UNITED STATES SECURITIES AND EXCHANGE COMMISSION Washington, D.C. 20549 FORM 10-Q (Mark One) ☒ Quarterly Report Pursuant to Section 13 or 15(d) of the Securities Exchange Act of 1934 For the quarterly period ended January 31, 2024 ☐ Transition Report Pursuant to Section 13 or 15(d) of the Securities Exchange Act of 1934 Commission File Number: 0-7928 (Exact name of registrant as specified in its charter) Delaware 11-2139466 (State or other jurisdiction of incorporation /organization) (I.R.S. Employer Identification Number) 305 N 54th Street, Chandler, Arizona 85226 (Address of principal executive offices) (Zip Code) (480) 333-2200 (Registrant's telephone number, including area code) Securities registered pursuant to Section 12(b) of the Act: Title of each class Trading Symbol(s) Name of each exchange on which registered Common Stock, par value $0.10 per share CMTL Nasdaq Stock Market LLC Indicate by check mark whether the registrant (1) has filed all reports required to be filed by Section 13 or 15(d) of the Securities Exchange Act of 1934 during the preceding 12 months (or for such shorter period that the registrant was required to file such reports), and (2) has been subject to such filing requirements for the past 90 days. ☒ Yes ☐ No Indicate by check mark whether the registrant has submitted electronically every Interactive Data file required to be submitted pursuant to Rule 405 of Regulation S-T (§ 232.405 of this chapter) during the preceding 12 months (or for such shorter period that the registrant was required to submit such files). ☒ Yes ☐ No Indicate by check mark whether the registrant is a large accelerated filer, an accelerated filer, a non-accelerated filer, a smaller reporting company, or an emerging growth company. See the definitions of "large accelerated filer," "accelerated filer," "smaller reporting company," and "emerging growth company" in Rule 12b-2 of the Exchange Act. Large accelerated filer ☐ Accelerated filer ☒ Emerging growth company ☐ Non-accelerated filer ☐ Smaller reporting company ☐ If an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act. ☐ Indicate by check mark whether registrant is a shell company (as defined in Rule 12b-2 of the Exchange Act). ☐ Yes ☒ No As of March 13, 2024, the number of outstanding shares of Common Stock, par value $0.10 per share, of the registrant was 28,473,822 shares. Index

COMTECH TELECOMMUNICATIONS CORP. INDEX Page PART I. FINANCIAL INFORMATION Item 1. Condensed Consolidated Financial Statements 2 Condensed Consolidated Balance Sheets - January 31, 2024 and July 31, 2023 (Unaudited) 2 Condensed Consolidated Statements of Operations - Three and Six Months Ended January 31, 2024 and 2023 (Unaudited) 3 Condensed Consolidated Statements of Convertible Preferred Stock and Stockholders' Equity - Three and Six Months Ended January 31, 2024 and 2023 (Unaudited) 4 Condensed Consolidated Statements of Cash Flows - Six Months Ended January 31, 2024 and 2023 (Unaudited) 6 Notes to Condensed Consolidated Financial Statements (Unaudited) 8 Item 2. Management's Discussion and Analysis of Financial Condition and Results of Operations 38 Item 3. Quantitative and Qualitative Disclosures About Market Risk 62 Item 4. Controls and Procedures 62 PART II. OTHER INFORMATION Item 1. Legal Proceedings 63 Item 1A. Risk Factors 63 Item 2. Unregistered Sales of Equity Securities and Use of Proceeds 64 Item 4. Mine Safety Disclosures 64 Item 5. Other Information 64 Item 6. Exhibits 65 Signature Page 67 Index 1

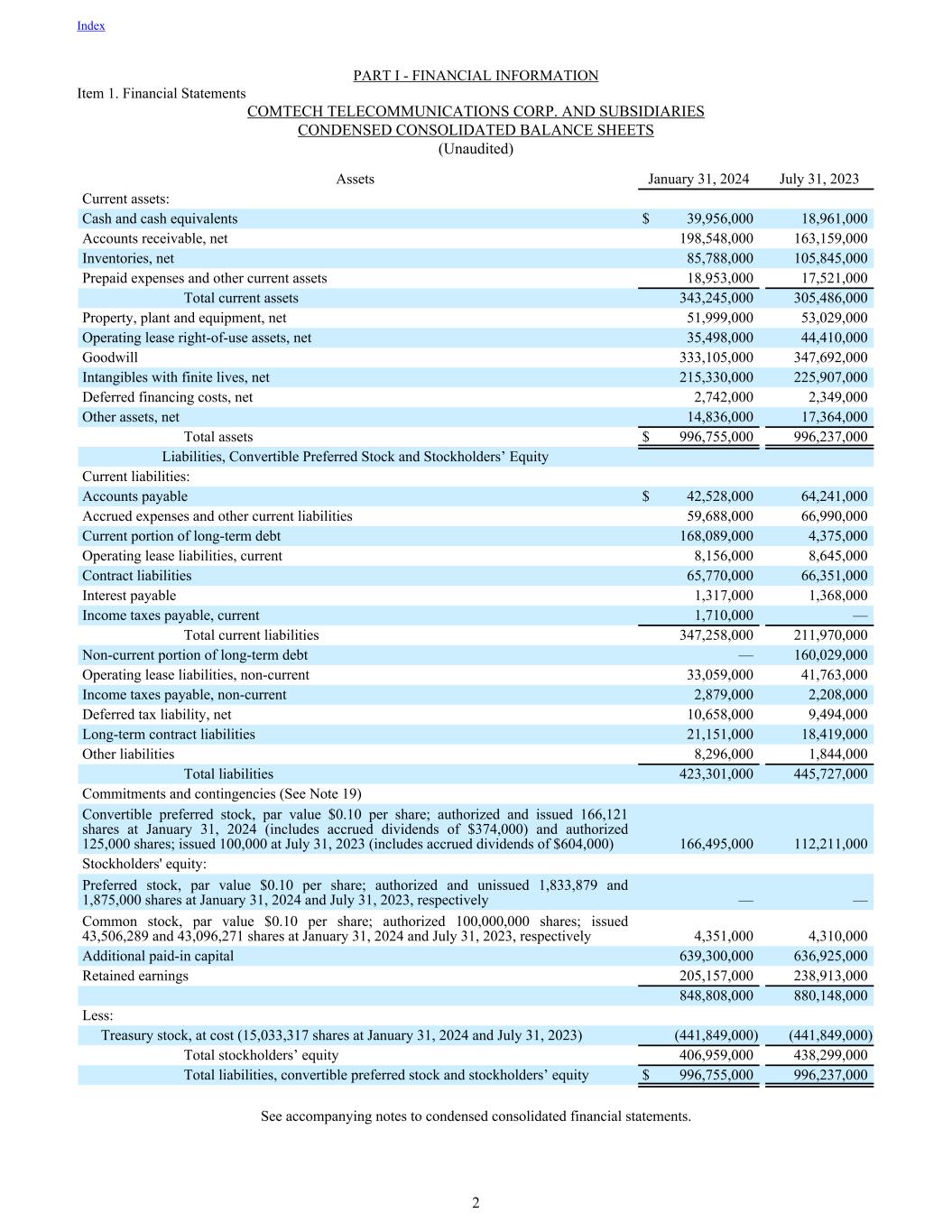

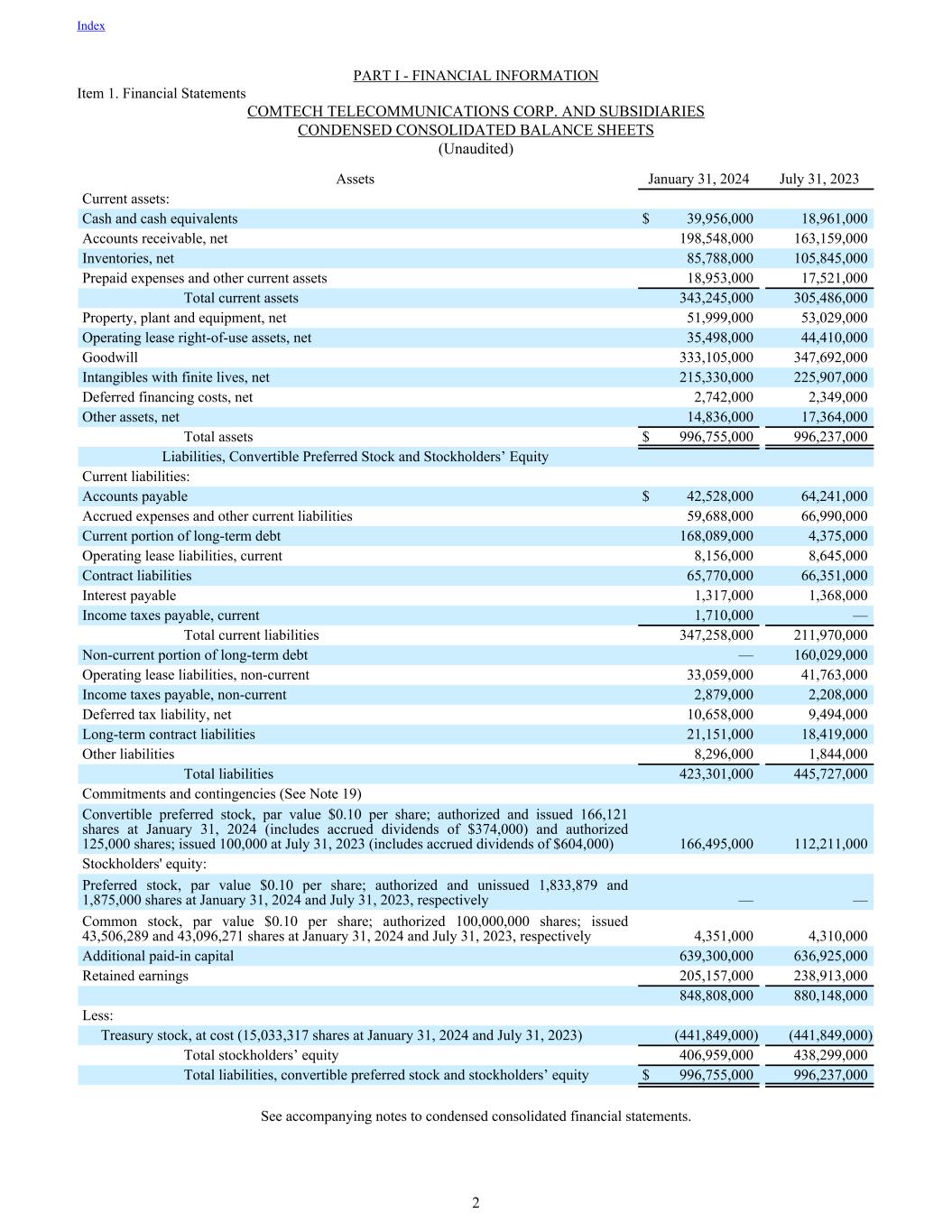

PART I - FINANCIAL INFORMATION Item 1. Financial Statements COMTECH TELECOMMUNICATIONS CORP. AND SUBSIDIARIES CONDENSED CONSOLIDATED BALANCE SHEETS (Unaudited) Assets January 31, 2024 July 31, 2023 Current assets: Cash and cash equivalents $ 39,956,000 18,961,000 Accounts receivable, net 198,548,000 163,159,000 Inventories, net 85,788,000 105,845,000 Prepaid expenses and other current assets 18,953,000 17,521,000 Total current assets 343,245,000 305,486,000 Property, plant and equipment, net 51,999,000 53,029,000 Operating lease right-of-use assets, net 35,498,000 44,410,000 Goodwill 333,105,000 347,692,000 Intangibles with finite lives, net 215,330,000 225,907,000 Deferred financing costs, net 2,742,000 2,349,000 Other assets, net 14,836,000 17,364,000 Total assets $ 996,755,000 996,237,000 Liabilities, Convertible Preferred Stock and Stockholders’ Equity Current liabilities: Accounts payable $ 42,528,000 64,241,000 Accrued expenses and other current liabilities 59,688,000 66,990,000 Current portion of long-term debt 168,089,000 4,375,000 Operating lease liabilities, current 8,156,000 8,645,000 Contract liabilities 65,770,000 66,351,000 Interest payable 1,317,000 1,368,000 Income taxes payable, current 1,710,000 — Total current liabilities 347,258,000 211,970,000 Non-current portion of long-term debt — 160,029,000 Operating lease liabilities, non-current 33,059,000 41,763,000 Income taxes payable, non-current 2,879,000 2,208,000 Deferred tax liability, net 10,658,000 9,494,000 Long-term contract liabilities 21,151,000 18,419,000 Other liabilities 8,296,000 1,844,000 Total liabilities 423,301,000 445,727,000 Commitments and contingencies (See Note 19) Convertible preferred stock, par value $0.10 per share; authorized and issued 166,121 shares at January 31, 2024 (includes accrued dividends of $374,000) and authorized 125,000 shares; issued 100,000 at July 31, 2023 (includes accrued dividends of $604,000) 166,495,000 112,211,000 Stockholders' equity: Preferred stock, par value $0.10 per share; authorized and unissued 1,833,879 and 1,875,000 shares at January 31, 2024 and July 31, 2023, respectively — — Common stock, par value $0.10 per share; authorized 100,000,000 shares; issued 43,506,289 and 43,096,271 shares at January 31, 2024 and July 31, 2023, respectively 4,351,000 4,310,000 Additional paid-in capital 639,300,000 636,925,000 Retained earnings 205,157,000 238,913,000 848,808,000 880,148,000 Less: Treasury stock, at cost (15,033,317 shares at January 31, 2024 and July 31, 2023) (441,849,000) (441,849,000) Total stockholders’ equity 406,959,000 438,299,000 Total liabilities, convertible preferred stock and stockholders’ equity $ 996,755,000 996,237,000 See accompanying notes to condensed consolidated financial statements. Index 2

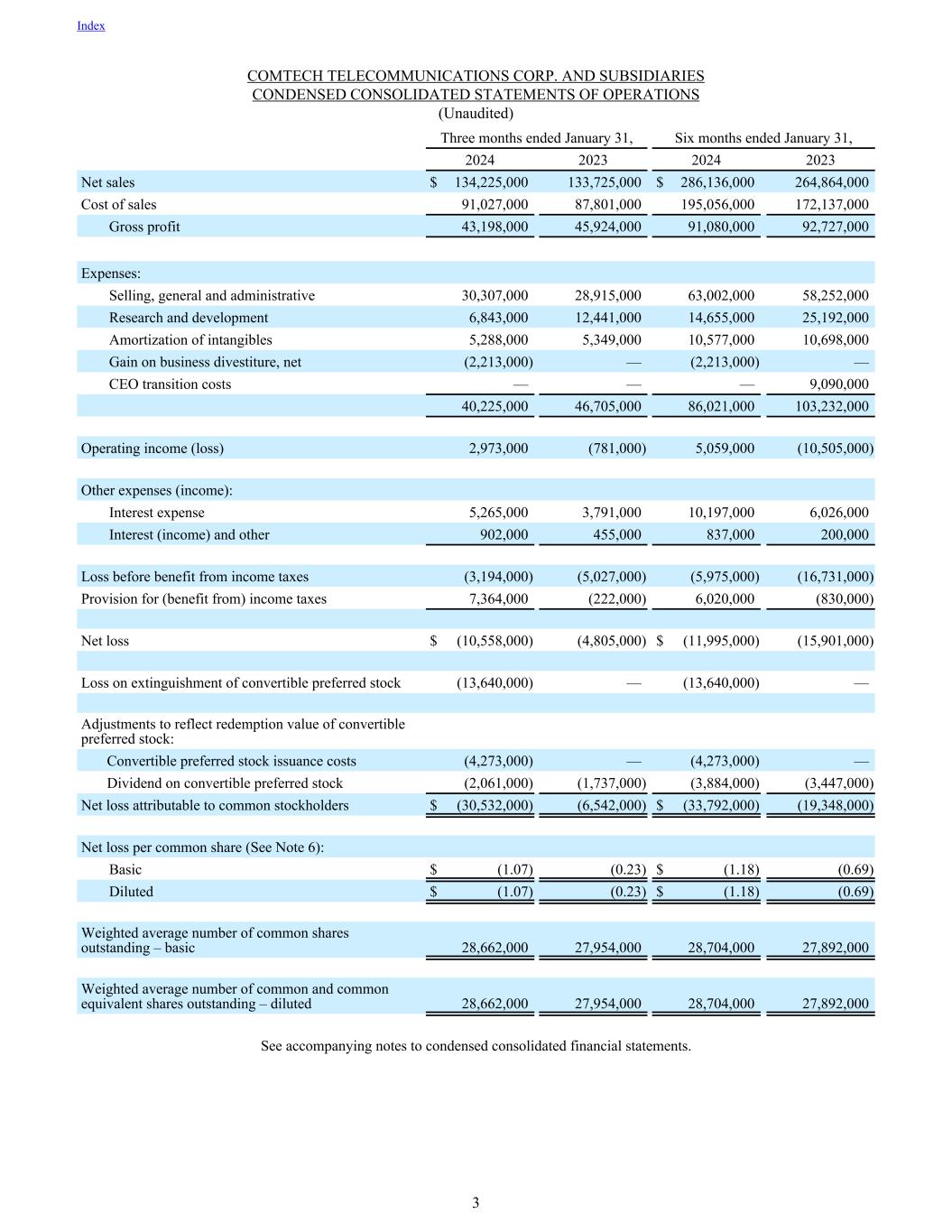

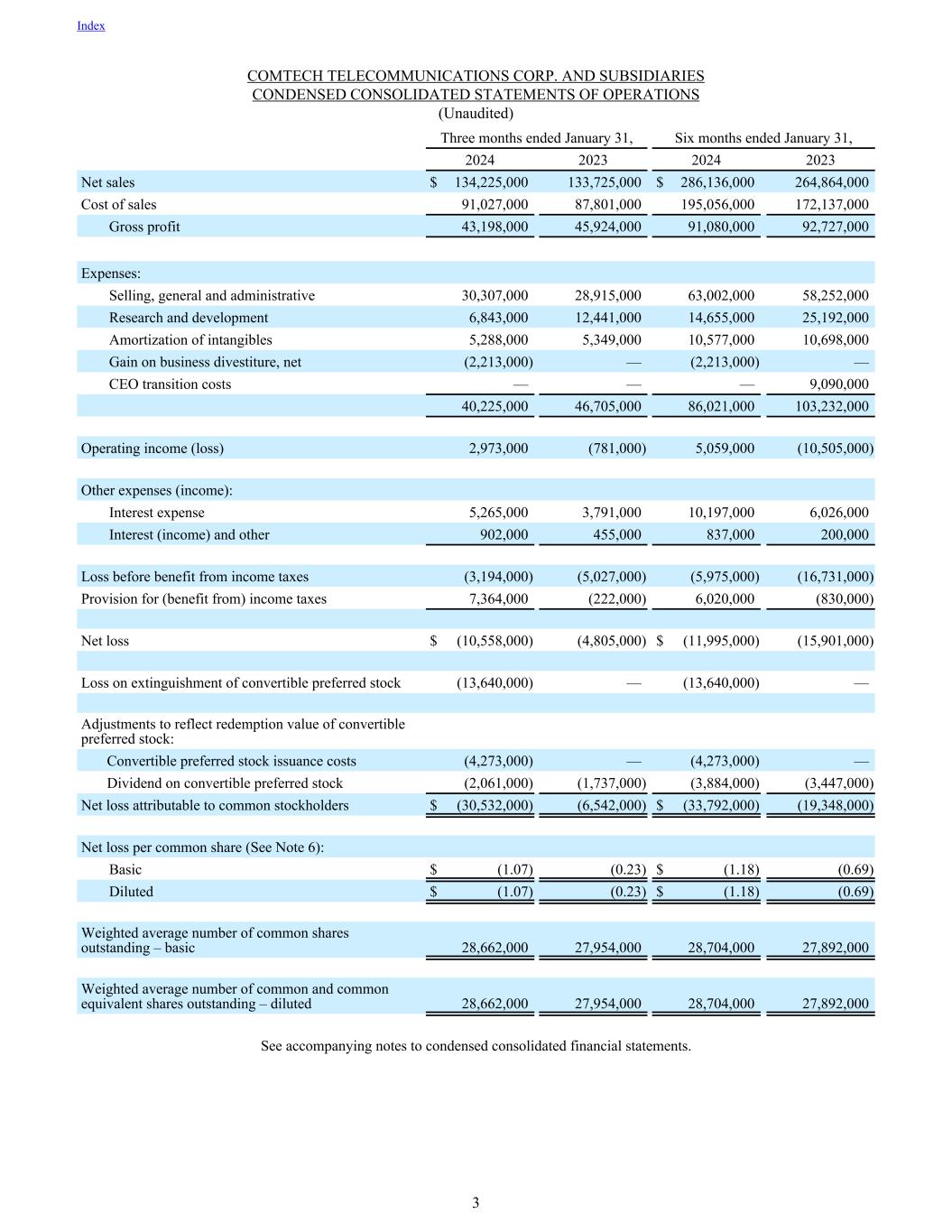

COMTECH TELECOMMUNICATIONS CORP. AND SUBSIDIARIES CONDENSED CONSOLIDATED STATEMENTS OF OPERATIONS (Unaudited) Three months ended January 31, Six months ended January 31, 2024 2023 2024 2023 Net sales $ 134,225,000 133,725,000 $ 286,136,000 264,864,000 Cost of sales 91,027,000 87,801,000 195,056,000 172,137,000 Gross profit 43,198,000 45,924,000 91,080,000 92,727,000 Expenses: Selling, general and administrative 30,307,000 28,915,000 63,002,000 58,252,000 Research and development 6,843,000 12,441,000 14,655,000 25,192,000 Amortization of intangibles 5,288,000 5,349,000 10,577,000 10,698,000 Gain on business divestiture, net (2,213,000) — (2,213,000) — CEO transition costs — — — 9,090,000 40,225,000 46,705,000 86,021,000 103,232,000 Operating income (loss) 2,973,000 (781,000) 5,059,000 (10,505,000) Other expenses (income): Interest expense 5,265,000 3,791,000 10,197,000 6,026,000 Interest (income) and other 902,000 455,000 837,000 200,000 Loss before benefit from income taxes (3,194,000) (5,027,000) (5,975,000) (16,731,000) Provision for (benefit from) income taxes 7,364,000 (222,000) 6,020,000 (830,000) Net loss $ (10,558,000) (4,805,000) $ (11,995,000) (15,901,000) Loss on extinguishment of convertible preferred stock (13,640,000) — (13,640,000) — Adjustments to reflect redemption value of convertible preferred stock: Convertible preferred stock issuance costs (4,273,000) — (4,273,000) — Dividend on convertible preferred stock (2,061,000) (1,737,000) (3,884,000) (3,447,000) Net loss attributable to common stockholders $ (30,532,000) (6,542,000) $ (33,792,000) (19,348,000) Net loss per common share (See Note 6): Basic $ (1.07) (0.23) $ (1.18) (0.69) Diluted $ (1.07) (0.23) $ (1.18) (0.69) Weighted average number of common shares outstanding – basic 28,662,000 27,954,000 28,704,000 27,892,000 Weighted average number of common and common equivalent shares outstanding – diluted 28,662,000 27,954,000 28,704,000 27,892,000 See accompanying notes to condensed consolidated financial statements. Index 3

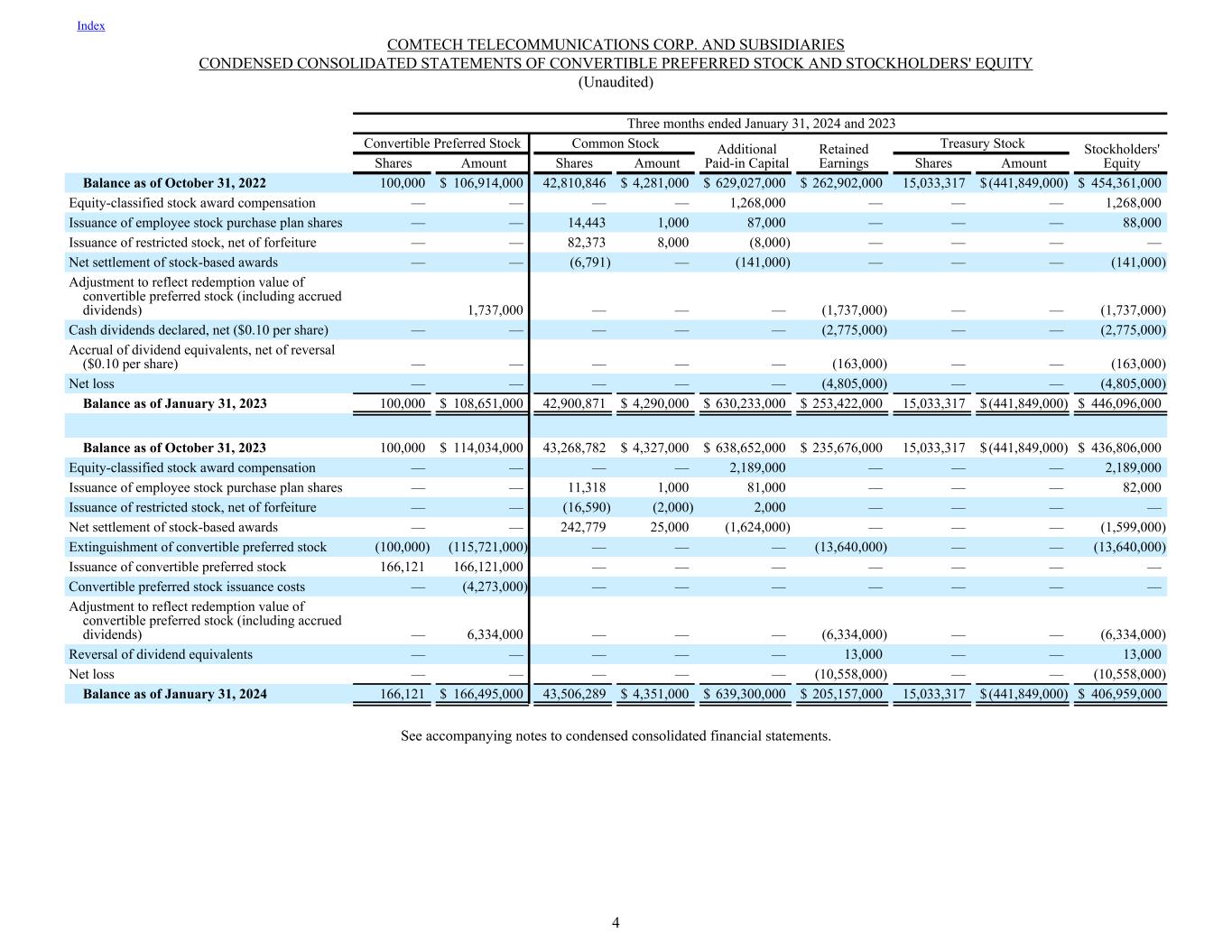

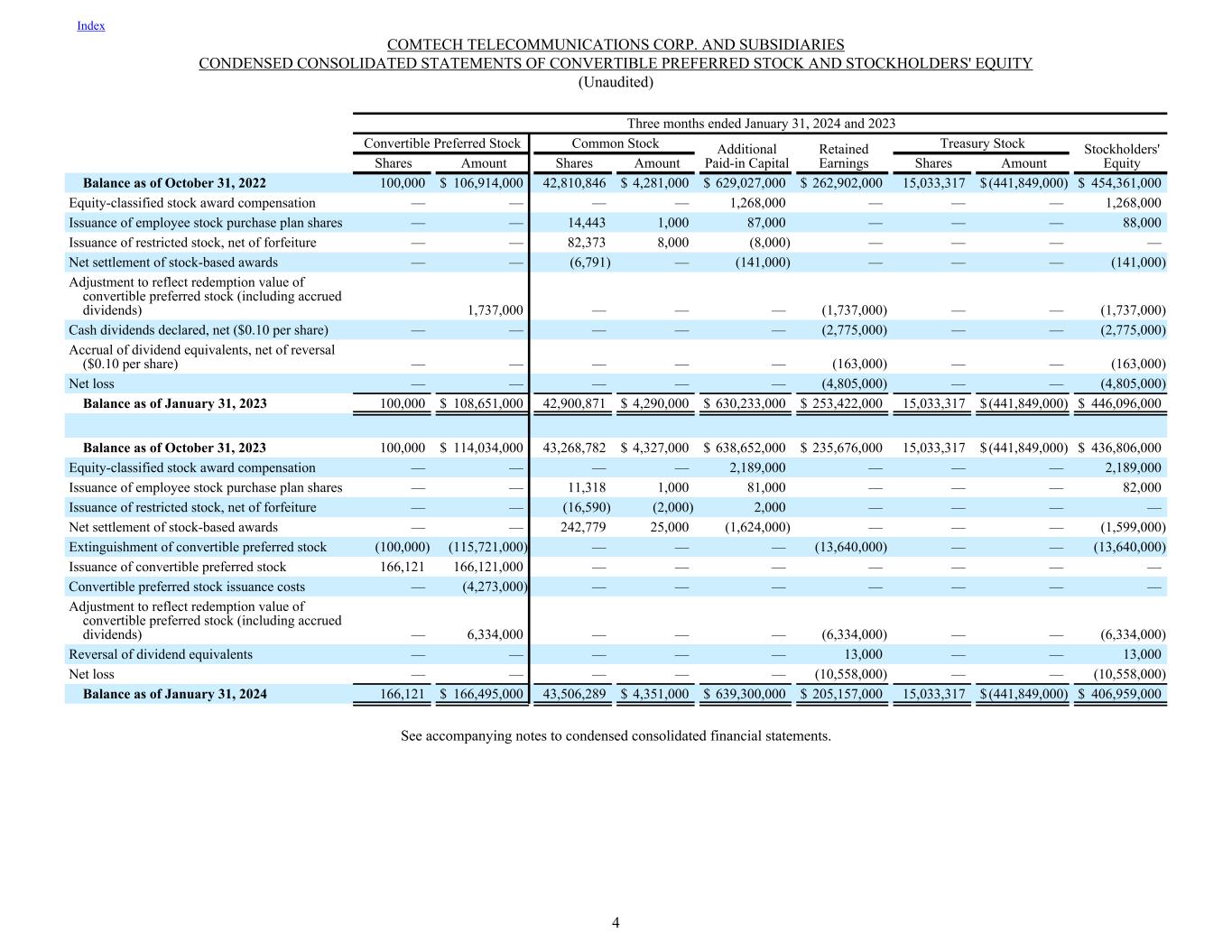

COMTECH TELECOMMUNICATIONS CORP. AND SUBSIDIARIES CONDENSED CONSOLIDATED STATEMENTS OF CONVERTIBLE PREFERRED STOCK AND STOCKHOLDERS' EQUITY (Unaudited) Three months ended January 31, 2024 and 2023 Convertible Preferred Stock Common Stock Additional Paid-in Capital Retained Earnings Treasury Stock Stockholders' EquityShares Amount Shares Amount Shares Amount Balance as of October 31, 2022 100,000 $ 106,914,000 42,810,846 $ 4,281,000 $ 629,027,000 $ 262,902,000 15,033,317 $ (441,849,000) $ 454,361,000 Equity-classified stock award compensation — — — — 1,268,000 — — — 1,268,000 Issuance of employee stock purchase plan shares — — 14,443 1,000 87,000 — — — 88,000 Issuance of restricted stock, net of forfeiture — — 82,373 8,000 (8,000) — — — — Net settlement of stock-based awards — — (6,791) — (141,000) — — — (141,000) Adjustment to reflect redemption value of convertible preferred stock (including accrued dividends) 1,737,000 — — — (1,737,000) — — (1,737,000) Cash dividends declared, net ($0.10 per share) — — — — — (2,775,000) — — (2,775,000) Accrual of dividend equivalents, net of reversal ($0.10 per share) — — — — — (163,000) — — (163,000) Net loss — — — — — (4,805,000) — — (4,805,000) Balance as of January 31, 2023 100,000 $ 108,651,000 42,900,871 $ 4,290,000 $ 630,233,000 $ 253,422,000 15,033,317 $ (441,849,000) $ 446,096,000 Balance as of October 31, 2023 100,000 $ 114,034,000 43,268,782 $ 4,327,000 $ 638,652,000 $ 235,676,000 15,033,317 $ (441,849,000) $ 436,806,000 Equity-classified stock award compensation — — — — 2,189,000 — — — 2,189,000 Issuance of employee stock purchase plan shares — — 11,318 1,000 81,000 — — — 82,000 Issuance of restricted stock, net of forfeiture — — (16,590) (2,000) 2,000 — — — — Net settlement of stock-based awards — — 242,779 25,000 (1,624,000) — — — (1,599,000) Extinguishment of convertible preferred stock (100,000) (115,721,000) — — — (13,640,000) — — (13,640,000) Issuance of convertible preferred stock 166,121 166,121,000 — — — — — — — Convertible preferred stock issuance costs — (4,273,000) — — — — — — — Adjustment to reflect redemption value of convertible preferred stock (including accrued dividends) — 6,334,000 — — — (6,334,000) — — (6,334,000) Reversal of dividend equivalents — — — — — 13,000 — — 13,000 Net loss — — — — — (10,558,000) — — (10,558,000) Balance as of January 31, 2024 166,121 $ 166,495,000 43,506,289 $ 4,351,000 $ 639,300,000 $ 205,157,000 15,033,317 $ (441,849,000) $ 406,959,000 See accompanying notes to condensed consolidated financial statements. Index 4

