| UNITED STATES SECURITIES AND EXCHANGE COMMISSION Washington, D.C. 20549 | |||||||||||||||||||||||||||||||||||

| |||||||||||||||||||||||||||||||||||

| FORM | 8-K | ||||||||||||||||||||||||||||||||||

| Current Report | |||||||||||||||||||||||||||||||||||

|

Pursuant to Section 13 or 15(d) of the Securities Exchange Act of 1934

| |||||||||||||||||||||||||||||||||||

| Date of Report (Date of earliest event reported): | August 1, 2023 | ||||||||||||||||||||||||||||||||||

| CATERPILLAR INC. | |||||||||||||||||||||||||||||||||||

| (Exact name of registrant as specified in its charter) | |||||||||||||||||||||||||||||||||||

| Delaware | 1-768 | 37-0602744 | |||||||||||||||||||||||||||||||||

| (State or other jurisdiction of incorporation) | (Commission File Number) |

(I.R.S Employer Identification No.) |

|||||||||||||||||||||||||||||||||

| 5205 N. O'Connor Blvd., | Suite 100, | Irving, | Texas | 75039 | ||||||||||||||||||||||||||||

| (Address of principal executive offices) | (Zip Code) | |||||||||||||||||||||||||||||||

| Registrant’s telephone number, including area code: | (972) | 891-7700 | ||||||||||||||||||||||||||||||

| Former name or former address, if changed since last report: | N/A | |||||||||||||||||||||||||||||||

| ☐ | Written communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425) | ||||||||||||||||||||||||||||||||||

| ☐ | Soliciting material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12) | ||||||||||||||||||||||||||||||||||

| ☐ | Pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b)) | ||||||||||||||||||||||||||||||||||

| ☐ | Pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4(c)) | ||||||||||||||||||||||||||||||||||

|

Securities registered pursuant to Section 12(b) of the Act:

| |||||||||||||||||||||||||||||||||||

| Title of each class | Trading Symbol (s) | Name of each exchange which registered | |||||||||||||||||||||||||||||||||

| Common Stock ($1.00 par value) | CAT | The New York Stock Exchange | |||||||||||||||||||||||||||||||||

| 5.3% Debentures due September 15, 2035 | CAT35 | The New York Stock Exchange | |||||||||||||||||||||||||||||||||

| Check the appropriate box below if the Form 8-K filing is intended to simultaneously satisfy the filing obligation of the registrant under any of the following provisions: | |||||||||||||||||||||||||||||||||||

| Indicate by check mark whether the registrant is an emerging growth company as defined by Rule 405 of the Securities Act of | |||||||||||||||||||||||||||||||||||

| 1933 (17 CFR §230.405 of this chapter) or Rule 12b-2 of the Securities Exchange Act of 1934 (17 CFR §240.12b-2 of this chapter). | |||||||||||||||||||||||||||||||||||

| Emerging growth company | ☐ | ||||||||||||||||||||||||||||||||||

| If an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period | |||||||||||||||||||||||||||||||||||

| for complying with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act. | ☐ | ||||||||||||||||||||||||||||||||||

| (d) | Exhibits: | ||||||||||

| The following is furnished as an exhibit to this report: | |||||||||||

| 99.1 | |||||||||||

| 99.2 | |||||||||||

| 104 | The cover page from this Current Report on Form 8-K, formatted in Inline XBRL. | ||||||||||

|

SIGNATURES

| ||||||||

| Pursuant to the requirements of the Securities Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf by the undersigned hereunto duly authorized. | ||||||||

| CATERPILLAR INC. | ||||||||

August 1, 2023 |

By: | /s/ Derek Owens | ||||||

| Derek Owens Senior Vice President and General Counsel |

||||||||

| Second Quarter | |||||||||||

| ($ in billions except profit per share) | 2023 | 2022 | |||||||||

| Sales and Revenues | $17.3 | $14.2 | |||||||||

| Profit Per Share | $5.67 | $3.13 | |||||||||

| Adjusted Profit Per Share | $5.55 | $3.18 | |||||||||

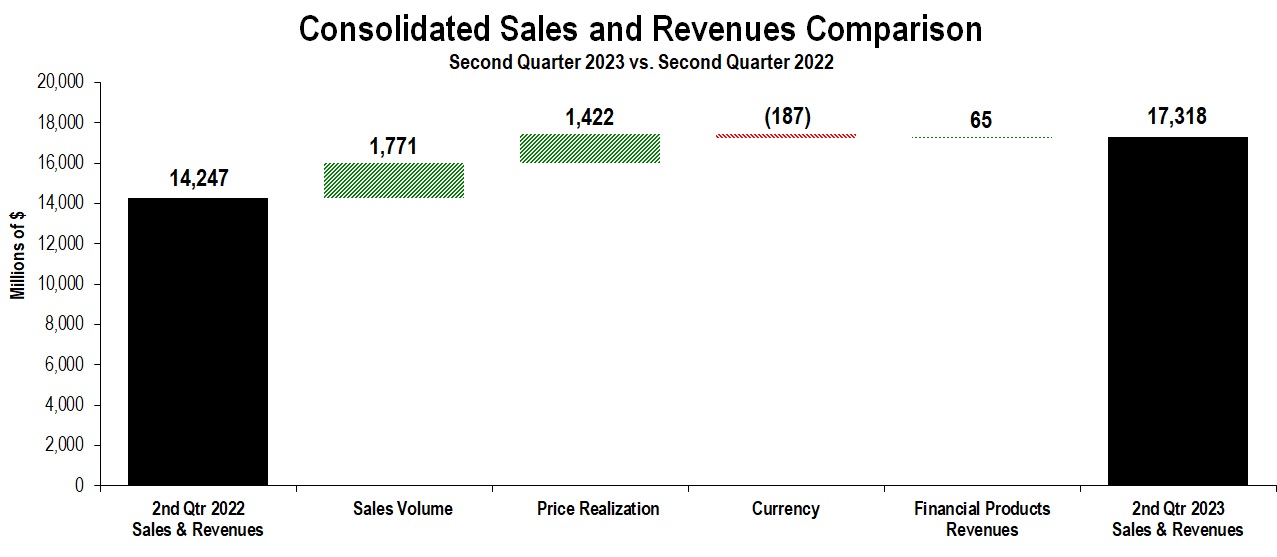

| ● | Second-quarter 2023 sales and revenues increased 22% to $17.3 billion |

||||

| ● | Second-quarter 2023 profit per share of $5.67; adjusted profit per share of $5.55 |

||||

| ● | Returned $2.0 billion to shareholders through share repurchases and dividends in the quarter |

||||

| Sales and Revenues by Segment | |||||||||||||||||||||||||||||||||||||||||||||||

| (Millions of dollars) | Second Quarter 2022 | Sales Volume |

Price Realization |

Currency | Inter-Segment / Other | Second Quarter 2023 | $ Change |

% Change |

|||||||||||||||||||||||||||||||||||||||

| Construction Industries | $ | 6,033 | $ | 606 | $ | 629 | $ | (105) | $ | (9) | $ | 7,154 | $ | 1,121 | 19% | ||||||||||||||||||||||||||||||||

| Resource Industries | 2,961 | 250 | 375 | (47) | 24 | 3,563 | 602 | 20% | |||||||||||||||||||||||||||||||||||||||

| Energy & Transportation | 5,705 | 932 | 417 | (32) | 197 | 7,219 | 1,514 | 27% | |||||||||||||||||||||||||||||||||||||||

| All Other Segment | 118 | (4) | — | (1) | 3 | 116 | (2) | (2%) | |||||||||||||||||||||||||||||||||||||||

| Corporate Items and Eliminations | (1,278) | (13) | 1 | (2) | (215) | (1,507) | (229) | ||||||||||||||||||||||||||||||||||||||||

| Machinery, Energy & Transportation | 13,539 | 1,771 | 1,422 | (187) | — | 16,545 | 3,006 | 22% | |||||||||||||||||||||||||||||||||||||||

| Financial Products Segment | 798 | — | — | — | 125 | 923 | 125 | 16% | |||||||||||||||||||||||||||||||||||||||

| Corporate Items and Eliminations | (90) | — | — | — | (60) | (150) | (60) | ||||||||||||||||||||||||||||||||||||||||

| Financial Products Revenues | 708 | — | — | — | 65 | 773 | 65 | 9% | |||||||||||||||||||||||||||||||||||||||

| Consolidated Sales and Revenues | $ | 14,247 | $ | 1,771 | $ | 1,422 | $ | (187) | $ | 65 | $ | 17,318 | $ | 3,071 | 22% | ||||||||||||||||||||||||||||||||

