| UNITED STATES SECURITIES AND EXCHANGE COMMISSION Washington, D.C. 20549 | |||||||||||||||||||||||||||||||||||

| |||||||||||||||||||||||||||||||||||

| FORM | 8-K | ||||||||||||||||||||||||||||||||||

| Current Report | |||||||||||||||||||||||||||||||||||

|

Pursuant to Section 13 or 15(d) of the Securities Exchange Act of 1934

| |||||||||||||||||||||||||||||||||||

| Date of Report (Date of earliest event reported): | January 30, 2025 | ||||||||||||||||||||||||||||||||||

| CATERPILLAR INC. | |||||||||||||||||||||||||||||||||||

| (Exact name of registrant as specified in its charter) | |||||||||||||||||||||||||||||||||||

| Delaware | 1-768 | 37-0602744 | |||||||||||||||||||||||||||||||||

| (State or other jurisdiction of incorporation) | (Commission File Number) |

(I.R.S Employer Identification No.) |

|||||||||||||||||||||||||||||||||

| 5205 N. O'Connor Blvd., | Suite 100, | Irving, | Texas | 75039 | ||||||||||||||||||||||||||||

| (Address of principal executive offices) | (Zip Code) | |||||||||||||||||||||||||||||||

| Registrant’s telephone number, including area code: | (972) | 891-7700 | ||||||||||||||||||||||||||||||

| Former name or former address, if changed since last report: | N/A | |||||||||||||||||||||||||||||||

| ☐ | Written communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425) | ||||||||||||||||||||||||||||||||||

| ☐ | Soliciting material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12) | ||||||||||||||||||||||||||||||||||

| ☐ | Pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b)) | ||||||||||||||||||||||||||||||||||

| ☐ | Pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4(c)) | ||||||||||||||||||||||||||||||||||

|

Securities registered pursuant to Section 12(b) of the Act:

| |||||||||||||||||||||||||||||||||||

| Title of each class | Trading Symbol (s) | Name of each exchange which registered | |||||||||||||||||||||||||||||||||

| Common Stock ($1.00 par value) | CAT | The New York Stock Exchange | |||||||||||||||||||||||||||||||||

| 5.3% Debentures due September 15, 2035 | CAT35 | The New York Stock Exchange | |||||||||||||||||||||||||||||||||

| Check the appropriate box below if the Form 8-K filing is intended to simultaneously satisfy the filing obligation of the registrant under any of the following provisions: | |||||||||||||||||||||||||||||||||||

| Indicate by check mark whether the registrant is an emerging growth company as defined by Rule 405 of the Securities Act of | |||||||||||||||||||||||||||||||||||

| 1933 (17 CFR §230.405 of this chapter) or Rule 12b-2 of the Securities Exchange Act of 1934 (17 CFR §240.12b-2 of this chapter). | |||||||||||||||||||||||||||||||||||

| Emerging growth company | ☐ | ||||||||||||||||||||||||||||||||||

| If an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period | |||||||||||||||||||||||||||||||||||

| for complying with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act. | ☐ | ||||||||||||||||||||||||||||||||||

| (d) | Exhibits: | ||||||||||

| The following is furnished as an exhibit to this report: | |||||||||||

| 99.1 | |||||||||||

| 99.2 | |||||||||||

| 104 | The cover page from this Current Report on Form 8-K, formatted in Inline XBRL. | ||||||||||

|

SIGNATURES

| ||||||||

| Pursuant to the requirements of the Securities Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf by the undersigned hereunto duly authorized. | ||||||||

| CATERPILLAR INC. | ||||||||

January 30, 2025 |

By: | /s/ Derek Owens | ||||||

| Derek Owens Chief Legal Officer and General Counsel |

||||||||

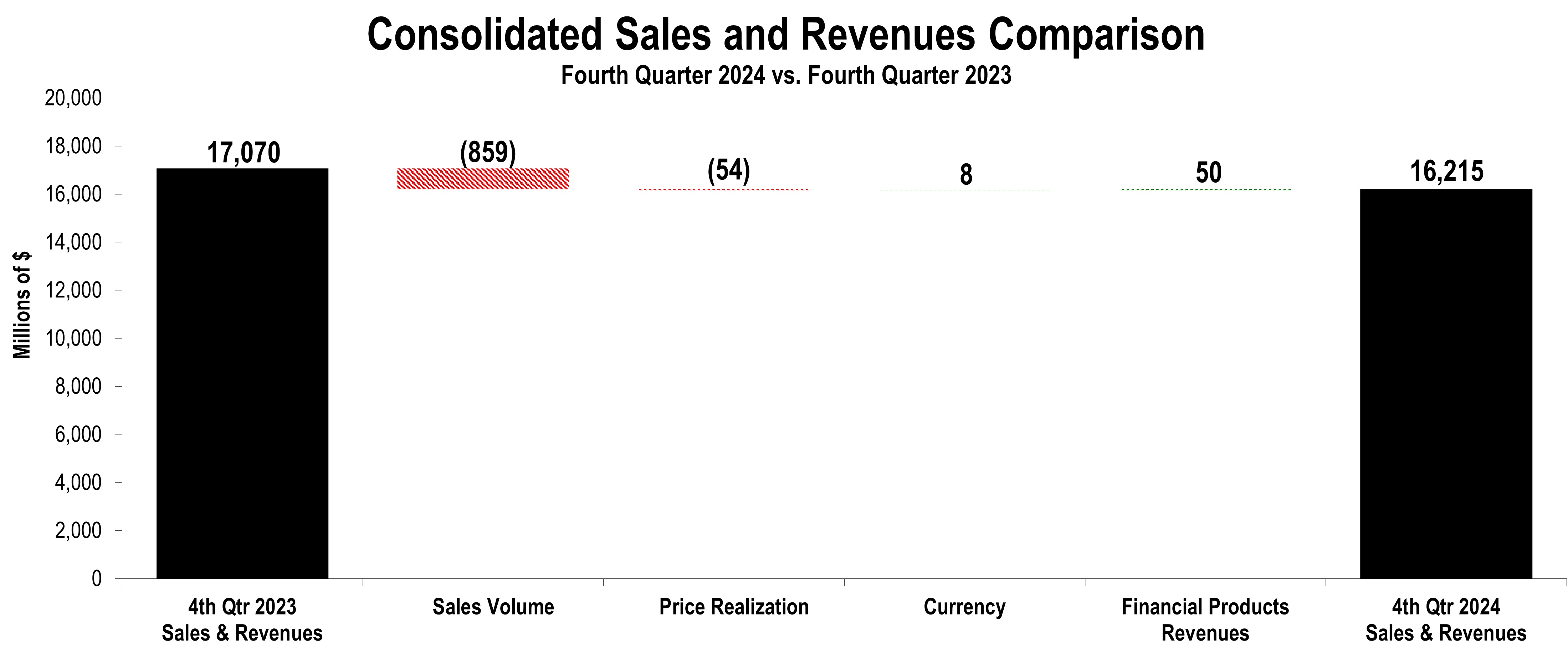

| ● | Fourth-quarter 2024 sales and revenues were $16.2 billion; full-year sales and revenues were $64.8 billion | ||||

| ● | Fourth-quarter 2024 profit per share of $5.78; adjusted profit per share of $5.14 | ||||

| ● | Full-year profit per share of $22.05; adjusted profit per share of $21.90 | ||||

| ● | Strong enterprise operating cash flow of $12.0 billion; ended the year with $6.9 billion of enterprise cash | ||||

| ● | Deployed $10.3 billion of cash for share repurchases and dividends in 2024 | ||||

| Fourth Quarter | Full Year | |||||||||||||||||||

| ($ in billions except profit per share) | 2024 | 2023 | 2024 | 2023 | ||||||||||||||||

| Sales and Revenues | $16.2 | $17.1 | $64.8 | $67.1 | ||||||||||||||||

| Profit Per Share | $5.78 | $5.28 | $22.05 | $20.12 | ||||||||||||||||

| Adjusted Profit Per Share | $5.14 | $5.23 | $21.90 | $21.21 | ||||||||||||||||

| Sales and Revenues by Segment | |||||||||||||||||||||||||||||||||||||||||||||||

| (Millions of dollars) | Fourth Quarter 2023 | Sales Volume |

Price Realization |

Currency | Inter-Segment / Other | Fourth Quarter 2024 | $ Change |

% Change |

|||||||||||||||||||||||||||||||||||||||

| Construction Industries | $ | 6,519 | $ | (227) | $ | (300) | $ | (2) | $ | 13 | $ | 6,003 | $ | (516) | (8%) | ||||||||||||||||||||||||||||||||

| Resource Industries | 3,242 | (316) | 26 | 3 | 7 | 2,962 | (280) | (9%) | |||||||||||||||||||||||||||||||||||||||

| Energy & Transportation | 7,669 | (301) | 221 | 8 | 52 | 7,649 | (20) | —% | |||||||||||||||||||||||||||||||||||||||

| All Other Segment | 116 | (7) | 1 | — | 6 | 116 | — | —% | |||||||||||||||||||||||||||||||||||||||

| Corporate Items and Eliminations | (1,309) | (8) | (2) | (1) | (78) | (1,398) | (89) | ||||||||||||||||||||||||||||||||||||||||

| Machinery, Energy & Transportation | 16,237 | (859) | (54) | 8 | — | 15,332 | (905) | (6%) | |||||||||||||||||||||||||||||||||||||||

| Financial Products Segment | 981 | — | — | — | 43 | 1,024 | 43 | 4% | |||||||||||||||||||||||||||||||||||||||

| Corporate Items and Eliminations | (148) | — | — | — | 7 | (141) | 7 | ||||||||||||||||||||||||||||||||||||||||

| Financial Products Revenues | 833 | — | — | — | 50 | 883 | 50 | 6% | |||||||||||||||||||||||||||||||||||||||

| Consolidated Sales and Revenues | $ | 17,070 | $ | (859) | $ | (54) | $ | 8 | $ | 50 | $ | 16,215 | $ | (855) | (5%) | ||||||||||||||||||||||||||||||||

