0000022444FALSE2024FY11http://fasb.org/us-gaap/2023#OtherAssetsNoncurrenthttp://fasb.org/us-gaap/2023#OtherAssetsNoncurrenthttp://fasb.org/us-gaap/2023#PropertyPlantAndEquipmentNethttp://fasb.org/us-gaap/2023#PropertyPlantAndEquipmentNethttp://fasb.org/us-gaap/2023#OtherAccountsPayableAndAccruedLiabilitieshttp://fasb.org/us-gaap/2023#OtherAccountsPayableAndAccruedLiabilitieshttp://fasb.org/us-gaap/2023#OtherLiabilitiesNoncurrenthttp://fasb.org/us-gaap/2023#OtherLiabilitiesNoncurrenthttp://fasb.org/us-gaap/2023#LongTermDebtCurrenthttp://fasb.org/us-gaap/2023#LongTermDebtCurrenthttp://fasb.org/us-gaap/2023#LongTermDebtAndCapitalLeaseObligationshttp://fasb.org/us-gaap/2023#LongTermDebtAndCapitalLeaseObligationshttp://fasb.org/us-gaap/2023#OtherComprehensiveIncomeLossNetOfTaxhttp://fasb.org/us-gaap/2023#CostOfGoodsAndServicesSoldhttp://fasb.org/us-gaap/2023#OtherComprehensiveIncomeLossNetOfTaxhttp://fasb.org/us-gaap/2023#CostOfGoodsAndServicesSoldhttp://fasb.org/us-gaap/2023#OtherComprehensiveIncomeLossNetOfTaxhttp://fasb.org/us-gaap/2023#CostOfGoodsAndServicesSoldhttp://fasb.org/us-gaap/2023#SellingGeneralAndAdministrativeExpensehttp://fasb.org/us-gaap/2023#SellingGeneralAndAdministrativeExpensehttp://fasb.org/us-gaap/2023#SellingGeneralAndAdministrativeExpensehttp://fasb.org/us-gaap/2023#SellingGeneralAndAdministrativeExpensehttp://fasb.org/us-gaap/2023#SellingGeneralAndAdministrativeExpensehttp://fasb.org/us-gaap/2023#SellingGeneralAndAdministrativeExpensehttp://fasb.org/us-gaap/2023#SellingGeneralAndAdministrativeExpensehttp://fasb.org/us-gaap/2023#OtherLiabilitiesNoncurrenthttp://fasb.org/us-gaap/2023#Liabilitieshttp://fasb.org/us-gaap/2023#OtherLiabilitiesNoncurrenthttp://fasb.org/us-gaap/2023#Liabilitiesiso4217:USDxbrli:sharesiso4217:USDxbrli:sharescmc:segmentscmc:millxbrli:purecmc:facilityiso4217:PLNcmc:numberOfTaxCreditTransactionsutr:tutr:MWhutr:MMBTUcmc:Interval00000224442023-09-012024-08-3100000224442024-02-2900000224442024-10-1400000224442022-09-012023-08-3100000224442021-09-012022-08-3100000224442024-08-3100000224442023-08-3100000224442022-08-3100000224442021-08-310000022444us-gaap:CommonStockMember2021-08-310000022444us-gaap:AdditionalPaidInCapitalMember2021-08-310000022444us-gaap:AccumulatedOtherComprehensiveIncomeMember2021-08-310000022444us-gaap:RetainedEarningsMember2021-08-310000022444us-gaap:TreasuryStockCommonMember2021-08-310000022444us-gaap:NoncontrollingInterestMember2021-08-310000022444us-gaap:RetainedEarningsMember2021-09-012022-08-310000022444us-gaap:AccumulatedOtherComprehensiveIncomeMember2021-09-012022-08-310000022444us-gaap:TreasuryStockCommonMember2021-09-012022-08-310000022444us-gaap:AdditionalPaidInCapitalMember2021-09-012022-08-310000022444us-gaap:CommonStockMember2022-08-310000022444us-gaap:AdditionalPaidInCapitalMember2022-08-310000022444us-gaap:AccumulatedOtherComprehensiveIncomeMember2022-08-310000022444us-gaap:RetainedEarningsMember2022-08-310000022444us-gaap:TreasuryStockCommonMember2022-08-310000022444us-gaap:NoncontrollingInterestMember2022-08-310000022444us-gaap:RetainedEarningsMember2022-09-012023-08-310000022444us-gaap:AccumulatedOtherComprehensiveIncomeMember2022-09-012023-08-310000022444us-gaap:TreasuryStockCommonMember2022-09-012023-08-310000022444us-gaap:AdditionalPaidInCapitalMember2022-09-012023-08-310000022444us-gaap:NoncontrollingInterestMember2022-09-012023-08-310000022444us-gaap:CommonStockMember2023-08-310000022444us-gaap:AdditionalPaidInCapitalMember2023-08-310000022444us-gaap:AccumulatedOtherComprehensiveIncomeMember2023-08-310000022444us-gaap:RetainedEarningsMember2023-08-310000022444us-gaap:TreasuryStockCommonMember2023-08-310000022444us-gaap:NoncontrollingInterestMember2023-08-310000022444us-gaap:RetainedEarningsMember2023-09-012024-08-310000022444us-gaap:AccumulatedOtherComprehensiveIncomeMember2023-09-012024-08-310000022444us-gaap:TreasuryStockCommonMember2023-09-012024-08-310000022444us-gaap:AdditionalPaidInCapitalMember2023-09-012024-08-310000022444us-gaap:NoncontrollingInterestMember2023-09-012024-08-310000022444us-gaap:CommonStockMember2024-08-310000022444us-gaap:AdditionalPaidInCapitalMember2024-08-310000022444us-gaap:AccumulatedOtherComprehensiveIncomeMember2024-08-310000022444us-gaap:RetainedEarningsMember2024-08-310000022444us-gaap:TreasuryStockCommonMember2024-08-310000022444us-gaap:NoncontrollingInterestMember2024-08-310000022444cmc:SecuredAccountsReceivableMember2024-08-310000022444cmc:SecuredAccountsReceivableMember2023-08-310000022444srt:MinimumMemberus-gaap:BuildingMember2024-08-310000022444srt:MaximumMemberus-gaap:BuildingMember2024-08-310000022444srt:MinimumMemberus-gaap:LandImprovementsMember2024-08-310000022444srt:MaximumMemberus-gaap:LandImprovementsMember2024-08-310000022444srt:MinimumMemberus-gaap:LeaseholdImprovementsMember2024-08-310000022444srt:MaximumMemberus-gaap:LeaseholdImprovementsMember2024-08-310000022444srt:MinimumMemberus-gaap:MachineryAndEquipmentMember2024-08-310000022444srt:MaximumMemberus-gaap:MachineryAndEquipmentMember2024-08-310000022444srt:MinimumMemberus-gaap:SoftwareDevelopmentMember2024-08-310000022444srt:MaximumMemberus-gaap:SoftwareDevelopmentMember2024-08-3100000224442023-06-012023-08-310000022444cmc:PolandCompensationSchemeActMember2023-09-012024-08-310000022444cmc:PolandCompensationSchemeActMember2022-09-012023-08-310000022444cmc:PolandCompensationSchemeActMember2021-09-012022-08-310000022444cmc:EnergyAidProgram2022Member2023-09-012024-08-310000022444cmc:EnergyAidProgram2022Member2022-09-012023-08-310000022444cmc:WestVirginiaEconomicDevelopmentAuthorityMember2023-09-012024-08-310000022444cmc:WestVirginiaEconomicDevelopmentAuthorityMember2022-09-012023-08-310000022444cmc:RoaneMetalsGroupLLCMember2023-03-032023-03-030000022444cmc:EDSCOFastenersLLCMember2023-07-122023-07-120000022444cmc:TensarMember2022-04-250000022444cmc:TensarMember2022-04-252022-04-250000022444cmc:TensarMember2022-04-252022-08-310000022444cmc:TensarMember2021-09-012022-08-310000022444cmc:RanchoCucamongaFacilityAndRebarFabricationFacilityMember2021-12-282021-12-280000022444cmc:RanchoCucamongaFacilityAndRebarFabricationFacilityMember2022-09-012023-08-310000022444cmc:RanchoCucamongaFacilityAndRebarFabricationFacilityMember2021-09-012022-08-310000022444us-gaap:AccumulatedTranslationAdjustmentMember2021-08-310000022444us-gaap:AccumulatedNetGainLossFromDesignatedOrQualifyingCashFlowHedgesMember2021-08-310000022444us-gaap:AccumulatedDefinedBenefitPlansAdjustmentMember2021-08-310000022444us-gaap:AccumulatedTranslationAdjustmentMember2021-09-012022-08-310000022444us-gaap:AccumulatedNetGainLossFromDesignatedOrQualifyingCashFlowHedgesMember2021-09-012022-08-310000022444us-gaap:AccumulatedDefinedBenefitPlansAdjustmentMember2021-09-012022-08-310000022444us-gaap:AccumulatedTranslationAdjustmentMember2022-08-310000022444us-gaap:AccumulatedNetGainLossFromDesignatedOrQualifyingCashFlowHedgesMember2022-08-310000022444us-gaap:AccumulatedDefinedBenefitPlansAdjustmentMember2022-08-310000022444us-gaap:AccumulatedTranslationAdjustmentMember2022-09-012023-08-310000022444us-gaap:AccumulatedNetGainLossFromDesignatedOrQualifyingCashFlowHedgesMember2022-09-012023-08-310000022444us-gaap:AccumulatedDefinedBenefitPlansAdjustmentMember2022-09-012023-08-310000022444us-gaap:AccumulatedTranslationAdjustmentMember2023-08-310000022444us-gaap:AccumulatedNetGainLossFromDesignatedOrQualifyingCashFlowHedgesMember2023-08-310000022444us-gaap:AccumulatedDefinedBenefitPlansAdjustmentMember2023-08-310000022444us-gaap:AccumulatedTranslationAdjustmentMember2023-09-012024-08-310000022444us-gaap:AccumulatedNetGainLossFromDesignatedOrQualifyingCashFlowHedgesMember2023-09-012024-08-310000022444us-gaap:AccumulatedDefinedBenefitPlansAdjustmentMember2023-09-012024-08-310000022444us-gaap:AccumulatedTranslationAdjustmentMember2024-08-310000022444us-gaap:AccumulatedNetGainLossFromDesignatedOrQualifyingCashFlowHedgesMember2024-08-310000022444us-gaap:AccumulatedDefinedBenefitPlansAdjustmentMember2024-08-310000022444cmc:FabricatedProductandInstallationServicesMemberus-gaap:TransferredOverTimeMembercmc:NorthAmericaSegmentMember2023-09-012024-08-310000022444cmc:FabricatedProductwithoutInstallationServicesMemberus-gaap:TransferredOverTimeMembercmc:NorthAmericaSegmentMember2023-09-012024-08-310000022444cmc:FabricatedProductwithoutInstallationServicesMemberus-gaap:TransferredOverTimeMembercmc:NorthAmericaSegmentMember2022-09-012023-08-310000022444cmc:FabricatedProductwithoutInstallationServicesMemberus-gaap:TransferredOverTimeMembercmc:NorthAmericaSegmentMember2021-09-012022-08-3100000224442024-09-012024-08-3100000224442025-09-012024-08-310000022444cmc:NorthAmericaSegmentMember2022-08-310000022444cmc:EuropeSegmentMember2022-08-310000022444cmc:NorthAmericaSteelGroupMember2022-08-310000022444cmc:EuropeSteelGroupMember2022-08-310000022444cmc:EmergingBusinessGroupMember2022-08-310000022444cmc:NorthAmericaSegmentMember2022-09-012023-08-310000022444cmc:EuropeSegmentMember2022-09-012023-08-310000022444cmc:NorthAmericaSteelGroupMember2022-09-012023-08-310000022444cmc:EuropeSteelGroupMember2022-09-012023-08-310000022444cmc:EmergingBusinessGroupMember2022-09-012023-08-310000022444cmc:NorthAmericaSegmentMember2023-08-310000022444cmc:EuropeSegmentMember2023-08-310000022444cmc:NorthAmericaSteelGroupMember2023-08-310000022444cmc:EuropeSteelGroupMember2023-08-310000022444cmc:EmergingBusinessGroupMember2023-08-310000022444cmc:NorthAmericaSegmentMember2023-09-012024-08-310000022444cmc:EuropeSegmentMember2023-09-012024-08-310000022444cmc:NorthAmericaSteelGroupMember2023-09-012024-08-310000022444cmc:EuropeSteelGroupMember2023-09-012024-08-310000022444cmc:EmergingBusinessGroupMember2023-09-012024-08-310000022444cmc:NorthAmericaSegmentMember2024-08-310000022444cmc:EuropeSegmentMember2024-08-310000022444cmc:NorthAmericaSteelGroupMember2024-08-310000022444cmc:EuropeSteelGroupMember2024-08-310000022444cmc:EmergingBusinessGroupMember2024-08-310000022444cmc:NorthAmericaSegmentMember2021-09-012022-08-310000022444cmc:EuropeSegmentMember2021-09-012022-08-310000022444cmc:NorthAmericaSteelGroupMember2021-09-012022-08-310000022444cmc:EuropeSteelGroupMember2021-09-012022-08-310000022444cmc:EmergingBusinessGroupMember2021-09-012022-08-310000022444cmc:SixQualitativeReportingUnitsMember2024-08-310000022444cmc:FirstQuantitativeReportingUnitMember2024-08-310000022444cmc:SecondQuantitativeReportingUnitMember2024-08-310000022444us-gaap:TradeNamesMembercmc:TensarMember2023-09-012024-08-310000022444us-gaap:TradeNamesMembercmc:TensarMember2022-09-012023-08-310000022444us-gaap:InProcessResearchAndDevelopmentMembercmc:TensarMember2023-09-012024-08-310000022444us-gaap:InProcessResearchAndDevelopmentMembercmc:TensarMember2022-09-012023-08-310000022444cmc:NonCompeteAgreementsMembercmc:TensarMember2023-09-012024-08-310000022444cmc:NonCompeteAgreementsMembercmc:TensarMember2022-09-012023-08-310000022444cmc:TensarMember2023-09-012024-08-310000022444cmc:TensarMember2022-09-012023-08-310000022444us-gaap:DevelopedTechnologyRightsMembercmc:TensarMember2024-08-310000022444us-gaap:DevelopedTechnologyRightsMembercmc:TensarMember2023-08-310000022444us-gaap:CustomerListsMember2024-08-310000022444us-gaap:CustomerListsMember2023-08-310000022444us-gaap:PatentsMember2024-08-310000022444us-gaap:PatentsMember2023-08-310000022444us-gaap:LeaseAgreementsMember2024-08-310000022444us-gaap:LeaseAgreementsMember2023-08-310000022444us-gaap:TradeNamesMember2024-08-310000022444us-gaap:TradeNamesMember2023-08-310000022444us-gaap:NoncompeteAgreementsMember2024-08-310000022444us-gaap:NoncompeteAgreementsMember2023-08-310000022444us-gaap:OtherIntangibleAssetsMember2024-08-310000022444us-gaap:OtherIntangibleAssetsMember2023-08-310000022444cmc:FinanceLeasesMember2024-08-310000022444srt:MinimumMember2024-08-310000022444srt:MaximumMember2024-08-310000022444cmc:A300MillionNotesAt4125DueJanuary2030Member2024-08-310000022444cmc:A300MillionNotesAt4125DueJanuary2030Member2023-08-310000022444cmc:A300MillionNotesAt3875DueFebruary2031Member2024-08-310000022444cmc:A300MillionNotesAt3875DueFebruary2031Member2023-08-310000022444cmc:A300MillionNotesAt4375DueMarch2032Member2024-08-310000022444cmc:A300MillionNotesAt4375DueMarch2032Member2023-08-310000022444cmc:Series2022BondsDue2047Member2024-08-310000022444cmc:Series2022BondsDue2047Member2023-08-310000022444us-gaap:ShortTermDebtMember2024-08-310000022444us-gaap:ShortTermDebtMember2023-08-310000022444cmc:OtherDebtMember2024-08-310000022444cmc:OtherDebtMember2023-08-310000022444cmc:FinanceLeasesMember2023-08-310000022444cmc:A300MillionNotesAt4125DueJanuary2030Member2022-01-310000022444cmc:A300MillionNotesAt4375DueMarch2032Member2022-01-3100000224442022-01-310000022444cmc:A300MillionNotesAt3875DueFebruary2031Member2021-02-280000022444cmc:A350millionnotesat5.75dueApril2026Member2021-02-280000022444cmc:Series2022BondsDue2047Member2022-02-280000022444cmc:Series2022BondsDue2047Member2022-02-012022-02-280000022444us-gaap:RevolvingCreditFacilityMembercmc:CreditAgreementMaturingMarch2026Member2024-08-310000022444us-gaap:RevolvingCreditFacilityMember2024-08-310000022444cmc:DelayedDrawSeniorSecuredTermLoanFacilityMember2024-08-310000022444us-gaap:RevolvingCreditFacilityMember2023-08-310000022444us-gaap:LetterOfCreditMember2024-08-310000022444us-gaap:RevolvingCreditFacilityMember2023-09-012024-08-310000022444cmc:CmcpMember2023-08-310000022444cmc:CmcpMember2024-08-310000022444us-gaap:StandbyLettersOfCreditMembercmc:CmcpMember2024-08-310000022444us-gaap:StandbyLettersOfCreditMembercmc:CmcpMember2023-08-310000022444cmc:PolandProgramMember2023-08-310000022444cmc:PolandProgramMember2024-08-3100000224442016-01-012017-12-310000022444cmc:MicroMillMembercmc:Fund156Member2023-09-012024-08-310000022444cmc:MicroMillMembercmc:Fund156Member2024-08-310000022444cmc:MicroMillMembercmc:Fund156Membercmc:QualifiedEquityInvestmentLoansMembercmc:CMCSteelOklahomaLLCMember2024-08-310000022444cmc:SpoolerProjectMembercmc:Fund249Member2023-09-012024-08-310000022444cmc:SpoolerProjectMembercmc:Fund249Member2024-08-310000022444cmc:SpoolerProjectMembercmc:Fund249Membercmc:QualifiedEquityInvestmentLoansMembercmc:CMCSteelOklahomaLLCMember2024-08-310000022444cmc:PostShopProjectMembercmc:Fund219andFund222Member2023-09-012024-08-310000022444cmc:PostShopProjectMembercmc:Fund219andFund222Member2024-08-310000022444cmc:PostShopProjectMembercmc:Fund219andFund222Membercmc:QualifiedEquityInvestmentLoansMembercmc:CMCSteelOklahomaLLCMember2024-08-310000022444cmc:Fund156andFund249Member2023-09-012024-08-310000022444cmc:Fund219Member2023-09-012024-08-310000022444cmc:Fund249Member2024-08-310000022444cmc:Fund219Member2024-08-310000022444cmc:Fund222Member2023-09-012024-08-310000022444cmc:Fund222Member2023-08-310000022444us-gaap:CommodityContractMember2024-08-310000022444us-gaap:CommodityContractMember2023-08-310000022444us-gaap:ForeignExchangeContractMember2024-08-310000022444us-gaap:ForeignExchangeContractMember2023-08-310000022444cmc:AluminumMemberus-gaap:LongMember2023-09-012024-08-310000022444cmc:CopperMemberus-gaap:LongMember2023-09-012024-08-310000022444cmc:CopperMemberus-gaap:ShortMember2023-09-012024-08-310000022444us-gaap:ElectricityMemberus-gaap:LongMember2023-09-012024-08-310000022444srt:NaturalGasReservesMemberus-gaap:LongMember2023-09-012024-08-310000022444us-gaap:CommodityMemberus-gaap:PrepaidExpensesAndOtherCurrentAssetsMember2024-08-310000022444us-gaap:CommodityMemberus-gaap:PrepaidExpensesAndOtherCurrentAssetsMember2023-08-310000022444us-gaap:CommodityMemberus-gaap:OtherNoncurrentAssetsMember2024-08-310000022444us-gaap:CommodityMemberus-gaap:OtherNoncurrentAssetsMember2023-08-310000022444us-gaap:ForeignExchangeMemberus-gaap:PrepaidExpensesAndOtherCurrentAssetsMember2024-08-310000022444us-gaap:ForeignExchangeMemberus-gaap:PrepaidExpensesAndOtherCurrentAssetsMember2023-08-310000022444us-gaap:CommodityMemberus-gaap:AccountsPayableAndAccruedLiabilitiesMember2024-08-310000022444us-gaap:CommodityMemberus-gaap:AccountsPayableAndAccruedLiabilitiesMember2023-08-310000022444us-gaap:CommodityMemberus-gaap:OtherNoncurrentLiabilitiesMember2024-08-310000022444us-gaap:CommodityMemberus-gaap:OtherNoncurrentLiabilitiesMember2023-08-310000022444us-gaap:ForeignExchangeMemberus-gaap:AccountsPayableAndAccruedLiabilitiesMember2024-08-310000022444us-gaap:ForeignExchangeMemberus-gaap:AccountsPayableAndAccruedLiabilitiesMember2023-08-310000022444us-gaap:CommodityContractMemberus-gaap:CostOfSalesMember2023-09-012024-08-310000022444us-gaap:CommodityContractMemberus-gaap:CostOfSalesMember2022-09-012023-08-310000022444us-gaap:CommodityContractMemberus-gaap:CostOfSalesMember2021-09-012022-08-310000022444us-gaap:ForeignExchangeContractMemberus-gaap:SellingGeneralAndAdministrativeExpensesMember2023-09-012024-08-310000022444us-gaap:ForeignExchangeContractMemberus-gaap:SellingGeneralAndAdministrativeExpensesMember2022-09-012023-08-310000022444us-gaap:ForeignExchangeContractMemberus-gaap:SellingGeneralAndAdministrativeExpensesMember2021-09-012022-08-310000022444us-gaap:CommodityContractMember2023-09-012024-08-310000022444us-gaap:CommodityContractMember2022-09-012023-08-310000022444us-gaap:CommodityContractMember2021-09-012022-08-310000022444us-gaap:ForeignExchangeContractMember2023-09-012024-08-310000022444us-gaap:ForeignExchangeContractMember