| New York | ||||||||

(State or other jurisdiction of incorporation) | ||||||||

|

1-9861

(Commission File Number)

|

16-0968385

(I.R.S. Employer Identification Number)

|

|||||||

One M&T Plaza, Buffalo, New York |

14203 | |||||||

| (Address of principal executive offices) | (Zip Code) | |||||||

Registrant's telephone number, including area code: (716) 635-4000 | ||||||||

☐ |

Written communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425) |

||||

☐ |

Soliciting material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12) |

||||

☐ |

Pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b)) |

||||

☐ |

Pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4(c)) |

||||

Securities registered pursuant to Section 12(b) of the Act: | ||||||||

Title of Each Class |

Trading Symbols |

Name of Each Exchange on Which Registered |

||||||

| Common Stock, $.50 par value | MTB | New York Stock Exchange | ||||||

| Perpetual Fixed-to-Floating Rate Non-Cumulative Preferred Stock, Series H |

MTBPrH | New York Stock Exchange | ||||||

| Perpetual Fixed Rate Non-Cumulative Preferred Stock, Series J |

MTBPrJ | New York Stock Exchange | ||||||

| Exhibit No. | Exhibit Description | |||||||

| 99.1 | ||||||||

| 99.2 | ||||||||

104 |

Cover Page Interactive Data File (embedded within the Inline XBRL document) |

|||||||

| M&T BANK CORPORATION | |||||||||||||||||

| Date: | October 16, 2025 | By: |

/s/ Daryl N. Bible | ||||||||||||||

| Daryl N. Bible | |||||||||||||||||

| Senior Executive Vice President and Chief Financial Officer |

|||||||||||||||||

|

News Release |

||||

| One M&T Plaza, Buffalo, NY 14203 | October 16, 2025 | ||||

M&T Bank Corporation (NYSE:MTB) announces third quarter 2025 results | |||||

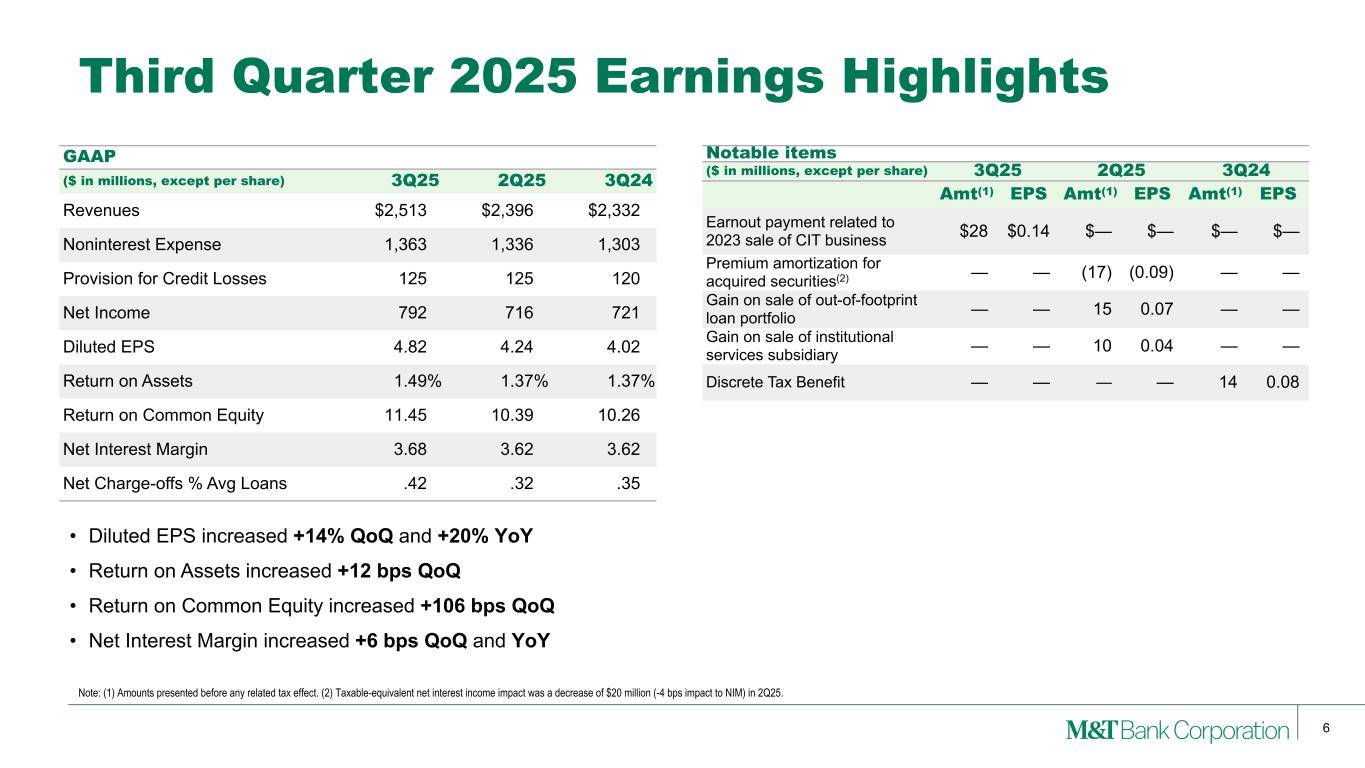

| (Dollars in millions, except per share data) | 3Q25 | 2Q25 | 3Q24 | |||||||||||||||||

| Earnings Highlights | ||||||||||||||||||||

| Net interest income | $ | 1,761 | $ | 1,713 | $ | 1,726 | ||||||||||||||

| Taxable-equivalent adjustment | 12 | 9 | 13 | |||||||||||||||||

| Net interest income - taxable-equivalent | 1,773 | 1,722 | 1,739 | |||||||||||||||||