| Sales and Revenues by Geographic Region | |||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| North America | Latin America | EAME | Asia/Pacific | External Sales and Revenues | Inter-Segment | Total Sales and Revenues | |||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| (Millions of dollars) | $ | % Chg | $ | % Chg | $ | % Chg | $ | % Chg | $ | % Chg | $ | % Chg | $ | % Chg | |||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| Fourth Quarter 2024 | |||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| Construction Industries | $ | 3,157 | (14%) | $ | 623 | 6% | $ | 1,122 | (1%) | $ | 1,057 | (2%) | $ | 5,959 | (8%) | $ | 44 | 42% | $ | 6,003 | (8%) | ||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| Resource Industries | 960 | (23%) | 579 | 9% | 455 | 2% | 872 | (7%) | 2,866 | (9%) | 96 | 8% | 2,962 | (9%) | |||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| Energy & Transportation | 3,532 | 6% | 467 | (32%) | 1,586 | (3%) | 931 | (1%) | 6,516 | (1%) | 1,133 | 5% | 7,649 | —% | |||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| All Other Segment | 13 | (13%) | 1 | —% | 1 | (80%) | 11 | (8%) | 26 | (19%) | 90 | 7% | 116 | —% | |||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| Corporate Items and Eliminations | (29) | — | (2) | (4) | (35) | (1,363) | (1,398) | ||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| Machinery, Energy & Transportation | 7,633 | (7%) | 1,670 | (7%) | 3,162 | (2%) | 2,867 | (4%) | 15,332 | (6%) | — | —% | 15,332 | (6%) | |||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| Financial Products Segment | 680 | 5% | 103 | 3% | 128 | 1% | 113 | 4% | 1,024 | 4% | — | —% | 1,024 | 4% | |||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| Corporate Items and Eliminations | (77) | (21) | (22) | (21) | (141) | — | (141) | ||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| Financial Products Revenues | 603 | 8% | 82 | (1%) | 106 | 1% | 92 | 5% | 883 | 6% | — | —% | 883 | 6% | |||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| Consolidated Sales and Revenues | $ | 8,236 | (6%) | $ | 1,752 | (7%) | $ | 3,268 | (2%) | $ | 2,959 | (3%) | $ | 16,215 | (5%) | $ | — | —% | $ | 16,215 | (5%) | ||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| Fourth Quarter 2023 | |||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| Construction Industries | $ | 3,689 | $ | 587 | $ | 1,129 | $ | 1,083 | $ | 6,488 | $ | 31 | $ | 6,519 | |||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| Resource Industries | 1,240 | 529 | 445 | 939 | 3,153 | 89 | 3,242 | ||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| Energy & Transportation | 3,324 | 684 | 1,638 | 942 | 6,588 | 1,081 | 7,669 | ||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| All Other Segment | 15 | — | 5 | 12 | 32 | 84 | 116 | ||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| Corporate Items and Eliminations | (18) | (2) | (2) | (2) | (24) | (1,285) | (1,309) | ||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| Machinery, Energy & Transportation | 8,250 | 1,798 | 3,215 | 2,974 | 16,237 | — | 16,237 | ||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| Financial Products Segment | 645 | 100 | 127 | 109 | 981 | — | 981 | ||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| Corporate Items and Eliminations | (88) | (17) | (22) | (21) | (148) | — | (148) | ||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| Financial Products Revenues | 557 | 83 | 105 | 88 | 833 | — | 833 | ||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| Consolidated Sales and Revenues | $ | 8,807 | $ | 1,881 | $ | 3,320 | $ | 3,062 | $ | 17,070 | $ | — | $ | 17,070 | |||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

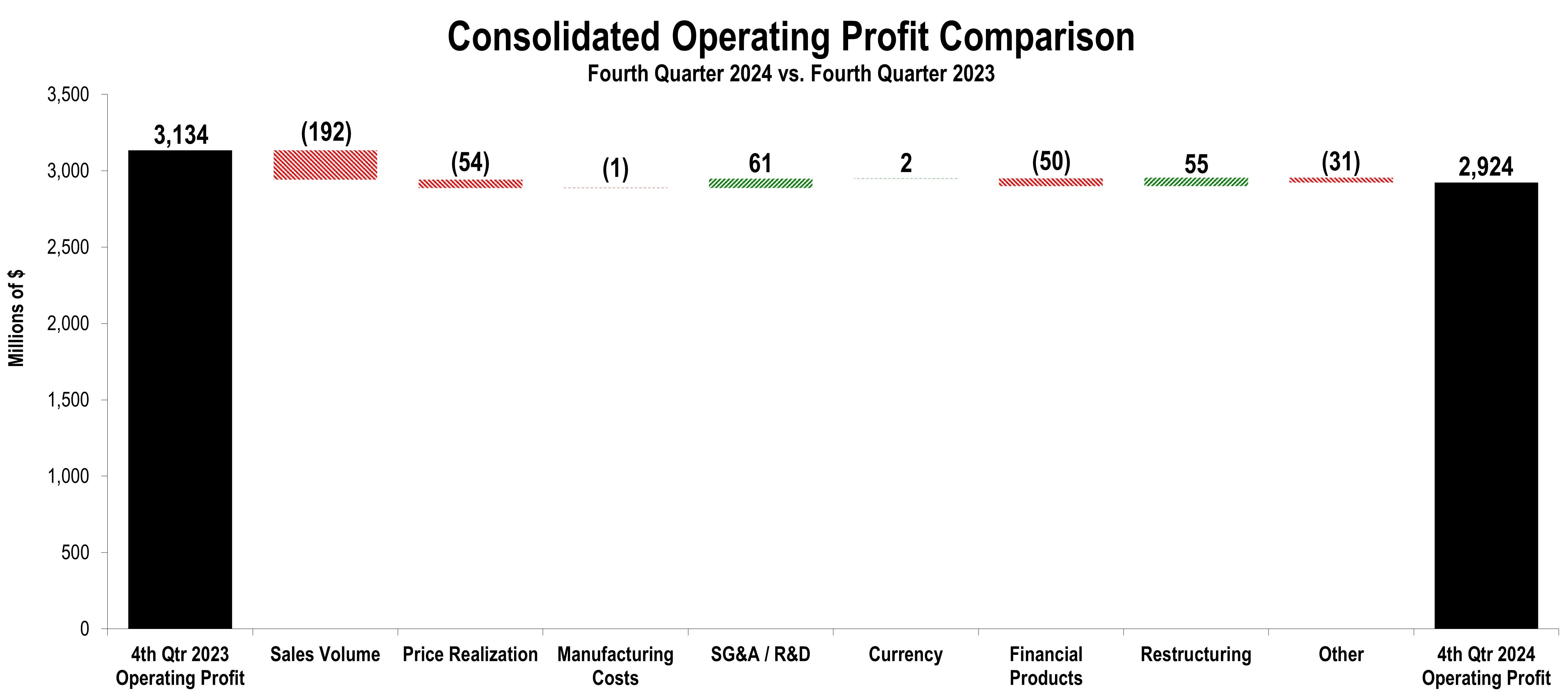

| Profit (Loss) by Segment | |||||||||||||||||||||||

| (Millions of dollars) | Fourth Quarter 2024 | Fourth Quarter 2023 | $ Change |

%

Change

|

|||||||||||||||||||

| Construction Industries | $ | 1,174 | $ | 1,535 | $ | (361) | (24 | %) | |||||||||||||||

| Resource Industries | 466 | 600 | (134) | (22 | %) | ||||||||||||||||||

| Energy & Transportation | 1,477 | 1,429 | 48 | 3 | % | ||||||||||||||||||

| All Other Segment | 16 | (24) | 40 | 167 | % | ||||||||||||||||||

| Corporate Items and Eliminations | (198) | (438) | 240 | ||||||||||||||||||||

| Machinery, Energy & Transportation | 2,935 | 3,102 | (167) | (5 | %) | ||||||||||||||||||

| Financial Products Segment | 166 | 234 | (68) | (29 | %) | ||||||||||||||||||

| Corporate Items and Eliminations | (29) | (46) | 17 | ||||||||||||||||||||

| Financial Products | 137 | 188 | (51) | (27 | %) | ||||||||||||||||||

| Consolidating Adjustments | (148) | (156) | 8 | ||||||||||||||||||||

| Consolidated Operating Profit | $ | 2,924 | $ | 3,134 | $ | (210) | (7 | %) | |||||||||||||||

| CONSTRUCTION INDUSTRIES | ||||||||||||||||||||||||||||||||||||||||||||||||||

| (Millions of dollars) | ||||||||||||||||||||||||||||||||||||||||||||||||||

| Segment Sales | ||||||||||||||||||||||||||||||||||||||||||||||||||

| Fourth Quarter 2023 | Sales Volume | Price Realization | Currency | Inter-Segment | Fourth Quarter 2024 | $ Change |

% Change |

|||||||||||||||||||||||||||||||||||||||||||

| Total Sales | $ | 6,519 | $ | (227) | $ | (300) | $ | (2) | $ | 13 | $ | 6,003 | $ | (516) | (8 | %) | ||||||||||||||||||||||||||||||||||

| Sales by Geographic Region | ||||||||||||||||||||||||||||||||||||||||||||||||||

| Fourth Quarter 2024 | Fourth Quarter 2023 | $ Change |

% Change |

|||||||||||||||||||||||||||||||||||||||||||||||

| North America | $ | 3,157 | $ | 3,689 | $ | (532) | (14 | %) | ||||||||||||||||||||||||||||||||||||||||||

| Latin America | 623 | 587 | 36 | 6 | % | |||||||||||||||||||||||||||||||||||||||||||||

| EAME | 1,122 | 1,129 | (7) | (1 | %) | |||||||||||||||||||||||||||||||||||||||||||||

| Asia/Pacific | 1,057 | 1,083 | (26) | (2 | %) | |||||||||||||||||||||||||||||||||||||||||||||

| External Sales | 5,959 | 6,488 | (529) | (8 | %) | |||||||||||||||||||||||||||||||||||||||||||||

| Inter-segment | 44 | 31 | 13 | 42 | % | |||||||||||||||||||||||||||||||||||||||||||||

| Total Sales | $ | 6,003 | $ | 6,519 | $ | (516) | (8 | %) | ||||||||||||||||||||||||||||||||||||||||||

| Segment Profit | ||||||||||||||||||||||||||||||||||||||||||||||||||

| Fourth Quarter 2024 | Fourth Quarter 2023 |

Change

|

% Change |

|||||||||||||||||||||||||||||||||||||||||||||||

| Segment Profit | $ | 1,174 | $ | 1,535 | $ | (361) | (24 | %) | ||||||||||||||||||||||||||||||||||||||||||

| Segment Profit Margin | 19.6 | % | 23.5 | % | (3.9 | pts) | ||||||||||||||||||||||||||||||||||||||||||||

| RESOURCE INDUSTRIES | ||||||||||||||||||||||||||||||||||||||||||||||||||

| (Millions of dollars) | ||||||||||||||||||||||||||||||||||||||||||||||||||

| Segment Sales | ||||||||||||||||||||||||||||||||||||||||||||||||||

| Fourth Quarter 2023 | Sales Volume | Price Realization | Currency | Inter-Segment | Fourth Quarter 2024 | $ Change |

