| (Exact name of registrant as specified in its charter) | ||

| Delaware | 1-5823 | 36-6169860 | ||||||||||||

| (State or other jurisdiction | (Commission | (IRS Employer | ||||||||||||

| of incorporation) | File Number) | Identification No.) | ||||||||||||

| NOT APPLICABLE | ||

| (Former name or former address, if changed since last report.) | ||

| Title of each class | Trading Symbol(s) | Name of each exchange on which registered | ||||||||||||

| Common Stock, Par value $2.50 | "CNA" | New York Stock Exchange | ||||||||||||

| Chicago Stock Exchange | ||||||||||||||

| Exhibit No. | Description | |||||||

| CNA Financial Corporation press release, issued November 4, 2024, providing information on the third quarter 2024 results of operations. | ||||||||

CNA Financial Corporation financial supplement, posted on its website November 4, 2024, providing supplemental financial information on the third quarter 2024. |

||||||||

| CNA Financial Corporation earnings presentation, posted on its website November 4, 2024, providing information on the third quarter 2024 results of operations. | ||||||||

| CNA Financial Corporation earnings remarks, posted on its website November 4, 2024, providing information on the third quarter 2024 results of operations. | ||||||||

| 104 | Cover Page Interactive Data File (embedded within the Inline XBRL document) | |||||||

| CNA Financial Corporation | ||||||||

| (Registrant) | ||||||||

| Date: November 4, 2024 | By | /s/ Scott R. Lindquist | ||||||

| (Signature) | ||||||||

| Scott R. Lindquist Executive Vice President and Chief Financial Officer |

||||||||

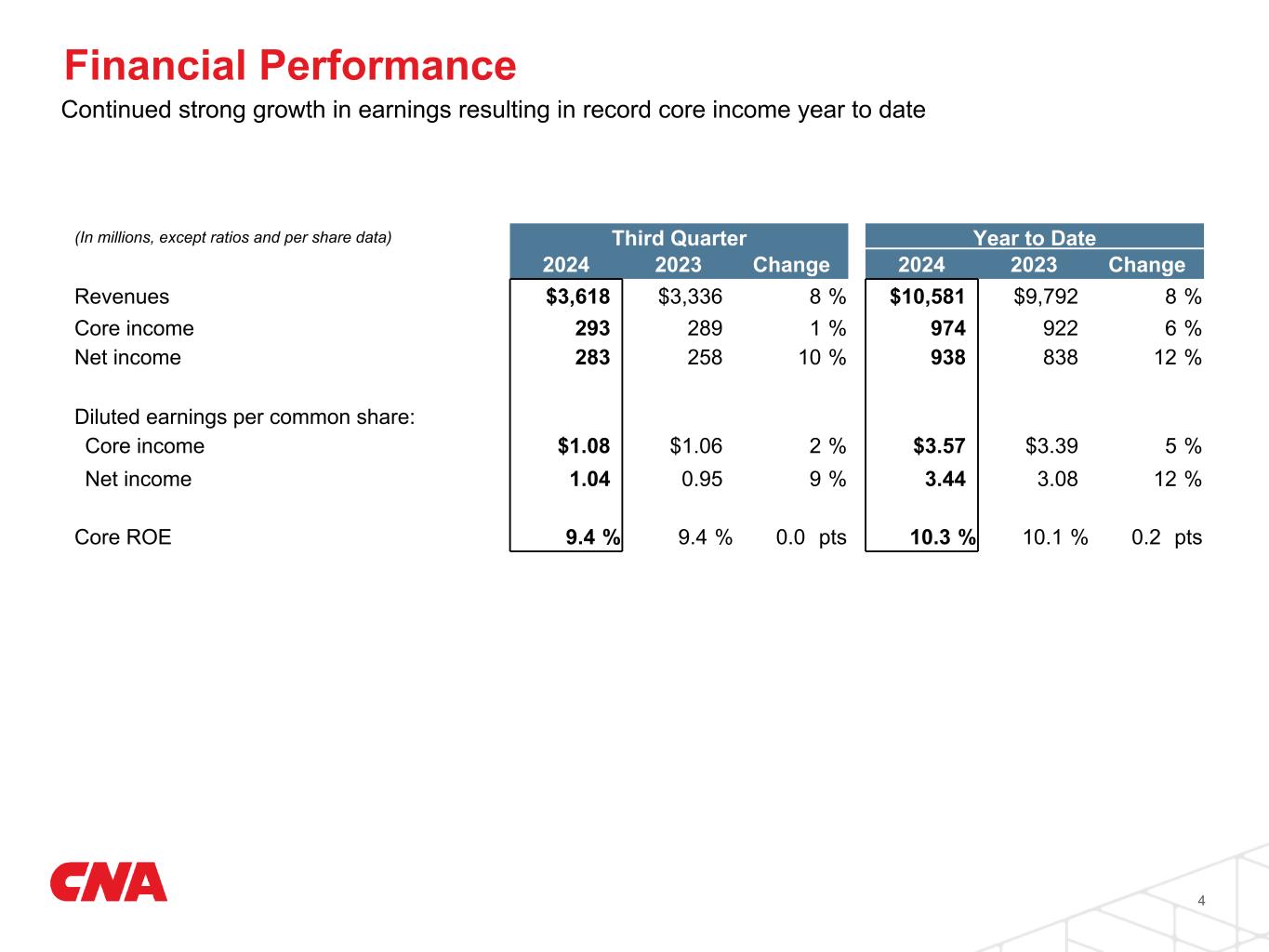

| Results for the Three Months Ended September 30 | Results for the Nine Months Ended September 30 | ||||||||||||||||||||||

| ($ millions, except per share data) | 2024 | 2023 | 2024 | 2023 | |||||||||||||||||||

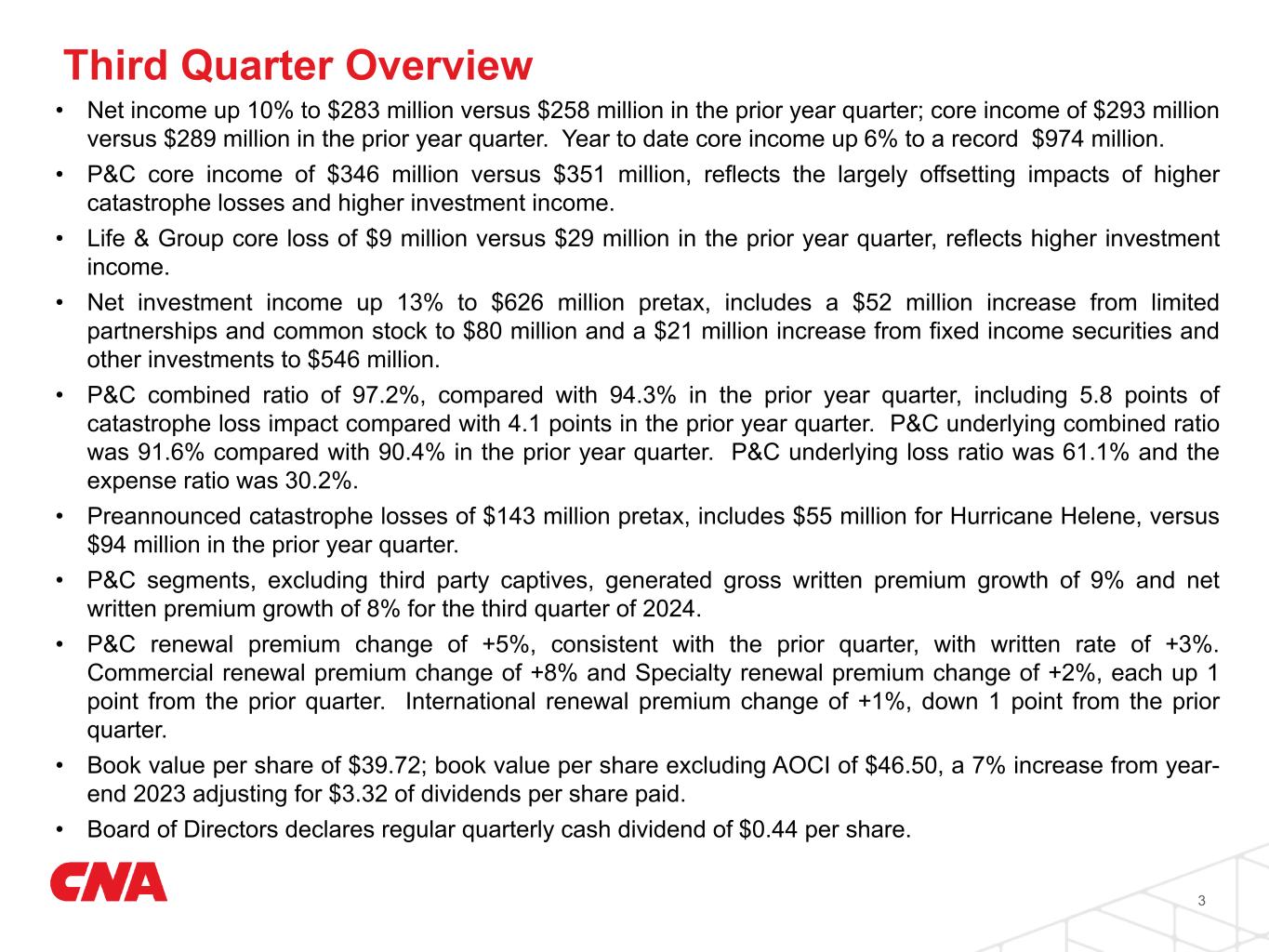

| Net income | $ | 283 | $ | 258 | $ | 938 | $ | 838 | |||||||||||||||

Core income (a) |

293 | 289 | 974 | 922 | |||||||||||||||||||

| Net income per diluted share | $ | 1.04 | $ | 0.95 | $ | 3.44 | $ | 3.08 | |||||||||||||||

| Core income per diluted share | 1.08 | 1.06 | 3.57 | 3.39 | |||||||||||||||||||

| September 30, 2024 | December 31, 2023 | ||||||||||||||||

| Book value per share | $ | 39.72 | $ | 36.52 | |||||||||||||

| Book value per share excluding AOCI | 46.50 | 46.39 | |||||||||||||||

| Results for the Three Months Ended September 30 | Results for the Nine Months Ended September 30 | ||||||||||||||||||||||||||||||||||

| ($ millions) | 2024 | 2023 | 2024 | 2023 | |||||||||||||||||||||||||||||||

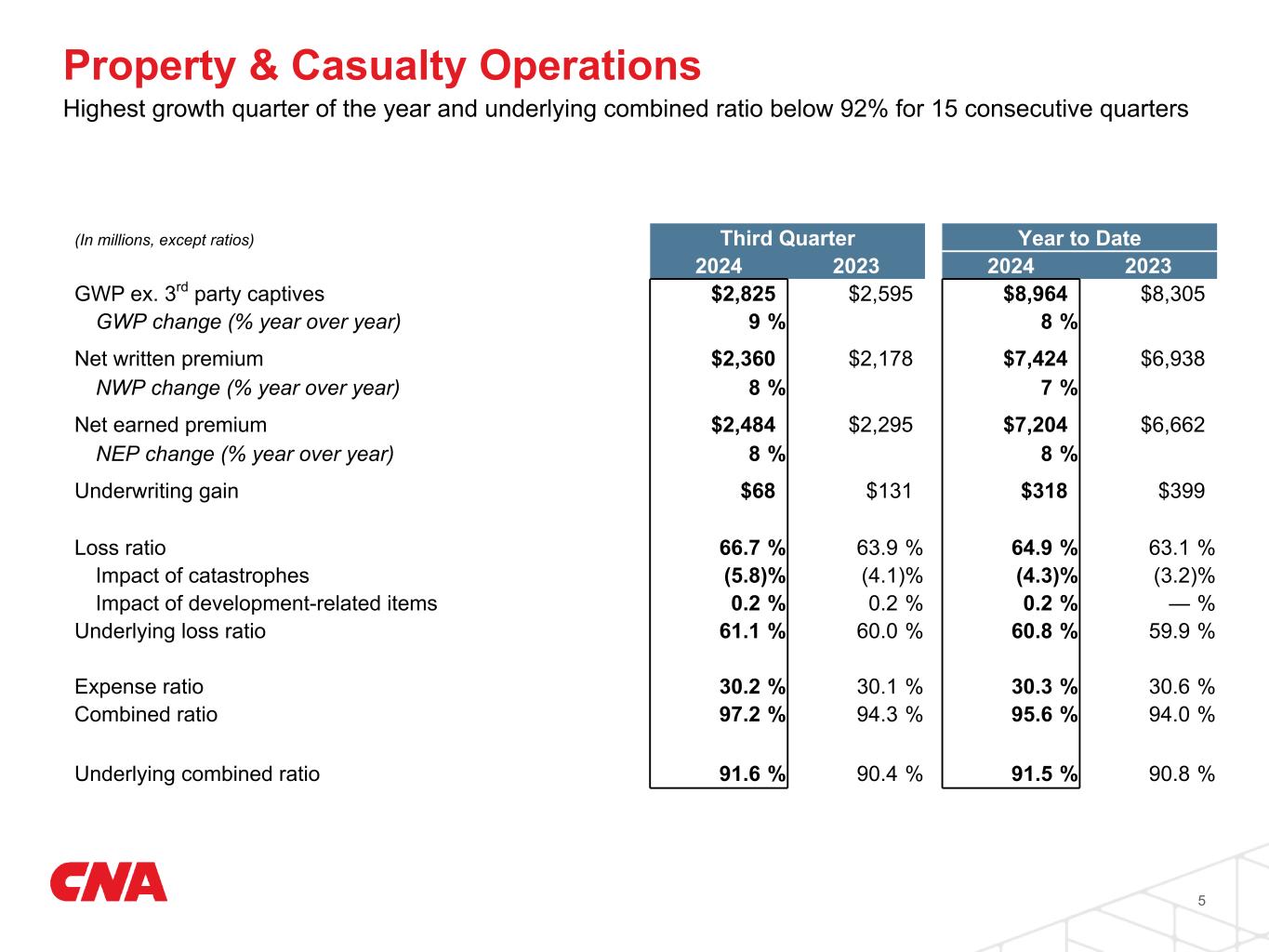

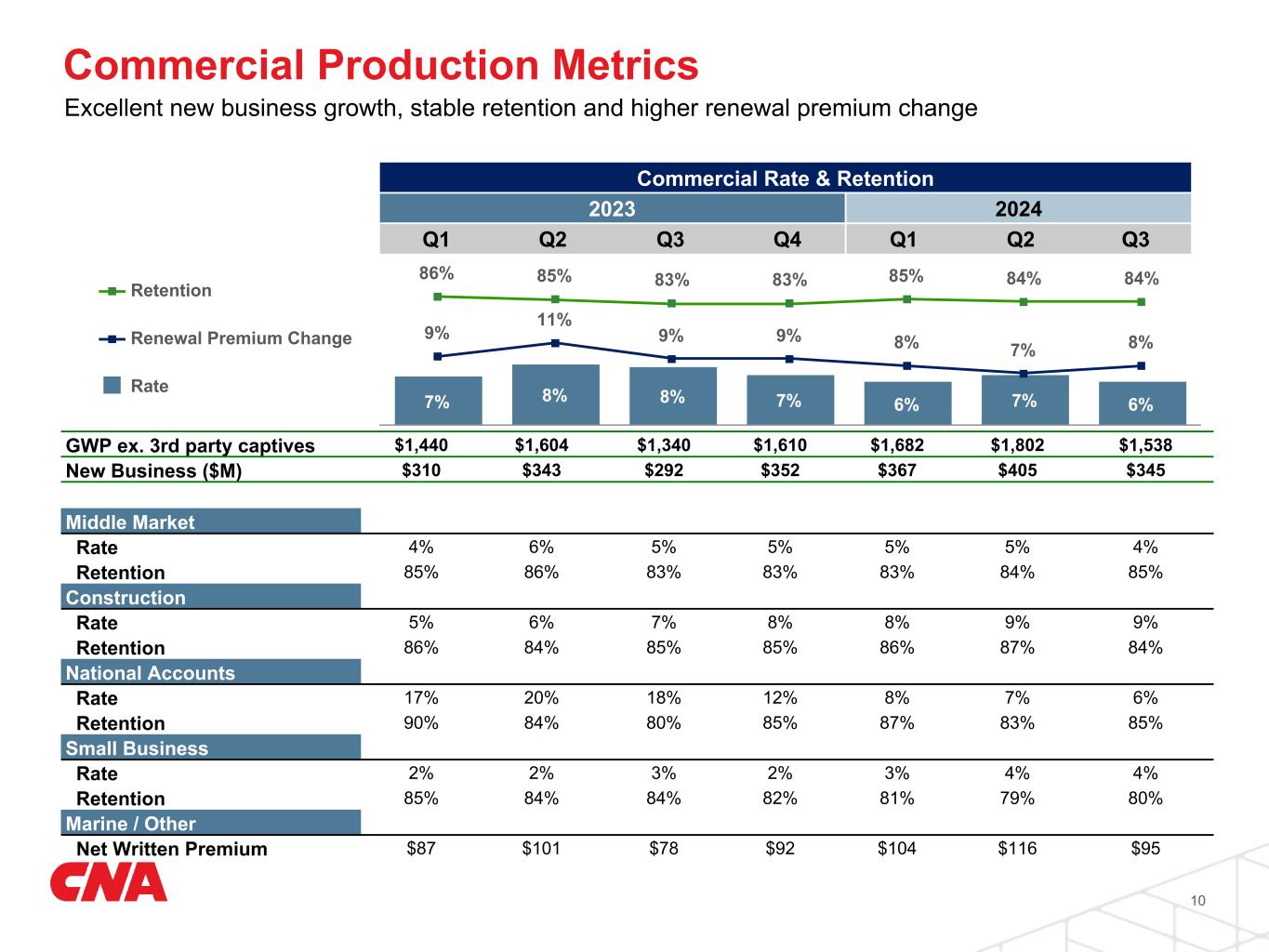

Gross written premiums ex. 3rd party captives |

$ | 2,825 | $ | 2,595 | $ | 8,964 | $ | 8,305 | |||||||||||||||||||||||||||

GWP ex. 3rd party captives change (% year over year) |

9 | % | 8 | % | |||||||||||||||||||||||||||||||

| Net written premiums | $ | 2,360 | $ | 2,178 | $ | 7,424 | $ | 6,938 | |||||||||||||||||||||||||||

| NWP change (% year over year) | 8 | % | 7 | % | |||||||||||||||||||||||||||||||

| Net earned premiums | $ | 2,484 | $ | 2,295 | $ | 7,204 | $ | 6,662 | |||||||||||||||||||||||||||

| NEP change (% year over year) | 8 | % | 8 | % | |||||||||||||||||||||||||||||||

| Underwriting gain | $ | 68 | $ | 131 | $ | 318 | $ | 399 | |||||||||||||||||||||||||||

| Net investment income | $ | 372 | $ | 318 | $ | 1,090 | $ | 951 | |||||||||||||||||||||||||||

| Core income | $ | 346 | $ | 351 | $ | 1,098 | $ | 1,071 | |||||||||||||||||||||||||||

| Loss ratio | 66.7 | % | 63.9 | % | 64.9 | % | 63.1 | % | |||||||||||||||||||||||||||

| Effect of catastrophe impacts | (5.8) | (4.1) | (4.3) | (3.2) | |||||||||||||||||||||||||||||||

| Effect of development-related items | 0.2 | 0.2 | 0.2 | — | |||||||||||||||||||||||||||||||

| Underlying loss ratio | 61.1 | % | 60.0 | % | 60.8 | % | 59.9 | % | |||||||||||||||||||||||||||

