| For the fiscal year ended | Commission file | |||||||||||||

| December 31, 2024 | number | 1-5805 | ||||||||||||

| Delaware | 13-2624428 | ||||||||||

| (State or other jurisdiction of incorporation or organization) |

(I.R.S. employer identification no.) |

||||||||||

| 383 Madison Avenue, | |||||||||||

| New York, | New York | 10179 | |||||||||

| (Address of principal executive offices) | (Zip Code) | ||||||||||

| Title of each class | Trading Symbol(s) | Name of each exchange on which registered | ||||||

| Common stock | JPM | The New York Stock Exchange | ||||||

| Depositary Shares, each representing a one-four hundredth interest in a share of 5.75% Non-Cumulative Preferred Stock, Series DD | JPM PR D | The New York Stock Exchange | ||||||

| Depositary Shares, each representing a one-four hundredth interest in a share of 6.00% Non-Cumulative Preferred Stock, Series EE | JPM PR C | The New York Stock Exchange | ||||||

| Depositary Shares, each representing a one-four hundredth interest in a share of 4.75% Non-Cumulative Preferred Stock, Series GG | JPM PR J | The New York Stock Exchange | ||||||

| Depositary Shares, each representing a one-four hundredth interest in a share of 4.55% Non-Cumulative Preferred Stock, Series JJ | JPM PR K | The New York Stock Exchange | ||||||

| Depositary Shares, each representing a one-four hundredth interest in a share of 4.625% Non-Cumulative Preferred Stock, Series LL | JPM PR L | The New York Stock Exchange | ||||||

| Depositary Shares, each representing a one-four hundredth interest in a share of 4.20% Non-Cumulative Preferred Stock, Series MM | JPM PR M | The New York Stock Exchange | ||||||

| Guarantee of Callable Fixed Rate Notes due June 10, 2032 of JPMorgan Chase Financial Company LLC | JPM/32 | The New York Stock Exchange | ||||||

| Guarantee of Alerian MLP Index ETNs due January 28, 2044 of JPMorgan Chase Financial Company LLC | AMJB | NYSE Arca, Inc. | ||||||

☒ |

Large accelerated filer | ☐ |

Accelerated filer |

☐

|

Non-accelerated filer | ☐ | Smaller reporting company | ☐ | Emerging growth company | ||||||||||||||||||||

| Page | ||||||||

| 1 | ||||||||

| 1 | ||||||||

| 1 | ||||||||

| 1 | ||||||||

| 2-7 | ||||||||

| 8-9 | ||||||||

| 322-326 | ||||||||

| 10-37 | ||||||||

| 38 | ||||||||

| 38 | ||||||||

| 38 | ||||||||

| 38 | ||||||||

| 39 | ||||||||

| 39 | ||||||||

| 39 | ||||||||

| 39 | ||||||||

| 40 | ||||||||

| 40 | ||||||||

| 40 | ||||||||

| 41 | ||||||||

| 41 | ||||||||

| 42 | ||||||||

| 43 | ||||||||

| 43 | ||||||||

| 43 | ||||||||

| 43 | ||||||||

| 44-47 | ||||||||

1 |

||||||||

2 |

||||||||

3 |

||||||||

4 |

||||||||

5 |

||||||||

6 |

||||||||

7 |

||||||||

| Employee Breakdown by Region | Employee Breakdown by LOB and Corporate | |||||||||||||||||||

| Region | Employees | LOB | Employees | |||||||||||||||||

| North America | 187,179 | CCB | 144,989 | |||||||||||||||||

| Asia-Pacific | 93,941 | CIB | 93,231 | |||||||||||||||||

Europe/Middle East/Africa |

30,729 | AWM | 29,403 | |||||||||||||||||

| Latin America/Caribbean | 5,384 | Corporate | 49,610 | |||||||||||||||||

| Total Firm | 317,233 | Total Firm | 317,233 | |||||||||||||||||

| December 31, 2024 | Total employees |

Senior level employees(e) |

Operating Committee | Board of Directors(f) |

|||||||||||||||||||||||||

Race/Ethnicity(a): |

|||||||||||||||||||||||||||||

| White | 43 | % | 74 | % | 86 | % | 80 | % | |||||||||||||||||||||

| Hispanic | 21 | % | 6 | % | 7 | % | — | ||||||||||||||||||||||

| Asian | 20 | % | 14 | % | 7 | % | — | ||||||||||||||||||||||

| Black | 13 | % | 5 | % | — | 20 | % | ||||||||||||||||||||||

Other(b) |

3 | % | 1 | % | — | — | |||||||||||||||||||||||

Gender(c): |

|||||||||||||||||||||||||||||

| Men | 51 | % | 71 | % | 53 | % | 50 | % | |||||||||||||||||||||

| Women | 49 | % | 29 | % | 47 | % | 50 | % | |||||||||||||||||||||

LGBTQ+(d) |

4 | % | 2 | % | 7 | % | — | ||||||||||||||||||||||

Military veterans(d) |

3 | % | 2 | % | — | 10 | % | ||||||||||||||||||||||

People with disabilities(d) |

5 | % | 3 | % | — | — | (g) |

||||||||||||||||||||||

8 |

||||||||

9 |

||||||||

10 |

||||||||

11 |

||||||||

12 |

||||||||

13 |

||||||||

14 |

||||||||

15 |

||||||||

16 |

||||||||

17 |

||||||||

18 |

||||||||

19 |

||||||||

20 |

||||||||

21 |

||||||||

22 |

||||||||

23 |

||||||||

24 |

||||||||

25 |

||||||||

26 |

||||||||

27 |

||||||||

28 |

||||||||

29 |

||||||||

30 |

||||||||

31 |

||||||||

32 |

||||||||

33 |

||||||||

34 |

||||||||

35 |

||||||||

36 |

||||||||

37 |

||||||||

| December 31, 2024 (in millions) |

Approximate square footage | ||||

United States(a) |

|||||

New York City, New York |

|||||

383 Madison Avenue, New York, New York |

1.1 | ||||

All other New York City locations |

6.0 | ||||

Total New York City, New York |

7.1 | ||||

Other U.S. locations |

|||||

Columbus/Westerville, Ohio |

3.5 | ||||

Chicago, Illinois |

2.7 | ||||

Dallas/Plano/Fort Worth, Texas |

2.5 | ||||

Wilmington/Newark, Delaware |

2.1 | ||||

Houston, Texas |

1.6 | ||||

Jersey City, New Jersey |

1.4 | ||||

Phoenix/Tempe, Arizona |

1.3 | ||||

All other U.S. locations |

33.8 | ||||

Total United States |

56.0 | ||||

Europe, the Middle East and Africa (“EMEA”) |

|||||

25 Bank Street, London, U.K. |

1.4 | ||||

All other U.K. locations |

2.3 | ||||

All other EMEA locations |

1.5 | ||||

Total EMEA |

5.2 | ||||

Asia-Pacific, Latin America and Canada |

|||||

India |

6.4 | ||||

| Philippines | 1.8 | ||||

All other locations |

2.8 | ||||

Total Asia-Pacific, Latin America and Canada |

11.0 | ||||

Total |

72.2 | ||||

38 |

||||||||

| Year ended December 31, 2024 | Total number of shares of common stock repurchased |

Average price paid per share of common stock(a) |

Aggregate purchase price of common stock repurchases

(in millions)(a)

|

Dollar value

of remaining

authorized

repurchase

(in millions)(a)(b)

|

|||||||||||||||||||||||||

| First quarter | 15,869,936 | $ | 179.50 | $ | 2,849 | $ | 16,886 | ||||||||||||||||||||||

| Second quarter | 27,019,730 | 196.83 | 5,318 | 11,568 | (c) |

||||||||||||||||||||||||

| Third quarter | 30,343,933 | 209.61 | 6,361 | 23,639 | |||||||||||||||||||||||||

| October | 6,173,254 | 218.00 | 1,345 | 22,294 | |||||||||||||||||||||||||

| November | 5,142,243 | 241.03 | 1,240 | 21,054 | |||||||||||||||||||||||||

| December | 7,170,130 | 241.10 | 1,728 | 19,326 | |||||||||||||||||||||||||

| Fourth quarter | 18,485,627 | 233.37 | 4,313 | 19,326 | |||||||||||||||||||||||||

Full year |

91,719,226 | $ | 205.43 | $ | 18,841 | $ | 19,326 | ||||||||||||||||||||||

39 |

||||||||

40 |

||||||||

| Name | Title | Adoption date | Duration(c) |

Aggregate number of shares to be sold |

||||||||||

Lori Beer |

Chief Information Officer |

November 15, 2024 | November 15, 2024 - March 31, 2025 |

4,105 | ||||||||||

James Dimon(a) |

Chairman and CEO |

November 7, 2024 | November 7, 2024 - August 1, 2025 |

1,000,000 | ||||||||||

Robin Leopold |

Head of Human Resources |

November 4, 2024 | November 4, 2024 - December 31, 2025 |

2,500 | ||||||||||

Jennifer Piepszak(b) |

Co-CEO, CIB |

October 30, 2024 | October 30, 2024 - March 31, 2025 |

8,545 | ||||||||||

Troy Rohrbaugh |

Co-CEO, CIB |

November 15, 2024 | November 15, 2024 - June 30, 2025 |

75,000 | ||||||||||

41 |

||||||||

| Age | ||||||||

| Name | (at December 31, 2024) | Positions and offices | ||||||

| James Dimon | 68 | Chairman of the Board since December 2006 and Chief Executive Officer since December 2005. |

||||||

| Ashley Bacon | 55 | Chief Risk Officer since June 2013. | ||||||

| Jeremy Barnum | 52 | Chief Financial Officer since May 2021, prior to which he was Head of Global Research for the former Corporate & Investment Bank since February 2021. He previously served as Chief Financial Officer of the former Corporate & Investment Bank from July 2013 until February 2021. | ||||||

| Lori A. Beer | 57 | Chief Information Officer since September 2017. |

||||||

| Mary Callahan Erdoes | 57 | Chief Executive Officer of Asset & Wealth Management since September 2009. | ||||||

| Stacey Friedman | 56 | General Counsel since January 2016. |

||||||

Marianne Lake |

55 | Chief Executive Officer of Consumer & Community Banking since January 2024, having previously served as its Co-Chief Executive Officer since May 2021. She was Chief Executive Officer of Consumer Lending from May 2019 until May 2021. |

||||||

| Robin Leopold | 60 | Head of Human Resources since January 2018. |

||||||

Jennifer A. Piepszak(a)(b) |

54 | Co-Chief Executive Officer of the Commercial & Investment Bank, having previously served as Co-Chief Executive Officer of Consumer & Community Banking since May 2021, prior to which she had been Chief Financial Officer since May 2019. |

||||||

Daniel E. Pinto(a)(b) |

62 | President and Chief Operating Officer since January 2022, Co-President and Co-Chief Operating Officer since January 2018. He also served as Chief Executive Officer of the former Corporate & Investment Bank from March 2014 until January 2024. |

||||||

Troy Rohrbaugh(a) |

54 | Co-Chief Executive Officer of the Commercial & Investment Bank since January 2024, prior to which he had been the Co-Head of Markets & Securities Services since June 2023. He was Head of Global Markets from January 2019 until June 2023. |

||||||

42 |

||||||||

| December 31, 2024 | Number of shares to be issued upon exercise of outstanding stock appreciation rights |

Weighted-average

exercise price of

outstanding

stock appreciation rights

|

Number of shares remaining available for future issuance under stock incentive plans | |||||||||||||||||||||||

| Plan category | ||||||||||||||||||||||||||

| Employee share-based incentive plans approved by shareholders | 2,250,000 | (a) |