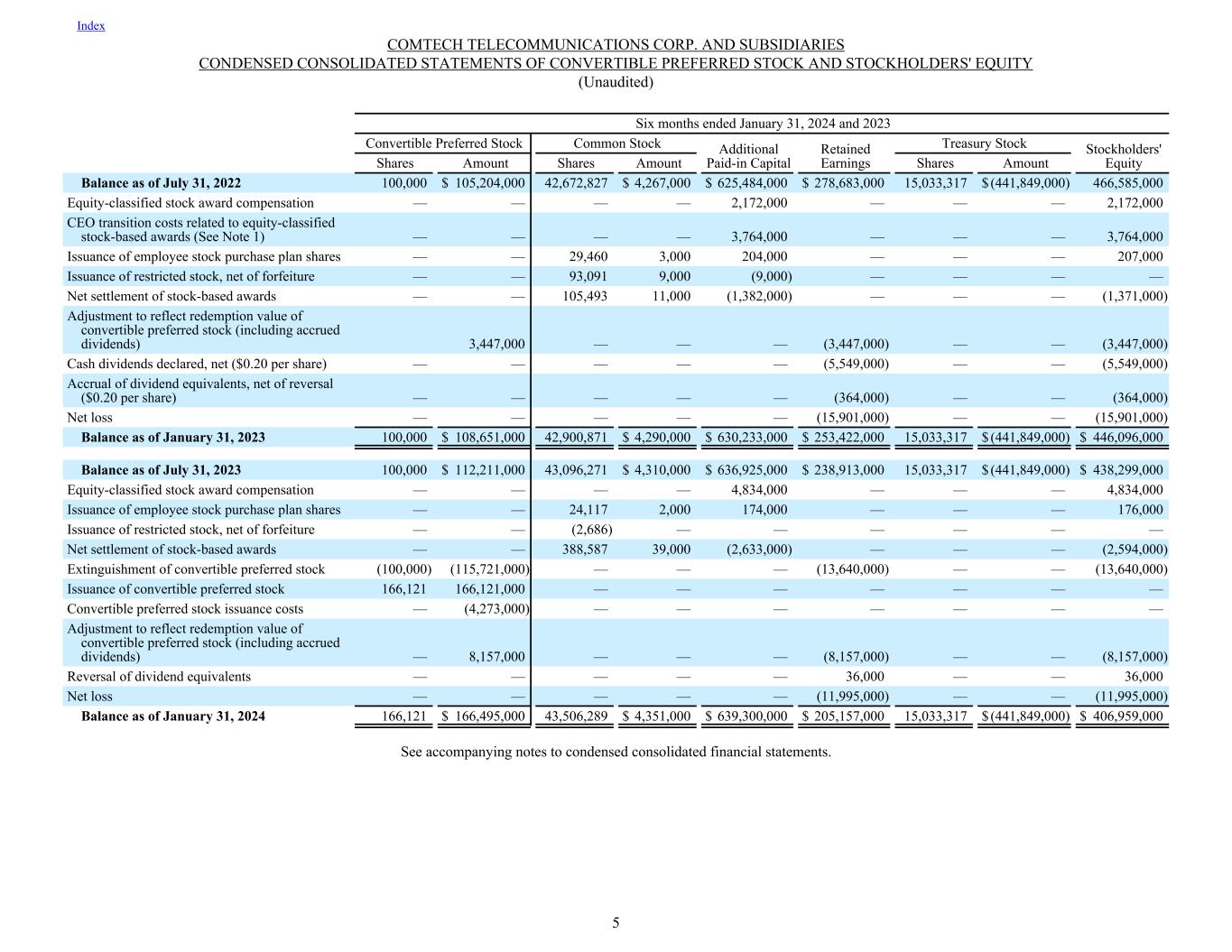

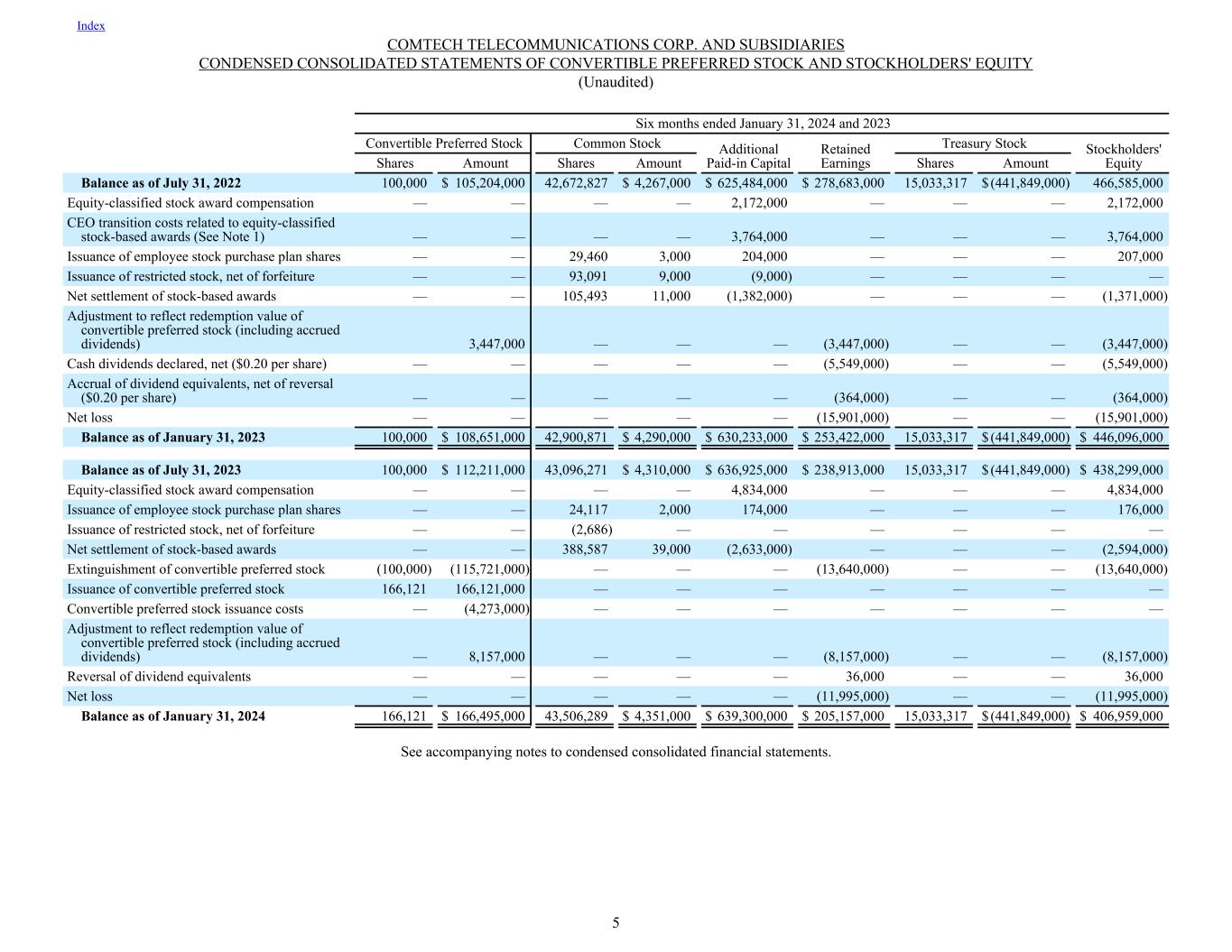

COMTECH TELECOMMUNICATIONS CORP. AND SUBSIDIARIES CONDENSED CONSOLIDATED STATEMENTS OF CONVERTIBLE PREFERRED STOCK AND STOCKHOLDERS' EQUITY (Unaudited) Six months ended January 31, 2024 and 2023 Convertible Preferred Stock Common Stock Additional Paid-in Capital Retained Earnings Treasury Stock Stockholders' EquityShares Amount Shares Amount Shares Amount Balance as of July 31, 2022 100,000 $ 105,204,000 42,672,827 $ 4,267,000 $ 625,484,000 $ 278,683,000 15,033,317 $ (441,849,000) 466,585,000 Equity-classified stock award compensation — — — — 2,172,000 — — — 2,172,000 CEO transition costs related to equity-classified stock-based awards (See Note 1) — — — — 3,764,000 — — — 3,764,000 Issuance of employee stock purchase plan shares — — 29,460 3,000 204,000 — — — 207,000 Issuance of restricted stock, net of forfeiture — — 93,091 9,000 (9,000) — — — — Net settlement of stock-based awards — — 105,493 11,000 (1,382,000) — — — (1,371,000) Adjustment to reflect redemption value of convertible preferred stock (including accrued dividends) 3,447,000 — — — (3,447,000) — — (3,447,000) Cash dividends declared, net ($0.20 per share) — — — — — (5,549,000) — — (5,549,000) Accrual of dividend equivalents, net of reversal ($0.20 per share) — — — — — (364,000) — — (364,000) Net loss — — — — — (15,901,000) — — (15,901,000) Balance as of January 31, 2023 100,000 $ 108,651,000 42,900,871 $ 4,290,000 $ 630,233,000 $ 253,422,000 15,033,317 $ (441,849,000) $ 446,096,000 Balance as of July 31, 2023 100,000 $ 112,211,000 43,096,271 $ 4,310,000 $ 636,925,000 $ 238,913,000 15,033,317 $ (441,849,000) $ 438,299,000 Equity-classified stock award compensation — — — — 4,834,000 — — — 4,834,000 Issuance of employee stock purchase plan shares — — 24,117 2,000 174,000 — — — 176,000 Issuance of restricted stock, net of forfeiture — — (2,686) — — — — — — Net settlement of stock-based awards — — 388,587 39,000 (2,633,000) — — — (2,594,000) Extinguishment of convertible preferred stock (100,000) (115,721,000) — — — (13,640,000) — — (13,640,000) Issuance of convertible preferred stock 166,121 166,121,000 — — — — — — — Convertible preferred stock issuance costs — (4,273,000) — — — — — — — Adjustment to reflect redemption value of convertible preferred stock (including accrued dividends) — 8,157,000 — — — (8,157,000) — — (8,157,000) Reversal of dividend equivalents — — — — — 36,000 — — 36,000 Net loss — — — — — (11,995,000) — — (11,995,000) Balance as of January 31, 2024 166,121 $ 166,495,000 43,506,289 $ 4,351,000 $ 639,300,000 $ 205,157,000 15,033,317 $ (441,849,000) $ 406,959,000 See accompanying notes to condensed consolidated financial statements. Index 5

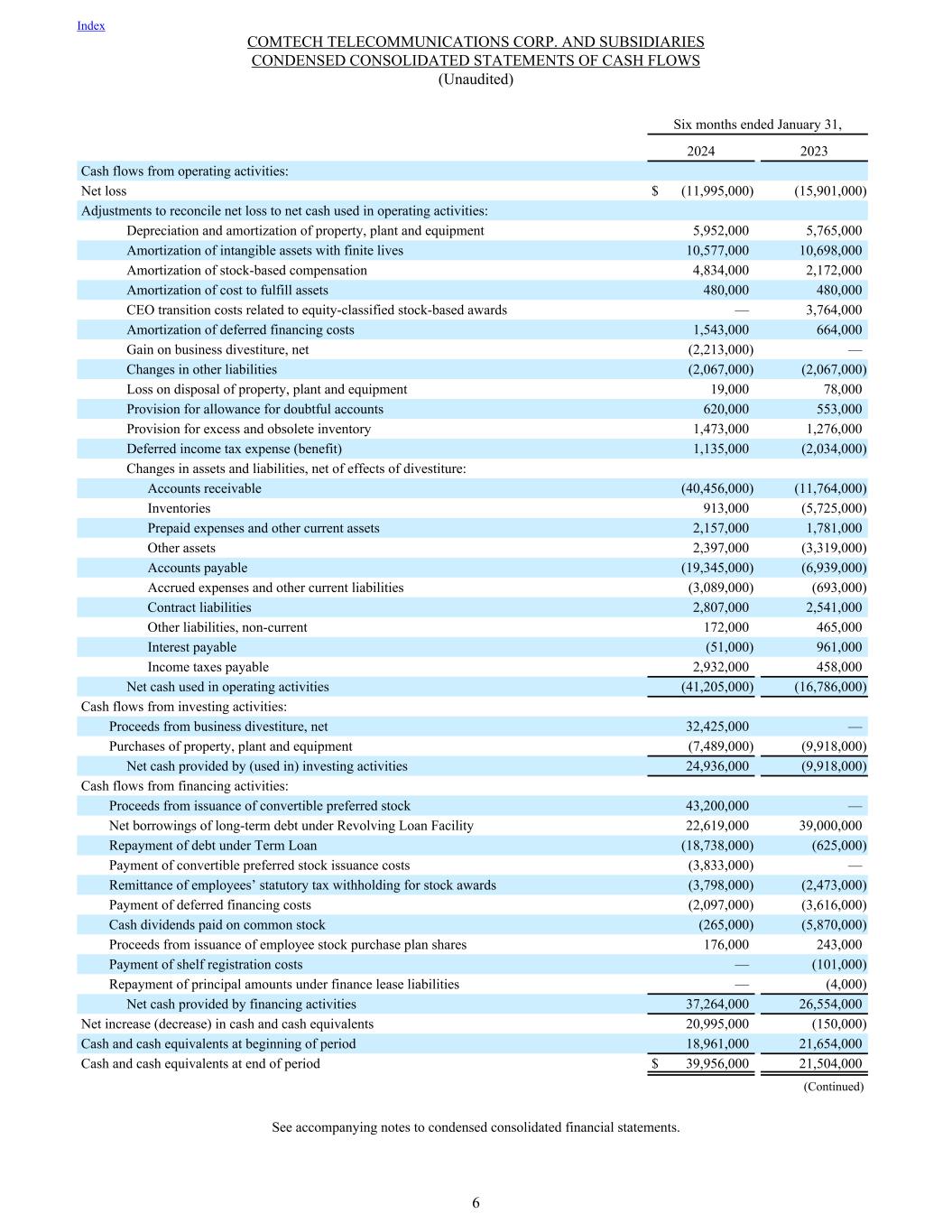

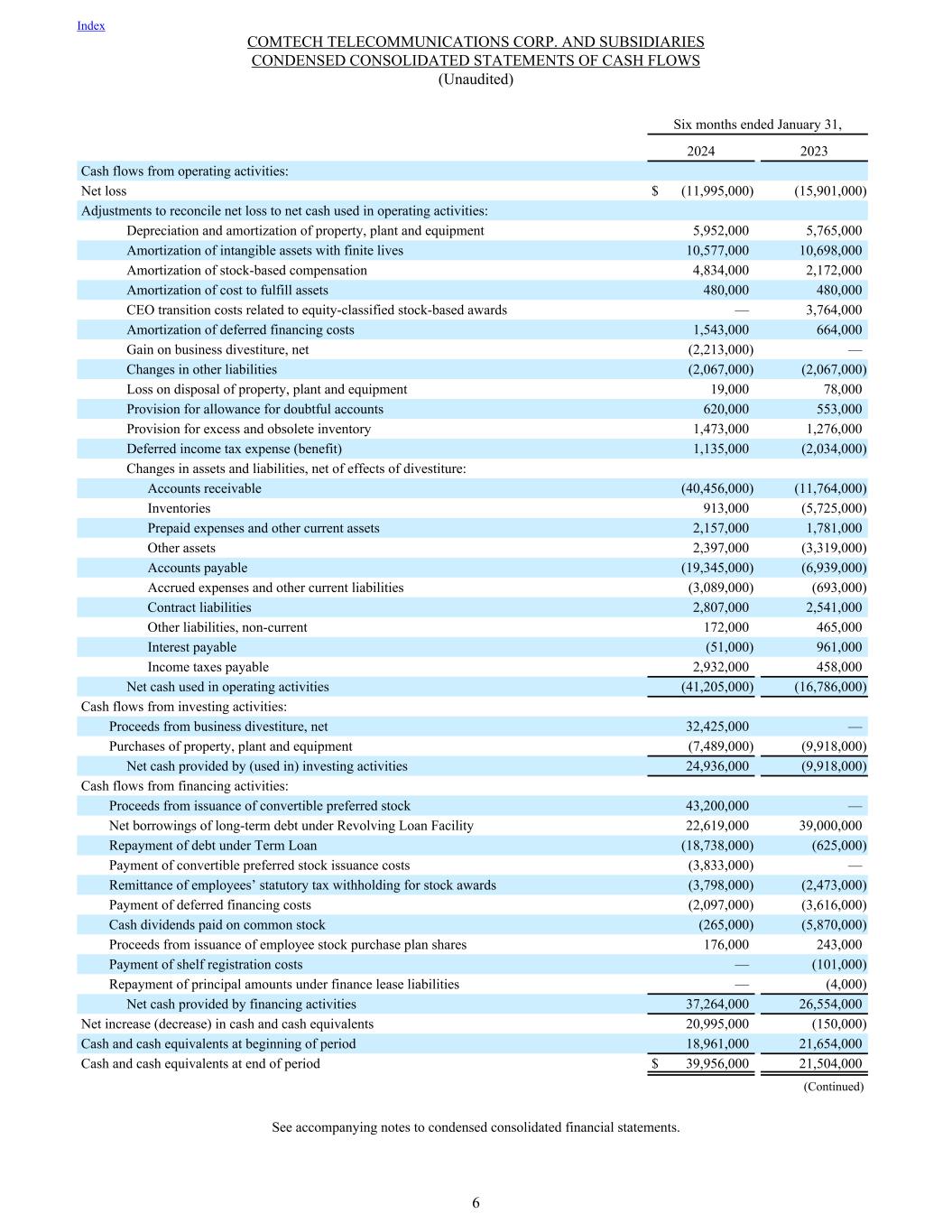

2024 2023 Cash flows from operating activities: Net loss $ (11,995,000) (15,901,000) Adjustments to reconcile net loss to net cash used in operating activities: Depreciation and amortization of property, plant and equipment 5,952,000 5,765,000 Amortization of intangible assets with finite lives 10,577,000 10,698,000 Amortization of stock-based compensation 4,834,000 2,172,000 Amortization of cost to fulfill assets 480,000 480,000 CEO transition costs related to equity-classified stock-based awards — 3,764,000 Amortization of deferred financing costs 1,543,000 664,000 Gain on business divestiture, net (2,213,000) — Changes in other liabilities (2,067,000) (2,067,000) Loss on disposal of property, plant and equipment 19,000 78,000 Provision for allowance for doubtful accounts 620,000 553,000 Provision for excess and obsolete inventory 1,473,000 1,276,000 Deferred income tax expense (benefit) 1,135,000 (2,034,000) Changes in assets and liabilities, net of effects of divestiture: Accounts receivable (40,456,000) (11,764,000) Inventories 913,000 (5,725,000) Prepaid expenses and other current assets 2,157,000 1,781,000 Other assets 2,397,000 (3,319,000) Accounts payable (19,345,000) (6,939,000) Accrued expenses and other current liabilities (3,089,000) (693,000) Contract liabilities 2,807,000 2,541,000 Other liabilities, non-current 172,000 465,000 Interest payable (51,000) 961,000 Income taxes payable 2,932,000 458,000 Net cash used in operating activities (41,205,000) (16,786,000) Cash flows from investing activities: Proceeds from business divestiture, net 32,425,000 — Purchases of property, plant and equipment (7,489,000) (9,918,000) Net cash provided by (used in) investing activities 24,936,000 (9,918,000) Cash flows from financing activities: Proceeds from issuance of convertible preferred stock 43,200,000 — Net borrowings of long-term debt under Revolving Loan Facility 22,619,000 39,000,000 Repayment of debt under Term Loan (18,738,000) (625,000) Payment of convertible preferred stock issuance costs (3,833,000) — Remittance of employees’ statutory tax withholding for stock awards (3,798,000) (2,473,000) Payment of deferred financing costs (2,097,000) (3,616,000) Cash dividends paid on common stock (265,000) (5,870,000) Proceeds from issuance of employee stock purchase plan shares 176,000 243,000 Payment of shelf registration costs — (101,000) Repayment of principal amounts under finance lease liabilities — (4,000) Net cash provided by financing activities 37,264,000 26,554,000 Net increase (decrease) in cash and cash equivalents 20,995,000 (150,000) Cash and cash equivalents at beginning of period 18,961,000 21,654,000 Cash and cash equivalents at end of period $ 39,956,000 21,504,000 (Continued) Six months ended January 31, See accompanying notes to condensed consolidated financial statements. Index COMTECH TELECOMMUNICATIONS CORP. AND SUBSIDIARIES CONDENSED CONSOLIDATED STATEMENTS OF CASH FLOWS (Unaudited) 6

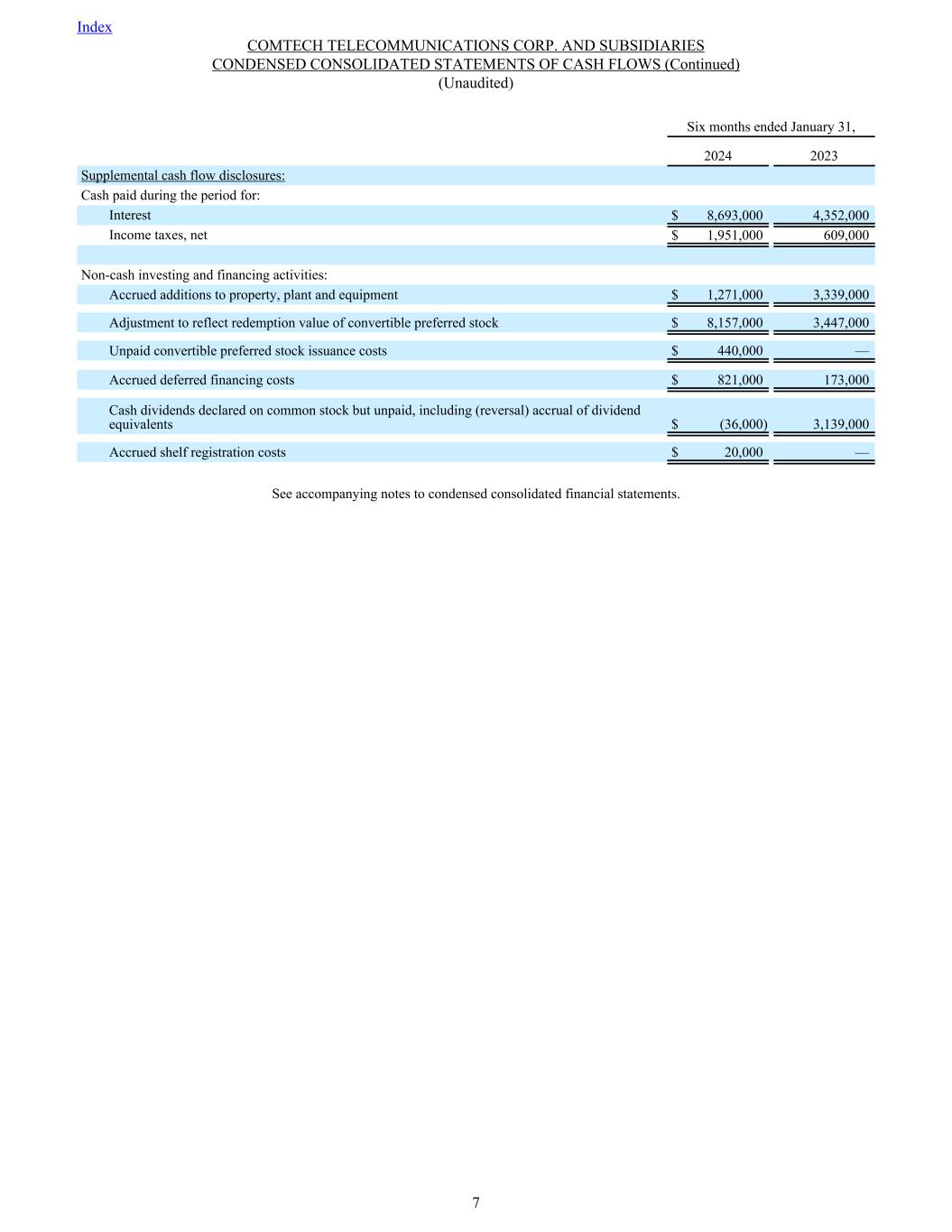

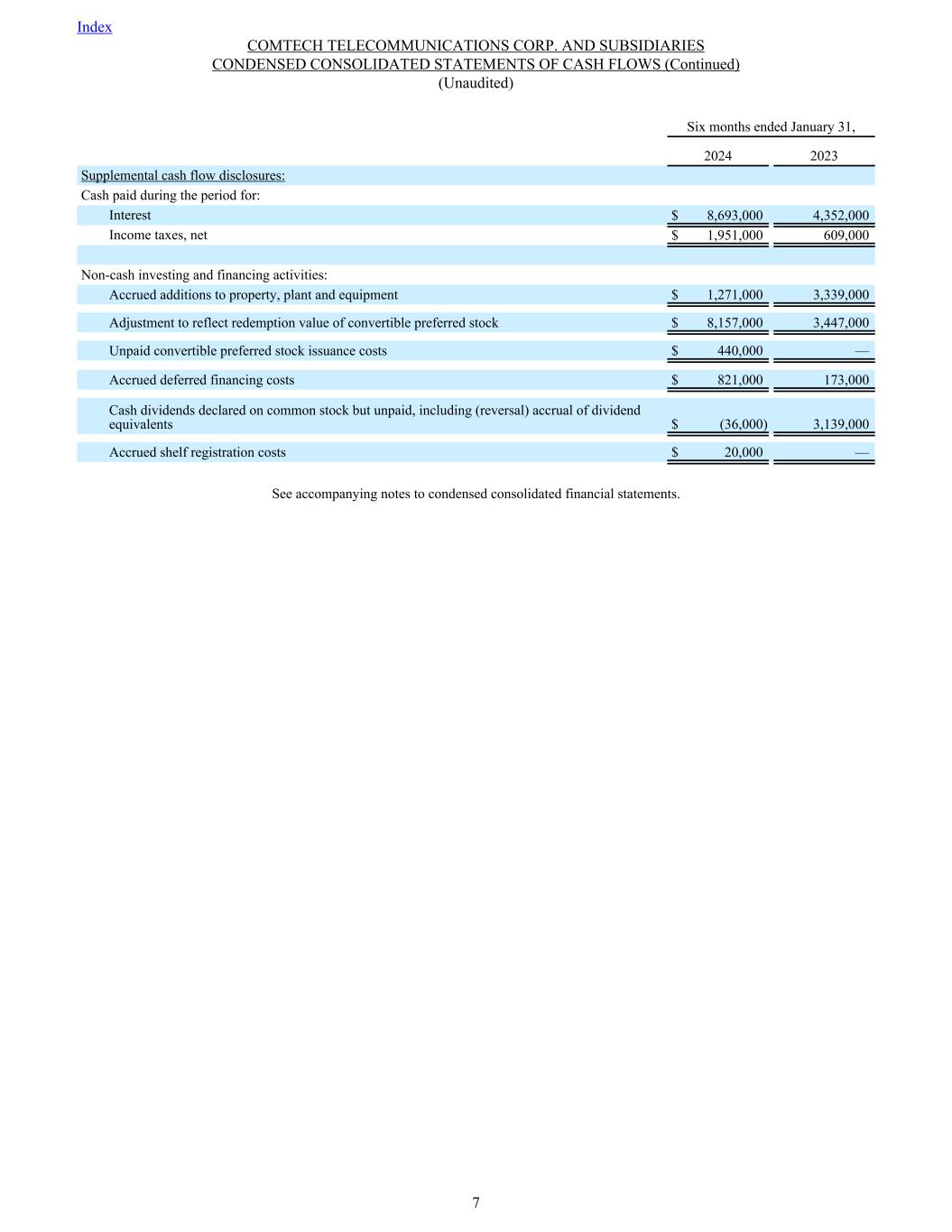

Six months ended January 31, 2024 2023 Supplemental cash flow disclosures: Cash paid during the period for: Interest $ 8,693,000 4,352,000 Income taxes, net $ 1,951,000 609,000 Non-cash investing and financing activities: Accrued additions to property, plant and equipment $ 1,271,000 3,339,000 Adjustment to reflect redemption value of convertible preferred stock $ 8,157,000 3,447,000 Unpaid convertible preferred stock issuance costs $ 440,000 — Accrued deferred financing costs $ 821,000 173,000 Cash dividends declared on common stock but unpaid, including (reversal) accrual of dividend equivalents $ (36,000) 3,139,000 Accrued shelf registration costs $ 20,000 — See accompanying notes to condensed consolidated financial statements. Index COMTECH TELECOMMUNICATIONS CORP. AND SUBSIDIARIES CONDENSED CONSOLIDATED STATEMENTS OF CASH FLOWS (Continued) (Unaudited) 7

