Q4 FY 2024 Supplemental Slides

2Q4 FY24 Supplemental Slides October 17, 2024 This presentation contains forward-looking statements within the meaning of the federal securities laws with respect to general economic conditions, key macro-economic drivers that impact our business, the effects of ongoing trade actions, the effects of continued pressure on the liquidity of our customers, potential synergies and growth provided by acquisitions and strategic investments, demand for our products, shipment volumes, metal margins, the ability to operate our steel mills at full capacity, future availability and cost of supplies of raw materials and energy for our operations, growth rates in certain segments, product margins within our Emerging Businesses Group, share repurchases, legal proceedings, construction activity, international trade, the impact of geopolitical conditions, capital expenditures, tax credits, our liquidity and our ability to satisfy future liquidity requirements, estimated contractual obligations, the expected capabilities and benefits of new facilities, the timeline for execution of our growth plan and our expectations or beliefs concerning future events. The statements in this presentation that are not historical statements, are forward- looking statements. These forward-looking statements can generally be identified by phrases such as we or our management “expects,” “anticipates,” “believes,” “estimates,” “future,” “intends,” “may,” “plans to,” “ought,” “could,” “will,” “should,” “likely,” “appears,” “projects,” “forecasts,” “outlook” or other similar words or phrases, as well as by discussions of strategy, plans or intentions. Our forward-looking statements are based on management’s expectations and beliefs as of the date of this presentation. Although we believe that our expectations are reasonable, we can give no assurance that these expectations will prove to have been correct, and actual results may vary materially. Except as required by law, we undertake no obligation to update, amend or clarify any forward-looking statements to reflect changed assumptions, the occurrence of anticipated or unanticipated events, new information or circumstances or any other changes. Important factors that could cause actual results to differ materially from our expectations include those described in our filings with the Securities and Exchange Commission, including, but not limited to, in Part I, Item 1A, “Risk Factors” of our annual report on Form 10-K for the fiscal year ended August 31, 2023, as well as the following: changes in economic conditions which affect demand for our products or construction activity generally, and the impact of such changes on the highly cyclical steel industry; rapid and significant changes in the price of metals, potentially impairing our inventory values due to declines in commodity prices or reducing the profitability of downstream contracts within our vertically integrated steel operations due to rising commodity pricing; excess capacity in our industry, particularly in China, and product availability from competing steel mills and other steel suppliers including import quantities and pricing; the impact of geopolitical conditions, including political turmoil and volatility, regional conflicts, terrorism and war on the global economy, inflation, energy supplies and raw materials; increased attention to environmental, social and governance (“ESG”) matters, including any targets or other ESG, environmental justice or regulatory initiatives; operating and startup risks, as well as market risks associated with the commissioning of new projects could prevent us from realizing anticipated benefits and could result in a loss of all or a substantial part of our investments; impacts from global public health crises on the economy, demand for our products, global supply chain and on our operations; compliance with and changes in existing and future laws, regulations and other legal requirements and judicial decisions that govern our business, including increased environmental regulations associated with climate change and greenhouse gas emissions; involvement in various environmental matters that may result in fines, penalties or judgments; evolving remediation technology, changing regulations, possible third-party contributions, the inherent uncertainties of the estimation process and other factors that may impact amounts accrued for environmental liabilities; potential limitations in our or our customers' abilities to access credit and non-compliance with their contractual obligations, including payment obligations; activity in repurchasing shares of our common stock under our share repurchase program; financial and non- financial covenants and restrictions on the operation of our business contained in agreements governing our debt; our ability to successfully identify, consummate and integrate acquisitions and realize any or all of the anticipated synergies or other benefits of acquisitions; the effects that acquisitions may have on our financial leverage; risks associated with acquisitions generally, such as the inability to obtain, or delays in obtaining, required approvals under applicable antitrust legislation and other regulatory and third-party consents and approvals; lower than expected future levels of revenues and higher than expected future costs; failure or inability to implement growth strategies in a timely manner; the impact of goodwill or other indefinite-lived intangible asset impairment charges; the impact of long-lived asset impairment charges; currency fluctuations; global factors, such as trade measures, military conflicts and political uncertainties, including changes to current trade regulations, such as Section 232 trade tariffs and quotas, tax legislation and other regulations which might adversely impact our business; availability and pricing of electricity, electrodes and natural gas for mill operations; our ability to hire and retain key executives and other employees; competition from other materials or from competitors that have a lower cost structure or access to greater financial resources; information technology interruptions and breaches in security; our ability to make necessary capital expenditures; availability and pricing of raw materials and other items over which we exert little influence, including scrap metal, energy and insurance; unexpected equipment failures; losses or limited potential gains due to hedging transactions; litigation claims and settlements, court decisions, regulatory rulings and legal compliance risks; risk of injury or death to employees, customers or other visitors to our operations; and civil unrest, protests and riots. Forward-Looking Statements

3 Q4 FY24 Supplemental Slides October 17, 2024 Leading positions in core products and geographies Focused strategy that leverages capabilities, competitive strengths, and market knowledge Strong balance sheet and cash generation provide flexibility to execute on strategy Vertical structure optimizes returns through the entire value chain Disciplined capital allocation focused on maximizing returns for our shareholders Increasing Shareholder Value With a Winning Formula

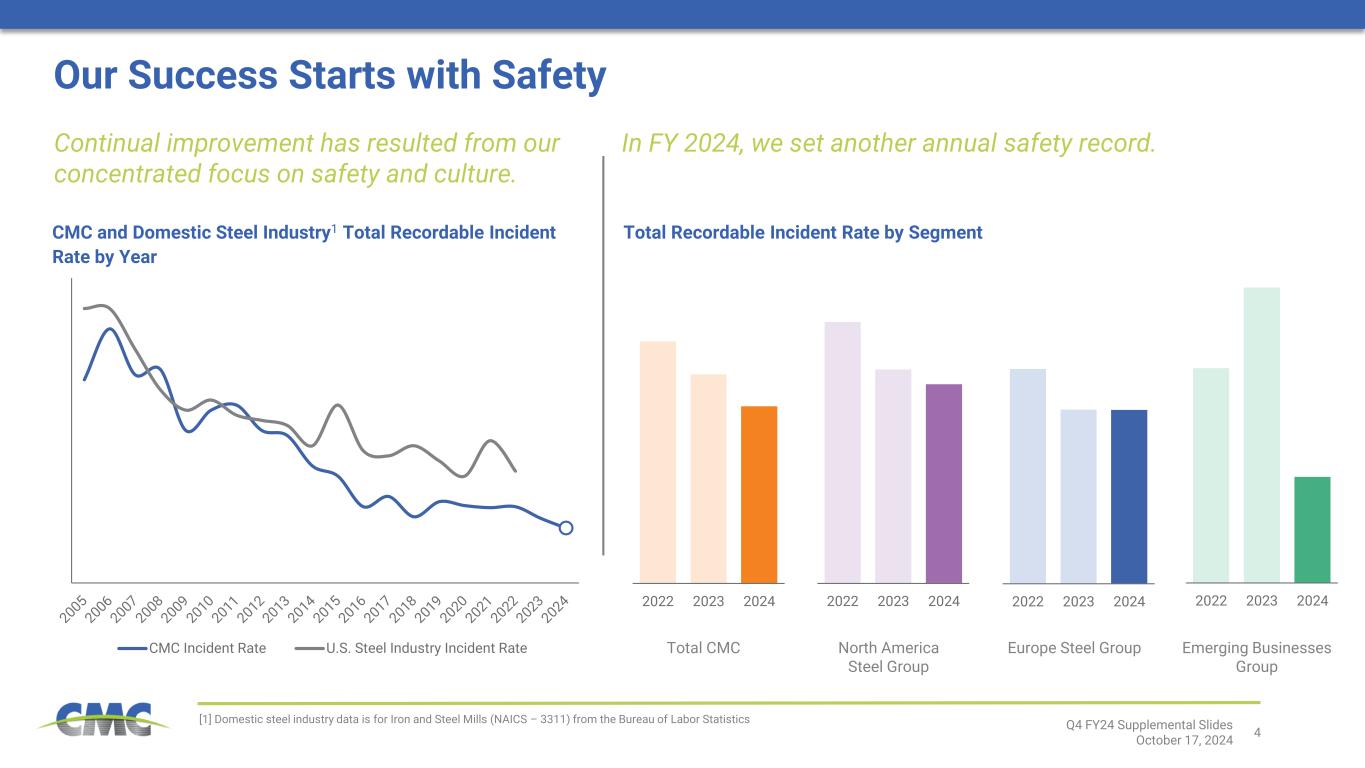

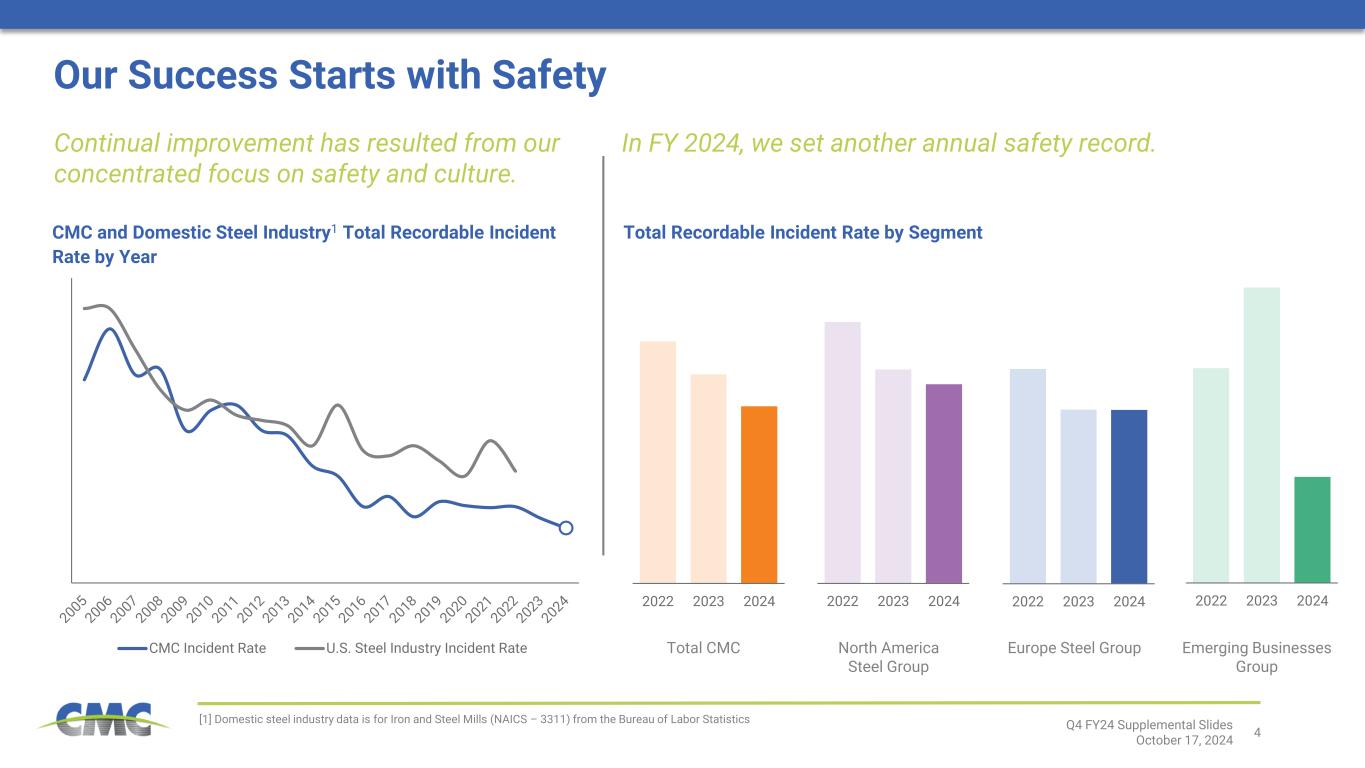

4 CMC Incident Rate U.S. Steel Industry Incident Rate 2022 2023 20242022 2023 20242022 2023 20242022 2023 2024 Our Success Starts with Safety [1] Domestic steel industry data is for Iron and Steel Mills (NAICS – 3311) from the Bureau of Labor Statistics CMC and Domestic Steel Industry1 Total Recordable Incident Rate by Year Continual improvement has resulted from our concentrated focus on safety and culture. Total CMC North America Steel Group Europe Steel Group Emerging Businesses Group Total Recordable Incident Rate by Segment In FY 2024, we set another annual safety record. Q4 FY24 Supplemental Slides October 17, 2024

5 Record employee safety performance • OSHA recordables and incident rate improved from FY 2023 Core EBITDA1 of $1.0 billion was the third highest in Company history; core EBITDA margin1 of 12.7% remained historically strong Strong cash flow from operating activities of $900 million, equal to 89% of core EBITDA2 Significant progress on strategic initiatives • Realignment of operating segments to support execution of strategy • Growing penetration of high margin proprietary solutions • Continued ramp up of Arizona 2, several merchant product families commissioned • Key milestones reached in construction of Steel West Virginia Cash distributions to shareholders reached $261.8 million, up 48% compared to FY 2023 Q4 FY24 Supplemental Slides October 17, 2024 [1] Core EBITDA and core EBITDA margin are non-GAAP financial measures. For definitions and reconciliations of non-GAAP financial measures to the most directly comparable GAAP financial measures, see the appendix to this document. [2] Calculated by dividing cash flow from operating activities ($900 million) by core EBITDA $1,009 million) $119MQ3 Net Earnings $1.02Q3 Diluted EPS $256MQ3 Core EBITDA1 12.3%Q3 Core EBITDA Margin1 11.3%Last 12 Months ROIC1 $52M Fiscal Year 2024 Accomplishments

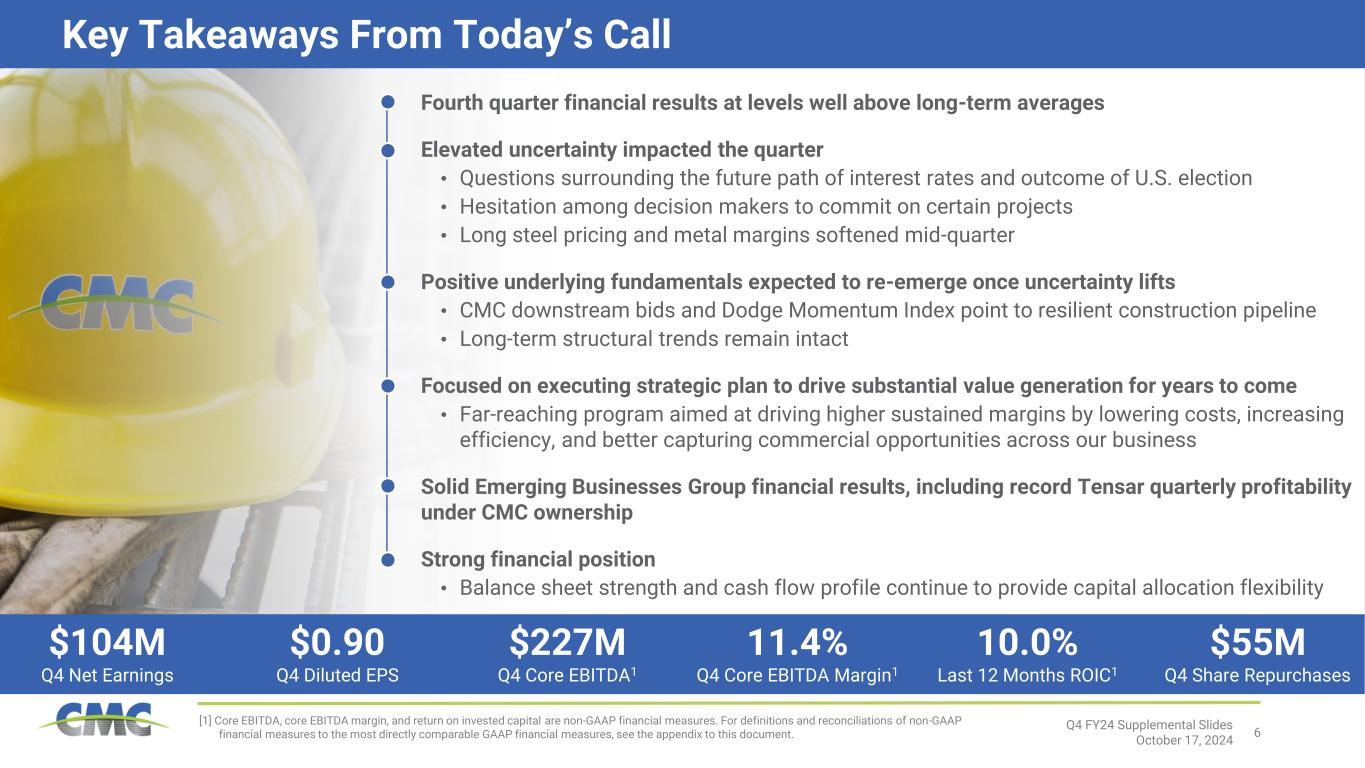

6 Fourth quarter financial results at levels well above long-term averages Elevated uncertainty impacted the quarter • Questions surrounding the future path of interest rates and outcome of U.S. election • Hesitation among decision makers to commit on certain projects • Long steel pricing and metal margins softened mid-quarter Positive underlying fundamentals expected to re-emerge once uncertainty lifts • CMC downstream bids and Dodge Momentum Index point to resilient construction pipeline • Long-term structural trends remain intact Focused on executing strategic plan to drive substantial value generation for years to come • Far-reaching program aimed at driving higher sustained margins by lowering costs, increasing efficiency, and better capturing commercial opportunities across our business Solid Emerging Businesses Group financial results, including record Tensar quarterly profitability under CMC ownership Strong financial position • Balance sheet strength and cash flow profile continue to provide capital allocation flexibility Q4 FY24 Supplemental Slides October 17, 2024 [1] Core EBITDA, core EBITDA margin, and return on invested capital are non-GAAP financial measures. For definitions and reconciliations of non-GAAP financial measures to the most directly comparable GAAP financial measures, see the appendix to this document. $104M Q4 Net Earnings $0.90 Q4 Diluted EPS $227M Q4 Core EBITDA1 11.4% Q4 Core EBITDA Margin1 10.0% Last 12 Months ROIC1 $55M Q4 Share Repurchases Key Takeaways From Today’s Call

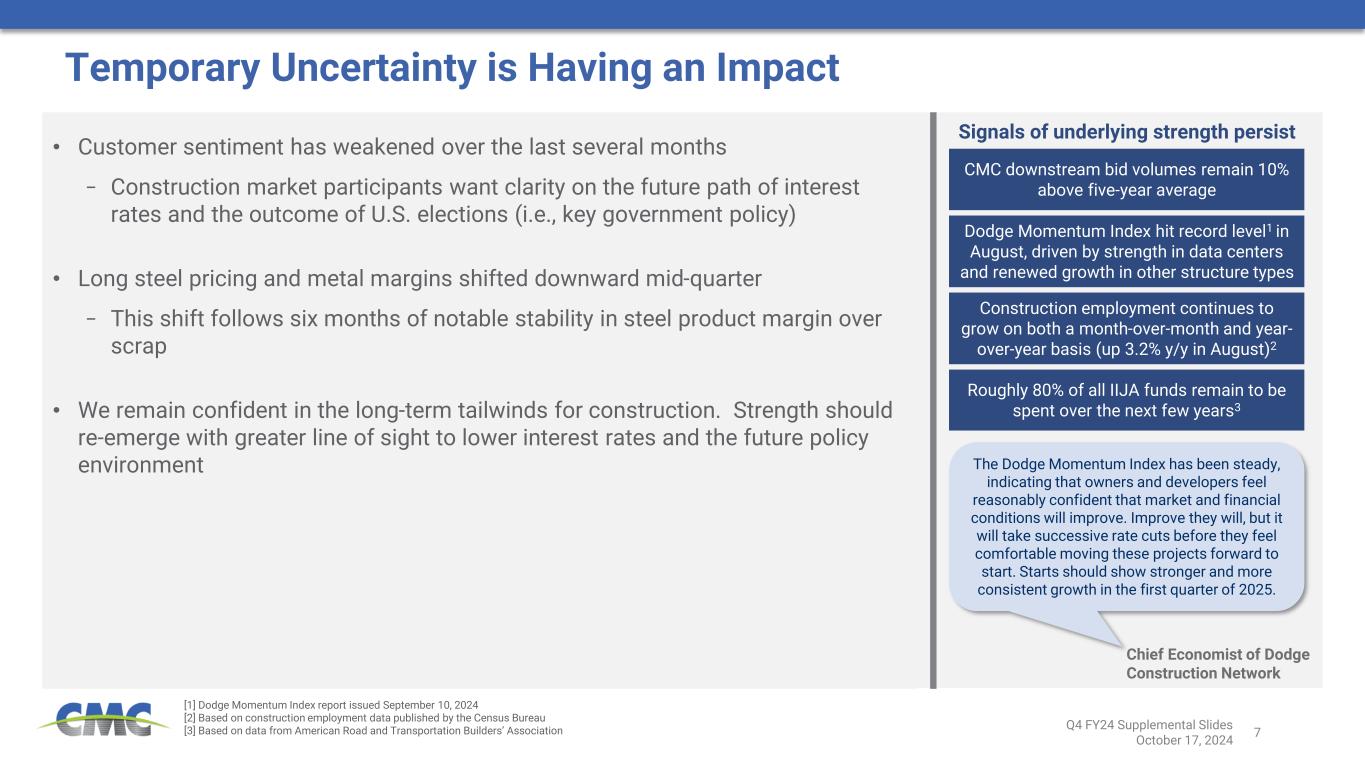

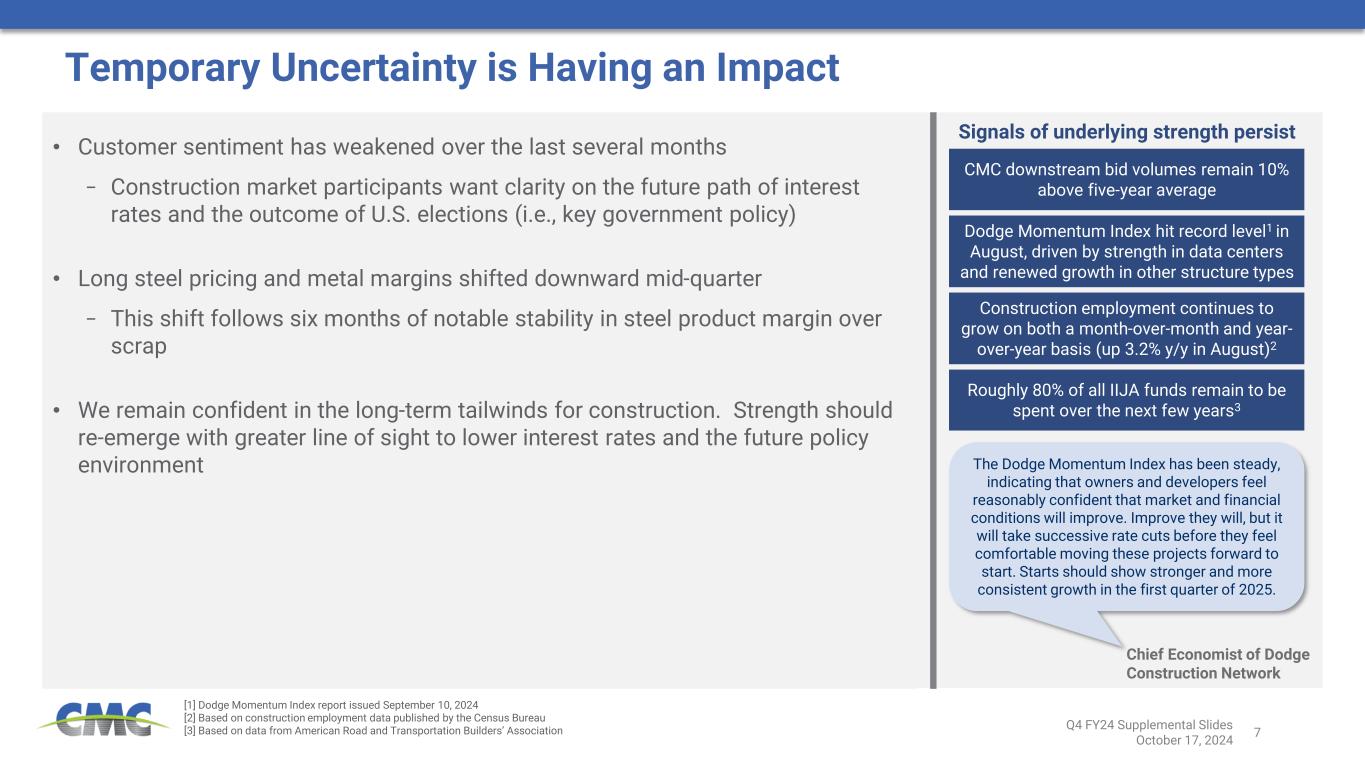

7 Temporary Uncertainty is Having an Impact • Customer sentiment has weakened over the last several months − Construction market participants want clarity on the future path of interest rates and the outcome of U.S. elections (i.e., key government policy) • Long steel pricing and metal margins shifted downward mid-quarter − This shift follows six months of notable stability in steel product margin over scrap • We remain confident in the long-term tailwinds for construction. Strength should re-emerge with greater line of sight to lower interest rates and the future policy environment CMC downstream bid volumes remain 10% above five-year average Dodge Momentum Index hit record level1 in August, driven by strength in data centers and renewed growth in other structure types Construction employment continues to grow on both a month-over-month and year- over-year basis (up 3.2% y/y in August)2 Signals of underlying strength persist [1] Dodge Momentum Index report issued September 10, 2024 [2] Based on construction employment data published by the Census Bureau [3] Based on data from American Road and Transportation Builders’ Association Roughly 80% of all IIJA funds remain to be spent over the next few years3 The Dodge Momentum Index has been steady, indicating that owners and developers feel reasonably confident that market and financial conditions will improve. Improve they will, but it will take successive rate cuts before they feel comfortable moving these projects forward to start. Starts should show stronger and more consistent growth in the first quarter of 2025. Chief Economist of Dodge Construction Network Q4 FY24 Supplemental Slides October 17, 2024

