Document

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

4Q23 Key Financial Data |

4Q23 and Full Year Financial Highlights |

|

|

|

|

|

|

|

|

|

|

PROFITABILITY METRICS |

4Q23 |

3Q23 |

4Q22 |

Full Year 2023 |

Full Year 2022 |

|

4Q23

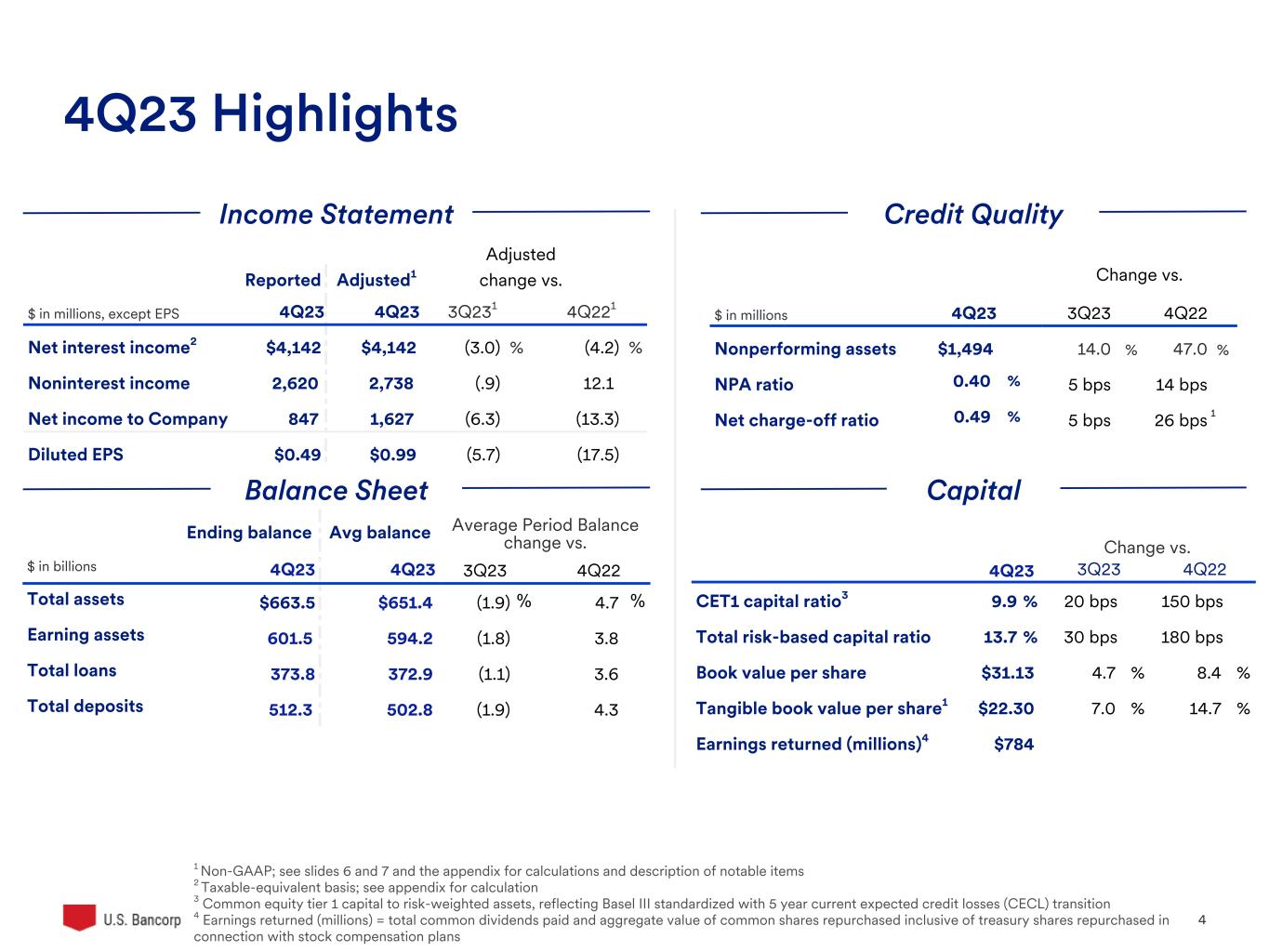

•Net revenue of $6,762 million, as reported, $6,880 million as adjusted for notable items, including $4,142 million of net interest income on a taxable-equivalent basis

•Net income of $1,627 million and diluted earnings per common share of $0.99, as adjusted for notable items

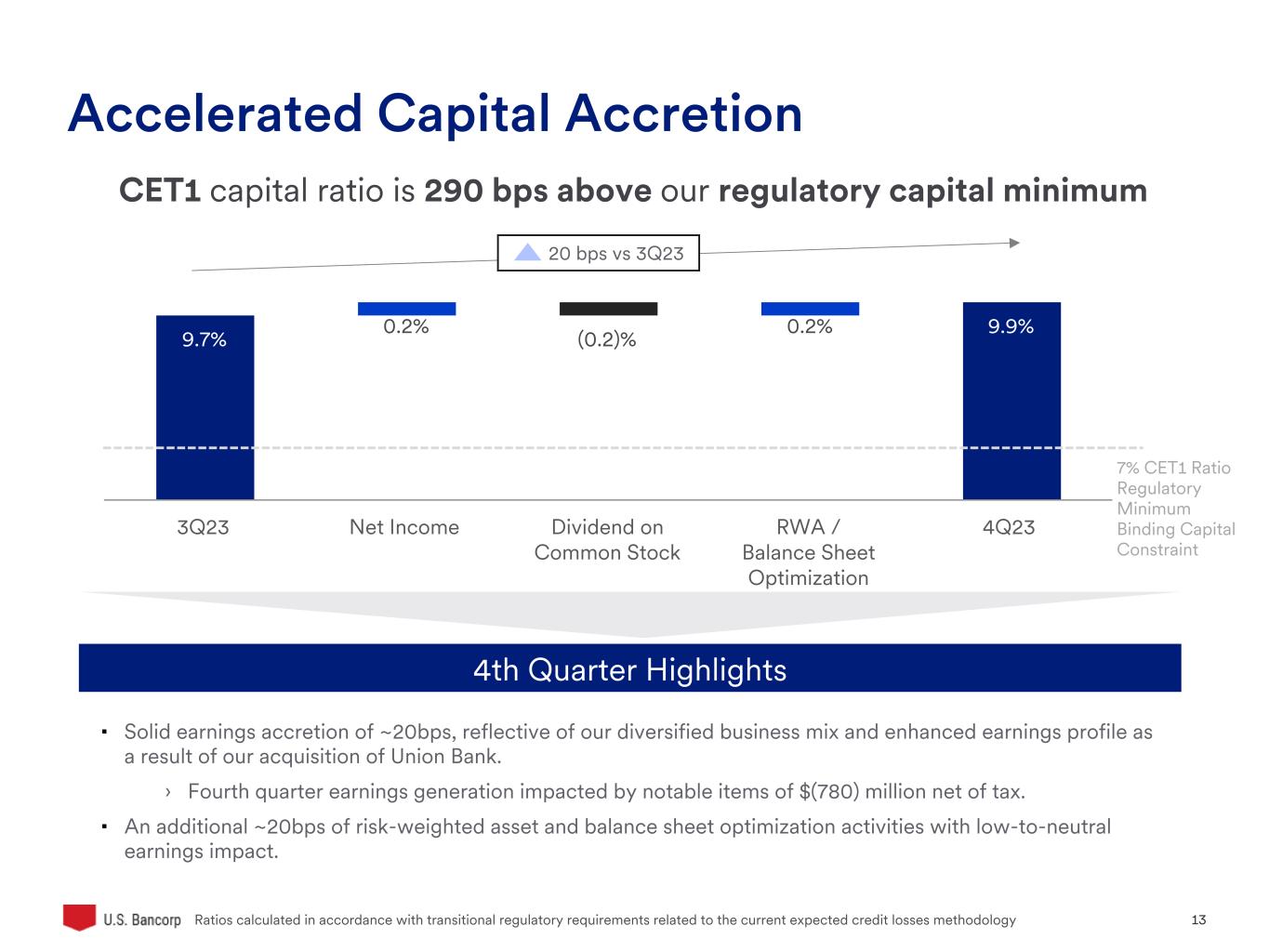

•CET1 capital ratio of 9.9% at December 31, 2023, compared with 9.7% at September 30, 2023

•Notable items, on a pretax basis, consist of $118 million of balance sheet optimization charges, $171 million of merger and integration-related charges related to the acquisition of MUFG Union Bank ("MUB"), $734 million Federal Deposit Insurance Corporation ("FDIC") special assessment and a $110 million charitable contribution to fund obligations under the Community Benefit Plan, partially offset by favorable tax settlements

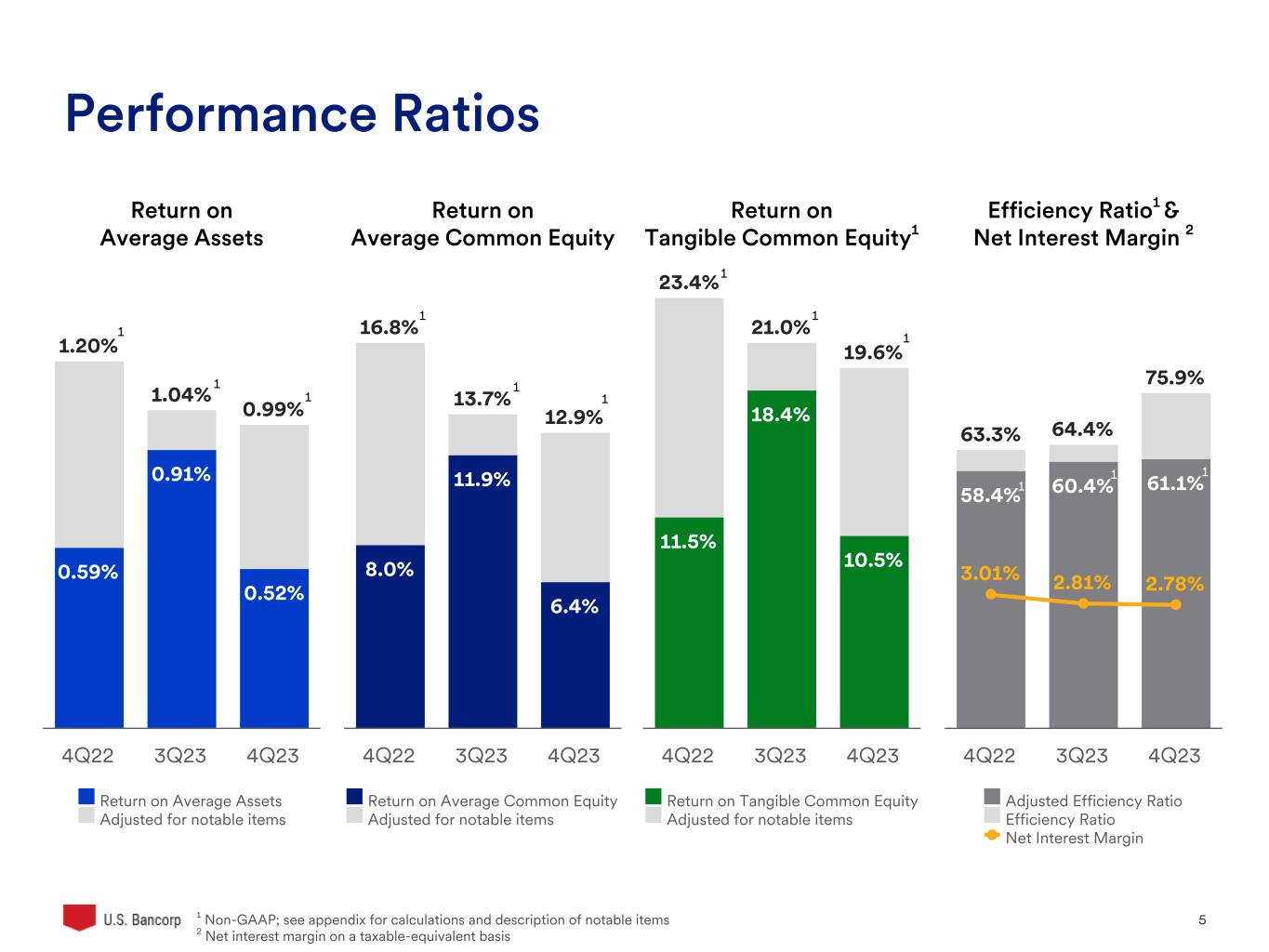

•Return on average assets of 0.99%, return on average common equity of 12.9%, and efficiency ratio of 61.1%, as adjusted for notable items

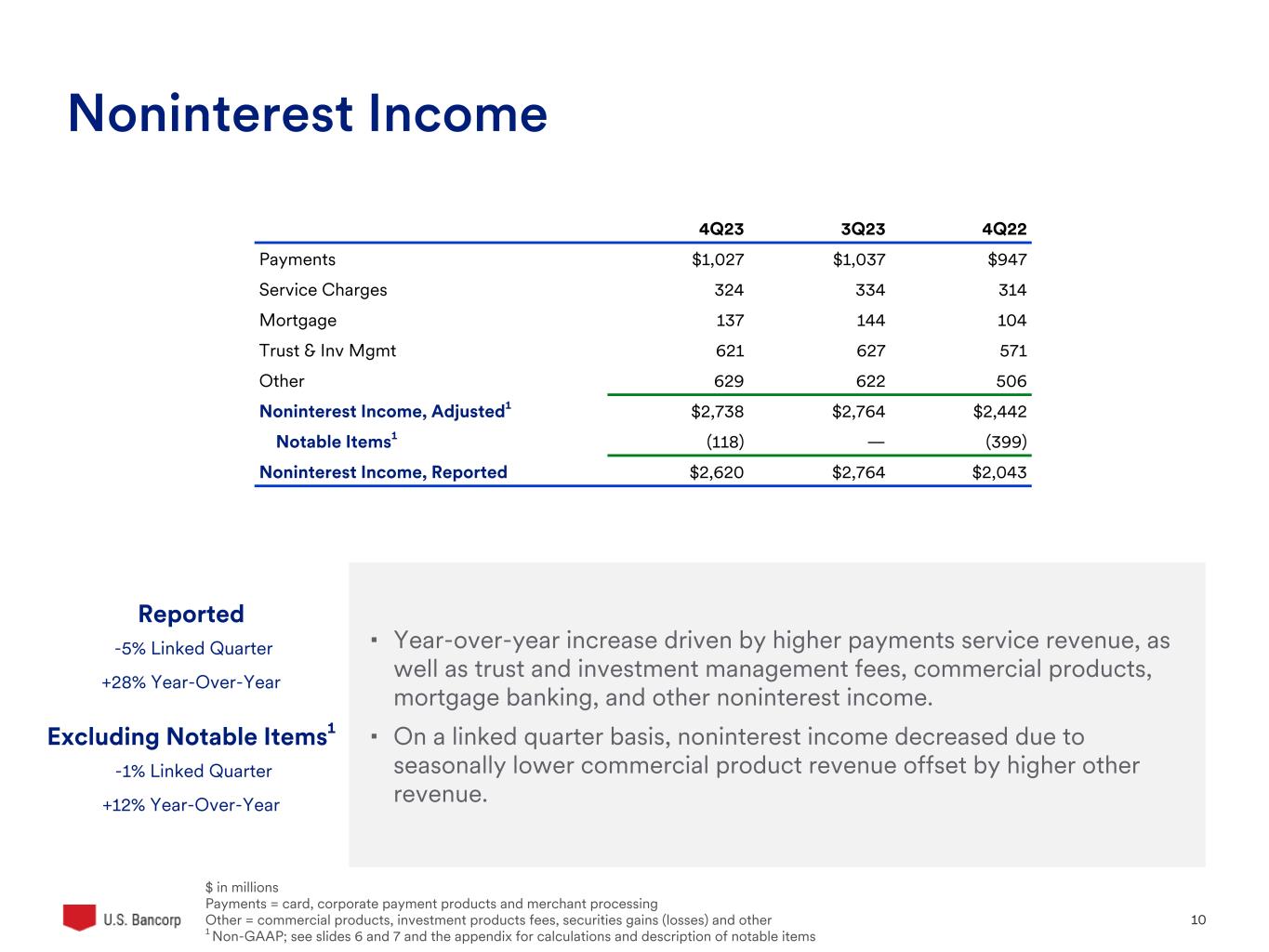

•Noninterest income increased 12.1% year-over-year and decreased 0.9% on a linked quarter basis, as adjusted for notable items