$ | 152.19 | 81,151,866 | (b) |

||||||||||||||||||||

| Total | 2,250,000 | $ | 152.19 | 81,151,866 | ||||||||||||||||||||||

43 |

||||||||

| 1 | Financial statements | |||||||

| The Consolidated Financial Statements, the Notes thereto and the report of the Independent Registered Public Accounting Firm thereon listed in Item 8 are set forth commencing on page 169. | ||||||||

| 2 | Financial statement schedules | |||||||

| 3 | Exhibits | |||||||

| 3.1 | ||||||||

| 3.2 | ||||||||

| 3.3 | ||||||||

| 3.4 |

|

|||||||

| 3.5 |

|

|||||||

| 3.6 | ||||||||

| 3.7 | ||||||||

| 3.8 | ||||||||

| 3.90 | ||||||||

| 3.10 | ||||||||

| 3.11 | ||||||||

| 3.12 | ||||||||

| 3.13 | ||||||||

| 3.14 | ||||||||

| 4.1(a) | ||||||||

44 |

||||||||

| 4.1(b) | ||||||||

| 4.2(a) | ||||||||

| 4.2(b) | ||||||||

| 4.3(a) | ||||||||

| 4.3(b) | ||||||||

| 4.4 | ||||||||

| 4.5 | ||||||||

| 4.6 | ||||||||

| Other instruments defining the rights of holders of long-term debt securities of JPMorgan Chase & Co. and its subsidiaries are omitted pursuant to Section (b)(4)(iii)(A) of Item 601 of Regulation S-K. JPMorgan Chase & Co. agrees to furnish copies of these instruments to the SEC upon request. | ||||||||

| 10.1 |

Deferred Compensation Plan for Non-Employee Directors of JPMorgan Chase & Co., as amended and restated July 2001 and as of December 31, 2004 (incorporated by reference to Exhibit 10.1 to the Annual Report on Form 10-K of JPMorgan Chase & Co. (File No. 1-5805) for the year ended December 31, 2007).(a)

|

|||||||

| 10.2 | ||||||||

| 10.3 | ||||||||

| 10.4 | ||||||||

| 10.5 | ||||||||

| 10.6 | ||||||||

| 10.7 | ||||||||

45 |

||||||||

46 |

||||||||

| 10.20 | ||||||||

| 10.21 | ||||||||

| 19 | ||||||||

| 21 | ||||||||

| 22.1 | Annual Report on Form 11-K of The JPMorgan Chase 401(k) Savings Plan for the year ended December 31, 2024 (to be filed pursuant to Rule 15d-21 under the Securities Exchange Act of 1934). |

|||||||

| 22.2 | ||||||||

| 23 | ||||||||

| 31.1 | ||||||||

| 31.2 | ||||||||

| 32 | ||||||||

| 97 | ||||||||

| 101.INS | The instance document does not appear in the interactive data file because its XBRL tags are embedded within the Inline XBRL document.(d) |

|||||||

| 101.SCH |

XBRL Taxonomy Extension Schema

Document.(b)

|

|||||||

| 101.CAL | XBRL Taxonomy Extension Calculation Linkbase Document.(b) |

|||||||

| 101.DEF | XBRL Taxonomy Extension Definition Linkbase Document.(b) |

|||||||

| 101.LAB | XBRL Taxonomy Extension Label Linkbase Document.(b) |

|||||||

| 101.PRE | XBRL Taxonomy Extension Presentation Linkbase Document.(b) |

|||||||

| 104 | Cover Page Interactive Data File (embedded within the Inline XBRL document and included in Exhibit 101). |

|||||||

47 |

||||||||

48 |

||||||||

| Financial: | Audited financial statements: | |||||||||||||||||||

| 50 | 168 | |||||||||||||||||||

| 51 | 169 | |||||||||||||||||||

| Management’s discussion and analysis: | 172 | |||||||||||||||||||

| 52 | 177 | |||||||||||||||||||

| 54 | ||||||||||||||||||||

| 59 | ||||||||||||||||||||

| 63 | Supplementary information: | |||||||||||||||||||

| 67 | 322 | |||||||||||||||||||

| 70 | 327 | |||||||||||||||||||

| 91 | ||||||||||||||||||||

| 96 | ||||||||||||||||||||

| 97 | ||||||||||||||||||||

| 108 | ||||||||||||||||||||

| 117 | ||||||||||||||||||||

| 141 | ||||||||||||||||||||

| 150 | ||||||||||||||||||||

| 152 | ||||||||||||||||||||

| 153 | ||||||||||||||||||||

| 161 | ||||||||||||||||||||

| 165 | ||||||||||||||||||||

| 167 | ||||||||||||||||||||

JPMorgan Chase & Co./2024 Form 10-K |

49 |

|||||||

|

As of or for the year ended December 31,

(in millions, except per share, ratio, employee data and where otherwise noted)

|

|||||||||||||||||||||||

| 2024 | 2023 | 2022 | |||||||||||||||||||||

| Selected income statement data | |||||||||||||||||||||||

| Total net revenue | $ | 177,556 | (e) |

$ | 158,104 | $ | 128,695 | ||||||||||||||||

| Total noninterest expense | 91,797 | (e) |

87,172 | 76,140 | |||||||||||||||||||

Pre-provision profit(a) |

85,759 | 70,932 | 52,555 | ||||||||||||||||||||

| Provision for credit losses | 10,678 | 9,320 | 6,389 | ||||||||||||||||||||

| Income before income tax expense | 75,081 | 61,612 | 46,166 | ||||||||||||||||||||

| Income tax expense | 16,610 | 12,060 | 8,490 | ||||||||||||||||||||

| Net income | $ | 58,471 | $ | 49,552 | $ | 37,676 | |||||||||||||||||

| Earnings per share data | |||||||||||||||||||||||

| Net income: Basic | $ | 19.79 | $ | 16.25 | $ | 12.10 | |||||||||||||||||

| Diluted | 19.75 | 16.23 | 12.09 | ||||||||||||||||||||

| Average shares: Basic | 2,873.9 | 2,938.6 | 2,965.8 | ||||||||||||||||||||

| Diluted | 2,879.0 | 2,943.1 | 2,970.0 | ||||||||||||||||||||

| Market and per common share data | |||||||||||||||||||||||

| Market capitalization | 670,618 | 489,320 | 393,484 | ||||||||||||||||||||

| Common shares at period-end | 2,797.6 | 2,876.6 | 2,934.2 | ||||||||||||||||||||

| Book value per share | 116.07 | 104.45 | 90.29 | ||||||||||||||||||||

Tangible book value per share (“TBVPS”)(a) |

97.30 | 86.08 | 73.12 | ||||||||||||||||||||

| Cash dividends declared per share | 4.80 | 4.10 | 4.00 | ||||||||||||||||||||

| Selected ratios and metrics | |||||||||||||||||||||||

| Return on common equity (“ROE”) | 18 | % | 17 | % | 14 | % | |||||||||||||||||

Return on tangible common equity (“ROTCE”)(a) |

22 | 21 | 18 | ||||||||||||||||||||

| Return on assets (“ROA”) | 1.43 | 1.30 | 0.98 | ||||||||||||||||||||

| Overhead ratio | 52 | 55 | 59 | ||||||||||||||||||||

| Loans-to-deposits ratio | 56 | 55 | 49 | ||||||||||||||||||||

Firm Liquidity coverage ratio (“LCR”) (average)(b) |

113 | 113 | 112 | ||||||||||||||||||||

JPMorgan Chase Bank, N.A. LCR (average)(b) |

124 | 129 | 151 | ||||||||||||||||||||

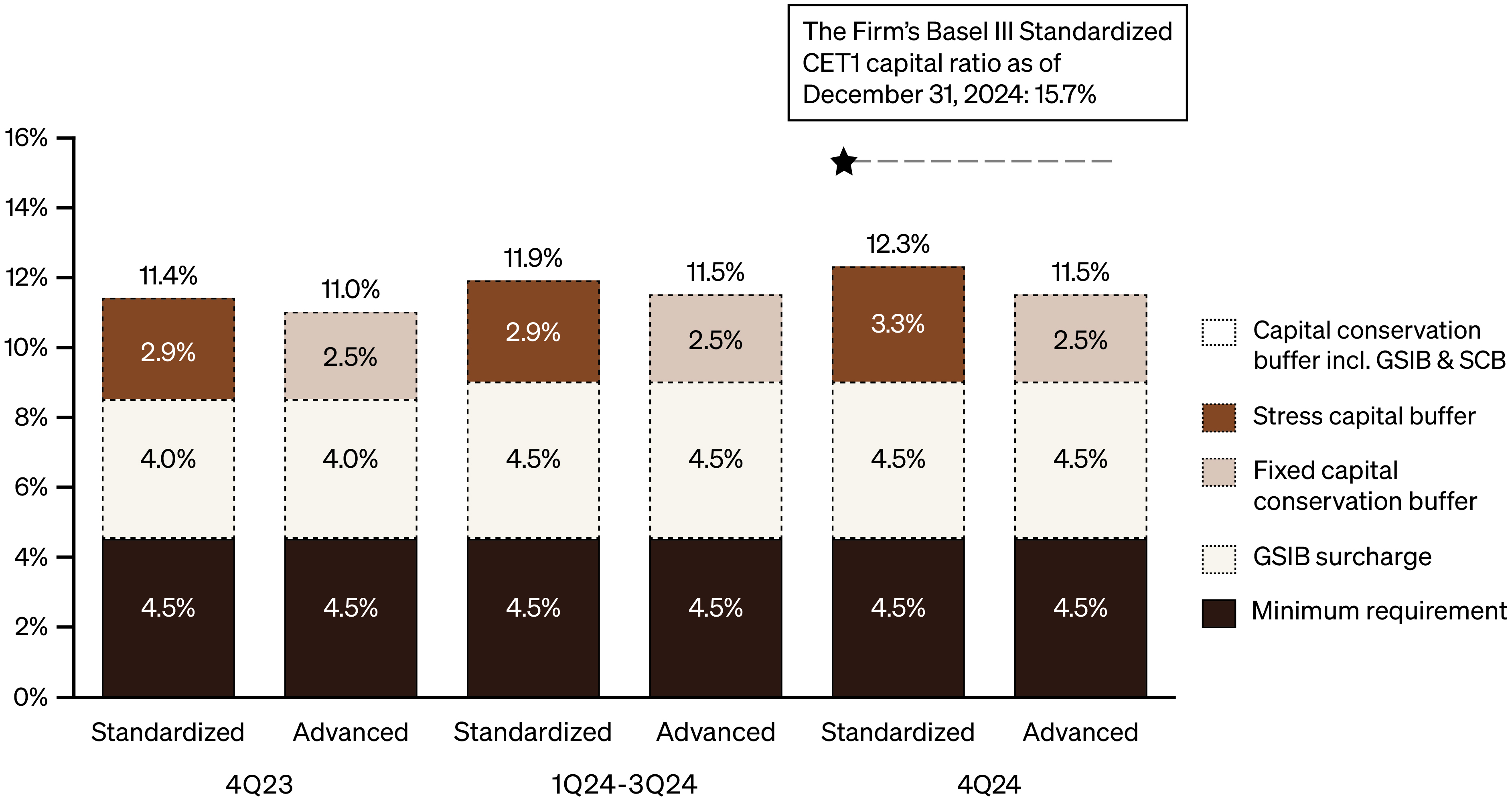

Common equity Tier 1 (“CET1”) capital ratio(c)(d) |

15.7 | 15.0 | 13.2 | ||||||||||||||||||||

Tier 1 capital ratio(c)(d) |

16.8 | 16.6 | 14.9 | ||||||||||||||||||||

Total capital ratio(c)(d) |

18.5 | 18.5 | 16.8 | ||||||||||||||||||||

Tier 1 leverage ratio(b)(c) |

7.2 | 7.2 | 6.6 | ||||||||||||||||||||

Supplementary leverage ratio (“SLR”)(b)(c) |

6.1 | 6.1 | 5.6 | ||||||||||||||||||||

Selected balance sheet data (period-end) |

|||||||||||||||||||||||

| Trading assets | $ | 637,784 | $ | 540,607 | $ | 453,799 | |||||||||||||||||

| Investment securities, net of allowance for credit losses | 681,320 | 571,552 | 631,162 | ||||||||||||||||||||