| Expense ratio | 30.2 | % | 30.1 | % | 30.3 | % | 30.6 | % | |||||||||||||||||||||||||||

| Combined ratio | 97.2 | % | 94.3 | % | 95.6 | % | 94.0 | % | |||||||||||||||||||||||||||

| Underlying combined ratio | 91.6 | % | 90.4 | % | 91.5 | % | 90.8 | % | |||||||||||||||||||||||||||

| Results for the Three Months Ended September 30 | Results for the Nine Months Ended September 30 | ||||||||||||||||||||||||||||||||||

| ($ millions) | 2024 | 2023 | 2024 | 2023 | |||||||||||||||||||||||||||||||

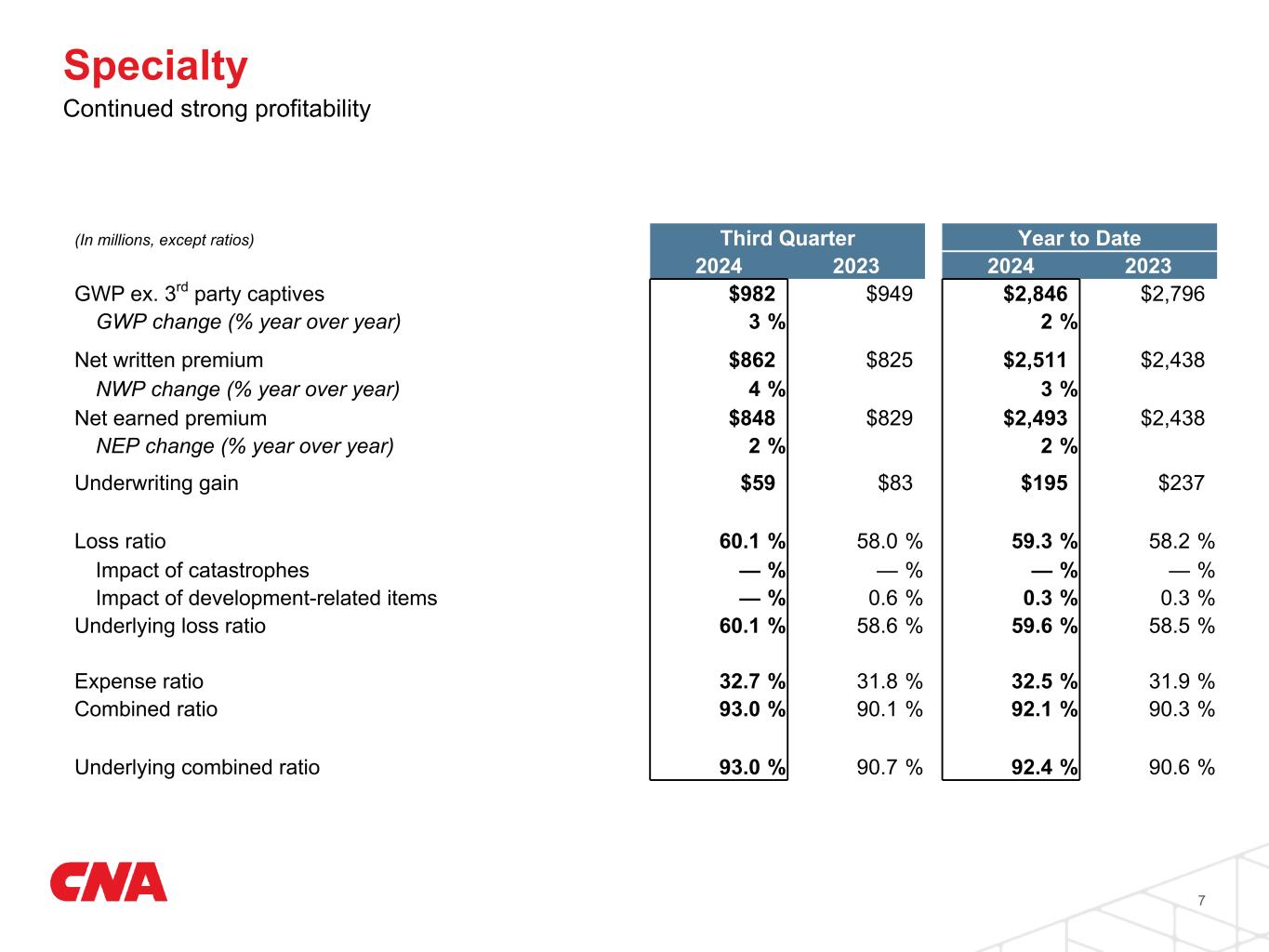

Gross written premiums ex. 3rd party captives |

$ | 982 | $ | 949 | $ | 2,846 | $ | 2,796 | |||||||||||||||||||||||||||

GWP ex. 3rd party captives change (% year over year) |

3 | % | 2 | % | |||||||||||||||||||||||||||||||

| Net written premiums | $ | 862 | $ | 825 | $ | 2,511 | $ | 2,438 | |||||||||||||||||||||||||||

| NWP change (% year over year) | 4 | % | 3 | % | |||||||||||||||||||||||||||||||

| Net earned premiums | $ | 848 | $ | 829 | $ | 2,493 | $ | 2,438 | |||||||||||||||||||||||||||

| NEP change (% year over year) | 2 | % | 2 | % | |||||||||||||||||||||||||||||||

| Underwriting gain | $ | 59 | $ | 83 | $ | 195 | $ | 237 | |||||||||||||||||||||||||||

| Loss ratio | 60.1 | % | 58.0 | % | 59.3 | % | 58.2 | % | |||||||||||||||||||||||||||

| Effect of catastrophe impacts | — | — | — | — | |||||||||||||||||||||||||||||||

| Effect of development-related items | — | 0.6 | 0.3 | 0.3 | |||||||||||||||||||||||||||||||

| Underlying loss ratio | 60.1 | % | 58.6 | % | 59.6 | % | 58.5 | % | |||||||||||||||||||||||||||

| Expense ratio | 32.7 | % | 31.8 | % | 32.5 | % | 31.9 | % | |||||||||||||||||||||||||||

| Combined ratio | 93.0 | % | 90.1 | % | 92.1 | % | 90.3 | % | |||||||||||||||||||||||||||

| Underlying combined ratio | 93.0 | % | 90.7 | % | 92.4 | % | 90.6 | % | |||||||||||||||||||||||||||

| Results for the Three Months Ended September 30 | Results for the Nine Months Ended September 30 | ||||||||||||||||||||||||||||||||||

| ($ millions) | 2024 | 2023 | 2024 | 2023 | |||||||||||||||||||||||||||||||

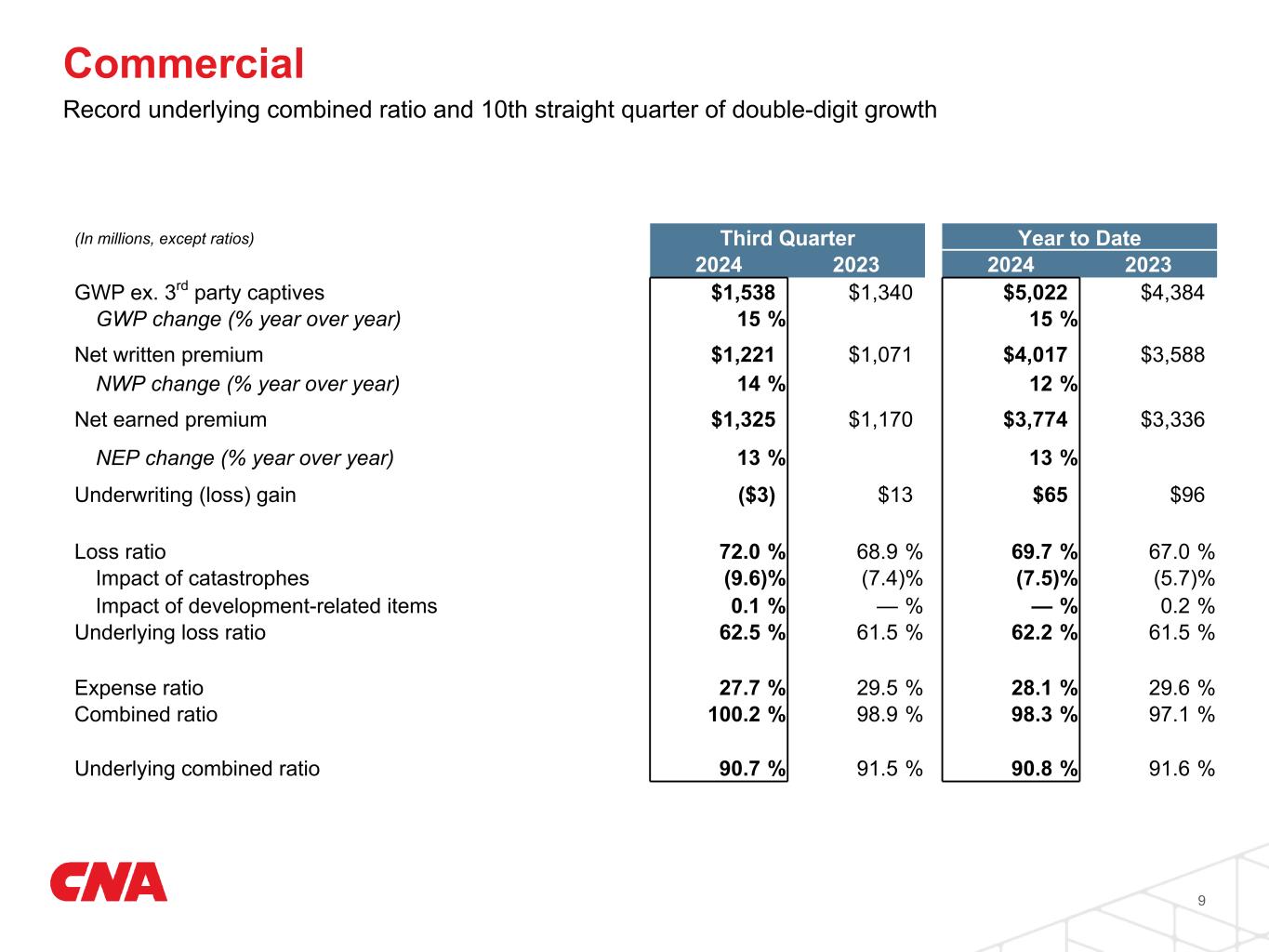

Gross written premiums ex. 3rd party captives |

$ | 1,538 | $ | 1,340 | $ | 5,022 | $ | 4,384 | |||||||||||||||||||||||||||

GWP ex. 3rd party captives change (% year over year) |

15 | % | % | 15 | % | ||||||||||||||||||||||||||||||

| Net written premiums | $ | 1,221 | $ | 1,071 | $ | 4,017 | $ | 3,588 | |||||||||||||||||||||||||||

| NWP change (% year over year) | 14 | % | % | 12 | % | ||||||||||||||||||||||||||||||

| Net earned premiums | $ | 1,325 | $ | 1,170 | $ | 3,774 | $ | 3,336 | |||||||||||||||||||||||||||

| NEP change (% year over year) | 13 | % | % | 13 | % | ||||||||||||||||||||||||||||||

| Underwriting (loss) gain | $ | (3) | $ | 13 | $ | 65 | $ | 96 | |||||||||||||||||||||||||||

| Loss ratio | 72.0 | % | 68.9 | % | 69.7 | % | 67.0 | % | |||||||||||||||||||||||||||

| Effect of catastrophe impacts | (9.6) | (7.4) | (7.5) | (5.7) | |||||||||||||||||||||||||||||||

| Effect of development-related items | 0.1 | — | — | 0.2 | |||||||||||||||||||||||||||||||

| Underlying loss ratio | 62.5 | % | 61.5 | % | 62.2 | % | 61.5 | % | |||||||||||||||||||||||||||

| Expense ratio | 27.7 | % | 29.5 | % | 28.1 | % | 29.6 | % | |||||||||||||||||||||||||||

| Combined ratio | 100.2 | % | 98.9 | % | 98.3 | % | 97.1 | % | |||||||||||||||||||||||||||

| Underlying combined ratio | 90.7 | % | 91.5 | % | 90.8 | % | 91.6 | % | |||||||||||||||||||||||||||

| Results for the Three Months Ended September 30 | Results for the Nine Months Ended September 30 | ||||||||||||||||||||||||||||||||||

| ($ millions) | 2024 | 2023 | 2024 | 2023 | |||||||||||||||||||||||||||||||

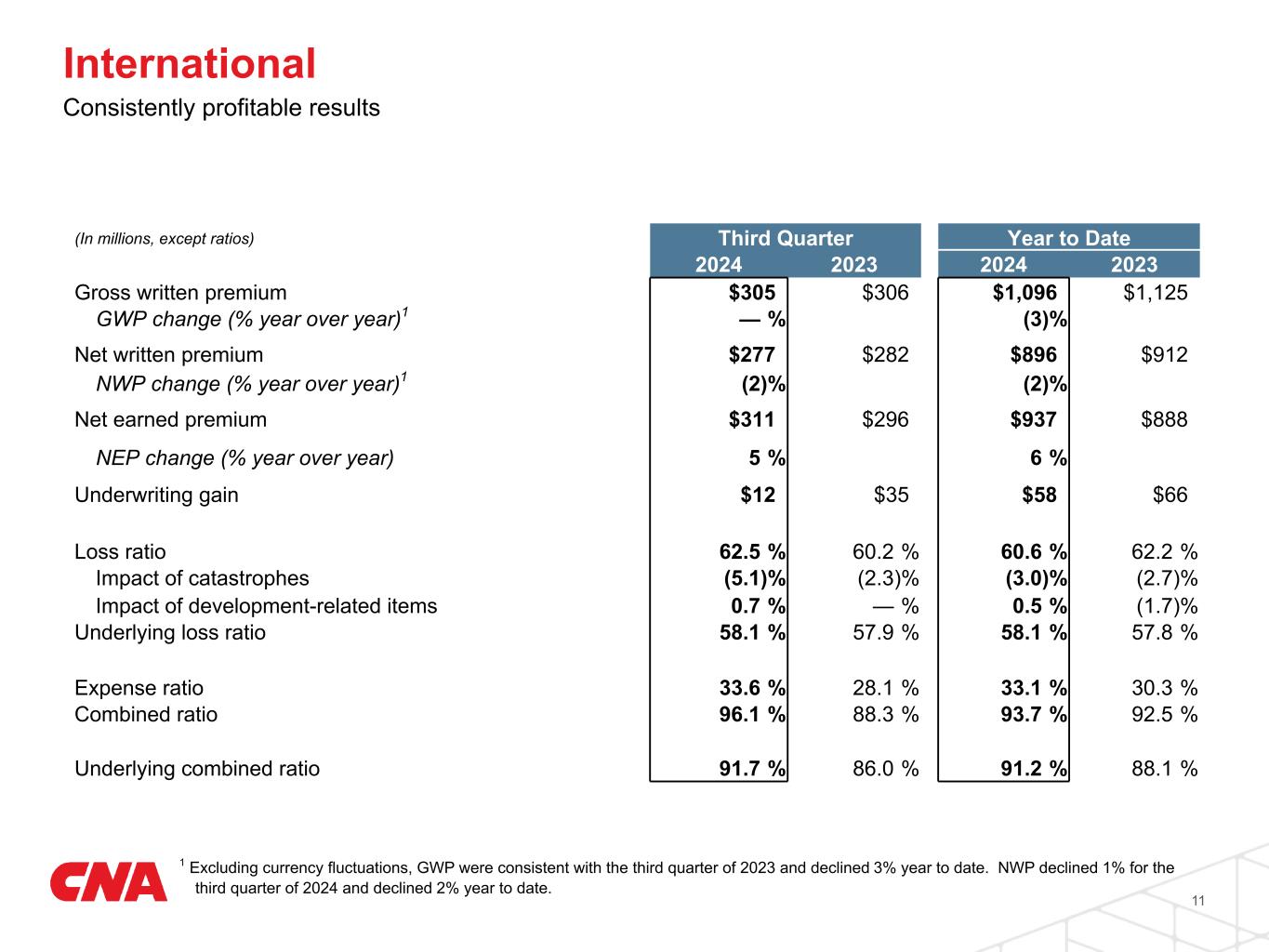

| Gross written premiums | $ | 305 | $ | 306 | $ | 1,096 | $ | 1,125 | |||||||||||||||||||||||||||

| GWP change (% year over year) | — | % | (3) | % | |||||||||||||||||||||||||||||||

| Net written premiums | $ | 277 | $ | 282 | $ | 896 | $ | 912 | |||||||||||||||||||||||||||

| NWP change (% year over year) | (2) | % | (2) | % | |||||||||||||||||||||||||||||||

| Net earned premiums | $ | 311 | $ | 296 | $ | 937 | $ | 888 | |||||||||||||||||||||||||||

| NEP change (% year over year) | 5 | % | 6 | % | |||||||||||||||||||||||||||||||

| Underwriting gain | $ | 12 | $ | 35 | $ | 58 | $ | 66 | |||||||||||||||||||||||||||

| Loss ratio | 62.5 | % | 60.2 | % | 60.6 | % | 62.2 | % | |||||||||||||||||||||||||||

| Effect of catastrophe impacts | (5.1) | (2.3) | (3.0) | (2.7) | |||||||||||||||||||||||||||||||

| Effect of development-related items | 0.7 | — | 0.5 | (1.7) | |||||||||||||||||||||||||||||||

| Underlying loss ratio | 58.1 | % | 57.9 | % | 58.1 | % | 57.8 | % | |||||||||||||||||||||||||||

| Expense ratio | 33.6 | % | 28.1 | % | 33.1 | % | 30.3 | % | |||||||||||||||||||||||||||

| Combined ratio | 96.1 | % | 88.3 | % | 93.7 | % | 92.5 | % | |||||||||||||||||||||||||||

| Underlying combined ratio | 91.7 | % | 86.0 | % | 91.2 | % | 88.1 | % | |||||||||||||||||||||||||||

