Document

Exhibit 99.1

|

|

|

|

|

|

|

CBSH |

1000 Walnut Street / Suite 700 / Kansas City, Missouri 64106 / 816.234.2000 |

|

FOR IMMEDIATE RELEASE:

Thursday, October 17, 2024

COMMERCE BANCSHARES, INC. REPORTS

THIRD QUARTER EARNINGS PER SHARE OF $1.07

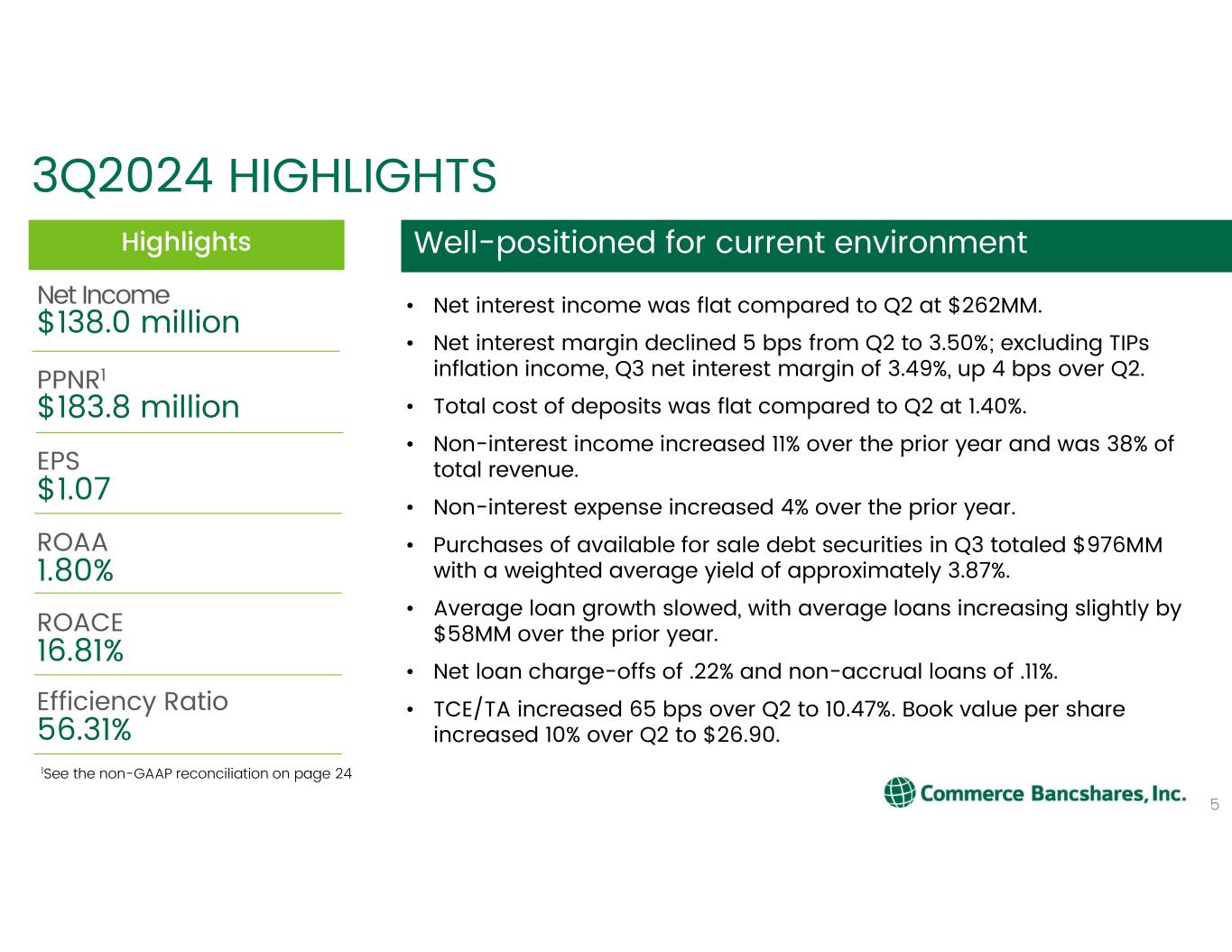

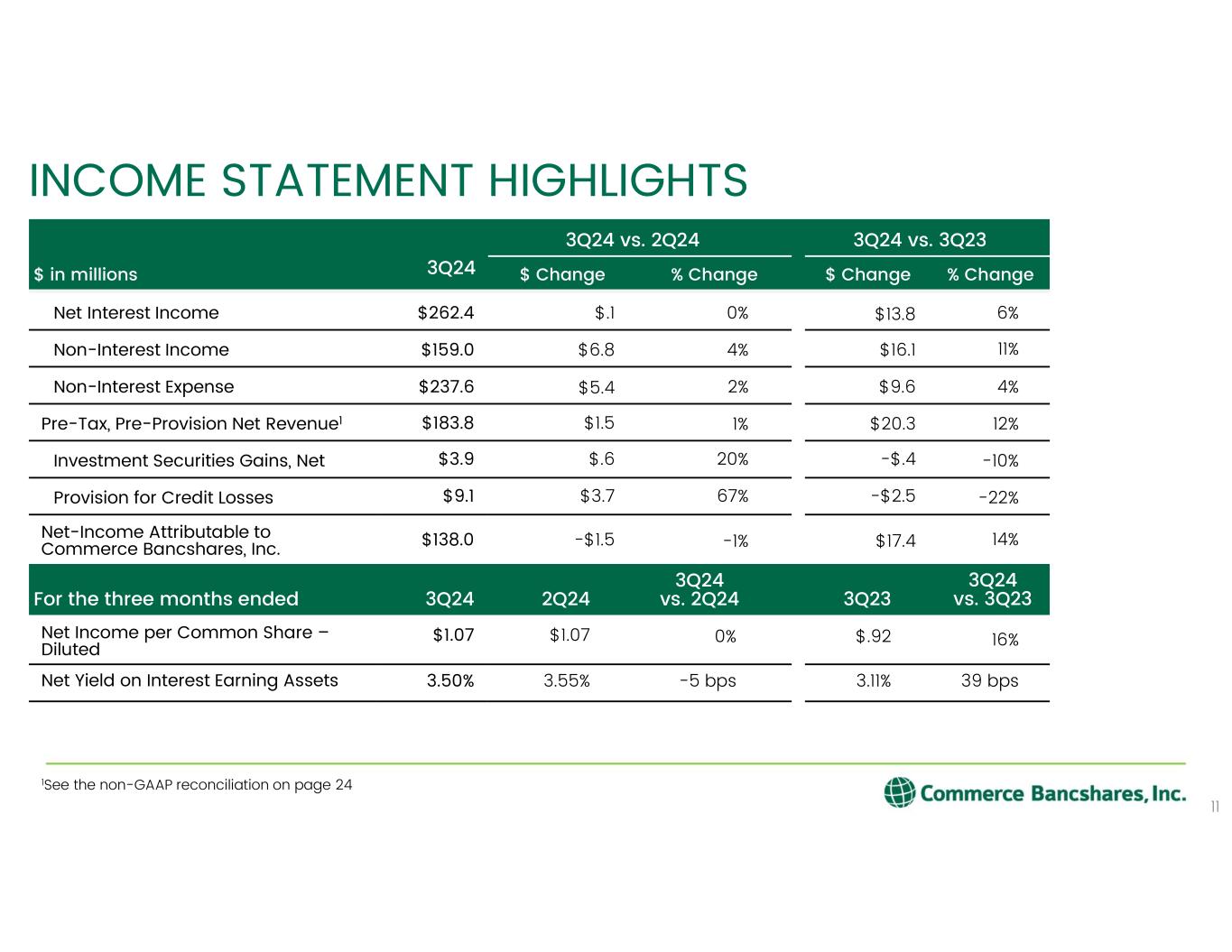

Commerce Bancshares, Inc. announced earnings of $1.07 per share for the three months ended September 30, 2024, compared to $.92 per share in the same quarter last year and $1.07 per share in the second quarter of 2024. Net income for the third quarter of 2024 amounted to $138.0 million, compared to $120.6 million in the third quarter of 2023 and $139.6 million in the prior quarter.

For the nine months ended September 30, 2024, earnings per share totaled $3.00, compared to $2.80 for the first nine months of 2023. Net income amounted to $390.2 million for the nine months ended September 30, 2024, compared to $367.8 million in the comparable period last year. For the year to date, the return on average assets was 1.71%, and the return on average equity was 16.92%.

In announcing these results, John Kemper, President and Chief Executive Officer, said, “We are pleased with our third quarter results, which exemplify our diversified operating model and the growth mindset of our team. Our net interest margin, excluding the impact of inflation income on treasury bonds, expanded four basis points from the prior quarter. Interest bearing deposit costs continue to flatten, increasing just one basis point this quarter when compared to the previous quarter, while average deposits increased slightly. Trust fees were strong and experienced continued growth, up 11.1% over the same period last year. Total non-interest income was 37.7% of total revenue. During the quarter, we purchased $976.1 million in available for sale debt securities, indicative of lower loan demand and the relatively short duration of our investment securities portfolio.

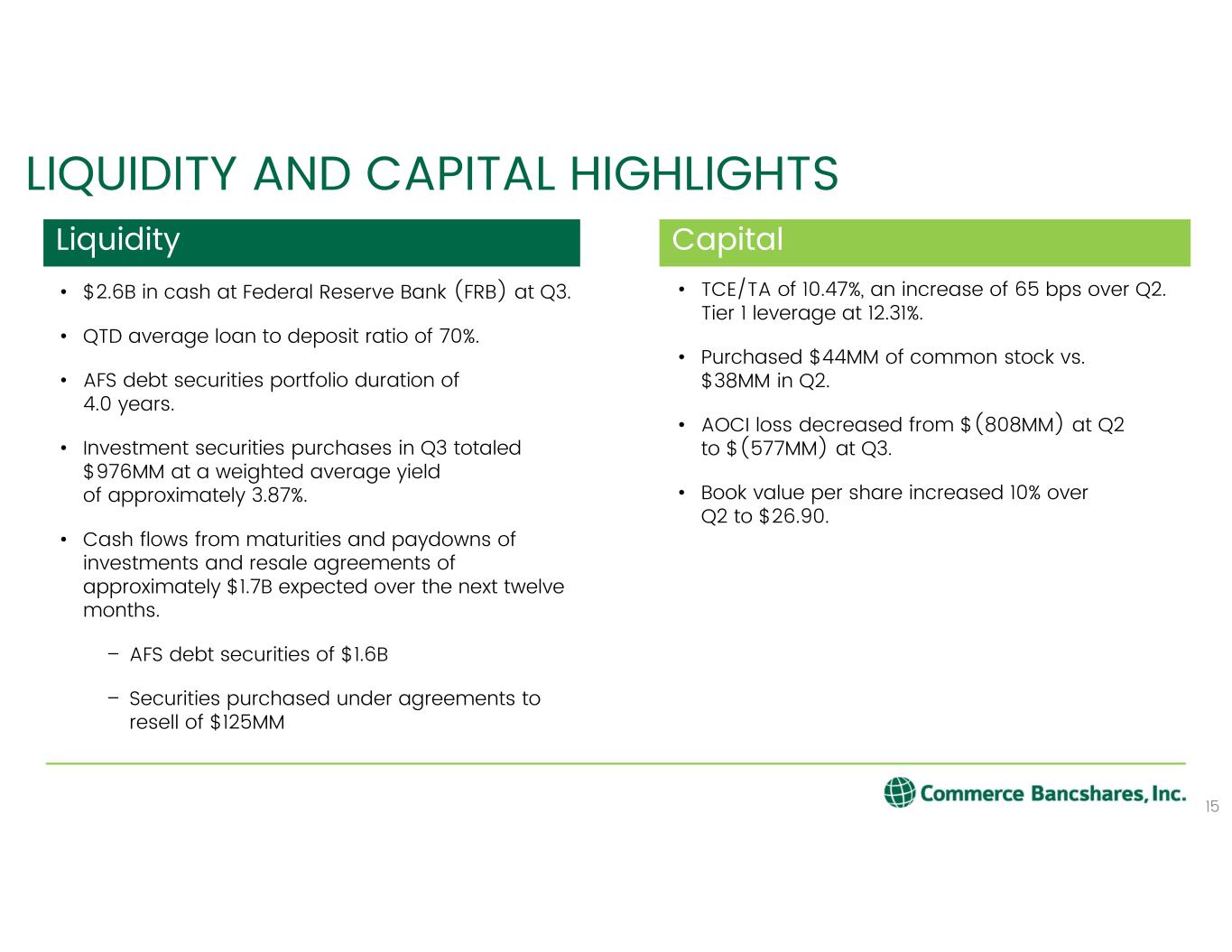

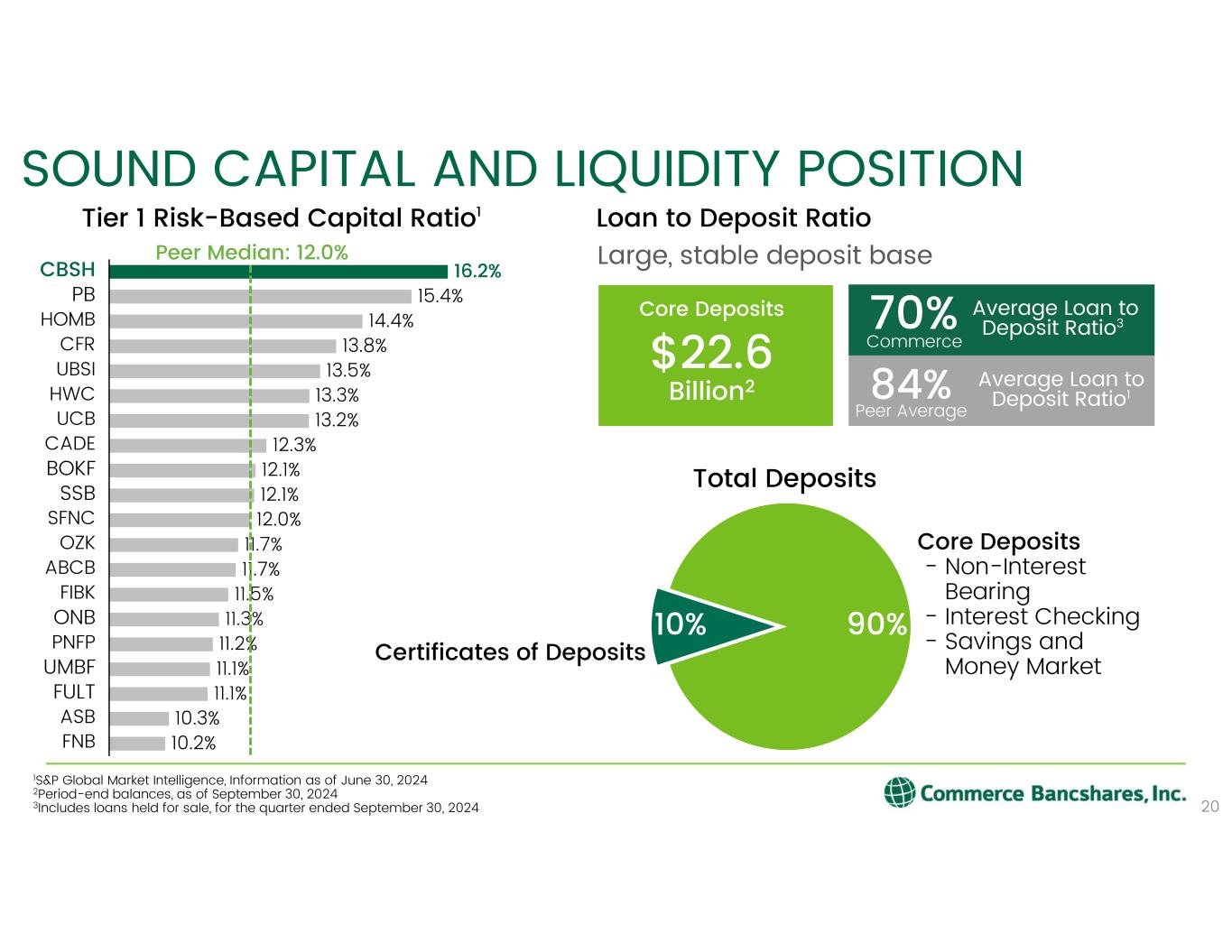

“Credit quality remains excellent, and we continue to maintain strong levels of capital. Non-accrual loans were .11% of total loans, flat when compared to the previous quarter. Our tangible common equity to tangible assets ratio increased to 10.47% as interest rates declined, and book value per share increased 9.9% during the quarter.”