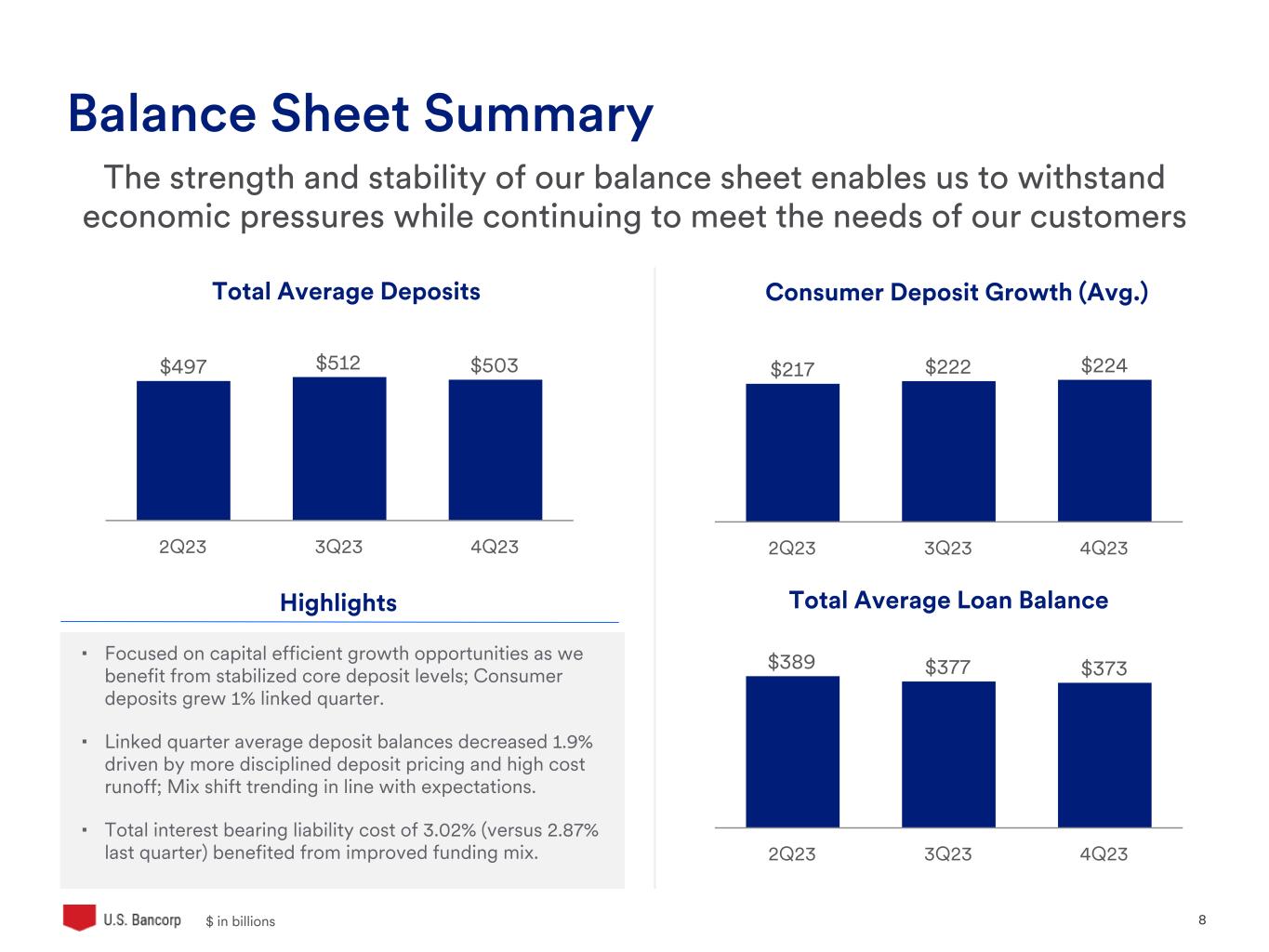

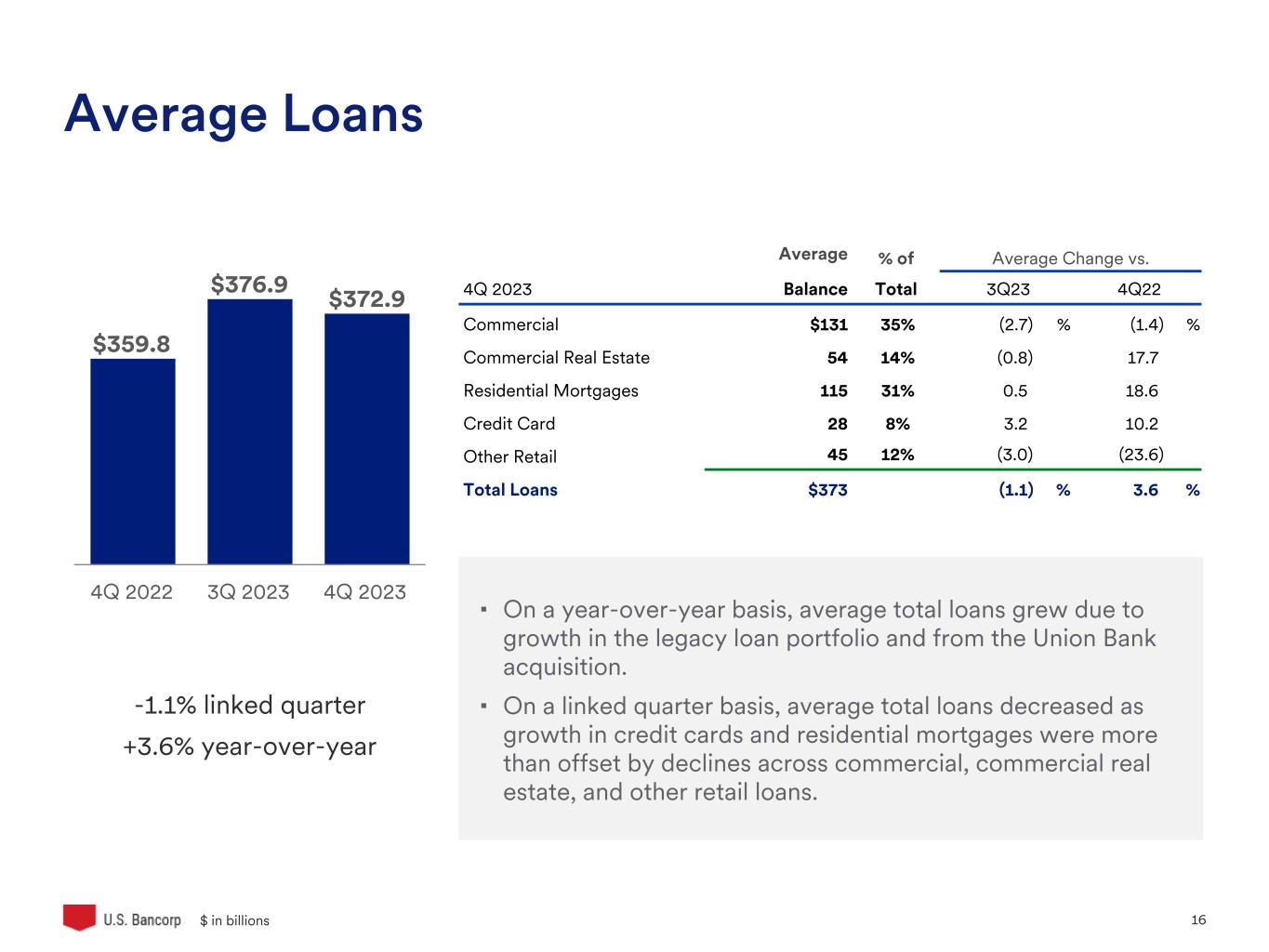

•Average total loan growth of 3.6% year-over-year and a decrease of 1.1% on a linked quarter basis

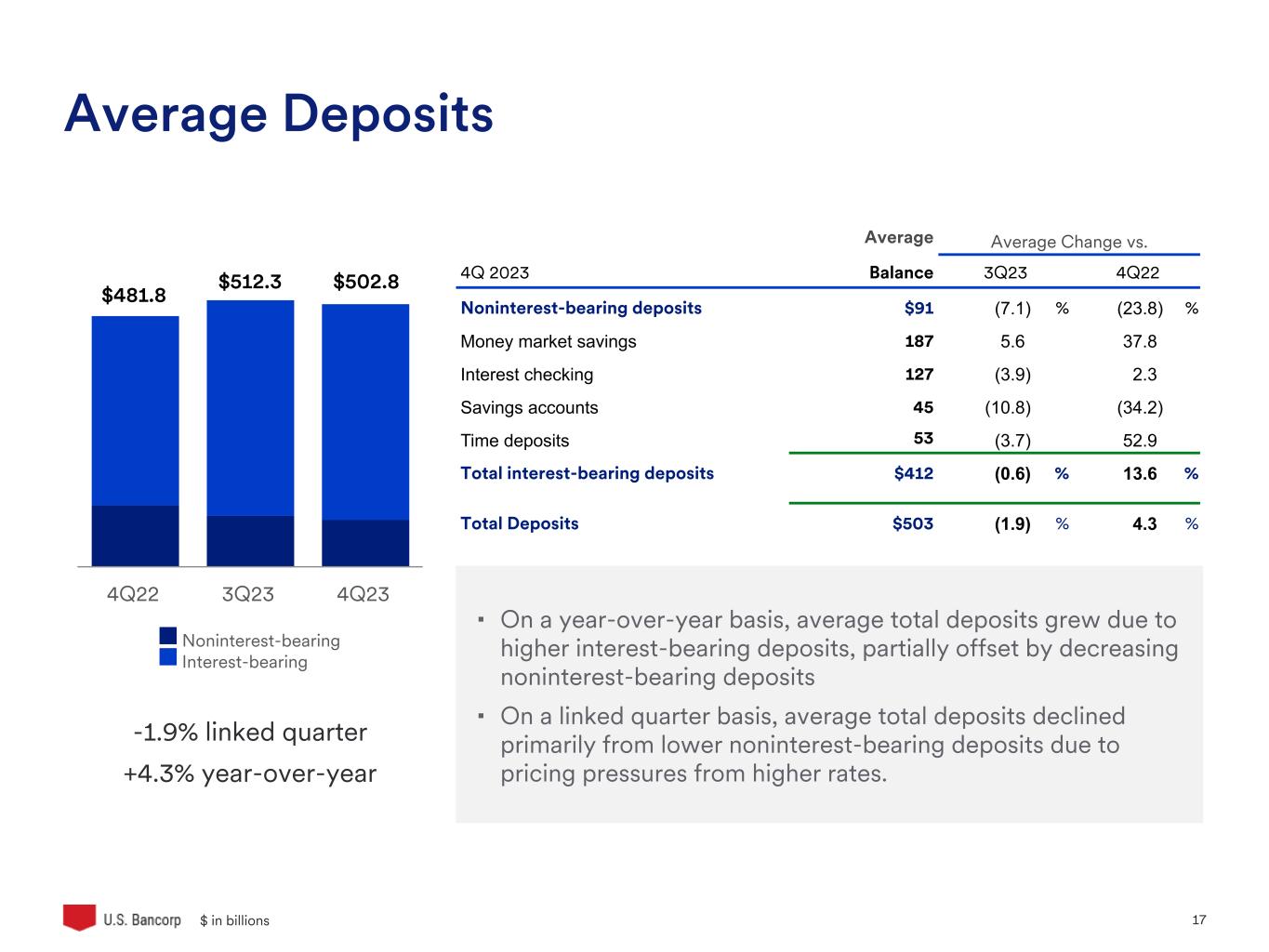

•Average total deposit growth of 4.3% year-over-year and a decrease of 1.9% on a linked quarter basis

Full Year

•Full year record net revenue of $28.1 billion, as reported and $28.3 billion, as adjusted for notable items

•Full year net income of $5,429 million and diluted earnings per common share of $3.27 as reported, $4.31 excluding notable items

|

|

Return on average assets (%) |

.52 |

|

.91 |

|

.59 |

|

.82 |

|

.98 |

|

|

|

Return on average common equity (%) |

6.4 |

|

11.9 |

|

8.0 |

|

10.8 |

|

12.6 |

|

|

|

Return on tangible common equity (%) (a) |

10.5 |

|

18.4 |

|

11.5 |

|

16.9 |

|

17.0 |

|

|

|

Net interest margin (%) |

2.78 |

|

2.81 |

|

3.01 |

|

2.90 |

|

2.72 |

|

|

|

Efficiency ratio (%) (a) |

75.9 |

|

64.4 |

|

63.3 |

|

66.7 |

|

61.4 |

|

|

|

Tangible efficiency ratio (%) (a) |

73.6 |

|

62.1 |

|

62.0 |

|

64.5 |

|

60.5 |

|

|

|

|

|

|

|

|

|

|

|

INCOME STATEMENT (b) |

4Q23 |

3Q23 |

4Q22 |

Full Year 2023 |

Full Year 2022 |

|

|

Net interest income (taxable-equivalent basis) |

$4,142 |

|

$4,268 |

|

$4,325 |

|

$17,527 |

|

$14,846 |

|

|

|

Noninterest income |

$2,620 |

|

$2,764 |

|

$2,043 |

|

$10,617 |

|

$9,456 |

|

|

|

Net income attributable to U.S. Bancorp |

$847 |

|

$1,523 |

|

$925 |

|

$5,429 |

|

$5,825 |

|

|

|

Diluted earnings per common share |

$.49 |

|

$.91 |

|

$.57 |

|

$3.27 |

|

$3.69 |

|

|

|

Dividends declared per common share |

$.49 |

|

$.48 |

|

$.48 |

|

$1.93 |

|

$1.88 |

|

|

|

|

|

|

|

|

|

|

|

BALANCE SHEET (b) |

4Q23 |

3Q23 |

4Q22 |

Full Year 2023 |

Full Year 2022 |

|

|

Average total loans |

$372,856 |

|

$376,877 |

|

$359,811 |

|

$381,275 |

|

$333,573 |

|

|

|

Average total deposits |

$502,782 |

|

$512,291 |

|

$481,834 |

|

$505,663 |

|

$462,384 |

|

|

|

Net charge-off ratio (%) |

.49 |

|

.44 |

|

.64 |

|

.50 |

|

.32 |

|

|

|

Book value per common share (period end) |

$31.13 |

|

$29.74 |

|

$28.71 |

|

|

|

|

|

Basel III standardized CET1 (%) (c) |

9.9 |

|

9.7 |

|

8.4 |

|

|

|

|

|

|

|

|

|

|

|

|

|

(a) See Non-GAAP Financial Measures reconciliation on page 18

(b) Dollars in millions, except per share data

(c) CET1 = Common equity tier 1 capital ratio

|

|

|

|

“In the fourth quarter, we reported diluted earnings per share of $0.99, excluding $(0.50) of notable items. This quarter we generated net revenue of $6.8 billion and increased our tangible book value per share to $22.30, an increase of 7% linked quarter. Full year results showcased solid fee revenue growth, prudent expense management, and the accretion of common equity tier 1 capital of 150 basis points, giving us a CET1 ratio of 9.9% as of December 31, 2023. We also met our goal this year of achieving full run-rate cost synergies of $900 million with the Union Bank acquisition. Looking ahead, we are making good progress on revenue growth opportunities with Union Bank and effectively managing the balance sheet for continued capital-efficient growth as we maintain our disciplined, through-the-cycle approach to credit risk management. In many ways, both fourth quarter and full year results highlighted the benefits of our well-diversified business model, enhanced scale, and operational resiliency, as we remained focused on delivering shareholder value. In what has been a meaningful year for the Company, I want to thank all of our employees for their valuable contributions and dedicated efforts to best serving our clients, communities and shareholders.”

