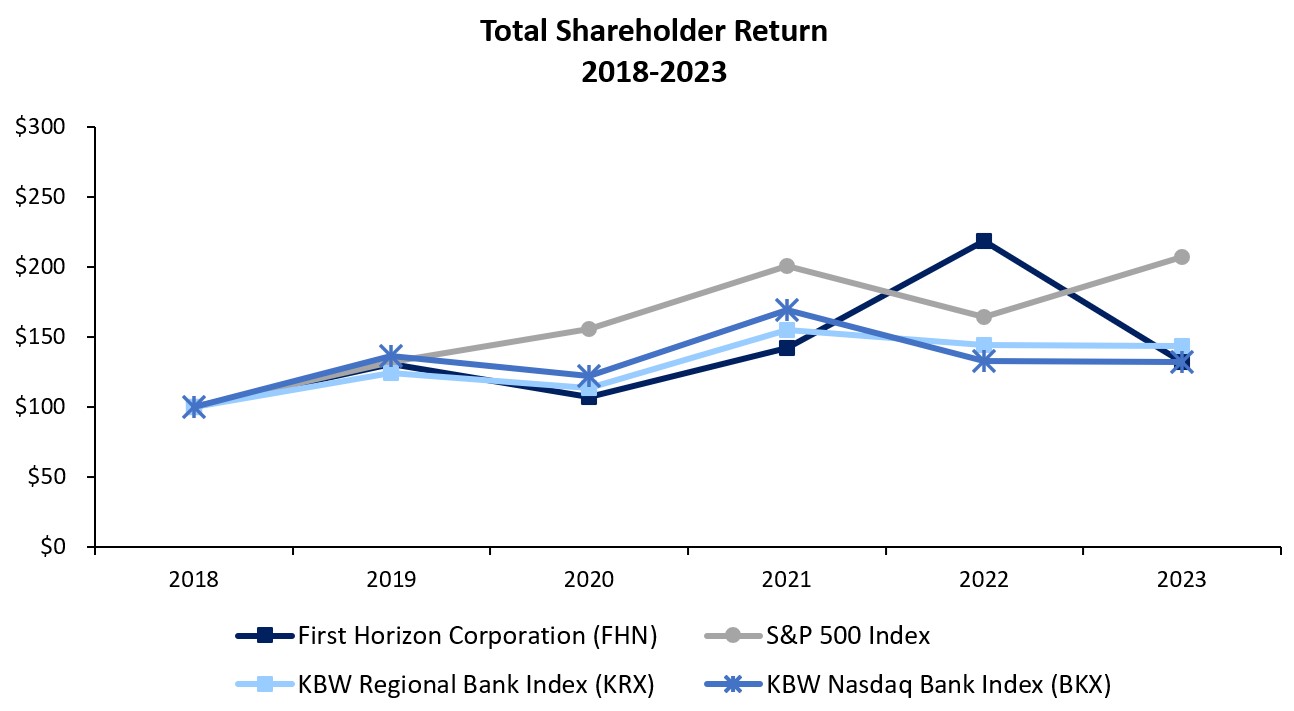

| 2018 | 2019 | 2020 | 2021 | 2022 | 2023 | |||||||||||||||

| First Horizon Corporation (FHN) | $ | 100.00 | $ | 130.43 | $ | 106.73 | $ | 141.55 | $ | 217.90 | $ | 131.82 | ||||||||

| S&P 500 Index | 100.00 | 131.47 | 155.65 | 200.29 | 163.98 | 207.04 | ||||||||||||||

| KBW Regional Bank Index (KRX) | 100.00 | 123.87 | 113.11 | 154.57 | 143.87 | 143.30 | ||||||||||||||

| KBW Nasdaq Bank Index (BKX) | 100.00 | 136.12 | 122.09 | 168.90 | 132.76 | 131.58 | ||||||||||||||

|

53 |

2023 FORM 10-K ANNUAL REPORT | ||||||

| ITEM 7. MANAGEMENT'S DISCUSSION & ANALYSIS (MD&A) | ||||||||

|

54 |

2023 FORM 10-K ANNUAL REPORT | ||||||

| ITEM 7. MANAGEMENT'S DISCUSSION & ANALYSIS (MD&A) | ||||||||

|

55 |

2023 FORM 10-K ANNUAL REPORT | ||||||

| ITEM 7. MANAGEMENT'S DISCUSSION & ANALYSIS (MD&A) | ||||||||

| For the years ended December 31, | |||||||||||||||||

| (Dollars in millions, except per share data) | 2023 | 2022 | 2021 | ||||||||||||||

| Pre-provision net revenue (a) | $ | 1,388 | $ | 1,254 | $ | 974 | |||||||||||

| Diluted earnings per common share | $ | 1.54 | $ | 1.53 | $ | 1.74 | |||||||||||

| Return on average assets (b) | 1.12 | % | 1.08 | % | 1.15 | % | |||||||||||

| Return on average common equity (c) | 11.01 | % | 11.81 | % | 12.53 | % | |||||||||||

| Return on average tangible common equity (a) (d) | 14.11 | % | 15.58 | % | 16.46 | % | |||||||||||

| Net interest margin (e) | 3.42 | % | 3.10 | % | 2.48 | % | |||||||||||

| Noninterest income to total revenue (f) | 26.82 | % | 24.99 | % | 34.77 | % | |||||||||||

| Efficiency ratio (g) | 59.90 | % | 61.24 | % | 68.56 | % | |||||||||||

| Allowance for loan and lease losses to total loans and leases | 1.26 | % | 1.18 | % | 1.22 | % | |||||||||||

| Net charge-offs (recoveries) to average loans and leases | 0.28 | % | 0.11 | % | — | % | |||||||||||

| Total period-end equity to period-end assets | 11.38 | % | 10.83 | % | 9.53 | % | |||||||||||

| Tangible common equity to tangible assets (a) | 8.48 | % | 7.12 | % | 6.73 | % | |||||||||||

| Cash dividends declared per common share | $ | 0.60 | $ | 0.60 | $ | 0.60 | |||||||||||

| Book value per common share | $ | 15.17 | $ | 13.48 | $ | 14.39 | |||||||||||

| Tangible book value per common share (a) | $ | 12.13 | $ | 10.23 | $ | 11.00 | |||||||||||

| Common equity Tier 1 | 11.40 | % | 10.17 | % | 9.92 | % | |||||||||||

| Market capitalization | $ | 7,913 | $ | 13,159 | $ | 8,713 | |||||||||||

|

56 |

2023 FORM 10-K ANNUAL REPORT | ||||||

| ITEM 7. MANAGEMENT'S DISCUSSION & ANALYSIS (MD&A) | ||||||||

| (Dollars in millions) | 2023 | 2022 | 2021 | |||||||||||||||||||||||||||||||||||||||||||||||||||||

| Assets: | Average Balance | Interest Income/Expense | Yield/Rate | Average Balance | Interest Income/Expense | Yield/Rate | Average Balance | Interest Income/Expense | Yield/Rate | |||||||||||||||||||||||||||||||||||||||||||||||

| Loans and leases: | ||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| Commercial loans and leases | $ | 46,175 | $ | 2,958 | 6.41 | % | $ | 43,691 | $ | 1,823 | 4.18 | % | $ | 44,325 | $ | 1,498 | 3.38 | % | ||||||||||||||||||||||||||||||||||||||

| Consumer loans | 13,994 | 630 | 4.48 | 12,261 | 479 | 3.89 | 11,973 | 469 | 3.92 | |||||||||||||||||||||||||||||||||||||||||||||||

| Total loans and leases | 60,169 | 3,588 | 5.96 | 55,952 | 2,302 | 4.11 | 56,298 | 1,967 | 3.49 | |||||||||||||||||||||||||||||||||||||||||||||||

| Loans held for sale | 664 | 51 | 7.71 | 884 | 39 | 4.41 | 956 | 33 | 3.44 | |||||||||||||||||||||||||||||||||||||||||||||||

| Investment securities | 9,912 | 250 | 2.52 | 9,976 | 200 | 2.01 | 8,623 | 123 | 1.43 | |||||||||||||||||||||||||||||||||||||||||||||||

| Trading securities | 1,179 | 78 | 6.62 | 1,438 | 58 | 4.04 | 1,366 | 30 | 2.17 | |||||||||||||||||||||||||||||||||||||||||||||||