2022-09-012023-08-310000022444us-gaap:ForeignExchangeContractMember2021-09-012022-08-310000022444us-gaap:FairValueMeasurementsRecurringMember2024-08-310000022444us-gaap:FairValueMeasurementsRecurringMemberus-gaap:FairValueInputsLevel1Member2024-08-310000022444us-gaap:FairValueMeasurementsRecurringMemberus-gaap:FairValueInputsLevel2Member2024-08-310000022444us-gaap:FairValueMeasurementsRecurringMemberus-gaap:FairValueInputsLevel3Member2024-08-310000022444us-gaap:CommodityContractMemberus-gaap:FairValueMeasurementsRecurringMember2024-08-310000022444us-gaap:FairValueInputsLevel1Memberus-gaap:CommodityContractMemberus-gaap:FairValueMeasurementsRecurringMember2024-08-310000022444us-gaap:FairValueInputsLevel2Memberus-gaap:CommodityContractMemberus-gaap:FairValueMeasurementsRecurringMember2024-08-310000022444us-gaap:FairValueInputsLevel3Memberus-gaap:CommodityContractMemberus-gaap:FairValueMeasurementsRecurringMember2024-08-310000022444us-gaap:ForeignExchangeContractMemberus-gaap:FairValueMeasurementsRecurringMember2024-08-310000022444us-gaap:FairValueInputsLevel1Memberus-gaap:ForeignExchangeContractMemberus-gaap:FairValueMeasurementsRecurringMember2024-08-310000022444us-gaap:FairValueInputsLevel2Memberus-gaap:ForeignExchangeContractMemberus-gaap:FairValueMeasurementsRecurringMember2024-08-310000022444us-gaap:FairValueInputsLevel3Memberus-gaap:ForeignExchangeContractMemberus-gaap:FairValueMeasurementsRecurringMember2024-08-310000022444us-gaap:FairValueMeasurementsRecurringMember2023-08-310000022444us-gaap:FairValueMeasurementsRecurringMemberus-gaap:FairValueInputsLevel1Member2023-08-310000022444us-gaap:FairValueMeasurementsRecurringMemberus-gaap:FairValueInputsLevel2Member2023-08-310000022444us-gaap:FairValueMeasurementsRecurringMemberus-gaap:FairValueInputsLevel3Member2023-08-310000022444us-gaap:CommodityContractMemberus-gaap:FairValueMeasurementsRecurringMember2023-08-310000022444us-gaap:FairValueInputsLevel1Memberus-gaap:CommodityContractMemberus-gaap:FairValueMeasurementsRecurringMember2023-08-310000022444us-gaap:FairValueInputsLevel2Memberus-gaap:CommodityContractMemberus-gaap:FairValueMeasurementsRecurringMember2023-08-310000022444us-gaap:FairValueInputsLevel3Memberus-gaap:CommodityContractMemberus-gaap:FairValueMeasurementsRecurringMember2023-08-310000022444us-gaap:ForeignExchangeContractMemberus-gaap:FairValueMeasurementsRecurringMember2023-08-310000022444us-gaap:FairValueInputsLevel1Memberus-gaap:ForeignExchangeContractMemberus-gaap:FairValueMeasurementsRecurringMember2023-08-310000022444us-gaap:FairValueInputsLevel2Memberus-gaap:ForeignExchangeContractMemberus-gaap:FairValueMeasurementsRecurringMember2023-08-310000022444us-gaap:FairValueInputsLevel3Memberus-gaap:ForeignExchangeContractMemberus-gaap:FairValueMeasurementsRecurringMember2023-08-310000022444us-gaap:FairValueInputsLevel3Memberus-gaap:ValuationTechniqueDiscountedCashFlowMembersrt:MinimumMemberus-gaap:CommodityContractMember2024-08-310000022444us-gaap:FairValueInputsLevel3Memberus-gaap:ValuationTechniqueDiscountedCashFlowMembersrt:MaximumMemberus-gaap:CommodityContractMember2024-08-310000022444us-gaap:FairValueInputsLevel3Memberus-gaap:ValuationTechniqueDiscountedCashFlowMembersrt:WeightedAverageMemberus-gaap:CommodityContractMember2024-08-310000022444us-gaap:FairValueInputsLevel3Memberus-gaap:ValuationTechniqueDiscountedCashFlowMembersrt:MinimumMemberus-gaap:CommodityContractMember2023-08-310000022444us-gaap:FairValueInputsLevel3Memberus-gaap:ValuationTechniqueDiscountedCashFlowMembersrt:MaximumMemberus-gaap:CommodityContractMember2023-08-310000022444us-gaap:FairValueInputsLevel3Memberus-gaap:ValuationTechniqueDiscountedCashFlowMembersrt:WeightedAverageMemberus-gaap:CommodityContractMember2023-08-310000022444us-gaap:CommodityContractMemberus-gaap:FairValueInputsLevel3Member2021-08-310000022444us-gaap:CommodityContractMemberus-gaap:FairValueInputsLevel3Member2021-09-012022-08-310000022444us-gaap:CommodityContractMemberus-gaap:FairValueInputsLevel3Member2022-08-310000022444us-gaap:CommodityContractMemberus-gaap:FairValueInputsLevel3Member2022-09-012023-08-310000022444us-gaap:CommodityContractMemberus-gaap:FairValueInputsLevel3Member2023-08-310000022444us-gaap:CommodityContractMemberus-gaap:FairValueInputsLevel3Member2023-09-012024-08-310000022444us-gaap:CommodityContractMemberus-gaap:FairValueInputsLevel3Member2024-08-3100000224442024-06-012024-08-310000022444us-gaap:FairValueInputsLevel2Member2024-08-310000022444us-gaap:FairValueInputsLevel2Member2023-08-310000022444us-gaap:StateAndLocalJurisdictionMember2024-08-310000022444us-gaap:ForeignCountryMember2024-08-310000022444country:USus-gaap:RestrictedStockUnitsRSUMember2023-09-012024-08-310000022444srt:MinimumMemberus-gaap:PerformanceSharesMember2023-09-012024-08-310000022444srt:MaximumMemberus-gaap:PerformanceSharesMember2023-09-012024-08-310000022444cmc:EBITDAMemberus-gaap:PerformanceSharesMember2022-09-012023-08-310000022444cmc:RelativeTotalShareholderReturnMemberus-gaap:PerformanceSharesMember2022-09-012023-08-310000022444us-gaap:RestrictedStockUnitsRSUMember2021-09-012022-08-310000022444us-gaap:PerformanceSharesMember2021-09-012022-08-310000022444us-gaap:RestrictedStockUnitsRSUMember2022-09-012023-08-310000022444us-gaap:PerformanceSharesMember2022-09-012023-08-310000022444us-gaap:RestrictedStockUnitsRSUMember2023-09-012024-08-310000022444us-gaap:PerformanceSharesMember2023-09-012024-08-310000022444cmc:RestrictedStockAwardsAndPsusexcludingthecashcomponentMember2021-08-310000022444cmc:RestrictedStockAwardsAndPsusexcludingthecashcomponentMember2021-09-012022-08-310000022444cmc:RestrictedStockAwardsAndPsusexcludingthecashcomponentMember2022-08-310000022444cmc:RestrictedStockAwardsAndPsusexcludingthecashcomponentMember2022-09-012023-08-310000022444cmc:RestrictedStockAwardsAndPsusexcludingthecashcomponentMember2023-08-310000022444cmc:RestrictedStockAwardsAndPsusexcludingthecashcomponentMember2023-09-012024-08-310000022444cmc:RestrictedStockAwardsAndPsusexcludingthecashcomponentMember2024-08-310000022444us-gaap:PhantomShareUnitsPSUsMember2023-09-012024-08-310000022444us-gaap:PhantomShareUnitsPSUsMember2022-09-012023-08-310000022444us-gaap:PhantomShareUnitsPSUsMember2024-08-310000022444us-gaap:EmployeeStockMember2023-09-012024-08-310000022444us-gaap:EmployeeStockMember2021-09-012022-08-310000022444us-gaap:EmployeeStockMember2022-09-012023-08-310000022444us-gaap:EmployeeStockMember2024-08-310000022444us-gaap:EmployeeStockMember2023-08-310000022444us-gaap:EmployeeStockMember2022-08-310000022444us-gaap:CostOfSalesMember2023-09-012024-08-310000022444us-gaap:CostOfSalesMember2022-09-012023-08-310000022444us-gaap:CostOfSalesMember2021-09-012022-08-310000022444us-gaap:SupplementalEmployeeRetirementPlanDefinedBenefitMember2024-08-310000022444us-gaap:SupplementalEmployeeRetirementPlanDefinedBenefitMember2023-08-310000022444us-gaap:OtherNoncurrentLiabilitiesMemberus-gaap:SupplementalEmployeeRetirementPlanDefinedBenefitMember2024-08-310000022444us-gaap:OtherNoncurrentLiabilitiesMemberus-gaap:SupplementalEmployeeRetirementPlanDefinedBenefitMember2023-08-310000022444us-gaap:SupplementalEmployeeRetirementPlanDefinedBenefitMember2023-09-012024-08-310000022444us-gaap:SupplementalEmployeeRetirementPlanDefinedBenefitMember2022-09-012023-08-310000022444us-gaap:SupplementalEmployeeRetirementPlanDefinedBenefitMember2021-09-012022-08-3100000224442022-10-012022-10-310000022444cmc:UKPensionPlanMember2023-08-310000022444cmc:UKPensionPlanMember2022-08-310000022444cmc:USPensionPlanMember2022-08-310000022444cmc:UKPensionPlanMember2023-09-012024-08-310000022444cmc:UKPensionPlanMember2022-09-012023-08-310000022444cmc:USPensionPlanMember2022-09-012023-08-310000022444cmc:USPensionPlanMember2023-09-012024-08-310000022444cmc:UKPensionPlanMember2024-08-310000022444cmc:USPensionPlanMember2023-08-310000022444cmc:UKPensionPlanMember2021-09-012022-08-310000022444us-gaap:FixedIncomeSecuritiesMembersrt:MinimumMembercmc:UKPensionPlanMember2024-08-310000022444us-gaap:FixedIncomeSecuritiesMembersrt:MaximumMembercmc:UKPensionPlanMember2024-08-310000022444us-gaap:FixedIncomeSecuritiesMembercmc:UKPensionPlanMember2024-08-310000022444us-gaap:FixedIncomeSecuritiesMembercmc:UKPensionPlanMember2023-08-310000022444us-gaap:DefinedBenefitPlanCashMembersrt:MinimumMembercmc:UKPensionPlanMember2024-08-310000022444us-gaap:DefinedBenefitPlanCashMembersrt:MaximumMembercmc:UKPensionPlanMember2024-08-310000022444us-gaap:DefinedBenefitPlanCashMembercmc:UKPensionPlanMember2024-08-310000022444us-gaap:DefinedBenefitPlanCashMembercmc:UKPensionPlanMember2023-08-310000022444us-gaap:FixedIncomeSecuritiesMemberus-gaap:FairValueInputsLevel1Membercmc:UKPensionPlanMember2024-08-310000022444us-gaap:FixedIncomeSecuritiesMemberus-gaap:FairValueInputsLevel2Membercmc:UKPensionPlanMember2024-08-310000022444us-gaap:FixedIncomeSecuritiesMemberus-gaap:FairValueInputsLevel3Membercmc:UKPensionPlanMember2024-08-310000022444us-gaap:DefinedBenefitPlanCashMemberus-gaap:FairValueInputsLevel1Membercmc:UKPensionPlanMember2024-08-310000022444us-gaap:DefinedBenefitPlanCashMemberus-gaap:FairValueInputsLevel2Membercmc:UKPensionPlanMember2024-08-310000022444us-gaap:DefinedBenefitPlanCashMemberus-gaap:FairValueInputsLevel3Membercmc:UKPensionPlanMember2024-08-310000022444us-gaap:FixedIncomeSecuritiesMemberus-gaap:FairValueInputsLevel1Membercmc:UKPensionPlanMember2023-08-310000022444us-gaap:FixedIncomeSecuritiesMemberus-gaap:FairValueInputsLevel2Membercmc:UKPensionPlanMember2023-08-310000022444us-gaap:FixedIncomeSecuritiesMemberus-gaap:FairValueInputsLevel3Membercmc:UKPensionPlanMember2023-08-310000022444us-gaap:DefinedBenefitPlanCashMemberus-gaap:FairValueInputsLevel1Membercmc:UKPensionPlanMember2023-08-310000022444us-gaap:DefinedBenefitPlanCashMemberus-gaap:FairValueInputsLevel2Membercmc:UKPensionPlanMember2023-08-310000022444us-gaap:DefinedBenefitPlanCashMemberus-gaap:FairValueInputsLevel3Membercmc:UKPensionPlanMember2023-08-310000022444us-gaap:FairValueInputsLevel3Membercmc:UKPensionPlanMember2022-08-310000022444us-gaap:FairValueInputsLevel3Membercmc:UKPensionPlanMember2022-09-012023-08-310000022444us-gaap:FairValueInputsLevel3Membercmc:UKPensionPlanMember2023-08-310000022444us-gaap:FairValueInputsLevel3Membercmc:UKPensionPlanMember2023-09-012024-08-310000022444us-gaap:FairValueInputsLevel3Membercmc:UKPensionPlanMember2024-08-3100000224442021-10-3100000224442024-01-310000022444cmc:CerclaSitesMember2024-08-310000022444cmc:CerclaSitesMember2023-08-310000022444us-gaap:OperatingSegmentsMembercmc:NorthAmericaSteelGroupMember2023-09-012024-08-310000022444us-gaap:OperatingSegmentsMembercmc:NorthAmericaSteelGroupMember2022-09-012023-08-310000022444us-gaap:OperatingSegmentsMembercmc:NorthAmericaSteelGroupMember2021-09-012022-08-310000022444us-gaap:OperatingSegmentsMembercmc:EuropeSteelGroupMember2023-09-012024-08-310000022444us-gaap:OperatingSegmentsMembercmc:EuropeSteelGroupMember2022-09-012023-08-310000022444us-gaap:OperatingSegmentsMembercmc:EuropeSteelGroupMember2021-09-012022-08-310000022444us-gaap:OperatingSegmentsMembercmc:EmergingBusinessGroupMember2023-09-012024-08-310000022444us-gaap:OperatingSegmentsMembercmc:EmergingBusinessGroupMember2022-09-012023-08-310000022444us-gaap:OperatingSegmentsMembercmc:EmergingBusinessGroupMember2021-09-012022-08-310000022444us-gaap:OperatingSegmentsMember2023-09-012024-08-310000022444us-gaap:OperatingSegmentsMember2022-09-012023-08-310000022444us-gaap:OperatingSegmentsMember2021-09-012022-08-310000022444us-gaap:OperatingSegmentsMemberus-gaap:CorporateAndOtherMember2023-09-012024-08-310000022444us-gaap:OperatingSegmentsMemberus-gaap:CorporateAndOtherMember2022-09-012023-08-310000022444us-gaap:OperatingSegmentsMemberus-gaap:CorporateAndOtherMember2021-09-012022-08-310000022444us-gaap:OperatingSegmentsMembercmc:NorthAmericaSteelGroupMember2024-08-310000022444us-gaap:OperatingSegmentsMembercmc:NorthAmericaSteelGroupMember2023-08-310000022444us-gaap:OperatingSegmentsMembercmc:NorthAmericaSteelGroupMember2022-08-310000022444us-gaap:OperatingSegmentsMembercmc:EuropeSteelGroupMember2024-08-310000022444us-gaap:OperatingSegmentsMembercmc:EuropeSteelGroupMember2023-08-310000022444us-gaap:OperatingSegmentsMembercmc:EuropeSteelGroupMember2022-08-310000022444us-gaap:OperatingSegmentsMembercmc:EmergingBusinessGroupMember2024-08-310000022444us-gaap:OperatingSegmentsMembercmc:EmergingBusinessGroupMember2023-08-310000022444us-gaap:OperatingSegmentsMembercmc:EmergingBusinessGroupMember2022-08-310000022444us-gaap:OperatingSegmentsMember2024-08-310000022444us-gaap:OperatingSegmentsMember2023-08-310000022444us-gaap:OperatingSegmentsMember2022-08-310000022444us-gaap:OperatingSegmentsMemberus-gaap:CorporateAndOtherMember2024-08-310000022444us-gaap:OperatingSegmentsMemberus-gaap:CorporateAndOtherMember2023-08-310000022444us-gaap:OperatingSegmentsMemberus-gaap:CorporateAndOtherMember2022-08-310000022444cmc:RawMaterialProductsMemberus-gaap:OperatingSegmentsMembercmc:NorthAmericaSteelGroupMember2023-09-012024-08-310000022444cmc:RawMaterialProductsMemberus-gaap:OperatingSegmentsMembercmc:EuropeSteelGroupMember2023-09-012024-08-310000022444cmc:RawMaterialProductsMemberus-gaap:OperatingSegmentsMembercmc:EmergingBusinessGroupMember2023-09-012024-08-310000022444cmc:RawMaterialProductsMemberus-gaap:OperatingSegmentsMemberus-gaap:CorporateAndOtherMember2023-09-012024-08-310000022444cmc:RawMaterialProductsMember2023-09-012024-08-310000022444cmc:SteelProductsMemberus-gaap:OperatingSegmentsMembercmc:NorthAmericaSteelGroupMember2023-09-012024-08-310000022444cmc:SteelProductsMemberus-gaap:OperatingSegmentsMembercmc:EuropeSteelGroupMember2023-09-012024-08-310000022444cmc:SteelProductsMemberus-gaap:OperatingSegmentsMembercmc:EmergingBusinessGroupMember2023-09-012024-08-310000022444cmc:SteelProductsMemberus-gaap:OperatingSegmentsMemberus-gaap:CorporateAndOtherMember2023-09-012024-08-310000022444cmc:SteelProductsMember2023-09-012024-08-310000022444cmc:DownstreamProductsMemberus-gaap:OperatingSegmentsMembercmc:NorthAmericaSteelGroupMember2023-09-012024-08-310000022444cmc:DownstreamProductsMemberus-gaap:OperatingSegmentsMembercmc:EuropeSteelGroupMember2023-09-012024-08-310000022444cmc:DownstreamProductsMemberus-gaap:OperatingSegmentsMembercmc:EmergingBusinessGroupMember2023-09-012024-08-310000022444cmc:DownstreamProductsMemberus-gaap:OperatingSegmentsMemberus-gaap:CorporateAndOtherMember2023-09-012024-08-310000022444cmc:DownstreamProductsMember2023-09-012024-08-310000022444cmc:ConstructionProductsMemberus-gaap:OperatingSegmentsMembercmc:NorthAmericaSteelGroupMember2023-09-012024-08-310000022444cmc:ConstructionProductsMemberus-gaap:OperatingSegmentsMembercmc:EuropeSteelGroupMember2023-09-012024-08-310000022444cmc:ConstructionProductsMemberus-gaap:OperatingSegmentsMembercmc:EmergingBusinessGroupMember2023-09-012024-08-310000022444cmc:ConstructionProductsMemberus-gaap:OperatingSegmentsMemberus-gaap:CorporateAndOtherMember2023-09-012024-08-310000022444cmc:ConstructionProductsMember2023-09-012024-08-310000022444cmc:GroundStabilizationProductsMemberus-gaap:OperatingSegmentsMembercmc:NorthAmericaSteelGroupMember2023-09-012024-08-310000022444cmc:GroundStabilizationProductsMemberus-gaap:OperatingSegmentsMembercmc:EuropeSteelGroupMember2023-09-012024-08-310000022444cmc:GroundStabilizationProductsMemberus-gaap:OperatingSegmentsMembercmc:EmergingBusinessGroupMember2023-09-012024-08-310000022444cmc:GroundStabilizationProductsMemberus-gaap:OperatingSegmentsMemberus-gaap:CorporateAndOtherMember2023-09-012024-08-310000022444cmc:GroundStabilizationProductsMember2023-09-012024-08-310000022444cmc:OtherProductMemberus-gaap:OperatingSegmentsMembercmc:NorthAmericaSteelGroupMember2023-09-012024-08-310000022444cmc:OtherProductMemberus-gaap:OperatingSegmentsMembercmc:EuropeSteelGroupMember2023-09-012024-08-310000022444cmc:OtherProductMemberus-gaap:OperatingSegmentsMembercmc:EmergingBusinessGroupMember2023-09-012024-08-310000022444cmc:OtherProductMemberus-gaap:OperatingSegmentsMemberus-gaap:CorporateAndOtherMember2023-09-012024-08-310000022444cmc:OtherProductMember2023-09-012024-08-310000022444us-gaap:MaterialReconcilingItemsMembercmc:NorthAmericaSteelGroupMember2023-09-012024-08-310000022444us-gaap:MaterialReconcilingItemsMembercmc:EuropeSteelGroupMember2023-09-012024-08-310000022444us-gaap:MaterialReconcilingItemsMembercmc:EmergingBusinessGroupMember2023-09-012024-08-310000022444us-gaap:MaterialReconcilingItemsMemberus-gaap:CorporateAndOtherMember2023-09-012024-08-310000022444us-gaap:MaterialReconcilingItemsMember2023-09-012024-08-310000022444us-gaap:CorporateAndOtherMember2023-09-012024-08-310000022444cmc:RawMaterialProductsMemberus-gaap:OperatingSegmentsMembercmc:NorthAmericaSteelGroupMember2022-09-012023-08-310000022444cmc:RawMaterialProductsMemberus-gaap:OperatingSegmentsMembercmc:EuropeSteelGroupMember2022-09-012023-08-310000022444cmc:RawMaterialProductsMemberus-gaap:OperatingSegmentsMembercmc:EmergingBusinessGroupMember2022-09-012023-08-310000022444cmc:RawMaterialProductsMemberus-gaap:OperatingSegmentsMemberus-gaap:CorporateAndOtherMember2022-09-012023-08-310000022444cmc:RawMaterialProductsMember2022-09-012023-08-310000022444cmc:SteelProductsMemberus-gaap:OperatingSegmentsMembercmc:NorthAmericaSteelGroupMember2022-09-012023-08-310000022444