Third Quarter 2024 Financial Highlights:

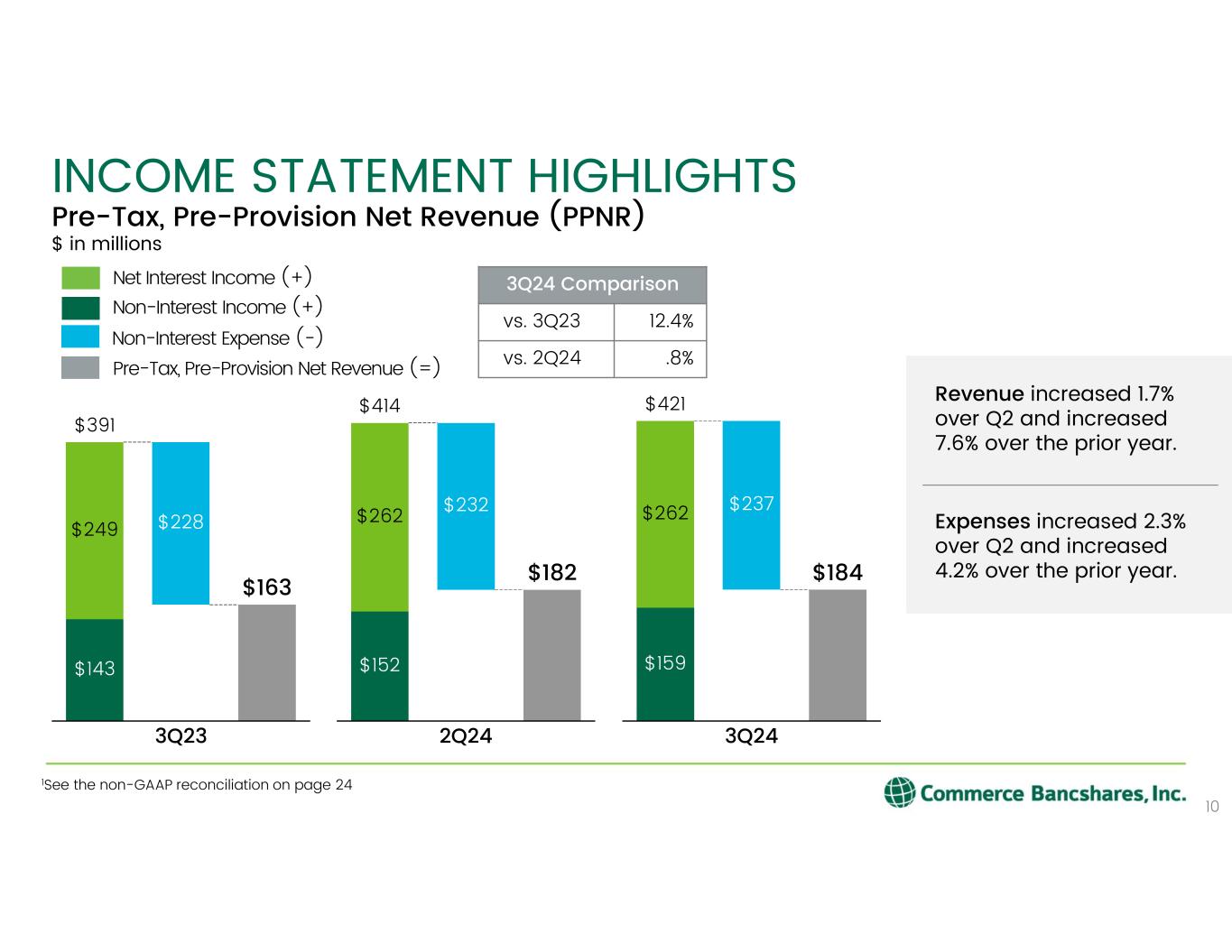

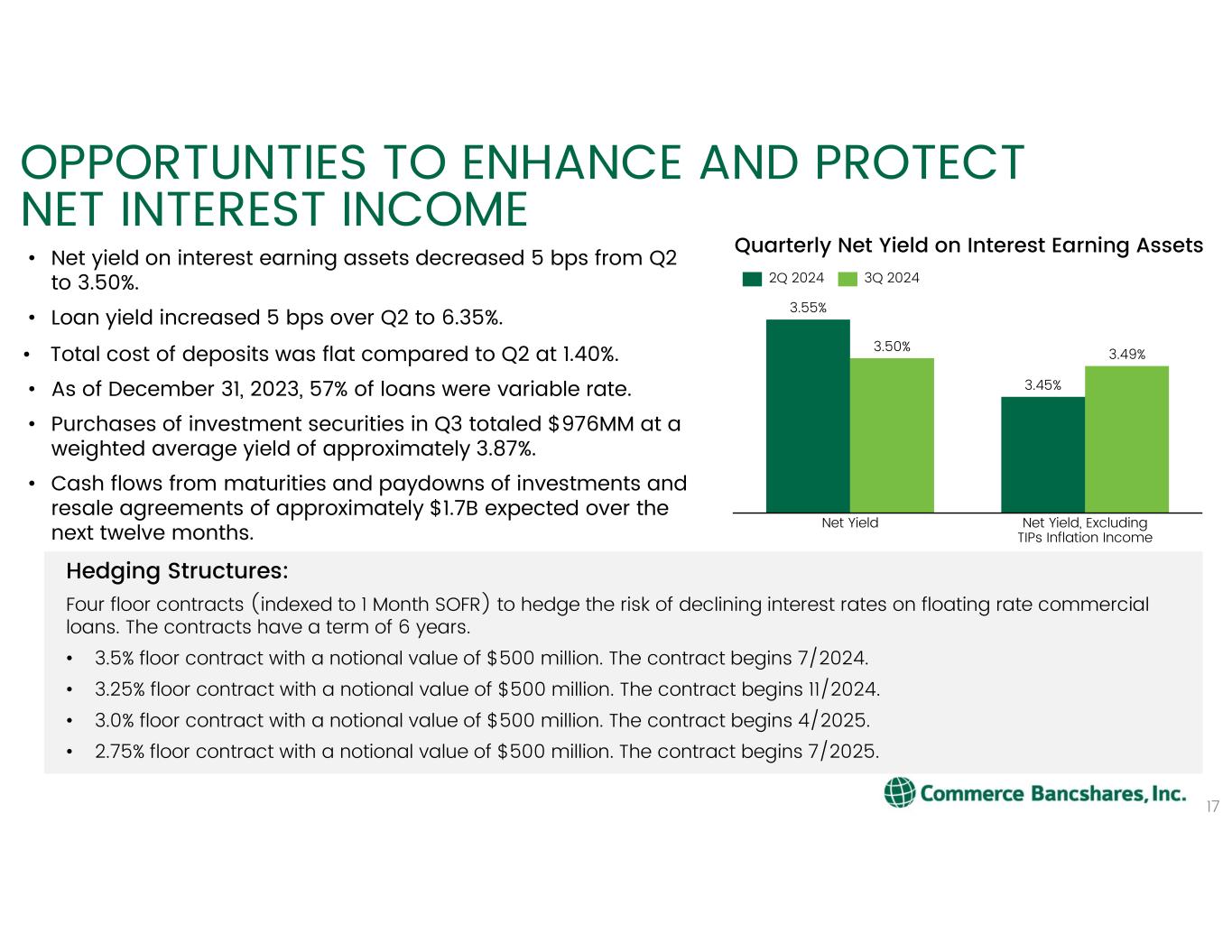

•Net interest income was $262.4 million, a $102 thousand increase over the prior quarter. The net yield on interest earning assets decreased five basis points to 3.50%.

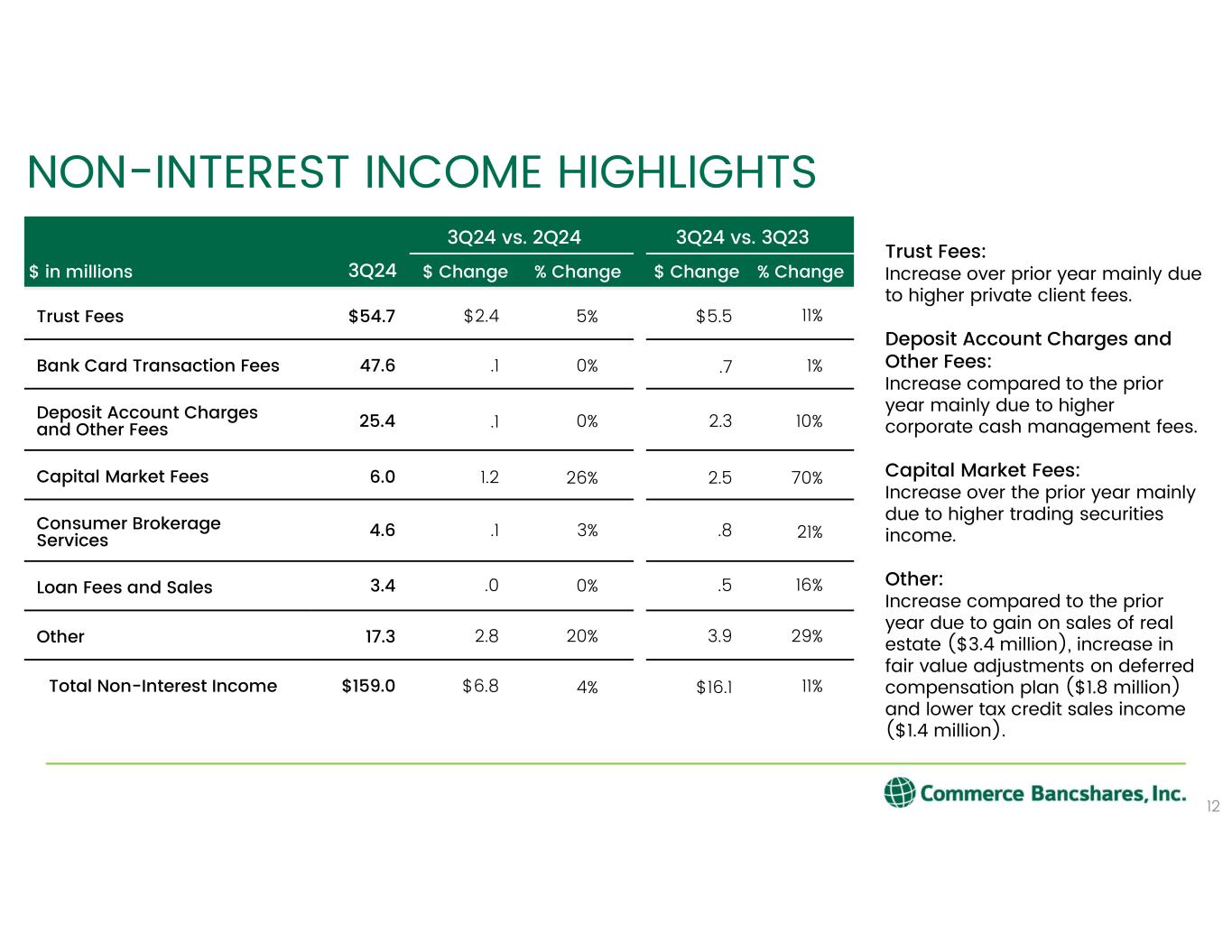

•Non-interest income totaled $159.0 million, an increase of $16.1 million over the same quarter last year.

•Trust fees grew $5.5 million, or 11.1%, compared to the same period last year, mostly due to higher private client fees.