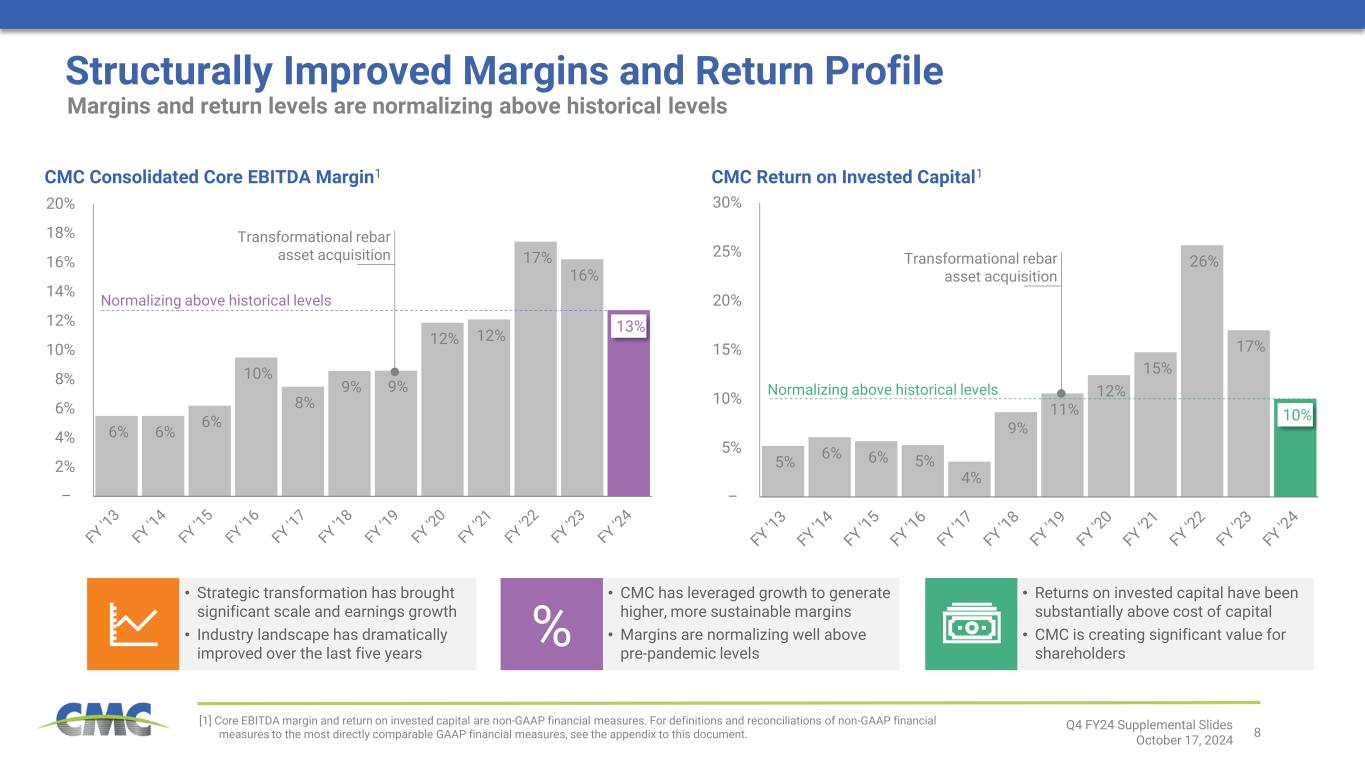

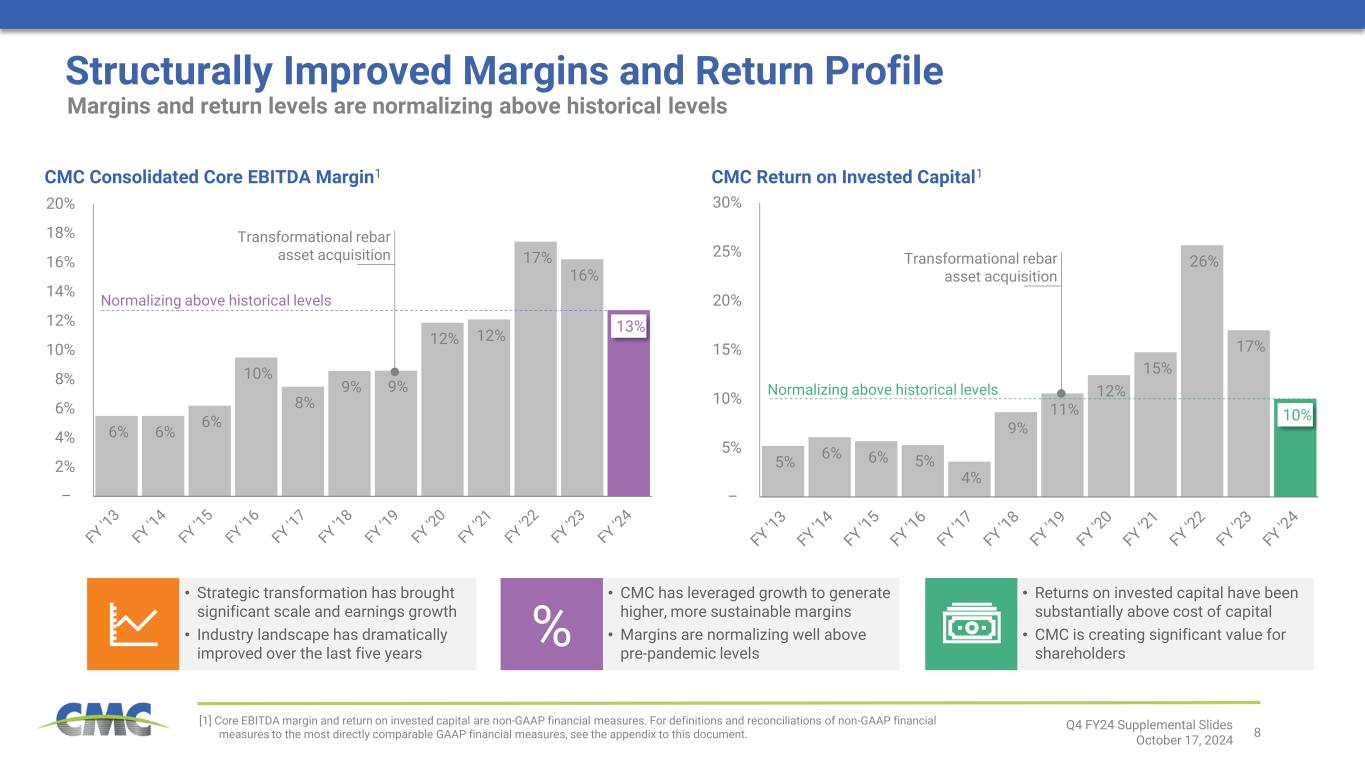

8 6% 6% 6% 10% 8% 9% 9% 12% 12% 17% 16% 13% – 2% 4% 6% 8% 10% 12% 14% 16% 18% 20% • Strategic transformation has brought significant scale and earnings growth • Industry landscape has dramatically improved over the last five years • CMC has leveraged growth to generate higher, more sustainable margins • Margins are normalizing well above pre-pandemic levels • Returns on invested capital have been substantially above cost of capital • CMC is creating significant value for shareholders Structurally Improved Margins and Return Profile 5% 6% 6% 5% 4% 9% 11% 12% 15% 26% 17% 10% – 5% 10% 15% 20% 25% 30% % CMC Consolidated Core EBITDA Margin1 CMC Return on Invested Capital1 Normalizing above historical levels Normalizing above historical levels Margins and return levels are normalizing above historical levels [1] Core EBITDA margin and return on invested capital are non-GAAP financial measures. For definitions and reconciliations of non-GAAP financial measures to the most directly comparable GAAP financial measures, see the appendix to this document. Q4 FY24 Supplemental Slides October 17, 2024 Transformational rebar asset acquisition Transformational rebar asset acquisition

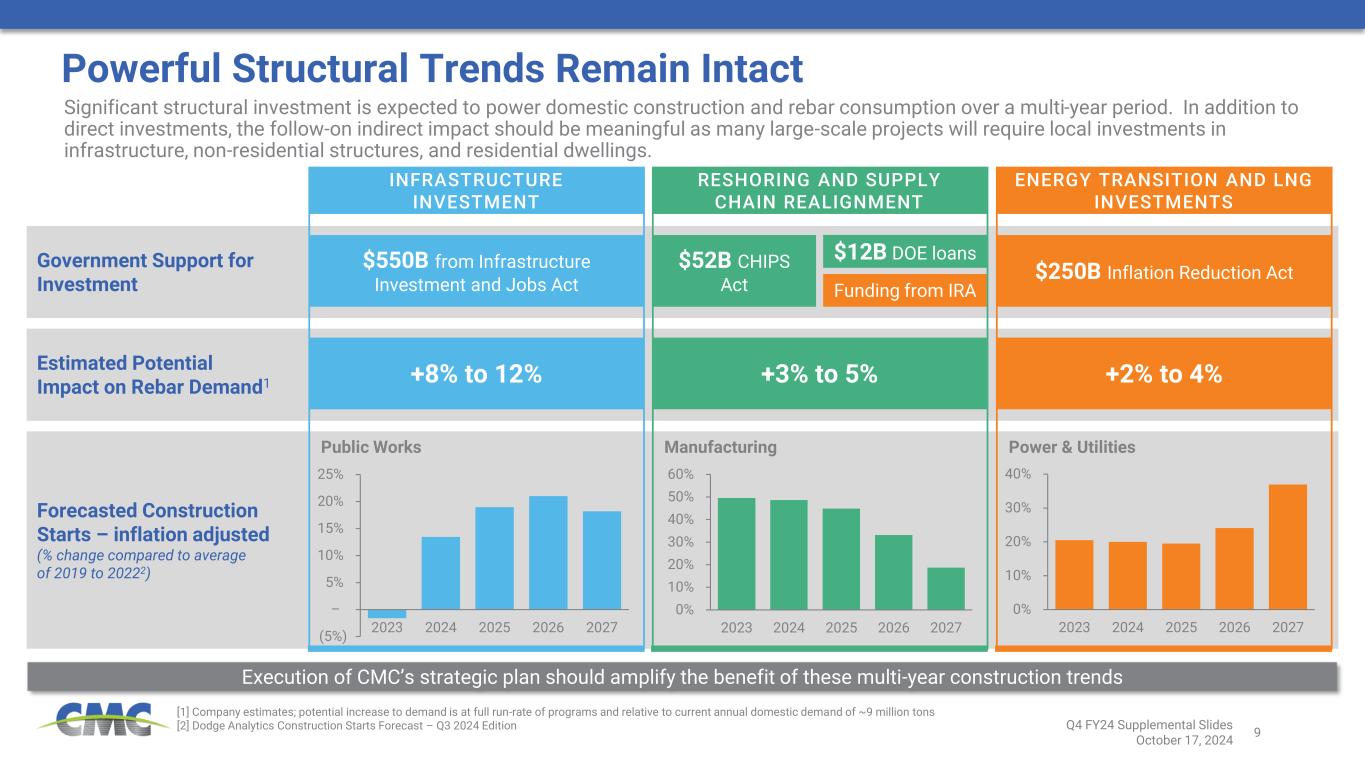

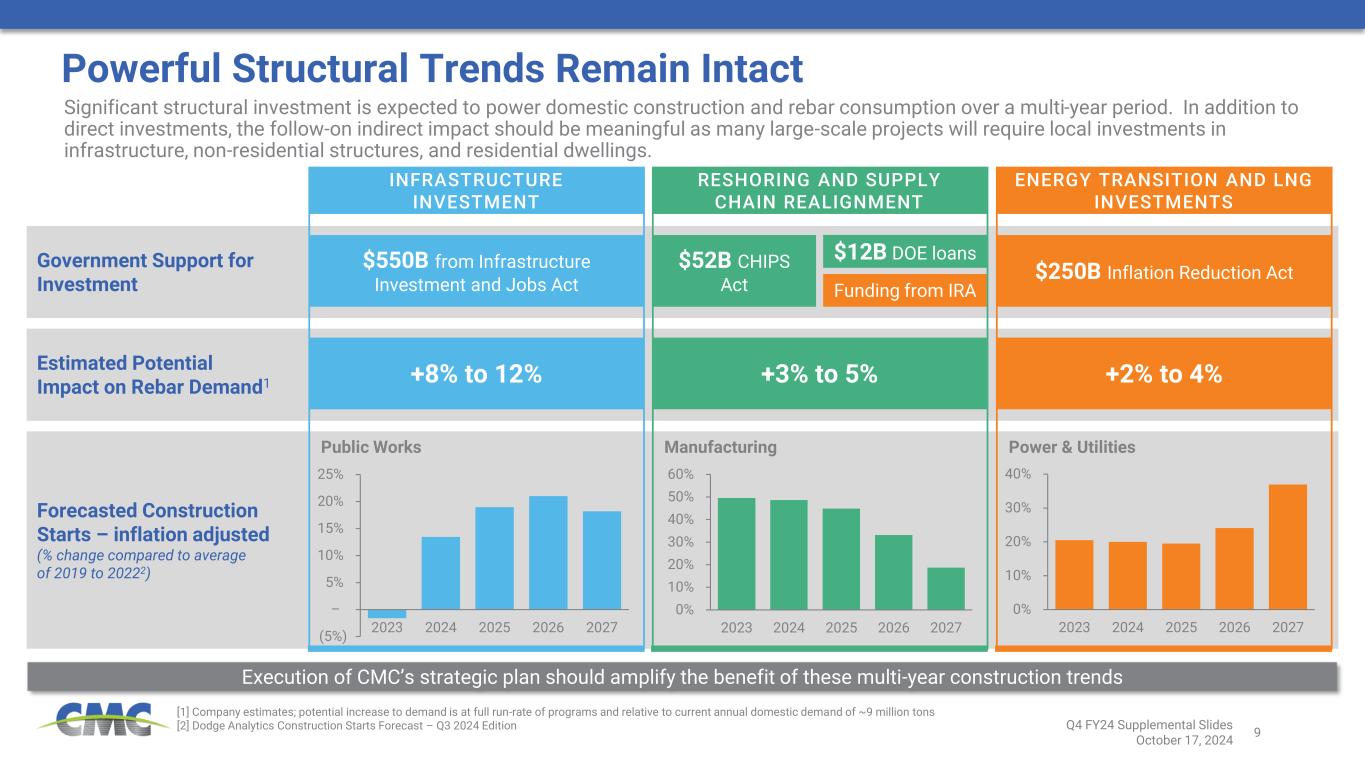

9 Forecasted Construction Starts – inflation adjusted (% change compared to average of 2019 to 20222) 0% 10% 20% 30% 40% 2023 2024 2025 2026 2027 0% 10% 20% 30% 40% 50% 60% 2023 2024 2025 2026 2027 (5%) – 5% 10% 15% 20% 25% 2023 2024 2025 2026 2027 Estimated Potential Impact on Rebar Demand1 Government Support for Investment Powerful Structural Trends Remain Intact RESHORING AND SUPPLY CHAIN REALIGNMENT ENERGY TRANSITION AND LNG INVESTMENTS Significant structural investment is expected to power domestic construction and rebar consumption over a multi-year period. In addition to direct investments, the follow-on indirect impact should be meaningful as many large-scale projects will require local investments in infrastructure, non-residential structures, and residential dwellings. [1] Company estimates; potential increase to demand is at full run-rate of programs and relative to current annual domestic demand of ~9 million tons [2] Dodge Analytics Construction Starts Forecast – Q3 2024 Edition INFRASTRUCTURE INVESTMENT $550B from Infrastructure Investment and Jobs Act $52B CHIPS Act $250B Inflation Reduction Act $12B DOE loans Funding from IRA Q4 FY24 Supplemental Slides October 17, 2024 +8% to 12% +3% to 5% +2% to 4% Public Works Manufacturing Power & Utilities Execution of CMC’s strategic plan should amplify the benefit of these multi-year construction trends

10 The Path Ahead – Running and Growing a Great Business Q4 FY24 Supplemental Slides October 17, 2024 • Focus on people to ensure safety and provide talent development opportunities • Enact operational and commercial excellence efforts that span all levels of the enterprise • Drive to achieve sustainably higher, less volatile, through-the-cycle margins Running a Great Business • Successful commissioning of micro mill projects; capture available internal synergies • Investment to support growth in high margin proprietary solutions • Investment in automation and efficiency gains, including to support operational and commercial excellence efforts Value Accretive Organic Growth • Broaden CMC’s commercial portfolio and improve customer value proposition through expansion into adjacent markets • Strengthen existing business through commercial synergies or internal demand pull • Meaningfully extend CMC’s growth runway Capability Enhancing Inorganic Growth Following the strategic transformation of the last decade, CMC is charting the course for its next phase of growth

11 Running a Great Business – Transform, Advance, Grow (TAG) • Every line of business and support function (including corporate) involved in identifying and quantifying opportunities − Ensures clear understanding of potential benefits and challenges − Creates buy-in and sense of ownership − Provides line of sight for execution • Opportunities exist across multiple fronts − Within lines of business, between lines of business, and between lines of business and central support • Execution to occur in multiple phases to ensure adequate organizational resources, progress tracking, and focus on success − Currently >20 active initiatives; >50 in backlog S e ve ra l L a ye rs I n to O rg a n iz a ti o n Every Line of Business and Support Function Scope: Touches every part of the business Goal: Permanently improve performance of the business • Higher through-the-cycle margins through lower costs, increased efficiencies, and capturing commercial opportunities across CMC • Reduced working capital needs at any point in the cycle Financial • Foster a culture of continuous improvement • Take an already collaborative culture to the next level • Methodical approach to identifying, communicating, and tracking results Culture / Habits Example 1: Melt shop yield improvements Mill 1 Mill 2 Mill 3 Mill 4 Mill 5 Mill 6 Mill 7 Mill 8 Yield By Melt Shop • Benchmark across facilities and identify performance gaps and root causes • Identify best demonstrated practices among mill footprint • Quantify opportunity • Implement cross-functional team to execute improvement program and track progress against targets Example 2: Enhanced logistics efficiencies Mill Delivery Lanes • CMC incurs over $450 million in freight costs annually for deliveries covering nearly 80 million miles traveled • Significant opportunities exist to: − Shorten delivery routes from mill to customer (i.e., customer served by closest mill) − Offset outbound cost through effective backhauls − Better utilize freight miles by ensuring loads weighed out at legal limit − Optimize mix of transportation mode (e.g., road to rail) Q4 FY24 Supplemental Slides October 17, 2024