| Sales and Revenues by Geographic Region | |||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| North America | Latin America | EAME | Asia/Pacific | External Sales and Revenues | Inter-Segment | Total Sales and Revenues | |||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| (Millions of dollars) | $ | % Chg | $ | % Chg | $ | % Chg | $ | % Chg | $ | % Chg | $ | % Chg | $ | % Chg | |||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| Second Quarter 2023 | |||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| Construction Industries | $ | 3,968 | 32% | $ | 566 | (11%) | $ | 1,438 | 20% | $ | 1,149 | —% | $ | 7,121 | 19% | $ | 33 | (21%) | $ | 7,154 | 19% | ||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| Resource Industries | 1,342 | 31% | 538 | 15% | 517 | 6% | 1,076 | 18% | 3,473 | 20% | 90 | 36% | 3,563 | 20% | |||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| Energy & Transportation | 3,120 | 37% | 459 | 20% | 1,479 | 22% | 899 | 17% | 5,957 | 28% | 1,262 | 18% | 7,219 | 27% | |||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| All Other Segment | 16 | (11%) | — | —% | 4 | (20%) | 14 | (7%) | 34 | (11%) | 82 | 3% | 116 | (2%) | |||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| Corporate Items and Eliminations | (32) | (2) | (2) | (4) | (40) | (1,467) | (1,507) | ||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| Machinery, Energy & Transportation | 8,414 | 33% | 1,561 | 5% | 3,436 | 18% | 3,134 | 10% | 16,545 | 22% | — | —% | 16,545 | 22% | |||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| Financial Products Segment | 593 | 17% | 102 | 17% | 118 | 22% | 110 | 1% | 923 | 16% | — | —% | 923 | 16% | |||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| Corporate Items and Eliminations | (85) | (21) | (21) | (23) | (150) | — | (150) | ||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| Financial Products Revenues | 508 | 10% | 81 | 23% | 97 | 11% | 87 | (5%) | 773 | 9% | — | —% | 773 | 9% | |||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| Consolidated Sales and Revenues | $ | 8,922 | 32% | $ | 1,642 | 6% | $ | 3,533 | 18% | $ | 3,221 | 10% | $ | 17,318 | 22% | $ | — | —% | $ | 17,318 | 22% | ||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| Second Quarter 2022 | |||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| Construction Industries | $ | 3,006 | $ | 635 | $ | 1,202 | $ | 1,148 | $ | 5,991 | $ | 42 | $ | 6,033 | |||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| Resource Industries | 1,027 | 466 | 489 | 913 | 2,895 | 66 | 2,961 | ||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| Energy & Transportation | 2,277 | 382 | 1,215 | 766 | 4,640 | 1,065 | 5,705 | ||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| All Other Segment | 18 | — | 5 | 15 | 38 | 80 | 118 | ||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| Corporate Items and Eliminations | (20) | (2) | — | (3) | (25) | (1,253) | (1,278) | ||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| Machinery, Energy & Transportation | 6,308 | 1,481 | 2,911 | 2,839 | 13,539 | — | 13,539 | ||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| Financial Products Segment | 505 | 87 | 97 | 109 | 798 | — | 798 | ||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| Corporate Items and Eliminations | (42) | (21) | (10) | (17) | (90) | — | (90) | ||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| Financial Products Revenues | 463 | 66 | 87 | 92 | 708 | — | 708 | ||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| Consolidated Sales and Revenues | $ | 6,771 | $ | 1,547 | $ | 2,998 | $ | 2,931 | $ | 14,247 | $ | — | $ | 14,247 | |||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

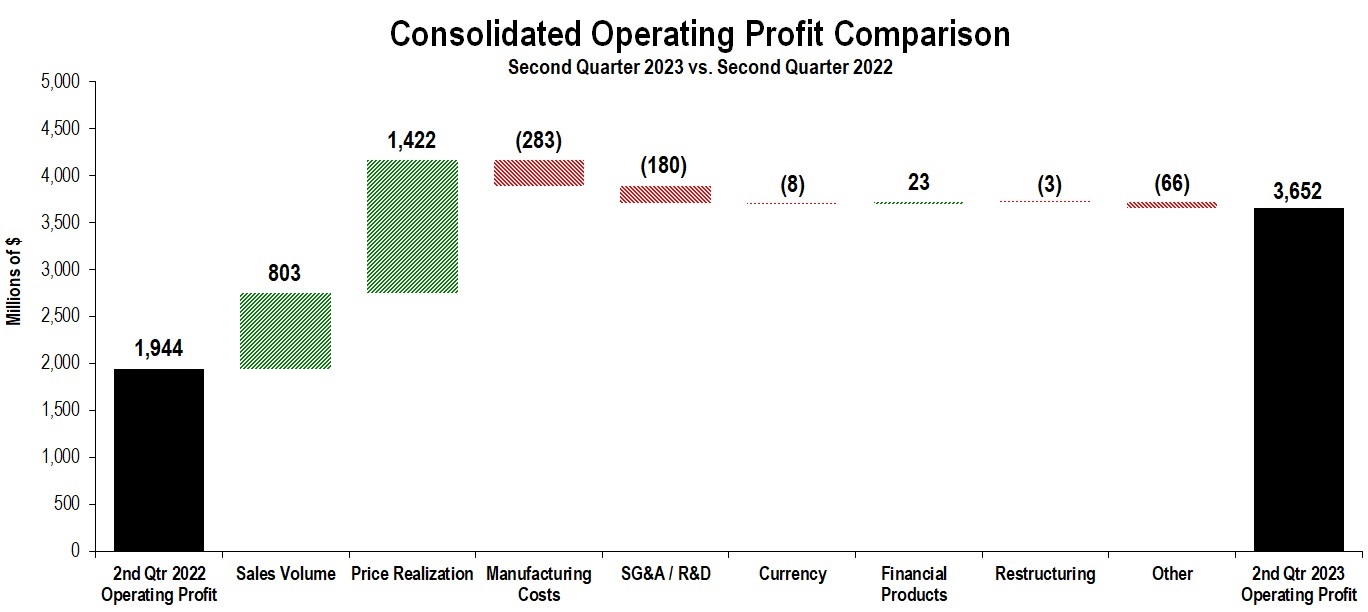

| Profit (Loss) by Segment | |||||||||||||||||||||||

| (Millions of dollars) | Second Quarter 2023 | Second Quarter 2022 | $ Change |

%

Change

|

|||||||||||||||||||

| Construction Industries | $ | 1,803 | $ | 989 | $ | 814 | 82 | % | |||||||||||||||

| Resource Industries | 740 | 355 | 385 | 108 | % | ||||||||||||||||||

| Energy & Transportation | 1,269 | 659 | 610 | 93 | % | ||||||||||||||||||

| All Other Segment | 10 | 31 | (21) | (68 | %) | ||||||||||||||||||

| Corporate Items and Eliminations | (272) | (230) | (42) | ||||||||||||||||||||

| Machinery, Energy & Transportation | 3,550 | 1,804 | 1,746 | 97 | % | ||||||||||||||||||

| Financial Products Segment | 240 | 217 | 23 | 11 | % | ||||||||||||||||||

| Corporate Items and Eliminations | 17 | 17 | — | ||||||||||||||||||||

| Financial Products | 257 | 234 | 23 | 10 | % | ||||||||||||||||||

| Consolidating Adjustments | (155) | (94) | (61) | ||||||||||||||||||||

| Consolidated Operating Profit | $ | 3,652 | $ | 1,944 | $ | 1,708 | 88 | % | |||||||||||||||

| CONSTRUCTION INDUSTRIES | ||||||||||||||||||||||||||||||||||||||||||||||||||

| (Millions of dollars) | ||||||||||||||||||||||||||||||||||||||||||||||||||

| Segment Sales | ||||||||||||||||||||||||||||||||||||||||||||||||||

| Second Quarter 2022 | Sales Volume | Price Realization | Currency | Inter-Segment | Second Quarter 2023 | $ Change |

% Change |

|||||||||||||||||||||||||||||||||||||||||||

| Total Sales | $ | 6,033 | $ | 606 | $ | 629 | $ | (105) | $ | (9) | $ | 7,154 | $ | 1,121 | 19 | % | ||||||||||||||||||||||||||||||||||

| Sales by Geographic Region | ||||||||||||||||||||||||||||||||||||||||||||||||||

| Second Quarter 2023 | Second Quarter 2022 | $ Change |

% Change |

|||||||||||||||||||||||||||||||||||||||||||||||

| North America | $ | 3,968 | $ | 3,006 | $ | 962 | 32 | % | ||||||||||||||||||||||||||||||||||||||||||

| Latin America | 566 | 635 | (69) | (11 | %) | |||||||||||||||||||||||||||||||||||||||||||||

| EAME | 1,438 | 1,202 | 236 | 20 | % | |||||||||||||||||||||||||||||||||||||||||||||

| Asia/Pacific | 1,149 | 1,148 | 1 | — | % | |||||||||||||||||||||||||||||||||||||||||||||

| External Sales | 7,121 | 5,991 | 1,130 | 19 | % | |||||||||||||||||||||||||||||||||||||||||||||

| Inter-segment | 33 | 42 | (9) | (21 | %) | |||||||||||||||||||||||||||||||||||||||||||||

| Total Sales | $ | 7,154 | $ | 6,033 | $ | 1,121 | 19 | % | ||||||||||||||||||||||||||||||||||||||||||

| Segment Profit | ||||||||||||||||||||||||||||||||||||||||||||||||||

| Second Quarter 2023 | Second Quarter 2022 |

Change |

% Change |

|||||||||||||||||||||||||||||||||||||||||||||||

| Segment Profit | $ | 1,803 | $ | 989 | $ | 814 | 82 | % | ||||||||||||||||||||||||||||||||||||||||||

| Segment Profit Margin | 25.2 | % | 16.4 | % | 8.8 | pts | ||||||||||||||||||||||||||||||||||||||||||||

| RESOURCE INDUSTRIES | ||||||||||||||||||||||||||||||||||||||||||||||||||

| (Millions of dollars) | ||||||||||||||||||||||||||||||||||||||||||||||||||

| Segment Sales | ||||||||||||||||||||||||||||||||||||||||||||||||||

| Second Quarter 2022 | Sales Volume | Price Realization | Currency | Inter-Segment | Second Quarter 2023 | $ Change |