% Change |

|||||||||||||||||||||||||||||||||||||||||||

| Total Sales | $ | 3,242 | $ | (316) | $ | 26 | $ | 3 | $ | 7 | $ | 2,962 | $ | (280) | (9 | %) | ||||||||||||||||||||||||||||||||||

| Sales by Geographic Region | ||||||||||||||||||||||||||||||||||||||||||||||||||

| Fourth Quarter 2024 | Fourth Quarter 2023 | $ Change |

% Change |

|||||||||||||||||||||||||||||||||||||||||||||||

| North America | $ | 960 | $ | 1,240 | $ | (280) | (23 | %) | ||||||||||||||||||||||||||||||||||||||||||

| Latin America | 579 | 529 | 50 | 9 | % | |||||||||||||||||||||||||||||||||||||||||||||

| EAME | 455 | 445 | 10 | 2 | % | |||||||||||||||||||||||||||||||||||||||||||||

| Asia/Pacific | 872 | 939 | (67) | (7 | %) | |||||||||||||||||||||||||||||||||||||||||||||

| External Sales | 2,866 | 3,153 | (287) | (9 | %) | |||||||||||||||||||||||||||||||||||||||||||||

| Inter-segment | 96 | 89 | 7 | 8 | % | |||||||||||||||||||||||||||||||||||||||||||||

| Total Sales | $ | 2,962 | $ | 3,242 | $ | (280) | (9 | %) | ||||||||||||||||||||||||||||||||||||||||||

| Segment Profit | ||||||||||||||||||||||||||||||||||||||||||||||||||

| Fourth Quarter 2024 | Fourth Quarter 2023 |

Change |

% Change |

|||||||||||||||||||||||||||||||||||||||||||||||

| Segment Profit | $ | 466 | $ | 600 | $ | (134) | (22 | %) | ||||||||||||||||||||||||||||||||||||||||||

| Segment Profit Margin | 15.7 | % | 18.5 | % | (2.8 | pts) | ||||||||||||||||||||||||||||||||||||||||||||

| ENERGY & TRANSPORTATION | ||||||||||||||||||||||||||||||||||||||||||||||||||

| (Millions of dollars) | ||||||||||||||||||||||||||||||||||||||||||||||||||

| Segment Sales | ||||||||||||||||||||||||||||||||||||||||||||||||||

| Fourth Quarter 2023 | Sales Volume | Price Realization | Currency | Inter-Segment | Fourth Quarter 2024 | $ Change |

% Change |

|||||||||||||||||||||||||||||||||||||||||||

| Total Sales | $ | 7,669 | $ | (301) | $ | 221 | $ | 8 | $ | 52 | $ | 7,649 | $ | (20) | — | % | ||||||||||||||||||||||||||||||||||

| Sales by Application | ||||||||||||||||||||||||||||||||||||||||||||||||||

| Fourth Quarter 2024 | Fourth Quarter 2023 | $ Change |

% Change |

|||||||||||||||||||||||||||||||||||||||||||||||

| Oil and Gas | $ | 1,927 | $ | 2,247 | $ | (320) | (14 | %) | ||||||||||||||||||||||||||||||||||||||||||

| Power Generation | 2,242 | 1,835 | 407 | 22 | % | |||||||||||||||||||||||||||||||||||||||||||||

| Industrial | 928 | 1,078 | (150) | (14 | %) | |||||||||||||||||||||||||||||||||||||||||||||

| Transportation | 1,419 | 1,428 | (9) | (1 | %) | |||||||||||||||||||||||||||||||||||||||||||||

| External Sales | 6,516 | 6,588 | (72) | (1 | %) | |||||||||||||||||||||||||||||||||||||||||||||

| Inter-segment | 1,133 | 1,081 | 52 | 5 | % | |||||||||||||||||||||||||||||||||||||||||||||

| Total Sales | $ | 7,649 | $ | 7,669 | $ | (20) | — | % | ||||||||||||||||||||||||||||||||||||||||||

| Segment Profit | ||||||||||||||||||||||||||||||||||||||||||||||||||

| Fourth Quarter 2024 | Fourth Quarter 2023 |

Change |

% Change |

|||||||||||||||||||||||||||||||||||||||||||||||

| Segment Profit | $ | 1,477 | $ | 1,429 | $ | 48 | 3 | % | ||||||||||||||||||||||||||||||||||||||||||

| Segment Profit Margin | 19.3 | % | 18.6 | % | 0.7 | pts | ||||||||||||||||||||||||||||||||||||||||||||

| FINANCIAL PRODUCTS SEGMENT | ||||||||||||||||||||||||||||||||||||||||||||||||||

| (Millions of dollars) | ||||||||||||||||||||||||||||||||||||||||||||||||||

| Revenues by Geographic Region | ||||||||||||||||||||||||||||||||||||||||||||||||||

| Fourth Quarter 2024 | Fourth Quarter 2023 | $ Change |

% Change |

|||||||||||||||||||||||||||||||||||||||||||||||

| North America | $ | 680 | $ | 645 | $ | 35 | 5 | % | ||||||||||||||||||||||||||||||||||||||||||

| Latin America | 103 | 100 | 3 | 3 | % | |||||||||||||||||||||||||||||||||||||||||||||

| EAME | 128 | 127 | 1 | 1 | % | |||||||||||||||||||||||||||||||||||||||||||||

| Asia/Pacific | 113 | 109 | 4 | 4 | % | |||||||||||||||||||||||||||||||||||||||||||||

| Total Revenues | $ | 1,024 | $ | 981 | $ | 43 | 4 | % | ||||||||||||||||||||||||||||||||||||||||||

| Segment Profit | ||||||||||||||||||||||||||||||||||||||||||||||||||

| Fourth Quarter 2024 | Fourth Quarter 2023 |

Change |

% Change |

|||||||||||||||||||||||||||||||||||||||||||||||

| Segment Profit | $ | 166 | $ | 234 | $ | (68) | (29 | %) | ||||||||||||||||||||||||||||||||||||||||||

| (Dollars in millions except per share data) | Operating Profit | Operating Profit Margin | Profit Before Taxes | Provision (Benefit) for Income Taxes | Profit | Profit per Share | ||||||||||||||||||||||||||||||||

| Three Months Ended December 31, 2024 - U.S. GAAP | $ | 2,924 | 18.0 | % | $ | 3,243 | $ | 463 | $ | 2,791 | $ | 5.78 | ||||||||||||||||||||||||||

| Other restructuring (income) costs | 37 | 0.3 | % | 37 | 10 | 27 | 0.05 | |||||||||||||||||||||||||||||||

| Pension/OPEB mark-to-market (gains) losses | — | — | % | (154) | (43) | (111) | (0.23) | |||||||||||||||||||||||||||||||

| Tax law change related to currency translation | — | — | % | — | 224 | (224) | (0.46) | |||||||||||||||||||||||||||||||

| Three Months Ended December 31, 2024 - Adjusted | $ | 2,961 | 18.3 | % | $ | 3,126 | $ | 654 | $ | 2,483 | $ | 5.14 | ||||||||||||||||||||||||||

| Three Months Ended December 31, 2023 - U.S. GAAP | $ | 3,134 | 18.4 | % | $ | 3,249 | $ | 587 | $ | 2,676 | $ | 5.28 | ||||||||||||||||||||||||||

| Other restructuring (income) costs | 92 | 0.5 | % | 92 | 27 | 65 | 0.13 | |||||||||||||||||||||||||||||||

| Pension/OPEB mark-to-market (gains) losses | — | — | % | (97) | (26) | (71) | (0.14) | |||||||||||||||||||||||||||||||

| Deferred tax valuation allowance adjustments | — | — | % | — | 18 | (18) | (0.04) | |||||||||||||||||||||||||||||||

| Three Months Ended December 31, 2023 - Adjusted | $ | 3,226 | 18.9 | % | $ | 3,244 | $ | 606 | $ | 2,652 | $ | 5.23 | ||||||||||||||||||||||||||

| Twelve Months Ended December 31, 2024 - U.S. GAAP | $ | 13,072 | 20.2 | % | $ | 13,373 | $ | 2,629 | $ | 10,792 | $ | 22.05 | ||||||||||||||||||||||||||

| Restructuring (income) costs - divestitures of certain non-U.S. entities | 164 | 0.2 | % | 164 | 54 | 110 | 0.22 | |||||||||||||||||||||||||||||||

| Other restructuring (income) costs | 195 | 0.3 | % | 195 | 46 | 149 | 0.32 | |||||||||||||||||||||||||||||||

| Pension/OPEB mark-to-market (gains) losses | — | — | % | (154) | (43) | (111) | (0.23) | |||||||||||||||||||||||||||||||

| Tax law change related to currency translation | — | — | % | — | 224 | (224) | (0.46) | |||||||||||||||||||||||||||||||

| Twelve Months Ended December 31, 2024 - Adjusted | $ | 13,431 | 20.7 | % | $ | 13,578 | $ | 2,910 | $ | 10,716 | $ | 21.90 | ||||||||||||||||||||||||||

| Twelve Months Ended December 31, 2023 - U.S. GAAP | $ | 12,966 | 19.3 | % | $ | 13,050 | $ | 2,781 | $ | 10,335 | $ | 20.12 | ||||||||||||||||||||||||||

| Restructuring costs - Longwall divestiture | 586 | 0.9 | % | 586 | — | 586 | 1.14 | |||||||||||||||||||||||||||||||

| Other restructuring (income) costs | 194 | 0.3 | % | 194 | 48 | 146 | 0.30 | |||||||||||||||||||||||||||||||

| Pension/OPEB mark-to-market (gains) losses | — | — | % | (97) | (26) | (71) | (0.14) | |||||||||||||||||||||||||||||||

| Deferred tax valuation allowance adjustments | — | — | % | — | 106 | (106) | (0.21) | |||||||||||||||||||||||||||||||

