Document

FULL-YEAR 2023 NET INCOME OF $881 MILLION, $6.44 PER SHARE

FOURTH QUARTER 2023 NET INCOME OF $33 MILLION, $0.20 PER SHARE

Continued Strong Credit Quality and Capital Position

Record Full-Year Average Loans and Annual Net Interest Income

Notable Items Impacted 4th Quarter Results

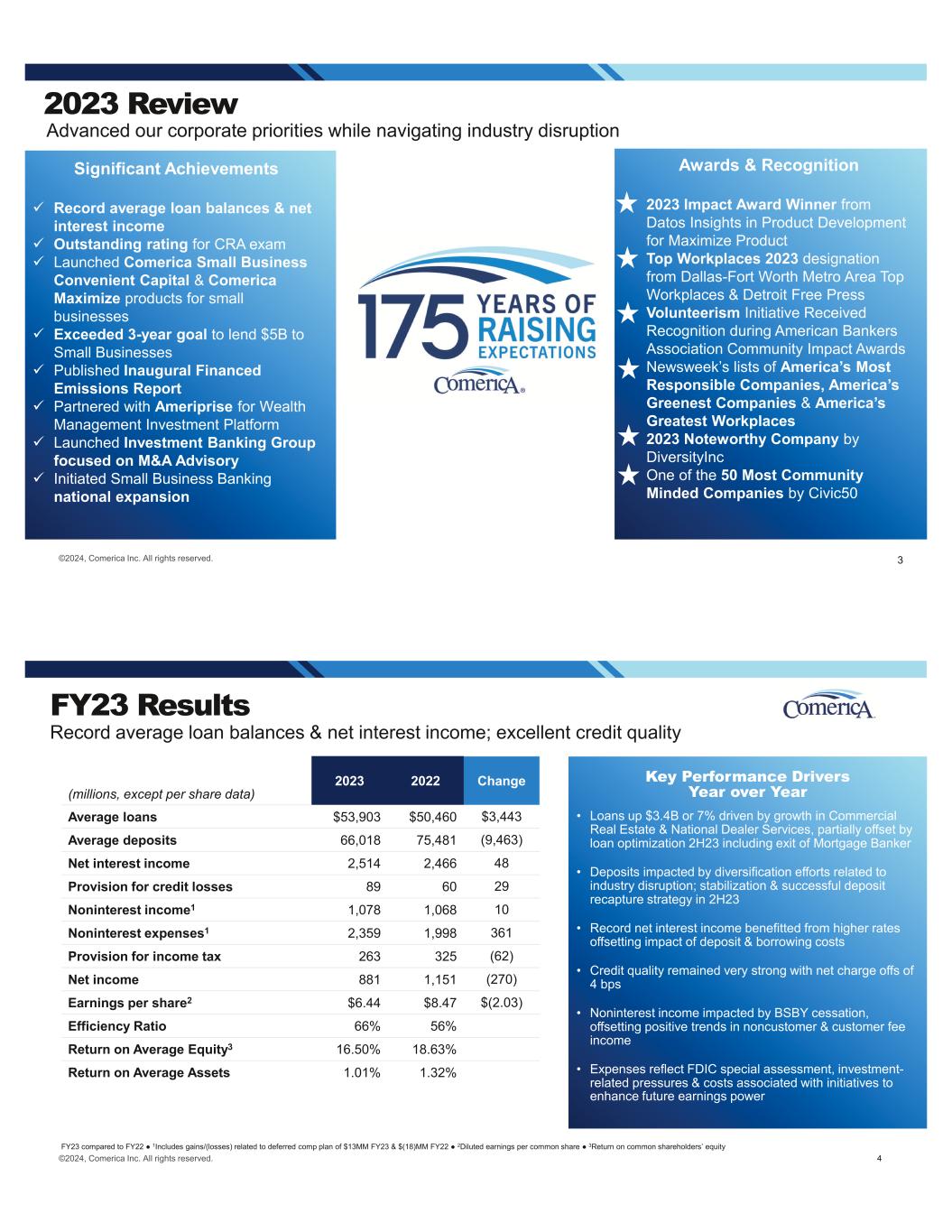

"In 2023, we demonstrated the strength and resilience of our model as we navigated disruptive industry events," said Curtis C. Farmer, Comerica Chairman and Chief Executive Officer. "We produced record average loans of $53.9 billion and the highest year of net interest income in our history. Deposits were impacted by diversification efforts, but successful execution of a targeted strategy and our strong customer relationships supported stabilization of our compelling funding base. Credit quality remained excellent with net charge-offs of 4 basis points, and we continued to grow capital well in excess of our 10% strategic target.

"Fourth quarter results were impacted by several notable items, while strategic management of our balance sheet produced loan and deposit results in line with expectations. Our proven credit discipline continued to be a foundational strength as net charge-offs remained below historical levels, and our estimated capital position grew even after the impact of notable items.

"With strategic actions to manage our balance sheet, calibrate expenses and prioritize key investments, we believe we are well-positioned to support our customers and enhance returns over time."

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

(dollar amounts in millions, except per share data) |

4th Qtr '23 |

|

3rd Qtr '23 |

|

|

|

2023 |

|

2022 |

|

|

FINANCIAL RESULTS |

|

|

|

|

|

|

|

|

|

|

|

Net interest income |

$ |

584 |

|

|

$ |

601 |

|

|

|

|

$ |

2,514 |

|

|

$ |

2,466 |

|

|

|

Provision for credit losses |

12 |

|

|

14 |

|

|

|

|

89 |

|

|

60 |

|

|

|

Noninterest income |

198 |

|

|

295 |

|

|

|

|

1,078 |

|

|

1,068 |

|

|

|

Noninterest expenses |

718 |

|

|

555 |

|

|

|

|

2,359 |

|

|

1,998 |

|

|

|

Pre-tax income |

52 |

|

|

327 |

|

|

|

|

1,144 |

|

|

1,476 |

|

|

|

Provision for income taxes |

19 |

|

|

76 |

|

|

|

|

263 |

|

|

325 |

|

|

|

Net income |

$ |

33 |

|

|

$ |

251 |

|

|

|

|

$ |

881 |

|

|

$ |

1,151 |

|

|

|

Diluted earnings per common share |

$ |

0.20 |

|

|

$ |

1.84 |

|

|

|

|

$ |

6.44 |

|

|

$ |

8.47 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Average loans |

52,796 |

|

|

53,987 |

|

|

|

|

53,903 |

|

|

50,460 |

|

|

|

Average deposits |

66,045 |

|

|

65,883 |

|

|

|

|

66,018 |

|

|

75,481 |

|

|

|

Return on average assets (ROA) |

0.15 |

% |

|

1.12 |

% |

|

|

|

1.01 |

% |

|

1.32 |

% |

|

|

Return on average common shareholders' equity (ROE) |

2.17 |

|

|

19.50 |

|

|

|

|

16.50 |

|

|

18.63 |

|

|

|

Net interest margin |

2.91 |

|

|

2.84 |

|

|

|

|

3.06 |

|

|

3.02 |

|

|

|

Efficiency ratio (a) |

91.86 |

|

|

61.86 |

|

|

|

|

65.56 |

|

|

56.32 |

|

|

|

Common equity Tier 1 capital ratio (b) |

11.09 |

|

|

10.80 |

|

|

|

|

11.09 |

|

|

10.00 |

|

|

|

Tier 1 capital ratio (b) |

11.61 |

|

|

11.30 |

|

|

|

|

11.61 |

|

|

10.50 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

(a)Noninterest expenses as a percentage of the sum of net interest income and noninterest income excluding net gains (losses) from securities, a derivative contract tied to the conversion rate of Visa Class B shares and changes in the value of shares obtained through monetization of warrants.

(b)December 31, 2023 ratios are estimated. See Reconciliations of Non-GAAP Financial Measures and Regulatory Ratios for additional information.

Impact of Notable Items to Financial Results

The following table reconciles adjusted diluted earnings per common share, net income attributable to common shareholders and return ratios. See Reconciliations of Non-GAAP Financial Measures and Regulatory Ratios for additional information.