% Change |

|||||||||||||||||||||||||||||||||||||||||||

| Total Sales | $ | 2,961 | $ | 250 | $ | 375 | $ | (47) | $ | 24 | $ | 3,563 | $ | 602 | 20 | % | ||||||||||||||||||||||||||||||||||

| Sales by Geographic Region | ||||||||||||||||||||||||||||||||||||||||||||||||||

| Second Quarter 2023 | Second Quarter 2022 | $ Change |

% Change |

|||||||||||||||||||||||||||||||||||||||||||||||

| North America | $ | 1,342 | $ | 1,027 | $ | 315 | 31 | % | ||||||||||||||||||||||||||||||||||||||||||

| Latin America | 538 | 466 | 72 | 15 | % | |||||||||||||||||||||||||||||||||||||||||||||

| EAME | 517 | 489 | 28 | 6 | % | |||||||||||||||||||||||||||||||||||||||||||||

| Asia/Pacific | 1,076 | 913 | 163 | 18 | % | |||||||||||||||||||||||||||||||||||||||||||||

| External Sales | 3,473 | 2,895 | 578 | 20 | % | |||||||||||||||||||||||||||||||||||||||||||||

| Inter-segment | 90 | 66 | 24 | 36 | % | |||||||||||||||||||||||||||||||||||||||||||||

| Total Sales | $ | 3,563 | $ | 2,961 | $ | 602 | 20 | % | ||||||||||||||||||||||||||||||||||||||||||

| Segment Profit | ||||||||||||||||||||||||||||||||||||||||||||||||||

| Second Quarter 2023 | Second Quarter 2022 |

Change |

% Change |

|||||||||||||||||||||||||||||||||||||||||||||||

| Segment Profit | $ | 740 | $ | 355 | $ | 385 | 108 | % | ||||||||||||||||||||||||||||||||||||||||||

| Segment Profit Margin | 20.8 | % | 12.0 | % | 8.8 | pts | ||||||||||||||||||||||||||||||||||||||||||||

| ENERGY & TRANSPORTATION | ||||||||||||||||||||||||||||||||||||||||||||||||||

| (Millions of dollars) | ||||||||||||||||||||||||||||||||||||||||||||||||||

| Segment Sales | ||||||||||||||||||||||||||||||||||||||||||||||||||

| Second Quarter 2022 | Sales Volume | Price Realization | Currency | Inter-Segment | Second Quarter 2023 | $ Change |

% Change |

|||||||||||||||||||||||||||||||||||||||||||

| Total Sales | $ | 5,705 | $ | 932 | $ | 417 | $ | (32) | $ | 197 | $ | 7,219 | $ | 1,514 | 27 | % | ||||||||||||||||||||||||||||||||||

| Sales by Application | ||||||||||||||||||||||||||||||||||||||||||||||||||

| Second Quarter 2023 | Second Quarter 2022 | $ Change |

% Change |

|||||||||||||||||||||||||||||||||||||||||||||||

| Oil and Gas | $ | 1,760 | $ | 1,232 | $ | 528 | 43 | % | ||||||||||||||||||||||||||||||||||||||||||

| Power Generation | 1,645 | 1,186 | 459 | 39 | % | |||||||||||||||||||||||||||||||||||||||||||||

| Industrial | 1,318 | 1,117 | 201 | 18 | % | |||||||||||||||||||||||||||||||||||||||||||||

| Transportation | 1,234 | 1,105 | 129 | 12 | % | |||||||||||||||||||||||||||||||||||||||||||||

| External Sales | 5,957 | 4,640 | 1,317 | 28 | % | |||||||||||||||||||||||||||||||||||||||||||||

| Inter-segment | 1,262 | 1,065 | 197 | 18 | % | |||||||||||||||||||||||||||||||||||||||||||||

| Total Sales | $ | 7,219 | $ | 5,705 | $ | 1,514 | 27 | % | ||||||||||||||||||||||||||||||||||||||||||

| Segment Profit | ||||||||||||||||||||||||||||||||||||||||||||||||||

| Second Quarter 2023 | Second Quarter 2022 |

Change |

% Change |

|||||||||||||||||||||||||||||||||||||||||||||||

| Segment Profit | $ | 1,269 | $ | 659 | $ | 610 | 93 | % | ||||||||||||||||||||||||||||||||||||||||||

| Segment Profit Margin | 17.6 | % | 11.6 | % | 6.0 | pts | ||||||||||||||||||||||||||||||||||||||||||||

| FINANCIAL PRODUCTS SEGMENT | ||||||||||||||||||||||||||||||||||||||||||||||||||

| (Millions of dollars) | ||||||||||||||||||||||||||||||||||||||||||||||||||

| Revenues by Geographic Region | ||||||||||||||||||||||||||||||||||||||||||||||||||

| Second Quarter 2023 | Second Quarter 2022 | $ Change |

% Change |

|||||||||||||||||||||||||||||||||||||||||||||||

| North America | $ | 593 | $ | 505 | $ | 88 | 17 | % | ||||||||||||||||||||||||||||||||||||||||||

| Latin America | 102 | 87 | 15 | 17 | % | |||||||||||||||||||||||||||||||||||||||||||||

| EAME | 118 | 97 | 21 | 22 | % | |||||||||||||||||||||||||||||||||||||||||||||

| Asia/Pacific | 110 | 109 | 1 | 1 | % | |||||||||||||||||||||||||||||||||||||||||||||

| Total Revenues | $ | 923 | $ | 798 | $ | 125 | 16 | % | ||||||||||||||||||||||||||||||||||||||||||

| Segment Profit | ||||||||||||||||||||||||||||||||||||||||||||||||||

| Second Quarter 2023 | Second Quarter 2022 |

Change |

% Change |

|||||||||||||||||||||||||||||||||||||||||||||||

| Segment Profit | $ | 240 | $ | 217 | $ | 23 | 11 | % | ||||||||||||||||||||||||||||||||||||||||||

| (Dollars in millions except per share data) | Operating Profit | Operating Profit Margin | Profit Before Taxes | Provision (Benefit) for Income Taxes | Effective Tax Rate | Profit | Profit per Share | |||||||||||||||||||||||||||||||||||||

Three Months Ended June 30, 2023 - U.S. GAAP |

$ | 3,652 | 21.1 | % | $ | 3,652 | $ | 752 | 20.6 | % | $ | 2,922 | $ | 5.67 | ||||||||||||||||||||||||||||||

| Restructuring costs | 31 | 0.2 | % | 31 | 6 | 20.0 | % | 25 | 0.05 | |||||||||||||||||||||||||||||||||||

| Deferred tax valuation allowance adjustments | — | — | % | — | 88 | — | % | (88) | (0.17) | |||||||||||||||||||||||||||||||||||

Three Months Ended June 30, 2023 - Adjusted |

$ | 3,683 | 21.3 | % | $ | 3,683 | $ | 846 | 23.0 | % | $ | 2,859 | $ | 5.55 | ||||||||||||||||||||||||||||||

Three Months Ended June 30, 2022 - U.S. GAAP |

$ | 1,944 | 13.6 | % | $ | 2,096 | $ | 427 | 20.4 | % | $ | 1,673 | $ | 3.13 | ||||||||||||||||||||||||||||||

| Restructuring costs | 28 | 0.2 | % | 28 | 2 | 10.0 | % | 26 | 0.05 | |||||||||||||||||||||||||||||||||||

Three Months Ended June 30, 2022 - Adjusted |

$ | 1,972 | 13.8 | % | $ | 2,124 | $ | 429 | 20.2 | % | $ | 1,699 | $ | 3.18 | ||||||||||||||||||||||||||||||

| Three Months Ended June 30, | Six Months Ended June 30, | ||||||||||||||||||||||

| 2023 | 2022 | 2023 | 2022 | ||||||||||||||||||||

| Sales and revenues: | |||||||||||||||||||||||

| Sales of Machinery, Energy & Transportation | $ | 16,545 | $ | 13,539 | $ | 31,644 | $ | 26,425 | |||||||||||||||

| Revenues of Financial Products | 773 | 708 | 1,536 | 1,411 | |||||||||||||||||||

| Total sales and revenues | 17,318 | 14,247 | 33,180 | 27,836 | |||||||||||||||||||

| Operating costs: | |||||||||||||||||||||||

| Cost of goods sold | 11,065 | 9,975 | 21,168 | 19,534 | |||||||||||||||||||

| Selling, general and administrative expenses | 1,528 | 1,425 | 2,991 | 2,771 | |||||||||||||||||||

| Research and development expenses | 528 | 480 | 1,000 | 937 | |||||||||||||||||||

| Interest expense of Financial Products | 245 | 120 | 462 | 226 | |||||||||||||||||||

| Other operating (income) expenses | 300 | 303 | 1,176 | 569 | |||||||||||||||||||

| Total operating costs | 13,666 | 12,303 | 26,797 | 24,037 | |||||||||||||||||||

| Operating profit | 3,652 | 1,944 | 6,383 | 3,799 | |||||||||||||||||||

| Interest expense excluding Financial Products | 127 | 108 | 256 | 217 | |||||||||||||||||||

| Other income (expense) | 127 | 260 | 159 | 513 | |||||||||||||||||||

| Consolidated profit before taxes | 3,652 | 2,096 | 6,286 | 4,095 | |||||||||||||||||||

| Provision (benefit) for income taxes | 752 | 427 | 1,460 | 896 | |||||||||||||||||||

| Profit of consolidated companies | 2,900 | 1,669 | 4,826 | 3,199 | |||||||||||||||||||

| Equity in profit (loss) of unconsolidated affiliated companies | 24 | 4 | 40 | 11 | |||||||||||||||||||

| Profit of consolidated and affiliated companies | 2,924 | 1,673 | 4,866 | 3,210 | |||||||||||||||||||

| Less: Profit (loss) attributable to noncontrolling interests | 2 | — | 1 | — | |||||||||||||||||||