| Federal funds sold | 61 | 4 | 5.56 | 191 | 4 | 2.09 | 37 | — | 0.15 | |||||||||||||||||||||||||||||||||||||||||||||||

| Securities purchased under agreements to resell (a) | 318 | 15 | 4.81 | 522 | 6 | 1.12 | 584 | — | (0.09) | |||||||||||||||||||||||||||||||||||||||||||||||

| Interest-bearing deposits with banks | 2,504 | 130 | 5.20 | 8,672 | 87 | 1.00 | 13,123 | 17 | 0.13 | |||||||||||||||||||||||||||||||||||||||||||||||

| Total earning assets / Total interest income | $ | 74,807 | $ | 4,116 | 5.50 | % | $ | 77,635 | $ | 2,696 | 3.47 | % | $ | 80,987 | $ | 2,170 | 2.68 | % | ||||||||||||||||||||||||||||||||||||||

| Cash and due from banks | 1,012 | 1,217 | 1,261 | |||||||||||||||||||||||||||||||||||||||||||||||||||||

| Goodwill and other intangible assets, net | 1,720 | 1,777 | 1,836 | |||||||||||||||||||||||||||||||||||||||||||||||||||||

| Premises and equipment, net | 596 | 636 | 712 | |||||||||||||||||||||||||||||||||||||||||||||||||||||

| Allowance for loan and lease losses | (740) | (648) | (834) | |||||||||||||||||||||||||||||||||||||||||||||||||||||

| Other assets | 4,288 | 3,600 | 3,647 | |||||||||||||||||||||||||||||||||||||||||||||||||||||

| Total assets | $ | 81,683 | $ | 84,217 | $ | 87,609 | ||||||||||||||||||||||||||||||||||||||||||||||||||

| Liabilities and Shareholders' Equity: | ||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| Interest-bearing deposits: | ||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| Savings | $ | 23,547 | $ | 679 | 2.88 | % | $ | 24,292 | $ | 94 | 0.39 | % | $ | 27,283 | $ | 36 | 0.13 | % | ||||||||||||||||||||||||||||||||||||||

| Other interest-bearing deposits | 15,300 | 351 | 2.30 | 15,641 | 72 | 0.47 | 15,688 | 20 | 0.13 | |||||||||||||||||||||||||||||||||||||||||||||||

| Time deposits | 6,095 | 236 | 3.87 | 2,963 | 18 | 0.60 | 4,281 | 25 | 0.57 | |||||||||||||||||||||||||||||||||||||||||||||||

| Total interest-bearing deposits | 44,942 | 1,266 | 2.82 | 42,896 | 184 | 0.43 | 47,252 | 81 | 0.17 | |||||||||||||||||||||||||||||||||||||||||||||||

| Federal funds purchased | 349 | 18 | 5.12 | 699 | 11 | 1.56 | 949 | 1 | 0.12 | |||||||||||||||||||||||||||||||||||||||||||||||

| Securities sold under agreements to repurchase | 1,426 | 52 | 3.66 | 881 | 7 | 0.77 | 1,235 | 4 | 0.30 | |||||||||||||||||||||||||||||||||||||||||||||||

| Trading liabilities | 301 | 12 | 4.16 | 480 | 12 | 2.56 | 540 | 6 | 1.11 | |||||||||||||||||||||||||||||||||||||||||||||||

| Other short-term borrowings | 2,688 | 140 | 5.19 | 229 | 5 | 2.26 | 124 | — | 0.09 | |||||||||||||||||||||||||||||||||||||||||||||||

| Term borrowings | 1,335 | 72 | 5.39 | 1,596 | 72 | 4.51 | 1,645 | 72 | 4.37 | |||||||||||||||||||||||||||||||||||||||||||||||

| Total interest-bearing liabilities / Total interest expense | $ | 51,041 | $ | 1,560 | 3.06 | % | $ | 46,781 | $ | 291 | 0.62 | % | $ | 51,745 | $ | 164 | 0.32 | % | ||||||||||||||||||||||||||||||||||||||

| Noninterest-bearing deposits | 19,341 | 26,851 | 25,879 | |||||||||||||||||||||||||||||||||||||||||||||||||||||

| Other liabilities | 2,396 | 2,006 | 1,506 | |||||||||||||||||||||||||||||||||||||||||||||||||||||

| Total liabilities | 72,778 | 75,638 | 79,130 | |||||||||||||||||||||||||||||||||||||||||||||||||||||

| Shareholders' equity | 8,610 | 8,284 | 8,184 | |||||||||||||||||||||||||||||||||||||||||||||||||||||

| Noncontrolling interest | 295 | 295 | 295 | |||||||||||||||||||||||||||||||||||||||||||||||||||||

| Total shareholders' equity | 8,905 | 8,579 | 8,479 | |||||||||||||||||||||||||||||||||||||||||||||||||||||

| Total liabilities and shareholders' equity | $ | 81,683 | $ | 84,217 | $ | 87,609 | ||||||||||||||||||||||||||||||||||||||||||||||||||

| Net earnings assets / Net interest income (TE) / Net interest spread | $ | 23,766 | $ | 2,556 | 2.44 | % | $ | 30,854 | $ | 2,405 | 2.85 | % | $ | 29,242 | $ | 2,006 | 2.36 | % | ||||||||||||||||||||||||||||||||||||||

| Taxable equivalent adjustment | (16) | 0.98 | (13) | 0.25 | (12) | 0.12 | ||||||||||||||||||||||||||||||||||||||||||||||||||

| Net interest income / Net interest margin (b) | $ | 2,540 | 3.42 | % | $ | 2,392 | 3.10 | % | $ | 1,994 | 2.48 | % | ||||||||||||||||||||||||||||||||||||||||||||

|

57 |

2023 FORM 10-K ANNUAL REPORT | ||||||

| ITEM 7. MANAGEMENT'S DISCUSSION & ANALYSIS (MD&A) | ||||||||

| 2023 Compared to 2022 | 2022 Compared to 2021 | |||||||||||||||||||||||||||||||||||||

Increase (Decrease) Due to (a) |

Increase (Decrease) Due to (a) |

|||||||||||||||||||||||||||||||||||||

| (Dollars in millions) | Rate (b) |

Volume (b) |

Total | Rate (b) |

Volume (b) |

Total | ||||||||||||||||||||||||||||||||

| Interest income: | ||||||||||||||||||||||||||||||||||||||

| Loans and leases (c) | $ | 1,101 | $ | 185 | $ | 1,286 | $ | 347 | $ | (12) | $ | 335 | ||||||||||||||||||||||||||

| Loans held for sale | 24 | (12) | 12 | 9 | (3) | 6 | ||||||||||||||||||||||||||||||||

| Investment securities (c) | 51 | (1) | 50 | 56 | 21 | 77 | ||||||||||||||||||||||||||||||||

| Trading securities | 32 | (12) | 20 | 27 | 1 | 28 | ||||||||||||||||||||||||||||||||

| Other earning assets: | ||||||||||||||||||||||||||||||||||||||

| Federal funds sold | 3 | (3) | — | 3 | 1 | 4 | ||||||||||||||||||||||||||||||||

| Securities purchased under agreements to resell | 13 | (4) | 9 | 6 | — | 6 | ||||||||||||||||||||||||||||||||

| Interest-bearing deposits with banks | 143 | (100) | 43 | 77 | (8) | 69 | ||||||||||||||||||||||||||||||||

| Total other earning assets | 159 | (107) | 52 | 86 | (7) | 79 | ||||||||||||||||||||||||||||||||

| Total change in interest income - earning assets | $ | 1,367 | $ | 53 | $ | 1,420 | $ | 525 | $ | — | $ | 525 | ||||||||||||||||||||||||||

| Interest expense: | ||||||||||||||||||||||||||||||||||||||

| Interest-bearing deposits: | ||||||||||||||||||||||||||||||||||||||

| Savings | $ | 588 | $ | (3) | $ | 585 | $ | 63 | $ | (5) | $ | 58 | ||||||||||||||||||||||||||

| Other interest-bearing deposits | 280 | (1) | 279 | 53 | (1) | 52 | ||||||||||||||||||||||||||||||||

| Time deposits | 183 | 35 | 218 | 1 | (8) | (7) | ||||||||||||||||||||||||||||||||

| Total interest-bearing deposits | 1,051 | 31 | 1,082 | 117 | (14) | 103 | ||||||||||||||||||||||||||||||||