cmc:SteelProductsMemberus-gaap:OperatingSegmentsMembercmc:EuropeSteelGroupMember2022-09-012023-08-310000022444cmc:SteelProductsMemberus-gaap:OperatingSegmentsMembercmc:EmergingBusinessGroupMember2022-09-012023-08-310000022444cmc:SteelProductsMemberus-gaap:OperatingSegmentsMemberus-gaap:CorporateAndOtherMember2022-09-012023-08-310000022444cmc:SteelProductsMember2022-09-012023-08-310000022444cmc:DownstreamProductsMemberus-gaap:OperatingSegmentsMembercmc:NorthAmericaSteelGroupMember2022-09-012023-08-310000022444cmc:DownstreamProductsMemberus-gaap:OperatingSegmentsMembercmc:EuropeSteelGroupMember2022-09-012023-08-310000022444cmc:DownstreamProductsMemberus-gaap:OperatingSegmentsMembercmc:EmergingBusinessGroupMember2022-09-012023-08-310000022444cmc:DownstreamProductsMemberus-gaap:OperatingSegmentsMemberus-gaap:CorporateAndOtherMember2022-09-012023-08-310000022444cmc:DownstreamProductsMember2022-09-012023-08-310000022444cmc:ConstructionProductsMemberus-gaap:OperatingSegmentsMembercmc:NorthAmericaSteelGroupMember2022-09-012023-08-310000022444cmc:ConstructionProductsMemberus-gaap:OperatingSegmentsMembercmc:EuropeSteelGroupMember2022-09-012023-08-310000022444cmc:ConstructionProductsMemberus-gaap:OperatingSegmentsMembercmc:EmergingBusinessGroupMember2022-09-012023-08-310000022444cmc:ConstructionProductsMemberus-gaap:OperatingSegmentsMemberus-gaap:CorporateAndOtherMember2022-09-012023-08-310000022444cmc:ConstructionProductsMember2022-09-012023-08-310000022444cmc:GroundStabilizationProductsMemberus-gaap:OperatingSegmentsMembercmc:NorthAmericaSteelGroupMember2022-09-012023-08-310000022444cmc:GroundStabilizationProductsMemberus-gaap:OperatingSegmentsMembercmc:EuropeSteelGroupMember2022-09-012023-08-310000022444cmc:GroundStabilizationProductsMemberus-gaap:OperatingSegmentsMembercmc:EmergingBusinessGroupMember2022-09-012023-08-310000022444cmc:GroundStabilizationProductsMemberus-gaap:OperatingSegmentsMemberus-gaap:CorporateAndOtherMember2022-09-012023-08-310000022444cmc:GroundStabilizationProductsMember2022-09-012023-08-310000022444cmc:OtherProductMemberus-gaap:OperatingSegmentsMembercmc:NorthAmericaSteelGroupMember2022-09-012023-08-310000022444cmc:OtherProductMemberus-gaap:OperatingSegmentsMembercmc:EuropeSteelGroupMember2022-09-012023-08-310000022444cmc:OtherProductMemberus-gaap:OperatingSegmentsMembercmc:EmergingBusinessGroupMember2022-09-012023-08-310000022444cmc:OtherProductMemberus-gaap:OperatingSegmentsMemberus-gaap:CorporateAndOtherMember2022-09-012023-08-310000022444cmc:OtherProductMember2022-09-012023-08-310000022444us-gaap:MaterialReconcilingItemsMembercmc:NorthAmericaSteelGroupMember2022-09-012023-08-310000022444us-gaap:MaterialReconcilingItemsMembercmc:EuropeSteelGroupMember2022-09-012023-08-310000022444us-gaap:MaterialReconcilingItemsMembercmc:EmergingBusinessGroupMember2022-09-012023-08-310000022444us-gaap:MaterialReconcilingItemsMemberus-gaap:CorporateAndOtherMember2022-09-012023-08-310000022444us-gaap:MaterialReconcilingItemsMember2022-09-012023-08-310000022444us-gaap:CorporateAndOtherMember2022-09-012023-08-310000022444cmc:RawMaterialProductsMemberus-gaap:OperatingSegmentsMembercmc:NorthAmericaSteelGroupMember2021-09-012022-08-310000022444cmc:RawMaterialProductsMemberus-gaap:OperatingSegmentsMembercmc:EuropeSteelGroupMember2021-09-012022-08-310000022444cmc:RawMaterialProductsMemberus-gaap:OperatingSegmentsMembercmc:EmergingBusinessGroupMember2021-09-012022-08-310000022444cmc:RawMaterialProductsMemberus-gaap:OperatingSegmentsMemberus-gaap:CorporateAndOtherMember2021-09-012022-08-310000022444cmc:RawMaterialProductsMember2021-09-012022-08-310000022444cmc:SteelProductsMemberus-gaap:OperatingSegmentsMembercmc:NorthAmericaSteelGroupMember2021-09-012022-08-310000022444cmc:SteelProductsMemberus-gaap:OperatingSegmentsMembercmc:EuropeSteelGroupMember2021-09-012022-08-310000022444cmc:SteelProductsMemberus-gaap:OperatingSegmentsMembercmc:EmergingBusinessGroupMember2021-09-012022-08-310000022444cmc:SteelProductsMemberus-gaap:OperatingSegmentsMemberus-gaap:CorporateAndOtherMember2021-09-012022-08-310000022444cmc:SteelProductsMember2021-09-012022-08-310000022444cmc:DownstreamProductsMemberus-gaap:OperatingSegmentsMembercmc:NorthAmericaSteelGroupMember2021-09-012022-08-310000022444cmc:DownstreamProductsMemberus-gaap:OperatingSegmentsMembercmc:EuropeSteelGroupMember2021-09-012022-08-310000022444cmc:DownstreamProductsMemberus-gaap:OperatingSegmentsMembercmc:EmergingBusinessGroupMember2021-09-012022-08-310000022444cmc:DownstreamProductsMemberus-gaap:OperatingSegmentsMemberus-gaap:CorporateAndOtherMember2021-09-012022-08-310000022444cmc:DownstreamProductsMember2021-09-012022-08-310000022444cmc:ConstructionProductsMemberus-gaap:OperatingSegmentsMembercmc:NorthAmericaSteelGroupMember2021-09-012022-08-310000022444cmc:ConstructionProductsMemberus-gaap:OperatingSegmentsMembercmc:EuropeSteelGroupMember2021-09-012022-08-310000022444cmc:ConstructionProductsMemberus-gaap:OperatingSegmentsMembercmc:EmergingBusinessGroupMember2021-09-012022-08-310000022444cmc:ConstructionProductsMemberus-gaap:OperatingSegmentsMemberus-gaap:CorporateAndOtherMember2021-09-012022-08-310000022444cmc:ConstructionProductsMember2021-09-012022-08-310000022444cmc:GroundStabilizationProductsMemberus-gaap:OperatingSegmentsMembercmc:NorthAmericaSteelGroupMember2021-09-012022-08-310000022444cmc:GroundStabilizationProductsMemberus-gaap:OperatingSegmentsMembercmc:EuropeSteelGroupMember2021-09-012022-08-310000022444cmc:GroundStabilizationProductsMemberus-gaap:OperatingSegmentsMembercmc:EmergingBusinessGroupMember2021-09-012022-08-310000022444cmc:GroundStabilizationProductsMemberus-gaap:OperatingSegmentsMemberus-gaap:CorporateAndOtherMember2021-09-012022-08-310000022444cmc:GroundStabilizationProductsMember2021-09-012022-08-310000022444cmc:OtherProductMemberus-gaap:OperatingSegmentsMembercmc:NorthAmericaSteelGroupMember2021-09-012022-08-310000022444cmc:OtherProductMemberus-gaap:OperatingSegmentsMembercmc:EuropeSteelGroupMember2021-09-012022-08-310000022444cmc:OtherProductMemberus-gaap:OperatingSegmentsMembercmc:EmergingBusinessGroupMember2021-09-012022-08-310000022444cmc:OtherProductMemberus-gaap:OperatingSegmentsMemberus-gaap:CorporateAndOtherMember2021-09-012022-08-310000022444cmc:OtherProductMember2021-09-012022-08-310000022444us-gaap:MaterialReconcilingItemsMembercmc:NorthAmericaSteelGroupMember2021-09-012022-08-310000022444us-gaap:MaterialReconcilingItemsMembercmc:EuropeSteelGroupMember2021-09-012022-08-310000022444us-gaap:MaterialReconcilingItemsMembercmc:EmergingBusinessGroupMember2021-09-012022-08-310000022444us-gaap:MaterialReconcilingItemsMemberus-gaap:CorporateAndOtherMember2021-09-012022-08-310000022444us-gaap:MaterialReconcilingItemsMember2021-09-012022-08-310000022444us-gaap:CorporateAndOtherMember2021-09-012022-08-310000022444country:US2023-09-012024-08-310000022444country:US2022-09-012023-08-310000022444country:US2021-09-012022-08-310000022444country:PL2023-09-012024-08-310000022444country:PL2022-09-012023-08-310000022444country:PL2021-09-012022-08-310000022444country:CN2023-09-012024-08-310000022444country:CN2022-09-012023-08-310000022444country:CN2021-09-012022-08-310000022444cmc:OtherGeographicalAreasMember2023-09-012024-08-310000022444cmc:OtherGeographicalAreasMember2022-09-012023-08-310000022444cmc:OtherGeographicalAreasMember2021-09-012022-08-310000022444country:US2024-08-310000022444country:US2023-08-310000022444country:US2022-08-310000022444country:PL2024-08-310000022444country:PL2023-08-310000022444country:PL2022-08-310000022444cmc:OtherGeographicalAreasMember2024-08-310000022444cmc:OtherGeographicalAreasMember2023-08-310000022444cmc:OtherGeographicalAreasMember2022-08-310000022444us-gaap:AllowanceForCreditLossMember2023-08-310000022444us-gaap:AllowanceForCreditLossMember2023-09-012024-08-310000022444us-gaap:AllowanceForCreditLossMember2024-08-310000022444us-gaap:ValuationAllowanceOfDeferredTaxAssetsMember2023-08-310000022444us-gaap:ValuationAllowanceOfDeferredTaxAssetsMember2023-09-012024-08-310000022444us-gaap:ValuationAllowanceOfDeferredTaxAssetsMember2024-08-310000022444us-gaap:AllowanceForCreditLossMember2022-08-310000022444us-gaap:AllowanceForCreditLossMember2022-09-012023-08-310000022444us-gaap:ValuationAllowanceOfDeferredTaxAssetsMember2022-08-310000022444us-gaap:ValuationAllowanceOfDeferredTaxAssetsMember2022-09-012023-08-310000022444us-gaap:AllowanceForCreditLossMember2021-08-310000022444us-gaap:AllowanceForCreditLossMember2021-09-012022-08-310000022444us-gaap:ValuationAllowanceOfDeferredTaxAssetsMember2021-08-310000022444us-gaap:ValuationAllowanceOfDeferredTaxAssetsMember2021-09-012022-08-31