Profit 1 |

$ | 2,922 | $ | 1,673 | $ | 4,865 | $ | 3,210 | |||||||||||||||

| Profit per common share | $ | 5.70 | $ | 3.15 | $ | 9.46 | $ | 6.03 | |||||||||||||||

Profit per common share — diluted 2 |

$ | 5.67 | $ | 3.13 | $ | 9.41 | $ | 5.99 | |||||||||||||||

| Weighted-average common shares outstanding (millions) | |||||||||||||||||||||||

| – Basic | 512.9 | 531.0 | 514.3 | 532.6 | |||||||||||||||||||

– Diluted 2 |

515.0 | 534.1 | 517.1 | 536.1 | |||||||||||||||||||

| 1 | Profit attributable to common shareholders. | ||||

| 2 | Diluted by assumed exercise of stock-based compensation awards using the treasury stock method. | ||||

| June 30, 2023 |

December 31, 2022 |

||||||||||

| Assets | |||||||||||

| Current assets: | |||||||||||

| Cash and cash equivalents | $ | 7,387 | $ | 7,004 | |||||||

| Receivables – trade and other | 9,416 | 8,856 | |||||||||

| Receivables – finance | 9,288 | 9,013 | |||||||||

| Prepaid expenses and other current assets | 3,163 | 2,642 | |||||||||

| Inventories | 17,746 | 16,270 | |||||||||

| Total current assets | 47,000 | 43,785 | |||||||||

| Property, plant and equipment – net | 12,124 | 12,028 | |||||||||

| Long-term receivables – trade and other | 1,161 | 1,265 | |||||||||

| Long-term receivables – finance | 12,022 | 12,013 | |||||||||

| Noncurrent deferred and refundable income taxes | 2,607 | 2,213 | |||||||||

| Intangible assets | 630 | 758 | |||||||||

| Goodwill | 5,293 | 5,288 | |||||||||

| Other assets | 4,590 | 4,593 | |||||||||

| Total assets | $ | 85,427 | $ | 81,943 | |||||||

| Liabilities | |||||||||||

| Current liabilities: | |||||||||||

| Short-term borrowings: | |||||||||||

| -- Machinery, Energy & Transportation | $ | — | $ | 3 | |||||||

| -- Financial Products | 5,548 | 5,954 | |||||||||

| Accounts payable | 8,443 | 8,689 | |||||||||

| Accrued expenses | 4,493 | 4,080 | |||||||||

| Accrued wages, salaries and employee benefits | 1,755 | 2,313 | |||||||||

| Customer advances | 2,137 | 1,860 | |||||||||

| Dividends payable | 663 | 620 | |||||||||

| Other current liabilities | 3,109 | 2,690 | |||||||||

| Long-term debt due within one year: | |||||||||||

| -- Machinery, Energy & Transportation | 1,043 | 120 | |||||||||

| -- Financial Products | 8,123 | 5,202 | |||||||||

| Total current liabilities | 35,314 | 31,531 | |||||||||

| Long-term debt due after one year: | |||||||||||

| -- Machinery, Energy & Transportation | 8,535 | 9,498 | |||||||||

| -- Financial Products | 14,450 | 16,216 | |||||||||

| Liability for postemployment benefits | 4,084 | 4,203 | |||||||||

| Other liabilities | 4,788 | 4,604 | |||||||||

| Total liabilities | 67,171 | 66,052 | |||||||||

| Shareholders’ equity | |||||||||||

| Common stock | 6,478 | 6,560 | |||||||||

| Treasury stock | (33,391) | (31,748) | |||||||||

| Profit employed in the business | 47,094 | 43,514 | |||||||||

| Accumulated other comprehensive income (loss) | (1,946) | (2,457) | |||||||||

| Noncontrolling interests | 21 | 22 | |||||||||

| Total shareholders’ equity | 18,256 | 15,891 | |||||||||

| Total liabilities and shareholders’ equity | $ | 85,427 | $ | 81,943 | |||||||

| Six Months Ended June 30, | |||||||||||

| 2023 | 2022 | ||||||||||

| Cash flow from operating activities: | |||||||||||

| Profit of consolidated and affiliated companies | $ | 4,866 | $ | 3,210 | |||||||

| Adjustments for non-cash items: | |||||||||||

| Depreciation and amortization | 1,074 | 1,110 | |||||||||

| Provision (benefit) for deferred income taxes | (355) | (283) | |||||||||

| Loss on divestiture | 572 | — | |||||||||

| Other | 106 | 49 | |||||||||

| Changes in assets and liabilities, net of acquisitions and divestitures: | |||||||||||

| Receivables – trade and other | (465) | 283 | |||||||||

| Inventories | (1,560) | (2,003) | |||||||||

| Accounts payable | 34 | 427 | |||||||||

| Accrued expenses | 381 | (80) | |||||||||

| Accrued wages, salaries and employee benefits | (562) | (445) | |||||||||

| Customer advances | 284 | 514 | |||||||||

| Other assets – net | 81 | 86 | |||||||||

| Other liabilities – net | 366 | (322) | |||||||||

| Net cash provided by (used for) operating activities | 4,822 | 2,546 | |||||||||

| Cash flow from investing activities: | |||||||||||

| Capital expenditures – excluding equipment leased to others | (683) | (586) | |||||||||

| Expenditures for equipment leased to others | (774) | (688) | |||||||||

| Proceeds from disposals of leased assets and property, plant and equipment | 368 | 468 | |||||||||

| Additions to finance receivables | (6,973) | (6,705) | |||||||||

| Collections of finance receivables | 6,759 | 6,519 | |||||||||

| Proceeds from sale of finance receivables | 29 | 21 | |||||||||

| Investments and acquisitions (net of cash acquired) | (20) | (36) | |||||||||

| Proceeds from sale of businesses and investments (net of cash sold) | (14) | 1 | |||||||||

| Proceeds from sale of securities | 463 | 1,204 | |||||||||

| Investments in securities | (1,078) | (2,118) | |||||||||

| Other – net | 41 | 32 | |||||||||

| Net cash provided by (used for) investing activities | (1,882) | (1,888) | |||||||||

| Cash flow from financing activities: | |||||||||||

| Dividends paid | (1,238) | (1,187) | |||||||||

| Common stock issued, including treasury shares reissued | (22) | 4 | |||||||||

| Common shares repurchased | (1,829) | (1,924) | |||||||||

| Proceeds from debt issued (original maturities greater than three months) | 3,299 | 4,015 | |||||||||

| Payments on debt (original maturities greater than three months) | (2,303) | (4,246) | |||||||||

| Short-term borrowings – net (original maturities three months or less) | (406) | (553) | |||||||||

| Net cash provided by (used for) financing activities | (2,499) | (3,891) | |||||||||

| Effect of exchange rate changes on cash | (60) | (7) | |||||||||

| Increase (decrease) in cash, cash equivalents and restricted cash | 381 | (3,240) | |||||||||

| Cash, cash equivalents and restricted cash at beginning of period | 7,013 | 9,263 | |||||||||

| Cash, cash equivalents and restricted cash at end of period | $ | 7,394 | $ | 6,023 | |||||||

