000002409012/312024Q3FALSExbrli:sharesiso4217:USDiso4217:USDxbrli:sharesxbrli:pure00000240902024-01-012024-09-3000000240902024-11-0100000240902024-09-3000000240902023-12-310000024090us-gaap:LifeInsuranceSegmentMember2024-09-300000024090us-gaap:LifeInsuranceSegmentMember2023-12-310000024090us-gaap:AccidentAndHealthInsuranceSegmentMember2024-09-300000024090us-gaap:AccidentAndHealthInsuranceSegmentMember2023-12-310000024090us-gaap:CommonClassAMember2024-09-300000024090us-gaap:CommonClassAMember2023-12-310000024090us-gaap:CommonClassBMember2023-12-310000024090us-gaap:CommonClassBMember2024-09-3000000240902024-07-012024-09-3000000240902023-07-012023-09-3000000240902023-01-012023-09-300000024090us-gaap:CommonClassAMember2024-07-012024-09-300000024090us-gaap:CommonClassAMember2023-07-012023-09-300000024090us-gaap:CommonClassAMember2024-01-012024-09-300000024090us-gaap:CommonClassAMember2023-01-012023-09-300000024090us-gaap:CommonStockMemberus-gaap:CommonClassAMember2023-12-310000024090us-gaap:CommonStockMemberus-gaap:CommonClassBMember2023-12-310000024090us-gaap:RetainedEarningsMember2023-12-310000024090us-gaap:AccumulatedOtherComprehensiveIncomeMember2023-12-310000024090us-gaap:TreasuryStockCommonMember2023-12-310000024090us-gaap:CommonStockMemberus-gaap:CommonClassAMember2024-01-012024-03-310000024090us-gaap:CommonStockMemberus-gaap:CommonClassBMember2024-01-012024-03-310000024090us-gaap:RetainedEarningsMember2024-01-012024-03-310000024090us-gaap:AccumulatedOtherComprehensiveIncomeMember2024-01-012024-03-310000024090us-gaap:TreasuryStockCommonMember2024-01-012024-03-3100000240902024-01-012024-03-310000024090us-gaap:CommonStockMemberus-gaap:CommonClassAMember2024-03-310000024090us-gaap:CommonStockMemberus-gaap:CommonClassBMember2024-03-310000024090us-gaap:RetainedEarningsMember2024-03-310000024090us-gaap:AccumulatedOtherComprehensiveIncomeMember2024-03-310000024090us-gaap:TreasuryStockCommonMember2024-03-3100000240902024-03-310000024090us-gaap:CommonStockMemberus-gaap:CommonClassAMember2024-04-012024-06-300000024090us-gaap:CommonStockMemberus-gaap:CommonClassBMember2024-04-012024-06-300000024090us-gaap:RetainedEarningsMember2024-04-012024-06-300000024090us-gaap:AccumulatedOtherComprehensiveIncomeMember2024-04-012024-06-300000024090us-gaap:TreasuryStockCommonMember2024-04-012024-06-3000000240902024-04-012024-06-300000024090us-gaap:CommonStockMemberus-gaap:CommonClassAMember2024-06-300000024090us-gaap:CommonStockMemberus-gaap:CommonClassBMember2024-06-300000024090us-gaap:RetainedEarningsMember2024-06-300000024090us-gaap:AccumulatedOtherComprehensiveIncomeMember2024-06-300000024090us-gaap:TreasuryStockCommonMember2024-06-3000000240902024-06-300000024090us-gaap:CommonStockMemberus-gaap:CommonClassAMember2024-07-012024-09-300000024090us-gaap:CommonStockMemberus-gaap:CommonClassBMember2024-07-012024-09-300000024090us-gaap:RetainedEarningsMember2024-07-012024-09-300000024090us-gaap:AccumulatedOtherComprehensiveIncomeMember2024-07-012024-09-300000024090us-gaap:TreasuryStockCommonMember2024-07-012024-09-300000024090us-gaap:CommonStockMemberus-gaap:CommonClassAMember2024-09-300000024090us-gaap:CommonStockMemberus-gaap:CommonClassBMember2024-09-300000024090us-gaap:RetainedEarningsMember2024-09-300000024090us-gaap:AccumulatedOtherComprehensiveIncomeMember2024-09-300000024090us-gaap:TreasuryStockCommonMember2024-09-300000024090us-gaap:CommonStockMemberus-gaap:CommonClassAMember2022-12-310000024090us-gaap:CommonStockMemberus-gaap:CommonClassBMember2022-12-310000024090us-gaap:RetainedEarningsMember2022-12-310000024090us-gaap:AccumulatedOtherComprehensiveIncomeMember2022-12-310000024090us-gaap:TreasuryStockCommonMember2022-12-3100000240902022-12-310000024090us-gaap:CommonStockMemberus-gaap:CommonClassAMember2023-01-012023-03-310000024090us-gaap:CommonStockMemberus-gaap:CommonClassBMember2023-01-012023-03-310000024090us-gaap:RetainedEarningsMember2023-01-012023-03-310000024090us-gaap:AccumulatedOtherComprehensiveIncomeMember2023-01-012023-03-310000024090us-gaap:TreasuryStockCommonMember2023-01-012023-03-3100000240902023-01-012023-03-310000024090us-gaap:CommonStockMemberus-gaap:CommonClassAMember2023-03-310000024090us-gaap:CommonStockMemberus-gaap:CommonClassBMember2023-03-310000024090us-gaap:RetainedEarningsMember2023-03-310000024090us-gaap:AccumulatedOtherComprehensiveIncomeMember2023-03-310000024090us-gaap:TreasuryStockCommonMember2023-03-3100000240902023-03-310000024090us-gaap:CommonStockMemberus-gaap:CommonClassAMember2023-04-012023-06-300000024090us-gaap:CommonStockMemberus-gaap:CommonClassBMember2023-04-012023-06-300000024090us-gaap:RetainedEarningsMember2023-04-012023-06-300000024090us-gaap:AccumulatedOtherComprehensiveIncomeMember2023-04-012023-06-300000024090us-gaap:TreasuryStockCommonMember2023-04-012023-06-3000000240902023-04-012023-06-300000024090us-gaap:CommonStockMemberus-gaap:CommonClassAMember2023-06-300000024090us-gaap:CommonStockMemberus-gaap:CommonClassBMember2023-06-300000024090us-gaap:RetainedEarningsMember2023-06-300000024090us-gaap:AccumulatedOtherComprehensiveIncomeMember2023-06-300000024090us-gaap:TreasuryStockCommonMember2023-06-3000000240902023-06-300000024090us-gaap:CommonStockMemberus-gaap:CommonClassAMember2023-07-012023-09-300000024090us-gaap:CommonStockMemberus-gaap:CommonClassBMember2023-07-012023-09-300000024090us-gaap:RetainedEarningsMember2023-07-012023-09-300000024090us-gaap:AccumulatedOtherComprehensiveIncomeMember2023-07-012023-09-300000024090us-gaap:TreasuryStockCommonMember2023-07-012023-09-300000024090us-gaap:CommonStockMemberus-gaap:CommonClassAMember2023-09-300000024090us-gaap:CommonStockMemberus-gaap:CommonClassBMember2023-09-300000024090us-gaap:RetainedEarningsMember2023-09-300000024090us-gaap:AccumulatedOtherComprehensiveIncomeMember2023-09-300000024090us-gaap:TreasuryStockCommonMember2023-09-3000000240902023-09-300000024090us-gaap:USTreasurySecuritiesMember2024-09-300000024090us-gaap:USGovernmentAgenciesDebtSecuritiesMember2024-09-300000024090us-gaap:USStatesAndPoliticalSubdivisionsMember2024-09-300000024090cia:CorporateDebtSecuritiesFinancialSectorMember2024-09-300000024090cia:CorporateDebtSecurityConsumerSectorMember2024-09-300000024090cia:CorporateDebtSecurityUtilitiesSectorMember2024-09-300000024090cia:CorporateDebtSecurityEnergySectorMember2024-09-300000024090cia:CorporateDebtSecurityCommunicationsSectorMember2024-09-300000024090cia:CorporateDebtSecurityAllOtherSectorMember2024-09-300000024090us-gaap:CommercialMortgageBackedSecuritiesMember2024-09-300000024090us-gaap:ResidentialMortgageBackedSecuritiesMember2024-09-300000024090us-gaap:AssetBackedSecuritiesMember2024-09-300000024090us-gaap:USTreasurySecuritiesMember2023-12-310000024090us-gaap:USGovernmentAgenciesDebtSecuritiesMember2023-12-310000024090us-gaap:USStatesAndPoliticalSubdivisionsMember2023-12-310000024090cia:CorporateDebtSecuritiesFinancialSectorMember2023-12-310000024090cia:CorporateDebtSecurityConsumerSectorMember2023-12-310000024090cia:CorporateDebtSecurityUtilitiesSectorMember2023-12-310000024090cia:CorporateDebtSecurityEnergySectorMember2023-12-310000024090cia:CorporateDebtSecurityCommunicationsSectorMember2023-12-310000024090cia:CorporateDebtSecurityAllOtherSectorMember2023-12-310000024090us-gaap:CommercialMortgageBackedSecuritiesMember2023-12-310000024090us-gaap:ResidentialMortgageBackedSecuritiesMember2023-12-310000024090us-gaap:AssetBackedSecuritiesMember2023-12-310000024090us-gaap:FixedIncomeFundsMember2024-09-300000024090us-gaap:FixedIncomeFundsMember2023-12-310000024090us-gaap:CommonStockMember2024-09-300000024090us-gaap:CommonStockMember2023-12-310000024090us-gaap:NonredeemablePreferredStockMember2024-09-300000024090us-gaap:NonredeemablePreferredStockMember2023-12-310000024090cia:CIA_NonredeemablePreferredStockFundMemberMember2024-09-300000024090cia:CIA_NonredeemablePreferredStockFundMemberMember2023-12-310000024090us-gaap:EquitySecuritiesMember2024-01-012024-09-300000024090us-gaap:EquitySecuritiesMember2024-07-012024-09-300000024090us-gaap:EquitySecuritiesMember2023-07-012023-09-300000