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| (dollar amounts in millions, except per share data) |

4th Qtr '23 |

|

3rd Qtr '23 |

|

|

|

2023 |

|

2022 |

| Diluted earnings per common share |

$ |

0.20 |

|

|

$ |

1.84 |

|

|

|

|

$ |

6.44 |

|

|

$ |

8.47 |

|

FDIC special assessment (a) |

0.62 |

|

|

— |

|

|

|

|

0.62 |

|

|

— |

|

Net BSBY cessation hedging losses (b) |

0.51 |

|

|

— |

|

|

|

|

0.51 |

|

|

— |

|

Expense recalibration initiatives (c) |

0.14 |

|

|

— |

|

|

|

|

0.14 |

|

|

— |

|

Modernization initiatives (d) |

(0.01) |

|

|

(0.08) |

|

|

|

|

0.04 |

|

|

0.22 |

|

| Adjusted diluted earnings per common share |

$ |

1.46 |

|

|

$ |

1.76 |

|

|

|

|

$ |

7.75 |

|

|

$ |

8.69 |

|

|

|

|

|

|

|

|

|

|

|

| Net income attributable to common shareholders |

$ |

27 |

|

|

$ |

244 |

|

|

|

|

$ |

854 |

|

|

$ |

1,122 |

|

FDIC special assessment (a) |

109 |

|

|

— |

|

|

|

|

109 |

|

|

— |

|

Net BSBY cessation hedging losses (b) |

88 |

|

|

— |

|

|

|

|

88 |

|

|

— |

|

Expense recalibration initiatives (c) |

25 |

|

|

— |

|

|

|

|

25 |

|

|

— |

|

Modernization initiatives (d) |

(4) |

|

|

(14) |

|

|

|

|

6 |

|

|

38 |

|

| Income tax impact of above items |

(52) |

|

|

3 |

|

|

|

|

(54) |

|

|

(8) |

|

| Adjusted net income attributable to common shareholders |

$ |

193 |

|

|

$ |

233 |

|

|

|

|

$ |

1,028 |

|

|

$ |

1,152 |

|

| ROA |

0.15 |

% |

|

1.12 |

% |

|

|

|

1.01 |

% |

|

1.32 |

% |

| Adjusted ROA |

0.94 |

|

|

1.07 |

|

|

|

|

1.21 |

|

|

1.35 |

|

| ROE |

2.17 |

|

|

19.50 |

|

|

|

|

16.50 |

|

|

18.63 |

|

| Adjusted ROE |

15.47 |

|

|

18.65 |

|

|

|

|

19.77 |

|

|

19.07 |

|

(a)Additional FDIC insurance expense resulting from the FDIC Board of Directors’ November 2023 approval of a special assessment to recover the loss to the Deposit Insurance Fund following the failures of Silicon Valley Bank and Signature Bank.

(b)The planned cessation of the Bloomberg Short-Term Bank Yield Index (BSBY) announced in November 2023 resulted in the de-designation of certain interest rate swaps requiring reclassification of amounts recognized in accumulated other comprehensive income (AOCI) into earnings. Settlement of interest payments and changes in fair value for each impacted swap are recorded as risk management hedging losses until the swap is re-designated.

(c)Related to certain initiatives expected to calibrate expenses to enhance earnings power while creating capacity for strategic and risk management initiatives.

(d)Related to certain modernization initiatives to transform the retail banking delivery model, align corporate facilities and optimize technology platforms.

Fourth Quarter 2023 Compared to Third Quarter 2023 Overview

Balance sheet items discussed in terms of average balances unless otherwise noted.

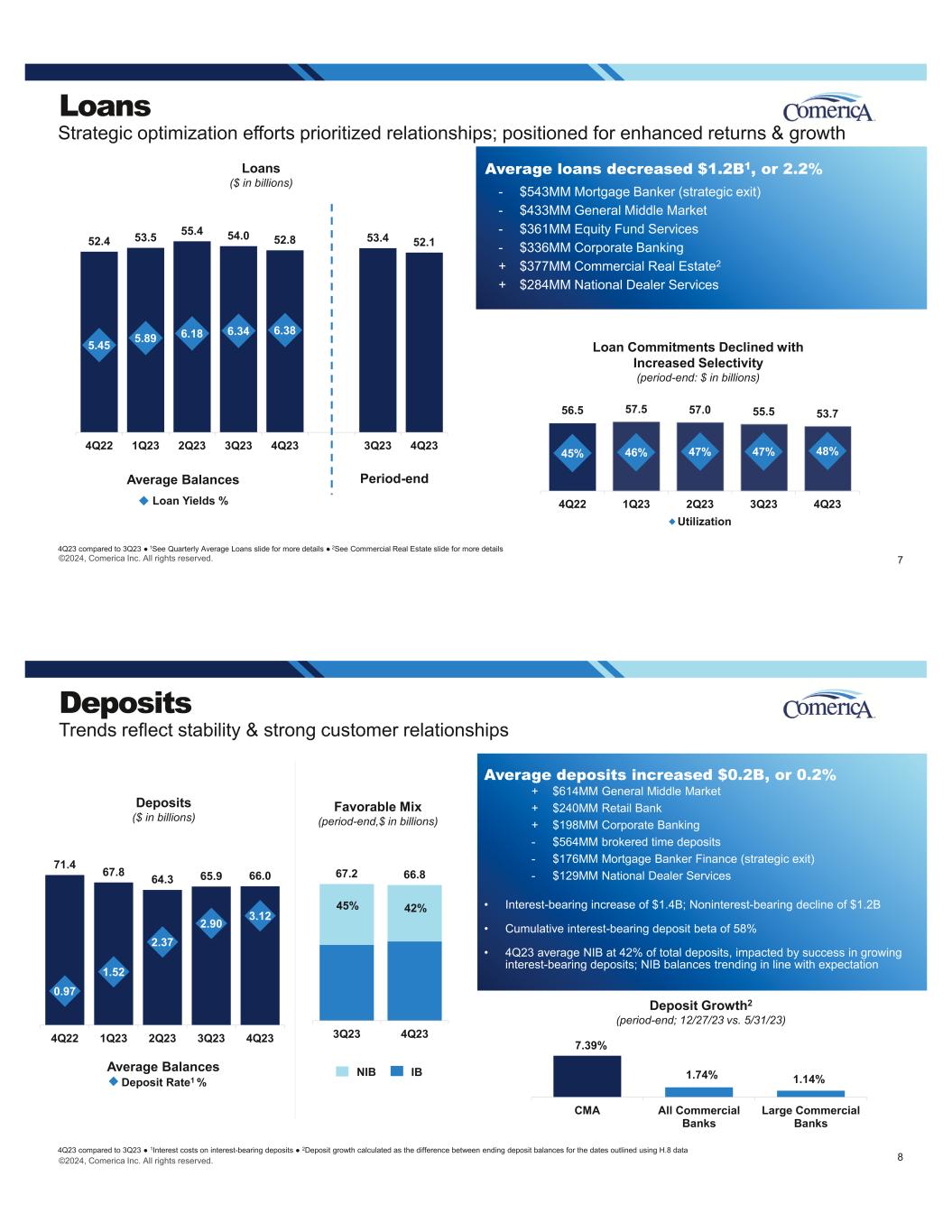

Loans decreased $1.2 billion to $52.8 billion.

•Largely driven by decreases of $543 million in Mortgage Banker Finance, $433 million in general Middle Market, $361 million in Equity Fund Services and $336 million in Corporate Banking, partially offset by increases of $377 million in Commercial Real Estate and $284 million in National Dealer Services.

◦Declines reflect strategic actions, including the planned exit from the Mortgage Banker Finance business, which is mostly complete, as well as increased selectivity in other lines of business and lower customer demand.

•Average yield on loans (including swaps) increased 4 basis points to 6.38%, reflecting higher short-term rates.

Securities decreased $592 million to $16.3 billion, reflecting paydowns and an increase in unrealized losses.

•Period-end unrealized losses on securities decreased $975 million to $2.7 billion.

Deposits were relatively stable at $66.0 billion.

•Interest-bearing deposits increased $1.4 billion, partially offset by a decrease of $1.2 billion in noninterest-bearing deposits.

◦Increases of $614 million in general Middle Market, $240 million in Retail Banking and $198 million in Corporate Banking, partially offset by decreases of $176 million in Mortgage Banker Finance related to planned exit from this business and $129 million in National Dealer Services. Additionally, brokered time deposits decreased $564 million.

•Period-end uninsured deposits as calculated per regulatory guidance totaled $31.5 billion, or 47.2% of total deposits; excluding affiliate deposits, uninsured deposits totaled $27.4 billion, or 41.1% of total deposits.

•The average cost of interest-bearing deposits increased 22 basis points to 312 basis points, mostly reflecting strategic growth in interest-bearing deposits as well as relationship-focused pricing in a higher-rate environment.

Short-term borrowings decreased $4.8 billion to $4.0 billion, due to a reduction in Federal Home Loan Bank (FHLB) advances, while medium- and long-term debt decreased $313 million to $6.1 billion, reflecting the full quarter impact of $850 million in senior notes that matured in the third quarter.