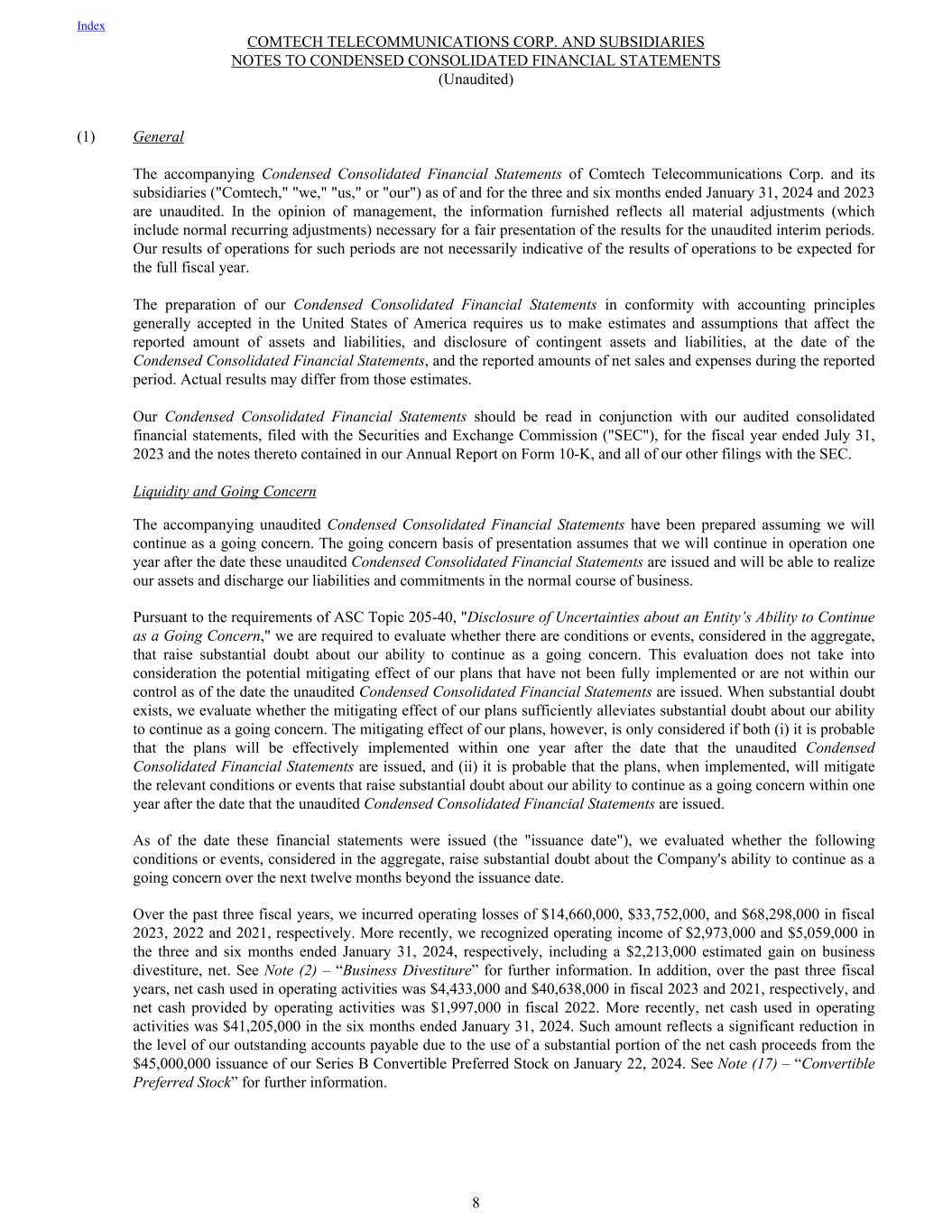

(1) General The accompanying Condensed Consolidated Financial Statements of Comtech Telecommunications Corp. and its subsidiaries ("Comtech," "we," "us," or "our") as of and for the three and six months ended January 31, 2024 and 2023 are unaudited. In the opinion of management, the information furnished reflects all material adjustments (which include normal recurring adjustments) necessary for a fair presentation of the results for the unaudited interim periods. Our results of operations for such periods are not necessarily indicative of the results of operations to be expected for the full fiscal year. The preparation of our Condensed Consolidated Financial Statements in conformity with accounting principles generally accepted in the United States of America requires us to make estimates and assumptions that affect the reported amount of assets and liabilities, and disclosure of contingent assets and liabilities, at the date of the Condensed Consolidated Financial Statements, and the reported amounts of net sales and expenses during the reported period. Actual results may differ from those estimates. Our Condensed Consolidated Financial Statements should be read in conjunction with our audited consolidated financial statements, filed with the Securities and Exchange Commission ("SEC"), for the fiscal year ended July 31, 2023 and the notes thereto contained in our Annual Report on Form 10-K, and all of our other filings with the SEC. Liquidity and Going Concern The accompanying unaudited Condensed Consolidated Financial Statements have been prepared assuming we will continue as a going concern. The going concern basis of presentation assumes that we will continue in operation one year after the date these unaudited Condensed Consolidated Financial Statements are issued and will be able to realize our assets and discharge our liabilities and commitments in the normal course of business. Pursuant to the requirements of ASC Topic 205-40, "Disclosure of Uncertainties about an Entity’s Ability to Continue as a Going Concern," we are required to evaluate whether there are conditions or events, considered in the aggregate, that raise substantial doubt about our ability to continue as a going concern. This evaluation does not take into consideration the potential mitigating effect of our plans that have not been fully implemented or are not within our control as of the date the unaudited Condensed Consolidated Financial Statements are issued. When substantial doubt exists, we evaluate whether the mitigating effect of our plans sufficiently alleviates substantial doubt about our ability to continue as a going concern. The mitigating effect of our plans, however, is only considered if both (i) it is probable that the plans will be effectively implemented within one year after the date that the unaudited Condensed Consolidated Financial Statements are issued, and (ii) it is probable that the plans, when implemented, will mitigate the relevant conditions or events that raise substantial doubt about our ability to continue as a going concern within one year after the date that the unaudited Condensed Consolidated Financial Statements are issued. As of the date these financial statements were issued (the "issuance date"), we evaluated whether the following conditions or events, considered in the aggregate, raise substantial doubt about the Company's ability to continue as a going concern over the next twelve months beyond the issuance date. Over the past three fiscal years, we incurred operating losses of $14,660,000, $33,752,000, and $68,298,000 in fiscal 2023, 2022 and 2021, respectively. More recently, we recognized operating income of $2,973,000 and $5,059,000 in the three and six months ended January 31, 2024, respectively, including a $2,213,000 estimated gain on business divestiture, net. See Note (2) – “Business Divestiture” for further information. In addition, over the past three fiscal years, net cash used in operating activities was $4,433,000 and $40,638,000 in fiscal 2023 and 2021, respectively, and net cash provided by operating activities was $1,997,000 in fiscal 2022. More recently, net cash used in operating activities was $41,205,000 in the six months ended January 31, 2024. Such amount reflects a significant reduction in the level of our outstanding accounts payable due to the use of a substantial portion of the net cash proceeds from the $45,000,000 issuance of our Series B Convertible Preferred Stock on January 22, 2024. See Note (17) – “Convertible Preferred Stock” for further information. Index COMTECH TELECOMMUNICATIONS CORP. AND SUBSIDIARIES NOTES TO CONDENSED CONSOLIDATED FINANCIAL STATEMENTS (Unaudited) 8

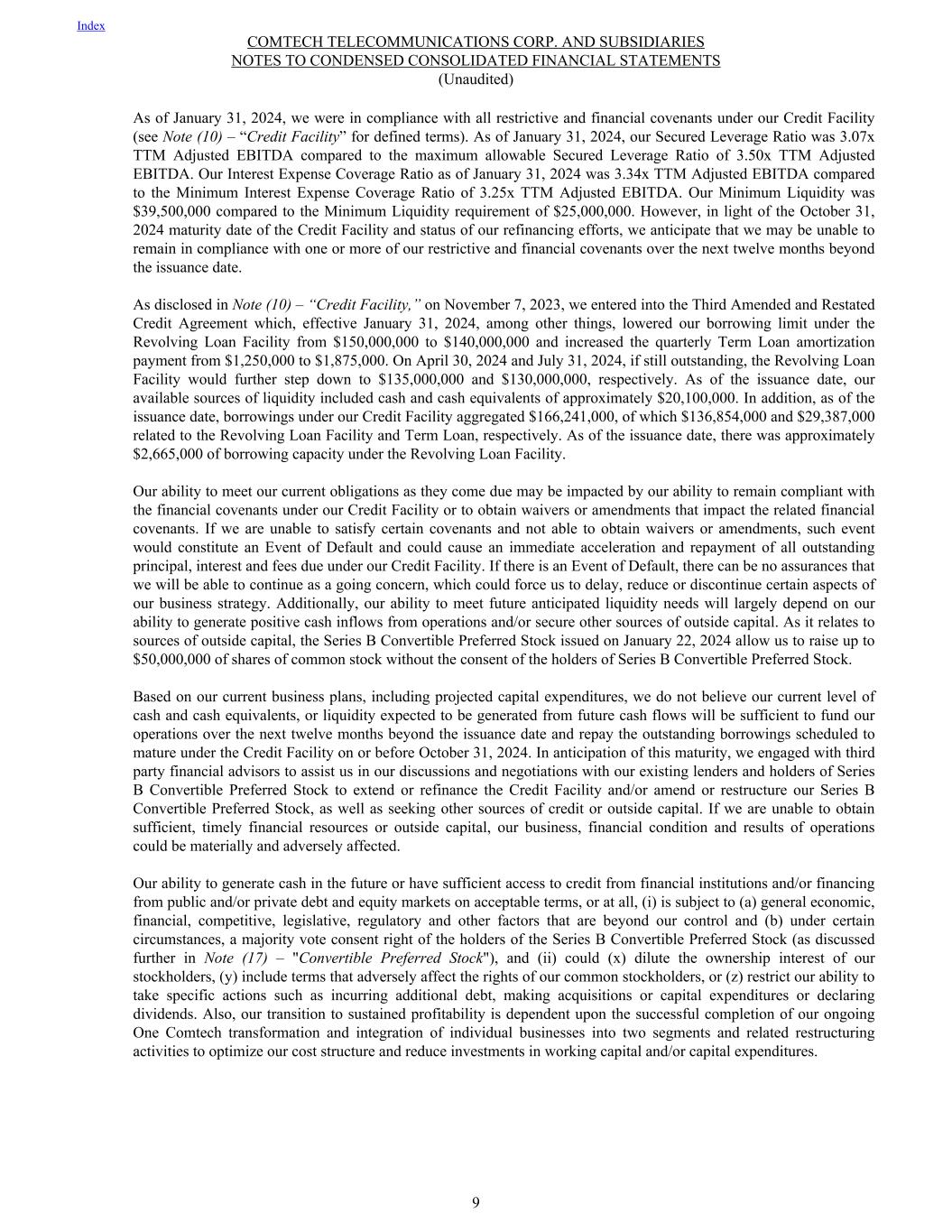

As of January 31, 2024, we were in compliance with all restrictive and financial covenants under our Credit Facility (see Note (10) – “Credit Facility” for defined terms). As of January 31, 2024, our Secured Leverage Ratio was 3.07x TTM Adjusted EBITDA compared to the maximum allowable Secured Leverage Ratio of 3.50x TTM Adjusted EBITDA. Our Interest Expense Coverage Ratio as of January 31, 2024 was 3.34x TTM Adjusted EBITDA compared to the Minimum Interest Expense Coverage Ratio of 3.25x TTM Adjusted EBITDA. Our Minimum Liquidity was $39,500,000 compared to the Minimum Liquidity requirement of $25,000,000. However, in light of the October 31, 2024 maturity date of the Credit Facility and status of our refinancing efforts, we anticipate that we may be unable to remain in compliance with one or more of our restrictive and financial covenants over the next twelve months beyond the issuance date. As disclosed in Note (10) – “Credit Facility,” on November 7, 2023, we entered into the Third Amended and Restated Credit Agreement which, effective January 31, 2024, among other things, lowered our borrowing limit under the Revolving Loan Facility from $150,000,000 to $140,000,000 and increased the quarterly Term Loan amortization payment from $1,250,000 to $1,875,000. On April 30, 2024 and July 31, 2024, if still outstanding, the Revolving Loan Facility would further step down to $135,000,000 and $130,000,000, respectively. As of the issuance date, our available sources of liquidity included cash and cash equivalents of approximately $20,100,000. In addition, as of the issuance date, borrowings under our Credit Facility aggregated $166,241,000, of which $136,854,000 and $29,387,000 related to the Revolving Loan Facility and Term Loan, respectively. As of the issuance date, there was approximately $2,665,000 of borrowing capacity under the Revolving Loan Facility. Our ability to meet our current obligations as they come due may be impacted by our ability to remain compliant with the financial covenants under our Credit Facility or to obtain waivers or amendments that impact the related financial covenants. If we are unable to satisfy certain covenants and not able to obtain waivers or amendments, such event would constitute an Event of Default and could cause an immediate acceleration and repayment of all outstanding principal, interest and fees due under our Credit Facility. If there is an Event of Default, there can be no assurances that we will be able to continue as a going concern, which could force us to delay, reduce or discontinue certain aspects of our business strategy. Additionally, our ability to meet future anticipated liquidity needs will largely depend on our ability to generate positive cash inflows from operations and/or secure other sources of outside capital. As it relates to sources of outside capital, the Series B Convertible Preferred Stock issued on January 22, 2024 allow us to raise up to $50,000,000 of shares of common stock without the consent of the holders of Series B Convertible Preferred Stock. Based on our current business plans, including projected capital expenditures, we do not believe our current level of cash and cash equivalents, or liquidity expected to be generated from future cash flows will be sufficient to fund our operations over the next twelve months beyond the issuance date and repay the outstanding borrowings scheduled to mature under the Credit Facility on or before October 31, 2024. In anticipation of this maturity, we engaged with third party financial advisors to assist us in our discussions and negotiations with our existing lenders and holders of Series B Convertible Preferred Stock to extend or refinance the Credit Facility and/or amend or restructure our Series B Convertible Preferred Stock, as well as seeking other sources of credit or outside capital. If we are unable to obtain sufficient, timely financial resources or outside capital, our business, financial condition and results of operations could be materially and adversely affected. Our ability to generate cash in the future or have sufficient access to credit from financial institutions and/or financing from public and/or private debt and equity markets on acceptable terms, or at all, (i) is subject to (a) general economic, financial, competitive, legislative, regulatory and other factors that are beyond our control and (b) under certain circumstances, a majority vote consent right of the holders of the Series B Convertible Preferred Stock (as discussed further in Note (17) – "Convertible Preferred Stock"), and (ii) could (x) dilute the ownership interest of our stockholders, (y) include terms that adversely affect the rights of our common stockholders, or (z) restrict our ability to take specific actions such as incurring additional debt, making acquisitions or capital expenditures or declaring dividends. Also, our transition to sustained profitability is dependent upon the successful completion of our ongoing One Comtech transformation and integration of individual businesses into two segments and related restructuring activities to optimize our cost structure and reduce investments in working capital and/or capital expenditures. Index COMTECH TELECOMMUNICATIONS CORP. AND SUBSIDIARIES NOTES TO CONDENSED CONSOLIDATED FINANCIAL STATEMENTS (Unaudited) 9

In addition to our plan to refinance the Credit Facility and/or secure new sources of credit or outside capital, our plans also include, among other things: • implementing certain cost savings and restructuring activities to reduce cash used in operations, as discussed further in Note (20) – “Cost Reduction;” • pursuing initiatives to reduce investments in working capital, namely accounts receivable and inventory; • improving process disciplines to attain and maintain profitable operations by entering into more favorable sales or service contracts; • reevaluating our business plans to identify opportunities to further reduce capital expenditures; • seeking opportunities to improve liquidity through any combination of debt and/or equity financing (including possibly restructuring our existing Series B Convertible Preferred Stock); and • seeking other strategic transactions and/or measures including, but not limited to, the potential sale or divestiture of assets. While we believe the implementation of some or all of the elements of our plans over the next twelve months beyond the issuance date will be successful, these plans are not all solely within management’s control and, as such, we can provide no assurance our plans are probable of being effectively implemented as of the issuance date. Therefore, these adverse conditions and events described above raise substantial doubt about our ability to continue as a going concern as of the issuance date. We prepared these unaudited condensed consolidated financial statements on a going concern basis, assuming our financial resources will be sufficient to meet our capital needs over the next twelve months and did not include any adjustments relating to the recoverability and realization of assets and classification of liabilities that might be necessary should we be unable to continue in operation for the next twelve months. CEO Transition Related On August 9, 2022, our Board of Directors appointed Ken Peterman as our Chairman of the Board, President and Chief Executive Officer ("CEO"). Transition costs related to our former President and CEO, Michael D. Porcelain, pursuant to his separation agreement with the Company, were $7,424,000, of which $3,764,000 related to the acceleration of unamortized stock based compensation, with the remaining $3,660,000 related to his severance payments and benefits upon termination of employment. The cash portion of the transition costs of $3,660,000 was paid to Mr. Porcelain in October 2022. Also, in connection with Mr. Peterman entering into an employment agreement with the Company, effective as of August 9, 2022, we incurred a $1,000,000 expense related to a cash sign-on bonus, which was paid to Mr. Peterman in January 2023. CEO transition costs related to Mr. Porcelain and Mr. Peterman were expensed in our Unallocated segment during the first quarter of fiscal 2023. There were no similar costs incurred in fiscal 2024. On March 12, 2024, Mr. Peterman's employment with the Company was terminated for cause and the Board of Directors appointed John Ratigan as interim CEO and Mark Quinlan as Chairman of the Board of Directors. Prior to the changes, Mr. Ratigan served as our Chief Corporate Development Officer and Mr. Quinlan served as a member of our Board of Directors. Upon termination of his employment, Mr. Peterman was deemed to have resigned from his position as Chairman of the Board of Directors and as a director pursuant to his employment contract. Index COMTECH TELECOMMUNICATIONS CORP. AND SUBSIDIARIES NOTES TO CONDENSED CONSOLIDATED FINANCIAL STATEMENTS (Unaudited) 10

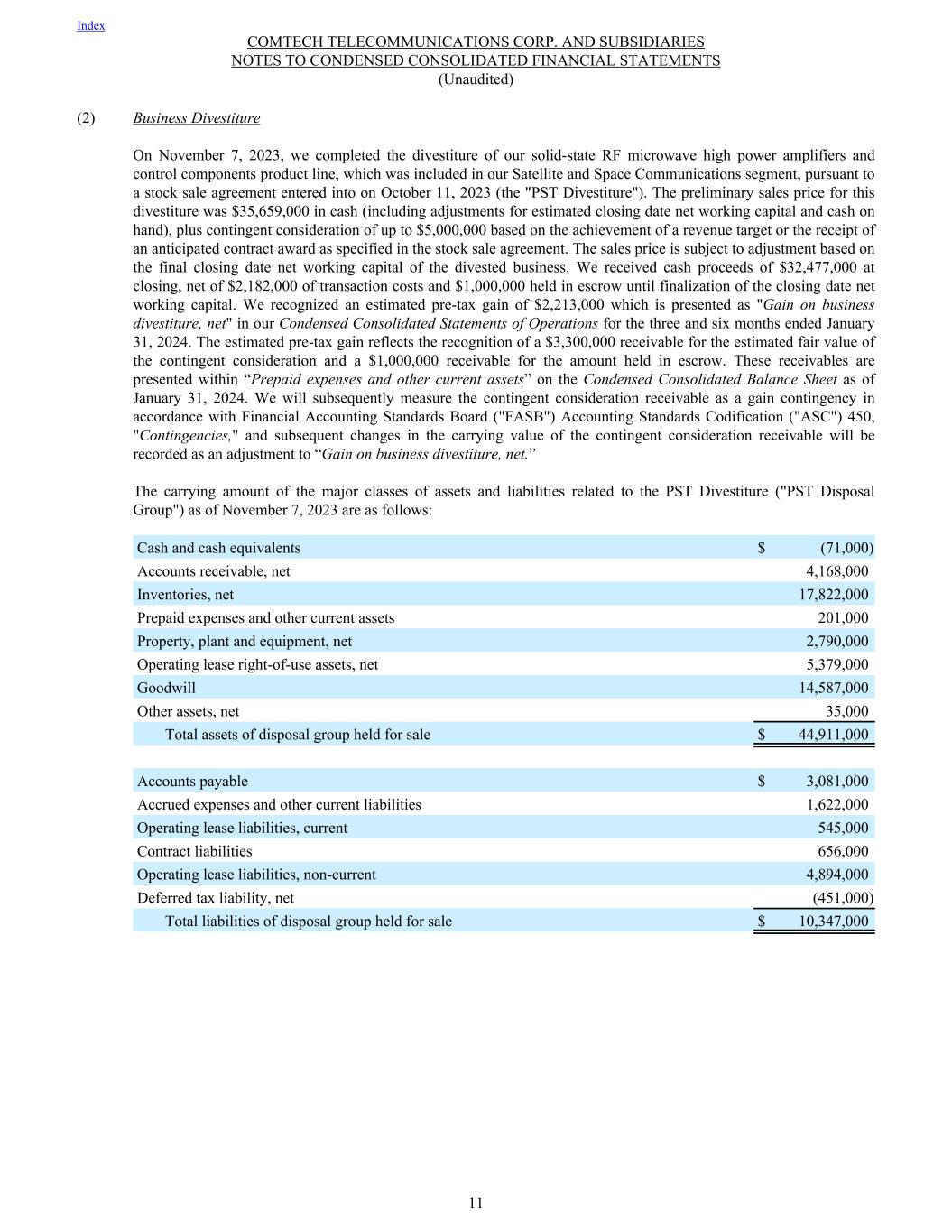

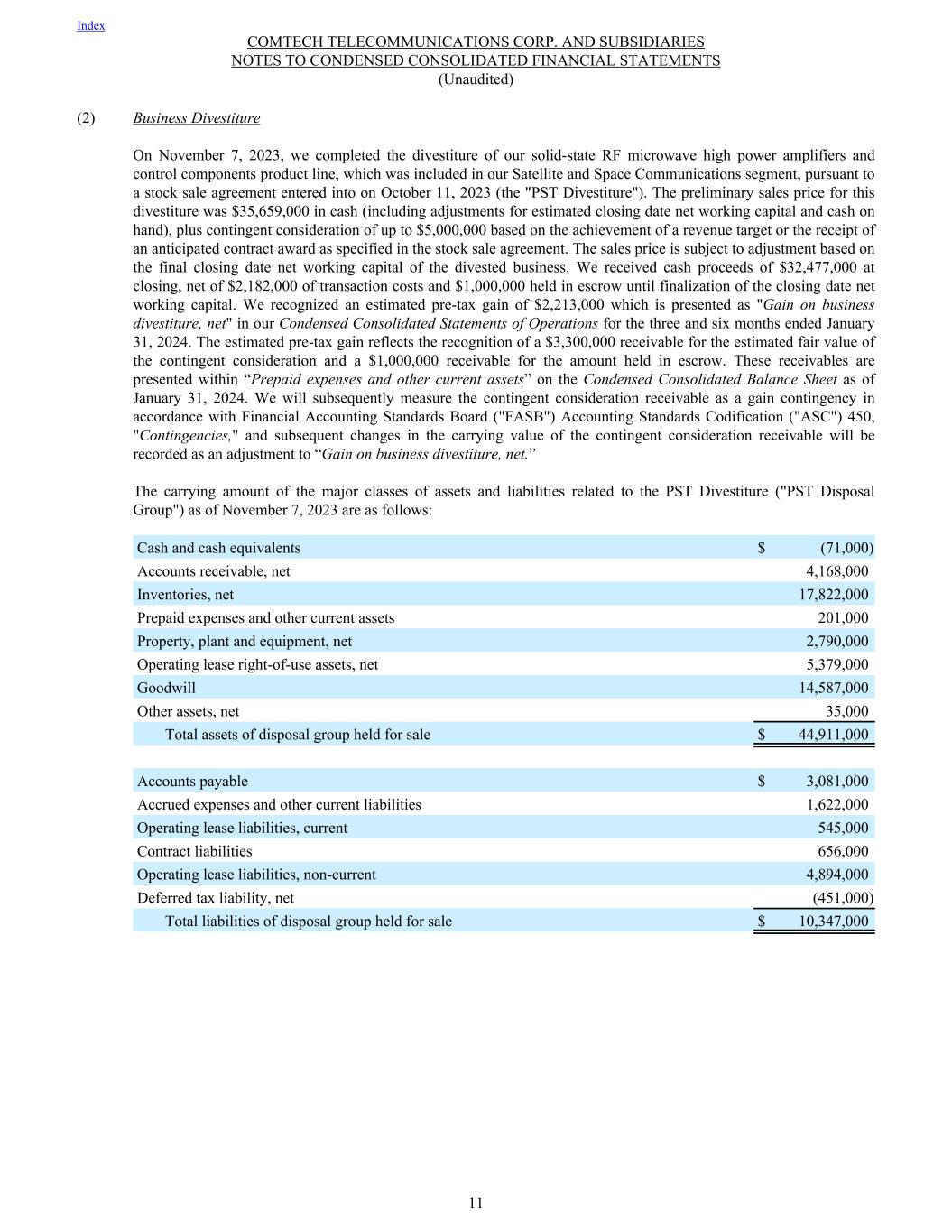

(2) Business Divestiture On November 7, 2023, we completed the divestiture of our solid-state RF microwave high power amplifiers and control components product line, which was included in our Satellite and Space Communications segment, pursuant to a stock sale agreement entered into on October 11, 2023 (the "PST Divestiture"). The preliminary sales price for this divestiture was $35,659,000 in cash (including adjustments for estimated closing date net working capital and cash on hand), plus contingent consideration of up to $5,000,000 based on the achievement of a revenue target or the receipt of an anticipated contract award as specified in the stock sale agreement. The sales price is subject to adjustment based on the final closing date net working capital of the divested business. We received cash proceeds of $32,477,000 at closing, net of $2,182,000 of transaction costs and $1,000,000 held in escrow until finalization of the closing date net working capital. We recognized an estimated pre-tax gain of $2,213,000 which is presented as "Gain on business divestiture, net" in our Condensed Consolidated Statements of Operations for the three and six months ended January 31, 2024. The estimated pre-tax gain reflects the recognition of a $3,300,000 receivable for the estimated fair value of the contingent consideration and a $1,000,000 receivable for the amount held in escrow. These receivables are presented within “Prepaid expenses and other current assets” on the Condensed Consolidated Balance Sheet as of January 31, 2024. We will subsequently measure the contingent consideration receivable as a gain contingency in accordance with Financial Accounting Standards Board ("FASB") Accounting Standards Codification ("ASC") 450, "Contingencies," and subsequent changes in the carrying value of the contingent consideration receivable will be recorded as an adjustment to “Gain on business divestiture, net.” The carrying amount of the major classes of assets and liabilities related to the PST Divestiture ("PST Disposal Group") as of November 7, 2023 are as follows: Cash and cash equivalents $ (71,000) Accounts receivable, net 4,168,000 Inventories, net 17,822,000 Prepaid expenses and other current assets 201,000 Property, plant and equipment, net 2,790,000 Operating lease right-of-use assets, net 5,379,000 Goodwill 14,587,000 Other assets, net 35,000 Total assets of disposal group held for sale $ 44,911,000 Accounts payable $ 3,081,000 Accrued expenses and other current liabilities 1,622,000 Operating lease liabilities, current 545,000 Contract liabilities 656,000 Operating lease liabilities, non-current 4,894,000 Deferred tax liability, net (451,000) Total liabilities of disposal group held for sale $ 10,347,000 Index COMTECH TELECOMMUNICATIONS CORP. AND SUBSIDIARIES NOTES TO CONDENSED CONSOLIDATED FINANCIAL STATEMENTS (Unaudited) 11

(3) Adoption of Accounting Standards and Updates We are required to prepare our Condensed Consolidated Financial Statements in accordance with the FASB ASC, which is the source for all authoritative U.S. generally accepted accounting principles, which are commonly referred to as "GAAP." The FASB ASC is subject to updates by the FASB, which are known as Accounting Standards Updates ("ASUs"). During the six months ended January 31, 2024, the following FASB ASUs have been issued and incorporated into the FASB ASC and have not yet been adopted by us as of January 31, 2024: • FASB ASU No. 2023-07, which requires the disclosure of significant segment expenses, by reportable segment, regularly provided to the chief operating decision maker (“CODM”) and included within each reported measure of segment profit or loss. The disclosure of other segment items by reportable segment are also required and would constitute the difference between segment revenues less these significant segment expenses and reported segment profit or loss. On an annual basis, the update requires an entity to disclose the CODM's title and position, as well as describe how the CODM uses the reported measures. Additionally, all existing annual disclosures about segment profit or loss must be provided on an interim basis in addition to the disclosure of significant segment expenses and other segment items. This ASU is effective for fiscal years beginning after December 15, 2023 (our fiscal year beginning on August 1, 2024) and for interim periods within fiscal years beginning after December 15, 2024 (our interim period beginning on October 31, 2025), with early adoption permitted. We are evaluating the impact of this ASU on our Condensed Consolidated Financial Statements and disclosures. • FASB ASU No. 2023-09 enhances and establishes new income tax disclosure requirements in addition to modifying and eliminating certain existing requirements. Most notably under the new requirements is greater disaggregation of information in the effective tax rate reconciliation, including the inclusion of both percentages and amounts, specific categories, and additional information for reconciling items meeting a quantitative threshold defined by the guidance. Additionally, disclosures of income taxes paid and income tax expense must be disaggregated by federal, state and foreign taxes, with income taxes paid further disaggregated for individual jurisdictions that represent 5 percent or more of total income taxes paid. This ASU is effective for fiscal years beginning after December 15, 2024 (our fiscal year beginning on August 1, 2025), with early adoption permitted. We are evaluating the impact of this ASU on our Condensed Consolidated Financial Statements and disclosures. Index COMTECH TELECOMMUNICATIONS CORP. AND SUBSIDIARIES NOTES TO CONDENSED CONSOLIDATED FINANCIAL STATEMENTS (Unaudited) 12

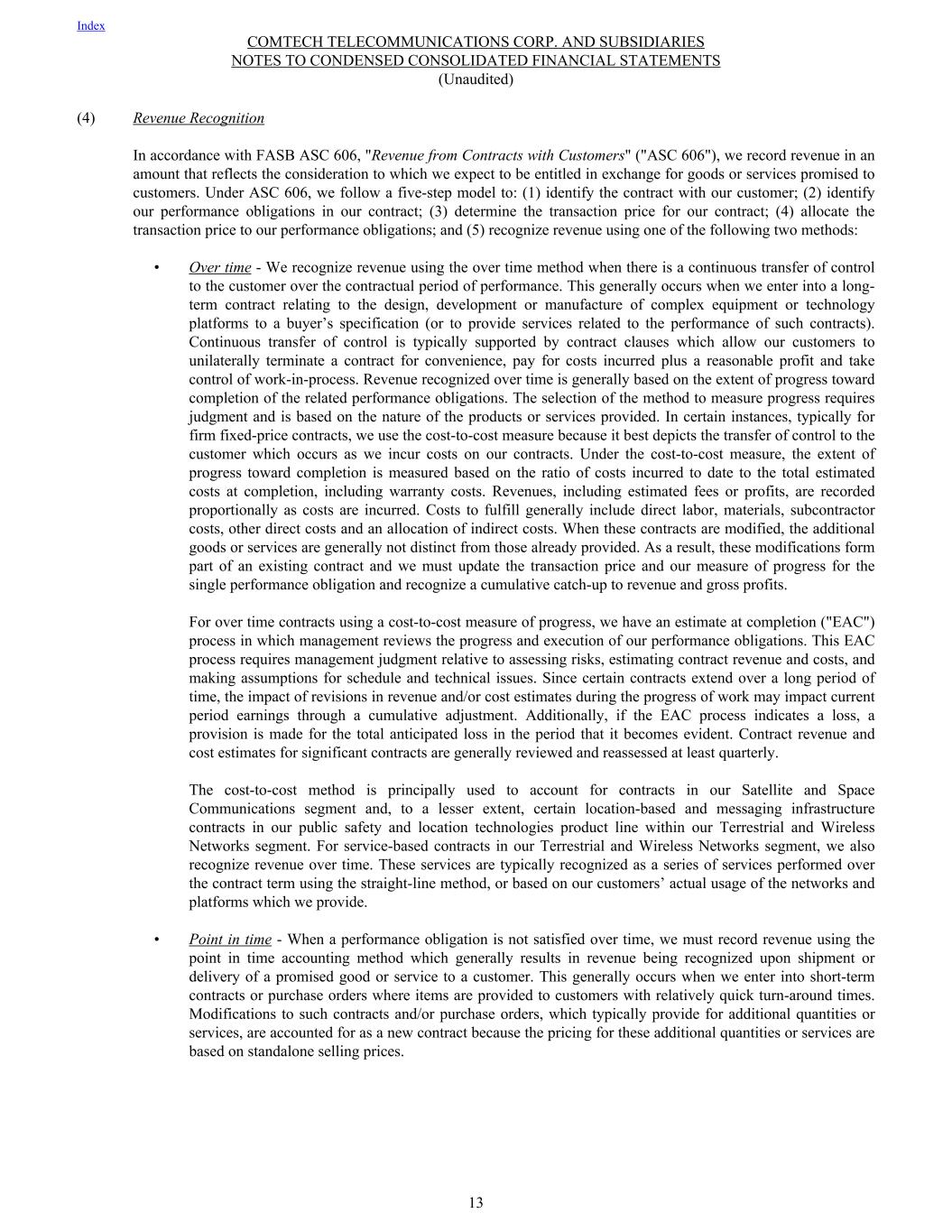

(4) Revenue Recognition In accordance with FASB ASC 606, "Revenue from Contracts with Customers" ("ASC 606"), we record revenue in an amount that reflects the consideration to which we expect to be entitled in exchange for goods or services promised to customers. Under ASC 606, we follow a five-step model to: (1) identify the contract with our customer; (2) identify our performance obligations in our contract; (3) determine the transaction price for our contract; (4) allocate the transaction price to our performance obligations; and (5) recognize revenue using one of the following two methods: • Over time - We recognize revenue using the over time method when there is a continuous transfer of control to the customer over the contractual period of performance. This generally occurs when we enter into a long- term contract relating to the design, development or manufacture of complex equipment or technology platforms to a buyer’s specification (or to provide services related to the performance of such contracts). Continuous transfer of control is typically supported by contract clauses which allow our customers to unilaterally terminate a contract for convenience, pay for costs incurred plus a reasonable profit and take control of work-in-process. Revenue recognized over time is generally based on the extent of progress toward completion of the related performance obligations. The selection of the method to measure progress requires judgment and is based on the nature of the products or services provided. In certain instances, typically for firm fixed-price contracts, we use the cost-to-cost measure because it best depicts the transfer of control to the customer which occurs as we incur costs on our contracts. Under the cost-to-cost measure, the extent of progress toward completion is measured based on the ratio of costs incurred to date to the total estimated costs at completion, including warranty costs. Revenues, including estimated fees or profits, are recorded proportionally as costs are incurred. Costs to fulfill generally include direct labor, materials, subcontractor costs, other direct costs and an allocation of indirect costs. When these contracts are modified, the additional goods or services are generally not distinct from those already provided. As a result, these modifications form part of an existing contract and we must update the transaction price and our measure of progress for the single performance obligation and recognize a cumulative catch-up to revenue and gross profits. For over time contracts using a cost-to-cost measure of progress, we have an estimate at completion ("EAC") process in which management reviews the progress and execution of our performance obligations. This EAC process requires management judgment relative to assessing risks, estimating contract revenue and costs, and making assumptions for schedule and technical issues. Since certain contracts extend over a long period of time, the impact of revisions in revenue and/or cost estimates during the progress of work may impact current period earnings through a cumulative adjustment. Additionally, if the EAC process indicates a loss, a provision is made for the total anticipated loss in the period that it becomes evident. Contract revenue and cost estimates for significant contracts are generally reviewed and reassessed at least quarterly. The cost-to-cost method is principally used to account for contracts in our Satellite and Space Communications segment and, to a lesser extent, certain location-based and messaging infrastructure contracts in our public safety and location technologies product line within our Terrestrial and Wireless Networks segment. For service-based contracts in our Terrestrial and Wireless Networks segment, we also recognize revenue over time. These services are typically recognized as a series of services performed over the contract term using the straight-line method, or based on our customers’ actual usage of the networks and platforms which we provide. • Point in time - When a performance obligation is not satisfied over time, we must record revenue using the point in time accounting method which generally results in revenue being recognized upon shipment or delivery of a promised good or service to a customer. This generally occurs when we enter into short-term contracts or purchase orders where items are provided to customers with relatively quick turn-around times. Modifications to such contracts and/or purchase orders, which typically provide for additional quantities or services, are accounted for as a new contract because the pricing for these additional quantities or services are based on standalone selling prices. Index COMTECH TELECOMMUNICATIONS CORP. AND SUBSIDIARIES NOTES TO CONDENSED CONSOLIDATED FINANCIAL STATEMENTS (Unaudited) 13

