Document

SELECTED RAILROAD STATISTICS - UNAUDITED

|

|

|

|

|

|

|

|

|

|

|

|

|

2023 |

|

2022 |

|

2021 |

|

| Financial measures |

|

|

|

Key financial performance indicators (1) |

|

|

|

Total revenues ($ millions) |

16,828 |

|

17,107 |

|

14,477 |

|

Freight revenues ($ millions) |

16,236 |

|

16,569 |

|

13,888 |

|

Operating income ($ millions) |

6,597 |

|

6,840 |

|

5,616 |

|

Adjusted operating income ($ millions) (2)(3) |

6,597 |

|

6,862 |

|

5,622 |

|

Net income ($ millions) |

5,625 |

|

5,118 |

|

4,899 |

|

Adjusted net income ($ millions) (2)(3) |

4,800 |

|

5,134 |

|

4,225 |

|

Diluted earnings per share ($) |

8.53 |

|

7.44 |

|

6.90 |

|

Adjusted diluted earnings per share ($) (2)(3) |

7.28 |

|

7.46 |

|

5.95 |

|

Free cash flow ($ millions) (2)(4) |

3,887 |

|

4,259 |

|

3,296 |

|

Gross property additions ($ millions) |

3,217 |

|

2,757 |

|

2,897 |

|

Share repurchases ($ millions) |

4,551 |

|

4,709 |

|

1,582 |

|

Dividends per share ($) |

3.16 |

|

2.93 |

|

2.46 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Financial ratios |

|

|

|

Operating ratio (%) (5) |

60.8 |

|

60.0 |

|

61.2 |

|

Adjusted operating ratio (%) (2)(3) |

60.8 |

|

59.9 |

|

61.2 |

|

Adjusted debt-to-adjusted EBITDA (times) (2)(4) |

2.25 |

|

1.86 |

|

1.82 |

|

Return on invested capital (ROIC) (%) (2)(6) |

16.8 |

|

15.8 |

|

16.4 |

|

Adjusted ROIC (%) (2)(6) |

14.5 |

|

15.9 |

|

14.1 |

|

Operational measures (7) |

|

|

|

| Statistical operating data |

|

|

|

Gross ton miles (GTMs) (millions) |

452,043 |

|

463,710 |

|

458,401 |

|

Revenue ton miles (RTMs) (millions) |

232,614 |

|

235,788 |

|

233,138 |

|

Carloads (thousands) |

5,436 |

|

5,697 |

|

5,701 |

|

Route miles (includes Canada and the U.S., end of year) |

18,800 |

|

18,600 |

|

19,500 |

|

Employees (end of year) |

24,987 |

|

23,971 |

|

22,604 |

|

Employees (average for the year) |

24,920 |

|

23,396 |

|

24,084 |

|

| Key operating measures |

|

|

|

Freight revenue per RTM (cents) |

6.98 |

|

7.03 |

|

5.96 |

|

Freight revenue per carload ($) |

2,987 |

|

2,908 |

|

2,436 |

|

GTMs per average number of employees (thousands) |

18,140 |

|

19,820 |

|

19,033 |

|

Operating expenses per GTM (cents) |

2.26 |

|

2.21 |

|

1.93 |

|

Labor and fringe benefits expense per GTM (cents) |

0.70 |

|

0.63 |

|

0.63 |

|

Diesel fuel consumed (US gallons in millions) |

395.2 |

|

402.2 |

|

405.2 |

|

Average fuel price ($/US gallon) |

4.62 |

|

5.42 |

|

3.28 |

|

Fuel efficiency (US gallons of locomotive fuel consumed per 1,000 GTMs) |

0.874 |

|

0.867 |

|

0.884 |

|

Train weight (tons) |

9,186 |

|

9,324 |

|

9,658 |

|

Train length (feet) |

7,891 |

|

8,160 |

|

8,559 |

|

Car velocity (car miles per day) |

213 |

|

196 |

|

195 |

|

Through dwell (entire railroad, hours) |

7.0 |

|

7.6 |

|

7.9 |

|

Through network train speed (miles per hour) |

19.8 |

|

18.9 |

|

19.2 |

|

Locomotive utilization (trailing GTMs per total horsepower) |

191 |

|

197 |

|

198 |

|

Safety indicators (8) |

|

|

|

Injury frequency rate (per 200,000 person hours) |

0.96 |

|

1.10 |

|

1.36 |

|

Accident rate (per million train miles) |

1.74 |

|

2.10 |

|

1.84 |

|

(1)Amounts expressed in Canadian dollars and prepared in accordance with United States generally accepted accounting principles (GAAP), unless otherwise noted.

(2)These non-GAAP measures do not have any standardized meaning prescribed by GAAP and therefore, may not be comparable to similar measures presented by other companies.

(3)See the section of this MD&A entitled Non-GAAP measures – Adjusted performance measures for an explanation of these non-GAAP measures.

(4)See the section of this MD&A entitled Liquidity and capital resources – Free cash flow and Adjusted debt-to-adjusted EBITDA multiple for an explanation of these non-GAAP measures.

(5)Operating ratio is defined as operating expenses as a percentage of revenues.

(6)See the section of this MD&A entitled Non-GAAP measures – ROIC and adjusted ROIC for an explanation of these non-GAAP measures.

(7)Statistical operating data, key operating measures and safety indicators are unaudited and based on estimated data available at such time and are subject to change as more complete information becomes available. Definitions of gross ton miles, fuel efficiency, train weight, train length, car velocity, through dwell and through network train speed are included within the Company’s Management’s Discussion and Analysis. Definitions of all other indicators are provided on CN's website, www.cn.ca/glossary.

(8)Based on Federal Railroad Administration (FRA) reporting criteria.

CN | 2023 Annual Report 1

MANAGEMENT'S DISCUSSION AND ANALYSIS

2 CN | 2023 Annual Report

MANAGEMENT'S DISCUSSION AND ANALYSIS

Forward-looking statements

Certain statements included in this MD&A are "forward-looking statements" within the meaning of the United States Private Securities Litigation Reform Act of 1995 and under Canadian securities laws, including statements based on management’s assessment and assumptions and publicly available information with respect to CN. By their nature, forward-looking statements involve risks, uncertainties and assumptions. CN cautions that its assumptions may not materialize and that current economic conditions render such assumptions, although reasonable at the time they were made, subject to greater uncertainty. Forward-looking statements may be identified by the use of terminology such as "believes", "expects", "anticipates", "assumes", "outlook", "plans", "targets" or other similar words.

Forward-looking statements include, but are not limited to, those set forth in the table below, which also presents key assumptions used in determining the forward-looking statements. See also the section of this MD&A entitled 2024 Business outlook and assumptions.

|

|

|

|

|

|

| Forward-looking statements |

Key assumptions |

| Statements relating to revenue growth opportunities, including those referring to general economic and business conditions |

•North American and global economic growth in the long term

•Long-term growth opportunities being less affected by current economic conditions

•No material disruption of CN’s operations or of the economy’s supply chains as a result of pandemics or geopolitical conflicts and tensions

|

| Statements relating to the Company's ability to meet debt repayments and future obligations in the foreseeable future, including income tax payments, and capital spending |

•Adequate credit ratios

•Investment-grade credit ratings

•Access to capital markets

•Adequate cash generated from operations and other sources of financing

|

| Statements relating to pension contributions |

•Adequate cash generated from operations and other sources of financing

•Adequate long-term return on investment on pension plan assets

•Level of funding as determined by actuarial valuations, particularly influenced by discount rates for funding purposes

|

Forward-looking statements are not guarantees of future performance and involve risks, uncertainties and other factors which may cause actual results, performance or achievements of CN to be materially different from the outlook or any future results, performance or achievements implied by such statements. Accordingly, readers are advised not to place undue reliance on forward-looking statements. Important risk factors that could affect the forward-looking statements include, but are not limited to, general economic and business conditions, including factors impacting global supply chains such as pandemics and geopolitical conflicts and tensions; industry competition; inflation, currency and interest rate fluctuations; changes in fuel prices; legislative and/or regulatory developments; compliance with environmental laws and regulations; actions by regulators; increases in maintenance and operating costs; security threats; reliance on technology and related cybersecurity risk; trade restrictions or other changes to international trade arrangements; transportation of hazardous materials; various events which could disrupt operations, including illegal blockades of rail networks, and natural events such as severe weather, droughts, fires, floods and earthquakes; climate change; labor negotiations and disruptions; environmental claims; uncertainties of investigations, proceedings and other types of claims and litigation; risks and liabilities arising from derailments; timing and completion of capital programs; the availability of and cost competitiveness of renewable fuels and the development of new locomotive propulsion technology; reputational risks; supplier concentration; pension funding requirements and volatility; and other risks detailed from time to time in reports filed by CN with securities regulators in Canada and the U.S., including its Annual Information Form and Form 40-F. See the section entitled Business risks of this MD&A for a description of major risk factors relating to CN.