024090us-gaap:EquitySecuritiesMember2023-01-012023-09-300000024090us-gaap:DebtSecuritiesMember2024-09-300000024090us-gaap:DebtSecuritiesMember2023-12-310000024090us-gaap:FairValueInputsLevel1Memberus-gaap:USTreasuryAndGovernmentMember2024-09-300000024090us-gaap:FairValueInputsLevel2Memberus-gaap:USTreasuryAndGovernmentMember2024-09-300000024090us-gaap:FairValueInputsLevel3Memberus-gaap:USTreasuryAndGovernmentMember2024-09-300000024090us-gaap:USTreasuryAndGovernmentMember2024-09-300000024090us-gaap:FairValueInputsLevel1Memberus-gaap:USStatesAndPoliticalSubdivisionsMember2024-09-300000024090us-gaap:FairValueInputsLevel2Memberus-gaap:USStatesAndPoliticalSubdivisionsMember2024-09-300000024090us-gaap:FairValueInputsLevel3Memberus-gaap:USStatesAndPoliticalSubdivisionsMember2024-09-300000024090us-gaap:USStatesAndPoliticalSubdivisionsMember2024-09-300000024090us-gaap:FairValueInputsLevel1Memberus-gaap:CorporateDebtSecuritiesMember2024-09-300000024090us-gaap:FairValueInputsLevel2Memberus-gaap:CorporateDebtSecuritiesMember2024-09-300000024090us-gaap:FairValueInputsLevel3Memberus-gaap:CorporateDebtSecuritiesMember2024-09-300000024090us-gaap:CorporateDebtSecuritiesMember2024-09-300000024090us-gaap:FairValueInputsLevel1Memberus-gaap:CommercialMortgageBackedSecuritiesMember2024-09-300000024090us-gaap:FairValueInputsLevel2Memberus-gaap:CommercialMortgageBackedSecuritiesMember2024-09-300000024090us-gaap:FairValueInputsLevel3Memberus-gaap:CommercialMortgageBackedSecuritiesMember2024-09-300000024090us-gaap:CommercialMortgageBackedSecuritiesMember2024-09-300000024090us-gaap:FairValueInputsLevel1Memberus-gaap:ResidentialMortgageBackedSecuritiesMember2024-09-300000024090us-gaap:FairValueInputsLevel2Memberus-gaap:ResidentialMortgageBackedSecuritiesMember2024-09-300000024090us-gaap:FairValueInputsLevel3Memberus-gaap:ResidentialMortgageBackedSecuritiesMember2024-09-300000024090us-gaap:ResidentialMortgageBackedSecuritiesMember2024-09-300000024090us-gaap:FairValueInputsLevel1Memberus-gaap:AssetBackedSecuritiesMember2024-09-300000024090us-gaap:FairValueInputsLevel2Memberus-gaap:AssetBackedSecuritiesMember2024-09-300000024090us-gaap:FairValueInputsLevel3Memberus-gaap:AssetBackedSecuritiesMember2024-09-300000024090us-gaap:AssetBackedSecuritiesMember2024-09-300000024090us-gaap:FairValueInputsLevel1Memberus-gaap:DebtSecuritiesMember2024-09-300000024090us-gaap:FairValueInputsLevel2Memberus-gaap:DebtSecuritiesMember2024-09-300000024090us-gaap:FairValueInputsLevel3Memberus-gaap:DebtSecuritiesMember2024-09-300000024090us-gaap:DebtSecuritiesMember2024-09-300000024090us-gaap:FairValueInputsLevel1Memberus-gaap:FixedIncomeFundsMember2024-09-300000024090us-gaap:FairValueInputsLevel2Memberus-gaap:FixedIncomeFundsMember2024-09-300000024090us-gaap:FairValueInputsLevel3Memberus-gaap:FixedIncomeFundsMember2024-09-300000024090us-gaap:FixedIncomeFundsMember2024-09-300000024090us-gaap:FairValueInputsLevel1Memberus-gaap:CommonStockMember2024-09-300000024090us-gaap:FairValueInputsLevel2Memberus-gaap:CommonStockMember2024-09-300000024090us-gaap:FairValueInputsLevel3Memberus-gaap:CommonStockMember2024-09-300000024090us-gaap:CommonStockMember2024-09-300000024090us-gaap:FairValueInputsLevel1Memberus-gaap:NonredeemablePreferredStockMember2024-09-300000024090us-gaap:FairValueInputsLevel2Memberus-gaap:NonredeemablePreferredStockMember2024-09-300000024090us-gaap:FairValueInputsLevel3Memberus-gaap:NonredeemablePreferredStockMember2024-09-300000024090us-gaap:NonredeemablePreferredStockMember2024-09-300000024090us-gaap:FairValueInputsLevel1Membercia:CIA_NonRedeemablePreferredStockFundMember2024-09-300000024090us-gaap:FairValueInputsLevel2Membercia:CIA_NonRedeemablePreferredStockFundMember2024-09-300000024090us-gaap:FairValueInputsLevel3Membercia:CIA_NonRedeemablePreferredStockFundMember2024-09-300000024090cia:CIA_NonRedeemablePreferredStockFundMember2024-09-300000024090us-gaap:FairValueInputsLevel1Memberus-gaap:EquitySecuritiesMember2024-09-300000024090us-gaap:FairValueInputsLevel2Memberus-gaap:EquitySecuritiesMember2024-09-300000024090us-gaap:FairValueInputsLevel3Memberus-gaap:EquitySecuritiesMember2024-09-300000024090us-gaap:EquitySecuritiesMember2024-09-300000024090us-gaap:FairValueInputsLevel1Member2024-09-300000024090us-gaap:FairValueInputsLevel2Member2024-09-300000024090us-gaap:FairValueInputsLevel3Member2024-09-300000024090us-gaap:OtherLongTermInvestmentsMember2024-09-300000024090us-gaap:FairValueInputsLevel1Memberus-gaap:USTreasuryAndGovernmentMember2023-12-310000024090us-gaap:FairValueInputsLevel2Memberus-gaap:USTreasuryAndGovernmentMember2023-12-310000024090us-gaap:FairValueInputsLevel3Memberus-gaap:USTreasuryAndGovernmentMember2023-12-310000024090us-gaap:USTreasuryAndGovernmentMember2023-12-310000024090us-gaap:FairValueInputsLevel1Memberus-gaap:USStatesAndPoliticalSubdivisionsMember2023-12-310000024090us-gaap:FairValueInputsLevel2Memberus-gaap:USStatesAndPoliticalSubdivisionsMember2023-12-310000024090us-gaap:FairValueInputsLevel3Memberus-gaap:USStatesAndPoliticalSubdivisionsMember2023-12-310000024090us-gaap:USStatesAndPoliticalSubdivisionsMember2023-12-310000024090us-gaap:FairValueInputsLevel1Memberus-gaap:CorporateDebtSecuritiesMember2023-12-310000024090us-gaap:FairValueInputsLevel2Memberus-gaap:CorporateDebtSecuritiesMember2023-12-310000024090us-gaap:FairValueInputsLevel3Memberus-gaap:CorporateDebtSecuritiesMember2023-12-310000024090us-gaap:CorporateDebtSecuritiesMember2023-12-310000024090us-gaap:FairValueInputsLevel1Memberus-gaap:CommercialMortgageBackedSecuritiesMember2023-12-310000024090us-gaap:FairValueInputsLevel2Memberus-gaap:CommercialMortgageBackedSecuritiesMember2023-12-310000024090us-gaap:FairValueInputsLevel3Memberus-gaap:CommercialMortgageBackedSecuritiesMember2023-12-310000024090us-gaap:CommercialMortgageBackedSecuritiesMember2023-12-310000024090us-gaap:FairValueInputsLevel1Memberus-gaap:ResidentialMortgageBackedSecuritiesMember2023-12-310000024090us-gaap:FairValueInputsLevel2Memberus-gaap:ResidentialMortgageBackedSecuritiesMember2023-12-310000024090us-gaap:FairValueInputsLevel3Memberus-gaap:ResidentialMortgageBackedSecuritiesMember2023-12-310000024090us-gaap:ResidentialMortgageBackedSecuritiesMember2023-12-310000024090us-gaap:FairValueInputsLevel1Memberus-gaap:AssetBackedSecuritiesMember2023-12-310000024090us-gaap:FairValueInputsLevel2Memberus-gaap:AssetBackedSecuritiesMember2023-12-310000024090us-gaap:FairValueInputsLevel3Memberus-gaap:AssetBackedSecuritiesMember2023-12-310000024090us-gaap:AssetBackedSecuritiesMember2023-12-310000024090us-gaap:FairValueInputsLevel1Memberus-gaap:DebtSecuritiesMember2023-12-310000024090us-gaap:FairValueInputsLevel2Memberus-gaap:DebtSecuritiesMember2023-12-310000024090us-gaap:FairValueInputsLevel3Memberus-gaap:DebtSecuritiesMember2023-12-310000024090us-gaap:DebtSecuritiesMember2023-12-310000024090us-gaap:FairValueInputsLevel1Memberus-gaap:FixedIncomeFundsMember2023-12-310000024090us-gaap:FairValueInputsLevel2Memberus-gaap:FixedIncomeFundsMember2023-12-310000024090us-gaap:FairValueInputsLevel3Memberus-gaap:FixedIncomeFundsMember2023-12-310000024090us-gaap:FixedIncomeFundsMember2023-12-310000024090us-gaap:FairValueInputsLevel1Memberus-gaap:CommonStockMember2023-12-310000024090us-gaap:FairValueInputsLevel2Memberus-gaap:CommonStockMember2023-12-310000024090us-gaap:FairValueInputsLevel3Memberus-gaap:CommonStockMember2023-12-310000024090us-gaap:CommonStockMember2023-12-310000024090us-gaap:FairValueInputsLevel1Memberus-gaap:NonredeemablePreferredStockMember2023-12-310000024090us-gaap:FairValueInputsLevel2Memberus-gaap:NonredeemablePreferredStockMember2023-12-310000024090us-gaap:FairValueInputsLevel3Memberus-gaap:NonredeemablePreferredStockMember2023-12-310000024090us-gaap:NonredeemablePreferredStockMember2023-12-310000024090us-gaap:FairValueInputsLevel1Membercia:CIA_NonRedeemablePreferredStockFundMember2023-12-310000024090us-gaap:FairValueInputsLevel2Membercia:CIA_NonRedeemablePreferredStockFundMember2023-12-310000024090us-gaap:FairValueInputsLevel3Membercia:CIA_NonRedeemablePreferredStockFundMember