Document

Exhibit 99.1

|

|

|

|

|

|

|

CBSH |

1000 Walnut Street / Suite 700 / Kansas City, Missouri 64106 / 816.234.2000 |

|

FOR IMMEDIATE RELEASE:

Wednesday, April 16, 2025

COMMERCE BANCSHARES, INC. REPORTS

FIRST QUARTER EARNINGS PER SHARE OF $.98

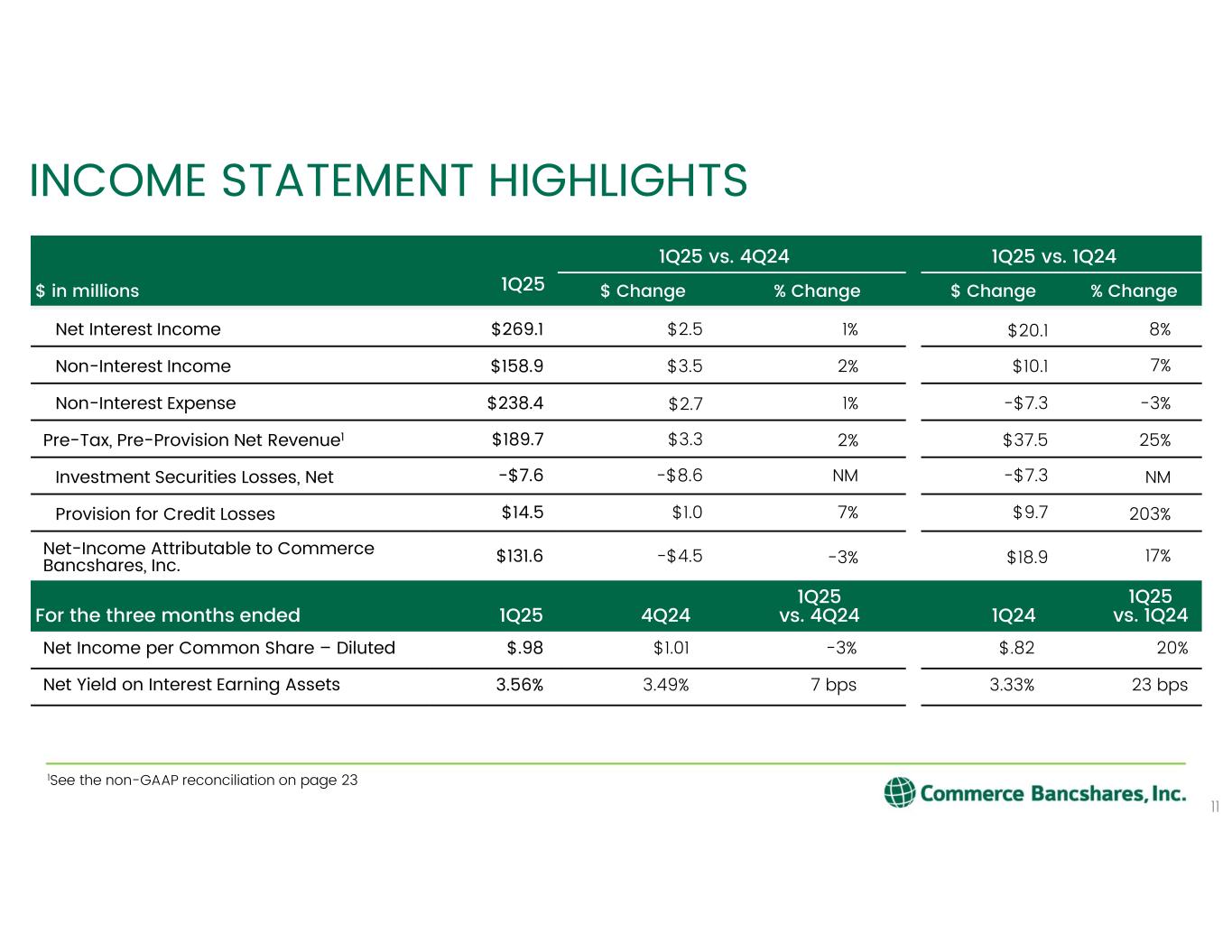

Commerce Bancshares, Inc. announced earnings of $.98 per share for the three months ended March 31, 2025, compared to $.82 per share in the same quarter last year and $1.01 per share in the fourth quarter of 2024. Net income for the first quarter of 2025 amounted to $131.6 million, compared to $112.7 million in the first quarter of 2024 and $136.1 million in the prior quarter.

In making this announcement, John Kemper, Chief Executive Officer, said, “These results are the product of strong execution against the backdrop of a relatively stable economy during the first quarter of 2025.”

Mr. Kemper continued, “Given recent news related to tariffs and trade restrictions, and in light of ongoing adjustment in capital markets, the outlook for the future is increasingly uncertain. Nonetheless, our franchise is well-positioned to weather any economic disruption, execute our long-term strategies, serve our customers and deliver value to our shareholders. Our credit profile remains strong, and capital and liquidity levels remain robust, supporting our ability to meet our customers’ borrowing, depository and service needs while ensuring the safety and soundness of the bank.”

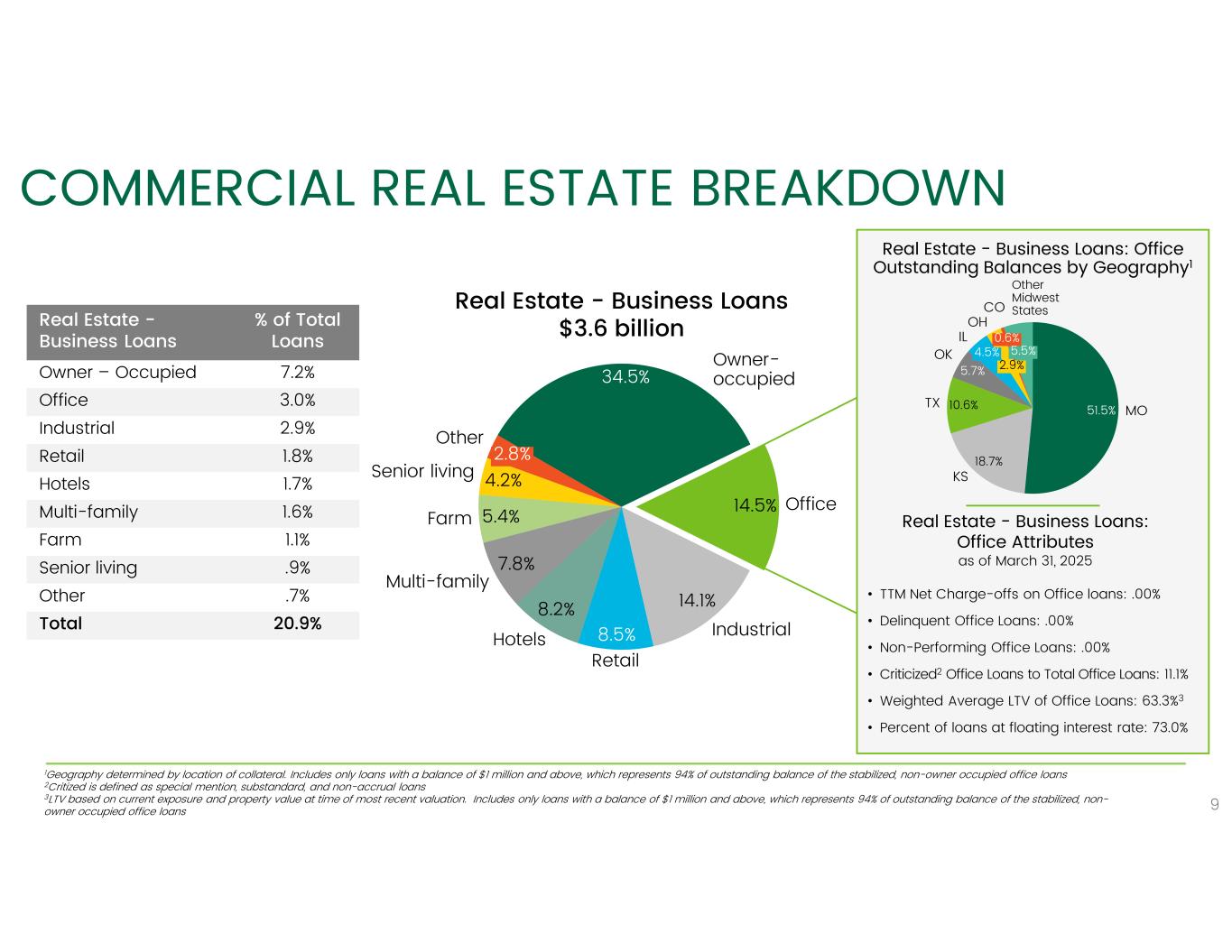

On first quarter earnings, Mr. Kemper said, “Net interest income of $269 million was a record quarter for Commerce and reflects the continued benefits of fixed-rate asset repricing, balance sheet growth, and our strong deposit franchise. Non-interest income was $159 million and made up 37.1% of total revenue, led by trust fees in our wealth management business of $57 million. Our strength in wealth management is exemplified by its continued growth, with trust fees up 10.7% over the same period last year. Credit quality of the loan portfolio remains excellent with non-accrual loans at .13% of total loans."

First Quarter 2025 Financial Highlights:

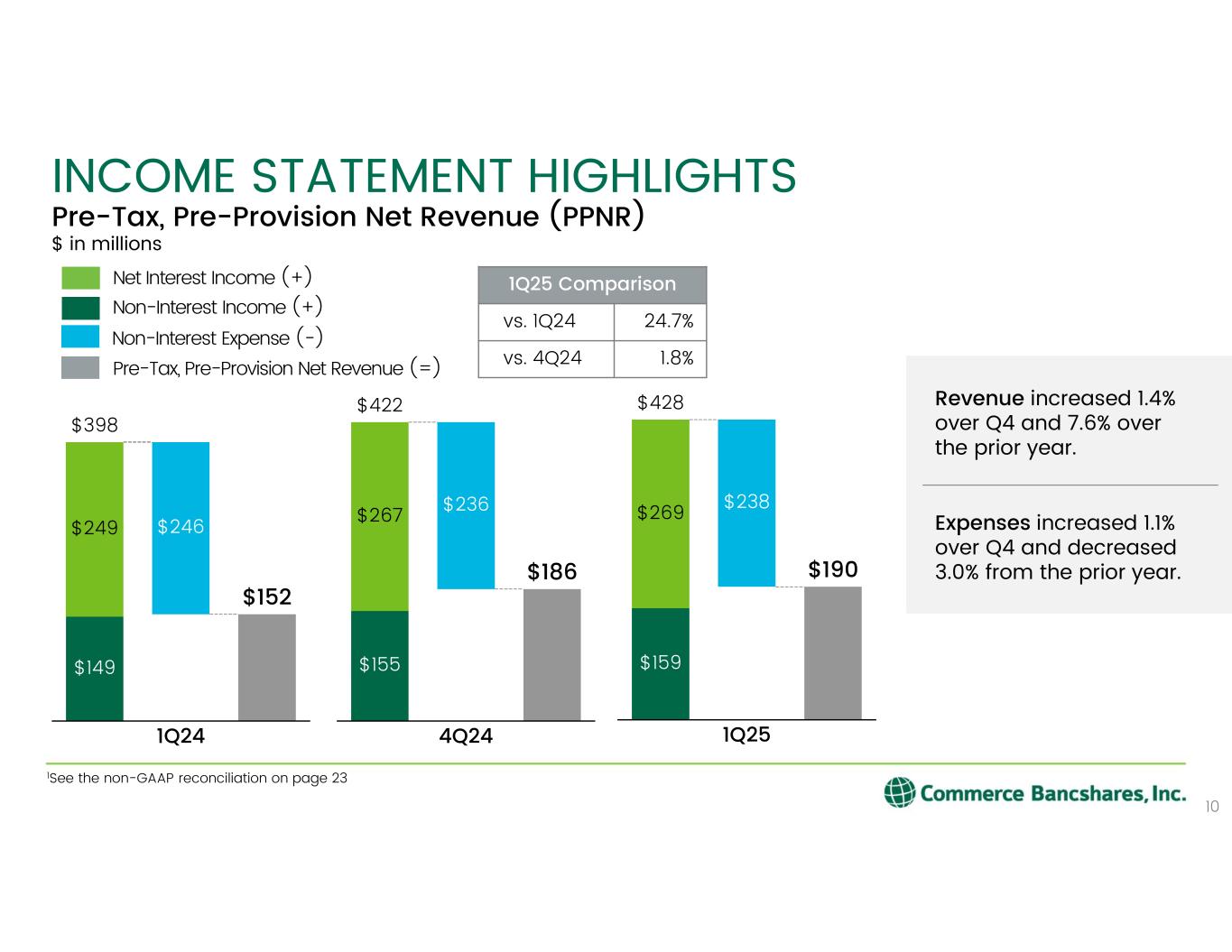

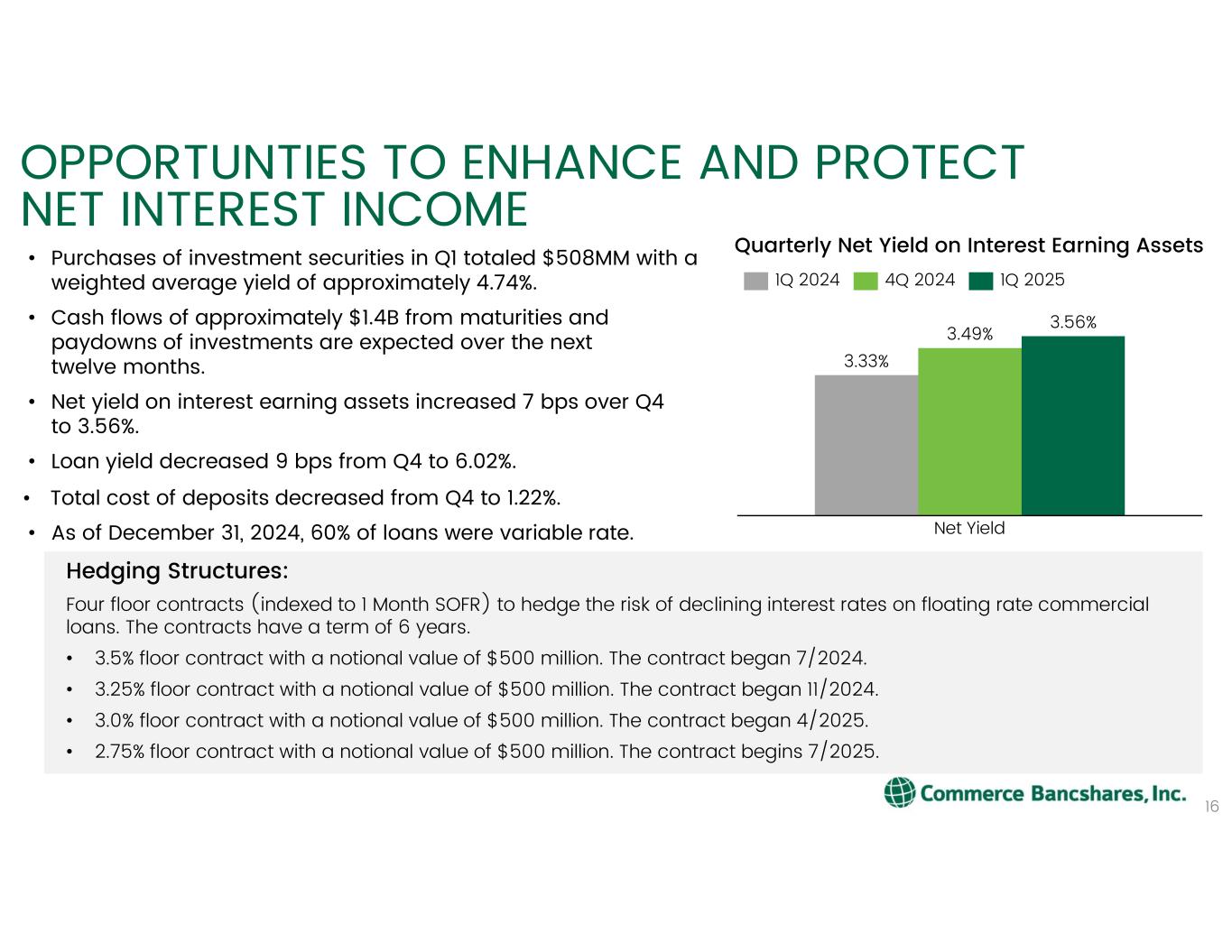

•Net interest income was $269.1 million, a $2.5 million increase over the prior quarter. The net yield on interest earning assets increased seven basis points to 3.56%.

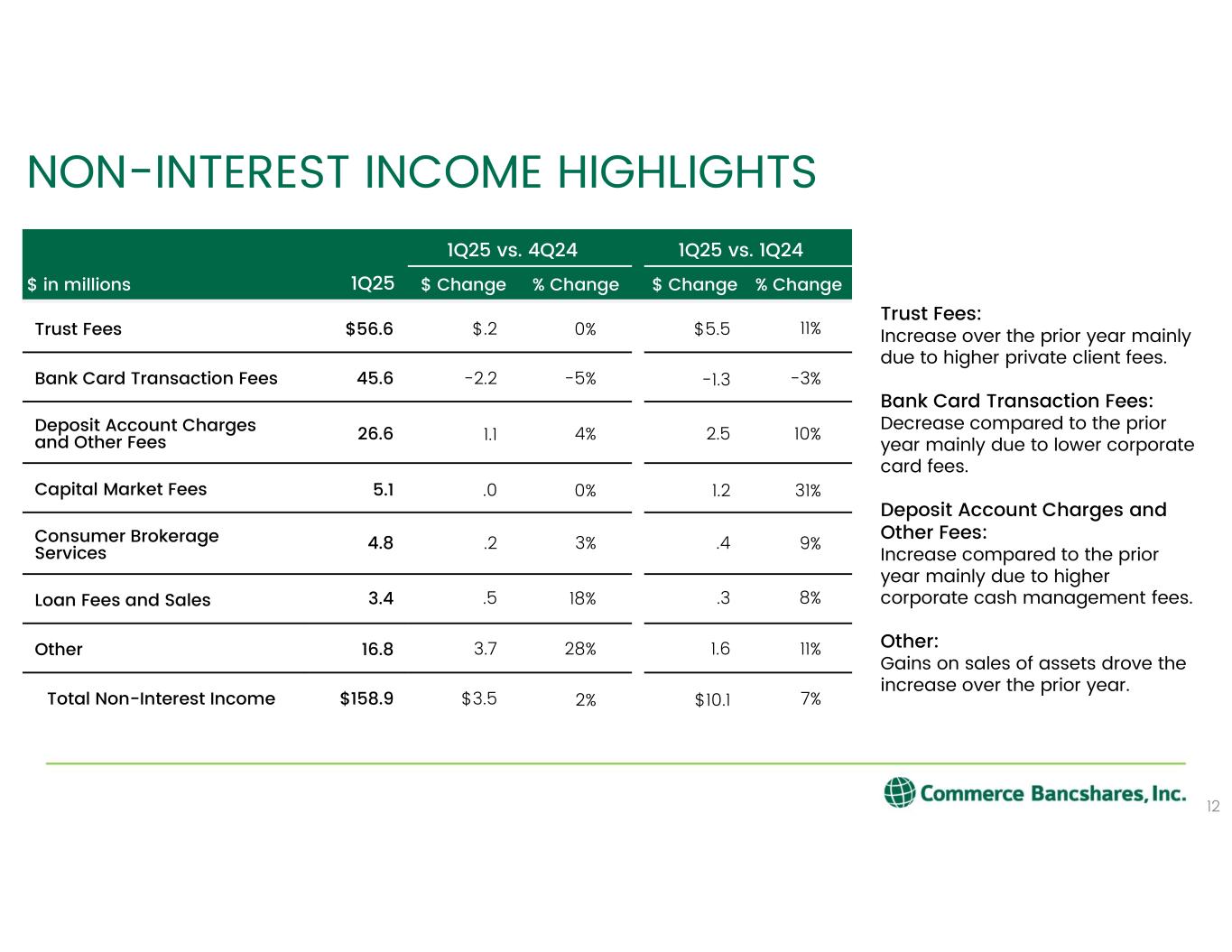

•Non-interest income totaled $158.9 million, an increase of $10.1 million, or 6.8%, over the same quarter last year.

•Trust fees grew $5.5 million, or 10.7%, compared to the same period last year, mostly due to higher private client fees.

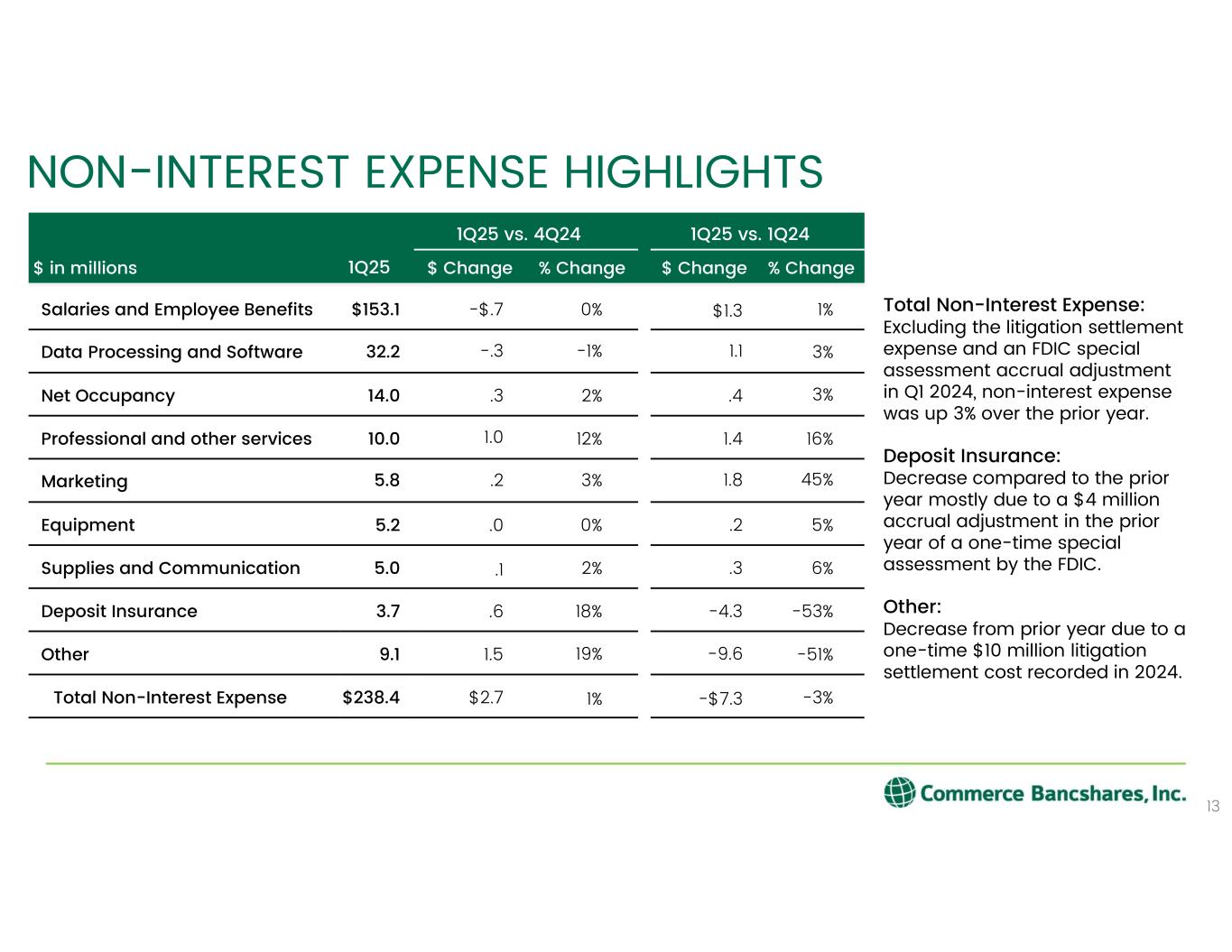

•Non-interest expense totaled $238.4 million, a decrease of $7.3 million, or 3.0%, compared to the same quarter last year.