— Andy Cecere, Chairman, President and CEO, U.S. Bancorp

|

|

|

| Business and Other Highlights |

Renewable Energy Initiative

U.S. Bancorp Impact Finance expanded its product offering through the facilitation of renewable energy tax credit transfers within the provisions of new Federal legislation. During the fourth quarter, this innovative business program completed $700 million of transferable renewable energy credits with several Fortune 1000 companies. These transactions, led by our best-in-class environmental finance and syndications teams, established methods in which clients can expand their investment in renewable energy. The transactions included solar, wind and stand-alone battery storage projects.

U.S. Bank Honored for Support of Veterans

We are proud to be ranked No. 3 in the country in the annual Best for Vets: Employers list by Military Times. We were previously named one of America's Best Employers for Veterans by Forbes. We actively recruit veterans through partnerships with Hiring Our Heroes and we have a dedicated careers page that matches military skills with open roles.

|

|

|

|

|

|

|

|

|

|

|

|

|

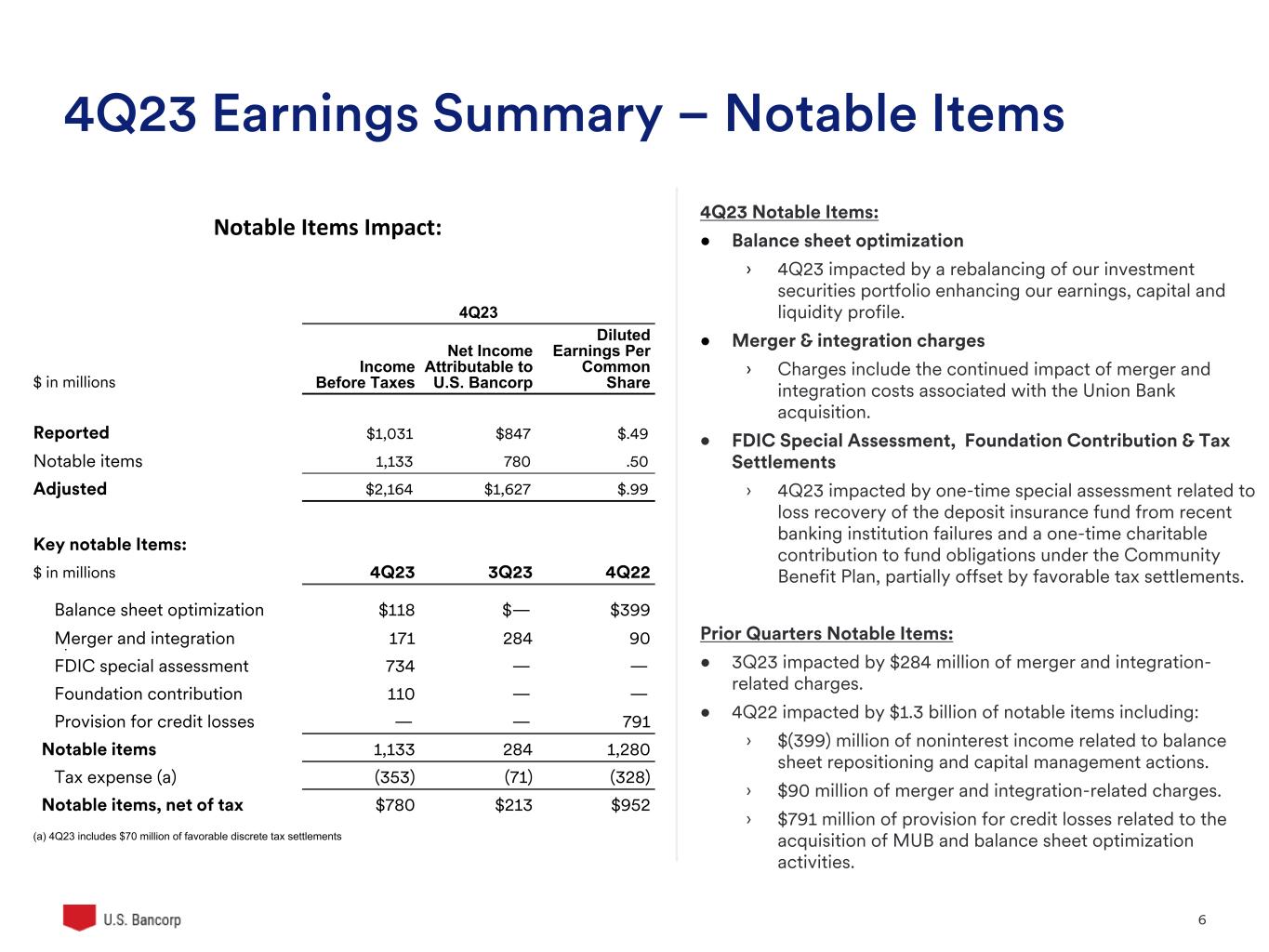

Notable Item Impacts 4Q23

($ in million, except per share data)

|

Income Before Taxes |

Net Income Attributable to U.S. Bancorp |

Diluted

Earnings Per

Common Share |

| Reported |

$1,031 |

|

$847 |

|

$.49 |

|

| Notable items |

1,133 |

|

780 |

|

.50 |

|

| Adjusted |

$2,164 |

|

$1,627 |

|

$.99 |

|

|

|

|

|

| Notable Items |

|

|

|

| ($ in millions) |

4Q23 |

3Q23 |

4Q22 |

| Balance sheet optimization |

$118 |

|

$— |

|

$399 |

|

| Merger and integration charges |

171 |

|

284 |

|

90 |

|

| FDIC special assessment |

734 |

|

— |

|

— |

|

| Foundation contribution |

110 |

|

— |

|

— |

|

| Provision for credit losses |

— |

|

— |

|

791 |

|

| Notable items |

1,133 |

|

284 |

|

1,280 |

|

| Tax expense (a) |

(353) |

|

(71) |

|

(328) |

|

| Notable items, net of tax expense |

$780 |

|

$213 |

|

$952 |

|

| (a) 4Q23 includes $70 million of favorable discrete tax settlements |

|

|

|

Investor contact: George Andersen, 612.303.3620 | Media contact: Jeff Shelman, 612.303.9933 |

|

|

|

|

|

|

|

U.S. Bancorp Fourth Quarter 2023 Results |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

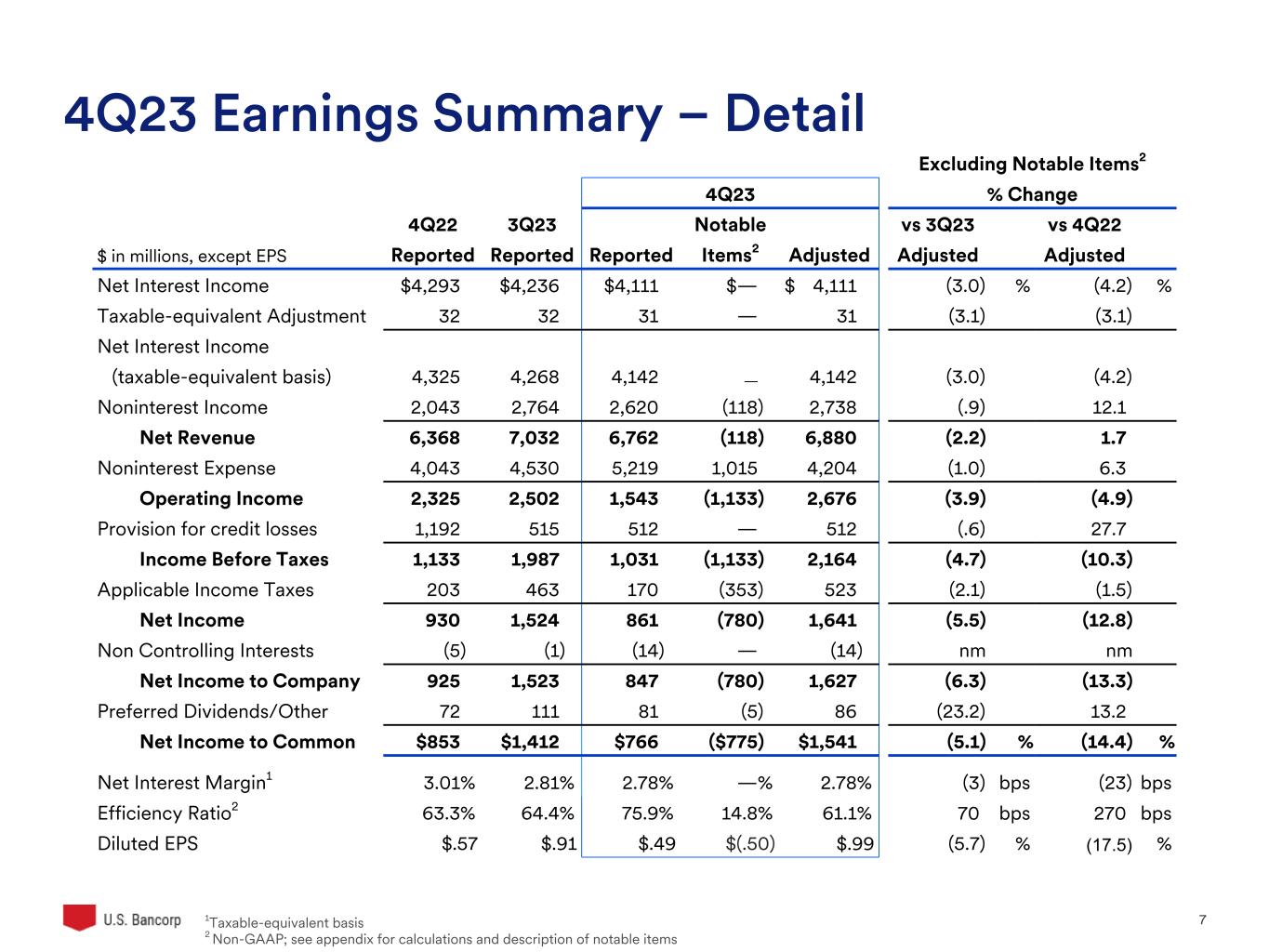

| INCOME STATEMENT HIGHLIGHTS |

| ($ in millions, except per share data) |

|

|

ADJUSTED (a) (b) |

|

|

|

|

Percent Change |

|

|

|

|

|

Percent Change |

|

4Q 2023 |

3Q 2023 |

4Q 2022 |

4Q23 vs 3Q23 |

4Q23 vs 4Q22 |

|

|

4Q 2023 |

3Q 2023 |

4Q 2022 |

4Q23 vs 3Q23 |

4Q23 vs 4Q22 |

|

|

|

|

|

|

|

|

|

|

|

|

|

| Net interest income |

$4,111 |

|

$4,236 |

|

$4,293 |

|

(3.0) |

|

(4.2) |

|

|

|

$4,111 |

|

$4,236 |

|

$4,293 |

|

(3.0) |

|

(4.2) |

|

| Taxable-equivalent adjustment |

31 |

|

32 |

|

32 |

|

(3.1) |

|

(3.1) |

|

|

|

31 |

|

32 |

|

32 |

|

(3.1) |

|

(3.1) |

|

| Net interest income (taxable-equivalent basis) |

4,142 |

|

4,268 |

|

4,325 |

|

(3.0) |

|

(4.2) |

|

|

|

4,142 |

|

4,268 |

|

4,325 |

|

(3.0) |

|

(4.2) |

|

| Noninterest income |

2,620 |

|

2,764 |

|

2,043 |

|

(5.2) |

|

28.2 |

|

|

|

2,738 |

|

2,764 |

|

2,442 |

|

(.9) |

|

12.1 |

|

| Total net revenue |

6,762 |

|

7,032 |

|

6,368 |

|

(3.8) |

|

6.2 |

|

|

|

6,880 |

|

7,032 |

|

6,767 |

|

(2.2) |

|

1.7 |

|

| Noninterest expense |

5,219 |

|

4,530 |

|

4,043 |

|

15.2 |

|

29.1 |

|

|

|

4,204 |

|

4,246 |

|

3,953 |

|

(1.0) |

|

6.3 |

|

| Income before provision and income taxes |

1,543 |

|

2,502 |

|

2,325 |

|

(38.3) |

|

(33.6) |

|

|

|

2,676 |

|

2,786 |

|

2,814 |

|

(3.9) |

|

(4.9) |

|

| Provision for credit losses |

512 |

|

515 |

|

1,192 |

|

(.6) |

|

(57.0) |

|

|

|

512 |

|

515 |

|

401 |

|

(.6) |

|

27.7 |

|

| Income before taxes |

1,031 |

|

1,987 |

|

1,133 |

|

(48.1) |

|

(9.0) |

|

|

|

2,164 |

|

2,271 |

|

2,413 |

|

(4.7) |

|

(10.3) |

|

| Income taxes and taxable-equivalent adjustment |

170 |

|

463 |

|

203 |

|

(63.3) |

|

(16.3) |

|

|

|

523 |

|

534 |

|

531 |

|

(2.1) |

|

(1.5) |

|

| Net income |

861 |

|

1,524 |

|

930 |

|

(43.5) |

|

(7.4) |

|

|

|

1,641 |

|

1,737 |

|

1,882 |

|

(5.5) |

|

(12.8) |

|

| Net (income) loss attributable to noncontrolling interests |

(14) |

|

(1) |

|

(5) |

|

nm |

nm |

|

|

(14) |

|

(1) |

|

(5) |

|

nm |

nm |

| Net income attributable to U.S. Bancorp |

$847 |

|

$1,523 |

|

$925 |

|

(44.4) |

|

(8.4) |

|

|

|

$1,627 |

|

$1,736 |

|

$1,877 |

|

(6.3) |

|

(13.3) |

|

| Net income applicable to U.S. Bancorp common shareholders |

$766 |

|

$1,412 |

|

$853 |

|

(45.8) |

|

(10.2) |

|

|

|

$1,541 |

|

$1,624 |

|

$1,801 |

|

(5.1) |

|

(14.4) |

|

| Diluted earnings per common share |

$.49 |

|

$.91 |

|

$.57 |

|

(46.2) |

|

(14.0) |

|

|

|

$.99 |

|

$1.05 |

|

$1.20 |

|

(5.7) |

|

(17.5) |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

(a)4Q23 excludes $1.1 billion ($780 million net-of-tax, including a $70 million discrete tax benefit) of notable items including: $(118) million of noninterest income related to investment securities balance sheet repositioning and capital management actions, $171 million of merger and integration-related charges, $734 million of FDIC special assessment charges and a $110 million charitable contribution. 3Q23 excludes $284 million ($213 million net-of-tax) of merger and integration-related charges. 4Q22 excludes $1.3 billion ($952 million net-of-tax) of notable items including: $(399) million of noninterest income related to balance sheet repositioning and capital management actions, $90 million of merger and integration-related charges and $791 million of provision for credit losses related to the acquisition of MUB and balance sheet optimization activities.