2023-12-310000024090cia:CIA_NonRedeemablePreferredStockFundMember2023-12-310000024090us-gaap:FairValueInputsLevel1Memberus-gaap:EquitySecuritiesMember2023-12-310000024090us-gaap:FairValueInputsLevel2Memberus-gaap:EquitySecuritiesMember2023-12-310000024090us-gaap:FairValueInputsLevel3Memberus-gaap:EquitySecuritiesMember2023-12-310000024090us-gaap:EquitySecuritiesMember2023-12-310000024090us-gaap:FairValueInputsLevel1Member2023-12-310000024090us-gaap:FairValueInputsLevel2Member2023-12-310000024090us-gaap:FairValueInputsLevel3Member2023-12-310000024090us-gaap:OtherLongTermInvestmentsMember2023-12-310000024090us-gaap:PrivateEquityFundsMember2024-07-012024-09-300000024090us-gaap:PrivateEquityFundsMember2024-01-012024-09-300000024090us-gaap:PrivateEquityFundsMember2023-07-012023-09-300000024090us-gaap:PrivateEquityFundsMember2023-01-012023-09-300000024090us-gaap:FairValueMeasuredAtNetAssetValuePerShareMembercia:PrivateEquityFundsMiddleMarketMember2024-09-300000024090us-gaap:FairValueMeasuredAtNetAssetValuePerShareMembercia:PrivateEquityFundsMiddleMarketMemberus-gaap:UnfundedLoanCommitmentMember2024-09-300000024090cia:PrivateEquityFundsMiddleMarketMember2024-01-012024-09-300000024090us-gaap:FairValueMeasuredAtNetAssetValuePerShareMembercia:PrivateEquityFundsMiddleMarketMember2023-12-310000024090us-gaap:FairValueMeasuredAtNetAssetValuePerShareMembercia:PrivateEquityFundsMiddleMarketMemberus-gaap:UnfundedLoanCommitmentMember2023-12-310000024090cia:PrivateEquityFundsMiddleMarketMember2023-01-012023-12-310000024090us-gaap:FairValueMeasuredAtNetAssetValuePerShareMembercia:PrivateEquityFundsGlobalMember2024-09-300000024090us-gaap:FairValueMeasuredAtNetAssetValuePerShareMembercia:PrivateEquityFundsGlobalMemberus-gaap:UnfundedLoanCommitmentMember2024-09-300000024090cia:PrivateEquityFundsGlobalMember2024-01-012024-09-300000024090us-gaap:FairValueMeasuredAtNetAssetValuePerShareMembercia:PrivateEquityFundsGlobalMember2023-12-310000024090us-gaap:FairValueMeasuredAtNetAssetValuePerShareMembercia:PrivateEquityFundsGlobalMemberus-gaap:UnfundedLoanCommitmentMember2023-12-310000024090cia:PrivateEquityFundsGlobalMember2023-01-012023-12-310000024090us-gaap:FairValueMeasuredAtNetAssetValuePerShareMembercia:PrivateEquityFundsLateStageGrowthMember2024-09-300000024090us-gaap:FairValueMeasuredAtNetAssetValuePerShareMembercia:PrivateEquityFundsLateStageGrowthMemberus-gaap:UnfundedLoanCommitmentMember2024-09-300000024090srt:MinimumMembercia:PrivateEquityFundsLateStageGrowthMember2024-01-012024-09-300000024090srt:MaximumMembercia:PrivateEquityFundsLateStageGrowthMember2024-01-012024-09-300000024090us-gaap:FairValueMeasuredAtNetAssetValuePerShareMembercia:PrivateEquityFundsLateStageGrowthMember2023-12-310000024090us-gaap:FairValueMeasuredAtNetAssetValuePerShareMembercia:PrivateEquityFundsLateStageGrowthMemberus-gaap:UnfundedLoanCommitmentMember2023-12-310000024090srt:MinimumMembercia:PrivateEquityFundsLateStageGrowthMember2023-01-012023-12-310000024090srt:MaximumMembercia:PrivateEquityFundsLateStageGrowthMember2023-01-012023-12-310000024090us-gaap:FairValueMeasuredAtNetAssetValuePerShareMembercia:PrivateEquityFundsInfrastructureMember2024-09-300000024090us-gaap:FairValueMeasuredAtNetAssetValuePerShareMembercia:PrivateEquityFundsInfrastructureMemberus-gaap:UnfundedLoanCommitmentMember2024-09-300000024090srt:MinimumMembercia:PrivateEquityFundsInfrastructureMember2024-01-012024-09-300000024090srt:MaximumMembercia:PrivateEquityFundsInfrastructureMember2024-01-012024-09-300000024090us-gaap:FairValueMeasuredAtNetAssetValuePerShareMembercia:PrivateEquityFundsInfrastructureMember2023-12-310000024090us-gaap:FairValueMeasuredAtNetAssetValuePerShareMembercia:PrivateEquityFundsInfrastructureMemberus-gaap:UnfundedLoanCommitmentMember2023-12-310000024090cia:PrivateEquityFundsInfrastructureMember2023-01-012023-12-310000024090us-gaap:FairValueMeasuredAtNetAssetValuePerShareMemberus-gaap:PrivateEquityFundsMember2024-09-300000024090us-gaap:FairValueMeasuredAtNetAssetValuePerShareMemberus-gaap:PrivateEquityFundsMemberus-gaap:UnfundedLoanCommitmentMember2024-09-300000024090us-gaap:FairValueMeasuredAtNetAssetValuePerShareMemberus-gaap:PrivateEquityFundsMember2023-12-310000024090us-gaap:FairValueMeasuredAtNetAssetValuePerShareMemberus-gaap:PrivateEquityFundsMemberus-gaap:UnfundedLoanCommitmentMember2023-12-310000024090us-gaap:CarryingReportedAmountFairValueDisclosureMember2024-09-300000024090us-gaap:EstimateOfFairValueFairValueDisclosureMember2024-09-300000024090us-gaap:CarryingReportedAmountFairValueDisclosureMember2023-12-310000024090us-gaap:EstimateOfFairValueFairValueDisclosureMember2023-12-310000024090srt:SingleFamilyMemberus-gaap:CarryingReportedAmountFairValueDisclosureMember2024-09-300000024090srt:SingleFamilyMemberus-gaap:EstimateOfFairValueFairValueDisclosureMember2024-09-300000024090srt:SingleFamilyMemberus-gaap:CarryingReportedAmountFairValueDisclosureMember2023-12-310000024090srt:SingleFamilyMemberus-gaap:EstimateOfFairValueFairValueDisclosureMember2023-12-3100000240902023-01-012023-12-310000024090srt:SingleFamilyMember2023-01-012023-12-310000024090srt:SingleFamilyMember2024-01-012024-09-300000024090cia:PermanentMembercia:LifeInsuranceBusinessSegmentMember2023-12-310000024090cia:PermanentLimitedPayMembercia:LifeInsuranceBusinessSegmentMember2023-12-310000024090cia:OtherBusinessMembercia:LifeInsuranceBusinessSegmentMember2023-12-310000024090cia:LifeInsuranceBusinessSegmentMember2023-12-310000024090cia:PermanentMembercia:LifeInsuranceBusinessSegmentMember2024-01-012024-09-300000024090cia:PermanentLimitedPayMembercia:LifeInsuranceBusinessSegmentMember2024-01-012024-09-300000024090cia:OtherBusinessMembercia:LifeInsuranceBusinessSegmentMember2024-01-012024-09-300000024090cia:LifeInsuranceBusinessSegmentMember2024-01-012024-09-300000024090cia:PermanentMembercia:LifeInsuranceBusinessSegmentMember2024-09-300000024090cia:PermanentLimitedPayMembercia:LifeInsuranceBusinessSegmentMember2024-09-300000024090cia:OtherBusinessMembercia:LifeInsuranceBusinessSegmentMember2024-09-300000024090cia:LifeInsuranceBusinessSegmentMember2024-09-300000024090cia:PermanentMembercia:HomeServiceInsuranceSegmentMember2023-12-310000024090cia:PermanentLimitedPayMembercia:HomeServiceInsuranceSegmentMember2023-12-310000024090cia:OtherBusinessMembercia:HomeServiceInsuranceSegmentMember2023-12-310000024090cia:HomeServiceInsuranceSegmentMember2023-12-310000024090cia:PermanentMembercia:HomeServiceInsuranceSegmentMember2024-01-012024-09-300000024090cia:PermanentLimitedPayMembercia:HomeServiceInsuranceSegmentMember2024-01-012024-09-300000024090cia:OtherBusinessMembercia:HomeServiceInsuranceSegmentMember2024-01-012024-09-300000024090cia:HomeServiceInsuranceSegmentMember2024-01-012024-09-300000024090cia:PermanentMembercia:HomeServiceInsuranceSegmentMember2024-09-300000024090cia:PermanentLimitedPayMembercia:HomeServiceInsuranceSegmentMember2024-09-300000024090cia:OtherBusinessMembercia:HomeServiceInsuranceSegmentMember2024-09-300000024090cia:HomeServiceInsuranceSegmentMember2024-09-300000024090cia:PermanentMember2023-12-310000024090cia:PermanentLimitedPayMember2023-12-310000024090cia:OtherBusinessMember2023-12-310000024090cia:PermanentMember2024-01-012024-09-300000024090cia:PermanentLimitedPayMember2024-01-012024-09-300000024090cia:OtherBusinessMember2024-01-012024-09-300000024090cia:PermanentMember2024-09-300000024090cia:PermanentLimitedPayMember2024-09-300000024090cia:OtherBusinessMember2024-09-300000024090cia:PermanentMembercia:LifeInsuranceBusinessSegmentMember2022-12-310000024090cia:PermanentLimitedPayMembercia:LifeInsuranceBusinessSegmentMember2022-12-310000024090cia:OtherBusinessMembercia:LifeInsuranceBusinessSegmentMember2022-12-310000024090cia:LifeInsuranceBusinessSegmentMember2022-12-310000024090cia:PermanentMembercia:LifeInsuranceBusinessSegmentMember2023-01-012023-09-300000024090cia:PermanentLimitedPayMembercia:LifeInsuranceBusinessSegmentMember2023-01-012023-09-300000024090cia:OtherBusinessMembercia:LifeInsuranceBusinessSegmentMember2023-01-012023-09-300000024090cia:LifeInsuranceBusinessSegmentMember2023-01-012023-09-300000024090cia:PermanentMembercia:LifeInsuranceBusinessSegmentMember2023-09-300000024090cia:PermanentLimitedPayMembercia:LifeInsuranceBusinessSegmentMember2023-09-300000024090cia:OtherBusinessMembercia:LifeInsuranceBusinessSegmentMember2023-09-300000024090cia:LifeInsuranceBusinessSegmentMember2023-09-300000024090cia:PermanentMembercia:HomeServiceInsuranceSegmentMember2022-12-310000024090cia:PermanentLimitedPayMembercia:HomeServiceInsuranceSegmentMember2022-12-310000024090cia:OtherBusinessMembercia:HomeServiceInsuranceSegmentMember2022-12-310000024090cia:HomeServiceInsuranceSegmentMember2022-12-310000024090cia:PermanentMembercia:HomeServiceInsuranceSegmentMember2023-01-012023-09-300000024090cia:PermanentLimitedPayMembercia:HomeServiceInsuranceSegmentMember2023-01-012023-09-300000024090cia:OtherBusinessMembercia:HomeServiceInsuranceSegmentMember2023-01-012023-09-300000024090cia:HomeServiceInsuranceSegmentMember2023-01-012023-09-300000024090cia:PermanentMembercia:HomeServiceInsuranceSegmentMember2023-09-300000024090cia:PermanentLimitedPayMembercia:HomeServiceInsuranceSegmentMember2023-09-300000024090cia:OtherBusinessMembercia:HomeServiceInsuranceSegmentMember2023-09-300000024090cia:HomeServiceInsuranceSegmentMember2023-09-300000024090cia:PermanentMember2022-12-310000024090cia:PermanentLimitedPayMember2022-12-310000024090cia:OtherBusinessMember2022-12-310000024090cia:PermanentMember2023-01-012023-09-300000024090cia:PermanentLimitedPayMember2023-01-012023-09-300000024090cia:OtherBusinessMember2023-01-012023-09-300000024090cia:PermanentMember2023-09-300000024090cia:PermanentLimitedPayMember2023-09-300000024090cia:OtherBusinessMember2023-09-300000024090cia:LifeInsurancePermanentMember2024-09-300000024090cia:HomeServiceInsuranceLifeInsurancePermanentMember2024-09-300000024090cia:LifeInsurancePermanentMember2023-09-300000024090cia:HomeServiceInsuranceLifeInsurancePermanentMember2023-09-300000024090cia:LifeInsurancePermanentLimitedPayMember2024-09-300000024090cia:HomeServiceInsuranceLifeInsurancePermanentLimitedPayMember2024-09-300000024090cia:LifeInsurancePermanentLimitedPayMember2023-09-300000024090cia:HomeServiceInsuranceLifeInsurancePermanentLimitedPayMember2023-09-300000024090cia:LifeInsuranceDeferredProfitLiabilityMember2024-09-300000024090cia:HomeServiceInsuranceLifeInsuranceDeferredProfitLiabilityMember2024-09-300000024090cia:DeferredProfitLiabilityMember2024-09-300000024090cia:LifeInsuranceDeferredProfitLiabilityMember2023-09-300000024090cia:HomeServiceInsuranceLifeInsuranceDeferredProfitLiabilityMember2023-09-300000024090cia:DeferredProfitLiabilityMember2023-09-300000024090cia:LifeInsuranceOtherMember2024-09-300000024090cia:HomeServiceInsuranceLifeInsuranceOtherMember2024-09-300000024090cia:OtherMember2024-09-300000024090cia:LifeInsuranceOtherMember2023-09-300000024090cia:HomeServiceInsuranceLifeInsuranceOtherMember2023-09-300000024090cia:OtherMember2023-09-300000024090cia:LifeInsuranceNetOfReinsuranceMember2024-09-300000024090cia:HomeServiceInsuranceLifeInsuranceNetOfReinsuranceMember2024-09-300000024090cia:LifeInsuranceNetOfReinsuranceMember2023-09-300000024090cia:HomeServiceInsuranceLifeInsuranceNetOfReinsuranceMember2023-09-300000024090us-gaap:LifeInsuranceSegmentMember2023-09-300000024090cia:LifeInsuranceAccidentAndHealthOtherMember2024-09-300000024090cia:HomeServiceInsuranceAccidentAndHealthOtherMember2024-09-300000024090cia:LifeInsuranceAccidentAndHealthOtherMember2023-09-300000024090cia:HomeServiceInsuranceAccidentAndHealthOtherMember2023-09-300000024090us-gaap:AccidentAndHealthInsuranceSegmentMember2023-09-300000024090cia:LifeInsuranceAndAccidentAndHealthMember2024-09-300000024090cia:HomeServiceInsuranceLifeInsuranceAndHomeServiceInsuranceAccidentAndHealthMember2024-09-300000024090cia:LifeInsuranceAndAccidentAndHealthMember2023-09-300000024090cia:HomeServiceInsuranceLifeInsuranceAndHomeServiceInsuranceAccidentAndHealthMember2023-09-300000024090cia:LifeInsurancePermanentMember2024-07-012024-09-300000024090cia:LifeInsurancePermanentMember2023-07-012023-09-300000024090cia:LifeInsurancePermanentMember2024-01-012024-09-300000024090cia:LifeInsurancePermanentMember2023-01-012023-09-300000024090cia:LifeInsurancePermanentLimitedPayMember2024-07-012024-09-300000024090cia:LifeInsurancePermanentLimitedPayMember2023-07-012023-09-300000024090cia:LifeInsurancePermanentLimitedPayMember2024-01-012024-09-300000024090cia:LifeInsurancePermanentLimitedPayMember2023-01-012023-09-300000024090cia:LifeInsuranceOtherMember2024-07-012024-09-300000024090cia:LifeInsuranceOtherMember2023-07-012023-09-300000024090cia:LifeInsuranceOtherMember2024-01-012024-09-300000024090cia:LifeInsuranceOtherMember2023-01-012023-09-300000024090cia:LifeInsuranceReinsuranceMember2024-07-012024-09-300000024090cia:LifeInsuranceReinsuranceMember2023-07-012023-09-300000024090cia:LifeInsuranceReinsuranceMember2024-01-012024-09-300000024090cia:LifeInsuranceReinsuranceMember2023-01-012023-09-300000024090cia:LifeInsuranceNetOfReinsuranceMember2024-07-012024-09-300000024090cia:LifeInsuranceNetOfReinsuranceMember2023-07-012023-09-300000024090cia:LifeInsuranceNetOfReinsuranceMember2024-01-012024-09-300000024090cia:LifeInsuranceNetOfReinsuranceMember2023-01-012023-09-300000024090cia:LifeInsuranceAccidentAndHealthOtherMember2024-07-012024-09-300000024090cia:LifeInsuranceAccidentAndHealthOtherMember2023-07-012023-09-300000024090cia:LifeInsuranceAccidentAndHealthOtherMember2024-01-012024-09-300000024090cia:LifeInsuranceAccidentAndHealthOtherMember2023-01-012023-09-300000024090cia:LifeInsuranceAccidentAndHealthReinsuranceMember2024-07-012024-09-300000024090cia:LifeInsuranceAccidentAndHealthReinsuranceMember2023-07-012023-09-300000024090cia:LifeInsuranceAccidentAndHealthReinsuranceMember2024-01-012024-09-300000024090cia:LifeInsuranceAccidentAndHealthReinsuranceMember2023-01-012023-09-300000024090cia:LifeInsuranceAccidentAndHealthNetOfReinsuranceMember2024-07-012024-09-300000024090cia:LifeInsuranceAccidentAndHealthNetOfReinsuranceMember2023-07-012023-09-300000024090cia:LifeInsuranceAccidentAndHealthNetOfReinsuranceMember2024-01-012024-09-300000024090cia:LifeInsuranceAccidentAndHealthNetOfReinsuranceMember2023-01-012023-09-300000024090cia:LifeInsuranceMember2024-07-012024-09-300000024090cia:LifeInsuranceMember2023-07-012023-09-300000024090cia:LifeInsuranceMember2024-01-012024-09-300000024090cia:LifeInsuranceMember2023-01-012023-09-300000024090cia:HomeServiceInsuranceLifeInsurancePermanentMember2024-07-012024-09-300000024090cia:HomeServiceInsuranceLifeInsurancePermanentMember2023-07-012023-09-300000024090cia:HomeServiceInsuranceLifeInsurancePermanentMember2024-01-012024-09-300000024090cia:HomeServiceInsuranceLifeInsurancePermanentMember2023-01-012023-09-300000024090cia:HomeServiceInsuranceLifeInsurancePermanentLimitedPayMember2024-07-012024-09-300000024090cia:HomeServiceInsuranceLifeInsurancePermanentLimitedPayMember2023-07-012023-09-300000024090cia:HomeServiceInsuranceLifeInsurancePermanentLimitedPayMember2024-01-012024-09-300000024090cia:HomeServiceInsuranceLifeInsurancePermanentLimitedPayMember2023-01-012023-09-300000024090cia:HomeServiceInsuranceLifeInsuranceOtherMember2024-07-012024-09-300000024090cia:HomeServiceInsuranceLifeInsuranceOtherMember2023-07-012023-09-300000024090cia:HomeServiceInsuranceLifeInsuranceOtherMember2024-01-012024-09-300000024090cia:HomeServiceInsuranceLifeInsuranceOtherMember2023-01-012023-09-300000024090cia:HomeServiceInsuranceLifeInsuranceReinsuranceMember2024-07-012024-09-300000024090cia:HomeServiceInsuranceLifeInsuranceReinsuranceMember2023-07-012023-09-300000024090cia:HomeServiceInsuranceLifeInsuranceReinsuranceMember2024-01-012024-09-300000024090cia:HomeServiceInsuranceLifeInsuranceReinsuranceMember2023-01-012023-09-300000024090cia:HomeServiceInsuranceLifeInsuranceNetOfReinsuranceMember2024-07-012024-09-300000024090cia:HomeServiceInsuranceLifeInsuranceNetOfReinsuranceMember2023-07-012023-09-300000024090cia:HomeServiceInsuranceLifeInsuranceNetOfReinsuranceMember2