|

Delaware

(State or Other Jurisdiction of Incorporation)

| ||||||||||||||

| 1-4304 | 75-0725338 | |||||||||||||

(Commission File Number) |

(IRS Employer Identification No.) |

|||||||||||||

| 6565 N. MacArthur Blvd. | ||||||||||||||

Irving, Texas |

75039 | |||||||||||||

| (Address of Principal Executive Offices) | (Zip Code) | |||||||||||||

☐ |

Written communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425) | ||||

☐ |

Soliciting material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12) | ||||

☐ |

Pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b)) | ||||

☐ |

Pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4(c)) | ||||

| Title of Each Class | Trading Symbol(s) | Name of Each Exchange on Which Registered | ||||||||||||

| Common Stock, $0.01 par value | CMC | New York Stock Exchange | ||||||||||||

| Emerging growth company | ☐ | ||||

| Item 9.01 Financial Statements and Exhibits. | |||||

| (d) | Exhibits | ||||

| The following exhibits are being furnished as part of this Current Report on Form 8-K: | |||||

| 99.1 | |||||

| 99.2 | |||||

| 99.3 | |||||

| 104 | Cover Page Interactive Data File (embedded within the Inline XBRL document) | ||||

COMMERCIAL METALS COMPANY |

||||||||

| Date: October 16, 2025 | By: /s/ Paul J. Lawrence | |||||||

| Name: Paul J. Lawrence | ||||||||

| Title: Senior Vice President and Chief Financial Officer | ||||||||

| COMMERCIAL METALS COMPANY AND SUBSIDIARIES FINANCIAL & OPERATING STATISTICS (UNAUDITED) | ||||||||||||||||||||||||||||||||||||||||||||

| Three Months Ended | Year Ended | |||||||||||||||||||||||||||||||||||||||||||

| (in thousands, except per ton amounts) | 8/31/2025 | 5/31/2025 | 2/28/2025 | 11/30/2024 | 8/31/2024 | 8/31/2025 | 8/31/2024 | |||||||||||||||||||||||||||||||||||||

| North America Steel Group | ||||||||||||||||||||||||||||||||||||||||||||

| Net sales to external customers | $ | 1,616,078 | $ | 1,562,286 | $ | 1,386,848 | $ | 1,518,637 | $ | 1,559,520 | $ | 6,083,849 | $ | 6,309,730 | ||||||||||||||||||||||||||||||

| Adjusted EBITDA | 239,416 | 179,936 | 136,954 | 186,179 | 202,865 | 742,485 | 944,388 | |||||||||||||||||||||||||||||||||||||

| Adjusted EBITDA margin | 14.8% | 11.5% | 9.9% | 12.3% | 13.0% | 12.2% | 15.0% | |||||||||||||||||||||||||||||||||||||

| External tons shipped | ||||||||||||||||||||||||||||||||||||||||||||

| Raw materials | 374 | 385 | 312 | 339 | 360 | 1,410 | 1,452 | |||||||||||||||||||||||||||||||||||||

| Rebar | 544 | 534 | 503 | 549 | 522 | 2,130 | 2,024 | |||||||||||||||||||||||||||||||||||||

| Merchant bar and other | 244 | 264 | 243 | 241 | 237 | 992 | 945 | |||||||||||||||||||||||||||||||||||||

| Steel products | 788 | 798 | 746 | 790 | 759 | 3,122 | 2,969 | |||||||||||||||||||||||||||||||||||||

| Downstream products | 366 | 355 | 298 | 356 | 361 | 1,375 | 1,394 | |||||||||||||||||||||||||||||||||||||

| Average selling price per ton | ||||||||||||||||||||||||||||||||||||||||||||

| Raw materials | $ | 881 | $ | 809 | $ | 956 | $ | 874 | $ | 866 | $ | 876 | $ | 874 | ||||||||||||||||||||||||||||||

| Steel products | 882 | 859 | 814 | 812 | 843 | 842 | 882 | |||||||||||||||||||||||||||||||||||||

| Downstream products | 1,214 | 1,212 | 1,221 | 1,259 | 1,311 | 1,226 | 1,346 | |||||||||||||||||||||||||||||||||||||

| Cost of raw materials per ton | $ | 649 | $ | 617 | $ | 713 | $ | 677 | $ | 664 | $ | 661 | $ | 654 | ||||||||||||||||||||||||||||||

| Cost of ferrous scrap utilized per ton | $ | 314 | $ | 360 | $ | 338 | $ | 323 | $ | 321 | $ | 333 | $ | 348 | ||||||||||||||||||||||||||||||

| Steel products metal margin per ton | $ | 568 | $ | 499 | $ | 476 | $ | 489 | $ | 522 | $ | 509 | $ | 534 | ||||||||||||||||||||||||||||||