•Total liquidity capacity at period-end totaled $47.7 billion, including cash and available liquidity through the FHLB, the FRB discount window and Bank Term Funding Program.

Net interest income decreased $17 million to $584 million.

•Driven by lower deposits held at the Federal Reserve Bank, a decline in loan balances, an increase in interest-bearing deposits and the net decrease from higher short-term rates, partially offset by a reduction in borrowing balances.

•Net interest margin increased 7 basis points to 2.91%, primarily reflecting a reduction in FHLB advances and an increase in the average yield on loans, partially offset by higher interest-bearing deposits, lower deposits held at the Federal Reserve Bank and a decline in loan balances.

Provision for credit losses decreased $2 million to $12 million.

•The allowance for credit losses decreased $8 million to $728 million at December 31, 2023, reflecting the continuation of an uncertain economic outlook and credit migration, as well as changes in portfolio composition. As a percentage of total loans, the allowance for credit losses was 1.40%, an increase of 2 basis points.

Noninterest income decreased $97 million to $198 million.

Fourth quarter results include changes in presentation consistent with contractual terms with new investment program partner resulting in offsetting decreases of $2 million to noninterest income and noninterest expenses. A net increase of $2 million presented as brokerage fees was due to reductions of $2 million each previously presented within fiduciary income, other noninterest income and salaries and benefits expense (commission expenses).

•Decreases of $91 million in risk management hedging income (BSBY cessation), $3 million each in fiduciary income, card fees, securities trading income and FHLB stock dividends and $2 million each in service charges on deposit accounts, commercial lending fees and bank-owned life insurance, partially offset by increases of $11 million in deferred compensation asset returns (offset in noninterest expenses) and $2 million in brokerage fees.

Noninterest expenses increased $163 million to $718 million.

Fourth quarter results include changes in presentation consistent with contractual terms with new investment program partner resulting in offsetting decreases of $2 million to noninterest expenses (salaries and benefits expense) and noninterest income.

•Increases of $113 million in FDIC insurance expense (primarily driven by special assessment), $44 million in salaries and benefits expense and $10 million in other noninterest expenses, partially offset by a decrease of $5 million in outside processing fee expense.

◦Salaries and benefits expense included increases of $23 million in severance costs (expense recalibration initiatives), $11 million in deferred compensation expense (offset in other noninterest income), $4 million in temporary labor and $3 million in staff insurance.

◦The increase in other noninterest expenses was primarily due to a $7 million reduction in gains on the sale of real estate (modernization initiatives) and an increase of $6 million in consulting expenses as well as smaller increases in various categories, partially offset by a decrease of $10 million in litigation and regulatory-related expenses.

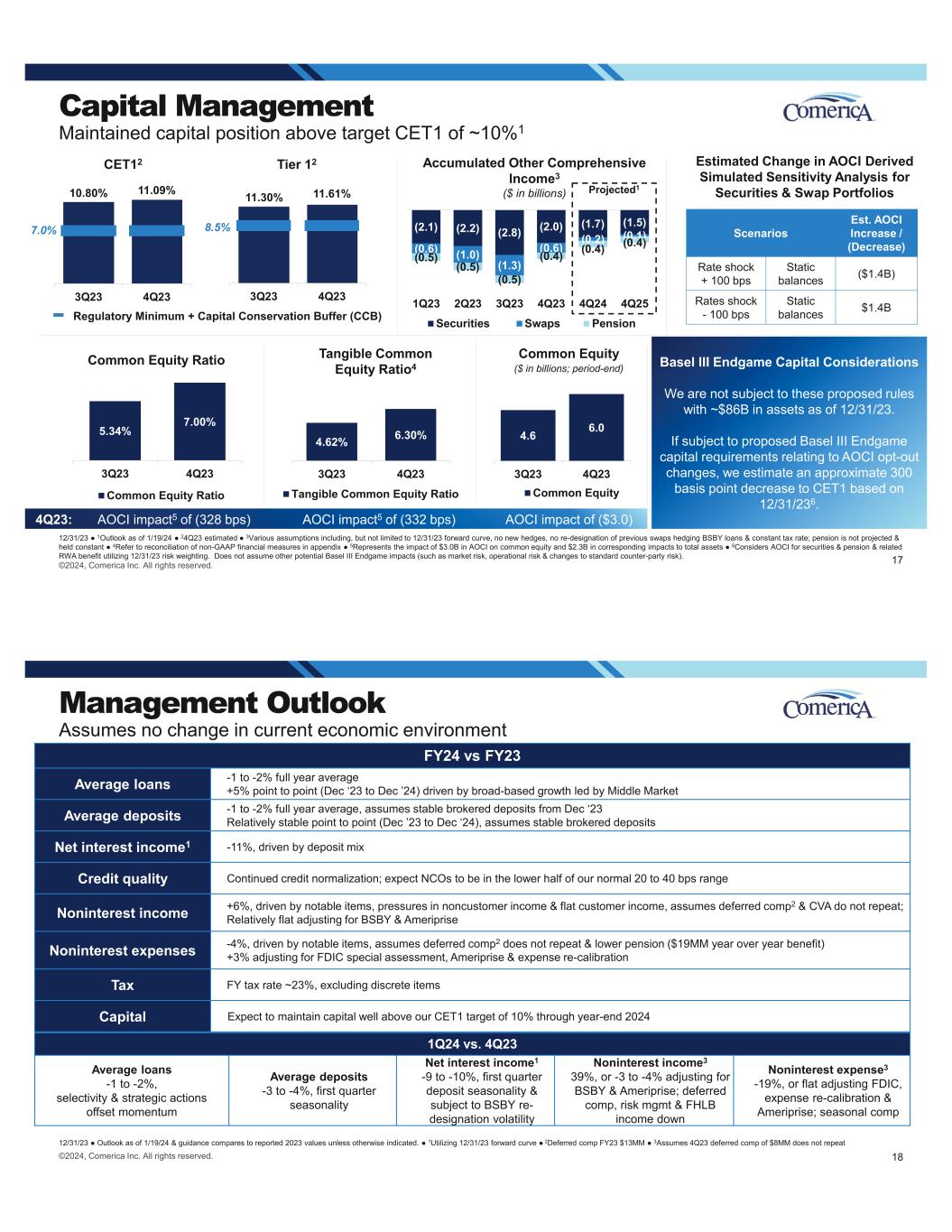

Common equity Tier 1 capital ratio of 11.09% and a Tier 1 capital ratio of 11.61%.

•Declared dividends of $93 million on common stock and $6 million on preferred stock.

•Tangible common equity ratio was 6.30%.

See Reconciliations of Non-GAAP Financial Measures and Regulatory Ratios.

Full-Year 2023 Compared to Full-Year 2022 Overview

Balance sheet items discussed in terms of average balances unless otherwise noted.

Loans increased $3.4 billion to $53.9 billion.

•Largely driven by increases of $2.2 billion in Commercial Real Estate, $1.1 billion in National Dealer Services, $516 million in Corporate Banking, $326 million in Wealth Management and $247 million in Environmental Services, partially offset by decreases of $634 million in Mortgage Banker Finance and $344 million in Equity Fund Services.

•Average yield on loans (including swaps) increased 193 basis points to 6.20%, reflecting higher short-term rates.

Securities decreased $1.6 billion to $17.4 billion.

•Driven by unrealized losses and maturities of Treasury securities, partially offset by the full-year impact of mortgage-backed securities purchased during 2022.

Deposits decreased $9.5 billion to $66.0 billion.

•Noninterest-bearing deposits decreased $11.1 billion, partially offset by a $1.7 billion increase in interest-bearing deposits.

•The average cost of interest-bearing deposits increased 222 basis points to 2.52%, mostly reflecting the impact of higher short-term rates, strategic growth in interest-bearing deposits as well as relationship-focused pricing in a higher-rate environment.

Net interest income increased $48 million to $2.5 billion.

•Net benefit from higher short-term rates and loan growth, partially offset by an increase in borrowings and interest-bearing deposits.

•Net interest margin increased 4 basis points to 3.06%, reflecting higher short-term rates, partially offset by higher-cost funding sources.

Provision for credit losses increased $29 million to $89 million.

•The allowance for credit losses increased $67 million, reflecting loan growth, an uncertain economic outlook and credit migration, as well as changes in portfolio composition. As a percentage of total loans, the allowance for credit losses increased 16 basis points.

Noninterest income increased $10 million to $1.1 billion.