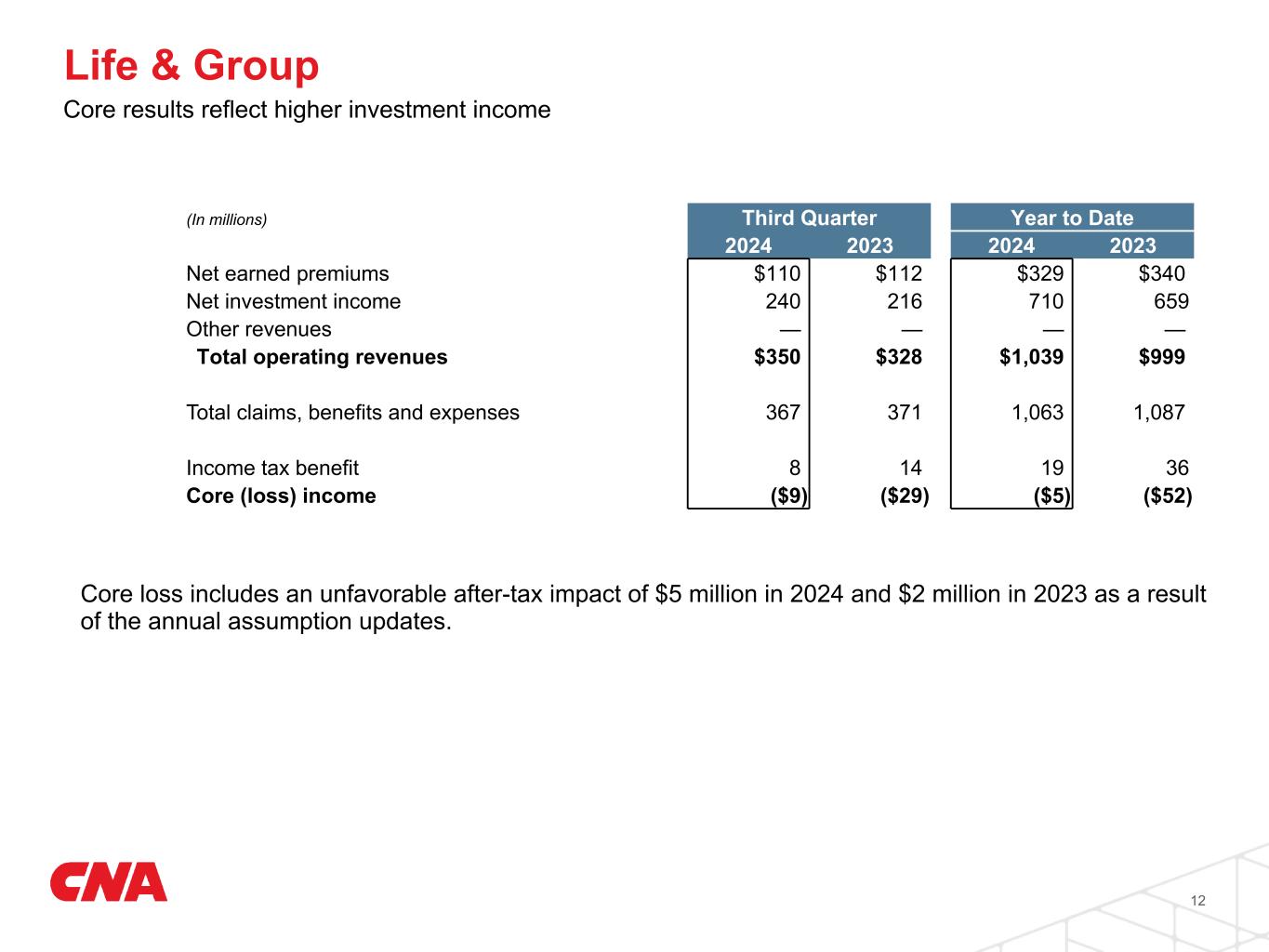

| Results for the Three Months Ended September 30 | Results for the Nine Months Ended September 30 | ||||||||||||||||||||||||||||||||||

| ($ millions) | 2024 | 2023 | 2024 | 2023 | |||||||||||||||||||||||||||||||

| Net earned premiums | $ | 110 | $ | 112 | $ | 329 | $ | 340 | |||||||||||||||||||||||||||

| Claims, benefits and expenses | 367 | 371 | 1,063 | 1,087 | |||||||||||||||||||||||||||||||

| Net investment income | 240 | 216 | 710 | 659 | |||||||||||||||||||||||||||||||

| Core loss | (9) | (29) | (5) | (52) | |||||||||||||||||||||||||||||||

| Results for the Three Months Ended September 30 | Results for the Nine Months Ended September 30 | ||||||||||||||||||||||||||||||||||

| ($ millions) | 2024 | 2023 | 2024 | 2023 | |||||||||||||||||||||||||||||||

| Insurance claims and policyholders' benefits | $ | 16 | $ | 10 | $ | 35 | $ | 32 | |||||||||||||||||||||||||||

| Interest expense | 32 | 35 | 101 | 93 | |||||||||||||||||||||||||||||||

| Net investment income | 14 | 19 | 53 | 43 | |||||||||||||||||||||||||||||||

| Core loss | (44) | (33) | (119) | (97) | |||||||||||||||||||||||||||||||

| Results for the Three Months Ended September 30 | Results for the Nine Months Ended September 30 | ||||||||||||||||||||||||||||||||||

| 2024 | 2023 | 2024 | 2023 | ||||||||||||||||||||||||||||||||

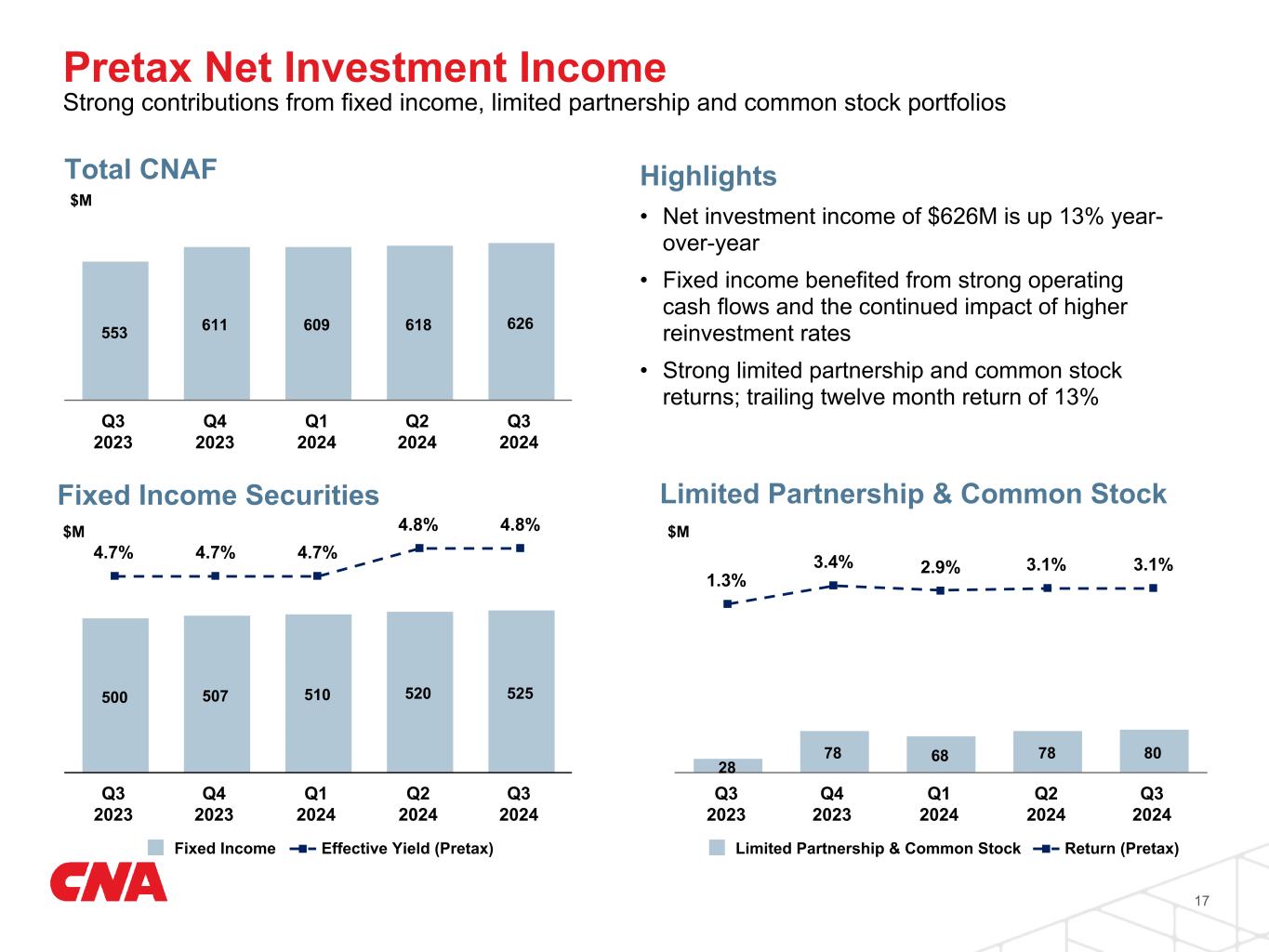

| Fixed income securities and other | $ | 546 | $ | 525 | $ | 1,627 | $ | 1,529 | |||||||||||||||||||||||||||

| Limited partnership and common stock investments | 80 | 28 | 226 | 124 | |||||||||||||||||||||||||||||||

| Net investment income | $ | 626 | $ | 553 | $ | 1,853 | $ | 1,653 | |||||||||||||||||||||||||||

| Media: | Analysts: | |||||||

Kelly Messina | Vice President, Marketing |

Ralitza K. Todorova | Vice President, Investor Relations & Rating Agencies |

|||||||

| 872-817-0350 | 312-822-3834 | |||||||

| Results for the Three Months Ended September 30 | Results for the Nine Months Ended September 30 | ||||||||||||||||||||||

| ($ millions) | 2024 | 2023 | 2024 | 2023 | |||||||||||||||||||

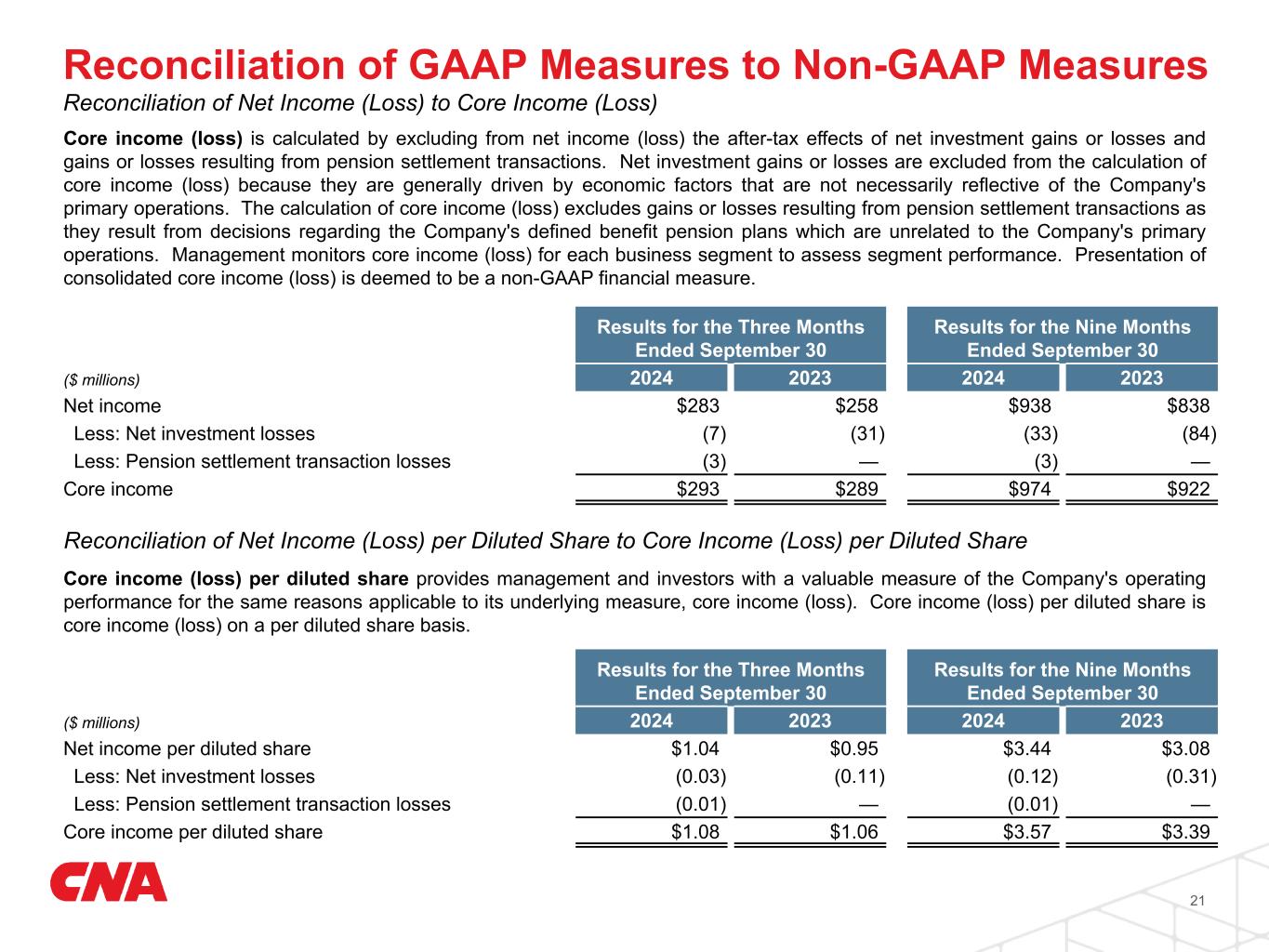

| Net income | $ | 283 | $ | 258 | $ | 938 | $ | 838 | |||||||||||||||

| Less: Net investment losses | (7) | (31) | (33) | (84) | |||||||||||||||||||

| Less: Pension settlement transaction losses | (3) | — | (3) | — | |||||||||||||||||||

| Core income | $ | 293 | $ | 289 | $ | 974 | $ | 922 | |||||||||||||||

| Results for the Three Months Ended September 30 | Results for the Nine Months Ended September 30 | ||||||||||||||||||||||

| 2024 | 2023 | 2024 | 2023 | ||||||||||||||||||||

| Net income per diluted share | $ | 1.04 | $ | 0.95 | $ | 3.44 | $ | 3.08 | |||||||||||||||

| Less: Net investment losses | (0.03) | (0.11) | (0.12) | (0.31) | |||||||||||||||||||

| Less: Pension settlement transaction losses | (0.01) | — | (0.01) | — | |||||||||||||||||||

| Core income per diluted share | $ | 1.08 | $ | 1.06 | $ | 3.57 | $ | 3.39 | |||||||||||||||

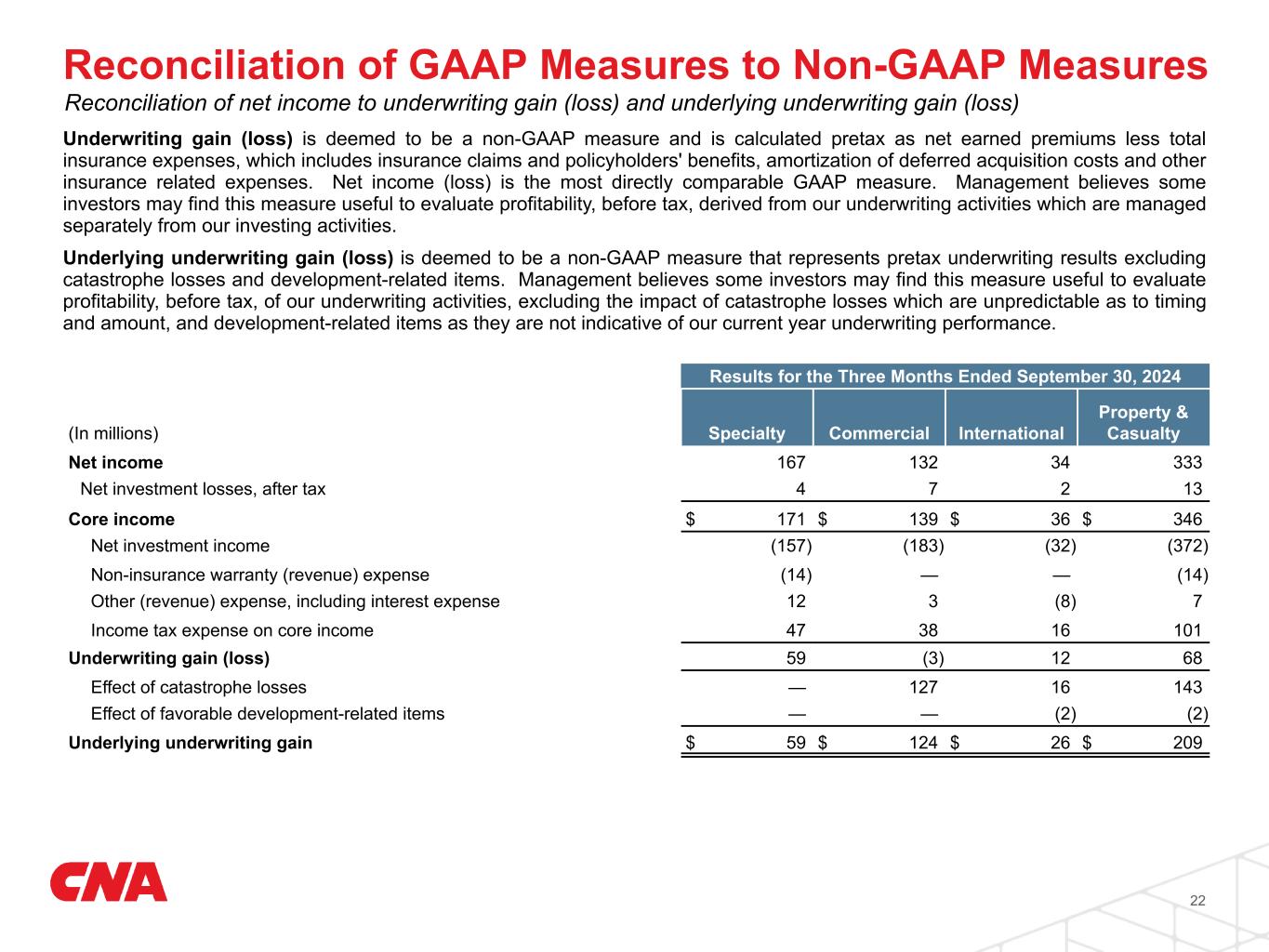

| Results for the Three Months Ended September 30, 2024 |

||||||||||||||

| Specialty | Commercial | International | Property & Casualty | |||||||||||

| (In millions) | ||||||||||||||

| Net income | $ | 167 | $ | 132 | $ | 34 | $ | 333 | ||||||

| Net investment losses, after tax | 4 | 7 | 2 | 13 | ||||||||||

| Core income | $ | 171 | $ | 139 | $ | 36 | $ | 346 | ||||||

| Net investment income | (157) | (183) | (32) | (372) | ||||||||||

| Non-insurance warranty (revenue) expense | (14) | — | — | (14) | ||||||||||

| Other (revenue) expense, including interest expense | 12 | 3 | (8) | 7 | ||||||||||

