| Ohio | 001-33653 | 31-0854434 | ||||||||||||

| (State or other jurisdiction of incorporation) |

(Commission File Number) |

(IRS Employer Identification No.) |

||||||||||||

| Fifth Third Center | ||||||||||||||||||||

| 38 Fountain Square Plaza | , | Cincinnati | , | Ohio | 45263 | |||||||||||||||

| (Address of Principal Executive Offices) | (Zip Code) | |||||||||||||||||||

| Securities registered pursuant to Section 12(b) of the Act: | ||||||||||||||||||||

| Title of each class | Trading Symbol(s) |

Name of each exchange on which registered |

||||||||||||||||||

| Common Stock, Without Par Value | FITB | The | NASDAQ | Stock Market LLC | ||||||||||||||||

| Depositary Shares Representing a 1/1000th Ownership Interest in a Share of 6.625% Fixed-to-Floating Rate Non-Cumulative Perpetual Preferred Stock, Series I | FITBI | The | NASDAQ | Stock Market LLC | ||||||||||||||||

| Depositary Shares Representing a 1/40th Ownership Interest in a Share of 6.00% Non-Cumulative Perpetual Class B Preferred Stock, Series A | FITBP | The | NASDAQ | Stock Market LLC | ||||||||||||||||

| Depositary Shares Representing a 1/1000th Ownership Interest in a Share of 4.95% Non-Cumulative Perpetual Preferred Stock, Series K | FITBO | The | NASDAQ | Stock Market LLC | ||||||||||||||||

| FIFTH THIRD BANCORP | ||||||||

| (Registrant) | ||||||||

Date: July 19, 2024 |

/s/ Bryan D. Preston | |||||||

| Bryan D. Preston | ||||||||

| Executive Vice President and Chief Financial Officer |

||||||||

| Key Financial Data | Key Highlights | |||||||||||||||||||||||||||||||

| $ in millions for all balance sheet and income statement items | ||||||||||||||||||||||||||||||||

2Q24 |

1Q24 |

2Q23 |

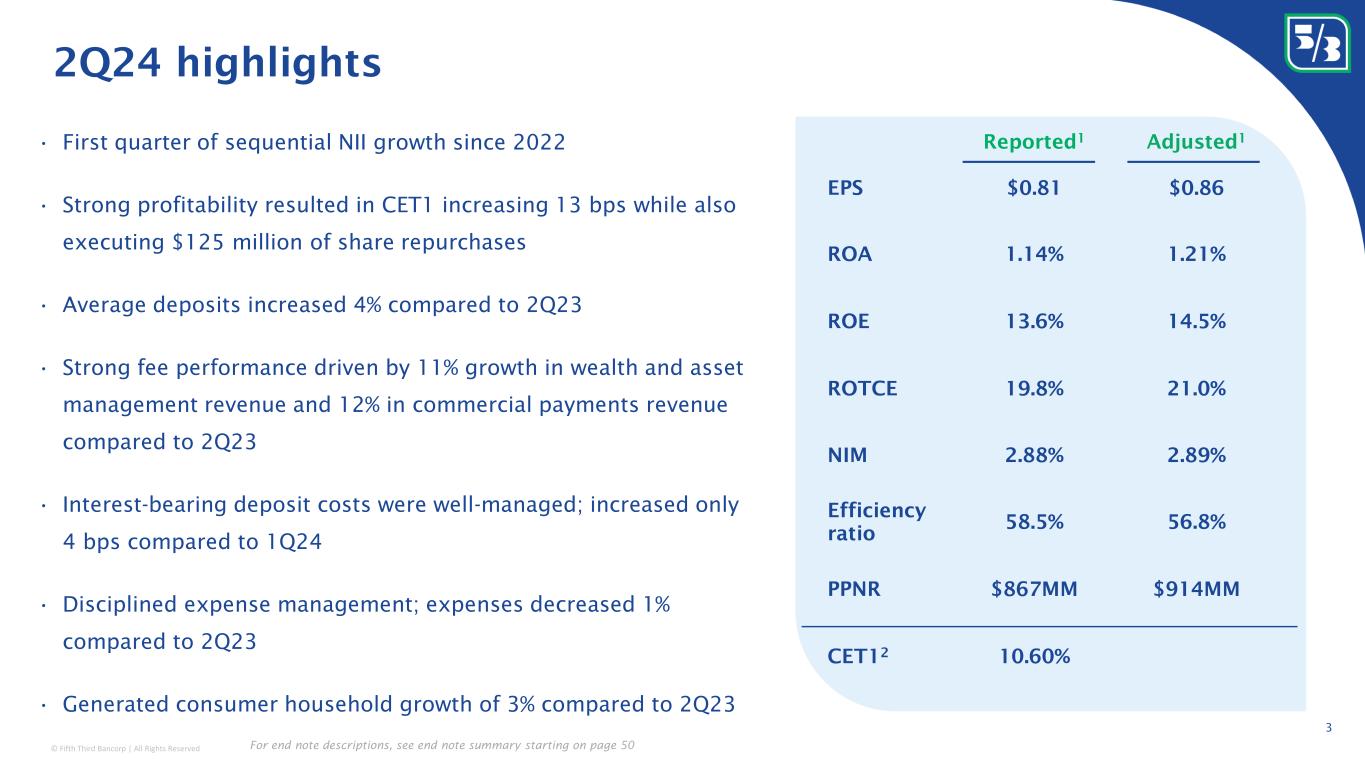

Stability:

•Continued repricing benefit on fixed rate loan portfolio and moderating deposit costs drove increased net interest income and net interest margin compared to prior quarter

•Strong profitability resulted in CET1 increasing to 10.60% while also executing $125 million share repurchase

•Fifth consecutive quarter of CRE NCO ratio below 1 bp

Profitability:

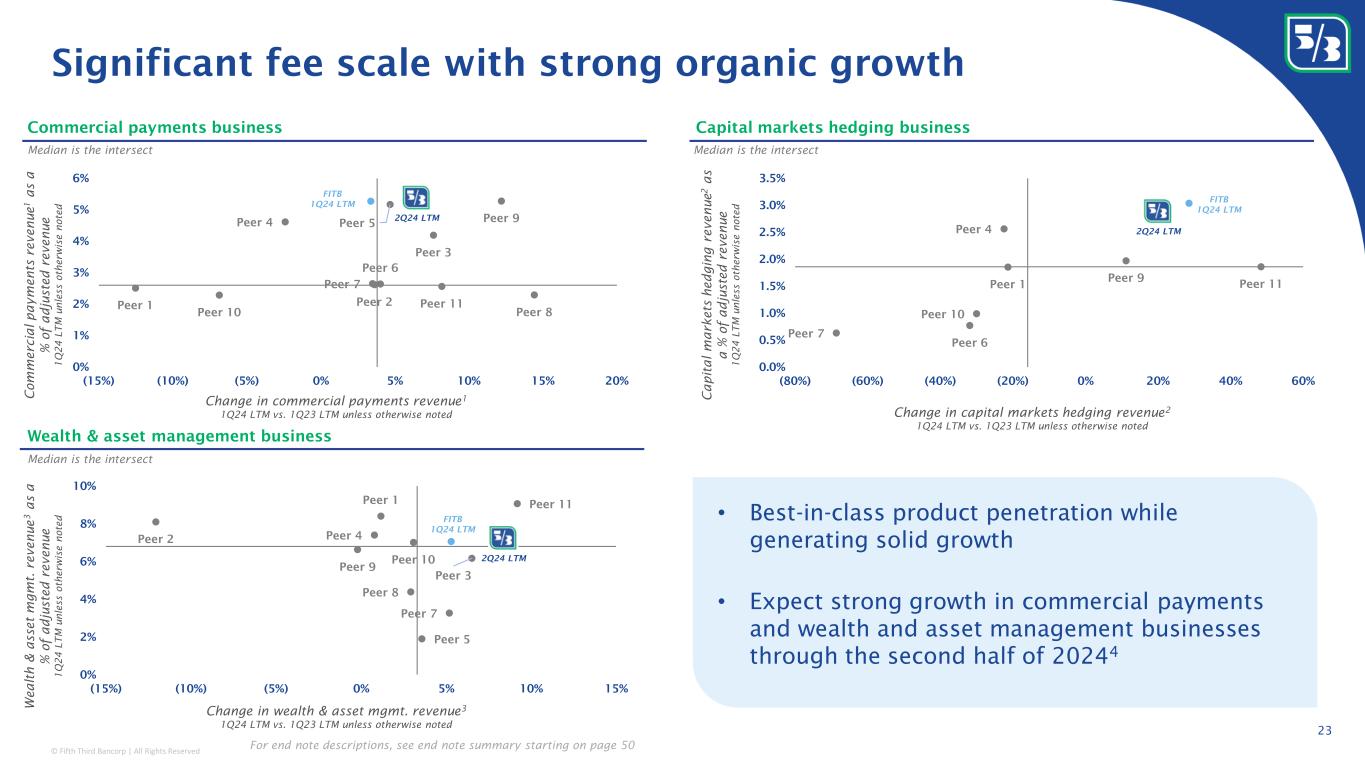

•Strong fee performance in wealth and asset management revenue (up 11%) and commercial payments revenue (up 12%) compared to 2Q23

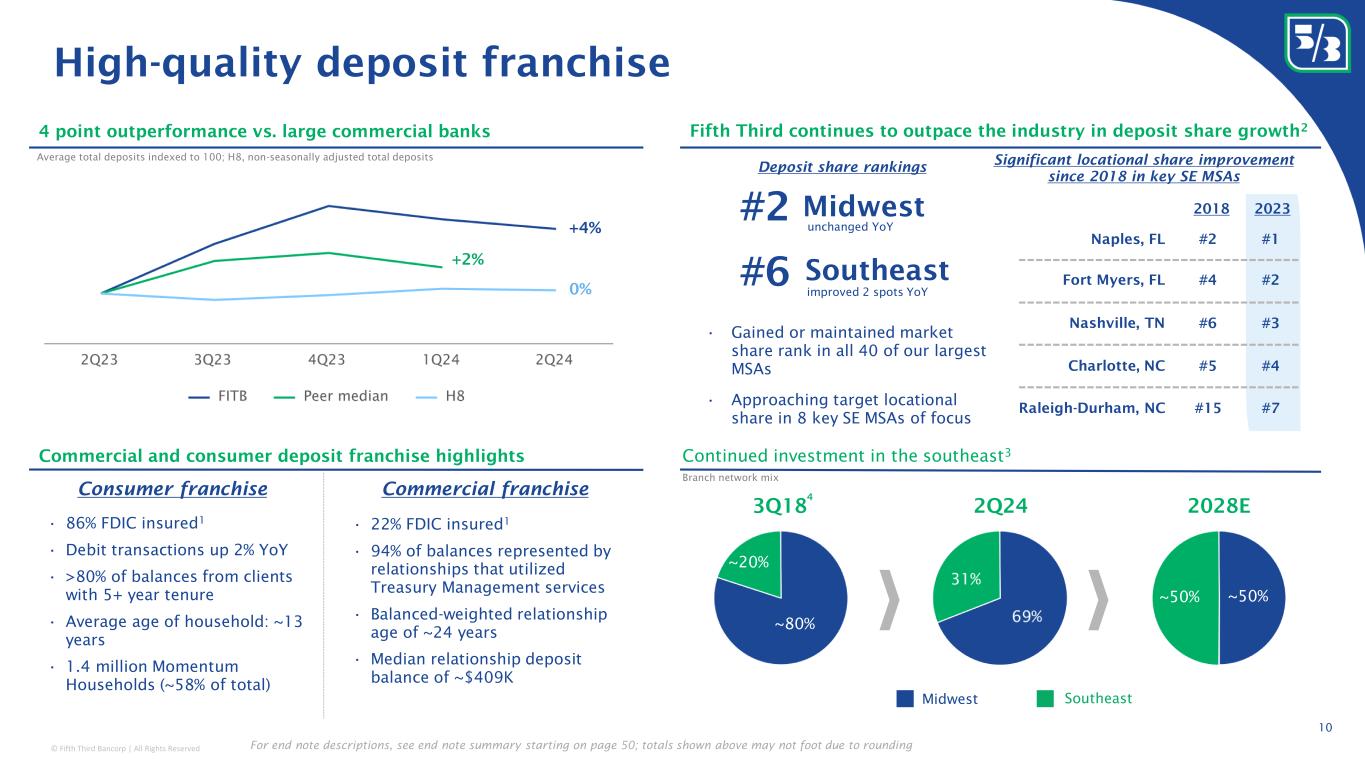

•Interest-bearing core deposit costs up only 4 bps compared to 1Q24

•Disciplined expense management; expenses decreased 1% compared to 2Q23

Growth:

•Generated consumer household growth of 3% compared to 2Q23, including 6% in the Southeast

•Fifth Third Wealth Advisors grew assets under management over 50% to $1.7 billion

|

|||||||||||||||||||||||||||||

| Income Statement Data | ||||||||||||||||||||||||||||||||

| Net income available to common shareholders | $561 | $480 | $562 | |||||||||||||||||||||||||||||

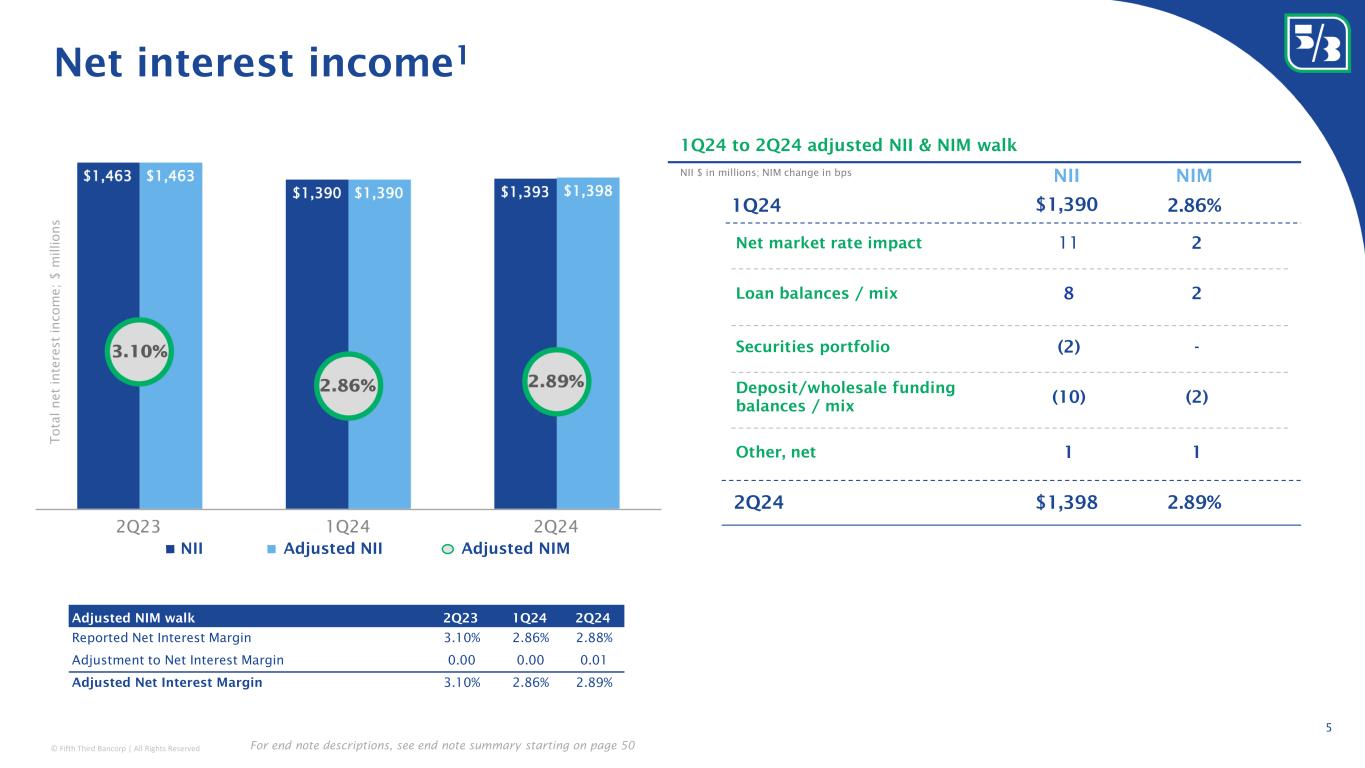

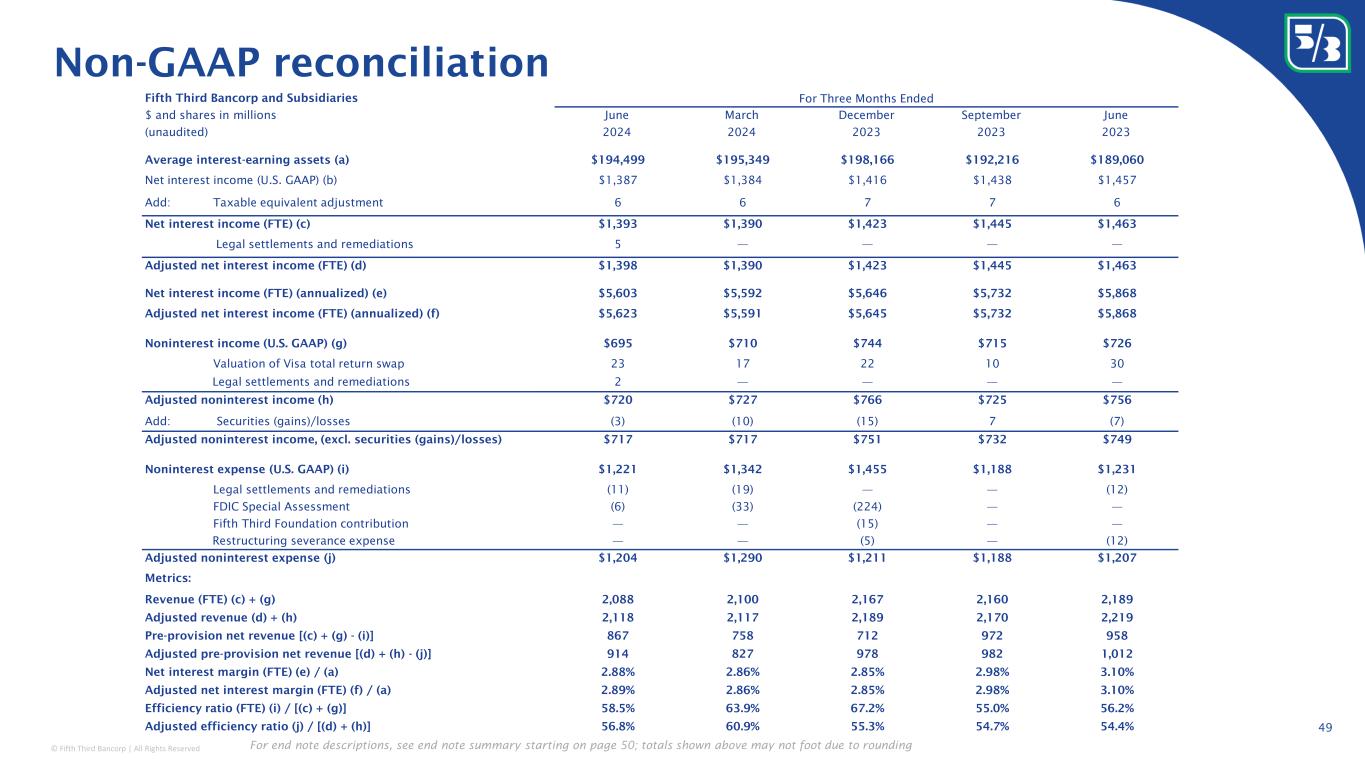

| Net interest income (U.S. GAAP) | 1,387 | 1,384 | 1,457 | |||||||||||||||||||||||||||||

Net interest income (FTE)(a) |

1,393 | 1,390 | 1,463 | |||||||||||||||||||||||||||||

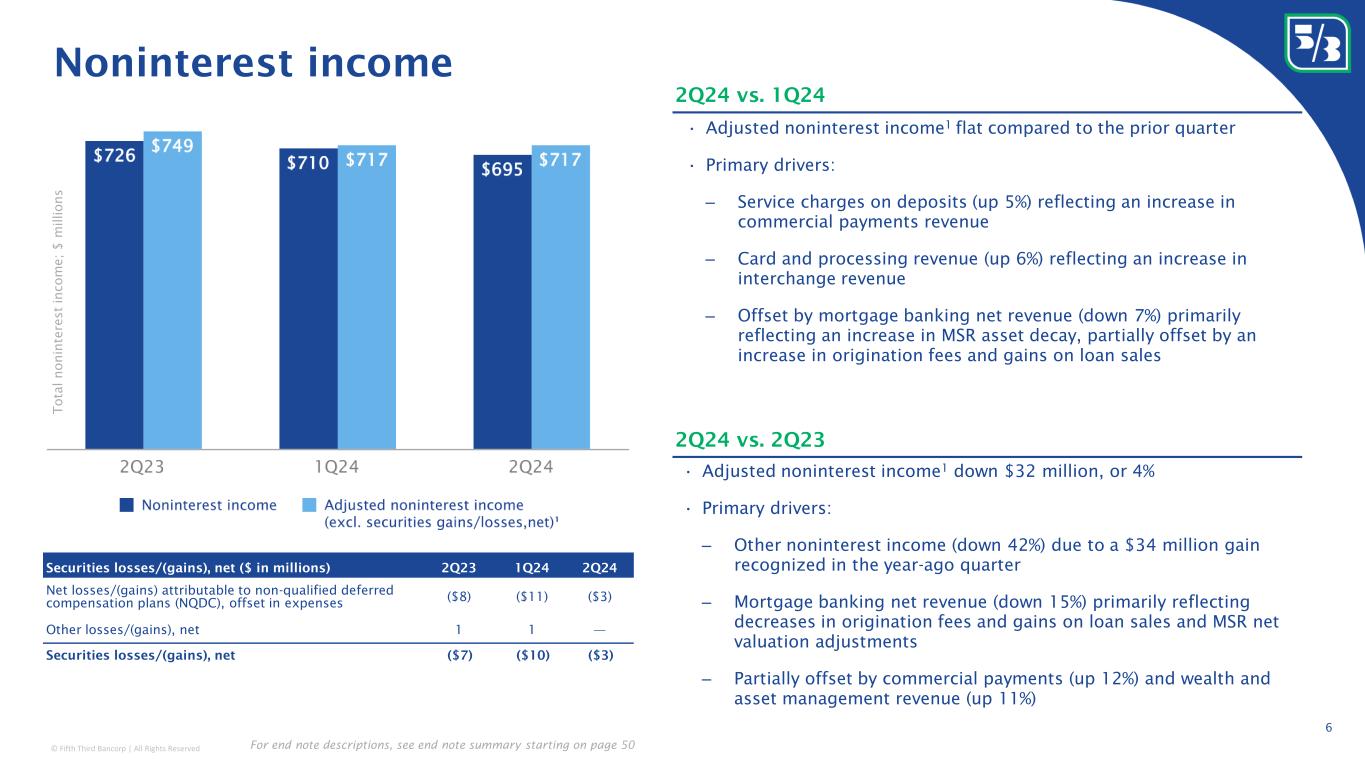

| Noninterest income | 695 | 710 | 726 | |||||||||||||||||||||||||||||

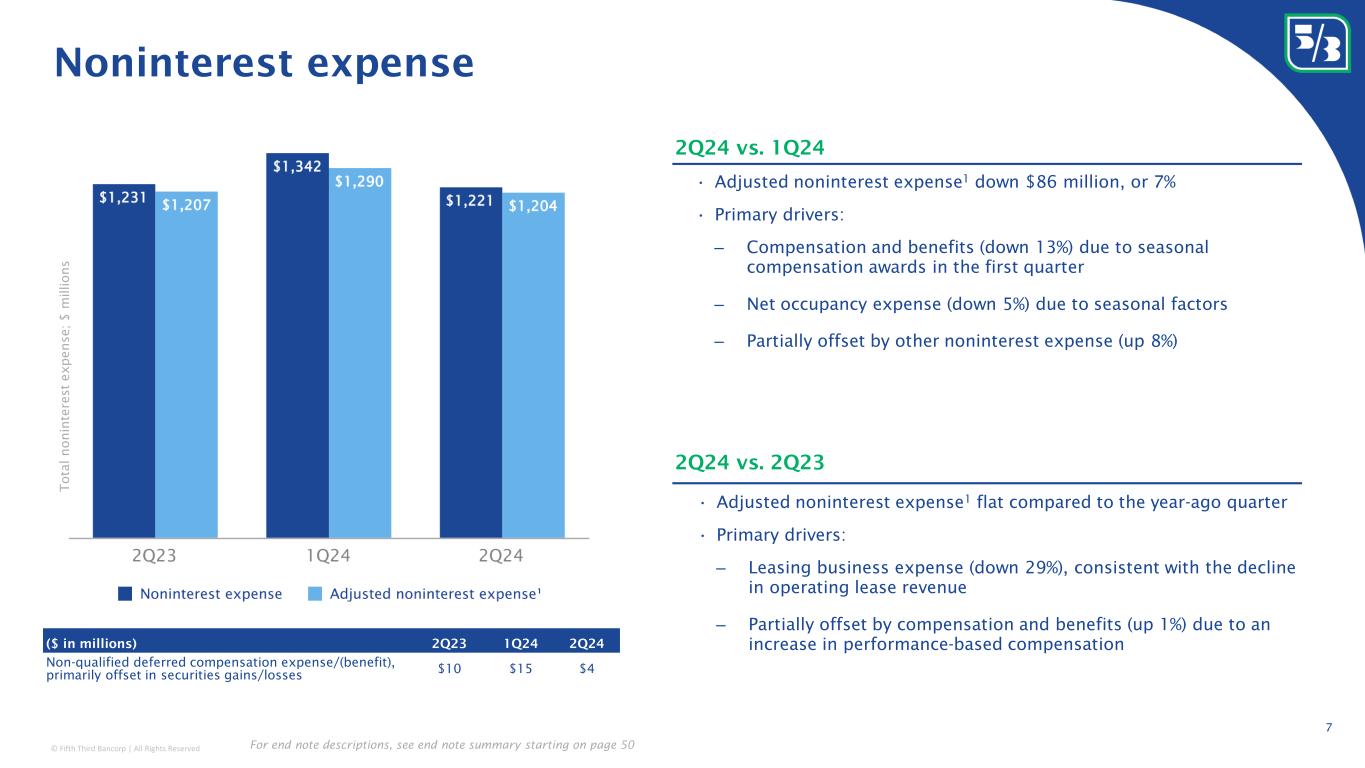

| Noninterest expense | 1,221 | 1,342 | 1,231 | |||||||||||||||||||||||||||||

| Per Share Data | ||||||||||||||||||||||||||||||||

| Earnings per share, basic | $0.82 | $0.70 | $0.82 | |||||||||||||||||||||||||||||

