000002409012/312025Q2FALSExbrli:sharesiso4217:USDiso4217:USDxbrli:sharesxbrli:pure00000240902025-01-012025-06-3000000240902025-08-0100000240902025-06-3000000240902024-12-310000024090us-gaap:LifeInsuranceSegmentMember2025-06-300000024090us-gaap:LifeInsuranceSegmentMember2024-12-310000024090us-gaap:AccidentAndHealthInsuranceSegmentMember2025-06-300000024090us-gaap:AccidentAndHealthInsuranceSegmentMember2024-12-310000024090us-gaap:CommonClassAMember2024-12-310000024090us-gaap:CommonClassAMember2025-06-300000024090us-gaap:CommonClassBMember2024-12-310000024090us-gaap:CommonClassBMember2025-06-300000024090us-gaap:LifeInsuranceSegmentMember2025-04-012025-06-300000024090us-gaap:LifeInsuranceSegmentMember2024-04-012024-06-300000024090us-gaap:LifeInsuranceSegmentMember2025-01-012025-06-300000024090us-gaap:LifeInsuranceSegmentMember2024-01-012024-06-300000024090us-gaap:AccidentAndHealthInsuranceSegmentMember2025-04-012025-06-300000024090us-gaap:AccidentAndHealthInsuranceSegmentMember2024-04-012024-06-300000024090us-gaap:AccidentAndHealthInsuranceSegmentMember2025-01-012025-06-300000024090us-gaap:AccidentAndHealthInsuranceSegmentMember2024-01-012024-06-3000000240902025-04-012025-06-3000000240902024-04-012024-06-3000000240902024-01-012024-06-300000024090us-gaap:CommonClassAMember2025-04-012025-06-300000024090us-gaap:CommonClassAMember2024-04-012024-06-300000024090us-gaap:CommonClassAMember2025-01-012025-06-300000024090us-gaap:CommonClassAMember2024-01-012024-06-300000024090us-gaap:CommonClassAMemberus-gaap:CommonStockMember2024-12-310000024090us-gaap:CommonClassBMemberus-gaap:CommonStockMember2024-12-310000024090us-gaap:RetainedEarningsMember2024-12-310000024090us-gaap:AccumulatedOtherComprehensiveIncomeMember2024-12-310000024090us-gaap:TreasuryStockCommonMember2024-12-310000024090us-gaap:CommonClassAMemberus-gaap:CommonStockMember2025-01-012025-03-310000024090us-gaap:CommonClassBMemberus-gaap:CommonStockMember2025-01-012025-03-310000024090us-gaap:RetainedEarningsMember2025-01-012025-03-310000024090us-gaap:AccumulatedOtherComprehensiveIncomeMember2025-01-012025-03-310000024090us-gaap:TreasuryStockCommonMember2025-01-012025-03-3100000240902025-01-012025-03-310000024090us-gaap:CommonClassAMemberus-gaap:CommonStockMember2025-03-310000024090us-gaap:CommonClassBMemberus-gaap:CommonStockMember2025-03-310000024090us-gaap:RetainedEarningsMember2025-03-310000024090us-gaap:AccumulatedOtherComprehensiveIncomeMember2025-03-310000024090us-gaap:TreasuryStockCommonMember2025-03-3100000240902025-03-310000024090us-gaap:CommonClassAMemberus-gaap:CommonStockMember2025-04-012025-06-300000024090us-gaap:CommonClassBMemberus-gaap:CommonStockMember2025-04-012025-06-300000024090us-gaap:RetainedEarningsMember2025-04-012025-06-300000024090us-gaap:AccumulatedOtherComprehensiveIncomeMember2025-04-012025-06-300000024090us-gaap:TreasuryStockCommonMember2025-04-012025-06-300000024090us-gaap:CommonClassAMemberus-gaap:CommonStockMember2025-06-300000024090us-gaap:CommonClassBMemberus-gaap:CommonStockMember2025-06-300000024090us-gaap:RetainedEarningsMember2025-06-300000024090us-gaap:AccumulatedOtherComprehensiveIncomeMember2025-06-300000024090us-gaap:TreasuryStockCommonMember2025-06-300000024090us-gaap:CommonClassAMemberus-gaap:CommonStockMember2023-12-310000024090us-gaap:CommonClassBMemberus-gaap:CommonStockMember2023-12-310000024090us-gaap:RetainedEarningsMember2023-12-310000024090us-gaap:AccumulatedOtherComprehensiveIncomeMember2023-12-310000024090us-gaap:TreasuryStockCommonMember2023-12-3100000240902023-12-310000024090us-gaap:CommonClassAMemberus-gaap:CommonStockMember2024-01-012024-03-310000024090us-gaap:CommonClassBMemberus-gaap:CommonStockMember2024-01-012024-03-310000024090us-gaap:RetainedEarningsMember2024-01-012024-03-310000024090us-gaap:AccumulatedOtherComprehensiveIncomeMember2024-01-012024-03-310000024090us-gaap:TreasuryStockCommonMember2024-01-012024-03-3100000240902024-01-012024-03-310000024090us-gaap:CommonClassAMemberus-gaap:CommonStockMember2024-03-310000024090us-gaap:CommonClassBMemberus-gaap:CommonStockMember2024-03-310000024090us-gaap:RetainedEarningsMember2024-03-310000024090us-gaap:AccumulatedOtherComprehensiveIncomeMember2024-03-310000024090us-gaap:TreasuryStockCommonMember2024-03-3100000240902024-03-310000024090us-gaap:CommonClassAMemberus-gaap:CommonStockMember2024-04-012024-06-300000024090us-gaap:CommonClassBMemberus-gaap:CommonStockMember2024-04-012024-06-300000024090us-gaap:RetainedEarningsMember2024-04-012024-06-300000024090us-gaap:AccumulatedOtherComprehensiveIncomeMember2024-04-012024-06-300000024090us-gaap:TreasuryStockCommonMember2024-04-012024-06-300000024090us-gaap:CommonClassAMemberus-gaap:CommonStockMember2024-06-300000024090us-gaap:CommonClassBMemberus-gaap:CommonStockMember2024-06-300000024090us-gaap:RetainedEarningsMember2024-06-300000024090us-gaap:AccumulatedOtherComprehensiveIncomeMember2024-06-300000024090us-gaap:TreasuryStockCommonMember2024-06-3000000240902024-06-300000024090us-gaap:USTreasurySecuritiesMember2025-06-300000024090us-gaap:USGovernmentAgenciesDebtSecuritiesMember2025-06-300000024090us-gaap:USStatesAndPoliticalSubdivisionsMember2025-06-300000024090cia:CorporateDebtSecuritiesFinancialSectorMember2025-06-300000024090cia:CorporateDebtSecurityConsumerSectorMember2025-06-300000024090cia:CorporateDebtSecurityUtilitiesSectorMember2025-06-300000024090cia:CorporateDebtSecurityEnergySectorMember2025-06-300000024090cia:CorporateDebtSecurityCommunicationsSectorMember2025-06-300000024090cia:CorporateDebtSecurityAllOtherSectorMember2025-06-300000024090us-gaap:CommercialMortgageBackedSecuritiesMember2025-06-300000024090us-gaap:ResidentialMortgageBackedSecuritiesMember2025-06-300000024090us-gaap:AssetBackedSecuritiesMember2025-06-300000024090us-gaap:USTreasurySecuritiesMember2024-12-310000024090us-gaap:USGovernmentAgenciesDebtSecuritiesMember2024-12-310000024090us-gaap:USStatesAndPoliticalSubdivisionsMember2024-12-310000024090cia:CorporateDebtSecuritiesFinancialSectorMember2024-12-310000024090cia:CorporateDebtSecurityConsumerSectorMember2024-12-310000024090cia:CorporateDebtSecurityUtilitiesSectorMember2024-12-310000024090cia:CorporateDebtSecurityEnergySectorMember2024-12-310000024090cia:CorporateDebtSecurityCommunicationsSectorMember2024-12-310000024090cia:CorporateDebtSecurityAllOtherSectorMember2024-12-310000024090us-gaap:CommercialMortgageBackedSecuritiesMember2024-12-310000024090us-gaap:ResidentialMortgageBackedSecuritiesMember2024-12-310000024090us-gaap:AssetBackedSecuritiesMember2024-12-310000024090us-gaap:FixedIncomeFundsMember2025-06-300000024090us-gaap:FixedIncomeFundsMember2024-12-310000024090us-gaap:CommonStockMember2025-06-300000024090us-gaap:CommonStockMember2024-12-310000024090us-gaap:NonredeemablePreferredStockMember2025-06-300000024090us-gaap:NonredeemablePreferredStockMember2024-12-310000024090cia:CIA_NonredeemablePreferredStockFundMemberMember2025-06-300000024090cia:CIA_NonredeemablePreferredStockFundMemberMember2024-12-310000024090us-gaap:EquitySecuritiesMember2025-04-012025-06-300000024090us-gaap:EquitySecuritiesMember2025-01-012025-06-300000024090us-gaap:EquitySecuritiesMember2024-04-012024-06-300000024090us-gaap:EquitySecuritiesMember2024-01-012024-06-300000024090us-gaap:DebtSecuritiesMember2025-06-300000024090us-gaap:DebtSecuritiesMember2024-12-310000024090cia:DiscoveryCommunicationsLLCMember2025-01-012025-06-300000024090us-gaap:USTreasuryAndGovernmentMemberus-gaap:FairValueInputsLevel1Member2025-06-300000024090us-gaap:USTreasuryAndGovernmentMemberus-gaap:FairValueInputsLevel2Member2025-06-300000024090us-gaap:USTreasuryAndGovernmentMemberus-gaap:FairValueInputsLevel3Member2025-06-300000024090us-gaap:USTreasuryAndGovernmentMember2025-06-300000024090us-gaap:USStatesAndPoliticalSubdivisionsMemberus-gaap:FairValueInputsLevel1Member2025-06-300000024090us-gaap:USStatesAndPoliticalSubdivisionsMemberus-gaap:FairValueInputsLevel2Member2025-06-300000024090us-gaap:USStatesAndPoliticalSubdivisionsMemberus-gaap:FairValueInputsLevel3Member2025-06-300000024090us-gaap:USStatesAndPoliticalSubdivisionsMember2025-06-300000024090us-gaap:CorporateDebtSecuritiesMemberus-gaap:FairValueInputsLevel1Member2025-06-300000024090us-gaap:CorporateDebtSecuritiesMemberus-gaap:FairValueInputsLevel2Member2025-06-300000024090us-gaap:CorporateDebtSecuritiesMemberus-gaap:FairValueInputsLevel3Member2025-06-300000024090us-gaap:CorporateDebtSecuritiesMember2025-06-300000024090us-gaap:CommercialMortgageBackedSecuritiesMemberus-gaap:FairValueInputsLevel1Member2025-06-300000024090us-gaap:CommercialMortgageBackedSecuritiesMemberus-gaap:FairValueInputsLevel2Member2025-06-300000024090us-gaap:CommercialMortgageBackedSecuritiesMemberus-gaap:FairValueInputsLevel3Member2025-06-300000024090us-gaap:CommercialMortgageBackedSecuritiesMember2025-06-300000024090us-gaap:ResidentialMortgageBackedSecuritiesMemberus-gaap:FairValueInputsLevel1Member2025-06-300000024090us-gaap:ResidentialMortgageBackedSecuritiesMemberus-gaap:FairValueInputsLevel2Member2025-06-300000024090us-gaap:ResidentialMortgageBackedSecuritiesMemberus-gaap:FairValueInputsLevel3Member2025-06-300000024090us-gaap:ResidentialMortgageBackedSecuritiesMember2025-06-300000024090us-gaap:AssetBackedSecuritiesMemberus-gaap:FairValueInputsLevel1Member2025-06-300000024090us-gaap:AssetBackedSecuritiesMemberus-gaap:FairValueInputsLevel2Member2025-06-300000024090us-gaap:AssetBackedSecuritiesMemberus-gaap:FairValueInputsLevel3Member2025-06-300000024090us-gaap:AssetBackedSecuritiesMember2025-06-300000024090us-gaap:DebtSecuritiesMemberus-gaap:FairValueInputsLevel1Member2025-06-300000024090us-gaap:DebtSecuritiesMemberus-gaap:FairValueInputsLevel2Member2025-06-300000024090us-gaap:DebtSecuritiesMemberus-gaap:FairValueInputsLevel3Member2025-06-300000024090us-gaap:DebtSecuritiesMember2025-06-300000024090us-gaap:FixedIncomeFundsMemberus-gaap:FairValueInputsLevel1Member2025-06-300000024090us-gaap:FixedIncomeFundsMemberus-gaap:FairValueInputsLevel2Member2025-06-300000024090us-gaap:FixedIncomeFundsMemberus-gaap:FairValueInputsLevel3Member2025-06-300000024090us-gaap:FixedIncomeFundsMember2025-06-300000024090us-gaap:CommonStockMemberus-gaap:FairValueInputsLevel1Member2025-06-300000024090us-gaap:CommonStockMemberus-gaap:FairValueInputsLevel2Member2025-06-300000024090us-gaap:CommonStockMemberus-gaap:FairValueInputsLevel3Member2025-06-300000024090us-gaap:CommonStockMember2025-06-300000024090us-gaap:NonredeemablePreferredStockMemberus-gaap:FairValueInputsLevel1Member2025-06-300000024090us-gaap:NonredeemablePreferredStockMemberus-gaap:FairValueInputsLevel2Member2025-06-300000024090us-gaap:NonredeemablePreferredStockMemberus-gaap:FairValueInputsLevel3Member2025-06-300000024090us-gaap:NonredeemablePreferredStockMember2025-06-300000024090cia:CIA_NonRedeemablePreferredStockFundMemberus-gaap:FairValueInputsLevel1Member2025-06-300000024090cia:CIA_NonRedeemablePreferredStockFundMemberus-gaap:FairValueInputsLevel2Member2025-06-300000024090cia:CIA_NonRedeemablePreferredStockFundMemberus-gaap:FairValueInputsLevel3Member2025-06-