| Federal funds purchased | 15 | (8) | 7 | 10 | — | 10 | ||||||||||||||||||||||||||||||||

| Securities sold under agreements to repurchase | 39 | 6 | 45 | 4 | (1) | 3 | ||||||||||||||||||||||||||||||||

| Trading liabilities | 6 | (6) | — | 7 | (1) | 6 | ||||||||||||||||||||||||||||||||

| Other short-term borrowings | 15 | 120 | 135 | 5 | — | 5 | ||||||||||||||||||||||||||||||||

| Term borrowings | 13 | (13) | — | 2 | (2) | — | ||||||||||||||||||||||||||||||||

| Total change in interest expense - interest-bearing liabilities | 1,139 | 130 | 1,269 | 145 | (18) | 127 | ||||||||||||||||||||||||||||||||

| Net interest income, taxable-equivalent | $ | 228 | $ | (77) | $ | 151 | $ | 380 | $ | 18 | $ | 398 | ||||||||||||||||||||||||||

|

58 |

2023 FORM 10-K ANNUAL REPORT | ||||||

| ITEM 7. MANAGEMENT'S DISCUSSION & ANALYSIS (MD&A) | ||||||||

| 2023 vs. 2022 | 2022 vs. 2021 | |||||||||||||||||||||||||||||||||||||||||||

| (Dollars in millions) | 2023 | 2022 | 2021 | $ Change | % Change | $ Change | % Change | |||||||||||||||||||||||||||||||||||||

| Noninterest income | ||||||||||||||||||||||||||||||||||||||||||||

| Deposit transactions and cash management | $ | 179 | $ | 171 | $ | 175 | $ | 8 | 5 | % | $ | (4) | (2) | % | ||||||||||||||||||||||||||||||

| Fixed income | 133 | 205 | 406 | (72) | (35) | (201) | (50) | |||||||||||||||||||||||||||||||||||||

| Brokerage, management fees and commissions | 90 | 92 | 88 | (2) | (2) | 4 | 5 | |||||||||||||||||||||||||||||||||||||

| Card and digital banking fees | 77 | 84 | 78 | (7) | (8) | 6 | 8 | |||||||||||||||||||||||||||||||||||||

| Other service charges and fees | 54 | 54 | 44 | — | — | 10 | 23 | |||||||||||||||||||||||||||||||||||||

| Trust services and investment management | 47 | 48 | 51 | (1) | (2) | (3) | (6) | |||||||||||||||||||||||||||||||||||||

| Mortgage banking and title income | 23 | 68 | 154 | (45) | (66) | (86) | (56) | |||||||||||||||||||||||||||||||||||||

| Gain on merger termination | 225 | — | — | 225 | 100 | — | — | |||||||||||||||||||||||||||||||||||||

| Securities gains (losses), net | (4) | 18 | 13 | (22) | (122) | 5 | 38 | |||||||||||||||||||||||||||||||||||||

| Other income | 103 | 75 | 67 | 28 | 37 | 8 | 12 | |||||||||||||||||||||||||||||||||||||

| Total noninterest income | $ | 927 | $ | 815 | $ | 1,076 | $ | 112 | 14 | % | $ | (261) | (24) | % | ||||||||||||||||||||||||||||||

|

59 |

2023 FORM 10-K ANNUAL REPORT | ||||||

| ITEM 7. MANAGEMENT'S DISCUSSION & ANALYSIS (MD&A) | ||||||||

| 2023 vs. 2022 | 2022 vs. 2021 | |||||||||||||||||||||||||||||||||||||||||||

| (Dollars in millions) | 2023 | 2022 | 2021 | $ Change | % Change | $ Change | % Change | |||||||||||||||||||||||||||||||||||||

| Noninterest expense | ||||||||||||||||||||||||||||||||||||||||||||

| Personnel expense | $ | 1,100 | $ | 1,101 | $ | 1,210 | $ | (1) | — | % | $ | (109) | (9) | % | ||||||||||||||||||||||||||||||

| Net occupancy expense | 123 | 128 | 137 | (5) | (4) | (9) | (7) | |||||||||||||||||||||||||||||||||||||

| Deposit insurance expense | 122 | 32 | 24 | 90 | 281 | 8 | 33 | |||||||||||||||||||||||||||||||||||||

| Computer software | 111 | 113 | 116 | (2) | (2) | (3) | (3) | |||||||||||||||||||||||||||||||||||||

| Operations services | 87 | 87 | 80 | — | — | 7 | 9 | |||||||||||||||||||||||||||||||||||||

| Advertising and public relations | 71 | 50 | 37 | 21 | 42 | 13 | 35 | |||||||||||||||||||||||||||||||||||||

| Contributions | 61 | 7 | 14 | 54 | 771 | (7) | (50) | |||||||||||||||||||||||||||||||||||||

| Legal and professional fees | 49 | 62 | 68 | (13) | (21) | (6) | (9) | |||||||||||||||||||||||||||||||||||||

| Contract employment and outsourcing | 49 | 54 | 67 | (5) | (9) | (13) | (19) | |||||||||||||||||||||||||||||||||||||

| Amortization of intangible assets | 47 | 51 | 56 | (4) | (8) | (5) | (9) | |||||||||||||||||||||||||||||||||||||

| Equipment expense | 42 | 45 | 47 | (3) | (7) | (2) | (4) | |||||||||||||||||||||||||||||||||||||

| Communications and delivery | 35 | 37 | 37 | (2) | (5) | — | — | |||||||||||||||||||||||||||||||||||||

| Impairment of long-lived assets | — | — | 34 | — | — | (34) | (100) | |||||||||||||||||||||||||||||||||||||

| Other expense | 182 | 186 | 169 | (4) | (2) | 17 | 10 | |||||||||||||||||||||||||||||||||||||

| Total noninterest expense | $ | 2,079 | $ | 1,953 | $ | 2,096 | $ | 126 | 6 | % | $ | (143) | (7) | % | ||||||||||||||||||||||||||||||

|

60 |

2023 FORM 10-K ANNUAL REPORT | ||||||

| ITEM 7. MANAGEMENT'S DISCUSSION & ANALYSIS (MD&A) | ||||||||

|

61 |

2023 FORM 10-K ANNUAL REPORT | ||||||

| ITEM 7. MANAGEMENT'S DISCUSSION & ANALYSIS (MD&A) | ||||||||

| 2023 | 2022 | ||||||||||||||||||||||

| (Dollars in millions) | Balance | Mix | Balance | Mix | |||||||||||||||||||

| Securities available for sale at fair value: | |||||||||||||||||||||||

| Government agency issued MBS and CMO | $ | 6,630 | 68 | % | $ | 7,076 | 69 | % | |||||||||||||||

| Other U.S. government agencies (a) | 1,172 | 12 | 1,163 | 12 | |||||||||||||||||||

| States and municipalities | 589 | 6 | 597 | 6 | |||||||||||||||||||

| Total securities available for sale | $ | 8,391 | 86 | % | $ | 8,836 | 87 | % | |||||||||||||||

| Securities held to maturity at amortized cost: | |||||||||||||||||||||||

| Government agency issued MBS and CMO | $ | 1,323 | 14 | % | $ | 1,371 | 13 | % | |||||||||||||||

| Total investment securities | $ | 9,714 | 100 | % | $ | 10,207 | 100 | % | |||||||||||||||

|

62 |

2023 FORM 10-K ANNUAL REPORT | ||||||

| ITEM 7. MANAGEMENT'S DISCUSSION & ANALYSIS (MD&A) | ||||||||

As of December 31, 2023 |

||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| After 1 year | After 5 years | |||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| Within 1 year | Within 5 years | Within 10 years | After 10 years | Total | ||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| (Dollars in millions) | Amount | Yield (b) | Amount | Yield (b) | Amount | Yield (b) | Amount | Yield (b) | Amount | Yield (b) | ||||||||||||||||||||||||||||||||||||||||||||||||||||

| Securities available for sale: | ||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| Government agency issued MBS and CMO (a) | $ | 29 | 2.30 | % | $ | 980 | 1.86 | % | $ | 1,060 | 2.22 | % | $ | 5,479 | 2.07 | % | $ | 7,548 | 2.34 | % | ||||||||||||||||||||||||||||||||||||||||||