| Earnings per share, diluted | 0.81 | 0.70 | 0.82 | |||||||||||||||||||||||||||||

| Book value per share | 25.13 | 24.72 | 23.05 | |||||||||||||||||||||||||||||

Tangible book value per share(a) |

17.75 | 17.35 | 15.61 | |||||||||||||||||||||||||||||

| Balance Sheet & Credit Quality | ||||||||||||||||||||||||||||||||

| Average portfolio loans and leases | $116,891 | $117,334 | $123,327 | |||||||||||||||||||||||||||||

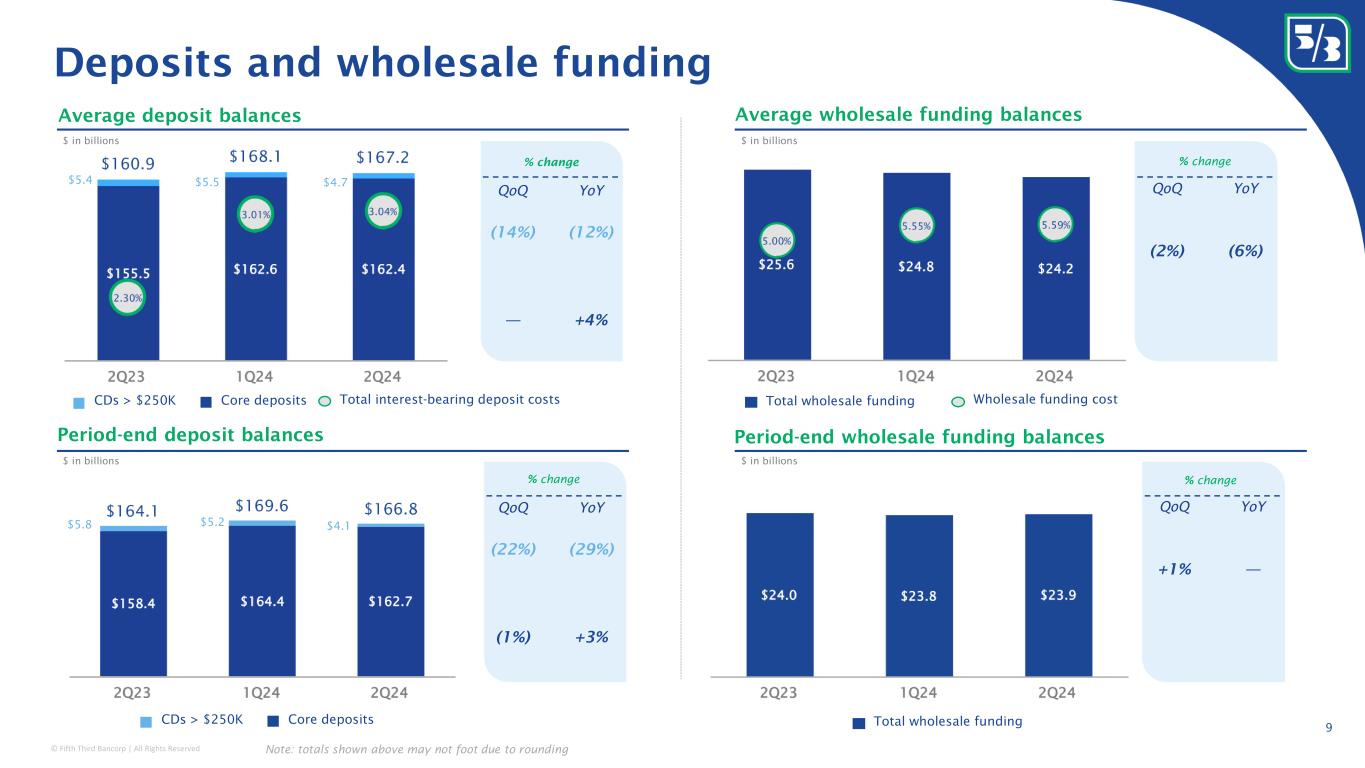

| Average deposits | 167,194 | 168,122 | 160,857 | |||||||||||||||||||||||||||||

| Accumulated other comprehensive loss | (4,901) | (4,888) | (5,166) | |||||||||||||||||||||||||||||

Net charge-off ratio(b) |

0.49 | % | 0.38 | % | 0.29 | % | ||||||||||||||||||||||||||

Nonperforming asset ratio(c) |

0.55 | 0.64 | 0.54 | |||||||||||||||||||||||||||||

| Financial Ratios | ||||||||||||||||||||||||||||||||

| Return on average assets | 1.14 | % | 0.98 | % | 1.17 | % | ||||||||||||||||||||||||||

| Return on average common equity | 13.6 | 11.6 | 13.9 | |||||||||||||||||||||||||||||

Return on average tangible common equity(a) |

19.8 | 17.0 | 20.5 | |||||||||||||||||||||||||||||

CET1 capital(d)(e) |

10.60 | 10.47 | 9.49 | |||||||||||||||||||||||||||||

Net interest margin(a) |

2.88 | 2.86 | 3.10 | |||||||||||||||||||||||||||||

Efficiency(a) |

58.5 | 63.9 | 56.2 | |||||||||||||||||||||||||||||

Other than the Quarterly Financial Review tables beginning on page 14, commentary is on a fully taxable-equivalent (FTE) basis unless otherwise noted. Consistent with SEC guidance in Regulation S-K that contemplates the calculation of tax-exempt income on a taxable-equivalent basis, net interest income, net interest margin, net interest rate spread, total revenue and the efficiency ratio are provided on an FTE basis. |

||||||||||||||||||||||||||||||||

| From Tim Spence, Fifth Third Chairman, CEO and President: | ||||||||||||||

| Income Statement Highlights | ||||||||||||||||||||||||||||||||||||||||||||

| ($ in millions, except per share data) | For the Three Months Ended | % Change | ||||||||||||||||||||||||||||||||||||||||||

| June | March | June | ||||||||||||||||||||||||||||||||||||||||||

| 2024 | 2024 | 2023 | Seq | Yr/Yr | ||||||||||||||||||||||||||||||||||||||||

| Condensed Statements of Income | ||||||||||||||||||||||||||||||||||||||||||||

Net interest income (NII)(a) |

$1,393 | $1,390 | $1,463 | — | (5)% | |||||||||||||||||||||||||||||||||||||||

| Provision for credit losses | 97 | 94 | 177 | 3% | (45)% | |||||||||||||||||||||||||||||||||||||||

| Noninterest income | 695 | 710 | 726 | (2)% | (4)% | |||||||||||||||||||||||||||||||||||||||

| Noninterest expense | 1,221 | 1,342 | 1,231 | (9)% | (1)% | |||||||||||||||||||||||||||||||||||||||

Income before income taxes(a) |

$770 | $664 | $781 | 16% | (1)% | |||||||||||||||||||||||||||||||||||||||

| Taxable equivalent adjustment | $6 | $6 | $6 | — | — | |||||||||||||||||||||||||||||||||||||||

| Applicable income tax expense | 163 | 138 | 174 | 18% | (6)% | |||||||||||||||||||||||||||||||||||||||

| Net income | $601 | $520 | $601 | 16% | — | |||||||||||||||||||||||||||||||||||||||

| Dividends on preferred stock | 40 | 40 | 39 | — | 3% | |||||||||||||||||||||||||||||||||||||||

| Net income available to common shareholders | $561 | $480 | $562 | 17% | — | |||||||||||||||||||||||||||||||||||||||

| Earnings per share, diluted | $0.81 | $0.70 | $0.82 | 16% | (1)% | |||||||||||||||||||||||||||||||||||||||

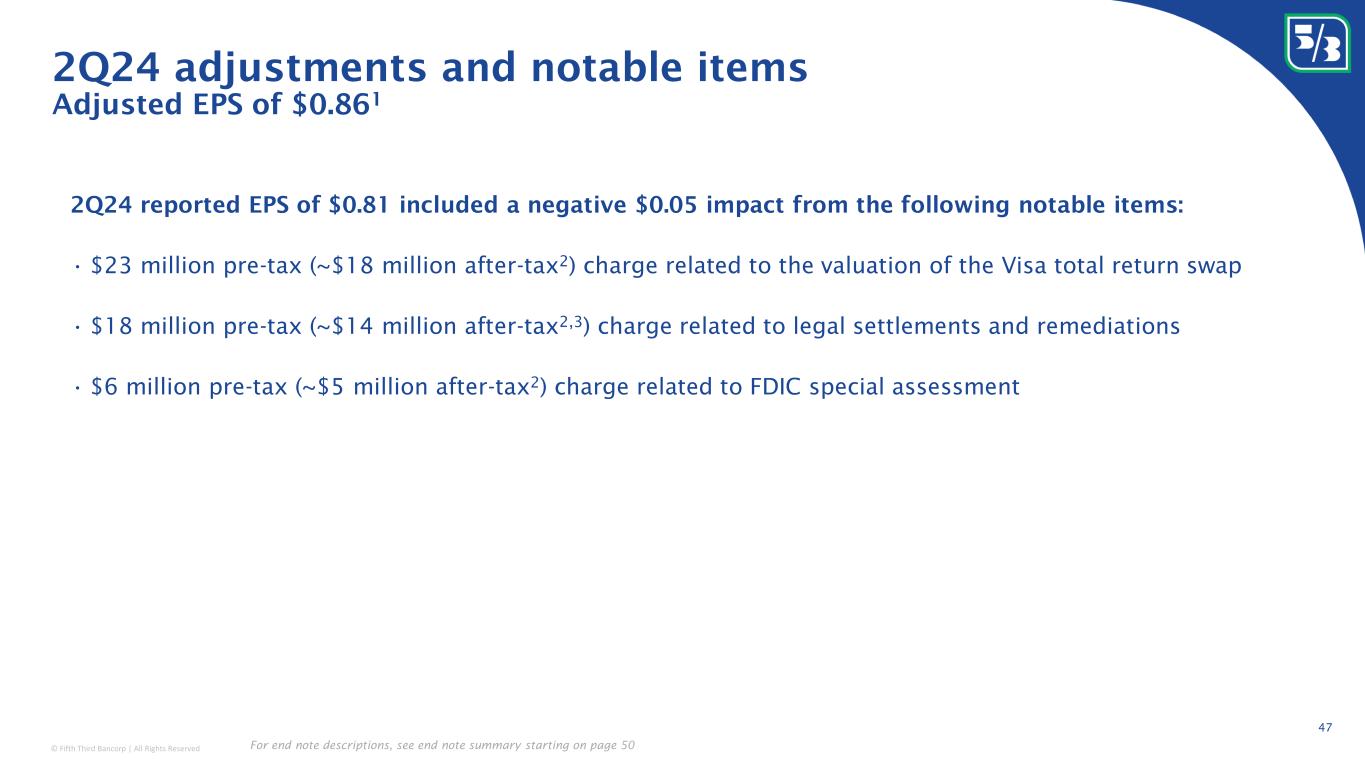

Diluted earnings per share impact of certain item(s) - 2Q24 |

|||||||||||||||||

(after-tax impact(f); $ in millions, except per share data) |

|||||||||||||||||

| Valuation of Visa total return swap | $(18) | ||||||||||||||||

| Legal settlements and remediations | (14) | ||||||||||||||||

| Update to the FDIC special assessment | (5) | ||||||||||||||||

After-tax impact(f) of certain items |

$(37) | ||||||||||||||||

Diluted earnings per share impact of certain item(s)1 |

$(0.05) | ||||||||||||||||

|

Totals may not foot due to rounding; 1Diluted earnings per share impact reflects 691.083 million average diluted shares outstanding

Items above decreased net interest income by $5 million and noninterest income by $25 million and increased noninterest expense by $17 million

|

|||||||||||||||||

| Net Interest Income | ||||||||||||||||||||||||||||||||||||||||||||

(FTE; $ in millions)(a) |

For the Three Months Ended | % Change | ||||||||||||||||||||||||||||||||||||||||||

| June | March | June | ||||||||||||||||||||||||||||||||||||||||||

| 2024 | 2024 | 2023 | Seq | Yr/Yr | ||||||||||||||||||||||||||||||||||||||||

| Interest Income | ||||||||||||||||||||||||||||||||||||||||||||

| Interest income | $2,626 | $2,614 | $2,376 | — | 11% | |||||||||||||||||||||||||||||||||||||||

| Interest expense | 1,233 | 1,224 | 913 | 1% | 35% | |||||||||||||||||||||||||||||||||||||||

| Net interest income (NII) | $1,393 | $1,390 | $1,463 | — | (5)% | |||||||||||||||||||||||||||||||||||||||

NII excluding certain items(a) |

$1,398 | $1,390 | $1,463 | 1% | (4)% | |||||||||||||||||||||||||||||||||||||||

| Average Yield/Rate Analysis | bps Change | |||||||||||||||||||||||||||||||||||||||||||

| Yield on interest-earning assets | 5.43 | % | 5.38 | % | 5.04 | % | 5 | 39 | ||||||||||||||||||||||||||||||||||||

| Rate paid on interest-bearing liabilities | 3.39 | % | 3.36 | % | 2.72 | % | 3 | 67 | ||||||||||||||||||||||||||||||||||||

| Ratios | ||||||||||||||||||||||||||||||||||||||||||||

| Net interest rate spread | 2.04 | % | 2.02 | % | 2.32 | % | 2 | (28) | ||||||||||||||||||||||||||||||||||||

| Net interest margin (NIM) | 2.88 | % | 2.86 | % | 3.10 | % | 2 | (22) | ||||||||||||||||||||||||||||||||||||

NIM excluding certain items(a) |

2.89 | % | 2.86 | % | 3.10 | % | 3 | (21) | ||||||||||||||||||||||||||||||||||||

| Noninterest Income | |||||||||||||||||||||||||||||||||||

| ($ in millions) | For the Three Months Ended | % Change | |||||||||||||||||||||||||||||||||

| June | March | June | |||||||||||||||||||||||||||||||||

| 2024 | 2024 | 2023 | Seq | Yr/Yr | |||||||||||||||||||||||||||||||

| Noninterest Income | |||||||||||||||||||||||||||||||||||

| Service charges on deposits | $156 | $151 | $144 | 3% | 8% | ||||||||||||||||||||||||||||||

| Commercial banking revenue | 144 | 143 | 146 | 1% | (1)% | ||||||||||||||||||||||||||||||

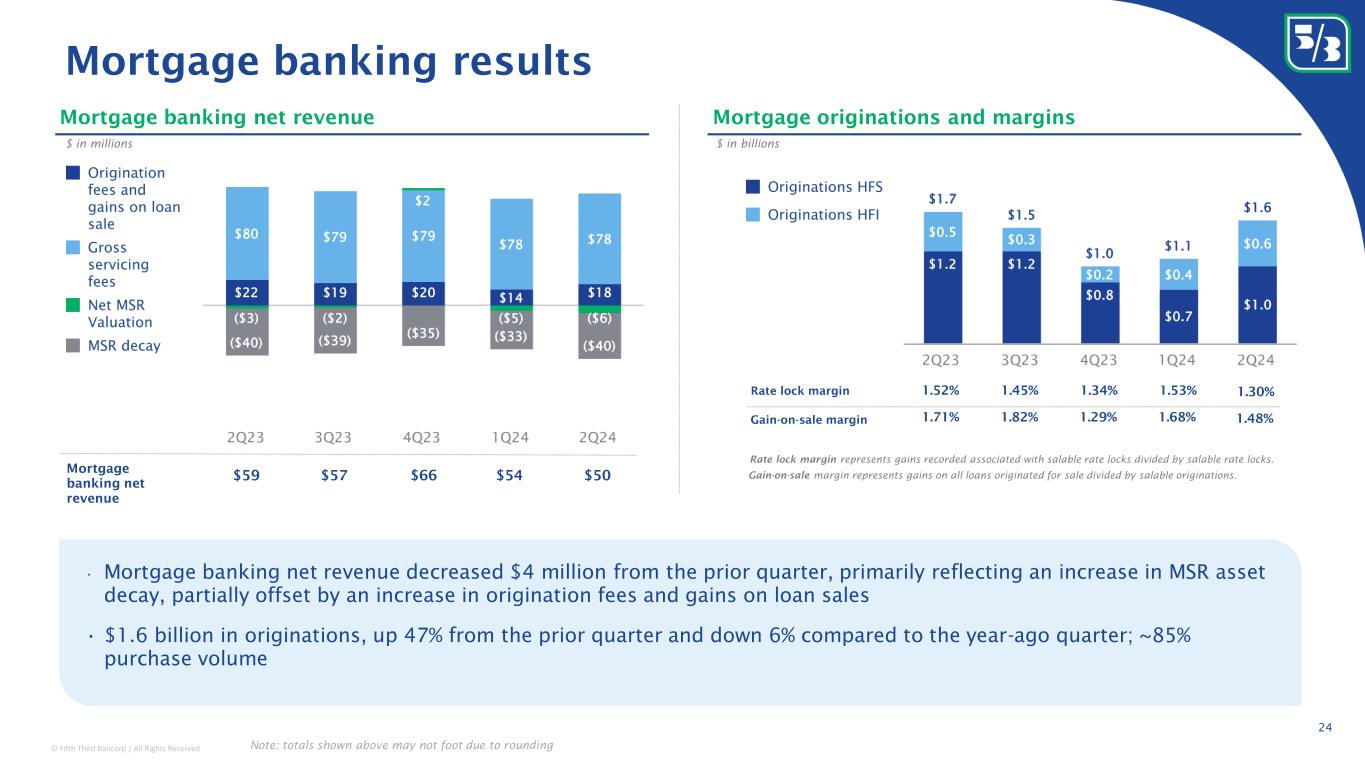

| Mortgage banking net revenue | 50 | 54 | 59 | (7)% | (15)% | ||||||||||||||||||||||||||||||

| Wealth and asset management revenue | 159 | 161 | 143 | (1)% | 11% | ||||||||||||||||||||||||||||||

| Card and processing revenue | 108 | 102 | 106 | 6% | 2% | ||||||||||||||||||||||||||||||

| Leasing business revenue | 38 | 39 | 47 | (3)% | (19)% | ||||||||||||||||||||||||||||||

| Other noninterest income | 37 | 50 | 74 | (26)% | (50)% | ||||||||||||||||||||||||||||||

| Securities gains, net | 3 | 10 | 7 | (70)% | (57)% | ||||||||||||||||||||||||||||||

| Total noninterest income | $695 | $710 | $726 | (2)% | (4)% | ||||||||||||||||||||||||||||||

| Noninterest Income excluding certain items | ||||||||||||||||||||||||||||||||||||||||||||

| ($ in millions) | For the Three Months Ended | |||||||||||||||||||||||||||||||||||||||||||

| June | March | June | % Change | |||||||||||||||||||||||||||||||||||||||||

| 2024 | 2024 | 2023 | Seq | Yr/Yr | ||||||||||||||||||||||||||||||||||||||||

| Noninterest Income excluding certain items | ||||||||||||||||||||||||||||||||||||||||||||

| Noninterest income (U.S. GAAP) | $695 | $710 | $726 | |||||||||||||||||||||||||||||||||||||||||

| Valuation of Visa total return swap | 23 | 17 | 30 | |||||||||||||||||||||||||||||||||||||||||

| Legal settlements and remediations | 2 | — | — | |||||||||||||||||||||||||||||||||||||||||

| Securities (gains) losses, net | (3) | (10) | (7) | |||||||||||||||||||||||||||||||||||||||||