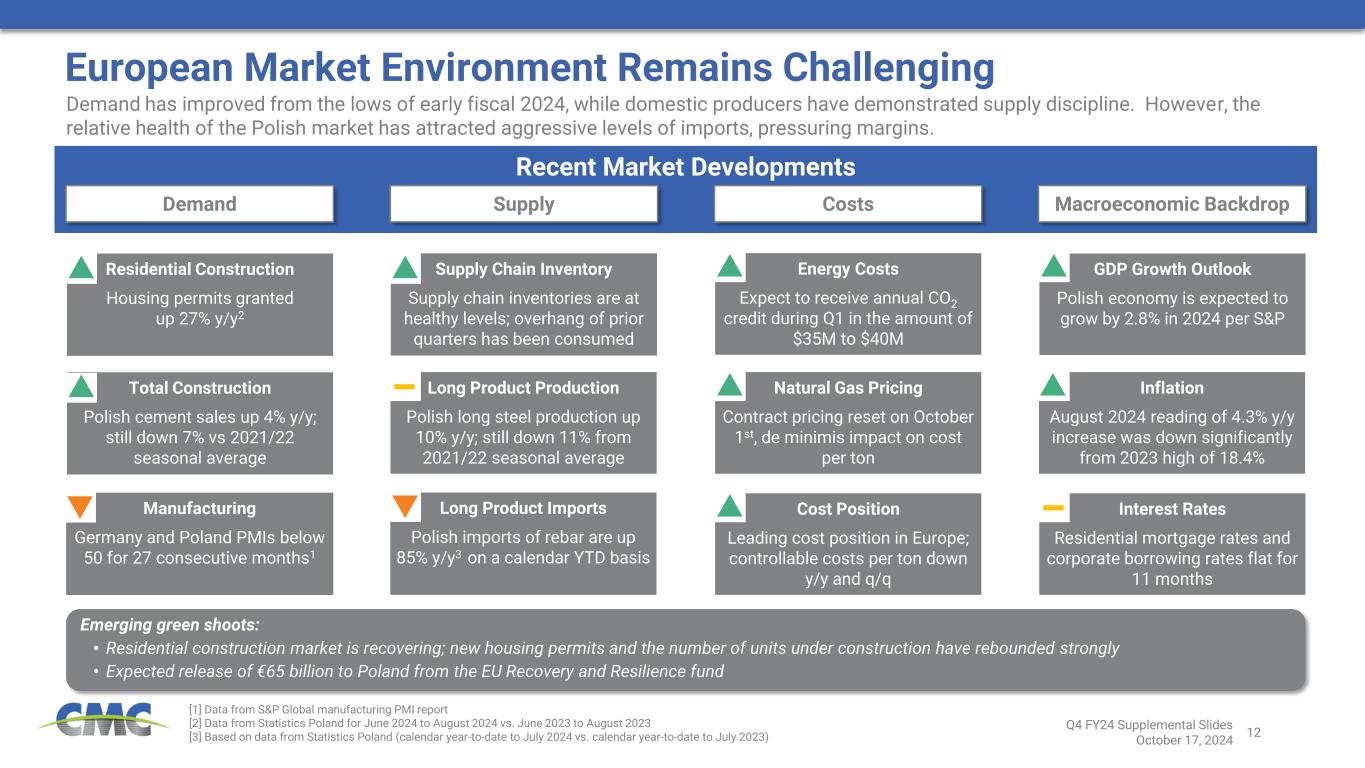

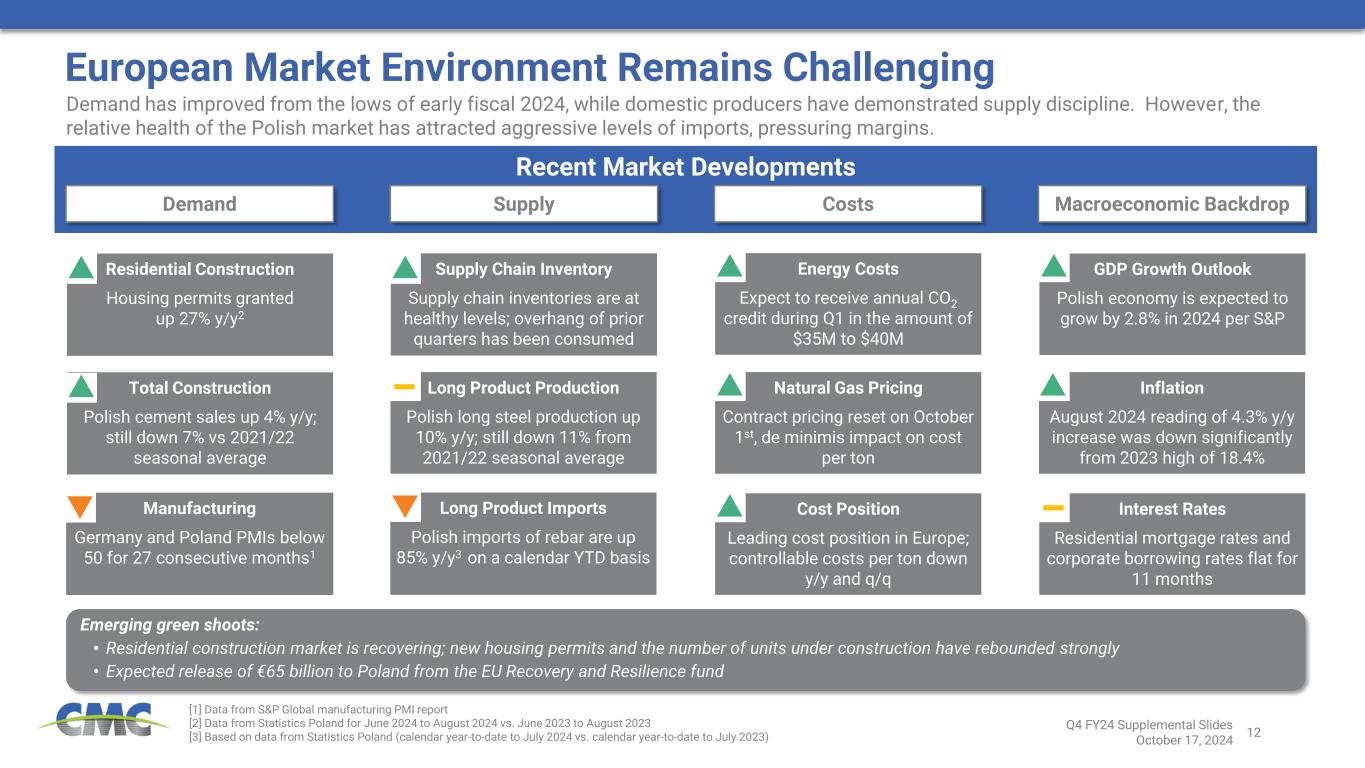

12 GDP Growth Outlook Polish economy is expected to grow by 2.8% in 2024 per S&P Recent Market Developments European Market Environment Remains Challenging [1] Data from S&P Global manufacturing PMI report [2] Data from Statistics Poland for June 2024 to August 2024 vs. June 2023 to August 2023 [3] Based on data from Statistics Poland (calendar year-to-date to July 2024 vs. calendar year-to-date to July 2023) Emerging green shoots: • Residential construction market is recovering; new housing permits and the number of units under construction have rebounded strongly • Expected release of €65 billion to Poland from the EU Recovery and Resilience fund Demand has improved from the lows of early fiscal 2024, while domestic producers have demonstrated supply discipline. However, the relative health of the Polish market has attracted aggressive levels of imports, pressuring margins. Demand Supply Costs Macroeconomic Backdrop Manufacturing Germany and Poland PMIs below 50 for 27 consecutive months1 Energy Costs Expect to receive annual CO2 credit during Q1 in the amount of $35M to $40M Natural Gas Pricing Contract pricing reset on October 1st, de minimis impact on cost per ton Cost Position Leading cost position in Europe; controllable costs per ton down y/y and q/q Inflation August 2024 reading of 4.3% y/y increase was down significantly from 2023 high of 18.4% Q4 FY24 Supplemental Slides October 17, 2024 Residential Construction Housing permits granted up 27% y/y2 Long Product Imports Polish imports of rebar are up 85% y/y3 on a calendar YTD basis Total Construction Polish cement sales up 4% y/y; still down 7% vs 2021/22 seasonal average Long Product Production Polish long steel production up 10% y/y; still down 11% from 2021/22 seasonal average Interest Rates Residential mortgage rates and corporate borrowing rates flat for 11 months Supply Chain Inventory Supply chain inventories are at healthy levels; overhang of prior quarters has been consumed

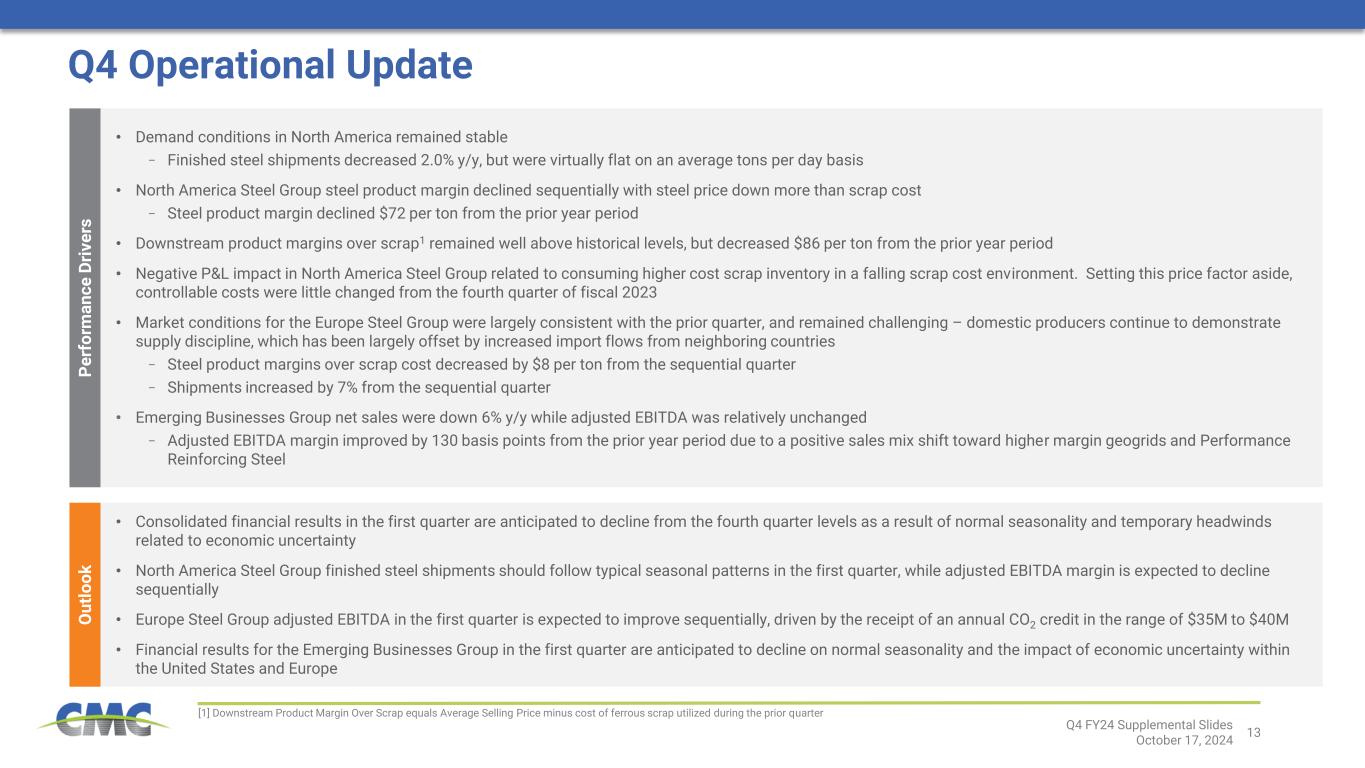

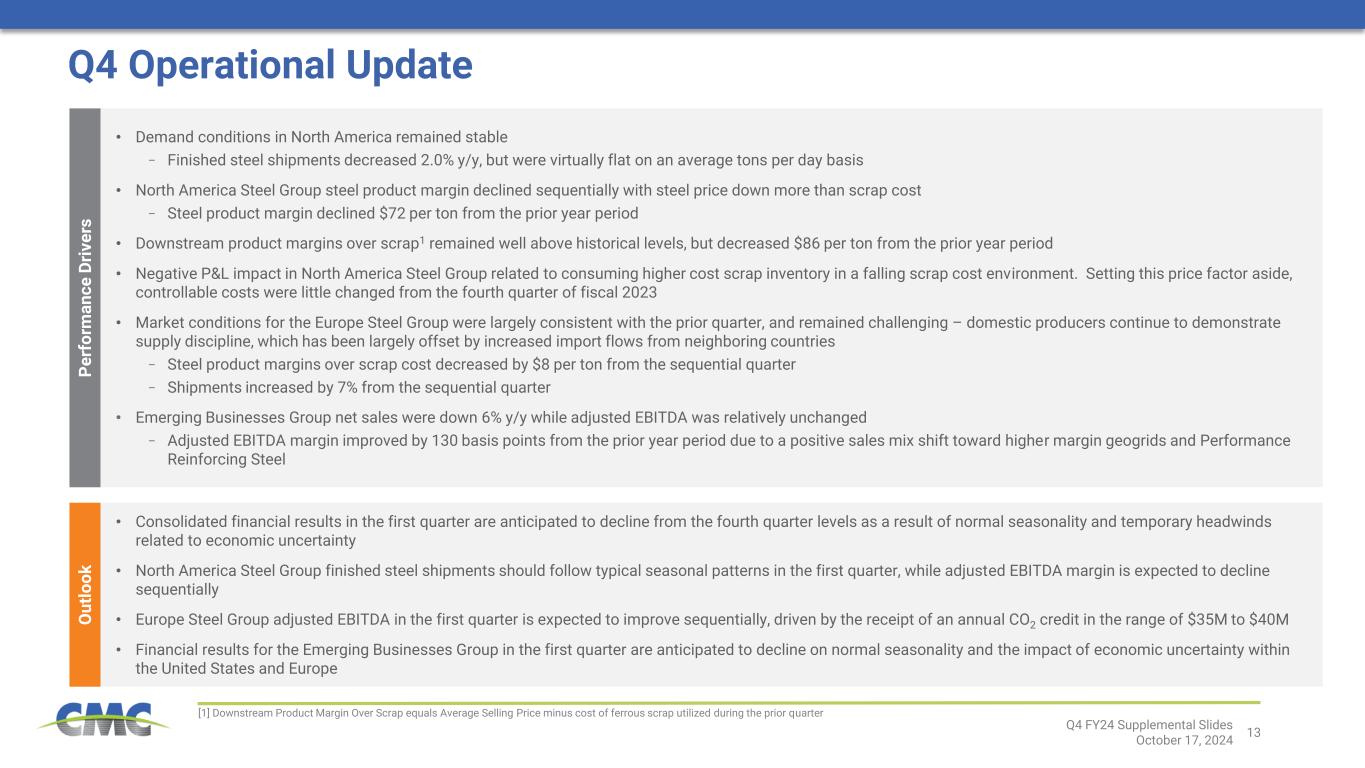

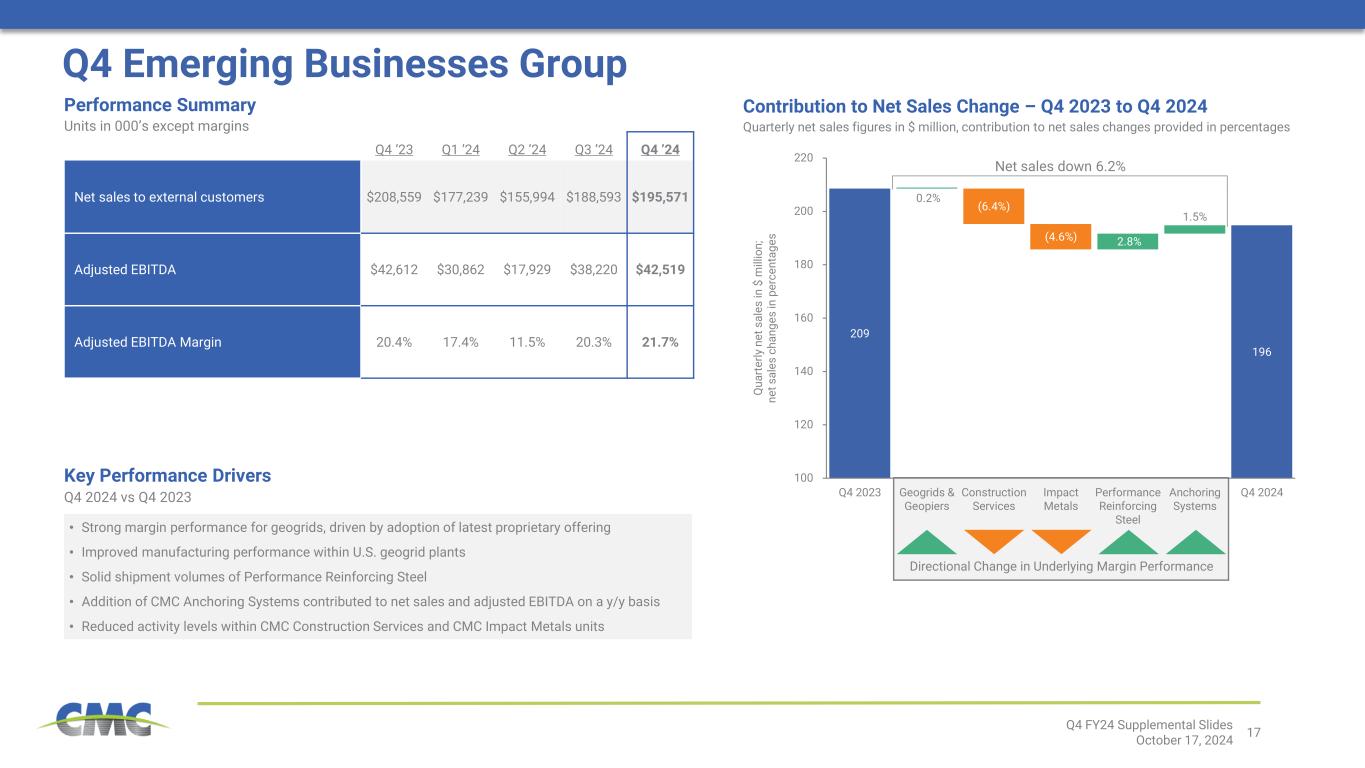

13 • Consolidated financial results in the first quarter are anticipated to decline from the fourth quarter levels as a result of normal seasonality and temporary headwinds related to economic uncertainty • North America Steel Group finished steel shipments should follow typical seasonal patterns in the first quarter, while adjusted EBITDA margin is expected to decline sequentially • Europe Steel Group adjusted EBITDA in the first quarter is expected to improve sequentially, driven by the receipt of an annual CO2 credit in the range of $35M to $40M • Financial results for the Emerging Businesses Group in the first quarter are anticipated to decline on normal seasonality and the impact of economic uncertainty within the United States and Europe • Demand conditions in North America remained stable − Finished steel shipments decreased 2.0% y/y, but were virtually flat on an average tons per day basis • North America Steel Group steel product margin declined sequentially with steel price down more than scrap cost − Steel product margin declined $72 per ton from the prior year period • Downstream product margins over scrap1 remained well above historical levels, but decreased $86 per ton from the prior year period • Negative P&L impact in North America Steel Group related to consuming higher cost scrap inventory in a falling scrap cost environment. Setting this price factor aside, controllable costs were little changed from the fourth quarter of fiscal 2023 • Market conditions for the Europe Steel Group were largely consistent with the prior quarter, and remained challenging – domestic producers continue to demonstrate supply discipline, which has been largely offset by increased import flows from neighboring countries − Steel product margins over scrap cost decreased by $8 per ton from the sequential quarter − Shipments increased by 7% from the sequential quarter • Emerging Businesses Group net sales were down 6% y/y while adjusted EBITDA was relatively unchanged − Adjusted EBITDA margin improved by 130 basis points from the prior year period due to a positive sales mix shift toward higher margin geogrids and Performance Reinforcing Steel P e rf o rm a n c e D ri v e rs O u tl o o k Q4 Operational Update [1] Downstream Product Margin Over Scrap equals Average Selling Price minus cost of ferrous scrap utilized during the prior quarter Q4 FY24 Supplemental Slides October 17, 2024

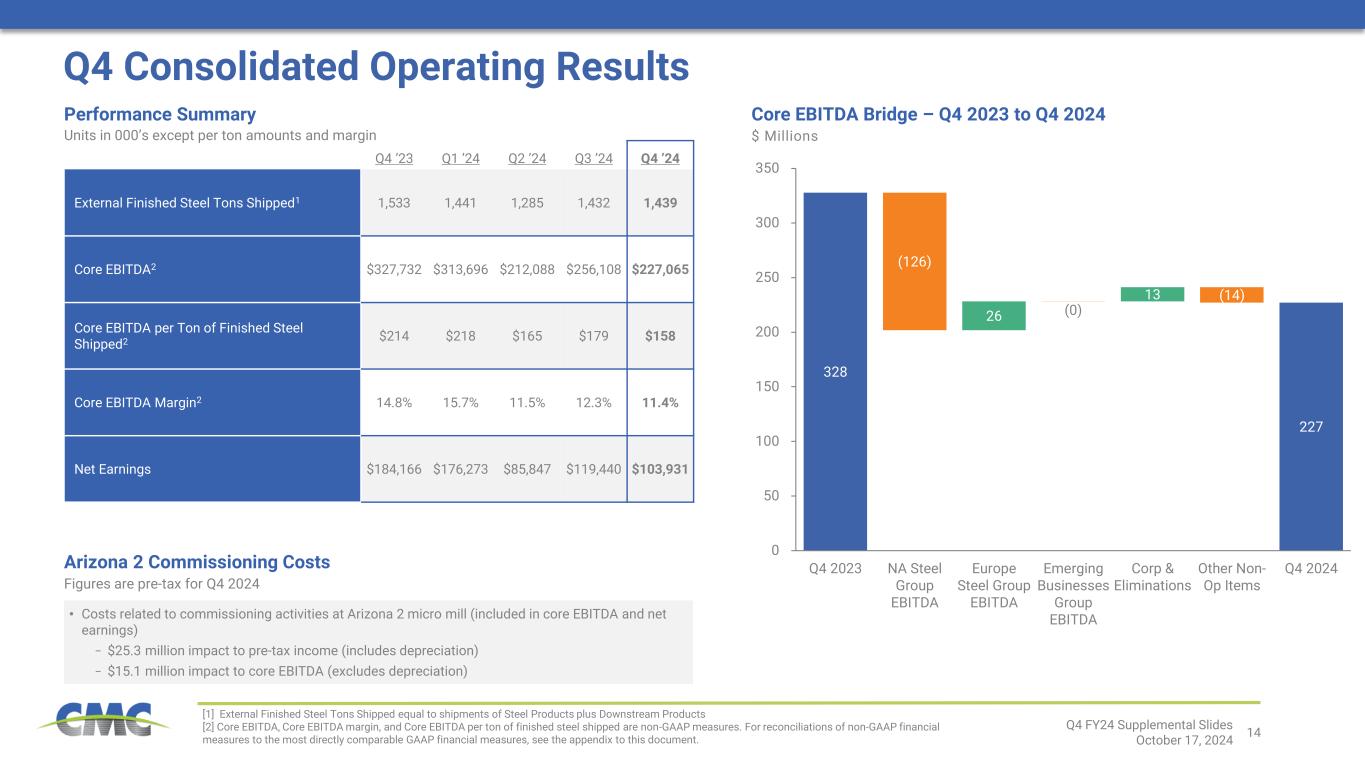

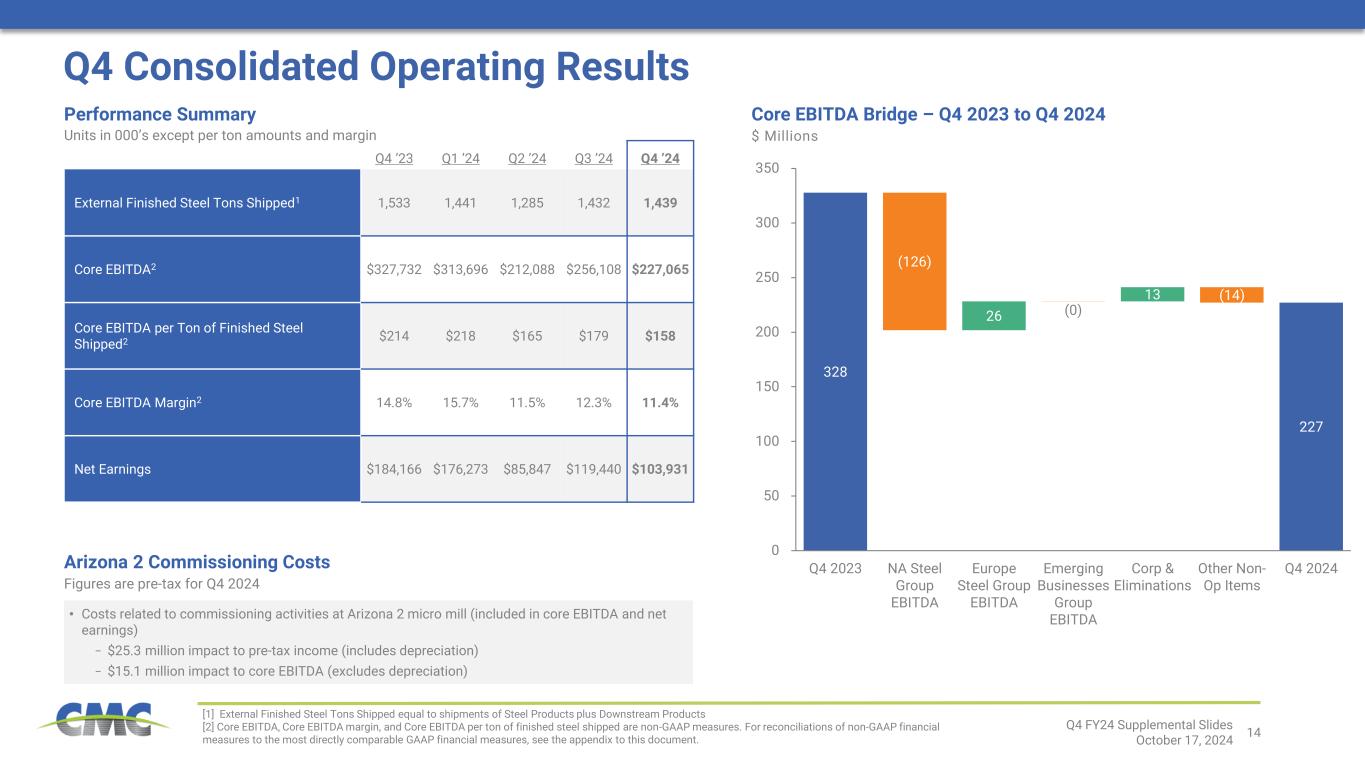

14 328 227 (126) 26 (0) 13 (14) 0 50 100 150 200 250 300 350 Q4 2023 NA Steel Group EBITDA Europe Steel Group EBITDA Emerging Businesses Group EBITDA Corp & Eliminations Other Non- Op Items Q4 2024 Q4 Consolidated Operating Results Q4 ’23 Q1 ’24 Q2 ’24 Q3 ’24 Q4 ’24 External Finished Steel Tons Shipped1 1,533 1,441 1,285 1,432 1,439 Core EBITDA2 $327,732 $313,696 $212,088 $256,108 $227,065 Core EBITDA per Ton of Finished Steel Shipped2 $214 $218 $165 $179 $158 Core EBITDA Margin2 14.8% 15.7% 11.5% 12.3% 11.4% Net Earnings $184,166 $176,273 $85,847 $119,440 $103,931 Performance Summary Units in 000’s except per ton amounts and margin • Costs related to commissioning activities at Arizona 2 micro mill (included in core EBITDA and net earnings) − $25.3 million impact to pre-tax income (includes depreciation) − $15.1 million impact to core EBITDA (excludes depreciation) Arizona 2 Commissioning Costs Figures are pre-tax for Q4 2024 [1] External Finished Steel Tons Shipped equal to shipments of Steel Products plus Downstream Products [2] Core EBITDA, Core EBITDA margin, and Core EBITDA per ton of finished steel shipped are non-GAAP measures. For reconciliations of non-GAAP financial measures to the most directly comparable GAAP financial measures, see the appendix to this document. Core EBITDA Bridge – Q4 2023 to Q4 2024 $ Millions Q4 FY24 Supplemental Slides October 17, 2024