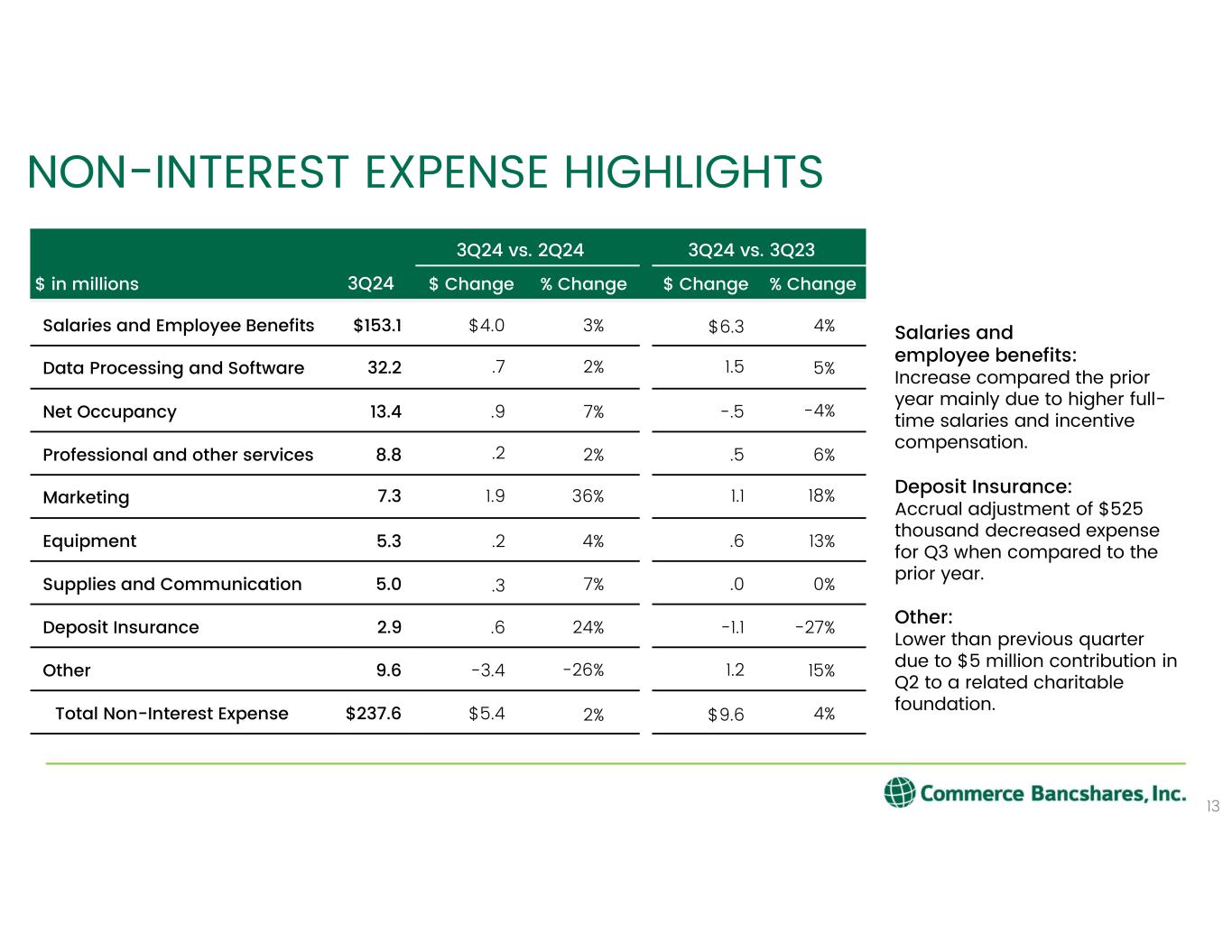

•Non-interest expense totaled $237.6 million, an increase of $9.6 million, or 4.2%, compared to the same quarter last year.

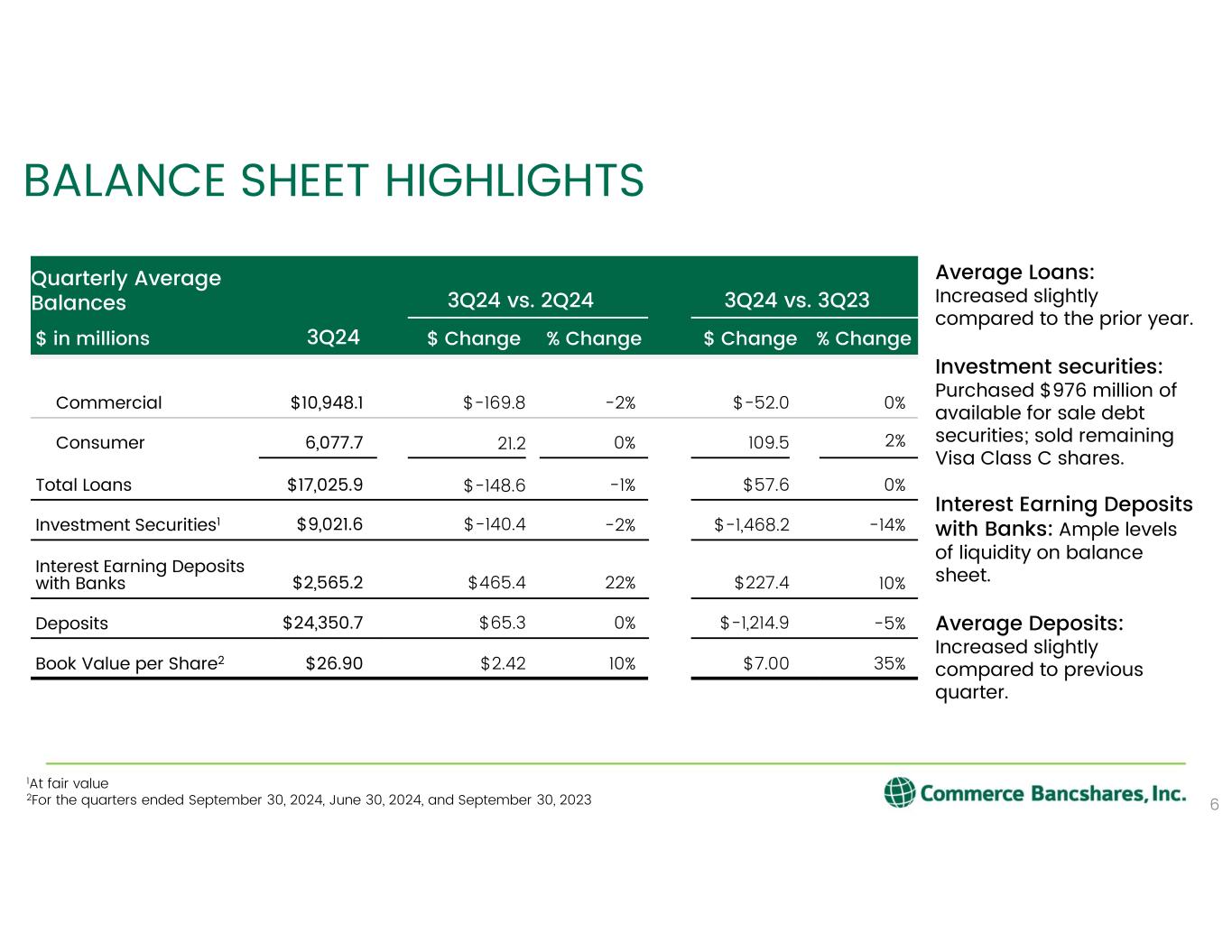

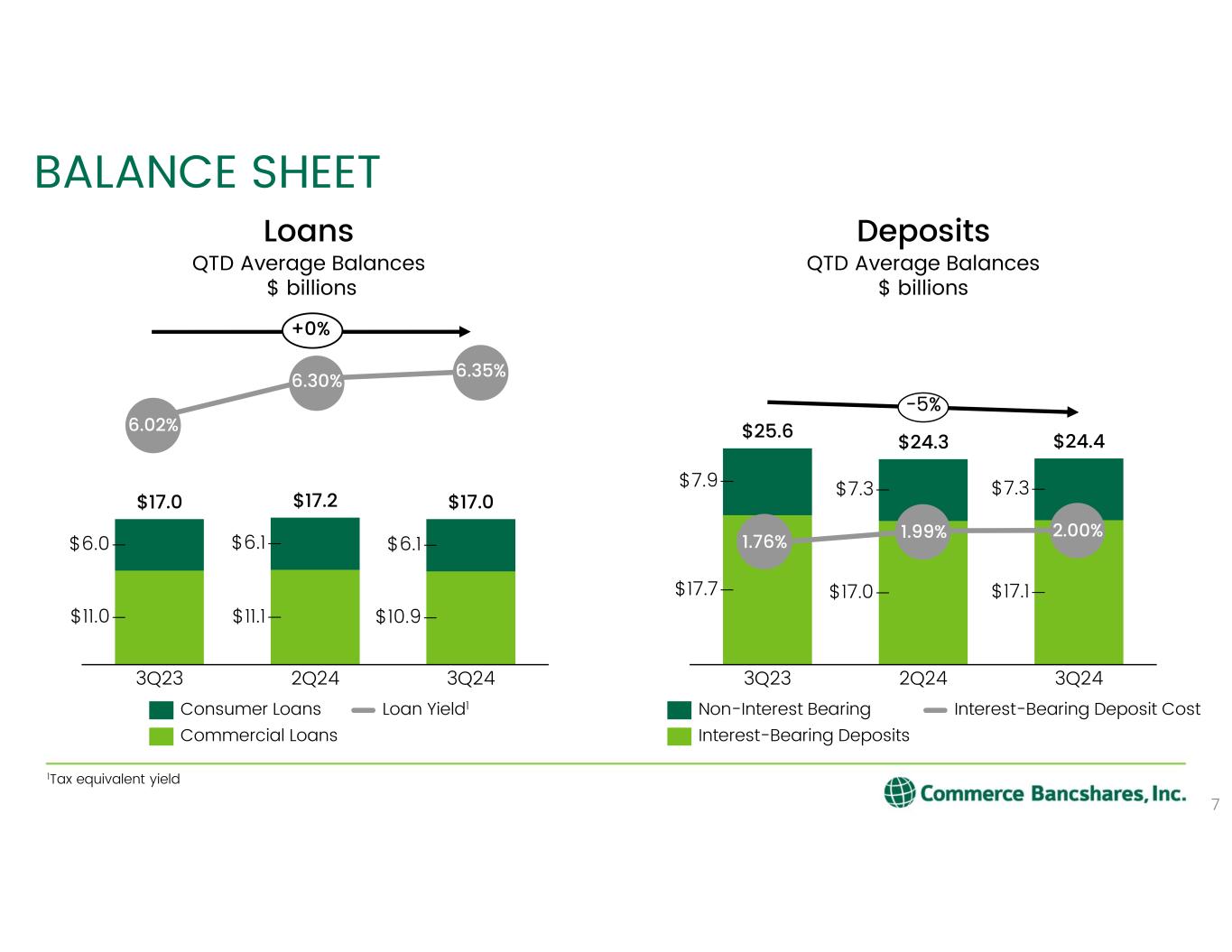

•Average loan balances totaled $17.0 billion, a decrease of .9% compared to the prior quarter.

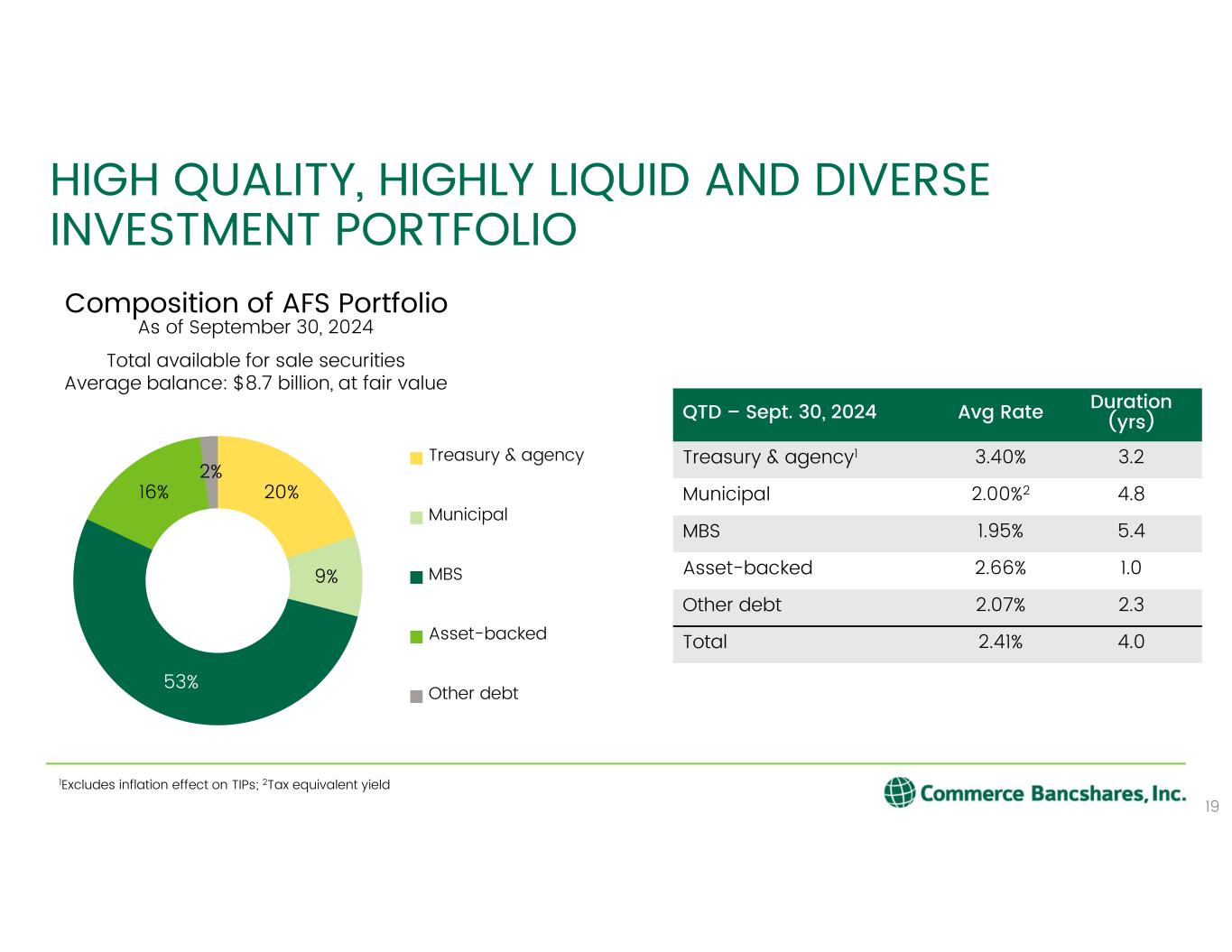

•Total average available for sale debt securities decreased $87.8 million from the prior quarter to $8.7 billion, at fair value. During the third quarter of 2024, the unrealized loss on available for sale debt securities decreased $287.4 million to $786.4 million, at period end.

•Total average deposits increased $65.3 million, or .3%, compared to the prior quarter. The average rate paid on interest bearing deposits in the current quarter was 2.00%.