Noninterest income excluding certain items(a) |

$717 | $717 | $749 | — | (4)% | |||||||||||||||||||||||||||||||||||||||

| Noninterest Expense | ||||||||||||||||||||||||||||||||||||||||||||

| ($ in millions) | For the Three Months Ended | % Change | ||||||||||||||||||||||||||||||||||||||||||

| June | March | June | ||||||||||||||||||||||||||||||||||||||||||

| 2024 | 2024 | 2023 | Seq | Yr/Yr | ||||||||||||||||||||||||||||||||||||||||

| Noninterest Expense | ||||||||||||||||||||||||||||||||||||||||||||

| Compensation and benefits | $656 | $753 | $650 | (13)% | 1% | |||||||||||||||||||||||||||||||||||||||

| Net occupancy expense | 83 | 87 | 83 | (5)% | — | |||||||||||||||||||||||||||||||||||||||

| Technology and communications | 114 | 117 | 114 | (3)% | — | |||||||||||||||||||||||||||||||||||||||

| Equipment expense | 38 | 37 | 36 | 3% | 6% | |||||||||||||||||||||||||||||||||||||||

| Card and processing expense | 21 | 20 | 20 | 5% | 5% | |||||||||||||||||||||||||||||||||||||||

| Leasing business expense | 22 | 25 | 31 | (12)% | (29)% | |||||||||||||||||||||||||||||||||||||||

| Marketing expense | 34 | 32 | 31 | 6% | 10% | |||||||||||||||||||||||||||||||||||||||

| Other noninterest expense | 253 | 271 | 266 | (7)% | (5)% | |||||||||||||||||||||||||||||||||||||||

| Total noninterest expense | $1,221 | $1,342 | $1,231 | (9)% | (1)% | |||||||||||||||||||||||||||||||||||||||

| Noninterest Expense excluding certain item(s) | ||||||||||||||||||||||||||||||||||||||||||||||||||

| ($ in millions) | For the Three Months Ended | % Change | ||||||||||||||||||||||||||||||||||||||||||||||||

| June | March | June | ||||||||||||||||||||||||||||||||||||||||||||||||

| 2024 | 2024 | 2023 | Seq | Yr/Yr | ||||||||||||||||||||||||||||||||||||||||||||||

| Noninterest Expense excluding certain item(s) | ||||||||||||||||||||||||||||||||||||||||||||||||||

| Noninterest expense (U.S. GAAP) | $1,221 | $1,342 | $1,231 | |||||||||||||||||||||||||||||||||||||||||||||||

| Legal settlements and remediations | (11) | (19) | (12) | |||||||||||||||||||||||||||||||||||||||||||||||

| FDIC special assessment | (6) | (33) | — | |||||||||||||||||||||||||||||||||||||||||||||||

| Restructuring severance expense | — | — | (12) | |||||||||||||||||||||||||||||||||||||||||||||||

Noninterest expense excluding certain item(s)(a) |

$1,204 | $1,290 | $1,207 | (7)% | — | |||||||||||||||||||||||||||||||||||||||||||||

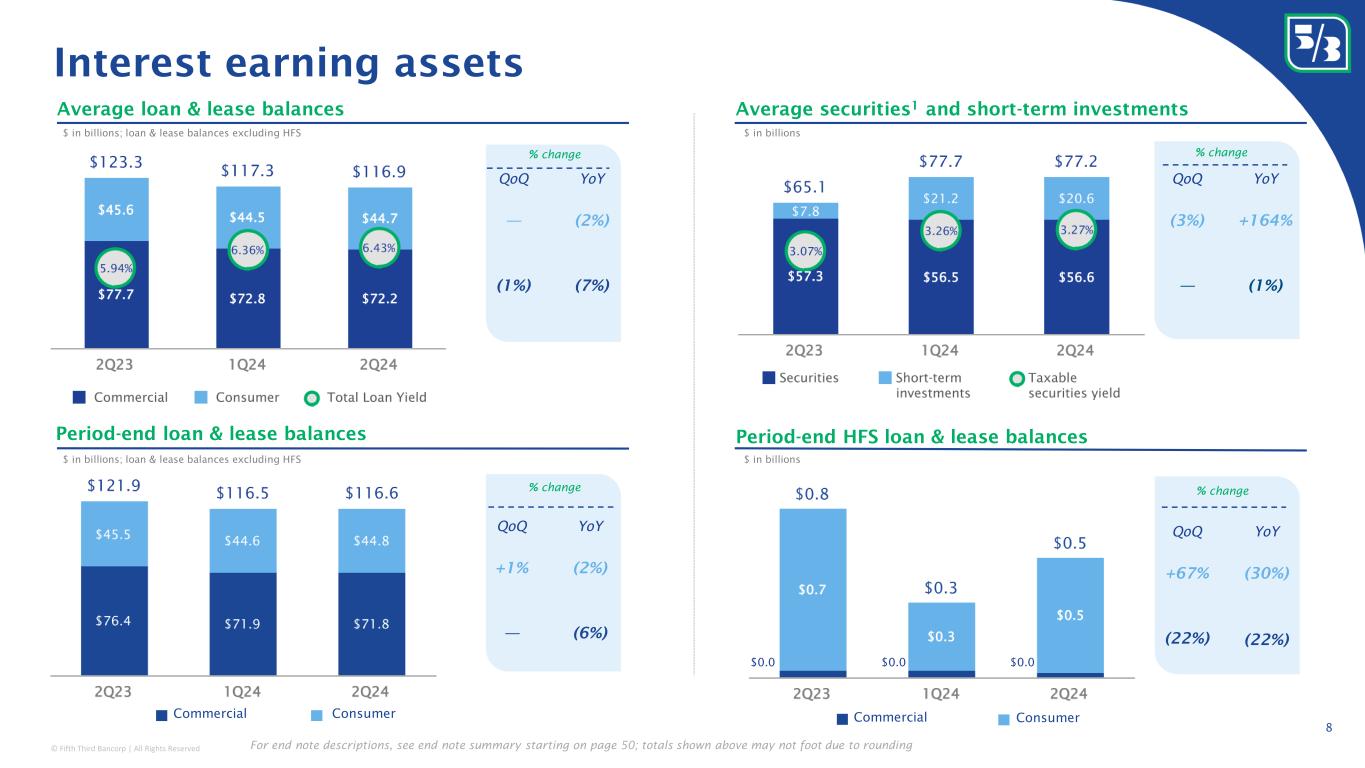

| Average Interest-Earning Assets | ||||||||||||||||||||||||||||||||||||||||||||

| ($ in millions) | For the Three Months Ended | % Change | ||||||||||||||||||||||||||||||||||||||||||

| June | March | June | ||||||||||||||||||||||||||||||||||||||||||

| 2024 | 2024 | 2023 | Seq | Yr/Yr | ||||||||||||||||||||||||||||||||||||||||

| Average Portfolio Loans and Leases | ||||||||||||||||||||||||||||||||||||||||||||

| Commercial loans and leases: | ||||||||||||||||||||||||||||||||||||||||||||

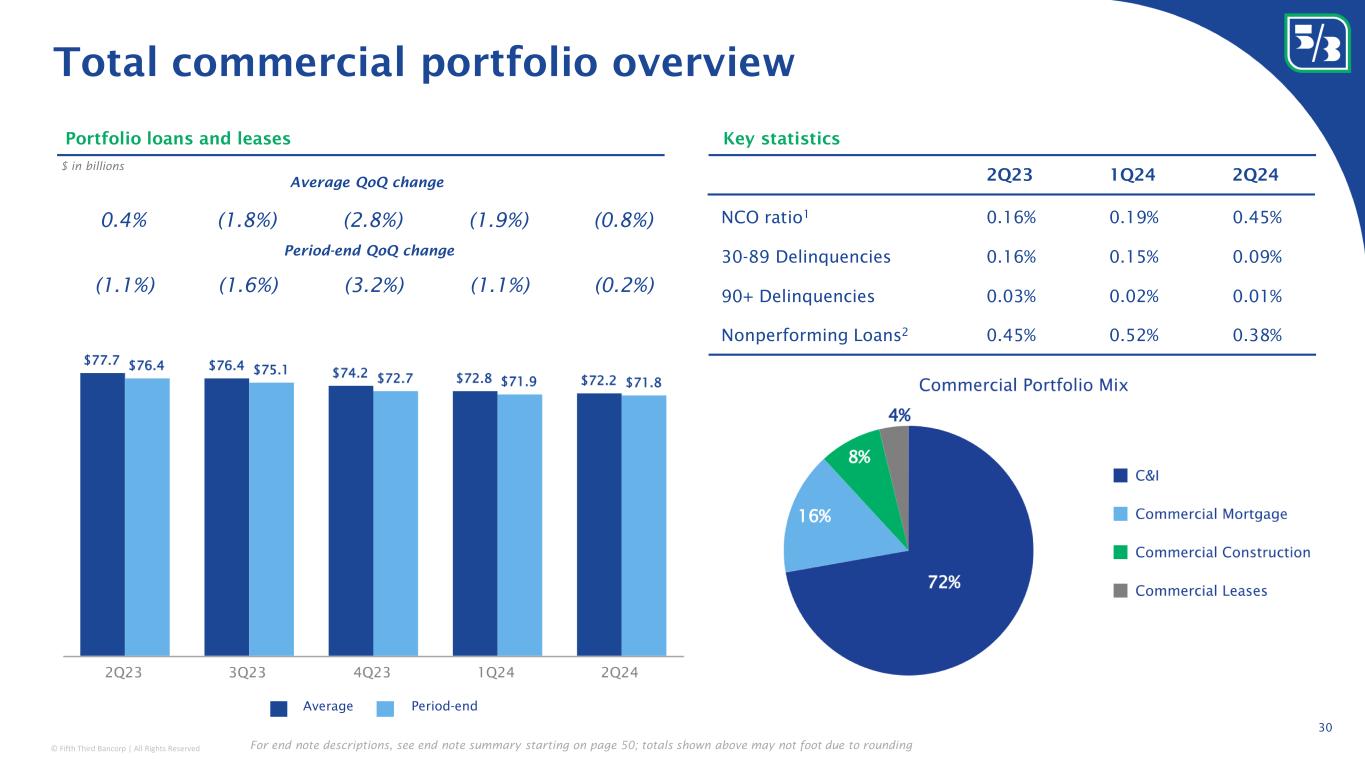

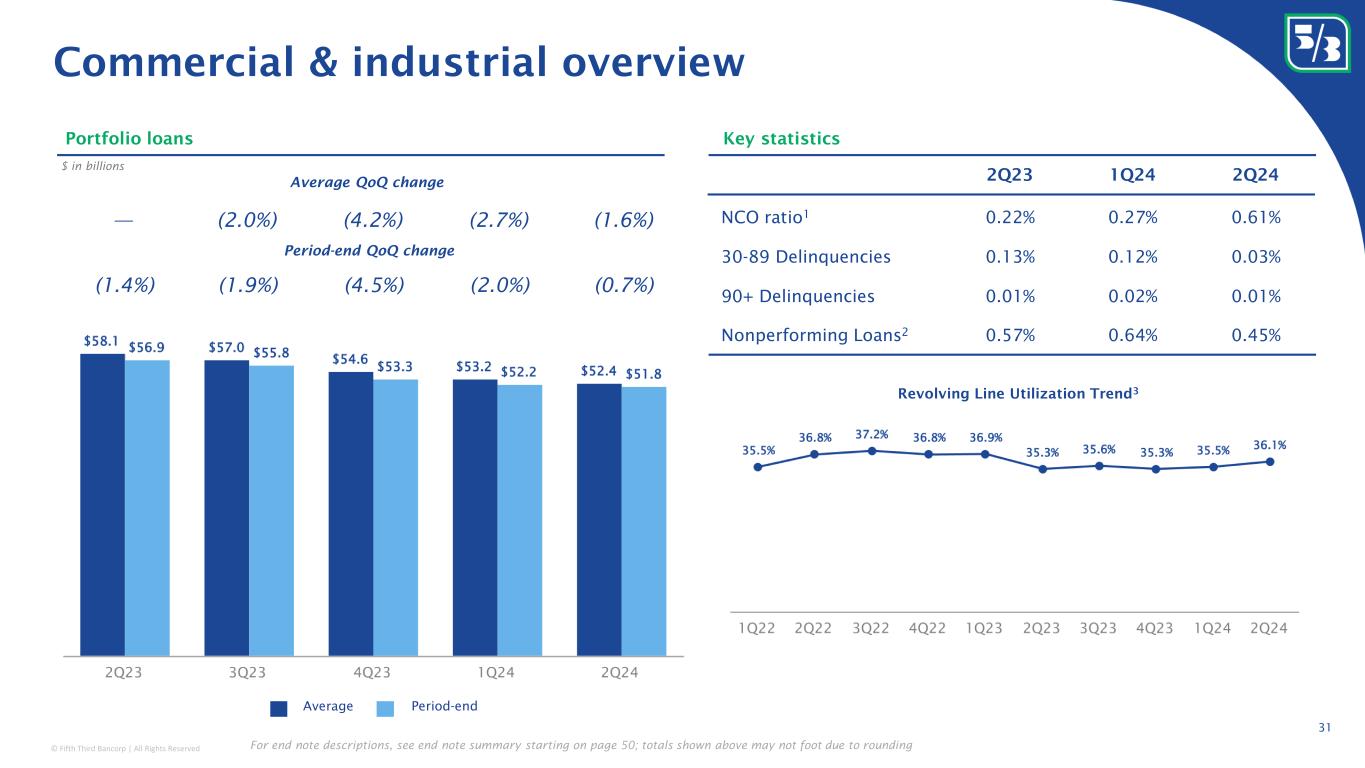

| Commercial and industrial loans | $52,357 | $53,183 | $58,137 | (2)% | (10)% | |||||||||||||||||||||||||||||||||||||||

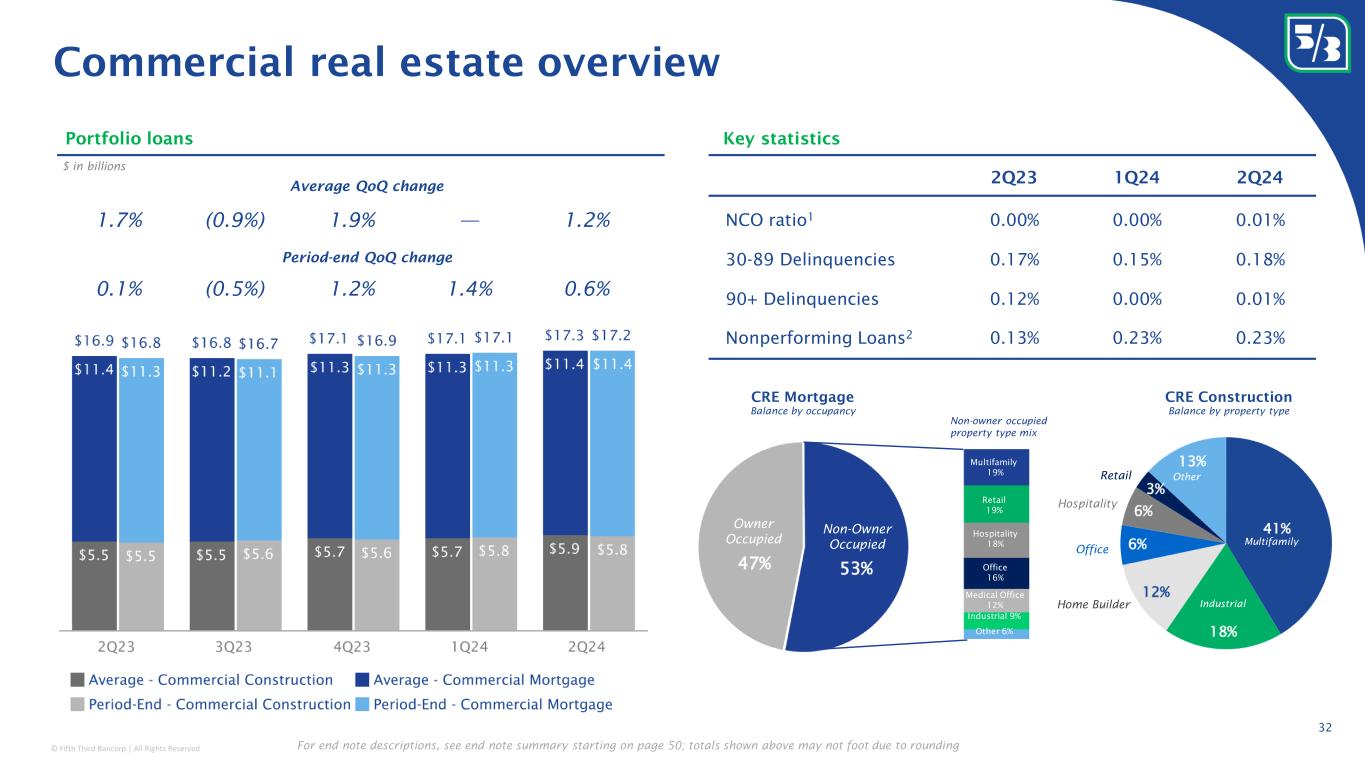

| Commercial mortgage loans | 11,352 | 11,339 | 11,373 | — | — | |||||||||||||||||||||||||||||||||||||||

| Commercial construction loans | 5,917 | 5,732 | 5,535 | 3% | 7% | |||||||||||||||||||||||||||||||||||||||

| Commercial leases | 2,575 | 2,542 | 2,700 | 1% | (5)% | |||||||||||||||||||||||||||||||||||||||

| Total commercial loans and leases | $72,201 | $72,796 | $77,745 | (1)% | (7)% | |||||||||||||||||||||||||||||||||||||||

| Consumer loans: | ||||||||||||||||||||||||||||||||||||||||||||

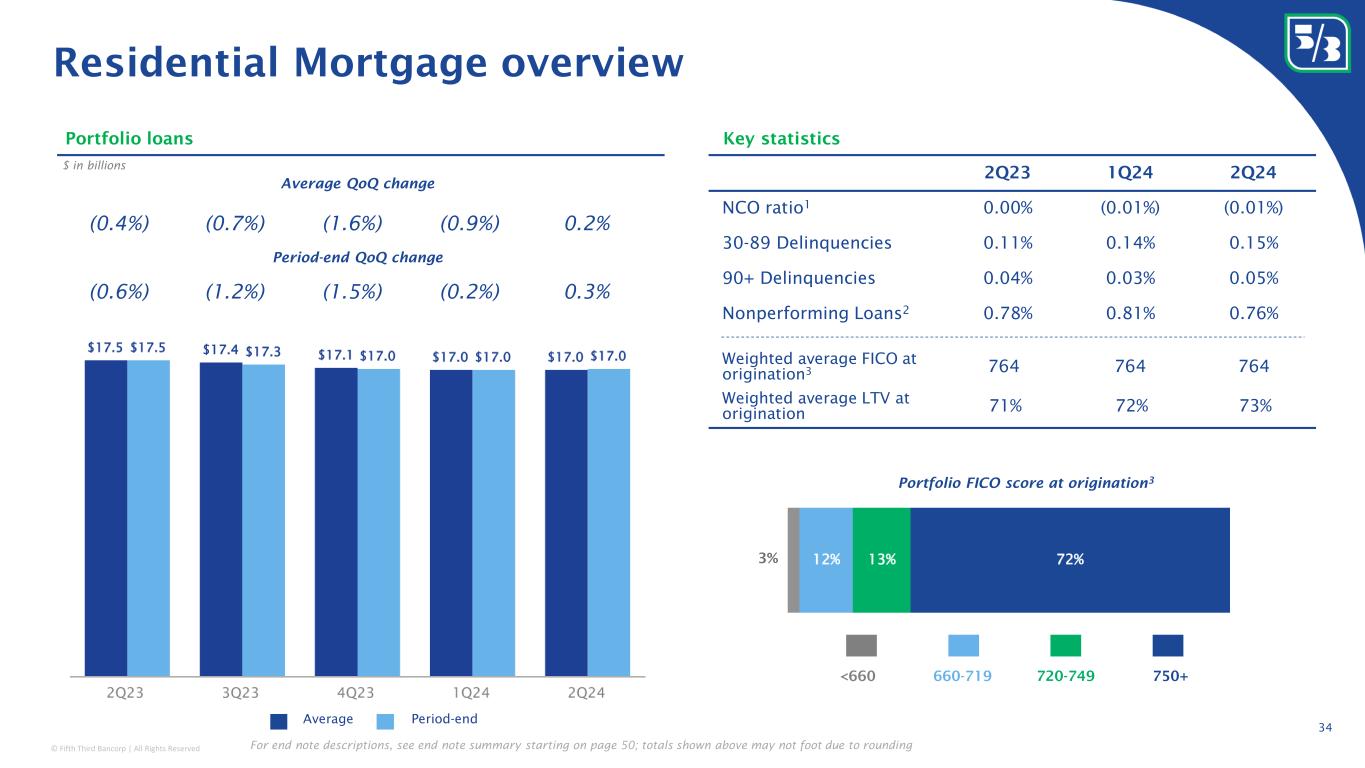

| Residential mortgage loans | $17,004 | $16,977 | $17,517 | — | (3)% | |||||||||||||||||||||||||||||||||||||||

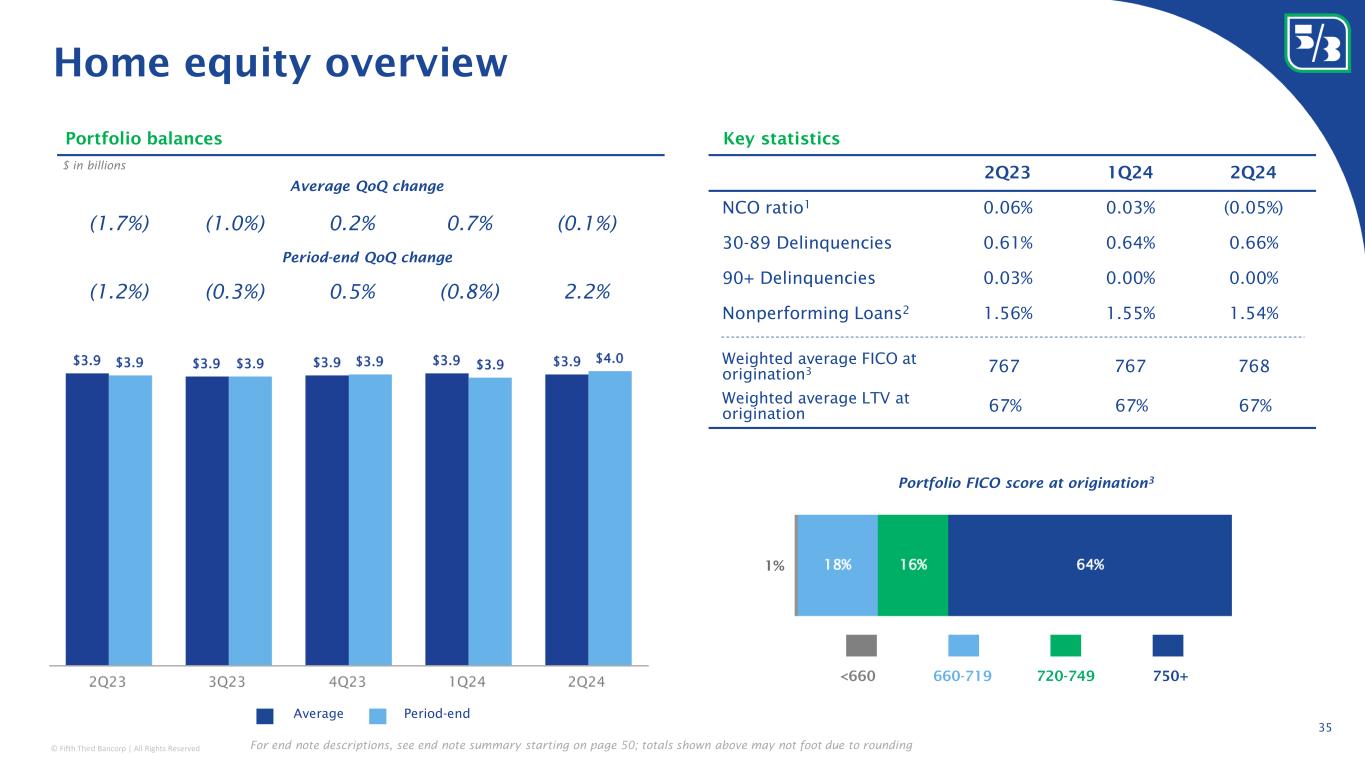

| Home equity | 3,929 | 3,933 | 3,937 | — | — | |||||||||||||||||||||||||||||||||||||||