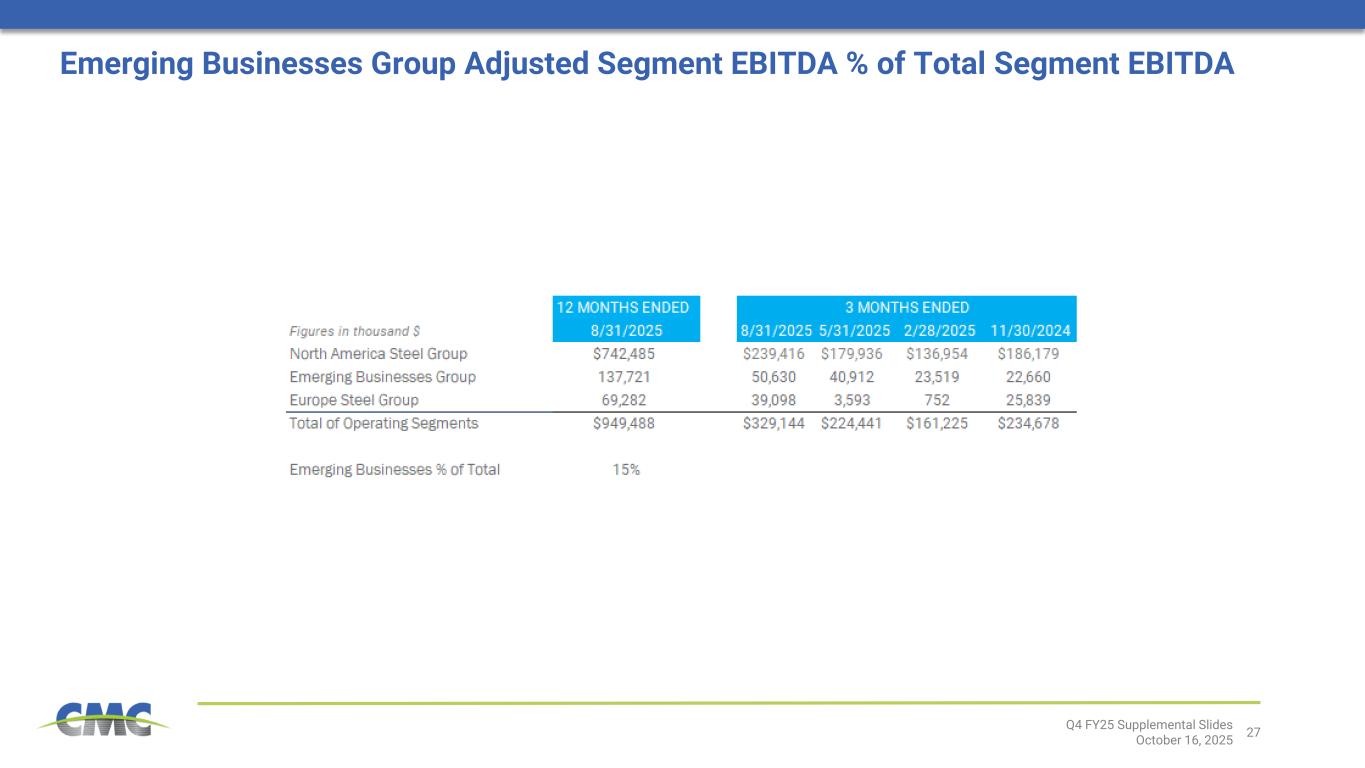

| Emerging Businesses Group | ||||||||||||||||||||||||||||||||||||||||||||

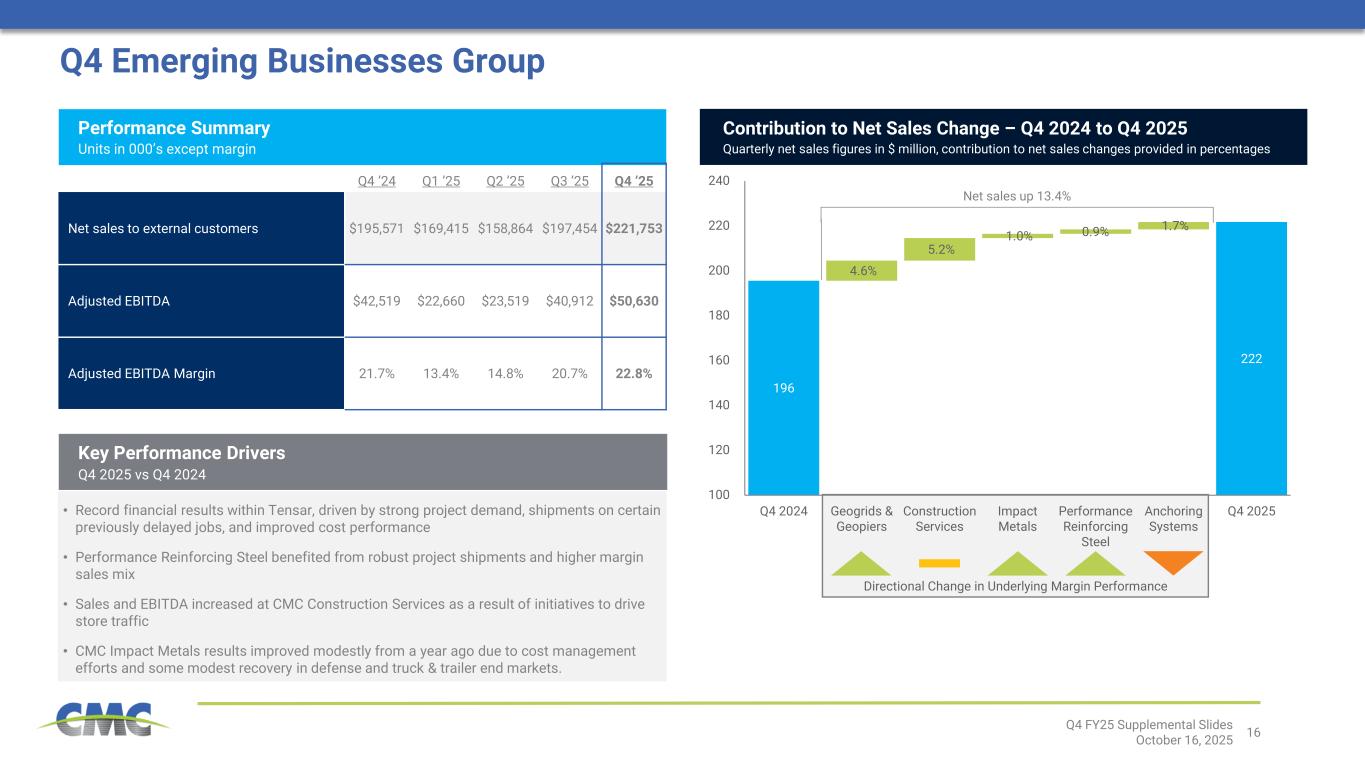

| Net sales to external customers | $ | 221,753 | $ | 197,454 | $ | 158,864 | $ | 169,415 | $ | 195,571 | $ | 747,486 | $ | 717,397 | ||||||||||||||||||||||||||||||

| Adjusted EBITDA | 50,630 | 40,912 | 23,519 | 22,660 | 42,519 | 137,721 | 129,530 | |||||||||||||||||||||||||||||||||||||

| Adjusted EBITDA margin | 22.8% | 20.7% | 14.8% | 13.4% | 21.7% | 18.4% | 18.1% | |||||||||||||||||||||||||||||||||||||

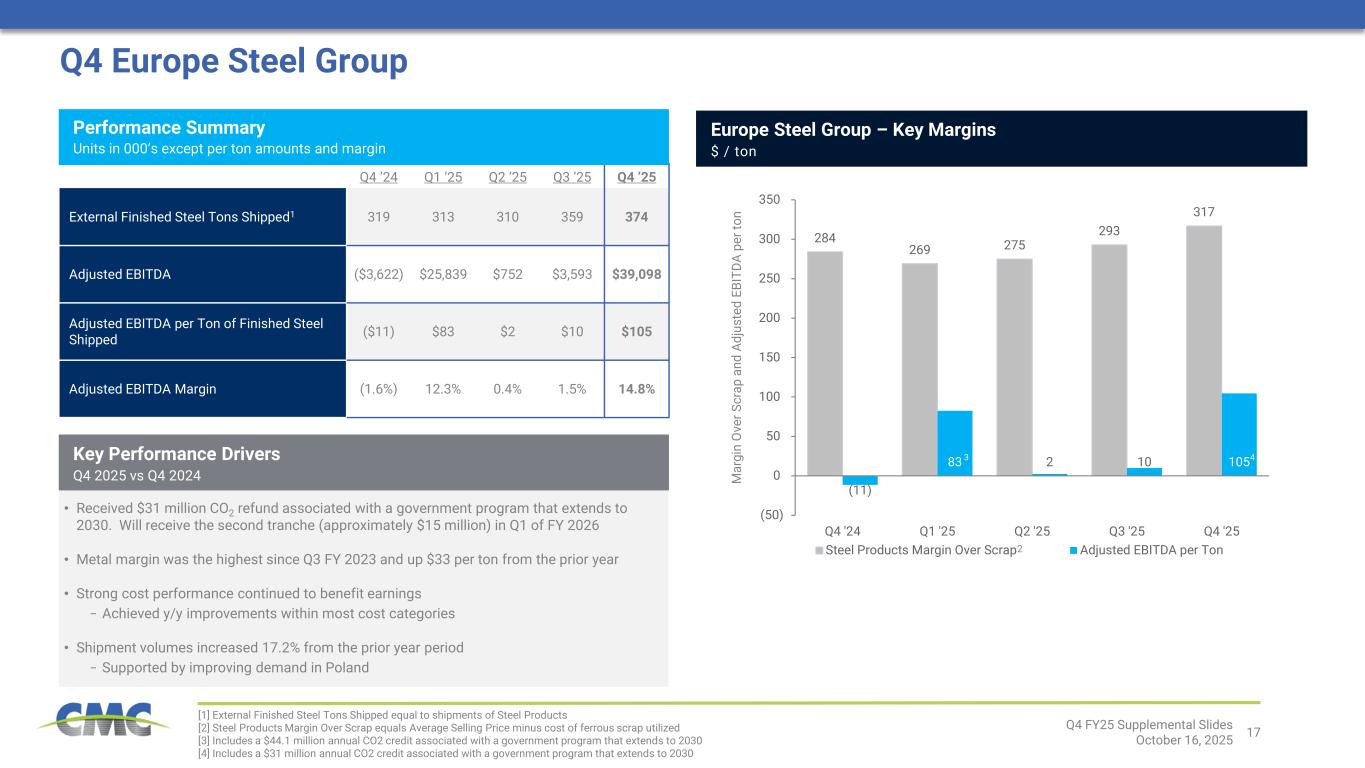

| Europe Steel Group | ||||||||||||||||||||||||||||||||||||||||||||

| Net sales to external customers | $ | 263,294 | $ | 247,590 | $ | 198,029 | $ | 209,407 | $ | 222,085 | $ | 918,320 | $ | 848,566 | ||||||||||||||||||||||||||||||

| Adjusted EBITDA | 39,098 | 3,593 | 752 | 25,839 | (3,622) | 69,282 | 22,517 | |||||||||||||||||||||||||||||||||||||

| Adjusted EBITDA margin | 14.8% | 1.5% | 0.4% | 12.3% | (1.6)% | 7.5% | 2.7% | |||||||||||||||||||||||||||||||||||||

| External tons shipped | ||||||||||||||||||||||||||||||||||||||||||||

| Rebar | 117 | 88 | 100 | 107 | 98 | 412 | 364 | |||||||||||||||||||||||||||||||||||||

| Merchant bar and other | 257 | 271 | 210 | 206 | 221 | 944 | 870 | |||||||||||||||||||||||||||||||||||||

| Steel products | 374 | 359 | 310 | 313 | 319 | 1,356 | 1,234 | |||||||||||||||||||||||||||||||||||||

| Average selling price per ton | ||||||||||||||||||||||||||||||||||||||||||||

| Steel products | $ | 668 | $ | 663 | $ | 612 | $ | 639 | $ | 667 | $ | 647 | $ | 663 | ||||||||||||||||||||||||||||||

| Cost of ferrous scrap utilized per ton | $ | 351 | $ | 370 | $ | 337 | $ | 370 | $ | 383 | $ | 357 | $ | 383 | ||||||||||||||||||||||||||||||

| Steel products metal margin per ton | $ | 317 | $ | 293 | $ | 275 | $ | 269 | $ | 284 | $ | 290 | $ | 280 | ||||||||||||||||||||||||||||||

| COMMERCIAL METALS COMPANY AND SUBSIDIARIES BUSINESS SEGMENTS (UNAUDITED) | ||||||||||||||||||||||||||||||||||||||||||||

| Three Months Ended | Year Ended | |||||||||||||||||||||||||||||||||||||||||||

| (in thousands) | 8/31/2025 | 5/31/2025 | 2/28/2025 | 11/30/2024 | 8/31/2024 | 8/31/2025 | 8/31/2024 | |||||||||||||||||||||||||||||||||||||

| Net sales to external customers | ||||||||||||||||||||||||||||||||||||||||||||

| North America Steel Group | $ | 1,616,078 | $ | 1,562,286 | $ | 1,386,848 | $ | 1,518,637 | $ | 1,559,520 | $ | 6,083,849 | $ | 6,309,730 | ||||||||||||||||||||||||||||||

| Emerging Businesses Group | 221,753 | 197,454 | 158,864 | 169,415 | 195,571 | 747,486 | 717,397 | |||||||||||||||||||||||||||||||||||||

| Europe Steel Group | 263,294 | 247,590 | 198,029 | 209,407 | 222,085 | 918,320 | 848,566 | |||||||||||||||||||||||||||||||||||||

| Corporate and Other | 13,393 | 12,654 | 10,635 | 12,143 | 18,973 | 48,825 | 50,279 | |||||||||||||||||||||||||||||||||||||

| Total net sales to external customers | $ | 2,114,518 | $ | 2,019,984 | $ | 1,754,376 | $ | 1,909,602 | $ | 1,996,149 | $ | 7,798,480 | $ | 7,925,972 | ||||||||||||||||||||||||||||||

| Adjusted EBITDA | ||||||||||||||||||||||||||||||||||||||||||||

| North America Steel Group | $ | 239,416 | $ | 179,936 | $ | 136,954 | $ | 186,179 | $ | 202,865 | $ | 742,485 | $ | 944,388 | ||||||||||||||||||||||||||||||

| Emerging Businesses Group | 50,630 | 40,912 | 23,519 | 22,660 | 42,519 | 137,721 | 129,530 | |||||||||||||||||||||||||||||||||||||

| Europe Steel Group | 39,098 | 3,593 | 752 | 25,839 | (3,622) | 69,282 | 22,517 | |||||||||||||||||||||||||||||||||||||

| Corporate and Other | (50,716) | (36,952) | (34,852) | (386,245) | (25,189) | (508,765) | (127,758) | |||||||||||||||||||||||||||||||||||||

| Total adjusted EBITDA | $ | 278,428 | $ | 187,489 | $ | 126,373 | $ | (151,567) | $ | 216,573 | $ | 440,723 | $ | 968,677 | ||||||||||||||||||||||||||||||

|

COMMERCIAL METALS COMPANY AND SUBSIDIARIES

CONSOLIDATED STATEMENTS OF EARNINGS (UNAUDITED)

| ||||||||||||||||||||||||||

| Three Months Ended August 31, | Year Ended August 31, | |||||||||||||||||||||||||

| (in thousands, except share and per share data) | 2025 | 2024 | 2025 | 2024 | ||||||||||||||||||||||

| Net sales | $ | 2,114,518 | $ | 1,996,149 | $ | 7,798,480 | $ | 7,925,972 | ||||||||||||||||||

| Costs and operating expenses: | ||||||||||||||||||||||||||

| Cost of goods sold | 1,721,710 | 1,673,087 | 6,578,324 | 6,567,287 | ||||||||||||||||||||||

| Selling, general and administrative expenses | 180,218 | 170,612 | 700,234 | 668,413 | ||||||||||||||||||||||

| Interest expense | 12,145 | 12,142 | 45,498 | 47,893 | ||||||||||||||||||||||

| Litigation expense | 3,776 | — | 362,272 | — | ||||||||||||||||||||||

| Asset impairments | 3,436 | 6,558 | 4,607 | 6,708 | ||||||||||||||||||||||

| Net costs and operating expenses | 1,921,285 | 1,862,399 | 7,690,935 | 7,290,301 | ||||||||||||||||||||||

