| Ohio | 0-4604 | 31-0746871 | |||||||||

| (State or other jurisdiction of incorporation) |

(Commission File Number) |

(I.R.S. Employer Identification No.) |

|||||||||

| 6200 S. Gilmore Road | Fairfield, | Ohio | 45014‑5141 | ||||||||

| (Address of principal executive offices) | (Zip Code) | ||||||||||

| Title of each class | Trading Symbol(s) | Name of each exchange on which registered | ||||||

| Common stock | CINF | Nasdaq Global Select Market | ||||||

| CINCINNATI FINANCIAL CORPORATION | |||||

Date: February 10, 2025 |

/S/ Michael J. Sewell | ||||

| Michael J. Sewell, CPA | |||||

| Chief Financial Officer, Senior Vice President and Treasurer (Principal Accounting Officer) |

|||||

|

The Cincinnati Insurance Company n The Cincinnati Indemnity Company

The Cincinnati Casualty Company n The Cincinnati Specialty Underwriters Insurance Company

The Cincinnati Life Insurance Company n CFC Investment Company n CSU Producer Resources Inc.

Cincinnati Global Underwriting Ltd. n Cincinnati Global Underwriting Agency Ltd.

|

|||||||

| (Dollars in millions except per share data) | Three months ended December 31, | Twelve months ended December 31, | ||||||||||||||||||||||||||||||||||||

| 2024 | 2023 | % Change | 2024 | 2023 | % Change | |||||||||||||||||||||||||||||||||

| Revenue Data | ||||||||||||||||||||||||||||||||||||||

| Earned premiums | $ | 2,365 | $ | 2,064 | 15 | $ | 8,889 | $ | 7,958 | 12 | ||||||||||||||||||||||||||||

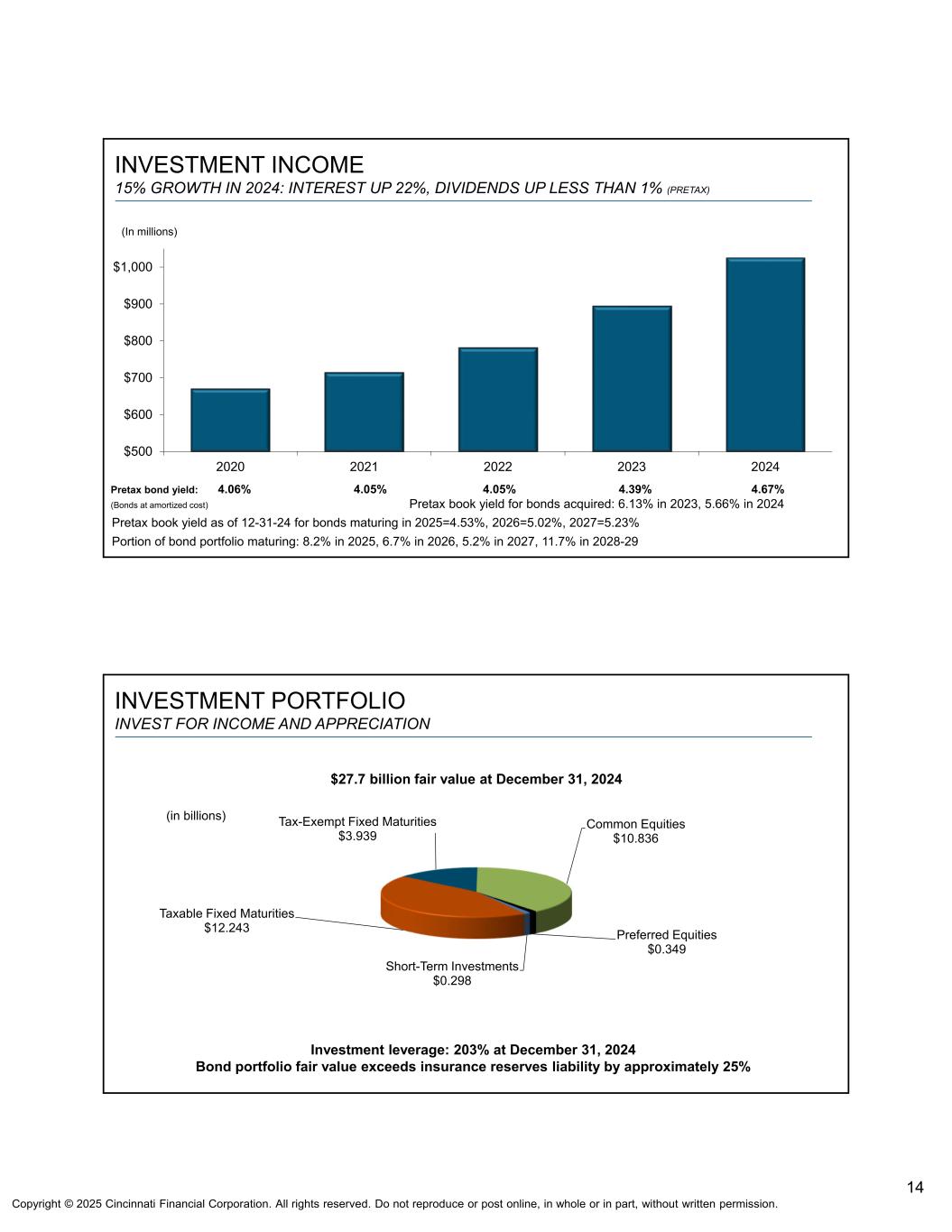

| Investment income, net of expenses | 280 | 239 | 17 | 1,025 | 894 | 15 | ||||||||||||||||||||||||||||||||

| Total revenues | 2,538 | 3,356 | (24) | 11,337 | 10,013 | 13 | ||||||||||||||||||||||||||||||||

| Income Statement Data | ||||||||||||||||||||||||||||||||||||||

| Net income | $ | 405 | $ | 1,183 | (66) | $ | 2,292 | $ | 1,843 | 24 | ||||||||||||||||||||||||||||

| Investment gains and losses, after-tax | (92) | 824 | nm | 1,095 | 891 | 23 | ||||||||||||||||||||||||||||||||

| Non-GAAP operating income* | $ | 497 | $ | 359 | 38 | $ | 1,197 | $ | 952 | 26 | ||||||||||||||||||||||||||||

| Per Share Data (diluted) | ||||||||||||||||||||||||||||||||||||||

| Net income | $ | 2.56 | $ | 7.50 | (66) | $ | 14.53 | $ | 11.66 | 25 | ||||||||||||||||||||||||||||

| Investment gains and losses, after-tax | (0.58) | 5.22 | nm | 6.95 | 5.63 | 23 | ||||||||||||||||||||||||||||||||

| Non-GAAP operating income* | $ | 3.14 | $ | 2.28 | 38 | $ | 7.58 | $ | 6.03 | 26 | ||||||||||||||||||||||||||||

| Book value | $ | 89.11 | $ | 77.06 | 16 | |||||||||||||||||||||||||||||||||

| Cash dividend declared | $ | 0.81 | $ | 0.75 | 8 | $ | 3.24 | $ | 3.00 | 8 | ||||||||||||||||||||||||||||

| Diluted weighted average shares outstanding | 158.1 | 157.8 | 0 | 157.8 | 158.1 | 0 | ||||||||||||||||||||||||||||||||

| (Dollars in millions) | Three months ended December 31, | Twelve months ended December 31, | ||||||||||||||||||||||||||||||||||||

| 2024 | 2023 | % Change | 2024 | 2023 | % Change | |||||||||||||||||||||||||||||||||

| Earned premiums | $ | 2,284 | $ | 1,984 | 15 | $ | 8,568 | $ | 7,645 | 12 | ||||||||||||||||||||||||||||

| Fee revenues | 3 | 3 | 0 | 12 | 11 | 9 | ||||||||||||||||||||||||||||||||

| Total revenues | 2,287 | 1,987 | 15 | 8,580 | 7,656 | 12 | ||||||||||||||||||||||||||||||||

| Loss and loss expenses | 1,255 | 1,118 | 12 | 5,436 | 4,958 | 10 | ||||||||||||||||||||||||||||||||

| Underwriting expenses | 680 | 617 | 10 | 2,564 | 2,297 | 12 | ||||||||||||||||||||||||||||||||

| Underwriting profit | $ | 352 | $ | 252 | 40 | $ | 580 | $ | 401 | 45 | ||||||||||||||||||||||||||||

| Ratios as a percent of earned premiums: | Pt. Change | Pt. Change | ||||||||||||||||||||||||||||||||||||

| Loss and loss expenses | 55.0 | % | 56.4 | % | (1.4) | 63.5 | % | 64.9 | % | (1.4) | ||||||||||||||||||||||||||||

| Underwriting expenses | 29.7 | 31.1 | (1.4) | 29.9 | 30.0 | (0.1) | ||||||||||||||||||||||||||||||||

| Combined ratio | 84.7 | % | 87.5 | % | (2.8) | 93.4 | % | 94.9 | % | (1.5) | ||||||||||||||||||||||||||||

| % Change | % Change | |||||||||||||||||||||||||||||||||||||

| Agency renewal written premiums | $ | 1,759 | $ | 1,534 | 15 | $ | 7,080 | $ | 6,261 | 13 | ||||||||||||||||||||||||||||

| Agency new business written premiums | 382 | 310 | 23 | 1,541 | 1,177 | 31 | ||||||||||||||||||||||||||||||||

| Other written premiums | 102 | 76 | 34 | 622 | 608 | 2 | ||||||||||||||||||||||||||||||||

| Net written premiums | $ | 2,243 | $ | 1,920 | 17 | $ | 9,243 | $ | 8,046 | 15 | ||||||||||||||||||||||||||||

| Ratios as a percent of earned premiums: | Pt. Change | Pt. Change | ||||||||||||||||||||||||||||||||||||

| Current accident year before catastrophe losses | 51.0 | % | 54.6 | % | (3.6) | 56.6 | % | 58.4 | % | (1.8) | ||||||||||||||||||||||||||||

| Current accident year catastrophe losses | 5.0 | 1.9 | 3.1 | 9.6 | 9.3 | 0.3 | ||||||||||||||||||||||||||||||||

| Prior accident years before catastrophe losses | (0.0) | 0.5 | (0.5) | (1.6) | (2.2) | 0.6 | ||||||||||||||||||||||||||||||||

| Prior accident years catastrophe losses | (1.0) | (0.6) | (0.4) | (1.1) | (0.6) | (0.5) | ||||||||||||||||||||||||||||||||

| Loss and loss expense ratio | 55.0 | % | 56.4 | % | (1.4) | 63.5 | % | 64.9 | % | (1.4) | ||||||||||||||||||||||||||||

| Current accident year combined ratio before catastrophe losses |

80.7 | % | 85.7 | % | (5.0) | 86.5 | % | 88.4 | % | (1.9) | ||||||||||||||||||||||||||||

| (Dollars in millions) | Three months ended December 31, | Twelve months ended December 31, | ||||||||||||||||||||||||||||||||||||

| 2024 | 2023 | % Change | 2024 | 2023 | % Change | |||||||||||||||||||||||||||||||||

| Earned premiums | $ | 1,160 | $ | 1,080 | 7 | $ | 4,486 | $ | 4,264 | 5 | ||||||||||||||||||||||||||||

| Fee revenues | 1 | 1 | 0 | 4 | 4 | 0 | ||||||||||||||||||||||||||||||||

| Total revenues | 1,161 | 1,081 | 7 | 4,490 | 4,268 | 5 | ||||||||||||||||||||||||||||||||

| Loss and loss expenses | 624 | 651 | (4) | 2,795 | 2,787 | 0 | ||||||||||||||||||||||||||||||||

| Underwriting expenses | 356 | 345 | 3 | 1,384 | 1,313 | 5 | ||||||||||||||||||||||||||||||||

| Underwriting profit | $ | 181 | $ | 85 | 113 | $ | 311 | $ | 168 | 85 | ||||||||||||||||||||||||||||

| Ratios as a percent of earned premiums: | Pt. Change | Pt. Change | ||||||||||||||||||||||||||||||||||||

| Loss and loss expenses | 53.8 | % | 60.3 | % | (6.5) | 62.3 | % | 65.4 | % | (3.1) | ||||||||||||||||||||||||||||

| Underwriting expenses | 30.7 | 31.9 | (1.2) | 30.9 | 30.8 | 0.1 | ||||||||||||||||||||||||||||||||

| Combined ratio | 84.5 | % | 92.2 | % | (7.7) | 93.2 | % | 96.2 | % | (3.0) | ||||||||||||||||||||||||||||

| % Change | % Change | |||||||||||||||||||||||||||||||||||||

| Agency renewal written premiums | $ | 1,001 | $ | 936 | 7 | $ | 4,087 | $ | 3,876 | 5 | ||||||||||||||||||||||||||||

| Agency new business written premiums | 179 | 153 | 17 | 741 | 584 | 27 | ||||||||||||||||||||||||||||||||

| Other written premiums | (37) | (29) | (28) | (138) | (124) | (11) | ||||||||||||||||||||||||||||||||

| Net written premiums | $ | 1,143 | $ | 1,060 | 8 | $ | 4,690 | $ | 4,336 | 8 | ||||||||||||||||||||||||||||

| Ratios as a percent of earned premiums: | Pt. Change | Pt. Change | ||||||||||||||||||||||||||||||||||||

| Current accident year before catastrophe losses | 53.8 | % | 58.8 | % | (5.0) | 59.3 | % | 60.8 | % | (1.5) | ||||||||||||||||||||||||||||

| Current accident year catastrophe losses | 1.8 | 1.3 | 0.5 | 6.1 | 7.4 | (1.3) | ||||||||||||||||||||||||||||||||

| Prior accident years before catastrophe losses | (0.9) | 1.0 | (1.9) | (2.4) | (2.6) | 0.2 | ||||||||||||||||||||||||||||||||