Point in time accounting is principally applied to contracts in our satellite ground station technologies product line (which includes satellite modems, solid-state and traveling wave tube amplifiers). The contracts related to these product lines do not meet the requirements for over time revenue recognition because our customers cannot utilize the equipment for its intended purpose during any phase of our manufacturing process; customers do not simultaneously receive and/or consume the benefits provided by our performance; customers do not control the asset (i.e., prior to delivery, customers cannot direct the use of the asset, sell or exchange the equipment, etc.); and, although many of our contracts have termination for convenience clauses and/or an enforceable right to payment for performance completed to date, our performance creates an asset with an alternative use through the point of delivery. In determining that our equipment has alternative use, we considered the underlying manufacturing process for our products. In the early phases of manufacturing, raw materials and work in process (including subassemblies) consist of common parts that are highly fungible among many different types of products and customer applications. Finished products are either configured to our standard configuration or based on our customers’ specifications. Finished products, whether built to our standard specification or to a customers’ specification, can be sold to a variety of customers and across many different end use applications with minimal rework, if needed, and without incurring a significant economic loss. When identifying a contract with our customer, we consider when it has approval and commitment from both parties, if the rights of the parties are identified, if the payment terms are identified, if it has commercial substance and if collectability is probable. When identifying performance obligations, we consider whether there are multiple promises and how to account for them. In our contracts, multiple promises are separated if they are distinct, both individually and in the context of the contract. If multiple promises in a contract are highly interrelated or comprise a series of distinct services performed over time, they are combined into a single performance obligation. In some cases, we may also provide the customer with an additional service-type warranty, which we recognize as a separate performance obligation. Service-type warranties do not represent a significant portion of our consolidated net sales. When service-type warranties represent a separate performance obligation, the revenue is deferred and recognized ratably over the extended warranty period. Our contracts, from time-to-time, may also include options for additional goods and services. To date, these options have not represented material rights to the customer as the pricing for them reflects standalone selling prices. As a result, we do not consider options we offer to be performance obligations for which we must allocate a portion of the transaction price. In many cases, we provide assurance-type warranty coverage for some of our products for a period of at least one year from the date of delivery. When identifying the transaction price, we typically utilize the contract's stated price as a starting point. The transaction price in certain arrangements may include estimated amounts of variable consideration, including award fees, incentive fees or other provisions that can either increase or decrease the transaction price. We estimate variable consideration as the amount to which we expect to be entitled, and we include estimated amounts in the transaction price to the extent it is probable that a significant reversal of cumulative revenue recognized will not occur when the estimation uncertainty is resolved. The estimation of this variable consideration and determination of whether to include estimated amounts in the transaction price are based largely on an assessment of our anticipated performance and all information (e.g., historical, current and forecasted) that is reasonably available to us. When allocating the contract’s transaction price, we consider each distinct performance obligation. For contracts with multiple performance obligations, we allocate the contract’s transaction price to each performance obligation using our best estimate of the standalone selling price of each distinct good or service in the contract. We determine standalone selling price based on the price at which the performance obligation is sold separately. If the standalone selling price is not observable through past transactions, we estimate the standalone selling price taking into account available information such as market conditions, including geographic or regional specific factors, competitive positioning, internal costs, profit objectives and internally approved pricing guidelines related to the performance obligations. Index COMTECH TELECOMMUNICATIONS CORP. AND SUBSIDIARIES NOTES TO CONDENSED CONSOLIDATED FINANCIAL STATEMENTS (Unaudited) 14

