| (Exact name of registrant as specified in its charter) | ||

| Delaware | 1-5823 | 36-6169860 | ||||||||||||

| (State or other jurisdiction | (Commission | (IRS Employer | ||||||||||||

| of incorporation) | File Number) | Identification No.) | ||||||||||||

| NOT APPLICABLE | ||

| (Former name or former address, if changed since last report.) | ||

| Title of each class | Trading Symbol(s) | Name of each exchange on which registered | ||||||||||||

| Common Stock, Par value $2.50 | "CNA" | New York Stock Exchange | ||||||||||||

| NYSE Texas | ||||||||||||||

| Exhibit No. | Description | |||||||

| CNA Financial Corporation press release, issued November 3, 2025, providing information on the third quarter 2025 results of operations. | ||||||||

| CNA Financial Corporation financial supplement, posted on its website November 3, 2025, providing supplemental financial information on the third quarter 2025. | ||||||||

| CNA Financial Corporation earnings presentation, posted on its website November 3, 2025, providing information on the third quarter 2025 results of operations. | ||||||||

| CNA Financial Corporation earnings remarks, posted on its website November 3, 2025, providing information on the third quarter 2025 results of operations. | ||||||||

| 104 | Cover Page Interactive Data File (embedded within the Inline XBRL document) | |||||||

| CNA Financial Corporation | ||||||||

| (Registrant) | ||||||||

| Date: November 3, 2025 | By | /s/ Scott R. Lindquist | ||||||

| (Signature) | ||||||||

| Scott R. Lindquist Executive Vice President and Chief Financial Officer |

||||||||

| Results for the Three Months Ended September 30 | Results for the Nine Months Ended September 30 | ||||||||||||||||||||||

| ($ millions, except per share data) | 2025 | 2024 | 2025 | 2024 | |||||||||||||||||||

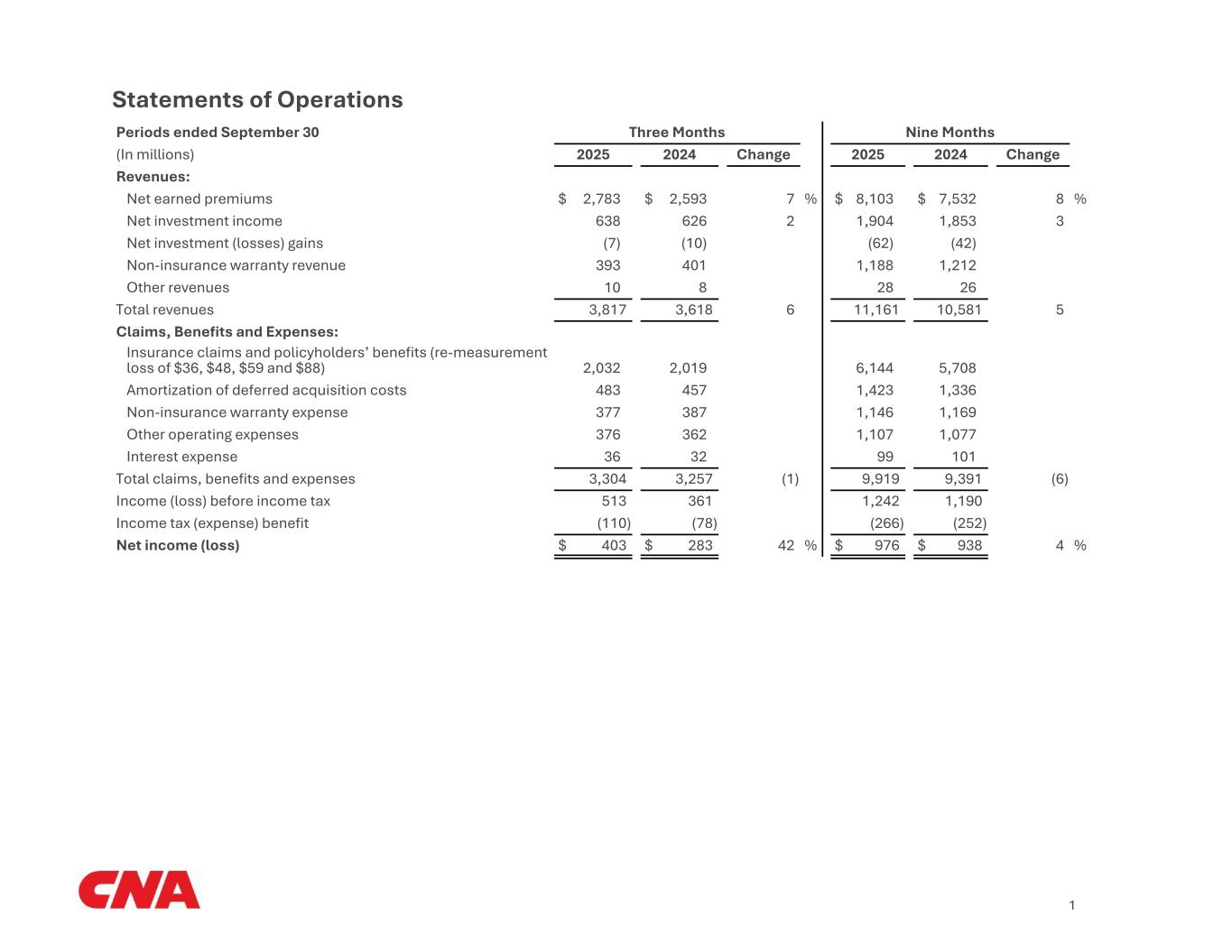

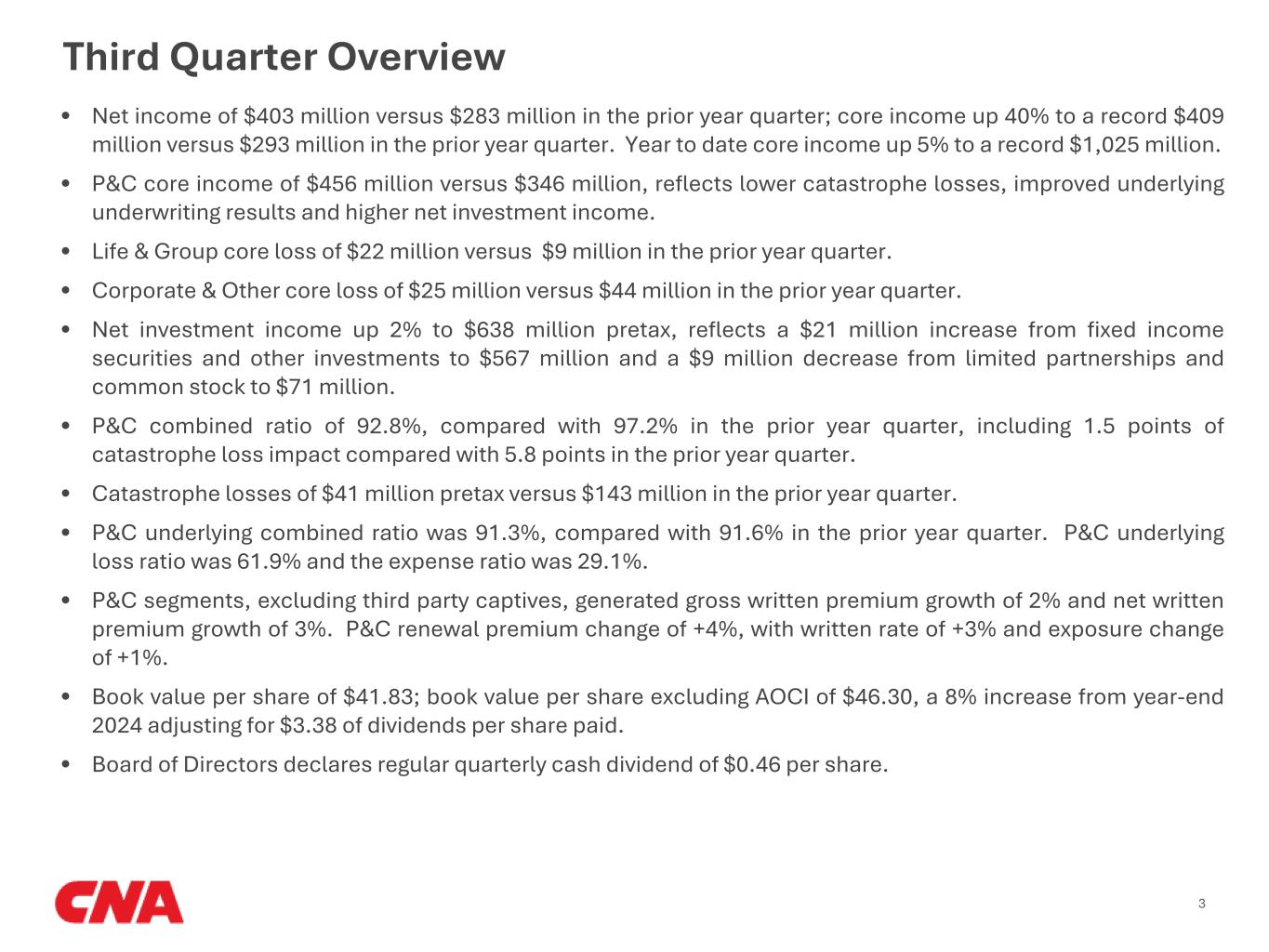

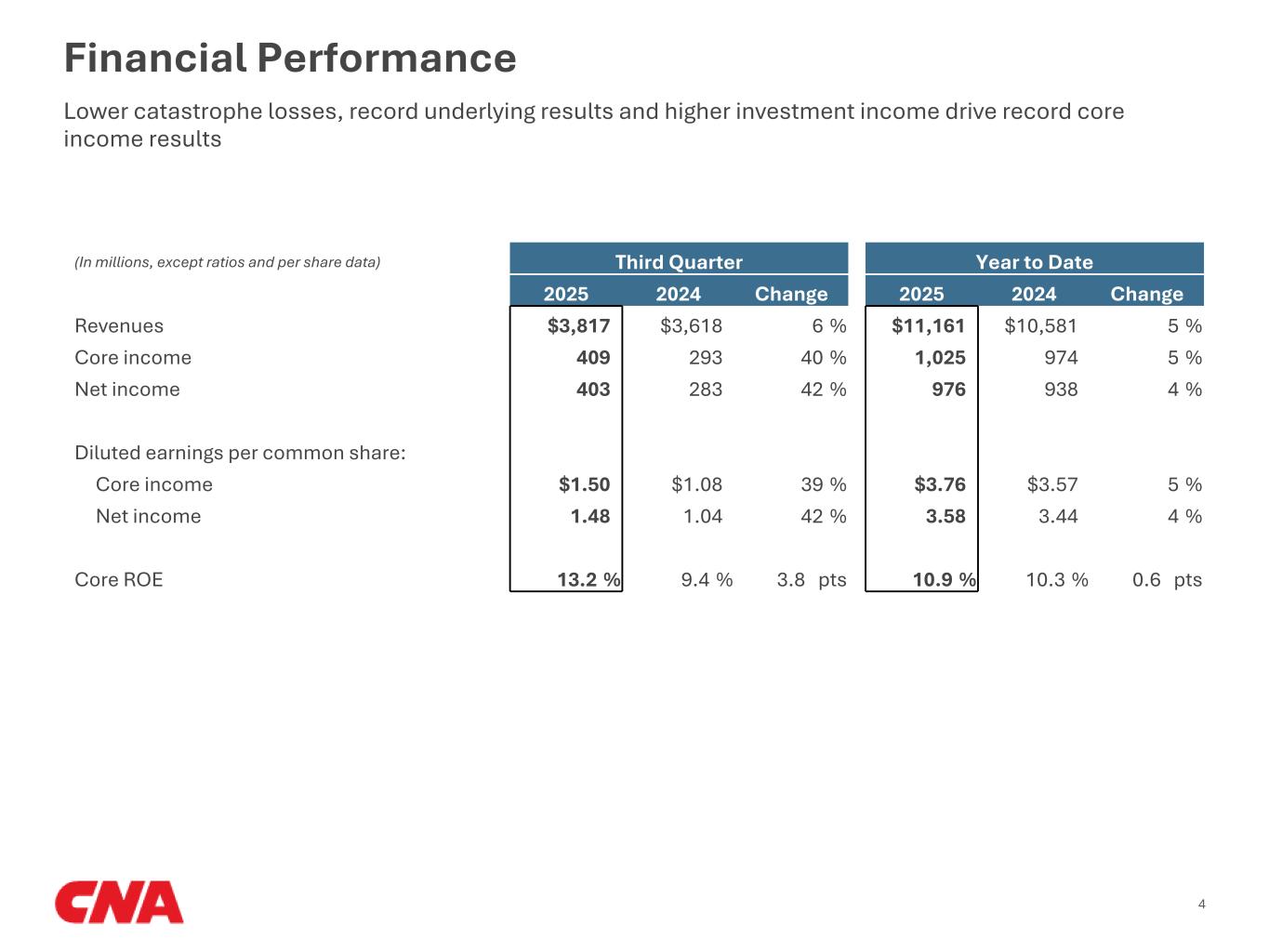

| Net income | $ | 403 | $ | 283 | $ | 976 | $ | 938 | |||||||||||||||

Core income (a) |

409 | 293 | 1,025 | 974 | |||||||||||||||||||

| Net income per diluted share | $ | 1.48 | $ | 1.04 | $ | 3.58 | $ | 3.44 | |||||||||||||||

| Core income per diluted share | 1.50 | 1.08 | 3.76 | 3.57 | |||||||||||||||||||

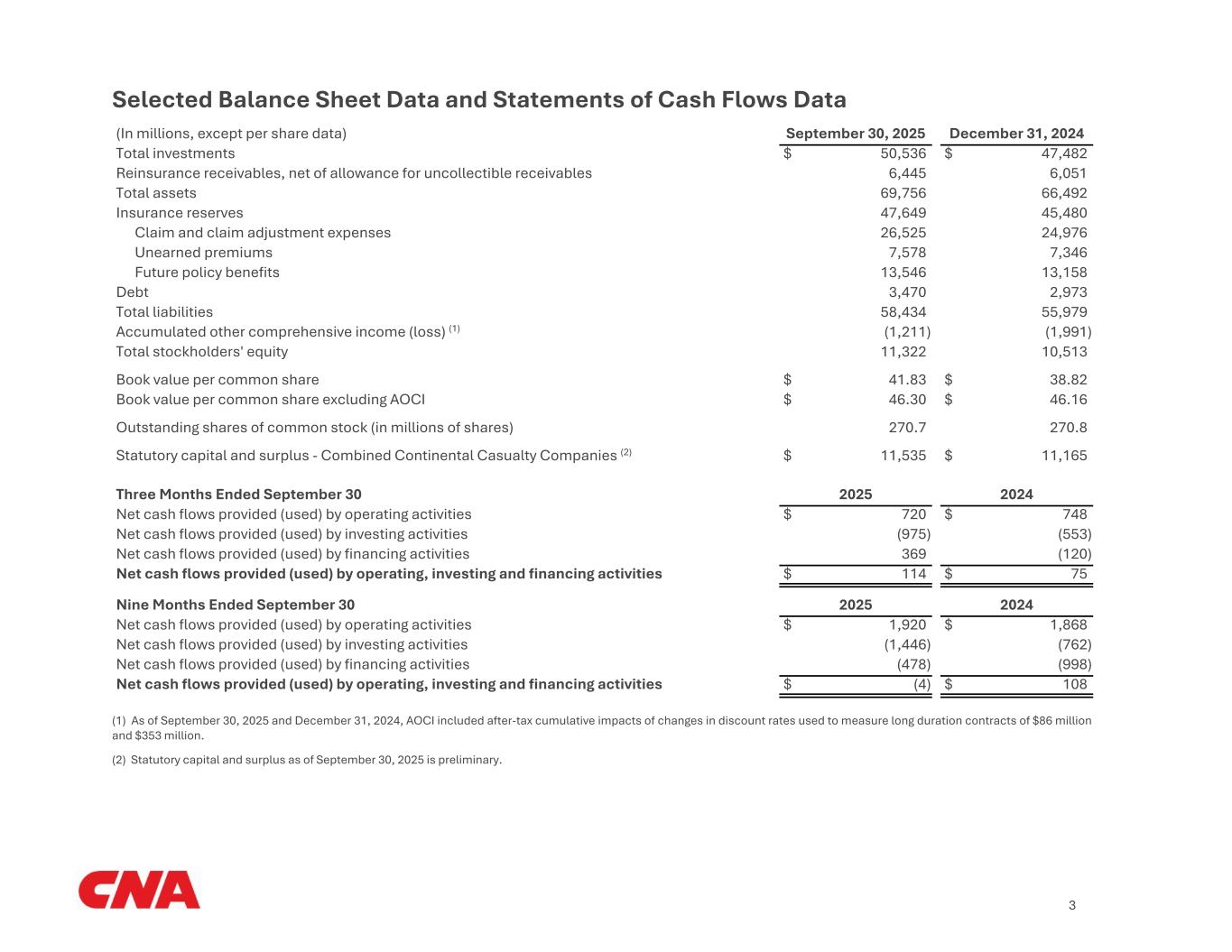

| September 30, 2025 | December 31, 2024 | ||||||||||||||||

| Book value per share | $ | 41.83 | $ | 38.82 | |||||||||||||

| Book value per share excluding AOCI | 46.30 | 46.16 | |||||||||||||||

| Results for the Three Months Ended September 30 | Results for the Nine Months Ended September 30 | ||||||||||||||||||||||||||||||||||