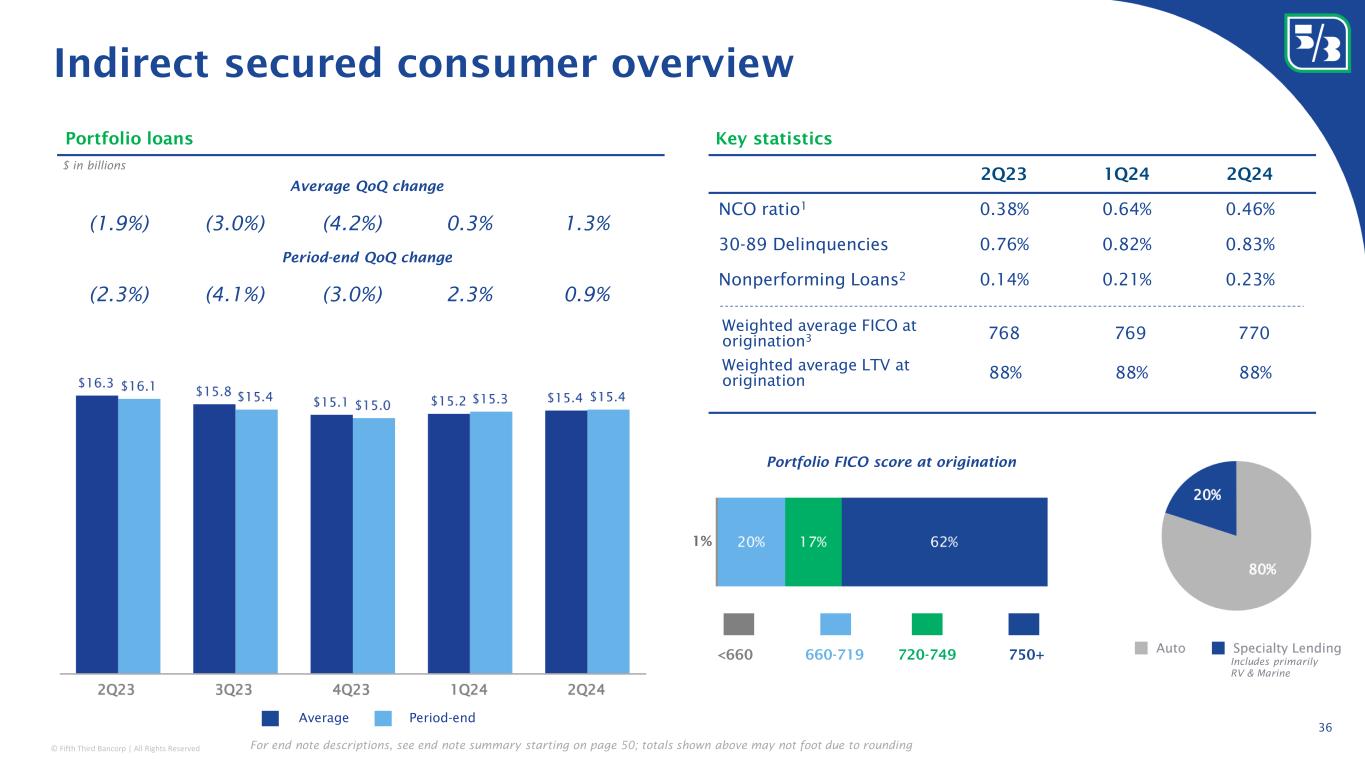

| Indirect secured consumer loans | 15,373 | 15,172 | 16,281 | 1% | (6)% | |||||||||||||||||||||||||||||||||||||||

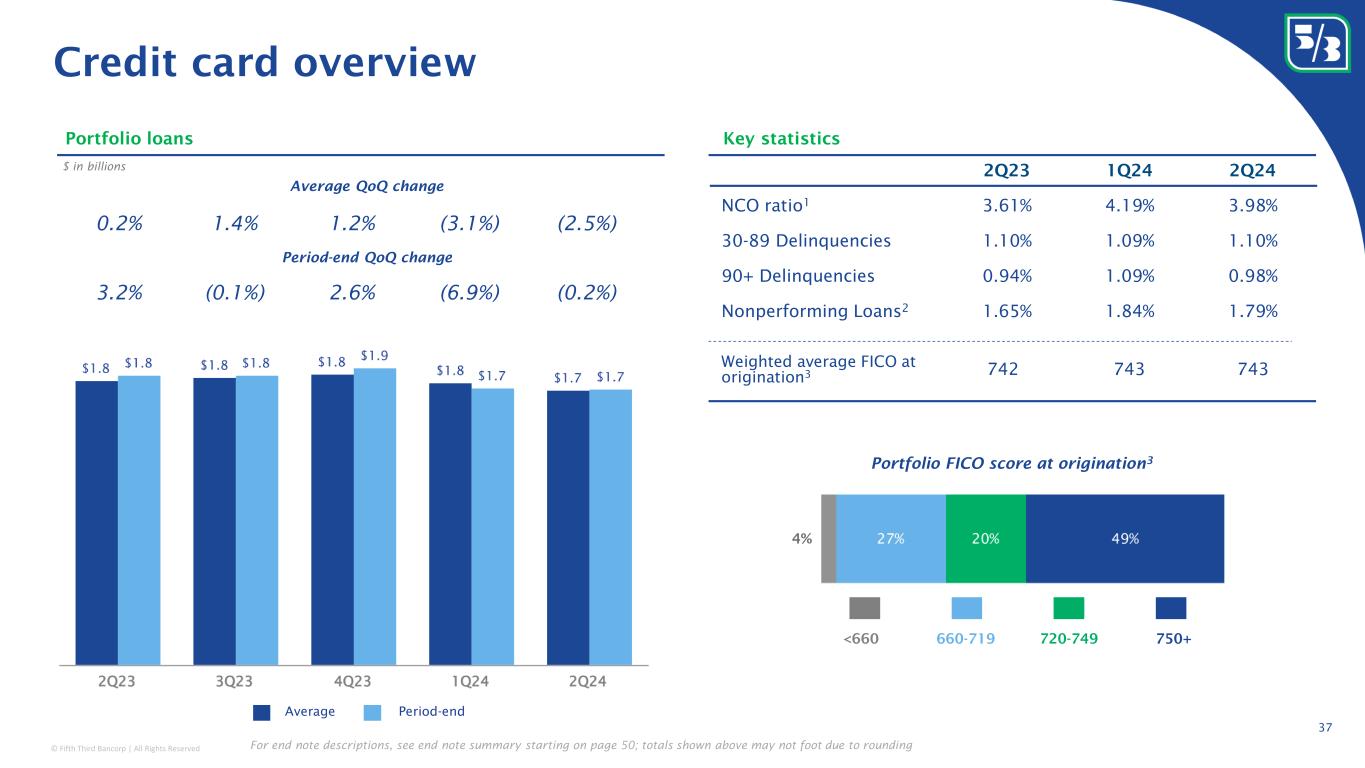

| Credit card | 1,728 | 1,773 | 1,783 | (3)% | (3)% | |||||||||||||||||||||||||||||||||||||||

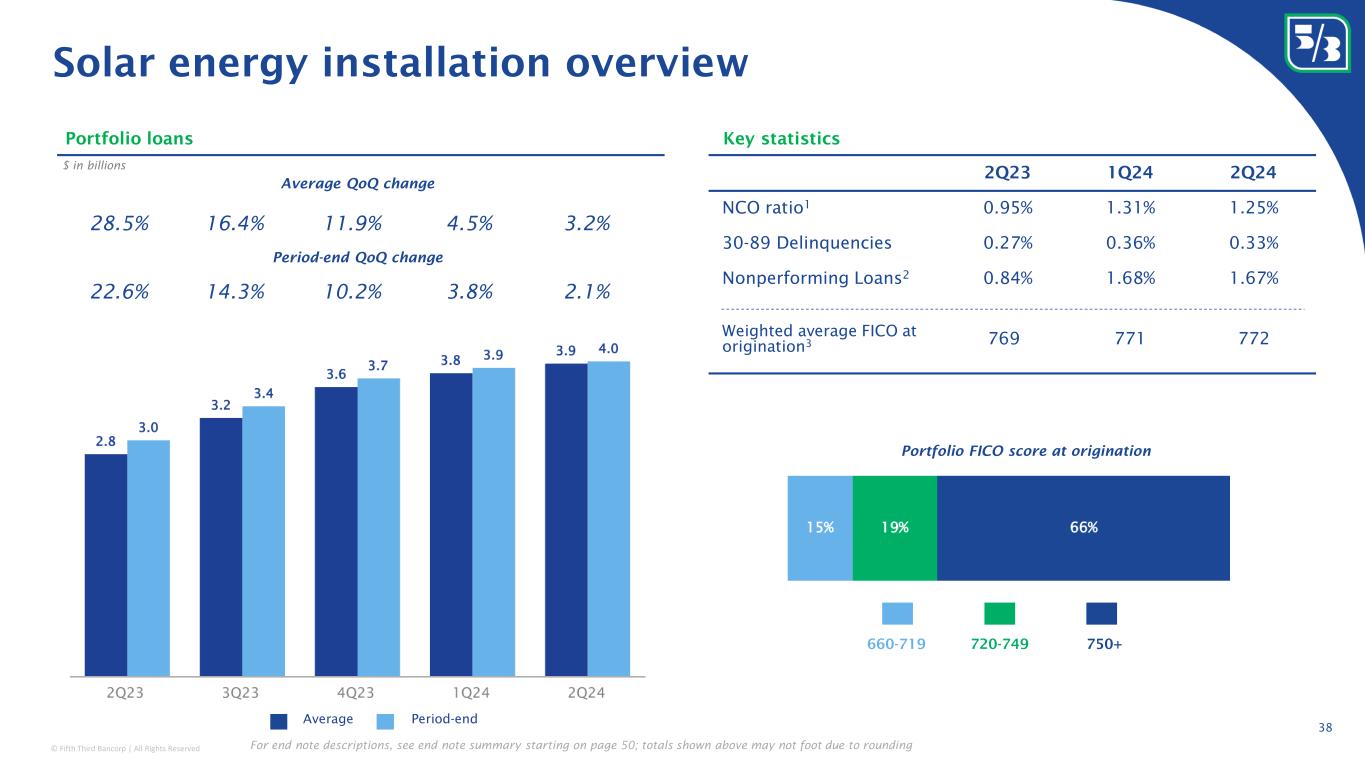

| Solar energy installation loans | 3,916 | 3,794 | 2,787 | 3% | 41% | |||||||||||||||||||||||||||||||||||||||

| Other consumer loans | 2,740 | 2,889 | 3,277 | (5)% | (16)% | |||||||||||||||||||||||||||||||||||||||

| Total consumer loans | $44,690 | $44,538 | $45,582 | — | (2)% | |||||||||||||||||||||||||||||||||||||||

| Total average portfolio loans and leases | $116,891 | $117,334 | $123,327 | — | (5)% | |||||||||||||||||||||||||||||||||||||||

| Average Loans and Leases Held for Sale | ||||||||||||||||||||||||||||||||||||||||||||

| Commercial loans and leases held for sale | $33 | $74 | $19 | (55)% | 74% | |||||||||||||||||||||||||||||||||||||||

| Consumer loans held for sale | 359 | 291 | 641 | 23% | (44)% | |||||||||||||||||||||||||||||||||||||||

| Total average loans and leases held for sale | $392 | $365 | $660 | 7% | (41)% | |||||||||||||||||||||||||||||||||||||||

| Total average loans and leases | $117,283 | $117,699 | $123,987 | — | (5)% | |||||||||||||||||||||||||||||||||||||||

| Securities (taxable and tax-exempt) | $56,607 | $56,456 | $57,267 | — | (1)% | |||||||||||||||||||||||||||||||||||||||

| Other short-term investments | 20,609 | 21,194 | 7,806 | (3)% | 164% | |||||||||||||||||||||||||||||||||||||||

| Total average interest-earning assets | $194,499 | $195,349 | $189,060 | — | 3% | |||||||||||||||||||||||||||||||||||||||

| Average Deposits | ||||||||||||||||||||||||||||||||||||||||||||

| ($ in millions) | For the Three Months Ended | % Change | ||||||||||||||||||||||||||||||||||||||||||

| June | March | June | ||||||||||||||||||||||||||||||||||||||||||

| 2024 | 2024 | 2023 | Seq | Yr/Yr | ||||||||||||||||||||||||||||||||||||||||

| Average Deposits | ||||||||||||||||||||||||||||||||||||||||||||

| Demand | $40,266 | $40,839 | $46,520 | (1)% | (13)% | |||||||||||||||||||||||||||||||||||||||

| Interest checking | 57,999 | 58,677 | 50,472 | (1)% | 15% | |||||||||||||||||||||||||||||||||||||||

| Savings | 17,747 | 18,107 | 21,675 | (2)% | (18)% | |||||||||||||||||||||||||||||||||||||||

| Money market | 35,511 | 34,589 | 28,913 | 3% | 23% | |||||||||||||||||||||||||||||||||||||||

Foreign office(g) |

157 | 145 | 143 | 8% | 10% | |||||||||||||||||||||||||||||||||||||||

| Total transaction deposits | $151,680 | $152,357 | $147,723 | — | 3% | |||||||||||||||||||||||||||||||||||||||

| CDs $250,000 or less | 10,767 | 10,244 | 7,759 | 5% | 39% | |||||||||||||||||||||||||||||||||||||||

| Total core deposits | $162,447 | $162,601 | $155,482 | — | 4% | |||||||||||||||||||||||||||||||||||||||

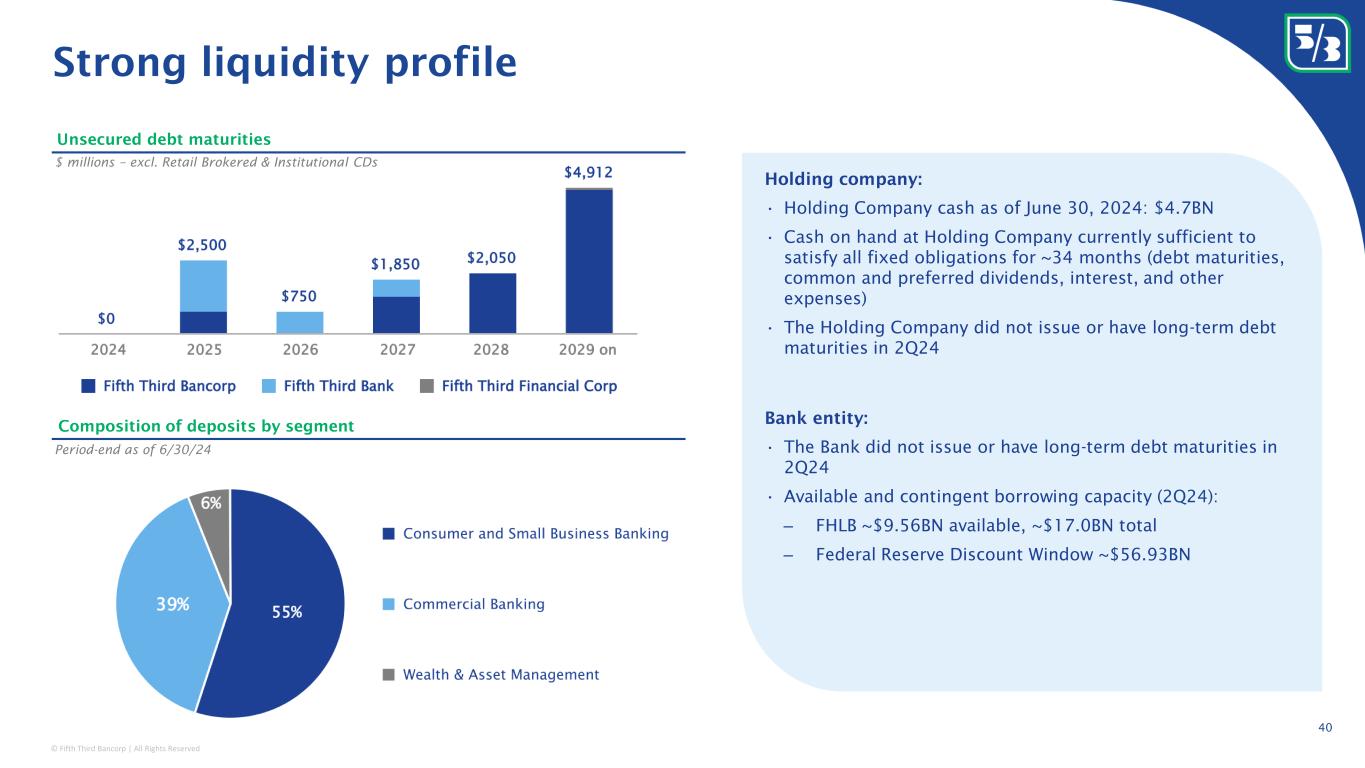

| CDs over $250,000 | 4,747 | 5,521 | 5,375 | (14)% | (12)% | |||||||||||||||||||||||||||||||||||||||

| Total average deposits | $167,194 | $168,122 | $160,857 | (1)% | 4% | |||||||||||||||||||||||||||||||||||||||

CDs over $250,000 includes $3.8BN, $4.7BN, and $4.9BN of retail brokered certificates of deposit which are fully covered by FDIC insurance for the three months ended 6/30/24, 3/31/24, and 6/30/23, respectively. |

||||||||||||||||||||||||||||||||||||||||||||

| Average Wholesale Funding | ||||||||||||||||||||||||||||||||||||||||||||

| ($ in millions) | For the Three Months Ended | % Change | ||||||||||||||||||||||||||||||||||||||||||

| June | March | June | ||||||||||||||||||||||||||||||||||||||||||

| 2024 | 2024 | 2023 | Seq | Yr/Yr | ||||||||||||||||||||||||||||||||||||||||

| Average Wholesale Funding | ||||||||||||||||||||||||||||||||||||||||||||

| CDs over $250,000 | $4,747 | $5,521 | $5,375 | (14)% | (12)% | |||||||||||||||||||||||||||||||||||||||

| Federal funds purchased | 230 | 201 | 376 | 14% | (39)% | |||||||||||||||||||||||||||||||||||||||

| Securities sold under repurchase agreements | 373 | 366 | 361 | 2% | 3% | |||||||||||||||||||||||||||||||||||||||

| FHLB advances | 3,165 | 3,111 | 6,589 | 2% | (52)% | |||||||||||||||||||||||||||||||||||||||

| Derivative collateral and other secured borrowings | 54 | 57 | 79 | (5)% | (32)% | |||||||||||||||||||||||||||||||||||||||

| Long-term debt | 15,611 | 15,515 | 12,848 | 1% | 22% | |||||||||||||||||||||||||||||||||||||||

| Total average wholesale funding | $24,180 | $24,771 | $25,628 | (2)% | (6)% | |||||||||||||||||||||||||||||||||||||||

CDs over $250,000 includes $3.8BN, $4.7BN, and $4.9BN of retail brokered certificates of deposit which are fully covered by FDIC insurance for the three months ended 6/30/24, 3/31/24, and 6/30/23, respectively. |

||||||||||||||||||||||||||||||||||||||||||||

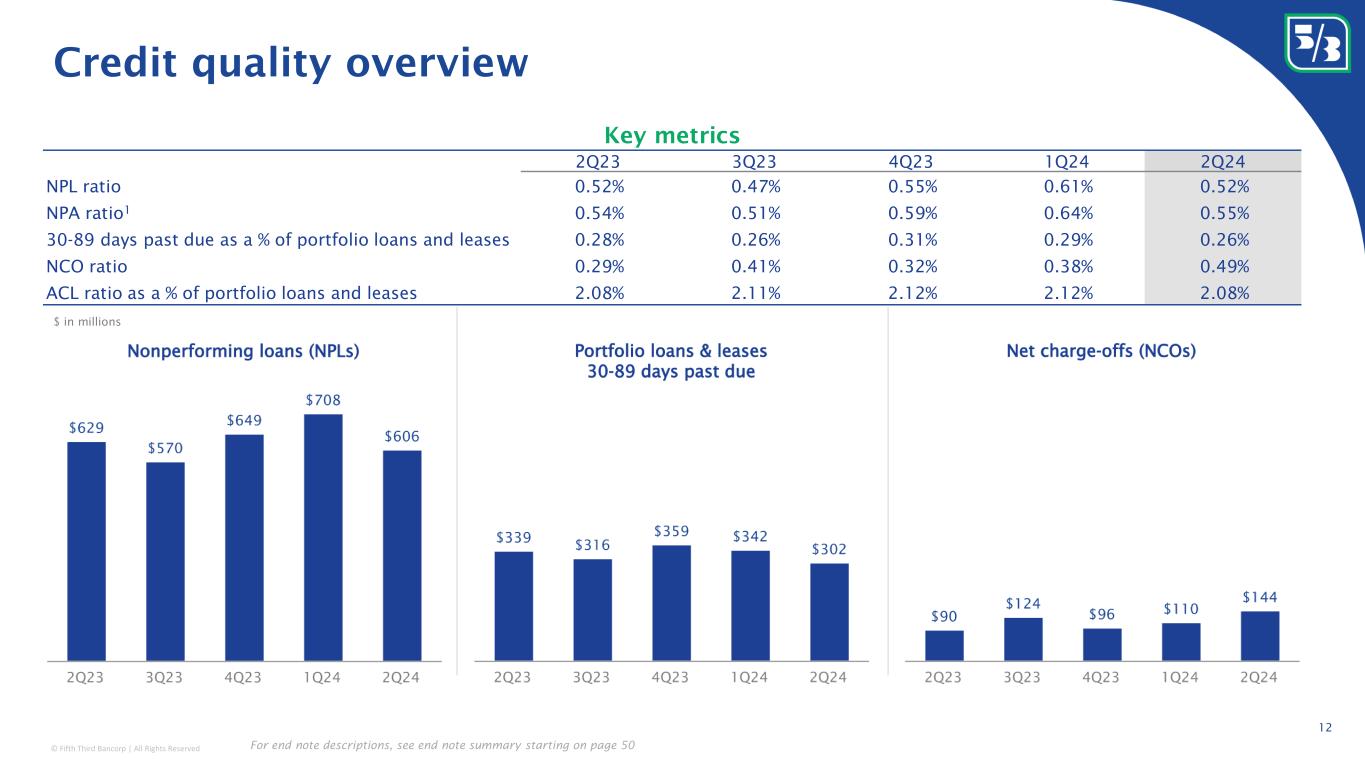

| Credit Quality Summary | ||||||||||||||||||||||||||||||||||||||||||||

| ($ in millions) | As of and For the Three Months Ended | |||||||||||||||||||||||||||||||||||||||||||

| June | March | December | September | June | ||||||||||||||||||||||||||||||||||||||||

| 2024 | 2024 | 2023 | 2023 | 2023 | ||||||||||||||||||||||||||||||||||||||||

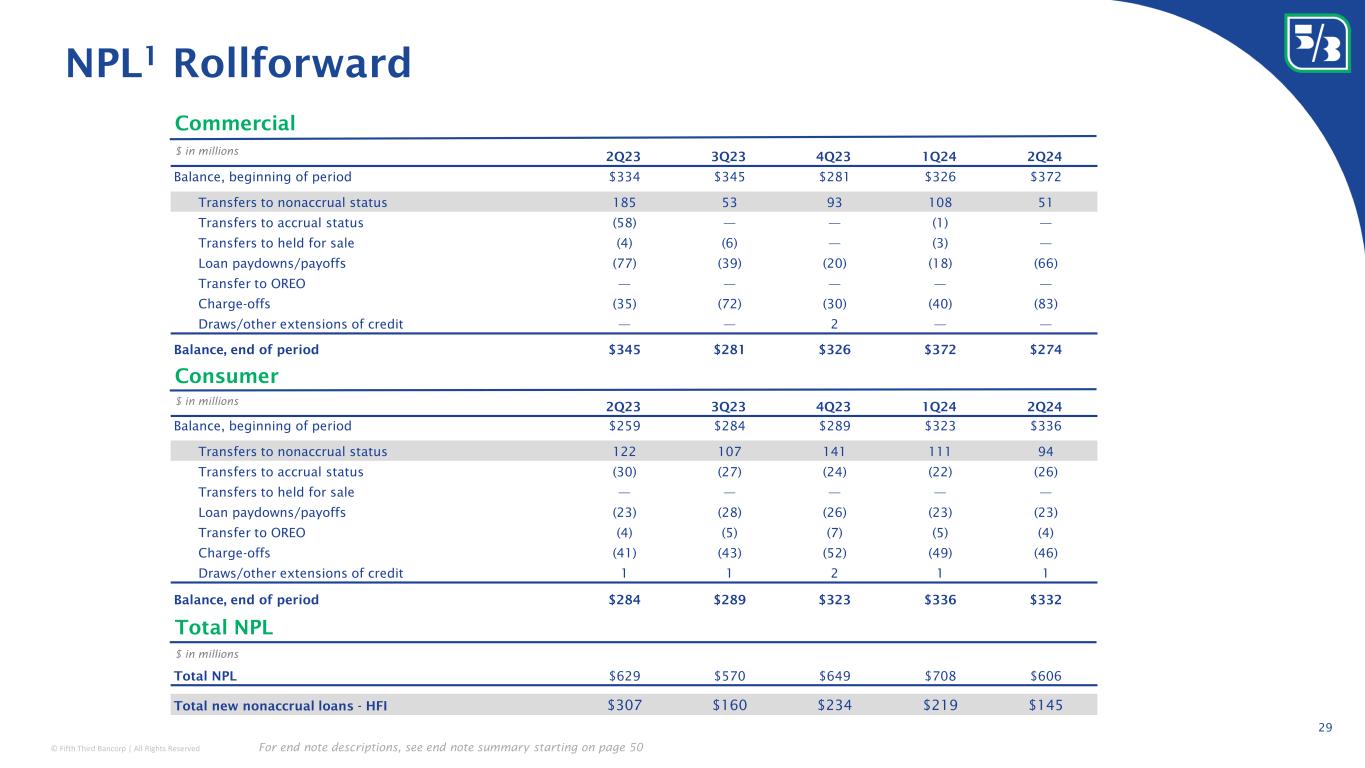

| Total nonaccrual portfolio loans and leases (NPLs) | $606 | $708 | $649 | $570 | $629 | |||||||||||||||||||||||||||||||||||||||

| Repossessed property | 9 | 8 | 10 | 11 | 8 | |||||||||||||||||||||||||||||||||||||||

| OREO | 28 | 27 | 29 | 31 | 24 | |||||||||||||||||||||||||||||||||||||||

| Total nonperforming portfolio loans and leases and OREO (NPAs) | $643 | $743 | $688 | $612 | $661 | |||||||||||||||||||||||||||||||||||||||