| Other U.S. government agencies | — | — | 12 | 1.70 | 219 | 1.98 | 1,090 | 2.97 | 1,321 | 3.04 | ||||||||||||||||||||||||||||||||||||||||||||||||||||

| States and municipalities | 36 | 2.38 | 87 | 0.73 | 178 | 1.72 | 326 | 2.74 | 627 | 2.66 | ||||||||||||||||||||||||||||||||||||||||||||||||||||

| Total securities available for sale | $ | 65 | 2.34 | % | $ | 1,079 | 1.77 | % | $ | 1,457 | 2.12 | % | $ | 6,895 | 2.24 | % | $ | 9,496 | 2.46 | % | ||||||||||||||||||||||||||||||||||||||||||

| Securities held to maturity: | ||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| Government agency issued MBS and CMO (a) | $ | — | — | % | $ | 148 | 3.56 | % | $ | 170 | 3.44 | % | $ | 1,005 | 2.73 | % | $ | 1,323 | 2.91 | % | ||||||||||||||||||||||||||||||||||||||||||

| Total securities held to maturity | $ | — | — | % | $ | 148 | 3.56 | % | $ | 170 | 3.44 | % | $ | 1,005 | 2.73 | % | $ | 1,323 | 2.91 | % | ||||||||||||||||||||||||||||||||||||||||||

| (Dollars in millions) | 2023 | Percent of total | 2023 Growth Rate | 2022 | Percent of total | 2022 Growth Rate | 2021 | Percent of total | 2021 Growth Rate | |||||||||||||||||||||||||||||||||||||||||||||||

| Commercial: | ||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| Commercial, financial, and industrial (a) | $ | 32,633 | 53 | % | 3 | % | $ | 31,781 | 55 | % | 2 | % | $ | 31,068 | 57 | % | (6) | % | ||||||||||||||||||||||||||||||||||||||

| Commercial real estate | 14,216 | 23 | 7 | 13,228 | 23 | 9 | 12,109 | 22 | (1) | |||||||||||||||||||||||||||||||||||||||||||||||

| Total commercial | 46,849 | 76 | 4 | 45,009 | 78 | 4 | 43,177 | 79 | (5) | |||||||||||||||||||||||||||||||||||||||||||||||

| Consumer: | ||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| Consumer real estate | 13,650 | 23 | 11 | 12,253 | 21 | 14 | 10,772 | 20 | (8) | |||||||||||||||||||||||||||||||||||||||||||||||

| Credit card and other | 793 | 1 | (6) | 840 | 1 | (8) | 910 | 1 | (19) | |||||||||||||||||||||||||||||||||||||||||||||||

| Total consumer | 14,443 | 24 | 10 | 13,093 | 22 | 12 | 11,682 | 21 | (9) | |||||||||||||||||||||||||||||||||||||||||||||||

| Total loans and leases | $ | 61,292 | 100 | % | 5 | % | $ | 58,102 | 100 | % | 6 | % | $ | 54,859 | 100 | % | (6) | % | ||||||||||||||||||||||||||||||||||||||

|

63 |

2023 FORM 10-K ANNUAL REPORT | ||||||

| ITEM 7. MANAGEMENT'S DISCUSSION & ANALYSIS (MD&A) | ||||||||

| (Dollars in millions) | Within 1 Year | After 1 Year Within 5 Years |

After 5 Years Within 15 Years | After 15 Years | Total | ||||||||||||||||||||||||

| Commercial, financial, and industrial | $ | 6,864 | $ | 17,159 | $ | 7,666 | $ | 944 | $ | 32,633 | |||||||||||||||||||

| Commercial real estate | 2,641 | 8,691 | 2,834 | 50 | 14,216 | ||||||||||||||||||||||||

| Consumer real estate | 74 | 241 | 1,369 | 11,966 | 13,650 | ||||||||||||||||||||||||

| Credit card and other | 208 | 313 | 75 | 197 | 793 | ||||||||||||||||||||||||

| Total loans and leases | $ | 9,787 | $ | 26,404 | $ | 11,944 | $ | 13,157 | $ | 61,292 | |||||||||||||||||||

| For maturities over one year at fixed interest rates: | |||||||||||||||||||||||||||||

| Commercial, financial, and industrial | $ | 4,492 | $ | 5,211 | $ | 734 | $ | 10,437 | |||||||||||||||||||||

| Commercial real estate | 2,441 | 1,129 | 36 | 3,606 | |||||||||||||||||||||||||

| Consumer real estate | 181 | 1,180 | 3,325 | 4,686 | |||||||||||||||||||||||||

| Credit card and other | 76 | 43 | 171 | 290 | |||||||||||||||||||||||||

| Total loans and leases at fixed interest rates | $ | 7,190 | $ | 7,563 | $ | 4,266 | $ | 19,019 | |||||||||||||||||||||

| For maturities over one year at floating interest rates: | |||||||||||||||||||||||||||||

| Commercial, financial, and industrial | $ | 12,666 | $ | 2,456 | $ | 209 | $ | 15,331 | |||||||||||||||||||||

| Commercial real estate | 6,250 | 1,705 | 15 | 7,970 | |||||||||||||||||||||||||

| Consumer real estate | 60 | 188 | 8,641 | 8,889 | |||||||||||||||||||||||||

| Credit card and other | 238 | 32 | 26 | 296 | |||||||||||||||||||||||||

| Total loans and leases at floating interest rates | $ | 19,214 | $ | 4,381 | $ | 8,891 | $ | 32,486 | |||||||||||||||||||||

| Total maturities over one year | $ | 26,404 | $ | 11,944 | $ | 13,157 | $ | 51,505 | |||||||||||||||||||||

|

64 |

2023 FORM 10-K ANNUAL REPORT | ||||||

| ITEM 7. MANAGEMENT'S DISCUSSION & ANALYSIS (MD&A) | ||||||||

|

65 |

2023 FORM 10-K ANNUAL REPORT | ||||||

| ITEM 7. MANAGEMENT'S DISCUSSION & ANALYSIS (MD&A) | ||||||||

| December 31, 2023 | December 31, 2022 | |||||||||||||||||||||||||

| (Dollars in millions) | Amount | Percent | Amount | Percent | ||||||||||||||||||||||

| Industry: | ||||||||||||||||||||||||||

| Finance and insurance | $ | 4,083 | 12 | % | $ | 4,120 | 13 | % | ||||||||||||||||||

| Real estate and rental and leasing (a) | 3,858 | 12 | 3,277 | 10 | ||||||||||||||||||||||

| Health care and social assistance | 2,676 | 8 | 2,657 | 8 | ||||||||||||||||||||||

| Accommodation and food service | 2,288 | 7 | 2,238 | 7 | ||||||||||||||||||||||

| Manufacturing | 2,267 | 7 | 2,206 | 7 | ||||||||||||||||||||||

| Wholesale trade | 2,147 | 7 | 2,212 | 7 | ||||||||||||||||||||||

| Loans to mortgage companies | 2,019 | 6 | 2,258 | 7 | ||||||||||||||||||||||

| Retail trade | 1,866 | 6 | 1,835 | 6 | ||||||||||||||||||||||

| Transportation and warehousing | 1,580 | 5 | 1,432 | 4 | ||||||||||||||||||||||

| Energy | 1,293 | 4 | 1,364 | 4 | ||||||||||||||||||||||

| Other (professional, construction, education, etc.) (b) | 8,556 | 26 | 8,182 | 27 | ||||||||||||||||||||||

| Total C&I loan portfolio | $ | 32,633 | 100 | % | $ | 31,781 | 100 | % | ||||||||||||||||||

|

66 |

2023 FORM 10-K ANNUAL REPORT | ||||||

| ITEM 7. MANAGEMENT'S DISCUSSION & ANALYSIS (MD&A) | ||||||||

|

67 |

2023 FORM 10-K ANNUAL REPORT | ||||||

| ITEM 7. MANAGEMENT'S DISCUSSION & ANALYSIS (MD&A) | ||||||||

| December 31, 2023 | December 31, 2022 | |||||||||||||||||||||||||

| Amount | Percent | Amount | Percent | |||||||||||||||||||||||

| Property Type: | ||||||||||||||||||||||||||

| Multi-family | $ | 4,409 | 31 | % | $ | 3,484 | 27 | % | ||||||||||||||||||

| Office | 2,782 | 20 | 2,814 | 21 | ||||||||||||||||||||||

| Retail | 2,310 | 16 | 2,331 | 18 | ||||||||||||||||||||||

| Industrial | 2,236 | 16 | 2,076 | 16 | ||||||||||||||||||||||

| Hospitality | 1,467 | 10 | 1,418 | 11 | ||||||||||||||||||||||

| Land/land development | 307 | 2 | 309 | 2 | ||||||||||||||||||||||

| Other CRE (a) | 705 | 5 | 796 | 5 | ||||||||||||||||||||||

| Total CRE loan portfolio | $ | 14,216 | 100 | % | $ | 13,228 | 100 | % | ||||||||||||||||||