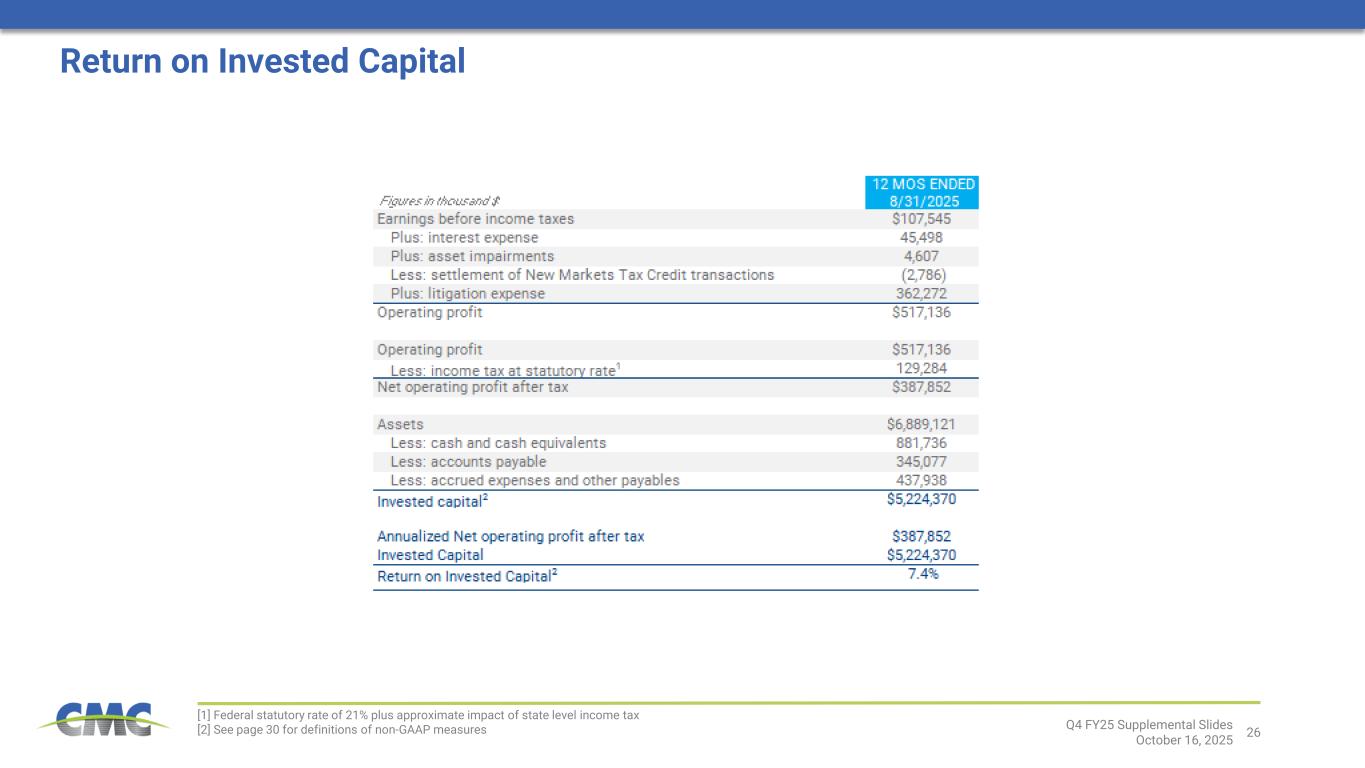

| Earnings before income taxes | 193,233 | 133,750 | 107,545 | 635,671 | ||||||||||||||||||||||

| Income tax expense | 41,452 | 29,819 | 22,883 | 150,180 | ||||||||||||||||||||||

| Net earnings | $ | 151,781 | $ | 103,931 | $ | 84,662 | $ | 485,491 | ||||||||||||||||||

| Earnings per share: | ||||||||||||||||||||||||||

| Basic | $ | 1.36 | $ | 0.91 | $ | 0.75 | $ | 4.19 | ||||||||||||||||||

| Diluted | 1.35 | 0.90 | 0.74 | 4.14 | ||||||||||||||||||||||

| Cash dividends per share | $ | 0.18 | $ | 0.18 | $ | 0.72 | $ | 0.68 | ||||||||||||||||||

| Average basic shares outstanding | 111,677,574 | 114,703,599 | 112,994,381 | 115,844,977 | ||||||||||||||||||||||

| Average diluted shares outstanding | 112,705,122 | 115,931,570 | 114,086,750 | 117,152,552 | ||||||||||||||||||||||

|

COMMERCIAL METALS COMPANY AND SUBSIDIARIES

CONSOLIDATED BALANCE SHEETS (UNAUDITED)

| ||||||||||||||

| (in thousands, except share and per share data) | August 31, 2025 | August 31, 2024 | ||||||||||||

| Assets | ||||||||||||||

| Current assets: | ||||||||||||||

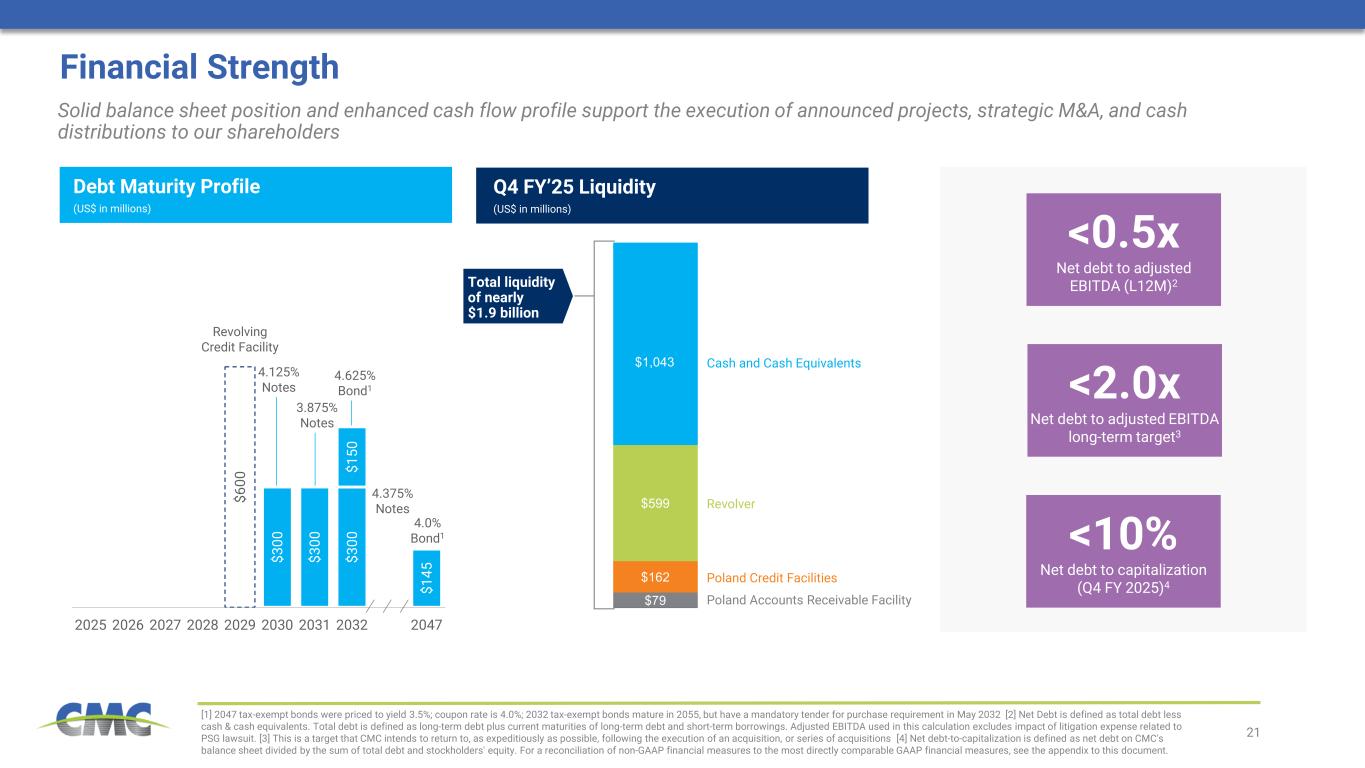

| Cash and cash equivalents | $ | 1,043,252 | $ | 857,922 | ||||||||||

Accounts receivable (less allowance for doubtful accounts of $3,186 and $3,494) |