300000024090cia:CIA_NonRedeemablePreferredStockFundMember2025-06-300000024090us-gaap:EquitySecuritiesMemberus-gaap:FairValueInputsLevel1Member2025-06-300000024090us-gaap:EquitySecuritiesMemberus-gaap:FairValueInputsLevel2Member2025-06-300000024090us-gaap:EquitySecuritiesMemberus-gaap:FairValueInputsLevel3Member2025-06-300000024090us-gaap:EquitySecuritiesMember2025-06-300000024090us-gaap:FairValueInputsLevel1Member2025-06-300000024090us-gaap:FairValueInputsLevel2Member2025-06-300000024090us-gaap:FairValueInputsLevel3Member2025-06-300000024090us-gaap:OtherLongTermInvestmentsMember2025-06-300000024090us-gaap:USTreasuryAndGovernmentMemberus-gaap:FairValueInputsLevel1Member2024-12-310000024090us-gaap:USTreasuryAndGovernmentMemberus-gaap:FairValueInputsLevel2Member2024-12-310000024090us-gaap:USTreasuryAndGovernmentMemberus-gaap:FairValueInputsLevel3Member2024-12-310000024090us-gaap:USTreasuryAndGovernmentMember2024-12-310000024090us-gaap:USStatesAndPoliticalSubdivisionsMemberus-gaap:FairValueInputsLevel1Member2024-12-310000024090us-gaap:USStatesAndPoliticalSubdivisionsMemberus-gaap:FairValueInputsLevel2Member2024-12-310000024090us-gaap:USStatesAndPoliticalSubdivisionsMemberus-gaap:FairValueInputsLevel3Member2024-12-310000024090us-gaap:USStatesAndPoliticalSubdivisionsMember2024-12-310000024090us-gaap:CorporateDebtSecuritiesMemberus-gaap:FairValueInputsLevel1Member2024-12-310000024090us-gaap:CorporateDebtSecuritiesMemberus-gaap:FairValueInputsLevel2Member2024-12-310000024090us-gaap:CorporateDebtSecuritiesMemberus-gaap:FairValueInputsLevel3Member2024-12-310000024090us-gaap:CorporateDebtSecuritiesMember2024-12-310000024090us-gaap:CommercialMortgageBackedSecuritiesMemberus-gaap:FairValueInputsLevel1Member2024-12-310000024090us-gaap:CommercialMortgageBackedSecuritiesMemberus-gaap:FairValueInputsLevel2Member2024-12-310000024090us-gaap:CommercialMortgageBackedSecuritiesMemberus-gaap:FairValueInputsLevel3Member2024-12-310000024090us-gaap:CommercialMortgageBackedSecuritiesMember2024-12-310000024090us-gaap:ResidentialMortgageBackedSecuritiesMemberus-gaap:FairValueInputsLevel1Member2024-12-310000024090us-gaap:ResidentialMortgageBackedSecuritiesMemberus-gaap:FairValueInputsLevel2Member2024-12-310000024090us-gaap:ResidentialMortgageBackedSecuritiesMemberus-gaap:FairValueInputsLevel3Member2024-12-310000024090us-gaap:ResidentialMortgageBackedSecuritiesMember2024-12-310000024090us-gaap:AssetBackedSecuritiesMemberus-gaap:FairValueInputsLevel1Member2024-12-310000024090us-gaap:AssetBackedSecuritiesMemberus-gaap:FairValueInputsLevel2Member2024-12-310000024090us-gaap:AssetBackedSecuritiesMemberus-gaap:FairValueInputsLevel3Member2024-12-310000024090us-gaap:AssetBackedSecuritiesMember2024-12-310000024090us-gaap:DebtSecuritiesMemberus-gaap:FairValueInputsLevel1Member2024-12-310000024090us-gaap:DebtSecuritiesMemberus-gaap:FairValueInputsLevel2Member2024-12-310000024090us-gaap:DebtSecuritiesMemberus-gaap:FairValueInputsLevel3Member2024-12-310000024090us-gaap:DebtSecuritiesMember2024-12-310000024090us-gaap:FixedIncomeFundsMemberus-gaap:FairValueInputsLevel1Member2024-12-310000024090us-gaap:FixedIncomeFundsMemberus-gaap:FairValueInputsLevel2Member2024-12-310000024090us-gaap:FixedIncomeFundsMemberus-gaap:FairValueInputsLevel3Member2024-12-310000024090us-gaap:FixedIncomeFundsMember2024-12-310000024090us-gaap:CommonStockMemberus-gaap:FairValueInputsLevel1Member2024-12-310000024090us-gaap:CommonStockMemberus-gaap:FairValueInputsLevel2Member2024-12-310000024090us-gaap:CommonStockMemberus-gaap:FairValueInputsLevel3Member2024-12-310000024090us-gaap:CommonStockMember2024-12-310000024090us-gaap:NonredeemablePreferredStockMemberus-gaap:FairValueInputsLevel1Member2024-12-310000024090us-gaap:NonredeemablePreferredStockMemberus-gaap:FairValueInputsLevel2Member2024-12-310000024090us-gaap:NonredeemablePreferredStockMemberus-gaap:FairValueInputsLevel3Member2024-12-310000024090us-gaap:NonredeemablePreferredStockMember2024-12-310000024090cia:CIA_NonRedeemablePreferredStockFundMemberus-gaap:FairValueInputsLevel1Member2024-12-310000024090cia:CIA_NonRedeemablePreferredStockFundMemberus-gaap:FairValueInputsLevel2Member2024-12-310000024090cia:CIA_NonRedeemablePreferredStockFundMemberus-gaap:FairValueInputsLevel3Member2024-12-310000024090cia:CIA_NonRedeemablePreferredStockFundMember2024-12-310000024090us-gaap:EquitySecuritiesMemberus-gaap:FairValueInputsLevel1Member2024-12-310000024090us-gaap:EquitySecuritiesMemberus-gaap:FairValueInputsLevel2Member2024-12-310000024090us-gaap:EquitySecuritiesMemberus-gaap:FairValueInputsLevel3Member2024-12-310000024090us-gaap:EquitySecuritiesMember2024-12-310000024090us-gaap:FairValueInputsLevel1Member2024-12-310000024090us-gaap:FairValueInputsLevel2Member2024-12-310000024090us-gaap:FairValueInputsLevel3Member2024-12-310000024090us-gaap:OtherLongTermInvestmentsMember2024-12-310000024090us-gaap:PrivateEquityFundsMember2025-04-012025-06-300000024090us-gaap:PrivateEquityFundsMember2025-01-012025-06-300000024090us-gaap:PrivateEquityFundsMember2024-04-012024-06-300000024090us-gaap:PrivateEquityFundsMember2024-01-012024-06-300000024090cia:PrivateEquityFundsMiddleMarketMemberus-gaap:FairValueMeasuredAtNetAssetValuePerShareMember2025-06-300000024090cia:PrivateEquityFundsMiddleMarketMemberus-gaap:FairValueMeasuredAtNetAssetValuePerShareMemberus-gaap:UnfundedLoanCommitmentMember2025-06-300000024090cia:PrivateEquityFundsMiddleMarketMember2025-01-012025-06-300000024090cia:PrivateEquityFundsMiddleMarketMemberus-gaap:FairValueMeasuredAtNetAssetValuePerShareMember2024-12-310000024090cia:PrivateEquityFundsMiddleMarketMemberus-gaap:FairValueMeasuredAtNetAssetValuePerShareMemberus-gaap:UnfundedLoanCommitmentMember2024-12-310000024090cia:PrivateEquityFundsMiddleMarketMember2024-01-012024-12-310000024090cia:PrivateEquityFundsGlobalMemberus-gaap:FairValueMeasuredAtNetAssetValuePerShareMember2025-06-300000024090cia:PrivateEquityFundsGlobalMemberus-gaap:FairValueMeasuredAtNetAssetValuePerShareMemberus-gaap:UnfundedLoanCommitmentMember2025-06-300000024090cia:PrivateEquityFundsGlobalMember2025-01-012025-06-300000024090cia:PrivateEquityFundsGlobalMemberus-gaap:FairValueMeasuredAtNetAssetValuePerShareMember2024-12-310000024090cia:PrivateEquityFundsGlobalMemberus-gaap:FairValueMeasuredAtNetAssetValuePerShareMemberus-gaap:UnfundedLoanCommitmentMember2024-12-310000024090cia:PrivateEquityFundsGlobalMember2024-01-012024-12-310000024090cia:PrivateEquityFundsLateStageGrowthMemberus-gaap:FairValueMeasuredAtNetAssetValuePerShareMember2025-06-300000024090cia:PrivateEquityFundsLateStageGrowthMemberus-gaap:FairValueMeasuredAtNetAssetValuePerShareMemberus-gaap:UnfundedLoanCommitmentMember2025-06-300000024090srt:MinimumMembercia:PrivateEquityFundsLateStageGrowthMember2025-01-012025-06-300000024090srt:MaximumMembercia:PrivateEquityFundsLateStageGrowthMember2025-01-012025-06-300000024090cia:PrivateEquityFundsLateStageGrowthMemberus-gaap:FairValueMeasuredAtNetAssetValuePerShareMember2024-12-310000024090cia:PrivateEquityFundsLateStageGrowthMemberus-gaap:FairValueMeasuredAtNetAssetValuePerShareMemberus-gaap:UnfundedLoanCommitmentMember2024-12-310000024090srt:MinimumMembercia:PrivateEquityFundsLateStageGrowthMember2024-01-012024-12-310000024090srt:MaximumMembercia:PrivateEquityFundsLateStageGrowthMember2024-01-012024-12-310000024090cia:PrivateEquityFundsInfrastructureMemberus-gaap:FairValueMeasuredAtNetAssetValuePerShareMember2025-06-300000024090cia:PrivateEquityFundsInfrastructureMemberus-gaap:FairValueMeasuredAtNetAssetValuePerShareMemberus-gaap:UnfundedLoanCommitmentMember2025-06-300000024090srt:MinimumMembercia:PrivateEquityFundsInfrastructureMember2025-01-012025-06-300000024090srt:MaximumMembercia:PrivateEquityFundsInfrastructureMember2025-01-012025-06-300000024090cia:PrivateEquityFundsInfrastructureMemberus-gaap:FairValueMeasuredAtNetAssetValuePerShareMember2024-12-310000024090cia:PrivateEquityFundsInfrastructureMemberus-gaap:FairValueMeasuredAtNetAssetValuePerShareMemberus-gaap:UnfundedLoanCommitmentMember2024-12-310000024090srt:MinimumMembercia:PrivateEquityFundsInfrastructureMember2024-01-012024-12-310000024090srt:MaximumMembercia:PrivateEquityFundsInfrastructureMember2024-01-012024-12-310000024090us-gaap:PrivateEquityFundsMemberus-gaap:FairValueMeasuredAtNetAssetValuePerShareMember2025-06-300000024090us-gaap:PrivateEquityFundsMemberus-gaap:FairValueMeasuredAtNetAssetValuePerShareMemberus-gaap:UnfundedLoanCommitmentMember2025-06-300000024090us-gaap:PrivateEquityFundsMemberus-gaap:FairValueMeasuredAtNetAssetValuePerShareMember2024-12-310000024090us-gaap:PrivateEquityFundsMemberus-gaap:FairValueMeasuredAtNetAssetValuePerShareMemberus-gaap:UnfundedLoanCommitmentMember2024-12-310000024090us-gaap:CarryingReportedAmountFairValueDisclosureMember2025-06-300000024090us-gaap:EstimateOfFairValueFairValueDisclosureMember2025-06-300000024090us-gaap:CarryingReportedAmountFairValueDisclosureMember2024-12-310000024090us-gaap:EstimateOfFairValueFairValueDisclosureMember2024-12-310000024090srt:SingleFamilyMemberus-gaap:CarryingReportedAmountFairValueDisclosureMember2025-06-300000024090srt:SingleFamilyMemberus-gaap:EstimateOfFairValueFairValueDisclosureMember2025-06-300000024090srt:SingleFamilyMemberus-gaap:CarryingReportedAmountFairValueDisclosureMember2024-12-310000024090srt:SingleFamilyMemberus-gaap:EstimateOfFairValueFairValueDisclosureMember2024-12-3100000240902024-01-012024-12-310000024090srt:SingleFamilyMember2025-01-012025-06-300000024090srt:SingleFamilyMember2024-01-012024-12-310000024090srt:SingleFamilyMember2025-06-300000024090cia:PermanentMembercia:LifeInsuranceBusinessSegmentMember2024-12-310000024090cia:PermanentLimitedPayMembercia:LifeInsuranceBusinessSegmentMember2024-12-310000024090cia:OtherBusinessMembercia:LifeInsuranceBusinessSegmentMember2024-12-310000024090cia:LifeInsuranceBusinessSegmentMember2024-12-310000024090cia:PermanentMembercia:LifeInsuranceBusinessSegmentMember2025-01-012025-06-300000024090cia:PermanentLimitedPayMembercia:LifeInsuranceBusinessSegmentMember2025-01-012025-06-300000024090cia:OtherBusinessMembercia:LifeInsuranceBusinessSegmentMember2025-01-012025-06-300000024090cia:LifeInsuranceBusinessSegmentMember2025-01-012025-06-300000024090cia:PermanentMembercia:LifeInsuranceBusinessSegmentMember2025-06-300000024090cia:PermanentLimitedPayMembercia:LifeInsuranceBusinessSegmentMember2025-06-300000024090cia:OtherBusinessMembercia:LifeInsuranceBusinessSegmentMember2025-06-300000024090cia:LifeInsuranceBusinessSegmentMember2025-06-300000024090cia:PermanentMembercia:HomeServiceInsuranceSegmentMember2024-12-310000024090cia:PermanentLimitedPayMembercia:HomeServiceInsuranceSegmentMember2024-12-310000024090cia:OtherBusinessMembercia:HomeServiceInsuranceSegmentMember2024-12-310000024090cia:HomeServiceInsuranceSegmentMember2024-12-310000024090cia:PermanentMembercia:HomeServiceInsuranceSegmentMember2025-01-012025-06-300000024090cia:PermanentLimitedPayMembercia:HomeServiceInsuranceSegmentMember2025-01-012025-06-300000024090cia:OtherBusinessMembercia:HomeServiceInsuranceSegmentMember2025-01-012025-06-300000024090cia:HomeServiceInsuranceSegmentMember2025-01-012025-06-300000024090cia:PermanentMembercia:HomeServiceInsuranceSegmentMember2025-06-300000024090cia:PermanentLimitedPayMembercia:HomeServiceInsuranceSegmentMember2025-06-300000024090cia:OtherBusinessMembercia:HomeServiceInsuranceSegmentMember2025-06-300000024090cia:HomeServiceInsuranceSegmentMember2025-06-300000024090cia:PermanentMember2024-12-310000024090cia:PermanentLimitedPayMember2024-12-310000024090cia:OtherBusinessMember2024-12-310000024090cia:PermanentMember2025-01-012025-06-300000024090cia:PermanentLimitedPayMember2025-01-012025-06-300000024090cia:OtherBusinessMember2025-01-012025-06-300000024090cia:PermanentMember2025-06-300000024090cia:PermanentLimitedPayMember2025-06-300000024090cia:OtherBusinessMember2025-06-300000024090cia:PermanentMembercia:LifeInsuranceBusinessSegmentMember2023-12-310000024090cia:PermanentLimitedPayMembercia:LifeInsuranceBusinessSegmentMember2023-12-310000024090cia:OtherBusinessMembercia:LifeInsuranceBusinessSegmentMember2023-12-310000024090cia:LifeInsuranceBusinessSegmentMember2023-12-310000024090cia:PermanentMembercia:LifeInsuranceBusinessSegmentMember2024-01-012024-06-300000024090cia:PermanentLimitedPayMembercia:LifeInsuranceBusinessSegmentMember2024-01-012024-06-300000024090cia:OtherBusinessMembercia:LifeInsuranceBusinessSegmentMember2024-01-012024-06-300000024090cia:LifeInsuranceBusinessSegmentMember2024-01-012024-06-300000024090cia:PermanentMembercia:LifeInsuranceBusinessSegmentMember2024-06-300000024090cia:PermanentLimitedPayMembercia:LifeInsuranceBusinessSegmentMember2024-06-300000024090cia:OtherBusinessMembercia:LifeInsuranceBusinessSegmentMember2024-06-300000024090cia:LifeInsuranceBusinessSegmentMember2024-06-300000024090cia:PermanentMembercia:HomeServiceInsuranceSegmentMember2023-12-310000024090cia:PermanentLimitedPayMembercia:HomeServiceInsuranceSegmentMember2023-12-310000024090cia:OtherBusinessMembercia:HomeServiceInsuranceSegmentMember2023-12-310000024090cia:HomeServiceInsuranceSegmentMember2023-12-310000024090cia:PermanentMembercia:HomeServiceInsuranceSegmentMember2024-01-012024-06-300000024090cia:PermanentLimitedPayMembercia:HomeServiceInsuranceSegmentMember2024-01-012024-06-300000024090cia:OtherBusinessMembercia:HomeServiceInsuranceSegmentMember2024-01-012024-06-300000024090cia:HomeServiceInsuranceSegmentMember2024-01-012024-06-300000024090cia:PermanentMembercia:HomeServiceInsuranceSegmentMember2024-06-300000024090cia:PermanentLimitedPayMembercia:HomeServiceInsuranceSegmentMember2024-06-300000024090cia:OtherBusinessMembercia:HomeServiceInsuranceSegmentMember2024-06-300000024090cia:HomeServiceInsuranceSegmentMember2024-06-300000024090cia:PermanentMember2023-12-310000024090cia:PermanentLimitedPayMember2023-12-310000024090cia:OtherBusinessMember2023-12-310000024090cia:PermanentMember2024-01-012024-06-300000024090cia:PermanentLimitedPayMember2024-01-012024-06-300000024090cia:OtherBusinessMember2024-01-012024-06-300000024090cia:PermanentMember2024-06-300000024090cia:PermanentLimitedPayMember2024-06-300000024090cia:OtherBusinessMember2024-06-300000024090cia:LifeInsurancePermanentMember2025-06-300000024090cia:HomeServiceInsuranceLifeInsurancePermanentMember2025-06-300000024090cia:LifeInsurancePermanentMember2024-06-300000024090cia:HomeServiceInsuranceLifeInsurancePermanentMember2024-06-300000024090cia:LifeInsurancePermanentLimitedPayMember2025-06-300000024090cia:HomeServiceInsuranceLifeInsurancePermanentLimitedPayMember2025-06-300000024090cia:LifeInsurancePermanentLimitedPayMember2024-06-300000024090cia:HomeServiceInsuranceLifeInsurancePermanentLimitedPayMember2024-06-300000024090cia:LifeInsuranceDeferredProfitLiabilityMember2025-06-300000024090cia:HomeServiceInsuranceLifeInsuranceDeferredProfitLiabilityMember2025-06-300000024090cia:DeferredProfitLiabilityMember2025-06-300000024090cia:LifeInsuranceDeferredProfitLiabilityMember2024-06-300000024090cia:HomeServiceInsuranceLifeInsuranceDeferredProfitLiabilityMember2024-06-300000024090cia:DeferredProfitLiabilityMember2024-06-300000024090cia:LifeInsuranceOtherMember2025-06-300000024090cia:HomeServiceInsuranceLifeInsuranceOtherMember2025-06-300000024090cia:OtherMember2025-06-300000024090cia:LifeInsuranceOtherMember2024-06-300000024090cia:HomeServiceInsuranceLifeInsuranceOtherMember2024-06-300000024090cia:OtherMember2024-06-300000024090cia:LifeInsuranceNetOfReinsuranceMember2025-06-300000024090cia:HomeServiceInsuranceLifeInsuranceNetOfReinsuranceMember2025-06-300000024090cia:LifeInsuranceNetOfReinsuranceMember2024-06-300000024090cia:HomeServiceInsuranceLifeInsuranceNetOfReinsuranceMember2024-06-300000024090us-gaap:LifeInsuranceSegmentMember2024-06-300000024090cia:LifeInsuranceAccidentAndHealthOtherMember2025-06-300000024090cia:HomeServiceInsuranceAccidentAndHealthOtherMember2025-06-300000024090cia:LifeInsuranceAccidentAndHealthOtherMember2024-06-300000024090cia:HomeServiceInsuranceAccidentAndHealthOtherMember2024-06-300000024090us-gaap:AccidentAndHealthInsuranceSegmentMember2024-06-300000024090cia:LifeInsuranceAndAccidentAndHealthMember2025-06-300000024090cia:HomeServiceInsuranceLifeInsuranceAndHomeServiceInsuranceAccidentAndHealthMember2025-06-300000024090cia:LifeInsuranceAndAccidentAndHealthMember2024-06-300000024090cia:HomeServiceInsuranceLifeInsuranceAndHomeServiceInsuranceAccidentAndHealthMember2024-06-300000024090cia:LifeInsurancePermanentMember2025-04-012025-06-300000024090cia:LifeInsurancePermanentMember2024-04-012024-06-300000024090cia:LifeInsurancePermanentMember2025-01-012025-06-300000024090cia:LifeInsurancePermanentMember2024-01-012024-06-300000024090cia:LifeInsurancePermanentLimitedPayMember2025-04-012025-06-300000024090cia:LifeInsurancePermanentLimitedPayMember2024-04-012024-06-300000024090cia:LifeInsurancePermanentLimitedPayMember2025-01-012025-06-300000024090cia:LifeInsurancePermanentLimitedPayMember2024-01-012024-06-300000024090cia:LifeInsuranceOtherMember2025-04-012025-06-300000024090cia:LifeInsuranceOtherMember2024-04-012024-06-300000024090cia:LifeInsuranceOtherMember2025-01-012025-06-300000024090cia:LifeInsuranceOtherMember2024-01-012024-06-300000024090cia:LifeInsuranceReinsuranceMember2025-04-012025-06-300000024090cia:LifeInsuranceReinsuranceMember2024-04-012024-06-300000024090cia:LifeInsuranceReinsuranceMember2025-01-012025-06-300000024090cia:LifeInsuranceReinsuranceMember2024-01-012024-06-300000024090cia:LifeInsuranceNetOfReinsuranceMember2025-04-012025-06-300000024090cia:LifeInsuranceNetOfReinsuranceMember2024-04-012024-06-300000024090cia:LifeInsuranceNetOfReinsuranceMember2025-01-012025-06-300000024090cia:LifeInsuranceNetOfReinsuranceMember2024-01-012024-06-300000024090cia:LifeInsuranceAccidentAndHealthOtherMember2025-04-012025-06-300000024090cia:LifeInsuranceAccidentAndHealthOtherMember2024-04-012024-06-300000024090cia:LifeInsuranceAccidentAndHealthOtherMember2025-01-012025-06-300000024090cia:LifeInsuranceAccidentAndHealthOtherMember2024-01-012024-06-300000024090cia:LifeInsuranceAccidentAndHealthReinsuranceMember2025-04-012025-06-300000024090cia:LifeInsuranceAccidentAndHealthReinsuranceMember2024-04-012024-06-300000024090cia:LifeInsuranceAccidentAndHealthReinsuranceMember2025-01-012025-06-300000024090cia:LifeInsuranceAccidentAndHealthReinsuranceMember2024-01-012024-06-300000024090cia:LifeInsuranceAccidentAndHealthNetOfReinsuranceMember2025-04-012025-06-300000024090cia:LifeInsuranceAccidentAndHealthNetOfReinsuranceMember2024-04-012024-06-300000024090cia:LifeInsuranceAccidentAndHealthNetOfReinsuranceMember2025-01-012025-06-300000024090cia:LifeInsuranceAccidentAndHealthNetOfReinsuranceMember2024-01-012024-06-300000024090cia:LifeInsuranceMember2025-04-012025-06-300000024090cia:LifeInsuranceMember2024-04-012024-06-300000024090cia:LifeInsuranceMember2025-01-012025-06-300000024090cia:LifeInsuranceMember2024-01-012024-06-300000024090cia:HomeServiceInsuranceLifeInsurancePermanentMember2025-04-012025-06-300000024090cia:HomeServiceInsuranceLifeInsurancePermanentMember2024-04-012024-06-300000024090cia:HomeServiceInsuranceLifeInsurancePermanentMember2025-01-012025-06-300000024090cia:HomeServiceInsuranceLifeInsurancePermanentMember2024-01-012024-06-300000024090cia:HomeServiceInsuranceLifeInsurancePermanentLimitedPayMember2025-04-012025-06-300000024090cia:HomeServiceInsuranceLifeInsurancePermanentLimitedPayMember2024-04-012024-06-300000024090cia:HomeServiceInsuranceLifeInsurancePermanentLimitedPayMember2025-01-012025-06-300000024090cia:HomeServiceInsuranceLifeInsurancePermanentLimitedPayMember2024-01-012024-06-300000024090cia:HomeServiceInsuranceLifeInsuranceOtherMember2025-04-012025-06-300000024090cia:HomeServiceInsuranceLifeInsuranceOtherMember2024-04-012024-06-300000024090cia:HomeServiceInsuranceLifeInsuranceOtherMember2025-01-012025-06-300000024090cia:HomeServiceInsuranceLifeInsuranceOtherMember2024-01-012024-06-300000024090cia:HomeServiceInsuranceLifeInsuranceReinsuranceMember2025-04-012025-06-300000024090cia:HomeServiceInsuranceLifeInsuranceReinsuranceMember2024-04-012024-06-300000024090cia:HomeServiceInsuranceLifeInsuranceReinsuranceMember2025-01-012025-06-300000024090cia:HomeServiceInsuranceLifeInsuranceReinsuranceMember2024-01-012024-06-300000024090cia:HomeServiceInsuranceLifeInsuranceNetOfReinsuranceMember2025-04-012025-06-300000024090cia:HomeServiceInsuranceLifeInsuranceNetOfReinsuranceMember2024-04-012024-06-300000024090cia:HomeServiceInsuranceLifeInsuranceNetOfReinsuranceMember2025-01-012025-06-300000024090cia:HomeServiceInsuranceLifeInsuranceNetOfReinsuranceMember2024-01-012024-06-300000024090cia:HomeServiceInsuranceAccidentAndHealthOtherMember2025-04-012025-06-300000024090cia:HomeServiceInsuranceAccidentAndHealthOtherMember2024-04-012024-06-300000024090cia:HomeServiceInsuranceAccidentAndHealthOtherMember2025-01-012025-06-300000024090cia:HomeServiceInsuranceAccidentAndHealthOtherMember2024-01-012024-06-300000024090cia:HomeServiceInsuranceSegmentMember2025-04-012025-06-300000024090cia:HomeServiceInsuranceSegmentMember2024-04-012024-06-300000024090srt:MinimumMembercia:PolicyholderAccountBalanceGuaranteedMinimumCreditingRateRangeFrom0000To0149Member2025-06-300000024090srt:MaximumMembercia:PolicyholderAccountBalanceGuaranteedMinimumCreditingRateRangeFrom0000To0149Member2025-06-300000024090us-gaap:PolicyholderAccountBalanceAtGuaranteedMinimumCreditingRateMembercia:PolicyholderAccountBalanceGuaranteedMinimumCreditingRateRangeFrom0000To0149Member2025-06-300000024090us-gaap:PolicyholderAccountBalanceAboveGuaranteedMinimumCreditingRateRangeFrom0001To0050Membercia:PolicyholderAccountBalanceGuaranteedMinimumCreditingRateRangeFrom0000To0149Member2025-06-300000024090us-gaap:PolicyholderAccountBalanceAboveGuaranteedMinimumCreditingRateRangeFrom0051To0150Membercia:PolicyholderAccountBalanceGuaranteedMinimumCreditingRateRangeFrom0000To0149Member2025-06-300000024090us-gaap:PolicyholderAccountBalanceAboveGuaranteedMinimumCreditingRateRangeFrom0151AndGreaterMembercia:PolicyholderAccountBalanceGuaranteedMinimumCreditingRateRangeFrom0000