| Loans | 1,347,988 | 1,323,706 | 1,135,647 | ||||||||||||||||||||

| Total assets | 4,002,814 | 3,875,393 | 3,665,743 | ||||||||||||||||||||

| Deposits | 2,406,032 | 2,400,688 | 2,340,179 | ||||||||||||||||||||

| Long-term debt | 401,418 | 391,825 | 295,865 | ||||||||||||||||||||

| Common stockholders’ equity | 324,708 | 300,474 | 264,928 | ||||||||||||||||||||

| Total stockholders’ equity | 344,758 | 327,878 | 292,332 | ||||||||||||||||||||

| Employees | 317,233 | 309,926 | 293,723 | ||||||||||||||||||||

| Credit quality metrics | |||||||||||||||||||||||

| Allowances for credit losses | $ | 26,866 | $ | 24,765 | $ | 22,204 | |||||||||||||||||

| Allowance for loan losses to total retained loans | 1.87 | % | 1.75 | % | 1.81 | % | |||||||||||||||||

| Nonperforming assets | $ | 9,300 | $ | 7,597 | $ | 7,247 | |||||||||||||||||

| Net charge-offs | 8,638 | 6,209 | 2,853 | ||||||||||||||||||||

| Net charge-off rate | 0.68 | % | 0.52 | % | 0.27 | % | |||||||||||||||||

50 |

JPMorgan Chase & Co./2024 Form 10-K |

|||||||

| December 31, (in dollars) |

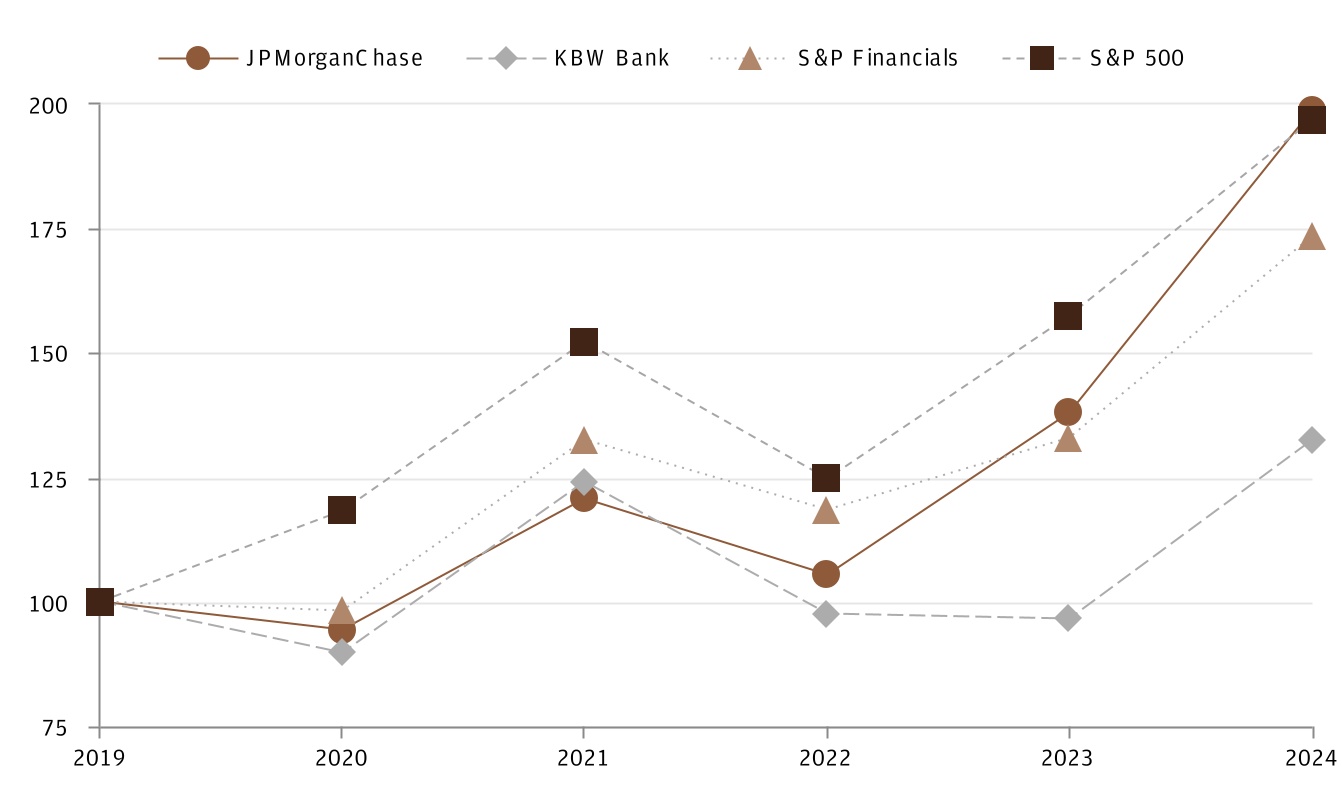

2019 | 2020 | 2021 | 2022 | 2023 | 2024 | |||||||||||||||||||||||||||||

| JPMorganChase | $ | 100.00 | $ | 94.48 | $ | 120.68 | $ | 105.48 | $ | 137.91 | $ | 198.96 | |||||||||||||||||||||||

| KBW Bank Index | 100.00 | 89.69 | 124.08 | 97.53 | 96.66 | 132.62 | |||||||||||||||||||||||||||||

| S&P Financials Index | 100.00 | 98.24 | 132.50 | 118.54 | 132.94 | 173.57 | |||||||||||||||||||||||||||||

| S&P 500 Index | 100.00 | 118.39 | 152.34 | 124.75 | 157.54 | 196.96 | |||||||||||||||||||||||||||||

JPMorgan Chase & Co./2024 Form 10-K |

51 |

|||||||

| INTRODUCTION | ||||||||||||||

52 |

JPMorgan Chase & Co./2024 Form 10-K |

|||||||

JPMorgan Chase & Co./2024 Form 10-K |

53 |

|||||||

| EXECUTIVE OVERVIEW | ||||||||||||||

| Financial performance of JPMorganChase | |||||||||||

| Year ended December 31, (in millions, except per share data and ratios) |

|||||||||||

| 2024 | 2023 | Change | |||||||||

| Selected income statement data | |||||||||||

| Noninterest revenue | $ | 84,973 | $ | 68,837 | 23% | ||||||

| Net interest income | 92,583 | 89,267 | 4 | ||||||||

| Total net revenue | 177,556 | 158,104 | 12 | ||||||||

| Total noninterest expense | 91,797 | 87,172 | 5 | ||||||||

| Pre-provision profit | 85,759 | 70,932 | 21 | ||||||||

| Provision for credit losses | 10,678 | 9,320 | 15 | ||||||||

| Net income | 58,471 | 49,552 | 18 | ||||||||

| Diluted earnings per share | 19.75 | 16.23 | 22 | ||||||||

| Selected ratios and metrics | |||||||||||

| Return on common equity | 18 | % | 17 | % | |||||||

Return on tangible common equity |

22 | 21 | |||||||||

| Book value per share | $ | 116.07 | $ | 104.45 | 11 | ||||||

| Tangible book value per share | 97.3 | 86.08 | 13 | ||||||||

Capital ratios(a)(b) |

|||||||||||

| CET1 capital | 15.7 | % | 15.0 | % | |||||||

| Tier 1 capital | 16.8 | 16.6 | |||||||||

Total capital |

18.5 | 18.5 | |||||||||

| Memo: | |||||||||||

NII excluding Markets(c) |

$ | 92,419 | $ | 90,041 | 3 | ||||||

NIR excluding Markets(c) |

58,167 | 44,361 | 31 | ||||||||

Markets(c) |

30,007 | 27,964 | 7 | ||||||||

| Total net revenue - managed basis | $ | 180,593 | $ | 162,366 | 11 | ||||||

54 |

JPMorgan Chase & Co./2024 Form 10-K |

|||||||

JPMorgan Chase & Co./2024 Form 10-K |

55 |

|||||||

|

CCB

ROE 32%

|

•Average deposits down 6%; client investment assets up 14%

•Average loans up 9%; Card Services net charge-off rate of 3.34%

•Debit and credit card sales volume(a) up 8%

•Active mobile customers(b) up 7%

|

|||||||

|

CIB(c)

ROE 18%

|

•Investment Banking fees up 37%; #1 ranking for Global Investment Banking fees with 9.3% wallet share for the year

•Markets revenue up 7%, with Fixed Income Markets up 5% and Equity Markets up 13%

•Average Banking & Payments loans up 2%; average client deposits(d) up 5%

|

|||||||

|

AWM

ROE 34%

|

•Assets under management ("AUM") of $4.0 trillion, up 18%

•Average loans up 3%; average deposits up 9% including the transfer of First Republic deposits to AWM in 4Q23(e)