| Twelve Months Ended December 31, 2023 - Adjusted | $ | 13,746 | 20.5 | % | $ | 13,733 | $ | 2,909 | $ | 10,890 | $ | 21.21 | ||||||||||||||||||||||||||

| (Dollars in millions) | Profit Before Taxes | Provision (Benefit) for Income Taxes | Effective Tax Rate | |||||||||||||||||

| Three Months Ended December 31, 2024 - U.S. GAAP | $ | 3,243 | $ | 463 | 14.3 | % | ||||||||||||||

| Pension/OPEB mark-to-market (gains) losses | (154) | (43) | ||||||||||||||||||

| Tax law change related to currency translation | — | 224 | ||||||||||||||||||

| Decrease in annual effective tax rate | — | 33 | ||||||||||||||||||

| Excess stock-based compensation | — | 8 | ||||||||||||||||||

| Annual effective tax rate, excluding discrete items | $ | 3,089 | $ | 685 | 22.2 | % | ||||||||||||||

| Decrease in annual effective tax rate | — | (33) | ||||||||||||||||||

| Excess stock-based compensation | — | (8) | ||||||||||||||||||

| Other restructuring (income) costs | 37 | 10 | ||||||||||||||||||

| Three Months Ended December 31, 2024 - Adjusted | $ | 3,126 | $ | 654 | ||||||||||||||||

| Three Months Ended December 31, 2023 - U.S. GAAP | $ | 3,249 | $ | 587 | 18.1 | % | ||||||||||||||

| Pension/OPEB mark-to-market (gains) losses | (97) | (26) | ||||||||||||||||||

| Decrease in annual effective tax rate | — | 112 | ||||||||||||||||||

| Excess stock-based compensation | — | 3 | ||||||||||||||||||

| Annual effective tax rate, excluding discrete items | $ | 3,152 | $ | 676 | 21.4 | % | ||||||||||||||

| Decrease in annual effective tax rate | — | (112) | ||||||||||||||||||

| Deferred tax valuation allowance adjustments | — | 18 | ||||||||||||||||||

| Excess stock-based compensation | — | (3) | ||||||||||||||||||

| Other restructuring (income) costs | 92 | 27 | ||||||||||||||||||

| Three Months Ended December 31, 2023 - Adjusted | $ | 3,244 | $ | 606 | ||||||||||||||||

| Twelve Months Ended December 31, 2024 - U.S. GAAP | $ | 13,373 | $ | 2,629 | 19.7 | % | ||||||||||||||

| Restructuring (income) costs - divestitures of certain non-U.S. entities | 164 | 54 | ||||||||||||||||||

| Pension/OPEB mark-to-market (gains) losses | (154) | (43) | ||||||||||||||||||

| Tax law change related to currency translation | — | 224 | ||||||||||||||||||

| Changes in estimates related to prior years | — | 47 | ||||||||||||||||||

| Excess stock-based compensation | — | 57 | ||||||||||||||||||

| Annual effective tax rate, excluding discrete items | $ | 13,383 | $ | 2,968 | 22.2 | % | ||||||||||||||

| Changes in estimates related to prior years | — | (47) | ||||||||||||||||||

| Excess stock-based compensation | — | (57) | ||||||||||||||||||

| Other restructuring (income) costs | 195 | 46 | ||||||||||||||||||

| Twelve Months Ended December 31, 2024 - Adjusted | $ | 13,578 | $ | 2,910 | ||||||||||||||||

| Twelve Months Ended December 31, 2023 - U.S. GAAP | $ | 13,050 | $ | 2,781 | 21.3 | % | ||||||||||||||

| Restructuring costs - Longwall divestiture | 586 | — | ||||||||||||||||||

| Pension/OPEB mark-to-market (gains) losses | (97) | (26) | ||||||||||||||||||

| Deferred tax valuation allowance adjustments | — | 88 | ||||||||||||||||||

| Excess stock-based compensation | — | 57 | ||||||||||||||||||

| Annual effective tax rate, excluding discrete items | $ | 13,539 | $ | 2,900 | 21.4 | % | ||||||||||||||

| Deferred tax valuation allowance adjustments | — | 18 | ||||||||||||||||||

| Excess stock-based compensation | — | (57) | ||||||||||||||||||

| Other restructuring (income) costs | 194 | 48 | ||||||||||||||||||

| Twelve Months Ended December 31, 2023 - Adjusted | $ | 13,733 | $ | 2,909 | ||||||||||||||||

| Three Months Ended December 31, | Twelve Months Ended December 31, | ||||||||||||||||||||||

| 2024 | 2023 | 2024 | 2023 | ||||||||||||||||||||

| Sales and revenues: | |||||||||||||||||||||||

| Sales of Machinery, Energy & Transportation | $ | 15,332 | $ | 16,237 | $ | 61,363 | $ | 63,869 | |||||||||||||||

| Revenues of Financial Products | 883 | 833 | 3,446 | 3,191 | |||||||||||||||||||

| Total sales and revenues | 16,215 | 17,070 | 64,809 | 67,060 | |||||||||||||||||||

| Operating costs: | |||||||||||||||||||||||

| Cost of goods sold | 10,321 | 11,016 | 40,199 | 42,767 | |||||||||||||||||||

| Selling, general and administrative expenses | 1,769 | 1,756 | 6,667 | 6,371 | |||||||||||||||||||

| Research and development expenses | 519 | 554 | 2,107 | 2,108 | |||||||||||||||||||

| Interest expense of Financial Products | 338 | 288 | 1,286 | 1,030 | |||||||||||||||||||

| Other operating (income) expenses | 344 | 322 | 1,478 | 1,818 | |||||||||||||||||||

| Total operating costs | 13,291 | 13,936 | 51,737 | 54,094 | |||||||||||||||||||

| Operating profit | 2,924 | 3,134 | 13,072 | 12,966 | |||||||||||||||||||

| Interest expense excluding Financial Products | 107 | 126 | 512 | 511 | |||||||||||||||||||

| Other income (expense) | 426 | 241 | 813 | 595 | |||||||||||||||||||

| Consolidated profit before taxes | 3,243 | 3,249 | 13,373 | 13,050 | |||||||||||||||||||

| Provision (benefit) for income taxes | 463 | 587 | 2,629 | 2,781 | |||||||||||||||||||

| Profit of consolidated companies | 2,780 | 2,662 | 10,744 | 10,269 | |||||||||||||||||||

| Equity in profit (loss) of unconsolidated affiliated companies | 10 | 11 | 44 | 63 | |||||||||||||||||||

| Profit of consolidated and affiliated companies | 2,790 | 2,673 | 10,788 | 10,332 | |||||||||||||||||||

| Less: Profit (loss) attributable to noncontrolling interests | (1) | (3) | (4) | (3) | |||||||||||||||||||

Profit 1 |

$ | 2,791 | $ | 2,676 | $ | 10,792 | $ | 10,335 | |||||||||||||||

| Profit per common share | $ | 5.81 | $ | 5.31 | $ | 22.17 | $ | 20.24 | |||||||||||||||

Profit per common share — diluted 2 |

$ | 5.78 | $ | 5.28 | $ | 22.05 | $ | 20.12 | |||||||||||||||

| Weighted-average common shares outstanding (millions) | |||||||||||||||||||||||

| – Basic | 480.0 | 504.4 | 486.7 | 510.6 | |||||||||||||||||||

– Diluted 2 |

482.6 | 507.0 | 489.4 | 513.6 | |||||||||||||||||||

| 1 | Profit attributable to common shareholders. | ||||

| 2 | Diluted by assumed exercise of stock-based compensation awards using the treasury stock method. | ||||

| December 31, 2024 |

December 31, 2023 |

||||||||||

| Assets | |||||||||||

| Current assets: | |||||||||||

| Cash and cash equivalents | $ | 6,889 | $ | 6,978 | |||||||

| Receivables – trade and other | 9,282 | 9,310 | |||||||||

| Receivables – finance | 9,565 | 9,510 | |||||||||

| Prepaid expenses and other current assets | 3,119 | 4,586 | |||||||||

| Inventories | 16,827 | 16,565 | |||||||||

| Total current assets | 45,682 | 46,949 | |||||||||

| Property, plant and equipment – net | 13,361 | 12,680 | |||||||||

| Long-term receivables – trade and other | 1,225 | 1,238 | |||||||||

| Long-term receivables – finance | 13,242 | 12,664 | |||||||||

| Noncurrent deferred and refundable income taxes | 3,312 | 2,816 | |||||||||

| Intangible assets | 399 | 564 | |||||||||

| Goodwill | 5,241 | 5,308 | |||||||||

| Other assets | 5,302 | 5,257 | |||||||||

| Total assets | $ | 87,764 | $ | 87,476 | |||||||

| Liabilities | |||||||||||

| Current liabilities: | |||||||||||

| Short-term borrowings: | |||||||||||

| -- Financial Products | $ | 4,393 | $ | 4,643 | |||||||

| Accounts payable | 7,675 | 7,906 | |||||||||

| Accrued expenses | 5,243 | 4,958 | |||||||||

| Accrued wages, salaries and employee benefits | 2,391 | 2,757 | |||||||||

| Customer advances | 2,322 | 1,929 | |||||||||

| Dividends payable | 674 | 649 | |||||||||

| Other current liabilities | 2,909 | 3,123 | |||||||||

| Long-term debt due within one year: | |||||||||||

| -- Machinery, Energy & Transportation | 46 | 1,044 | |||||||||

| -- Financial Products | 6,619 | 7,719 | |||||||||

| Total current liabilities | 32,272 | 34,728 | |||||||||

| Long-term debt due after one year: | |||||||||||

| -- Machinery, Energy & Transportation | 8,564 | 8,579 | |||||||||

| -- Financial Products | 18,787 | 15,893 | |||||||||

| Liability for postemployment benefits | 3,757 | 4,098 | |||||||||

| Other liabilities | 4,890 | 4,675 | |||||||||

| Total liabilities | 68,270 | 67,973 | |||||||||

| Shareholders’ equity | |||||||||||

| Common stock | 6,941 | 6,403 | |||||||||

| Treasury stock | (44,331) | (36,339) | |||||||||

| Profit employed in the business | 59,352 | 51,250 | |||||||||

| Accumulated other comprehensive income (loss) | (2,471) | (1,820) | |||||||||

| Noncontrolling interests | 3 | 9 | |||||||||

| Total shareholders’ equity | 19,494 | 19,503 | |||||||||

| Total liabilities and shareholders’ equity | $ | 87,764 | $ | 87,476 | |||||||

| Twelve Months Ended December 31, |

|||||||||||

| 2024 | 2023 | ||||||||||

| Cash flow from operating activities: | |||||||||||

| Profit of consolidated and affiliated companies | $ | 10,788 | $ | 10,332 | |||||||