| Provision for credit losses | 125 | 125 | 120 | |||||||||||||||||

| Noninterest income | 752 | 683 | 606 | |||||||||||||||||

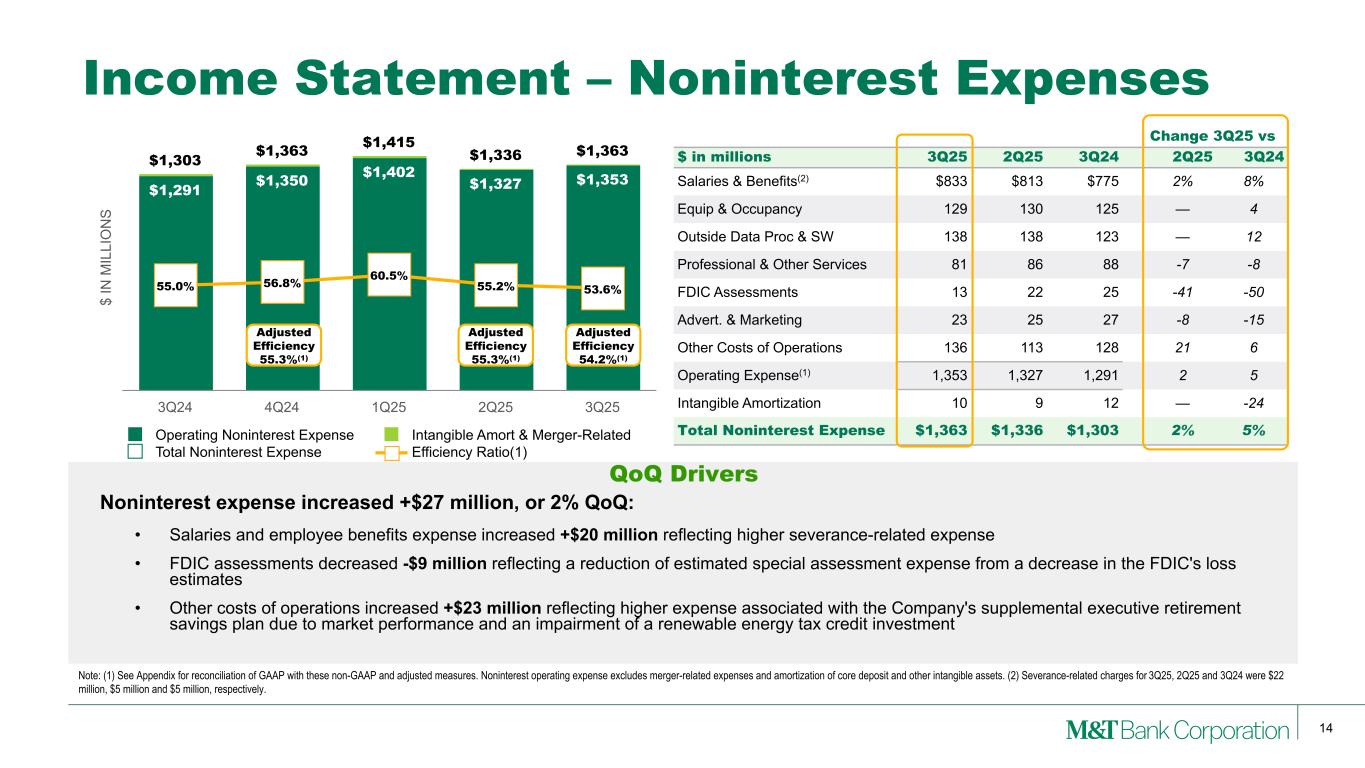

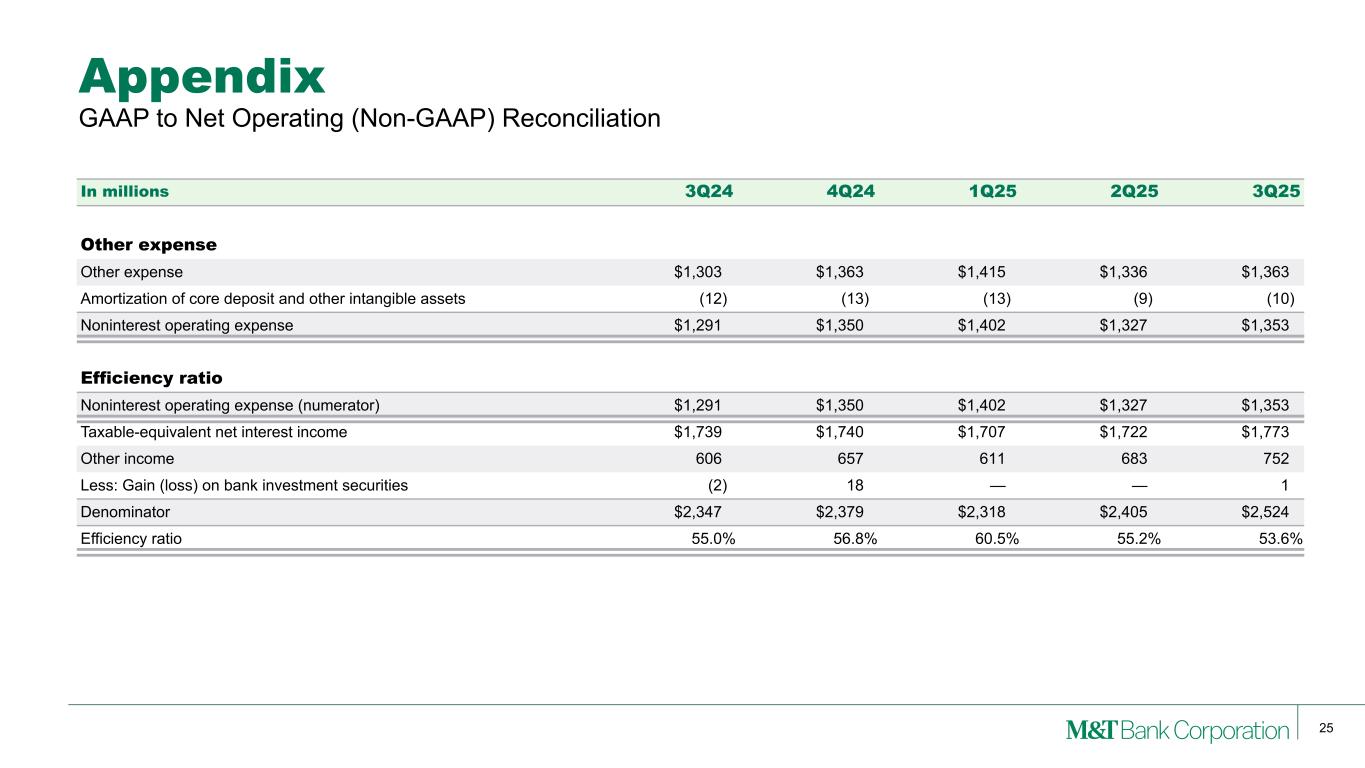

| Noninterest expense | 1,363 | 1,336 | 1,303 | |||||||||||||||||

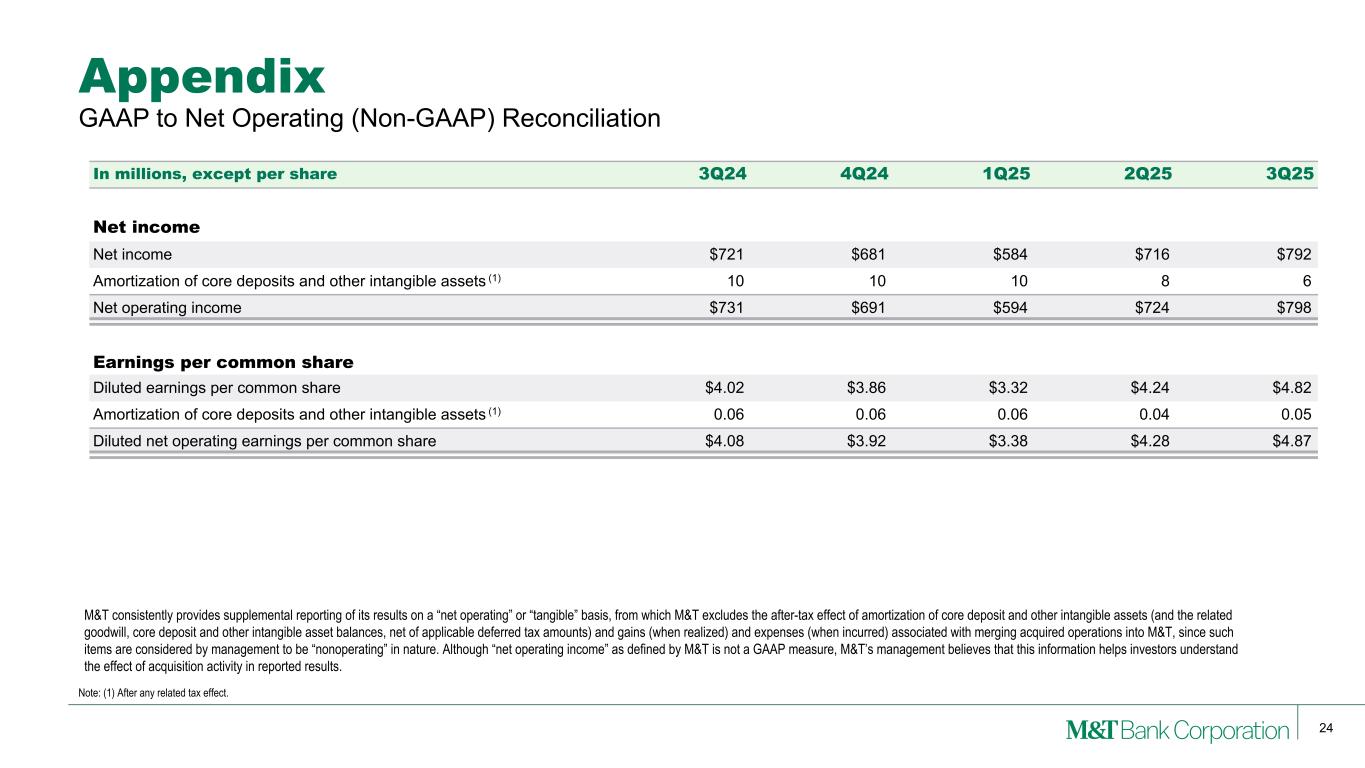

| Net income | 792 | 716 | 721 | |||||||||||||||||

| Net income available to common shareholders - diluted | 754 | 679 | 674 | |||||||||||||||||

| Diluted earnings per common share | 4.82 | 4.24 | 4.02 | |||||||||||||||||

| Return on average assets - annualized | 1.49 | % | 1.37 | % | 1.37 | % | ||||||||||||||

| Return on average common shareholders' equity - annualized | 11.45 | 10.39 | 10.26 | |||||||||||||||||

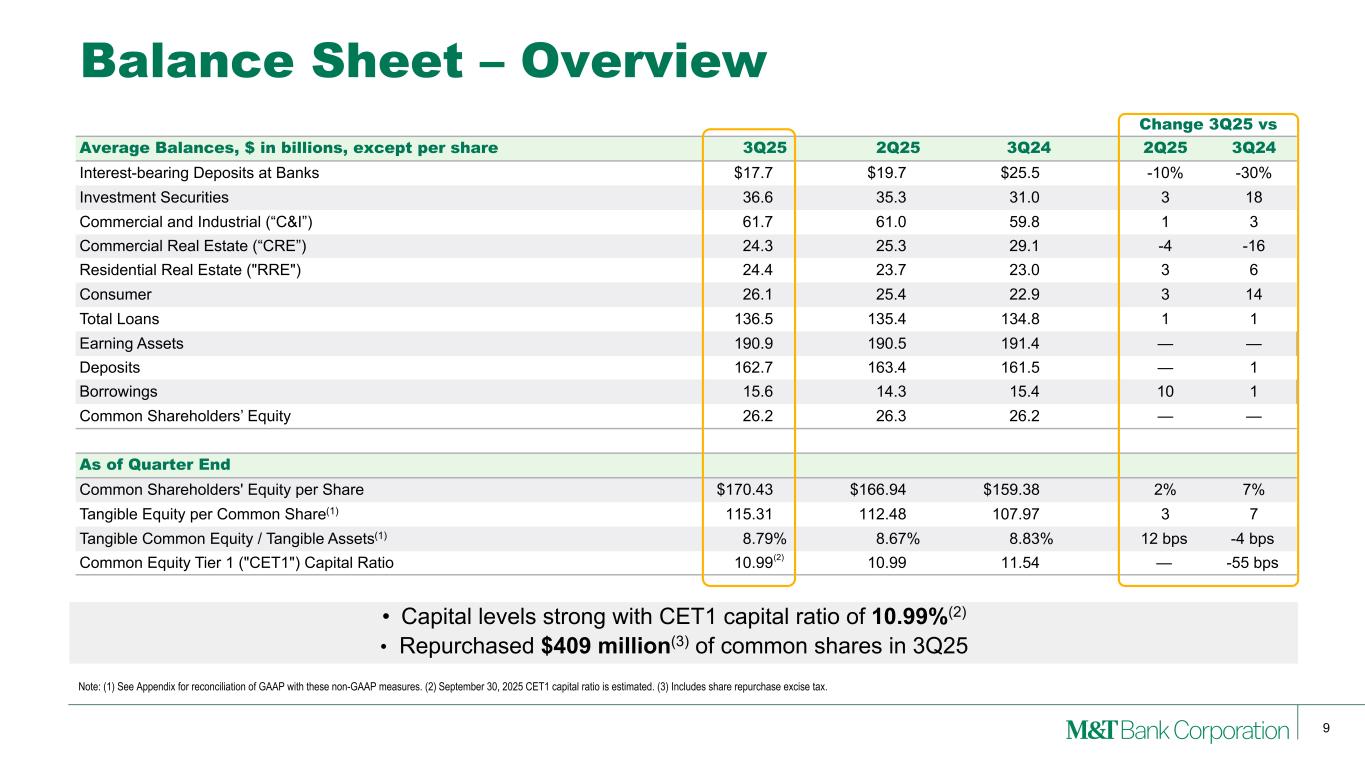

| Average Balance Sheet | ||||||||||||||||||||

| Total assets | $ | 211,053 | $ | 210,261 | $ | 209,581 | ||||||||||||||

| Interest-bearing deposits at banks | 17,739 | 19,698 | 25,491 | |||||||||||||||||