|

|||||||

$2.8 trillion |

Total credit provided and capital raised (including loans and commitments) |

|||||||

|

$250

billion

|

Credit for consumers |

|||||||

|

$40

billion

|

Credit for U.S. small businesses |

|||||||

$2.4 trillion |

Credit and capital for corporations and non-U.S. government entities(a) |

|||||||

|

$65

billion

|

Credit and capital for nonprofit and U.S. government entities(b) |

|||||||

56 |

JPMorgan Chase & Co./2024 Form 10-K |

|||||||

JPMorgan Chase & Co./2024 Form 10-K |

57 |

|||||||

58 |

JPMorgan Chase & Co./2024 Form 10-K |

|||||||

| CONSOLIDATED RESULTS OF OPERATIONS | ||||||||||||||

| Revenue | |||||||||||||||||

| Year ended December 31, (in millions) |

|||||||||||||||||

| 2024 | 2023 | 2022 | |||||||||||||||

| Investment banking fees | $ | 8,910 | $ | 6,519 | $ | 6,686 | |||||||||||

| Principal transactions | 24,787 | 24,460 | 19,912 | ||||||||||||||

| Lending- and deposit-related fees | 7,606 | 7,413 | 7,098 | ||||||||||||||

| Asset management fees | 17,801 | 15,220 | 14,096 | ||||||||||||||

| Commissions and other fees | 7,530 | 6,836 | 6,581 | ||||||||||||||

| Investment securities losses | (1,021) | (3,180) | (2,380) | ||||||||||||||

| Mortgage fees and related income | 1,401 | 1,176 | 1,250 | ||||||||||||||

| Card income | 5,497 | 4,784 | 4,420 | ||||||||||||||

Other income(a)(b) |

12,462 | (c) |

5,609 | (d) |

4,322 | ||||||||||||

| Noninterest revenue | 84,973 | 68,837 | 61,985 | ||||||||||||||

| Net interest income | 92,583 | 89,267 | 66,710 | ||||||||||||||

| Total net revenue | $ | 177,556 | $ | 158,104 | $ | 128,695 | |||||||||||

JPMorgan Chase & Co./2024 Form 10-K |

59 |

|||||||

60 |

JPMorgan Chase & Co./2024 Form 10-K |

|||||||

| Provision for credit losses | |||||||||||||||||

| Year ended December 31, | |||||||||||||||||

| (in millions) | 2024 | 2023 | 2022 | ||||||||||||||

Consumer, excluding credit card |

$ | 631 | $ | 935 | $ | 506 | |||||||||||

| Credit card | 9,292 | 6,048 | 3,353 | ||||||||||||||

| Total consumer | 9,923 | 6,983 | 3,859 | ||||||||||||||

| Wholesale | 731 | 2,299 | 2,476 | ||||||||||||||

| Investment securities | 24 | 38 | 54 | ||||||||||||||

Total provision for credit losses |

$ | 10,678 | $ | 9,320 | $ | 6,389 | |||||||||||

JPMorgan Chase & Co./2024 Form 10-K |

61 |

|||||||

| Noninterest expense | ||||||||||||||

| Year ended December 31, | ||||||||||||||

| (in millions) | 2024 | 2023 | 2022 | |||||||||||

Compensation expense |

$ | 51,357 | $ | 46,465 | $ | 41,636 | ||||||||

Noncompensation expense: |

||||||||||||||

| Occupancy | 5,026 | 4,590 | 4,696 | |||||||||||

Technology, communications and equipment(a) |

9,831 | 9,246 | 9,358 | |||||||||||

Professional and outside services |

11,057 | 10,235 | 10,174 | |||||||||||

| Marketing | 4,974 | 4,591 | 3,911 | |||||||||||

| Other expense | 9,552 | (c) |

12,045 | 6,365 | ||||||||||

| Total noncompensation expense | 40,440 | 40,707 | 34,504 | |||||||||||

Total noninterest expense |

$ | 91,797 | $ | 87,172 | $ | 76,140 | ||||||||

Certain components of other expense(b) |

||||||||||||||

| Legal expense | $ | 740 | $ | 1,436 | $ | 266 | ||||||||

| FDIC-related expense | 1,893 | 4,203 | 860 | |||||||||||

| Operating losses | 1,417 | 1,228 | 1,101 | |||||||||||

| Income tax expense | |||||||||||||||||

| Year ended December 31, (in millions, except rate) |

|||||||||||||||||

| 2024 | 2023 | 2022 | |||||||||||||||

Income before income tax expense |

$ | 75,081 | $ | 61,612 | $ | 46,166 | |||||||||||

| Income tax expense | 16,610 | (a) |

12,060 | 8,490 | |||||||||||||

| Effective tax rate | 22.1 | % | 19.6 | % | 18.4 | % | |||||||||||

62 |

JPMorgan Chase & Co./2024 Form 10-K |

|||||||

| CONSOLIDATED BALANCE SHEETS AND CASH FLOWS ANALYSIS | ||||||||||||||

| Selected Consolidated balance sheets data | ||||||||||||||

| December 31, (in millions) | 2024 | 2023 | Change | |||||||||||

| Assets | ||||||||||||||

| Cash and due from banks | $ | 23,372 | $ | 29,066 | (20) | % | ||||||||

| Deposits with banks | 445,945 | 595,085 | (25) | |||||||||||

Federal funds sold and securities purchased under resale agreements |

295,001 | 276,152 | 7 | |||||||||||

| Securities borrowed | 219,546 | 200,436 | 10 | |||||||||||

| Trading assets | 637,784 | 540,607 | 18 | |||||||||||

| Available-for-sale securities | 406,852 | 201,704 | 102 | |||||||||||

| Held-to-maturity securities | 274,468 | 369,848 | (26) | |||||||||||

| Investment securities, net of allowance for credit losses | 681,320 | 571,552 | 19 | |||||||||||

| Loans | 1,347,988 | 1,323,706 | 2 | |||||||||||

| Allowance for loan losses | (24,345) | (22,420) | 9 | |||||||||||

| Loans, net of allowance for loan losses | 1,323,643 | 1,301,286 | 2 | |||||||||||

Accrued interest and accounts receivable |

101,223 | 107,363 | (6) | |||||||||||

| Premises and equipment | 32,223 | 30,157 | 7 | |||||||||||

| Goodwill, MSRs and other intangible assets | 64,560 | 64,381 | — | |||||||||||

| Other assets | 178,197 | 159,308 | 12 | |||||||||||

| Total assets | $ | 4,002,814 | $ | 3,875,393 | 3 | % | ||||||||

JPMorgan Chase & Co./2024 Form 10-K |

63 |

|||||||

| Selected Consolidated balance sheets data (continued) | ||||||||||||||

| December 31, (in millions) | 2024 | 2023 | Change | |||||||||||

| Liabilities | ||||||||||||||

| Deposits | $ | 2,406,032 | $ | 2,400,688 | — | |||||||||

Federal funds purchased and securities loaned or sold under repurchase agreements |

296,835 | 216,535 | 37 | |||||||||||

| Short-term borrowings | 52,893 | 44,712 | 18 | |||||||||||

| Trading liabilities | 192,883 | 180,428 | 7 | |||||||||||

| Accounts payable and other liabilities | 280,672 | 290,307 | (3) | |||||||||||

Beneficial interests issued by consolidated variable interest entities (“VIEs”) |

27,323 | 23,020 | 19 | |||||||||||

| Long-term debt | 401,418 | 391,825 | 2 | |||||||||||

| Total liabilities | 3,658,056 | 3,547,515 | 3 | |||||||||||

| Stockholders’ equity | 344,758 | 327,878 | 5 | |||||||||||

Total liabilities and stockholders’ equity |

$ | 4,002,814 | $ | 3,875,393 | 3 | % | ||||||||

64 |

JPMorgan Chase & Co./2024 Form 10-K |

|||||||

JPMorgan Chase & Co./2024 Form 10-K |

65 |

|||||||

| (in millions) | Year ended December 31, | |||||||||||||||||||

| 2024 | 2023 | 2022 | ||||||||||||||||||

|

Net cash provided by/

(used in)

|

||||||||||||||||||||

| Operating activities | $ | (42,012) | $ | 12,974 | $ | 107,119 | ||||||||||||||

| Investing activities | (163,403) | 67,643 | (137,819) | |||||||||||||||||

Financing activities |

63,447 | (25,571) | (126,257) | |||||||||||||||||

Effect of exchange rate changes on cash |

(12,866) | 1,871 | (16,643) | |||||||||||||||||

Net increase/(decrease) in cash and due from banks and deposits with banks |

$ | (154,834) | $ | 56,917 | $ | (173,600) | ||||||||||||||

66 |

JPMorgan Chase & Co./2024 Form 10-K |

|||||||

EXPLANATION AND RECONCILIATION OF THE FIRM’S USE OF NON-GAAP FINANCIAL MEASURES | ||

| 2024 | 2023 | 2022 | |||||||||||||||||||||||||||||||||

| Year ended December 31, (in millions, except ratios) |

Reported | Fully taxable-equivalent adjustments(b) |

Managed basis |

Reported | Fully taxable-equivalent adjustments(b) |

Managed basis |

Reported | Fully taxable-equivalent adjustments(b) |

Managed basis |

||||||||||||||||||||||||||

| Other income | $ | 12,462 | (a) |

$ | 2,560 | (a) |

$ | 15,022 | $ | 5,609 | $ | 3,782 | $ | 9,391 | $ | 4,322 | $ | 3,148 | $ | 7,470 | |||||||||||||||

| Total noninterest revenue | 84,973 | 2,560 | 87,533 | 68,837 | 3,782 | 72,619 | 61,985 | 3,148 | 65,133 | ||||||||||||||||||||||||||

| Net interest income | 92,583 | 477 | 93,060 | 89,267 | 480 | 89,747 | 66,710 | 434 | 67,144 | ||||||||||||||||||||||||||

| Total net revenue | 177,556 | 3,037 | 180,593 | 158,104 | 4,262 | 162,366 | 128,695 | 3,582 | 132,277 | ||||||||||||||||||||||||||

| Total noninterest expense | 91,797 | NA | 91,797 | 87,172 | NA | 87,172 | 76,140 | NA | 76,140 | ||||||||||||||||||||||||||

| Pre-provision profit | 85,759 | 3,037 | 88,796 | 70,932 | 4,262 | 75,194 | 52,555 | 3,582 | 56,137 | ||||||||||||||||||||||||||

| Provision for credit losses | 10,678 | NA | 10,678 | 9,320 | NA | 9,320 | 6,389 | NA | 6,389 | ||||||||||||||||||||||||||

| Income before income tax expense | 75,081 | 3,037 | 78,118 | 61,612 | 4,262 | 65,874 | 46,166 | 3,582 | 49,748 | ||||||||||||||||||||||||||

| Income tax expense | 16,610 | (a) |

3,037 | (a) |

19,647 | 12,060 | 4,262 | 16,322 | 8,490 | 3,582 | 12,072 | ||||||||||||||||||||||||

| Net income | $ | 58,471 | NA | $ | 58,471 | $ | 49,552 | NA | $ | 49,552 | $ | 37,676 | NA | $ | 37,676 | ||||||||||||||||||||

| Overhead ratio | 52 | % | NM | 51 | % | 55 | % | NM | 54 | % | 59 | % | NM | 58 | % | ||||||||||||||||||||

JPMorgan Chase & Co./2024 Form 10-K |

67 |

|||||||

| Year ended December 31, (in millions, except rates) |

2024 | 2023 | 2022 | ||||||||

Net interest income – reported(a) |

$ | 92,583 | $ | 89,267 | $ | 66,710 | |||||

| Fully taxable-equivalent adjustments | 477 | 480 | 434 | ||||||||

| Net interest income – managed basis | $ | 93,060 | $ | 89,747 | $ | 67,144 | |||||

Less: Markets net interest income(b) |

641 | (294) | 4,789 | ||||||||

| Net interest income excluding Markets | $ | 92,419 | $ | 90,041 | $ | 62,355 | |||||

Average interest-earning assets(a) |

$ | 3,537,567 | $ | 3,325,708 | $ | 3,349,079 | |||||

Less: Average Markets interest-earning assets(b) |

1,128,153 | 985,777 | 953,195 | ||||||||

| Average interest-earning assets excluding Markets | $ | 2,409,414 | $ | 2,339,931 | $ | 2,395,884 | |||||

Net yield on average interest-earning assets – managed basis |

2.63 | % | 2.70 | % | 2.00 | % | |||||

Net yield on average Markets interest-earning assets(b) |

0.06 | (0.03) | 0.50 | ||||||||

Net yield on average interest-earning assets excluding Markets |

3.84 | % | 3.85 | % | 2.60 | % | |||||

Noninterest revenue – reported(c) |

$ | 84,973 | $ | 68,837 | $ | 61,985 | |||||

Fully taxable-equivalent adjustments(c) |

2,560 | 3,782 | 3,148 | ||||||||

| Noninterest revenue – managed basis | $ | 87,533 | $ | 72,619 | $ | 65,133 | |||||

Less: Markets noninterest revenue(b)(d) |

29,366 | 28,258 | 24,373 | ||||||||

| Noninterest revenue excluding Markets | $ | 58,167 | $ | 44,361 | $ | 40,760 | |||||

Memo: Total Markets net revenue(b) |

$ | 30,007 | $ | 27,964 | $ | 29,162 | |||||

Calculation of certain U.S. GAAP and non-GAAP financial measures | ||||||||||||||

Certain U.S. GAAP and non-GAAP financial measures are calculated as follows: | ||||||||||||||

|

Book value per share (“BVPS”)

Common stockholders’ equity at period-end /

Common shares at period-end

| ||||||||||||||

|

Overhead ratio

Total noninterest expense / Total net revenue

| ||||||||||||||

|

ROA

Reported net income / Total average assets

| ||||||||||||||

|

ROE

Net income* / Average common stockholders’ equity

| ||||||||||||||

|

ROTCE

Net income* / Average tangible common equity

| ||||||||||||||

|

TBVPS

Tangible common equity at period-end / Common shares at period-end

| ||||||||||||||

* Represents net income applicable to common equity | ||||||||||||||

68 |

JPMorgan Chase & Co./2024 Form 10-K |

|||||||

| Period-end | Average | |||||||||||||||||||

| Dec 31, 2024 |

Dec 31, 2023 |

Year ended December 31, | ||||||||||||||||||

| (in millions, except per share and ratio data) | 2024 | 2023 | 2022 | |||||||||||||||||