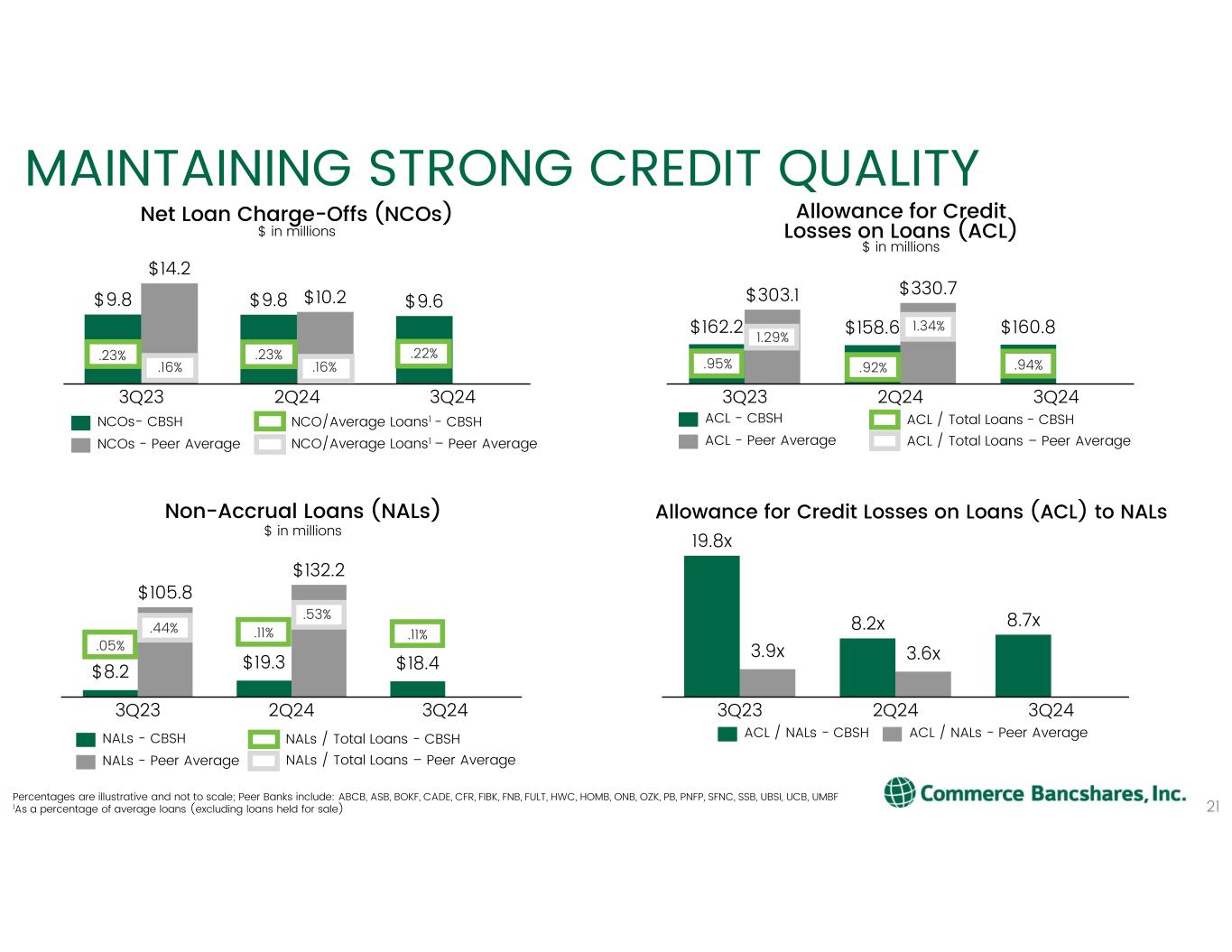

•The ratio of annualized net loan charge-offs to average loans was .22% compared to .23% in the prior quarter.

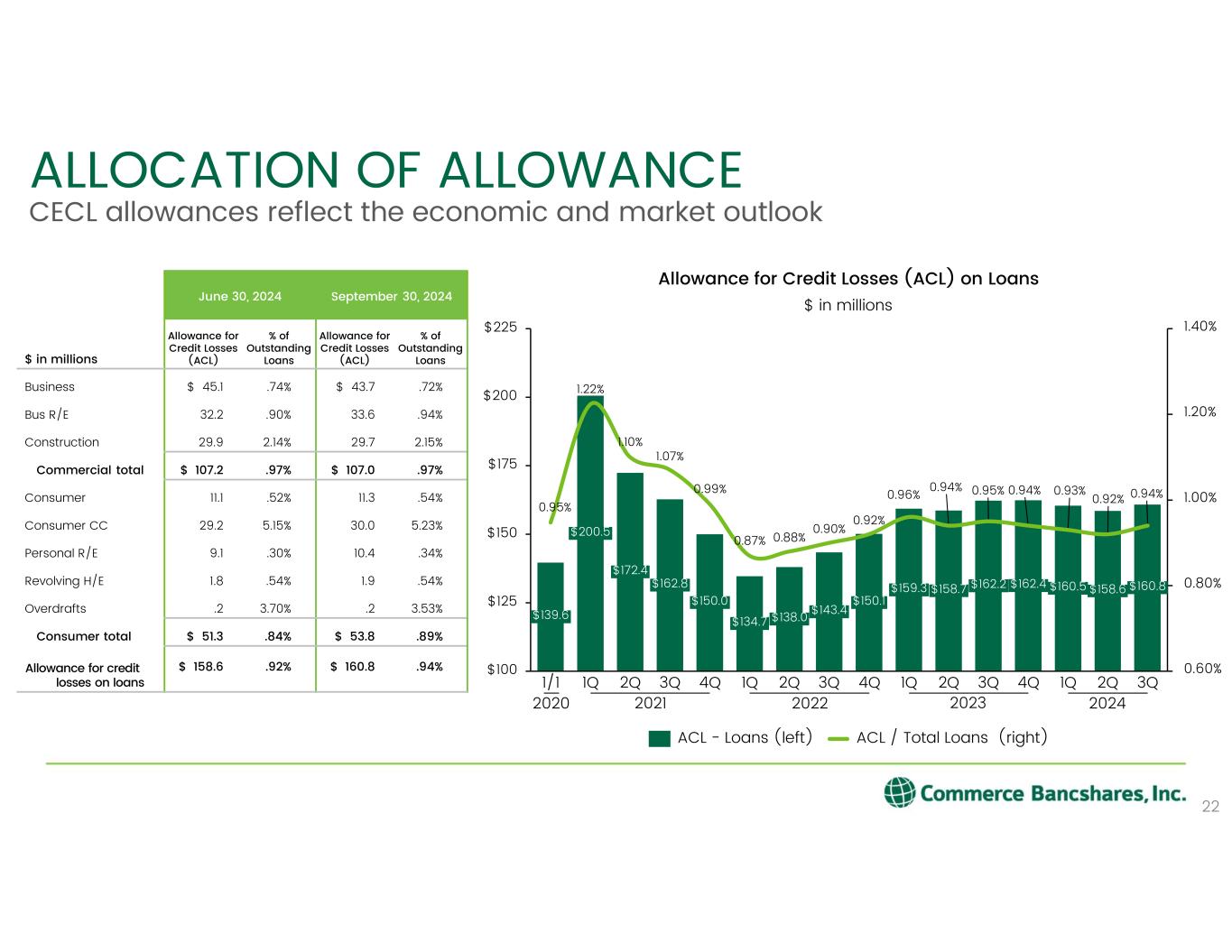

•The allowance for credit losses on loans increased $2.3 million during the third quarter of 2024 to $160.8 million, and the ratio of the allowance for credit losses on loans to total loans was .94%, at September 30, 2024, compared to .92% at June 30, 2024.

•Total assets at September 30, 2024 were $31.5 billion, an increase of $924.2 million, or 3.0%, compared to the prior quarter.

•For the quarter, the return on average assets was 1.80%, the return on average equity was 16.81%, and the efficiency ratio was 56.3%.

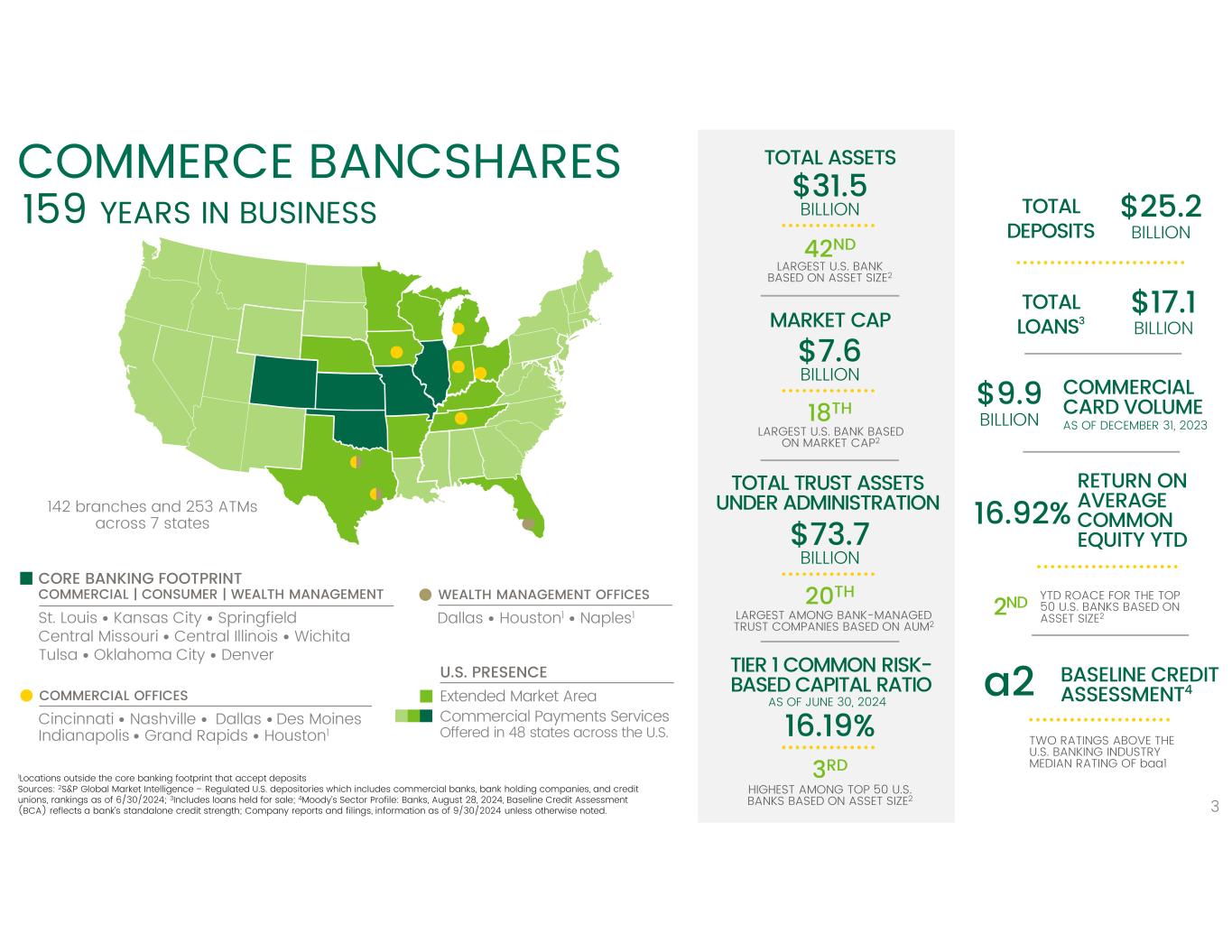

Commerce Bancshares, Inc. is a regional bank holding company offering a full line of banking services through its subsidiaries, including payment solutions, investment management and securities brokerage. One of its subsidiaries, Commerce Bank, leverages nearly 160 years of proven strength and experience to help individuals and businesses solve financial challenges. In addition to offering payment solutions across the U.S., Commerce Bank currently operates full-service banking facilities across the Midwest including the St. Louis and Kansas City metropolitan areas, Springfield, Central Missouri, Central Illinois, Wichita, Tulsa, Oklahoma City, and Denver. Beyond the Midwest, Commerce also maintains commercial offices in Dallas, Houston, Cincinnati, Nashville, Des Moines, Indianapolis, and Grand Rapids and wealth offices in Dallas, Houston, and Naples. Commerce delivers high-touch service and sophisticated financial solutions at regional branches, commercial and wealth offices, ATMs, online, mobile and through a 24/7 customer service line.

This financial news release and the supplementary Earnings Highlights presentation are available on the Company’s website at https://investor.commercebank.com/news-info/financial-news-releases/default.aspx.

* * * * * * * * * * * * * * *

For additional information, contact

Matt Burkemper, Investor Relations

(314) 746-7485

www.commercebank.com

matthew.burkemper@commercebank.com

COMMERCE BANCSHARES, INC. and SUBSIDIARIES

FINANCIAL HIGHLIGHTS

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| |

|

For the Three Months Ended |

For the Nine Months Ended |

(Unaudited)

(Dollars in thousands, except per share data) |

|

Sep. 30, 2024 |

Jun. 30, 2024 |

Sep. 30, 2023 |

Sep. 30, 2024 |

Sep. 30, 2023 |

| FINANCIAL SUMMARY |

|

|

|

|

|

|

| Net interest income |

|

$262,351 |

|

$262,249 |

|

$248,547 |

|

$773,599 |

|

$749,708 |

|

| Non-interest income |

|

159,025 |

|

152,244 |

|

142,949 |

|

460,117 |

|

428,166 |

|

| Total revenue |

|

421,376 |

|

414,493 |

|

391,496 |

|

1,233,716 |

|

1,177,874 |

|

| Investment securities gains (losses) |

|

3,872 |

|

3,233 |

|

4,298 |

|

6,846 |

|

7,384 |

|

| Provision for credit losses |

|

9,140 |

|

5,468 |

|

11,645 |

|

19,395 |

|

29,572 |

|

| Non-interest expense |

|

237,600 |

|

232,214 |

|

228,010 |

|

715,511 |

|

679,728 |

|

| Income before taxes |

|

178,508 |

|

180,044 |

|

156,139 |

|

505,656 |

|

475,958 |

|

| Income taxes |

|

38,245 |

|

38,602 |

|

33,439 |

|

108,499 |

|

102,242 |

|

| Non-controlling interest expense |

|

2,256 |

|

1,889 |

|

2,104 |

|

6,934 |

|

5,879 |

|

| Net income attributable to Commerce Bancshares, Inc. |

$138,007 |

|

$139,553 |

|

$120,596 |

|

$390,223 |

|

$367,837 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Earnings per common share: |

|

|

|

|

|

|

| Net income — basic |

|

$1.07 |

|

$1.07 |

|

$0.92 |

|

$3.01 |

|

$2.80 |

|

| Net income — diluted |

|

$1.07 |

|

$1.07 |

|

$0.92 |

|

$3.00 |

|

$2.80 |

|

| Effective tax rate |

|

21.70 |

% |

21.67 |

% |

21.71 |

% |

21.76 |

% |

21.75 |

% |

| Fully-taxable equivalent net interest income |

|

$264,638 |

|

$264,578 |

|

$250,962 |

|

$780,528 |

|

$756,130 |

|

Average total interest earning assets (1) |

|

$30,051,845 |

|

$30,016,060 |

|

$31,974,945 |

|

$ |

30,144,221 |

|

$31,986,696 |

|

| Diluted wtd. average shares outstanding |

|

127,995,072 |

|

128,610,693 |

|

130,008,840 |

|

128,595,025 |

|

130,227,782 |

|

|

|

|

|

|

|

|

| RATIOS |

|

|

|

|

|

|

Average loans to deposits (2) |

|

69.93 |

% |

70.73 |

% |

66.39 |

% |

70.17 |

% |

65.85 |

% |

| Return on total average assets |

|

1.80 |

|

1.86 |

|

1.49 |

|

1.71 |

|

1.53 |

|

|

|

|

|

|

|

|

Return on average equity (3) |

|

16.81 |

|

18.52 |

|

17.73 |

|

16.92 |

|

18.42 |

|

| Non-interest income to total revenue |

|

37.74 |

|

36.73 |

|

36.51 |

|

37.30 |

|

36.35 |

|

Efficiency ratio (4) |

|

56.31 |

|

55.95 |

|

58.15 |

|

57.92 |

|

57.62 |

|

| Net yield on interest earning assets |

|

3.50 |

|

3.55 |

|

3.11 |

|

3.46 |

|

3.16 |

|

|

|

|

|

|

|

|

| EQUITY SUMMARY |

|

|

|

|

|

|

| Cash dividends per share |

|

$.270 |

|

$.270 |

|

$.257 |

|

$.810 |

|

$.771 |

|

| Cash dividends on common stock |

|

$34,794 |

|

$34,960 |

|

$33,657 |

|

$104,894 |

|

$101,160 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Book value per share (5) |

|

$26.90 |

|

$24.48 |

|

$19.90 |

|

|

|

Market value per share (5) |

|

$59.40 |

|

$55.78 |

|

$45.70 |

|

|

|

| High market value per share |

|

$65.86 |

|

$57.48 |

|

$52.37 |

|

|

|

| Low market value per share |

|

$54.88 |

|

$50.92 |

|

$44.10 |

|

|

|

Common shares outstanding (5) |

|

128,378,890 |

|

129,004,231 |

|

130,586,153 |

|

|

|

Tangible common equity to tangible assets (6) |

|

10.47 |

% |

9.82 |

% |

7.78 |

% |

|

|

| Tier I leverage ratio |

|

12.31 |

% |

12.13 |

% |

10.87 |

% |

|

|

|

|

|

|

|

|

|

| OTHER QTD INFORMATION |

|

|

|

|

|

|

| Number of bank/ATM locations |

|

244 |

|

247 |

|

266 |

|

|

|

| Full-time equivalent employees |

|

4,711 |

|

4,724 |

|

4,714 |

|

|

|

(1) Excludes allowance for credit losses on loans and unrealized gains/(losses) on available for sale debt securities.