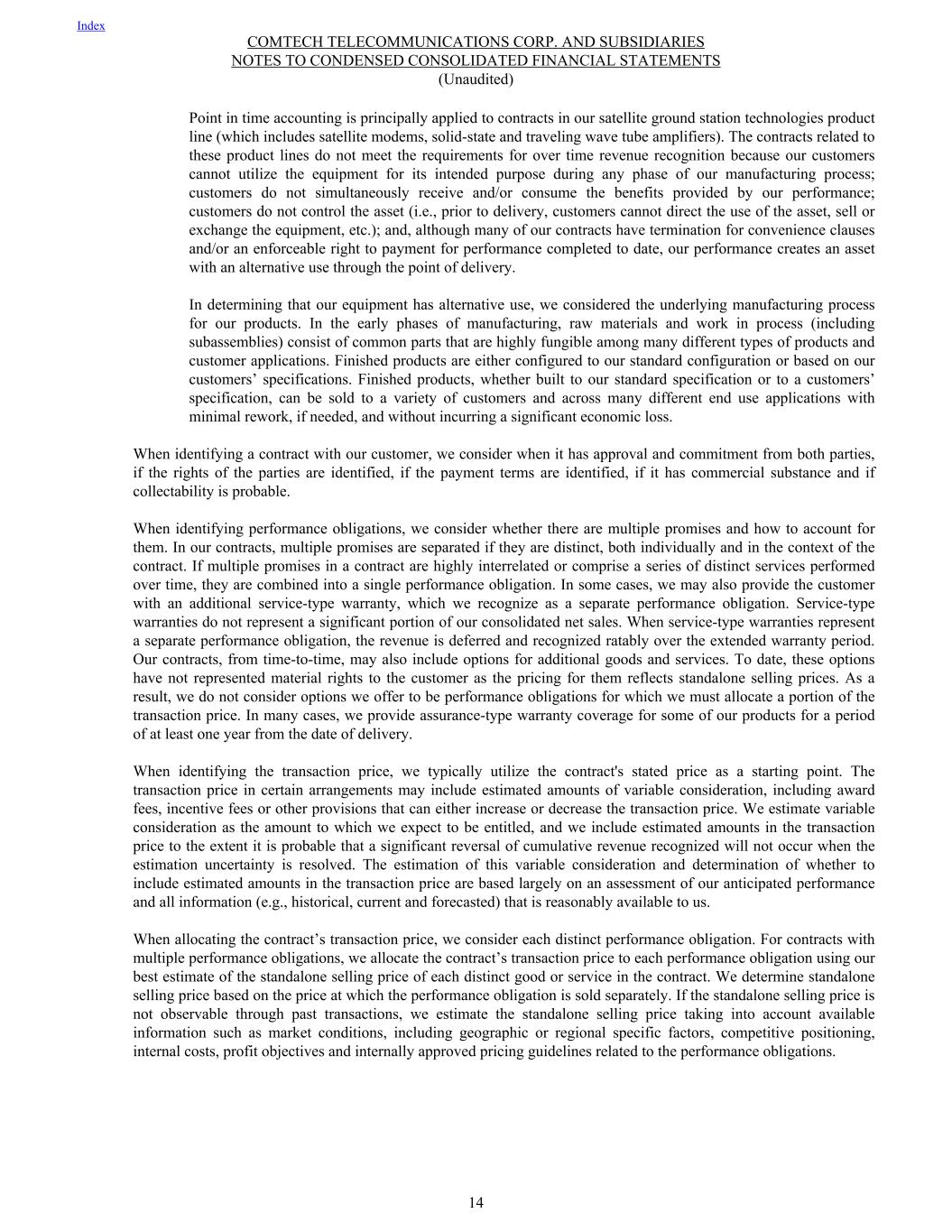

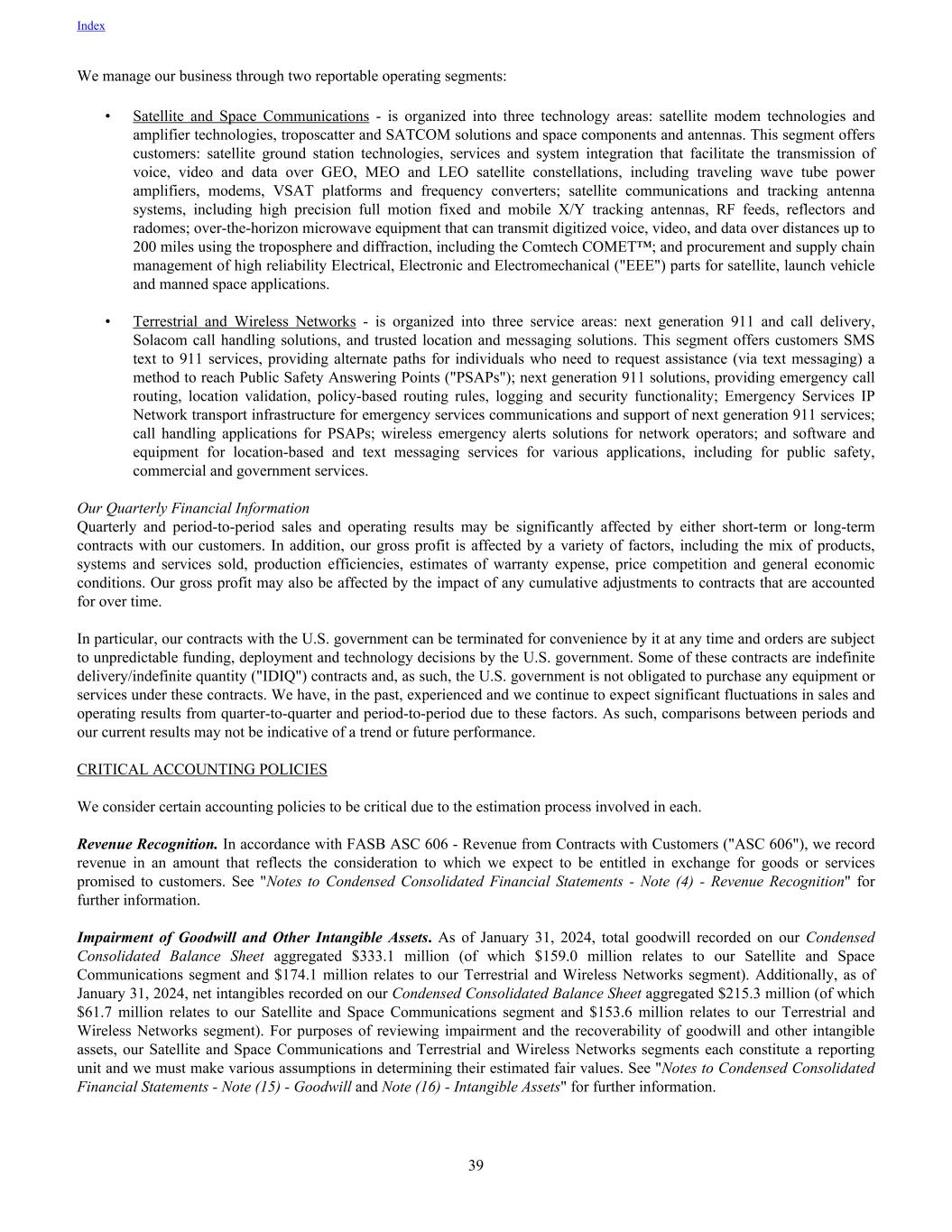

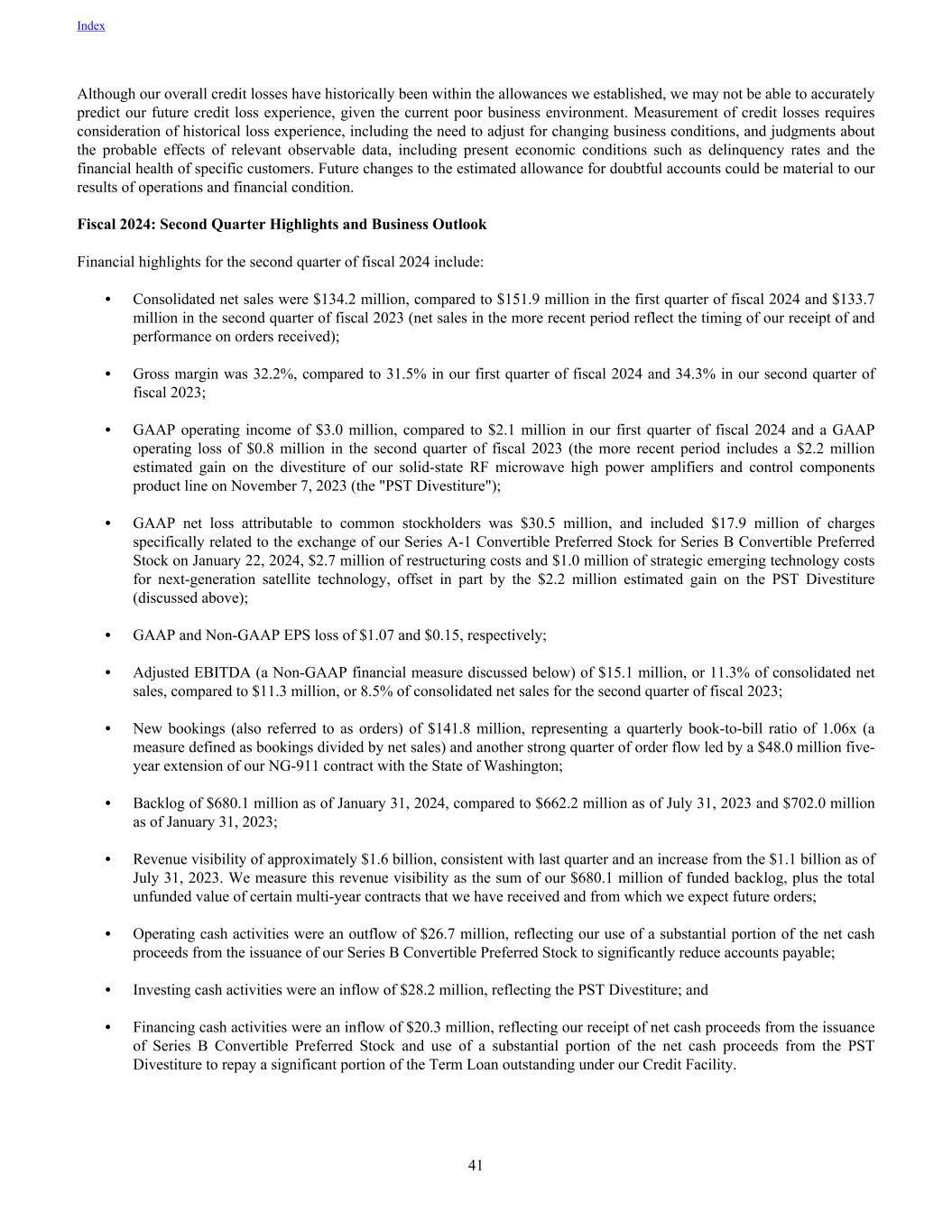

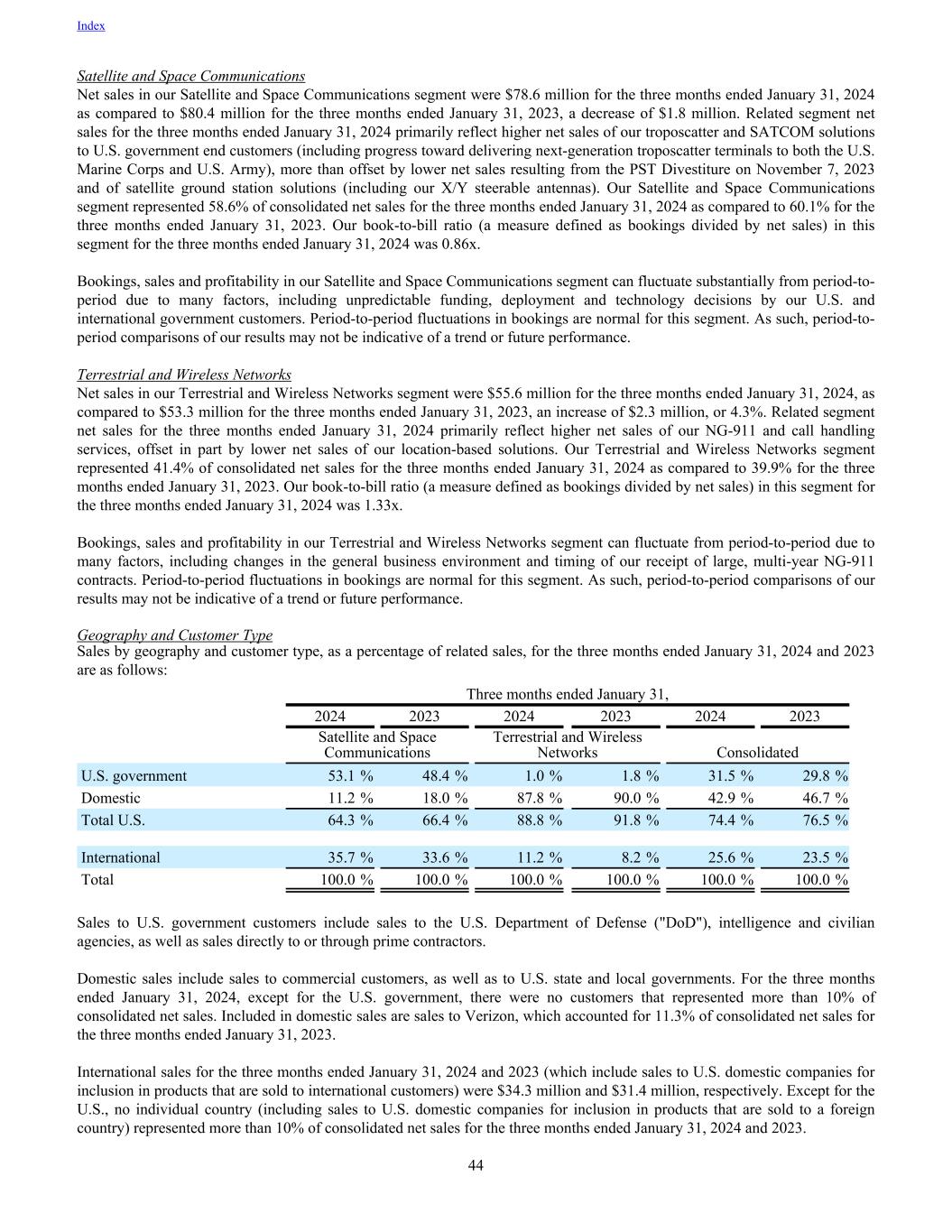

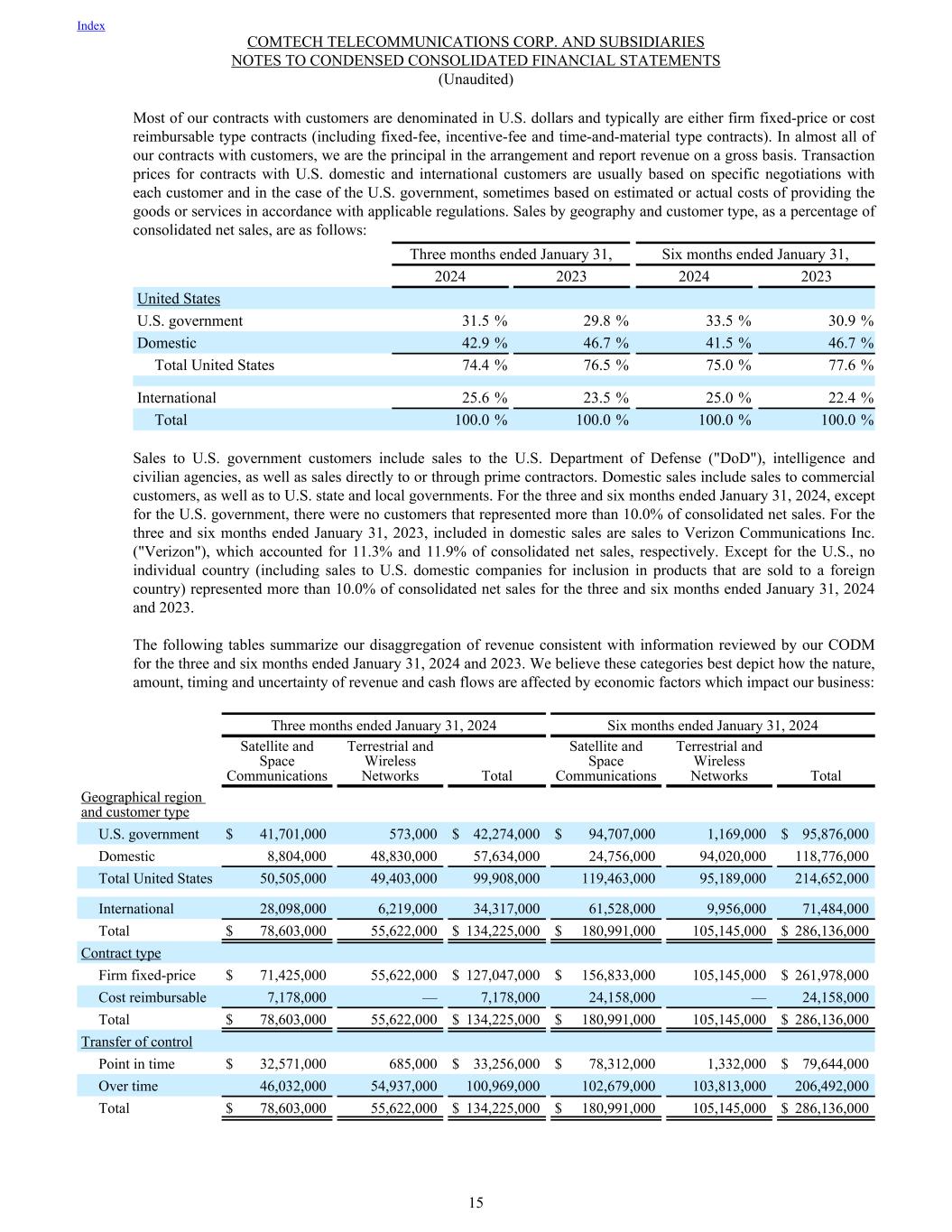

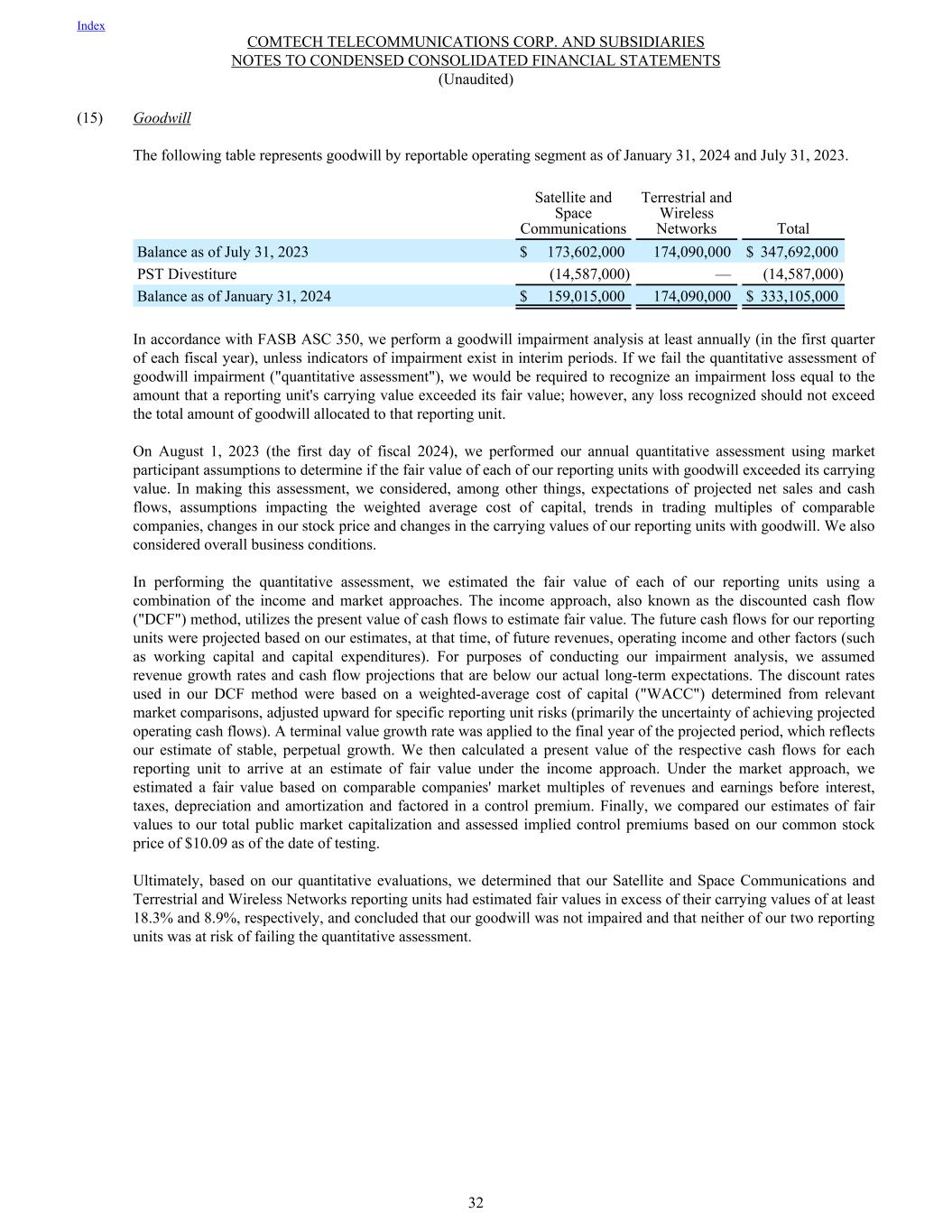

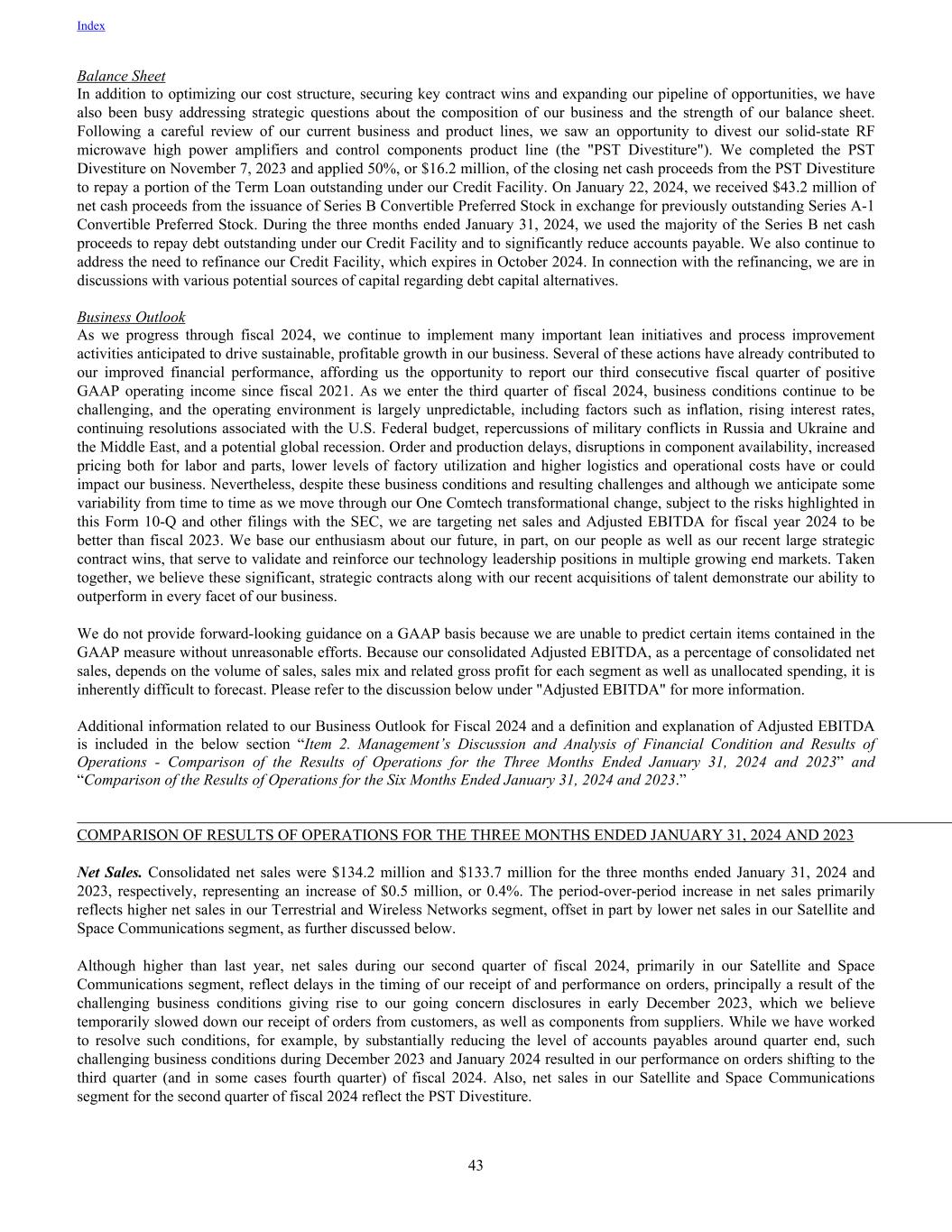

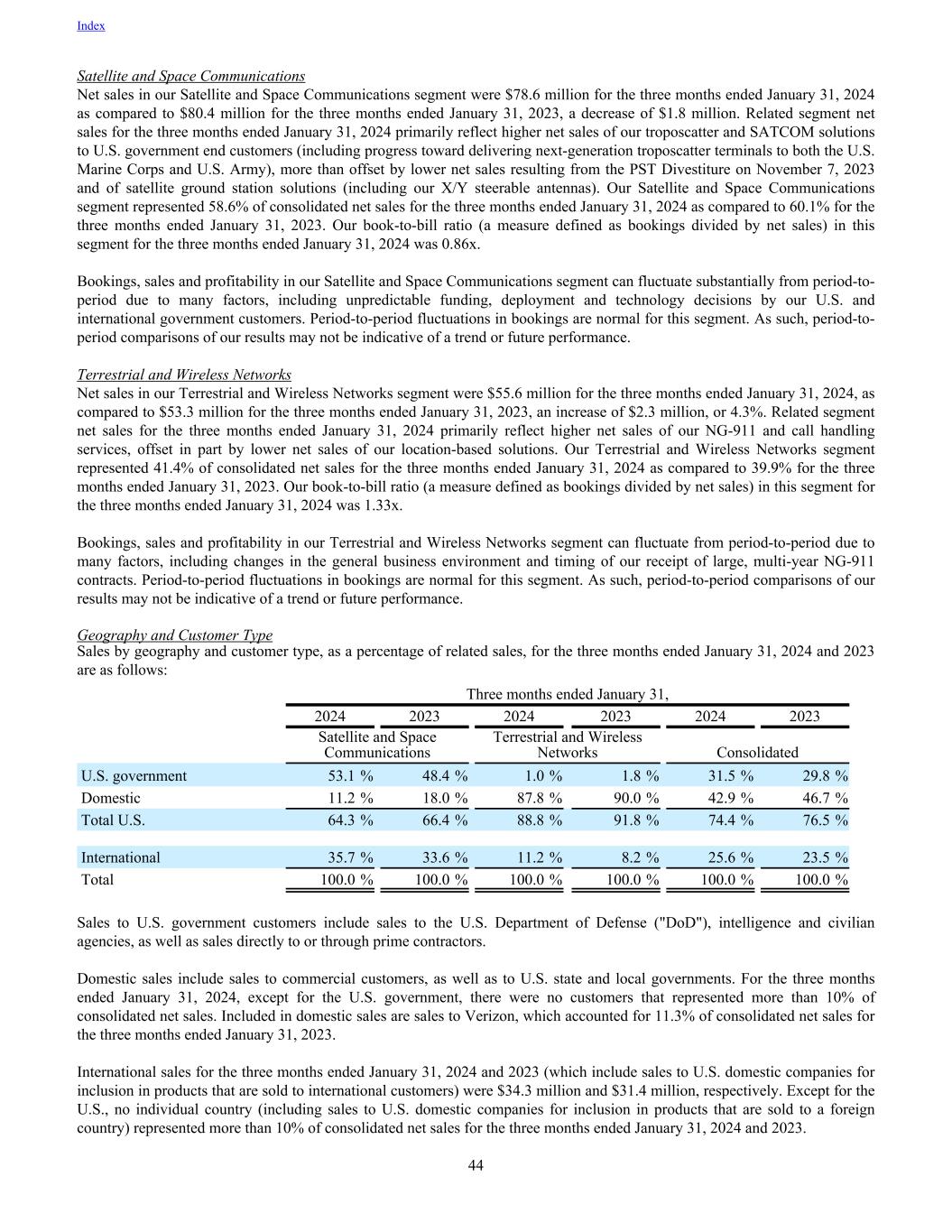

Most of our contracts with customers are denominated in U.S. dollars and typically are either firm fixed-price or cost reimbursable type contracts (including fixed-fee, incentive-fee and time-and-material type contracts). In almost all of our contracts with customers, we are the principal in the arrangement and report revenue on a gross basis. Transaction prices for contracts with U.S. domestic and international customers are usually based on specific negotiations with each customer and in the case of the U.S. government, sometimes based on estimated or actual costs of providing the goods or services in accordance with applicable regulations. Sales by geography and customer type, as a percentage of consolidated net sales, are as follows: Three months ended January 31, Six months ended January 31, 2024 2023 2024 2023 United States U.S. government 31.5 % 29.8 % 33.5 % 30.9 % Domestic 42.9 % 46.7 % 41.5 % 46.7 % Total United States 74.4 % 76.5 % 75.0 % 77.6 % International 25.6 % 23.5 % 25.0 % 22.4 % Total 100.0 % 100.0 % 100.0 % 100.0 % Sales to U.S. government customers include sales to the U.S. Department of Defense ("DoD"), intelligence and civilian agencies, as well as sales directly to or through prime contractors. Domestic sales include sales to commercial customers, as well as to U.S. state and local governments. For the three and six months ended January 31, 2024, except for the U.S. government, there were no customers that represented more than 10.0% of consolidated net sales. For the three and six months ended January 31, 2023, included in domestic sales are sales to Verizon Communications Inc. ("Verizon"), which accounted for 11.3% and 11.9% of consolidated net sales, respectively. Except for the U.S., no individual country (including sales to U.S. domestic companies for inclusion in products that are sold to a foreign country) represented more than 10.0% of consolidated net sales for the three and six months ended January 31, 2024 and 2023. The following tables summarize our disaggregation of revenue consistent with information reviewed by our CODM for the three and six months ended January 31, 2024 and 2023. We believe these categories best depict how the nature, amount, timing and uncertainty of revenue and cash flows are affected by economic factors which impact our business: Three months ended January 31, 2024 Six months ended January 31, 2024 Satellite and Space Communications Terrestrial and Wireless Networks Total Satellite and Space Communications Terrestrial and Wireless Networks Total Geographical region and customer type U.S. government $ 41,701,000 573,000 $ 42,274,000 $ 94,707,000 1,169,000 $ 95,876,000 Domestic 8,804,000 48,830,000 57,634,000 24,756,000 94,020,000 118,776,000 Total United States 50,505,000 49,403,000 99,908,000 119,463,000 95,189,000 214,652,000 International 28,098,000 6,219,000 34,317,000 61,528,000 9,956,000 71,484,000 Total $ 78,603,000 55,622,000 $ 134,225,000 $ 180,991,000 105,145,000 $ 286,136,000 Contract type Firm fixed-price $ 71,425,000 55,622,000 $ 127,047,000 $ 156,833,000 105,145,000 $ 261,978,000 Cost reimbursable 7,178,000 — 7,178,000 24,158,000 — 24,158,000 Total $ 78,603,000 55,622,000 $ 134,225,000 $ 180,991,000 105,145,000 $ 286,136,000 Transfer of control Point in time $ 32,571,000 685,000 $ 33,256,000 $ 78,312,000 1,332,000 $ 79,644,000 Over time 46,032,000 54,937,000 100,969,000 102,679,000 103,813,000 206,492,000 Total $ 78,603,000 55,622,000 $ 134,225,000 $ 180,991,000 105,145,000 $ 286,136,000 Index COMTECH TELECOMMUNICATIONS CORP. AND SUBSIDIARIES NOTES TO CONDENSED CONSOLIDATED FINANCIAL STATEMENTS (Unaudited) 15

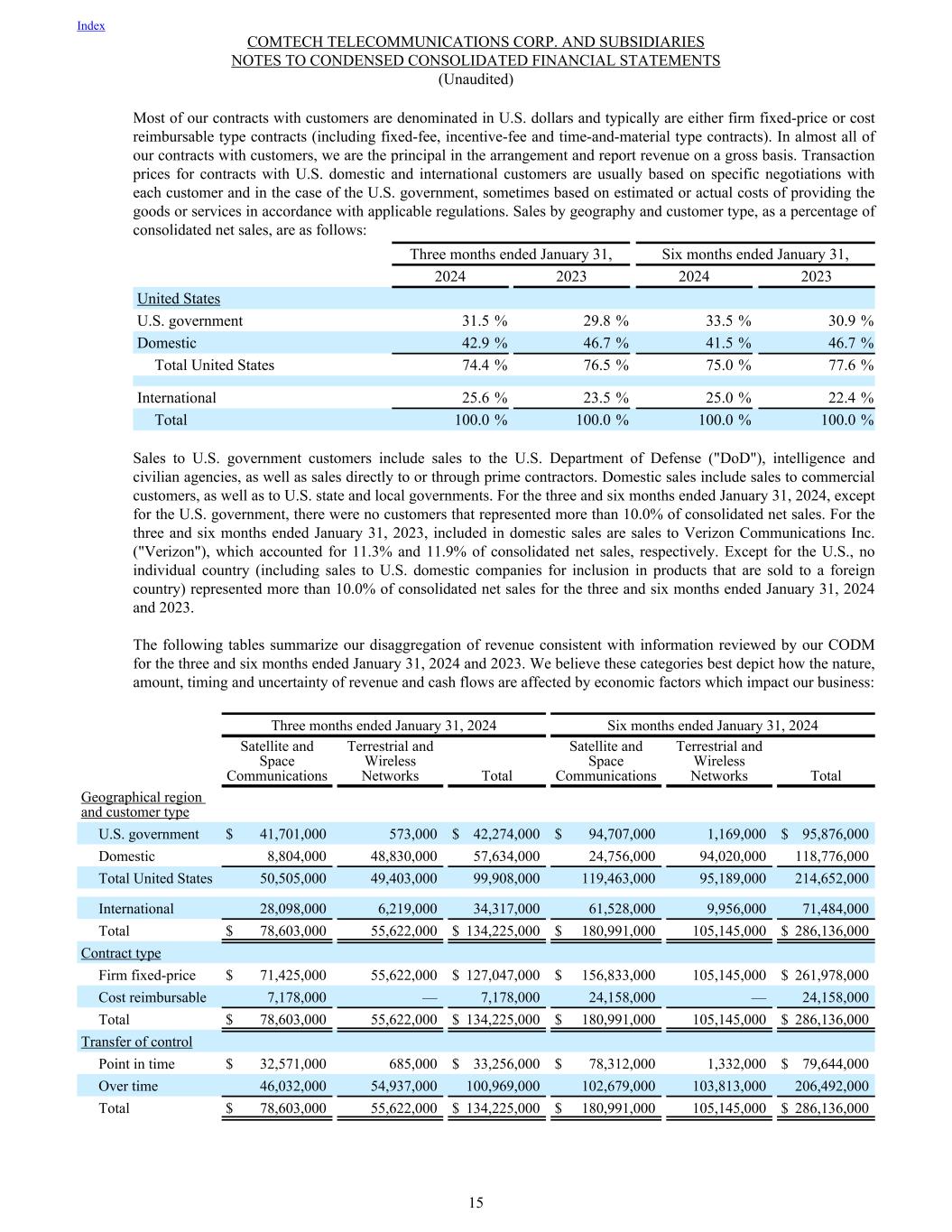

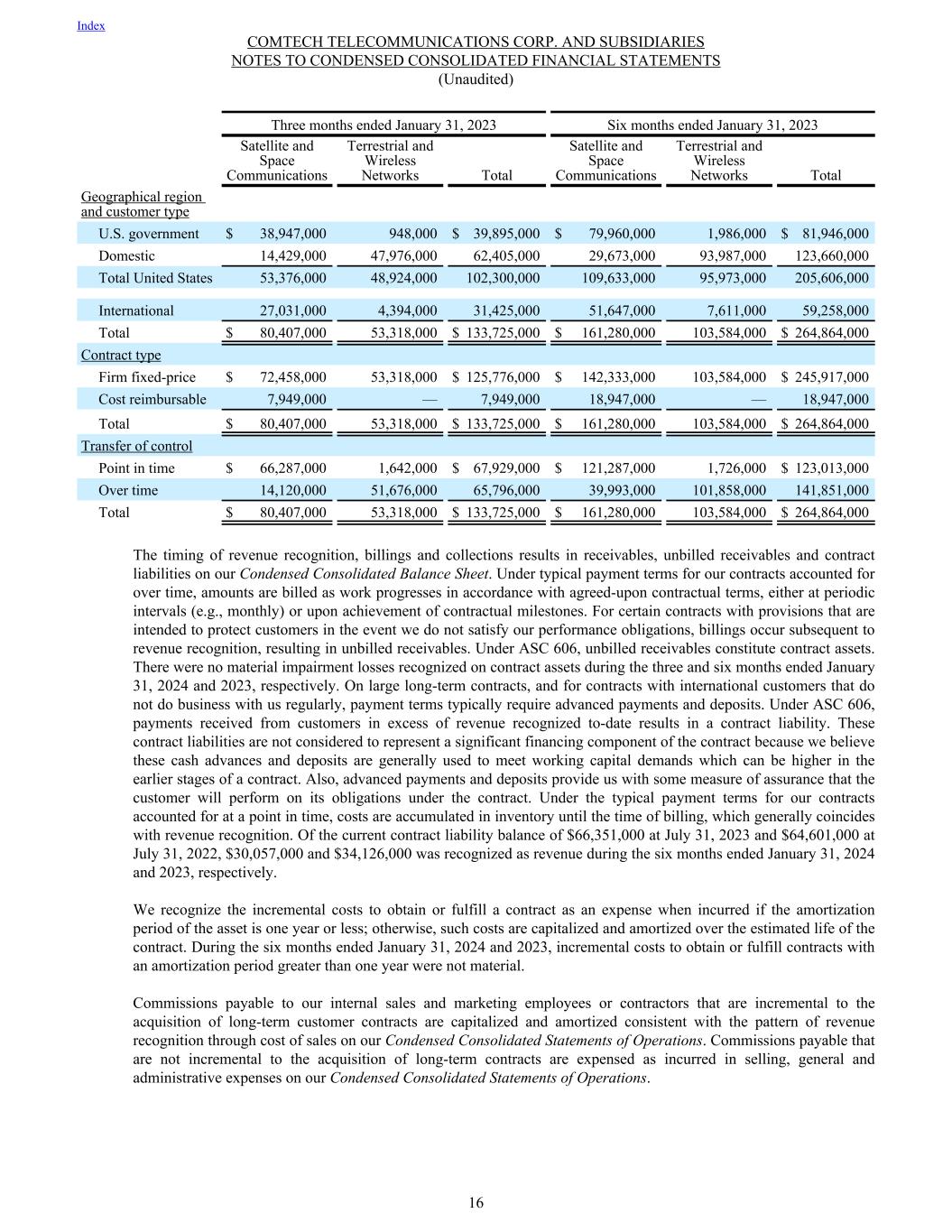

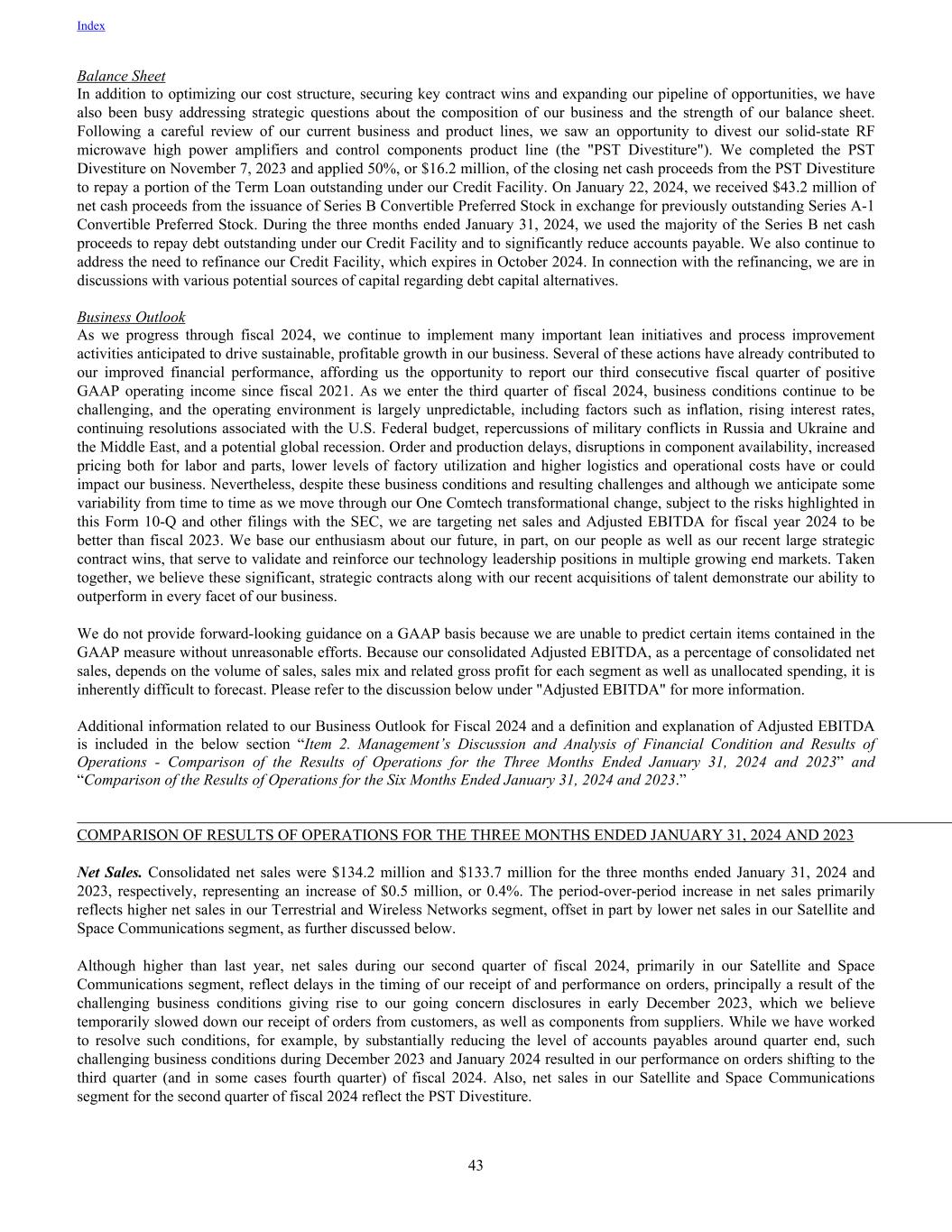

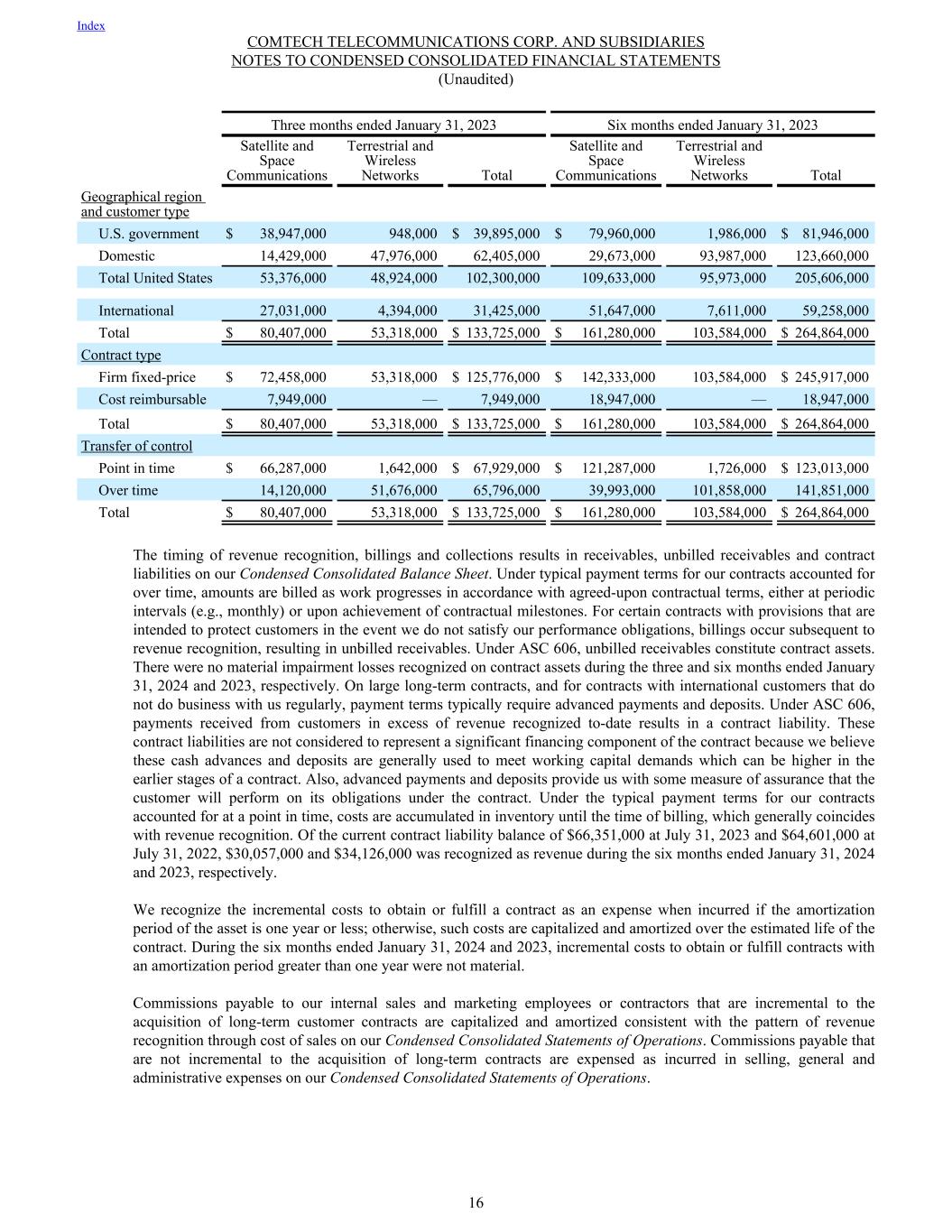

Three months ended January 31, 2023 Six months ended January 31, 2023 Satellite and Space Communications Terrestrial and Wireless Networks Total Satellite and Space Communications Terrestrial and Wireless Networks Total Geographical region and customer type U.S. government $ 38,947,000 948,000 $ 39,895,000 $ 79,960,000 1,986,000 $ 81,946,000 Domestic 14,429,000 47,976,000 62,405,000 29,673,000 93,987,000 123,660,000 Total United States 53,376,000 48,924,000 102,300,000 109,633,000 95,973,000 205,606,000 International 27,031,000 4,394,000 31,425,000 51,647,000 7,611,000 59,258,000 Total $ 80,407,000 53,318,000 $ 133,725,000 $ 161,280,000 103,584,000 $ 264,864,000 Contract type Firm fixed-price $ 72,458,000 53,318,000 $ 125,776,000 $ 142,333,000 103,584,000 $ 245,917,000 Cost reimbursable 7,949,000 — 7,949,000 18,947,000 — 18,947,000 Total $ 80,407,000 53,318,000 $ 133,725,000 $ 161,280,000 103,584,000 $ 264,864,000 Transfer of control Point in time $ 66,287,000 1,642,000 $ 67,929,000 $ 121,287,000 1,726,000 $ 123,013,000 Over time 14,120,000 51,676,000 65,796,000 39,993,000 101,858,000 141,851,000 Total $ 80,407,000 53,318,000 $ 133,725,000 $ 161,280,000 103,584,000 $ 264,864,000 The timing of revenue recognition, billings and collections results in receivables, unbilled receivables and contract liabilities on our Condensed Consolidated Balance Sheet. Under typical payment terms for our contracts accounted for over time, amounts are billed as work progresses in accordance with agreed-upon contractual terms, either at periodic intervals (e.g., monthly) or upon achievement of contractual milestones. For certain contracts with provisions that are intended to protect customers in the event we do not satisfy our performance obligations, billings occur subsequent to revenue recognition, resulting in unbilled receivables. Under ASC 606, unbilled receivables constitute contract assets. There were no material impairment losses recognized on contract assets during the three and six months ended January 31, 2024 and 2023, respectively. On large long-term contracts, and for contracts with international customers that do not do business with us regularly, payment terms typically require advanced payments and deposits. Under ASC 606, payments received from customers in excess of revenue recognized to-date results in a contract liability. These contract liabilities are not considered to represent a significant financing component of the contract because we believe these cash advances and deposits are generally used to meet working capital demands which can be higher in the earlier stages of a contract. Also, advanced payments and deposits provide us with some measure of assurance that the customer will perform on its obligations under the contract. Under the typical payment terms for our contracts accounted for at a point in time, costs are accumulated in inventory until the time of billing, which generally coincides with revenue recognition. Of the current contract liability balance of $66,351,000 at July 31, 2023 and $64,601,000 at July 31, 2022, $30,057,000 and $34,126,000 was recognized as revenue during the six months ended January 31, 2024 and 2023, respectively. We recognize the incremental costs to obtain or fulfill a contract as an expense when incurred if the amortization period of the asset is one year or less; otherwise, such costs are capitalized and amortized over the estimated life of the contract. During the six months ended January 31, 2024 and 2023, incremental costs to obtain or fulfill contracts with an amortization period greater than one year were not material. Commissions payable to our internal sales and marketing employees or contractors that are incremental to the acquisition of long-term customer contracts are capitalized and amortized consistent with the pattern of revenue recognition through cost of sales on our Condensed Consolidated Statements of Operations. Commissions payable that are not incremental to the acquisition of long-term contracts are expensed as incurred in selling, general and administrative expenses on our Condensed Consolidated Statements of Operations. Index COMTECH TELECOMMUNICATIONS CORP. AND SUBSIDIARIES NOTES TO CONDENSED CONSOLIDATED FINANCIAL STATEMENTS (Unaudited) 16

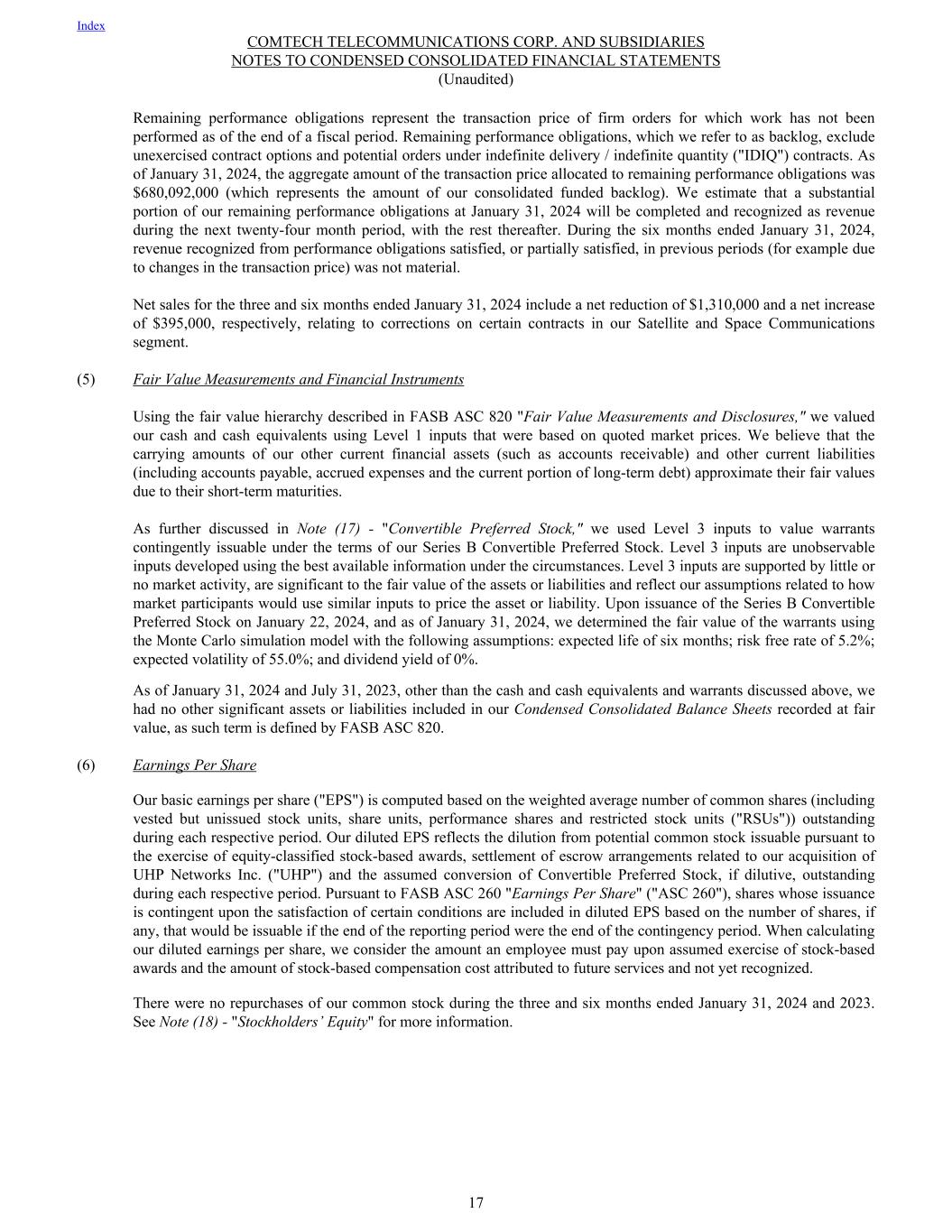

Remaining performance obligations represent the transaction price of firm orders for which work has not been performed as of the end of a fiscal period. Remaining performance obligations, which we refer to as backlog, exclude unexercised contract options and potential orders under indefinite delivery / indefinite quantity ("IDIQ") contracts. As of January 31, 2024, the aggregate amount of the transaction price allocated to remaining performance obligations was $680,092,000 (which represents the amount of our consolidated funded backlog). We estimate that a substantial portion of our remaining performance obligations at January 31, 2024 will be completed and recognized as revenue during the next twenty-four month period, with the rest thereafter. During the six months ended January 31, 2024, revenue recognized from performance obligations satisfied, or partially satisfied, in previous periods (for example due to changes in the transaction price) was not material. Net sales for the three and six months ended January 31, 2024 include a net reduction of $1,310,000 and a net increase of $395,000, respectively, relating to corrections on certain contracts in our Satellite and Space Communications segment. (5) Fair Value Measurements and Financial Instruments Using the fair value hierarchy described in FASB ASC 820 "Fair Value Measurements and Disclosures," we valued our cash and cash equivalents using Level 1 inputs that were based on quoted market prices. We believe that the carrying amounts of our other current financial assets (such as accounts receivable) and other current liabilities (including accounts payable, accrued expenses and the current portion of long-term debt) approximate their fair values due to their short-term maturities. As further discussed in Note (17) - "Convertible Preferred Stock," we used Level 3 inputs to value warrants contingently issuable under the terms of our Series B Convertible Preferred Stock. Level 3 inputs are unobservable inputs developed using the best available information under the circumstances. Level 3 inputs are supported by little or no market activity, are significant to the fair value of the assets or liabilities and reflect our assumptions related to how market participants would use similar inputs to price the asset or liability. Upon issuance of the Series B Convertible Preferred Stock on January 22, 2024, and as of January 31, 2024, we determined the fair value of the warrants using the Monte Carlo simulation model with the following assumptions: expected life of six months; risk free rate of 5.2%; expected volatility of 55.0%; and dividend yield of 0%. As of January 31, 2024 and July 31, 2023, other than the cash and cash equivalents and warrants discussed above, we had no other significant assets or liabilities included in our Condensed Consolidated Balance Sheets recorded at fair value, as such term is defined by FASB ASC 820. (6) Earnings Per Share Our basic earnings per share ("EPS") is computed based on the weighted average number of common shares (including vested but unissued stock units, share units, performance shares and restricted stock units ("RSUs")) outstanding during each respective period. Our diluted EPS reflects the dilution from potential common stock issuable pursuant to the exercise of equity-classified stock-based awards, settlement of escrow arrangements related to our acquisition of UHP Networks Inc. ("UHP") and the assumed conversion of Convertible Preferred Stock, if dilutive, outstanding during each respective period. Pursuant to FASB ASC 260 "Earnings Per Share" ("ASC 260"), shares whose issuance is contingent upon the satisfaction of certain conditions are included in diluted EPS based on the number of shares, if any, that would be issuable if the end of the reporting period were the end of the contingency period. When calculating our diluted earnings per share, we consider the amount an employee must pay upon assumed exercise of stock-based awards and the amount of stock-based compensation cost attributed to future services and not yet recognized. There were no repurchases of our common stock during the three and six months ended January 31, 2024 and 2023. See Note (18) - "Stockholders’ Equity" for more information. Index COMTECH TELECOMMUNICATIONS CORP. AND SUBSIDIARIES NOTES TO CONDENSED CONSOLIDATED FINANCIAL STATEMENTS (Unaudited) 17