Fourth quarter results include changes in presentation consistent with contractual terms with new investment program partner resulting in a net $2 million increase to brokerage fees with corresponding decreases of $2 million each in fiduciary income, other noninterest income and commission costs (recorded within salaries and benefits expense).

•Increases of $52 million in other noninterest income, $9 million in brokerage fees, $7 million in card fees and $4 million each in commercial lending fees and letter of credit fees, partially offset by decreases of $50 million in risk management hedging income (BSBY cessation, partially offset by higher price alignment income received for centrally cleared risk management positions), $10 million in services charges on deposit accounts and $7 million in capital markets income.

◦Other noninterest income included increases of $31 million in deferred compensation asset returns (offset in noninterest expenses) and $27 million in FHLB stock dividends.

Noninterest expenses increased $361 million to $2.4 billion.

•Increases of $149 million in FDIC insurance expense (primarily driven by special assessment), $98 million in salaries and benefits expense, $80 million in other noninterest expenses, $26 million in outside processing fee expense and $10 million in software expense.

◦Salaries and benefits expense included increases of $66 million in merit increases and staff additions, $32 million in temporary labor and $31 million in deferred compensation expense (offset in other noninterest income), partially offset by a $51 million decrease in incentive compensation.

◦Other noninterest expenses included increases of $69 million in non-salary pension expense, $17 million in litigation and regulatory-related expenses, $14 million in consulting fees and $9 million in legal fees, partially offset by a $36 million impact related to fixed asset disposals (includes gains on real estate and asset impairments related to modernization initiatives).

Net Interest Income

Balance sheet items presented and discussed in terms of average balances.

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| (dollar amounts in millions) |

4th Qtr '23 |

|

3rd Qtr '23 |

|

2023 |

|

2022 |

|

|

|

|

| Net interest income |

$ |

584 |

|

|

$ |

601 |

|

|

$ |

2,514 |

|

|

$ |

2,466 |

|

|

|

|

|

| Net interest margin |

2.91 |

% |

|

2.84 |

% |

|

3.06 |

% |

|

3.02 |

% |

|

|

|

|

| Selected balances: |

|

|

|

|

|

|

|

|

|

|

|

| Total earning assets |

$ |

76,167 |

|

|

$ |

80,996 |

|

|

$ |

79,214 |

|

|

$ |

79,025 |

|

|

|

|

|

| Total loans |

52,796 |

|

|

53,987 |

|

|

53,903 |

|

|

50,460 |

|

|

|

|

|

| Total investment securities |

16,289 |

|

|

16,881 |

|

|

17,442 |

|

|

19,015 |

|

|

|

|

|

| Federal Reserve Bank deposits |

6,456 |

|

|

9,443 |

|

|

7,297 |

|

|

9,036 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Total deposits |

66,045 |

|

|

65,883 |

|

|

66,018 |

|

|

75,481 |

|

|

|

|

|

| Total noninterest-bearing deposits |

27,814 |

|

|

29,016 |

|

|

30,882 |

|

|

42,018 |

|

|

|

|

|

| Short-term borrowings |

4,002 |

|

|

8,847 |

|

|

7,218 |

|

|

436 |

|

|

|

|

|

| Medium- and long-term debt |

6,070 |

|

|

6,383 |

|

|

5,847 |

|

|

2,818 |

|

|

|

|

|

Net interest income decreased $17 million, and net interest margin increased 7 basis points, compared to third quarter 2023. Amounts shown in parentheses represent the impacts to net interest income and net interest margin, respectively, with impacts of hedging strategy included with rate.

•Interest income on loans decreased $13 million and reduced net interest margin by 2 basis points, driven by lower loan balances (-$22 million, -7 basis points), partially offset by higher short-term rates (+$6 million, +4 basis points) and the impact of BSBY cessation (+$3 million, +1 basis point).

•Interest income on investment securities decreased $1 million, while net interest margin remained stable, reflecting a decline in securities balances.

•Interest income on short-term investments decreased $40 million and reduced net interest margin by 9 basis points, primarily reflecting a decrease of $3.0 billion in deposits with the Federal Reserve Bank (-$42 million, -10 basis points), partially offset by higher short-term rates (+$2 million, +1 basis point)

•Interest expense on deposits increased $31 million and reduced net interest margin by 15 basis points, reflecting higher rates (-$20 million, -9 basis points) and higher average interest-bearing deposit balances (-$11 million, -6 basis points).

•Interest expense on debt decreased $68 million and improved net interest margin by 33 basis points, primarily driven by decreases of $4.9 billion in short-term FHLB advances (+$70 million, +35 basis points) and $313 million in medium- and long-term debt (+$3 million, +1 basis point), partially offset by higher rates (-$5 million, -3 basis point).

The net impact of higher rates to fourth quarter 2023 net interest income was a decrease of $17 million and a reduction of 7 basis points to net interest margin.

Credit Quality

“Credit quality remained strong with modest portfolio migration and net charge-offs, evidencing expected normalization,” said Farmer. “Normalization trends drove a slight increase in the allowance for credit losses to 1.40% of total loans. We feel our highly regarded approach to credit positions us well to support our customers and navigate future migration.”

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| (dollar amounts in millions) |

4th Qtr '23 |

|

3rd Qtr '23 |

|

4th Qtr '22 |

| Charge-offs |

$ |

25 |

|

|

$ |

14 |

|

|

$ |

11 |

|

| Recoveries |

5 |

|

|

8 |

|

|

15 |

|

| Net charge-offs (recoveries) |

20 |

|

|

6 |

|

|

(4) |

|

| Net charge-offs (recoveries)/Average total loans |

0.15 |

% |

|

0.05 |

% |

|

(0.03 |

%) |

| Provision for credit losses |

$ |

12 |

|

|

$ |

14 |

|

|

$ |

33 |

|

|

|

|

|

|

|

| Nonperforming loans |

178 |

|

|

154 |

|

|

244 |

|

| Nonperforming assets (NPAs) |

178 |

|

|

154 |

|

|

244 |

|

| NPAs/Total loans and foreclosed property |

0.34 |

% |

|

0.29 |

% |

|

0.46 |

% |

| Loans past due 90 days or more and still accruing |

$ |

20 |

|

|

$ |

45 |

|

|

$ |

23 |

|

| Allowance for loan losses |

688 |

|

|

694 |

|

|

610 |

|

| Allowance for credit losses on lending-related commitments (a) |

40 |

|

|

42 |

|

|

51 |

|

| Total allowance for credit losses |

728 |

|

|

736 |

|

|

661 |

|

|

|

|

|

|

|

|

|

|

|

|

|

| Allowance for credit losses/Period-end total loans |

1.40 |

% |

|

1.38 |

% |

|

1.24 |

% |

|

|

|

|

|

|

| Allowance for credit losses/Nonperforming loans |

4.1x |

|

4.8x |

|

2.7x |

(a) Included in accrued expenses and other liabilities on the Consolidated Balance Sheets.

•The allowance for credit losses totaled $728 million at December 31, 2023 and increased by 2 basis points to 1.40% of total loans, reflecting the continuation of an uncertain economic outlook and credit migration, as well as changes in portfolio composition.

•Criticized loans increased $115 million to $2.4 billion, or 4.6% of total loans. Criticized loans are generally consistent with the Special Mention, Substandard and Doubtful categories defined by regulatory authorities.

◦The increase in criticized loans was primarily driven by general Middle Market and Corporate Banking.

•Nonperforming assets increased $24 million to $178 million, or 0.34% of total loans and foreclosed property, compared to 0.29% in third quarter 2023.

•Net charge-offs totaled $20 million, compared to net charge-offs of $6 million in third quarter 2023.

Strategic Lines of Business

Comerica's operations are strategically aligned into three major business segments: the Commercial Bank, the Retail Bank and Wealth Management. The Finance Division is also reported as a segment. For a summary of business segment quarterly results, see the Business Segment Financial Results tables included later in this press release. From time to time, Comerica may make reclassifications among the segments to reflect management's current view of the segments, and methodologies may be modified as the management accounting system is enhanced and changes occur in the organizational structure and/or product lines. The financial results provided are based on the internal business unit structures of Comerica and methodologies in effect at December 31, 2023. A discussion of business segment year-to-date results will be included in Comerica’s December 31, 2023 Form 10-K.