To0149Member2025-06-300000024090cia:PolicyholderAccountBalanceGuaranteedMinimumCreditingRateRangeFrom0000To0149Member2025-06-300000024090srt:MinimumMembercia:PolicyholderAccountBalanceGuaranteedMinimumCreditingRateRangeFrom0150To0299Member2025-06-300000024090srt:MaximumMembercia:PolicyholderAccountBalanceGuaranteedMinimumCreditingRateRangeFrom0150To0299Member2025-06-300000024090us-gaap:PolicyholderAccountBalanceAtGuaranteedMinimumCreditingRateMembercia:PolicyholderAccountBalanceGuaranteedMinimumCreditingRateRangeFrom0150To0299Member2025-06-300000024090us-gaap:PolicyholderAccountBalanceAboveGuaranteedMinimumCreditingRateRangeFrom0001To0050Membercia:PolicyholderAccountBalanceGuaranteedMinimumCreditingRateRangeFrom0150To0299Member2025-06-300000024090us-gaap:PolicyholderAccountBalanceAboveGuaranteedMinimumCreditingRateRangeFrom0051To0150Membercia:PolicyholderAccountBalanceGuaranteedMinimumCreditingRateRangeFrom0150To0299Member2025-06-300000024090us-gaap:PolicyholderAccountBalanceAboveGuaranteedMinimumCreditingRateRangeFrom0151AndGreaterMembercia:PolicyholderAccountBalanceGuaranteedMinimumCreditingRateRangeFrom0150To0299Member2025-06-300000024090cia:PolicyholderAccountBalanceGuaranteedMinimumCreditingRateRangeFrom0150To0299Member2025-06-300000024090srt:MinimumMembercia:PolicyholderAccountBalanceGuaranteedMinimumCreditingRateRangeFrom0300To0449Member2025-06-300000024090srt:MaximumMembercia:PolicyholderAccountBalanceGuaranteedMinimumCreditingRateRangeFrom0300To0449Member2025-06-300000024090us-gaap:PolicyholderAccountBalanceAtGuaranteedMinimumCreditingRateMembercia:PolicyholderAccountBalanceGuaranteedMinimumCreditingRateRangeFrom0300To0449Member2025-06-300000024090us-gaap:PolicyholderAccountBalanceAboveGuaranteedMinimumCreditingRateRangeFrom0001To0050Membercia:PolicyholderAccountBalanceGuaranteedMinimumCreditingRateRangeFrom0300To0449Member2025-06-300000024090us-gaap:PolicyholderAccountBalanceAboveGuaranteedMinimumCreditingRateRangeFrom0051To0150Membercia:PolicyholderAccountBalanceGuaranteedMinimumCreditingRateRangeFrom0300To0449Member2025-06-300000024090us-gaap:PolicyholderAccountBalanceAboveGuaranteedMinimumCreditingRateRangeFrom0151AndGreaterMembercia:PolicyholderAccountBalanceGuaranteedMinimumCreditingRateRangeFrom0300To0449Member2025-06-300000024090cia:PolicyholderAccountBalanceGuaranteedMinimumCreditingRateRangeFrom0300To0449Member2025-06-300000024090cia:PolicyholderAccountBalanceGuaranteedMinimumCreditingRateRangeFromGreaterThanOrEqualTo0450Member2025-06-300000024090us-gaap:PolicyholderAccountBalanceAtGuaranteedMinimumCreditingRateMembercia:PolicyholderAccountBalanceGuaranteedMinimumCreditingRateRangeFromGreaterThanOrEqualTo0450Member2025-06-300000024090us-gaap:PolicyholderAccountBalanceAboveGuaranteedMinimumCreditingRateRangeFrom0001To0050Membercia:PolicyholderAccountBalanceGuaranteedMinimumCreditingRateRangeFromGreaterThanOrEqualTo0450Member2025-06-300000024090us-gaap:PolicyholderAccountBalanceAboveGuaranteedMinimumCreditingRateRangeFrom0051To0150Membercia:PolicyholderAccountBalanceGuaranteedMinimumCreditingRateRangeFromGreaterThanOrEqualTo0450Member2025-06-300000024090us-gaap:PolicyholderAccountBalanceAboveGuaranteedMinimumCreditingRateRangeFrom0151AndGreaterMembercia:PolicyholderAccountBalanceGuaranteedMinimumCreditingRateRangeFromGreaterThanOrEqualTo0450Member2025-06-300000024090us-gaap:PolicyholderAccountBalanceAtGuaranteedMinimumCreditingRateMember2025-06-300000024090us-gaap:PolicyholderAccountBalanceAboveGuaranteedMinimumCreditingRateRangeFrom0001To0050Member2025-06-300000024090us-gaap:PolicyholderAccountBalanceAboveGuaranteedMinimumCreditingRateRangeFrom0051To0150Member2025-06-300000024090us-gaap:PolicyholderAccountBalanceAboveGuaranteedMinimumCreditingRateRangeFrom0151AndGreaterMember2025-06-300000024090srt:MinimumMembercia:PolicyholderAccountBalanceGuaranteedMinimumCreditingRateRangeFrom0000To0149Member2024-06-300000024090srt:MaximumMembercia:PolicyholderAccountBalanceGuaranteedMinimumCreditingRateRangeFrom0000To0149Member2024-06-300000024090us-gaap:PolicyholderAccountBalanceAtGuaranteedMinimumCreditingRateMembercia:PolicyholderAccountBalanceGuaranteedMinimumCreditingRateRangeFrom0000To0149Member2024-06-300000024090us-gaap:PolicyholderAccountBalanceAboveGuaranteedMinimumCreditingRateRangeFrom0001To0050Membercia:PolicyholderAccountBalanceGuaranteedMinimumCreditingRateRangeFrom0000To0149Member2024-06-300000024090us-gaap:PolicyholderAccountBalanceAboveGuaranteedMinimumCreditingRateRangeFrom0051To0150Membercia:PolicyholderAccountBalanceGuaranteedMinimumCreditingRateRangeFrom0000To0149Member2024-06-300000024090us-gaap:PolicyholderAccountBalanceAboveGuaranteedMinimumCreditingRateRangeFrom0151AndGreaterMembercia:PolicyholderAccountBalanceGuaranteedMinimumCreditingRateRangeFrom0000To0149Member2024-06-300000024090cia:PolicyholderAccountBalanceGuaranteedMinimumCreditingRateRangeFrom0000To0149Member2024-06-300000024090srt:MinimumMembercia:PolicyholderAccountBalanceGuaranteedMinimumCreditingRateRangeFrom0150To0299Member2024-06-300000024090srt:MaximumMembercia:PolicyholderAccountBalanceGuaranteedMinimumCreditingRateRangeFrom0150To0299Member2024-06-300000024090us-gaap:PolicyholderAccountBalanceAtGuaranteedMinimumCreditingRateMembercia:PolicyholderAccountBalanceGuaranteedMinimumCreditingRateRangeFrom0150To0299Member2024-06-300000024090us-gaap:PolicyholderAccountBalanceAboveGuaranteedMinimumCreditingRateRangeFrom0001To0050Membercia:PolicyholderAccountBalanceGuaranteedMinimumCreditingRateRangeFrom0150To0299Member2024-06-300000024090us-gaap:PolicyholderAccountBalanceAboveGuaranteedMinimumCreditingRateRangeFrom0051To0150Membercia:PolicyholderAccountBalanceGuaranteedMinimumCreditingRateRangeFrom0150To0299Member2024-06-300000024090us-gaap:PolicyholderAccountBalanceAboveGuaranteedMinimumCreditingRateRangeFrom0151AndGreaterMembercia:PolicyholderAccountBalanceGuaranteedMinimumCreditingRateRangeFrom0150To0299Member2024-06-300000024090cia:PolicyholderAccountBalanceGuaranteedMinimumCreditingRateRangeFrom0150To0299Member2024-06-300000024090srt:MinimumMembercia:PolicyholderAccountBalanceGuaranteedMinimumCreditingRateRangeFrom0300To0449Member2024-06-300000024090srt:MaximumMembercia:PolicyholderAccountBalanceGuaranteedMinimumCreditingRateRangeFrom0300To0449Member2024-06-300000024090us-gaap:PolicyholderAccountBalanceAtGuaranteedMinimumCreditingRateMembercia:PolicyholderAccountBalanceGuaranteedMinimumCreditingRateRangeFrom0300To0449Member2024-06-300000024090us-gaap:PolicyholderAccountBalanceAboveGuaranteedMinimumCreditingRateRangeFrom0001To0050Membercia:PolicyholderAccountBalanceGuaranteedMinimumCreditingRateRangeFrom0300To0449Member2024-06-300000024090us-gaap:PolicyholderAccountBalanceAboveGuaranteedMinimumCreditingRateRangeFrom0051To0150Membercia:PolicyholderAccountBalanceGuaranteedMinimumCreditingRateRangeFrom0300To0449Member2024-06-300000024090us-gaap:PolicyholderAccountBalanceAboveGuaranteedMinimumCreditingRateRangeFrom0151AndGreaterMembercia:PolicyholderAccountBalanceGuaranteedMinimumCreditingRateRangeFrom0300To0449Member2024-06-300000024090cia:PolicyholderAccountBalanceGuaranteedMinimumCreditingRateRangeFrom0300To0449Member2024-06-300000024090cia:PolicyholderAccountBalanceGuaranteedMinimumCreditingRateRangeFromGreaterThanOrEqualTo0450Member2024-06-300000024090us-gaap:PolicyholderAccountBalanceAtGuaranteedMinimumCreditingRateMembercia:PolicyholderAccountBalanceGuaranteedMinimumCreditingRateRangeFromGreaterThanOrEqualTo0450Member2024-06-300000024090us-gaap:PolicyholderAccountBalanceAboveGuaranteedMinimumCreditingRateRangeFrom0001To0050Membercia:PolicyholderAccountBalanceGuaranteedMinimumCreditingRateRangeFromGreaterThanOrEqualTo0450Member2024-06-300000024090us-gaap:PolicyholderAccountBalanceAboveGuaranteedMinimumCreditingRateRangeFrom0051To0150Membercia:PolicyholderAccountBalanceGuaranteedMinimumCreditingRateRangeFromGreaterThanOrEqualTo0450Member2024-06-300000024090us-gaap:PolicyholderAccountBalanceAboveGuaranteedMinimumCreditingRateRangeFrom0151AndGreaterMembercia:PolicyholderAccountBalanceGuaranteedMinimumCreditingRateRangeFromGreaterThanOrEqualTo0450Member2024-06-300000024090us-gaap:PolicyholderAccountBalanceAtGuaranteedMinimumCreditingRateMember2024-06-300000024090us-gaap:PolicyholderAccountBalanceAboveGuaranteedMinimumCreditingRateRangeFrom0001To0050Member2024-06-300000024090us-gaap:PolicyholderAccountBalanceAboveGuaranteedMinimumCreditingRateRangeFrom0051To0150Member2024-06-300000024090us-gaap:PolicyholderAccountBalanceAboveGuaranteedMinimumCreditingRateRangeFrom0151AndGreaterMember2024-06-300000024090cia:SupplementalContractsWithoutLifeContingenciesMember2024-12-310000024090us-gaap:FixedAnnuityMember2024-12-310000024090cia:DividendAccumulationsMember2024-12-310000024090cia:PremiumsPaidInAdvanceMember2024-12-310000024090cia:SupplementalContractsWithoutLifeContingenciesMember2025-01-012025-06-300000024090us-gaap:FixedAnnuityMember2025-01-012025-06-300000024090cia:DividendAccumulationsMember2025-01-012025-06-300000024090cia:PremiumsPaidInAdvanceMember2025-01-012025-06-300000024090cia:SupplementalContractsWithoutLifeContingenciesMember2025-06-300000024090us-gaap:FixedAnnuityMember2025-06-300000024090cia:DividendAccumulationsMember2025-06-300000024090cia:PremiumsPaidInAdvanceMember2025-06-300000024090cia:SupplementalContractsWithoutLifeContingenciesMember2023-12-310000024090us-gaap:FixedAnnuityMember2023-12-310000024090cia:DividendAccumulationsMember2023-12-310000024090cia:PremiumsPaidInAdvanceMember2023-12-310000024090cia:SupplementalContractsWithoutLifeContingenciesMember2024-01-012024-06-300000024090us-gaap:FixedAnnuityMember2024-01-012024-06-300000024090cia:DividendAccumulationsMember2024-01-012024-06-300000024090cia:PremiumsPaidInAdvanceMember2024-01-012024-06-300000024090cia:SupplementalContractsWithoutLifeContingenciesMember2024-06-300000024090us-gaap:FixedAnnuityMember2024-06-300000024090cia:DividendAccumulationsMember2024-06-300000024090cia:PremiumsPaidInAdvanceMember2024-06-300000024090cia:UnearnedRevenueReserveMember2025-06-300000024090cia:UnearnedRevenueReserveMember2024-06-300000024090us-gaap:AccidentAndHealthInsuranceExcludingWorkersCompensationMember2025-01-012025-06-300000024090us-gaap:OtherInsuranceProductLineMember2025-06-300000024090us-gaap:OtherInsuranceProductLineMember2024-12-310000024090us-gaap:OtherShortdurationInsuranceProductLineMember2025-04-012025-06-300000024090us-gaap:OtherShortdurationInsuranceProductLineMember2024-04-012024-06-300000024090us-gaap:OtherShortdurationInsuranceProductLineMember2025-01-012025-06-300000024090us-gaap:OtherShortdurationInsuranceProductLineMember2024-01-012024-06-300000024090us-gaap:OtherLongdurationInsuranceProductLineMember2025-04-012025-06-300000024090us-gaap:OtherLongdurationInsuranceProductLineMember2024-04-012024-06-300000024090us-gaap:OtherLongdurationInsuranceProductLineMember2025-01-012025-06-300000024090us-gaap:OtherLongdurationInsuranceProductLineMember2024-01-012024-06-300000024090us-gaap:UnfundedLoanCommitmentMember2025-06-3000000240902024-05-032024-05-030