1,201,680 | 1,158,946 | ||||||||||||

| Inventories | 934,310 | 971,755 | ||||||||||||

| Prepaid and other current assets | 314,372 | 285,489 | ||||||||||||

| Assets held for sale | 1,204 | 18,656 | ||||||||||||

| Total current assets | 3,494,818 | 3,292,768 | ||||||||||||

| Property, plant and equipment: | ||||||||||||||

| Land | 170,823 | 165,674 | ||||||||||||

| Buildings and improvements | 1,206,672 | 1,166,788 | ||||||||||||

| Equipment | 3,477,813 | 3,317,537 | ||||||||||||

| Construction in process | 449,616 | 261,321 | ||||||||||||

| 5,304,924 | 4,911,320 | |||||||||||||

| Less accumulated depreciation and amortization | (2,562,151) | (2,334,184) | ||||||||||||

| Property, plant and equipment, net | 2,742,773 | 2,577,136 | ||||||||||||

| Intangible assets, net | 210,815 | 234,869 | ||||||||||||

| Goodwill | 386,846 | 385,630 | ||||||||||||

| Other noncurrent assets | 336,582 | 327,436 | ||||||||||||

| Total assets | $ | 7,171,834 | $ | 6,817,839 | ||||||||||

| Liabilities and stockholders' equity | ||||||||||||||

| Current liabilities: | ||||||||||||||

| Accounts payable | $ | 358,373 | $ | 350,550 | ||||||||||

| Accrued contingent litigation-related loss | 362,272 | — | ||||||||||||

| Other accrued expenses and payables | 493,879 | 445,514 | ||||||||||||

| Current maturities of long-term debt | 44,289 | 38,786 | ||||||||||||

| Total current liabilities | 1,258,813 | 834,850 | ||||||||||||

| Deferred income taxes | 184,645 | 276,908 | ||||||||||||

| Other noncurrent liabilities | 225,044 | 255,222 | ||||||||||||

| Long-term debt | 1,310,006 | 1,150,835 | ||||||||||||

| Total liabilities | 2,978,508 | 2,517,815 | ||||||||||||

| Stockholders' equity: | ||||||||||||||

| Common stock, par value $0.01 per share; authorized 200,000,000 shares; issued 129,060,664 shares; outstanding 111,189,136 and 114,104,057 shares | 1,290 | 1,290 | ||||||||||||

| Additional paid-in capital | 406,916 | 407,232 | ||||||||||||

| Accumulated other comprehensive loss | (25,251) | (85,952) | ||||||||||||

| Retained earnings | 4,507,114 | 4,503,885 | ||||||||||||

Less treasury stock, 17,871,528 and 14,956,607 shares at cost |

(697,003) | (526,679) | ||||||||||||

| Stockholders' equity | 4,193,066 | 4,299,776 | ||||||||||||

| Stockholders' equity attributable to non-controlling interests | 260 | 248 | ||||||||||||

| Total stockholders' equity | 4,193,326 | 4,300,024 | ||||||||||||

| Total liabilities and stockholders' equity | $ | 7,171,834 | $ | 6,817,839 | ||||||||||

|

COMMERCIAL METALS COMPANY AND SUBSIDIARIES

CONSOLIDATED STATEMENTS OF CASH FLOWS (UNAUDITED)

|

||||||||||||||

| Year Ended August 31, | ||||||||||||||

| (in thousands) | 2025 | 2024 | ||||||||||||

| Cash flows from (used by) operating activities: | ||||||||||||||

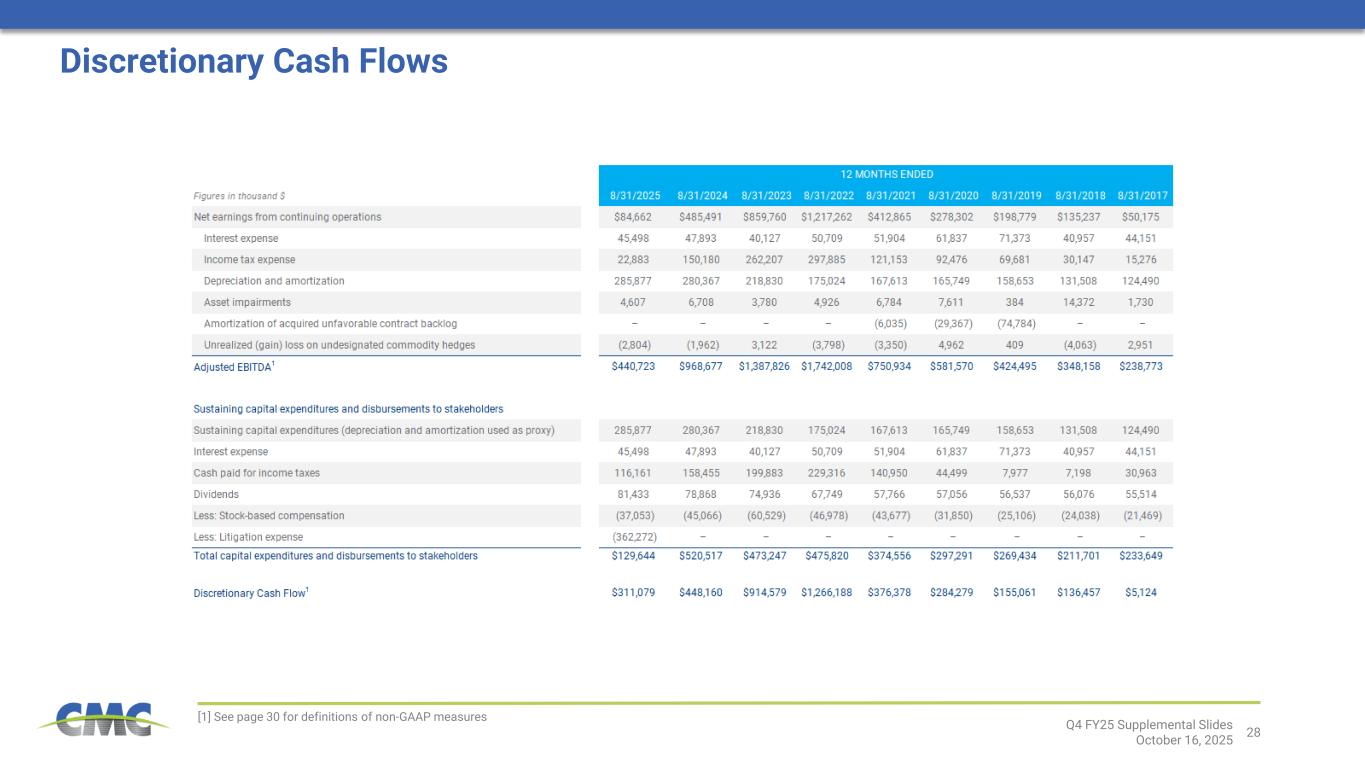

| Net earnings | $ | 84,662 | $ | 485,491 | ||||||||||

Adjustments to reconcile net earnings to net cash flows from operating activities: |

||||||||||||||

| Depreciation and amortization | 285,877 | 280,367 | ||||||||||||

| Stock-based compensation | 37,053 | 45,066 | ||||||||||||

| Deferred income taxes and other long-term taxes | (98,304) | (15,319) | ||||||||||||

| Write-down of inventory | 2,473 | 5,098 | ||||||||||||

| Unrealized gain on undesignated commodity hedges | (2,804) | (1,962) | ||||||||||||

| Asset impairments | 4,607 | 6,708 | ||||||||||||

Net loss on sales of assets |

1,827 | 3,321 | ||||||||||||

| Litigation expense | 362,272 | — | ||||||||||||

| Settlement of New Markets Tax Credit transactions | (2,786) | (6,748) | ||||||||||||

| Other | 1,644 | 3,553 | ||||||||||||

| Changes in operating assets and liabilities | 38,549 | 94,133 | ||||||||||||

Net cash flows from operating activities |

715,070 | 899,708 | ||||||||||||

| Cash flows from (used by) investing activities: | ||||||||||||||

| Capital expenditures | (402,821) | (324,271) | ||||||||||||

| Proceeds from government assistance related to property, plant and equipment | 50,000 | — | ||||||||||||

| Proceeds from insurance | 2,237 | — | ||||||||||||

| Proceeds from the sale of property, plant and equipment | 5,758 | 756 | ||||||||||||

| Other | (1,946) | 513 | ||||||||||||

Net cash flows used by investing activities |

(346,772) | (323,002) | ||||||||||||

| Cash flows from (used by) financing activities: | ||||||||||||||

| Proceeds from issuance of long-term debt, net | 147,724 | — | ||||||||||||

| Repayments of long-term debt | (41,480) | (36,346) | ||||||||||||

| Debt issuance and extinguishment | (622) | — | ||||||||||||

| Proceeds from accounts receivable facilities | 35,979 | 175,322 | ||||||||||||

| Repayments under accounts receivable facilities | (35,979) | (183,347) | ||||||||||||

| Treasury stock acquired | (198,822) | (182,932) | ||||||||||||

| Tax withholdings related to share settlements, net of purchase plans | (8,823) | (7,595) | ||||||||||||

| Dividends | (81,433) | (78,868) | ||||||||||||

| Contribution from non-controlling interest | 12 | 7 | ||||||||||||

Net cash flows used by financing activities |

(183,444) | (313,759) | ||||||||||||

| Effect of exchange rate changes on cash | 1,495 | 891 | ||||||||||||

Increase in cash and cash equivalents |

186,349 | 263,838 | ||||||||||||

| Cash, restricted cash and cash equivalents at beginning of period | 859,555 | 595,717 | ||||||||||||

| Cash, restricted cash and cash equivalents at end of period | $ | 1,045,904 | $ | 859,555 | ||||||||||

| Supplemental information: | ||||||||||||||

| Cash paid for income taxes | $ | 116,161 | $ | 158,455 | ||||||||||

| Cash paid for interest | 51,078 | 49,463 | ||||||||||||

| Cash and cash equivalents | $ | 1,043,252 | $ | 857,922 | ||||||||||

| Restricted cash | 2,652 | 1,633 | ||||||||||||

| Total cash, restricted cash and cash equivalents | $ | 1,045,904 | $ | 859,555 | ||||||||||