| Prior accident years catastrophe losses | (0.9) | (0.8) | (0.1) | (0.7) | (0.2) | (0.5) | ||||||||||||||||||||||||||||||||

| Loss and loss expense ratio | 53.8 | % | 60.3 | % | (6.5) | 62.3 | % | 65.4 | % | (3.1) | ||||||||||||||||||||||||||||

| Current accident year combined ratio before catastrophe losses |

84.5 | % | 90.7 | % | (6.2) | 90.2 | % | 91.6 | % | (1.4) | ||||||||||||||||||||||||||||

| (Dollars in millions) | Three months ended December 31, | Twelve months ended December 31, | ||||||||||||||||||||||||||||||||||||

| 2024 | 2023 | % Change | 2024 | 2023 | % Change | |||||||||||||||||||||||||||||||||

| Earned premiums | $ | 726 | $ | 560 | 30 | $ | 2,623 | $ | 2,044 | 28 | ||||||||||||||||||||||||||||

| Fee revenues | 1 | 1 | 0 | 5 | 4 | 25 | ||||||||||||||||||||||||||||||||

| Total revenues | 727 | 561 | 30 | 2,628 | 2,048 | 28 | ||||||||||||||||||||||||||||||||

| Loss and loss expenses | 374 | 304 | 23 | 1,795 | 1,442 | 24 | ||||||||||||||||||||||||||||||||

| Underwriting expenses | 208 | 169 | 23 | 762 | 610 | 25 | ||||||||||||||||||||||||||||||||

| Underwriting profit (loss) | $ | 145 | $ | 88 | 65 | $ | 71 | $ | (4) | nm | ||||||||||||||||||||||||||||

| Ratios as a percent of earned premiums: | Pt. Change | Pt. Change | ||||||||||||||||||||||||||||||||||||

| Loss and loss expenses | 51.5 | % | 54.3 | % | (2.8) | 68.5 | % | 70.5 | % | (2.0) | ||||||||||||||||||||||||||||

| Underwriting expenses | 28.7 | 30.4 | (1.7) | 29.0 | 29.9 | (0.9) | ||||||||||||||||||||||||||||||||

| Combined ratio | 80.2 | % | 84.7 | % | (4.5) | 97.5 | % | 100.4 | % | (2.9) | ||||||||||||||||||||||||||||

| % Change | % Change | |||||||||||||||||||||||||||||||||||||

| Agency renewal written premiums | $ | 625 | $ | 486 | 29 | $ | 2,495 | $ | 1,957 | 27 | ||||||||||||||||||||||||||||

| Agency new business written premiums | 154 | 109 | 41 | 604 | 416 | 45 | ||||||||||||||||||||||||||||||||

| Other written premiums | (26) | (16) | (63) | (100) | (71) | (41) | ||||||||||||||||||||||||||||||||

| Net written premiums | $ | 753 | $ | 579 | 30 | $ | 2,999 | $ | 2,302 | 30 | ||||||||||||||||||||||||||||

| Ratios as a percent of earned premiums: | Pt. Change | Pt. Change | ||||||||||||||||||||||||||||||||||||

| Current accident year before catastrophe losses | 49.7 | % | 51.5 | % | (1.8) | 53.9 | % | 56.4 | % | (2.5) | ||||||||||||||||||||||||||||

| Current accident year catastrophe losses | 1.8 | 4.6 | (2.8) | 15.6 | 17.3 | (1.7) | ||||||||||||||||||||||||||||||||

| Prior accident years before catastrophe losses | 1.6 | (1.4) | 3.0 | 0.7 | (1.0) | 1.7 | ||||||||||||||||||||||||||||||||

| Prior accident years catastrophe losses | (1.6) | (0.4) | (1.2) | (1.7) | (2.2) | 0.5 | ||||||||||||||||||||||||||||||||

| Loss and loss expense ratio | 51.5 | % | 54.3 | % | (2.8) | 68.5 | % | 70.5 | % | (2.0) | ||||||||||||||||||||||||||||

| Current accident year combined ratio before catastrophe losses |

78.4 | % | 81.9 | % | (3.5) | 82.9 | % | 86.3 | % | (3.4) | ||||||||||||||||||||||||||||

| (Dollars in millions) | Three months ended December 31, | Twelve months ended December 31, | ||||||||||||||||||||||||||||||||||||

| 2024 | 2023 | % Change | 2024 | 2023 | % Change | |||||||||||||||||||||||||||||||||

| Earned premiums | $ | 168 | $ | 148 | 14 | $ | 615 | $ | 542 | 13 | ||||||||||||||||||||||||||||

| Fee revenues | 1 | 1 | 0 | 3 | 3 | 0 | ||||||||||||||||||||||||||||||||

| Total revenues | 169 | 149 | 13 | 618 | 545 | 13 | ||||||||||||||||||||||||||||||||

| Loss and loss expenses | 112 | 93 | 20 | 411 | 350 | 17 | ||||||||||||||||||||||||||||||||

| Underwriting expenses | 45 | 40 | 13 | 167 | 141 | 18 | ||||||||||||||||||||||||||||||||

| Underwriting profit | $ | 12 | $ | 16 | (25) | $ | 40 | $ | 54 | (26) | ||||||||||||||||||||||||||||

| Ratios as a percent of earned premiums: | Pt. Change | Pt. Change | ||||||||||||||||||||||||||||||||||||

| Loss and loss expenses | 66.5 | % | 62.6 | % | 3.9 | 66.9 | % | 64.5 | % | 2.4 | ||||||||||||||||||||||||||||

| Underwriting expenses | 26.6 | 27.2 | (0.6) | 27.1 | 26.1 | 1.0 | ||||||||||||||||||||||||||||||||

| Combined ratio | 93.1 | % | 89.8 | % | 3.3 | 94.0 | % | 90.6 | % | 3.4 | ||||||||||||||||||||||||||||

| % Change | % Change | |||||||||||||||||||||||||||||||||||||

| Agency renewal written premiums | $ | 133 | $ | 112 | 19 | $ | 498 | $ | 428 | 16 | ||||||||||||||||||||||||||||

| Agency new business written premiums | 49 | 48 | 2 | 196 | 177 | 11 | ||||||||||||||||||||||||||||||||

| Other written premiums | (11) | (10) | (10) | (40) | (35) | (14) | ||||||||||||||||||||||||||||||||

| Net written premiums | $ | 171 | $ | 150 | 14 | $ | 654 | $ | 570 | 15 | ||||||||||||||||||||||||||||

| Ratios as a percent of earned premiums: | Pt. Change | Pt. Change | ||||||||||||||||||||||||||||||||||||

| Current accident year before catastrophe losses | 63.1 | % | 60.5 | % | 2.6 | 64.2 | % | 65.9 | % | (1.7) | ||||||||||||||||||||||||||||

| Current accident year catastrophe losses | 1.0 | 0.5 | 0.5 | 1.3 | 0.7 | 0.6 | ||||||||||||||||||||||||||||||||

| Prior accident years before catastrophe losses | 2.3 | 1.4 | 0.9 | 1.4 | (2.0) | 3.4 | ||||||||||||||||||||||||||||||||

| Prior accident years catastrophe losses | 0.1 | 0.2 | (0.1) | (0.0) | (0.1) | 0.1 | ||||||||||||||||||||||||||||||||

| Loss and loss expense ratio | 66.5 | % | 62.6 | % | 3.9 | 66.9 | % | 64.5 | % | 2.4 | ||||||||||||||||||||||||||||

| Current accident year combined ratio before catastrophe losses |

89.7 | % | 87.7 | % | 2.0 | 91.3 | % | 92.0 | % | (0.7) | ||||||||||||||||||||||||||||

| (Dollars in millions) | Three months ended December 31, | Twelve months ended December 31, | ||||||||||||||||||||||||||||||||||||

| 2024 | 2023 | % Change | 2024 | 2023 | % Change | |||||||||||||||||||||||||||||||||

| Term life insurance | $ | 59 | $ | 57 | 4 | $ | 233 | $ | 227 | 3 | ||||||||||||||||||||||||||||

| Whole life insurance | 13 | 13 | 0 | 52 | 50 | 4 | ||||||||||||||||||||||||||||||||

| Universal life and other | 9 | 10 | (10) | 36 | 36 | 0 | ||||||||||||||||||||||||||||||||

| Earned premiums | 81 | 80 | 1 | 321 | 313 | 3 | ||||||||||||||||||||||||||||||||

| Investment income, net of expenses | 48 | 47 | 2 | 190 | 184 | 3 | ||||||||||||||||||||||||||||||||

| Investment gains and losses, net | 2 | (8) | nm | (7) | (9) | 22 | ||||||||||||||||||||||||||||||||

| Fee revenues | 1 | 2 | (50) | 5 | 10 | (50) | ||||||||||||||||||||||||||||||||

| Total revenues | 132 | 121 | 9 | 509 | 498 | 2 | ||||||||||||||||||||||||||||||||

| Contract holders’ benefits incurred | 75 | 86 | (13) | 301 | 316 | (5) | ||||||||||||||||||||||||||||||||

| Underwriting expenses incurred | 23 | 23 | 0 | 93 | 87 | 7 | ||||||||||||||||||||||||||||||||

| Total benefits and expenses | 98 | 109 | (10) | 394 | 403 | (2) | ||||||||||||||||||||||||||||||||

| Net income before income tax | 34 | 12 | 183 | 115 | 95 | 21 | ||||||||||||||||||||||||||||||||

| Income tax | 6 | 2 | 200 | 24 | 20 | 20 | ||||||||||||||||||||||||||||||||

| Net income of the life insurance subsidiary | $ | 28 | $ | 10 | 180 | $ | 91 | $ | 75 | 21 | ||||||||||||||||||||||||||||

| (Dollars in millions) | Three months ended December 31, | Twelve months ended December 31, | ||||||||||||||||||||||||||||||||||||

| 2024 | 2023 | % Change | 2024 | 2023 | % Change | |||||||||||||||||||||||||||||||||

| Investment income, net of expenses | $ | 280 | $ | 239 | 17 | $ | 1,025 | $ | 894 | 15 | ||||||||||||||||||||||||||||

| Investment interest credited to contract holders | (31) | (30) | (3) | (125) | (121) | (3) | ||||||||||||||||||||||||||||||||

| Investment gains and losses, net | (116) | 1,043 | nm | 1,391 | 1,127 | 23 | ||||||||||||||||||||||||||||||||

| Investment profit (loss) | $ | 133 | $ | 1,252 | (89) | $ | 2,291 | $ | 1,900 | 21 | ||||||||||||||||||||||||||||

| Investment income: | ||||||||||||||||||||||||||||||||||||||

| Interest | $ | 204 | $ | 159 | 28 | $ | 733 | $ | 600 | 22 | ||||||||||||||||||||||||||||

| Dividends | 74 | 77 | (4) | 283 | 282 | 0 | ||||||||||||||||||||||||||||||||

| Other | 7 | 7 | 0 | 25 | 25 | 0 | ||||||||||||||||||||||||||||||||

| Less investment expenses | 5 | 4 | 25 | 16 | 13 | 23 | ||||||||||||||||||||||||||||||||

| Investment income, pretax | 280 | 239 | 17 | 1,025 | 894 | 15 | ||||||||||||||||||||||||||||||||

| Less income taxes | 47 | 39 | 21 | 172 | 145 | 19 | ||||||||||||||||||||||||||||||||

| Total investment income, after-tax | $ | 233 | $ | 200 | 17 | $ | 853 | $ | 749 | 14 | ||||||||||||||||||||||||||||

| Investment returns: | ||||||||||||||||||||||||||||||||||||||

| Average invested assets plus cash and cash equivalents |

$ | 29,987 | $ | 26,174 | $ | 28,374 | $ | 25,685 | ||||||||||||||||||||||||||||||

| Average yield pretax | 3.73 | % | 3.65 | % | 3.61 | % | 3.48 | % | ||||||||||||||||||||||||||||||

| Average yield after-tax | 3.11 | 3.06 | 3.01 | 2.92 | ||||||||||||||||||||||||||||||||||

| Effective tax rate | 17.0 | 16.3 | 16.8 | 16.2 | ||||||||||||||||||||||||||||||||||

| Fixed-maturity returns: | ||||||||||||||||||||||||||||||||||||||

| Average amortized cost | $ | 16,554 | $ | 14,206 | $ | 15,697 | $ | 13,670 | ||||||||||||||||||||||||||||||

| Average yield pretax | 4.93 | % | 4.48 | % | 4.67 | % | 4.39 | % | ||||||||||||||||||||||||||||||

| Average yield after-tax | 4.03 | 3.68 | 3.83 | 3.62 | ||||||||||||||||||||||||||||||||||

| Effective tax rate | 18.3 | 17.7 | 18.0 | 17.5 | ||||||||||||||||||||||||||||||||||

| (Dollars in millions) | Three months ended December 31, | Twelve months ended December 31, | ||||||||||||||||||||||||

| 2024 | 2023 | 2024 | 2023 | |||||||||||||||||||||||

| Investment gains and losses on equity securities sold, net | $ | — | $ | 7 | $ | 181 | $ | (17) | ||||||||||||||||||

| Unrealized gains and losses on equity securities still held, net | (136) | 1,043 | 1,275 | 1,168 | ||||||||||||||||||||||

| Investment gains and losses on fixed-maturity securities, net | (2) | (16) | (116) | (22) | ||||||||||||||||||||||

| Other | 22 | 9 | 51 | (2) | ||||||||||||||||||||||

| Subtotal - investment gains and losses reported in net income | (116) | 1,043 | 1,391 | 1,127 | ||||||||||||||||||||||

| Change in unrealized investment gains and losses - fixed maturities | (350) | 637 | 17 | 277 | ||||||||||||||||||||||

| Total | $ | (466) | $ | 1,680 | $ | 1,408 | $ | 1,404 | ||||||||||||||||||

| (Dollars in millions except share data) | At December 31, | At December 31, | ||||||||||||

| 2024 | 2023 | |||||||||||||

| Total investments | $ | 28,378 | $ | 25,357 | ||||||||||

| Total assets | 36,501 | 32,769 | ||||||||||||

| Short-term debt | 25 | 25 | ||||||||||||

| Long-term debt | 790 | 790 | ||||||||||||

| Shareholders’ equity | 13,935 | 12,098 | ||||||||||||

| Book value per share | 89.11 | 77.06 | ||||||||||||

| Debt-to-total-capital ratio | 5.5 | % | 6.3 | % | ||||||||||

| (Dollars in millions except per share data) | December 31, | December 31, | ||||||||||||

| 2024 | 2023 | |||||||||||||

| Assets | ||||||||||||||

| Investments | ||||||||||||||

| Fixed maturities, at fair value (amortized cost: 2024—$16,735; 2023—$14,361) | $ | 16,182 | $ | 13,791 | ||||||||||

| Equity securities, at fair value (cost: 2024—$3,953; 2023—$4,282) | 11,185 | 10,989 | ||||||||||||

| Short-term investments, at fair value (amortized cost: 2024—$298; 2023—$0) | 298 | — | ||||||||||||

| Other invested assets | 713 | 577 | ||||||||||||

| Total investments | 28,378 | 25,357 | ||||||||||||

| Cash and cash equivalents | 983 | 907 | ||||||||||||

| Investment income receivable | 222 | 192 | ||||||||||||

| Finance receivable | 120 | 108 | ||||||||||||

| Premiums receivable | 2,969 | 2,592 | ||||||||||||

| Reinsurance recoverable | 523 | 651 | ||||||||||||

| Prepaid reinsurance premiums | 70 | 55 | ||||||||||||

| Deferred policy acquisition costs | 1,242 | 1,093 | ||||||||||||

| Land, building and equipment, net, for company use (accumulated depreciation: 2024—$347; 2023—$337) |