| Income tax expense on core income | 47 | 38 | 16 | 101 | ||||||||||

| Underwriting gain (loss) | 59 | (3) | 12 | 68 | ||||||||||

| Effect of catastrophe losses | — | 127 | 16 | 143 | ||||||||||

| Effect of favorable development-related items | — | — | (2) | (2) | ||||||||||

| Underlying underwriting gain | $ | 59 | $ | 124 | $ | 26 | $ | 209 | ||||||

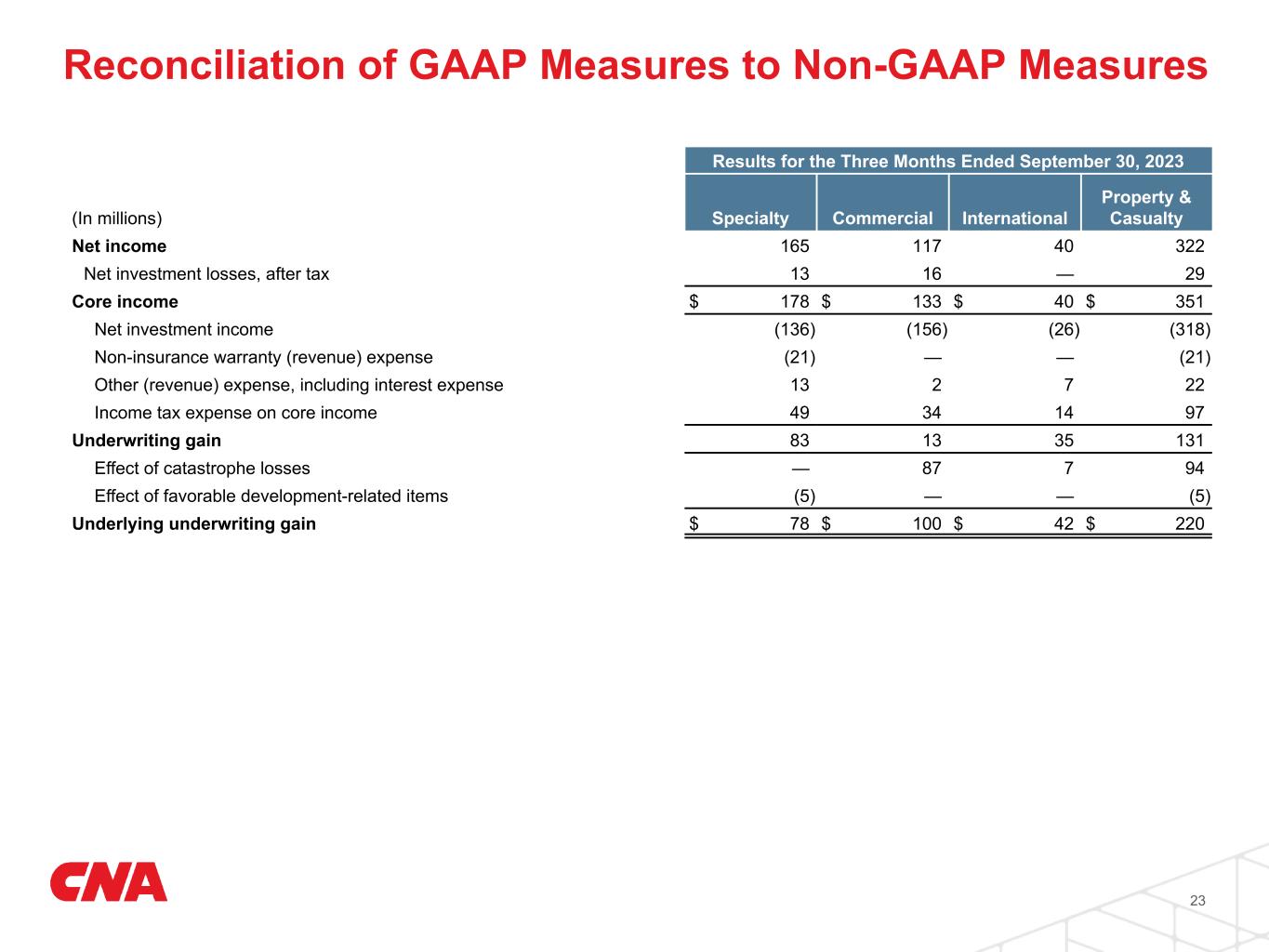

| Results for the Three Months Ended September 30, 2023 | ||||||||||||||

| Specialty | Commercial | International | Property & Casualty | |||||||||||

| (In millions) | ||||||||||||||

| Net income | $ | 165 | $ | 117 | $ | 40 | $ | 322 | ||||||

| Net investment losses, after tax | 13 | 16 | — | 29 | ||||||||||

| Core income | $ | 178 | $ | 133 | $ | 40 | $ | 351 | ||||||

| Net investment income | (136) | (156) | (26) | (318) | ||||||||||

| Non-insurance warranty (revenue) expense | (21) | — | — | (21) | ||||||||||

| Other (revenue) expense, including interest expense | 13 | 2 | 7 | 22 | ||||||||||

| Income tax expense on core income | 49 | 34 | 14 | 97 | ||||||||||

| Underwriting gain | 83 | 13 | 35 | 131 | ||||||||||

| Effect of catastrophe losses | — | 87 | 7 | 94 | ||||||||||

| Effect of favorable development-related items | (5) | — | — | (5) | ||||||||||

| Underlying underwriting gain | $ | 78 | $ | 100 | $ | 42 | $ | 220 | ||||||

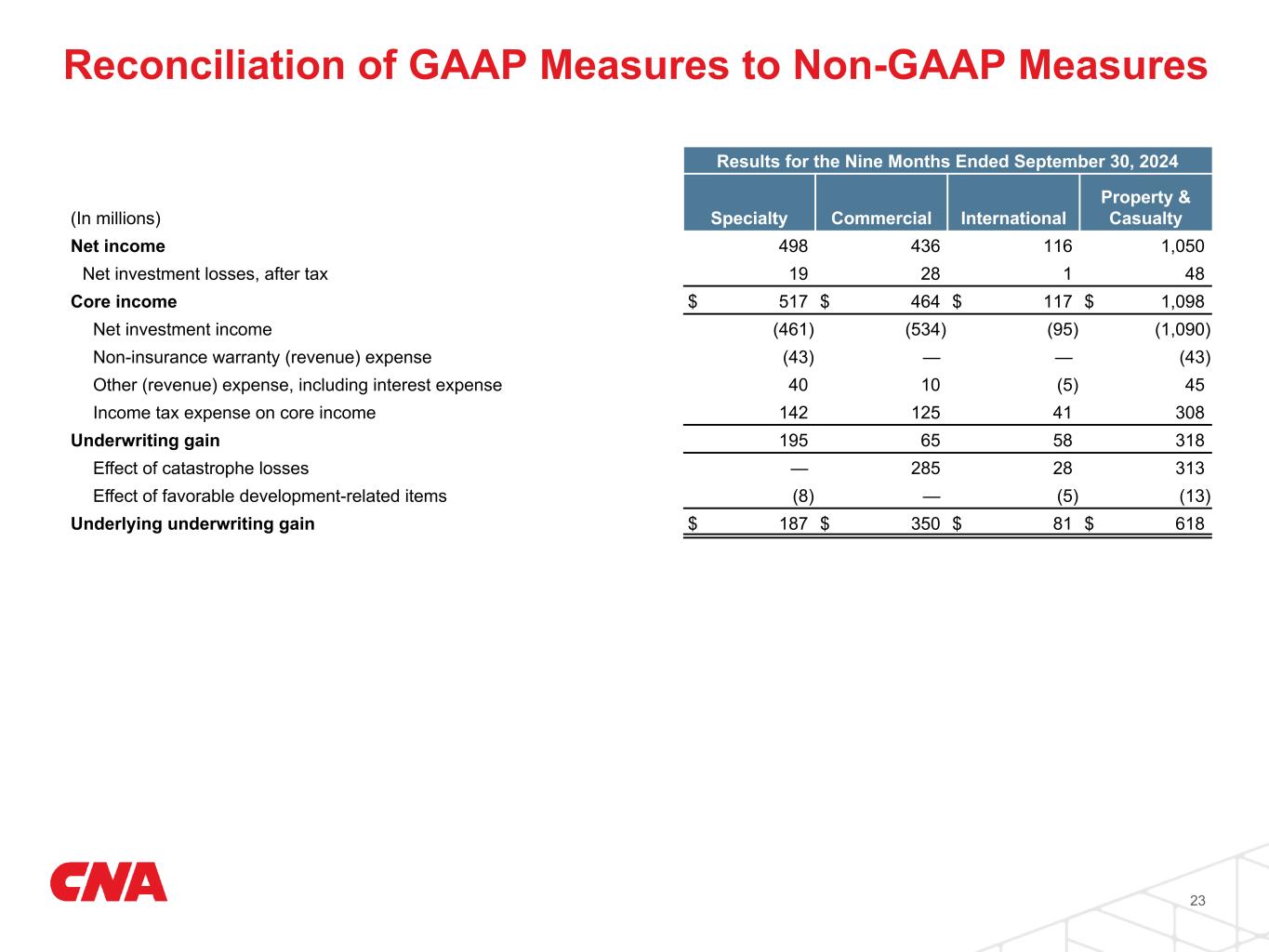

| Results for the Nine Months Ended September 30, 2024 | ||||||||||||||

| Specialty | Commercial | International | Property & Casualty | |||||||||||

| (In millions) | ||||||||||||||

| Net income | $ | 498 | $ | 436 | $ | 116 | $ | 1,050 | ||||||

| Net investment losses, after tax | 19 | 28 | 1 | 48 | ||||||||||

| Core income | $ | 517 | $ | 464 | $ | 117 | $ | 1,098 | ||||||

| Net investment income | (461) | (534) | (95) | (1,090) | ||||||||||

| Non-insurance warranty (revenue) expense | (43) | — | — | (43) | ||||||||||

| Other (revenue) expense, including interest expense | 40 | 10 | (5) | 45 | ||||||||||

| Income tax expense on core income | 142 | 125 | 41 | 308 | ||||||||||

| Underwriting gain | 195 | 65 | 58 | 318 | ||||||||||

| Effect of catastrophe losses | — | 285 | 28 | 313 | ||||||||||

| Effect of favorable development-related items | (8) | — | (5) | (13) | ||||||||||

| Underlying underwriting gain | $ | 187 | $ | 350 | $ | 81 | $ | 618 | ||||||

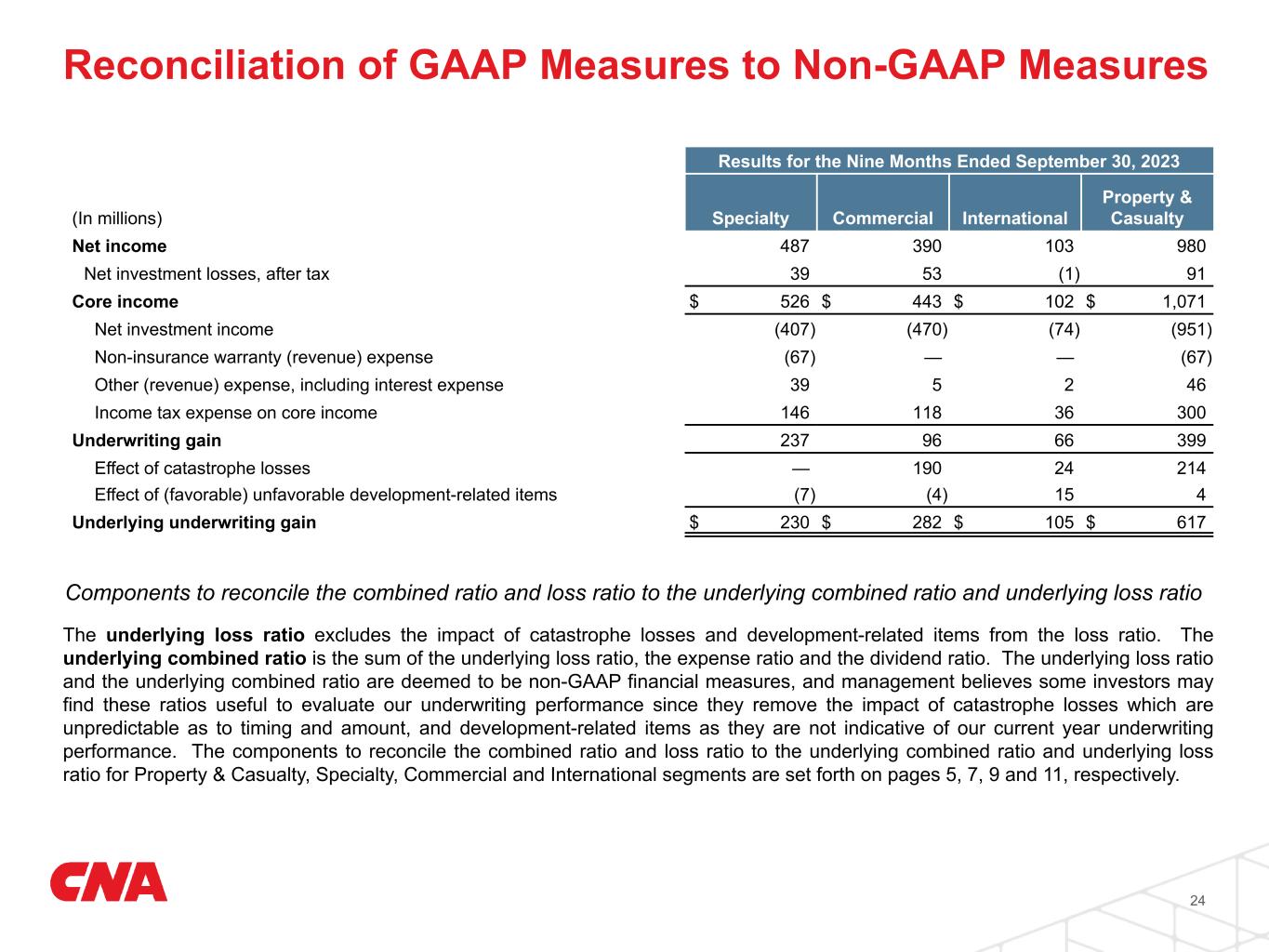

| Results for the Nine Months Ended September 30, 2023 | ||||||||||||||

| Specialty | Commercial | International | Property & Casualty | |||||||||||

| (In millions) | ||||||||||||||

| Net income | $ | 487 | $ | 390 | $ | 103 | $ | 980 | ||||||

| Net investment losses (gains), after tax | 39 | 53 | (1) | 91 | ||||||||||

| Core income | $ | 526 | $ | 443 | $ | 102 | $ | 1,071 | ||||||

| Net investment income | (407) | (470) | (74) | (951) | ||||||||||

| Non-insurance warranty (revenue) expense | (67) | — | — | (67) | ||||||||||

| Other (revenue) expense, including interest expense | 39 | 5 | 2 | 46 | ||||||||||

| Income tax expense on core income | 146 | 118 | 36 | 300 | ||||||||||

| Underwriting gain | 237 | 96 | 66 | 399 | ||||||||||

| Effect of catastrophe losses | — | 190 | 24 | 214 | ||||||||||

| Effect of (favorable) unfavorable development-related items | (7) | (4) | 15 | 4 | ||||||||||

| Underlying underwriting gain | $ | 230 | $ | 282 | $ | 105 | $ | 617 | ||||||

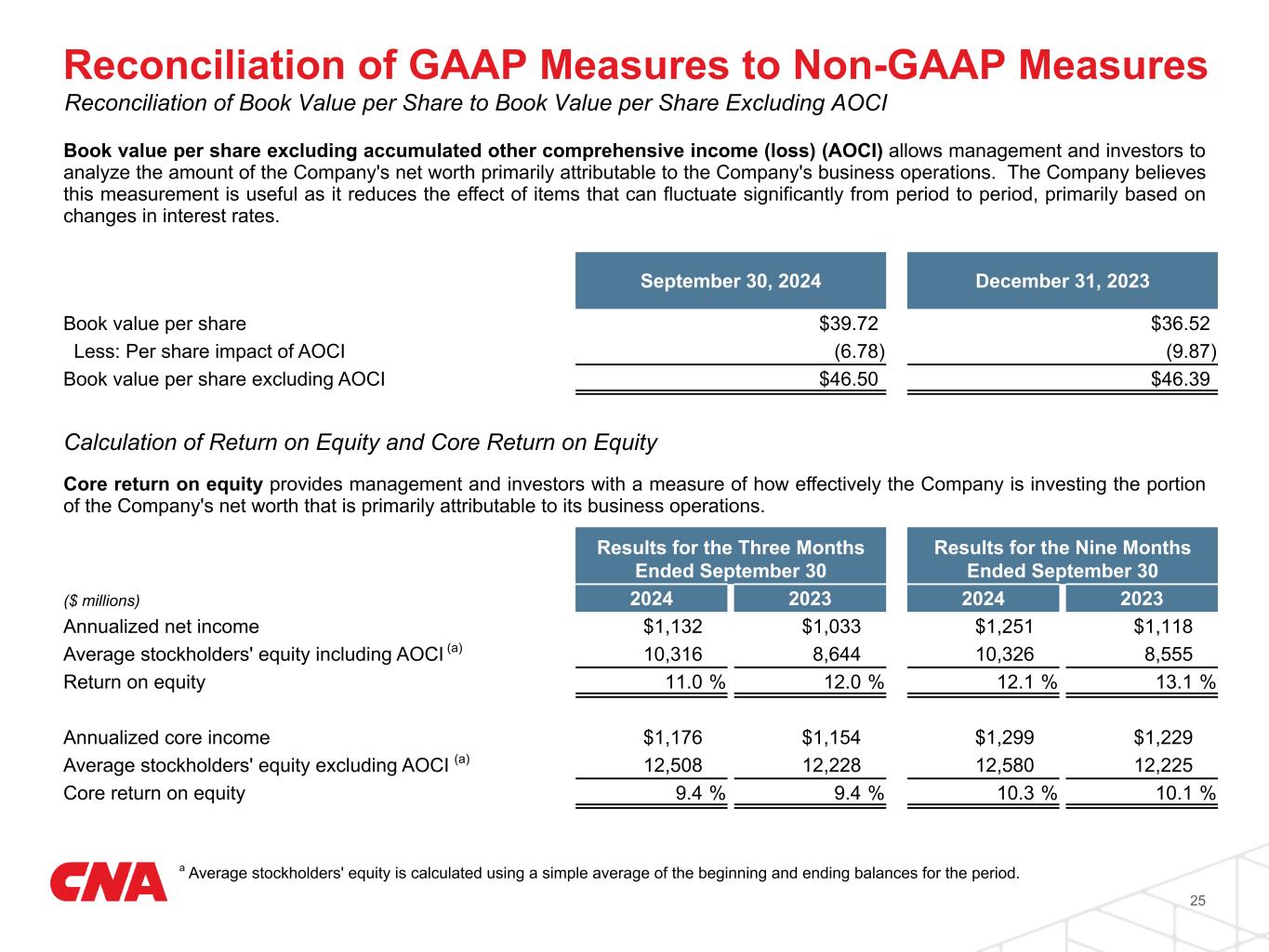

| September 30, 2024 | December 31, 2023 | ||||||||||

| Book value per share | $ | 39.72 | $ | 36.52 | |||||||

| Less: Per share impact of AOCI | (6.78) | (9.87) | |||||||||

| Book value per share excluding AOCI | $ | 46.50 | $ | 46.39 | |||||||

| Results for the Three Months Ended September 30 | Results for the Nine Months Ended September 30 | |||||||||||||||||||||||||

| ($ millions) | 2024 | 2023 | 2024 | 2023 | ||||||||||||||||||||||

| Annualized net income | $ | 1,132 | $ | 1,033 | $ | 1,251 | $ | 1,118 | ||||||||||||||||||

Average stockholders' equity including AOCI (a) |

10,316 | 8,644 | 10,326 | 8,555 | ||||||||||||||||||||||

| Return on equity | 11.0 | % | 11.9 | % | 12.1 | % | 13.1 | % | ||||||||||||||||||

| Annualized core income | $ | 1,176 | $ | 1,154 | $ | 1,299 | $ | 1,229 | ||||||||||||||||||

Average stockholders' equity excluding AOCI (a) |

12,508 | 12,228 | 12,580 | 12,225 | ||||||||||||||||||||||

| Core return on equity | 9.4 | % | 9.4 | 10.3 | % | 10.1 | % | |||||||||||||||||||

| Page | |||||

| Consolidated Results | |||||

| Results of Operations | |||||

| Investment Information | |||||

| Other | |||||

| Periods ended September 30 | Three Months | Nine Months | |||||||||||||||||||||||||||||||||||||||

| (In millions) | 2024 | 2023 | Change | 2024 | 2023 | Change | |||||||||||||||||||||||||||||||||||

| Revenues: | |||||||||||||||||||||||||||||||||||||||||

| Net earned premiums | $ | 2,593 | $ | 2,406 | 8 | % | $ | 7,532 | $ | 7,001 | 8 | % | |||||||||||||||||||||||||||||

| Net investment income | 626 | 553 | 13 | 1,853 | 1,653 | 12 | |||||||||||||||||||||||||||||||||||

| Net investment (losses) gains | (10) | (38) | (42) | (105) | |||||||||||||||||||||||||||||||||||||

| Non-insurance warranty revenue | 401 | 407 | 1,212 | 1,221 | |||||||||||||||||||||||||||||||||||||

| Other revenues | 8 | 8 | 26 | 22 | |||||||||||||||||||||||||||||||||||||

| Total revenues | 3,618 | 3,336 | 8 | 10,581 | 9,792 | 8 | |||||||||||||||||||||||||||||||||||

| Claims, Benefits and Expenses: | |||||||||||||||||||||||||||||||||||||||||

Insurance claims and policyholders’ benefits (re-measurement loss of $(48), $(41), $(88) and $(75)) |