Forward-looking statements reflect information as of the date on which they are made. CN assumes no obligation to update or revise forward-looking statements to reflect future events, changes in circumstances, or changes in beliefs, unless required by applicable securities laws. In the event CN does update any forward-looking statement, no inference should be made that CN will make additional updates with respect to that statement, related matters, or any other forward-looking statement. Information contained on, or accessible through, our website is not incorporated by reference into this MD&A.

CN | 2023 Annual Report 3

MANAGEMENT'S DISCUSSION AND ANALYSIS

Introduction

This Management's Discussion and Analysis (MD&A) dated January 31, 2024, relates to the consolidated financial position and results of operations of Canadian National Railway Company, together with its wholly-owned subsidiaries, collectively "CN" or the "Company," and should be read in conjunction with the Company's 2023 Annual Consolidated Financial Statements and Notes thereto. All financial information reflected herein is expressed in Canadian dollars and prepared in accordance with United States generally accepted accounting principles (GAAP), unless otherwise noted.

CN's common shares are listed on the Toronto and New York stock exchanges. Additional information about CN filed with Canadian securities regulatory authorities and the United States Securities and Exchange Commission (SEC), including the Company's 2023 Annual Information Form and Form 40-F, may be found online on SEDAR+ at www.sedarplus.ca, on the SEC's website at www.sec.gov through EDGAR, and on the Company's website at www.cn.ca in the Investors section. Printed copies of such documents may be obtained by contacting CN's Corporate Secretary's Office.

Business profile

CN is engaged in the rail and related transportation business. CN's network of 18,800 route miles of track spans Canada and the United States of America (U.S.), connecting Canada's Eastern and Western coasts with the U.S. South. CN's extensive network and efficient connections to all Class I railroads provide CN customers access to Canada, the U.S. and Mexico. Essential to the economy, to the customers, and to the communities it serves, CN safely transports more than 300 million tons of cargo annually, serving exporters, importers, retailers, farmers and manufacturers. CN and its affiliates have been contributing to community prosperity and sustainable trade since 1919. CN is committed to programs supporting social responsibility and environmental stewardship.

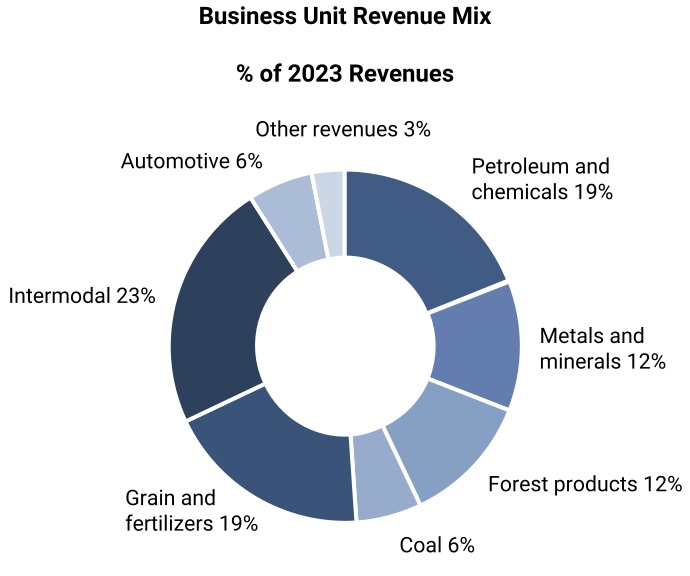

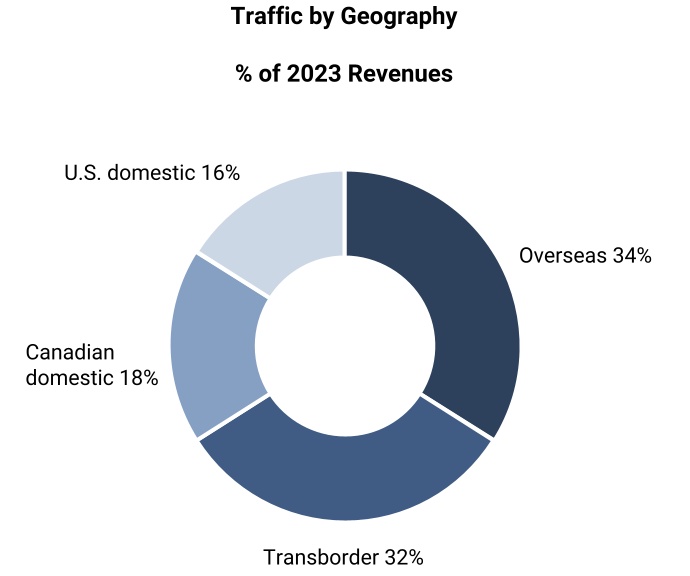

CN's freight revenues are derived from seven commodity groups representing a diversified and balanced portfolio of goods transported between a wide range of origins and destinations. This product and geographic diversity better position the Company to face economic fluctuations and enhances its potential for growth opportunities. For the year ended December 31, 2023, CN's largest commodity group, Intermodal, accounted for 23% of total revenues. From a geographic standpoint, 34% of revenues relate to overseas traffic, 32% to transborder traffic, 18% to Canadian domestic traffic and 16% to U.S. domestic traffic. The Company is the originating carrier for over 85%, and the originating and terminating carrier for over 65%, of traffic moving along its network, which allows it both to capitalize on service advantages and build on opportunities to efficiently use assets.

4 CN | 2023 Annual Report

MANAGEMENT'S DISCUSSION AND ANALYSIS

Corporate organization

The Company manages its rail operations in Canada and the U.S. as one business segment. Financial information reported at this level, such as revenues, operating income and cash flow from operations, is used by the Company's corporate management in evaluating financial and operational performance and allocating resources across CN's network. The Company's strategic initiatives are developed and managed centrally by corporate management and are communicated to its regional activity centers (the Western Region, Eastern Region and U.S. Region), whose role is to manage the day-to-day service requirements of their respective territories, control direct costs incurred locally, and execute the strategy and operating plan established by corporate management.

See Note 24 – Segmented information to the Company's 2023 Annual Consolidated Financial Statements for additional information on the Company's corporate organization, as well as selected financial information by geographic area.

2023 Highlights

Financial results - 2023 compared to 2022

•Revenues of $16,828 million, a decrease of $279 million, or 2%.

•Operating income of $6,597 million, a decrease of $243 million, or 4%.

•Operating ratio, defined as operating expenses as a percentage of revenues, of 60.8%, an increase of 0.8 points, or an increase of 0.9 points on an adjusted basis. (1)(2)

•Net income of $5,625 million, an increase of $507 million, or 10% and adjusted net income of $4,800 million, a decrease of $334 million, or 7%. (1)(2)

•Diluted earnings per share (EPS) of $8.53, an increase of 15% and adjusted diluted EPS of $7.28, a decrease of 2%. (1)(2)

•The Company generated free cash flow of $3,887 million, a 9% decrease. (1)(3)

•ROIC of 16.8%, an increase of 1.0-point and adjusted ROIC of 14.5%, a decrease of 1.4 points. (1)(4)

Operating performance - 2023 compared to 2022

•Injury frequency rate at a record low of 0.96 (per 200,000 person hours), an improvement of 13%.

•Accident rate of 1.74 (per million train miles), an improvement of 17%.

•Through dwell of 7.0 (entire railroad, hours), an improvement of 8%.

•Car velocity of 213 (car miles per day), an improvement of 9%.

•Through network train speed of 19.8 (mph), an improvement of 5%.

•Fuel efficiency of 0.874 (US gallons of locomotive fuel consumed per 1,000 gross ton miles (GTMs)), less efficient by 1%.

•Train length of 7,891 (feet), a decrease of 3%.

•Revenue ton miles (RTMs) of 232,614 (millions), a decrease of 1%.

(1) These non-GAAP measures do not have any standardized meaning prescribed by GAAP and therefore, may not be comparable to similar measures presented by other companies.

(2) See the section of this MD&A entitled Non-GAAP measures – Adjusted performance measures for an explanation of these non-GAAP measures.

(3) See the section of this MD&A entitled Liquidity and capital resources – Free cash flow for an explanation of this non-GAAP measure.

(4) See the section of this MD&A entitled Non-GAAP measures – ROIC and adjusted ROIC for an explanation of these non-GAAP measures.

2023 Financial outlook

During the year, the Company issued and updated its 2023 financial outlook. The 2023 actual results were in line with the Company's last 2023 outlook that was updated on July 25, 2023.

Recent developments

Business acquisitions and combinations

Iowa Northern Railway Company

On December 6, 2023, the Company acquired the shares of the Iowa Northern Railway Company (IANR), a Class III short-line railroad that owns and leases approximately 175 route miles in northeast Iowa that are connected to CN’s U.S. rail network. CN paid US$230 million ($312 million), including transaction costs to date. IANR serves upper Midwest agricultural and industrial markets covering many goods, including biofuels and

CN | 2023 Annual Report 5

MANAGEMENT'S DISCUSSION AND ANALYSIS

grain. This transaction represents a meaningful opportunity to support the growth of local business by creating single-line service to North American destinations, while preserving access to existing carrier options.