214 | 208 | ||||||||||||

| Other assets | 828 | 681 | ||||||||||||

| Separate accounts | 952 | 925 | ||||||||||||

| Total assets | $ | 36,501 | $ | 32,769 | ||||||||||

| Liabilities | ||||||||||||||

| Insurance reserves | ||||||||||||||

| Loss and loss expense reserves | $ | 10,003 | $ | 9,050 | ||||||||||

| Life policy and investment contract reserves | 2,960 | 3,068 | ||||||||||||

| Unearned premiums | 4,813 | 4,119 | ||||||||||||

| Other liabilities | 1,487 | 1,311 | ||||||||||||

| Deferred income tax | 1,476 | 1,324 | ||||||||||||

| Note payable | 25 | 25 | ||||||||||||

| Long-term debt and lease obligations | 850 | 849 | ||||||||||||

| Separate accounts | 952 | 925 | ||||||||||||

| Total liabilities | 22,566 | 20,671 | ||||||||||||

| Shareholders' Equity | ||||||||||||||

| Common stock, par value—$2 per share; (authorized: 2024 and 2023—500 million shares; issued: 2024 and 2023—198.3 million shares) |

397 | 397 | ||||||||||||

| Paid-in capital | 1,502 | 1,437 | ||||||||||||

| Retained earnings | 14,869 | 13,084 | ||||||||||||

| Accumulated other comprehensive loss | (309) | (435) | ||||||||||||

| Treasury stock at cost (2024—41.9 million shares and 2023—41.3 million shares) | (2,524) | (2,385) | ||||||||||||

| Total shareholders' equity | $ | 13,935 | $ | 12,098 | ||||||||||

| Total liabilities and shareholders' equity | $ | 36,501 | $ | 32,769 | ||||||||||

| (Dollars in millions except per share data) | Three months ended December 31, | Twelve months ended December 31, | |||||||||||||||||||||

| 2024 | 2023 | 2024 | 2023 | ||||||||||||||||||||

| Revenues | |||||||||||||||||||||||

| Earned premiums | $ | 2,365 | $ | 2,064 | $ | 8,889 | $ | 7,958 | |||||||||||||||

| Investment income, net of expenses | 280 | 239 | 1,025 | 894 | |||||||||||||||||||

| Investment gains and losses, net | (116) | 1,043 | 1,391 | 1,127 | |||||||||||||||||||

| Fee revenues | 4 | 5 | 17 | 21 | |||||||||||||||||||

| Other revenues | 5 | 5 | 15 | 13 | |||||||||||||||||||

| Total revenues | 2,538 | 3,356 | 11,337 | 10,013 | |||||||||||||||||||

| Benefits and Expenses | |||||||||||||||||||||||

| Insurance losses and contract holders’ benefits | 1,330 | 1,204 | 5,737 | 5,274 | |||||||||||||||||||

| Underwriting, acquisition and insurance expenses | 703 | 640 | 2,657 | 2,384 | |||||||||||||||||||

| Interest expense | 13 | 14 | 53 | 54 | |||||||||||||||||||

| Other operating expenses | 13 | 8 | 32 | 25 | |||||||||||||||||||

| Total benefits and expenses | 2,059 | 1,866 | 8,479 | 7,737 | |||||||||||||||||||

| Income Before Income Taxes | 479 | 1,490 | 2,858 | 2,276 | |||||||||||||||||||

| Provision (Benefit) for Income Taxes | |||||||||||||||||||||||

| Current | 156 | 86 | 449 | 210 | |||||||||||||||||||

| Deferred | (82) | 221 | 117 | 223 | |||||||||||||||||||

| Total provision for income taxes | 74 | 307 | 566 | 433 | |||||||||||||||||||

| Net Income | $ | 405 | $ | 1,183 | $ | 2,292 | $ | 1,843 | |||||||||||||||

| Per Common Share | |||||||||||||||||||||||

| Net income—basic | $ | 2.59 | $ | 7.54 | $ | 14.65 | $ | 11.74 | |||||||||||||||

| Net income—diluted | 2.56 | 7.50 | 14.53 | 11.66 | |||||||||||||||||||

| Net Income Reconciliation | ||||||||||||||||||||||||||

| (Dollars in millions except per share data) | Three months ended December 31, | Twelve months ended December 31, | ||||||||||||||||||||||||

| 2024 | 2023 | 2024 | 2023 | |||||||||||||||||||||||

| Net income | $ | 405 | $ | 1,183 | $ | 2,292 | $ | 1,843 | ||||||||||||||||||

| Less: | ||||||||||||||||||||||||||

| Investment gains and losses, net | (116) | 1,043 | 1,391 | 1,127 | ||||||||||||||||||||||

| Income tax on investment gains and losses | 24 | (219) | (296) | (236) | ||||||||||||||||||||||

| Investment gains and losses, after-tax | (92) | 824 | 1,095 | 891 | ||||||||||||||||||||||

| Non-GAAP operating income | $ | 497 | $ | 359 | $ | 1,197 | $ | 952 | ||||||||||||||||||

| Diluted per share data: | ||||||||||||||||||||||||||

| Net income | $ | 2.56 | $ | 7.50 | $ | 14.53 | $ | 11.66 | ||||||||||||||||||

| Less: | ||||||||||||||||||||||||||

| Investment gains and losses, net | (0.73) | 6.61 | 8.82 | 7.13 | ||||||||||||||||||||||

| Income tax on investment gains and losses | 0.15 | (1.39) | (1.87) | (1.50) | ||||||||||||||||||||||

| Investment gains and losses, after-tax | (0.58) | 5.22 | 6.95 | 5.63 | ||||||||||||||||||||||

| Non-GAAP operating income | $ | 3.14 | $ | 2.28 | $ | 7.58 | $ | 6.03 | ||||||||||||||||||

| Life Insurance Reconciliation | ||||||||||||||||||||||||||

| (Dollars in millions) | Three months ended December 31, | Twelve months ended December 31, | ||||||||||||||||||||||||

| 2024 | 2023 | 2024 | 2023 | |||||||||||||||||||||||

| Net income of life insurance subsidiary | $ | 28 | $ | 10 | $ | 91 | $ | 75 | ||||||||||||||||||

| Investment gains and losses, net | 2 | (8) | (7) | (9) | ||||||||||||||||||||||

| Income tax on investment gains and losses | 1 | (2) | (1) | (2) | ||||||||||||||||||||||

| Non-GAAP operating income | 27 | 16 | 97 | 82 | ||||||||||||||||||||||

| Investment income, net of expenses | (48) | (47) | (190) | (184) | ||||||||||||||||||||||

| Investment income credited to contract holders | 31 | 30 | 125 | 121 | ||||||||||||||||||||||

| Income tax excluding tax on investment gains and losses, net |

5 | 4 | 25 | 22 | ||||||||||||||||||||||

| Life insurance segment profit | $ | 15 | $ | 3 | $ | 57 | $ | 41 | ||||||||||||||||||

| Property Casualty Insurance Reconciliation | ||||||||||||||||||||||||||||||||||||||||||||

| (Dollars in millions) | Three months ended December 31, 2024 | |||||||||||||||||||||||||||||||||||||||||||

| Consolidated | Commercial | Personal | E&S | Other* | ||||||||||||||||||||||||||||||||||||||||

| Premiums: | ||||||||||||||||||||||||||||||||||||||||||||

| Net written premiums | $ | 2,243 | $ | 1,143 | $ | 753 | $ | 171 | $ | 176 | ||||||||||||||||||||||||||||||||||

| Unearned premiums change | 41 | 17 | (27) | (3) | 54 | |||||||||||||||||||||||||||||||||||||||

| Earned premiums | $ | 2,284 | $ | 1,160 | $ | 726 | $ | 168 | $ | 230 | ||||||||||||||||||||||||||||||||||

| Underwriting profit | $ | 352 | $ | 181 | $ | 145 | $ | 12 | $ | 14 | ||||||||||||||||||||||||||||||||||

| (Dollars in millions) | Twelve months ended December 31, 2024 | |||||||||||||||||||||||||||||||||||||||||||

| Consolidated | Commercial | Personal | E&S | Other* | ||||||||||||||||||||||||||||||||||||||||

| Premiums: | ||||||||||||||||||||||||||||||||||||||||||||

| Net written premiums | $ | 9,243 | $ | 4,690 | $ | 2,999 | $ | 654 | $ | 900 | ||||||||||||||||||||||||||||||||||

| Unearned premiums change | (675) | (204) | (376) | (39) | (56) | |||||||||||||||||||||||||||||||||||||||

| Earned premiums | $ | 8,568 | $ | 4,486 | $ | 2,623 | $ | 615 | $ | 844 | ||||||||||||||||||||||||||||||||||

| Underwriting profit | $ | 580 | $ | 311 | $ | 71 | $ | 40 | $ | 158 | ||||||||||||||||||||||||||||||||||

| (Dollars in millions) | Three months ended December 31, 2023 | |||||||||||||||||||||||||||||||||||||||||||

| Consolidated | Commercial | Personal | E&S | Other* | ||||||||||||||||||||||||||||||||||||||||

| Premiums: | ||||||||||||||||||||||||||||||||||||||||||||

| Net written premiums | $ | 1,920 | $ | 1,060 | $ | 579 | $ | 150 | $ | 131 | ||||||||||||||||||||||||||||||||||

| Unearned premiums change | 64 | 20 | (19) | (2) | 65 | |||||||||||||||||||||||||||||||||||||||

| Earned premiums | $ | 1,984 | $ | 1,080 | $ | 560 | $ | 148 | $ | 196 | ||||||||||||||||||||||||||||||||||

| Underwriting profit | $ | 252 | $ | 85 | $ | 88 | $ | 16 | $ | 63 | ||||||||||||||||||||||||||||||||||

| (Dollars in millions) | Twelve months ended December 31, 2023 | |||||||||||||||||||||||||||||||||||||||||||

| Consolidated | Commercial | Personal | E&S | Other* | ||||||||||||||||||||||||||||||||||||||||

| Premiums: | ||||||||||||||||||||||||||||||||||||||||||||

| Net written premiums | $ | 8,046 | $ | 4,336 | $ | 2,302 | $ | 570 | $ | 838 | ||||||||||||||||||||||||||||||||||

| Unearned premiums change | (401) | (72) | (258) | (28) | (43) | |||||||||||||||||||||||||||||||||||||||

| Earned premiums | $ | 7,645 | $ | 4,264 | $ | 2,044 | $ | 542 | $ | 795 | ||||||||||||||||||||||||||||||||||

| Underwriting profit (loss) | $ | 401 | $ | 168 | $ | (4) | $ | 54 | $ | 183 | ||||||||||||||||||||||||||||||||||

| Dollar amounts shown are rounded to millions; certain amounts may not add due to rounding. | ||||||||||||||||||||||||||||||||||||||||||||

| (Dollars are per share) | Three months ended December 31, | Twelve months ended December 31, | ||||||||||||||||||||||||

| 2024 | 2023 | 2024 | 2023 | |||||||||||||||||||||||

| Value creation ratio: | ||||||||||||||||||||||||||

| End of period book value* | $ | 89.11 | $ | 77.06 | $ | 89.11 | $ | 77.06 | ||||||||||||||||||

| Less beginning of period book value | 88.32 | 67.72 | 77.06 | 67.01 | ||||||||||||||||||||||

| Change in book value | 0.79 | 9.34 | 12.05 | 10.05 | ||||||||||||||||||||||

| Dividend declared to shareholders | 0.81 | 0.75 | 3.24 | 3.00 | ||||||||||||||||||||||

| Total value creation | $ | 1.60 | $ | 10.09 | $ | 15.29 | $ | 13.05 | ||||||||||||||||||

| Value creation ratio from change in book value** | 0.9 | % | 13.8 | % | 15.6 | % | 15.0 | % | ||||||||||||||||||