NPL ratio(h) |

0.52 | % | 0.61 | % | 0.55 | % | 0.47 | % | 0.52 | % | ||||||||||||||||||||||||||||||||||

NPA ratio(c) |

0.55 | % | 0.64 | % | 0.59 | % | 0.51 | % | 0.54 | % | ||||||||||||||||||||||||||||||||||

| Portfolio loans and leases 30-89 days past due (accrual) | $302 | $342 | $359 | $316 | $339 | |||||||||||||||||||||||||||||||||||||||

| Portfolio loans and leases 90 days past due (accrual) | 33 | 35 | 36 | 29 | 51 | |||||||||||||||||||||||||||||||||||||||

| 30-89 days past due as a % of portfolio loans and leases | 0.26 | % | 0.29 | % | 0.31 | % | 0.26 | % | 0.28 | % | ||||||||||||||||||||||||||||||||||

| 90 days past due as a % of portfolio loans and leases | 0.03 | % | 0.03 | % | 0.03 | % | 0.02 | % | 0.04 | % | ||||||||||||||||||||||||||||||||||

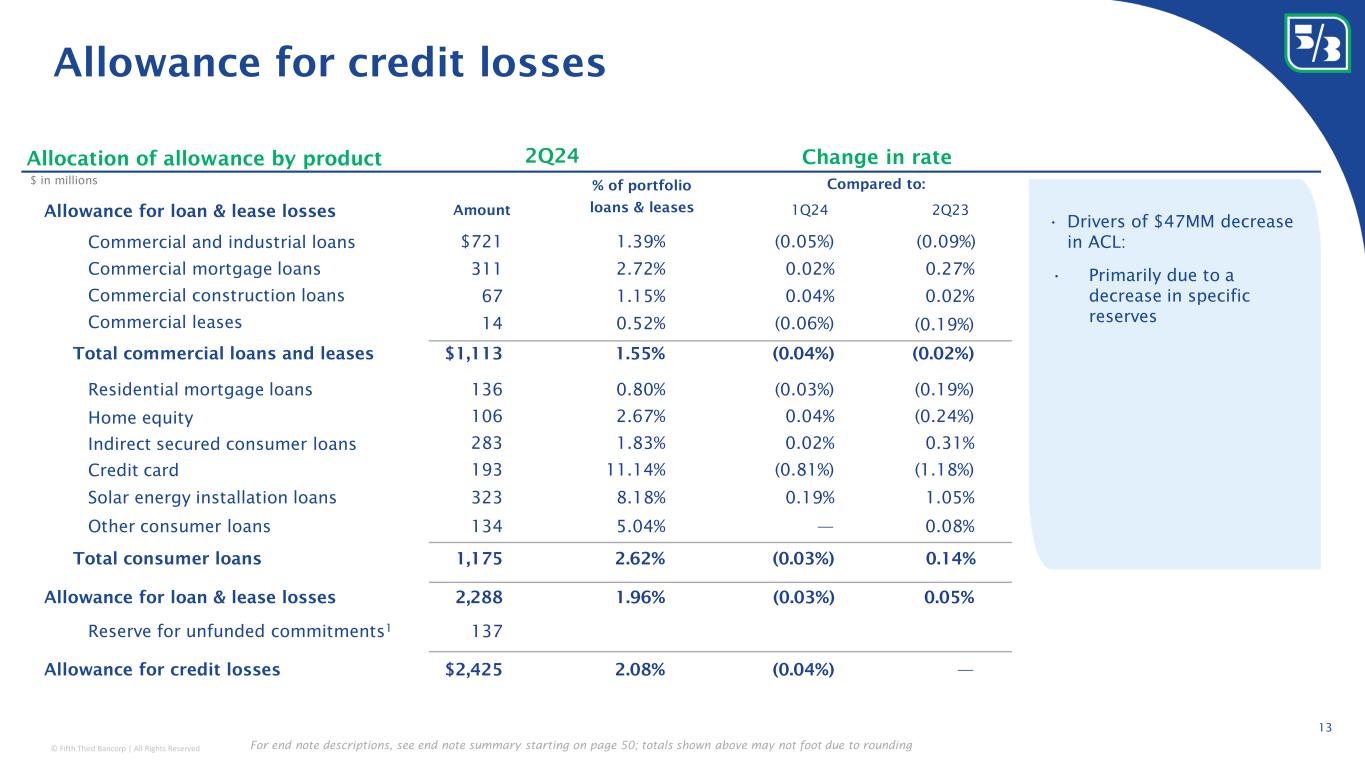

| Allowance for loan and lease losses (ALLL), beginning | $2,318 | $2,322 | $2,340 | $2,327 | $2,215 | |||||||||||||||||||||||||||||||||||||||

| Total net losses charged-off | (144) | (110) | (96) | (124) | (90) | |||||||||||||||||||||||||||||||||||||||

| Provision for loan and lease losses | 114 | 106 | 78 | 137 | 202 | |||||||||||||||||||||||||||||||||||||||

| ALLL, ending | $2,288 | $2,318 | $2,322 | $2,340 | $2,327 | |||||||||||||||||||||||||||||||||||||||

| Reserve for unfunded commitments, beginning | $154 | $166 | $189 | $207 | $232 | |||||||||||||||||||||||||||||||||||||||

| Benefit from the reserve for unfunded commitments | (17) | (12) | (23) | (18) | (25) | |||||||||||||||||||||||||||||||||||||||

| Reserve for unfunded commitments, ending | $137 | $154 | $166 | $189 | $207 | |||||||||||||||||||||||||||||||||||||||

| Total allowance for credit losses (ACL) | $2,425 | $2,472 | $2,488 | $2,529 | $2,534 | |||||||||||||||||||||||||||||||||||||||

| ACL ratios: | ||||||||||||||||||||||||||||||||||||||||||||

| As a % of portfolio loans and leases | 2.08 | % | 2.12 | % | 2.12 | % | 2.11 | % | 2.08 | % | ||||||||||||||||||||||||||||||||||

| As a % of nonperforming portfolio loans and leases | 400 | % | 349 | % | 383 | % | 443 | % | 403 | % | ||||||||||||||||||||||||||||||||||

| As a % of nonperforming portfolio assets | 377 | % | 333 | % | 362 | % | 413 | % | 383 | % | ||||||||||||||||||||||||||||||||||

| ALLL as a % of portfolio loans and leases | 1.96 | % | 1.99 | % | 1.98 | % | 1.95 | % | 1.91 | % | ||||||||||||||||||||||||||||||||||

| Total losses charged-off | $(182) | $(146) | $(133) | $(158) | $(121) | |||||||||||||||||||||||||||||||||||||||

| Total recoveries of losses previously charged-off | 38 | 36 | 37 | 34 | 31 | |||||||||||||||||||||||||||||||||||||||

| Total net losses charged-off | $(144) | $(110) | $(96) | $(124) | $(90) | |||||||||||||||||||||||||||||||||||||||

Net charge-off ratio (NCO ratio)(b) |

0.49 | % | 0.38 | % | 0.32 | % | 0.41 | % | 0.29 | % | ||||||||||||||||||||||||||||||||||

| Commercial NCO ratio | 0.45 | % | 0.19 | % | 0.13 | % | 0.34 | % | 0.16 | % | ||||||||||||||||||||||||||||||||||

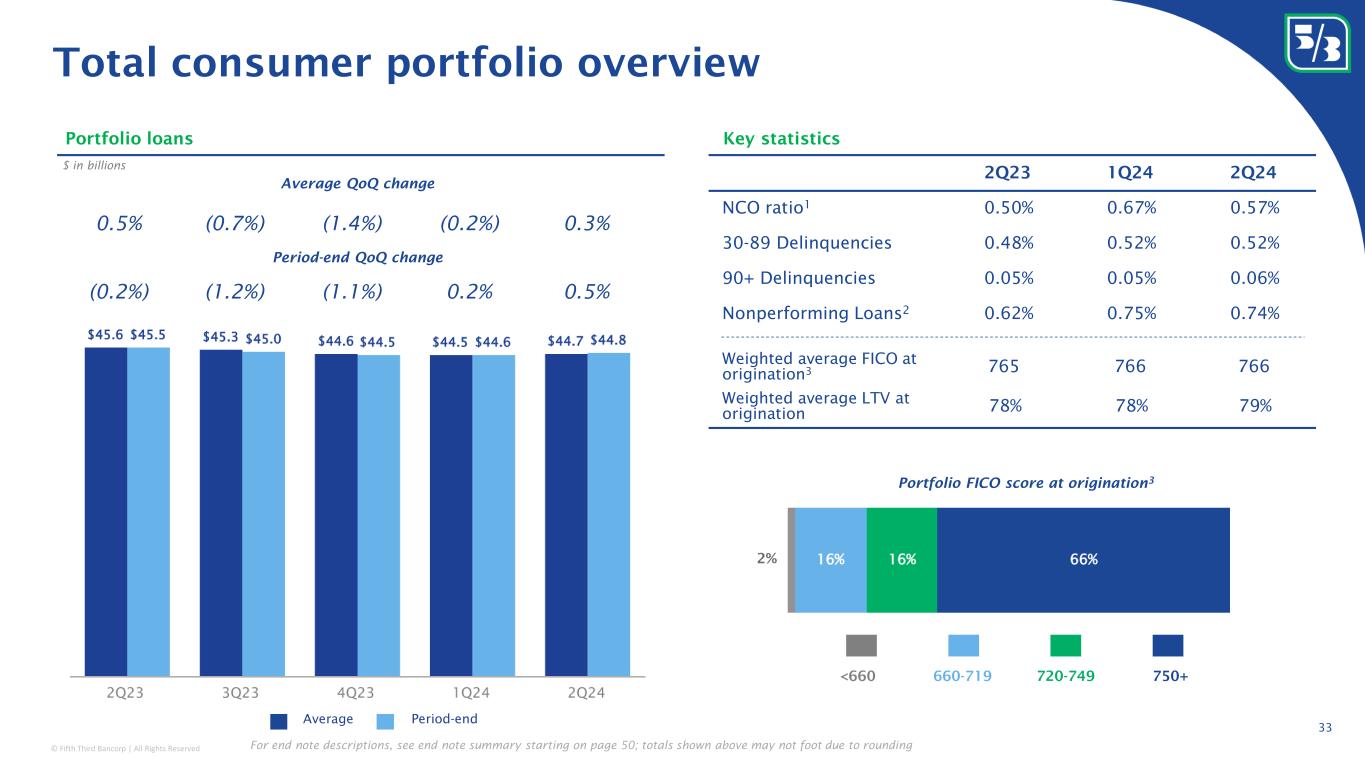

| Consumer NCO ratio | 0.57 | % | 0.67 | % | 0.64 | % | 0.53 | % | 0.50 | % | ||||||||||||||||||||||||||||||||||

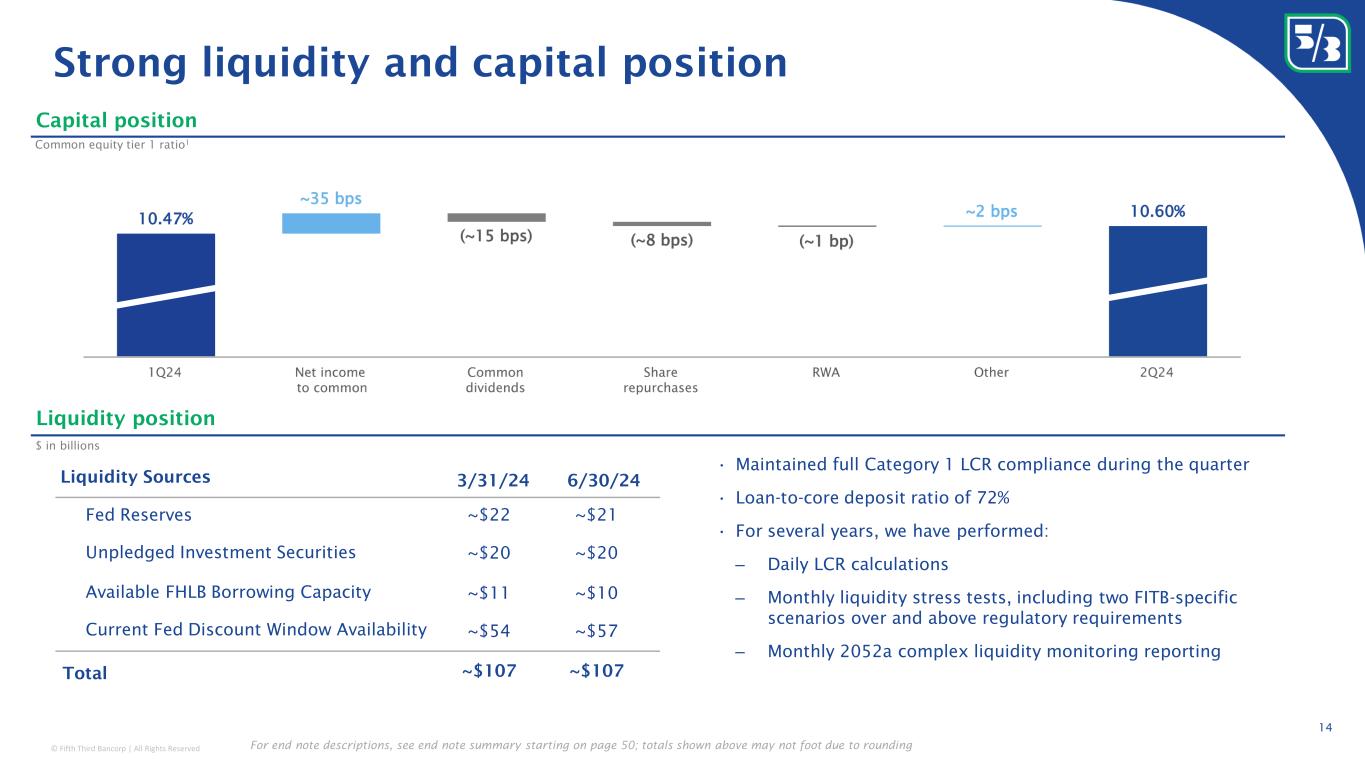

| Capital Position | ||||||||||||||||||||||||||||||||||||||||||||||||||

| As of and For the Three Months Ended | ||||||||||||||||||||||||||||||||||||||||||||||||||

| June | March | December | September | June | ||||||||||||||||||||||||||||||||||||||||||||||

| 2024 | 2024 | 2023 | 2023 | 2023 | ||||||||||||||||||||||||||||||||||||||||||||||

| Capital Position | ||||||||||||||||||||||||||||||||||||||||||||||||||

Average total Bancorp shareholders' equity as a % of average assets |

8.80% | 8.78% | 8.04% | 8.30% | 8.90 | % | ||||||||||||||||||||||||||||||||||||||||||||

Tangible equity(a) |

8.91% | 8.75% | 8.65% | 8.46% | 8.58 | % | ||||||||||||||||||||||||||||||||||||||||||||

Tangible common equity (excluding AOCI)(a) |

7.92% | 7.77% | 7.67% | 7.49% | 7.57 | % | ||||||||||||||||||||||||||||||||||||||||||||

Tangible common equity (including AOCI)(a) |

5.80% | 5.67% | 5.73% | 4.51% | 5.26 | % | ||||||||||||||||||||||||||||||||||||||||||||

Regulatory Capital Ratios(d)(e) |

||||||||||||||||||||||||||||||||||||||||||||||||||

CET1 capital |

10.60 | % | 10.47% | 10.29% | 9.80% | 9.49 | % | |||||||||||||||||||||||||||||||||||||||||||

Tier 1 risk-based capital |

11.90 | % | 11.77% | 11.59% | 11.06% | 10.73 | % | |||||||||||||||||||||||||||||||||||||||||||

Total risk-based capital |

13.93 | % | 13.81% | 13.72% | 13.13% | 12.83 | % | |||||||||||||||||||||||||||||||||||||||||||

| Leverage | 9.07 | % | 8.94% | 8.73% | 8.85% | 8.81 | % | |||||||||||||||||||||||||||||||||||||||||||

| Financial Highlights | 14-15 | ||||||||||

| Consolidated Statements of Income | 16-17 | ||||||||||

| Consolidated Balance Sheets | 18-19 | ||||||||||

| Consolidated Statements of Changes in Equity | 20 | ||||||||||

| Average Balance Sheets and Yield/Rate Analysis | 21-22 | ||||||||||

| Summary of Loans and Leases | 23 | ||||||||||

| Regulatory Capital | 24 | ||||||||||

| Summary of Credit Loss Experience | 25 | ||||||||||

| Asset Quality | 26 | ||||||||||

| Non-GAAP Reconciliation | 27-29 | ||||||||||

| Segment Presentation | 30 | ||||||||||

| Fifth Third Bancorp and Subsidiaries | |||||||||||||||||||||||||||||

| Financial Highlights | As of and For the Three Months Ended | % / bps | % / bps | ||||||||||||||||||||||||||

| $ in millions, except per share data | Change | Year to Date | Change | ||||||||||||||||||||||||||

| (unaudited) | June | March | June | June | June | ||||||||||||||||||||||||

| 2024 | 2024 | 2023 | Seq | Yr/Yr | 2024 | 2023 | Yr/Yr | ||||||||||||||||||||||

| Income Statement Data | |||||||||||||||||||||||||||||

| Net interest income | $1,387 | $1,384 | $1,457 | — | (5%) | $2,771 | $2,974 | (7%) | |||||||||||||||||||||

Net interest income (FTE)(a) |

1,393 | 1,390 | 1,463 | — | (5%) | 2,783 | 2,985 | (7%) | |||||||||||||||||||||

| Noninterest income | 695 | 710 | 726 | (2%) | (4%) | 1,406 | 1,422 | (1%) | |||||||||||||||||||||

Total revenue (FTE)(a) |

2,088 | 2,100 | 2,189 | (1%) | (5%) | 4,189 | 4,407 | (5%) | |||||||||||||||||||||

| Provision for credit losses | 97 | 94 | 177 | 3% | (45%) | 191 | 341 | (44%) | |||||||||||||||||||||

| Noninterest expense | 1,221 | 1,342 | 1,231 | (9%) | (1%) | 2,562 | 2,562 | — | |||||||||||||||||||||

| Net income | 601 | 520 | 601 | 16% | — | 1,122 | 1,159 | (3%) | |||||||||||||||||||||

| Net income available to common shareholders | 561 | 480 | 562 | 17% | — | 1,041 | 1,097 | (5%) | |||||||||||||||||||||

| Earnings Per Share Data | |||||||||||||||||||||||||||||

| Net income allocated to common shareholders | $561 | $480 | $562 | 17% | — | $1,041 | $1,097 | (5%) | |||||||||||||||||||||

| Average common shares outstanding (in thousands): | |||||||||||||||||||||||||||||

| Basic | 686,781 | 685,750 | 684,029 | — | — | 686,265 | 684,023 | — | |||||||||||||||||||||

| Diluted | 691,083 | 690,634 | 686,386 | — | 1% | 690,858 | 687,967 | — | |||||||||||||||||||||

| Earnings per share, basic | $0.82 | $0.70 | $0.82 | 17% | — | $1.52 | $1.60 | (5%) | |||||||||||||||||||||

| Earnings per share, diluted | 0.81 | 0.70 | 0.82 | 16% | (1%) | 1.51 | 1.59 | (5%) | |||||||||||||||||||||

| Common Share Data | |||||||||||||||||||||||||||||

| Cash dividends per common share | $0.35 | $0.35 | $0.33 | — | 6% | $0.70 | $0.66 | 6% | |||||||||||||||||||||

| Book value per share | 25.13 | 24.72 | 23.05 | 2% | 9% | 25.13 | 23.05 | 9% | |||||||||||||||||||||

| Market value per share | 36.49 | 37.21 | 26.21 | (2%) | 39% | 36.49 | 26.21 | 39% | |||||||||||||||||||||

| Common shares outstanding (in thousands) | 680,789 | 683,812 | 680,850 | — | — | 680,789 | 680,850 | — | |||||||||||||||||||||

| Market capitalization | $24,842 | $25,445 | $17,845 | (2%) | 39% | $24,842 | $17,845 | 39% | |||||||||||||||||||||

| Financial Ratios | |||||||||||||||||||||||||||||

| Return on average assets | 1.14 | % | 0.98 | % | 1.17 | % | 16 | (3) | 1.06 | % | 1.14 | % | (8) | ||||||||||||||||

| Return on average common equity | 13.6 | % | 11.6 | % | 13.9 | % | 198 | (28) | 12.6 | % | 13.8 | % | (120) | ||||||||||||||||