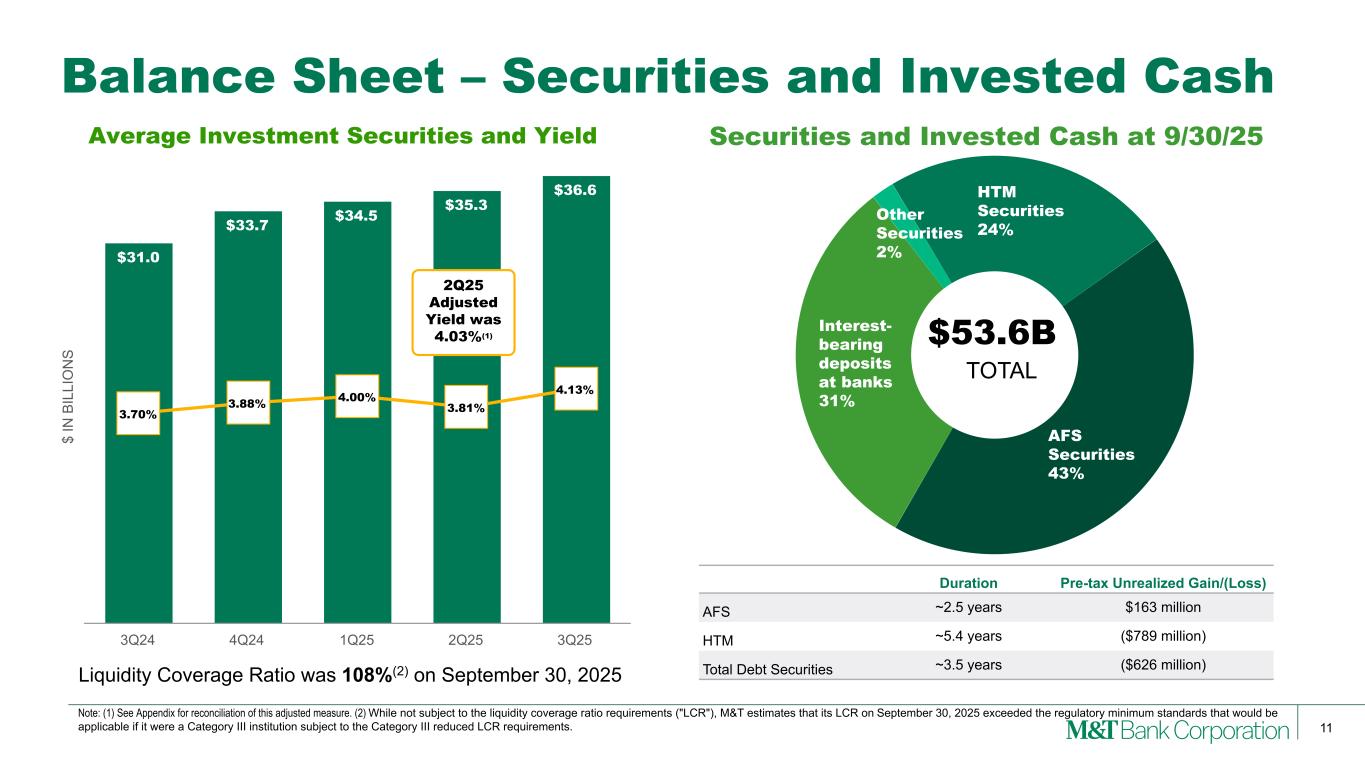

| Investment securities | 36,559 | 35,335 | 31,023 | |||||||||||||||||

| Loans | 136,527 | 135,407 | 134,751 | |||||||||||||||||

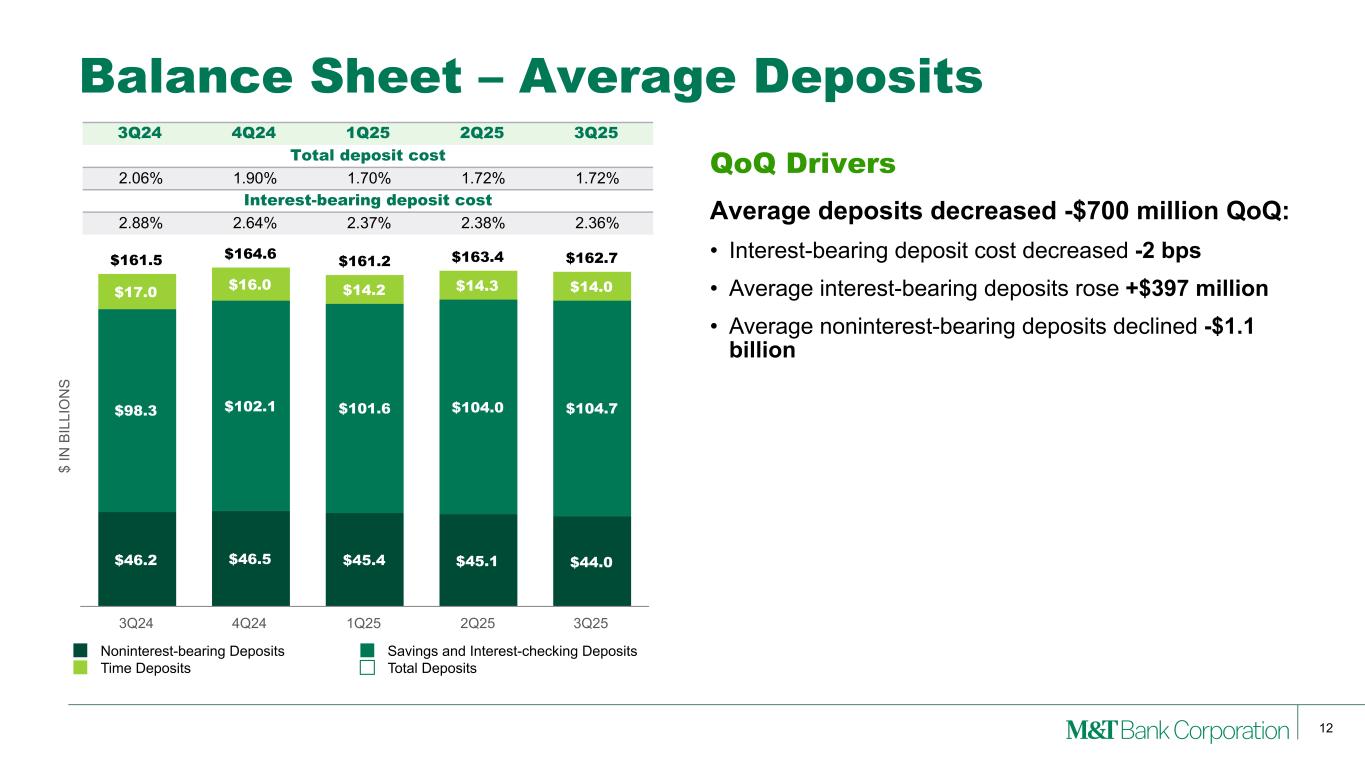

| Deposits | 162,706 | 163,406 | 161,505 | |||||||||||||||||

| Borrowings | 15,633 | 14,263 | 15,428 | |||||||||||||||||

| Selected Ratios | ||||||||||||||||||||

| (Amounts expressed as a percent, except per share data) | ||||||||||||||||||||

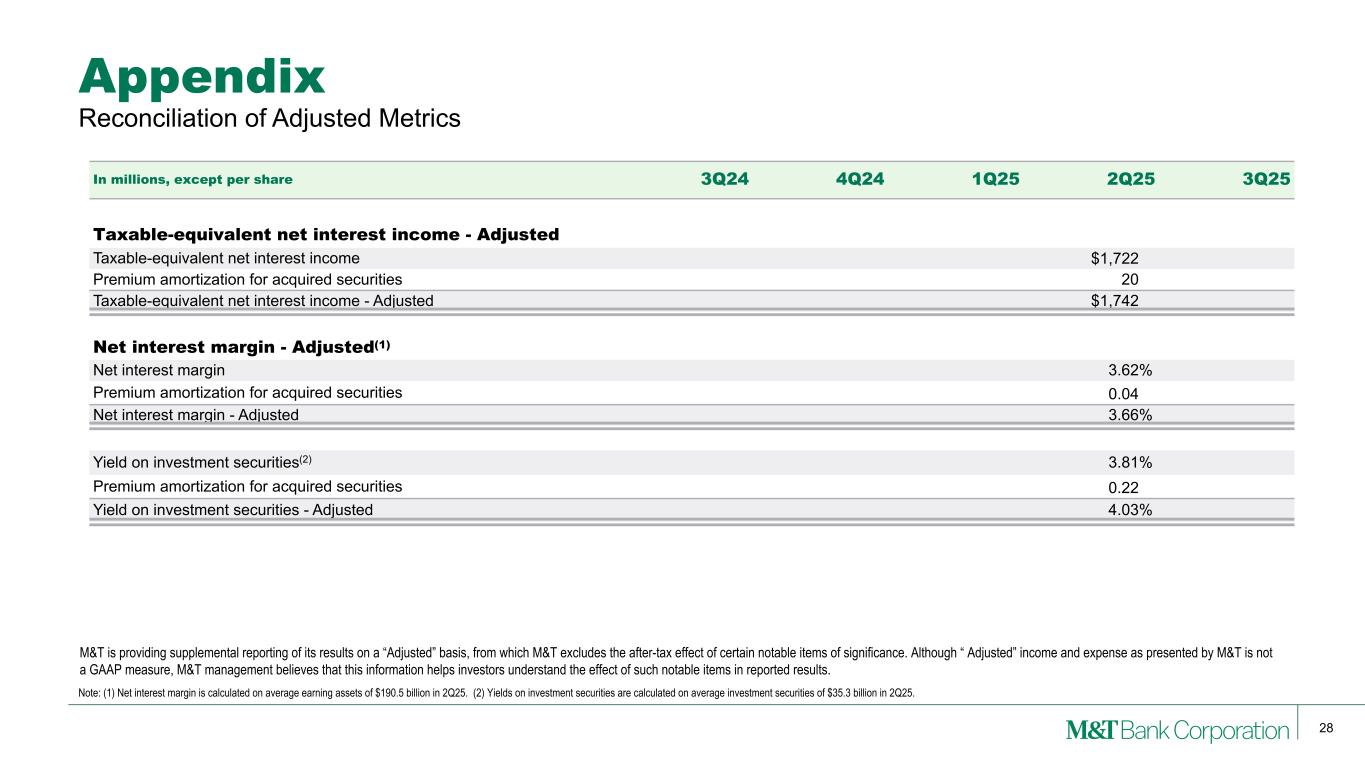

| Net interest margin | 3.68 | % | 3.62 | % | 3.62 | % | ||||||||||||||

| Efficiency ratio (1) | 53.6 | 55.2 | 55.0 | |||||||||||||||||

| Net charge-offs to average total loans - annualized | .42 | .32 | .35 | |||||||||||||||||

| Allowance for loan losses to total loans | 1.58 | 1.61 | 1.62 | |||||||||||||||||

| Nonaccrual loans to total loans | 1.10 | 1.16 | 1.42 | |||||||||||||||||

| Common equity Tier 1 ("CET1") capital ratio (2) | 10.99 | 10.99 | 11.54 | |||||||||||||||||

| Common shareholders' equity per share | $ | 170.43 | $ | 166.94 | $ | 159.38 | ||||||||||||||

| Financial Highlights | ||

| Chief Financial Officer Commentary | ||

|

Third Quarter 2025 Results | ||||

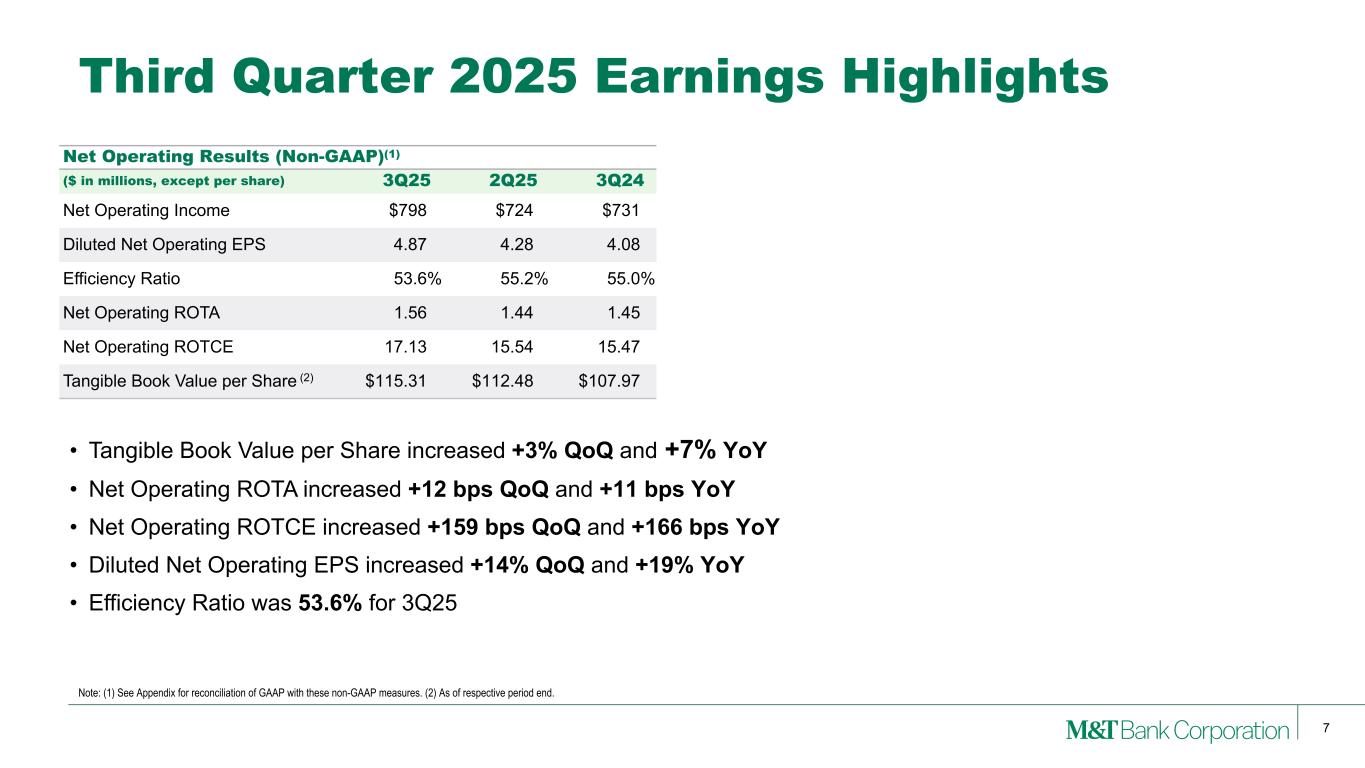

| Non-GAAP Measures (1) | ||||||||||||||||||||||||||||||||

| (Dollars in millions, except per share data) | 3Q25 | 2Q25 | Change 3Q25 vs. 2Q25 | 3Q24 | Change 3Q25 vs. 3Q24 | |||||||||||||||||||||||||||