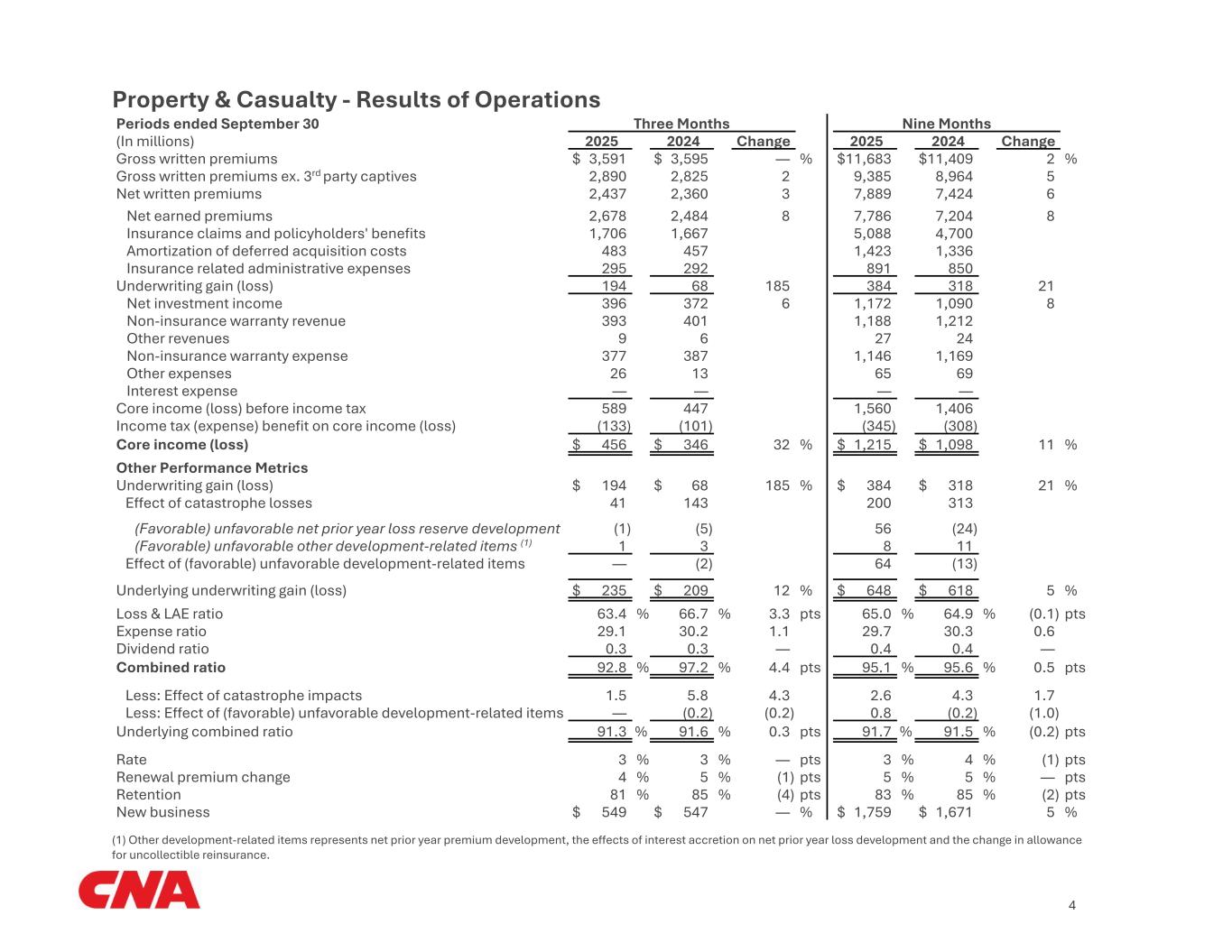

| ($ millions) | 2025 | 2024 | 2025 | 2024 | |||||||||||||||||||||||||||||||

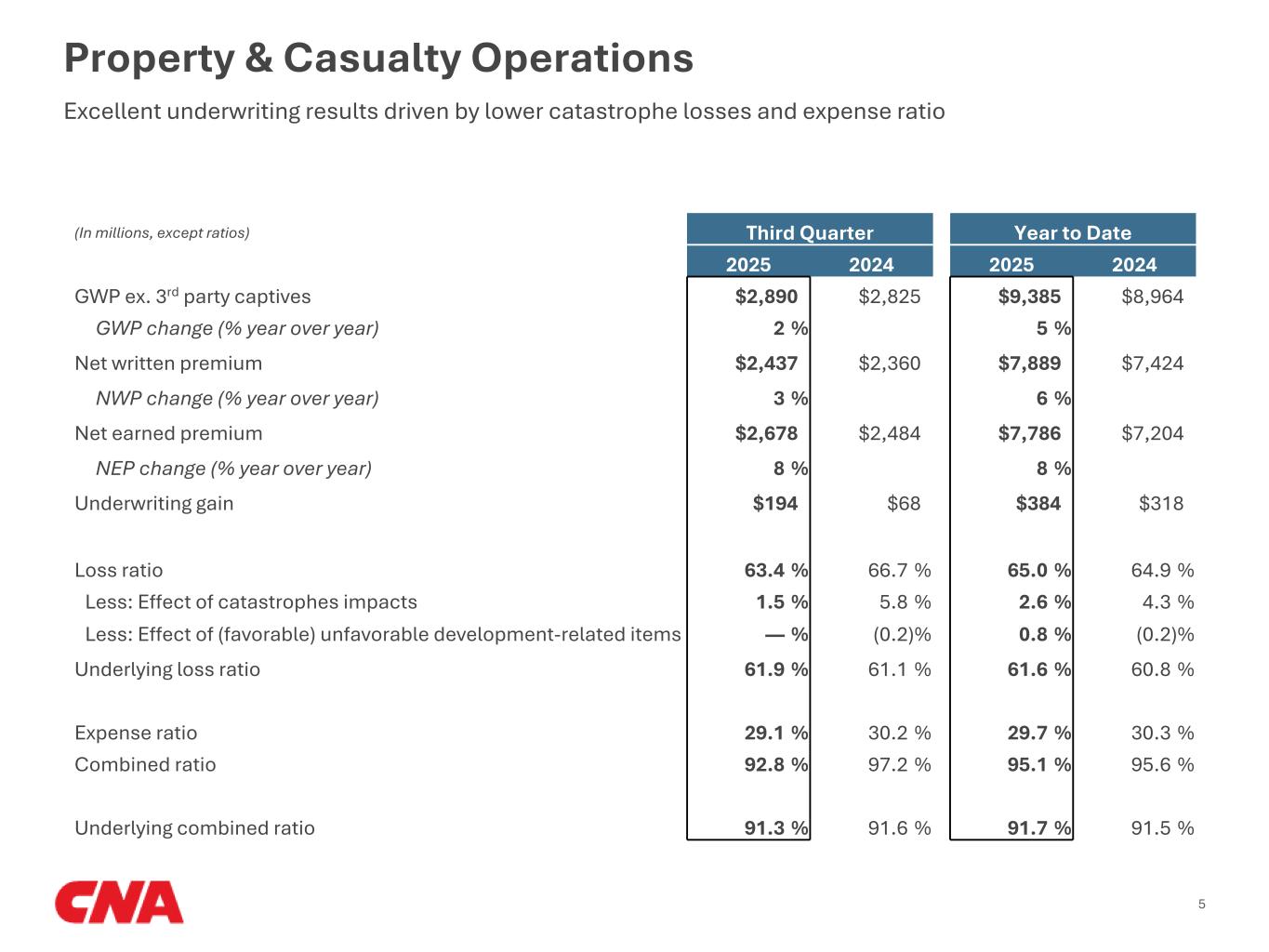

Gross written premiums ex. 3rd party captives |

$ | 2,890 | $ | 2,825 | $ | 9,385 | $ | 8,964 | |||||||||||||||||||||||||||

GWP ex. 3rd party captives change (% year over year) |

2 | % | 5 | % | |||||||||||||||||||||||||||||||

| Net written premiums | $ | 2,437 | $ | 2,360 | $ | 7,889 | $ | 7,424 | |||||||||||||||||||||||||||

| NWP change (% year over year) | 3 | % | 6 | % | |||||||||||||||||||||||||||||||

| Net earned premiums | $ | 2,678 | $ | 2,484 | $ | 7,786 | $ | 7,204 | |||||||||||||||||||||||||||

| NEP change (% year over year) | 8 | % | 8 | % | |||||||||||||||||||||||||||||||

| Underwriting gain | $ | 194 | $ | 68 | $ | 384 | $ | 318 | |||||||||||||||||||||||||||

| Net investment income | $ | 396 | $ | 372 | $ | 1,172 | $ | 1,090 | |||||||||||||||||||||||||||

| Core income | $ | 456 | $ | 346 | $ | 1,215 | $ | 1,098 | |||||||||||||||||||||||||||

| Loss ratio | 63.4 | % | 66.7 | % | 65.0 | % | 64.9 | % | |||||||||||||||||||||||||||

| Less: Effect of catastrophe impacts | 1.5 | 5.8 | 2.6 | 4.3 | |||||||||||||||||||||||||||||||

| Less: Effect of (favorable) unfavorable development-related items | — | (0.2) | 0.8 | (0.2) | |||||||||||||||||||||||||||||||

| Underlying loss ratio | 61.9 | % | 61.1 | % | 61.6 | % | 60.8 | % | |||||||||||||||||||||||||||

| Expense ratio | 29.1 | % | 30.2 | % | 29.7 | % | 30.3 | % | |||||||||||||||||||||||||||

| Combined ratio | 92.8 | % | 97.2 | % | 95.1 | % | 95.6 | % | |||||||||||||||||||||||||||

| Underlying combined ratio | 91.3 | % | 91.6 | % | 91.7 | % | 91.5 | % | |||||||||||||||||||||||||||

| Results for the Three Months Ended September 30 | Results for the Nine Months Ended September 30 | ||||||||||||||||||||||||||||||||||