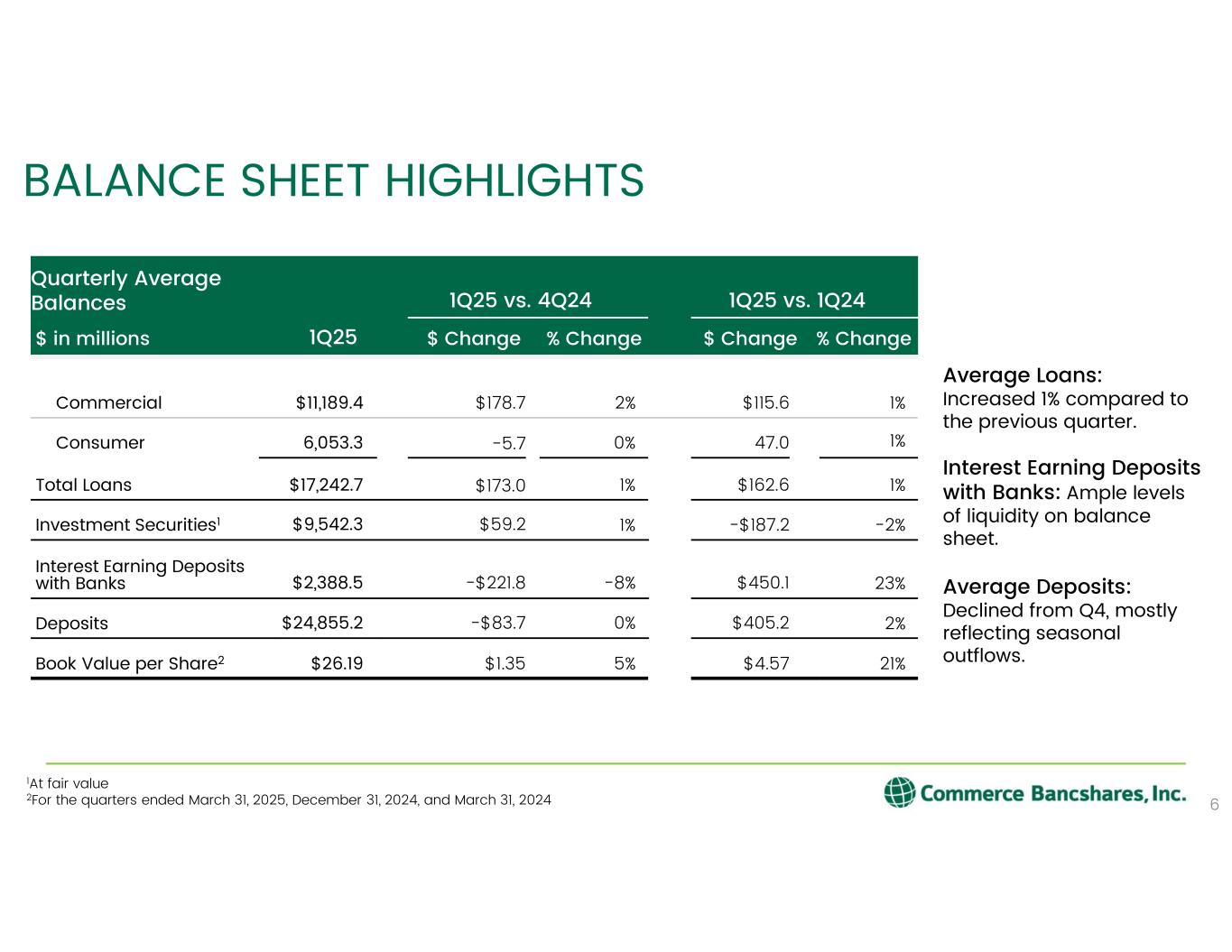

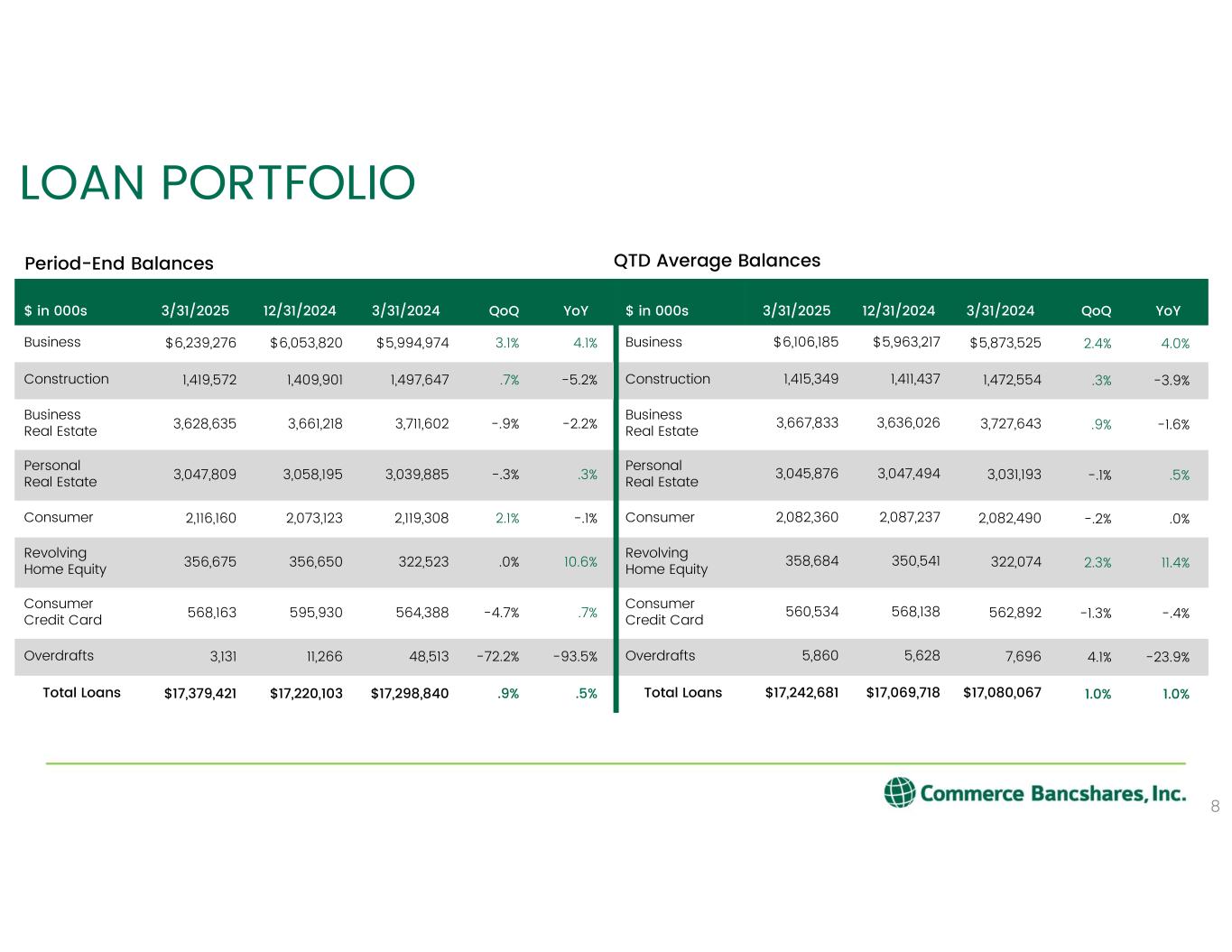

•Average loan balances totaled $17.2 billion, an increase of 1.0% compared to the prior quarter.

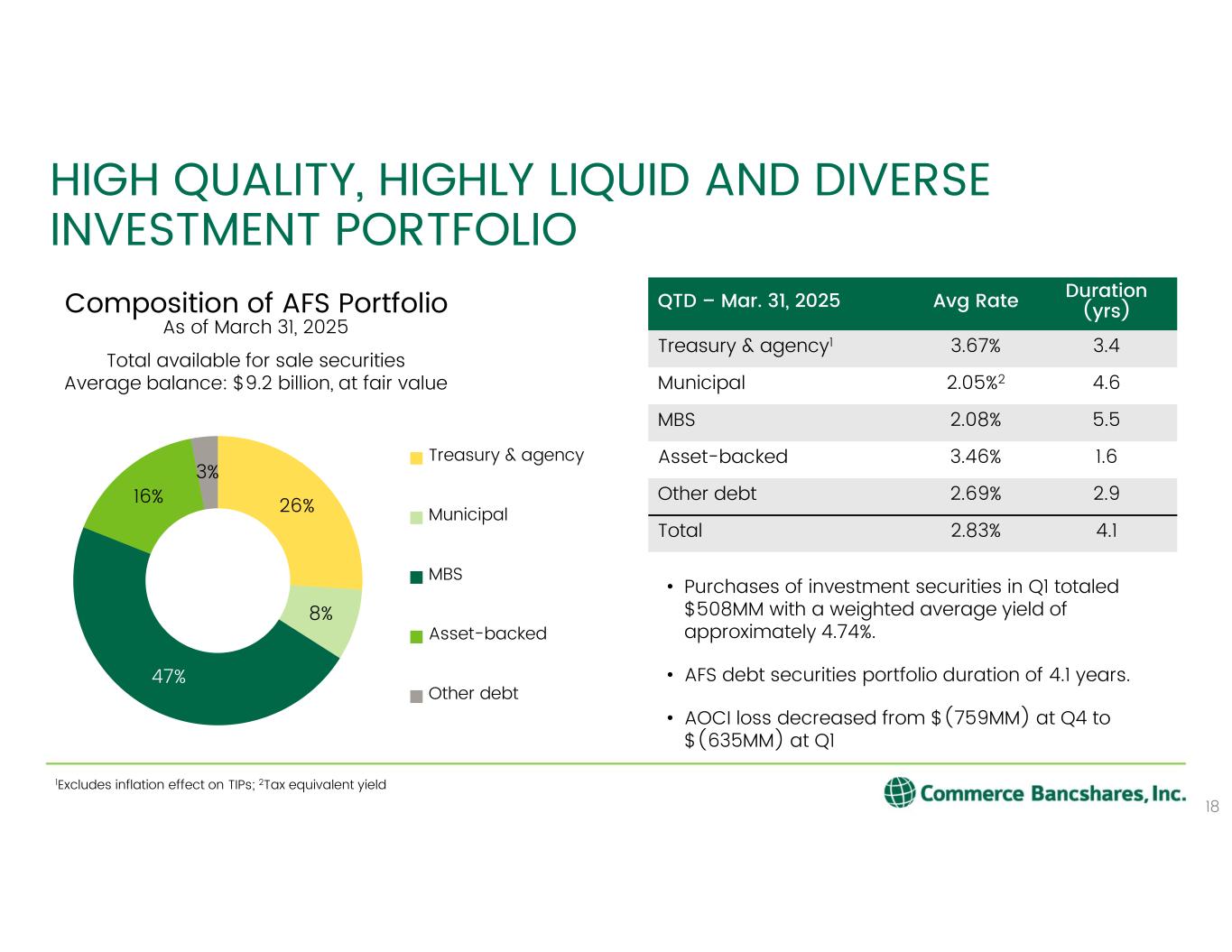

•Total average available for sale debt securities increased $66.1 million over the prior quarter to $9.2 billion, at fair value.

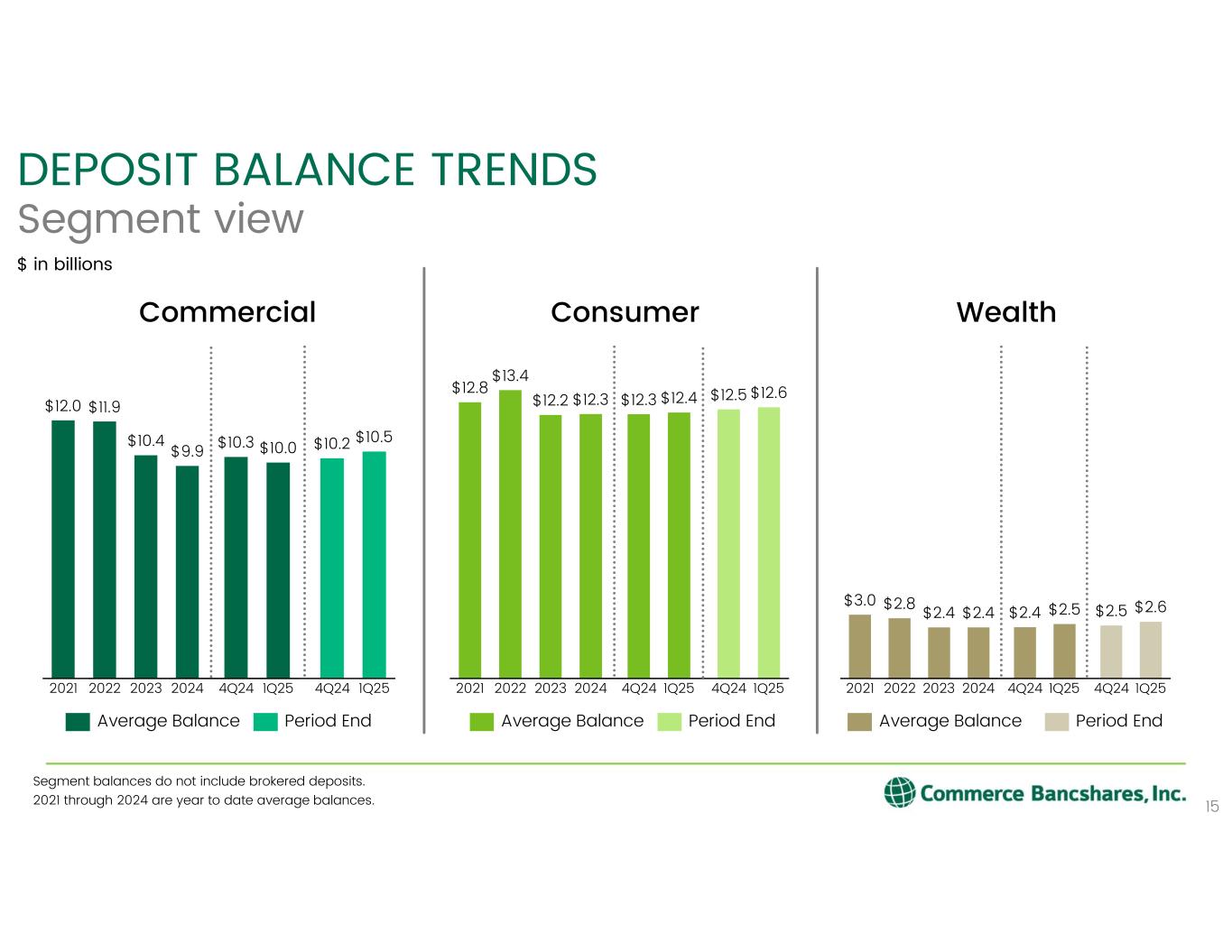

•Total average deposits decreased $83.7 million, or .3%, compared to the prior quarter. The average rate paid on interest bearing deposits declined 15 basis points to 1.72%, compared to the prior quarter.