Common stockholders’ equity |

$ | 324,708 | $ | 300,474 | $ | 312,370 | $ | 282,056 | $ | 253,068 | ||||||||||

| Less: Goodwill | 52,565 | 52,634 | 52,627 | 52,258 | 50,952 | |||||||||||||||

Less: Other intangible assets |

2,874 | 3,225 | 3,042 | 2,572 | 1,112 | |||||||||||||||

Add: Certain deferred tax liabilities(a) |

2,943 | 2,996 | 2,970 | 2,883 | 2,505 | |||||||||||||||

| Tangible common equity | $ | 272,212 | $ | 247,611 | $ | 259,671 | $ | 230,109 | $ | 203,509 | ||||||||||

| Return on tangible common equity | NA | NA | 22 | % | 21 | % | 18 | % | ||||||||||||

| Tangible book value per share | $ | 97.30 | $ | 86.08 | NA | NA | NA | |||||||||||||

JPMorgan Chase & Co./2024 Form 10-K |

69 |

|||||||

| BUSINESS SEGMENT & CORPORATE RESULTS | ||||||||||||||

70 |

JPMorgan Chase & Co./2024 Form 10-K |

|||||||

JPMorgan Chase & Co./2024 Form 10-K |

71 |

|||||||

| Year ended December 31, | Consumer & Community Banking | Commercial & Investment Bank | Asset & Wealth Management | ||||||||||||||||||||||||||||||||

| (in millions, except ratios) | 2024 | 2023 | 2022 | 2024 | 2023 | 2022 | 2024 | 2023 | 2022 | ||||||||||||||||||||||||||

| Total net revenue | $ | 71,507 | $ | 70,148 | $ | 54,814 | (a) |

$ | 70,114 | $ | 64,353 | $ | 59,635 | (a) |

$ | 21,578 | $ | 19,827 | $ | 17,748 | |||||||||||||||

| Total noninterest expense | 38,036 | 34,819 | 31,208 | (a) |

35,353 | 33,972 | 32,069 | (a) |

14,414 | 12,780 | 11,829 | ||||||||||||||||||||||||

| Pre-provision profit/(loss) | 33,471 | 35,329 | 23,606 | 34,761 | 30,381 | 27,566 | 7,164 | 7,047 | 5,919 | ||||||||||||||||||||||||||

| Provision for credit losses | 9,974 | 6,899 | 3,813 | 762 | 2,091 | 2,426 | (68) | 159 | 128 | ||||||||||||||||||||||||||

| Net income/(loss) | 17,603 | 21,232 | 14,916 | (a) |

24,846 | 20,272 | 19,138 | (a) |

5,421 | 5,227 | 4,365 | ||||||||||||||||||||||||

| Return on equity (“ROE”) | 32 | % | 38 | % | 29 | % | 18 | % | 14 | % | 14 | % | 34 | % | 31 | % | 25 | % | |||||||||||||||||

| Year ended December 31, | Corporate | Total | ||||||||||||||||||||||||

| (in millions, except ratios) | 2024 | 2023 | 2022 | 2024 | 2023 | 2022 | ||||||||||||||||||||

| Total net revenue | $ | 17,394 | (b) |

$ | 8,038 | $ | 80 | $ | 180,593 | (b) |

$ | 162,366 | $ | 132,277 | ||||||||||||

| Total noninterest expense | 3,994 | (c) |

5,601 | 1,034 | 91,797 | (c) |

87,172 | 76,140 | ||||||||||||||||||

| Pre-provision profit/(loss) | 13,400 | 2,437 | (954) | 88,796 | 75,194 | 56,137 | ||||||||||||||||||||

| Provision for credit losses | 10 | 171 | 22 | 10,678 | 9,320 | 6,389 | ||||||||||||||||||||

| Net income/(loss) | 10,601 | 2,821 | (743) | 58,471 | 49,552 | 37,676 | ||||||||||||||||||||

| Return on equity (“ROE”) | NM | NM | NM | 18 | % | 17 | % | 14 | % | |||||||||||||||||

72 |

JPMorgan Chase & Co./2024 Form 10-K |

|||||||

| CONSUMER & COMMUNITY BANKING | ||||||||||||||

Consumer & Community Banking offers products and services to consumers and small businesses through bank branches, ATMs, digital (including mobile and online) and telephone banking. CCB is organized into Banking & Wealth Management (including Consumer Banking, Business Banking and J.P. Morgan Wealth Management), Home Lending (including Home Lending Production, Home Lending Servicing and Real Estate Portfolios) and Card Services & Auto. Banking & Wealth Management offers deposit, investment and lending products, cash management, payments and services. Home Lending includes mortgage origination and servicing activities, as well as portfolios consisting of residential mortgages and home equity loans. Card Services issues credit cards and offers travel services. Auto originates and services auto loans and leases. | ||

| Selected income statement data | ||||||||||||||||||||

| Year ended December 31, | ||||||||||||||||||||

| (in millions, except ratios) | 2024 | 2023 | 2022 | |||||||||||||||||

| Revenue | ||||||||||||||||||||

| Lending- and deposit-related fees | $ | 3,387 | $ | 3,356 | $ | 3,316 | ||||||||||||||

| Asset management fees | 4,014 | 3,282 | 2,734 | |||||||||||||||||

| Mortgage fees and related income | 1,378 | 1,175 | 1,236 | |||||||||||||||||

| Card income | 3,139 | 2,532 | 2,469 | |||||||||||||||||

All other income(a) |

4,731 | 4,773 | 5,131 | |||||||||||||||||

| Noninterest revenue | 16,649 | 15,118 | 14,886 | |||||||||||||||||

| Net interest income | 54,858 | 55,030 | 39,928 | |||||||||||||||||

| Total net revenue | 71,507 | 70,148 | 54,814 | |||||||||||||||||

| Provision for credit losses | 9,974 | 6,899 | 3,813 | |||||||||||||||||

| Noninterest expense | ||||||||||||||||||||

| Compensation expense | 17,045 | 15,171 | 13,092 | |||||||||||||||||

Noncompensation expense(b) |

20,991 | 19,648 | 18,116 | |||||||||||||||||

| Total noninterest expense | 38,036 | 34,819 | (d) |

31,208 | ||||||||||||||||

| Income before income tax expense | 23,497 | 28,430 | 19,793 | |||||||||||||||||

| Income tax expense | 5,894 | 7,198 | 4,877 | |||||||||||||||||

| Net income | $ | 17,603 | $ | 21,232 | $ | 14,916 | ||||||||||||||

| Revenue by business | ||||||||||||||||||||

| Banking & Wealth Management | $ | 40,943 | $ | 43,199 | $ | 30,059 | ||||||||||||||

| Home Lending | 5,097 | 4,140 | 3,674 | |||||||||||||||||

| Card Services & Auto | 25,467 | 22,809 | 21,081 | |||||||||||||||||

| Mortgage fees and related income details: | ||||||||||||||||||||

| Production revenue | 627 | 421 | 497 | |||||||||||||||||

|

Net mortgage servicing

revenue(c)

|

751 | 754 | 739 | |||||||||||||||||

| Mortgage fees and related income | $ | 1,378 | $ | 1,175 | $ | 1,236 | ||||||||||||||

| Financial ratios | ||||||||||||||||||||

| Return on equity | 32 | % | 38 | % | 29 | % | ||||||||||||||

| Overhead ratio | 53 | 50 | 57 | |||||||||||||||||

JPMorgan Chase & Co./2024 Form 10-K |

73 |

|||||||

74 |

JPMorgan Chase & Co./2024 Form 10-K |

|||||||

| Selected metrics | |||||||||||

| As of or for the year ended December 31, |

|||||||||||

(in millions, except employees) |

2024 | 2023 | 2022 | ||||||||

| Selected balance sheet data (period-end) | |||||||||||

| Total assets | $ | 650,268 | $ | 642,951 | $ | 514,085 | |||||

| Loans: | |||||||||||

| Banking & Wealth Management | 33,221 | 31,142 | 29,008 | ||||||||

Home Lending(a) |

246,498 | 259,181 | 172,554 | ||||||||

| Card Services | 233,016 | 211,175 | 185,175 | ||||||||

| Auto | 73,619 | 77,705 | 68,191 | ||||||||

| Total loans | 586,354 | 579,203 | 454,928 | ||||||||

Deposits(b) |

1,056,652 | 1,094,738 | 1,131,611 | ||||||||

| Equity | 54,500 | 55,500 | 50,000 | ||||||||

| Selected balance sheet data (average) | |||||||||||

| Total assets | $ | 631,648 | $ | 584,367 | $ | 497,263 | |||||

| Loans: | |||||||||||

| Banking & Wealth Management | 31,544 | 30,142 | 31,545 | ||||||||

Home Lending(c) |

252,542 | 232,115 | 176,285 | ||||||||

| Card Services | 214,139 | 191,424 | 163,335 | ||||||||

| Auto | 75,009 | 72,674 | 68,098 | ||||||||

| Total loans | 573,234 | 526,355 | 439,263 | ||||||||

Deposits(b) |

1,064,215 | 1,126,552 | 1,162,680 | ||||||||

| Equity | 54,500 | 54,349 | 50,000 | ||||||||

Employees |

144,989 | 141,640 | 135,347 | ||||||||

| Selected metrics | ||||||||||||||||||||

| As of or for the year ended December 31, |

||||||||||||||||||||

| (in millions, except ratio data) | 2024 | 2023 | 2022 | |||||||||||||||||

| Credit data and quality statistics | ||||||||||||||||||||

Nonaccrual loans(a) |

$ | 3,366 | $ | 3,740 | $ | 3,899 | ||||||||||||||

| Net charge-offs/(recoveries) | ||||||||||||||||||||

| Banking & Wealth Management | 442 | 340 | 370 | |||||||||||||||||

| Home Lending | (106) | (56) | (229) | |||||||||||||||||

| Card Services | 7,148 | 4,699 | 2,403 | |||||||||||||||||

| Auto | 444 | 357 | 144 | |||||||||||||||||

| Total net charge-offs/(recoveries) | $ | 7,928 | $ | 5,340 | $ | 2,688 | ||||||||||||||

| Net charge-off/(recovery) rate | ||||||||||||||||||||

| Banking & Wealth Management | 1.40 | % | 1.13 | % | 1.17 | % | ||||||||||||||

| Home Lending | (0.04) | (0.02) | (0.14) | |||||||||||||||||

| Card Services | 3.34 | 2.45 | 1.47 | |||||||||||||||||

| Auto | 0.59 | 0.49 | 0.21 | |||||||||||||||||

| Total net charge-off/(recovery) rate | 1.40 | % | 1.02 | % | 0.62 | % | ||||||||||||||

| 30+ day delinquency rate | ||||||||||||||||||||

Home Lending(b) |

0.78 | % | 0.66 | % | 0.83 | % | ||||||||||||||

| Card Services | 2.17 | 2.14 | 1.45 | |||||||||||||||||

| Auto | 1.43 | 1.19 | 1.01 | |||||||||||||||||

90+ day delinquency rate - Card Services |

1.14 | % | 1.05 | % | 0.68 | % | ||||||||||||||

| Allowance for loan losses | ||||||||||||||||||||

| Banking & Wealth Management | $ | 764 | $ | 685 | $ | 722 | ||||||||||||||

| Home Lending | 447 | 578 | 867 | |||||||||||||||||

| Card Services | 14,608 | 12,453 | 11,200 | |||||||||||||||||

| Auto | 692 | 742 | 715 | |||||||||||||||||

| Total allowance for loan losses | $ | 16,511 | $ | 14,458 | $ | 13,504 | ||||||||||||||

JPMorgan Chase & Co./2024 Form 10-K |

75 |

|||||||

| Selected metrics | ||||||||||||||||||||

| As of or for the year ended December 31, | ||||||||||||||||||||

| (in billions, except ratios and where otherwise noted) | 2024 | 2023 | 2022 | |||||||||||||||||

| Business Metrics | ||||||||||||||||||||

CCB Consumer customers (in millions) |

84.4 | 82.1 | 79.2 | |||||||||||||||||

CCB Small business customers (in millions) |

7.0 | 6.4 | 5.7 | |||||||||||||||||

| Number of branches | 4,966 | 4,897 | 4,787 | |||||||||||||||||

|

Active digital customers

(in thousands)(a)

|

70,813 | 66,983 | 63,136 | |||||||||||||||||

|

Active mobile customers

(in thousands)(b)

|

57,821 | 53,828 | 49,710 | |||||||||||||||||

|

Debit and credit card

sales volume

|

$ | 1,805.4 | $ | 1,678.6 | $ | 1,555.4 | ||||||||||||||

Total payments transaction volume (in trillions)(c) |

6.4 | 5.9 | 5.6 | |||||||||||||||||

| Banking & Wealth Management | ||||||||||||||||||||

| Average deposits | $ | 1,049.3 | $ | 1,111.7 | $ | 1,145.7 | ||||||||||||||

| Deposit margin | 2.66 | % | 2.84 | % | 1.71 | % | ||||||||||||||

|

Business Banking

average loans

|

$ | 19.5 | $ | 19.6 | $ | 22.3 | ||||||||||||||

|

Business Banking

origination volume

|

4.5 | 4.8 | 4.3 | |||||||||||||||||

|

Client investment

assets(d)

|

1,087.6 | 951.1 | 647.1 | |||||||||||||||||

| Number of client advisors | 5,755 | 5,456 | 5,029 | |||||||||||||||||

| Home Lending | ||||||||||||||||||||

| Mortgage origination volume by channel | ||||||||||||||||||||

| Retail | $ | 25.5 | $ | 22.4 | $ | 38.5 | ||||||||||||||

| Correspondent | 15.3 | 12.7 | 26.9 | |||||||||||||||||

Total mortgage origination volume(e) |

$ | 40.8 | $ | 35.1 | $ | 65.4 | ||||||||||||||

| Third-party mortgage loans serviced (period-end) | $ | 648.0 | $ | 631.2 | $ | 584.3 | ||||||||||||||

|

MSR carrying value

(period-end)

|

9.1 | 8.5 | 8.0 | |||||||||||||||||

| Card Services | ||||||||||||||||||||

| Sales volume, excluding commercial card | $ | 1,259.3 | $ | 1,163.6 | $ | 1,064.7 | ||||||||||||||

| Net revenue rate | 10.03 | % | 9.72 | % | 9.87 | % | ||||||||||||||

|

Net yield on average

loans

|

9.73 | 9.61 | 9.77 | |||||||||||||||||

|

New credit card accounts

opened (in millions)

|

10.0 | 10.0 | 9.6 | |||||||||||||||||

| Auto | ||||||||||||||||||||

|

Loan and lease

origination volume

|

$ | 40.3 | $ | 41.3 | $ | 30.4 | ||||||||||||||

|

Average auto

operating lease assets

|

11.1 | 10.9 | 14.3 | |||||||||||||||||

76 |

JPMorgan Chase & Co./2024 Form 10-K |

|||||||

COMMERCIAL & INVESTMENT BANK(a) | ||||||||||||||

The Commercial & Investment Bank is comprised of the Banking & Payments and Markets & Securities Services businesses. These businesses offer investment banking, lending, payments, market-making, financing, custody and securities products and services to a global base of corporate and institutional clients. Banking & Payments offers products and services in all major capital markets, including advising on corporate strategy and structure, capital-raising in equity and debt markets, and loan origination and syndication. Banking & Payments also provides services that enable clients to manage payments globally across liquidity and account solutions, commerce solutions, clearing, trade, and working capital. Markets & Securities Services includes Markets, which is a global market-maker across products, including cash and derivative instruments, and also offers sophisticated risk management solutions, lending, prime brokerage, clearing and research. Markets & Securities Services also includes Securities Services, a leading global custodian that provides custody, fund services, liquidity and trading services, and data solutions products. | ||

| Selected income statement data | |||||||||||||||||

| Year ended December 31, (in millions) |

2024 | 2023 | 2022 | ||||||||||||||

| Revenue | |||||||||||||||||

| Investment banking fees | $ | 9,116 | $ | 6,631 | $ | 6,977 | |||||||||||

| Principal transactions | 24,382 | 23,794 | 19,792 | ||||||||||||||

| Lending- and deposit-related fees | 3,914 | 3,423 | 3,662 | ||||||||||||||

| Commissions and other fees | 5,278 | 4,879 | 5,113 | ||||||||||||||

| Card income | 2,310 | 2,213 | 1,934 | ||||||||||||||

| All other income | 3,253 | 2,869 | 2,060 | ||||||||||||||

| Noninterest revenue | 48,253 | 43,809 | 39,538 | ||||||||||||||

| Net interest income | 21,861 | 20,544 | 20,097 | ||||||||||||||

Total net revenue(a) |

70,114 | 64,353 | 59,635 | ||||||||||||||

| Provision for credit losses | 762 | 2,091 | 2,426 | ||||||||||||||

| Noninterest expense | |||||||||||||||||

| Compensation expense | 18,191 | 17,105 | 16,214 | ||||||||||||||

| Noncompensation expense | 17,162 | 16,867 | 15,855 | ||||||||||||||

| Total noninterest expense | 35,353 | 33,972 | 32,069 | ||||||||||||||

Income before income tax expense |

33,999 | 28,290 | 25,140 | ||||||||||||||

| Income tax expense | 9,153 | 8,018 | 6,002 | ||||||||||||||

| Net income | $ | 24,846 | $ | 20,272 | $ | 19,138 | |||||||||||

| Selected income statement data | |||||||||||||||||

| Year ended December 31, (in millions, except ratios) |

2024 | 2023 | 2022 | ||||||||||||||

| Financial ratios | |||||||||||||||||

| Return on equity | 18 | % | 14 | % | 14 | % | |||||||||||

| Overhead ratio | 50 | 53 | 54 | ||||||||||||||

|

Compensation expense as

percentage of total net

revenue

|

26 | 27 | 27 | ||||||||||||||

| Revenue by business | |||||||||||||||||

| Investment Banking | $ | 9,636 | $ | 7,076 | $ | 7,205 | |||||||||||

| Payments | 18,085 | 17,818 | 13,490 | ||||||||||||||

| Lending | 7,470 | 6,896 | 5,882 | ||||||||||||||

| Other | 76 | 107 | 244 | ||||||||||||||

| Total Banking & Payments | 35,267 | 31,897 | 26,821 | ||||||||||||||

Fixed Income Markets(a) |

20,066 | 19,180 | 19,074 | ||||||||||||||

Equity Markets(a) |

9,941 | 8,784 | 10,088 | ||||||||||||||

| Securities Services | 5,084 | 4,772 | 4,488 | ||||||||||||||

Credit Adjustments & Other(b) |

(244) | (280) | (836) | ||||||||||||||

|

Total Markets & Securities

Services

|

34,847 | 32,456 | 32,814 | ||||||||||||||

| Total net revenue | $ | 70,114 | $ | 64,353 | $ | 59,635 | |||||||||||

JPMorgan Chase & Co./2024 Form 10-K |

77 |

|||||||

|

Banking & Payments Revenue by Client Coverage Segment: (a)

Global Corporate Banking & Global Investment Banking provides banking products and services generally to large corporations, financial institutions and merchants.

Commercial Banking provides banking products and services generally to middle market clients, including start-ups, small and mid-sized companies, local governments, municipalities, and nonprofits, as well as to commercial real estate clients.

Other includes amounts related to credit protection purchased against certain retained loans and lending-related commitments in Lending, the impact of equity investments in Payments and revenues not aligned with a primary client coverage segment.

(a)Global Banking is a client coverage view within the Banking & Payments business and is comprised of the Global Corporate Banking, Global Investment Banking and Commercial Banking client coverage segments.

| ||

| Selected income statement data | |||||||||||||||||

|

Year ended December 31,

(in millions)

|

2024 | 2023 | 2022 | ||||||||||||||

| Banking & Payments revenue by client coverage segment | |||||||||||||||||

Global Corporate Banking & Global Investment Banking |

$ | 24,549 | $ | 21,700 | $ | 19,325 | |||||||||||

Commercial Banking |

11,487 | 11,050 | 7,906 | ||||||||||||||

| Middle Market Banking | 7,759 | 7,740 | 5,443 | ||||||||||||||

| Commercial Real Estate Banking | 3,728 | 3,310 | 2,463 | ||||||||||||||

Other |

(769) | (853) | (410) | ||||||||||||||

| Total Banking & Payments revenue | $ | 35,267 | $ | 31,897 | $ | 26,821 | |||||||||||

78 |

JPMorgan Chase & Co./2024 Form 10-K |

|||||||

JPMorgan Chase & Co./2024 Form 10-K |

79 |

|||||||

| Selected metrics | |||||||||||||||||

| As of or for the year ended December 31, (in millions, except employees) |

2024 | 2023 | 2022 | ||||||||||||||

Selected balance sheet data (period-end) |

|||||||||||||||||

| Total assets | $ | 1,773,194 | $ | 1,638,493 | $ | 1,591,402 | |||||||||||

| Loans: | |||||||||||||||||

| Loans retained | 483,043 | 475,186 | 421,521 | ||||||||||||||

Loans held-for-sale and loans at fair value(a) |

40,324 | 39,464 | 43,011 | ||||||||||||||

| Total loans | 523,367 | 514,650 | 464,532 | ||||||||||||||

| Equity | 132,000 | 138,000 | 128,000 | ||||||||||||||

Banking & Payments loans by client coverage segment (period-end)(b) |

|||||||||||||||||

| Global Corporate Banking & Global Investment Banking | $ | 125,083 | $ | 128,097 | $ | 128,165 | |||||||||||

| Commercial Banking | 217,674 | 221,550 | 180,624 | ||||||||||||||

| Middle Market Banking | 72,814 | 78,043 | 72,625 | ||||||||||||||

| Commercial Real Estate Banking | 144,860 | 143,507 | 107,999 | ||||||||||||||

| Other | 187 | 526 | 122 | ||||||||||||||

| Total Banking & Payments loans | 342,944 | 350,173 | 308,911 | ||||||||||||||

Selected balance sheet data (average) |

|||||||||||||||||

| Total assets | $ | 1,912,466 | $ | 1,716,755 | $ | 1,649,358 | |||||||||||

| Trading assets-debt and equity instruments | 624,032 | 508,792 | 405,948 | ||||||||||||||

| Trading assets-derivative receivables | 57,028 | 63,862 | 77,822 | ||||||||||||||

| Loans: | |||||||||||||||||

| Loans retained | $ | 475,426 | $ | 457,886 | $ | 395,015 | |||||||||||

Loans held-for-sale and loans at fair value(a) |

43,621 | 40,891 | 48,196 | ||||||||||||||

| Total loans | $ | 519,047 | $ | 498,777 | $ | 443,211 | |||||||||||

Deposits(c) |

1,061,488 | 996,295 | 1,033,880 | ||||||||||||||

| Equity | 132,000 | 137,507 | 128,000 | ||||||||||||||

Banking & Payments loans by client coverage segment (average)(b) |

|||||||||||||||||

| Global Corporate Banking & Global Investment Banking | $ | 128,142 | $ | 131,230 | $ | 122,174 | |||||||||||

| Commercial Banking | 220,285 | 209,244 | 173,289 | ||||||||||||||

| Middle Market Banking | 75,605 | 77,130 | 67,830 | ||||||||||||||

| Commercial Real Estate Banking | 144,680 | 132,114 | 105,459 | ||||||||||||||

| Other | 354 | 331 | 168 | ||||||||||||||

| Total Banking & Payments loans | $ | 348,781 | $ | 340,805 | $ | 295,631 | |||||||||||