| Net operating income | $ | 798 | $ | 724 | 10 | % | $ | 731 | 9 | % | ||||||||||||||||||||||

| Diluted net operating earnings per common share | 4.87 | 4.28 | 14 | 4.08 | 19 | |||||||||||||||||||||||||||

| Annualized return on average tangible assets | 1.56 | % | 1.44 | % | 1.45 | % | ||||||||||||||||||||||||||

| Annualized return on average tangible common equity | 17.13 | 15.54 | 15.47 | |||||||||||||||||||||||||||||

| Efficiency ratio | 53.6 | 55.2 | 55.0 | |||||||||||||||||||||||||||||

| Tangible equity per common share | $ | 115.31 | $ | 112.48 | 3 | $ | 107.97 | 7 | ||||||||||||||||||||||||

| Taxable-equivalent Net Interest Income | ||||||||||||||||||||||||||||||||

| (Dollars in millions) | 3Q25 | 2Q25 | Change 3Q25 vs. 2Q25 | 3Q24 | Change 3Q25 vs. 3Q24 | |||||||||||||||||||||||||||

| Average earning assets | $ | 190,920 | $ | 190,535 | — | % | $ | 191,366 | — | % | ||||||||||||||||||||||

| Average interest-bearing liabilities | 134,283 | 132,516 | 1 | 130,775 | 3 | |||||||||||||||||||||||||||

| Net interest income - taxable-equivalent | 1,773 | 1,722 | 3 | 1,739 | 2 | |||||||||||||||||||||||||||

| Yield on average earning assets | 5.59 | % | 5.51 | % | 5.82 | % | ||||||||||||||||||||||||||

| Cost of interest-bearing liabilities | 2.71 | 2.71 | 3.22 | |||||||||||||||||||||||||||||

| Net interest spread | 2.88 | 2.80 | 2.60 | |||||||||||||||||||||||||||||

| Net interest margin | 3.68 | 3.62 | 3.62 | |||||||||||||||||||||||||||||

|

Third Quarter 2025 Results | ||||

| Average Earning Assets | ||||||||||||||||||||||||||||||||

| (Dollars in millions) | 3Q25 | 2Q25 | Change 3Q25 vs. 2Q25 | 3Q24 | Change 3Q25 vs. 3Q24 | |||||||||||||||||||||||||||

| Interest-bearing deposits at banks | $ | 17,739 | $ | 19,698 | -10 | % | $ | 25,491 | -30 | % | ||||||||||||||||||||||

| Trading account | 95 | 95 | — | 101 | -6 | |||||||||||||||||||||||||||

| Investment securities | 36,559 | 35,335 | 3 | 31,023 | 18 | |||||||||||||||||||||||||||

| Loans | ||||||||||||||||||||||||||||||||

| Commercial and industrial | 61,716 | 61,036 | 1 | 59,779 | 3 | |||||||||||||||||||||||||||

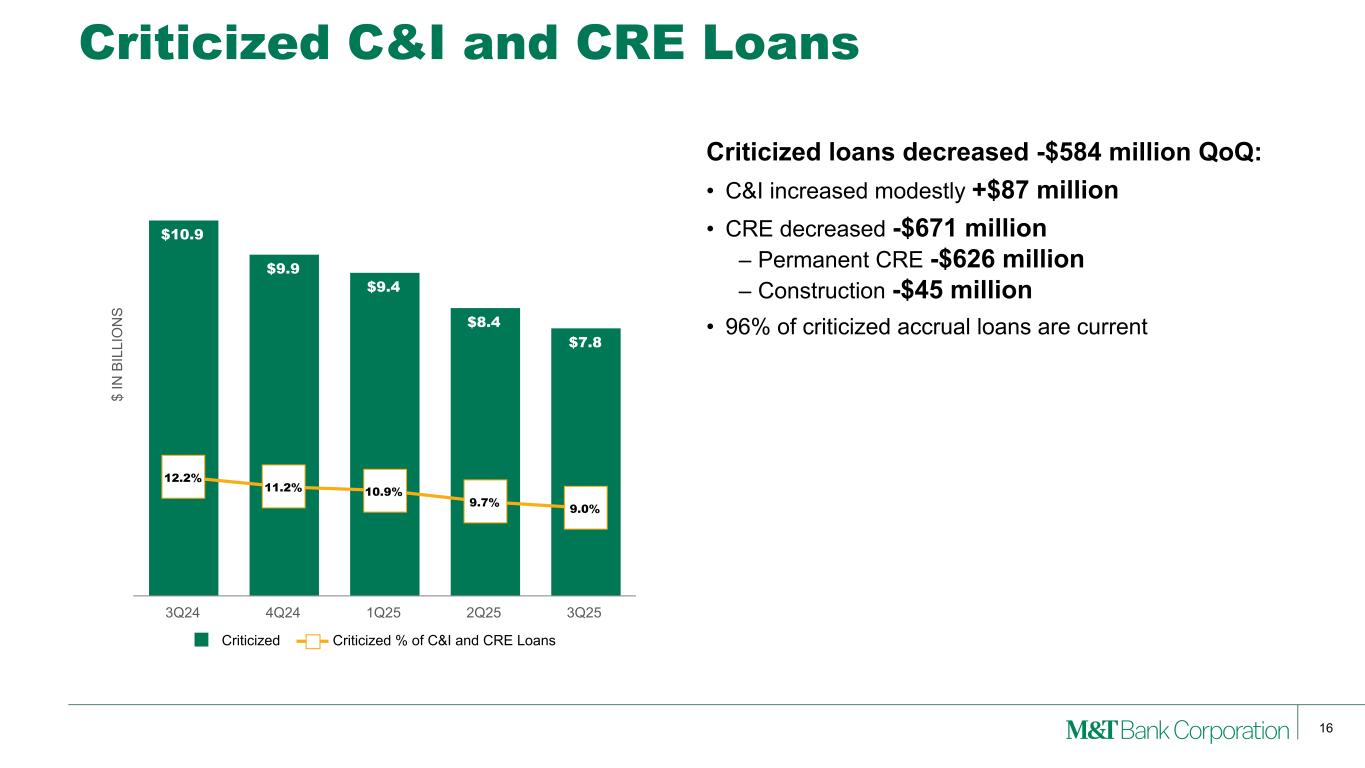

| Real estate - commercial | 24,353 | 25,333 | -4 | 29,075 | -16 | |||||||||||||||||||||||||||

| Real estate - residential | 24,359 | 23,684 | 3 | 22,994 | 6 | |||||||||||||||||||||||||||

| Consumer | 26,099 | 25,354 | 3 | 22,903 | 14 | |||||||||||||||||||||||||||

| Total loans | 136,527 | 135,407 | 1 | 134,751 | 1 | |||||||||||||||||||||||||||

| Total earning assets | $ | 190,920 | $ | 190,535 | — | $ | 191,366 | — | ||||||||||||||||||||||||

|

Third Quarter 2025 Results | ||||

| Average Interest-bearing Liabilities | ||||||||||||||||||||||||||||||||

| (Dollars in millions) | 3Q25 | 2Q25 | Change 3Q25 vs. 2Q25 | 3Q24 | Change 3Q25 vs. 3Q24 | |||||||||||||||||||||||||||

| Interest-bearing deposits | ||||||||||||||||||||||||||||||||

| Savings and interest-checking deposits | $ | 104,660 | $ | 103,963 | 1 | % | $ | 98,295 | 6 | % | ||||||||||||||||||||||

| Time deposits | 13,990 | 14,290 | -2 | 17,052 | -18 | |||||||||||||||||||||||||||

| Total interest-bearing deposits | 118,650 | 118,253 | — | 115,347 | 3 | |||||||||||||||||||||||||||

| Short-term borrowings | 2,844 | 3,327 | -15 | 4,034 | -30 | |||||||||||||||||||||||||||

| Long-term borrowings | 12,789 | 10,936 | 17 | 11,394 | 12 | |||||||||||||||||||||||||||

| Total interest-bearing liabilities | $ | 134,283 | $ | 132,516 | 1 | $ | 130,775 | 3 | ||||||||||||||||||||||||

|

Third Quarter 2025 Results | ||||

| Provision for Credit Losses/Asset Quality | ||||||||||||||||||||||||||||||||

| (Dollars in millions) | 3Q25 | 2Q25 | Change 3Q25 vs. 2Q25 |

3Q24 | Change 3Q25 vs. 3Q24 |

|||||||||||||||||||||||||||

| At end of quarter | ||||||||||||||||||||||||||||||||

| Nonaccrual loans | $ | 1,512 | $ | 1,573 | -4 | % | $ | 1,926 | -21 | % | ||||||||||||||||||||||

| Real estate and other foreclosed assets | 37 | 30 | 23 | 37 | — | |||||||||||||||||||||||||||

| Total nonperforming assets | 1,549 | 1,603 | -3 | 1,963 | -21 | |||||||||||||||||||||||||||

| Accruing loans past due 90 days or more (1) | 432 | 496 | -13 | 288 | 50 | |||||||||||||||||||||||||||

| Nonaccrual loans as % of loans outstanding | 1.10 | % | 1.16 | % | 1.42 | % | ||||||||||||||||||||||||||

| Allowance for loan losses | $ | 2,161 | $ | 2,197 | -2 | $ | 2,204 | -2 | ||||||||||||||||||||||||

| Allowance for loan losses as % of loans outstanding | 1.58 | % | 1.61 | % | 1.62 | % | ||||||||||||||||||||||||||

| Reserve for unfunded credit commitments | $ | 95 | $ | 80 | 19 | $ | 60 | 59 | ||||||||||||||||||||||||

| For the period | ||||||||||||||||||||||||||||||||

| Provision for loan losses | $ | 110 | $ | 105 | 5 | $ | 120 | -8 | ||||||||||||||||||||||||