The shares of IANR were deposited into an independent voting trust while the U.S Surface Transportation Board (STB) considers the Company's application to acquire control of IANR. During the trust period, IANR will continue to be operated under its current management and the Company cannot exercise day-to-day control. As a result, the Company recorded its investment in IANR at its acquisition cost under the equity method of accounting. Subject to final approval by the STB, the Company would obtain control of IANR and would account for the acquisition as a business combination under the acquisition method of accounting.

On the acquisition date of December 6, 2023, immediately prior to the acquisition, there was a basis difference of $236 million between the consideration paid to acquire IANR and the underlying carrying value of the net assets of IANR. The basis difference related to depreciable properties and if any, intangible assets with definite lives will be amortized over the related assets' remaining useful lives. The remainder of the basis difference, relating to land, intangible assets with indefinite lives if any, and equity method goodwill, would not be amortized and would be carried at cost subject to an assessment for impairment. The estimated fair value of IANR’s underlying net assets is preliminary based on information available to the Company to date and subject to change over the measurement period, which may be up to twelve months from the acquisition date.

Cape Breton & Central Nova Scotia Railway

On November 1, 2023, the Company acquired from Genesee & Wyoming Inc. a stake in the Cape Breton & Central Nova Scotia Railway (CBNS), a Class III short-line railroad that owns approximately 150 route miles. CN paid $78 million in cash, net of cash acquired and including working capital adjustments. The acquisition was accounted for as a business combination. As a result, the Company’s Consolidated Balance Sheet includes the net assets of CBNS as of November 1, 2023, which were comprised of $101 million in fair value of properties mostly track and roadway assets, partly offset by $18 million in deferred tax liabilities. The remaining net assets were comprised of current assets and liabilities which were individually insignificant and there were no identifiable intangible assets. No goodwill was recognized. The fair value of CBNS's underlying net assets has been estimated on a preliminary basis and may be subject to change as additional information becomes available over the next twelve months.

Canadian regulatory update

On June 22, 2023, Bill C-47 an Act to implement certain provisions of the budget tabled in Parliament on March 28, 2023, received Royal Assent and the proposed amendments to the Canada Transportation Act were adopted. These amendments provide for the extension of the interswitching limits located in the Prairie provinces from 30 kilometers to 160 kilometers. This extension will be in force for a trial period of 18 months. On November 24, 2023 the Canadian Transportation Agency (CTA) established interswitching rates for 2024. On December 22, 2023, the Company sought leave to appeal this decision on rates. No assurance can be given that these and any other current or future regulatory or legislative initiatives by the Canadian federal government and agencies will not materially adversely affect the Company's results of operations or its competitive and financial position.

U.S. regulatory update

On September 7, 2023, the STB proposed new regulations for reciprocal switching for inadequate service. Under the STB’s proposal, the new rule allows customers to obtain reciprocal switching access to an alternate carrier in a terminal area if the incumbent railroad’s service falls below one of three objective metrics (original estimated time of arrival, transit time, and first-mile/last-mile service) and if certain other conditions are met. The STB has proposed that if a reciprocal switch were granted for a facility in the United States, that switch would be available for a period between two to four years and could be renewed. In addition, the STB also closed consideration of a 2016 proposal to amend its existing regulations for reciprocal switching to increase competition, which was the subject of a public hearing in 2022. Comments were submitted in November and December 2023, and the STB members conducted meetings with stakeholders. No assurance can be given that these and any other current or future regulatory or legislative initiatives by the U.S. federal government and agencies will not materially adversely affect the Company's results of operations or its competitive and financial position.

Labor workforce and negotiations - Canada

On May 1, 2023, the collective agreement with Unifor was ratified by its members, renewing the collective agreement for a two-year term, retroactive to January 1, 2023, which will expire on December 31, 2024. Unifor represents approximately 3,400 employees in Canada working in various departments such as Mechanical, Intermodal, Facility Management, and in clerical positions.

6 CN | 2023 Annual Report

MANAGEMENT'S DISCUSSION AND ANALYSIS

On May 26, 2023, the collective agreement with Teamsters Canada Rail Conference (TCRC) was ratified by its members, renewing the collective agreement for a one-year term, retroactive to January 1, 2023, which expired on December 31, 2023. TCRC represents approximately 6,000 employees in Canada working as Locomotive Engineers, Yard Coordinators and Yard Conductors on our mainline, short lines and yards. Bargaining commenced on November 27, 2023.

On September 6, 2023, the United Steel Workers Union (USW) served notice to commence bargaining for the renewal of the collective agreement with the Company, governing approximately 2,500 bridge and structures and work equipment employees in Canada, which expired on December 31, 2023. Bargaining commenced on October 23, 2023.

On January 17, 2024, CN reached a tentative agreement with owner-operators affiliated with Unifor. The four-year agreement covers approximately 750 owner-operator truck drivers in Canada under contract with Canadian National Transportation Limited, a wholly owned subsidiary of the Company, until December 31, 2027. Ratification by the membership is expected in the first quarter of 2024.

The Company’s collective agreements remain in effect until the bargaining process outlined under the Canada Labor Code has been exhausted.

Leadership changes

On January 8, 2024, CN announced that Remi G. Lalonde was appointed as CN’s Executive Vice-President and Special Advisor to the CEO, in anticipation of his transition to the role of Executive Vice-President and Chief Commercial Officer (CCO). Mr. Lalonde will succeed Doug MacDonald, Executive Vice-President and Chief Marketing Officer, who will remain in his current role until Mr. Lalonde’s transition is completed later this year.

On October 18, 2023, CN announced that Patrick Whitehead was appointed as CN’s Executive Vice-President and Chief Network Operating Officer and Derek Taylor was appointed as CN’s Executive Vice-President and Chief Field Operating Officer effective November 15, 2023. Mr. Whitehead and Mr. Taylor succeed Edmond (Ed) Harris who has taken on a consultant role until March 31, 2024 to ensure a seamless transition.

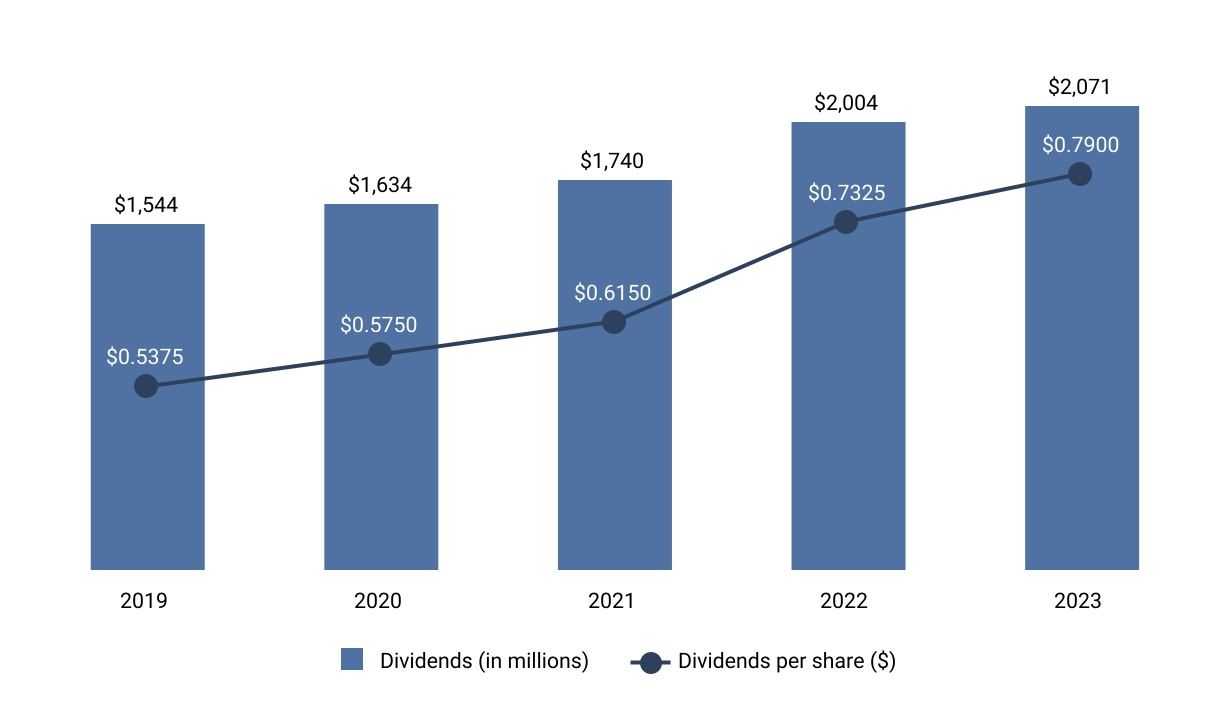

Future value creation

On January 23, 2024, the Company's Board of Directors approved a new Normal Course Issuer Bid (NCIB) that allows for the repurchase of up to 32.0 million common shares between February 1, 2024 and January 31, 2025. In addition, on that same day, the Company's Board of Directors approved an increase of 7% to the quarterly dividend to common shareholders, from $0.7900 per share in 2023 to $0.8450 per share in 2024, effective for the first quarter.