|

68 |

2023 FORM 10-K ANNUAL REPORT | ||||||

| ITEM 7. MANAGEMENT'S DISCUSSION & ANALYSIS (MD&A) | ||||||||

| December 31, 2023 | December 31, 2022 | |||||||||||||||||||||||||

| (Dollars in millions) | Repayment Amount |

Percent | Repayment Amount |

Percent | ||||||||||||||||||||||

| Months remaining in draw period: | ||||||||||||||||||||||||||

| 0-12 | $ | 30 | 1 | % | $ | 31 | 2 | % | ||||||||||||||||||

| 13-24 | 90 | 4 | 40 | 2 | ||||||||||||||||||||||

| 25-36 | 110 | 5 | 109 | 6 | ||||||||||||||||||||||

| 37-48 | 163 | 8 | 135 | 7 | ||||||||||||||||||||||

| 49-60 | 178 | 9 | 204 | 11 | ||||||||||||||||||||||

| >60 | 1,530 | 73 | 1,356 | 72 | ||||||||||||||||||||||

| Total | $ | 2,101 | 100 | % | $ | 1,875 | 100 | % | ||||||||||||||||||

|

69 |

2023 FORM 10-K ANNUAL REPORT | ||||||

| ITEM 7. MANAGEMENT'S DISCUSSION & ANALYSIS (MD&A) | ||||||||

| December 31, | |||||||||||||||||||||||

| (Dollars in millions) | 2023 | 2022 | 2021 | ||||||||||||||||||||

| Allowance for loan and lease losses | |||||||||||||||||||||||

| C&I | $ | 339 | $ | 308 | $ | 334 | |||||||||||||||||

| CRE | 172 | 146 | 154 | ||||||||||||||||||||

| Consumer real estate | 233 | 200 | 163 | ||||||||||||||||||||

| Credit card and other | 29 | 31 | 19 | ||||||||||||||||||||

| Total allowance for loan and lease losses | $ | 773 | $ | 685 | $ | 670 | |||||||||||||||||

| Reserve for remaining unfunded commitments | |||||||||||||||||||||||

| C&I | $ | 49 | $ | 55 | $ | 46 | |||||||||||||||||

| CRE | 22 | 22 | 12 | ||||||||||||||||||||

| Consumer real estate | 12 | 10 | 8 | ||||||||||||||||||||

| Credit card and other | — | — | — | ||||||||||||||||||||

| Total reserve for remaining unfunded commitments | $ | 83 | $ | 87 | $ | 66 | |||||||||||||||||

| Allowance for credit losses | |||||||||||||||||||||||

| C&I | $ | 388 | $ | 363 | $ | 380 | |||||||||||||||||

| CRE | 194 | 168 | 166 | ||||||||||||||||||||

| Consumer real estate | 245 | 210 | 171 | ||||||||||||||||||||

| Credit card and other | 29 | 31 | 19 | ||||||||||||||||||||

| Total allowance for credit losses | $ | 856 | $ | 772 | $ | 736 | |||||||||||||||||

| Period-end loans and leases | |||||||||||||||||||||||

| C&I | $ | 32,633 | $ | 31,781 | $ | 31,068 | |||||||||||||||||

| CRE | 14,216 | 13,228 | 12,109 | ||||||||||||||||||||

| Consumer real estate | 13,650 | 12,253 | 10,772 | ||||||||||||||||||||

| Credit card and other | 793 | 840 | 910 | ||||||||||||||||||||

| Total period-end loans and leases | $ | 61,292 | $ | 58,102 | $ | 54,859 | |||||||||||||||||

| ALLL / loans and leases % | |||||||||||||||||||||||

| C&I | 1.04 | % | 0.97 | % | 1.07 | % | |||||||||||||||||

| CRE | 1.21 | 1.10 | 1.27 | ||||||||||||||||||||

| Consumer real estate | 1.71 | 1.63 | 1.51 | ||||||||||||||||||||

| Credit card and other | 3.63 | 3.72 | 2.14 | ||||||||||||||||||||

| Total ALLL / loans and leases % | 1.26 | % | 1.18 | % | 1.22 | % | |||||||||||||||||

|

70 |

2023 FORM 10-K ANNUAL REPORT | ||||||

| ITEM 7. MANAGEMENT'S DISCUSSION & ANALYSIS (MD&A) | ||||||||

| ACL / loans and leases % | |||||||||||||||||||||||

| C&I | 1.19 | % | 1.14 | % | 1.22 | % | |||||||||||||||||

| CRE | 1.36 | 1.27 | 1.37 | ||||||||||||||||||||

| Consumer real estate | 1.79 | 1.71 | 1.59 | ||||||||||||||||||||

| Credit card and other | 3.63 | 3.72 | 2.09 | ||||||||||||||||||||

| Total ACL / loans and leases % | 1.40 | % | 1.33 | % | 1.34 | % | |||||||||||||||||

| Net charge-offs (recoveries) | |||||||||||||||||||||||

| C&I | $ | 142 | $ | 53 | $ | 13 | |||||||||||||||||

| CRE | 15 | — | — | ||||||||||||||||||||

| Consumer real estate | (5) | (14) | (22) | ||||||||||||||||||||

| Credit card and other | 18 | 20 | 11 | ||||||||||||||||||||

| Total net charge-offs | $ | 170 | $ | 59 | $ | 2 | |||||||||||||||||

| Average loans and leases | |||||||||||||||||||||||

| C&I | $ | 32,390 | $ | 30,969 | $ | 32,010 | |||||||||||||||||

| CRE | 13,785 | 12,722 | 12,314 | ||||||||||||||||||||

| Consumer real estate | 13,179 | 11,397 | 10,969 | ||||||||||||||||||||

| Credit card and other | 815 | 864 | 1,005 | ||||||||||||||||||||

| Total average loans and leases | $ | 60,169 | $ | 55,952 | $ | 56,298 | |||||||||||||||||

| Charge-off % | |||||||||||||||||||||||

| C&I | 0.44 | % | 0.17 | % | 0.04 | % | |||||||||||||||||

| CRE | 0.10 | — | 0.01 | ||||||||||||||||||||

| Consumer real estate | NM | NM | NM | ||||||||||||||||||||

| Credit card and other | 2.18 | 2.39 | 1.05 | ||||||||||||||||||||

| Total charge-off % | 0.28 | % | 0.11 | % | — | % | |||||||||||||||||

| ALLL / net charge-offs | |||||||||||||||||||||||

| C&I | 239 | % | 578 | % | 2,645 | % | |||||||||||||||||

| CRE | 1,097 | NM | 13,189 | ||||||||||||||||||||

| Consumer real estate | NM | NM | NM | ||||||||||||||||||||

| Credit card and other | 162 | 151 | 185 | ||||||||||||||||||||

| Total ALLL / net charge-offs | 455 | % | 1,155 | % | 30,641 | % | |||||||||||||||||

|

71 |

2023 FORM 10-K ANNUAL REPORT | ||||||

| ITEM 7. MANAGEMENT'S DISCUSSION & ANALYSIS (MD&A) | ||||||||

| December 31, | |||||||||||||||||||||||

| (Dollars in millions) | 2023 | 2022 | 2021 | ||||||||||||||||||||

| Nonperforming loans and leases | |||||||||||||||||||||||

| C&I | $ | 184 | $ | 153 | $ | 125 | |||||||||||||||||

| CRE | 136 | 9 | 9 | ||||||||||||||||||||

| Consumer real estate | 140 | 152 | 138 | ||||||||||||||||||||

| Credit card and other | 2 | 2 | 3 | ||||||||||||||||||||

| Total nonperforming loans and leases (a) (c) | $ | 462 | $ | 316 | $ | 275 | |||||||||||||||||