| Adjustments to reconcile profit to net cash provided by operating activities: | |||||||||||

| Depreciation and amortization | 2,153 | 2,144 | |||||||||

| Actuarial (gain) loss on pension and postretirement benefits | (154) | (97) | |||||||||

| Provision (benefit) for deferred income taxes | (621) | (592) | |||||||||

| (Gain) loss on divestiture | 164 | 572 | |||||||||

| Other | 564 | 375 | |||||||||

| Changes in assets and liabilities, net of acquisitions and divestitures: | |||||||||||

| Receivables – trade and other | (160) | (437) | |||||||||

| Inventories | (414) | (364) | |||||||||

| Accounts payable | (282) | (754) | |||||||||

| Accrued expenses | 191 | 796 | |||||||||

| Accrued wages, salaries and employee benefits | (363) | 486 | |||||||||

| Customer advances | 370 | 80 | |||||||||

| Other assets – net | (97) | (95) | |||||||||

| Other liabilities – net | (104) | 439 | |||||||||

| Net cash provided by (used for) operating activities | 12,035 | 12,885 | |||||||||

| Cash flow from investing activities: | |||||||||||

| Capital expenditures – excluding equipment leased to others | (1,988) | (1,597) | |||||||||

| Expenditures for equipment leased to others | (1,227) | (1,495) | |||||||||

| Proceeds from disposals of leased assets and property, plant and equipment | 722 | 781 | |||||||||

| Additions to finance receivables | (15,409) | (15,161) | |||||||||

| Collections of finance receivables | 13,608 | 14,034 | |||||||||

| Proceeds from sale of finance receivables | 83 | 63 | |||||||||

| Investments and acquisitions (net of cash acquired) | (34) | (75) | |||||||||

| Proceeds from sale of businesses and investments (net of cash sold) | (61) | (4) | |||||||||

| Proceeds from maturities and sale of securities | 3,155 | 1,891 | |||||||||

| Investments in securities | (1,495) | (4,405) | |||||||||

| Other – net | 193 | 97 | |||||||||

| Net cash provided by (used for) investing activities | (2,453) | (5,871) | |||||||||

| Cash flow from financing activities: | |||||||||||

| Dividends paid | (2,646) | (2,563) | |||||||||

| Common stock issued, including treasury shares reissued | 20 | 12 | |||||||||

| Payments to purchase common stock | (7,697) | (4,975) | |||||||||

| Excise tax paid on purchases of common stock | (40) | — | |||||||||

| Proceeds from debt issued (original maturities greater than three months) | 10,283 | 8,257 | |||||||||

| Payments on debt (original maturities greater than three months) | (9,316) | (6,318) | |||||||||

| Short-term borrowings – net (original maturities three months or less) | (168) | (1,345) | |||||||||

| Other – net | (1) | — | |||||||||

| Net cash provided by (used for) financing activities | (9,565) | (6,932) | |||||||||

| Effect of exchange rate changes on cash | (106) | (110) | |||||||||

| Increase (decrease) in cash, cash equivalents and restricted cash | (89) | (28) | |||||||||

| Cash, cash equivalents and restricted cash at beginning of period | 6,985 | 7,013 | |||||||||

| Cash, cash equivalents and restricted cash at end of period | $ | 6,896 | $ | 6,985 | |||||||

| Cash equivalents primarily represent short-term, highly liquid investments with original maturities of generally three months or less. | ||

| Supplemental Consolidating Data | ||||||||||||||||||||||||||

| Consolidated | Machinery, Energy & Transportation |

Financial Products |

Consolidating Adjustments |

|||||||||||||||||||||||

| Sales and revenues: | ||||||||||||||||||||||||||

| Sales of Machinery, Energy & Transportation | $ | 15,332 | $ | 15,332 | $ | — | $ | — | ||||||||||||||||||

| Revenues of Financial Products | 883 | — | 1,062 | (179) | 1 | |||||||||||||||||||||

| Total sales and revenues | 16,215 | 15,332 | 1,062 | (179) | ||||||||||||||||||||||

| Operating costs: | ||||||||||||||||||||||||||

| Cost of goods sold | 10,321 | 10,323 | — | (2) | 2 | |||||||||||||||||||||

| Selling, general and administrative expenses | 1,769 | 1,535 | 226 | 8 | 2 | |||||||||||||||||||||

| Research and development expenses | 519 | 519 | — | — | ||||||||||||||||||||||

| Interest expense of Financial Products | 338 | — | 338 | — | ||||||||||||||||||||||

| Other operating (income) expenses | 344 | 20 | 361 | (37) | 2 | |||||||||||||||||||||

| Total operating costs | 13,291 | 12,397 | 925 | (31) | ||||||||||||||||||||||

| Operating profit | 2,924 | 2,935 | 137 | (148) | ||||||||||||||||||||||

| Interest expense excluding Financial Products | 107 | 111 | — | (4) | 3 | |||||||||||||||||||||

| Other income (expense) | 426 | 891 | 16 | (481) | 4 | |||||||||||||||||||||

| Consolidated profit before taxes | 3,243 | 3,715 | 153 | (625) | ||||||||||||||||||||||

| Provision (benefit) for income taxes | 463 | 680 | (217) | — | ||||||||||||||||||||||

| Profit of consolidated companies | 2,780 | 3,035 | 370 | (625) | ||||||||||||||||||||||

| Equity in profit (loss) of unconsolidated affiliated companies | 10 | 10 | — | — | ||||||||||||||||||||||

| Profit of consolidated and affiliated companies | 2,790 | 3,045 | 370 | (625) | ||||||||||||||||||||||

| Less: Profit (loss) attributable to noncontrolling interests | (1) | (1) | — | — | ||||||||||||||||||||||

Profit 5 |

$ | 2,791 | $ | 3,046 | $ | 370 | $ | (625) | ||||||||||||||||||

| 1 | Elimination of Financial Products’ revenues earned from ME&T. |

||||

| 2 | Elimination of net expenses recorded between ME&T and Financial Products. | ||||

| 3 | Elimination of interest expense recorded between Financial Products and ME&T. | ||||

| 4 | Elimination of discount recorded by ME&T on receivables sold to Financial Products and of interest earned between ME&T and Financial Products as well as dividends paid by Financial Products to ME&T. |

||||

| 5 | Profit attributable to common shareholders. | ||||

| Supplemental Consolidating Data | ||||||||||||||||||||||||||

| Consolidated | Machinery, Energy & Transportation | Financial Products |

Consolidating Adjustments |

|||||||||||||||||||||||

| Sales and revenues: | ||||||||||||||||||||||||||

| Sales of Machinery, Energy & Transportation | $ | 16,237 | $ | 16,237 | $ | — | $ | — | ||||||||||||||||||

| Revenues of Financial Products | 833 | — | 1,020 | (187) | 1 | |||||||||||||||||||||

| Total sales and revenues | 17,070 | 16,237 | 1,020 | (187) | ||||||||||||||||||||||

| Operating costs: | ||||||||||||||||||||||||||

| Cost of goods sold | 11,016 | 11,018 | — | (2) | 2 | |||||||||||||||||||||

| Selling, general and administrative expenses | 1,756 | 1,557 | 197 | 2 | 2 | |||||||||||||||||||||

| Research and development expenses | 554 | 554 | — | — | ||||||||||||||||||||||

| Interest expense of Financial Products | 288 | — | 290 | (2) | 2 | |||||||||||||||||||||

| Other operating (income) expenses | 322 | 6 | 345 | (29) | 2 | |||||||||||||||||||||

| Total operating costs | 13,936 | 13,135 | 832 | (31) | ||||||||||||||||||||||

| Operating profit | 3,134 | 3,102 | 188 | (156) | ||||||||||||||||||||||

| Interest expense excluding Financial Products | 126 | 126 | — | — | ||||||||||||||||||||||

| Other income (expense) | 241 | 322 | 33 | (114) | 3 | |||||||||||||||||||||

| Consolidated profit before taxes | 3,249 | 3,298 | 221 | (270) | ||||||||||||||||||||||

| Provision (benefit) for income taxes | 587 | 567 | 20 | — | ||||||||||||||||||||||

| Profit of consolidated companies | 2,662 | 2,731 | 201 | (270) | ||||||||||||||||||||||

| Equity in profit (loss) of unconsolidated affiliated companies | 11 | 12 | — | (1) | 4 | |||||||||||||||||||||

| Profit of consolidated and affiliated companies | 2,673 | 2,743 | 201 | (271) | ||||||||||||||||||||||

| Less: Profit (loss) attributable to noncontrolling interests | (3) | (2) | — | (1) | 5 | |||||||||||||||||||||