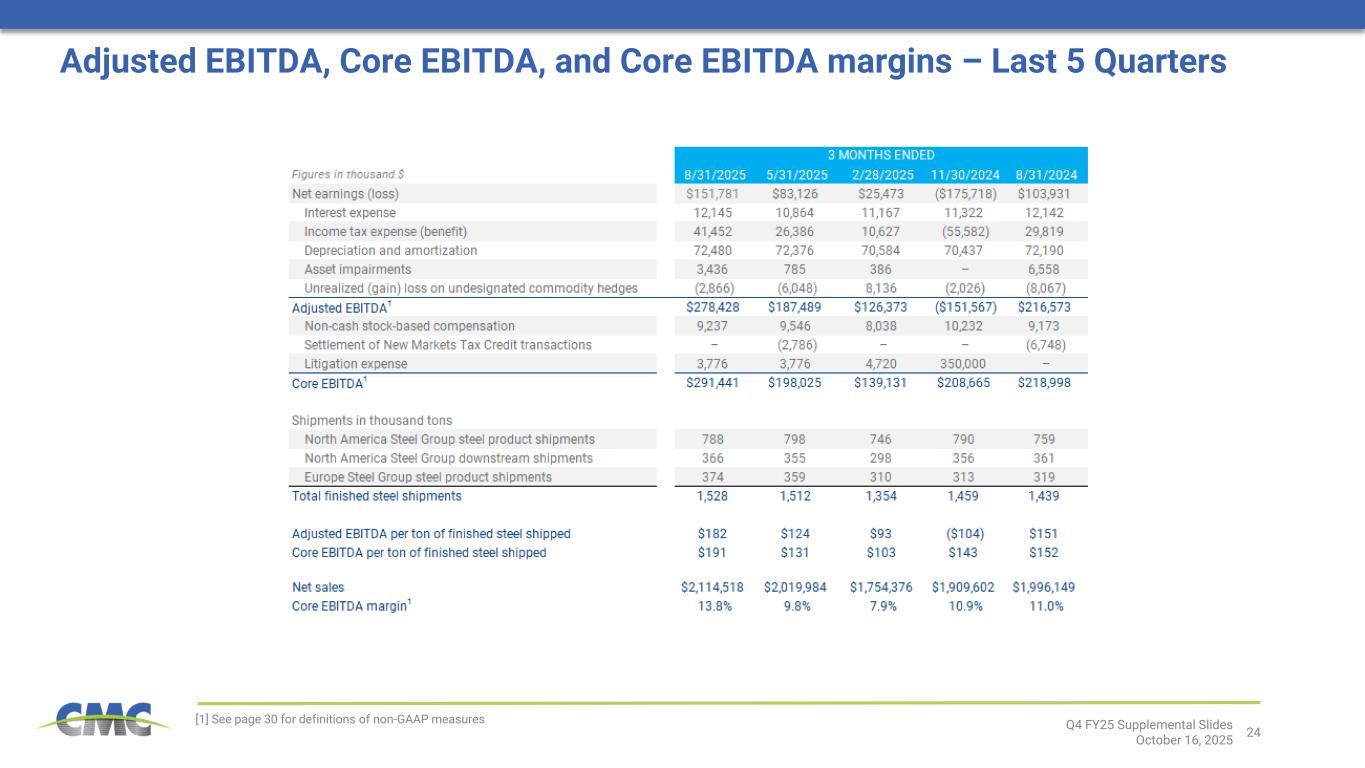

| Three Months Ended | Year Ended | |||||||||||||||||||||||||||||||||||||||||||

| (in thousands) | 8/31/2025 | 5/31/2025 | 2/28/2025 | 11/30/2024 | 8/31/2024 | 8/31/2025 | 8/31/2024 | |||||||||||||||||||||||||||||||||||||

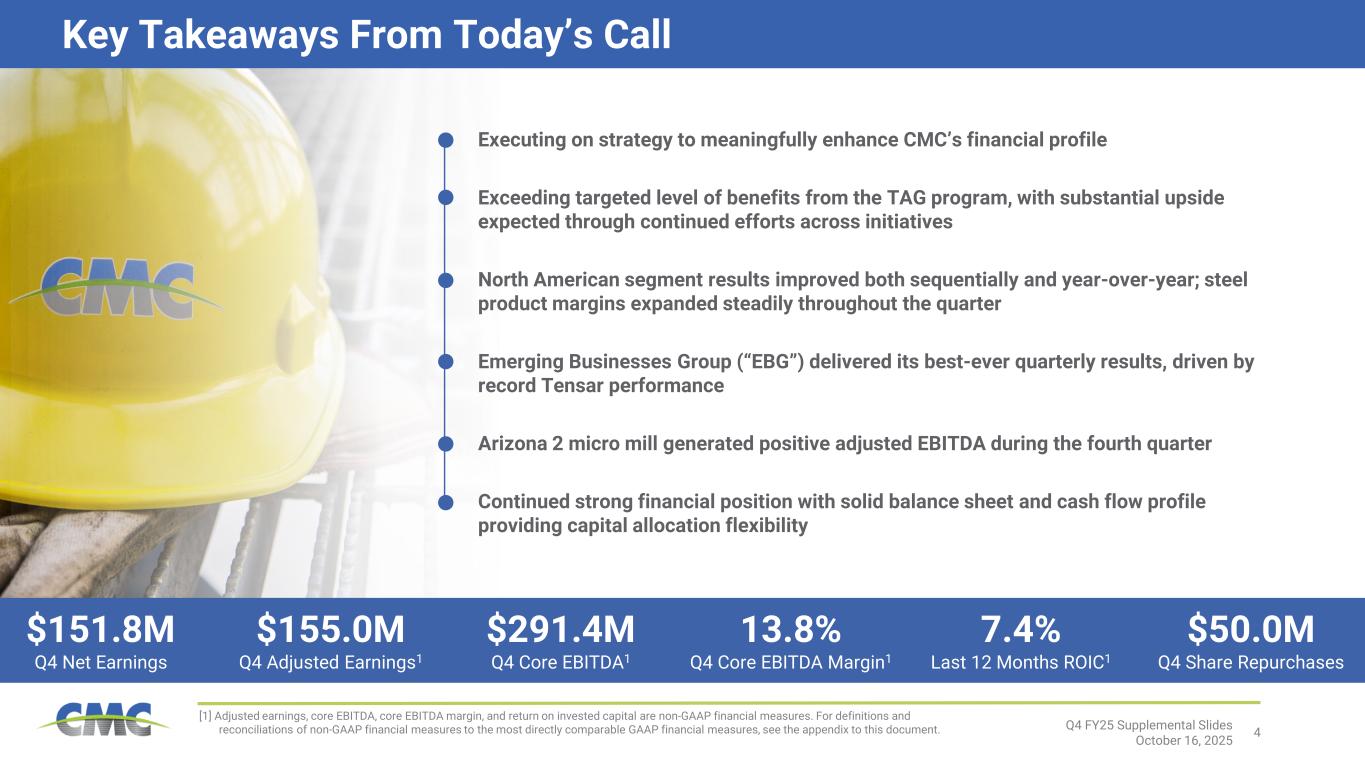

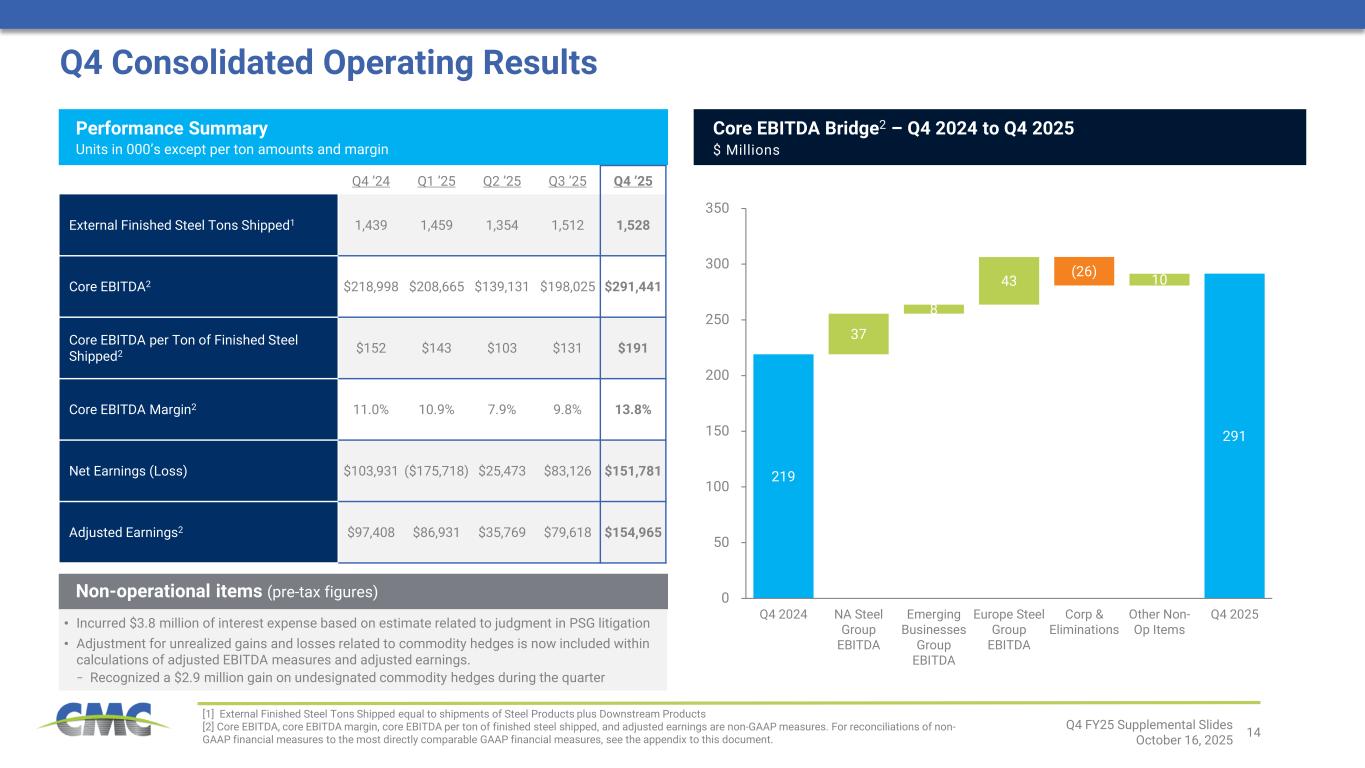

| Net earnings (loss) | $ | 151,781 | $ | 83,126 | $ | 25,473 | $ | (175,718) | $ | 103,931 | $ | 84,662 | $ | 485,491 | ||||||||||||||||||||||||||||||