| Nonperforming loans held for sale (a) | $ | 3 | $ | 8 | $ | 7 | |||||||||||||||||

| Foreclosed real estate and other assets (b) | 4 | 3 | 3 | ||||||||||||||||||||

| Total nonperforming assets (a) (b) | $ | 469 | $ | 327 | $ | 285 | |||||||||||||||||

| Nonperforming loans and leases to total loans and leases | |||||||||||||||||||||||

| C&I | 0.57 | % | 0.48 | % | 0.40 | % | |||||||||||||||||

| CRE | 0.96 | 0.07 | 0.08 | ||||||||||||||||||||

| Consumer real estate | 1.02 | 1.24 | 1.29 | ||||||||||||||||||||

| Credit card and other | 0.30 | 0.27 | 0.31 | ||||||||||||||||||||

| Total NPL % | 0.75 | % | 0.54 | % | 0.50 | % | |||||||||||||||||

| ALLL / NPLs | |||||||||||||||||||||||

| C&I | 184 | % | 202 | % | 268 | % | |||||||||||||||||

| CRE | 126 | 1,554 | 1,671 | ||||||||||||||||||||

| Consumer real estate | 167 | 131 | 118 | ||||||||||||||||||||

| Credit card and other | 1,202 | 1,364 | 699 | ||||||||||||||||||||

| Total ALLL / NPLs | 167 | % | 217 | % | 244 | % | |||||||||||||||||

|

72 |

2023 FORM 10-K ANNUAL REPORT | ||||||

| ITEM 7. MANAGEMENT'S DISCUSSION & ANALYSIS (MD&A) | ||||||||

| December 31, | |||||||||||||||||||||||

| (Dollars in millions) | 2023 | 2022 | 2021 | ||||||||||||||||||||

| Nonperforming loans and leases (a) (b) | |||||||||||||||||||||||

| Regional Banking | $ | 323 | $ | 227 | $ | 163 | |||||||||||||||||

| Specialty Banking | 116 | 60 | 78 | ||||||||||||||||||||

| Corporate | 23 | 29 | 34 | ||||||||||||||||||||

| Consolidated | $ | 462 | $ | 316 | $ | 275 | |||||||||||||||||

| Foreclosed real estate (c) | |||||||||||||||||||||||

| Regional Banking | $ | 1 | $ | — | $ | 2 | |||||||||||||||||

| Specialty Banking | 3 | 2 | — | ||||||||||||||||||||

| Corporate | — | 1 | 1 | ||||||||||||||||||||

| Consolidated | $ | 4 | $ | 3 | $ | 3 | |||||||||||||||||

| Nonperforming Assets (a) (b) (c) | |||||||||||||||||||||||

| Regional Banking | $ | 324 | $ | 227 | $ | 165 | |||||||||||||||||

| Specialty Banking | 119 | 62 | 78 | ||||||||||||||||||||

| Corporate | 23 | 30 | 35 | ||||||||||||||||||||

| Consolidated | $ | 466 | $ | 319 | $ | 278 | |||||||||||||||||

| Nonperforming loans and leases to total loans and leases | |||||||||||||||||||||||

| Regional Banking | 0.74 | % | 0.54 | % | 0.43 | % | |||||||||||||||||

| Specialty Banking | 0.68 | 0.37 | 0.48 | ||||||||||||||||||||

| Corporate | 4.87 | 6.28 | 5.39 | ||||||||||||||||||||

| Consolidated | 0.75 | % | 0.54 | % | 0.50 | % | |||||||||||||||||

| NPA % (d) | |||||||||||||||||||||||

| Regional Banking | 0.74 | % | 0.55 | % | 0.44 | % | |||||||||||||||||

| Specialty Banking | 0.70 | 0.39 | 0.48 | ||||||||||||||||||||

| Corporate | 4.96 | 6.54 | 5.51 | ||||||||||||||||||||

| Consolidated | 0.76 | % | 0.55 | % | 0.51 | % | |||||||||||||||||

|

73 |

2023 FORM 10-K ANNUAL REPORT | ||||||

| ITEM 7. MANAGEMENT'S DISCUSSION & ANALYSIS (MD&A) | ||||||||

| December 31, | |||||||||||||||||||||||

| (Dollars in millions) | 2023 | 2022 | 2021 | ||||||||||||||||||||

| Accruing loans and leases 30+ days past due | |||||||||||||||||||||||

| C&I | $ | 32 | $ | 61 | $ | 58 | |||||||||||||||||

| CRE | 8 | 11 | 13 | ||||||||||||||||||||

| Consumer real estate | 57 | 55 | 70 | ||||||||||||||||||||

| Credit card and other | 8 | 11 | 7 | ||||||||||||||||||||

| Total accruing loans and leases 30+ days past due | $ | 105 | $ | 138 | $ | 148 | |||||||||||||||||

| Accruing loans and leases 30+ days past due % | |||||||||||||||||||||||

| C&I | 0.10 | % | 0.19 | % | 0.19 | % | |||||||||||||||||

| CRE | 0.06 | 0.08 | 0.11 | ||||||||||||||||||||

| Consumer real estate | 0.42 | 0.44 | 0.65 | ||||||||||||||||||||

| Credit card and other | 1.03 | 1.28 | 0.76 | ||||||||||||||||||||

| Total accruing loans and leases 30+ days past due % | 0.17 | % | 0.24 | % | 0.27 | % | |||||||||||||||||

| Accruing loans and leases 90+ days past due (a) (b) (c) | |||||||||||||||||||||||

| C&I | $ | 1 | $ | 11 | $ | 5 | |||||||||||||||||

| CRE | — | — | — | ||||||||||||||||||||

| Consumer real estate | 17 | 18 | 33 | ||||||||||||||||||||

| Credit card and other | 3 | 4 | 2 | ||||||||||||||||||||

| Total accruing loans and leases 90+ days past due | $ | 21 | $ | 33 | $ | 40 | |||||||||||||||||

| Loans held for sale | |||||||||||||||||||||||

| 30 to 89 days past due (b) | $ | 12 | $ | 10 | $ | 7 | |||||||||||||||||

| 30 to 89 days past due - guaranteed portion (b) (d) | 8 | 7 | 2 | ||||||||||||||||||||

| 90+ days past due (b) | 9 | 16 | 24 | ||||||||||||||||||||

| 90+ days past due - guaranteed portion (b) (d) | 4 | 6 | 12 | ||||||||||||||||||||

|

74 |

2023 FORM 10-K ANNUAL REPORT | ||||||

| ITEM 7. MANAGEMENT'S DISCUSSION & ANALYSIS (MD&A) | ||||||||

|

75 |

2023 FORM 10-K ANNUAL REPORT | ||||||

| ITEM 7. MANAGEMENT'S DISCUSSION & ANALYSIS (MD&A) | ||||||||

| (Dollars in millions) | 2023 | Percent of Total | 2023 Growth Rate | 2022 | Percent of Total | 2022 Growth Rate | ||||||||||||||||||||||||||||||||

| Savings | $ | 25,082 | 38 | % | 14 | % | $ | 21,971 | 35 | % | (17) | % | ||||||||||||||||||||||||||

| Time deposits | 6,804 | 10 | 136 | 2,887 | 4 | (18) | ||||||||||||||||||||||||||||||||

| Other interest-bearing deposits | 16,690 | 26 | 10 | 15,165 | 24 | (11) | ||||||||||||||||||||||||||||||||

| Total interest-bearing deposits | 48,576 | 74 | 21 | 40,023 | 63 | (15) | ||||||||||||||||||||||||||||||||

| Noninterest-bearing deposits | 17,204 | 26 | (27) | 23,466 | 37 | (16) | ||||||||||||||||||||||||||||||||

| Total deposits | $ | 65,780 | 100 | % | 4 | % | $ | 63,489 | 100 | % | (15) | % | ||||||||||||||||||||||||||

| For the Year Ended December 31, | ||||||||||||||

| (Dollars in millions) | 2023 | 2022 | ||||||||||||

| Uninsured deposits | $ | 26,752 | $ | 30,304 | ||||||||||

| (Dollars in millions) | December 31, 2023 | December 31, 2022 | ||||||||||||

| Portion of U.S. time deposits in excess of insurance limit | $ | 1,143 | $ | 643 | ||||||||||