Employees |

93,231 | 92,271 | 88,139 | ||||||||||||||

| Selected metrics | |||||||||||||||||

| As of or for the year ended December 31, (in millions, except ratios) |

2024 | 2023 | 2022 | ||||||||||||||

Credit data and quality statistics |

|||||||||||||||||

Net charge-offs/(recoveries) |

$ | 689 | (d) |

$ | 588 | $ | 166 | ||||||||||

| Nonperforming assets: | |||||||||||||||||

| Nonaccrual loans: | |||||||||||||||||

Nonaccrual loans retained(a) |

$ | 3,258 | $ | 1,675 | $ | 1,484 | |||||||||||

Nonaccrual loans held-for-sale and loans at fair value(b) |

1,502 | 828 | 848 | ||||||||||||||

Total nonaccrual loans |

4,760 | 2,503 | 2,332 | ||||||||||||||

| Derivative receivables | 145 | 364 | 296 | ||||||||||||||

Assets acquired in loan satisfactions |

213 | 169 | 87 | ||||||||||||||

Total nonperforming assets |

$ | 5,118 | $ | 3,036 | $ | 2,715 | |||||||||||

| Allowance for credit losses: | |||||||||||||||||

| Allowance for loan losses | $ | 7,294 | $ | 7,326 | $ | 5,616 | |||||||||||

| Allowance for lending-related commitments | 1,976 | 1,849 | 2,278 | ||||||||||||||

Total allowance for credit losses |

$ | 9,270 | $ | 9,175 | $ | 7,894 | |||||||||||

Net charge-off/(recovery) rate(c) |

0.14 | % | 0.13 | % | 0.04 | % | |||||||||||

|

Allowance for loan losses to period-end loans

retained

|

1.51 | 1.54 | 1.33 | ||||||||||||||

|

Allowance for loan losses to nonaccrual loans

retained(a)

|

224 | 437 | 378 | ||||||||||||||

| Nonaccrual loans to total period-end loans | 0.91 | 0.49 | 0.50 | ||||||||||||||

80 |

JPMorgan Chase & Co./2024 Form 10-K |

|||||||

| Investment banking fees | |||||||||||||||||

|

Year ended December 31,

(in millions)

|

2024 | 2023 | 2022 | ||||||||||||||

Advisory |

$ | 3,290 | $ | 2,814 | $ | 3,051 | |||||||||||

Equity underwriting |

1,692 | 1,151 | 1,034 | ||||||||||||||

Debt underwriting(a) |

4,134 | 2,666 | 2,892 | ||||||||||||||

Total investment banking fees |

$ | 9,116 | $ | 6,631 | $ | 6,977 | |||||||||||

| League table results – wallet share | ||||||||||||||||||||||||||

| 2024 | 2023 | 2022 | ||||||||||||||||||||||||

| Year ended December 31, | Rank | Share | Rank | Share | Rank | Share | ||||||||||||||||||||

Based on fees(a) |

||||||||||||||||||||||||||

M&A(b) |

||||||||||||||||||||||||||

Global |

# | 1 | 9.6 | % | # | 2 | 9.0 | % | # | 2 | 7.9 | % | ||||||||||||||

U.S. |

1 | 11.4 | 2 | 10.9 | 2 | 8.9 | ||||||||||||||||||||

Equity and equity-related(c) |

||||||||||||||||||||||||||

Global |

1 | 11.0 | 1 | 7.7 | 2 | 5.7 | ||||||||||||||||||||

U.S. |

1 | 14.7 | 1 | 14.4 | 1 | 14.0 | ||||||||||||||||||||

Long-term debt(d) |

||||||||||||||||||||||||||

Global |

1 | 7.6 | 1 | 7.0 | 1 | 6.9 | ||||||||||||||||||||

U.S. |

1 | 11.4 | 1 | 10.9 | 1 | 12.1 | ||||||||||||||||||||

Loan syndications |

||||||||||||||||||||||||||

| Global | 1 | 10.2 | 1 | 11.9 | 1 | 11.0 | ||||||||||||||||||||

| U.S. | 1 | 11.8 | 1 | 15.1 | 1 | 12.9 | ||||||||||||||||||||

Global investment banking fees(e) |

# | 1 | 9.3 | % | # | 1 | 8.6 | % | # | 1 | 7.8 | % | ||||||||||||||

JPMorgan Chase & Co./2024 Form 10-K |

81 |

|||||||

| 2024 | 2023 | 2022 | |||||||||||||||||||||||||||||||||

| Year ended December 31, (in millions, except where otherwise noted) |

Fixed Income Markets | Equity Markets | Total Markets | Fixed Income Markets(c) |

Equity Markets(c) |

Total Markets | Fixed Income Markets(c) |

Equity Markets(c) |

Total Markets | ||||||||||||||||||||||||||

Principal transactions |

$ | 10,603 | $ | 13,526 | $ | 24,129 | $ | 13,198 | $ | 10,380 | $ | 23,578 | $ | 12,244 | $ | 8,284 | $ | 20,528 | |||||||||||||||||

| Lending- and deposit-related fees | 391 | 100 | 491 | 307 | 40 | 347 | 303 | 22 | 325 | ||||||||||||||||||||||||||

| Commissions and other fees | 605 | 2,086 | 2,691 | 596 | 1,908 | 2,504 | 550 | 1,975 | 2,525 | ||||||||||||||||||||||||||

| All other income | 2,120 | (65) | 2,055 | 1,908 | (79) | 1,829 | 1,083 | (88) | 995 | ||||||||||||||||||||||||||

| Noninterest revenue | 13,719 | 15,647 | 29,366 | 16,009 | 12,249 | 28,258 | 14,180 | 10,193 | 24,373 | ||||||||||||||||||||||||||

Net interest income(a) |

6,347 | (5,706) | 641 | 3,171 | (3,465) | (294) | 4,894 | (105) | 4,789 | ||||||||||||||||||||||||||

| Total net revenue | $ | 20,066 | $ | 9,941 | $ | 30,007 | $ | 19,180 | $ | 8,784 | $ | 27,964 | $ | 19,074 | $ | 10,088 | $ | 29,162 | |||||||||||||||||

Loss days(b) |

1 | 2 | 7 | ||||||||||||||||||||||||||||||||

| Selected metrics | |||||||||||||||||

| As of or for the year ended December 31, (in millions, except where otherwise noted) |

2024 | 2023 | 2022 | ||||||||||||||

| Assets under custody ("AUC") by asset class (period-end) (in billions): | |||||||||||||||||

| Fixed Income | $ | 16,409 | $ | 15,543 | $ | 14,361 | |||||||||||

| Equity | 14,848 | 12,927 | 10,748 | ||||||||||||||

Other(a) |

4,023 | 3,922 | 3,526 | ||||||||||||||

| Total AUC | $ | 35,280 | $ | 32,392 | $ | 28,635 | |||||||||||

Client deposits and other third-party liabilities (average)(b) |

$ | 961,646 | $ | 912,859 | $ | 981,653 | |||||||||||

82 |

JPMorgan Chase & Co./2024 Form 10-K |

|||||||

| International metrics | |||||||||||||||||

| As of or for the year ended December 31, (in millions, except where otherwise noted) |

2024 | 2023 | 2022 | ||||||||||||||

Total net revenue(a) |

|||||||||||||||||

| Europe/Middle East/Africa | $ | 15,191 | $ | 14,418 | $ | 15,716 | |||||||||||

| Asia-Pacific | 8,867 | 7,891 | 8,043 | ||||||||||||||

| Latin America/Caribbean | 2,427 | 2,161 | 2,288 | ||||||||||||||

| Total international net revenue | 26,485 | 24,470 | 26,047 | ||||||||||||||

| North America | 43,629 | 39,883 | 33,588 | ||||||||||||||

| Total net revenue | $ | 70,114 | $ | 64,353 | $ | 59,635 | |||||||||||

Loans retained (period-end)(a) |

|||||||||||||||||

| Europe/Middle East/Africa | $ | 44,374 | $ | 44,793 | $ | 40,715 | |||||||||||

| Asia-Pacific | 16,107 | 15,506 | 16,764 | ||||||||||||||

| Latin America/Caribbean | 10,331 | 8,610 | 8,866 | ||||||||||||||

| Total international loans | 70,812 | 68,909 | 66,345 | ||||||||||||||

| North America | 412,231 | 406,277 | 355,176 | ||||||||||||||

| Total loans retained | $ | 483,043 | $ | 475,186 | $ | 421,521 | |||||||||||

Client deposits and other third-party liabilities (average)(b) |

|||||||||||||||||

| Europe/Middle East/Africa | $ | 264,227 | $ | 247,804 | $ | 265,061 | |||||||||||

| Asia-Pacific | 141,042 | 135,388 | 136,539 | ||||||||||||||

| Latin America/Caribbean | 42,716 | 39,861 | 40,531 | ||||||||||||||

| Total international | $ | 447,985 | $ | 423,053 | $ | 442,131 | |||||||||||

| North America | 513,661 | 489,806 | 539,522 | ||||||||||||||

Total client deposits and other third-party liabilities |

$ | 961,646 | $ | 912,859 | $ | 981,653 | |||||||||||

AUC (period-end)(b) (in billions) |

|||||||||||||||||

| North America | $ | 23,845 | $ | 21,792 | $ | 19,219 | |||||||||||

| All other regions | 11,435 | 10,600 | 9,416 | ||||||||||||||

| Total AUC | $ | 35,280 | $ | 32,392 | $ | 28,635 | |||||||||||

JPMorgan Chase & Co./2024 Form 10-K |

83 |

|||||||

| ASSET & WEALTH MANAGEMENT | ||||||||||||||

|

Asset & Wealth Management, with client assets of $5.9 trillion, is a global leader in investment and wealth management.

Asset Management

Offers multi-asset investment management solutions across equities, fixed income, alternatives and money market funds to institutional and retail investors providing for a broad range of clients’ investment needs.

Global Private Bank

Provides retirement products and services, brokerage, custody, estate planning, lending, deposits and investment management to high net worth clients.

The majority of AWM’s client assets are in actively managed portfolios.

| ||

| Selected income statement data | |||||||||||||||||

| Year ended December 31, (in millions, except ratios) |

2024 | 2023 | 2022 | ||||||||||||||

| Revenue | |||||||||||||||||

| Asset management fees | $ | 13,693 | $ | 11,826 | $ | 11,510 | |||||||||||

| Commissions and other fees | 874 | 697 | $ | 662 | |||||||||||||

| All other income | 456 | (a) |

1,037 | (a)(b) |

335 | ||||||||||||

| Noninterest revenue | 15,023 | 13,560 | 12,507 | ||||||||||||||

| Net interest income | 6,555 | 6,267 | 5,241 | ||||||||||||||

| Total net revenue | 21,578 | 19,827 | 17,748 | ||||||||||||||

| Provision for credit losses | (68) | 159 | 128 | ||||||||||||||

| Noninterest expense | |||||||||||||||||

| Compensation expense | 7,984 | 7,115 | 6,336 | ||||||||||||||

| Noncompensation expense | 6,430 | 5,665 | 5,493 | ||||||||||||||

| Total noninterest expense | 14,414 | 12,780 | 11,829 | ||||||||||||||

| Income before income tax expense | 7,232 | 6,888 | 5,791 | ||||||||||||||

| Income tax expense | 1,811 | 1,661 | 1,426 | ||||||||||||||

| Net income | $ | 5,421 | $ | 5,227 | $ | 4,365 | |||||||||||

| Revenue by line of business | |||||||||||||||||

| Asset Management | $ | 10,175 | $ | 9,129 | $ | 8,818 | |||||||||||

| Global Private Bank | 11,403 | 10,698 | 8,930 | ||||||||||||||

| Total net revenue | $ | 21,578 | $ | 19,827 | $ | 17,748 | |||||||||||

| Financial ratios | |||||||||||||||||

| Return on equity | 34 | % | 31 | % | 25 | % | |||||||||||

| Overhead ratio | 67 | 64 | 67 | ||||||||||||||

| Pre-tax margin ratio: | |||||||||||||||||

| Asset Management | 31 | 31 | 30 | ||||||||||||||

| Global Private Bank | 35 | 38 | 35 | ||||||||||||||

| Asset & Wealth Management | 34 | 35 | 33 | ||||||||||||||

84 |

JPMorgan Chase & Co./2024 Form 10-K |

|||||||

| Asset Management has two high-level measures of its overall fund performance. | ||||||||||||||