Cash equivalents primarily represent short-term, highly liquid investments with original maturities of generally three months or less. | ||

| Supplemental Consolidating Data | ||||||||||||||||||||||||||

| Consolidated | Machinery, Energy & Transportation | Financial Products |

Consolidating Adjustments |

|||||||||||||||||||||||

| Sales and revenues: | ||||||||||||||||||||||||||

| Sales of Machinery, Energy & Transportation | $ | 16,545 | $ | 16,545 | $ | — | $ | — | ||||||||||||||||||

| Revenues of Financial Products | 773 | — | 955 | (182) | 1 | |||||||||||||||||||||

| Total sales and revenues | 17,318 | 16,545 | 955 | (182) | ||||||||||||||||||||||

| Operating costs: | ||||||||||||||||||||||||||

| Cost of goods sold | 11,065 | 11,068 | — | (3) | 2 | |||||||||||||||||||||

| Selling, general and administrative expenses | 1,528 | 1,389 | 143 | (4) | 2 | |||||||||||||||||||||

| Research and development expenses | 528 | 528 | — | — | ||||||||||||||||||||||

| Interest expense of Financial Products | 245 | — | 245 | — | ||||||||||||||||||||||

| Other operating (income) expenses | 300 | 10 | 310 | (20) | 2 | |||||||||||||||||||||

| Total operating costs | 13,666 | 12,995 | 698 | (27) | ||||||||||||||||||||||

| Operating profit | 3,652 | 3,550 | 257 | (155) | ||||||||||||||||||||||

| Interest expense excluding Financial Products | 127 | 127 | — | — | ||||||||||||||||||||||

| Other income (expense) | 127 | (10) | (18) | 155 | 3 | |||||||||||||||||||||

| Consolidated profit before taxes | 3,652 | 3,413 | 239 | — | ||||||||||||||||||||||

| Provision (benefit) for income taxes | 752 | 691 | 61 | — | ||||||||||||||||||||||

| Profit of consolidated companies | 2,900 | 2,722 | 178 | — | ||||||||||||||||||||||

| Equity in profit (loss) of unconsolidated affiliated companies | 24 | 24 | — | — | ||||||||||||||||||||||

| Profit of consolidated and affiliated companies | 2,924 | 2,746 | 178 | — | ||||||||||||||||||||||

| Less: Profit (loss) attributable to noncontrolling interests | 2 | (1) | 3 | — | ||||||||||||||||||||||

Profit 4 |

$ | 2,922 | $ | 2,747 | $ | 175 | $ | — | ||||||||||||||||||

| 1 | Elimination of Financial Products’ revenues earned from ME&T. |

||||

| 2 | Elimination of net expenses recorded by ME&T paid to Financial Products. |

||||

| 3 | Elimination of discount recorded by ME&T on receivables sold to Financial Products and of interest earned between ME&T and Financial Products as well as dividends paid by Financial Products to ME&T. |

||||

| 4 | Profit attributable to common shareholders. | ||||

| Supplemental Consolidating Data | ||||||||||||||||||||||||||

| Consolidated | Machinery, Energy & Transportation | Financial Products |

Consolidating Adjustments |

|||||||||||||||||||||||

| Sales and revenues: | ||||||||||||||||||||||||||

| Sales of Machinery, Energy & Transportation | $ | 13,539 | $ | 13,539 | $ | — | $ | — | ||||||||||||||||||

| Revenues of Financial Products | 708 | — | 828 | (120) | 1 | |||||||||||||||||||||

| Total sales and revenues | 14,247 | 13,539 | 828 | (120) | ||||||||||||||||||||||

| Operating costs: | ||||||||||||||||||||||||||

| Cost of goods sold | 9,975 | 9,978 | — | (3) | 2 | |||||||||||||||||||||

| Selling, general and administrative expenses | 1,425 | 1,261 | 167 | (3) | 2 | |||||||||||||||||||||

| Research and development expenses | 480 | 480 | — | — | ||||||||||||||||||||||

| Interest expense of Financial Products | 120 | — | 120 | — | ||||||||||||||||||||||

| Other operating (income) expenses | 303 | 16 | 307 | (20) | 2 | |||||||||||||||||||||

| Total operating costs | 12,303 | 11,735 | 594 | (26) | ||||||||||||||||||||||

| Operating profit | 1,944 | 1,804 | 234 | (94) | ||||||||||||||||||||||

| Interest expense excluding Financial Products | 108 | 108 | — | — | ||||||||||||||||||||||

| Other income (expense) | 260 | 180 | (14) | 94 | 3 | |||||||||||||||||||||

| Consolidated profit before taxes | 2,096 | 1,876 | 220 | — | ||||||||||||||||||||||

| Provision (benefit) for income taxes | 427 | 374 | 53 | — | ||||||||||||||||||||||

| Profit of consolidated companies | 1,669 | 1,502 | 167 | — | ||||||||||||||||||||||

| Equity in profit (loss) of unconsolidated affiliated companies | 4 | 7 | — | (3) | 4 | |||||||||||||||||||||

| Profit of consolidated and affiliated companies | 1,673 | 1,509 | 167 | (3) | ||||||||||||||||||||||

| Less: Profit (loss) attributable to noncontrolling interests | — | — | 3 | (3) | 5 | |||||||||||||||||||||

Profit 6 |

$ | 1,673 | $ | 1,509 | $ | 164 | $ | — | ||||||||||||||||||

| 1 | Elimination of Financial Products’ revenues earned from ME&T. |

||||

| 2 | Elimination of net expenses recorded by ME&T paid to Financial Products. |

||||

| 3 | Elimination of discount recorded by ME&T on receivables sold to Financial Products and of interest earned between ME&T and Financial Products as well as dividends paid by Financial Products to ME&T. |

||||

| 4 | Elimination of equity profit (loss) earned from Financial Products’ subsidiaries partially owned by ME&T subsidiaries. |

||||

| 5 | Elimination of noncontrolling interest profit (loss) recorded by Financial Products for subsidiaries partially owned by ME&T subsidiaries. |

||||

| 6 | Profit attributable to common shareholders. | ||||

| Supplemental Consolidating Data | ||||||||||||||||||||||||||

| Consolidated | Machinery, Energy & Transportation | Financial Products |

Consolidating Adjustments |

|||||||||||||||||||||||

| Sales and revenues: | ||||||||||||||||||||||||||

| Sales of Machinery, Energy & Transportation | $ | 31,644 | $ | 31,644 | $ | — | $ | — | ||||||||||||||||||

| Revenues of Financial Products | 1,536 | — | 1,890 | (354) | 1 | |||||||||||||||||||||

| Total sales and revenues | 33,180 | 31,644 | 1,890 | (354) | ||||||||||||||||||||||

| Operating costs: | ||||||||||||||||||||||||||

| Cost of goods sold | 21,168 | 21,172 | — | (4) | 2 | |||||||||||||||||||||

| Selling, general and administrative expenses | 2,991 | 2,709 | 301 | (19) | 2 | |||||||||||||||||||||

| Research and development expenses | 1,000 | 1,000 | — | — | ||||||||||||||||||||||

| Interest expense of Financial Products | 462 | — | 462 | — | ||||||||||||||||||||||

| Other operating (income) expenses | 1,176 | 599 | 613 | (36) | 2 | |||||||||||||||||||||

| Total operating costs | 26,797 | 25,480 | 1,376 | (59) | ||||||||||||||||||||||

| Operating profit | 6,383 | 6,164 | 514 | (295) | ||||||||||||||||||||||

| Interest expense excluding Financial Products | 256 | 256 | — | — | ||||||||||||||||||||||

| Other income (expense) | 159 | (24) | (37) | 220 | 3 | |||||||||||||||||||||

| Consolidated profit before taxes | 6,286 | 5,884 | 477 | (75) | ||||||||||||||||||||||

| Provision (benefit) for income taxes | 1,460 | 1,339 | 121 | — | ||||||||||||||||||||||

| Profit of consolidated companies | 4,826 | 4,545 | 356 | (75) | ||||||||||||||||||||||

| Equity in profit (loss) of unconsolidated affiliated companies | 40 | 43 | — | (3) | 4 | |||||||||||||||||||||

| Profit of consolidated and affiliated companies | 4,866 | 4,588 | 356 | (78) | ||||||||||||||||||||||

| Less: Profit (loss) attributable to noncontrolling interests | 1 | (1) | 5 | (3) | 5 | |||||||||||||||||||||

Profit 6 |

$ | 4,865 | $ | 4,589 | $ | 351 | $ | (75) | ||||||||||||||||||

| 1 | Elimination of Financial Products’ revenues earned from ME&T. |

||||

| 2 | Elimination of net expenses recorded by ME&T paid to Financial Products. |

||||

| 3 | Elimination of discount recorded by ME&T on receivables sold to Financial Products and of interest earned between ME&T and Financial Products as well as dividends paid by Financial Products to ME&T. |

||||

| 4 | Elimination of equity profit (loss) earned from Financial Products’ subsidiaries partially owned by ME&T subsidiaries. |

||||

| 5 | Elimination of noncontrolling interest profit (loss) recorded by Financial Products for subsidiaries partially owned by ME&T subsidiaries. |

||||

| 6 | Profit attributable to common shareholders. | ||||

| Supplemental Consolidating Data | ||||||||||||||||||||||||||

| Consolidated | Machinery, Energy & Transportation | Financial Products |

Consolidating Adjustments |

|||||||||||||||||||||||

| Sales and revenues: | ||||||||||||||||||||||||||

| Sales of Machinery, Energy & Transportation | $ | 26,425 | $ | 26,425 | $ | — | $ | — | ||||||||||||||||||

| Revenues of Financial Products | 1,411 | — | 1,641 | (230) | 1 | |||||||||||||||||||||

| Total sales and revenues | 27,836 | 26,425 | 1,641 | (230) | ||||||||||||||||||||||

| Operating costs: | ||||||||||||||||||||||||||

| Cost of goods sold | 19,534 | 19,538 | — | (4) | 2 | |||||||||||||||||||||

| Selling, general and administrative expenses | 2,771 | 2,443 | 339 | (11) | 2 | |||||||||||||||||||||

| Research and development expenses | 937 | 937 | — | — | ||||||||||||||||||||||

| Interest expense of Financial Products | 226 | — | 226 | — | ||||||||||||||||||||||

| Other operating (income) expenses | 569 | (12) | 621 | (40) | 2 | |||||||||||||||||||||

| Total operating costs | 24,037 | 22,906 | 1,186 | (55) | ||||||||||||||||||||||

| Operating profit | 3,799 | 3,519 | 455 | (175) | ||||||||||||||||||||||

| Interest expense excluding Financial Products | 217 | 217 | — | — | ||||||||||||||||||||||

| Other income (expense) | 513 | 337 | 1 | 175 | 3 | |||||||||||||||||||||

| Consolidated profit before taxes | 4,095 | 3,639 | 456 | — | ||||||||||||||||||||||

| Provision (benefit) for income taxes | 896 | 786 | 110 | — | ||||||||||||||||||||||

| Profit of consolidated companies | 3,199 | 2,853 | 346 | — | ||||||||||||||||||||||

| Equity in profit (loss) of unconsolidated affiliated companies | 11 | 15 | — | (4) | 4 | |||||||||||||||||||||

| Profit of consolidated and affiliated companies | 3,210 | 2,868 | 346 | (4) | ||||||||||||||||||||||

| Less: Profit (loss) attributable to noncontrolling interests | — | — | 4 | (4) | 5 | |||||||||||||||||||||