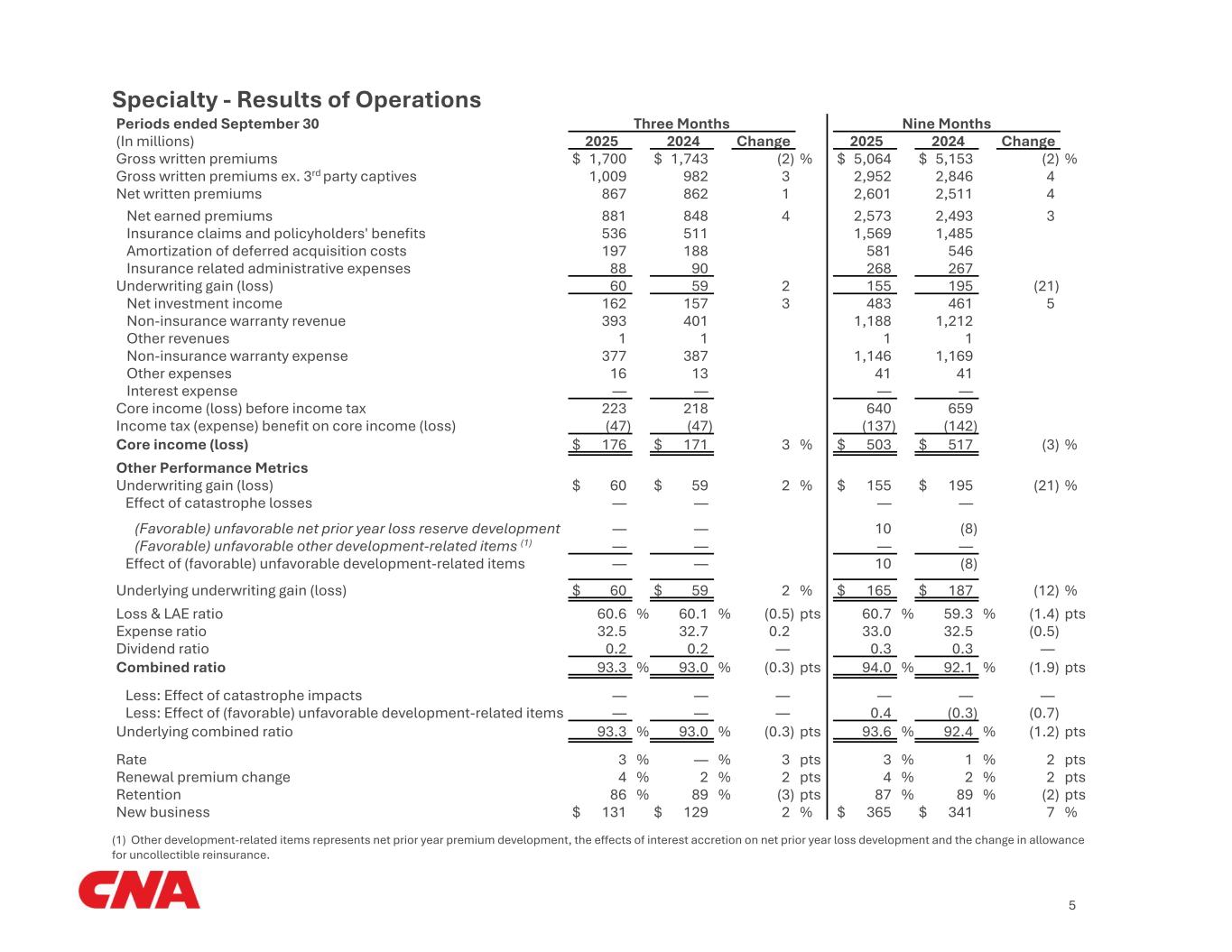

| ($ millions) | 2025 | 2024 | 2025 | 2024 | |||||||||||||||||||||||||||||||

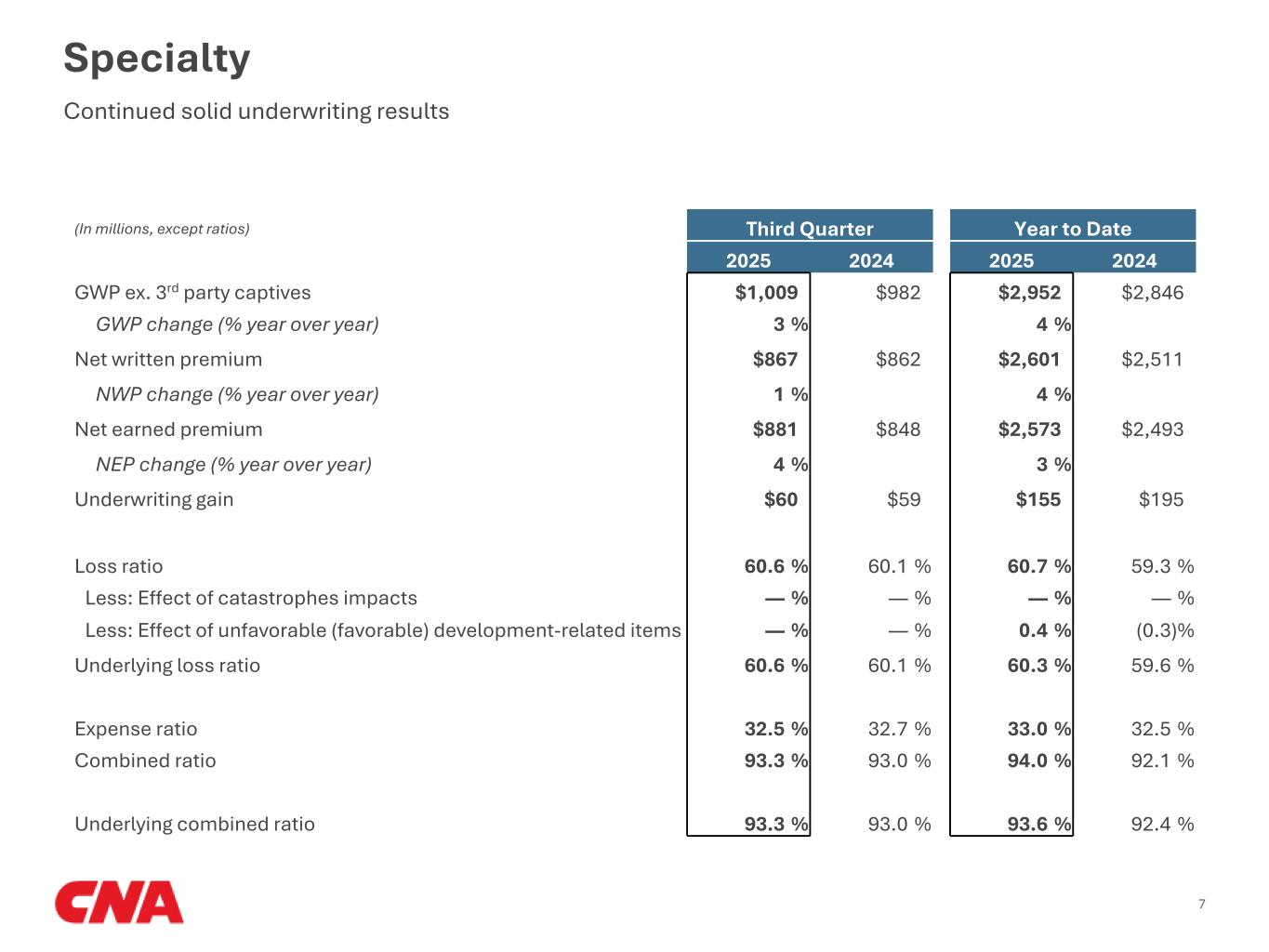

Gross written premiums ex. 3rd party captives |

$ | 1,009 | $ | 982 | $ | 2,952 | $ | 2,846 | |||||||||||||||||||||||||||

GWP ex. 3rd party captives change (% year over year) |

3 | % | 4 | % | |||||||||||||||||||||||||||||||

| Net written premiums | $ | 867 | $ | 862 | $ | 2,601 | $ | 2,511 | |||||||||||||||||||||||||||

| NWP change (% year over year) | 1 | % | 4 | % | |||||||||||||||||||||||||||||||

| Net earned premiums | $ | 881 | $ | 848 | $ | 2,573 | $ | 2,493 | |||||||||||||||||||||||||||

| NEP change (% year over year) | 4 | % | 3 | % | |||||||||||||||||||||||||||||||

| Underwriting gain | $ | 60 | $ | 59 | $ | 155 | $ | 195 | |||||||||||||||||||||||||||

| Loss ratio | 60.6 | % | 60.1 | % | 60.7 | % | 59.3 | % | |||||||||||||||||||||||||||

| Less: Effect of catastrophe impacts | — | — | — | — | |||||||||||||||||||||||||||||||

| Less: Effect of unfavorable (favorable) development-related items | — | — | 0.4 | (0.3) | |||||||||||||||||||||||||||||||

| Underlying loss ratio | 60.6 | % | 60.1 | % | 60.3 | % | 59.6 | % | |||||||||||||||||||||||||||

| Expense ratio | 32.5 | % | 32.7 | % | 33.0 | % | 32.5 | % | |||||||||||||||||||||||||||

| Combined ratio | 93.3 | % | 93.0 | % | 94.0 | % | 92.1 | % | |||||||||||||||||||||||||||

| Underlying combined ratio | 93.3 | % | 93.0 | % | 93.6 | % | 92.4 | % | |||||||||||||||||||||||||||

| Results for the Three Months Ended September 30 | Results for the Nine Months Ended September 30 | ||||||||||||||||||||||||||||||||||

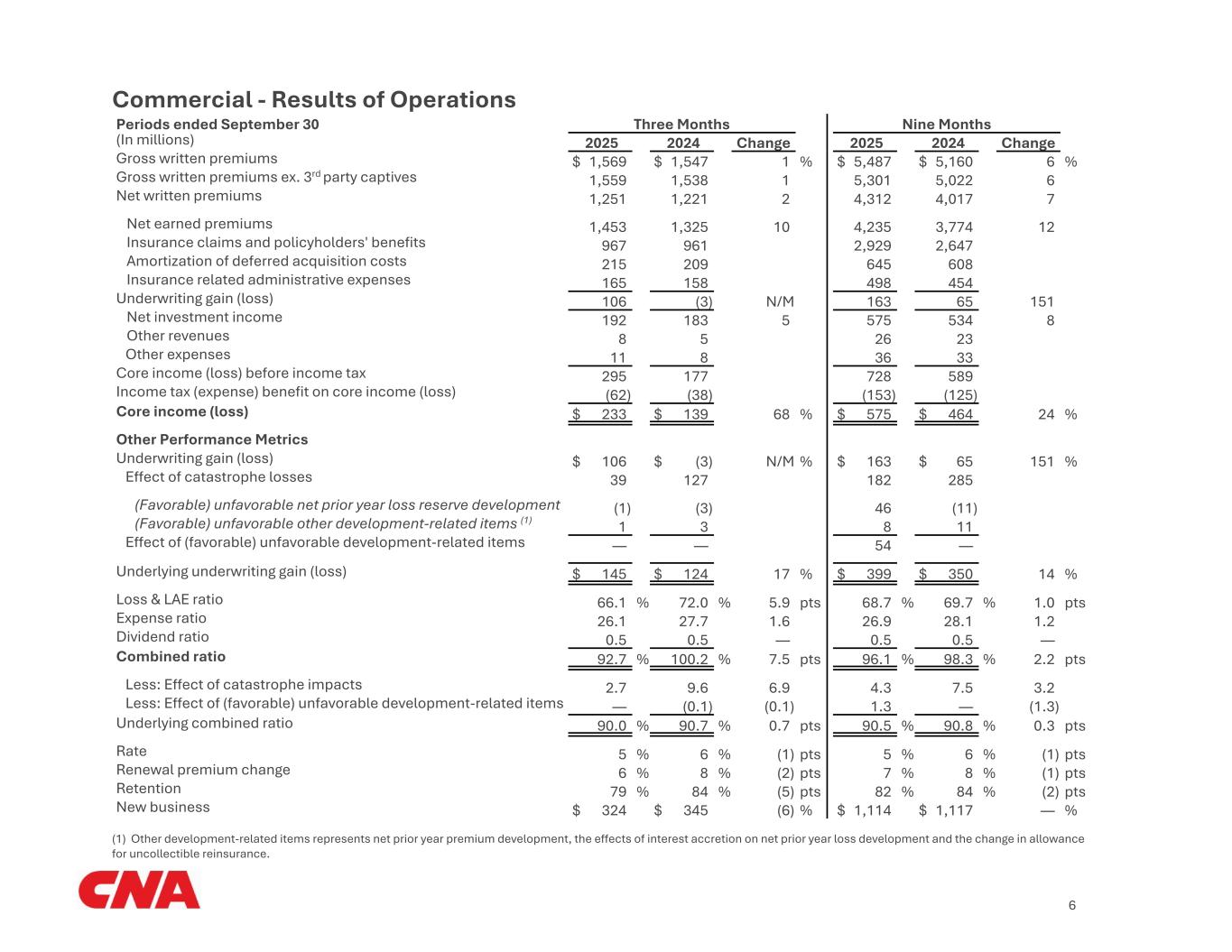

| ($ millions) | 2025 | 2024 | 2025 | 2024 | |||||||||||||||||||||||||||||||

Gross written premiums ex. 3rd party captives |

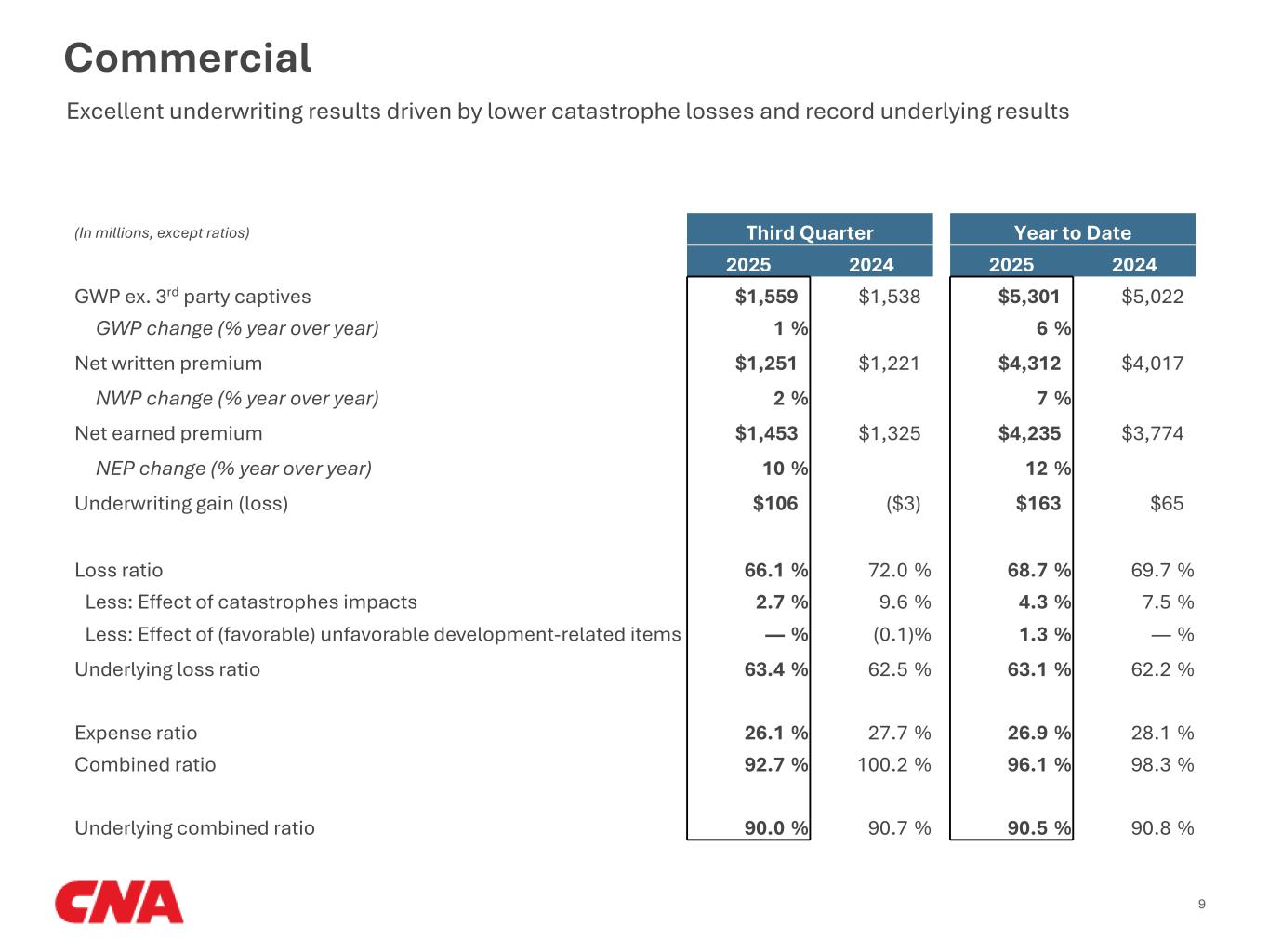

$ | 1,559 | $ | 1,538 | $ | 5,301 | $ | 5,022 | |||||||||||||||||||||||||||

GWP ex. 3rd party captives change (% year over year) |

1 | % | 6 | % | |||||||||||||||||||||||||||||||

| Net written premiums | $ | 1,251 | $ | 1,221 | $ | 4,312 | $ | 4,017 | |||||||||||||||||||||||||||

| NWP change (% year over year) | 2 | % | 7 | % | |||||||||||||||||||||||||||||||

| Net earned premiums | $ | 1,453 | $ | 1,325 | $ | 4,235 | $ | 3,774 | |||||||||||||||||||||||||||

| NEP change (% year over year) | 10 | % | 12 | % | |||||||||||||||||||||||||||||||

| Underwriting gain (loss) | $ | 106 | $ | (3) | $ | 163 | $ | 65 | |||||||||||||||||||||||||||

| Loss ratio | 66.1 | % | 72.0 | % | 68.7 | % | 69.7 | % | |||||||||||||||||||||||||||

| Less: Effect of catastrophe impacts | 2.7 | 9.6 | 4.3 | 7.5 | |||||||||||||||||||||||||||||||

| Less: Effect of (favorable) unfavorable development-related items | — | (0.1) | 1.3 | — | |||||||||||||||||||||||||||||||

| Underlying loss ratio | 63.4 | % | 62.5 | % | 63.1 | % | 62.2 | % | |||||||||||||||||||||||||||

| Expense ratio | 26.1 | % | 27.7 | % | 26.9 | % | 28.1 | % | |||||||||||||||||||||||||||

| Combined ratio | 92.7 | % | 100.2 | % | 96.1 | % | 98.3 | % | |||||||||||||||||||||||||||

| Underlying combined ratio | 90.0 | % | 90.7 | % | 90.5 | % | 90.8 | % | |||||||||||||||||||||||||||

| Results for the Three Months Ended September 30 | Results for the Nine Months Ended September 30 | ||||||||||||||||||||||||||||||||||

| ($ millions) | 2025 | 2024 | 2025 | 2024 | |||||||||||||||||||||||||||||||

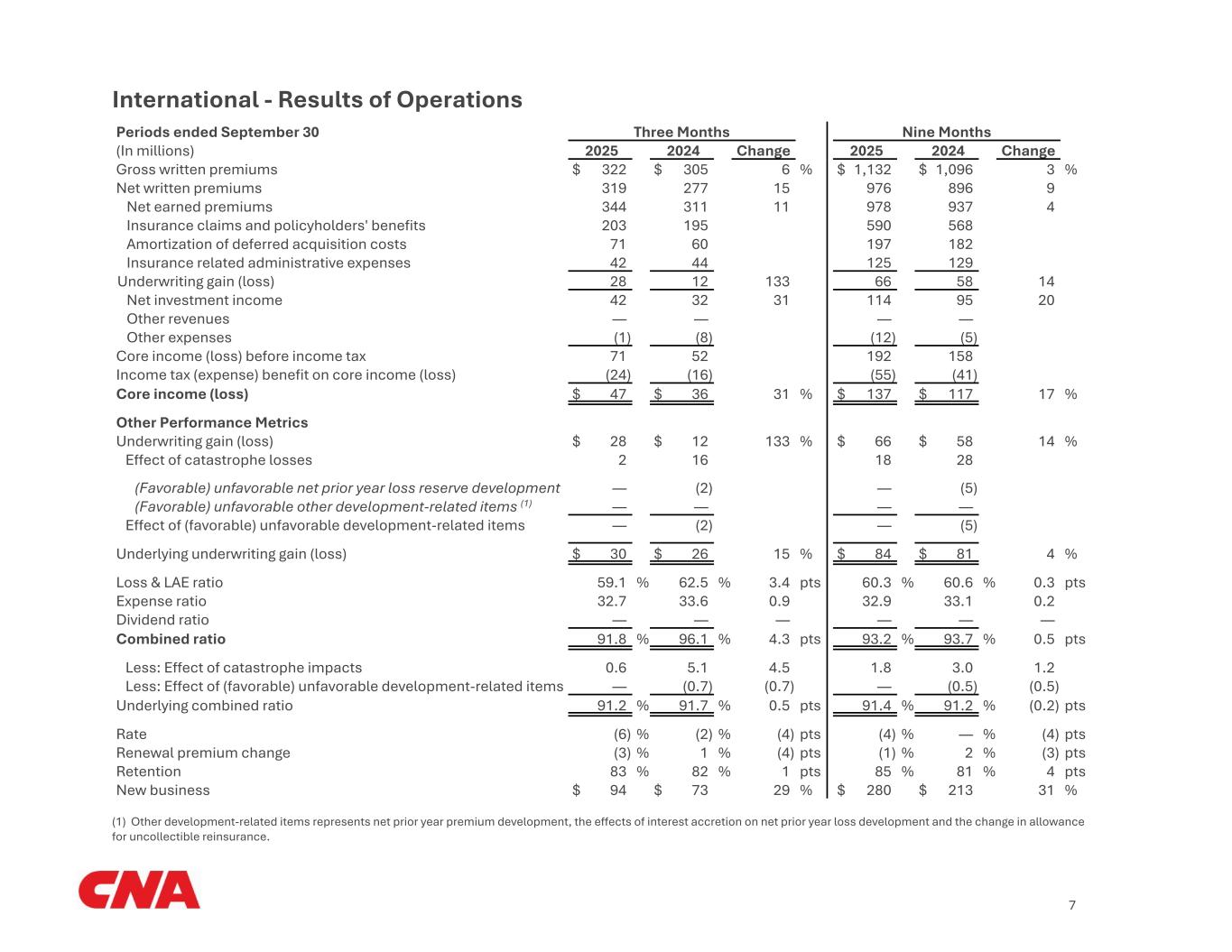

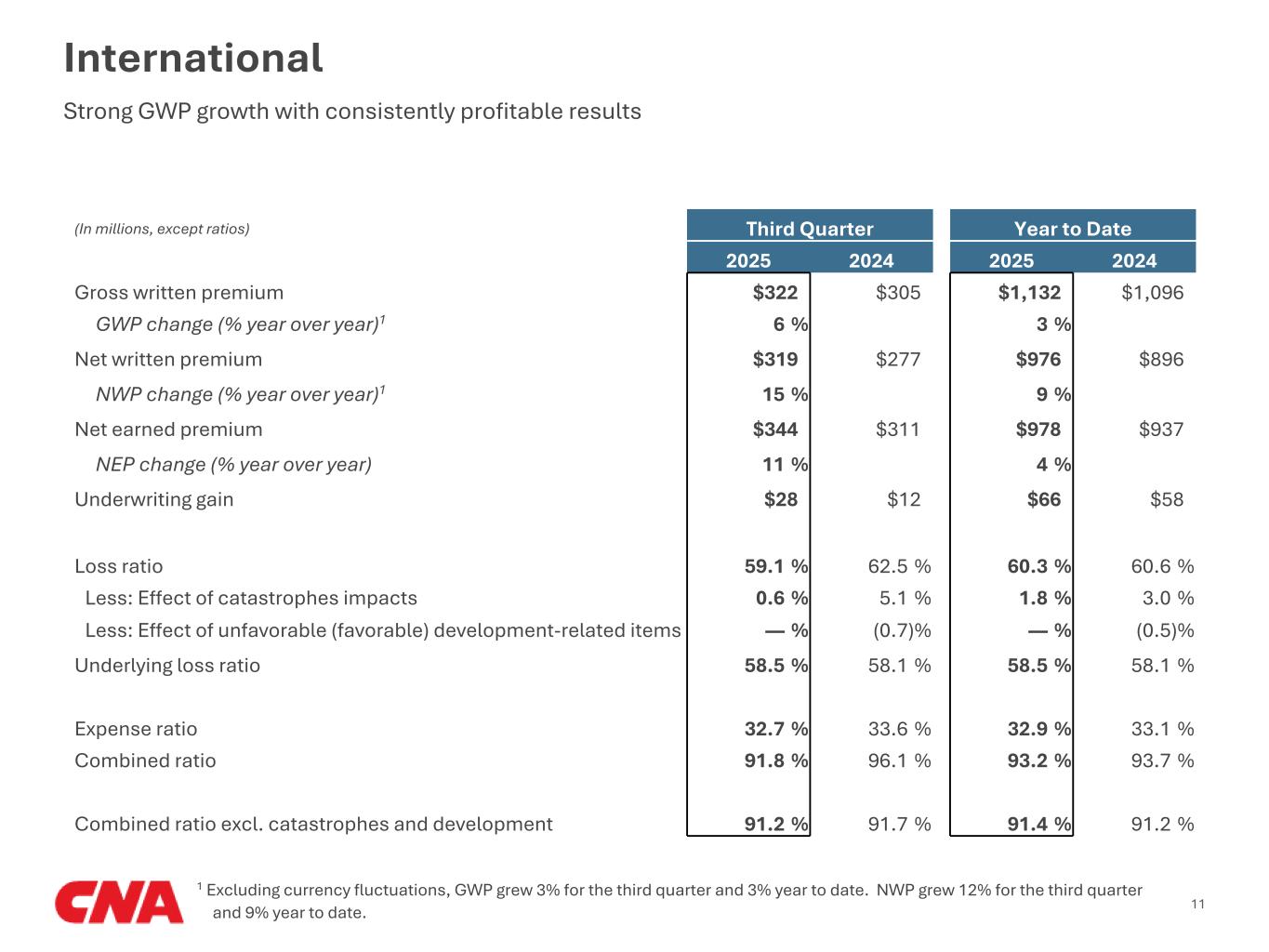

| Gross written premiums | $ | 322 | $ | 305 | $ | 1,132 | $ | 1,096 | |||||||||||||||||||||||||||

| GWP change (% year over year) | 6 | % | 3 | % | |||||||||||||||||||||||||||||||

| Net written premiums | $ | 319 | $ | 277 | $ | 976 | $ | 896 | |||||||||||||||||||||||||||

| NWP change (% year over year) | 15 | % | 9 | % | |||||||||||||||||||||||||||||||

| Net earned premiums | $ | 344 | $ | 311 | $ | 978 | $ | 937 | |||||||||||||||||||||||||||

| NEP change (% year over year) | 11 | % | 4 | % | |||||||||||||||||||||||||||||||

| Underwriting gain | $ | 28 | $ | 12 | $ | 66 | $ | 58 | |||||||||||||||||||||||||||

| Loss ratio | 59.1 | % | 62.5 | % | 60.3 | % | 60.6 | % | |||||||||||||||||||||||||||

| Less: Effect of catastrophe impacts | 0.6 | 5.1 | 1.8 | 3.0 | |||||||||||||||||||||||||||||||

| Less: Effect of favorable development-related items | — | (0.7) | — | (0.5) | |||||||||||||||||||||||||||||||

| Underlying loss ratio | 58.5 | % | 58.1 | % | 58.5 | % | 58.1 | % | |||||||||||||||||||||||||||

| Expense ratio | 32.7 | % | 33.6 | % | 32.9 | % | 33.1 | % | |||||||||||||||||||||||||||

| Combined ratio | 91.8 | % | 96.1 | % | 93.2 | % | 93.7 | % | |||||||||||||||||||||||||||

| Underlying combined ratio | 91.2 | % | 91.7 | % | 91.4 | % | 91.2 | % | |||||||||||||||||||||||||||

| Results for the Three Months Ended September 30 | Results for the Nine Months Ended September 30 | ||||||||||||||||||||||||||||||||||

| ($ millions) | 2025 | 2024 | 2025 | 2024 | |||||||||||||||||||||||||||||||

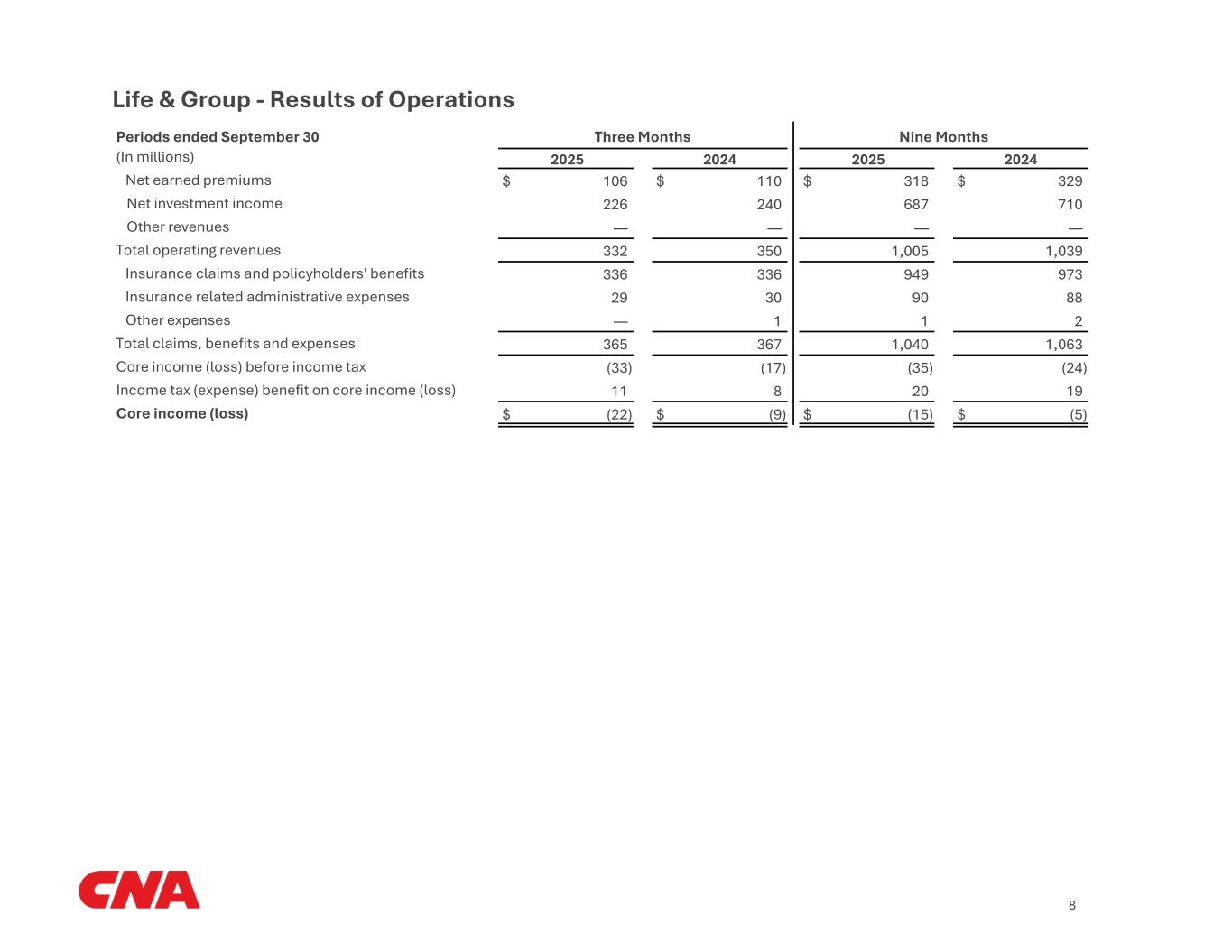

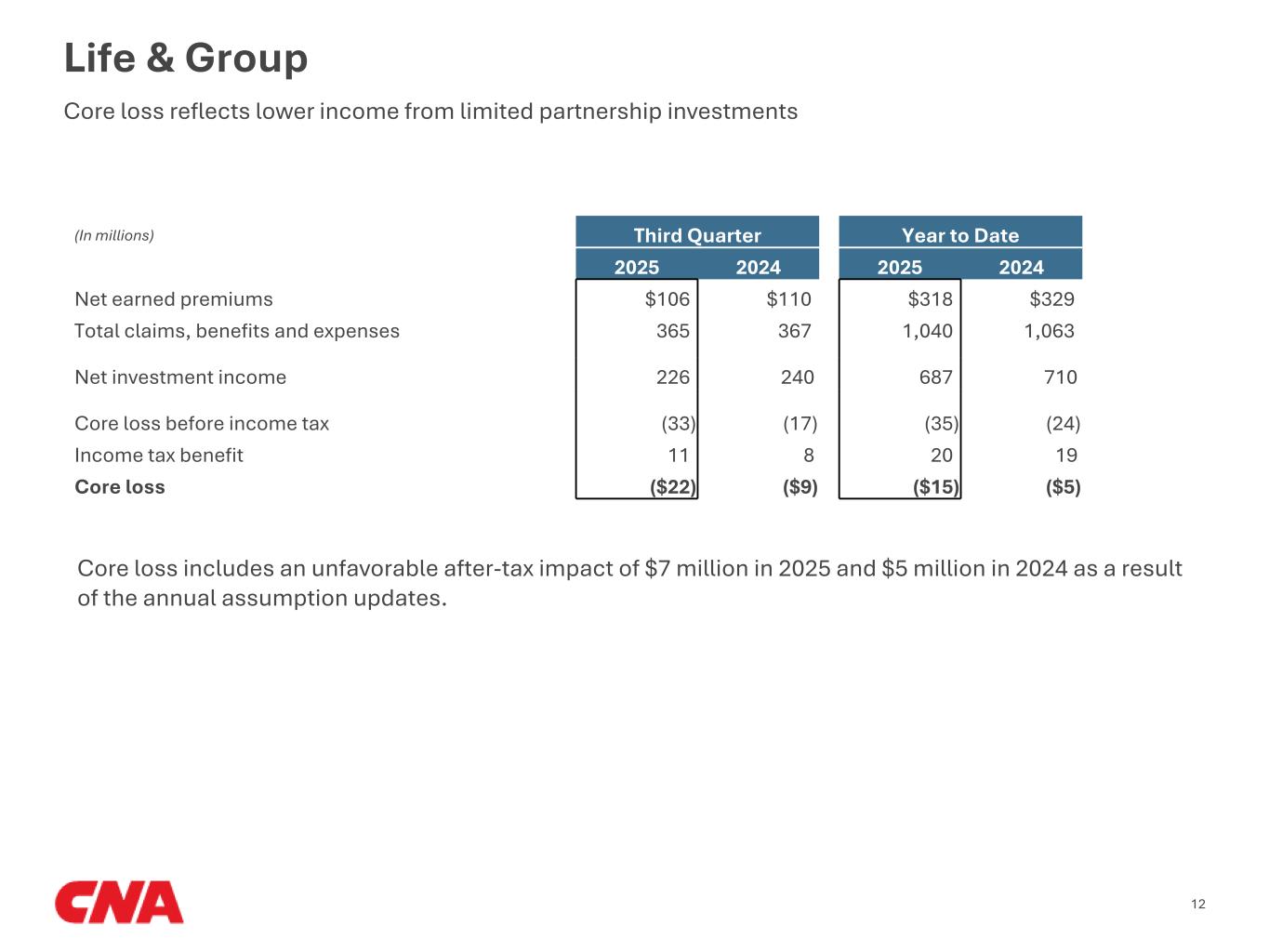

| Net earned premiums | $ | 106 | $ | 110 | $ | 318 | $ | 329 | |||||||||||||||||||||||||||

| Claims, benefits and expenses | 365 | 367 | 1,040 | 1,063 | |||||||||||||||||||||||||||||||

| Net investment income | 226 | 240 | 687 | 710 | |||||||||||||||||||||||||||||||

| Core loss | (22) | (9) | (15) | (5) | |||||||||||||||||||||||||||||||

| Results for the Three Months Ended September 30 | Results for the Nine Months Ended September 30 | ||||||||||||||||||||||||||||||||||