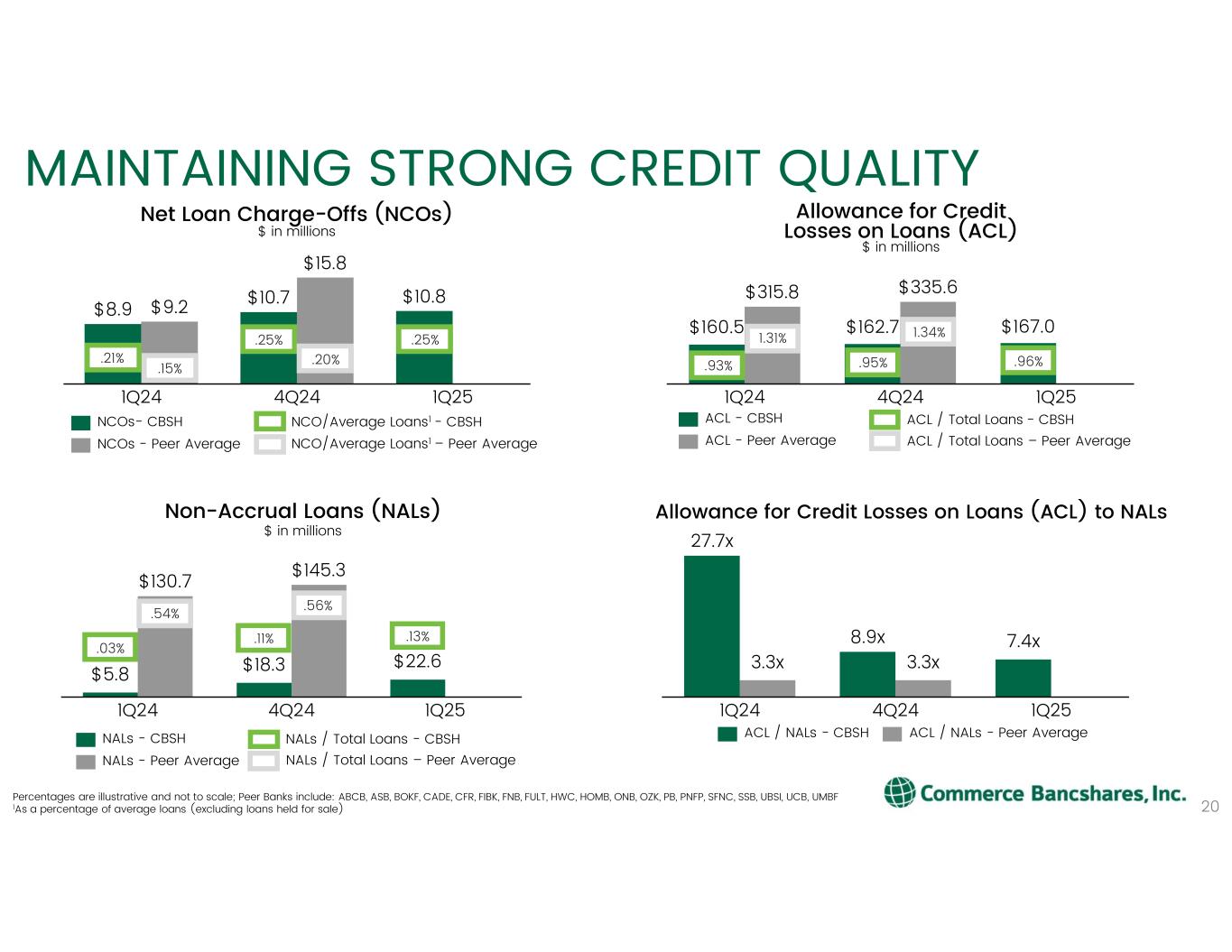

•The ratio of annualized net loan charge-offs to average loans was .25% in the current and prior quarters.

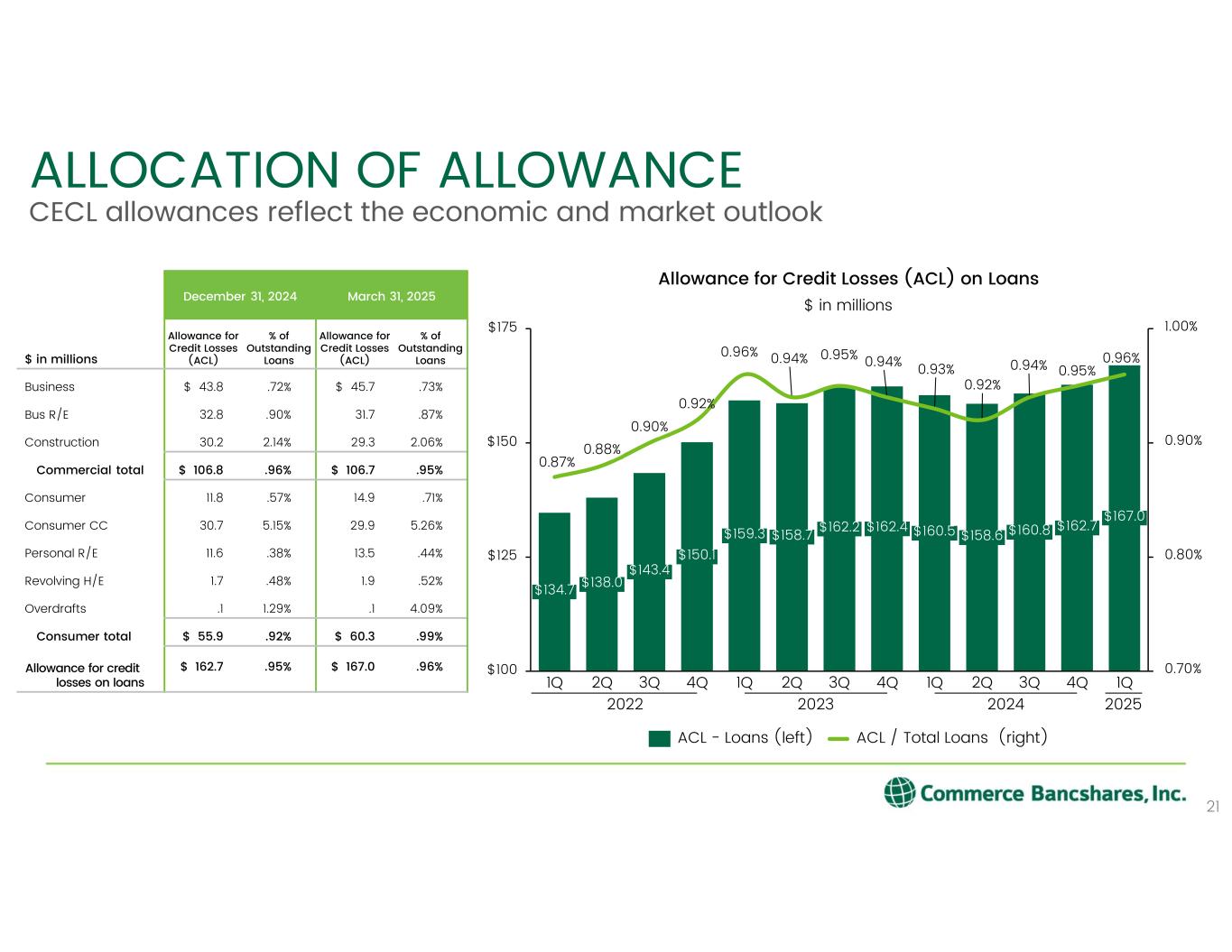

•The allowance for credit losses on loans increased $4.3 million during the first quarter of 2025 to $167.0 million, and the ratio of the allowance for credit losses on loans to total loans was .96%, at March 31, 2025, compared to .95% at December 31, 2024.

•Total assets at March 31, 2025 were $32.4 billion, an increase of $368.3 million, or 1.2%, over the prior quarter.

•For the quarter, the return on average assets was 1.69%, the return on average equity was 15.82%, and the efficiency ratio was 55.6%.

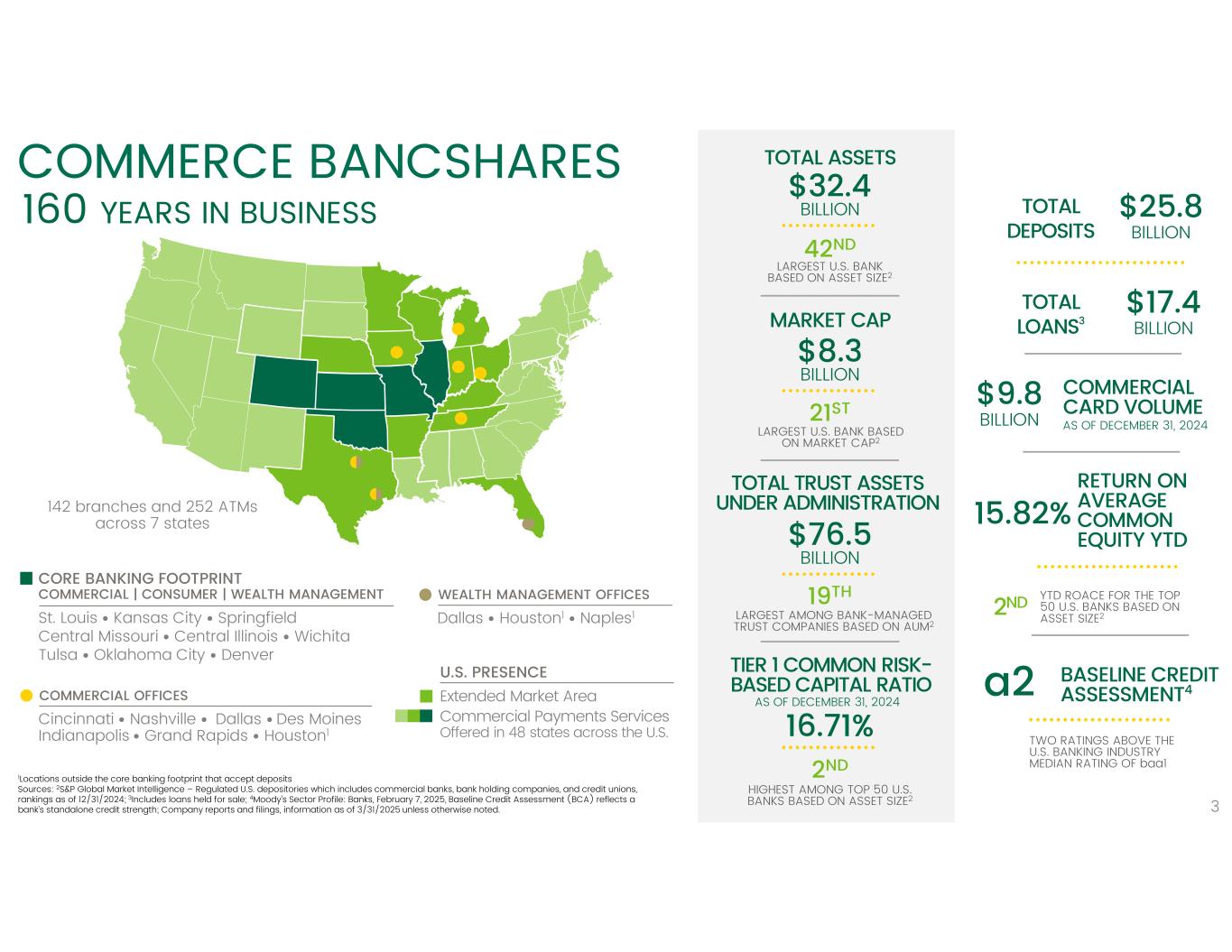

Commerce Bancshares, Inc. is a regional bank holding company offering a full line of banking services through its subsidiaries, including payment solutions, investment management and securities brokerage. One of its subsidiaries, Commerce Bank, leverages 160 years of proven strength and experience to help individuals and businesses solve financial challenges. In addition to offering payment solutions across the U.S., Commerce Bank currently operates full-service banking facilities across the Midwest including the St. Louis and Kansas City metropolitan areas, Springfield, Central Missouri, Central Illinois, Wichita, Tulsa, Oklahoma City, and Denver. Beyond the Midwest, Commerce also maintains commercial offices in Dallas, Houston, Cincinnati, Nashville, Des Moines, Indianapolis, and Grand Rapids and wealth offices in Dallas, Houston, and Naples. Commerce delivers high-touch service and sophisticated financial solutions at regional branches, commercial and wealth offices, ATMs, online, mobile and through a 24/7 customer service line.

This financial news release and the supplementary Earnings Highlights presentation are available on the Company’s website at https://investor.commercebank.com/news-info/financial-news-releases/default.aspx.