| Value creation ratio from dividends declared to shareholders*** |

0.9 | 1.1 | 4.2 | 4.5 | ||||||||||||||||||||||

| Value creation ratio | 1.8 | % | 14.9 | % | 19.8 | % | 19.5 | % | ||||||||||||||||||

| * Book value per share is calculated by dividing end of period total shareholders’ equity by end of period shares outstanding | ||||||||||||||||||||||||||

| ** Change in book value divided by the beginning of period book value | ||||||||||||||||||||||||||

| *** Dividend declared to shareholders divided by beginning of period book value | ||||||||||||||||||||||||||

| Investor Contact: | Media Contact: | Shareholder Contact: | ||||||

| Dennis E. McDaniel | Betsy E. Ertel | Brandon McIntosh | ||||||

| 513-870-2768 | 513-603-5323 | 513-870-2696 | ||||||

| A.M. Best Company | Fitch Ratings | Moody's Investors Service | S&P Global Ratings | |||||||||||

| Cincinnati Financial Corporation | ||||||||||||||

| Corporate Debt | a | A- | A3 | BBB+ | ||||||||||

| The Cincinnati Insurance Companies | ||||||||||||||

| Insurer Financial Strength | ||||||||||||||

| Property Casualty Group | ||||||||||||||

| Standard Market Subsidiaries: | A+ | — | A1 | A+ | ||||||||||

| The Cincinnati Insurance Company | A+ | A+ | A1 | A+ | ||||||||||

| The Cincinnati Indemnity Company | A+ | A+ | A1 | A+ | ||||||||||

| The Cincinnati Casualty Company | A+ | A+ | A1 | A+ | ||||||||||

| Surplus Lines Subsidiary: | ||||||||||||||

| The Cincinnati Specialty Underwriters Insurance Company | A+ | — | — | — | ||||||||||

| The Cincinnati Life Insurance Company | A+ | A+ | — | A+ | ||||||||||

| Cincinnati Financial Corporation | ||||||||

| Supplemental Financial Data | ||||||||

| Fourth Quarter 2024 | ||||||||

| Page | ||||||||

| Definitions of Non-GAAP Information and Reconciliation to Comparable GAAP Measures | ||||||||

| Consolidated | ||||||||

| CFC and Subsidiaries Consolidation – Twelve Months Ended December 31, 2024 | ||||||||

| CFC and Subsidiaries Consolidation – Three Months Ended December 31, 2024 | ||||||||

| Five-Year Net Income Reconciliation and Key Metrics | ||||||||

| Consolidated Property Casualty Insurance Operations | ||||||||

| Losses Incurred Detail | ||||||||

| Loss Ratio Detail | ||||||||

| Loss Claim Count Detail | ||||||||

| Direct Written Premiums by Risk State by Line of Business | ||||||||

| Quarterly Property Casualty Data – Commercial Lines | ||||||||

| Quarterly Property Casualty Data – Personal Lines and Excess & Surplus Lines | ||||||||

| Loss and Loss Expense Analysis – Twelve Months Ended December 31, 2024 | ||||||||

| Loss and Loss Expense Analysis – Three Months Ended December 31, 2024 | ||||||||

| Reconciliation Data | ||||||||

| Quarterly Property Casualty Data – Consolidated | ||||||||

| Quarterly Property Casualty Data – Commercial Lines | ||||||||

| Quarterly Property Casualty Data – Personal Lines | ||||||||

| Quarterly Property Casualty Data – Excess & Surplus Lines | ||||||||

| Statutory Statements of Income | ||||||||

| Consolidated Cincinnati Insurance Companies Statutory Statements of Income | ||||||||

| The Cincinnati Life Insurance Company Statutory Statements of Income | ||||||||

| Other | ||||||||

| Quarterly Data – Other | ||||||||

| Cincinnati Financial Corporation and Subsidiaries | ||||||||||||||||||||

| Consolidated Statements of Income for the Twelve Months Ended December 31, 2024 | ||||||||||||||||||||

| (Dollars in millions) | CFC | CONSOL P&C | CLIC | CFC-I | ELIM | Total | ||||||||||||||

| Revenues | ||||||||||||||||||||

| Premiums earned: | ||||||||||||||||||||

| Property casualty | $ | — | $ | 8,980 | $ | — | $ | — | $ | — | $ | 8,980 | ||||||||

| Life | — | — | 404 | — | — | 404 | ||||||||||||||

| Premiums ceded | — | (412) | (83) | — | — | (495) | ||||||||||||||

| Total earned premium | — | 8,568 | 321 | — | — | 8,889 | ||||||||||||||

| Investment income, net of expenses | 122 | 715 | 190 | — | (2) | 1,025 | ||||||||||||||

| Investment gains and losses, net | 644 | 755 | (7) | 1 | (2) | 1,391 | ||||||||||||||

| Fee revenues | — | 12 | 5 | — | — | 17 | ||||||||||||||

| Other revenues | 15 | 9 | — | 9 | (18) | 15 | ||||||||||||||

| Total revenues | $ | 781 | $ | 10,059 | $ | 509 | $ | 10 | $ | (22) | $ | 11,337 | ||||||||

| Benefits & expenses | ||||||||||||||||||||

| Losses & contract holders' benefits | $ | — | $ | 5,461 | $ | 358 | $ | — | $ | — | $ | 5,819 | ||||||||

| Reinsurance recoveries | — | (25) | (57) | — | — | (82) | ||||||||||||||

| Underwriting, acquisition and insurance expenses | — | 2,564 | 93 | — | — | 2,657 | ||||||||||||||

| Interest expense | 52 | — | — | 4 | (3) | 53 | ||||||||||||||

| Other operating expenses | 42 | 5 | — | 4 | (19) | 32 | ||||||||||||||

| Total expenses | $ | 94 | $ | 8,005 | $ | 394 | $ | 8 | $ | (22) | $ | 8,479 | ||||||||

| Income before income taxes | $ | 687 | $ | 2,054 | $ | 115 | $ | 2 | $ | — | $ | 2,858 | ||||||||

| Provision (benefit) for income taxes | ||||||||||||||||||||

| Current operating income | $ | (60) | $ | 176 | $ | 36 | $ | 1 | $ | — | $ | 153 | ||||||||

| Capital gains/losses | 136 | 161 | (1) | — | — | 296 | ||||||||||||||

| Deferred | 64 | 64 | (11) | — | — | 117 | ||||||||||||||

| Total provision for income taxes | $ | 140 | $ | 401 | $ | 24 | $ | 1 | $ | — | $ | 566 | ||||||||

| Net income - current year | $ | 547 | $ | 1,653 | $ | 91 | $ | 1 | $ | — | $ | 2,292 | ||||||||

| Net income - prior year | $ | 544 | $ | 1,222 | $ | 75 | $ | 2 | $ | — | $ | 1,843 | ||||||||

| *Dollar amounts shown are rounded to millions; certain amounts may not add due to rounding. | ||||||||||||||||||||

| Consolidated property casualty data includes results from our Cincinnati Re operations and Cincinnati Global. | ||||||||||||||||||||

| Cincinnati Financial Corporation and Subsidiaries | ||||||||||||||||||||

| Consolidated Statements of Income for the Three Months Ended December 31, 2024 | ||||||||||||||||||||

| (Dollars in millions) | CFC | CONSOL P&C | CLIC | CFC-I | ELIM | Total | ||||||||||||||

| Revenues | ||||||||||||||||||||

| Premiums earned: | ||||||||||||||||||||

| Property casualty | $ | — | $ | 2,386 | $ | — | $ | — | $ | — | $ | 2,386 | ||||||||

| Life | — | — | 103 | — | — | 103 | ||||||||||||||

| Premiums ceded | — | (102) | (22) | — | — | (124) | ||||||||||||||

| Total earned premium | — | 2,284 | 81 | — | — | 2,365 | ||||||||||||||

| Investment income, net of expenses | 36 | 196 | 48 | — | — | 280 | ||||||||||||||

| Investment gains and losses, net | 20 | (137) | 2 | 1 | (2) | (116) | ||||||||||||||

| Fee revenues | — | 3 | 1 | — | — | 4 | ||||||||||||||

| Other revenues | 4 | 2 | — | 2 | (3) | 5 | ||||||||||||||

| Total revenues | $ | 60 | $ | 2,348 | $ | 132 | $ | 3 | $ | (5) | $ | 2,538 | ||||||||

| Benefits & expenses | ||||||||||||||||||||

| Losses & contract holders' benefits | $ | — | $ | 1,259 | $ | 96 | $ | — | $ | — | $ | 1,355 | ||||||||

| Reinsurance recoveries | — | (4) | (21) | — | — | (25) | ||||||||||||||

| Underwriting, acquisition and insurance expenses | — | 680 | 23 | — | — | 703 | ||||||||||||||

| Interest expense | 13 | — | — | 1 | (1) | 13 | ||||||||||||||

| Other operating expenses | 14 | 2 | — | 1 | (4) | 13 | ||||||||||||||

| Total expenses | $ | 27 | $ | 1,937 | $ | 98 | $ | 2 | $ | (5) | $ | 2,059 | ||||||||

| Income before income taxes | $ | 33 | $ | 411 | $ | 34 | $ | 1 | $ | — | $ | 479 | ||||||||

| Provision (benefit) for income taxes | ||||||||||||||||||||

| Current operating income | $ | 8 | $ | 162 | $ | 8 | $ | 1 | $ | — | $ | 179 | ||||||||

| Capital gains/losses | 4 | (28) | 1 | — | — | (23) | ||||||||||||||

| Deferred | (24) | (55) | (3) | — | — | (82) | ||||||||||||||

| Total provision (benefit) for income taxes | $ | (12) | $ | 79 | $ | 6 | $ | 1 | $ | — | $ | 74 | ||||||||

| Net income - current year | $ | 45 | $ | 332 | $ | 28 | $ | — | $ | — | $ | 405 | ||||||||

| Net income - prior year | $ | 393 | $ | 780 | $ | 10 | $ | — | $ | — | $ | 1,183 | ||||||||

| *Dollar amounts shown are rounded to millions; certain amounts may not add due to rounding. | ||||||||||||||||||||

| Consolidated property casualty data includes results from our Cincinnati Re operations and Cincinnati Global. | ||||||||||||||||||||

| Cincinnati Financial Corporation | |||||||||||||||||

| Five-Year Net Income Reconciliation and Key Metrics | |||||||||||||||||

| (Dollars in millions except per share data) | Years ended December 31, | ||||||||||||||||

| 2024 | 2023 | 2022 | 2021 | 2020 | |||||||||||||

| Net income (loss) | $ | 2,292 | $ | 1,843 | $ | (487) | $ | 2,968 | $ | 1,216 | |||||||

| Less: | |||||||||||||||||

| Investment gains and losses, net | 1,391 | 1,127 | (1,467) | 2,409 | 865 | ||||||||||||

| Income tax on investment gains and losses | (296) | (236) | 308 | (506) | (182) | ||||||||||||

| Investment gains and losses, after-tax | 1,095 | 891 | (1,159) | 1,903 | 683 | ||||||||||||

| Non-GAAP operating income | $ | 1,197 | $ | 952 | $ | 672 | $ | 1,065 | $ | 533 | |||||||

| Non-GAAP operating income: Five-year compound annual growth rate | 11.5 | % | 11.6 | % | 8.1 | % | 15.8 | % | (2.0) | % | |||||||

| Diluted per share data: | |||||||||||||||||

| Net income (loss) | $ | 14.53 | $ | 11.66 | $ | (3.06) | $ | 18.24 | $ | 7.49 | |||||||

| Less: | |||||||||||||||||

| Investment gains and losses, net | 8.82 | 7.13 | (9.24) | 14.80 | 5.33 | ||||||||||||

| Income tax on investment gains and losses | (1.87) | (1.50) | 1.94 | (3.11) | (1.12) | ||||||||||||

| Investment gains and losses, after-tax | 6.95 | 5.63 | (7.30) | 11.69 | 4.21 | ||||||||||||

| Non-GAAP operating income | $ | 7.58 | $ | 6.03 | $ | 4.24 | $ | 6.55 | $ | 3.28 | |||||||

| Value creation ratio | |||||||||||||||||

| Book value per share growth | 15.6 | % | 15.0 | % | (18.0) | % | 21.9 | % | 10.7 | % | |||||||

| Shareholder dividend declared as a percentage of beginning book value | 4.2 | 4.5 | 3.4 | 3.8 | 4.0 | ||||||||||||

| Value creation ratio | 19.8 | % | 19.5 | % | (14.6) | % | 25.7 | % | 14.7 | % | |||||||

| Value creation ratio: Five-year average | 13.0 | % | 15.2 | % | 11.2 | % | 18.7 | % | 16.5 | % | |||||||

| Investment income, net of expenses | $ | 1,025 | $ | 894 | $ | 781 | $ | 714 | $ | 670 | |||||||

| *Dollar amounts shown are rounded to millions; certain amounts may not add due to rounding. Ratios are calculated based on whole dollar amounts. | |||||||||||||||||