Profit 6 |

$ | 3,210 | $ | 2,868 | $ | 342 | $ | — | ||||||||||||||||||

| 1 | Elimination of Financial Products’ revenues earned from ME&T. |

||||

| 2 | Elimination of net expenses recorded by ME&T paid to Financial Products. |

||||

| 3 | Elimination of discount recorded by ME&T on receivables sold to Financial Products and of interest earned between ME&T and Financial Products as well as dividends paid by Financial Products to ME&T. |

||||

| 4 | Elimination of equity profit (loss) earned from Financial Products’ subsidiaries partially owned by ME&T subsidiaries. |

||||

| 5 | Elimination of noncontrolling interest profit (loss) recorded by Financial Products for subsidiaries partially owned by ME&T subsidiaries. |

||||

| 6 | Profit attributable to common shareholders. | ||||

| Supplemental Consolidating Data | ||||||||||||||||||||||||||

| Consolidated | Machinery, Energy & Transportation |

Financial Products |

Consolidating Adjustments |

|||||||||||||||||||||||

| Assets | ||||||||||||||||||||||||||

| Current assets: | ||||||||||||||||||||||||||

| Cash and cash equivalents | $ | 7,387 | $ | 6,323 | $ | 1,064 | $ | — | ||||||||||||||||||

| Receivables – trade and other | 9,416 | 3,467 | 591 | 5,358 | 1,2 |

|||||||||||||||||||||

| Receivables – finance | 9,288 | — | 14,850 | (5,562) | 2 | |||||||||||||||||||||

| Prepaid expenses and other current assets | 3,163 | 2,936 | 308 | (81) | 3 | |||||||||||||||||||||

| Inventories | 17,746 | 17,746 | — | — | ||||||||||||||||||||||

| Total current assets | 47,000 | 30,472 | 16,813 | (285) | ||||||||||||||||||||||

| Property, plant and equipment – net | 12,124 | 8,102 | 4,022 | — | ||||||||||||||||||||||

| Long-term receivables – trade and other | 1,161 | 523 | 155 | 483 | 1,2 |

|||||||||||||||||||||

| Long-term receivables – finance | 12,022 | — | 12,544 | (522) | 2 | |||||||||||||||||||||

| Noncurrent deferred and refundable income taxes | 2,607 | 3,122 | 116 | (631) | 4 | |||||||||||||||||||||

| Intangible assets | 630 | 630 | — | — | ||||||||||||||||||||||

| Goodwill | 5,293 | 5,293 | — | — | ||||||||||||||||||||||

| Other assets | 4,590 | 3,802 | 1,966 | (1,178) | 5 | |||||||||||||||||||||

| Total assets | $ | 85,427 | $ | 51,944 | $ | 35,616 | $ | (2,133) | ||||||||||||||||||

| Liabilities | ||||||||||||||||||||||||||

| Current liabilities: | ||||||||||||||||||||||||||

| Short-term borrowings | $ | 5,548 | $ | — | $ | 5,548 | $ | — | ||||||||||||||||||

| Accounts payable | 8,443 | 8,364 | 298 | (219) | 6,7 | |||||||||||||||||||||

| Accrued expenses | 4,493 | 4,003 | 490 | — | ||||||||||||||||||||||

| Accrued wages, salaries and employee benefits | 1,755 | 1,718 | 37 | — | ||||||||||||||||||||||

| Customer advances | 2,137 | 2,121 | 1 | 15 | 7 | |||||||||||||||||||||

| Dividends payable | 663 | 663 | — | — | ||||||||||||||||||||||

| Other current liabilities | 3,109 | 2,484 | 729 | (104) | 4,8 |

|||||||||||||||||||||

| Long-term debt due within one year | 9,166 | 1,043 | 8,123 | — | ||||||||||||||||||||||

| Total current liabilities | 35,314 | 20,396 | 15,226 | (308) | ||||||||||||||||||||||

| Long-term debt due after one year | 22,985 | 8,574 | 14,450 | (39) | 9 | |||||||||||||||||||||

| Liability for postemployment benefits | 4,084 | 4,084 | — | — | ||||||||||||||||||||||

| Other liabilities | 4,788 | 3,855 | 1,617 | (684) | 4 | |||||||||||||||||||||

| Total liabilities | 67,171 | 36,909 | 31,293 | (1,031) | ||||||||||||||||||||||

| Shareholders’ equity | ||||||||||||||||||||||||||

| Common stock | 6,478 | 6,478 | 905 | (905) | 10 | |||||||||||||||||||||

| Treasury stock | (33,391) | (33,391) | — | — | ||||||||||||||||||||||

| Profit employed in the business | 47,094 | 42,739 | 4,344 | 11 | 10 | |||||||||||||||||||||

| Accumulated other comprehensive income (loss) | (1,946) | (815) | (1,131) | — | ||||||||||||||||||||||

| Noncontrolling interests | 21 | 24 | 205 | (208) | 10 | |||||||||||||||||||||

| Total shareholders’ equity | 18,256 | 15,035 | 4,323 | (1,102) | ||||||||||||||||||||||

| Total liabilities and shareholders’ equity | $ | 85,427 | $ | 51,944 | $ | 35,616 | $ | (2,133) | ||||||||||||||||||

| 1 | Elimination of receivables between ME&T and Financial Products. |

||||

| 2 | Reclassification of ME&T’s trade receivables purchased by Financial Products and Financial Products’ wholesale inventory receivables. |

||||

| 3 | Elimination of ME&T's insurance premiums that are prepaid to Financial Products. | ||||

| 4 | Reclassification reflecting required netting of deferred tax assets/liabilities by taxing jurisdiction. |

||||

| 5 | Elimination of other intercompany assets between ME&T and Financial Products. |

||||

| 6 | Elimination of payables between ME&T and Financial Products. |

||||

| 7 | Reclassification of Financial Products' payables to accrued expenses or customer advances. | ||||

| 8 | Elimination of prepaid insurance in Financial Products’ other liabilities. | ||||

| 9 | Elimination of debt between ME&T and Financial Products. |

||||

| 10 | Eliminations associated with ME&T’s investments in Financial Products’ subsidiaries. |

||||

| Supplemental Consolidating Data | ||||||||||||||||||||||||||

| Consolidated | Machinery, Energy & Transportation |

Financial Products |

Consolidating Adjustments |

|||||||||||||||||||||||

| Assets | ||||||||||||||||||||||||||

| Current assets: | ||||||||||||||||||||||||||

| Cash and cash equivalents | $ | 7,004 | $ | 6,042 | $ | 962 | $ | — | ||||||||||||||||||

| Receivables – trade and other | 8,856 | 3,710 | 519 | 4,627 | 1,2 |

|||||||||||||||||||||

| Receivables – finance | 9,013 | — | 13,902 | (4,889) | 2 | |||||||||||||||||||||

| Prepaid expenses and other current assets | 2,642 | 2,488 | 290 | (136) | 3 | |||||||||||||||||||||

| Inventories | 16,270 | 16,270 | — | — | ||||||||||||||||||||||

| Total current assets | 43,785 | 28,510 | 15,673 | (398) | ||||||||||||||||||||||

| Property, plant and equipment – net | 12,028 | 8,186 | 3,842 | — | ||||||||||||||||||||||

| Long-term receivables – trade and other | 1,265 | 418 | 339 | 508 | 1,2 |

|||||||||||||||||||||

| Long-term receivables – finance | 12,013 | — | 12,552 | (539) | 2 | |||||||||||||||||||||

| Noncurrent deferred and refundable income taxes | 2,213 | 2,755 | 115 | (657) | 4 | |||||||||||||||||||||

| Intangible assets | 758 | 758 | — | — | ||||||||||||||||||||||

| Goodwill | 5,288 | 5,288 | — | — | ||||||||||||||||||||||

| Other assets | 4,593 | 3,882 | 1,892 | (1,181) | 5 | |||||||||||||||||||||

| Total assets | $ | 81,943 | $ | 49,797 | $ | 34,413 | $ | (2,267) | ||||||||||||||||||