| Provision for unfunded credit commitments | 15 | 20 | -25 | — | 100 | |||||||||||||||||||||||||||

| Total provision for credit losses | 125 | 125 | — | 120 | 4 | |||||||||||||||||||||||||||

| Net charge-offs | 146 | 108 | 34 | 120 | 21 | |||||||||||||||||||||||||||

| Net charge-offs as % of average loans (annualized) | .42 | % | .32 | % | .35 | % | ||||||||||||||||||||||||||

|

Third Quarter 2025 Results | ||||

| Noninterest Income | ||||||||||||||||||||||||||||||||

| (Dollars in millions) | 3Q25 | 2Q25 | Change 3Q25 vs. 2Q25 | 3Q24 | Change 3Q25 vs. 3Q24 | |||||||||||||||||||||||||||

| Mortgage banking revenues | $ | 147 | $ | 130 | 13 | % | $ | 109 | 36 | % | ||||||||||||||||||||||

| Service charges on deposit accounts | 141 | 137 | 2 | 132 | 7 | |||||||||||||||||||||||||||

| Trust income | 181 | 182 | -1 | 170 | 7 | |||||||||||||||||||||||||||

| Brokerage services income | 34 | 31 | 9 | 32 | 9 | |||||||||||||||||||||||||||

| Trading account and other non-hedging derivative gains | 18 | 12 | 66 | 13 | 34 | |||||||||||||||||||||||||||

| Gain (loss) on bank investment securities | 1 | — | — | (2) | — | |||||||||||||||||||||||||||

| Other revenues from operations | 230 | 191 | 21 | 152 | 50 | |||||||||||||||||||||||||||

| Total | $ | 752 | $ | 683 | 10 | $ | 606 | 24 | ||||||||||||||||||||||||

|

Third Quarter 2025 Results | ||||

| Noninterest Expense | ||||||||||||||||||||||||||||||||

| (Dollars in millions) | 3Q25 | 2Q25 | Change 3Q25 vs. 2Q25 | 3Q24 | Change 3Q25 vs. 3Q24 | |||||||||||||||||||||||||||

| Salaries and employee benefits | $ | 833 | $ | 813 | 2 | % | $ | 775 | 8 | % | ||||||||||||||||||||||

| Equipment and net occupancy | 129 | 130 | — | 125 | 4 | |||||||||||||||||||||||||||

| Outside data processing and software | 138 | 138 | — | 123 | 12 | |||||||||||||||||||||||||||

| Professional and other services | 81 | 86 | -7 | 88 | -8 | |||||||||||||||||||||||||||

| FDIC assessments | 13 | 22 | -41 | 25 | -50 | |||||||||||||||||||||||||||

| Advertising and marketing | 23 | 25 | -8 | 27 | -15 | |||||||||||||||||||||||||||

| Amortization of core deposit and other intangible assets | 10 | 9 | — | 12 | -24 | |||||||||||||||||||||||||||

| Other costs of operations | 136 | 113 | 21 | 128 | 6 | |||||||||||||||||||||||||||

| Total | $ | 1,363 | $ | 1,336 | 2 | $ | 1,303 | 5 | ||||||||||||||||||||||||

| Income Taxes | ||

|

Third Quarter 2025 Results | ||||

| Capital and Liquidity | ||||||||||||||||||||

| 3Q25 | 2Q25 | 3Q24 | ||||||||||||||||||

| CET1 | 10.99 | % | (1) | 10.99 | % | 11.54 | % | |||||||||||||

| Tier 1 capital | 12.49 | (1) | 12.50 | 13.08 | ||||||||||||||||

| Total capital | 14.35 | (1) | 13.96 | 14.65 | ||||||||||||||||

| Tangible capital – common | 8.79 | 8.67 | 8.83 | |||||||||||||||||

| Conference Call | ||

| About M&T | ||

|

Third Quarter 2025 Results | ||||

| Forward-Looking Statements | ||

|

Third Quarter 2025 Results | ||||

| Three Months Ended | Nine Months Ended | ||||||||||||||||||||||||||||||||||

| September 30, | September 30, | ||||||||||||||||||||||||||||||||||

| (Dollars in millions, except per share, shares in thousands) | 2025 | 2024 | Change | 2025 | 2024 | Change | |||||||||||||||||||||||||||||

| Performance | |||||||||||||||||||||||||||||||||||

| Net income | $ | 792 | $ | 721 | 10 | % | $ | 2,092 | $ | 1,907 | 10 | % | |||||||||||||||||||||||

| Net income available to common shareholders | 754 | 674 | 12 | 1,981 | 1,805 | 10 | |||||||||||||||||||||||||||||

| Per common share: | |||||||||||||||||||||||||||||||||||

| Basic earnings | 4.85 | 4.04 | 20 | 12.41 | 10.83 | 15 | |||||||||||||||||||||||||||||

| Diluted earnings | 4.82 | 4.02 | 20 | 12.34 | 10.78 | 14 | |||||||||||||||||||||||||||||

| Cash dividends | 1.50 | 1.35 | 11 | 4.20 | 4.00 | 5 | |||||||||||||||||||||||||||||

| Common shares outstanding: | |||||||||||||||||||||||||||||||||||

| Average - diluted (1) | 156,553 | 167,567 | -7 | 160,503 | 167,437 | -4 | |||||||||||||||||||||||||||||

| Period end (2) | 154,518 | 166,157 | -7 | 154,518 | 166,157 | -7 | |||||||||||||||||||||||||||||

| Return on (annualized): | |||||||||||||||||||||||||||||||||||

| Average total assets | 1.49 | % | 1.37 | % | 1.33 | % | 1.21 | % | |||||||||||||||||||||||||||

| Average common shareholders' equity | 11.45 | 10.26 | 10.07 | 9.47 | |||||||||||||||||||||||||||||||

| Taxable-equivalent net interest income | $ | 1,773 | $ | 1,739 | 2 | $ | 5,202 | $ | 5,162 | 1 | |||||||||||||||||||||||||

| Yield on average earning assets | 5.59 | % | 5.82 | % | 5.54 | % | 5.79 | % | |||||||||||||||||||||||||||

| Cost of interest-bearing liabilities | 2.71 | 3.22 | 2.71 | 3.24 | |||||||||||||||||||||||||||||||

| Net interest spread | 2.88 | 2.60 | 2.83 | 2.55 | |||||||||||||||||||||||||||||||

| Contribution of interest-free funds | .80 | 1.02 | .83 | 1.03 | |||||||||||||||||||||||||||||||

| Net interest margin | 3.68 | 3.62 | 3.66 | 3.58 | |||||||||||||||||||||||||||||||

| Net charge-offs to average total net loans (annualized) | .42 | .35 | .36 | .39 | |||||||||||||||||||||||||||||||

| Net operating results (3) | |||||||||||||||||||||||||||||||||||

| Net operating income | $ | 798 | $ | 731 | 9 | $ | 2,116 | $ | 1,939 | 9 | |||||||||||||||||||||||||

| Diluted net operating earnings per common share | 4.87 | 4.08 | 19 | 12.49 | 10.97 | 14 | |||||||||||||||||||||||||||||

| Return on (annualized): | |||||||||||||||||||||||||||||||||||

| Average tangible assets | 1.56 | % | 1.45 | % | 1.41 | % | 1.28 | % | |||||||||||||||||||||||||||

| Average tangible common equity | 17.13 | 15.47 | 15.07 | 14.51 | |||||||||||||||||||||||||||||||

| Efficiency ratio | 53.6 | 55.0 | 56.3 | 57.0 | |||||||||||||||||||||||||||||||

| At September 30, | |||||||||||||||||||||||||||||||||||

| Loan quality | 2025 | 2024 | Change | ||||||||||||||||||||||||||||||||

| Nonaccrual loans | $ | 1,512 | $ | 1,926 | -21 | % | |||||||||||||||||||||||||||||

| Real estate and other foreclosed assets | 37 | 37 | — | ||||||||||||||||||||||||||||||||

| Total nonperforming assets | $ | 1,549 | $ | 1,963 | -21 | ||||||||||||||||||||||||||||||

| Accruing loans past due 90 days or more (4) | $ | 432 | $ | 288 | 50 | ||||||||||||||||||||||||||||||

| Government guaranteed loans included in totals above: | |||||||||||||||||||||||||||||||||||

| Nonaccrual loans | $ | 71 | $ | 69 | 4 | ||||||||||||||||||||||||||||||

| Accruing loans past due 90 days or more | 403 | 269 | 50 | ||||||||||||||||||||||||||||||||

| Nonaccrual loans to total loans | 1.10 | % | 1.42 | % | |||||||||||||||||||||||||||||||

| Allowance for loan losses to total loans | 1.58 | 1.62 | |||||||||||||||||||||||||||||||||

| Additional information | |||||||||||||||||||||||||||||||||||

| Period end common stock price | $ | 197.62 | $ | 178.12 | 11 | ||||||||||||||||||||||||||||||

| Domestic banking offices | 942 | 957 | -2 | ||||||||||||||||||||||||||||||||

| Full time equivalent employees | 22,383 | 21,986 | 2 | ||||||||||||||||||||||||||||||||

|

Third Quarter 2025 Results | ||||

| Three Months Ended | |||||||||||||||||||||||||||||

| September 30, | June 30, | March 31, | December 31, | September 30, | |||||||||||||||||||||||||

| (Dollars in millions, except per share, shares in thousands) | 2025 | 2025 | 2025 | 2024 | 2024 | ||||||||||||||||||||||||

| Performance | |||||||||||||||||||||||||||||

| Net income | $ | 792 | $ | 716 | $ | 584 | $ | 681 | $ | 721 | |||||||||||||||||||

| Net income available to common shareholders | 754 | 679 | 547 | 644 | 674 | ||||||||||||||||||||||||

| Per common share: | |||||||||||||||||||||||||||||

| Basic earnings | 4.85 | 4.26 | 3.33 | 3.88 | 4.04 | ||||||||||||||||||||||||

| Diluted earnings | 4.82 | 4.24 | 3.32 | 3.86 | 4.02 | ||||||||||||||||||||||||

| Cash dividends | 1.50 | 1.35 | 1.35 | 1.35 | 1.35 | ||||||||||||||||||||||||

| Common shares outstanding: | |||||||||||||||||||||||||||||

| Average - diluted (1) | 156,553 | 160,005 | 165,047 | 166,969 | 167,567 | ||||||||||||||||||||||||

| Period end (2) | 154,518 | 156,532 | 162,552 | 165,526 | 166,157 | ||||||||||||||||||||||||

| Return on (annualized): | |||||||||||||||||||||||||||||

| Average total assets | 1.49 | % | 1.37 | % | 1.14 | % | 1.28 | % | 1.37 | % | |||||||||||||||||||

| Average common shareholders' equity | 11.45 | 10.39 | 8.36 | 9.75 | 10.26 | ||||||||||||||||||||||||

| Taxable-equivalent net interest income | $ | 1,773 | $ | 1,722 | $ | 1,707 | $ | 1,740 | $ | 1,739 | |||||||||||||||||||

| Yield on average earning assets | 5.59 | % | 5.51 | % | 5.52 | % | 5.60 | % | 5.82 | % | |||||||||||||||||||

| Cost of interest-bearing liabilities | 2.71 | 2.71 | 2.70 | 2.94 | 3.22 | ||||||||||||||||||||||||

