| New Jersey | 1-2256 | 13-5409005 | ||||||

| (State or other jurisdiction of incorporation) |

(Commission File Number) |

(IRS Employer Identification No.) |

||||||

| (Former name or former address, if changed since last report) | ||

| Name of Each Exchange | ||||||||

| Title of Each Class | Trading Symbol | on Which Registered | ||||||

| Common Stock, without par value | XOM | New York Stock Exchange | ||||||

| 0.142% Notes due 2024 | XOM24B | New York Stock Exchange | ||||||

| 0.524% Notes due 2028 | XOM28 | New York Stock Exchange | ||||||

| 0.835% Notes due 2032 | XOM32 | New York Stock Exchange | ||||||

| 1.408% Notes due 2039 | XOM39A | New York Stock Exchange | ||||||

| Item 2.02 | Results of Operations and Financial Condition | ||||

| Item 7.01 | Regulation FD Disclosure | ||||

| The following information is furnished pursuant to both Item 2.02 and Item 7.01. |

|||||

The Registrant hereby furnishes the information set forth in its News Release, dated April 26, 2024, announcing first quarter 2024 results, a copy of which is included as Exhibit 99.1, and furnishes the information in the related 1Q24 Investor Relations Data Summary, a copy of which is included as Exhibit 99.2. Material available by hyperlink from the News Release is not deemed to be furnished herewith or included in this filing. |

|||||

| Exhibit No. | Description | ||||

Exxon Mobil Corporation News Release, dated April 26, 2024, announcing first quarter 2024 results. |

|||||

1Q24 Investor Relations Data Summary. |

|||||

| 104 | Cover Page Interactive Data File (formatted as Inline XBRL). | ||||

| EXXON MOBIL CORPORATION | ||||||||

Date: April 26, 2024 |

By: | /s/ LEN M. FOX | ||||||

| Len M. Fox | ||||||||

| Vice President and Controller | ||||||||

| (Principal Accounting Officer) | ||||||||

|

EXHIBIT 99.1 | |||||||||||||

1Q 2024 Earnings Release |

||||||||||||||

| FOR IMMEDIATE RELEASE | April 26, 2024 |

|||||||||||||

| Results Summary | |||||||||||||||||

Dollars in millions (except per share data) |

1Q24 | 4Q23 |

Change

vs

4Q23

|

1Q23 |

Change

vs

1Q23

|

||||||||||||

| Earnings (U.S. GAAP) | 8,220 | 7,630 | +590 | 11,430 | -3,210 | ||||||||||||

| Earnings Excluding Identified Items (non-GAAP) | 8,220 | 9,963 | -1,743 | 11,618 | -3,398 | ||||||||||||

Earnings Per Common Share ³ |

2.06 | 1.91 | +0.15 | 2.79 | -0.73 | ||||||||||||

Earnings Excluding Identified Items Per Common Share (non-GAAP) ³ |

2.06 | 2.48 | -0.42 | 2.83 | -0.77 | ||||||||||||

| Capital and Exploration Expenditures | 5,839 | 7,757 | -1,918 | 6,380 | -541 | ||||||||||||