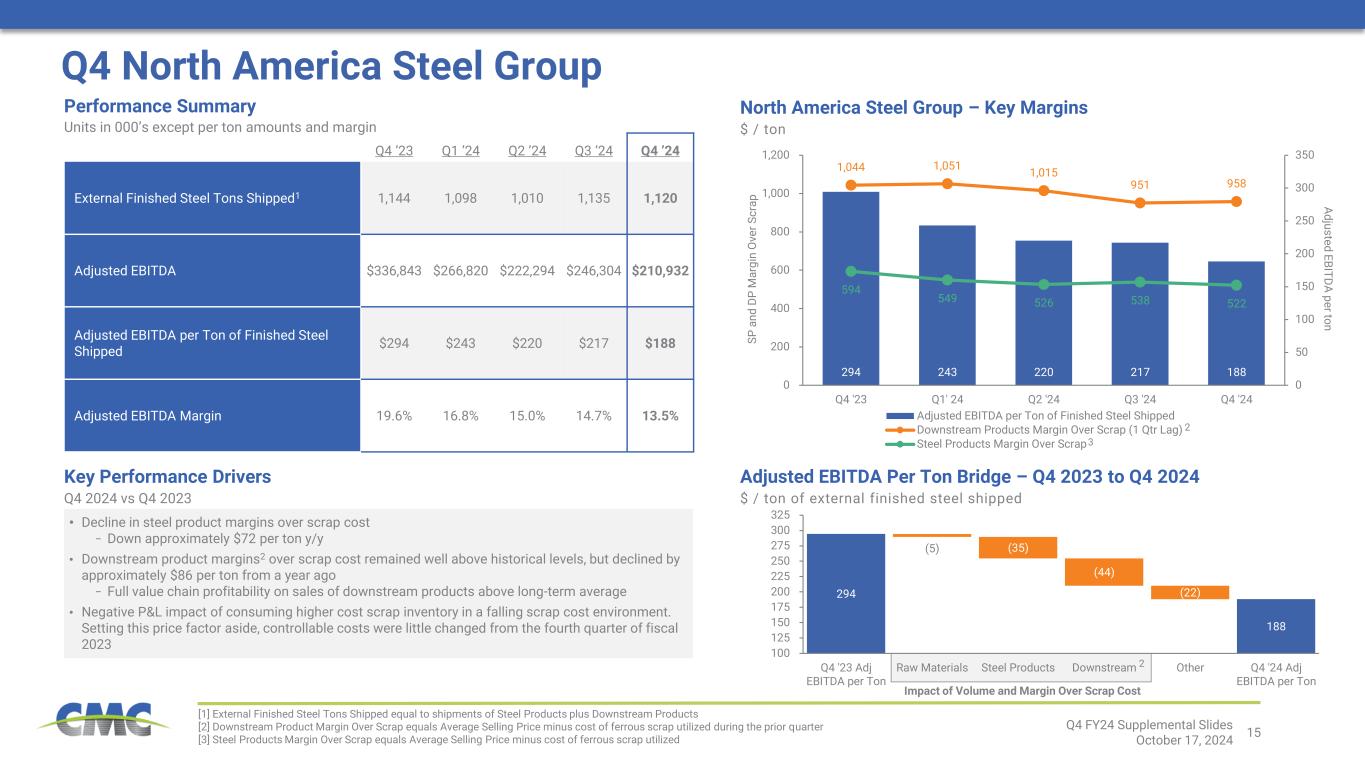

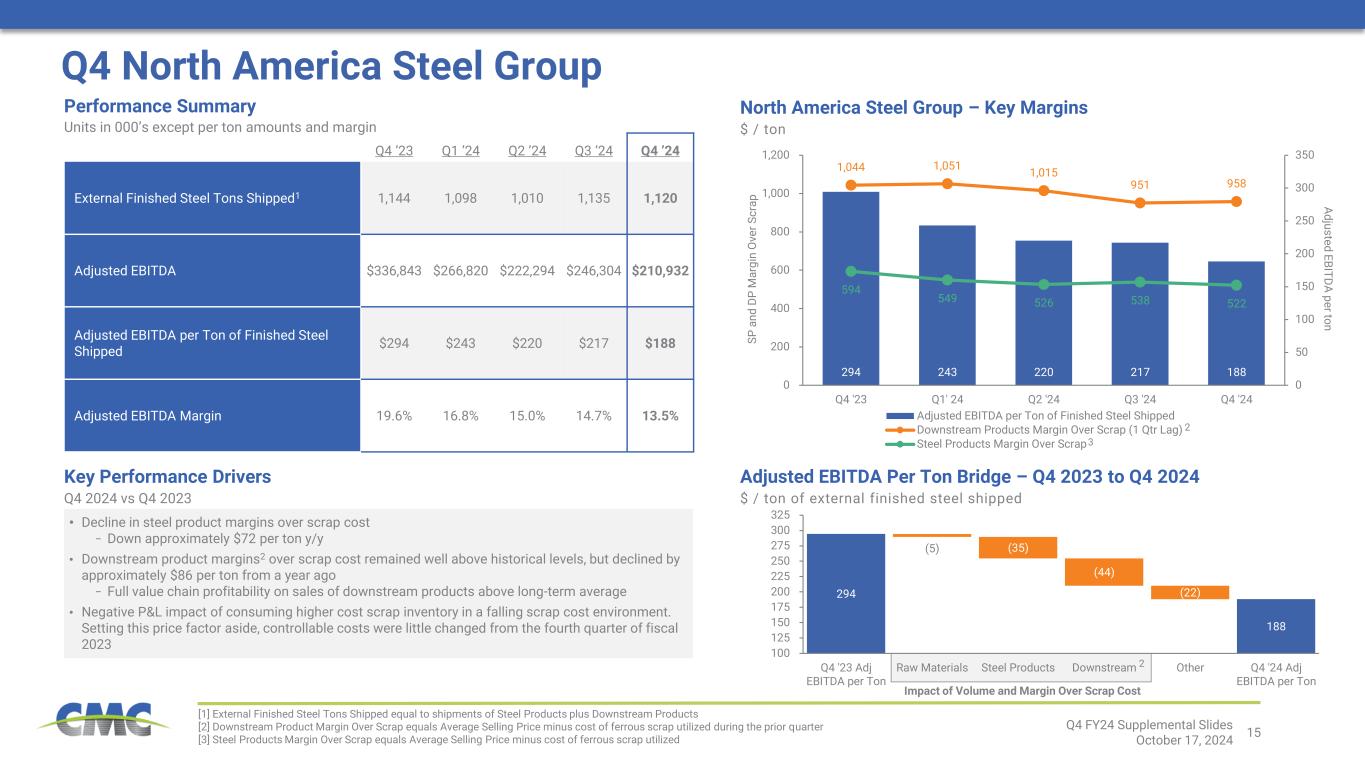

15 294 188 (5) (35) (44) (22) 100 125 150 175 200 225 250 275 300 325 Q4 '23 Adj EBITDA per Ton Raw Materials Steel Products Downstream Other Q4 '24 Adj EBITDA per Ton 294 243 220 217 188 1,044 1,051 1,015 951 958 594 549 526 538 522 0 50 100 150 200 250 300 350 0 200 400 600 800 1,000 1,200 Q4 '23 Q1' 24 Q2 '24 Q3 '24 Q4 '24 Adjusted EBITDA per Ton of Finished Steel Shipped Downstream Products Margin Over Scrap (1 Qtr Lag) Steel Products Margin Over Scrap Key Performance Drivers Q4 2024 vs Q4 2023 Q4 North America Steel Group Q4 ’23 Q1 ’24 Q2 ’24 Q3 ’24 Q4 ’24 External Finished Steel Tons Shipped1 1,144 1,098 1,010 1,135 1,120 Adjusted EBITDA $336,843 $266,820 $222,294 $246,304 $210,932 Adjusted EBITDA per Ton of Finished Steel Shipped $294 $243 $220 $217 $188 Adjusted EBITDA Margin 19.6% 16.8% 15.0% 14.7% 13.5% Performance Summary Units in 000’s except per ton amounts and margin • Decline in steel product margins over scrap cost − Down approximately $72 per ton y/y • Downstream product margins2 over scrap cost remained well above historical levels, but declined by approximately $86 per ton from a year ago − Full value chain profitability on sales of downstream products above long-term average • Negative P&L impact of consuming higher cost scrap inventory in a falling scrap cost environment. Setting this price factor aside, controllable costs were little changed from the fourth quarter of fiscal 2023 [1] External Finished Steel Tons Shipped equal to shipments of Steel Products plus Downstream Products [2] Downstream Product Margin Over Scrap equals Average Selling Price minus cost of ferrous scrap utilized during the prior quarter [3] Steel Products Margin Over Scrap equals Average Selling Price minus cost of ferrous scrap utilized North America Steel Group – Key Margins $ / ton S P a n d D P M a rg in O ve r S c ra p A d ju s te d E B IT D A p e r to n Adjusted EBITDA Per Ton Bridge – Q4 2023 to Q4 2024 $ / ton of external finished steel shipped 2 3 2 Impact of Volume and Margin Over Scrap Cost Q4 FY24 Supplemental Slides October 17, 2024

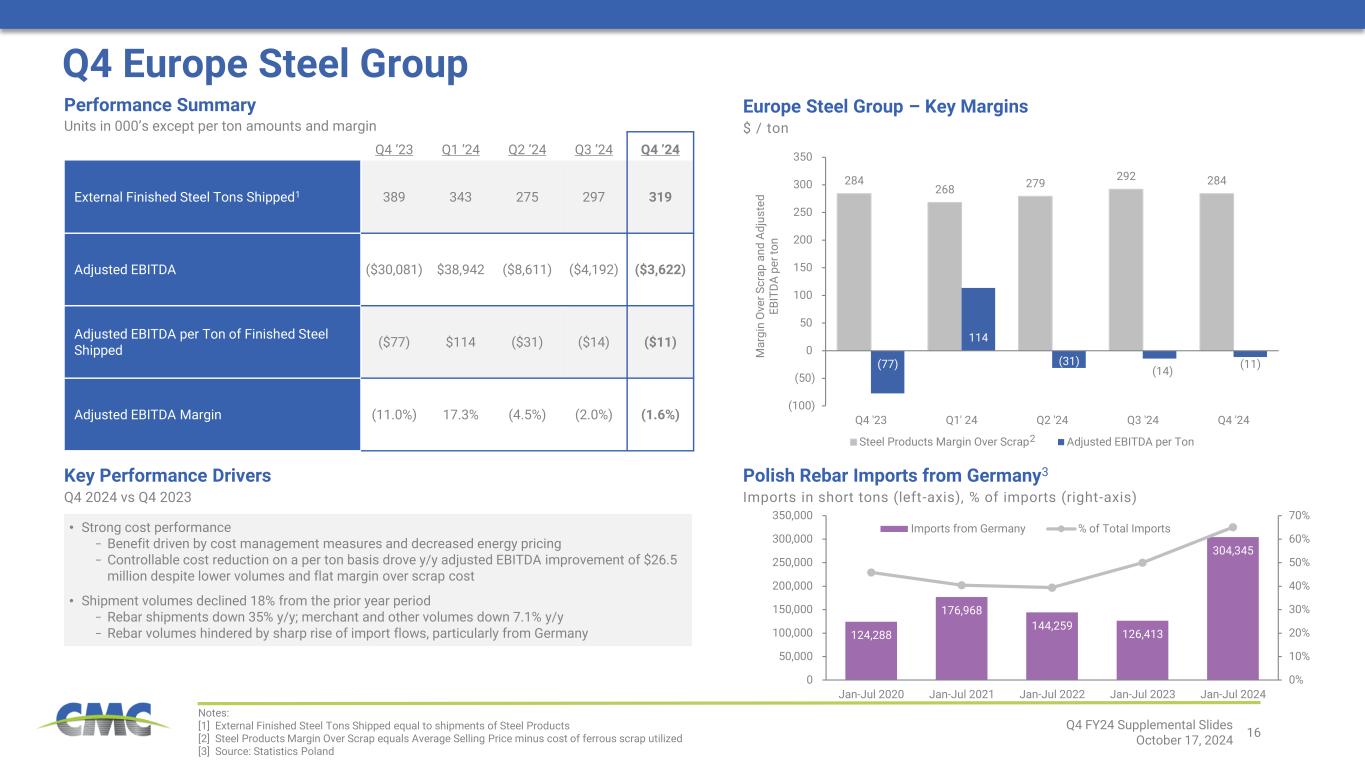

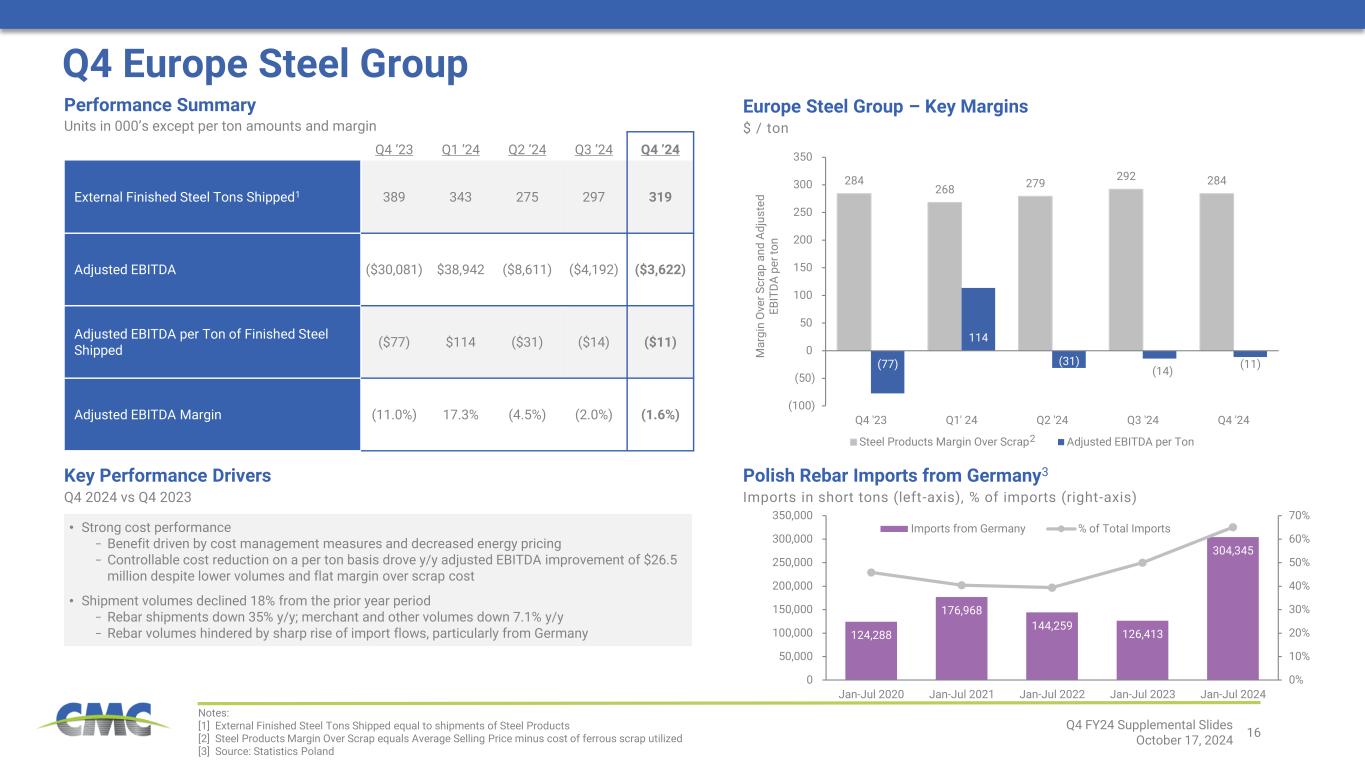

16 124,288 176,968 144,259 126,413 304,345 0% 10% 20% 30% 40% 50% 60% 70% 0 50,000 100,000 150,000 200,000 250,000 300,000 350,000 Jan-Jul 2020 Jan-Jul 2021 Jan-Jul 2022 Jan-Jul 2023 Jan-Jul 2024 Imports from Germany % of Total Imports 284 268 279 292 284 (77) 114 (31) (14) (11) (100) (50) 0 50 100 150 200 250 300 350 Q4 '23 Q1' 24 Q2 '24 Q3 '24 Q4 '24 Steel Products Margin Over Scrap Adjusted EBITDA per Ton Key Performance Drivers Q4 2024 vs Q4 2023 Q4 Europe Steel Group Q4 ’23 Q1 ’24 Q2 ’24 Q3 ’24 Q4 ’24 External Finished Steel Tons Shipped1 389 343 275 297 319 Adjusted EBITDA ($30,081) $38,942 ($8,611) ($4,192) ($3,622) Adjusted EBITDA per Ton of Finished Steel Shipped ($77) $114 ($31) ($14) ($11) Adjusted EBITDA Margin (11.0%) 17.3% (4.5%) (2.0%) (1.6%) Performance Summary Units in 000’s except per ton amounts and margin • Strong cost performance − Benefit driven by cost management measures and decreased energy pricing − Controllable cost reduction on a per ton basis drove y/y adjusted EBITDA improvement of $26.5 million despite lower volumes and flat margin over scrap cost • Shipment volumes declined 18% from the prior year period − Rebar shipments down 35% y/y; merchant and other volumes down 7.1% y/y − Rebar volumes hindered by sharp rise of import flows, particularly from Germany Europe Steel Group – Key Margins $ / ton Polish Rebar Imports from Germany3 Imports in short tons (left-axis), % of imports (right-axis) 2 Notes: [1] External Finished Steel Tons Shipped equal to shipments of Steel Products [2] Steel Products Margin Over Scrap equals Average Selling Price minus cost of ferrous scrap utilized [3] Source: Statistics Poland M a rg in O ve r S c ra p a n d A d ju s te d E B IT D A p e r to n Q4 FY24 Supplemental Slides October 17, 2024

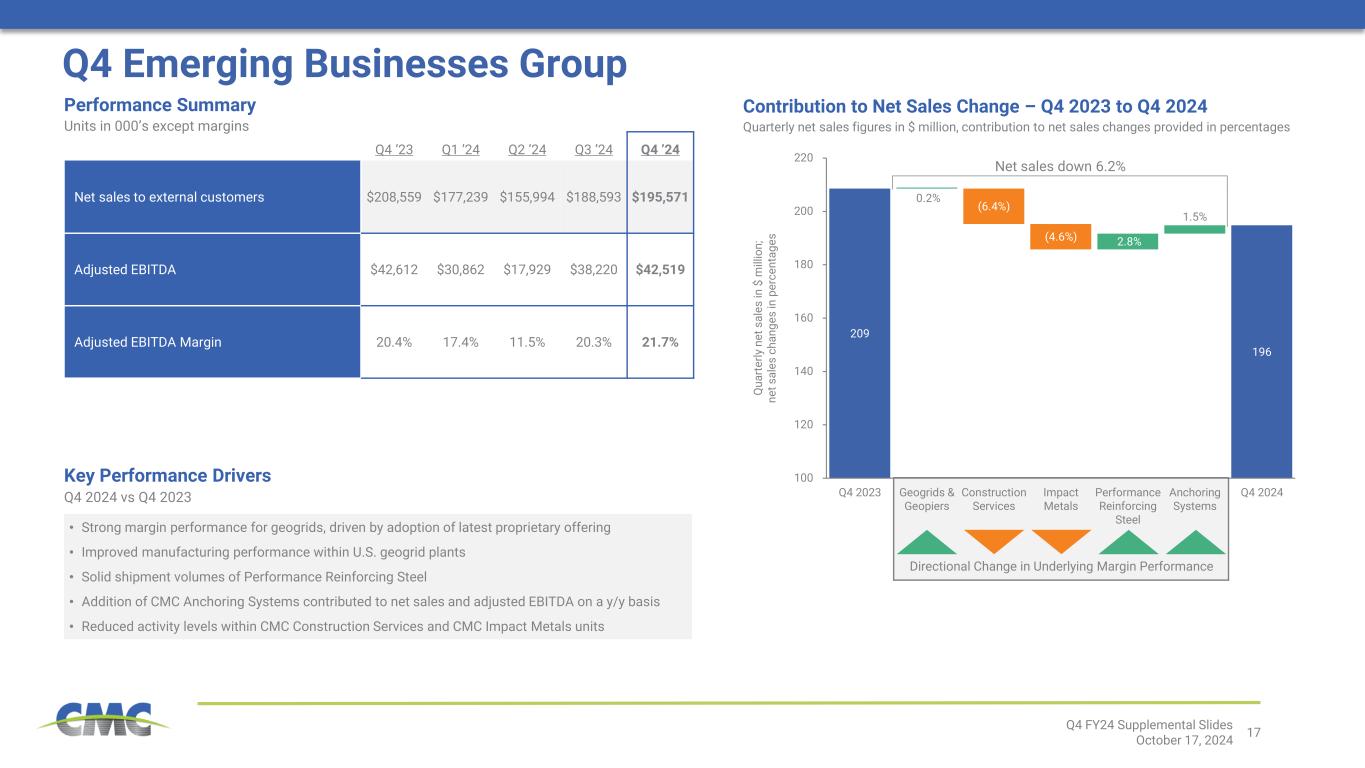

17 209 196 0.2% (6.4%) (4.6%) 2.8% 1.5% 100 120 140 160 180 200 220 Q4 2023 Geogrids & Geopiers Construction Services Impact Metals Performance Reinforcing Steel Anchoring Systems Q4 2024 Key Performance Drivers Q4 2024 vs Q4 2023 Q4 Emerging Businesses Group Q4 ’23 Q1 ’24 Q2 ’24 Q3 ’24 Q4 ’24 Net sales to external customers $208,559 $177,239 $155,994 $188,593 $195,571 Adjusted EBITDA $42,612 $30,862 $17,929 $38,220 $42,519 Adjusted EBITDA Margin 20.4% 17.4% 11.5% 20.3% 21.7% Performance Summary Units in 000’s except margins • Strong margin performance for geogrids, driven by adoption of latest proprietary offering • Improved manufacturing performance within U.S. geogrid plants • Solid shipment volumes of Performance Reinforcing Steel • Addition of CMC Anchoring Systems contributed to net sales and adjusted EBITDA on a y/y basis • Reduced activity levels within CMC Construction Services and CMC Impact Metals units Contribution to Net Sales Change – Q4 2023 to Q4 2024 Quarterly net sales figures in $ million, contribution to net sales changes provided in percentages Q4 FY24 Supplemental Slides October 17, 2024 Q u a rt e rl y n e t s a le s in $ m ill io n ; n e t s a le s c h a n g e s in p e rc e n ta g e s Net sales down 6.2% Directional Change in Underlying Margin Performance