* * * * * * * * * * * * * * *

For additional information, contact

Matt Burkemper, Investor Relations

(314) 746-7485

www.commercebank.com

matthew.burkemper@commercebank.com

COMMERCE BANCSHARES, INC. and SUBSIDIARIES

FINANCIAL HIGHLIGHTS

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| |

|

For the Three Months Ended |

|

(Unaudited)

(Dollars in thousands, except per share data) |

|

Mar. 31, 2025 |

Dec. 31, 2024 |

Mar. 31, 2024 |

|

|

| FINANCIAL SUMMARY |

|

|

|

|

|

|

| Net interest income |

|

$269,102 |

|

$266,647 |

|

$248,999 |

|

|

|

| Non-interest income |

|

158,949 |

|

155,436 |

|

148,848 |

|

|

|

| Total revenue |

|

428,051 |

|

422,083 |

|

397,847 |

|

|

|

| Investment securities gains (losses) |

|

(7,591) |

|

977 |

|

(259) |

|

|

|

| Provision for credit losses |

|

14,487 |

|

13,508 |

|

4,787 |

|

|

|

| Non-interest expense |

|

238,376 |

|

235,718 |

|

245,697 |

|

|

|

| Income before taxes |

|

167,597 |

|

173,834 |

|

147,104 |

|

|

|

| Income taxes |

|

36,964 |

|

36,590 |

|

31,652 |

|

|

|

| Non-controlling interest expense (income) |

|

(959) |

|

1,136 |

|

2,789 |

|

|

|

| Net income attributable to Commerce Bancshares, Inc. |

$131,592 |

|

$136,108 |

|

$112,663 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Earnings per common share: |

|

|

|

|

|

|

| Net income — basic |

|

$0.98 |

|

$1.01 |

|

$0.82 |

|

|

|

| Net income — diluted |

|

$0.98 |

|

$1.01 |

|

$0.82 |

|

|

|

| Effective tax rate |

|

21.93 |

% |

21.19 |

% |

21.93 |

% |

|

|

| Fully-taxable equivalent net interest income |

|

$271,416 |

|

$268,935 |

|

$251,312 |

|

|

|

Average total interest earning assets (1) |

|

$30,901,110 |

|

$30,628,722 |

|

$30,365,774 |

|

|

|

| Diluted wtd. average shares outstanding |

|

133,071,719 |

|

133,686,588 |

|

135,645,198 |

|

|

|

|

|

|

|

|

|

|

| RATIOS |

|

|

|

|

|

|

Average loans to deposits (2) |

|

69.38 |

% |

68.45 |

% |

69.87 |

% |

|

|

| Return on total average assets |

|

1.69 |

|

1.73 |

|

1.48 |

|

|

|

|

|

|

|

|

|

|

Return on average equity (3) |

|

15.82 |

|

15.97 |

|

15.39 |

|

|

|

| Non-interest income to total revenue |

|

37.13 |

|

36.83 |

|

37.41 |

|

|

|

Efficiency ratio (4) |

|

55.61 |

|

55.77 |

|

61.67 |

|

|

|

| Net yield on interest earning assets |

|

3.56 |

|

3.49 |

|

3.33 |

|

|

|

|

|

|

|

|

|

|

| EQUITY SUMMARY |

|

|

|

|

|

|

| Cash dividends per share |

|

$.275 |

|

$.257 |

|

$.257 |

|

|

|

| Cash dividends on common stock |

|

$36,866 |

|

$34,609 |

|

$35,140 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Book value per share (5) |

|

$26.19 |

|

$24.84 |

|

$21.62 |

|

|

|

Market value per share (5) |

|

$62.23 |

|

$62.31 |

|

$50.67 |

|

|

|

| High market value per share |

|

$68.87 |

|

$72.75 |

|

$52.99 |

|

|

|

| Low market value per share |

|

$58.80 |

|

$54.01 |

|

$47.09 |

|

|

|

Common shares outstanding (5) |

|

133,597,405 |

|

134,152,172 |

|

136,179,336 |

|

|

|

Tangible common equity to tangible assets (6) |

|

10.33 |

% |

9.92 |

% |

9.24 |

% |

|

|

| Tier I leverage ratio |

|

12.29 |

% |

12.26 |

% |

11.75 |

% |

|

|

|

|

|

|

|

|

|

| OTHER QTD INFORMATION |

|

|

|

|

|

|

| Number of bank/ATM locations |

|

242 |

|

243 |

|

254 |

|

|

|

| Full-time equivalent employees |

|

4,662 |

|

4,693 |

|

4,721 |

|

|

|

(1) Excludes allowance for credit losses on loans and unrealized gains/(losses) on available for sale debt securities.

(2) Includes loans held for sale.

(3) Annualized net income attributable to Commerce Bancshares, Inc. divided by average total equity.

(4) The efficiency ratio is calculated as non-interest expense (excluding intangibles amortization) as a percent of total revenue.

(5) As of period end.

(6) The tangible common equity ratio is a non-gaap ratio and is calculated as stockholders’ equity reduced by goodwill and other intangible assets (excluding mortgage servicing rights) divided by total assets reduced by goodwill and other intangible assets (excluding mortgage servicing rights).

All share and per share amounts have been restated to reflect the 5% stock dividend distributed in December 2024.

COMMERCE BANCSHARES, INC. and SUBSIDIARIES

CONSOLIDATED STATEMENTS OF INCOME

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

(Unaudited)

(In thousands, except per share data) |

|

For the Three Months Ended |

|

|

Mar. 31, 2025 |

Dec. 31, 2024 |

Sep. 30, 2024 |

Jun. 30, 2024 |

Mar. 31, 2024 |

|

|

| Interest income |

|

$364,365 |

|

$369,405 |

|

$372,068 |

|

$369,363 |

|

$358,721 |

|

|

|

| Interest expense |

|

95,263 |

|

102,758 |

|

109,717 |

|

107,114 |

|

109,722 |

|

|

|

| Net interest income |

|

269,102 |

|

266,647 |

|

262,351 |

|

262,249 |

|

248,999 |

|

|

|

| Provision for credit losses |

|

14,487 |

|

13,508 |

|

9,140 |

|

5,468 |

|

4,787 |

|

|

|

| Net interest income after credit losses |

254,615 |

|

253,139 |

|

253,211 |

|

256,781 |

|

244,212 |

|

|

|

| NON-INTEREST INCOME |

|

|

|

|

|

|

|

|

| Trust fees |

|

56,592 |

|

56,345 |

|

54,689 |

|

52,291 |

|

51,105 |

|

|

|

| Bank card transaction fees |

|

45,593 |

|

47,807 |

|

47,570 |

|

47,477 |

|

46,930 |

|

|

|

| Deposit account charges and other fees |

26,622 |

|

25,480 |

|

25,380 |

|

25,325 |

|

24,151 |

|

|

|

| Capital market fees |

|

5,112 |

|

5,129 |

|

5,995 |

|

4,760 |

|

3,892 |

|

|

|

| Consumer brokerage services |

|

4,785 |

|

4,636 |

|

4,619 |

|

4,478 |

|

4,408 |

|

|

|

| Loan fees and sales |

|

3,404 |

|

2,874 |

|

3,444 |

|

3,431 |

|

3,141 |

|

|

|

| Other |

|

16,841 |

|

13,165 |

|

17,328 |

|

14,482 |

|

15,221 |

|

|

|

| Total non-interest income |

|

158,949 |

|

155,436 |

|

159,025 |

|

152,244 |

|

148,848 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| INVESTMENT SECURITIES GAINS (LOSSES), NET |

(7,591) |

|

977 |

|

3,872 |

|

3,233 |

|

(259) |

|

|

|

| NON-INTEREST EXPENSE |

|

|

|

|

|

|

|

|

| Salaries and employee benefits |

|

153,078 |

|

153,819 |

|

153,122 |

|

149,120 |

|

151,801 |

|

|

|

| Data processing and software |

|

32,238 |

|

32,514 |

|

32,194 |

|

31,529 |

|

31,153 |

|

|

|

| Net occupancy |

|

14,020 |

|

13,694 |

|

13,411 |

|

12,544 |

|

13,574 |

|

|

|

| Professional and other services |

|

10,026 |

|

8,982 |

|

8,830 |

|

8,617 |

|

8,648 |

|

|

|

| Marketing |

|

5,843 |

|

5,683 |

|

7,278 |

|

5,356 |

|

4,036 |

|

|

|

| Equipment |

|

5,248 |

|

5,232 |

|

5,286 |

|

5,091 |

|

5,010 |

|

|

|

| Supplies and communication |

|

5,046 |

|

4,948 |

|

4,963 |

|

4,636 |

|

4,744 |

|

|

|

| Deposit Insurance |

|

3,744 |

|

3,181 |

|

2,930 |

|

2,354 |

|

8,017 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Other |

|

9,133 |

|

7,665 |

|

9,586 |

|

12,967 |

|

18,714 |

|

|

|

| Total non-interest expense |

|

238,376 |

|

235,718 |

|

237,600 |

|

232,214 |

|

245,697 |

|

|

|

| Income before income taxes |

|

167,597 |

|

173,834 |

|

178,508 |

|

180,044 |

|

147,104 |

|

|

|

| Less income taxes |

|

36,964 |

|

36,590 |

|

38,245 |

|

38,602 |

|

31,652 |

|

|

|

| Net income |

|

130,633 |

|

137,244 |

|

140,263 |

|

141,442 |

|

115,452 |

|

|

|

| Less non-controlling interest expense (income) |

(959) |

|

1,136 |

|

2,256 |

|

1,889 |

|

2,789 |

|

|

|

| Net income attributable to Commerce Bancshares, Inc. |

$131,592 |

|

$136,108 |

|

$138,007 |

|

$139,553 |

|

$112,663 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Net income per common share — basic |

$0.98 |

|

$1.01 |

|

$1.02 |

|

$1.03 |

|

$0.82 |

|

|

|

| Net income per common share — diluted |

$0.98 |

|

$1.01 |

|

$1.01 |

|

$1.03 |

|

$0.82 |

|

|

|

|

|

|

|

|

|

|

|

|

| OTHER INFORMATION |

|

|

|

|

|

|

|

| Return on total average assets |

|

1.69 |

% |

1.73 |

% |

1.80 |

% |

1.86 |

% |

1.48 |

% |

|

|

Return on average equity (1) |

15.82 |

|

15.97 |

|

16.81 |

|

18.52 |

|

15.39 |

|

|

|

Efficiency ratio (2) |

|

55.61 |

|

55.77 |

|

56.31 |

|

55.95 |

|

61.67 |

|

|

|

| Effective tax rate |

|

21.93 |

|

21.19 |

|

21.70 |

|

21.67 |

|

21.93 |

|

|

|

| Net yield on interest earning assets |

3.56 |

|

3.49 |

|

3.50 |

|

3.55 |

|

3.33 |

|

|

|

| Fully-taxable equivalent net interest income |

|

$271,416 |

|

$268,935 |

|

$264,638 |

|

$264,578 |

|

$251,312 |

|

|

|

(1) Annualized net income attributable to Commerce Bancshares, Inc. divided by average total equity.

(2) The efficiency ratio is calculated as non-interest expense (excluding intangibles amortization) as a percent of total revenue.

COMMERCE BANCSHARES, INC. and SUBSIDIARIES

CONSOLIDATED BALANCE SHEETS - PERIOD END

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

(Unaudited)