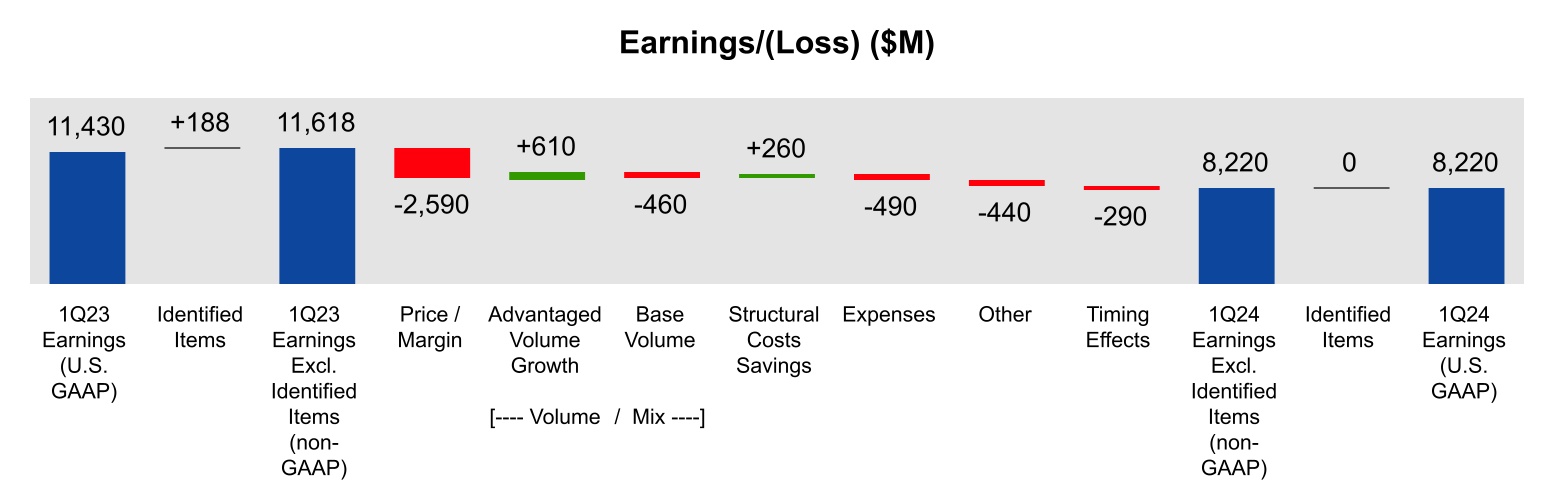

1Q23 to 1Q24 Factor Analysis1 |

||||||||||||||||||||||||||

|

. | |||||||||||||

EARNINGS AND VOLUME SUMMARY BY SEGMENT | ||||||||||||||

Upstream | |||||||||||

| Dollars in millions (unless otherwise noted) | 1Q24 |

4Q23 |

1Q23 |

||||||||

| Earnings/(Loss) (U.S. GAAP) | |||||||||||

| United States | 1,054 | 84 | 1,632 | ||||||||

| Non-U.S. | 4,606 | 4,065 | 4,825 | ||||||||

| Worldwide | 5,660 | 4,149 | 6,457 | ||||||||

| Earnings/(Loss) Excluding Identified Items (non-GAAP) | |||||||||||

| United States | 1,054 | 1,573 | 1,632 | ||||||||

| Non-U.S. | 4,606 | 4,693 | 4,983 | ||||||||

| Worldwide | 5,660 | 6,266 | 6,615 | ||||||||

| Production (koebd) | 3,784 | 3,824 | 3,831 | ||||||||

Energy Products | |||||||||||

| Dollars in millions (unless otherwise noted) | 1Q24 |

4Q23 |

1Q23 |

||||||||

| Earnings/(Loss) (U.S. GAAP) | |||||||||||

| United States | 836 | 1,329 | 1,910 | ||||||||

| Non-U.S. | 540 | 1,878 | 2,273 | ||||||||

| Worldwide | 1,376 | 3,207 | 4,183 | ||||||||

| Earnings/(Loss) Excluding Identified Items (non-GAAP) | |||||||||||

| United States | 836 | 1,137 | 1,910 | ||||||||

| Non-U.S. | 540 | 1,881 | 2,303 | ||||||||

| Worldwide | 1,376 | 3,018 | 4,213 | ||||||||

| Energy Products Sales (kbd) | 5,232 | 5,357 | 5,277 | ||||||||

Chemical Products | |||||||||||

| Dollars in millions (unless otherwise noted) | 1Q24 | 4Q23 | 1Q23 | ||||||||

| Earnings/(Loss) (U.S. GAAP) | |||||||||||

| United States | 504 | 478 | 324 | ||||||||

| Non-U.S. | 281 | (289) | 47 | ||||||||

| Worldwide | 785 | 189 | 371 | ||||||||

| Earnings/(Loss) Excluding Identified Items (non-GAAP) | |||||||||||

| United States | 504 | 446 | 324 | ||||||||

| Non-U.S. | 281 | 131 | 47 | ||||||||

| Worldwide | 785 | 577 | 371 | ||||||||

| Chemical Products Sales (kt) | 5,054 | 4,776 | 4,649 | ||||||||

Specialty Products | |||||||||||

| Dollars in millions (unless otherwise noted) | 1Q24 |

4Q23 |

1Q23 |

||||||||

| Earnings/(Loss) (U.S. GAAP) | |||||||||||

| United States | 404 | 386 | 451 | ||||||||

| Non-U.S. | 357 | 264 | 323 | ||||||||

| Worldwide | 761 | 650 | 774 | ||||||||

| Earnings/(Loss) Excluding Identified Items (non-GAAP) | |||||||||||

| United States | 404 | 374 | 451 | ||||||||

| Non-U.S. | 357 | 369 | 323 | ||||||||

| Worldwide | 761 | 743 | 774 | ||||||||

| Specialty Product Sales (kt) | 1,959 | 1,839 | 1,940 | ||||||||

Corporate and Financing |

|||||||||||

| Dollars in millions (unless otherwise noted) | 1Q24 |

4Q23 |

1Q23 |

||||||||

| Earnings/(Loss) (U.S. GAAP) | (362) | (565) | (355) | ||||||||

| Earnings/(Loss) Excluding Identified Items (non-GAAP) | (362) | (641) | (355) | ||||||||

|

. | |||||||||||||

CASH FLOW FROM OPERATIONS AND ASSET SALES EXCLUDING WORKING CAPITAL | ||||||||||||||

| Dollars in millions (unless otherwise noted) | 1Q24 |

4Q23 |

1Q23 |

||||||||

| Net income/(loss) including noncontrolling interests | 8,566 | 8,012 | 11,843 | ||||||||

| Depreciation and depletion (includes impairments) | 4,812 | 7,740 | 4,244 | ||||||||

| Changes in operational working capital, excluding cash and debt | 2,008 | (2,191) | (302) | ||||||||

| Other | (722) | 121 | 556 | ||||||||

| Cash Flow from Operating Activities (U.S. GAAP) | 14,664 | 13,682 | 16,341 | ||||||||

| Proceeds from asset sales and returns of investments | 703 | 1,020 | 854 | ||||||||

| Cash Flow from Operations and Asset Sales (non-GAAP) | 15,367 | 14,702 | 17,195 | ||||||||

| Less: Changes in operational working capital, excluding cash and debt | (2,008) | 2,191 | 302 | ||||||||

| Cash Flow from Operations and Asset Sales excluding Working Capital (non-GAAP) | 13,359 | 16,893 | 17,497 | ||||||||

FREE CASH FLOW |

|||||||||||

| Dollars in millions (unless otherwise noted) | 1Q24 |

4Q23 |

1Q23 |

||||||||

| Cash Flow from Operating Activities (U.S. GAAP) | 14,664 | 13,682 | 16,341 | ||||||||

| Additions to property, plant and equipment | (5,074) | (6,228) | (5,412) | ||||||||

| Additional investments and advances | (421) | (1,854) | (445) | ||||||||

| Other investing activities including collection of advances | 215 | 1,348 | 78 | ||||||||

| Proceeds from asset sales and returns of investments | 703 | 1,020 | 854 | ||||||||

| Free Cash Flow (non-GAAP) | 10,087 | 7,968 | 11,416 | ||||||||

| CALCULATION OF STRUCTURAL COST SAVINGS | ||||||||||||||||||||

| Dollars in billions (unless otherwise noted) | Twelve Months Ended December 31, |

Three Months

Ended March 31,

|

||||||||||||||||||

| 2019 | 2023 | 2023 | 2024 | |||||||||||||||||

| Components of Operating Costs | ||||||||||||||||||||

| From ExxonMobil’s Consolidated Statement of Income (U.S. GAAP) |

||||||||||||||||||||

| Production and manufacturing expenses | 36.8 | 36.9 | 9.4 | 9.1 | ||||||||||||||||

| Selling, general and administrative expenses | 11.4 | 9.9 | 2.4 | 2.5 | ||||||||||||||||

| Depreciation and depletion (includes impairments) | 19.0 | 20.6 | 4.2 | 4.8 | ||||||||||||||||

| Exploration expenses, including dry holes | 1.3 | 0.8 | 0.1 | 0.1 | ||||||||||||||||

| Non-service pension and postretirement benefit expense | 1.2 | 0.7 | 0.2 | — | ||||||||||||||||

| Subtotal | 69.7 | 68.9 | 16.4 | 16.5 | ||||||||||||||||

| ExxonMobil’s share of equity company expenses (non-GAAP) | 9.1 | 10.5 | 2.7 | 2.4 | ||||||||||||||||

| Total Adjusted Operating Costs (non-GAAP) | 78.8 | 79.4 | 19.1 | 18.9 | ||||||||||||||||

| Total Adjusted Operating Costs (non-GAAP) | 78.8 | 79.4 | 19.1 | 18.9 | ||||||||||||||||

| Less: | ||||||||||||||||||||

| Depreciation and depletion (includes impairments) | 19.0 | 20.6 | 4.2 | 4.8 | ||||||||||||||||

| Non-service pension and postretirement benefit expense | 1.2 | 0.7 | 0.2 | — | ||||||||||||||||

| Other adjustments (includes equity company depreciation and depletion) |

3.6 | 3.7 | 0.8 | 0.9 | ||||||||||||||||

| Total Cash Operating Expenses (Cash Opex) (non-GAAP) | 55.0 | 54.4 | 13.9 | 13.2 | ||||||||||||||||

| Energy and production taxes (non-GAAP) | 11.0 | 14.9 | 4.3 | 3.4 | ||||||||||||||||