| Liabilities | ||||||||||||||||||||||||||

| Current liabilities: | ||||||||||||||||||||||||||

| Short-term borrowings | $ | 5,957 | $ | 3 | $ | 5,954 | $ | — | ||||||||||||||||||

| Accounts payable | 8,689 | 8,657 | 294 | (262) | 6 | |||||||||||||||||||||

| Accrued expenses | 4,080 | 3,687 | 393 | — | ||||||||||||||||||||||

| Accrued wages, salaries and employee benefits | 2,313 | 2,264 | 49 | — | ||||||||||||||||||||||

| Customer advances | 1,860 | 1,860 | — | — | ||||||||||||||||||||||

| Dividends payable | 620 | 620 | — | — | ||||||||||||||||||||||

| Other current liabilities | 2,690 | 2,215 | 635 | (160) | 4,7 |

|||||||||||||||||||||

| Long-term debt due within one year | 5,322 | 120 | 5,202 | — | ||||||||||||||||||||||

| Total current liabilities | 31,531 | 19,426 | 12,527 | (422) | ||||||||||||||||||||||

| Long-term debt due after one year | 25,714 | 9,529 | 16,216 | (31) | 8 | |||||||||||||||||||||

| Liability for postemployment benefits | 4,203 | 4,203 | — | — | ||||||||||||||||||||||

| Other liabilities | 4,604 | 3,677 | 1,638 | (711) | 4 | |||||||||||||||||||||

| Total liabilities | 66,052 | 36,835 | 30,381 | (1,164) | ||||||||||||||||||||||

| Shareholders’ equity | ||||||||||||||||||||||||||

| Common stock | 6,560 | 6,560 | 905 | (905) | 9 | |||||||||||||||||||||

| Treasury stock | (31,748) | (31,748) | — | — | ||||||||||||||||||||||

| Profit employed in the business | 43,514 | 39,435 | 4,068 | 11 | 9 | |||||||||||||||||||||

| Accumulated other comprehensive income (loss) | (2,457) | (1,310) | (1,147) | — | ||||||||||||||||||||||

| Noncontrolling interests | 22 | 25 | 206 | (209) | 9 | |||||||||||||||||||||

| Total shareholders’ equity | 15,891 | 12,962 | 4,032 | (1,103) | ||||||||||||||||||||||

| Total liabilities and shareholders’ equity | $ | 81,943 | $ | 49,797 | $ | 34,413 | $ | (2,267) | ||||||||||||||||||

| 1 | Elimination of receivables between ME&T and Financial Products. |

||||

| 2 | Reclassification of ME&T’s trade receivables purchased by Financial Products and Financial Products’ wholesale inventory receivables. |

||||

| 3 | Elimination of ME&T’s insurance premiums that are prepaid to Financial Products. | ||||

| 4 | Reclassification reflecting required netting of deferred tax assets/liabilities by taxing jurisdiction. |

||||

| 5 | Elimination of other intercompany assets between ME&T and Financial Products. |

||||

| 6 | Elimination of payables between ME&T and Financial Products. | ||||

| 7 | Elimination of prepaid insurance in Financial Products’ other liabilities. |

||||

| 8 | Elimination of debt between ME&T and Financial Products. | ||||

| 9 | Eliminations associated with ME&T’s investments in Financial Products’ subsidiaries. |

||||

| Supplemental Consolidating Data | ||||||||||||||||||||||||||

| Consolidated | Machinery, Energy & Transportation | Financial Products |

Consolidating Adjustments |

|||||||||||||||||||||||

| Cash flow from operating activities: | ||||||||||||||||||||||||||

| Profit of consolidated and affiliated companies | $ | 4,866 | $ | 4,588 | $ | 356 | $ | (78) | 1,5 | |||||||||||||||||

| Adjustments for non-cash items: | ||||||||||||||||||||||||||

| Depreciation and amortization | 1,074 | 690 | 384 | — | ||||||||||||||||||||||

| Provision (benefit) for deferred income taxes | (355) | (338) | (17) | — | ||||||||||||||||||||||

| Loss on divestiture | 572 | 572 | — | — | ||||||||||||||||||||||

| Other | 106 | 198 | (368) | 276 | 2 | |||||||||||||||||||||

| Changes in assets and liabilities, net of acquisitions and divestitures: | ||||||||||||||||||||||||||

| Receivables – trade and other | (465) | 132 | 57 | (654) | 2,3 |

|||||||||||||||||||||

| Inventories | (1,560) | (1,558) | — | (2) | 2 | |||||||||||||||||||||

| Accounts payable | 34 | (28) | 2 | 60 | 2 | |||||||||||||||||||||

| Accrued expenses | 381 | 318 | 63 | — | ||||||||||||||||||||||

| Accrued wages, salaries and employee benefits | (562) | (550) | (12) | — | ||||||||||||||||||||||

| Customer advances | 284 | 283 | 1 | — | ||||||||||||||||||||||

| Other assets – net | 81 | 149 | 5 | (73) | 2 | |||||||||||||||||||||

| Other liabilities – net | 366 | 211 | 71 | 84 | 2 | |||||||||||||||||||||

| Net cash provided by (used for) operating activities | 4,822 | 4,667 | 542 | (387) | ||||||||||||||||||||||

| Cash flow from investing activities: | ||||||||||||||||||||||||||

| Capital expenditures – excluding equipment leased to others | (683) | (678) | (11) | 6 | 2 | |||||||||||||||||||||

| Expenditures for equipment leased to others | (774) | (7) | (772) | 5 | 2 | |||||||||||||||||||||

| Proceeds from disposals of leased assets and property, plant and equipment | 368 | 27 | 350 | (9) | 2 | |||||||||||||||||||||

| Additions to finance receivables | (6,973) | — | (7,957) | 984 | 3 | |||||||||||||||||||||

| Collections of finance receivables | 6,759 | — | 7,516 | (757) | 3 | |||||||||||||||||||||

| Net intercompany purchased receivables | — | — | (83) | 83 | 3 | |||||||||||||||||||||

| Proceeds from sale of finance receivables | 29 | — | 29 | — | ||||||||||||||||||||||

| Net intercompany borrowings | — | — | 4 | (4) | 4 | |||||||||||||||||||||

| Investments and acquisitions (net of cash acquired) | (20) | (20) | — | — | ||||||||||||||||||||||

| Proceeds from sale of businesses and investments (net of cash sold) | (14) | (14) | — | — | ||||||||||||||||||||||

| Proceeds from sale of securities | 463 | 332 | 131 | — | ||||||||||||||||||||||

| Investments in securities | (1,078) | (866) | (212) | — | ||||||||||||||||||||||

| Other – net | 41 | 41 | — | — | ||||||||||||||||||||||

| Net cash provided by (used for) investing activities | (1,882) | (1,185) | (1,005) | 308 | ||||||||||||||||||||||

| Cash flow from financing activities: | ||||||||||||||||||||||||||

| Dividends paid | (1,238) | (1,238) | (75) | 75 | 5 | |||||||||||||||||||||

| Common stock issued, including treasury shares reissued | (22) | (22) | — | — | ||||||||||||||||||||||

| Common shares repurchased | (1,829) | (1,829) | — | — | ||||||||||||||||||||||

| Net intercompany borrowings | — | (4) | — | 4 | 4 | |||||||||||||||||||||

| Proceeds from debt issued > 90 days | 3,299 | — | 3,299 | — | ||||||||||||||||||||||

| Payments on debt > 90 days | (2,303) | (95) | (2,208) | — | ||||||||||||||||||||||

| Short-term borrowings – net < 90 days | (406) | (3) | (403) | — | ||||||||||||||||||||||

| Net cash provided by (used for) financing activities | (2,499) | (3,191) | 613 | 79 | ||||||||||||||||||||||

| Effect of exchange rate changes on cash | (60) | (12) | (48) | — | ||||||||||||||||||||||

| Increase (decrease) in cash, cash equivalents and restricted cash | 381 | 279 | 102 | — | ||||||||||||||||||||||

| Cash, cash equivalents and restricted cash at beginning of period | 7,013 | 6,049 | 964 | — | ||||||||||||||||||||||

| Cash, cash equivalents and restricted cash at end of period | $ | 7,394 | $ | 6,328 | $ | 1,066 | $ | — | ||||||||||||||||||

| 1 | Elimination of equity profit earned from Financial Products' subsidiaries partially owned by ME&T subsidiaries. | ||||

| 2 | Elimination of non-cash adjustments and changes in assets and liabilities related to consolidated reporting. | ||||

| 3 | Reclassification of Financial Products’ cash flow activity from investing to operating for receivables that arose from the sale of inventory. | ||||

| 4 | Elimination of net proceeds and payments to/from ME&T and Financial Products. | ||||

| 5 | Elimination of dividend activity between Financial Products and ME&T. | ||||

| Supplemental Consolidating Data | ||||||||||||||||||||||||||

| Consolidated | Machinery, Energy & Transportation | Financial Products |

Consolidating Adjustments |

|||||||||||||||||||||||

| Cash flow from operating activities: | ||||||||||||||||||||||||||

| Profit of consolidated and affiliated companies | $ | 3,210 | $ | 2,868 | $ | 346 | $ | (4) | 1 | |||||||||||||||||