UNITED STATES SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

Form 10-K

|

|

|

|

|

|

|

|

|

| ☑ |

|

ANNUAL REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934 |

|

|

For the fiscal year ended August 31, 2024 |

|

|

|

|

|

|

|

|

|

| ☐ |

|

TRANSITION REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934 |

|

|

For the transition period from to |

Commission file number 1-4304

Commercial Metals Company

(Exact name of registrant as specified in its charter)

|

|

|

|

|

|

|

|

|

| Delaware |

|

75-0725338 |

| (State or other jurisdiction of incorporation or organization) |

|

(I.R.S. Employer Identification No.) |

6565 N. MacArthur Blvd., Irving, Texas 75039

(Address of Principal Executive Office) (Zip Code)

(214) 689-4300

(Registrant's Telephone Number, Including Area Code)

Securities registered pursuant to Section 12(b) of the Act:

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Title of Each Class |

|

Trading Symbol(s) |

|

Name of Each Exchange on Which Registered |

| Common Stock, $0.01 par value |

|

CMC |

|

New York Stock Exchange |

Securities registered pursuant to Section 12(g) of the Act: None

Indicate by check mark if the registrant is a well-known seasoned issuer, as defined in Rule 405 of the Securities Act. Yes þ No o

Indicate by check mark if the registrant is not required to file reports pursuant to Section 13 or Section 15(d) of the Act. Yes o No þ

Indicate by check mark whether the registrant (1) has filed all reports required to be filed by Section 13 or 15(d) of the Securities Exchange Act of 1934 during the preceding 12 months (or for such shorter period that the registrant was required to file such reports), and (2) has been subject to such filing requirements for the past 90 days. Yes þ No o

Indicate by check mark whether the registrant has submitted electronically every Interactive Data File required to be submitted pursuant to Rule 405 of Regulation S-T (§ 232.405 of this chapter) during the preceding 12 months (or for such shorter period that the registrant was required to submit such files). Yes þ No o

Indicate by check mark whether the registrant is a large accelerated filer, an accelerated filer, a non-accelerated filer, a smaller reporting company, or an emerging growth company. See the definitions of "large accelerated filer," "accelerated filer," "smaller reporting company," and "emerging growth company" in Rule 12b-2 of the Exchange Act.

|

|

|

|

|

|

|

|

|

|

|

|

| Large accelerated filer |

☑ |

Accelerated filer |

☐ |

| Non-accelerated filer |

☐ |

Smaller reporting company |

☐ |

|

|

Emerging growth company |

☐ |

If an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act. ☐

Indicate by check mark whether the registrant has filed a report on and attestation to its management's assessment of the effectiveness of its internal control over financial reporting under Section 404(b) of the Sarbanes-Oxley Act (15 U.S.C 7262(b)) by the registered public accounting firm that prepared or issued its audit report. ☑

If securities are registered pursuant to Section 12(b) of the Act, indicate by check mark whether the financial statements of the registrant included in the filing reflect the correction of an error to previously issued financial statements. ☐

Indicate by check mark whether any of those error corrections are restatements that required a recovery analysis of incentive-based compensation received by any of the registrant’s executive officers during the relevant recovery period pursuant to §240.10D-1(b). ☐

Indicate by check mark whether the registrant is a shell company (as defined in Rule 12b-2 of the Act). Yes ☐ No ☑

The aggregate market value of the Company's common stock on February 29, 2024 held by non-affiliates of the registrant based on the closing price per share on February 29, 2024 on the New York Stock Exchange was approximately $6.2 billion.

As of October 14, 2024, 113,909,587 shares of the registrant's common stock, par value $0.01 per share, were outstanding.

DOCUMENTS INCORPORATED BY REFERENCE:

Portions of the definitive proxy statement for the 2025 annual meeting of stockholders are incorporated by reference into Part III.

COMMERCIAL METALS COMPANY AND SUBSIDIARIES

TABLE OF CONTENTS

|

|

|

|

|

|

|

|

| |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| |

|

|

|

| |

|

|

|

Item 6: Intentionally Omitted |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| |

|

|

|

| |

|

|

|

|

|

|

|

|

|

|

|

| |

|

|

|

| |

|

|

|

|

|

PART I

ITEM 1. BUSINESS

DISCLOSURE REGARDING FORWARD-LOOKING STATEMENTS

This annual report on Form 10-K (hereinafter referred to as the "Annual Report") contains forward-looking statements within the meaning of Section 27A of the Securities Act of 1933, as amended (the "Securities Act"), Section 21E of the Securities Exchange Act of 1934, as amended (the "Exchange Act") and the Private Securities Litigation Reform Act of 1995. Actual results, performance or achievements could differ materially from those projected in the forward-looking statements as a result of a number of risks, uncertainties and other factors. For a discussion of important factors that could cause our results, performance or achievements to differ materially from any future results, performance or achievements expressed or implied by our forward-looking statements, please refer to Part I, Item 1A, Risk Factors and Part II, Item 7, Management's Discussion and Analysis of Financial Condition and Results of Operations in this Annual Report.

References in this Annual Report to "CMC," "the Company," "we," "our" and "us" refer to Commercial Metals Company and its subsidiaries unless otherwise indicated.

Certain trademarks or service marks of CMC appearing in this Annual Report are the property of CMC and are protected under applicable intellectual property laws. Solely for convenience, our trademarks and tradenames referred to in this Annual Report may appear without the ® or ™ symbols, but such references are not intended to indicate in any way that we will not assert, to the fullest extent under applicable law, our rights to these trademarks and tradenames.

OVERVIEW

Founded in 1915 as a single scrap yard in Dallas, Texas, CMC is an innovative solutions provider helping build a stronger, safer and more sustainable world. Through an extensive manufacturing network principally located in the United States ("U.S.") and Central Europe, we offer products and technologies to meet the critical reinforcement needs of the global construction sector. CMC’s solutions support construction across a wide variety of applications, including infrastructure, non-residential, residential, industrial and energy generation and transmission. Our operations are conducted through three operating and reportable segments: North America Steel Group, Europe Steel Group and Emerging Businesses Group.

At CMC, we believe "it’s what’s inside that counts." This reflects the nature of our products, which are found in critical infrastructure worldwide, and also applies to our culture and employees. We operate under the guiding principles of placing the customer at the core of all we do, staying committed to our employees, giving back to our communities and creating value for our investors, all while continuing our commitment to sustainability. From our inception, our business model has been strategically built on sustainable principles, including recycling metals, manufacturing products from approximately 98% recycled material using energy-efficient technology and employing closed-loop water recycling processes.

Our focus on safety and talent development allows us to run a great company and achieve operational and commercial excellence across our business. We provide differentiating value for our customers through our industry-leading customer service with a low cost, high-quality production process. Further, we have achieved market leadership through our commitment to transformation, advancement and long-term growth by investing in our business and in our people. As our customers' needs and preferences have evolved, our products have expanded to include diverse and innovative solutions and future growth platforms. Through a combination of both value-accretive organic growth that captures available internal synergies, and capability-enhancing inorganic growth that broadens our portfolio, we aim to provide our customers with a comprehensive solution.

We maintain our corporate office at 6565 North MacArthur Boulevard, Suite 800, Irving, Texas 75039. Our telephone number is (214) 689-4300, and our website is http://www.cmc.com. Our fiscal year ends August 31st, and any reference in this Annual Report to a year refers to the fiscal year ended August 31st of that year, unless otherwise noted. Any reference in this Annual Report to a ton refers to the U.S. short ton, a unit of weight equal to 2,000 pounds.