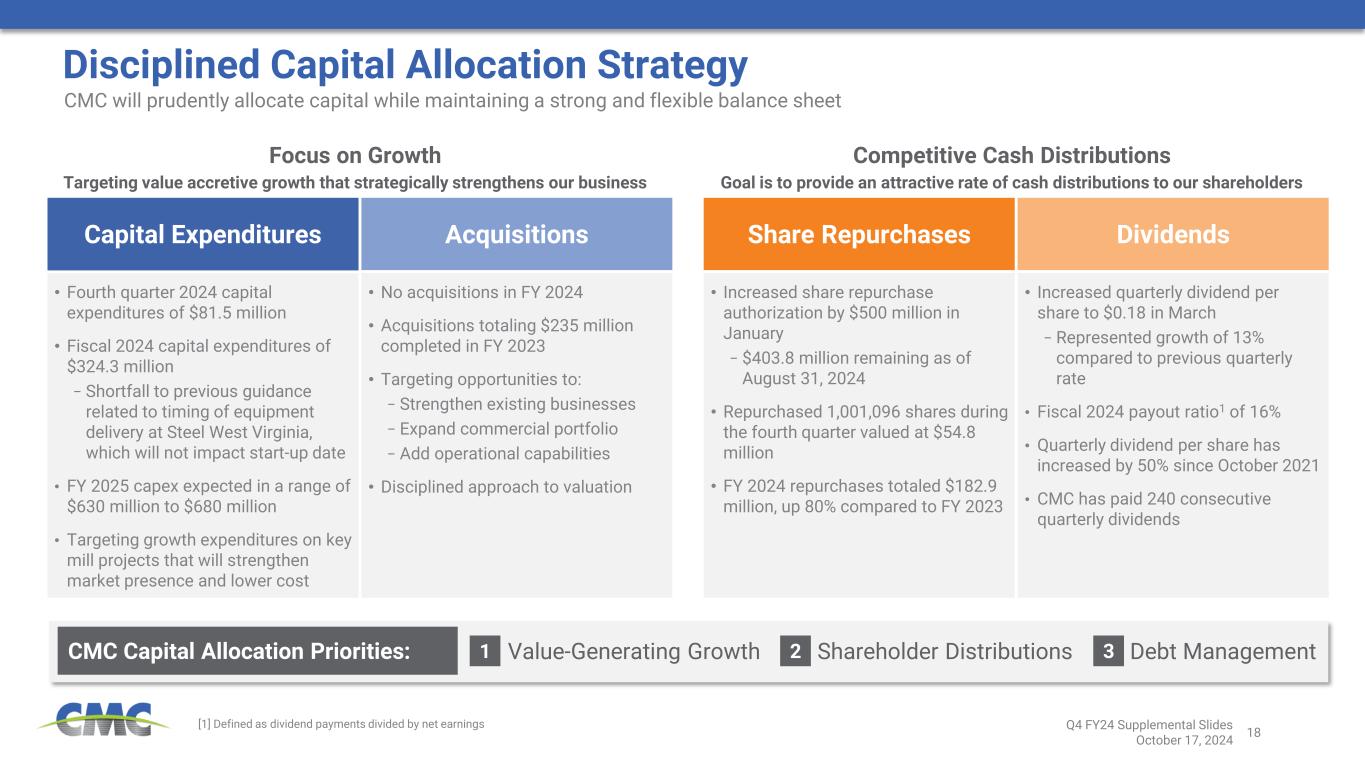

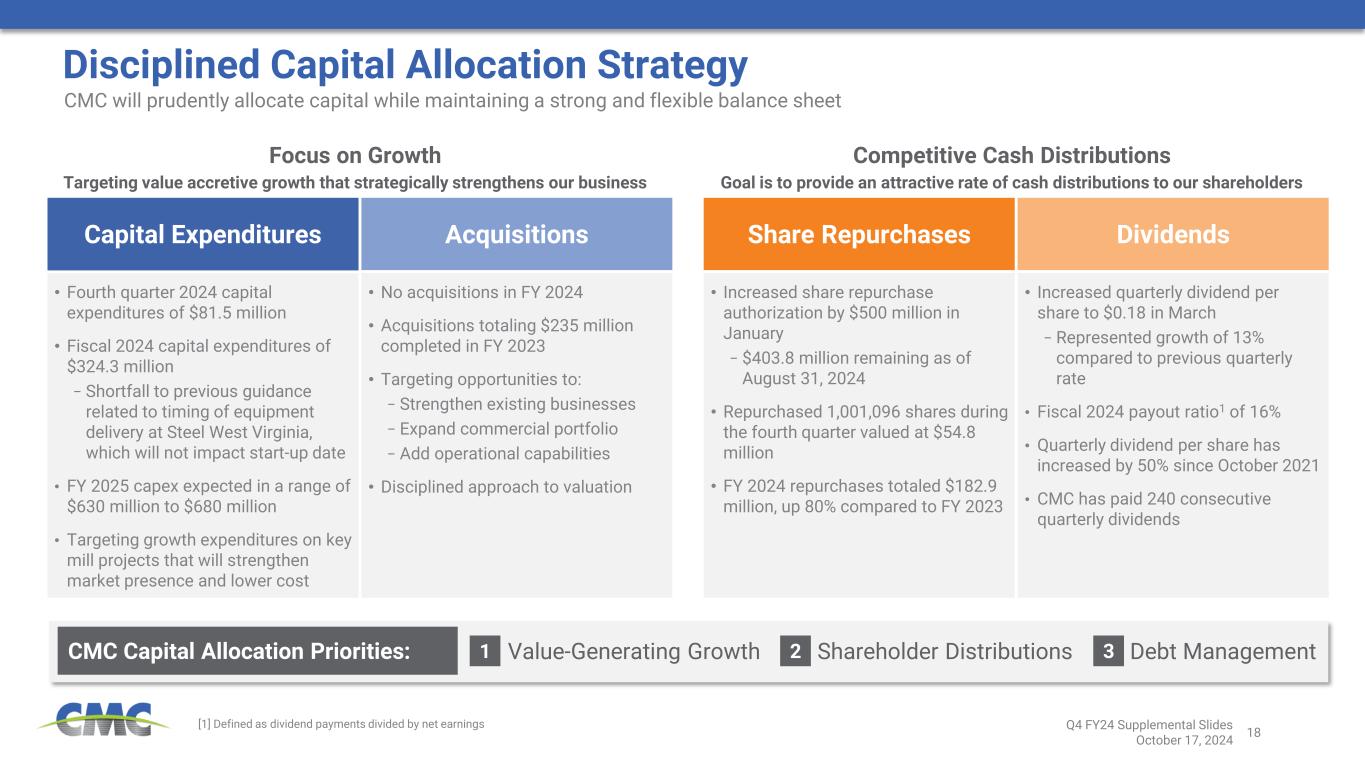

18 • Fourth quarter 2024 capital expenditures of $81.5 million • Fiscal 2024 capital expenditures of $324.3 million − Shortfall to previous guidance related to timing of equipment delivery at Steel West Virginia, which will not impact start-up date • FY 2025 capex expected in a range of $630 million to $680 million • Targeting growth expenditures on key mill projects that will strengthen market presence and lower cost Disciplined Capital Allocation Strategy CMC will prudently allocate capital while maintaining a strong and flexible balance sheet Q4 FY24 Supplemental Slides October 17, 2024 [1] Defined as dividend payments divided by net earnings 2 31 Value-Generating Growth Shareholder Distributions Debt ManagementCMC Capital Allocation Priorities: Capital Expenditures Acquisitions Share Repurchases Dividends • No acquisitions in FY 2024 • Acquisitions totaling $235 million completed in FY 2023 • Targeting opportunities to: − Strengthen existing businesses − Expand commercial portfolio − Add operational capabilities • Disciplined approach to valuation • Increased share repurchase authorization by $500 million in January − $403.8 million remaining as of August 31, 2024 • Repurchased 1,001,096 shares during the fourth quarter valued at $54.8 million • FY 2024 repurchases totaled $182.9 million, up 80% compared to FY 2023 • Increased quarterly dividend per share to $0.18 in March − Represented growth of 13% compared to previous quarterly rate • Fiscal 2024 payout ratio1 of 16% • Quarterly dividend per share has increased by 50% since October 2021 • CMC has paid 240 consecutive quarterly dividends Focus on Growth Targeting value accretive growth that strategically strengthens our business Competitive Cash Distributions Goal is to provide an attractive rate of cash distributions to our shareholders

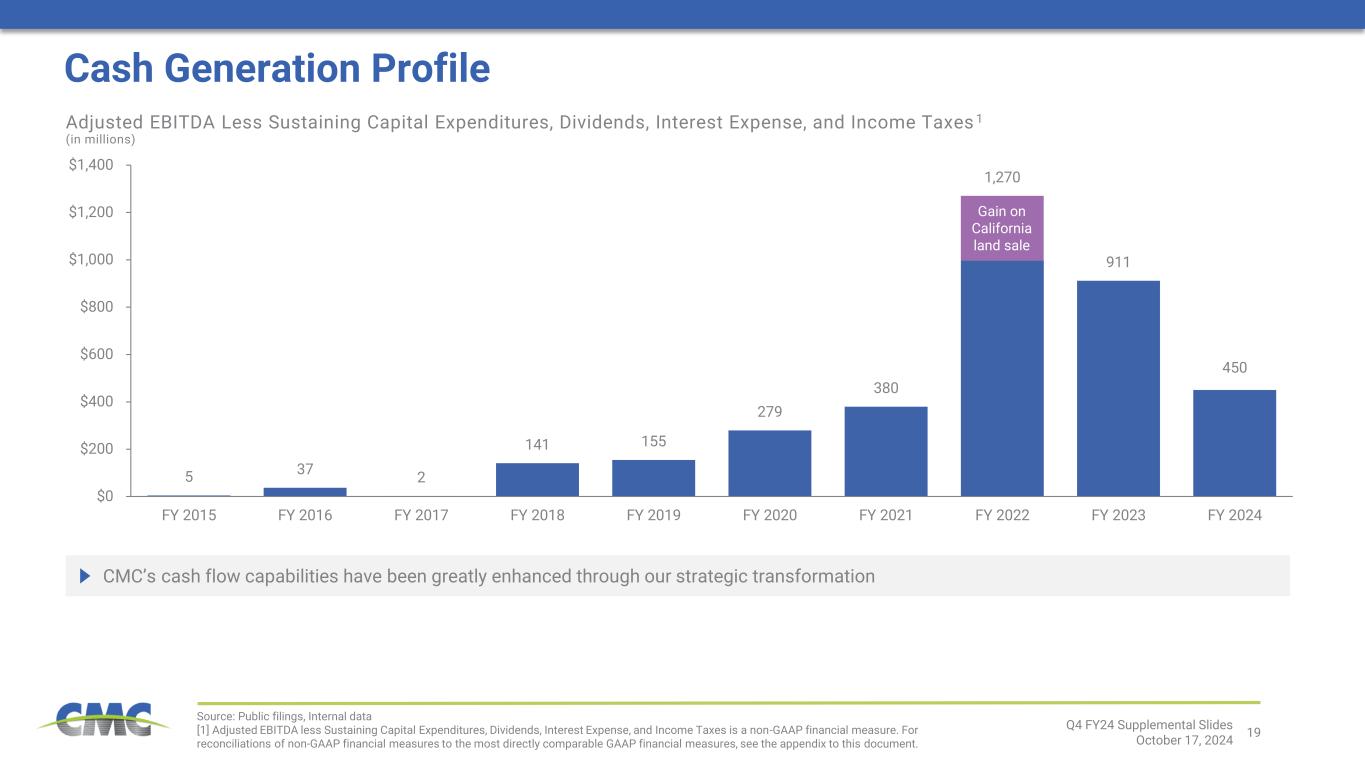

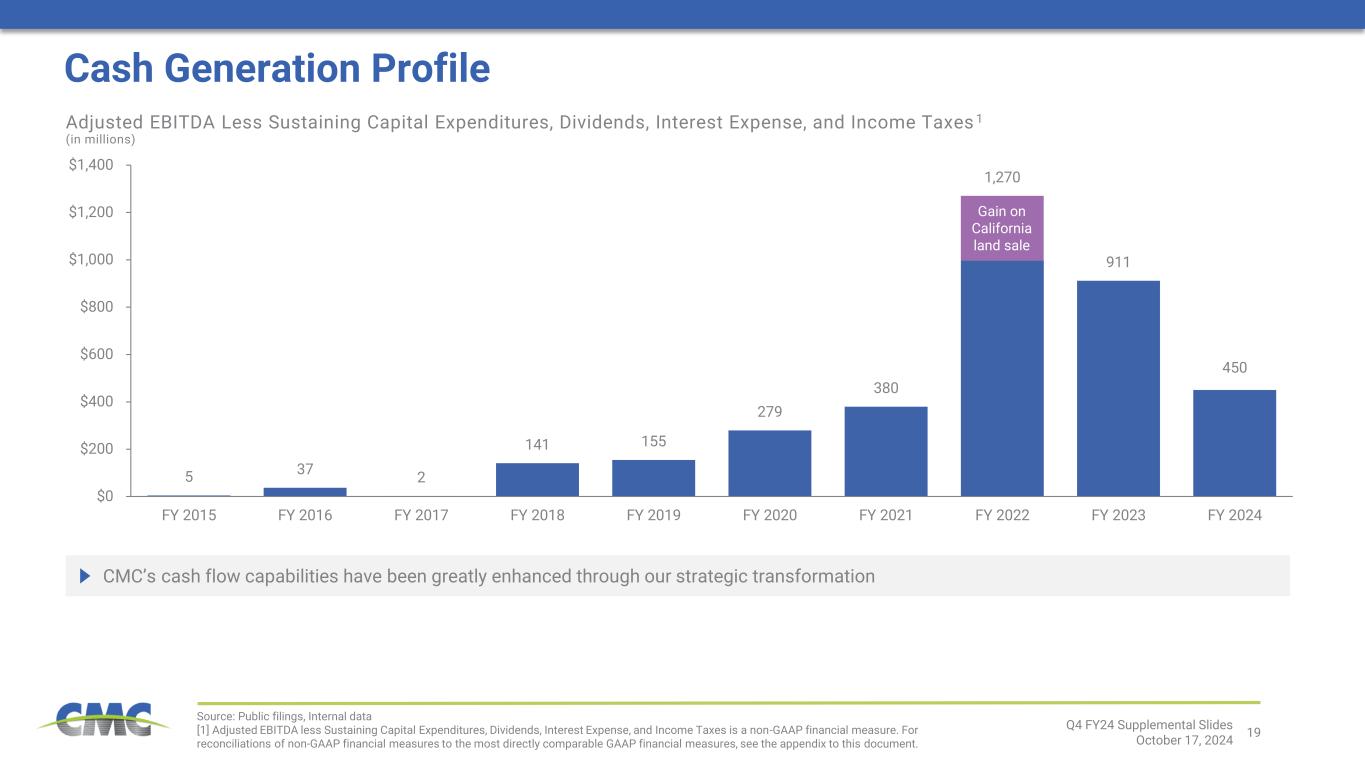

19 450 5 37 2 141 155 279 380 1,270 911 $0 $200 $400 $600 $800 $1,000 $1,200 $1,400 FY 2015 FY 2016 FY 2017 FY 2018 FY 2019 FY 2020 FY 2021 FY 2022 FY 2023 FY 2024 Cash Generation Profile Adjusted EBITDA Less Sustaining Capital Expenditures, Dividends, Interest Expense, and Income Taxes 1 (in millions) CMC’s cash flow capabilities have been greatly enhanced through our strategic transformation Source: Public filings, Internal data [1] Adjusted EBITDA less Sustaining Capital Expenditures, Dividends, Interest Expense, and Income Taxes is a non-GAAP financial measure. For reconciliations of non-GAAP financial measures to the most directly comparable GAAP financial measures, see the appendix to this document. Gain on California land sale Q4 FY24 Supplemental Slides October 17, 2024

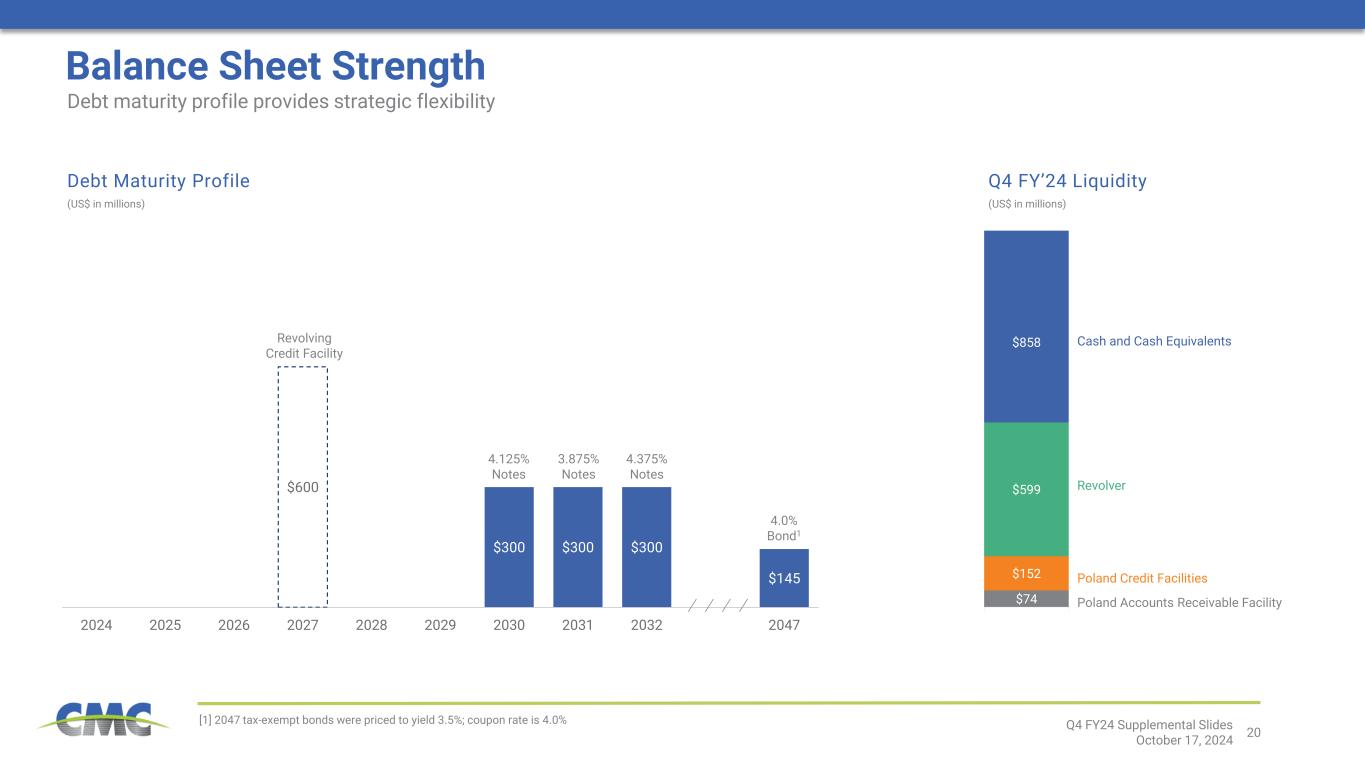

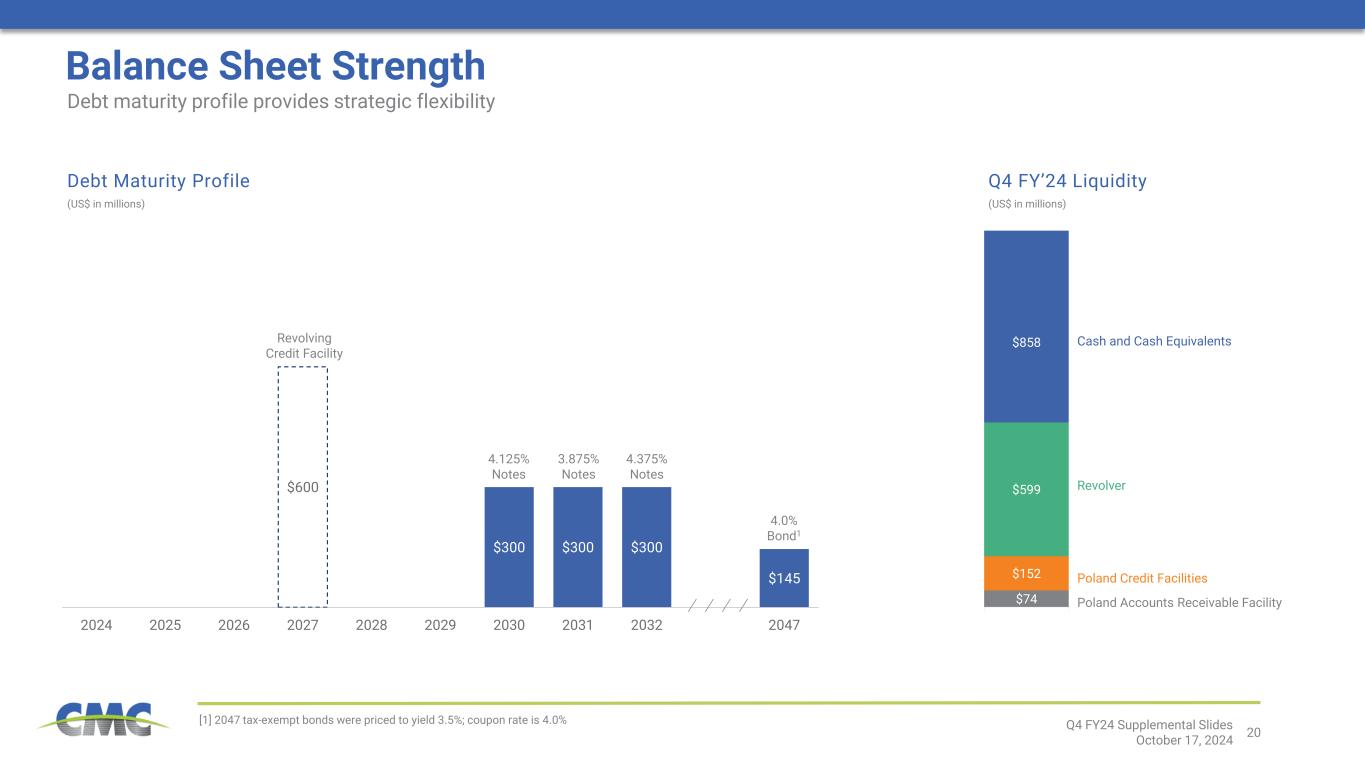

20 $74 $152 $599 $858 $300 $300 $300 $145 $600 2024 2025 2026 2027 2028 2029 2030 2031 2032 2047 Balance Sheet Strength [1] 2047 tax-exempt bonds were priced to yield 3.5%; coupon rate is 4.0% Revolver Poland Credit Facilities (US$ in millions) Revolving Credit Facility 4.125% Notes Cash and Cash Equivalents 3.875% Notes Debt maturity profile provides strategic flexibility Debt Maturity Profile Q4 FY’24 Liquidity (US$ in millions) 4.375% Notes 4.0% Bond1 Poland Accounts Receivable Facility Q4 FY24 Supplemental Slides October 17, 2024