(b)See Non-GAAP Financial Measures reconciliation on page 18

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| INCOME STATEMENT HIGHLIGHTS |

| ($ in millions, except per share data) |

|

|

|

|

|

ADJUSTED (c) (d) |

|

Full Year 2023 |

Full Year 2022 |

Percent

Change |

|

|

Full Year 2023 |

Full Year 2022 |

Percent

Change |

|

|

|

|

|

|

|

|

|

| Net interest income |

$17,396 |

|

$14,728 |

|

18.1 |

|

|

|

$17,396 |

|

$14,728 |

|

18.1 |

|

| Taxable-equivalent adjustment |

131 |

|

118 |

|

11.0 |

|

|

|

131 |

|

118 |

|

11.0 |

|

| Net interest income (taxable-equivalent basis) |

17,527 |

|

14,846 |

|

18.1 |

|

|

|

17,527 |

|

14,846 |

|

18.1 |

|

| Noninterest income |

10,617 |

|

9,456 |

|

12.3 |

|

|

|

10,757 |

|

9,855 |

|

9.2 |

|

| Total net revenue |

28,144 |

|

24,302 |

|

15.8 |

|

|

|

28,284 |

|

24,701 |

|

14.5 |

|

| Noninterest expense |

18,873 |

|

14,906 |

|

26.6 |

|

|

|

17,020 |

|

14,577 |

|

16.8 |

|

| Income before provision and income taxes |

9,271 |

|

9,396 |

|

(1.3) |

|

|

|

11,264 |

|

10,124 |

|

11.3 |

|

| Provision for credit losses |

2,275 |

|

1,977 |

|

15.1 |

|

|

|

2,032 |

|

1,186 |

|

71.3 |

|

| Income before taxes |

6,996 |

|

7,419 |

|

(5.7) |

|

|

|

9,232 |

|

8,938 |

|

3.3 |

|

| Income taxes and taxable-equivalent adjustment |

1,538 |

|

1,581 |

|

(2.7) |

|

|

|

2,166 |

|

1,962 |

|

10.4 |

|

| Net income |

5,458 |

|

5,838 |

|

(6.5) |

|

|

|

7,066 |

|

6,976 |

|

1.3 |

|

| Net (income) loss attributable to noncontrolling interests |

(29) |

|

(13) |

|

nm |

|

|

(29) |

|

(13) |

|

nm |

| Net income attributable to U.S. Bancorp |

$5,429 |

|

$5,825 |

|

(6.8) |

|

|

|

$7,037 |

|

$6,963 |

|

1.1 |

|

| Net income applicable to U.S. Bancorp common shareholders |

$5,051 |

|

$5,501 |

|

(8.2) |

|

|

|

$6,648 |

|

$6,635 |

|

.2 |

|

| Diluted earnings per common share |

$3.27 |

|

$3.69 |

|

(11.4) |

|

|

|

$4.31 |

|

$4.45 |

|

(3.1) |

|

|

|

|

|

|

|

|

|

|

(c)2023 excludes $2.2 billion ($1.6 billion net-of-tax, including a $70 million discrete tax benefit) of notable items including: $(140) million of noninterest income related to investment securities balance sheet repositioning and capital management actions, $1.0 billion of merger and integration-related charges, $734 million of FDIC special assessment charges, a $110 million charitable contribution and $243 million of provision for credit losses related to balance sheet repositioning and capital management actions. 2022 excludes $1.5 billion ($1.1 billion net-of-tax) of notable items including: $(399) million of noninterest income related to balance sheet repositioning and capital management actions, $329 million of merger and integration-related charges and $791 million of provision for credit losses related to the acquisition of MUB and balance sheet optimization activities.

(d)See Non-GAAP Financial Measures reconciliation on page 18

|

|

|

|

|

|

|

U.S. Bancorp Fourth Quarter 2023 Results |

Net income attributable to U.S. Bancorp was $847 million for the fourth quarter of 2023, which was $78 million lower than the $925 million for the fourth quarter of 2022 and $676 million lower than the $1,523 million for the third quarter of 2023. Diluted earnings per common share was $0.49 in the fourth quarter of 2023, compared with $0.57 in the fourth quarter of 2022 and $0.91 in the third quarter of 2023. The fourth quarter of 2023 included $780 million, or $(0.50) per diluted common share, of notable items, net-of-tax, compared with $952 million or $(0.63) per diluted common share in the fourth quarter of 2022, and $213 million, or $(0.14) per diluted common share in the third quarter of 2023. On an adjusted basis, excluding the impacts of these notable items, net income applicable to common shareholders for the fourth quarter of 2023 was $1,541 million, which was $260 million lower than the fourth quarter of 2022 and $83 million lower than the third quarter of 2023. Adjusted diluted earnings per common share was $0.99 in the fourth quarter of 2023.

The decrease in net income attributable to U.S. Bancorp year-over-year was primarily due to the notable items and an increase in the provision for credit losses. Pretax income, excluding notable items, in the fourth quarter decreased 10.3 percent compared with a year ago. Net interest income decreased 4.2 percent on a year-over-year taxable-equivalent basis, due to the impact of higher interest rates on deposit mix and pricing, partially offset by the impact of the MUB acquisition and higher rates on earning assets. The net interest margin decreased to 2.78 percent in the fourth quarter of 2023 from 3.01 percent in the fourth quarter of 2022 driven by similar factors. Excluding the impact of notable items, noninterest income increased 12.1 percent compared with a year ago driven by the impact of the MUB acquisition and higher fee revenue across all categories. Excluding the impact of notable items, noninterest expense increased 6.3 percent primarily driven by MUB operating expenses, including core deposit intangible amortization expense, and higher compensation expense to support business growth, partially offset by a decrease in other expenses. Excluding the fourth quarter of 2022 notable items, the fourth quarter of 2023 provision for credit losses increased $111 million (27.7 percent) compared with the fourth quarter of 2022 driven by normalizing credit losses and commercial real estate credit quality, partially offset by relative stability in the economic outlook.

Net income attributable to U.S. Bancorp decreased on a linked quarter basis primarily due to the notable items. Pretax income, excluding notable items, decreased 4.7 percent on a linked quarter basis. Net interest income decreased 3.0 percent on a taxable-equivalent basis due to deposit mix and pricing, partially offset by the impact of higher interest rates on earning assets and balance sheet repositioning. The net interest margin decreased to 2.78 percent in the fourth quarter of 2023 from 2.81 percent in the third quarter of 2023 driven by similar factors. Noninterest income excluding notable items decreased 0.9 percent compared with the third quarter of 2023 driven primarily by lower payment services and commercial products revenue, partially offset by higher other noninterest income. Excluding notable items, noninterest expense decreased 1.0 percent due to prudent expense management. The provision for credit losses decreased $3 million (0.6 percent) compared with the third quarter of 2023 primarily due to relative stability in the economic outlook, partially offset by normalizing credit losses and credit card balance growth.

|

|

|

|

|

|

|

U.S. Bancorp Fourth Quarter 2023 Results |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| NET INTEREST INCOME |

| (Taxable-equivalent basis; $ in millions) |

|

|

|

|

|

|

Change |

|

|

|

|

|

|

|

4Q 2023 |

|

3Q 2023 |

|

4Q 2022 |

|

4Q23 vs 3Q23 |

|

4Q23 vs 4Q22 |

|

Full Year 2023 |

|

Full Year 2022 |

|

Change |

|

| Components of net interest income |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Income on earning assets |

$ |

7,795 |

|

|

$ |

7,788 |

|

|

$ |

6,008 |

|

|

$ |

7 |

|

|

$ |

1,787 |

|

|

$ |

30,144 |

|

|

$ |

18,066 |

|

|

$ |

12,078 |

|

|

| Expense on interest-bearing liabilities |

3,653 |

|

|

3,520 |

|

|

1,683 |

|

|

133 |

|

|

1,970 |

|

|

12,617 |

|

|

3,220 |

|

|

9,397 |

|

|

| Net interest income |

$ |

4,142 |

|

|

$ |

4,268 |

|

|

$ |

4,325 |

|

|

$ |

(126) |

|

|

$ |

(183) |

|

|

$ |

17,527 |

|

|

$ |

14,846 |

|

|

$ |

2,681 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Average yields and rates paid |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Earning assets yield |

5.22 |

|

% |

5.12 |

|

% |

4.17 |

|

% |

.10 |

|

% |

1.05 |

|

% |

4.98 |

|

% |

3.31 |

|

% |

1.67 |

|

% |

| Rate paid on interest-bearing liabilities |

3.02 |

|

|

2.87 |

|

|

1.55 |

|

|

.15 |

|

|

1.47 |

|

|

2.65 |

|

|

.80 |

|

|

1.85 |

|

|

| Gross interest margin |

2.20 |

|

% |

2.25 |

|

% |

2.62 |

|

% |

(.05) |

|

% |

(.42) |

|

% |

2.33 |

|

% |

2.51 |

|

% |

(.18) |

|

% |

| Net interest margin |

2.78 |

|

% |

2.81 |

|

% |

3.01 |

|

% |

(.03) |

|

% |

(.23) |

|

% |

2.90 |

|

% |

2.72 |

|

% |

.18 |

|

% |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Average balances |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Investment securities (a) |

$161,885 |

|

|

$163,236 |

|

|

$166,993 |

|

|

$ |

(1,351) |

|

|

$ |

(5,108) |

|

|

$162,757 |

|

|

$169,442 |

|

|

$ |

(6,685) |

|

|

| Loans |

372,856 |

|

|

376,877 |

|

|

359,811 |

|

|

(4,021) |

|

|

13,045 |

|

|

381,275 |

|

|

333,573 |

|

|

47,702 |

|

|

| Interest-bearing deposits with banks |

47,532 |

|

|

53,100 |

|

|

35,565 |

|

|

(5,568) |

|

|

11,967 |

|

|

49,000 |

|

|

31,425 |

|

|

17,575 |

|

|

| Earning assets |

594,244 |

|

|

605,245 |

|

|

572,678 |

|

|

(11,001) |

|

|

21,566 |

|

|

605,199 |

|

|

545,343 |

|

|

59,856 |

|

|

| Interest-bearing liabilities |

479,700 |

|

|

486,143 |

|

|

430,600 |

|

|

(6,443) |

|

|

49,100 |

|

|

476,178 |

|

|

400,844 |

|

|

75,334 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| (a) Excludes unrealized gain (loss) |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

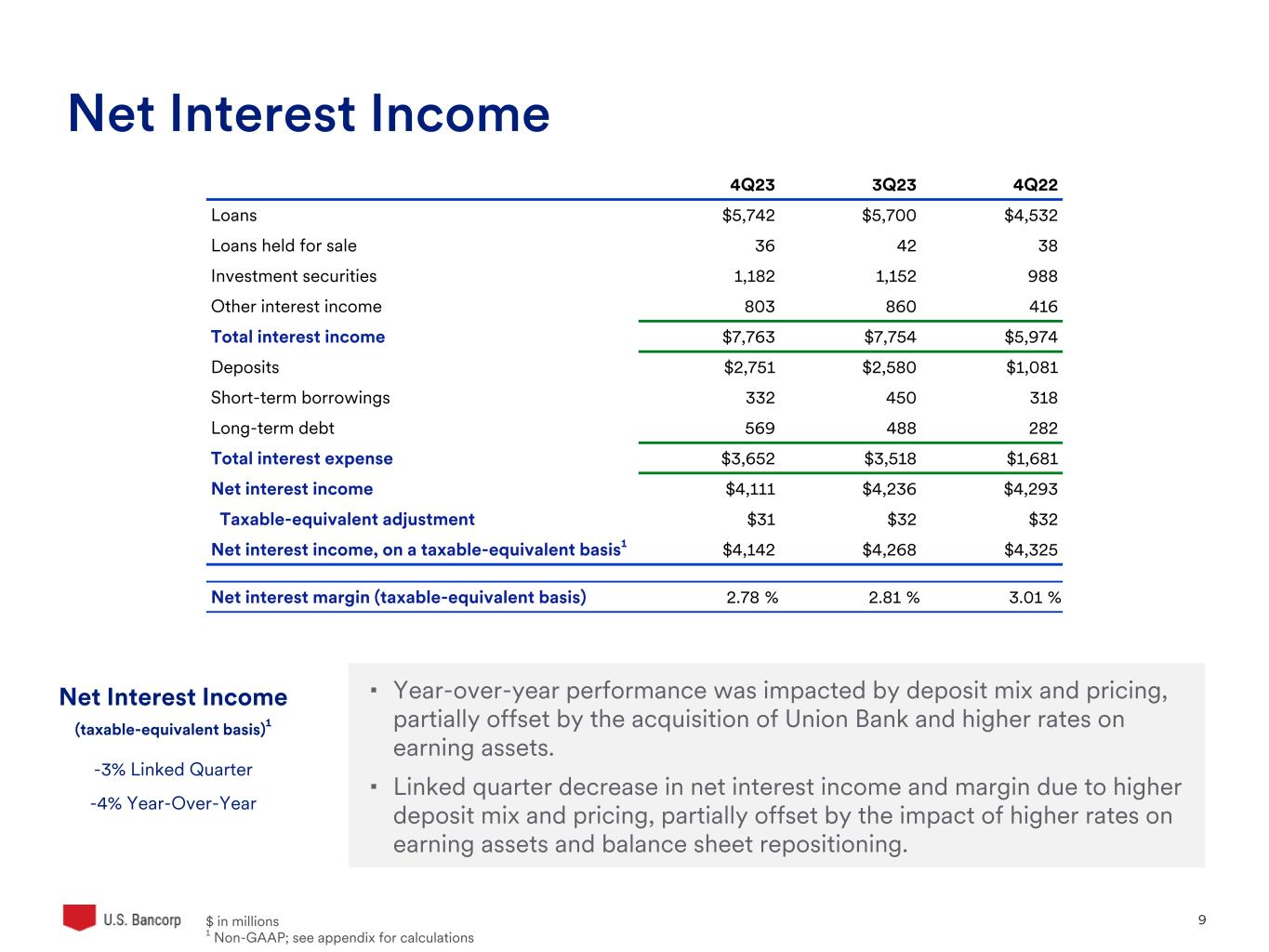

Net interest income on a taxable-equivalent basis in the fourth quarter of 2023 was $4,142 million, a decrease of $183 million (4.2 percent) from the fourth quarter of 2022. The decrease was primarily due to the impact of deposit mix and pricing, partially offset by the acquisition of MUB and higher rates on earning assets. Average earning assets were $21.6 billion (3.8 percent) higher than the fourth quarter of 2022, reflecting increases of $13.0 billion (3.6 percent) in average total loans and $12.0 billion (33.6 percent) in average interest-bearing deposits with banks. Average investment securities decreased $5.1 billion (3.1 percent) reflecting balance sheet repositioning and liquidity management.

Net interest income on a taxable-equivalent basis decreased $126 million (3.0 percent) on a linked quarter basis primarily due to the impact of deposit mix and pricing, partially offset by higher rates on earning assets due to balance sheet repositioning. Average earning assets were $11.0 billion (1.8 percent) lower on a linked quarter basis, reflecting decreases of $4.0 billion (1.1 percent) in average total loans and $5.6 billion (10.5 percent) in average interest-bearing deposits with banks. In addition, average investment securities decreased $1.4 billion (0.8 percent) reflecting balance sheet repositioning and liquidity management.