• Percentage of active mutual fund and active ETF assets under management in funds rated 4- or 5-star: Mutual fund rating services rank funds based on their risk adjusted performance over various periods. A 5-star rating is the best rating and represents the top 10% of industry-wide ranked funds. A 4-star rating represents the next 22.5% of industry-wide ranked funds. A 3-star rating represents the next 35% of industry-wide ranked funds. A 2-star rating represents the next 22.5% of industry-wide ranked funds. A 1-star rating is the worst rating and represents the bottom 10% of industry-wide ranked funds. An overall Morningstar rating is derived from a weighted average of the performance associated with a fund’s three-, five and ten- year (if applicable) Morningstar Rating metrics. For U.S.-domiciled funds, separate star ratings are provided at the individual share class level. The Nomura “star rating” is based on three-year risk-adjusted performance only. Funds with fewer than three years of history are not rated and hence excluded from these rankings. All ratings, the assigned peer categories and the asset values used to derive these rankings are sourced from the applicable fund rating provider. Where applicable, the fund rating providers redenominate asset values into U.S. dollars. The percentage of AUM is based on star ratings at the share class level for U.S.-domiciled funds, and at a “primary share class” level to represent the star rating of all other funds, except for Japan, for which Nomura provides ratings at the fund level. The performance data may have been different if all share classes had been included. Past performance is not indicative of future results. | ||||||||||||||

• Percentage of active mutual fund and active ETF assets under management in funds ranked in the 1st or 2nd quartile (one, three and five years):All quartile rankings, the assigned peer categories and the asset values used to derive these rankings are sourced from the fund rating providers. Quartile rankings are based on the net-of-fee absolute return of each fund. Where applicable, the fund rating providers redenominate asset values into U.S. dollars. The percentage of AUM is based on fund performance and associated peer rankings at the share class level for U.S.-domiciled funds, at a “primary share class” level to represent the quartile ranking for U.K., Luxembourg and Hong Kong SAR funds and at the fund level for all other funds. The performance data may have been different if all share classes had been included. Past performance is not indicative of future results. | ||||||||||||||

“Primary share class” means the C share class for European funds and Acc share class for Hong Kong SAR and Taiwan funds. If these share classes are not available, the oldest share class is used as the primary share class. | ||||||||||||||

| Selected metrics | |||||||||||||||||

|

As of or for the year ended December 31,

(in millions, except ranking data, ratios and employees)

|

2024 | 2023 | 2022 | ||||||||||||||

% of JPM mutual fund assets and ETFs rated as 4- or 5-star(a) |

69 | % | 69 | % | 73 | % | |||||||||||

|

% of JPM mutual fund assets and ETFs ranked in 1st or 2nd

quartile:(b)

|

|||||||||||||||||

| 1 year | 73 | 40 | 68 | ||||||||||||||

| 3 years | 75 | 67 | 76 | ||||||||||||||

| 5 years | 77 | 71 | 81 | ||||||||||||||

Selected balance sheet data (period-end)(c) |

|||||||||||||||||

| Total assets | $ | 255,385 | $ | 245,512 | $ | 232,037 | |||||||||||

| Loans | 236,303 | 227,929 | 214,006 | ||||||||||||||

| Deposits | 248,287 | 233,232 | (d) |

233,130 | |||||||||||||

| Equity | 15,500 | 17,000 | 17,000 | ||||||||||||||

Selected balance sheet data (average)(c) |

|||||||||||||||||

| Total assets | $ | 246,254 | $ | 240,222 | $ | 232,438 | |||||||||||

| Loans | 227,676 | 220,487 | 215,582 | ||||||||||||||

| Deposits | 235,146 | 216,178 | (d) |

261,489 | |||||||||||||

| Equity | 15,500 | 16,671 | 17,000 | ||||||||||||||

Employees |

29,403 | 28,485 | 26,041 | ||||||||||||||

| Number of Global Private Bank client advisors | 3,775 | 3,515 | 3,137 | ||||||||||||||

Credit data and quality statistics(c) |

|||||||||||||||||

| Net charge-offs/(recoveries) | $ | 21 | $ | 13 | $ | (7) | |||||||||||

| Nonaccrual loans | 700 | 650 | 459 | ||||||||||||||

| Allowance for credit losses: | |||||||||||||||||

| Allowance for loan losses | $ | 539 | $ | 633 | $ | 494 | |||||||||||

Allowance for lending-related commitments |

35 | 28 | 20 | ||||||||||||||

Total allowance for credit losses |

$ | 574 | $ | 661 | $ | 514 | |||||||||||

| Net charge-off/(recovery) rate | 0.01 | % | 0.01 | % | — | % | |||||||||||

Allowance for loan losses to period-end loans |

0.23 | 0.28 | 0.23 | ||||||||||||||

Allowance for loan losses to nonaccrual loans |

77 | 97 | 108 | ||||||||||||||

Nonaccrual loans to period-end loans |

0.30 | 0.29 | 0.21 | ||||||||||||||

JPMorgan Chase & Co./2024 Form 10-K |

85 |

|||||||

| Client assets | |||||||||||

| December 31, (in billions) |

2024 | 2023 | 2022 | ||||||||

| Assets by asset class | |||||||||||

| Liquidity | $ | 1,083 | $ | 926 | $ | 654 | |||||

| Fixed income | 851 | 751 | 638 | ||||||||

| Equity | 1,128 | 868 | 670 | ||||||||

| Multi-asset | 764 | 680 | 603 | ||||||||

| Alternatives | 219 | 197 | 201 | ||||||||

| Total assets under management | 4,045 | 3,422 | 2,766 | ||||||||

|

Custody/brokerage/

administration/deposits

|

1,887 | 1,590 | 1,282 | ||||||||

Total client assets(a) |

$ | 5,932 | $ | 5,012 | $ | 4,048 | |||||

| Assets by client segment | |||||||||||

| Private Banking | $ | 1,234 | $ | 974 | $ | 751 | |||||

| Global Institutional | 1,692 | 1,488 | 1,252 | ||||||||

| Global Funds | 1,119 | 960 | 763 | ||||||||

| Total assets under management | $ | 4,045 | $ | 3,422 | $ | 2,766 | |||||

Private Banking |

$ | 2,974 | $ | 2,452 | $ | 1,964 | |||||

| Global Institutional | 1,820 | 1,594 | 1,314 | ||||||||

| Global Funds | 1,138 | 966 | 770 | ||||||||

Total client assets(a) |

$ | 5,932 | $ | 5,012 | $ | 4,048 | |||||

| Client assets (continued) | |||||||||||

| Year ended December 31, (in billions) |

2024 | 2023 | 2022 | ||||||||

Assets under management rollforward |

|||||||||||

| Beginning balance | $ | 3,422 | $ | 2,766 | $ | 3,113 | |||||

| Net asset flows: | |||||||||||

| Liquidity | 140 | 242 | (55) | ||||||||

| Fixed income | 91 | 70 | 13 | ||||||||

| Equity | 114 | 70 | 35 | ||||||||

| Multi-asset | 19 | 1 | (9) | ||||||||

| Alternatives | 10 | (1) | 8 | ||||||||

| Market/performance/other impacts | 249 | 274 | (339) | ||||||||

| Ending balance, December 31 | $ | 4,045 | $ | 3,422 | $ | 2,766 | |||||

| Client assets rollforward | |||||||||||

| Beginning balance | $ | 5,012 | $ | 4,048 | $ | 4,295 | |||||

| Net asset flows | 486 | 490 | 49 | ||||||||

| Market/performance/other impacts | 434 | 474 | (296) | ||||||||

| Ending balance, December 31 | $ | 5,932 | $ | 5,012 | $ | 4,048 | |||||

Selected Metrics |

||||||||||||||

| As of December 31, | ||||||||||||||

| 2024 | 2023 | Change | ||||||||||||

| Firmwide Wealth Management | ||||||||||||||

Client assets (in billions)(a) |

$ | 3,756 | $ | 3,177 | 18 | % | ||||||||

| Number of client advisors | 9,530 | 8,971 | 6 | |||||||||||

Stock Plan Administration(b) |

||||||||||||||

| Number of stock plan participants (in thousands) | 1,327 | 974 | 36 | |||||||||||

| Client assets (in billions) | $ | 270 | $ | 230 | 17 | % | ||||||||

86 |

JPMorgan Chase & Co./2024 Form 10-K |

|||||||

| International metrics | |||||||||||

| Year ended December 31, (in billions, except where otherwise noted) |

2024 | 2023 | 2022 | ||||||||

Total net revenue (in millions)(a) |

|||||||||||

| Europe/Middle East/Africa | $ | 3,563 | $ | 3,377 | $ | 3,240 | |||||

| Asia-Pacific | 2,023 | 1,876 | 1,836 | ||||||||

| Latin America/Caribbean | 1,065 | 985 | 967 | ||||||||

| Total international net revenue | 6,651 | 6,238 | 6,043 | ||||||||

| North America | 14,927 | 13,589 | 11,705 | ||||||||

| Total net revenue | $ | 21,578 | $ | 19,827 | $ | 17,748 | |||||

| Assets under management | |||||||||||

| Europe/Middle East/Africa | $ | 604 | $ | 539 | $ | 487 | |||||

| Asia-Pacific | 302 | 263 | 218 | ||||||||

| Latin America/Caribbean | 106 | 86 | 69 | ||||||||

| Total international assets under management | 1,012 | 888 | 774 | ||||||||

| North America | 3,033 | 2,534 | 1,992 | ||||||||

| Total assets under management | $ | 4,045 | $ | 3,422 | $ | 2,766 | |||||

| Client assets | |||||||||||

| Europe/Middle East/Africa | $ | 841 | $ | 740 | $ | 610 | |||||

| Asia-Pacific | 482 | 406 | 331 | ||||||||

| Latin America/Caribbean | 254 | 232 | 189 | ||||||||

| Total international client assets | 1,577 | 1,378 | 1,130 | ||||||||

| North America | 4,355 | 3,634 | 2,918 | ||||||||

| Total client assets | $ | 5,932 | $ | 5,012 | $ | 4,048 | |||||

JPMorgan Chase & Co./2024 Form 10-K |

87 |

|||||||

CORPORATE | ||||||||||||||

|

Corporate consists of Treasury and Chief Investment Office (“CIO”) and Other Corporate. Treasury and CIO is predominantly responsible for measuring, monitoring, reporting and managing the Firm’s liquidity, funding, capital, structural interest rate and foreign exchange risks.

Other Corporate includes staff functions and expense that is centrally managed as well as certain Firm initiatives and activities not solely aligned to a specific LOB. The major Other Corporate functions include Real Estate, Technology, Legal, Corporate Finance, Human Resources, Internal Audit, Risk Management, Compliance, Control Management, Corporate Responsibility and various Other Corporate groups.

|

|||||

| Selected income statement and balance sheet data | |||||||||||||||||

|

Year ended December 31,

(in millions, except employees)

|

2024 | 2023 | 2022 | ||||||||||||||

| Revenue | |||||||||||||||||

| Principal transactions | $ | 152 | $ | 302 | $ | (227) | |||||||||||

Investment securities losses |

(1,020) | (3,180) | (2,380) | ||||||||||||||

| All other income | 8,476 | (c) |

3,010 | (f) |

809 | ||||||||||||

| Noninterest revenue | 7,608 | 132 | (1,798) | ||||||||||||||

| Net interest income | 9,786 | 7,906 | 1,878 | ||||||||||||||

Total net revenue(a) |

17,394 | 8,038 | 80 | ||||||||||||||

| Provision for credit losses | 10 | 171 | 22 | ||||||||||||||