000024090us-gaap:RevolvingCreditFacilityMember2024-05-0300000240902024-05-030000024090us-gaap:FederalFundsEffectiveSwapRateMember2024-05-032024-05-030000024090us-gaap:SecuredOvernightFinancingRateSofrMember2024-05-032024-05-030000024090us-gaap:RevolvingCreditFacilityMember2024-05-032024-05-030000024090us-gaap:RevolvingCreditFacilityMember2025-06-3000000240902004-03-040000024090us-gaap:CommonClassAMember2004-03-040000024090us-gaap:CommonClassBMember2004-03-040000024090us-gaap:TreasuryStockCommonMember2024-12-310000024090us-gaap:CommonClassAMember2023-12-310000024090us-gaap:TreasuryStockCommonMember2023-12-310000024090us-gaap:TreasuryStockCommonMember2025-01-012025-06-300000024090us-gaap:TreasuryStockCommonMember2024-01-012024-06-300000024090us-gaap:TreasuryStockCommonMember2025-06-300000024090us-gaap:CommonClassAMember2024-06-300000024090us-gaap:TreasuryStockCommonMember2024-06-300000024090srt:ParentCompanyMember2024-03-272024-03-270000024090cia:CICALifeInsuranceCompanyOfAmericaAColoradoCompanyMembersrt:ParentCompanyMember2024-03-272024-03-270000024090cia:CICALifeInsuranceCompanyOfAmericaAColoradoCompanyMember2025-01-012025-06-300000024090country:PR2025-01-012025-06-300000024090cia:CICALifeAIAPuertoRicoCompanyMember2025-01-012025-06-300000024090us-gaap:OperatingSegmentsMemberus-gaap:LifeInsuranceSegmentMembercia:LifeInsuranceBusinessSegmentMember2025-04-012025-06-300000024090us-gaap:OperatingSegmentsMemberus-gaap:LifeInsuranceSegmentMembercia:HomeServiceInsuranceSegmentMember2025-04-012025-06-300000024090us-gaap:CorporateNonSegmentMemberus-gaap:LifeInsuranceSegmentMember2025-04-012025-06-300000024090us-gaap:OperatingSegmentsMemberus-gaap:AccidentAndHealthInsuranceSegmentMembercia:LifeInsuranceBusinessSegmentMember2025-04-012025-06-300000024090us-gaap:OperatingSegmentsMemberus-gaap:AccidentAndHealthInsuranceSegmentMembercia:HomeServiceInsuranceSegmentMember2025-04-012025-06-300000024090us-gaap:CorporateNonSegmentMemberus-gaap:AccidentAndHealthInsuranceSegmentMember2025-04-012025-06-300000024090us-gaap:OperatingSegmentsMembercia:LifeInsuranceBusinessSegmentMember2025-04-012025-06-300000024090us-gaap:OperatingSegmentsMembercia:HomeServiceInsuranceSegmentMember2025-04-012025-06-300000024090us-gaap:CorporateNonSegmentMember2025-04-012025-06-300000024090us-gaap:OperatingSegmentsMemberus-gaap:LifeInsuranceSegmentMembercia:LifeInsuranceBusinessSegmentMember2025-01-012025-06-300000024090us-gaap:OperatingSegmentsMemberus-gaap:LifeInsuranceSegmentMembercia:HomeServiceInsuranceSegmentMember2025-01-012025-06-300000024090us-gaap:CorporateNonSegmentMemberus-gaap:LifeInsuranceSegmentMember2025-01-012025-06-300000024090us-gaap:OperatingSegmentsMemberus-gaap:AccidentAndHealthInsuranceSegmentMembercia:LifeInsuranceBusinessSegmentMember2025-01-012025-06-300000024090us-gaap:OperatingSegmentsMemberus-gaap:AccidentAndHealthInsuranceSegmentMembercia:HomeServiceInsuranceSegmentMember2025-01-012025-06-300000024090us-gaap:CorporateNonSegmentMemberus-gaap:AccidentAndHealthInsuranceSegmentMember2025-01-012025-06-300000024090us-gaap:OperatingSegmentsMembercia:LifeInsuranceBusinessSegmentMember2025-01-012025-06-300000024090us-gaap:OperatingSegmentsMembercia:HomeServiceInsuranceSegmentMember2025-01-012025-06-300000024090us-gaap:CorporateNonSegmentMember2025-01-012025-06-300000024090us-gaap:OperatingSegmentsMemberus-gaap:LifeInsuranceSegmentMembercia:LifeInsuranceBusinessSegmentMember2024-04-012024-06-300000024090us-gaap:OperatingSegmentsMemberus-gaap:LifeInsuranceSegmentMembercia:HomeServiceInsuranceSegmentMember2024-04-012024-06-300000024090us-gaap:CorporateNonSegmentMemberus-gaap:LifeInsuranceSegmentMember2024-04-012024-06-300000024090us-gaap:OperatingSegmentsMemberus-gaap:AccidentAndHealthInsuranceSegmentMembercia:LifeInsuranceBusinessSegmentMember2024-04-012024-06-300000024090us-gaap:OperatingSegmentsMemberus-gaap:AccidentAndHealthInsuranceSegmentMembercia:HomeServiceInsuranceSegmentMember2024-04-012024-06-300000024090us-gaap:CorporateNonSegmentMemberus-gaap:AccidentAndHealthInsuranceSegmentMember2024-04-012024-06-300000024090us-gaap:OperatingSegmentsMembercia:LifeInsuranceBusinessSegmentMember2024-04-012024-06-300000024090us-gaap:OperatingSegmentsMembercia:HomeServiceInsuranceSegmentMember2024-04-012024-06-300000024090us-gaap:CorporateNonSegmentMember2024-04-012024-06-300000024090us-gaap:OperatingSegmentsMemberus-gaap:LifeInsuranceSegmentMembercia:LifeInsuranceBusinessSegmentMember2024-01-012024-06-300000024090us-gaap:OperatingSegmentsMemberus-gaap:LifeInsuranceSegmentMembercia:HomeServiceInsuranceSegmentMember2024-01-012024-06-300000024090us-gaap:CorporateNonSegmentMemberus-gaap:LifeInsuranceSegmentMember2024-01-012024-06-300000024090us-gaap:OperatingSegmentsMemberus-gaap:AccidentAndHealthInsuranceSegmentMembercia:LifeInsuranceBusinessSegmentMember2024-01-012024-06-300000024090us-gaap:OperatingSegmentsMemberus-gaap:AccidentAndHealthInsuranceSegmentMembercia:HomeServiceInsuranceSegmentMember2024-01-012024-06-300000024090us-gaap:CorporateNonSegmentMemberus-gaap:AccidentAndHealthInsuranceSegmentMember2024-01-012024-06-300000024090us-gaap:OperatingSegmentsMembercia:LifeInsuranceBusinessSegmentMember2024-01-012024-06-300000024090us-gaap:OperatingSegmentsMembercia:HomeServiceInsuranceSegmentMember2024-01-012024-06-300000024090us-gaap:CorporateNonSegmentMember2024-01-012024-06-300000024090us-gaap:OperatingSegmentsMembercia:DirectFirstYearPremiumMembercia:LifeInsuranceBusinessSegmentMember2025-04-012025-06-300000024090us-gaap:OperatingSegmentsMembercia:DirectFirstYearPremiumMembercia:LifeInsuranceBusinessSegmentMember2024-04-012024-06-300000024090us-gaap:OperatingSegmentsMembercia:DirectFirstYearPremiumMembercia:LifeInsuranceBusinessSegmentMember2025-01-012025-06-300000024090us-gaap:OperatingSegmentsMembercia:DirectFirstYearPremiumMembercia:LifeInsuranceBusinessSegmentMember2024-01-012024-06-300000024090us-gaap:OperatingSegmentsMembercia:DirectRenewalPremiumMembercia:LifeInsuranceBusinessSegmentMember2025-04-012025-06-300000024090us-gaap:OperatingSegmentsMembercia:DirectRenewalPremiumMembercia:LifeInsuranceBusinessSegmentMember2024-04-012024-06-300000024090us-gaap:OperatingSegmentsMembercia:DirectRenewalPremiumMembercia:LifeInsuranceBusinessSegmentMember2025-01-012025-06-300000024090us-gaap:OperatingSegmentsMembercia:DirectRenewalPremiumMembercia:LifeInsuranceBusinessSegmentMember2024-01-012024-06-300000024090us-gaap:OperatingSegmentsMembercia:DirectFirstYearPremiumMembercia:HomeServiceInsuranceSegmentMember2025-04-012025-06-300000024090us-gaap:OperatingSegmentsMembercia:DirectFirstYearPremiumMembercia:HomeServiceInsuranceSegmentMember2024-04-012024-06-300000024090us-gaap:OperatingSegmentsMembercia:DirectFirstYearPremiumMembercia:HomeServiceInsuranceSegmentMember2025-01-012025-06-300000024090us-gaap:OperatingSegmentsMembercia:DirectFirstYearPremiumMembercia:HomeServiceInsuranceSegmentMember2024-01-012024-06-300000024090us-gaap:OperatingSegmentsMembercia:DirectRenewalPremiumMembercia:HomeServiceInsuranceSegmentMember2025-04-012025-06-300000024090us-gaap:OperatingSegmentsMembercia:DirectRenewalPremiumMembercia:HomeServiceInsuranceSegmentMember2024-04-012024-06-300000024090us-gaap:OperatingSegmentsMembercia:DirectRenewalPremiumMembercia:HomeServiceInsuranceSegmentMember2025-01-012025-06-300000024090us-gaap:OperatingSegmentsMembercia:DirectRenewalPremiumMembercia:HomeServiceInsuranceSegmentMember2024-01-012024-06-300000024090us-gaap:OperatingSegmentsMembercia:LifeInsuranceBusinessSegmentMember2025-06-300000024090us-gaap:OperatingSegmentsMembercia:LifeInsuranceBusinessSegmentMember2024-06-300000024090us-gaap:OperatingSegmentsMembercia:HomeServiceInsuranceSegmentMember2025-06-300000024090us-gaap:OperatingSegmentsMembercia:HomeServiceInsuranceSegmentMember2024-06-300000024090us-gaap:OperatingSegmentsMember2025-06-300000024090us-gaap:OperatingSegmentsMember2024-06-300000024090us-gaap:CorporateNonSegmentMember2025-06-300000024090us-gaap:CorporateNonSegmentMember2024-06-300000024090country:US2025-04-012025-06-300000024090country:US2024-04-012024-06-300000024090country:US2025-01-012025-06-300000024090country:US2024-01-012024-06-300000024090country:CO2025-04-012025-06-300000024090country:CO2024-04-012024-06-300000024090country:CO2025-01-012025-06-300000024090country:CO2024-01-012024-06-300000024090country:TW2025-04-012025-06-300000024090country:TW2024-04-012024-06-300000024090country:TW2025-01-012025-06-300000024090country:TW2024-01-012024-06-300000024090country:VE2025-04-012025-06-300000024090country:VE2024-04-012024-06-300000024090country:VE2025-01-012025-06-300000024090country:VE2024-01-012024-06-300000024090country:EC2025-04-012025-06-300000024090country:EC2024-04-012024-06-300000024090country:EC2025-01-012025-06-300000024090country:EC2024-01-012024-06-300000024090country:AR2025-04-012025-06-300000024090country:AR2024-04-012024-06-300000024090country:AR2025-01-012025-06-300000024090country:AR2024-01-012024-06-300000024090cia:OtherNonUSMember2025-04-012025-06-300000024090cia:OtherNonUSMember2024-04-012024-06-300000024090cia:OtherNonUSMember2025-01-012025-06-300000024090cia:OtherNonUSMember2024-01-012024-06-300000024090country:AllCountriesDomain2025-04-012025-06-300000024090country:AllCountriesDomain2024-04-012024-06-300000024090country:AllCountriesDomain2025-01-012025-06-300000024090country:AllCountriesDomain2024-01-012024-06-300000024090cia:GovernmentOfPuertoRicoMember2025-01-012025-06-300000024090us-gaap:AccumulatedNetUnrealizedInvestmentGainLossMember2024-12-310000024090us-gaap:AociLiabilityForFuturePolicyBenefitParentMember2024-12-310000024090us-gaap:AccumulatedNetUnrealizedInvestmentGainLossMember2025-01-012025-03-310000024090us-gaap:AociLiabilityForFuturePolicyBenefitParentMember2025-01-012025-03-310000024090us-gaap:AccumulatedNetUnrealizedInvestmentGainLossMember2025-03-310000024090us-gaap:AociLiabilityForFuturePolicyBenefitParentMember2025-03-310000024090us-gaap:AccumulatedNetUnrealizedInvestmentGainLossMember2025-04-012025-06-300000024090us-gaap:AociLiabilityForFuturePolicyBenefitParentMember2025-04-012025-06-300000024090us-gaap:AccumulatedNetUnrealizedInvestmentGainLossMember2025-06-300000024090us-gaap:AociLiabilityForFuturePolicyBenefitParentMember2025-06-300000024090us-gaap:AccumulatedNetUnrealizedInvestmentGainLossMember2023-12-310000024090us-gaap:AociLiabilityForFuturePolicyBenefitParentMember2023-12-310000024090us-gaap:AccumulatedNetUnrealizedInvestmentGainLossMember2024-01-012024-03-310000024090us-gaap:AociLiabilityForFuturePolicyBenefitParentMember2024-01-012024-03-310000024090us-gaap:AccumulatedNetUnrealizedInvestmentGainLossMember2024-03-310000024090us-gaap:AociLiabilityForFuturePolicyBenefitParentMember2024-03-310000024090us-gaap:AccumulatedNetUnrealizedInvestmentGainLossMember2024-04-012024-06-300000024090us-gaap:AociLiabilityForFuturePolicyBenefitParentMember2024-04-012024-06-300000024090us-gaap:AccumulatedNetUnrealizedInvestmentGainLossMember2024-06-300000024090us-gaap:AociLiabilityForFuturePolicyBenefitParentMember2024-06-30