2,019 | 1,826 | 5,708 | 5,258 | |||||||||||||||||||||||||||||||||||||

| Amortization of deferred acquisition costs | 457 | 426 | 1,336 | 1,208 | |||||||||||||||||||||||||||||||||||||

| Non-insurance warranty expense | 387 | 386 | 1,169 | 1,154 | |||||||||||||||||||||||||||||||||||||

| Other operating expenses | 362 | 338 | 1,077 | 1,021 | |||||||||||||||||||||||||||||||||||||

| Interest | 32 | 34 | 101 | 93 | |||||||||||||||||||||||||||||||||||||

| Total claims, benefits and expenses | 3,257 | 3,010 | (8) | 9,391 | 8,734 | (8) | |||||||||||||||||||||||||||||||||||

| Income (loss) before income tax | 361 | 326 | 1,190 | 1,058 | |||||||||||||||||||||||||||||||||||||

| Income tax (expense) benefit | (78) | (68) | (252) | (220) | |||||||||||||||||||||||||||||||||||||

| Net income (loss) | $ | 283 | $ | 258 | 10 | % | $ | 938 | $ | 838 | 12 | % | |||||||||||||||||||||||||||||

1

1| Periods ended September 30 | Three Months | Nine Months | |||||||||||||||||||||||||||

| (In millions, except per share data) | 2024 | 2023 | 2024 | 2023 | |||||||||||||||||||||||||

| Components of Income (Loss) | |||||||||||||||||||||||||||||

| Core income (loss) | $ | 293 | $ | 289 | $ | 974 | $ | 922 | |||||||||||||||||||||

| Net investment gains (losses) | (7) | (31) | (33) | (84) | |||||||||||||||||||||||||

| Pension settlement transaction gains (losses) | (3) | — | (3) | — | |||||||||||||||||||||||||

| Net income (loss) | $ | 283 | $ | 258 | $ | 938 | $ | 838 | |||||||||||||||||||||

| Diluted Earnings (Loss) Per Common Share | |||||||||||||||||||||||||||||

| Core income (loss) | $ | 1.08 | $ | 1.06 | $ | 3.57 | $ | 3.39 | |||||||||||||||||||||

| Net investment gains (losses) | (0.03) | (0.11) | (0.12) | (0.31) | |||||||||||||||||||||||||

| Pension settlement transaction gains (losses) | (0.01) | — | (0.01) | — | |||||||||||||||||||||||||

| Diluted earnings (loss) per share | $ | 1.04 | $ | 0.95 | $ | 3.44 | $ | 3.08 | |||||||||||||||||||||

| Weighted Average Outstanding Common Stock and Common Stock Equivalents | |||||||||||||||||||||||||||||

| Basic | 271.3 | 271.2 | 271.5 | 271.2 | |||||||||||||||||||||||||

| Diluted | 272.7 | 272.3 | 272.7 | 272.2 | |||||||||||||||||||||||||

| Return on Equity | |||||||||||||||||||||||||||||

Net income (loss) (1) |

11.0 | % | 11.9 | % | 12.1 | % | 13.1 | % | |||||||||||||||||||||

Core income (loss) (2) |

9.4 | 9.4 | 10.3 | 10.1 | |||||||||||||||||||||||||

2

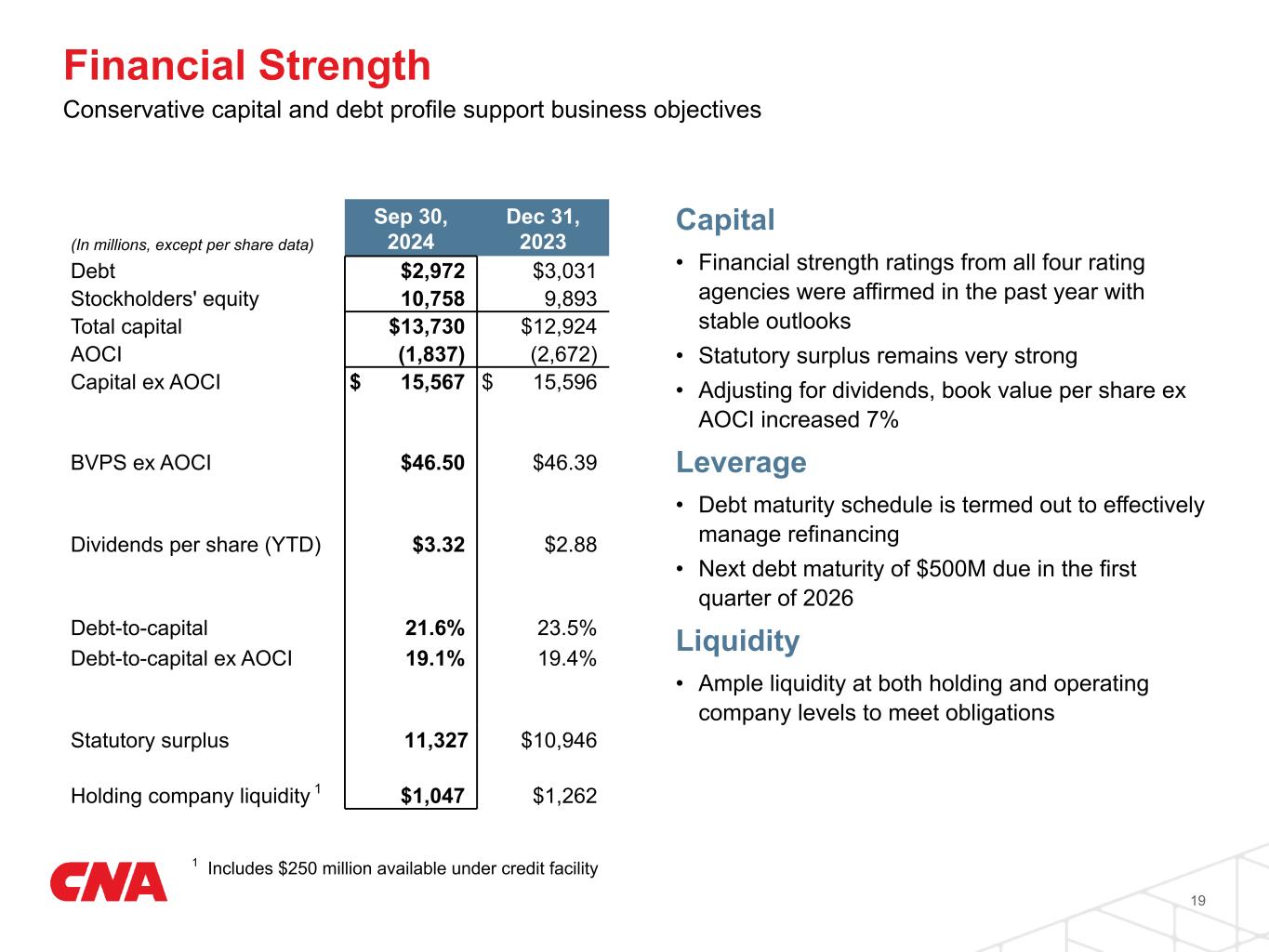

2| (In millions, except per share data) | September 30, 2024 | December 31, 2023 | |||||||||

| Total investments | $ | 48,695 | $ | 46,562 | |||||||

| Reinsurance receivables, net of allowance for uncollectible receivables | 5,798 | 5,412 | |||||||||

| Total assets | 67,356 | 64,711 | |||||||||

| Insurance reserves | 45,864 | 44,196 | |||||||||

| Claim and claim adjustment expenses | 24,558 | 23,304 | |||||||||

| Unearned premiums | 7,259 | 6,933 | |||||||||

| Future policy benefits | 14,047 | 13,959 | |||||||||

| Debt | 2,972 | 3,031 | |||||||||

| Total liabilities | 56,598 | 54,818 | |||||||||

Accumulated other comprehensive income (loss) (1) |

(1,837) | (2,672) | |||||||||

| Total stockholders' equity | 10,758 | 9,893 | |||||||||

| Book value per common share | $ | 39.72 | $ | 36.52 | |||||||

| Book value per common share excluding AOCI | $ | 46.50 | $ | 46.39 | |||||||

| Outstanding shares of common stock (in millions of shares) | 270.8 | 270.9 | |||||||||

Statutory capital and surplus - Combined Continental Casualty Companies (2) |

$ | 11,327 | $ | 10,946 | |||||||

| Three Months Ended September 30 | 2024 | 2023 | |||||||||

| Net cash flows provided (used) by operating activities | $ | 748 | $ | 828 | |||||||

| Net cash flows provided (used) by investing activities | (553) | (679) | |||||||||

| Net cash flows provided (used) by financing activities | (120) | (18) | |||||||||

| Net cash flows provided (used) by operating, investing and financing activities | $ | 75 | $ | 131 | |||||||

| Nine Months Ended September 30 | 2024 | 2023 | |||||||||

| Net cash flows provided (used) by operating activities | $ | 1,868 | $ | 1,765 | |||||||

| Net cash flows provided (used) by investing activities | (762) | (1,537) | |||||||||

| Net cash flows provided (used) by financing activities | (998) | (218) | |||||||||

| Net cash flows provided (used) by operating, investing and financing activities | $ | 108 | $ | 10 | |||||||

3

3| Periods ended September 30 | Three Months | Nine Months | |||||||||||||||||||||||||||||||||||||||

| (In millions) | 2024 | 2023 | Change | 2024 | 2023 | Change | |||||||||||||||||||||||||||||||||||

| Gross written premiums | $ | 3,595 | $ | 3,424 | 5 | % | $ | 11,409 | $ | 10,953 | 4 | % | |||||||||||||||||||||||||||||

Gross written premiums ex. 3rd party captives |

2,825 | 2,595 | 9 | 8,964 | 8,305 | 8 | |||||||||||||||||||||||||||||||||||

| Net written premiums | 2,360 | 2,178 | 8 | 7,424 | 6,938 | 7 | |||||||||||||||||||||||||||||||||||

| Net earned premiums | 2,484 | 2,295 | 8 | 7,204 | 6,662 | 8 | |||||||||||||||||||||||||||||||||||

| Insurance claims and policyholders' benefits | 1,667 | 1,473 | 4,700 | 4,228 | |||||||||||||||||||||||||||||||||||||

| Amortization of deferred acquisition costs | 457 | 426 | 1,336 | 1,208 | |||||||||||||||||||||||||||||||||||||

| Other insurance related expenses | 292 | 265 | 850 | 827 | |||||||||||||||||||||||||||||||||||||

| Underwriting gain (loss) | 68 | 131 | (48) | 318 | 399 | (20) | |||||||||||||||||||||||||||||||||||

| Net investment income | 372 | 318 | 17 | 1,090 | 951 | 15 | |||||||||||||||||||||||||||||||||||

| Non-insurance warranty revenue | 401 | 407 | 1,212 | 1,221 | |||||||||||||||||||||||||||||||||||||

| Other revenues | 6 | 8 | 24 | 22 | |||||||||||||||||||||||||||||||||||||

| Non-insurance warranty expense | 387 | 386 | 1,169 | 1,154 | |||||||||||||||||||||||||||||||||||||

| Other expenses | 13 | 30 | 69 | 68 | |||||||||||||||||||||||||||||||||||||

| Core income (loss) before income tax | 447 | 448 | 1,406 | 1,371 | |||||||||||||||||||||||||||||||||||||

| Income tax (expense) benefit on core income (loss) | (101) | (97) | (308) | (300) | |||||||||||||||||||||||||||||||||||||

| Core income (loss) | $ | 346 | $ | 351 | (1) | % | $ | 1,098 | $ | 1,071 | 3 | % | |||||||||||||||||||||||||||||

| Other Performance Metrics | |||||||||||||||||||||||||||||||||||||||||

| Underwriting gain (loss) | $ | 68 | $ | 131 | (48) | % | $ | 318 | $ | 399 | (20) | % | |||||||||||||||||||||||||||||

| Effect of catastrophe losses | 143 | 94 | 313 | 214 | |||||||||||||||||||||||||||||||||||||

| Effect of (favorable) unfavorable development-related items | (2) | (5) | (13) | 4 | |||||||||||||||||||||||||||||||||||||

| Underlying underwriting gain (loss) | $ | 209 | $ | 220 | (5) | % | $ | 618 | $ | 617 | — | % | |||||||||||||||||||||||||||||

| Loss & LAE ratio | 66.7 | % | 63.9 | % | (2.8) | pts | 64.9 | % | 63.1 | % | (1.8) | pts | |||||||||||||||||||||||||||||

| Expense ratio | 30.2 | 30.1 | (0.1) | 30.3 | 30.6 | 0.3 | |||||||||||||||||||||||||||||||||||

| Dividend ratio | 0.3 | 0.3 | — | 0.4 | 0.3 | (0.1) | |||||||||||||||||||||||||||||||||||

| Combined ratio | 97.2 | % | 94.3 | % | (2.9) | pts | 95.6 | % | 94.0 | % | (1.6) | pts | |||||||||||||||||||||||||||||

| Effect of catastrophe impacts | (5.8) | (4.1) | 1.7 | (4.3) | (3.2) | 1.1 | |||||||||||||||||||||||||||||||||||

| Effect of development-related items | 0.2 | 0.2 | — | 0.2 | — | (0.2) | |||||||||||||||||||||||||||||||||||

| Underlying combined ratio | 91.6 | % | 90.4 | % | (1.2) | pts | 91.5 | % | 90.8 | % | (0.7) | pts | |||||||||||||||||||||||||||||

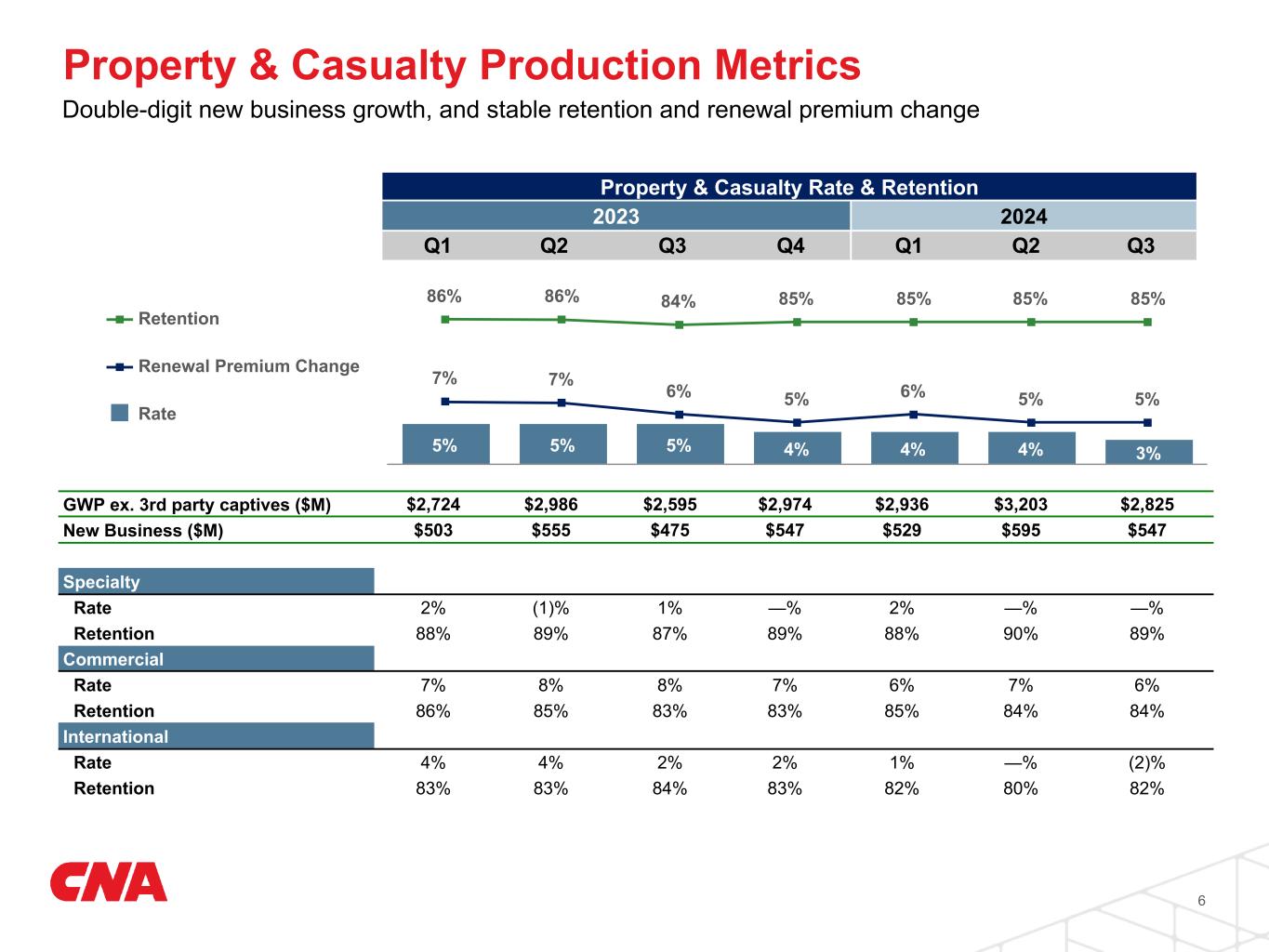

| Rate | 3 | % | 5 | % | (2) | pts | 4 | % | 5 | % | (1) | pts | |||||||||||||||||||||||||||||

| Renewal premium change | 5 | % | 6 | % | (1) | pts | 5 | % | 7 | % | (2) | pts | |||||||||||||||||||||||||||||

| Retention | 85 | % | 84 | % | 1 | pts | 85 | % | 85 | % | — | pts | |||||||||||||||||||||||||||||

| New business | $ | 547 | $ | 475 | 15 | % | $ | 1,671 | $ | 1,533 | 9 | % | |||||||||||||||||||||||||||||

4

4| Periods ended September 30 | Three Months | Nine Months | |||||||||||||||||||||||||||||||||||||||

| (In millions) | 2024 | 2023 | Change | 2024 | 2023 | Change | |||||||||||||||||||||||||||||||||||

| Gross written premiums | $ | 1,743 | $ | 1,775 | (2) | % | $ | 5,153 | $ | 5,324 | (3) | % | |||||||||||||||||||||||||||||