(2) Includes loans held for sale.

(3) Annualized net income attributable to Commerce Bancshares, Inc. divided by average total equity.

(4) The efficiency ratio is calculated as non-interest expense (excluding intangibles amortization) as a percent of total revenue.

(5) As of period end.

(6) The tangible common equity ratio is a non-gaap ratio and is calculated as stockholders’ equity reduced by goodwill and other intangible assets (excluding mortgage servicing rights) divided by total assets reduced by goodwill and other intangible assets (excluding mortgage servicing rights).

All share and per share amounts have been restated to reflect the 5% stock dividend distributed in December 2023.

COMMERCE BANCSHARES, INC. and SUBSIDIARIES

CONSOLIDATED STATEMENTS OF INCOME

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

(Unaudited)

(In thousands, except per share data) |

|

For the Three Months Ended |

For the Nine Months Ended |

|

Sep. 30, 2024 |

Jun. 30, 2024 |

Mar. 31, 2024 |

Dec. 31, 2023 |

Sep. 30, 2023 |

Sep. 30, 2024 |

Sep. 30, 2023 |

| Interest income |

|

$372,068 |

|

$369,363 |

|

$358,721 |

|

$362,609 |

|

$361,162 |

|

$1,100,152 |

|

$1,018,682 |

|

| Interest expense |

|

109,717 |

|

107,114 |

|

109,722 |

|

114,188 |

|

112,615 |

|

326,553 |

|

268,974 |

|

| Net interest income |

|

262,351 |

|

262,249 |

|

248,999 |

|

248,421 |

|

248,547 |

|

773,599 |

|

749,708 |

|

| Provision for credit losses |

|

9,140 |

|

5,468 |

|

4,787 |

|

5,879 |

|

11,645 |

|

19,395 |

|

29,572 |

|

| Net interest income after credit losses |

253,211 |

|

256,781 |

|

244,212 |

|

242,542 |

|

236,902 |

|

754,204 |

|

720,136 |

|

| NON-INTEREST INCOME |

|

|

|

|

|

|

|

|

| Trust fees |

|

54,689 |

|

52,291 |

|

51,105 |

|

49,154 |

|

49,207 |

|

158,085 |

|

141,800 |

|

| Bank card transaction fees |

|

47,570 |

|

47,477 |

|

46,930 |

|

47,878 |

|

46,899 |

|

141,977 |

|

143,278 |

|

| Deposit account charges and other fees |

25,380 |

|

25,325 |

|

24,151 |

|

23,517 |

|

23,090 |

|

74,856 |

|

67,475 |

|

| Capital market fees |

|

5,995 |

|

4,760 |

|

3,892 |

|

4,269 |

|

3,524 |

|

14,647 |

|

9,831 |

|

| Consumer brokerage services |

|

4,619 |

|

4,478 |

|

4,408 |

|

3,641 |

|

3,820 |

|

13,505 |

|

13,582 |

|

| Loan fees and sales |

|

3,444 |

|

3,431 |

|

3,141 |

|

2,875 |

|

2,966 |

|

10,016 |

|

8,290 |

|

| Other |

|

17,328 |

|

14,482 |

|

15,221 |

|

13,545 |

|

13,443 |

|

47,031 |

|

43,910 |

|

| Total non-interest income |

|

159,025 |

|

152,244 |

|

148,848 |

|

144,879 |

|

142,949 |

|

460,117 |

|

428,166 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| INVESTMENT SECURITIES GAINS (LOSSES), NET |

3,872 |

|

3,233 |

|

(259) |

|

7,601 |

|

4,298 |

|

6,846 |

|

7,384 |

|

| NON-INTEREST EXPENSE |

|

|

|

|

|

|

|

|

| Salaries and employee benefits |

|

153,122 |

|

149,120 |

|

151,801 |

|

147,456 |

|

146,805 |

|

454,043 |

|

436,607 |

|

| Data processing and software |

|

32,194 |

|

31,529 |

|

31,153 |

|

31,141 |

|

30,744 |

|

94,876 |

|

87,617 |

|

| Net occupancy |

|

13,411 |

|

12,544 |

|

13,574 |

|

13,927 |

|

13,948 |

|

39,529 |

|

39,702 |

|

| Professional and other services |

|

8,830 |

|

8,617 |

|

8,648 |

|

9,219 |

|

8,293 |

|

26,095 |

|

26,979 |

|

| Marketing |

|

7,278 |

|

5,356 |

|

4,036 |

|

6,505 |

|

6,167 |

|

16,670 |

|

18,006 |

|

| Equipment |

|

5,286 |

|

5,091 |

|

5,010 |

|

5,137 |

|

4,697 |

|

15,387 |

|

14,411 |

|

| Supplies and communication |

|

4,963 |

|

4,636 |

|

4,744 |

|

5,242 |

|

4,963 |

|

14,343 |

|

14,178 |

|

| Deposit Insurance |

|

2,930 |

|

2,354 |

|

8,017 |

|

20,304 |

|

4,029 |

|

13,301 |

|

12,859 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Other |

|

9,586 |

|

12,967 |

|

18,714 |

|

12,323 |

|

8,364 |

|

41,267 |

|

29,369 |

|

| Total non-interest expense |

|

237,600 |

|

232,214 |

|

245,697 |

|

251,254 |

|

228,010 |

|

715,511 |

|

679,728 |

|

| Income before income taxes |

|

178,508 |

|

180,044 |

|

147,104 |

|

143,768 |

|

156,139 |

|

505,656 |

|

475,958 |

|

| Less income taxes |

|

38,245 |

|

38,602 |

|

31,652 |

|

32,307 |

|

33,439 |

|

108,499 |

|

102,242 |

|

| Net income |

|

140,263 |

|

141,442 |

|

115,452 |

|

111,461 |

|

122,700 |

|

397,157 |

|

373,716 |

|

| Less non-controlling interest expense (income) |

2,256 |

|

1,889 |

|

2,789 |

|

2,238 |

|

2,104 |

|

6,934 |

|

5,879 |

|

| Net income attributable to Commerce Bancshares, Inc. |

$138,007 |

|

$139,553 |

|

$112,663 |

|

$109,223 |

|

$120,596 |

|

$390,223 |

|

$367,837 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Net income per common share — basic |

$1.07 |

|

$1.07 |

|

$0.87 |

|

$0.84 |

|

$0.92 |

|

$3.01 |

|

$2.80 |

|

| Net income per common share — diluted |

$1.07 |

|

$1.07 |

|

$0.86 |

|

$0.84 |

|

$0.92 |

|

$3.00 |

|

$2.80 |

|

|

|

|

|

|

|

|

|

|

| OTHER INFORMATION |

|

|

|

|

|

|

|

| Return on total average assets |

|

1.80 |

% |

1.86 |

% |

1.48 |

% |

1.38 |

% |

1.49 |

% |

1.71 |

% |

1.53 |

% |

Return on average equity (1) |

16.81 |

|

18.52 |

|

15.39 |

|

16.48 |

|

17.73 |

|

16.92 |

|

18.42 |

|

Efficiency ratio (2) |

|

56.31 |

|

55.95 |

|

61.67 |

|

63.80 |

|

58.15 |

|

57.92 |

|

57.62 |

|

| Effective tax rate |

|

21.70 |

|

21.67 |

|

21.93 |

|

22.83 |

|

21.71 |

|

21.76 |

|

21.75 |

|

| Net yield on interest earning assets |

3.50 |

|

3.55 |

|

3.33 |

|

3.17 |

|

3.11 |

|

3.46 |

|

3.16 |

|

| Fully-taxable equivalent net interest income |

|

$264,638 |

|

$264,578 |

|

$251,312 |

|

$250,547 |

|

$250,962 |

|

$780,528 |

|

$756,130 |

|

(1) Annualized net income attributable to Commerce Bancshares, Inc. divided by average total equity.

(2) The efficiency ratio is calculated as non-interest expense (excluding intangibles amortization) as a percent of total revenue.

The income statement above reflects the reclassification of non-interest income of $1.1 million and $1.5 million from other non-interest income to capital market fees for the third quarter of 2023 and the first nine months of 2023, respectively.

COMMERCE BANCSHARES, INC. and SUBSIDIARIES

CONSOLIDATED BALANCE SHEETS - PERIOD END

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

(Unaudited)

(In thousands) |

|

Sep. 30, 2024 |

Jun. 30, 2024 |

Sep. 30, 2023 |

| ASSETS |

|

|

|

|

| Loans |

|

|

|

|

| Business |

|

$ |

6,048,328 |

|

$ |

6,090,724 |

|

$ |

5,908,330 |

|

| Real estate — construction and land |

|

1,381,607 |

|

1,396,515 |

|

1,539,566 |

|

| Real estate — business |

|

3,586,999 |

|

3,572,539 |

|

3,647,168 |

|

| Real estate — personal |

|

3,043,391 |

|

3,055,182 |

|

3,024,639 |

|

| Consumer |

|

2,108,281 |

|

2,145,609 |

|

2,125,804 |

|

| Revolving home equity |

|

342,376 |

|

331,381 |

|

305,237 |

|

| Consumer credit card |

|

574,746 |

|

566,925 |

|

574,829 |

|

| Overdrafts |

|

4,272 |

|

4,190 |

|

3,753 |

|

| Total loans |

|

17,090,000 |

|

17,163,065 |

|

17,129,326 |

|

| Allowance for credit losses on loans |

|

(160,839) |

|

(158,557) |

|

(162,244) |

|

| Net loans |

|

16,929,161 |

|

17,004,508 |

|

16,967,082 |

|

| Loans held for sale |

|

1,707 |

|

2,930 |

|

5,120 |

|

| Investment securities: |

|

|

|

|

| Available for sale debt securities |

|

9,167,681 |

|

8,534,271 |

|

9,860,828 |

|

| Trading debt securities |

|

42,645 |

|

45,499 |

|

35,564 |

|

| Equity securities |

|

57,115 |

|

113,584 |

|

12,212 |

|

| Other securities |

|

216,543 |

|

223,798 |

|

230,792 |

|

| Total investment securities |

|

9,483,984 |

|

8,917,152 |

|

10,139,396 |

|

| Federal funds sold |

|

10 |

|

— |

|

2,735 |

|

| Securities purchased under agreements to resell |

|

475,000 |

|

475,000 |

|

450,000 |

|

| Interest earning deposits with banks |

|

2,642,048 |

|

2,215,057 |

|

1,847,641 |

|

| Cash and due from banks |

|

507,941 |

|

329,692 |

|

358,010 |

|

| Premises and equipment — net |

|

469,986 |

|

467,256 |

|

460,830 |

|

| Goodwill |

|

146,539 |

|

146,539 |

|

146,539 |

|

| Other intangible assets — net |

|

13,722 |

|

13,801 |

|

14,432 |

|

| Other assets |

|

823,494 |

|

997,423 |

|

984,907 |

|

| Total assets |

|

$ |

31,493,592 |

|

$ |

30,569,358 |

|

$ |

31,376,692 |

|

| LIABILITIES AND STOCKHOLDERS’ EQUITY |

|

|

|

|

| Deposits: |

|

|

|

|

| Non-interest bearing |

|

$ |

7,396,153 |

|

$ |

7,492,751 |

|

$ |

7,961,402 |

|

| Savings, interest checking and money market |

|

15,216,557 |

|

14,367,710 |

|

14,154,275 |

|

| Certificates of deposit of less than $100,000 |

|

1,113,962 |

|

1,010,251 |

|

1,210,169 |

|

| Certificates of deposit of $100,000 and over |

|

1,511,120 |

|

1,408,548 |

|

1,764,611 |

|

| Total deposits |

|

25,237,792 |

|

24,279,260 |

|

25,090,457 |

|

| Federal funds purchased and securities sold under agreements to repurchase |

|

2,182,229 |

|

2,551,399 |

|

2,745,181 |

|

| Other borrowings |

|

10,201 |

|

3,984 |

|

503,589 |

|

| Other liabilities |

|

609,831 |

|

576,380 |

|

438,199 |

|

| Total liabilities |

|

28,040,053 |

|

27,411,023 |

|

28,777,426 |

|

| Stockholders’ equity: |

|

|

|

|

|

|

|

|

|

| Common stock |

|

655,322 |

|

655,322 |

|

629,319 |

|

| Capital surplus |

|

3,154,300 |

|

3,153,107 |

|

2,924,211 |

|

| Retained earnings |

|

338,512 |

|

235,299 |

|

298,297 |

|

| Treasury stock |

|

(139,149) |

|

(98,176) |

|

(76,888) |

|

| Accumulated other comprehensive income (loss) |

|

(576,904) |

|

(807,817) |

|

(1,193,534) |

|

| Total stockholders’ equity |

|

3,432,081 |

|

3,137,735 |

|

2,581,405 |

|

| Non-controlling interest |

|

21,458 |

|

20,600 |

|

17,861 |

|

| Total equity |

|

3,453,539 |

|

3,158,335 |

|

2,599,266 |

|

| Total liabilities and equity |

|

$ |

31,493,592 |

|

$ |

30,569,358 |

|

$ |

31,376,692 |

|

COMMERCE BANCSHARES, INC. and SUBSIDIARIES

AVERAGE BALANCE SHEETS

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

(Unaudited)