| Total Cash Operating Expenses (Cash Opex) excluding Energy and Production Taxes (non-GAAP) | 44.0 | 39.5 | 9.6 | 9.8 | ||||||||||||||||

| Change vs 2019 |

Change vs 2023 |

Estimated Cumulative vs 2019 |

||||||||||||||||||

| Total Cash Operating Expenses (Cash Opex) excluding Energy and Production Taxes (non-GAAP) | -4.5 | +0.2 | ||||||||||||||||||

| Market | +3.6 | +0.1 | ||||||||||||||||||

| Activity/Other | +1.6 | +0.5 | ||||||||||||||||||

| Structural Cost Savings | -9.7 | -0.4 | -10.1 | |||||||||||||||||

|

. | ATTACHMENT I-a |

||||||||||||

CONDENSED CONSOLIDATED STATEMENT OF INCOME | ||||||||||||||

| (Preliminary) | ||||||||||||||

| Dollars in millions (unless otherwise noted) | Three Months Ended March 31, |

|||||||

| 2024 | 2023 | |||||||

| Revenues and other income | ||||||||

| Sales and other operating revenue | 80,411 | 83,644 | ||||||

| Income from equity affiliates | 1,842 | 2,381 | ||||||

| Other income | 830 | 539 | ||||||

| Total revenues and other income | 83,083 | 86,564 | ||||||

| Costs and other deductions | ||||||||

| Crude oil and product purchases | 47,601 | 46,003 | ||||||

| Production and manufacturing expenses | 9,091 | 9,436 | ||||||

| Selling, general and administrative expenses | 2,495 | 2,390 | ||||||

| Depreciation and depletion (includes impairments) | 4,812 | 4,244 | ||||||

| Exploration expenses, including dry holes | 148 | 141 | ||||||

| Non-service pension and postretirement benefit expense | 23 | 167 | ||||||

| Interest expense | 221 | 159 | ||||||

| Other taxes and duties | 6,323 | 7,221 | ||||||

| Total costs and other deductions | 70,714 | 69,761 | ||||||

| Income/(Loss) before income taxes | 12,369 | 16,803 | ||||||

| Income tax expense/(benefit) | 3,803 | 4,960 | ||||||

| Net income/(loss) including noncontrolling interests | 8,566 | 11,843 | ||||||

| Net income/(loss) attributable to noncontrolling interests | 346 | 413 | ||||||

| Net income/(loss) attributable to ExxonMobil | 8,220 | 11,430 | ||||||

| OTHER FINANCIAL DATA | ||||||||

| Dollars in millions (unless otherwise noted) | Three Months Ended March 31, |

|||||||

| 2024 | 2023 | |||||||

Earnings per common share (U.S. dollars) |

2.06 | 2.79 | ||||||

Earnings per common share - assuming dilution (U.S. dollars) |

2.06 | 2.79 | ||||||

| Dividends on common stock | ||||||||

| Total | 3,808 | 3,738 | ||||||

Per common share (U.S. dollars) |

0.95 | 0.91 | ||||||

| Millions of common shares outstanding | ||||||||

| Average - assuming dilution | 3,998 | 4,102 | ||||||

| Taxes | ||||||||

| Income taxes | 3,803 | 4,960 | ||||||

| Total other taxes and duties | 7,160 | 8,095 | ||||||

| Total taxes | 10,963 | 13,055 | ||||||

| Sales-based taxes | 5,549 | 6,032 | ||||||

| Total taxes including sales-based taxes | 16,512 | 19,087 | ||||||

| ExxonMobil share of income taxes of equity companies (non-GAAP) | 998 | 1,235 | ||||||

|

. | ATTACHMENT I-b | ||||||||||||

| CONDENSED CONSOLIDATED BALANCE SHEET | ||||||||||||||

| (Preliminary) | ||||||||||||||

| Dollars in millions (unless otherwise noted) |

March 31,

2024

|

December 31, 2023 | ||||||

| ASSETS | ||||||||

| Current assets | ||||||||

| Cash and cash equivalents | 33,320 | 31,539 | ||||||

| Cash and cash equivalents – restricted | 29 | 29 | ||||||

| Notes and accounts receivable – net | 40,366 | 38,015 | ||||||

| Inventories | ||||||||

| Crude oil, products and merchandise | 18,891 | 20,528 | ||||||

| Materials and supplies | 4,600 | 4,592 | ||||||

| Other current assets | 2,171 | 1,906 | ||||||

| Total current assets | 99,377 | 96,609 | ||||||

| Investments, advances and long-term receivables | 47,608 | 47,630 | ||||||

| Property, plant and equipment – net | 213,723 | 214,940 | ||||||

| Other assets, including intangibles – net | 17,210 | 17,138 | ||||||

| Total Assets | 377,918 | 376,317 | ||||||

| LIABILITIES | ||||||||

| Current liabilities | ||||||||

| Notes and loans payable | 8,227 | 4,090 | ||||||

| Accounts payable and accrued liabilities | 59,531 | 58,037 | ||||||

| Income taxes payable | 4,163 | 3,189 | ||||||

| Total current liabilities | 71,921 | 65,316 | ||||||

| Long-term debt | 32,213 | 37,483 | ||||||

| Postretirement benefits reserves | 10,475 | 10,496 | ||||||

| Deferred income tax liabilities | 24,106 | 24,452 | ||||||

| Long-term obligations to equity companies | 1,909 | 1,804 | ||||||

| Other long-term obligations | 24,242 | 24,228 | ||||||

| Total Liabilities | 164,866 | 163,779 | ||||||

| EQUITY | ||||||||

| Common stock without par value | ||||||||

(9,000 million shares authorized, 8,019 million shares issued) |

17,971 | 17,781 | ||||||

| Earnings reinvested | 458,339 | 453,927 | ||||||

| Accumulated other comprehensive income | (13,169) | (11,989) | ||||||

| Common stock held in treasury | ||||||||

(4,076 million shares at March 31, 2024, and 4,048 million shares at December 31, 2023) |