The net interest margin in the fourth quarter of 2023 was 2.78 percent, compared with 3.01 percent in the fourth quarter of 2022 and 2.81 percent in the third quarter of 2023. The decrease in the net interest margin from the prior year was primarily due to deposit mix and pricing, partially offset by higher rates on earning assets and the acquisition of MUB. The decrease in the net interest margin on a linked quarter basis reflected deposit mix and pricing, partially offset by the impact of higher interest rates on earning assets and balance sheet repositioning.

|

|

|

|

|

|

|

U.S. Bancorp Fourth Quarter 2023 Results |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| AVERAGE LOANS |

| ($ in millions) |

|

|

|

Percent Change |

|

|

|

|

4Q 2023 |

3Q 2023 |

4Q 2022 |

4Q23 vs 3Q23 |

4Q23 vs 4Q22 |

Full Year 2023 |

Full Year 2022 |

Percent Change |

|

|

|

|

|

|

|

|

|

| Commercial |

$126,884 |

|

$130,415 |

|

$128,269 |

|

(2.7) |

|

(1.1) |

|

$130,544 |

|

$118,967 |

|

9.7 |

|

| Lease financing |

4,212 |

|

4,305 |

|

4,649 |

|

(2.2) |

|

(9.4) |

|

4,339 |

|

4,830 |

|

(10.2) |

|

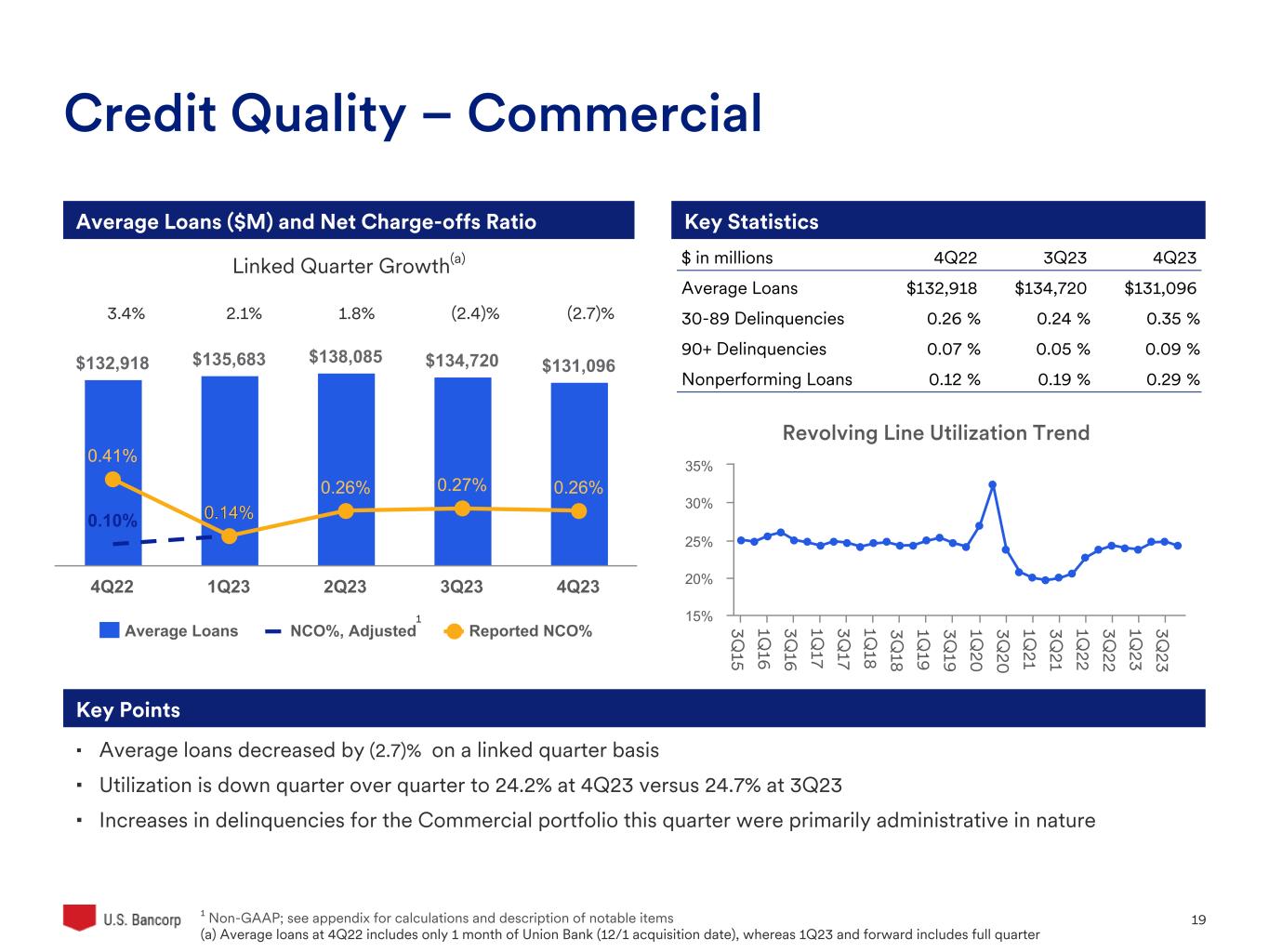

| Total commercial |

131,096 |

|

134,720 |

|

132,918 |

|

(2.7) |

|

(1.4) |

|

134,883 |

|

123,797 |

|

9.0 |

|

|

|

|

|

|

|

|

|

|

| Commercial mortgages |

42,089 |

|

42,665 |

|

34,997 |

|

(1.4) |

|

20.3 |

|

42,894 |

|

30,890 |

|

38.9 |

|

| Construction and development |

11,736 |

|

11,588 |

|

10,725 |

|

1.3 |

|

9.4 |

|

11,752 |

|

10,208 |

|

15.1 |

|

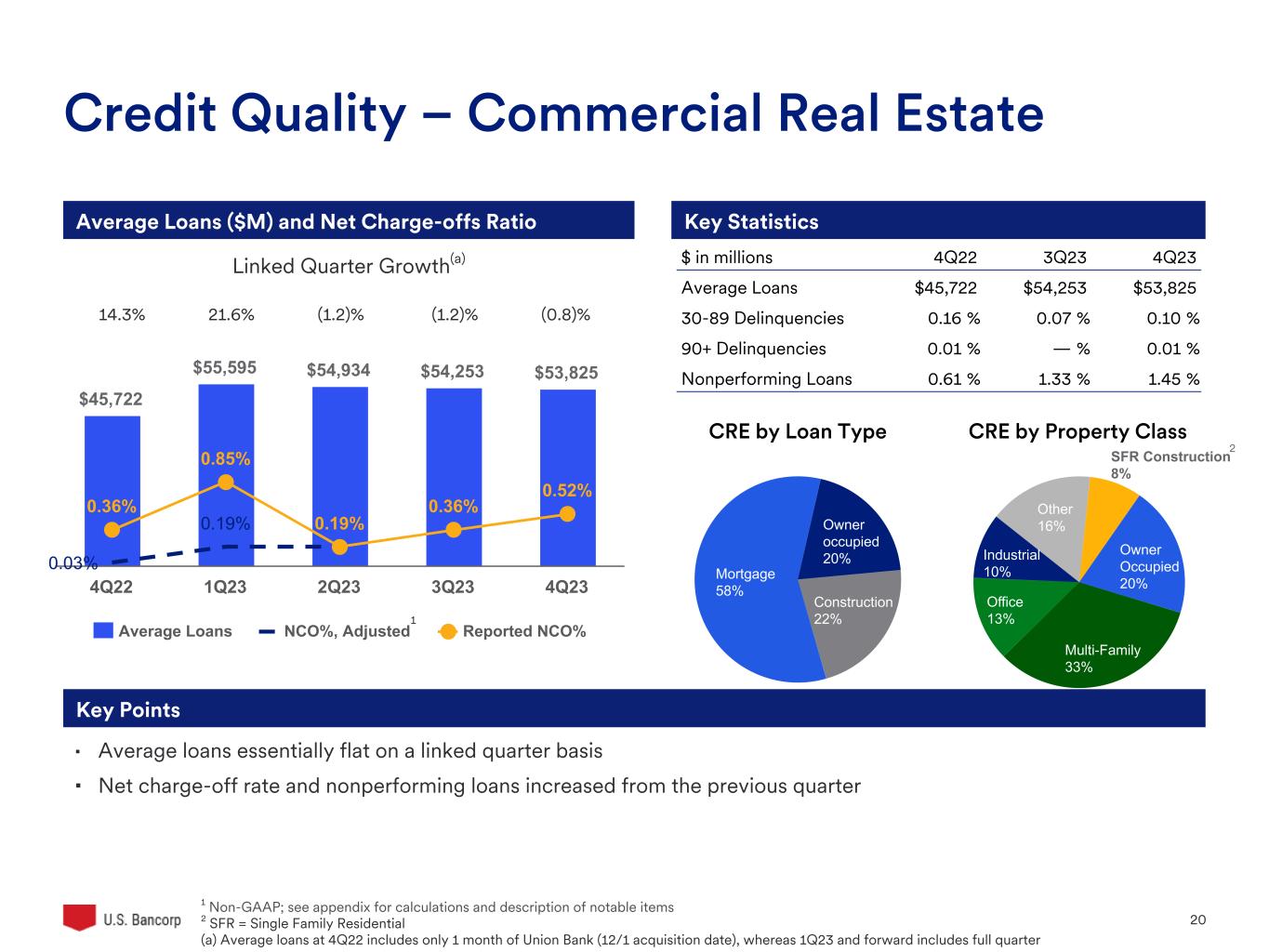

| Total commercial real estate |

53,825 |

|

54,253 |

|

45,722 |

|

(.8) |

|

17.7 |

|

54,646 |

|

41,098 |

|

33.0 |

|

|

|

|

|

|

|

|

|

|

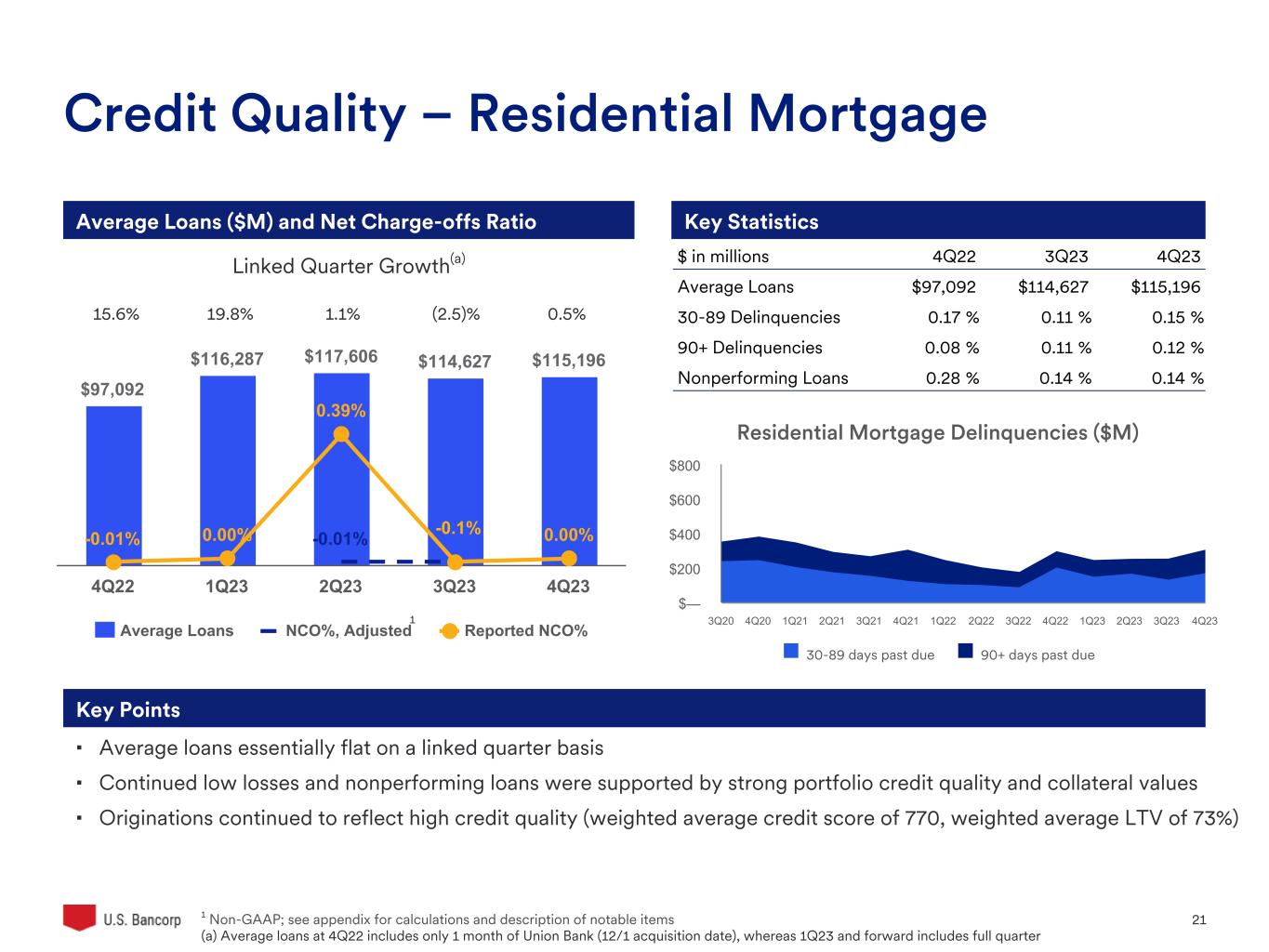

| Residential mortgages |

115,196 |

|

114,627 |

|

97,092 |

|

.5 |

|

18.6 |

|

115,922 |

|

84,749 |

|

36.8 |

|

|

|

|

|

|

|

|

|

|

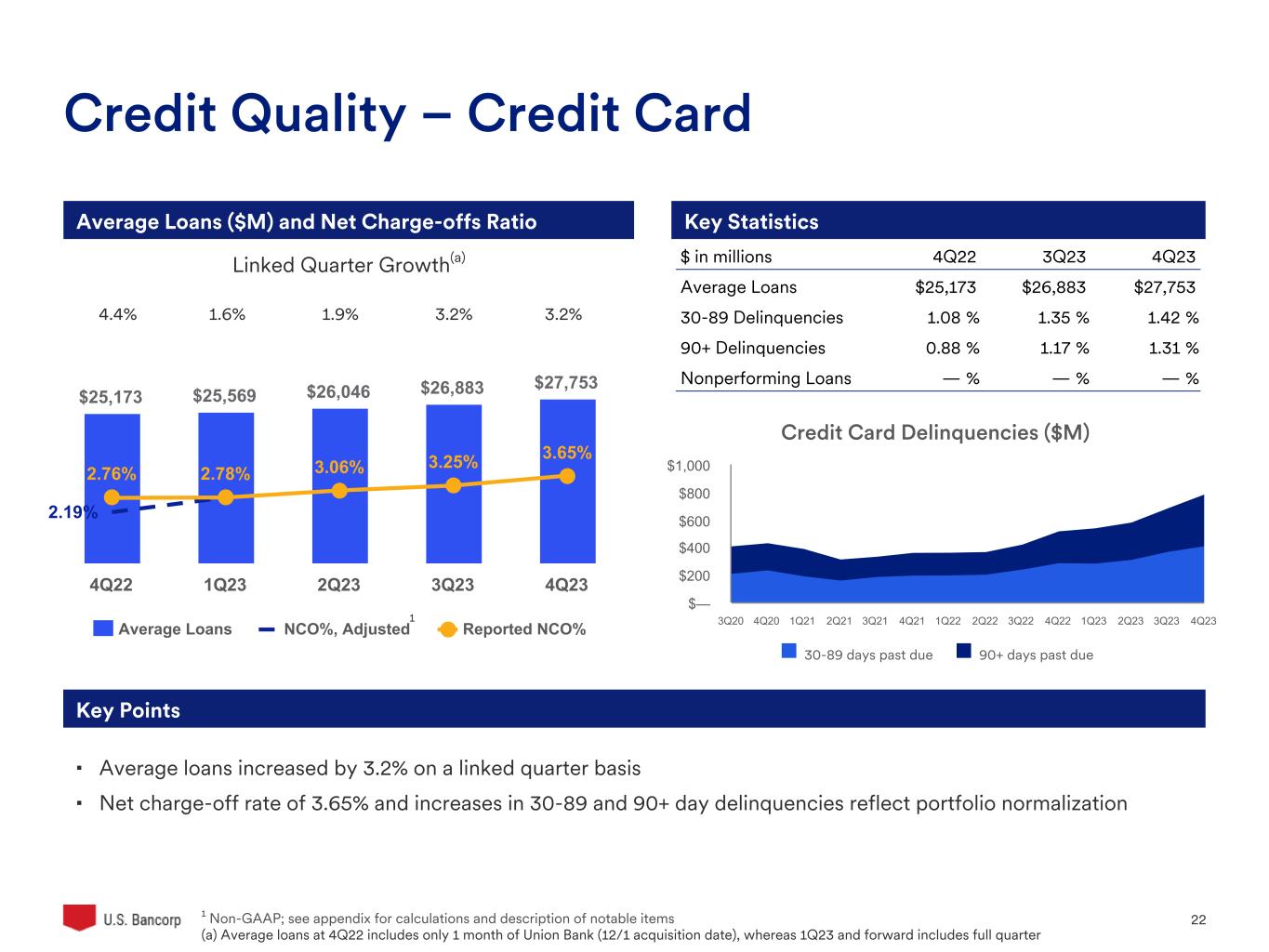

| Credit card |

27,753 |

|

26,883 |

|

25,173 |

|

3.2 |

|

10.2 |

|

26,570 |

|

23,478 |

|

13.2 |

|

|

|

|

|

|

|

|

|

|

| Retail leasing |

4,167 |

|

4,436 |

|

5,774 |

|

(6.1) |

|

(27.8) |

|

4,665 |

|

6,459 |

|

(27.8) |

|

| Home equity and second mortgages |

12,977 |

|

12,809 |

|

11,927 |

|

1.3 |

|

8.8 |

|

12,829 |

|

11,051 |

|

16.1 |

|

| Other |

27,842 |

|

29,149 |

|

41,205 |

|

(4.5) |

|

(32.4) |

|

31,760 |

|

42,941 |

|

(26.0) |

|

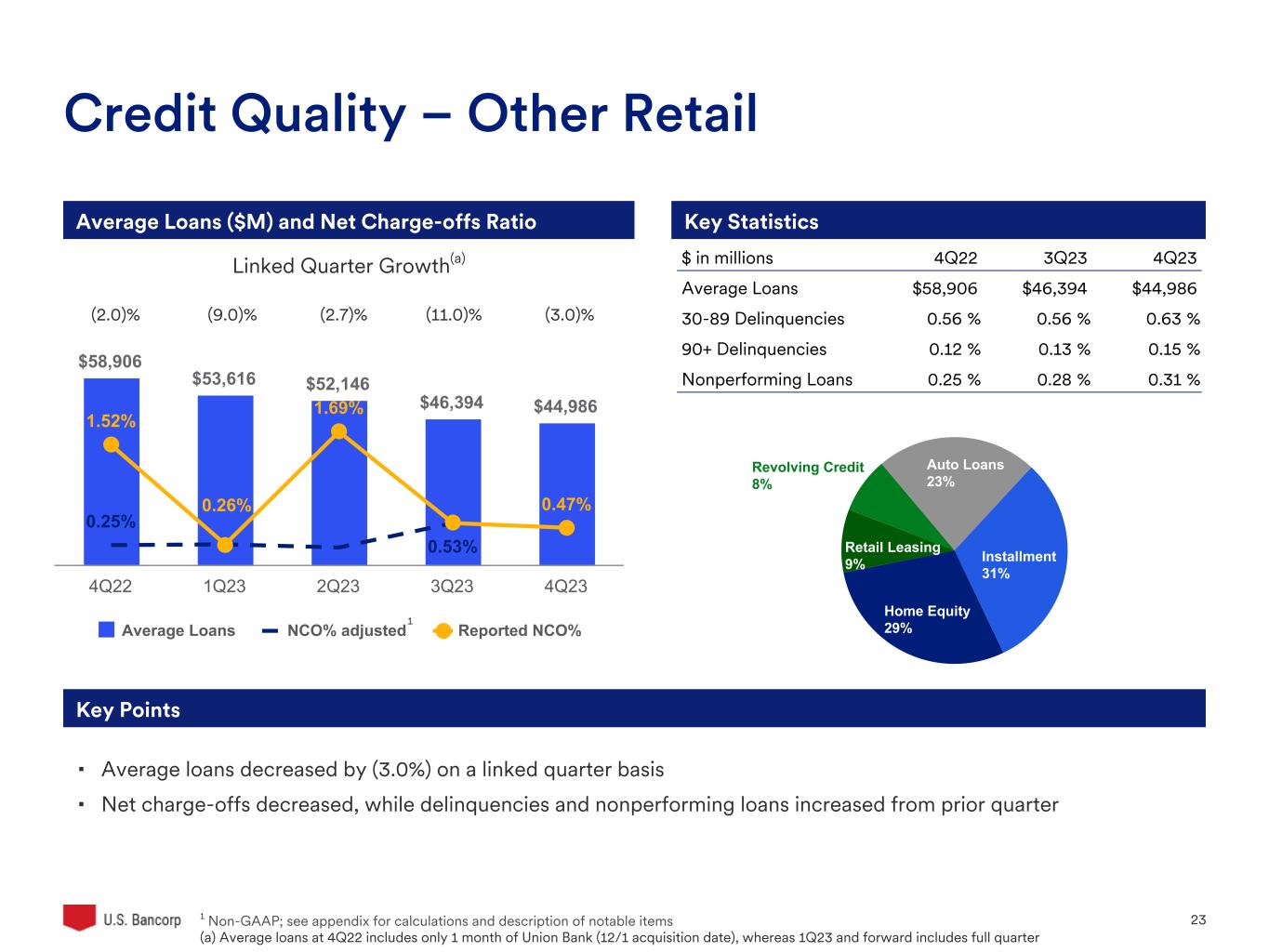

| Total other retail |

44,986 |

|

46,394 |

|

58,906 |

|

(3.0) |

|

(23.6) |

|

49,254 |

|

60,451 |

|

(18.5) |

|

|

|

|

|

|

|

|

|

|

| Total loans |

$372,856 |

|

$376,877 |

|

$359,811 |

|

(1.1) |

|

3.6 |

|

$381,275 |

|

$333,573 |

|

14.3 |

|

|

|

|

|

|

|

|

|

|

Average total loans for the fourth quarter of 2023 were $13.0 billion (3.6 percent) higher than the fourth quarter of 2022. The increase was driven by growth in the Company's legacy loan portfolio as well as from the MUB acquisition, which are primarily reflected in commercial loans, commercial mortgages and residential mortgages. Increases in total commercial real estate loans (17.7 percent), residential mortgages (18.6 percent) and credit card loans (10.2 percent) were partially offset by lower total commercial loans (1.4 percent) and total other retail loans (23.6 percent). The increase in total commercial real estate loans and residential mortgages was driven by the acquisition of MUB. The increase in credit card loans was primarily driven by higher spend volume. The decrease in other retail loans was primarily due to balance sheet repositioning and capital management activities.

Average total loans were $4.0 billion (1.1 percent) lower than the third quarter of 2023. Decreases in total commercial loans (2.7 percent), total commercial real estate loans (0.8 percent) and total other retail loans (3.0 percent) were partially offset by higher residential mortgages (0.5 percent) and credit card loans (3.2 percent).

|

|

|

|

|

|

|

U.S. Bancorp Fourth Quarter 2023 Results |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| AVERAGE DEPOSITS |

| ($ in millions) |

|

|

|

Percent Change |

|

|

|

|

4Q 2023 |

3Q 2023 |

4Q 2022 |

4Q23 vs 3Q23 |

4Q23 vs 4Q22 |

Full Year 2023 |

Full Year 2022 |

Percent Change |

|

|

|

|

|

|

|

|

|

| Noninterest-bearing deposits |

$90,590 |

|

$97,524 |

|

$118,912 |

|

(7.1) |

|

(23.8) |

|

$107,768 |

|

$120,394 |

|

(10.5) |

|

| Interest-bearing savings deposits |

|

|

|

|

|

|

|

|

| Interest checking |

127,445 |

|

132,560 |

|

124,522 |

|

(3.9) |

|

2.3 |

|

129,341 |

|

117,471 |

|

10.1 |

|

| Money market savings |

187,322 |

|

177,340 |

|

135,949 |

|

5.6 |

|

37.8 |

|

166,272 |

|

126,221 |

|

31.7 |

|

| Savings accounts |

44,728 |

|

50,138 |

|

67,991 |

|

(10.8) |

|

(34.2) |

|

55,590 |

|

67,722 |

|

(17.9) |

|

| Total savings deposits |

359,495 |

|

360,038 |

|

328,462 |

|

(.2) |

|

9.4 |

|

351,203 |

|

311,414 |

|

12.8 |

|

| Time deposits |

52,697 |

|

54,729 |

|

34,460 |

|

(3.7) |

|

52.9 |

|

46,692 |

|

30,576 |

|

52.7 |

|

| Total interest-bearing deposits |

412,192 |

|

414,767 |

|