Profit 6 |

$ | 2,676 | $ | 2,745 | $ | 201 | $ | (270) | ||||||||||||||||||

| 1 | Elimination of Financial Products’ revenues earned from ME&T. |

||||

| 2 | Elimination of net expenses recorded between ME&T paid to Financial Products. | ||||

| 3 | Elimination of discount recorded by ME&T on receivables sold to Financial Products and of interest earned between ME&T and Financial Products as well as dividends paid by Financial Products to ME&T. |

||||

| 4 | Elimination of equity profit (loss) earned from Financial Products’ subsidiaries partially owned by ME&T subsidiaries. |

||||

| 5 | Elimination of noncontrolling interest profit (loss) recorded by Financial Products for subsidiaries partially owned by ME&T subsidiaries. |

||||

| 6 | Profit attributable to common shareholders. | ||||

| Supplemental Consolidating Data | ||||||||||||||||||||||||||

| Consolidated | Machinery, Energy & Transportation | Financial Products |

Consolidating Adjustments |

|||||||||||||||||||||||

| Sales and revenues: | ||||||||||||||||||||||||||

| Sales of Machinery, Energy & Transportation | $ | 61,363 | $ | 61,363 | $ | — | $ | — | ||||||||||||||||||

| Revenues of Financial Products | 3,446 | — | 4,212 | (766) | 1 | |||||||||||||||||||||

| Total sales and revenues | 64,809 | 61,363 | 4,212 | (766) | ||||||||||||||||||||||

| Operating costs: | ||||||||||||||||||||||||||

| Cost of goods sold | 40,199 | 40,206 | — | (7) | 2 | |||||||||||||||||||||

| Selling, general and administrative expenses | 6,667 | 5,881 | 786 | — | ||||||||||||||||||||||

| Research and development expenses | 2,107 | 2,107 | — | — | ||||||||||||||||||||||

| Interest expense of Financial Products | 1,286 | — | 1,286 | — | ||||||||||||||||||||||

| Other operating (income) expenses | 1,478 | 71 | 1,535 | (128) | 2 | |||||||||||||||||||||

| Total operating costs | 51,737 | 48,265 | 3,607 | (135) | ||||||||||||||||||||||

| Operating profit | 13,072 | 13,098 | 605 | (631) | ||||||||||||||||||||||

| Interest expense excluding Financial Products | 512 | 518 | — | (6) | 3 | |||||||||||||||||||||

| Other income (expense) | 813 | 728 | 85 | — | ||||||||||||||||||||||

| Consolidated profit before taxes | 13,373 | 13,308 | 690 | (625) | ||||||||||||||||||||||

| Provision (benefit) for income taxes | 2,629 | 2,663 | (34) | — | ||||||||||||||||||||||

| Profit of consolidated companies | 10,744 | 10,645 | 724 | (625) | ||||||||||||||||||||||

| Equity in profit (loss) of unconsolidated affiliated companies | 44 | 44 | — | — | ||||||||||||||||||||||

| Profit of consolidated and affiliated companies | 10,788 | 10,689 | 724 | (625) | ||||||||||||||||||||||

| Less: Profit (loss) attributable to noncontrolling interests | (4) | (5) | 1 | — | ||||||||||||||||||||||

Profit 4 |

$ | 10,792 | $ | 10,694 | $ | 723 | $ | (625) | ||||||||||||||||||

| 1 | Elimination of Financial Products’ revenues earned from ME&T. |

||||

| 2 | Elimination of net expenses recorded between ME&T and Financial Products. |

||||

| 3 | Elimination of interest expense recorded between Financial Products and ME&T. | ||||

| 4 | Profit attributable to common shareholders. | ||||

| Supplemental Consolidating Data | ||||||||||||||||||||||||||

| Consolidated | Machinery, Energy & Transportation | Financial Products |

Consolidating Adjustments |

|||||||||||||||||||||||

| Sales and revenues: | ||||||||||||||||||||||||||

| Sales of Machinery, Energy & Transportation | $ | 63,869 | $ | 63,869 | $ | — | $ | — | ||||||||||||||||||

| Revenues of Financial Products | 3,191 | — | 3,927 | (736) | 1 | |||||||||||||||||||||

| Total sales and revenues | 67,060 | 63,869 | 3,927 | (736) | ||||||||||||||||||||||

| Operating costs: | ||||||||||||||||||||||||||

| Cost of goods sold | 42,767 | 42,776 | — | (9) | 2 | |||||||||||||||||||||

| Selling, general and administrative expenses | 6,371 | 5,696 | 704 | (29) | 2 | |||||||||||||||||||||

| Research and development expenses | 2,108 | 2,108 | — | — | ||||||||||||||||||||||

| Interest expense of Financial Products | 1,030 | — | 1,032 | (2) | 2 | |||||||||||||||||||||

| Other operating (income) expenses | 1,818 | 630 | 1,268 | (80) | 2 | |||||||||||||||||||||

| Total operating costs | 54,094 | 51,210 | 3,004 | (120) | ||||||||||||||||||||||

| Operating profit | 12,966 | 12,659 | 923 | (616) | ||||||||||||||||||||||

| Interest expense excluding Financial Products | 511 | 511 | — | — | ||||||||||||||||||||||

| Other income (expense) | 595 | 340 | (16) | 271 | 3 | |||||||||||||||||||||

| Consolidated profit before taxes | 13,050 | 12,488 | 907 | (345) | ||||||||||||||||||||||

| Provision (benefit) for income taxes | 2,781 | 2,560 | 221 | — | ||||||||||||||||||||||

| Profit of consolidated companies | 10,269 | 9,928 | 686 | (345) | ||||||||||||||||||||||

| Equity in profit (loss) of unconsolidated affiliated companies | 63 | 67 | — | (4) | 4 | |||||||||||||||||||||

| Profit of consolidated and affiliated companies | 10,332 | 9,995 | 686 | (349) | ||||||||||||||||||||||

| Less: Profit (loss) attributable to noncontrolling interests | (3) | (4) | 5 | (4) | 5 | |||||||||||||||||||||

Profit 6 |

$ | 10,335 | $ | 9,999 | $ | 681 | $ | (345) | ||||||||||||||||||

| 1 | Elimination of Financial Products’ revenues earned from ME&T. |

||||

| 2 | Elimination of net expenses recorded between ME&T and Financial Products. | ||||

| 3 | Elimination of discount recorded by ME&T on receivables sold to Financial Products and of interest earned between ME&T and Financial Products as well as dividends paid by Financial Products to ME&T. |

||||

| 4 | Elimination of equity profit (loss) earned from Financial Products’ subsidiaries partially owned by ME&T subsidiaries. |

||||

| 5 | Elimination of noncontrolling interest profit (loss) recorded by Financial Products for subsidiaries partially owned by ME&T subsidiaries. |

||||

| 6 | Profit attributable to common shareholders. | ||||

| Supplemental Consolidating Data | ||||||||||||||||||||||||||

| Consolidated | Machinery, Energy & Transportation |

Financial Products |

Consolidating Adjustments |

|||||||||||||||||||||||

| Assets | ||||||||||||||||||||||||||

| Current assets: | ||||||||||||||||||||||||||

| Cash and cash equivalents | $ | 6,889 | $ | 6,165 | $ | 724 | $ | — | ||||||||||||||||||

| Receivables – trade and other | 9,282 | 3,463 | 688 | 5,131 | 1,2 |

|||||||||||||||||||||

| Receivables – finance | 9,565 | — | 14,957 | (5,392) | 2 | |||||||||||||||||||||

| Prepaid expenses and other current assets | 3,119 | 2,872 | 401 | (154) | 3 | |||||||||||||||||||||

| Inventories | 16,827 | 16,827 | — | — | ||||||||||||||||||||||

| Total current assets | 45,682 | 29,327 | 16,770 | (415) | ||||||||||||||||||||||

| Property, plant and equipment – net | 13,361 | 9,531 | 3,830 | — | ||||||||||||||||||||||

| Long-term receivables – trade and other | 1,225 | 500 | 86 | 639 | 1,2 |

|||||||||||||||||||||

| Long-term receivables – finance | 13,242 | — | 14,048 | (806) | 2 | |||||||||||||||||||||

| Noncurrent deferred and refundable income taxes | 3,312 | 3,594 | 118 | (400) | 4 | |||||||||||||||||||||

| Intangible assets | 399 | 399 | — | — | ||||||||||||||||||||||

| Goodwill | 5,241 | 5,241 | — | — | ||||||||||||||||||||||

| Other assets | 5,302 | 4,050 | 2,277 | (1,025) | 5 | |||||||||||||||||||||

| Total assets | $ | 87,764 | $ | 52,642 | $ | 37,129 | $ | (2,007) | ||||||||||||||||||

| Liabilities | ||||||||||||||||||||||||||

| Current liabilities: | ||||||||||||||||||||||||||

| Short-term borrowings | $ | 4,393 | $ | — | $ | 4,393 | $ | — | ||||||||||||||||||

| Accounts payable | 7,675 | 7,619 | 331 | (275) | 6,7 | |||||||||||||||||||||

| Accrued expenses | 5,243 | 4,589 | 654 | — | ||||||||||||||||||||||

| Accrued wages, salaries and employee benefits | 2,391 | 2,335 | 56 | — | ||||||||||||||||||||||

| Customer advances | 2,322 | 2,305 | 3 | 14 | 7 | |||||||||||||||||||||

| Dividends payable | 674 | 674 | — | — | ||||||||||||||||||||||

| Other current liabilities | 2,909 | 2,388 | 696 | (175) | 4,8 |

|||||||||||||||||||||

| Long-term debt due within one year | 6,665 | 46 | 6,619 | — | ||||||||||||||||||||||

| Total current liabilities | 32,272 | 19,956 | 12,752 | (436) | ||||||||||||||||||||||

| Long-term debt due after one year | 27,351 | 8,731 | 18,787 | (167) | 9 | |||||||||||||||||||||

| Liability for postemployment benefits | 3,757 | 3,757 | — | — | ||||||||||||||||||||||

| Other liabilities | 4,890 | 3,977 | 1,344 | (431) | 4 | |||||||||||||||||||||

| Total liabilities | 68,270 | 36,421 | 32,883 | (1,034) | ||||||||||||||||||||||

| Shareholders’ equity | ||||||||||||||||||||||||||

| Common stock | 6,941 | 6,941 | 905 | (905) | 10 | |||||||||||||||||||||

| Treasury stock | (44,331) | (44,331) | — | — | ||||||||||||||||||||||

| Profit employed in the business | 59,352 | 54,787 | 4,555 | 10 | 10 | |||||||||||||||||||||

| Accumulated other comprehensive income (loss) | (2,471) | (1,182) | (1,289) | — | ||||||||||||||||||||||

| Noncontrolling interests | 3 | 6 | 75 | (78) | 10 | |||||||||||||||||||||

| Total shareholders’ equity | 19,494 | 16,221 | 4,246 | (973) | ||||||||||||||||||||||

| Total liabilities and shareholders’ equity | $ | 87,764 | $ | 52,642 | $ | 37,129 | $ | (2,007) | ||||||||||||||||||

| 1 | Elimination of receivables between ME&T and Financial Products. |

||||

| 2 | Reclassification of ME&T’s trade receivables purchased by Financial Products and Financial Products’ wholesale inventory receivables. |

||||

| 3 | Elimination of ME&T's insurance premiums that are prepaid to Financial Products. | ||||

| 4 | Reclassification reflecting required netting of deferred tax assets/liabilities by taxing jurisdiction. |

||||

| 5 | Elimination of other intercompany assets and liabilities between ME&T and Financial Products. | ||||

| 6 | Elimination of payables between ME&T and Financial Products. |

||||

| 7 | Reclassification of Financial Products’ payables to customer advances. | ||||