Conference Call and Webcast

Comerica will host a conference call and live webcast to review fourth quarter 2023 financial results at 7 a.m. CT Friday, January 19, 2024. Interested parties may access the conference call by calling (877) 484-6065 or (201) 689-8846. The call and supplemental financial information, as well as a replay of the Webcast, can also be accessed via Comerica's "Investor Relations" page at www.comerica.com. Comerica’s presentation may include forward-looking statements, such as descriptions of plans and objectives for future or past operations, products or services; forecasts of revenue, earnings or other measures of economic performance and profitability; and estimates of credit trends and stability.

Comerica Incorporated is a financial services company headquartered in Dallas, Texas, and strategically aligned by three business segments: the Commercial Bank, the Retail Bank and Wealth Management. Comerica is one of the 25 largest U.S. commercial bank financial holding companies and focuses on building relationships and helping people and businesses be successful. Comerica provides more than 400 banking centers across the country with locations in Arizona, California, Florida, Michigan and Texas. Founded 174 years ago in Detroit, Michigan, Comerica continues to expand into new regions, including its Southeast Market, based in North Carolina, and Mountain West Market in Colorado. Comerica has offices in 17 states and services 14 of the 15 largest U.S. metropolitan areas, as well as Canada and Mexico.

This press release contains (and Comerica’s related upcoming conference call and live webcast will discuss) both financial measures based on accounting principles generally accepted in the United States (GAAP) and non-GAAP based financial measures, which are used where management believes it to be helpful in understanding Comerica's results of operations or financial position. Where non-GAAP financial measures are used, the comparable GAAP financial measure, as well as a reconciliation to the comparable GAAP financial measure, can be found in this press release or in the investor relations portions of Comerica’s website, www.comerica.com. These disclosures should not be viewed as a substitute for operating results determined in accordance with GAAP, nor are they necessarily comparable to non-GAAP performance measures that may be presented by other companies.

Forward-looking Statements

Any statements in this news release that are not historical facts are forward-looking statements as defined in the Private Securities Litigation Reform Act of 1995. Words such as “anticipate, assume, believe, commit, confident, continue, designed, estimate, expect, feel, forecast, forward, future, goal, grow, initiative, intend, model, outlook, plan, position, potential, project, propose, remain, seek, strategy, target, trend, until, well-positioned, will” or similar expressions, as they relate to Comerica, or to economic, market or other environmental conditions, or its management, are intended to identify forward-looking statements. These forward-looking statements are predicated on the beliefs and assumptions of Comerica's management based on information known to Comerica's management as of the date of this news release and do not purport to speak as of any other date. Forward-looking statements may include descriptions of plans and objectives of Comerica's management for future or past operations, products or services, and forecasts of Comerica's revenue, earnings or other measures of economic performance, including statements of profitability, business segments and subsidiaries as well as estimates of credit trends and global stability. Such statements reflect the view of Comerica's management as of this date with respect to future events and are subject to risks and uncertainties. Should one or more of these risks materialize or should underlying beliefs or assumptions prove incorrect, Comerica's actual results could differ materially from those discussed. Factors that could cause or contribute to such differences include credit risks (changes in customer behavior; unfavorable developments concerning credit quality; and declines or other changes in the businesses or industries of Comerica's customers); market risks (changes in monetary and fiscal policies; fluctuations in interest rates and their impact on deposit pricing; and transitions away from LIBOR towards new interest rate benchmarks); liquidity risks (Comerica's ability to maintain adequate sources of funding and liquidity; reductions in Comerica's credit rating; and the interdependence of financial service companies); technology risks (cybersecurity risks and heightened legislative and regulatory focus on cybersecurity and data privacy); operational risks (operational, systems or infrastructure failures; reliance on other companies to provide certain key components of business infrastructure; the impact of legal and regulatory proceedings or determinations; losses due to fraud; and controls and procedures failures); compliance risks (changes in regulation or oversight, or changes in Comerica’s status with respect to existing regulations or oversight; the effects of stringent capital requirements; and the impacts of future legislative, administrative or judicial changes to tax regulations); strategic risks (damage to Comerica's reputation; Comerica's ability to utilize technology to efficiently and effectively develop, market and deliver new products and services; competitive product and pricing pressures among financial institutions within Comerica's markets; the implementation of Comerica's strategies and business initiatives; management's ability to maintain and expand customer relationships; management's ability to retain key officers and employees; and any future strategic acquisitions or divestitures); and other general risks (changes in general economic, political or industry conditions; negative effects from inflation; the effectiveness of methods of reducing risk exposures; the effects of catastrophic events, including pandemics; physical or transition risks related to climate change; changes in accounting standards; the critical nature of Comerica's accounting policies; and the volatility of Comerica’s stock price). Comerica cautions that the foregoing list of factors is not all-inclusive. For discussion of factors that may cause actual results to differ from expectations, please refer to our filings with the Securities and Exchange Commission. In particular, please refer to “Item 1A. Risk Factors” beginning on page 13 of Comerica's Annual Report on Form 10-K for the year ended December 31, 2022, as updated by "Item 1A. Risk Factors" beginning on page 64 of Comerica's Quarterly Report on Form 10-Q for the quarter ended September 30, 2023. Forward-looking statements speak only as of the date they are made. Comerica does not undertake to update forward-looking statements to reflect facts, circumstances, assumptions or events that occur after the date the forward-looking statements are made. For any forward-looking statements made in this news release or in any documents, Comerica claims the protection of the safe harbor for forward-looking statements contained in the Private Securities Litigation Reform Act of 1995.

|

|

|

|

|

|

| Media Contacts: |

Investor Contacts: |

| Nicole Hogan |

Kelly Gage |

| (214) 462-6657 |

(833) 571-0486 |

|

|

| Louis H. Mora |

Morgan Mathers |

| (214) 462-6669 |

(833) 571-0486 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| CONSOLIDATED FINANCIAL HIGHLIGHTS (unaudited) |