362,922 |

|

(.6) |

|

13.6 |

|

397,895 |

|

341,990 |

|

16.3 |

|

| Total deposits |

$502,782 |

|

$512,291 |

|

$481,834 |

|

(1.9) |

|

4.3 |

|

$505,663 |

|

$462,384 |

|

9.4 |

|

|

|

|

|

|

|

|

|

|

Average total deposits for the fourth quarter of 2023 were $20.9 billion (4.3 percent) higher than the fourth quarter of 2022, including the impact of the MUB acquisition. Average noninterest-bearing deposits decreased $28.3 billion (23.8 percent) driven by decreases within Wealth, Corporate, Commercial and Institutional Banking and Consumer and Business Banking, partially offset by the impact of the acquisition of MUB. Average total savings deposits were $31.0 billion (9.4 percent) higher year-over-year driven by increases within Wealth, Corporate, Commercial and Institutional Banking and Consumer and Business Banking, including the impact of the acquisition of MUB. Average time deposits were $18.2 billion (52.9 percent) higher than the fourth quarter of 2022 due to the acquisition of MUB, partially offset by decreases within Wealth, Corporate, Commercial and Institutional Banking. Changes in time deposits are primarily related to those deposits managed as an alternative to other funding sources, based largely on relative pricing and liquidity characteristics.

Average total deposits decreased $9.5 billion (1.9 percent) from the third quarter of 2023. On a linked quarter basis, average noninterest-bearing deposits decreased $6.9 billion (7.1 percent) driven by pricing pressures from higher interest rates. Average total savings deposits decreased $543 million (0.2 percent) driven by decreases within Wealth, Corporate, Commercial and Institutional Banking partially offset by increases in Consumer and Business Banking. Average time deposits were $2.0 billion (3.7 percent) lower on a linked quarter basis mainly within Wealth, Corporate, Commercial and Institutional Banking, partially offset by increases in Consumer and Business Banking. Changes in time deposits are primarily related to those deposits managed as an alternative to other funding sources, based largely on relative pricing and liquidity characteristics.

|

|

|

|

|

|

|

U.S. Bancorp Fourth Quarter 2023 Results |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| NONINTEREST INCOME |

| ($ in millions) |

|

|

|

Percent Change |

|

|

|

|

4Q 2023 |

3Q 2023 |

4Q 2022 |

4Q23 vs 3Q23 |

4Q23 vs 4Q22 |

Full Year 2023 |

Full Year 2022 |

Percent Change |

|

|

|

|

|

|

|

|

|

| Card revenue |

$436 |

|

$412 |

|

$384 |

|

5.8 |

|

13.5 |

|

$1,630 |

|

$1,512 |

|

7.8 |

|

| Corporate payment products revenue |

182 |

|

198 |

|

178 |

|

(8.1) |

|

2.2 |

|

759 |

|

698 |

|

8.7 |

|

| Merchant processing services |

409 |

|

427 |

|

385 |

|

(4.2) |

|

6.2 |

|

1,659 |

|

1,579 |

|

5.1 |

|

| Trust and investment management fees |

621 |

|

627 |

|

571 |

|

(1.0) |

|

8.8 |

|

2,459 |

|

2,209 |

|

11.3 |

|

| Service charges |

324 |

|

334 |

|

314 |

|

(3.0) |

|

3.2 |

|

1,306 |

|

1,298 |

|

.6 |

|

| Commercial products revenue |

326 |

|

354 |

|

264 |

|

(7.9) |

|

23.5 |

|

1,372 |

|

1,105 |

|

24.2 |

|

| Mortgage banking revenue |

137 |

|

144 |

|

104 |

|

(4.9) |

|

31.7 |

|

570 |

|

527 |

|

8.2 |

|

| Investment products fees |

73 |

|

70 |

|

58 |

|

4.3 |

|

25.9 |

|

279 |

|

235 |

|

18.7 |

|

| Securities gains (losses), net |

2 |

|

— |

|

— |

|

nm |

nm |

(27) |

|

38 |

|

nm |

| Other |

228 |

|

198 |

|

184 |

|

15.2 |

|

23.9 |

|

750 |

|

654 |

|

14.7 |

|

| Total before balance sheet optimization |

2,738 |

|

2,764 |

|

2,442 |

|

(.9) |

|

12.1 |

|

10,757 |

|

9,855 |

|

9.2 |

|

| Balance sheet optimization |

(118) |

|

— |

|

(399) |

|

nm |

70.4 |

|

(140) |

|

(399) |

|

64.9 |

|

| Total noninterest income |

$2,620 |

|

$2,764 |

|

$2,043 |

|

(5.2) |

|

28.2 |

|

$10,617 |

|

$9,456 |

|

12.3 |

|

|

|

|

|

|

|

|

|

|

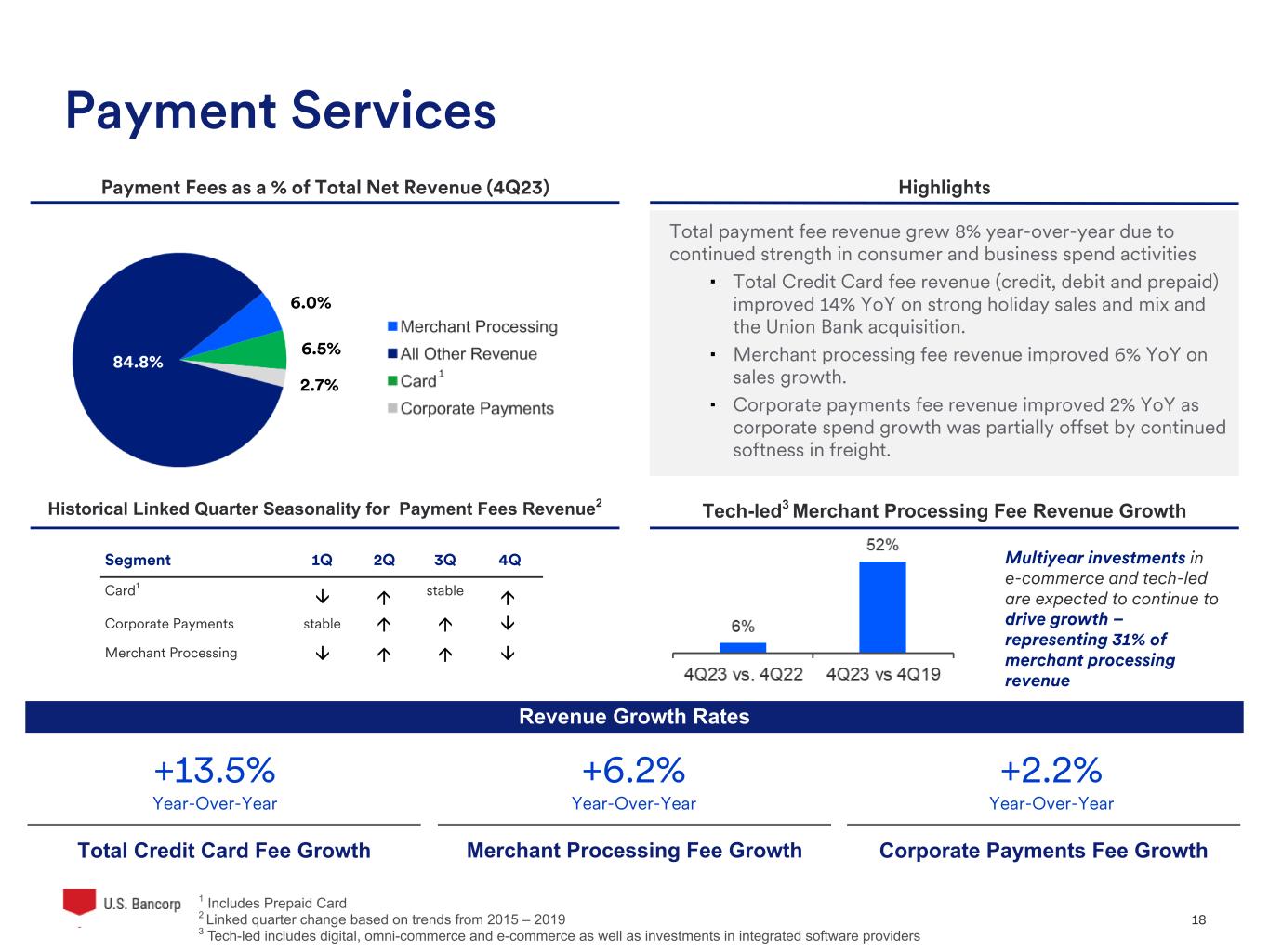

Fourth quarter noninterest income of $2,620 million was $577 million (28.2 percent) higher than the fourth quarter of 2022 driven by higher payment services revenue, trust and investment management fees, commercial products revenue, mortgage banking revenue, and other noninterest income. Excluding the balance sheet optimization impact, noninterest income increased $296 million (12.1 percent). Payment services revenue increased $80 million (8.4 percent) compared with the fourth quarter of 2022. Within payment services revenue, card revenue increased $52 million (13.5 percent) driven by higher spend volume and favorable rates, and merchant processing revenue increased $24 million (6.2 percent) due to higher sales volume. Trust and investment management fees increased $50 million (8.8 percent) driven by the acquisition of MUB and core business growth. Commercial products revenue increased $62 million (23.5 percent) driven by higher trading revenue and corporate bond fees. Mortgage banking revenue increased $33 million (31.7 percent) primarily driven by a favorable change in the valuation of mortgage servicing rights, net of hedging activities. Other revenue, excluding notable items, increased $44 million (23.9 percent) driven by higher tax credit investment activity.