| 8 | Elimination of prepaid insurance in Financial Products’ other liabilities. | ||||

| 9 | Elimination of debt between ME&T and Financial Products. |

||||

| 10 | Eliminations associated with ME&T’s investments in Financial Products’ subsidiaries. |

||||

| Supplemental Consolidating Data | ||||||||||||||||||||||||||

| Consolidated | Machinery, Energy & Transportation |

Financial Products |

Consolidating Adjustments |

|||||||||||||||||||||||

| Assets | ||||||||||||||||||||||||||

| Current assets: | ||||||||||||||||||||||||||

| Cash and cash equivalents | $ | 6,978 | $ | 6,106 | $ | 872 | $ | — | ||||||||||||||||||

| Receivables – trade and other | 9,310 | 3,971 | 570 | 4,769 | 1,2 |

|||||||||||||||||||||

| Receivables – finance | 9,510 | — | 14,499 | (4,989) | 2 | |||||||||||||||||||||

| Prepaid expenses and other current assets | 4,586 | 4,327 | 341 | (82) | 3 | |||||||||||||||||||||

| Inventories | 16,565 | 16,565 | — | — | ||||||||||||||||||||||

| Total current assets | 46,949 | 30,969 | 16,282 | (302) | ||||||||||||||||||||||

| Property, plant and equipment – net | 12,680 | 8,694 | 3,986 | — | ||||||||||||||||||||||

| Long-term receivables – trade and other | 1,238 | 565 | 85 | 588 | 1,2 |

|||||||||||||||||||||

| Long-term receivables – finance | 12,664 | — | 13,299 | (635) | 2 | |||||||||||||||||||||

| Noncurrent deferred and refundable income taxes | 2,816 | 3,360 | 148 | (692) | 4 | |||||||||||||||||||||

| Intangible assets | 564 | 564 | — | — | ||||||||||||||||||||||

| Goodwill | 5,308 | 5,308 | — | — | ||||||||||||||||||||||

| Other assets | 5,257 | 4,218 | 2,082 | (1,043) | 5 | |||||||||||||||||||||

| Total assets | $ | 87,476 | $ | 53,678 | $ | 35,882 | $ | (2,084) | ||||||||||||||||||

| Liabilities | ||||||||||||||||||||||||||

| Current liabilities: | ||||||||||||||||||||||||||

| Short-term borrowings | $ | 4,643 | $ | — | $ | 4,643 | $ | — | ||||||||||||||||||

| Accounts payable | 7,906 | 7,827 | 314 | (235) | 6,7 | |||||||||||||||||||||

| Accrued expenses | 4,958 | 4,361 | 597 | — | ||||||||||||||||||||||

| Accrued wages, salaries and employee benefits | 2,757 | 2,696 | 61 | — | ||||||||||||||||||||||

| Customer advances | 1,929 | 1,912 | 2 | 15 | 7 | |||||||||||||||||||||

| Dividends payable | 649 | 649 | — | — | ||||||||||||||||||||||

| Other current liabilities | 3,123 | 2,583 | 647 | (107) | 4,8 |

|||||||||||||||||||||

| Long-term debt due within one year | 8,763 | 1,044 | 7,719 | — | ||||||||||||||||||||||

| Total current liabilities | 34,728 | 21,072 | 13,983 | (327) | ||||||||||||||||||||||

| Long-term debt due after one year | 24,472 | 8,626 | 15,893 | (47) | 9 | |||||||||||||||||||||

| Liability for postemployment benefits | 4,098 | 4,098 | — | — | ||||||||||||||||||||||

| Other liabilities | 4,675 | 3,806 | 1,607 | (738) | 4 | |||||||||||||||||||||

| Total liabilities | 67,973 | 37,602 | 31,483 | (1,112) | ||||||||||||||||||||||

| Shareholders’ equity | ||||||||||||||||||||||||||

| Common stock | 6,403 | 6,403 | 905 | (905) | 10 | |||||||||||||||||||||

| Treasury stock | (36,339) | (36,339) | — | — | ||||||||||||||||||||||

| Profit employed in the business | 51,250 | 46,783 | 4,457 | 10 | 10 | |||||||||||||||||||||

| Accumulated other comprehensive income (loss) | (1,820) | (783) | (1,037) | — | ||||||||||||||||||||||

| Noncontrolling interests | 9 | 12 | 74 | (77) | 10 | |||||||||||||||||||||

| Total shareholders’ equity | 19,503 | 16,076 | 4,399 | (972) | ||||||||||||||||||||||

| Total liabilities and shareholders’ equity | $ | 87,476 | $ | 53,678 | $ | 35,882 | $ | (2,084) | ||||||||||||||||||

| 1 | Elimination of receivables between ME&T and Financial Products. |

||||

| 2 | Reclassification of ME&T’s trade receivables purchased by Financial Products and Financial Products’ wholesale inventory receivables. |

||||

| 3 | Elimination of ME&T's insurance premiums that are prepaid to Financial Products. | ||||

| 4 | Reclassification reflecting required netting of deferred tax assets/liabilities by taxing jurisdiction. |

||||

| 5 | Elimination of other intercompany assets and liabilities between ME&T and Financial Products. | ||||

| 6 | Elimination of payables between ME&T and Financial Products. |

||||

| 7 | Reclassification of Financial Products’ payables to customer advances. | ||||

| 8 | Elimination of prepaid insurance in Financial Products’ other liabilities. | ||||

| 9 | Elimination of debt between ME&T and Financial Products. |

||||

| 10 | Eliminations associated with ME&T’s investments in Financial Products’ subsidiaries. |

||||

| Supplemental Consolidating Data | ||||||||||||||||||||||||||

| Consolidated | Machinery, Energy & Transportation | Financial Products |

Consolidating Adjustments |

|||||||||||||||||||||||

| Cash flow from operating activities: | ||||||||||||||||||||||||||

| Profit of consolidated and affiliated companies | $ | 10,788 | $ | 10,689 | $ | 724 | $ | (625) | 1,5 | |||||||||||||||||

| Adjustments to reconcile profit to net cash provided by operating activities: | ||||||||||||||||||||||||||

| Depreciation and amortization | 2,153 | 1,368 | 785 | — | ||||||||||||||||||||||

| Actuarial (gain) loss on pension and postretirement benefits | (154) | (154) | — | — | ||||||||||||||||||||||

| Provision (benefit) for deferred income taxes | (621) | (327) | (294) | — | ||||||||||||||||||||||

| (Gain) loss on divestiture | 164 | (46) | 210 | — | ||||||||||||||||||||||

| Other | 564 | 355 | (388) | 597 | 2 | |||||||||||||||||||||

| Changes in assets and liabilities, net of acquisitions and divestitures: | ||||||||||||||||||||||||||

| Receivables – trade and other | (160) | 413 | 207 | (780) | 2,3 |

|||||||||||||||||||||

| Inventories | (414) | (400) | — | (14) | 2 | |||||||||||||||||||||

| Accounts payable | (282) | (200) | (41) | (41) | 2 | |||||||||||||||||||||

| Accrued expenses | 191 | 78 | 113 | — | ||||||||||||||||||||||

| Accrued wages, salaries and employee benefits | (363) | (358) | (5) | — | ||||||||||||||||||||||

| Customer advances | 370 | 369 | 1 | — | ||||||||||||||||||||||

| Other assets – net | (97) | (188) | 48 | 43 | 2 | |||||||||||||||||||||

| Other liabilities – net | (104) | (162) | 85 | (27) | 2 | |||||||||||||||||||||

| Net cash provided by (used for) operating activities | 12,035 | 11,437 | 1,445 | (847) | ||||||||||||||||||||||

| Cash flow from investing activities: | ||||||||||||||||||||||||||

| Capital expenditures – excluding equipment leased to others | (1,988) | (1,952) | (41) | 5 | 2 | |||||||||||||||||||||

| Expenditures for equipment leased to others | (1,227) | (36) | (1,211) | 20 | 2 | |||||||||||||||||||||

| Proceeds from disposals of leased assets and property, plant and equipment | 722 | 35 | 698 | (11) | 2 | |||||||||||||||||||||

| Additions to finance receivables | (15,409) | — | (16,845) | 1,436 | 3 | |||||||||||||||||||||

| Collections of finance receivables | 13,608 | — | 14,707 | (1,099) | 3 | |||||||||||||||||||||

| Net intercompany purchased receivables | — | — | 129 | (129) | 3 | |||||||||||||||||||||

| Proceeds from sale of finance receivables | 83 | — | 83 | — | ||||||||||||||||||||||

| Net intercompany borrowings | — | — | 21 | (21) | 4 | |||||||||||||||||||||

| Investments and acquisitions (net of cash acquired) | (34) | (34) | — | — | ||||||||||||||||||||||

| Proceeds from sale of businesses and investments (net of cash sold) | (61) | 92 | (153) | — | ||||||||||||||||||||||

| Proceeds from maturities and sale of securities | 3,155 | 2,795 | 360 | — | ||||||||||||||||||||||

| Investments in securities | (1,495) | (909) | (586) | — | ||||||||||||||||||||||

| Other – net | 193 | 142 | 51 | — | ||||||||||||||||||||||

| Net cash provided by (used for) investing activities | (2,453) | 133 | (2,787) | 201 | ||||||||||||||||||||||

| Cash flow from financing activities: | ||||||||||||||||||||||||||

| Dividends paid | (2,646) | (2,646) | (625) | 625 | 5 | |||||||||||||||||||||

| Common stock issued, including treasury shares reissued | 20 | 20 | — | — | ||||||||||||||||||||||

| Payments to purchase common stock | (7,697) | (7,697) | — | — | ||||||||||||||||||||||

| Excise tax paid on purchases of common stock | (40) | (40) | — | — | ||||||||||||||||||||||

| Net intercompany borrowings | — | (21) | — | 21 | 4 | |||||||||||||||||||||

| Proceeds from debt issued (original maturities greater than three months) | 10,283 | — | 10,283 | — | ||||||||||||||||||||||

| Payments on debt (original maturities greater than three months) | (9,316) | (1,032) | (8,284) | — | ||||||||||||||||||||||

| Short-term borrowings – net (original maturities three months or less) | (168) | — | (168) | — | ||||||||||||||||||||||

| Other – net | (1) | (1) | — | — | ||||||||||||||||||||||

| Net cash provided by (used for) financing activities | (9,565) | (11,417) | 1,206 | 646 | ||||||||||||||||||||||