|

|

|

| Comerica Incorporated and Subsidiaries |

|

|

|

|

|

|

|

Three Months Ended |

|

Years Ended |

|

December 31, |

September 30, |

December 31, |

|

December 31, |

| (in millions, except per share data) |

2023 |

2023 |

2022 |

|

2023 |

2022 |

| PER COMMON SHARE AND COMMON STOCK DATA |

|

|

|

|

|

|

| Diluted earnings per common share |

$ |

0.20 |

|

$ |

1.84 |

|

$ |

2.58 |

|

|

$ |

6.44 |

|

$ |

8.47 |

|

|

|

|

|

|

|

|

| Cash dividends declared |

0.71 |

|

0.71 |

|

0.68 |

|

|

2.84 |

|

2.72 |

|

| Average diluted shares (in thousands) |

132,756 |

|

132,655 |

|

132,382 |

|

|

132,576 |

|

132,554 |

|

| PERFORMANCE RATIOS |

|

|

|

|

|

|

| Return on average common shareholders' equity |

2.17 |

% |

19.50 |

% |

27.92 |

% |

|

16.50 |

% |

18.63 |

% |

| Return on average assets |

0.15 |

|

1.12 |

|

1.65 |

|

|

1.01 |

|

1.32 |

|

| Efficiency ratio (a) |

91.86 |

|

61.86 |

|

53.00 |

|

|

65.56 |

|

56.32 |

|

| CAPITAL |

|

|

|

|

|

|

| Common equity tier 1 capital (b), (c) |

$ |

8,414 |

|

$ |

8,472 |

|

$ |

7,884 |

|

|

|

|

| Tier 1 capital (b), (c) |

8,808 |

|

8,866 |

|

8,278 |

|

|

|

|

| Risk-weighted assets (b) |

75,876 |

|

78,439 |

|

78,871 |

|

|

|

|

| Common equity tier 1 capital ratio (b), (c) |

11.09 |

% |

10.80 |

% |

10.00 |

% |

|

|

|

| Tier 1 capital ratio (b), (c) |

11.61 |

|

11.30 |

|

10.50 |

|

|

|

|

| Total capital ratio (b) |

13.53 |

|

13.17 |

|

12.45 |

|

|

|

|

| Leverage ratio (b) |

10.06 |

|

9.60 |

|

9.55 |

|

|

|

|

| Common shareholders' equity per share of common stock |

$ |

45.58 |

|

$ |

34.73 |

|

$ |

36.55 |

|

|

|

|

| Tangible common equity per share of common stock (c) |

40.70 |

|

29.85 |

|

31.62 |

|

|

|

|

| Common equity ratio |

7.00 |

% |

5.34 |

% |

5.60 |

% |

|

|

|

| Tangible common equity ratio (c) |

6.30 |

|

4.62 |

|

4.89 |

|

|

|

|

| AVERAGE BALANCES |

|

|

|

|

|

|

| Commercial loans |

$ |

28,163 |

|

$ |

29,721 |

|

$ |

30,585 |

|

|

$ |

30,009 |

|

$ |

29,846 |

|

| Real estate construction loans |

4,798 |

|

4,294 |

|

2,978 |

|

|

4,041 |

|

2,607 |

|

| Commercial mortgage loans |

13,706 |

|

13,814 |

|

12,752 |

|

|

13,697 |

|

12,135 |

|

| Lease financing |

794 |

|

770 |

|

753 |

|

|

776 |

|

680 |

|

| International loans |

1,169 |

|

1,241 |

|

1,227 |

|

|

1,226 |

|

1,246 |

|

| Residential mortgage loans |

1,902 |

|

1,915 |

|

1,786 |

|

|

1,877 |

|

1,776 |

|

| Consumer loans |

2,264 |

|

2,232 |

|

2,294 |

|

|

2,277 |

|

2,170 |

|

| Total loans |

52,796 |

|

53,987 |

|

52,375 |

|

|

53,903 |

|

50,460 |

|

| Earning assets |

76,167 |

|

80,996 |

|

75,538 |

|

|

79,214 |

|

79,025 |

|

| Total assets |

84,123 |

|

89,150 |

|

83,808 |

|

|

87,194 |

|

87,272 |

|

| Noninterest-bearing deposits |

27,814 |

|

29,016 |

|

39,955 |

|

|

30,882 |

|

42,018 |

|

| Interest-bearing deposits |

38,231 |

|

36,867 |

|

31,400 |

|

|

35,136 |

|

33,463 |

|

| Total deposits |

66,045 |

|

65,883 |

|

71,355 |

|

|

66,018 |

|

75,481 |

|

| Common shareholders' equity |

4,947 |

|

4,984 |

|

4,887 |

|

|

5,201 |

|

6,057 |

|

| Total shareholders' equity |

5,341 |

|

5,378 |

|

5,281 |

|

|

5,595 |

|

6,451 |

|

| NET INTEREST INCOME |

|

|

|

|

|

|

| Net interest income |

$ |

584 |

|

$ |

601 |

|

$ |

742 |

|

|

$ |

2,514 |

|

$ |

2,466 |

|

| Net interest margin |

2.91 |

% |

2.84 |

% |

3.74 |

% |

|

3.06 |

% |

3.02 |

% |

| CREDIT QUALITY |

|

|

|

|

|

|

| Nonperforming assets |

$ |

178 |

|

$ |

154 |

|

$ |

244 |

|

|

|

|

| Loans past due 90 days or more and still accruing |

20 |

|

45 |

|

23 |

|

|

|

|

| Net charge-offs (recoveries) |

20 |

|

6 |

|

(4) |

|

|

$ |

22 |

|

$ |

17 |

|

| Allowance for loan losses |

688 |

|

694 |

|

610 |

|

|

|

|

| Allowance for credit losses on lending-related commitments |

40 |

|

42 |

|

51 |

|

|

|

|

| Total allowance for credit losses |

728 |

|

736 |

|

661 |

|

|

|

|

| Allowance for credit losses as a percentage of total loans |

1.40 |

% |

1.38 |

% |

1.24 |

% |

|

|

|

| Net loan charge-offs (recoveries) as a percentage of average total loans |

0.15 |

|

0.05 |

|

(0.03) |

|

|

0.04 |

% |

0.03 |

% |

Nonperforming assets as a percentage of total loans and foreclosed property |

0.34 |

|

0.29 |

|

0.46 |

|

|

|

|

| Allowance for credit losses as a multiple of total nonperforming loans |

4.1x |

4.8x |

2.7x |

|

|

|

| OTHER KEY INFORMATION |

|

|

|

|

|

|

| Number of banking centers |

408 |

|

408 |

|

410 |

|

|

|

|

| Number of employees - full time equivalent |

7,701 |

|

7,667 |

|

7,488 |

|

|

|

|

(a) Noninterest expenses as a percentage of the sum of net interest income and noninterest income excluding net gains (losses) from securities, a derivative contract tied to the conversion rate of Visa Class B shares and changes in the value of shares obtained through monetization of warrants.

(b) December 31, 2023 ratios are estimated.

(c) See Reconciliations of Non-GAAP Financial Measures and Regulatory Ratios.

|

|

|

|

|

|

|

|

|

|

|

|

|

| CONSOLIDATED BALANCE SHEETS |

| Comerica Incorporated and Subsidiaries |

|

|

|

|

|

|

|

|

|

|

December 31, |

September 30, |

December 31, |

|

| (in millions, except share data) |

2023 |

2023 |

2022 |

|

|

(unaudited) |

(unaudited) |

|

|

| ASSETS |

|

|

|

|

| Cash and due from banks |

$ |

1,443 |

|

$ |

1,228 |

|

$ |

1,758 |

|

|

|

|

|

|

|

| Interest-bearing deposits with banks |

8,059 |

|

6,884 |

|

4,524 |

|

|

| Other short-term investments |

399 |

|

403 |

|

157 |

|

|

| Investment securities available-for-sale |

16,869 |

|

16,323 |

|

19,012 |

|

|

|

|

|

|

|

| Commercial loans |

27,251 |

|

29,007 |

|

30,909 |

|

|

| Real estate construction loans |

5,083 |

|

4,545 |

|

3,105 |

|

|

| Commercial mortgage loans |

13,686 |

|

13,721 |

|

13,306 |

|

|

| Lease financing |

807 |

|

790 |

|

760 |

|

|

| International loans |

1,102 |

|

1,194 |

|

1,197 |

|

|

| Residential mortgage loans |

1,889 |

|

1,905 |

|

1,814 |

|

|

| Consumer loans |

2,295 |

|

2,236 |

|

2,311 |

|

|

| Total loans |

52,113 |

|

53,398 |

|

53,402 |

|

|

| Allowance for loan losses |

(688) |

|

(694) |

|

(610) |

|

|

| Net loans |

51,425 |

|

52,704 |

|

52,792 |

|

|

| Premises and equipment |

445 |

|

410 |

|

400 |

|

|

| Accrued income and other assets |

7,194 |

|

7,754 |

|

6,763 |

|

|

| Total assets |

$ |

85,834 |

|

$ |

85,706 |

|

$ |

85,406 |

|

|

| LIABILITIES AND SHAREHOLDERS' EQUITY |

|

|

|

|

| Noninterest-bearing deposits |

$ |

27,849 |

|

$ |

29,922 |

|

$ |

39,945 |

|

|

| Money market and interest-bearing checking deposits |

28,246 |

|

26,298 |

|

26,290 |

|

|

| Savings deposits |

2,381 |

|

2,521 |

|

3,225 |

|

|

| Customer certificates of deposit |

3,723 |

|

3,401 |

|

1,762 |

|

|

| Other time deposits |

4,550 |

|

5,011 |

|

124 |

|

|

| Foreign office time deposits |

13 |

|

5 |

|

51 |

|

|

| Total interest-bearing deposits |

38,913 |

|

37,236 |

|

31,452 |

|

|

| Total deposits |

66,762 |

|

67,158 |

|

71,397 |

|

|

| Short-term borrowings |

3,565 |

|

4,812 |

|

3,211 |

|

|

| Accrued expenses and other liabilities |

2,895 |

|

2,715 |

|

2,593 |

|

|

| Medium- and long-term debt |

6,206 |

|

6,049 |

|

3,024 |

|

|

| Total liabilities |

79,428 |

|

80,734 |

|

80,225 |

|

|

| Fixed-rate reset non-cumulative perpetual preferred stock, series A, no par value, $100,000 liquidation preference per share: |

|

|

|

|

| Authorized - 4,000 shares |

|

|

|

|

| Issued - 4,000 shares |

394 |

|

394 |

|

394 |

|

|

| Common stock - $5 par value: |

|

|

|

|

| Authorized - 325,000,000 shares |

|

|

|

|

| Issued - 228,164,824 shares |

1,141 |

|

1,141 |

|

1,141 |

|

|

| Capital surplus |

2,224 |

|

2,220 |

|

2,220 |

|

|

| Accumulated other comprehensive loss |

(3,048) |

|

(4,540) |

|

(3,742) |

|

|

| Retained earnings |

11,727 |

|

11,796 |

|

11,258 |

|

|

Less cost of common stock in treasury - 96,266,568 shares at 12/31/23, 96,374,736 shares at 9/30/23, 97,197,962 shares at 12/31/22 |