| Interest expense | 12,145 | 10,864 | 11,167 | 11,322 | 12,142 | 45,498 | 47,893 | |||||||||||||||||||||||||||||||||||||

| Income tax expense (benefit) | 41,452 | 26,386 | 10,627 | (55,582) | 29,819 | 22,883 | 150,180 | |||||||||||||||||||||||||||||||||||||

| Depreciation and amortization | 72,480 | 72,376 | 70,584 | 70,437 | 72,190 | 285,877 | 280,367 | |||||||||||||||||||||||||||||||||||||

| Asset impairments | 3,436 | 785 | 386 | — | 6,558 | 4,607 | 6,708 | |||||||||||||||||||||||||||||||||||||

| Unrealized (gain) loss on undesignated commodity hedges | (2,866) | (6,048) | 8,136 | (2,026) | (8,067) | (2,804) | (1,962) | |||||||||||||||||||||||||||||||||||||

| Adjusted EBITDA | 278,428 | 187,489 | 126,373 | (151,567) | 216,573 | 440,723 | 968,677 | |||||||||||||||||||||||||||||||||||||

| Non-cash equity compensation | 9,237 | 9,546 | 8,038 | 10,232 | 9,173 | 37,053 | 45,066 | |||||||||||||||||||||||||||||||||||||

| Settlement of New Markets Tax Credit transactions | — | (2,786) | — | — | (6,748) | (2,786) | (6,748) | |||||||||||||||||||||||||||||||||||||

| Litigation expense | 3,776 | 3,776 | 4,720 | 350,000 | — | 362,272 | — | |||||||||||||||||||||||||||||||||||||

| Core EBITDA | $ | 291,441 | $ | 198,025 | $ | 139,131 | $ | 208,665 | $ | 218,998 | $ | 837,262 | $ | 1,006,995 | ||||||||||||||||||||||||||||||

| Net sales | $ | 2,114,518 | $ | 2,019,984 | $ | 1,754,376 | $ | 1,909,602 | $ | 1,996,149 | $ | 7,798,480 | $ | 7,925,972 | ||||||||||||||||||||||||||||||

| Core EBITDA margin | 13.8% | 9.8% | 7.9% | 10.9% | 11.0% | 10.7% | 12.7% | |||||||||||||||||||||||||||||||||||||

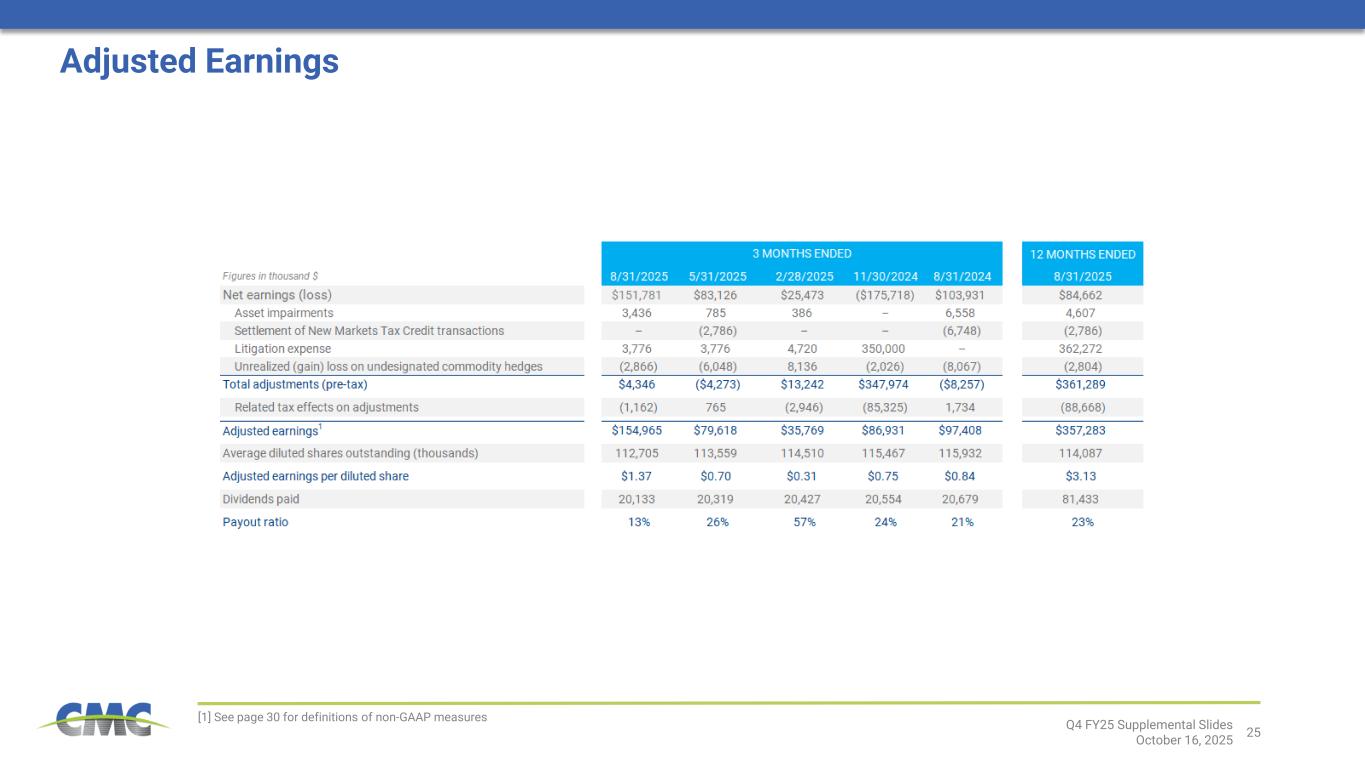

| Three Months Ended | Year Ended | |||||||||||||||||||||||||||||||||||||||||||

| (in thousands, except per share data) | 8/31/2025 | 5/31/2025 | 2/28/2025 | 11/30/2024 | 8/31/2024 | 8/31/2025 | 8/31/2024 | |||||||||||||||||||||||||||||||||||||

| Net earnings (loss) | $ | 151,781 | $ | 83,126 | $ | 25,473 | $ | (175,718) | $ | 103,931 | $ | 84,662 | $ | 485,491 | ||||||||||||||||||||||||||||||

| Asset impairments | 3,436 | 785 | 386 | — | 6,558 | 4,607 | 6,708 | |||||||||||||||||||||||||||||||||||||

| Settlement of New Markets Tax Credit transactions | — | (2,786) | — | — | (6,748) | (2,786) | (6,748) | |||||||||||||||||||||||||||||||||||||

| Litigation expense | 3,776 | 3,776 | 4,720 | 350,000 | — | 362,272 | — | |||||||||||||||||||||||||||||||||||||

| Unrealized (gain) loss on undesignated commodity hedges | (2,866) | (6,048) | 8,136 | (2,026) | (8,067) | (2,804) | (1,962) | |||||||||||||||||||||||||||||||||||||

| Total adjustments (pre-tax) | $ | 4,346 | $ | (4,273) | $ | 13,242 | $ | 347,974 | $ | (8,257) | $ | 361,289 | $ | (2,002) | ||||||||||||||||||||||||||||||

| Related tax effects on adjustments | (1,162) | 765 | (2,946) | (85,325) | 1,734 | (88,668) | 420 | |||||||||||||||||||||||||||||||||||||

| Adjusted earnings | $ | 154,965 | $ | 79,618 | $ | 35,769 | $ | 86,931 | $ | 97,408 | $ | 357,283 | $ | 483,909 | ||||||||||||||||||||||||||||||

Net earnings (loss) per diluted share(1) |

$ | 1.35 | $ | 0.73 | $ | 0.22 | $ | (1.54) | $ | 0.90 | $ | 0.74 | $ | 4.14 | ||||||||||||||||||||||||||||||