*Net income (loss) and Net income (loss) per diluted share have been adjusted due to the adoption of an accounting standards update for long-duration contracts for 2022 and 2021. | |||||||||||||||||

| Consolidated Property Casualty | ||||||||||||||||||||||||||||||||||||||||||||

| Losses Incurred Detail | ||||||||||||||||||||||||||||||||||||||||||||

| (Dollars in millions) | Three months ended | Six months ended | Nine months ended | Twelve months ended | ||||||||||||||||||||||||||||||||||||||||

| 12/31/24 | 9/30/24 | 6/30/24 | 3/31/24 | 12/31/23 | 9/30/23 | 6/30/23 | 3/31/23 | 6/30/24 | 6/30/23 | 9/30/24 | 9/30/23 | 12/31/24 | 12/31/23 | |||||||||||||||||||||||||||||||

| Consolidated | ||||||||||||||||||||||||||||||||||||||||||||

| Current accident year losses greater than $5,000,000 | $ | 19 | $ | 18 | $ | 31 | $ | — | $ | 38 | $ | 24 | $ | 43 | $ | 36 | $ | 31 | $ | 79 | $ | 49 | $ | 103 | $ | 68 | $ | 141 | ||||||||||||||||

| Current accident year losses $2,000,000-$5,000,000 | 37 | 51 | 28 | 22 | 42 | 52 | 35 | 15 | 50 | 50 | 101 | 102 | 138 | 144 | ||||||||||||||||||||||||||||||

| Large loss prior accident year reserve development | 19 | 19 | 15 | 22 | 34 | 32 | 19 | 9 | 37 | 28 | 56 | 60 | 75 | 94 | ||||||||||||||||||||||||||||||

| Total large losses incurred | $ | 75 | $ | 88 | $ | 74 | $ | 44 | $ | 114 | $ | 108 | $ | 97 | $ | 60 | $ | 118 | $ | 157 | $ | 206 | $ | 265 | $ | 281 | $ | 379 | ||||||||||||||||

| Losses incurred but not reported | 182 | 185 | 165 | 251 | 122 | 150 | 96 | 179 | 416 | 324 | 601 | 474 | 783 | 596 | ||||||||||||||||||||||||||||||

| Other losses excluding catastrophe losses | 653 | 711 | 741 | 677 | 665 | 639 | 675 | 641 | 1,418 | 1,267 | 2,129 | 1,906 | 2,782 | 2,571 | ||||||||||||||||||||||||||||||

| Catastrophe losses | 83 | 282 | 228 | 111 | 20 | 170 | 217 | 227 | 339 | 444 | 621 | 614 | 704 | 634 | ||||||||||||||||||||||||||||||

| Total losses incurred | $ | 993 | $ | 1,266 | $ | 1,208 | $ | 1,083 | $ | 921 | $ | 1,067 | $ | 1,085 | $ | 1,107 | $ | 2,291 | $ | 2,192 | $ | 3,557 | $ | 3,259 | $ | 4,550 | $ | 4,180 | ||||||||||||||||

| Commercial Lines | ||||||||||||||||||||||||||||||||||||||||||||

| Current accident year losses greater than $5,000,000 | $ | 9 | $ | 11 | $ | 31 | $ | — | $ | 33 | $ | 18 | $ | 28 | $ | 30 | $ | 31 | $ | 58 | $ | 42 | $ | 76 | $ | 51 | $ | 109 | ||||||||||||||||

| Current accident year losses $2,000,000-$5,000,000 | 12 | 36 | 11 | 11 | 31 | 28 | 28 | 12 | 22 | 40 | 58 | 68 | 70 | 99 | ||||||||||||||||||||||||||||||

| Large loss prior accident year reserve development | 19 | 20 | 22 | 12 | 37 | 30 | 19 | 3 | 34 | 22 | 54 | 52 | 73 | 89 | ||||||||||||||||||||||||||||||

| Total large losses incurred | $ | 40 | $ | 67 | $ | 64 | $ | 23 | $ | 101 | $ | 76 | $ | 75 | $ | 45 | $ | 87 | $ | 120 | $ | 154 | $ | 196 | $ | 194 | $ | 297 | ||||||||||||||||

| Losses incurred but not reported | 105 | 117 | 92 | 156 | 86 | 88 | 29 | 125 | 248 | 154 | 365 | 242 | 470 | 328 | ||||||||||||||||||||||||||||||

| Other losses excluding catastrophe losses | 328 | 337 | 384 | 368 | 338 | 336 | 384 | 335 | 752 | 719 | 1,089 | 1,055 | 1,417 | 1,393 | ||||||||||||||||||||||||||||||

| Catastrophe losses | 8 | 58 | 101 | 64 | 3 | 67 | 115 | 106 | 165 | 221 | 223 | 288 | 231 | 291 | ||||||||||||||||||||||||||||||

| Total losses incurred | $ | 481 | $ | 579 | $ | 641 | $ | 611 | $ | 528 | $ | 567 | $ | 603 | $ | 611 | $ | 1,252 | $ | 1,214 | $ | 1,831 | $ | 1,781 | $ | 2,312 | $ | 2,309 | ||||||||||||||||

| Personal Lines | ||||||||||||||||||||||||||||||||||||||||||||

| Current accident year losses greater than $5,000,000 | $ | 10 | $ | 7 | $ | — | $ | — | $ | 5 | $ | 6 | $ | 15 | $ | 6 | $ | — | $ | 21 | $ | 7 | $ | 27 | $ | 17 | $ | 32 | ||||||||||||||||

| Current accident year losses $2,000,000-$5,000,000 | 25 | 13 | 15 | 11 | 11 | 24 | 7 | 3 | 26 | 10 | 39 | 34 | 64 | 45 | ||||||||||||||||||||||||||||||

| Large loss prior accident year reserve development | — | (1) | (7) | 10 | (2) | 2 | 1 | 6 | 3 | 7 | 2 | 9 | 2 | 7 | ||||||||||||||||||||||||||||||

| Total large losses incurred | $ | 35 | $ | 19 | $ | 8 | $ | 21 | $ | 14 | $ | 32 | $ | 23 | $ | 15 | $ | 29 | $ | 38 | $ | 48 | $ | 70 | $ | 83 | $ | 84 | ||||||||||||||||

| Losses incurred but not reported | 22 | 33 | 31 | 22 | 5 | 7 | 26 | 27 | 53 | 53 | 86 | 60 | 108 | 65 | ||||||||||||||||||||||||||||||

| Other losses excluding catastrophe losses | 245 | 256 | 256 | 231 | 218 | 210 | 194 | 187 | 487 | 381 | 743 | 591 | 988 | 809 | ||||||||||||||||||||||||||||||

| Catastrophe losses | (4) | 178 | 129 | 50 | 21 | 71 | 93 | 113 | 179 | 206 | 357 | 277 | 353 | 298 | ||||||||||||||||||||||||||||||

| Total losses incurred | $ | 298 | $ | 486 | $ | 424 | $ | 324 | $ | 258 | $ | 320 | $ | 336 | $ | 342 | $ | 748 | $ | 678 | $ | 1,234 | $ | 998 | $ | 1,532 | $ | 1,256 | ||||||||||||||||

| Excess & Surplus Lines | ||||||||||||||||||||||||||||||||||||||||||||

| Current accident year losses greater than $5,000,000 | $ | — | $ | — | $ | — | $ | — | $ | — | $ | — | $ | — | $ | — | $ | — | $ | — | $ | — | $ | — | $ | — | $ | — | ||||||||||||||||

| Current accident year losses $2,000,000-$5,000,000 | — | 2 | 2 | — | — | — | — | — | 2 | — | 4 | — | 4 | — | ||||||||||||||||||||||||||||||

| Large loss prior accident year reserve development | — | — | — | — | (1) | — | (1) | — | — | (1) | — | (1) | — | (2) | ||||||||||||||||||||||||||||||

| Total large losses incurred | $ | — | $ | 2 | $ | 2 | $ | — | $ | (1) | $ | — | $ | (1) | $ | — | $ | 2 | $ | (1) | $ | 4 | $ | (1) | $ | 4 | $ | (2) | ||||||||||||||||

| Losses incurred but not reported | 28 | 12 | 17 | 30 | 16 | 16 | 20 | 27 | 47 | 47 | 59 | 63 | 87 | 79 | ||||||||||||||||||||||||||||||

| Other losses excluding catastrophe losses | 46 | 55 | 51 | 37 | 52 | 45 | 45 | 28 | 88 | 73 | 143 | 118 | 189 | 170 | ||||||||||||||||||||||||||||||

| Catastrophe losses | 2 | 2 | 3 | 1 | 1 | (1) | 2 | 1 | 4 | 3 | 6 | 2 | 8 | 3 | ||||||||||||||||||||||||||||||

| Total losses incurred | $ | 76 | $ | 71 | $ | 73 | $ | 68 | $ | 68 | $ | 60 | $ | 66 | $ | 56 | $ | 141 | $ | 122 | $ | 212 | $ | 182 | $ | 288 | $ | 250 | ||||||||||||||||

| *Dollar amounts shown are rounded to millions; certain amounts may not add due to rounding. The sum of quarterly amounts may not equal the full year as each is computed independently. | ||||||||||||||||||||||||||||||||||||||||||||

| *Consolidated property casualty data includes results from our Cincinnati Re operations and Cincinnati Global. | ||||||||||||||||||||||||||||||||||||||||||||

| Consolidated Property Casualty | ||||||||||||||||||||||||||||||||||||||||||||

| Loss Ratio Detail | ||||||||||||||||||||||||||||||||||||||||||||

| Three months ended | Six months ended | Nine months ended | Twelve months ended | |||||||||||||||||||||||||||||||||||||||||

| 12/31/24 | 9/30/24 | 6/30/24 | 3/31/24 | 12/31/23 | 9/30/23 | 6/30/23 | 3/31/23 | 6/30/24 | 6/30/23 | 9/30/24 | 9/30/23 | 12/31/24 | 12/31/23 | |||||||||||||||||||||||||||||||

| Consolidated | ||||||||||||||||||||||||||||||||||||||||||||

| Current accident year losses greater than $5,000,000 | 0.8 | % | 0.9 | % | 1.5 | % | — | % | 1.9 | % | 1.2 | % | 2.4 | % | 1.9 | % | 0.8 | % | 2.2 | % | 0.8 | % | 1.8 | % | 0.8 | % | 1.9 | % | ||||||||||||||||

| Current accident year losses $2,000,000-$5,000,000 | 1.5 | 2.3 | 1.4 | 1.1 | 2.1 | 2.7 | 1.9 | 0.8 | 1.2 | 1.3 | 1.6 | 1.8 | 1.6 | 1.9 | ||||||||||||||||||||||||||||||

| Large loss prior accident year reserve development | 0.9 | 0.8 | 0.7 | 1.1 | 1.7 | 1.6 | 1.0 | 0.5 | 0.9 | 0.8 | 0.9 | 1.1 | 0.9 | 1.2 | ||||||||||||||||||||||||||||||

| Total large loss ratio | 3.2 | % | 4.0 | % | 3.6 | % | 2.2 | % | 5.7 | % | 5.5 | % | 5.3 | % | 3.2 | % | 2.9 | % | 4.3 | % | 3.3 | % | 4.7 | % | 3.3 | % | 5.0 | % | ||||||||||||||||

| Losses incurred but not reported | 8.0 | 8.4 | 8.0 | 12.6 | 6.2 | 7.6 | 5.2 | 9.7 | 10.2 | 8.7 | 9.6 | 8.4 | 9.1 | 7.8 | ||||||||||||||||||||||||||||||

| Other losses excluding catastrophe losses | 28.7 | 32.0 | 35.6 | 34.0 | 33.5 | 32.7 | 36.1 | 34.9 | 34.9 | 34.2 | 33.8 | 33.7 | 32.5 | 33.6 | ||||||||||||||||||||||||||||||

| Catastrophe losses | 3.6 | 12.7 | 11.0 | 5.6 | 1.0 | 8.7 | 11.6 | 12.3 | 8.3 | 12.0 | 9.9 | 10.8 | 8.2 | 8.3 | ||||||||||||||||||||||||||||||

| Total loss ratio | 43.5 | % | 57.1 | % | 58.2 | % | 54.4 | % | 46.4 | % | 54.5 | % | 58.2 | % | 60.1 | % | 56.3 | % | 59.2 | % | 56.6 | % | 57.6 | % | 53.1 | % | 54.7 | % | ||||||||||||||||

| Commercial Lines | ||||||||||||||||||||||||||||||||||||||||||||

| Current accident year losses greater than $5,000,000 | 0.8 | % | 1.0 | % | 2.8 | % | — | % | 3.1 | % | 1.7 | % | 2.6 | % | 2.8 | % | 1.4 | % | 2.8 | % | 1.3 | % | 2.4 | % | 1.1 | % | 2.5 | % | ||||||||||||||||

| Current accident year losses $2,000,000-$5,000,000 | 1.0 | 3.2 | 1.0 | 1.0 | 2.8 | 2.6 | 2.7 | 1.1 | 1.0 | 1.9 | 1.7 | 2.1 | 1.5 | 2.3 | ||||||||||||||||||||||||||||||

| Large loss prior accident year reserve development | 1.6 | 1.7 | 2.0 | 1.1 | 3.4 | 2.8 | 1.8 | 0.3 | 1.6 | 1.0 | 1.6 | 1.6 | 1.7 | 2.1 | ||||||||||||||||||||||||||||||

| Total large loss ratio | 3.4 | % | 5.9 | % | 5.8 | % | 2.1 | % | 9.3 | % | 7.1 | % | 7.1 | % | 4.2 | % | 4.0 | % | 5.7 | % | 4.6 | % | 6.1 | % | 4.3 | % | 6.9 | % | ||||||||||||||||

| Losses incurred but not reported | 9.1 | 10.3 | 8.3 | 14.4 | 8.0 | 8.3 | 2.7 | 11.8 | 11.3 | 7.2 | 11.0 | 7.6 | 10.5 | 7.7 | ||||||||||||||||||||||||||||||

| Other losses excluding catastrophe losses | 28.2 | 29.7 | 34.6 | 34.0 | 31.3 | 31.7 | 35.9 | 31.9 | 34.3 | 33.9 | 32.8 | 33.2 | 31.5 | 32.7 | ||||||||||||||||||||||||||||||

| Catastrophe losses | 0.7 | 5.1 | 9.1 | 6.0 | 0.3 | 6.3 | 10.8 | 10.0 | 7.6 | 10.4 | 6.7 | 9.0 | 5.2 | 6.8 | ||||||||||||||||||||||||||||||

| Total loss ratio | 41.4 | % | 51.0 | % | 57.8 | % | 56.5 | % | 48.9 | % | 53.4 | % | 56.5 | % | 57.9 | % | 57.2 | % | 57.2 | % | 55.1 | % | 55.9 | % | 51.5 | % | 54.1 | % | ||||||||||||||||