(In thousands) |

|

Mar. 31, 2025 |

Dec. 31, 2024 |

Mar. 31, 2024 |

| ASSETS |

|

|

|

|

| Loans |

|

|

|

|

| Business |

|

$ |

6,239,276 |

|

$ |

6,053,820 |

|

$ |

5,994,974 |

|

| Real estate — construction and land |

|

1,419,572 |

|

1,409,901 |

|

1,497,647 |

|

| Real estate — business |

|

3,628,635 |

|

3,661,218 |

|

3,711,602 |

|

| Real estate — personal |

|

3,047,809 |

|

3,058,195 |

|

3,039,885 |

|

| Consumer |

|

2,116,160 |

|

2,073,123 |

|

2,119,308 |

|

| Revolving home equity |

|

356,675 |

|

356,650 |

|

322,523 |

|

| Consumer credit card |

|

568,163 |

|

595,930 |

|

564,388 |

|

| Overdrafts |

|

3,131 |

|

11,266 |

|

48,513 |

|

| Total loans |

|

17,379,421 |

|

17,220,103 |

|

17,298,840 |

|

| Allowance for credit losses on loans |

|

(167,031) |

|

(162,742) |

|

(160,465) |

|

| Net loans |

|

17,212,390 |

|

17,057,361 |

|

17,138,375 |

|

| Loans held for sale |

|

2,890 |

|

3,242 |

|

2,328 |

|

| Investment securities: |

|

|

|

|

| Available for sale debt securities |

|

9,264,947 |

|

9,136,853 |

|

9,141,695 |

|

| Trading debt securities |

|

56,569 |

|

38,034 |

|

56,716 |

|

| Equity securities |

|

58,182 |

|

57,442 |

|

12,852 |

|

| Other securities |

|

221,370 |

|

230,051 |

|

229,146 |

|

| Total investment securities |

|

9,601,068 |

|

9,462,380 |

|

9,440,409 |

|

| Federal funds sold |

|

— |

|

3,000 |

|

— |

|

| Securities purchased under agreements to resell |

|

850,000 |

|

625,000 |

|

225,000 |

|

| Interest earning deposits with banks |

|

2,756,521 |

|

2,624,553 |

|

1,609,614 |

|

| Cash and due from banks |

|

517,332 |

|

748,357 |

|

291,040 |

|

| Premises and equipment — net |

|

476,921 |

|

475,275 |

|

467,377 |

|

| Goodwill |

|

146,539 |

|

146,539 |

|

146,539 |

|

| Other intangible assets — net |

|

13,441 |

|

13,632 |

|

13,918 |

|

| Other assets |

|

787,862 |

|

837,288 |

|

1,037,508 |

|

| Total assets |

|

$ |

32,364,964 |

|

$ |

31,996,627 |

|

$ |

30,372,108 |

|

| LIABILITIES AND STOCKHOLDERS’ EQUITY |

|

|

|

|

| Deposits: |

|

|

|

|

| Non-interest bearing |

|

$ |

7,518,243 |

|

$ |

8,150,669 |

|

$ |

7,513,464 |

|

| Savings, interest checking and money market |

|

15,975,283 |

|

14,754,571 |

|

14,463,211 |

|

| Certificates of deposit of less than $100,000 |

|

985,878 |

|

996,721 |

|

997,979 |

|

| Certificates of deposit of $100,000 and over |

|

1,362,393 |

|

1,391,683 |

|

1,465,541 |

|

| Total deposits |

|

25,841,797 |

|

25,293,644 |

|

24,440,195 |

|

| Federal funds purchased and securities sold under agreements to repurchase |

|

2,400,036 |

|

2,926,758 |

|

2,505,576 |

|

| Other borrowings |

|

17,743 |

|

56 |

|

2,359 |

|

| Other liabilities |

|

606,986 |

|

443,694 |

|

460,089 |

|

| Total liabilities |

|

28,866,562 |

|

28,664,152 |

|

27,408,219 |

|

| Stockholders’ equity: |

|

|

|

|

|

|

|

|

|

| Common stock |

|

676,054 |

|

676,054 |

|

655,322 |

|

| Capital surplus |

|

3,381,960 |

|

3,395,645 |

|

3,148,649 |

|

| Retained earnings |

|

140,220 |

|

45,494 |

|

130,706 |

|

| Treasury stock |

|

(85,871) |

|

(48,401) |

|

(59,674) |

|

| Accumulated other comprehensive income (loss) |

|

(634,576) |

|

(758,911) |

|

(931,027) |

|

| Total stockholders’ equity |

|

3,477,787 |

|

3,309,881 |

|

2,943,976 |

|

| Non-controlling interest |

|

20,615 |

|

22,594 |

|

19,913 |

|

| Total equity |

|

3,498,402 |

|

3,332,475 |

|

2,963,889 |

|

| Total liabilities and equity |

|

$ |

32,364,964 |

|

$ |

31,996,627 |

|

$ |

30,372,108 |

|

COMMERCE BANCSHARES, INC. and SUBSIDIARIES

AVERAGE BALANCE SHEETS

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

(Unaudited)