(In thousands) |

For the Three Months Ended |

| Sep. 30, 2024 |

Jun. 30, 2024 |

Mar. 31, 2024 |

Dec. 31, 2023 |

Sep. 30, 2023 |

| ASSETS: |

|

|

|

|

|

| Loans: |

|

|

|

|

|

| Business |

$ |

5,966,797 |

|

$ |

5,980,364 |

|

$ |

5,873,525 |

|

$ |

5,861,229 |

|

$ |

5,849,227 |

|

| Real estate — construction and land |

1,400,563 |

|

1,471,504 |

|

1,472,554 |

|

1,523,682 |

|

1,508,850 |

|

| Real estate — business |

3,580,772 |

|

3,666,057 |

|

3,727,643 |

|

3,644,589 |

|

3,642,010 |

|

| Real estate — personal |

3,047,563 |

|

3,044,943 |

|

3,031,193 |

|

3,027,664 |

|

2,992,500 |

|

| Consumer |

2,129,483 |

|

2,127,650 |

|

2,082,490 |

|

2,117,268 |

|

2,102,281 |

|

| Revolving home equity |

335,817 |

|

326,204 |

|

322,074 |

|

310,282 |

|

304,055 |

|

| Consumer credit card |

559,410 |

|

552,896 |

|

562,892 |

|

568,112 |

|

564,039 |

|

| Overdrafts |

5,460 |

|

4,856 |

|

7,696 |

|

5,258 |

|

5,341 |

|

Total loans |

17,025,865 |

|

17,174,474 |

|

17,080,067 |

|

17,058,084 |

|

16,968,303 |

|

| Allowance for credit losses on loans |

(158,003) |

|

(159,791) |

|

(161,891) |

|

(161,932) |

|

(158,335) |

|

| Net loans |

16,867,862 |

|

17,014,683 |

|

16,918,176 |

|

16,896,152 |

|

16,809,968 |

|

| Loans held for sale |

2,448 |

|

2,455 |

|

2,149 |

|

5,392 |

|

5,714 |

|

| Investment securities: |

|

|

|

|

|

| U.S. government and federal agency obligations |

1,888,985 |

|

1,201,954 |

|

851,656 |

|

889,390 |

|

986,284 |

|

| Government-sponsored enterprise obligations |

55,583 |

|

55,634 |

|

55,652 |

|

55,661 |

|

55,676 |

|

| State and municipal obligations |

856,620 |

|

1,069,934 |

|

1,330,808 |

|

1,363,649 |

|

1,391,541 |

|

| Mortgage-backed securities |

5,082,091 |

|

5,553,656 |

|

5,902,328 |

|

6,022,502 |

|

6,161,348 |

|

| Asset-backed securities |

1,525,593 |

|

1,785,598 |

|

2,085,050 |

|

2,325,089 |

|

2,553,562 |

|

Other debt securities |

224,528 |

|

364,828 |

|

503,204 |

|

510,721 |

|

514,787 |

|

| Unrealized gain (loss) on debt securities |

(961,695) |

|

(1,272,127) |

|

(1,274,125) |

|

(1,595,845) |

|

(1,458,141) |

|

| Total available for sale debt securities |

8,671,705 |

|

8,759,477 |

|

9,454,573 |

|

9,571,167 |

|

10,205,057 |

|

Trading debt securities |

47,440 |

|

46,565 |

|

40,483 |

|

37,234 |

|

35,044 |

|

| Equity securities |

85,118 |

|

127,584 |

|

12,768 |

|

12,249 |

|

12,230 |

|

| Other securities |

217,377 |

|

228,403 |

|

221,695 |

|

222,378 |

|

237,518 |

|

| Total investment securities |

9,021,640 |

|

9,162,029 |

|

9,729,519 |

|

9,843,028 |

|

10,489,849 |

|

| Federal funds sold |

12 |

|

1,612 |

|

599 |

|

1,194 |

|

2,722 |

|

| Securities purchased under agreements to resell |

474,997 |

|

303,586 |

|

340,934 |

|

450,000 |

|

712,472 |

|

| Interest earning deposits with banks |

2,565,188 |

|

2,099,777 |

|

1,938,381 |

|

2,387,415 |

|

2,337,744 |

|

| Other assets |

1,648,321 |

|

1,651,808 |

|

1,715,716 |

|

1,797,849 |

|

1,750,222 |

|

| Total assets |

$ |

30,580,468 |

|

$ |

30,235,950 |

|

$ |

30,645,474 |

|

$ |

31,381,030 |

|

$ |

32,108,691 |

|

|

|

|

|

|

|

| LIABILITIES AND EQUITY: |

|

|

|

|

|

| Non-interest bearing deposits |

$ |

7,284,834 |

|

$ |

7,297,955 |

|

$ |

7,328,603 |

|

$ |

7,748,654 |

|

$ |

7,939,190 |

|

| Savings |

1,303,675 |

|

1,328,989 |

|

1,333,983 |

|

1,357,733 |

|

1,436,149 |

|

| Interest checking and money market |

13,242,398 |

|

13,162,118 |

|

13,215,270 |

|

13,166,783 |

|

13,048,199 |

|

| Certificates of deposit of less than $100,000 |

1,055,683 |

|

1,003,798 |

|

976,804 |

|

1,097,224 |

|

1,423,965 |

|

| Certificates of deposit of $100,000 and over |

1,464,143 |

|

1,492,592 |

|

1,595,310 |

|

1,839,057 |

|

1,718,126 |

|

| Total deposits |

24,350,733 |

|

24,285,452 |

|

24,449,970 |

|

25,209,451 |

|

25,565,629 |

|

| Borrowings: |

|

|

|

|

|

| Federal funds purchased |

206,644 |

|

265,042 |

|

328,216 |

|

473,534 |

|

508,851 |

|

| Securities sold under agreements to repurchase |

2,351,870 |

|

2,254,849 |

|

2,511,959 |

|

2,467,118 |

|

2,283,020 |

|

| Other borrowings |

496 |

|

838 |

|

76 |

|

179,587 |

|

685,222 |

|

| Total borrowings |

2,559,010 |

|

2,520,729 |

|

2,840,251 |

|

3,120,239 |

|

3,477,093 |

|

| Other liabilities |

405,490 |

|

399,080 |

|

410,310 |

|

421,402 |

|

367,741 |

|

| Total liabilities |

27,315,233 |

|

27,205,261 |

|

27,700,531 |

|

28,751,092 |

|

29,410,463 |

|

| Equity |

3,265,235 |

|

3,030,689 |

|

2,944,943 |

|

2,629,938 |

|

2,698,228 |

|

| Total liabilities and equity |

$ |

30,580,468 |

|

$ |

30,235,950 |

|

$ |

30,645,474 |

|

$ |

31,381,030 |

|

$ |

32,108,691 |

|

|

|

|

|

|

|

|

|

|

|

|

|

COMMERCE BANCSHARES, INC. and SUBSIDIARIES

AVERAGE RATES

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| (Unaudited) |

For the Three Months Ended |

| Sep. 30, 2024 |

Jun. 30, 2024 |

Mar. 31, 2024 |

Dec. 31, 2023 |

Sep. 30, 2023 |

| ASSETS: |

|

|

|

|

|

| Loans: |

|

|

|

|

|

Business (1) |

6.17 |

% |

6.11 |

% |

6.07 |

% |

5.91 |

% |

5.77 |

% |

| Real estate — construction and land |

8.44 |

|

8.36 |

|

8.40 |

|

8.34 |

|

8.17 |

|

| Real estate — business |

6.28 |

|

6.26 |

|

6.26 |

|

6.18 |

|

6.13 |

|

| Real estate — personal |

4.10 |

|

4.04 |

|

3.95 |

|

3.85 |

|

3.73 |

|

| Consumer |

6.64 |

|

6.56 |

|

6.40 |

|

6.21 |

|

5.97 |

|

| Revolving home equity |

7.69 |

|

7.68 |

|

7.70 |

|

7.70 |

|

7.76 |

|

| Consumer credit card |

14.01 |

|

13.96 |

|

14.11 |

|

13.83 |

|

13.77 |

|

| Overdrafts |

— |

|

— |

|

— |

|

— |

|

— |

|

| Total loans |

6.35 |

|

6.30 |

|

6.27 |

|

6.15 |

|

6.02 |

|

| Loans held for sale |

6.34 |

|

7.54 |

|

7.49 |

|

9.93 |

|

10.55 |

|

| Investment securities: |

|

|

|

|

|

| U.S. government and federal agency obligations |

3.68 |

|

5.04 |

|

2.08 |

|

2.32 |

|

2.31 |

|

| Government-sponsored enterprise obligations |

2.37 |

|

2.39 |

|

2.39 |

|

2.36 |

|

2.36 |

|

State and municipal obligations (1) |

2.00 |

|

2.00 |

|

1.97 |

|

1.94 |

|

1.95 |

|

| Mortgage-backed securities |

1.95 |

|

2.09 |

|

2.19 |

|

2.05 |

|

2.06 |

|

| Asset-backed securities |

2.66 |

|

2.50 |

|

2.39 |

|

2.30 |

|

2.20 |

|

| Other debt securities |

2.07 |

|

2.01 |

|

1.93 |

|

1.85 |

|

1.75 |

|

| Total available for sale debt securities |

2.41 |

|

2.50 |

|

2.18 |

|

2.10 |

|

2.08 |

|

Trading debt securities (1) |

4.52 |

|

4.95 |

|

5.30 |

|

5.05 |

|

5.11 |

|

Equity securities (1) |

4.44 |

|

2.82 |

|

25.64 |

|

27.47 |

|

23.06 |

|

Other securities (1) |

6.09 |

|

13.20 |

|

13.04 |

|

8.60 |

|

13.13 |

|

| Total investment securities |

2.52 |

|

2.75 |

|

2.44 |

|

2.27 |

|

2.33 |

|

| Federal funds sold |

— |

|

6.74 |

|

6.71 |

|

6.65 |

|

6.56 |

|

| Securities purchased under agreements to resell |

3.53 |

|

3.21 |

|

1.93 |

|

1.64 |

|

2.08 |

|

| Interest earning deposits with banks |

5.43 |

|

5.48 |

|

5.48 |

|

5.47 |

|

5.39 |

|

| Total interest earning assets |

4.96 |

|

4.98 |

|

4.78 |

|

4.62 |

|

4.51 |

|

|

|

|

|

|

|

| LIABILITIES AND EQUITY: |

|

|

|

|

|

| Interest bearing deposits: |

|

|

|

|

|

| Savings |

.07 |

|

.06 |

|

.06 |

|

.05 |

|

.05 |

|

| Interest checking and money market |

1.74 |

|

1.73 |

|

1.69 |

|

1.57 |

|

1.33 |

|

| Certificates of deposit of less than $100,000 |

4.17 |

|

4.22 |

|

4.20 |

|

4.21 |

|

4.32 |

|

| Certificates of deposit of $100,000 and over |

4.51 |

|

4.55 |

|

4.56 |

|

4.55 |

|

4.37 |

|

| Total interest bearing deposits |

2.00 |

|

1.99 |

|

1.97 |

|

1.93 |

|

1.76 |

|

| Borrowings: |

|

|

|

|

|

| Federal funds purchased |

5.38 |

|

5.42 |

|

5.42 |

|

5.40 |

|

5.33 |

|

| Securities sold under agreements to repurchase |

3.56 |

|

3.44 |

|

3.43 |

|

3.25 |

|

3.20 |

|

| Other borrowings |

4.81 |

|

3.84 |

|

— |

|

5.45 |

|

5.30 |

|

| Total borrowings |

3.71 |

|

3.65 |

|

3.66 |

|

3.71 |

|

3.93 |

|

| Total interest bearing liabilities |

2.22 |

% |

2.21 |

% |

2.21 |

% |

2.20 |

% |

2.12 |

% |

|

|

|

|

|

|

| Net yield on interest earning assets |

3.50 |

% |

3.55 |

% |

3.33 |

% |

3.17 |

% |

3.11 |

% |

(1) Stated on a fully taxable-equivalent basis using a federal income tax rate of 21%.

COMMERCE BANCSHARES, INC. and SUBSIDIARIES

CREDIT QUALITY

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| |

|

For the Three Months Ended |

For the Nine Months Ended |

(Unaudited)