| Net interest spread | 2.88 | 2.80 | 2.82 | 2.66 | 2.60 | ||||||||||||||||||||||||

| Contribution of interest-free funds | .80 | .82 | .84 | .92 | 1.02 | ||||||||||||||||||||||||

| Net interest margin | 3.68 | 3.62 | 3.66 | 3.58 | 3.62 | ||||||||||||||||||||||||

| Net charge-offs to average total net loans (annualized) | .42 | .32 | .34 | .47 | .35 | ||||||||||||||||||||||||

| Net operating results (3) | |||||||||||||||||||||||||||||

| Net operating income | $ | 798 | $ | 724 | $ | 594 | $ | 691 | $ | 731 | |||||||||||||||||||

| Diluted net operating earnings per common share | 4.87 | 4.28 | 3.38 | 3.92 | 4.08 | ||||||||||||||||||||||||

| Return on (annualized): | |||||||||||||||||||||||||||||

| Average tangible assets | 1.56 | % | 1.44 | % | 1.21 | % | 1.35 | % | 1.45 | % | |||||||||||||||||||

| Average tangible common equity | 17.13 | 15.54 | 12.53 | 14.66 | 15.47 | ||||||||||||||||||||||||

| Efficiency ratio | 53.6 | 55.2 | 60.5 | 56.8 | 55.0 | ||||||||||||||||||||||||

| September 30, | June 30, | March 31, | December 31, | September 30, | |||||||||||||||||||||||||

| Loan quality | 2025 | 2025 | 2025 | 2024 | 2024 | ||||||||||||||||||||||||

| Nonaccrual loans | $ | 1,512 | $ | 1,573 | $ | 1,540 | $ | 1,690 | $ | 1,926 | |||||||||||||||||||

| Real estate and other foreclosed assets | 37 | 30 | 34 | 35 | 37 | ||||||||||||||||||||||||

| Total nonperforming assets | $ | 1,549 | $ | 1,603 | $ | 1,574 | $ | 1,725 | $ | 1,963 | |||||||||||||||||||

| Accruing loans past due 90 days or more (4) | $ | 432 | $ | 496 | $ | 384 | $ | 338 | $ | 288 | |||||||||||||||||||

| Government guaranteed loans included in totals above: | |||||||||||||||||||||||||||||

| Nonaccrual loans | 71 | 75 | 69 | 69 | 69 | ||||||||||||||||||||||||

| Accruing loans past due 90 days or more | 403 | 450 | 368 | 318 | 269 | ||||||||||||||||||||||||

| Nonaccrual loans to total loans | 1.10 | % | 1.16 | % | 1.14 | % | 1.25 | % | 1.42 | % | |||||||||||||||||||

| Allowance for loan losses to total loans | 1.58 | 1.61 | 1.63 | 1.61 | 1.62 | ||||||||||||||||||||||||

| Additional information | |||||||||||||||||||||||||||||

| Period end common stock price | $ | 197.62 | $ | 193.99 | $ | 178.75 | $ | 188.01 | $ | 178.12 | |||||||||||||||||||

| Domestic banking offices | 942 | 941 | 955 | 955 | 957 | ||||||||||||||||||||||||

| Full time equivalent employees | 22,383 | 22,590 | 22,291 | 22,101 | 21,986 | ||||||||||||||||||||||||

|

Third Quarter 2025 Results | ||||

| Three Months Ended | Nine Months Ended | ||||||||||||||||||||||||||||||||||

| September 30, | September 30, | ||||||||||||||||||||||||||||||||||

| (Dollars in millions) | 2025 | 2024 | Change | 2025 | 2024 | Change | |||||||||||||||||||||||||||||

| Interest income | $ | 2,680 | $ | 2,785 | -4 | % | $ | 7,849 | $ | 8,319 | -6 | % | |||||||||||||||||||||||

| Interest expense | 919 | 1,059 | -13 | 2,680 | 3,195 | -16 | |||||||||||||||||||||||||||||

| Net interest income | 1,761 | 1,726 | 2 | 5,169 | 5,124 | 1 | |||||||||||||||||||||||||||||

| Provision for credit losses | 125 | 120 | 4 | 380 | 470 | -19 | |||||||||||||||||||||||||||||

| Net interest income after provision for credit losses | 1,636 | 1,606 | 2 | 4,789 | 4,654 | 3 | |||||||||||||||||||||||||||||

| Other income | |||||||||||||||||||||||||||||||||||

| Mortgage banking revenues | 147 | 109 | 36 | 395 | 319 | 24 | |||||||||||||||||||||||||||||

| Service charges on deposit accounts | 141 | 132 | 7 | 411 | 383 | 7 | |||||||||||||||||||||||||||||

| Trust income | 181 | 170 | 7 | 540 | 500 | 8 | |||||||||||||||||||||||||||||

| Brokerage services income | 34 | 32 | 9 | 97 | 91 | 7 | |||||||||||||||||||||||||||||

| Trading account and other non-hedging derivative gains |

18 | 13 | 34 | 39 | 29 | 32 | |||||||||||||||||||||||||||||

| Gain (loss) on bank investment securities | 1 | (2) | — | 1 | (8) | — | |||||||||||||||||||||||||||||

| Other revenues from operations | 230 | 152 | 50 | 563 | 456 | 23 | |||||||||||||||||||||||||||||

| Total other income | 752 | 606 | 24 | 2,046 | 1,770 | 16 | |||||||||||||||||||||||||||||

| Other expense | |||||||||||||||||||||||||||||||||||

| Salaries and employee benefits | 833 | 775 | 8 | 2,533 | 2,372 | 7 | |||||||||||||||||||||||||||||

| Equipment and net occupancy | 129 | 125 | 4 | 391 | 379 | 3 | |||||||||||||||||||||||||||||

| Outside data processing and software | 138 | 123 | 12 | 412 | 367 | 12 | |||||||||||||||||||||||||||||

| Professional and other services | 81 | 88 | -8 | 251 | 264 | -5 | |||||||||||||||||||||||||||||

| FDIC assessments | 13 | 25 | -50 | 58 | 122 | -53 | |||||||||||||||||||||||||||||

| Advertising and marketing | 23 | 27 | -15 | 70 | 74 | -6 | |||||||||||||||||||||||||||||

| Amortization of core deposit and other intangible assets |

10 | 12 | -24 | 32 | 40 | -20 | |||||||||||||||||||||||||||||

| Other costs of operations | 136 | 128 | 6 | 367 | 378 | -3 | |||||||||||||||||||||||||||||

| Total other expense | 1,363 | 1,303 | 5 | 4,114 | 3,996 | 3 | |||||||||||||||||||||||||||||

| Income before taxes | 1,025 | 909 | 13 | 2,721 | 2,428 | 12 | |||||||||||||||||||||||||||||

| Income taxes | 233 | 188 | 24 | 629 | 521 | 21 | |||||||||||||||||||||||||||||

| Net income | $ | 792 | $ | 721 | 10 | % | $ | 2,092 | $ | 1,907 | 10 | % | |||||||||||||||||||||||

|

Third Quarter 2025 Results | ||||

| Three Months Ended | |||||||||||||||||||||||||||||

| September 30, | June 30, | March 31, | December 31, | September 30, | |||||||||||||||||||||||||

| (Dollars in millions) | 2025 | 2025 | 2025 | 2024 | 2024 | ||||||||||||||||||||||||

| Interest income | $ | 2,680 | $ | 2,609 | $ | 2,560 | $ | 2,707 | $ | 2,785 | |||||||||||||||||||

| Interest expense | 919 | 896 | 865 | 979 | 1,059 | ||||||||||||||||||||||||

| Net interest income | 1,761 | 1,713 | 1,695 | 1,728 | 1,726 | ||||||||||||||||||||||||

| Provision for credit losses | 125 | 125 | 130 | 140 | 120 | ||||||||||||||||||||||||

| Net interest income after provision for credit losses | 1,636 | 1,588 | 1,565 | 1,588 | 1,606 | ||||||||||||||||||||||||

| Other income | |||||||||||||||||||||||||||||

| Mortgage banking revenues | 147 | 130 | 118 | 117 | 109 | ||||||||||||||||||||||||

| Service charges on deposit accounts | 141 | 137 | 133 | 131 | 132 | ||||||||||||||||||||||||

| Trust income | 181 | 182 | 177 | 175 | 170 | ||||||||||||||||||||||||

| Brokerage services income | 34 | 31 | 32 | 30 | 32 | ||||||||||||||||||||||||

| Trading account and other non-hedging derivative gains |

18 | 12 | 9 | 10 | 13 | ||||||||||||||||||||||||

| Gain (loss) on bank investment securities | 1 | — | — | 18 | (2) | ||||||||||||||||||||||||

| Other revenues from operations | 230 | 191 | 142 | 176 | 152 | ||||||||||||||||||||||||

| Total other income | 752 | 683 | 611 | 657 | 606 | ||||||||||||||||||||||||

| Other expense | |||||||||||||||||||||||||||||

| Salaries and employee benefits | 833 | 813 | 887 | 790 | 775 | ||||||||||||||||||||||||

| Equipment and net occupancy | 129 | 130 | 132 | 133 | 125 | ||||||||||||||||||||||||

| Outside data processing and software | 138 | 138 | 136 | 125 | 123 | ||||||||||||||||||||||||

| Professional and other services | 81 | 86 | 84 | 80 | 88 | ||||||||||||||||||||||||

| FDIC assessments | 13 | 22 | 23 | 24 | 25 | ||||||||||||||||||||||||

| Advertising and marketing | 23 | 25 | 22 | 30 | 27 | ||||||||||||||||||||||||

| Amortization of core deposit and other intangible assets |

10 | 9 | 13 | 13 | 12 | ||||||||||||||||||||||||

| Other costs of operations | 136 | 113 | 118 | 168 | 128 | ||||||||||||||||||||||||

| Total other expense | 1,363 | 1,336 | 1,415 | 1,363 | 1,303 | ||||||||||||||||||||||||

| Income before taxes | 1,025 | 935 | 761 | 882 | 909 | ||||||||||||||||||||||||

| Income taxes | 233 | 219 | 177 | 201 | 188 | ||||||||||||||||||||||||

| Net income | $ | 792 | $ | 716 | $ | 584 | $ | 681 | $ | 721 | |||||||||||||||||||