Gross written premiums ex. 3rd party captives |

982 | 949 | 3 | 2,846 | 2,796 | 2 | |||||||||||||||||||||||||||||||||||

| Net written premiums | 862 | 825 | 4 | 2,511 | 2,438 | 3 | |||||||||||||||||||||||||||||||||||

| Net earned premiums | 848 | 829 | 2 | 2,493 | 2,438 | 2 | |||||||||||||||||||||||||||||||||||

| Insurance claims and policyholders' benefits | 511 | 482 | 1,485 | 1,424 | |||||||||||||||||||||||||||||||||||||

| Amortization of deferred acquisition costs | 188 | 175 | 546 | 508 | |||||||||||||||||||||||||||||||||||||

| Other insurance related expenses | 90 | 89 | 267 | 269 | |||||||||||||||||||||||||||||||||||||

| Underwriting gain (loss) | 59 | 83 | (29) | 195 | 237 | (18) | |||||||||||||||||||||||||||||||||||

| Net investment income | 157 | 136 | 15 | 461 | 407 | 13 | |||||||||||||||||||||||||||||||||||

| Non-insurance warranty revenue | 401 | 407 | 1,212 | 1,221 | |||||||||||||||||||||||||||||||||||||

| Other revenues | 1 | — | 1 | — | |||||||||||||||||||||||||||||||||||||

| Non-insurance warranty expense | 387 | 386 | 1,169 | 1,154 | |||||||||||||||||||||||||||||||||||||

| Other expenses | 13 | 13 | 41 | 39 | |||||||||||||||||||||||||||||||||||||

| Core income (loss) before income tax | 218 | 227 | 659 | 672 | |||||||||||||||||||||||||||||||||||||

| Income tax (expense) benefit on core income (loss) | (47) | (49) | (142) | (146) | |||||||||||||||||||||||||||||||||||||

| Core income (loss) | $ | 171 | $ | 178 | (4) | % | $ | 517 | $ | 526 | (2) | % | |||||||||||||||||||||||||||||

| Other Performance Metrics | |||||||||||||||||||||||||||||||||||||||||

| Underwriting gain (loss) | $ | 59 | $ | 83 | (29) | % | $ | 195 | $ | 237 | (18) | % | |||||||||||||||||||||||||||||

| Effect of catastrophe losses | — | — | — | — | |||||||||||||||||||||||||||||||||||||

| Effect of (favorable) unfavorable development-related items | — | (5) | (8) | (7) | |||||||||||||||||||||||||||||||||||||

| Underlying underwriting gain (loss) | $ | 59 | $ | 78 | (24) | % | $ | 187 | $ | 230 | (19) | % | |||||||||||||||||||||||||||||

| Loss & LAE ratio | 60.1 | % | 58.0 | % | (2.1) | pts | 59.3 | % | 58.2 | % | (1.1) | pts | |||||||||||||||||||||||||||||

| Expense ratio | 32.7 | 31.8 | (0.9) | 32.5 | 31.9 | (0.6) | |||||||||||||||||||||||||||||||||||

| Dividend ratio | 0.2 | 0.3 | 0.1 | 0.3 | 0.2 | (0.1) | |||||||||||||||||||||||||||||||||||

| Combined ratio | 93.0 | % | 90.1 | % | (2.9) | pts | 92.1 | % | 90.3 | % | (1.8) | pts | |||||||||||||||||||||||||||||

| Effect of catastrophe impacts | — | — | — | — | — | — | |||||||||||||||||||||||||||||||||||

| Effect of development-related items | — | 0.6 | 0.6 | 0.3 | 0.3 | — | |||||||||||||||||||||||||||||||||||

| Underlying combined ratio | 93.0 | % | 90.7 | % | (2.3) | pts | 92.4 | % | 90.6 | % | (1.8) | pts | |||||||||||||||||||||||||||||

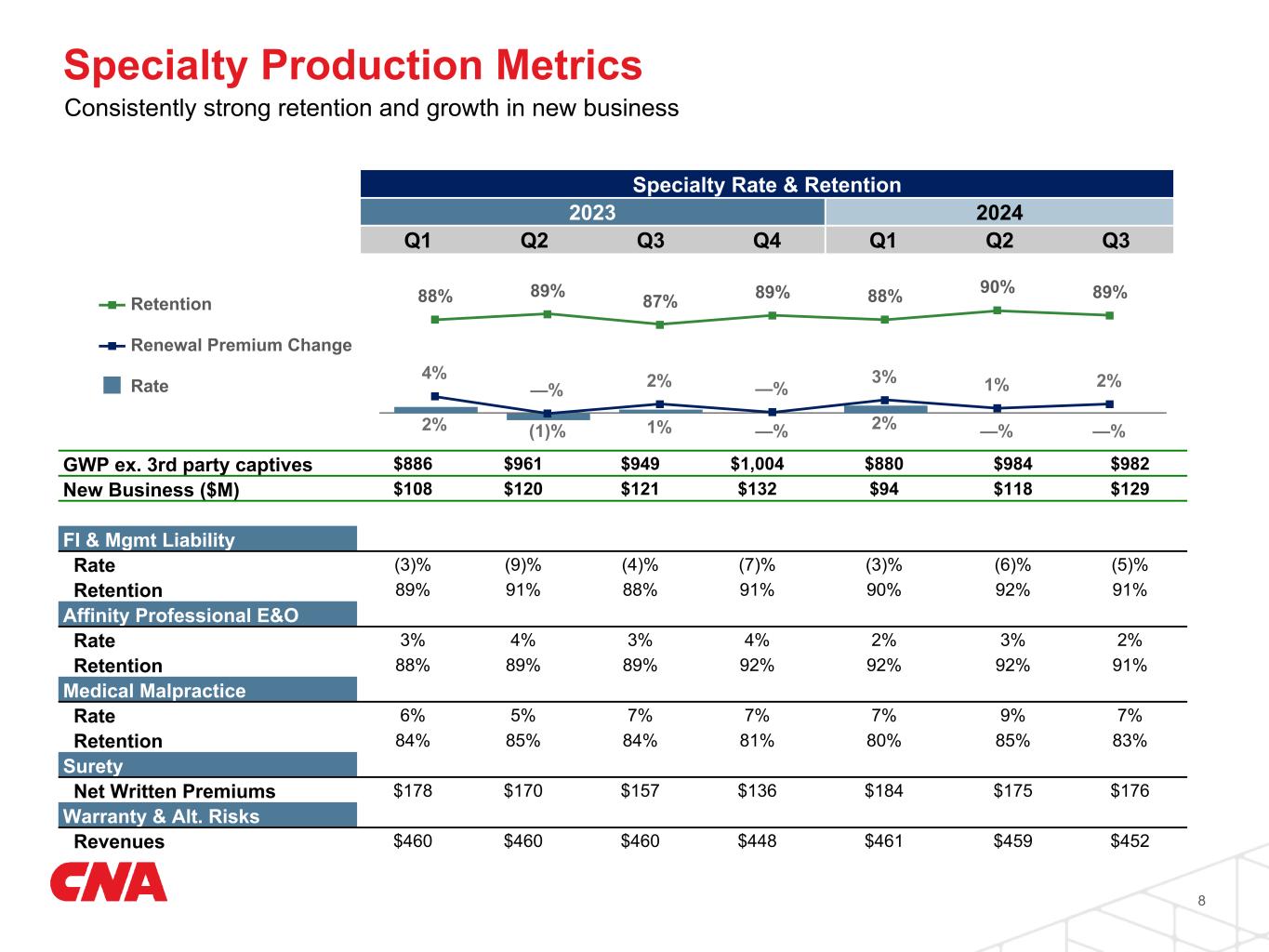

| Rate | — | % | 1 | % | (1) | pts | 1 | % | 1 | % | — | pts | |||||||||||||||||||||||||||||

| Renewal premium change | 2 | % | 2 | % | — | pts | 2 | % | 2 | % | — | pts | |||||||||||||||||||||||||||||

| Retention | 89 | % | 87 | % | 2 | pts | 89 | % | 88 | % | 1 | pts | |||||||||||||||||||||||||||||

| New business | $ | 129 | $ | 121 | 7 | % | $ | 341 | $ | 349 | (2) | % | |||||||||||||||||||||||||||||

5

5| Periods ended September 30 | Three Months | Nine Months | |||||||||||||||||||||||||||||||||||||||

| (In millions) | 2024 | 2023 | Change | 2024 | 2023 | Change | |||||||||||||||||||||||||||||||||||

| Gross written premiums | $ | 1,547 | $ | 1,343 | 15 | % | $ | 5,160 | $ | 4,504 | 15 | % | |||||||||||||||||||||||||||||

Gross written premiums ex. 3rd party captives |

1,538 | 1,340 | 15 | 5,022 | 4,384 | 15 | |||||||||||||||||||||||||||||||||||

| Net written premiums | 1,221 | 1,071 | 14 | 4,017 | 3,588 | 12 | |||||||||||||||||||||||||||||||||||

| Net earned premiums | 1,325 | 1,170 | 13 | 3,774 | 3,336 | 13 | |||||||||||||||||||||||||||||||||||

| Insurance claims and policyholders' benefits | 961 | 813 | 2,647 | 2,252 | |||||||||||||||||||||||||||||||||||||

| Amortization of deferred acquisition costs | 209 | 188 | 608 | 532 | |||||||||||||||||||||||||||||||||||||

| Other insurance related expenses | 158 | 156 | 454 | 456 | |||||||||||||||||||||||||||||||||||||

| Underwriting gain (loss) | (3) | 13 | (123) | 65 | 96 | (32) | |||||||||||||||||||||||||||||||||||

| Net investment income | 183 | 156 | 17 | 534 | 470 | 14 | |||||||||||||||||||||||||||||||||||

| Other revenues | 5 | 9 | 23 | 22 | |||||||||||||||||||||||||||||||||||||

| Other expenses | 8 | 11 | 33 | 27 | |||||||||||||||||||||||||||||||||||||

| Core income (loss) before income tax | 177 | 167 | 589 | 561 | |||||||||||||||||||||||||||||||||||||

| Income tax (expense) benefit on core income (loss) | (38) | (34) | (125) | (118) | |||||||||||||||||||||||||||||||||||||

| Core income (loss) | $ | 139 | $ | 133 | 5 | % | $ | 464 | $ | 443 | 5 | % | |||||||||||||||||||||||||||||

| Other Performance Metrics | |||||||||||||||||||||||||||||||||||||||||

| Underwriting gain (loss) | $ | (3) | $ | 13 | (123) | % | $ | 65 | $ | 96 | (32) | % | |||||||||||||||||||||||||||||

| Effect of catastrophe losses | 127 | 87 | 285 | 190 | |||||||||||||||||||||||||||||||||||||

| Effect of (favorable) unfavorable development-related items | — | — | — | (4) | |||||||||||||||||||||||||||||||||||||

| Underlying underwriting gain (loss) | $ | 124 | $ | 100 | 24 | % | $ | 350 | $ | 282 | 24 | % | |||||||||||||||||||||||||||||

| Loss & LAE ratio | 72.0 | % | 68.9 | % | (3.1) | pts | 69.7 | % | 67.0 | % | (2.7) | pts | |||||||||||||||||||||||||||||

| Expense ratio | 27.7 | 29.5 | 1.8 | 28.1 | 29.6 | 1.5 | |||||||||||||||||||||||||||||||||||

| Dividend ratio | 0.5 | 0.5 | — | 0.5 | 0.5 | — | |||||||||||||||||||||||||||||||||||

| Combined ratio | 100.2 | % | 98.9 | % | (1.3) | pts | 98.3 | % | 97.1 | % | (1.2) | pts | |||||||||||||||||||||||||||||

| Effect of catastrophe impacts | (9.6) | (7.4) | 2.2 | (7.5) | (5.7) | 1.8 | |||||||||||||||||||||||||||||||||||

| Effect of development-related items | 0.1 | — | (0.1) | — | 0.2 | 0.2 | |||||||||||||||||||||||||||||||||||

| Underlying combined ratio | 90.7 | % | 91.5 | % | 0.8 | pts | 90.8 | % | 91.6 | % | 0.8 | pts | |||||||||||||||||||||||||||||

| Rate | 6 | % | 8 | % | (2) | pts | 6 | % | 8 | % | (2) | pts | |||||||||||||||||||||||||||||

| Renewal premium change | 8 | % | 9 | % | (1) | pts | 8 | % | 10 | % | (2) | pts | |||||||||||||||||||||||||||||

| Retention | 84 | % | 83 | % | 1 | pts | 84 | % | 85 | % | (1) | pts | |||||||||||||||||||||||||||||

| New business | $ | 345 | $ | 292 | 18 | % | $ | 1,117 | $ | 945 | 18 | % | |||||||||||||||||||||||||||||

6

6| Periods ended September 30 | Three Months | Nine Months | |||||||||||||||||||||||||||||||||||||||

| (In millions) | 2024 | 2023 | Change | 2024 | 2023 | Change | |||||||||||||||||||||||||||||||||||

| Gross written premiums | $ | 305 | $ | 306 | — | % | $ | 1,096 | $ | 1,125 | (3) | % | |||||||||||||||||||||||||||||

| Net written premiums | 277 | 282 | (2) | 896 | 912 | (2) | |||||||||||||||||||||||||||||||||||

| Net earned premiums | 311 | 296 | 5 | 937 | 888 | 6 | |||||||||||||||||||||||||||||||||||

| Insurance claims and policyholders' benefits | 195 | 178 | 568 | 552 | |||||||||||||||||||||||||||||||||||||

| Amortization of deferred acquisition costs | 60 | 63 | 182 | 168 | |||||||||||||||||||||||||||||||||||||

| Other insurance related expenses | 44 | 20 | 129 | 102 | |||||||||||||||||||||||||||||||||||||

| Underwriting gain (loss) | 12 | 35 | (66) | 58 | 66 | (12) | |||||||||||||||||||||||||||||||||||

| Net investment income | 32 | 26 | 23 | 95 | 74 | 28 | |||||||||||||||||||||||||||||||||||

| Other revenues | — | (1) | — | — | |||||||||||||||||||||||||||||||||||||

| Other expenses | (8) | 6 | (5) | 2 | |||||||||||||||||||||||||||||||||||||

| Core income (loss) before income tax | 52 | 54 | 158 | 138 | |||||||||||||||||||||||||||||||||||||

| Income tax (expense) benefit on core income (loss) | (16) | (14) | (41) | (36) | |||||||||||||||||||||||||||||||||||||

| Core income (loss) | $ | 36 | $ | 40 | (10) | % | $ | 117 | $ | 102 | 15 | % | |||||||||||||||||||||||||||||

| Other Performance Metrics | |||||||||||||||||||||||||||||||||||||||||

| Underwriting gain (loss) | $ | 12 | $ | 35 | (66) | % | $ | 58 | $ | 66 | (12) | % | |||||||||||||||||||||||||||||

| Effect of catastrophe losses | 16 | 7 | 28 | 24 | |||||||||||||||||||||||||||||||||||||

| Effect of (favorable) unfavorable development-related items | (2) | — | (5) | 15 | |||||||||||||||||||||||||||||||||||||

| Underlying underwriting gain (loss) | $ | 26 | $ | 42 | (38) | % | $ | 81 | $ | 105 | (23) | % | |||||||||||||||||||||||||||||

| Loss & LAE ratio | 62.5 | % | 60.2 | % | (2.3) | pts | 60.6 | % | 62.2 | % | 1.6 | pts | |||||||||||||||||||||||||||||

| Expense ratio | 33.6 | 28.1 | (5.5) | 33.1 | 30.3 | (2.8) | |||||||||||||||||||||||||||||||||||

| Dividend ratio | — | — | — | — | — | — | |||||||||||||||||||||||||||||||||||

| Combined ratio | 96.1 | % | 88.3 | % | (7.8) | pts | 93.7 | % | 92.5 | % | (1.2) | pts | |||||||||||||||||||||||||||||

| Effect of catastrophe impacts | (5.1) | (2.3) | 2.8 | (3.0) | (2.7) | 0.3 | |||||||||||||||||||||||||||||||||||

| Effect of development-related items | 0.7 | — | (0.7) | 0.5 | (1.7) | (2.2) | |||||||||||||||||||||||||||||||||||

| Underlying combined ratio | 91.7 | % | 86.0 | % | (5.7) | pts | 91.2 | % | 88.1 | % | (3.1) | pts | |||||||||||||||||||||||||||||

| Rate | (2) | % | 2 | % | (4) | pts | — | % | 4 | % | (4) | pts | |||||||||||||||||||||||||||||

| Renewal premium change | 1 | % | 7 | % | (6) | pts | 2 | % | 7 | % | (5) | pts | |||||||||||||||||||||||||||||

| Retention | 82 | % | 84 | % | (2) | pts | 81 | % | 83 | % | (2) | pts | |||||||||||||||||||||||||||||

| New business | $ | 73 | $ | 62 | 18 | % | $ | 213 | $ | 239 | (11) | % | |||||||||||||||||||||||||||||

7

7| Periods ended September 30 | Three Months | Nine Months | ||||||||||||||||||||||||

| (In millions) | 2024 | 2023 | 2024 | 2023 | ||||||||||||||||||||||

| Net earned premiums | $ | 110 | $ | 112 | $ | 329 | $ | 340 | ||||||||||||||||||

| Net investment income | 240 | 216 | 710 | 659 | ||||||||||||||||||||||

| Other revenues | — | — | — | — | ||||||||||||||||||||||

| Total operating revenues | 350 | 328 | 1,039 | 999 | ||||||||||||||||||||||

| Insurance claims and policyholders' benefits | 336 | 343 | 973 | 998 | ||||||||||||||||||||||

| Other insurance related expenses | 30 | 29 | 88 | 89 | ||||||||||||||||||||||

| Other expenses | 1 | (1) | 2 | — | ||||||||||||||||||||||

| Total claims, benefits and expenses | 367 | 371 | 1,063 | 1,087 | ||||||||||||||||||||||

| Core income (loss) before income tax | (17) | (43) | (24) | (88) | ||||||||||||||||||||||

| Income tax (expense) benefit on core income (loss) | 8 | 14 | 19 | 36 | ||||||||||||||||||||||

| Core income (loss) | $ | (9) | $ | (29) | $ | (5) | $ | (52) | ||||||||||||||||||

8

8| Periods ended September 30 | Three Months | Nine Months | ||||||||||||||||||||||||

| (In millions) | 2024 | 2023 | 2024 | 2023 | ||||||||||||||||||||||

| Net earned premiums | $ | (1) | $ | (1) | $ | (1) | $ | (1) | ||||||||||||||||||

| Net investment income | 14 | 19 | 53 | 43 | ||||||||||||||||||||||

| Other revenues | 2 | — | 2 | — | ||||||||||||||||||||||

| Total operating revenues | 15 | 18 | 54 | 42 | ||||||||||||||||||||||

| Insurance claims and policyholders' benefits | 16 | 10 | 35 | 32 | ||||||||||||||||||||||

| Other insurance related expenses | (1) | — | (1) | 1 | ||||||||||||||||||||||

| Interest expense | 32 | 35 | 101 | 93 | ||||||||||||||||||||||

| Other expenses | 23 | 14 | 65 | 36 | ||||||||||||||||||||||

| Total claims, benefits and expenses | 70 | 59 | 200 | 162 | ||||||||||||||||||||||

| Core income (loss) before income tax | (55) | (41) | (146) | (120) | ||||||||||||||||||||||

| Income tax (expense) benefit on core income (loss) | 11 | 8 | 27 | 23 | ||||||||||||||||||||||

| Core income (loss) | $ | (44) | $ | (33) | $ | (119) | $ | (97) | ||||||||||||||||||