| Personal Lines | ||||||||||||||||||||||||||||||||||||||||||||

| Current accident year losses greater than $5,000,000 | 1.4 | % | 1.1 | % | — | % | — | % | 1.0 | % | 1.1 | % | 3.0 | % | 1.3 | % | — | % | 2.2 | % | 0.4 | % | 1.8 | % | 0.7 | % | 1.6 | % | ||||||||||||||||

| Current accident year losses $2,000,000-$5,000,000 | 3.4 | 2.0 | 2.4 | 1.8 | 1.9 | 4.7 | 1.4 | 0.6 | 2.1 | 1.0 | 2.1 | 2.3 | 2.4 | 2.2 | ||||||||||||||||||||||||||||||

| Large loss prior accident year reserve development | — | (0.2) | (1.1) | 1.8 | (0.4) | 0.4 | 0.2 | 1.4 | 0.3 | 0.8 | 0.1 | 0.6 | 0.1 | 0.3 | ||||||||||||||||||||||||||||||

| Total large loss ratio | 4.8 | % | 2.9 | % | 1.3 | % | 3.6 | % | 2.5 | % | 6.2 | % | 4.6 | % | 3.3 | % | 2.4 | % | 4.0 | % | 2.6 | % | 4.7 | % | 3.2 | % | 4.1 | % | ||||||||||||||||

| Losses incurred but not reported | 3.0 | 5.0 | 4.8 | 3.8 | 0.9 | 1.2 | 5.3 | 5.9 | 4.3 | 5.6 | 4.6 | 4.0 | 4.1 | 3.2 | ||||||||||||||||||||||||||||||

| Other losses excluding catastrophe losses | 33.7 | 37.6 | 40.5 | 39.4 | 38.7 | 39.9 | 39.4 | 40.2 | 39.9 | 39.7 | 39.0 | 39.9 | 37.6 | 39.5 | ||||||||||||||||||||||||||||||

| Catastrophe losses | (0.4) | 26.2 | 20.5 | 8.4 | 3.8 | 13.4 | 19.0 | 24.3 | 14.7 | 21.6 | 18.8 | 18.7 | 13.5 | 14.6 | ||||||||||||||||||||||||||||||

| Total loss ratio | 41.1 | % | 71.7 | % | 67.1 | % | 55.2 | % | 45.9 | % | 60.7 | % | 68.3 | % | 73.7 | % | 61.3 | % | 70.9 | % | 65.0 | % | 67.3 | % | 58.4 | % | 61.4 | % | ||||||||||||||||

| Excess & Surplus Lines | ||||||||||||||||||||||||||||||||||||||||||||

| Current accident year losses greater than $5,000,000 | — | % | — | % | — | % | — | % | — | % | — | % | — | % | — | % | — | % | — | % | — | % | — | % | — | % | — | % | ||||||||||||||||

| Current accident year losses $2,000,000-$5,000,000 | — | 1.3 | 1.3 | — | — | — | — | — | 0.7 | — | 0.9 | — | 0.7 | — | ||||||||||||||||||||||||||||||

| Large loss prior accident year reserve development | — | — | — | — | (0.5) | — | (0.4) | (0.3) | — | (0.3) | — | (0.2) | — | (0.3) | ||||||||||||||||||||||||||||||

| Total large loss ratio | — | % | 1.3 | % | 1.3 | % | — | % | (0.5) | % | — | % | (0.4) | % | (0.3) | % | 0.7 | % | (0.3) | % | 0.9 | % | (0.2) | % | 0.7 | % | (0.3) | % | ||||||||||||||||

| Losses incurred but not reported | 16.9 | 7.1 | 11.6 | 21.6 | 10.9 | 11.9 | 15.2 | 21.3 | 16.4 | 18.0 | 13.2 | 15.9 | 14.2 | 14.6 | ||||||||||||||||||||||||||||||

| Other losses excluding catastrophe losses | 27.2 | 35.4 | 33.8 | 26.8 | 35.2 | 33.2 | 33.5 | 22.2 | 30.4 | 28.1 | 32.1 | 29.9 | 30.8 | 31.3 | ||||||||||||||||||||||||||||||

| Catastrophe losses | 1.0 | 1.5 | 1.9 | 0.5 | 0.6 | (0.9) | 1.3 | 1.1 | 1.2 | 1.2 | 1.3 | 0.5 | 1.2 | 0.5 | ||||||||||||||||||||||||||||||

| Total loss ratio | 45.1 | % | 45.3 | % | 48.6 | % | 48.9 | % | 46.2 | % | 44.2 | % | 49.6 | % | 44.3 | % | 48.7 | % | 47.0 | % | 47.5 | % | 46.1 | % | 46.9 | % | 46.1 | % | ||||||||||||||||

| *Certain amounts may not add due to rounding. Ratios are calculated based on whole dollar amounts. | ||||||||||||||||||||||||||||||||||||||||||||

| *Consolidated property casualty data includes results from our Cincinnati Re operations and Cincinnati Global. | ||||||||||||||||||||||||||||||||||||||||||||

| Consolidated Property Casualty | ||||||||||||||||||||||||||||||||||||||||||||

| Loss Claim Count Detail | ||||||||||||||||||||||||||||||||||||||||||||

| Three months ended | Six months ended | Nine months ended | Twelve months ended | |||||||||||||||||||||||||||||||||||||||||

| 12/31/24 | 9/30/24 | 6/30/24 | 3/31/24 | 12/31/23 | 9/30/23 | 6/30/23 | 3/31/23 | 6/30/24 | 6/30/23 | 9/30/24 | 9/30/23 | 12/31/24 | 12/31/23 | |||||||||||||||||||||||||||||||

| Consolidated | ||||||||||||||||||||||||||||||||||||||||||||

| Current accident year reported losses greater than $5,000,000 |

1 | 3 | 5 | — | 5 | 4 | 6 | 5 | 5 | 11 | 8 | 15 | 10 | 22 | ||||||||||||||||||||||||||||||

| Current accident year reported losses $2,000,000 - $5,000,000 |

14 | 18 | 11 | 8 | 17 | 19 | 11 | 5 | 19 | 16 | 37 | 35 | 49 | 49 | ||||||||||||||||||||||||||||||

| Prior accident year reported losses on large losses |

11 | 6 | 9 | 7 | 14 | 3 | 7 | 3 | 16 | 10 | 22 | 13 | 33 | 27 | ||||||||||||||||||||||||||||||

| Non-Catastrophe reported losses on large losses total |

26 | 27 | 25 | 15 | 36 | 26 | 24 | 13 | 40 | 37 | 67 | 63 | 92 | 98 | ||||||||||||||||||||||||||||||

| Commercial Lines | ||||||||||||||||||||||||||||||||||||||||||||

| Current accident year reported losses greater than $5,000,000 |

— | 2 | 5 | — | 5 | 3 | 4 | 4 | 5 | 8 | 7 | 11 | 8 | 17 | ||||||||||||||||||||||||||||||

| Current accident year reported losses $2,000,000 - $5,000,000 |

7 | 12 | 4 | 4 | 13 | 11 | 9 | 4 | 8 | 13 | 20 | 24 | 26 | 35 | ||||||||||||||||||||||||||||||

| Prior accident year reported losses on large losses |

11 | 6 | 9 | 4 | 14 | 3 | 7 | 2 | 13 | 9 | 19 | 12 | 30 | 26 | ||||||||||||||||||||||||||||||

| Non-Catastrophe reported losses on large losses total |

18 | 20 | 18 | 8 | 32 | 17 | 20 | 10 | 26 | 30 | 46 | 47 | 64 | 78 | ||||||||||||||||||||||||||||||

| Personal Lines | ||||||||||||||||||||||||||||||||||||||||||||

| Current accident year reported losses greater than $5,000,000 |

1 | 1 | — | — | — | 1 | 2 | 1 | — | 3 | 1 | 4 | 2 | 5 | ||||||||||||||||||||||||||||||

| Current accident year reported losses $2,000,000 - $5,000,000 |

7 | 5 | 6 | 4 | 4 | 8 | 2 | 1 | 10 | 3 | 15 | 11 | 21 | 14 | ||||||||||||||||||||||||||||||

| Prior accident year reported losses on large losses |

— | — | — | 3 | — | — | — | 1 | 3 | 1 | 3 | 1 | 3 | 1 | ||||||||||||||||||||||||||||||

| Non-Catastrophe reported losses on large losses total |

8 | 6 | 6 | 7 | 4 | 9 | 4 | 3 | 13 | 7 | 19 | 16 | 26 | 20 | ||||||||||||||||||||||||||||||

| Excess & Surplus Lines | ||||||||||||||||||||||||||||||||||||||||||||

| Current accident year reported losses greater than $5,000,000 |

— | — | — | — | — | — | — | — | — | — | — | — | — | — | ||||||||||||||||||||||||||||||

| Current accident year reported losses $2,000,000 - $5,000,000 |

— | 1 | 1 | — | — | — | — | — | 1 | — | 2 | — | 2 | — | ||||||||||||||||||||||||||||||

| Prior accident year reported losses on large losses |

— | — | — | — | — | — | — | — | — | — | — | — | — | — | ||||||||||||||||||||||||||||||

| Non-Catastrophe reported losses on large losses total |

— | 1 | 1 | — | — | — | — | — | 1 | — | 2 | — | 2 | — | ||||||||||||||||||||||||||||||

| *The sum of quarterly amounts may not equal the full year as each is computed independently. | ||||||||||||||||||||||||||||||||||||||||||||

| Consolidated Cincinnati Insurance Companies | ||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| Direct Written Premiums by Risk State by Line of Business for the Twelve Months Ended December 31, 2024 | ||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| (Dollars in millions) | Commercial Lines | Personal Lines | E & S | Consolidated | Comm'l Change % |

Personal Change % |

E & S Change % |

Consol Change % |

||||||||||||||||||||||||||||||||||||||||||||||||

| Risk State |

Comm Casualty |

Comm Property |

Comm Auto |

Workers' Comp |

Other Comm | Personal Auto |

Home Owner | Other Personal |

All Lines |

2024 | 2023 | |||||||||||||||||||||||||||||||||||||||||||||

| Total | Total | |||||||||||||||||||||||||||||||||||||||||||||||||||||||

| OH | $ | 205.4 | $ | 240.0 | $ | 126.4 | $ | 0.1 | $ | 57.7 | $ | 173.0 | $ | 197.1 | $ | 48.1 | $ | 34.9 | $ | 1,082.4 | $ | 972.2 | 7.3 | 18.0 | 10.6 | 11.3 | ||||||||||||||||||||||||||||||

| IL | 80.6 | 92.7 | 42.2 | 27.5 | 20.7 | 75.7 | 88.7 | 21.8 | 43.9 | 493.7 | 421.0 | 8.3 | 32.5 | 18.0 | 17.3 | |||||||||||||||||||||||||||||||||||||||||

| NY | 92.2 | 62.0 | 23.7 | 10.6 | 18.5 | 46.5 | 122.9 | 33.0 | 56.8 | 466.4 | 403.2 | 11.9 | 14.7 | 36.7 | 15.7 | |||||||||||||||||||||||||||||||||||||||||

| NC | 71.4 | 117.7 | 43.0 | 13.2 | 24.9 | 46.0 | 60.8 | 14.2 | 25.9 | 417.2 | 354.3 | 13.7 | 31.6 | 5.6 | 17.8 | |||||||||||||||||||||||||||||||||||||||||

| GA | 49.5 | 68.5 | 37.1 | 8.1 | 23.8 | 74.1 | 75.3 | 17.9 | 31.9 | 386.2 | 351.3 | 4.5 | 14.8 | 19.6 | 9.9 | |||||||||||||||||||||||||||||||||||||||||

| IN | 73.0 | 80.9 | 44.3 | 19.6 | 20.9 | 41.9 | 53.7 | 11.2 | 22.3 | 367.9 | 319.1 | 12.8 | 22.1 | 11.9 | 15.3 | |||||||||||||||||||||||||||||||||||||||||

| TX | 59.3 | 28.5 | 39.2 | 3.6 | 15.1 | 44.6 | 88.7 | 18.3 | 51.1 | 348.3 | 291.2 | (3.3) | 58.6 | 13.5 | 19.6 | |||||||||||||||||||||||||||||||||||||||||

| PA | 83.6 | 76.8 | 45.6 | 22.7 | 17.6 | 23.8 | 30.2 | 8.7 | 29.5 | 338.6 | 316.0 | 3.2 | 24.4 | 10.0 | 7.2 | |||||||||||||||||||||||||||||||||||||||||

| MO | 57.5 | 61.7 | 37.5 | 14.3 | 9.8 | 48.7 | 66.1 | 9.0 | 25.7 | 330.5 | 261.6 | 10.7 | 61.7 | 19.0 | 26.3 | |||||||||||||||||||||||||||||||||||||||||

| MI | 52.0 | 61.6 | 31.8 | 9.6 | 16.4 | 43.4 | 43.0 | 9.2 | 22.5 | 289.5 | 249.4 | 6.3 | 38.8 | 16.4 | 16.1 | |||||||||||||||||||||||||||||||||||||||||

| TN | 52.6 | 71.2 | 36.0 | 7.4 | 17.0 | 28.1 | 45.7 | 10.1 | 19.2 | 287.4 | 254.6 | 6.9 | 27.1 | 18.3 | 12.9 | |||||||||||||||||||||||||||||||||||||||||

| VA | 59.0 | 54.2 | 38.3 | 12.4 | 20.0 | 24.6 | 30.5 | 9.3 | 13.8 | 262.1 | 223.6 | 11.8 | 37.7 | 12.0 | 17.2 | |||||||||||||||||||||||||||||||||||||||||