|

Third Quarter 2025 Results | ||||

| September 30, | |||||||||||||||||

| (Dollars in millions) | 2025 | 2024 | Change | ||||||||||||||

| ASSETS | |||||||||||||||||

| Cash and due from banks | $ | 1,950 | $ | 2,216 | -12 | % | |||||||||||

| Interest-bearing deposits at banks | 16,751 | 24,417 | -31 | ||||||||||||||

| Trading account | 95 | 102 | -7 | ||||||||||||||

| Investment securities | 36,864 | 32,327 | 14 | ||||||||||||||

| Loans: | |||||||||||||||||

| Commercial and industrial | 61,887 | 61,012 | 1 | ||||||||||||||

| Real estate - commercial | 24,046 | 28,683 | -16 | ||||||||||||||

| Real estate - residential | 24,662 | 23,019 | 7 | ||||||||||||||

| Consumer | 26,379 | 23,206 | 14 | ||||||||||||||

| Total loans | 136,974 | 135,920 | 1 | ||||||||||||||

| Less: allowance for loan losses | 2,161 | 2,204 | -2 | ||||||||||||||

| Net loans | 134,813 | 133,716 | 1 | ||||||||||||||

| Goodwill | 8,465 | 8,465 | — | ||||||||||||||

| Core deposit and other intangible assets | 74 | 107 | -31 | ||||||||||||||

| Other assets | 12,265 | 10,435 | 18 | ||||||||||||||

| Total assets | $ | 211,277 | $ | 211,785 | — | % | |||||||||||

| LIABILITIES AND SHAREHOLDERS' EQUITY | |||||||||||||||||

| Noninterest-bearing deposits | $ | 44,994 | $ | 47,344 | -5 | % | |||||||||||

| Interest-bearing deposits | 118,432 | 117,210 | 1 | ||||||||||||||

| Total deposits | 163,426 | 164,554 | -1 | ||||||||||||||

| Short-term borrowings | 2,059 | 2,605 | -21 | ||||||||||||||

| Long-term borrowings | 12,928 | 11,583 | 12 | ||||||||||||||

| Accrued interest and other liabilities | 4,136 | 4,167 | -1 | ||||||||||||||

| Total liabilities | 182,549 | 182,909 | — | ||||||||||||||

| Shareholders' equity: | |||||||||||||||||

| Preferred | 2,394 | 2,394 | — | ||||||||||||||

| Common | 26,334 | 26,482 | -1 | ||||||||||||||

| Total shareholders' equity | 28,728 | 28,876 | -1 | ||||||||||||||

| Total liabilities and shareholders' equity | $ | 211,277 | $ | 211,785 | — | % | |||||||||||

|

Third Quarter 2025 Results | ||||

| September 30, | June 30, | March 31, | December 31, | September 30, | |||||||||||||||||||||||||

| (Dollars in millions) | 2025 | 2025 | 2025 | 2024 | 2024 | ||||||||||||||||||||||||

| ASSETS | |||||||||||||||||||||||||||||

| Cash and due from banks | $ | 1,950 | $ | 2,128 | $ | 2,109 | $ | 1,909 | $ | 2,216 | |||||||||||||||||||

| Interest-bearing deposits at banks | 16,751 | 19,297 | 20,656 | 18,873 | 24,417 | ||||||||||||||||||||||||

| Trading account | 95 | 93 | 96 | 101 | 102 | ||||||||||||||||||||||||

| Investment securities | 36,864 | 35,568 | 35,137 | 34,051 | 32,327 | ||||||||||||||||||||||||

| Loans: | |||||||||||||||||||||||||||||

| Commercial and industrial | 61,887 | 61,660 | 60,596 | 61,481 | 61,012 | ||||||||||||||||||||||||

| Real estate - commercial | 24,046 | 24,567 | 25,867 | 26,764 | 28,683 | ||||||||||||||||||||||||

| Real estate - residential | 24,662 | 24,117 | 23,284 | 23,166 | 23,019 | ||||||||||||||||||||||||

| Consumer | 26,379 | 25,772 | 24,827 | 24,170 | 23,206 | ||||||||||||||||||||||||

| Total loans | 136,974 | 136,116 | 134,574 | 135,581 | 135,920 | ||||||||||||||||||||||||

| Less: allowance for loan losses | 2,161 | 2,197 | 2,200 | 2,184 | 2,204 | ||||||||||||||||||||||||

| Net loans | 134,813 | 133,919 | 132,374 | 133,397 | 133,716 | ||||||||||||||||||||||||

| Goodwill | 8,465 | 8,465 | 8,465 | 8,465 | 8,465 | ||||||||||||||||||||||||

| Core deposit and other intangible assets | 74 | 84 | 93 | 94 | 107 | ||||||||||||||||||||||||

| Other assets | 12,265 | 12,030 | 11,391 | 11,215 | 10,435 | ||||||||||||||||||||||||

| Total assets | $ | 211,277 | $ | 211,584 | $ | 210,321 | $ | 208,105 | $ | 211,785 | |||||||||||||||||||

| LIABILITIES AND SHAREHOLDERS' EQUITY | |||||||||||||||||||||||||||||

| Noninterest-bearing deposits | $ | 44,994 | $ | 47,485 | $ | 49,051 | $ | 46,020 | $ | 47,344 | |||||||||||||||||||

| Interest-bearing deposits | 118,432 | 116,968 | 116,358 | 115,075 | 117,210 | ||||||||||||||||||||||||

| Total deposits | 163,426 | 164,453 | 165,409 | 161,095 | 164,554 | ||||||||||||||||||||||||

| Short-term borrowings | 2,059 | 2,071 | 1,573 | 1,060 | 2,605 | ||||||||||||||||||||||||

| Long-term borrowings | 12,928 | 12,380 | 10,496 | 12,605 | 11,583 | ||||||||||||||||||||||||

| Accrued interest and other liabilities | 4,136 | 4,155 | 3,852 | 4,318 | 4,167 | ||||||||||||||||||||||||

| Total liabilities | 182,549 | 183,059 | 181,330 | 179,078 | 182,909 | ||||||||||||||||||||||||

| Shareholders' equity: | |||||||||||||||||||||||||||||

| Preferred | 2,394 | 2,394 | 2,394 | 2,394 | 2,394 | ||||||||||||||||||||||||

| Common | 26,334 | 26,131 | 26,597 | 26,633 | 26,482 | ||||||||||||||||||||||||

| Total shareholders' equity | 28,728 | 28,525 | 28,991 | 29,027 | 28,876 | ||||||||||||||||||||||||

| Total liabilities and shareholders' equity | $ | 211,277 | $ | 211,584 | $ | 210,321 | $ | 208,105 | $ | 211,785 | |||||||||||||||||||

|

Third Quarter 2025 Results | ||||

| Three Months Ended | Change in Balance | Nine Months Ended | |||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| September 30, | June 30, | September 30, | September 30, 2025 from | September 30, | Change | ||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| 2025 | 2025 | 2024 | June 30, | September 30, | 2025 | 2024 | in | ||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| (Dollars in millions) | Balance | Rate | Balance | Rate | Balance | Rate | 2025 | 2024 | Balance | Rate | Balance | Rate | Balance | ||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| ASSETS | |||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| Interest-bearing deposits at banks | $ | 17,739 | 4.43 | % | $ | 19,698 | 4.47 | % | $ | 25,491 | 5.43 | % | -10 | % | -30 | % | $ | 19,037 | 4.46 | % | $ | 28,467 | 5.48 | % | -33 | % | |||||||||||||||||||||||||||||||||||||||||||||||||||

| Trading account | 95 | 3.48 | 95 | 3.46 | 101 | 3.40 | — | -6 | 96 | 3.45 | 102 | 3.43 | -6 | ||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| Investment securities (1) | 36,559 | 4.13 | 35,335 | 3.81 | 31,023 | 3.70 | 3 | 18 | 35,466 | 3.98 | 29,773 | 3.54 | 19 | ||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| Loans: | |||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| Commercial and industrial | 61,716 | 6.45 | 61,036 | 6.40 | 59,779 | 7.01 | 1 | 3 | 61,271 | 6.41 | 58,256 | 7.01 | 5 | ||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| Real estate - commercial | 24,353 | 6.35 | 25,333 | 6.31 | 29,075 | 6.27 | -4 | -16 | 25,308 | 6.27 | 31,069 | 6.34 | -19 | ||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| Real estate - residential | 24,359 | 4.59 | 23,684 | 4.52 | 22,994 | 4.41 | 3 | 6 | 23,744 | 4.51 | 23,045 | 4.33 | 3 | ||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| Consumer | 26,099 | 6.60 | 25,354 | 6.57 | 22,903 | 6.72 | 3 | 14 | 25,275 | 6.58 | 22,009 | 6.63 | 15 | ||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| Total loans | 136,527 | 6.14 | 135,407 | 6.11 | 134,751 | 6.38 | 1 | 1 | 135,598 | 6.10 | 134,379 | 6.36 | 1 | ||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| Total earning assets | 190,920 | 5.59 | 190,535 | 5.51 | 191,366 | 5.82 | — | — | 190,197 | 5.54 | 192,721 | 5.79 | -1 | ||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| Goodwill | 8,465 | 8,465 | 8,465 | — | — | 8,465 | 8,465 | — | |||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| Core deposit and other intangible assets | 79 | 89 | 113 | -11 | -31 | 86 | 126 | -32 | |||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| Other assets | 11,589 | 11,172 | 9,637 | 4 | 20 | 11,141 | 9,696 | 15 | |||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| Total assets | $ | 211,053 | $ | 210,261 | $ | 209,581 | — | % | 1 | % | $ | 209,889 | $ | 211,008 | -1 | % | |||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| LIABILITIES AND SHAREHOLDERS' EQUITY | |||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| Interest-bearing deposits | |||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| Savings and interest-checking deposits | $ | 104,660 | 2.23 | % | $ | 103,963 | 2.24 | % | $ | 98,295 | 2.65 | % | 1 | % | 6 | % | $ | 103,407 | 2.22 | % | $ | 96,379 | 2.62 | % | 7 | % | |||||||||||||||||||||||||||||||||||||||||||||||||||

| Time deposits | 13,990 | 3.38 | 14,290 | 3.45 | 17,052 | 4.19 | -2 | -18 | 14,166 | 3.46 | 19,138 | 4.34 | -26 | ||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| Total interest-bearing deposits | 118,650 | 2.36 | 118,253 | 2.38 | 115,347 | 2.88 | — | 3 | 117,573 | 2.37 | 115,517 | 2.90 | 2 | ||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| Short-term borrowings | 2,844 | 4.50 | 3,327 | 4.49 | 4,034 | 5.60 | -15 | -30 | 3,013 | 4.50 | 5,071 | 5.53 | -41 | ||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| Long-term borrowings | 12,789 | 5.59 | 10,936 | 5.72 | 11,394 | 5.83 | 17 | 12 | 11,675 | 5.65 | 10,887 | 5.82 | 7 | ||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| Total interest-bearing liabilities | 134,283 | 2.71 | 132,516 | 2.71 | 130,775 | 3.22 | 1 | 3 | 132,261 | 2.71 | 131,475 | 3.24 | 1 | ||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| Noninterest-bearing deposits | 44,056 | 45,153 | 46,158 | -2 | -5 | 44,877 | 47,498 | -6 | |||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| Other liabilities | 4,131 | 3,926 | 3,923 | 5 | 5 | 4,003 | 4,202 | -5 | |||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| Total liabilities | 182,470 | 181,595 | 180,856 | — | 1 | 181,141 | 183,175 | -1 | |||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| Shareholders' equity | 28,583 | 28,666 | 28,725 | — | — | 28,748 | 27,833 | 3 | |||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| Total liabilities and shareholders' equity | $ | 211,053 | $ | 210,261 | $ | 209,581 | — | % | 1 | % | $ | 209,889 | $ | 211,008 | -1 | % | |||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| Net interest spread | 2.88 | 2.80 | 2.60 | 2.83 | 2.55 | ||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| Contribution of interest-free funds | .80 | .82 | 1.02 | .83 | 1.03 | ||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| Net interest margin | 3.68 | % | 3.62 | % | 3.62 | % | 3.66 | % | 3.58 | % | |||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