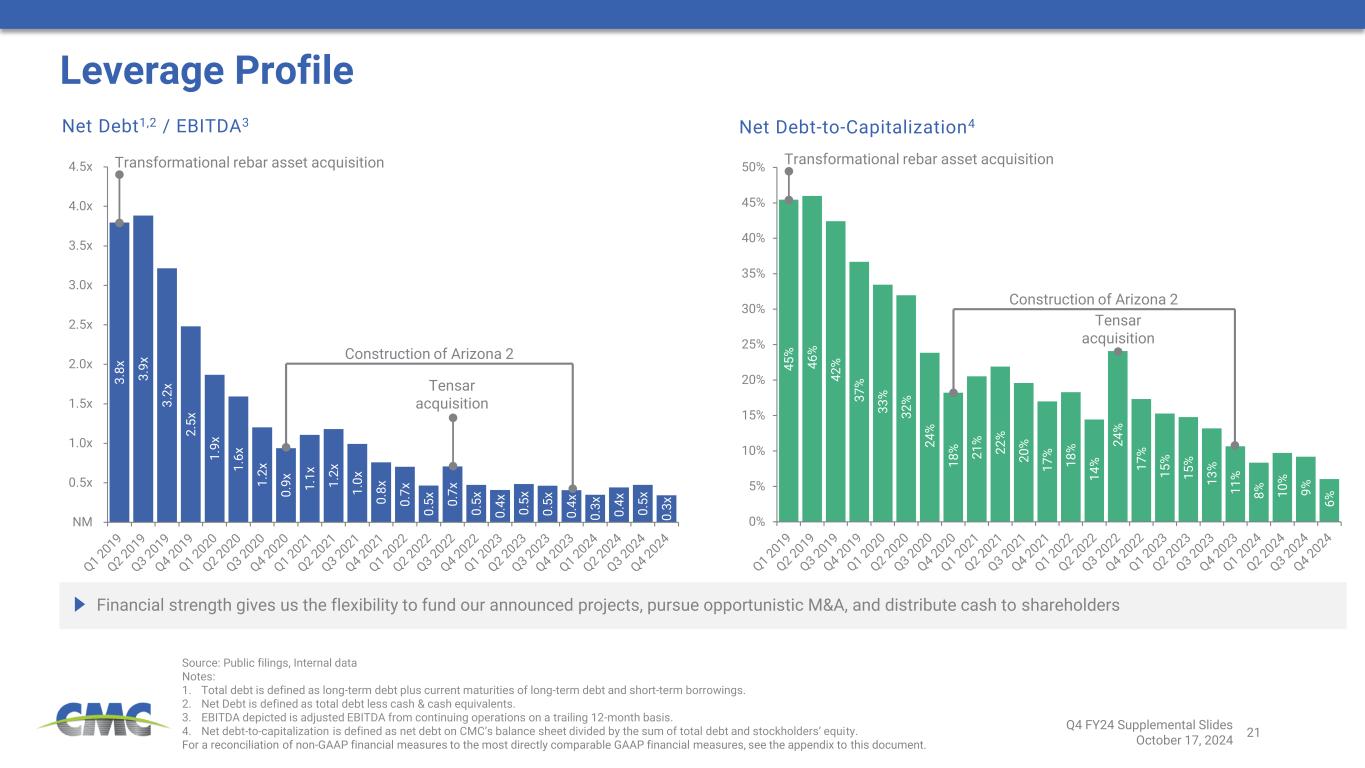

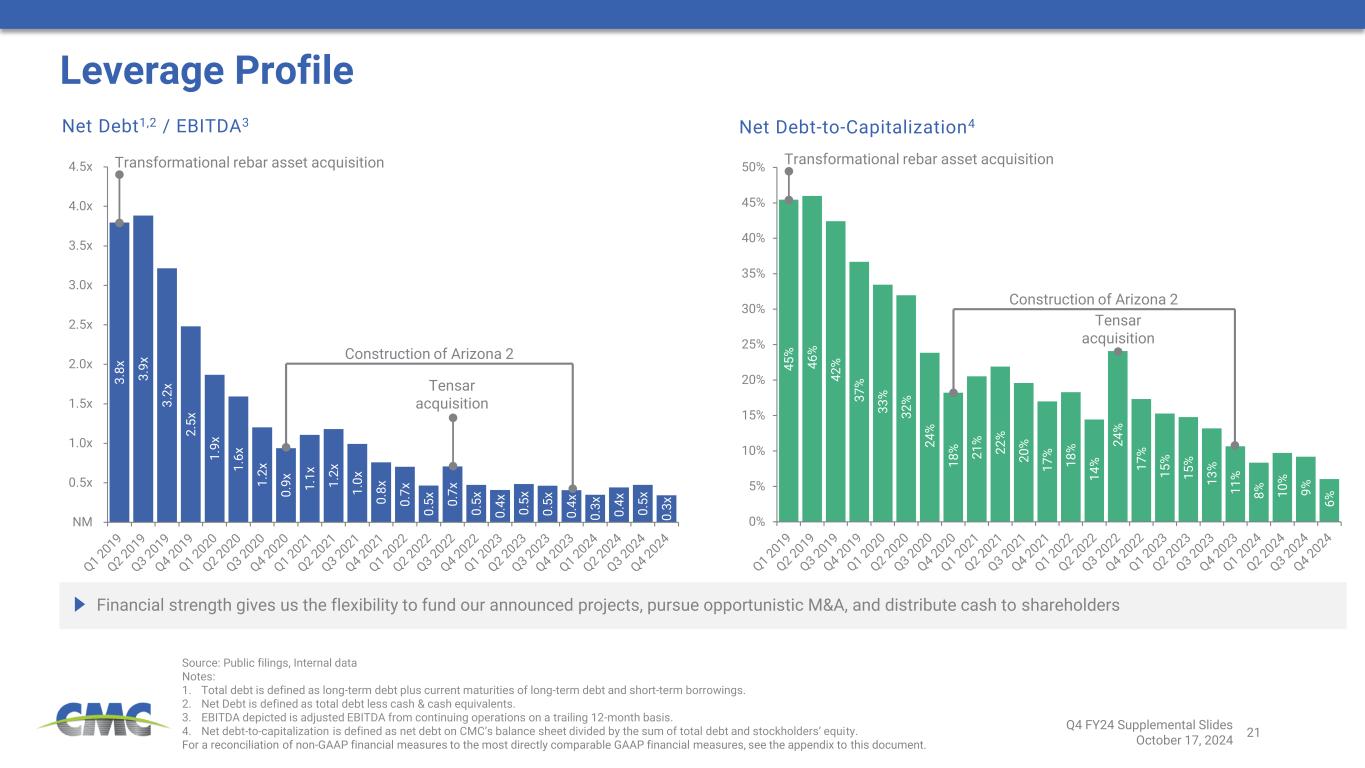

21 4 5 % 4 6 % 4 2 % 3 7 % 3 3 % 3 2 % 2 4 % 1 8 % 2 1 % 2 2 % 2 0 % 1 7 % 1 8 % 1 4 % 2 4 % 1 7 % 1 5 % 1 5 % 1 3 % 1 1 % 8 % 1 0 % 9 % 6 % 0% 5% 10% 15% 20% 25% 30% 35% 40% 45% 50% 3 .8 x 3 .9 x 3 .2 x 2 .5 x 1 .9 x 1 .6 x 1 .2 x 0 .9 x 1 .1 x 1 .2 x 1 .0 x 0 .8 x 0 .7 x 0 .5 x 0 .7 x 0 .5 x 0 .4 x 0 .5 x 0 .5 x 0 .4 x 0 .3 x 0 .4 x 0 .5 x 0 .3 x NM 0.5x 1.0x 1.5x 2.0x 2.5x 3.0x 3.5x 4.0x 4.5x Source: Public filings, Internal data Notes: 1. Total debt is defined as long-term debt plus current maturities of long-term debt and short-term borrowings. 2. Net Debt is defined as total debt less cash & cash equivalents. 3. EBITDA depicted is adjusted EBITDA from continuing operations on a trailing 12-month basis. 4. Net debt-to-capitalization is defined as net debt on CMC’s balance sheet divided by the sum of total debt and stockholders’ equity. For a reconciliation of non-GAAP financial measures to the most directly comparable GAAP financial measures, see the appendix to this document. Leverage Profile Financial strength gives us the flexibility to fund our announced projects, pursue opportunistic M&A, and distribute cash to shareholders Net Debt1,2 / EBITDA3 Net Debt-to-Capitalization4 Transformational rebar asset acquisition Tensar acquisition Construction of Arizona 2 Transformational rebar asset acquisition Tensar acquisition Construction of Arizona 2 Q4 FY24 Supplemental Slides October 17, 2024

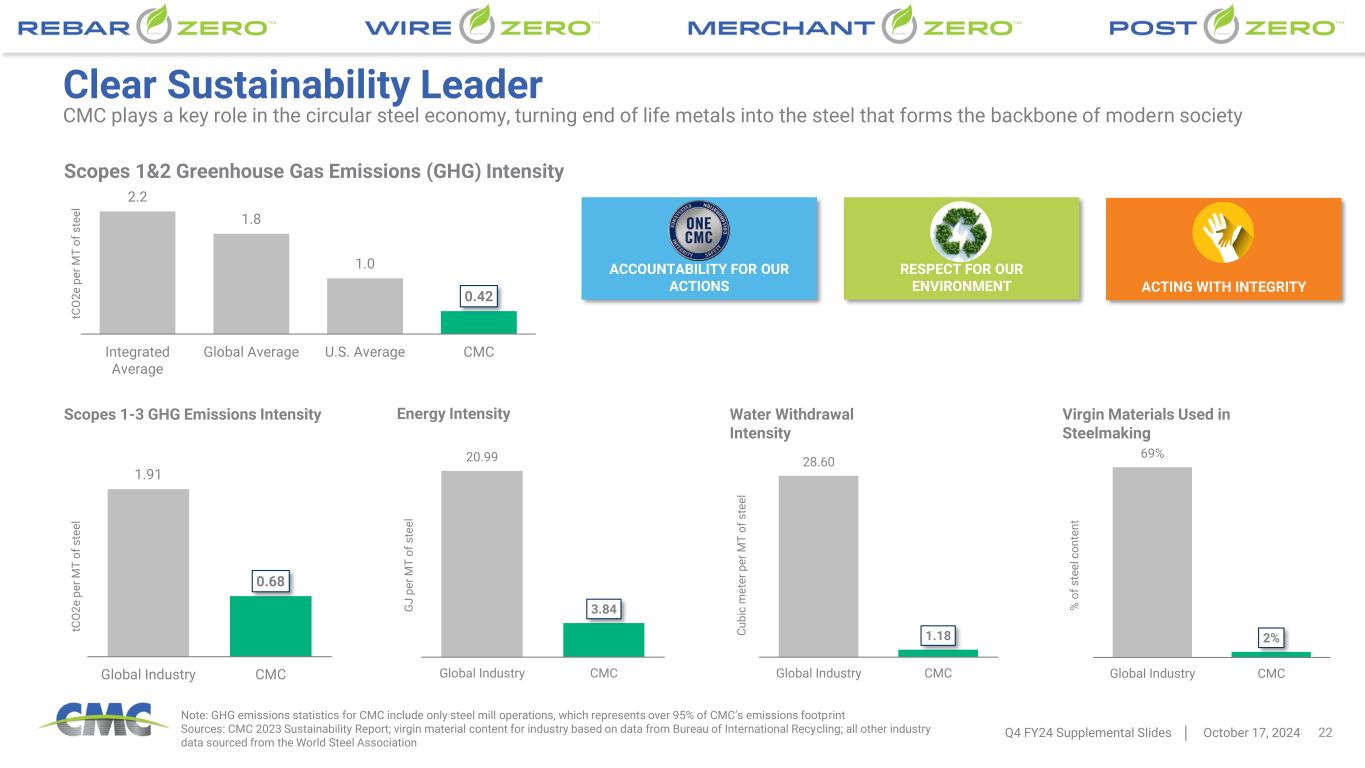

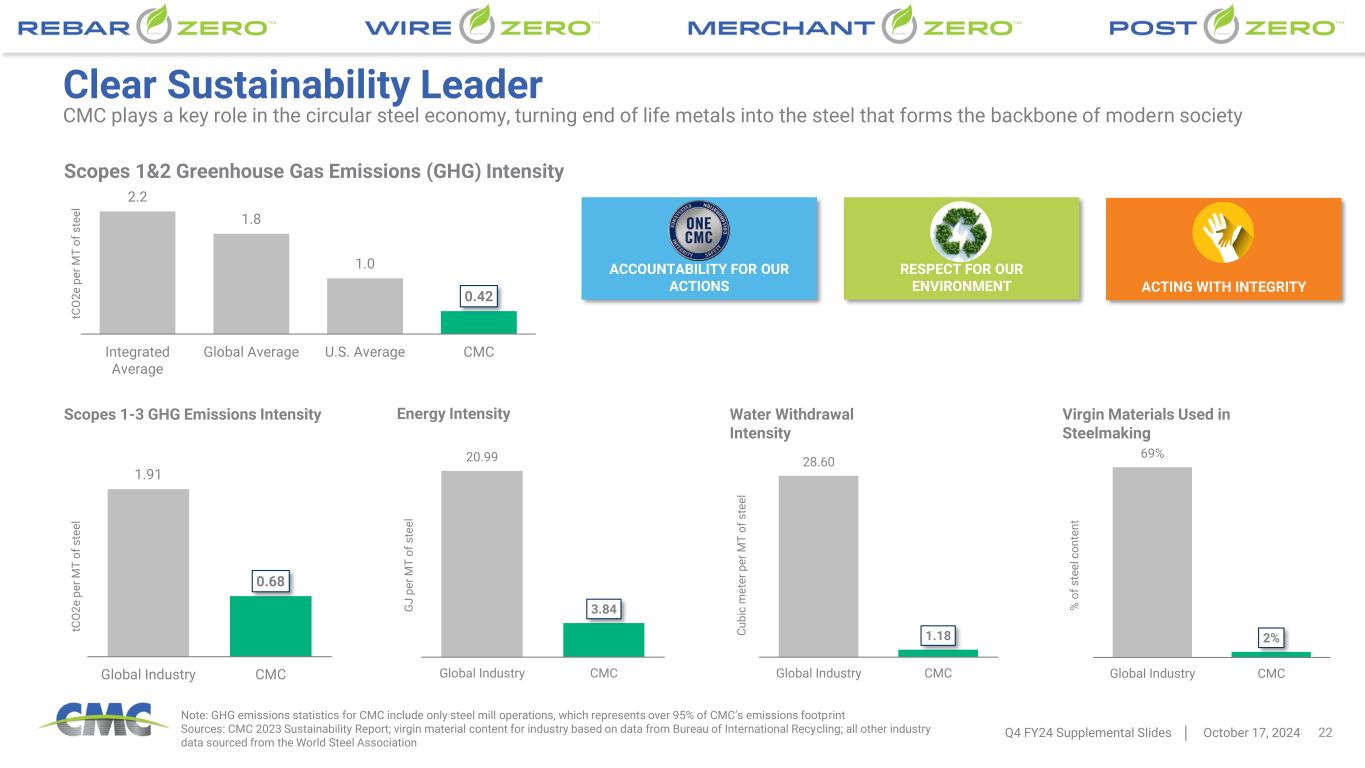

Clear Sustainability Leader Q4 FY24 Supplemental Slides │ October 17, 2024 22 Note: GHG emissions statistics for CMC include only steel mill operations, which represents over 95% of CMC’s emissions footprint Sources: CMC 2023 Sustainability Report; virgin material content for industry based on data from Bureau of International Recycling; all other industry data sourced from the World Steel Association CMC plays a key role in the circular steel economy, turning end of life metals into the steel that forms the backbone of modern society ACCOUNTABILITY FOR OUR ACTIONS RESPECT FOR OUR ENVIRONMENT ACTING WITH INTEGRITY 2.2 1.8 1.0 0.42 Integrated Average Global Average U.S. Average CMC Scopes 1&2 Greenhouse Gas Emissions (GHG) Intensity tC O 2 e p e r M T o f s te e l 0.68 1.91 CMCGlobal Industry Scopes 1-3 GHG Emissions Intensity tC O 2 e p e r M T o f s te e l 3.84 20.99 CMCGlobal Industry Energy Intensity G J p e r M T o f s te e l 1.18 28.60 CMCGlobal Industry Water Withdrawal Intensity C u b ic m e te r p e r M T o f s te e l 2% 69% CMCGlobal Industry Virgin Materials Used in Steelmaking % o f s te e l c o n te n t

© CMC Appendix: Non-GAAP Financial Reconciliations

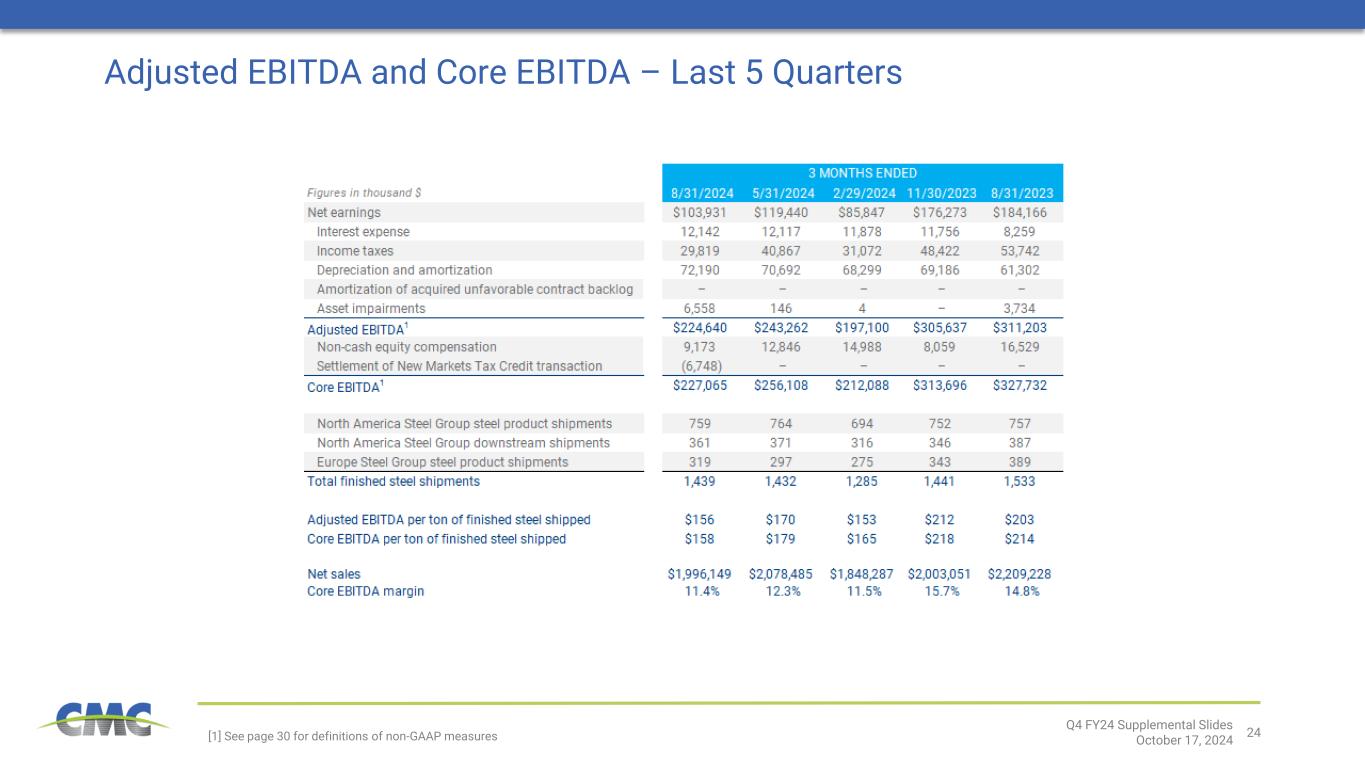

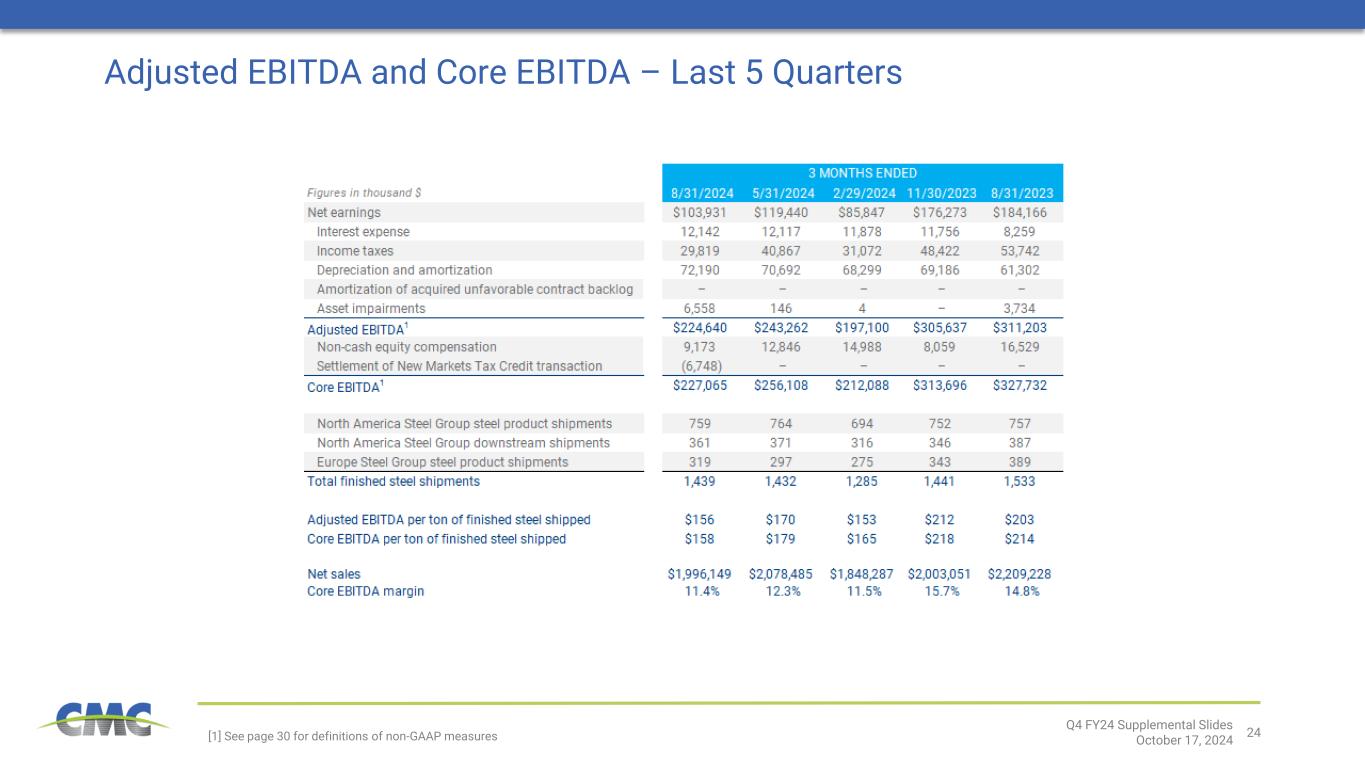

24 Adjusted EBITDA and Core EBITDA – Last 5 Quarters [1] See page 30 for definitions of non-GAAP measures Q4 FY24 Supplemental Slides October 17, 2024