(In thousands, except ratios) |

|

Sep. 30, 2024 |

Jun. 30, 2024 |

Mar. 31, 2024 |

Dec. 31, 2023 |

Sep. 30, 2023 |

Sep. 30, 2024 |

Sep. 30, 2023 |

| ALLOWANCE FOR CREDIT LOSSES ON LOANS |

|

|

|

|

|

|

|

|

| Balance at beginning of period |

|

$158,557 |

|

$160,465 |

|

$162,395 |

|

$162,244 |

|

$158,685 |

|

$162,395 |

|

$150,136 |

|

|

|

|

|

|

|

|

|

|

| Provision for credit losses on loans |

|

11,861 |

|

7,849 |

|

6,947 |

|

8,170 |

|

13,343 |

|

26,657 |

|

35,155 |

|

| Net charge-offs (recoveries): |

|

|

|

|

|

|

|

|

| Commercial portfolio: |

|

|

|

|

|

|

|

|

| Business |

|

114 |

|

622 |

|

23 |

|

96 |

|

2,613 |

|

759 |

|

3,008 |

|

| Real estate — construction and land |

|

— |

|

— |

|

— |

|

— |

|

— |

|

— |

|

(115) |

|

| Real estate — business |

|

(7) |

|

(8) |

|

(141) |

|

128 |

|

(15) |

|

(156) |

|

(24) |

|

|

|

107 |

|

614 |

|

(118) |

|

224 |

|

2,598 |

|

603 |

|

2,869 |

|

| Personal banking portfolio: |

|

|

|

|

|

|

|

|

| Consumer credit card |

|

6,273 |

|

6,746 |

|

6,435 |

|

5,325 |

|

4,716 |

|

19,454 |

|

13,728 |

|

| Consumer |

|

2,759 |

|

1,804 |

|

1,983 |

|

1,903 |

|

1,797 |

|

6,546 |

|

4,345 |

|

| Overdraft |

|

464 |

|

521 |

|

557 |

|

588 |

|

683 |

|

1,542 |

|

2,178 |

|

| Real estate — personal |

|

128 |

|

79 |

|

24 |

|

(11) |

|

(9) |

|

231 |

|

(26) |

|

| Revolving home equity |

|

(152) |

|

(7) |

|

(4) |

|

(10) |

|

(1) |

|

(163) |

|

(47) |

|

|

|

9,472 |

|

9,143 |

|

8,995 |

|

7,795 |

|

7,186 |

|

27,610 |

|

20,178 |

|

| Total net loan charge-offs |

|

9,579 |

|

9,757 |

|

8,877 |

|

8,019 |

|

9,784 |

|

28,213 |

|

23,047 |

|

| Balance at end of period |

|

$160,839 |

|

$158,557 |

|

$160,465 |

|

$162,395 |

|

$162,244 |

|

$160,839 |

|

$162,244 |

|

| LIABILITY FOR UNFUNDED LENDING COMMITMENTS |

|

$17,984 |

|

$20,705 |

|

$23,086 |

|

$25,246 |

|

$27,537 |

|

|

|

|

|

|

|

|

|

|

|

|

NET CHARGE-OFF RATIOS (1) |

|

|

|

|

|

|

|

|

| Commercial portfolio: |

|

|

|

|

|

|

|

|

| Business |

|

.01 |

% |

.04 |

% |

— |

% |

.01 |

% |

.18 |

% |

.02 |

% |

.07 |

% |

| Real estate — construction and land |

|

— |

|

— |

|

— |

|

— |

|

— |

|

— |

|

(.01) |

|

| Real estate — business |

|

— |

|

— |

|

(.02) |

|

.01 |

|

— |

|

(.01) |

|

— |

|

|

|

— |

|

.02 |

|

— |

|

.01 |

|

.09 |

|

.01 |

|

.04 |

|

| Personal banking portfolio: |

|

|

|

|

|

|

|

|

| Consumer credit card |

|

4.46 |

|

4.91 |

|

4.60 |

|

3.72 |

|

3.32 |

|

4.65 |

|

3.28 |

|

| Consumer |

|

.52 |

|

.34 |

|

.38 |

|

.36 |

|

.34 |

|

.41 |

|

.28 |

|

| Overdraft |

|

33.81 |

|

43.15 |

|

29.11 |

|

44.37 |

|

50.73 |

|

34.32 |

|

60.54 |

|

| Real estate — personal |

|

.02 |

|

.01 |

|

— |

|

— |

|

— |

|

.01 |

|

— |

|

| Revolving home equity |

|

(.18) |

|

(.01) |

|

— |

|

(.01) |

|

— |

|

(.07) |

|

(.02) |

|

|

|

.62 |

|

.61 |

|

.60 |

|

.51 |

|

.48 |

|

.61 |

|

.46 |

|

| Total |

|

.22 |

% |

.23 |

% |

.21 |

% |

.19 |

% |

.23 |

% |

.22 |

% |

.18 |

% |

|

|

|

|

|

|

|

|

|

| CREDIT QUALITY RATIOS |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Non-accrual loans to total loans |

|

.11 |

% |

.11 |

% |

.03 |

% |

.04 |

% |

.05 |

% |

|

|

|

|

|

|

|

|

|

|

|

| Allowance for credit losses on loans to total loans |

|

.94 |

|

.92 |

|

.93 |

|

.94 |

|

.95 |

|

|

|

|

|

|

|

|

|

|

|

|

| NON-ACCRUAL AND PAST DUE LOANS |

|

|

|

|

|

|

|

|

| Non-accrual loans: |

|

|

|

|

|

|

|

|

| Business |

|

$354 |

|

$504 |

|

$1,038 |

|

$3,622 |

|

$6,602 |

|

|

|

|

|

|

|

|

|

|

|

|

| Real estate — business |

|

14,944 |

|

15,050 |

|

1,246 |

|

60 |

|

76 |

|

|

|

| Real estate — personal |

|

1,144 |

|

1,772 |

|

1,523 |

|

1,653 |

|

1,531 |

|

|

|

|

|

|

|

|

|

|

|

|

| Revolving home equity |

|

1,977 |

|

1,977 |

|

1,977 |

|

1,977 |

|

— |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Total |

|

18,419 |

|

19,303 |

|

5,784 |

|

7,312 |

|

8,209 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Loans past due 90 days and still accruing interest |

$21,986 |

|

$18,566 |

|

$20,281 |

|

$21,864 |

|

$18,580 |

|

|

|

(1) Net charge-offs are annualized and calculated as a percentage of average loans (excluding loans held for sale).

Exhibit 99.1

COMMERCE BANCSHARES, INC.

Management Discussion of Third Quarter Results

September 30, 2024

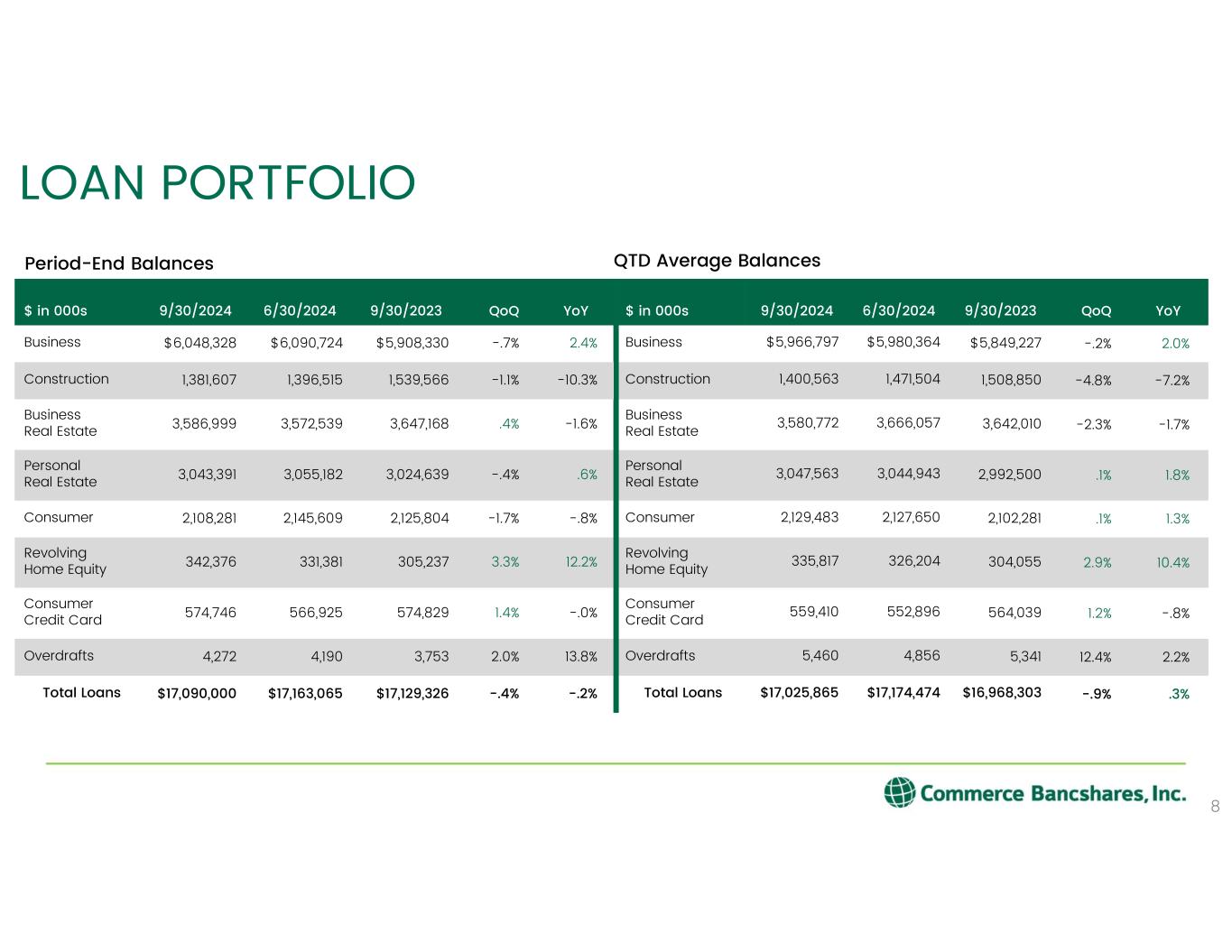

For the quarter ended September 30, 2024, net income amounted to $138.0 million, compared to $139.6 million in the previous quarter and $120.6 million in the same quarter last year. The decrease in net income compared to the previous quarter was primarily the result of increases in the provision for credit losses and non-interest expense, partly offset by higher non-interest income. The net yield on interest earning assets decreased five basis points compared to the previous quarter to 3.50%. Average deposits increased $65.3 million over the prior quarter, while average loans and available for sale debt securities, at fair value, declined $148.6 million and $87.8 million, respectively. For the quarter, the return on average assets was 1.80%, the return on average equity was 16.81%, and the efficiency ratio was 56.3%.

Balance Sheet Review

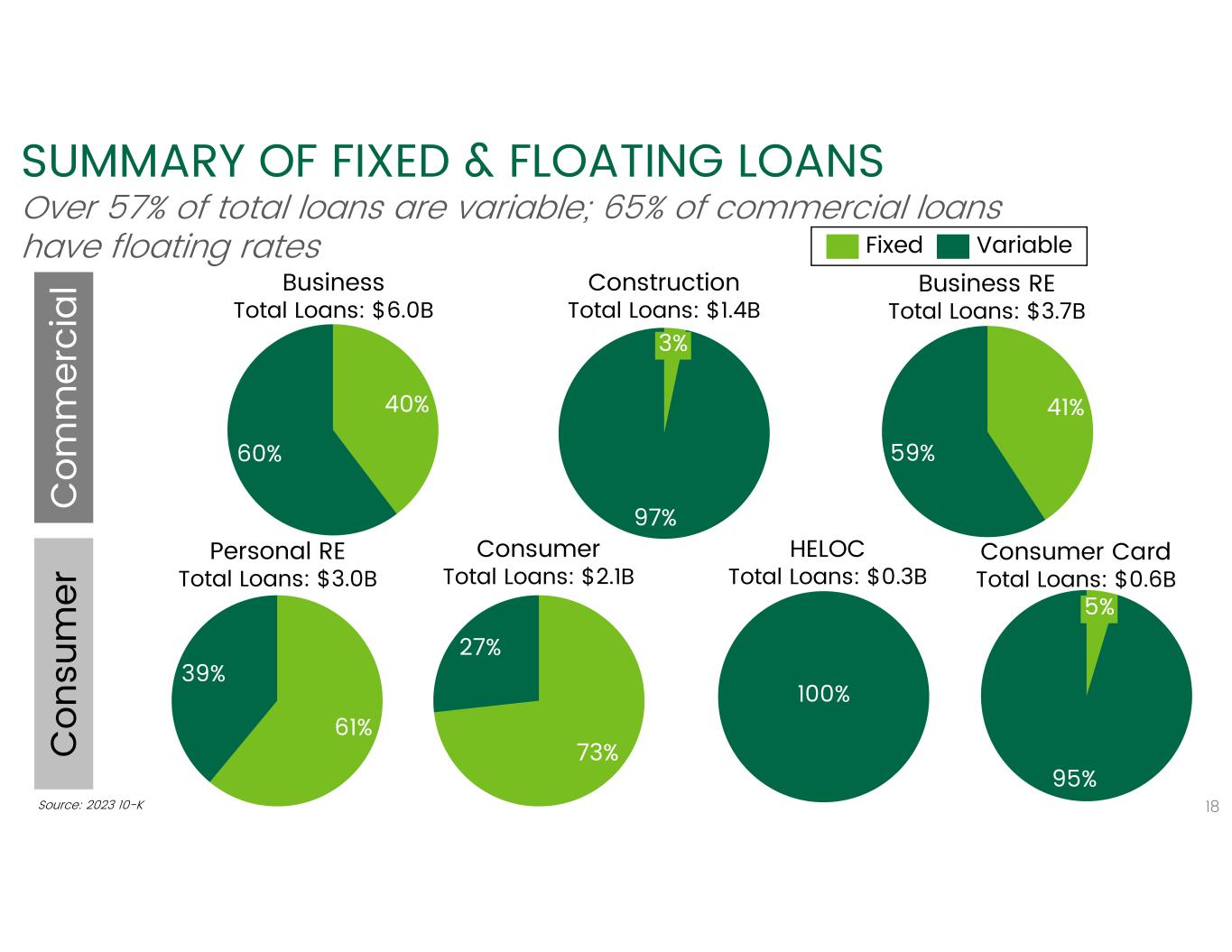

During the 3rd quarter of 2024, average loans totaled $17.0 billion, a decrease of $148.6 million compared to the prior quarter, and an increase of $57.6 million, or .3%, over the same quarter last year. Compared to the previous quarter, average balances of business real estate and construction loans declined $85.3 million and $70.9 million, respectively. During the current quarter, the Company sold certain fixed rate personal real estate loans totaling $22.6 million, compared to $18.2 million in the prior quarter.

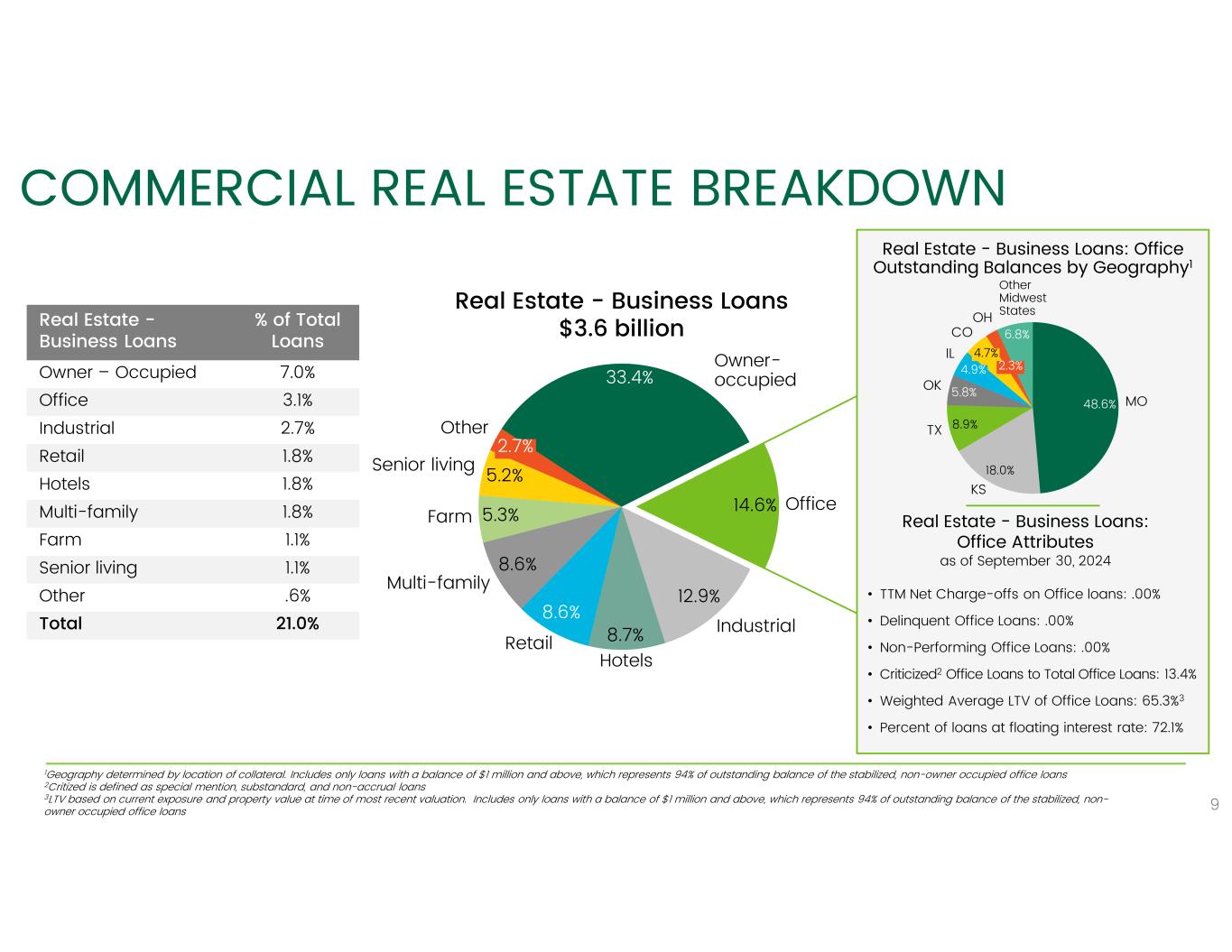

Total average available for sale debt securities decreased $87.8 million compared to the previous quarter to $8.7 billion, at fair value. The decrease in debt securities was mainly the result of lower average balances of mortgage-backed, asset-backed, state and municipal obligations, and other debt securities, partly offset by higher average balances of U.S. government and federal agency obligations. During the 3rd quarter of 2024, the unrealized loss on available for sale debt securities decreased $287.4 million to $786.4 million, at period end. Also, during the 3rd quarter of 2024, purchases of available for sale debt securities totaled $976.1 million with a weighted average yield of approximately 3.87%, and sales, maturities and pay downs of available for sale debt securities were $630.3 million. At September 30, 2024, the duration of the available for sale investment portfolio was 4.0 years, and maturities and pay downs of approximately $1.6 billion are expected to occur during the next 12 months.