| Time deposits otherwise uninsured with a maturity of: | ||||||||||||||

| 3 months or less | 304 | 198 | ||||||||||||

| Over 3 months through 6 months | 519 | 147 | ||||||||||||

| Over 6 months through 12 months | 282 | 225 | ||||||||||||

| Over 12 months | 38 | 73 | ||||||||||||

|

76 |

2023 FORM 10-K ANNUAL REPORT | ||||||

| ITEM 7. MANAGEMENT'S DISCUSSION & ANALYSIS (MD&A) | ||||||||

|

77 |

2023 FORM 10-K ANNUAL REPORT | ||||||

| ITEM 7. MANAGEMENT'S DISCUSSION & ANALYSIS (MD&A) | ||||||||

| (Dollars in millions) | December 31, 2023 | December 31, 2022 | ||||||||||||

| FHN shareholders’ equity | $ | 8,996 | $ | 8,252 | ||||||||||

| Modified CECL transitional amount (a) | 57 | 85 | ||||||||||||

| FHN non-cumulative perpetual preferred | (520) | (1,014) | ||||||||||||

| Common equity tier 1 before regulatory adjustments | $ | 8,533 | $ | 7,323 | ||||||||||

| Regulatory adjustments: | ||||||||||||||

| Disallowed goodwill and other intangibles | $ | (1,617) | $ | (1,658) | ||||||||||

| Net unrealized (gains) losses on securities available for sale | 836 | 972 | ||||||||||||

| Net unrealized (gains) losses on pension and other postretirement plans | 273 | 269 | ||||||||||||

| Net unrealized (gains) losses on cash flow hedges | 79 | 126 | ||||||||||||

| Common equity tier 1 | $ | 8,104 | $ | 7,032 | ||||||||||

| FHN non-cumulative perpetual preferred (b) | 426 | 920 | ||||||||||||

| Qualifying noncontrolling interest—First Horizon Bank preferred stock | 295 | 295 | ||||||||||||

| Tier 1 capital | $ | 8,825 | $ | 8,247 | ||||||||||

| Tier 2 capital | 1,097 | 975 | ||||||||||||

| Total regulatory capital | $ | 9,922 | $ | 9,222 | ||||||||||

| Risk-Weighted Assets | ||||||||||||||

| First Horizon Corporation | $ | 71,074 | $ | 69,163 | ||||||||||

| First Horizon Bank | 70,635 | 68,728 | ||||||||||||

| Average Assets for Leverage | ||||||||||||||

| First Horizon Corporation | $ | 82,540 | $ | 79,583 | ||||||||||

| First Horizon Bank | 81,898 | 78,923 | ||||||||||||

| December 31, 2023 | December 31, 2022 | |||||||||||||||||||||||||

| (Dollars in millions) | Ratio | Amount | Ratio | Amount | ||||||||||||||||||||||

| Common Equity Tier 1 | ||||||||||||||||||||||||||

| First Horizon Corporation | 11.40 | % | $ | 8,104 | 10.17 | % | $ | 7,032 | ||||||||||||||||||

| First Horizon Bank | 11.40 | 8,055 | 10.77 | 7,405 | ||||||||||||||||||||||

| Tier 1 | ||||||||||||||||||||||||||

| First Horizon Corporation | 12.42 | 8,825 | 11.92 | 8,247 | ||||||||||||||||||||||

| First Horizon Bank | 11.82 | 8,350 | 11.20 | 7,700 | ||||||||||||||||||||||

| Total | ||||||||||||||||||||||||||

| First Horizon Corporation | 13.96 | 9,922 | 13.33 | 9,222 | ||||||||||||||||||||||

| First Horizon Bank | 13.17 | 9,303 | 12.41 | 8,532 | ||||||||||||||||||||||

| Tier 1 Leverage | ||||||||||||||||||||||||||

| First Horizon Corporation | 10.69 | 8,825 | 10.36 | 8,247 | ||||||||||||||||||||||

| First Horizon Bank | 10.20 | 8,350 | 9.76 | 7,700 | ||||||||||||||||||||||

| Other Capital Ratios | ||||||||||||||||||||||||||

| Total period-end equity to period-end assets | 11.38 | 10.83 | ||||||||||||||||||||||||

| Tangible common equity to tangible assets (c) | 8.48 | 7.12 | ||||||||||||||||||||||||

| Adjusted tangible common equity to risk weighted assets (c) | 10.72 | 9.35 | ||||||||||||||||||||||||

|

78 |

2023 FORM 10-K ANNUAL REPORT | ||||||

| ITEM 7. MANAGEMENT'S DISCUSSION & ANALYSIS (MD&A) | ||||||||

|

79 |

2023 FORM 10-K ANNUAL REPORT | ||||||

| ITEM 7. MANAGEMENT'S DISCUSSION & ANALYSIS (MD&A) | ||||||||

| (Dollar values and volume in thousands, except per share data) | Total number of shares purchased | Average price paid per share (a) | Total number of shares purchased as part of publicly announced programs | Maximum approximate dollar value that may yet be purchased under the programs (b) | ||||||||||||||||||||||

| 2023 | ||||||||||||||||||||||||||

| October 1 to October 31 | — | N/A | — | $ | 598,646 | |||||||||||||||||||||

| November 1 to November 30 | — | N/A | — | — | ||||||||||||||||||||||

| December 1 to December 31 | — | N/A | — | — | ||||||||||||||||||||||

| Total | — | N/A | — | |||||||||||||||||||||||

|

80 |

2023 FORM 10-K ANNUAL REPORT | ||||||

| ITEM 7. MANAGEMENT'S DISCUSSION & ANALYSIS (MD&A) | ||||||||

| (Volume in thousands, except per share data) | Total number of shares purchased |

Average price paid per share |

Total number of shares purchased as part of publicly announced programs |

Maximum number of shares that may yet be purchased under the programs (a) |

||||||||||||||||||||||

| 2023 | ||||||||||||||||||||||||||

| October 1 to October 31 | 31 | $ | 10.71 | 31 | 21,724 | |||||||||||||||||||||

| November 1 to November 30 | 1 | 11.74 | 1 | 21,723 | ||||||||||||||||||||||

| December 1 to December 31 | 23 | 13.35 | 23 | 21,700 | ||||||||||||||||||||||

| Total | 55 | $ | 11.82 | 55 | ||||||||||||||||||||||

|

81 |

2023 FORM 10-K ANNUAL REPORT | ||||||

| ITEM 7. MANAGEMENT'S DISCUSSION & ANALYSIS (MD&A) | ||||||||

|

82 |

2023 FORM 10-K ANNUAL REPORT | ||||||

| ITEM 7. MANAGEMENT'S DISCUSSION & ANALYSIS (MD&A) | ||||||||

| Year Ended December 31, 2023 | As of December 31, 2023 |

|||||||||||||||||||||||||

| (Dollars in millions) | Mean | High | Low | |||||||||||||||||||||||

| 1-day | ||||||||||||||||||||||||||

| VaR | $ | 3 | $ | 4 | $ | 2 | $ | 3 | ||||||||||||||||||

| SVaR | 6 | 8 | 3 | 6 | ||||||||||||||||||||||

| 10-day | ||||||||||||||||||||||||||

| VaR | 8 | 11 | 4 | 10 | ||||||||||||||||||||||

| SVaR | 24 | 34 | 12 | 28 | ||||||||||||||||||||||

| Year Ended December 31, 2022 | As of December 31, 2022 |

|||||||||||||||||||||||||

| (Dollars in millions) | Mean | High | Low | |||||||||||||||||||||||

| 1-day | ||||||||||||||||||||||||||

| VaR | $ | 2 | $ | 4 | $ | 2 | $ | 3 | ||||||||||||||||||

| SVaR | 5 | 7 | 4 | 6 | ||||||||||||||||||||||

| 10-day | ||||||||||||||||||||||||||

| VaR | 8 | 11 | 3 | 10 | ||||||||||||||||||||||

| SVaR | 24 | 34 | 18 | 29 | ||||||||||||||||||||||

| As of December 31, 2023 | As of December 31, 2022 | |||||||||||||||||||||||||

| (Dollars in millions) | 1-day | 10-day | 1-day | 10-day | ||||||||||||||||||||||