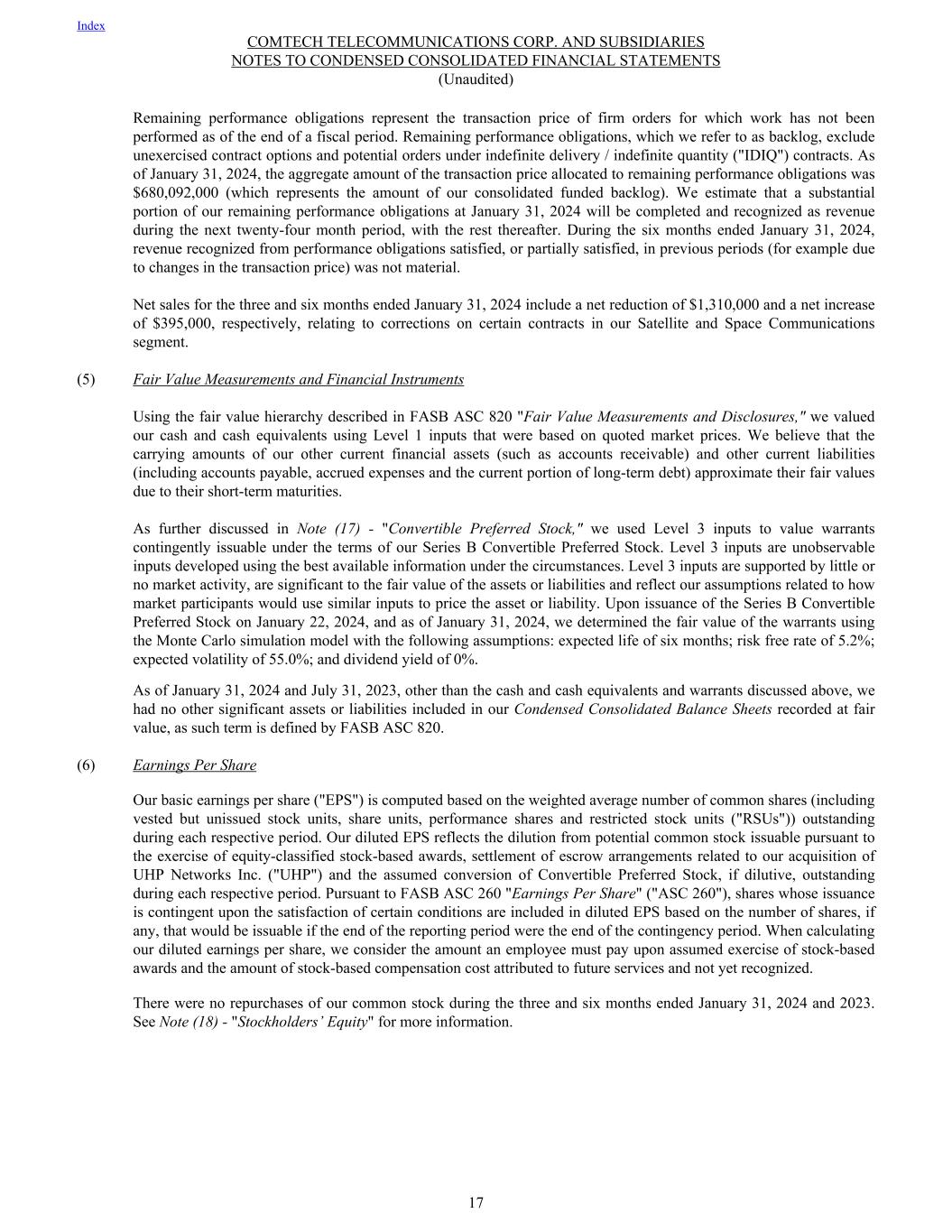

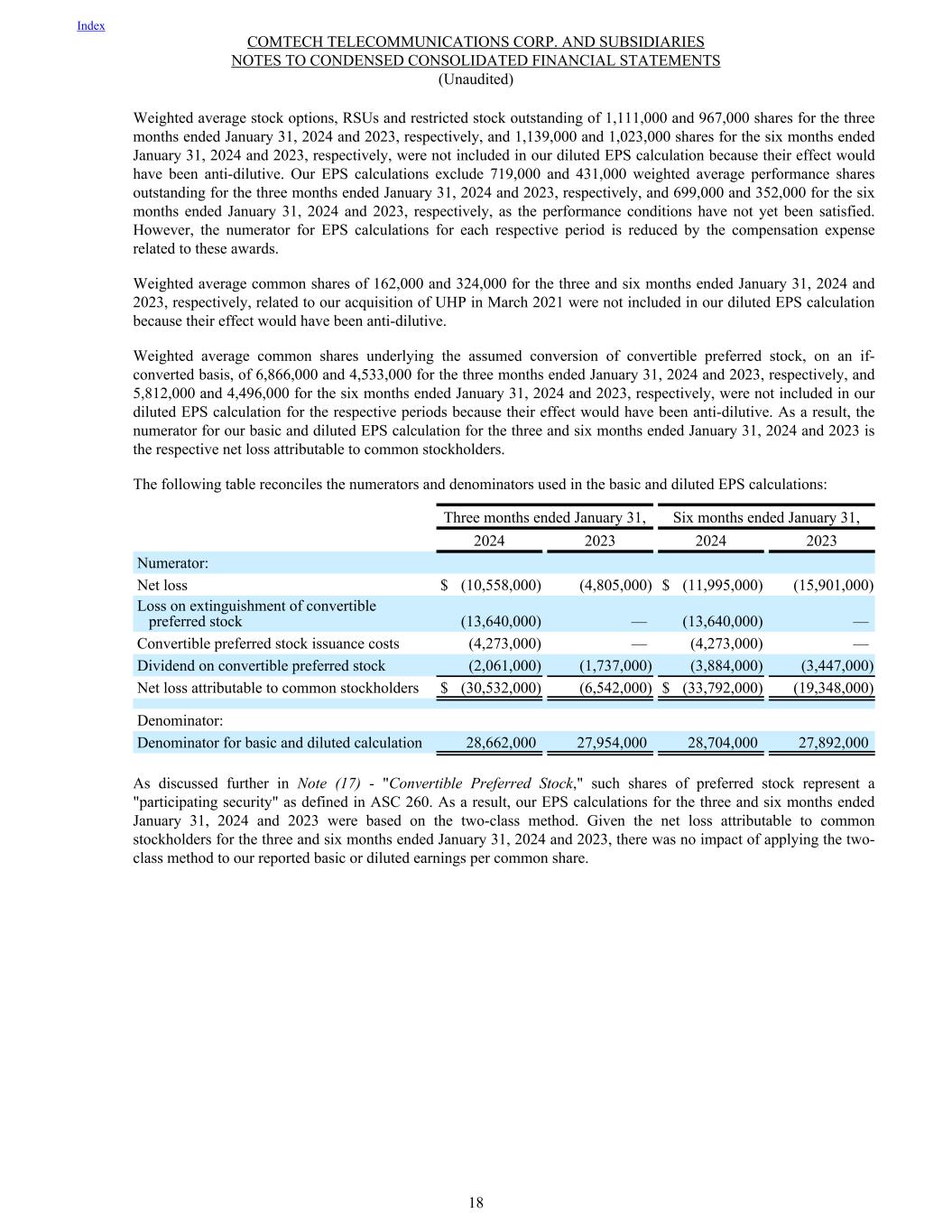

Weighted average stock options, RSUs and restricted stock outstanding of 1,111,000 and 967,000 shares for the three months ended January 31, 2024 and 2023, respectively, and 1,139,000 and 1,023,000 shares for the six months ended January 31, 2024 and 2023, respectively, were not included in our diluted EPS calculation because their effect would have been anti-dilutive. Our EPS calculations exclude 719,000 and 431,000 weighted average performance shares outstanding for the three months ended January 31, 2024 and 2023, respectively, and 699,000 and 352,000 for the six months ended January 31, 2024 and 2023, respectively, as the performance conditions have not yet been satisfied. However, the numerator for EPS calculations for each respective period is reduced by the compensation expense related to these awards. Weighted average common shares of 162,000 and 324,000 for the three and six months ended January 31, 2024 and 2023, respectively, related to our acquisition of UHP in March 2021 were not included in our diluted EPS calculation because their effect would have been anti-dilutive. Weighted average common shares underlying the assumed conversion of convertible preferred stock, on an if- converted basis, of 6,866,000 and 4,533,000 for the three months ended January 31, 2024 and 2023, respectively, and 5,812,000 and 4,496,000 for the six months ended January 31, 2024 and 2023, respectively, were not included in our diluted EPS calculation for the respective periods because their effect would have been anti-dilutive. As a result, the numerator for our basic and diluted EPS calculation for the three and six months ended January 31, 2024 and 2023 is the respective net loss attributable to common stockholders. The following table reconciles the numerators and denominators used in the basic and diluted EPS calculations: Three months ended January 31, Six months ended January 31, 2024 2023 2024 2023 Numerator: Net loss $ (10,558,000) (4,805,000) $ (11,995,000) (15,901,000) Loss on extinguishment of convertible preferred stock (13,640,000) — (13,640,000) — Convertible preferred stock issuance costs (4,273,000) — (4,273,000) — Dividend on convertible preferred stock (2,061,000) (1,737,000) (3,884,000) (3,447,000) Net loss attributable to common stockholders $ (30,532,000) (6,542,000) $ (33,792,000) (19,348,000) Denominator: Denominator for basic and diluted calculation 28,662,000 27,954,000 28,704,000 27,892,000 As discussed further in Note (17) - "Convertible Preferred Stock," such shares of preferred stock represent a "participating security" as defined in ASC 260. As a result, our EPS calculations for the three and six months ended January 31, 2024 and 2023 were based on the two-class method. Given the net loss attributable to common stockholders for the three and six months ended January 31, 2024 and 2023, there was no impact of applying the two- class method to our reported basic or diluted earnings per common share. Index COMTECH TELECOMMUNICATIONS CORP. AND SUBSIDIARIES NOTES TO CONDENSED CONSOLIDATED FINANCIAL STATEMENTS (Unaudited) 18

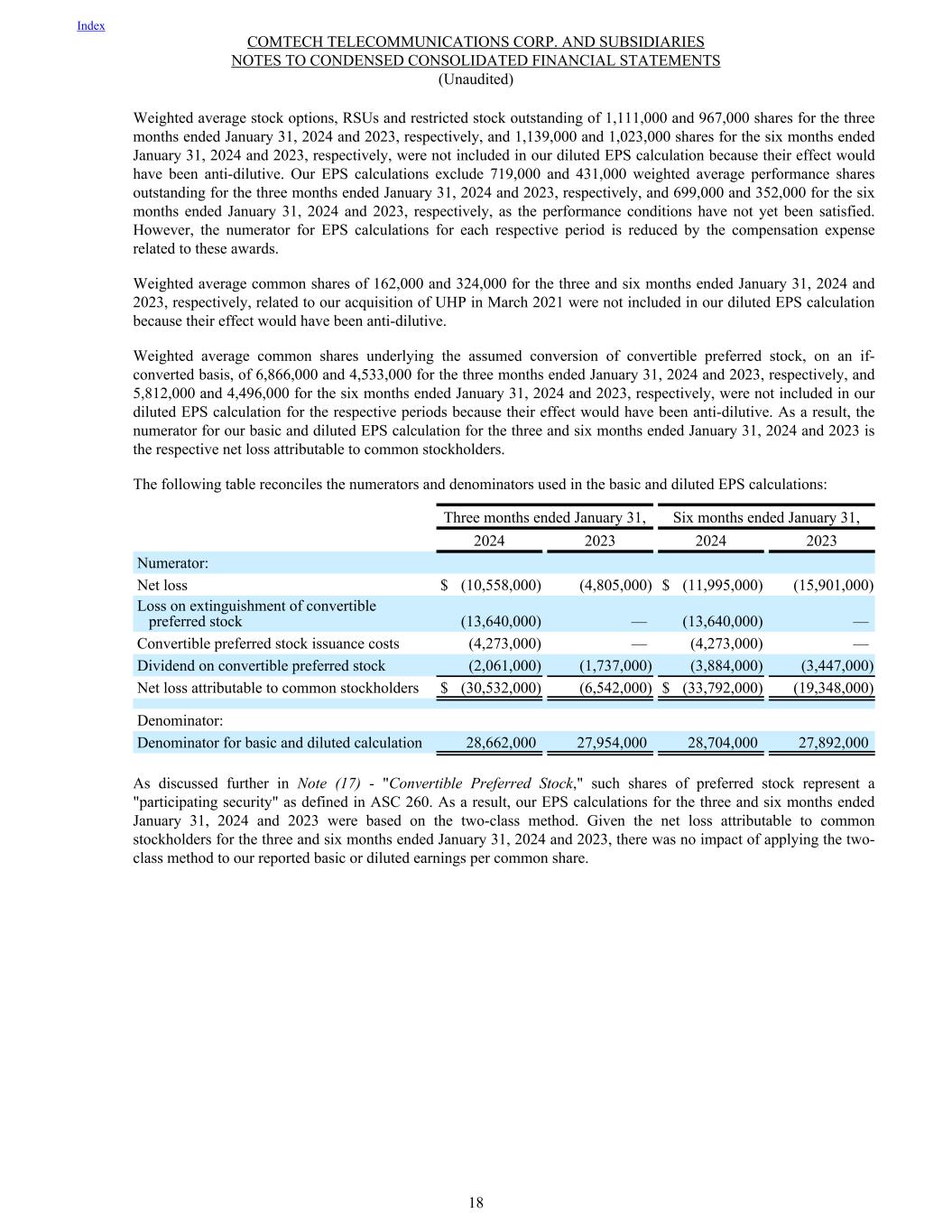

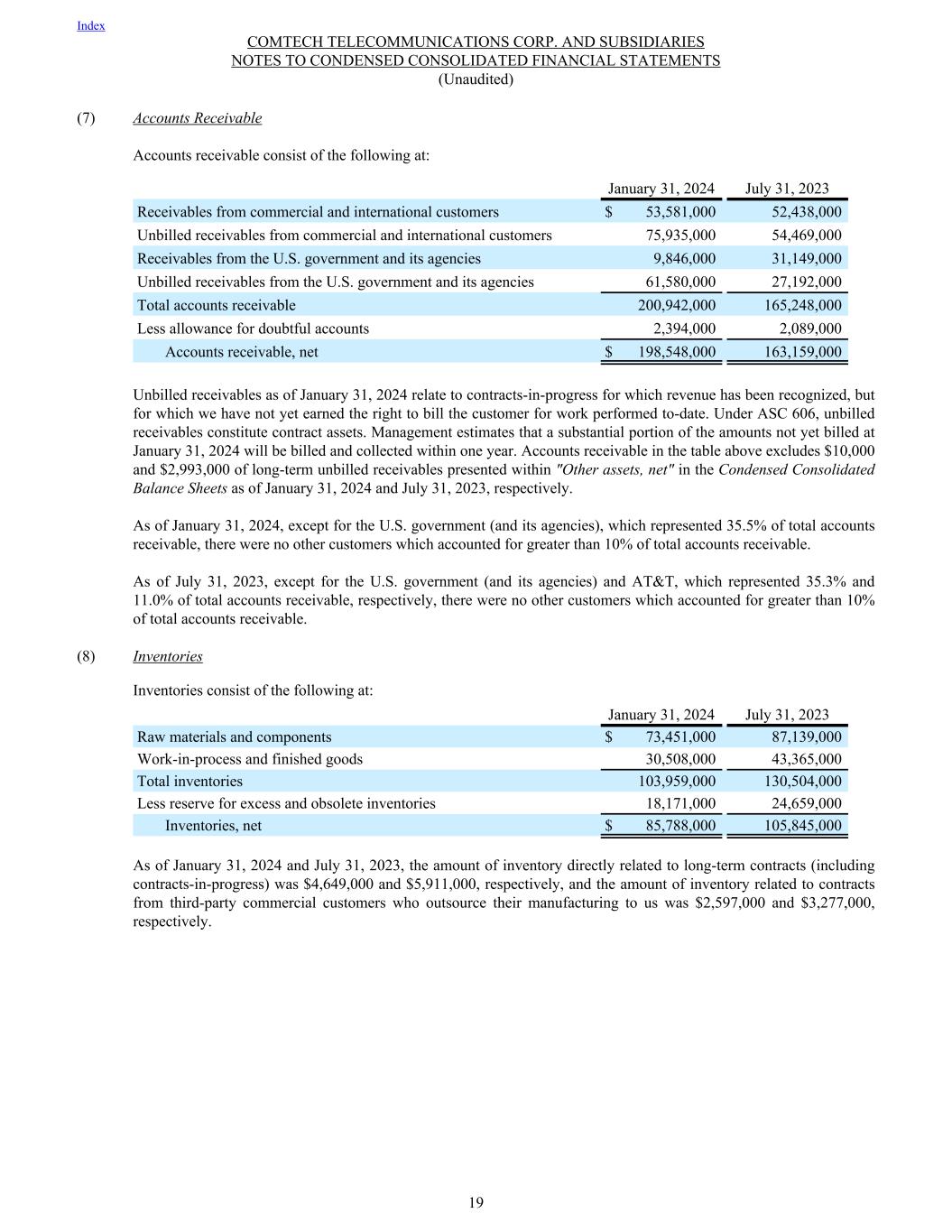

(7) Accounts Receivable Accounts receivable consist of the following at: January 31, 2024 July 31, 2023 Receivables from commercial and international customers $ 53,581,000 52,438,000 Unbilled receivables from commercial and international customers 75,935,000 54,469,000 Receivables from the U.S. government and its agencies 9,846,000 31,149,000 Unbilled receivables from the U.S. government and its agencies 61,580,000 27,192,000 Total accounts receivable 200,942,000 165,248,000 Less allowance for doubtful accounts 2,394,000 2,089,000 Accounts receivable, net $ 198,548,000 163,159,000 Unbilled receivables as of January 31, 2024 relate to contracts-in-progress for which revenue has been recognized, but for which we have not yet earned the right to bill the customer for work performed to-date. Under ASC 606, unbilled receivables constitute contract assets. Management estimates that a substantial portion of the amounts not yet billed at January 31, 2024 will be billed and collected within one year. Accounts receivable in the table above excludes $10,000 and $2,993,000 of long-term unbilled receivables presented within "Other assets, net" in the Condensed Consolidated Balance Sheets as of January 31, 2024 and July 31, 2023, respectively. As of January 31, 2024, except for the U.S. government (and its agencies), which represented 35.5% of total accounts receivable, there were no other customers which accounted for greater than 10% of total accounts receivable. As of July 31, 2023, except for the U.S. government (and its agencies) and AT&T, which represented 35.3% and 11.0% of total accounts receivable, respectively, there were no other customers which accounted for greater than 10% of total accounts receivable. (8) Inventories Inventories consist of the following at: January 31, 2024 July 31, 2023 Raw materials and components $ 73,451,000 87,139,000 Work-in-process and finished goods 30,508,000 43,365,000 Total inventories 103,959,000 130,504,000 Less reserve for excess and obsolete inventories 18,171,000 24,659,000 Inventories, net $ 85,788,000 105,845,000 As of January 31, 2024 and July 31, 2023, the amount of inventory directly related to long-term contracts (including contracts-in-progress) was $4,649,000 and $5,911,000, respectively, and the amount of inventory related to contracts from third-party commercial customers who outsource their manufacturing to us was $2,597,000 and $3,277,000, respectively. Index COMTECH TELECOMMUNICATIONS CORP. AND SUBSIDIARIES NOTES TO CONDENSED CONSOLIDATED FINANCIAL STATEMENTS (Unaudited) 19

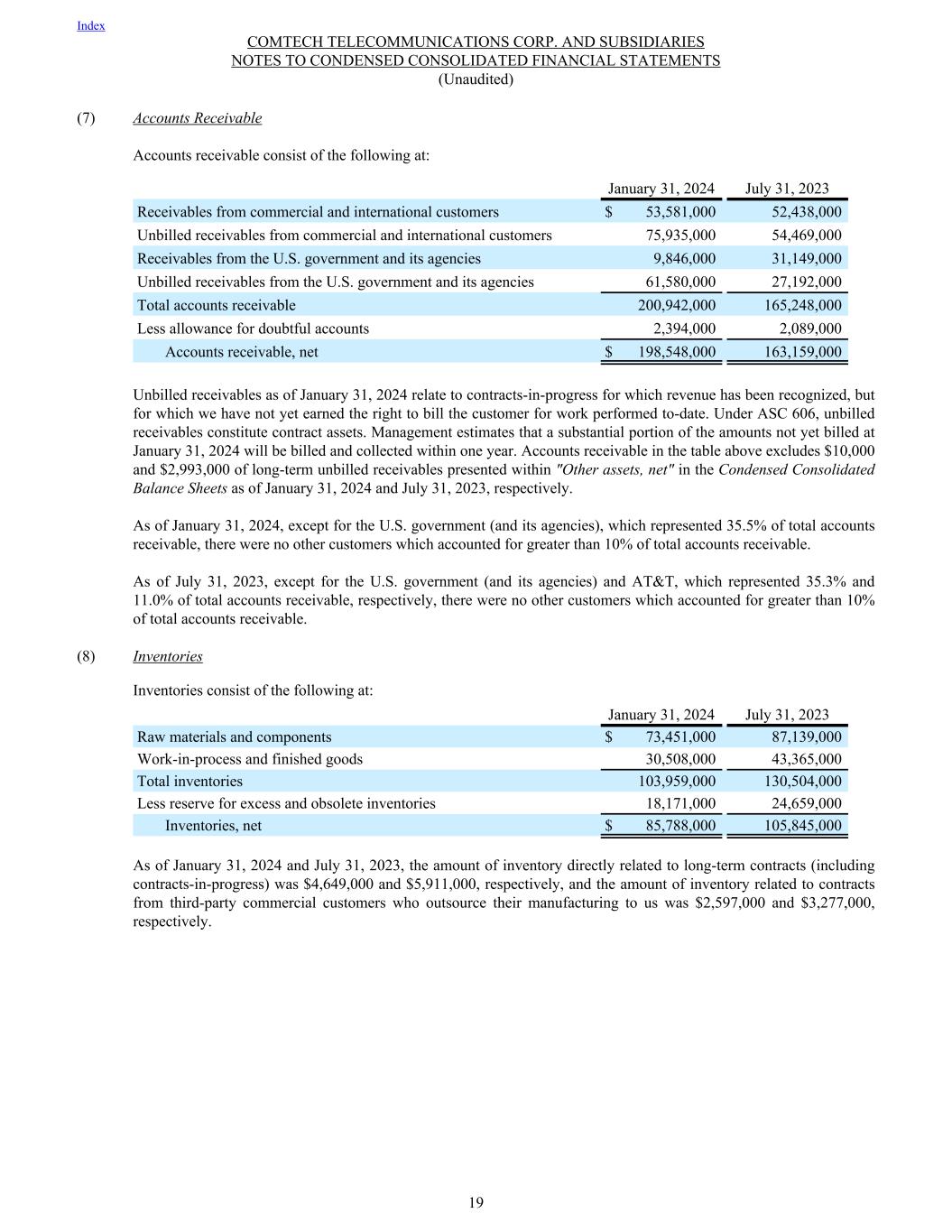

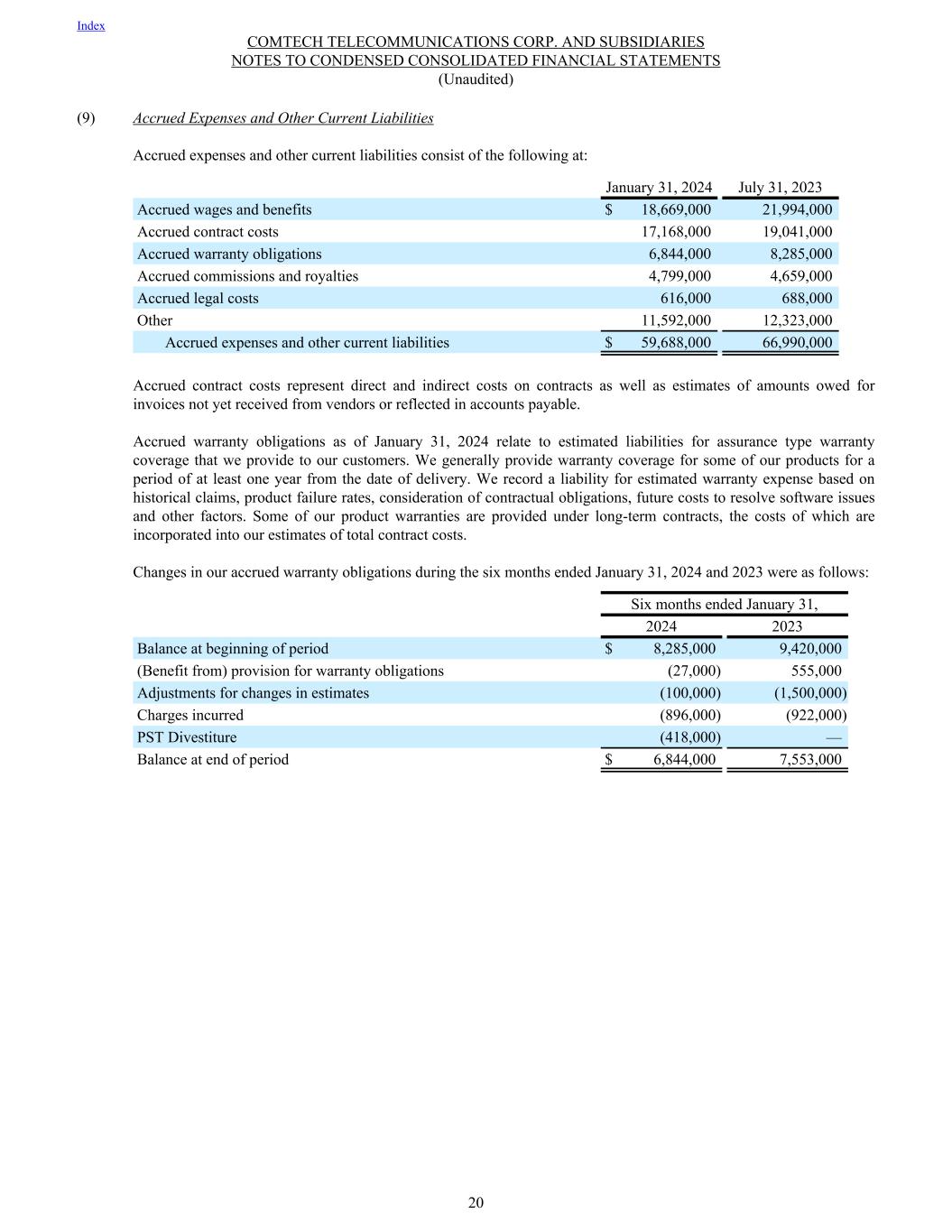

(9) Accrued Expenses and Other Current Liabilities Accrued expenses and other current liabilities consist of the following at: January 31, 2024 July 31, 2023 Accrued wages and benefits $ 18,669,000 21,994,000 Accrued contract costs 17,168,000 19,041,000 Accrued warranty obligations 6,844,000 8,285,000 Accrued commissions and royalties 4,799,000 4,659,000 Accrued legal costs 616,000 688,000 Other 11,592,000 12,323,000 Accrued expenses and other current liabilities $ 59,688,000 66,990,000 Accrued contract costs represent direct and indirect costs on contracts as well as estimates of amounts owed for invoices not yet received from vendors or reflected in accounts payable. Accrued warranty obligations as of January 31, 2024 relate to estimated liabilities for assurance type warranty coverage that we provide to our customers. We generally provide warranty coverage for some of our products for a period of at least one year from the date of delivery. We record a liability for estimated warranty expense based on historical claims, product failure rates, consideration of contractual obligations, future costs to resolve software issues and other factors. Some of our product warranties are provided under long-term contracts, the costs of which are incorporated into our estimates of total contract costs. Changes in our accrued warranty obligations during the six months ended January 31, 2024 and 2023 were as follows: Six months ended January 31, 2024 2023 Balance at beginning of period $ 8,285,000 9,420,000 (Benefit from) provision for warranty obligations (27,000) 555,000 Adjustments for changes in estimates (100,000) (1,500,000) Charges incurred (896,000) (922,000) PST Divestiture (418,000) — Balance at end of period $ 6,844,000 7,553,000 Index COMTECH TELECOMMUNICATIONS CORP. AND SUBSIDIARIES NOTES TO CONDENSED CONSOLIDATED FINANCIAL STATEMENTS (Unaudited) 20