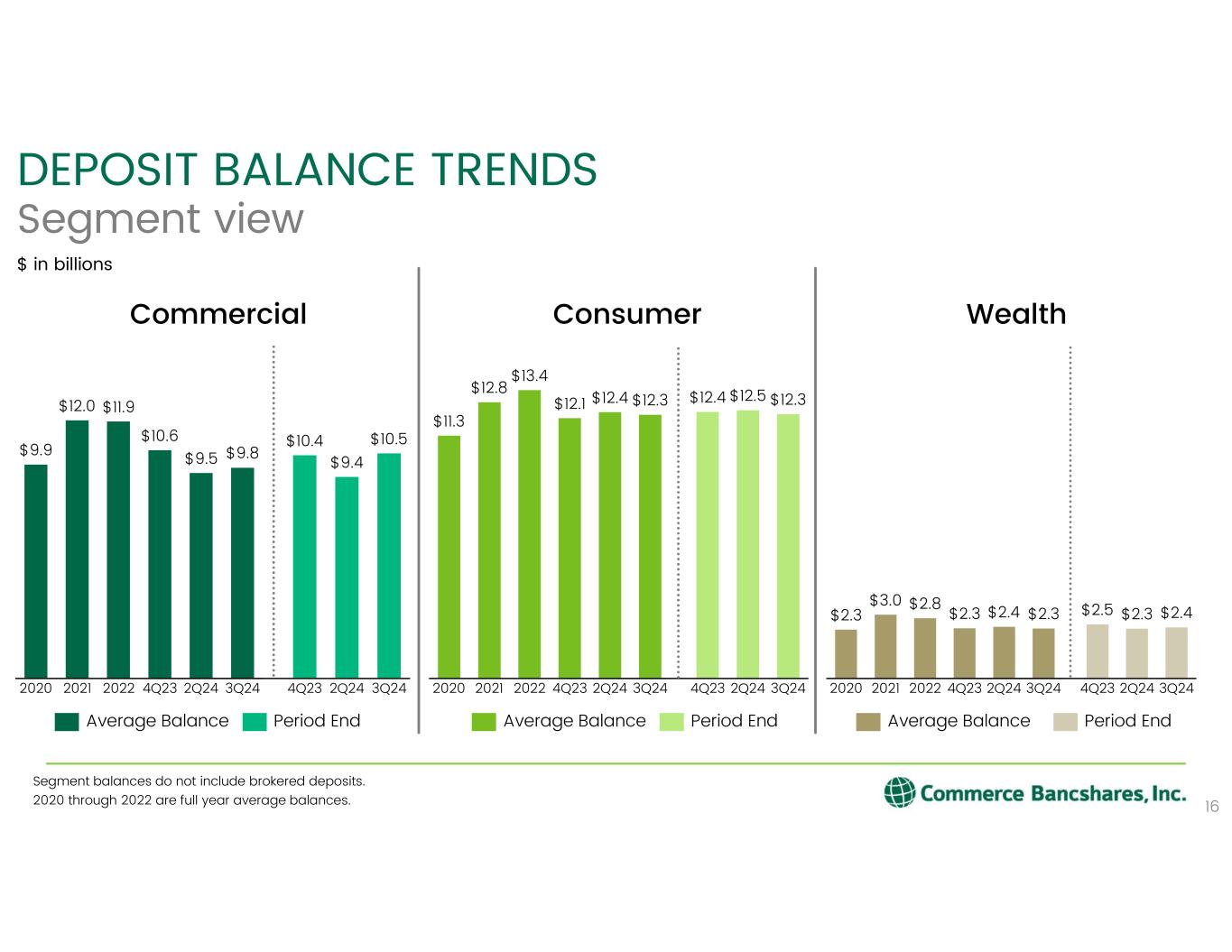

Total average deposits increased $65.3 million this quarter compared to the previous quarter. The increase in deposits mostly resulted from growth of $80.3 million in interest checking and money market average balances. Compared to the previous quarter, total average commercial deposits grew $250.3 million, while average consumer and trust deposits declined $117.6 million and $82.2 million, respectively. The average loans to deposits ratio was 69.9% in the current quarter and 70.7% in the prior quarter. The Company’s average borrowings, which

included average customer repurchase agreements of $2.4 billion, increased $38.3 million to $2.6 billion in the 3rd quarter of 2024.

Net Interest Income

Net interest income in the 3rd quarter of 2024 amounted to $262.4 million, an increase of $102 thousand over the previous quarter. On a fully taxable-equivalent (FTE) basis, net interest income for the current quarter increased $60 thousand over the previous quarter to $264.6 million. The increase in net interest income was mostly due to higher interest income on loans and deposits with banks, partly offset by lower interest income on investment securities and higher interest expense on deposits and borrowings. The net yield (FTE) on earning assets decreased to 3.50%, from 3.55% in the prior quarter.

Compared to the previous quarter, interest income on loans (FTE) increased $2.7 million, due to higher average rates earned on all loan categories, partly offset by lower balances on construction and business real estate loans. The average yield (FTE) on the loan portfolio increased five basis points to 6.35% this quarter.

Interest income on investment securities (FTE) decreased $8.1 million compared to the prior quarter, mostly due to lower rates earned on U.S. government and federal agency, mortgage-backed and other securities. Interest income earned on U.S. government and federal agency securities increased due to higher average balances, partly offset by lower rates, which included the impact of $5.5 million in lower inflation income from Treasury inflation-protected securities compared to previous quarter. Additionally, the Company recorded a $286 thousand adjustment to premium amortization at September 30, 2024, which decreased interest income to reflect slightly faster forward prepayment speed estimates on mortgage-backed securities. This decrease was lower than the $740 thousand adjustment increasing interest income in the prior quarter. The average yield (FTE) on total investment securities was 2.52% in the current quarter, compared to 2.75% in the previous quarter.

Compared to the previous quarter, interest income on deposits with banks increased $6.4 million, due to higher average balances of $465.4 million. Interest earned on securities purchased under agreements to resell increased $1.8 million due to higher average balances and rates.

Interest expense increased $2.6 million compared to the previous quarter, mainly due to higher average borrowing rates and average interest bearing deposit balances. Interest expense on borrowings increased $994 thousand due to higher average rates and balances of customer repurchase agreements, partly offset by lower average balances of federal funds purchased. Interest expense on deposits increased $1.6 million mostly due to higher average balances.

Exhibit 99.1

COMMERCE BANCSHARES, INC.

Management Discussion of Third Quarter Results

September 30, 2024

The average rate paid on interest bearing deposits totaled 2.00% in the current quarter compared to 1.99% in the prior quarter. The overall rate paid on interest bearing liabilities was 2.22% in the current quarter and 2.21% in the prior quarter.

Non-Interest Income

In the 3rd quarter of 2024, total non-interest income amounted to $159.0 million, an increase of $16.1 million, or 11.2%, over the same period last year and an increase of $6.8 million compared to the prior quarter. The increase in non-interest income compared to the same period last year was mainly due to higher trust fees, capital market fees, deposit account fees, and gains on the sales of real estate, partly offset by lower tax credit sales income. Additionally, an increase of $1.8 million in fair value adjustments was recorded on the company’s deferred compensation plan, which are held in a trust and recorded as both an asset and liability, affecting both other income and other expense. The increase in non-interest income compared to the prior quarter was mainly due to higher trust fees, capital market fees, and gains on the sales of real estate.

Total net bank card fees in the current quarter increased $671 thousand, or 1.4%, compared to the same period last year, and increased $93 thousand compared to the prior quarter. Net corporate card fees increased $234 thousand, or .9%, compared to the same quarter of last year mainly due to lower rewards expense. Net merchant fees decreased $378 thousand, or 6.5%, mainly due to higher network expense. Net debit card fees increased $288 thousand, or 2.6%, while net credit card fees increased $527 thousand, or 15.4%, mostly due to higher interchange fees and lower rewards expense. Total net bank card fees this quarter were comprised of fees on corporate card ($26.8 million), debit card ($11.4 million), merchant ($5.5 million) and credit card ($4.0 million) transactions.

In the current quarter, trust fees increased $5.5 million, or 11.1%, over the same period last year, mostly resulting from higher private client fees. Compared to the same period last year, deposit account fees increased $2.3 million, or 9.9%, mostly due to higher corporate cash management fees, while capital market fees increased $2.5 million, or 70.1%, mostly due to higher trading securities income.

Other non-interest income increased compared to the same period last year primarily due to higher gains on the sales of real estate of $3.4 million and the deferred compensation adjustment previously mentioned, partly offset by lower tax credit sales income of $1.4 million. For the 3rd quarter of 2024, non-interest income comprised 37.7% of the Company’s total revenue.

Investment Securities Gains and Losses

The Company recorded net securities gains of $3.9 million in the current quarter, compared to gains of $3.2 million in the prior quarter and gains of $4.3 million in the 3rd quarter of 2023. Net securities gains in the current quarter resulted from net gains of $9.5 million on the Company’s portfolio of private equity investments, driven by $7.4 million of fair value adjustments. These net gains were partly offset by losses of $5.4 million on sales of available for sale debt securities and a loss of $417 thousand resulting from the Company’s sale of 217,872 shares of Visa Class A common stock (converted from 54,468 shares of Visa Class C common stock). As of September 30, 2024, the Company has sold all of the Visa Class C shares it received from the Visa exchange offer.

Non-Interest Expense

Non-interest expense for the current quarter amounted to $237.6 million, compared to $228.0 million in the same period last year and $232.2 million in the prior quarter. The increase in non-interest expense compared to the same period last year was mainly due to higher salaries and employee benefits expense, data processing and software expense, and marketing expense, partly offset by lower deposit insurance expense. The increase in non-interest expense compared to the prior quarter was mainly due to higher salaries and employee benefits expense and marketing expense, partly offset by a donation to a related charitable foundation recorded in the prior quarter that did not reoccur in the current quarter.

Compared to the 3rd quarter of last year, salaries and employee benefits expense increased $6.3 million, or 4.3%, mostly due to higher full-time salaries expense of $3.5 million, and incentive compensation of $2.2 million. Full-time equivalent employees totaled 4,711 and 4,714 at September 30, 2024 and 2023, respectively.

Compared to the same period last year, data processing and software expense increased $1.5 million due to increased costs for service providers, and marketing expense increased $1.1 million. These increases were partly offset by a decrease in deposit insurance expense of $1.1 million, which was partially the result of a $525 thousand accrual adjustment to the FDIC’s special assessment.

Income Taxes

The effective tax rate for the Company was 21.7% in the current quarter, unchanged from both the previous quarter, and the 3rd quarter of 2023.

Credit Quality

Net loan charge-offs in the 3rd quarter of 2024 amounted to $9.6 million, compared to $9.8 million in both the prior quarter and the same period last year. The ratio of annualized net loan charge-offs to total average loans was .22% in the current quarter, and .23% in both the previous quarter and the same quarter of last year.

Exhibit 99.1

COMMERCE BANCSHARES, INC.

Management Discussion of Third Quarter Results

September 30, 2024

Compared to the prior quarter, net loan charge-offs on business and consumer credit card loans decreased $508 thousand and $473 thousand, respectively, while consumer loan net charge-offs increased $955 thousand.

In the 3rd quarter of 2024, annualized net loan charge-offs on average consumer credit card loans were 4.46%, compared to 4.91% in the previous quarter and 3.32% in the same quarter last year. Consumer loan net charge-offs were .52% of average consumer loans in the current quarter, and .34% in both the prior quarter and the same quarter last year.

At September 30, 2024, the allowance for credit losses on loans totaled $160.8 million, or .94% of total loans, and increased $2.3 million compared to the prior quarter. Additionally, the liability for unfunded lending commitments at September 30, 2024 was $18.0 million, a decrease of $2.7 million compared to the liability at June 30, 2024.

At September 30, 2024, total non-accrual loans amounted to $18.4 million, a decrease of $884 thousand compared to the previous quarter. At September 30, 2024, the balance of non-accrual loans, which represented .11% of loans outstanding, included business loans of $354 thousand, revolving home equity loans of $2.0 million, personal real estate loans of $1.1 million, and business real estate loans of $14.9 million. Loans more than 90 days past due and still accruing interest totaled $22.0 million at September 30, 2024.

Other

During the 3rd quarter of 2024, the Company paid a cash dividend of $.27 per common share, representing a 5.1% increase over the same period last year. The Company purchased 699,919 shares of treasury stock during the current quarter at an average price of $62.39.

Forward Looking Information

This information contains forward-looking statements within the meaning of the Private Securities Litigation Reform Act of 1995. Such statements include future financial and operating results, expectations, intentions, and other statements that are not historical facts. Such statements are based on current beliefs and expectations of the Company’s management and are subject to significant risks and uncertainties. Actual results may differ materially from those set forth in the forward-looking statements. Additional information about risks and uncertainties is included in the “Risk Factors” and “Management’s Discussion and Analysis of Financial Condition and Results of Operations” sections within the Company's Annual Report on Form 10-K.