Our Annual Report, Quarterly Reports on Form 10-Q, Current Reports on Form 8-K and all amendments to these reports are made available free of charge through the Investors section of our website as soon as reasonably practicable after such material is electronically filed with, or furnished to, the U.S. Securities and Exchange Commission (the "SEC"). The information contained on our website or available by hyperlink from our website is not incorporated into this Annual Report or other documents we file with, or furnish to, the SEC.

Segments

During the first quarter of 2024, we changed our reportable segments to reflect a change in the manner in which our business is managed. Based on changes to our organizational structure, the evolution of our solutions offerings outside of traditional steel products, the growing importance of non-steel solutions to our financial results and future outlook and how our chief operating decision maker, our President and Chief Executive Officer, reviews operating results and makes decisions about resource allocation, the Company now has three reportable segments that represent the primary businesses reported in our consolidated financial statements: North America Steel Group, Europe Steel Group and Emerging Businesses Group. As a result of this change in reportable segments, certain prior year amounts have been recast to conform to the current year presentation. Throughout this Annual Report, unless otherwise indicated, amounts and activity affected by the change in reportable segments have been reclassified.

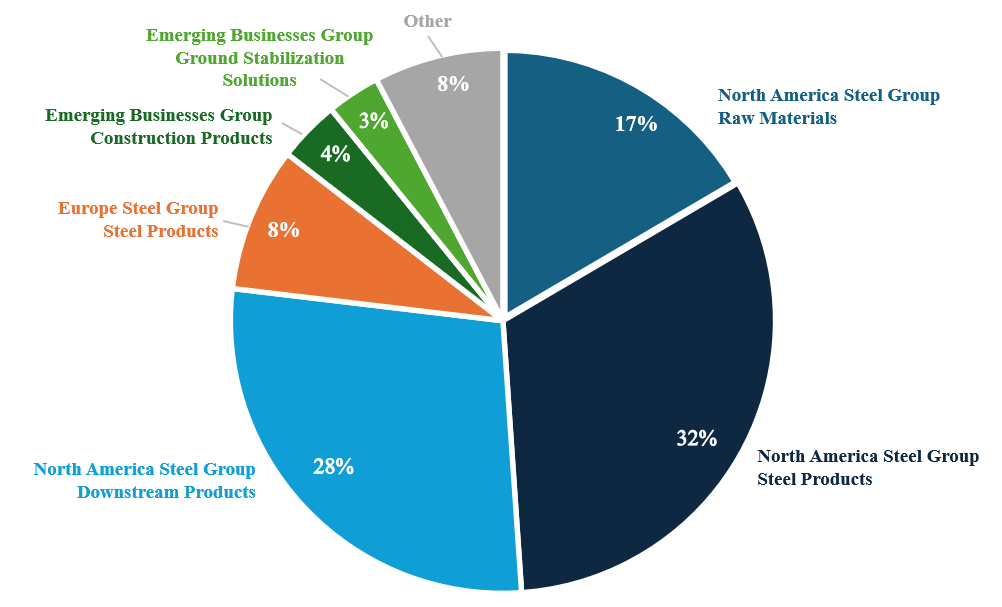

The following chart summarizes net sales to external customers by major product category within each reportable segment during 2024. For a historical breakout of our net sales to external customers by major product category within each reportable segment, see Note 19, Segment Information, in Part II, Item 8 of this Annual Report.

NORTH AMERICA STEEL GROUP SEGMENT

Our North America Steel Group segment provides a diverse offering of products and solutions to support the construction sector. Composed of a vertically integrated network of recycling facilities, steel mills and fabrication operations, our strategy in North America is to optimize our vertically integrated value chain to maximize profitability while providing industry-leading customer service. To execute our strategy, we seek to (i) obtain inputs at the lowest possible cost, including materials procured from our recycling facilities, which are operated to provide low-cost scrap to our steel mills, (ii) operate modern, efficient electric arc furnace ("EAF") steel mills and (iii) enhance operational efficiency by utilizing our fabrication operations to optimize our steel mill volumes and obtain the highest possible selling prices to maximize metal margin. We strive to maximize cash flow generation through increased productivity, high-capacity utilization and optimal product mix. To remain competitive, we regularly make substantial capital expenditures. We have invested approximately 77%, 88% and 91% of total capital expenditures in our North America Steel Group segment during 2024, 2023 and 2022, respectively. For logistics, we utilize a fleet of trucks we own or lease as well as private haulers, railcars, export containers and barges.

Our 43 scrap metal recycling facilities, primarily located in the southeast and central U.S., process ferrous and nonferrous scrap metals. These facilities purchase processed and unprocessed ferrous and nonferrous scrap metals from a variety of sources including manufacturing and industrial plants, metal fabrication plants, electric utilities, machine shops, factories, refineries, shipyards, demolition businesses, automobile salvage firms, wrecking companies and retail individuals. Our recycling facilities utilize specialized equipment to efficiently process large volumes of ferrous material, including seven large machines capable of shredding obsolete automobiles or other sources of scrap metal. Certain facilities also have nonferrous downstream separation equipment, including equipment at three of our facilities that reclaim metal from insulated copper wire, to allow us to capture more metal content. With the exception of precious metals, our scrap metal processing facilities recycle and process almost all types of metal.

We sell ferrous and nonferrous scrap metals (collectively referred to as "raw materials") to steel mills and foundries, aluminum sheet and ingot manufacturers, brass and bronze ingot makers, copper refineries and mills, secondary lead smelters, specialty steel mills, high temperature alloy manufacturers and other consumers. Raw materials margin per ton is defined as the difference between the selling prices for processed and recycled ferrous and nonferrous scrap metals and the price paid to purchase obsolete and industrial scrap.

Our steel mill operations consist of six EAF mini mills, three EAF micro mills and one rerolling mill. Our steel mills manufacture finished long steel products including rebar, merchant bar, light structural and other special sections and wire rod, as well as semi-finished billets for rerolling and forging applications (collectively referred to as "steel products" in the context of the North America Steel Group segment). Each EAF mini mill consists of:

•a melt shop with an EAF;

•continuous casting equipment that shapes molten metal into billets;

•a reheating furnace that prepares billets for rolling;

•a rolling line that forms products from heated billets;

•a mechanical cooling bed that receives hot products from the rolling line;

•finishing facilities that shear, straighten, bundle and prepare products for shipping; and

•supporting facilities such as maintenance, warehouse and office areas.

Our EAF micro mills utilize similar equipment and processes as described above; however, these facilities utilize unique continuous process technology where metal flows uninterrupted from melting to casting to rolling into finished steel products. Our rerolling mill does not utilize a melt shop; the rerolling process begins by reheating billets to roll into finished steel products. CMC has three facilities capable of producing spooled rebar. The estimated annual capacity for our steel mills, included in Part I, Item 2, Properties, of this Annual Report assumes a typical product mix and is not necessarily indicative of the expected production volumes or shipments in any fiscal year. Descriptions of mill capacity, particularly rolling capacity, are highly dependent on the specific product mix manufactured. Our mills roll many different types and sizes of products depending on market conditions, including pricing and demand.

Ferrous scrap is the primary raw material used by our steel mills and is subject to significant price fluctuations. We believe the supply of ferrous scrap available to us is adequate to meet our future needs. Our mills consume large amounts of electricity and natural gas. We have not had any significant curtailments, and we believe that energy supplies are adequate. The supply and demand of regional and national energy, and the extent of applicable regulatory oversight of rates charged by providers, affect the prices we pay for electricity and natural gas. Our mills ship to a broad range of customers and end markets across the U.S. The primary end markets are construction and fabricating industries, metals service centers, original equipment manufacturers and agricultural, energy and petrochemical industries. Due to the nature of our steel products, we do not have a long lead time between order receipt and delivery. We generally fill orders for steel products from inventory or with products near completion. As a result, we do not believe our steel products backlog is a significant factor in the evaluation of our North America Steel Group operations.

Our fabrication operations include 54 facilities engaged in various aspects of steel fabrication; 50 of these facilities engage in general fabrication of reinforcing steel, including shearing, bending and welding, and four of these facilities fabricate steel fence posts. Fabricated rebar is used to reinforce concrete primarily in the construction of commercial and non-commercial buildings, hospitals, convention centers, industrial plants, power plants, highways, bridges, arenas, stadiums and dams, and is generally sold in response to a competitive bid solicitation. Many of the resulting projects are fixed price over the life of the project. We also provide installation services of fabricated rebar in certain markets. We obtain steel for our fabrication operations primarily from our own steel mills, and the demand created by our fabrication operations optimizes the production from our steel mills. Our steel fence posts have many applications, including residential and commercial landscaping and agricultural and livestock containment. Additionally, we have three facilities that supply post-tension cable for use in a variety of projects, such as slab-on-grade foundations, bridges, buildings, parking structures and rock-and-soil anchors. The fabrication and post-tension cable offerings are collectively referred to as "downstream products" in the context of the North America Steel Group segment. Downstream products backlog, defined as the total value of unfulfilled orders, was $1.6 billion at August 31, 2024.

EUROPE STEEL GROUP SEGMENT

Our Europe Steel Group segment is composed of a vertically integrated network of recycling facilities, an EAF mini mill and fabrication operations located in Poland. Our strategy in Europe is to optimize profitability of the products manufactured by our mini mill, and we execute this strategy in the same way in our Europe Steel Group segment as we do in our North America Steel Group segment.

Our 12 scrap metal recycling facilities, located throughout Poland, process ferrous scrap metals for use as a raw material for our mini mill. These facilities provide material almost exclusively to our mini mill and operate in order to lower the cost of scrap used by our mini mill. The equipment utilized at these facilities is similar to our North America Steel Group recycling operations and includes one large capacity scrap metal shredder similar to the largest shredder we operate in North America. Nonferrous scrap metal is not material to this segment’s operations.

Our mini mill is a significant manufacturer of rebar, merchant bar, wire rod and semi-finished billets in Central Europe and includes three rolling lines. The first rolling line is designed to allow efficient and flexible production of a range of medium section merchant bar products. The second rolling line is dedicated primarily to rebar production. The third rolling line is designed to produce high grade wire rod. The products produced by the mini mill are collectively referred to as "steel products" in the context of our Europe Steel Group segment. Our mini mill sells steel products primarily to fabricators, manufacturers, distributors and construction companies, mostly to customers located within Poland. However, the mini mill also exports steel products to the Czech Republic, France, Germany, Italy and Slovakia, among other countries. Ferrous scrap metal, the principal raw material used by our mini mill, electricity, natural gas and other necessary raw materials for the steel manufacturing process are generally readily available, although they can be subject to significant price fluctuations. Our mini mill generally fills orders for steel products from inventory or with products near completion. As a result, we do not believe that our steel products backlog is a significant factor in evaluating the operations of our Europe Steel Group segment.