Return on average tangible common equity(a) |

19.8 | % | 17.0 | % | 20.5 | % | 280 | (73) | 18.3 | % | 20.5 | % | (220) | ||||||||||||||||

Noninterest income as a percent of total revenue(a) |

33 | % | 34 | % | 33 | % | (100) | — | 34 | % | 32 | % | 129 | ||||||||||||||||

| Dividend payout | 42.7 | % | 50.0 | % | 40.2 | % | (730) | 250 | 46.1 | % | 41.3 | % | 480 | ||||||||||||||||

Average total Bancorp shareholders’ equity as a percent of average assets |

8.80 | % | 8.78 | % | 8.90 | % | 2 | (10) | 8.79 | % | 8.83 | % | (4) | ||||||||||||||||

Tangible common equity(a) |

7.92 | % | 7.77 | % | 7.57 | % | 15 | 35 | 7.92 | % | 7.57 | % | 35 | ||||||||||||||||

Net interest margin (FTE)(a) |

2.88 | % | 2.86 | % | 3.10 | % | 2 | (22) | 2.87 | % | 3.20 | % | (33) | ||||||||||||||||

Efficiency (FTE)(a) |

58.5 | % | 63.9 | % | 56.2 | % | (540) | 230 | 61.2 | % | 58.1 | % | 310 | ||||||||||||||||

| Effective tax rate | 21.3 | % | 21.1 | % | 22.5 | % | 20 | (120) | 21.2 | % | 22.4 | % | (120) | ||||||||||||||||

| Credit Quality | |||||||||||||||||||||||||||||

| Net losses charged-off | $144 | $110 | $90 | 31 | % | 60 | % | $254 | $168 | 51 | % | ||||||||||||||||||

| Net losses charged-off as a percent of average portfolio loans and leases (annualized) | 0.49 | % | 0.38 | % | 0.29 | % | 11 | 20 | 0.44 | % | 0.27 | % | 17 | ||||||||||||||||

| ALLL as a percent of portfolio loans and leases | 1.96 | % | 1.99 | % | 1.91 | % | (3) | 5 | 1.96 | % | 1.91 | % | 5 | ||||||||||||||||

ACL as a percent of portfolio loans and leases(g) |

2.08 | % | 2.12 | % | 2.08 | % | (4) | — | 2.08 | % | 2.08 | % | — | ||||||||||||||||

| Nonperforming portfolio assets as a percent of portfolio loans and leases and OREO | 0.55 | % | 0.64 | % | 0.54 | % | (9) | 1 | 0.55 | % | 0.54 | % | 1 | ||||||||||||||||

| Average Balances | |||||||||||||||||||||||||||||

| Loans and leases, including held for sale | $117,283 | $117,699 | $123,987 | — | (5%) | $117,491 | $123,802 | (5%) | |||||||||||||||||||||

| Securities and other short-term investments | 77,216 | 77,650 | 65,073 | (1%) | 19% | 77,433 | 64,436 | 20% | |||||||||||||||||||||

| Assets | 212,475 | 213,203 | 206,079 | — | 3% | 212,839 | 205,584 | 4% | |||||||||||||||||||||

Transaction deposits(b) |

151,680 | 152,357 | 147,723 | — | 3% | 152,018 | 149,414 | 2% | |||||||||||||||||||||

Core deposits(c) |

162,447 | 162,601 | 155,482 | — | 4% | 162,523 | 155,887 | 4% | |||||||||||||||||||||

Wholesale funding(d) |

24,180 | 24,771 | 25,628 | (2%) | (6%) | 24,476 | 24,680 | (1%) | |||||||||||||||||||||

Bancorp shareholders' equity |

18,707 | 18,727 | 18,344 | — | 2% | 18,717 | 18,162 | 3% | |||||||||||||||||||||

Regulatory Capital Ratios(e)(f) |

|||||||||||||||||||||||||||||

CET1 capital |

10.60 | % | 10.47 | % | 9.49 | % | 13 | 111 | 10.60 | % | 9.49 | % | 111 | ||||||||||||||||

Tier 1 risk-based capital |

11.90 | % | 11.77 | % | 10.73 | % | 13 | 117 | 11.90 | % | 10.73 | % | 117 | ||||||||||||||||

Total risk-based capital |

13.93 | % | 13.81 | % | 12.83 | % | 12 | 110 | 13.93 | % | 12.83 | % | 110 | ||||||||||||||||

| Leverage | 9.07 | % | 8.94 | % | 8.81 | % | 13 | 26 | 9.07 | % | 8.81 | % | 26 | ||||||||||||||||

| Additional Metrics | |||||||||||||||||||||||||||||

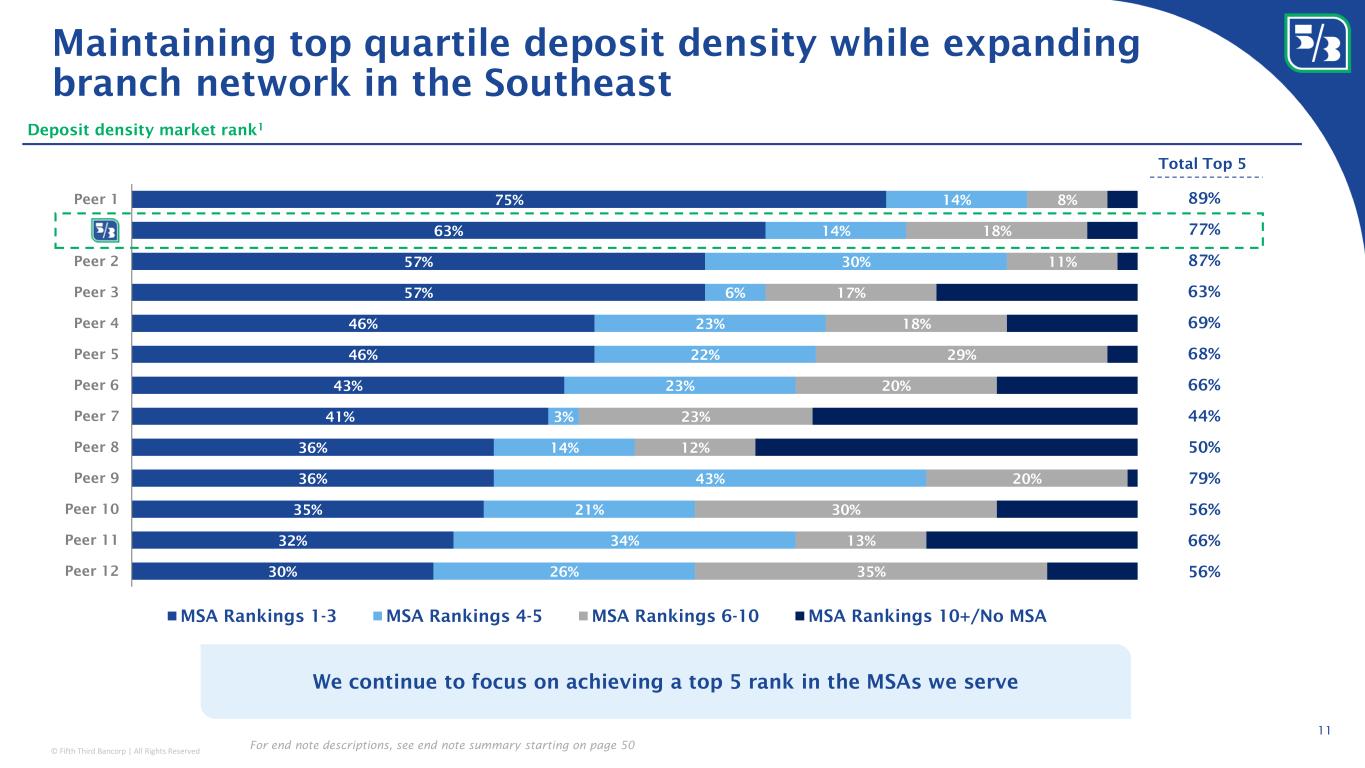

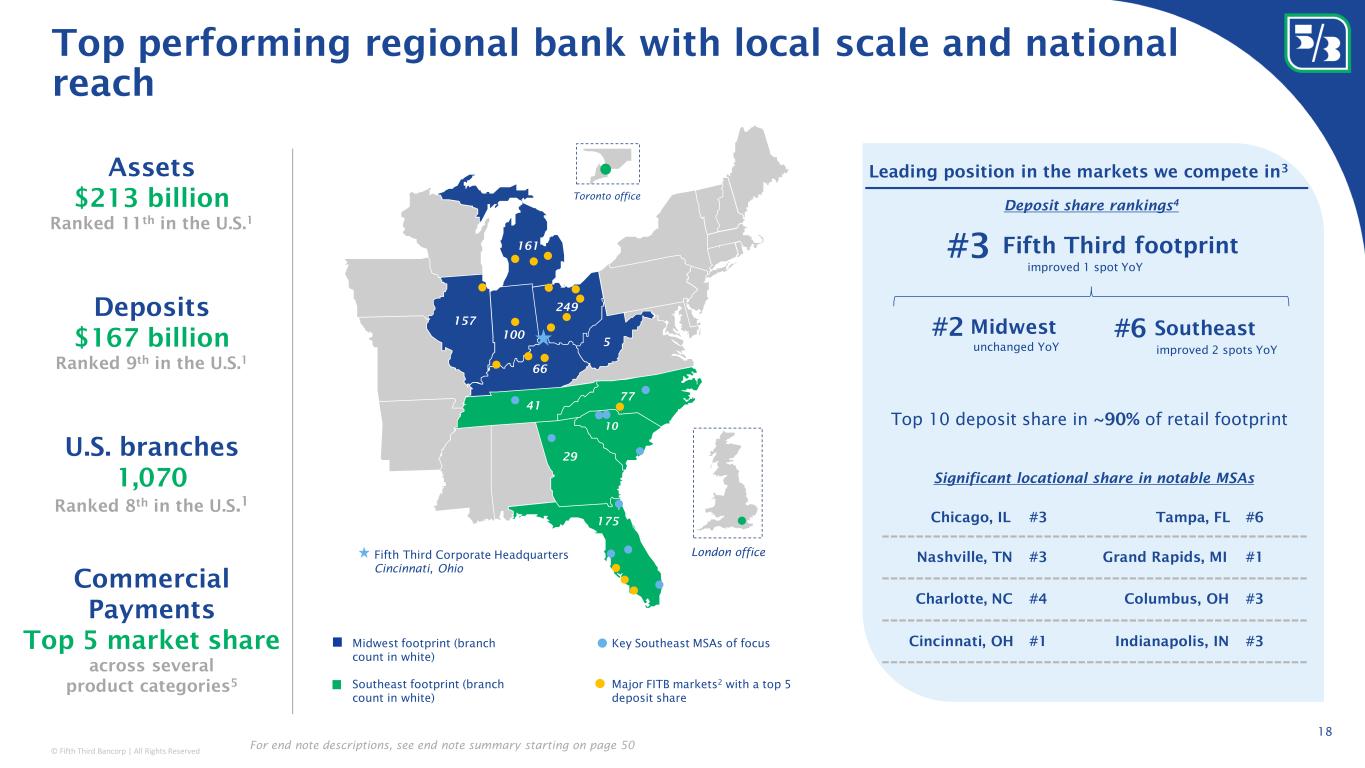

| Banking centers | 1,070 | 1,070 | 1,072 | — | — | 1,070 | 1,072 | — | |||||||||||||||||||||

| ATMs | 2,067 | 2,082 | 2,114 | (1%) | (2%) | 2,067 | 2,114 | (2%) | |||||||||||||||||||||

| Full-time equivalent employees | 18,607 | 18,657 | 19,225 | — | (3%) | 18,607 | 19,225 | (3%) | |||||||||||||||||||||

Assets under care ($ in billions)(h) |

$631 | $634 | $554 | — | 14% | $631 | $554 | 14% | |||||||||||||||||||||

Assets under management ($ in billions)(h) |

65 | 62 | 59 | 5% | 10% | 65 | 59 | 10% | |||||||||||||||||||||

| Fifth Third Bancorp and Subsidiaries | ||||||||||||||||||||

| Financial Highlights | ||||||||||||||||||||

| $ in millions, except per share data | As of and For the Three Months Ended | |||||||||||||||||||

| (unaudited) | June | March | December | September | June | |||||||||||||||

| 2024 | 2024 | 2023 | 2023 | 2023 | ||||||||||||||||

| Income Statement Data | ||||||||||||||||||||

| Net interest income | $1,387 | $1,384 | $1,416 | $1,438 | $1,457 | |||||||||||||||

Net interest income (FTE)(a) |

1,393 | 1,390 | 1,423 | 1,445 | 1,463 | |||||||||||||||

| Noninterest income | 695 | 710 | 744 | 715 | 726 | |||||||||||||||

Total revenue (FTE)(a) |

2,088 | 2,100 | 2,167 | 2,160 | 2,189 | |||||||||||||||

| Provision for credit losses | 97 | 94 | 55 | 119 | 177 | |||||||||||||||

| Noninterest expense | 1,221 | 1,342 | 1,455 | 1,188 | 1,231 | |||||||||||||||

| Net income | 601 | 520 | 530 | 660 | 601 | |||||||||||||||

| Net income available to common shareholders | 561 | 480 | 492 | 623 | 562 | |||||||||||||||

| Earnings Per Share Data | ||||||||||||||||||||

| Net income allocated to common shareholders | $561 | $480 | $492 | $623 | $562 | |||||||||||||||

| Average common shares outstanding (in thousands): | ||||||||||||||||||||

| Basic | 686,781 | 685,750 | 684,413 | 684,224 | 684,029 | |||||||||||||||

| Diluted | 691,083 | 690,634 | 687,729 | 687,059 | 686,386 | |||||||||||||||

| Earnings per share, basic | $0.82 | $0.70 | $0.72 | $0.91 | $0.82 | |||||||||||||||

| Earnings per share, diluted | 0.81 | 0.70 | 0.72 | 0.91 | 0.82 | |||||||||||||||

| Common Share Data | ||||||||||||||||||||

| Cash dividends per common share | $0.35 | $0.35 | $0.35 | $0.35 | $0.33 | |||||||||||||||

| Book value per share | 25.13 | 24.72 | 25.04 | 21.19 | 23.05 | |||||||||||||||

| Market value per share | 36.49 | 37.21 | 34.49 | 25.33 | 26.21 | |||||||||||||||

| Common shares outstanding (in thousands) | 680,789 | 683,812 | 681,125 | 680,990 | 680,850 | |||||||||||||||

| Market capitalization | $24,842 | $25,445 | $23,492 | $17,249 | $17,845 | |||||||||||||||

| Financial Ratios | ||||||||||||||||||||

| Return on average assets | 1.14 | % | 0.98 | % | 0.98 | % | 1.26 | % | 1.17 | % | ||||||||||

| Return on average common equity | 13.6 | % | 11.6 | % | 12.9 | % | 16.3 | % | 13.9 | % | ||||||||||

Return on average tangible common equity(a) |

19.8 | % | 17.0 | % | 19.8 | % | 24.7 | % | 20.5 | % | ||||||||||

Noninterest income as a percent of total revenue(a) |

33 | % | 34 | % | 34 | % | 33 | % | 33 | % | ||||||||||

| Dividend payout | 42.7 | % | 50.0 | % | 48.6 | % | 38.5 | % | 40.2 | % | ||||||||||

Average total Bancorp shareholders’ equity as a percent of average assets |

8.80 | % | 8.78 | % | 8.04 | % | 8.30 | % | 8.90 | % | ||||||||||

Tangible common equity(a) |

7.92 | % | 7.77 | % | 7.67 | % | 7.49 | % | 7.57 | % | ||||||||||

Net interest margin (FTE)(a) |

2.88 | % | 2.86 | % | 2.85 | % | 2.98 | % | 3.10 | % | ||||||||||

Efficiency (FTE)(a) |

58.5 | % | 63.9 | % | 67.2 | % | 55.0 | % | 56.2 | % | ||||||||||

| Effective tax rate | 21.3 | % | 21.1 | % | 18.4 | % | 22.0 | % | 22.5 | % | ||||||||||

| Credit Quality | ||||||||||||||||||||

| Net losses charged-off | $144 | $110 | $96 | $124 | $90 | |||||||||||||||

| Net losses charged-off as a percent of average portfolio loans and leases (annualized) | 0.49 | % | 0.38 | % | 0.32 | % | 0.41 | % | 0.29 | % | ||||||||||

| ALLL as a percent of portfolio loans and leases | 1.96 | % | 1.99 | % | 1.98 | % | 1.95 | % | 1.91 | % | ||||||||||

ACL as a percent of portfolio loans and leases(g) |

2.08 | % | 2.12 | % | 2.12 | % | 2.11 | % | 2.08 | % | ||||||||||

| Nonperforming portfolio assets as a percent of portfolio loans and leases and OREO | 0.55 | % | 0.64 | % | 0.59 | % | 0.51 | % | 0.54 | % | ||||||||||

| Average Balances | ||||||||||||||||||||

| Loans and leases, including held for sale | $117,283 | $117,699 | $119,309 | $122,266 | $123,987 | |||||||||||||||

| Securities and other short-term investments | 77,216 | 77,650 | 78,857 | 69,950 | 65,073 | |||||||||||||||

| Assets | 212,475 | 213,203 | 214,057 | 208,385 | 206,079 | |||||||||||||||

Transaction deposits(b) |

151,680 | 152,357 | 153,232 | 150,088 | 147,723 | |||||||||||||||

Core deposits(c) |

162,447 | 162,601 | 163,788 | 159,718 | 155,482 | |||||||||||||||

Wholesale funding(d) |

24,180 | 24,771 | 26,115 | 24,289 | 25,628 | |||||||||||||||

Bancorp shareholders’ equity |

18,707 | 18,727 | 17,201 | 17,305 | 18,344 | |||||||||||||||

Regulatory Capital Ratios(e)(f) |

||||||||||||||||||||

CET1 capital |

10.60 | % | 10.47 | % | 10.29 | % | 9.80 | % | 9.49 | % | ||||||||||

| Tier 1 risk-based capital | 11.90 | % | 11.77 | % | 11.59 | % | 11.06 | % | 10.73 | % | ||||||||||

Total risk-based capital |

13.93 | % | 13.81 | % | 13.72 | % | 13.13 | % | 12.83 | % | ||||||||||

| Leverage | 9.07 | % | 8.94 | % | 8.73 | % | 8.85 | % | 8.81 | % | ||||||||||

| Additional Metrics | ||||||||||||||||||||

| Banking centers | 1,070 | 1,070 | 1,088 | 1,073 | 1,072 | |||||||||||||||

| ATMs | 2,067 | 2,082 | 2,104 | 2,101 | 2,114 | |||||||||||||||

| Full-time equivalent employees | 18,607 | 18,657 | 18,724 | 18,804 | 19,225 | |||||||||||||||

Assets under care ($ in billions)(h) |

$631 | $634 | $574 | $547 | $554 | |||||||||||||||

Assets under management ($ in billions)(h) |

65 | 62 | 59 | 57 | 59 | |||||||||||||||

| Fifth Third Bancorp and Subsidiaries | ||||||||||||||||||||||||||

| Consolidated Statements of Income | ||||||||||||||||||||||||||

| $ in millions | For the Three Months Ended | % Change | Year to Date | % Change | ||||||||||||||||||||||

| (unaudited) | June | March | June | June | June | |||||||||||||||||||||

| 2024 | 2024 | 2023 | Seq | Yr/Yr | 2024 | 2023 | Yr/Yr | |||||||||||||||||||

| Interest Income | ||||||||||||||||||||||||||

| Interest and fees on loans and leases | $1,871 | $1,859 | $1,831 | 1% | 2% | $3,731 | $3,545 | 5% | ||||||||||||||||||

| Interest on securities | 458 | 455 | 437 | 1% | 5% | 913 | 876 | 4% | ||||||||||||||||||

| Interest on other short-term investments | 291 | 294 | 102 | (1%) | 185% | 584 | 162 | 260% | ||||||||||||||||||

| Total interest income | 2,620 | 2,608 | 2,370 | — | 11% | 5,228 | 4,583 | 14% | ||||||||||||||||||

| Interest Expense | ||||||||||||||||||||||||||

| Interest on deposits | 958 | 954 | 655 | — | 46% | 1,912 | 1,133 | 69% | ||||||||||||||||||

| Interest on federal funds purchased | 3 | 3 | 5 | — | (40%) | 6 | 10 | (40%) | ||||||||||||||||||

| Interest on other short-term borrowings | 48 | 47 | 90 | 2% | (47%) | 95 | 147 | (35%) | ||||||||||||||||||

| Interest on long-term debt | 224 | 220 | 163 | 2% | 37% | 444 | 319 | 39% | ||||||||||||||||||

| Total interest expense | 1,233 | 1,224 | 913 | 1% | 35% | 2,457 | 1,609 | 53% | ||||||||||||||||||

| Net Interest Income | 1,387 | 1,384 | 1,457 | — | (5%) | 2,771 | 2,974 | (7%) | ||||||||||||||||||

| Provision for credit losses | 97 | 94 | 177 | 3% | (45%) | 191 | 341 | (44%) | ||||||||||||||||||

| Net Interest Income After Provision for Credit Losses | 1,290 | 1,290 | 1,280 | — | 1% | 2,580 | 2,633 | (2%) | ||||||||||||||||||

| Noninterest Income | ||||||||||||||||||||||||||

| Service charges on deposits | 156 | 151 | 144 | 3% | 8% | 306 | 281 | 9% | ||||||||||||||||||

| Commercial banking revenue | 144 | 143 | 146 | 1% | (1%) | 288 | 307 | (6%) | ||||||||||||||||||

| Mortgage banking net revenue | 50 | 54 | 59 | (7%) | (15%) | 104 | 127 | (18%) | ||||||||||||||||||

| Wealth and asset management revenue | 159 | 161 | 143 | (1%) | 11% | 320 | 289 | 11% | ||||||||||||||||||

| Card and processing revenue | 108 | 102 | 106 | 6% | 2% | 210 | 206 | 2% | ||||||||||||||||||

| Leasing business revenue | 38 | 39 | 47 | (3%) | (19%) | 77 | 104 | (26%) | ||||||||||||||||||

| Other noninterest income | 37 | 50 | 74 | (26%) | (50%) | 88 | 97 | (9%) | ||||||||||||||||||

| Securities gains, net | 3 | 10 | 7 | (70%) | (57%) | 13 | 11 | 18% | ||||||||||||||||||

| Total noninterest income | 695 | 710 | 726 | (2%) | (4%) | 1,406 | 1,422 | (1%) | ||||||||||||||||||

| Noninterest Expense | ||||||||||||||||||||||||||

| Compensation and benefits | 656 | 753 | 650 | (13%) | 1% | 1,409 | 1,407 | — | ||||||||||||||||||

| Net occupancy expense | 83 | 87 | 83 | (5%) | — | 170 | 164 | 4% | ||||||||||||||||||

| Technology and communications | 114 | 117 | 114 | (3%) | — | 231 | 232 | — | ||||||||||||||||||

| Equipment expense | 38 | 37 | 36 | 3% | 6% | 76 | 73 | 4% | ||||||||||||||||||

| Card and processing expense | 21 | 20 | 20 | 5% | 5% | 41 | 42 | (2%) | ||||||||||||||||||

| Leasing business expense | 22 | 25 | 31 | (12%) | (29%) | 48 | 65 | (26%) | ||||||||||||||||||

| Marketing expense | 34 | 32 | 31 | 6% | 10% | 66 | 60 | 10% | ||||||||||||||||||

| Other noninterest expense | 253 | 271 | 266 | (7%) | (5%) | 521 | 519 | — | ||||||||||||||||||