| Effect of exchange rate changes on cash | (106) | (94) | (12) | — | ||||||||||||||||||||||

| Increase (decrease) in cash, cash equivalents and restricted cash | (89) | 59 | (148) | — | ||||||||||||||||||||||

| Cash, cash equivalents and restricted cash at beginning of period | 6,985 | 6,111 | 874 | — | ||||||||||||||||||||||

| Cash, cash equivalents and restricted cash at end of period | $ | 6,896 | $ | 6,170 | $ | 726 | $ | — | ||||||||||||||||||

| 1 | Elimination of equity profit earned from Financial Products' subsidiaries partially owned by ME&T subsidiaries. | ||||

| 2 | Elimination of non-cash adjustments and changes in assets and liabilities related to consolidated reporting. | ||||

| 3 | Reclassification of Financial Products’ cash flow activity from investing to operating for receivables that arose from the sale of inventory. | ||||

| 4 | Elimination of net proceeds and payments to/from ME&T and Financial Products. | ||||

| 5 | Elimination of dividend activity between Financial Products and ME&T. | ||||

| Supplemental Consolidating Data | ||||||||||||||||||||||||||

| Consolidated | Machinery, Energy & Transportation | Financial Products |

Consolidating Adjustments |

|||||||||||||||||||||||

| Cash flow from operating activities: | ||||||||||||||||||||||||||

| Profit of consolidated and affiliated companies | $ | 10,332 | $ | 9,995 | $ | 686 | $ | (349) | 1,5 | |||||||||||||||||

| Adjustments to reconcile profit to net cash provided by operating activities: | ||||||||||||||||||||||||||

| Depreciation and amortization | 2,144 | 1,361 | 783 | — | ||||||||||||||||||||||

| Actuarial (gain) loss on pension and postretirement benefits | (97) | (97) | — | — | ||||||||||||||||||||||

| Provision (benefit) for deferred income taxes |

(592) | (576) | (16) | — | ||||||||||||||||||||||

| (Gain) loss on divestiture | 572 | 572 | — | — | ||||||||||||||||||||||

| Other | 375 | 444 | (577) | 508 | 2 | |||||||||||||||||||||

| Changes in assets and liabilities, net of acquisitions and divestitures: | ||||||||||||||||||||||||||

| Receivables – trade and other | (437) | (367) | 61 | (131) | 2,3 |

|||||||||||||||||||||

| Inventories | (364) | (360) | — | (4) | 2 | |||||||||||||||||||||

| Accounts payable | (754) | (836) | 41 | 41 | 2 | |||||||||||||||||||||

| Accrued expenses | 796 | 690 | 106 | — | ||||||||||||||||||||||

| Accrued wages, salaries and employee benefits | 486 | 474 | 12 | — | ||||||||||||||||||||||

| Customer advances | 80 | 78 | 2 | — | ||||||||||||||||||||||

| Other assets – net | (95) | 94 | (110) | (79) | 2 | |||||||||||||||||||||

| Other liabilities – net | 439 | 216 | 118 | 105 | 2 | |||||||||||||||||||||

| Net cash provided by (used for) operating activities | 12,885 | 11,688 | 1,106 | 91 | ||||||||||||||||||||||

| Cash flow from investing activities: | ||||||||||||||||||||||||||

| Capital expenditures – excluding equipment leased to others | (1,597) | (1,624) | (22) | 49 | 2 | |||||||||||||||||||||

| Expenditures for equipment leased to others | (1,495) | (39) | (1,466) | 10 | 2 | |||||||||||||||||||||

| Proceeds from disposals of leased assets and property, plant and equipment | 781 | 55 | 781 | (55) | 2 | |||||||||||||||||||||

| Additions to finance receivables | (15,161) | — | (17,321) | 2,160 | 3 | |||||||||||||||||||||

| Collections of finance receivables | 14,034 | — | 15,634 | (1,600) | 3 | |||||||||||||||||||||

| Net intercompany purchased receivables | — | — | 1,080 | (1,080) | 3 | |||||||||||||||||||||

| Proceeds from sale of finance receivables | 63 | — | 63 | — | ||||||||||||||||||||||

| Net intercompany borrowings | — | — | 10 | (10) | 4 | |||||||||||||||||||||

| Investments and acquisitions (net of cash acquired) | (75) | (75) | — | — | ||||||||||||||||||||||

| Proceeds from sale of businesses and investments (net of cash sold) | (4) | (4) | — | — | ||||||||||||||||||||||

| Proceeds from maturities and sale of securities | 1,891 | 1,642 | 249 | — | ||||||||||||||||||||||

| Investments in securities | (4,405) | (3,982) | (423) | — | ||||||||||||||||||||||

| Other – net | 97 | 106 | (9) | — | ||||||||||||||||||||||

| Net cash provided by (used for) investing activities | (5,871) | (3,921) | (1,424) | (526) | ||||||||||||||||||||||

| Cash flow from financing activities: | ||||||||||||||||||||||||||

| Dividends paid | (2,563) | (2,563) | (425) | 425 | 5 | |||||||||||||||||||||

| Common stock issued, including treasury shares reissued | 12 | 12 | — | — | ||||||||||||||||||||||

| Payments to purchase common stock | (4,975) | (4,975) | — | — | ||||||||||||||||||||||

| Net intercompany borrowings | — | (10) | — | 10 | 4 | |||||||||||||||||||||

| Proceeds from debt issued (original maturities greater than three months) | 8,257 | — | 8,257 | — | ||||||||||||||||||||||

| Payments on debt (original maturities greater than three months) | (6,318) | (106) | (6,212) | — | ||||||||||||||||||||||

| Short-term borrowings – net (original maturities three months or less) | (1,345) | (3) | (1,342) | — | ||||||||||||||||||||||

| Net cash provided by (used for) financing activities | (6,932) | (7,645) | 278 | 435 | ||||||||||||||||||||||

| Effect of exchange rate changes on cash | (110) | (60) | (50) | — | ||||||||||||||||||||||

| Increase (decrease) in cash, cash equivalents and restricted cash | (28) | 62 | (90) | — | ||||||||||||||||||||||

| Cash, cash equivalents and restricted cash at beginning of period | 7,013 | 6,049 | 964 | — | ||||||||||||||||||||||

| Cash, cash equivalents and restricted cash at end of period | $ | 6,985 | $ | 6,111 | $ | 874 | $ | — | ||||||||||||||||||

| 1 | Elimination of equity profit earned from Financial Products' subsidiaries partially owned by ME&T subsidiaries. | ||||

| 2 | Elimination of non-cash adjustments and changes in assets and liabilities related to consolidated reporting. | ||||

| 3 | Reclassification of Financial Products’ cash flow activity from investing to operating for receivables that arose from the sale of inventory. | ||||

| 4 | Elimination of net proceeds and payments to/from ME&T and Financial Products. | ||||

| 5 | Elimination of dividend activity between Financial Products and ME&T. | ||||

| Caterpillar Inc. Quarterly Retail Sales Statistics |

|||||||||||||||||

| Machines and E&T Combined | 4th Quarter 2024 | 3rd Quarter 2024 | 2nd Quarter 2024 | 1st Quarter 2024 | |||||||||||||

| World | DOWN 2% | DOWN 6% | DOWN 3% | DOWN 5% | |||||||||||||

| Machines | 4th Quarter 2024 | 3rd Quarter 2024 | 2nd Quarter 2024 | 1st Quarter 2024 | |||||||||||||

| Asia/Pacific | DOWN 8% | DOWN 9% | DOWN 24% | DOWN 10% | |||||||||||||

| EAME | DOWN 2% | DOWN 20% | DOWN 12% | DOWN 29% | |||||||||||||

| Latin America | UP 1% | UNCHANGED | UP 6% | UP 4% | |||||||||||||

| North America | DOWN 3% | DOWN 9% | DOWN 3% | DOWN 1% | |||||||||||||

| World | DOWN 3% | DOWN 10% | DOWN 8% | DOWN 9% | |||||||||||||

| Resource Industries (RI) | 4th Quarter 2024 | 3rd Quarter 2024 | 2nd Quarter 2024 | 1st Quarter 2024 | |||||||||||||

| Asia/Pacific | DOWN 4% | DOWN 13% | DOWN 37% | DOWN 16% | |||||||||||||

| EAME | UP 15% | DOWN 38% | DOWN 19% | DOWN 39% | |||||||||||||

| Latin America | DOWN 5% | DOWN 10% | UP 11% | UP 38% | |||||||||||||

| North America | DOWN 11% | DOWN 12% | DOWN 2% | DOWN 17% | |||||||||||||

| World | DOWN 3% | DOWN 18% | DOWN 15% | DOWN 17% | |||||||||||||

| Construction Industries (CI) | 4th Quarter 2024 | 3rd Quarter 2024 | 2nd Quarter 2024 | 1st Quarter 2024 | |||||||||||||

| Asia/Pacific | DOWN 11% | DOWN 7% | DOWN 12% | DOWN 6% | |||||||||||||

| EAME | DOWN 8% | DOWN 12% | DOWN 10% | DOWN 24% | |||||||||||||

| Latin America | UP 5% | UP 6% | UP 4% | DOWN 10% | |||||||||||||

| North America | DOWN 1% | DOWN 8% | DOWN 3% | UP 4% | |||||||||||||

| World | DOWN 3% | DOWN 7% | DOWN 5% | DOWN 5% | |||||||||||||

| Reported in dollars and based on unit sales as reported primarily by dealers. | |||||||||||||||||

Energy & Transportation (E&T) Retail Sales by industry for the quarter ended as indicated compared with the same period of the prior year: |

|||||||||||||||||

| Energy & Transportation (E&T) | 4th Quarter 2024 | 3rd Quarter 2024 | 2nd Quarter 2024 | 1st Quarter 2024 | |||||||||||||

| Power Gen | UP 27% | UP 11% | UP 28% | UP 9% | |||||||||||||

| Industrial | DOWN 22% | DOWN 29% | DOWN 40% | DOWN 39% | |||||||||||||

| Transportation | UP 6% | UP 25% | UP 68% | UP 45% | |||||||||||||

| Oil & Gas | DOWN 13% | UP 10% | UP 9% | UP 35% | |||||||||||||

| Total | UP 2% | UP 5% | UP 10% | UP 9% | |||||||||||||

| Reported in dollars based on reporting from dealers and direct sales. | |||||||||||||||||