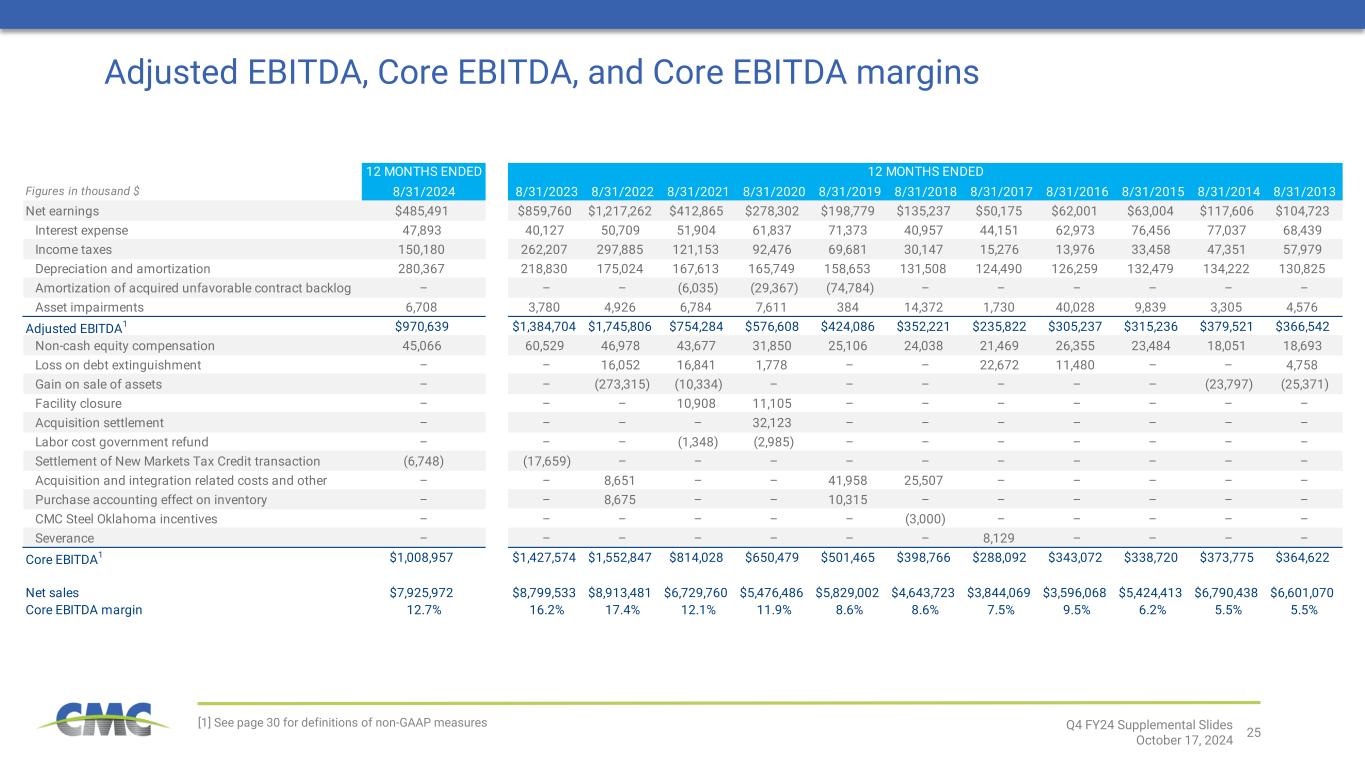

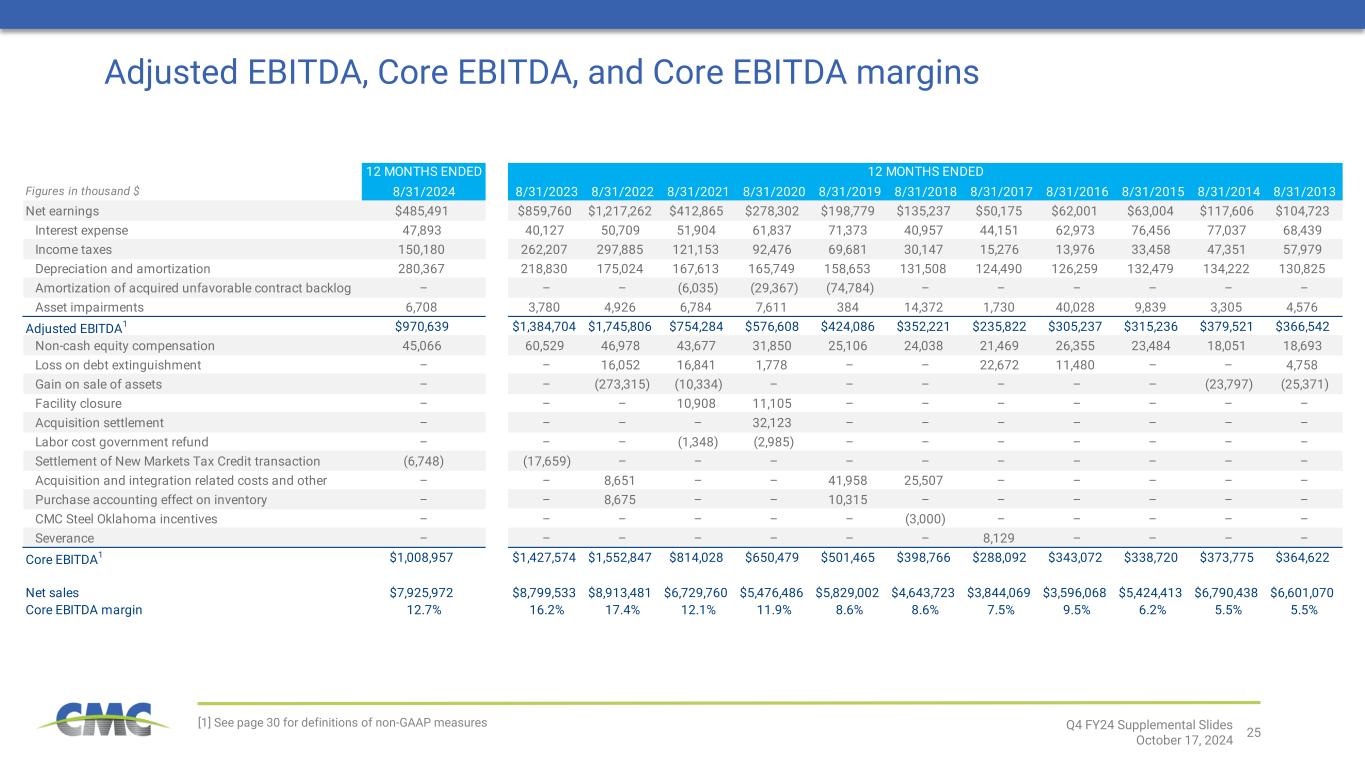

25 Adjusted EBITDA, Core EBITDA, and Core EBITDA margins [1] See page 30 for definitions of non-GAAP measures Q4 FY24 Supplemental Slides October 17, 2024 Figures in thousand $ 8/31/2024 8/31/2023 8/31/2022 8/31/2021 8/31/2020 8/31/2019 8/31/2018 8/31/2017 8/31/2016 8/31/2015 8/31/2014 8/31/2013 Net earnings $485,491 $859,760 $1,217,262 $412,865 $278,302 $198,779 $135,237 $50,175 $62,001 $63,004 $117,606 $104,723 Interest expense 47,893 40,127 50,709 51,904 61,837 71,373 40,957 44,151 62,973 76,456 77,037 68,439 Income taxes 150,180 262,207 297,885 121,153 92,476 69,681 30,147 15,276 13,976 33,458 47,351 57,979 Depreciation and amortization 280,367 218,830 175,024 167,613 165,749 158,653 131,508 124,490 126,259 132,479 134,222 130,825 Amortization of acquired unfavorable contract backlog – – – (6,035) (29,367) (74,784) – – – – – – Asset impairments 6,708 3,780 4,926 6,784 7,611 384 14,372 1,730 40,028 9,839 3,305 4,576 Adjusted EBITDA1 $970,639 $1,384,704 $1,745,806 $754,284 $576,608 $424,086 $352,221 $235,822 $305,237 $315,236 $379,521 $366,542 Non-cash equity compensation 45,066 60,529 46,978 43,677 31,850 25,106 24,038 21,469 26,355 23,484 18,051 18,693 Loss on debt extinguishment – – 16,052 16,841 1,778 – – 22,672 11,480 – – 4,758 Gain on sale of assets – – (273,315) (10,334) – – – – – – (23,797) (25,371) Facility closure – – – 10,908 11,105 – – – – – – – Acquisition settlement – – – – 32,123 – – – – – – – Labor cost government refund – – – (1,348) (2,985) – – – – – – – Settlement of New Markets Tax Credit transaction (6,748) (17,659) – – – – – – – – – – Acquisition and integration related costs and other – – 8,651 – – 41,958 25,507 – – – – – Purchase accounting effect on inventory – – 8,675 – – 10,315 – – – – – – CMC Steel Oklahoma incentives – – – – – – (3,000) – – – – – Severance – – – – – – – 8,129 – – – – Core EBITDA 1 $1,008,957 $1,427,574 $1,552,847 $814,028 $650,479 $501,465 $398,766 $288,092 $343,072 $338,720 $373,775 $364,622 Net sales $7,925,972 $8,799,533 $8,913,481 $6,729,760 $5,476,486 $5,829,002 $4,643,723 $3,844,069 $3,596,068 $5,424,413 $6,790,438 $6,601,070 Core EBITDA margin 12.7% 16.2% 17.4% 12.1% 11.9% 8.6% 8.6% 7.5% 9.5% 6.2% 5.5% 5.5% 12 MONTHS ENDED 12 MONTHS ENDED