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

WASHINGTON, D.C. 20549

FORM 10-Q

☒ QUARTERLY REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934

For the Quarterly Period Ended June 30, 2025

OR

☐ TRANSITION REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934

For the Transition Period from to

COMMISSION FILE NUMBER: 000-16509

|

|

|

| CITIZENS, INC. |

| (Exact name of registrant as specified in its charter) |

|

|

|

|

|

|

| Colorado |

84-0755371 |

| (State or other jurisdiction of incorporation or organization) |

(I.R.S. Employer Identification No.) |

11815 Alterra Pkwy, Floor 15, Austin, TX 78758

(Current Address)

Registrant's telephone number, including area code: (512) 837-7100

|

|

|

|

|

|

|

|

|

| Securities registered pursuant to Section 12(b) of the Act |

|

| Class A Common Stock |

CIA |

NYSE |

| (Title of each class) |

(Trading symbol(s)) |

(Name of each exchange on which registered) |

Indicate by check mark whether the registrant: (1) has filed all reports required to be filed by Section 13 or 15(d) of the Securities Exchange Act of 1934 during the preceding 12 months (or for such shorter period that the registrant was required to file such reports), and (2) has been subject to such filing requirements for the past 90 days. x Yes o No

Indicate by check mark whether the registrant has submitted electronically every Interactive Data File required to be submitted pursuant to Rule 405 of Regulation S-T (§232.405 of this chapter) during the preceding 12 months (or for such shorter period that the registrant was required to submit such files). x Yes o No

Indicate by check mark whether the registrant is a large accelerated filer, an accelerated filer, a non-accelerated filer, a smaller reporting company or an emerging growth company. See the definitions of "large accelerated filer," "accelerated filer," "smaller reporting company" and "emerging growth company" in Rule 12b-2 of the Exchange Act:

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Large accelerated filer |

☐ |

|

Accelerated filer |

☒ |

|

Non-accelerated filer |

☐ |

|

Smaller reporting company |

☒ |

|

Emerging growth company |

☐ |

|

If an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act. o

Indicate by check mark whether the registrant is a shell company (as defined in Rule 12b-2 of the Exchange Act). ☐ Yes x No

As of August 1, 2025, the Registrant had 50,245,367 shares of Class A common stock outstanding.