Adjusted earnings per diluted share(1) |

$ | 1.37 | $ | 0.70 | $ | 0.31 | $ | 0.76 | $ | 0.84 | $ | 3.13 | $ | 4.13 | ||||||||||||||||||||||||||||||

| Three Months Ended | Year Ended | |||||||||||||||||||||||||||||||

| (in thousands, except per share data) | 11/30/2023 | 2/29/2024 | 5/31/2024 | 8/31/2024 | 8/31/2024 | |||||||||||||||||||||||||||

| Net earnings | $ | 176,273 | $ | 85,847 | $ | 119,440 | $ | 103,931 | $ | 485,491 | ||||||||||||||||||||||

| Interest expense | 11,756 | 11,878 | 12,117 | 12,142 | 47,893 | |||||||||||||||||||||||||||

| Income tax expense | 48,422 | 31,072 | 40,867 | 29,819 | 150,180 | |||||||||||||||||||||||||||

| Depreciation and amortization | 69,186 | 68,299 | 70,692 | 72,190 | 280,367 | |||||||||||||||||||||||||||

| Asset impairments | — | 4 | 146 | 6,558 | 6,708 | |||||||||||||||||||||||||||

| Unrealized (gain) loss on undesignated commodity hedges | 2,480 | (1,980) | 5,605 | (8,067) | (1,962) | |||||||||||||||||||||||||||

| Adjusted EBITDA | 308,117 | 195,120 | 248,867 | 216,573 | 968,677 | |||||||||||||||||||||||||||

| Non-cash equity compensation | 8,059 | 14,988 | 12,846 | 9,173 | 45,066 | |||||||||||||||||||||||||||

| Settlement of New Markets Tax Credit transactions | — | — | — | (6,748) | (6,748) | |||||||||||||||||||||||||||

| Core EBITDA | $ | 316,176 | $ | 210,108 | $ | 261,713 | $ | 218,998 | $ | 1,006,995 | ||||||||||||||||||||||

| Net sales | $ | 2,003,051 | $ | 1,848,287 | $ | 2,078,485 | $ | 1,996,149 | $ | 7,925,972 | ||||||||||||||||||||||

| Core EBITDA margin | 15.8% | 11.4% | 12.6% | 11.0% | 12.7% | |||||||||||||||||||||||||||

| Net earnings | $ | 176,273 | $ | 85,847 | $ | 119,440 | $ | 103,931 | $ | 485,491 | ||||||||||||||||||||||

| Asset impairments | — | 4 | 146 | 6,558 | 6,708 | |||||||||||||||||||||||||||

| Settlement of New Markets Tax Credit transactions | — | — | — | (6,748) | (6,748) | |||||||||||||||||||||||||||

| Unrealized (gain) loss on undesignated commodity hedges | 2,480 | (1,980) | 5,605 | (8,067) | (1,962) | |||||||||||||||||||||||||||

| Total adjustments (pre-tax) | $ | 2,480 | $ | (1,976) | $ | 5,751 | $ | (8,257) | $ | (2,002) | ||||||||||||||||||||||

| Related tax effects on adjustments | (521) | 415 | (1,208) | 1,734 | 420 | |||||||||||||||||||||||||||

| Adjusted earnings | $ | 178,232 | $ | 84,286 | $ | 123,983 | $ | 97,408 | $ | 483,909 | ||||||||||||||||||||||

Net earnings per diluted share(1) |

$ | 1.49 | $ | 0.73 | $ | 1.02 | $ | 0.90 | $ | 4.14 | ||||||||||||||||||||||

Adjusted earnings per diluted share(1) |

$ | 1.51 | $ | 0.72 | $ | 1.06 | $ | 0.84 | $ | 4.13 | ||||||||||||||||||||||

| Three Months Ended | Year Ended | |||||||||||||||||||||||||||||||

| (in thousands, except per share data) | 11/30/2022 | 2/28/2023 | 5/31/2023 | 8/31/2023 | 8/31/2023 | |||||||||||||||||||||||||||

| Net earnings | $ | 261,774 | $ | 179,849 | $ | 233,971 | $ | 184,166 | $ | 859,760 | ||||||||||||||||||||||

| Interest expense | 13,045 | 9,945 | 8,878 | 8,259 | 40,127 | |||||||||||||||||||||||||||

| Income tax expense | 76,725 | 55,641 | 76,099 | 53,742 | 262,207 | |||||||||||||||||||||||||||

| Depreciation and amortization | 51,183 | 51,216 | 55,129 | 61,302 | 218,830 | |||||||||||||||||||||||||||

| Asset impairments | 9 | 36 | 1 | 3,734 | 3,780 | |||||||||||||||||||||||||||

| Unrealized (gain) loss on undesignated commodity hedges | 6,459 | (554) | (6,781) | 3,998 | 3,122 | |||||||||||||||||||||||||||

| Adjusted EBITDA | 409,195 | 296,133 | 367,297 | 315,201 | 1,387,826 | |||||||||||||||||||||||||||

| Non-cash equity compensation | 16,675 | 16,949 | 10,376 | 16,529 | 60,529 | |||||||||||||||||||||||||||

| Settlement of New Markets Tax Credit transactions | — | (17,659) | — | — | (17,659) | |||||||||||||||||||||||||||

| Core EBITDA | $ | 425,870 | $ | 295,423 | $ | 377,673 | $ | 331,730 | $ | 1,430,696 | ||||||||||||||||||||||

| Net sales | $ | 2,227,313 | $ | 2,018,003 | $ | 2,344,989 | $ | 2,209,228 | $ | 8,799,533 | ||||||||||||||||||||||

| Core EBITDA margin | 19.1% | 14.6% | 16.1% | 15.0% | 16.3% | |||||||||||||||||||||||||||

| Net earnings | $ | 261,774 | $ | 179,849 | $ | 233,971 | $ | 184,166 | $ | 859,760 | ||||||||||||||||||||||

| Asset impairments | 9 | 36 | 1 | 3,734 | 3,780 | |||||||||||||||||||||||||||

| Settlement of New Markets Tax Credit transactions | — | (17,659) | — | — | (17,659) | |||||||||||||||||||||||||||

| Unrealized (gain) loss on undesignated commodity hedges | 6,459 | (554) | (6,781) | 3,998 | 3,122 | |||||||||||||||||||||||||||

| Total adjustments (pre-tax) | $ | 6,468 | $ | (18,177) | $ | (6,780) | $ | 7,732 | $ | (10,757) | ||||||||||||||||||||||

| Related tax effects on adjustments | (1,358) | 3,817 | 1,424 | (1,624) | 2,259 | |||||||||||||||||||||||||||

| Adjusted earnings | $ | 266,884 | $ | 165,489 | $ | 228,615 | $ | 190,274 | $ | 851,262 | ||||||||||||||||||||||

Net earnings per diluted share(1) |

$ | 2.20 | $ | 1.51 | $ | 1.98 | $ | 1.56 | $ | 7.25 | ||||||||||||||||||||||

Adjusted earnings per diluted share(1) |

$ | 2.24 | $ | 1.39 | $ | 1.93 | $ | 1.61 | $ | 7.18 | ||||||||||||||||||||||

| Three Months Ended | Year Ended | |||||||||||||||||||||||||||||||

| (in thousands, except per share data) | 11/30/2021 | 2/28/2022 | 5/31/2022 | 8/31/2022 | 8/31/2022 | |||||||||||||||||||||||||||

| Net earnings | $ | 232,889 | $ | 383,314 | $ | 312,429 | $ | 288,630 | $ | 1,217,262 | ||||||||||||||||||||||

| Interest expense | 11,035 | 12,011 | 13,433 | 14,230 | 50,709 | |||||||||||||||||||||||||||

| Income tax expense | 28,872 | 126,432 | 92,590 | 49,991 | 297,885 | |||||||||||||||||||||||||||

| Depreciation and amortization | 41,226 | 41,134 | 43,583 | 49,081 | 175,024 | |||||||||||||||||||||||||||

| Asset impairments | — | 1,228 | 3,245 | 453 | 4,926 | |||||||||||||||||||||||||||

| Unrealized (gain) loss on undesignated commodity hedges | (2,184) | 1,641 | (2,556) | (699) | (3,798) | |||||||||||||||||||||||||||

| Adjusted EBITDA | 311,838 | 565,760 | 462,724 | 401,686 | 1,742,008 | |||||||||||||||||||||||||||

| Non-cash equity compensation | 9,619 | 16,251 | 11,986 | 9,122 | 46,978 | |||||||||||||||||||||||||||

| Acquisition and integration related costs and other | 3,165 | — | 4,478 | 1,008 | 8,651 | |||||||||||||||||||||||||||

| Purchase accounting effect on inventory | — | — | 2,169 | 6,506 | 8,675 | |||||||||||||||||||||||||||

| Gain on sale of assets | — | (273,315) | — | — | (273,315) | |||||||||||||||||||||||||||

| Loss on debt extinguishment | — | 16,052 | — | — | 16,052 | |||||||||||||||||||||||||||

| Core EBITDA | $ | 324,622 | $ | 324,748 | $ | 481,357 | $ | 418,322 | $ | 1,549,049 | ||||||||||||||||||||||

| Net sales | $ | 1,981,801 | $ | 2,008,888 | $ | 2,515,727 | $ | 2,407,065 | $ | 8,913,481 | ||||||||||||||||||||||

| Core EBITDA margin | 16.4% | 16.2% | 19.1% | 17.4% | 17.4% | |||||||||||||||||||||||||||

| Net earnings | $ | 232,889 | $ | 383,314 | $ | 312,429 | $ | 288,630 | $ | 1,217,262 | ||||||||||||||||||||||

| Asset impairments | — | 1,228 | 3,245 | 453 | 4,926 | |||||||||||||||||||||||||||

| Acquisition and integration related costs and other | 3,165 | — | 4,478 | 1,008 | 8,651 | |||||||||||||||||||||||||||

| Purchase accounting effect on inventory | — | — | 2,169 | 6,506 | 8,675 | |||||||||||||||||||||||||||

| Gain on sale of assets | — | (273,315) | — | — | (273,315) | |||||||||||||||||||||||||||

| Loss on debt extinguishment | — | 16,052 | — | — | 16,052 | |||||||||||||||||||||||||||

| Unrealized (gain) loss on undesignated commodity hedges | (2,184) | 1,641 | (2,556) | (699) | (3,798) | |||||||||||||||||||||||||||

| Total adjustments (pre-tax) | $ | 981 | $ | (254,394) | $ | 7,336 | $ | 7,268 | $ | (238,809) | ||||||||||||||||||||||

| International restructuring | (36,237) | — | — | — | (36,237) | |||||||||||||||||||||||||||

| Related tax effects on adjustments | (206) | 59,930 | (1,541) | (1,526) | 56,657 | |||||||||||||||||||||||||||

| Adjusted earnings | $ | 197,427 | $ | 188,850 | $ | 318,224 | $ | 294,372 | $ | 998,873 | ||||||||||||||||||||||