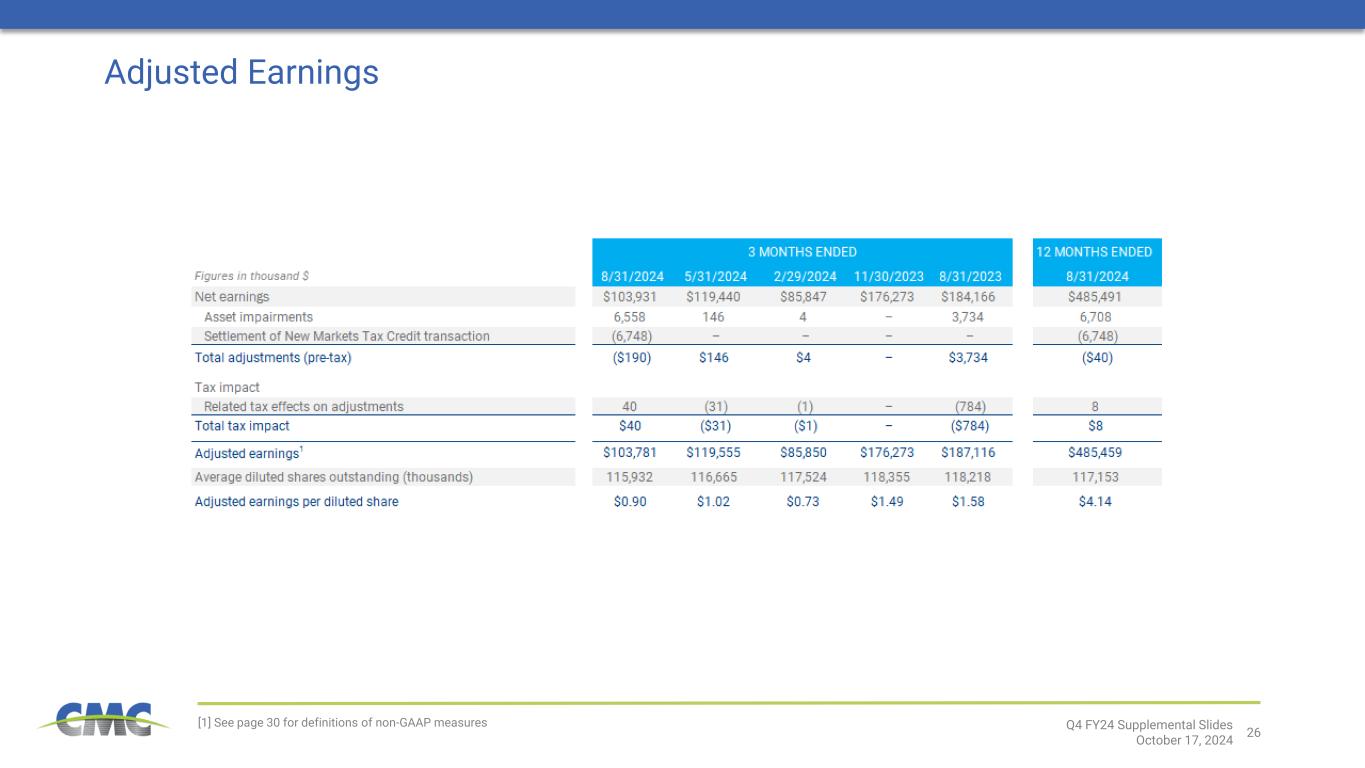

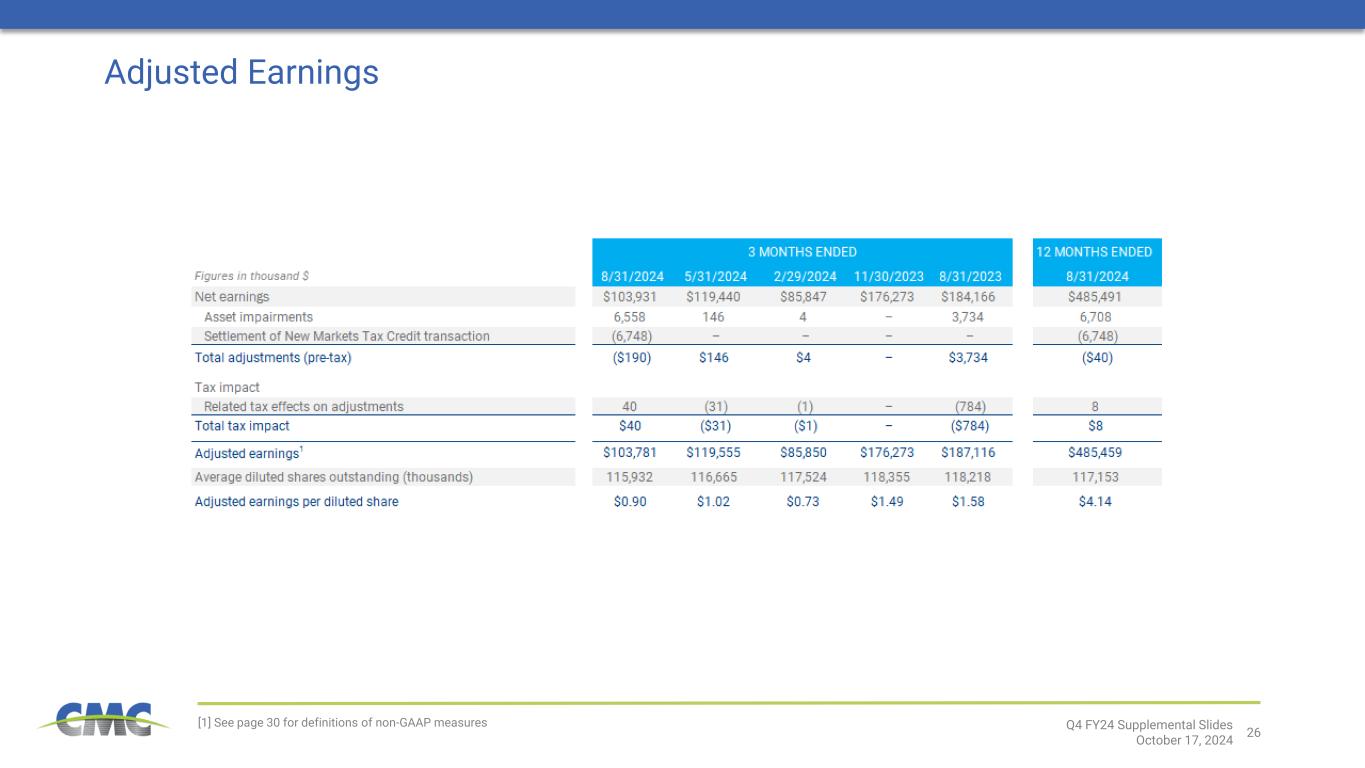

26 Adjusted Earnings [1] See page 30 for definitions of non-GAAP measures Q4 FY24 Supplemental Slides October 17, 2024

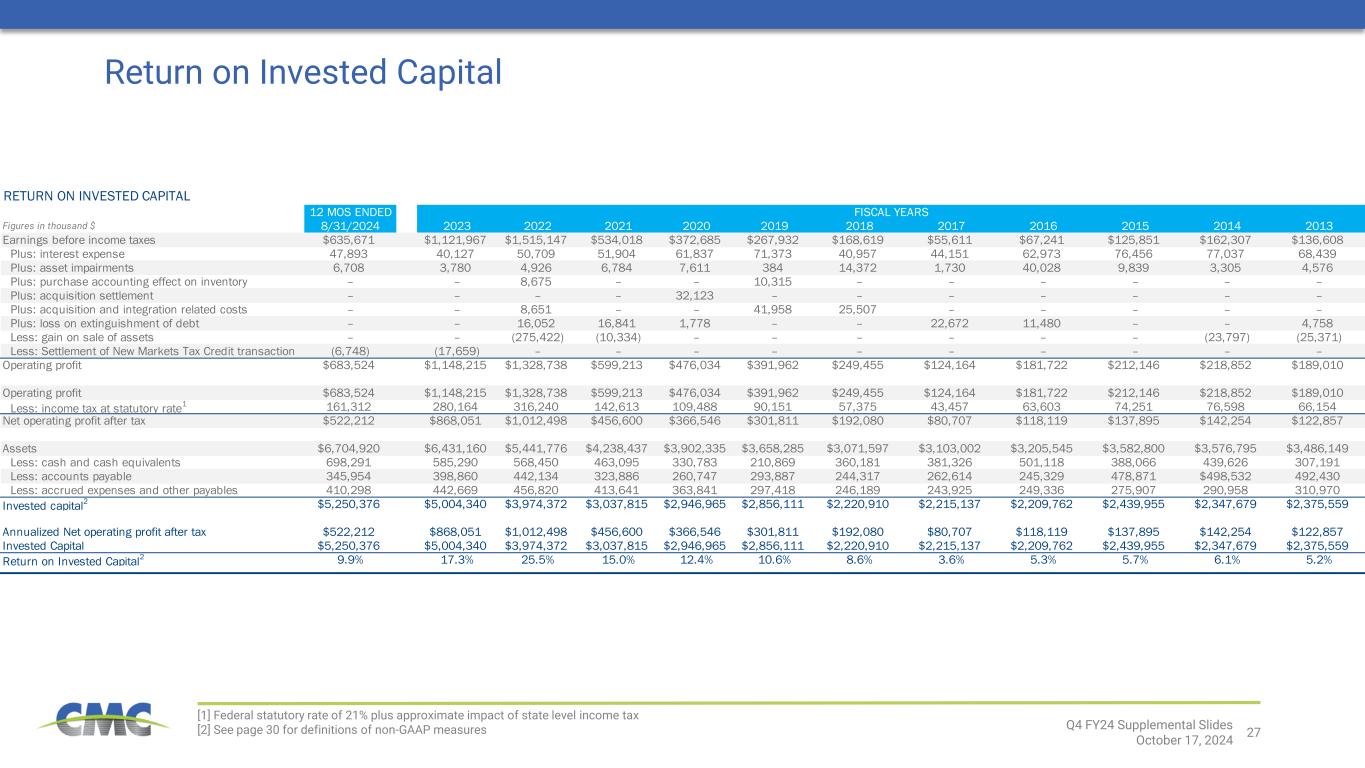

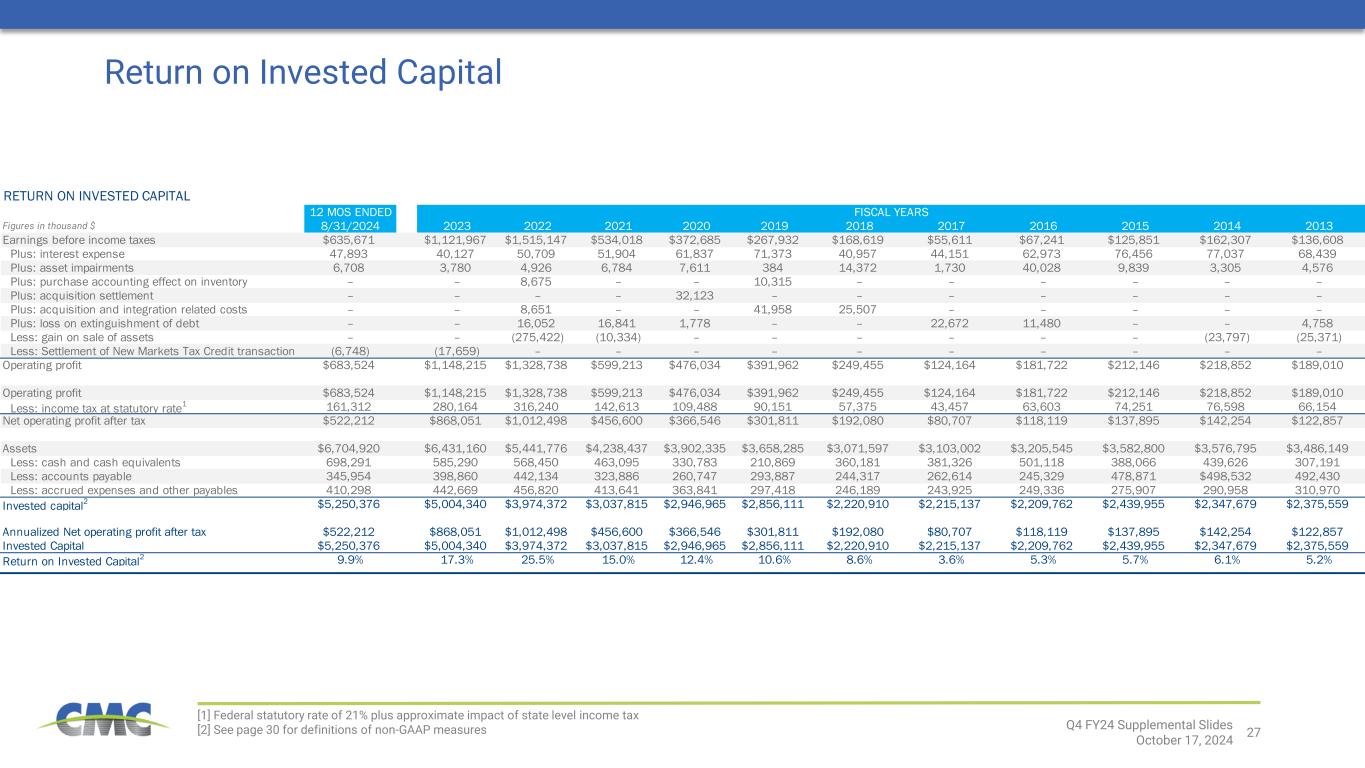

27 Return on Invested Capital [1] Federal statutory rate of 21% plus approximate impact of state level income tax [2] See page 30 for definitions of non-GAAP measures Q4 FY24 Supplemental Slides October 17, 2024 RETURN ON INVESTED CAPITAL 12 MOS ENDED FISCAL YEARS Figures in thousand $ 8/31/2024 2023 2022 2021 2020 2019 2018 2017 2016 2015 2014 2013 Earnings before income taxes $635,671 $1,121,967 $1,515,147 $534,018 $372,685 $267,932 $168,619 $55,611 $67,241 $125,851 $162,307 $136,608 Plus: interest expense 47,893 40,127 50,709 51,904 61,837 71,373 40,957 44,151 62,973 76,456 77,037 68,439 Plus: asset impairments 6,708 3,780 4,926 6,784 7,611 384 14,372 1,730 40,028 9,839 3,305 4,576 Plus: purchase accounting effect on inventory – – 8,675 – – 10,315 – – – – – – Plus: acquisition settlement – – – – 32,123 – – – – – – – Plus: acquisition and integration related costs – – 8,651 – – 41,958 25,507 – – – – – Plus: loss on extinguishment of debt – – 16,052 16,841 1,778 – – 22,672 11,480 – – 4,758 Less: gain on sale of assets – – (275,422) (10,334) – – – – – – (23,797) (25,371) Less: Settlement of New Markets Tax Credit transaction (6,748) (17,659) – – – – – – – – – – Operating profit $683,524 $1,148,215 $1,328,738 $599,213 $476,034 $391,962 $249,455 $124,164 $181,722 $212,146 $218,852 $189,010 Operating profit $683,524 $1,148,215 $1,328,738 $599,213 $476,034 $391,962 $249,455 $124,164 $181,722 $212,146 $218,852 $189,010 Less: income tax at statutory rate 1 161,312 280,164 316,240 142,613 109,488 90,151 57,375 43,457 63,603 74,251 76,598 66,154 Net operating profit after tax $522,212 $868,051 $1,012,498 $456,600 $366,546 $301,811 $192,080 $80,707 $118,119 $137,895 $142,254 $122,857 Assets $6,704,920 $6,431,160 $5,441,776 $4,238,437 $3,902,335 $3,658,285 $3,071,597 $3,103,002 $3,205,545 $3,582,800 $3,576,795 $3,486,149 Less: cash and cash equivalents 698,291 585,290 568,450 463,095 330,783 210,869 360,181 381,326 501,118 388,066 439,626 307,191 Less: accounts payable 345,954 398,860 442,134 323,886 260,747 293,887 244,317 262,614 245,329 478,871 $498,532 492,430 Less: accrued expenses and other payables 410,298 442,669 456,820 413,641 363,841 297,418 246,189 243,925 249,336 275,907 290,958 310,970 Invested capital 2 $5,250,376 $5,004,340 $3,974,372 $3,037,815 $2,946,965 $2,856,111 $2,220,910 $2,215,137 $2,209,762 $2,439,955 $2,347,679 $2,375,559 Annualized Net operating profit after tax $522,212 $868,051 $1,012,498 $456,600 $366,546 $301,811 $192,080 $80,707 $118,119 $137,895 $142,254 $122,857 Invested Capital $5,250,376 $5,004,340 $3,974,372 $3,037,815 $2,946,965 $2,856,111 $2,220,910 $2,215,137 $2,209,762 $2,439,955 $2,347,679 $2,375,559 Return on Invested Capital 2 9.9% 17.3% 25.5% 15.0% 12.4% 10.6% 8.6% 3.6% 5.3% 5.7% 6.1% 5.2%

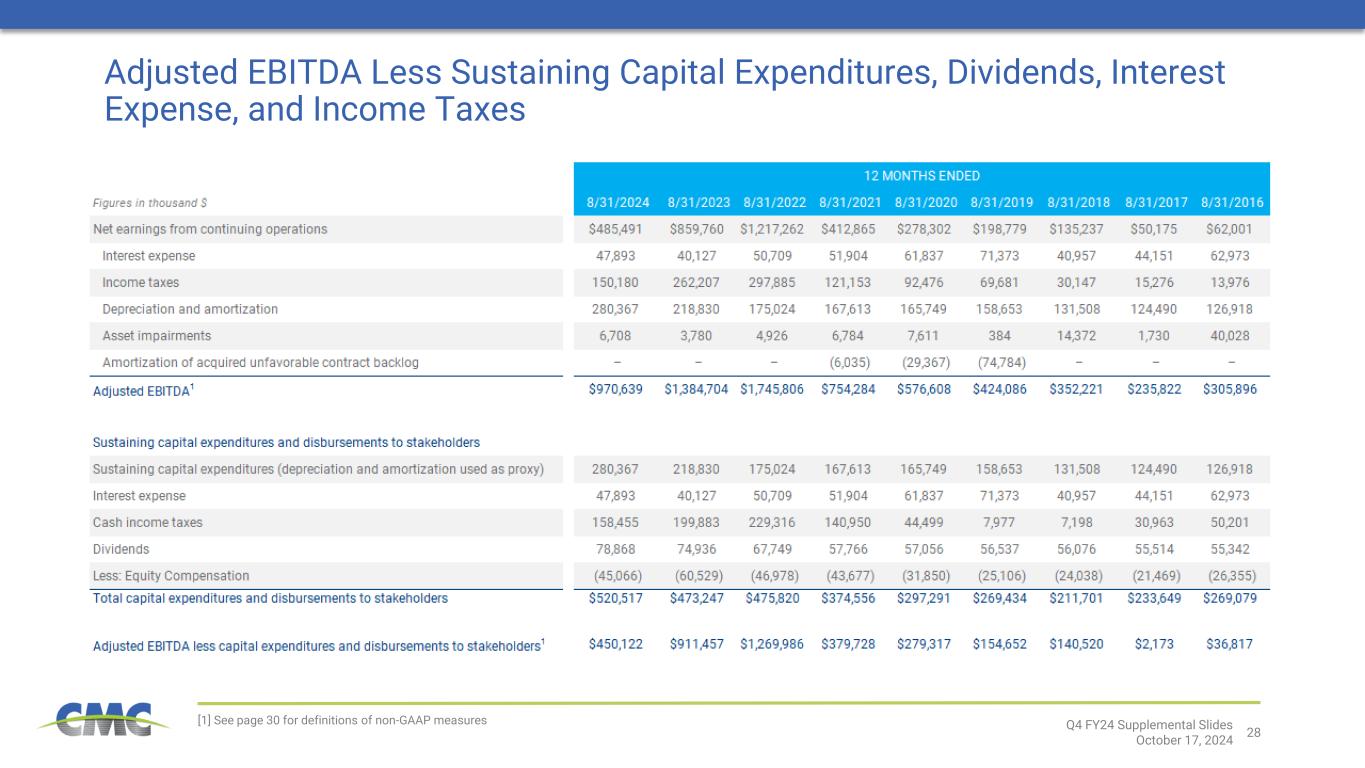

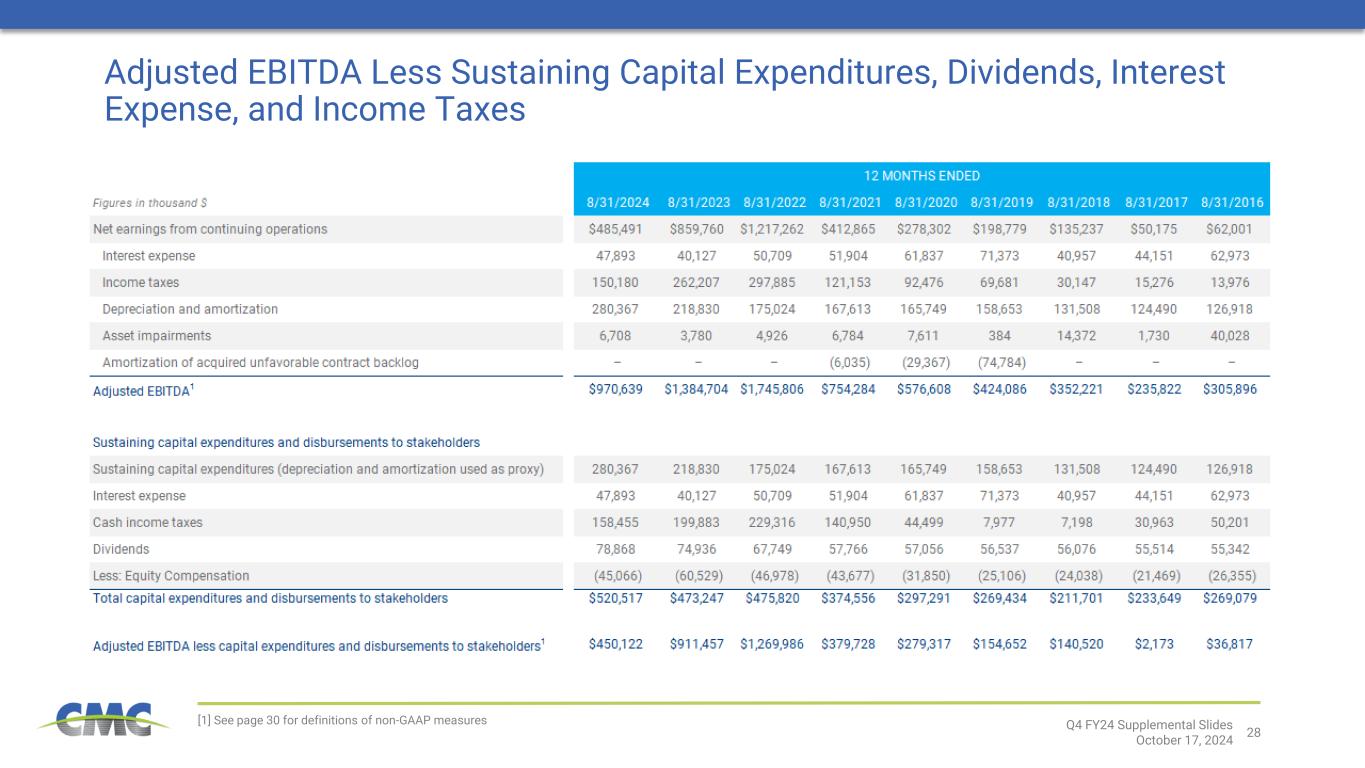

28 [1] See page 30 for definitions of non-GAAP measures Adjusted EBITDA Less Sustaining Capital Expenditures, Dividends, Interest Expense, and Income Taxes Q4 FY24 Supplemental Slides October 17, 2024

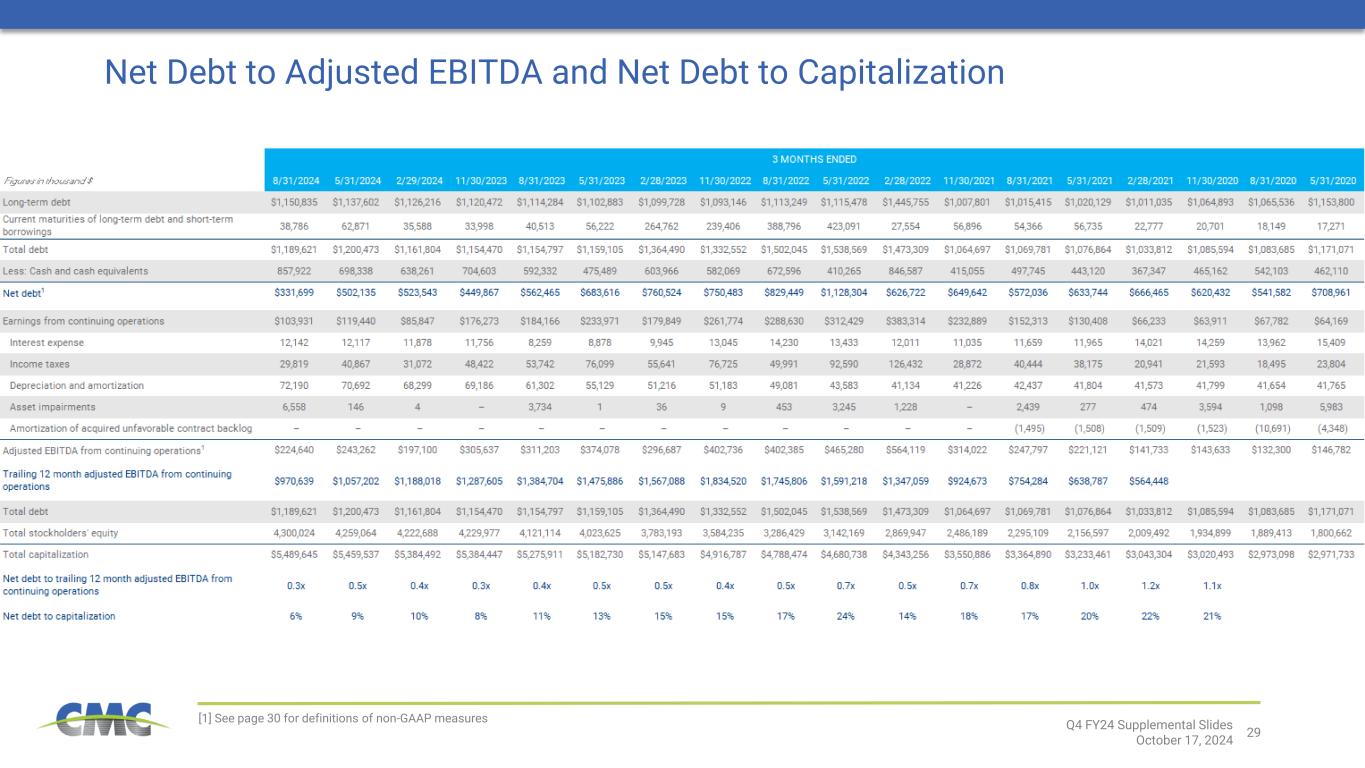

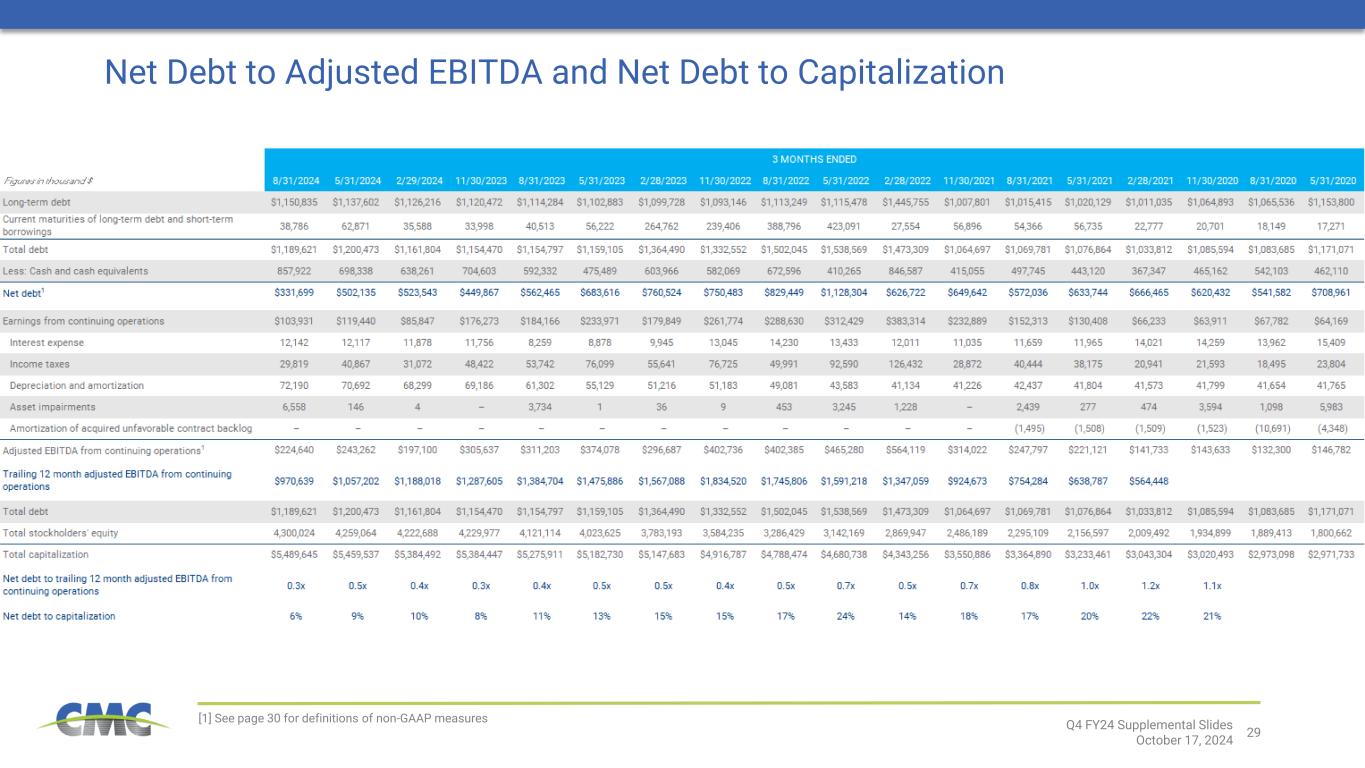

29 Net Debt to Adjusted EBITDA and Net Debt to Capitalization [1] See page 30 for definitions of non-GAAP measures Q4 FY24 Supplemental Slides October 17, 2024

30 Definitions for non-GAAP financial measures ADJUSTED EARNINGS Adjusted earnings is a non-GAAP financial measure that is equal to earnings before asset impairments, including the estimated income tax effects thereof. The adjustment settlement for New Markets Tax Credit transaction represents the recognition of deferred revenue from 2016 and 2017 resulting from the Company’s participation in the New Markets Tax Credit program provided for in the Community Renewal Tax Relief Act of 2000 during the development of a micro mill, spooler and T-post shop located in eligible zones as determined by the Internal Revenue Service. Adjusted earnings should not be considered as an alternative to net earnings or any other performance measure derived in accordance with GAAP. However, we believe that adjusted earnings provides relevant and useful information to investors as it allows: (i) a supplemental measure of our ongoing core performance and (ii) the assessment of period-to-period performance trends. Management uses adjusted earnings to evaluate our financial performance. Adjusted earnings may be inconsistent with similar measures presented by other companies. Adjusted earnings per diluted share (or adjusted EPS) is defined as adjusted earnings on a diluted per share basis. CORE EBITDA Core EBITDA is the sum of net earnings before interest expense and income taxes. It also excludes recurring non-cash charges for depreciation and amortization, asset impairments, and amortization of acquired unfavorable contract backlog. Core EBITDA also excludes settlement for New Market Tax Credit transactions, non-cash equity compensation, loss on debt extinguishments, gains on sale of assets, facility closures, acquisition settlements, labor cost government refunds, acquisition and integration related costs, purchase accounting effect on inventory, CMC Steel Oklahoma incentives, and severances. The adjustment settlement for New Markets Tax Credit transaction represents the recognition of deferred revenue from 2016 and 2017 resulting from the Company’s participation in the New Markets Tax Credit program provided for in the Community Renewal Tax Relief Act of 2000 during the development of a micro mill, spooler and T-post shop located in eligible zones as determined by the Internal Revenue Service. Core EBITDA should not be considered an alternative to earnings (loss) from continuing operations or net earnings (loss), or as a better measure of liquidity than net cash flows from operating activities, as determined by GAAP. However, we believe that Core EBITDA provides relevant and useful information, which is often used by analysts, creditors and other interested parties in our industry as it allows: (i) comparison of our earnings to those of our competitors; (ii) a supplemental measure of our ongoing core performance; and (iii) the assessment of period-to-period performance trends. Additionally, Core EBITDA is the target benchmark for our annual and long- term cash incentive performance plans for management. Core EBITDA may be inconsistent with similar measures presented by other companies. ADJUSTED EBITDA Adjusted EBITDA is a non-GAAP financial measure. Adjusted EBITDA is the sum of the Company’s net earnings before interest expense, income taxes, depreciation and amortization expense, asset impairments, and amortization of acquired unfavorable contract backlog. Adjusted EBITDA should not be considered as an alternative to net earnings, or any other performance measure derived in accordance with GAAP. However, we believe that adjusted EBITDA provides relevant and useful information to investors as it allows: (i) a supplemental measure of our ongoing performance and (ii) the assessment of period-to-period performance trends. Management uses adjusted EBITDA to evaluate our financial performance. Adjusted EBITDA may be inconsistent with similar measures presented by other companies. ADJUSTED EBITDA LESS SUSTAINING CAPITAL EXPENDITURES AND DISBURSEMENTS TO STAKEHOLDERS Adjusted EBITDA less sustaining capital expenditures and disbursements to shareholders is defined as Adjusted EBITDA less depreciation and amortization (used as a proxy for sustaining capital expenditures) less interest expense, less cash income taxes less dividend payments plus stock-based compensation. NET DEBT Net debt is defined as total debt less cash and cash equivalents. RETURN ON INVESTED CAPITAL Return on Invested Capital is defined as: 1) after-tax operating profit divided by 2) total assets less cash & cash equivalents less non-interest-bearing liabilities. For annual measures, trailing 5-quarter averages are used for balance sheet figures. In prior periods, the Company included within the definition of core EBITDA, core EBITDA margin, adjusted earnings and adjusted earnings per diluted share an adjustment for “Mill operational commissioning costs” related to the Company's third micro mill, which was placed into service during the fourth quarter of fiscal 2023. Periods commencing subsequent to February 29, 2024 no longer include an adjustment for mill operational commissioning costs. Accordingly, the Company has recast core EBITDA, core EBITDA margin, adjusted earnings and adjusted earnings per diluted share for all prior periods to conform to this presentation. Q4 FY24 Supplemental Slides October 17, 2024

CMC.COM