(257,891) | (254,917) | ||||||

| ExxonMobil share of equity | 205,250 | 204,802 | ||||||

| Noncontrolling interests | 7,802 | 7,736 | ||||||

| Total Equity | 213,052 | 212,538 | ||||||

| Total Liabilities and Equity | 377,918 | 376,317 | ||||||

|

. | ATTACHMENT I-c | ||||||||||||

| CONDENSED CONSOLIDATED STATEMENT OF CASH FLOWS | ||||||||||||||

| (Preliminary) | ||||||||||||||

| Dollars in millions (unless otherwise noted) |

Three Months Ended

March 31,

|

|||||||

| 2024 | 2023 | |||||||

| CASH FLOWS FROM OPERATING ACTIVITIES | ||||||||

| Net income/(loss) including noncontrolling interests | 8,566 | 11,843 | ||||||

| Depreciation and depletion (includes impairments) | 4,812 | 4,244 | ||||||

| Changes in operational working capital, excluding cash and debt | 2,008 | (302) | ||||||

| All other items – net | (722) | 556 | ||||||

| Net cash provided by operating activities | 14,664 | 16,341 | ||||||

| CASH FLOWS FROM INVESTING ACTIVITIES | ||||||||

| Additions to property, plant and equipment | (5,074) | (5,412) | ||||||

| Proceeds from asset sales and returns of investments | 703 | 854 | ||||||

| Additional investments and advances | (421) | (445) | ||||||

| Other investing activities including collection of advances | 215 | 78 | ||||||

| Net cash used in investing activities | (4,577) | (4,925) | ||||||

| CASH FLOWS FROM FINANCING ACTIVITIES | ||||||||

Additions to long-term debt |

108 | 20 | ||||||

| Reductions in short-term debt | (1,106) | (126) | ||||||

| Additions/(Reductions) in debt with three months or less maturity | (5) | (192) | ||||||

| Cash dividends to ExxonMobil shareholders | (3,808) | (3,738) | ||||||

| Cash dividends to noncontrolling interests | (166) | (115) | ||||||

| Changes in noncontrolling interests | 6 | (16) | ||||||

| Common stock acquired | (3,011) | (4,340) | ||||||

| Net cash provided by (used in) financing activities | (7,982) | (8,507) | ||||||

| Effects of exchange rate changes on cash | (324) | 102 | ||||||

| Increase/(Decrease) in cash and cash equivalents | 1,781 | 3,011 | ||||||

| Cash and cash equivalents at beginning of period | 31,568 | 29,665 | ||||||

| Cash and cash equivalents at end of period | 33,349 | 32,676 | ||||||

|

. | ATTACHMENT II-a | ||||||||||||

KEY FIGURES: IDENTIFIED ITEMS | ||||||||||||||

| Dollars in millions (unless otherwise noted) | 1Q24 |

4Q23 |

1Q23 |

||||||||

| Earnings/(Loss) (U.S. GAAP) | 8,220 | 7,630 | 11,430 | ||||||||

| Identified Items | |||||||||||

| Impairments | — | (3,040) | — | ||||||||

| Gain/(loss) on sale of assets | — | 305 | — | ||||||||

| Tax-related items | — | 577 | (188) | ||||||||

| Other | — | (175) | — | ||||||||

| Total Identified Items | — | (2,333) | (188) | ||||||||

| Earnings/(Loss) Excluding Identified Items (non-GAAP) | 8,220 | 9,963 | 11,618 | ||||||||

| Dollars per common share | 1Q24 |

4Q23 |

1Q23 |

||||||||

| Earnings/(Loss) Per Common Share (U.S. GAAP) ¹ | 2.06 | 1.91 | 2.79 | ||||||||

| Identified Items Per Common Share ¹ | |||||||||||

| Impairments | — | (0.75) | — | ||||||||

| Gain/(loss) on sale of assets | — | 0.08 | — | ||||||||

| Tax-related items | — | 0.14 | (0.04) | ||||||||

| Other | — | (0.04) | — | ||||||||

| Total Identified Items Per Common Share ¹ | — | (0.57) | (0.04) | ||||||||

| Earnings/(Loss) Excl. Identified Items Per Common Share (non-GAAP) ¹ | 2.06 | 2.48 | 2.83 | ||||||||

| ¹ Assuming dilution. | |||||||||||

|

. | ATTACHMENT II-b | ||||||||||||

KEY FIGURES: IDENTIFIED ITEMS BY SEGMENT | ||||||||||||||

| First Quarter 2024 | Upstream | Energy Products | Chemical Products | Specialty Products | Corporate & Financing |

Total | ||||||||||||||||||||||||||

| Dollars in millions (unless otherwise noted) | U.S. | Non-U.S. | U.S. | Non-U.S. | U.S. | Non-U.S. | U.S. | Non-U.S. | ||||||||||||||||||||||||

| Earnings/(Loss) (U.S. GAAP) | 1,054 | 4,606 | 836 | 540 | 504 | 281 | 404 | 357 | (362) | 8,220 | ||||||||||||||||||||||

| Total Identified Items | — | — | — | — | — | — | — | — | — | — | ||||||||||||||||||||||

| Earnings/(Loss) Excl. Identified Items (non-GAAP) | 1,054 | 4,606 | 836 | 540 | 504 | 281 | 404 | 357 | (362) | 8,220 | ||||||||||||||||||||||

| Fourth Quarter 2023 | Upstream | Energy Products | Chemical Products | Specialty Products | Corporate & Financing |

Total | ||||||||||||||||||||||||||

| Dollars in millions (unless otherwise noted) | U.S. | Non-U.S. | U.S. | Non-U.S. | U.S. | Non-U.S. | U.S. | Non-U.S. | ||||||||||||||||||||||||

| Earnings/(Loss) (U.S. GAAP) | 84 | 4,065 | 1,329 | 1,878 | 478 | (289) | 386 | 264 | (565) | 7,630 | ||||||||||||||||||||||

| Identified Items | ||||||||||||||||||||||||||||||||

| Impairments | (1,978) | (686) | — | — | (21) | (273) | — | (82) | — | (3,040) | ||||||||||||||||||||||

| Gain/(Loss) on sale of assets | 305 | — | — | — | — | — | — | — | — | 305 | ||||||||||||||||||||||

| Tax-related items | 184 | 58 | 192 | (3) | 53 | — | 12 | 5 | 76 | 577 | ||||||||||||||||||||||

| Other | — | — | — | — | — | (147) | — | (28) | — | (175) | ||||||||||||||||||||||

| Total Identified Items | (1,489) | (628) | 192 | (3) | 32 | (420) | 12 | (105) | 76 | (2,333) | ||||||||||||||||||||||

| Earnings/(Loss) Excl. Identified Items (non-GAAP) | 1,573 | 4,693 | 1,137 | 1,881 | 446 | 131 | 374 | 369 | (641) | 9,963 | ||||||||||||||||||||||

| First Quarter 2023 | Upstream | Energy Products | Chemical Products | Specialty Products | Corporate & Financing |

Total | ||||||||||||||||||||||||||

| Dollars in millions (unless otherwise noted) | U.S. | Non-U.S. | U.S. | Non-U.S. | U.S. | Non-U.S. | U.S. | Non-U.S. | ||||||||||||||||||||||||

| Earnings/(Loss) (U.S. GAAP) | 1,632 | 4,825 | 1,910 | 2,273 | 324 | 47 | 451 | 323 | (355) | 11,430 | ||||||||||||||||||||||

| Identified Items | ||||||||||||||||||||||||||||||||

| Tax-related items | — | (158) | — | (30) | — | — | — | — | — | (188) | ||||||||||||||||||||||

| Total Identified Items | — | (158) | — | (30) | — | — | — | — | — | (188) | ||||||||||||||||||||||

| Earnings/(Loss) Excl. Identified Items (non-GAAP) | 1,632 | 4,983 | 1,910 | 2,303 | 324 | 47 | 451 | 323 | (355) | 11,618 | ||||||||||||||||||||||

|

. | ATTACHMENT III | ||||||||||||

KEY FIGURES: UPSTREAM VOLUMES | ||||||||||||||

| Net production of crude oil, natural gas liquids, bitumen and synthetic oil, thousand barrels per day (kbd) | 1Q24 |