THIS PAGE INTENTIONALLY LEFT BLANK

TABLE OF CONTENTS

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Page Number |

| Part I. FINANCIAL INFORMATION |

|

|

|

|

|

| |

Item 1. |

|

|

|

|

|

|

| |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| |

|

|

|

|

|

|

|

| |

|

|

|

|

|

|

|

| |

Item 2. |

|

|

|

|

|

|

| |

Item 3. |

|

|

|

|

|

|

| |

Item 4. |

|

|

|

|

|

|

| Part II. OTHER INFORMATION |

|

|

|

|

|

| |

Item 1. |

|

|

|

|

|

|

|

Item 1A. |

|

|

|

|

|

|

| |

Item 2. |

|

|

|

|

|

|

| |

Item 3. |

|

|

|

|

|

|

| |

Item 4. |

|

|

|

|

|

|

| |

Item 5. |

|

|

|

|

|

|

| |

Item 6. |

|

|

PART I. FINANCIAL INFORMATION

Item 1. FINANCIAL STATEMENTS

CITIZENS, INC. AND CONSOLIDATED SUBSIDIARIES

Consolidated Balance Sheets

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| (In thousands) |

June 30, 2025 |

|

December 31, 2024 |

|

(Unaudited) |

|

|

Assets: |

|

|

|

| Investments: |

|

|

|

Fixed maturity securities available-for-sale, at fair value (amortized cost: $1,403,782 and $1,401,301 in 2025 and 2024, respectively) |

$ |

1,242,271 |

|

|

1,220,961 |

|

|

|

|

|

| Equity securities, at fair value |

5,478 |

|

|

5,447 |

|

|

|

|

|

| Policy loans |

69,648 |

|

|

71,216 |

|

|

|

|

|

|

|

|

|

Other long-term investments (portion measured at fair value $96,142 and $93,337 in 2025 and 2024, respectively) |

96,424 |

|

|

93,604 |

|

|

|

|

|

| Total investments |

1,413,821 |

|

|

1,391,228 |

|

Cash and cash equivalents (restricted portion: $1,554 in both 2025 and 2024) |

22,671 |

|

|

29,271 |

|

| Accrued investment income |

17,523 |

|

|

17,546 |

|

|

|

|

|

| Reinsurance recoverable |

9,388 |

|

|

6,941 |

|

| Deferred policy acquisition costs |

208,944 |

|

|

199,635 |

|

| Cost of insurance acquired |

9,269 |

|

|

9,446 |

|

| Current federal income tax receivable |

1,143 |

|

|

148 |

|

|

|

|

|

| Property and equipment, net |

9,845 |

|

|

10,574 |

|

| Due premiums |

10,735 |

|

|

11,721 |

|

|

|

|

|

Other assets (less allowance for losses of $743 and $516 in 2025 and 2024, respectively) |

9,161 |

|

|

8,815 |

|

| Total assets |

$ |

1,712,500 |

|

|

1,685,325 |

|

See accompanying Notes to Consolidated Financial Statements.

CITIZENS, INC. AND CONSOLIDATED SUBSIDIARIES

Consolidated Balance Sheets, Continued

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| (In thousands, except share amounts) |

June 30, 2025 |

|

December 31, 2024 |

|

(Unaudited) |

|

|

Liabilities and Stockholders' Equity: |

|

|

|

| Liabilities: |

|

|

|

| Policy liabilities: |

|

|

|

| Future policy benefit reserves: |

|

|

|

| Life insurance |

$ |

1,170,116 |

|

|

1,172,034 |

|

| Accident and health insurance |

1,240 |

|

|

1,071 |

|

| Total future policy benefit reserves |

1,171,356 |

|

|

1,173,105 |

|

| Policyholders' funds: |

|

|

|

| Annuities |

158,652 |

|

|

149,977 |

|

| Dividend accumulations |

49,281 |

|

|

47,768 |

|

| Premiums paid in advance |

31,063 |

|

|

31,182 |

|

| Policy claims payable |

8,411 |

|

|

8,822 |

|

| Other policyholders' funds |

8,372 |

|

|

7,271 |

|

| Total policyholders' funds |

255,779 |

|

|

245,020 |

|

| Total policy liabilities |

1,427,135 |

|

|

1,418,125 |

|

| Commissions payable |

4,010 |

|

|

4,546 |

|

|

|

|

|

| Deferred federal income tax liability |

4,999 |

|

|

3,442 |

|

|

|

|

|

| Other liabilities |

47,330 |

|

|

48,857 |

|

| Total liabilities |

1,483,474 |

|

|

1,474,970 |

|

Commitments and contingencies ( Notes 7 and 8) |

|

|

|

| Stockholders' Equity: |

|

|

|

| Common stock: |

|

|

|

Class A, no par value, 100,000,000 shares authorized, 54,565,526 and 54,235,165 shares issued and outstanding in 2025 and 2024, respectively, including shares in treasury of 4,327,810 in 2025 and 2024 |

271,324 |

|

|

269,799 |

|

Class B, no par value, 2,000,000 shares authorized, 1,001,714 shares issued and outstanding in 2025 and 2024, including shares in treasury of 1,001,714 in 2025 and 2024 |

3,184 |

|

|

3,184 |

|

| Retained earnings |

61,898 |

|

|

57,062 |

|

| Accumulated other comprehensive income (loss) |

(83,655) |

|

|

(95,965) |

|

| Treasury stock, at cost |

(23,725) |

|

|

(23,725) |

|

| Total stockholders' equity |

229,026 |

|

|

210,355 |

|

| Total liabilities and stockholders' equity |

$ |

1,712,500 |

|

|

1,685,325 |

|

See accompanying Notes to Consolidated Financial Statements.

CITIZENS, INC. AND CONSOLIDATED SUBSIDIARIES

Consolidated Statements of Operations and Comprehensive Income (Loss)

(Unaudited)