2024 Business outlook and assumptions

The Company assumes slightly positive North American industrial production in 2024. For the 2023/2024 crop year, the grain crop in Canada was below its three-year average (also below when excluding the significantly lower 2021/2022 crop year) and the U.S. grain crop was above its three-year average. The Company assumes that the 2024/2025 grain crop in Canada will be in line with its three-year average (excluding the significantly lower 2021/2022 crop year) and the U.S. grain crop will also be in line with its three-year average.

In 2024, the Company expects to invest approximately $3.5 billion in its capital program, net of amounts reimbursed by customers, to improve the safety, efficiency and integrity of its network. These investments are intended to also enable and support the growth of the Company and will be financed with cash generated from operations or with cash from financing activities.

The forward-looking statements discussed in this section are subject to risks and uncertainties that could cause actual results or performance to differ materially from those expressed or implied in such statements and are based on certain factors and assumptions which the Company considers reasonable about events, developments, prospects and opportunities that may not materialize or that may be offset entirely or partially by other events and developments. In addition to the assumptions and expectations discussed in this section, reference should be made to the section of this MD&A entitled Forward-looking statements for assumptions and risk factors affecting such statements.

CN | 2023 Annual Report 7

MANAGEMENT'S DISCUSSION AND ANALYSIS

Strategy overview

CN’s purpose is to power the economy by enabling global supply chains and moving goods sustainably and efficiently, working together with our customers, our people, and the communities in which we operate. CN is committed to delivering a safe, consistent and reliable scheduled service that creates value for customers, shareholders and stakeholders. In 2023, CN continued its “back to basics” approach, re-establishing a disciplined scheduled operation. CN’s “make the plan, run the plan, sell the plan” operating approach has driven strong operational, safety, and customer service outcomes.

CN aims to drive consistent shareholder returns and earnings growth by striving for sustainable financial performance, including profitable top-line growth, strong free cash flow generation and return on invested capital well above the Company’s cost of capital. CN also returns value to shareholders through dividend payments and share repurchases.

Build service excellence, grow our business and invest in our people

Going forward, CN will continue to focus on sustaining and building service excellence, growing the business and developing our people. Providing reliable and efficient customer service is the foundation for growth. CN aims to leverage its strong customer service and operating efficiency of rail to grow the business profitably. CN continues to invest in the safety and fluidity of the network, and in increasing capacity to cost effectively grow volumes. CN is also investing to drive incremental fuel and carbon efficiency and to improve network resiliency. Critical to CN’s long-term success are also the people investments being made to ensure the optimal workforce, with the right skills and leadership capabilities, are available to meet the challenges of tomorrow.

Delivering Responsibly

Sustainability is at the heart of how CN is building for the future. Delivering Responsibly is the encapsulation of the Company’s sustainability strategy and commitments. The Company is focused on transporting goods safely and efficiently, doing so in a manner that seeks to minimize the impact on the environment, attracting, retaining and engaging top talent, and helping to build stronger, safer communities, while adhering to the highest governance standards. CN understands that transparency is essential for stakeholder trust concerning the Company’s Environmental, Social and Governance (ESG) commitments. In that regard, CN seeks to align its ESG disclosures with global best practice frameworks, reporting on commitments and performance with focus, clarity and comparability. In 2023, CN published its latest biennial sustainability report, outlining the Company's targets, programs and achievements in corporate governance, environment, safety, people, community involvement and stakeholder engagement. CN is proud of its 2023 accomplishments as the Company's sustainability practices earned it a place on the Dow Jones Sustainability World and North American Indices, for the 12th and 15th consecutive year, respectively.

Safety is a core value

CN is committed to the health and safety of its employees, the communities and environments in which it operates and the customers it serves. The Company embraces a values-based safety culture. CN’s objective is to reduce serious injuries and fatalities. The Company is employing advanced technologies and innovative training to help achieve this goal. More specifically, CN is:

•Fostering an engaged workforce that understands and respects Life Critical Rules.

•Embedding a mindset whereby employees take ownership for their own safety and the safety of others by Looking Out for Each Other.

•Training employees to identify and mitigate exposures.

•Using advanced technologies to proactively mitigate human error and reduce risk.

•Maintaining reliable and safe equipment and infrastructure.

•Investing in employee training, coaching, recognition and engagement initiatives.

See the section of this MD&A entitled Human capital management - Health and safety for additional information regarding CN's safety initiatives.

Tackling the impact of climate change

The Company's goal is to conduct its operations in a way that seeks to minimize environmental impact, while offering a carbon-efficient and sustainable way to move goods. CN is focused on making a positive contribution in the fight against climate change and playing a key role in the transition to a lower-carbon economy.

8 CN | 2023 Annual Report

MANAGEMENT'S DISCUSSION AND ANALYSIS

With approximately 85% of its direct greenhouse gas (GHG) emissions generated from rail operations, CN focuses on five key strategic areas: fleet renewal, innovative technology, big data, operating practices and cleaner fuels. Over the years, this focus has resulted in significant progress in decoupling volume growth from carbon emissions intensity. CN continues to maintain its leadership position among Class I North American railways, generating approximately 15% less locomotive GHG emissions per gross ton mile than the industry average. CN was also the first North American railway, and among the first 100 companies globally, to announce an approved science-based climate target. CN aims to reduce GHG emissions in line with the Paris Agreement and in 2021, committed to setting a net-zero target by joining the "Business Ambition for 1.5 °C" and the United Nations' "Race to Zero" campaign.

To achieve its decarbonization targets, CN will need to continue improving the fuel efficiency of its fleets, increase its use of sustainable renewable fuels and test, and eventually deploy alternative propulsion locomotive technologies. Collaboration with suppliers, customers, supply chain partners, innovators and regulators is critical for CN to deliver on its climate commitments and to help drive economic prosperity in a lower-carbon emissions environment.

The Company's CDP Report, including a Task Force on Climate-related Financial Disclosures (TCFD) index, is available on CN's website in the Delivering Responsibly section. Information contained on, or accessible through, our website is not incorporated by reference into this MD&A.

Building the talent and culture to drive CN's continuous performance

CN people have always been the Company's most important differentiator, caring passionately about railroading and bringing optimism, commitment and resilience to daily tasks. CN aims to attract, develop, and retain the very best talent, with a focus on a diverse and inclusive work environment where employees are engaged, inspired and motivated. CN trains its employees with the necessary skills for an increasingly automated and data-driven work environment.

See the section of this MD&A entitled Human capital management for additional information regarding CN's human capital initiatives.

Community engagement

At CN, we are committed to being good neighbors who listen, learn, and do our part to help build safer, stronger, more prosperous communities. Connecting Canada’s Eastern and Western coasts with the U.S. Gulf Coast, CN spans eight provinces, 16 states, and operates within or adjacent to nearly 230 reserve lands of more than 120 First Nations and Métis communities in Canada, seven Tribal communities in the United States, and more than 2,000 towns and cities across its network. CN plays an essential role and contributes to economic prosperity through job creation, investments and freight transportation services. The Company seeks open and proactive engagement to ensure stakeholders and Indigenous communities are aware of its strategy, operations, opportunities and obligations, and aims to foster effective two-way communications that ensures a respectful and beneficial exchange.

CN also partners with communities to enhance railway safety. Under CN's structured Community Engagement program, the Company engages with municipal officers and their emergency responders to assist them in their emergency response planning. During this frequent outreach, CN discusses its comprehensive safety programs and performance, the nature, volume and economic importance of dangerous goods it transports through their communities and emergency response planning. CN annually conducts hundreds of training events for thousands of emergency responders, totaling over 130,000 first responders since 1988. Additional training sites have been constructed to offer onsite full scale dangerous goods training.

The outreach builds on CN's involvement in Transportation Community Awareness and Emergency Response (TRANSCAER®), through which the Company has been working for many years to help communities in Canada and the U.S. understand the movement of hazardous materials and what is required in the event of transportation incidents. All Aboard for Safety is CN’s flagship community education program. Every year, CN employees make hundreds of presentations and talk to thousands of children and adults at schools and community events in Canada and the U.S. about the importance of rail safety and the dangers of walking or playing on or near railway tracks.

As part of CN’s year‑round outreach effort, the CN Police Service continues to be active in communities across the CN network to promote safe behavior around railroad infrastructure. Activities include conducting enforcement initiatives with external agencies and delivering safety presentations to high‑risk groups. During the industry’s annual Rail Safety Week campaign, CN police officers and other employees, in partnership with Operation Lifesaver®, participate in numerous safety initiatives to raise awareness about preventing accidents and injuries around railway property.