(In thousands) |

For the Three Months Ended |

| Mar. 31, 2025 |

Dec. 31, 2024 |

Sep. 30, 2024 |

Jun. 30, 2024 |

Mar. 31, 2024 |

| ASSETS: |

|

|

|

|

|

| Loans: |

|

|

|

|

|

| Business |

$ |

6,106,185 |

|

$ |

5,963,217 |

|

$ |

5,966,797 |

|

$ |

5,980,364 |

|

$ |

5,873,525 |

|

| Real estate — construction and land |

1,415,349 |

|

1,411,437 |

|

1,400,563 |

|

1,471,504 |

|

1,472,554 |

|

| Real estate — business |

3,667,833 |

|

3,636,026 |

|

3,580,772 |

|

3,666,057 |

|

3,727,643 |

|

| Real estate — personal |

3,045,876 |

|

3,047,494 |

|

3,047,563 |

|

3,044,943 |

|

3,031,193 |

|

| Consumer |

2,082,360 |

|

2,087,237 |

|

2,129,483 |

|

2,127,650 |

|

2,082,490 |

|

| Revolving home equity |

358,684 |

|

350,541 |

|

335,817 |

|

326,204 |

|

322,074 |

|

| Consumer credit card |

560,534 |

|

568,138 |

|

559,410 |

|

552,896 |

|

562,892 |

|

| Overdrafts |

5,860 |

|

5,628 |

|

5,460 |

|

4,856 |

|

7,696 |

|

Total loans |

17,242,681 |

|

17,069,718 |

|

17,025,865 |

|

17,174,474 |

|

17,080,067 |

|

| Allowance for credit losses on loans |

(162,186) |

|

(160,286) |

|

(158,003) |

|

(159,791) |

|

(161,891) |

|

| Net loans |

17,080,495 |

|

16,909,432 |

|

16,867,862 |

|

17,014,683 |

|

16,918,176 |

|

| Loans held for sale |

1,584 |

|

2,080 |

|

2,448 |

|

2,455 |

|

2,149 |

|

| Investment securities: |

|

|

|

|

|

| U.S. government and federal agency obligations |

2,586,944 |

|

2,459,485 |

|

1,888,985 |

|

1,201,954 |

|

851,656 |

|

| Government-sponsored enterprise obligations |

55,330 |

|

55,428 |

|

55,583 |

|

55,634 |

|

55,652 |

|

| State and municipal obligations |

804,363 |

|

831,695 |

|

856,620 |

|

1,069,934 |

|

1,330,808 |

|

| Mortgage-backed securities |

4,788,102 |

|

4,905,187 |

|

5,082,091 |

|

5,553,656 |

|

5,902,328 |

|

| Asset-backed securities |

1,655,701 |

|

1,570,878 |

|

1,525,593 |

|

1,785,598 |

|

2,085,050 |

|

Other debt securities |

258,136 |

|

221,076 |

|

224,528 |

|

364,828 |

|

503,204 |

|

| Unrealized gain (loss) on debt securities |

(935,054) |

|

(896,346) |

|

(961,695) |

|

(1,272,127) |

|

(1,274,125) |

|

| Total available for sale debt securities |

9,213,522 |

|

9,147,403 |

|

8,671,705 |

|

8,759,477 |

|

9,454,573 |

|

Trading debt securities |

38,298 |

|

56,440 |

|

47,440 |

|

46,565 |

|

40,483 |

|

| Equity securities |

57,028 |

|

56,758 |

|

85,118 |

|

127,584 |

|

12,768 |

|

| Other securities |

233,461 |

|

222,529 |

|

217,377 |

|

228,403 |

|

221,695 |

|

| Total investment securities |

9,542,309 |

|

9,483,130 |

|

9,021,640 |

|

9,162,029 |

|

9,729,519 |

|

| Federal funds sold |

2,089 |

|

826 |

|

12 |

|

1,612 |

|

599 |

|

| Securities purchased under agreements to resell |

788,889 |

|

566,307 |

|

474,997 |

|

303,586 |

|

340,934 |

|

| Interest earning deposits with banks |

2,388,504 |

|

2,610,315 |

|

2,565,188 |

|

2,099,777 |

|

1,938,381 |

|

| Other assets |

1,698,296 |

|

1,701,822 |

|

1,648,321 |

|

1,651,808 |

|

1,715,716 |

|

| Total assets |

$ |

31,502,166 |

|

$ |

31,273,912 |

|

$ |

30,580,468 |

|

$ |

30,235,950 |

|

$ |

30,645,474 |

|

|

|

|

|

|

|

| LIABILITIES AND EQUITY: |

|

|

|

|

|

| Non-interest bearing deposits |

$ |

7,298,686 |

|

$ |

7,464,255 |

|

$ |

7,284,834 |

|

$ |

7,297,955 |

|

$ |

7,328,603 |

|

| Savings |

1,294,174 |

|

1,281,291 |

|

1,303,675 |

|

1,328,989 |

|

1,333,983 |

|

| Interest checking and money market |

13,906,827 |

|

13,679,666 |

|

13,242,398 |

|

13,162,118 |

|

13,215,270 |

|

| Certificates of deposit of less than $100,000 |

991,826 |

|

1,061,783 |

|

1,055,683 |

|

1,003,798 |

|

976,804 |

|

| Certificates of deposit of $100,000 and over |

1,363,655 |

|

1,451,851 |

|

1,464,143 |

|

1,492,592 |

|

1,595,310 |

|

| Total deposits |

24,855,168 |

|

24,938,846 |

|

24,350,733 |

|

24,285,452 |

|

24,449,970 |

|

| Borrowings: |

|

|

|

|

|

| Federal funds purchased |

128,340 |

|

121,781 |

|

206,644 |

|

265,042 |

|

328,216 |

|

| Securities sold under agreements to repurchase |

2,723,227 |

|

2,445,956 |

|

2,351,870 |

|

2,254,849 |

|

2,511,959 |

|

| Other borrowings |

616 |

|

1,067 |

|

496 |

|

838 |

|

76 |

|

| Total borrowings |

2,852,183 |

|

2,568,804 |

|

2,559,010 |

|

2,520,729 |

|

2,840,251 |

|

| Other liabilities |

421,370 |

|

375,463 |

|

405,490 |

|

399,080 |

|

410,310 |

|

| Total liabilities |

28,128,721 |

|

27,883,113 |

|

27,315,233 |

|

27,205,261 |

|

27,700,531 |

|

| Equity |

3,373,445 |

|

3,390,799 |

|

3,265,235 |

|

3,030,689 |

|

2,944,943 |

|

| Total liabilities and equity |

$ |

31,502,166 |

|

$ |

31,273,912 |

|

$ |

30,580,468 |

|

$ |

30,235,950 |

|

$ |

30,645,474 |

|

|

|

|

|

|

|

|

|

|

|

|

|

COMMERCE BANCSHARES, INC. and SUBSIDIARIES

AVERAGE RATES

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| (Unaudited) |

For the Three Months Ended |

| Mar. 31, 2025 |

Dec. 31, 2024 |

Sep. 30, 2024 |

Jun. 30, 2024 |

Mar. 31, 2024 |

| ASSETS: |

|

|

|

|

|

| Loans: |

|

|

|

|

|

Business (1) |

5.75 |

% |

5.86 |

% |

6.17 |

% |

6.11 |

% |

6.07 |

% |

| Real estate — construction and land |

7.30 |

|

7.75 |

|

8.44 |

|

8.36 |

|

8.40 |

|

| Real estate — business |

5.88 |

|

6.01 |

|

6.28 |

|

6.26 |

|

6.26 |

|

| Real estate — personal |

4.28 |

|

4.17 |

|

4.10 |

|

4.04 |

|

3.95 |

|

| Consumer |

6.52 |

|

6.52 |

|

6.64 |

|

6.56 |

|

6.40 |

|

| Revolving home equity |

7.26 |

|

7.28 |

|

7.69 |

|

7.68 |

|

7.70 |

|

| Consumer credit card |

13.49 |

|

13.60 |

|

14.01 |

|

13.96 |

|

14.11 |

|

| Overdrafts |

— |

|

— |

|

— |

|

— |

|

— |

|

| Total loans |

6.02 |

|

6.11 |

|

6.35 |

|

6.30 |

|

6.27 |

|

| Loans held for sale |

5.89 |

|

7.65 |

|

6.34 |

|

7.54 |

|

7.49 |

|

| Investment securities: |

|

|

|

|

|

| U.S. government and federal agency obligations |

4.09 |

|

3.86 |

|

3.68 |

|

5.04 |

|

2.08 |

|

| Government-sponsored enterprise obligations |

2.40 |

|

2.36 |

|

2.37 |

|

2.39 |

|

2.39 |

|

State and municipal obligations (1) |

2.05 |

|

2.01 |

|

2.00 |

|

2.00 |

|

1.97 |

|

| Mortgage-backed securities |

2.08 |

|

2.17 |

|

1.95 |

|

2.09 |

|

2.19 |

|

| Asset-backed securities |

3.46 |

|

2.99 |

|

2.66 |

|

2.50 |

|

2.39 |

|

| Other debt securities |

2.69 |

|

2.11 |

|

2.07 |

|

2.01 |

|

1.93 |

|

| Total available for sale debt securities |

2.83 |

|

2.70 |

|

2.41 |

|

2.50 |

|

2.18 |

|

Trading debt securities (1) |

4.97 |

|

4.26 |

|

4.52 |

|

4.95 |

|

5.30 |

|

Equity securities (1) |

8.02 |

|

6.58 |

|

4.44 |

|

2.82 |

|

25.64 |

|

Other securities (1) |

7.85 |

|

5.75 |

|

6.09 |

|

13.20 |

|

13.04 |

|

| Total investment securities |

2.98 |

|

2.80 |

|

2.52 |

|

2.75 |

|

2.44 |

|

| Federal funds sold |

5.63 |

|

5.78 |

|

— |

|

6.74 |

|

6.71 |

|

| Securities purchased under agreements to resell |

3.81 |

|

3.57 |

|

3.53 |

|

3.21 |

|

1.93 |

|

| Interest earning deposits with banks |

4.46 |

|

4.78 |

|

5.43 |

|

5.48 |

|

5.48 |

|

| Total interest earning assets |

4.81 |

|

4.83 |

|

4.96 |

|

4.98 |

|

4.78 |

|

|

|

|

|

|

|

| LIABILITIES AND EQUITY: |

|

|

|

|

|

| Interest bearing deposits: |

|

|

|

|

|

| Savings |

.05 |

|

.05 |

|

.07 |

|

.06 |

|

.06 |

|

| Interest checking and money market |

1.52 |

|

1.63 |

|

1.74 |

|

1.73 |

|

1.69 |

|

| Certificates of deposit of less than $100,000 |

3.65 |

|

3.91 |

|

4.17 |

|

4.22 |

|

4.20 |

|

| Certificates of deposit of $100,000 and over |

3.96 |

|

4.24 |

|

4.51 |

|

4.55 |

|

4.56 |

|

| Total interest bearing deposits |

1.72 |

|

1.87 |

|

2.00 |

|

1.99 |

|

1.97 |

|

| Borrowings: |

|

|

|

|

|

| Federal funds purchased |

4.37 |

|

4.71 |

|

5.38 |

|

5.42 |

|

5.42 |

|

| Securities sold under agreements to repurchase |

2.86 |

|

3.11 |

|

3.56 |

|

3.44 |

|

3.43 |

|

| Other borrowings |

.66 |

|

3.36 |

|

4.81 |

|

3.84 |

|

— |

|

| Total borrowings |

2.93 |

|

3.18 |

|

3.71 |

|

3.65 |

|

3.66 |

|

| Total interest bearing liabilities |

1.89 |

% |

2.04 |

% |

2.22 |

% |

2.21 |

% |

2.21 |

% |

|

|

|

|

|

|

| Net yield on interest earning assets |

3.56 |

% |

3.49 |

% |

3.50 |

% |

3.55 |

% |

3.33 |

% |

(1) Stated on a fully taxable-equivalent basis using a federal income tax rate of 21%.

COMMERCE BANCSHARES, INC. and SUBSIDIARIES

CREDIT QUALITY

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| |

|

For the Three Months Ended |

|

(Unaudited)

(In thousands, except ratios) |

|

Mar. 31, 2025 |

Dec. 31, 2024 |

Sep. 30, 2024 |

Jun. 30, 2024 |

Mar. 31, 2024 |

|

|

| ALLOWANCE FOR CREDIT LOSSES ON LOANS |

|

|

|

|

|

|

|

|

| Balance at beginning of period |

|

$162,742 |

|

$160,839 |

|

$158,557 |

|

$160,465 |

|

$162,395 |

|

|

|

|

|

|

|

|

|

|

|

|

| Provision for credit losses on loans |

|

15,095 |

|

12,557 |

|

11,861 |

|

7,849 |

|

6,947 |

|

|

|

| Net charge-offs (recoveries): |

|

|

|

|

|

|

|

|

| Commercial portfolio: |

|

|

|

|

|

|

|

|

| Business |

|

46 |

|

335 |

|

114 |

|

622 |

|

23 |

|

|

|

| Real estate — construction and land |

|

— |

|

— |

|

— |

|

— |

|

— |

|

|

|

| Real estate — business |

|

377 |

|

50 |

|

(7) |

|

(8) |

|

(141) |

|

|

|

|

|

423 |

|

385 |

|

107 |

|

614 |

|

(118) |

|

|

|

| Personal banking portfolio: |

|

|

|

|

|

|

|

|

| Consumer credit card |

|

6,967 |

|

6,557 |

|

6,273 |

|

6,746 |

|

6,435 |

|

|

|

| Consumer |

|

2,852 |

|

3,237 |

|

2,759 |

|

1,804 |

|

1,983 |

|

|

|

| Overdraft |

|

495 |

|

470 |

|

464 |

|

521 |

|

557 |

|

|

|

| Real estate — personal |

|

72 |

|

8 |

|

128 |

|

79 |

|

24 |

|

|

|

| Revolving home equity |

|

(3) |

|

(3) |

|

(152) |

|

(7) |

|

(4) |

|

|

|

|

|

10,383 |

|

10,269 |

|

9,472 |

|

9,143 |

|

8,995 |

|

|

|

| Total net loan charge-offs |

|

10,806 |

|

10,654 |

|

9,579 |

|

9,757 |

|

8,877 |

|

|

|

| Balance at end of period |

|

$167,031 |

|

$162,742 |

|

$160,839 |

|

$158,557 |

|

$160,465 |

|

|

|

| LIABILITY FOR UNFUNDED LENDING COMMITMENTS |

|

$18,327 |

|

$18,935 |

|

$17,984 |

|

$20,705 |

|

$23,086 |

|

|

|

|

|

|

|

|

|

|

|

|

NET CHARGE-OFF RATIOS (1) |

|

|

|

|

|

|

|

|

| Commercial portfolio: |

|

|

|

|

|

|

|

|

| Business |

|

— |

% |

.02 |

% |

.01 |

% |

.04 |

% |

— |

% |

|

|

| Real estate — construction and land |

|

— |

|

— |

|

— |

|

— |

|

— |

|

|

|

| Real estate — business |

|

.04 |

|

.01 |

|

— |

|

— |

|

(.02) |

|

|

|

|

|

.02 |

|

.01 |

|

— |

|

.02 |

|

— |

|

|

|

| Personal banking portfolio: |

|

|

|

|

|

|

|

|

| Consumer credit card |

|

5.04 |

|

4.59 |

|

4.46 |

|

4.91 |

|

4.60 |

|

|

|

| Consumer |

|

.56 |

|

.62 |

|

.52 |

|

.34 |

|

.38 |

|

|

|

| Overdraft |

|

34.26 |

|

33.22 |

|

33.81 |

|

43.15 |

|

29.11 |

|

|

|

| Real estate — personal |

|

.01 |

|

— |

|

.02 |

|

.01 |

|

— |

|

|

|

| Revolving home equity |

|

— |

|

— |

|

(.18) |

|

(.01) |

|

— |

|

|

|

|

|

.70 |

|

.67 |

|

.62 |

|

.61 |

|

.60 |

|

|

|

| Total |

|

.25 |

% |

.25 |

% |

.22 |

% |

.23 |

% |

.21 |

% |

|

|

|

|

|

|

|

|

|

|

|

| CREDIT QUALITY RATIOS |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Non-accrual loans to total loans |

|

.13 |

% |

.11 |

% |

.11 |

% |

.11 |

% |

.03 |

% |

|

|

|

|

|

|

|

|

|

|

|

| Allowance for credit losses on loans to total loans |

|

.96 |

|

.95 |

|

.94 |

|

.92 |

|

.93 |

|

|

|

|

|

|

|

|

|

|

|

|

| NON-ACCRUAL AND PAST DUE LOANS |

|

|

|

|

|

|

|

|

| Non-accrual loans: |

|

|

|

|

|

|

|

|

| Business |

|

$1,112 |

|

$101 |

|

$354 |

|

$504 |

|

$1,038 |

|

|

|

| Real estate — construction and land |

|

220 |

|

220 |

|

— |

|

— |

|

— |

|

|

|

| Real estate — business |

|

18,305 |

|

14,954 |

|

14,944 |

|

15,050 |

|

1,246 |

|

|

|

| Real estate — personal |

|

989 |

|

1,026 |

|

1,144 |

|

1,772 |

|

1,523 |

|

|

|

|

|

|

|

|

|

|

|

|

| Revolving home equity |

|

1,977 |

|

1,977 |

|

1,977 |

|

1,977 |

|

1,977 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Total |

|

22,603 |

|

18,278 |

|

18,419 |

|

19,303 |

|

5,784 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Loans past due 90 days and still accruing interest |

$19,417 |

|

$24,516 |

|

$21,986 |

|

$18,566 |

|

$20,281 |

|

|

|

(1) Net charge-offs are annualized and calculated as a percentage of average loans (excluding loans held for sale).

Exhibit 99.1

COMMERCE BANCSHARES, INC.

Management Discussion of First Quarter Results

March 31, 2025

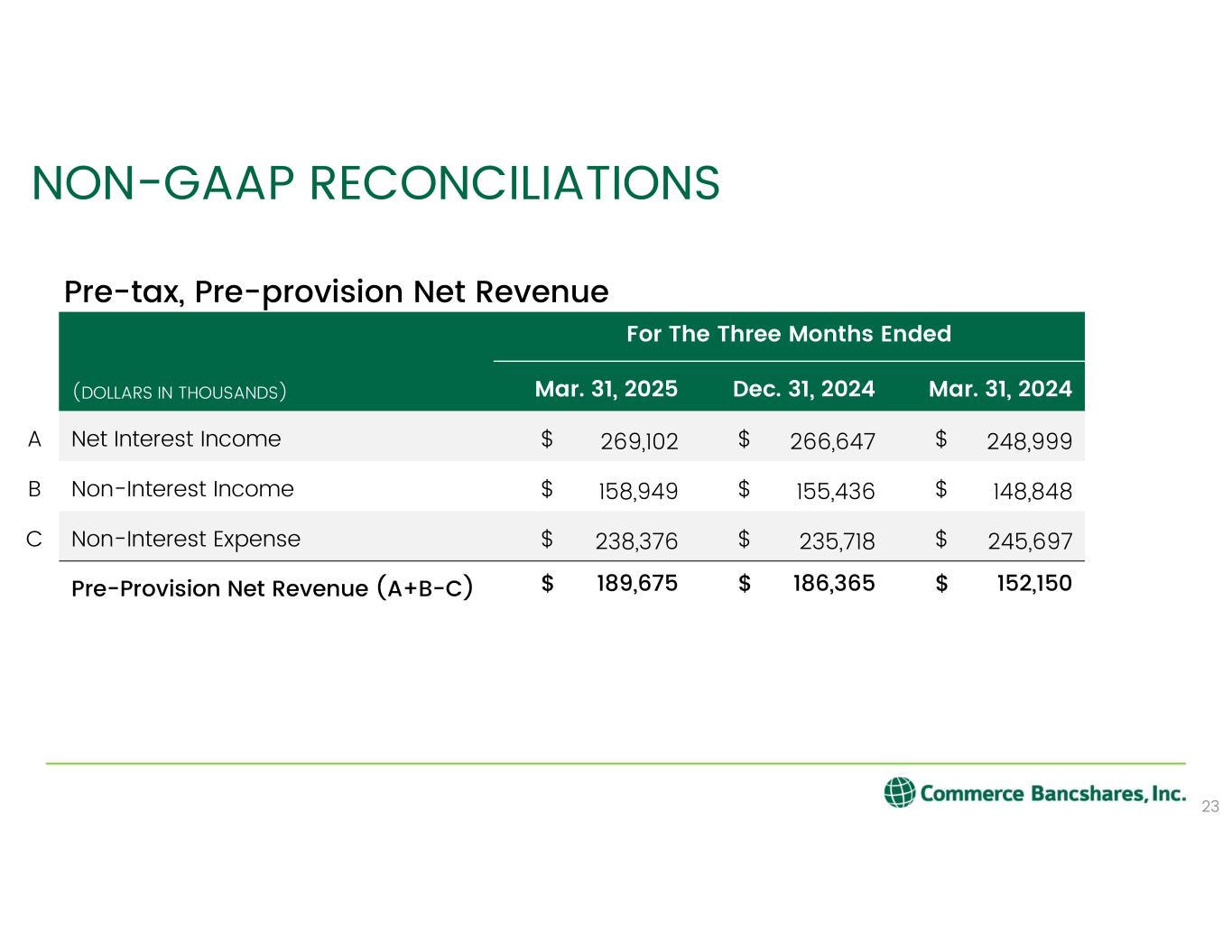

For the quarter ended March 31, 2025, net income amounted to $131.6 million, compared to $136.1 million in the previous quarter and $112.7 million in the same quarter last year. The decrease in net income compared to the previous quarter was primarily the result of investment securities losses and higher non-interest expense, partly offset by higher net interest income and non-interest income. The net yield on interest earning assets increased seven basis points over the previous quarter to 3.56%. Average available for sale debt securities, at fair value, and average loans increased $66.1 million and $173.0 million, respectively, while average deposits decreased $83.7 million compared to the prior quarter. For the quarter, the return on average assets was 1.69%, the return on average equity was 15.82%, and the efficiency ratio was 55.6%.

Balance Sheet Review

During the 1st quarter of 2025, average loans totaled $17.2 billion, an increase of $173.0 million over the prior quarter, and an increase of $162.6 million over the same quarter last year. Compared to the previous quarter, average balances of business loans and business real estate loans grew $143.0 million and $31.8 million, respectively. During the current quarter, the Company sold certain fixed rate personal real estate loans totaling $14.9 million, compared to $21.9 million in the prior quarter.