4Q23 |

1Q23 |

||||||||

| United States | 816 | 851 | 820 | ||||||||

| Canada/Other Americas | 772 | 709 | 670 | ||||||||

| Europe | 4 | 3 | 4 | ||||||||

| Africa | 224 | 231 | 220 | ||||||||

| Asia | 711 | 722 | 749 | ||||||||

| Australia/Oceania | 30 | 34 | 32 | ||||||||

| Worldwide | 2,557 | 2,550 | 2,495 | ||||||||

| Net natural gas production available for sale, million cubic feet per day (mcfd) | 1Q24 |

4Q23 |

1Q23 |

||||||||

| United States | 2,241 | 2,262 | 2,367 | ||||||||

| Canada/Other Americas | 94 | 98 | 94 | ||||||||

| Europe | 377 | 367 | 548 | ||||||||

| Africa | 150 | 149 | 134 | ||||||||

| Asia | 3,274 | 3,486 | 3,597 | ||||||||

| Australia/Oceania | 1,226 | 1,283 | 1,276 | ||||||||

| Worldwide | 7,362 | 7,645 | 8,016 | ||||||||

Oil-equivalent production (koebd) ¹ |

3,784 | 3,824 | 3,831 | ||||||||

1 Natural gas is converted to an oil-equivalent basis at six million cubic feet per one thousand barrels. | |||||||||||

|

. | ATTACHMENT IV | ||||||||||||

KEY FIGURES: MANUFACTURING THROUGHPUT AND SALES | ||||||||||||||

| Refinery throughput, thousand barrels per day (kbd) | 1Q24 |

4Q23 |

1Q23 |

||||||||

| United States | 1,900 | 1,933 | 1,643 | ||||||||

| Canada | 407 | 407 | 417 | ||||||||

| Europe | 954 | 1,014 | 1,189 | ||||||||

| Asia Pacific | 402 | 450 | 565 | ||||||||

| Other | 180 | 82 | 184 | ||||||||

| Worldwide | 3,843 | 3,886 | 3,998 | ||||||||

| Energy Products sales, thousand barrels per day (kbd) | 1Q24 |

4Q23 |

1Q23 |

||||||||

| United States | 2,576 | 2,704 | 2,459 | ||||||||

| Non-U.S. | 2,656 | 2,653 | 2,818 | ||||||||

| Worldwide | 5,232 | 5,357 | 5,277 | ||||||||

| Gasolines, naphthas | 2,178 | 2,255 | 2,177 | ||||||||

| Heating oils, kerosene, diesel | 1,742 | 1,735 | 1,770 | ||||||||

| Aviation fuels | 339 | 328 | 312 | ||||||||

| Heavy fuels | 214 | 185 | 215 | ||||||||

| Other energy products | 759 | 854 | 803 | ||||||||

| Worldwide | 5,232 | 5,357 | 5,277 | ||||||||

| Chemical Products sales, thousand metric tons (kt) | 1Q24 |

4Q23 |

1Q23 |

||||||||

| United States | 1,847 | 1,743 | 1,561 | ||||||||

| Non-U.S. | 3,207 | 3,033 | 3,088 | ||||||||

| Worldwide | 5,054 | 4,776 | 4,649 | ||||||||

| Specialty Products sales, thousand metric tons (kt) | 1Q24 | 4Q23 | 1Q23 | ||||||||

| United States | 495 | 473 | 476 | ||||||||

| Non-U.S. | 1,464 | 1,367 | 1,464 | ||||||||

| Worldwide | 1,959 | 1,839 | 1,940 | ||||||||

|

. | ATTACHMENT V | ||||||||||||

KEY FIGURES: CAPITAL AND EXPLORATION EXPENDITURES | ||||||||||||||

| Dollars in millions (unless otherwise noted) | 1Q24 |

4Q23 |

1Q23 |

||||||||

| Upstream | |||||||||||

| United States | 2,269 | 2,258 | 2,108 | ||||||||

| Non-U.S. | 2,313 | 3,512 | 2,473 | ||||||||

| Total | 4,582 | 5,770 | 4,581 | ||||||||

| Energy Products | |||||||||||

| United States | 179 | 227 | 358 | ||||||||

| Non-U.S. | 348 | 485 | 327 | ||||||||

| Total | 527 | 712 | 685 | ||||||||

| Chemical Products | |||||||||||

| United States | 152 | 211 | 285 | ||||||||

| Non-U.S. | 281 | 641 | 546 | ||||||||

| Total | 433 | 852 | 831 | ||||||||

| Specialty Products | |||||||||||

| United States | 8 | 22 | 11 | ||||||||

| Non-U.S. | 68 | 127 | 80 | ||||||||

| Total | 76 | 149 | 91 | ||||||||

| Other | |||||||||||

| Other | 221 | 274 | 192 | ||||||||

| Worldwide | 5,839 | 7,757 | 6,380 | ||||||||

| CASH CAPITAL EXPENDITURES | |||||||||||

| Dollars in millions (unless otherwise noted) | 1Q24 |

4Q23 |

1Q23 |

||||||||

| Additions to property, plant and equipment | 5,074 | 6,228 | 5,412 | ||||||||

| Net investments and advances | 206 | 506 | 367 | ||||||||

| Total Cash Capital Expenditures | 5,280 | 6,734 | 5,779 | ||||||||

|

. | ATTACHMENT VI | ||||||||||||

KEY FIGURES: YEAR-TO-DATE EARNINGS/(LOSS) | ||||||||||||||

| Results Summary | |||||||||||||||||

| Dollars in millions (except per share data) | 1Q24 | 4Q23 | Change vs 4Q23 |

1Q23 | Change vs 1Q23 |

||||||||||||

| Earnings (U.S. GAAP) | 8,220 | 7,630 | +590 | 11,430 | -3,210 | ||||||||||||

| Earnings Excluding Identified Items (non-GAAP) | 8,220 | 9,963 | -1,743 | 11,618 | -3,398 | ||||||||||||