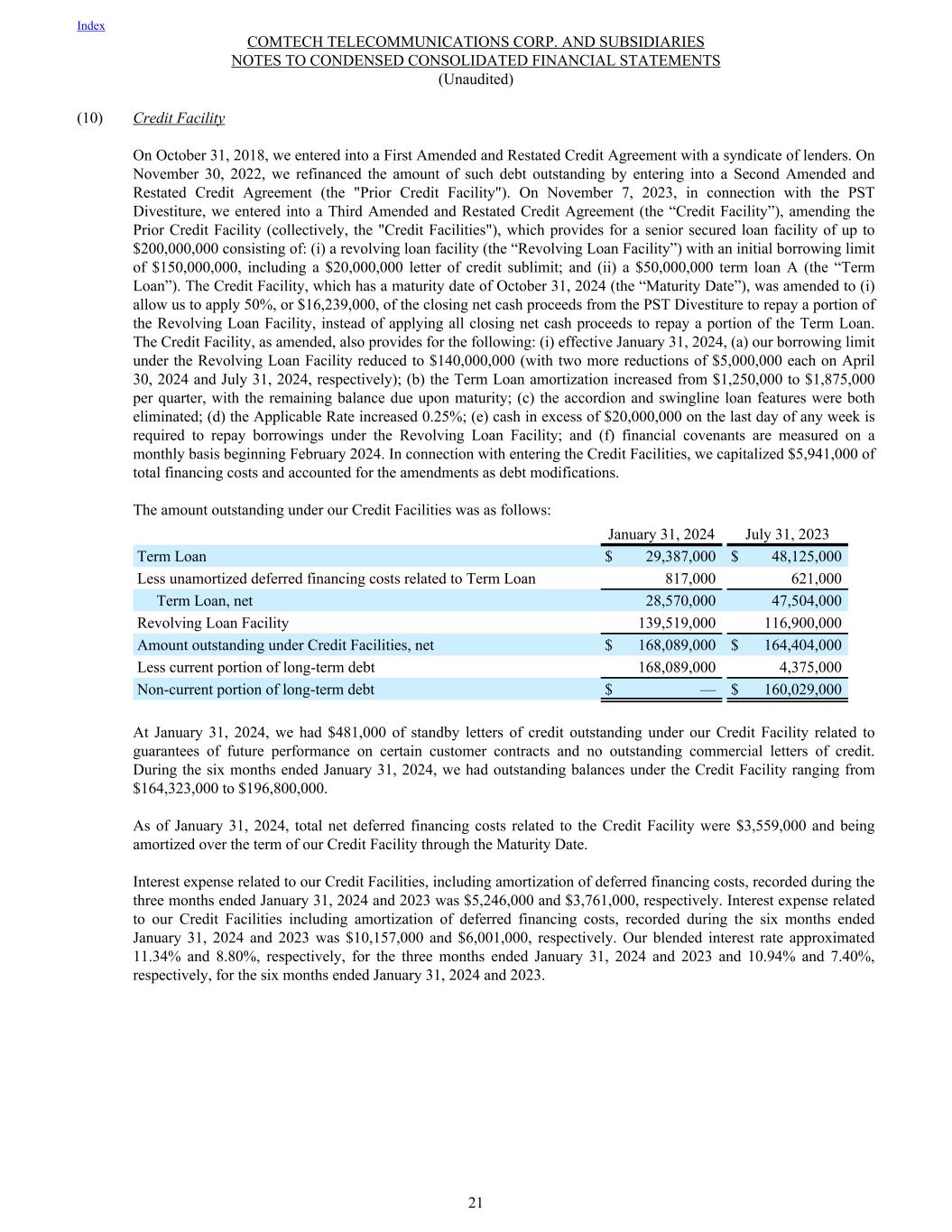

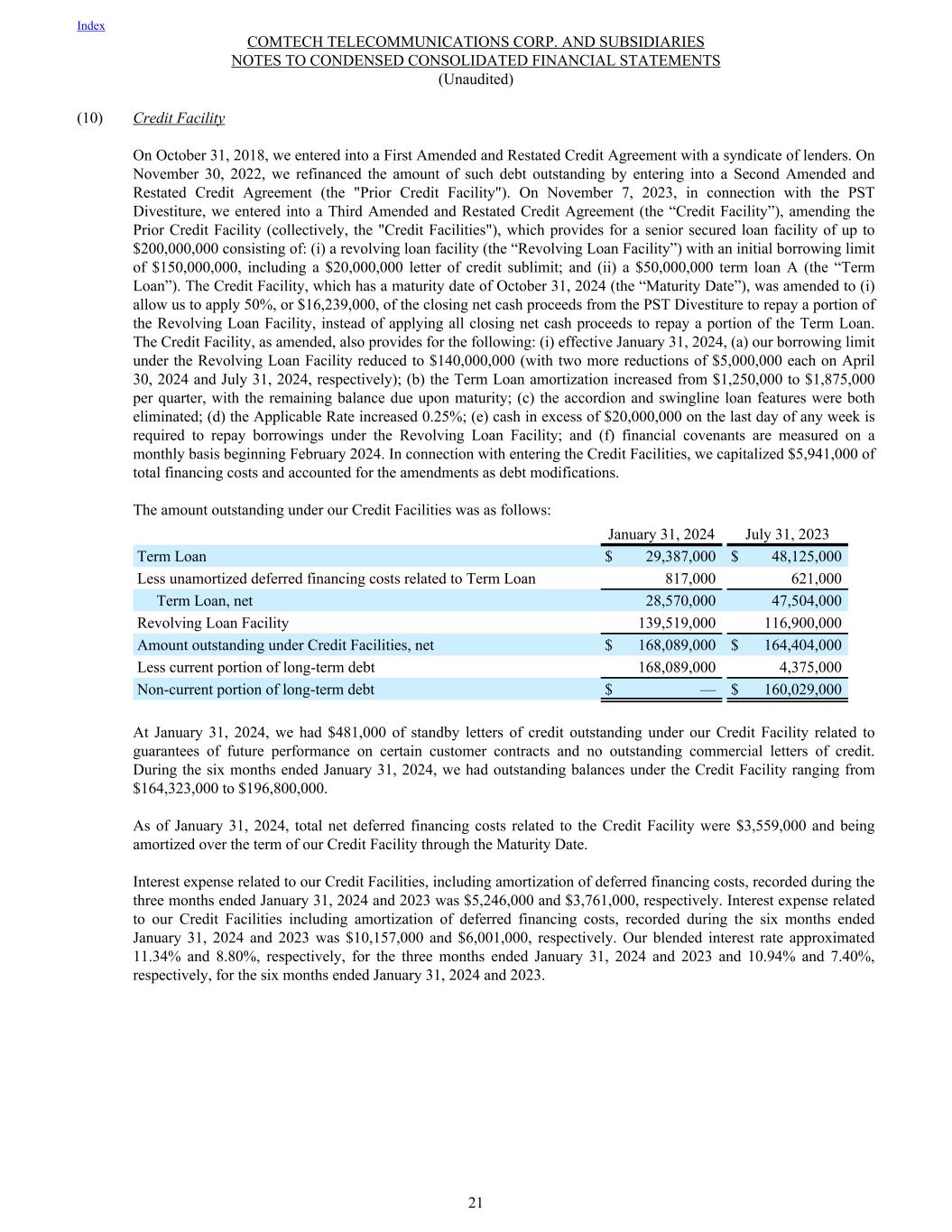

(10) Credit Facility On October 31, 2018, we entered into a First Amended and Restated Credit Agreement with a syndicate of lenders. On November 30, 2022, we refinanced the amount of such debt outstanding by entering into a Second Amended and Restated Credit Agreement (the "Prior Credit Facility"). On November 7, 2023, in connection with the PST Divestiture, we entered into a Third Amended and Restated Credit Agreement (the “Credit Facility”), amending the Prior Credit Facility (collectively, the "Credit Facilities"), which provides for a senior secured loan facility of up to $200,000,000 consisting of: (i) a revolving loan facility (the “Revolving Loan Facility”) with an initial borrowing limit of $150,000,000, including a $20,000,000 letter of credit sublimit; and (ii) a $50,000,000 term loan A (the “Term Loan”). The Credit Facility, which has a maturity date of October 31, 2024 (the “Maturity Date”), was amended to (i) allow us to apply 50%, or $16,239,000, of the closing net cash proceeds from the PST Divestiture to repay a portion of the Revolving Loan Facility, instead of applying all closing net cash proceeds to repay a portion of the Term Loan. The Credit Facility, as amended, also provides for the following: (i) effective January 31, 2024, (a) our borrowing limit under the Revolving Loan Facility reduced to $140,000,000 (with two more reductions of $5,000,000 each on April 30, 2024 and July 31, 2024, respectively); (b) the Term Loan amortization increased from $1,250,000 to $1,875,000 per quarter, with the remaining balance due upon maturity; (c) the accordion and swingline loan features were both eliminated; (d) the Applicable Rate increased 0.25%; (e) cash in excess of $20,000,000 on the last day of any week is required to repay borrowings under the Revolving Loan Facility; and (f) financial covenants are measured on a monthly basis beginning February 2024. In connection with entering the Credit Facilities, we capitalized $5,941,000 of total financing costs and accounted for the amendments as debt modifications. The amount outstanding under our Credit Facilities was as follows: January 31, 2024 July 31, 2023 Term Loan $ 29,387,000 $ 48,125,000 Less unamortized deferred financing costs related to Term Loan 817,000 621,000 Term Loan, net 28,570,000 47,504,000 Revolving Loan Facility 139,519,000 116,900,000 Amount outstanding under Credit Facilities, net $ 168,089,000 $ 164,404,000 Less current portion of long-term debt 168,089,000 4,375,000 Non-current portion of long-term debt $ — $ 160,029,000 At January 31, 2024, we had $481,000 of standby letters of credit outstanding under our Credit Facility related to guarantees of future performance on certain customer contracts and no outstanding commercial letters of credit. During the six months ended January 31, 2024, we had outstanding balances under the Credit Facility ranging from $164,323,000 to $196,800,000. As of January 31, 2024, total net deferred financing costs related to the Credit Facility were $3,559,000 and being amortized over the term of our Credit Facility through the Maturity Date. Interest expense related to our Credit Facilities, including amortization of deferred financing costs, recorded during the three months ended January 31, 2024 and 2023 was $5,246,000 and $3,761,000, respectively. Interest expense related to our Credit Facilities including amortization of deferred financing costs, recorded during the six months ended January 31, 2024 and 2023 was $10,157,000 and $6,001,000, respectively. Our blended interest rate approximated 11.34% and 8.80%, respectively, for the three months ended January 31, 2024 and 2023 and 10.94% and 7.40%, respectively, for the six months ended January 31, 2024 and 2023. Index COMTECH TELECOMMUNICATIONS CORP. AND SUBSIDIARIES NOTES TO CONDENSED CONSOLIDATED FINANCIAL STATEMENTS (Unaudited) 21

Borrowings under the Revolving Loan Facility and Term Loan are either: (i) Alternate Base Rate borrowings, which would bear interest from the applicable borrowing date at a rate per annum equal to (x) the highest of (a) the Prime Rate in effect on such day, (b) the Federal Funds Effective Rate in effect on such day plus 0.50% and (c) the Adjusted Term SOFR for a one-month tenor in effect on such day (or, if such day is not a business day, the immediately preceding business day) plus 1.00%, plus (y) the Applicable Rate, or (ii) SOFR borrowings, which would bear interest from the applicable borrowing date at a rate per annum equal to (x) the Adjusted Term SOFR for such interest period plus (y) the Applicable Rate. Determination of the Applicable Rate is based on a pricing grid dependent upon our Leverage Ratio as of the end of each fiscal quarter for which consolidated financial statements have been most recently delivered. The Credit Facility contains customary representations, warranties and affirmative covenants. The Credit Facility also contains customary conditions to drawing the Revolving Loan Facility and customary negative covenants, subject to negotiated exceptions, including but not limited to: (i) liens, (ii) investments, (iii) indebtedness, (iv) significant corporate changes, including mergers and acquisitions, (v) dispositions, including the disposition of assets by any Loan Party to any Subsidiary that is not a Subsidiary Loan Party, (vi) restricted payments, including stockholder dividends, (vii) distributions, including the repayment of subordinated intercompany and third party indebtedness, and (viii) certain other restrictive agreements. The Credit Facility also contains certain financial covenants and customary events of default (subject to grace periods, as appropriate), such as payment defaults, cross-defaults to other material indebtedness, bankruptcy and insolvency, the occurrence of a defined change in control and the failure to observe the negative covenants and other covenants related to the operation of our business. In addition, under certain circumstances, we may be required to enter into amendments to the Credit Facility in connection with any further syndication of the Credit Facility. As of January 31, 2024, our Secured Leverage Ratio was 3.07x trailing twelve months ("TTM") Adjusted Earnings Before Interest, Taxes, Depreciation and Amortization ("Adjusted EBITDA"), compared to the maximum allowable Secured Leverage Ratio of 3.50x TTM Adjusted EBITDA as of January 31, 2024 and for the remaining term of the Credit Facility; our Interest Expense Coverage Ratio was 3.34x TTM Adjusted EBITDA, compared to the Minimum Interest Expense Coverage Ratio of 3.25x TTM Adjusted EBITDA as of January 31, 2024 and for the remaining term of the Credit Facility; and our Minimum Liquidity was $39,500,000, compared to the Minimum Liquidity requirement of $25,000,000 as of January 31, 2024 and for the remaining term of the Credit Facility. The obligations under the Credit Facility are guaranteed by certain of our domestic and foreign subsidiaries (the “Guarantors”). As collateral security under the Credit Facility and the guarantees thereof, we and the Guarantors granted to the administrative agent, for the benefit of the lenders, a lien on, and first priority security interest in, substantially all of our tangible and intangible assets. Capitalized terms used but not defined herein have the meanings set forth for such terms in the Credit Facility, which has been documented and filed with the SEC. The Credit Facility Maturity Date is less than one year out from the balance sheet date and, because as of such date we have not entered into an agreement to extend the Maturity Date or refinance our existing Credit Facility, the outstanding amount of debt is classified as a current liability on our balance sheet as of January 31, 2024. In anticipation of the upcoming Maturity Date, we engaged third-party financial advisors to assist us with the refinancing of our existing Credit Facility and/or amending or restructuring our Series B Convertible Preferred Stock, seeking other sources of credit or outside capital and evaluating other capital structure-related alternatives and mitigating plans. Index COMTECH TELECOMMUNICATIONS CORP. AND SUBSIDIARIES NOTES TO CONDENSED CONSOLIDATED FINANCIAL STATEMENTS (Unaudited) 22