CN | 2023 Annual Report 9

MANAGEMENT'S DISCUSSION AND ANALYSIS

CN believes another way to help build more sustainable communities is to actively contribute financially through its CN Stronger Communities Fund to organizations, programs and initiatives that promote diversity and inclusion, innovation and safety, education, environmental protection, and many other causes such as food banks, homeless shelters, domestic violence shelters, healthcare centers, and anti-poverty organizations.

CN is proud of its employees, retirees and their families who volunteer to make their communities better places to live, work and play. The CN Railroaders in the Community program recognizes these acts of kindness by providing grants to the community‑based not‑for‑profit organizations employees (current, retired or family) choose to support through their volunteer efforts. CN also encourages employee community involvement through its annual volunteer CN In Your Community Day.

Working alongside Indigenous communities, CN makes it a priority to strengthen its ties, cultivate respectful and mutually beneficial relationships, and work toward reconciliation. CN continues to engage in open dialogue with Indigenous communities, identify and foster business opportunities, increase our employees’ awareness and understanding of Indigenous culture, and enhance its ability to attract Indigenous talent. CN provides awareness training on Indigenous culture, beliefs, and history to its employees to foster an inclusive work environment. Since the program began in 2014, more than 24,000 employees have completed the training.

Disciplined capital allocation and execution

CN's success depends on a steady stream of capital investments that are aligned with and support its business strategy. These investments cover a wide range of areas, from track infrastructure and rolling stock to information and operating technologies, as well as other equipment and assets that are intended to improve the safety, efficiency, capacity and reliability of CN's service offering. Investments in track infrastructure are designed to enhance the safety and integrity of the physical plant, increase the capacity and fluidity of the network, promote service excellence, and support growth. New locomotives equipped with distributed power capability increase capacity, fuel and carbon productivity and efficiency, and improve service reliability, particularly in cold weather, while improving train handling and safety. Targeted railcar acquisitions aim to tap growth opportunities, complementing the fleet of privately owned railcars that traverse CN's network. CN is also investing in and deploying advanced technologies to automate labor-intensive tasks like track and railcar inspections, as well as to improve the customer experience through ‘track and trace’ functionality. CN's long-term economic viability depends on the presence of a supportive regulatory and government policy environment that encourages investment and innovation.

The multi-year implementation of CN’s strategic plan requires a disciplined, analysis-driven approach to capital investment. Talent, technology and capital need to be fully aligned. The Company’s capital investment roadmap includes several core elements:

•Investing in the maintenance of a safe and reliable network.

•Investing in asset infrastructure to increase the capacity of its three-coast network.

•Developing a portfolio approach to technology with business-led investment decisions, delivering value at each stage of implementation.

•Deepening supply chain partnerships with its customers, including road-to-rail conversion.

•Investing in data analytic systems, including artificial intelligence (AI), to support data-driven decision-making.

•Investing in technologies and capital assets to support decarbonization of its footprint.

•Growing its physical and commercial reach through strategic partnerships and acquisitions.

Human capital management

CN's ability to develop the best railroaders in the industry has been a key contributor to the Company's success. CN recognizes that without the right people, no matter how good a service plan or business model a company may have, it will not be able to fully execute. The Company continues to focus on hiring the right people, onboarding them successfully, helping them build positive relationships with their colleagues and supporting all employees to grow and develop, while deepening its commitment to develop talent and plan for the future.

10 CN | 2023 Annual Report

MANAGEMENT'S DISCUSSION AND ANALYSIS

Governance

CN’s Senior Vice President and Chief Human Resources Officer has leadership accountability for the Company’s workforce policies and programs and reports directly to the CEO. CN’s Board and its committees, including the Governance, Sustainability and Safety Committee and Human Resources and Compensation Committee (HRCC) provide oversight of the Company's human capital management strategies, programs, practices and performance. The HRCC is responsible for monitoring executive management’s performance assessment, compensation and succession planning as well as ensuring effective talent management and monitoring union relations and strategy for consistency with CN’s strategic direction. The HRCC also has the mandate to review human resources practices and policies by ensuring, amongst other things, that appropriate human resources programs, practices and systems are in place so that the Company can attract, motivate and retain the quality and diversity of employees required to meet its business objectives. The Company’s senior management provides regular briefings on human capital matters to the Board and its committees to facilitate oversight.

The Board of Directors and management are committed to maintaining and instilling a strong ethical culture at CN, and as such, have developed a solid ethics program based on CN’s core values of integrity and respect. Each director, executive officer and management employee must certify annually their compliance with the Code of Business Conduct and employees are required to complete an online training course on the Code of Business Conduct. Integrity training is also part of every new employee’s onboarding program. In addition, Anti-Fraud Policy and Guidelines apply to all employees of CN and its wholly owned subsidiaries and set out steps to be taken in response to reported or suspected fraud in all its forms, as well as measures that are taken to identify, prevent and manage fraud-related risks.

Total employees

As at December 31, 2023, CN employed a total of 18,162 employees in Canada (2022 – 17,392), of which 13,346, or 73%, were unionized employees (2022 – 12,841, or 74%) and 6,825 employees in the U.S. (2022 – 6,579) of which 5,786, or 85%, were unionized employees (2022 – 5,571, or 85%).

Canadian workforce

As of January 31, 2024, three of the eight collective agreements in Canada are open for negotiation. See the section of this MD&A entitled 2023 Highlights - Recent developments for additional information regarding labor negotiations. The Company’s collective agreements remain in effect until the bargaining process outlined under the Canada Labor Code has been exhausted.

U.S. workforce

As of January 31, 2024, collective agreements covering all non-operating and operating craft employees at Grand Trunk Western Railroad Company (GTW), companies owned by Illinois Central Corporation (ICC), companies owned by Wisconsin Central Ltd. (WC) and Bessemer & Lake Erie Railroad Company (BLE), and all employees at Pittsburgh and Conneaut Dock Company (PCD) were ratified and remain in place. The agreements in place have various moratorium provisions, which preserve the status quo with respect to the given collective agreement during the terms of such moratoriums. Where negotiations are ongoing, the terms and conditions of existing agreements generally continue to apply until new agreements are reached or the processes of the Railway Labor Act have been exhausted. The general approach to labor negotiations by U.S. Class I railroads is to bargain on a collective national basis with the industry, which GTW, ICC, WC and BLE currently participate in, for collective bargaining agreements covering all union-represented employees.

Health and safety

CN has an uncompromising commitment to the health and safety of its employees, the customers it serves, and the communities and environments in which it operates. The Company's long-term safety improvement is driven by continued investments in infrastructure, rigorous safety processes and exposure reduction efforts, as well as efforts to continue deepening the Company’s safety culture. The attainment of annual accident and injury targets is a component of management’s annual incentive bonus plan. The Company’s injury frequency rate and accident rate, defined according to the criteria of the Federal Railroad Administration (FRA), are provided for the entire company’s operations and are publicly disclosed on a quarterly basis. See the section of this MD&A entitled Selected railroad statistics for additional information on CN’s safety measures.

CN’s culture and commitment to safety is supported by its focus on training, leadership, and technology. CN's Safety Management System is the framework for putting safety at the center of its day-to-day operations. This proactive plan is designed to minimize risk, drive continuous improvement in the reduction of injuries and accidents, and engage employees at all levels of the organization.

CN | 2023 Annual Report 11

MANAGEMENT'S DISCUSSION AND ANALYSIS

The Looking Out For Each Other peer-to-peer engagement program focuses on raising awareness among all employees of the top causes of incidents and injuries, identifying and reviewing safe work procedures, training employees to be aware of their surroundings and recognize potential at-risk work practices, teaching employees how to provide constructive feedback to their peers and learning from past incidents. The Company's Life Critical Rules address the day-to-day activities that have the potential to cause serious harm or even loss of life. They are based on past incidents and are designed to help ensure they do not happen again. CN's safety leadership training program is heavily focused on teaching employees the importance of controlling exposures to risk and on developing the attitudes and behaviors required for a values-driven safety culture.

CN also continues to leverage new technology to drive improved safety performance including installing powerful sensor and AI technology into specially equipped autonomous track inspection cars positioned in existing train service, enabling track inspections at normal track speed. AI technology is also enhancing how CN inspects its railcar fleet. Automated inspection portals feature ultra-high-definition cameras that capture a 360° view of a train as it travels through at track speed. Both these innovations in automation increase inspection frequency and quality and play an important role in preventing incidents. CN has also implemented Electronic Track Authority Verification (ETAV), a geospatial navigation aid application that improves safety by leveraging precise location information to warn track maintenance vehicle operators of approaching or exceeded limits of Track Authority (TA).

CN strives for continuous improvement in our environmental, health, safety, and security (EHS&S) performance and is proud to be a long-standing Responsible Care® Partner. Triennially, CN undergoes a Responsible Care® audit conducted by an external audit team to ensure CN’s processes, programs and policies meet the rigorous Responsible Care® Management System Specifications, Guiding Principles and Stewardship Codes.