Our fabrication operations consist of five steel fabrication facilities located in Poland which produce downstream products including fabricated rebar, wire mesh, welded steel mesh, wire rod, cold rolled rebar, cold rolled wire rod, assembled rebar cages and other fabricated rebar by-products (collectively referred to as "downstream products" in the context of our Europe Steel Group segment). These facilities obtain rebar and wire rod primarily from the mini mill. Three of the facilities are similar to the facilities operated by our North America Steel Group segment and sell fabricated rebar primarily to contractors for incorporation into construction projects. The other two fabrication facilities in Poland produce welded steel mesh, cold rolled wire rod and cold rolled rebar. We are among the largest manufacturers of wire mesh in Poland, and our wire mesh customers include metals service centers and construction contractors. In addition to sales of downstream products in the Polish market, we also export our downstream products to neighboring countries such as the Czech Republic and Germany. The downstream products backlog is not a significant factor in evaluating the operations of our Europe Steel Group segment.

EMERGING BUSINESSES GROUP SEGMENT

Our Emerging Businesses Group segment provides construction-related solutions and value-added products with strong underlying growth fundamentals to serve domestic and international markets that are adjacent to those served by our vertically integrated operations in the North America Steel Group segment and the Europe Steel Group segment. The Emerging Businesses Group segment's portfolio consists of the following:

•CMC Construction Services operations sell and rent construction-related products and equipment to concrete installers and other businesses in the construction industry (collectively referred to as "construction products").

•Tensar operations sell geogrids and Geopier foundation systems (collectively referred to as "ground stabilization solutions"). Geogrids are polymer-based products used for ground stabilization, soil reinforcement and asphalt optimization in construction applications, including roadways, public infrastructure and industrial facilities. Geopier foundation systems are rammed aggregate pier and other foundation solutions that increase the load-bearing characteristics of ground structures and working surfaces and can be applied in soil types and construction situations in which traditional support methods are impractical or would make a project infeasible.

•CMC Impact Metals operations manufacture heat-treated, high-strength steel products, such as high-strength bar for the truck trailer industry, special bar quality steel for the energy market and armor plate for military vehicles.

•Our group of performance reinforcing steel offerings include innovative products such as Galvabar (galvanized rebar with a zinc alloy coating that provides corrosion protection and post-fabrication formability), ChromX (designed for high-strength capabilities, corrosion resistance and a service life of more than 100 years), and CryoSteel (a cryogenic reinforcing steel that exceeds minimum performance requirements for strength and ductility at extremely low temperatures). Additionally, CMC Anchoring Systems' operations supply custom engineered anchor cages, bolts and fasteners that are fabricated principally from rebar and are used primarily to secure high voltage electrical transmission poles to concrete foundations.

•Through our licensing agreement with InQuik Inc., CMC Bridge Systems is the authorized provider of InQuik Bridges in the U.S. CMC Bridge Systems offers a prefabricated and modular method used to build reinforced concrete bridge components off-site, which are then installed on-site with poured concrete for a cast-in-place structure.

SEASONALITY

Our facilities primarily serve customers in the construction industry. Due to the increase in construction activities during the spring and summer months, our net sales are generally higher in our third and fourth quarters than in our first and second quarters.

COMPETITION

Our North America Steel Group recycling operations compete with scrap metal processors and primary nonferrous scrap metal producers. The nonferrous recycling industry is highly fragmented in the U.S.; however, we believe our recycling operations are among the largest engaged in the recycling of nonferrous scrap metals in the U.S. We are also a major regional processor of ferrous scrap metal. For both nonferrous and ferrous scrap metals, we compete primarily on the quality and price of our products. Our Europe Steel Group recycling facilities operate to provide raw materials almost exclusively to our mini mill in Poland.

We produce a significant percentage of the total U.S. output of rebar and merchant bar through our EAF steel mills. Domestic and international competitors include local, regional, national and international manufacturers and suppliers of steel. We compete primarily on the services we provide to our customers and on the quality and price of our products. In the U.S., we believe we are the largest manufacturer and fabricator of rebar, the largest manufacturer of steel fence posts and among the largest manufacturers of merchant bar. In Poland, we believe we are the largest producer of rebar and merchant bars for the products we produce and the second largest producer of wire rod.

Furthermore, the global steel industry is cyclical and highly competitive, consisting of domestic and international producers for all major product lines across our North America Steel Group and Europe Steel Group segments. Global steelmaking capacity greatly exceeds demand for steel products in many regions around the world, and this overcapacity results in competition from steel imports into the regions we operate. Our global strategy and differentiating customer service allow us to navigate the risks arising from overproduction. Additionally, trade enforcement laws, such as the tariffs and quotas enforced by Section 232 of the U.S. Trade Expansion Act of 1962 ("Section 232"), have supported domestic production and reduced unfairly priced steel imports. However, these restrictions may be temporary and import competition continues to be a significant threat facing the steel industry.

Competitive Advantage

CMC's diverse product offerings support a wide variety of applications and position us as a global solutions provider to the construction industry, capable of addressing multiple stages of the early phases of construction. We believe our vertically integrated manufacturing platform provides an advantageous cost structure and maximizes the results of our steel-related operations. Our recycling and fabrication operations are designed to support our steel mills. Our recycling operations provide scrap metal to our steel mills, which in turn use the scrap metal to produce and supply steel required by our fabrication operations. As our recycling facilities are generally located near our steel mills, we can ensure a secure supply of low-cost raw materials, and our fabrication facilities provide a significant and consistent source of demand as well as forward visibility into end customer demand. This is a strategic advantage when imports increase as our steel mills can continue to supply our fabricators. Contract pricing that is utilized for these operations helps to stabilize short-term volatility. The construction-related solutions and value-added products within our Emerging Businesses Group segment complement our existing concrete reinforcement product lines and broaden our commercial portfolio, allowing us to address multiple stages of the early phases of commercial and infrastructure construction and provide a comprehensive solution for our customers.

Our operational footprint also provides a competitive advantage in North America and Europe. Our steel mills and fabrication operations in North America and Europe are well-positioned geographically with steel mill locations in some of the highest demand locations for rebar and merchant bar consumption. In North America, we operate a network of operations that stretch from the East Coast to the West Coast and can reach every major metro area in the U.S. Demand for our products in the U.S. is highest in the Sun Belt region where most of our steel mills are located, which positions us to capitalize on growth in this region as well as benefit from a longer construction season.

Our mini mill in Poland also provides strategic benefits as it is well positioned to serve neighboring European economies.

See Part I, Item 1A, Risk Factors, of this Annual Report for more information on competitive factors described above.

SUSTAINABILITY

Sustainability is embedded in our business model and remains central to our strategy. For over 50 years, we have manufactured steel using recycled scrap metal and EAF technology, which is more efficient and environmentally friendly than traditional blast furnace technology, using less energy than the industry average and producing significantly less carbon dioxide per ton of steel we melt. We play a key role in returning our primary input, ferrous scrap, into the economy in the form of rebar, merchant bar, wire rod and fence post for use in a wide variety of applications. In 2024, recycled content made up approximately 98% of the raw materials used in our manufactured finished steel. Our Tensar geogrid technology is also inherently sustainable, as its use in construction projects can, for example, extend road service life, conserve water resources, control soil erosion and reduce consumption of aggregate.

Increasingly, our customers are prioritizing sustainable business practices in and through their supply chains. We help our customers meet their own sustainability needs by offering products such as our RebarZero, MerchantZero, WireZero and PostZero product lines, among others in our portfolio of "net-zero" emissions products. Annually, our vertically integrated manufacturing process keeps millions of tons of scrap metal out of landfills. Our process includes five primary steps:

|

|

|

|

1. Locally source, purchase and process scrap metal as feedstock, which allows us to lower emissions and put more waste to beneficial use.

2. Melt the recycled scrap metal into new steel in our mills using our modern, efficient EAFs, which consume less energy and reduce greenhouse gas ("GHG") emissions compared to traditional blast furnace technology.

3. Roll the new steel into finished long steel products, including rebar, merchant bar, light structural shapes and other special sections, wire rod and semi-finished billets for rerolling.

4. Fabricate the finished products into custom shapes and lengths for end use by our customers.

5. Reclaim end-of-life steel material as feedstock for new steel products, thereby starting our cycle of steel production once again.

|

|

|

|

|

|

|

|

|

We continue to invest in new technologies and processes to reduce our impact on the environment, including our newly commissioned micro mill located in Mesa, Arizona, which employs the latest technology in EAF power supply systems and is able to directly connect the EAF and the ladle furnace to renewable energy sources such as solar and wind.

Information relating to our environmental, social and governance ("ESG") commitments and the goals we have established to increase our use of renewable energy and reduce our energy consumption, GHG emissions and water withdrawal is available on the ESG section of our website, www.esg.cmc.com.

ENVIRONMENTAL MATTERS

A significant factor in our business is our compliance with environmental laws and regulations. Compliance with and changes to various environmental requirements and environmental risks applicable to our industry may adversely affect our business, results of operations and financial condition.

Under the Comprehensive Environmental Response, Compensation and Liability Act ("CERCLA" or "Superfund") and analogous state statutes, we may occasionally be required to cleanup or take remedial action with regard to (or pay for cleanup or remedial action with regard to) sites we operate or formerly operated. If we are found to have arranged for treatment or disposal of hazardous substances at a site, we could be named as a potentially responsible party ("PRP") and responsible for both the costs of cleanup as well as for associated natural resource damages at such site. The U.S. Environmental Protection Agency ("EPA"), or equivalent state agency, has named us as a PRP at several federal Superfund sites or similar state sites. In some cases, these agencies allege that we are a PRP because we sold scrap metals to, or otherwise disposed of materials at, the site. With respect to the sale of scrap metals, we contend that an arm's length sale of valuable scrap metal for use as a raw material in a manufacturing process that we do not control should not constitute "an arrangement for disposal or treatment of hazardous substances" as defined under federal law. Subject to the satisfaction of certain conditions, the Superfund Recycling Equity Act provides legitimate sellers of scrap metal for recycling with some relief from Superfund liability under federal law.

Despite Congress' clarification of the intent of the federal law, some state laws and environmental agencies still seek to impose liability on the basis of such arm's length sale constituting "an arrangement for disposal or treatment of hazardous substances." We believe efforts to impose such liability are contrary to public policy objectives and legislation encouraging recycling and promoting the use of recycled materials, and we continue to support clarification of state laws and regulations consistent with Congress' action.