(6,032) |

|

(6,039) |

|

(6,090) |

|

|

| Total shareholders' equity |

6,406 |

|

4,972 |

|

5,181 |

|

|

| Total liabilities and shareholders' equity |

$ |

85,834 |

|

$ |

85,706 |

|

$ |

85,406 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| CONSOLIDATED STATEMENTS OF COMPREHENSIVE INCOME |

| Comerica Incorporated and Subsidiaries |

|

|

|

|

|

|

|

|

|

|

|

|

Three Months Ended |

|

Years Ended |

|

December 31, |

|

December 31, |

| (in millions, except per share data) |

2023 |

2022 |

|

2023 |

2022 |

|

(unaudited) |

(unaudited) |

|

(unaudited) |

|

| INTEREST INCOME |

|

|

|

|

|

| Interest and fees on loans |

$ |

849 |

|

$ |

719 |

|

|

$ |

3,340 |

|

$ |

2,153 |

|

| Interest on investment securities |

104 |

|

118 |

|

|

430 |

|

414 |

|

| Interest on short-term investments |

96 |

|

39 |

|

|

405 |

|

105 |

|

| Total interest income |

1,049 |

|

876 |

|

|

4,175 |

|

2,672 |

|

| INTEREST EXPENSE |

|

|

|

|

|

| Interest on deposits |

302 |

|

78 |

|

|

892 |

|

102 |

|

| Interest on short-term borrowings |

58 |

|

16 |

|

|

391 |

|

17 |

|

| Interest on medium- and long-term debt |

105 |

|

40 |

|

|

378 |

|

87 |

|

| Total interest expense |

465 |

|

134 |

|

|

1,661 |

|

206 |

|

| Net interest income |

584 |

|

742 |

|

|

2,514 |

|

2,466 |

|

| Provision for credit losses |

12 |

|

33 |

|

|

89 |

|

60 |

|

| Net interest income after provision for credit losses |

572 |

|

709 |

|

|

2,425 |

|

2,406 |

|

| NONINTEREST INCOME |

|

|

|

|

|

| Card fees |

68 |

|

68 |

|

|

280 |

|

273 |

|

| Fiduciary income |

56 |

|

55 |

|

|

235 |

|

233 |

|

| Service charges on deposit accounts |

45 |

|

47 |

|

|

185 |

|

195 |

|

| Capital markets income (a) |

34 |

|

34 |

|

|

147 |

|

154 |

|

| Commercial lending fees (a) |

17 |

|

18 |

|

|

72 |

|

68 |

|

| Letter of credit fees |

11 |

|

10 |

|

|

42 |

|

38 |

|

| Bank-owned life insurance |

10 |

|

10 |

|

|

46 |

|

47 |

|

| Brokerage fees |

8 |

|

7 |

|

|

30 |

|

21 |

|

|

|

|

|

|

|

| Risk management hedging (loss) income (a) |

(74) |

|

8 |

|

|

(42) |

|

8 |

|

| Other noninterest income (a) |

23 |

|

21 |

|

|

83 |

|

31 |

|

| Total noninterest income |

198 |

|

278 |

|

|

1,078 |

|

1,068 |

|

| NONINTEREST EXPENSES |

|

|

|

|

|

| Salaries and benefits expense |

359 |

|

318 |

|

|

1,306 |

|

1,208 |

|

| FDIC insurance expense |

132 |

|

7 |

|

|

180 |

|

31 |

|

| Outside processing fee expense |

70 |

|

63 |

|

|

277 |

|

251 |

|

| Occupancy expense |

45 |

|

53 |

|

|

171 |

|

175 |

|

| Software expense |

44 |

|

41 |

|

|

171 |

|

161 |

|

| Equipment expense |

14 |

|

14 |

|

|

50 |

|

50 |

|

| Advertising expense |

10 |

|

14 |

|

|

40 |

|

38 |

|

| Other noninterest expenses |

44 |

|

31 |

|

|

164 |

|

84 |

|

| Total noninterest expenses |

718 |

|

541 |

|

|

2,359 |

|

1,998 |

|

| Income before income taxes |

52 |

|

446 |

|

|

1,144 |

|

1,476 |

|

| Provision for income taxes |

19 |

|

96 |

|

|

263 |

|

325 |

|

| NET INCOME |

33 |

|

350 |

|

|

881 |

|

1,151 |

|

| Less: |

|

|

|

|

|

| Income allocated to participating securities |

— |

|

2 |

|

|

4 |

|

6 |

|

| Preferred stock dividends |

6 |

|

6 |

|

|

23 |

|

23 |

|

| Net income attributable to common shares |

$ |

27 |

|

$ |

342 |

|

|

$ |

854 |

|

$ |

1,122 |

|

| Earnings per common share: |

|

|

|

|

|

| Basic |

$ |

0.20 |

|

$ |

2.61 |

|

|

$ |

6.47 |

|

$ |

8.56 |

|

| Diluted |

0.20 |

|

2.58 |

|

|

6.44 |

|

8.47 |

|

| Comprehensive income (loss) |

1,525 |

|

195 |

|

|

1,575 |

|

(2,379) |

|

| Cash dividends declared on common stock |

93 |

|

89 |

|

|

375 |

|

356 |

|

| Cash dividends declared per common share |

0.71 |

|

0.68 |

|

|

2.84 |

|

2.72 |

|

(a) Adjusted 2022 amounts. See Reconciliations of Previously Reported Balances.

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| CONSOLIDATED QUARTERLY STATEMENTS OF COMPREHENSIVE INCOME (unaudited) |

| Comerica Incorporated and Subsidiaries |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Fourth |