CN works closely with all of its customers and suppliers to ensure adherence to Life Critical Rules where applicable, and to encourage a shared commitment to a values-based safety culture.

Talent management

Attraction and recruitment

CN continues to align its talent strategies to the business objectives, by focusing on acquiring as well as developing the various skills and capabilities required to meet its commitments, address challenges, and ensure a solid bench of talent to mitigate risk. CN recruits and hires talent with a broad range of strengths, perspectives and experiences, while also engaging with partners across our network, including Indigenous and other equity-seeking groups to ensure CN reflects the communities it crosses. Over the last year, similar to other organizations, CN has had to compete extensively to attract talent, however its refreshed early career strategy with partner universities and its community engagement and partnerships with diversity organizations across Canada and the U.S., has helped create strong visibility of our jobs and opportunities.

Once again in 2023, CN was recognized as one of Canada’s Top 100 Employers and Montreal’s Top Employers and also listed as one of Canada’s best Diversity Employers by Mediacorp Canada Inc.

Training and development

CN offers a variety of training programs, which cover regulatory or CN mandated requirements or are part of an employee's learning journey and development. This ensures that its employees are equipped to perform in their roles and prepare for career advancement opportunities, as required.

The Company offers trainings in technical, business and leadership programs, with either online, e-learning or virtually-led courses, and, when possible, through in-person sessions. People leaders are supported in building the skills and knowledge needed to successfully perform at each level and this includes a focus on enhancing communication skills, increasing collaboration across teams and creating a strong base of inclusive leadership throughout our workforce. In 2023, CN continued to provide an expanded offering of online and curated playlists/curricula for more self-guided and self-paced learning to allow for development tools to be available throughout the year and to be self-directed by the employee, when it is most convenient. For the Operations group, CN has various entry-level supervisory programs, to onboard front-line management with a focus on providing those leaders with an understanding of railway operations, safety leadership, people leadership and a perspective on customer service. Furthermore, CN also supports its employees through a structured performance management process. At the beginning of each year, non-unionized employees set goals for the year that align to its business strategy and objectives. At mid and year-end, there is a formal discussion and review of progress against these goals as well as how they were achieved. CN continues to emphasize the

12 CN | 2023 Annual Report

MANAGEMENT'S DISCUSSION AND ANALYSIS

importance of a performance-based culture. In 2023, CN also introduced development planning tools and launched the “Aspire to develop yourself” campaign where the Company encourages and equips our employees to own their career and build actionable development plans for growth. In addition, there are also development discussions with key talent to enhance skills, capabilities and experience across the talent pools.

Compensation

CN’s approach to compensation continues to be driven by our goal to deliver sustainable value creation, while ensuring that target compensation supports the attraction and retention of talent. Compensation programs are designed to encourage appropriate behaviors and include appropriate risk mitigation mechanisms. In addition, compensation best practices adopted by CN include industry benchmarking and pay positioning as well as pay equity reviews.

CN offers a competitive compensation portfolio that consists of base salary, employee share investment plan, short-term and long-term incentives (applicable to certain employees only), benefits, retirement plans and other non-monetary elements.

Diversity, Equity and Inclusion (DE&I)

At CN, employees are the Company's single greatest asset and the importance of creating a work environment that welcomes the contribution and uniqueness of every employee is recognized. CN is committed to creating a workforce of top talent that reflects the diversity of the population and stakeholders it serves. The Diversity, Equity and Inclusion Plan ("Diversity Plan") focuses on developing a more inclusive workplace by increasing the representation of women, people of color, Indigenous peoples, persons with disabilities and veterans. The plan applies at all levels within the organization and includes strategies on sourcing (among others, early career sourcing through internships, co-op and new graduate programs), selection, hiring, training and development of diverse candidates, anchoring CN’s commitment to Diversity, Equity and Inclusion (DE&I).

The Company has embedded diversity in its policy regarding composition of the Board and executive management. The Diversity Policy, which also applies to executive management, states that in fulfilling its oversight role, the HRCC regularly reviews CN’s integrated approach to executive and high-potential talent management and succession planning, in order to ensure that CN has diverse candidate pools for potential successors for executive roles.

CN is undertaking various initiatives aimed at better promoting and reinforcing diversity, equity and inclusion which are strongly supported through active involvement by management and the Board. Some examples include:

•building on established DE&I fundamentals by conducting a DE&I diagnostic and creating a revised multi-year DE&I strategy and vision;

•running regular reviews of pay equity and defining a roadmap to address identified gaps;

•refocusing our sponsorships and donations budget to better align with our strategic DE&I vision;

•continually assessing hiring practices to leverage diversity focused recruitment agencies and requiring diverse candidate slates for all recruitment mandates;

•developing inclusive leaders through targeted training and education, including unconscious bias and inclusive leadership training, as leaders will be critical in creating and sustaining an inclusive environment;

•continuing to support and leverage the Employee Resource Groups (ERGs) that are backed by executive sponsors (currently eight ERGs); and

•having sufficient resources to support our DE&I vision.

In January 2024 CN established that moving forward it aspires to maintain a Board composition in which independent Board members are comprised of at least 40% of each gender (male and female) and at least two members come from the broader underrepresented groups, beyond gender. Currently, five out of 10, or 50% of independent Board members are women and two, or 20% of independent Board members are from underrepresented groups. CN has also elected to revise the gender diversity target for executive management (comprising all Vice-Presidents and more senior positions), whereby by the end of 2027, and thereafter, CN aspires to maintain an executive management team in which at least 35% of this group are women. As at December 31, 2023 27%, or eight of the 30 executive management roles, were held by women.

CN | 2023 Annual Report 13

MANAGEMENT'S DISCUSSION AND ANALYSIS

Financial highlights

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

% Change |

|

|

|

|

Favorable/(Unfavorable) |

| In millions, except percentage and per share data |

2023 |

|

2022 |

|

2021 |

|

2023 vs 2022 |

2022 vs 2021 |

| Revenues |

$ |

16,828 |

|

$ |

17,107 |

|

$ |

14,477 |

|

(2 |

%) |

18 |

% |

| Operating income |

$ |

6,597 |

|

$ |

6,840 |

|

$ |

5,616 |

|

(4 |

%) |

22 |

% |

Adjusted operating income (1)(2) |

$ |

6,597 |

|

$ |

6,862 |

|

$ |

5,622 |

|

(4 |

%) |

22 |

% |

Net income |

$ |

5,625 |

|

$ |

5,118 |

|

$ |

4,899 |

|

10 |

% |

4 |

% |

Adjusted net income (1)(2) |

$ |

4,800 |

|

$ |

5,134 |

|

$ |

4,225 |

|

(7 |

%) |

22 |

% |

Basic earnings per share |

$ |

8.55 |

|

$ |

7.46 |

|

$ |

6.91 |

|

15 |

% |

8 |

% |

|

|

|

|

|

|

Diluted earnings per share |

$ |

8.53 |

|

$ |

7.44 |

|

$ |

6.90 |

|

15 |

% |

8 |

% |

Adjusted diluted earnings per share (1)(2) |

$ |

7.28 |

|

$ |

7.46 |

|

$ |

5.95 |

|

(2 |

%) |

25 |

% |

| Dividends declared per share |

$ |

3.16 |

|

$ |

2.93 |

|

$ |

2.46 |

|

8 |

% |

19 |

% |

Operating ratio (3) |

60.8 |

% |

60.0 |

% |

61.2 |

% |

(0.8) |

pts |

1.2 |

pts |

Adjusted operating ratio (1)(2) |

60.8 |

% |

59.9 |

% |

61.2 |

% |

(0.9) |

pts |

1.3 |

pts |

| Net cash provided by operating activities |

$ |

6,965 |

|

$ |

6,667 |

|

$ |

6,971 |

|

4 |

% |

(4 |

%) |

| Net cash used in investing activities |

$ |

3,468 |

|

$ |

2,510 |

|

$ |

2,873 |

|

(38 |

%) |

13 |

% |

Free cash flow (1)(4) |

$ |

3,887 |

|

$ |

4,259 |

|

$ |

3,296 |

|

(9 |

%) |

29 |

% |

|

|

|

|

|

|

|

|

|

|

% Change |

|

|

|

|

Favorable/(Unfavorable) |

| In millions, except percentages |

As at December 31, 2023 |

As at December 31, 2022 |

As at December 31, 2021 |

2023 vs 2022 |

2022 vs 2021 |

| Financial position |

|

|

|

|

|

| Total assets |

$ |

52,666 |

|

$ |

50,662 |

|

$ |

48,538 |

|

4 |

% |

4 |

% |

Total long-term liabilities (5) |

$ |

27,514 |

|

$ |

25,436 |

|

$ |

22,674 |

|

(8 |

%) |

(12 |

%) |

(1)These non-GAAP measures do not have any standardized meaning prescribed by GAAP and therefore, may not be comparable to similar measures presented by other companies.

(2)See the section of this MD&A entitled Non-GAAP measures – Adjusted performance measures for an explanation of these non-GAAP measures.