| ($ millions) | 2025 | 2024 | 2025 | 2024 | |||||||||||||||||||||||||||||||

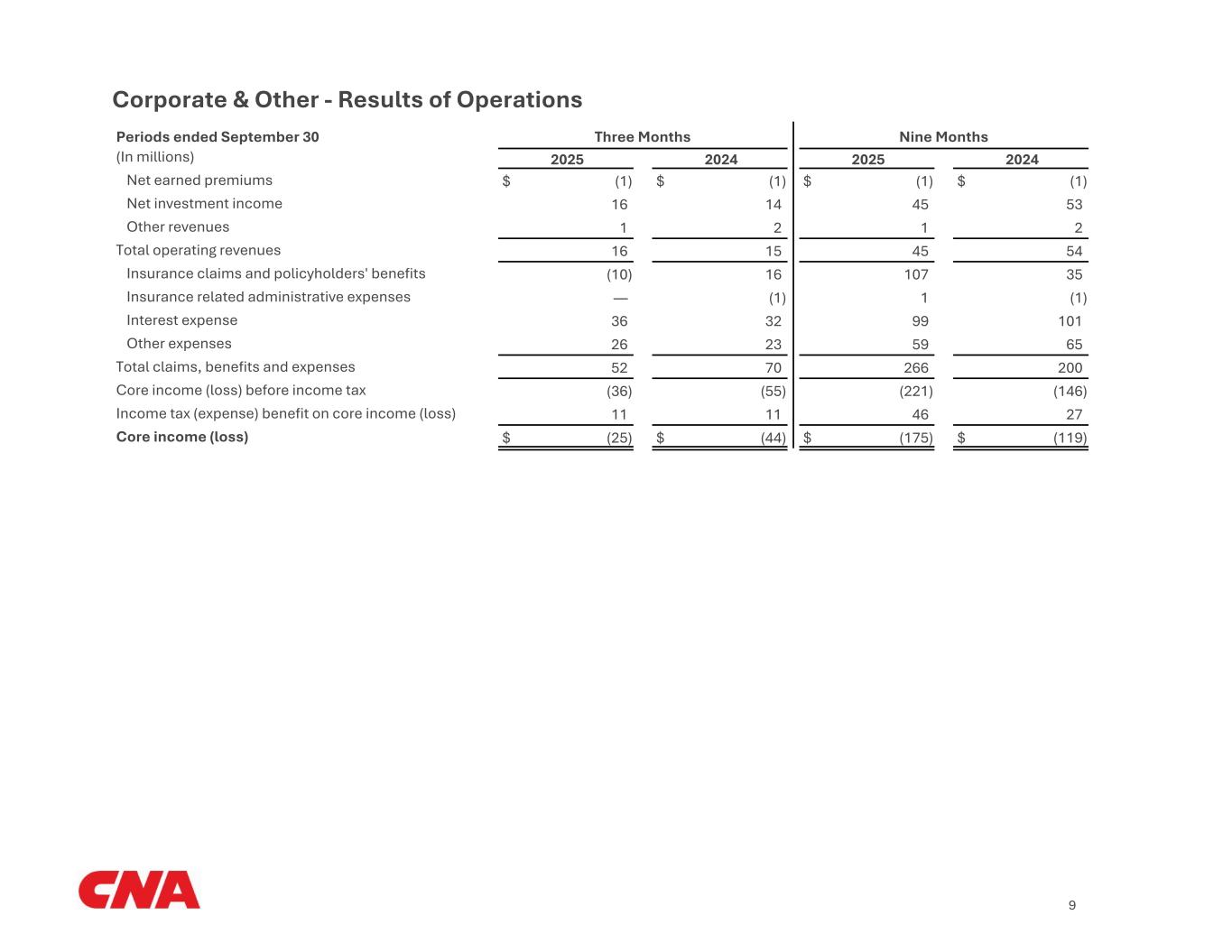

| Insurance claims and policyholders' benefits | $ | (10) | $ | 16 | $ | 107 | $ | 35 | |||||||||||||||||||||||||||

| Interest expense | 36 | 32 | 99 | 101 | |||||||||||||||||||||||||||||||

| Net investment income | 16 | 14 | 45 | 53 | |||||||||||||||||||||||||||||||

| Core loss | (25) | (44) | (175) | (119) | |||||||||||||||||||||||||||||||

| Results for the Three Months Ended September 30 | Results for the Nine Months Ended September 30 | ||||||||||||||||||||||||||||||||||

| 2025 | 2024 | 2025 | 2024 | ||||||||||||||||||||||||||||||||

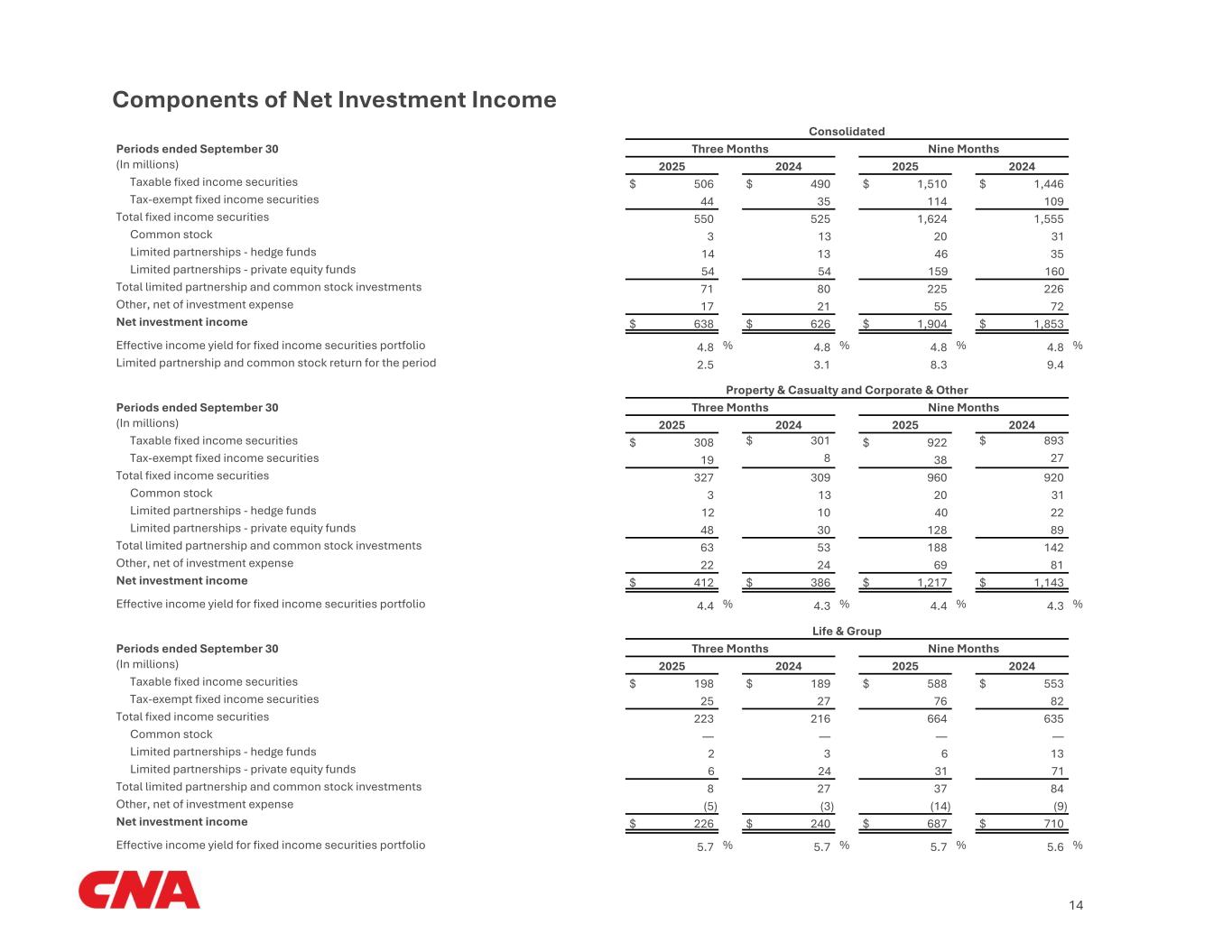

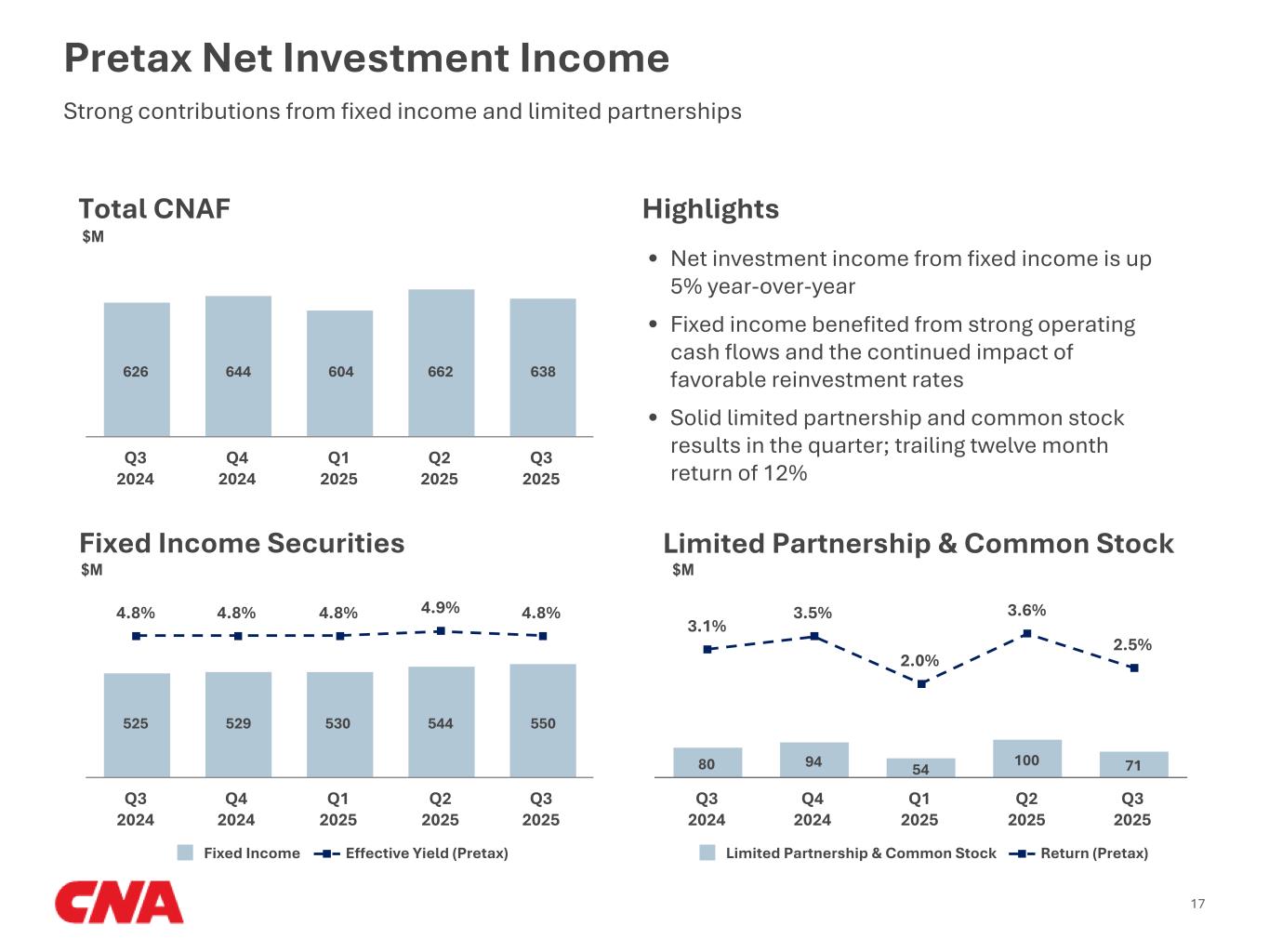

| Fixed income securities and other | $ | 567 | $ | 546 | $ | 1,679 | $ | 1,627 | |||||||||||||||||||||||||||

| Limited partnership and common stock investments | 71 | 80 | 225 | 226 | |||||||||||||||||||||||||||||||

| Net investment income | $ | 638 | $ | 626 | $ | 1,904 | $ | 1,853 | |||||||||||||||||||||||||||

| Media: | Analysts: | |||||||

|

Kelly Messina | Vice President,

Marketing

|

Ralitza K. Todorova | Vice President, Investor Relations & Rating Agencies |

|||||||

| 872-817-0350 | 312-822-3834 | |||||||

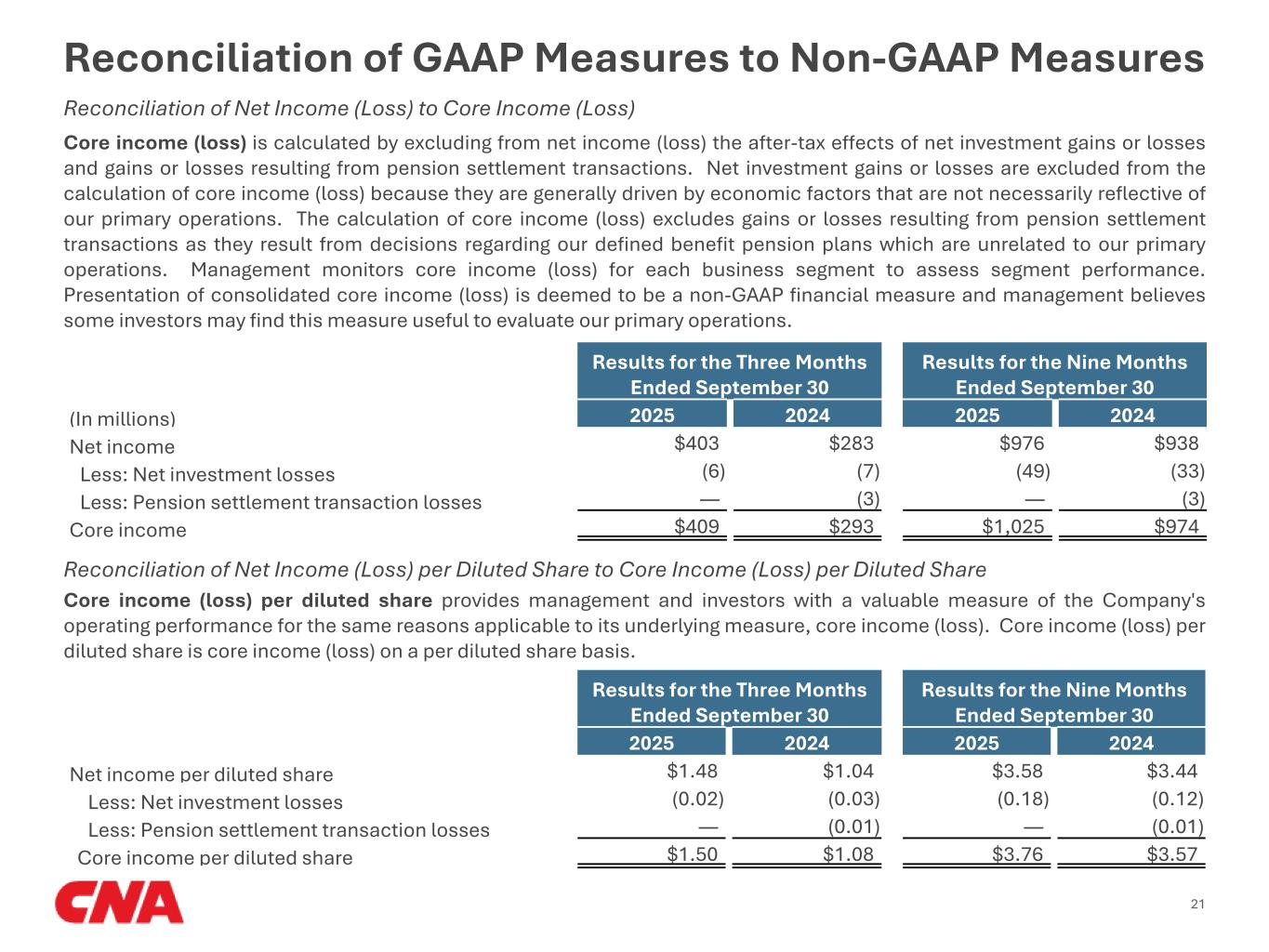

| Results for the Three Months Ended September 30 | Results for the Nine Months Ended September 30 | ||||||||||||||||||||||