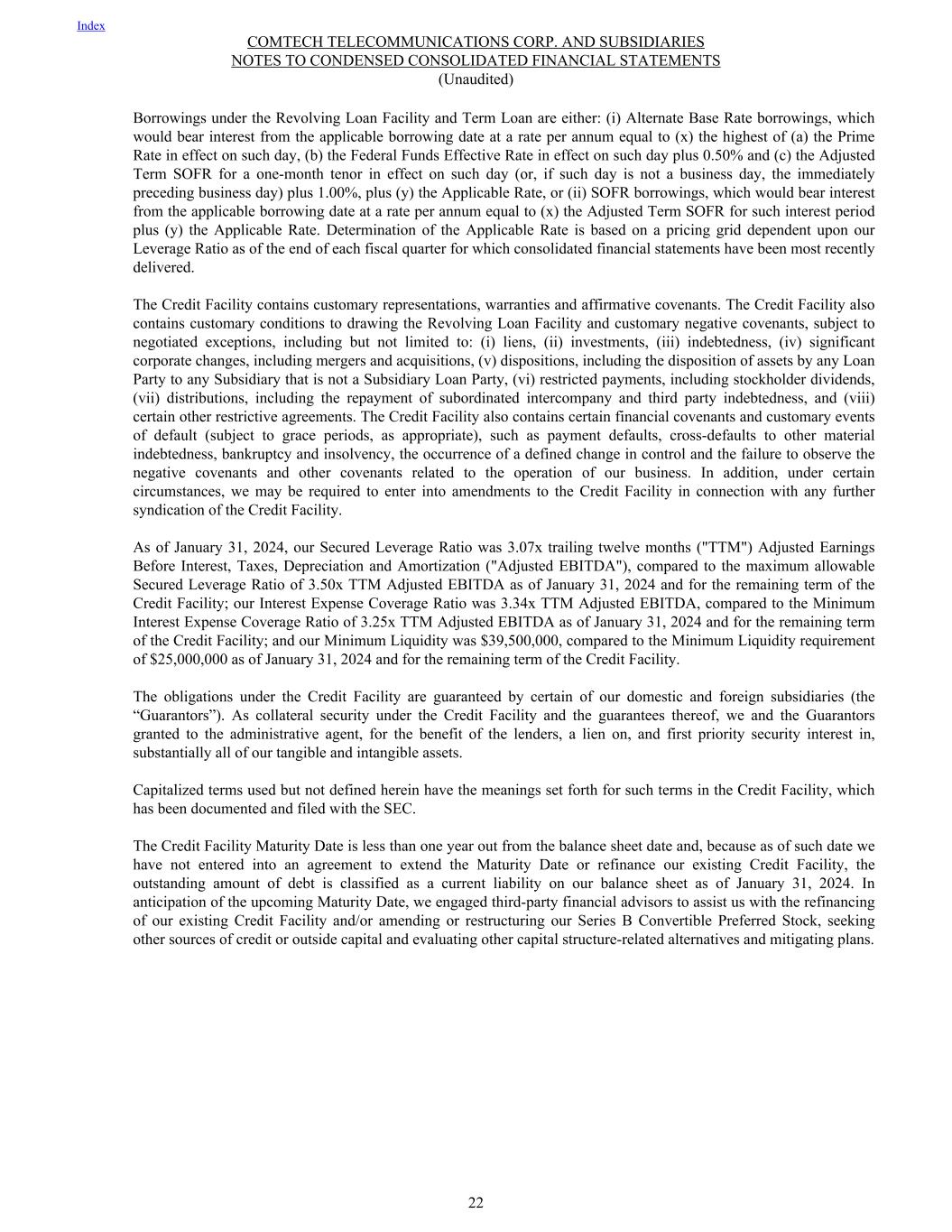

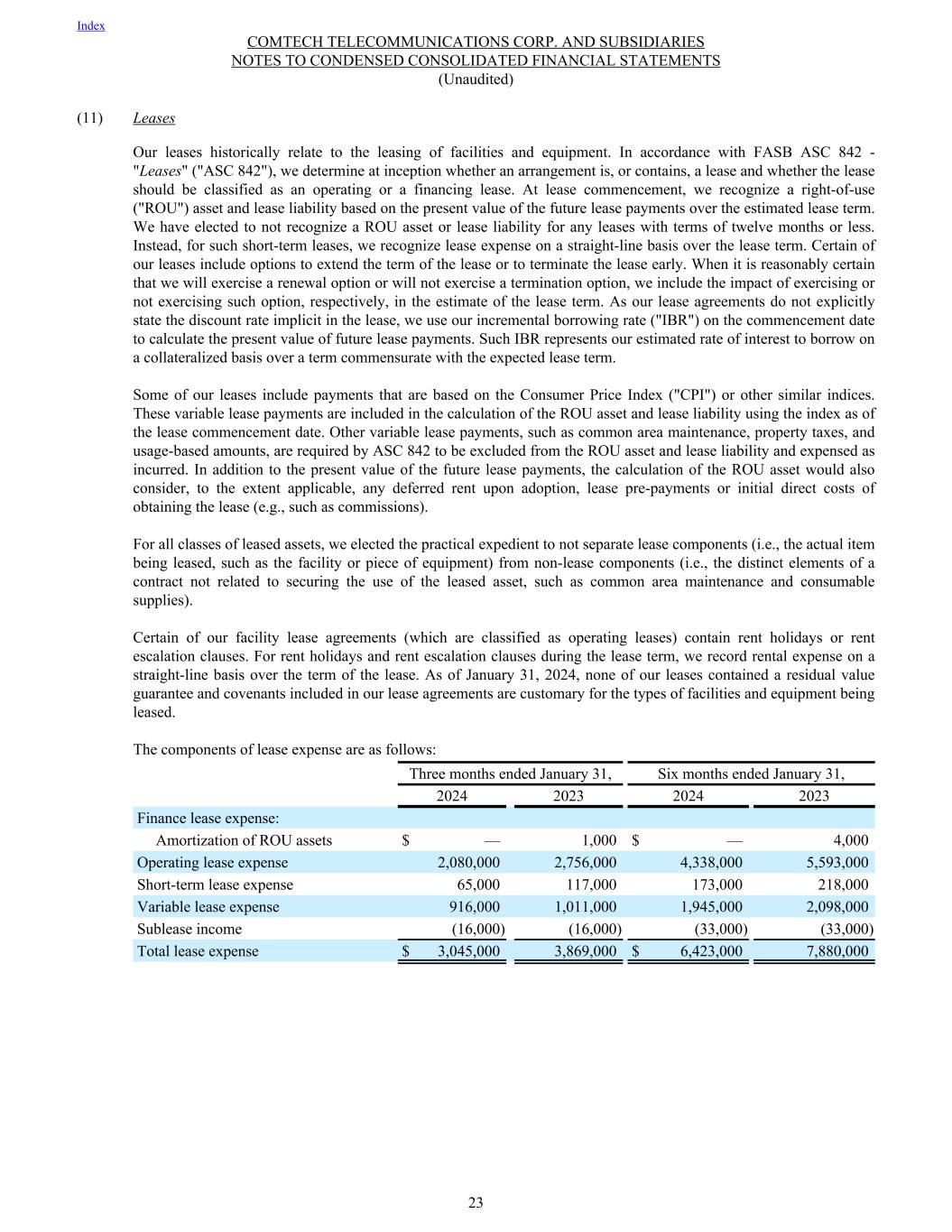

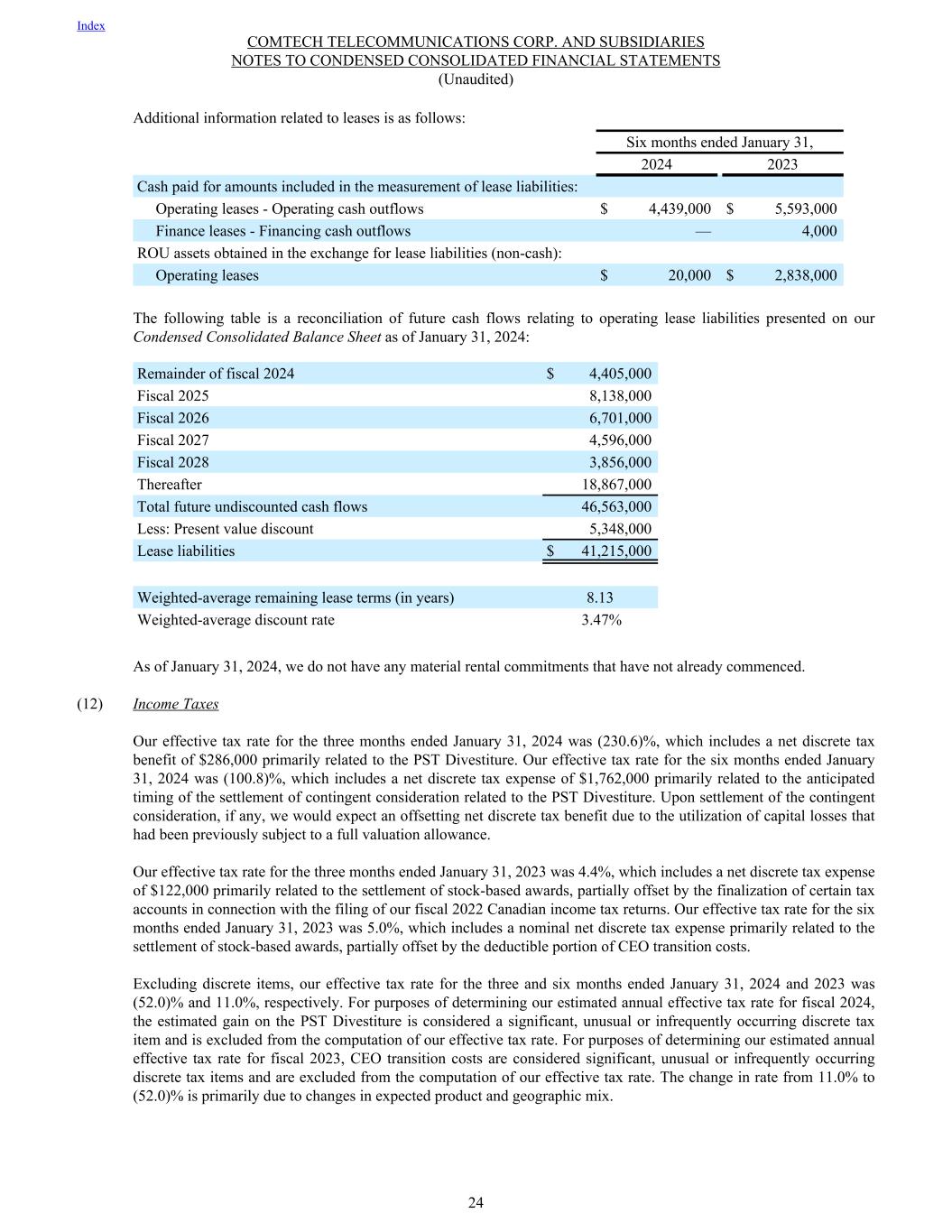

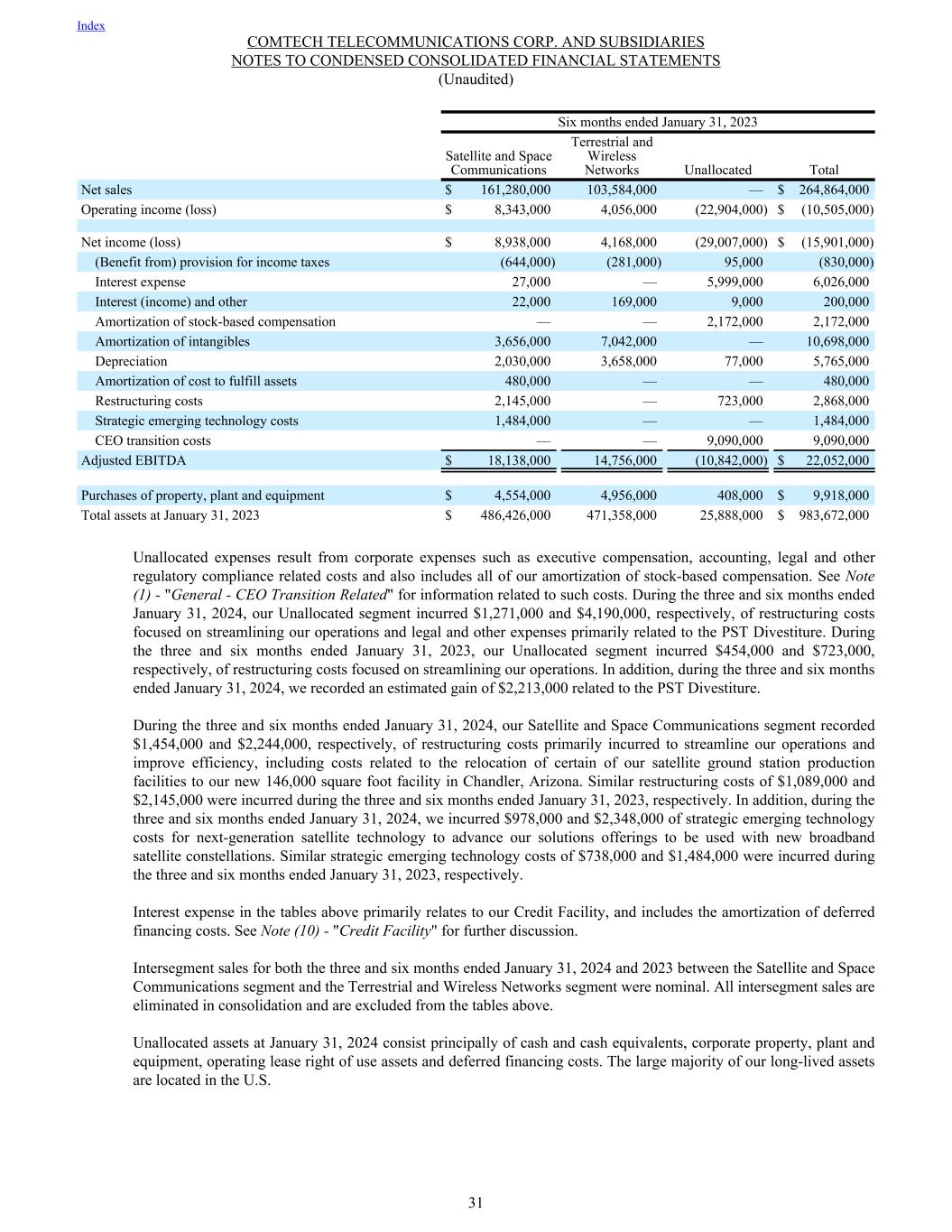

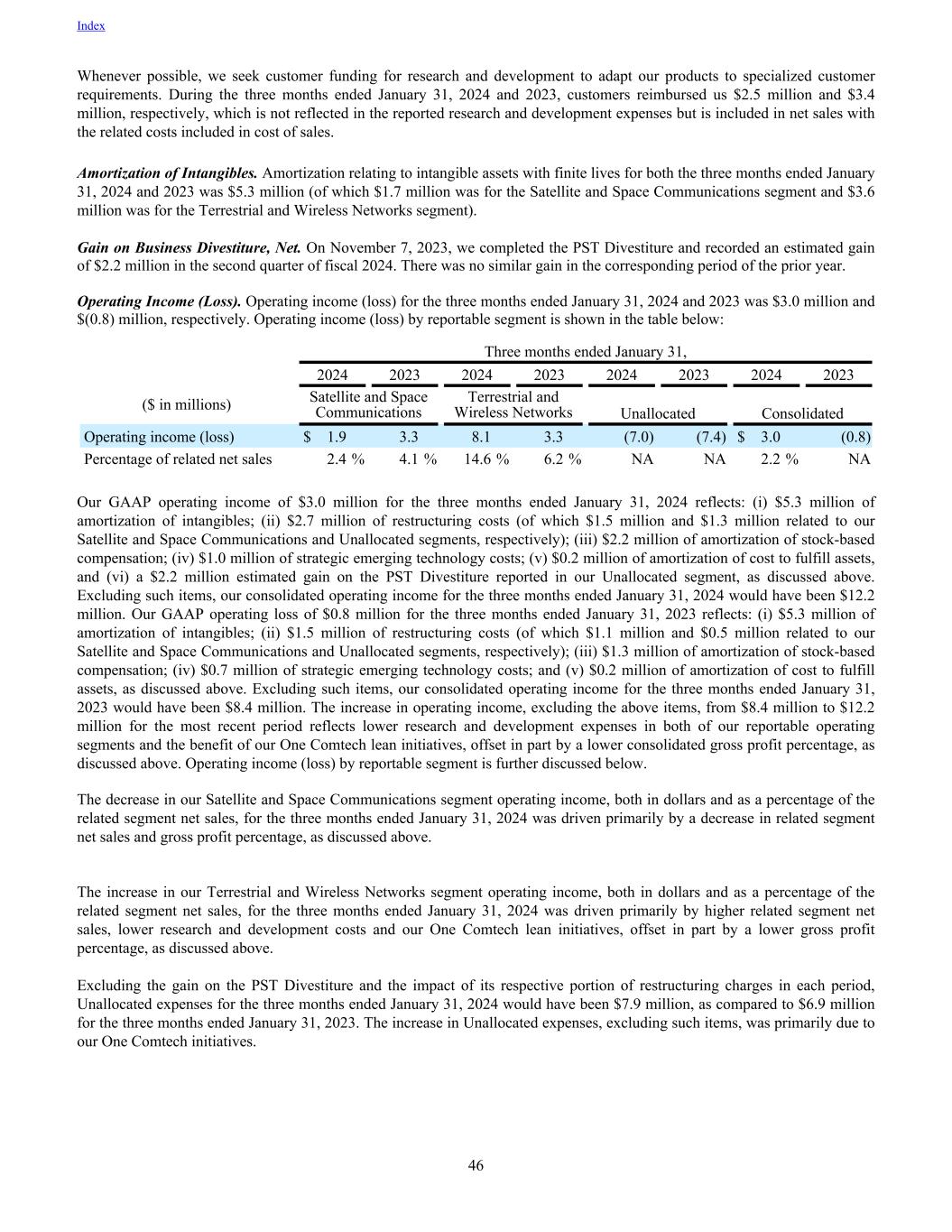

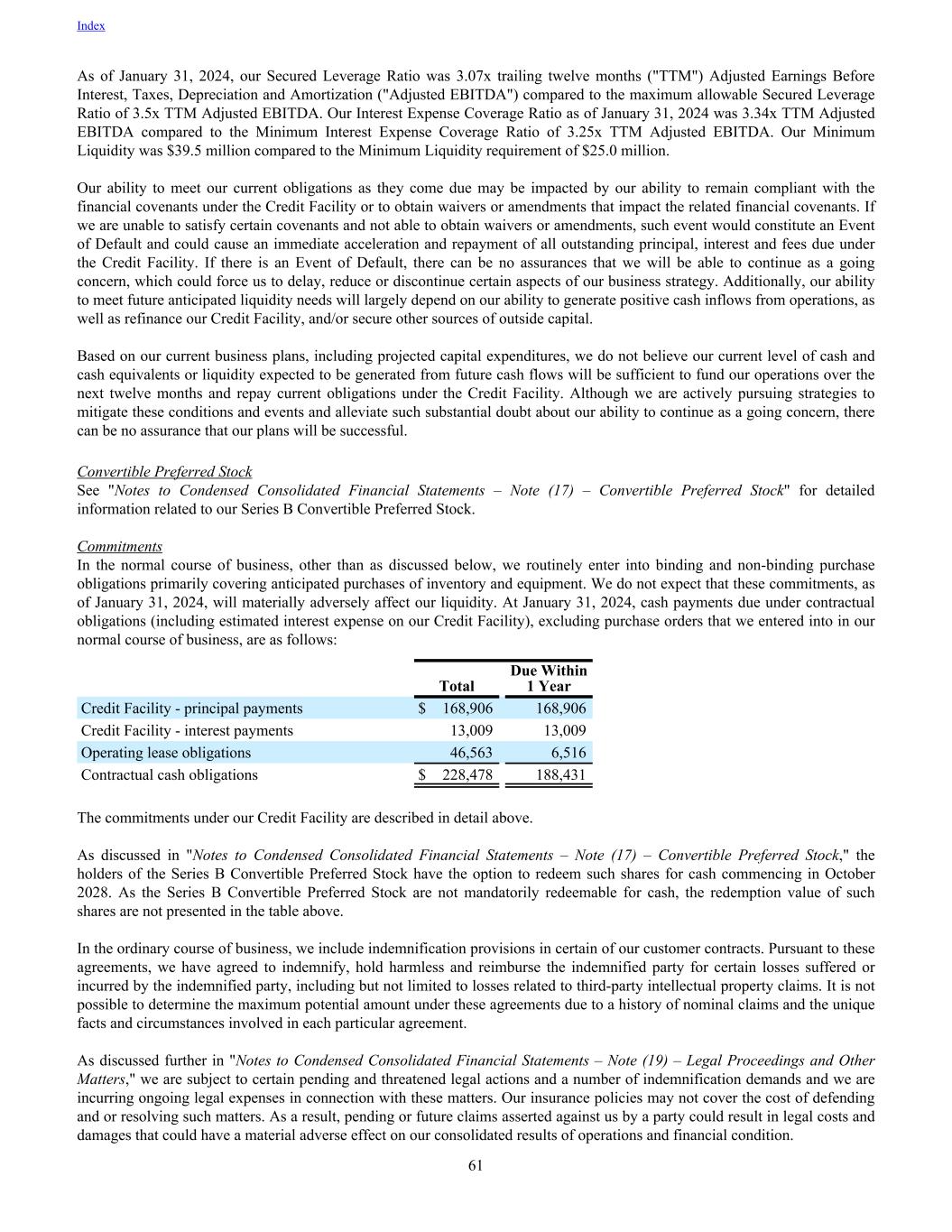

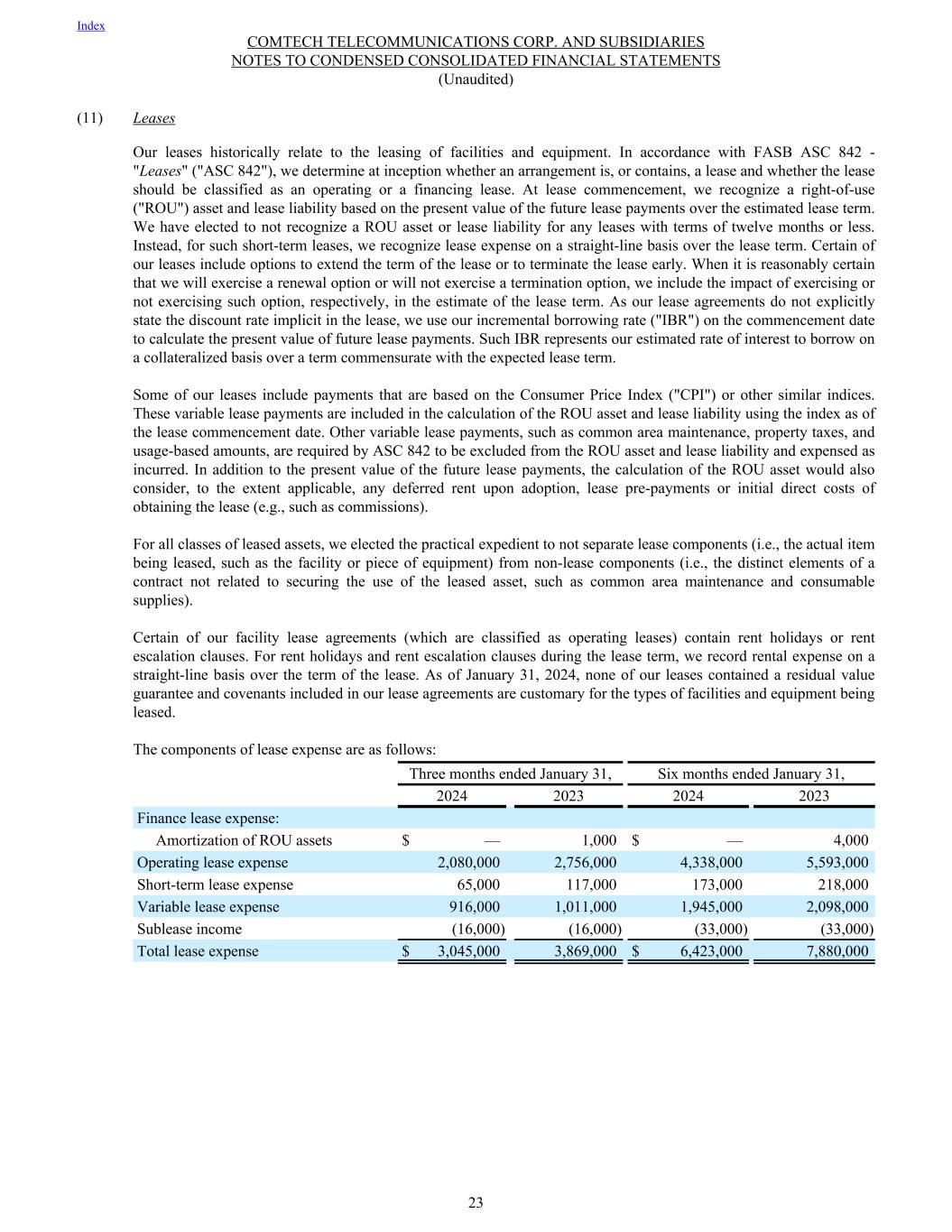

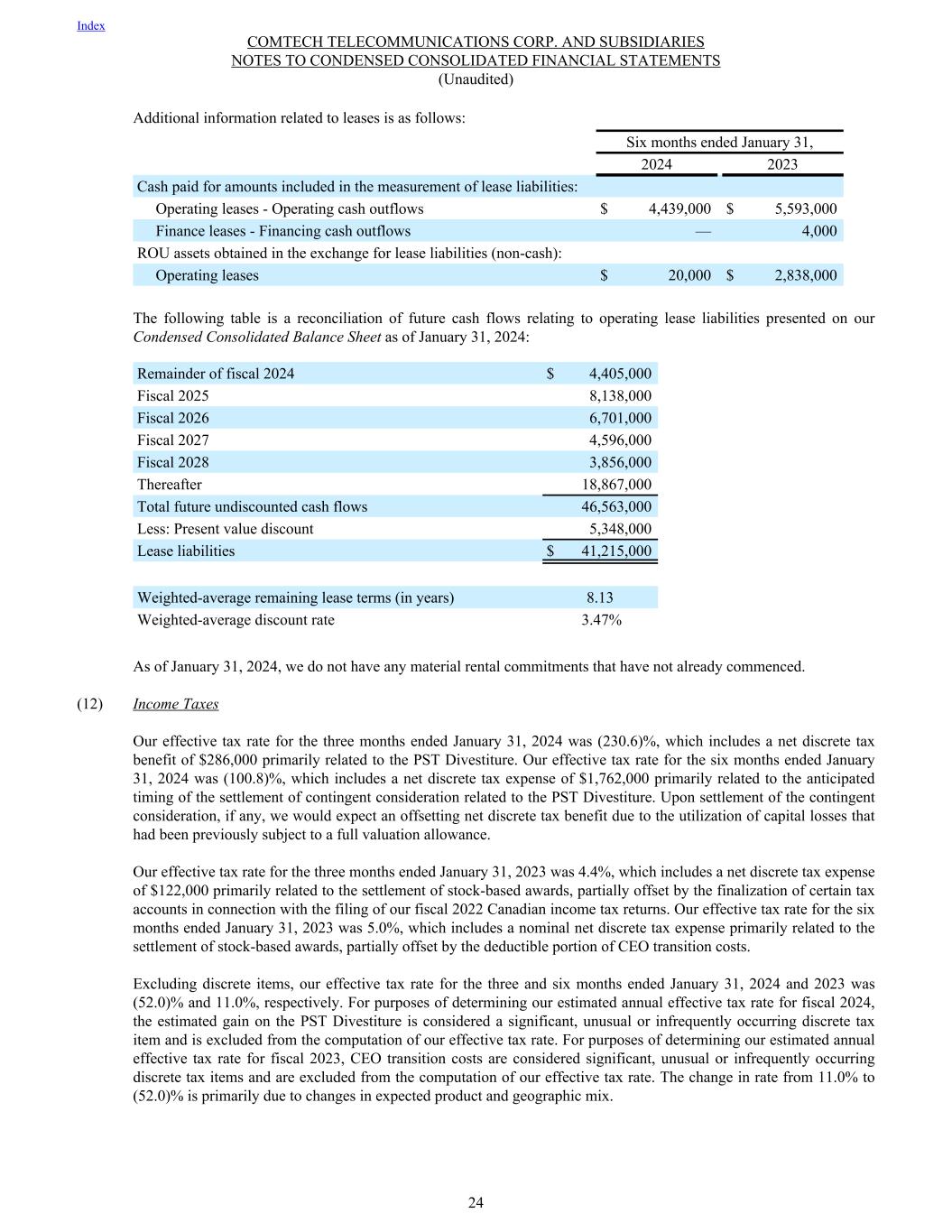

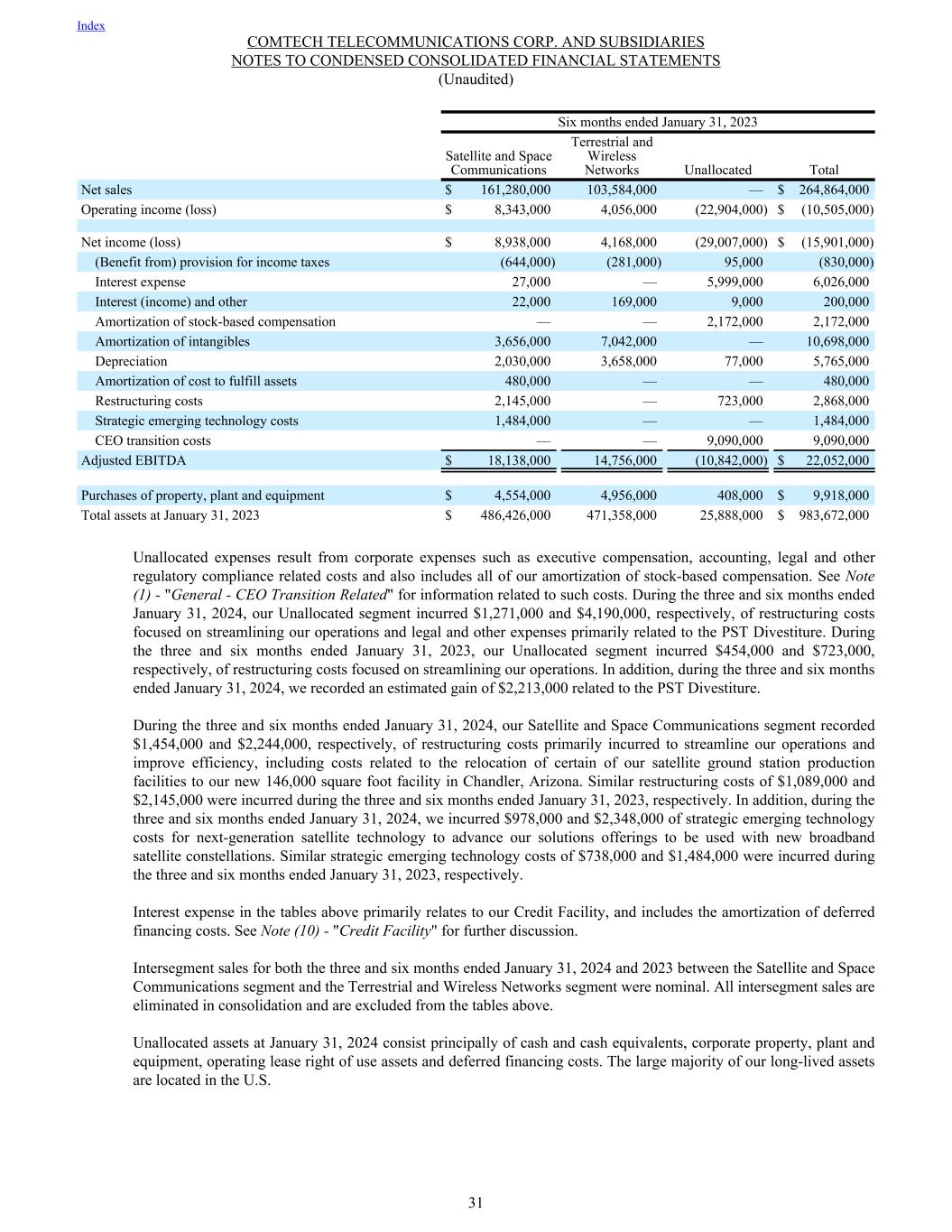

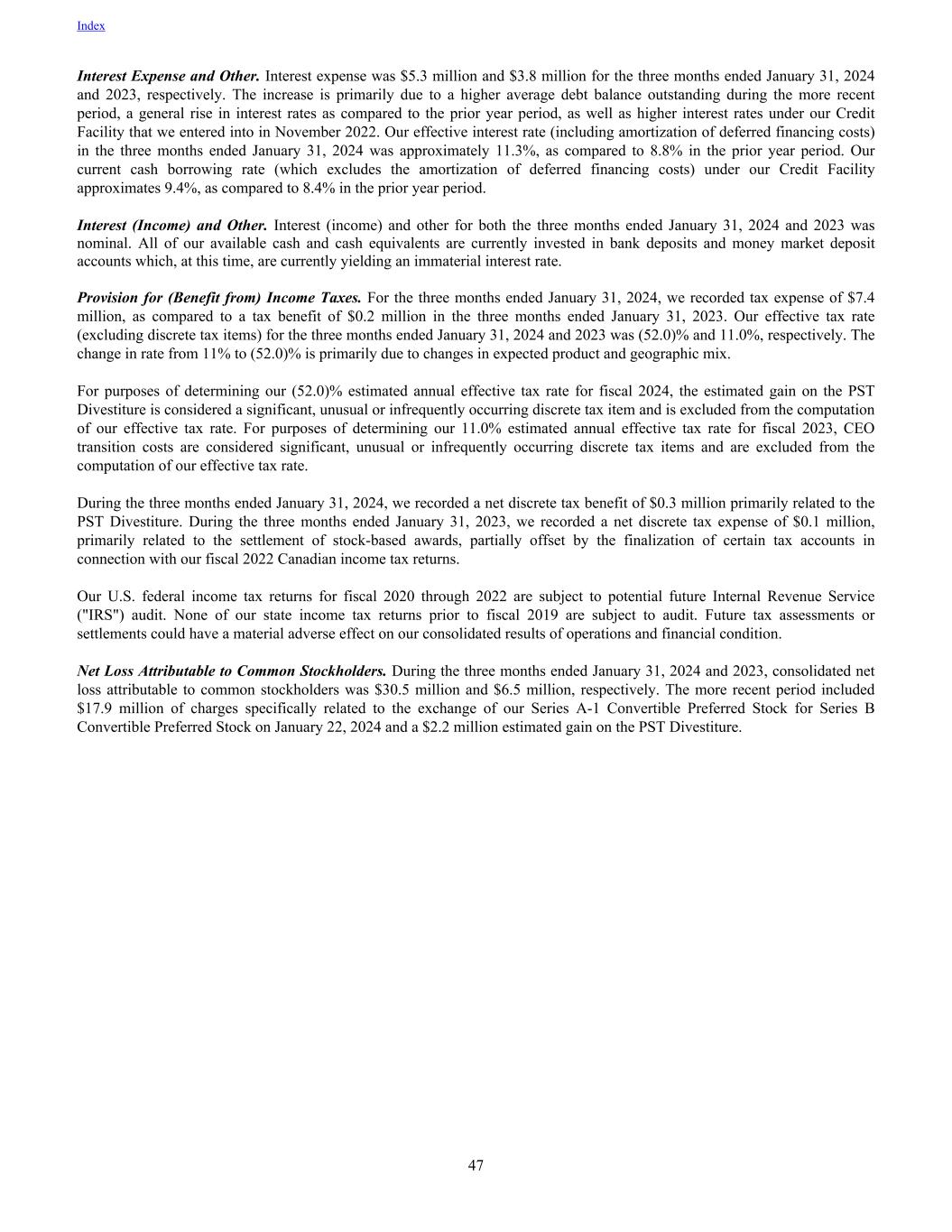

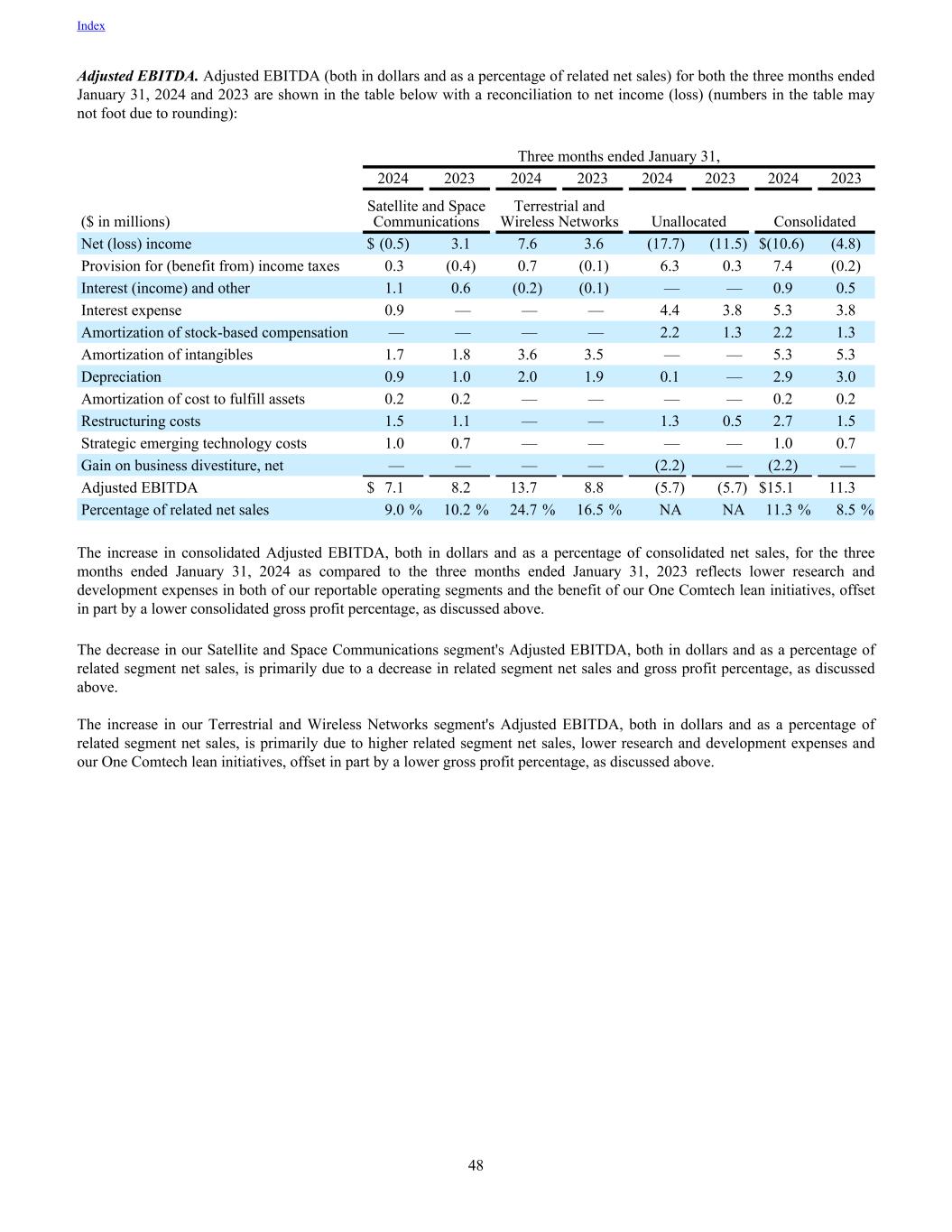

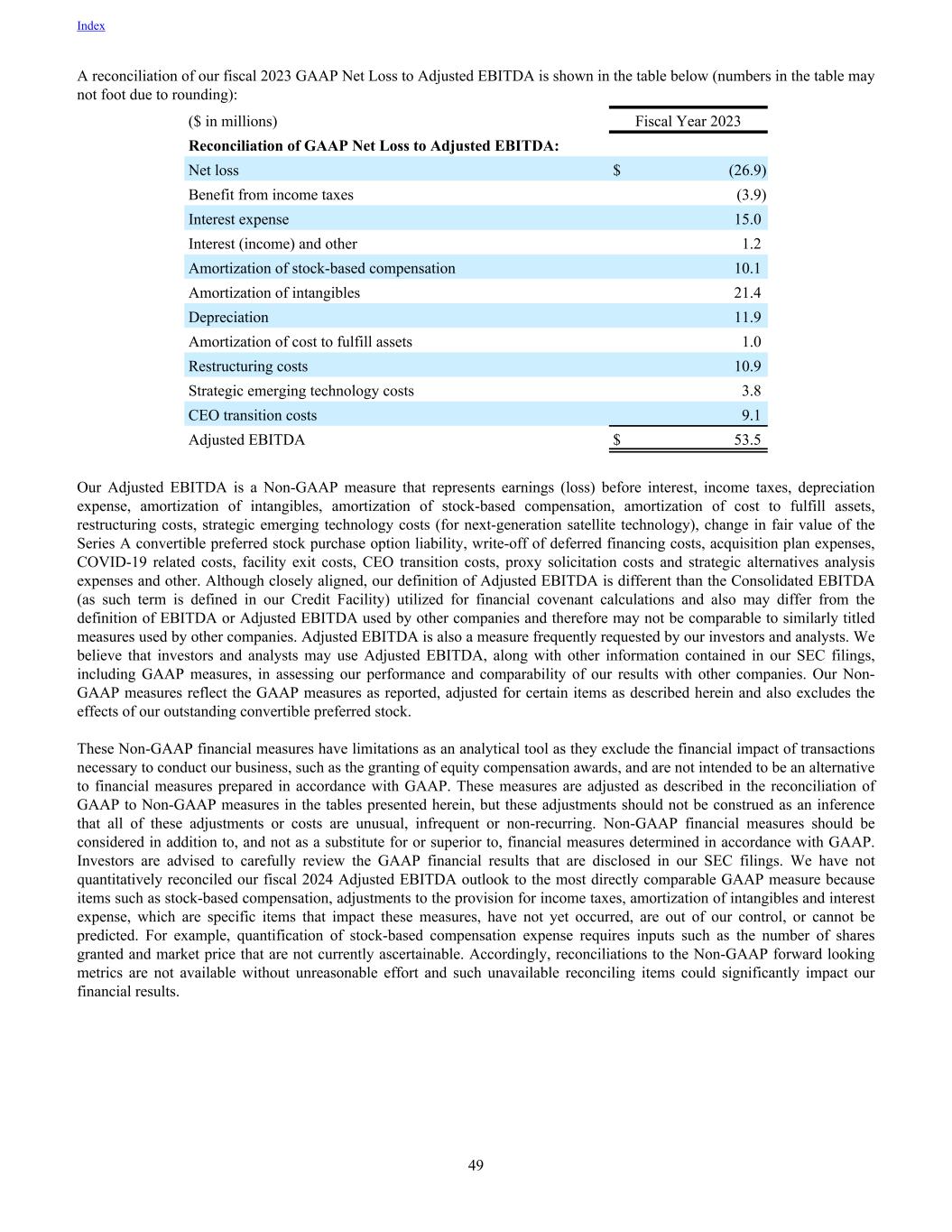

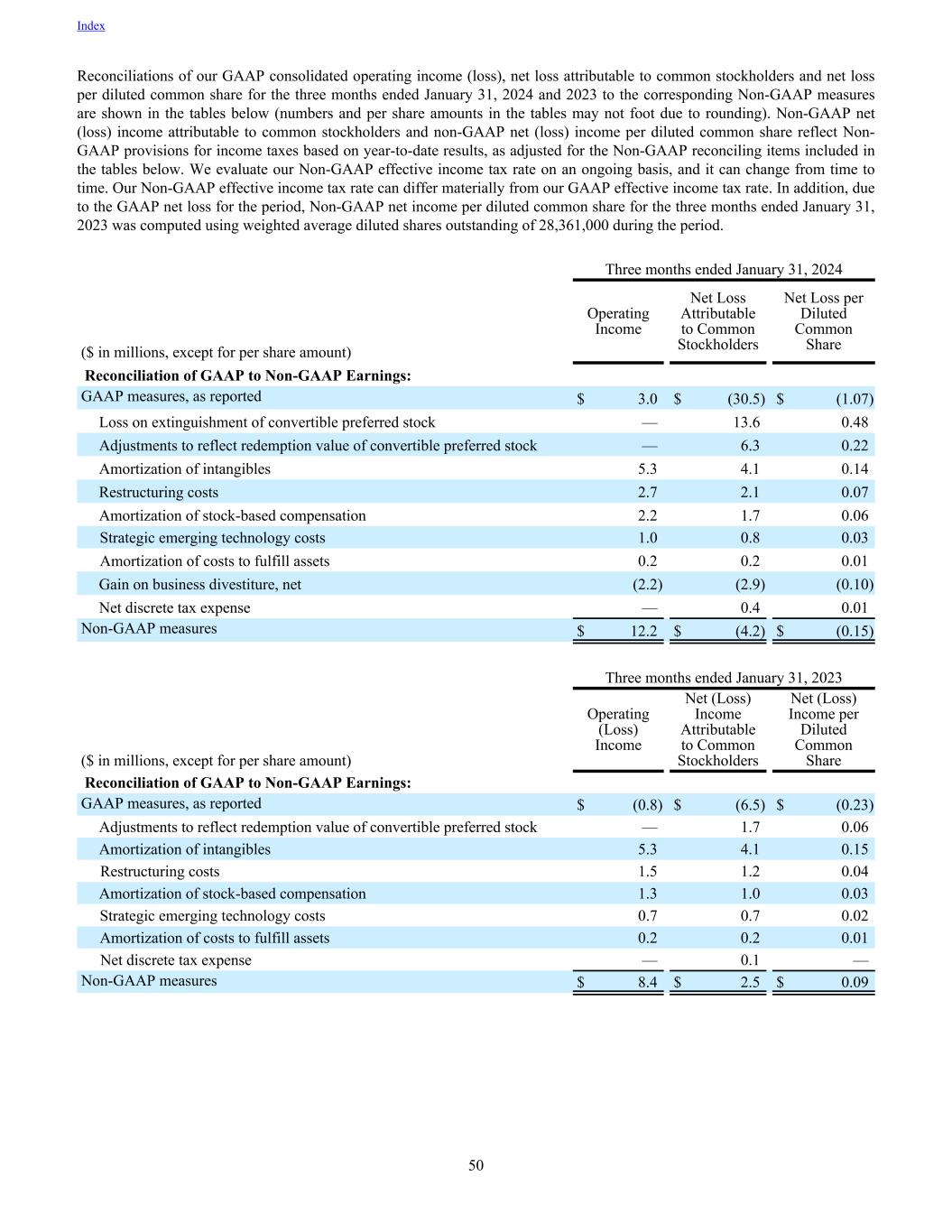

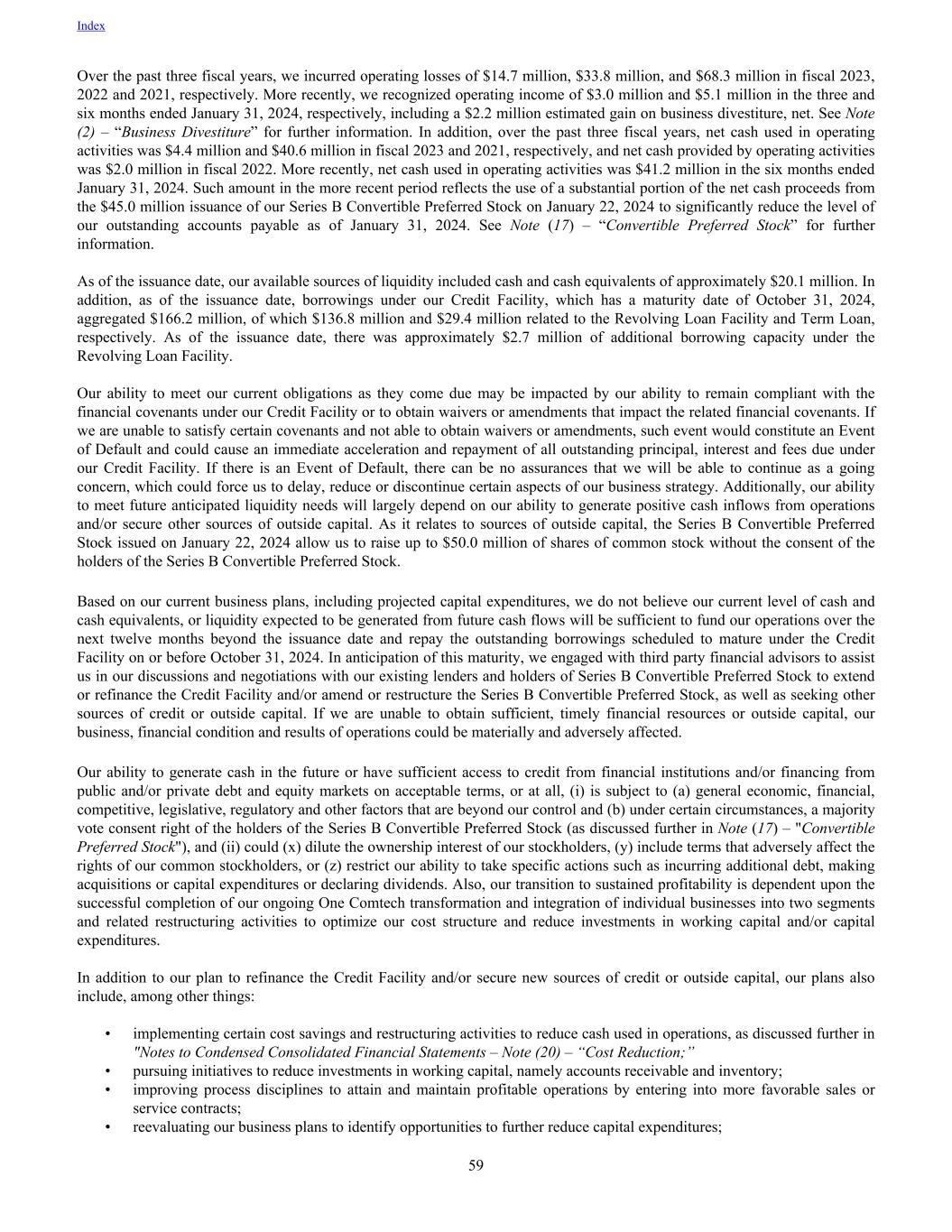

(11) Leases Our leases historically relate to the leasing of facilities and equipment. In accordance with FASB ASC 842 - "Leases" ("ASC 842"), we determine at inception whether an arrangement is, or contains, a lease and whether the lease should be classified as an operating or a financing lease. At lease commencement, we recognize a right-of-use ("ROU") asset and lease liability based on the present value of the future lease payments over the estimated lease term. We have elected to not recognize a ROU asset or lease liability for any leases with terms of twelve months or less. Instead, for such short-term leases, we recognize lease expense on a straight-line basis over the lease term. Certain of our leases include options to extend the term of the lease or to terminate the lease early. When it is reasonably certain that we will exercise a renewal option or will not exercise a termination option, we include the impact of exercising or not exercising such option, respectively, in the estimate of the lease term. As our lease agreements do not explicitly state the discount rate implicit in the lease, we use our incremental borrowing rate ("IBR") on the commencement date to calculate the present value of future lease payments. Such IBR represents our estimated rate of interest to borrow on a collateralized basis over a term commensurate with the expected lease term. Some of our leases include payments that are based on the Consumer Price Index ("CPI") or other similar indices. These variable lease payments are included in the calculation of the ROU asset and lease liability using the index as of the lease commencement date. Other variable lease payments, such as common area maintenance, property taxes, and usage-based amounts, are required by ASC 842 to be excluded from the ROU asset and lease liability and expensed as incurred. In addition to the present value of the future lease payments, the calculation of the ROU asset would also consider, to the extent applicable, any deferred rent upon adoption, lease pre-payments or initial direct costs of obtaining the lease (e.g., such as commissions). For all classes of leased assets, we elected the practical expedient to not separate lease components (i.e., the actual item being leased, such as the facility or piece of equipment) from non-lease components (i.e., the distinct elements of a contract not related to securing the use of the leased asset, such as common area maintenance and consumable supplies). Certain of our facility lease agreements (which are classified as operating leases) contain rent holidays or rent escalation clauses. For rent holidays and rent escalation clauses during the lease term, we record rental expense on a straight-line basis over the term of the lease. As of January 31, 2024, none of our leases contained a residual value guarantee and covenants included in our lease agreements are customary for the types of facilities and equipment being leased. The components of lease expense are as follows: Three months ended January 31, Six months ended January 31, 2024 2023 2024 2023 Finance lease expense: Amortization of ROU assets $ — 1,000 $ — 4,000 Operating lease expense 2,080,000 2,756,000 4,338,000 5,593,000 Short-term lease expense 65,000 117,000 173,000 218,000 Variable lease expense 916,000 1,011,000 1,945,000 2,098,000 Sublease income (16,000) (16,000) (33,000) (33,000) Total lease expense $ 3,045,000 3,869,000 $ 6,423,000 7,880,000 Index COMTECH TELECOMMUNICATIONS CORP. AND SUBSIDIARIES NOTES TO CONDENSED CONSOLIDATED FINANCIAL STATEMENTS (Unaudited) 23