(3)Operating ratio is defined as operating expenses as a percentage of revenues.

(4)See the section of this MD&A entitled Liquidity and capital resources – Free cash flow for an explanation of this non-GAAP measure.

(5)Total long-term liabilities is the difference between Total liabilities and Total current liabilities.

2023 Results of operations

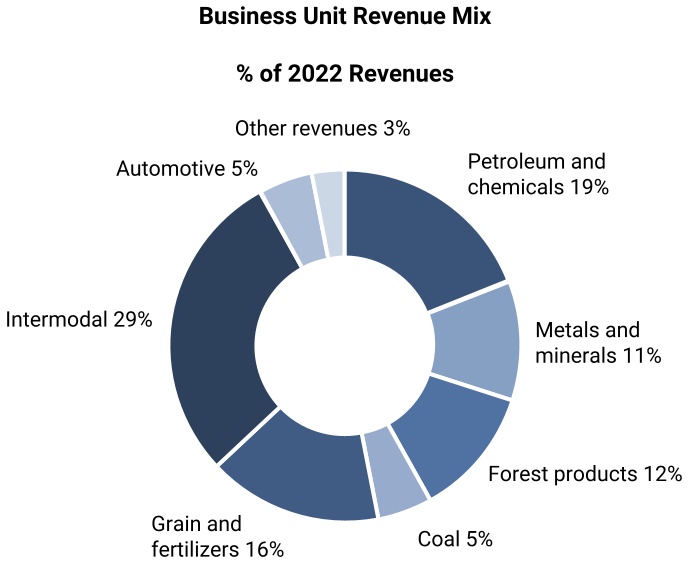

Revenues for the year ended December 31, 2023 were $16,828 million compared to $17,107 million in 2022. The decrease of $279 million, or 2%, was mainly due to lower shipments of intermodal, crude oil, U.S. grain and forest products as well as lower container storage fees and lower fuel surcharge revenues as a result of lower fuel prices; partly offset by freight rate increases, higher Canadian grain export shipments and higher shipments of potash and the positive translation impact of a weaker Canadian dollar.

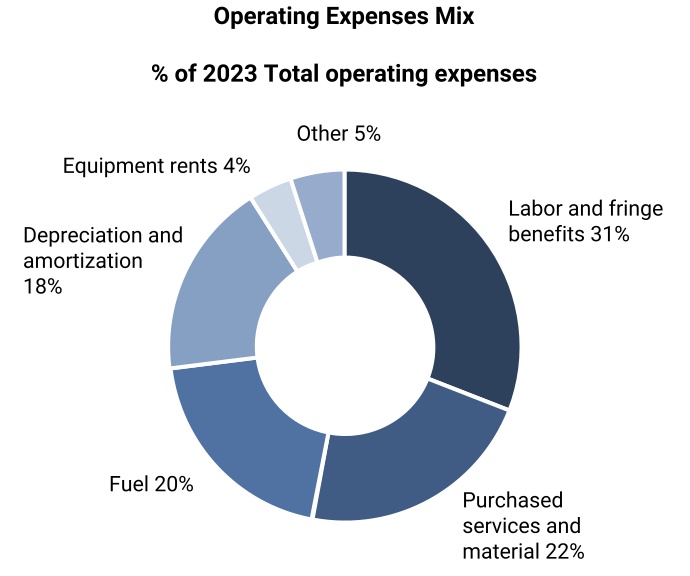

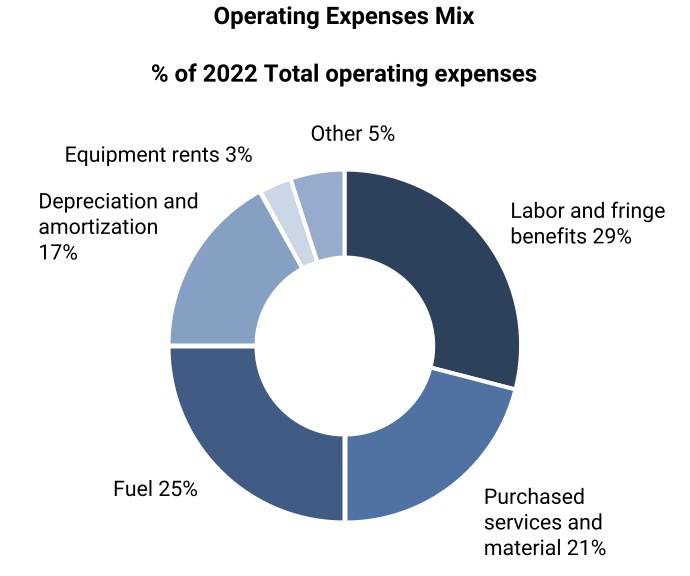

Operating expenses for the year ended December 31, 2023 were $10,231 million compared to $10,267 million in 2022. Operating expenses remained flat mainly due to lower fuel prices; offset by the negative translation impact of a weaker Canadian dollar and higher labor and fringe benefits expense mainly driven by general wage increases and higher average headcount.

Operating income for the year ended December 31, 2023 decreased by $243 million, or 4%, to $6,597 million, when compared to the same period in 2022. The operating ratio was 60.8% in 2023, compared to 60.0% in 2022, a 0.8-point increase.

Net income for the year ended December 31, 2023 was $5,625 million, an increase of $507 million, or 10%, when compared to 2022, and diluted earnings per share increased by 15% to $8.53. The increase was mainly due to a net deferred income tax recovery of $713 million resulting from tax filings consistent with a ruling that the Company received in a non-U.S. foreign jurisdiction in connection with prior taxation years; partly offset by lower revenues.

14 CN | 2023 Annual Report

MANAGEMENT'S DISCUSSION AND ANALYSIS

Key operating metrics

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

% Change |

|

|

|

|

Favorable/(Unfavorable) |

|

2023 |

|

2022 |

|

2021 |

|

2023 vs 2022 |

2022 vs 2021 |

Gross ton miles (GTMs) (millions) (1) |

452,043 |

|

463,710 |

|

458,401 |

|

(3 |

%) |

1 |

% |

Train weight (tons) (2) |

9,186 |

|

9,324 |

|

9,658 |

|

(1 |

%) |

(3 |

%) |

Train length (feet) (3) |

7,891 |

|

8,160 |

|

8,559 |

|

(3 |

%) |

(5 |

%) |

Through network train speed (miles per hour) (4) |

19.8 |

|

18.9 |

|

19.2 |

|

5 |

% |

(2 |

%) |

Fuel efficiency (US gallons of locomotive fuel consumed per 1,000 GTMs) (5) |

0.874 |

|

0.867 |

|

0.884 |

|

(1 |

%) |

2 |

% |

Through dwell (entire railroad, hours) (6) |

7.0 |

|

7.6 |

|

7.9 |

|

8 |

% |

4 |

% |

Car velocity (car miles per day) (7) |

213 |

|

196 |

|

195 |

|

9 |

% |

1 |

% |

(1)GTMs: The workload performed by system trains in hauling freight or equipment. GTMs are calculated by multiplying the trailing weight by the distance the train moved. A larger number is an indicator of more traffic (and thus more revenue) being moved.

(2)Train weight: An efficiency measurement on how much tonnage each mainline train handles on average as it crosses the network. Calculated as the total of GTMs and divided by total train miles, this measure provides insight on how well each train was maximized in terms of its capacity to move traffic. This operating measure was formerly named Train productivity.

(3)Train length: An efficiency measurement on average trailing length of each mainline train on the network. Calculated as the total of car foot miles (the sum of car length multiplied by miles travelled for each trailing car) divided by total train miles, this measure provides insight on how well each train was maximized in terms of its capacity to move traffic.

(4)Through network train speed: A measure of the line-haul movement from origin to destination, including time at terminals. The average speed is calculated by dividing train miles by total hours operated, excluding yard and local trains, passenger trains, maintenance of way trains, and foreign trains. This measure represents the fluidity of trains on the network, with a higher value also indicating a more fluid network.

(5)Fuel efficiency: This measure represents how efficient the Company is in the generation and utilization of locomotive horsepower in freight train operations, with a lower number indicating improved performance. Fuel efficiency is defined as US gallons of locomotive fuel consumed per 1,000 GTMs. Annual fuel efficiency metrics for 2021 have been revised as more complete information became available.

(6)Through dwell: The average time a car resides within terminal boundaries expressed in hours. The measurement begins with a customer release, received interchange, or train arrival event and ends with a customer placement (actual or constructive), delivered or offered in interchange, or train departure event. This excludes stored, bad ordered, maintenance of way cars, or cars with dwell greater than 10 days. This measure represents the efficiency of handling cars within the terminal, with a lower value indicating higher performance.

(7)Car velocity: The average miles per day traveled by loaded and empty cars (including all active cars whether private, foreign or CN owned) on company lines. This measure represents the fluidity of cars on the network, calculated by the sum of miles each car traveled divided by the sum of all of the cars’ active time, with a higher value indicating a smoother and more fluid operation.