Earnings Per Common Share ¹ |

2.06 | 1.91 | +0.15 | 2.79 | -0.73 | ||||||||||||

Earnings Excluding Identified Items Per Common Share (non-GAAP) ¹ |

2.06 | 2.48 | -0.42 | 2.83 | -0.77 | ||||||||||||

| Capital and Exploration Expenditures | 5,839 | 7,757 | -1,918 | 6,380 | -541 | ||||||||||||

| ¹ Assuming dilution | |||||||||||||||||

| EARNINGS/(LOSS) BY QUARTER | |||||||||||||||||

| Dollars in millions (unless otherwise noted) | 2024 |

2023 |

2022 |

2021 |

2020 |

||||||||||||

| First Quarter | 8,220 | 11,430 | 5,480 | 2,730 | (610) | ||||||||||||

| Second Quarter | — | 7,880 | 17,850 | 4,690 | (1,080) | ||||||||||||

| Third Quarter | — | 9,070 | 19,660 | 6,750 | (680) | ||||||||||||

| Fourth Quarter | — | 7,630 | 12,750 | 8,870 | (20,070) | ||||||||||||

| Full Year | — | 36,010 | 55,740 | 23,040 | (22,440) | ||||||||||||

| Dollars per common share ² | 2024 |

2023 |

2022 |

2021 |

2020 |

||||||||||||

| First Quarter | 2.06 | 2.79 | 1.28 | 0.64 | (0.14) | ||||||||||||

| Second Quarter | — | 1.94 | 4.21 | 1.10 | (0.26) | ||||||||||||

| Third Quarter | — | 2.25 | 4.68 | 1.57 | (0.15) | ||||||||||||

| Fourth Quarter | — | 1.91 | 3.09 | 2.08 | (4.70) | ||||||||||||

| Full Year | — | 8.89 | 13.26 | 5.39 | (5.25) | ||||||||||||

2 Computed using the average number of shares outstanding during each period; assuming dilution. |

|||||||||||||||||

|

. | EXHIBIT 99.2 | |||||||||||||||

To assist investors in assessing 1Q24 results, the following disclosures have been made available in this 8-K filing: | |||||||||||||||||

–Identified items of $0.00 per share assuming dilution, as noted on page 1 of the news release | |||||||||||||||||

–A reconciliation of cash flow from operations and asset sales excluding working capital on page 1 of this exhibit and on page 6 of the news release | |||||||||||||||||

1Q24 INVESTOR RELATIONS DATA SUMMARY (PAGE 1 of 4) | ||||||||||||||||||||

| Earnings/(Loss), $M (unless noted) | 1Q24 | 4Q23 | 3Q23 | 2Q23 | 1Q23 | |||||||||||||||

| Upstream | United States | 1,054 | 84 | 1,566 | 920 | 1,632 | ||||||||||||||

| Non-U.S. | 4,606 | 4,065 | 4,559 | 3,657 | 4,825 | |||||||||||||||

| Total | 5,660 | 4,149 | 6,125 | 4,577 | 6,457 | |||||||||||||||

| Energy Products | United States | 836 | 1,329 | 1,356 | 1,528 | 1,910 | ||||||||||||||

| Non-U.S. | 540 | 1,878 | 1,086 | 782 | 2,273 | |||||||||||||||

| Total | 1,376 | 3,207 | 2,442 | 2,310 | 4,183 | |||||||||||||||

| Chemical Products | United States | 504 | 478 | 338 | 486 | 324 | ||||||||||||||

| Non-U.S. | 281 | (289) | (89) | 342 | 47 | |||||||||||||||

| Total | 785 | 189 | 249 | 828 | 371 | |||||||||||||||

| Specialty Products | United States | 404 | 386 | 326 | 373 | 451 | ||||||||||||||

| Non-U.S. | 357 | 264 | 293 | 298 | 323 | |||||||||||||||

| Total | 761 | 650 | 619 | 671 | 774 | |||||||||||||||

| Corporate and Financing | (362) | (565) | (365) | (506) | (355) | |||||||||||||||

| Net income attributable to ExxonMobil (U.S. GAAP) | 8,220 | 7,630 | 9,070 | 7,880 | 11,430 | |||||||||||||||

| Earnings/(Loss) per common share (U.S. GAAP) | 2.06 | 1.91 | 2.25 | 1.94 | 2.79 | |||||||||||||||

| Earnings/(Loss) per common share - assuming dilution (U.S. GAAP) | 2.06 | 1.91 | 2.25 | 1.94 | 2.79 | |||||||||||||||

| Effective Income Tax Rate, % | 36 | % | 30 | % | 34 | % | 33 | % | 34 | % | ||||||||||

| Capital and Exploration Expenditures, $M | 1Q24 | 4Q23 | 3Q23 | 2Q23 | 1Q23 | |||||||||||||||

| Upstream | United States | 2,269 | 2,258 | 2,241 | 2,206 | 2,108 | ||||||||||||||

| Non-U.S. | 2,313 | 3,512 | 2,560 | 2,403 | 2,473 | |||||||||||||||

| Total | 4,582 | 5,770 | 4,801 | 4,609 | 4,581 | |||||||||||||||

| Energy Products | United States | 179 | 227 | 261 | 349 | 358 | ||||||||||||||

| Non-U.S. | 348 | 485 | 386 | 382 | 327 | |||||||||||||||

| Total | 527 | 712 | 647 | 731 | 685 | |||||||||||||||

| Chemical Products | United States | 152 | 211 | 103 | 152 | 285 | ||||||||||||||

| Non-U.S. | 281 | 641 | 268 | 507 | 546 | |||||||||||||||

| Total | 433 | 852 | 371 | 659 | 831 | |||||||||||||||

| Specialty Products | United States | 8 | 22 | 16 | 14 | 11 | ||||||||||||||

| Non-U.S. | 68 | 127 | 95 | 89 | 80 | |||||||||||||||

| Total | 76 | 149 | 111 | 103 | 91 | |||||||||||||||

| Other | 221 | 274 | 92 | 64 | 192 | |||||||||||||||

| Total Capital and Exploration Expenditures | 5,839 | 7,757 | 6,022 | 6,166 | 6,380 | |||||||||||||||

| Exploration expenses, including dry holes | 148 | 139 | 338 | 133 | 141 | |||||||||||||||

| Cash Capital Expenditures, $M | 1Q24 | 4Q23 | 3Q23 | 2Q23 | 1Q23 | |||||||||||||||

| Additions to property, plant and equipment | 5,074 | 6,228 | 4,920 | 5,359 | 5,412 | |||||||||||||||

| Net investments and advances | 206 | 506 | 276 | 284 | 367 | |||||||||||||||

| Total Cash Capital Expenditures | 5,280 | 6,734 | 5,196 | 5,643 | 5,779 | |||||||||||||||

| Total Cash and Cash Equivalents, $G | 33.3 | 31.6 | 33.0 | 29.6 | 32.7 | |||||||||||||||

| Total Debt, $G | 40.4 | 41.6 | 41.3 | 41.5 | 41.4 | |||||||||||||||

| Cash Flow from Operations and Asset Sales excluding working capital (non-GAAP), $M | 1Q24 | 4Q23 | 3Q23 | 2Q23 | 1Q23 | |||||||||||||||

| Net cash provided by operating activities (GAAP) | 14,664 | 13,682 | 15,963 | 9,383 | 16,341 | |||||||||||||||