024-01-012024-09-300000024090cia:HomeServiceInsuranceLifeInsuranceNetOfReinsuranceMember2023-01-012023-09-300000024090cia:HomeServiceInsuranceAccidentAndHealthOtherMember2024-07-012024-09-300000024090cia:HomeServiceInsuranceAccidentAndHealthOtherMember2023-07-012023-09-300000024090cia:HomeServiceInsuranceAccidentAndHealthOtherMember2024-01-012024-09-300000024090cia:HomeServiceInsuranceAccidentAndHealthOtherMember2023-01-012023-09-300000024090cia:HomeServiceInsuranceSegmentMember2024-07-012024-09-300000024090cia:HomeServiceInsuranceSegmentMember2023-07-012023-09-300000024090cia:PolicyholderAccountBalanceGuaranteedMinimumCreditingRateRangeFrom0000To0149Membersrt:MinimumMember2024-09-300000024090cia:PolicyholderAccountBalanceGuaranteedMinimumCreditingRateRangeFrom0000To0149Membersrt:MaximumMember2024-09-300000024090us-gaap:PolicyholderAccountBalanceAtGuaranteedMinimumCreditingRateMembercia:PolicyholderAccountBalanceGuaranteedMinimumCreditingRateRangeFrom0000To0149Member2024-09-300000024090us-gaap:PolicyholderAccountBalanceAboveGuaranteedMinimumCreditingRateRangeFrom0001To0050Membercia:PolicyholderAccountBalanceGuaranteedMinimumCreditingRateRangeFrom0000To0149Member2024-09-300000024090us-gaap:PolicyholderAccountBalanceAboveGuaranteedMinimumCreditingRateRangeFrom0051To0150Membercia:PolicyholderAccountBalanceGuaranteedMinimumCreditingRateRangeFrom0000To0149Member2024-09-300000024090us-gaap:PolicyholderAccountBalanceAboveGuaranteedMinimumCreditingRateRangeFrom0151AndGreaterMembercia:PolicyholderAccountBalanceGuaranteedMinimumCreditingRateRangeFrom0000To0149Member2024-09-300000024090cia:PolicyholderAccountBalanceGuaranteedMinimumCreditingRateRangeFrom0000To0149Member2024-09-300000024090cia:PolicyholderAccountBalanceGuaranteedMinimumCreditingRateRangeFrom0150To0299Membersrt:MinimumMember2024-09-300000024090cia:PolicyholderAccountBalanceGuaranteedMinimumCreditingRateRangeFrom0150To0299Membersrt:MaximumMember2024-09-300000024090us-gaap:PolicyholderAccountBalanceAtGuaranteedMinimumCreditingRateMembercia:PolicyholderAccountBalanceGuaranteedMinimumCreditingRateRangeFrom0150To0299Member2024-09-300000024090us-gaap:PolicyholderAccountBalanceAboveGuaranteedMinimumCreditingRateRangeFrom0001To0050Membercia:PolicyholderAccountBalanceGuaranteedMinimumCreditingRateRangeFrom0150To0299Member2024-09-300000024090us-gaap:PolicyholderAccountBalanceAboveGuaranteedMinimumCreditingRateRangeFrom0051To0150Membercia:PolicyholderAccountBalanceGuaranteedMinimumCreditingRateRangeFrom0150To0299Member2024-09-300000024090us-gaap:PolicyholderAccountBalanceAboveGuaranteedMinimumCreditingRateRangeFrom0151AndGreaterMembercia:PolicyholderAccountBalanceGuaranteedMinimumCreditingRateRangeFrom0150To0299Member2024-09-300000024090cia:PolicyholderAccountBalanceGuaranteedMinimumCreditingRateRangeFrom0150To0299Member2024-09-300000024090cia:PolicyholderAccountBalanceGuaranteedMinimumCreditingRateRangeFrom0300To0449Membersrt:MinimumMember2024-09-300000024090cia:PolicyholderAccountBalanceGuaranteedMinimumCreditingRateRangeFrom0300To0449Membersrt:MaximumMember2024-09-300000024090us-gaap:PolicyholderAccountBalanceAtGuaranteedMinimumCreditingRateMembercia:PolicyholderAccountBalanceGuaranteedMinimumCreditingRateRangeFrom0300To0449Member2024-09-300000024090us-gaap:PolicyholderAccountBalanceAboveGuaranteedMinimumCreditingRateRangeFrom0001To0050Membercia:PolicyholderAccountBalanceGuaranteedMinimumCreditingRateRangeFrom0300To0449Member2024-09-300000024090us-gaap:PolicyholderAccountBalanceAboveGuaranteedMinimumCreditingRateRangeFrom0051To0150Membercia:PolicyholderAccountBalanceGuaranteedMinimumCreditingRateRangeFrom0300To0449Member2024-09-300000024090us-gaap:PolicyholderAccountBalanceAboveGuaranteedMinimumCreditingRateRangeFrom0151AndGreaterMembercia:PolicyholderAccountBalanceGuaranteedMinimumCreditingRateRangeFrom0300To0449Member2024-09-300000024090cia:PolicyholderAccountBalanceGuaranteedMinimumCreditingRateRangeFrom0300To0449Member2024-09-300000024090cia:PolicyholderAccountBalanceGuaranteedMinimumCreditingRateRangeFromGreaterThanOrEqualTo0450Member2024-09-300000024090us-gaap:PolicyholderAccountBalanceAtGuaranteedMinimumCreditingRateMembercia:PolicyholderAccountBalanceGuaranteedMinimumCreditingRateRangeFromGreaterThanOrEqualTo0450Member2024-09-300000024090us-gaap:PolicyholderAccountBalanceAboveGuaranteedMinimumCreditingRateRangeFrom0001To0050Membercia:PolicyholderAccountBalanceGuaranteedMinimumCreditingRateRangeFromGreaterThanOrEqualTo0450Member2024-09-300000024090us-gaap:PolicyholderAccountBalanceAboveGuaranteedMinimumCreditingRateRangeFrom0051To0150Membercia:PolicyholderAccountBalanceGuaranteedMinimumCreditingRateRangeFromGreaterThanOrEqualTo0450Member2024-09-300000024090us-gaap:PolicyholderAccountBalanceAboveGuaranteedMinimumCreditingRateRangeFrom0151AndGreaterMembercia:PolicyholderAccountBalanceGuaranteedMinimumCreditingRateRangeFromGreaterThanOrEqualTo0450Member2024-09-300000024090us-gaap:PolicyholderAccountBalanceAtGuaranteedMinimumCreditingRateMember2024-09-300000024090us-gaap:PolicyholderAccountBalanceAboveGuaranteedMinimumCreditingRateRangeFrom0001To0050Member2024-09-300000024090us-gaap:PolicyholderAccountBalanceAboveGuaranteedMinimumCreditingRateRangeFrom0051To0150Member2024-09-300000024090us-gaap:PolicyholderAccountBalanceAboveGuaranteedMinimumCreditingRateRangeFrom0151AndGreaterMember2024-09-300000024090cia:PolicyholderAccountBalanceGuaranteedMinimumCreditingRateRangeFrom0000To0149Membersrt:MinimumMember2023-09-300000024090cia:PolicyholderAccountBalanceGuaranteedMinimumCreditingRateRangeFrom0000To0149Membersrt:MaximumMember2023-09-300000024090us-gaap:PolicyholderAccountBalanceAtGuaranteedMinimumCreditingRateMembercia:PolicyholderAccountBalanceGuaranteedMinimumCreditingRateRangeFrom0000To0149Member2023-09-300000024090us-gaap:PolicyholderAccountBalanceAboveGuaranteedMinimumCreditingRateRangeFrom0001To0050Membercia:PolicyholderAccountBalanceGuaranteedMinimumCreditingRateRangeFrom0000To0149Member2023-09-300000024090us-gaap:PolicyholderAccountBalanceAboveGuaranteedMinimumCreditingRateRangeFrom0051To0150Membercia:PolicyholderAccountBalanceGuaranteedMinimumCreditingRateRangeFrom0000To0149Member2023-09-300000024090us-gaap:PolicyholderAccountBalanceAboveGuaranteedMinimumCreditingRateRangeFrom0151AndGreaterMembercia:PolicyholderAccountBalanceGuaranteedMinimumCreditingRateRangeFrom0000To0149Member2023-09-300000024090cia:PolicyholderAccountBalanceGuaranteedMinimumCreditingRateRangeFrom0000To0149Member2023-09-300000024090cia:PolicyholderAccountBalanceGuaranteedMinimumCreditingRateRangeFrom0150To0299Membersrt:MinimumMember2023-09-300000024090cia:PolicyholderAccountBalanceGuaranteedMinimumCreditingRateRangeFrom0150To0299Membersrt:MaximumMember2023-09-300000024090us-gaap:PolicyholderAccountBalanceAtGuaranteedMinimumCreditingRateMembercia:PolicyholderAccountBalanceGuaranteedMinimumCreditingRateRangeFrom0150To0299Member2023-09-300000024090us-gaap:PolicyholderAccountBalanceAboveGuaranteedMinimumCreditingRateRangeFrom0001To0050Membercia:PolicyholderAccountBalanceGuaranteedMinimumCreditingRateRangeFrom0150To0299Member2023-09-300000024090us-gaap:PolicyholderAccountBalanceAboveGuaranteedMinimumCreditingRateRangeFrom0051To0150Membercia:PolicyholderAccountBalanceGuaranteedMinimumCreditingRateRangeFrom0150To0299Member2023-09-300000024090us-gaap:PolicyholderAccountBalanceAboveGuaranteedMinimumCreditingRateRangeFrom0151AndGreaterMembercia:PolicyholderAccountBalanceGuaranteedMinimumCreditingRateRangeFrom0150To0299Member2023-09-300000024090cia:PolicyholderAccountBalanceGuaranteedMinimumCreditingRateRangeFrom0150To0299Member2023-09-300000024090cia:PolicyholderAccountBalanceGuaranteedMinimumCreditingRateRangeFrom0300To0449Membersrt:MinimumMember2023-09-300000024090cia:PolicyholderAccountBalanceGuaranteedMinimumCreditingRateRangeFrom0300To0449Membersrt:MaximumMember2023-09-300000024090us-gaap:PolicyholderAccountBalanceAtGuaranteedMinimumCreditingRateMembercia:PolicyholderAccountBalanceGuaranteedMinimumCreditingRateRangeFrom0300To0449Member2023-09-300000024090us-gaap:PolicyholderAccountBalanceAboveGuaranteedMinimumCreditingRateRangeFrom0001To0050Membercia:PolicyholderAccountBalanceGuaranteedMinimumCreditingRateRangeFrom0300To0449Member2023-09-300000024090us-gaap:PolicyholderAccountBalanceAboveGuaranteedMinimumCreditingRateRangeFrom0051To0150Membercia:PolicyholderAccountBalanceGuaranteedMinimumCreditingRateRangeFrom0300To0449Member2023-09-300000024090us-gaap:PolicyholderAccountBalanceAboveGuaranteedMinimumCreditingRateRangeFrom0151AndGreaterMembercia:PolicyholderAccountBalanceGuaranteedMinimumCreditingRateRangeFrom0300To0449Member2023-09-300000024090cia:PolicyholderAccountBalanceGuaranteedMinimumCreditingRateRangeFrom0300To0449Member2023-09-300000024090cia:PolicyholderAccountBalanceGuaranteedMinimumCreditingRateRangeFromGreaterThanOrEqualTo0450Member2023-09-300000024090us-gaap:PolicyholderAccountBalanceAtGuaranteedMinimumCreditingRateMembercia:PolicyholderAccountBalanceGuaranteedMinimumCreditingRateRangeFromGreaterThanOrEqualTo0450Member2023-09-300000024090us-gaap:PolicyholderAccountBalanceAboveGuaranteedMinimumCreditingRateRangeFrom0001To0050Membercia:PolicyholderAccountBalanceGuaranteedMinimumCreditingRateRangeFromGreaterThanOrEqualTo0450Member2023-09-300000024090us-gaap:PolicyholderAccountBalanceAboveGuaranteedMinimumCreditingRateRangeFrom0051To0150Membercia:PolicyholderAccountBalanceGuaranteedMinimumCreditingRateRangeFromGreaterThanOrEqualTo0450Member2023-09-300000024090us-gaap:PolicyholderAccountBalanceAboveGuaranteedMinimumCreditingRateRangeFrom0151AndGreaterMembercia:PolicyholderAccountBalanceGuaranteedMinimumCreditingRateRangeFromGreaterThanOrEqualTo0450Member2023-09-300000024090us-gaap:PolicyholderAccountBalanceAtGuaranteedMinimumCreditingRateMember2023-09-300000024090us-gaap:PolicyholderAccountBalanceAboveGuaranteedMinimumCreditingRateRangeFrom0001To0050Member2023-09-300000024090us-gaap:PolicyholderAccountBalanceAboveGuaranteedMinimumCreditingRateRangeFrom0051To0150Member2023-09-300000024090us-gaap:PolicyholderAccountBalanceAboveGuaranteedMinimumCreditingRateRangeFrom0151AndGreaterMember2023-09-300000024090cia:SupplementalContractsWithoutLifeContingenciesMember2023-12-310000024090us-gaap:FixedAnnuityMember2023-12-310000024090cia:DividendAccumulationsMember2023-12-310000024090cia:PremiumsPaidInAdvanceMember2023-12-310000024090cia:SupplementalContractsWithoutLifeContingenciesMember2024-01-012024-09-300000024090us-gaap:FixedAnnuityMember2024-01-012024-09-300000024090cia:DividendAccumulationsMember2024-01-012024-09-300000024090cia:PremiumsPaidInAdvanceMember2024-01-012024-09-300000024090cia:SupplementalContractsWithoutLifeContingenciesMember2024-09-300000024090us-gaap:FixedAnnuityMember2024-09-300000024090cia:DividendAccumulationsMember2024-09-300000024090cia:PremiumsPaidInAdvanceMember2024-09-300000024090cia:SupplementalContractsWithoutLifeContingenciesMember2022-12-310000024090us-gaap:FixedAnnuityMember2022-12-310000024090cia:DividendAccumulationsMember2022-12-310000024090cia:PremiumsPaidInAdvanceMember2022-12-310000024090cia:SupplementalContractsWithoutLifeContingenciesMember2023-01-012023-09-300000024090us-gaap:FixedAnnuityMember2023-01-012023-09-300000024090cia:DividendAccumulationsMember2023-01-012023-09-300000024090cia:PremiumsPaidInAdvanceMember2023-01-012023-09-300000024090cia:SupplementalContractsWithoutLifeContingenciesMember2023-09-300000024090us-gaap:FixedAnnuityMember2023-09-300000024090cia:DividendAccumulationsMember2023-09-300000024090cia:PremiumsPaidInAdvanceMember2023-09-300000024090cia:UnearnedRevenueReserveMember2024-09-300000024090cia:UnearnedRevenueReserveMember2023-09-300000024090us-gaap:LifeInsuranceSegmentMember2024-01-012024-09-300000024090us-gaap:AccidentAndHealthInsuranceExcludingWorkersCompensationMember2024-01-012024-09-300000024090us-gaap:LifeInsuranceSegmentMember2024-07-012024-09-300000024090us-gaap:PropertyAndCasualtyPersonalInsuranceProductLineMember2023-01-012023-09-300000024090us-gaap:OtherInsuranceProductLineMember2024-09-300000024090us-gaap:OtherInsuranceProductLineMember2023-12-310000024090us-gaap:OtherShortdurationInsuranceProductLineMember2024-07-012024-09-300000024090us-gaap:OtherShortdurationInsuranceProductLineMember2023-07-012023-09-300000024090us-gaap:OtherShortdurationInsuranceProductLineMember2024-01-012024-09-300000024090us-gaap:OtherShortdurationInsuranceProductLineMember2023-01-012023-09-300000024090us-gaap:OtherLongdurationInsuranceProductLineMember2024-07-012024-09-300000024090us-gaap:OtherLongdurationInsuranceProductLineMember2023-07-012023-09-300000024090us-gaap:OtherLongdurationInsuranceProductLineMember2024-01-012024-09-300000024090us-gaap:OtherLongdurationInsuranceProductLineMember2023-01-012023-09-300000024090cia:FormerEmployeesBreechOfContractMemberus-gaap:JudicialRulingMember2023-01-012023-12-310000024090cia:FormerEmployeesBreechOfContractMemberus-gaap:JudicialRulingMember2024-07-262024-07-260000024090cia:FormerEmployeesBreechOfContractMemberus-gaap:PendingLitigationMember2024-01-012024-09-300000024090cia:FormerEmployeesBreechOfContractMember2024-09-300000024090us-gaap:UnfundedLoanCommitmentMember2024-09-3000000240902024-05-032024-05-030000024090us-gaap:RevolvingCreditFacilityMember2024-05-0300000240902024-05-030000024090us-gaap:FederalFundsEffectiveSwapRateMember2024-05-032024-05-030000024090us-gaap:SecuredOvernightFinancingRateSofrMember2024-05-032024-05-030000024090us-gaap:RevolvingCreditFacilityMember2024-05-032024-05-030000024090us-gaap:RevolvingCreditFacilityMember2024-09-3000000240902004-03-040000024090us-gaap:CommonClassAMember2004-03-040000024090us-gaap:CommonClassBMember2004-03-040000024090us-gaap:TreasuryStockCommonMember2023-12-310000024090us-gaap:CommonClassAMember2022-12-310000024090us-gaap:TreasuryStockCommonMember2022-12-310000024090us-gaap:TreasuryStockCommonMember2024-01-012024-09-300000024090us-gaap:TreasuryStockCommonMember2023-01-012023-09-300000024090us-gaap:TreasuryStockCommonMember2024-09-300000024090us-gaap:CommonClassAMember2023-09-300000024090us-gaap:TreasuryStockCommonMember2023-09-300000024090srt:ParentCompanyMember2024-03-272024-03-270000024090cia:CICALifeInsuranceCompanyOfAmericaAColoradoCompanyMembersrt:ParentCompanyMember2024-03-272024-03-270000024090cia:CICALifeInsuranceCompanyOfAmericaAColoradoCompanyMember2024-01-012024-09-300000024090country:PR2024-01-012024-09-300000024090cia:CICALifeAIAPuertoRicoCompanyMember2024-01-012024-09-300000024090us-gaap:OperatingSegmentsMembercia:LifeInsuranceBusinessSegmentMember2024-07-012024-09-300000024090us-gaap:OperatingSegmentsMembercia:HomeServiceInsuranceSegmentMember2024-07-012024-09-300000024090us-gaap:CorporateNonSegmentMember2024-07-012024-09-300000024090us-gaap:OperatingSegmentsMembercia:LifeInsuranceBusinessSegmentMember2024-01-012024-09-300000024090us-gaap:OperatingSegmentsMembercia:HomeServiceInsuranceSegmentMember2024-01-012024-09-300000024090us-gaap:CorporateNonSegmentMember2024-01-012024-09-300000024090us-gaap:OperatingSegmentsMembercia:LifeInsuranceBusinessSegmentMember2023-07-012023-09-300000024090us-gaap:OperatingSegmentsMembercia:HomeServiceInsuranceSegmentMember2023-07-012023-09-300000024090us-gaap:CorporateNonSegmentMember2023-07-012023-09-300000024090us-gaap:OperatingSegmentsMembercia:LifeInsuranceBusinessSegmentMember2023-01-012023-09-300000024090us-gaap:OperatingSegmentsMembercia:HomeServiceInsuranceSegmentMember2023-01-012023-09-300000024090us-gaap:CorporateNonSegmentMember2023-01-012023-09-300000024090us-gaap:OfficeOfTheTaxCommissionerBermudaMember2023-01-012023-09-300000024090cia:GovernmentOfPuertoRicoMember2024-01-012024-09-300000024090cia:CICALifeAIAPuertoRicoCompanyMember2023-08-3100000240902023-08-310000024090us-gaap:AociIncludingPortionAttributableToNoncontrollingInterestMember2024-07-012024-09-300000024090us-gaap:AociIncludingPortionAttributableToNoncontrollingInterestMember2023-07-012023-09-300000024090us-gaap:AociIncludingPortionAttributableToNoncontrollingInterestMember2024-01-012024-09-300000024090us-gaap:AociIncludingPortionAttributableToNoncontrollingInterestMember2023-01-012023-09-30