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Three Months Ended |

|

Six Months Ended |

|

June 30, |

|

June 30, |

(In thousands, except per share amounts) |

2025 |

|

2024 |

|

2025 |

|

2024 |

| Revenues: |

|

|

|

|

|

|

|

| Premiums: |

|

|

|

|

|

|

|

| Life insurance |

$ |

42,937 |

|

|

42,101 |

|

|

82,286 |

|

|

80,362 |

|

| Accident and health insurance |

451 |

|

|

458 |

|

|

899 |

|

|

872 |

|

| Property insurance |

— |

|

|

— |

|

|

— |

|

|

(2) |

|

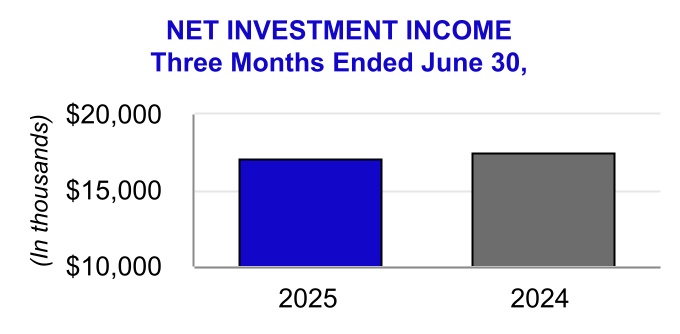

| Net investment income |

17,169 |

|

|

17,540 |

|

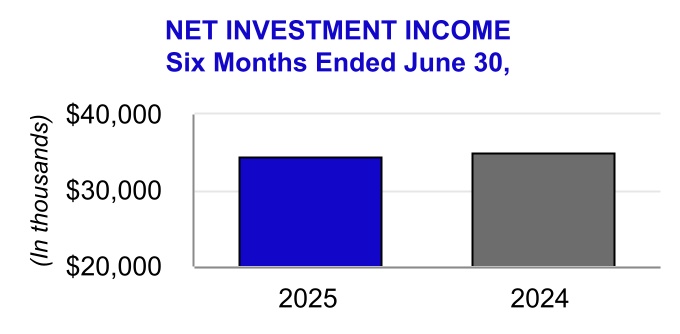

|

34,546 |

|

|

35,027 |

|

| Investment related gains (losses), net |

2,408 |

|

|

(253) |

|

|

(486) |

|

|

710 |

|

| Other income |

2,121 |

|

|

2,238 |

|

|

3,493 |

|

|

2,827 |

|

| Total revenues |

65,086 |

|

|

62,084 |

|

|

120,738 |

|

|

119,796 |

|

| Benefits and Expenses: |

|

|

|

|

|

|

|

| Insurance benefits paid or provided: |

|

|

|

|

|

|

|

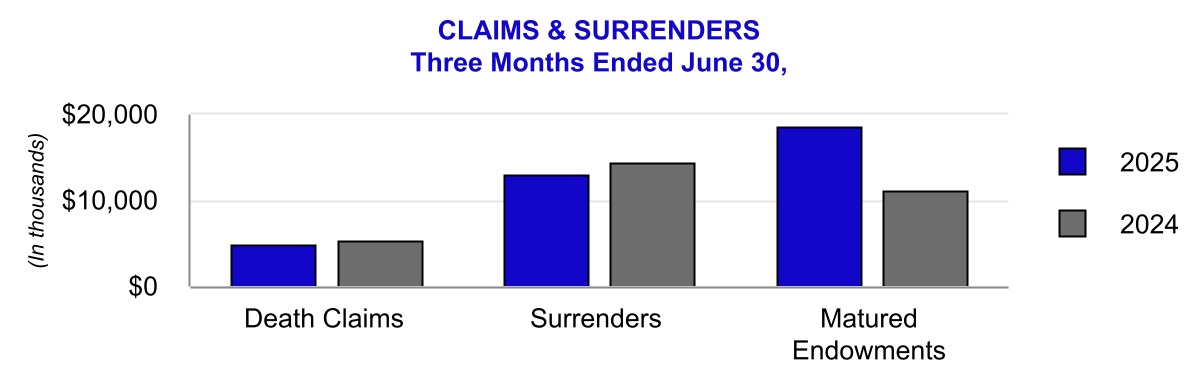

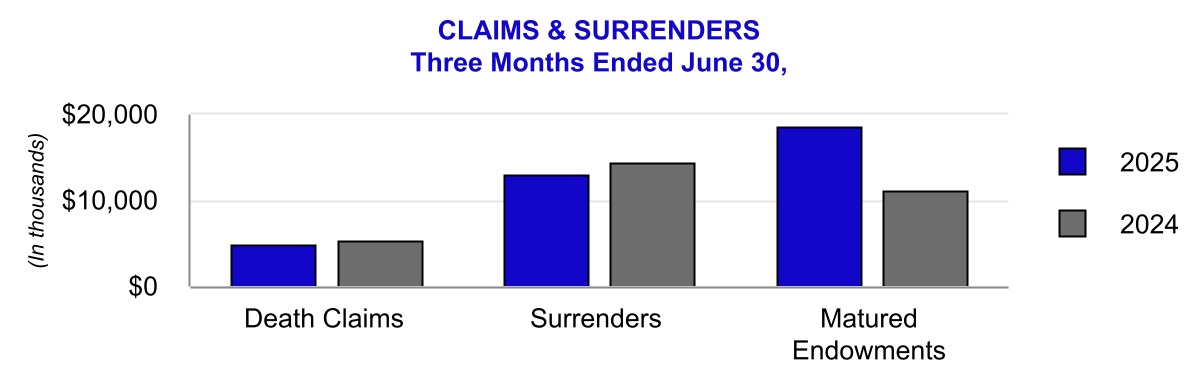

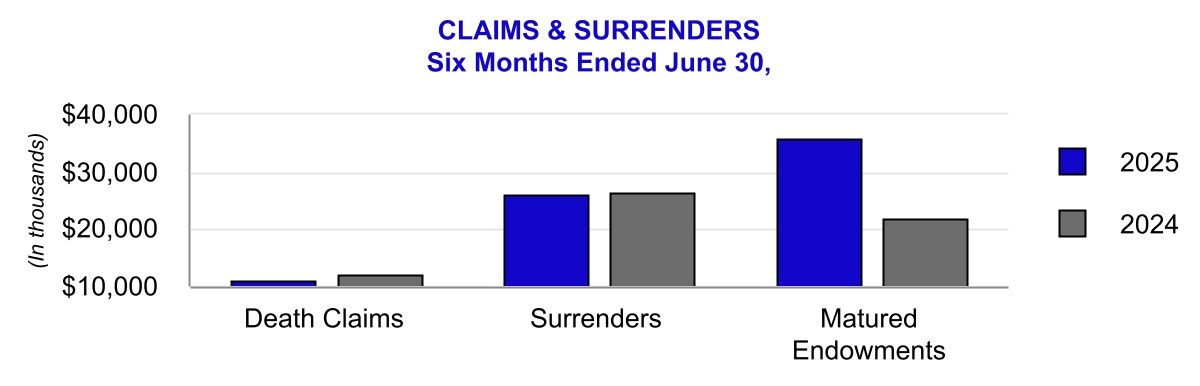

| Claims and surrenders |

40,220 |

|

|

34,530 |

|

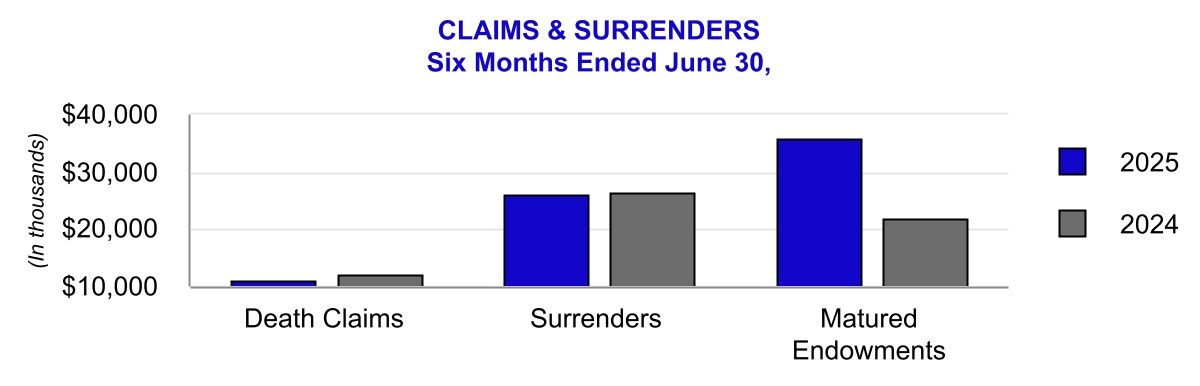

|

80,318 |

|

|

67,643 |

|

| Increase (decrease) in future policy benefit reserves |

(4,554) |

|

|

(1,052) |

|

|

(8,200) |

|

|

(601) |

|

| Policyholder liability remeasurement (gain) loss |

1,351 |

|

|

1,360 |

|

|

1,179 |

|

|

1,679 |

|

| Policyholders' dividends |

1,315 |

|

|

1,191 |

|

|

2,610 |

|

|

2,428 |

|

| Total insurance benefits paid or provided |

38,332 |

|

|

36,029 |

|

|

75,907 |

|

|

71,149 |

|

|

|

|

|

|

|

|

|

| Commissions |

11,409 |

|

|

12,232 |

|

|

22,684 |

|

|

22,682 |

|

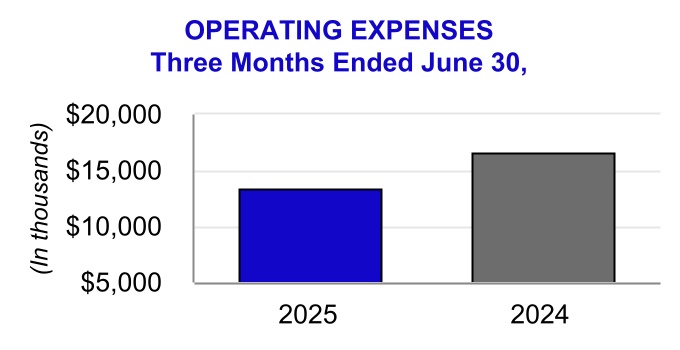

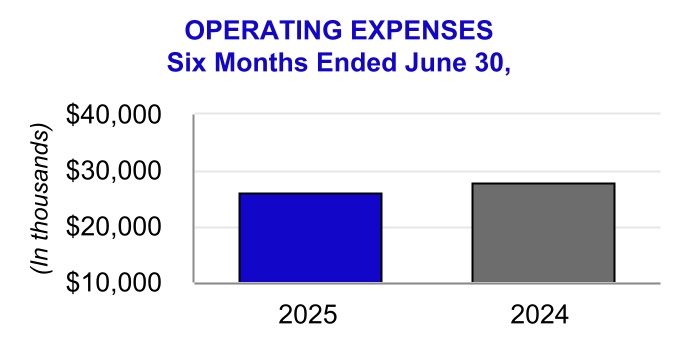

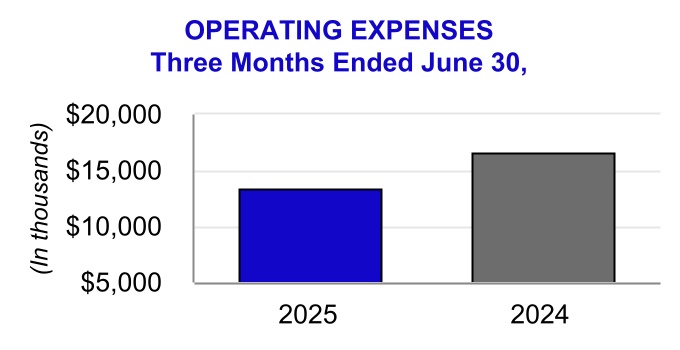

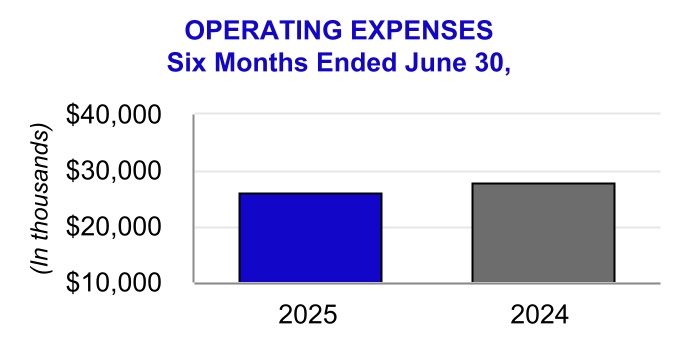

| Other general expenses |

13,459 |

|

|

16,639 |

|

|

26,152 |

|

|

27,977 |

|

| Capitalization of deferred policy acquisition costs |

(9,720) |

|

|

(10,543) |

|

|

(18,569) |

|

|

(18,874) |

|

| Amortization of deferred policy acquisition costs |

4,613 |

|

|

4,273 |

|

|

9,260 |

|

|

8,311 |

|

| Amortization of cost of insurance acquired |

79 |

|

|

152 |

|

|

177 |

|

|

324 |

|

| Total benefits and expenses |

58,172 |

|

|

58,782 |

|

|

115,611 |

|

|

111,569 |

|

Income (loss) before federal income tax |

6,914 |

|

|

3,302 |

|

|

5,127 |

|

|

8,227 |

|

Federal income tax expense (benefit) |

455 |

|

|

(657) |

|

|

291 |

|

|

(274) |

|

Net income (loss) |

6,459 |

|

|

3,959 |

|

|

4,836 |

|

|

8,501 |

|

|

|

|

|

|

|

|

|

| Per Share Amounts: |

|

|

|

|

|

|

|

Basic and diluted earnings (loss) per share of Class A common stock |

0.13 |

|

|

0.08 |

|

|

0.10 |

|

|

0.17 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Other Comprehensive Income (Loss): |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Unrealized gains (losses) on fixed maturity securities: |

|

|

|

|

|

|

|

| Unrealized holding gains (losses) arising during period |

243 |

|

|

(14,258) |

|

|

18,577 |

|

|

(27,674) |

|

Reclassification adjustment for (gains) losses included in net income (loss) |

168 |

|

|

199 |

|

|

251 |

|

|

647 |

|

| Unrealized gains (losses) on fixed maturity securities, net |

411 |

|

|

(14,059) |

|

|

18,828 |

|

|

(27,027) |

|

| Change in current discount rate for liability for future policy benefits |

4,003 |

|

|

5,522 |

|

|

(4,586) |

|

|

39,517 |

|

| Income tax expense (benefit) on other comprehensive income items |

995 |

|

|

(383) |

|

|

1,932 |

|

|

2,259 |

|

| Other comprehensive income (loss) |

3,419 |

|

|

(8,154) |

|

|

12,310 |

|

|

10,231 |

|

| Total comprehensive income (loss) |

$ |

9,878 |

|

|

(4,195) |

|

|

17,146 |

|

|

18,732 |

|

See accompanying Notes to Consolidated Financial Statements.

CITIZENS, INC. AND CONSOLIDATED SUBSIDIARIES

Consolidated Statements of Stockholders' Equity

(Unaudited)

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| |

Common Stock |

Retained Earnings |

Accumulated Other Comprehensive Income (Loss) |

Treasury Stock |

Total Stockholders' Equity |

| (In thousands) |

Class A |

Class B |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Balance at December 31, 2024 |

$ |

269,799 |

|

|

3,184 |

|

|

57,062 |

|

|

(95,965) |

|

|

(23,725) |

|

|

210,355 |

|

| Comprehensive income (loss): |

|

|

|

|

|

|

|

|

|

|

|

Net income (loss) |

— |

|

|

— |

|

|

(1,623) |

|

|

— |

|

|

— |

|

|

(1,623) |

|

| Other comprehensive income (loss) |

— |

|

|

— |

|

|

— |

|

|

8,891 |

|

|

— |

|

|

8,891 |

|

| Total comprehensive income (loss) |

— |

|

|

— |

|

|

(1,623) |

|

|

8,891 |

|

|

— |

|

|

7,268 |

|

|

|

|

|

|

|

|

|

|

|

|

|

| Stock-based compensation |

516 |

|

|

— |

|

|

— |

|

|

— |

|

|

— |

|

|

516 |

|

| Balance at March 31, 2025 |

270,315 |

|

|

3,184 |

|

|

55,439 |

|

|

(87,074) |

|

|

(23,725) |

|

|

218,139 |

|

| Comprehensive income (loss): |

|

|

|

|

|

|

|

|

|

|

|

Net income (loss) |

— |

|

|

— |

|

|

6,459 |

|

|

— |

|

|

— |

|

|

6,459 |

|

| Other comprehensive income (loss) |

— |

|

|

— |

|

|

— |

|

|

3,419 |

|

|

— |

|

|

3,419 |

|

| Total comprehensive income (loss) |

— |

|

|

— |

|

|

6,459 |

|

|

3,419 |

|

|

— |

|

|

9,878 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Stock-based compensation |

1,009 |

|

|

— |

|

|

— |

|

|

— |

|

|

— |

|

|

1,009 |

|

| Balance at June 30, 2025 |

$ |

271,324 |

|

|

3,184 |

|

|

61,898 |

|

|

(83,655) |

|

|

(23,725) |

|

|

229,026 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Balance at December 31, 2023 |

$ |

268,675 |

|

|

3,184 |

|

|

42,150 |

|

|

(118,155) |

|

|

(23,725) |

|