Noninterest income was $144 million (5.2 percent) lower in the fourth quarter of 2023 compared with the third quarter of 2023. Excluding the balance sheet optimization impact in the fourth quarter of 2023, fourth quarter noninterest income decreased $26 million (0.9 percent) compared with the third quarter of 2023. Payment services revenue decreased $10 million (1.0 percent) compared with the third quarter of 2023. Within payment services revenue, card revenue increased $24 million (5.8 percent) driven by seasonally higher spend volume and favorable rates, while corporate payment products revenue decreased $16 million (8.1 percent) and merchant processing revenue decreased $18 million (4.2 percent) both due to lower sales volume. Service charges decreased $10 million (3.0 percent) due to lower deposit service charges. Commercial products revenue decreased $28 million (7.9 percent) due to lower trading and capital markets origination and syndication activity. Other revenue increased $30 million (15.2 percent) driven by seasonally higher tax credit investment activity.

|

|

|

|

|

|

|

U.S. Bancorp Fourth Quarter 2023 Results |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| NONINTEREST EXPENSE |

| ($ in millions) |

|

|

|

Percent Change |

|

|

|

|

4Q 2023 |

3Q 2023 |

4Q 2022 |

4Q23 vs 3Q23 |

4Q23 vs 4Q22 |

Full Year 2023 |

Full Year 2022 |

Percent Change |

|

|

|

|

|

|

|

|

|

| Compensation and employee benefits |

$2,509 |

|

$2,615 |

|

$2,402 |

|

(4.1) |

|

4.5 |

|

$10,416 |

|

$9,157 |

|

13.7 |

|

| Net occupancy and equipment |

316 |

|

313 |

|

290 |

|

1.0 |

|

9.0 |

|

1,266 |

|

1,096 |

|

15.5 |

|

| Professional services |

158 |

|

127 |

|

173 |

|

24.4 |

|

(8.7) |

|

560 |

|

529 |

|

5.9 |

|

| Marketing and business development |

196 |

|

176 |

|

144 |

|

11.4 |

|

36.1 |

|

616 |

|

456 |

|

35.1 |

|

| Technology and communications |

513 |

|

511 |

|

459 |

|

.4 |

|

11.8 |

|

2,049 |

|

1,726 |

|

18.7 |

|

| Other intangibles |

156 |

|

161 |

|

85 |

|

(3.1) |

|

83.5 |

|

636 |

|

215 |

|

nm |

| Other |

356 |

|

343 |

|

400 |

|

3.8 |

|

(11.0) |

|

1,477 |

|

1,398 |

|

5.7 |

|

| Total before notable items |

4,204 |

|

4,246 |

|

3,953 |

|

(1.0) |

|

6.3 |

|

17,020 |

|

14,577 |

|

16.8 |

|

| Notable items |

1,015 |

|

284 |

|

90 |

|

nm |

nm |

1,853 |

|

329 |

|

nm |

| Total noninterest expense |

$5,219 |

|

$4,530 |

|

$4,043 |

|

15.2 |

|

29.1 |

|

$18,873 |

|

$14,906 |

|

26.6 |

|

|

|

|

|

|

|

|

|

|

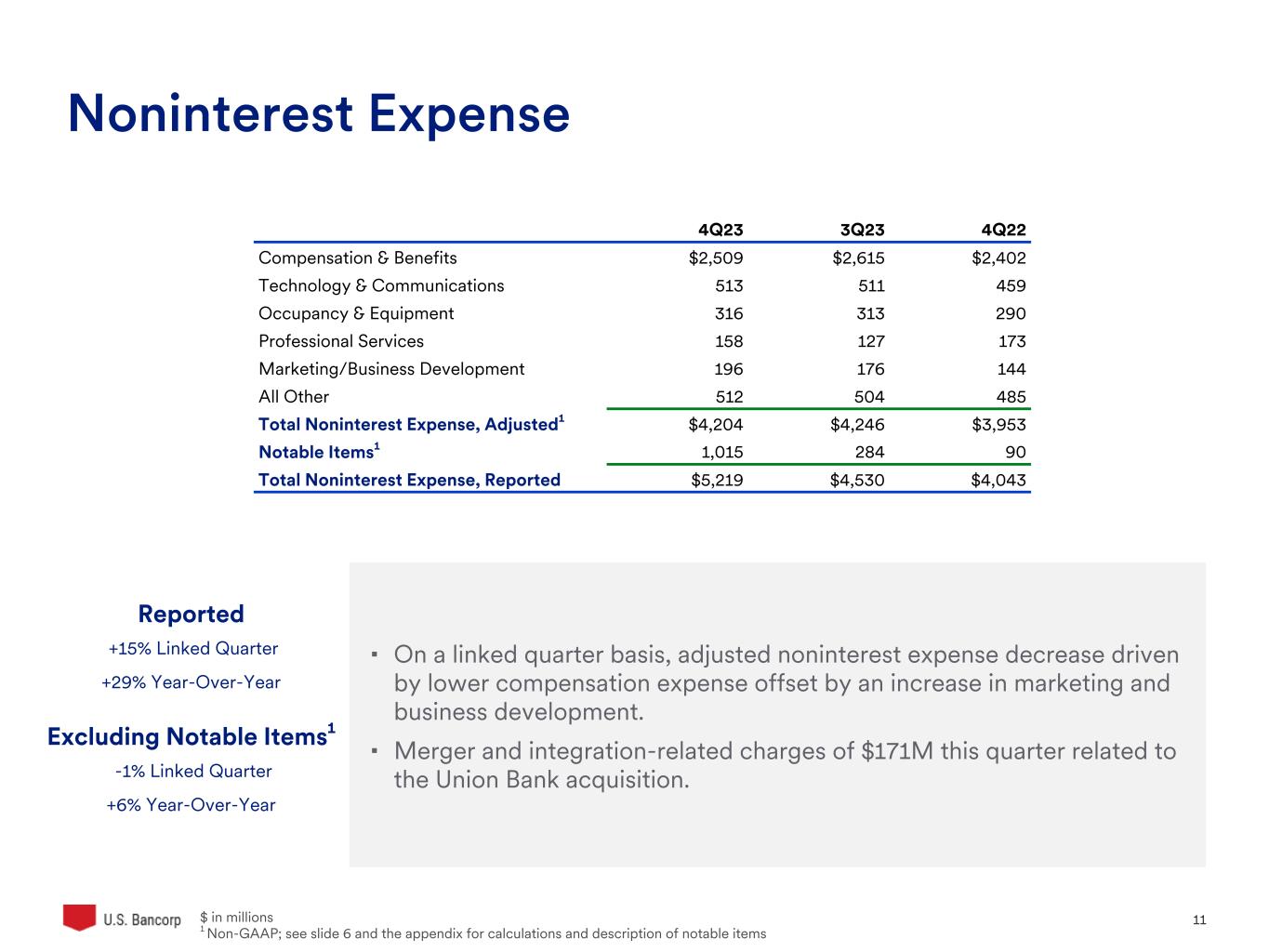

Fourth quarter noninterest expense of $5,219 million was $1,176 million (29.1 percent) higher than the fourth quarter of 2022. Excluding notable items of $1,015 million in the fourth quarter of 2023 and $90 million in the fourth quarter of 2022, fourth quarter noninterest expense increased $251 million (6.3 percent) compared with the fourth quarter of 2022, driven by the impact of MUB operating expenses, core deposit intangible amortization expense, and higher compensation expense. Compensation expense increased $107 million (4.5 percent) compared with the fourth quarter of 2022 primarily due to MUB expense as well as merit and hiring to support business growth. Intangible amortization increased $71 million (83.5 percent) driven by the core deposit intangible created as a result of the MUB acquisition.

Noninterest expense increased $689 million (15.2 percent) on a linked quarter basis. Excluding notable items of $1,015 million in the fourth quarter of 2023 and $284 million in the third quarter of 2023, fourth quarter noninterest expense decreased $42 million (1.0 percent) from the third quarter of 2023 driven by lower compensation expense offset by an increase in marketing and business development. Compensation expense decreased $106 million (4.1 percent) compared with the third quarter of 2023 primarily due to prudent expense management and continued focus on operational efficiency. Marketing and business development expense increased $20 million (11.4 percent) as the Company continues to invest in its national brand and global reach.

Provision for Income Taxes

The provision for income taxes for the fourth quarter of 2023 resulted in a tax rate of 16.5 percent on a taxable-equivalent basis (effective tax rate of 13.9 percent), compared with 17.9 percent on a taxable-equivalent basis (effective tax rate of 15.5 percent) in the fourth quarter of 2022, and a tax rate of 23.3 percent on a taxable-equivalent basis (effective tax rate of 22.0 percent) in the third quarter of 2023. Excluding the impact of notable items, the fourth quarter 2023 tax rate was 24.2 percent on a taxable-equivalent basis, compared with 22.0 percent on a taxable-equivalent basis in the fourth quarter of 2022, and 23.5 percent on a taxable-equivalent basis in the third quarter of 2023. The fourth quarter of 2023 included $70 million of favorable tax settlements.

|

|

|

|

|

|

|

U.S. Bancorp Fourth Quarter 2023 Results |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| ALLOWANCE FOR CREDIT LOSSES |

| ($ in millions) |

4Q 2023 |

% (a) |

3Q 2023 |

% (a) |

2Q 2023 |

% (a) |

1Q 2023 |

% (a) |

4Q 2022 |

% (a) |

| Balance, beginning of period |

$7,790 |

|

|

$7,695 |

|

|

$7,523 |

|

|

$7,404 |

|

|

$6,455 |

|

|

| Change in accounting principle (b) |

— |

|

|

— |

|

|

— |

|

|

(62) |

|

|

— |

|

|

| Allowance for acquired credit losses (c) |

— |

|

|

— |

|

|

— |

|

|

127 |

|

|

336 |

|

|

| Net charge-offs |

|

|

|

|

|

|

|

|

|

|

| Total excluding acquisition and optimization impacts |

463 |

|

.49 |

|

420 |

|

.44 |

|

340 |

|

.35 |

|

282 |

|

.30 |

|

210 |

|

.23 |

|

| Balance sheet optimization impact |

— |

|

|

— |

|

|

309 |

|

|

— |

|

|

189 |

|

|

| Acquisition impact |

— |

|

|

— |

|

|

— |

|

|

91 |

|

|

179 |

|

|

| Total net charge-offs |

463 |

|

.49 |

|

420 |

|

.44 |

|

649 |

|

.67 |

|

373 |

|

.39 |

|

578 |

|

.64 |

|

| Provision for credit losses |

|

|

|

|

|

|

|

|

|

|

| Total excluding acquisition and optimization impacts |

512 |

|

|

515 |

|

|

578 |

|

|

427 |

|

|

401 |

|

|

| Balance sheet optimization impact |

— |

|

|

— |

|

|

243 |

|

|

— |

|

|

129 |

|

|

| Acquisition impact of initial provision |

— |

|

|

— |

|

|

— |

|

|

— |

|

|

662 |

|

|

| Total provision for credit losses |

512 |

|

|

515 |

|

|

821 |

|

|

427 |

|

|

1,192 |

|

|

| Other changes |

— |

|

|

— |

|

|

— |

|

|

— |

|

|

(1) |

|

|

| Balance, end of period |

$7,839 |

|

|

$7,790 |

|

|

$7,695 |

|

|

$7,523 |

|

|

$7,404 |

|

|

| Components |

|

|

|

|

|

|

|

|

|

|

| Allowance for loan losses |

$7,379 |

|

|

$7,218 |

|

|

$7,164 |

|

|

$7,020 |

|

|

$6,936 |

|

|

| Liability for unfunded |

|

|

|

|

|

|

|

|

|

|

| credit commitments |

460 |

|

|

572 |

|

|

531 |

|

|

503 |

|

|

468 |

|

|

| Total allowance for credit losses |

$7,839 |

|

|

$7,790 |

|

|

$7,695 |

|

|

$7,523 |

|

|

$7,404 |

|

|

| Allowance for credit losses as a percentage of |

|

|

|

|

|

|

|

|

|

|

| Period-end loans (%) |

2.10 |

|

|

2.08 |

|

|

2.03 |

|

|

1.94 |

|

|

1.91 |

|

|

| Nonperforming loans (%) |

541 |

|

|

615 |

|

|

739 |

|

|

660 |

|

|

762 |

|

|

| Nonperforming assets (%) |

525 |

|

|

595 |

|

|

709 |

|

|

637 |

|

|

729 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

(a)Annualized and calculated on average loan balances

(b)Effective January 1, 2023, the Company adopted accounting guidance which removed the separate recognition and measurement of troubled debt restructurings

(c)Allowance for purchased credit deteriorated and charged-off loans acquired from MUB

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| SUMMARY OF NET CHARGE-OFFS |

| ($ in millions) |

4Q 2023 |

% (a) |

3Q 2023 |

% (a) |

2Q 2023 |

% (a) |

1Q 2023 |

% (a) |

4Q 2022 |

% (a) |

|

|

|

|

|

|

|

|

|

|

|

| Net charge-offs |

|

|

|

|

|

|

|

|

|

|

| Commercial |

$78 |

|

.24 |

|

$86 |

|

.26 |

|

$87 |

|

.26 |

|

$42 |

|

.13 |

|

$133 |

|

.41 |

|

| Lease financing |

7 |

|

.66 |

|

6 |

|

.55 |

|

3 |

|

.27 |

|

5 |

|

.46 |

|

5 |

|

.43 |

|

| Total commercial |

85 |

|

.26 |

|

92 |

|

.27 |

|

90 |

|

.26 |

|

47 |

|

.14 |

|

138 |

|

.41 |

|

| Commercial mortgages |

75 |

|

.71 |

|

49 |

|

.46 |

|

26 |

|

.24 |

|

115 |

|

1.07 |

|

25 |

|

.28 |

|

| Construction and development |

(4) |

|

(.14) |

|

— |

|

— |

|

— |

|

— |

|

2 |

|

.07 |

|

17 |

|

.63 |

|

| Total commercial real estate |

71 |

|

.52 |

|

49 |

|

.36 |

|

26 |

|

.19 |

|

117 |

|

.85 |

|

42 |

|

.36 |

|

| Residential mortgages |

(1) |

|

— |

|

(3) |

|

(.01) |

|

114 |

|

.39 |

|

(1) |

|

— |

|

(3) |

|

(.01) |

|

| Credit card |

255 |

|

3.65 |

|

220 |

|

3.25 |

|

199 |

|

3.06 |

|

175 |

|

2.78 |

|

175 |

|

2.76 |

|

| Retail leasing |

2 |

|

.19 |

|

2 |

|

.18 |

|

1 |

|

.08 |

|

1 |

|

.08 |

|

1 |

|

.07 |

|

| Home equity and second mortgages |

(1) |

|

(.03) |

|

1 |

|

.03 |

|

(1) |

|

(.03) |

|

(1) |

|

(.03) |

|

— |

|

— |

|

| Other |

52 |

|

.74 |

|

59 |

|

.80 |

|

220 |

|

2.55 |

|

35 |

|

.40 |

|

225 |

|

2.17 |

|

| Total other retail |

53 |

|

.47 |

|

62 |

|

.53 |

|

220 |

|

1.69 |

|

35 |

|

.26 |

|

226 |

|

1.52 |

|

| Total net charge-offs |

$463 |

|

.49 |

|

$420 |

|

.44 |

|

$649 |

|

.67 |

|

$373 |

|

.39 |

|

$578 |

|

.64 |

|

|

|

|

|

|

|

|

|

|

|

|

| Gross charge-offs |

$559 |

|

|

$508 |

|

|

$755 |

|

|

$469 |

|

|

$669 |

|

|

| Gross recoveries |

$96 |

|

|

$88 |

|

|

$106 |

|

|

$96 |

|

|

$91 |

|

|

| (a) Annualized and calculated on average loan balances |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