The Company’s continued focus on scheduled railroading in 2023, helped by more favorable winter operating conditions partly offset by operational disruptions related to Canadian wildfires and the Canadian West Coast dock workers strike, resulted in improvements in car velocity, train speed and through dwell when compared to 2022. GTMs were negatively impacted in 2023 when compared to 2022 primarily due to weaker demand for freight services. Fuel efficiency decreased by 1% mainly due to running shorter trains.

For the year ended December 31, 2022, when compared to 2021, the Company’s focus on scheduled railroading resulted in improvements in car velocity, through dwell and fuel efficiency, as well as a decrease in train length and train weight, despite negative impacts from the harsh winter in the first quarter of 2022. In addition, the Company's fuel initiatives allowed it to achieve a new record for fuel efficiency.

Non-GAAP measures

This MD&A makes reference to non-GAAP measures including adjusted performance measures, constant currency, return on invested capital (ROIC) and adjusted ROIC, free cash flow, and adjusted debt-to-adjusted EBITDA multiple that do not have any standardized meaning prescribed by GAAP and therefore, may not be comparable to similar measures presented by other companies. From management's perspective, these non-GAAP measures are useful measures of performance and provide investors with supplementary information to assess the Company's results of operations and liquidity. These non-GAAP measures should not be considered in isolation or as a substitute for financial measures prepared in accordance with GAAP.

For further details of these non-GAAP measures, including a reconciliation to the most directly comparable GAAP financial measures, refer to the sections of this MD&A entitled Non-GAAP measures: Adjusted performance measures, ROIC and adjusted ROIC and Constant currency, as well as the section entitled Liquidity and capital resources: Free cash flow and Adjusted debt-to-adjusted EBITDA multiple.

CN | 2023 Annual Report 15

MANAGEMENT'S DISCUSSION AND ANALYSIS

Adjusted performance measures

Adjusted net income, adjusted diluted earnings per share, adjusted operating income, adjusted operating expenses and adjusted operating ratio are non-GAAP measures that are used to set performance goals and to measure CN's performance. Management believes that these adjusted performance measures provide additional insight to management and investors into the Company's operations and underlying business trends as well as facilitate period-to-period comparisons, as they exclude certain significant items that are not reflective of CN's underlying business operations and could distort the analysis of trends in business performance. These items may include:

i.operating expense adjustments: workforce reduction program, depreciation expense on the deployment of replacement system, advisory fees related to shareholder matters, losses and recoveries from assets held for sale, business acquisition-related costs;

ii.non-operating expense adjustments: business acquisition-related financing fees, merger termination income, gains and losses on disposal of property; and

iii.the effect of changes in tax laws including rate enactments, and changes in tax positions affecting prior years.

These non-GAAP measures do not have any standardized meaning prescribed by GAAP and therefore, may not be comparable to similar measures presented by other companies.

For the year ended December 31, 2023, the Company's adjusted net income was $4,800 million, or $7.28 per diluted share, which excludes:

•a gain on disposal of property within the Bala Subdivision located in Markham and Richmond Hill, Ontario, Canada of $129 million, or $112 million after-tax ($0.17 per diluted share) recorded in the fourth quarter in Other income within the Consolidated Statements of Income; and

•a net deferred income tax recovery of $713 million ($1.08 per diluted share) recorded in the fourth quarter resulting from tax filings consistent with a ruling that the Company received in a non-U.S. foreign jurisdiction in connection with prior taxation years.

For the year ended December 31, 2022, the Company's adjusted net income was $5,134 million, or $7.46 per diluted share, which excludes advisory fees related to shareholder matters of $22 million, or $16 million after-tax ($0.02 per diluted share) of which $12 million, or $9 million after-tax ($0.01 per diluted share) was recorded in the second quarter and $10 million, or $7 million after-tax ($0.01 per diluted share) was recorded in the first quarter in Other expense within the Consolidated Statements of Income.

For the year ended December 31, 2021, the Company reported adjusted net income of $4,225 million, or $5.95 per diluted share, which excludes:

•employee termination benefits and severance costs related to a workforce reduction program of $39 million, or $29 million after-tax ($0.04 per diluted share) recorded in the third quarter in Labor and fringe benefits within the Consolidated Statements of Income;

•advisory fees related to shareholder matters of $20 million, or $15 million after-tax ($0.02 per diluted share) of which $13 million, or $10 million after-tax ($0.01 per diluted share) was recorded in the fourth quarter and $7 million, or $5 million after-tax ($0.01 per diluted share) was recorded in the third quarter in Other expense within the Consolidated Statements of Income;

•the recovery of $137 million, or $102 million after-tax ($0.14 per diluted share) recorded in the first quarter related to the loss on assets held for sale in the second quarter of 2020, to reflect an agreement for the sale for on-going rail operations, certain non-core rail lines in Wisconsin, Michigan and Ontario to a short line operator;

•transaction-related costs, consisting of an advance to Kansas City Southern (KCS) and a related refund, net of transaction costs, of $84 million, or $70 million after-tax ($0.10 per diluted share), recorded in the third quarter resulting from the terminated CN Merger Agreement with KCS;

•amortization of bridge financing and other fees of $97 million, or $84 million after-tax ($0.11 per diluted share), of which $65 million, or $60 million after-tax ($0.08 per diluted share) was recorded in the third quarter and $32 million, or $24 million after-tax ($0.03 per diluted share) was recorded in the second quarter, resulting from the KCS transaction, recorded in Interest expense within the Consolidated Statements of Income; and

•merger termination fee paid by KCS to CN of $886 million, or $770 million after-tax ($1.08 per diluted share), recorded in the third quarter resulting from KCS' notice of termination of the CN Merger Agreement with KCS.

16 CN | 2023 Annual Report

MANAGEMENT'S DISCUSSION AND ANALYSIS

Adjusted net income is defined as Net income in accordance with GAAP adjusted for certain significant items. Adjusted diluted earnings per share is defined as adjusted net income divided by the weighted-average diluted shares outstanding. The following table provides a reconciliation of Net income and Earnings per share in accordance with GAAP, as reported for the years ended December 31, 2023, 2022 and 2021, to the non-GAAP adjusted performance measures presented herein:

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| In millions, except per share data |

Year ended December 31, |

2023 |

|

2022 |

|

2021 |

|

Net income |

$ |

5,625 |

|

$ |

5,118 |

|

$ |

4,899 |

|

| Adjustments: |

|

|

|

|

| Operating expense adjustments: |

|

|

|

| Workforce reduction program |

|

— |

|

— |

|

39 |

|

|

|

|

|

| Advisory fees related to shareholder matters |

— |

|

22 |

|

20 |

|

| Recovery on assets held for sale |

|

— |

|

— |

|

(137) |

|

| Transaction-related costs |

|

— |

|

— |

|

84 |

|

| Non-operating expense adjustments: |

|

|

|

| Amortization of bridge financing and other fees |

— |

|

— |

|

97 |

|

| Merger termination fee |

|

— |

|

— |

|

(886) |

|

| Gain on disposal of property |

(129) |

|

— |

|

— |

|

| Tax adjustments: |

|

|

|

Tax effect of adjustments (1) |

|

17 |

|

(6) |

|

109 |

|

Tax-deductible goodwill and related impacts (2) |

(713) |

|

— |

|

— |

|

|

|

|

|

| Total adjustments |

(825) |

|

16 |

|

(674) |

|

Adjusted net income |

$ |

4,800 |

|

$ |

5,134 |

|

$ |

4,225 |

|

|

|

|

|

|

|

|

|

|

|

|

|

Diluted earnings per share |

$ |

8.53 |

|

$ |

7.44 |

|

$ |

6.90 |

|

| Impact of adjustments, per share |

(1.25) |

|

0.02 |

|

(0.95) |

|

Adjusted diluted earnings per share |

$ |

7.28 |

|

$ |

7.46 |

|

$ |

5.95 |

|

(1)The tax impact of adjustments is based on the nature of the item for tax purposes and related tax rates in the applicable jurisdiction.

(2)Relates to the impacts resulting from tax filings consistent with a ruling that the Company received in a non-U.S. foreign jurisdiction in connection with prior taxation years.

Adjusted operating income is defined as Operating income in accordance with GAAP adjusted for certain significant operating expense items. Adjusted operating expenses is defined as Operating expenses in accordance with GAAP adjusted for certain significant operating expense items. Adjusted operating ratio is defined as adjusted operating expenses as a percentage of revenues. The following table provides a reconciliation of Operating income, Operating expenses and operating ratio, as reported for the years ended December 31, 2023, 2022 and 2021, to the non-GAAP adjusted performance measures presented herein:

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| In millions, except percentages |

Year ended December 31, |

2023 |

|

2022 |

|

2021 |

|

| Operating income |

$ |

6,597 |

|

$ |

6,840 |

|

$ |

5,616 |

|

| Adjustments: |

|

|

|

| Workforce reduction program |

— |

|

— |

|

39 |

|

|

|

|

|