|

Third Quarter 2025 Results | ||||

| Three Months Ended | Nine Months Ended | ||||||||||||||||||||||

| September 30, | September 30, | ||||||||||||||||||||||

| 2025 | 2024 | 2025 | 2024 | ||||||||||||||||||||

| (Dollars in millions, except per share) | |||||||||||||||||||||||

| Income statement data | |||||||||||||||||||||||

| Net income | |||||||||||||||||||||||

| Net income | $ | 792 | $ | 721 | $ | 2,092 | $ | 1,907 | |||||||||||||||

| Amortization of core deposit and other intangible assets (1) | 6 | 10 | 24 | 32 | |||||||||||||||||||

| Net operating income | $ | 798 | $ | 731 | $ | 2,116 | $ | 1,939 | |||||||||||||||

| Earnings per common share | |||||||||||||||||||||||

| Diluted earnings per common share | $ | 4.82 | $ | 4.02 | $ | 12.34 | $ | 10.78 | |||||||||||||||

| Amortization of core deposit and other intangible assets (1) | .05 | .06 | .15 | .19 | |||||||||||||||||||

| Diluted net operating earnings per common share | $ | 4.87 | $ | 4.08 | $ | 12.49 | $ | 10.97 | |||||||||||||||

| Other expense | |||||||||||||||||||||||

| Other expense | $ | 1,363 | $ | 1,303 | $ | 4,114 | $ | 3,996 | |||||||||||||||

| Amortization of core deposit and other intangible assets | (10) | (12) | (32) | (40) | |||||||||||||||||||

| Noninterest operating expense | $ | 1,353 | $ | 1,291 | $ | 4,082 | $ | 3,956 | |||||||||||||||

| Efficiency ratio | |||||||||||||||||||||||

| Noninterest operating expense (numerator) | $ | 1,353 | $ | 1,291 | $ | 4,082 | $ | 3,956 | |||||||||||||||

| Taxable-equivalent net interest income | $ | 1,773 | $ | 1,739 | $ | 5,202 | $ | 5,162 | |||||||||||||||

| Other income | 752 | 606 | 2,046 | 1,770 | |||||||||||||||||||

| Less: Gain (loss) on bank investment securities | 1 | (2) | 1 | (8) | |||||||||||||||||||

| Denominator | $ | 2,524 | $ | 2,347 | $ | 7,247 | $ | 6,940 | |||||||||||||||

| Efficiency ratio | 53.6 | % | 55.0 | % | 56.3 | % | 57.0 | % | |||||||||||||||

| Balance sheet data | |||||||||||||||||||||||

| Average assets | |||||||||||||||||||||||

| Average assets | $ | 211,053 | $ | 209,581 | $ | 209,889 | $ | 211,008 | |||||||||||||||

| Goodwill | (8,465) | (8,465) | (8,465) | (8,465) | |||||||||||||||||||

| Core deposit and other intangible assets | (79) | (113) | (86) | (126) | |||||||||||||||||||

| Deferred taxes | 24 | 28 | 25 | 30 | |||||||||||||||||||

| Average tangible assets | $ | 202,533 | $ | 201,031 | $ | 201,363 | $ | 202,447 | |||||||||||||||

| Average common equity | |||||||||||||||||||||||

| Average total equity | $ | 28,583 | $ | 28,725 | $ | 28,748 | $ | 27,833 | |||||||||||||||

| Preferred stock | (2,394) | (2,565) | (2,394) | (2,328) | |||||||||||||||||||

| Average common equity | 26,189 | 26,160 | 26,354 | 25,505 | |||||||||||||||||||

| Goodwill | (8,465) | (8,465) | (8,465) | (8,465) | |||||||||||||||||||

| Core deposit and other intangible assets | (79) | (113) | (86) | (126) | |||||||||||||||||||

| Deferred taxes | 24 | 28 | 25 | 30 | |||||||||||||||||||

| Average tangible common equity | $ | 17,669 | $ | 17,610 | $ | 17,828 | $ | 16,944 | |||||||||||||||

| At end of quarter | |||||||||||||||||||||||

| Total assets | |||||||||||||||||||||||

| Total assets | $ | 211,277 | $ | 211,785 | |||||||||||||||||||

| Goodwill | (8,465) | (8,465) | |||||||||||||||||||||

| Core deposit and other intangible assets | (74) | (107) | |||||||||||||||||||||

| Deferred taxes | 23 | 30 | |||||||||||||||||||||

| Total tangible assets | $ | 202,761 | $ | 203,243 | |||||||||||||||||||

| Total common equity | |||||||||||||||||||||||

| Total equity | $ | 28,728 | $ | 28,876 | |||||||||||||||||||

| Preferred stock | (2,394) | (2,394) | |||||||||||||||||||||

| Common equity | 26,334 | 26,482 | |||||||||||||||||||||

| Goodwill | (8,465) | (8,465) | |||||||||||||||||||||

| Core deposit and other intangible assets | (74) | (107) | |||||||||||||||||||||

| Deferred taxes | 23 | 30 | |||||||||||||||||||||

| Total tangible common equity | $ | 17,818 | $ | 17,940 | |||||||||||||||||||

|

Third Quarter 2025 Results | ||||

| Three Months Ended | |||||||||||||||||||||||||||||

| September 30, | June 30, | March 31, | December 31, | September 30, | |||||||||||||||||||||||||

| 2025 | 2025 | 2025 | 2024 | 2024 | |||||||||||||||||||||||||

| (Dollars in millions, except per share) | |||||||||||||||||||||||||||||

| Income statement data | |||||||||||||||||||||||||||||

| Net income | |||||||||||||||||||||||||||||

| Net income | $ | 792 | $ | 716 | $ | 584 | $ | 681 | $ | 721 | |||||||||||||||||||

| Amortization of core deposit and other intangible assets (1) | 6 | 8 | 10 | 10 | 10 | ||||||||||||||||||||||||

| Net operating income | $ | 798 | $ | 724 | $ | 594 | $ | 691 | $ | 731 | |||||||||||||||||||

| Earnings per common share | |||||||||||||||||||||||||||||

| Diluted earnings per common share | $ | 4.82 | $ | 4.24 | $ | 3.32 | $ | 3.86 | $ | 4.02 | |||||||||||||||||||

| Amortization of core deposit and other intangible assets (1) | .05 | .04 | .06 | .06 | .06 | ||||||||||||||||||||||||

| Diluted net operating earnings per common share | $ | 4.87 | $ | 4.28 | $ | 3.38 | $ | 3.92 | $ | 4.08 | |||||||||||||||||||

| Other expense | |||||||||||||||||||||||||||||

| Other expense | $ | 1,363 | $ | 1,336 | $ | 1,415 | $ | 1,363 | $ | 1,303 | |||||||||||||||||||

| Amortization of core deposit and other intangible assets | (10) | (9) | (13) | (13) | (12) | ||||||||||||||||||||||||

| Noninterest operating expense | $ | 1,353 | $ | 1,327 | $ | 1,402 | $ | 1,350 | $ | 1,291 | |||||||||||||||||||

| Efficiency ratio | |||||||||||||||||||||||||||||

| Noninterest operating expense (numerator) | $ | 1,353 | $ | 1,327 | $ | 1,402 | $ | 1,350 | $ | 1,291 | |||||||||||||||||||

| Taxable-equivalent net interest income | $ | 1,773 | $ | 1,722 | $ | 1,707 | $ | 1,740 | $ | 1,739 | |||||||||||||||||||

| Other income | 752 | 683 | 611 | 657 | 606 | ||||||||||||||||||||||||

| Less: Gain (loss) on bank investment securities | 1 | — | — | 18 | (2) | ||||||||||||||||||||||||

| Denominator | $ | 2,524 | $ | 2,405 | $ | 2,318 | $ | 2,379 | $ | 2,347 | |||||||||||||||||||

| Efficiency ratio | 53.6 | % | 55.2 | % | 60.5 | % | 56.8 | % | 55.0 | % | |||||||||||||||||||

| Balance sheet data | |||||||||||||||||||||||||||||

| Average assets | |||||||||||||||||||||||||||||

| Average assets | $ | 211,053 | $ | 210,261 | $ | 208,321 | $ | 211,853 | $ | 209,581 | |||||||||||||||||||

| Goodwill | (8,465) | (8,465) | (8,465) | (8,465) | (8,465) | ||||||||||||||||||||||||

| Core deposit and other intangible assets | (79) | (89) | (92) | (100) | (113) | ||||||||||||||||||||||||

| Deferred taxes | 24 | 26 | 27 | 29 | 28 | ||||||||||||||||||||||||

| Average tangible assets | $ | 202,533 | $ | 201,733 | $ | 199,791 | $ | 203,317 | $ | 201,031 | |||||||||||||||||||

| Average common equity | |||||||||||||||||||||||||||||

| Average total equity | $ | 28,583 | $ | 28,666 | $ | 28,998 | $ | 28,707 | $ | 28,725 | |||||||||||||||||||

| Preferred stock | (2,394) | (2,394) | (2,394) | (2,394) | (2,565) | ||||||||||||||||||||||||

| Average common equity | 26,189 | 26,272 | 26,604 | 26,313 | 26,160 | ||||||||||||||||||||||||

| Goodwill | (8,465) | (8,465) | (8,465) | (8,465) | (8,465) | ||||||||||||||||||||||||

| Core deposit and other intangible assets | (79) | (89) | (92) | (100) | (113) | ||||||||||||||||||||||||

| Deferred taxes | 24 | 26 | 27 | 29 | 28 | ||||||||||||||||||||||||

| Average tangible common equity | $ | 17,669 | $ | 17,744 | $ | 18,074 | $ | 17,777 | $ | 17,610 | |||||||||||||||||||

| At end of quarter | |||||||||||||||||||||||||||||

| Total assets | |||||||||||||||||||||||||||||

| Total assets | $ | 211,277 | $ | 211,584 | $ | 210,321 | $ | 208,105 | $ | 211,785 | |||||||||||||||||||

| Goodwill | (8,465) | (8,465) | (8,465) | (8,465) | (8,465) | ||||||||||||||||||||||||

| Core deposit and other intangible assets | (74) | (84) | (93) | (94) | (107) | ||||||||||||||||||||||||

| Deferred taxes | 23 | 25 | 26 | 28 | 30 | ||||||||||||||||||||||||

| Total tangible assets | $ | 202,761 | $ | 203,060 | $ | 201,789 | $ | 199,574 | $ | 203,243 | |||||||||||||||||||

| Total common equity | |||||||||||||||||||||||||||||

| Total equity | $ | 28,728 | $ | 28,525 | $ | 28,991 | $ | 29,027 | $ | 28,876 | |||||||||||||||||||

| Preferred stock | (2,394) | (2,394) | (2,394) | (2,394) | (2,394) | ||||||||||||||||||||||||

| Common equity | 26,334 | 26,131 | 26,597 | 26,633 | 26,482 | ||||||||||||||||||||||||

| Goodwill | (8,465) | (8,465) | (8,465) | (8,465) | (8,465) | ||||||||||||||||||||||||

| Core deposit and other intangible assets | (74) | (84) | (93) | (94) | (107) | ||||||||||||||||||||||||

| Deferred taxes | 23 | 25 | 26 | 28 | 30 | ||||||||||||||||||||||||

| Total tangible common equity | $ | 17,818 | $ | 17,607 | $ | 18,065 | $ | 18,102 | $ | 17,940 | |||||||||||||||||||