| Total noninterest expense | 1,221 | 1,342 | 1,231 | (9%) | (1%) | 2,562 | 2,562 | — | ||||||||||||||||||

| Income Before Income Taxes | 764 | 658 | 775 | 16% | (1%) | 1,424 | 1,493 | (5%) | ||||||||||||||||||

| Applicable income tax expense | 163 | 138 | 174 | 18% | (6%) | 302 | 334 | (10%) | ||||||||||||||||||

| Net Income | 601 | 520 | 601 | 16% | — | 1,122 | 1,159 | (3%) | ||||||||||||||||||

| Dividends on preferred stock | 40 | 40 | 39 | — | 3% | 81 | 62 | 31% | ||||||||||||||||||

| Net Income Available to Common Shareholders | $561 | $480 | $562 | 17% | — | $1,041 | $1,097 | (5%) | ||||||||||||||||||

| Fifth Third Bancorp and Subsidiaries | |||||||||||||||||

| Consolidated Statements of Income | |||||||||||||||||

| $ in millions | For the Three Months Ended | ||||||||||||||||

| (unaudited) | June | March | December | September | June | ||||||||||||

| 2024 | 2024 | 2023 | 2023 | 2023 | |||||||||||||

| Interest Income | |||||||||||||||||

| Interest and fees on loans and leases | $1,871 | $1,859 | $1,889 | $1,899 | $1,831 | ||||||||||||

| Interest on securities | 458 | 455 | 451 | 444 | 437 | ||||||||||||

| Interest on other short-term investments | 291 | 294 | 308 | 186 | 102 | ||||||||||||

| Total interest income | 2,620 | 2,608 | 2,648 | 2,529 | 2,370 | ||||||||||||

| Interest Expense | |||||||||||||||||

| Interest on deposits | 958 | 954 | 952 | 844 | 655 | ||||||||||||

| Interest on federal funds purchased | 3 | 3 | 3 | 2 | 5 | ||||||||||||

| Interest on other short-term borrowings | 48 | 47 | 49 | 52 | 90 | ||||||||||||

| Interest on long-term debt | 224 | 220 | 228 | 193 | 163 | ||||||||||||

| Total interest expense | 1,233 | 1,224 | 1,232 | 1,091 | 913 | ||||||||||||

| Net Interest Income | 1,387 | 1,384 | 1,416 | 1,438 | 1,457 | ||||||||||||

| Provision for credit losses | 97 | 94 | 55 | 119 | 177 | ||||||||||||

| Net Interest Income After Provision for Credit Losses | 1,290 | 1,290 | 1,361 | 1,319 | 1,280 | ||||||||||||

| Noninterest Income | |||||||||||||||||

| Service charges on deposits | 156 | 151 | 146 | 149 | 144 | ||||||||||||

| Commercial banking revenue | 144 | 143 | 163 | 154 | 146 | ||||||||||||

| Mortgage banking net revenue | 50 | 54 | 66 | 57 | 59 | ||||||||||||

| Wealth and asset management revenue | 159 | 161 | 147 | 145 | 143 | ||||||||||||

| Card and processing revenue | 108 | 102 | 106 | 104 | 106 | ||||||||||||

| Leasing business revenue | 38 | 39 | 46 | 58 | 47 | ||||||||||||

| Other noninterest income | 37 | 50 | 54 | 55 | 74 | ||||||||||||

| Securities gains (losses), net | 3 | 10 | 15 | (7) | 7 | ||||||||||||

| Securities gains, net - non-qualifying hedges on mortgage servicing rights | — | — | 1 | — | — | ||||||||||||

| Total noninterest income | 695 | 710 | 744 | 715 | 726 | ||||||||||||

| Noninterest Expense | |||||||||||||||||

| Compensation and benefits | 656 | 753 | 659 | 629 | 650 | ||||||||||||

| Net occupancy expense | 83 | 87 | 83 | 84 | 83 | ||||||||||||

| Technology and communications | 114 | 117 | 117 | 115 | 114 | ||||||||||||

| Equipment expense | 38 | 37 | 37 | 37 | 36 | ||||||||||||

| Card and processing expense | 21 | 20 | 21 | 21 | 20 | ||||||||||||

| Leasing business expense | 22 | 25 | 27 | 29 | 31 | ||||||||||||

| Marketing expense | 34 | 32 | 30 | 35 | 31 | ||||||||||||

| Other noninterest expense | 253 | 271 | 481 | 238 | 266 | ||||||||||||

| Total noninterest expense | 1,221 | 1,342 | 1,455 | 1,188 | 1,231 | ||||||||||||

| Income Before Income Taxes | 764 | 658 | 650 | 846 | 775 | ||||||||||||

| Applicable income tax expense | 163 | 138 | 120 | 186 | 174 | ||||||||||||

| Net Income | 601 | 520 | 530 | 660 | 601 | ||||||||||||

| Dividends on preferred stock | 40 | 40 | 38 | 37 | 39 | ||||||||||||

| Net Income Available to Common Shareholders | $561 | $480 | $492 | $623 | $562 | ||||||||||||

| Fifth Third Bancorp and Subsidiaries | |||||||||||||||||

| Consolidated Balance Sheets | |||||||||||||||||

| $ in millions, except per share data | As of | % Change | |||||||||||||||

| (unaudited) | June | March | June | ||||||||||||||

| 2024 | 2024 | 2023 | Seq | Yr/Yr | |||||||||||||

| Assets | |||||||||||||||||

| Cash and due from banks | $2,837 | $2,796 | $2,594 | 1% | 9% | ||||||||||||

| Other short-term investments | 21,085 | 22,840 | 10,943 | (8%) | 93% | ||||||||||||

Available-for-sale debt and other securities(a) |

38,986 | 38,791 | 49,329 | 1% | (21%) | ||||||||||||

Held-to-maturity securities(b) |

11,443 | 11,520 | 2 | (1%) | NM | ||||||||||||

| Trading debt securities | 1,132 | 1,151 | 1,139 | (2%) | (1%) | ||||||||||||

| Equity securities | 476 | 380 | 331 | 25% | 44% | ||||||||||||

| Loans and leases held for sale | 537 | 339 | 760 | 58% | (29%) | ||||||||||||

| Portfolio loans and leases: | |||||||||||||||||

| Commercial and industrial loans | 51,840 | 52,209 | 56,897 | (1%) | (9%) | ||||||||||||

| Commercial mortgage loans | 11,429 | 11,346 | 11,310 | 1% | 1% | ||||||||||||

| Commercial construction loans | 5,806 | 5,789 | 5,475 | — | 6% | ||||||||||||

| Commercial leases | 2,708 | 2,572 | 2,670 | 5% | 1% | ||||||||||||

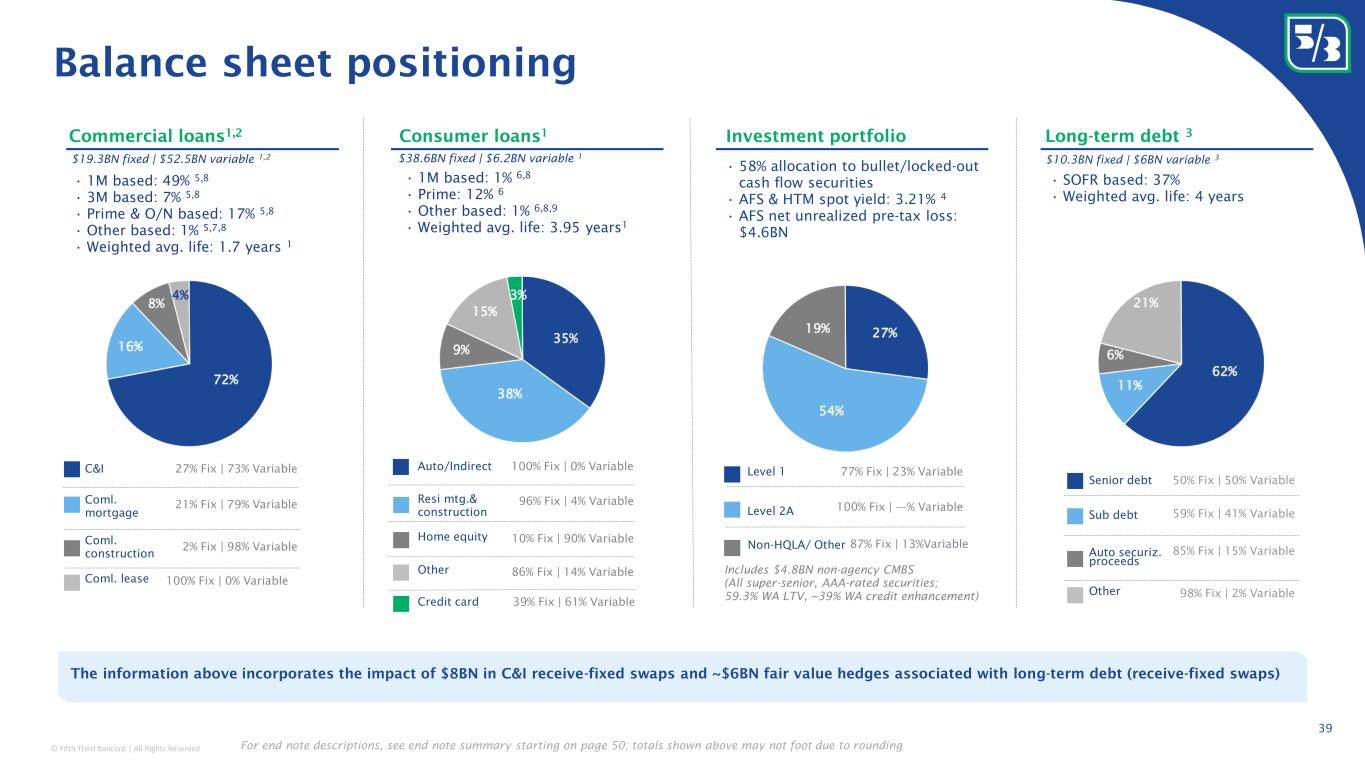

| Total commercial loans and leases | 71,783 | 71,916 | 76,352 | — | (6%) | ||||||||||||

| Residential mortgage loans | 17,040 | 16,995 | 17,503 | — | (3%) | ||||||||||||

| Home equity | 3,969 | 3,883 | 3,911 | 2% | 1% | ||||||||||||

| Indirect secured consumer loans | 15,442 | 15,306 | 16,097 | 1% | (4%) | ||||||||||||

| Credit card | 1,733 | 1,737 | 1,818 | — | (5%) | ||||||||||||

| Solar energy installation loans | 3,951 | 3,871 | 2,961 | 2% | 33% | ||||||||||||

| Other consumer loans | 2,661 | 2,777 | 3,249 | (4%) | (18%) | ||||||||||||

| Total consumer loans | 44,796 | 44,569 | 45,539 | 1% | (2%) | ||||||||||||

| Portfolio loans and leases | 116,579 | 116,485 | 121,891 | — | (4%) | ||||||||||||

| Allowance for loan and lease losses | (2,288) | (2,318) | (2,327) | (1%) | (2%) | ||||||||||||

| Portfolio loans and leases, net | 114,291 | 114,167 | 119,564 | — | (4%) | ||||||||||||

| Bank premises and equipment | 2,389 | 2,376 | 2,275 | 1% | 5% | ||||||||||||

| Operating lease equipment | 392 | 427 | 537 | (8%) | (27%) | ||||||||||||

| Goodwill | 4,918 | 4,918 | 4,919 | — | — | ||||||||||||

| Intangible assets | 107 | 115 | 146 | (7%) | (27%) | ||||||||||||

| Servicing rights | 1,731 | 1,756 | 1,764 | (1%) | (2%) | ||||||||||||

| Other assets | 12,938 | 12,930 | 12,973 | — | — | ||||||||||||

| Total Assets | $213,262 | $214,506 | $207,276 | (1%) | 3% | ||||||||||||

| Liabilities | |||||||||||||||||

| Deposits: | |||||||||||||||||

| Demand | $40,617 | $41,849 | $45,264 | (3%) | (10%) | ||||||||||||

| Interest checking | 57,390 | 58,809 | 52,743 | (2%) | 9% | ||||||||||||

| Savings | 17,419 | 18,229 | 21,342 | (4%) | (18%) | ||||||||||||

| Money market | 36,259 | 35,025 | 30,012 | 4% | 21% | ||||||||||||

| Foreign office | 119 | 129 | 182 | (8%) | (35%) | ||||||||||||

| CDs $250,000 or less | 10,882 | 10,337 | 8,833 | 5% | 23% | ||||||||||||

| CDs over $250,000 | 4,082 | 5,209 | 5,752 | (22%) | (29%) | ||||||||||||

| Total deposits | 166,768 | 169,587 | 164,128 | (2%) | 2% | ||||||||||||

| Federal funds purchased | 194 | 247 | 163 | (21%) | 19% | ||||||||||||

| Other short-term borrowings | 3,370 | 2,866 | 5,817 | 18% | (42%) | ||||||||||||

| Accrued taxes, interest and expenses | 2,040 | 1,965 | 1,765 | 4% | 16% | ||||||||||||

| Other liabilities | 5,371 | 5,379 | 5,316 | — | 1% | ||||||||||||

| Long-term debt | 16,293 | 15,444 | 12,278 | 5% | 33% | ||||||||||||

| Total Liabilities | 194,036 | 195,488 | 189,467 | (1%) | 2% | ||||||||||||

| Equity | |||||||||||||||||

Common stock(c) |

2,051 | 2,051 | 2,051 | — | — | ||||||||||||

| Preferred stock | 2,116 | 2,116 | 2,116 | — | — | ||||||||||||

| Capital surplus | 3,764 | 3,742 | 3,708 | 1% | 2% | ||||||||||||

| Retained earnings | 23,542 | 23,224 | 22,366 | 1% | 5% | ||||||||||||

| Accumulated other comprehensive loss | (4,901) | (4,888) | (5,166) | — | (5%) | ||||||||||||

| Treasury stock | (7,346) | (7,227) | (7,266) | 2% | 1% | ||||||||||||

| Total Equity | 19,226 | 19,018 | 17,809 | 1% | 8% | ||||||||||||

| Total Liabilities and Equity | $213,262 | $214,506 | $207,276 | (1%) | 3% | ||||||||||||

| (a) Amortized cost | $43,596 | $43,400 | $55,399 | — | (21%) | ||||||||||||

| (b) Market values | 11,187 | 11,341 | 2 | (1 | %) | NM | |||||||||||

| (c) Common shares, stated value $2.22 per share (in thousands): | |||||||||||||||||

| Authorized | 2,000,000 | 2,000,000 | 2,000,000 | — | — | ||||||||||||

| Outstanding, excluding treasury | 680,789 | 683,812 | 680,850 | — | — | ||||||||||||

| Treasury | 243,103 | 240,080 | 243,042 | 1 | % | — | |||||||||||

| Fifth Third Bancorp and Subsidiaries | |||||||||||||||||

| Consolidated Balance Sheets | |||||||||||||||||

| $ in millions, except per share data | As of | ||||||||||||||||

| (unaudited) | June | March | December | September | June | ||||||||||||

| 2024 | 2024 | 2023 | 2023 | 2023 | |||||||||||||

| Assets | |||||||||||||||||

| Cash and due from banks | $2,837 | $2,796 | $3,142 | $2,837 | $2,594 | ||||||||||||

| Other short-term investments | 21,085 | 22,840 | 22,082 | 18,923 | 10,943 | ||||||||||||

Available-for-sale debt and other securities(a) |

38,986 | 38,791 | 50,419 | 47,893 | 49,329 | ||||||||||||

Held-to-maturity securities(b) |

11,443 | 11,520 | 2 | 2 | 2 | ||||||||||||

| Trading debt securities | 1,132 | 1,151 | 899 | 1,222 | 1,139 | ||||||||||||

| Equity securities | 476 | 380 | 613 | 250 | 331 | ||||||||||||

| Loans and leases held for sale | 537 | 339 | 378 | 614 | 760 | ||||||||||||

| Portfolio loans and leases: | |||||||||||||||||

| Commercial and industrial loans | 51,840 | 52,209 | 53,270 | 55,790 | 56,897 | ||||||||||||

| Commercial mortgage loans | 11,429 | 11,346 | 11,276 | 11,122 | 11,310 | ||||||||||||

| Commercial construction loans | 5,806 | 5,789 | 5,621 | 5,582 | 5,475 | ||||||||||||

| Commercial leases | 2,708 | 2,572 | 2,579 | 2,624 | 2,670 | ||||||||||||

| Total commercial loans and leases | 71,783 | 71,916 | 72,746 | 75,118 | 76,352 | ||||||||||||

| Residential mortgage loans | 17,040 | 16,995 | 17,026 | 17,293 | 17,503 | ||||||||||||

| Home equity | 3,969 | 3,883 | 3,916 | 3,898 | 3,911 | ||||||||||||

| Indirect secured consumer loans | 15,442 | 15,306 | 14,965 | 15,434 | 16,097 | ||||||||||||

| Credit card | 1,733 | 1,737 | 1,865 | 1,817 | 1,818 | ||||||||||||

| Solar energy installation loans | 3,951 | 3,871 | 3,728 | 3,383 | 2,961 | ||||||||||||

| Other consumer loans | 2,661 | 2,777 | 2,988 | 3,145 | 3,249 | ||||||||||||

| Total consumer loans | 44,796 | 44,569 | 44,488 | 44,970 | 45,539 | ||||||||||||

| Portfolio loans and leases | 116,579 | 116,485 | 117,234 | 120,088 | 121,891 | ||||||||||||

| Allowance for loan and lease losses | (2,288) | (2,318) | (2,322) | (2,340) | (2,327) | ||||||||||||

| Portfolio loans and leases, net | 114,291 | 114,167 | 114,912 | 117,748 | 119,564 | ||||||||||||

| Bank premises and equipment | 2,389 | 2,376 | 2,349 | 2,303 | 2,275 | ||||||||||||

| Operating lease equipment | 392 | 427 | 459 | 480 | 537 | ||||||||||||

| Goodwill | 4,918 | 4,918 | 4,919 | 4,919 | 4,919 | ||||||||||||

| Intangible assets | 107 | 115 | 125 | 136 | 146 | ||||||||||||

| Servicing rights | 1,731 | 1,756 | 1,737 | 1,822 | 1,764 | ||||||||||||

| Other assets | 12,938 | 12,930 | 12,538 | 13,818 | 12,973 | ||||||||||||

| Total Assets | $213,262 | $214,506 | $214,574 | $212,967 | $207,276 | ||||||||||||

| Liabilities | |||||||||||||||||

| Deposits: | |||||||||||||||||

| Demand | $40,617 | $41,849 | $43,146 | $43,844 | $45,264 | ||||||||||||

| Interest checking | 57,390 | 58,809 | 57,257 | 53,421 | 52,743 | ||||||||||||

| Savings | 17,419 | 18,229 | 18,215 | 20,195 | 21,342 | ||||||||||||

| Money market | 36,259 | 35,025 | 34,374 | 33,492 | 30,012 | ||||||||||||

| Foreign office | 119 | 129 | 162 | 168 | 182 | ||||||||||||

| CDs $250,000 or less | 10,882 | 10,337 | 10,552 | 10,306 | 8,833 | ||||||||||||

| CDs over $250,000 | 4,082 | 5,209 | 5,206 | 6,246 | 5,752 | ||||||||||||

| Total deposits | 166,768 | 169,587 | 168,912 | 167,672 | 164,128 | ||||||||||||

| Federal funds purchased | 194 | 247 | 193 | 205 | 163 | ||||||||||||

| Other short-term borrowings | 3,370 | 2,866 | 2,861 | 4,594 | 5,817 | ||||||||||||

| Accrued taxes, interest and expenses | 2,040 | 1,965 | 2,195 | 1,834 | 1,765 | ||||||||||||

| Other liabilities | 5,371 | 5,379 | 4,861 | 5,808 | 5,316 | ||||||||||||

| Long-term debt | 16,293 | 15,444 | 16,380 | 16,310 | 12,278 | ||||||||||||

| Total Liabilities | 194,036 | 195,488 | 195,402 | 196,423 | 189,467 | ||||||||||||

| Equity | |||||||||||||||||

Common stock(c) |

2,051 | 2,051 | 2,051 | 2,051 | 2,051 | ||||||||||||

| Preferred stock | 2,116 | 2,116 | 2,116 | 2,116 | 2,116 | ||||||||||||

| Capital surplus | 3,764 | 3,742 | 3,757 | 3,733 | 3,708 | ||||||||||||

| Retained earnings | 23,542 | 23,224 | 22,997 | 22,747 | 22,366 | ||||||||||||

| Accumulated other comprehensive loss | (4,901) | (4,888) | (4,487) | (6,839) | (5,166) | ||||||||||||

| Treasury stock | (7,346) | (7,227) | (7,262) | (7,264) | (7,266) | ||||||||||||

| Total Equity | 19,226 | 19,018 | 19,172 | 16,544 | 17,809 | ||||||||||||

| Total Liabilities and Equity | $213,262 | $214,506 | $214,574 | $212,967 | $207,276 | ||||||||||||

| (a) Amortized cost | $43,596 | $43,400 | $55,789 | $55,557 | $55,399 | ||||||||||||

| (b) Market values | 11,187 | 11,341 | 2 | 2 | 2 | ||||||||||||

| (c) Common shares, stated value $2.22 per share (in thousands): | |||||||||||||||||

| Authorized | 2,000,000 | 2,000,000 | 2,000,000 | 2,000,000 | 2,000,000 | ||||||||||||

| Outstanding, excluding treasury | 680,789 | 683,812 | 681,125 | 680,990 | 680,850 | ||||||||||||

| Treasury | 243,103 | 240,080 | 242,768 | 242,903 | 243,042 | ||||||||||||

| Fifth Third Bancorp and Subsidiaries | ||||||||||||||||||||

| Consolidated Statements of Changes in Equity | ||||||||||||||||||||

| $ in millions | ||||||||||||||||||||

| (unaudited) | ||||||||||||||||||||

| For the Three Months Ended | Year to Date | |||||||||||||||||||

| June | June | June | June | |||||||||||||||||

| 2024 | 2023 | 2024 | 2023 | |||||||||||||||||

| Total Equity, Beginning | $19,018 | $18,364 | $19,172 | $17,327 | ||||||||||||||||

| Impact of cumulative effect of change in accounting principle | — | — | (10) | 37 | ||||||||||||||||

| Net income | 601 | 601 | 1,122 | 1,159 | ||||||||||||||||

| Other comprehensive (loss) income, net of tax: | ||||||||||||||||||||

| Change in unrealized losses: | ||||||||||||||||||||

| Available-for-sale debt securities | 2 | (633) | (177) | (33) | ||||||||||||||||

| Qualifying cash flow hedges | (40) | (289) | (287) | (24) | ||||||||||||||||

| Amortization of unrealized losses on securities transferred to held-to-maturity | 25 | — | 50 | — | ||||||||||||||||

| Change in accumulated other comprehensive income related to employee benefit plans | — | 1 | — | 1 | ||||||||||||||||

| Comprehensive income (loss) | 588 | (320) | 708 | 1,103 | ||||||||||||||||

| Cash dividends declared: | ||||||||||||||||||||

| Common stock | (243) | (228) | (486) | (457) | ||||||||||||||||

| Preferred stock | (40) | (39) | (81) | (62) | ||||||||||||||||

| Impact of stock transactions under stock compensation plans, net | 28 | 32 | 48 | 62 | ||||||||||||||||

| Shares acquired for treasury | (125) | — | (125) | (201) | ||||||||||||||||

| Total Equity, Ending | $19,226 | $17,809 | $19,226 | $17,809 | ||||||||||||||||

| Fifth Third Bancorp and Subsidiaries | ||||||||||||||||||||||||||

| Average Balance Sheets and Yield/Rate Analysis | For the Three Months Ended | |||||||||||||||||||||||||

| $ in millions | June | March | June | |||||||||||||||||||||||

| (unaudited) | 2024 | 2024 | 2023 | |||||||||||||||||||||||

| Average | Average | Average | Average | Average | Average | |||||||||||||||||||||

| Balance | Yield/Rate | Balance | Yield/Rate | Balance | Yield/Rate | |||||||||||||||||||||

| Assets | ||||||||||||||||||||||||||

| Interest-earning assets: | ||||||||||||||||||||||||||

| Loans and leases: | ||||||||||||||||||||||||||

Commercial and industrial loans(a) |

$52,389 | 7.13 | % | $53,256 | 7.08 | % | $58,152 | 6.78 | % | |||||||||||||||||

Commercial mortgage loans(a) |

11,353 | 6.26 | % | 11,339 | 6.28 | % | 11,374 | 5.92 | % | |||||||||||||||||

Commercial construction loans(a) |

5,917 | 7.14 | % | 5,732 | 7.20 | % | 5,535 | 6.80 | % | |||||||||||||||||

Commercial leases(a) |

2,576 | 4.33 | % | 2,543 | 4.24 | % | 2,703 | 3.54 | % | |||||||||||||||||

| Total commercial loans and leases | 72,235 | 6.90 | % | 72,870 | 6.87 | % | 77,764 | 6.54 | % | |||||||||||||||||

| Residential mortgage loans | 17,363 | 3.66 | % | 17,268 | 3.55 | % | 18,158 | 3.39 | % | |||||||||||||||||

| Home equity | 3,929 | 8.37 | % | 3,933 | 8.29 | % | 3,937 | 7.39 | % | |||||||||||||||||

| Indirect secured consumer loans | 15,373 | 5.18 | % | 15,172 | 4.93 | % | 16,281 | 4.19 | % | |||||||||||||||||

| Credit card | 1,728 | 12.86 | % | 1,773 | 13.73 | % | 1,783 | 13.93 | % | |||||||||||||||||

| Solar energy installation loans | 3,916 | 8.35 | % | 3,794 | 7.77 | % | 2,787 | 5.59 | % | |||||||||||||||||

| Other consumer loans | 2,739 | 9.17 | % | 2,889 | 8.96 | % | 3,277 | 8.60 | % | |||||||||||||||||

| Total consumer loans | 45,048 | 5.69 | % | 44,829 | 5.54 | % | 46,223 | 4.92 | % | |||||||||||||||||

| Total loans and leases | 117,283 | 6.43 | % | 117,699 | 6.36 | % | 123,987 | 5.94 | % | |||||||||||||||||

| Securities: | ||||||||||||||||||||||||||

| Taxable securities | 55,241 | 3.27 | % | 55,016 | 3.26 | % | 55,771 | 3.07 | % | |||||||||||||||||