| ($ millions) | 2025 | 2024 | 2025 | 2024 | |||||||||||||||||||

| Net income | $ | 403 | $ | 283 | $ | 976 | $ | 938 | |||||||||||||||

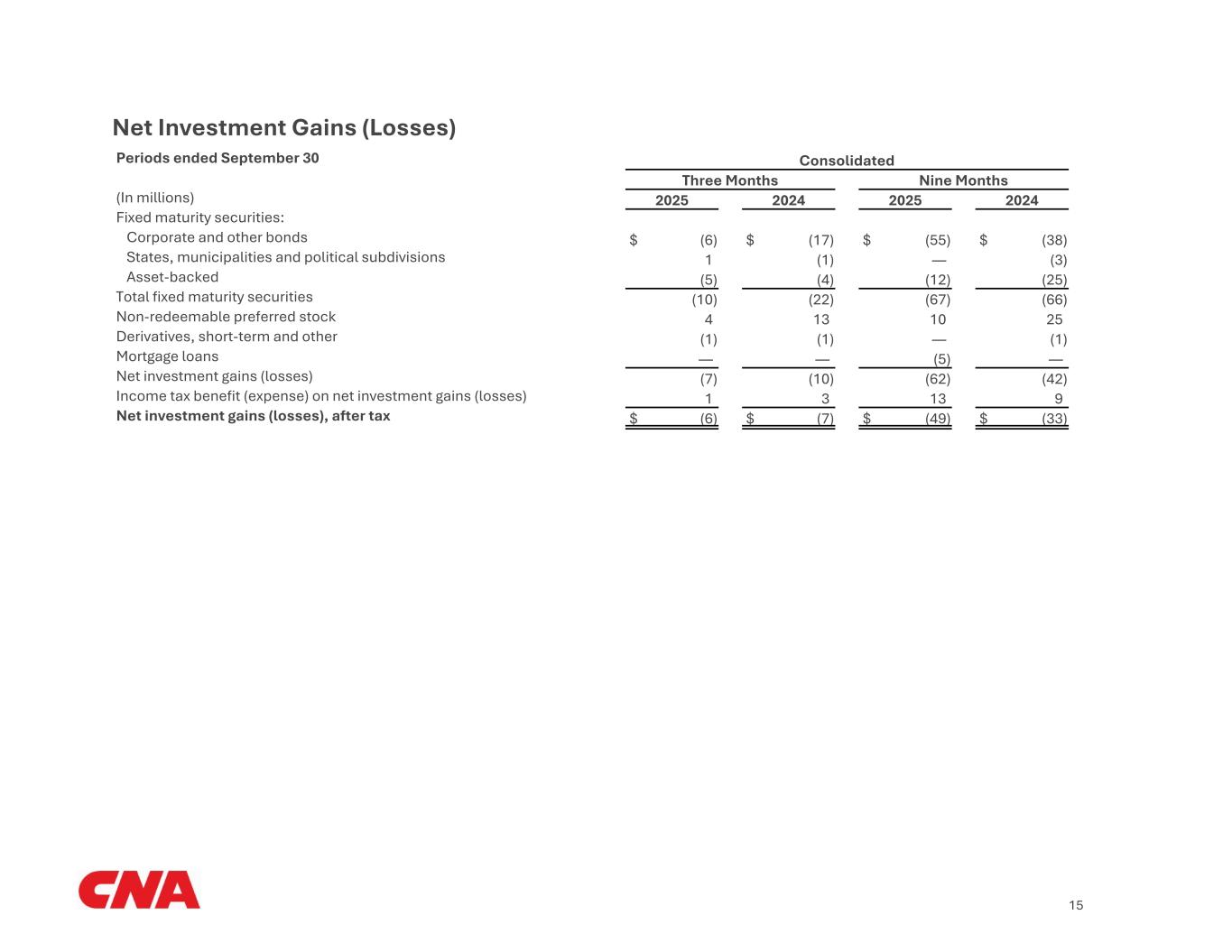

| Less: Net investment losses | (6) | (7) | (49) | (33) | |||||||||||||||||||

| Less: Pension settlement transaction losses | — | (3) | — | (3) | |||||||||||||||||||

| Core income | $ | 409 | $ | 293 | $ | 1,025 | $ | 974 | |||||||||||||||

| Results for the Three Months Ended September 30 | Results for the Nine Months Ended September 30 | ||||||||||||||||||||||

| 2025 | 2024 | 2025 | 2024 | ||||||||||||||||||||

| Net income per diluted share | $ | 1.48 | $ | 1.04 | $ | 3.58 | $ | 3.44 | |||||||||||||||

| Less: Net investment losses | (0.02) | (0.03) | (0.18) | (0.12) | |||||||||||||||||||

| Less: Pension settlement transaction losses | — | (0.01) | — | (0.01) | |||||||||||||||||||

| Core income per diluted share | $ | 1.50 | $ | 1.08 | $ | 3.76 | $ | 3.57 | |||||||||||||||

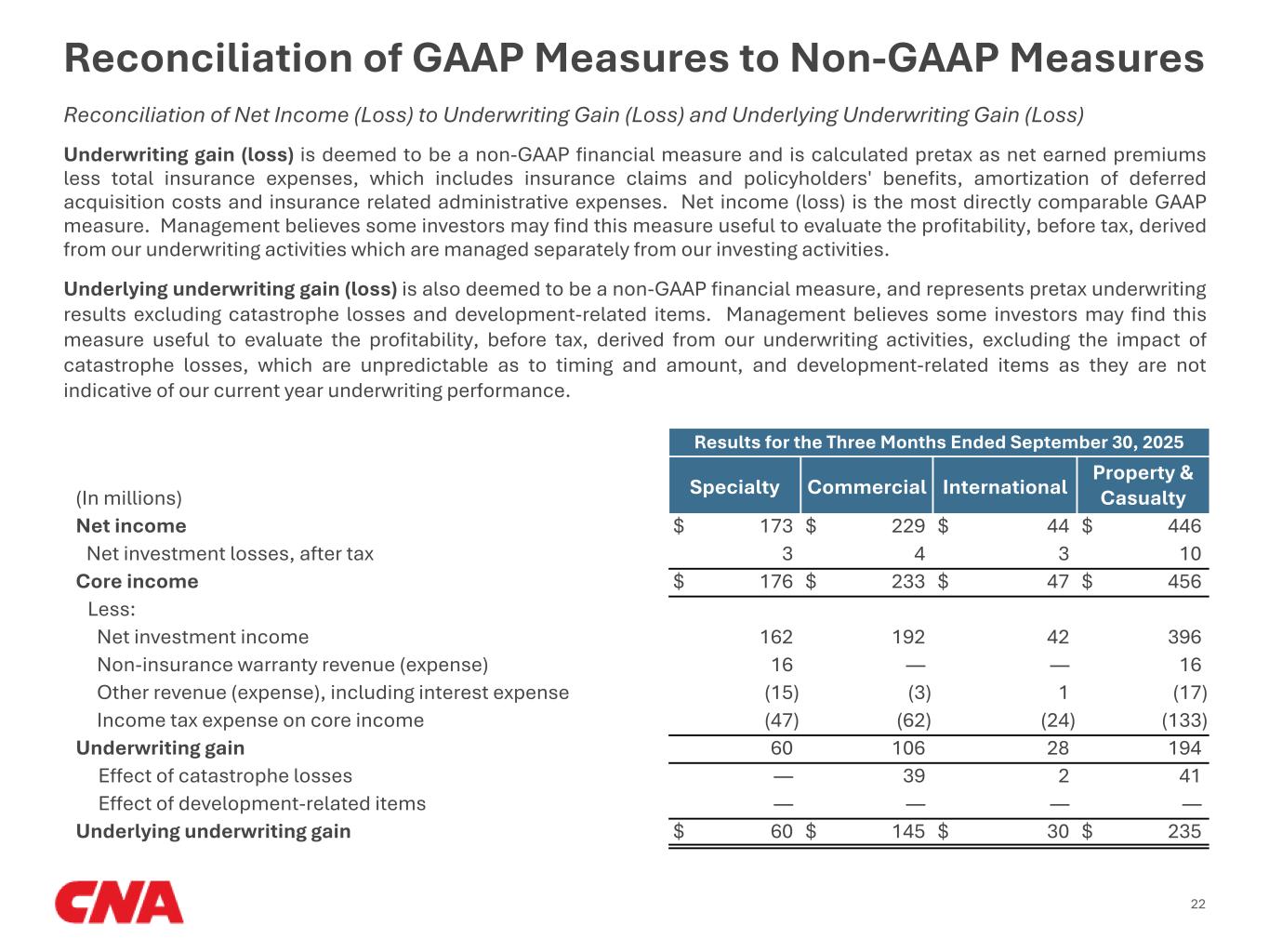

| Results for the Three Months Ended September 30, 2025 | ||||||||||||||

| Specialty | Commercial | International | Property & Casualty | |||||||||||

| (In millions) | ||||||||||||||

| Net income | $ | 173 | $ | 229 | $ | 44 | $ | 446 | ||||||

| Net investment losses, after tax | 3 | 4 | 3 | 10 | ||||||||||

| Core income | $ | 176 | $ | 233 | $ | 47 | $ | 456 | ||||||

| Less: | ||||||||||||||

| Net investment income | 162 | 192 | 42 | 396 | ||||||||||

| Non-insurance warranty revenue (expense) | 16 | — | — | 16 | ||||||||||

| Other revenue (expense), including interest expense | (15) | (3) | 1 | (17) | ||||||||||

| Income tax expense on core income | (47) | (62) | (24) | (133) | ||||||||||

| Underwriting gain | 60 | 106 | 28 | 194 | ||||||||||

| Effect of catastrophe losses | — | 39 | 2 | 41 | ||||||||||

| Effect of development-related items | — | — | — | — | ||||||||||

| Underlying underwriting gain | $ | 60 | $ | 145 | $ | 30 | $ | 235 | ||||||

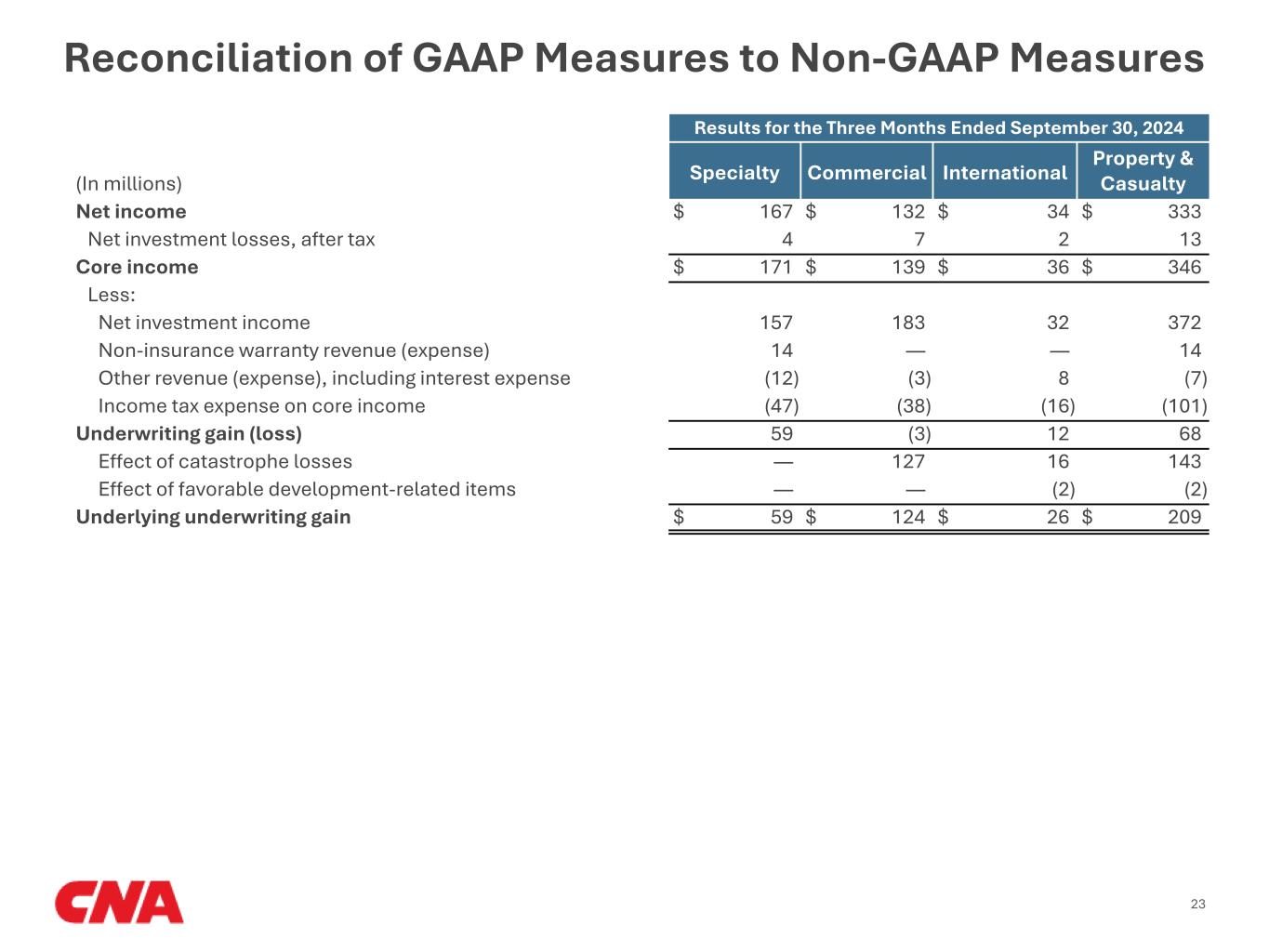

| Results for the Three Months Ended September 30, 2024 | ||||||||||||||

| Specialty | Commercial | International | Property & Casualty | |||||||||||

| (In millions) | ||||||||||||||

| Net income | $ | 167 | $ | 132 | $ | 34 | $ | 333 | ||||||

| Net investment losses, after tax | 4 | 7 | 2 | 13 | ||||||||||

| Core income | $ | 171 | $ | 139 | $ | 36 | $ | 346 | ||||||

| Less: | ||||||||||||||

| Net investment income | 157 | 183 | 32 | 372 | ||||||||||

| Non-insurance warranty revenue (expense) | 14 | — | — | 14 | ||||||||||

| Other revenue (expense), including interest expense | (12) | (3) | 8 | (7) | ||||||||||

| Income tax expense on core income | (47) | (38) | (16) | (101) | ||||||||||

| Underwriting gain (loss) | 59 | (3) | 12 | 68 | ||||||||||

| Effect of catastrophe losses | — | 127 | 16 | 143 | ||||||||||

| Effect of favorable development-related items | — | — | (2) | (2) | ||||||||||

| Underlying underwriting gain | $ | 59 | $ | 124 | $ | 26 | $ | 209 | ||||||

| Results for the Nine Months Ended September 30, 2025 | ||||||||||||||

| Specialty | Commercial | International | Property & Casualty | |||||||||||

| (In millions) | ||||||||||||||

| Net income | $ | 487 | $ | 552 | $ | 135 | $ | 1,174 | ||||||

| Net investment losses, after tax | 16 | 23 | 2 | 41 | ||||||||||

| Core income | $ | 503 | $ | 575 | $ | 137 | $ | 1,215 | ||||||

| Less: | ||||||||||||||

| Net investment income | 483 | 575 | 114 | 1,172 | ||||||||||

| Non-insurance warranty revenue (expense) | 42 | — | — | 42 | ||||||||||

| Other revenue (expense), including interest expense | (40) | (10) | 12 | (38) | ||||||||||

| Income tax expense on core income | (137) | (153) | (55) | (345) | ||||||||||

| Underwriting gain | 155 | 163 | 66 | 384 | ||||||||||

| Effect of catastrophe losses | — | 182 | 18 | 200 | ||||||||||

| Effect of unfavorable development-related items | 10 | 54 | — | 64 | ||||||||||