| Interest rate risk | $ | 1 | $ | 2 | $ | 1 | $ | 3 | ||||||||||||||||||

| Credit spread risk | 1 | 1 | 1 | 2 | ||||||||||||||||||||||

|

83 |

2023 FORM 10-K ANNUAL REPORT | ||||||

| ITEM 7. MANAGEMENT'S DISCUSSION & ANALYSIS (MD&A) | ||||||||

| Shifts in Interest Rates (in bps) |

% Change in Projected Net Interest Income | |||||||

| -100 | (3.6)% | |||||||

| -50 | (1.7)% | |||||||

| -25 | (0.9)% | |||||||

| +25 | 0.7% | |||||||

| +50 | 1.4% | |||||||

| +100 | 2.6% | |||||||

| +200 | 3.3% | |||||||

|

84 |

2023 FORM 10-K ANNUAL REPORT | ||||||

| ITEM 7. MANAGEMENT'S DISCUSSION & ANALYSIS (MD&A) | ||||||||

|

85 |

2023 FORM 10-K ANNUAL REPORT | ||||||

| ITEM 7. MANAGEMENT'S DISCUSSION & ANALYSIS (MD&A) | ||||||||

|

86 |

2023 FORM 10-K ANNUAL REPORT | ||||||

| ITEM 7. MANAGEMENT'S DISCUSSION & ANALYSIS (MD&A) | ||||||||

|

87 |

2023 FORM 10-K ANNUAL REPORT | ||||||

| ITEM 7. MANAGEMENT'S DISCUSSION & ANALYSIS (MD&A) | ||||||||

|

88 |

2023 FORM 10-K ANNUAL REPORT | ||||||

| ITEM 7. MANAGEMENT'S DISCUSSION & ANALYSIS (MD&A) | ||||||||

| (Dollars in millions) | Total Capacity |

Outstanding Borrowings | Available Liquidity | |||||||||||||||||

| Cash on deposit with FRB (a) | $ | 1,201 | $ | — | $ | 1,201 | ||||||||||||||

| FHLB | 9,352 | — | 9,352 | |||||||||||||||||

| FRB: | ||||||||||||||||||||

| Discount Window | 23,417 | — | 23,417 | |||||||||||||||||

| BTFP | 834 | — | 834 | |||||||||||||||||

| Unencumbered securities (b) | 812 | — | 812 | |||||||||||||||||

| Total Available Liquidity | $ | 35,616 | ||||||||||||||||||

|

89 |

2023 FORM 10-K ANNUAL REPORT | ||||||

| ITEM 7. MANAGEMENT'S DISCUSSION & ANALYSIS (MD&A) | ||||||||

| Dividend/Share | Record Date | Payment Date | ||||||||||||||||||

| Common Stock | $ | 0.15 | 3/15/2024 | 4/1/2024 | ||||||||||||||||

| Preferred Stock | ||||||||||||||||||||

| Series C | $ | 165.00 | 4/16/2024 | 5/1/2024 | ||||||||||||||||

| Series D | $ | 305.00 | 4/16/2024 | 5/1/2024 | ||||||||||||||||

| Series E | $ | 1,625.00 | 3/26/2024 | 4/10/2024 | ||||||||||||||||

| Series F | $ | 1,175.00 | 3/26/2024 | 4/10/2024 | ||||||||||||||||

| Payments due by period (a) | ||||||||||||||||||||||||||||||||

| Less than | 1 year - | 3 years - | After 5 | |||||||||||||||||||||||||||||

| (Dollars in millions) | 1 year | < 3 years | < 5 years | years | Total | |||||||||||||||||||||||||||

| Contractual obligations: | ||||||||||||||||||||||||||||||||

| Time deposit maturities (b) (c) | $ | 6,528 | $ | 194 | $ | 75 | $ | 7 | $ | 6,804 | ||||||||||||||||||||||

| Short-term borrowings (b) (d) | 3,058 | — | — | — | 3,058 | |||||||||||||||||||||||||||

| Term borrowings (b) (e) | 6 | 350 | — | 812 | 1,168 | |||||||||||||||||||||||||||

| Annual rental commitments under noncancelable leases (b) (f) | 44 | 85 | 76 | 204 | 409 | |||||||||||||||||||||||||||

| Purchase obligations | 224 | 120 | 30 | 3 | 377 | |||||||||||||||||||||||||||

| Total contractual obligations | $ | 9,860 | $ | 749 | $ | 181 | $ | 1,026 | $ | 11,816 | ||||||||||||||||||||||

|

90 |

2023 FORM 10-K ANNUAL REPORT | ||||||

| ITEM 7. MANAGEMENT'S DISCUSSION & ANALYSIS (MD&A) | ||||||||

| Moody's (a) | Fitch (b) | ||||||||||||||||

| First Horizon Corporation | |||||||||||||||||

| Overall credit rating: Long-term/Short-term/Outlook | Baa3/--/NEG | BBB/F2/Stable | |||||||||||||||

| Long-term senior debt | Baa3 | BBB | |||||||||||||||

| Subordinated debt (c) | Baa3 | BBB- | |||||||||||||||

| Junior subordinated debt (c) | Ba1 | BB- | |||||||||||||||

| Preferred stock | Ba2 | BB- | |||||||||||||||

| First Horizon Bank | |||||||||||||||||

| Overall credit rating: Long-term/Short-term/Outlook | Baa3/P-2/NEG | BBB/F2/Stable | |||||||||||||||

| Long-term/short-term deposits | A3/P-2 | BBB+/F2 | |||||||||||||||

| Long-term/short-term senior debt (c) | Baa3/P-2 | BBB/F2 | |||||||||||||||

| Subordinated debt | Baa3 | BBB- | |||||||||||||||

| Preferred stock | Ba2 | BB- | |||||||||||||||

| FT Real Estate Securities Company, Inc. | |||||||||||||||||

| Preferred stock | Ba1 | ||||||||||||||||

|

91 |

2023 FORM 10-K ANNUAL REPORT | ||||||

| ITEM 7. MANAGEMENT'S DISCUSSION & ANALYSIS (MD&A) | ||||||||

|

92 |

2023 FORM 10-K ANNUAL REPORT | ||||||

| ITEM 7. MANAGEMENT'S DISCUSSION & ANALYSIS (MD&A) | ||||||||

|

93 |

2023 FORM 10-K ANNUAL REPORT | ||||||

| ITEM 7. MANAGEMENT'S DISCUSSION & ANALYSIS (MD&A) | ||||||||

|

94 |

2023 FORM 10-K ANNUAL REPORT | ||||||

| ITEM 7. MANAGEMENT'S DISCUSSION & ANALYSIS (MD&A) | ||||||||

|

95 |

2023 FORM 10-K ANNUAL REPORT | ||||||

| ITEM 7. MANAGEMENT'S DISCUSSION & ANALYSIS (MD&A) | ||||||||

|

96 |

2023 FORM 10-K ANNUAL REPORT | ||||||

| ITEM 7. MANAGEMENT'S DISCUSSION & ANALYSIS (MD&A) | ||||||||

|

97 |

2023 FORM 10-K ANNUAL REPORT | ||||||

| ITEM 7. MANAGEMENT'S DISCUSSION & ANALYSIS (MD&A) | ||||||||

|

98 |

2023 FORM 10-K ANNUAL REPORT | ||||||

| ITEM 7. MANAGEMENT'S DISCUSSION & ANALYSIS (MD&A) | ||||||||

| (Dollars in millions; shares in thousands) | 2023 | 2022 | 2021 | |||||||||||||||||

| Pre-provision Net Revenue (Non-GAAP) | ||||||||||||||||||||

| Net interest income (GAAP) | $ | 2,540 | $ | 2,392 | $ | 1,994 | ||||||||||||||

| Plus: Noninterest income (GAAP) | 927 | 815 | 1,076 | |||||||||||||||||

| Total Revenues (GAAP) | 3,467 | 3,207 | 3,070 | |||||||||||||||||

| Less: Noninterest expense (GAAP) | 2,079 | 1,953 | 2,096 | |||||||||||||||||

| Pre-provision Net Revenue (Non-GAAP) | $ | 1,388 | $ | 1,254 | $ | 974 | ||||||||||||||

| Tangible Common Equity (Non-GAAP) | ||||||||||||||||||||

| (A) Total equity (GAAP) | $ | 9,291 | $ | 8,547 | $ | 8,494 | ||||||||||||||

| Less: Noncontrolling interest (a) | 295 | 295 | 295 | |||||||||||||||||

| Less: Preferred stock (a) | 520 | 1,014 | 520 | |||||||||||||||||