Third |

Second |

First |

Fourth |

|

Fourth Quarter 2023 Compared to: |

|

Quarter |

Quarter |

Quarter |

Quarter |

Quarter |

|

Third Quarter 2023 |

|

Fourth Quarter 2022 |

| (in millions, except per share data) |

2023 |

2023 |

2023 |

2023 |

2022 |

|

Amount |

Percent |

|

Amount |

Percent |

| INTEREST INCOME |

|

|

|

|

|

|

|

|

|

|

|

| Interest and fees on loans |

$ |

849 |

|

$ |

862 |

|

$ |

852 |

|

$ |

777 |

|

$ |

719 |

|

|

$ |

(13) |

|

(1 |

%) |

|

$ |

130 |

|

18 |

% |

| Interest on investment securities |

104 |

|

105 |

|

108 |

|

113 |

|

118 |

|

|

(1) |

|

(2) |

|

(14) |

|

(12) |

|

| Interest on short-term investments |

96 |

|

136 |

|

114 |

|

59 |

|

39 |

|

|

(40) |

|

(29) |

|

|

57 |

|

n/m |

| Total interest income |

1,049 |

|

1,103 |

|

1,074 |

|

949 |

|

876 |

|

|

(54) |

|

(5) |

|

|

173 |

|

20 |

|

| INTEREST EXPENSE |

|

|

|

|

|

|

|

|

|

|

|

| Interest on deposits |

302 |

|

271 |

|

201 |

|

118 |

|

78 |

|

|

31 |

|

11 |

|

|

224 |

|

n/m |

| Interest on short-term borrowings |

58 |

|

125 |

|

142 |

|

66 |

|

16 |

|

|

(67) |

|

(54) |

|

42 |

|

n/m |

| Interest on medium- and long-term debt |

105 |

|

106 |

|

110 |

|

57 |

|

40 |

|

|

(1) |

|

(1) |

|

|

65 |

|

n/m |

| Total interest expense |

465 |

|

502 |

|

453 |

|

241 |

|

134 |

|

|

(37) |

|

(7) |

|

|

331 |

|

n/m |

| Net interest income |

584 |

|

601 |

|

621 |

|

708 |

|

742 |

|

|

(17) |

|

(3) |

|

|

(158) |

|

(21) |

|

| Provision for credit losses |

12 |

|

14 |

|

33 |

|

30 |

|

33 |

|

|

(2) |

|

(20) |

|

|

(21) |

|

(66) |

|

Net interest income after provision

for credit losses

|

572 |

|

587 |

|

588 |

|

678 |

|

709 |

|

|

(15) |

|

(3) |

|

|

(137) |

|

(19) |

| NONINTEREST INCOME |

|

|

|

|

|

|

|

|

|

|

|

| Card fees |

68 |

|

71 |

|

72 |

|

69 |

|

68 |

|

|

(3) |

|

(4) |

|

|

— |

|

— |

|

| Fiduciary income |

56 |

|

59 |

|

62 |

|

58 |

|

55 |

|

|

(3) |

|

(6) |

|

|

1 |

|

2 |

|

| Service charges on deposit accounts |

45 |

|

47 |

|

47 |

|

46 |

|

47 |

|

|

(2) |

|

(2) |

|

|

(2) |

|

(2) |

|

| Capital markets income (a) |

34 |

|

35 |

|

39 |

|

39 |

|

34 |

|

|

(1) |

|

(4) |

|

|

— |

|

— |

|

| Commercial lending fees (a) |

17 |

|

19 |

|

18 |

|

18 |

|

18 |

|

|

(2) |

|

(13) |

|

|

(1) |

|

(5) |

|

| Letter of credit fees |

11 |

|

10 |

|

11 |

|

10 |

|

10 |

|

|

1 |

|

— |

|

|

1 |

|

3 |

|

| Bank-owned life insurance |

10 |

|

12 |

|

14 |

|

10 |

|

10 |

|

|

(2) |

|

(25) |

|

|

— |

|

— |

|

| Brokerage fees |

8 |

|

6 |

|

8 |

|

8 |

|

7 |

|

|

2 |

|

50 |

|

|

1 |

|

30 |

|

|

|

|

|

|

|

|

|

|

|

|

|

| Risk management hedging (loss) income (a) |

(74) |

|

17 |

|

7 |

|

8 |

|

8 |

|

|

(91) |

|

n/m |

|

(82) |

|

n/m |

| Other noninterest income (a) |

23 |

|

19 |

|

25 |

|

16 |

|

21 |

|

|

4 |

|

26 |

|

|

2 |

|

9 |

|

| Total noninterest income |

198 |

|

295 |

|

303 |

|

282 |

|

278 |

|

|

(97) |

|

(33) |

|

|

(80) |

|

(29) |

|

| NONINTEREST EXPENSES |

|

|

|

|

|

|

|

|

|

|

|

| Salaries and benefits expense |

359 |

|

315 |

|

306 |

|

326 |

|

318 |

|

|

44 |

|

14 |

|

|

41 |

|

12 |

|

| FDIC insurance expense |

132 |

|

19 |

|

16 |

|

13 |

|

7 |

|

|

113 |

|

n/m |

|

125 |

|

n/m |

| Outside processing fee expense |

70 |

|

75 |

|

68 |

|

64 |

|

63 |

|

|

(5) |

|

(8) |

|

|

7 |

|

10 |

|

| Occupancy expense |

45 |

|

44 |

|

41 |

|

41 |

|

53 |

|

|

1 |

|

2 |

|

|

(8) |

|

(14) |

|

| Software expense |

44 |

|

44 |

|

43 |

|

40 |

|

41 |

|

|

— |

|

— |

|

|

3 |

|

10 |

|

| Equipment expense |

14 |

|

12 |

|

12 |

|

12 |

|

14 |

|

|

2 |

|

10 |

|

|

— |

|

— |

|

| Advertising expense |

10 |

|

12 |

|

10 |

|

8 |

|

14 |

|

|

(2) |

|

(9) |

|

|

(4) |

|

(18) |

|

| Other noninterest expenses |

44 |

|

34 |

|

39 |

|

47 |

|

31 |

|

|

10 |

|

29 |

|

|

13 |

|

41 |

|

| Total noninterest expenses |

718 |

|

555 |

|

535 |

|

551 |

|

541 |

|

|

163 |

|

29 |

|

|

177 |

|

33 |

|

| Income before income taxes |

52 |

|

327 |

|

356 |

|

409 |

|

446 |

|

|

(275) |

|

(84) |

|

|

(394) |

|

(88) |

|

| Provision for income taxes |

19 |

|

76 |

|

83 |

|

85 |

|

96 |

|

|

(57) |

|

(75) |

|

|

(77) |

|

(80) |

|

| NET INCOME |

33 |

|

251 |

|

273 |

|

324 |

|

350 |

|

|

(218) |

|

(87) |

|

|

(317) |

|

(91) |

|

| Less: |

|

|

|

|

|

|

|

|

|

|

|

| Income allocated to participating securities |

— |

|

1 |

|

2 |

|

1 |

|

2 |

|

|

(1) |

|

(60) |

|

|

(2) |

|

(72) |

|

| Preferred stock dividends |

6 |

|

6 |

|

5 |

|

6 |

|

6 |

|

|

— |

|

— |

|

|

— |

|

— |

|

| Net income attributable to common shares |

$ |

27 |

|

$ |

244 |

|

$ |

266 |

|

$ |

317 |

|

$ |

342 |

|

|

$ |

(217) |

|

(89 |

%) |

|

$ |

(315) |

|

(92 |

%) |

| Earnings per common share: |

|

|

|

|

|

|

|

|

|

|

|

| Basic |

$ |

0.20 |

|

$ |

1.85 |

|

$ |

2.02 |

|

$ |

2.41 |

|

$ |

2.61 |

|

|

$ |

(1.65) |

|

(89 |

%) |

|

$ |

(2.41) |

|

(92 |

%) |

| Diluted |

0.20 |

|

1.84 |

|

2.01 |

|

2.39 |

|

2.58 |

|

|

(1.64) |

|

(89) |

|

|

(2.38) |

|

(92) |

|

| Comprehensive income (loss) |

1,525 |

|

(533) |

|

(312) |

|

895 |

|

195 |

|

|

2,058 |

|

n/m |

|

1,330 |

|

n/m |

| Cash dividends declared on common stock |

93 |

|

94 |

|

94 |

|

94 |

|

89 |

|

|

(1) |

|

— |

|

|

4 |

|

5 |

|

| Cash dividends declared per common share |

0.71 |

|

0.71 |

|

0.71 |

|

0.71 |

|

0.68 |

|

|

— |

|

— |

|

|

0.03 |

|

4 |

|

(a) Adjusted prior period amounts. See Reconciliations of Previously Reported Balances.

n/m - not meaningful

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| ANALYSIS OF THE ALLOWANCE FOR CREDIT LOSSES (unaudited) |

| Comerica Incorporated and Subsidiaries |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

2023 |

|

2022 |

| (in millions) |

4th Qtr |

|

3rd Qtr |

2nd Qtr |

1st Qtr |

|

4th Qtr |

| Balance at beginning of period: |

|

|

|

|

|

|

|

| Allowance for loan losses |

$ |

694 |

|

|

$ |

684 |

|

$ |

641 |

|

$ |

610 |

|

|

$ |

576 |

|

| Allowance for credit losses on lending-related commitments |

42 |

|

|

44 |

|

52 |

|

51 |

|

|

48 |

|

| Allowance for credit losses |

736 |

|

|

728 |

|

693 |

|

661 |

|

|

624 |

|

|

|

|

|

|

|

|

|

| Loan charge-offs: |

|

|

|

|

|

|

|

| Commercial |

13 |

|

|

9 |

|

9 |

|

11 |

|

|

10 |

|

|

|

|

|

|

|

|

|

| Commercial mortgage |

1 |

|

|

3 |

|

— |

|

— |

|

|

— |

|

|

|

|

|

|

|

|

|

| International |

11 |

|

|

1 |

|

1 |

|

— |

|

|

— |

|

|

|

|

|

|

|

|

|

| Consumer |

— |

|

|

1 |

|

1 |

|

1 |

|

|

1 |

|

| Total loan charge-offs |

25 |

|

|

14 |

|

11 |

|

12 |

|

|

11 |

|

|

|

|

|

|

|

|

|

| Recoveries on loans previously charged-off: |

|

|

|

|

|

|

|

| Commercial |

3 |

|

|

5 |

|

12 |

|

13 |

|

|

13 |

|

| Real estate construction |

— |

|

|

— |

|

— |

|

— |

|

|

1 |

|

| Commercial mortgage |

2 |

|

|

2 |

|

1 |

|

— |

|

|

— |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Residential mortgage |

— |

|

|

— |

|

— |

|

— |

|

|

— |

|

| Consumer |

— |

|

|

1 |

|

— |

|

1 |

|

|

1 |

|

| Total recoveries |

5 |

|

|

8 |

|

13 |

|

14 |

|

|

15 |

|

| Net loan charge-offs (recoveries) |

20 |

|

|

6 |

|

(2) |

|

(2) |

|

|

(4) |

|

| Provision for credit losses: |

|

|

|

|

|

|

|

| Provision for loan losses |

14 |

|

|

16 |

|

41 |

|

29 |

|

|

30 |

|

| Provision for credit losses on lending-related commitments |

(2) |

|

|

(2) |

|

(8) |

|

1 |

|

|

3 |

|

| Provision for credit losses |

12 |

|

|

14 |

|

33 |

|

30 |

|

|

33 |

|

|

|

|

|

|

|

|

|