| Underlying underwriting gain | $ | 165 | $ | 399 | $ | 84 | $ | 648 | ||||||

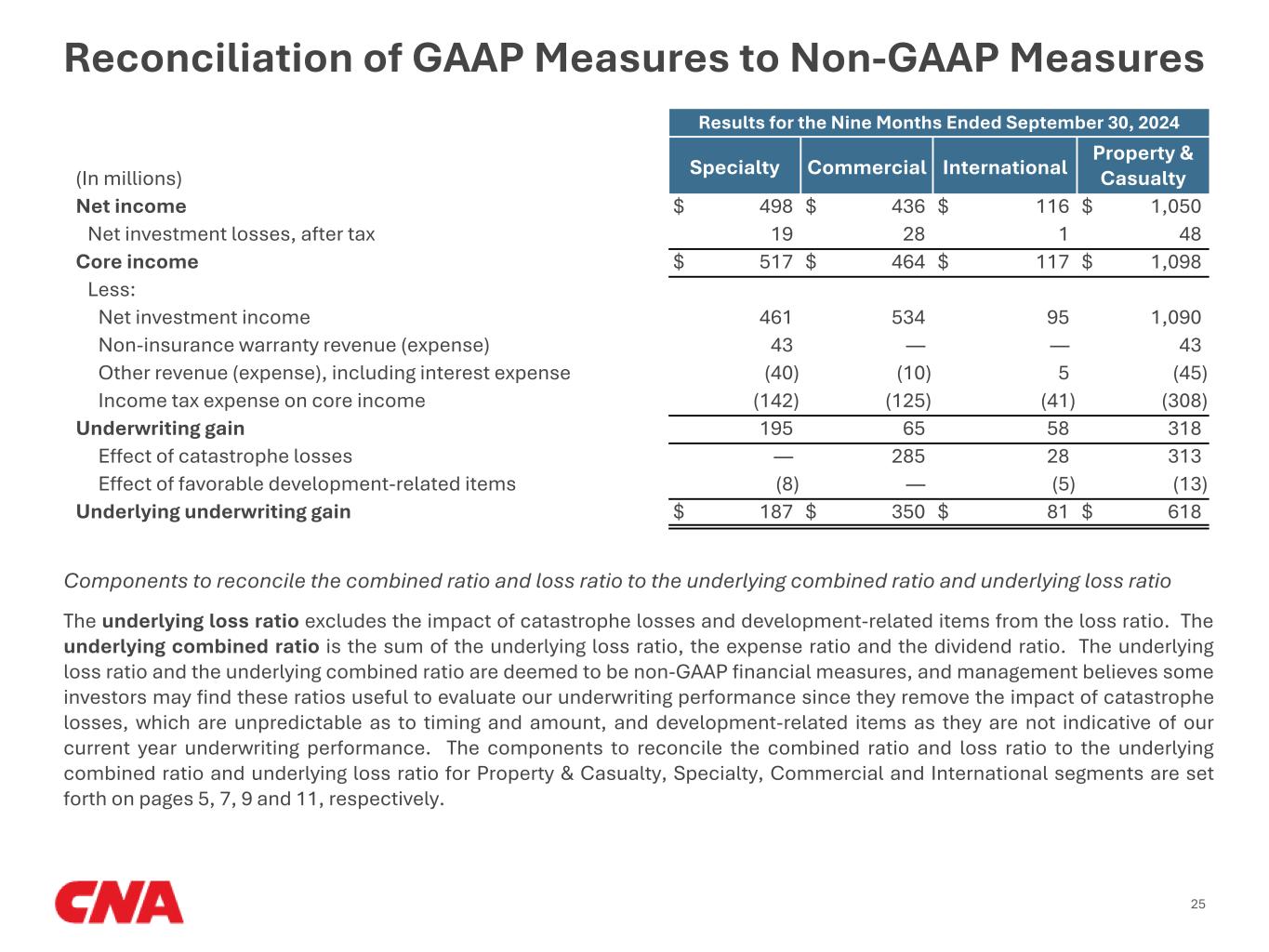

| Results for the Nine Months Ended September 30, 2024 | ||||||||||||||

| Specialty | Commercial | International | Property & Casualty | |||||||||||

| (In millions) | ||||||||||||||

| Net income | $ | 498 | $ | 436 | $ | 116 | $ | 1,050 | ||||||

| Net investment losses, after tax | 19 | 28 | 1 | 48 | ||||||||||

| Core income | $ | 517 | $ | 464 | $ | 117 | $ | 1,098 | ||||||

| Net investment income | 461 | 534 | 95 | 1,090 | ||||||||||

| Non-insurance warranty revenue (expense) | 43 | — | — | 43 | ||||||||||

| Other revenue (expense), including interest expense | (40) | (10) | 5 | (45) | ||||||||||

| Income tax expense on core income | (142) | (125) | (41) | (308) | ||||||||||

| Underwriting gain | 195 | 65 | 58 | 318 | ||||||||||

| Effect of catastrophe losses | — | 285 | 28 | 313 | ||||||||||

| Effect of favorable development-related items | (8) | — | (5) | (13) | ||||||||||

| Underlying underwriting gain | $ | 187 | $ | 350 | $ | 81 | $ | 618 | ||||||

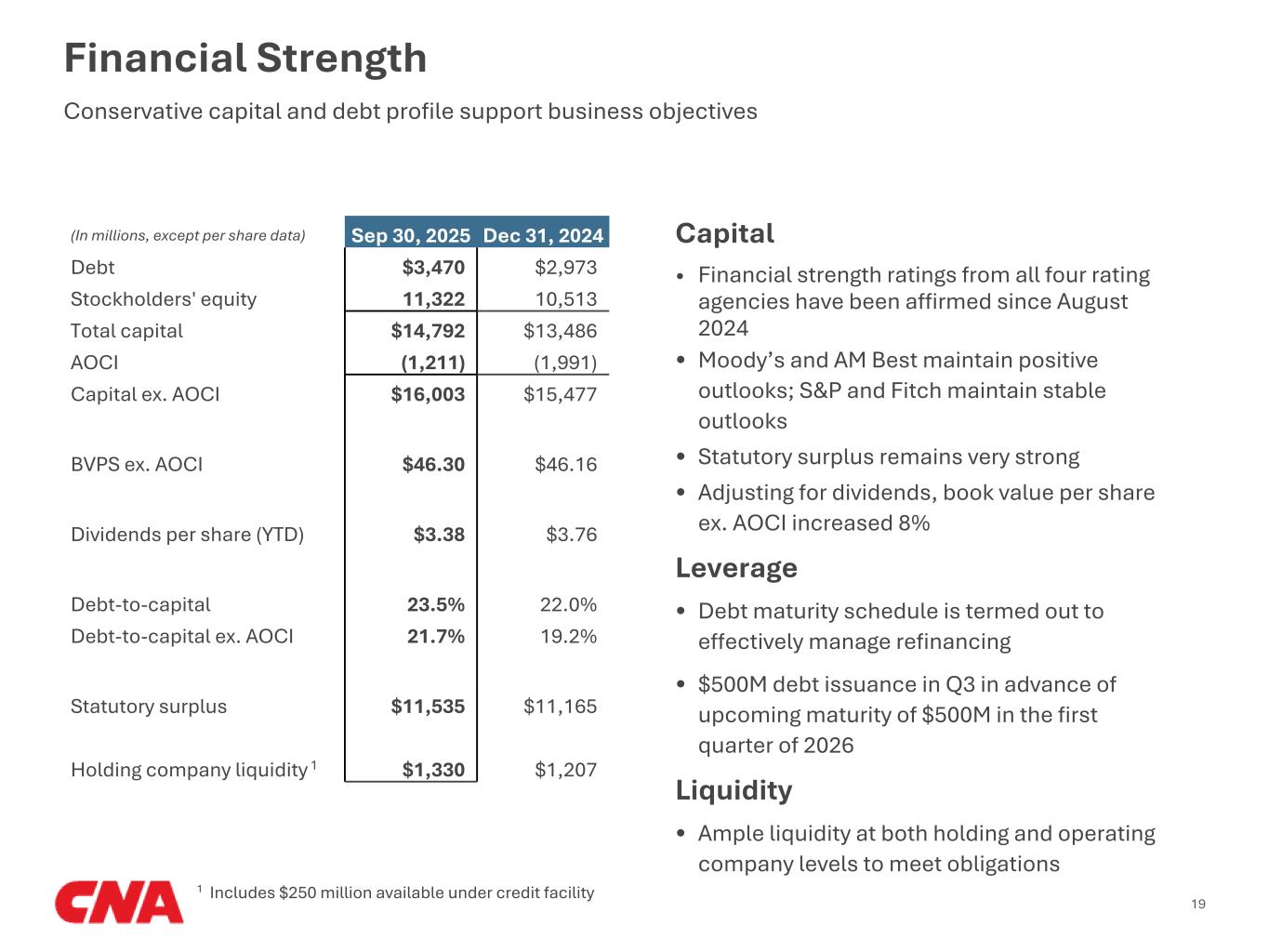

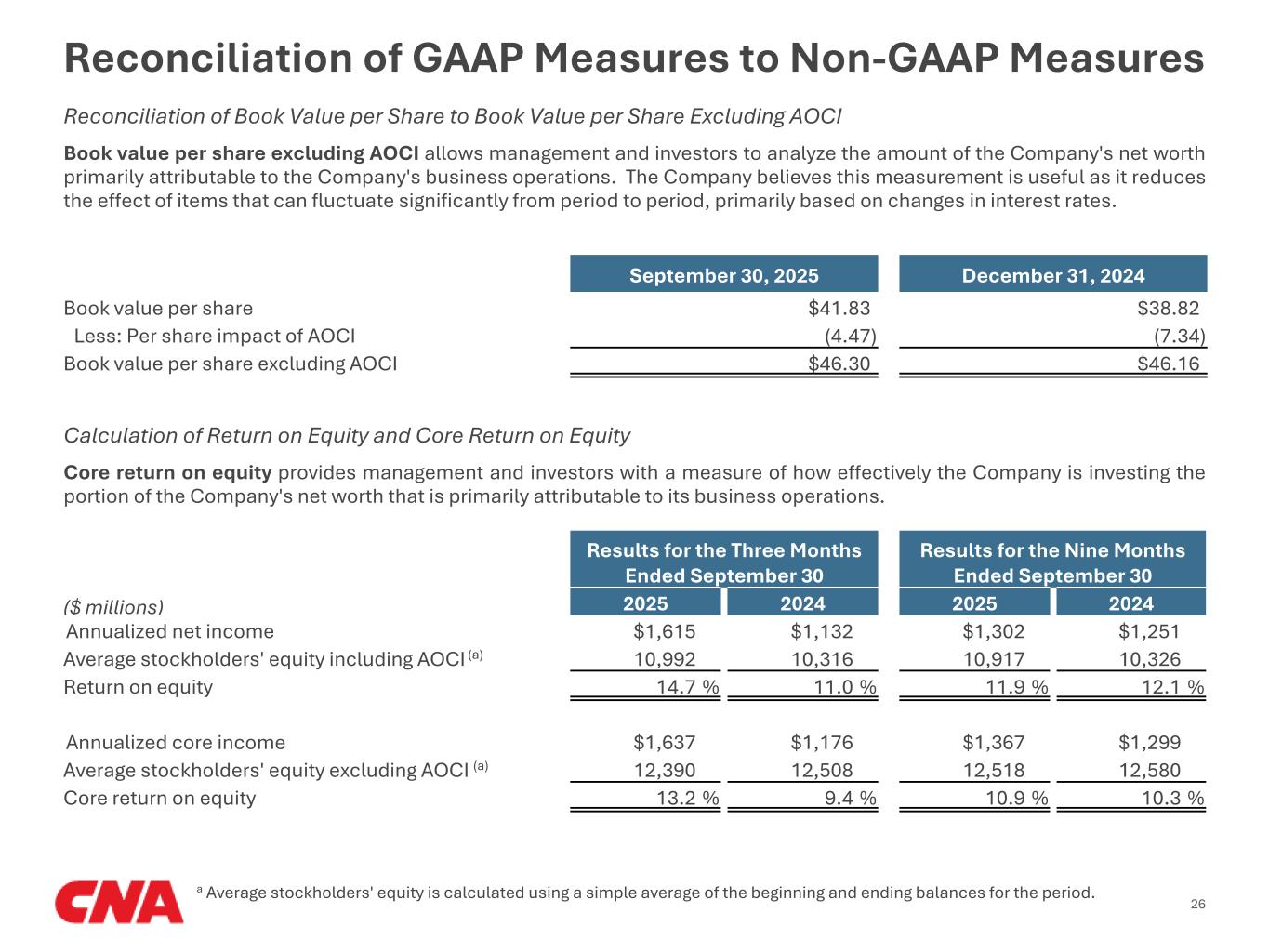

| September 30, 2025 | December 31, 2024 | ||||||||||

| Book value per share | $ | 41.83 | $ | 38.82 | |||||||

| Less: Per share impact of AOCI | (4.47) | (7.34) | |||||||||

| Book value per share excluding AOCI | $ | 46.30 | $ | 46.16 | |||||||

| Results for the Three Months Ended September 30 | Results for the Nine Months Ended September 30 | |||||||||||||||||||||||||

| ($ millions) | 2025 | 2024 | 2025 | 2024 | ||||||||||||||||||||||

| Annualized net income | $ | 1,615 | $ | 1,132 | $ | 1,302 | $ | 1,251 | ||||||||||||||||||

Average stockholders' equity including AOCI (a) |

10,992 | 10,316 | 10,917 | 10,326 | ||||||||||||||||||||||

| Return on equity | 14.7 | % | 11.0 | % | 11.9 | % | 12.1 | % | ||||||||||||||||||

| Annualized core income | $ | 1,637 | $ | 1,176 | $ | 1,367 | $ | 1,299 | ||||||||||||||||||

Average stockholders' equity excluding AOCI (a) |

12,390 | 12,508 | 12,518 | 12,580 | ||||||||||||||||||||||

| Core return on equity | 13.2 | % | 9.4 | % | 10.9 | % | 10.3 | % | ||||||||||||||||||

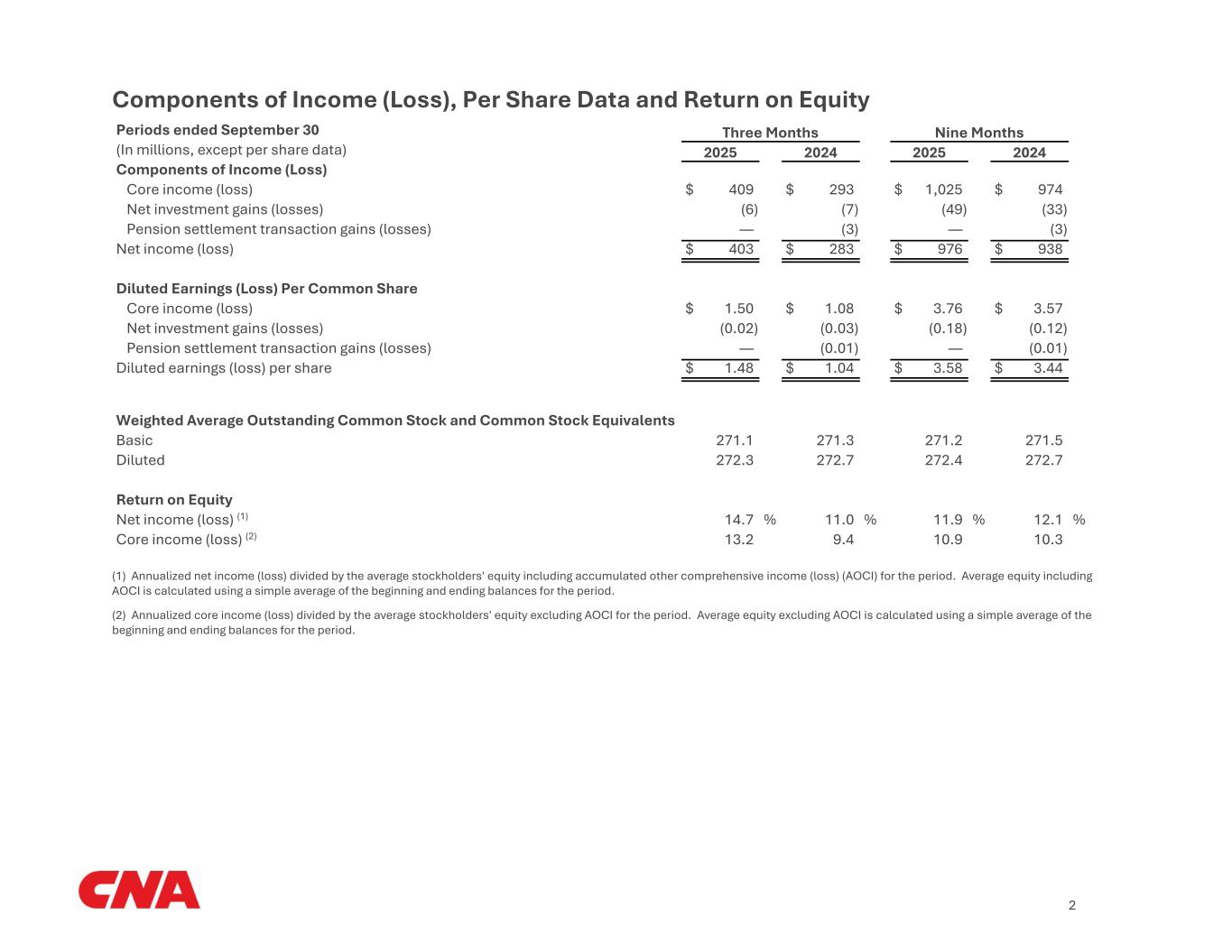

| Results for the Three Months Ended September 30 | Results for the Nine Months Ended September 30 | ||||||||||||||||||||||