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

WASHINGTON, D.C. 20549

FORM 10-Q

☒ QUARTERLY REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934

For the Quarterly Period Ended September 30, 2024

OR

☐ TRANSITION REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934

For the Transition Period from to

COMMISSION FILE NUMBER: 000-16509

|

|

|

| CITIZENS, INC. |

| (Exact name of registrant as specified in its charter) |

|

|

|

|

|

|

| Colorado |

84-0755371 |

| (State or other jurisdiction of incorporation or organization) |

(I.R.S. Employer Identification No.) |

11815 Alterra Pkwy, Floor 15, Austin, TX 78758

(Current Address)

Registrant's telephone number, including area code: (512) 837-7100

|

|

|

|

|

|

|

|

|

| Securities registered pursuant to Section 12(b) of the Act |

|

| Class A Common Stock |

CIA |

NYSE |

| (Title of each class) |

(Trading symbol(s)) |

(Name of each exchange on which registered) |

Indicate by check mark whether the registrant: (1) has filed all reports required to be filed by Section 13 or 15(d) of the Securities Exchange Act of 1934 during the preceding 12 months (or for such shorter period that the registrant was required to file such reports), and (2) has been subject to such filing requirements for the past 90 days. x Yes o No

Indicate by check mark whether the registrant has submitted electronically every Interactive Data File required to be submitted pursuant to Rule 405 of Regulation S-T (§232.405 of this chapter) during the preceding 12 months (or for such shorter period that the registrant was required to submit such files). x Yes o No

Indicate by check mark whether the registrant is a large accelerated filer, an accelerated filer, a non-accelerated filer, a smaller reporting company or an emerging growth company. See the definitions of "large accelerated filer," "accelerated filer," "smaller reporting company" and "emerging growth company" in Rule 12b-2 of the Exchange Act:

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Large accelerated filer |

☐ |

|

Accelerated filer |

☒ |

|

Non-accelerated filer |

☐ |

|

Smaller reporting company |

☒ |

|

Emerging growth company |

☐ |

|

If an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act. o

Indicate by check mark whether the registrant is a shell company (as defined in Rule 12b-2 of the Exchange Act). ☐ Yes x No

As of November 1, 2024, the Registrant had 49,906,575 shares of Class A common stock outstanding.

THIS PAGE INTENTIONALLY LEFT BLANK

TABLE OF CONTENTS

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Page Number |

| Part I. FINANCIAL INFORMATION |

|

|

|

|

|

| |

Item 1. |

|

|

|

|

|

|

| |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| |

|

|

|

|

|

|

|

| |

|

|

|

|

|

|

|

| |

Item 2. |

|

|

|

|

|

|

| |

Item 3. |

|

|

|

|

|

|

| |

Item 4. |

|

|

|

|

|

|

| Part II. OTHER INFORMATION |

|

|

|

|

|

| |

Item 1. |

|

|

|

|

|

|

|

Item 1A. |

|

|

|

|

|

|

| |

Item 2. |

|

|

|

|

|

|

| |

Item 3. |

|

|

|

|

|

|

| |

Item 4. |

|

|

|

|

|

|

| |

Item 5. |

|

|

|

|

|

|

| |

Item 6. |

|

|

September 30, 2024 | 10-Q 1

PART I. FINANCIAL INFORMATION

Item 1. FINANCIAL STATEMENTS

CITIZENS, INC. AND CONSOLIDATED SUBSIDIARIES

Consolidated Balance Sheets

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| (In thousands) |

September 30, 2024 |

|

December 31, 2023 |

|

(Unaudited) |

|

|

Assets: |

|

|

|

| Investments: |

|

|

|

Fixed maturity securities available-for-sale, at fair value (amortized cost: $1,391,580 and $1,389,038 in 2024 and 2023, respectively) |

$ |

1,273,497 |

|

|

1,238,981 |

|

|

|

|

|

| Equity securities, at fair value |

5,716 |

|

|

5,282 |

|

|

|

|

|

| Policy loans |

72,463 |

|

|

75,359 |

|

|

|

|

|

|

|

|

|

Other long-term investments (portion measured at fair value $93,167 and $82,460 in 2024 and 2023, respectively) |

93,433 |

|

|

82,725 |

|

|

|

|

|

| Total investments |

1,445,109 |

|

|

1,402,347 |

|

| Cash and cash equivalents |

32,382 |

|

|

26,997 |

|

| Accrued investment income |

17,082 |

|

|

17,360 |

|

|

|

|

|

| Reinsurance recoverable |

7,278 |

|

|

3,991 |

|

| Deferred policy acquisition costs |

192,268 |

|

|

175,768 |

|

| Cost of insurance acquired |

9,566 |

|

|

10,043 |

|

| Current federal income tax receivable |

505 |

|

|

1,546 |

|

|

|

|

|

| Property and equipment, net |

10,975 |

|

|

11,809 |

|

| Due premiums |

10,090 |

|

|

11,264 |

|

|

|

|

|

Other assets (less allowance for losses of $574 and $408 in 2024 and 2023, respectively) |

10,554 |

|

|

7,803 |

|

| Total assets |

$ |

1,735,809 |

|

|

1,668,928 |

|

See accompanying Notes to Consolidated Financial Statements.

September 30, 2024 | 10-Q 2

CITIZENS, INC. AND CONSOLIDATED SUBSIDIARIES

Consolidated Balance Sheets, Continued

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| (In thousands, except share amounts) |

September 30, 2024 |

|

December 31, 2023 |

|

(Unaudited) |

|

|

Liabilities and Stockholders' Equity: |

|

|

|

| Liabilities: |

|

|

|

| Policy liabilities: |

|

|

|

| Future policy benefit reserves: |

|

|

|

| Life insurance |

$ |

1,236,873 |

|

|

1,229,253 |

|

| Accident and health insurance |

998 |

|

|

889 |

|

| Total future policy benefit reserves |

1,237,871 |

|

|

1,230,142 |

|

| Policyholders' funds: |

|

|

|

| Annuities |

145,838 |

|

|

133,216 |

|

| Dividend accumulations |

47,052 |

|

|

44,960 |

|

| Premiums paid in advance |

32,420 |

|

|

32,446 |

|

| Policy claims payable |

9,236 |

|

|

6,637 |

|

| Other policyholders' funds |

7,076 |

|

|

7,363 |

|

| Total policyholders' funds |

241,622 |

|

|

224,622 |

|

| Total policy liabilities |

1,479,493 |

|

|

1,454,764 |

|

| Commissions payable |

3,843 |

|

|

3,445 |

|

|

|

|

|

| Deferred federal income tax liability |

2,367 |

|

|

1,102 |

|

|

|

|

|

| Other liabilities |

42,533 |

|

|

37,488 |

|

| Total liabilities |

1,528,236 |

|

|

1,496,799 |

|

Commitments and contingencies ( Notes 7 and 8) |

|

|

|

| Stockholders' Equity: |

|

|

|

| Common stock: |

|

|

|

Class A, no par value, 100,000,000 shares authorized, 54,222,644 and 53,882,661 shares issued and outstanding in 2024 and 2023, respectively, including shares in treasury of 4,327,810 in 2024 and 2023 |

269,356 |

|

|

268,675 |

|

Class B, no par value, 2,000,000 shares authorized, 1,001,714 shares issued and outstanding in 2024 and 2023, including shares in treasury of 1,001,714 in 2024 and 2023 |

3,184 |

|

|

3,184 |

|

| Retained earnings |

53,441 |

|

|

42,150 |

|

| Accumulated other comprehensive income (loss) |

(94,683) |

|

|

(118,155) |

|

| Treasury stock, at cost |

(23,725) |

|

|

(23,725) |

|

| Total stockholders' equity |

207,573 |

|

|

172,129 |

|

| Total liabilities and stockholders' equity |

$ |

1,735,809 |

|

|

1,668,928 |

|

See accompanying Notes to Consolidated Financial Statements.

September 30, 2024 | 10-Q 3

CITIZENS, INC. AND CONSOLIDATED SUBSIDIARIES

Consolidated Statements of Operations and Comprehensive Income (Loss)

(Unaudited)