| Proceeds associated with asset sales | 703 | 1,020 | 917 | 1,287 | 854 | |||||||||||||||

| Cash flow from operations and asset sales (non-GAAP) | 15,367 | 14,702 | 16,880 | 10,670 | 17,195 | |||||||||||||||

| Changes in operational working capital | (2,008) | 2,191 | (1,821) | 3,583 | 302 | |||||||||||||||

|

Cash flow from operations and asset sales

excluding working capital (non-GAAP)

|

13,359 | 16,893 | 15,059 | 14,253 | 17,497 | |||||||||||||||

| Common Shares Outstanding, millions | 1Q24 | 4Q23 | 3Q23 | 2Q23 | 1Q23 | |||||||||||||||

| At quarter end | 3,943 | 3,971 | 3,963 | 4,003 | 4,043 | |||||||||||||||

| Weighted-average - assuming dilution | 3,998 | 4,010 | 4,025 | 4,066 | 4,102 | |||||||||||||||

|

. | ||||||||||||||||

1Q24 INVESTOR RELATIONS DATA SUMMARY (PAGE 2 of 4) | ||||||||||||||||||||

| Upstream Volumes | 1Q24 | 4Q23 | 3Q23 | 2Q23 | 1Q23 | |||||||||||||||

| Liquids production (kbd) ¹ | ||||||||||||||||||||

| United States | 816 | 851 | 756 | 785 | 820 | |||||||||||||||

| Canada/Other Americas | 772 | 709 | 655 | 618 | 670 | |||||||||||||||

| Europe | 4 | 3 | 4 | 4 | 4 | |||||||||||||||

| Africa | 224 | 231 | 229 | 206 | 220 | |||||||||||||||

| Asia | 711 | 722 | 713 | 702 | 749 | |||||||||||||||

| Australia/Oceania | 30 | 34 | 40 | 38 | 32 | |||||||||||||||

| Worldwide liquids production | 2,557 | 2,550 | 2,397 | 2,353 | 2,495 | |||||||||||||||

| ¹ Net production of crude oil, natural gas liquids, bitumen and synthetic oil, kbd. | ||||||||||||||||||||

| Natural gas production available for sale (mcfd) | ||||||||||||||||||||

| United States | 2,241 | 2,262 | 2,271 | 2,346 | 2,367 | |||||||||||||||

| Canada/Other Americas | 94 | 98 | 94 | 97 | 94 | |||||||||||||||

| Europe | 377 | 367 | 368 | 375 | 548 | |||||||||||||||

| Africa | 150 | 149 | 129 | 86 | 134 | |||||||||||||||

| Asia | 3,274 | 3,486 | 3,528 | 3,350 | 3,597 | |||||||||||||||

| Australia/Oceania | 1,226 | 1,283 | 1,358 | 1,275 | 1,276 | |||||||||||||||

| Worldwide natural gas production available for sale | 7,362 | 7,645 | 7,748 | 7,529 | 8,016 | |||||||||||||||

Oil-equivalent production, koebd ² |

3,784 | 3,824 | 3,688 | 3,608 | 3,831 | |||||||||||||||

| ² Natural gas is converted to an oil-equivalent basis at six million cubic feet per one thousand barrels. | ||||||||||||||||||||

| Manufacturing Throughput and Sales | 1Q24 | 4Q23 | 3Q23 | 2Q23 | 1Q23 | |||||||||||||||

| Refinery throughput, kbd | ||||||||||||||||||||

| United States | 1,900 | 1,933 | 1,868 | 1,944 | 1,643 | |||||||||||||||

| Canada | 407 | 407 | 415 | 388 | 417 | |||||||||||||||

| Europe | 954 | 1,014 | 1,251 | 1,209 | 1,189 | |||||||||||||||

| Asia Pacific | 402 | 450 | 517 | 463 | 565 | |||||||||||||||

| Other | 180 | 82 | 164 | 169 | 184 | |||||||||||||||

| Worldwide refinery throughput | 3,843 | 3,886 | 4,215 | 4,173 | 3,998 | |||||||||||||||

| Energy Products sales, kbd | ||||||||||||||||||||

| United States | 2,576 | 2,704 | 2,626 | 2,743 | 2,459 | |||||||||||||||

| Non-U.S. | 2,656 | 2,653 | 2,925 | 2,916 | 2,818 | |||||||||||||||

| Worldwide Energy Products sales | 5,232 | 5,357 | 5,551 | 5,658 | 5,277 | |||||||||||||||

| Gasolines, naphthas | 2,178 | 2,255 | 2,316 | 2,401 | 2,177 | |||||||||||||||

| Heating oils, kerosene, diesel | 1,742 | 1,735 | 1,834 | 1,842 | 1,770 | |||||||||||||||

| Aviation fuels | 339 | 328 | 358 | 344 | 312 | |||||||||||||||

| Heavy fuels | 214 | 185 | 229 | 228 | 215 | |||||||||||||||

| Other energy products | 759 | 854 | 814 | 844 | 803 | |||||||||||||||

| Worldwide Energy Products sales | 5,232 | 5,357 | 5,551 | 5,658 | 5,277 | |||||||||||||||

| Chemical Products sales, kt | ||||||||||||||||||||

| United States | 1,847 | 1,743 | 1,750 | 1,725 | 1,561 | |||||||||||||||

| Non-U.S. | 3,207 | 3,033 | 3,358 | 3,124 | 3,088 | |||||||||||||||

| Worldwide Chemical Products sales | 5,054 | 4,776 | 5,108 | 4,849 | 4,649 | |||||||||||||||

| Specialty Products sales, kt | ||||||||||||||||||||

| United States | 495 | 473 | 498 | 514 | 476 | |||||||||||||||

| Non-U.S. | 1,463 | 1,367 | 1,414 | 1,391 | 1,464 | |||||||||||||||

| Worldwide Specialty Products sales | 1,959 | 1,839 | 1,912 | 1,905 | 1,940 | |||||||||||||||