| ($ millions) | 2025 | 2024 | 2025 | 2024 | |||||||||||||||||||

| Net income | $ | 403 | $ | 283 | $ | 976 | $ | 938 | |||||||||||||||

| Less: Net investment losses | (6) | (7) | (49) | (33) | |||||||||||||||||||

| Less: Pension settlement transaction losses | — | (3) | — | (3) | |||||||||||||||||||

| Core income | $ | 409 | $ | 293 | $ | 1,025 | $ | 974 | |||||||||||||||

| Results for the Three Months Ended September 30 | Results for the Nine Months Ended September 30 | ||||||||||||||||||||||

| 2025 | 2024 | 2025 | 2024 | ||||||||||||||||||||

| Net income per diluted share | $ | 1.48 | $ | 1.04 | $ | 3.58 | $ | 3.44 | |||||||||||||||

| Less: Net investment losses | (0.02) | (0.03) | (0.18) | (0.12) | |||||||||||||||||||

| Less: Pension settlement transaction losses | — | (0.01) | — | (0.01) | |||||||||||||||||||

| Core income per diluted share | $ | 1.50 | $ | 1.08 | $ | 3.76 | $ | 3.57 | |||||||||||||||

| Results for the Three Months Ended September 30, 2025 | ||||||||||||||

| Specialty | Commercial | International | Property & Casualty | |||||||||||

| (In millions) | ||||||||||||||

| Net income | $ | 173 | $ | 229 | $ | 44 | $ | 446 | ||||||

| Net investment losses, after tax | 3 | 4 | 3 | 10 | ||||||||||

| Core income | $ | 176 | $ | 233 | $ | 47 | $ | 456 | ||||||

| Less: | ||||||||||||||

| Net investment income | 162 | 192 | 42 | 396 | ||||||||||

| Non-insurance warranty revenue (expense) | 16 | — | — | 16 | ||||||||||

| Other revenue (expense), including interest expense | (15) | (3) | 1 | (17) | ||||||||||

| Income tax expense on core income | (47) | (62) | (24) | (133) | ||||||||||

| Underwriting gain | 60 | 106 | 28 | 194 | ||||||||||

| Effect of catastrophe losses | — | 39 | 2 | 41 | ||||||||||

| Effect of development-related items | — | — | — | — | ||||||||||

| Underlying underwriting gain | $ | 60 | $ | 145 | $ | 30 | $ | 235 | ||||||

| Results for the Three Months Ended September 30, 2024 | ||||||||||||||

| Specialty | Commercial | International | Property & Casualty | |||||||||||

| (In millions) | ||||||||||||||

| Net income | $ | 167 | $ | 132 | $ | 34 | $ | 333 | ||||||

| Net investment losses, after tax | 4 | 7 | 2 | 13 | ||||||||||

| Core income | $ | 171 | $ | 139 | $ | 36 | $ | 346 | ||||||

| Less: | ||||||||||||||

| Net investment income | 157 | 183 | 32 | 372 | ||||||||||

| Non-insurance warranty revenue (expense) | 14 | — | — | 14 | ||||||||||

| Other revenue (expense), including interest expense | (12) | (3) | 8 | (7) | ||||||||||

| Income tax expense on core income | (47) | (38) | (16) | (101) | ||||||||||

| Underwriting gain (loss) | 59 | (3) | 12 | 68 | ||||||||||

| Effect of catastrophe losses | — | 127 | 16 | 143 | ||||||||||

| Effect of favorable development-related items | — | — | (2) | (2) | ||||||||||

| Underlying underwriting gain | $ | 59 | $ | 124 | $ | 26 | $ | 209 | ||||||

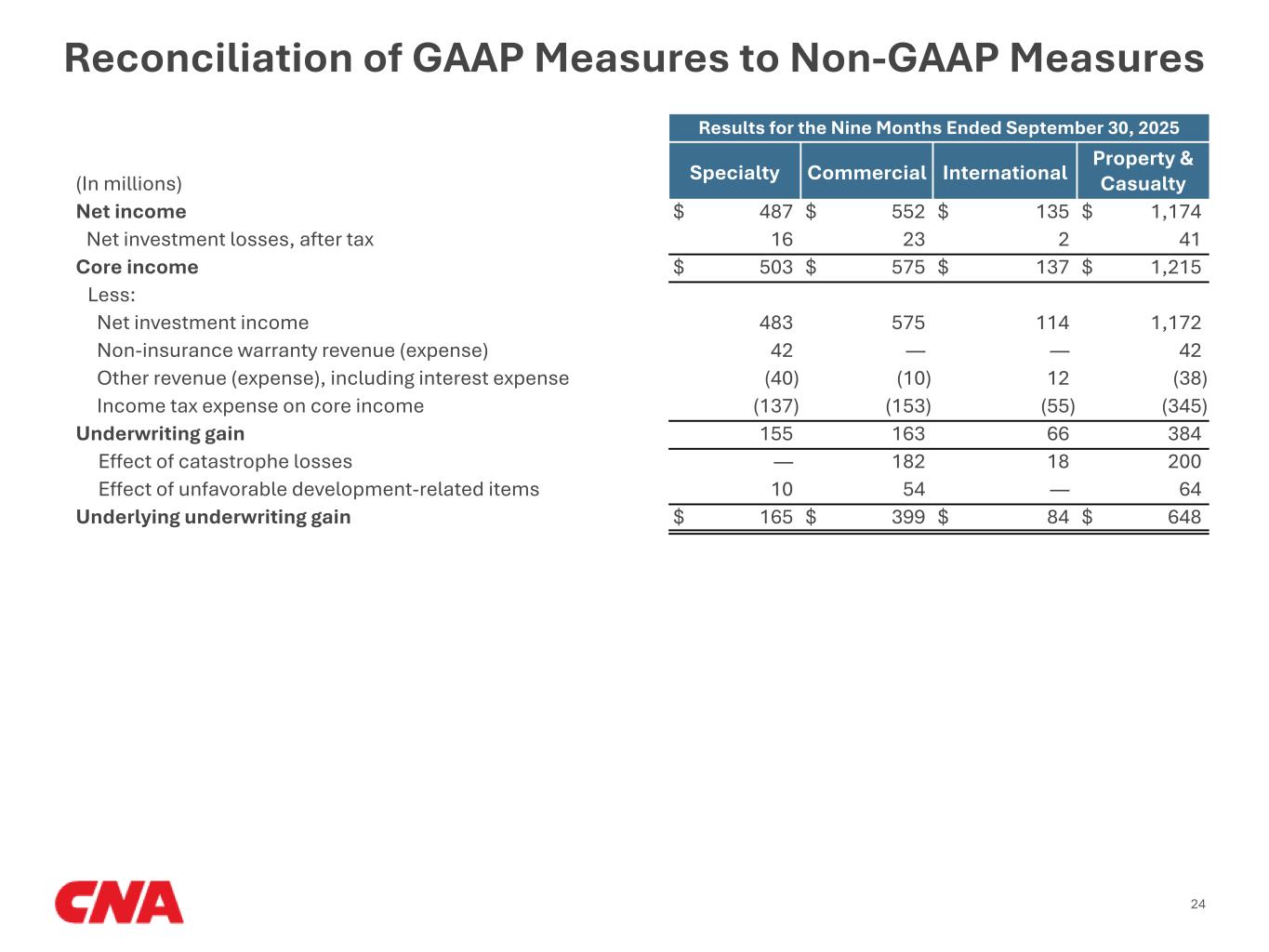

| Results for the Nine Months Ended September 30, 2025 | ||||||||||||||

| Specialty | Commercial | International | Property & Casualty | |||||||||||

| (In millions) | ||||||||||||||

| Net income | $ | 487 | $ | 552 | $ | 135 | $ | 1,174 | ||||||

| Net investment losses, after tax | 16 | 23 | 2 | 41 | ||||||||||

| Core income | $ | 503 | $ | 575 | $ | 137 | $ | 1,215 | ||||||

| Less: | ||||||||||||||

| Net investment income | 483 | 575 | 114 | 1,172 | ||||||||||

| Non-insurance warranty revenue (expense) | 42 | — | — | 42 | ||||||||||

| Other revenue (expense), including interest expense | (40) | (10) | 12 | (38) | ||||||||||

| Income tax expense on core income | (137) | (153) | (55) | (345) | ||||||||||

| Underwriting gain | 155 | 163 | 66 | 384 | ||||||||||

| Effect of catastrophe losses | — | 182 | 18 | 200 | ||||||||||

| Effect of unfavorable development-related items | 10 | 54 | — | 64 | ||||||||||

| Underlying underwriting gain | $ | 165 | $ | 399 | $ | 84 | $ | 648 | ||||||

| Results for the Nine Months Ended September 30, 2024 | ||||||||||||||

| Specialty | Commercial | International | Property & Casualty | |||||||||||

| (In millions) | ||||||||||||||

| Net income | $ | 498 | $ | 436 | $ | 116 | $ | 1,050 | ||||||

| Net investment losses, after tax | 19 | 28 | 1 | 48 | ||||||||||

| Core income | $ | 517 | $ | 464 | $ | 117 | $ | 1,098 | ||||||

| Less: | ||||||||||||||

| Net investment income | 461 | 534 | 95 | 1,090 | ||||||||||

| Non-insurance warranty revenue (expense) | 43 | — | — | 43 | ||||||||||

| Other revenue (expense), including interest expense | (40) | (10) | 5 | (45) | ||||||||||

| Income tax expense on core income | (142) | (125) | (41) | (308) | ||||||||||

| Underwriting gain | 195 | 65 | 58 | 318 | ||||||||||

| Effect of catastrophe losses | — | 285 | 28 | 313 | ||||||||||

| Effect of favorable development-related items | (8) | — | (5) | (13) | ||||||||||

| Underlying underwriting gain | $ | 187 | $ | 350 | $ | 81 | $ | 618 | ||||||

| Results for the Three Months Ended September 30 | Results for the Nine Months Ended September 30 | ||||||||||||||||||||||||||||||||||

| 2025 | 2024 | 2025 | 2024 | ||||||||||||||||||||||||||||||||

| Loss ratio | 60.6 | % | 60.1 | % | 60.7 | % | 59.3 | % | |||||||||||||||||||||||||||

| Less: Effect of catastrophe impacts | — | — | — | — | |||||||||||||||||||||||||||||||

| Less: Effect of unfavorable (favorable) development-related items | — | — | 0.4 | (0.3) | |||||||||||||||||||||||||||||||

| Underlying loss ratio | 60.6 | % | 60.1 | % | 60.3 | % | 59.6 | % | |||||||||||||||||||||||||||

| Expense ratio | 32.5 | % | 32.7 | % | 33.0 | % | 32.5 | % | |||||||||||||||||||||||||||

| Combined ratio | 93.3 | % | 93.0 | % | 94.0 | % | 92.1 | % | |||||||||||||||||||||||||||

| Underlying combined ratio | 93.3 | % | 93.0 | % | 93.6 | % | 92.4 | % | |||||||||||||||||||||||||||

| Results for the Three Months Ended September 30 | Results for the Nine Months Ended September 30 | ||||||||||||||||||||||||||||||||||

| 2025 | 2024 | 2025 | 2024 | ||||||||||||||||||||||||||||||||

| Loss ratio | 66.1 | % | 72.0 | % | 68.7 | % | 69.7 | % | |||||||||||||||||||||||||||

| Less: Effect of catastrophe impacts | 2.7 | 9.6 | 4.3 | 7.5 | |||||||||||||||||||||||||||||||

| Less: Effect of (favorable) unfavorable development-related items | — | (0.1) | 1.3 | — | |||||||||||||||||||||||||||||||

| Underlying loss ratio | 63.4 | % | 62.5 | % | 63.1 | % | 62.2 | % | |||||||||||||||||||||||||||

| Expense ratio | 26.1 | % | 27.7 | % | 26.9 | % | 28.1 | % | |||||||||||||||||||||||||||

| Combined ratio | 92.7 | % | 100.2 | % | 96.1 | % | 98.3 | % | |||||||||||||||||||||||||||

| Underlying combined ratio | 90.0 | % | 90.7 | % | 90.5 | % | 90.8 | % | |||||||||||||||||||||||||||

| Results for the Three Months Ended September 30 | Results for the Nine Months Ended September 30 | ||||||||||||||||||||||||||||||||||

| 2025 | 2024 | 2025 | 2024 | ||||||||||||||||||||||||||||||||

| Loss ratio | 59.1 | % | 62.5 | % | 60.3 | % | 60.6 | % | |||||||||||||||||||||||||||

| Less: Effect of catastrophe impacts | 0.6 | 5.1 | 1.8 | 3.0 | |||||||||||||||||||||||||||||||

| Less: Effect of favorable development-related items | — | (0.7) | — | (0.5) | |||||||||||||||||||||||||||||||

| Underlying loss ratio | 58.5 | % | 58.1 | % | 58.5 | % | 58.1 | % | |||||||||||||||||||||||||||

| Expense ratio | 32.7 | % | 33.6 | % | 32.9 | % | 33.1 | % | |||||||||||||||||||||||||||

| Combined ratio | 91.8 | % | 96.1 | % | 93.2 | % | 93.7 | % | |||||||||||||||||||||||||||

| Underlying combined ratio | 91.2 | % | 91.7 | % | 91.4 | % | 91.2 | % | |||||||||||||||||||||||||||

| Results for the Three Months Ended September 30 | Results for the Nine Months Ended September 30 | ||||||||||||||||||||||||||||||||||

| 2025 | 2024 | 2025 | 2024 | ||||||||||||||||||||||||||||||||

| Loss ratio | 63.4 | % | 66.7 | % | 65.0 | % | 64.9 | % | |||||||||||||||||||||||||||

| Less: Effect of catastrophe impacts | 1.5 | 5.8 | 2.6 | 4.3 | |||||||||||||||||||||||||||||||

| Less: Effect of (favorable) unfavorable development-related items | — | (0.2) | 0.8 | (0.2) | |||||||||||||||||||||||||||||||

| Underlying loss ratio | 61.9 | % | 61.1 | % | 61.6 | % | 60.8 | % | |||||||||||||||||||||||||||

| Expense ratio | 29.1 | % | 30.2 | % | 29.7 | % | 30.3 | % | |||||||||||||||||||||||||||

| Combined ratio | 92.8 | % | 97.2 | % | 95.1 | % | 95.6 | % | |||||||||||||||||||||||||||

| Underlying combined ratio | 91.3 | % | 91.6 | % | 91.7 | % | 91.5 | % | |||||||||||||||||||||||||||

| September 30, 2025 | December 31, 2024 | ||||||||||

| Book value per share | $ | 41.83 | $ | 38.82 | |||||||

| Less: Per share impact of AOCI | (4.47) | (7.34) | |||||||||

| Book value per share excluding AOCI | $ | 46.30 | $ | 46.16 | |||||||

| Results for the Three Months Ended September 30 | Results for the Nine Months Ended September 30 | |||||||||||||||||||||||||

| ($ millions) | 2025 | 2024 | 2025 | 2024 | ||||||||||||||||||||||

| Annualized net income | $ | 1,615 | $ | 1,132 | $ | 1,302 | $ | 1,251 | ||||||||||||||||||

Average stockholders' equity including AOCI (a) |

10,992 | 10,316 | 10,917 | 10,326 | ||||||||||||||||||||||

| Return on equity | 14.7 | % | 11.0 | % | 11.9 | % | 12.1 | % | ||||||||||||||||||

| Annualized core income | $ | 1,637 | $ | 1,176 | $ | 1,367 | $ | 1,299 | ||||||||||||||||||

Average stockholders' equity excluding AOCI (a) |

12,390 | 12,508 | 12,518 | 12,580 | ||||||||||||||||||||||

| Core return on equity | 13.2 | % | 9.4 | % | 10.9 | % | 10.3 | % | ||||||||||||||||||