Tax exempt securities(a) |

1,366 | 3.27 | % | 1,440 | 3.27 | % | 1,496 | 3.19 | % | |||||||||||||||||

| Other short-term investments | 20,609 | 5.67 | % | 21,194 | 5.58 | % | 7,806 | 5.24 | % | |||||||||||||||||

| Total interest-earning assets | 194,499 | 5.43 | % | 195,349 | 5.38 | % | 189,060 | 5.04 | % | |||||||||||||||||

| Cash and due from banks | 2,637 | 2,743 | 2,622 | |||||||||||||||||||||||

| Other assets | 17,656 | 17,432 | 16,613 | |||||||||||||||||||||||

| Allowance for loan and lease losses | (2,317) | (2,321) | (2,216) | |||||||||||||||||||||||

| Total Assets | $212,475 | $213,203 | $206,079 | |||||||||||||||||||||||

| Liabilities | ||||||||||||||||||||||||||

| Interest-bearing liabilities: | ||||||||||||||||||||||||||

| Interest checking deposits | $57,999 | 3.39 | % | $58,677 | 3.38 | % | $50,472 | 2.81 | % | |||||||||||||||||

| Savings deposits | 17,747 | 0.67 | % | 18,107 | 0.69 | % | 21,675 | 0.72 | % | |||||||||||||||||

| Money market deposits | 35,511 | 3.00 | % | 34,589 | 2.91 | % | 28,913 | 1.86 | % | |||||||||||||||||

| Foreign office deposits | 157 | 2.11 | % | 145 | 2.43 | % | 143 | 1.25 | % | |||||||||||||||||

| CDs $250,000 or less | 10,767 | 4.22 | % | 10,244 | 4.15 | % | 7,759 | 3.48 | % | |||||||||||||||||

| Total interest-bearing core deposits | 122,181 | 2.95 | % | 121,762 | 2.91 | % | 108,962 | 2.19 | % | |||||||||||||||||

| CDs over $250,000 | 4,747 | 5.16 | % | 5,521 | 5.22 | % | 5,375 | 4.53 | % | |||||||||||||||||

| Total interest-bearing deposits | 126,928 | 3.04 | % | 127,283 | 3.01 | % | 114,337 | 2.30 | % | |||||||||||||||||

| Federal funds purchased | 230 | 5.41 | % | 201 | 5.41 | % | 376 | 5.11 | % | |||||||||||||||||

| Securities sold under repurchase agreements | 373 | 1.97 | % | 366 | 1.82 | % | 361 | 1.17 | % | |||||||||||||||||

| FHLB advances | 3,165 | 5.71 | % | 3,111 | 5.72 | % | 6,589 | 5.23 | % | |||||||||||||||||

| Derivative collateral and other secured borrowings | 54 | 6.87 | % | 57 | 7.21 | % | 79 | 15.07 | % | |||||||||||||||||

| Long-term debt | 15,611 | 5.78 | % | 15,515 | 5.71 | % | 12,848 | 5.12 | % | |||||||||||||||||

| Total interest-bearing liabilities | 146,361 | 3.39 | % | 146,533 | 3.36 | % | 134,590 | 2.72 | % | |||||||||||||||||

| Demand deposits | 40,266 | 40,839 | 46,520 | |||||||||||||||||||||||

| Other liabilities | 7,141 | 7,104 | 6,625 | |||||||||||||||||||||||

| Total Liabilities | 193,768 | 194,476 | 187,735 | |||||||||||||||||||||||

| Total Equity | 18,707 | 18,727 | 18,344 | |||||||||||||||||||||||

| Total Liabilities and Equity | $212,475 | $213,203 | $206,079 | |||||||||||||||||||||||

| Ratios: | ||||||||||||||||||||||||||

Net interest margin (FTE)(b) |

2.88 | % | 2.86 | % | 3.10 | % | ||||||||||||||||||||

Net interest rate spread (FTE)(b) |

2.04 | % | 2.02 | % | 2.32 | % | ||||||||||||||||||||

| Interest-bearing liabilities to interest-earning assets | 75.25 | % | 75.01 | % | 71.19 | % | ||||||||||||||||||||

| (a) Average Yield/Rate of these assets are presented on an FTE basis. | ||||||||||||||||||||||||||

(b) Non-GAAP measure; see discussion and reconciliation of non-GAAP measures beginning on page 27. |

||||||||||||||||||||||||||

| Fifth Third Bancorp and Subsidiaries | |||||||||||||||||

| Average Balance Sheets and Yield/Rate Analysis | Year to Date | ||||||||||||||||

| $ in millions | June | June | |||||||||||||||

| (unaudited) | 2024 | 2023 | |||||||||||||||

| Average | Average | Average | Average | ||||||||||||||

| Balance | Yield/Rate | Balance | Yield/Rate | ||||||||||||||

| Assets | |||||||||||||||||

| Interest-earning assets: | |||||||||||||||||

| Loans and leases: | |||||||||||||||||

Commercial and industrial loans(a) |

$52,820 | 7.11 | % | $58,178 | 6.59 | % | |||||||||||

Commercial mortgage loans(a) |

11,346 | 6.27 | % | 11,248 | 5.74 | % | |||||||||||

Commercial construction loans(a) |

5,825 | 7.17 | % | 5,521 | 6.65 | % | |||||||||||

Commercial leases(a) |

2,560 | 4.28 | % | 2,683 | 3.51 | % | |||||||||||

| Total commercial loans and leases | 72,551 | 6.88 | % | 77,630 | 6.37 | % | |||||||||||

| Residential mortgage loans | 17,316 | 3.60 | % | 18,243 | 3.39 | % | |||||||||||

| Home equity | 3,931 | 8.33 | % | 3,971 | 6.93 | % | |||||||||||

| Indirect secured consumer loans | 15,273 | 5.06 | % | 16,439 | 4.07 | % | |||||||||||

| Credit card | 1,751 | 13.30 | % | 1,781 | 14.04 | % | |||||||||||

| Solar energy installation loans | 3,855 | 8.07 | % | 2,478 | 5.17 | % | |||||||||||

| Other consumer loans | 2,814 | 9.06 | % | 3,260 | 8.55 | % | |||||||||||

| Total consumer loans | 44,940 | 5.61 | % | 46,172 | 4.81 | % | |||||||||||

| Total loans and leases | 117,491 | 6.40 | % | 123,802 | 5.78 | % | |||||||||||

| Securities: | |||||||||||||||||

| Taxable securities | 55,128 | 3.27 | % | 56,437 | 3.07 | % | |||||||||||

Tax exempt securities(a) |

1,403 | 3.27 | % | 1,450 | 3.15 | % | |||||||||||

| Other short-term investments | 20,902 | 5.62 | % | 6,549 | 5.00 | % | |||||||||||

| Total interest-earning assets | 194,924 | 5.41 | % | 188,238 | 4.92 | % | |||||||||||

| Cash and due from banks | 2,690 | 2,878 | |||||||||||||||

| Other assets | 17,544 | 16,649 | |||||||||||||||

| Allowance for loan and lease losses | (2,319) | (2,181) | |||||||||||||||

| Total Assets | $212,839 | $205,584 | |||||||||||||||

| Liabilities | |||||||||||||||||

| Interest-bearing liabilities: | |||||||||||||||||

| Interest checking deposits | $58,338 | 3.39 | % | $49,599 | 2.58 | % | |||||||||||

| Savings deposits | 17,927 | 0.68 | % | 22,387 | 0.65 | % | |||||||||||

| Money market deposits | 35,050 | 2.96 | % | 28,668 | 1.53 | % | |||||||||||

| Foreign office deposits | 151 | 2.26 | % | 143 | 1.57 | % | |||||||||||

| CDs $250,000 or less | 10,505 | 4.18 | % | 6,473 | 3.15 | % | |||||||||||

| Total interest-bearing core deposits | 121,971 | 2.93 | % | 107,270 | 1.93 | % | |||||||||||

| CDs over $250,000 | 5,134 | 5.19 | % | 4,865 | 4.36 | % | |||||||||||

| Total interest-bearing deposits | 127,105 | 3.02 | % | 112,135 | 2.00 | % | |||||||||||

| Federal funds purchased | 216 | 5.41 | % | 431 | 4.79 | % | |||||||||||

| Securities sold under repurchase agreements | 369 | 1.90 | % | 344 | 0.96 | % | |||||||||||

| FHLB advances | 3,138 | 5.71 | % | 5,701 | 4.90 | % | |||||||||||

| Derivative collateral and other secured borrowings | 56 | 7.05 | % | 161 | 8.14 | % | |||||||||||

| Long-term debt | 15,563 | 5.74 | % | 13,178 | 4.90 | % | |||||||||||

| Total interest-bearing liabilities | 146,447 | 3.37 | % | 131,950 | 2.46 | % | |||||||||||

| Demand deposits | 40,552 | 48,617 | |||||||||||||||

| Other liabilities | 7,123 | 6,855 | |||||||||||||||

| Total Liabilities | 194,122 | 187,422 | |||||||||||||||

| Total Equity | 18,717 | 18,162 | |||||||||||||||

| Total Liabilities and Equity | $212,839 | $205,584 | |||||||||||||||

| Ratios: | |||||||||||||||||

Net interest margin (FTE)(b) |

2.87 | % | 3.20 | % | |||||||||||||

Net interest rate spread (FTE)(b) |

2.04 | % | 2.46 | % | |||||||||||||

| Interest-bearing liabilities to interest-earning assets | 75.13 | % | 70.10 | % | |||||||||||||

| (a) Average Yield/Rate of these assets are presented on an FTE basis. | |||||||||||||||||

| (b) Non-GAAP measure; see discussion and reconciliation of non-GAAP measures beginning on page 27. | |||||||||||||||||

| Fifth Third Bancorp and Subsidiaries | |||||||||||||||||

| Summary of Loans and Leases | |||||||||||||||||

| $ in millions | For the Three Months Ended | ||||||||||||||||

| (unaudited) | June | March | December | September | June | ||||||||||||

| 2024 | 2024 | 2023 | 2023 | 2023 | |||||||||||||

| Average Portfolio Loans and Leases | |||||||||||||||||

| Commercial loans and leases: | |||||||||||||||||

| Commercial and industrial loans | $52,357 | $53,183 | $54,633 | $57,001 | $58,137 | ||||||||||||

| Commercial mortgage loans | 11,352 | 11,339 | 11,338 | 11,216 | 11,373 | ||||||||||||

| Commercial construction loans | 5,917 | 5,732 | 5,727 | 5,539 | 5,535 | ||||||||||||

| Commercial leases | 2,575 | 2,542 | 2,535 | 2,616 | 2,700 | ||||||||||||

| Total commercial loans and leases | 72,201 | 72,796 | 74,233 | 76,372 | 77,745 | ||||||||||||

| Consumer loans: | |||||||||||||||||

| Residential mortgage loans | 17,004 | 16,977 | 17,129 | 17,400 | 17,517 | ||||||||||||

| Home equity | 3,929 | 3,933 | 3,905 | 3,897 | 3,937 | ||||||||||||

| Indirect secured consumer loans | 15,373 | 15,172 | 15,129 | 15,787 | 16,281 | ||||||||||||

| Credit card | 1,728 | 1,773 | 1,829 | 1,808 | 1,783 | ||||||||||||

| Solar energy installation loans | 3,916 | 3,794 | 3,630 | 3,245 | 2,787 | ||||||||||||

| Other consumer loans | 2,740 | 2,889 | 3,003 | 3,121 | 3,277 | ||||||||||||

| Total consumer loans | 44,690 | 44,538 | 44,625 | 45,258 | 45,582 | ||||||||||||

| Total average portfolio loans and leases | $116,891 | $117,334 | $118,858 | $121,630 | $123,327 | ||||||||||||

| Average Loans and Leases Held for Sale | |||||||||||||||||

| Commercial loans and leases held for sale | $33 | $74 | $72 | $17 | $19 | ||||||||||||

| Consumer loans held for sale | 359 | 291 | 379 | 619 | 641 | ||||||||||||

| Average loans and leases held for sale | $392 | $365 | $451 | $636 | $660 | ||||||||||||

| End of Period Portfolio Loans and Leases | |||||||||||||||||

| Commercial loans and leases: | |||||||||||||||||

| Commercial and industrial loans | $51,840 | $52,209 | $53,270 | $55,790 | $56,897 | ||||||||||||

| Commercial mortgage loans | 11,429 | 11,346 | 11,276 | 11,122 | 11,310 | ||||||||||||

| Commercial construction loans | 5,806 | 5,789 | 5,621 | 5,582 | 5,475 | ||||||||||||

| Commercial leases | 2,708 | 2,572 | 2,579 | 2,624 | 2,670 | ||||||||||||

| Total commercial loans and leases | 71,783 | 71,916 | 72,746 | 75,118 | 76,352 | ||||||||||||

| Consumer loans: | |||||||||||||||||

| Residential mortgage loans | 17,040 | 16,995 | 17,026 | 17,293 | 17,503 | ||||||||||||

| Home equity | 3,969 | 3,883 | 3,916 | 3,898 | 3,911 | ||||||||||||

| Indirect secured consumer loans | 15,442 | 15,306 | 14,965 | 15,434 | 16,097 | ||||||||||||

| Credit card | 1,733 | 1,737 | 1,865 | 1,817 | 1,818 | ||||||||||||

| Solar energy installation loans | 3,951 | 3,871 | 3,728 | 3,383 | 2,961 | ||||||||||||

| Other consumer loans | 2,661 | 2,777 | 2,988 | 3,145 | 3,249 | ||||||||||||

| Total consumer loans | 44,796 | 44,569 | 44,488 | 44,970 | 45,539 | ||||||||||||

| Total portfolio loans and leases | $116,579 | $116,485 | $117,234 | $120,088 | $121,891 | ||||||||||||

End of Period Loans and Leases Held for Sale |

|||||||||||||||||

| Commercial loans and leases held for sale | $25 | $32 | $44 | $81 | $32 | ||||||||||||

| Consumer loans held for sale | 512 | 307 | 334 | 533 | 728 | ||||||||||||

| Loans and leases held for sale | $537 | $339 | $378 | $614 | $760 | ||||||||||||

| Operating lease equipment | $392 | $427 | $459 | $480 | $537 | ||||||||||||

Loans and Leases Serviced for Others(a) |

|||||||||||||||||

| Commercial and industrial loans | $1,201 | $1,197 | $1,231 | $1,217 | $1,122 | ||||||||||||

| Commercial mortgage loans | 616 | 632 | 655 | 711 | 748 | ||||||||||||

| Commercial construction loans | 309 | 293 | 283 | 288 | 260 | ||||||||||||

| Commercial leases | 730 | 703 | 703 | 721 | 642 | ||||||||||||

| Residential mortgage loans | 97,280 | 99,596 | 100,842 | 101,889 | 102,817 | ||||||||||||

| Solar energy installation loans | 625 | 641 | 658 | 673 | 691 | ||||||||||||

| Other consumer loans | 133 | 139 | 146 | 154 | 162 | ||||||||||||

| Total loans and leases serviced for others | 100,894 | 103,201 | 104,518 | 105,653 | 106,442 | ||||||||||||

| Total loans and leases owned or serviced | $218,402 | $220,452 | $222,589 | $226,835 | $229,630 | ||||||||||||

| Fifth Third Bancorp and Subsidiaries | |||||||||||||||||||||||

| Regulatory Capital | |||||||||||||||||||||||

| $ in millions | As of | ||||||||||||||||||||||

| (unaudited) | June | March | December | September | June | ||||||||||||||||||

2024(a) |

2024 | 2023 | 2023 | 2023 | |||||||||||||||||||

Regulatory Capital(b) |

|||||||||||||||||||||||

| CET1 capital | $17,161 | $16,931 | $16,800 | $16,510 | $16,100 | ||||||||||||||||||

| Additional tier 1 capital | 2,116 | 2,116 | 2,116 | 2,116 | 2,116 | ||||||||||||||||||

| Tier 1 capital | 19,277 | 19,047 | 18,916 | 18,626 | 18,216 | ||||||||||||||||||

| Tier 2 capital | 3,277 | 3,288 | 3,484 | 3,485 | 3,565 | ||||||||||||||||||

| Total regulatory capital | $22,554 | $22,335 | $22,400 | $22,111 | $21,781 | ||||||||||||||||||

Risk-weighted assets |

$161,967 | $161,769 | $163,223 | $168,433 | $169,720 | ||||||||||||||||||

| Ratios | |||||||||||||||||||||||

Average total Bancorp shareholders' equity as a percent of average assets |

8.80 | % | 8.78 | % | 8.04 | % | 8.30 | % | 8.90 | % | |||||||||||||

Regulatory Capital Ratios(b) |

|||||||||||||||||||||||

| Fifth Third Bancorp | |||||||||||||||||||||||

CET1 capital |

10.60 | % | 10.47 | % | 10.29 | % | 9.80 | % | 9.49 | % | |||||||||||||

Tier 1 risk-based capital |

11.90 | % | 11.77 | % | 11.59 | % | 11.06 | % | 10.73 | % | |||||||||||||

Total risk-based capital |

13.93 | % | 13.81 | % | 13.72 | % | 13.13 | % | 12.83 | % | |||||||||||||

| Leverage | 9.07 | % | 8.94 | % | 8.73 | % | 8.85 | % | 8.81 | % | |||||||||||||

| Fifth Third Bank, National Association | |||||||||||||||||||||||

Tier 1 risk-based capital |

12.78 | % | 12.65 | % | 12.42 | % | 11.96 | % | 11.25 | % | |||||||||||||

Total risk-based capital |

14.11 | % | 13.99 | % | 13.85 | % | 13.38 | % | 12.67 | % | |||||||||||||

| Leverage | 9.76 | % | 9.61 | % | 9.38 | % | 9.59 | % | 9.26 | % | |||||||||||||

| Fifth Third Bancorp and Subsidiaries | |||||||||||||||||

| Summary of Credit Loss Experience | |||||||||||||||||

| $ in millions | For the Three Months Ended | ||||||||||||||||

| (unaudited) | June | March | December | September | June | ||||||||||||

| 2024 | 2024 | 2023 | 2023 | 2023 | |||||||||||||

| Average portfolio loans and leases: | |||||||||||||||||

| Commercial and industrial loans | $52,357 | $53,183 | $54,633 | $57,001 | $58,137 | ||||||||||||

| Commercial mortgage loans | 11,352 | 11,339 | 11,338 | 11,216 | 11,373 | ||||||||||||

| Commercial construction loans | 5,917 | 5,732 | 5,727 | 5,539 | 5,535 | ||||||||||||

| Commercial leases | 2,575 | 2,542 | 2,535 | 2,616 | 2,700 | ||||||||||||

| Total commercial loans and leases | 72,201 | 72,796 | 74,233 | 76,372 | 77,745 | ||||||||||||

| Residential mortgage loans | 17,004 | 16,977 | 17,129 | 17,400 | 17,517 | ||||||||||||

| Home equity | 3,929 | 3,933 | 3,905 | 3,897 | 3,937 | ||||||||||||

| Indirect secured consumer loans | 15,373 | 15,172 | 15,129 | 15,787 | 16,281 | ||||||||||||

| Credit card | 1,728 | 1,773 | 1,829 | 1,808 | 1,783 | ||||||||||||

| Solar energy installation loans | 3,916 | 3,794 | 3,630 | 3,245 | 2,787 | ||||||||||||

| Other consumer loans | 2,740 | 2,889 | 3,003 | 3,121 | 3,277 | ||||||||||||

| Total consumer loans | 44,690 | 44,538 | 44,625 | 45,258 | 45,582 | ||||||||||||

| Total average portfolio loans and leases | $116,891 | $117,334 | $118,858 | $121,630 | $123,327 | ||||||||||||

| Losses charged-off: | |||||||||||||||||

| Commercial and industrial loans | ($83) | ($40) | ($30) | ($70) | ($35) | ||||||||||||

| Commercial mortgage loans | — | — | — | — | — | ||||||||||||

| Commercial construction loans | — | — | — | — | — | ||||||||||||

| Commercial leases | — | — | — | — | — | ||||||||||||

| Total commercial loans and leases | (83) | (40) | (30) | (70) | (35) | ||||||||||||

| Residential mortgage loans | (1) | — | (1) | (1) | (1) | ||||||||||||

| Home equity | (1) | (2) | (2) | (2) | (2) | ||||||||||||

| Indirect secured consumer loans | (31) | (35) | (35) | (27) | (25) | ||||||||||||

| Credit card | (22) | (23) | (22) | (19) | (21) | ||||||||||||

| Solar energy installation loans | (14) | (14) | (11) | (8) | (7) | ||||||||||||

| Other consumer loans | (30) | (32) | (32) | (31) | (30) | ||||||||||||

| Total consumer loans | (99) | (106) | (103) | (88) | (86) | ||||||||||||

| Total losses charged-off | ($182) | ($146) | ($133) | ($158) | ($121) | ||||||||||||