U.S. Bancorp Fourth Quarter 2023 Results |

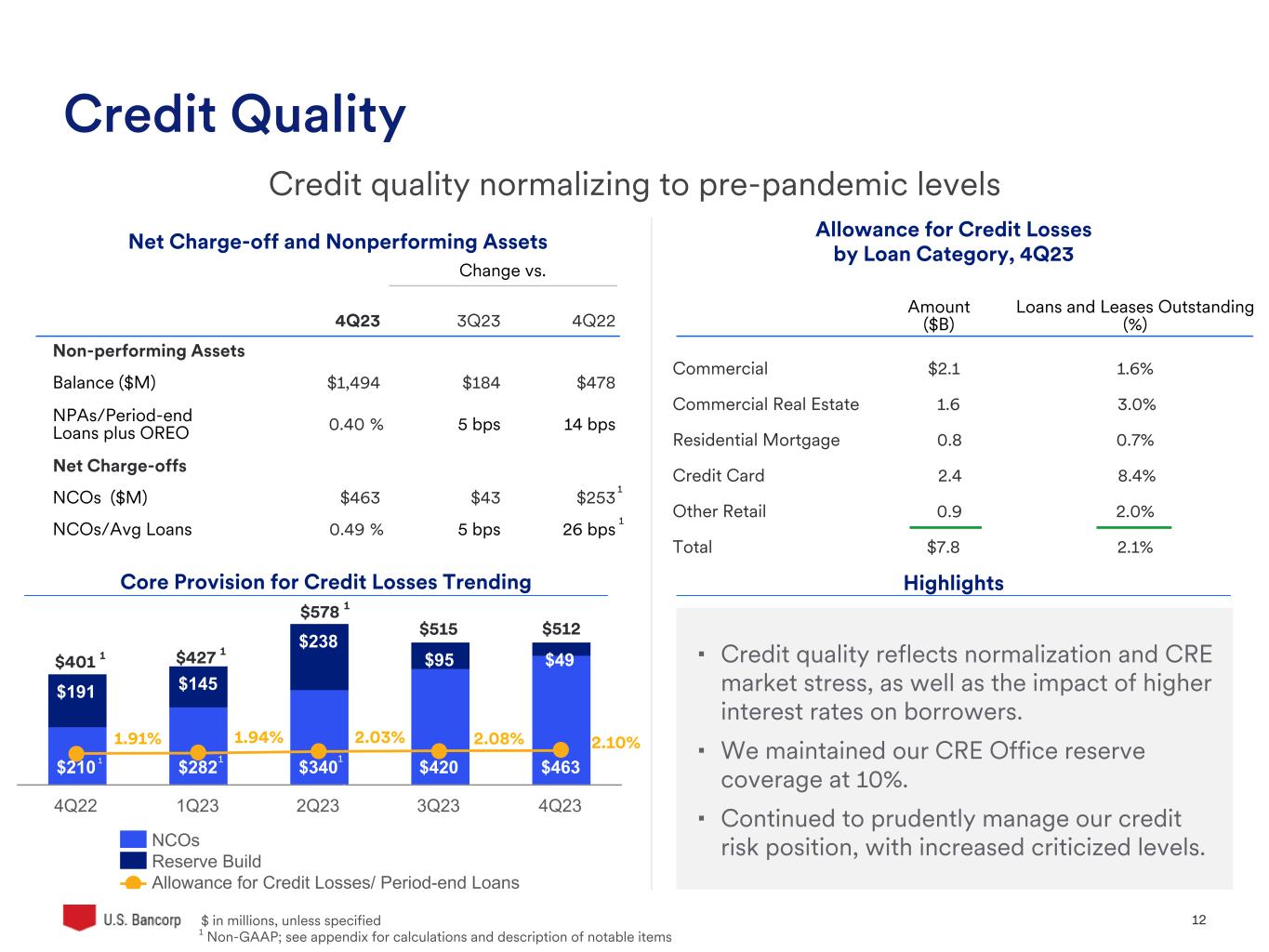

The Company’s provision for credit losses for the fourth quarter of 2023 was $512 million, compared with $515 million in the third quarter of 2023 and $1,192 million in the fourth quarter of 2022. The fourth quarter of 2023 provision was $3 million (0.6 percent) lower than the third quarter of 2023 and $680 million (57.0 percent) lower than the fourth quarter of 2022. Excluding the fourth quarter of 2022 notable item of $791 million related to the initial provision for credit losses related to the MUB acquisition and balance sheet optimization activities, the provision for credit losses for the fourth quarter of 2023 increased $111 million (27.7 percent) compared with the fourth quarter of 2022, driven by normalizing credit losses and stress in commercial real estate, partially offset by relative stability in the economic outlook. Expected loss estimates consider various factors including customer specific information impacting changes in risk ratings, projected delinquencies, and the impact of economic deterioration on borrowers’ liquidity and ability to repay. During 2023, economic uncertainty and recession risk increased due to rising interest rates, inflationary concerns, market volatility, and pressure on corporate earnings related to these factors, contributing to increased provision for credit losses. Consumer portfolio credit losses are normalizing amid rising delinquencies and lower collateral values. Some stress in commercial portfolios is anticipated as the impact of rising interest rates filters through companies’ financials. Commercial real estate valuations are also affected by rising interest rates and the changing demand for office properties.

Total net charge-offs in the fourth quarter of 2023 were $463 million, compared with $420 million in the third quarter of 2023 and $578 million in the fourth quarter of 2022. Net charge-offs for the fourth quarter of 2022 included $368 million of charge-offs related to uncollectible amounts on acquired loans and balance sheet optimization activities. The net charge-off ratio was 0.49 percent in the fourth quarter of 2023, compared with 0.44 percent in the third quarter of 2023 and 0.64 percent in the fourth quarter of 2022 (0.23 percent excluding the impact of notable items). Net charge-offs, excluding the impact of the fourth quarter of 2022 notable items, increased $253 million on a year-over-year basis reflecting higher charge-offs in most loan categories consistent with normalizing credit conditions and adverse conditions in commercial real estate.

The allowance for credit losses was $7,839 million at December 31, 2023, compared with $7,790 million at September 30, 2023, and $7,404 million at December 31, 2022. The linked quarter increase in the allowance for credit losses was primarily driven by normalizing credit losses and credit card balance growth. The ratio of the allowance for credit losses to period-end loans was 2.10 percent at December 31, 2023, compared with 2.08 percent at September 30, 2023, and 1.91 percent at December 31, 2022. The ratio of the allowance for credit losses to nonperforming loans was 541 percent at December 31, 2023, compared with 615 percent at September 30, 2023, and 762 percent at December 31, 2022.

Nonperforming assets were $1,494 million at December 31, 2023, compared with $1,310 million at September 30, 2023, and $1,016 million at December 31, 2022. The ratio of nonperforming assets to loans and other real estate was 0.40 percent at December 31, 2023, compared with 0.35 percent at September 30, 2023, and 0.26 percent at December 31, 2022. The increase in nonperforming assets on a linked quarter basis was primarily due to higher commercial and commercial real estate nonperforming loans. The increase in nonperforming assets on a year-over year basis was primarily due to higher commercial and commercial real estate nonperforming loans, partially offset by lower nonperforming residential mortgages. Accruing loans 90 days or more past due were $698 million at December 31, 2023, compared with $569 million at September 30, 2023, and $491 million at December 31, 2022.

|

|

|

|

|

|

|

U.S. Bancorp Fourth Quarter 2023 Results |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| DELINQUENT LOAN RATIOS AS A PERCENT OF ENDING LOAN BALANCES |

| (Percent) |

Dec 31 2023 |

Sep 30 2023 |

Jun 30 2023 |

Mar 31 2023 |

Dec 31 2022 |

|

|

|

|

|

|

| Delinquent loan ratios - 90 days or more past due |

|

|

|

|

|

| Commercial |

.09 |

|

.05 |

|

.04 |

|

.05 |

|

.07 |

|

| Commercial real estate |

.01 |

|

— |

|

— |

|

.01 |

|

.01 |

|

| Residential mortgages |

.12 |

|

.11 |

|

.08 |

|

.08 |

|

.08 |

|

| Credit card |

1.31 |

|

1.17 |

|

1.02 |

|

1.00 |

|

.88 |

|

| Other retail |

.15 |

|

.13 |

|

.12 |

|

.12 |

|

.12 |

|

| Total loans |

.19 |

|

.15 |

|

.12 |

|

.13 |

|

.13 |

|

|

|

|

|

|

|

| Delinquent loan ratios - 90 days or more past due and nonperforming loans |

| Commercial |

.37 |

|

.24 |

|

.21 |

|

.18 |

|

.19 |

|

| Commercial real estate |

1.46 |

|

1.33 |

|

.87 |

|

.98 |

|

.62 |

|

| Residential mortgages |

.25 |

|

.25 |

|

.26 |

|

.33 |

|

.36 |

|

| Credit card |

1.31 |

|

1.17 |

|

1.02 |

|

1.01 |

|

.88 |

|

| Other retail |

.46 |

|

.41 |

|

.39 |

|

.37 |

|

.37 |

|

| Total loans |

.57 |

|

.49 |

|

.40 |

|

.42 |

|

.38 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| ASSET QUALITY (a) |

| ($ in millions) |

|

|

|

|

|

|

Dec 31 2023 |

Sep 30 2023 |

Jun 30 2023 |

Mar 31 2023 |

Dec 31 2022 |

| Nonperforming loans |

|

|

|

|

|

| Commercial |

$349 |

|

$231 |

|

$204 |

|

$150 |

|

$139 |

|

| Lease financing |

27 |

|

25 |

|

27 |

|

28 |

|

30 |

|

| Total commercial |

376 |

|

256 |

|

231 |

|

178 |

|

169 |

|

|

|

|

|

|

|

| Commercial mortgages |

675 |

|

566 |

|

361 |

|

432 |

|

251 |

|

| Construction and development |

102 |

|

155 |

|

113 |

|

103 |

|

87 |

|

| Total commercial real estate |

777 |

|

721 |

|

474 |

|

535 |

|

338 |

|

|

|

|

|

|

|

| Residential mortgages |

158 |

|

161 |

|

207 |

|

292 |

|

325 |

|

| Credit card |

— |

|

— |

|

— |

|

1 |

|

1 |

|

| Other retail |

138 |

|

129 |

|

129 |

|

133 |

|

139 |

|

| Total nonperforming loans |

1,449 |

|

1,267 |

|

1,041 |

|

1,139 |

|

972 |

|

|

|

|

|

|

|

| Other real estate |

26 |

|

25 |

|

25 |

|

23 |

|

23 |

|

| Other nonperforming assets |

19 |

|

18 |

|

19 |

|

19 |

|

21 |

|

| Total nonperforming assets |

$1,494 |

|

$1,310 |

|

$1,085 |

|

$1,181 |

|

$1,016 |

|

| Accruing loans 90 days or more past due |

$698 |

|

$569 |

|

$474 |

|

$494 |

|

$491 |

|

| Nonperforming assets to loans plus ORE (%) |

.40 |

|

.35 |

|

.29 |

|

.30 |

|

.26 |

|

|

|

|

|

|

|

| (a) Throughout this document, nonperforming assets and related ratios do not include accruing loans 90 days or more past due |

|

|

|

|

|

|

|

|

|

|

|

|

|

U.S. Bancorp Fourth Quarter 2023 Results |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| COMMON SHARES |

| (Millions) |

4Q 2023 |

3Q 2023 |

2Q 2023 |

1Q 2023 |

4Q 2022 |

|

|

|

|

|

|

| Beginning shares outstanding |

1,557 |

|

1,533 |

|

1,533 |

|

1,531 |

|

1,486 |

|

| Shares issued for stock incentive plans, |

|

|

|

|

|

| acquisitions and other corporate purposes |

1 |

|

24 |

|

— |

|

3 |

|

45 |

|

| Shares repurchased |

— |

|

— |

|

— |

|

(1) |

|

— |

|

| Ending shares outstanding |

1,558 |

|

1,557 |

|

1,533 |

|

1,533 |

|

1,531 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| CAPITAL POSITION |

|

Preliminary Data |

| ($ in millions) |

Dec 31 2023 |

|

Sep 30 2023 |

|

Jun 30 2023 |

|

Mar 31 2023 |

|

Dec 31 2022 |

|

|

|

|

|

|

|

|

|

|

|

|

| Total U.S. Bancorp shareholders' equity |

$55,306 |

|

|

$53,113 |

|

|

$53,019 |

|

|

$52,989 |

|

|

$50,766 |

|

|

|

|

|

|

|

|

|

|

|

|

|

| Basel III Standardized Approach (a) |

|

|

|

|

|

|

|

|

|

|

| Common equity tier 1 capital |

$44,947 |

|

|

$44,655 |

|

|

$42,944 |

|

|

$42,027 |

|

|

$41,560 |

|

|

| Tier 1 capital |

52,199 |

|

|

51,906 |

|

|

50,187 |

|

|

49,278 |

|

|

48,813 |

|

|

| Total risk-based capital |

61,921 |

|

|

61,737 |

|

|

60,334 |

|

|

59,920 |

|

|

59,015 |

|

|

|

|

|

|

|

|

|

|

|

|

|

| Common equity tier 1 capital ratio |

9.9 |

|

% |

9.7 |

|

% |

9.1 |

|

% |

8.5 |

|

% |

8.4 |

|

% |

| Tier 1 capital ratio |

11.5 |

|

|

11.2 |

|

|

10.6 |

|

|

10.0 |

|

|

9.8 |

|

|

| Total risk-based capital ratio |

13.7 |

|

|

13.4 |

|

|

12.7 |

|

|

12.1 |

|

|

11.9 |

|

|

| Leverage ratio |

8.1 |

|

|

7.9 |

|

|

7.5 |

|

|

7.5 |

|

|

7.9 |

|

|

|

|

|

|

|

|

|

|

|

|

|

| Tangible common equity to tangible assets (b) |

5.3 |

|

|

5.0 |

|

|

4.8 |

|

|

4.8 |

|

|

4.5 |

|

|

| Tangible common equity to risk-weighted assets (b) |

7.7 |

|

|

7.0 |

|

|

6.8 |

|

|

6.5 |

|

|

6.0 |

|

|

| Common equity tier 1 capital to risk-weighted assets, reflecting the full implementation of the current expected credit losses methodology (b) |

9.7 |

|

|

9.5 |

|

|

8.9 |

|

|

8.3 |

|

|

8.1 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

(a) Amounts and ratios calculated in accordance with transitional regulatory requirements related to the current expected credit losses methodology

(b) See Non-GAAP Financial Measures reconciliation on page 18

|

|

|

|

|

|

|

|

|

|

|

|

Total U.S. Bancorp shareholders’ equity was $55.3 billion at December 31, 2023, compared with $53.1 billion at September 30,

2023 and $50.8 billion at December 31, 2022. In the third quarter of 2023 the Company issued 24 million shares of common stock to Mitsubishi UFG Financial Group, Inc. (“MUFG”), for which the proceeds from the issuance were used to repay a portion of the debt obligation with MUFG for the acquisition of MUB. The Company suspended all common stock repurchases at the beginning of the third quarter of 2021, except for those done exclusively in connection with its stock-based compensation programs, due to the acquisition of MUB. The Company will evaluate its share repurchases in connection with the potential capital requirements given proposed regulatory capital rules and related landscape.