| CA | 1.7 | 2.0 | 1.8 | 3.0 | 0.7 | 24.9 | 197.1 | 26.3 | 0.7 | 258.3 | 212.6 | 9.4 | 22.5 | (49.4) | 21.5 | |||||||||||||||||||||||||||||||||||||||||

| KY | 41.9 | 54.4 | 33.5 | 4.1 | 15.2 | 36.0 | 41.0 | 7.9 | 14.8 | 248.7 | 215.5 | 7.9 | 28.1 | 32.5 | 15.4 | |||||||||||||||||||||||||||||||||||||||||

| AL | 38.8 | 56.0 | 25.9 | 2.0 | 15.8 | 29.1 | 51.9 | 9.0 | 19.1 | 247.6 | 223.4 | 11.0 | 14.3 | (3.6) | 10.9 | |||||||||||||||||||||||||||||||||||||||||

| FL | 35.9 | 16.2 | 28.4 | 2.5 | 14.6 | 10.9 | 40.3 | 17.5 | 37.3 | 203.8 | 210.3 | (8.4) | 6.9 | (5.4) | (3.1) | |||||||||||||||||||||||||||||||||||||||||

| WI | 34.4 | 41.5 | 16.5 | 15.9 | 11.2 | 19.6 | 22.4 | 7.6 | 16.8 | 185.7 | 162.4 | 5.9 | 40.0 | 17.6 | 14.4 | |||||||||||||||||||||||||||||||||||||||||

| WA | 30.8 | 22.1 | 20.8 | — | 7.6 | 29.9 | 24.6 | 6.7 | 15.3 | 157.8 | 113.4 | 16.1 | 85.3 | 48.0 | 39.2 | |||||||||||||||||||||||||||||||||||||||||

| MN | 29.4 | 37.6 | 10.9 | 6.3 | 8.9 | 15.3 | 24.6 | 5.4 | 17.1 | 155.6 | 142.5 | 5.2 | 18.9 | 8.1 | 9.2 | |||||||||||||||||||||||||||||||||||||||||

| MD | 24.3 | 21.7 | 17.6 | 6.2 | 7.9 | 25.8 | 30.8 | 9.2 | 9.3 | 152.7 | 131.6 | 5.7 | 38.3 | (12.0) | 16.1 | |||||||||||||||||||||||||||||||||||||||||

| AZ | 27.6 | 22.4 | 18.0 | 3.2 | 7.4 | 21.9 | 25.5 | 8.2 | 13.5 | 147.6 | 118.0 | 6.7 | 70.4 | 15.3 | 25.1 | |||||||||||||||||||||||||||||||||||||||||

| CT | 16.0 | 13.5 | 7.0 | 4.2 | 2.6 | 36.0 | 46.2 | 13.5 | 5.7 | 144.7 | 106.4 | 21.1 | 45.4 | 18.8 | 36.0 | |||||||||||||||||||||||||||||||||||||||||

| OR | 41.9 | 24.0 | 26.4 | 0.3 | 7.5 | 10.5 | 8.6 | 2.0 | 17.5 | 138.7 | 114.7 | 13.1 | 61.5 | 33.8 | 20.9 | |||||||||||||||||||||||||||||||||||||||||

| MA | 21.0 | 14.7 | 9.9 | 3.9 | 3.0 | 18.0 | 45.9 | 10.3 | 7.9 | 134.6 | 101.3 | 28.7 | 38.1 | 15.8 | 32.8 | |||||||||||||||||||||||||||||||||||||||||

| UT | 24.7 | 21.9 | 16.7 | 2.4 | 6.2 | 18.4 | 18.0 | 2.8 | 17.0 | 128.0 | 106.6 | 11.2 | 53.2 | 3.1 | 20.0 | |||||||||||||||||||||||||||||||||||||||||

| KS | 24.1 | 26.3 | 18.4 | 5.3 | 6.0 | 14.5 | 21.3 | 3.8 | 5.9 | 125.7 | 98.0 | 16.7 | 65.7 | 9.1 | 28.2 | |||||||||||||||||||||||||||||||||||||||||

| AR | 20.1 | 30.8 | 22.5 | 2.8 | 5.6 | 12.5 | 18.2 | 3.8 | 8.8 | 125.2 | 106.3 | 12.5 | 35.3 | 9.9 | 17.8 | |||||||||||||||||||||||||||||||||||||||||

| CO | 23.4 | 14.4 | 15.5 | 1.7 | 4.6 | 6.6 | 21.9 | 2.3 | 22.8 | 113.1 | 93.8 | 8.7 | 48.0 | 25.1 | 20.6 | |||||||||||||||||||||||||||||||||||||||||

| MT | 34.0 | 29.1 | 18.7 | 0.5 | 5.7 | 4.4 | 10.1 | 1.3 | 8.3 | 112.2 | 97.0 | 10.8 | 35.9 | 39.7 | 15.6 | |||||||||||||||||||||||||||||||||||||||||

| SC | 15.5 | 20.0 | 10.6 | 3.7 | 6.4 | 15.9 | 21.8 | 3.5 | 12.2 | 109.6 | 94.9 | 4.4 | 37.4 | 10.8 | 15.6 | |||||||||||||||||||||||||||||||||||||||||

| IA | 18.4 | 26.1 | 8.9 | 5.5 | 8.0 | 9.3 | 12.6 | 2.1 | 6.6 | 97.6 | 86.6 | 1.8 | 59.2 | 15.9 | 12.7 | |||||||||||||||||||||||||||||||||||||||||

| NJ | 15.0 | 12.5 | 6.4 | 4.0 | 3.6 | 11.6 | 19.1 | 8.2 | 10.9 | 91.4 | 74.3 | 19.1 | 28.9 | 18.2 | 23.0 | |||||||||||||||||||||||||||||||||||||||||

| ID | 21.4 | 19.1 | 12.4 | 0.6 | 4.5 | 3.7 | 5.1 | 1.0 | 5.7 | 73.7 | 70.3 | 2.1 | 20.9 | 9.8 | 4.8 | |||||||||||||||||||||||||||||||||||||||||

| NE | 13.9 | 16.5 | 11.0 | 3.4 | 3.3 | 0.5 | 1.3 | 0.2 | 7.5 | 57.5 | 54.5 | 5.3 | (10.0) | 13.5 | 5.6 | |||||||||||||||||||||||||||||||||||||||||

| WV | 11.7 | 15.2 | 9.7 | 1.1 | 2.0 | 0.4 | 1.0 | 0.1 | 7.5 | 48.7 | 43.0 | 9.9 | 82.3 | 22.4 | 13.1 | |||||||||||||||||||||||||||||||||||||||||

| VT | 8.3 | 10.0 | 4.6 | 3.7 | 3.3 | 2.6 | 5.0 | 0.8 | 3.6 | 41.8 | 37.4 | 6.4 | 22.0 | 46.1 | 11.9 | |||||||||||||||||||||||||||||||||||||||||

| NM | 9.3 | 7.9 | 6.6 | 0.5 | 2.8 | 1.1 | 1.9 | 0.3 | 5.4 | 35.9 | 33.5 | 2.4 | 52.4 | 12.9 | 7.2 | |||||||||||||||||||||||||||||||||||||||||

| NH | 6.4 | 7.2 | 3.7 | 1.6 | 1.9 | 3.6 | 5.9 | 1.6 | 2.6 | 34.3 | 30.8 | 3.3 | 34.5 | 2.4 | 11.5 | |||||||||||||||||||||||||||||||||||||||||

| DE | 9.1 | 7.2 | 4.8 | 2.1 | 2.2 | 1.9 | 3.1 | 0.6 | 2.5 | 33.5 | 28.5 | 12.6 | 70.9 | (4.9) | 17.7 | |||||||||||||||||||||||||||||||||||||||||

| WY | 7.0 | 6.8 | 5.0 | — | 1.5 | 0.3 | 1.7 | 0.2 | 3.2 | 25.8 | 21.6 | 17.2 | 47.1 | 19.5 | 19.7 | |||||||||||||||||||||||||||||||||||||||||

| SD | 6.0 | 6.8 | 3.9 | 1.8 | 1.9 | — | — | — | 1.5 | 21.9 | 19.3 | 12.7 | — | 25.8 | 13.5 | |||||||||||||||||||||||||||||||||||||||||

| NV | 1.5 | 1.4 | 2.4 | 0.7 | 0.4 | 6.0 | 5.1 | 1.9 | 2.3 | 21.7 | 10.2 | 97.4 | 118.3 | 131.6 | 113.0 | |||||||||||||||||||||||||||||||||||||||||

| DC | 3.3 | 2.3 | 0.3 | 1.1 | 1.8 | 2.3 | 3.0 | 1.1 | 3.0 | 18.2 | 14.0 | 14.2 | 77.8 | 9.8 | 29.6 | |||||||||||||||||||||||||||||||||||||||||

| ND | 3.6 | 5.0 | 2.5 | — | 1.7 | 1.1 | 1.5 | 0.4 | 1.4 | 17.4 | 17.8 | (7.1) | 14.2 | 13.8 | (2.4) | |||||||||||||||||||||||||||||||||||||||||

| RI | 1.0 | 1.0 | 0.9 | 0.3 | 0.1 | 1.7 | 6.7 | 1.8 | 2.1 | 15.6 | 10.6 | 75.1 | 41.7 | 36.5 | 46.9 | |||||||||||||||||||||||||||||||||||||||||

| ME | 1.1 | 0.9 | 0.4 | 0.2 | 0.4 | 2.0 | 5.7 | 0.9 | 0.9 | 12.4 | 7.3 | (2.0) | 145.3 | 15.5 | 69.2 | |||||||||||||||||||||||||||||||||||||||||

| All Other States | 2.0 | 1.2 | 1.6 | 1.9 | 1.8 | 0.3 | 4.8 | 0.1 | 0.5 | 13.9 | 12.1 | (4.9) | 92.4 | (40.4) | 13.9 | |||||||||||||||||||||||||||||||||||||||||

| Total | $ | 1,561.0 | $ | 1,631.8 | $ | 949.3 | $ | 245.4 | $ | 440.3 | $ | 1,069.2 | $ | 1,656.1 | $ | 373.4 | $ | 694.9 | $ | 8,621.2 | $ | 7,438.0 | 8.2 | 30.5 | 15.0 | 15.5 | ||||||||||||||||||||||||||||||

| *Dollar amounts shown are rounded to the nearest hundred thousand; certain amounts may not add due to rounding. Percentage changes are calculated based on whole dollar amounts. *nm - Not meaningful *Total excludes Cincinnati Re, Cincinnati Global and other direct, such as assigned risk pools. | ||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| Quarterly Property Casualty Data - Commercial Lines | ||||||||||||||||||||||||||||||||||||||||||||

| (Dollars in millions) | Three months ended | Six months ended | Nine months ended | Twelve months ended | ||||||||||||||||||||||||||||||||||||||||

| 12/31/24 | 9/30/24 | 6/30/24 | 3/31/24 | 12/31/23 | 9/30/23 | 6/30/23 | 3/31/23 | 6/30/24 | 6/30/23 | 9/30/24 | 9/30/23 | 12/31/24 | 12/31/23 | |||||||||||||||||||||||||||||||

| Commercial casualty: | ||||||||||||||||||||||||||||||||||||||||||||

| Net written premiums | $ | 385 | $ | 364 | $ | 391 | $ | 417 | $ | 361 | $ | 331 | $ | 378 | $ | 404 | $ | 808 | $ | 782 | $ | 1,172 | $ | 1,114 | $ | 1,557 | $ | 1,475 | ||||||||||||||||

| Year over year change %-written premium | 7 | % | 10 | % | 3 | % | 3 | % | 2 | % | 2 | % | 1 | % | 4 | % | 3 | % | 2 | % | 5 | % | 2 | % | 6 | % | 2 | % | ||||||||||||||||

| Earned premiums | $ | 390 | $ | 381 | $ | 372 | $ | 365 | $ | 366 | $ | 365 | $ | 373 | $ | 377 | $ | 737 | $ | 750 | $ | 1,118 | $ | 1,115 | $ | 1,508 | $ | 1,481 | ||||||||||||||||

| Current accident year before catastrophe losses | 72.9 | % | 74.1 | % | 69.6 | % | 73.6 | % | 69.6 | % | 68.3 | % | 70.5 | % | 72.6 | % | 71.6 | % | 71.6 | % | 72.5 | % | 70.5 | % | 72.6 | % | 70.3 | % | ||||||||||||||||

| Current accident year catastrophe losses | — | — | — | — | — | — | — | — | — | — | — | — | — | — | ||||||||||||||||||||||||||||||

| Prior accident years before catastrophe losses | (0.3) | (0.4) | 7.6 | 0.1 | 14.0 | — | (9.2) | (0.3) | 3.9 | (4.8) | 2.4 | (3.2) | 1.7 | 1.0 | ||||||||||||||||||||||||||||||

| Prior accident years catastrophe losses | — | — | — | — | — | — | — | — | — | — | — | — | — | — | ||||||||||||||||||||||||||||||

| Total loss and loss expense ratio | 72.6 | % | 73.7 | % | 77.2 | % | 73.7 | % | 83.6 | % | 68.3 | % | 61.3 | % | 72.3 | % | 75.5 | % | 66.8 | % | 74.9 | % | 67.3 | % | 74.3 | % | 71.3 | % | ||||||||||||||||

| Commercial property: | ||||||||||||||||||||||||||||||||||||||||||||

| Net written premiums | $ | 383 | $ | 389 | $ | 392 | $ | 362 | $ | 338 | $ | 344 | $ | 335 | $ | 316 | $ | 754 | $ | 650 | $ | 1,143 | $ | 994 | $ | 1,526 | $ | 1,332 | ||||||||||||||||

| Year over year change %-written premium | 13 | % | 13 | % | 17 | % | 15 | % | 14 | % | 11 | % | 9 | % | 6 | % | 16 | % | 7 | % | 15 | % | 9 | % | 15 | % | 10 | % | ||||||||||||||||