Total average available for sale debt securities increased $66.1 million over the previous quarter to $9.2 billion, at fair value. The increase in available for sale debt securities was mainly the result of higher average balances of U.S. government and federal agency obligations and other asset-backed securities, partly offset by lower average balances of mortgage-backed securities. During the 1st quarter of 2025, the unrealized loss on available for sale debt securities decreased $157.7 million to $832.9 million, at period end. Also, during the 1st quarter of 2025, purchases of available for sale debt securities totaled $507.7 million with a weighted average yield of approximately 4.74%, and maturities and pay downs of available for sale debt securities were $542.3 million. At March 31, 2025, the duration of the available for sale investment portfolio was 4.1 years, and maturities and pay downs of approximately $1.4 billion are expected to occur during the next 12 months.

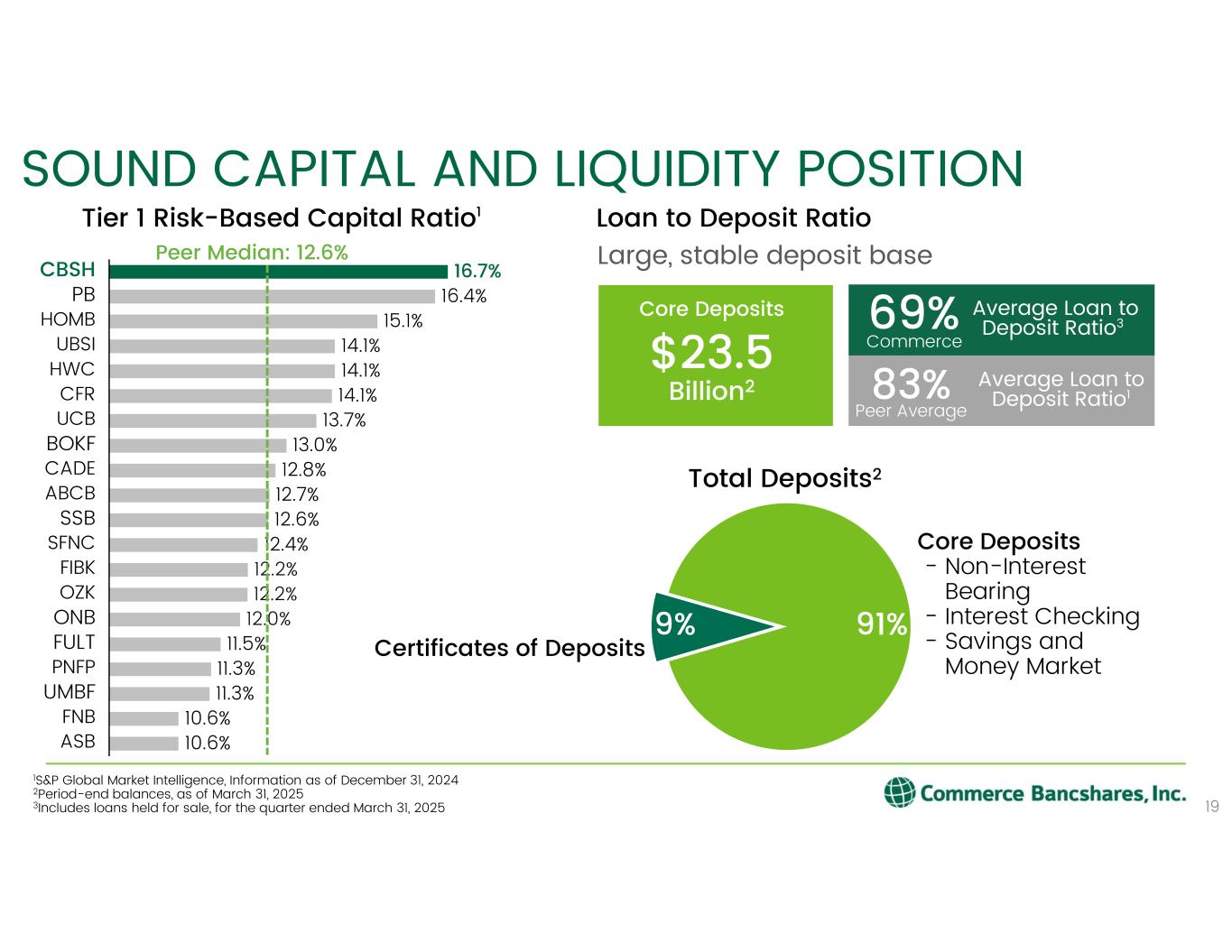

Total average deposits decreased $83.7 million this quarter compared to the previous quarter. The decrease in deposits mostly resulted from declines of $165.6 million and $158.2 million in average balances of demand deposits and certificates of deposit, respectively, partly offset by higher interest checking and money market deposit average balances of $227.2 million. Compared to the previous quarter, total average commercial deposits declined $264.7 million, while wealth and consumer average deposits grew $145.7 million and $82.2 million, respectively. The average loans to deposits ratio was 69.4% in the current quarter and 68.5% in the prior quarter. The Company’s average borrowings, which included average customer repurchase

agreements of $2.7 billion, increased $283.4 million to $2.9 billion in the 1st quarter of 2025.

Net Interest Income

Net interest income in the 1st quarter of 2025 amounted to $269.1 million, an increase of $2.5 million over the previous quarter. On a fully taxable-equivalent (FTE) basis, net interest income for the current quarter increased $2.5 million over the previous quarter to $271.4 million. The increase in net interest income was mostly due to higher interest income on investment securities and lower interest expense on deposits, partly offset by lower interest income on loans and deposits with banks. The net yield (FTE) on earning assets increased to 3.56%, from 3.49% in the prior quarter.

Compared to the previous quarter, interest income on loans (FTE) decreased $6.3 million, mostly due to lower average rates earned on commercial banking loans, partly offset by higher average business loan balances. The average yield (FTE) on the loan portfolio decreased nine basis points to 6.02% this quarter.

Interest income on investment securities (FTE) increased $4.1 million over the prior quarter, mostly due to higher average balances and rates earned on U.S. government and federal agency securities and other asset-backed securities, partially offset by lower rates and average balances of mortgage-backed securities. Interest income earned on U.S. government and federal agency securities included the impact of $1.1 million in higher inflation income from Treasury inflation-protected securities compared to previous quarter. Additionally, the Company recorded a $539 thousand adjustment to premium amortization at March 31, 2025, which increased interest income to reflect slower forward prepayment speed estimates on mortgage-backed securities. This increase was lower than the $2.3 million adjustment that increased interest income in the prior quarter. The average yield (FTE) on total investment securities was 2.98% in the current quarter, compared to 2.80% in the previous quarter.

Compared to the previous quarter, interest income on deposits with banks decreased $5.1 million, due to lower average balances and rates. Additionally, interest earned on securities purchased under agreements to resell increased $2.3 million mostly due to higher average balances.

Interest expense decreased $7.5 million compared to the previous quarter, mainly due to lower average rates paid on deposits and borrowings, partly offset by higher average balances of borrowings. Interest expense on borrowings increased $49 thousand due to higher average balances, mostly offset by lower average rates. Interest expense on deposits decreased $7.5 million mostly due to lower average rates. The average rate paid on interest bearing deposits totaled 1.72% in the current quarter compared to 1.87% in the prior quarter. The overall rate paid on interest bearing liabilities was 1.89% in the current quarter and 2.04% in the prior quarter.

Exhibit 99.1

COMMERCE BANCSHARES, INC.

Management Discussion of First Quarter Results

March 31, 2025

Non-Interest Income

In the 1st quarter of 2025, total non-interest income amounted to $158.9 million, an increase of $10.1 million, or 6.8%, over the same period last year and an increase of $3.5 million over the prior quarter. The increase in non-interest income compared to the same period last year was mainly due to higher trust fees and deposit account fees and gains on sales of assets. The increase in non-interest income compared to the prior quarter was mainly due to higher gains on sales of assets.

Total net bank card fees in the current quarter decreased $1.3 million, or 2.8%, compared to the same period last year, and decreased $2.2 million compared to the prior quarter. Net corporate card fees decreased $1.6 million, or 5.7%, compared to the same quarter of last year mainly due to lower interchange fees, partly offset by lower rewards expense. Net merchant fees increased $520 thousand, or 9.9%, mainly due to higher fees and lower network expense. Net debit card fees decreased $117 thousand, or 1.1%, while net credit card fees decreased $164 thousand, or 4.3%, mostly due to lower interchange fees. Total net bank card fees this quarter were comprised of fees on corporate card ($25.9 million), debit card ($10.3 million), merchant ($5.8 million) and credit card ($3.6 million) transactions.

In the current quarter, trust fees increased $5.5 million, or 10.7%, over the same period last year, mostly resulting from higher private client fees. Compared to the same period last year, deposit account fees increased $2.5 million, or 10.2%, mostly due to higher corporate cash management fees, while capital market fees increased $1.2 million, or 31.3%, mostly due to higher underwriting and trading securities income.

Other non-interest income increased over the same period last year primarily due to higher gains on sales of assets of $2.4 million. For the 1st quarter of 2025, non-interest income comprised 37.1% of the Company’s total revenue.

Investment Securities Gains and Losses

The Company recorded net securities losses of $7.6 million in the current quarter, compared to gains of $977 thousand in the prior quarter and losses of $259 thousand in the 1st quarter of 2024. Net securities losses in the current quarter mostly resulted from net fair value adjustments of $8.5 million and a $1.0 million gain on the sale of an investment in the Company’s portfolio of private equity investments.

Non-Interest Expense

Non-interest expense for the current quarter amounted to $238.4 million, compared to $245.7 million in the same period last year and $235.7 million in the prior quarter. The decrease in non-interest expense compared to the same period last year was mainly due to litigation settlement expense and an FDIC special assessment accrual adjustment, both occurring in 2024 and not recurring in 2025, partly offset by higher marketing expense, salaries expense, professional and other services expense, and data

processing and software expense. The increase in non-interest expense compared to the prior quarter was mainly due to higher employee benefits expense and professional and other services expense, partly offset by lower salaries expense.

Compared to the 1st quarter of 2024, salaries and employee benefits expense increased $1.3 million, or .8%, mostly due to higher full-time salaries expense of $577 thousand and incentive compensation of $811 thousand, partly offset by lower medical expense of $970 thousand. Full-time equivalent employees totaled 4,662 and 4,721 at March 31, 2025 and 2024, respectively.

Compared to the same period last year, deposit insurance expense decreased $4.3 million, mostly due to a $4.0 million accrual adjustment in the prior year of a one-time special assessment by the FDIC to replenish the Deposit Insurance Fund. Data processing and software expense increased $1.1 million due to higher costs for service providers and software. Professional and other services increased $1.4 million and marketing expense increased $1.8 million. Additionally, other non-interest expense decreased mainly due to $10.0 million of litigation settlement costs in 2024 that did not reoccur.

Income Taxes

The effective tax rate for the Company was 21.9% in the current quarter, 21.2% in the prior quarter, and 21.9% in the 1st quarter of 2024.

Credit Quality

Net loan charge-offs in the 1st quarter of 2025 amounted to $10.8 million, compared to $10.7 million in the prior quarter, and $8.9 million in the same period last year. The ratio of annualized net loan charge-offs to total average loans was .25% in the current and previous quarters, and .21% in the same quarter of last year. Compared to the prior quarter, net loan charge-offs on consumer loans decreased $385 thousand, while net loan charge-offs on consumer credit card loans increased $410 thousand.

In the 1st quarter of 2025, annualized net loan charge-offs on average consumer credit card loans were 5.04%, compared to 4.59% in the previous quarter and 4.60% in the same quarter last year. Consumer loan net charge-offs were .56% of average consumer loans in the current quarter, .62% in the prior quarter, and .38% in the same quarter last year.

At March 31, 2025, the allowance for credit losses on loans totaled $167.0 million, or .96% of total loans, and increased $4.3 million compared to the prior quarter. Additionally, the liability for unfunded lending commitments at March 31, 2025 was $18.3 million, a decrease of $608 thousand compared to the liability at December 31, 2024.

At March 31, 2025, total non-accrual loans amounted to $22.6 million, an increase of $4.3 million over the previous quarter. At March 31, 2025, the balance of non-accrual loans, which represented .13% of loans outstanding, included business loans of $1.1 million, revolving home equity loans of $2.0 million, personal real estate loans of $989 thousand, construction loans of $220 thousand, and business real estate loans of $18.3 million.

Exhibit 99.1

COMMERCE BANCSHARES, INC.

Management Discussion of First Quarter Results

March 31, 2025

Loans more than 90 days past due and still accruing interest totaled $19.4 million at March 31, 2025.

Other

During the 1st quarter of 2025, the Company paid a cash dividend of $.275 per common share, representing a 7.0% increase over the same period last year. The Company purchased 854,806 shares of treasury stock during the current quarter at an average price of $64.56.

Forward Looking Information

This information contains forward-looking statements within the meaning of the Private Securities Litigation Reform Act of 1995. Such statements include future financial and operating results, expectations, intentions, and other statements that are not historical facts. Such statements are based on current beliefs and expectations of the Company’s management and are subject to significant risks and uncertainties. Actual results may differ materially from those set forth in the forward-looking statements. Additional information about risks and uncertainties is included in the “Risk Factors” and “Management’s Discussion and Analysis of Financial Condition and Results of Operations” sections within the Company's Annual Report on Form 10-K.