|

. | ||||||||||||||||

1Q24 INVESTOR RELATIONS DATA SUMMARY (PAGE 3 of 4) |

||||||||

| Earnings Factor Analysis, $M | 1Q24 vs 1Q23 |

1Q24 vs 4Q23 |

||||||

| Upstream | ||||||||

| Prior Period | 6,457 | 4,149 | ||||||

| Price | (820) | (490) | ||||||

| Advantaged Volume Growth (Advantaged assets) | 430 | 190 | ||||||

| Base Volume | (400) | (310) | ||||||

| Structural Cost Savings | 90 | 20 | ||||||

| Expenses | (160) | 10 | ||||||

| Identified Items | 160 | 2,120 | ||||||

| Other | (470) | (70) | ||||||

| Timing Effects | 370 | 40 | ||||||

| Current Period | 5,660 | 5,660 | ||||||

| Energy Products | ||||||||

| Prior Period | 4,183 | 3,207 | ||||||

| Margin | (2,000) | 540 | ||||||

| Advantaged Volume Growth (Strategic projects) | 140 | — | ||||||

| Base Volume | (210) | (290) | ||||||

| Structural Cost Savings | 140 | — | ||||||

| Expenses | (290) | (150) | ||||||

| Identified Items | 30 | (190) | ||||||

| Other | 40 | (680) | ||||||

| Timing Effects | (660) | (1,060) | ||||||

| Current Period | 1,376 | 1,376 | ||||||

| Chemical Products | ||||||||

| Prior Period | 371 | 189 | ||||||

| Margin | 200 | 80 | ||||||

| Advantaged Volume Growth (High-value products) | 40 | 10 | ||||||

| Base Volume | 160 | 120 | ||||||

| Structural Cost Savings | 20 | — | ||||||

| Expenses | 10 | 10 | ||||||

| Identified Items | — | 390 | ||||||

| Other | (20) | (10) | ||||||

| Current Period | 785 | 785 | ||||||

| Specialty Products | ||||||||

| Prior Period | 774 | 650 | ||||||

| Margin | 30 | 70 | ||||||

| Advantaged Volume Growth (High-value products) | — | 20 | ||||||

| Base Volume | (20) | 30 | ||||||

| Structural Cost Savings | 20 | — | ||||||

| Expenses | (40) | 50 | ||||||

| Identified Items | — | 90 | ||||||

| Other | — | (150) | ||||||

| Current Period | 761 | 761 | ||||||

|

. | ||||||||||||||||

1Q24 INVESTOR RELATIONS DATA SUMMARY (PAGE 4 of 4) |

||||||||

| Upstream Volume Factor Analysis, koebd | 1Q24 vs 1Q23 |

1Q24 vs 4Q23 |

||||||

| Prior Period | 3,831 | 3,824 | ||||||

| Entitlements - Price / Spend / Other | (41) | (84) | ||||||

| Government Mandates | (17) | 12 | ||||||

| Divestments | (66) | (25) | ||||||

| Growth / Other | 77 | 57 | ||||||

| Current Period | 3,784 | 3,784 | ||||||

| Average Realization Data | 1Q24 | 4Q23 | 3Q23 | 2Q23 | 1Q23 | ||||||||||||

| United States | |||||||||||||||||

| ExxonMobil | |||||||||||||||||

| Crude ($/b) | 74.96 | 76.64 | 80.45 | 71.36 | 73.95 | ||||||||||||

| Natural Gas ($/kcf) | 2.22 | 2.55 | 2.30 | 1.45 | 3.20 | ||||||||||||

| Benchmarks | |||||||||||||||||

| WTI ($/b) | 77.06 | 78.37 | 82.50 | 73.78 | 76.11 | ||||||||||||

| ANS-WC ($/b) | 81.37 | 84.02 | 87.90 | 78.43 | 79.14 | ||||||||||||

| Henry Hub ($/mbtu) | 2.25 | 2.88 | 2.54 | 2.09 | 3.44 | ||||||||||||

| Non-U.S. | |||||||||||||||||

| ExxonMobil | |||||||||||||||||

| Crude ($/b) | 72.00 | 74.23 | 77.48 | 70.08 | 67.93 | ||||||||||||

| Natural Gas ($/kcf) | 11.37 | 12.58 | 10.50 | 11.44 | 17.39 | ||||||||||||

| European NG ($/kcf) | 14.04 | 17.34 | 13.71 | 14.61 | 27.46 | ||||||||||||

| Benchmarks | |||||||||||||||||

| Brent ($/b) | 83.24 | 84.05 | 86.76 | 78.40 | 81.28 | ||||||||||||

The above numbers reflect ExxonMobil’s current estimate of volumes and realizations given data available as of the end of the first quarter of 2024. Volumes and realizations may be adjusted when full statements on joint venture operations are received from outside operators. ExxonMobil management assumes no duty to update these estimates. | ||

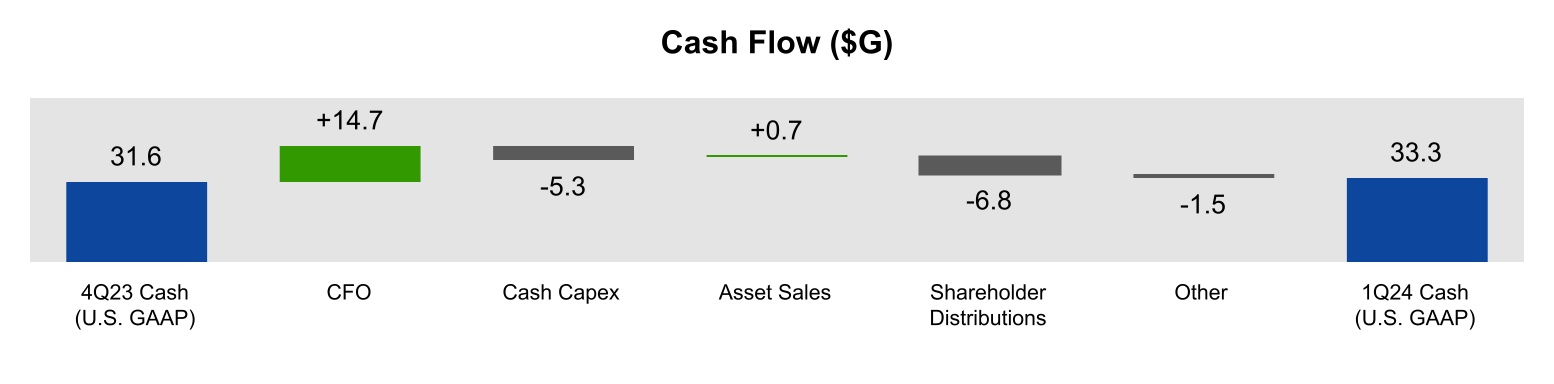

| Sources and Uses of Funds, $M | 1Q24 | ||||||||||||||||

| Beginning Cash | 31,568 | ||||||||||||||||

| Earnings | 8,220 | ||||||||||||||||

| Depreciation | 4,812 | ||||||||||||||||

| Working Capital / Other | 1,632 | ||||||||||||||||

| Proceeds Associated with Asset Sales | 703 | ||||||||||||||||

| Cash Capital Expenditures ¹ | (5,280) | ||||||||||||||||

| Shareholder Distributions | (6,816) | ||||||||||||||||

| Debt / Other Financing | (1,490) | ||||||||||||||||

| Ending Cash | 33,349 | ||||||||||||||||

¹ 1Q24 Cash Capital Expenditures includes PP&E adds of ($5.1B) and net advances of ($0.2B). |

|||||||||||||||||

| Throughout this press release, both Exhibit 99.1 as well as Exhibit 99.2, due to rounding, numbers presented may not add up precisely to the totals indicated. | ||