| Earned premiums | $ | 373 | $ | 361 | $ | 348 | $ | 336 | $ | 331 | $ | 321 | $ | 312 | $ | 299 | $ | 684 | $ | 611 | $ | 1,045 | $ | 933 | $ | 1,418 | $ | 1,264 | ||||||||||||||||

| Current accident year before catastrophe losses | 22.3 | % | 40.9 | % | 45.7 | % | 48.5 | % | 44.4 | % | 45.2 | % | 43.4 | % | 49.0 | % | 47.0 | % | 46.1 | % | 44.9 | % | 45.8 | % | 39.0 | % | 45.5 | % | ||||||||||||||||

| Current accident year catastrophe losses | 7.7 | 16.7 | 28.9 | 21.3 | 5.0 | 23.0 | 35.0 | 34.7 | 25.2 | 34.9 | 22.3 | 30.8 | 18.4 | 24.0 | ||||||||||||||||||||||||||||||

| Prior accident years before catastrophe losses | 3.2 | (7.8) | (3.9) | (4.2) | (3.2) | (2.8) | (1.5) | (7.8) | (4.0) | (4.6) | (5.4) | (4.0) | (3.1) | (3.8) | ||||||||||||||||||||||||||||||

| Prior accident years catastrophe losses | (2.6) | (1.3) | (2.1) | (2.5) | (2.6) | (0.5) | (1.4) | 2.4 | (2.3) | 0.5 | (1.9) | 0.2 | (2.1) | (0.6) | ||||||||||||||||||||||||||||||

| Total loss and loss expense ratio | 30.6 | % | 48.5 | % | 68.6 | % | 63.1 | % | 43.6 | % | 64.9 | % | 75.5 | % | 78.3 | % | 65.9 | % | 76.9 | % | 59.9 | % | 72.8 | % | 52.2 | % | 65.1 | % | ||||||||||||||||

| Commercial auto: | ||||||||||||||||||||||||||||||||||||||||||||

| Net written premiums | $ | 223 | $ | 223 | $ | 248 | $ | 259 | $ | 207 | $ | 199 | $ | 233 | $ | 239 | $ | 506 | $ | 472 | $ | 730 | $ | 671 | $ | 953 | $ | 878 | ||||||||||||||||

| Year over year change %-written premium | 8 | % | 12 | % | 6 | % | 8 | % | 3 | % | 3 | % | 3 | % | 1 | % | 7 | % | 2 | % | 9 | % | 2 | % | 9 | % | 2 | % | ||||||||||||||||

| Earned premiums | $ | 237 | $ | 231 | $ | 228 | $ | 220 | $ | 218 | $ | 216 | $ | 214 | $ | 213 | $ | 448 | $ | 428 | $ | 679 | $ | 644 | $ | 916 | $ | 862 | ||||||||||||||||

| Current accident year before catastrophe losses | 65.5 | % | 66.7 | % | 67.9 | % | 70.0 | % | 65.0 | % | 70.1 | % | 68.3 | % | 73.5 | % | 68.9 | % | 70.9 | % | 68.2 | % | 70.6 | % | 67.5 | % | 69.2 | % | ||||||||||||||||

| Current accident year catastrophe losses | (3.3) | 2.2 | 4.4 | 1.6 | (1.1) | (0.8) | 6.7 | 0.9 | 3.0 | 3.8 | 2.7 | 2.3 | 1.2 | 1.5 | ||||||||||||||||||||||||||||||

| Prior accident years before catastrophe losses | 2.4 | 0.2 | (3.8) | (0.8) | (2.6) | 0.7 | (1.4) | 2.7 | (2.4) | 0.7 | (1.5) | 0.6 | (0.5) | (0.2) | ||||||||||||||||||||||||||||||

| Prior accident years catastrophe losses | (0.2) | — | — | (0.1) | — | — | (0.3) | (1.5) | — | (1.0) | — | (0.6) | (0.1) | (0.5) | ||||||||||||||||||||||||||||||

| Total loss and loss expense ratio | 64.4 | % | 69.1 | % | 68.5 | % | 70.7 | % | 61.3 | % | 70.0 | % | 73.3 | % | 75.6 | % | 69.5 | % | 74.4 | % | 69.4 | % | 72.9 | % | 68.1 | % | 70.0 | % | ||||||||||||||||

| Workers' compensation: | ||||||||||||||||||||||||||||||||||||||||||||

| Net written premiums | $ | 54 | $ | 56 | $ | 55 | $ | 79 | $ | 57 | $ | 57 | $ | 65 | $ | 82 | $ | 134 | $ | 147 | $ | 190 | $ | 203 | $ | 244 | $ | 260 | ||||||||||||||||

| Year over year change %-written premium | (5) | % | (2) | % | (15) | % | (4) | % | (11) | % | (5) | % | (6) | % | (5) | % | (9) | % | (5) | % | (6) | % | (5) | % | (6) | % | (6) | % | ||||||||||||||||

| Earned premiums | $ | 60 | $ | 61 | $ | 59 | $ | 61 | $ | 65 | $ | 66 | $ | 72 | $ | 74 | $ | 120 | $ | 146 | $ | 182 | $ | 212 | $ | 242 | $ | 277 | ||||||||||||||||

| Current accident year before catastrophe losses | 87.9 | % | 88.2 | % | 86.5 | % | 91.5 | % | 87.2 | % | 90.3 | % | 90.0 | % | 83.2 | % | 89.0 | % | 86.5 | % | 88.8 | % | 87.7 | % | 88.5 | % | 87.6 | % | ||||||||||||||||

| Current accident year catastrophe losses | — | — | — | — | — | — | — | — | — | — | — | — | — | — | ||||||||||||||||||||||||||||||

| Prior accident years before catastrophe losses | (44.4) | (26.7) | (46.9) | (19.3) | (31.1) | (30.7) | (15.4) | (19.6) | (32.9) | (17.5) | (30.8) | (21.6) | (34.2) | (23.9) | ||||||||||||||||||||||||||||||

| Prior accident years catastrophe losses | — | — | — | — | — | — | — | — | — | — | — | — | — | — | ||||||||||||||||||||||||||||||

| Total loss and loss expense ratio | 43.5 | % | 61.5 | % | 39.6 | % | 72.2 | % | 56.1 | % | 59.6 | % | 74.6 | % | 63.6 | % | 56.1 | % | 69.0 | % | 58.0 | % | 66.1 | % | 54.3 | % | 63.7 | % | ||||||||||||||||

| Other commercial: | ||||||||||||||||||||||||||||||||||||||||||||

| Net written premiums | $ | 98 | $ | 106 | $ | 100 | $ | 106 | $ | 97 | $ | 98 | $ | 95 | $ | 100 | $ | 207 | $ | 196 | $ | 312 | $ | 294 | $ | 410 | $ | 391 | ||||||||||||||||

| Year over year change %-written premium | 1 | % | 8 | % | 5 | % | 6 | % | 5 | % | 3 | % | 2 | % | 15 | % | 6 | % | 9 | % | 6 | % | 7 | % | 5 | % | 7 | % | ||||||||||||||||

| Earned premiums | $ | 100 | $ | 103 | $ | 100 | $ | 100 | $ | 100 | $ | 94 | $ | 95 | $ | 93 | $ | 200 | $ | 187 | $ | 302 | $ | 280 | $ | 402 | $ | 380 | ||||||||||||||||

| Current accident year before catastrophe losses | 47.9 | % | 50.5 | % | 40.7 | % | 40.5 | % | 34.5 | % | 39.1 | % | 35.2 | % | 38.1 | % | 40.6 | % | 36.6 | % | 43.9 | % | 37.4 | % | 44.9 | % | 36.7 | % | ||||||||||||||||

| Current accident year catastrophe losses | 0.1 | 0.1 | — | 0.1 | — | 0.2 | 0.1 | — | 0.1 | 0.1 | 0.1 | 0.1 | 0.1 | 0.1 | ||||||||||||||||||||||||||||||

| Prior accident years before catastrophe losses | — | 0.4 | 0.2 | (2.8) | (4.0) | (5.8) | (0.8) | (2.5) | (1.3) | (1.6) | (0.6) | (3.0) | (0.5) | (3.3) | ||||||||||||||||||||||||||||||

| Prior accident years catastrophe losses | — | (0.1) | 0.1 | 0.1 | 0.1 | — | — | (0.1) | 0.1 | (0.1) | — | — | — | — | ||||||||||||||||||||||||||||||

| Total loss and loss expense ratio | 48.0 | % | 50.9 | % | 41.0 | % | 37.9 | % | 30.6 | % | 33.5 | % | 34.5 | % | 35.5 | % | 39.5 | % | 35.0 | % | 43.4 | % | 34.5 | % | 44.5 | % | 33.5 | % | ||||||||||||||||

| *Dollar amounts shown are rounded to millions; certain amounts may not add due to rounding. Ratios are calculated based on whole dollar amounts. The sum of quarterly amounts may not equal the full year as each is computed independently. | ||||||||||||||||||||||||||||||||||||||||||||

| Quarterly Property Casualty Data - Personal Lines | ||||||||||||||||||||||||||||||||||||||||||||

| (Dollars in millions) | Three months ended | Six months ended | Nine months ended | Twelve months ended | ||||||||||||||||||||||||||||||||||||||||

| 12/31/24 | 9/30/24 | 6/30/24 | 3/31/24 | 12/31/23 | 9/30/23 | 6/30/23 | 3/31/23 | 6/30/24 | 6/30/23 | 9/30/24 | 9/30/23 | 12/31/24 | 12/31/23 | |||||||||||||||||||||||||||||||

| Personal auto: | ||||||||||||||||||||||||||||||||||||||||||||

| Net written premiums | $ | 270 | $ | 296 | $ | 283 | $ | 216 | $ | 207 | $ | 227 | $ | 212 | $ | 163 | $ | 499 | $ | 374 | $ | 795 | $ | 602 | $ | 1,065 | $ | 809 | ||||||||||||||||

| Year over year change %-written premium | 30 | % | 30 | % | 33 | % | 33 | % | 31 | % | 27 | % | 20 | % | 16 | % | 33 | % | 18 | % | 32 | % | 21 | % | 32 | % | 24 | % | ||||||||||||||||

| Earned premiums | $ | 258 | $ | 242 | $ | 224 | $ | 208 | $ | 197 | $ | 185 | $ | 173 | $ | 166 | $ | 432 | $ | 339 | $ | 674 | $ | 524 | $ | 932 | $ | 721 | ||||||||||||||||

| Current accident year before catastrophe losses | 70.0 | % | 68.7 | % | 73.3 | % | 73.8 | % | 66.7 | % | 73.2 | % | 76.6 | % | 78.8 | % | 73.5 | % | 77.7 | % | 71.8 | % | 76.0 | % | 71.3 | % | 73.6 | % | ||||||||||||||||

| Current accident year catastrophe losses | (3.6) | 6.6 | 3.6 | 3.4 | (1.1) | (3.4) | 8.9 | 4.2 | 3.5 | 6.6 | 4.6 | 3.1 | 2.3 | 1.9 | ||||||||||||||||||||||||||||||

| Prior accident years before catastrophe losses | 4.0 | 1.5 | 5.3 | (1.9) | (1.3) | — | (4.1) | 0.3 | 1.9 | (1.9) | 1.7 | (1.2) | 2.4 | (1.3) | ||||||||||||||||||||||||||||||

| Prior accident years catastrophe losses | — | — | (0.1) | (0.7) | — | (0.1) | (0.7) | (2.7) | (0.4) | (1.7) | (0.2) | (1.1) | (0.2) | (0.8) | ||||||||||||||||||||||||||||||

| Total loss and loss expense ratio | 70.4 | % | 76.8 | % | 82.1 | % | 74.6 | % | 64.3 | % | 69.7 | % | 80.7 | % | 80.6 | % | 78.5 | % | 80.7 | % | 77.9 | % | 76.8 | % | 75.8 | % | 73.4 | % | ||||||||||||||||

| Homeowner: | ||||||||||||||||||||||||||||||||||||||||||||

| Net written premiums | $ | 394 | $ | 442 | $ | 433 | $ | 303 | $ | 298 | $ | 339 | $ | 330 | $ | 222 | $ | 736 | $ | 552 | $ | 1,178 | $ | 890 | $ | 1,572 | $ | 1,188 | ||||||||||||||||

| Year over year change %-written premium | 32 | % | 30 | % | 31 | % | 36 | % | 32 | % | 33 | % | 27 | % | 23 | % | 33 | % | 25 | % | 32 | % | 28 | % | 32 | % | 29 | % | ||||||||||||||||

| Earned premiums | $ | 379 | $ | 352 | $ | 326 | $ | 303 | $ | 289 | $ | 271 | $ | 251 | $ | 232 | $ | 629 | $ | 484 | $ | 981 | $ | 755 | $ | 1,360 | $ | 1,044 | ||||||||||||||||

| Current accident year before catastrophe losses | 34.2 | % | 40.9 | % | 42.2 | % | 46.9 | % | 42.2 | % | 45.0 | % | 47.4 | % | 46.5 | % | 44.4 | % | 46.9 | % | 43.1 | % | 46.3 | % | 40.7 | % | 45.1 | % | ||||||||||||||||

| Current accident year catastrophe losses | 2.6 | 47.4 | 38.5 | 21.0 | 9.2 | 30.2 | 33.5 | 56.1 | 30.1 | 44.4 | 36.3 | 39.3 | 26.9 | 31.0 | ||||||||||||||||||||||||||||||

| Prior accident years before catastrophe losses | (1.3) | (1.4) | 1.2 | (2.0) | (2.5) | (1.0) | 0.7 | (2.6) | (0.3) | (0.8) | (0.7) | (0.9) | (0.9) | (1.4) | ||||||||||||||||||||||||||||||