| Adjustments for non-cash items: | ||||||||||||||||||||||||||

| Depreciation and amortization | 1,110 | 715 | 395 | — | ||||||||||||||||||||||

| Provision (benefit) for deferred income taxes | (283) | (232) | (51) | — | ||||||||||||||||||||||

| Other | 49 | (54) | (93) | 196 | 2 | |||||||||||||||||||||

| Changes in assets and liabilities, net of acquisitions and divestitures: | ||||||||||||||||||||||||||

| Receivables – trade and other | 283 | (32) | 12 | 303 | 2,3 |

|||||||||||||||||||||

| Inventories | (2,003) | (2,003) | — | — | 2 | |||||||||||||||||||||

| Accounts payable | 427 | 396 | 11 | 20 | 2 | |||||||||||||||||||||

| Accrued expenses | (80) | (89) | 9 | — | ||||||||||||||||||||||

| Accrued wages, salaries and employee benefits | (445) | (428) | (17) | — | ||||||||||||||||||||||

| Customer advances | 514 | 515 | (1) | — | ||||||||||||||||||||||

| Other assets – net | 86 | (44) | (25) | 155 | 2 | |||||||||||||||||||||

| Other liabilities – net | (322) | (323) | 149 | (148) | 2 | |||||||||||||||||||||

| Net cash provided by (used for) operating activities | 2,546 | 1,289 | 735 | 522 | ||||||||||||||||||||||

| Cash flow from investing activities: | ||||||||||||||||||||||||||

| Capital expenditures – excluding equipment leased to others | (586) | (583) | (5) | 2 | 2 | |||||||||||||||||||||

| Expenditures for equipment leased to others | (688) | (11) | (683) | 6 | 2 | |||||||||||||||||||||

| Proceeds from disposals of leased assets and property, plant and equipment | 468 | 43 | 433 | (8) | 2 | |||||||||||||||||||||

| Additions to finance receivables | (6,705) | — | (7,175) | 470 | 3 | |||||||||||||||||||||

| Collections of finance receivables | 6,519 | — | 6,896 | (377) | 3 | |||||||||||||||||||||

| Net intercompany purchased receivables | — | — | 615 | (615) | 3 | |||||||||||||||||||||

| Proceeds from sale of finance receivables | 21 | — | 21 | — | ||||||||||||||||||||||

| Net intercompany borrowings | — | — | 3 | (3) | 4 | |||||||||||||||||||||

| Investments and acquisitions (net of cash acquired) | (36) | (36) | — | — | ||||||||||||||||||||||

| Proceeds from sale of businesses and investments (net of cash sold) | 1 | 1 | — | — | ||||||||||||||||||||||

| Proceeds from sale of securities | 1,204 | 1,014 | 190 | — | ||||||||||||||||||||||

| Investments in securities | (2,118) | (1,724) | (394) | — | ||||||||||||||||||||||

| Other – net | 32 | 58 | (26) | — | ||||||||||||||||||||||

| Net cash provided by (used for) investing activities | (1,888) | (1,238) | (125) | (525) | ||||||||||||||||||||||

| Cash flow from financing activities: | ||||||||||||||||||||||||||

| Dividends paid | (1,187) | (1,187) | — | — | ||||||||||||||||||||||

| Common stock issued, including treasury shares reissued | 4 | 4 | — | — | ||||||||||||||||||||||

| Common shares repurchased | (1,924) | (1,924) | — | — | ||||||||||||||||||||||

| Net intercompany borrowings | — | (3) | — | 3 | 4 | |||||||||||||||||||||

| Proceeds from debt issued > 90 days | 4,015 | — | 4,015 | — | ||||||||||||||||||||||

| Payments on debt > 90 days | (4,246) | (13) | (4,233) | — | ||||||||||||||||||||||

| Short-term borrowings – net < 90 days | (553) | (141) | (412) | — | ||||||||||||||||||||||

| Net cash provided by (used for) financing activities | (3,891) | (3,264) | (630) | 3 | ||||||||||||||||||||||

| Effect of exchange rate changes on cash | (7) | — | (7) | — | ||||||||||||||||||||||

| Increase (decrease) in cash, cash equivalents and restricted cash | (3,240) | (3,213) | (27) | — | ||||||||||||||||||||||

| Cash, cash equivalents and restricted cash at beginning of period | 9,263 | 8,433 | 830 | — | ||||||||||||||||||||||

| Cash, cash equivalents and restricted cash at end of period | $ | 6,023 | $ | 5,220 | $ | 803 | $ | — | ||||||||||||||||||

| 1 | Elimination of equity profit earned from Financial Products' subsidiaries partially owned by ME&T subsidiaries. | ||||

| 2 | Elimination of non-cash adjustments and changes in assets and liabilities related to consolidated reporting. | ||||

| 3 | Reclassification of Financial Products’ cash flow activity from investing to operating for receivables that arose from the sale of inventory. | ||||

| 4 | Elimination of net proceeds and payments to/from ME&T and Financial Products. | ||||

| Caterpillar Inc. Quarterly Retail Sales Statistics | ||||||||||||||

| Machines and E&T Combined | 2nd Quarter 2023 | 1st Quarter 2023 | 4th Quarter 2022 | 3rd Quarter 2022 | ||||||||||

| World | UP 16% | UP 13% | UP 8% | UP 7% | ||||||||||

| Machines | 2nd Quarter 2023 | 1st Quarter 2023 | 4th Quarter 2022 | 3rd Quarter 2022 | ||||||||||

| Asia/Pacific | UP 2% | DOWN 14% | UNCHANGED | UP 4% | ||||||||||

| EAME | DOWN 10% | UP 13% | DOWN 6% | DOWN 2% | ||||||||||

| Latin America | UNCHANGED | DOWN 6% | UP 5% | UP 9% | ||||||||||

| North America | UP 21% | UP 15% | UP 13% | UP 2% | ||||||||||

| World | UP 8% | UP 5% | UP 4% | UP 2% | ||||||||||

| Resource Industries (RI) | 2nd Quarter 2023 | 1st Quarter 2023 | 4th Quarter 2022 | 3rd Quarter 2022 | ||||||||||

| Asia/Pacific | UP 31% | DOWN 12% | UP 1% | UP 30% | ||||||||||

| EAME | DOWN 10% | UP 27% | DOWN 18% | UP 5% | ||||||||||

| Latin America | UP 28% | DOWN 12% | UP 13% | DOWN 11% | ||||||||||

| North America | UP 47% | UP 56% | UP 61% | UP 8% | ||||||||||

| World | UP 26% | UP 18% | UP 13% | UP 10% | ||||||||||

| Construction Industries (CI) | 2nd Quarter 2023 | 1st Quarter 2023 | 4th Quarter 2022 | 3rd Quarter 2022 | ||||||||||

| Asia/Pacific | DOWN 14% | DOWN 15% | DOWN 1% | DOWN 7% | ||||||||||

| EAME | DOWN 9% | UP 7% | DOWN 2% | DOWN 5% | ||||||||||

| Latin America | DOWN 8% | DOWN 4% | UP 2% | UP 20% | ||||||||||

| North America | UP 16% | UP 5% | UP 4% | UP 1% | ||||||||||

| World | UP 3% | UNCHANGED | UP 1% | UNCHANGED | ||||||||||

| Reported in dollars and based on unit sales as reported primarily by dealers. | ||||||||||||||

Energy & Transportation (E&T) Retail Sales by industry for the quarter ended as indicated compared with the same period of the prior year: | ||||||||||||||

| Energy & Transportation (E&T) | 2nd Quarter 2023 | 1st Quarter 2023 | 4th Quarter 2022 | 3rd Quarter 2022 | ||||||||||

| Power Gen | UP 30% | UP 43% | UP 14% | UP 26% | ||||||||||

| Industrial | UP 39% | UP 42% | UP 27% | UP 31% | ||||||||||

| Transportation | UP 48% | DOWN 8% | DOWN 36% | UP 30% | ||||||||||

| Oil & Gas | UP 71% | UP 43% | UP 38% | UP 11% | ||||||||||

| Total | UP 47% | UP 39% | UP 19% | UP 22% | ||||||||||

| Reported in dollars based on reporting from dealers and direct sales. | ||||||||||||||

| · Asphalt Pavers | · Motor Graders | · Track-Type Tractors (small, medium) | ||||||

· Backhoe Loaders |

· Pipelayers | · Track Excavators (mini, small, | ||||||

· Cold Planers |

· Road Reclaimers | medium, large) | ||||||

· Compactors |

· Skid Steer Loaders | · Wheel Excavators |

||||||

· Compact Track Loaders |

· Telehandlers | · Wheel Loaders (compact, small, | ||||||

| · Forestry Machines | · Track-Type Loaders | medium) | ||||||

| · Material Handlers | ||||||||

| · Large Track-Type tractors | · Hydraulic Shovels | · Wheel Tractor Scrapers | ||||||

| · Large Mining Trucks | · Rotary Drills | · Wheel Dozers | ||||||

| · Hard Rock Vehicles | · Large Wheel Loaders | · Landfill Compactors | ||||||

| · Electric Rope Shovels | · Off-Highway Trucks | · Soil Compactors | ||||||

| · Draglines | · Articulated Trucks | |||||||