Net earnings per diluted share(1) |

$ | 1.90 | $ | 3.12 | $ | 2.54 | $ | 2.40 | $ | 9.95 | ||||||||||||||||||||||

Adjusted earnings per diluted share(1) |

$ | 1.61 | $ | 1.54 | $ | 2.59 | $ | 2.44 | $ | 8.16 | ||||||||||||||||||||||

| Three Months Ended | Year Ended | |||||||||||||||||||||||||||||||

| (in thousands, except per share data) | 11/30/2020 | 2/28/2021 | 5/31/2021 | 8/31/2021 | 8/31/2021 | |||||||||||||||||||||||||||

| Earnings from continuing operations | $ | 63,911 | $ | 66,233 | $ | 130,408 | $ | 152,313 | $ | 412,865 | ||||||||||||||||||||||

| Interest expense | 14,259 | 14,021 | 11,965 | 11,659 | 51,904 | |||||||||||||||||||||||||||

| Income tax expense | 21,593 | 20,941 | 38,175 | 40,444 | 121,153 | |||||||||||||||||||||||||||

| Depreciation and amortization | 41,799 | 41,573 | 41,804 | 42,437 | 167,613 | |||||||||||||||||||||||||||

| Amortization of acquired unfavorable contract backlog | (1,523) | (1,509) | (1,508) | (1,495) | (6,035) | |||||||||||||||||||||||||||

| Asset impairments | 3,594 | 474 | 277 | 2,439 | 6,784 | |||||||||||||||||||||||||||

| Unrealized (gain) loss on undesignated commodity hedges | 1,801 | 381 | (360) | (5,172) | (3,350) | |||||||||||||||||||||||||||

| Adjusted EBITDA from continuing operations | 145,434 | 142,114 | 220,761 | 242,625 | 750,934 | |||||||||||||||||||||||||||

| Non-cash equity compensation | 9,062 | 12,696 | 13,800 | 8,119 | 43,677 | |||||||||||||||||||||||||||

| Gain on sale of assets | — | (5,877) | (4,457) | — | (10,334) | |||||||||||||||||||||||||||

| Loss on debt extinguishment | — | 16,841 | — | — | 16,841 | |||||||||||||||||||||||||||

| Facility closure | 5,214 | 5,694 | — | — | 10,908 | |||||||||||||||||||||||||||

| Labor cost government refund | (1,348) | — | — | — | (1,348) | |||||||||||||||||||||||||||

| Core EBITDA from continuing operations | $ | 158,362 | $ | 171,468 | $ | 230,104 | $ | 250,744 | $ | 810,678 | ||||||||||||||||||||||

| Net sales | $ | 1,391,803 | $ | 1,462,270 | $ | 1,845,041 | $ | 2,030,646 | $ | 6,729,760 | ||||||||||||||||||||||

| Core EBITDA from continuing operations margin | 11.4% | 11.7% | 12.5% | 12.3% | 12.0% | |||||||||||||||||||||||||||

| Net earnings from continuing operations | $ | 63,911 | $ | 66,233 | $ | 130,408 | $ | 152,313 | $ | 412,865 | ||||||||||||||||||||||

| Gain on sale of assets | — | (5,877) | (4,457) | — | (10,334) | |||||||||||||||||||||||||||

| Asset impairments | 3,594 | 474 | 277 | 2,439 | 6,784 | |||||||||||||||||||||||||||

| Loss on debt extinguishment | — | 16,841 | — | — | 16,841 | |||||||||||||||||||||||||||

| Facility closure | 5,214 | 5,694 | — | — | 10,908 | |||||||||||||||||||||||||||

| Labor cost government refund | (1,348) | — | — | — | (1,348) | |||||||||||||||||||||||||||

| Unrealized (gain) loss on undesignated commodity hedges | 1,801 | 381 | (360) | (5,172) | (3,350) | |||||||||||||||||||||||||||

| Total adjustments (pre-tax) | $ | 9,261 | $ | 17,513 | $ | (4,540) | $ | (2,733) | $ | 19,501 | ||||||||||||||||||||||

| Related tax effects on adjustments | (1,972) | (3,678) | 953 | 574 | (4,123) | |||||||||||||||||||||||||||

| Adjusted earnings from continuing operations | $ | 71,200 | $ | 80,068 | $ | 126,821 | $ | 150,154 | $ | 428,243 | ||||||||||||||||||||||

Earnings from continuing operations per diluted share(1) |

$ | 0.53 | $ | 0.54 | $ | 1.07 | $ | 1.24 | $ | 3.38 | ||||||||||||||||||||||

Adjusted earnings from continuing operations per diluted share(1) |

$ | 0.59 | $ | 0.66 | $ | 1.04 | $ | 1.23 | $ | 3.51 | ||||||||||||||||||||||

| Three Months Ended | Year Ended | |||||||||||||||||||||||||||||||

| (in thousands, except per share data) | 11/30/2019 | 2/29/2020 | 5/31/2020 | 8/31/2020 | 8/31/2020 | |||||||||||||||||||||||||||

| Earnings from continuing operations | $ | 82,755 | $ | 63,596 | $ | 64,169 | $ | 67,782 | $ | 278,302 | ||||||||||||||||||||||

| Interest expense | 16,578 | 15,888 | 15,409 | 13,962 | 61,837 | |||||||||||||||||||||||||||

| Income tax expense | 27,332 | 22,845 | 23,804 | 18,495 | 92,476 | |||||||||||||||||||||||||||

| Depreciation and amortization | 40,941 | 41,389 | 41,765 | 41,654 | 165,749 | |||||||||||||||||||||||||||

| Asset impairments | 530 | — | 5,983 | 1,098 | 7,611 | |||||||||||||||||||||||||||

| Amortization of acquired unfavorable contract backlog | (8,331) | (5,997) | (4,348) | (10,691) | (29,367) | |||||||||||||||||||||||||||

| Unrealized (gain) loss on undesignated commodity hedges | 1,380 | (1,764) | 2,232 | 3,114 | 4,962 | |||||||||||||||||||||||||||

| Adjusted EBITDA from continuing operations | 161,185 | 135,957 | 149,014 | 135,414 | 581,570 | |||||||||||||||||||||||||||

| Non-cash equity compensation | 8,269 | 7,536 | 6,170 | 9,875 | 31,850 | |||||||||||||||||||||||||||

| Loss on debt extinguishment | — | — | — | 1,778 | 1,778 | |||||||||||||||||||||||||||

| Facility closure | 6,339 | — | 1,863 | 2,903 | 11,105 | |||||||||||||||||||||||||||

| Labor cost government refund | — | — | — | (2,985) | (2,985) | |||||||||||||||||||||||||||

| Acquisition settlement | — | — | — | 32,123 | 32,123 | |||||||||||||||||||||||||||

| Core EBITDA from continuing operations | $ | 175,793 | $ | 143,493 | $ | 157,047 | $ | 179,108 | $ | 655,441 | ||||||||||||||||||||||

| Net sales | $ | 1,384,708 | $ | 1,340,963 | $ | 1,341,683 | $ | 1,409,132 | $ | 5,476,486 | ||||||||||||||||||||||

| Core EBITDA from continuing operations margin | 12.7% | 10.7% | 11.7% | 12.7% | 12.0% | |||||||||||||||||||||||||||

| Earnings from continuing operations | $ | 82,755 | $ | 63,596 | $ | 64,169 | $ | 67,782 | $ | 278,302 | ||||||||||||||||||||||

| Acquisition settlement | — | — | — | 32,123 | 32,123 | |||||||||||||||||||||||||||

| Labor cost government refund | — | — | — | (2,985) | (2,985) | |||||||||||||||||||||||||||

| Facility closure | 6,339 | — | 1,863 | 2,903 | 11,105 | |||||||||||||||||||||||||||

| Loss on debt extinguishment | — | — | — | 1,778 | 1,778 | |||||||||||||||||||||||||||

| Asset impairments | — | — | 5,983 | 1,098 | 7,081 | |||||||||||||||||||||||||||

| Unrealized (gain) loss on undesignated commodity hedges | 1,380 | (1,764) | 2,232 | 3,114 | 4,962 | |||||||||||||||||||||||||||

| Total adjustments (pre-tax) | $ | 7,719 | $ | — | $ | (1,764) | $ | 10,078 | $ | 38,031 | $ | 54,064 | ||||||||||||||||||||

| Related tax effects on adjustments | (1,621) | 370 | (2,116) | (8,046) | (11,413) | |||||||||||||||||||||||||||

| Adjusted earnings from continuing operations | $ | 88,853 | $ | 62,202 | $ | 72,131 | $ | 97,767 | $ | 320,953 | ||||||||||||||||||||||

Earnings from continuing operations per diluted share(1) |

$ | 0.69 | $ | 0.53 | $ | 0.53 | $ | 0.56 | $ | 2.31 | ||||||||||||||||||||||

Adjusted earnings from continuing operations per diluted share(1) |

$ | 0.74 | $ | 0.52 | $ | 0.60 | $ | 0.81 | $ | 2.67 | ||||||||||||||||||||||

| Three Months Ended | Year Ended | |||||||||||||||||||||||||||||||

| (in thousands) | 11/30/2018 | 2/28/2019 | 5/31/2019 | 8/31/2019 | 8/31/2019 | |||||||||||||||||||||||||||

| Earnings from continuing operations | $ | 19,420 | $ | 14,928 | $ | 78,551 | $ | 85,880 | $ | 198,779 | ||||||||||||||||||||||

| Interest expense | 16,663 | 18,495 | 18,513 | 17,702 | 71,373 | |||||||||||||||||||||||||||

| Income tax expense | 5,609 | 18,141 | 29,105 | 16,826 | 69,681 | |||||||||||||||||||||||||||

| Depreciation and amortization | 35,176 | 41,245 | 41,181 | 41,051 | 158,653 | |||||||||||||||||||||||||||

| Asset impairments | — | — | 15 | 369 | 384 | |||||||||||||||||||||||||||

| Amortization of acquired unfavorable contract backlog | (11,332) | (23,476) | (23,394) | (16,582) | (74,784) | |||||||||||||||||||||||||||

| Unrealized (gain) loss on undesignated commodity hedges | 1,835 | 1,917 | (3,938) | 595 | 409 | |||||||||||||||||||||||||||

| Adjusted EBITDA from continuing operations | $ | 67,371 | $ | 71,250 | $ | 140,033 | $ | 145,841 | $ | 424,495 | ||||||||||||||||||||||