9

9| September 30, 2024 | June 30, 2024 | December 31, 2023 | |||||||||||||||||||||||||||||||||

| (In millions) | Carrying Value | Net Unrealized Gains (Losses) | Carrying Value | Net Unrealized Gains (Losses) | Carrying Value | Net Unrealized Gains (Losses) | |||||||||||||||||||||||||||||

| Fixed maturity securities: | |||||||||||||||||||||||||||||||||||

| Corporate and other bonds | $ | 25,792 | $ | (74) | $ | 24,372 | $ | (1,095) | $ | 24,268 | $ | (748) | |||||||||||||||||||||||

| States, municipalities and political subdivisions: | |||||||||||||||||||||||||||||||||||

| Tax-exempt | 3,333 | 65 | 3,333 | (33) | 3,722 | 88 | |||||||||||||||||||||||||||||

| Taxable | 3,815 | (323) | 3,696 | (498) | 3,670 | (409) | |||||||||||||||||||||||||||||

| Total states, municipalities and political subdivisions | 7,148 | (258) | 7,029 | (531) | 7,392 | (321) | |||||||||||||||||||||||||||||

| Asset-backed: | |||||||||||||||||||||||||||||||||||

| RMBS | 3,354 | (330) | 3,115 | (487) | 3,002 | (409) | |||||||||||||||||||||||||||||

| CMBS | 1,741 | (126) | 1,611 | (179) | 1,631 | (223) | |||||||||||||||||||||||||||||

| Other ABS | 3,585 | (146) | 3,379 | (243) | 3,268 | (243) | |||||||||||||||||||||||||||||

| Total asset-backed | 8,680 | (602) | 8,105 | (909) | 7,901 | (875) | |||||||||||||||||||||||||||||

| U.S. Treasury and obligations of government-sponsored enterprises | 222 | (2) | 191 | (2) | 151 | (1) | |||||||||||||||||||||||||||||

| Foreign government | 737 | (18) | 706 | (36) | 713 | (28) | |||||||||||||||||||||||||||||

| Redeemable preferred stock | — | — | — | — | — | — | |||||||||||||||||||||||||||||

| Total fixed maturity securities | 42,579 | (954) | 40,403 | (2,573) | 40,425 | (1,973) | |||||||||||||||||||||||||||||

| Equities: | |||||||||||||||||||||||||||||||||||

| Common stock | 183 | — | 180 | — | 191 | — | |||||||||||||||||||||||||||||

| Non-redeemable preferred stock | 485 | — | 489 | — | 492 | — | |||||||||||||||||||||||||||||

| Total equities | 668 | — | 669 | — | 683 | — | |||||||||||||||||||||||||||||

| Limited partnership investments: | |||||||||||||||||||||||||||||||||||

| Hedge funds | 356 | — | 347 | — | 332 | — | |||||||||||||||||||||||||||||

| Private equity funds | 2,106 | — | 2,020 | — | 1,842 | — | |||||||||||||||||||||||||||||

| Total limited partnership investments | 2,462 | — | 2,367 | — | 2,174 | — | |||||||||||||||||||||||||||||

| Other invested assets | 83 | — | 73 | — | 80 | — | |||||||||||||||||||||||||||||

| Mortgage loans | 1,003 | — | 986 | — | 1,035 | — | |||||||||||||||||||||||||||||

| Short-term investments | 1,900 | — | 1,747 | — | 2,165 | 1 | |||||||||||||||||||||||||||||

| Total investments | $ | 48,695 | $ | (954) | $ | 46,245 | $ | (2,573) | $ | 46,562 | $ | (1,972) | |||||||||||||||||||||||

| Net receivable/(payable) on investment activity | $ | (93) | $ | (6) | $ | 36 | |||||||||||||||||||||||||||||

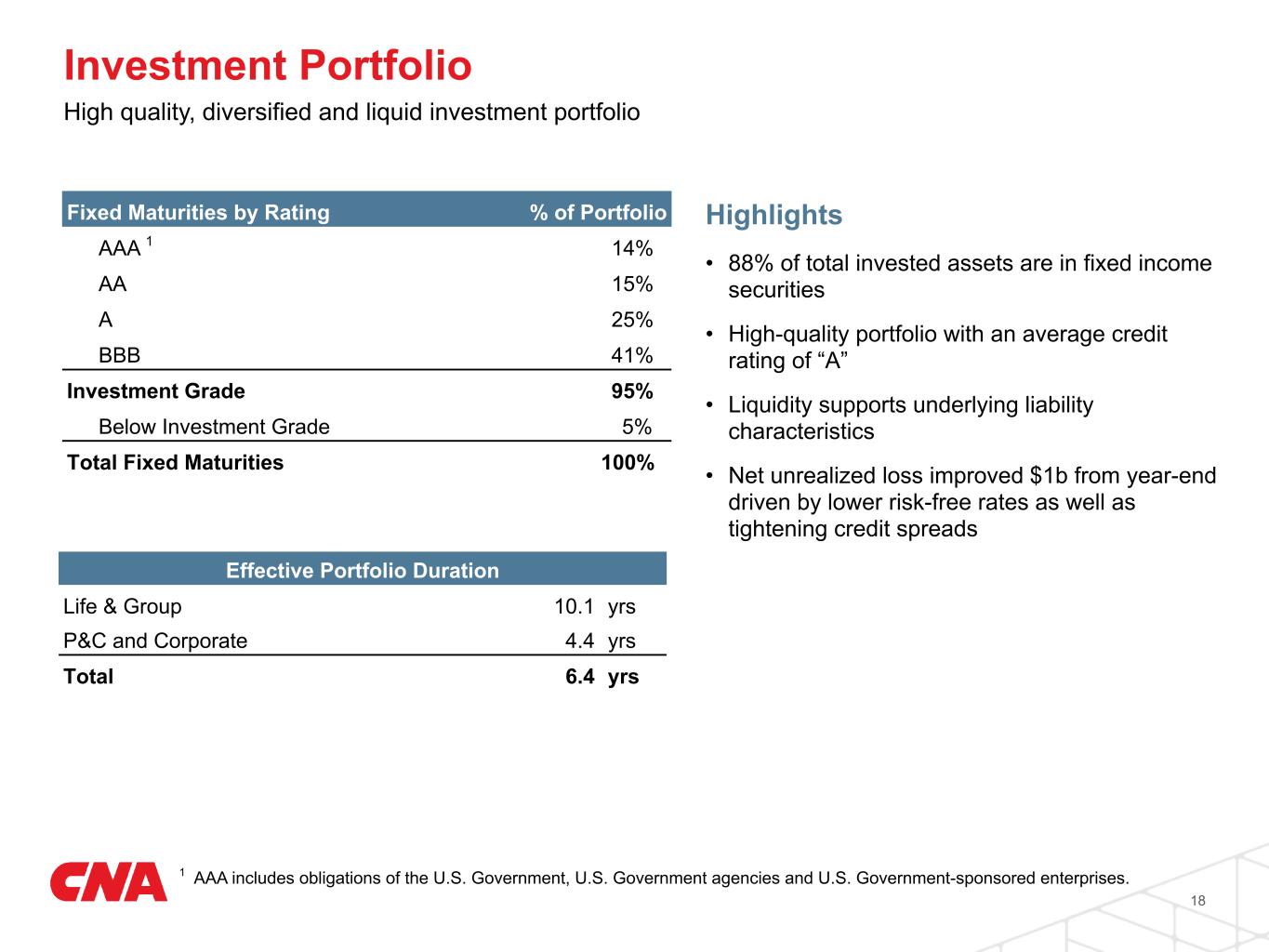

| Effective duration (in years) | 6.4 | 6.4 | 6.5 | ||||||||||||||||||||||||||||||||

Weighted average rating (1) |

A | A | A | ||||||||||||||||||||||||||||||||

10

10| September 30, 2024 | June 30, 2024 | December 31, 2023 | |||||||||||||||||||||||||||||||||

| (In millions) | Carrying Value | Net Unrealized Gains (Losses) | Carrying Value | Net Unrealized Gains (Losses) | Carrying Value | Net Unrealized Gains (Losses) | |||||||||||||||||||||||||||||

| Fixed maturity securities: | |||||||||||||||||||||||||||||||||||

| Corporate and other bonds | $ | 15,158 | $ | (333) | $ | 14,311 | $ | (779) | $ | 14,424 | $ | (756) | |||||||||||||||||||||||

| States, municipalities and political subdivisions: | |||||||||||||||||||||||||||||||||||

| Tax-exempt | 1,027 | (157) | 1,008 | (190) | 1,160 | (159) | |||||||||||||||||||||||||||||

| Taxable | 2,240 | (329) | 2,133 | (428) | 2,076 | (399) | |||||||||||||||||||||||||||||

| Total states, municipalities and political subdivisions | 3,267 | (486) | 3,141 | (618) | 3,236 | (558) | |||||||||||||||||||||||||||||

| Asset-backed: | |||||||||||||||||||||||||||||||||||

| RMBS | 3,352 | (330) | 3,113 | (487) | 3,000 | (409) | |||||||||||||||||||||||||||||

| CMBS | 1,718 | (124) | 1,588 | (177) | 1,601 | (221) | |||||||||||||||||||||||||||||

| Other ABS | 2,983 | (78) | 2,813 | (140) | 2,676 | (170) | |||||||||||||||||||||||||||||

| Total asset-backed | 8,053 | (532) | 7,514 | (804) | 7,277 | (800) | |||||||||||||||||||||||||||||

| U.S. Treasury and obligations of government-sponsored enterprises | 213 | (2) | 191 | (2) | 150 | (1) | |||||||||||||||||||||||||||||

| Foreign government | 688 | (11) | 660 | (26) | 685 | (20) | |||||||||||||||||||||||||||||

| Redeemable preferred stock | — | — | — | — | — | — | |||||||||||||||||||||||||||||

| Total fixed maturity securities | 27,379 | (1,364) | 25,817 | (2,229) | 25,772 | (2,135) | |||||||||||||||||||||||||||||

| Equities: | |||||||||||||||||||||||||||||||||||

| Common stock | 183 | — | 180 | — | 191 | — | |||||||||||||||||||||||||||||

| Non-redeemable preferred stock | 99 | — | 82 | — | 82 | — | |||||||||||||||||||||||||||||

| Total equities | 282 | — | 262 | — | 273 | — | |||||||||||||||||||||||||||||

| Limited partnership investments: | |||||||||||||||||||||||||||||||||||

| Hedge funds | 272 | — | 265 | — | 184 | — | |||||||||||||||||||||||||||||

| Private equity funds | 1,611 | — | 1,545 | — | 1,019 | — | |||||||||||||||||||||||||||||

| Total limited partnership investments | 1,883 | — | 1,810 | — | 1,203 | — | |||||||||||||||||||||||||||||

| Other invested assets | 83 | — | 73 | — | 80 | — | |||||||||||||||||||||||||||||

| Mortgage loans | 814 | — | 796 | — | 842 | — | |||||||||||||||||||||||||||||

| Short-term investments | 1,739 | — | 1,698 | — | 2,094 | 1 | |||||||||||||||||||||||||||||

| Total investments | $ | 32,180 | $ | (1,364) | $ | 30,456 | $ | (2,229) | $ | 30,264 | $ | (2,134) | |||||||||||||||||||||||

| Net receivable/(payable) on investment activity | $ | (99) | $ | (19) | $ | 33 | |||||||||||||||||||||||||||||

| Effective duration (in years) | 4.4 | 4.4 | 4.5 | ||||||||||||||||||||||||||||||||

Weighted average rating (1) |

A | A | A | ||||||||||||||||||||||||||||||||

11

11| September 30, 2024 | June 30, 2024 | December 31, 2023 | |||||||||||||||||||||||||||||||||

| (In millions) | Carrying Value | Net Unrealized Gains (Losses) | Carrying Value | Net Unrealized Gains (Losses) | Carrying Value | Net Unrealized Gains (Losses) | |||||||||||||||||||||||||||||

| Fixed maturity securities: | |||||||||||||||||||||||||||||||||||

| Corporate and other bonds | $ | 10,634 | $ | 259 | $ | 10,061 | $ | (316) | $ | 9,844 | $ | 8 | |||||||||||||||||||||||

| States, municipalities and political subdivisions: | |||||||||||||||||||||||||||||||||||

| Tax-exempt | 2,306 | 222 | 2,325 | 157 | 2,562 | 247 | |||||||||||||||||||||||||||||

| Taxable | 1,575 | 6 | 1,563 | (70) | 1,594 | (10) | |||||||||||||||||||||||||||||

| Total states, municipalities and political subdivisions | 3,881 | 228 | 3,888 | 87 | 4,156 | 237 | |||||||||||||||||||||||||||||

| Asset-backed: | |||||||||||||||||||||||||||||||||||

| RMBS | 2 | — | 2 | — | 2 | — | |||||||||||||||||||||||||||||

| CMBS | 23 | (2) | 23 | (2) | 30 | (2) | |||||||||||||||||||||||||||||

| Other ABS | 602 | (68) | 566 | (103) | 592 | (73) | |||||||||||||||||||||||||||||

| Total asset-backed | 627 | (70) | 591 | (105) | 624 | (75) | |||||||||||||||||||||||||||||

| U.S. Treasury and obligations of government-sponsored enterprises | 9 | — | — | — | 1 | — | |||||||||||||||||||||||||||||

| Foreign government | 49 | (7) | 46 | (10) | 28 | (8) | |||||||||||||||||||||||||||||

| Redeemable preferred stock | — | — | — | — | — | — | |||||||||||||||||||||||||||||

| Total fixed maturity securities | 15,200 | 410 | 14,586 | (344) | 14,653 | 162 | |||||||||||||||||||||||||||||

| Equities: | |||||||||||||||||||||||||||||||||||

| Common stock | — | — | — | — | — | — | |||||||||||||||||||||||||||||

| Non-redeemable preferred stock | 386 | — | 407 | — | 410 | — | |||||||||||||||||||||||||||||

| Total equities | 386 | — | 407 | — | 410 | — | |||||||||||||||||||||||||||||

| Limited partnership investments: | |||||||||||||||||||||||||||||||||||

| Hedge funds | 84 | — | 82 | — | 148 | — | |||||||||||||||||||||||||||||

| Private equity funds | 495 | — | 475 | — | 823 | — | |||||||||||||||||||||||||||||

| Total limited partnership investments | 579 | — | 557 | — | 971 | — | |||||||||||||||||||||||||||||

| Other invested assets | — | — | — | — | — | — | |||||||||||||||||||||||||||||

| Mortgage loans | 189 | — | 190 | — | 193 | — | |||||||||||||||||||||||||||||

| Short-term investments | 161 | — | 49 | — | 71 | — | |||||||||||||||||||||||||||||

| Total investments | $ | 16,515 | $ | 410 | $ | 15,789 | $ | (344) | $ | 16,298 | $ | 162 | |||||||||||||||||||||||

| Net receivable/(payable) on investment activity | $ | 6 | $ | 13 | $ | 3 | |||||||||||||||||||||||||||||

| Effective duration (in years) | 10.1 | 9.9 | 10.2 | ||||||||||||||||||||||||||||||||

Weighted average rating (1) |

A- | A- | A- | ||||||||||||||||||||||||||||||||

12

12| September 30, 2024 | U.S. Government, Government agencies and Government-sponsored enterprises | AAA | AA | A | BBB | Non-investment grade | Total | ||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| (In millions) | Fair Value | Net Unrealized Gains (Losses) | Fair Value | Net Unrealized Gains (Losses) | Fair Value | Net Unrealized Gains (Losses) | Fair Value | Net Unrealized Gains (Losses) | Fair Value | Net Unrealized Gains (Losses) | Fair Value | Net Unrealized Gains (Losses) | Fair Value | Net Unrealized Gains (Losses) | |||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| Corporate and other bonds | $ | — | $ | — | $ | 29 | $ | — | $ | 745 | $ | (3) | $ | 7,941 | $ | 24 | $ | 15,454 | $ | (66) | $ | 1,623 | $ | (29) | $ | 25,792 | $ | (74) | |||||||||||||||||||||||||||||||||||||||||||||||||||||||

| States, municipalities and political subdivisions | — | — | 1,126 | (17) | 4,503 | (195) | 1,229 | (5) | 270 | (36) | 20 | (5) | 7,148 | (258) | |||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| Asset-backed: | |||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| RMBS | 2,843 | (240) | 494 | (93) | 8 | — | — | — | — | — | 9 | 3 | 3,354 | (330) | |||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| CMBS | — | — | 700 | (7) | 628 | (52) | 189 | (19) | 183 | (21) | 41 | (27) | 1,741 | (126) | |||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| Other ABS | — | — | 480 | — | 270 | (47) | 1,346 | (37) | 1,305 | (49) | 184 | (13) | 3,585 | (146) | |||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| Total asset-backed | 2,843 | (240) | 1,674 | (100) | 906 | (99) | 1,535 | (56) | 1,488 | (70) | 234 | (37) | 8,680 | (602) | |||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| U.S. Treasury and obligations of government-sponsored enterprises | 222 | (2) | — | — | — | — | — | — | — | — | — | — | 222 | (2) | |||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| Foreign government | — | — | 214 | (2) | 390 | (6) | 40 | (5) | 93 | (5) | — | — | 737 | (18) | |||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| Redeemable preferred stock | — | — | — | — | — | — | — | — | — | — | — | — | — | — | |||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| Total fixed maturity securities | $ | 3,065 | $ | (242) | $ | 3,043 | $ | (119) | $ | 6,544 | $ | (303) | $ | 10,745 | $ | (42) | $ | 17,305 | $ | (177) | $ | 1,877 | $ | (71) | $ | 42,579 | $ | (954) | |||||||||||||||||||||||||||||||||||||||||||||||||||||||

| Percentage of total fixed maturity securities | 7 | % | 7 | % | 15 | % | 25 | % | 41 | % | 5 | % | 100 | % | |||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

13

13| Periods ended September 30 | Consolidated | |||||||||||||||||||||||||

| Three Months | Nine Months | |||||||||||||||||||||||||

| (In millions) | 2024 | 2023 | 2024 | 2023 | ||||||||||||||||||||||

| Taxable fixed income securities | $ | 490 | $ | 457 | $ | 1,446 | $ | 1,331 | ||||||||||||||||||

| Tax-exempt fixed income securities | 35 | 43 | 109 | 138 | ||||||||||||||||||||||

| Total fixed income securities | 525 | 500 | 1,555 | 1,469 | ||||||||||||||||||||||

| Common stock | 13 | — | 31 | 16 | ||||||||||||||||||||||

| Limited partnerships - hedge funds | 13 | (2) | 35 | 19 | ||||||||||||||||||||||

| Limited partnerships - private equity funds | 54 | 30 | 160 | 89 | ||||||||||||||||||||||

| Total limited partnership and common stock investments | 80 | 28 | 226 | 124 | ||||||||||||||||||||||

| Other, net of investment expense | 21 | 25 | 72 | 60 | ||||||||||||||||||||||

| Net investment income | $ | 626 | $ | 553 | $ | 1,853 | $ | 1,653 | ||||||||||||||||||

| Effective income yield for fixed income securities portfolio | 4.8 | % | 4.7 | % | 4.8 | % | 4.6 | % | ||||||||||||||||||

| Limited partnership and common stock return for the period | 3.1 | 1.3 | 9.4 | 5.8 | ||||||||||||||||||||||

| Property & Casualty and Corporate & Other | ||||||||||||||||||||||||||

| Periods ended September 30 | ||||||||||||||||||||||||||

| Three Months | Nine Months | |||||||||||||||||||||||||

| (In millions) | 2024 | 2023 | 2024 | 2023 | ||||||||||||||||||||||

| Taxable fixed income securities | $ | 301 | $ | 283 | $ | 893 | $ | 816 | ||||||||||||||||||

| Tax-exempt fixed income securities | 8 | 10 | 27 | 32 | ||||||||||||||||||||||

| Total fixed income securities | 309 | 293 | 920 | 848 | ||||||||||||||||||||||

| Common stock | 13 | — | 31 | 16 | ||||||||||||||||||||||

| Limited partnerships - hedge funds | 10 | — | 22 | 11 | ||||||||||||||||||||||

| Limited partnerships - private equity funds | 30 | 16 | 89 | 49 | ||||||||||||||||||||||

| Total limited partnership and common stock investments | 53 | 16 | 142 | 76 | ||||||||||||||||||||||

| Other, net of investment expense | 24 | 28 | 81 | 70 | ||||||||||||||||||||||

| Net investment income | $ | 386 | $ | 337 | $ | 1,143 | $ | 994 | ||||||||||||||||||

| Effective income yield for fixed income securities portfolio | 4.3 | % | 4.2 | % | 4.3 | % | 4.1 | % | ||||||||||||||||||

| Periods ended September 30 | Life & Group | |||||||||||||||||||||||||

| Three Months | Nine Months | |||||||||||||||||||||||||

| (In millions) | 2024 | 2023 | 2024 | 2023 | ||||||||||||||||||||||

| Taxable fixed income securities | $ | 189 | $ | 174 | $ | 553 | $ | 515 | ||||||||||||||||||

| Tax-exempt fixed income securities | 27 | 33 | 82 | 106 | ||||||||||||||||||||||

| Total fixed income securities | 216 | 207 | 635 | 621 | ||||||||||||||||||||||

| Common stock | — | — | — | — | ||||||||||||||||||||||

| Limited partnerships - hedge funds | 3 | (2) | 13 | 8 | ||||||||||||||||||||||

| Limited partnerships - private equity funds | 24 | 14 | 71 | 40 | ||||||||||||||||||||||

| Total limited partnership and common stock investments | 27 | 12 | 84 | 48 | ||||||||||||||||||||||

| Other, net of investment expense | (3) | (3) | (9) | (10) | ||||||||||||||||||||||

| Net investment income | $ | 240 | $ | 216 | $ | 710 | $ | 659 | ||||||||||||||||||

| Effective income yield for fixed income securities portfolio | 5.7 | % | 5.6 | % | 5.6 | % | 5.6 | % | ||||||||||||||||||