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Three Months Ended |

|

Nine Months Ended |

|

September 30, |

|

September 30, |

(In thousands, except per share amounts) |

2024 |

|

2023 |

|

2024 |

|

2023 |

| Revenues: |

|

|

|

|

|

|

|

| Premiums: |

|

|

|

|

|

|

|

| Life insurance |

$ |

42,461 |

|

|

41,794 |

|

|

122,823 |

|

|

118,020 |

|

| Accident and health insurance |

452 |

|

|

296 |

|

|

1,324 |

|

|

1,201 |

|

| Property insurance |

(16) |

|

|

(64) |

|

|

(18) |

|

|

780 |

|

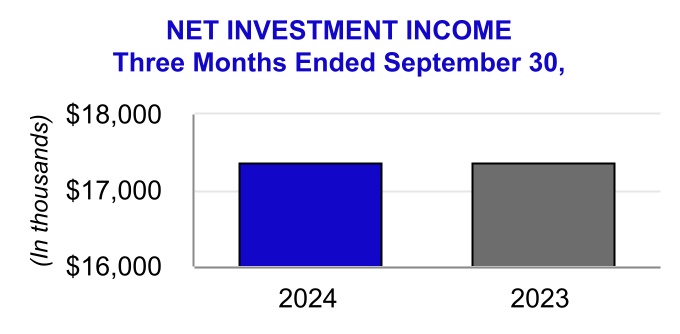

| Net investment income |

17,377 |

|

|

17,372 |

|

|

52,404 |

|

|

51,687 |

|

| Investment related gains (losses), net |

827 |

|

|

(892) |

|

|

1,537 |

|

|

(477) |

|

| Other income |

630 |

|

|

884 |

|

|

3,457 |

|

|

2,620 |

|

| Total revenues |

61,731 |

|

|

59,390 |

|

|

181,527 |

|

|

173,831 |

|

| Benefits and Expenses: |

|

|

|

|

|

|

|

| Insurance benefits paid or provided: |

|

|

|

|

|

|

|

| Claims and surrenders |

36,478 |

|

|

37,723 |

|

|

104,121 |

|

|

100,798 |

|

| Increase (decrease) in future policy benefit reserves |

471 |

|

|

(3,880) |

|

|

(130) |

|

|

(5,802) |

|

| Policyholder liability remeasurement (gain) loss |

1,157 |

|

|

1,024 |

|

|

2,836 |

|

|

2,860 |

|

| Policyholders' dividends |

1,320 |

|

|

1,414 |

|

|

3,748 |

|

|

3,783 |

|

| Total insurance benefits paid or provided |

39,426 |

|

|

36,281 |

|

|

110,575 |

|

|

101,639 |

|

|

|

|

|

|

|

|

|

| Commissions |

12,957 |

|

|

9,444 |

|

|

35,639 |

|

|

27,340 |

|

| Other general expenses |

12,095 |

|

|

11,949 |

|

|

40,072 |

|

|

35,477 |

|

| Capitalization of deferred policy acquisition costs |

(10,430) |

|

|

(7,132) |

|

|

(29,304) |

|

|

(20,034) |

|

| Amortization of deferred policy acquisition costs |

4,493 |

|

|

4,056 |

|

|

12,804 |

|

|

11,544 |

|

| Amortization of cost of insurance acquired |

153 |

|

|

151 |

|

|

477 |

|

|

465 |

|

| Total benefits and expenses |

58,694 |

|

|

54,749 |

|

|

170,263 |

|

|

156,431 |

|

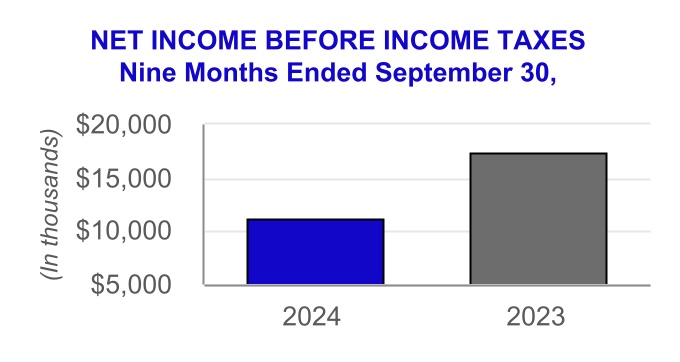

| Income before federal income tax |

3,037 |

|

|

4,641 |

|

|

11,264 |

|

|

17,400 |

|

Federal income tax expense (benefit) |

247 |

|

|

1,943 |

|

|

(27) |

|

|

3,704 |

|

| Net income |

2,790 |

|

|

2,698 |

|

|

11,291 |

|

|

13,696 |

|

|

|

|

|

|

|

|

|

| Per Share Amounts: |

|

|

|

|

|

|

|

Basic earnings per share of Class A common stock |

0.06 |

|

|

0.06 |

|

|

0.23 |

|

|

0.28 |

|

Diluted earnings per share of Class A common stock |

0.05 |

|

|

0.05 |

|

|

0.22 |

|

|

0.27 |

|

|

|

|

|

|

|

|

|

| Other Comprehensive Income (Loss): |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Unrealized gains (losses) on fixed maturity securities: |

|

|

|

|

|

|

|

| Unrealized holding gains (losses) arising during period |

59,101 |

|

|

(59,817) |

|

|

31,427 |

|

|

(36,811) |

|

| Reclassification adjustment for losses (gains) included in net income |

(100) |

|

|

419 |

|

|

547 |

|

|

481 |

|

| Unrealized gains (losses) on fixed maturity securities, net |

59,001 |

|

|

(59,398) |

|

|

31,974 |

|

|

(36,330) |

|

| Change in current discount rate for liability for future policy benefits |

(45,404) |

|

|

60,054 |

|

|

(5,887) |

|

|

45,825 |

|

| Income tax expense (benefit) on other comprehensive income items |

356 |

|

|

(1,040) |

|

|

2,615 |

|

|

(882) |

|

| Other comprehensive income (loss) |

13,241 |

|

|

1,696 |

|

|

23,472 |

|

|

10,377 |

|

| Total comprehensive income (loss) |

$ |

16,031 |

|

|

4,394 |

|

|

34,763 |

|

|

24,073 |

|

See accompanying Notes to Consolidated Financial Statements.

September 30, 2024 | 10-Q 4

CITIZENS, INC. AND CONSOLIDATED SUBSIDIARIES

Consolidated Statements of Stockholders' Equity

(Unaudited)

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| |

Common Stock |

Retained Earnings |

Accumulated Other Comprehensive Income (Loss) |

Treasury Stock |

Total Stockholders' Equity |

| (In thousands) |

Class A |

Class B |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Balance at December 31, 2023 |

$ |

268,675 |

|

|

3,184 |

|

|

42,150 |

|

|

(118,155) |

|

|

(23,725) |

|

|

172,129 |

|

| Comprehensive income (loss): |

|

|

|

|

|

|

|

|

|

|

|

Net income |

— |

|

|

— |

|

|

4,542 |

|

|

— |

|

|

— |

|

|

4,542 |

|

| Other comprehensive income (loss) |

— |

|

|

— |

|

|

— |

|

|

18,385 |

|

|

— |

|

|

18,385 |

|

| Total comprehensive income (loss) |

— |

|

|

— |

|

|

4,542 |

|

|

18,385 |

|

|

— |

|

|

22,927 |

|

|

|

|

|

|

|

|

|

|

|

|

|

| Stock-based compensation |

127 |

|

|

— |

|

|

— |

|

|

— |

|

|

— |

|

|

127 |

|

| Balance at March 31, 2024 |

268,802 |

|

|

3,184 |

|

|

46,692 |

|

|

(99,770) |

|

|

(23,725) |

|

|

195,183 |

|

| Comprehensive income (loss): |

|

|

|

|

|

|

|

|

|

|

|

Net income |

— |

|

|

— |

|

|

3,959 |

|

|

— |

|

|

— |

|

|

3,959 |

|

| Other comprehensive income (loss) |

— |

|

|

— |

|

|

— |

|

|

(8,154) |

|

|

— |

|

|

(8,154) |

|

| Total comprehensive income (loss) |

— |

|

|

— |

|

|

3,959 |

|

|

(8,154) |

|

|

— |

|

|

(4,195) |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Stock-based compensation |

481 |

|

|

— |

|

|

— |

|

|

— |

|

|

— |

|

|

481 |

|

| Balance at June 30, 2024 |

269,283 |

|

|

3,184 |

|

|

50,651 |

|

|

(107,924) |

|

|

(23,725) |

|

|

191,469 |

|

| Comprehensive income (loss): |

|

|

|

|

|

|

|

|

|

|

|

Net income |

— |

|

|

— |

|

|

2,790 |

|

|

— |

|

|

— |

|

|

2,790 |

|

| Other comprehensive income (loss) |

— |

|

|

— |

|

|

— |

|

|

13,241 |

|

|

— |

|

|

13,241 |

|

| Total comprehensive income (loss) |

— |

|

|

— |

|

|

2,790 |

|

|

13,241 |

|

|

— |

|

|

16,031 |

|

|

|

|

|

|

|

|

|

|

|

|

|

| Stock-based compensation |

73 |

|

|

— |

|

|

— |

|

|

— |

|

|

— |

|

|

73 |

|

| Balance at September 30, 2024 |

$ |

269,356 |

|

|

3,184 |

|

|

53,441 |

|

|

(94,683) |

|

|

(23,725) |

|

|

207,573 |

|

See accompanying Notes to Consolidated Financial Statements.

September 30, 2024 | 10-Q 5

CITIZENS, INC. AND CONSOLIDATED SUBSIDIARIES

Consolidated Statements of Stockholders' Equity, Continued

(Unaudited)

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| |

Common Stock |

Retained Earnings |

Accumulated Other Comprehensive

Income (Loss)

|

Treasury Stock |

Total Stockholders' Equity |

| (In thousands) |

Class A |

Class B |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Balance at December 31, 2022 |

$ |

268,147 |

|

|

3,184 |

|

|

16,309 |

|

|

(137,044) |

|

|

(22,806) |

|

|

127,790 |

|

| Comprehensive income (loss): |

|

|

|

|

|

|

|

|

|

|

|

Net income |

— |

|

|

— |

|

|

4,872 |

|

|

— |

|

|

— |

|

|

4,872 |

|

| Other comprehensive income (loss) |

— |

|

|

— |

|

|

— |

|

|

21,579 |

|

|

— |

|

|

21,579 |

|

| Total comprehensive income (loss) |

— |

|

|

— |

|

|

4,872 |

|

|

21,579 |

|

|

— |

|

|

26,451 |

|

|

|

|

|

|

|

|

|

|

|

|

|

| Stock-based compensation |

50 |

|

|

— |

|

|

— |

|

|

— |

|

|

— |

|

|

50 |

|

| Balance at March 31, 2023 |

268,197 |

|

|

3,184 |

|

|

21,181 |

|

|

(115,465) |

|

|

(22,806) |

|

|

154,291 |

|

| Comprehensive income (loss): |

|

|

|

|

|

|

|

|

|

|

|

Net income |

— |

|

|

— |

|

|

6,126 |

|

|

— |

|

|

— |

|

|

6,126 |

|

| Other comprehensive income (loss) |

— |

|

|

— |

|

|

— |

|

|

(12,898) |

|

|

— |

|

|

(12,898) |

|

| Total comprehensive income (loss) |

— |

|

|

— |

|

|

6,126 |

|

|

(12,898) |

|

|

— |

|

|

(6,772) |

|

|

|

|

|

|

|

|

|

|

|

|

|

| Acquisition of treasury stock |

— |

|

|

— |

|

|

— |

|

|

— |

|

|

(719) |

|

|

(719) |

|

| Stock-based compensation |

46 |

|

|

— |

|

|

— |

|

|

— |

|

|

— |

|

|

46 |

|

| Balance at June 30, 2023 |

268,243 |

|

|

3,184 |

|

|

27,307 |

|

|

(128,363) |

|

|

(23,525) |

|

|

146,846 |

|

| Comprehensive income (loss): |

|

|

|

|

|

|

|

|

|

|

|

Net income |

— |

|

|

— |

|

|

2,698 |

|

|

— |

|

|

— |

|

|

2,698 |

|

| Other comprehensive income (loss) |

— |

|

|

— |

|

|

— |

|

|

1,696 |

|

|

— |

|

|

1,696 |

|

| Total comprehensive income (loss) |

— |

|

|

— |

|

|

2,698 |

|

|

1,696 |

|

|

— |

|

|

4,394 |

|

|

|

|

|

|

|

|

|

|