14

14| Periods ended September 30 | Consolidated | ||||||||||||||||||||||

| Three Months | Nine Months | ||||||||||||||||||||||

| (In millions) | 2024 | 2023 | 2024 | 2023 | |||||||||||||||||||

| Fixed maturity securities: | |||||||||||||||||||||||

| Corporate and other bonds | $ | (17) | $ | (11) | $ | (38) | $ | (46) | |||||||||||||||

| States, municipalities and political subdivisions | (1) | (4) | (3) | 3 | |||||||||||||||||||

| Asset-backed | (4) | (22) | (25) | (43) | |||||||||||||||||||

| Total fixed maturity securities | (22) | (37) | (66) | (86) | |||||||||||||||||||

| Non-redeemable preferred stock | 13 | 2 | 25 | (9) | |||||||||||||||||||

| Derivatives, short-term and other | (1) | 2 | (1) | 1 | |||||||||||||||||||

| Mortgage loans | — | (5) | — | (11) | |||||||||||||||||||

| Net investment gains (losses) | (10) | (38) | (42) | (105) | |||||||||||||||||||

| Income tax benefit (expense) on net investment gains (losses) | 3 | 7 | 9 | 21 | |||||||||||||||||||

| Net investment gains (losses), after tax | $ | (7) | $ | (31) | $ | (33) | $ | (84) | |||||||||||||||

15

15|

Three months ended September 30, 2024

(In millions)

|

Specialty |

Commercial |

International | P&C Operations | Life & Group | Corporate & Other | Total Operations | ||||||||||||||||||||||||||||||||||

| Claim & claim adjustment expense reserves, beginning of period | |||||||||||||||||||||||||||||||||||||||||

| Gross | $ | 7,319 | $ | 10,617 | $ | 2,783 | $ | 20,719 | $ | 651 | $ | 2,604 | $ | 23,974 | |||||||||||||||||||||||||||

| Ceded | 1,407 | 1,184 | 443 | 3,034 | 90 | 2,234 | 5,358 | ||||||||||||||||||||||||||||||||||

| Net | 5,912 | 9,433 | 2,340 | 17,685 | 561 | 370 | 18,616 | ||||||||||||||||||||||||||||||||||

| Net incurred claim & claim adjustment expenses | 510 | 955 | 195 | 1,660 | (2) | 26 | 1,684 | ||||||||||||||||||||||||||||||||||

| Net claim & claim adjustment expense payments | (489) | (656) | (112) | (1,257) | (11) | (9) | (1,277) | ||||||||||||||||||||||||||||||||||

| Foreign currency translation adjustment and other | — | — | 76 | 76 | 16 | 1 | 93 | ||||||||||||||||||||||||||||||||||

| Claim & claim adjustment expense reserves, end of period | |||||||||||||||||||||||||||||||||||||||||

| Net | 5,933 | 9,732 | 2,499 | 18,164 | 564 | 388 | 19,116 | ||||||||||||||||||||||||||||||||||

| Ceded | 1,395 | 1,286 | 491 | 3,172 | 86 | 2,184 | 5,442 | ||||||||||||||||||||||||||||||||||

| Gross | $ | 7,328 | $ | 11,018 | $ | 2,990 | $ | 21,336 | $ | 650 | $ | 2,572 | $ | 24,558 | |||||||||||||||||||||||||||

|

Nine months ended September 30, 2024

(In millions)

|

Specialty |

Commercial |

International | P&C Operations | Life & Group | Corporate & Other | Total Operations | ||||||||||||||||||||||||||||||||||

| Claim & claim adjustment expense reserves, beginning of period | |||||||||||||||||||||||||||||||||||||||||

| Gross | $ | 7,131 | $ | 10,103 | $ | 2,709 | $ | 19,943 | $ | 675 | $ | 2,686 | $ | 23,304 | |||||||||||||||||||||||||||

| Ceded | 1,215 | 1,082 | 433 | 2,730 | 93 | 2,318 | 5,141 | ||||||||||||||||||||||||||||||||||

| Net | 5,916 | 9,021 | 2,276 | 17,213 | 582 | 368 | 18,163 | ||||||||||||||||||||||||||||||||||

| Net incurred claim & claim adjustment expenses | 1,479 | 2,629 | 568 | 4,676 | 16 | 70 | 4,762 | ||||||||||||||||||||||||||||||||||

| Net claim & claim adjustment expense payments | (1,461) | (1,919) | (381) | (3,761) | (33) | (50) | (3,844) | ||||||||||||||||||||||||||||||||||

| Foreign currency translation adjustment and other | (1) | 1 | 36 | 36 | (1) | — | 35 | ||||||||||||||||||||||||||||||||||

| Claim & claim adjustment expense reserves, end of period | |||||||||||||||||||||||||||||||||||||||||

| Net | 5,933 | 9,732 | 2,499 | 18,164 | 564 | 388 | 19,116 | ||||||||||||||||||||||||||||||||||

| Ceded | 1,395 | 1,286 | 491 | 3,172 | 86 | 2,184 | 5,442 | ||||||||||||||||||||||||||||||||||

| Gross | $ | 7,328 | $ | 11,018 | $ | 2,990 | $ | 21,336 | $ | 650 | $ | 2,572 | $ | 24,558 | |||||||||||||||||||||||||||

16

16Three months ended September 30, 2024 (In millions) |

Claim and claim adjustment expenses | Future policy benefits | Total | ||||||||||||||

| Beginning of Period | $ | 561 | $ | 13,211 | $ | 13,772 | |||||||||||

Incurred claims and policyholders' benefits (1) |

(2) | 338 | 336 | ||||||||||||||

| Benefit and expense payments | (11) | (291) | (302) | ||||||||||||||

| Change in discount rate assumptions and other (AOCI) | 16 | 789 | 805 | ||||||||||||||

| End of Period | $ | 564 | $ | 14,047 | 14,611 | ||||||||||||

Nine months ended September 30, 2024 (In millions) |

Claim and claim adjustment expenses | Future policy benefits | Total | ||||||||||||||

| Beginning of Period | $ | 582 | $ | 13,959 | $ | 14,541 | |||||||||||

Incurred claims and policyholders' benefits (1) |

16 | 959 | 975 | ||||||||||||||

| Benefit and expense payments | (33) | (883) | (916) | ||||||||||||||

| Change in discount rate assumptions and other (AOCI) | (1) | 12 | 11 | ||||||||||||||

| End of Period | $ | 564 | $ | 14,047 | $ | 14,611 | |||||||||||

17

17 18

18 19

19

1

1 2

2 3

3 4

4 5

5 6

6 7

7| Results for the Three Months Ended September 30 | Results for the Nine Months Ended September 30 | ||||||||||||||||||||||

| ($ millions) | 2024 | 2023 | 2024 | 2023 | |||||||||||||||||||

| Net income | $ | 283 | $ | 258 | $ | 938 | $ | 838 | |||||||||||||||

| Less: Net investment losses | (7) | (31) | (33) | (84) | |||||||||||||||||||

| Less: Pension settlement transaction losses | (3) | — | (3) | — | |||||||||||||||||||

| Core income | $ | 293 | $ | 289 | $ | 974 | $ | 922 | |||||||||||||||

| Results for the Three Months Ended September 30 | Results for the Nine Months Ended September 30 | ||||||||||||||||||||||

| 2024 | 2023 | 2024 | 2023 | ||||||||||||||||||||

| Net income per diluted share | $ | 1.04 | $ | 0.95 | $ | 3.44 | $ | 3.08 | |||||||||||||||

| Less: Net investment losses | (0.03) | (0.11) | (0.12) | (0.31) | |||||||||||||||||||

| Less: Pension settlement transaction losses | (0.01) | — | (0.01) | — | |||||||||||||||||||

| Core income per diluted share | $ | 1.08 | $ | 1.06 | $ | 3.57 | $ | 3.39 | |||||||||||||||

8

8| Results for the Three Months Ended September 30, 2024 | ||||||||||||||

| Specialty | Commercial | International | Property & Casualty | |||||||||||

| (In millions) | ||||||||||||||

| Net income | $ | 167 | $ | 132 | $ | 34 | $ | 333 | ||||||

| Net investment losses, after tax | 4 | 7 | 2 | 13 | ||||||||||

| Core income | $ | 171 | $ | 139 | $ | 36 | $ | 346 | ||||||

| Net investment income | (157) | (183) | (32) | (372) | ||||||||||

| Non-insurance warranty (revenue) expense | (14) | — | — | (14) | ||||||||||

| Other (revenue) expense, including interest expense | 12 | 3 | (8) | 7 | ||||||||||

| Income tax expense on core income | 47 | 38 | 16 | 101 | ||||||||||

| Underwriting gain (loss) | 59 | (3) | 12 | 68 | ||||||||||

| Effect of catastrophe losses | — | 127 | 16 | 143 | ||||||||||

| Effect of favorable development-related items | — | — | (2) | (2) | ||||||||||

| Underlying underwriting gain | $ | 59 | $ | 124 | $ | 26 | $ | 209 | ||||||

| Results for the Three Months Ended September 30, 2023 | ||||||||||||||

| Specialty | Commercial | International | Property & Casualty | |||||||||||

| (In millions) | ||||||||||||||

| Net income | $ | 165 | $ | 117 | $ | 40 | $ | 322 | ||||||

| Net investment losses, after tax | 13 | 16 | — | 29 | ||||||||||

| Core income | $ | 178 | $ | 133 | $ | 40 | $ | 351 | ||||||

| Net investment income | (136) | (156) | (26) | (318) | ||||||||||

| Non-insurance warranty (revenue) expense | (21) | — | — | (21) | ||||||||||

| Other (revenue) expense, including interest expense | 13 | 2 | 7 | 22 | ||||||||||

| Income tax expense on core income | 49 | 34 | 14 | 97 | ||||||||||

| Underwriting gain | 83 | 13 | 35 | 131 | ||||||||||

| Effect of catastrophe losses | — | 87 | 7 | 94 | ||||||||||

| Effect of favorable development-related items | (5) | — | — | (5) | ||||||||||

| Underlying underwriting gain | $ | 78 | $ | 100 | $ | 42 | $ | 220 | ||||||

9

9| Results for the Nine Months Ended September 30, 2024 | ||||||||||||||

| Specialty | Commercial | International | Property & Casualty | |||||||||||

| (In millions) | ||||||||||||||

| Net income | $ | 498 | $ | 436 | $ | 116 | $ | 1,050 | ||||||

| Net investment losses, after tax | 19 | 28 | 1 | 48 | ||||||||||

| Core income | $ | 517 | $ | 464 | $ | 117 | $ | 1,098 | ||||||

| Net investment income | (461) | (534) | (95) | (1,090) | ||||||||||

| Non-insurance warranty (revenue) expense | (43) | — | — | (43) | ||||||||||

| Other (revenue) expense, including interest expense | 40 | 10 | (5) | 45 | ||||||||||

| Income tax expense on core income | 142 | 125 | 41 | 308 | ||||||||||

| Underwriting gain | 195 | 65 | 58 | 318 | ||||||||||

| Effect of catastrophe losses | — | 285 | 28 | 313 | ||||||||||

| Effect of favorable development-related items | (8) | — | (5) | (13) | ||||||||||

| Underlying underwriting gain | $ | 187 | $ | 350 | $ | 81 | $ | 618 | ||||||

| Results for the Nine Months Ended September 30, 2023 | ||||||||||||||

| Specialty | Commercial | International | Property & Casualty | |||||||||||

| (In millions) | ||||||||||||||

| Net income | $ | 487 | $ | 390 | $ | 103 | $ | 980 | ||||||

| Net investment losses, after tax | 39 | 53 | (1) | 91 | ||||||||||

| Core income | $ | 526 | $ | 443 | $ | 102 | $ | 1,071 | ||||||

| Net investment income | (407) | (470) | (74) | (951) | ||||||||||

| Non-insurance warranty (revenue) expense | (67) | — | — | (67) | ||||||||||

| Other (revenue) expense, including interest expense | 39 | 5 | 2 | 46 | ||||||||||

| Income tax expense on core income | 146 | 118 | 36 | 300 | ||||||||||

| Underwriting gain | 237 | 96 | 66 | 399 | ||||||||||

| Effect of catastrophe losses | — | 190 | 24 | 214 | ||||||||||

| Effect of (favorable) unfavorable development-related items | (7) | (4) | 15 | 4 | ||||||||||

| Underlying underwriting gain | $ | 230 | $ | 282 | $ | 105 | $ | 617 | ||||||

10

10Results for the Three Months Ended September 30 |

Results for the Nine Months Ended September 30 |

||||||||||||||||||||||||||||||||||

2024 |

2023 |

2024 |

2023 |

||||||||||||||||||||||||||||||||

Loss ratio |

60.1 | % |

58.0 | % |

59.3 | % |

58.2 | % |

|||||||||||||||||||||||||||

Effect of catastrophe impacts |

— | — | — | — | |||||||||||||||||||||||||||||||

| Effect of development-related items | — | 0.6 | 0.3 | 0.3 | |||||||||||||||||||||||||||||||

Underlying loss ratio |

60.1 | % |

58.6 | % |

59.6 | % |

58.5 | % |

|||||||||||||||||||||||||||

Combined ratio |

93.0 | % |

90.1 | % |

92.1 | % |

90.3 | % |

|||||||||||||||||||||||||||

Underlying combined ratio |

93.0 | % |

90.7 | % |

92.4 | % |

90.6 | % |

|||||||||||||||||||||||||||

Results for the Three Months Ended September 30 |

Results for the Nine Months Ended September 30 |

||||||||||||||||||||||||||||||||||

2024 |

2023 |

2024 |

2023 |

||||||||||||||||||||||||||||||||

Loss ratio |

72.0 | % |

68.9 | % |

69.7 | % |

67.0 | % |

|||||||||||||||||||||||||||

Effect of catastrophe impacts |

(9.6) | (7.4) | (7.5) | (5.7) | |||||||||||||||||||||||||||||||

Effect of development-related items |

0.1 | — | — | 0.2 | |||||||||||||||||||||||||||||||

Underlying loss ratio |

62.5 | % |

61.5 | % |

62.2 | % |

61.5 | % |

|||||||||||||||||||||||||||

Combined ratio |

100.2 | % |

98.9 | % |

98.3 | % |

97.1 | % |

|||||||||||||||||||||||||||

Underlying combined ratio |

90.7 | % |

91.5 | % |

90.8 | % |

91.6 | % |

|||||||||||||||||||||||||||

Results for the Three Months Ended September 30 |

Results for the Nine Months Ended September 30 |

||||||||||||||||||||||||||||||||||

2024 |

2023 |

2024 |

2023 |

||||||||||||||||||||||||||||||||

Loss ratio |

62.5 | % |

60.2 | % |

60.6 | % |

62.2 | % |

|||||||||||||||||||||||||||

Effect of catastrophe impacts |

(5.1) | (2.3) | (3.0) | (2.7) | |||||||||||||||||||||||||||||||

Effect of development-related items |

0.7 | — | 0.5 | (1.7) | |||||||||||||||||||||||||||||||

Underlying loss ratio |

58.1 | % |

57.9 | % |

58.1 | % |

57.8 | % |

|||||||||||||||||||||||||||

Combined ratio |

96.1 | % |

88.3 | % |

93.7 | % |

92.5 | % |

|||||||||||||||||||||||||||

Underlying combined ratio |

91.7 | % |

86.0 | % |

91.2 | % |

88.1 | % |

|||||||||||||||||||||||||||

11

11Results for the Three Months Ended September 30 |

Results for the Nine Months Ended September 30 |

||||||||||||||||||||||||||||||||||

2024 |

2023 |

2024 |

2023 |

||||||||||||||||||||||||||||||||

Loss ratio |

66.7 | % |

63.9 | % |

64.9 | % |

63.1 | % |

|||||||||||||||||||||||||||

Effect of catastrophe impacts |

(5.8) | (4.1) | (4.3) | (3.2) | |||||||||||||||||||||||||||||||

Effect of development-related items |

0.2 | 0.2 | 0.2 | — | |||||||||||||||||||||||||||||||

Underlying loss ratio |

61.1 | % |

60.0 | % |

60.8 | % |

59.9 | % |

|||||||||||||||||||||||||||

Combined ratio |

97.2 | % |

94.3 | % |

95.6 | % |

94.0 | % |

|||||||||||||||||||||||||||

Underlying combined ratio |

91.6 | % |

90.4 | % |

91.5 | % |

90.8 | % |

|||||||||||||||||||||||||||

| September 30, 2024 | December 31, 2023 | ||||||||||

| Book value per share | $ | 39.72 | $ | 36.52 | |||||||

| Less: Per share impact of AOCI | (6.78) | (9.87) | |||||||||

| Book value per share excluding AOCI | $ | 46.50 | $ | 46.39 | |||||||

| Results for the Three Months Ended September 30 | Results for the Nine Months Ended September 30 | |||||||||||||||||||||||||

| ($ millions) | 2024 | 2023 | 2024 | 2023 | ||||||||||||||||||||||

| Annualized net income | $ | 1,132 | $ | 1,033 | $ | 1,251 | $ | 1,118 | ||||||||||||||||||

Average stockholders' equity including AOCI (a) |

10,316 | 8,644 | 10,326 | 8,555 | ||||||||||||||||||||||

| Return on equity | 11.0 | % | 11.9 | % | 12.1 | % | 13.1 | % | ||||||||||||||||||

| Annualized core income | $ | 1,176 | $ | 1,154 | $ | 1,299 | $ | 1,229 | ||||||||||||||||||

Average stockholders' equity excluding AOCI (a) |

12,508 | 12,228 | 12,580 | 12,225 | ||||||||||||||||||||||

| Core return on equity | 9.4 | % | 9.4 | % | 10.3 | % | 10.1 | % | ||||||||||||||||||

12

12 13

13